-

@ 472f440f:5669301e

2025-05-16 00:18:45

@ 472f440f:5669301e

2025-05-16 00:18:45Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.

While all this was going on, there was something happening back in the United States that many people outside of fringe corners of FinTwit are not talking about, which is the fact that the 10-year and 30-year U.S. Treasury bond yields are back on the rise. Yesterday, they surpassed the levels of mid-April that caused a market panic and are hovering back around levels that have not been seen since right before Donald Trump's inauguration.

I imagine that there isn't as much of an uproar right now because I'm pretty confident the media freakouts we were experiencing in mid-April were driven by the fact that many large hedge funds found themselves off sides of large levered basis trades. I wouldn't be surprised if those funds have decreased their leverage in those trades and bond yields being back to mid-April levels is not affecting those funds as much as they were last month. But the point stands, the 10-year and 30-year yields are significantly elevated with the 30-year approaching 5%. Regardless of the deals that are currently being made in the Middle East, the Treasury has a big problem on its hands. It still has to roll over many trillions worth of debt over over the next few years and doing so at these rates is going to be massively detrimental to fiscal deficits over the next decade. The interest expense on the debt is set to explode in the coming years.

On that note, data from the first quarter of 2025 has been released by the government and despite all the posturing by the Trump administration around DOGE and how tariffs are going to be beneficial for the U.S. economy, deficits are continuing to explode while the interest expense on the debt has definitively surpassed our annual defense budget.

via Charlie Bilello

via Mohamed Al-Erian

To make matters worse, as things are deteriorating on the fiscal side of things, the U.S. consumer is getting crushed by credit. The 90-plus day delinquency rates for credit card and auto loans are screaming higher right now.

via TXMC

One has to wonder how long all this can continue without some sort of liquidity crunch. Even though equities markets have recovered from their post-Liberation Day month long bear market, I would not be surprised if what we're witnessing is a dead cat bounce that can only be continued if the money printers are turned back on. Something's got to give, both on the fiscal side and in the private markets where the Common Man is getting crushed because he's been forced to take on insane amounts of debt to stay afloat after years of elevated levels of inflation. Add on the fact that AI has reached a state of maturity that will enable companies to replace their current meat suit workers with an army of cheap, efficient and fast digital workers and it isn't hard to see that some sort of employment crisis could be on the horizon as well.

Now is not the time to get complacent. While I do believe that the deals that are currently being made in the Middle East are probably in the best interest of the United States as the world, again, moves toward a more multi-polar reality, we are facing problems that one cannot simply wish away. They will need to be confronted. And as we've seen throughout the 21st century, the problems are usually met head-on with a money printer.

I take no pleasure in saying this because it is a bit uncouth to be gleeful to benefit from the strife of others, but it is pretty clear to me that all signs are pointing to bitcoin benefiting massively from everything that is going on. The shift towards a more multi-polar world, the runaway debt situation here in the United States, the increasing deficits, the AI job replacements and the consumer credit crisis that is currently unfolding, All will need to be "solved" by turning on the money printers to levels they've never been pushed to before.

Weird times we're living in.

China's Manufacturing Dominance: Why It Matters for the U.S.

In my recent conversation with Lyn Alden, she highlighted how China has rapidly ascended the manufacturing value chain. As Lyn pointed out, China transformed from making "sneakers and plastic trinkets" to becoming the world's largest auto exporter in just four years. This dramatic shift represents more than economic success—it's a strategic power play. China now dominates solar panel production with greater market control than OPEC has over oil and maintains near-monopoly control of rare earth elements crucial for modern technology.

"China makes like 10 times more steel than the United States does... which is relevant in ship making. It's relevant in all sorts of stuff." - Lyn Alden

Perhaps most concerning, as Lyn emphasized, is China's financial leverage. They hold substantial U.S. assets that could be strategically sold to disrupt U.S. treasury market functioning. This combination of manufacturing dominance, resource control, and financial leverage gives China significant negotiating power in any trade disputes, making our attempts to reshoring manufacturing all the more challenging.

Check out the full podcast here for more on Triffin's dilemma, Bitcoin's role in monetary transition, and the energy requirements for rebuilding America's industrial base.

Headlines of the Day

Financial Times Under Fire Over MicroStrategy Bitcoin Coverage - via X

Trump in Qatar: Historic Boeing Deal Signed - via X

Get our new STACK SATS hat - via tftcmerch.io

Johnson Backs Stock Trading Ban; Passage Chances Slim - via X

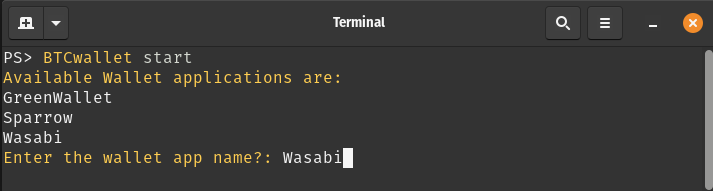

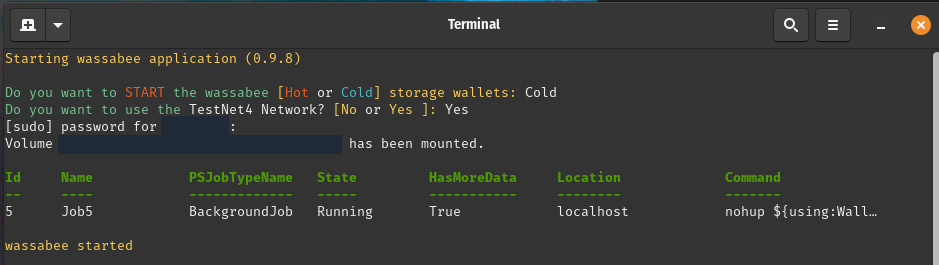

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Building things of value is satisfying.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 472f440f:5669301e

2025-05-14 13:17:04

@ 472f440f:5669301e

2025-05-14 13:17:04Marty's Bent

via me

It seems like every other day there's another company announced that is going public with the intent of competing with Strategy by leveraging capital markets to create financial instruments to acquire Bitcoin in a way that is accretive for shareholders. This is certainly a very interesting trend, very bullish for bitcoin in the short-term, and undoubtedly making it so bitcoin is top of mind in the mainstream. I won't pretend to know whether or not these strategies will ultimately be successful or fail in the short, medium or long term. However, one thing I do know is that the themes that interest me, both here at TFTC and in my role as Managing Partner at Ten31, are companies that are building good businesses that are efficient, have product-market-fit, generate revenues and profits and roll those profits into bitcoin.

