-

@ bf47c19e:c3d2573b

2025-05-24 16:29:55

@ bf47c19e:c3d2573b

2025-05-24 16:29:55Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Šta je Bitcoin?

- Šta Bitcoin može da učini za vas?

- Zašto ljudi kupuju Bitcoin?

- Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

- Šta je bolje za štednju od dolara, kuća i akcija?

- Po čemu se Bitcoin razlikuje od ostalih valuta?

- kako Bitcoin spašava svet?

- Kako mogu da saznam više o Bitcoin-u?

Bitcoin čini da štednja novca bude kul – i praktična – ponovo. Ovaj članak objašnjava kako i zašto.

Šta je Bitcoin?

Bitcoin se naziva digitalno zlato, mašina za istinu, blockchain, peer to peer mreža čvorova, energetski ponor i još mnogo toga. Bitcoin je, u stvari, sve ovo. Međutim, ova objašnjenja su često toliko tehnička i suvoparna, da bi većina ljudi radije gledala kako trava raste. Što je najvažnije, ova objašnjenja ne pokazuju kako Bitcoin ima bilo kakve koristi za vas.

iPod nije postao kulturološka senzacija jer ga je Apple nazvao „prenosnim digitalnim medijskim uređajem“. Postao je senzacija jer su ga zvali “1,000 pesama u vašem džepu.”

Ne zanima vas šta je Bitcoin. Vas zanima šta on može da učini za vas.

Baš kao i Internet, vaš auto, vaš telefon, kao i mnogi drugi uređaji i sistemi koje svakodnevno koristite, vi ne treba da znate šta je Bitcoin ili kako to funkcioniše da biste razumeli šta on može da učini za vas.

Šta Bitcoin može da učini za vas?

Bitcoin može da sačuva vaš teško zarađeni novac.

Bitcoin je stekao veliku pažnju u 2017. i 2018. godini zbog svoje spekulativne upotrebe. Mnogi ljudi su ga kupili nadajući se da će se obogatiti. Cena je naglo porasla, a zatim se srušila. Ovo nije bio prvi put da je Bitcoin uradio to. Međutim, niko nikada nije izgubio novac držeći bitcoin duže od 3,5 godine – ćak i ako je kupio na apsolutnim vrhovima.

Zašto Bitcoin konstantno raste? Ljudi počinju da shvataju koliko je Bitcoin moćan, kao način uštede novca u svetu u kojem je ’novac’ poput dolara, eura i drugih nacionalnih valuta dizajniran da gubi vrednost.

Ovo čini Bitcoin odličnom opcijom za štednju novca na nekoliko godina ili više. Bitcoin je bolji od štednje novca u dolarima, akcijama, nekretninama, pa čak i u zlatu.

Zato pokušajte da zaboravite na trenutak na razumevanje blockchaina, digitalne valute, kriptografije, seed fraza, novčanika, rudarstva i svih ostalih nerazumljivih termina. Za sada, razgovarajmo o tome zašto ljudi kupuju Bitcoin: razlog je prostiji nego što vi mislite.

Zašto ljudi kupuju Bitcoin?

Naravno, svako ima svoj razlog za kupovinu Bitcoin-a. Jedan od razloga, koji verovatno često čujete, je taj što mu vrednost raste. Ljudi žele da se obogate. Uskoče kao spekulanti, krenu u vožnju i najverovatnije ih prodaju ubrzo nakon kupovine.

Međutim, čak i kada cena krene naglo prema gore i strmoglavo padne nazad, mnogi ljudi ostanu i nakon tog pada. Otkud mi to znamo? Broj aktivnih novčanika dnevno, koji je otprilike sličan broju korisnika Bitcoin-a, nastavlja da raste. Takođe, nakon svakog balona u istoriji Bitcoin-a, cena se nikada ne vraća na svoju cenu pre balona. Uvek ostane malo višlja. Bitcoin se penje, a svaka masovna spekulativna serija dovodi sve više i više ljudi.

Broj aktivnih Bitcoin novčanika neprekidno raste

„Aktivna adresa“ znači da je neko tog dana poslao Bitcoin transakciju. Donji grafikon je na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeCena Bitcoina se neprestano penje

Kroz istoriju Bitcoin-a možemo videti divlje kolebanje cena, ali nakon svakog balona, cena se ostaje višlja nego pre. Ovo je cena Bitcoin-a na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeTo pokazuje da se ljudi zadržavaju: potražnja za Bitcoin-om se povećava. Da je svaki masovni rast cena bio samo balon koji su iscenirali prevaranti koji žele brzo da se obogate, cena bi se vratila na nivo pre balona. To se dogodilo sa lalama, ali ne i sa Bitcoin-om.

I zašto se onda cena Bitcoin-a stalno povećava? Sve veći broj ljudi čuva Bitcoin dugoročno – oni razumeju šta Bitcoin može učiniti za njihovu štednju.

Zašto ljudi štede svoj novac u Bitcoin-u umesto na štednim računima, kućama, deonicama ili zlatu? Hajde da pogledajmo sve te metode štednje, i zatim da ih uporedimo sa Bitcoin-om.

Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

Tokom mnogo godina, to su bile pristojne opcije za štednju. Međutim, sistem koji podržava vrednost svega ovoga je u krizi.

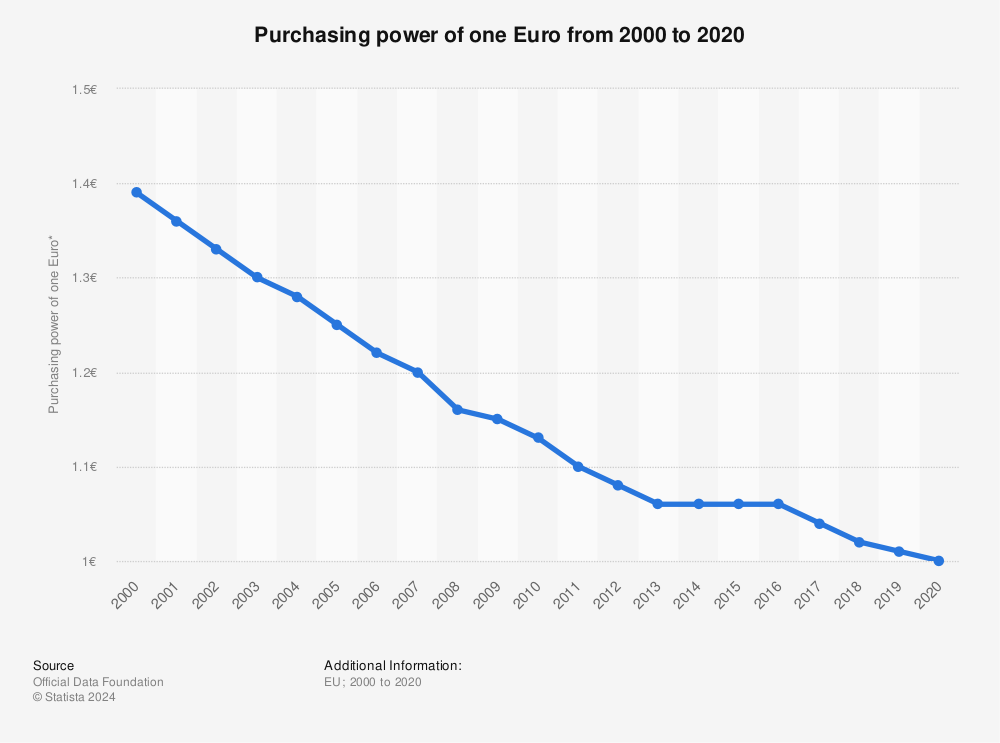

Dolari, Euri, Dinari

Dolari i sve ostale „tradicionalne“ valute koje proizvode vlade, stvorene su da izgube vrednost kroz inflaciju. Banke i tradicionalni monetarni sistem uzrokuju inflaciju stalnim stvaranjem i distribucijom novog novca. Kada Američke Federalne Rezerve objave ciljanu stopu od 2% inflacije, to znači da žele da vaš novac svake godine izgubi 2% od svoje vrednosti. Čak i sa inflacijom od samo 2%, vaša štednja u dolarima izgubiće polovinu vrednosti tokom 40-godišnjeg radnog veka.

