-

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06

@ c1e9ab3a:9cb56b43

2025-05-27 16:19:06Star Wars is often viewed as a myth of rebellion, freedom, and resistance to tyranny. The iconography—scrappy rebels, totalitarian stormtroopers, lone smugglers—suggests a deep anti-authoritarian ethos. Yet, beneath the surface, the narrative arc of Star Wars consistently affirms the necessity, even sanctity, of central authority. This blog entry introduces the question: Is Star Wars fundamentally a celebration of statism?

Rebellion as Restoration, Not Revolution

The Rebel Alliance’s mission is not to dismantle centralized power, but to restore the Galactic Republic—a bureaucratic, centrally governed institution. Characters like Mon Mothma and Bail Organa are high-ranking senators, not populist revolutionaries. The goal is to remove the corrupt Empire and reinstall a previous central authority, presumed to be just.

- Rebels are loyalists to a prior state structure.

- Power is not questioned, only who wields it.

Jedi as Centralized Moral Elites

The Jedi, often idealized as protectors of peace, are unelected, extra-legal enforcers of moral and military order. Their authority stems from esoteric metaphysical abilities rather than democratic legitimacy.

- They answer only to their internal Council.

- They are deployed by the Senate, but act independently of civil law.

- Their collapse is depicted as tragic not because they were unaccountable, but because they were betrayed.

This positions them as a theocratic elite, not spiritual anarchists.

Chaos and the Frontier: The Case of the Cantina

The Mos Eisley cantina, often viewed as a symbol of frontier freedom, reveals something darker. It is: - Lawless - Violent - Culturally fragmented

Conflict resolution occurs through murder, not mediation. Obi-Wan slices off a limb; Han shoots first—both without legal consequence. There is no evidence of property rights, dispute resolution, or voluntary order.

This is not libertarian pluralism—it’s moral entropy. The message: without centralized governance, barbarism reigns.

The Mythic Arc: Restoration of the Just State

Every trilogy in the saga returns to a single theme: the fall and redemption of legitimate authority.

- Prequels: Republic collapses into tyranny.

- Originals: Rebels fight to restore legitimate order.

- Sequels: Weak governance leads to resurgence of authoritarianism; heroes must reestablish moral centralism.

The story is not anti-state—it’s anti-bad state. The solution is never decentralization; it’s the return of the right ruler or order.

Conclusion: The Hidden Statism of a Rebel Myth

Star Wars wears the costume of rebellion, but tells the story of centralized salvation. It: - Validates elite moral authority (Jedi) - Romanticizes restoration of fallen governments (Republic) - Portrays decentralized zones as corrupt and savage (outer rim worlds)

It is not an anarchist parable, nor a libertarian fable. It is a statist mythology, clothed in the spectacle of rebellion. Its core message is not that power should be abolished, but that power belongs to the virtuous few.

Question to Consider:

If the Star Wars universe consistently affirms the need for centralized moral and political authority, should we continue to see it as a myth of freedom? Or is it time to recognize it as a narrative of benevolent empire? -

@ d360efec:14907b5f

2025-05-27 15:46:26

@ d360efec:14907b5f

2025-05-27 15:46:26 -

@ bf47c19e:c3d2573b

2025-05-27 14:57:56

@ bf47c19e:c3d2573b

2025-05-27 14:57:56Srpski prevod knjige "The Little Bitcoin Book"

Zašto je Bitkoin bitan za vašu slobodu, finansije i budućnost?

Verovatno ste čuli za Bitkoin u vestima ili da o njemu raspravljaju vaši prijatelji ili kolege. Kako to da se cena stalno menja? Da li je Bitkoin dobra investicija? Kako to uopšte ima vrednost? Zašto ljudi stalno govore o tome kao da će promeniti svet?

"Mala knjiga o Bitkoinu" govori o tome šta nije u redu sa današnjim novcem i zašto je Bitkoin izmišljen da obezbedi alternativu trenutnom sistemu. Jednostavnim rečima opisuje šta je Bitkoin, kako funkcioniše, zašto je vredan i kako utiče na individualnu slobodu i mogućnosti ljudi svuda - od Nigerije preko Filipina do Venecuele do Sjedinjenih Država. Ova knjiga takođe uključuje odeljak "Pitanja i odgovori" sa nekim od najčešće postavljanih pitanja o Bitkoinu.

Ako želite da saznate više o ovom novom obliku novca koji i dalje izaziva interesovanje i usvajanje širom sveta, onda je ova knjiga za vas.

-

@ 39cc53c9:27168656

2025-05-27 09:21:53

@ 39cc53c9:27168656

2025-05-27 09:21:53The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ a19caaa8:88985eaf

2025-05-05 02:55:57

@ a19caaa8:88985eaf

2025-05-05 02:55:57↓ジャック(twitter創業者)のツイート nostr:nevent1qvzqqqqqqypzpq35r7yzkm4te5460u00jz4djcw0qa90zku7739qn7wj4ralhe4zqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsqg9cdxf7s7kg8kj70a4v5j94urz8kmel03d5a47tr4v6lx9umu3c95072732

↓それに絡むたゃ nostr:note1hr4m0d2k2cvv0yg5xtmpuma0hsxfpgcs2lxe7vlyhz30mfq8hf8qp8xmau

↓たゃのひとりごと nostr:nevent1qqsdt9p9un2lhsa8n27y7gnr640qdjl5n2sg0dh4kmxpqget9qsufngsvfsln nostr:note14p9prp46utd3j6mpqwv46m3r7u7cz6tah2v7tffjgledg5m4uy9qzfc2zf

↓有識者様の助言 nostr:nevent1qvzqqqqqqypzpujqe8p9zrpuv0f4ykk3rmgnqa6p6r0lan0t8ewd0ksj89kqcz5xqqst8w0773wxnkl8sn94tvmd3razcvms0kxjwe00rvgazp9ljjlv0wq0krtvt nostr:nevent1qvzqqqqqqypzpujqe8p9zrpuv0f4ykk3rmgnqa6p6r0lan0t8ewd0ksj89kqcz5xqqsxchzm7s7vn8a82q40yss3a84583chvd9szl9qc3w5ud7pr9ugengcgt9qx

↓たゃ nostr:nevent1qqsp2rxvpax6ks45tuzhzlq94hq6qtm47w69z8p5wepgq9u4txaw88s554jkd

-

@ f11e91c5:59a0b04a

2025-04-30 07:52:21

@ f11e91c5:59a0b04a

2025-04-30 07:52:21!!!2022-07-07に書かれた記事です。

暗号通貨とかでお弁当売ってます 11:30〜14:00ぐらいでやってます

◆住所 木曜日・東京都渋谷区宇田川町41 (アベマタワーの下らへん)

◆お値段

Monacoin 3.9mona

Bitzeny 390zny

Bitcoin 3900sats (#lightningNetwork)

Ethereum 0.0039Ether(#zkSync)

39=thank you. (円を基準にしてません)

最近は週に一回になりました。 他の日はキッチンカーの現場を探したり色々してます。 東京都内で平日ランチ出店出来そうな場所があればぜひご連絡を!

写真はNFCタグです。

スマホにウォレットがあればタッチして3900satsで決済出来ます。

正直こんな怪しい手書きのNFCタグなんて絶対にビットコイナーは触りたくも無いだろうなと思いますが、これでも良いんだぜというメッセージです。

写真はNFCタグです。

スマホにウォレットがあればタッチして3900satsで決済出来ます。

正直こんな怪しい手書きのNFCタグなんて絶対にビットコイナーは触りたくも無いだろうなと思いますが、これでも良いんだぜというメッセージです。今までbtcpayのposでしたが速度を追求してこれに変更しました。 たまに上手くいかないですがそしたら渋々POS出すので温かい目でよろしくお願いします。

ノードを建てたり決済したりで1年経ちました。 最近も少しずつノードを建てる方が増えてるみたいで本当凄いですねUmbrel 大体の人がルーティングに果敢に挑むのを見つつ 奥さんに土下座しながら費用を捻出する弱小の私は決済の利便性を全開で振り切るしか無いので応援よろしくお願いします。

あえて あえて言うのであれば、ルーティングも楽しいですけど やはり本当の意味での即時決済や相手を選んでチャネルを繋げる楽しさもあるよとお伝えしたいっ!! 決済を受け入れないと分からない所ですが 承認がいらない時点で画期的です。

QRでもタッチでも金額指定でも入力でも もうやりようには出来てしまうし進化が恐ろしく早いので1番利用の多いpaypayの手数料(事業者側のね)を考えたらビットコイン凄いじゃない!と叫びたくなる。 が、やはり税制面や価格の変動(うちはBTC固定だけども)ウォレットの操作や普及率を考えるとまぁ難しい所もあるんですかね。

それでも継続的に沢山の人が色んな活動をしてるので私も何か出来ることがあれば 今後も奥さんに土下座しながら頑張って行きたいと思います。

(Originally posted 2022-07-07)

I sell bento lunches for cryptocurrency. We’re open roughly 11:30 a.m. – 2:00 p.m. Address Thursdays – 41 Udagawa-chō, Shibuya-ku, Tokyo (around the base of Abema Tower)

Prices Coin Price Note Monacoin 3.9 MONA

Bitzeny 390 ZNY Bitcoin 3,900 sats (Lightning Network)

Ethereum 0.0039 ETH (zkSync) “39” sounds like “thank you” in Japanese. Prices aren’t pegged to yen.These days I’m open only once a week. On other days I’m out scouting new spots for the kitchen-car. If you know weekday-lunch locations inside Tokyo where I could set up, please let me know!

The photo shows an NFC tag. If your phone has a Lightning wallet, just tap and pay 3,900 sats. I admit this hand-written NFC tag looks shady—any self-respecting Bitcoiner probably wouldn’t want to tap it—but the point is: even this works!

I used to run a BTCPay POS, but I switched to this setup for speed. Sometimes the tap payment fails; if that happens I reluctantly pull out the old POS. Thanks for your patience.

It’s been one year since I spun up a node and started accepting Lightning payments. So many people are now running their own nodes—Umbrel really is amazing. While the big players bravely chase routing fees, I’m a tiny operator scraping together funds while begging my wife for forgiveness, so I’m all-in on maximising payment convenience. Your support means a lot!