While it seems pretty clear that Strategy has tapped into an arbitrage that exists in capital markets, it's not really that exciting. From a business perspective, it's actually pretty straightforward and simple; find where potential arbitrage opportunities exists between pools of capital looking for exposure to spot bitcoin or bitcoin's volatility but can't buy the actual asset, and provide them with products that give them access to exposure while simultaneously creating a cult-like retail following. Rinse and repeat. To the extent that this strategy is repeatable is yet to be seen. I imagine it can expand pretty rapidly. Particularly if we have a speculative fervor around companies that do this. But in the long run, I think the signal is falling back to first principles, looking for businesses that are actually providing goods and services to the broader economy - not focused on the hyper-financialized part of the economy - to provide value and create efficiencies that enable higher margins and profitability.

With this in mind, I think it's important to highlight the combined leverage that entrepreneurs have by utilizing bitcoin treasuries and AI tools that are emerging and becoming more advanced by the week. As I said in the tweet above, there's never been a better time to start a business that finds product-market fit and cash flows quickly with a team of two to three people. If you've been reading this rag over the last few weeks, you know that I've been experimenting with these AI tools and using them to make our business processes more efficient here at TFTC. I've also been using them at Ten31 to do deep research and analysis.

It has become abundantly clear to me that any founder or entrepreneur that is not utilizing the AI tools that are emerging is going to get left behind. As it stands today, all anyone has to do to get an idea from a thought in your head to the prototype stage to a minimum viable product is to hop into something like Claude or ChatGPT, have a brief conversation with an AI model that can do deep research about a particular niche that you want to provide a good service to and begin building.

Later this week, I will launch an app called Opportunity Cost in the Chrome and Firefox stores. It took me a few hours of work over the span of a week to ideate and iterate on the concept to the point where I had a working prototype that I handed off to a developer who is solving the last mile problem I have as an "idea guy" of getting the product to market. Only six months ago, accomplishing something like this would have been impossible for me. I've never written a line of code that's actually worked outside of the modded MySpace page I made back in middle school. I've always had a lot of ideas but have never been able to effectively communicate them to developers who can actually build them. With a combination of ChatGPT-03 and Replit, I was able to build an actual product that works. I'm using it in my browser today. It's pretty insane.

There are thousands of people coming to the same realization at the same time right now and going out there and building niche products very cheaply, with small teams, they are getting to market very quickly, and are amassing five figures, six figures, sometimes seven figures of MRR with extremely high profit margins. What most of these entrepreneurs have not really caught on to yet is that they should be cycling a portion - in my opinion, a large portion - of those profits into bitcoin. The combination of building a company utilizing these AI tools, getting it to market, getting revenue and profits, and turning those profits into bitcoin cannot be understated. You're going to begin seeing teams of one to ten people building businesses worth billions of dollars and they're going to need to store the value they create, any money that cannot be debased.

nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgy8fkmd9kmm8yp4lea2cx0g8fyz27g4ud7572j4edx2v6lz6aa23qmp5dth , one of the co-founders of Ten31, wrote about this in early 2024, bitcoin being the fourth lever of equity value growth for companies.

Bitcoin Treasury - The Fourth Lever to Equity Value Growth

We already see this theme playing out at Ten31 with some of our portfolio companies, most notably nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqex7mdykw786qxvmtuls208uyxmn0hse95rfwsarvfde5yg6wy7jqjrm2qp , which recently released some of their financials, highlighting the fact that they're extremely profitable with high margins and a relatively small team (\~75). This is extremely impressive, especially when you consider the fact that they're a global company competing with the likes of Coinbase and Block, which have each thousands of employees.

