-

@ 5d4b6c8d:8a1c1ee3

2025-06-13 13:39:20

@ 5d4b6c8d:8a1c1ee3

2025-06-13 13:39:20Here's a video about the Pacers' offensive adjustments to OKC's extraordinary defense:

https://youtu.be/1LF2Sd1jTXQ

This finals matchup probably has the highest level team basketball I remember seeing.

https://stacker.news/items/1005445

-

@ 9c9d2765:16f8c2c2

2025-06-13 13:31:00

@ 9c9d2765:16f8c2c2

2025-06-13 13:31:00In the heart of a forgotten village, wrapped in fog and silence, lived a girl named Lisa who had never seen her reflection.

There were no mirrors in the village, only old tales whispered by elders that mirrors “stole your spirit” or “showed things best left hidden.” Lisa never questioned it. She believed what she was told: she was plain, timid, and destined for nothing more than blending into shadows.

But she felt something inside a flicker, like a candle trying to burn through thick glass.

One day, while gathering herbs deep in the forest, Lisa stumbled upon the ruins of an ancient house. Inside, beneath sheets of ivy and dust, stood an enormous mirror tall, cracked, and untouched for decades.

She froze.

Curiosity trembled in her chest. Carefully, she wiped away the dust with her sleeve.

At first, she saw only her eyes, wild, curious, and afraid. Then, slowly, the whole reflection emerged. Not plain. Not broken. But alive.

It was her, and yet someone more stronger, prouder, freer.

Tears welled in her eyes. All her life, she had believed others’ words. But here, in silence, she saw the truth for herself.

She began visiting the mirror each day, not to admire beauty, but to remind herself she was real. That her thoughts mattered. That what lived inside her could not be shaped by lies spoken outside.

When she returned to the village, she walked differently.

She spoke.

She led.

And others began to wonder: What did she see that changed her?

Lisa simply smiled and said, “I stopped seeing what they told me I was. And started seeing who I truly am.”

Moral: You are not what others say you are. You are who you choose to see.

-

@ 9c9d2765:16f8c2c2

2025-06-13 13:04:54

@ 9c9d2765:16f8c2c2

2025-06-13 13:04:54In a quiet coastal town where summer lingered like a forgotten song, lived an old gardener named Ali. His home sat at the edge of the cliffs, where ocean wind tossed sea spray into the air and the sun kissed everything golden. Ali’s garden was a legend of tulips that sang with color, vines that danced in the breeze, and trees that whispered stories to anyone who would listen.

But Ali had grown frail. His hands, once strong, now trembled. His memory sometimes slipped like sand through a sieve. Yet every day, he tended the plants. Not because he needed them but because they still needed him.

One autumn, a young boy named Ben moved into the neighboring house. Ben had not spoken a word since losing his mother the year before. He would sit for hours at the fence, watching Ali work.

Ali never asked him to speak. Instead, he gave Ben a sunflower seed.

“Plant it,” he said. “And believe in the bloom.”

Ben did.

The next day, Ali gave him a cracked watering can. The next, a rusty trowel. Day by day, silence became action. The boy mimicked Ali’s movements. Dug soil. Watered. Waited.

Then winter came fast. A cruel one.

One morning, Ali was gone.

The town whispered, “The gardener has passed.” Snow dusted the garden. The plants withered. Ben stood before the tiny sunflower shoot and wept silently.

But spring arrived timid and uncertain.

And from the earth, a single sunflower broke through.

Ben spoke his first words in months to the flower.

“You’re not alone.”

And in a voice that cracked but carried, he added, “Neither am I.”

Moral: Even after loss, life finds a way. Sometimes, a single leaf can carry the weight of hope for someone else.

-

@ 9ca447d2:fbf5a36d

2025-06-13 13:01:52

@ 9ca447d2:fbf5a36d

2025-06-13 13:01:52El Salvador – June 3, 2025 — The grassroots Bitcoin community of El Salvador is proud to announce the return of Bitcoin Week, taking place this November with five dynamic events celebrating Bitcoin adoption, education, and community-led innovation.

Join us for a week of inspiration, collaboration, and impact.

Bitcoin Week 2025 calendar

📍 November 12 – Bitcoin Education Celebration Gala: Kick off the week in style with a luxurious and intimate evening at a high-class dinner, celebrating “proof of work” and the achievements of the Bitcoin education movement.

Expect major plans for the year(s) ahead but also a reflection to past proof-of-work—and don’t miss out on the Great Grassroots Giveaway, included with every ticket.📍 November 13 – Bitcoin Educators Unconference: Hosted for the third time in San Salvador at Cadejo Montaña, this sixth edition of the Educators Unconference embodies our commitment to provide a space for decentralized, community-led conversations.

Join educators and leaders shaping the global Bitcoin conversation!📍 November 14–15 – Adopting Bitcoin: The Network Effect: Now in its fifth year, Adopting Bitcoin returns with a powerful focus on real-world Bitcoin usage across global communities.

This year’s theme—The Network Effect—explores how interconnected local initiatives can spark exponential growth in adoption.📍 November 16 – Visit Bitcoin Beach, El Zonte: Make your way to Bitcoin Beach, the heart of El Salvador’s Bitcoin story. Enjoy a day of connection and discovery in this iconic beachside town. Full details coming soon.

📍 November 22–23 – Economía Bitcoin, Berlín: Head to the town of Berlín, El Salvador for the second edition of Economía Bitcoin, a powerful, small-scale conference and festival focused on circular economies and practical Bitcoin use.

Spend sats freely in town and see how local action drives global impact.With five unique events across three regions in Bitcoin Country, this edition of Bitcoin Week is your chance to experience El Salvador’s Bitcoin journey up close. Whether you’re an educator, builder, Bitcoiner, or simply curious—you’re invited.

Join us this November. Be part of the movement.

-

@ cae03c48:2a7d6671

2025-06-13 13:01:11

@ cae03c48:2a7d6671

2025-06-13 13:01:11Bitcoin Magazine

Remixpoint Invests ¥887 Million More Into BitcoinRemixpoint Inc. (3825.T), a management consulting services company, announced it has purchased ¥887.3 million worth of Bitcoin, acquiring 55.68 BTC at an average price of ¥15.94 million per coin.

JUST IN:

JUST IN:  Remixpoint just keeps buying more #bitcoin. Another 55.68 BTC today and they now have a total of 981.39 BTC. pic.twitter.com/mTkZg8mNO4

Remixpoint just keeps buying more #bitcoin. Another 55.68 BTC today and they now have a total of 981.39 BTC. pic.twitter.com/mTkZg8mNO4— NLNico (@btcNLNico) June 12, 2025

Following this purchase, the company now holds a total of 981.39 BTC, with a market value of approximately ¥15.63 billion. The unrealized gain on its Bitcoin holdings stands at ¥2.32 billion, reflecting their confidence in Bitcoin’s long term value. The funds came from the exercise of stock acquisition rights conducted on June 10.

Remixpoint Inc. is a Japanese company that started in the auto and energy sectors but has changed toward digital assets. It’s one of the few public companies in Japan actively holding Bitcoin, seeing it as both a store of value and a hedge against the weakening yen. Their move highlights a growing shift in Japan’s corporate space toward Bitcoin adoption.

Bitcoin has been so strong over the years that even in Japan, more companies are adding it to their balance sheets. It all started with Metaplanet, which was originally a hotel and hospitality company. In 2024, they shifted their strategy entirely and began accumulating Bitcoin as a treasury asset. That move caught the attention of investors and marked a turning point in Japan’s corporate approach to digital assets. Since then, Metaplanet has leaned fully into the Bitcoin thesis, positioning itself as Japan’s version of Strategy.

Recently, Metaplanet also announced its “555 Million Plan,” aiming to acquire 210,000 BTC, which is about 1% of Bitcoin’s total supply, by the end of 2027. This represents a major step up from its original “21 Million Plan,” which aimed for just 21,000 BTC. As of June 2, the company had already secured 8,888 BTC, far ahead of schedule and signaling strong momentum in its accumulation strategy.

Metaplanet has launched Asia’s largest-ever equity raise dedicated to Bitcoin:

¥770.9 billion (~$5.4B) capital raise

¥770.9 billion (~$5.4B) capital raise

555 million shares via moving strike warrants

555 million shares via moving strike warrants

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo— Simon Gerovich (@gerovich) June 6, 2025

To fund this effort, Metaplanet launched Japan’s first moving strike warrant structure, issuing 555 million shares to raise approximately ¥770.9 billion. The plan was approved following a 10-for-1 stock split and a shareholder vote to increase authorized shares. With robust BTC yield performance and growing investor backing, Metaplanet is quickly establishing itself as Japan’s most influential corporate player in the Bitcoin space.

