-

@ cae03c48:2a7d6671

2025-06-07 10:01:23

@ cae03c48:2a7d6671

2025-06-07 10:01:23Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ b1ddb4d7:471244e7

2025-06-07 09:01:36

@ b1ddb4d7:471244e7

2025-06-07 09:01:36When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ cae03c48:2a7d6671

2025-06-07 09:01:21

@ cae03c48:2a7d6671

2025-06-07 09:01:21Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 044da344:073a8a0e

2025-06-07 07:49:53

@ 044da344:073a8a0e

2025-06-07 07:49:53Es ist merkwürdig, wie sich die Dinge manchmal fügen. Himmelfahrt bin ich mit den beiden größeren Enkeln, 2 und 4, in einen Zirkus gegangen. Wir mussten ein wenig suchen, okay, haben das Zelt aber irgendwann entdeckt am Ufer des Regen. Ich könnte schreiben: klein, aber fein, so richtig trifft es das jedoch nicht. Klein schon. Ich will hier auch nicht schimpfen, weil sich die Zirkusfamilie alle Mühe gegeben hat, einen preisgekrönten Artisten dabeihatte (Silberner Clown in Monte Carlo) und sogar reichlich Tiere in die Manege brachte. Vier Araberpferde, zwei Dromedare, einen Esel und Ziegen.

Dann aber kamen die Katzen. Richtig gelesen. Katzen dort, wo es Tiger, Löwen, Bären gegeben hat, als ich selbst noch ein Kind war. Ich meine gar nicht die großen Zelte in der DDR, Berolina, Busch oder Aeros. Diese Riesen verirrten sich nicht in einen Badeort auf Rügen. Die Wiese gleich hinter unserem Haus gehörte ab Anfang der 1980er Rüdiger Probst, alle paar Jahre wieder. Ein junger Mann, der gar nicht so viel älter war als ich, keine Angst vor großen Tieren hatte und mit einem Salto von Pferd zu Pferd sprang. In einem kleinen Zirkus wie gesagt, für ein paar Groschen und meist vor vollem Haus. Mit den Enkeln hatte ich jetzt allen Platz der Welt und hinterher ein leeres Portemonnaie. Sieben Euro allein für Popcorn (es gab nur eine Tütengröße) und fünf (freiwillig) für ein paar Möhrenstücke, damit die Kinder in der Pause was zum Füttern in der Hand hatten.

Am Abend dann das neue Buch von Matthias Krauß. „Die falschen Fragen gestellt“. Ich habe mich ein wenig gewundert, als das Paket im Kasten lag, weil der Autor vor gar nicht allzu langer Zeit einen „einseitigen Waffenstillstand“ ausgerufen hatte und Schluss machen wollte mit seinem Kampf gegen die „Aufarbeitungsindustrie“ und mit der Verteidigung der DDR. Ich zitiere einfach aus meiner Rezension von 2019:

Matthias Krauß, 1960 in Hennigsdorf geboren, weiß natürlich, was da alles im Argen lag. Er hat selbst an der Sektion Journalistik studiert und in den späten 1980ern noch ein wenig für die Parteipresse gearbeitet. „Apologetisch“, sagt er. Vor allem Innen- und Wirtschaftspolitik. Sein Aber: erstens die Kultur. Begegnungen vor allem mit dem, was in Osteuropa so an Filmen, Serien, Kunst produziert wurde. Punkt zwei: „der einfache Mensch“. „Ungleich häufiger“ im Bild als heute. Und drittens „gab es eine prinzipielle und grundsätzliche Kritik“ am Westen und am Kapitalismus.

Der Zirkus am Ufer des Regen. Ein totes Pferd soll man nicht reiten. Deshalb tauche ich ein in ein Buch, das etwas schafft, was selbst ich nicht für möglich gehalten habe. Matthias Krauß singt ein Loblied auf den DDR-Journalismus, ohne dass es peinlich wird. Er bleibt dabei ganz bei sich – bei der Mappe mit Zeitungsausschnitten, die er als Schüler angelegt hat, bei den Aktbildern im Magazin, das sein Vater abonniert hatte und das dem Sohn auch jenseits der Erotik ganze Welten öffnete, bei einem Porträt, das ihm die Lokalzeitung 1977 widmete.

Das Schöne ist: Matthias Krauß hat das alles aufgehoben und darf jetzt als reifer Mann zurückschauen – als Journalist, der später auch die andere Seite erlebt hat, folglich vergleichen kann und vor allem niemandem mehr nach dem Mund reden muss. Die „Qualität der Bilder“, okay. Eher „Kartoffeldruck“ als Zeitung. Die immer gleichen alten Männer, klar. Die Grenzen, die jedes Parteiorgan hat und die auch ein junger Mann wie Krauß schon zu spüren bekam. Aber eben auch Texte, die nah dran waren am Leben (vor allem an der Arbeit) und ihre Leser ernst nahmen. Matthias Krauß ist nach dem Studium 1986 Redakteur der Jugendseite des Potsdamer SED-Blatts geworden und ruft den Journalismusforschern heute zu: Vergleicht doch einfach die Bravo mit dem Neuen Leben, einer Zeitschrift, die damals sein Leitstern war und immer ausverkauft. These von Matthias Krauß: Das Neue Leben

war vielseitiger, anspruchsvoller und in jeder Hinsicht höherwertiger als die Bravo-Post, mit dem endlos einfältigen Star-Rummel, den auf Kauf und Konsum orientierten Modetipps, dem Klatsch und Abklatsch und den klischeehaften Rollenbildern – Ausdruck des insgesamt unpolitischen Grundanspruchs. Nun gut, aus exakt diesem Grund wird dieser Vergleich wohl niemals stattfinden. (S. 103)

Matthias Krauß hat ein kaum zu schlagendes Argument auf seiner Seite: Er, der SED-Propagandist, hatte nach 1990 schnell wieder das Vertrauen des Publikums, das er „bei Lichte besehen“ vielleicht gar nicht verdiente, aber allein wegen seiner Herkunft bekam (S. 116). Und: Er kann sogar jemanden zitieren, der die Ernte-Berichterstattung vermisst, Hassobjekt von Lesern wie von Journalisten – einen Landwirt aus dem Westen, der dort sehen konnte, wie weit die Kollegen waren, was sie wie machten und wie sie auf das Wetter reagierten (S. 166).

