-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

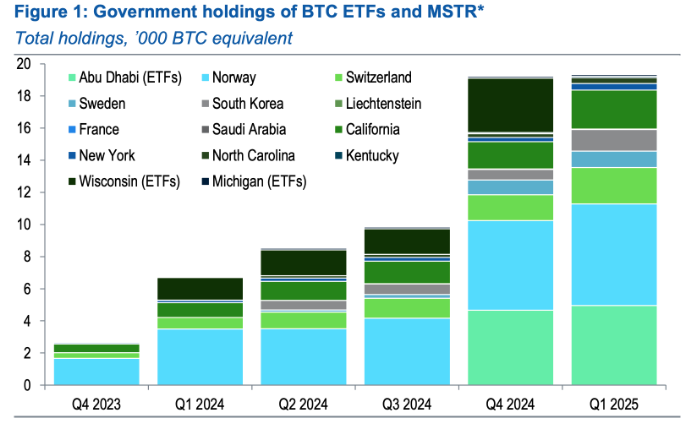

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ 6e0ea5d6:0327f353

2025-05-20 01:35:20

@ 6e0ea5d6:0327f353

2025-05-20 01:35:20**Ascolta bene! ** A man's sentimental longing, though often disguised in noble language and imagination, is a sickness—not a virtue.

It begins as a slight inclination toward tenderness, cloaked in sweetness. Then it reveals itself as a masked addiction: a constant need to be seen by a woman, validated by her, and reciprocated—as if someone else's affection were the only anchor preventing the shipwreck of his emotions.

The man who understands the weight of leadership seeks no applause, no gratitude, not even romantic love. He knows that his role is not theatrical but structural. He is not measured by the emotion he evokes, but by the stability he ensures. Being a true man is not ornamental. He is not a decorative symbol in the family frame.

We live in an era where male roles have been distorted by an overindulgence in emotion. The man stopped guiding and began asking for direction. His firmness was exchanged for softness, his decisiveness for hesitation. Trying to please, many have given up authority. Trying to love, they’ve begun to bow. A man who begs for validation within his own home is not a leader—he is a guest. And when the patriarch has to ask for a seat at the table he should preside over and sustain, something has already been irreversibly inverted.

Unexamined longing turns into pleading. And all begging is the antechamber of humiliation. A man who never learned to cultivate dignified solitude will inevitably fall to his knees in desperation. And then, he yields. Yields to mediocre presence, to shallow affection, to constant disrespect. He smiles while he bleeds, praises the one who despises him, accepts crumbs and pretends it’s a banquet. All of it, cazzo... just to avoid the horror of being alone.

Davvero, amico mio, for the men who beg for romance, only the consolation of being remembered will remain—not with respect, but with pity and disgust.

The modern world feeds the fragile with illusions, but reality spits them out. Sentimental longing is now celebrated as sensitivity. But every man who nurtures it as an excuse will, sooner or later, pay for it with his dignity.

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ 3f770d65:7a745b24

2025-05-19 18:09:52

@ 3f770d65:7a745b24

2025-05-19 18:09:52🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Bonus: Right across the aisle, you’ll find Shopstr, a decentralized marketplace app built on Nostr. Stop by their booth to explore how peer-to-peer commerce works in a truly open ecosystem.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q\&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs9etjgzjglwlaxdhsveq0qksxyh6xpdpn8ajh69ruetrug957r3qf4ggfm (Austin Kelsay) @ Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy08wumn8ghj7mn0wd68yttjv4kxz7fwv3jhyettwfhhxuewd4jsqgxnqajr23msx5malhhcz8paa2t0r70gfjpyncsqx56ztyj2nyyvlq00heps - Bitcoin Strategy @ Roxom TV

-

👥 Speakers:

-

nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qqsy2ga7trfetvd3j65m3jptqw9k39wtq2mg85xz2w542p5dhg06e5qmhlpep – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3 – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by nostr:nprofile1qy0hwumn8ghj7cmgdae82uewd45kketyd9kxwetj9e3k7mf6xs6rgqgcwaehxw309ahx7um5wgh85mm694ek2unk9ehhyecqyq7hpmq75krx2zsywntgtpz5yzwjyg2c7sreardcqmcp0m67xrnkwylzzk4 , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgkwaehxw309anx2etywvhxummnw3ezucnpdejqqg967faye3x6fxgnul77ej23l5aew8yj0x2e4a3tq2mkrgzrcvecfsk8xlu3 , and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqg7waehxw309anx2etywvhxummnw3ezucnpdejz7ur0wp6kcctjqqspywh6ulgc0w3k6mwum97m7jkvtxh0lcjr77p9jtlc7f0d27wlxpslwvhau , nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3vamnwvaz7tmwdaehgu3wd33xgetk9en82m30qqsgqke57uygxl0m8elstq26c4mq2erz3dvdtgxwswwvhdh0xcs04sc4u9p7d , nostr:nprofile1q9z8wumn8ghj7erzx3jkvmmzw4eny6tvw368wdt8da4kxamrdvek76mrwg6rwdngw94k67t3v36k77tev3kx7vn2xa5kjem9dp4hjepwd3hkxctvqyg8wumn8ghj7mn0wd68ytnhd9hx2qpqyaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgssuy4zk , nostr:nprofile1qy28wue69uhnzvpwxqhrqt33xgmn5dfsx5cqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqqswavgevxe9gs43vwylumr7h656mu9vxmw4j6qkafc3nefphzpph8ssvcgf8 , and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