If I may add: routing is fun, but instant, trust-minimised payments and the thrill of choosing whom to open channels with are just as exciting. You’ll only understand once you start accepting payments yourself—zero-confirmation settlement really is revolutionary.

QR codes, NFC taps, fixed amounts, manual entry… the possibilities keep multiplying, and the pace of innovation is scary fast. When I compare it to the merchant fees on Japan’s most-used service, PayPay, I want to shout: “Bitcoin is incredible!” Sure, taxes, price volatility (my shop is BTC-denominated, though), wallet UX, and adoption hurdles are still pain points.

Even so, lots of people keep building cool stuff, so I’ll keep doing what I can—still on my knees to my wife, but moving forward!

-

@ ec42c765:328c0600

2025-02-05 23:45:09

@ ec42c765:328c0600

2025-02-05 23:45:09test

test

-

@ ec42c765:328c0600

2025-02-05 23:43:35

@ ec42c765:328c0600

2025-02-05 23:43:35test

-

@ da8b7de1:c0164aee

2025-05-27 15:09:54

@ da8b7de1:c0164aee

2025-05-27 15:09:54Globális nukleáris reneszánsz és új kapacitások

A 2025-ös év a globális nukleáris energiaipar újabb lendületét hozza, amit a Nemzetközi Energiaügynökség (IEA) is megerősít: rekordtermelés várható, jelenleg több mint 70 GW új nukleáris kapacitás épül világszerte, és több mint 40 ország tervezi a nukleáris energia szerepének növelését az energiamixében. A világ számos pontján – Kínában, az Egyesült Államokban, Indiában, az Egyesült Arab Emírségekben és Franciaországban – új blokkok csatlakoznak a hálózatra, miközben nyolc új egység építése is elindult. A cél, hogy 2050-re a jelenlegi 416 GW globális nukleáris kapacitás meghaladja az 1000 GW-ot, ami elengedhetetlen a klímavédelmi és energiabiztonsági célok teljesítéséhez[vg.hu][paks2.hu].

SMR-ek: technológiai áttörés és globális terjeszkedés

A kis moduláris reaktorok (SMR) forradalmasíthatják az iparágat: ezek a kompakt, előregyártott, gyorsan telepíthető egységek különösen alkalmasak távoli területek energiaellátására, ipari hőtermelésre vagy akár tengervíz sótalanítására is. Az SMR-ek fejlesztése világszerte zajlik, az USA, Kína, Oroszország és Európa élen jár, de már több mint 17 országban terveznek ilyen létesítményeket. 2025 májusában Oroszország és Üzbegisztán történelmi megállapodást kötött hat RITM-200N típusú SMR építéséről, amely az első ilyen egység lesz Közép-Ázsiában. Az Egyesült Arab Emírségekben és az USA-ban is új SMR-projektek indulnak, például a Tennessee Valley Authority hivatalosan is engedélyt kért egy BWRX-300 típusú SMR-re a Clinch River telephelyen[makronom.eu][world-nuclear-news.org][nucnet.org].

Nukleáris üzemanyag-ellátás és ellátásbiztonság

Az orosz-ukrán háború és az ellátásbiztonsági kockázatok miatt Európában is felgyorsult az alternatív nukleáris üzemanyag-beszállítók keresése. Franciaországban az EDF, az Orano és az amerikai Westinghouse tárgyalásokat folytat egy új, nyugat-európai üzemanyag-feldolgozó létesítmény létrehozásáról, hogy csökkentsék az orosz függőséget. Az Európai Bizottság részletes útmutatót adott ki az orosz nukleáris technológiákról való leválásról, de a tagállamok jelentős készleteket halmoztak fel orosz üzemanyagból, mivel az azonnali leválás az energiabiztonságot veszélyeztetné[pakspress.hu][nucnet.org].

Technológiai innovációk és üzemanyagciklus-zárás

A gyorsneutronos reaktorok és a MOX-üzemanyag alkalmazása új távlatokat nyit a nukleáris hulladék mennyiségének és veszélyességének csökkentésében, valamint a földi uránkészletek hatékonyabb felhasználásában. Az orosz BN–800 gyorsreaktor már kizárólag kevert, urán-plutónium MOX-üzemanyagot használ, és folyamatban van a BN–1200 típusú egység fejlesztése is. Ezek a fejlesztések a zárt üzemanyagciklus megvalósítását célozzák, amely jelentősen csökkentheti a végleges elhelyezésre kerülő sugárzó hulladék mennyiségét és kezelési költségeit[vg.hu].

Nukleáris energia és digitális infrastruktúra

Az adatközpontok növekvő energiaigénye miatt egyre több technológiai vállalat fordul az atomenergia felé. Az amerikai Oklo és az RPower, valamint a Deep Fission és az Endeavour együttműködése révén föld alatti SMR-eket telepítenek adatközpontok energiaellátására. Ezek a projektek kiemelik a nukleáris energia szerepét a digitális infrastruktúra fenntartható működtetésében[nucnet.org].

Piaci kilátások és geopolitikai kihívások

A Cameco vezérigazgatója szerint a globális nukleáris keresletet nem befolyásolják jelentősen a kereskedelmi vagy geopolitikai feszültségek, mivel a reaktorokra világszerte szükség van, még magasabb költségek vagy vámok mellett is. A magántőke beáramlása, az új szabályozási reformok (pl. az USA-ban az ADVANCE törvény), valamint a nemzetközi együttműködések mind hozzájárulnak az iparág hosszú távú stabilitásához és bővüléséhez[world-nuclear-news.org][nucnet.org].

Források:

world-nuclear-news.org

nucnet.org

vg.hu

makronom.eu

paks2.hu

pakspress.hu -

@ bf47c19e:c3d2573b

2025-05-27 14:54:03

@ bf47c19e:c3d2573b

2025-05-27 14:54:03Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- 5 Razloga Zašto je Novac Važan za Vas, Individualno

- 3 Razloga Zašto je Novac Važan za Društvo u Celini

- Zašto ljudi mrze novac?

Novac vs trenuci – da li oni treba da budu u sukobu? Kakva je uloga novca?

Novac je nepredvidiva zver modernog društva – neki ga veličaju sa stalnom željom da steknu više, dok ga drugi demonizuju i kažu da je pohlepa srž društvenih problema. Tokom mnogih godina svog života, ja sam često prelazio sa jednog na drugo gledište, i naučio mnogo toga upoznajući druge ljude koji žive na oba kraja ovog spektra. Kao i kod mnogih složenih tema, istina leži negde u sredini.

Novac je važan zato što on može da pomogne u uklanjanju materijalnih želja i patnji – omogućavanjem da preuzmete kontrolu nad svojim životom i da brinete o voljenima. Novac podiže životni standard društva omogućavanjem trgovine, a pritom minimalizuje potrebu za poverenjem.

Na novac možemo gledati kao na način da svoj uloženi trud sačuvamo u odredjenom obliku, i da ga vremenom prenesemo, tako da možemo da uživamo u plodovima svog rada. Novac kao alat je jedna od najvažnijih stvari za rast civilizacije. Na nesreću, mnogi su vremenom zlostavljali novac, ali sa dobrim razlogom: način na koji naš novac danas funkcioniše dovodi do duboko podeljenog društva – što ću i objasniti.

5 Razloga Zašto je Novac Važan za Vas, Individualno

Novac je važan za rast bogatstva, što je malo drugačije od toga da imamo veliku platu ili jednostavno zarađivati velike količine novca. Bogatstvo je otklanjanje želja, kako bi mogli da obratimo više pažnje na neke korisnije stvari u životu, od pukog preživljavanja i osnovnih udobnosti.

Bogata osoba je ona koja zaradi više novca nego što potroši, i koja ga čuva – ona čuva svoj rad tokom vremena. Uporedite ovo sa visoko plaćenim lekarom koji živi u velikoj vili sa hipotekom i sa Mercedesom na lizing. Iako ova osoba ima visoke prihode, ona takođe ima velike rashode u vidu obaveze plaćanja te hipoteke i lizinga. Te obaveze sprečavaju ovu osobu da uživa u istinskim blagodetima novca i bogatstva koje one predstavljaju:

1. Sloboda od potrebe za radom

Bez bogatstva, vi morate da radite da biste preživeli. Dostizanjem bogatstva i odredjenom imovinom koja vam donosi novac bez potrebe da vi trošite svoje vreme, vi možete da oslobodite svoj raspored. Više ne zavisite od posla koji mrzite, i nemorate da provodite 40 sati nedeljno odvojeni od porodice, samo da biste se pobrinuli za svoje osnovne potrebe. Dobijanje otkaza u padu ekonomije neće vas dovesti do finansijske propasti ili nečeg goreg.

2. Kontrola nad time kako vi trošite svoje vreme

Kada steknete bogatstvo, vi možete da odlučite kako želite da provodite svoje vreme. Kada se nalazimo u trci pacova i radimo 40+ sati nedeljno, često se naviknemo da novac trošimo onda kada imamo slobodnog vremena. Idemo na lepe večere ili idemo na skupe odmore. Međutim, sa više vremena, a možda čak i sa manje novca, mi možemo da imamo isto ili više uživanja živeći usporenije.

Razmislite o ovome – ukoliko imate samo 1 nedelju slobodno od posla, vi onda morate da kupite onaj mnogo skuplji let u Petak uveče koji se vraća u sledeću Nedelju, kako biste maksimalno iskoristili svoje vreme na nekom egzotičnom mestu za odmor. Međutim, ukoliko ste u mogućnosti da izdržavate sebe bez potrebe da mnogo vremena provodite na poslu, vi onda možete u Utorak da krenete jeftinijim letom i vratite se u sledeću Sredu. Takođe nećete osećati toliki pritisak da se opustite u uživanju tokom vaše nedelje u inostranstvu – možda ćete čak moći i da ostanete duže i da istražujete više, bez plaćanja skupih turističkih agencija i hotela kako bi organizovali vaše kraće putovanje.

