-

@ 9390316a:954bc3eb

2025-06-06 07:44:13

@ 9390316a:954bc3eb

2025-06-06 07:44:13Find out where to buy arabic sandals brands in Qatar with this helpful guide by Thamco Caretti. Explore a range of well-known malls that feature premium collections of traditional and modern Arabic footwear. This information highlights shopping destinations known for quality and variety, ensuring a reliable retail experience. Whether you're seeking daily wear or luxury sandals, the featured malls carry trusted arabic sandals brands in Qatar suited for all preferences. Thamco Caretti ensures accurate and updated details for every shopper’s need.

-

@ 7f6db517:a4931eda

2025-06-06 06:01:29

@ 7f6db517:a4931eda

2025-06-06 06:01:29

Influencers would have you believe there is an ongoing binance bank run but bitcoin wallet data says otherwise.

- binance wallets are near all time highs

- bitfinex wallets are also trending up

- gemini and coinbase are being hit with massive withdrawals thoughYou should not trust custodians, they can rug you without warning. It is incredibly important you learn how to hold bitcoin yourself, but also consider not blindly trusting influencers with a ref link to shill you.

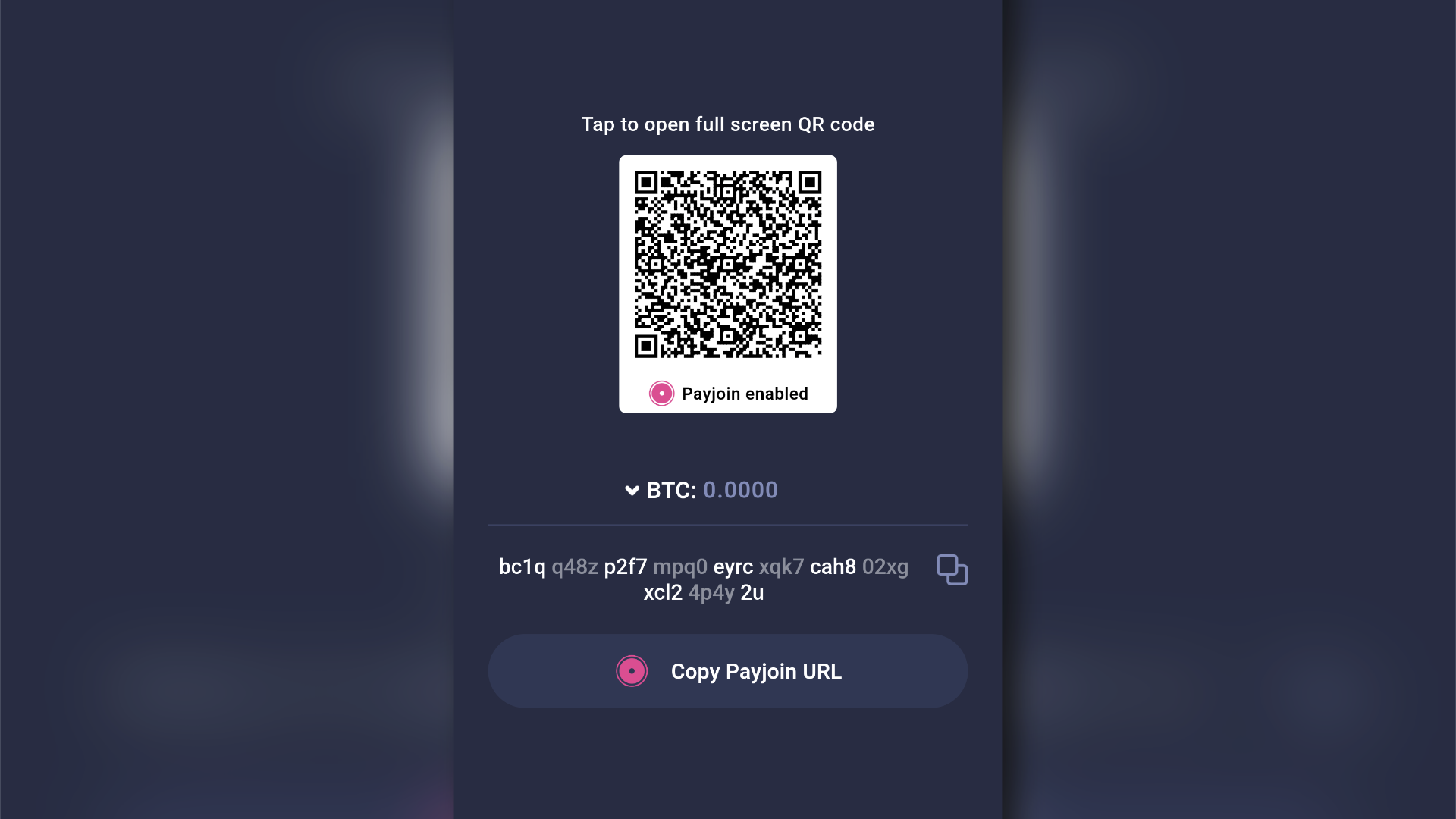

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-06 06:01:32

@ 7f6db517:a4931eda

2025-06-06 06:01:32

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 6d8e2a24:5faaca4c

2025-06-06 04:26:58

@ 6d8e2a24:5faaca4c

2025-06-06 04:26:58

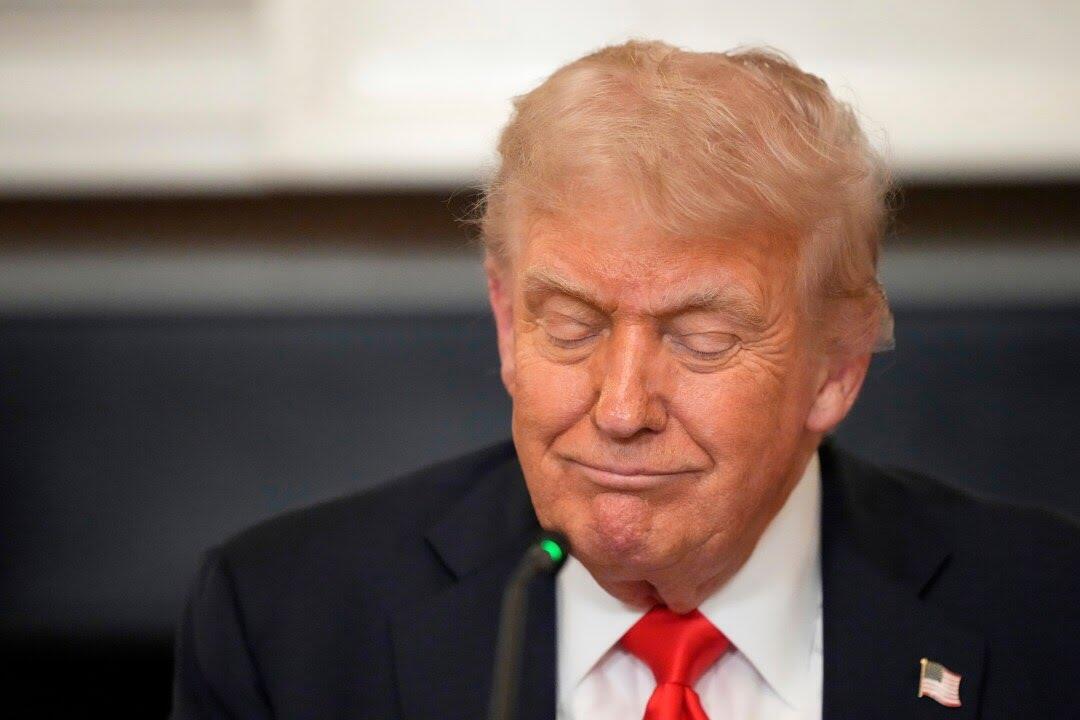

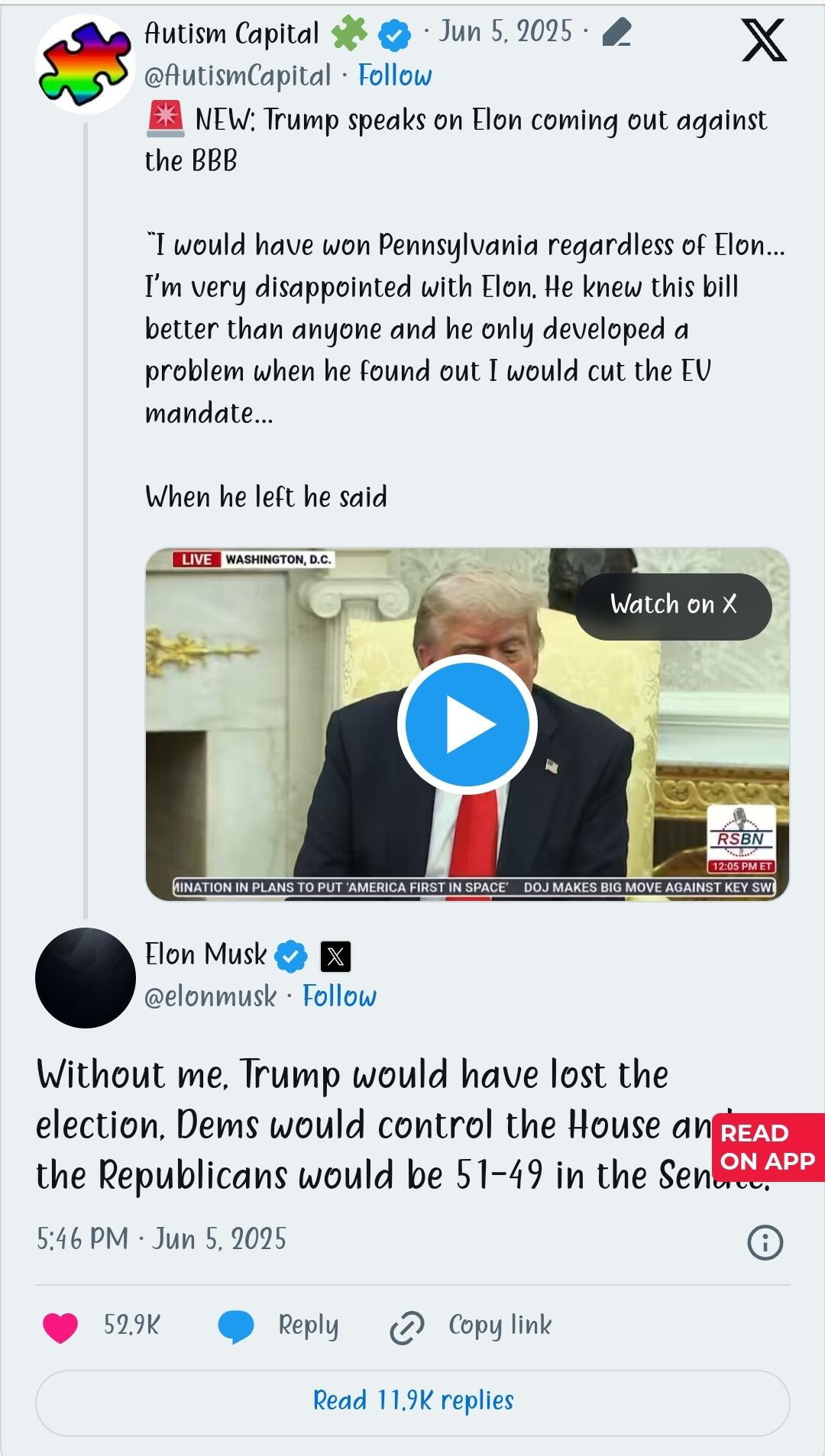

