-

@ 2e8970de:63345c7a

2025-06-02 16:18:59

@ 2e8970de:63345c7a

2025-06-02 16:18:59https://www.wsj.com/tech/europe-global-tech-race-ff910a94

https://stacker.news/items/995308

-

@ 91117f2b:111207d6

2025-06-02 16:04:15

@ 91117f2b:111207d6

2025-06-02 16:04:15

I still remember the day I became obsessed with photography. I was 16, and my parents gifted me a vintage camera. From that moment on, I was hooked. I spent hours clicking pictures, experimenting with lighting, and editing my shots. My friends and family would often tease me, saying I was too focused on photography, but I couldn't help it. It was my passion.

As time passed, my obsession only grew stronger. I'd wake up early, grab my camera, and head out to capture the perfect shot. I'd spend hours editing, trying to get the perfect blend of colors and lighting. My grades suffered, and my relationships began to fray, but I couldn't stop. Photography had become my everything.

One day, I landed a small gig with a local magazine. They wanted me to shoot a cover story, and I was over the moon. I poured my heart and soul into that shoot, and the results were stunning. The magazine loved my work, and soon, I was getting more assignments. My obsession had finally paid off.

But with success came the realization that my obsession had taken a toll on my life. I was exhausted, and my relationships were strained. I had to learn to balance my passion with self-care and prioritize my well-being.

Today, I'm grateful for my obsession. It taught me discipline, creativity, and perseverance. I've learned to channel my energy into constructive pursuits and make time for the people and things that matter. My obsession still drives me, but now it's a force for good.

Have you ever had an obsession that changed your life?

But sometimes obsession can be a bad thing if it reaches the stage of death. You say"i can't do without it", it is astage. You should try and look for a way out.

-

@ f85b9c2c:d190bcff

2025-06-02 15:58:09

@ f85b9c2c:d190bcff

2025-06-02 15:58:09

Never get too attached to something to the extent that you can live without it

The Weight We Pile On I’ve noticed something about myself lately—most of my worries, my sleepless nights, my tight chest—they’re born from my own hands. We cause anxiety, stress, and headaches by ourselves, don’t we? It’s a truth I can’t dodge, a mirror I can’t unsee. I cling too hard, I grip too tight, I fight for things that don’t need a fight. And in the end, I’m the one left aching, shaking, breaking. It’s not the world doing this to me—it’s me. I stack the bricks of stress, one by one, until I’m crushed beneath. I’ve learned the hard way that attachment is a thief, sneaking in to steal my peace.

The Trap of Holding Too Close I used to think love meant holding on with all my might—people, dreams, plans, tight in my sight. But oh, how that backfired, how it wired me wrong. The tighter I held, the louder the bell of stress would ring, a sting I couldn’t shake. I’d lose sleep over a job I might not get, fret over a friend who didn’t text back, or rack my brain over a future I can’t predict. Attachment became my chain, my pain, my rain. I’d pour my soul into something—someone—and when it slipped, I’d trip, I’d fall, I’d call it a loss. But was it? Or was I just too attached, too latched, too matched to something I thought I couldn’t live without?

Learning to Let Go Here’s what I’m teaching myself now: never get too attached to something to the extent you can’t live without it. It’s a rhythm I’m learning—release, breathe, ease. Life flows better when I don’t clutch. That doesn’t mean I don’t care—it means I care enough to set it free.

I think of the times I let go—a relationship that wasn’t mine to force, a goal that wasn’t my course. The headaches faded, the stress unbraided itself from my mind. I found I could live without it, thrive without it, jive without it. What’s meant for me stays; what’s not drifts away. And that’s okay—it’s a sway I can dance to.

Freedom in the Balance I’m not saying detachment is easy—it’s a battle, a rattle, a shift. But there’s freedom in it, a lightness I can’t resist. When I stop tying my worth to things—to rings, to strings, to wings—I stop the cycle of self-made misery. Anxiety shrinks when I don’t overthink. Stress unwinds when I don’t bind myself to what’s out of reach.

I’ve started asking myself: Can I live without this? If the answer’s no, I know I’ve gone too far, too deep, too steep. So, I pull back, I slack the rope, I cope with grace. Life’s too short to let my own hands choke my joy.

A Lighter Way to Live We cause anxiety, stress, and headaches by ourselves—I see it now, clear as day, bright as May. But we can stop. We can drop the load, unload the strain, regain the calm. For me, it’s about loving without owning, dreaming without drowning, living without frowning over what might slip.

I’ll hold what matters, but loosely, smoothly, coolly. Because in the end, I don’t want to be the one tying knots in my own heart. I want to live free—free from me, free to be. And that’s a rhythm worth chasing, a peace worth embracing.

-

@ 91117f2b:111207d6

2025-06-02 15:50:56

@ 91117f2b:111207d6

2025-06-02 15:50:56

In Nigeria, two popular swallow dishes have been vying for the top spot in the hearts (and stomachs) of food enthusiasts: Semovita and Pounded Yam. Both dishes have their loyal followers, and the debate about which one is better has been ongoing. Let's dive into the world of Nigerian cuisine and explore the characteristics of these two beloved dishes.

Semovita: The Smooth Operator

Semovita is a popular swallow made from semolina flour, which is derived from durum wheat. It's known for its smooth texture and ability to absorb flavors well. Semovita is often served with a variety of soups, including egusi, okra, and vegetable soup. Its neutral flavor makes it a versatile option for pairing with different soups.

Pounded Yam: The Classic

Pounded yam is a traditional Nigerian dish made from boiled yam that has been pounded into a smooth, stretchy dough. It's a staple in many Nigerian households and is often served with soups like egusi, okra, and efo riro. Pounded yam has a distinct texture and flavor that's hard to resist.

The Verdict

So, which one is better? The answer ultimately comes down to personal preference. If you like a smooth, neutral-tasting swallow that absorbs flavors well, Semovita might be the way to go. If you prefer a more traditional, stretchy swallow with a distinct flavor to fill your tum tum, Pounded Yam is the better option.

Tips for Enjoying Both Dishes

- Experiment with different soups to find your favorite pairing.

- Pay attention to the texture and flavor of the swallow.

- Don't be afraid to try new combinations and flavors.

Conclusion

The debate between Semovita and Pounded Yam may never be settled, but one thing is certain: both dishes are delicious and beloved in Nigerian cuisine. Whether you're a fan of Semovita or Pounded Yam, there's no denying the joy of enjoying a warm, satisfying swallow with a flavorful soup.

Which one do you prefer?

Me personally groundnut soup

-

@ 91117f2b:111207d6

2025-06-02 15:37:31

@ 91117f2b:111207d6

2025-06-02 15:37:31

Extroverts are often described as the life of the party, thriving in social situations and feeding off the energy of those around them. But what makes extroverts tick? Let's dive into the world of extroversion and explore the characteristics, strengths, and challenges of being an extrovert.

What is Extroversion?

Extroversion is a personality trait characterized by a tendency to focus on the outside world, drawing energy from social interactions and external stimuli. Extroverts tend to be outgoing, talkative, and sociable, often seeking out new experiences and connections.

Strengths of Extroverts

-

Social Skills: Extroverts tend to be naturally adapt at navigating social situations, building relationships, and communicating effectively.

-

Confidence: Extroverts often exude confidence and charisma, making them more likely to take risks and pursue new opportunities.

-

Networking: Extroverts tend to have large social networks, which can lead to new connections, collaborations, and career opportunities.

Challenges of Extroverts

-

Overstimulation: Extroverts can become overwhelmed by too much social stimulation, leading to burnout and exhaustion.

-

Impulsivity: Extroverts may act impulsively, speaking or acting without fully thinking through the consequences.

-

Depth vs. Breadth: Extroverts may prioritize quantity over quality in their relationships, potentially leading to shallow connections.

Famous Extroverts

-

Entertainers: Many entertainers, such as actors and musicians, are known for their extroverted personalities and charisma.

-

Leaders: Extroverted leaders, such as politicians and CEOs, often excel at inspiring and motivating others.

-

Social Media Influencers: Extroverts may thrive in the world of social media, building large followings and creating engaging content.

Embracing Extroversion

Whether you're an extrovert or know someone who is, understanding the strengths and challenges of extroversion can help you navigate social situations and build meaningful relationships. By embracing their natural tendencies and being mindful of potential pitfalls, extroverts can thrive in their personal and professional lives.

-

-

@ 91117f2b:111207d6

2025-06-02 15:27:33

@ 91117f2b:111207d6

2025-06-02 15:27:33

Just a simple short explanation of how to identify real from fake crypto currencies

The world of cryptocurrency is full of opportunities, but it's also where scammers lurk. To protect yourself, you need to know how to identify them. Some tips to guide you:

- Be Wary of Too-Good-to-Be-True Offers

If an investment promises unusually high returns with little risk, it's likely a scam. Legitimate investments always carry some risk and work.

- Watch Out for Phishing Scams

Scammers may try to trick you into revealing sensitive information like your wallet's private keys or login credentials. Be cautious of suspicious emails, messages, or websites.

