-

@ b1ddb4d7:471244e7

2025-06-12 14:01:32

@ b1ddb4d7:471244e7

2025-06-12 14:01:32The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ 5627e59c:d484729e

2025-06-11 22:32:38

@ 5627e59c:d484729e

2025-06-11 22:32:38Ik hou van de natuur en van verbinding maken\ Van diepgang en van mensen raken

Van creatief schrijven en programmeren\ Van speels bewegen en nieuwe dingen leren

Ik hou van leven en van dromen\ En van mensen zien\ Hun diepste wensen uit doen komen

-

@ 5627e59c:d484729e

2025-06-11 22:32:11

@ 5627e59c:d484729e

2025-06-11 22:32:11Ik sta hier nu een poos\ Bevroren, machteloos

Ik wil graag iets veranderen\ Gewoon iets doen voor anderen

Maar het mag precies niet zijn\ En dat doet me veel pijn

Verlamd en vol van onbegrip\ Ik krijg er maar geen grip op

Op de wereld en de mensen\ Zij verpletteren mijn diepste wensen

Niemand die eens hoort\ Naar wat mij toch zo stoort

Ik kan nog eens proberen\ Om de wereld om te keren

Maar ik weet, het heeft geen zin\ Ik raak nooit binnen in

De ander\ Kom, verander

Misschien wordt het eens tijd\ Dat ik mezelf bevrijd

Van al die overmacht\ Die mij toch zo versmacht

Een stapje achteruit\ Adem in en adem uit

Ik doe mijn oogjes dicht\ En zie wie mij verplicht

Opzadelt met ambitie\ Van waar komt toch die missie

Al de pijn die ik niet aankan\ En van 't bestaan verban

Al 't bewijs voor mijn geloof\ Dat ik niet meer vliegen kan

-

@ 5627e59c:d484729e

2025-06-11 22:31:59

@ 5627e59c:d484729e

2025-06-11 22:31:59Een warme chocomelk\ Een knuffel en de moed te durven spreken\ Een leuk oprecht verhaal\ En een stap naar mijn verlangen

Deze dingen allemaal\ Maken me warm vanbinnen\ Ik hou van deze dingen\ Ze doen mijn hartje zingen

Ik wens iedereen zo'n warmte toe\ Ik wou dat ik het delen kon\ Maar het ziet er anders uit\ Voor jou dan hoe voor mij

Het enige wat ik echt kan zeggen\ Het enige dat ik zeker weet\ De kracht om warmte te creëren\ Ligt in je eigen handen

In je voeten, in je mond\ Het zit ook in je ogen\ En ook in je haar\ En zei ik al je mond\ En zelfs ook in je kont

Haha, ik ben maar wat aan 't lachen\ Dat is wat mij verlucht\ En ervoor zorgt dat wat ik zeg\ Van mij los kan komen\ En jou bereiken kan

Zo kan ik op beide oren slapen\ Dat ik deed dat wat ik kon\ Ik sprak dat wat belangrijk is\ Voor mij en liet het los

De wijde wereld in\ Voor al die horen wil en daar om geeft\ Om die warmte in hun hartje\ En daar misschien naar streeft

Ik wens je al 't succes toe in de wereld\ Want God weet, je bent het waard\ Het ligt nu in jouw handen\ Deze woorden, wat ik zeg\ Iets om over na te denken\ Tussen 't brood en het beleg

Leef gewoon je leven\ En zorg goed voor jezelf\ En als je 't graag wilt vinden\ Is het daar voor jou aan 't wachten\ Tot jij klaar bent met geloven\ In al dat anders klinkt

Ik kan je niets beloven\ Maar vertrouw op jouw instinct

-

@ 5627e59c:d484729e

2025-06-11 22:31:47

@ 5627e59c:d484729e

2025-06-11 22:31:47Warmte betekent zachtheid aan de grenzen\ Omringt door zachte mensen

Warmte betekent vrijheid\ Vrij om mij te tonen en te bewegen

Warmte betekent rust\ Om hier niet ver vandaan te hoeven zijn

Warmte betekent leven\ Iets waar ik vol van liefde mijn aandacht aan wil geven

Warmte betekent vriendschap\ Alle vriendschap die mijn hartje vult

Warmte betekent vol zijn\ Vol betekenis die mijn omgeving aan mij schenkt

Warmte betekent geven\ Geven om wat ik voor jou en jij voor mij\ Wij voor elkaar nu eigenlijk echt betekenen

-

@ 5627e59c:d484729e

2025-06-11 22:31:19

@ 5627e59c:d484729e

2025-06-11 22:31:19Enlightenment is just\ You catching up with time

Enlightenment is just\ Successfully processing your current situation\ And what it has to do with your past

Enlightenment is just\ Separating what you believe from what you know\ What is real from what is true

Enlightenment is living\ According to what you believe\ Because that's what is real for you\ Yet knowing it might turn out\ To be not really true

Enlightenment is giving thanks\ For being proven wrong

For how else would we grow\ The things we're conscious of\ The things that're real for us\ And the things we really know

How else would we align those things\ With the truth of what is (t)here\ Beyond\ That which we are

-

@ 5627e59c:d484729e

2025-06-11 22:30:36

@ 5627e59c:d484729e

2025-06-11 22:30:36Nooit is mijn dans echter\ Dan net nadat het regende\ Want regen biedt een kans\ Om mijn gevoel te voelen

Zolang de regen spettert\ En ik mezelf graag zie\ Wordt er niets verplettert\ Ook al lijkt dat soms wel zo

Zodra de regen ophoudt\ En zich terugtrekt met de wolken\ Komt een nieuwe glans\ Voor het eerst mijn ogen binnen

Wat is het leven heerlijk\ Als ik eerlijk ben en voel\ Wat is het leven zacht\ En het brengt me naar mijn doel

Wat zou ik weten zonder regen\ Gewoon steeds evenveel\ Niet groeien is niet leven\ Daarom dans ik het liefst

Net na de echte regen

-

@ 5627e59c:d484729e

2025-06-11 22:30:23

@ 5627e59c:d484729e

2025-06-11 22:30:23My life is my way Home\ My death is my arrival

I can't wait to be Home\ And so I love life

I can't wait to be Home\ And so I want to live to the fullest

For there are no shortcuts

Many people die\ And never make it Home

They will have to wait\ For another chance to die

Another chance to live fully\ And die totally

I'm so thankful to be alive\ I'm on my way Home

I'm so thankful to be alive\ To have another chance to die

Every day I take a step\ In the direction of my death\ I do not postpone it

Every day I take a step\ In the direction of my truth\ I do not avoid it

It is who I am, always have been\ And always will be

It lies beyond that door\ That keeps everything in check

Where only can go through\ Which is forever true

-

@ 5627e59c:d484729e

2025-06-11 22:28:08

@ 5627e59c:d484729e

2025-06-11 22:28:08Here's to the ones who can\ Feel their cause\ Surrender\ Change their ways\ But keep their fire\ And never give up

We will transform this world\ Restructuring\ One belief at a time

-

@ 2b998b04:86727e47

2025-06-11 19:36:40

@ 2b998b04:86727e47

2025-06-11 19:36:40🌋 Ka ʻImi i ka Pono: Seeking What’s Right

A 7-Day Series on Sovereignty, Bitcoin, and the Soul of the Islands

> "Man is not free unless he wills to be free."\ > — Johann Gottlieb Fichte

Hawai‘i understands sovereignty. It always has.\ But it was taken — first with pen and politics, then with force and fiat.

Bitcoin offers something different:\ A way to reclaim sovereignty without violence.\ A tool for self-rule, not state rule.\ A system built not on empire, but on truth and time.

This week, I’ll be posting a 7-part series exploring this tension:\ Between the Hawai‘i that was, the system that is, and the future that might be — if we choose to build on bedrock instead of paper.

