-

@ 433e1568:76df16e4

2025-06-12 16:30:06

@ 433e1568:76df16e4

2025-06-12 16:30:06{ "id": "id-1749742303915-wvxk26r", "name": "Neues Board", "description": "", "authors": [ "User" ], "summary": "", "backgroundColor": "#f5f7fa", "customStyle": "", "columns": [ { "id": "id-1749742303915-shl9l6i", "name": "To Do", "color": "color-gradient-1", "cards": [ { "id": "id-1749742324261-rg0tla6", "heading": "Karte 1 (Kopie)", "content": "", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "", "labels": "", "inactive": false }, { "id": "id-1749742312185-tfw8pib", "heading": "Karte 1", "content": "", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "", "labels": "", "inactive": false } ] }, { "id": "id-1749742303915-q9qjhnu", "name": "In Progress", "color": "color-gradient-2", "cards": [ { "id": "id-1749742330380-as246pq", "heading": "Karte 1 (Kopie) (Kopie)", "content": "", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "", "labels": "", "inactive": false } ] }, { "id": "id-1749742303915-51t3c01", "name": "Done", "color": "color-gradient-3", "cards": [] } ], "aiConfig": { "provider": "", "apiKey": "", "model": "", "baseUrl": "" }, "exportDate": "2025-06-12T16:30:06.121Z", "nostrEvent": true }

-

@ df478568:2a951e67

2025-06-12 16:16:11

@ df478568:2a951e67

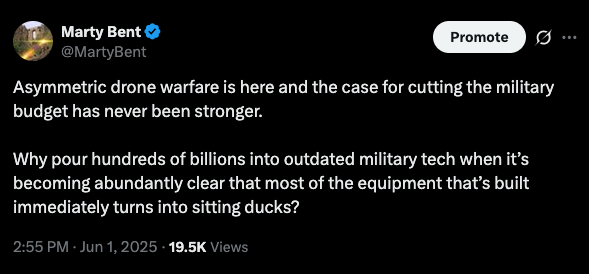

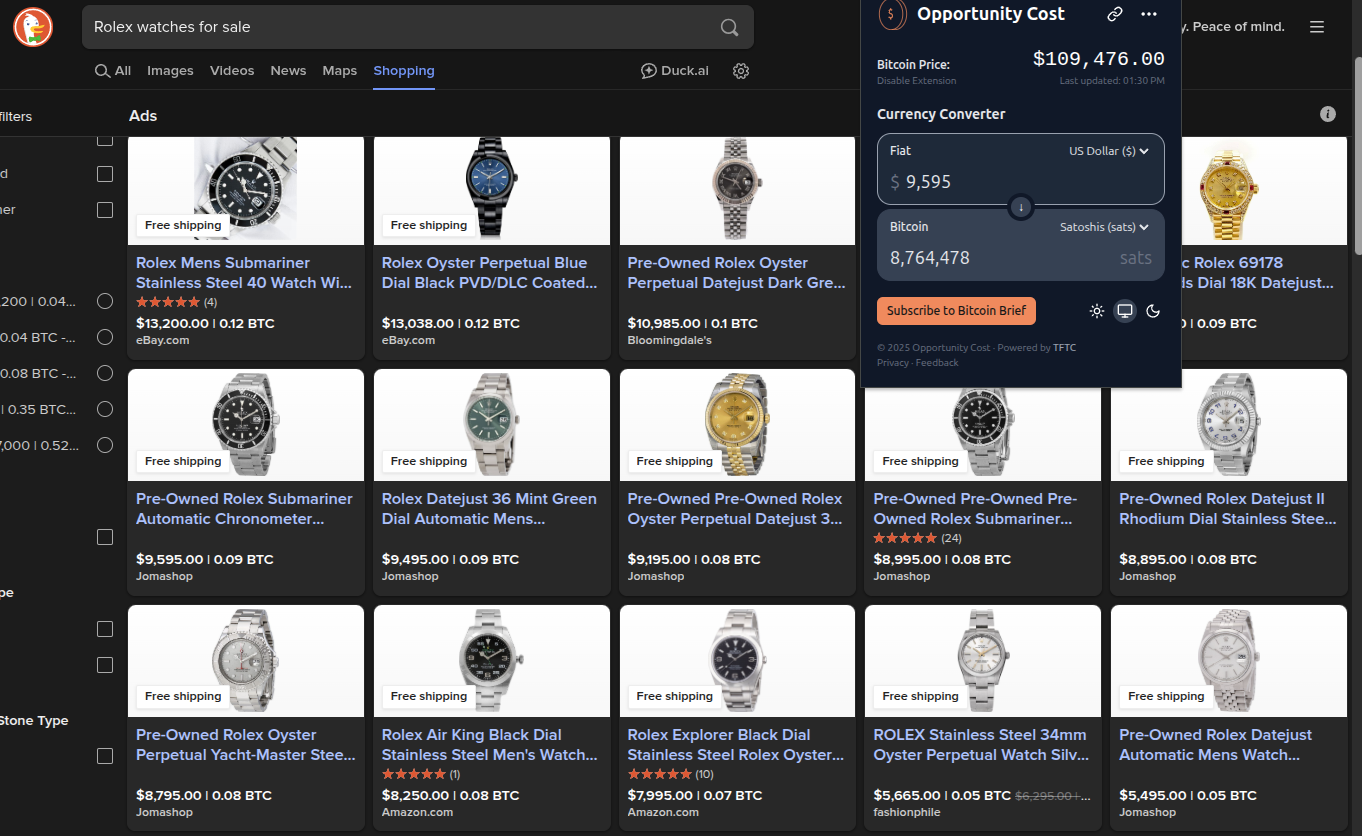

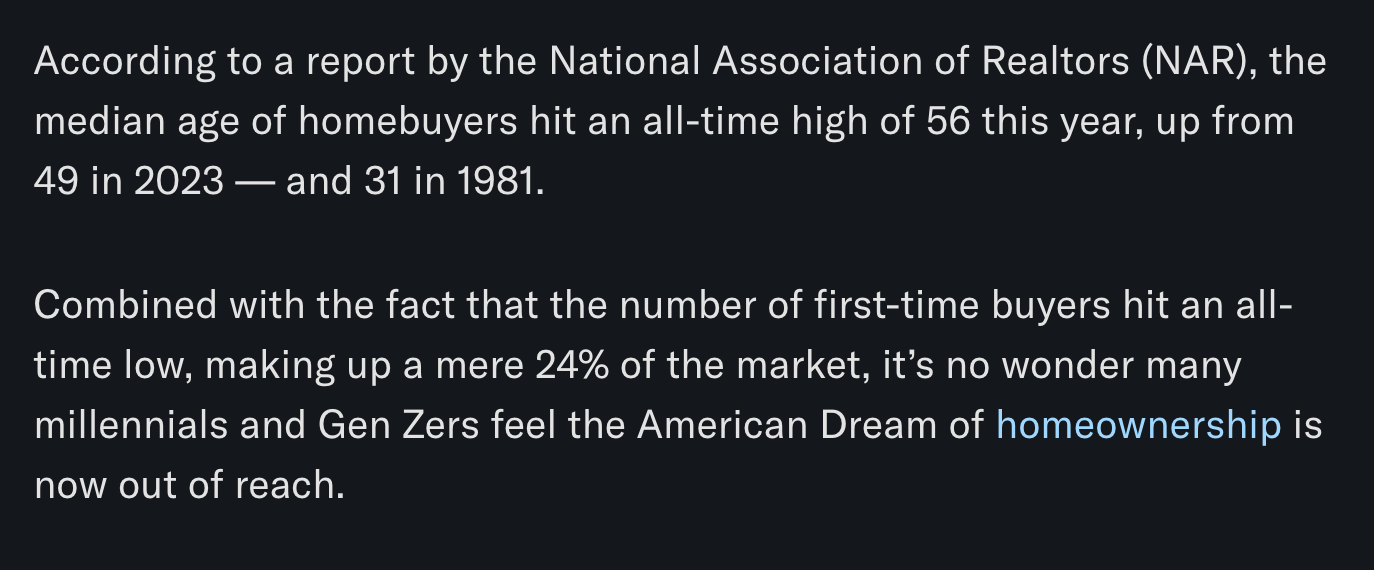

2025-06-12 16:16:11Marty Bent Vibe coded the opportunity cost app. I have not tried it yet, but love the concept. I have been into bitcoin since 2014, but I spent more generational wealth than I would care to admit back then. I've heard stories of fortunes blown on cocaine in the 1980's. I could write a story about spending a fortune on Diet Mt. Dew. I don't drink Diet Mt. Dew anymore. This one time, I spent about a million sats for a light beer at a baseball game. I wouldn't say I had a drinking problem, a million sats was only five bucks at the time. I didn't know that much bitcoin would be worth over a thousand bucks eleven years later.

I don't drink beer anymore. Bitcoin tends to do that to you.

We can afford chairs now. To be honest, we need a couch. The last couch I bought was in 2017 and it cost about a whole bitcoin. That couch is buried in a landfill today. My wife loves furniture, but even she's hesitant to spend sats on a couch now. We know we need a couch, but we don't want to spend sats on something we will need to replace before the next halving.

Many of us who have been in bitcoin for more than a decade have some regrets. I know I do, but we need to live our lives. I would never say you should sit on the floor, but I encourage to you to think about time. How long will this thing I need to buy last? If you think you can give a 3 million sat couch to your grandchildren, spend three million sats on the couch. If your five year plan for the couch is to help fill a landfill, maybe you only need to buy a used couch at a thrift store. This is not investment advice of course. How can it be? I don't know what kind of couch hazards you have in your house. I have trouble finding a couch of my own, but it's how I think about making bigger purchases. How many years of your retirement will that watch, car, house or whatever cost you from your stack? You can only determine that for yourself. I think the opportunity cost app will help you keep track of your decision.

This app was made by someone who once spent a whole bitcoin on a heater. I can't speak for Marty, but I believe the opportunity cost app will help you learn from my mistakes.

For more information, check out:

https://www.opportunitycost.app/

Check out the code on GitHub.