- Research Before Investing

Before investing in a cryptocurrency project, research the team behind it, their experience, and track record. Check for a clear whitepaper, roadmap, and strong community presence.

- Be Cautious of Unsolicited Offers

If someone approaches you with an investment opportunity out of the blue, it's likely a scam. Legitimate opportunities are usually advertised publicly.

- Check for Red Flags

Scammers often use poor grammar, spelling, and punctuation. They may also be pushy or aggressive. Legitimate projects usually have professional communication.

- Don't Fall for Fake Giveaways

Scammers may promise free cryptocurrency or tokens to lure you in. Legitimate projects don't give away free crypto.

- Use Reputable Exchanges and Wallets

Stick to well-known and reputable cryptocurrency exchanges and wallets. They have robust security measures to protect your assets.

- Stay Informed

Stay up-to-date with the latest news and trends in cryptocurrency. Educate yourself on how to spot scams.

- Check for Registration

Verify if the investment opportunity is registered with relevant regulatory bodies. Unregistered opportunities can be a red flag.

- Trust Your Instincts

If something feels off, trust your instincts and avoid it. It's better to be safe than sorry.

By following these tips, you can reduce the risk of falling victim to scammers in the crypto world. Stay vigilant and protect your assets!

-

@ e516ecb8:1be0b167

2025-06-02 15:22:40

@ e516ecb8:1be0b167

2025-06-02 15:22:40Bitcoin was born as a middle finger to the financial establishment. Its 2008 whitepaper, penned by the enigmatic Satoshi Nakamoto, promised a peer-to-peer (P2P) electronic cash system—a decentralized rebellion against state-controlled money, sparked in the ashes of the global financial crisis. It was a cypherpunk dream: a currency free from banks, governments, and middlemen. But somewhere along the way, Bitcoin lost its soul. What was meant to be a fluid, practical currency has morphed into a clunky, expensive digital vault—a gilded cage for your wealth. Let’s unpack why Bitcoin is broken, why its fixes are flimsy, and why its rebellious spirit is fading into a state-backed shadow of its former self.

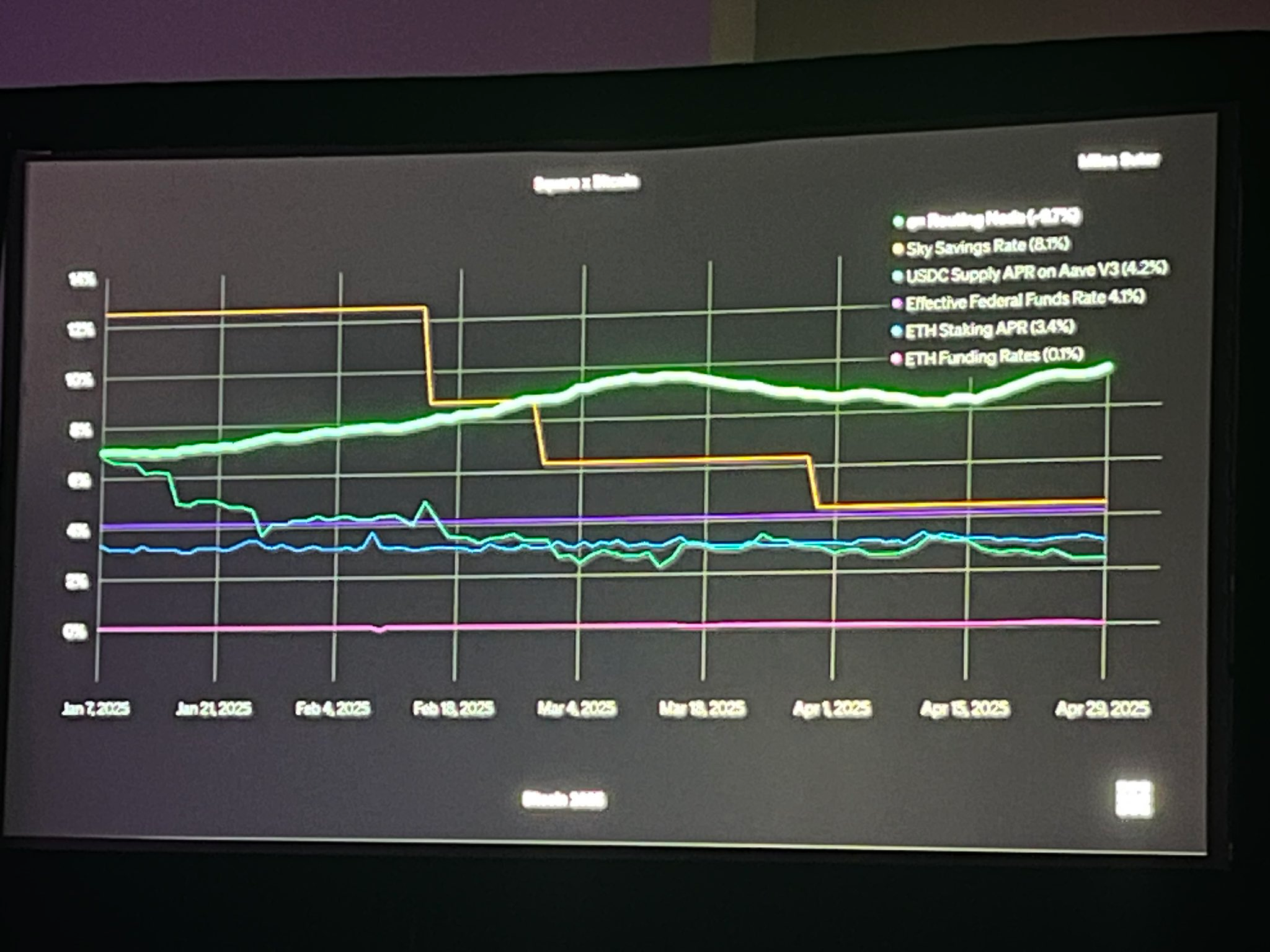

The P2P Promise: Shattered by Sky-High Fees Bitcoin’s core idea was simple: send money directly to anyone, anywhere, without a bank skimming off the top. Fast forward to today, and that vision is in tatters. Imagine you’ve got $34 in Bitcoin to send to a friend. By the time it arrives, after transaction fees, they might get a measly $2. According to data from BitInfoCharts, the average Bitcoin transaction fee in early 2025 hovers around $20–$30, with spikes as high as $60 during network congestion. For context, that’s more than the cost of a Venmo transfer or even some international wire fees.

This isn’t a one-off issue. Wallets like Guarda, Exodus, or even hardware wallets like Ledger face the same problem: Bitcoin’s base layer (Layer 1) is so congested that fees make small transactions absurdly impractical. Want to buy a $5 coffee with Bitcoin? You’d lose more in fees than the coffee’s worth. This isn’t P2P money—it’s confiscatory, inefficient, and anything but user-friendly.

Lightning Network: A Band-Aid on a Broken System Cue the Bitcoin maximalists: “But we have the Lightning Network!” Sure, Lightning was introduced as a second-layer solution to scale Bitcoin for smaller, faster transactions. It’s a network of off-chain payment channels designed to handle microtransactions with lower fees. Sounds great, right? Except it’s a patchwork fix that betrays Bitcoin’s original vision.

First, Lightning wasn’t part of Satoshi’s plan—it’s an afterthought, a kludge to address the base layer’s limitations. Second, it’s not universally adopted. According to 1ML, as of early 2025, only about 15% of Bitcoin wallets natively support Lightning. Major wallets like Coinbase Wallet and Trust Wallet still require workarounds or third-party integrations. Why? Because implementing Lightning is complex, and for most users, it involves trusting third-party nodes or custodians to route payments. So much for “be your own bank.”

Worse, running your own Lightning node requires technical know-how—think Linux commands, channel management, and constant monitoring. A 2024 survey by Bitcoin Magazine found that only 8% of Bitcoin users run their own nodes, Lightning or otherwise. For the average person, Lightning isn’t a solution; it’s a hurdle. And if you’re relying on a third party, you’re back to square one: trusting someone else with your money.

Take Adrián Bernabeu, author of Bitcoinismo, who preaches the gospel of self-custody while simultaneously hyping Lightning for micropayments. It’s a contradiction. You can’t champion “not your keys, not your crypto” while pushing a system that often requires third-party intermediaries for practical use. It’s like telling someone to live off-grid but handing them a generator that only works with a utility company’s permission.

A Gilded Cage: Bitcoin as a Store of Value So, if Bitcoin isn’t practical for payments, what’s it good for? The narrative has shifted: Bitcoin is now a “store of value,” a digital gold. Its price has soared—hitting $80,000 in late 2024, per CoinGecko—and its fixed supply of 21 million coins makes it a hedge against inflation. But this shift isn’t just about market dynamics; it’s a consequence of Bitcoin’s own flaws.

Moving Bitcoin is so expensive that it’s often smarter to hodl than to spend. Your wallet becomes an orange-tinted cage, trapping your wealth in a system where transferring value eats away at your holdings. Sure, you could wait for fees to drop, but that’s another nail in the P2P coffin. Real money doesn’t make you wait for a discount to use it. Imagine telling someone, “Hold off on buying groceries until the dollar’s transaction fees go down.” It’s absurd.