I don’t know if there’s a traditional Hawaiian word for a 7-day week — maybe there doesn’t need to be.\ Time moves differently on these islands.\ But for the next 7 days, I’ll mark each reflection as a kind of modern lā hoʻomanaʻo — a day of remembering, reckoning, and restoring.

This is personal. It’s philosophical. It’s also unfinished.

But that’s what sovereignty looks like:\ Not something given — something reclaimed.

Stay tuned. Stay akamai.\ 🟧\ — Andrew G. Stanton (aka akamaister)

-

@ 79be667e:16f81798

2025-06-11 19:11:59

@ 79be667e:16f81798

2025-06-11 19:11:59I am here too\ In the same space like you

In the same situation I'm in\ It's a matter of positioning

I cannot leave this place I'm in\ It was brought about\ By what's been happening

So please don't look at me\ For what I can or cannot do for you\ But look at what is happening for me\ And what is happening for you

Let's communicate\ Not orchestrate

Because there's something I wish to do\ And there's a place I wish to go to

And I'm sure that there is too\ In your heart a fire\ Known by only you

So let us listen, look and see\ For what's true for you\ And what's true for me

That we may act upon what's here\ In order for us both to take a step\ In the direction we wish to steer

-

@ 79be667e:16f81798

2025-06-11 18:58:10

@ 79be667e:16f81798

2025-06-11 18:58:10Kan jij zien, er is geen hemel\ Probeer het zelf, dan lukt het wel\ Geen hel staat ons te wachten\ Enkel sterren hangen ons boven het hoofd\ Kan jij zien, iedereen leeft voor dit moment

Kan jij zien, er zijn geen landen\ Het is niet moeilijk gewoon land te zien\ Niets om voor te moorden of te sterven\ Ook geloof wordt niet gezien\ Kan jij zien, het leven wordt geleefd door iedereen in vrede

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

Kan jij zien, er is geen bezit\ Ik vraag me af of jij dit kan\ Geen hebben of een nood\ In een samen-leving van mensen\ Kan jij zien, wij delen de wereld met elkaar

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

-

@ 9ca447d2:fbf5a36d

2025-06-12 18:01:58

@ 9ca447d2:fbf5a36d

2025-06-12 18:01:58Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ 5627e59c:d484729e

2025-06-11 18:48:00

@ 5627e59c:d484729e

2025-06-11 18:48:00Love, I thank you for your warmth\ Ever lifting

You keep me charmed\ Ever drifting

May I be me\ And you be you

In a perfect harmony\ Embracing all life makes us grow through

-

@ 5627e59c:d484729e

2025-06-11 18:42:09

@ 5627e59c:d484729e

2025-06-11 18:42:09Jaren tellen\ Hoeft voor mij niet

Verhalen vertellen\ Over geluk en verdriet

Een warme haven\ Veilig en fijn

Dromen voorgedragen\ Onschuldig en rein

Momenten ervaard, geleerd\ En geïntegreerd

Ideeën, geloven en gevoelens\ Gevormd en gecreëerd

Zonder eind of echt begin\ Vallen, groeien, leren, stoeien

Een gezin in een gezin met een gezin erin\ Gezind gericht blijft liefde vloeien

-

@ df478568:2a951e67

2025-06-12 16:16:11

@ df478568:2a951e67

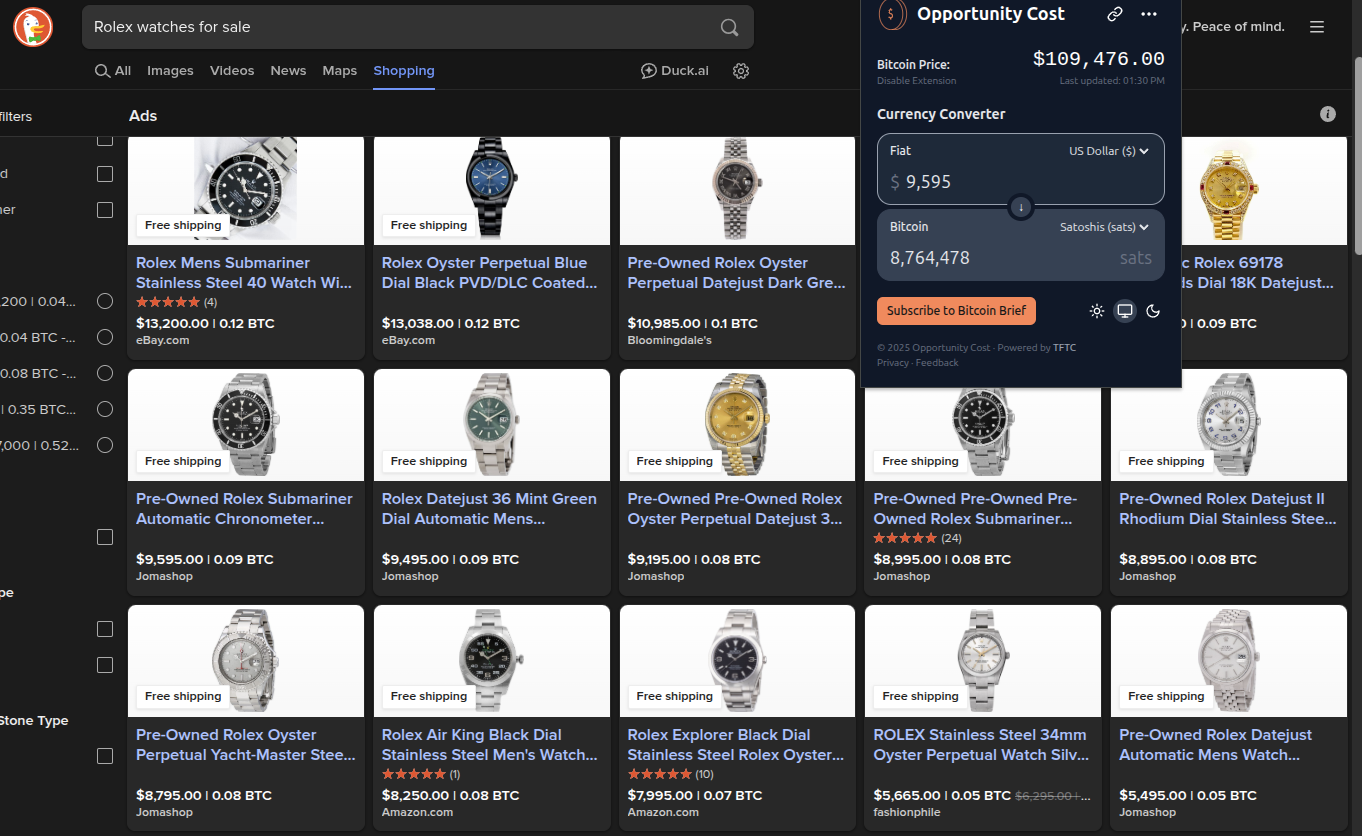

2025-06-12 16:16:11Marty Bent Vibe coded the opportunity cost app. I have not tried it yet, but love the concept. I have been into bitcoin since 2014, but I spent more generational wealth than I would care to admit back then. I've heard stories of fortunes blown on cocaine in the 1980's. I could write a story about spending a fortune on Diet Mt. Dew. I don't drink Diet Mt. Dew anymore. This one time, I spent about a million sats for a light beer at a baseball game. I wouldn't say I had a drinking problem, a million sats was only five bucks at the time. I didn't know that much bitcoin would be worth over a thousand bucks eleven years later.

I don't drink beer anymore. Bitcoin tends to do that to you.

We can afford chairs now. To be honest, we need a couch. The last couch I bought was in 2017 and it cost about a whole bitcoin. That couch is buried in a landfill today. My wife loves furniture, but even she's hesitant to spend sats on a couch now. We know we need a couch, but we don't want to spend sats on something we will need to replace before the next halving.