This post Remixpoint Invests ¥887 Million More Into Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 0403c86a:66d3a378

2025-06-13 12:55:09

@ 0403c86a:66d3a378

2025-06-13 12:55:09Exciting news for FOOTBALL fans ⚽! Global Sports Central 🌐 is teaming up with Predyx, a leading prediction market in the Bitcoin ecosystem, to bring you comprehensive coverage of the very first Club World Cup directly on Nostr. This partnership is all about enhancing your experience with the latest news, insights, and interactive features!

The Club World Cup will showcase the best clubs from around the globe, and with our collaboration, you’ll be fully engaged in the action. Predyx focuses on long-term outcomes, allowing you to make predictions on who will win it all. Plus, if you’re not happy with your predictions, you can sell your shares at any time and switch allegiance—after all, it’s a free market!

What You Can Expect:

-

Latest News and Match Reports: Stay updated with the latest news, in-depth match reports, and insights from the tournament, ensuring you never miss a moment.

-

Market Odds Tracking: Follow the shifts in market odds in real-time, giving you the edge when making predictions and engaging with the action.

-

Player of the Day Card: Celebrate standout performances with our Daily Player of the Day card, highlighting the top players from the tournament.

-

Game oN Frontpage: Each day, we’ll feature the frontpage of the day, showcasing the most historical matchups and capturing the feel of the game.

-

Best Moments Replays: Relive the excitement with replays of the best moments from the Cup, so you can catch all the highlights and unforgettable plays.

-

Long-Term Predictions: Engage with Predyx to forecast who will win the tournament and who will take home the MVP award, allowing you to make strategic predictions as the tournament unfolds.

-

Easy Login System: Getting started is a breeze! All you need is a Lightning wallet to log in and participate, making it simple for everyone to join in on the fun.

-

Lightning-Fast Bitcoin Payments: With the Lightning Network, placing your bets and making predictions is faster and easier than ever. Enjoy seamless transactions while you cheer for your favorite teams!

"Predyx is excited to be part of this innovative partnership," said Derek. "We’re bringing fans a new way to interact with the game they love, all while using the fast and secure Lightning Network."

Predyx is a Bitcoin-native prediction market platform running on the Lightning Network. We’re building the fastest, most trust-minimized betting engine in the world — no deposits, instant payouts, sats-native, and degen-friendly.

Global Sports Central 🌐 Your daily spin around the sports world 🔄 Stay in the loop with the latest scores, stories, and stats.

GSC360 - Where Every Angle Matters

-

-

@ f0fd6902:a2fbaaab

2025-06-13 11:56:10

@ f0fd6902:a2fbaaab

2025-06-13 11:56:10https://stacker.news/items/1005372

-

@ b1ddb4d7:471244e7

2025-06-13 13:01:31

@ b1ddb4d7:471244e7

2025-06-13 13:01:31Paris, France – June 6, 2025 – Flash, the easiest Bitcoin payment gateway for businesses, just announced a new partnership with the Bitcoin Only Brewery, marking the first-ever beverage company to leverage Flash for seamless Bitcoin payments.

Bitcoin Buys Beer Thanks to Flash!

As Co-Founder of Flash, it's not every day we get to toast to a truly refreshing milestone.

Okay, jokes aside.

We're super buzzed to see our friends at @Drink_B0B

Bitcoin Only Brewery using Flash to power their online sales!The first… pic.twitter.com/G7TWhy50pX

— Pierre Corbin (@CierrePorbin) June 3, 2025

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack – shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented: “Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest Bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept Bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

Bitcoin payment usage is growing thanks to Lightning

In May, fast-food chain Steak ‘N Shake went viral for integrating bitcoin at their restaurants around the world. In the same month, the bitcoin2025 conference in Las Vegas set a new world record with 4,000 Lightning payments in one day.

According to a report by River Intelligence, public Lightning payment volume surged by 266% from August 2023 to August 2024. This growth is also reflected in the overall accessibility of lighting infrastructure for consumers. According to Lightning Service Provider Breez, over 650 Million users now have access to the Lightning Network through apps like CashApp, Kraken or Strike.

Bitcoin Only Brewery’s adoption of Flash reflects the growing trend of businesses integrating Bitcoin payments to cater to a global, privacy-conscious customer base. By offering no-KYC delivery across Europe, the brewery aligns with the ethos of decentralization and financial sovereignty, appealing to the increasing number of consumers and businesses embracing Bitcoin as a legitimate payment method.

“Flash is committed to driving innovation in the Bitcoin ecosystem,” Corbin added. “We’re building a future where businesses of all sizes can seamlessly integrate Bitcoin payments, unlocking new opportunities in the global market. It’s never been easier to start selling in bitcoin and we invite retailers globally to join us in this revolution.”

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

About Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comPhotos paywithflash.com/about/pressHow Flash Enables Interoperable, Self-Custodial Bitcoin Commerce

-

@ f0fd6902:a2fbaaab

2025-06-13 11:43:17

@ f0fd6902:a2fbaaab

2025-06-13 11:43:17From my end, it s not one thing but a sentence:

A borderless world in a decentralized economy, where age, sex, race, religion... have not labels in a society where human are sovereigns.