Ich gebe zu: Ich habe eine Schwäche für autobiografische Texte. Solche Bücher erlauben mir, all das mit Leben zu füllen, was in den Akten bald zu Staub zerfällt. Ich habe ein Fußballregal (gleich zweimal Lothar Matthäus!), eine DDR-Abteilung, Erinnerungen von Wissenschaftlern und natürlich Journalisten. Da längst nicht jeder schreibt, der etwas zu sagen hat, helfe ich immer wieder nach und sammle als Interviewer Lebensgeschichten ein. Matthias Krauß dürfte einer der ersten ostdeutschen Medienmenschen aus der Geburtskohorte um 1960 sein, der sich öffentlich äußert und dabei nicht einfach das nachbetet, was ohnehin schon überall steht.

Das gilt auch jenseits des Themas Journalismus. Der Wehrdienst, für mich bis heute ein Albtraum, wird von Matthias Krauß als „Entscheidung für eine Art persönlicher Freiheit“ interpretiert (S. 43). Mit 18 unabhängig sein von den Eltern und dann auch ohne Geldsorgen studieren können. Leipzig war für ihn in den 1980ern nicht nur Uni-Standort, sondern auch „Messestadt“ und damit „Weltstadt“ (S. 50). Und der Aufregung um jede DDR-Exmatrikulation, die er keineswegs schönredet, werden „die Millionen Opfer der Demokratisierung“ gegenübergestellt und das laute gesamtdeutsche Schweigen nicht nur in diesem Punkt (S. 58).

Was das alles mit dem Zirkus zu tun hat? Matthias Krauß hat in der DDR das Motto für sein Leben als Journalist gefunden – bei der Arbeit mit einem Parteisoldaten, der einfach nicht rauswollte aus dem Korsett, das die Genossen über sein Leben geworfen hatten.

Ja, sagte ich mir, stelle immer die falschen Fragen. (S. 153)

In Sachen Zirkus liegen alle Antworten auf dem Tisch. Meine Trauer habe ich schon vor mehr als zehn Jahren verarbeitet. Mal schauen, was die Enkel eines Tages dazu sagen.

Matthias Krauß: Die falschen Fragen gestellt. Journalist in zwei deutschen Staaten. Berlin: Das Neue Berlin 2025, 189 Seiten, 18 Euro.

-

@ cae03c48:2a7d6671

2025-06-07 05:01:25

@ cae03c48:2a7d6671

2025-06-07 05:01:25Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 6a6be47b:3e74e3e1

2025-06-07 09:28:14

@ 6a6be47b:3e74e3e1

2025-06-07 09:28:14Hi frens! 📕

How are you today? How’s your weekend going? I hope you’ve found a moment to rest and recharge—even just for a few minutes. If you’re on the hunt for your next great read, I’ve got something exciting to share!

I just found out that the new book from Robert Galbraith (aka J.K. Rowling) "The Hallmarked Man" has finally been announced! It’s coming out this September, and I’ll admit—I screamed and did a little happy dance. The last book ended on such a major cliffhanger!

🕵️♂️ If you’re not familiar, Robert Galbraith is Rowling’s pen name for her detective series featuring the duo Cormoran Strike and Robin Ellacott. Strike is the founder of their private investigation agency, and Robin, who started as a temp secretary, quickly proved she’s a natural-born detective (and it’s been her dream job for years).

If you’re wondering whether you need to read the earlier books first, I get it. The story of Robin and Strike definitely makes more sense if you start from the beginning, but Rowling is clever—she avoids major spoilers, so you can jump in out of order if you want (like I did!). Just be warned: you’ll get hooked and want to know what happens next.

Each book centers on a new crime for Strike and Robin to solve, so you’re pulled into the mystery first—and then deeper into their lives. That’s part of what makes the series so addictive.

📖 Why am I so hyped for the new release? The last book, The Running Grave, was a wild ride: tense, heart-wrenching, and impossible to put down. I was on the edge of my seat the whole time! For me, it’s the best in the series so far. By the end, I was fully invested in all the characters—even the secondary ones. I just had to know what would happen to them.

Of course, not everyone is a fan of Rowling’s style, and some say her books could use a bit of editing. But I think she weaves tension, character development, and mystery together brilliantly. To each their own, though!

❤️ I have really high hopes for the next book this fall. If you love mysteries with complex characters and dark twists, I hope you’ll give this series a shot. Sometimes the truth is even darker than you expect!

Let me know what you think if you’ve read them—or if you’re planning to start.

🌟 Enjoy your weekend and godspeed!

https://stacker.news/items/999611

-

@ 8bad92c3:ca714aa5

2025-06-07 11:01:49

@ 8bad92c3:ca714aa5

2025-06-07 11:01:49Marty's Bent

If you do one thing today, take the time to spend an hour to watch this YouTube video. As someone creating content who has become very cognizant of the effects of the algorithm and the pressures to cater to it, this video was unexpectedly and incredibly satisfying. We're coming up on the eight year anniversary of this newsletter and the podcast that accompanies it and over that eight year period, the pressures to compete in the world of ever increasing digital soy slop grow at an accelerating rate.

If you've seen our YouTube channel recently, you'll probably notice that we've bent the knee to the thumbnail and title clickbait game in an attempt to get our content out to a wider audience. This is something I've held out on for many years now at this point, but recently became convinced that it's something we simply have to do if we want to get our message out to a wider audience. As I write this, I'm thinking that maybe the fact that we have to do that in the first place says something about the content we're putting out there and whether or not it is actually valuable. But I do think the high velocity trash economy becoming completely saturated with digital soy slop has made it so people who truly want to get their message out have to play that game.

I want to make one thing clear. I certainly do not think I'm an artist, but I do like to think that over the last eight years we've been putting out information via content mediums that is valuable to you, dear reader. However, the informational content we put out there, particularly the audio and video content, is put on platforms where it is forced to compete with others who cater to the lowest common denominators of dopamine hijacking and in-group signaling that draws the masses like moths to a flame.

