-

@ 04c915da:3dfbecc9

2025-05-15 15:31:45

@ 04c915da:3dfbecc9

2025-05-15 15:31:45Capitalism is the most effective system for scaling innovation. The pursuit of profit is an incredibly powerful human incentive. Most major improvements to human society and quality of life have resulted from this base incentive. Market competition often results in the best outcomes for all.

That said, some projects can never be monetized. They are open in nature and a business model would centralize control. Open protocols like bitcoin and nostr are not owned by anyone and if they were it would destroy the key value propositions they provide. No single entity can or should control their use. Anyone can build on them without permission.

As a result, open protocols must depend on donation based grant funding from the people and organizations that rely on them. This model works but it is slow and uncertain, a grind where sustainability is never fully reached but rather constantly sought. As someone who has been incredibly active in the open source grant funding space, I do not think people truly appreciate how difficult it is to raise charitable money and deploy it efficiently.

Projects that can be monetized should be. Profitability is a super power. When a business can generate revenue, it taps into a self sustaining cycle. Profit fuels growth and development while providing projects independence and agency. This flywheel effect is why companies like Google, Amazon, and Apple have scaled to global dominance. The profit incentive aligns human effort with efficiency. Businesses must innovate, cut waste, and deliver value to survive.

Contrast this with non monetized projects. Without profit, they lean on external support, which can dry up or shift with donor priorities. A profit driven model, on the other hand, is inherently leaner and more adaptable. It is not charity but survival. When survival is tied to delivering what people want, scale follows naturally.

The real magic happens when profitable, sustainable businesses are built on top of open protocols and software. Consider the many startups building on open source software stacks, such as Start9, Mempool, and Primal, offering premium services on top of the open source software they build out and maintain. Think of companies like Block or Strike, which leverage bitcoin’s open protocol to offer their services on top. These businesses amplify the open software and protocols they build on, driving adoption and improvement at a pace donations alone could never match.

When you combine open software and protocols with profit driven business the result are lean, sustainable companies that grow faster and serve more people than either could alone. Bitcoin’s network, for instance, benefits from businesses that profit off its existence, while nostr will expand as developers monetize apps built on the protocol.

Capitalism scales best because competition results in efficiency. Donation funded protocols and software lay the groundwork, while market driven businesses build on top. The profit incentive acts as a filter, ensuring resources flow to what works, while open systems keep the playing field accessible, empowering users and builders. Together, they create a flywheel of innovation, growth, and global benefit.

-

@ 08f96856:ffe59a09

2025-05-15 01:22:34

@ 08f96856:ffe59a09

2025-05-15 01:22:34เมื่อพูดถึง Bitcoin Standard หลายคนมักนึกถึงภาพโลกอนาคตที่ทุกคนใช้บิตคอยน์ซื้อกาแฟหรือของใช้ในชีวิตประจำวัน ภาพแบบนั้นดูเหมือนไกลตัวและเป็นไปไม่ได้ในความเป็นจริง หลายคนถึงกับพูดว่า “คงไม่ทันเห็นในช่วงชีวิตนี้หรอก” แต่ในมุมมองของผม Bitcoin Standard อาจไม่ได้เริ่มต้นจากการที่เราจ่ายบิตคอยน์โดยตรงในร้านค้า แต่อาจเริ่มจากบางสิ่งที่เงียบกว่า ลึกกว่า และเกิดขึ้นแล้วในขณะนี้ นั่นคือ การล่มสลายทีละน้อยของระบบเฟียตที่เราใช้กันอยู่

ระบบเงินที่อิงกับอำนาจรัฐกำลังเข้าสู่ช่วงขาลง รัฐบาลทั่วโลกกำลังจมอยู่ในภาระหนี้ระดับประวัติการณ์ แม้แต่ประเทศมหาอำนาจก็เริ่มแสดงสัญญาณของภาวะเสี่ยงผิดนัดชำระหนี้ อัตราเงินเฟ้อกลายเป็นปัญหาเรื้อรังที่ไม่มีท่าทีจะหายไป ธนาคารที่เคยโอนฟรีเริ่มกลับมาคิดค่าธรรมเนียม และประชาชนก็เริ่มรู้สึกถึงการเสื่อมศรัทธาในระบบการเงินดั้งเดิม แม้จะยังพูดกันไม่เต็มเสียงก็ตาม

ในขณะเดียวกัน บิตคอยน์เองก็กำลังพัฒนาแบบเงียบ ๆ เงียบ... แต่ไม่เคยหยุด โดยเฉพาะในระดับ Layer 2 ที่เริ่มแสดงศักยภาพอย่างจริงจัง Lightning Network เป็น Layer 2 ที่เปิดใช้งานมาได้ระยะเวลสหนึ่ง และยังคงมีบทบาทสำคัญที่สุดในระบบนิเวศของบิตคอยน์ มันทำให้การชำระเงินเร็วขึ้น มีต้นทุนต่ำ และไม่ต้องบันทึกทุกธุรกรรมลงบล็อกเชน เครือข่ายนี้กำลังขยายตัวทั้งในแง่ของโหนดและการใช้งานจริงทั่วโลก

