-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

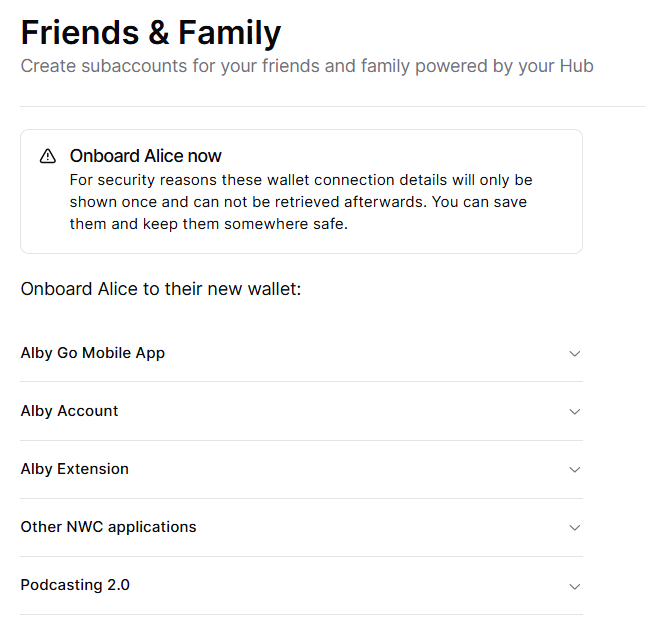

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ a19caaa8:88985eaf

2025-05-05 02:55:57

@ a19caaa8:88985eaf

2025-05-05 02:55:57↓ジャック(twitter創業者)のツイート nostr:nevent1qvzqqqqqqypzpq35r7yzkm4te5460u00jz4djcw0qa90zku7739qn7wj4ralhe4zqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsqg9cdxf7s7kg8kj70a4v5j94urz8kmel03d5a47tr4v6lx9umu3c95072732

↓それに絡むたゃ nostr:note1hr4m0d2k2cvv0yg5xtmpuma0hsxfpgcs2lxe7vlyhz30mfq8hf8qp8xmau

↓たゃのひとりごと nostr:nevent1qqsdt9p9un2lhsa8n27y7gnr640qdjl5n2sg0dh4kmxpqget9qsufngsvfsln nostr:note14p9prp46utd3j6mpqwv46m3r7u7cz6tah2v7tffjgledg5m4uy9qzfc2zf

↓有識者様の助言 nostr:nevent1qvzqqqqqqypzpujqe8p9zrpuv0f4ykk3rmgnqa6p6r0lan0t8ewd0ksj89kqcz5xqqst8w0773wxnkl8sn94tvmd3razcvms0kxjwe00rvgazp9ljjlv0wq0krtvt nostr:nevent1qvzqqqqqqypzpujqe8p9zrpuv0f4ykk3rmgnqa6p6r0lan0t8ewd0ksj89kqcz5xqqsxchzm7s7vn8a82q40yss3a84583chvd9szl9qc3w5ud7pr9ugengcgt9qx

↓たゃ nostr:nevent1qqsp2rxvpax6ks45tuzhzlq94hq6qtm47w69z8p5wepgq9u4txaw88s554jkd

-

@ f11e91c5:59a0b04a

2025-04-30 07:52:21

@ f11e91c5:59a0b04a

2025-04-30 07:52:21!!!2022-07-07に書かれた記事です。

暗号通貨とかでお弁当売ってます 11:30〜14:00ぐらいでやってます

◆住所 木曜日・東京都渋谷区宇田川町41 (アベマタワーの下らへん)

◆お値段

Monacoin 3.9mona

Bitzeny 390zny

Bitcoin 3900sats (#lightningNetwork)

Ethereum 0.0039Ether(#zkSync)

39=thank you. (円を基準にしてません)

最近は週に一回になりました。 他の日はキッチンカーの現場を探したり色々してます。 東京都内で平日ランチ出店出来そうな場所があればぜひご連絡を!

写真はNFCタグです。

スマホにウォレットがあればタッチして3900satsで決済出来ます。

正直こんな怪しい手書きのNFCタグなんて絶対にビットコイナーは触りたくも無いだろうなと思いますが、これでも良いんだぜというメッセージです。

写真はNFCタグです。

スマホにウォレットがあればタッチして3900satsで決済出来ます。

正直こんな怪しい手書きのNFCタグなんて絶対にビットコイナーは触りたくも無いだろうなと思いますが、これでも良いんだぜというメッセージです。今までbtcpayのposでしたが速度を追求してこれに変更しました。 たまに上手くいかないですがそしたら渋々POS出すので温かい目でよろしくお願いします。

ノードを建てたり決済したりで1年経ちました。 最近も少しずつノードを建てる方が増えてるみたいで本当凄いですねUmbrel 大体の人がルーティングに果敢に挑むのを見つつ 奥さんに土下座しながら費用を捻出する弱小の私は決済の利便性を全開で振り切るしか無いので応援よろしくお願いします。

あえて あえて言うのであれば、ルーティングも楽しいですけど やはり本当の意味での即時決済や相手を選んでチャネルを繋げる楽しさもあるよとお伝えしたいっ!! 決済を受け入れないと分からない所ですが 承認がいらない時点で画期的です。

QRでもタッチでも金額指定でも入力でも もうやりようには出来てしまうし進化が恐ろしく早いので1番利用の多いpaypayの手数料(事業者側のね)を考えたらビットコイン凄いじゃない!と叫びたくなる。 が、やはり税制面や価格の変動(うちはBTC固定だけども)ウォレットの操作や普及率を考えるとまぁ難しい所もあるんですかね。

それでも継続的に沢山の人が色んな活動をしてるので私も何か出来ることがあれば 今後も奥さんに土下座しながら頑張って行きたいと思います。

(Originally posted 2022-07-07)

I sell bento lunches for cryptocurrency. We’re open roughly 11:30 a.m. – 2:00 p.m. Address Thursdays – 41 Udagawa-chō, Shibuya-ku, Tokyo (around the base of Abema Tower)

Prices Coin Price Note Monacoin 3.9 MONA

Bitzeny 390 ZNY Bitcoin 3,900 sats (Lightning Network)

Ethereum 0.0039 ETH (zkSync) “39” sounds like “thank you” in Japanese. Prices aren’t pegged to yen.These days I’m open only once a week. On other days I’m out scouting new spots for the kitchen-car. If you know weekday-lunch locations inside Tokyo where I could set up, please let me know!

The photo shows an NFC tag. If your phone has a Lightning wallet, just tap and pay 3,900 sats. I admit this hand-written NFC tag looks shady—any self-respecting Bitcoiner probably wouldn’t want to tap it—but the point is: even this works!

I used to run a BTCPay POS, but I switched to this setup for speed. Sometimes the tap payment fails; if that happens I reluctantly pull out the old POS. Thanks for your patience.

It’s been one year since I spun up a node and started accepting Lightning payments. So many people are now running their own nodes—Umbrel really is amazing. While the big players bravely chase routing fees, I’m a tiny operator scraping together funds while begging my wife for forgiveness, so I’m all-in on maximising payment convenience. Your support means a lot!

If I may add: routing is fun, but instant, trust-minimised payments and the thrill of choosing whom to open channels with are just as exciting. You’ll only understand once you start accepting payments yourself—zero-confirmation settlement really is revolutionary.

QR codes, NFC taps, fixed amounts, manual entry… the possibilities keep multiplying, and the pace of innovation is scary fast. When I compare it to the merchant fees on Japan’s most-used service, PayPay, I want to shout: “Bitcoin is incredible!” Sure, taxes, price volatility (my shop is BTC-denominated, though), wallet UX, and adoption hurdles are still pain points.

Even so, lots of people keep building cool stuff, so I’ll keep doing what I can—still on my knees to my wife, but moving forward!

-

@ 9223d2fa:b57e3de7

2025-04-15 02:54:00

@ 9223d2fa:b57e3de7

2025-04-15 02:54:0012,600 steps

-

@ b2d670de:907f9d4a

2025-02-28 16:39:38

@ b2d670de:907f9d4a

2025-02-28 16:39:38onion-service-nostr-relays

A list of nostr relays exposed as onion services.