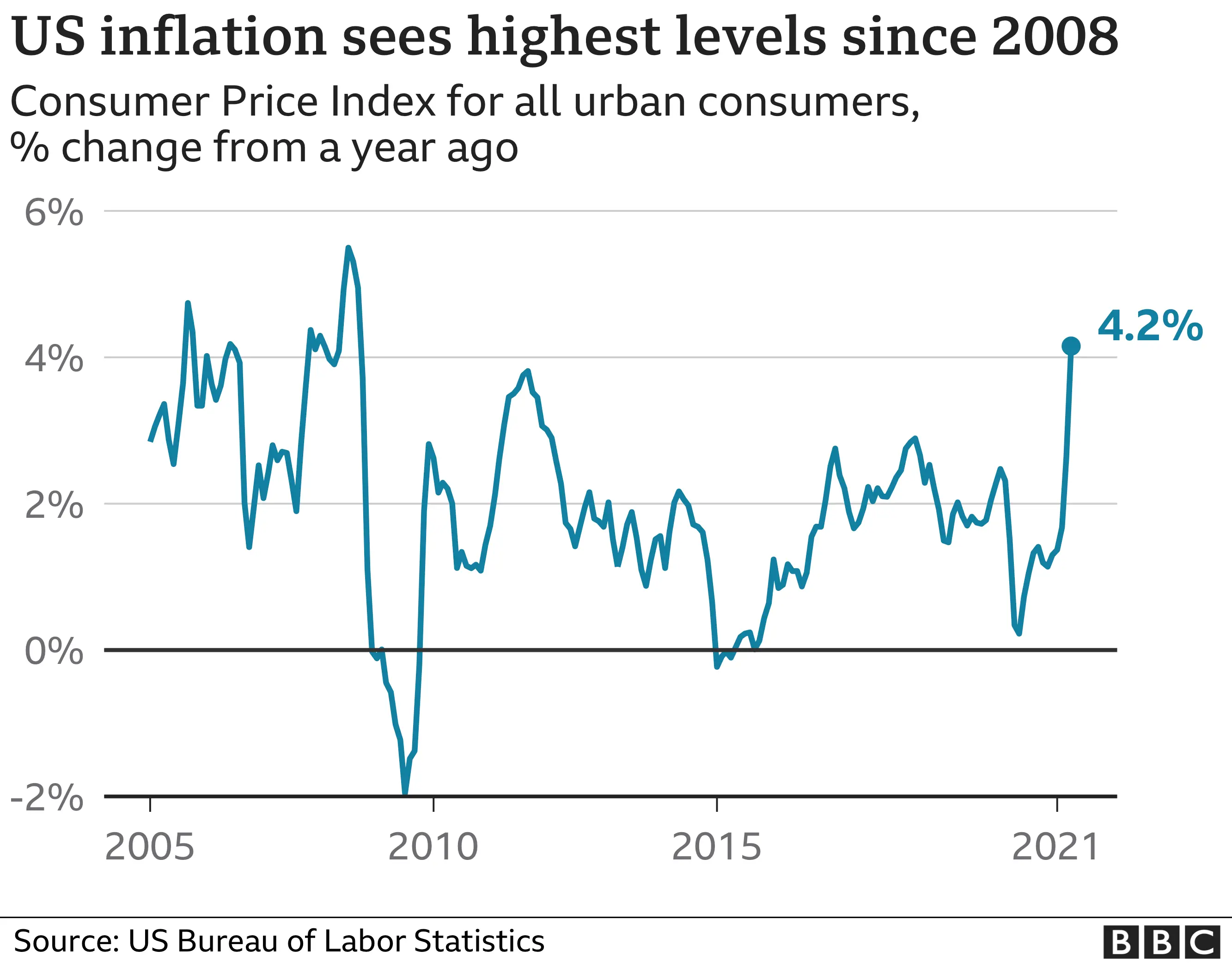

Izveštena inflacija se danas opasno povečava, uprkos rastućem „buretu sa barutom“ koji bi mogao da explodira i dovede do masivne hiperinflacije. Što je više valute u opticaju, to je više baruta u buretu.

Naše vlade su ekonomiju napunile valutama da bankarski sistem ne bi propao nakon finansijske krize koja se dogodila 2008. godine. Od tada je većina glavnih centralnih banaka postavila vrlo niske kamatne stope, što pojedincima i korporacijama omogućava dobijanje jeftinijih kredita. To znači da mnogi pojedinci i korporacije podižu ogromne kredite i koriste ih za kupovinu druge imovine poput deonica, umetničkih dela i nekretnina. Sve ovo pozajmljivanje znači da stvaramo tone novog novca i stavljamo ga u opticaj.

Računi za podsticaje (stimulus bills) COVID-19 za 2020. godinu unose trilione u sistem. Ovoliko stvaranje valuta na kraju dovodi do inflacije – velikog gubitka u vrednosti valute.

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. Izvor

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. IzvorRačuni za podsticaje su bez presedana, toliko da je neko izmislio meme da opiše ovu situaciju.

Resurs koji vlade mogu da naprave u većem broju da bi platile svoje račune? Ne zvuči kao dobro mesto za štednju novca.

Kuće

Kuće su tokom prošlog veka bile pristojan način štednje novca. Međutim, pad cena nekretnina 2007. godine doveo je do toga da su mnogi vlasnici kuća izgubili svu ušteđevinu.

Danas su kuće gotovo nepristupačne za prosečnog čoveka. Jedan od načina da se ovo izmeri je koliko godišnjih zarada treba prosečnom čoveku da zaradi ekvivalent vrednosti prosečne kuće. Prema CityLab-u, publikaciji Bloomberg-a koja pokriva gradove, porodica može da priuštiti određenu kuću ako košta manje od 2,6 godišnjih prihoda domaćinstva te porodice.

Međutim, prema RZS (Republički zavod za statistiku) prosečan prihod porodičnog domaćinstva u Srbiji iznosi oko 570 EUR mesečno ili otprilike 7.000 EUR godišnje. Nažalost, samo najjeftinija područja van gradova imaju srednje cene kuća od oko 2,6 prosečnih godišnjih prihoda domaćinstva. U većim gradovima poput Beograda i Novog Sada srednja cena kuće je veća od 10 prosečnih godišnjih prihoda jednog domaćinstva.

Ako nekako možete sebi da priuštite kuću, ona bi mogla biti pristojna zaliha vrednosti. Dokle god ne doživimo još jedan krah i izvršitelji zaplene ovu imovinu mnogim vlasnicima kuća.

Akcije

Berza je u prošlosti takođe dobro poslovala. Međutim, sporo i stabilno povećanje tržišta događa se u dosadnom, predvidljivom svetu. Svakog dana vidimo sve manje toga. Nakon ubrzanja korona virusa, videli smo smo najbrži pad američke berze u istoriji od 25% – brži od Velike depresije.

Neki se odlučuju za ulaganje u obveznice i drugu finansijsku imovinu, ali ’prinosi’ za tu imovinu – procenat kamate zarađene na imovinu iz godine u godinu – stalno opada. Sve veći broj odredjenih imovina ima čak i negativne prinose, što znači da posedovanje te imovine košta! Ovo je veliki problem za sve koji se oslanjaju na penziju. Plus, s obzirom na to da su akcije denominovane u tradicionalnim valutama poput dolara i evra, inflacija pojede prinos koji investitor dobije.

Najgore od svega je to što ti isti ekonomski krahovi koji uzrokuju masovna otpuštanja i teško tržište rada takođe znače i nagli pad cena akcija. Čuvanje ušteđevine u akcijama može značiti i gubitak štednje i gubitak posla zbog recesije. Teška vremena mogu da vas prisile da svoje akcije prodate po vrlo malim cenama samo da biste platili svoje račune.

A to nije baš siguran način štednje novca.

Zlato

Vrednost zlata neprekidno se povećavala tokom 5000 godina, obično padajući onda kada berza obećava jače prinose.

Evidencija vrednosti zlata je solidna. Međutim, zlato nosi i druge rizike. Većina ljudi poseduje zlato na papiru. Oni fizički ne poseduju zlato, već ga njihova banka čuva za njih. Zbog toga je zlato veoma podložno konfiskaciji od strane vlade.

Zašto bi vlada konfiskovala nečije zlato, a kamoli u demokratskoj zemlji u „slobodnom svetu“? Ali to se dešavalo i ranije. 1933. godine Izvršnom Naredbom 6102, predsednik Roosevelt naredio je svim Amerikancima da prodaju svoje zlato vladi u zamenu za papirne dolare. Vlada je iskoristila pretnju zatvorom za prikupljanje zlata u fizičkom obliku. Znali su da se zlato više poštuje kao zaliha vrednosti širom sveta od papirnih dolara.

Ako posedujete svoje zlato na nekoj od aplikacija za trgovanje akcijama, možete se kladiti da će vam ga država oduzeti ako joj zatreba. Čak i ako posedujete fizičko zlato, onda ga izlažete mogućnosti krađe – od strane kriminalca ili vaše vlade.

Vaša uštedjevina nije bezbedna.

Rast cena svih gore navedenih sredstava zavisi od našeg trenutnog političkog i ekonomskog sistema koji se nastavlja kao i tokom proteklih 100 godina. Međutim, danas vidimo ogromne pukotine u ovom sistemu.

Sistem ne funkcioniše dobro za većinu ljudi.