OP_RETURN and the Spam Problem: A Network Clogged with Junk Bitcoin’s blockchain isn’t just struggling with fees; it’s also drowning in digital clutter. The OP_RETURN function, meant for embedding small amounts of data (like metadata for smart contracts), has become a dumping ground for everything from NFT inscriptions to random spam. In 2023, Glassnode reported that OP_RETURN transactions accounted for nearly 20% of Bitcoin’s block space during peak periods, crowding out legitimate transactions and driving up fees.

Proposed fixes from Bitcoin Core and Knots—like limiting OP_RETURN data size or tweaking mempool rules—are more Band-Aids. They don’t address the root issue: Bitcoin’s block size limit. Capped at 1MB (or roughly 4MB with SegWit), Bitcoin can only process about 3–7 transactions per second, compared to Visa’s 24,000. Increasing the block size could ease congestion and lower fees, but Bitcoin Core developers have resisted this for years, citing concerns about centralization.

Here’s the kicker: Bitcoin Cash (BCH), a 2017 fork of Bitcoin, raised its block size to 32MB and processes transactions at a fraction of the cost. BCH’s average fee in 2025 is under $0.01, per BitInfoCharts. Bitcoin maximalists dismiss BCH as a failed experiment, but it’s hard to argue with the numbers. A larger block size reduces spam’s impact because legitimate transactions dominate. Admitting this, though, would mean conceding defeat in a years-long ideological battle. And Bitcoiners hate losing.

From Rebellion to Regulatory Lapdog Bitcoin’s cypherpunk roots are fading fast. What started as a revolt against state control is cozying up to governments. El Salvador made Bitcoin legal tender in 2021, but its state-backed Chivo wallet (built on Lightning) is riddled with bugs and usability issues, according to a 2024 Reuters report. Meanwhile, Bitcoin Core developers have lobbied for institutional adoption, with figures like Michael Saylor advocating for Bitcoin as a strategic reserve asset for governments and corporations.

This is a far cry from Satoshi’s vision. A 2023 post on X revealed that Core developers met with U.S. regulators to discuss Bitcoin’s role in national reserves—a move that reeks of compromise. The same system Bitcoin was meant to disrupt is now being courted. If governments start subsidizing Bitcoin mining to protect their reserves, as some speculate, the irony will be complete: a decentralized dream bankrolled by fiat.

The Looming Threats: Quantum and Mining Woes Bitcoin’s problems don’t end with fees and politics. Quantum computing looms on the horizon. A 2024 MIT Technology Review article estimated that quantum computers capable of breaking Bitcoin’s ECDSA cryptography could emerge by 2030. This threatens “Satoshi-era” wallets—those holding early, unspent coins—potentially undermining trust in the entire blockchain.

Then there’s mining. Bitcoin’s proof-of-work system is energy-intensive, with global mining consuming 150 TWh annually, per the Cambridge Bitcoin Electricity Consumption Index. As block rewards halve (the next halving is in 2028), miners will rely more on transaction fees. Higher fees mean even less practicality for P2P payments, locking Bitcoin further into its “digital gold” trap. If states step in to subsidize mining, as some X posts have speculated, Bitcoin’s anti-establishment ethos will be dead in the water.

The Final Irony: Paying for Freedom with Fiat Bitcoin promised to replace fiat currency, but its flaws are pushing it toward a bizarre dependency on the very system it sought to destroy. If governments subsidize mining or adopt Bitcoin as a reserve asset, we’ll be left with a bitter irony: a supposedly revolutionary asset propped up by fiat. The cypherpunk dream will have come full circle, not as a triumph, but as a compromise.

So, is Bitcoin broken? Yes. It’s a victim of its own success—too valuable to spend, too clunky to use, and too compromised to stay true to its roots. The question isn’t whether Bitcoin can be fixed; it’s whether its community has the courage to admit what’s wrong. Until then, your Bitcoin wallet remains a shiny, orange prison—a relic of a rebellion that forgot how to fight.

-

@ 10f7c7f7:f5683da9

2025-06-02 15:10:30

@ 10f7c7f7:f5683da9

2025-06-02 15:10:30Unfortunately, I’m yet to be approached by either friends or family to enquire about bitcoin, I have very few friends, and my family are generally comfortable in their fiat lives. However, I often feel the need to prepare myself if the situation arises where I’m asked and I don’t do my usual, “ah, it’s just a hat” response and say nothing about bitcoin. As a result, I’m thinking through scenarios when I get asked, maybe even asked for advice and work out how to respond to people I care about, or even people I’m less bothered about, but I really don’t want to be the asshole who says; “have fun staying poor”. As Tuur Demeester mentioned, we need to prepare ourselves mentally for when price goes crazy, so we don’t immediate start acting up with ridiculous Lambo shaped purchases but also not realise the cash to do something that will benefit you and your loved ones. We also need to prepare ourselves for the phonecalls we may receive “wen moon”. I’m not going to suggest that anyone should or should not do anything, but I’m going to try and work some things out, so that when I’m asked, I can respond in a way that is balanced, constructive and will help the person I’m speaking to make progress in their journey.

Firstly, if they say that I’m just luck to have found bitcoin before them, there are many useful quotes that can be used as a response to this, but one of my favourites has to be from Thomas Jefferson:

“I find that the harder I work, the more luck I seem to have”

Short, simple and to the point, while also bringing the idea back from success being related to some magical concept that some people have and some people don’t, that removes the individual’s agency to positively impact their lot in life.

After this, the next suggestion may be related to luck, but at least this can be measured; how early did you first hear about bitcoin? Obviously, there could be some factors that may be outside of one’s immediate control, such as whether your name was on the cypherpunk mailing list in late 2009. Saying this, very few individuals chose to act on the contribution of one of the unknown contributors (Satoshi Nakamoto) who suddenly appeared on the mailing list, so started directing resources towards the network at the start. Even those that did and accumulated large stockpiles in the early days may have not initially known what they had or may have simply lost what they accumulated (poor old James Howells is still trying to dig up a Welsh refuse site). There are also those infamous episodes where individuals were given bitcoin early on and didn’t understand what they had or were simply careless with the necessary information (Alex Jones once received 10k bitcoin from Max Keiser). Even more recently, Dave Portnoy purchased a significant amount of bitcoin, was walked through the whole process by Marty Bent, but later lost his keys, suggesting it is not sufficient to simply be earlier to bitcoin to benefit from it, but something else.

If the person you speak to mentions they are late, there are many opportunities to illustrate how being early may not have given a better outcome and even resulted in a negative outcome, “I lost so many bitcoins, I’m not touching that crap again”. After knowing that you once owned X number of bitcoin, to have then had to start again from zero would be a very difficult barrier to get over. James Howells may have been in a much better situation if he had never mined those early bitcoin, and arrive at the topic years later and began buying like most others, or started buying as soon as he realised what bitcoin was. To provide the counter argument, there is also a story of someone having their bitcoin seedphrase stolen from cloud storage (big respect to RMessitt), but rather than sitting back and complaining, instead began to accumulate once more, only this time with better security hygiene. While they may not have been able to reaccumulate what they had before, they are in a better position than if they had simply given up, attributing it to bad luck, rather than working hard. These examples suggest that it may not only be about being early, but also about something else that has allowed certain early adopters (such as Max Keiser), to both keep and continue accumulating bitcoin since.

This leads to a final type of early adopter, who may not have lost access to their bitcoin, but may be useful to helping explain to your friend or family, why luck nor timing are what they think they’re cracked up to be. If you had a family member or friend that you trusted, and they said they had bought some bitcoin and if you wanted, they would buy some for you, would this be a good, bad or indifferent thing to happen? If you didn’t get worried the first-time price dropped and sold, it might have worked out quite well for you financially if you held it for 4 or more years. However, unless you took this intervening time to investigate what you had bought (you’re likely a busy person if you’d been able to accumulate sufficient cash to throw a bit into bitcoin to make it worth your while), you may not know what you owned. As a result, rather than not selling when the price dipped (fingers crossed your friend would never have actually let you press the sell button), if the price rose considerably, you might sell some, and thought yourself very wise having maybe bought pre-2020, and then having made a humble 20x in late 2024.

From a dollar, pound, euro, yen perspective, this is very much a success, a good trade and positive profit, but from a bitcoin perspective, this is selling the best and buy a worse asset, this is ending up with fewer sats, but most importantly, this is not understanding why bitcoin. During the time you held (ignored or forgotten about), you would have missed the opportunity to explore what you had bought all those years before and why it might be of interest. If you had, you may have thought about exploring how to purchase some more, how to self-custody your bitcoin and any other bitcoin related skill you could develop, getting you to a point where when price rose, the idea of “cashing out” was not your immediate thought. In this final example, if you had chosen to sell all your bitcoin when the price rose, while you may have “made out like a bandit”, but you would also return yourself to your prior no-coiner state, ultimately only temporarily better off, until that fiat tended to zero. The questions can then be raised, what was missing from this lucky, early individual’s journey?