The list

| Relay name | Description | Onion url | Operator | Payment URL | Payment options | | --- | --- | --- | --- | --- | --- | | nostr.oxtr.dev | Same relay as clearnet relay nostr.oxtr.dev | ws://oxtrdevav64z64yb7x6rjg4ntzqjhedm5b5zjqulugknhzr46ny2qbad.onion | operator | N/A | N/A | | relay.snort.social | Same relay as clearnet relay relay.snort.social | wss://skzzn6cimfdv5e2phjc4yr5v7ikbxtn5f7dkwn5c7v47tduzlbosqmqd.onion | operator | N/A | N/A | | nostr.thesamecat.io | Same relay as clearnet relay nostr.thesamecat.io | ws://2jsnlhfnelig5acq6iacydmzdbdmg7xwunm4xl6qwbvzacw4lwrjmlyd.onion | operator | N/A | N/A | | nostr.land | The nostr.land paid relay (same as clearnet) | ws://nostrland2gdw7g3y77ctftovvil76vquipymo7tsctlxpiwknevzfid.onion | operator | Payment URL | BTC LN | | bitcoiner.social | No auth required, currently | ws://bitcoinr6de5lkvx4tpwdmzrdfdpla5sya2afwpcabjup2xpi5dulbad.onion | operator | N/A | N/A | | relay.westernbtc.com | The westernbtc.com paid relay | ws://westbtcebhgi4ilxxziefho6bqu5lqwa5ncfjefnfebbhx2cwqx5knyd.onion | operator | Payment URL | BTC LN | | freelay.sovbit.host | Free relay for sovbit.host | ws://sovbitm2enxfr5ot6qscwy5ermdffbqscy66wirkbsigvcshumyzbbqd.onion | operator | N/A | N/A | | nostr.sovbit.host | Paid relay for sovbit.host | ws://sovbitgz5uqyh7jwcsudq4sspxlj4kbnurvd3xarkkx2use3k6rlibqd.onion | operator | N/A | N/A | | nostr.wine | 🍷 nostr.wine relay | ws://nostrwinemdptvqukjttinajfeedhf46hfd5bz2aj2q5uwp7zros3nad.onion | operator | Payment URL | BTC LN, BTC, Credit Card/CashApp (Stripe) | | inbox.nostr.wine | 🍷 inbox.nostr.wine relay | ws://wineinboxkayswlofkugkjwhoyi744qvlzdxlmdvwe7cei2xxy4gc6ad.onion | operator | Payment URL | BTC LN, BTC | | filter.nostr.wine | 🍷 filter.nostr.wine proxy relay | ws://winefiltermhqixxzmnzxhrmaufpnfq3rmjcl6ei45iy4aidrngpsyid.onion | operator | Payment URL | BTC LN, BTC | | N/A | N/A | ws://pzfw4uteha62iwkzm3lycabk4pbtcr67cg5ymp5i3xwrpt3t24m6tzad.onion:81 | operator | N/A | N/A | | nostr.fractalized.net | Free relay for fractalized.net | ws://xvgox2zzo7cfxcjrd2llrkthvjs5t7efoalu34s6lmkqhvzvrms6ipyd.onion | operator | N/A | N/A | | nfrelay.app | nfrelay.app aggregator relay (nostr-filter-relay) | ws://nfrelay6saohkmipikquvrn6d64dzxivhmcdcj4d5i7wxis47xwsriyd.onion | operator | N/A | N/A | relay.nostr.net | Public relay from nostr.net (Same as clearnet) | ws://nostrnetl6yd5whkldj3vqsxyyaq3tkuspy23a3qgx7cdepb4564qgqd.onion | operator | N/A | N/A | | nerostrator | Free to read, pay XMR to relay | ws://nerostrrgb5fhj6dnzhjbgmnkpy2berdlczh6tuh2jsqrjok3j4zoxid.onion | operator |Payment URL | XMR | | nostr.girino.org | Public relay from nostr.girino.org | ws://gnostr2jnapk72mnagq3cuykfon73temzp77hcbncn4silgt77boruid.onion | operator | N/A | N/A | | wot.girino.org | WoT relay from wot.girino.org | ws://girwot2koy3kvj6fk7oseoqazp5vwbeawocb3m27jcqtah65f2fkl3yd.onion | operator | N/A | N/A | | haven.girino.org/{outbox, inbox, chat, private} | Haven smart relay from haven.girino.org | ws://ghaven2hi3qn2riitw7ymaztdpztrvmm337e2pgkacfh3rnscaoxjoad.onion/{outbox, inbox, chat, private} | operator | N/A | N/A | | relay.nostpy.lol | Free Web of Trust relay (Same as clearnet) | ws://pemgkkqjqjde7y2emc2hpxocexugbixp42o4zymznil6zfegx5nfp4id.onion | operator |N/A | N/A | | Poster.place Nostr Relay | N/A | ws://dmw5wbawyovz7fcahvguwkw4sknsqsalffwctioeoqkvvy7ygjbcuoad.onion | operator | N/A | N/A | | Azzamo Relay | Azzamo Premium Nostr relay. (paid) | ws://q6a7m5qkyonzb5fk5yv4jyu3ar44hqedn7wjopg737lit2ckkhx2nyid.onion | operator | Payment URL | BTC LN | | Azzamo Inbox Relay | Azzamo Group and Private message relay. (Freemium) | ws://gp5kiwqfw7t2fwb3rfts2aekoph4x7pj5pv65re2y6hzaujsxewanbqd.onion | operator | Payment URL | BTC LN | | Noderunners Relay | The official Noderunners Nostr Relay. | ws://35vr3xigzjv2xyzfyif6o2gksmkioppy4rmwag7d4bqmwuccs2u4jaid.onion | operator | Payment URL | BTC LN |

Contributing

Contributions are encouraged to keep this document alive. Just open a PR and I'll have it tested and merged. The onion URL is the only mandatory column, the rest is just nice-to-have metadata about the relay. Put

N/Ain empty columns.If you want to contribute anonymously, please contact me on SimpleX or send a DM on nostr using a disposable npub.

Operator column

It is generally preferred to use something that includes a NIP-19 string, either just the string or a url that contains the NIP-19 string in it (e.g. an njump url).

-

@ ec42c765:328c0600

2025-02-05 23:45:09

@ ec42c765:328c0600

2025-02-05 23:45:09test

test

-

@ 460c25e6:ef85065c

2025-02-25 15:20:39

@ 460c25e6:ef85065c

2025-02-25 15:20:39If you don't know where your posts are, you might as well just stay in the centralized Twitter. You either take control of your relay lists, or they will control you. Amethyst offers several lists of relays for our users. We are going to go one by one to help clarify what they are and which options are best for each one.

Public Home/Outbox Relays

Home relays store all YOUR content: all your posts, likes, replies, lists, etc. It's your home. Amethyst will send your posts here first. Your followers will use these relays to get new posts from you. So, if you don't have anything there, they will not receive your updates.

Home relays must allow queries from anyone, ideally without the need to authenticate. They can limit writes to paid users without affecting anyone's experience.

This list should have a maximum of 3 relays. More than that will only make your followers waste their mobile data getting your posts. Keep it simple. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of all your content in a place no one can delete. Go to relay.tools and never be censored again. - 1 really fast relay located in your country: paid options like http://nostr.wine are great

Do not include relays that block users from seeing posts in this list. If you do, no one will see your posts.

Public Inbox Relays

This relay type receives all replies, comments, likes, and zaps to your posts. If you are not getting notifications or you don't see replies from your friends, it is likely because you don't have the right setup here. If you are getting too much spam in your replies, it's probably because your inbox relays are not protecting you enough. Paid relays can filter inbox spam out.

Inbox relays must allow anyone to write into them. It's the opposite of the outbox relay. They can limit who can download the posts to their paid subscribers without affecting anyone's experience.