If you haven't watched the YouTube video yet, which I'm assuming 99.9% of you haven't, this may seem like a nonsensical ramble. So, I'll keep this one short and urge you to go watch the social commentary from comedian Jarrett Moore about the state of art, "content" and its effect on culture as it stands today. I'm assuming this isn't too much of a spoiler alert, but the situation is pretty dire. The world needs better art and people who are willing to support artists who are truly creative and take risks. This has nothing to do with bitcoin. But I think it highlights an interesting part of our society that is deteriorating at a rapid clip. And it's something that all of us should feel compelled to attend to lest we speed run into Idiocracy.

It made me feel uneasy about parts of my approach to this business, and that's a good thing.

Don't forget to buy a Bitkey!

Iran's Nuclear Ambitions Create a "Never-Ending Crisis"

In our latest discussion, energy expert Dr. Anas Alhajji described what he called Iran's "never-ending crisis" – a thesis he first published over 20 years ago that has proven remarkably accurate. As Alhajji explained, this crisis persists because of a fundamental contradiction: the U.S. sees any Iranian nuclear program (even peaceful) as strengthening a hostile regime, while Iran views nuclear energy as essential for domestic stability and economic survival.

"Iran is not going to negotiate over the bomb. They want to drag everything for the longest period until they get the bomb." - Dr. Anas Alhajji

What's particularly concerning is Iran's resilience against sanctions. Alhajji detailed how Iran has masterfully circumvented oil export restrictions through China, using a dedicated Chinese bank to process payments outside the international system. Iran's leadership appears willing to endure temporary geopolitical losses in Syria, Lebanon, and potentially Yemen, calculating that obtaining nuclear weapons will fundamentally transform regional politics and their treatment by the United States.

Check out the full podcast here for more on Trump's Middle East strategy, the future of BRICS, and critical challenges facing global energy infrastructure.

Headlines of the Day

Standard Chartered Predicts Bitcoin Will Reach $500K by 2028 - via X

Lummis: Genius Act Makes US Leader in Digital Asset Policy - via X

Get our new STACK SATS hat - via tftcmerch.io

Jake Tapper's Admission on Biden's Decline Sparks Media Ethics Debate - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

My oldest is already at the "faking sick to get out of school" stage and I'm extremely proud.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ da8b7de1:c0164aee

2025-06-07 04:42:05

@ da8b7de1:c0164aee

2025-06-07 04:42:05Nukleáris technológiai és projektfejlesztési hírek

Több jelentős nemzetközi fejlemény történt a nukleáris energia területén. A Westinghouse Electric Company megkapta az amerikai Energiaügyi Minisztériumtól a kulcsfontosságú biztonsági jóváhagyást az eVinci mikroreaktorához, ami fontos lépés ennek az innovatív nukleáris technológiának a bevezetése felé. A vállalat Idaho államban tervezi egy tesztreaktor létesítését, ami jól mutatja, hogy a mikroreaktorok piaca egyre nagyobb lendületet kap.

Eközben a nukleáris kapacitás gyors bővítéséhez szükséges ellátási lánc felkészültsége volt a fő témája a World Nuclear Association első konferenciájának. Jelentős projektfrissítések között szerepel a kritikus turbinakomponensek beszerelése a kínai Haiyang atomerőműben, az indiai Mahi Banswara Rajasthan Atomerőmű négy blokkjára vonatkozó szabályozói engedély, valamint egy új olaszországi partnerség, a Nuclitalia, amely fejlett nukleáris technológiákra fókuszál. Belgiumban a Nukleáris Kutatóközpont hivatalos konzultációkat indított egy ólom-hűtésű kis moduláris reaktor (SMR) ügyében, Brazília pedig bejelentette, hogy Oroszországgal közösen fejleszt SMR-projektet.

Szabályozási és biztonsági aktualitások

A Nemzetközi Atomenergia-ügynökség (IAEA) meghosszabbította a tanulmányok benyújtási határidejét a közelgő, nukleáris létesítmények ellenállóképességéről szóló konferenciájára, hangsúlyozva a nukleáris létesítmények alkalmazkodásának fontosságát a klímaváltozás jelentette növekvő kockázatokhoz. A konferenciát 2025 októberében rendezik Bécsben, és fő témája a nukleáris létesítmények biztonságának és ellenállóképességének növelése lesz, különös tekintettel a külső eseményekre, mint az árvizek és földrengések.

Kanadában a Nukleáris Biztonsági Bizottság engedélyezte az Ontario Power Generation számára, hogy megkezdje egy BWRX-300 típusú reaktor építését a Darlington New Nuclear Project helyszínén, ami a nukleáris építkezések folyamatos szabályozói támogatását mutatja. Az Egyesült Államokban a Nukleáris Szabályozási Bizottság további 20 évvel meghosszabbította a Duke Energy Oconee atomerőművi blokkjainak üzemeltetési engedélyét, valamint támogatást nyújtott a michigani Palisades atomerőmű újraindításához.

Iparági és gazdasági trendek

Az iparági vezetők optimistán nyilatkoztak a nukleáris energia jelenlegi helyzetéről, kiemelve az Egyesült Államokban zajló aktív projekteket (például a TerraPower Wyomingban és az X-energy együttműködése a Dow vállalattal), valamint a fejlett nukleáris üzemanyaggyártásba irányuló magánbefektetések növekedését. Felmerült az is, hogy a Világbank nukleáris projekteket is finanszírozhatna, ami tovább ösztönözhetné a globális beruházásokat, és megerősítené a nukleáris energia szerepét az energetikai átmenetben.

Belgiumban a kormány és az Engie közüzemi vállalat végleges megállapodást kötött a Tihange 3 és Doel 4 reaktorok üzemidejének tíz évvel történő meghosszabbításáról, amely az energiabiztonságot és a radioaktív hulladék kezelését is szolgálja. Németországban a nukleáris technológiai szövetség hangsúlyozta, hogy akár hat, nemrégiben leállított reaktor újraindítása technikailag megvalósítható, és a nukleáris energia biztonságos, gazdaságos, valamint klímabarát alternatívát jelent.

Nemzetközi együttműködés és kutatás

Kanadában a Prodigy Clean Energy és a Serco közel jár a szállítható atomerőművek tesztprogramjának befejezéséhez, amelynek középpontjában a biztonság és az extrém helyzetekben való ellenállóképesség áll. Az EnergySolutions és a WEC Energy Group új nukleáris kapacitás létesítését vizsgálja a wisconsini Kewaunee helyszínen, és előzetes engedélyeket kívánnak szerezni a jövőbeni telepítéshez.