https://stacker.news/items/1005361

-

@ 8bad92c3:ca714aa5

2025-06-13 11:01:53

@ 8bad92c3:ca714aa5

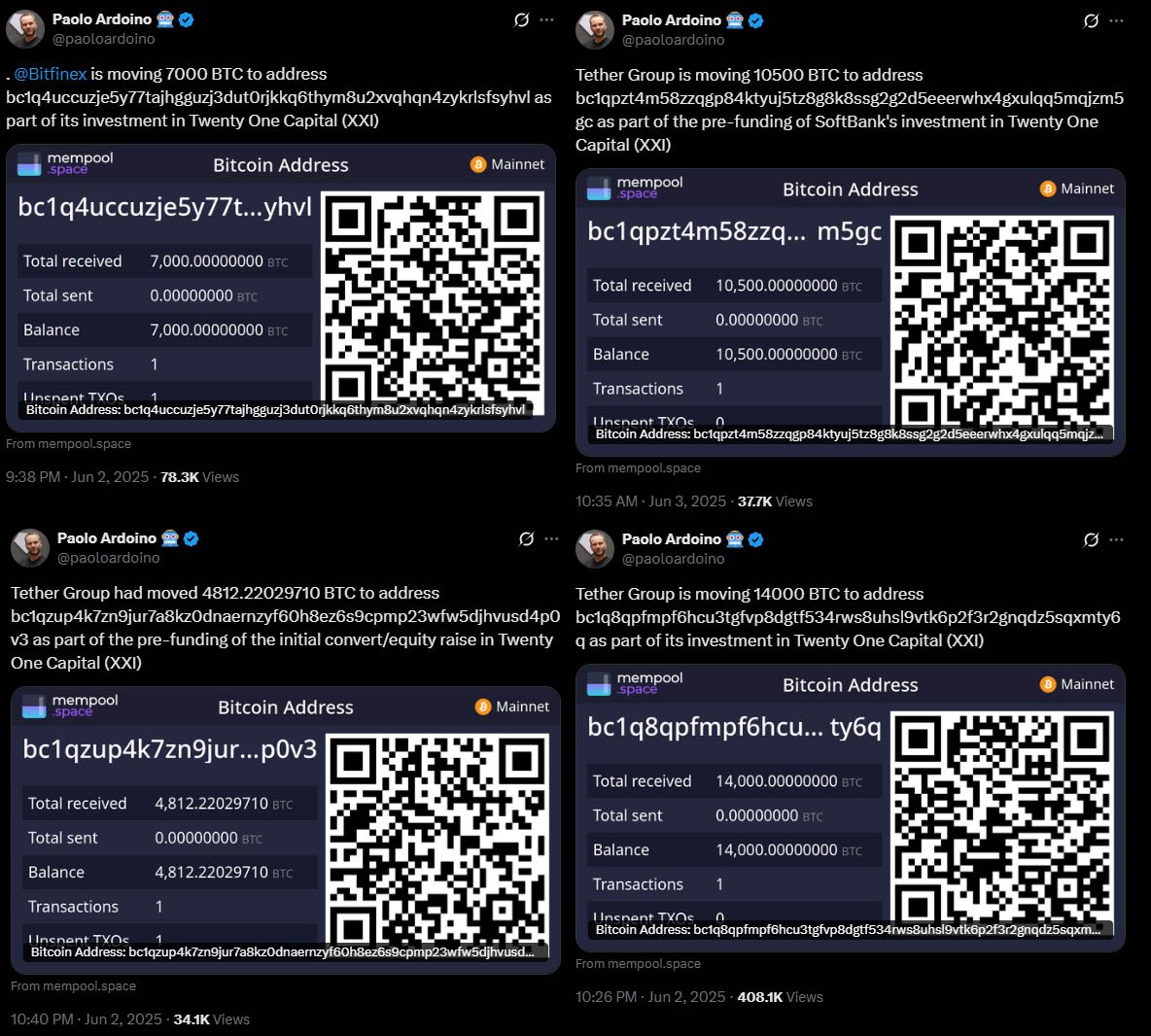

2025-06-13 11:01:53Marty's Bent

J.P. Morgan CEO Jamie Dimon has long been an outspoken skeptic and critic of bitcoin. He has called Bitcoin a speculative asset, a fraud, a pet rock, and has opined that it will inevitably blow up. A couple of years ago, he was on Capitol Hill saying that if he were the government, he would "close it down". Just within the last month, he was on Fox Business News talking with Maria Bartiromo, proclaiming that the U.S. should be stockpiling bullets and rare earth metals instead of bitcoin. It's pretty clear that Jamie Dimon, who is at the helm of the most powerful and largest bank in the world, does not like bitcoin one bit.

Evidence below:

via Bitcoin Magazine

via me

via CNBC

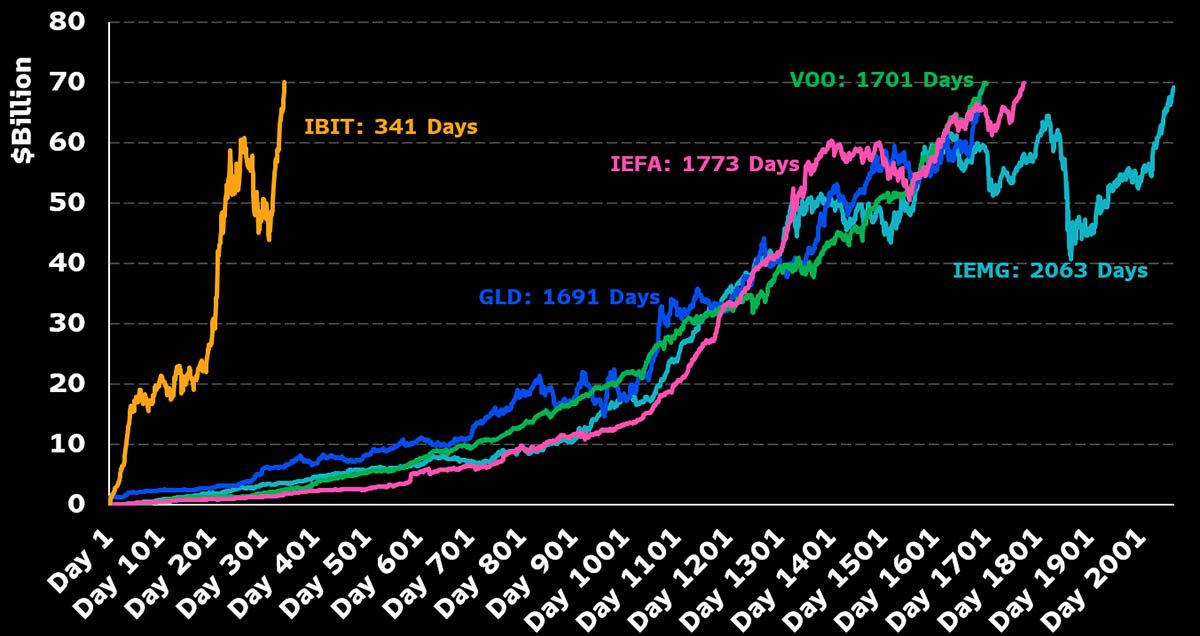

Despite Dimon's distinguished disdain for Bitcoin, J.P. Morgan cannot deny reality. The CEO of the largest bank in the world is certainly a powerful man, but no one individual, even in the position that Jamie Dimon is in, is more powerful than the market. And the market has spoken very clearly, it is demanding bitcoin. The Bitcoin ETFs have been the most successful ETFs in terms of pace of growth since their launch. They've accumulated tens of billions of dollars in AUM in a very short period of time. Outpacing the previous record set by the gold ETF, GLD.

Whether or not Jamie Dimon himself likes Bitcoin doesn't matter. J.P. Morgan, as the largest bank in the world and a publicly traded company, has a duty to shareholders. And that duty is to increase shareholder value by any ethical and legal means necessary. Earlier today, J.P. Morgan announced plans to offer clients financing against their Bitcoin ETFs, as well as some other benefits, including having their bitcoin holdings recognized in their overall net worth and liquid assets, similar to stocks, cars, and art, which will be massive for bitcoiners looking to get mortgages and other types of loans.

via Bloomberg

I've talked about this recently, but trying to buy a house when most of your liquid net worth is held in bitcoin is a massive pain in the ass. Up until this point, if you wanted to have your bitcoin recognized as part of your net worth and count towards your overall credit profile, you would need to sell some bitcoin, move it to a bank account, and have it sit there for a certain period of time before it was recognized toward your net worth. This is not ideal for bitcoiners who have sufficient cash flows and don't want to sell their bitcoin, pay the capital gains tax, and risk not being able to buy back the amount of sats they were forced to sell just to get a mortgage.

It's not yet clear to me whether or not J.P. Morgan will recognize bitcoin in cold storage toward their clients' net worth and credit profile, or if this is simply for bitcoin ETFs only. However, regardless, this is a step in the right direction and a validation of something that many bitcoiners have been saying for years. Inevitably, everyone will have to bend the knee to bitcoin. Today, it just happened to be the largest bank in the world. I expect more of this to come in the coming months, years, and decades.

Lyn Alden likes to say it in the context of the U.S. national debt and the fiscal crisis, but it also applies to bitcoin adoption and the need for incumbents to orient themselves around the demands of individual bitcoiners; nothing stops this train.

Real Estate Correction Coming

Real estate expert Leon Wankum shared his perspective on why property prices need to find a new equilibrium by 2026. He pointed to the 18-year property cycle theory, noting we're at the end of the current cycle with a massive imbalance - 34% more sellers than buyers, the highest gap since records began in 2013. Leon explained that sellers still have unrealistic expectations based on 2021-2022 peaks, while buyers face a fundamentally different reality with higher borrowing costs.

"We need a price equilibrium. We need demand and supply prices to match. It's going to take a long time, I think." - Leon Wankum

Leon doesn't expect a catastrophic crash, however. He emphasized that the financial system depends too heavily on real estate as collateral for authorities to allow a complete collapse. With interest rates likely staying above 3% to combat inflation, he sees a healthy correction rather than devastation - a necessary adjustment that creates opportunities for patient buyers who understand the new market dynamics.

Check out the full podcast here for more on Bitcoin treasury strategies, dual collateralization, and corporate BTC adoption

Headlines of the Day

California May Seize Idle Bitcoin After 3 Years - via X

Semler Scientific Buys $20M More Bitcoin, Holds $467M - via X

US Home Sellers Surge as Buyers Hit 4-Year Low - via X

Get our new STACK SATS hat - via tftcmerch.io

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I feel old.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ f0fd6902:a2fbaaab

2025-06-13 10:36:58

@ f0fd6902:a2fbaaab

2025-06-13 10:36:58The Pallas cat wasn’t known to live on Mount Everest until a National Geographic Expedition in 2019 made a surprising discovery. The research team, made up of scientists from eight different countries, unexpectedly found Pallas feces in the Sagarmatha National Park in Nepal. “It is phenomenal to discover proof of this rare and remarkable species at the top of the world,” said Dr Tracie Seimon of the Wildlife Conservation Society’s Zoological Health Program.