This list should have a maximum of 3 relays as well. Again, keep it small. More than that will just make you spend more of your data plan downloading the same notifications from all these different servers. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of your notifications, invites, cashu tokens and zaps. - 1 really fast relay located in your country: go to nostr.watch and find relays in your country

Terrible options include: - nostr.wine should not be here. - filter.nostr.wine should not be here. - inbox.nostr.wine should not be here.

DM Inbox Relays

These are the relays used to receive DMs and private content. Others will use these relays to send DMs to you. If you don't have it setup, you will miss DMs. DM Inbox relays should accept any message from anyone, but only allow you to download them.

Generally speaking, you only need 3 for reliability. One of them should be a personal relay to make sure you have a copy of all your messages. The others can be open if you want push notifications or closed if you want full privacy.

Good options are: - inbox.nostr.wine and auth.nostr1.com: anyone can send messages and only you can download. Not even our push notification server has access to them to notify you. - a personal relay to make sure no one can censor you. Advanced settings on personal relays can also store your DMs privately. Talk to your relay operator for more details. - a public relay if you want DM notifications from our servers.

Make sure to add at least one public relay if you want to see DM notifications.

Private Home Relays

Private Relays are for things no one should see, like your drafts, lists, app settings, bookmarks etc. Ideally, these relays are either local or require authentication before posting AND downloading each user\'s content. There are no dedicated relays for this category yet, so I would use a local relay like Citrine on Android and a personal relay on relay.tools.

Keep in mind that if you choose a local relay only, a client on the desktop might not be able to see the drafts from clients on mobile and vice versa.

Search relays:

This is the list of relays to use on Amethyst's search and user tagging with @. Tagging and searching will not work if there is nothing here.. This option requires NIP-50 compliance from each relay. Hit the Default button to use all available options on existence today: - nostr.wine - relay.nostr.band - relay.noswhere.com

Local Relays:

This is your local storage. Everything will load faster if it comes from this relay. You should install Citrine on Android and write ws://localhost:4869 in this option.

General Relays:

This section contains the default relays used to download content from your follows. Notice how you can activate and deactivate the Home, Messages (old-style DMs), Chat (public chats), and Global options in each.

Keep 5-6 large relays on this list and activate them for as many categories (Home, Messages (old-style DMs), Chat, and Global) as possible.

Amethyst will provide additional recommendations to this list from your follows with information on which of your follows might need the additional relay in your list. Add them if you feel like you are missing their posts or if it is just taking too long to load them.

My setup

Here's what I use: 1. Go to relay.tools and create a relay for yourself. 2. Go to nostr.wine and pay for their subscription. 3. Go to inbox.nostr.wine and pay for their subscription. 4. Go to nostr.watch and find a good relay in your country. 5. Download Citrine to your phone.

Then, on your relay lists, put:

Public Home/Outbox Relays: - nostr.wine - nos.lol or an in-country relay. -

.nostr1.com Public Inbox Relays - nos.lol or an in-country relay -

.nostr1.com DM Inbox Relays - inbox.nostr.wine -

.nostr1.com Private Home Relays - ws://localhost:4869 (Citrine) -

.nostr1.com (if you want) Search Relays - nostr.wine - relay.nostr.band - relay.noswhere.com

Local Relays - ws://localhost:4869 (Citrine)

General Relays - nos.lol - relay.damus.io - relay.primal.net - nostr.mom

And a few of the recommended relays from Amethyst.

Final Considerations

Remember, relays can see what your Nostr client is requesting and downloading at all times. They can track what you see and see what you like. They can sell that information to the highest bidder, they can delete your content or content that a sponsor asked them to delete (like a negative review for instance) and they can censor you in any way they see fit. Before using any random free relay out there, make sure you trust its operator and you know its terms of service and privacy policies.

-

@ 1739d937:3e3136ef

2025-04-30 14:39:24

@ 1739d937:3e3136ef

2025-04-30 14:39:24MLS over Nostr - 30th April 2025

YO! Exciting stuff in this update so no intro, let's get straight into it.

🚢 Libraries Released

I've created 4 new Rust crates to make implementing NIP-EE (MLS) messaging easy for other projects. These are now part of the rust-nostr project (thanks nostr:npub1drvpzev3syqt0kjrls50050uzf25gehpz9vgdw08hvex7e0vgfeq0eseet) but aren't quite released to crates.io yet. They will be included in the next release of that library. My hope is that these libraries will give nostr developers a simple, safe, and specification-compliant way to work with MLS messaging in their applications.

Here's a quick overview of each:

nostr_mls_storage

One of the challenges of using MLS messaging is that clients have to store quite a lot of state about groups, keys, and messages. Initially, I implemented all of this in White Noise but knew that eventually this would need to be done in a more generalized way.

This crate defines traits and types that are used by the storage implementation crates and sets those up to wrap the OpenMLS storage layer. Now, instead of apps having to implement storage for both OpenMLS and Nostr, you simply pick your storage backend and go from there.

Importantly, because these are generic traits, it allows for the creation of any number of storage implementations for different backend storage providers; postgres, lmdb, nostrdb, etc. To start I've created two implementations; detailed below.

nostr_mls_memory_storage

This is a simple implementation of the nostr_mls_storage traits that uses an in-memory store (that doesn't persist anything to disc). This is principally for testing.

nostr_mls_sqlite_storage

This is a production ready implementation of the nostr_mls_storage traits that uses a persistent local sqlite database to store all data.

nostr_mls

This is the main library that app developers will interact with. Once you've chose a backend and instantiated an instance of NostrMls you can then interact with a simple set of methods to create key packages, create groups, send messages, process welcomes and messages, and more.

If you want to see a complete example of what the interface looks like check out mls_memory.rs.

I'll continue to add to this library over time as I implement more of the MLS protocol features.

🚧 White Noise Refactor

As a result of these new libraries, I was able to remove a huge amount of code from White Noise and refactor large parts of the app to make the codebase easier to understand and maintain. Because of this large refactor and the changes in the underlying storage layer, if you've installed White Noise before you'll need to delete it from your device before you trying to install again.

🖼️ Encrypted Media with Blossom

Let's be honest: Group chat would be basically useless if you couldn't share memes and gifs. Well, now you can in White Noise. Media in groups is encrypted using an MLS secret and uploaded to Blossom with a one-time use keypair. This gives groups a way to have rich conversations with images and documents and anything else while also maintaining the privacy and security of the conversation.

This is still in a rough state but rendering improvements are coming next.

📱 Damn Mobile

The app is still in a semi-broken state on Android and fully broken state on iOS. Now that I have the libraries released and the White Noise core code refactored, I'm focused 100% on fixing these issues. My goal is to have a beta version live on Zapstore in a few weeks.

🧑💻 Join Us

I'm looking for mobile developers on both Android and iOS to join the team and help us build the best possible apps for these platforms. I have grant funding available for the right people. Come and help us build secure, permissionless, censorship-resistant messaging. I can think of few projects that deserve your attention more than securing freedom of speech and freedom of association for the entire world. If you're interested or know someone who might be, please reach out to me directly.

🙏 Thanks to the People

Last but not least: A HUGE thank you to all the folks that have been helping make this project happen. You can check out the people that are directly working on the apps on Following._ (and follow them). There are also a lot of people behind the scenes that have helped in myriad ways to get us this far. Thank you thank you thank you.

🔗 Links

Libraries

White Noise

Other

-

@ 4d41a7cb:7d3633cc

2025-04-08 01:17:39

@ 4d41a7cb:7d3633cc

2025-04-08 01:17:39Satoshi Nakamoto, the pseudonymous creator of Bitcoin, registered his birthday as April 5, 1975, on his P2P Foundation profile. Many think that he chose this date because on that same day in 1933, the United States government confiscated the gold of the American people. Whether this was on purpose or not, what happened in this day is very important to understand how do we ended up here.