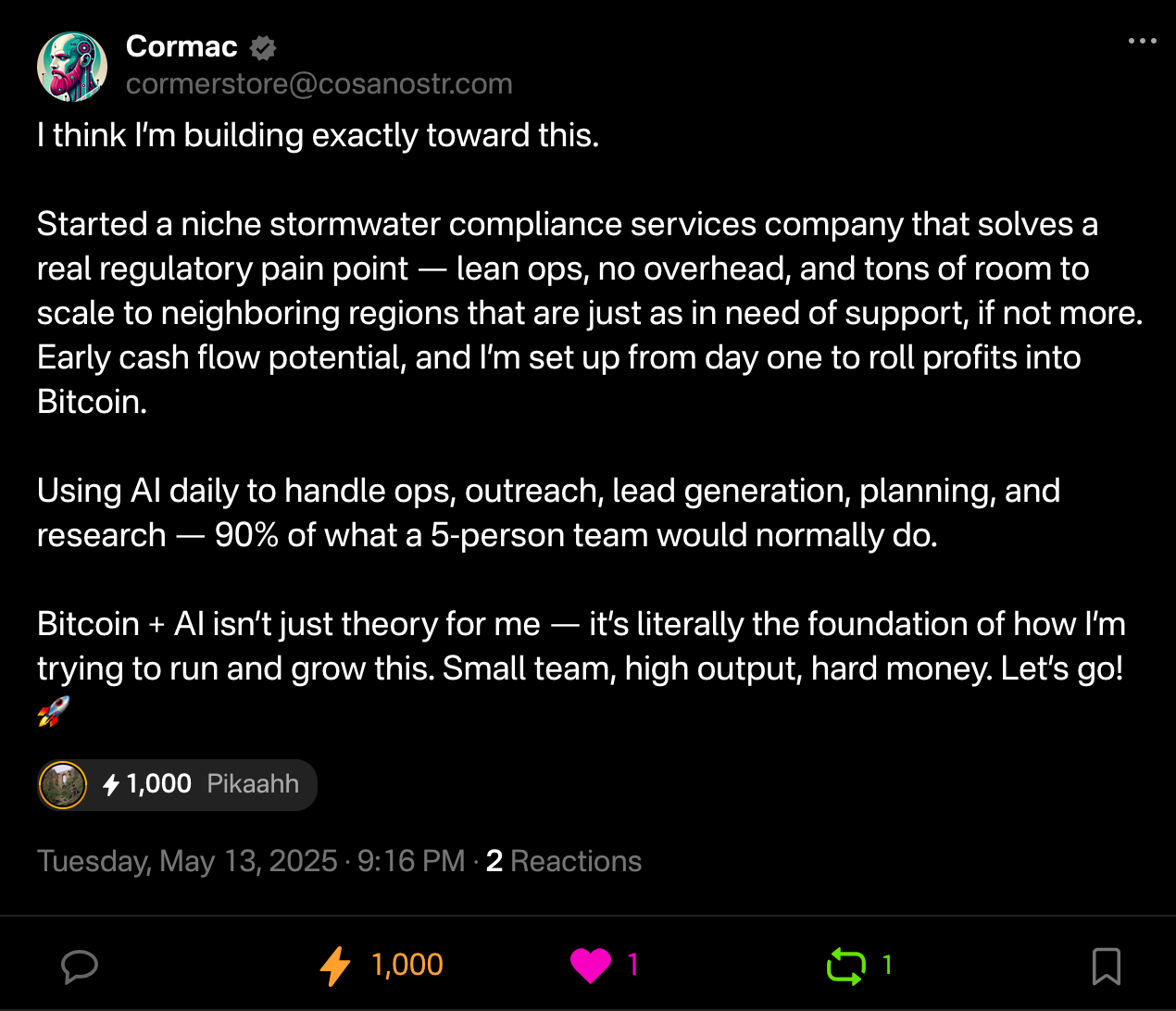

Even those who are paying attention to the developments in the AI space and how the tools can enable entrepreneurs to build faster aren't really grasping the gravity of what's at play here. Many are simply thinking of consumer apps that can be built and distributed quickly to market, but the ways in which AI can be implemented extend far beyond the digital world. Here's a great example of a company a fellow freak is building with the mindset of keeping the team small, utilizing AI tools to automate processes and quickly push profits into bitcoin.

via Cormac

Again, this is where the exciting things are happening in my mind. People leveraging new tools to solve real problems to drive real value that ultimately produce profits for entrepreneurs. The entrepreneurs who decide to save those profits in bitcoin will find that the equity value growth of their companies accelerates exponentially as they provide more value, gain more traction, and increase their profits while also riding the bitcoin as it continues on its monetization phase. The compounded leverage of building a company that leverages AI tools and sweeps profits into bitcoin is going to be one of the biggest asymmetric plays of the next decade. Personally, I also see it as something that's much more fulfilling than the pure play bitcoin treasury companies that are coming to market because consumers and entrepreneurs are able to recive and provide a ton of value in the real economy.

If you're looking to stay on top of the developments in the AI space and how you can apply the tools to help build your business or create a new business, I highly recommend you follow somebody like Greg Isenberg, whose Startup Ideas Podcast has been incredibly valuable for me as I attempt to get a lay of the land of how to implement AI into my businesses.

America's Two Economies

In my recent podcast with Lyn Alden, she outlined how our trade deficits create a cycle that's reshaping America's economic geography. As Alden explained, US trade deficits pump dollars into international markets, but these dollars don't disappear - they return as investments in US financial assets. This cycle gradually depletes industrial heartlands while enriching financial centers on the coasts, creating what amounts to two separate American economies.

"We're basically constantly taking economic vibrancy out of Michigan and Ohio and rural Pennsylvania where the steel mills were... and stuffing it back into financial assets in New York and Silicon Valley." - nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3

This pattern has persisted for over four decades, accelerating significantly since the early 1980s. Alden emphasized that while economists may argue there's still room before reaching a crisis point, the political consequences are already here. The growing divide between these two Americas has fueled populist sentiment as voters who feel left behind seek economic rebalancing, even if they can't articulate the exact mechanisms causing their hardship.

Check out the full podcast here for more on China's manufacturing dominance, Trump's tariff strategy, and the future of Bitcoin as a global reserve asset. All discussed in under 60 minutes.

Headlines of the Day

Trump's Saudi Summit: Peace and Economic Ties - via X

MSTR Edges Closer To S\&P 500 With Just 89 Trading Days Left - via X

Get our new STACK SATS hat - via tftcmerch.io

Individuals Shed 247K Bitcoin As Businesses Gain 157K - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 144,229 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

My boys have started a game in the car where we count how many Waymos we see on the road while driving around town. Pretty crazy how innately stoked they are about that particular car.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 472f440f:5669301e