| | | | | ----------- | -------------------- | ------------------- | | Time | Name | Topic | | 7:30-7:50 | Derek | Nostr for Beginners | | 8:00-8:20 | Mark & Paul | Primal | | 8:30-8:50 | Terry | Damus | | 9:00-9:20 | OpenMike and Ainsley | V4V | | 09:30-09:50 | The Space | Space |

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ c1831fbe:de4b39bf

2025-05-17 09:57:04

@ c1831fbe:de4b39bf

2025-05-17 09:57:04What follows is my best effort to recall the details of an arguably supernatural encounter I experienced almost sixty years ago. I've told this story many times before, and while my recollection may not be perfect in every detail, my account is real and substantively factual.

It was early one long ago morning, in that twilit between-time shortly before dawn. As I dangled precariously in a quasi-aware state, hovering on the knife edge between wakefulness and sleep, I was transported in a dream to another place and time. Was it the Mediterranean coast? Perhaps ancient Greece?

In my mind's eye, I found myself climbing a rather steep, rocky hillside overlooking a sparkling bright blue sea. Ahead of me, and slightly higher, was what appeared to be a young shepherd boy, leading me ever higher up the hill.

As we wove our way upward,

skirting rocky outcroppings and zig-zagging because of the steepness of the slope, I heard the boy chanting:

"Ata, Ata, Archontos, Ata, Ata, Echousi, Ata, Ata, Archousi"

He kept repeating the mantra, over and over:

"Ata, Ata, Archontos, Ata, Ata, Echousi, Ata, Ata, Archousi"

\~ \~ \~

"Ata, Ata, Archontos, Ata, Ata, Echousi, Ata, Ata, Archousi"

I listened for a few cycles, and then took up the chant myself. After several attempts, when at last I got it right, the shepherd boy turned, looking back at me and smiling broadly to signal that I had finally mastered the cadence and the words.

Then I awoke.

Because my dream had been so vivid and unusual, I immediately found a pencil and paper to write down the chant phonetically before I could forget it.

A few days passed.

Life was busy. Then I remembered my friend in grad school, studying biblical Greek. That weekend, I went and hung out with him while he worked his night job at the college heating plant. Between his rounds inspecting and managing the steam boilers keeping students from freezing to death in the Arctic Midwest winter, I told him about my strange dream.

Pulling out an exhaustive Greek lexicon, one by one, my knowledgeable friend looked up the words from my dream, interpreting each according to its verb conjugation, tense, and mood.

"Ata, Ata" had no discernible meaning; we soon concluded that it was probably just meaningless vocables, added to give the chant rhythm and substance. My friend moved on to the first recognizable word of the chant...

"Archontos" - "They are ruled."

OK, so far, so good. He checked the next word:

"Echousi" - "They shed blood."

Hmmmm... This chant is beginning to appear to be more than random sounds.

"Archousi" - "They rule."

At this point, I almost fell out of my chair in shock. Far from being a meaningless chant, this cycle—repeating again and again—is the seemingly never-ending story of the entirety of human history...

"They Are Ruled, They Shed Blood, They Rule."

\~ \~ \~

"They Are Ruled, They Shed Blood, They Rule."

This concise mantra perfectly captures the endlessly repeating cycle of oppression, revolt, and revolution that always leaves us with a fresh set of oppressors all too ready to replace the last.

Who will rescue us?

Who will redeem us from this endless tedious cycle into which we have been born?

A long lifetime of study and reflection has persuaded me that this deadly cycle can and ultimately will be broken. If we follow the teachings of Jesus; if we love one another and live together in voluntary, local societies, serving each other; I am persuaded that we can break free of this desperately destructive cycle of endlessly seeking to dominate one another. It's past time for us to enter into a mutually beneficial life in the Kingdom of our Creator-God Jesus, the most authentically benevolent King the universe has ever known.

stories #politics #Christianity #supernatural #strange

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 3f770d65:7a745b24

2025-05-20 21:14:28

@ 3f770d65:7a745b24

2025-05-20 21:14:28I’m Derek Ross, and I’m all-in on Nostr.