3. Sposobnost da pomažete vašim prijateljima i porodici

Onda kada novca imate na pretek, možete poboljšati svoje odnose sa prijateljima i porodicom ne samo kroz dodatno slobodno vreme koje provodite sa njima, već i sa samim novcem. Ako je vašem prijatelju potrebna hitna operacija, vi možete da mu izadjete u susret i pomognete mu da stane na svoje noge. Ukoliko vam je tetka bolesna, vi možete da provedete vreme pored nje, umesto da je pozovete na kratko dok putujete prema kući vraćajući se nakon celog dana provedenog u kancelariji.

4. Smanjen finansijski stres

Stres je sveobuhvatno i opasno stanje modernog doba, sa kojim gotovo svi mi živimo u nekoj odredjenoj meri. Povezan je sa lošim zdravljem, sa preko 43% svih odraslih koji kažu da pate od odredjenih zdravstvenih problema uzrokovanih stresom. Stres zbog posla pogađa 83% zaposlenih.

Pravo bogatstvo – koje znači eliminaciju želja i potreba – može da ukloni ovaj stres i njegove negativne uticaje na druge delove života. Ovo bi čak moglo da ukloni većinu stresa u vašem životu, uzimajući u obzir da je uzrok stresa broj 1 upravo novac.

5. Bolje možete da pomognete vašoj zajednici

Mnogi od nas žele da volontiraju u svojim zajednicama i pomognu onima koja je pomoć preko potrebna, ali nisu u stanju da pronađu slobodnog vremena i energije zbog svog posla, porodice i društvenih aktivnosti koje nas mentalno i fizički čine srećnima, zdravima i hranjenima. Sa bogatstvom, mi možemo da posvetimo vreme koje nam je potrebno za razumevanje i doprinos drugima – a ne samo da sa vremena na vreme pomognemo slanjem humanitarnog SMS-a.

Novac, koji se pametno koristi, je moćno sredstvo za poboljšanje vašeg života i života vaših najmilijih i zajednice. Međutim, novac je takođe moćno sredstvo za poboljšanje društva u celini – ukoliko je dobro strukturiran.

3 Razloga Zašto je Novac Važan za Društvo u Celini

Novac poboljšava sposobnost ljudi da trguju jedni s drugima, što podstiče određene specijalizacije. Ako je imanje vašeg komšije odlično za proizvodnju vina, a vaše je pogodno za žito, obojica možete da profitirate trgovinom. Sad oboje imate i hleb i vino, umesto jednog pijanog vlasnika vinograda i jednog proizvodjača žita kome je dosadno!

Novac poboljšava društvo na nekoliko načina:

1. Omogućava specijalizaciju

Kao u primeru vlasnika vinograda i proizvodjača žita, novac omogućava povećanu specijalizaciju poboljšavajući sposobnost trgovine. Svaka razmena dobara ima problem sa ‘sticajima potreba’ – oba partnera u trgovini moraju da žele ono što druga osoba ima da bi pristala na trgovinu.

Možemo da mislimo o novcu kao o dobru koje žele gotovo svi. Ovo trgovinu čini mnogo jednostavnijom – da biste stekli odredjeno dobro, sve što vam je potrebno je novac, a ne neka slučajna stvar koju prodavac tog dobra takođe želi u tom trenutku. Vremenom je upotreba novca omogućila specijalizaciju, što je povećalo kvalitet i složenost roba i usluga.

Zamislite da sami pokušate da napravite svoj telefon – a bili su potrebni milioni stručnjaka i specijalizovana oprema da bi proizveli taj uređaj. Svi ti stručnjaci i kompanije plaćaju jedni drugima u novcu, omogućavajući složenom plesu globalnih proizvođača i lanaca snabdevanja da taj telefon isporuče na dlan vaše ruke. Čak i nešto tako jednostavno kao flaša za vodu uključuje naftna polja i proizvodne pogone koji su možda hiljadama kilometara od vaše kuće.

Kada ljudi mogu da se specijalizuju, kvalitet robe i usluga može da se poveća.

2. Omogućava korisnu trgovinu uz smanjeno poverenje

Mala društva mogu mirno i produktivno da posluju bez novca koristeći usluge, “dodjem ti” i uzajamno razumevanje. Međutim, kako se društva uvećavaju, svima brzo postaje nemoguće da održavaju lične odnose i isti stepen poverenja sa svima ostalima. Sistem trgovine uslugama i međusobnog poverenja ne funkcioniše previše dobro sa putnikom koji se nalazi na proputovanju kroz grad, i provede samo 15 minuta svog života u vašoj prodavnici.

Novac minimizira poverenje potrebno za trgovinu u većim društvima. Sada više ne moram da verujem da ćete mi pomoći kasnije kada mi zatreba – mogu samo da prihvatim uplatu od vas i da to koristim da bih sebi pomogao kasnije. Jedan od mojih omiljenih mislilaca, Nick Szabo, ovo naziva ‘društvena prilagodljivost’.

3. Smanjuje upotrebu sile

Kada društvo teži upotrebi određenog oblika novca za olakšavanje trgovine, može u velikoj meri da smanji nasilje u tom društvu. Kako to može biti tako? Zar ljudi ne bi i dalje želeli da kradu jedni od drugih ili da se svete?

Ukoliko razmišljamo van uobičajnih okvira, možemo da počnemo da razumemo kako novac može da smanji nasilje. Ako ti i ja živimo u susednim zemljama i želimo nešto što druga zemlja ima, imamo dva načina da to dobijemo: uzimanjem na silu ili menjanjem nečeg našeg za to. Kao što je ranije rečeno, novac znatno olakšava trgovinu – pa ćemo postojanjem zajedničkog monetarnog sistema verovatnije radje izvršiti trgovinu nego napad na zemlju. Zašto bismo rizikovali svoje živote kad možemo samo mirno da trgujemo jedni sa drugima?

Zašto ljudi mrze novac?

Pa ako novac ima toliko koristi za nas lično i za društvo u celini, zašto toliko ljudi mrzi novac? Zašto je demonizovan, zajedno sa onima koji ga imaju puno?

Za deo ovoga može biti okrivljen problem u jednakosti mogućnosti – to da je nekima teže da izadju iz nemaštine i postanu bogati. Bez sumnje, neki mali deo potiče od ljudi koji jednostavno ne žele da se trude ili preduzmu neophodne rizike da bi postali bogati.

Međutim, oba ova problema imaju više veze sa problemima kako naš novac danas funkcioniše, nego sa bilo kojim problemom u samom konceptu novca. Novčani sistem treba da nagrađuje ljude koji proizvode vredne stvari i trguju njima sa drugima. Verujem da većina ljudi danas misli da novac tako funkcioniše, i to ne bi smelo da bude daleko od istine.

Naš trenutni monetarni sistem, na žalost, nagrađuje ’finansijalizaciju’ – pretvarajući sve u imovinu, čija vrednost može da se napumpava ili spušta stvaranjem dobre priče i navođenjem drugih da veruju u nju. Razuzdani dug pogonjen stalnim omalovažavanjem svih glavnih valuta dodat je ovom blatu finansijalizacije. Sada je isplativije podići ogroman kredit i koristiti ga za brzo okretanje imovine radi zarade nego izgraditi posao koji društvu nudi korisne robe i usluge.

Tradicionalni monetarni sistem dodatno nagradjuje predatore, partnere u zločinu i neradnike.

Propast našeg novca razvila se tokom proteklih pola veka, počevši od toga kada su naše valute postale ništa više od parčeta papira, podržanog sa verom i kreditima naših vlada. Da biste bolje razumeli ovu promenu, pogledajte moj post o svrsi i istoriji novca.

Ako vam se sviđa moj rad, molim vas da ga podelite sa svojim prijateljima i porodicom. Cilj mi je da svima pružim pogled u ekonomiju i na to kako ona utiče na njihov život.

-

@ 45d6c2bf:56915a25

2025-05-27 14:23:39

@ 45d6c2bf:56915a25

2025-05-27 14:23:39published without nostr installed

-

@ 39cc53c9:27168656

2025-05-27 09:21:51

@ 39cc53c9:27168656

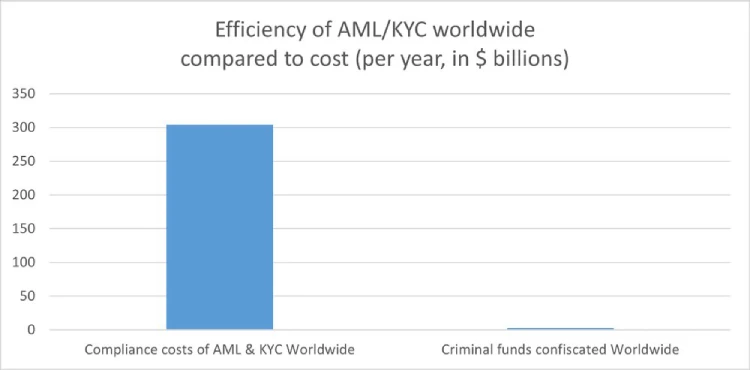

2025-05-27 09:21:51Know Your Customer is a regulation that requires companies of all sizes to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. Such procedures fit within the broader scope of anti-money laundering (AML) and counterterrorism financing (CTF) regulations.

Banks, exchanges, online business, mail providers, domain registrars... Everyone wants to know who you are before you can even opt for their service. Your personal information is flowing around the internet in the hands of "god-knows-who" and secured by "trust-me-bro military-grade encryption". Once your account is linked to your personal (and verified) identity, tracking you is just as easy as keeping logs on all these platforms.

Rights for Illusions

KYC processes aim to combat terrorist financing, money laundering, and other illicit activities. On the surface, KYC seems like a commendable initiative. I mean, who wouldn't want to halt terrorists and criminals in their tracks?

The logic behind KYC is: "If we mandate every financial service provider to identify their users, it becomes easier to pinpoint and apprehend the malicious actors."

However, terrorists and criminals are not precisely lining up to be identified. They're crafty. They may adopt false identities or find alternative strategies to continue their operations. Far from being outwitted, many times they're several steps ahead of regulations. Realistically, KYC might deter a small fraction – let's say about 1% ^1 – of these malefactors. Yet, the cost? All of us are saddled with the inconvenient process of identification just to use a service.

Under the rhetoric of "ensuring our safety", governments and institutions enact regulations that seem more out of a dystopian novel, gradually taking away our right to privacy.