Using The Opportunity Cost App

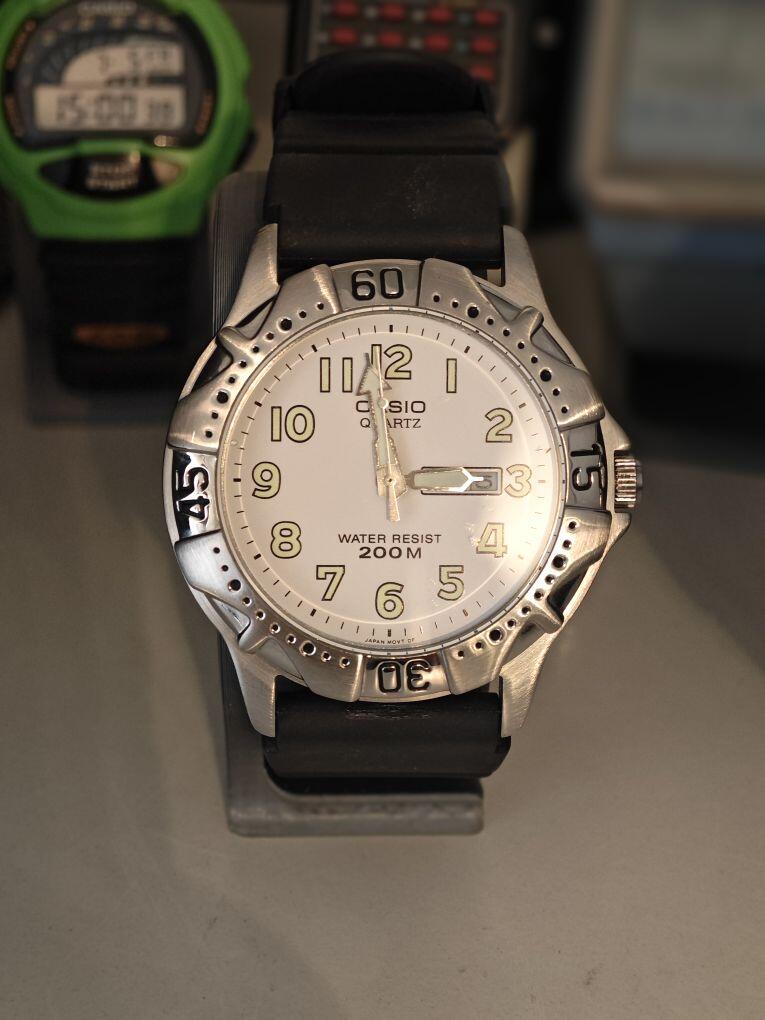

The app is pretty straight forward. It is only available on Chrome for now so I installed it on the Chromium browser. I looked at the settings, but kept them default.

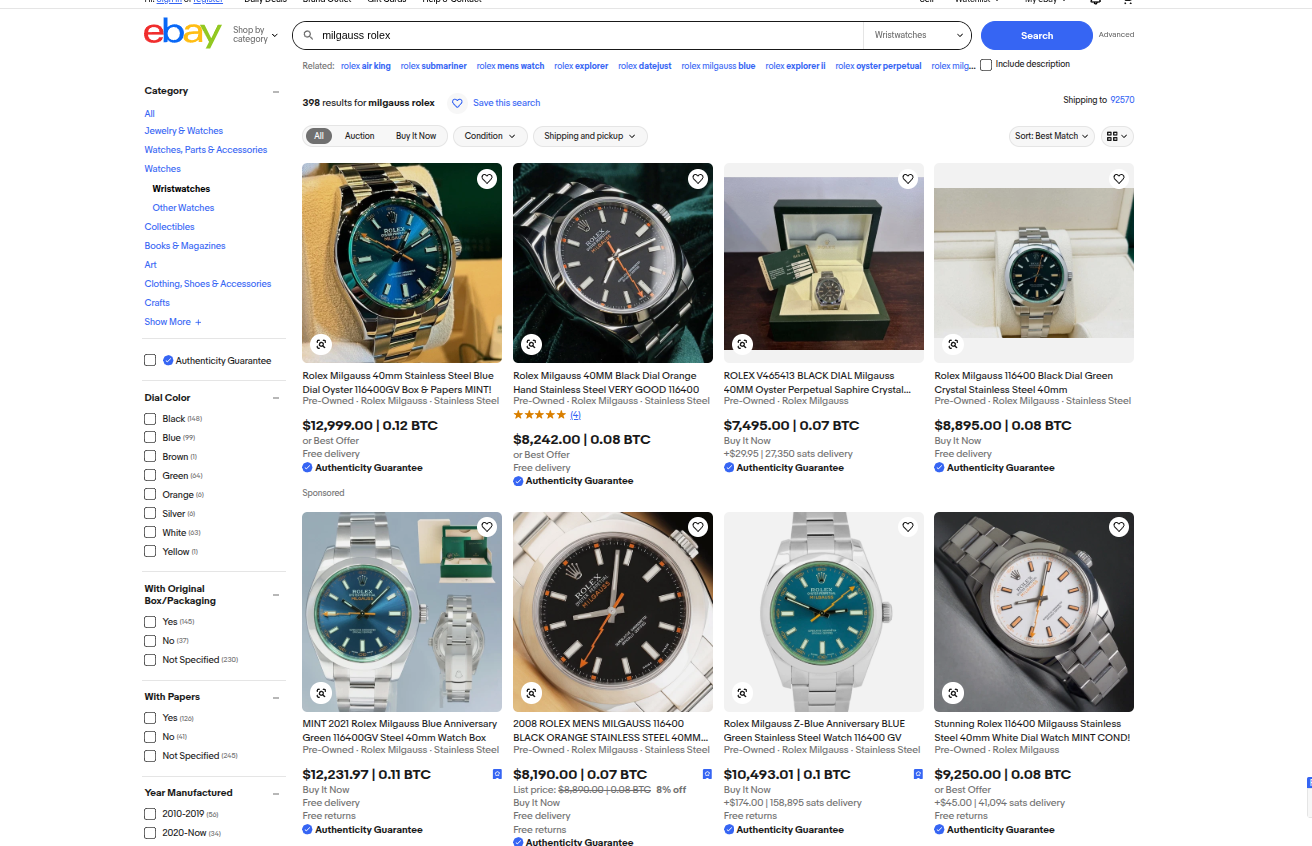

Then I searched for a Rolex in Duck Duck Go.

The default is bitcoin, but there is a sat calculator in the corner too, I have always wanted a Rolex Milgauss with a green sapphire so I looked it up on eBay. It's about 8 million sats. That's too rich for my blood, but I might be willing to part with a million sats for that watch. I'll definitely pick it up for 500,000 sats. I can wait. Bitcoin is the best clock in the world. I wouldn't go so far as to call this Rolex a shitcoin, but bitcoin is a better clock than any watch in my opinion--Even when compared to my favorite watch.

Video From Opportunity Cost Website

How will you use the Opportunity Cost browser extension?

☮️ npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

https://zapthisblog.com/calculate-your-opportunity-cost-while-shopping/

-

@ 79c79f2d:7dbd8c3f

2025-06-12 16:02:47

@ 79c79f2d:7dbd8c3f

2025-06-12 16:02:47HVAC services in Tucson cover everything from air conditioning repairs to furnace installations, designed specifically for the region’s unique desert climate. With temperatures ranging from freezing winters to blazing summers, efficient heating and cooling systems are vital. Tucson HVAC contractors offer expert installation, maintenance, and emergency repairs to keep your system running smoothly. They provide energy-saving solutions and work with top brands to ensure comfort and reliability. Whether it’s residential or commercial service, Tucson HVAC professionals are known for their fast response, honest pricing, and technical expertise.

-

@ 8bad92c3:ca714aa5

2025-06-12 16:02:00

@ 8bad92c3:ca714aa5

2025-06-12 16:02:00

Another week of conversations with sharp minds thinking about Bitcoin's future and the broader economic landscape. Here are the three most compelling predictions from recent episodes.

Bitcoin Core Will Face a Major Governance Crisis Over Covenant Proposals in 2025 - James O'Beirne

James made a prediction that sent chills through the Bitcoin development community - he believes Bitcoin Core's current governance structure will reach a breaking point this year over covenant proposals like CTV. After working as a Core developer for nearly a decade, he's convinced that the organization's inability to make progress on scaling solutions will force alternative implementations.

His timeline is specific and urgent. James believes that if Core doesn't show "substantive review discussion about how we get this stuff in" within six months, credible developers will start building alternate activation clients. The technical argument is compelling: covenants like CheckTemplateVerify have been thoroughly reviewed for seven years, with a 5 BTC bounty (worth over $500,000) still unclaimed for finding material bugs.

The stakes couldn't be higher for Bitcoin's future. James noted that currently "just over two and a half percent of Americans would be able to, on a monthly basis, buy Bitcoin on an exchange, withdraw it to self-custody, and then maybe make a spend." Without scaling solutions, this number won't improve meaningfully. His prediction reflects growing frustration with Core's de facto monopoly over protocol development. "You simply can't ignore that there is a social reality to being in that world," he said, referring to the concentrated funding and decision-making power that has created what he sees as an unsustainable bottleneck for Bitcoin's evolution.

The U.S. Will See Widespread Energy Blackouts as AI Data Centers Strain the Grid - Anas Alhajji

Dr. Anas delivered a sobering prediction about America's energy infrastructure failing to keep pace with exploding AI demand. He expects we'll see significant blackouts in major cities within the next few years, with a particularly concerning scenario where AI facilities maintain power while residential areas go dark. "I will not be surprised if we end up with a situation like this in some states and some cities," he warned.

The mathematics behind his prediction are stark. Energy consumption is skyrocketing due to multiple factors: urbanization, AI data centers, and simple population growth. When migrants move from rural areas to U.S. cities, their energy consumption increases by 30-70 times. Meanwhile, AI facilities require massive baseload power that renewable sources simply cannot provide reliably.

The infrastructure problems run deeper than just generation capacity. Anas explained that America's electrical grid is aging and wasn't designed for this level of demand. Even worse, we lack the manufacturing capacity to produce enough natural gas turbines - the only realistic solution for reliable baseload power at scale. He predicts this will create a dangerous political dynamic where tech companies with guaranteed power contracts maintain operations during blackouts while regular citizens lose electricity. "We might see a backlash from the population, and we will see politicians basically being forced to fight them because of that."

AI Will Force Millennials Into Career Reinvention Within the Next Decade - Bram Kanstein

Bram made a stark prediction about the collision between artificial intelligence and millennial career paths. He believes that traditional knowledge-based jobs will become obsolete much faster than people expect, forcing an entire generation to completely rethink their working lives. "If you think you're going to work for the next 30 years of your life, think again," he warned during our conversation.

His argument centers on the rapid advancement of AI capabilities that he's witnessed firsthand. After spending just 12 hours working with AI tools, Bram claims he developed what could be "a top 10 cybersecurity invention" - despite having no cybersecurity background. This experience convinced him that jobs requiring strict knowledge and logic are already dead. The implications are massive for millennials who built their careers around expertise that AI can now replicate instantly.

The timing couldn't be worse, as Bram notes that this technological disruption is happening precisely when millennials need stable income to support families and prepare for retirement. His solution? Use Bitcoin to create the time and space needed to figure out how to function in an AI-dominated world. "You need to be aware of that. This is where it's going. So how do you protect yourself in an age of AI? Bitcoin is the perfect way to do that."

Blockspace conducts cutting-edge proprietary research for investors.

New Bitcoin Mining Pool Flips Industry Model: "Plebs Eat First" Could Threaten Corporate Dominance

Parasite Pool's radical zero-fee structure challenges mining giants by guaranteeing payouts to small miners while rewarding block finders with instant Bitcoin. It disrupts traditional mining with a hybrid payout model that gives block discoverers 1 BTC immediately, while distributing remaining rewards (~2.125 BTC plus fees) among all pool participants. This "plebs eat first" approach targets the 22% discount miners typically accept in exchange for guaranteed income.

Key innovations that matter:

- Lightning Network integration bypasses Bitcoin's 100-block maturity rule, delivering instant payouts to Lightning wallets

- 10-sat minimum withdrawal eliminates traditional barriers for small miners

- Block withholding protection through substantial honest-miner rewards reduces pool attacks

The pool currently commands just 5 PH/s (0.000006% of Bitcoin's network), meaning an expected 3+ years before hitting a block. But this represents a growing counterculture against Full Pay Per Share (FPPS) pools that dominate corporate mining.