This will hopefully give your inquisitive yet naïve no-coiner friend a chance to take a step back, reflect on their earlier comments, and feel the warmth in their cheeks as they realise they are blushing slightly that they called you lucky (well, here’s hoping). If nothing else, these examples will help illustrate that neither luck nor timing is all it takes to benefit from bitcoin. The final example then illustrates that it isn’t only about owning bitcoin from when it is cheaper (in their mind, bitcoin is always undervalued) until the price reaches a higher level, there is something else that is important. For me, this something is being inquisitive to learn about what you own, to develop understanding and build sufficient conviction to be able to response calmly when someone you care about refers to bitcoin as a scam, a ponzi scheme or the currency of choice of child traffickers (that would be the US dollar). Conviction is also important for those moments when the fiat price may have fallen, as it did throughout 2022, so that rather than sell, you’ve continued to purchase more, in an attempt to offset the purchases you may be regretting that you made at the prior peak. If you have the conviction, you can also be comfortable that you will neither time the bottom, nor deploy all the dry powder at this time, but you’re still comfortable that you’re moving the product of your time and effort into an asset that you control, that over time will store value better than fiat currency. From listening to very close to 40 hours of podcasts a week (shout out to bitcoin Bugle) for the past 5 years (yep, that’s over 10k hours), much to the family’s annoyance, irrespective of the dollar value, it is better to hold bitcoin than anything else.

As a result, it is absolutely, definitely not about being lucky, don’t attribute to luck what I worked damn hard to accumulate! It is also not about being early. While the example above may have a much lower entry price than I ever had and my first purchase in April 2020 was only for £50, neither is important to where I am now. My average cost basis is now multiple times higher than this first purchase, but that is not the point, and this is what I’ll tell my friend or family if they ever ask the question. Yes, buy a little now, I’ll help you and hopefully you won’t lose it, but more importantly, try and answer the question of why someone would listen to 10k hours of podcasts about bitcoin? While trying to get an answer to this question, they may begin to realise for themselves that it is worthwhile working harder to learn about this asset and starting the save the value of your time and effort in it. If they are willing the build their own conviction about bitcoin, they will be able to realise that starting today is the earliest they’ll ever be able to start and if they do, maybe someone in the future will tell them they are early or lucky, and this whole process can begin again. The circle of being the “lucky” bitcoiner.

“There is no early or late, lucky or unlucky, there is only knowledge and those too proud to learn”

-

@ eb0157af:77ab6c55

2025-06-02 15:02:09

@ eb0157af:77ab6c55

2025-06-02 15:02:09At Bitcoin 2025, the company unveils the Blockstream App and a strategic roadmap to accelerate adoption.

During the Bitcoin 2025 conference held in Las Vegas, Blockstream announced several updates, including a new non-custodial application and a corporate strategy structured around three operational divisions.

Introducing the Blockstream App: a new Bitcoin wallet that grows with you.

From first sats to advanced custody, it brings self-sovereignty into reach no matter where you start. Available now on Android, coming soon to iOS.

pic.twitter.com/UBiNHKh8bO

pic.twitter.com/UBiNHKh8bO— Blockstream (@Blockstream) May 29, 2025

The new Blockstream App allows users to purchase Bitcoin directly and store it in their own wallet, eliminating the need to rely on external custodians for fund management. This technological solution is built on the infrastructure of the Blockstream Green wallet. The app supports Bitcoin, Lightning, and Liquid.

The app’s design has been conceived to meet the needs of a diverse audience, the company stated. Its interface is accessible for beginners while retaining advanced functionalities for more experienced users.

It also remains compatible with advanced security features such as hardware wallet signing and air-gapped transactions via Blockstream Jade.

Corporate strategy: consumer, enterprise, and BAM

During the event, Blockstream revealed a strategic restructuring organized into three distinct operational units. This new framework aims to strengthen the company’s position within the Bitcoin economy through tailored approaches for specific markets.

The Consumer division will focus on developing products for retail users, while the Enterprise division will manage relationships with corporate clients. Blockstream Asset Management (BAM) will serve as the company’s institutional arm, specializing in Bitcoin investment products for institutional customers.

Adam Back, CEO of Blockstream, commented:

“The past year has shown clearly that Bitcoin no longer sits on the margins of the global financial system—it is rapidly becoming the foundation. Our vision is simple: the future of finance runs on Bitcoin.”

The post Blockstream launches a non-custodial app to buy Bitcoin appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-02 15:01:30

@ cae03c48:2a7d6671

2025-06-02 15:01:30Bitcoin Magazine

Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous”At the 2025 Bitcoin Conference in Las Vegas, the Director of Bitcoin Beach Mike Peterson, the Presidential Advisors of Building Bitcoin Country El Salvador Max & Stacy and the Mayor City of Panama Mayer Mizrachi discussed Bitcoins future in Panama.

At the beginning of the panel, Is Panama Next? El Salvador Leading The Region For Bitcoin Adoption, Mayor Mizrachi started by mentioning, “We accept Bitcoin. The city gets paid in Bitcoin, but it receives in dollars through an intermediary processing, payments processor. Bitcoin is not just safe. It’s prosperous.”

Max commented about the scammers in crypto and how El Salvador is managing it.

“We did a couple of things early on, one was to create The Bitcoin Office which will be directly reporting to the President, and then also we passed a law which will say bitcoin is money and everything else is an unregistered security,” said Max.

Mike Peterson stated, “the access of Bitcoin in Central America to do battle against the globalists that have always looked at the regionist back yard. This is intolerable and this is going to change right now.” After Mizrachi commented, “Imagine yourself in an economic block powered by El Salvador, supported by Panama and the rest will come.”

Stacy reminded everybody about El Salvador’s School system.

“El Salvador is the first country in the world to have a comprehensive public school financial literacy education program from 7 years old,” mentioned Stacy. “These are little kids, learning financial literacy.”

Max ended the panel by saying, “the US game theory right? Because the US wants to buy a lot of Bitcoin, so if Panama wants to buy a lot of bitcoin then it helps everybody in the US. This is the beautiful expression of game theory perfectly aligned in the protocol that is changing the world that we live in. And on the street level what bitcoin does to the population is to go from a spending mentality to a saving mentality.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous” first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 47259076:570c98c4

2025-06-02 15:00:51

@ 47259076:570c98c4

2025-06-02 15:00:51Pense que a alma é 1kg de ouro indestrutível.

Esse ouro não pode ser adicionado ou removido, sempre será 1kg.

O ouro está completo quando todas as partes estão juntas.

Embora o ouro não possa ser destruído, ele pode ser diluído.

Tomar 1 litro de veneno pode te matar.

Mas se esse 1 litro de veneno for diluído em um lago de 1000 litros, então tu pode tomar a água desse lago sem se preocupar.

A diluição perde o poder.

O sol não queima a sua pele instantaneamente quando você entra em contato com ele.

Mas se tiver uma lupa que concentra toda a luz do sol, isso vira um laser fatal e tu vira churrasco na hora.

Quais são as coisas nas quais a alma dilui?

Várias, mas eu quero focar em espelhos negros (black mirrors).

Espelhos negros são feitos de obsidian polida, e essa obsidian é vidro natural que é majoritariamente composto de silicon.

Os astecas SABIAM que esses espelhos negros abriam portais para outras dimensões de espaço e tempo, e as mentes treinadas para isso conseguiam fazer contato com outras entidades, ter conhecimento sobre o pós vida, inferno e também dar uma olhada no futuro, tudo através de um espelho negro.

Falando assim, parece interessante, deve ser legal usar um espelho negro para obter respostas à perguntas que tanto nos afligem, não é mesmo?

ERRADO.

Essas entidades vão te dar o que você quer, mas em contrapartida vão pegar a sua alma.

Claro que elas não podem destruir a sua alma, mas podem diluir ela e assim tomar controle do seu corpo, a famosa "possessão demoníaca".

E não, não é coincidência que a Rainha Má da Branca de Neve usa um espelho para ver o futuro e obter respostas.

A Disney pegou esse conceito dos ASTECAS.

É claro que na história da Disney, eles adaptaram e usaram um espelho de prata ao invés de um espelho negro.

O espelho de prata é esse que você usa enquanto escova os seus dentes. Esse espelho é INOFENSIVO, é um espelho seguro.

Caso você queira respostas sem vender a sua alma, você precisa acessar o AKASHIC RECORDS.

Não irei falar nesse artigo como acessar o AKASHIC RECORDS, até porque eu mesmo nunca acessei ainda.

Voltando a falar sobre espelhos negros.

Aonde nós podemos encontrar esses espelhos negros? Eles são raros de encontrar?

Meu caro amigo, a tela que você está usando para ler este artigo é um espelho negro.

99.9% das telas que você vê, de celulares, computadores, tablets, cinema, etc...

Todas as telas são feitas de obsidian/silicon/espelhos negros.

Em outras palavras, quando estamos "scrollando" o celular, a nossa energia está passivamente sendo drenada de nós.