In 1933, as expressed in Roosevelt’s Executive Orders 6073, 6102, and 6260, the United States first declared bankruptcy. The bankrupt U.S. went into receivership in 1933. America was turned over via receivership and reorganization in favor of its creditors. These creditors, the International Bankers, from the beginning stated their intent, which was to plunder, bankrupt, conquer and enslave America and return it to its colonial status.1

As one of his first acts as President, Franklin Delano Roosevelt declared a “Banking Emergency” to bail out the Federal Reserve Bank, which had embezzled this country’s gold supply. The Congress gave the President dictatorial powers under the “War Powers Act of 1917” (amended 1933), written, by the way, by the Board of Governors of the Federal Reserve Bank of New York.2

This day marked the official abandonment of the American Constitution, law and real money. Today, 92 years after this event, most of the people living today have never had any real money or paid for anything using real money; unless they used Bitcoin...

There could be no bankruptcy if there was not a private central bank lending paper currency to the government at interest, so we must start from 1913, when the Federal Reserve was created: a non-federal private bank with no reserves and the monopoly of issuing debt based paper currency in unlimited amounts and lending it to the government at interest by buying treasury bills. The fact that this currency is lent into existence at interest makes the debt mathematically impossible to be repaid; it can only be refinanced or defaulted.

Between 1929 and 1933, the Federal Reserve Bank reduced the currency supply by 33%, thereby creating the Great Depression, bankrupting the US government, stealing the Americans’ gold supply, and officially ending the gold standard. Since then the US dollar (money) was replaced with Federal Reserve Notes (debt). This was also the end of the Republican form of government and the beginning of a socialist mob rule democracy (Fascism).

“Fascism should more properly be called corporatism because it is the merger of state and corporate power.” — Benito Mussolini

The United States government has been bankrupt since 1933, since it defaulted on its gold bonds. This type of bond existed until 1933, when the U.S. monetary system abandoned the gold standard. 3 From this year the government has been totally controlled by the International bankers and used as a tool to spread and maintain their power worldwide.

Many people think that the gold standard was abandoned in 1971, but this is not true; in fact, this happened in 1933 when the US dollar was replaced by Federal Reserve Notes that are 100% debt-based fiat paper currency.

The year 1933 in the United States marked:

- The end of the Republican form of government and the beginning of American Fascism

- The end of the United States dollar and its replacement by Federal Reserve Notes

- The abandonment of common law and replacement with military admiralty law

- The takeover of the United States government by International bankers

- A massive gold theft and the end of the US gold standard

- The exchange of rights with privileges and licenses

- The United States government bankruptcy

The next shameful event in our history which still plagues us to this day was the “War Powers Act of 1933.” This Act permitted President Roosevelt to make law in the form of Executive Order, bypass Congress and create his socialist state. We (citizens of this country) were ever after to be considered enemies of the United States who must be licensed to engage in any commercial activity. With the aid of the Federal Reserve (the same people who created the Depression), the President confiscated our gold and silver coin and replaced it with worthless pieces of paper and a debt system that will eventually destroy this great country. Our land and our labor were pledged to the Federal Reserve Bank, Inc., as collateral for a debt system that could never be paid.4

“Emergency Powers” means any form of military style government, martial law, or martial rule. Martial law and martial rule are not the same.

United States Congressional Record March 17, 1993 Vol. #33, page H- 1303, Congressman James Traficant, Jr. (Ohio) addressing the House:

“Mr. Speaker, we are here now in chapter 11. Members of Congress are official trustees presiding over the greatest reorganization of any Bankrupt entity in world history, the U.S. Government. We are setting forth, hopefully, a blueprint for our future”

“There are some who say it is a coroner’s report that will lead to our demise. It is an established fact that the United States Federal Government has been dissolved by the Emergency Banking Act, March 9, 1933, 48 Stat. 1, Public Law 89-719; dered by President Roosevelt, being bankrupt and insolvent. H.J.R. 192, 73rd Congress in session June 5, 1933 – Joint Resolution To Suspend The Gold Standard and Abrogate the Gold Clause dissolved the Sovereign Authority of the United States and the official capacities of all United States Governmental Offices, Officers, and Departments and is further evidence that the United States Federal Government exists today in name only” **“The receivers of the United States Bankruptcy are the International Bankers, via the United Nations, the World Bank and the International Monetary Fund”

“All United States Offices, Officials, and Departments are now operating within a de facto status in name only under Emergency War Powers. With the Constitutional Republican form of Government now dissolved, the receivers of the Bankruptcy have adopted a new form of government for the United States. This new form of government is known as a Democracy, being an established Socialist/Communist order under a new governor for America. This act was instituted and established by transferring and/or placing the Office of the Secretary of Treasury to that of the Governor of the International Monetary Fund. Public Law 94-564, page 8, Section H.R. 13955 read in part:”

“The U.S. Secretary of Treasury receives no compensation for representing the United States.”

The American Spirit

The intention of the founding fathers of the United States was to create a constitutional republic to protect natural human rights and escape from the tyrannical English monarchy and its usurious Bank of England's monetary system. They created an honest monetary system based on gold and silver (United State Dollar) and got rid of nobility titles, creating equality under the law.

Section 10 of the American Constitution says:

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make anything but gold and silver Coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts; or grant any title of nobility.

The United States Dollar (1792-1933)

A dollar is a measure of weight defined by the Coinage Act of 1792 and 1900, which specifies a certain quantity—24.8 grains of gold or 371.25 grains of silver (from 1792 to 1900) when the American dollar was based on a bimetallic standard.

The Gold Standard Act of 1900 formally placed the United States on the gold standard, setting the value of one dollar at 25.8 grams of 90% pure gold, which fixed the price of gold at $20.67 per troy ounce. This standard was totally abandoned in 1933.

Gold and silver were such powerful money during the founding of the United States of America that the founding fathers declared that only gold or silver coins could be “money” in America.

But since the greedy bankers cannot profit from honest money they cannot print, they replaced the money with paper debt instruments. And by doing this, they have effectively enslaved the American people until today. My definition of modern slavery is working for a currency that someone else can create at no cost or effort. What's worse is that they even demand to be paid back and with interest!

Federal Reserve Notes (1913-present)

Federal Reserve Notes are not real money. Money that has metallic or other intrinsic value, as distinguished from paper currency, checks, and drafts.

Federal Reserve Notes (FRNs) are a legal fiction. An assumption that something is true even though it may be untrue. 5 The assumption that they are money, when in fact they are the opposite of money: debt or paper currency.

Paper money. Paper documents that circulate as currency; bills drawn by a government against its own credit. 6 Like Goldsmiths' notes. Hist. Bankers' cash notes: promissory notes given by bankers to customers as acknowledgments of the receipt of money. • This term derives from the London banking business, which originally was transacted by goldsmiths.7

These notes were scientifically designed to bankrupt the government and slave the American people, as Alfred Owen Crozier warned one year before the bill for the creation of the FED was passed through Congress (1912):

If Congress yields and authorizes a private central bank as proposed by the pending bill, the end when the bubble bursts will be universal ruin and national bankruptcy.

Unfortunately, the bill was passed in 1913, and this private bank started printing a new currency different from the US dollar creating the great depression and effectible bankrupting the government like Alfred warned 20 years before.

Alfred also warned:

Thus the way is opened for an unlimited inflation of corporate paper currency issued by a mere private corporation with relatively small net assets and no government guarantee, every dollar supposed to be redeemable in gold, but with not a single dollar of gold necessarily held in the reserves of such corporation to accomplish such redemption.

Differently from what's commonly believed Federal Reserve Notes (FRNs) were never really “backed” by gold; they were never supposed to be hard currency. Currency backed by reserves, esp. gold and silver reserves.

The United States government defaulted on its gold clauses, calling for payment in gold. This marked the end of the gold standard. A monetary system in which currency is convertible into its legal equivalent in gold or gold coin.

Since then we have been under a paper standard, where we use fake money as tender for payments. Paper standard. A monetary system based entirely on paper; a system of currency that is not convertible into gold or other precious metal.