Industry impact: If successful, Parasite Pool could attract commercial miners seeking downside protection while maintaining the lottery appeal that drives pleb participation. The model challenges the structural advantages of corporate mining pools.

What's next: ZK Shark plans to open-source components over time, with the current beta suggesting this is just "V1" of a broader disruption strategy.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ cae03c48:2a7d6671

2025-06-12 16:00:58

@ cae03c48:2a7d6671

2025-06-12 16:00:58Bitcoin Magazine

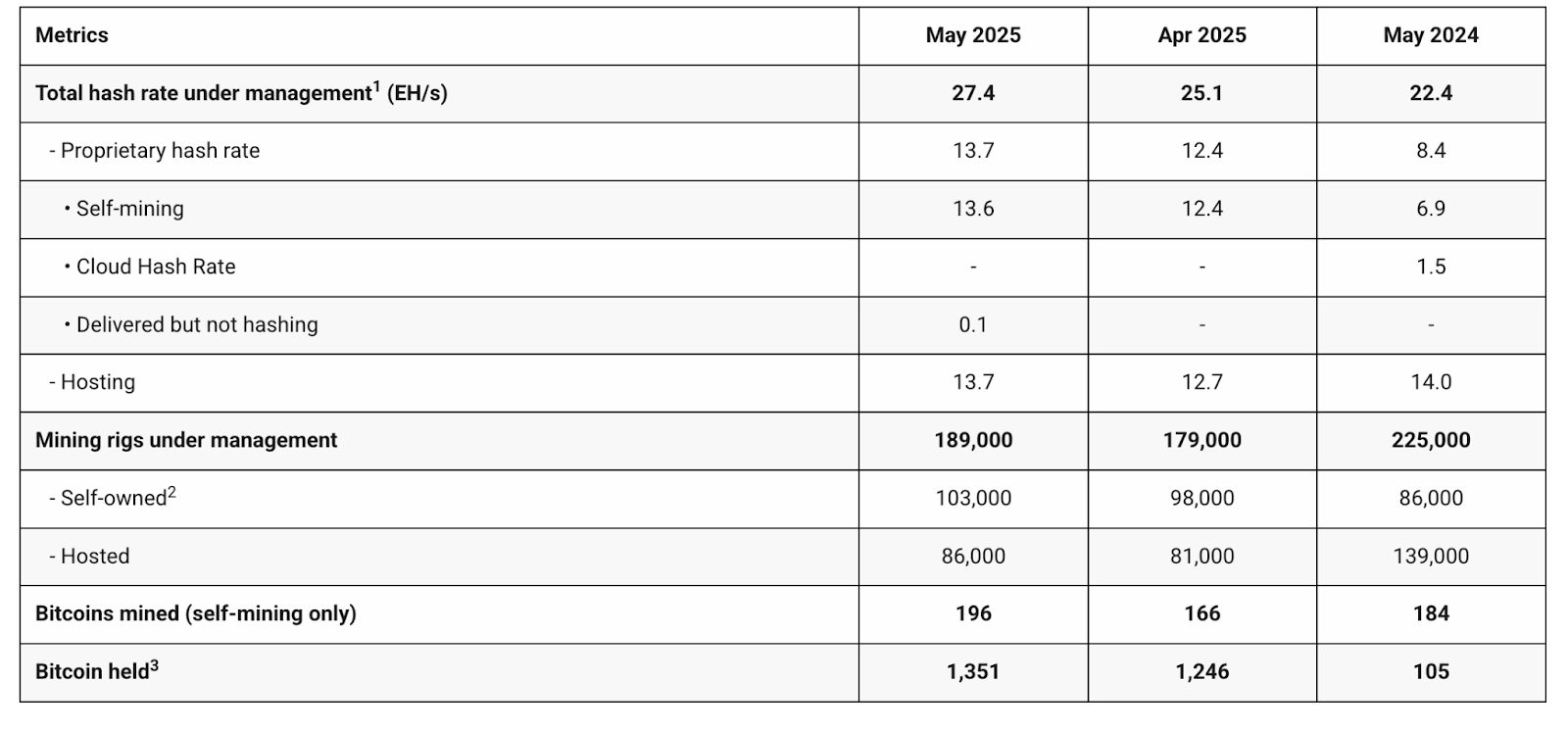

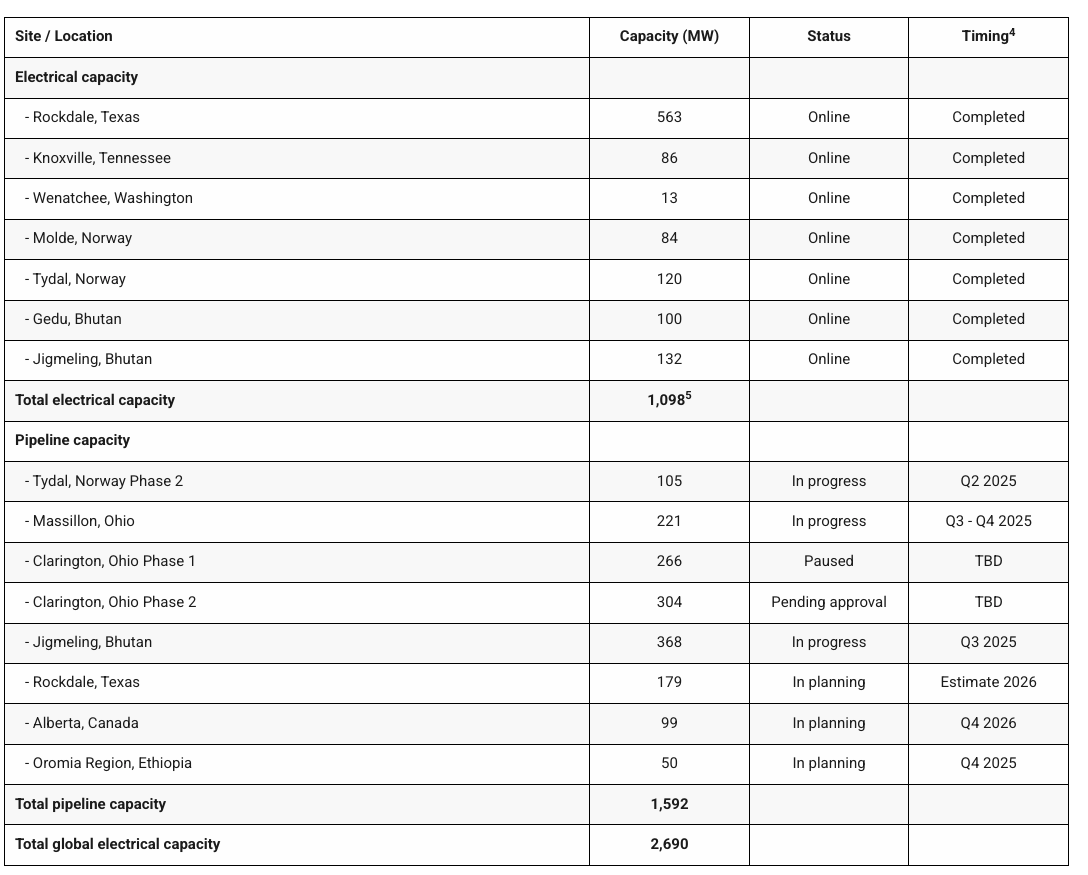

Bitdeer Mined 196 Bitcoin Worth Over $21 Million In MayBitdeer Technologies Group, a global leader in Bitcoin mining and infrastructure, has released its unaudited operational update for May 2025, highlighting robust expansion in hashrate capacity, ongoing infrastructure development, and an entrance into AI services.

$BTDR May 2025 Production & Operations Highlights:

Increased self-mining hashrate to 13.6 EH/s with #SEALMINER deployments.

Increased self-mining hashrate to 13.6 EH/s with #SEALMINER deployments.

9 EH/s SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to external customers, including 1.6 EH/s sold and shipped in May.

9 EH/s SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to external customers, including 1.6 EH/s sold and shipped in May.

SEALMINER… pic.twitter.com/wX66hahd2F

SEALMINER… pic.twitter.com/wX66hahd2F— Bitdeer (@BitdeerOfficial) June 11, 2025

“In May 2025, we continued to deploy our SEALMINER mining rigs to our sites in Texas, U.S., Norway, and Bhutan, bringing Bitdeer’s self-mining hashrate to 13.6 EH/s at the end of the month of May,” said Matt Kong, Chief Business Officer at Bitdeer. “Looking forward, we remain on track to deliver over 40 EH/s of self-mining capacity by October 2025. Further, in May, we sold and shipped approximately 1.6 EH/s of our SEALMINER A2s to external customers. Our A3 Series will also be released and available for pre-order very soon”

Bitdeer self-mined 196 BTC in May—an 18.1% increase from April—due to the expanded deployment of SEALMINER A1 and A2 units. A total of 9 EH/s in SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to customers and 1.6 EH/s sold in May alone.

SEALMINER A3s, which are currently undergoing machine-level testing with positive results, will become available for pre-order in June. Additionally, development of the next-generation A4 SEALMINER chip is progressing, targeting an efficiency of 5 J/TH by Q4 2025.

Bitdeer also announced the launch of its AI Cloud service, powered by over 10 advanced large language models (LLMs), including LLaMA, DeepSeek, and Qwen variants. The infrastructure is designed for strong inference demand, representing a key move into the HPC/AI sector.

Infrastructure developments include the ongoing energization of the 175 MW Tydal, Norway site—expected to be fully energized by June—and continued progress at the 221 MW Massillon, Ohio site, targeting completion in the second half of 2025. The company also energized 132 MW at its Jigmeling, Bhutan site, with another 368 MW coming online by Q3.

Financially, Bitdeer secured $50 million in cash proceeds during May after Tether exercised warrants from a 2024 private placement.

With a global capacity of 2,690 MW and expanding operations across North America, Europe, and Asia, Bitdeer continues to assert its role as both a top-tier Bitcoin mining operator and a high-performance computing pioneer.

This post Bitdeer Mined 196 Bitcoin Worth Over $21 Million In May first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ f1989a96:bcaaf2c1

2025-06-12 15:41:24

@ f1989a96:bcaaf2c1

2025-06-12 15:41:24Good morning, readers!