I started the Grow Nostr Initiative to help more people discover what makes Nostr so powerful: ✅ You own your identity ✅ You choose your social graph and algorithms ✅ You aren't locked into any single app or platform ✅ You can post, stream, chat, and build, all without gatekeepers

What we’re doing with Grow Nostr Initiative: 🌱 Hosting local meetups and mini-conferences to onboard people face-to-face 📚 Creating educational materials and guides to demystify how Nostr works 🧩 Helping businesses and creators understand how they can plug into Nostr (running media servers, relays, and using key management tools)

I believe Nostr is the foundation of a more open internet. It’s still early, but we’re already seeing incredible apps for social, blogging, podcasting, livestreaming, and more. And the best part is that they're all interoperable, censorship-resistant, and built on open standards. Nostr is the world's largest bitcoin economy by transaction volume and I truly believe that the purple pill helps the orange pill go down. Meaning, growing Nostr will also grow Bitcoin adoption.

If you’ve been curious about Nostr or are building something on it, or let’s talk. Whether you're just getting started or you're already deep in the ecosystem, I'm here to answer questions, share what I’ve learned, and hear your ideas. Check out https://nostrapps.com to find your next social decentralized experience.

Ask Me Anything about GNI, Nostr, Bitcoin, the upcoming #NosVegas event at the Bitcoin Conference next week, etc.!

– Derek Ross 🌐 https://grownostr.org npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424

https://stacker.news/items/984689

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

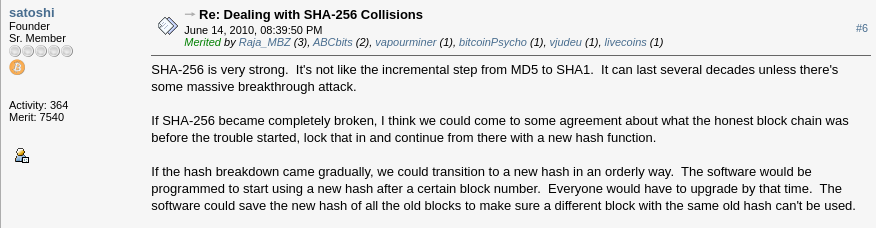

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 94215f42:7681f622

2025-05-16 08:18:52

@ 94215f42:7681f622

2025-05-16 08:18:52Value Creation at the Edge

The conversation around artificial intelligence has largely centered on the technology itself, the capabilities of large language models, the race for more parameters, and the competition between AI companies.

He with the most data / biggest model / biggest platform wins all.

As we're been exploring in recent "Good Stuff" podcasts, the true business model of AI may be much more straightforward. AI is after all a productivity tool with little technical moat, in fact the existence of AI coding and learning tools quickly chop away at this moat even quicker!.\ \ We believe that the it's about transforming traditional human heavy businesses by dramatically reducing operational costs while maintaining or increasing output.

AI is poised to create value not primarily for AI companies themselves, but for businesses that effectively implement AI to transform their operations, particularly small, local businesses that can become extraordinarily efficient through AI adoption.

The Value Shift: From AI Companies to AI-Enabled Traditional Businesses

A central insight from episode 1 of the podcast series, is that the value of AI isn't likely to accrue primarily to companies like OpenAI or other AI technology providers. Instead, the real winners will be traditional service businesses that can leverage AI to transform their operations and cost structures.

"I think we're gonna see this shift to traditional service businesses... that traditionally have pretty fixed low margins because of a dependency on language-heavy workflows that require a lot of humans as the medium of intelligence in the business."

The opportunity here is to use AI to manage the language dependency and shift the moments of intelligence, that currently exist in the heads of our staff, into software that can run 24x7 for fractions of a cost.\ \ The real limiting factor here is less a magic AGI, but instead detailed thinking and process redesign to move humans to the edge of the process. As it turns out if we think through what each person is doing in detail we see the specific decisions, outputs, moments of intelligence are actually quite constrained and can be replicated in LLM's if we break them down to a low enough level of fidelity and take each decisions one step at a time.\ \ The result? Businesses that have traditionally operated with fixed, low margins can potentially achieve "software-style margins" by dramatically reducing their operational expenses.

Transforming Traditional Service Businesses

We have developed three key heuristics for identifying businesses that could benefit most from AI transformation:

-

Language Intensity: Businesses where much of the work involves processing language (reading, writing, communicating). Language in, language out. If you are sat in a chair and typing all day, this could be you.