These irritated-looking kitties live at high elevations throughout Asia and are considered “super predators,” meaning they are extremely successful at catching their prey. Analysis of scat revealed the feline is surving on pika within the mountain region.

https://stacker.news/items/1005336

-

@ f0fd6902:a2fbaaab

2025-06-13 10:26:19

@ f0fd6902:a2fbaaab

2025-06-13 10:26:19Panpsychism is the view that mentality is fundamental and ubiquitous in the natural world. The view has a long and venerable history in philosophical traditions of both East and West, and has recently enjoyed a revival in analytic philosophy. For its proponents panpsychism offers an attractive middle way between physicalism on the one hand and dualism on the other. The worry with dualism—the view that mind and matter are fundamentally different kinds of thing—is that it leaves us with a radically disunified picture of nature, and the deep difficulty of understanding how mind and brain interact. And whilst physicalism offers a simple and unified vision of the world, this is arguably at the cost of being unable to give a satisfactory account of the emergence of human and animal consciousness. Panpsychism, strange as it may sound on first hearing, promises a satisfying account of the human mind within a unified conception of nature.

For more details: https://plato.stanford.edu/entries/panpsychism/

https://stacker.news/items/1005324

-

@ b1ddb4d7:471244e7

2025-06-13 08:01:22

@ b1ddb4d7:471244e7

2025-06-13 08:01:22The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ cae03c48:2a7d6671

2025-06-13 10:01:39

@ cae03c48:2a7d6671

2025-06-13 10:01:39Bitcoin Magazine

F Street Announced Goal Of Accumulating $10 Million In BitcoinToday, F Street, an alternative investment and private lending firm, announced it has begun adding Bitcoin to its corporate treasury, with a goal of accumulating $10 million in BTC.

JUST IN: Investment firm F Street announced it's buying Bitcoin daily using business proceeds for its treasury reserves

They plan to buy $10 million Bitcoin

pic.twitter.com/NMLOteyUYU

pic.twitter.com/NMLOteyUYU— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

The company began daily BTC purchases on June 9, using business proceeds and treasury funds. This move is part of a broader strategy to strengthen F Street’s capital base and support its real estate lending and investment operations.

“Bitcoin offers a compelling hedge against inflation and dollar debasement,” said the Chief Operating Officer of F Street Mike Doney. “Incorporating it into our treasury is a strategic step to preserve and grow value for our investors and our business interests.”

In line with its commitment to transparency, F Street also plans to establish a public proof of reserves so that stakeholders can independently verify the custody of its Bitcoin assets. The firm aims to build a meaningful BTC position that supports its long term vision of a capital framework.

F Street’s move comes at a time when institutional interest in Bitcoin is experiencing a notable surge, and many prominent voices in the financial world are starting to support it. Billionaire investor Paul Tudor Jones, speaking today in an interview with Bloomberg, named Bitcoin as a critical part of what he considers the ideal portfolio against inflation.

“What would an ideal portfolio be… But it would be some kind of combination of probably gold, vol adjusted, Bitcoin, gold, stocks,” Jones said. “That’s probably your best portfolio to fight inflation. Vol adjusted because the vol of Bitcoin obviously is five times that of gold, so you’re going to do it in different ways.”

Adding to the momentum, the Head of Digital Assets of BlackRock Robert Mitchnick explained two days ago what’s really driving the surge in demand for Bitcoin ETFs.

“It’s a lot of things coming together. Out of the gate was retail and investor demand…” said Mitchnick. “Now, more recently, we’ve seen just steady progress of more wealth advisor adoption, more institutional adoption. It’s been a mix of people who it’s the first time that they’ve invested in anything in the crypto space. And then on the other hand, you have lots of people who’ve been invested in Bitcoin for a long time and they’re taking advantage of the ETP wrapper.”

This post F Street Announced Goal Of Accumulating $10 Million In Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7460b7fd:4fc4e74b

2025-06-13 09:04:33

@ 7460b7fd:4fc4e74b

2025-06-13 09:04:33从“出行规则”看监管逻辑与比特币的制度之道

FATF“出行规则”的治理逻辑与监管者的苦衷

金融行动特别工作组(FATF)在2019年推出“Travel Rule”(出行规则),试图将传统银行体系的反洗钱规制延伸至加密资产领域complyadvantage.com。这一规则要求虚拟资产服务商(VASPs)在转账过程中收集并传递交易双方的身份信息,使这些信息如同“随行护照”般伴随资金流动complyadvantage.com。其背后的治理逻辑不难理解:随着加密货币跨境使用的激增,监管者担心加密交易的匿名性为洗钱、恐怖融资提供了便利通道complyadvantage.com。因此,FATF将传统金融领域的第16号建议(关于跨境电汇信息)更新,明确要求加密交易同样附带发送人和接收人的姓名、地址等识别数据complyadvantage.comcomplyadvantage.com。这一举措体现了监管机构的苦衷:在犯罪分子利用技术躲避监管的现实下,他们感到有责任“补上漏洞”,即便这意味着套用旧有的银行规则到全新的区块链技术上。

然而,落实出行规则绝非易事。首先,不同司法管辖区行动步调不一,FATF多次批评各国实施进度缓慢,许多国家尚未将该规则转化为国内法complyadvantage.com。即使在已经执行的地区,监管部门也面临两难:既要防止非法资金流动,又担心过严管制扼杀金融创新。监管者的“苦衷”在于,他们既害怕被视作纵容犯罪,又担心被指责扼杀技术进步。出行规则要求VASPs收集详尽的客户身份信息,并在交易时与对方机构共享,这在实践中遇到技术和隐私保护方面的阻碍trisa.io。一些国家(如瑞士、新加坡)甚至在无最低金额门槛的情况下要求对所有交易执行该规则,欧盟更规定即使收款方是私人自管钱包也必须提交信息trisa.io。这种高标准加重了行业合规负担,使守法企业叫苦不迭,而不法分子则可能转入地下或转向无监管区域继续活动。可以说,监管机构陷入“猫抓老鼠”的困境:不推行吧,担心放任犯罪;推行过严吧,又恐打击面过广。正因如此,FATF在其2024年报告中承认出行规则的全球落实“严重滞后”complyadvantage.com,这既反映各国执法能力的差异,也凸显了此规则本身在新技术环境下的水土不服。

全球跨境资金与信息的系统性压制

出行规则的推行,从宏观上看是在全球金融体系施加新的“信息围墙”。一方面,它将原本开放的价值互联网重新划分为受监管的透明区和未监管的黑箱区。凡是跨过一定金额门槛(FATF建议为1000美元/欧元)的交易,都必须在链上绑定用户的实名信息complyadvantage.com。这意味着个人的资金流动和身份信息被深度绑定并广泛共享,一举打破了加密货币原有的准匿名特性。这种做法固然提升了追踪非法交易的可能性,但也埋下了系统性压制的隐患。正如业界联盟TRISA所警告的那样,将出行规则机械地套用于公开区块链,实则打造了一个集中存储个人隐私与财富信息的“数据金库”,极易成为黑客、犯罪组织甚至敌对政府垂涎的目标trisa.iotrisa.io。因为在传统银行体系下,账户账本是私密的,第三方难以直接获取交易明细;而在区块链上,一旦将姓名、地址等个人识别数据与公开的钱包地址关联,任何人都能通过链上记录分析出个人的财富状况和社交图谱trisa.io。这种对跨境资金和信息流动的全面记录与监控,实质上构成了对个人金融自由的系统性压制:人们在国际转账时不得不暴露隐私,否则交易将被拒之门外。更有甚者,一些国家已将这一逻辑无限延伸,例如中国公安机关提示即便一笔1000 USDT(泰达币)的转账都有可能被列入重点监控名单binance.com。当连如此小额的个人跨境交易都被严密审查时,金融交易所承载的信息自由流动已大打折扣。