ขณะเดียวกัน Layer 2 ทางเลือกอื่นอย่าง Ark Protocol ก็กำลังพัฒนาเพื่อตอบโจทย์ด้านความเป็นส่วนตัวและประสบการณ์ใช้งานที่ง่าย BitVM เปิดแนวทางใหม่ให้บิตคอยน์รองรับ smart contract ได้ในระดับ Turing-complete ซึ่งทำให้เกิดความเป็นไปได้ในกรณีใช้งานอีกมากมาย และเทคโนโลยีที่น่าสนใจอย่าง Taproot Assets, Cashu และ Fedimint ก็ทำให้การออกโทเคนหรือสกุลเงินที่อิงกับบิตคอยน์เป็นจริงได้บนโครงสร้างของบิตคอยน์เอง

เทคโนโลยีเหล่านี้ไม่ใช่การเติบโตแบบปาฏิหาริย์ แต่มันคืบหน้าอย่างต่อเนื่องและมั่นคง และนั่นคือเหตุผลที่มันจะ “อยู่รอด” ได้ในระยะยาว เมื่อฐานของความน่าเชื่อถือไม่ใช่บริษัท รัฐบาล หรือทุน แต่คือสิ่งที่ตรวจสอบได้และเปลี่ยนกฎไม่ได้

แน่นอนว่าบิตคอยน์ต้องแข่งขันกับ stable coin, เงินดิจิทัลของรัฐ และ cryptocurrency อื่น ๆ แต่สิ่งที่ทำให้มันเหนือกว่านั้นไม่ใช่ฟีเจอร์ หากแต่เป็นความทนทาน และความมั่นคงของกฎที่ไม่มีใครเปลี่ยนได้ ไม่มีทีมพัฒนา ไม่มีบริษัท ไม่มีประตูปิด หรือการยึดบัญชี มันยืนอยู่บนคณิตศาสตร์ พลังงาน และเวลา

หลายกรณีใช้งานที่เคยถูกทดลองในโลกคริปโตจะค่อย ๆ เคลื่อนเข้ามาสู่บิตคอยน์ เพราะโครงสร้างของมันแข็งแกร่งกว่า ไม่ต้องการทีมพัฒนาแกนกลาง ไม่ต้องพึ่งกลไกเสี่ยงต่อการผูกขาด และไม่ต้องการ “ความเชื่อใจ” จากใครเลย

Bitcoin Standard ที่ผมพูดถึงจึงไม่ใช่การเปลี่ยนแปลงแบบพลิกหน้ามือเป็นหลังมือ แต่คือการ “เปลี่ยนฐานของระบบ” ทีละชั้น ระบบการเงินใหม่ที่อิงอยู่กับบิตคอยน์กำลังเกิดขึ้นแล้ว มันไม่ใช่โลกที่ทุกคนถือเหรียญบิตคอยน์ แต่มันคือโลกที่คนใช้อาจไม่รู้ตัวด้วยซ้ำว่า “สิ่งที่เขาใช้นั้นอิงอยู่กับบิตคอยน์”

ผู้คนอาจใช้เงินดิจิทัลที่สร้างบน Layer 3 หรือ Layer 4 ผ่านแอป ผ่านแพลตฟอร์ม หรือผ่านสกุลเงินใหม่ที่ดูไม่ต่างจากเดิม แต่เบื้องหลังของระบบจะผูกไว้กับบิตคอยน์

และถ้ามองในเชิงพัฒนาการ บิตคอยน์ก็เหมือนกับอินเทอร์เน็ต ครั้งหนึ่งอินเทอร์เน็ตก็ถูกมองว่าเข้าใจยาก ต้องพิมพ์ http ต้องรู้จัก TCP/IP ต้องตั้ง proxy เอง แต่ปัจจุบันผู้คนใช้งานอินเทอร์เน็ตโดยไม่รู้ว่าเบื้องหลังมีอะไรเลย บิตคอยน์กำลังเดินตามเส้นทางเดียวกัน โปรโตคอลกำลังถอยออกจากสายตา และวันหนึ่งเราจะ “ใช้มัน” โดยไม่ต้องรู้ว่ามันคืออะไร

หากนับจากช่วงเริ่มต้นของอินเทอร์เน็ตในยุค 1990 จนกลายเป็นโครงสร้างหลักของโลกในสองทศวรรษ เส้นเวลาของบิตคอยน์ก็กำลังเดินตามรอยเท้าของอินเทอร์เน็ต และถ้าเราเชื่อว่าวัฏจักรของเทคโนโลยีมีจังหวะของมันเอง เราก็จะรู้ว่า Bitcoin Standard นั้นไม่ใช่เรื่องของอนาคตไกลโพ้น แต่มันเกิดขึ้นแล้ว

siamstr

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ ae1008d2:a166d760

2025-04-01 00:29:56

@ ae1008d2:a166d760

2025-04-01 00:29:56This is part one in a series of long-form content of my ideas as to what we are entering into in my opinion;The Roaring '20's 2.0 (working title). I hope you'll join me on this journey together.