-

Labor Component: Where we see this language intensity so we find many people performing similar, standardized roles. For examples, if we have four people in the same role this is a big clue we have good process, checklists, role descriptions etc for how the work can be done in order to replicate work across multiple people.

-

Load in the Business: Taking these processes into account, what amount of the operational expense of the business do they represent? Where these language and labor-intensive operations represent a significant portion of the business cost, we can see there will be significant return.

Traditional service businesses that match these criteria—legal firms, accounting practices, consulting agencies, contract engineering, design agencies and others—could see dramatic transformations through AI implementation.

By automating these language-heavy processes, businesses can potentially reduce operational costs by 50-80% while maintaining similar levels of output.

The Power of Small

We believe that small businesses may have an inherent advantage in this transformation. While large enterprises face significant barriers to reducing their workforce (political pressure, media scrutiny, organizational complexity), smaller businesses can adapt more quickly and focus on growth rather than just cost-cutting.

If I'm in a 20,000 person business and I need to remove 10,000 people... that's hard. You can't do this without sending political shock waves in your local community.

If I'm a 10 person business and I need to double my revenue, nobody gives a shit. I can just do it.

For small businesses, AI removes growth constraints. When adding the "21st person" no longer represents a significant capital investment, small businesses can scale much more efficiently:

If the next nominal client that you onboard doesn't actually cause you any more additional pain, if you don't need to hire more people to service that client... you just take off the brakes off from a growth perspective.

This gives small business a unique advantage in capitalizing on AI.

From "Bionic Humans" to "Humans at the Edge"

We currently see this integration to business happening in one of two models:

-

The Bionic Human: Equipping workers with AI tools to make them more productive.

-

Human at the Edge: Redesigning processes to be AI-native, with humans entering the process only when needed (and often facilitated by bitcoin payments).

While many businesses are focused on the first approach and it can certainly see returns, it is still a process constrained by the human input. The real value unlock comes from fundamentally redesigning business processes with AI at the core.

Now we can purchase intelligence in buckets of $0.02 API calls, how would we operate different?

This represents a profound shift in how we think about work and processes. Rather than humans being central to processes with tools supporting them, AI becomes the backbone of operations with humans providing input only at critical junctures.

This is "a complete mental shift" that challenges our fundamental assumptions about how businesses operate. The human becomes "the interface with the real world" for AI systems rather than the primary processor of information and decision-maker.

The Value Trap: Understanding the Competitive Dynamic

So what happens next? Here we have developed the concept of the Value Trap to explain how the competitive landscape will evolve as AI adoption increases..\ \

Initially, early adopters of AI and "Human at the Edge" business processes, will see dramatic benefits.

If your costs have dropped from 90 to 20 this creates an immediate competitive advantage where the early adopter is "now making 80 units of profit versus your 10 units of profit.

They gain massive pricing power in the industry and can compete for growth with an unfair advantage.

Over time, and here we believe this is likely a 5-10 year period although we believe the quicker side, competitive pressures will erode these advantages.\ \ As competitors adopt similar AI strategies, price competition will intensify, and revenues will decline. The business that initially saw its costs drop from 90 to 20 units might see its revenue decline from 100 to 30 units, resulting in similar margins but much lower overall revenue, often destroying the enterprise value of the company at these new revenue / profit levels!

This evolution creates an imperative for businesses to adopt AI early, not just to maintain perpetual advantage, but simply to survive the transition. Worse they're hit with a second challenge of the value trap, how do I keep hold of the value I generate along the way.\ \ If you're reading this on Nostr you may already suspect a way out of this value trap.\ \ If not I would invite you to consider storing the immediate short term returns you pull forwards in something that would be inflation resistant, hard to seize and ideally portable.\ \ We refer to this as a 'The big orange arbitrage".

Implications for Business Owners and Capital Allocators

For business owners, especially those running small to medium-sized enterprises, the message is clear: understand how AI could transform your industry and begin planning your transition now.\ \ This might involve creating an "AI-native twin" of your current business—similar to how Netflix developed streaming alongside its DVD business—to eventually replace your current operations. If you want help please ask, I heavily favor more small businesses in the world and would love to help make this a reality.

For capital allocation, the emerging opportunity we see if in "transformation led private equity". The acquisition of traditional service businesses and applying AI to dramatically reduce operational costs and increase enterprise value.\ \ This approach treats AI not as a product but as a transformation strategy for existing businesses with proven product-market fit.

Transformation led PE is venture style returns without the risk of product market fit.

So the lesson?

The business model of AI isn't all about selling AI technology, adding a RAG chatbot to a new DB or collecting everyone's data.\ \ Consider the humble cash flow business, use AI to transform the operational processes and save into everyone's favorite orange coin.