2025-05-14 01:15:12

@ 472f440f:5669301e

2025-05-14 01:15:12Marty's Bent

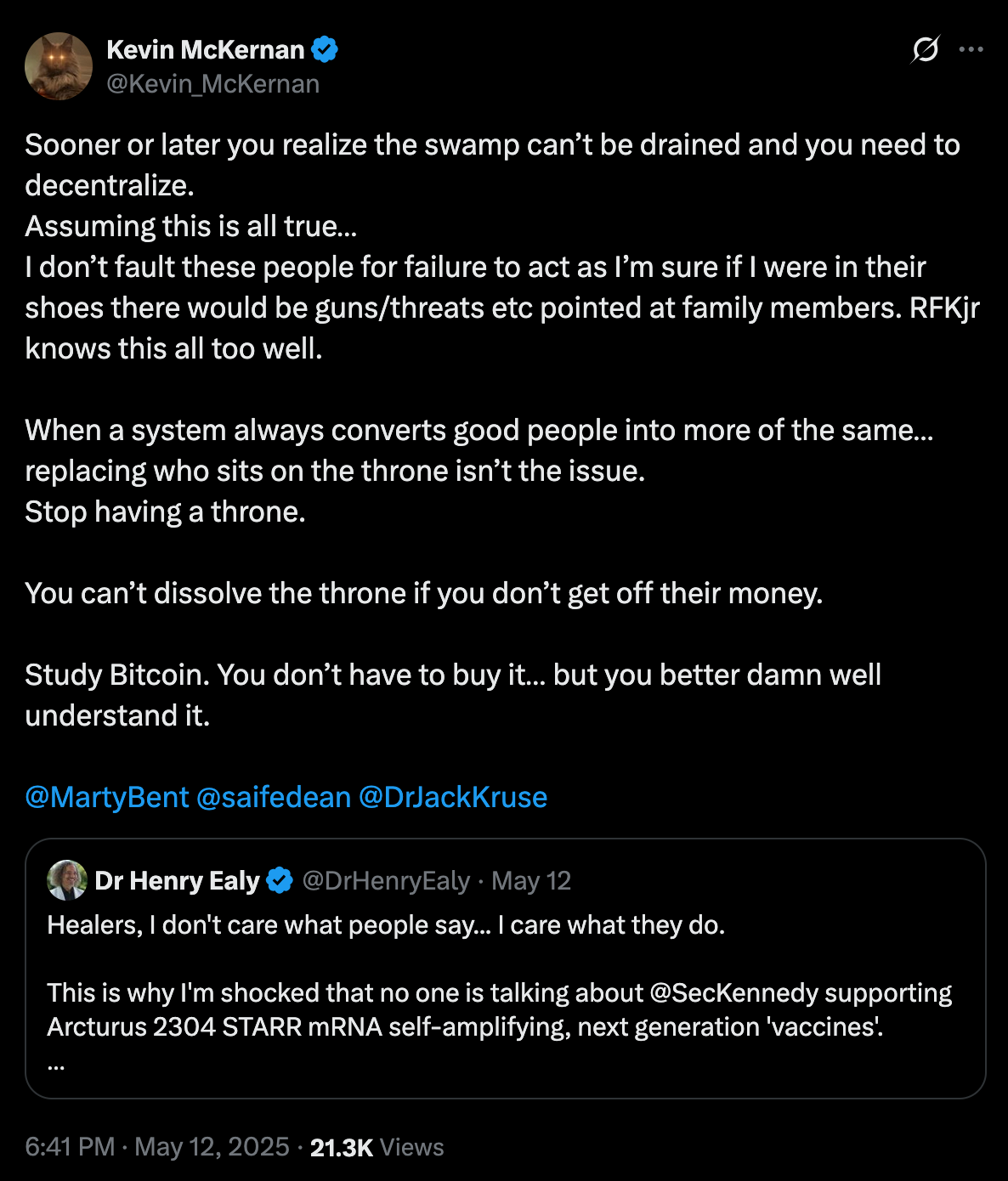

via Kevin McKernan

There's been a lot of discussion this week about Casey Means being nominated for Surgeon General of the United States and a broader overarching conversation about the effectiveness of MAHA since the inauguration and how effective it may or may not be moving forward. Many would say that President Trump won re-election due to Robert F. Kennedy Jr. and Nicole Shanahan deciding to reach across the aisle and join the Trump ticket, bringing with them the MAHA Moms, who are very focused on reorienting the healthcare system in the United States with a strong focus on the childhood vaccine schedule.

I'm not going to lie, this is something I'm passionate about as well, particularly after having many conversations over the years with doctors like Kevin McKernan, Dr. Jack Kruse, Dr. Mary Talley Bowden, Dr. Brooke Miller, Dr. Peter McCullough and others about the dangers of the COVID mRNA vaccines. As it stands today, I think this is the biggest elephant in the room in the world of healthcare. If you look at the data, particularly disability claims, life insurance claims, life expectancy, miscarriage rates, fertility issues and rates of turbo cancer around the world since the COVID vaccine was introduced in 2021, it seems pretty clear that there is harm being done to many of the people who have taken them.

The risk-reward ratio of the vaccines seems to be incredibly skewed towards risk over reward and children - who have proven to be least susceptible to COVID - are expected to get three COVID shots in the first year of their life if their parents follow the vaccine schedule. For some reason or another it seems that Robert F. Kennedy Jr. has shied away from this topic after becoming the head of Health and Human Services within the Trump administration. This is after a multi-year campaign during which getting the vaccines removed from the market war a core part of his platform messaging.

I'm still holding out hope that sanity will prevail. The COVID mRNA vaccines will be taken off the market in a serious conversation about the crimes against humanity that unfolded during the COVID years will take place. However, we cannot depend on that outcome. We must build with the assumption in mind that that outcome may never materialize. This leads to identifying where the incentives within the system are misconstrued. One area where I think it's pretty safe to say that the incentives are misaligned is the fact that 95% of doctors work for and answer to a corporation driven by their bottom line. Instead of listening to their patients and truly caring about the outcome of each individual, doctors forced to think about the monetary outcome of the corporation they work for first.

The most pernicious way in which these misaligned incentives emerge is the way in which the hospital systems and physicians are monetarily incentivized by big pharma companies to push the COVID vaccine and other vaccines on their patients. It is important to acknowledge that we cannot be dependent on a system designed in this way to change from within. Instead, we must build a new incentive system and market structure. And obviously, if you're reading this newsletter, you know that I believe that bitcoin will play a pivotal role in realigning incentives across every industry. Healthcare just being one of them.

Bitcoiners who have identified the need to become sovereign in our monetary matters, it probably makes sense to become sovereign when it comes to our healthcare as well. This means finding doctors who operate outside the corporate controlled system and are able to offer services that align incentives with the end patient. My family utilizes a combination of CrowdHealth and a private care physician to align incentives. We've even utilized a private care physician who allowed us to pay in Bitcoin for her services for a number of years. I think this is the model. Doctors accepting hard censorship resistant money for the healthcare and advice they provide. Instead of working for a corporation looking to push pharmaceutical products on their patients so they can bolster their bottom line, work directly with patients who will pay in bitcoin, which will appreciate in value over time.

I had a lengthy discussion with Dr. Jack Kruse on the podcast earlier today discussing these topic and more. It will be released on Thursday and I highly recommend you freaks check it out once it is published. Make sure you subscribe so you don't miss it.

How the "Exorbitant Privilege" of the Dollar is Undermining Our Manufacturing Base

In my conversation with Lyn Alden, we explored America's fundamental economic contradiction. As Lyn expertly explained, maintaining the dollar's reserve currency status while attempting to reshore manufacturing presents a near-impossible challenge - what economists call Triffin's Dilemma. The world's appetite for dollars gives Americans tremendous purchasing power but simultaneously hollows out our industrial base. The overvalued dollar makes our exports less competitive, especially for lower-margin manufacturing, while our imports remain artificially strong.