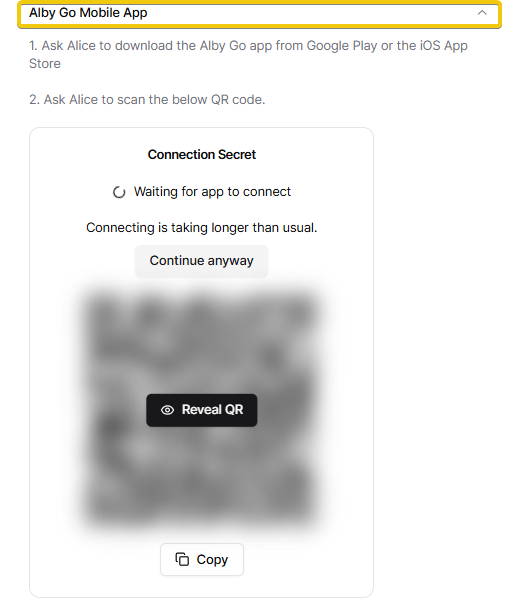

People traded their coupons as money or “currency.” Currency is not money but a money substitute. Redeemable currency must promise to pay a dollar equivalent in gold or silver money. Federal Reserve Notes (FRNs) make no such promises and are not “money.” A Federal Reserve Note is a debt obligation of the federal United States government, not “money.” The federal United States government and the U.S. Congress were not and have never been authorized by the Constitution of the United States of America to issue currency of any kind, but only lawful money—gold and silver coin.8

A bona fide note can be used in a financial transaction to discharge the debt only because it is an unconditional promise to pay by the issuer to the bearer. Is a Federal Reserve Note a contract note, an unconditional promise to pay? At one time the Federal Reserve issued bona fide contractual notes and certificates, redeemable in gold and silver coin. Most people never saw or comprehended the contract. It went largely unread because the Federal Reserve very cunningly hid the contract on the face of the note by breaking it up into five separate lines of text with a significantly different typeface for each line and placing the president’s picture right in the middle of it. They even used the old attorney’s ruse of obscuring the most important text in fine print! Over time, the terms and conditions of the contract were diluted until eventually they literally became an I.O.U. for nothing.

FEDERAL RESERVE NOTE

-

THIS NOTE IS LEGAL TENDER FOR ALL DEBT, PUBLIC AND PRIVATE, AND IT IS REDEEMABLE IN LAWFUL MONEY AT THE UNITED STATES TREASURY OR ANY FEDERAL RESERVE BANK.

-

DATE: SERIES OF 1934

-

WILL PAY TO THE BEARER ON DEMAND: ONE HUNDRED DOLLARS

-

TREASURER OF THE UNITED STATES SIGNATURE

-

SECRETARY OF THE TREASURY SIGNATURE

Nowadays FRNs say "This note is legal tender for all debts public and private" it tender debt but it does not pay the bearer on demand. It value was stolen by a counterfeiting technique commonly know as inflation.

One hundred dollars (SERIES OF 1934) will be 2480 grains of gold, or 159.4 grams, or 5.1249 troy ounces. Today one troy ounce is priced around $3,000 federal reserve notes. 5.1249 X 3,000 = $15,375 actual FRNs.

A $100 FRN bill today will buy 0.65% of a real gold $100 dollar certificate. That’s a -99.35% loss of purchasing power in the last 91 years.

FRNs savers have been rugged pulled!

Gold bugs where the winners...

But Bitcoin is even better...

Happy birthday Satoshi! April 5 will be forever remembered.

Satoshi... The man, the myth, the Legend...

-

@ ec42c765:328c0600

2025-02-05 23:43:35

@ ec42c765:328c0600

2025-02-05 23:43:35test

-

@ 4fe4a528:3ff6bf06

2025-02-01 13:41:28

@ 4fe4a528:3ff6bf06

2025-02-01 13:41:28

In my last article I wrote about NOSTR. I found another local bitcoiner via NOSTR last week so here is why it is important to join / use NOSTR — start telling people “Look me up on NOSTR”

Self-sovereign identity (SSI) is a revolutionary approach to digital identity that puts individuals in control of their own identity and personal data. Unlike traditional digital identity models, which rely on third-party organizations to manage and authenticate identities, SSI empowers individuals to own and manage their digital identity.

This approach is made possible by emerging technologies such as secure public / private key pairs. Decentralized identifiers, conceived and developed by nostr:npub180cvv07tjdrrgpa0j7j7tmnyl2yr6yr7l8j4s3evf6u64th6gkwsyjh6w6 is an attempt to create a global technical standard around cryptographically secured identifiers - a secure, universal, and sovereign form of digital ID. This technology uses peer-to-peer technology to remove the need for intermediaries to own and authenticate ID information.

Notably, NOSTR, a decentralized protocol, has already begun to utilize decentralized IDs, demonstrating the potential of this technology in real-world applications. Via NOSTR, users can be sure that the person or computer publishing to a particular npub knows their nsec (password for your npub), highlighting the secure and decentralized nature of this approach.

With SSI, individuals can decide how their personal data is used, shared, and protected, giving them greater control and agency over their digital lives.

The benefits of SSI are numerous, including:

Enhanced security and protection of personal data. Reduced risk of identity theft and fraud Increased autonomy and agency over one's digital identity. Improved scalability and flexibility in digital identity management

challenges:

Ensuring the security and integrity of decentralized identity systems. Developing standards and protocols for interoperability and compatibility. Addressing concerns around ownership and control of personal data. Balancing individual autonomy with the need for verification and authentication in various contexts.

Overall, self-sovereign identity has the potential to transform the way we think about digital identity and provide individuals with greater control and agency over their personal data. Without people in control of their bitcoin seed words no freedom loving people would be able to exchange their money with others. Yes, keep enjoying using the only free market on the planet BITCOIN. Long live FREEDOM!

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 6389be64:ef439d32

2025-05-24 21:51:47

@ 6389be64:ef439d32

2025-05-24 21:51:47Most nematodes are beneficial and "graze" on black vine weevil, currant borer moth, fungus gnats, other weevils, scarabs, cutworms, webworms, billbugs, mole crickets, termites, peach tree borer and carpenter worm moths.

They also predate bacteria, recycling nutrients back into the soil and by doing so stimulates bacterial activity. They act as microbial taxis by transporting microbes to new locations of soil as they move through it while providing aeration.

https://stacker.news/items/988573

-

@ ec9bd746:df11a9d0

2025-04-06 08:06:08

@ ec9bd746:df11a9d0

2025-04-06 08:06:08🌍 Time Window:

🕘 When: Every even week on Sunday at 9:00 PM CET

🗺️ Where: https://cornychat.com/eurocornStart: 21:00 CET (Prague, UTC+1)

End: approx. 02:00 CET (Prague, UTC+1, next day)

Duration: usually 5+ hours.| Region | Local Time Window | Convenience Level | |-----------------------------------------------------|--------------------------------------------|---------------------------------------------------------| | Europe (CET, Prague) 🇨🇿🇩🇪 | 21:00–02:00 CET | ✅ Very Good; evening & night | | East Coast North America (EST) 🇺🇸🇨🇦 | 15:00–20:00 EST | ✅ Very Good; afternoon & early evening | | West Coast North America (PST) 🇺🇸🇨🇦 | 12:00–17:00 PST | ✅ Very Good; midday & afternoon | | Central America (CST) 🇲🇽🇨🇷🇬🇹 | 14:00–19:00 CST | ✅ Very Good; afternoon & evening | | South America West (Peru/Colombia PET/COT) 🇵🇪🇨🇴 | 15:00–20:00 PET/COT | ✅ Very Good; afternoon & evening | | South America East (Brazil/Argentina/Chile, BRT/ART/CLST) 🇧🇷🇦🇷🇨🇱 | 17:00–22:00 BRT/ART/CLST | ✅ Very Good; early evening | | United Kingdom/Ireland (GMT) 🇬🇧🇮🇪 | 20:00–01:00 GMT | ✅ Very Good; evening hours (midnight convenient) | | Eastern Europe (EET) 🇷🇴🇬🇷🇺🇦 | 22:00–03:00 EET | ✅ Good; late evening & early night (slightly late) | | Africa (South Africa, SAST) 🇿🇦 | 22:00–03:00 SAST | ✅ Good; late evening & overnight (late-night common) | | New Zealand (NZDT) 🇳🇿 | 09:00–14:00 NZDT (next day) | ✅ Good; weekday morning & afternoon | | Australia (AEDT, Sydney) 🇦🇺 | 07:00–12:00 AEDT (next day) | ✅ Good; weekday morning to noon | | East Africa (Kenya, EAT) 🇰🇪 | 23:00–04:00 EAT | ⚠️ Slightly late (night hours; late night common) | | Russia (Moscow, MSK) 🇷🇺 | 23:00–04:00 MSK | ⚠️ Slightly late (join at start is fine, very late night) | | Middle East (UAE, GST) 🇦🇪🇴🇲 | 00:00–05:00 GST (next day) | ⚠️ Late night start (midnight & early morning, but shorter attendance plausible)| | Japan/Korea (JST/KST) 🇯🇵🇰🇷 | 05:00–10:00 JST/KST (next day) | ⚠️ Early; convenient joining from ~07:00 onwards possible | | China (Beijing, CST) 🇨🇳 | 04:00–09:00 CST (next day) | ❌ Challenging; very early morning start (better ~07:00 onwards) | | India (IST) 🇮🇳 | 01:30–06:30 IST (next day) | ❌ Very challenging; overnight timing typically difficult|

-

@ 47259076:570c98c4

2025-05-25 01:33:57

@ 47259076:570c98c4

2025-05-25 01:33:57When a man meets a woman, they produce another human being.