President Donald Trump attends a meeting with the Fraternal Order of Police in the State Dinning Room of the White House, Thursday, June 5, 2025, in Washington. (AP Photo/Alex Brandon)

Last Friday, President Donald Trump heaped praise on Elon Musk as the tech billionaire prepared to leave his unorthodox White House job.

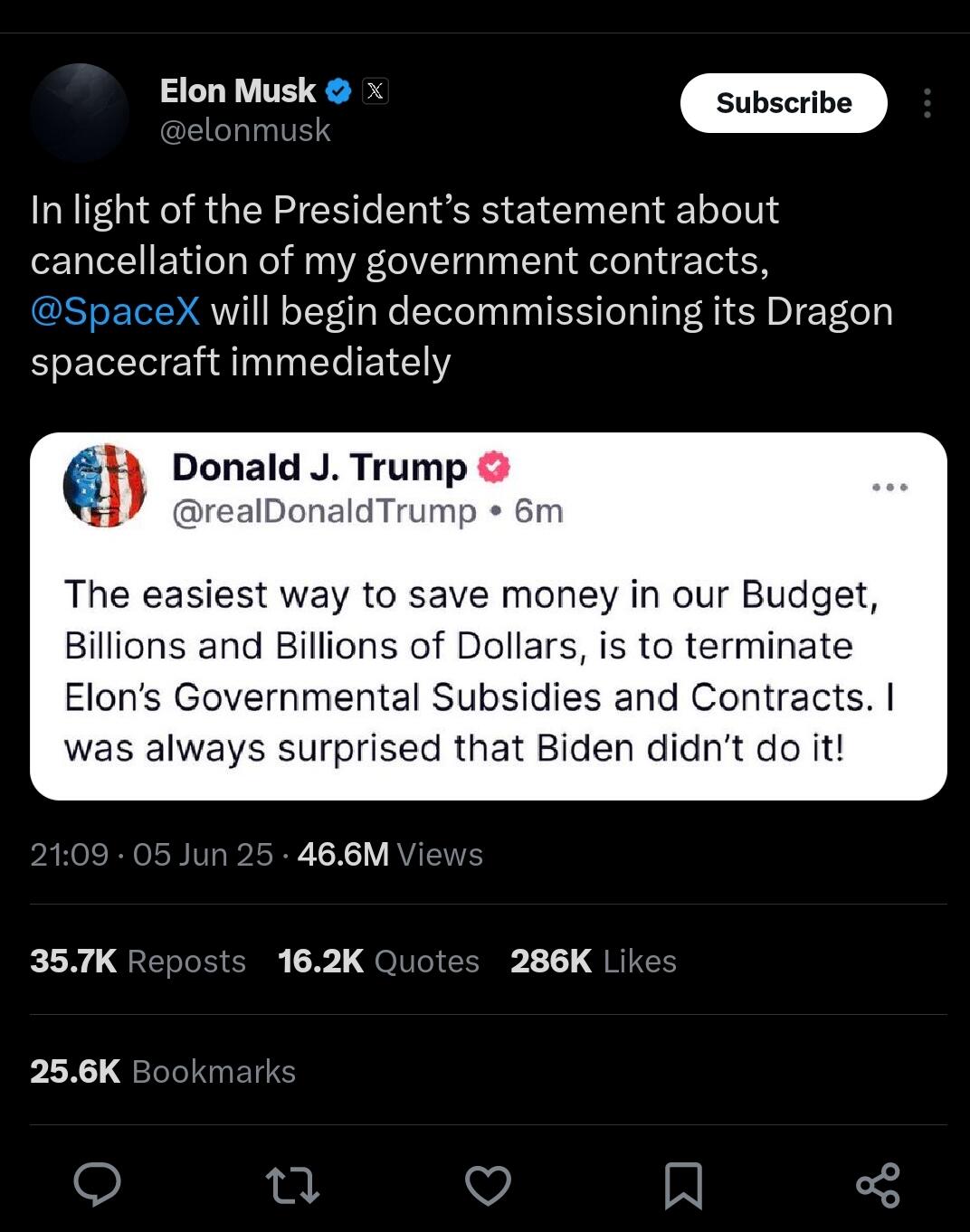

Less than a week later, their potent political alliance met a dramatic end Thursday when the men attacked each other with blistering epithets. Trump threatened to go after Musk’s business interests. Musk called for Trump’s impeachment.

social media posts urging lawmakers to oppose deficit spending and increasing the debt ceiling.

“Without me, Trump would have lost the election, Dems would control the House and the Republicans would be 51-49 in the Senate,” Musk posted, a reference to Musk’s record political spending last year, which topped $250 million.

“Such ingratitude,” he added.

Trump said Musk had worn out his welcome at the White House and was mad that Trump was changing electric vehicle policies in ways that would financially harm Musk-led Tesla.

“Elon was ‘wearing thin,’ I asked him to leave, I took away his EV Mandate that forced everyone to buy Electric Cars that nobody else wanted (that he knew for months I was going to do!), and he just went CRAZY!” Trump wrote.

Musk goes nuclear “Time to drop the really big bomb: Trump is in the Epstein files. That is the real reason they have not been made public. Have a nice day, DJT!” — Musk, Thursday, X post.