"Having the reserve currency does come with a bunch of benefits, historically called an exorbitant privilege, but then it has certain costs to maintain it." - Lyn Alden

This dilemma forces America to run persistent trade deficits, as this is how dollars flow to the world. For over four decades, these deficits have accumulated, creating massive economic imbalances that can't be quickly reversed. The Trump administration's attempts to address this through tariffs showcase how difficult rebalancing has become. As Lyn warned, even if we successfully pivot toward reshoring manufacturing, we'll face difficult trade-offs: potentially giving up some reserve currency benefits to rebuild our industrial foundation. This isn't just economic theory - it's the restructuring challenge that will define America's economic future.

Check out the full podcast here for more on China's manufacturing dominance, the role of Bitcoin in monetary transitions, and energy production as the foundation for future industrial power.

Headlines of the Day

Coinbase to replace Discover in S\&P 500 on May 19 - via X

Mallers promises no rehypothecation in Strike Bitcoin loans - via X

Get our new STACK SATS hat - via tftcmerch.io

Missouri passes HB 594, eliminates Bitcoin capital gains tax - via X

The 2025 Bitcoin Policy Summit is set for June 25th—and it couldn’t come at a more important time. The Bitcoin industry is at a pivotal moment in Washington, with initiatives like the Strategic Bitcoin Reserve gaining rapid traction. Whether you’re a builder, advocate, academic, or policymaker—we want you at the table. Join us in DC to help define the future of freedom, money & innovation in the 21st century.

Ten31, the largest bitcoin-focused investor, has deployed 144,264 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The 100+ degree days have returned to Austin, TX. Not mad about it... yet.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 609f186c:0aa4e8af

2025-05-16 20:57:43

@ 609f186c:0aa4e8af

2025-05-16 20:57:43Google says that Android 16 is slated to feature an optional high security mode. Cool.

Advanced Protection has a bunch of requested features that address the kinds of threats we worry about.

It's the kind of 'turn this one thing on if you face elevated risk' that we've been asking for from Google.

And likely reflects some learning after Google watched Apple 's Lockdown Mode play out. I see a lot of value in this..

Here are some features I'm excited to see play out:

The Intrusion Logging feature is interesting & is going to impose substantial cost on attackers trying to hide evidence of exploitation. Logs get e2ee encrypted into the cloud. This one is spicy.

The Offline Lock, Inactivity Reboot & USB protection will frustrate non-consensual attempts to physically grab device data.

Memory Tagging Extension is going to make a lot of attack & exploitation categories harder.

2G Network Protection & disabling Auto-connect to insecure networks are going to address categories of threat from things like IMSI catchers & hostile WiFi.

I'm curious about some other features such as:

Spam & Scam detection: Google messages feature that suggests message content awareness and some kind of scanning.

Scam detection for Phone by Google is interesting & coming later. The way it is described suggests phone conversation awareness. This also addresses a different category of threat than the stuff above. I can see it addressing a whole category of bad things that regular users (& high risk ones too!) face. Will be curious how privacy is addressed or if this done purely locally. Getting messy: Friction points? I see Google thinking these through, but I'm going to add a potential concern: what will users do when they encounter friction? Will they turn this off & forget to re-enable? We've seen users turn off iOS Lockdown Mode when they run into friction for specific websites or, say, legacy WiFi. They then forget to turn it back on. And stay vulnerable.

Bottom line: users disabling Apple's Lockdown Mode for a temporary thing & leaving it off because they forget to turn it on happens a lot. This is a serious % of users in my experience...

And should be factored into design decisions for similar modes. I feel like a good balance is a 'snooze button' or equivalent so that users can disable all/some features for a brief few minute period to do something they need to do, and then auto re-enable.

Winding up:

I'm excited to see how Android Advanced Protection plays with high risk users' experiences. I'm also super curious whether the spam/scam detection features may also be helpful to more vulnerable users (think: aging seniors)...

Niche but important:

Some users, esp. those that migrated to security & privacy-focused Android distros because of because of the absence of such a feature are clear candidates for it... But they may also voice privacy concerns around some of the screening features. Clear communication from the Google Security / Android team will be key here.

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ c631e267:c2b78d3e

2025-05-16 18:40:18

@ c631e267:c2b78d3e

2025-05-16 18:40:18Die zwei mächtigsten Krieger sind Geduld und Zeit. \ Leo Tolstoi

Zum Wohle unserer Gesundheit, unserer Leistungsfähigkeit und letztlich unseres Glücks ist es wichtig, die eigene Energie bewusst zu pflegen. Das gilt umso mehr für an gesellschaftlichen Themen interessierte, selbstbewusste und kritisch denkende Menschen. Denn für deren Wahrnehmung und Wohlbefinden waren und sind die rasanten, krisen- und propagandagefüllten letzten Jahre in Absurdistan eine harte Probe.

Nur wer regelmäßig Kraft tankt und Wege findet, mit den Herausforderungen umzugehen, kann eine solche Tortur überstehen, emotionale Erschöpfung vermeiden und trotz allem zufrieden sein. Dazu müssen wir erkunden, was uns Energie gibt und was sie uns raubt. Durch Selbstreflexion und Achtsamkeit finden wir sicher Dinge, die uns erfreuen und inspirieren, und andere, die uns eher stressen und belasten.

Die eigene Energie ist eng mit unserer körperlichen und mentalen Gesundheit verbunden. Methoden zur Förderung der körperlichen Gesundheit sind gut bekannt: eine ausgewogene Ernährung, regelmäßige Bewegung sowie ausreichend Schlaf und Erholung. Bei der nicht minder wichtigen emotionalen Balance wird es schon etwas komplizierter. Stress abzubauen, die eigenen Grenzen zu kennen oder solche zum Schutz zu setzen sowie die Konzentration auf Positives und Sinnvolles wären Ansätze.

Der emotionale ist auch der Bereich, über den «Energie-Räuber» bevorzugt attackieren. Das sind zum Beispiel Dinge wie Überforderung, Perfektionismus oder mangelhafte Kommunikation. Social Media gehören ganz sicher auch dazu. Sie stehlen uns nicht nur Zeit, sondern sind höchst manipulativ und erhöhen laut einer aktuellen Studie das Risiko für psychische Probleme wie Angstzustände und Depressionen.