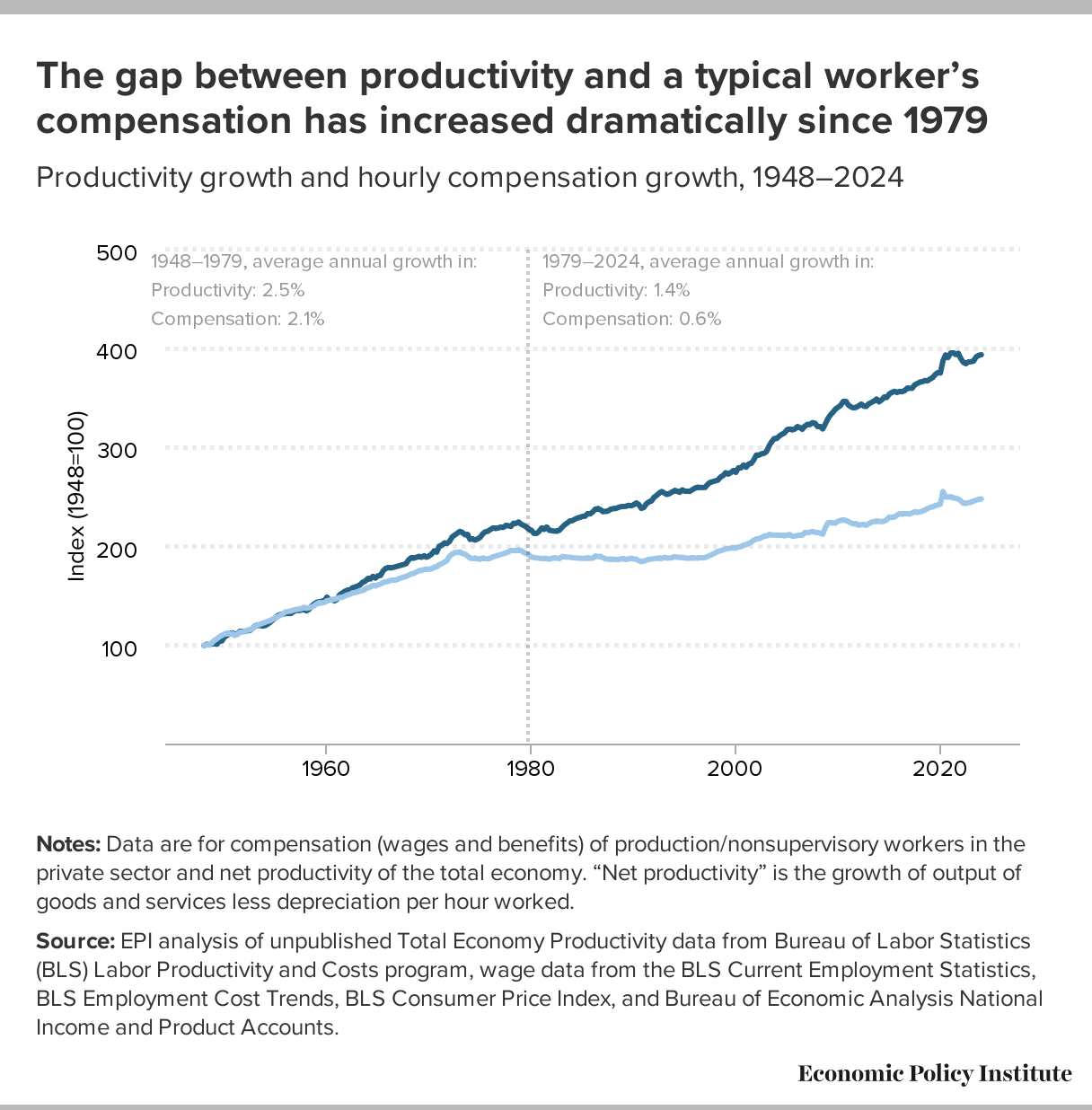

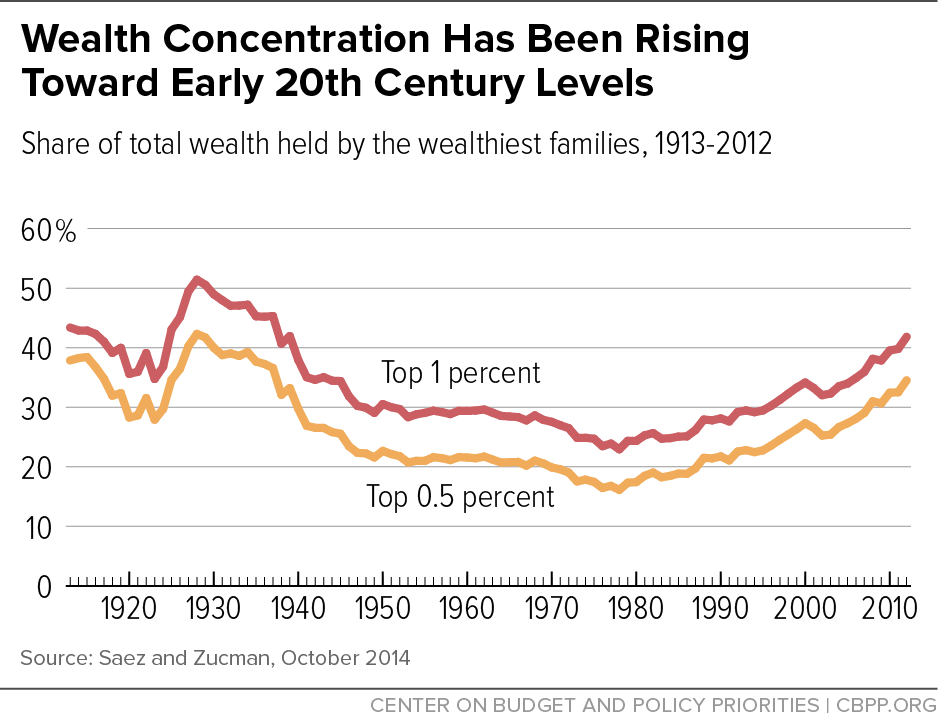

Od 1971. plate većine američkih radnika nisu rasle. S druge strane, bogatstvo koje imaju najbogatiji u društvu nalazi se na nivoima koji nisu viđeni više od 80 godina. U međuvremenu, ljudi sve manje i manje veruju institucijama poput banaka i vlada.

CBPP Nejednakost Bogatstva Tokom Vremena

CBPP Nejednakost Bogatstva Tokom VremenaŠirom sveta možemo videti dokaze o slamanju sistema kroz politički ekstremizam: izbor Trampa i drugih ekstremističkih desničarskih kandidata, Bregzit, pokret Occupy, popularizacija koncepta univerzalnog osnovnog dohotka, povratak pojma „socijalizam“ nazad u modu. Ljudi na svim delovima političkog i društvenog spektra osećaju problematična vremena i posežu za sve radikalnijim rešenjima.

Šta je bolje za štednju od dolara, kuća i akcija?

Pa kako ljudi mogu da štede novac u ovim teškim vremenima? Ili ne koriste tradicionalne valute, ili kupuju sredstva koja će zadržati vrednost u teškim vremenima.

Bitcoin ima najviše potencijala da zadrži vrednost kroz politička i ekonomska previranja od bilo koje druge imovine. Na tom putu će biti rupa na kojima će se rušiti ili pumpati, međutim, njegova svojstva čine ga takvim da će verovatno preživeti previranja kada druga imovina ne bude to mogla.

Šta Bitcoin čini drugačijim?

Bitcoini su retki.

Proces ‘rudarenja’ bitcoin-a, proizvodnju bitcoin-a čini veoma skupom, a Bitcoin protokol ograničava ukupan broj bitcoin-a na 21 milion novčića. To čini Bitcoin imunim na nagle poraste ponude. Ovo se veoma razlikuje od tradicionalnih valuta, koje vlade mogu da štampaju sve više kad god one to požele. Zapamtite, povećanje ponude vrši veliki pritisak na vrednost valute.

Bitcoini nemaju drugu ugovornu stranu.

Bitcoin se takođe razlikuje od imovine kao što su obveznice, akcije i kuće, jer mu nedostaje druga ugovorna strana. Druge ugovorne strane su drugi subjekti uključeni u vrednost sredstva, koji to sredstvo mogu obezvrediti ili vam ga uzeti. Ako imate hipoteku na svojoj kući, banka je druga ugovorna strana. Kada sledeći put dođe do velikog finansijskog kraha, banka vam može oduzeti kuću. Kompanije su kvazi-ugovorne strane akcijama i obveznicama, jer mogu da počnu da donose loše odluke koje utiču na njihovu cenu akcija ili na „neizvršenje“ duga (da ga ne vraćaju vama ili drugim poveriocima). Bitcoin nema ovih problema.

Bitcoin je pristupačan.

Svako sa 5 eura i mobilnim telefonom može da kupi i poseduje mali deo bitcoin-a. Važno je da znate da ne morate da kupite ceo bitcoin. Bitcoin-i su deljivi do 100-milionite jedinice, tako da možete da kupite Bitcoin u vrednosti od samo nekoliko eura. Neuporedivo lakše nego kupovina kuće, zlata ili akcija!

Bitcoin se ne može konfiskovati.

Banke drže većinu vaših eura, zlata i akcija za vas. Većina ljudi u razvijenom svetu veruje bankama, jer većina ljudi koji žive u današnje vreme nikada nije doživela konfiskaciju imovine ili ’šišanje’ od strane banaka ili vlada. Nažalost, postoji presedan za konfiskaciju imovine čak i u demokratskim zemljama sa snažnom vladavinom prava.

Kada vlada konfiskuje imovinu, ona obično ubedi javnost da će je menjati za imovinu jednake vrednosti. U SAD-u 1930-ih, vlada je davala dolare vlasnicima zlata. Vlada je znala da uvek može da odštampa još više dolara, ali da ne može da napravi više zlata. Na Kipru 2012. godine, jedna propala banka je svojim klijentima dala deonice banke da pokrije dolare klijenata koje je banka trebala da ima. I dolari i deonice su strmoglavo opali u odnosu na imovinu koja je uzeta od ovih ljudi.

Doći do bitcoin-a koji ljudi poseduju, biće mnogo teže jer se bitcoin-i mogu čuvati u novčaniku koji ne poseduje neka treća strana, a vi možete čak i da zapamtite privatne ključeve do vašeg bitcoin-a u glavi.

Bitcoin je za štednju.

Bitcoin se polako pokazuje kao najbolja opcija za dugoročnu štednju novca, posebno s obzirom na današnju ekonomsku klimu. Posedovanje čak i malog dela, je polisa osiguranja koja se isplati ako svet i dalje nastavi da ludi. Cena Bitcoin-a u dolarima može divlje da varira u roku od godinu ili dve, ali tokom 3+ godine skoro svi vide slične ili više cene od trenutka kada su ga kupili. U stvari, doslovno niko nije izgubio novac čuvajući Bitcoin duže od 3,5 godine – čak i ako je kupio BTC na apsolutnim vrhovima tržišta.

Imajte na umu da nakon ove tačke ti ljudi više nikada nisu videli rizik od gubitka. Cena se nikada nije smanjila niže od najviše cene u prethodnom ciklusu.

Po čemu se Bitcoin razlikuje od ostalih valuta?

Bitcoin funkcioniše tako dobro kao način štednje zbog svog neobičnog dizajna, koji ga čini drugačijim od bilo kog drugog oblika novca koji je postojao pre njega. Bitcoin je digitalna valuta, prvi i verovatno jedini primer valute koja ima ograničenu ponudu dok radi na otvorenom, decentralizovanom sistemu. Vlade strogo kontrolišu valute koje danas koristimo, poput dolara i eura, i proizvode ih za finansiranje ratova i dugova. Korisnici Bitcoin-a – poput vas – kontrolišu Bitcoin protokol.

Evo šta Bitcoin razlikuje od dolara, eura i drugih valuta:

Bitcoin je otvoren sistem.