"History does not repeat itself, but it often rhymes"; - Samuel Clemens, aka Mark Twain. My only class I received an A+ in high school was history, this opened up the opportunity for me to enroll in an AP (college level) history class my senior year. There was an inherent nature for me to study history. Another quote I found to live by; "If we do not study history, we are bound to repeat it", a paraphrased quote by the many great philosphers of old from Edmund Burke, George Santayana and even Winston Churchill, all pulling from the same King Solomon quote; "What has been will be again, what has been done will be done again; there is nothing new under the sun". My curiousity of human actions, psychological and therefore economical behavior, has benefitted me greatly throughout my life and career, at such a young age. Being able to 'see around the curves' ahead I thought was a gift many had, but was sorely mistaken. People are just built different. One, if not my hardest action for me is to share. I just do things; act, often without even thinking about writing down or sharing in anyway shape or form what I just did here with friends, what we just built or how we formed these startups, etc., I've finally made the time, mainly for myself, to share my thoughts and ideas as to where we are at, and what we can do moving forward. It's very easy for us living a sovereign-lifestyle in Bitcoin, Nostr and other P2P, cryptographically-signed sovereign tools and tech-stacks alike, permissionless and self-hostable, to take all these tools for granted. We just live with them. Use them everyday. Do you own property? Do you have to take care of the cattle everyday? To live a sovereign life is tough, but most rewarding. As mentioned above, I'm diving into the details in a several part series as to what the roaring '20's were about, how it got to the point it did, and the inevitable outcome we all know what came to be. How does this possibly repeat itself almost exactly a century later? How does Bitcoin play a role? Are we all really going to be replaced by AI robots (again, history rhymes here)? Time will tell, but I think most of us actually using the tools will also forsee many of these possible outcomes, as it's why we are using many of these tools today. The next parts of this series will be released periodically, maybe once per month, maybe once per quarter. I'll also be releasing these on other platforms like Medium for reach, but Nostr will always be first, most important and prioritized.

I'll leave you with one of my favorite quotes I've lived by from one of the greatest traders of all time, especially during this roaring '20's era, Jesse Livermore; "Money is made by sitting, not trading". -

@ 21335073:a244b1ad

2025-03-15 23:00:40

@ 21335073:a244b1ad

2025-03-15 23:00:40I want to see Nostr succeed. If you can think of a way I can help make that happen, I’m open to it. I’d like your suggestions.

My schedule’s shifting soon, and I could volunteer a few hours a week to a Nostr project. I won’t have more total time, but how I use it will change.

Why help? I care about freedom. Nostr’s one of the most powerful freedom tools I’ve seen in my lifetime. If I believe that, I should act on it.

I don’t care about money or sats. I’m not rich, I don’t have extra cash. That doesn’t drive me—freedom does. I’m volunteering, not asking for pay.

I’m not here for clout. I’ve had enough spotlight in my life; it doesn’t move me. If I wanted clout, I’d be on Twitter dropping basic takes. Clout’s easy. Freedom’s hard. I’d rather help anonymously. No speaking at events—small meetups are cool for the vibe, but big conferences? Not my thing. I’ll never hit a huge Bitcoin conference. It’s just not my scene.

That said, I could be convinced to step up if it’d really boost Nostr—as long as it’s legal and gets results.

In this space, I’d watch for social engineering. I watch out for it. I’m not here to make friends, just to help. No shade—you all seem great—but I’ve got a full life and awesome friends irl. I don’t need your crew or to be online cool. Connect anonymously if you want; I’d encourage it.

I’m sick of watching other social media alternatives grow while Nostr kinda stalls. I could trash-talk, but I’d rather do something useful.

Skills? I’m good at spotting social media problems and finding possible solutions. I won’t overhype myself—that’s weird—but if you’re responding, you probably see something in me. Perhaps you see something that I don’t see in myself.

If you need help now or later with Nostr projects, reach out. Nostr only—nothing else. Anonymous contact’s fine. Even just a suggestion on how I can pitch in, no project attached, works too. 💜

Creeps or harassment will get blocked or I’ll nuke my simplex code if it becomes a problem.

https://simplex.chat/contact#/?v=2-4&smp=smp%3A%2F%2FSkIkI6EPd2D63F4xFKfHk7I1UGZVNn6k1QWZ5rcyr6w%3D%40smp9.simplex.im%2FbI99B3KuYduH8jDr9ZwyhcSxm2UuR7j0%23%2F%3Fv%3D1-2%26dh%3DMCowBQYDK2VuAyEAS9C-zPzqW41PKySfPCEizcXb1QCus6AyDkTTjfyMIRM%253D%26srv%3Djssqzccmrcws6bhmn77vgmhfjmhwlyr3u7puw4erkyoosywgl67slqqd.onion

-

@ 04c915da:3dfbecc9

2025-03-13 19:39:28

@ 04c915da:3dfbecc9

2025-03-13 19:39:28In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-03-10 23:31:30

@ 04c915da:3dfbecc9

2025-03-10 23:31:30Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Usually stolen bitcoin for the reserve creates a perverse incentive. If governments see a bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14I. Historical Foundations of U.S. Monetary Architecture

The early monetary system of the United States was built atop inherited commodity money conventions from Europe’s maritime economies. Silver and gold coins—primarily Spanish pieces of eight, Dutch guilders, and other foreign specie—formed the basis of colonial commerce. These units were already integrated into international trade and piracy networks and functioned with natural compatibility across England, France, Spain, and Denmark. Lacking a centralized mint or formal currency, the U.S. adopted these forms de facto.

As security risks and the practical constraints of physical coinage mounted, banks emerged to warehouse specie and issue redeemable certificates. These certificates evolved into fiduciary media—claims on specie not actually in hand. Banks observed over time that substantial portions of reserves remained unclaimed for years. This enabled fractional reserve banking: issuing more claims than reserves held, so long as redemption demand stayed low. The practice was inherently unstable, prone to panics and bank runs, prompting eventual centralization through the formation of the Federal Reserve in 1913.