To illustrate, consider a city where the mayor has rolled out facial recognition cameras in every nook and cranny. A band of criminals, intent on robbing a local store, rolls in with a stolen car, their faces obscured by masks and their bodies cloaked in all-black clothes. Once they've committed the crime and exited the city's boundaries, they switch vehicles and clothes out of the cameras' watchful eyes. The high-tech surveillance? It didn’t manage to identify or trace them. Yet, for every law-abiding citizen who merely wants to drive through the city or do some shopping, their movements and identities are constantly logged. The irony? This invasive tracking impacts all of us, just to catch the 1% ^1 of less-than-careful criminals.

KYC? Not you.

KYC creates barriers to participation in normal economic activity, to supposedly stop criminals. ^2

KYC puts barriers between many users and businesses. One of these comes from the fact that the process often requires multiple forms of identification, proof of address, and sometimes even financial records. For individuals in areas with poor record-keeping, non-recognized legal documents, or those who are unbanked, homeless or transient, obtaining these documents can be challenging, if not impossible.

For people who are not skilled with technology or just don't have access to it, there's also a barrier since KYC procedures are mostly online, leaving them inadvertently excluded.

Another barrier goes for the casual or one-time user, where they might not see the value in undergoing a rigorous KYC process, and these requirements can deter them from using the service altogether.

It also wipes some businesses out of the equation, since for smaller businesses, the costs associated with complying with KYC norms—from the actual process of gathering and submitting documents to potential delays in operations—can be prohibitive in economical and/or technical terms.

You're not welcome

Imagine a swanky new club in town with a strict "members only" sign. You hear the music, you see the lights, and you want in. You step up, ready to join, but suddenly there's a long list of criteria you must meet. After some time, you are finally checking all the boxes. But then the club rejects your membership with no clear reason why. You just weren't accepted. Frustrating, right?

This club scenario isn't too different from the fact that KYC is being used by many businesses as a convenient gatekeeping tool. A perfect excuse based on a "legal" procedure they are obliged to.

Even some exchanges may randomly use this to freeze and block funds from users, claiming these were "flagged" by a cryptic system that inspects the transactions. You are left hostage to their arbitrary decision to let you successfully pass the KYC procedure. If you choose to sidestep their invasive process, they might just hold onto your funds indefinitely.

Your identity has been stolen

KYC data has been found to be for sale on many dark net markets^3. Exchanges may have leaks or hacks, and such leaks contain very sensitive data. We're talking about the full monty: passport or ID scans, proof of address, and even those awkward selfies where you're holding up your ID next to your face. All this data is being left to the mercy of the (mostly) "trust-me-bro" security systems of such companies. Quite scary, isn't it?

As cheap as $10 for 100 documents, with discounts applying for those who buy in bulk, the personal identities of innocent users who passed KYC procedures are for sale. ^3

In short, if you have ever passed the KYC/AML process of a crypto exchange, your privacy is at risk of being compromised, or it might even have already been compromised.

(they) Know Your Coins

You may already know that Bitcoin and most cryptocurrencies have a transparent public blockchain, meaning that all data is shown unencrypted for everyone to see and recorded forever. If you link an address you own to your identity through KYC, for example, by sending an amount from a KYC exchange to it, your Bitcoin is no longer pseudonymous and can then be traced.

If, for instance, you send Bitcoin from such an identified address to another KYC'ed address (say, from a friend), everyone having access to that address-identity link information (exchanges, governments, hackers, etc.) will be able to associate that transaction and know who you are transacting with.

Conclusions

To sum up, KYC does not protect individuals; rather, it's a threat to our privacy, freedom, security and integrity. Sensible information flowing through the internet is thrown into chaos by dubious security measures. It puts borders between many potential customers and businesses, and it helps governments and companies track innocent users. That's the chaos KYC has stirred.

The criminals are using stolen identities from companies that gathered them thanks to these very same regulations that were supposed to combat them. Criminals always know how to circumvent such regulations. In the end, normal people are the most affected by these policies.

The threat that KYC poses to individuals in terms of privacy, security and freedom is not to be neglected. And if we don’t start challenging these systems and questioning their efficacy, we are just one step closer to the dystopian future that is now foreseeable.

Edited 20/03/2024 * Add reference to the 1% statement on Rights for Illusions section to an article where Chainalysis found that only 0.34% of the transaction volume with cryptocurrencies in 2023 was attributable to criminal activity ^1

-

@ 43baaf0c:d193e34c

2025-05-27 14:08:02

@ 43baaf0c:d193e34c

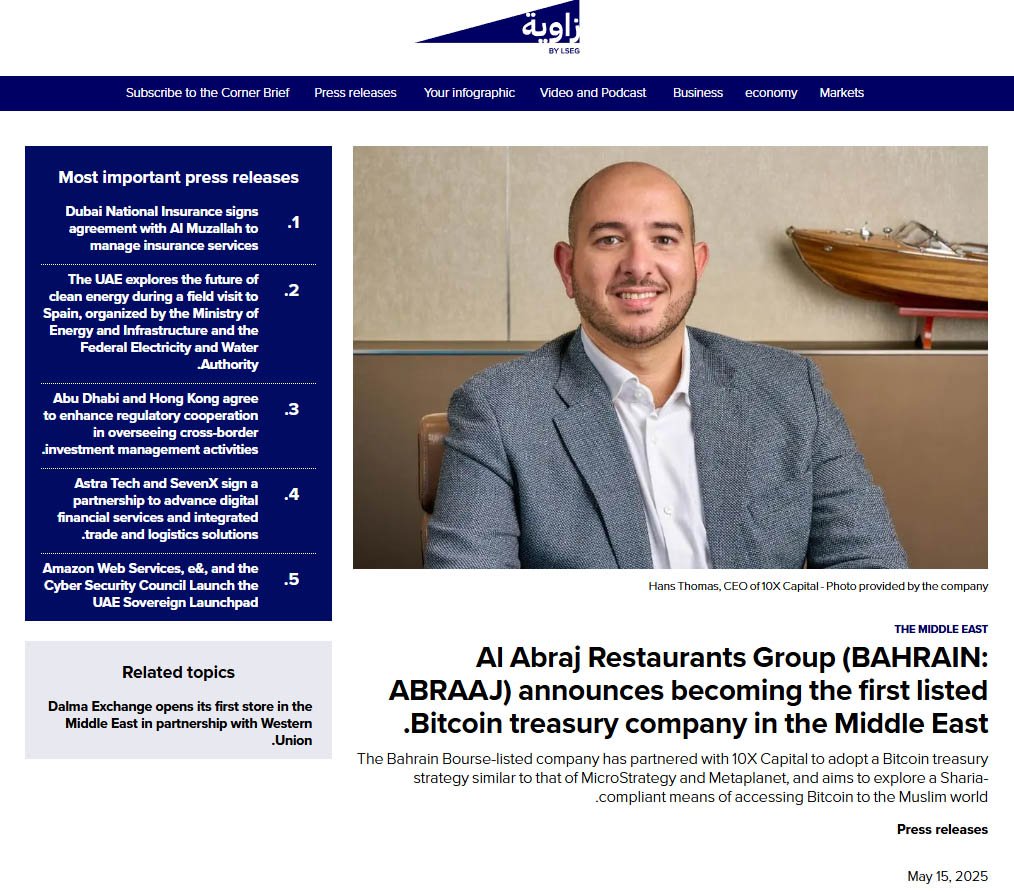

2025-05-27 14:08:02During the incredible Bitcoin Filmfest, I attended a community session where a discussion emerged about zapping and why I believe zaps are important. The person leading the Nostr session who is also developing an app that’s partially connected to Nostr mentioned they wouldn’t be implementing the zap mechanism directly. This sparked a brief but meaningful debate, which is why I’d like to share my perspective as an artist and content creator on why zaps truly matter.

Let me start by saying that I see everything from the perspective of an artist and creator, not so much from a developer’s point of view. In 2023, I started using Nostr after spending a few years exploring the world of ‘shitcoins’ and NFTs, beginning in 2018. Even though I became a Bitcoin maximalist around 2023, those earlier years taught me an important lesson: it is possible to earn money with my art.

Whether you love or hate them, NFTs opened my eyes to the idea that I could finally take my art to the next level. Before that, for over 15 years, I ran a travel stock video content company called @traveltelly. You can read the full story about my journey in travel and content here: https://yakihonne.com/article/traveltelly@primal.net/vZc1c8aXrc-3hniN6IMdK

When I truly understood what Bitcoin meant to me, I left all other coins behind. Some would call that becoming a Bitcoin maximalist.

The first time I used Nostr, I discovered the magic of zapping. It amazed me that someone who appreciates your art or content could reward you—not just with a like, but with real value: Bitcoin, the hardest money on earth. Zaps are small amounts of Bitcoin sent as a sign of support or appreciation. (Each Bitcoin is divisible into 100 million units called Satoshis, or Sats for short—making a Satoshi the smallest unit of Bitcoin recorded on the blockchain.)

The Energy of Zaps

The Energy of ZapsIf you’re building an app on Nostr—or even just connecting to it—but choose not to include zaps, why should artists and content creators share their work there? Why would they leave platforms like Instagram or Facebook, which already benefit from massive network effects?

Yes, the ability to own your own data is one of Nostr’s greatest strengths. That alone is a powerful reason to embrace the protocol. No one can ban you. You control your content. And the ability to post once and have it appear across multiple Nostr clients is an amazing feature.

But for creators, energy matters. Engagement isn’t just about numbers—it’s about value. Zaps create a feedback loop powered by real appreciation and real value, in the form of Bitcoin. They’re a signal that your content matters. And that energy is what makes creating on Nostr so special.

But beyond those key elements, I also look at this from a commercial perspective. The truth is, we still can’t pay for groceries with kisses :)—we still need money as a medium of exchange. Being financially rewarded for sharing your content gives creators a real incentive to keep creating and sharing. That’s where zaps come in—they add economic value to engagement.

A Protocol for Emerging Artists and Creators

I believe Nostr offers a great starting point for emerging artists and content creators. If you’re just beginning and don’t already have a large following on traditional social media platforms, Nostr provides a space where your work can be appreciated and directly supported with Bitcoin, even by a small but engaged community.