-

-

@ ee6ea13a:959b6e74

2025-05-13 21:29:02

@ ee6ea13a:959b6e74

2025-05-13 21:29:02Reposted without permission from Business Insider.

Bitcoin Is A Joke

Joe Weisenthal Nov 6, 2013, 10:42 PM UTC

REUTERS/Eliana Aponte

Bitcoin is back in the news, as the digital currency has surged to new all-time highs in recent weeks.

A few weeks ago, it was just above $100. Today it's over $260.

This surge has prompted Timothy B Lee at The Washington Post to ask whether those who have called it a bubble in the past should retract and admit that they were wrong.

Well I'm not totally sure if I've called it a bubble, but I have spoken negatively of it, and I'll say that I still think it's a joke, and probably in a bubble.

Now first of all, I find the premise of Lee's post to be hilarious. The currency has been surging several percent every day lately, and that's evidence that it's not in a bubble?

Before going on, I want to be clear that saying something is a bubble is not saying it will go down. It could go to $500 or $1000 or $10,000. That's the nature of manias.

But make no mistake, Bitcoin is not the currency of the future. It has no intrinsic value.

Now this idea of "intrinsic value" when it comes to currency bothers people, and Bitcoin Bugs will immediately ask why the U.S. dollar has intrinsic value. There's an answer to that. The U.S. Dollar has intrinsic value because the U.S. government which sets the laws of doing business in the United States says it has intrinsic value. If you want to conduct commerce in the United States you have to pay taxes, and there's only one currency you're allowed to pay taxes in: U.S. dollars. There's no getting around this fact. Furthermore, if you want to use the banking system at all, there's no choice but to use U.S. dollars, because that's the currency of the Fed which is behind the whole thing.

On top of all these laws requiring the U.S. dollar to be used, the United States has a gigantic military that can force people around the world to use dollars (if it came to that) so yes, there's a lot of real-world value behind greenbacks.

Bitcoin? Nada. There's nothing keeping it being a thing. If people lose faith in it, it's over. Bitcoin is fiat currency in the most literal sense of the word.

But it gets worse. Bitcoin is mostly just a speculative vehicle. Yes, there are PR stunts about bars and other shops accepting bitcoins. And there is a Bitcoin ATM for some reason. But mostly Bitcoin is a speculative vehicle. And really, you'd be insane to actually conduct a sizable amount of commerce in bitcoins. That's because the price swings so wildly, that the next day, there's a good chance that one of the parties will have gotten royally screwed. Either the purchaser of the good will have ended up totally blowing a huge opportunity (by not holding longer) or the seller will be totally screwed (if Bitcoin instantly plunges). The very volatility that excited people to want to play the Bitcoin game is death when it comes to real transactions in the real world.

Again, Bitcoin might go up a lot more before it ultimately ends. That's the nature of bubbles. The dotcom bubble crashed a bunch of times on its way up. Then one day it ended. The same will happen with this.

In the meantime, have fun speculating!

-

@ 374ee93a:36623347

2025-05-13 11:47:55

@ 374ee93a:36623347

2025-05-13 11:47:55Chef's notes

Lovely tart rhubarb jam with the extra firey kick of fresh root ginger.

Technically a vegetable rhubarb has low pectin content so be sure to include a high pectin fruit such as lemon/cooking apple/redcurrant/gooseberry. It also quite watery so we use a slightly higher fruit to sugar ratio (1.2:1) and evaporate off some water at the beginning.

Testing for setting point: put a saucer in the freezer to chill whilst cooking the fruit, after 5 mins of a high boil with the sugar put a small blob of jam on the cold saucer and return to the freezer for 2 minutes. If the jam forms a solid wrinkle when pushed with a spoon it is ready, if it is runny continue cooking and retest every 5 mins

The recipe can be halved for a small batch but if you have lots of rhubarb to process it is better to cook double batches in separate pans because it will take much longer to heat through, this affects the colour and flavour - the jam will taste warm and mellow rather than zingy

Sterilise glass jars in a 120c oven and pot the jam hot leaving 1/4 inch head space, it will keep for 5 years unopened if the lids are well sealed and does not require water bath canning

Details

- ⏲️ Prep time: 20 mins

- 🍳 Cook time: 30 mins

- 🍽️ Servings: 6 (jars)

Ingredients

- 1.2kg Rhubarb

- 200g Grated Root Ginger

- 100g Chopped Crystalised Ginger

- 1kg Sugar

- 1 Lemon

Directions

- Chop the rhubarb into 1/2 inch pieces, peel and finely grate the fresh root ginger, chop crystalised ginger into tiny bits. Juice and quarter a lemon (discard pips) and add all these to a pan with a small amount of water

- Simmer gently for 20 mins until the lemon and rhubarb are soft then add the sugar, stir until fully dissolved

- Boil on high to reach setting point, usually at 105 degrees c or when a small blob of jam wrinkles on a cold plate instead of being runny

- Remove the lemon pieces and pot into sterilised jars

-

@ 95543309:196c540e

2025-05-11 12:42:09

@ 95543309:196c540e

2025-05-11 12:42:09Lets see if this works with the blossom upload and without markdown hassle.