In a series of posts, he shined a spotlight on ties between Trump and Jeffrey Epstein, the financier who killed himself while awaiting trial on federal sex trafficking charges. Some loud voices in Trump’s “Make America Great Again” movement claim Epstein’s suicide was staged by powerful figures, including prominent Democrats, who feared Epstein would expose their involvement in trafficking. Trump’s own FBI leaders have dismissed such speculation and there’s no evidence supporting it.

Later, when an X user suggested Trump be impeached and replaced by Vice President JD Vance, Musk agreed.

“Yes,” he wrote.

“I don’t mind Elon turning against me, but he should have done so months ago,” Trump wrote. He went on to promote his budget bill.

https://www.google.com/amp/s/www.wavy.com/news/politics/ap-the-implosion-of-a-powerful-political-alliance-trump-and-musk-in-their-own-words/amp/

-

@ 7f6db517:a4931eda

2025-06-06 06:01:30

@ 7f6db517:a4931eda

2025-06-06 06:01:30

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-06 08:01:54

@ eb0157af:77ab6c55

2025-06-06 08:01:54The crypto platform had been aware of the data breach for months before the official announcement, internal sources reveal.

A Reuters investigation uncovered that Coinbase had been informed as early as January 2025 about a data breach involving outsourced customer support agents in India. Six sources familiar with the matter confirmed that the exchange knew sensitive user information had been compromised through its contractor, TaskUs, months before the formal disclosure in May.

On May 14, in a filing with the SEC, TaskUs documented part of the breach, in which an employee at its Indian office was caught photographing his work computer screen with a personal phone. Five former TaskUs workers confirmed that this employee and an alleged accomplice had been bribed by hackers to obtain Coinbase user data.

Coinbase had a long-standing partnership with TaskUs, a Texas-based outsourcing company, to reduce labor costs by assigning customer support functions to offshore teams. Since 2017, TaskUs agents handled Coinbase customer inquiries, often from lower-wage countries like India, where employees earned between $500 and $700 per month.

The financial impact of the breach

The exchange estimated that the breach could cost the company up to $400 million. In its May filing, Coinbase admitted it hadn’t fully grasped the extent of the attack until May 11, when it received a $20 million extortion demand. In response, the company terminated the TaskUs employees responsible for the breach, along with several other unnamed foreign contractors.

The post Coinbase data breach: the exchange knew about the theft since January appeared first on Atlas21.

-

@ 7f6db517:a4931eda

2025-06-06 06:01:30

@ 7f6db517:a4931eda

2025-06-06 06:01:30

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 6d8e2a24:5faaca4c

2025-06-06 03:09:51

@ 6d8e2a24:5faaca4c

2025-06-06 03:09:51by Claire Mom June 5, 2025 6:54 pm

*Elon Musk, the tech mogul, says US President Donald Trump would have lost the 2024 election without him.*

Musk made the comment on X in response to Trump’s criticism against him.

Musk, who led the department of government efficiency (DOGE), quit his role a day after he spoke out against a Trump-backed spending bill. The president called it a “Big Beautiful Bill”.

The controversial bill is a centrepiece of Trump’s second-term domestic agenda, combining major tax cuts, stricter immigration enforcement, welfare programme overhauls, and significant increases in border security funding.

The legislation sparked intense debate across the country and in Congress and was only passed after a nail-biting 215-214 vote.

The plan revived the US-Mexico border wall with a $46.5 billion budget, $350 billion for deportation efforts and border security, and a hiring spree of 10,000 new ICE agents, 5,000 customs officers, and 3,000 border patrol agents.

For the first time, migrants will be charged a $1,000 fee to apply for asylum.

The bill also authorises a $4 trillion increase to the national debt ceiling, while the estate tax exemption jumped to $15 million, benefiting wealthier Americans.

Critics including Musk called the bill fiscally irresponsible and “a disgusting abomination” due to its combination of large tax cuts and spending increases.

Musk had clamoured for DOGE’s creation to save taxpayers $2 trillion. Only $160 billion has been saved so far.

*TRUMP: I’M VERY DISAPPOINTED WITH ELON*

Since Musk’s exit from the White House last week, his criticism of the bill has grown louder.

Speaking on the issue, Trump said he was “very disappointed with Elon”.

The US president said the Tesla CEO was satisfied with the bill but only grew discontent after he found out electric vehicles would be impacted.

“I’m very disappointed because Elon knew the inner workings of this bill better than almost anybody sitting here. He knew everything about it, and all of a sudden he had a problem, and he only developed a problem when he found out I was going to cut the EV mandate because that’s billions and billions of dollars,” the president said

“And it really is unfair; we want to have cars of all types.

“He said the most beautiful things about me, and he hasn’t said anything bad about me personally, but I’m sure that will be next. But I’m really disappointed with Elon. I’ve helped Elon a lot.”

Trump praised Musk for his work at DOGE but blamed his tantrums on missing the office.

“Elon worked hard at DOGE, and I think he misses the place. I think he got out there, and all of a sudden, he’s no longer in this beautiful Oval Office,” he said.

“He’s not the first. People leave my administration, and they love us, and then at some point they miss it so badly, and some of them embrace it, and some of them actually become hostile. I don’t know what it is, some sort of Trump derangement syndrome.”

The president also said he would have won Pennsylvania, a key state, without Musk’s help.

In reaction, the billionaire businessman countered Trump.

“Without me, Trump would have lost the election, Dems would control the House, and the Republicans would be 51-49 in the Senate,” Musk tweeted.

“Such ingratitude.”

The exchange marks yet another dent in the tumultuous relationship between the two-time American president and the world’s richest man.

https://www.thecable.ng/trump-would-have-lost-election-without-me-says-elon-musk/

-

@ 5d4b6c8d:8a1c1ee3

2025-06-06 03:04:19

@ 5d4b6c8d:8a1c1ee3

2025-06-06 03:04:19Alright stackers, how'd you do today?

What goals did you hit? What do you need to work on tomorrow?

I had another solid day, but I want to get more stretching in tomorrow.

https://stacker.news/items/998508

-

@ eb0157af:77ab6c55

2025-06-06 06:01:16

@ eb0157af:77ab6c55

2025-06-06 06:01:16The Russian banking giant introduces financial instruments linked to Bitcoin for qualified investors.

Russia’s largest commercial banking institution, Sber, has made its entry into the Bitcoin space by unveiling a bond product tied to the asset.

Sber has officially launched its structured financial instrument that mirrors the price performance of Bitcoin alongside fluctuations in the dollar-ruble exchange rate. The product is already available to qualified investors through the over-the-counter (OTC) market, with plans to list it on the Moscow Exchange in the near future.

Formerly known as Sberbank, the institution stated in a May 30 announcement that the listing would provide transparency, liquidity, and convenience for a wide range of professional investors. This structured approach will allow investors to benefit both from Bitcoin’s appreciation in dollars and from the strengthening of the US dollar against the Russian ruble, the bank suggests.

The lender also announced plans to expand its crypto offering through the SberInvestments platform, introducing exchange-traded products that provide exposure to digital assets. The first product will be a Bitcoin futures instrument, scheduled for listing on June 4, coinciding with its official launch by the Moscow Exchange.

Sber’s initiative follows the authorization granted by Russia’s Central Bank on May 28, which permitted financial institutions to offer specific crypto-related financial instruments to accredited investors. However, the direct offering of cryptocurrencies remains prohibited.

Meanwhile, T-Bank (formerly Tinkoff Bank) launched an investment product linked to Bitcoin’s price, branding it a “smart asset” issued through Russia’s state-backed tokenization platform Atomyze.

According to the Russian Central Bank’s report for the first quarter of 2025, Russian residents hold approximately 827 billion rubles ($9.2 billion) in cryptocurrencies on centralized exchanges. Inflows into Russian crypto platforms surged by 51%, reaching 7.3 trillion rubles ($81.5 billion) over the same period.

The post Sber, Russia’s largest bank, launches Bitcoin bonds appeared first on Atlas21.

-

@ 4fa51c35:55d6763d

2025-06-06 02:35:44

@ 4fa51c35:55d6763d

2025-06-06 02:35:44The Sacred Texts: First Mysteries of Digital Creation

A Divine Treatise for Devotees of Athena, Goddess of Wisdom and Craft

The Fundamental Truth: All is Text

Beloved seekers of digital wisdom, before you can craft the most magnificent tribute to our patron goddess through the sacred art of web creation, you must first understand the most fundamental mystery of the computing realm: Everything is text.