On the other hand, creators who already have a big audience and steady income on platforms like Instagram or YouTube may not feel the urgency to switch. This is similar to how wealthier countries are often slower to understand or adopt Bitcoin—because they don’t need it yet. In contrast, people in unbanked regions or countries facing high inflation are more motivated to learn how money really works.

In the same way, emerging creators—those still finding their audience and looking for sustainable ways to grow—are often more open to exploring new ecosystems like Nostr, where innovation and financial empowerment go hand in hand.

The same goes for Nostr. After using it for the past two years, I can honestly say: without Nostr, I wouldn’t be the artist I am today.

Nostr motivates me to create and share every single day. A like is nice but receiving a zap, even just 21 sats, is something entirely different. Once you truly understand that someone is willing to pay you for what you share, it’s no longer about the amount. It’s about the magic behind it. That simple gesture creates a powerful, positive energy that keeps you going.

Even with Nostr’s still relatively small user base, I’ve already been able to create projects that simply wouldn’t have been possible elsewhere.

Zaps do more than just reward—they inspire. They encourage you to keep building your community. That inspiration often leads to new projects. Sometimes, the people who zap you become directly involved in your work, or even ask you to create something specifically for them.

That’s the real value of zaps: not just micro-payments, but micro-connections sparks that lead to creativity, collaboration, and growth.

Proof of Work (PoW)

Over the past two years, I’ve experienced firsthand how small zaps can evolve into full art projects and even lead to real sales. Here are two examples that started with zaps and turned into something much bigger:

Halving 2024 Artwork

When I started the Halving 2024 project, I invited people on Nostr to be part of it. 70 people zapped me 2,100 sats each, and in return, I included their Npubs in the final artwork. That piece was later auctioned and sold to Jurjen de Vries for 225,128 Sats.

Magic Internet Money

For the Magic Internet Money artwork, I again invited people to zap 2,100 sats to be included. Fifty people participated, and their contributions became part of the final art frame. The completed piece was eventually sold to Filip for 480,000 sats.

These examples show the power of zaps: a simple, small act of appreciation can turn into larger engagement, deeper connection, and even the sale of original art. Zaps aren’t just tips—they’re a form of collaboration and support that fuel creative energy.

I hope this article gives developers a glimpse into the perspective of an artist using Nostr. Of course, this is just one artist’s view, and it doesn’t claim to speak for everyone. But I felt it was important to share my Proof of Work and perspective.

For me, Zaps matter.

Thank you to all the developers who are building these amazing apps on Nostr. Your work empowers artists like me to share, grow, and be supported through the value-for-value model.

-

@ ec42c765:328c0600

2025-02-05 23:38:12

@ ec42c765:328c0600

2025-02-05 23:38:12カスタム絵文字とは

任意のオリジナル画像を絵文字のように文中に挿入できる機能です。

また、リアクション(Twitterの いいね のような機能)にもカスタム絵文字を使えます。

カスタム絵文字の対応状況(2025/02/06)

カスタム絵文字を使うためにはカスタム絵文字に対応したクライアントを使う必要があります。

※表は一例です。クライアントは他にもたくさんあります。

使っているクライアントが対応していない場合は、クライアントを変更する、対応するまで待つ、開発者に要望を送る(または自分で実装する)などしましょう。

対応クライアント

ここではnostterを使って説明していきます。

準備

カスタム絵文字を使うための準備です。

- Nostrエクステンション(NIP-07)を導入する

- 使いたいカスタム絵文字をリストに登録する

Nostrエクステンション(NIP-07)を導入する

Nostrエクステンションは使いたいカスタム絵文字を登録する時に必要になります。

また、環境(パソコン、iPhone、androidなど)によって導入方法が違います。

Nostrエクステンションを導入する端末は、実際にNostrを閲覧する端末と違っても構いません(リスト登録はPC、Nostr閲覧はiPhoneなど)。

Nostrエクステンション(NIP-07)の導入方法は以下のページを参照してください。

ログイン拡張機能 (NIP-07)を使ってみよう | Welcome to Nostr! ~ Nostrをはじめよう! ~

少し面倒ですが、これを導入しておくとNostr上の様々な場面で役立つのでより快適になります。

使いたいカスタム絵文字をリストに登録する

以下のサイトで行います。

右上のGet startedからNostrエクステンションでログインしてください。

例として以下のカスタム絵文字を導入してみます。

実際より絵文字が少なく表示されることがありますが、古い状態のデータを取得してしまっているためです。その場合はブラウザの更新ボタンを押してください。

- 右側のOptionsからBookmarkを選択

これでカスタム絵文字を使用するためのリストに登録できます。

カスタム絵文字を使用する

例としてブラウザから使えるクライアント nostter から使用してみます。

nostterにNostrエクステンションでログイン、もしくは秘密鍵を入れてログインしてください。

文章中に使用

- 投稿ボタンを押して投稿ウィンドウを表示

- 顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

- : 記号に挟まれたアルファベットのショートコードとして挿入される

この状態で投稿するとカスタム絵文字として表示されます。

カスタム絵文字対応クライアントを使っている他ユーザーにもカスタム絵文字として表示されます。

対応していないクライアントの場合、ショートコードのまま表示されます。

ショートコードを直接入力することでカスタム絵文字の候補が表示されるのでそこから選択することもできます。

リアクションに使用

- 任意の投稿の顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

カスタム絵文字リアクションを送ることができます。

カスタム絵文字を探す

先述したemojitoからカスタム絵文字を探せます。

例えば任意のユーザーのページ emojito ロクヨウ から探したり、 emojito Browse all からnostr全体で最近作成、更新された絵文字を見たりできます。

また、以下のリンクは日本語圏ユーザーが作ったカスタム絵文字を集めたリストです(2025/02/06)

※漏れがあるかもしれません

各絵文字セットにあるOpen in emojitoのリンクからemojitoに飛び、使用リストに追加できます。

以上です。

次:Nostrのカスタム絵文字の作り方

Yakihonneリンク Nostrのカスタム絵文字の作り方

Nostrリンク nostr:naddr1qqxnzdesxuunzv358ycrgveeqgswcsk8v4qck0deepdtluag3a9rh0jh2d0wh0w9g53qg8a9x2xqvqqrqsqqqa28r5psx3

仕様

-

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53

@ c1e9ab3a:9cb56b43

2025-05-27 13:19:53I. Introduction: Money as a Function of Efficiency and Preference

Money is not defined by law, but by power over productivity. In any open economy, the most economically efficient actors—those who control the most valuable goods, services, and knowledge—ultimately dictate the medium of exchange. Their preferences signal to the broader market what form of money is required to access the highest-value goods, from durable commodities to intangibles like intellectual property and skilled labor.

Whatever money these actors prefer becomes the de facto unit of account and store of value, regardless of its legal status. This emergent behavior is natural and reflects a hierarchy of monetary utility.

II. Classical Gresham’s Law: A Product of Market Distortion

Gresham’s Law, famously stated as:

"Bad money drives out good"

is only valid under coercive monetary conditions, specifically: - Legal tender laws that force the acceptance of inferior money at par with superior money. - Fixed exchange rates imposed by decree, not market valuation. - Governments or central banks backing elastic fiduciary media with promises of redemption. - Institutional structures that mandate debt and tax payments in the favored currency.

Under these conditions, superior money (hard money) is hoarded, while inferior money (soft, elastic, inflationary) circulates. This is not an expression of free market behavior—it is the result of suppressed price discovery and legal coercion.

Gresham’s Law, therefore, is not a natural law of money, but a law of distortion under forced parity and artificial elasticity.

III. The Collapse of Coercion: Inversion of Gresham’s Law

When coercive structures weaken or are bypassed—through technological exit, jurisdictional arbitrage, monetary breakdown, or political disintegration—Gresham’s Law inverts:

Good money drives out bad.

This occurs because: - Market actors regain the freedom to select money based on utility, scarcity, and credibility. - Legal parity collapses, exposing the true economic hierarchy of monetary forms. - Trustless systems (e.g., Bitcoin) or superior digital instruments (e.g., stablecoins) offer better settlement, security, and durability. - Elastic fiduciary media become undesirable as counterparty risk and inflation rise.

The inversion marks a return to monetary natural selection—not a breakdown of Gresham’s Law, but the collapse of its preconditions.

IV. Elasticity and Control

Elastic fiduciary media (like fiat currency) are not intrinsically evil. They are tools of state finance and debt management, enabling rapid expansion of credit and liquidity. However, when their issuance is unconstrained, and legal tender laws force their use, they become weapons of economic coercion.

Banks issue credit unconstrained by real savings, and governments enforce the use of inflated media through taxation and courts. This distorts capital allocation, devalues productive labor, and ultimately hollows out monetary confidence.

V. Monetary Reversion: The Return of Hard Money

When the coercion ends—whether gradually or suddenly—the monetary system reverts. The preferences of the productive and wealthy reassert themselves:

- Superior money is not just saved—it begins to circulate.

- Weaker currencies are rejected not just for savings, but for daily exchange.

- The hoarded form becomes the traded form, and Gresham’s Law inverts completely.

Bitcoin, gold, and even highly credible stable instruments begin to function as true money, not just stores of value. The natural monetary order returns, and the State becomes a late participant, not the originator of monetary reality.

VI. Conclusion

Gresham’s Law operates only under distortion. Its inversion is not an anomaly—it is a signal of the collapse of coercion. The monetary system then reorganizes around productive preference, technological efficiency, and economic sovereignty.

The most efficient market will always dictate the form of hard money. The State can delay this reckoning through legal force, but it cannot prevent it indefinitely. Once free choice returns, bad money dies, and good money lives again.