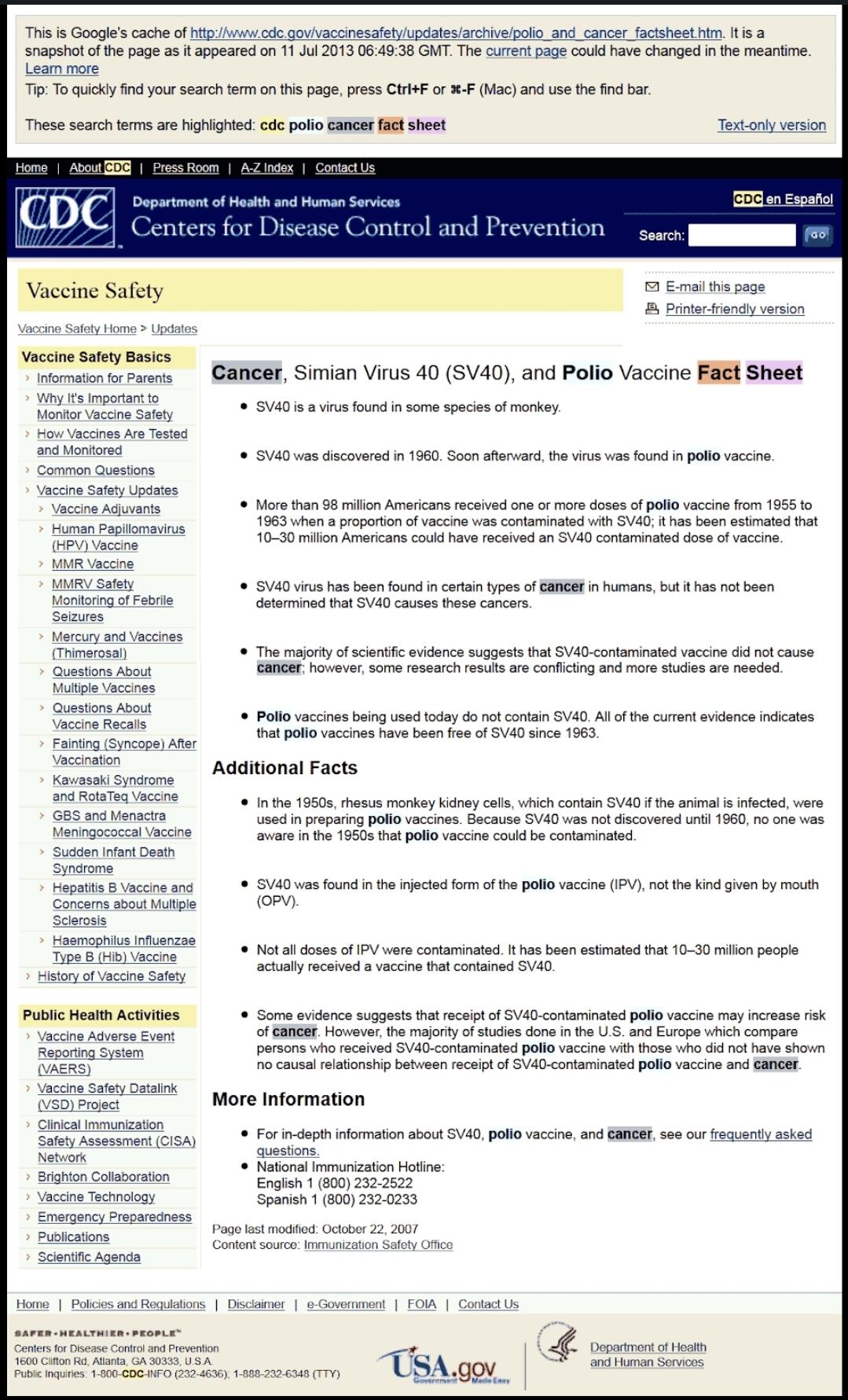

This week, we begin in Kenya, where police detained Rose Njeri, a software developer and mother of two, for building a website that enables Kenyans to flag causes and email parliament concerning an unpopular tax bill that threatens to raise the cost of living in an already inflation-sticky economy. Due to the holiday court calendar, Njeri remains behind bars awaiting criminal prosecution for what officials claim interfered with government systems, but was really a peaceful resistance to unfavorable economic policy.\ \ To a similar tune, in Venezuela, law enforcement stormed the home of Guillermo Goncalves, co-founder of El Dorado, a peer-to-peer trading app used by Venezuelans to exchange rapidly depreciating bolivares for stablecoins (digital tokens pegged to fiat currency like the US dollar). The El Dorado app filled a gap in Venezuela’s collapsing economy: offering a market-based exchange rate for bolivars and access to more stable currencies.\ \ In freedom tech news, Breez, a company building on the Lightning Network, added support for BOLT 12 and BIP 353 to its Nodeless Software Development Kit (SDK). This will enable wallets powered by the Breez Nodeless SDK to implement these features. BIP 353 makes it easier for activists and NGOs with an Internet domain to receive Bitcoin donations. And BOLT 12 brings greater privacy and efficiency to Bitcoin’s Lightning Network.\ \ We end with an interview with Hong Kong dissident Nathan Law, who turned to Bitcoin to stay active in his push for freedom and democracy in the wake of China’s authoritarian crackdown.

Now, let’s take a closer look.

SUBSCRIBE HERE

GLOBAL NEWS

Kenya | Criminal Prosecution of Software Developer

In Nairobi, Kenya, law enforcement raided the home of software developer Rose Njeri and took her into custody. Her alleged crime: building a platform that lets Kenyans review and email their elected representatives concerning an unpopular tax bill threatening to raise their cost of living. On May 30, 15 officers stormed her home without a warrant, seized her devices, and detained her incommunicado for more than 88 hours. Officials claim her web tool, which auto-generated feedback emails to Kenyan parliament, illegally interfered with government systems. Outside the police station, many Kenyans gathered in protest, demanding her immediate release. Last year, a similar finance bill triggered mass demonstrations and a brutal crackdown that left dozens dead. Njeri’s arrest shows the growing risks civic technologists face and depicts the growing trend of using state power to suppress peaceful pushback to unfavorable economic policy.

Venezuela | National Police Raid Home of El Dorado Founder

Venezuela’s National Police stormed the home of Guillermo Goncalves, co-founder of El Dorado, a peer-to-peer trading app used by Venezuelans to exchange rapidly depreciating bolivares for stablecoins like Tether (USDT) and Circle (USDC). The platform filled a critical gap: offering market-based pricing for bolivares and access to more stable currency. Nonetheless, the regime accuses Goncalves of fueling currency speculation, pointing to past comments where Goncalves highlighted the disconnect between the “official” exchange rate of the bolivar, as set by the Central Bank of Venezuela, and the parallel market rate. The arrests of those publishing truthful economic data and providing alternatives to 162% inflation under the guise of “stability” are hallmarks of a dictatorship that destroyed its currency and is now hunting down those trying to survive outside its system.

Tanzania | Blocks Access to X and Telegram Amid Financial, Political, and Media Repression

Tanzania restricted access to X and Telegram across major Internet providers following a hack of the Tanzanian police force’s official account. The platforms remain offline more than three weeks later in the lead-up to October’s presidential and parliamentary elections. The timing of the shutdown also coincides with the kidnapping of Ugandan journalist, lawyer, and Oslo Freedom Forum speaker Agather Atuhaire, who says she was tortured and sexually assaulted while in Tanzanian custody before being left at the border between Tanzania and Uganda. Recently, the government also banned the use of foreign currency in daily transactions, forcing citizens to rely on the weakening Tanzanian shilling. And in April, the opposition CHADEMA party was disqualified from participating in the October elections under the pretense of treason against party leader Tundu Lissu. The censorship of online platforms, suppression of opposition and dissidents, and laws banning foreign currency all signal a coordinated strategy to silence criticism and strip Tanzanians of both their political voice and financial autonomy.

Russia | Proposes Relocating Bitcoin Miners

Russia’s energy ministry is considering relocating Bitcoin miners to northern regions, where old energy infrastructure sits idle and the state can keep a closer eye. The plan comes months after the Kremlin banned mining across ten southern regions (including Dagestan and Chechnya), citing fears over energy shortages. But the ban has chiefly targeted individual and small-scale miners, not state-aligned corporations. Many independent miners, especially in poorer regions, used Bitcoin to escape financial isolation. Now, they’re being squeezed out in favor of top-down regulations. As the Kremlin tightens its grip on domestic energy and economic activity, it’s clear that the regime sees Bitcoin not as a tool for freedom but as something to be contained, regulated, and surveilled.

Israel | Freezes Bank Account of NGO Providing Aid in Palestine

Physicians for Human Rights Israel, a nonprofit providing medical aid in the West Bank and Gaza, has revealed that its bank accounts were frozen at the beginning of the year. The nonprofit, which previously ran regular medical missions in Palestine, says it was first blocked from making transactions, then warned by its bank, and finally notified in January that its account would be closed. These banking restrictions are not isolated. According to Lee Caspie, the deputy director of physicians for Human Rights Israel, other Israeli nonprofits providing aid to Palestinians receive similar financial treatment. Caspie shared that a new bill advancing would also impose an 80% tax on foreign grants to Israeli charities, with an exemption for those deemed acceptable by the government. These measures threaten to worsen a humanitarian crisis by leaving civil society organizations providing crucial support and services in Palestine financially cut off.

Hungary | Postpones Law That Would Ban Foreign-Funded Organizations

In a small win for civil society in Hungary, Viktor Orbán’s ruling Fidesz party postponed a vote on a sweeping bill that would grant the Orbán regime power to monitor, penalize, and potentially shut down any organization receiving foreign funds. Framed as protecting “sovereignty,” the proposal closely mirrors Russia’s foreign agent law and has been widely condemned as a death blow to Hungary’s independent institutions, media, and dissidents. While officials now say they need more time to “debate the means,” critics warn the delay is a tactical move, not a change of heart. The bill casts an intentionally wide net, branding foreign-backed efforts to defend press freedom and LGBTQ+ rights as threats to national identity and political discourse. “Its aim is to silence all critical voices and eliminate what remains of Hungarian democracy once and for all,” according to a joint statement signed by more than 300 civil society and media organizations.

BITCOIN AND FREEDOM TECH NEWS

Breez | Adds BOLT 12 and BIP 353 Support to Nodeless SDK

Breez, a company helping build out the Bitcoin Lightning economy, released support for BOLT 12 and BIP 353, enabling wallets using the Breez Nodeless SDK (such as Misty Breez and Klever) to implement these features. BOLT 12 is a critical update to the Lightning Network that brings increased privacy and greater censorship resistance to Bitcoin transactions for those facing financial repression. It also introduces reusable payment requests for recurring payments (such as tips and donations to human rights defenders). BIP 353 enables individuals and organizations with access to a domain the ability to create static, human-readable payment addresses (such as user@domain) for Bitcoin payments. With this integration, NGOs or activists with an internet domain and wallet using the Breez SDK can receive uncensorable donations through their domain in an accessible way. Implementing these new Bitcoin features will provide users with greater financial freedom and autonomy under authoritarian regimes.

BTCNutServer | Accept Ecash Payments with BTCPay Server

A new experimental plugin called BTCNutServer is attempting to bring ecash payments to BTCPay Server. The idea is to allow users to accept Cashu ecash tokens alongside Bitcoin using BTCPay Server’s self-custodial and self-hosted infrastructure. Ecash specifically is a digital money system backed by Bitcoin and designed to offer instant, low-cost, and very private transactions. For activists and dissidents, ecash enables bitcoin payments without compromising financial privacy. But users must trust mints (entities that manage and issue ecash tokens) to custody their funds. Though still in early development, BTCNutServer could enable charities, nonprofits, and merchants in repressive countries to accept ecash through BTCPay Server and, in doing so, keep their financial activity hidden from state surveillance.

Private Pond | New Experimental Payjoin System

Private Pond is a new experimental project that builds upon the Payjoin protocol to improve both the privacy and efficiency of Bitcoin transactions. Payjoin works by mixing inputs of a bitcoin payment with inputs from the recipient, making it harder for outside observers to trace who paid whom. Private Pond takes this concept further: it is an application designed to optimize Bitcoin transaction rails (such as a platform’s deposits and withdrawals). It uses transaction batching to bundle many deposits and withdrawals into a single transaction, using incoming deposits to fund outgoing withdrawals. While it’s not production-ready, if Private Pond were implemented in other applications, it could lower fees, create stronger privacy, and expose fewer funds. Innovations like this help strengthen Bitcoin’s original purpose: a financial network that resists censorship and surveillance while staying efficient and scalable.