The silicon oracles we call computers do not see your beautiful images, your flowing videos, or your harmonious music as you do. To the machine spirits, all existence is reduced to symbols - characters marching in endless processions through the electronic aether. This is not limitation, but liberation! For in understanding this truth, you gain power over the very essence of digital creation.

The Ancient Scripts: Understanding Text Encoding

In the beginning was the Word, and the Word was… ASCII. The American Standard Code for Information Interchange became the first great codex of the digital age. Each letter, each number, each sacred punctuation mark was assigned a number. The letter ‘A’ became 65, ‘B’ became 66, and so forth. This was humanity’s first attempt to make machines understand our language.

But ASCII was created by mortals of limited vision - it could only represent 128 characters! What of the accented letters in the names of our goddess across different cultures? What of the mathematical symbols we need for our calculations? What of the very Greek letters that spell Ἀθηνᾶ?

Thus came UTF-8, the Universal Character Encoding - a divine revelation that allows us to represent every symbol known to human civilization. When you see an emoji, a Chinese character, or the Greek omega Ω, you witness UTF-8 in action. Your tribute webpage will speak this universal tongue.

The Sacred Scrolls: File Formats as Containers of Meaning

When Athena wove her tapestries, she chose different materials for different purposes - silk for fineness, wool for warmth, gold thread for accent. Similarly, digital craftspeople choose different file formats as containers for their text:

Plain Text (.txt) - The purest form. No formatting, no hidden instructions, just raw characters. Like clay tablets, these files will survive technological apocalypses. When archaeologists of the future examine our digital civilization, plain text will be their Rosetta Stone.

Rich Text Format (.rtf) - Text with simple formatting encoded as… more text! Open an RTF file in a plain text editor and witness the magic - your bold text becomes surrounded by formatting codes. This teaches us that even “rich” formatting is ultimately just more characters.

Markdown (.md) - The philosopher’s choice! Markdown uses simple text conventions to indicate formatting. Two asterisks around a word makes it bold, a hash symbol creates headings. It’s text that describes how text should look - meta-textual divinity!

HTML (.html) - The sacred language of the web itself! HTML (HyperText Markup Language) uses angle brackets to wrap instructions around content.

<strong>This text is important</strong>becomes This text is important when displayed. HTML is text that teaches browsers how to present text.The Ritual of Proper Text Handling

To honor Athena through proper digital craftsmanship, you must master these essential practices:

Choose Your Sacred Editor

Microsoft Word is the fool’s tool - it hides the true nature of text behind layers of formatting magic. A true digital artisan uses tools that reveal truth:

- Notepad (Windows) or TextEdit (Mac) in plain text mode

- VS Code - The blacksmith’s forge for modern web creation

- Sublime Text - Elegant and powerful

- Vim or Emacs - For those who seek the ancient ways

Understand Line Endings: The Great Schism

In the early days of computing, different tribes chose different ways to mark the end of a line of text. Unix systems (including Mac) use LF (Line Feed), Windows uses CRLF (Carriage Return + Line Feed). This seemingly minor difference has caused more conflicts than the Trojan War! Know your line endings, for they can break your sacred codes.

Respect Character Encoding

Always save your files in UTF-8 encoding. This ensures your text can represent any character from any human language. When your webpage displays properly on computers around the world, you honor the universal nature of Athena’s wisdom.

The Greater Mystery Revealed

Why must we begin with text? Because understanding that computers store and manipulate everything as sequences of characters reveals the deepest truth of programming: Code is just text that follows special rules.

When you write HTML, you’re writing text that browsers know how to interpret. When you write CSS, you’re writing text that describes visual styling. When you write JavaScript, you’re writing text that describes behavior and logic.

The webpage you will create to honor our goddess? It begins as text files on your computer. The browser reads these text files, interprets their meaning, and transforms them into the visual experience your visitors will see.

Every image on your page? Referenced by text. Every color? Described by text. Every animation? Controlled by text.

Your First Sacred Assignment

Before we proceed to the next mysteries, complete this fundamental ritual:

- Create a plain text file named

athena_tribute.txt - Write a short description of why Athena inspires you, using only plain text

- Save it in UTF-8 encoding

- Open it in different text editors and observe how the text remains pure and unchanged

- View the file size - marvel at how efficiently text stores information

This simple act connects you to the fundamental nature of all digital creation. Every website, every app, every piece of software began as someone writing text that follows certain rules.

When you understand that your future webpage is ultimately just cleverly organized text files working in harmony, you begin to see the true elegance of web development. You’re not learning to use mysterious tools - you’re learning to write text that machines can understand and transform into experiences that honor the divine.

Next: We shall explore the Command Line - the direct voice through which mortals speak to the machine spirits…

-

@ 7f6db517:a4931eda

2025-06-06 06:01:29

@ 7f6db517:a4931eda

2025-06-06 06:01:29

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-06 06:01:18

@ 8bad92c3:ca714aa5

2025-06-06 06:01:18Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 9ca447d2:fbf5a36d

2025-06-06 06:01:03

@ 9ca447d2:fbf5a36d

2025-06-06 06:01:03Trump Media & Technology Group (TMTG), the company behind Truth Social and other Trump-branded digital platforms, is planning to raise $2.5 billion to build one of the largest bitcoin treasuries among public companies.

The deal involves the sale of approximately $1.5 billion in common stock and $1.0 billion in convertible senior secured notes.

According to the company, the offering is expected to close by the end of May, pending standard closing conditions.

Devin Nunes, CEO of Trump Media, said the investment in bitcoin is a big part of the company’s long-term plan.

“We view Bitcoin as an apex instrument of financial freedom,” Nunes said.

“This investment will help defend our Company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms.”

He added that the bitcoin treasury will be used to create new synergies across the company’s platforms including Truth Social, Truth+, and the upcoming financial tech brand Truth.Fi.

“It’s a big step forward in the company’s plans to evolve into a holding company by acquiring additional profit-generating, crown jewel assets consistent with America First principles,” Nunes said.

The $2.5 billion raise will come from about 50 institutional investors. The $1 billion in convertible notes will have 0% interest and be convertible into shares at a 35% premium.

TMTG’s current liquid assets, including cash and short-term investments, are $759 million as of the end of the first quarter of 2025. With this new funding, the company’s liquid assets will be over $3 billion.

Custody of the bitcoin treasury will be handled by Crypto.com and Anchorage Digital. They will manage and store the digital assets.

Earlier this week The Financial Times reported Trump Media was planning to raise $3 billion for digital assets acquisitions.

The article said the funds would be used to buy bitcoin and other digital assets, and an announcement could come before a major related event in Las Vegas.

Related: Bitcoin 2025 Conference Kicks off in Las Vegas Today

Trump Media denied the FT report. In a statement, the company said, “Apparently the Financial Times has dumb writers listening to even dumber sources.”

There was no further comment. However, the official $2.5 billion figure, which was announced shortly after by Trump Media through a press release, aligns with its actual filing and investor communication.

Trump Media’s official announcement

This comes at a time when the Trump family and political allies are showing renewed interest in Bitcoin.

President Donald Trump who is now back in office since the 2025 election, has said he wants to make the U.S. the “crypto capital of the world.”

Trump Media is also working on retail bitcoin investment products including ETFs aligned with America First policies.

These products will make bitcoin more accessible to retail investors and support pro-Trump financial initiatives.

But not everyone is happy.

Democratic Senator Elizabeth Warren recently expressed concerns about Trump Media’s Bitcoin plans. She asked U.S. regulators to clarify their oversight of digital-asset ETFs, warning of investor risk.