Az IAEA ismételten hangsúlyozta, hogy kész támogatni a Zaporizzsjai Atomerőműre vonatkozó megállapodásokat, amely továbbra is orosz katonai ellenőrzés alatt áll, kiemelve a térségben fennálló geopolitikai és biztonsági kihívásokat.

Források:

world-nuclear-news.org

nucnet.org

iaea.org

ans.org -

@ 9ca447d2:fbf5a36d

2025-06-07 11:01:31

@ 9ca447d2:fbf5a36d

2025-06-07 11:01:31LAS VEGAS, May 28 2025 — Blockstream, the global leader in Bitcoin-powered financial infrastructure, has today revealed its strategic vision to support Bitcoin’s next pivotal phase of growth, building on over a decade of pioneering work at the forefront of Bitcoin innovation.

Unveiled in a keynote by Blockstream Co-Founder and CEO Dr. Adam Back at Bitcoin 2025 in Las Vegas and anchored by a bold new tagline, The Future of Finance Runs on Bitcoin, the vision introduces a clear framework based on three core business units—Consumer, Enterprise and Blockstream Asset Management (BAM).

This framework represents a unified approach to onboarding users across the rapidly growing Bitcoin economy, from individuals to institutions.

“The past year has shown clearly that Bitcoin no longer sits on the margins of the global financial system—it is rapidly becoming the foundation,” said Dr. Back.

“Our vision is simple: The Future of Finance Runs on Bitcoin. Guided by this idea, Blockstream is working hard to build the vertically integrated platform to support that transition, from individual self-custody to enterprise-scale asset issuance and regulated investment products.”

A New Era for Bitcoin-Native Finance

According to crypto ETF analytics platform SoSoValue, Bitcoin has attracted over $41 billion in net ETF inflows alone since the launch of U.S. spot ETFs in early 2024, led by major institutions such as BlackRock, Fidelity, and Franklin Templeton.

At the same time, New Hampshire and Arizona have become the first U.S. states to pursue Strategic Bitcoin Reserves and the number of corporate treasuries holding bitcoin continues to climb.

With a market cap of just over $2 trillion and trillions settled annually on-chain, Bitcoin’s role as a legitimate financial layer is becoming increasingly clear, hastening the need for scalable infrastructure.

Blockstream has been building that infrastructure for over a decade.

Founded in 2014 by Dr. Adam Back—inventor of Bitcoin’s proof-of-work (PoW) mechanism—the company has focused from the outset on expanding Bitcoin’s functionality without compromising its foundational principles.

Blockstream Research, led by renowned cryptographer Andrew Poelstra, is a key contributor to Bitcoin Core and drives advances in applied cryptography and protocol development.

On the product side, Blockstream maintains Core Lightning (CLN) for scalable payments, the Liquid Network and Blocksteam Asset Management Platform (AMP) for tokenized asset issuance and settlement, as well as self-custody tools including the open-source Jade hardware wallet.

The All-New Blockstream App—Self Custody on Your Terms

Headlining today’s keynote was the launch of the all-new Blockstream app—a streamlined, self-custodial experience that lets users buy bitcoin and secure it immediately in their own wallet.

Built on the foundation of the trusted Blockstream Green wallet, the updated app offers seamless support for managing bitcoin and Liquid assets within a redesigned interface tailored to both new and experienced users.

The Blockstream app is designed to make onboarding intuitive from day one, minimizing friction while staying true to the principles of self-custody.

Users can begin simply and gradually adopt more advanced features at their own pace—including hardware signing and air-gapped transactions with the Blockstream Jade.

Current Blockstream Green users will find all existing functionality preserved within the redesigned interface.

With support for 31 languages, the app makes Bitcoin accessible to anyone with a smartphone, opening the door to secure, sovereign finance worldwide

“The new Blockstream app isn’t just a wallet,” said Peter Bain, VP of Consumer Products at Blockstream.

“It’s a gateway to the full power of Bitcoin—enabling secure savings, fast payments, and seamless management of tokenized assets, all within an intuitive interface designed for both newcomers and hardcore bitcoiners.”

Blockstream Enterprise: Bitcoin-Native Financial Infrastructure

Dr. Back also used his keynote to highlight the growing importance of Blockstream Enterprise, the company’s evolving platform for corporations, governments and participants across the broader financial sector.

Underpinned by the Liquid Network and Blockstream AMP, the platform enables secure asset issuance, as well as treasury and balance sheet management.

It also facilitates integration with custodians, exchanges and core financial systems via industry-standard FIX and REST APIs.

With the first iteration of AMP already available and additional features rolling out over time, the platform builds on Liquid’s momentum, which recently surpassed $3.27 billion in total value locked (TVL).

In doing so, it provides a Bitcoin-native foundation for tokenization and institutional settlement focused on regulated custody, compliant off-exchange settlement, and programmable financial instruments.

“As capital markets evolve, businesses, institutions, and governments will need infrastructure that is secure, programmable and built directly on Bitcoin’s rapidly growing network,” said Dr. Back.

“Blockstream Enterprise brings that infrastructure together—enabling asset issuance, management, and settlement on Liquid, Bitcoin’s first and most battle-tested sidechain.”

Unifying Consumer, Enterprise, and Institutional Products

Today’s keynote marks a strategic inflection point, aligning Blockstream’s efforts across the three market segments it serves.

In 2024, the company raised $210 million to accelerate development and launched Blockstream Asset Management (BAM), a dedicated division focused on institutional-grade Bitcoin investment products.

The company has also deepened collaborations with regulated custodians, corporate treasuries and financial service providers to support the integration of Liquid and AMP into existing financial infrastructure.

The Future of Finance Runs on Bitcoin

The vision laid out by Dr. Back reflects Blockstream’s conviction that Bitcoin is no longer just a $2 trillion asset class but a settlement layer, a development platform, and the most credible foundation for building the next financial system.

“The financial world is waking up to what we’ve known for years,” said Dr. Back. “Bitcoin is here to stay —and it’s never been easier to build on it.”

“From first-time users to trillion-dollar institutions, our aim is to give everyone the tools to participate in this new economy, with the transparency, security and resilience that only Bitcoin can provide.”

To learn more visit Booth 2121 at Bitcoin 2025 or visit www.blockstream.com.