Geben wir negativen oder gar bösen Menschen keine Macht über uns. Das Dauerfeuer der letzten Jahre mit Krisen, Konflikten und Gefahren sollte man zwar kennen, darf sich aber davon nicht runterziehen lassen. Das Ziel derartiger konzertierter Aktionen ist vor allem, unsere innere Stabilität zu zerstören, denn dann sind wir leichter zu steuern. Aber Geduld: Selbst vermeintliche «Sonnenköniginnen» wie EU-Kommissionspräsidentin von der Leyen fallen, wenn die Zeit reif ist.

Es ist wichtig, dass wir unsere ganz eigenen Bedürfnisse und Werte erkennen. Unsere Energiequellen müssen wir identifizieren und aktiv nutzen. Dazu gehören soziale Kontakte genauso wie zum Beispiel Hobbys und Leidenschaften. Umgeben wir uns mit Sinnhaftigkeit und lassen wir uns nicht die Energie rauben!

Mein Wahlspruch ist schon lange: «Was die Menschen wirklich bewegt, ist die Kultur.» Jetzt im Frühjahr beginnt hier in Andalusien die Zeit der «Ferias», jener traditionellen Volksfeste, die vor Lebensfreude sprudeln. Konzentrieren wir uns auf die schönen Dinge und auf unsere eigenen Talente – soziale Verbundenheit wird helfen, unsere innere Kraft zu stärken und zu bewahren.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 472f440f:5669301e

2025-05-12 23:29:50

@ 472f440f:5669301e

2025-05-12 23:29:50Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.

It seems that this is not the case as the SDNY responded to a letter sent from the defense to dismiss the case by stating that they fully plan to move forward. Stating that they only sought the recommendations of FinCEN employees and did not believe that those employees' comments were indicative of FinCEN's overall views on this particular case. It's a pretty egregious abuse of power by the SDNY. I'm not sure if the particular lawyers and judges within the Southern District of New York are very passionate about preventing the use of self-custody bitcoin and products that enable bitcoiners to transact privately, or if they're simply participating in a broader meta war with the Trump administration - who has made it clear to federal judges across the country that last Fall's election will have consequences, mainly that the Executive Branch will try to effectuate the policies that President Trump campaigned on by any legal means necessary - and Samouari Wallet is simply in the middle of that meta war.

However, one thing is pretty clear to me, this is an egregious overstep of power. The interpretation of that law, as has been laid out and confirmed by FinCEN over the last decade, is pretty clear; you cannot be a money services business if you do not control the funds that people are sending to each other, which is definitely the case with Samourai Wallet. People downloaded Samourai Wallet, spun up their own private-public key pairs and initiated transactions themselves. Samourai never custodied funds or initiated transactions on behalf of their users. This is very cut and dry. Straight to the point. It should be something that anyone with more than two brain cells is able to discern pretty quickly.

It is imperative that anybody in the industry who cares about being able to hold bitcoin in self-custody, to mine bitcoin, and to send bitcoin in a peer-to-peer fashion makes some noise around this case. None of the current administration's attempts to foster innovation around bitcoin in the United States will matter if the wrong precedent is set in this case. If the SDNY is successful in prosecuting Samourai Wallet, it will mean that anybody holding Bitcoin in self-custody, running a bitcoin fold node or mining bitcoin will have to KYC all of their users and counterparts lest they be labeled a money services business that is breaking laws stemming from the Bank Secrecy Act. This will effectively make building a self-custody bitcoin wallet, running a node, or mining bitcoin in tillegal in the United States. The ability to comply with the rules that would be unleashed if this Samourai case goes the wrong way, are such that it will effectively destroy the industry overnight.

It is yet to be seen whether or not the Department of Justice will step in to publicly flog the SDNY and force them to stop pursuing this case. This is the only likely way that the case will go away at this point, so it is very important that bitcoiners who care about being able to self-custody bitcoin, mine bitcoin, or send bitcoin in a peer-to-peer fashion in the United States make it clear to the current administration and any local politicians that this is an issue that you care deeply about. If we are too complacent, there is a chance that the SDNY could completely annihilate the bitcoin industry in America despite of all of the positive momentum we're seeing from all angles at the moment.

Make some noise!

Bitcoin Adoption by Power Companies: The Next Frontier

In my recent conversation with Andrew Myers from Satoshi Energy, he shared their ambitious mission to "enable every electric power company to use bitcoin by block 1,050,000" – roughly three years from now. This strategic imperative isn't just about creating new Bitcoin users; it's about sovereignty. Andrew emphasized that getting Bitcoin into the hands of energy companies who value self-sovereignty creates a more balanced future economic landscape. The excitement was palpable as he described how several energy companies are already moving beyond simply selling power to Bitcoin miners and are beginning to invest in mining operations themselves.

"You have global commodity companies being like, 'Oh, this is another commodity – we want to invest in this, we want to own this,'" - Andrew Myers

Perhaps most fascinating was Andrew's revelation about major energy companies in Texas developing Bitcoin collateral products for power contracts – a practical application that could revolutionize how energy transactions are settled. As energy companies continue embracing Bitcoin for both operations and collateral, we're witnessing the early stages of a profound shift in how critical infrastructure interfaces with sound money. The implications for both sectors could be transformative.

Check out the full podcast here for more on remote viewing, Nikola Tesla's predictions, and the convergence of Bitcoin and AI technology. We cover everything from humanoid robots to the energy demands of next-generation computing.

Headlines of the Day

Steak n Shake to Accept Bitcoin at All Locations May 16 - via X

Facebook Plans Crypto Wallets for 3B Users, Bitcoin Impact Looms - via X

Trump Urges Americans to Buy Stocks for Economic Boom - via X

UK Drops Tariffs, U.S. Farmers Set to Reap Major Benefits - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 145,630 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Happy belated Mother's Day to all the moms out there.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 472f440f:5669301e

2025-05-12 23:29:25

@ 472f440f:5669301e

2025-05-12 23:29:25Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.