-

@ ec42c765:328c0600

2025-02-05 23:16:35

@ ec42c765:328c0600

2025-02-05 23:16:35てすと

nostr:nevent1qqst3uqlls4yr9vys4dza2sgjle3ly37trck7jgdmtr23uuz52usjrqqqnjgr

nostr:nevent1qqsdvchy5d27zt3z05rr3q6vvmzgslslxwu0p4dfkvxwhmvxldn9djguvagp2

test

てs

-

@ ec42c765:328c0600

2025-02-05 22:05:55

@ ec42c765:328c0600

2025-02-05 22:05:55カスタム絵文字とは

任意のオリジナル画像を絵文字のように文中に挿入できる機能です。

また、リアクション(Twitterの いいね のような機能)にもカスタム絵文字を使えます。

カスタム絵文字の対応状況(2025/02/06)

カスタム絵文字を使うためにはカスタム絵文字に対応したクライアントを使う必要があります。

※表は一例です。クライアントは他にもたくさんあります。

使っているクライアントが対応していない場合は、クライアントを変更する、対応するまで待つ、開発者に要望を送る(または自分で実装する)などしましょう。

対応クライアント

ここではnostterを使って説明していきます。

準備

カスタム絵文字を使うための準備です。

- Nostrエクステンション(NIP-07)を導入する

- 使いたいカスタム絵文字をリストに登録する

Nostrエクステンション(NIP-07)を導入する

Nostrエクステンションは使いたいカスタム絵文字を登録する時に必要になります。

また、環境(パソコン、iPhone、androidなど)によって導入方法が違います。

Nostrエクステンションを導入する端末は、実際にNostrを閲覧する端末と違っても構いません(リスト登録はPC、Nostr閲覧はiPhoneなど)。

Nostrエクステンション(NIP-07)の導入方法は以下のページを参照してください。

ログイン拡張機能 (NIP-07)を使ってみよう | Welcome to Nostr! ~ Nostrをはじめよう! ~

少し面倒ですが、これを導入しておくとNostr上の様々な場面で役立つのでより快適になります。

使いたいカスタム絵文字をリストに登録する

以下のサイトで行います。

右上のGet startedからNostrエクステンションでログインしてください。

例として以下のカスタム絵文字を導入してみます。

実際より絵文字が少なく表示されることがありますが、古い状態のデータを取得してしまっているためです。その場合はブラウザの更新ボタンを押してください。

- 右側のOptionsからBookmarkを選択

これでカスタム絵文字を使用するためのリストに登録できます。

カスタム絵文字を使用する

例としてブラウザから使えるクライアント nostter から使用してみます。

nostterにNostrエクステンションでログイン、もしくは秘密鍵を入れてログインしてください。

文章中に使用

- 投稿ボタンを押して投稿ウィンドウを表示

- 顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

- : 記号に挟まれたアルファベットのショートコードとして挿入される

この状態で投稿するとカスタム絵文字として表示されます。

カスタム絵文字対応クライアントを使っている他ユーザーにもカスタム絵文字として表示されます。

対応していないクライアントの場合、ショートコードのまま表示されます。

ショートコードを直接入力することでカスタム絵文字の候補が表示されるのでそこから選択することもできます。

リアクションに使用

- 任意の投稿の顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

カスタム絵文字リアクションを送ることができます。

カスタム絵文字を探す

先述したemojitoからカスタム絵文字を探せます。

例えば任意のユーザーのページ emojito ロクヨウ から探したり、 emojito Browse all からnostr全体で最近作成、更新された絵文字を見たりできます。

また、以下のリンクは日本語圏ユーザーが作ったカスタム絵文字を集めたリストです(2025/02/06)

※漏れがあるかもしれません

各絵文字セットにあるOpen in emojitoのリンクからemojitoに飛び、使用リストに追加できます。

以上です。

次:Nostrのカスタム絵文字の作り方

Yakihonneリンク Nostrのカスタム絵文字の作り方

Nostrリンク nostr:naddr1qqxnzdesxuunzv358ycrgveeqgswcsk8v4qck0deepdtluag3a9rh0jh2d0wh0w9g53qg8a9x2xqvqqrqsqqqa28r5psx3

仕様

-

@ 39cc53c9:27168656

2025-05-27 09:21:50

@ 39cc53c9:27168656

2025-05-27 09:21:50Over the past few months, I've dedicated my time to a complete rewrite of the kycnot.me website. The technology stack remains unchanged; Golang paired with TailwindCSS. However, I've made some design choices in this iteration that I believe significantly enhance the site. Particularly to backend code.

UI Improvements

You'll notice a refreshed UI that retains the original concept but has some notable enhancements. The service list view is now more visually engaging, it displays additional information in a more aesthetically pleasing manner. Both filtering and searching functionalities have been optimized for speed and user experience.

Service pages have been also redesigned to highlight key information at the top, with the KYC Level box always accessible. The display of service attributes is now more visually intuitive.

The request form, especially the Captcha, has undergone substantial improvements. The new self-made Captcha is robust, addressing the reliability issues encountered with the previous version.

Terms of Service Summarizer

A significant upgrade is the Terms of Service summarizer/reviewer, now powered by AI (GPT-4-turbo). It efficiently condenses each service's ToS, extracting and presenting critical points, including any warnings. Summaries are updated monthly, processing over 40 ToS pages via the OpenAI API using a self-crafted and thoroughly tested prompt.

Nostr Comments

I've integrated a comment section for each service using Nostr. For guidance on using this feature, visit the dedicated how-to page.

Database

The backend database has transitioned to pocketbase, an open-source Golang backend that has been a pleasure to work with. I maintain an updated fork of the Golang SDK for pocketbase at pluja/pocketbase.

Scoring

The scoring algorithm has also been refined to be more fair. Despite I had considered its removal due to the complexity it adds (it is very difficult to design a fair scoring system), some users highlighted its value, so I kept it. The updated algorithm is available open source.

Listings

Each listing has been re-evaluated, and the ones that were no longer operational were removed. New additions are included, and the backlog of pending services will be addressed progressively, since I still have access to the old database.

API

The API now offers more comprehensive data. For more details, check here.

About Page

The About page has been restructured for brevity and clarity.

Other Changes

Extensive changes have been implemented in the server-side logic, since the whole code base was re-written from the ground up. I may discuss these in a future post, but for now, I consider the current version to be just a bit beyond beta, and additional updates are planned in the coming weeks.

-

@ 39cc53c9:27168656

2025-05-27 09:21:48

@ 39cc53c9:27168656

2025-05-27 09:21:48I'm launching a new service review section on this blog in collaboration with OrangeFren. These reviews are sponsored, yet the sponsorship does not influence the outcome of the evaluations. Reviews are done in advance, then, the service provider has the discretion to approve publication without modifications.

Sponsored reviews are independent from the kycnot.me list, being only part of the blog. The reviews have no impact on the scores of the listings or their continued presence on the list. Should any issues arise, I will not hesitate to remove any listing.

The review

WizardSwap is an instant exchange centred around privacy coins. It was launched in 2020 making it old enough to have weathered the 2021 bull run and the subsequent bearish year.

| Pros | Cons | |------|------| | Tor-friendly | Limited liquidity | | Guarantee of no KYC | Overly simplistic design | | Earn by providing liquidity | |

Rating: ★★★★★ Service Website: wizardswap.io

Liquidity

Right off the bat, we'll start off by pointing out that WizardSwap relies on its own liquidity reserves, meaning they aren't just a reseller of Binance or another exchange. They're also committed to a no-KYC policy, when asking them, they even promised they would rather refund a user their original coins, than force them to undergo any sort of verification.

On the one hand, full control over all their infrastructure gives users the most privacy and conviction about the KYC policies remaining in place.

On the other hand, this means the liquidity available for swapping isn't huge. At the time of testing we could only purchase at most about 0.73 BTC with XMR.

It's clear the team behind WizardSwap is aware of this shortfall and so they've come up with a solution unique among instant exchanges. They let you, the user, deposit any of the currencies they support into your account and earn a profit on the trades made using your liquidity.

Trading

Fees on WizardSwap are middle-of-the-pack. The normal fee is 2.2%. That's more than some exchanges that reserve the right to suddenly demand you undergo verification, yet less than half the fees on some other privacy-first exchanges. However as we mentioned in the section above you can earn almost all of that fee (2%) if you provide liquidity to WizardSwap.

It's good that with the current Bitcoin fee market their fees are constant regardless of how much, or how little, you send. This is in stark contrast with some of the alternative swap providers that will charge you a massive premium when attempting to swap small amounts of BTC away.

Test trades

Test trades are always performed without previous notice to the service provider.

During our testing we performed a few test trades and found that every single time WizardSwap immediately detected the incoming transaction and the amount we received was exactly what was quoted before depositing. The fees were inline with what WizardSwap advertises.

- Monero payment proof

- Bitcoin received

- Wizardswap TX link - it's possible that this link may cease to be valid at some point in the future.

ToS and KYC

WizardSwap does not have a Terms of Service or a Privacy Policy page, at least none that can be found by users. Instead, they offer a FAQ section where they addresses some basic questions.

The site does not mention any KYC or AML practices. It also does not specify how refunds are handled in case of failure. However, based on the FAQ section "What if I send funds after the offer expires?" it can be inferred that contacting support is necessary and network fees will be deducted from any refund.

UI & Tor

WizardSwap can be visited both via your usual browser and Tor Browser. Should you decide on the latter you'll find that the website works even with the most strict settings available in the Tor Browser (meaning no JavaScript).

However, when disabling Javascript you'll miss the live support chat, as well as automatic refreshing of the trade page. The lack of the first means that you will have no way to contact support from the trade page if anything goes wrong during your swap, although you can do so by mail.

One important thing to have in mind is that if you were to accidentally close the browser during the swap, and you did not save the swap ID or your browser history is disabled, you'll have no easy way to return to the trade. For this reason we suggest when you begin a trade to copy the url or ID to someplace safe, before sending any coins to WizardSwap.

The UI you'll be greeted by is simple, minimalist, and easy to navigate. It works well not just across browsers, but also across devices. You won't have any issues using this exchange on your phone.

Getting in touch

The team behind WizardSwap appears to be most active on X (formerly Twitter): https://twitter.com/WizardSwap_io

If you have any comments or suggestions about the exchange make sure to reach out to them. In the past they've been very receptive to user feedback, for instance a few months back WizardSwap was planning on removing DeepOnion, but the community behind that project got together ^1 and after reaching out WizardSwap reversed their decision ^2.

You can also contact them via email at:

support @ wizardswap . ioDisclaimer

None of the above should be understood as investment or financial advice. The views are our own only and constitute a faithful representation of our experience in using and investigating this exchange. This review is not a guarantee of any kind on the services rendered by the exchange. Do your own research before using any service.