Following the Civil War and unstable reinstatements of gold convertibility, the U.S. sought global monetary stability. After World War II, the Bretton Woods system formalized the U.S. dollar as the global reserve currency. The dollar was nominally backed by gold, but most international dollars were held offshore and recycled into U.S. Treasuries. The Nixon Shock of 1971 eliminated the gold peg, converting the dollar into pure fiat. Yet offshore dollar demand remained, sustained by oil trade mandates and the unique role of Treasuries as global reserve assets.

II. The Structure of Fiduciary Media and Treasury Demand

Under this system, foreign trade surpluses with the U.S. generate excess dollars. These surplus dollars are parked in U.S. Treasuries, thereby recycling trade imbalances into U.S. fiscal liquidity. While technically loans to the U.S. government, these purchases act like interest-only transfers—governments receive yield, and the U.S. receives spendable liquidity without principal repayment due in the short term. Debt is perpetually rolled over, rarely extinguished.

This creates an illusion of global subsidy: U.S. deficits are financed via foreign capital inflows that, in practice, function more like financial tribute systems than conventional debt markets. The underlying asset—U.S. Treasury debt—functions as the base reserve asset of the dollar system, replacing gold in post-Bretton Woods monetary logic.

III. Emergence of Tether and the Parastatal Dollar

Tether (USDT), as a private issuer of dollar-denominated tokens, mimics key central bank behaviors while operating outside the regulatory perimeter. It mints tokens allegedly backed 1:1 by U.S. dollars or dollar-denominated securities (mostly Treasuries). These tokens circulate globally, often in jurisdictions with limited banking access, and increasingly serve as synthetic dollar substitutes.

If USDT gains dominance as the preferred medium of exchange—due to technological advantages, speed, programmability, or access—it displaces Federal Reserve Notes (FRNs) not through devaluation, but through functional obsolescence. Gresham’s Law inverts: good money (more liquid, programmable, globally transferable USDT) displaces bad (FRNs) even if both maintain a nominal 1:1 parity.

Over time, this preference translates to a systemic demand shift. Actors increasingly use Tether instead of FRNs, especially in global commerce, digital marketplaces, or decentralized finance. Tether tokens effectively become shadow base money.

IV. Interaction with Commercial Banking and Redemption Mechanics

Under traditional fractional reserve systems, commercial banks issue loans denominated in U.S. dollars, expanding the money supply. When borrowers repay loans, this destroys the created dollars and contracts monetary elasticity. If borrowers repay in USDT instead of FRNs:

- Banks receive a non-Fed liability (USDT).

- USDT is not recognized as reserve-eligible within the Federal Reserve System.

- Banks must either redeem USDT for FRNs, or demand par-value conversion from Tether to settle reserve requirements and balance their books.

This places redemption pressure on Tether and threatens its 1:1 peg under stress. If redemption latency, friction, or cost arises, USDT’s equivalence to FRNs is compromised. Conversely, if banks are permitted or compelled to hold USDT as reserve or regulatory capital, Tether becomes a de facto reserve issuer.

In this scenario, banks may begin demanding loans in USDT, mirroring borrower behavior. For this to occur sustainably, banks must secure Tether liquidity. This creates two options: - Purchase USDT from Tether or on the secondary market, collateralized by existing fiat. - Borrow USDT directly from Tether, using bank-issued debt as collateral.

The latter mirrors Federal Reserve discount window operations. Tether becomes a lender of first resort, providing monetary elasticity to the banking system by creating new tokens against promissory assets—exactly how central banks function.

V. Structural Consequences: Parallel Central Banking

If Tether begins lending to commercial banks, issuing tokens backed by bank notes or collateralized debt obligations: - Tether controls the expansion of broad money through credit issuance. - Its balance sheet mimics a central bank, with Treasuries and bank debt as assets and tokens as liabilities. - It intermediates between sovereign debt and global liquidity demand, replacing the Federal Reserve’s open market operations with its own issuance-redemption cycles.

Simultaneously, if Tether purchases U.S. Treasuries with FRNs received through token issuance, it: - Supplies the Treasury with new liquidity (via bond purchases). - Collects yield on government debt. - Issues a parallel form of U.S. dollars that never require redemption—an interest-only loan to the U.S. government from a non-sovereign entity.

In this context, Tether performs monetary functions of both a central bank and a sovereign wealth fund, without political accountability or regulatory transparency.

VI. Endgame: Institutional Inversion and Fed Redundancy

This paradigm represents an institutional inversion:

- The Federal Reserve becomes a legacy issuer.

- Tether becomes the operational base money provider in both retail and interbank contexts.

- Treasuries remain the foundational reserve asset, but access to them is mediated by a private intermediary.

- The dollar persists, but its issuer changes. The State becomes a fiscal agent of a decentralized financial ecosystem, not its monetary sovereign.

Unless the Federal Reserve reasserts control—either by absorbing Tether, outlawing its instruments, or integrating its tokens into the reserve framework—it risks becoming irrelevant in the daily function of money.

Tether, in this configuration, is no longer a derivative of the dollar—it is the dollar, just one level removed from sovereign control. The future of monetary sovereignty under such a regime is post-national and platform-mediated.

-

@ 6389be64:ef439d32

2025-02-27 21:32:12

@ 6389be64:ef439d32

2025-02-27 21:32:12GA, plebs. The latest episode of Bitcoin And is out, and, as always, the chicanery is running rampant. Let’s break down the biggest topics I covered, and if you want the full, unfiltered rant, make sure to listen to the episode linked below.