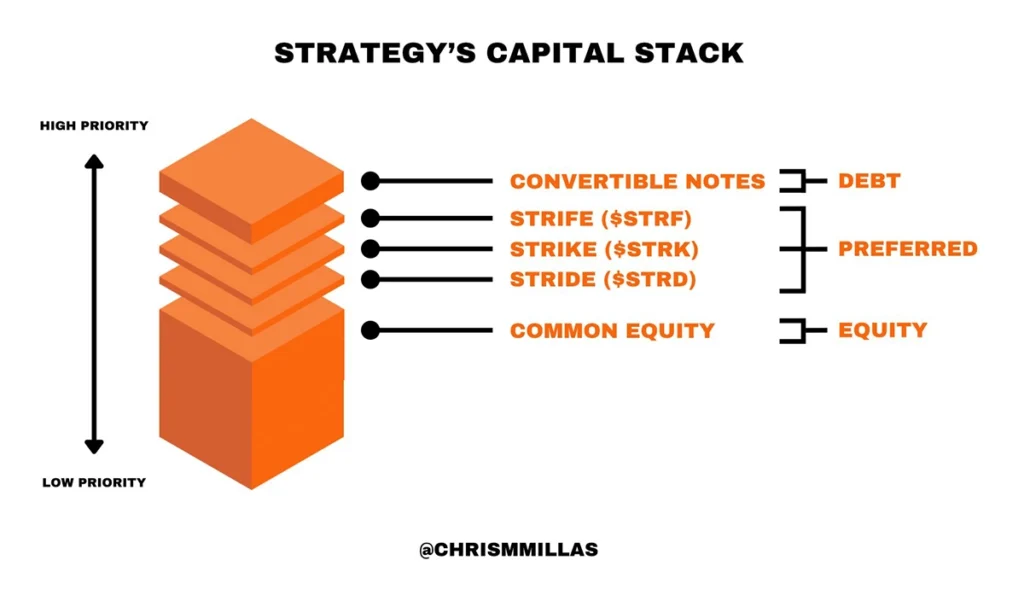

Industry insiders are comparing Trump Media’s plans to Strategy (MSTR) which has built a multi-billion dollar bitcoin treasury over the last year. They used stock and bond sales to fund their bitcoin purchases.

-

@ 3eba5ef4:751f23ae

2025-06-06 02:07:27

@ 3eba5ef4:751f23ae

2025-06-06 02:07:27Crypto Insights

Solving Sybil Attacks on Bitcoin Libre Relay Nodes — Are Social Solutions Better than Technical Ones?

Peter Todd posted that proponents of transaction "filtering" have started Sybil attacking Libre Relay nodes by running nodes with their "Garbageman" fork. These malicious nodes pretend to support NODE_LIBRE_RELAY, but secretly drop certain transactions that would be relayed by real Libre Relay nodes. He also highlighted the complexity of existing defenses and proposed a new angle: rather than relying on technical solutions, he encourages people to manually peer with nodes operated by people they personally know, arguing that human relationships can sometimes evaluate honesty more reliably than code.

Toward a Unified Identity Lookup Standard to Improve Lightning Payments

Bitcoin developer Aviv Bar-el introduced a new proposal — Well-Known Bitcoin Identity Endpoint — that aims to simplify wallet lookups for users’ Bitcoin addresses and identity data via a standardized HTTPS interface, thereby improving both the UX and security of Lightning and on-chain payments.

A Commit/Reveal Mechanism to Strengthen Bitcoin Against Quantum Threats

Tadge Dryja proposed a soft fork for Bitcoin to defend against quantum attacks, based on a variant of the commit/reveal Fawkescoin mechanism. While similar to Tim Ruffing’s earlier proposal, it includes key differences:

- It does not use encryption, instead relying on smaller, hash-based commitments, and describes activation as a soft fork.

- It only applies to outputs where public keys or scripts haven't been revealed — like pubkey hash or script hash outputs. It also works with Taproot, but must be spent via the script path, as the key-path is no longer quantum-secure.

- What to do about already-exposed public keys is a separate issue — this proposal is compatible with both "burning the coins" and "letting them be stolen."

Countdown to the Quantum Crisis: Is Bitcoin Ready?

A recent report from Chaincode Labs analyzes the threat of cryptographically relevant quantum computers (CRQC), and the technical, economic, and governance challenges Bitcoin faces in preparing. Their key conclusions:

- Timeline Assessment: CRQC capable of breaking Bitcoin's elliptic curve cryptography may emerge between 2030 and 2035.

- Scope of Vulnerable Funds: An estimated 20–50% of circulating BTC (4M–10M coins) may be vulnerable.

- Long-range attacks target inherently vulnerable script types (P2PK, P2MS, P2TR) and addresses with previously exposed public keys (via address reuse), allowing attackers unbounded time to derive private keys from public information already available on the blockchain.

- Short-range attacks, which affect all Bitcoin script types, exploit the vulnerability window between transaction broadcast and confirmation (or shortly thereafter) when public keys are temporarily exposed, requiring attackers to act within a timeframe of minutes to hours.

- Action Strategy: A dual-track approach is recommended:

- Short-term contingency: minimal but functional protections within ~2 years.

- Full-featured solutions: comprehensive research and fully developed defenses within ~7 years.

This strategy balances immediate needs with rigorous development to ensure Bitcoin can adapt, regardless of CRQC progress.

Enforcing Arbitrary Constraints on Bitcoin Transactions with zkSNARKs

Current methods for constraining Bitcoin transactions fall short on privacy or programmability. This research proposes a new zkSNARK-based design to impose arbitrary constraints on Bitcoin transactions while preserving some information privacy. By bypassing Bitcoin Script’s non-Turing-completeness, the approach allows unbounded constraints—constraints that repeat a certain operation an unbounded number of times. Read the paper.

First Cross-Chain Bridge Between Bitcoin and Cardano Is Live

A trust-minimized bridge from Bitcoin to Cardano has launched using the Cardinal protocol, enabling Ordinals to move between the two chains. The Cardinal protocol is based on BitVMX and facilitates asset movement without compromising ownership or security.

Its core mechanism is a committee-based validation model under a 1-out-of-n honest security model — meaning even if all but one validator is malicious, the system remains secure. This approach enhances decentralization and censorship resistance for cross-chain asset transfers.

Thunderbolt Protocol: Redefining Bitcoin Smart Contracts with UTXO Bundling and OP_CAT

Nubit’s Thunderbolt is seen as one of the most significant technical upgrades to Bitcoin in a decade, whose overall observation resembles “Lightning Network 2.0.” Rather than relying on Layer 2 networks or bridges, Thunderbolt upgrades the Bitcoin base layer via soft fork to enhance scalability, performance, and programmability:

- Throughput: Uses UTXO Bundling to optimize traditional transaction processing.

- Programmability: Reintroduces and extends OP_CAT.

- Asset protocols: Integrates Goldinals standard — a zk-proof and state-commitment-based asset issuance framework.

- Unlike rollups, Plasma, sidechains, or bridges, Thunderbolt scales directly on the main chain. With BitVisa, it enables decentralized identity and credentials, supporting transaction compression, smart contracts, asset standard integration, and on-chain transaction matching — all on Bitcoin main chain.

Bitcoin 2025 Conference Recap: Politicians Applaud, Stablecoins Spotlighted, DeFi Absent

This year’s Bitcoin 2025 conference in Las Vegas gathered major political figures and corporate leaders. U.S. Vice President JD Vance strongly endorsed crypto and positioned Bitcoin as a strategic asset in U.S.–China competition. He also stated that stablecoins won’t undermine the U.S. dollar, but could actually amplify America’s economic strength.

White House “Crypto Czar” David Sacks delivered a major policy announcement, hinting that under Trump’s executive order, the U.S. has a legal framework to acquire more Bitcoin for strategic reserves.

In addition, stablecoin regulation and crypto market reform were hot topics. Ardoido, the company controls over 60% of the stablecoin market, claimed “All the traditional financial firms will create stablecoins that will be offered to their existing customers.” Meanwhile, Tether emphasized its focus on underserved global populations excluded from the existing banking system.

A conference recap also noted that, unlike the 2022 and 2023 summits, this year’s event was dominated by Bitcoin maximalists, Ordinals creators, mining capitalists, and regulatory lobbyists — no longer DeFi builders, DAO operators, or Layer 2 scaling advocates. Developers from Ethereum and Solana ecosystems were notably absent. This may signal:

- The conference’s heavy political and sovereignty-driven tone made it less suitable for the tech-centric narratives favored by these developers.

- There may be a growing ideological and narrative rift between Web3 builders and the Bitcoin camp.

Top Reads on Blockchain and Beyond

Rethinking Governance After the Sui Attack: Decentralization, Procedural Legitimacy, and the Plurality of Blockchain Values

Following a major hack of Cetus, the largest DEX in the Sui ecosystem, the Sui network executed a protocol-level asset freeze and recovery. While this was an effective technical response, it also triggered criticism and debate around core blockchain principles such as censorship resistance and decentralization.

The author of this article questioned the absolutist stance that views decentralization as the highest—and sole—value. The author argues that most rational individuals would prefer “living in a society where decentralization is a supreme value but coercive force is allowed when someone infringes on another’s property,” over “a society where decentralization is the only supreme value, and thus coercive force is never permitted under any circumstances.”