从制度批判的视角看,这种全球范围的信息管制源自某些法律传统下对国家主权和税收控制的执念。在大陆法系传统中,国家往往通过成文法律对经济活动实施自上而下的强力规范,历史上形成了构筑信息壁垒以巩固主权和财政的路径依赖。例如许多大陆法系国家长期实行外汇管制和资本流动限制,以防范资金外逃、维护本国税基。这种做法虽出于主权自主的考虑,却与自由贸易要求的要素自由流动天然矛盾。研究表明,不同法律体系的国家在经贸合作模式上偏好迥异,法律传统差异往往成为国际经济一体化的无形藩篱,甚至导致经济关系的割裂cogitatiopress.com。典型案例如中国,对加密资产和稳定币采取高压监管,正是延续了其在资本项目下的信息管控传统。2024年链上数据显示,中国境内USDT跨境流动规模同比激增400%,日均交易额超过50亿美元binance.com。大量民间资金试图借助稳定币绕开官方的外汇管制,形成了一条隐蔽的“数字资金高速公路”binance.com。对此当局迅速祭出国家安全大旗,不仅将无证出入境资金视为重大风险隐患,甚至明确指出USDT等稳定币已成资本无序外逃的工具,必须强力封堵binance.combinance.com。在这一背景下,FATF出行规则等于为各国提供了一个合法理由,在全球范围内实施对跨境资金与信息的联合围堵:以打击洗钱之名,行资本管制之实。这套机制所产生的结构性效果,是在国际金融体系中嵌入了一种“默认不信任”的基调——跨境资金流动被一律视为潜在不法,必须层层验证、记录在案。其结果不仅压抑了资金与信息的自由流通,也为公民个人头上加装了“数字镣铐”,让人们在国际经贸往来中丧失匿名行动的选择权。

隐私协议的滥用:区块链匿名性的两面

在区块链世界中,隐私与匿名性原本被视作一项珍贵的技术特性,代表着去中心化金融对个人隐私权的尊重。然而,当缺乏法理自洽性和契约中立性的支撑,这种匿名性工具却易被犯罪集团所劫持,成为逃避监管的温床。以太坊上的“Tornado Cash”混币协议就是前车之鉴。作为一个去中心化的匿名交易服务,Tornado Cash初衷在于增强用户隐私,但由于缺少必要的合法约束和内部控制,一再被不法之徒利用:自2019年成立以来,该协议已被用于清洗超过70亿美元的犯罪收益,其中包括朝鲜黑客组织“拉撒路集团”在攻击Axie Infinity游戏桥后盗取的4.55亿美元secrss.com。2022年美国财政部更指出,尽管开发者声称Tornado Cash只是中立工具,但其并未采取哪怕基本的措施来阻止服务被反复用于恶意洗钱secrss.com。最终,美国OFAC直接将Tornado Cash列入制裁清单,以此警示加密行业:缺乏法理支撑的匿名协议,终将因为被滥用于洗钱而招致严厉监管惩罚secrss.com。

类似的情况也发生在波场(Tron)等链上。一些基于Tron的混币机制号称提供端到端加密、零知识证明等技术手段来隐匿交易来源sites.google.com。表面上看,这些系统满足了用户追求隐私的需求,但在现实中却成为电信诈骗、网络赌盘等犯罪链条的最爱。联合国毒品和犯罪办公室2024年的报告披露:Tron区块链上的泰达币(USDT)已成为网络诈骗、洗钱、非法赌博的首选工具int-comp.org。犯罪分子之所以偏爱Tron上的USDT,正因为它具备价格稳定、跨境转账手续费低、速度快等优势,可以在不引人注目的情况下快速大额转移资金int-comp.org。链上分析亦显示,高风险USDT转账有高达83%无法追溯最终去向,犯罪团伙通过混币器、地址拆分等技术手段把资金搞得支离破碎,以至于监管部门难以跟踪binance.com。这背后反映出一个发人深省的现象:当一套隐私工具本身没有内置中立的契约约束(如合法用途的限定或责任追踪机制),那么它的匿名性越强,越可能被不法势力挟持利用。波场USDT的大规模滥用已经引起各方警觉,Tron项目方甚至与稳定币发行商和区块链分析公司合作,成立“T3打击犯罪特别小组”,截止2024年底已冻结逾1亿美元涉嫌犯罪的USDTtrmlabs.comcointelegraph.com。可见,当匿名性的武器落入犯罪网络之手,技术提供者也不得不被动介入“事后补救”,这恰恰说明当初设计时若缺乏法理上的自我约束,最终仍要以行政手段清理残局。

隐私协议被滥用的另一面,还体现在某些区块链应用与既有法律文化格格不入。以太坊上的去中心化预测市场「Polymarket」提供了一种赌博式合约交易平台,用户可以下注现实事件的结果。然而从伊斯兰教法视角看,这类“预测市场”无异于赤裸裸的**赌博(Maysir)**行为——参与者纯粹为了不确定事件的结果赌上一把财富,得利者以他人损失为代价,没有创造任何实际价值blog.zoya.financeblog.zoya.finance。根据伊斯兰金融原则,任何脱离实体经济、以纯粹机会为基础获取收益的交易都被视为不道德且明令禁止blog.zoya.finance。因此,Polymarket之类的平台与伊斯兰法对契约合法性的根本要求完全不兼容。这提醒我们:区块链技术的创新若缺乏契约中立性(即契约不偏离基本的公平与道义原则),就容易触犯某些法律或宗教的底线,从而被视作无效甚至有害的合约。无论是Tornado Cash这样的匿名洗钱温床,Tron链上被诈骗集团操控的资金暗道,还是Polymarket式的“去中心化赌场”,这些系统都凸显出当技术试图凌驾法律和伦理时所面临的巨大风险。它们要么被政府如临大敌般封杀(正如Tornado Cash遭制裁),要么被正义力量反制清理(如Tether冻结波场诈骗资金reuters.com),要么在道义上遭到主流文化的排斥(如伊斯兰世界视预测赌博为禁忌)。这一系列教训昭示:区块链生态中的隐私与创新,必须建立在法理自洽和契约中立的基础上,否则技术越前卫,反噬也越猛烈。

比特币的保守式创新:技术中立与合约合法性的统一

在区块链的众多创新中,比特币无疑是一个特殊的存在。它被称为“保守派的创新”,乃因其在开创数字货币新时代的同时,恪守了一些朴素但持久的原则。首先,比特币的设计追求技术中立。中立并不意味着纵容匿名滥用,而是指比特币网络对任何参与者一视同仁,仅仅按照既定算法规则处理交易,无内置偏见或特殊权限。比特币交易记录公开透明,所有交易在全球共享的账本上广播确认,其匿名性是“假名制”(pseudonymous)而非无法穿透的黑箱。事实上,正是由于比特币交易记录可被区块链分析工具去匿名化,在过去几年中我们看到犯罪团伙对比特币的兴趣有所降低,反而转向了Monero等完全匿名币或Tron-USDT等更隐匿便捷的手段int-comp.orgint-comp.org。Chainalysis的最新报告显示,2024年稳定币已经取代比特币成为犯罪分子使用的主要加密货币,占非法交易量的63%,而比特币在非法用途中的占比显著下降int-comp.orgint-comp.org。这个趋势从反面印证了比特币系统“公开且中立”的特性天然抑制了部分洗钱和犯罪滥用:任何人在比特币区块链上大额频繁作恶,都更容易被全球监管机构捕捉线索,留下破案的蛛丝马迹。

其次,比特币体现了交易确定性和契约精神的统一。在法律体系(尤其是英美普通法和伊斯兰教法)中,一份契约要具有合法性,核心在于当事各方自愿、条款清晰且不违背基本道德。比特币网络上的交易契约以代码方式自动执行,一旦双方签名广播,交易即被不可篡改地记录,一切权利义务随即完结。这种**“交割即结算”的机制提供了绝对的确定性,杜绝了传统金融中常见的赖账、拒付、无限制 chargeback(退款)等不确定因素。比特币不需要中央中介担保信用,依靠分布式共识来保证交易的最终性,这种确定性契合了普通法系对契约履行的重视:契约一旦成立即应严格履行,不得任意毁约。更值得注意的是,比特币没有利息(riba)和债务膨胀的设计**,2100万枚的恒定供应和逐步减半的发行机制,使其更接近一种数字商品而非通过债务衍生的货币nasdaq.com。在伊斯兰金融原则下,收取或支付利息被视为不公正,属明令禁止的行为,而比特币的货币体系天生规避了“利息”的概念nasdaq.com。同时,比特币交易公开透明,每一笔转账都记录在链上且需双方同意才能发生,这与伊斯兰教法要求交易双方充分知情、协商一致的原则不谋而合nasdaq.comnasdaq.com。尽管有人担忧加密货币的投机性带来不确定性(Gharar),但那更多是市场行为层面的波动,而比特币协议本身的运作是清晰明确、不含欺瞒的nasdaq.com。在穆斯林学者看来,如果加密货币被用于合法且善意的目的,它并不必然违反伊斯兰金融核心原则nasdaq.com。例如,中东一些创新项目已尝试将区块链用于公益和慈善,对每笔币交易提取天课(宗教捐献)用于慈善基金,以确保技术符合伊斯兰伦理nasdaq.comnasdaq.com。这种做法其实与比特币“协议中立、用途开放”的精神一致——技术本身不预设善恶关键,在于使用者是否将其用于合乎道义的契约。