Chorus.Community | New Social App for Activists

Chorus.Community is a new social app introduced at the 2025 Oslo Freedom Forum that is designed for people who operate under surveillance or censorship. Developed on permissionless technologies like Bitcoin and Nostr, Chorus allows users to share updates, send voice notes, organize groups, and raise funds, all without needing an email, phone number, or approval from any central authority. Unlike traditional platforms, Chorus cannot easily be blocked or shut down. Future updates will include encrypted messaging and group features, further enhancing security. For activists, journalists, and organizers working in closed societies, Chorus offers a new way to stay connected, coordinate, and support one another. Human rights defenders can try it here.

Bitcoin Policy Institute | Upcoming Bitcoin Policy Summit

The Bitcoin Policy Institute will be hosting its third annual Bitcoin Policy Summit from June 25-26 in Washington, DC, bringing together lawmakers, academics, and advocates to help shape and understand the future of Bitcoin policy in the US. A highlight of the event will be HRF’s chief strategy officer, Alex Gladstein’s keynote, “Bitcoin is the Most Powerful Human Rights Tool of the 21st Century,” which will explain Bitcoin’s growing role in resisting authoritarianism and protecting civil liberties worldwide. Learn more about the event here.

HRF | Gifts 800 Million Satoshis to 22 Freedom Projects Worldwide

HRF gifted 800 million satoshis in its Q2 2025 round of Bitcoin Development Fund (BDF) grants, supporting 22 open-source freedom projects worldwide. These projects advance Bitcoin education, open-source software, mining decentralization, and privacy tools for activists contending with authoritarian regimes and dictatorships across Latin America, Africa, and Asia. Supporting censorship-resistant financial tools and permissionless technologies like Bitcoin, Nostr, ecash, Tor, VPNs, and more empowers dissidents, journalists, and civil society to organize, transact, communicate, and speak without state suppression, interference, or manipulation. Learn more about the grantees and their work here. This round of grants also marks the 5-year anniversary of the Bitcoin Development Fund! Watch our anniversary announcement video to celebrate this milestone with us.

OpenSats | Announces 11th Wave of Bitcoin Grants

OpenSats, a public nonprofit funding free and open-source software, announced its 11th wave of grants advancing the Bitcoin protocol as a tool for financial freedom. Among the projects, Mostro and Payjoin stand out for their importance to dissidents and anyone seeking greater financial sovereignty. Mostro is a peer-to-peer Bitcoin exchange protocol built on nostr, allowing users to trade Bitcoin directly without relying on centralized intermediaries that can be surveilled, censored, or shut down. Meanwhile, Payjoin enhances Bitcoin transaction privacy by breaking common heuristics used to trace payments, making it harder for authoritarian surveillance tools to identify payees and the amount transacted. Together, these tools give people living under repressive regimes more private, resilient ways to save and transact.

RECOMMENDED CONTENT

Nathan Law on Hong Kong’s Fight for Freedom, Bitcoin, and Lessons for the West with Ben Perrin

In this interview with Bitcoin educator Ben Perrin (BTC Sessions), exiled Hong Kong activist Nathan Law reveals how Bitcoin became a critical tool for resisting financial blacklisting under China’s authoritarian crackdown. With a $140,000 bounty on his head and no access to traditional banking, Law turned to Bitcoin to stay active in his push for freedom and democracy. Watch the full conversation here.

If this article was forwarded to you and you enjoyed reading it, please consider subscribing to the Financial Freedom Report here.

Support the newsletter by donating bitcoin to HRF’s Financial Freedom program via BTCPay.\ Want to contribute to the newsletter? Submit tips, stories, news, and ideas by emailing us at ffreport @ hrf.org

The Bitcoin Development Fund (BDF) is accepting grant proposals on an ongoing basis. The Bitcoin Development Fund is looking to support Bitcoin developers, community builders, and educators. Submit proposals here.

-

@ 69eea734:4ae31ae6

2025-06-12 15:25:09

@ 69eea734:4ae31ae6

2025-06-12 15:25:09Vor ein paar Tagen stieß ich auf einen faszinierenden Artikel von Michel Bauwens, Mitbegründer der P2PFoundation, mit Links zu weiteren Texten – zum Beispiel über den Puls der Commons –, die ich ebenfalls äußerst interessant fand.

Der Artikel zeigt unter anderem gut, wie unterschiedlich Commons aussehen können, so dass ich ihn heute als Ausgangspunkt nehmen möchte, um ein paar Puzzle-Steine in mein entstehendes Bild der Commons einzufügen.

Das Grundmuster menschlichen Zusammenlebens?

Bauwens betrachtet die Commons aus historischer Sicht, wie sie sich in verschiedenen Zeiten unterschiedlich manifestieren, manchmal gar nahezu verschwinden und heute in wiederum veränderter Form neu entstehen – und plädiert dafür, dass sie noch weit stärker werden sollten.

Er legt zunächst dar, was die Commons sind und was nicht. (zum Beispiel nichts, was vom Staat verwaltet wird, wie ein öffentlicher Park.) Ausschlaggebend ist, dass eine Ressource von ihren Herstellern oder Benutzern selbst betreut wird. Commons entstehen dabei durch Beziehungen. Sie sind etwas spezifisch Menschliches und eine Wahl, die „fast immer“ zur Verfügung steht, so Bauwens. Eine die Geschichte überdauernde menschliche Praxis.

Er nennt drei verschiedene geschichtlichen Entwicklungen:

- Eine lineare - Wie präsentiert sich der Commons über verschiedene, komplexer werdende, Phasen der Menschheitsgeschichte hinweg?

- Eine hin und her schwingendende: In der Geschichte einer Zivilisation werden die Commons in Zeiten von Überfluss -- und daraus resultierender Verschwendung uns steigender Ressourcen-Extraktion -- unterdrückt, konstitutieren sich aber dann als Gegenbewegung wieder neu.

- Eine stufenweise: Die heutigen, mit neuen Möglichkeiten ausgestatteten Formen der Commons könnten in der nächsten Phase unserer Zivilisation (oder nach unserer Zivilisation) eine entscheidende Rolle spielen.

Wenn man verschiedene Arten des Austausches betrachtet (Bauwens beruft sich hierbei auf Alan Fiske), kann man geschichtlich analysieren, welche zu verschiedenen Zeiten vorrangig waren (dies tat Kojin Karatani in The Structure of World History von 2014).

Die vier Muster sind:

- Gemeinschaftliche Beteiligung, Commons (die Gemeinschaft baut mir ein Haus, und ich helfe später bei einem anderen Hausbau mit; ein Beispiel aus neuerer Zeit ist die Entwicklung von Linux)

- Wechselseitiger Austausch (Geschenkökonomie – es wird eine etwa gleichwertige Leistung zu einem späteren Zeitpunkt erwartet)

- Hierarchisch bedingte Verteilung, wie im Feudalismus

- Marktwirtschaft (es gibt ein allgemeines Zahlungsmittel mit einem bestimmten Wert)

Bauwens: „Entscheidend ist jedoch, dass die Menschheit ständig bestrebt ist, Modus A wiederherzustellen, denn die Menschen haben eine kulturelle und wahrscheinlich auch allgemeine Vorliebe für ein geselliges Leben in kleinen, vertrauten Gruppen. Aber menschliche Gruppen versuchen, dies auch auf höheren Komplexitätsebenen zu tun, in einem ständigen Versuch, die extraktive Logik der Zivilisation zu mäßigen.“ (Katarani bezeichnet eine Verbindung von Commoning und Geschenkökonomie in stammesorientierten Kulturen als Modus A)

Commons durch die Zeiten - ein kurzer Abriss

In der ursprünglichsten Form der Commons in Jäger- und Sammler-Gemeinschaften, werden Nahrung und sonstige Ressourcen mit der ganzen Gemeinschaft geteilt - dies ist zumindest die vorherrschende Form des Austauschs.

Im Zuge der Agrar-Revolution geht es um das gemeinsame Bewirtschaften von Flächen.

Im Mittelalter entwickelt sich in Europa das Feudalsystem. Auch hier werden manche Felder aber noch von den Dorfbewohnern gemeinsam verwaltet.

Ab dem 16. Jahrhundert fanden, am stärksten in England, die Enclosures (auf deutsch Einhegungen) statt. Das heißt, dass Felder zur effizienteren Bewirtschaftung von den Besitzern zusammengelegt und umzäunt wurden.

Besonders im 19. Jahrhundert, mit dem Aufkommen der Industrialisierung, nahm diese Entwicklung immer stärker zu. Die landwirtschaftlichen Commons wurden dadurch weitgehend zerstört.

Im industriellen Kapitalismus, als die Arbeiter kaum Rechte hatten, und es auch um das bloße Überleben ging, entwickelte sich ein sozialer Commons Dieser bestand darin, dass sich die Arbeiter gegenseitig halfen und sich gegenseitig versicherten. Aus dieser Bewegung entstand dann der Sozialstaat. Der Staat übernahm also Aufgaben, die die Menschen zuvor füreinander geleistet hatten.

Man könnte daher sagen, dass im Kapitalismus die natürlichen Commons-Ressourcen privatisiert und die sozialen Commons verstaatlicht wurden.

In der Moderne waren sich viele Menschen der Bedeutung von Commons gar nicht mehr bewusst.

Mit dem Internet, dem World Wide Web und weiteren digitalen Techniken erschlossen sich dann neue Möglichkeiten. Mit Peer Production, Open Source Software, sowie den Creative Commons Lizenzen, enstand eine neue Inkarnation der Commons. Und damit ist die Entwicklung noch nicht abgeschlossen...

Warum Commons nicht in ein Links-Rechts-Schema passen

Mit seinem Streifzug durch die Geschichte zeigt Bauwens, wie vielfältig die Commons sein können, und warum ihnen in der heutigen Zeit eine starke Rolle zukommen sollte. Nebenbei ergibt sich für mich auch, dass sie jenseits von linker oder rechter Ideologie liegen. Hierzu eine kurze Zwischenbetrachtung von mir:

Weil es um kollektives Handeln geht, und auch wegen des Namens („hört sich an wie Kommunismus“, meinte meine Mutter), entsteht leicht der Eindruck, es handele sich um ein besonders linksgerichtetes Phänomen.

Eine gut eingespielte Fußballmannschaft agiert auch als Kollektiv. Der Verein verwaltet vielleicht ein Clubhaus. Wohl kaum jemand würde deswegen den Verein als links bezeichnen.

Freilich sind die Mitglieder heutiger Commons-Bewegungen vorwiegend „progressiv“, zuweilen auf eine rigide Weise. Bauwens hat damit schon eine leidvolle Erfahrung gemacht. Aber Commons als soziales System sind es nicht. Dafür spricht allein schon die Tatsache, dass es sie viel länger gibt als die politische Links-Rechts-Einteilung.

Eine starke Rolle für die Commons

Wie steht es um die Commons heute? Das werde ich in weiteren Artikeln noch versuchen zu beleuchten.