House Democrats’ MEME Act: A Bad Joke?

House Democrats are proposing a bill to ban presidential meme coins, clearly aimed at Trump’s and Melania’s ill-advised token launches. While grifters launching meme coins is bad, this bill is just as ridiculous. If this legislation moves forward, expect a retaliatory strike exposing how politicians like Pelosi and Warren mysteriously amassed their fortunes. Will it pass? Doubtful. But it’s another sign of the government’s obsession with regulating everything except itself.

Senate Banking’s First Digital Asset Hearing: The Real Target Is You

Cynthia Lummis chaired the first digital asset hearing, and—surprise!—it was all about control. The discussion centered on stablecoins, AML, and KYC regulations, with witnesses suggesting Orwellian measures like freezing stablecoin transactions unless pre-approved by authorities. What was barely mentioned? Bitcoin. They want full oversight of stablecoins, which is really about controlling financial freedom. Expect more nonsense targeting self-custody wallets under the guise of stopping “bad actors.”

Bank of America and PayPal Want In on Stablecoins

Bank of America’s CEO openly stated they’ll launch a stablecoin as soon as regulation allows. Meanwhile, PayPal’s CEO paid for a hat using Bitcoin—not their own stablecoin, Pi USD. Why wouldn’t he use his own product? Maybe he knows stablecoins aren’t what they’re hyped up to be. Either way, the legacy financial system is gearing up to flood the market with stablecoins, not because they love crypto, but because it’s a tool to extend U.S. dollar dominance.

MetaPlanet Buys the Dip

Japan’s MetaPlanet issued $13.4M in bonds to buy more Bitcoin, proving once again that institutions see the writing on the wall. Unlike U.S. regulators who obsess over stablecoins, some companies are actually stacking sats.

UK Expands Crypto Seizure Powers

Across the pond, the UK government is pushing legislation to make it easier to seize and destroy crypto linked to criminal activity. While they frame it as going after the bad guys, it’s another move toward centralized control and financial surveillance.

Bitcoin Tools & Tech: Arc, SatoChip, and Nunchuk

Some bullish Bitcoin developments: ARC v0.5 is making Bitcoin’s second layer more efficient, SatoChip now supports Taproot and Nostr, and Nunchuk launched a group wallet with chat, making multisig collaboration easier.

The Bottom Line

The state is coming for financial privacy and control, and stablecoins are their weapon of choice. Bitcoiners need to stay focused, keep their coins in self-custody, and build out parallel systems. Expect more regulatory attacks, but don’t let them distract you—just keep stacking and transacting in ways they can’t control.

🎧 Listen to the full episode here: https://fountain.fm/episode/PYITCo18AJnsEkKLz2Ks

💰 Support the show by boosting sats on Podcasting 2.0! and I will see you on the other side.

-

@ dc4cd086:cee77c06

2025-02-09 03:35:25

@ dc4cd086:cee77c06

2025-02-09 03:35:25Have you ever wanted to learn from lengthy educational videos but found it challenging to navigate through hours of content? Our new tool addresses this problem by transforming long-form video lectures into easily digestible, searchable content.

Key Features:

Video Processing:

- Automatically downloads YouTube videos, transcripts, and chapter information

- Splits transcripts into sections based on video chapters

Content Summarization:

- Utilizes language models to transform spoken content into clear, readable text

- Formats output in AsciiDoc for improved readability and navigation

- Highlights key terms and concepts with [[term]] notation for potential cross-referencing

Diagram Extraction:

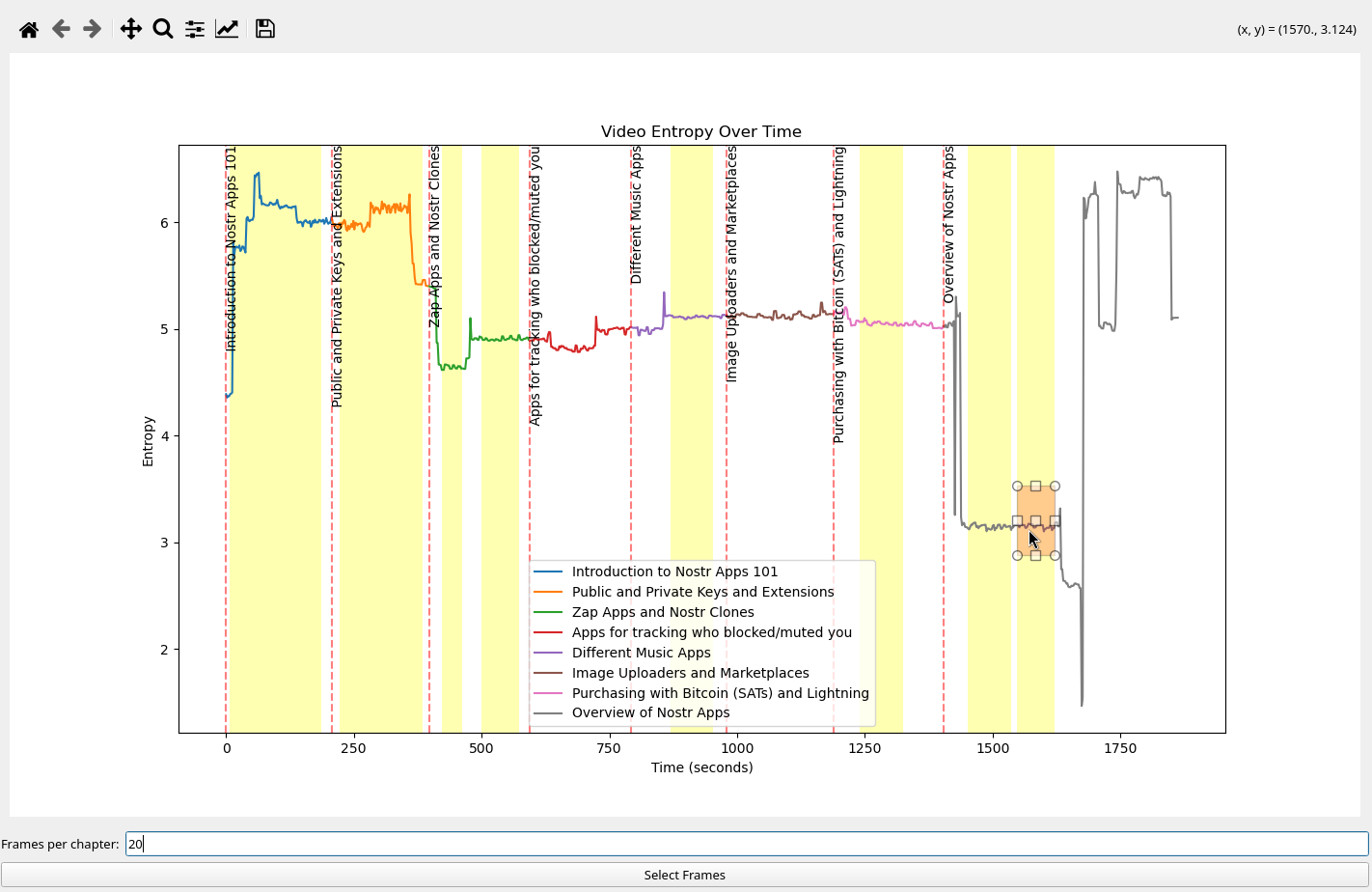

- Analyzes video entropy to identify static diagram/slide sections

- Provides a user-friendly GUI for manual selection of relevant time ranges

- Allows users to pick representative frames from selected ranges

Going Forward:

Currently undergoing a rewrite to improve organization and functionality, but you are welcome to try the current version, though it might not work on every machine. Will support multiple open and closed language models for user choice Free and open-source, allowing for personal customization and integration with various knowledge bases. Just because we might not have it on our official Alexandria knowledge base, you are still welcome to use it on you own personal or community knowledge bases! We want to help find connections between ideas that exist across relays, allowing individuals and groups to mix and match knowledge bases between each other, allowing for any degree of openness you care.

While designed with #Alexandria users in mind, it's available for anyone to use and adapt to their own learning needs.

Screenshots

Frame Selection

This is a screenshot of the frame selection interface. You'll see a signal that represents frame entropy over time. The vertical lines indicate the start and end of a chapter. Within these chapters you can select the frames by clicking and dragging the mouse over the desired range where you think diagram is in that chapter. At the bottom is an option that tells the program to select a specific number of frames from that selection.

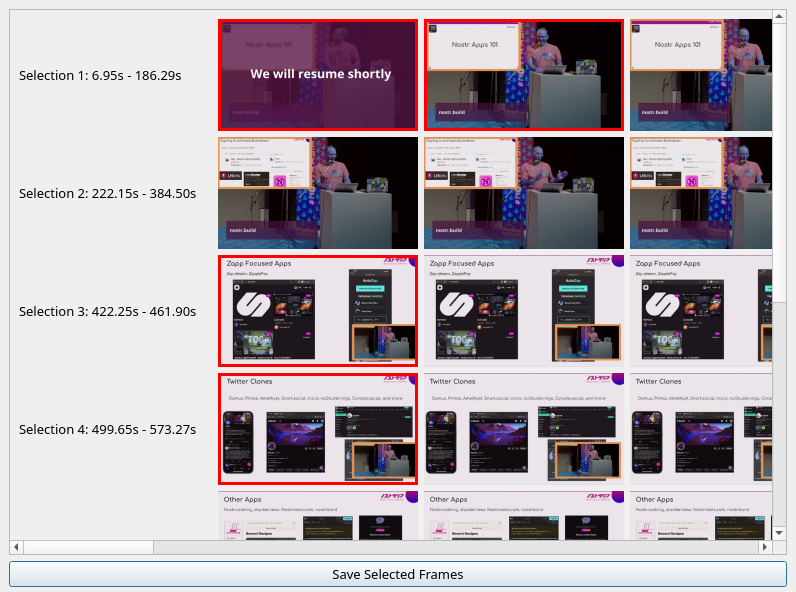

Diagram Extraction

This is a screenshot of the diagram extraction interface. For every selection you've made, there will be a set of frames that you can choose from. You can select and deselect as many frames as you'd like to save.