换言之,比特币之“保守”,保守在它选择做“数字黄金”而非肆意重塑社会契约。它遵循价值储藏和交换媒介的基本定位,没有内置复杂的金融衍生功能,也不鼓励凭空创造信用泡沫。这种克制让比特币能够较自然地融入现行法治框架:作为一种私人财产和交换工具,比特币交易遵循“你情我愿,金额确定”的简明契约模型,各法域只需按财产或货物的属性去规范它即可。在英美法下,比特币已逐渐被法院视为可执行财产权益,盗窃比特币等同于盗窃有形财物来惩处。伊斯兰世界中,越来越多学者承认比特币具有财产价值,可以作为货币或商品使用,只要不用于赌博等不法用途,即可被视为“清洁”的财富。在迪拜等地,监管机构也探索制定符合沙里亚原则的加密货币监管指南,承认比特币等作为投资和支付工具的地位。这一切说明,比特币的核心设计没有违背人类社会关于契约正当性的根本要求——公平、自愿、透明,以及不伤害无辜第三方的利益。相比之下,许多后来的加密项目试图在隐私、金融工程上“开历史倒车”,结果反而凸显出比特币朴素设计的高明之处:它为维护基本道义预留了空间,通过公开透明防范了极端滥用,用技术手段恢复了契约的确定性和中立性。

历史视角:数字黄金如何推动正和博弈

历史的眼光往往能够校准当下的纷争。在货币演进的长河中,每当权力过度介入导致“恶币驱逐良币”时,人类总会试图寻回更公正稳健的交换媒介。16世纪格雷欣法则(劣币驱逐良币)揭示出,当政府滥铸货币、削减贵金属含量时,真正有价值的硬币(良币)便会被人们藏匿起来,劣币充斥市面yilinhut.netyilinhut.net。但值得深思的是,格雷欣现象并非不可逆的自然规律,而是统治者操控货币所致的扭曲。正如有学者指出的:“劣币驱逐良币并非市场自发,而是‘政府用劣币驱逐良币’的缩影;一旦能够摆脱政府的控制,这一定律就会失效,比特币恰恰旨在让货币摆脱政府控制,让良币重归市场”yilinhut.net。比特币作为现代数字黄金,其出现为全球经济提供了一种从新回归良币的可能。它不隶属于任何单一国家,其价值不依赖特定主权信用背书,而源于全球共识和算力保障的稀缺性。从国际贸易角度看,比特币类似于跨境结算中的黄金或白银——当两个国家缺乏互信或不愿接受对方货币时,完全可以通过比特币这种“中性资产”进行价值锚定交换,从而避开法币汇率波动和政治干预的风险。近年来,一些案例显示,比特币在地缘冲突或关税战背景下扮演了避险工具的角色:有分析指出,由于比特币不受制于特定国家的贸易政策,投资者把它视为对冲关税风险的手段,当贸易争端导致股市下跌时,比特币反倒逆势上涨,展现出独立于国际贸易格局的价值定位nai500.com。这印证了比特币作为“数字黄金”的一个要义:在国家壁垒与货币战争横生的世界里,它提供了一种超脱政治藩篱的价值载体,使得资金能够在更大程度的自由中逐利避险。

更深一层看,比特币蕴含着推动全球从零和博弈走向正和博弈的制度潜能。传统的法币体系常常被国家间博弈所挟持:各国竞相贬值本币以刺激出口、通过货币超发转嫁债务,这种你输我赢的零和心态导致国际金融秩序暗流汹涌。而比特币的兴起为“货币互信”提供了新范式。设想一个场景:若若干主要经济体将比特币纳入储备或结算体系,它们之间反而可能降低竞争性贬值的冲动,因为谁也无法单方面增发比特币来占便宜,大家只有共同维护其价值稳定才有利可图。这种在公开透明规则下的竞争,更接近“正和游戏”,即各方通过合作都能获益,而非此消彼长。有人将比特币视为一种“人类道义契约”,意指它不是某强权逼迫他国接受的货币(如历史上的殖民通货),而是全球无数个体自愿选择的价值共识。它的运行不依赖枪炮和法律强制,而靠的是对规则的信任与技术的确保。可以说,比特币构筑了一个前所未有的“自愿制度”:人人遵守21万块区块的发行上限和去中心化共识,这本身就是人类史上少见的跨文化、跨政治的合作现象。当这种制度逐步深入国际贸易和金融关系,我们有理由期待一个更公平的格局:劣币不再轻易驱逐良币,反而诚实守信的货币会赢得更广泛的使用;国家壁垒不会彻底消弭,但各国将更难通过封锁金融信息来要挟他国或剥夺公民,因为人们手中握有主权无法轻易触及的价值锚。

当然,比特币并非万能良药,它也会经历价格周期波动、面临技术升级挑战。然而,从历史视角出发,它承载的意义堪比现代版的黄金/白银——一种超越民族国家、服务于全球贸易和人类福祉的价值尺度。当年金本位体系在19世纪促进了世界贸易的繁荣,那是因为金银天然具有防范滥发的属性,使各国币值维持相对稳定。而比特币有望在21世纪承担类似的角色:在数字时代为世界提供一个防止无序贬值和信用滥用的“价值中轴”。这不仅是经济议题,更是道义命题。正如卢梭等思想家描述的社会契约,只有当制度建立在自愿与道义基础上,才能实现持久的正和博弈。比特币所体现的,就是这样一种自下而上凝聚的制度工具:它让个人与个人之间、国家与国家之间有机会基于共同利益而非强制权力来协作。一旦“良币”不再总是被逐出市场,人类就可能跳出过去那种劣币横行、以鄙胜良的怪圈,迎来金融领域的道义复归。

结语:拥抱创新契约,重塑监管范式

当下,FATF的出行规则所代表的监管思路与比特币所代表的技术革新,正站在历史的对立面上交锋。一方以安全与主权之名筑墙设限,另一方以中立与自由之实开辟新径。本文从制度批判的角度剖析了出行规则背后的治理逻辑与局限,揭示了过度管制对全球资金与信息流动的系统性压制,也反思了隐私技术在缺乏法理支撑时被滥用的教训。与此形成鲜明对照的是,比特币作为“保守式创新”的范例,展现出通过技术中立与契约确定性来天然抑制犯罪、兼容多元法统的独特优势。历史的回声告诉我们:真正良好的制度应当是使善者获益、恶者难存,其出发点是信任合作而非恐惧防范。

面对这一新旧范式的碰撞,立法者和监管者理应有所醒悟。与其穷尽手段构筑高墙、不惜牺牲公民自由来堵截风险,不如顺应技术发展的大势,拥抱那些内生具有道义契约性质的创新。在反洗钱和金融稳定目标下,监管可以也应该与技术“正和博弈”:鼓励像比特币这样透明中立的系统发挥正面效应,同时针对真正的黑箱匿名工具精确打击;在国际合作中,以开放心态探索新的全球货币协议,避免陷入零和的管制竞赛。只有这样,我们才能既防范“劣币”作乱,又让“良币”留在市井,形成一个既有秩序又有自由的金融生态。比特币之所以令无数持有者怀抱信念,不仅因为其经济价值,更因为其背后蕴含着对更公正更自由的制度可能性的期待。这份期待正在转化为现实的政治倡议,推动立法和监管的变革。在不久的将来,当我们回望今日,或许会发现:正是这一场关于“出行规则”与“数字黄金”的争论,催生出金融治理范式的转折点——让人类第一次有机会以合作共赢的契约,去取代那延续千年的强权博弈。

参考文献:

-

FATF. What is the FATF Travel Rule? ComplyAdvantagecomplyadvantage.comcomplyadvantage.com