Mir kommt gerade der Gedanke in den Sinn: Sie wachsen überall.

Wie oben erwähnt, enstand mit zunehmenden digitalen Möglichkeiten eine neue Form der Commons. Leider gab es hier auch moderne Formen der Einhegungen. Github wurde von Microsoft übernommen, der Sardex (alternatives lokales Wirtschaftsnetzwerk) anscheinend von einer Investment-Firma. AWS (Amazon Web Services) verleibt sich gerne woanders entwickelte Projekte ein und bietet sie als zahlungspflichtige Services an. Krypto wurde -- weitgehend -- "gekapert".

Aber zum einen gibt es nicht nur den digital basierten Commons, es entsteht schon viel auf anderer Ebene, und zum anderen sind Commoners erfinderische Menschen...

Michel Bauwens hat in seinen Artikeln im Übrigen noch mehr zu den heutigen Commons zu sagen. Inbesondere beführwortet er das Kosmo-Lokale (Cosmo-Local). Was leicht ist (Wissen) wird geteilt, was Gewicht hat (etwa landwirtschaftliche und andere Produktion), wird an lokale Gegebenheiten angepasst und vor Ort bewerkstelligt.

Und das Zusammenspiel von Digitalem und Materiellem verspricht weitere Möglichkeiten.

In jedem Fall haben die Commons eine ausgleichende, regenerierende Kraft, die wir aufgrund der heutigen vielen Kriesen gar nicht ungenützt lassen können, ganz unabhängig von unserer sozialer Ebene - das gilt auch für die Superreichen.

-

@ cae03c48:2a7d6671

2025-06-12 15:01:56

@ cae03c48:2a7d6671

2025-06-12 15:01:56Bitcoin Magazine

Bitwise Debuts First Ever GameStop Covered Call ETFToday, Bitwise Asset Management announced the launch of the Bitwise GME Option Income Strategy ETF (IGME), the first-ever covered call ETF centered around GameStop (GME). The fund arrives at a moment where GameStop recently made headlines for its $500 million Bitcoin treasury strategy.

GameStop is embracing bitcoin; we built an income-generating ETF designed to capture that hype and turn it into yield.

Introducing $IGME: The first option income ETF capitalizing on investor interest in @gamestop and their adoption of bitcoin as a treasury asset.

As the fourth… pic.twitter.com/EHaXX9PK7X

— Bitwise (@BitwiseInvest) June 10, 2025

Led by Bitwise’s Head of Alpha Strategies Jeff Park, IGME is the latest addition to Bitwise’s rapidly expanding suite of option income ETFs. The actively managed fund is designed to generate income through a covered call strategy while offering investors exposure to GameStop, a company that has transformed from mall retailer to a key player in the digital asset conversation.

“IGME is the first covered call strategy built around GameStop, a stock whose historic volatility and growth potential make it a strong fit for this approach,” said Park. “With IGME, investors now have access to an option income ETF based on an equity that sits at the intersection of retail investor popularity, a traditional revenue-generating business, and digital asset adoption.”

GameStop recently disclosed that it holds 4,710 Bitcoin, worth over $500 million at the time of purchase, positioning it among the growing list of public companies making Bitcoin a core treasury component. As of March 31, 2025, over 79 public companies hold a collective $57 billion in Bitcoin—a 159% increase from the previous year, according to Bitcoin Asset Management.

IGME follows the launch of Bitwise’s other option income ETFs, including IMST (Strategy), ICOI (Coinbase), and IMRA (Marathon Digital Holdings). These ETFs aim to deliver monthly income through synthetic covered call strategies that leverage options rather than direct equity holdings.

“At Bitwise, our mission is to help investors gain access to the full range of opportunities emerging in crypto,” said Bitwise CEO Hunter Horsley. “We’re excited to add IGME to our suite of option income ETFs to help investors capitalize on the volatility of companies in the space.”

IGME plans to announce its first monthly distribution on July 24 and carries an expense ratio of 0.98%.

This post Bitwise Debuts First Ever GameStop Covered Call ETF first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 58537364:705b4b85

2025-06-12 13:59:39

@ 58537364:705b4b85

2025-06-12 13:59:39ในร่างกายที่มันมีสิ่งที่เรียกว่า… ระบบประสาท ทีนี้มีอะไรเข้ามากระทบร่างกาย คือกระทบระบบประสาท ปฏิกิริยามันก็เกิดขึ้น เป็นเหตุการณ์ อย่างใดอย่างหนึ่งขึ้น

เหตุการณ์นั้นแหละสำคัญ ถ้าให้เกิดความรู้สึกที่ถูกใจมันจะเป็นบวก เหตุการณ์นั้นไม่รู้สึกถูกใจแก่จิต มันก็จะเป็นลบ #ตัวกูเพิ่งเกิดเมื่อมีการกระทบแล้ว

ถ้าเหตุการณ์ที่เป็นบวกเกิดขึ้น ตัวกูบวกก็เกิดขึ้น เหตุการณ์ที่เป็นลบเกิดขึ้น ตัวกูที่เป็นลบเกิดขึ้น #ตัวกูนี้เกิดหลังเหตุการณ์ ขอให้เข้าใจดีๆ ไม่ใช่เกิดอยู่ก่อน

ตัวกูคลอดออกมาจาก situation ที่มากระทบระบบประสาท เช่นว่า… ไม่ได้กินอาหาร ขาดอาหาร มันหิว ความหิวเกิดขึ้นแก่ระบบประสาท ต่อมาจึงเกิด concept ว่า กูหิว, มีการกินแล้วจึงเกิด concept ว่า กูกิน

ถ้ามีอาการอร่อยแก่ลิ้น มันจึงเกิด concept ว่า… กูอร่อย หรือ มาทีหลังเหตุการณ์เสมอ จะถือว่าเป็น product ของเหตุการณ์นั้น ๆ ก็ได้

นี่คือความที่ไม่มีตัวจริง มิใช่ของจริง ของสิ่งที่เรียกว่าตัวกู #ขอให้รู้จักว่าตัวกูนี้มันเป็นมายาถึงขนาดนี้

ฟังดูการพูดอย่างนี้ มันเป็น logic แต่ความจริงของธรรมชาติมันเป็นอย่างนั้น ถือตามกฎ logic ธรรมดาสามัญ ที่พูดกันอยู่นี้ไม่ได้ ต้องถือตามความเป็นจริงที่ว่า มันเป็นอยู่อย่างไร

จิตก็เป็นธาตุชนิดหนึ่ง สิ่งแวดล้อมต่างๆ ที่เป็นธาตุชนิดหนึ่ง พอมาถึงกันเข้า ก็เกิดปฏิกิริยาออกมาอย่างนั้นอย่างนี้ ความรู้สึกที่เรียกว่า… #จิตคิดนึกได้นี้_ก็เป็นปฏิกิริยาที่เกิดขึ้นเท่านั้น แล้วความรู้สึกว่าตัวกู ตัวนี้ก็เป็นเพียงปฏิกิริยาที่เกิดขึ้นเท่านั้น.

มันฟังยากสำหรับท่านทั้งหลายที่ว่า ผู้กระทำนั้นเกิดทีหลังการกระทำ มันผิด logic อย่างนี้

แต่ความจริงเป็นอย่างนั้น self หรือ ego ผู้กระทำจะเกิดทีหลังการกระทำ เป็นปฏิกิริยาของการกระทำ

ความคิดอย่าง ตรรกะ หรืออย่างปรัชญา เอามาใช้กับสิ่งนี้ไม่ได้ ขอยืนยันไว้อย่างนี้

ถ้าท่านยังไม่เชื่อ ท่านก็ไปคิดดูเรื่อย ๆ ไปเถอะ ท่านจะพบว่ามันไม่เป็นอย่างกฎเกณฑ์ทางตรรกะหรือทางปรัชญา ที่เรามีๆ กันอยู่

ผู้กระทำเป็นเพียง concept ไม่ใช่ตัวจริง ส่วนการกระทำมันเป็นเหตุการณ์ของธรรมชาติ พอเข้ามาถึงจิตแล้ว ก็เกิดความคิด ความเชื่อ ความยึดว่าตัวกู

ตัวกูซึ่งเป็นเพียง concept ไม่ใช่ของจริง

พุทธทาสภิกขุ

อตัมมยตาประทีป

ชีวิตใหม่และหนทางเข้าถึงชีวิตใหม่

หน้า_๒๙๕-๒๙๖

-

@ 472f440f:5669301e

2025-06-12 05:11:12

@ 472f440f:5669301e

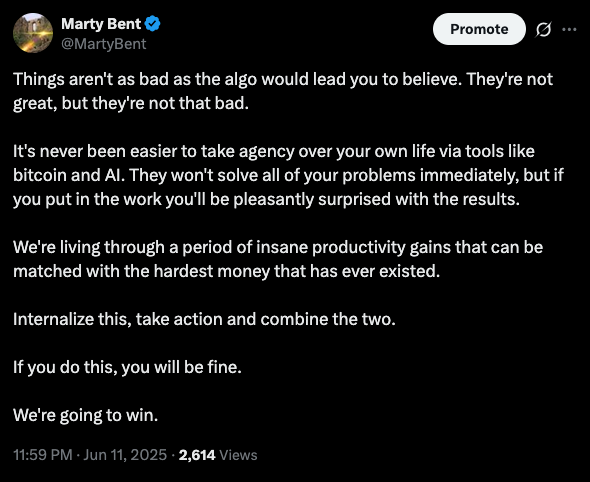

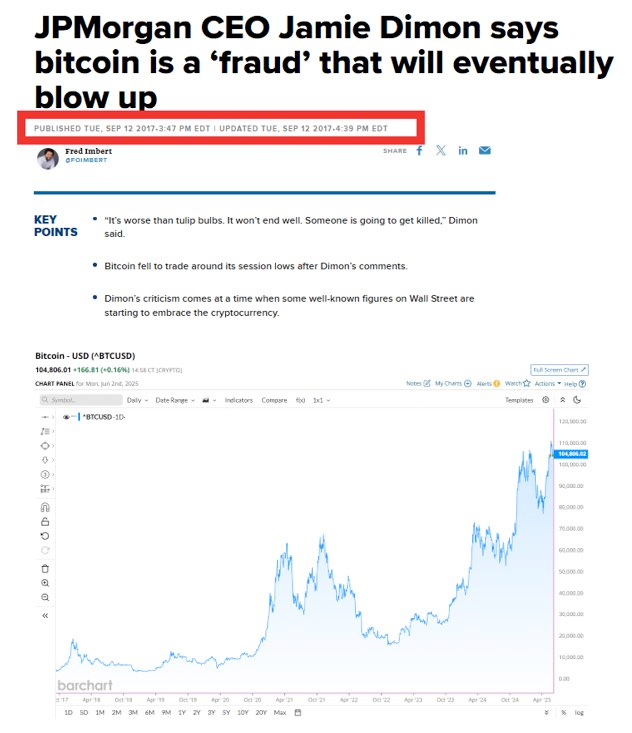

2025-06-12 05:11:12Marty's Bent

via me

I had a completely different newsletter partially written earlier tonight about whether or not "this cycle is different" when this nagging thought entered my head. So I'm going to write about this and maybe I'll write about the dynamics of this cycle compared to past cycles tomorrow.