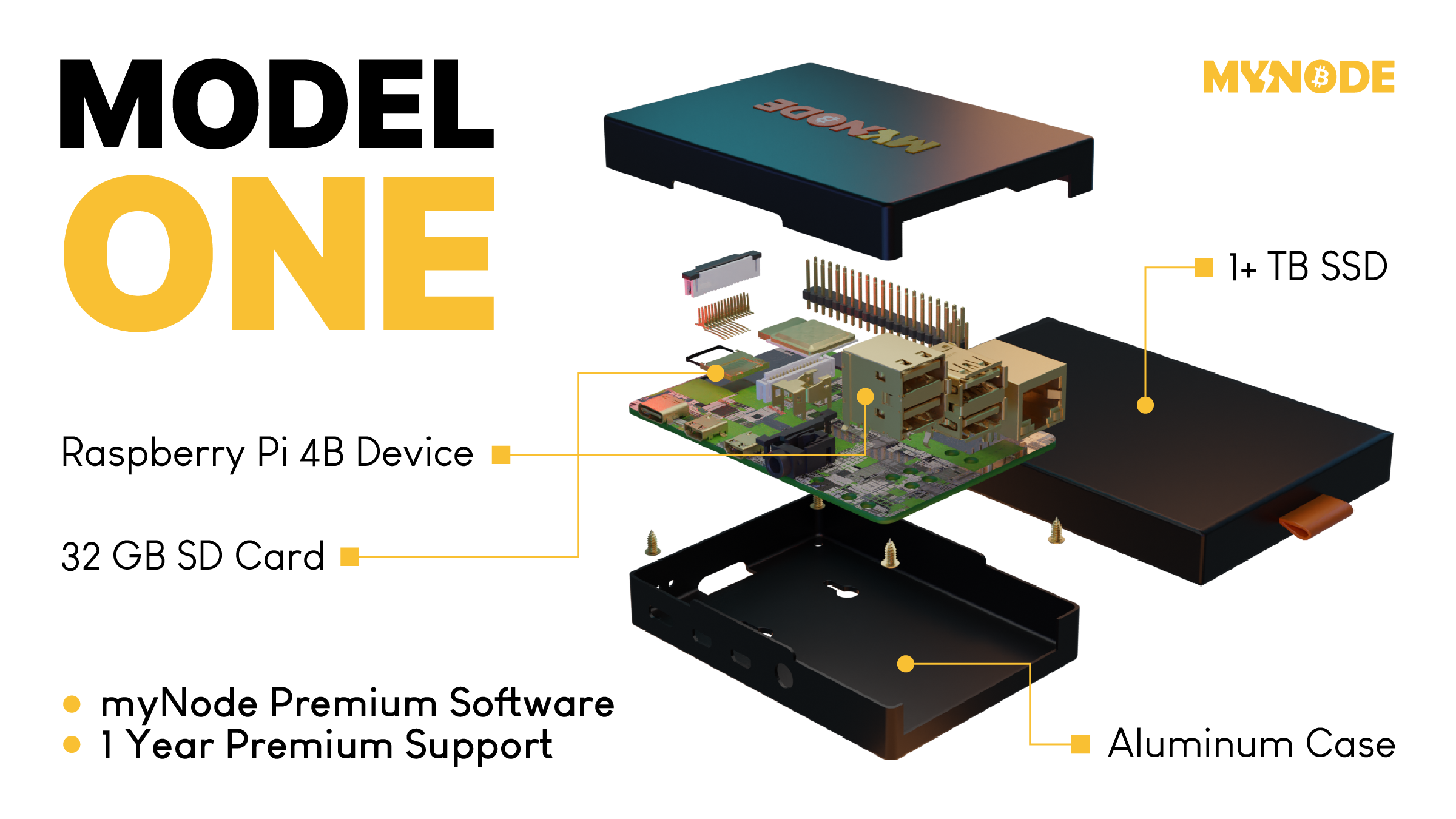

Svako može da odluči da se pridruži Bitcoin mreži i primeni pravila softverskog protokola, što je dovelo do vrlo decentralizovanog sistema u kojem nijedan pojedinac ili entitet ne može da blokira transakciju, zamrzne sredstva ili da ukrade od druge osobe.Današnji savremeni bankarski sistem se uveliko razlikuje. Nekoliko banaka je dobilo poverenje da gotovo sve valute, akcije i druge vredne predmete čuvaju na “sigurnom” za svoje klijente. Da biste postali banka, potrebni su vam milioni dolara i neverovatne količine političkog uticaja. Da biste pokrenuli Bitcoin čvor i postali „svoja banka“, potrebno vam je nekoliko stotina dolara i jedno slobodno popodne.

Tako izgleda Bitcoin čvor – Node

MyNode čvor vam omogućava da postanete svoja banka za samo nekoliko minuta.

Tako izgleda Bitcoin čvor – Node

MyNode čvor vam omogućava da postanete svoja banka za samo nekoliko minuta.Bitcoin ima ograničenu ponudu.

Softverski protokol otvorenog koda koji upravlja Bitcoin sistemom ograničava broj novih bitcoin-a koji se mogu stvoriti tokom vremena, sa ograničenjem od ukupno 21.000.000 bitcoin-a. S druge strane, valute koje danas koristimo imaju neograničenu ponudu. Istorija i sadašnje odluke centralnih banaka govore nam da će vlade uvek štampati sve više i više valuta, sve dok valuta ne bude bezvredna. Sve ovo štampanje uzrokuje inflaciju, što pravi štetu običnim radnim ljudima i štedišama.

Tradicionalne valute su dizajnirane tako da opadaju vremenom. Svaki put kada centralna banka kaže da cilja određenu stopu inflacije, oni ustvari kažu da žele da vaš novac svake godine izgubi određeni procenat svoje vrednosti.

Bitcoin-ova ograničena ponuda znači da je on tako dizajniran da raste vremenom kako se potražnja za njim povećava.

Bitcoin putuje oko sveta za nekoliko minuta.

Svako može da pošalje bitcoin-e za nekoliko minuta širom sveta, bez obzira na granice, banke i vlade. Potrebno je manje od minuta da se transakcija pojavi na novčaniku primaoca i oko 60 minuta da se transakcija u potpunosti „obračuna“, tako da primaoc može da bude siguran da su primljeni bitcoin-i sada njegovi (6 konfirmacija bloka). Slanje drugih valuta širom sveta traje danima ili čak mesecima ako se šalju milionski iznosi, a podrazumeva i visoke naknade.

Neke vlade i novinari tvrde da ova sloboda putovanja koju pruža Bitcoin pomaže kriminalcima i teroristima. Međutim, transakciju Bitcoin-a je lakše pratiti nego većinu transakcija u dolarima ili eurima.

Bitcoin se može čuvati na “USB-u”.

Dizajn Bitcoin-a je takav da vam treba samo da čuvate privatni ključ do svojih ‘bitcoin’ adresa (poput lozinke do bankovnih računa) da biste pristupili svojim bitcoin-ima odakle god poželite. Ovaj privatni ključ možete da sačuvate na disku ili na papiru u obliku 12 ili 24 reči na engleskom jeziku. Kao rezultat toga, možete da držite Bitcoin-e vredne milione dolara u svojoj šaci.

Sve ostale valute danas možete ili da strpate u svoj dušek ili da ih poverite banci na čuvanje. Za većinu ljudi koji žive u razvijenom svetu, i koji ne osporavaju autoritet i poverenje u banku, ovo deluje sasvim dobro. Međutim, oni kojima je potrebno da pobegnu od ugnjetavačke vlade ili koji naljute pogrešne ljude, ne mogu verovati bankama. Za njih je sposobnost da nose svoju ušteđevinu bez potrebe za ogromnim koferom neprocenjiva. Čak i ako ne živite na mestu poput ovog, cena Bitcoin-a se i dalje povećava kada ih neko kome oni trebaju kupi.

Kako Bitcoin spašava svet?

Bitcoin, kao ultimativni način štednje, je cakum pakum, ali da li on pomaže u poboljšanju sveta u celini?

Kao što ćete početi da shvatate, ulazeći sve dublje i u druge sadržaje na ovoj stranici, mnogi temeljni delovi našeg današnjeg monetarnog sistema i ekonomije su duboko slomljeni. Međutim, oni koji upravljaju imaju korist od ovakvih sistema, pa se on verovatno neće promeniti bez revolucije ili mirnog svrgavanja od strane naroda. Bitcoin predstavlja novi sistem, sa nekoliko glavnih prednosti:

- Bitcoin popravlja novac, koji je milenijumima služio kao važan alat za rast i poboljšanje društva.

- Bitcoin vraća zdrav razum pozajmljivanju, uklanjanjem apsurdnih situacija poput negativnih kamatnih stopa (gde zajmitelj plaća da bi se zadužio).

- Bitcoin pokreće ulaganja u obnovljive izvore energije i poboljšava energetsku efikasnost u mreži, služeći kao „krajnji kupac“ za sve vrste energije.

Kako mogu da saznam više o Bitcoin-u?

Ovaj članak vam je dao osnovno razumevanje zašto biste trebali razmišljati o Bitcoin-u. Ako želite da saznate više, preporučujem ove resurse:

- Film "Bitcoin: Kraj Novca Kakav Poznajemo"

- Još uvek je rano za Bitcoin

- Zasto baš Bitcoin?

- Šta je to Bitcoin?

- The Bitcoin Whitepaper ← objavljen 2008. godine, ovo je izložio dizajn za Bitcoin.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ bf47c19e:c3d2573b

2025-05-24 16:21:56

@ bf47c19e:c3d2573b

2025-05-24 16:21:56Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Šta uzrokuje Inflaciju?

- Da li nam je infacija potrebna?

- Kako se meri inflacija?

- Da li inflacija pokreće ekonomski rast?

- Da li inflacija pokreće ili umanjuje nejednakost bogatstva?

- Gde se danas javlja inflacija?

- Šta je deflacija?

- Kakav uticaj inflacija ima na društvo?

Inflacija može da bude uznemirujuća tema, jer uključuje amorfni koncept novca. Međutim, inflacija je zapravo jednostavna tema koja je napravljena da bude složena razdvajanjem novca i drugih dobara. U ovom članku razlažemo inflaciju i njene uzroke.

Najjednostavnija definicija inflacije je rast cena dobara i usluga. Kada cene rastu, to takođe znači da vrednost jedinice novca – poput dolara – opada. Uzmimo primer McDonald’s hamburgera: 1955. ovaj skromni hamburger se prodavao za samo 15 centi. U 2018. godini se prodavao za 1,09 USD. U 2021. godini prodaje se za 2,49 USD – ogroman rast cene od 1650%.

To znači da je dolar izgubio dosta svoje vrednosti. 1955. godine mogli ste da kupite gotovo 7 hamburgera za novčanicu od jednog dolara. 2021. godine taj dolar vam ne bi kupio ni jedan hamburger. Zašto se čini da cene uvek rastu tokom vremena? I šta možete da učinite povodom toga? Ovaj članak ima za cilj da odgovori na ta pitanja.

Ekonomisti pokušavaju da sumiraju rast cena mnogih dobara i usluga kao jedan prosečan broj. Ovaj broj predstavlja promenu ukupnih troškova u godišnjim troškovima prosečnog potrošača, kao što su stanarina, hrana i gorivo.

U Sjedinjenim Državama ovaj broj je poznat kao Indeks Potrošačkih Cena, eng. Consumer Price Index (CPI). Kada se CPI poveća tokom određenog vremenskog perioda, ekonomisti kažu da imamo inflaciju. Kada se smanji, to se naziva deflacija.

Šta uzrokuje Inflaciju?

Mnogi izvori kažu da je stalna inflacija koju danas doživljavamo ili uzrokovana povećanjem potražnje (eng. demand-pull) ili smanjenjem ponude usled povećanih proizvodnih troškova (eng. cost-push).

Ovi razlozi nisu tačni – hajde da pogledamo zašto.

Da bismo razumeli pravi razlog inflacije, moramo da sagledamo dve vrste inflacije:

- Inflacija Cena: Cene vremenom rastu.

- Monetarna Inflacija: Količina valute u opticaju raste sa vremenom.