Many of us who have been in bitcoin for more than a decade have some regrets. I know I do, but we need to live our lives. I would never say you should sit on the floor, but I encourage to you to think about time. How long will this thing I need to buy last? If you think you can give a 3 million sat couch to your grandchildren, spend three million sats on the couch. If your five year plan for the couch is to help fill a landfill, maybe you only need to buy a used couch at a thrift store. This is not investment advice of course. How can it be? I don't know what kind of couch hazards you have in your house. I have trouble finding a couch of my own, but it's how I think about making bigger purchases. How many years of your retirement will that watch, car, house or whatever cost you from your stack? You can only determine that for yourself. I think the opportunity cost app will help you keep track of your decision.

This app was made by someone who once spent a whole bitcoin on a heater. I can't speak for Marty, but I believe the opportunity cost app will help you learn from my mistakes.

For more information, check out:

https://www.opportunitycost.app/

Check out the code on GitHub.

Using The Opportunity Cost App

The app is pretty straight forward. It is only available on Chrome for now so I installed it on the Chromium browser. I looked at the settings, but kept them default.

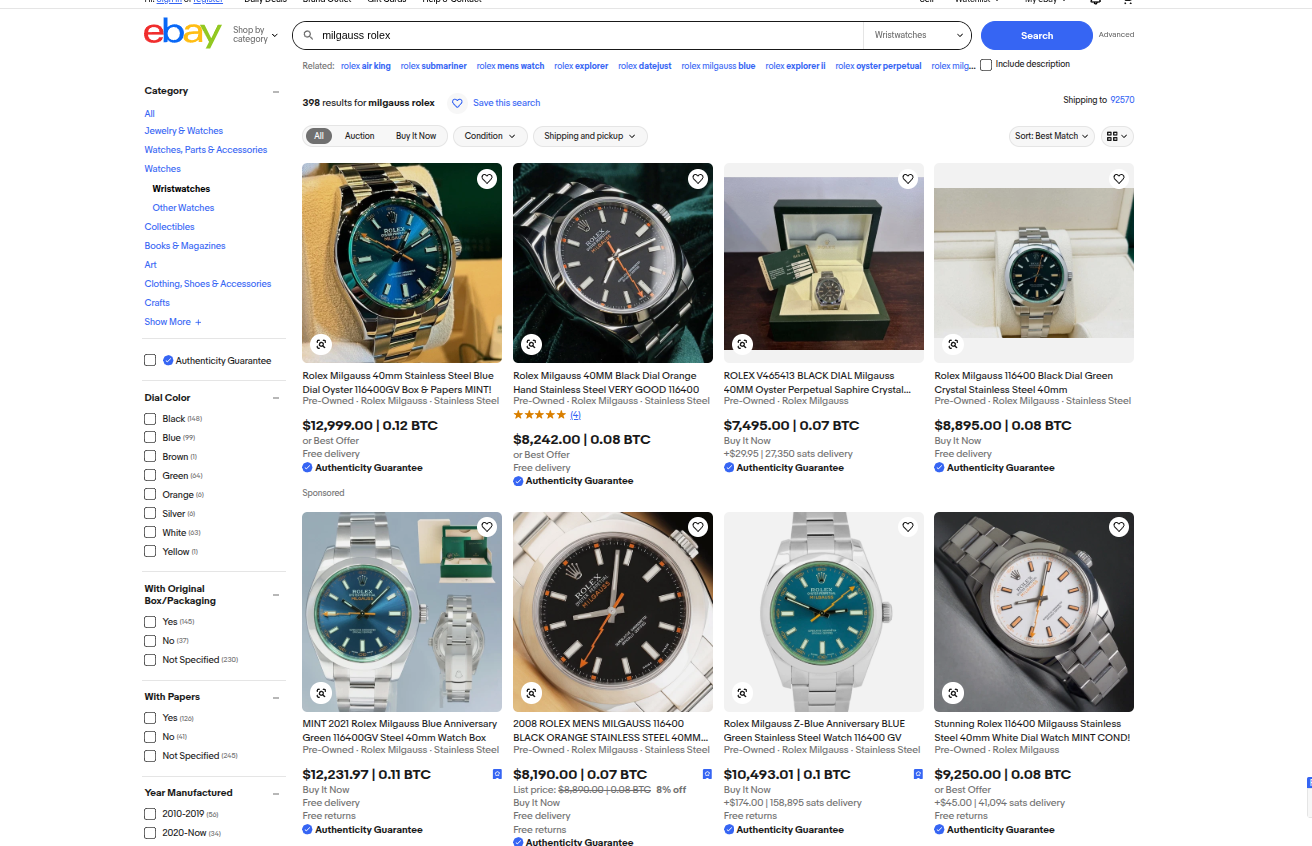

Then I searched for a Rolex in Duck Duck Go.

The default is bitcoin, but there is a sat calculator in the corner too, I have always wanted a Rolex Milgauss with a green sapphire so I looked it up on eBay. It's about 8 million sats. That's too rich for my blood, but I might be willing to part with a million sats for that watch. I'll definitely pick it up for 500,000 sats. I can wait. Bitcoin is the best clock in the world. I wouldn't go so far as to call this Rolex a shitcoin, but bitcoin is a better clock than any watch in my opinion--Even when compared to my favorite watch.

Video From Opportunity Cost Website

How will you use the Opportunity Cost browser extension?

☮️ npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

https://zapthisblog.com/calculate-your-opportunity-cost-while-shopping/

-

@ 7f6db517:a4931eda

2025-06-12 15:02:58

@ 7f6db517:a4931eda

2025-06-12 15:02:58

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 58537364:705b4b85

2025-06-12 13:59:39

@ 58537364:705b4b85

2025-06-12 13:59:39ในร่างกายที่มันมีสิ่งที่เรียกว่า… ระบบประสาท ทีนี้มีอะไรเข้ามากระทบร่างกาย คือกระทบระบบประสาท ปฏิกิริยามันก็เกิดขึ้น เป็นเหตุการณ์ อย่างใดอย่างหนึ่งขึ้น

เหตุการณ์นั้นแหละสำคัญ ถ้าให้เกิดความรู้สึกที่ถูกใจมันจะเป็นบวก เหตุการณ์นั้นไม่รู้สึกถูกใจแก่จิต มันก็จะเป็นลบ #ตัวกูเพิ่งเกิดเมื่อมีการกระทบแล้ว

ถ้าเหตุการณ์ที่เป็นบวกเกิดขึ้น ตัวกูบวกก็เกิดขึ้น เหตุการณ์ที่เป็นลบเกิดขึ้น ตัวกูที่เป็นลบเกิดขึ้น #ตัวกูนี้เกิดหลังเหตุการณ์ ขอให้เข้าใจดีๆ ไม่ใช่เกิดอยู่ก่อน

ตัวกูคลอดออกมาจาก situation ที่มากระทบระบบประสาท เช่นว่า… ไม่ได้กินอาหาร ขาดอาหาร มันหิว ความหิวเกิดขึ้นแก่ระบบประสาท ต่อมาจึงเกิด concept ว่า กูหิว, มีการกินแล้วจึงเกิด concept ว่า กูกิน

ถ้ามีอาการอร่อยแก่ลิ้น มันจึงเกิด concept ว่า… กูอร่อย หรือ มาทีหลังเหตุการณ์เสมอ จะถือว่าเป็น product ของเหตุการณ์นั้น ๆ ก็ได้

นี่คือความที่ไม่มีตัวจริง มิใช่ของจริง ของสิ่งที่เรียกว่าตัวกู #ขอให้รู้จักว่าตัวกูนี้มันเป็นมายาถึงขนาดนี้

ฟังดูการพูดอย่างนี้ มันเป็น logic แต่ความจริงของธรรมชาติมันเป็นอย่างนั้น ถือตามกฎ logic ธรรมดาสามัญ ที่พูดกันอยู่นี้ไม่ได้ ต้องถือตามความเป็นจริงที่ว่า มันเป็นอยู่อย่างไร

จิตก็เป็นธาตุชนิดหนึ่ง สิ่งแวดล้อมต่างๆ ที่เป็นธาตุชนิดหนึ่ง พอมาถึงกันเข้า ก็เกิดปฏิกิริยาออกมาอย่างนั้นอย่างนี้ ความรู้สึกที่เรียกว่า… #จิตคิดนึกได้นี้_ก็เป็นปฏิกิริยาที่เกิดขึ้นเท่านั้น แล้วความรู้สึกว่าตัวกู ตัวนี้ก็เป็นเพียงปฏิกิริยาที่เกิดขึ้นเท่านั้น.