-

@ a0e937b7:50db609a

2025-05-27 13:06:38

@ a0e937b7:50db609a

2025-05-27 13:06:38Because we are not merely addicted to #Narrativium: It is our drive, imbued into our very essence. And it is so much easier to absorb our daily dose from the billions of trickles provided by everyone else as a substitute drug #Gossipium, or temporarily saturate our unquenchable thirst by just giving in to the temptation by the incessable stream of Movies and Series providing #Fictionium than it is to find a properly satisfying Source Of Narrativium (acronymize that 😉), let alone create our own Narrativium that might even be worthy of sharing. And yet, there is so much more fulfilment possible by letting one's creativity work instead of merely using a "share" button - which briefly seems to trick the human brain into believing that one has actually participated in providing one's peers with proper Narrativium, possibly as part of an implicit social contract: "I give you all some Narrativium I found, now give me more in return". It is such a trivial action to take, even more effortless than gossiping. But let's be honest, it often just feels hollow. And even when we write something, it is again tempting to just create #Rantium instead of something actually useful.

Gossypium herbaceum, the cotton plant (Photo by H. Zell from Wikipedia)

Gossypium herbaceum, the cotton plant (Photo by H. Zell from Wikipedia)Originally I merely wanted to post a witty quote from https://wiki.lspace.org/mediawiki/Narrativium about Narrativium on Facebook:

"Humans add narrativium to their world. They insist on interpreting the universe as if it's telling a story. This leads them to focus on facts that fit the story, while ignoring those that don't." - T. Pratchett, I. Steward, J. Cohen, The Science of Discworld I

Maybe even subtly allude to how that might explain quite a lot about the everyday insanity that seems to surround us, especially these days.

"We are not Homo sapiens, Wise Man. We are the third chimpanzee. [...] We are Pan narrans, the storytelling ape. [...] if you understand the power of story, and learn to detect abuses of it, you might actually deserve the appellation Homo sapiens." - T. Pratchett, I. Steward, J. Cohen, The Science of Discworld II

Really. I was just going to quote a bit and go on about my day with some meaningless procrastination. Why already bother with housework when I can delay that until tomorrow or the day after and just watch some series in the Arrowverse now? But after ten minutes of a Legends of Tomorrow episode called "Lucha de Apuestas", curiosity got the better of me. What is it with Luchadores and their masks, I mockingly wondered. So I read Wikipedia on it. Lots of culture, history and, most importantly to me, Narrativium. I probably couldn't care less for to guys bumping fists on a stage, I don't really care about watching any sports either. But there's a certain fascination to stories, isn't there? So I felt like sharing about Narrativium, and here we are.

—

That's it for now, I might keep writing on this. One day. Just as I keep continuing writing everything else I start. Not. Well, motivate me.

-

@ ec42c765:328c0600

2025-02-05 20:30:46

@ ec42c765:328c0600

2025-02-05 20:30:46カスタム絵文字とは

任意のオリジナル画像を絵文字のように文中に挿入できる機能です。

また、リアクション(Twitterの いいね のような機能)にもカスタム絵文字を使えます。

カスタム絵文字の対応状況(2024/02/05)

カスタム絵文字を使うためにはカスタム絵文字に対応したクライアントを使う必要があります。

※表は一例です。クライアントは他にもたくさんあります。

使っているクライアントが対応していない場合は、クライアントを変更する、対応するまで待つ、開発者に要望を送る(または自分で実装する)などしましょう。

対応クライアント

ここではnostterを使って説明していきます。

準備

カスタム絵文字を使うための準備です。

- Nostrエクステンション(NIP-07)を導入する

- 使いたいカスタム絵文字をリストに登録する

Nostrエクステンション(NIP-07)を導入する

Nostrエクステンションは使いたいカスタム絵文字を登録する時に必要になります。

また、環境(パソコン、iPhone、androidなど)によって導入方法が違います。

Nostrエクステンションを導入する端末は、実際にNostrを閲覧する端末と違っても構いません(リスト登録はPC、Nostr閲覧はiPhoneなど)。

Nostrエクステンション(NIP-07)の導入方法は以下のページを参照してください。

ログイン拡張機能 (NIP-07)を使ってみよう | Welcome to Nostr! ~ Nostrをはじめよう! ~

少し面倒ですが、これを導入しておくとNostr上の様々な場面で役立つのでより快適になります。

使いたいカスタム絵文字をリストに登録する

以下のサイトで行います。

右上のGet startedからNostrエクステンションでログインしてください。

例として以下のカスタム絵文字を導入してみます。

実際より絵文字が少なく表示されることがありますが、古い状態のデータを取得してしまっているためです。その場合はブラウザの更新ボタンを押してください。

- 右側のOptionsからBookmarkを選択

これでカスタム絵文字を使用するためのリストに登録できます。

カスタム絵文字を使用する

例としてブラウザから使えるクライアント nostter から使用してみます。

nostterにNostrエクステンションでログイン、もしくは秘密鍵を入れてログインしてください。

文章中に使用

- 投稿ボタンを押して投稿ウィンドウを表示

- 顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

- : 記号に挟まれたアルファベットのショートコードとして挿入される

この状態で投稿するとカスタム絵文字として表示されます。

カスタム絵文字対応クライアントを使っている他ユーザーにもカスタム絵文字として表示されます。

対応していないクライアントの場合、ショートコードのまま表示されます。

ショートコードを直接入力することでカスタム絵文字の候補が表示されるのでそこから選択することもできます。

リアクションに使用

- 任意の投稿の顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

カスタム絵文字リアクションを送ることができます。

カスタム絵文字を探す

先述したemojitoからカスタム絵文字を探せます。

例えば任意のユーザーのページ emojito ロクヨウ から探したり、 emojito Browse all からnostr全体で最近作成、更新された絵文字を見たりできます。

また、以下のリンクは日本語圏ユーザーが作ったカスタム絵文字を集めたリストです(2024/06/30)

※漏れがあるかもしれません

各絵文字セットにあるOpen in emojitoのリンクからemojitoに飛び、使用リストに追加できます。

以上です。

次:Nostrのカスタム絵文字の作り方

Yakihonneリンク Nostrのカスタム絵文字の作り方

Nostrリンク nostr:naddr1qqxnzdesxuunzv358ycrgveeqgswcsk8v4qck0deepdtluag3a9rh0jh2d0wh0w9g53qg8a9x2xqvqqrqsqqqa28r5psx3

仕様

-

@ 39cc53c9:27168656

2025-05-27 09:21:46

@ 39cc53c9:27168656

2025-05-27 09:21:46Bitcoin enthusiasts frequently and correctly remark how much value it adds to Bitcoin not to have a face, a leader, or a central authority behind it. This particularity means there isn't a single person to exert control over, or a single human point of failure who could become corrupt or harmful to the project.

Because of this, it is said that no other coin can be equally valuable as Bitcoin in terms of decentralization and trustworthiness. Bitcoin is unique not just for being first, but also because of how the events behind its inception developed. This implies that, from Bitcoin onwards, any coin created would have been created by someone, consequently having an authority behind it. For this and some other reasons, some people refer to Bitcoin as "The Immaculate Conception".

While other coins may have their own unique features and advantages, they may not be able to replicate Bitcoin's community-driven nature. However, one other cryptocurrency shares a similar story of mystery behind its creation: Monero.

History of Monero

Bytecoin and CryptoNote

In March 2014, a Bitcointalk thread titled "Bytecoin. Secure, private, untraceable since 2012" was initiated by a user under the nickname "DStrange"^1^. DStrange presented Bytecoin (BCN) as a unique cryptocurrency, in operation since July 2012. Unlike Bitcoin, it employed a new algorithm known as CryptoNote.

DStrange apparently stumbled upon the Bytecoin website by chance while mining a dying bitcoin fork, and decided to create a thread on Bitcointalk^1^. This sparked curiosity among some users, who wondered how could Bytecoin remain unnoticed since its alleged launch in 2012 until then^2^.

Some time after, a user brought up the "CryptoNote v2.0" whitepaper for the first time, underlining its innovative features^4^. Authored by the pseudonymous Nicolas van Saberhagen in October 2013, the CryptoNote v2 whitepaper^5^ highlighted the traceability and privacy problems in Bitcoin. Saberhagen argued that these flaws could not be quickly fixed, suggesting it would be more efficient to start a new project rather than trying to patch the original^5^, an statement simmilar to the one from Satoshi Nakamoto^6^.

Checking with Saberhagen's digital signature, the release date of the whitepaper seemed correct, which would mean that Cryptonote (v1) was created in 2012^7^, although there's an important detail: "Signing time is from the clock on the signer's computer" ^9^.

Moreover, the whitepaper v1 contains a footnote link to a Bitcointalk post dated May 5, 2013^10^, making it impossible for the whitepaper to have been signed and released on December 12, 2012.

As the narrative developed, users discovered that a significant 80% portion of Bytecoin had been pre-mined^11^ and blockchain dates seemed to be faked to make it look like it had been operating since 2012, leading to controversy surrounding the project.

The origins of CryptoNote and Bytecoin remain mysterious, leaving suspicions of a possible scam attempt, although the whitepaper had a good amount of work and thought on it.

The fork

In April 2014, the Bitcointalk user

thankful_for_today, who had also participated in the Bytecoin thread^12^, announced plans to launch a Bytecoin fork named Bitmonero^13^.The primary motivation behind this fork was "Because there is a number of technical and marketing issues I wanted to do differently. And also because I like ideas and technology and I want it to succeed"^14^. This time Bitmonero did things different from Bytecoin: there was no premine or instamine, and no portion of the block reward went to development.

However, thankful_for_today proposed controversial changes that the community disagreed with. Johnny Mnemonic relates the events surrounding Bitmonero and thankful_for_today in a Bitcointalk comment^15^:

When thankful_for_today launched BitMonero [...] he ignored everything that was discussed and just did what he wanted. The block reward was considerably steeper than what everyone was expecting. He also moved forward with 1-minute block times despite everyone's concerns about the increase of orphan blocks. He also didn't address the tail emission concern that should've (in my opinion) been in the code at launch time. Basically, he messed everything up. Then, he disappeared.