Download the new Blockstream app today and take control of your bitcoin—on your terms.

Institutions, enterprises, and governments interested in building on Bitcoin with Liquid and AMP can connect with the Blockstream team directly at business@blockstream.com.

Media contact:

Edward Moore – Head of PR, Blockstream

emoore@blockstream.comAbout Blockstream

Founded in 2014, Blockstream is a global leader in Bitcoin and blockchain infrastructure, with offices and team members distributed around the world.

Serving as the technology provider for the Liquid Network, Blockstream offers a sidechain solution that enables secure, trustless Bitcoin swap settlements and robust smart contracts, empowering financial institutions to tokenize assets efficiently.

The company’s Core Lightning is a leading implementation of the open Lightning Network protocol, widely adopted for enterprise Bitcoin Lightning Network deployments.

Blockstream Jade, an open-source hardware wallet, delivers advanced security for Bitcoin and Liquid assets in an easy-to-use form factor.

For consumers, Blockstream app is a highly secure and user-friendly Bitcoin wallet.

Disclaimer

This press release contains forward-looking statements, including but not limited to statements regarding the expected launch timeline of the Blockstream Enterprise platform and time to market of Blockstream Asset Management products.

Other “forward looking statements” may, without limitation, include statements that are preceded by, followed by, or include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “foresees,” or similar expressions, and other statements concerning anticipated future events and expectations that are not historical facts.

_Actual results may differ materially due to regulatory developments, competition from other hardware and technology services providers (in the case of Jade and the app) and both traditional finance and crypto native managers (in the case of BAM), market conditions and other risks. Actual results may differ materially. Blockstream undertakes no oblig

-

@ cae03c48:2a7d6671

2025-06-07 03:00:52

@ cae03c48:2a7d6671

2025-06-07 03:00:52Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 57d1a264:69f1fee1

2025-06-07 06:08:19

@ 57d1a264:69f1fee1

2025-06-07 06:08:19In the rural areas of Vietnam, people tend to give the land plot next to their house to their grown up children to build a new home – thus a new family. This poses many interesting problems about the two generation’s living spaces. In the case of Ai Nghia House, we pay close attention to the connection and privacy between the two families.

The skylit courtyard

Learning from the structure of traditional houses in Hoi An, we create a courtyard in the middle of the house, connecting the parents’ house and the children’s new house. The courtyard plays its role as a funnel collecting sunlight and natural wind, also, it’s a place for sharing daily stories, common or private. It’s a place where parents watch over the house and the kids, where families pass over a little spice in cooking time, or simply a place where the sky is only one perk away. The courtyard is thus shared naturally between the families as a continuation between generations.

The framed garden

The front garden is framed into a red brick facade, making the greenery stand out. Voids are boldly cut to allow sunlight to reach the plants, making the garden comes to life. Altogether that frame becomes a lively picture of nature and many daily moments of each member in the family.

Read more about Naqi & Partners at https://naqipartners.com/project/ai-nghia-house-quang-nam/

https://stacker.news/items/999526

-

@ cae03c48:2a7d6671

2025-06-07 00:01:29

@ cae03c48:2a7d6671

2025-06-07 00:01:29Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 57d1a264:69f1fee1

2025-06-07 05:48:57

@ 57d1a264:69f1fee1

2025-06-07 05:48:57There is only one item on my CSS wishlist for 2025: a slower pace!

After years of rapid innovation, now feels like the right time for browser vendors to take a beat to consolidate, fix browser inconsistencies, and let the rest of us catch up.

After all, we might've heard about

subgrid, :has(), scroll-drivenanimations, and all the other recent CSS improvements – but how many of us can say that we've actually used all these features, let alone mastered them?This is why this year's survey will be so interesting. It'll be a chance to see which of the past few year's new CSS additions have already been adopted by the community, and which ones are still on our to-do list.

So once again, please join me for this year's State of CSS!

Take the survey at https://survey.devographics.com/en-US/survey/state-of-css/2025

https://stacker.news/items/999510

-

@ 57d1a264:69f1fee1

2025-06-07 05:38:49

@ 57d1a264:69f1fee1

2025-06-07 05:38:49Every purchase we make ties us to a vast, hidden network of people, machines, and resources — whether we see it or not.

Supply chains are large industrial systems. They are composed of heterogeneous elements, such as ships, aircraft, trains, and trucks, but also systems of labor, information, and finance that build them and connect them together. Usually the goods flow in one direction and money flows in the opposite direction. Their physical substrates are themselves industrial products, relying on ships, trucks, cranes, fossil fuels, and electric power, tied together by skilled human operators, supervisors, managers, and other industrial roles.

Few of us would likely condone every moment of every supply chain for every product we consume.

Consider any product in your home. Where was it made? (That should be written on the label somewhere.) Where were the parts made? Who put them all together? How did it get to your doorstep?

Continue reading at https://thereader.mitpress.mit.edu/supply-chains-are-us/

https://stacker.news/items/999509

-

@ cae03c48:2a7d6671

2025-06-06 23:01:23

@ cae03c48:2a7d6671

2025-06-06 23:01:23Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-06 22:00:31