Prva, inflacija cena, retko se javlja tokom dužih perioda (decenije, vekovi) zbog povećane potražnje ili povećanih troškova. Zašto? Tržišta teže da se uravnoteže. Tokom istorije smo više puta videli da povećana potražnja za dobrom povećava njegovu cenu, što podstiče proizvođače da proizvode više tog dobra. Kada se ponuda poveća, cene se smanjuju.

Ovaj ciklus može da potraje nekoliko godina, i javlja se kod gotovo svake robe i „konačnog dobra“ (automobili, televizori, hrana itd.) na Zemlji. Izuzetak su retki metali poput zlata i srebra. Dokazi o tome su prikazani u nastavku.

Kada se poveća trošak za proizvodnju dobra, cena tog dobra često raste da bi pokrila te troškove. Ovaj rast cene dovodi do toga da potrošači tog dobra traže alternativu ili smanjuju potrošnju tog dobra, što dovodi do pada cena na prethodni nivo.

Tržište se prirodno uravnotežava, a cene se smanjuju ili povećanjem ponude ili smanjenjem potražnje.

Da li imamo dokaze da tržišta vremenom uravnotežuju ponudu i potražnju?

Podaci o cenama robe tokom vremena mogu nam dati bolje razumevanje da li tržišta zaista efikasno uravnotežuju ponudu i potražnju. Međutim, cene ne možemo da posmatramo u smislu nacionalnih valuta, jer naše vlade uvek štampaju više svojih nacionalnih valuta.

Oni sprovode monetarnu inflaciju, koja može da izazove inflaciju cena. Posmatranje tržišnih cena u smislu nacionalnih valuta, poput američkog dolara, je poput merenja visine lenjirom koji se neprestano smanjuje. Vaša visina u broju biće sve veća i veća, ali stvarna visina se ne menja.

Mi možemo da znamo da li tržišta uravnotežuju ponudu i potražnju gledajući cene dobara u smislu monetarnog dobra koje ima vrlo konzistentnu ponudu tokom vremena.

Vremenom se pokazalo da zlato ima najmanju monetarnu inflaciju od svih postojećih valuta i dobara. To čini zlato odličnim ‘lenjirom’ za merenje da li tržišta vremenom uravnotežuju ponudu i potražnju. Da bismo bolje razumeli inflaciju cena tokom vremena, pitaćemo koliko unci zlata nešto košta tokom vremena.

Cene u zlatu pokazuju nam da se tržišta vremenom uravnotežuju

Ako cene dobara posmatramo u obliku zlata, vidimo da cene robe prate srednje tačke tokom dužih vremenskih perioda.

Nafta, na primer, je vrlo nestabilna, ali ima tendenciju da se kreće oko 2,5 grama zlata po barelu.

WTI Sirova Nafta u gramima Zlata po Barelu

WTI Sirova Nafta u gramima Zlata po BareluCena nafte je promenljiva, ali tokom decenija ima tendenciju da se kreće po strani.

Cene kuća tokom proteklih 10 godina takođe su prilično stabilne, iako imamo fiksnu količinu zemlje na planeti. Vidimo da cene kuća u pogledu zlata imaju tendenciju da variraju oko indeksne cene od oko 80, prikazane na grafikonu.

Shiller-ov US indeks cena kuća u USD i zlatu

Shiller-ov US indeks cena kuća u USD i zlatuOvaj grafikon je na logaritamskoj skali, što nam omogućava da vizualizujemo zapanjujuća povećanja u zelenoj liniji, koja predstavlja domove u dolarima.

Grafički izražene u američkim dolarima, cene ovih dobara uvek rastu – baš kao i McDonald’s hamburger. Da su povećana potražnja ili povećani troškovi odgovorni za konstantnu inflaciju cena, takođe bismo videli kako se cena ove robe povećava u smislu zlata. Podaci iznad pokazuju da su cene konstantne.

Moraju da postoje i drugi razlozi za upornu inflaciju cena koju smo videli u dolarskim iznosima tokom proteklog veka.

Evo šta znamo o tome šta dugoročno utiče na cene, kao u periodu od 1955. do 2018. godine:

- Rast produktivnosti uzrokovan inovacijama, što dovodi do pada cena tokom vremena

- Monetarna inflacija – štampanje velikih količina valute – koja uzrokuje porast cena denominovanih u toj valuti tokom vremena

Znamo da cene izražene u dolarima, eurima i ostalim valutama neprestano rastu. Ako ne mislimo da naša produktivnost kao društva ide unazad, postoji samo jedan jednostavan razlog za inflaciju cena: štampanje većih količina valute, iliti monetarna inflacija.

Naše vlade i banke su zapravo prilično iskrene u pogledu zapanjujućih količina valute koje štampaju. Oni nam svakodnevno govore da oni uzrokuju monetarnu inflaciju.

Da li nam je infacija potrebna?

Bez uporne monetarne inflacije (koja uzrokuje inflaciju cena), naša celokupna savremena ekonomija bi se srušila.

Dozvolite da vam objasnim. Sledeći odeljak može da bude šokantan, i ohrabrujem vas da i sami istražite ukoliko mislite da nisam u pravu.

Kada centralne banke i komercijalne banke daju zajmove, one stvaraju novu valutu.

Kada centralne banke daju zajmove vladama “kupujući državni dug”, one stvaraju novu valutu kada to urade. To omogućava vladama da vode budžetski deficit trošeći više nego što uzimaju od poreza. U tom procesu državni dug se nagomilava.

Komercijalne banke stvaraju novu valutu kada daju zajmove fizičkim licima i preduzećima. Jedino ograničenje koliko novog novca mogu da stvore je zakonski zahtev da banka ima na raspolaganju određeni procenat od ukupnog iznosa novca koji su ljudi deponovali. Zbog toga je naš bankarski sistem poznat kao delimična rezerva – banke pri ruci moraju da imaju samo deo vašeg novca.

Stvaranje valute je neophodno da bi održalo sistem u životu

Budući da se svi zajmovi uglavnom sastoje od novostvorene valute, mora se stvoriti još više valute da bi se taj dug otplatio. A evo i zašto:

Recimo da su prošle godine sve svetske kreditne aktivnosti dovele do stvaranja 100 milijardi dolara. Svih tih 100 milijardi dolara je novostvoreno, i one se duguju bankama sa nekom dodatnom vrednošću za kamate. Odakle dolazi ova dodatna valuta za plaćanje kamata? Budući da ovde govorimo o celokupnoj svetskoj ekonomiji, to plaćanje kamata mora da dodje iz nove količine novostvorene valute.

Sve jedinice današnjih valuta nastale su pozajmljivanjem, a isplata kamate na te zajmove znači da moramo stalno da stvaramo još više nove valute. To dovodi do beskrajne monetarne inflacije. Kada nova valuta cirkuliše kroz ekonomiju, to dovodi do porasta cena: inflacije cena.

Previše monetarne inflacije može dovesti do hiperinflacije cena. U Venecueli je krajem 2018. godine piletina koštala preko 14 miliona Bolivara. Izvor: NBC News

Previše monetarne inflacije može dovesti do hiperinflacije cena. U Venecueli je krajem 2018. godine piletina koštala preko 14 miliona Bolivara. Izvor: NBC NewsMonetarni sistem se raspada ako se ova monetarna inflacija zaustavi, jer bi to značilo da veliki broj onih koji su uzeli zajam širom sveta ne bi mogao da vrati novac koji su pozajmili – oni ne bi izmirili svoje dugove.

Banke ili zajmodavci koji drže dug tada bi imali bezvrednu imovinu. Budući da vrednost duga podupire vrednost valute, vrednost valute bi strmoglavo padala zajedno sa dugom.

Kada ljudi izgube poverenje u ’tradicionalnu’ valutu, ona brzo postane bezvredna. To se dogodilo u Nemačkoj nakon Prvog svetskog rata, u Peruu devedesetih, Jugoslaviji 1994. ,Zimbabveu, Venecueli i sa još bezbroj drugih tradicionalnih valuta. Da bi odložile ovaj neizbežni ishod dokle god mogu, centralne banke jačaju poverenje u sistem nastavljajući da štampaju valutu stabilnim kursom.

Ovo osigurava da većina ljudi koju su uzeli zajam ima valutu za otplatu svojih kredita. Upravo to se dešava kada vlada izvrši „spas“ kao 2008. ili 2020. – oni osiguravaju da svi imaju dovoljno novca za plaćanje dugova, tako da laž može da se nastavi.

Inflacija ne dolazi iz povećanja potražnje

Sa više valute u opticaju, monetarna inflacija može da izgleda kao povećanje potražnje. Međutim, ekonomisti koji kažu da povećana potražnja pokreće stabilnu inflaciju tokom decenija propuštaju suptilnu poentu: iako monetarna inflacija može da prouzrokuje veću potrošnju, to nije zato što su ljudi zaista bogatiji, već zato što veruju da su bogatiji.

Kada se puno novca ubrizga u ekonomiju, cene jednostavno rastu jer više valute pokriva istu količinu robe. Rast cena znači pad vrednosti valute, tako da nema realnog povećanja stvarnog bogatstva, iako ljudi možda “troše više” u nominalnom iznosu valute.

Uzmimo ovaj primer: vi mesečno zarađujete 1.500 EUR, i prema svom trenutnom načinu života vi mesečno trošite oko 1.500 EUR. Dolazi vlada i počinje da vam daje dodatnih 500 EUR svakog meseca – vi se osećate poprilično dobro, zar ne? Sada možete da izlazite češće u restoran.

Međutim, vlada daje svima po 500 EUR mesečno, i svi ostali takođe troše taj novac. Ekonomista u vladinoj kancelariji, vidi da sada svi troše tih dodatnih 500 EUR mesečno i zaključuje da je vlada ‘stimulisala ekonomiju’.

Ipak, kako sav taj dodatni novac kruži ekonomijom, cene prirodno rastu. Sada vam je potrebno 2.000 EUR da biste održali svoj trenutni način života.

Da li si nešto bogatiji?

Vi možda imate više eura na vašem bankovnom računu, ali svaki od njih vam kupuje manje. Sada trošite 2.000 EUR mesečno da biste živeli životnim stilom koji vas je nekada koštao samo 1.500 EUR mesečno.

Ovo je ono što monetarna inflacija radi, i zašto je toliko pametnih ekonomista zavarano da misle da povećana potražnja, radije nego štampanje novca, pokreće trajnu inflaciju cena.