-

TRISA. Recommendations to FATF for Virtual Assets Travel Ruletrisa.iotrisa.io

-

E安全. 美国对朝鲜黑客关联加密货币Tornado Cash实施制裁secrss.comsecrss.com

-

Rezaul Karim. Stablecoins: The new epicentre of crypto fraud, ICAint-comp.org

-

币圈线人. 凌晨三点的USDT警报:当稳定币变成资本外逃的「数字高速公路」binance.combinance.com

-

最高检. 依法惩治跨境电信网络诈骗及其关联犯罪典型案例spp.gov.cn

-

Zoya Finance. Election Betting Markets: Halal or Haram?blog.zoya.finance

-

胡翌霖. 为什么比特币不适用格雷欣法则(劣币驱逐良币)?yilinhut.net

-

Reuters. Tether says it has frozen $225 mln linked to human traffickingreuters.comreuters.com

-

NAI500财经. 再创历史新高的比特币,究竟是科技股还是“数字黄金”?nai500.com

-

Nasdaq. How Cryptocurrency Aligns with Islamic Financenasdaq.comnasdaq.com

-

-

@ 7f6db517:a4931eda

2025-06-13 03:02:44

@ 7f6db517:a4931eda

2025-06-13 03:02:44

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-13 11:01:33

@ 9ca447d2:fbf5a36d

2025-06-13 11:01:33Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ 7f6db517:a4931eda

2025-06-13 04:02:39

@ 7f6db517:a4931eda

2025-06-13 04:02:39

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-13 07:02:19

@ b1ddb4d7:471244e7

2025-06-13 07:02:19Jason Lowery’s thesis, Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, reframes bitcoin not merely as digital cash but as a transformative security technology with profound implications for investors and nation-states alike.

For centuries, craft brewers understood that true innovation balanced tradition with experimentation—a delicate dance between established techniques and bold new flavors.

Much like the craft beer revolution reshaped a global industry, bitcoin represents a fundamental recalibration of how humans organize value and project power in the digital age.

The Antler in the Digital Forest: Power Projection

Lowery, a U.S. Space Force officer and MIT scholar, anchors his Softwar theory in a biological metaphor: Bitcoin as humanity’s “digital antler.” In nature, antlers allow animals like deer to compete for resources through non-lethal contests—sparring matches where power is demonstrated without fatal consequences. This contrasts sharply with wolves, who must resort to violent, potentially deadly fights to establish hierarchy.

The Human Power Dilemma: Historically, humans projected power and settled resource disputes through physical force—wars, seizures, or coercive control of assets. Even modern financial systems rely on abstract power structures: court orders, bank freezes, or government sanctions enforced by legal threat rather than immediate physical reality.

Lowery argues this creates inherent fragility: abstract systems can collapse when met with superior physical force (e.g., invasions, revolutions). Nature only respects physical power.

Bitcoin’s Physical Power Engine: Bitcoin introduces a novel solution through its proof-of-work consensus mechanism. Miners compete to solve computationally intense cryptographic puzzles, expending real-world energy (megawatts) to validate transactions and secure the network.

This process converts electricity—a tangible, physical resource—into digital security and immutable property rights. Winning a “block” is like winning a sparring match: it consumes significant resources (energy/cost) but is non-destructive.

The miner gains the right to write the next page of the ledger and collect rewards, but no participant is physically harmed, and no external infrastructure is destroyed.

Table: Traditional vs. Bitcoin-Based Power Systems

Power System

Mechanism

Key Vulnerability

Resource Cost

Traditional (Fiat/Banking)

Legal abstraction, threat of state force

Centralized points of failure, corruption, political change

Low immediate cost, high systemic risk

Military/Economic Coercion

Physical force, sanctions

Escalation, collateral damage, moral hazard

Very high (lives, capital, instability)

Bitcoin (Proof-of-Work)

Competition via energy expenditure

High energy cost, concentration risk (mining)

High energy cost, low systemic risk

Softwar Theory National Strategic Imperative: Governments Are Taking Notice

Lowery’s Softwar Theory has moved beyond academia into the corridors of power, shaping U.S. national strategy:

- The Strategic Bitcoin Reserve: Vice President JD Vance recently framed bitcoin as an instrument projecting American values—”innovation, entrepreneurship, freedom, and lack of censorship”. State legislation is now underway to implement this reserve, preventing easy reversal by future administrations.

- Regulatory Transformation: The SEC is shifting from an “enforcement-first” stance under previous leadership. New initiatives include:

- Repealing Staff Accounting Bulletin 121 (SAB 121), which discouraged banks from custodying digital currency by forcing unfavorable balance sheet treatment.

- Creating the Cyber and Emerging Technologies Unit (CETU) to develop clearer crypto registration/disclosure rules.

The Investor’s Lens: Scarcity, Security, and Asymmetric Opportunity

For investors, understanding “Softwar” validates bitcoin’s unique value proposition beyond price speculation:

-

Digital Scarcity as Strategic Depth: Bitcoin’s fixed supply of 21 million makes it the only digital asset with truly inelastic supply, a programmed scarcity immune to political whims or central bank printing.

This “scarcity imperative” acts as a natural antidote to global fiat debasement. As central banks expanded money supplies aggressively (Global M2), bitcoin’s price has shown strong correlation, acting as a pressure valve for inflation concerns. The quadrennial “halving” (latest: April 2024) mechanically reduces new supply, creating built-in supply shocks as adoption grows. * The Antifragile Security Feedback Loop: Bitcoin’s security isn’t static; it’s antifragile. The network strengthens through demand: * More users → More transactions → Higher fees → More miner revenue → More hashpower (computational security) → Greater network resilience → More user confidence.

This self-reinforcing cycle contrasts sharply with traditional systems, where security is a cost center (e.g., bank security budgets, military spending). Bitcoin turns security into a profitable, market-driven activity. * Institutionalization Without Centralization: While institutional ownership via ETFs (like BlackRock’s IBIT) and corporate treasuries (MicroStrategy, Metaplanet) has surged, supply remains highly decentralized.Individuals still hold the largest share of bitcoin, preventing a dangerous concentration of control. Spot Bitcoin ETFs alone are projected to see over $20 billion in net inflows in 2025, demonstrating robust institutional capital allocation.

The Bitcoin Community: Building the Digital Antler’s Resilience

Lowery’s “Softwar” theory underscores why bitcoin’s decentralized architecture is non-negotiable. Its strength lies in the alignment of incentives across three participant groups:

- Miners: Provide computational power (hashrate), validating transactions and securing the network. Incentivized by block rewards (newly minted BTC) and transaction fees. Their physical energy expenditure is the “muscle” behind the digital antler.

- Nodes: Independently verify and enforce the protocol rules, maintaining the blockchain’s integrity. Run by users, businesses, and enthusiasts globally. They ensure decentralized consensus, preventing unilateral protocol changes.

- Users: Individuals, institutions, and corporations holding, transacting, or building on bitcoin. Their demand drives transaction fees and fuels the security feedback loop.

This structure creates “Mutually Assured Preservation”. Attacking bitcoin requires overwhelming its global, distributed physical infrastructure (miners/nodes), a feat far more complex and costly than seizing a central bank’s gold vault or freezing a bank’s assets. It transforms financial security from a centralized liability into a decentralized, physically-grounded asset.

Risks & Responsibilities

Investors and policymakers must acknowledge persistent challenges:

- Volatility: Bitcoin remains volatile, though this has decreased as markets mature. Dollar-cost averaging (DCA) is widely recommended to mitigate timing risk.

- Regulatory Uncertainty: While U.S. policy is increasingly favorable, global coordination is lacking. The EU’s MiCAR regulation exemplifies divergent approaches.

- Security & Custody: While Bitcoin’s protocol is robust, user errors (lost keys) or exchange hacks remain risks.

- Environmental Debate: Proof-of-Work energy use is scrutinized, though mining increasingly uses stranded energy/renewables. Innovations continue.

Jason Lowery’s “Softwar” theory elevates bitcoin from a financial instrument to a socio-technological innovation on par with the invention of the corporation, the rule of law, or even the antler in evolutionary biology. It provides a coherent framework for understanding why:

- Nations like the U.S. are looking to establish bitcoin reserves and embracing stablecoins—they recognize bitcoin’s role in projecting economic power non-violently in the digital age.

- Institutional Investors are allocating billions via ETFs—they see a scarce, secure, uncorrelated asset with antifragile properties.

- Individuals in hyperinflationary economies or under authoritarian regimes use bitcoin—it offers self-sovereign wealth storage immune to seizure or debasement.

For the investor, bitcoin represents more than potential price appreciation. It offers exposure to a fundamental reorganization of how power and value are secured and exchanged globally, grounded not in abstract promises, but in the unyielding laws of physics and mathematics.