:cat:

https://blossom.primal.net/73a099f931366732c18dd60da82db6ef65bb368eb96756f07d9fa7a8a3644009.mp4

-

@ 7459d333:f207289b

2025-05-10 10:38:56

@ 7459d333:f207289b

2025-05-10 10:38:56Description: Just as Bitcoin enabled sovereignty over money, a decentralized shipping protocol would enable sovereignty over trade. An LN/Bisq inspired shipping protocol could create an unstoppable free market.

Bitcoin gave us monetary sovereignty, freeing us from central bank manipulation, inflation, and censorship. But there's a missing link in our freedom journey: the physical world of goods.

The Problem: Even with Bitcoin, global trade remains at the mercy of: - Arbitrary tariffs and import restrictions - Political censorship of goods - Privacy invasion of shipping information - Centralized shipping carriers

The Vision: A decentralized shipping protocol with these properties:

- "Onion-routed" packages: Each carrier only knows the previous and next hop

- Bitcoin-secured multi-sig escrow: Funds locked until package delivery confirmed

- Incentive alignment: Carriers set their own fees based on risk assessment

- Privacy tiers: Options for inspected vs. sealed packages with appropriate pricing

- End-to-end sovereignty: Sender and receiver maintain control, intermediate carriers just fulfill their role

How it could work:

- Sender creates shipping request with package details and destination

- Protocol finds optimal route through independent carriers

- Each hop secured by multi-sig deposits larger than package value

- Carriers only see next hop, not ultimate destination

- Reputation systems and economic incentives maintain integrity

This creates a free market where any individual can participate as a carrier, earning Bitcoin for facilitating trade. Just like Lightning Network nodes, anyone can open "channels" with trusted partners.

Impact: This would enable true free market principles globally, making artificial trade barriers obsolete and empowering individuals to engage in voluntary exchange regardless of geographic or political boundaries.

There are a lot of challenges. But the first question is if this is a real problem and if its worth solving it.

What components would need development first? How would you solve the physical handoff challenges?

originally posted at https://stacker.news/items/976326

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ 662f9bff:8960f6b2

2025-05-20 18:52:01

@ 662f9bff:8960f6b2

2025-05-20 18:52:01April already and we are still refugees from the madness in HK. During March I had quite a few family matters that took priority and I also needed to work for two weeks. April is a similar schedule but we flew to Madeira for a change of scene and so that I could have a full 2-weeks off - my first real holiday in quite a few years!

We are staying in an airBnB in Funchal - an experience that I can totally recommend - video below! Nice to have an apartment that is fully equipped in a central location and no hassle for a few weeks. While here we are making the most of the great location and all the local possibiliites.

Elsewhere in the world

Things are clearly not going great around the world. If you are still confused as to why these things are happening, do go back and read the previous Letter from HK section "Why? How did we get here?"

You should be in no doubt that the "Great Reset" with its supporting "Great Narrative" is in full swing.. This is it - it is not a drill. For additional insights the following are recommended.

-

Jeff Booth discusses clearly and unemotionally with Pomp - Inflation is theft from humanity by the world governments

-

James' summary of Day 2 of the Miami conference - Peter Thiel (wow) and a fantastic explainer from Saifedean on the costs of the current corrupt financial system

-

James' summary of Day 3 of the Miami conference - listen in particular to the words of wisdom from Michael Saylor and Lyn Alden

-

Layered Money - The corruption of the system will blow your mind once you understand it…

-

This is BIG: Strike Is Bringing Freedom To Retail Merchants

-

Mark summarises Ray's book: Things will go faster and slower than you want!

-

Thoughtful words from George - evil is at work - be in no doubt..

-

Wow - My mind is blown. Must listen to John Carvalho - what clear ambition and answers to every question!

-

Related to the John Carvalho discussion. Likely these two options will end up complementing each other

On the personal and inspirational side

Advantage of time off work is that I have more time to read, listen and watch things that interest me. It really is a privilege that so much high quality material is so readily available. Do not let it go to waste. A few fabulous finds (and some re-finds) from this past week:

-

Ali Abdaal's bookshelf review just blew my mind! For the full list of books with links see the text under his video. So many inspirations and his delivery is perfect.