Da li smo uvek imali inflaciju?

Stalna inflacija cena relativno je nedavna pojava u modernim ekonomijama i započela je u vreme kada su Sjedinjene Države počele da konstantno štampaju valutu. Ako bi promene ponude i potražnje zaista dugoročno uzrokovale inflaciju cena, videli bismo inflaciju cena tokom istorije. Podaci govore drugačiju priču.

Indeks potrošačkih cena, koji se povećava kada imamo inflaciju cena, bio je prilično konstantan pre početka našeg trenutnog tradicionalnog ’fiat’ monetarnog sistema.

Taj sistem je započeo Bretton Woods-ovim sporazumom iz 1945. godine, a ubrzao se kada je Nixon 1971. okončao svetski zlatni standard.

Indeks potrošačkih cena, Sjedinjene Države, 1790-2015

Indeks potrošačkih cena, Sjedinjene Države, 1790-2015Kako se meri inflacija?

Inflacija cena se često prikazuje kao promena indeksa potrošačkih cena (CPI). CPI je prosek cena raznih dobara koje ljudi kupuju u svakodnevnom životu: hrane, goriva, stanovanja itd. U Sjedinjenim Državama, vladin odsek pod nazivom Biro za statistiku rada (BLS) meri promene cena. To rade tako što posećuju maloprodajne radnje, beleže cene, računaju prosek i izveštavaju godišnju inflaciju kao promenu u odnosu na prošlu godinu.

Stopa inflacije koja se izveštava, je važna svima jer se koristi za određivanje povećanja troškova života i socijalnih davanja, poput plaćanja socijalnog osiguranja. Kada se CPI prilagodi naniže, isplate zarada i naknada su manje nego što bi trebalo da budu.

Efekti su se vremenom sjedinili: osoba koja u svojoj prvoj godini rada zaradi 40.000 USD zarađivaće samo 52.000 USD u svojoj desetoj godini staža, sa povećanim troškovima života od 3% da bi se plata podudarala sa inflacijom. Ako bi vlada umesto toga prijavila inflaciju od 6%, ta osoba bi u svojoj desetoj godini zarađivala 67.500 USD – tj. oko 30% više. Način na koji izračunavamo i prijavljujemo inflaciju ima ogroman uticaj na zaradu većine zaposlenih i građana.

Ovo je inflacija (procentualna promena u CPI) izmerena u poslednjih 20 godina u Sjedinjenim Državama:

Prvobitno je BLS jednostavno beležio cenu korpe robe široke potrošnje svake godine. Međutim, istraživanje Boskinove Komisije 1996. godine dovelo je do novih alata koji Birou za statistiku rada omogućavaju prilagođavanje cena u CPI. Dva najvažnija alata su geometrijsko ponderisanje i hedonika.

Geometrijsko Ponderisanje

Geometrijsko ponderisanje znači da kupovne navike sada mogu da utiču na to koliko promena cene pojedinog dobra utiče na CPI. Ako potrošači kupe manje robe, ona ima manju težinu kada se ubaci u presek indeksa potrošačkih cena. Boskinova Komisija je tvrdila da bi ova promena pomogla da se promene sklonosti potrošača. Međutim, ne postoji način da se utvrdi da li ljudi menjaju svoje kupovne navike jer zapravo žele da kupuju različite stvari. Vrlo je moguće da ljudi kupuju manje određenog dobra jer ono raste u ceni. Stoga geometrijsko ponderisanje uzrokuje da roba sa velikim rastom cena ima manje uticaja na CPI, što dovodi do niže prijavljene inflacije.

Hedonika

Hedonika omogućava Birou za statistiku rada da menja cenu dobra na osnovu njegovog opaženog povećanja ‘korisnosti’ tokom vremena. Evo primera: recimo da se televizor sa rezolucijom od 720p 2009. godine prodavao za 200 USD. U 2010. godini isti model televizora sada ima rezoluciju od 1080p i prodaje se po istoj ceni: 200 USD. Međutim, pošto se tehnologija u televizoru poboljšala, zaposleni u Birou za statistiku rada mogu da izmisle ‘korisni’ broj i pomoću njega oduzmu deo vrednosti od cene televizora. Kao rezultat, BLS može da kaže da TV košta 180 USD u 2010. godini – iako je njegova cena 200 USD. Ovo dovodi do pada prijavljene inflacije.

Oba ova prilagođavanja smanjuju prijavljenu stopu inflacije, što smanjuje povećanje troškova života i isplate naknada za socijalno osiguranje. Koliko ta prilagođavanja inflacije pogađaju radničku klasu i penzionere? Neke procene, poput procena ekonomiste John Williams-a, sa koledža u Darmouthu, stavljaju stvarnu inflaciju u SAD na u proseku 3% – 6% više nego što je izveštavano od strane Bira za statistiku rada. To bi inflaciju u 2020 dovelo do 5% – 8%, umesto na prijavljenih 2%.

U 2021. godini prijavljena inflacija je 5.4%, u prvom kvartalu.

Da li inflacija pokreće ekonomski rast?

Mnogi ljudi veruju da stabilna inflacija pokreće ekonomski rast podstičući investicije i potrošnju umesto štednje. Međutim, osnovni ekonomski podaci pobijaju ovu uobičajenu tvrdnju.

Ako za primer uzmemo Sjedinjene Države, nacija je imala samo kratke periode inflacije od 1775. do oko 1950. godine, kao što pokazuje indeks potrošačkih cena koji je ostao nepromenjen. Inflacija dobija zamah tek nakon 1971. godine, pa bi bilo za očekivati da će i stopa rasta bruto domaćeg proizvoda (BDP) Sjedinjenih Država porasti nakon 1971. godine.

Indeks potrošačkih cena, Sjedinjene Države, 1790-2015

Indeks potrošačkih cena, Sjedinjene Države, 1790-2015Međutim, vidimo da se bruto domaći proizvod (BDP) po stanovniku u Sjedinjenim Državama, uobičajena mera ekonomske snage, neprekidno povećavao od 1820. godine do danas po stopi od oko 1,85% godišnje. Ne postoji porast oko 1971. godine, uprkos rastućoj inflaciji koja je započela u to vreme.

Ovo je logaritamski grafikon, koji nam omogućava da bolje vizualizujemo rast tokom vremena: što više logaritamski grafikon podseća na pravu liniju, to je stopa promene konzistentnija. Za više detalja, ovde pogledajte naslov: Rast na tehnološkoj granici i rast dostizanja.

To pokazuje da inflacija ne pokreće ekonomski rast.

Nažalost, imamo dokaze da inflacija ima i druge neželjene posledice, poput nejednakosti bogatstva. Koncentracija bogatstva u top 1%, počela je da raste krajem 1970-ih, nekoliko godina nakon što su Sjedinjene Države skinule svet sa zlatnog standarda i pretvorile se u monetarni sistem zasnovan na dugovima koji zahteva monetarnu inflaciju, a time i inflaciju cena, da bi preživeo.

Za potpunu istoriju tranzicije novca sa robnog sistema na dužni sistem, pročitajte naš članak o novcu.

Da li inflacija pokreće ili umanjuje nejednakost bogatstva?

Veza između inflacije i nejednakosti bogatstva postaje jasna kada pogledamo kako novostvorena valuta ulazi u ekonomiju. Vlade, komercijalne banke, velike korporacije i bogati često koriste kredite da bi iskoristili prednosti svojih moći. Kada podignu kredite, oni novonastalu valutu dobijaju ranije od svih ostalih. Oni imaju koristi od inflacije trošenjem nove valute pre nego što cene počnu da rastu kao rezultat te nove valute koja kruži u ekonomiji. Veliki i bogati subjekti često mogu da dobiju kredite po nižim troškovima od prosečnog građanina ili malog preduzeća. To znači da mogu da povećaju svoje poslovanje i bogatstvo brže od manjih firmi.

Bogati mogu da dobiju jeftine zajmove, zahvaljujući Federalnim Rezervama koje zadržavaju niske kamatne stope. To im omogućava da koriste ovo prednost za ostvarivanje ogromne dobiti.

Inflacija pogadja one koji rade za platu i ne mogu da ulože veći deo svog prihoda. Zarade se polako menjaju, ponekad se uskladjuju samo jednom godišnje. Kao rezultat, cene osnovnih dobara i usluga često rastu mnogo pre nego što zarade porastu. Cena potrošačke korpe takođe se smanjuje sa manipulacijama indeksom potrošačkih cena (CPI) koji skriva rast inflacije.

Gde se danas javlja inflacija?

Rekordno visoka inflacija javlja se u zemljama kao što su Venecuela, Zimbabve, Turska, Iran, Kuba, Južna Afrika i Argentina. To dovodi do sloma trgovine i političke nestabilnosti.

U razvijenom svetu vlade izveštavaju o niskoj inflaciji cena. Međutim, globalni bankarski sistem stvara nove valute u tonama – u toku je velika monetarna inflacija. Centralne banke dovode do sve većeg stvaranja valuta snižavanjem kamatnih stopa. To dovodi do toga da korporacije i pojedinci mogu da uzimaju jeftinije kredite, a svaki kredit znači stvaranje nove valute. Od 2008. godine, gotovo sve glavne centralne banke postavile su kamatne stope blizu nule.

Mnoge centralne banke takođe su pozajmljivale ogromne iznose vladama i bankama koje su propale nakon finansijske krize 2008. godine. Za samo nekoliko meseci, ovo je udvostručilo (ponekad utrostručilo ili učetvorostručilo) novčanu masu mnogih nacija. Oni su ovo nazvali „kvantitativno ublažavanje“.

Ako banke koriste toliku monetarnu inflaciju, zašto onda mi ne vidimo inflaciju cena?

Jednostavno rečeno, većina nove valute nije dospela u ruke običnih ljudi. Kada obični ljudi budu mogli da potroše novoštampanu valutu na svoje svakodnevne potrebe, tada ćemo videti rast CPI i inflacije.

Danas većina valuta ulazi u svet putem bankarskih zajmova, pa banke igraju veliku ulogu u tome gde se dešava inflacija. Banke prvenstveno pozajmljuju vrlo ‘sigurnim’ klijentima poput bogatih pojedinaca, vlada i velikih korporacija. Ovi subjekti kupuju luksuznu robu, umetnička dela, finansijsku imovinu i državne obveznice.

Cene ovih vrsta imovine nisu uključene u CPI, tako da je prijavljena inflacija niska. Kao rezultat, povećanje plata i isplate socijalnog osiguranja su takođe na niskom nivou.