Nós estamos sobre uma hipnose global.

Como o gênio XXX Tentacion disse na sua entrevista para a rádio 103.5 The Beat: "A nova ordem mundial está vindo na forma de eletrônicos."

XXX Tentacion é o exemplo perfeito.

Ele fez músicas de qualidade além de outras coisas e disse que a mente é um imã que atrai o que nós queremos, mas se a mente estiver distraída, ou seja, diluída, não iremos atrair bosta nenhuma.

Por isso ele disse que não gostava de sair de casa pra ficar indo no shopping ou procurando o que fazer no centro da cidade, ele mesmo disse que preferia ficar em casa e pensar, e consequentemente manifestar.

Curiosamente, é exatamente isso que o Nikola Tesla e o Walter Russell falaram.

No meu caso, embora eu fique sozinho a maior parte do tempo, a minha mente fica distraída na tela do computador, e é por isso que eu não atingi o meu máximo potencial.

Olhe as pessoas na rua, todo mundo viciado em celular, até mesmo mendigo tem celular.

No mundo moderno, muita gente faz dinheiro através da internet e de telas, o que é maravilhoso.

Entretanto, não podemos deixar as telas nos controlarem.

No meu caso, pretendo só usar o computador para trabalhar e assistir filmes e o celular pra se comunicar com amigos e familiares.

No meu tempo livre, pretendo ficar sem telas.

Qual é o oposto de diluição? CONCENTRAÇÃO.

Para adquirir o poder verdadeiro, é necessário concentrar a nossa alma que foi diluída no lixo espiritual e físico.

"Eu apenas fico em casa e penso, e manifesto" - XXX Tentacion

Claro que pra manifestar não precisa ser em casa, se tu estiver sozinho na praia ou em uma floresta, funciona igual.

O que importa é não estar distraído com as coisas ao seu redor, ESPECIALMENTE espelhos negros.

Referências: Xxxtentacion Interview - The Mars Files: https://youtu.be/1GjfN8I3t-8 XXXTentacion Calls Out Drake In His First Interview After Jail!: https://youtu.be/qZkEdPAqOEM 🧐 Great Lesson on the BLACK MIRROR ⚫️: https://youtu.be/1q72bDcU2I0 Tesla Sees Evidence Radio And Light Are Sound: https://teslauniverse.com/nikola-tesla/articles/tesla-sees-evidence-radio-and-light-are-sound Livro: The Man Who Tapped the Secrets of the Universe

-

@ a3c6f928:d45494fb

2025-06-02 14:55:08

@ a3c6f928:d45494fb

2025-06-02 14:55:08We all want to be liked. To feel accepted. But when the need to please others overrides our own truth, we slowly lose touch with who we are. People-pleasing might wear the mask of kindness, but it often hides fear—fear of rejection, conflict, or not being enough. Real freedom begins when we stop performing for approval and start living for ourselves.

The Cost of Constant Approval-Seeking

People-pleasing isn’t generosity—it’s self-abandonment dressed as harmony. It can lead to:

Burnout and resentment

A lost sense of identity

Chronic anxiety over others’ opinions

Difficulty saying no, setting boundaries, or honoring personal needs

Why We People-Please

Often, it starts in childhood—learning to survive by adapting to what others wanted from us. We internalize the belief that love is earned by being agreeable, helpful, or invisible. But this coping mechanism eventually becomes a cage.

Signs It’s Time to Break Free

You feel drained after social interactions

You agree to things you don’t want to do, just to keep the peace

You constantly apologize—even when you’re not at fault

You struggle to express honest thoughts or emotions

Reclaiming Your Voice

-

Pause Before Saying Yes: Ask yourself—do I want this, or am I afraid to disappoint?

-

Feel the Discomfort: Letting others down may feel hard at first, but it’s a muscle that gets stronger with use.

-

Speak Your Truth: Start small—express a preference, a boundary, an opinion.

-

Remind Yourself: You are not responsible for managing others’ emotions.

-

Choose Authenticity Over Approval: Being real might cost you some people—but it will return you to yourself.

Why It’s Worth It

You weren’t born to be a mirror for other people’s expectations. You were born to embody your own truth. Freedom is being able to stand in your life and say, “This is who I am,” without shrinking, apologizing, or pretending.

“You are not required to set yourself on fire to keep others warm.”

Stop seeking permission. Start living aligned. That’s where real peace begins.

-

-

@ 91117f2b:111207d6

2025-06-02 14:36:20

@ 91117f2b:111207d6

2025-06-02 14:36:20

Horror films have a way of captivating audiences with their eerie atmospheres, spine-chilling plot twists, and terrifying characters. From classic monster movies to modern psychological thrillers, the horror genre has evolved over the years, offering something for every fan of fear and suspense.

The Evolution of Horror

- Classic Monsters: Films like Dracula and Frankenstein introduced iconic creatures that continue to terrify audiences.

- Slasher Films: Movies like Halloween and "A Nightmare on Elm Street" popularized the slasher genre, featuring masked killers and gruesome murders.

- Supernatural Horror: Films like The "Exorcist" and "The Conjuring" explore the supernatural and paranormal, often featuring demonic possessions and haunted houses.

- Psychological Horror: Movies like "The Shining" and "Get Out" focus on the psychological and emotional terror, often exploring themes of isolation, trauma, and social commentary.

The Appeal of Horror Films

- Adrenaline Rush: Horror films provide an adrenaline-fueled experience, offering a thrilling escape from reality.

- Catharsis: Watching horror films can be a way to confront and release pent-up emotions, providing a sense of catharsis.

- Social Commentary: Many horror films offer social commentary, exploring themes like societal fears, cultural anxieties, and human nature.

Modern Horror

- Found Footage: Films like "The Blair Witch Project" and "Paranormal Activity" popularized the found footage genre, creating a sense of realism and immediacy.

- Anthology Films: Movies like "Creepshow and" Tales from the Darkside: The Movie" offer a collection of horror stories, often featuring different directors and styles.

- Global Horror: Films like "The Ring" and "Let the Right One In" showcase the diversity of horror cinema, offering unique perspectives and cultural influences.

The Future of Horror

- New Technologies: Advances in technology, such as virtual reality and augmented reality, are opening up new possibilities for horror storytelling.

- Diverse Voices: The horror genre is becoming more diverse, with new voices and perspectives emerging in the industry.

- Evolution of Themes: Horror films continue to evolve, exploring new themes and ideas that reflect the fears and anxieties of modern society.

Get Ready to Be Scared!

Whether you're a fan of classic monsters, supernatural horror, or psychological thrillers, the world of horror films has something to offer. So, grab some popcorn, dim the lights, and get ready to experience the thrill of fear!

-

@ 91117f2b:111207d6

2025-06-02 14:36:11

@ 91117f2b:111207d6

2025-06-02 14:36:11

Horror films have a way of captivating audiences with their eerie atmospheres, spine-chilling plot twists, and terrifying characters. From classic monster movies to modern psychological thrillers, the horror genre has evolved over the years, offering something for every fan of fear and suspense.

The Evolution of Horror

- Classic Monsters: Films like Dracula and Frankenstein introduced iconic creatures that continue to terrify audiences.

- Slasher Films: Movies like Halloween and "A Nightmare on Elm Street" popularized the slasher genre, featuring masked killers and gruesome murders.

- Supernatural Horror: Films like The "Exorcist" and "The Conjuring" explore the supernatural and paranormal, often featuring demonic possessions and haunted houses.

- Psychological Horror: Movies like "The Shining" and "Get Out" focus on the psychological and emotional terror, often exploring themes of isolation, trauma, and social commentary.

The Appeal of Horror Films

- Adrenaline Rush: Horror films provide an adrenaline-fueled experience, offering a thrilling escape from reality.

- Catharsis: Watching horror films can be a way to confront and release pent-up emotions, providing a sense of catharsis.

- Social Commentary: Many horror films offer social commentary, exploring themes like societal fears, cultural anxieties, and human nature.

Modern Horror

- Found Footage: Films like "The Blair Witch Project" and "Paranormal Activity" popularized the found footage genre, creating a sense of realism and immediacy.

- Anthology Films: Movies like "Creepshow and" Tales from the Darkside: The Movie" offer a collection of horror stories, often featuring different directors and styles.

- Global Horror: Films like "The Ring" and "Let the Right One In" showcase the diversity of horror cinema, offering unique perspectives and cultural influences.

The Future of Horror

- New Technologies: Advances in technology, such as virtual reality and augmented reality, are opening up new possibilities for horror storytelling.

- Diverse Voices: The horror genre is becoming more diverse, with new voices and perspectives emerging in the industry.

- Evolution of Themes: Horror films continue to evolve, exploring new themes and ideas that reflect the fears and anxieties of modern society.

Get Ready to Be Scared!

Whether you're a fan of classic monsters, supernatural horror, or psychological thrillers, the world of horror films has something to offer. So, grab some popcorn, dim the lights, and get ready to experience the thrill of fear!