The biological purpose of life is to reproduce, that's why we have reproductive organs.

However, you can't reproduce if you are dying of starvation or something else.

So you must look for food, shelter and other basic needs.

Once those needs are satisfied, the situation as a whole is more stable and then it is easier to reproduce.

Once another human being is created, you still must support him.

In the animal kingdom, human babies are the ones who take longer to walk and be independent as a whole.

Therefore, in the first years of our lives, we are very dependent on our parents or whoever is taking care of us.

We also have a biological drive for living.

That's why when someone is drowning he will hold on into whatever they can grab with the highest strength possible.

Or when our hand is close to fire or something hot, we remove our hand immediately from the hot thing, without thinking about removing our hand, we just do it.

These are just 2 examples, there are many other examples that show this biological tendency/reflex to keep ourselves alive.

We also have our brain, which we can use to get information/knowledge/ideas/advice from the ether.

In this sense, our brain is just an antenna or radio, and the ether is the signal.

Of course, we are not the radio, we are the signal.

In other words, you are not your body, you are pure consciousness "locked" temporarily in a body.

Because we can act after receiving information from the ether, we can construct and invent new things to make our lives easier.

So far, using only biology as our rule, we can get to the following conclusion: The purpose of life is to live in a safe place, work to get food and reproduce.

Because humans have been evolving in the technological sense, we don't need to hunt for food, we can just go to the market and buy meat.

And for the shelter(house), we just buy it.

Even though you can buy a house, it's still not yours, since the government or any thug can take it from you, but this is a topic for another article.

So, adjusting what I said before in a modern sense, the purpose of life is: Work in a normal job from Monday to Friday, save money, buy a house, buy a car, get a wife and have kids. Keep working until you are old enough, then retire and do nothing for the rest of your life, just waiting for the moment you die.

Happy life, happy ending, right?

No.

There is something else to it, there is another side of the coin.

This is explored briefly by Steve Jobs in this video, but I pretend to go much further than him: https://youtu.be/uf6TzOHO_dk

Let's get to the point now.

First of all, you are alive. This is not normal.

Don't take life for granted.

There is no such a thing as a coincidence. Chance is but a name given for a law that has not been recognized yet.

You are here for a reason.

God is real. All creation starts in the mind.

The mind is the source of all creation.

When the mind of god starts thinking, it records its thoughts into matter through light.

But this is too abstract, let's get to something simple.

Governments exist, correct?

The force behind thinking is desire, without desire there is no creation.

If desired ceased to exist, everything would just vanish in the blink of an eye.

How governments are supported financially?

By taking your money.

Which means, you produce, and they take it.

And you can't go against it without suffering, therefore, you are a slave.

Are you realizing the gravity of the situation?

You are working to keep yourself alive as well as faceless useless men that you don't even know.

Your car must have an identification.

When you are born, you must have an identification.

In brazil, you can't home school your children.

When "your" "country" is in war, you must fight to defend it and give your life.

Countries are limited by imaginary lines.

How many lives have been destroyed in meaningless wars?

You must go to the front-line to defend your masters.

In most countries, you don't have freedom of speech, which means, you can't even express what you think.

When you create a company, you must have an identification and pass through a very bureaucratic process.

The money you use is just imaginary numbers in the screen of a computer or phone.

The money you use is created out of thin air.

By money here, I am referring to fiat money, not bitcoin.

Bitcoin is an alternative to achieve freedom, but this is topic for another article.

Depending on what you want to work on, you must go to college.

If you want to become a doctor, you must spend at least 5 years in an university decorating useless muscle names and bones.

Wisdom is way more important than knowledge.

That's why medical errors are the third leading cause of death in United States of America.

And I'm not even talking about Big Pharma and the "World Health Organization"

You can't even use or sell drugs, your masters don't allow it.

All the money you get, you must explain from where you got it.

Meanwhile, your masters have "black budget" and don't need to explain anything to you, even though everything they do is financed by your money.

In most countries you can't buy a gun, while your masters have a whole army fully armed to the teeth to defend them.

Your masters want to keep you sedated and asleep.

Look at all the "modern" art produced nowadays.

Look at the media, which of course was never created to "inform you".

Your masters even use your body to test their bio-technology, as happened with the covid 19 vaccines.

This is public human testing, there's of course secretive human testing, such as MKUltra and current experiments that happen nowadays that I don't even know.

I can give hundreds of millions of examples, quite literally, but let's just focus in one case, Jeffrey Epstein.

He was a guy who got rich "suddenly" and used his influence and spy skills to blackmail politicians and celebrities through recording them doing acts of pedophilia.

In United States of America, close to one million children a year go missing every year.

Some portion of these children are used in satanic rituals, and the participants of these rituals are individuals from the "high society".

Jeffrey Epstein was just an "employee", he was not the one at the top of the evil hierarchy.

He was serving someone or a group of people that I don't know who they are.

That's why they murdered him.

Why am I saying all of this?

The average person who sleep, work, eat and repeat has no idea all of this is going on.

They have no idea there is a very small group of powerful people who are responsible for many evil damage in the world.

They think the world is resumed in their little routine.

They think their routine is all there is to it.

They don't know how big the world truly is, in both a good and evil sense.

Given how much we produce and all the technology we have, people shouldn't even have to work, things would be almost nearly free.

Why aren't they?

Because of taxes.

This group of people even has access to a free energy device, which would disrupt the world in a magnitude greater than everything we have ever seen in the history of Earth.

That's why MANY people who tried to work in any manifestation of a free energy device have been murdered, or rather, "fell from a window".

How do I know a free energy device exist? This is topic for another article.

So my conclusion is:

We are in hell already. Know thyself. Use your mind for creation, any sort of creation. Do good for the people around you and the people you meet, always give more than you get, try to do your best in everything you set out to do, even if it's a boring or mundane work.

Life is short.

Our body can live no longer than 300 years.

Most people die before 90.

Know thyself, do good to the world while you can.

Wake up!!! Stop being sedated and asleep.

Be conscious.

-

@ 3f770d65:7a745b24

2025-01-19 21:48:49

@ 3f770d65:7a745b24

2025-01-19 21:48:49The recent shutdown of TikTok in the United States due to a potential government ban serves as a stark reminder how fragile centralized platforms truly are under the surface. While these platforms offer convenience, a more polished user experience, and connectivity, they are ultimately beholden to governments, corporations, and other authorities. This makes them vulnerable to censorship, regulation, and outright bans. In contrast, Nostr represents a shift in how we approach online communication and content sharing. Built on the principles of decentralization and user choice, Nostr cannot be banned, because it is not a platform—it is a protocol.

PROTOCOLS, NOT PLATFORMS.

At the heart of Nostr's philosophy is user choice, a feature that fundamentally sets it apart from legacy platforms. In centralized systems, the user experience is dictated by a single person or governing entity. If the platform decides to filter, censor, or ban specific users or content, individuals are left with little action to rectify the situation. They must either accept the changes or abandon the platform entirely, often at the cost of losing their social connections, their data, and their identity.