Bogati su uživali u periodu od 2008. do 2021. godine, kada je njihova imovina upumpavana sa velikom količinom novog novca proizvedenog od bankarskih kredita!

Bogati su uživali u periodu od 2008. do 2021. godine, kada je njihova imovina upumpavana sa velikom količinom novog novca proizvedenog od bankarskih kredita!Šta se dešava kada nova valuta dodje u ruke običnih ljudi?

Nažalost, jednog dana će sva ova nova valuta da uđe u normalnu ekonomiju i time će se povećati cene svakodnevne robe. To je poćelo da se dešava 2021. godine kao rezultat stimulativnih programa COVID-19 u Sjedinjenim Državama, koji su ljudima distribuirali trilione dolara. Iako je ovo zasigurno poželjnije od spašavanja korporacija, svaka vrsta spašavanja koja uključuje štampanje novca ima gadne dugoročne efekte.

Ovo što sada doživljavamo dogodilo se u Nemačkoj tokom i posle Prvog svetskog rata. Cene u Nemačkoj su zapravo pale tokom Prvog svetskog rata uprkos velikom stvaranju valute od strane Nemačke centralne banke. Nisko poverenje u ekonomiju sprečavalo je nemački narod da troši novac. Međutim, kad se rat završio i kada su ljudi ponovo počeli da ga troše, cene su vrlo naglo skočile i valuta je postala bezvredna. To bi moglo da se dogodi 2020-ih u Sjedinjenim Državama, sa obzirom na predložene programe podsticaja.

Politike poput Univerzalnog Osnovnog Dohotka, eng. Universal Basic Income (UBI), koje izgledaju pogodne za njihova obećanja da će “spasiti ljude”, takođe mogu da pokrenu hiperinflaciju. Obični ljudi bi se osećali imućnije, trošili bi svoju novoštampanu valutu i doveli do brzog rasta cena. Ovo bi u suštini poništilo pozitivan uticaj građana koji dobijaju “besplatan novac” svakog meseca.

Pa kako onda vi možete da zaštitite svoju ušteđevinu od inflacije? Kupujte imovinu koja je retka, potcenjena i koju vlade teško mogu da prigrabe. Ova imovina su plemeniti metali poput zlata, i Bitcoin.

Šta je deflacija?

Deflacija znači pad cena tokom vremena. Mnogi ekonomisti kažu da će ovo dovesti do toga da ljudi gomilaju valutu i da će dovesti do ekonomskog kolapsa, jer ljudi prestaju da kupuju robu i ulažu u preduzeća. To jednostavno nije tačno, jer ljudi uvek imaju potrebe i želje zbog kojih kupuju odredjenu robu. Stalni pad cena tokom vremena jednostavno bi promenio psihologiju potrošačke kulture u kojoj živimo.

Potrošačka kultura potiče od inflacije

Kako je to istina? Pogledajmo na sledećem primeru. Recimo da želite novi auto i da imate dovoljno novca da ga kupite. Poznato je da u našem svetu zbog stalne inflacije vaš novac vremenom postaje sve manje i manje vredan. U paralelnom svemiru u kojem se javlja stalna deflacija, vaš novac vremenom postaje sve vredniji.

- Uz konstantnu inflaciju, auto će koštati nešto više sledeće godine, i nešto više naredne godine. Niste sigurni gde da uložite novac da biste sa vremenom sigurno očuvali njegovu kupovnu moć. Ako niste sigurni da li ćete da kupite auto, ima više finansijskog smisla da ga kupite odmah, da biste dobili najbolju ponudu.

- Uz konstantnu deflaciju, auto će koštati nešto manje sledeće, i još manje naredne godine. Ako samo čuvate vaš novac, sledeće godine ćete dobiti bolju ponudu za auto. Ako niste sigurni da li ćete da kupite auto, ima više finansijskog smisla da sačekate malo duže da biste dobili bolju ponudu.

Sada razmislite o ta dva scenarija, pomnožena bilionima ljudi i proizvoda. Uz konstantnu inflaciju, svako ima malo više razloga da kupuje stvari upravo sada. Uz konstantnu deflaciju, svi sada imaju malo manje razloga da kupuju. Upravo na taj način inflacija je u osnovi naše materijalističke, potrošačke kulture. Deflacija bi mogla da bude lek.

Inflacija uzrokuje loše investicije

Vaš novac godišnje gubi “2%” svoje vrednosti zbog inflacije. Sada, recimo da vas Stefan pita da investirate u njegov Fast food. Nakon uvida u brojeve, verujete da ćete ovom investicijom izgubiti 1% od vrednosti svog novca. Gubitak od 1% u Stefanovom poslu bolji je od gubitka od 2% zbog inflacije, pa se vi odlučujete da uložite. Ovo je loša investicija, eng. malinvestment – investirajući vi ćete da izgubite deo vrednosti. Međutim, čuvanje valute je još gore, zato ulažete.

Mnogi investitori, poput penzijskih fondova, danas su prisiljeni da investiraju u neprofitabilne biznise zbog investicionih mandata i same veličine njihove ‘imovine pod upravljanjem’.

Pristalice konstantno niske inflacije veruju da bi deflacija smanjila investicije. Međutim, to bi samo smanjilo ulaganje u preduzeća sa negativnim očekivanim prinosom poput Stefanovog Fast food-a. Na primer, recimo da je deflacija u proseku oko 2% godišnje. Na ovom tržištu investitori bi jednostavno prestali da ulažu u projekte za koje misle da će im zaraditi manje od 2% godišnjeg povrata ulaganja.

Neznatno deflaciona valuta obeshrabriće ulaganja u lažna i loša preduzeća i podstaći ulaganje u solidna preduzeća koja svetu dodaju vrednost.

Kakav uticaj inflacija ima na društvo?

Inflacija pokreće povećanu potrošnju, smanjenu štednju i povećani dug. Sve ove stvari dovode do toga da većina ljudi mora da radi više sati i duže u starosti. Iako inflacija kažnjava one koji rade za platu, ona obogaćuje vlasnike bilo koje imovine koja dobija na ceni kada nova valuta uđe u sistem. Ova imovina uključuje akcije, umetnička dela, nekretnine i drugu imovinu koju bogataši koriste za čuvanje svog bogatstva.

Vremenom ljudi i firme izmišljaju nove načine za jeftinije stvaranje dobara i usluga višeg kvaliteta. Ovo je poznato kao ‘rast produktivnosti’ i trebalo bi da uzrokuje da cene tokom vremena konstantno padaju, a ne da rastu. Samo konstantno stvaranje valute koje je neophodno zbog monetarnog sistema zasnovanog na dugu naše vlade uzrokuje stalnu inflaciju i njene loše efekte.

Ako vam se sviđa moj rad, molim vas da ga podelite sa svojim prijateljima i porodicom. Cilj mi je da svima pružim pogled u ekonomiju i na to kako ona utiče na njihov život.

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 5ea46480:450da5bd

2025-05-24 09:57:37

@ 5ea46480:450da5bd

2025-05-24 09:57:37Decentralization refers to control/power, and relates to censorship resistance. That is it, it is not more complicated then that. Resilience is a function of redundancy; a centralized censored system can have a redundant set-up and therefor be resilient.

Take Bitcoin; the blockchain is a central database, it is resilient because it has many redundant copies among a lot of different nodes. The message (txs and blocks) propagation is decentralized due to existence of a p2p network among these nodes, making the data distribution censorship resistant (hello op_return debate). But onchain transactions themselves are NOT p2p, they require a middlemen (a miner) because it is a central database, as opposed to something like lightning which is p2p. Peer to Peer says something about relative architectural hierarchical position/relation. P2P provides censorship resistance because it entails equal power relations, provided becoming a peer is permissionless. What makes onchain transactions censorship resistant is that mining is permissionless, and involves this open power struggle/game where competition results in a power distribution among players, meaning (hopefully) decentralization. The fact users rely on these middlemen is mitigated by this decentralization on the one hand, and temper-proofing via cryptographic signatures on the other, resulting in what we call trustlessness (or trust minimization for the autists in the room); we only rely on a miner to perform a job (including your tx into a block), but we don’t trust the miner to perform the job correctly, this we can verify ourselves.

This leads us to Nostr, because that last part is exactly what Nostr does as well. It uses cryptography to get tamper-proof messaging, which then allows you to use middle-men in a trust minimized way. The result is decentralization because in general terms, any middle man is as good as any other (same as with miners), and becoming such a middleman is permissionless(somewhat, mostly); which in turn leads to censorship resistance. It also allows for resilience because you are free to make things as redundant as you'd like.

Ergo, the crux is putting the cryptography central, making it the starting point of the system; decentralization then becomes an option due to trust minimization. The difference between Bitcoin an Nostr, is that Bitcoin maintains a global state/central ledger and needs this PoW/Nakamoto consensus fanfare; Nostr rests itself with local perspectives on 'the network'.

The problem with the Fediverse, is that it does not provide trust minimization in relation to the middlemen. Sure, there are a lot different servers, but you rely on a particular one (and the idea you could switch never really seemed to have materialized in a meaningful way). It also fails in permisionlessness because you rely on the association between servers, i.e. federation, to have meaningful access to the rest of the network. In other words, it is more a requirement of association than freedom of association; you have the freedom to be excommunicated.

The problem with ATproto is that is basically does not solve this dynamic; it only complicates it by pulling apart the components; identity and data, distribution and perspective are now separated, and supposedly you don’t rely on any particular one of these sub-component providers in the stack; but you do rely on all these different sub-component providers in the stack to play nice with each other. And this ‘playing nice’ is just the same old ‘requirement of association’ and ‘freedom of excommunication’ that looms at the horizon.

Yes, splitting up the responsibilities of identity, hosting and indexing is what is required to safe us from the platform hellscape which at this stage takes care of all three. But as it turns out, it was not a matter cutting those up into various (on paper) interchangeable middlemen. All that is required is putting cryptographic keys in the hands of the user; the tamperproofing takes care of the rest, simply by trust minimizing the middlemen we use. All the sudden it does not matter which middlemen we use, and no one is required to play nice; we lost the requirement of association, and gained freedom of association, which was the purpose of censorship resistance and therefor decentralization, to begin with.

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 3f770d65:7a745b24

2025-05-20 21:14:28

@ 3f770d65:7a745b24

2025-05-20 21:14:28I’m Derek Ross, and I’m all-in on Nostr.