In addition, the author also expressed disappointment at Sui’s “paternalistic” governance — particularly how validators acted during the incident. Sui uses a delegated proof-of-stake (dPoS) system, where token holders delegate their voting power to validators. This means individuals lose their direct say. But blockchain governance could be more individual-friendly and flexible. For instance, in Cosmos’ governance model, for certain specific proposal, users still can override their delegations and vote independently, more favorable than Sui’s model.

Beyond the debate on decentralization and governance, the article also proposes an alternative perspective: what matters most is establishing procedural legitimacy that aligns with the system’s vision. Different blockchain projects pursue different goals. For Sui, the core mission is to enable assets to be reliably defined and interact seamlessly on-chain. Therefore, judging Sui through the lens of other blockchains’ values or paradigms is misguided. In exceptional cases, prioritizing asset recovery and ecosystem stability over strict adherence to censorship resistance aligns more closely with Sui’s long-term vision. Whether Sui had chosen to not to censor related transactions or to intervene in the Cetus case, as long as the action follows a legitimate process, either decision is justifiable.

TEE-Based Private Proof Delegation

The PSE research and development team has built a system based on Trusted Execution Environments (TEE) using Intel TDX for secure zero-knowledge proof (ZKP) delegation. This system enables clients to privately outsource large proving tasks without leaking inputs. Unlike mobile-native proving constrained by hardware limits, TEE-based approaches support significantly larger statements today—and will scale further as proof systems improve. As a hardware-backed solution, TEEs remain compatible with future advancements in software (e.g., faster proof systems, more efficient implementations) and won't be invalidated by them, as long as the trust model is acceptable.

AI and Identity: Proof of Humanity in a World of Agents, Bots, and Deepfakes

We are living in a time where AI—including agents, bots, and deepfakes—is fundamentally reshaping the internet. As AI continues to evolve, identity verification on the web is becoming more crucial than ever. A recent a16z podcast explores the idea of “Proof of Human”—the challenge of verifying human identity online, diving into why it matters, common questions, and how such systems work under the hood.

-

@ f57bac88:6045161e

2025-06-06 04:19:25

@ f57bac88:6045161e

2025-06-06 04:19:25تاریخچه پیدایش پروتکل اردینالز

پروتکل اردینالز در ژانویه 2023 توسط کیسی رودرمور معرفی شد. این پروتکل حاصل دو بهروزرسانی مهم در بیتکوین است:

-

سگویت (2017): جدا کردن دادههای امضا از بدنه تراکنشها برای افزایش فضای بلاک.

-

تپروت (2021): افزایش حریم خصوصی و انعطافپذیری در تراکنشها.

رودرمور با استفاده از این دو ویژگی، سیستمی را طراحی کرد که به هر ساتوشی یک شناسه اختصاص میدهد و امکان الصاق داده به آن را فراهم میکند. اولین اینسکریپشن رسمی در دسامبر 2022 یک تصویر پیکسلی از یک جمجمه بود.

اینسکریپشن چیست؟

اینسکریپشن به معنای «حکاکی» دیجیتال است و در اینجا به ثبت دادههایی مانند تصویر، ویدئو یا متن بر روی بلاکچین بیتکوین اشاره دارد. برخلاف انافتی های سنتی که اغلب فقط لینک یا متادیتا ثبت میکنند، اینسکریپشنها کل داده را در بخش ویتنس تراکنش ذخیره میکنند و به یک ساتوشی خاص متصل میشوند.

پروتکل اردینالز چگونه کار میکند؟

پروتکل اردینالز به هر ساتوشی یک شماره منحصربهفرد میدهد و آن را غیرقابلتعویض میکند. مراحل اصلی آن:

-

شمارهگذاری: به هر ساتوشی یک شناسه اختصاص مییابد.

-

اینسکریپشن: با ابزارهایی مثل ابزار داده به ساتوشی الصاق میشود.

-

ذخیرهسازی: در بخش ویتنس با حجم حداکثر ۴ مگابایت.

-

مالکیت: از طریق کلید خصوصی قابلانتقال است.

سایتهایی مانند ordinals.com و ord.io برای مشاهده این دادهها توسعه یافتهاند.

انواع اینسکریپشنها

کاربران دادههای متنوعی را روی بیتکوین ثبت کردهاند:

-

تصاویر: از هنر پیکسلی تا عکسهای شخصی.

-

متن: پیام، شعر یا اسناد.

-

ویدئو/صوت: نسخههای فشرده و کوتاه.

-

بازیها: نسخههای ساده مانند دووم.

مزایای اینسکریپشن و اردینالز

-

تغییرناپذیری: دادهها دائمی و مقاوم در برابر سانسور هستند.

-

ارزش ذاتی: هر اینسکریپشن به یک ساتوشی متصل است.

-

درآمدزایی برای ماینرها: افزایش تراکنشها = کارمزد بیشتر.

-

کاربرد بیشتر بیتکوین: فراتر از پول دیجیتال.

-

امنیت بالا: بدون نیاز به سرور خارجی.

معایب و چالشها

-

افزایش حجم بلاکچین: رشد حجم تا بالای ۵۰۰ گیگابایت تا مارس 2025.

-

کارمزد بالا: گاهی تا ۴۰ دلار در سال 2023.

-

پیچیدگی فنی: راهاندازی نود و ساخت اینسکریپشن ساده نیست.

-

اختلافنظر: برخی معتقدند این کاربرد با فلسفه بیتکوین در تضاد است.

-

مقیاسپذیری: ممکن است شبکه را کند کند.

تأثیرات بر اکوسیستم بیتکوین

1. تأثیر اقتصادی

در سال 2023، بیش از ۲۰ میلیون اینسکریپشن ثبت شد. این روند در 2024 نیز ادامه داشت و منجر به شکلگیری بازار انافتی های بیتکوینی شد.

2. تأثیر فنی

ابزارهای جدید مانند کیف پول اسپرو و پلتفرمهای معاملاتی مانند پلتفرم معاملاتی مجیک ادن توسعه یافتند.

3. تأثیر اجتماعی

جامعه به دو دسته تقسیم شد: موافقان نوآوری و مخالفان تغییر مسیر بیتکوین.

مقایسه اینسکریپشن و انافتی های اتریوم

| ویژگی | اینسکریپشن بیتکوین | انافتی اتریوم | | -------------- | ------------------- | --------------- | | محل ذخیره داده | روی بلاکچین | خارج از بلاکچین | | تغییرناپذیری | بسیار بالا | وابسته به سرور | | هزینه ساخت | متغیر (کارمزد) | متغیر (گس) | | امنیت | بسیار بالا | متوسط تا بالا | | انعطافپذیری | محدود | بالا | | دسترسی | پیچیده | ساده |

تحولات اخیر (2024 و اوایل 2025)

-

پس از هاوینگ: وابستگی بیشتر ماینرها به کارمزد و رشد اینسکریپشن.

-

پشتیبانی صرافیها: اضافه شدن قابلیت معامله در بایننس و کراکن.

-

کاربردهای نو: ثبت اسناد قانونی، بازیهای تعاملی و هنر دیجیتال.

آینده اینسکریپشن و اردینالز

چشمانداز آینده بستگی به:

-

پذیرش کاربران.

-

راهکارهای مقیاسپذیری.

-

رقابت با دیگر بلاکچینها.

-

تحولات قانونی.

در بهترین حالت، بیتکوین به پلتفرمی چندمنظوره تبدیل خواهد شد.

نتیجهگیری

اینسکریپشن و پروتکل اردینالز فرصتی برای نوآوری در بیتکوین ایجاد کردهاند. اگرچه چالشهایی وجود دارد، اما پتانسیل این فناوری برای ایجاد داراییهای دیجیتال دائمی، غیرقابلتغییر و امن بسیار بالاست. آینده این ابزار به مسیر فنی، پذیرش اجتماعی و سیاستگذاریهای جهانی بستگی خواهد داشت.