มันฟังยากสำหรับท่านทั้งหลายที่ว่า ผู้กระทำนั้นเกิดทีหลังการกระทำ มันผิด logic อย่างนี้

แต่ความจริงเป็นอย่างนั้น self หรือ ego ผู้กระทำจะเกิดทีหลังการกระทำ เป็นปฏิกิริยาของการกระทำ

ความคิดอย่าง ตรรกะ หรืออย่างปรัชญา เอามาใช้กับสิ่งนี้ไม่ได้ ขอยืนยันไว้อย่างนี้

ถ้าท่านยังไม่เชื่อ ท่านก็ไปคิดดูเรื่อย ๆ ไปเถอะ ท่านจะพบว่ามันไม่เป็นอย่างกฎเกณฑ์ทางตรรกะหรือทางปรัชญา ที่เรามีๆ กันอยู่

ผู้กระทำเป็นเพียง concept ไม่ใช่ตัวจริง ส่วนการกระทำมันเป็นเหตุการณ์ของธรรมชาติ พอเข้ามาถึงจิตแล้ว ก็เกิดความคิด ความเชื่อ ความยึดว่าตัวกู

ตัวกูซึ่งเป็นเพียง concept ไม่ใช่ของจริง

พุทธทาสภิกขุ

อตัมมยตาประทีป

ชีวิตใหม่และหนทางเข้าถึงชีวิตใหม่

หน้า_๒๙๕-๒๙๖

-

@ a296b972:e5a7a2e8

2025-06-12 12:36:22

@ a296b972:e5a7a2e8

2025-06-12 12:36:22Europa sitzt in einem Demokratie-Simulator. Auf die Scheiben im Cockpit werden Bilder projiziert, die nicht der Realität entsprechen, und es gibt immer noch zu viele Menschen, die diese Simulation nicht erkannt haben.

Nichts wäre erstrebenswerter, als über eine positive Entwicklung, hin zur Vernunft und realitätsbezogenen, auf Tatsachen beruhenden Entscheidungen, berichten zu können. Die Frage ist, ob nicht zuerst unentwegt auf Missstände hingewiesen werden muss, um weitere Menschen dazu zu bewegen, sich denjenigen anzuschließen, die offensichtlich an Indoktrinationsintoleranz leiden.

Wer sich vor Hofberichterstattung und die tägliche Fahrt durch die Gehirnwaschanlage schützen will, der meidet den öffentlich-rechtlichen Unfug und die einschlägigen Käseblätter, die vielleicht noch halbwegs dazu geeignet sind, den Fisch auf dem Markt einzuschlagen, um ihn nach Hause zu tragen, vorausgesetzt, man kann ihn sich noch leisten.

Die Neuen Medien liefern die Informationen, die man sonst im „Qualitäts-Mainstream“ nicht finden kann, was nicht verwundert, denn infiltriert von willigen Erfüllungsgehilfen, die Angst um ihr Prestige und ihre Stellung haben, kann man hier keine freie Berichterstattung erwarten.

Beste Unterhaltung bietet auch die Bundespressekonferenz-Show, auf die schon näher eingegangen wurde. Offizieller Regierungssprech in höchster Perfektion. Ob man dort wirklich davon überzeugt ist, dass es irgendjemanden gibt, der diesen Verlautbarungen Glauben schenkt? Was hat Tante Käthe immer gesagt: G E L D L O C K T I M M E R !

Was also tun? Die Neuen Medien auch noch meiden, und sich vor dem blanken Wahnsinn schützen, in dem man ihn ignoriert, was jedoch nicht bewirkt, dass er nicht mehr da wäre.

Temporäre Abstinenz tut auch hier gut, allerdings ist der Wiedereinstieg so ähnlich, wie der erste Arbeitstag nach einem zweimonatigen Urlaub, falls man nicht in seinem Lieblings-Job gelandet ist.

Und was, wenn die Irren vollends durchdrehen, und man bekommt es nicht mit? Schön, ändern kann man vielleicht wenig, aber man kann sich vielleicht noch eine richtig gute, edle Flasche Rotwein kaufen, und die am Vorabend des Untergangs genießen, oder noch schnell einen Baum pflanzen.

Hier ein Beispiel für jemanden, dessen besonderer Blick sehr an den Universal-Gesundheits-Klima-Hysteriker erinnert:

https\://rumble.com/v6umjdj-respekt-und-anerkennung-deutscher-general-lobt-ukrainische-angriffe-in-russ.html

Wie sieht der Alltag aus, wenn man sich einmal nicht mit den Informationen über Dauer- Bekloppte beschäftigt?

Wenn sich ein Besuch in der nächst größeren Stadt nicht vermeiden lässt, sieht man vor allem gehetzte Menschen, viele mit einem finsteren Blick, anders, als früher.

Viele zahlen mit Karte oder ihrem Handy, Kleckerbeträge. „Zahlen Sie noch bar, oder schon mit Überwachung?“, wünschte man sich, dass die Verkäuferinnen den Kunden fragen würden. Tun sie aber nicht.

Die Menschen scheinen keine Ahnung zu haben, was auf sie zukommt. Im Oktober soll der digitale Euro eingeführt werden, natürlich zuerst nur freiwillig. Was das bedeutet, kennt man ja schon. Freiwilligkeit durch das Schaffen eines Raumes, in dem der Zwang in der Luft hängt, wie damals der Kohlenstaub im Ruhrgebiet. Es wird die persönliche ID vorangetrieben, mit einem Wallet, das die Anonymität und die persönliche Freiheit immer mehr aushöhlen will.

Europa soll unter einen Demokratie-Schutzschirm gestellt werden, der zu nichts anderem dient, als dass diejenigen, die derzeit glauben zu wissen, was gut für die Menschen ist, ihre kruden Vorstellungen auch durchsetzen können. Zweifelhaft, was in den USA vorgeht, was da gerade mit Palantir, natürlich nur zur Sicherheit der Amerikaner, so im Hintergrund schon anläuft. Hierzu gibt es interessante Informationen von Regenauer und Tögel. Einziger Hoffnungsschimmer, besonders für Deutschland: Das klappt sowieso nicht. In den hintersten Bergdörfern in den italienischen Alpen gibt es Glasfaseranschluss, und fährt man in Deutschland auf’s Land, reiht sich Funkloch an Funkloch.

Die wirklich wichtige und große Frage ist, wie können sich Gemeinschaften, die diesen Irrsinn nicht mitmachen wollen, weitgehend aus dem System ausklinken? Bitcoin ist ein erster Schritt zur finanziellen Unabhängigkeit. Eine regionale Lebensmittelversorgung, mit nicht verseuchten, genunmanipulierten, mit Schadstoffen weitgehend unbelasteten Produkten entwickelt sich ebenfalls schon sehr gut. Was, wenn der Zugang zu Informationen über das Internet von einer Anmeldung mit persönlicher ID abhängt und man will und hat keine? Was ist mit Dokumenten, wenn man verreisen oder das Land verlassen will? Was ist, wenn man krank wird und auf das noch vorhandene Rest-Gesundheitssystem angewiesen ist? Was, wenn das Unternehmen seine Mitarbeiter auf staatliche Anweisung zu etwas zwingen muss, was der Mitarbeiter vielleicht gar nicht will, er aber auf das Einkommen angewiesen ist?