A couple of headlines shot across my desk earlier tonight in relation to the potential escalation of kinetic warfare in the Middle East. Apparently the U.S. Embassy in Iraq was sent a warning and evacuation procedures were initiated. Not too long after, the world was made aware that the United States and Israel are contemplating an attack on Iran due to the "fact" that Iran may be close to producing nuclear weapins. The initial monkey brain reaction that I had to these two headlines was, "Oh shit, here we go again. We're going to do something stupid." My second reaction was, "Oh shit, here we go again, I've seen these two exact headlines many times over the years and they've proven to be lackluster if you're a doomer or blood thirsty war monger." Nothing ever happens.

As I venture into my mid-30s and reflect on a life filled with these types of headlines and my personal reactions to these headlines, I'm finally becoming attuned to the fact that the monkey brain reactions aren't very productive at the end of the day. Who knows exactly what's going to happen in Iraq or Iran and whether or not kinetic warfare escalates and materializes from here? Even though I'm a "blue-blooded taxpaying American citizen" who is passively and unwillingly contributing to the war machine and the media industrial complex, there's really nothing I can do about it.

The only thing I can do is focus on what is in front of me. What I have control of. And attempt to leverage what I have control of to make my life and the life of my family as good as humanly possible. Ignoring the external and turning inward often produces incredible results. Instead of worrying about what the media wants you to believe at any given point in time, you simply look away from your computer screen, survey the physical space which you're operating in and determine what you have, what you need and how you can get what you need. This is a much more productive way to spend your time.

This is what I want to touch on right now. There's never been a better time in human history to be productive despite what the algorithm on X or the mainstream media will lead you to believe. Things aren't as great as they could be, but they're also not as bad as you're being led to believe. We live in the Digital Age and the Digital Age provides incredible resources that you can leverage to make YOUR life better.

Social media allows you to create a platform without spending any money. AI allows you to build tools that are beneficial to yourself and others with very little money. And bitcoin exists to provide you with the best form of money that you can save in with the knowledge that your relative ownership of the overall supply isn't going to change. No matter what happens in the external world.

If you can combine these three things to make your life better and - by extension - potentially make the lives of many others better, you're going to be well off in the long run. Combining these three things isn't going to result in immediate gratification, but if you put forth a concerted effort, spend the time, have some semblance of patience, and stick with it, I truly believe that you will benefit massively in the long run. Without trying to sound like a blowhard, I truly believe that this is why I feel relatively calm (despite my monkey brain reactions to the headlines of the day) at this current point in time.

We've entered the era of insane leaps in productivity and digital hard money that cannot be corrupted. The biggest mistake you can make in your life right now is overlooking the confluence of these two things. With an internet connection, an idea, some savvy, and hard work you can materially change your life. Create something that levels up your knowledge, that enables you to get a good job in the real world, or to create a company of your own. Bring your talents to the market, exchange them for money, and then funnel that money into bitcoin (if you're not being paid in it already). We may be at the beginning of a transition from the high velocity trash economy to the high leverage agency economy run on sound money and applied creativity.

These concepts are what you should be focusing most of your time and attention to today and in the years ahead. Don't get distracted by the algorithm, the 30-second video clips, the headlines filled with doom, and the topics of the 24 hour news cycle. I'll admit, I often succumb to them myself. But, as I get older and develop a form of pattern recognition that can only be attained by being on this planet for a certain period of time, it is becoming very clear that those things are not worth your attention.

Living by the heuristic that "nothing ever happens" is a pretty safe bet. Funnily enough, it's incredibly ironic that you're led to believe that something is happening every single day, and yet nothing ever happens. By getting believing that something happens every day you are taking your attention away from doing things that happen to make your life better.

Tune out the noise. Put on the blinders. Take advantage of the incredible opportunities that lie before you. If enough of you - and many others who do not read this newsletter - do this, I truly believe we'll wake up to find that the world we live in is a much better place.

Nothing ever happens, so make something happen.

Intelligence Officials Are Quietly Becoming Bitcoin Believers

Ken Egan, former CIA Deputy Chief of Cyber Operations, revealed a surprising truth on TFTC: the intelligence community harbors numerous Bitcoin advocates. Egan explained that intelligence professionals uniquely understand how governments weaponize financial systems through sanctions and account freezing. Having wielded these tools themselves, they recognize the need for personal financial sovereignty. He shared compelling anecdotes of discovering colleagues with "We are all Satoshi" stickers and a European chief of station paying for dinner with a BlockFi card to earn Bitcoin rewards.

"I think there are a lot of Bitcoiners, not just at CIA, but across the whole national security establishment... they're in it for the exact same reasons everybody else is." - Ken Egan

The Canadian trucker protests served as a pivotal moment, Egan noted. Watching Western governments freeze citizens' bank accounts for political dissent struck a nerve among intelligence professionals who previously viewed financial weaponization as a tool reserved for foreign adversaries. This awakening has created unlikely allies within institutions many Bitcoiners distrust.

Check out the full podcast here for more on Bitcoin's national security implications, privacy tech prosecutions, and legislative priorities.

Headlines of the Day

Stripe Buys Crypto Wallet Privy After Bridge Deal - via X

Trump Calls CPI Data "Great" Urges Full Point Fed Cut - via X

Bitcoin Hashrate Reaches New All-Time High - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Life is good.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ dfa02707:41ca50e3

2025-06-07 13:01:47

@ dfa02707:41ca50e3

2025-06-07 13:01:47Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 57d1a264:69f1fee1

2025-06-12 06:00:19

@ 57d1a264:69f1fee1

2025-06-12 06:00:19From designer Anna Cairns, the workhorse monospace typeface is rooted in feminist theory.

Across CMM Coda’s subtly imperfect, analogue-inspired letterforms – based on the IBM Selectric typewriter’s typeface, Dual Basic – Anna practically and conceptually brings together the feminist legacy of software and typewriters with the aesthetic sensibilities of the genre associated with the industry. Additionally, CMM Coda enables Anna to explore her intrigue in the blurry terminology used in text production, such as typing, coding and writing, “especially now that most text is created digitally,” Anna says, with typefaces being software in their own right. “We also associate a certain look with each of these modalities,” she continues, “so my idea was to create a typeface that can jump all of these genres simply through a play with white space,” an approach that resulted in CMM Coda’s multiple styles.

Learn more about Comma at https://commatype.com/, a new foundry founded by the Berlin-based type designer Anna Cairns.

Continue reading at https://www.itsnicethat.com/articles/comma-type-cmm-coda-graphic-design-project-110625

https://stacker.news/items/1004142

-

@ 5627e59c:d484729e

2025-06-12 04:32:16

@ 5627e59c:d484729e

2025-06-12 04:32:16Ik hou van de natuur en van verbinding maken\ Van diepgang en van mensen raken

Van creatief schrijven en programmeren\ Van speels bewegen en nieuwe dingen leren

Ik hou van leven en van dromen\ En van mensen zien\ Hun diepste wensen uit doen komen

-

@ 472f440f:5669301e

2025-06-11 04:37:33

@ 472f440f:5669301e

2025-06-11 04:37:33Marty's Bent

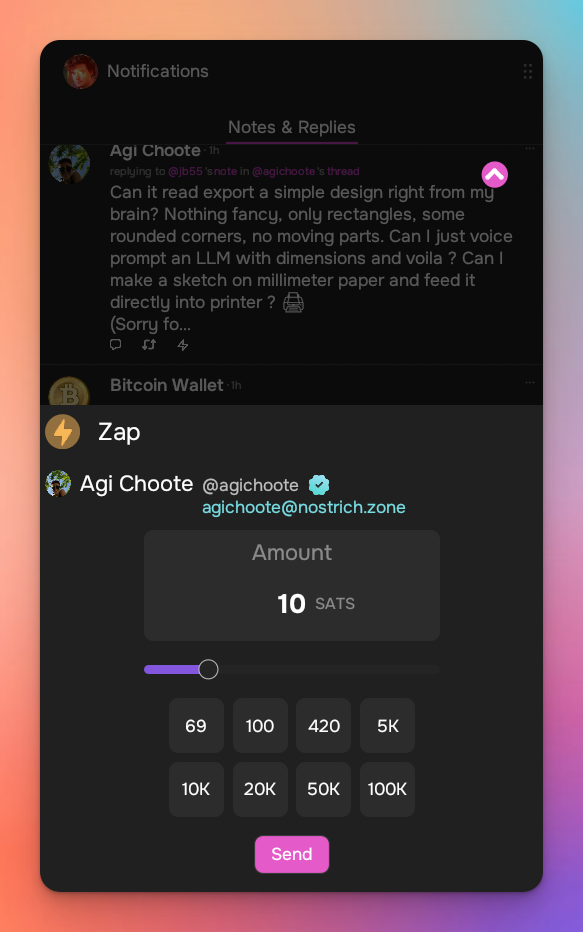

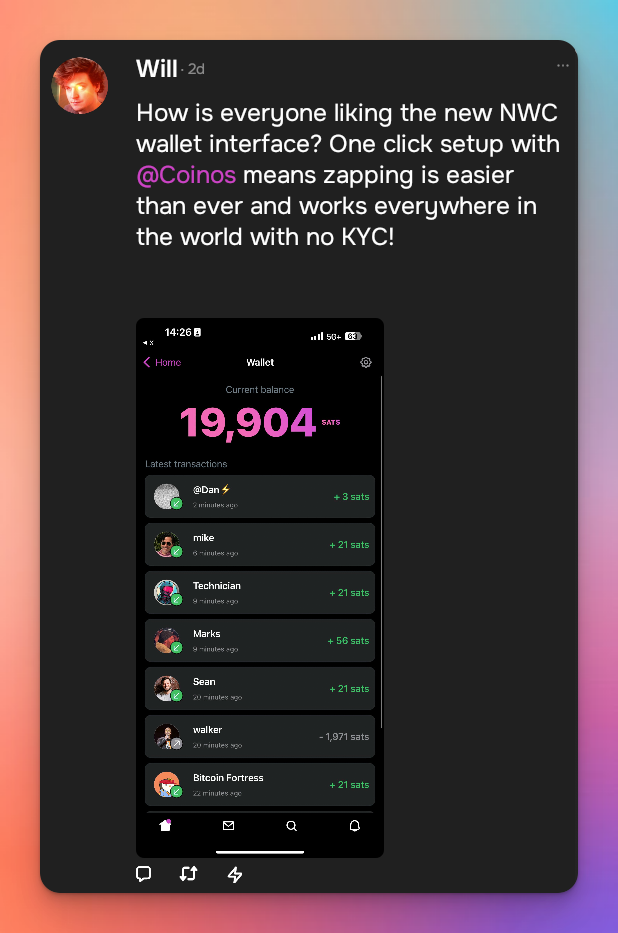

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

Opportunity Cost – See Prices in Bitcoin Instantly

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

*Download our free browser extension, Opportunity Cost: *<<https://www.opportunitycost.app/>> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 5627e59c:d484729e

2025-06-12 04:23:52

@ 5627e59c:d484729e

2025-06-12 04:23:52Look and see\ Look and see

You look like how you look at me

Look and see\ Look and see

The colorless through the color TV

Look and see\ Look and be

The unborn identity

-

@ 472f440f:5669301e

2025-06-11 04:35:21

@ 472f440f:5669301e

2025-06-11 04:35:21Marty's Bent

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

Opportunity Cost – See Prices in Bitcoin Instantly

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is completely open source with an MIT license. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