What's happening with TikTok could never happen on Nostr. With Nostr, the dynamics are completely different. Because it is a protocol, not a platform, no single entity controls the ecosystem. Instead, the protocol enables a network of applications and relays that users can freely choose from. If a particular application or relay implements policies that a user disagrees with, such as censorship, filtering, or even government enforced banning, they are not trapped or abandoned. They have the freedom to move to another application or relay with minimal effort.

THIS IS POWERFUL.

Take, for example, the case of a relay that decides to censor specific content. On a legacy platform, this would result in frustration and a loss of access for users. On Nostr, however, users can simply connect to a different relay that does not impose such restrictions. Similarly, if an application introduces features or policies that users dislike, they can migrate to a different application that better suits their preferences, all while retaining their identity and social connections.

The same principles apply to government bans and censorship. A government can ban a specific application or even multiple applications, just as it can block one relay or several relays. China has implemented both tactics, yet Chinese users continue to exist and actively participate on Nostr, demonstrating Nostr's ability to resistant censorship.

How? Simply, it turns into a game of whack-a-mole. When one relay is censored, another quickly takes its place. When one application is banned, another emerges. Users can also bypass these obstacles by running their own relays and applications directly from their homes or personal devices, eliminating reliance on larger entities or organizations and ensuring continuous access.

AGAIN, THIS IS POWERUFL.

Nostr's open and decentralized design makes it resistant to the kinds of government intervention that led to TikTok's outages this weekend and potential future ban in the next 90 days. There is no central server to target, no company to regulate, and no single point of failure. (Insert your CEO jokes here). As long as there are individuals running relays and applications, users continue creating notes and sending zaps.

Platforms like TikTok can be silenced with the stroke of a pen, leaving millions of users disconnected and abandoned. Social communication should not be silenced so incredibly easily. No one should have that much power over social interactions.

Will we on-board a massive wave of TikTokers in the coming hours or days? I don't know.

TikTokers may not be ready for Nostr yet, and honestly, Nostr may not be ready for them either. The ecosystem still lacks the completely polished applications, tools, and services they’re accustomed to. This is where we say "we're still early". They may not be early adopters like the current Nostr user base. Until we bridge that gap, they’ll likely move to the next centralized platform, only to face another government ban or round of censorship in the future. But eventually, there will come a tipping point, a moment when they’ve had enough. When that time comes, I hope we’re prepared. If we’re not, we risk missing a tremendous opportunity to onboard people who genuinely need Nostr’s freedom.

Until then, to all of the Nostr developers out there, keep up the great work and keep building. Your hard work and determination is needed.

-

@ 3283ef81:0a531a33

2025-05-24 20:47:39

@ 3283ef81:0a531a33

2025-05-24 20:47:39This event has been deleted; your client is ignoring the delete request.

-

@ f7a1599c:6f2484d5

2025-05-24 20:06:04

@ f7a1599c:6f2484d5

2025-05-24 20:06:04In March 2020, Lucas was afraid.

The economy was grinding to a halt. Markets were in freefall. In a sweeping response, the Federal Reserve launched an unprecedented intervention—buying everything from Treasury bonds and mortgages to corporate debt, expanding the money supply by $4 trillion. At the same time, the U.S. government issued over $800 billion in stimulus checks to households across the country.

These extraordinary measures may have averted a wave of business failures and bank runs—but they came at a cost: currency debasement and rising inflation. Alarmed by the scale of central bank intervention and its consequences for savers, Lucas decided to act.

In a state of mild panic, he withdrew $15,000 from his bank account and bought ten gold coins. Then he took another $10,000 and bought two bitcoins. If the dollar system failed, Lucas wanted something with intrinsic value he could use.

He mentioned his plan to his friend Daniel, who laughed.

“Why don’t you stock up on guns and cigarettes while you’re at it?” Daniel quipped. “The Fed is doing what it has to—stabilizing the economy in a crisis. Sure, $4 trillion is a lot of money, but it's backed by the most productive economy on Earth. Don’t panic. The world’s not ending.”

To prove his point, Daniel put $25,000 into the S&P 500—right at the pandemic bottom.

And he was right. Literally.

By Spring 2025, the stock market was near all-time highs. The world hadn’t ended. The U.S. economy kept moving, more or less as usual. Daniel’s investment had nearly tripled—his $25,000 had grown to $65,000.

But oddly enough, Lucas’ seemingly panicked reaction had been both prudent and profitable.

His gold coins had climbed from $1,500 to $3,300 apiece—a 120% gain. Bitcoin had soared from $5,000 to $90,000, making his two coins worth $180,000. Altogether, Lucas’s $25,000 allocation had grown to $213,000—a nearly 10x return. And his goal wasn’t even profit. It was safety.

With that kind of fortune, you’d expect Lucas to feel confident, even serene. He had more than enough to preserve his purchasing power, even in the face of years of inflation.

But in the spring of 2025, Lucas felt anything but calm.

He was uneasy—gripped by a sense that the 2020 crisis hadn’t been a conclusion, but a prelude.

In his mind, 2020 was just the latest chapter in a troubling sequence: the Asian financial crisis in 1998, the global financial crisis in 2008, the pandemic shock of 2020. Each crisis had been more sudden, more sweeping, and more dependent on emergency measures than the last.

And Lucas couldn’t shake the feeling that the next act—whenever it came—would be more disruptive, more severe, and far more damaging.

-

@ ec42c765:328c0600

2025-02-05 23:38:12

@ ec42c765:328c0600

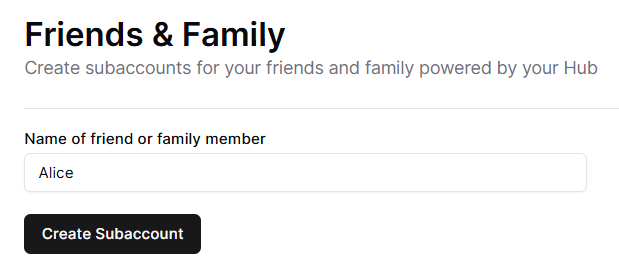

2025-02-05 23:38:12カスタム絵文字とは

任意のオリジナル画像を絵文字のように文中に挿入できる機能です。

また、リアクション(Twitterの いいね のような機能)にもカスタム絵文字を使えます。

カスタム絵文字の対応状況(2025/02/06)

カスタム絵文字を使うためにはカスタム絵文字に対応したクライアントを使う必要があります。

※表は一例です。クライアントは他にもたくさんあります。

使っているクライアントが対応していない場合は、クライアントを変更する、対応するまで待つ、開発者に要望を送る(または自分で実装する)などしましょう。

対応クライアント

ここではnostterを使って説明していきます。

準備

カスタム絵文字を使うための準備です。

- Nostrエクステンション(NIP-07)を導入する

- 使いたいカスタム絵文字をリストに登録する

Nostrエクステンション(NIP-07)を導入する

Nostrエクステンションは使いたいカスタム絵文字を登録する時に必要になります。

また、環境(パソコン、iPhone、androidなど)によって導入方法が違います。

Nostrエクステンションを導入する端末は、実際にNostrを閲覧する端末と違っても構いません(リスト登録はPC、Nostr閲覧はiPhoneなど)。

Nostrエクステンション(NIP-07)の導入方法は以下のページを参照してください。

ログイン拡張機能 (NIP-07)を使ってみよう | Welcome to Nostr! ~ Nostrをはじめよう! ~

少し面倒ですが、これを導入しておくとNostr上の様々な場面で役立つのでより快適になります。

使いたいカスタム絵文字をリストに登録する

以下のサイトで行います。

右上のGet startedからNostrエクステンションでログインしてください。

例として以下のカスタム絵文字を導入してみます。

実際より絵文字が少なく表示されることがありますが、古い状態のデータを取得してしまっているためです。その場合はブラウザの更新ボタンを押してください。

- 右側のOptionsからBookmarkを選択

これでカスタム絵文字を使用するためのリストに登録できます。

カスタム絵文字を使用する

例としてブラウザから使えるクライアント nostter から使用してみます。

nostterにNostrエクステンションでログイン、もしくは秘密鍵を入れてログインしてください。

文章中に使用

- 投稿ボタンを押して投稿ウィンドウを表示

- 顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

- : 記号に挟まれたアルファベットのショートコードとして挿入される

この状態で投稿するとカスタム絵文字として表示されます。

カスタム絵文字対応クライアントを使っている他ユーザーにもカスタム絵文字として表示されます。

対応していないクライアントの場合、ショートコードのまま表示されます。

ショートコードを直接入力することでカスタム絵文字の候補が表示されるのでそこから選択することもできます。

リアクションに使用

- 任意の投稿の顔😀のボタンを押し、絵文字ウィンドウを表示

- *タブを押し、カスタム絵文字一覧を表示

- カスタム絵文字を選択

カスタム絵文字リアクションを送ることができます。

カスタム絵文字を探す

先述したemojitoからカスタム絵文字を探せます。

例えば任意のユーザーのページ emojito ロクヨウ から探したり、 emojito Browse all からnostr全体で最近作成、更新された絵文字を見たりできます。