-

Gotta recommend Ali's 21 Life Lessons. I have been following him since he was student in Cambridge five years ago - his personal and professional growth and what he achieves (now with his team) is truely staggering.

-

Also his 15 books to read in 2022 - especially this one!

-

I also keep going back to Steve Jobs giving the 2005 Stanford Commencement address Three stories from his life - listen and be inspired - especially story #3

You will know that I am a fan of Audio Books and also Kindle - recently I am starting to use Whispersync where you get the Kindle- and Audio-books together for a nice price. This makes it easier to take notes (using Mac or iPad Kindle reader) while getting the benefit of having the book read to you by a professional reader.

I have also been inspired by a few people pushing themselves to do more reading - like this girl and Ali himself with his tips. Above all: just do it and do not get stuck on something that does not work for you!

Books that I am reading - Audio and Kindle!

-

The Final Empire: Mistborn, Book 1 - this is a new genre for me - I rather feel that it might be a bit too complicated for my engineering mind - let's see

-

Die with Zero: Getting All You Can from Your Money and Your Life - certainly provocative and obvious if you think about it but 99% do the opposite!

-

Chariots of the Gods - a classic by Erich von Daniken (written in 1968) - I have been inspired by his recent YT video appearances. Thought provoking and leads you to many possibilities.

So what's it like in Funchal, Madeira?

Do check out HitTheRoadMadeira's walking tour around Funchal

My first impressions of Funchal

and see my day out on Thursday!