It seems that this is not the case as the SDNY responded to a letter sent from the defense to dismiss the case by stating that they fully plan to move forward. Stating that they only sought the recommendations of FinCEN employees and did not believe that those employees' comments were indicative of FinCEN's overall views on this particular case. It's a pretty egregious abuse of power by the SDNY. I'm not sure if the particular lawyers and judges within the Southern District of New York are very passionate about preventing the use of self-custody bitcoin and products that enable bitcoiners to transact privately, or if they're simply participating in a broader meta war with the Trump administration - who has made it clear to federal judges across the country that last Fall's election will have consequences, mainly that the Executive Branch will try to effectuate the policies that President Trump campaigned on by any legal means necessary - and Samouari Wallet is simply in the middle of that meta war.

However, one thing is pretty clear to me, this is an egregious overstep of power. The interpretation of that law, as has been laid out and confirmed by FinCEN over the last decade, is pretty clear; you cannot be a money services business if you do not control the funds that people are sending to each other, which is definitely the case with Samourai Wallet. People downloaded Samourai Wallet, spun up their own private-public key pairs and initiated transactions themselves. Samourai never custodied funds or initiated transactions on behalf of their users. This is very cut and dry. Straight to the point. It should be something that anyone with more than two brain cells is able to discern pretty quickly.

It is imperative that anybody in the industry who cares about being able to hold bitcoin in self-custody, to mine bitcoin, and to send bitcoin in a peer-to-peer fashion makes some noise around this case. None of the current administration's attempts to foster innovation around bitcoin in the United States will matter if the wrong precedent is set in this case. If the SDNY is successful in prosecuting Samourai Wallet, it will mean that anybody holding Bitcoin in self-custody, running a bitcoin fold node or mining bitcoin will have to KYC all of their users and counterparts lest they be labeled a money services business that is breaking laws stemming from the Bank Secrecy Act. This will effectively make building a self-custody bitcoin wallet, running a node, or mining bitcoin in tillegal in the United States. The ability to comply with the rules that would be unleashed if this Samourai case goes the wrong way, are such that it will effectively destroy the industry overnight.

It is yet to be seen whether or not the Department of Justice will step in to publicly flog the SDNY and force them to stop pursuing this case. This is the only likely way that the case will go away at this point, so it is very important that bitcoiners who care about being able to self-custody bitcoin, mine bitcoin, or send bitcoin in a peer-to-peer fashion in the United States make it clear to the current administration and any local politicians that this is an issue that you care deeply about. If we are too complacent, there is a chance that the SDNY could completely annihilate the bitcoin industry in America despite of all of the positive momentum we're seeing from all angles at the moment.

Make some noise!

Bitcoin Adoption by Power Companies: The Next Frontier

In my recent conversation with Andrew Myers from Satoshi Energy, he shared their ambitious mission to "enable every electric power company to use bitcoin by block 1,050,000" – roughly three years from now. This strategic imperative isn't just about creating new Bitcoin users; it's about sovereignty. Andrew emphasized that getting Bitcoin into the hands of energy companies who value self-sovereignty creates a more balanced future economic landscape. The excitement was palpable as he described how several energy companies are already moving beyond simply selling power to Bitcoin miners and are beginning to invest in mining operations themselves.

"You have global commodity companies being like, 'Oh, this is another commodity – we want to invest in this, we want to own this,'" - Andrew Myers

Perhaps most fascinating was Andrew's revelation about major energy companies in Texas developing Bitcoin collateral products for power contracts – a practical application that could revolutionize how energy transactions are settled. As energy companies continue embracing Bitcoin for both operations and collateral, we're witnessing the early stages of a profound shift in how critical infrastructure interfaces with sound money. The implications for both sectors could be transformative.

Check out the full podcast here for more on remote viewing, Nikola Tesla's predictions, and the convergence of Bitcoin and AI technology. We cover everything from humanoid robots to the energy demands of next-generation computing.

Headlines of the Day

Steak n Shake to Accept Bitcoin at All Locations May 16 - via X

Facebook Plans Crypto Wallets for 3B Users, Bitcoin Impact Looms - via X

Trump Urges Americans to Buy Stocks for Economic Boom - via X

UK Drops Tariffs, U.S. Farmers Set to Reap Major Benefits - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 145,630 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Happy belated Mother's Day to all the moms out there.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ cae03c48:2a7d6671

2025-05-19 22:21:46

@ cae03c48:2a7d6671

2025-05-19 22:21:46Bitcoin Magazine

BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First ClientToday, BitMine Immersion Technologies, Inc. (OTCQX: BMNRD) announced the launch of its Bitcoin Treasury Advisory Practice and a $4 million deal with a U.S. exchange-listed company. The deal saw Bitmine surpass its last year’s total revenue in that single transaction alone, according to the announcement.

BitMine ( OTCQX: $BMNRD $BMNR) launches Bitcoin Treasury Advisory Practice and secures $4M deal with first client.

This single transaction exceeds our 2024 revenue and sets the stage for major growth.

Read now: https://t.co/R89K3WXdZZ pic.twitter.com/5vIvlYPZUY

— Bitmine Immersion Technologies, Inc. (@BitMNR) May 19, 2025

BitMine will provide “Mining as a Service” (MaaS) by leasing 3,000 Bitcoin ASIC miners to the client through December 30, 2025, in a $3.2 million lease deal, with $1.6 million paid upfront. Additionally, the client has signed an $800,000 consulting agreement for one year focusing on Bitcoin Mining-as-a-Service and Bitcoin Treasury Strategy.

“Currently, there are almost 100 public companies that have adopted Bitcoin as a treasury holding. We expect this number to grow in the future. As more companies adopt Bitcoin treasury strategies, the need for infrastructure, revenue generation, and expert guidance grows along with it,” said Jonathan Bates, CEO of BitMine. “This single transaction is greater than our entire 2024 fiscal year revenue, and we feel there is an opportunity to acquire more clients in the near future as interest in Bitcoin ownership grows.”

BitMine’s first quarter 2025 results showed strong revenue growth, with GAAP revenue rising approximately 135% to $1.2 million, up from $511,000 in Q1 2024, supported by an expanded mining capacity of 4,640 miners as of November 30, 2024, compared to 1,606 the previous year. Despite this growth, the company reported a net loss of $3.9 million in Q1 2025, primarily due to a one-time, non-cash accounting adjustment related to preferred stock; excluding this charge, the adjusted loss was approximately $975,000, consistent with the prior year’s results.