Like the brewers who balanced tradition with innovation to create something enduring and valuable, bitcoin pioneers are building the infrastructure for a more resilient digital future—one computationally secured block at a time. The “Softwar” is here, and it is reshaping the landscape of p

-

@ 8bad92c3:ca714aa5

2025-06-12 18:02:19

@ 8bad92c3:ca714aa5

2025-06-12 18:02:19Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 3c389c8f:7a2eff7f

2025-06-13 00:13:50

@ 3c389c8f:7a2eff7f

2025-06-13 00:13:50Most of my time on Nostr, relays served content simply based on what was requested. Clients mostly requested follow list based content, and often only if the user requested to 'read' from a particular relay. Very simple, though not ideal. Clients that attempted to offer some 'global' or 'universal' feed made it possible to discover some new things but also served spam, redundant bot posts, and even some malicious things that managed to make it through a relay's filters. Paid relays began to gain some ground, with better filters to reduce spam and malicious content, which has helped a lot to clean up these broader feeds that expand beyond the follow-based timeline. Many of the relays hosted redundant content, too, which is important but it's not the only thing that is. The system still left a lot to be desired, particularly for anyone who has understood the potential behind the client-relay set up. Other concerns, like relay centralization through user concentration, still needed to be discussed and addressed.

Despite the voicing of relay diversity advocates, this system seemed to provide most of what people were looking for to replace their typical social media experience. Still, though, reply spam attacks found their way through, as they do. Web-of-Trust relays began to pop up to help mitigate the problem. Using contact lists and extended contact lists as a method of reducing the prevalence of spam has worked really well, but does have it limitations as to how new users can enter into these social graphs, without already knowing someone who is using Nostr. Also not ideal, but it has been a step forward for Nostr's social media use case. Hosted relay services that offered more diverse policy for a relay to operate under finally began to take some hold for those that wanted more choice and control. Still though, potential had barely been breeched.

It might have been before the WoT relay movement, but of nowhere (not really but it kind of seemed like it), a cat relay appeared within the ecosystem. This silly, fun, cute, clever relay collected notes with the #catstr hashtag and used some fancy image analysis stuff (that I can't explain) to collect notes and images of nothing but cats. Such a simple thing, but that was a catalyst (🥁) moment for Nostr. A relay could do more than just collect notes from following lists?? A couple more iterations of the curated content relay model came to be, driving home the idea that this wasn't some silly pie-in-the-sky concept. It was an aha moment for some, sheer joy for the relay advocates, and a turning point for expanding Nostr beyond the basic social media replacement. Very few client options for simply browsing one relay existed at the time, and while it was novel to see, the rest of the framework to support it was not strong nor very easy to use. Even with this dilemma, the catstr relay set off what has become some of the most interesting and useful innovation that has happened within the Nostr ecosystem since I arrived.

Since then, I have spent a lot of my time on Nostr exploring some of what has been developed on the relay front, experimenting where I have found the opportunity and thinking a lot about where this all could lead. Innovation on both the relay and client sides of Nostr have been expanding, not quite in lockstep, but closely enough that someone like myself can now easily jump onto a client like Jumble.social and get a glimpse into what is happening and get an idea of the potential of what is yet to come. For those working in the relay field, I am sure this feels like one slow moving train. For a client developer, it probably feels a little overwhelming to shift an entire model away from what has worked for something that will work better. As a less-than-technical user who is mostly disconnected from any major development, it's exciting. Relay diversity brings actual utility to Nostr. It also brings the assurances that Nostr offers, which whether we have been subjugated to these problems before or not, it is the main reason why Nostr exists and why we are here using it now.

For most anyone reading this, it probably sounds like some weird, unnecessary history lesson. This is actually one long introduction into a little mini-series of relay recaps though.... I was wondering what I would write about next, and this is it. I may just be a user but I'm an adventurous one and I pay attention, so I'm excited to share some of my thoughts, experiences, and observations over the coming weeks... because exciting isn't a strong enough word for the what I see as possible. :)

-

@ dfa02707:41ca50e3

2025-06-12 07:02:18

@ dfa02707:41ca50e3

2025-06-12 07:02:18Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 9ca447d2:fbf5a36d

2025-06-13 09:02:31

@ 9ca447d2:fbf5a36d

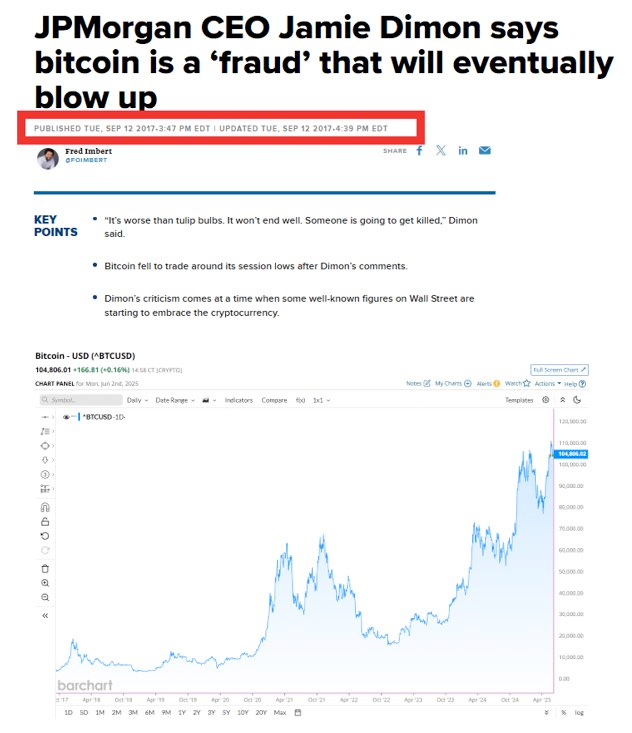

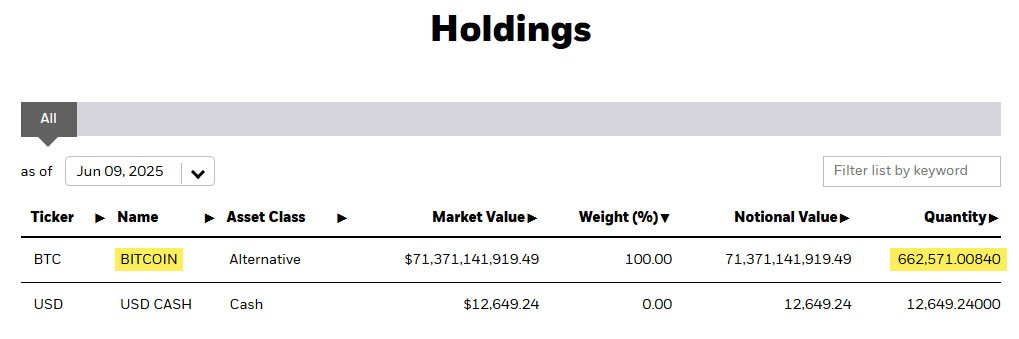

2025-06-13 09:02:31BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest exchange-traded fund (ETF) to ever reach $70 billion in assets under management (AUM).

The fund, which launched in January 2024, hit this milestone in just 341 trading days—five times faster than the previous record-holder, the SPDR Gold Shares ETF (GLD), which took 1,691 days to reach the same mark.

IBIT now holds over 662,000 BTC — iShares

Bloomberg ETF analyst Eric Balchunas tweeted on June 9, “IBIT just blew through $70 billion and is now the fastest ETF to ever hit that mark in only 341 days.” This is a big deal and shows bitcoin is going mainstream.

IBIT has beaten fastest growing ETFs in history — Eric Balchunas on X

The fund’s rapid growth means institutional investors are embracing bitcoin at scale.

The fund has $71.9 billion in AUM and holds over 662,000 bitcoin. This makes BlackRock the largest institutional bitcoin holder in the world. To put that in perspective, the fund holds more bitcoin than Binance or Michael Saylor’s Strategy.

“IBIT’s growth is unprecedented,” said Bloomberg analyst James Seyffart. “It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class.”

BlackRock’s bitcoin ETF isn’t just big. It’s also greatly outperforming other spot bitcoin ETFs launched at the same time. BlackRock’s brand and global client base gave the fund instant credibility.

Many institutional investors want a regulated and convenient way to get into bitcoin without holding the asset directly, and this fund has made it easy for them to invest.