Das alles sind Fragen, zu denen es schwer ist, auch in den Neuen Medien, passende Antworten zu finden. Die würden in der Tat Hoffnung machen, dass es ein Schlupfloch gibt, sich, wenn vielleicht auch mit Einschränkungen, den „demokratischen“ Verhältnissen, auf denen nur noch Demokratie draufsteht, aber sehr wenig bis keine Demokratie mehr drin ist, so weit es geht zu entziehen. Sachdienliche Hinweise gerne in der Kommentarfunktion.

Oder ist es „gesünder“, sich zurückzuziehen, die Klappe zu halten und dafür zu sorgen, dass man unter dem Radar bleibt? Diese Gabe ist leider nicht jedem gegeben. Besonders nicht denen, die einen ausgeprägten Wahrheitssinn und ein starkes Gerechtigkeitsgefühl haben.

Menschen die andere belügen, die werden geliebt. Menschen, die anderen sagen, dass sie belogen werden, die werden gehasst.

„Die Wahrheit ist dem Menschen zumutbar.“ (Ingeborg Bachmann)

„Kein Mensch hat das Recht zu gehorchen.“ (Hannah Ahrendt)

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ 5627e59c:d484729e

2025-06-11 18:36:19

@ 5627e59c:d484729e

2025-06-11 18:36:19Happy New Year!

Happy New Year, my dearest human family\ Happy New Year, my dearest animal family

Dear children of the Earth\ I wish you all a magical year

May it be utterly new\ Ever-changing\ New now

And may your journey say\ Life is amazing! I'm in a maze\ Life is awesome! Quite some awe\ Life is magical! True alchemy

I am human\ Black woman, I love you so\ Life-giver of my origin, the negro [nigiro]

I am\ Thus physical and non-physical meet

Life is to be\ As the elements are and compete\ And as they collide with one another\ One becomes aware of an other\ And so life sets on a journey\ To discover the other

Animal life is set to explore\ Allowing all experience the other has in store\ Life left to experience without a voice\ Until it discovers there is an 'I'\ And it has a choice

Human life is to be inside a human body\ Thus fusion between intellect and feeling\ Gets to express its perspective\ Inside infinity

Truly, a magical gift\ My Holy Trinity

And so from human life flow many voices\ As it navigates through infinite choices\

Thus I say

Life is magic\ A gift for all that is here\ Perceived by too many as tragic\ Take care of your vision, I tell you, my dear [tell-a-vision]

Life is magic\ And words are spells\ Placing your aim beyond your reach\ It takes away efficiency from your speech

Life is magic\ Above all else\ Even when it has me feeling blue\ Seemingly left without a clue

Still I say

Perfection\ You are everything\ And I am of you

The source, the mirror\ And the reflection

-

@ 79be667e:16f81798

2025-06-11 18:33:35

@ 79be667e:16f81798

2025-06-11 18:33:35De laatste zonnestralen van de dag streken over de eeuwige golven en weerkaatsten als lichtpuntjes in de ogen van schipper Joris terwijl hij nog een slok nam van zijn glazen fles die de vorm had van het hoofd van een oude monnik.

Gekregen van een oude vrouw uit de bergen van de Himalaya, zorgde de rum genaamd 'Old Monk' voor een verwarmend gezelschap op deze eenzame kerstnacht.

Joris had met zijn boot naar India gevaren nadat zijn vrouw hem had verlaten en hij een Indiër had ontmoet die had gezegd: "Waar ik vandaan kom, zijn vrouwen vrij en worden ze niet gezien als enkel en alleen de mooie lichamen die zij bezitten of als eeuwig bezit van een gezin."

Verward en ongelovig had Joris gekeken naar de wereld en besefte dat vrouwen inderdaad slechts gezien werden als hun fysieke schoonheid, genegeerd werden voor hun koesterende gevoeligheid en bekritiseerd werden door hun spontane intensheid en had hierop voor twee jaar lang gezocht in India naar deze vrije vrouwen met als enig resultaat een oude vrouw te ontmoeten die alleen in de bergen woonde en dagelijks haar wijsheid deelde met ieder luisterend oor.

Daar ging het doorzichtig monnikshoofd en verliet met een grote gebogen vlucht de hand van schipper Joris toen plots met groot kabaal de boot abrupt tot stilstand kwam en Joris hals over kop naar de andere kant van het dek geslingerd werd.

Het monnikshoofd verdween in het donker terwijl Joris zijn lichaam probeerde te lokaliseren en met zijn ogen wijd open zijn hersenen zo veel mogelijk informatie probeerde door te spelen.

Tevergeefs, want zijn enorme verschot werd gevolgd door een enkel groeiende verbazing, ongeloof en desoriëntatie toen de boot begon te kantelen.

De bundel licht, afkomstig van de mast van de boot, zwierde doorheen het donker en kwam te schijnen op een gigantische rots in het midden van de zee die werd bezeten door een oogverblindende glinstergroene schijn.

Uit het donker kwam het monnikshoofd, dat nog steeds in volle vlucht was, in het vizier van de lichtbundel en plaatste zich exact tussen de glinstergroene verschijning en Joris waarbij Joris doorheen het monnikshoofd gezegend werd met het zicht op een pracht van een zeemeermin die uitnodigend poseerde op de rots.

Met een luide plons viel Joris achterover in het water toen hij zich realiseerde dat vrouwen zichzelf ook lieten vangen door lust en hun uiterlijke opmaakcompetities en met een dankbare glimlach zonk hij naar de bodem van de zee en was opnieuw geboren.

-

@ 79be667e:16f81798

2025-06-11 18:29:06

@ 79be667e:16f81798

2025-06-11 18:29:06Zonneschijn\ Stralen, lachen, zo fijn\ Moge de wereld dankbaar zijn

De vrouw, mijn gevoeligheid\ Bron van creativiteit

Genietend niets doen in het gras\ Met wat brood en wat wijn in het glas

-

@ 5627e59c:d484729e

2025-06-12 10:21:02

@ 5627e59c:d484729e

2025-06-12 10:21:02Liefde\ De samenkomst\ Van zien en zijn

Leven\ Het zijn en zien\ Een vorm gekregen

Sterven\ Een deur\ Die vrijheid geeft van vorm

En eeuwig leven\ Aan liefde

-

@ dfa02707:41ca50e3

2025-06-12 07:02:18

@ dfa02707:41ca50e3

2025-06-12 07:02:18Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ b1ddb4d7:471244e7

2025-06-12 07:01:38

@ b1ddb4d7:471244e7

2025-06-12 07:01:38Paris, France – June 6, 2025 – Flash, the easiest Bitcoin payment gateway for businesses, just announced a new partnership with the Bitcoin Only Brewery, marking the first-ever beverage company to leverage Flash for seamless Bitcoin payments.

Bitcoin Buys Beer Thanks to Flash!

As Co-Founder of Flash, it's not every day we get to toast to a truly refreshing milestone.

Okay, jokes aside.

We're super buzzed to see our friends at @Drink_B0B

Bitcoin Only Brewery using Flash to power their online sales!The first… pic.twitter.com/G7TWhy50pX

— Pierre Corbin (@CierrePorbin) June 3, 2025

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack – shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented: “Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest Bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept Bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

Bitcoin payment usage is growing thanks to Lightning

In May, fast-food chain Steak ‘N Shake went viral for integrating bitcoin at their restaurants around the world. In the same month, the bitcoin2025 conference in Las Vegas set a new world record with 4,000 Lightning payments in one day.