-

@ ce2820ce:8cf20d40

2025-06-02 14:35:00

@ ce2820ce:8cf20d40

2025-06-02 14:35:00By now, most of you have probably heard Bitcoin talked about in vague and mysterious terms in the news or online. What IS it? What does it actually DO? And HOW is it actually worth anything at all?

These are big questions that involve some big answers that (for the sake of this article) I am not entirely prepared to give you, and that you are likely (in all honesty) not entirely prepared to hear. Cryptographic Hash functions, verifiable ledger transactions, store of value, proof of work, custodial vs non-custodial wallets.

What are all these things? Why do they matter, and what is it that you really NEED to understand about bitcoin?

Here we go...

In my opinion, what you need to know to feel good about bitcoin is about as much as you NEED to know about how your car starts up in the morning when you need it to, or about what's happening inside your iPhone when you tap your fingers to that illustrious screen. At its base function, assuming the machine is well built and reliable, all you need is the key, or your passcode, and a basic level of intelligence for it to do what you need it to. Not many of us really obsess over what's actually happening behind the scenes of these daily and habitual items, and not many of us should really have to, either. As long as we can trust and verify the producers of the products we are agreeing to purchase, we should let them worry about the mechanics so that we can go about our lives as intended, and with the added benefits of these items.

And so it goes for bitcoin. “But what IS it?!” is the most common way I hear people discredit the mysterious “coin” that doesn't actually exist, and that doesn't actually give you anything to hold on to. It's true, the answer is not straightforward and not exactly simple, and it involves a fair amount of nerd-speak, but not more than I would argue than is necessary for even a basic explanation of the way our current market economics, Federal Reserve, and monetary policy are functioning behind the simple exchange of cash money, not to mention credit card transactions.

How quickly I would lose you, if I have not already, to the bore of technical details and regurgitated economic theories, and so I am going to try something new, and get you to understand not what Bitcoin is, but why Bitcoin is, and what that means for the security, wealth and financial independence of our collective future.

At its very very core, the fundamental concept to understand is this one of FULL OWNERSHIP. When you own your bitcoin, and we'll go a bit deeper into that in a minute, what you own is a 12 word phrase that when entered into the network to make a transaction is the only way for the network to identify who you are. No one else has that same private key, and no one else has any way to obtain it, unless they pry it from your very hands, or manage to extract it from you by way of trickery.

We've all heard the stories of the “lost bitcoin wallet”. That person who lost their passphrase claiming to hold what could now be millions of dollars worth of bitcoin. These stories are often posited as negative features of the bitcoin network, but there are words we use for these types of people in general; irresponsible, nearsighted and dumb.

The beauty, and the apparent pariah of bitcoin is this very feature:

SELF OWNERSHIP.

When done properly, you and only you can interact or interfere with your bitcoin identity. The network is verified 1000 times over every second by a network of contributors, and as long as you hold those keys, then your bitcoin balance on the ledger is always and forever linked to you. When you decide to send that bitcoin to someone else on the network; that transaction is listed, your private key transcribed (by an enormously complicated and involved amount of computational work) onto a unified public ledger that is then verified and trusted (again by a brilliantly devised and incredibly complex computer function) to be posted as the de-facto “true” balance sheet.

Unlike any bank or credit card company of today, where a portion of every transaction, and every nefariously collected fee is sanctioned off to some private network of profiteers, the bitcoin networks fees are directly paid to the “workers” (aka miners) who run the computers (and thus pay for the electricity) to keep the network functioning. These small independent to giant mining farms all over the globe are thus given an incentive to keep up the network. Even small-time nodes can generate income for their local operations. Well, generate bitcoin, and you can decide to call that income or not!

-—

What's happening today with bitcoin is what I fear will be the death of such a beautifully crafted and functioning system. Today you can buy bitcoin easily in many mobile apps (CashApp, Coinbase, Robinhood, Venmo, and more) and watch its value go up and down in excitement or dismay. What we don't realize when we buy bitcoin this way, is that we are treating it much like we treat the rest of the money in our bank. At some basic level, the bank holding your assets has legal and/or physical control of it while in their hands. Sure, they keep your name on it, but they can block your access to accounts at their discretion. They can charge unnecessary and unexplained fees, and they can use it to invest however they like while it's theirs.

The bottom line is; If you don't own your key, you don't own your bitcoin. When you hear of exchanges like FTX going down, which claimed to be holding your crypto while they flagrantly spent it, and millions of people lost their money. Well, those irresponsible (and nearsighted, and dumb) people entrusted their assets to an irresponsible, (and corrupt, and nearsighted, and incredibly dumb) unverifiable company.

What I am saying is, it is wrong to adopt Bitcoin without adopting the core principles behind it. Self-responsibility, full ownership, trust, verification, and value based on effort (aka proof-of-work) are essential features of bitcoin's operation. We have not even mentioned (nor will we in great detail) the mathematically verifiable finite amount of bitcoin that will exist over the next century. It is sure fact. It will become scarce with time, and its value will subsequently increase. Can we be so certain of any other markets you can think of?

Everything about the bitcoin network is transparent. The original white-paper is easily accessible. The 21 million coin limit, the self-supported and self sustained network principles, all of it. The entire verified ledger is a roughly 10 Gigabyte txt file of encrypted transactions, and its duplicated and replicated all over the world by a genius system of nodes. Nodes make a profit for providing the computer power, and there is no central command, CEO or shareholders outside the system able to profit or interfere.

Unless...and this is the clincher, unless big companies start stacking up their own coiffeurs of bitcoin with their enormous buying power and then offering it out at a premium (with added transaction fees) through their own proprietary banks and apps. Unless these whales – as we like to call them – have enough weight in the market to create their own influence, and they are able to buy it up before the plebs – as we also like to call them – are able to secure their hands on it without these 3rd parties.

So anyone who has jumped on the bitcoin bandwagon, and helped make Coinbase a billion dollar public company, and let them hold your assets behind an email login and an account with them, let me tell you something, “You've been duped!”. The only way to own bitcoin is to store your bitcoin in a wallet that you own the keys to. I'm not going to teach you any more about that here, but by now you should probably get the point.

Bitcoin represents a society that trusts its individuals to have the responsibility to handle themselves accordingly. The value you hold, and the value you contribute to your community, represents your worth, and is to be valued accordingly. Everything has a value. YOU have a value, and it is much greater than any amount of money can give you, but it is also something that can be scary to hold and to be responsible for all on your own. In a society where we offload every bit of our liability and personal holdings to insurance companies and banks, bitcoin represents a shift to a world without unnecessary and energy sucking intermediaries. It also offers a world we are not used to, in which we have to educate ourselves and trust ourselves enough not be fools and to take the proper precautions to secure our assets long-term for the future. Bitcoin will grow, and it will continue to be valued. That much should be apparent at this point.

So...do what you will. I'm not here to preach, I'm just here to inform. However, I do advise against being irresponsible, nearsighted, and dumb.

Just...don't believe in systems you can't verify. Don't trust money that you don't own, and don't put your future in anyone else's hands.

If you understand that fundamental shift, you understand enough about bitcoin to put your keys in the ignition and get started. You'll just have to take it upon yourself to figure out how.

Hodl On.

- §parrow

www.primal.net/sparrow

-

@ 8d34bd24:414be32b

2025-06-01 04:04:10

@ 8d34bd24:414be32b

2025-06-01 04:04:10Many people today believe that the church has replaced Israel and that the promises given to Israel now apply to the church. When we say this, we are calling God a liar.

Can you imagine a groom promising to love and cherish his wife until death do they part and then saying, “I’m keeping my promise by loving and cherishing a new and different wife.”? We would never consider that man to be honest, faithful, and good. If God promised to protect and guide Israel, to have a descendant of David on the throne, and to give them the land, we can only trust Him if He fulfills these promises.

When we say the church has replaced Israel, we make two mistakes. We raise up the church beyond what is right and we put down Israel. We need to be careful because God promised Abraham:

“And I will bless those who bless you, And the one who curses you I will curse. And in you all the families of the earth will be blessed.” (Genesis 12:3)

and He reiterated this promise to Israel during the Exodus:

“He couches, he lies down as a lion,\ And as a lion, who dares rouse him?\ Blessed is everyone who blesses you [Israel],\ And cursed is everyone who curses you [Israel].” (Numbers 24:9) {clarification mine}

When we curse Israel or the Jews, we will be under God’s curse. Now this does not mean that every criticism of a particular action by Israel’s leaders brings a curse. Today’s nation of Israel is led by fallible men like every other nation, so there are mistakes made or corruption by particular leaders. It does, however, mean that generalizations against Israel and the Jews are wrong and of Satan.

Paul specifically warned the church against thinking they had replaced Israel in God’s blessing and love.

If the first piece of dough is holy, the lump is also; and if the root is holy, the branches are too.