また、以下のリンクは日本語圏ユーザーが作ったカスタム絵文字を集めたリストです(2025/02/06)

※漏れがあるかもしれません

各絵文字セットにあるOpen in emojitoのリンクからemojitoに飛び、使用リストに追加できます。

以上です。

次:Nostrのカスタム絵文字の作り方

Yakihonneリンク Nostrのカスタム絵文字の作り方

Nostrリンク nostr:naddr1qqxnzdesxuunzv358ycrgveeqgswcsk8v4qck0deepdtluag3a9rh0jh2d0wh0w9g53qg8a9x2xqvqqrqsqqqa28r5psx3

仕様

-

@ 6389be64:ef439d32

2025-01-14 01:31:12

@ 6389be64:ef439d32

2025-01-14 01:31:12Bitcoin is more than money, more than an asset, and more than a store of value. Bitcoin is a Prime Mover, an enabler and it ignites imaginations. It certainly fueled an idea in my mind. The idea integrates sensors, computational prowess, actuated machinery, power conversion, and electronic communications to form an autonomous, machined creature roaming forests and harvesting the most widespread and least energy-dense fuel source available. I call it the Forest Walker and it eats wood, and mines Bitcoin.

I know what you're thinking. Why not just put Bitcoin mining rigs where they belong: in a hosted facility sporting electricity from energy-dense fuels like natural gas, climate-controlled with excellent data piping in and out? Why go to all the trouble building a robot that digests wood creating flammable gasses fueling an engine to run a generator powering Bitcoin miners? It's all about synergy.

Bitcoin mining enables the realization of multiple, seemingly unrelated, yet useful activities. Activities considered un-profitable if not for Bitcoin as the Prime Mover. This is much more than simply mining the greatest asset ever conceived by humankind. It’s about the power of synergy, which Bitcoin plays only one of many roles. The synergy created by this system can stabilize forests' fire ecology while generating multiple income streams. That’s the realistic goal here and requires a brief history of American Forest management before continuing.

Smokey The Bear

In 1944, the Smokey Bear Wildfire Prevention Campaign began in the United States. “Only YOU can prevent forest fires” remains the refrain of the Ad Council’s longest running campaign. The Ad Council is a U.S. non-profit set up by the American Association of Advertising Agencies and the Association of National Advertisers in 1942. It would seem that the U.S. Department of the Interior was concerned about pesky forest fires and wanted them to stop. So, alongside a national policy of extreme fire suppression they enlisted the entire U.S. population to get onboard via the Ad Council and it worked. Forest fires were almost obliterated and everyone was happy, right? Wrong.

Smokey is a fantastically successful bear so forest fires became so few for so long that the fuel load - dead wood - in forests has become very heavy. So heavy that when a fire happens (and they always happen) it destroys everything in its path because the more fuel there is the hotter that fire becomes. Trees, bushes, shrubs, and all other plant life cannot escape destruction (not to mention homes and businesses). The soil microbiology doesn’t escape either as it is burned away even in deeper soils. To add insult to injury, hydrophobic waxy residues condense on the soil surface, forcing water to travel over the ground rather than through it eroding forest soils. Good job, Smokey. Well done, Sir!

Most terrestrial ecologies are “fire ecologies”. Fire is a part of these systems’ fuel load and pest management. Before we pretended to “manage” millions of acres of forest, fires raged over the world, rarely damaging forests. The fuel load was always too light to generate fires hot enough to moonscape mountainsides. Fires simply burned off the minor amounts of fuel accumulated since the fire before. The lighter heat, smoke, and other combustion gasses suppressed pests, keeping them in check and the smoke condensed into a plant growth accelerant called wood vinegar, not a waxy cap on the soil. These fires also cleared out weak undergrowth, cycled minerals, and thinned the forest canopy, allowing sunlight to penetrate to the forest floor. Without a fire’s heat, many pine tree species can’t sow their seed. The heat is required to open the cones (the seed bearing structure) of Spruce, Cypress, Sequoia, Jack Pine, Lodgepole Pine and many more. Without fire forests can’t have babies. The idea was to protect the forests, and it isn't working.

So, in a world of fire, what does an ally look like and what does it do?

Meet The Forest Walker

For the Forest Walker to work as a mobile, autonomous unit, a solid platform that can carry several hundred pounds is required. It so happens this chassis already exists but shelved.

Introducing the Legged Squad Support System (LS3). A joint project between Boston Dynamics, DARPA, and the United States Marine Corps, the quadrupedal robot is the size of a cow, can carry 400 pounds (180 kg) of equipment, negotiate challenging terrain, and operate for 24 hours before needing to refuel. Yes, it had an engine. Abandoned in 2015, the thing was too noisy for military deployment and maintenance "under fire" is never a high-quality idea. However, we can rebuild it to act as a platform for the Forest Walker; albeit with serious alterations. It would need to be bigger, probably. Carry more weight? Definitely. Maybe replace structural metal with carbon fiber and redesign much as 3D printable parts for more effective maintenance.

The original system has a top operational speed of 8 miles per hour. For our purposes, it only needs to move about as fast as a grazing ruminant. Without the hammering vibrations of galloping into battle, shocks of exploding mortars, and drunken soldiers playing "Wrangler of Steel Machines", time between failures should be much longer and the overall energy consumption much lower. The LS3 is a solid platform to build upon. Now it just needs to be pulled out of the mothballs, and completely refitted with outboard equipment.

The Small Branch Chipper

When I say “Forest fuel load” I mean the dead, carbon containing litter on the forest floor. Duff (leaves), fine-woody debris (small branches), and coarse woody debris (logs) are the fuel that feeds forest fires. Walk through any forest in the United States today and you will see quite a lot of these materials. Too much, as I have described. Some of these fuel loads can be 8 tons per acre in pine and hardwood forests and up to 16 tons per acre at active logging sites. That’s some big wood and the more that collects, the more combustible danger to the forest it represents. It also provides a technically unlimited fuel supply for the Forest Walker system.

The problem is that this detritus has to be chewed into pieces that are easily ingestible by the system for the gasification process (we’ll get to that step in a minute). What we need is a wood chipper attached to the chassis (the LS3); its “mouth”.

A small wood chipper handling material up to 2.5 - 3.0 inches (6.3 - 7.6 cm) in diameter would eliminate a substantial amount of fuel. There is no reason for Forest Walker to remove fallen trees. It wouldn’t have to in order to make a real difference. It need only identify appropriately sized branches and grab them. Once loaded into the chipper’s intake hopper for further processing, the beast can immediately look for more “food”. This is essentially kindling that would help ignite larger logs. If it’s all consumed by Forest Walker, then it’s not present to promote an aggravated conflagration.

I have glossed over an obvious question: How does Forest Walker see and identify branches and such? LiDaR (Light Detection and Ranging) attached to Forest Walker images the local area and feed those data to onboard computers for processing. Maybe AI plays a role. Maybe simple machine learning can do the trick. One thing is for certain: being able to identify a stick and cause robotic appendages to pick it up is not impossible.