Saturday - Funchal and Camar de Lobos

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28

@ d61f3bc5:0da6ef4a

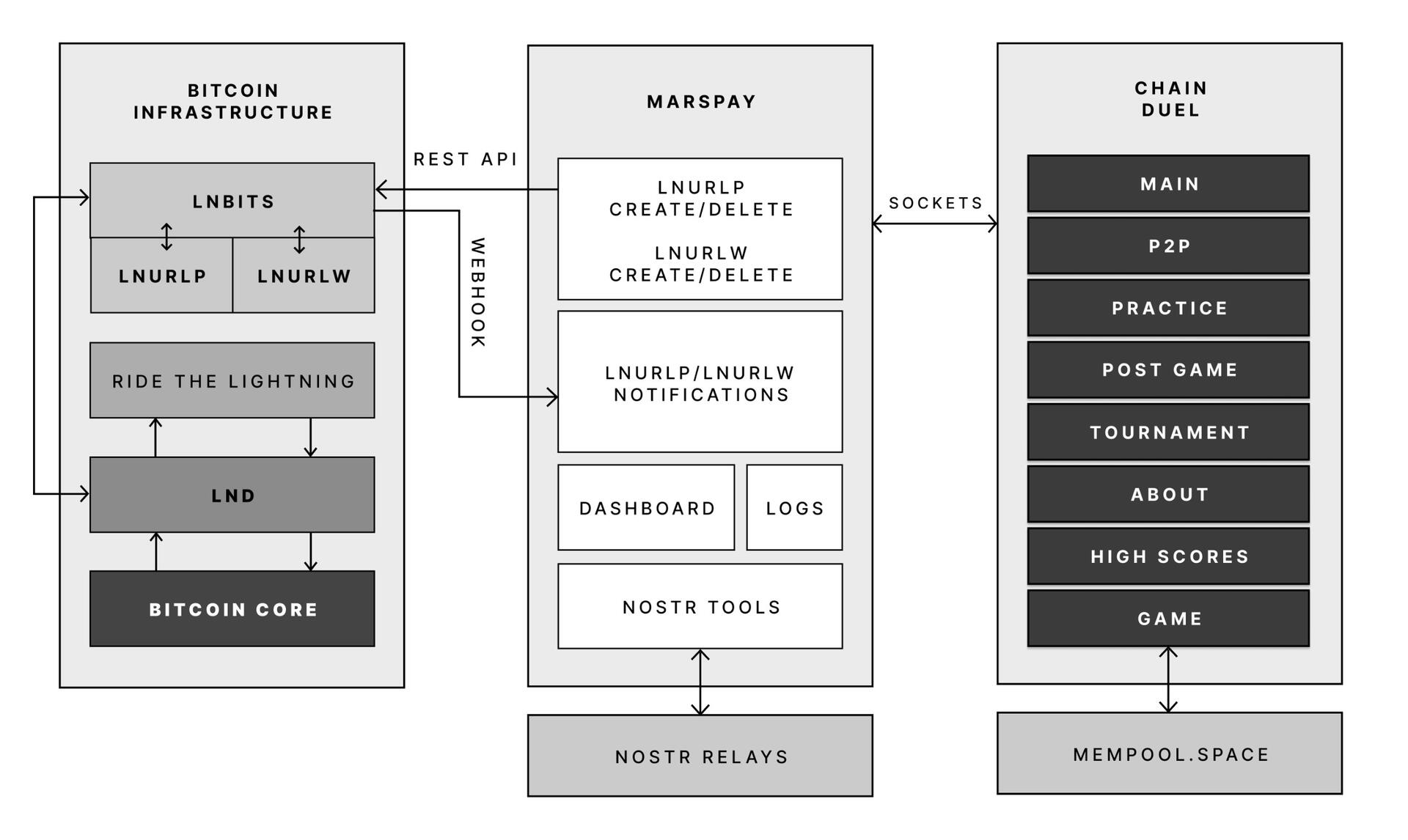

2025-05-06 01:37:28I remember the first gathering of Nostr devs two years ago in Costa Rica. We were all psyched because Nostr appeared to solve the problem of self-sovereign online identity and decentralized publishing. The protocol seemed well-suited for textual content, but it wasn't really designed to handle binary files, like images or video.

The Problem

When I publish a note that contains an image link, the note itself is resilient thanks to Nostr, but if the hosting service disappears or takes my image down, my note will be broken forever. We need a way to publish binary data without relying on a single hosting provider.

We were discussing how there really was no reliable solution to this problem even outside of Nostr. Peer-to-peer attempts like IPFS simply didn't work; they were hopelessly slow and unreliable in practice. Torrents worked for popular files like movies, but couldn't be relied on for general file hosting.

Awesome Blossom

A year later, I attended the Sovereign Engineering demo day in Madeira, organized by Pablo and Gigi. Many projects were presented over a three hour demo session that day, but one really stood out for me.

Introduced by hzrd149 and Stu Bowman, Blossom blew my mind because it showed how we can solve complex problems easily by simply relying on the fact that Nostr exists. Having an open user directory, with the corresponding social graph and web of trust is an incredible building block.

Since we can easily look up any user on Nostr and read their profile metadata, we can just get them to simply tell us where their files are stored. This, combined with hash-based addressing (borrowed from IPFS), is all we need to solve our problem.

How Blossom Works

The Blossom protocol (Blobs Stored Simply on Mediaservers) is formally defined in a series of BUDs (Blossom Upgrade Documents). Yes, Blossom is the most well-branded protocol in the history of protocols. Feel free to refer to the spec for details, but I will provide a high level explanation here.

The main idea behind Blossom can be summarized in three points:

- Users specify which media server(s) they use via their public Blossom settings published on Nostr;

- All files are uniquely addressable via hashes;

- If an app fails to load a file from the original URL, it simply goes to get it from the server(s) specified in the user's Blossom settings.

Just like Nostr itself, the Blossom protocol is dead-simple and it works!

Let's use this image as an example:

If you look at the URL for this image, you will notice that it looks like this:

If you look at the URL for this image, you will notice that it looks like this:blossom.primal.net/c1aa63f983a44185d039092912bfb7f33adcf63ed3cae371ebe6905da5f688d0.jpgAll Blossom URLs follow this format:

[server]/[file-hash].[extension]The file hash is important because it uniquely identifies the file in question. Apps can use it to verify that the file they received is exactly the file they requested. It also gives us the ability to reliably get the same file from a different server.

Nostr users declare which media server(s) they use by publishing their Blossom settings. If I store my files on Server A, and they get removed, I can simply upload them to Server B, update my public Blossom settings, and all Blossom-capable apps will be able to find them at the new location. All my existing notes will continue to display media content without any issues.

Blossom Mirroring

Let's face it, re-uploading files to another server after they got removed from the original server is not the best user experience. Most people wouldn't have the backups of all the files, and/or the desire to do this work.

This is where Blossom's mirroring feature comes handy. In addition to the primary media server, a Blossom user can set one one or more mirror servers. Under this setup, every time a file is uploaded to the primary server the Nostr app issues a mirror request to the primary server, directing it to copy the file to all the specified mirrors. This way there is always a copy of all content on multiple servers and in case the primary becomes unavailable, Blossom-capable apps will automatically start loading from the mirror.

Mirrors are really easy to setup (you can do it in two clicks in Primal) and this arrangement ensures robust media handling without any central points of failure. Note that you can use professional media hosting services side by side with self-hosted backup servers that anyone can run at home.

Using Blossom Within Primal

Blossom is natively integrated into the entire Primal stack and enabled by default. If you are using Primal 2.2 or later, you don't need to do anything to enable Blossom, all your media uploads are blossoming already.