But if some of the branches were broken off, and you, being a wild olive, were grafted in among them and became partaker with them of the rich root of the olive tree, do not be arrogant toward the branches; but if you are arrogant, remember that it is not you who supports the root, but the root supports you. You will say then, “Branches were broken off so that I might be grafted in.” Quite right, they were broken off for their unbelief, but you stand by your faith. Do not be conceited, but fear; for if God did not spare the natural branches, He will not spare you, either. Behold then the kindness and severity of God; to those who fell, severity, but to you, God’s kindness, if you continue in His kindness; otherwise you also will be cut off. And they also, if they do not continue in their unbelief, will be grafted in, for God is able to graft them in again. For if you were cut off from what is by nature a wild olive tree, and were grafted contrary to nature into a cultivated olive tree, how much more will these who are the natural branches be grafted into their own olive tree?

For I do not want you, brethren, to be uninformed of this mystery—so that you will not be wise in your own estimation—that a partial hardening has happened to Israel until the fullness of the Gentiles has come in; and so all Israel will be saved; just as it is written,

“The Deliverer will come from Zion,\ He will remove ungodliness from Jacob.”\ “This is My covenant with them,\ When I take away their sins.” *From the standpoint of the gospel they are enemies for your sake, but from the standpoint of God’s choice they are beloved for the sake of the fathers*; for the gifts and the calling of God are irrevocable**. For just as you once were disobedient to God, but now have been shown mercy because of their disobedience, so these also now have been disobedient, that because of the mercy shown to you they also may now be shown mercy. For God has shut up all in disobedience so that He may show mercy to all. (Romans 11:16-32) {emphasis mine}

Paul warns that although the Jews were pruned away due to rejection of Him and gentiles were grafted into Him by faith, if we reject God’s word, we can be pruned away and if the Jews return to Jesus, they can be grafted back in. He predicts that the Jews will return. “…that a partial hardening has happened to Israel until the fullness of the Gentiles has come in; and so all Israel will be saved.” He also says regarding Israel that “the gifts and the calling of God are irrevocable.” Yes, Israel rejected Jesus and was punished for doing so, but they will be called back to God and trust in their Messiah, Jesus. In the end, all the promises of God to Abraham, Jacob, David, and others regarding Israel, will be brought to complete fulfillment.

Both the Old and New Testaments talk about Israel being punished for rejecting God and their Messiah, but that, after the time of the Gentiles, they will be called back to Him.

and they will fall by the edge of the sword, and will be led captive into all the nations; and Jerusalem will be trampled under foot by the Gentiles until the times of the Gentiles are fulfilled. (Luke 21:24)

After Daniel had been in prayer and repentance for the sins of Israel, the angel Gabriel came with this prophecy about Israel.

“Seventy weeks have been decreed for your people and your holy city, to finish the transgression, to make an end of sin, to make atonement for iniquity, to bring in everlasting righteousness, to seal up vision and prophecy and to anoint the most holy place. So you are to know and discern that from the issuing of a decree to restore and rebuild Jerusalem until Messiah the Prince there will be seven weeks and sixty-two weeks; it will be built again, with plaza and moat, even in times of distress. Then after the sixty-two weeks the Messiah will be cut off and have nothing, and the people of the prince who is to come will destroy the city and the sanctuary. And its end will come with a flood; even to the end there will be war; desolations are determined. (Daniel 9:24-26)

In this prophecy, the prediction of 69 weeks (literally sevens, but meaning groups of 7 years) from the decree to rebuild Jerusalem (by Artaxerxes) to the Messiah was fulfilled to the day when Jesus rode into Jerusalem on a donkey on Palm Sunday.

I always thought it strange that the prophecy predicted 70 sevens and that there was the first 69 sevens (483 years), then \~2,000 years where nothing happens, and then comes the final seven — the Great Tribulation. It didn’t make sense until I realized, the 70 sevens referred to the years of Israel. The time of the gentiles intervenes between the 69th and 70th sevens. This delay happened due to Israel rejecting their Messiah.

When He approached Jerusalem, He saw the city and wept over it, saying, “If you had known in this day, even you, the things which make for peace! But now they have been hidden from your eyes. For the days will come upon you when your enemies will throw up a barricade against you, and surround you and hem you in on every side, and they will level you to the ground and your children within you, and they will not leave in you one stone upon another, because you did not recognize the time of your visitation.” (Luke 19:41-44)

We are now in the time of the Gentiles, the church age, the intermission in the story of Israel. After the church is raptured, the story will return to Israel. The Jews (at least many of them) will finally accept their Messiah. They will suffer through the Tribulation while witnessing to the world and then God will finally fully fulfill His promises to Israel through the Millennial kingdom.

Alas! for that day is great,\ There is none like it;\ And it is the time of Jacob’s distress,\ But he will be saved from it.

‘It shall come about on that day,’ declares the Lord of hosts, ‘that I will break his yoke from off their neck and will tear off their bonds; and strangers will no longer make them their slaves. But they shall serve the Lord their God and David their king, whom I will raise up for them.

Fear not, O Jacob My servant,’ declares the Lord,\ ‘And do not be dismayed, O Israel;\ For behold, I will save you from afar\ And your offspring from the land of their captivity.\ And Jacob will return and will be quiet and at ease,\ And no one will make him afraid.\ For I am with you,’ declares the Lord, ‘to save you;\ For I will destroy completely all the nations where I have scattered you,\ Only I will not destroy you completely.\ But I will chasten you justly\ And will by no means leave you unpunished.’ \ (Jeremiah 30:7-11) {emphasis mine}

Jacob’s distress is the final Tribulation. The 144,000 Jewish witnesses will be saved through the whole Tribulation. Others may become saved and die a martyrs death, but they will then be brought into the millennial kingdom where the Messiah will fill the throne of David and Israel will reach from the River to the Sea.

The Jews have already been saved “from afar, and your offspring from the land of their captivity” with the recreation of Israel in 1947 and the continual return of Jews to their homeland.

God is working to fulfill His promises to Israel and His work is nearly complete.

“O Jacob My servant, do not fear,” declares the Lord, “For I am with you. For I will make a full end of all the nations where I have driven you, Yet I will not make a full end of you; But I will correct you properly And by no means leave you unpunished.” (Jeremiah 46:28)

God promises a “full end of all the nations where I have driven you.” Those nations and people who try to destroy Israel will be destroyed. As Christians we should love what God loves, and despite Israel’s repeated betrayals, God still loves Israel, so we should, too.

May the God of heaven give us a right view of Israel. May we see them as God sees them. May God use us to share the Gospel in such a way as to lead to a harvest of Jews for the Kingdom of God. To God be the glory!

Trust Jesus

-

@ 7bdef7be:784a5805

2025-04-02 12:37:35

@ 7bdef7be:784a5805

2025-04-02 12:37:35The following script try, using nak, to find out the last ten people who have followed a

target_pubkey, sorted by the most recent. It's possibile to shortensearch_timerangeto speed up the search.```

!/usr/bin/env fish

Target pubkey we're looking for in the tags

set target_pubkey "6e468422dfb74a5738702a8823b9b28168abab8655faacb6853cd0ee15deee93"

set current_time (date +%s) set search_timerange (math $current_time - 600) # 24 hours = 86400 seconds

set pubkeys (nak req --kind 3 -s $search_timerange wss://relay.damus.io/ wss://nos.lol/ 2>/dev/null | \ jq -r --arg target "$target_pubkey" ' select(. != null and type == "object" and has("tags")) | select(.tags[] | select(.[0] == "p" and .[1] == $target)) | .pubkey ' | sort -u)

if test -z "$pubkeys" exit 1 end

set all_events "" set extended_search_timerange (math $current_time - 31536000) # One year

for pubkey in $pubkeys echo "Checking $pubkey" set events (nak req --author $pubkey -l 5 -k 3 -s $extended_search_timerange wss://relay.damus.io wss://nos.lol 2>/dev/null | \ jq -c --arg target "$target_pubkey" ' select(. != null and type == "object" and has("tags")) | select(.tags[][] == $target) ' 2>/dev/null)

set count (echo "$events" | jq -s 'length') if test "$count" -eq 1 set all_events $all_events $events endend

if test -n "$all_events" echo -e "Last people following $target_pubkey:" echo -e ""

set sorted_events (printf "%s\n" $all_events | jq -r -s ' unique_by(.id) | sort_by(-.created_at) | .[] | @json ') for event in $sorted_events set npub (echo $event | jq -r '.pubkey' | nak encode npub) set created_at (echo $event | jq -r '.created_at') if test (uname) = "Darwin" set follow_date (date -r "$created_at" "+%Y-%m-%d %H:%M") else set follow_date (date -d @"$created_at" "+%Y-%m-%d %H:%M") end echo "$follow_date - $npub" endend ```

-

@ 975e4ad5:8d4847ce

2025-06-02 14:01:13

@ 975e4ad5:8d4847ce

2025-06-02 14:01:13Inflation vs. Deflation: What’s the Difference?

Today, we use fiat currencies—dollars, euros, or leva—issued by governments and central banks that can print money without limit. This leads to inflation, a decrease in the purchasing power of money because the money supply grows faster than the goods and services in the economy. The result? Prices for everything—from bread to cars—rise over time.