@ cae03c48:2a7d6671

2025-06-06 22:00:31Bitcoin Magazine

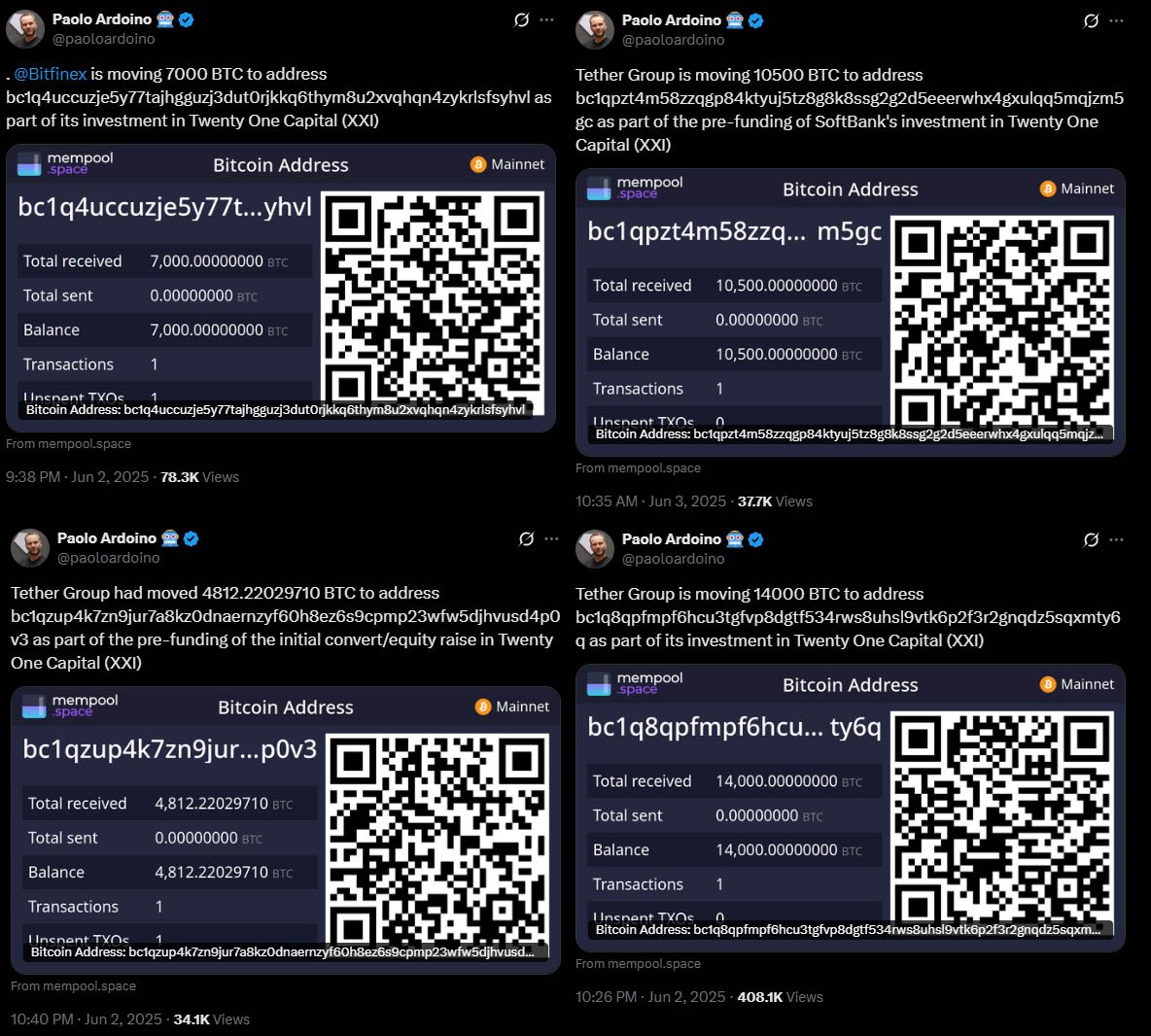

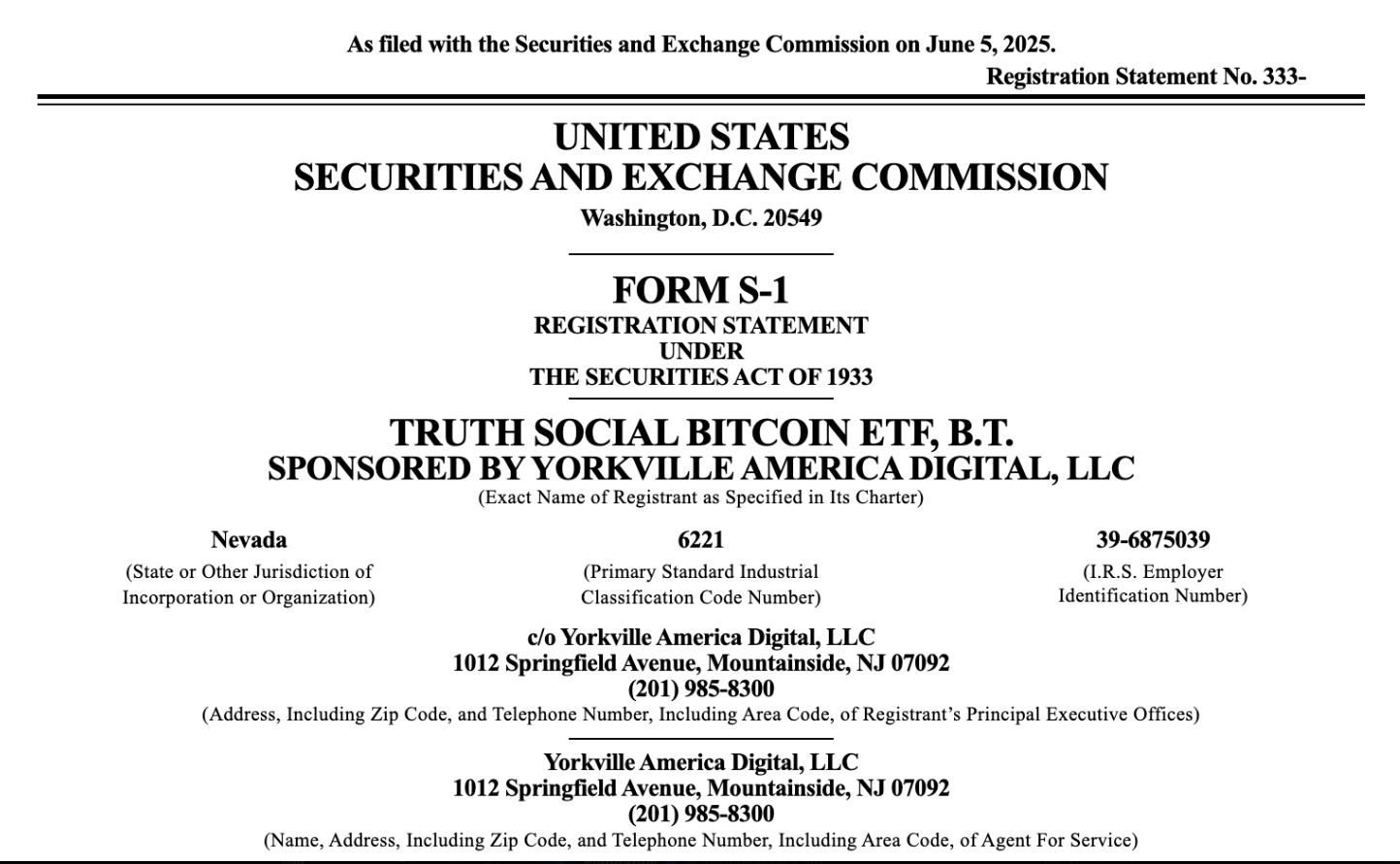

President Trump’s Truth Social Files S-1 Form For Bitcoin ETFToday, Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) filed with the US Securities and Exchange Commission (SEC) a Form S-1 for their upcoming Truth Social Bitcoin ETF.