$BMNR reports a 135% revenue increase YOY for Q1 2025 and tripled self-mining capacity with 3,000 new miners! CEO Jonathan Bates credits a team-driven approach and creative financing for this growth.

Read the full release here: https://t.co/slNrZv8Ocn pic.twitter.com/Gb4tk1UfAO— Bitmine Immersion Technologies, Inc. (@BitMNR) January 13, 2025

BitMine’s new Bitcoin Treasury Advisory Practice, along with the $4 million deal, joins a trend among public companies exploring Bitcoin not just as a treasury asset but also as a source of revenue.

This post BitMine Launches Bitcoin Treasury Advisory Practice, Secures $4M Deal with First Client first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 472f440f:5669301e

2025-05-12 23:29:19

@ 472f440f:5669301e

2025-05-12 23:29:19Marty's Bent

Last week we covered the bombshell developments in the Samourai Wallet case. For those who didn't read that, last Monday the world was made aware of the fact that the SDNY was explicitly told by FinCEN that the federal regulator did not believe that Samourai Wallet was a money services business six months before arresting the co-founders of Samourai Wallet for conspiracy to launder money and illegally operating a money services business. This was an obvious overstep by the SDNY that many believed would be quickly alleviated, especially considering the fact that the Trump administration via the Department of Justice has made it clear that they do not intend to rule via prosecution.

It seems that this is not the case as the SDNY responded to a letter sent from the defense to dismiss the case by stating that they fully plan to move forward. Stating that they only sought the recommendations of FinCEN employees and did not believe that those employees' comments were indicative of FinCEN's overall views on this particular case. It's a pretty egregious abuse of power by the SDNY. I'm not sure if the particular lawyers and judges within the Southern District of New York are very passionate about preventing the use of self-custody bitcoin and products that enable bitcoiners to transact privately, or if they're simply participating in a broader meta war with the Trump administration - who has made it clear to federal judges across the country that last Fall's election will have consequences, mainly that the Executive Branch will try to effectuate the policies that President Trump campaigned on by any legal means necessary - and Samouari Wallet is simply in the middle of that meta war.

However, one thing is pretty clear to me, this is an egregious overstep of power. The interpretation of that law, as has been laid out and confirmed by FinCEN over the last decade, is pretty clear; you cannot be a money services business if you do not control the funds that people are sending to each other, which is definitely the case with Samourai Wallet. People downloaded Samourai Wallet, spun up their own private-public key pairs and initiated transactions themselves. Samourai never custodied funds or initiated transactions on behalf of their users. This is very cut and dry. Straight to the point. It should be something that anyone with more than two brain cells is able to discern pretty quickly.

It is imperative that anybody in the industry who cares about being able to hold bitcoin in self-custody, to mine bitcoin, and to send bitcoin in a peer-to-peer fashion makes some noise around this case. None of the current administration's attempts to foster innovation around bitcoin in the United States will matter if the wrong precedent is set in this case. If the SDNY is successful in prosecuting Samourai Wallet, it will mean that anybody holding Bitcoin in self-custody, running a bitcoin fold node or mining bitcoin will have to KYC all of their users and counterparts lest they be labeled a money services business that is breaking laws stemming from the Bank Secrecy Act. This will effectively make building a self-custody bitcoin wallet, running a node, or mining bitcoin in tillegal in the United States. The ability to comply with the rules that would be unleashed if this Samourai case goes the wrong way, are such that it will effectively destroy the industry overnight.

It is yet to be seen whether or not the Department of Justice will step in to publicly flog the SDNY and force them to stop pursuing this case. This is the only likely way that the case will go away at this point, so it is very important that bitcoiners who care about being able to self-custody bitcoin, mine bitcoin, or send bitcoin in a peer-to-peer fashion in the United States make it clear to the current administration and any local politicians that this is an issue that you care deeply about. If we are too complacent, there is a chance that the SDNY could completely annihilate the bitcoin industry in America despite of all of the positive momentum we're seeing from all angles at the moment.

Make some noise!

Bitcoin Adoption by Power Companies: The Next Frontier

In my recent conversation with Andrew Myers from Satoshi Energy, he shared their ambitious mission to "enable every electric power company to use bitcoin by block 1,050,000" – roughly three years from now. This strategic imperative isn't just about creating new Bitcoin users; it's about sovereignty. Andrew emphasized that getting Bitcoin into the hands of energy companies who value self-sovereignty creates a more balanced future economic landscape. The excitement was palpable as he described how several energy companies are already moving beyond simply selling power to Bitcoin miners and are beginning to invest in mining operations themselves.

"You have global commodity companies being like, 'Oh, this is another commodity – we want to invest in this, we want to own this,'" - Andrew Myers

Perhaps most fascinating was Andrew's revelation about major energy companies in Texas developing Bitcoin collateral products for power contracts – a practical application that could revolutionize how energy transactions are settled. As energy companies continue embracing Bitcoin for both operations and collateral, we're witnessing the early stages of a profound shift in how critical infrastructure interfaces with sound money. The implications for both sectors could be transformative.

Check out the full podcast here for more on remote viewing, Nikola Tesla's predictions, and the convergence of Bitcoin and AI technology. We cover everything from humanoid robots to the energy demands of next-generation computing.

Headlines of the Day

Steak n Shake to Accept Bitcoin at All Locations May 16 - via X

Facebook Plans Crypto Wallets for 3B Users, Bitcoin Impact Looms - via X

Trump Urges Americans to Buy Stocks for Economic Boom - via X

UK Drops Tariffs, U.S. Farmers Set to Reap Major Benefits - via X

Looking for the perfect video to push the smartest person you know from zero to one on bitcoin? Bitcoin, Not Crypto is a three-part master class from Parker Lewis and Dhruv Bansal that cuts through the noise—covering why 21 million was the key technical simplification that made bitcoin possible, why blockchains don’t create decentralization, and why everything else will be built on bitcoin.

Ten31, the largest bitcoin-focused investor, has deployed 145,630 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Happy belated Mother's Day to all the moms out there.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-03-13 19:39:28

@ 04c915da:3dfbecc9

2025-03-13 19:39:28In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 04c915da:3dfbecc9

2025-02-25 03:55:08

@ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-