Links

- repo: https://github.com/limina1/video_article_converter

- Nostr Apps 101: https://www.youtube.com/watch?v=Flxa_jkErqE

Output

And now, we have a demonstration of the final result of this tool, with some quick cleaning up. The video we will be using this tool on is titled Nostr Apps 101 by nostr:npub1nxy4qpqnld6kmpphjykvx2lqwvxmuxluddwjamm4nc29ds3elyzsm5avr7 during Nostrasia. The following thread is an analog to the modular articles we are constructing for Alexandria, and I hope it conveys the functionality we want to create in the knowledge space. Note, this tool is the first step! You could use a different prompt that is most appropriate for the specific context of the transcript you are working with, but you can also manually clean up any discrepancies that don't portray the video accurately. You can now view the article on #Alexandria https://next-alexandria.gitcitadel.eu/publication?d=nostr-apps-101

Initially published as chained kind 1's nostr:nevent1qvzqqqqqqypzp5r5hd579v2sszvvzfel677c8dxgxm3skl773sujlsuft64c44ncqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qgwwaehxw309ahx7uewd3hkctcpzemhxue69uhhyetvv9ujumt0wd68ytnsw43z7qghwaehxw309aex2mrp0yhxummnw3ezucnpdejz7qgewaehxw309aex2mrp0yh8xmn0wf6zuum0vd5kzmp0qqsxunmjy20mvlq37vnrcshkf6sdrtkfjtjz3anuetmcuv8jswhezgc7hglpn

Or view on Coracle https://coracle.social /nevent1qqsxunmjy20mvlq37vnrcshkf6sdrtkfjtjz3anuetmcuv8jswhezgcppemhxue69uhkummn9ekx7mp0qgsdqa9md83tz5yqnrqjw07hhkpmfjpkuv9hlh5v8yhu8z274w9dv7qnnq0s3

-

@ 40bdcc08:ad00fd2c

2025-05-06 14:24:22

@ 40bdcc08:ad00fd2c

2025-05-06 14:24:22Introduction

Bitcoin’s

OP_RETURNopcode, a mechanism for embedding small data in transactions, has ignited a significant debate within the Bitcoin community. Originally designed to support limited metadata while preserving Bitcoin’s role as a peer-to-peer electronic cash system,OP_RETURNis now at the center of proposals that could redefine Bitcoin’s identity. The immutable nature of Bitcoin’s timechain makes it an attractive platform for data storage, creating tension with those who prioritize its monetary function. This discussion, particularly around Bitcoin Core pull request #32406 (GitHub PR #32406), highlights a critical juncture for Bitcoin’s future.What is

OP_RETURN?Introduced in 2014,

OP_RETURNallows users to attach up to 80 bytes of data to a Bitcoin transaction. Unlike other transaction outputs,OP_RETURNoutputs are provably unspendable, meaning they don’t burden the Unspent Transaction Output (UTXO) set—a critical database for Bitcoin nodes. This feature was a compromise to provide a standardized, less harmful way to include metadata, addressing earlier practices that embedded data in ways that bloated the UTXO set. The 80-byte limit and restriction to oneOP_RETURNoutput per transaction are part of Bitcoin Core’s standardness rules, which guide transaction relay and mining but are not enforced by the network’s consensus rules (Bitcoin Stack Exchange).Standardness vs. Consensus Rules

Standardness rules are Bitcoin Core’s default policies for relaying and mining transactions. They differ from consensus rules, which define what transactions are valid across the entire network. For

OP_RETURN: - Consensus Rules: AllowOP_RETURNoutputs with data up to the maximum script size (approximately 10,000 bytes) and multiple outputs per transaction (Bitcoin Stack Exchange). - Standardness Rules: LimitOP_RETURNdata to 80 bytes and one output per transaction to discourage excessive data storage and maintain network efficiency.Node operators can adjust these policies using settings like

-datacarrier(enables/disablesOP_RETURNrelay) and-datacarriersize(sets the maximum data size, defaulting to 83 bytes to account for theOP_RETURNopcode and pushdata byte). These settings allow flexibility but reflect Bitcoin Core’s default stance on limiting data usage.The Proposal: Pull Request #32406

Bitcoin Core pull request #32406, proposed by developer instagibbs, seeks to relax these standardness restrictions (GitHub PR #32406). Key changes include: - Removing Default Size Limits: The default

-datacarriersizewould be uncapped, allowing largerOP_RETURNdata without a predefined limit. - Allowing Multiple Outputs: The restriction to oneOP_RETURNoutput per transaction would be lifted, with the total data size across all outputs subject to a configurable limit. - Deprecating Configuration Options: The-datacarrierand-datacarriersizesettings are marked as deprecated, signaling potential removal in future releases, which could limit node operators’ ability to enforce custom restrictions.This proposal does not alter consensus rules, meaning miners and nodes can already accept transactions with larger or multiple

OP_RETURNoutputs. Instead, it changes Bitcoin Core’s default relay policy to align with existing practices, such as miners accepting non-standard transactions via services like Marathon Digital’s Slipstream (CoinDesk).Node Operator Flexibility

Currently, node operators can customize

OP_RETURNhandling: - Default Settings: Relay transactions with oneOP_RETURNoutput up to 80 bytes. - Custom Settings: Operators can disableOP_RETURNrelay (-datacarrier=0) or adjust the size limit (e.g.,-datacarriersize=100). These options remain in #32406 but are deprecated, suggesting that future Bitcoin Core versions might not support such customization, potentially standardizing the uncapped policy.Arguments in Favor of Relaxing Limits

Supporters of pull request #32406 and similar proposals argue that the current restrictions are outdated and ineffective. Their key points include: - Ineffective Limits: Developers bypass the 80-byte limit using methods like Inscriptions, which store data in other transaction parts, often at higher cost and inefficiency (BitcoinDev Mailing List). Relaxing

OP_RETURNcould channel data into a more efficient format. - Preventing UTXO Bloat: By encouragingOP_RETURNuse, which doesn’t affect the UTXO set, the proposal could reduce reliance on harmful alternatives like unspendable Taproot outputs used by projects like Citrea’s Clementine bridge. - Supporting Innovation: Projects like Citrea require more data (e.g., 144 bytes) for security proofs, and relaxed limits could enable new Layer 2 solutions (CryptoSlate). - Code Simplification: Developers like Peter Todd argue that these limits complicate Bitcoin Core’s codebase unnecessarily (CoinGeek). - Aligning with Practice: Miners already process non-standard transactions, and uncapping defaults could improve fee estimation and reduce reliance on out-of-band services, as noted by ismaelsadeeq in the pull request discussion.In the GitHub discussion, developers like Sjors and TheCharlatan expressed support (Concept ACK), citing these efficiency and innovation benefits.