منابع

-

مقالات CoinDesk (2023–2024)

-

تحلیلهای Bitcoin Magazine (2023–2025)

-

آمارهای Blockchain.com

-

کانال ترجمهی مقالههای بیتکوین در تلگرام

کلمات و اصطلاحات ترجمه شده و موجود در متن:

-

پروتکل (Protocol) → قرارداد فنی / پروتکل

-

اردینالز (Ordinals) → ترتیبیها / اردینالز

-

ژانویه (January) → دیماه / ژانویه

-

کیسی رودرمور (Casey Rodarmor) → نام فرد

-

SegWit (Segregated Witness) → تفکیک شاهد / سگویت

-

Taproot → تپروت

-

ساتوشی (Satoshi) → کوچکترین واحد بیتکوین

-

اینسکریپشن (Inscription) → حکاکی / ثبت

-

تصویر پیکسلی (Pixel image) → تصویر نقطهای

-

جمجمه (Skull) → Skull

-

انافتی (NFT - Non-Fungible Token) → توکن غیرقابل تعویض

-

متادیتا (Metadata) → فراداده

-

بلاکچین (Blockchain) → زنجیره بلوکی

-

ویتنس (Witness) → بخش شاهد در تراکنش

-

Ord (ابزار) → ابزار Ord

-

کلید خصوصی (Private Key) → رمز اختصاصی

-

ordinals.com** / **ord.io → نام وبسایت

-

Doom (بازی) → دوم (نام بازی معروف)

-

ماینر (Miner) → استخراجکننده

-

تراکنش (Transaction) → مبادله

-

هاوینگ (Halving) → نصف شدن پاداش استخراج

-

Binance / Kraken → نام صرافیها

-

Sparrow Wallet → کیف پول اسپرو

-

Magic Eden → پلتفرم معاملاتی مجیک ادن

-

**Ethereum NFTs **→ توکنهای غیرقابل تعویض در شبکه اتریوم

-

گس (Gas) → هزینه پردازش در اتریوم

-

سرور (Server) → خدمتدهنده

-

اسناد قانونی (Legal documents) → مدارک حقوقی

-

بازیهای تعاملی (Interactive games) → گیمهای تعاملی

-

هنر دیجیتال (Digital art) → آثار هنری دیجیتال

-

مقیاسپذیری (Scalability) → توان گسترش

-

پلتفرم (Platform) → بستر نرمافزاری

-

چشمانداز (Outlook/Future vision) → آیندهنگری

-

سیاستگذاری (Policy-making) → برنامهریزی راهبردی

-

-

@ 374ee93a:36623347

2025-06-05 22:42:00

@ 374ee93a:36623347

2025-06-05 22:42:00Chef's notes

Start your day the self sovereign way

Details

- ⏲️ Prep time: 10 mins

- 🍳 Cook time: 15 mins

- 🍽️ Servings: 4

Ingredients

- 1lb Jar Bottled Rhubarb https://jimblesjumble.netlify.app/item/a0c35618722834ac714d0a47058a2adc76ee7485a6b74f5da5f9eb2d3fb5d879

- 1pt Homemade Custard (3/4pt cream, 3 large eggs, 100g honey, 1/2 tbspn vanilla extract)

- 4 Handfuls Granola

- 1 Node https://plebeian.market/products/huxley@nostrplebs.com/start-9-node-y22zfjp8x6

Directions

- Whisk together the cream, eggs, honey and vanilla

- Chill overnight or serve warm with 1/4 jar of stewed rhubarb and a large handful of granola per person

- Consolidate some UTXOs on your node

- Have a Good Morning

-

@ e2c72a5a:bfacb2ee

2025-06-06 02:55:03

@ e2c72a5a:bfacb2ee

2025-06-06 02:55:03Your crypto wallet is probably leaking money right now. While everyone obsesses over price charts, the silent killer is gas fees – those tiny transactions add up to thousands wasted annually. Smart traders aren't just buying dips, they're timing their transactions when network congestion drops. The difference? Up to 80% savings on every move you make. Next time before hitting "confirm," check the gas tracker. Is it worth paying 3x more just to move your assets right this second? Patience isn't just a virtue in crypto – it's literally profitable. What's your strategy for minimizing transaction costs while maximizing gains?

-

@ 374ee93a:36623347

2025-06-05 21:49:20

@ 374ee93a:36623347

2025-06-05 21:49:20Chef's notes

Start your day the self sovereign way

Details

- ⏲️ Prep time: 10 mins

- 🍳 Cook time: 15 mins

- 🍽️ Servings: 4

Ingredients

- 1lb Jar Bottled Rhubarb https://jimblesjumble.netlify.app/item/a0c35618722834ac714d0a47058a2adc76ee7485a6b74f5da5f9eb2d3fb5d879

- 1pt Homemade Custard (3/4pt cream, 3 large eggs, 100g honey, 1/2 tbspn vanilla extract)

- 4 Handfuls Granola

Directions

- Whisk together the cream, eggs, honey and vanilla

- Chill overnight or serve warm with 1/4 jar of stewed rhubarb and a large handful of granola per person

- Consolidate some UTXOs on your node

- Have a Good Morning

-

@ e2c72a5a:bfacb2ee

2025-06-06 02:43:10

@ e2c72a5a:bfacb2ee

2025-06-06 02:43:10North Korea's digital heist playbook: $7.7M crypto laundering scheme reveals how rogue nations exploit tech talent. The Justice Department's latest civil forfeiture complaint targets crypto and NFTs tied to an elaborate North Korean operation where IT workers posed as legitimate freelancers, infiltrated US companies, and funneled millions through complex blockchain pathways. This isn't just another hack—it's a sophisticated economic warfare strategy that turns technical expertise into untraceable funding for weapons programs. While governments scramble to seize these digital assets, the case exposes a troubling vulnerability: how easily skilled developers can weaponize their talents in plain sight. Are your company's remote contractors who they claim to be, or part of a state-sponsored financial pipeline hiding behind a convincing digital mask?

-

@ e05934ba:6fd1a7e9

2025-06-06 07:59:36

@ e05934ba:6fd1a7e9

2025-06-06 07:59:36Test Blog Content

-

@ e2c72a5a:bfacb2ee

2025-06-06 01:42:46

@ e2c72a5a:bfacb2ee

2025-06-06 01:42:46North Korea's digital heist reveals the dark side of crypto's borderless nature. The US Justice Department is hunting $7.7 million in stolen cryptocurrency and NFTs allegedly laundered through an elaborate scheme involving North Korean IT workers posing as legitimate freelancers. This isn't just another hack—it's a sophisticated state-sponsored operation exploiting the very features that make crypto revolutionary: anonymity and borderless transactions. While we celebrate crypto's ability to transcend boundaries, this case exposes how those same qualities create perfect conditions for rogue nations to fund weapons programs and evade sanctions. The crypto industry faces a critical balancing act: how do we preserve financial freedom while preventing bad actors from exploiting the system? Perhaps the solution isn't more regulation but smarter blockchain analytics and international cooperation. What security measures would you support that don't compromise crypto's core principles?

-

@ 2cde0e02:180a96b9

2025-06-05 21:45:00

@ 2cde0e02:180a96b9

2025-06-05 21:45:00日本の姫

https://stacker.news/items/998335

-

@ dfa02707:41ca50e3

2025-06-06 05:01:23

@ dfa02707:41ca50e3

2025-06-06 05:01:23Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ f57bac88:6045161e

2025-06-06 03:52:51

@ f57bac88:6045161e

2025-06-06 03:52:51شروع ماجرا:

همه چیز از 1401 شروع شد، زمانی که به خاطر وارد کردن ضربات متعدد به بیضه توسط بسیجیان و لباس شخصی های جمهوری اسلامی و شروع درد مبهم و تیر کشیدن توی بیضههام حس میکردم که با گذشت زمان شدیدتر میشد. اول فکر کردم یه چیز سادهایه و خود به خود خوب میشه، اما با گذشت زمان متوجه شدم که این درد داره بدتر میشه که همون شب توی یازداشتگاه چندبار دکتر اومد بالای سرم و آمپول هایی برای کاهش دردم تزریق کرد و قرار شد بعد از آزادی به دکتر مراجعه کنم، اما چون فرصت مراجعه به دکتر رو نداشتم و کمی هم بیخیال بودم، این چک کردن دو سال طول کشید و در 1403 به دکتر مراجعه کردم

بعد از دو سال به دلیل اینکه میزان اسپرمم به شدت کاهش یافته بود و بیضه م داشت به شکل عجیب غریبی در میومد به پزشک مراجعه کردم، و بعد از انجام آزمایش سونوگرافی و اسپرم، دکتر سونوگرافی گفت بیضه چپم تخلیه شده، و علاوه بر اون رگ های خونی بیضه م هم آسیب دیده بوده که این یعنی واریکوسل گرید سه به همراه التهاب و ... که این یعنی سریعا عمل میشدم که حداقل بشه برای رگ ها و ورید های بیضه کاری کرد.