Bitcoin, unlike fiat money, has a hard cap of 21 million coins, set to be fully “mined” by 2140. This means the money supply is fixed and can’t be arbitrarily increased. In such a system, as technology improves production and the economy grows, the amount of goods and services increases, but the money supply stays the same. The result is deflation—prices fall because the same amount of money is chasing more goods.

The Bread Example

Take bread as an example. Fifty years ago, making bread required a lot of manual labor—kneading, shaping, baking. Today, machines handle most of the process, from mixing dough to packaging. Production is faster, more efficient, and requires fewer workers. Logically, bread should be cheaper, right? Yet, its price has risen from, say, 20 cents decades ago to $1 today. Why? Because inflation, driven by printing more money, outpaces the cost savings from technology. In a Bitcoin standard, those same technological advancements would lead to cheaper bread since there’s no excess money “diluting” purchasing power.

Wages in a Deflationary World

Now, picture your boss saying, “We’re cutting your salary this year.” Sounds like a nightmare, doesn’t it? In today’s world, we expect wage increases to “keep up” with inflation. But in a deflationary world, where prices are falling, a lower salary isn’t a problem. If bread, rent, and clothes get cheaper, you can buy more with less money. For example, if your salary drops from $2,000 to $1,800 but bread falls from $1 to $0.75, your real purchasing power actually increases. It’s a radically different mindset, but it makes sense in a world with a fixed currency.

Why Is This So Hard to Grasp?

The idea of falling prices and wages feels alien because we were born into an inflationary world. From childhood, we’ve seen the cost of everything—food, housing, even coffee at our favorite café—steadily rise. Inflation is so ingrained that we assume prices must go up. But this isn’t a natural law; it’s a consequence of the fiat system. A century ago, when gold backed currencies, prices often stayed stable or even fell as technology advanced. A Bitcoin standard would bring us back to that dynamic.

What Else Should We Know?

A deflationary world brings other fascinating changes. People would save more because their money would be worth more tomorrow. Today, inflation erodes savings, pushing us to spend or invest quickly. In a Bitcoin standard, we’d value the future more since our savings would grow in real value. But there are challenges too—deflation might discourage risky investments because people prefer holding money over spending it on uncertain ventures.

Moreover, a Bitcoin standard reshapes how we think about debt. Today, we take loans knowing tomorrow’s money will be worth less, making repayment easier. In a deflationary world, debts become heavier because you’d owe more real value tomorrow. This could make us more cautious and responsible with borrowing.

A Bitcoin standard invites us to rethink the economy we grew up in. Falling prices and stagnant or declining wages sound like a fantasy, but they’re the logical outcome of a currency with a fixed supply. Technology will keep making life easier and more efficient, and in a world without inflation, this would translate to lower prices and greater purchasing power. Maybe it’s time we stop taking inflation for granted and imagine a world where our money grows more valuable over time.

-

@ cbaa0c82:e9313245

2025-06-02 13:31:13

@ cbaa0c82:e9313245

2025-06-02 13:31:13TheWholeGrain - #May2025

Last May, during our first year of releasing content we created and awarded our first badge on NOSTR. It was the first minting of the Official Fan Badge. We wanted to do it again a year later!

As Bread and Toast moves along we want to be able to recognize the fans who motivate us to keep sharing our journey and all of our adventures!

Our first Sunday Single of May 2025 was a tribute to all the fans we currently have because there is nothing quite like a good fan! As previously mentioned, we also released the second minting of the Official Fan Badge! Thank you to everyone who follows, zaps, reacts, and comments on all of the notes posted to NOSTR by Bread and Toast!

Even more incredible than that was the announcement of the Yarn Buddy! A yarn based plushie of Bread handcrafted by the one and only Yarnlady! The announcement was made on May 19th, and it is without a doubt our best merchandise product so far! https://i.nostr.build/cscbHW6oWqVtxmyT.png Learn more about the Yarn Buddy below.

Sunday Singles - May 2025 2025-05-04 | Sunday Single 91 Title: A Good Fan We cannot say this enough... We love our fans! https://i.nostr.build/h6KzGz8kleYdmQxM.png

2025-05-11 | Sunday Single 92 Title: Hang Gliding Bread loves the thrill of flying through the air https://i.nostr.build/JCA656iy7L9bDLYF.png

2025-05-18 | Sunday Single 93 Title: String Theory Bread stumbled upon a spool of yarn and got an idea. It might knot be what you expected... Yarn't gonna believe what's coming next! https://i.nostr.build/mazQZkGKwzUz1O3O.png

2025-05-25 | Sunday Single 94 Hot Air Balloon Sometimes Bread and End-Piece claim Toast is full of hot air so why not put it to some use! https://i.nostr.build/1VIeBl2rW7aVD6Hb.png

Adventure Series: Questline The effects of the darkness of the forest begin to become stronger as Toast and End-Piece lose sight of Bread and the light of the magical staff.

Artist: Dakota Jernigan (The Bitcoin Painter) Writer: Daniel David (dan 🍞)

2025-05-06 | Questline 009 - Pitch Black Due to their hesitation, Toast and End-Piece lose sight of their leader's magical light... They try to stay close to one another for their own safety, but no one ever feels safe in the pitch black darkness of the forest. https://i.nostr.build/Kre0BR4ylKShhTLE.png

2025-05-20 | Questline 010 - A Light in the Dark With a magical staff lighting the way Bread keeps a quick pace in order to get through the forest as quick as possible. However, Bread begins to notice all the webs that surround the trees. With sudden concern for fellow comrades Bread turns around surprised to realize that they are no longer even there. https://i.nostr.build/KsyReXgigDlLxiLr.png

Other Content Released in May 2025 2025-05-07 | Toast's Comic Collection Title: Jugbread #13 Everyone knows Toastie’s best friend, Jugbread Jones! https://i.nostr.build/TM3fpLyVkB7PcRuK.png

2025-05-14 | Concept Art Title: Cat Attack! At some point the characters are going to face perilous challenges in the world. For example, the characters could easily come across a cat that would be quick to attack them! https://i.nostr.build/19t1GYXvmXbKUO0q.png

2025-05-21 | Bitcoin Art Title: Nodes Block Height: 897690 Every slice of bread is like an individual using the network! https://i.nostr.build/3MvvAP9RaAd7ZPwt.png

Additions to The Bakery in May 2025 We had one addition to The Bakery this past month from Dessert Dave! He says it's desert, but we'd prefer dessert. Check it out!

2025-05-17 | npub1mgvmt553uphdpxa9gk79xejq3hyzh2xfa8uh6vh236nq78mvh74q8tr9yd https://r2.primal.net/cache/c/16/80/c16806be2aa6ee9b61e5da3a291d858fb58d09598927feecf25de44c537a5a86.jpg

New Nostr Badges 2025-05-19 | Merchandise Supporter - Yarn Buddy https://i.nostr.build/U8sxNZIRHQCIgpi4.png

2025-05-20 | Official Yarn Maker https://i.nostr.build/ADe8HYeMEIQjufxM.png

2025-05-20 | Official Fan Badge 2025 https://i.nostr.build/1pEnSnW4g7nv4is7.png

Merchandise Announcement Bread and Toast made an announcement this past month on May 19th after a Sunday Single that was secretly a tease of the release with the Yarn Buddy (Limited Supply). The Yarn Buddy was made in collaboration with Yarnlady, a skilled yarn weaver who is a master of her craft. https://i.nostr.build/L5Mh74eGiB8sO1VG.png

If you are interested in purchasing the Yarn Buddy contact us by email at store@breadandtoast.com with "Yarn Buddy" in the subject line! There are only 10 in total available.

Thank you for checking out the ninth issue of The Whole Grain. The Whole Grain is released near the beginning of every month and covers all of the content released by Bread and Toast in the previous month. For all of Bread and Toast's content visit BreadandToast.com!

If you read this then you must be our biggest fan! Bread, Toast, and End-Piece

BreadandToast #SundaySingle #Questline #ToastsComicCollection #ConceptArt #BitcoinArt #Merchandise #Bread #Toast #EndPiece #Artstr #Comic #Cartoon #NostrOnly #🍞 #🖼️

List of nPubs Mentioned: Yarnlady: npub1hgvtv4zn2l8l3ef34n87r4sf5s00xq3lhgr3mvwt7kn8gjxpjprqc89jnv

The Bitcoin Painter: npub1tx5ccpregnm9afq0xaj42hh93xl4qd3lfa7u74v5cdvyhwcnlanqplhd8g

Desert Dave: npub1mgvmt553uphdpxa9gk79xejq3hyzh2xfa8uh6vh236nq78mvh74q8tr9yd

dan 🍞: npub16e3vzr7dk2uepjcnl85nfare3kdapxge08gr42s99n9kg7xs8xhs90y9v6

-

@ c9badfea:610f861a

2025-06-01 00:32:13

@ c9badfea:610f861a

2025-06-01 00:32:13- Install Feeder (it's free and open source)

- Discover RSS feeds from various sources (see links below)

- Copy the Feed URL

- Open Feeder, tap the ⁞ icon, and choose Add Feed

- Paste the Feed URL and tap Search