The ETF, which will hold bitcoin directly, is designed to track the bitcoin’s price performance.

“Truth Social Bitcoin ETF, B.T. is a Nevada business trust that issues beneficial interests in its net assets,” stated the Form S-1. “The assets of the Trust consist primarily of bitcoin held by a custodian on behalf of the Trust. The Trust seeks to reflect generally the performance of the price of bitcoin.”

The ETF is sponsored by Yorkville America Digital, LLC and will trade under NYSE Arca. The Trust’s assets primarily consist of bitcoin held by Foris DAX Trust Company, LLC, the designated bitcoin custodian. Crypto.com will act as the ETF’s prime execution agent and liquidity provider.

“Shares will be offered to the public from time to time at varying prices that will reflect the price of bitcoin and the trading price of the Shares on New York Stock Exchange Arca, Inc. at the time of the offer,” mentioned the Form S-1.

While the ETF offers investors a regulated avenue for bitcoin exposure, the Trust warned of several risks related to digital assets:

- Loss, theft, or compromise of private keys could result in permanent loss of bitcoin.

- Bitcoin’s reliance on blockchain and Internet technologies makes it vulnerable to disruptions and cyber threats.

- Environmental and regulatory pressures tied to high electricity use in bitcoin mining could impact market stability.

- Potential forks or protocol failures in the Bitcoin Network may lead to volatility and uncertainty in asset value.

Last week, during an interview at the 2025 Bitcoin Conference, Donald Trump Jr. announced that TMTG and Truth Social were forming a Bitcoin treasury with $2.5 billion. “We’re seriously on crypto—we’re seriously on Bitcoin,” said Trump Jr. “We’re in three major deals. I believe we’re at the beginning of what will be the future of finance. And the opportunity is massive.”

The day after that interview, Eric Trump and Donald Trump Jr., joined by American Bitcoin Executive Chairman and Board Member Mike Ho, CEO Matt Prusak, and Altcoin Daily founder Aaron Arnold, discussed the future of Bitcoin.

“The whole system is broken and now all of the sudden you have crypto which solves all the problems,” commented Eric Trump. “It makes everything cheaper, it makes everything faster, it makes it safer, it makes it more transparent. It makes the whole system more functional.“

“Everybody wants Bitcoin. Everybody is buying Bitcoin,” Eric added.

This post President Trump’s Truth Social Files S-1 Form For Bitcoin ETF first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-06 22:00:30

@ cae03c48:2a7d6671

2025-06-06 22:00:30Bitcoin Magazine

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 57d1a264:69f1fee1

2025-06-07 05:28:26

@ 57d1a264:69f1fee1

2025-06-07 05:28:26In the early days of computer vision, when memory was scarce and every byte counted, innovation thrived under constraint. “An Efficient Chain-Linking Algorithm,” developed at Inria in the late 1980s, is a brilliant example of this spirit. Now preserved and shared by Software Heritage, this compact yet powerful piece of C code showcases how elegance and efficiency went hand in hand in outlining the future of image processing—one pixel chain at a time.

The code resulted from research work carried out between 1985 and 1991 at Inria, by Gérard Giraudon (research and principal investigator), Philippe Garnesson (a PhD student), and Patrick Cipière (software engineer). Down in sunny Sophia Antipolis, a tech park 20 minutes inland from Antibes, the team tackled computer vision with a distinctly local flavor. They called themselves PASTIS, a playful nod to the anise drink. Still, the acronym – Scene Analysis and Symbolic Image Processing Project (Projet d’Analyse de Scène et de Traitement d’Image Symbolique) – hinted at their serious mission.

Continue reading at https://www.softwareheritage.org/2025/06/04/history_computer_vision/

https://stacker.news/items/999507

-

@ 97c70a44:ad98e322

2025-06-06 20:48:33

@ 97c70a44:ad98e322

2025-06-06 20:48:33Vibe coding is taking the nostr developer community by storm. While it's all very exciting and interesting, I think it's important to pump the brakes a little - not in order to stop the vehicle, but to try to keep us from flying off the road as we approach this curve.

In this note Pablo is subtweeting something I said to him recently (although I'm sure he's heard it from other quarters as well):

nostr:nevent1qvzqqqqqqypzp75cf0tahv5z7plpdeaws7ex52nmnwgtwfr2g3m37r844evqrr6jqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qghwaehxw309aex2mrp0yh8qunfd4skctnwv46z7qg6waehxw309ac8junpd45kgtnxd9shg6npvchxxmmd9uqzq0z48d4ttzzkupswnkyt5a2xfkhxl3hyavnxjujwn5k2k529aearwtecp4

There is a naive, curmudgeonly case for simply "not doing AI". I think the intuition is a good one, but the subject is obviously more complicated - not doing it, either on an individual or a collective level, is just not an option. I recently read Tools for Conviviality by Ivan Illich, which I think can help us here. For Illich, the best kind of tool is one which serves "politically interrelated individuals rather than managers".

This is obviously a core value for bitcoiners. And I think the talks given at the Oslo Freedom Forum this year present a compelling case for adoption of LLMs for the purposes of 1. using them for good, and 2. developing them further so that they don't get captured by corporations and governments. Illich calls both the telephone and print "almost ideally convivial". I would add the internet, cryptography, and LLMs to this list, because each one allows individuals to work cooperatively within communities to embody their values in their work.

But this is only half the story. Illich also points out how "the manipulative nature of institutions... have put these ideally convivial tools at the service of more [managerial dominance]."

Preventing the subversion and capture of our tools is not just a matter of who uses what, and for which ends. It also requires an awareness of the environment that the use of the tool (whether for virtuous or vicious ends) creates, which in turn forms the abilities, values, and desires of those who inhabit the environment.