I started the Grow Nostr Initiative to help more people discover what makes Nostr so powerful: ✅ You own your identity ✅ You choose your social graph and algorithms ✅ You aren't locked into any single app or platform ✅ You can post, stream, chat, and build, all without gatekeepers

What we’re doing with Grow Nostr Initiative: 🌱 Hosting local meetups and mini-conferences to onboard people face-to-face 📚 Creating educational materials and guides to demystify how Nostr works 🧩 Helping businesses and creators understand how they can plug into Nostr (running media servers, relays, and using key management tools)

I believe Nostr is the foundation of a more open internet. It’s still early, but we’re already seeing incredible apps for social, blogging, podcasting, livestreaming, and more. And the best part is that they're all interoperable, censorship-resistant, and built on open standards. Nostr is the world's largest bitcoin economy by transaction volume and I truly believe that the purple pill helps the orange pill go down. Meaning, growing Nostr will also grow Bitcoin adoption.

If you’ve been curious about Nostr or are building something on it, or let’s talk. Whether you're just getting started or you're already deep in the ecosystem, I'm here to answer questions, share what I’ve learned, and hear your ideas. Check out https://nostrapps.com to find your next social decentralized experience.

Ask Me Anything about GNI, Nostr, Bitcoin, the upcoming #NosVegas event at the Bitcoin Conference next week, etc.!

– Derek Ross 🌐 https://grownostr.org npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424

https://stacker.news/items/984689

-

@ bf47c19e:c3d2573b

2025-05-24 16:13:51

@ bf47c19e:c3d2573b

2025-05-24 16:13:51Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Definisanje novca

- Šta je sredstvo razmene?

- Šta je obračunska jedinica?

- Šta je zaliha vrednosti?

- Zašto su važne funkcije novca?

- Novac Gubi Funkciju: Alhemičar iz Njutonije

- Eksploatacija pomoću Novca: Agri Perle

- Novac Gubi Funkciju 2. Deo: Kejnslandski Bankar

- Da li nas novac danas eksploatiše?

- Šta je novac, i zašto trebate da brinete?

- Efikasnija Ušteda Novca

- Zasluge

- Molim vas da šerujete!

Google izveštava o stalnom povećanju interesa u svetu za pitanje „Šta je novac?“ koji se postavlja iz godine u godinu, od 2004. do 2021., a sa naglim porastom nakon finansijske krize 2008. godine.

I izgleda se da niko nema dobar odgovor za to.

Godišnji proseci mesečnih interesa za pretragu. 100 predstavlja najveći interes za pretragu tokom čitavog perioda, koji se dogodio u decembru 2019. Podaci sa Google Trends-a.

Godišnji proseci mesečnih interesa za pretragu. 100 predstavlja najveći interes za pretragu tokom čitavog perioda, koji se dogodio u decembru 2019. Podaci sa Google Trends-a.Međutim, odgovaranje na ovo naizgled jednostavno pitanje pomoći će vam da razjasnite ulogu novca u vašem životu. Jednom kada shvatite kako novac funkcioniše, tačno ćete videti i zašto svet danas ludi – i šta učiniti povodom toga. Zato hajde da se udubimo u to.

Na pitanje šta je novac, većina ljudi otvori svoje novčanike i pokaže nekoliko novčanica – “evo, ovo je novac!”

Ali po čemu se ove novčanice razlikuju od stranica vaše omiljene knjige? Pa, naravno, zavod za izradu novčanica te zemlje je odštampao te novčanice iz vašeg novčanika kako bi se oduprla falsifikovanju, i svi ih koriste da bi kupili odredjene stvari.

Međutim, Nemačka Marka imala je sva ova svojstva u prošlosti – ali preduzeća danas ne prihvataju te novčanice. Zapravo, građani Nemačke su početkom dvadesetih godina prošlog veka spaljivali papirne Marke kako bi grejali svoje domove. Marka je imala veću vrednost kao papir za potpalu nego kao novac!

1923. nemačka valuta poznata kao Marka bila je jeftinija od uglja i drveta!

Pa šta to čini novac, novcem?

Ispostavilo se da ovo nije pitanje na koje je lako dati odgovor.

Definisanje novca

Novac nije fizička stvar poput novčanice dolara. Novac je društveni sistem koji koristimo da bismo olakšali trgovinu robom i uslugama. Međutim, tokom istorije fizička monetarna dobra igrala su ključnu ulogu u društvenom sistemu novca, često kao znakovi koji predstavljaju vrednost u monetarnom sistemu. Ovaj sistem ima tri funkcije: 1) Sredstvo Razmene, 2) Obračunsku Jedinicu i 3) Zalihu Vrednosti.

Odakle dolaze ove funkcije, i zašto su one vredne?

Šta je sredstvo razmene?

Sredstvo razmene je neko dobro koje se obično razmenjuje za drugo dobro. Najčešće objašnjenje za to kako su se pojavila sredstva razmene glasi otprilike ovako: Boris ima ječam i želeo bi da kupi ovcu od Marka. Marko ima ovce, ali želi samo piliće. Ana ima piliće, ali ona ne želi ječam ili ovce.

To se naziva problem sticaja potreba: dve strane moraju da žele ono što druga ima da bi mogle da trguju. Ako se želje dve osobe ne podudaraju, oni moraju da pronađu druge ljude sa kojima će trgovati dok svi ne pronađu dobro koje žele.

Ljudi koji trguju robom i uslugama moraju da imaju potrebe koje se podudaraju.

Ljudi koji trguju robom i uslugama moraju da imaju potrebe koje se podudaraju.Vremenom, veoma je verovatno da će se određena vrsta robe, poput pšenice, pojaviti kao sredstvo razmene jer su je mnogi ljudi želeli. Uzimajući pšenicu kao primer: pšenica je rešila “sticaje potreba” u mnogim zanatima, jer čak i ako onaj koji prima pšenicu a nije želeo da je koristi za sebe, znao je da će je neko drugi želeti.

Ovo nazivamo prodajnost imovine.

Pšenica je dobar primer dobra za prodaju jer svi moraju da jedu, a od pšenice se pravi hleb. Pšenica ima vrednost kao sastojak hleba i kao dobro koje olakšava trgovinu rešavanjem problema „sticaja potreba“.

Razmislite o svojoj želji da dobijete više novčanica u eurima ili drugoj valuti. Ne možete da jedete novčanice da biste preživeli, a i ne bi vam bile od velike koristi ako poželite da ih koristite kao građevinski materijal za vašu kuću. Međutim, znate da sa tim novčanicama možete da kupite hranu i kuću.

Stvarne fizičke novčanice su beskorisne za vas. Novčanice su vam dragocene samo zato što će ih drugi prihvatiti za stvari koje su vama korisne.

Tokom dugog perioda istorije, novac je evoluirao do te mere da monetarno dobro može imati vrednost, a da to dobro ne služi za bilo koju drugu ‘suštinsku’ upotrebu, poput hrane ili energije. Umesto toga, njegova upotreba je zaliha vrednosti i jednostavna zamena za drugu robu u bilo kom trenutku koji poželite.

Šta jedno dobro čini poželjnijim i prodajnijim od drugog dobra?

Deljivost

Definicija: Sposobnost podele dobra na manje količine.

Loš Primer: Dijamante je teško podeliti na manje komade. Za zajednicu od hiljada ljudi koji dnevno izvrše milione transakcija, dijamanti čine loše sredstvo razmene. Previše su retki i nedeljivi da bi se koristili za mnoge transakcije.

Ujednačenost

Definicija: Sličnost pojedinačnih jedinica odredjenog dobra.

Loš Primer: Krave nisu ujednačene – neke su veće, neke manje, neke bolesne, neke zdrave. Sa druge strane, unca čistog zlata je jednolična – jedna unca je potpuno ista kao sledeća. Ovo svojstvo se takođe često naziva zamenljivost.

Prenosivost

Definicija: Lakoća transporta dobra.

Loš Primer: Krava nije baš prenosiva. Zlatnici su prilično prenosivi. Papirne novčanice su još prenošljivije. Knjiga u kojoj se jednostavno beleži vlasništvo nad tim vrednostima (poput Rai kamenog sistema ili digitalnog bankovnog računa) je neverovatno prenosiva, jer nema fizičkog dobra koje treba nositi sa sobom za kupovinu. Postoji samo sistem za evidentiranje vlasništva nad tim vrednostima u nematerijalnom obliku.

Kako dobro postaje sredstvo razmene?

Dobra postaju, i ostaju sredstva razmene zbog svoje univerzalne potražnje, takođe poznate kao njihova prodajnost, čemu pomažu svojstva koja su gore nabrojana.

Mnogo različitih dobara mogu u različitoj meri delovati kao sredstva razmene u ekonomiji. Danas, naša globalna ekonomija koristi valute koje izdaju države, zlato, pa čak i robu poput nafte kao sredstvo razmene.

Šta je obračunska jedinica?

Stvari se komplikuju kada u ekonomiji postoji mnogo robe koja se prodaje. Čak i sa samo 5 dobara, postoji 10 “kurseva razmene” između svake robe kojih svi u ekonomiji moraju da se sete: 1 svinja se menja za 15 pilića, 1 pile se menja za 15 litara mleka, desetak jaja se menja za 15 litara mleka, i tako dalje. Ako ekonomija ima 50 dobara, među njima postoji 1.225 “kurseva razmene”!

Sredstvo za merenje vrednosti

Zamislite obračunsku jedinicu kao sredstvo za merenje vrednosti. Umesto da se sećamo vrednosti svakog dobra u poredjenju sa drugim dobrima, mi samo treba da se setimo vrednosti svakog dobra u poredjenju sa jednim dobrom – obračunskom jedinicom.

Umesto da se setimo 1.225 kurseva razmene kada imamo 50 proizvoda na tržištu, mi treba da zapamtimo samo 50 cena.

Na primer, ne treba da se sećamo da litar mleka vredi 1/15 piletine ili desetak jaja, možemo da se samo setimo da litar mleka košta 1USD.

Poređenje dobara je lakše sa obračunskom jedinicom

Obračunska jedinica takođe olakšava upoređivanje vrednosti i donošenje odluka. Zamislite da pokušavate da kupite par Nike Air Jordan patika kada ih jedan prodavac prodaje za jedno pile, a drugi za 50 klipova kukuruza.

Šta je zaliha vrednosti?

Do sada smo gledali samo primere transakcija koje se odvijaju u određenom trenutku u vremenu.