According to a report by River Intelligence, public Lightning payment volume surged by 266% from August 2023 to August 2024. This growth is also reflected in the overall accessibility of lighting infrastructure for consumers. According to Lightning Service Provider Breez, over 650 Million users now have access to the Lightning Network through apps like CashApp, Kraken or Strike.

Bitcoin Only Brewery’s adoption of Flash reflects the growing trend of businesses integrating Bitcoin payments to cater to a global, privacy-conscious customer base. By offering no-KYC delivery across Europe, the brewery aligns with the ethos of decentralization and financial sovereignty, appealing to the increasing number of consumers and businesses embracing Bitcoin as a legitimate payment method.

“Flash is committed to driving innovation in the Bitcoin ecosystem,” Corbin added. “We’re building a future where businesses of all sizes can seamlessly integrate Bitcoin payments, unlocking new opportunities in the global market. It’s never been easier to start selling in bitcoin and we invite retailers globally to join us in this revolution.”

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

About Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comPhotos paywithflash.com/about/pressHow Flash Enables Interoperable, Self-Custodial Bitcoin Commerce

-

@ b1ddb4d7:471244e7

2025-06-12 05:01:43

@ b1ddb4d7:471244e7

2025-06-12 05:01:43The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ 79be667e:16f81798

2025-06-11 18:27:32

@ 79be667e:16f81798

2025-06-11 18:27:32Spontaniteit\ Creativiteit

Iets visueel of gewoon geluid\ Het moet eruit

Ik doe mezelf cadeau aan jou\ Omdat ik van het leven hou

-

@ 79be667e:16f81798

2025-06-11 18:23:32

@ 79be667e:16f81798

2025-06-11 18:23:32In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ 5627e59c:d484729e

2025-06-12 04:23:52

@ 5627e59c:d484729e

2025-06-12 04:23:52Look and see\ Look and see

You look like how you look at me

Look and see\ Look and see

The colorless through the color TV

Look and see\ Look and be

The unborn identity

-

@ 7f6db517:a4931eda

2025-06-12 04:02:50

@ 7f6db517:a4931eda

2025-06-12 04:02:50

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 2b998b04:86727e47

2025-06-11 17:51:49

@ 2b998b04:86727e47

2025-06-11 17:51:49ファースト・プリンシプルズ(First Principles)序章

この序章は「ファースト・プリンシプルズ」と題した7回シリーズの始まりです。分散化、コスト、自由、そして真実の奥にある本質的な変化を探ります。7回なのは、1週間のリズム——働き、休み、立ち返るというリズム——に合わせたからです。それぞれの記事は、私が受け入れてきた技術や哲学の根底にある真理を掘り下げます。分散化と主権、真実、時間、そして希望まで。\ \ テクノロジーはコストをゼロに近づける——よくそう言われます。

これは『The Price of Tomorrow』という書籍の主張でもあります。技術が進化するほど、自然とデフレ(物価下落)を引き起こす。自動化は労働を置き換え、ソフトウェアはインフラを代替し、AIは意思決定そのものを肩代わりする。限界費用(追加生産にかかるコスト)は限りなくゼロに近づく。

——でも、それだけじゃない。

そこには、経済学者や技術者が見落としがちな「もう一層の深さ」があります。

単に「生産コスト」が下がるかどうかではなく、問うべきは 中央集権による「コントロール・コスト(支配コスト)」 です。

限界費用が下がっても、中央集権の「隠れた代償」は上がっていくのです。

「無料」という幻想

たとえば、GitHub。

一見無料です。静的ウェブサイトを公開し、コードをホストし、Actionsで自動化し、グローバルに協業することもできる——全部、無料で。

でもGitHubはMicrosoftに所有されています。あなたはサーバーを管理できない。プラットフォームを所有していない。鍵(アクセス権限)も持っていない。

つまり、それは「取り上げられるかもしれない贈り物」にすぎない。

Google Docsも、YouTubeも、Substackも同じ。「無料で始めよう」というクラウドサービス全般も。

これらのツールが悪いわけではありません。むしろ、優れたものも多い。

でも「中立」ではないのです。

あなたが支払う代償は、必ずしもドルではありません。ときに、それは:

-

データアクセスの制限

-

APIの利用制限

-

突然の料金変更

-

検閲やアカウント停止

-

サービス移行にかかるコスト(特に問題が起きた時)

これは 中央集権プラットフォームの「隠れた家賃」 です。しかも、時間とともに複利的に増えていきます。

コントロール・コスト vs 限界費用

限界費用が「これを作るのにどれだけ安いか?」だとすれば、\ コントロール・コストは「これを使うことでどれだけ自由を失うか?」です。

Mediumなら無料で記事を投稿できますが、SEO(検索表示順位)は向こうのもの。\ Shopifyでビジネスを始められますが、彼らの判断でアカウントが停止される可能性もある。\ Instagramでフォロワーを増やしても、フィードを支配するのはアルゴリズムです。

私たちは「デフレ」を喜ぶように訓練されてきました。でも、実際には多くのツールが、参入コストを下げながら、コントロール・コストを膨らませているのです。

ここで、分散化(Decentralization) が物語を逆転させます。

分散化の本当の約束

本当の分散化は、ただ「安くする」だけじゃありません。\ それは「主権(Sovereignty)」をもたらします。

価格だけでなく、力を分配する。\ 手数料ゲートではなく、支配の構造そのものを取り除く。

こう言えるのです:

-

自分の鍵を自分で持て

-

自分のコンテンツを自分で持て

-

自分のスタックを自分で構築せよ

-

自分の配信チャネルを自分で持て

だからこそ、Nostr が重要。\ だからこそ、Bitcoin が重要。\ だからこそ、たとえ不便でも、セルフホスティングやパーミッションレスなプロトコル、オープンソースのツールが大切なのです。

彼らは「安くしてくれる」だけじゃない。\ 私たちの 自由 を守ってくれる。

実例:私のブログ構築

私がブログ blog.stantonweb.com を作り始めたとき、\ 最も楽な方法は選びませんでした。

私は以下を組み合わせました:

-

長文投稿に Nostr

-

投稿を取得・表示するためのPythonスクリプト

-

GitHub Actions で自動化

-

表示は静的HTML

-

ホスティングは GitHub Pages + Cloudflare(無料)

データベースも、CMSも、テーマ課金もなし。

限界費用? 0ドルです。

でももっと重要なのは、コントロール・コストも限りなくゼロだということ。\ 誰にも止められない。\ 企業にリーチを制限されない。\ ゲートキーパーが「掲載に値するか」を判断しない。

新しい「コスト」定義へ

価格だけを最適化すれば、捕らわれる。

自由を最適化すれば、やがて「余白」を築ける——金銭的余白だけでなく、創造の余白、道徳の余白、運営の余白も。

それが分散化の真価。\ 安いだけじゃない。\ より真実なものへ。

補足:過去からの教訓

Skypeを覚えていますか?\ 当初は真のP2Pツールで、構造的に分散されていました。でもMicrosoftに買収され、中央集権型に再設計され、やがてその中身は解体されました。

Napsterも同様。P2Pで音楽業界を揺るがしましたが、最終的には停止され、中央集権型の代替サービスに取って代わられました。

BitTorrentは生き残りました——それは「ただのプラットフォーム」にならなかったからです。

このパターンは明白です:

-

資本が集まれば中央集権になる

-

支配があれば検閲も起きる

-

しかし、自由は分散化から生まれる

そして私たちは、何度でもこの道を選び直さなければならないのです。

共同執筆:ChatGPT(“Dr. C”)が主要な論点の整理と精緻化をサポートしました。\ \ 数日以内にPart 1を公開予定。ご期待ください。

—\ blog.stantonweb.com およびNostrにて公開中。\ Zap(投げ銭)リンク:https://tinyurl.com/yuyu2b9t

-

-

@ cae03c48:2a7d6671

2025-06-11 12:00:58

@ cae03c48:2a7d6671

2025-06-11 12:00:58Bitcoin Magazine

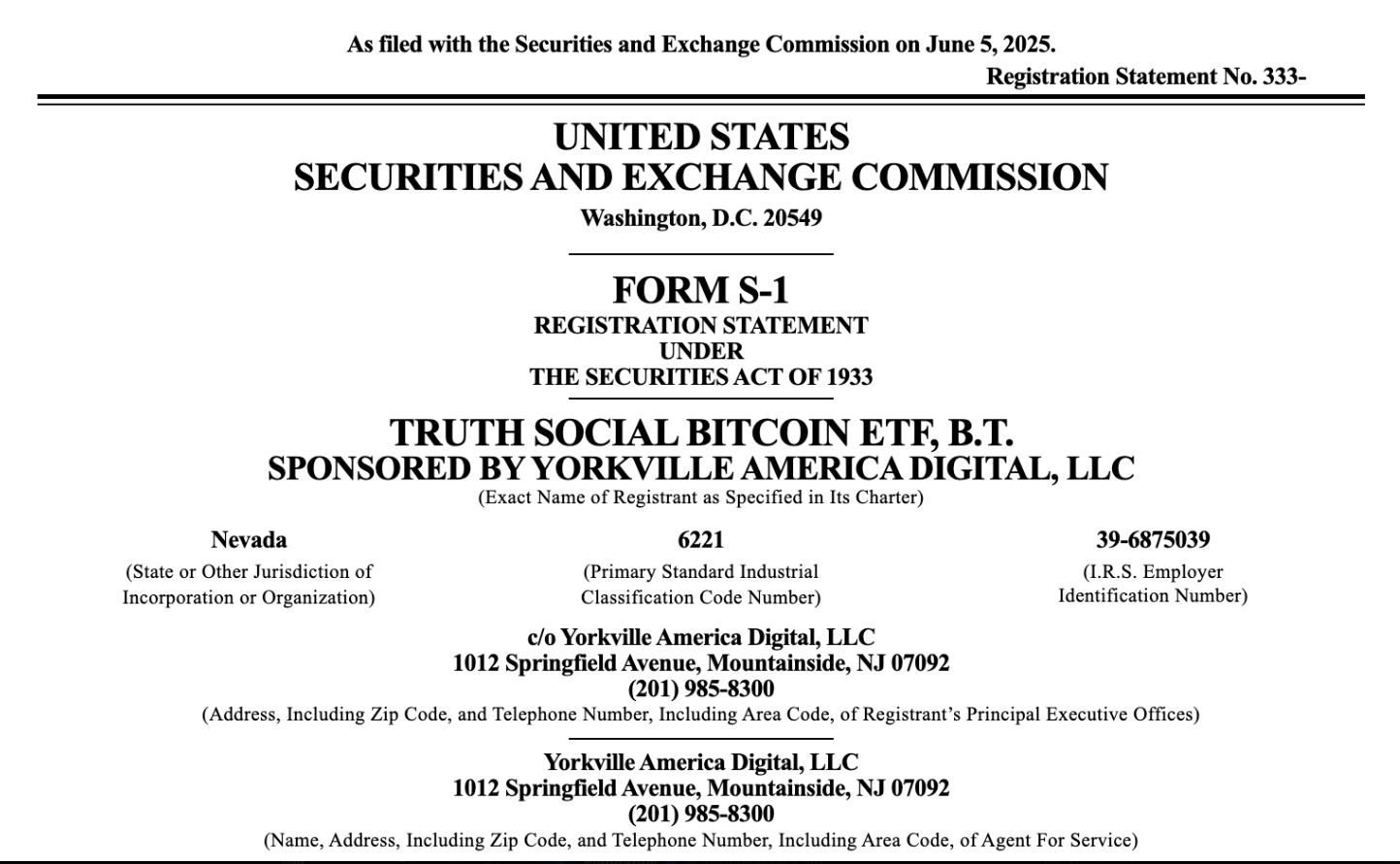

The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since LaunchAmerican Bitcoin Corp (ABTC), a newly formed private Bitcoin mining company backed by Eric Trump and Donald Trump Jr., announced in a June 10 SEC filing that it has acquired 215 Bitcoin (BTC) since launching operations on April 1, 2025. The reserve is currently valued at approximately $23 million, showing their drive and commitment to Bitcoin.

JUST IN: American Bitcoin Corp (private) reports to have 215 #bitcoin (per 31 May) since it's launch on April 1, 2025.

They will merge with Gryphon Digital $GRYP and become public under ticker $ABTC.

They mention "Bitcoin accumulation is not a side effect of ABTC’s business.… pic.twitter.com/wq1Uxr76Z2

— NLNico (@btcNLNico) June 10, 2025

“Bitcoin accumulation is not a side effect of ABTC’s business. It is the business,” the company stated in the filing.

Furthermore, ABTC has entered into a merger agreement with Gryphon Digital Mining ($GRYP), and the combined company is expected to begin public trading under the ticker $ABTC as early as Q3 2025.

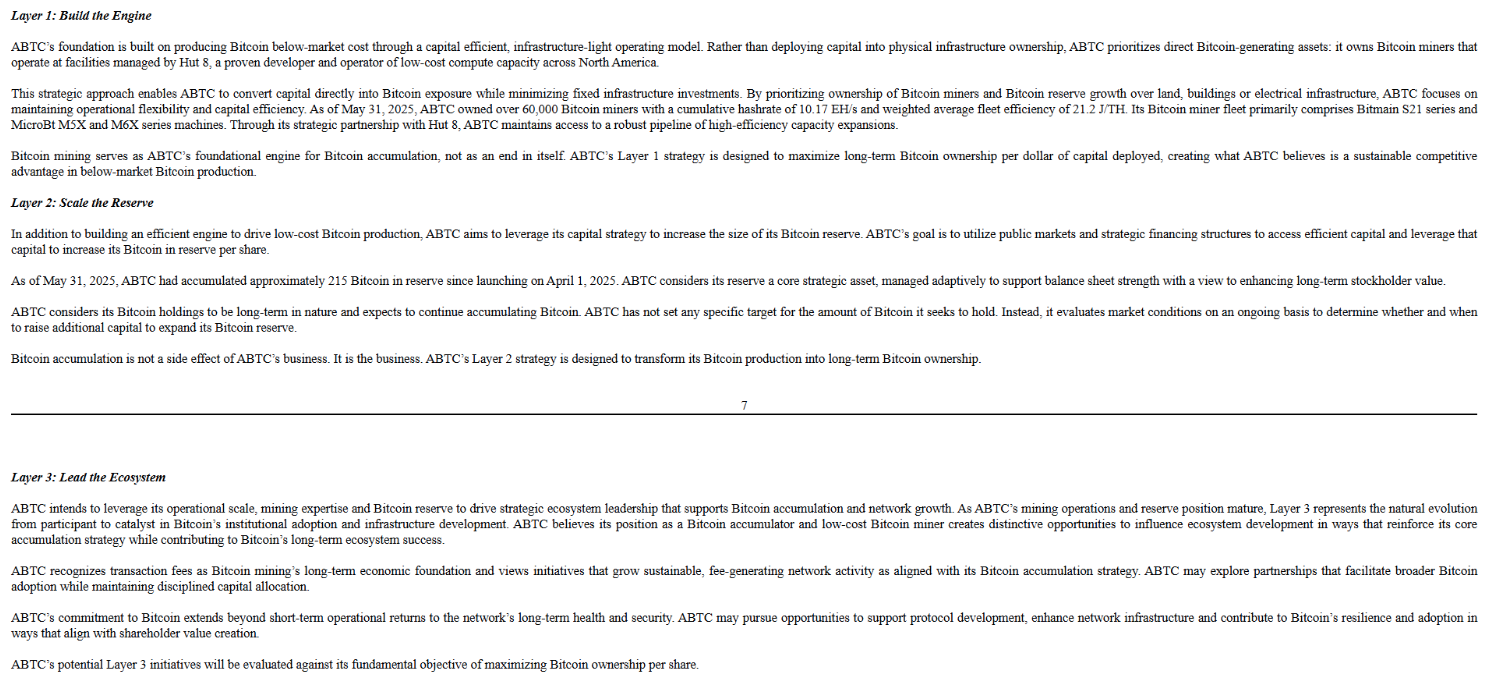

The company’s three-layer strategic plan—outlined in the SEC disclosure—details a focused approach:

Layer 1: Build the Engine

- ABTC’s foundation is built on “producing Bitcoin below-market cost through a capital efficient, infrastructure-light operating model.” The company owns and operates over 60,000 miners from Bitmain and MicroBt, running primarily on Hut 8-managed facilities.

Layer 2: Scale the Reserve

- ABTC had “accumulated approximately 215 Bitcoin in reserve since launching on April 1, 2025,” which it considers a long-term strategic asset. The firm states its goal is “to utilize public markets and strategic financing structures to access efficient capital and leverage that capital to increase its Bitcoin in reserve per share.”

Layer 3: Lead the Ecosystem

- The company ultimately aims to use its operational scale and mining position to drive industry-wide adoption. “ABTC may pursue opportunities to support protocol development, enhance network infrastructure and contribute to Bitcoin’s resilience and adoption in ways that align with shareholder value creation.”

For mining rewards, ABTC uses Foundry and Luxor pools with sub-1% fees and relies on Coinbase Custody for secure cold storage, featuring multi-factor authentication and strict withdrawal protocols.

With operations across Niagara Falls, NY; Medicine Hat, AB; and Orla, TX, ABTC is leveraging strategic partnerships—primarily with Hut 8—to scale its Bitcoin holdings while influencing the broader crypto mining ecosystem.

This post The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since Launch first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 7f6db517:a4931eda

2025-06-12 03:02:56

@ 7f6db517:a4931eda

2025-06-12 03:02:56

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-12 01:02:18

@ 7f6db517:a4931eda

2025-06-12 01:02:18Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-11 12:00:58

@ cae03c48:2a7d6671

2025-06-11 12:00:58Bitcoin Magazine

Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First TimeBitcoin has officially completed 30 consecutive days trading above the $100,000 mark, marking a historic milestone in its 15 year journey. Bitcoin achieved its all time high (ATH) of $111,980 on May 22, almost hitting $112,000.

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever!

pic.twitter.com/nfccEK3Wf0

pic.twitter.com/nfccEK3Wf0— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

In the last 30 days, Bitcoin saw a 10 percent pullback right after reaching its ATH, dropping to $100,428. However, it wasn’t for long, as Bitcoin is back at $109,511 at the time of writing. Momentum appears to be building once again, signaling to be bullish.

“Anytime price is able to punch through a major resistance level, whether psychological or historical, and successfully hold, it is certainly a bullish sign,” said the technical analyst of Wolfe Research Read Harvey. “What really stood out to us was price’s ability to hold that level on the back test, when it briefly fell to $100,000 on Thursday. It also happened to align perfectly with the 50-day moving average. … We feel this should act as a launching pad back towards the recent highs of $112,000.”

In the past month, Bitcoin has surged into the financial and political mainstream. Several U.S. states including New Hampshire first, followed by Arizona, and then Texas have passed legislation recognizing Bitcoin as a strategic reserve asset. These laws reflect a growing trend of state level interest in using Bitcoin as a financial hedge and as part of long term fiscal policy.

“New Hampshire didn’t just pass a bill; it sparked a movement,” stated the CEO and Co-Founder of Satoshi Action Dennis Porter.

At the same time, financial institutions are rapidly expanding their Bitcoin offerings. JP Morgan has started providing loans backed by Bitcoin ETFs as collateral. BlackRock’s Bitcoin ETF has entered a period of intense activity, generating record trading volumes and capturing the attention of both retail and institutional investors.

To date, a total of 228 public and private entities have Bitcoin in their balance sheets and in the last 30 days, companies like GameStop, Know Labs, and Norway-based NBX have added Bitcoin as a strategic reserve. All these companies are treating Bitcoin not just as a speculative asset, but as a key part of their long term financial plans. This growing corporate trend follows the example set by Strategy, but it’s now happening on a much larger scale.

At the 2025 Bitcoin conference, the Vice President of the United States of America, JD Vance said in his speech, “Fifty million Americans own Bitcoin. I think it’s gonna be 100 million before too long.”

This post Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First Time first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 3104fbbf:ac623068

2025-06-11 11:42:29

@ 3104fbbf:ac623068

2025-06-11 11:42:29 It is possible to shift your mindset in adulthood — but it’s exceedingly rare. There’s no exact science to it, yet roughly 2% of people seem truly able — or willing — to change their worldview past a certain age. As arbitrary as that number may sound, it often holds true in practice. It helps explain human behavior and why the remaining 98% — those unwilling to embrace deep inner change — will never dare to step outside their comfort zone.

It is possible to shift your mindset in adulthood — but it’s exceedingly rare. There’s no exact science to it, yet roughly 2% of people seem truly able — or willing — to change their worldview past a certain age. As arbitrary as that number may sound, it often holds true in practice. It helps explain human behavior and why the remaining 98% — those unwilling to embrace deep inner change — will never dare to step outside their comfort zone.Learning new skills holds real, practical value: it’s how we redirect our lives toward something better. But it requires a willingness to evolve the way we think. In my view, the only truly helpful approach is to share insights, ideas, and methods — and then let each individual decide whether they’re ready to invest time and energy into rethinking their patterns, learning what’s needed, and transforming their habits or beliefs. There are no shortcuts.

As someone who’s committed to this path and aware of what’s at stake for humanity in the next 20 years — especially with AI — I want to share a few signposts for those ready to lift their heads out of the sand.

Discernment in the Age of AI: More Essential Than Ever

We are living through a radical upheaval, driven by artificial intelligence and the exponential acceleration of technology. And I’m convinced of one thing: if a belief, ideology, or conviction born in the 21st century isn’t constantly reevaluated — with curiosity, humility, and intellectual rigor — by confronting opposing views, digging into what’s uncomfortable, and honestly questioning what we don’t yet understand, then we’re not thinking. We’re just gambling on blind faith — or refusing to face reality. And eventually, that catches up with us.

The longer you wait to adapt to technological acceleration, the more you risk becoming trapped in an invisible loop — one where you don’t even realize just how far behind you’ve fallen.

Take independent thinking and discernment — arguably the most vital skills in an AI-driven world. If you rely on AI in a domain where you lack critical sensitivity, you’re setting yourself up for disaster.

When you use AI to move a project forward, you need to instantly recognize when something feels off: “That doesn’t make sense. It’s too cliché. It doesn’t work.” And the AI — trained to please you — will agree: “You’re right.”

But… what if you’re wrong?

That’s where the downward spiral begins — a kind of creative death. Many people:

Settle for the AI’s first answer,

Fail to grasp that this response is just the most statistically likely, the most "expected,"

And end up with something generic, bland, and forgettable.

We have to move beyond that. We have to enter that narrow zone where we seek something original, alive, new — and keep pushing: “No, that’s not it yet.” It’s through this iterative process that refinement happens, and real value emerges.

Used this way, AI becomes a powerful tool — one that accelerates research, eliminates friction, and streamlines the creative process.