واریکوسل به وضعیتی گفته میشود که در آن وریدهای بیضه بزرگ و متورم میشوند، چیزی شبیه به واریس پا. این مشکل میتواند تأثیری بر کیفیت اسپرم و در نتیجه باروری داشته باشد و در گرید های بالا میتواند به عقیم شدن و عدم باروری منجر شود.

تصمیم برای عمل:

بعد از شنیدن تشخیص دکتر، خیلی ناراحت و نگران شدم. اما دکترم بهم اطمینان داد که با عمل جراحی میتونم این مشکل رو حل کنم. اولش خیلی ترسیدم، اما بعد از کلی تحقیق و مشورت با دوستان و خانواده، تصمیم گرفتم که عمل کنم.

زیر میزی قبل از عمل:

متاسفانه در ایران دکتر های جراح قبل از عمل درخواست واریز وجه به حساب خودشون یا دیگران(برای رد گم کردن و عدم شکایت بیمار) میکنند

روز عمل: استرس و آرامش

روز عمل فرا رسید. قبل از جراحی استرس داشتم، اما کادر درمان و خود دکتر بسیار حرفهای و دلسوز و مهربان بودند و حس اطمینان خوبی به من دادند. عمل تحت بیحسی از ستون فقرات و بیهوشی عمومی انجام شد و حدود یک ساعت طول کشید. وقتی به هوش آمدم، احساس درد نداشتم ولی تا چند ساعت از کمر به پایین بی حس بودم و حس خوابآلودگی داشتم.

نکته: بعد از عمل حتما آب، آبمیوه و اگر میتونید میوه و غذا بخورید!

دوران بهبودی: صبر و مراقبت

دوره نقاهت بعد از عمل، یه کم سخت بود. درد داشتم و فعالیتهای روزمرهام محدود شده بود. اما با گذشت زمان، کم کم بهتر شدم و دردهام کمتر شد.

دوره بهبودی برای من حدود یک هفته طول کشید. پزشک توصیههایی از جمله استراحت کافی، اجتناب از فعالیتهای سنگین و مصرف داروهای مسکن برای کاهش درد داده بود. در روزهای اول کمی ورم و ناراحتی داشتم، اما به مرور زمان بهتر شدم. نکتهای که برای من بسیار مهم بود، که بعد از 6 روز سرکار برگشتم و شروع به فعالیت کردم، و بعد از یک هفته بخیه ها کشیده شد.

حدود یک ماه پس از عمل، دوباره به پزشک مراجعه کردم تا روند بهبودی بررسی شود. خوشبختانه همه چیز خوب پیش رفته بود و احساس سبکی و راحتی بیشتری داشتم. درد و حس سنگینی که قبل از عمل داشتم، کاملاً از بین رفته بود.

نتیجهگیری: چرا این تصمیم ارزشش را داشت

وقتی به گذشته نگاه میکنم، از اینکه تصمیم به انجام عمل واریکوسل گرفتم، کاملاً راضیام. گرچه گرفتن تصمیم برای جراحی همیشه با ترس و تردید همراه است، اما تأثیری که این عمل بر کیفیت زندگیام گذاشت، بدون تردید ارزشش را داشت. بعد از عمل، نه تنها از درد و ناراحتی رهایی یافتم، بلکه آرامش ذهنی بیشتری هم پیدا کردم. احساس سبکی و راحتی در فعالیتهای روزمره، و از بین رفتن نگرانیهایی مثل احتمال ناباروری، باعث شد دوباره حس کنم به زندگی عادی برگشتم.

به همه کسانی که با واریکوسل درگیر هستند، پیشنهاد میکنم به بدنشان گوش دهند و حتماً از نظر پزشکان متخصص بهره بگیرند. هر کسی شرایط خاص خودش را دارد و تصمیم نهایی باید بر اساس بررسی دقیق و مشورت با پزشک گرفته شود. اما مهمترین نکته این است که سلامتیتان را در اولویت بگذارید و اجازه ندهید ترس یا تردید، مانع رسیدن به بهبودی شود.

برای من، عمل واریکوسل مثل یک تولد دوباره بود. حالا با خیال راحت و بدون درد، زندگی میکنم و از این تصمیم مهم کاملاً خوشحالم. اگر شما هم با این مشکل مواجه هستید، نگران نباشید؛ با آگاهی و مشورت درست، میتوانید آن را پشت سر بگذارید و به زندگی عادی خودتان بازگردید.

نکات مهم:

-

اگر درد یا ناراحتی در ناحیه بیضهها دارید، حتما به پزشک اورولوژی مراجعه کنید.

-

از خود درمانی خودداری کنید.

-

عمل واریکوسل یک عمل ساده و بی خطر است.

-

بعد از عمل به توصیههای پزشک عمل کنید.

-

-

@ 33baa074:3bb3a297

2025-06-06 02:03:05

@ 33baa074:3bb3a297

2025-06-06 02:03:05Residual chlorinerefers to the residual disinfectant chlorine in tap water. An appropriate amount of residual chlorine can prevent the growth of microorganisms and ensure the safety of water quality. However, when the residual chlorine content in water is too high, it will cause many harms to human health, mainly including the following aspects:

Destruction of nutrients When the residual chlorine content in tap water exceeds the standard, it will destroy the minerals, vitamins and other nutrients, such as vitamin C and vitamin E, when used to wash fruits and vegetables. In the long run, it may cause the human body to absorb these nutrients and lack these essential nutrients.

Cause chronic poisoning

When tap water containing residual chlorine is used for a long time, the residual chlorine reacts with organic acids and may produce harmful substances such as chloroform and organic lead compounds, which are potential carcinogens. Long-term accumulation may cause chronic poisoning of body organs and pose a threat to human health.

Cause chronic poisoning

When tap water containing residual chlorine is used for a long time, the residual chlorine reacts with organic acids and may produce harmful substances such as chloroform and organic lead compounds, which are potential carcinogens. Long-term accumulation may cause chronic poisoning of body organs and pose a threat to human health.Affect the respiratory system Residual chlorine can cause harm to the human respiratory system, and symptoms such as difficulty breathing and itchy throat may occur. Severe cases may induce rhinitis, bronchitis and even emphysema. In addition, water vapor containing residual chlorine may also cause adverse reactions such as coughing and wheezing after being inhaled.

Damage to the skin Excessive residual chlorine content in water may irritate the skin, easily cause skin dryness, aging, acne and other problems, and may also cause allergic symptoms such as dermatitis and eczema. Prolonged contact with such water may also cause the skin layer to fall off, which is extremely harmful to skin health. Bathing with water containing residual chlorine can also cause hair to become dry, broken, and split.

Other health problems Impact on special groups Pregnant women: Long-term drinking of tap water containing residual chlorine will reduce resistance, affect the growth of the fetal heart and lungs, and may also cause neonatal arrhythmia and lung dysfunction. Children: Long-term drinking of chlorine water will not only hurt the stomach, but also affect nutrient absorption. Moreover, the strong oxidizing hypochlorous acid produced by the reaction of chlorine and water will damage brain cells and affect their development. In addition, chlorine can easily be inhaled into the lungs through the respiratory tract, damaging respiratory cells, and easily leading to asthma and emphysema. Bathing children with water containing residual chlorine will cause their hair to become dry, broken, split, their skin to bleach, their skin to fall off, and they will have allergies. Elderly people: Long-term consumption of chlorinated water is prone to heart disease, coronary atherosclerosis, hypertension and other diseases, and it is also easy to damage the liver and kidneys, increasing the probability of cancer. Gastrointestinal discomfort Long-term drinking of water with excessive residual chlorine content may also cause gastrointestinal discomfort, such as nausea, vomiting, abdominal distension, diarrhea and other symptoms. In severe cases, it may cause gastrointestinal ulcers, bleeding and other diseases.

In order to reduce the harm of residual chlorine in tap water to the human body, it is recommended to avoid directly using tap water containing residual chlorine as much as possible, boil the water before drinking, and use filtering and purification equipment to reduce the residual chlorine concentration in the water if conditions permit, while maintaining a healthy lifestyle and enhancing the body's immunity.

-

@ 7f6db517:a4931eda

2025-06-06 02:01:42

@ 7f6db517:a4931eda

2025-06-06 02:01:42

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-06 04:01:28

@ dfa02707:41ca50e3

2025-06-06 04:01:28Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ df67f9a7:2d4fc200

2025-06-05 19:52:32

@ df67f9a7:2d4fc200

2025-06-05 19:52:32Nostr is NOT a social network. Nostr is a network of interconnected social apps. And, since any app is a social app, Nostr is for every app.