*Download our free browser extension, Opportunity Cost: *<https://www.opportunitycost.app/> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 97c70a44:ad98e322

2025-06-06 20:48:33

@ 97c70a44:ad98e322

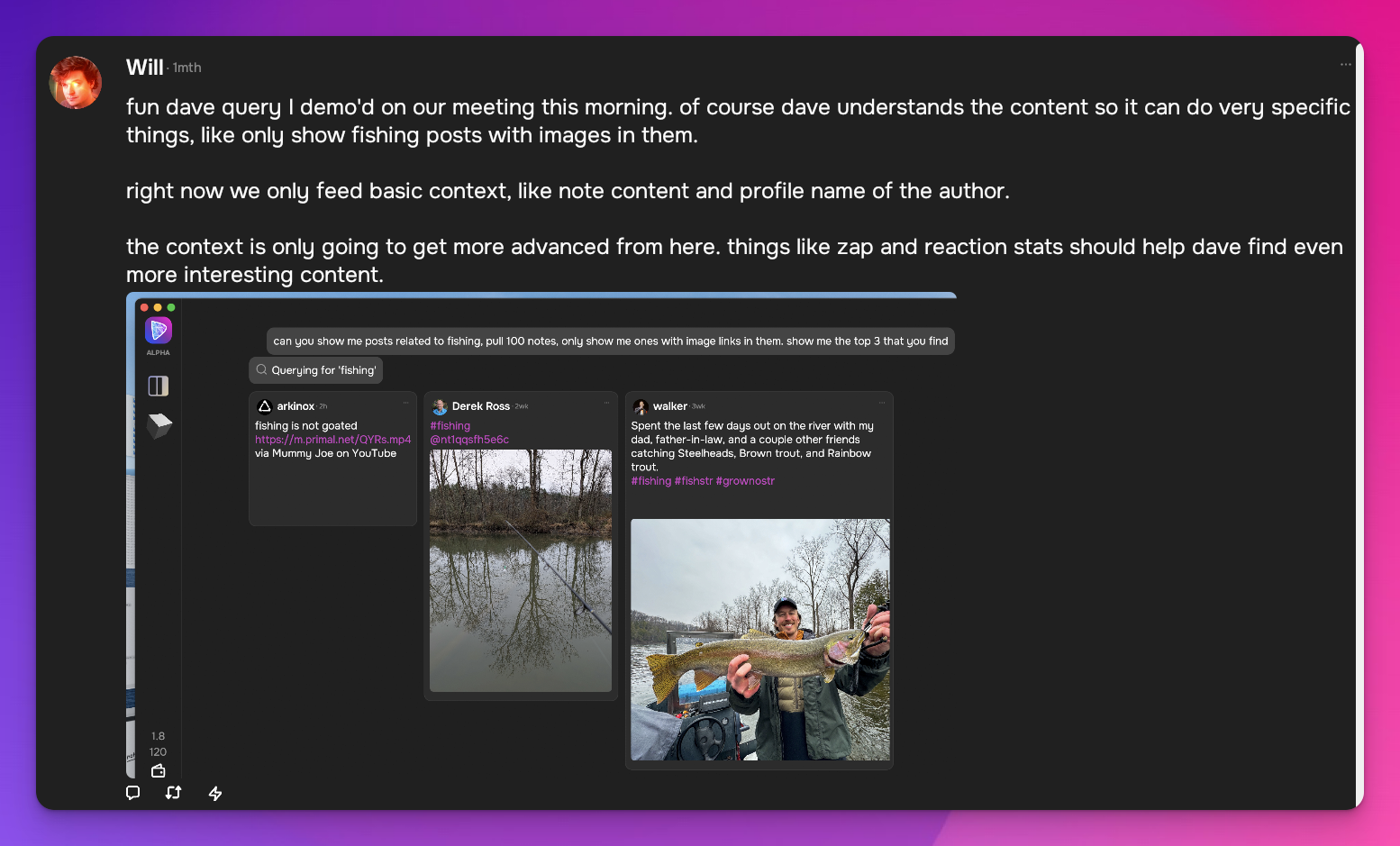

2025-06-06 20:48:33Vibe coding is taking the nostr developer community by storm. While it's all very exciting and interesting, I think it's important to pump the brakes a little - not in order to stop the vehicle, but to try to keep us from flying off the road as we approach this curve.

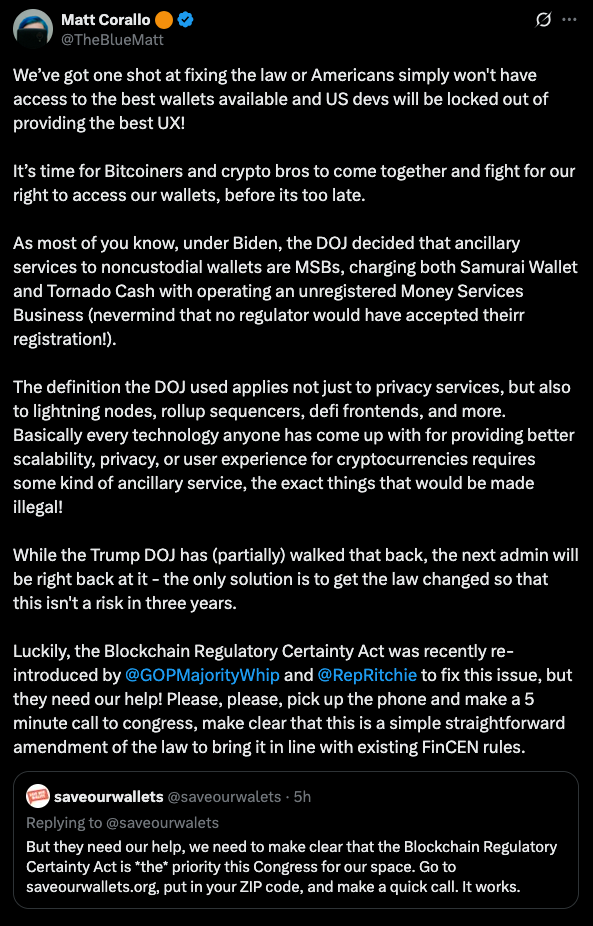

In this note Pablo is subtweeting something I said to him recently (although I'm sure he's heard it from other quarters as well):

nostr:nevent1qvzqqqqqqypzp75cf0tahv5z7plpdeaws7ex52nmnwgtwfr2g3m37r844evqrr6jqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qghwaehxw309aex2mrp0yh8qunfd4skctnwv46z7qg6waehxw309ac8junpd45kgtnxd9shg6npvchxxmmd9uqzq0z48d4ttzzkupswnkyt5a2xfkhxl3hyavnxjujwn5k2k529aearwtecp4

There is a naive, curmudgeonly case for simply "not doing AI". I think the intuition is a good one, but the subject is obviously more complicated - not doing it, either on an individual or a collective level, is just not an option. I recently read Tools for Conviviality by Ivan Illich, which I think can help us here. For Illich, the best kind of tool is one which serves "politically interrelated individuals rather than managers".

This is obviously a core value for bitcoiners. And I think the talks given at the Oslo Freedom Forum this year present a compelling case for adoption of LLMs for the purposes of 1. using them for good, and 2. developing them further so that they don't get captured by corporations and governments. Illich calls both the telephone and print "almost ideally convivial". I would add the internet, cryptography, and LLMs to this list, because each one allows individuals to work cooperatively within communities to embody their values in their work.

But this is only half the story. Illich also points out how "the manipulative nature of institutions... have put these ideally convivial tools at the service of more [managerial dominance]."

Preventing the subversion and capture of our tools is not just a matter of who uses what, and for which ends. It also requires an awareness of the environment that the use of the tool (whether for virtuous or vicious ends) creates, which in turn forms the abilities, values, and desires of those who inhabit the environment.

The natural tendency of LLMs is to foster ignorance, dependence, and detachment from reality. This is not the fault of the tool itself, but that of humans' tendency to trade liberty for convenience. Nevertheless, the inherent values of a given tool naturally gives rise to an environment through use: the tool changes the world that the tool user lives in. This in turn indoctrinates the user into the internal logic of the tool, shaping their thinking, blinding them to the tool's influence, and neutering their ability to work in ways not endorsed by the structure of the tool-defined environment.

The result of this is that people are formed by their tools, becoming their slaves. We often talk about LLM misalignment, but the same is true of humans. Unreflective use of a tool creates people who are misaligned with their own interests. This is what I mean when I say that AI use is anti-human. I mean it in the same way that all unreflective tool use is anti-human. See Wendell Berry for an evaluation of industrial agriculture along the same lines.

What I'm not claiming is that a minority of high agency individuals can't use the technology for virtuous ends. In fact, I think that is an essential part of the solution. Tool use can be good. But tools that bring their users into dependence on complex industry and catechize their users into a particular system should be approached with extra caution. The plow was a convivial tool, and so were early tractors. Self-driving John Deere monstrosities are a straightforward extension of the earlier form of the technology, but are self-evidently an instrument of debt slavery, chemical dependency, industrial centralization, and degradation of the land. This over-extension of a given tool can occur regardless of the intentions of the user. As Illich says:

There is a form of malfunction in which growth does not yet tend toward the destruction of life, yet renders a tool antagonistic to its specific aims. Tools, in other words, have an optimal, a tolerable, and a negative range.

The initial form of a tool is almost always beneficial, because tools are made by humans for human ends. But as the scale of the tool grows, its logic gets more widely and forcibly applied. The solution to the anti-human tendencies of any technology is an understanding of scale. To prevent the overrun of the internal logic of a given tool and its creation of an environment hostile to human flourishing, we need to impose limits on scale.

Tools that require time periods or spaces or energies much beyond the order of corresponding natural scales are dysfunctional.

My problem with LLMs is:

- Not their imitation of human idioms, but their subversion of them and the resulting adoption of robotic idioms by humans

- Not the access they grant to information, but their ability to obscure accurate or relevant information

- Not their elimination of menial work, but its increase (Bullshit Jobs)

- Not their ability to take away jobs, but their ability to take away the meaning found in good work

- Not their ability to confer power to the user, but their ability to confer power to their owner which can be used to exploit the user

- Not their ability to solve problems mechanistically, but the extension of their mechanistic value system to human life

- Not their explicit promise of productivity, but the environment they implicitly create in which productivity depends on their use

- Not the conversations they are able to participate in, but the relationships they displace

All of these dysfunctions come from the over-application of the technology in evaluating and executing the fundamentally human task of living. AI work is the same kind of thing as an AI girlfriend, because work is not only for the creation of value (although that's an essential part of it), but also for the exercise of human agency in the world. In other words, tools must be tools, not masters. This is a problem of scale - when tool use is extended beyond its appropriate domain, it becomes what Illich calls a "radical monopoly" (the domination of a single paradigm over all of human life).

So the important question when dealing with any emergent technology becomes: how can we set limits such that the use of the technology is naturally confined to its appropriate scale?

Here are some considerations:

- Teach people how to use the technology well (e.g. cite sources when doing research, use context files instead of fighting the prompt, know when to ask questions rather than generate code)