The natural tendency of LLMs is to foster ignorance, dependence, and detachment from reality. This is not the fault of the tool itself, but that of humans' tendency to trade liberty for convenience. Nevertheless, the inherent values of a given tool naturally gives rise to an environment through use: the tool changes the world that the tool user lives in. This in turn indoctrinates the user into the internal logic of the tool, shaping their thinking, blinding them to the tool's influence, and neutering their ability to work in ways not endorsed by the structure of the tool-defined environment.

The result of this is that people are formed by their tools, becoming their slaves. We often talk about LLM misalignment, but the same is true of humans. Unreflective use of a tool creates people who are misaligned with their own interests. This is what I mean when I say that AI use is anti-human. I mean it in the same way that all unreflective tool use is anti-human. See Wendell Berry for an evaluation of industrial agriculture along the same lines.

What I'm not claiming is that a minority of high agency individuals can't use the technology for virtuous ends. In fact, I think that is an essential part of the solution. Tool use can be good. But tools that bring their users into dependence on complex industry and catechize their users into a particular system should be approached with extra caution. The plow was a convivial tool, and so were early tractors. Self-driving John Deere monstrosities are a straightforward extension of the earlier form of the technology, but are self-evidently an instrument of debt slavery, chemical dependency, industrial centralization, and degradation of the land. This over-extension of a given tool can occur regardless of the intentions of the user. As Illich says:

There is a form of malfunction in which growth does not yet tend toward the destruction of life, yet renders a tool antagonistic to its specific aims. Tools, in other words, have an optimal, a tolerable, and a negative range.

The initial form of a tool is almost always beneficial, because tools are made by humans for human ends. But as the scale of the tool grows, its logic gets more widely and forcibly applied. The solution to the anti-human tendencies of any technology is an understanding of scale. To prevent the overrun of the internal logic of a given tool and its creation of an environment hostile to human flourishing, we need to impose limits on scale.

Tools that require time periods or spaces or energies much beyond the order of corresponding natural scales are dysfunctional.

My problem with LLMs is:

- Not their imitation of human idioms, but their subversion of them and the resulting adoption of robotic idioms by humans

- Not the access they grant to information, but their ability to obscure accurate or relevant information

- Not their elimination of menial work, but its increase (Bullshit Jobs)

- Not their ability to take away jobs, but their ability to take away the meaning found in good work

- Not their ability to confer power to the user, but their ability to confer power to their owner which can be used to exploit the user

- Not their ability to solve problems mechanistically, but the extension of their mechanistic value system to human life

- Not their explicit promise of productivity, but the environment they implicitly create in which productivity depends on their use

- Not the conversations they are able to participate in, but the relationships they displace

All of these dysfunctions come from the over-application of the technology in evaluating and executing the fundamentally human task of living. AI work is the same kind of thing as an AI girlfriend, because work is not only for the creation of value (although that's an essential part of it), but also for the exercise of human agency in the world. In other words, tools must be tools, not masters. This is a problem of scale - when tool use is extended beyond its appropriate domain, it becomes what Illich calls a "radical monopoly" (the domination of a single paradigm over all of human life).

So the important question when dealing with any emergent technology becomes: how can we set limits such that the use of the technology is naturally confined to its appropriate scale?

Here are some considerations:

- Teach people how to use the technology well (e.g. cite sources when doing research, use context files instead of fighting the prompt, know when to ask questions rather than generate code)

- Create and use open source and self-hosted models and tools (MCP, stacks, tenex). Refuse to pay for closed or third-party hosted models and tools.

- Recognize the dependencies of the tool itself, for example GPU availability, and diversify the industrial sources to reduce fragility and dependence.

- Create models with built-in limits. The big companies have attempted this (resulting in Japanese Vikings), but the best-case effect is a top-down imposition of corporate values onto individuals. But the idea isn't inherently bad - a coding model that refuses to generate code in response to vague prompts, or which asks clarifying questions is an example. Or a home assistant that recognized childrens' voices and refuses to interact.

- Divert the productivity gains to human enrichment. Without mundane work to do, novice lawyers, coders, and accountants don't have an opportunity to hone their skills. But their learning could be subsidized by the bots in order to bring them up to a level that continues to be useful.

- Don't become a slave to the bots. Know when not to use it. Talk to real people. Write real code, poetry, novels, scripts. Do your own research. Learn by experience. Make your own stuff. Take a break from reviewing code to write some. Be independent, impossible to control. Don't underestimate the value to your soul of good work.

- Resist both monopoly and "radical monopoly". Both naturally collapse over time, but by cultivating an appreciation of the goodness of hand-crafted goods, non-synthetic entertainment, embodied relationship, and a balance between mobility and place, we can relegate new, threatening technologies to their correct role in society.

I think in all of this is implicit the idea of technological determinism, that productivity is power, and if you don't adapt you die. I reject this as an artifact of darwinism and materialism. The world is far more complex and full of grace than we think.

The idea that productivity creates wealth is, as we all know, bunk. GDP continues to go up, but ungrounded metrics don't reflect anything about the reality of human flourishing. We have to return to a qualitative understanding of life as whole, and contextualize quantitative tools and metrics within that framework.

Finally, don't believe the hype. Even if AI delivers everything it promises, conservatism in changing our ways of life will decelerate the rate of change society is subjected to and allow time for reflection and proper use of the tool. Curmudgeons are as valuable as technologists. There will be no jobspocalypse if there is sufficient political will to value human good over mere productivity. It's ok to pump the breaks.

-

@ 5d4b6c8d:8a1c1ee3

2025-06-07 02:18:51

@ 5d4b6c8d:8a1c1ee3

2025-06-07 02:18:51This is the place to reflect on how well you met your ~HealthAndFitness goals today.

Where did you succeed? What do you need to keep working on?

I probably didn't get enough sleep and overcompensated with caffeine. Otherwise, today was pretty solid. Other than a big cookie, I ate well and kept it within a decent window. Activity level was good, not great.

I meant to stretch more today, which I didn't really do, but I suppose I can do now.

https://stacker.news/items/999453

-

@ cae03c48:2a7d6671

2025-06-06 19:01:15

@ cae03c48:2a7d6671

2025-06-06 19:01:15Bitcoin Magazine