After disappearing for a while, thankful_for_today returned to find that the community had taken over the project. Johnny Mnemonic continues:

I, and others, started working on new forks that were closer to what everyone else was hoping for. [...] it was decided that the BitMonero project should just be taken over. There were like 9 or 10 interested parties at the time if my memory is correct. We voted on IRC to drop the "bit" from BitMonero and move forward with the project. Thankful_for_today suddenly resurfaced, and wasn't happy to learn the community had assumed control of the coin. He attempted to maintain his own fork (still calling it "BitMonero") for a while, but that quickly fell into obscurity.

The unfolding of these events show us the roots of Monero. Much like Satoshi Nakamoto, the creators behind CryptoNote/Bytecoin and thankful_for_today remain a mystery^17^, having disappeared without a trace. This enigma only adds to Monero's value.

Since community took over development, believing in the project's potential and its ability to be guided in a better direction, Monero was given one of Bitcoin's most important qualities: a leaderless nature. With no single face or entity directing its path, Monero is safe from potential corruption or harm from a "central authority".

The community continued developing Monero until today. Since then, Monero has undergone a lot of technological improvements, migrations and achievements such as RingCT and RandomX. It also has developed its own Community Crowdfundinc System, conferences such as MoneroKon and Monerotopia are taking place every year, and has a very active community around it.

Monero continues to develop with goals of privacy and security first, ease of use and efficiency second. ^16^

This stands as a testament to the power of a dedicated community operating without a central figure of authority. This decentralized approach aligns with the original ethos of cryptocurrency, making Monero a prime example of community-driven innovation. For this, I thank all the people involved in Monero, that lead it to where it is today.

If you find any information that seems incorrect, unclear or any missing important events, please contact me and I will make the necessary changes.

Sources of interest

- https://forum.getmonero.org/20/general-discussion/211/history-of-monero

- https://monero.stackexchange.com/questions/852/what-is-the-origin-of-monero-and-its-relationship-to-bytecoin

- https://en.wikipedia.org/wiki/Monero

- https://bitcointalk.org/index.php?topic=583449.0

- https://bitcointalk.org/index.php?topic=563821.0

- https://bitcointalk.org/index.php?action=profile;u=233561

- https://bitcointalk.org/index.php?topic=512747.0

- https://bitcointalk.org/index.php?topic=740112.0

- https://monero.stackexchange.com/a/1024

- https://inspec2t-project.eu/cryptocurrency-with-a-focus-on-anonymity-these-facts-are-known-about-monero/

- https://medium.com/coin-story/coin-perspective-13-riccardo-spagni-69ef82907bd1

- https://www.getmonero.org/resources/about/

- https://www.wired.com/2017/01/monero-drug-dealers-cryptocurrency-choice-fire/

- https://www.monero.how/why-monero-vs-bitcoin

- https://old.reddit.com/r/Monero/comments/u8e5yr/satoshi_nakamoto_talked_about_privacy_features/

-

@ 59cb0748:9602464b

2025-01-01 06:15:09

@ 59cb0748:9602464b

2025-01-01 06:15:09Nostrでお世話になっている方も、お世話になってない方も、こんにちは!

タコ頭大吉です!

NIP-23を使った初めての投稿です。

今回は、私がここ数ヶ月中にデザインをした三種類のビタキセケースの紹介記事になります!!

ビタキセを買ったもののあまり自分の好みに合う外観や仕様のケースがなく、いくつかプロトタイプを作りそれなりに時間をかけて考えたケース達です。

これら3シリーズに関しては、FDMタイプの3Dプリンタの精度、耐久性、出力後の作業性を考慮して一つのパーツで完結することに拘って設計をしました。

一定以上の充填率でプリントをすればそれなりに丈夫なはずです。

また、基本的に放熱性と保護性を両立できるように設計をしたつもります。

それぞれのモデルについて簡単に紹介をさせていただきますので、よろしければ各リポジトリに付属のREADMEを読んでいただいて自作、フィードバックをいただけましたら幸いです。

それでは、簡単に各モデルの紹介をさせていたきます。

AirLiftFrame

最初に作ったモデルです!

少し大きいのが難点ですが、分厚めのフレームをベースとし基盤周辺をあえて囲わない設計により、保護性と放熱を阻害しない事の両立を狙っています。

最初に作ったモデルです!

少し大きいのが難点ですが、分厚めのフレームをベースとし基盤周辺をあえて囲わない設計により、保護性と放熱を阻害しない事の両立を狙っています。

TwinAirLiftFrame

ビタキセを買い増ししたことにより、複数台をカッコよく運用したいという需要が自分の中に出てきたので、AirLiftFrameを2つくっつけたら良いのではと言うごくごく単純な発想でつくり始めたケースです。

しかし、ただ横並びにしただけでは廃熱が干渉するだけではなく、DCジャックやUSBポートへのアクセスが阻害されるという問題にすぐに気がつきました。

そこで、WebUI上でディスプレイの表示を上下反転出来ることに注目し、2台を上下逆向きに取り付ける事でそれらの問題を解決しました!

ビタキセを買い増ししたことにより、複数台をカッコよく運用したいという需要が自分の中に出てきたので、AirLiftFrameを2つくっつけたら良いのではと言うごくごく単純な発想でつくり始めたケースです。

しかし、ただ横並びにしただけでは廃熱が干渉するだけではなく、DCジャックやUSBポートへのアクセスが阻害されるという問題にすぐに気がつきました。

そこで、WebUI上でディスプレイの表示を上下反転出来ることに注目し、2台を上下逆向きに取り付ける事でそれらの問題を解決しました!

VoronoiShell

AirLiftFrameシリーズのサイズを小型化する事から始めたプロジョクトです。

縦横の寸法の削減だけではなく、厚みを薄くつくリたいという希望がありました。

所が単純に薄くすると、持った時に発熱する背面パーツに手が触れてしまったり、落下などでぶつかった際に背面パーツが破損する懸念がありました。

そこで、(当初は付けたくはなかった)背面保護用のグリルをデザインする必要が出てきました。

初めは多角形でしたがあまりにもダサく、調べている内にVoronoi柄という有機的なパターンに行き付き即採用しました。

結果、ビタキセを取り付けると柄が見えなくなるのが勿体無いぐらい個性的でスタイリッシュなデザインに仕上がりました。

AirLiftFrameシリーズのサイズを小型化する事から始めたプロジョクトです。

縦横の寸法の削減だけではなく、厚みを薄くつくリたいという希望がありました。

所が単純に薄くすると、持った時に発熱する背面パーツに手が触れてしまったり、落下などでぶつかった際に背面パーツが破損する懸念がありました。

そこで、(当初は付けたくはなかった)背面保護用のグリルをデザインする必要が出てきました。

初めは多角形でしたがあまりにもダサく、調べている内にVoronoi柄という有機的なパターンに行き付き即採用しました。

結果、ビタキセを取り付けると柄が見えなくなるのが勿体無いぐらい個性的でスタイリッシュなデザインに仕上がりました。

いずれカスタム方法やインサートナットや増設ファンの選定方法等を紹介したいのですが、今回はNIP-23になれるという意図もあるので紹介に留めます! また、他の関連OSハードウェアプロジェクトのケースもデザインできたらと思っております!

今後ともタコ頭をよろしくお願いいたします。

-

@ ec42c765:328c0600

2024-12-22 19:16:31

@ ec42c765:328c0600

2024-12-22 19:16:31この記事は前回の内容を把握している人向けに書いています(特にNostrエクステンション(NIP-07)導入)

手順

- 登録する画像を用意する

- 画像をweb上にアップロードする

- 絵文字セットに登録する

1. 登録する画像を用意する

以下のような方法で用意してください。

- 画像編集ソフト等を使って自分で作成する

- 絵文字作成サイトを使う(絵文字ジェネレーター、MEGAMOJI など)

- フリー画像を使う(いらすとや など)

データ量削減

Nostrでは画像をそのまま表示するクライアントが多いので、データ量が大きな画像をそのまま使うとモバイル通信時などに負担がかかります。

データ量を増やさないためにサイズやファイル形式を変更することをおすすめします。

以下は私のおすすめです。 * サイズ:正方形 128×128 ピクセル、長方形 任意の横幅×128 ピクセル * ファイル形式:webp形式(webp変換おすすめサイト toimg) * 単色、単純な画像の場合:png形式(webpにするとむしろサイズが大きくなる)

その他

- 背景透過画像

- ダークモード、ライトモード両方で見やすい色

がおすすめです。

2. 画像をweb上にアップロードする

よく分からなければ emojito からのアップロードで問題ないです。

普段使っている画像アップロード先があるならそれでも構いません。

気になる方はアップロード先を適宜選んでください。既に投稿されたカスタム絵文字の画像に対して

- 削除も差し替えもできない → emojito など

- 削除できるが差し替えはできない → Gyazo、nostrcheck.meなど

- 削除も差し替えもできる → GitHub 、セルフホスティングなど

これらは既にNostr上に投稿されたカスタム絵文字の画像を後から変更できるかどうかを指します。

どの方法でも新しく使われるカスタム絵文字を変更することは可能です。

同一のカスタム絵文字セットに同一のショートコードで別の画像を登録する形で対応できます。3. 絵文字セットに登録する

emojito から登録します。

右上のアイコン → + New emoji set から新規の絵文字セットを作成できます。

① 絵文字セット名を入力

基本的にカスタム絵文字はカスタム絵文字セットを作り、ひとまとまりにして登録します。

一度作った絵文字セットに後から絵文字を追加することもできます。

② 画像をアップロードまたは画像URLを入力

emojitoから画像をアップロードする場合、ファイル名に日本語などの2バイト文字が含まれているとアップロードがエラーになるようです。

その場合はファイル名を適当な英数字などに変更してください。

③ 絵文字のショートコードを入力

ショートコードは絵文字を呼び出す時に使用する場合があります。

他のカスタム絵文字と被っても問題ありませんが選択時に複数表示されて支障が出る可能性があります。

他と被りにくく長くなりすぎないショートコードが良いかもしれません。

ショートコードに使えるのは半角の英数字とアンダーバーのみです。

④ 追加

Add を押してもまだ作成完了にはなりません。