Arguments Against Relaxing Limits

Opponents, including prominent developers and community members, raise significant concerns about the implications of these changes: - Deviation from Bitcoin’s Purpose: Critics like Luke Dashjr, who called the proposal “utter insanity,” argue that Bitcoin’s base layer should prioritize peer-to-peer cash, not data storage (CoinDesk). Jason Hughes warned it could turn Bitcoin into a “worthless altcoin” (BeInCrypto). - Blockchain Bloat: Additional data increases the storage and processing burden on full nodes, potentially making node operation cost-prohibitive and threatening decentralization (CryptoSlate). - Network Congestion: Unrestricted data could lead to “spam” transactions, raising fees and hindering Bitcoin’s use for financial transactions. - Risk of Illicit Content: The timechain’s immutability means data, including potentially illegal or objectionable content, is permanently stored on every node. The 80-byte limit acts as a practical barrier, and relaxing it could exacerbate this issue. - Preserving Consensus: Developers like John Carvalho view the limits as a hard-won community agreement, not to be changed lightly.

In the pull request discussion, nsvrn and moth-oss expressed concerns about spam and centralization, advocating for gradual changes. Concept NACKs from developers like wizkid057 and Luke Dashjr reflect strong opposition.

Community Feedback

The GitHub discussion for pull request #32406 shows a divided community: - Support (Concept ACK): Sjors, polespinasa, ismaelsadeeq, miketwenty1, TheCharlatan, Psifour. - Opposition (Concept NACK): wizkid057, BitcoinMechanic, Retropex, nsvrn, moth-oss, Luke Dashjr. - Other: Peter Todd provided a stale ACK, indicating partial or outdated support.

Additional discussions on the BitcoinDev mailing list and related pull requests (e.g., #32359 by Peter Todd) highlight similar arguments, with #32359 proposing a more aggressive removal of all

OP_RETURNlimits and configuration options (GitHub PR #32359).| Feedback Type | Developers | Key Points | |---------------|------------|------------| | Concept ACK | Sjors, ismaelsadeeq, others | Improves efficiency, supports innovation, aligns with mining practices. | | Concept NACK | Luke Dashjr, wizkid057, others | Risks bloat, spam, centralization, and deviation from Bitcoin’s purpose. | | Stale ACK | Peter Todd | Acknowledges proposal but with reservations or outdated support. |

Workarounds and Their Implications

The existence of workarounds, such as Inscriptions, which exploit SegWit discounts to embed data, is a key argument for relaxing

OP_RETURNlimits. These methods are costlier and less efficient, often costing more thanOP_RETURNfor data under 143 bytes (BitcoinDev Mailing List). Supporters argue that formalizing largerOP_RETURNdata could streamline these use cases. Critics, however, see workarounds as a reason to strengthen, not weaken, restrictions, emphasizing the need to address underlying incentives rather than accommodating bypasses.Ecosystem Pressures

External factors influence the debate: - Miners: Services like Marathon Digital’s Slipstream process non-standard transactions for a fee, showing that market incentives already bypass standardness rules. - Layer 2 Projects: Citrea’s Clementine bridge, requiring more data for security proofs, exemplifies the demand for relaxed limits to support innovative applications. - Community Dynamics: The debate echoes past controversies, like the Ordinals debate, where data storage via inscriptions raised similar concerns about Bitcoin’s purpose (CoinDesk).

Bitcoin’s Identity at Stake

The

OP_RETURNdebate is not merely technical but philosophical, questioning whether Bitcoin should remain a focused monetary system or evolve into a broader data platform. Supporters see relaxed limits as a pragmatic step toward efficiency and innovation, while opponents view them as a risk to Bitcoin’s decentralization, accessibility, and core mission. The community’s decision will have lasting implications, affecting node operators, miners, developers, and users.Conclusion

As Bitcoin navigates this crossroads, the community must balance the potential benefits of relaxed

OP_RETURNlimits—such as improved efficiency and support for new applications—against the risks of blockchain bloat, network congestion, and deviation from its monetary roots. The ongoing discussion, accessible via pull request #32406 on GitHub (GitHub PR #32406). Readers are encouraged to explore the debate and contribute to ensuring that any changes align with Bitcoin’s long-term goals as a decentralized, secure, and reliable system. -

@ 6be5cc06:5259daf0

2025-01-21 23:17:29

@ 6be5cc06:5259daf0

2025-01-21 23:17:29A seguir, veja como instalar e configurar o Privoxy no Pop!_OS.

1. Instalar o Tor e o Privoxy

Abra o terminal e execute:

bash sudo apt update sudo apt install tor privoxyExplicação:

- Tor: Roteia o tráfego pela rede Tor.

- Privoxy: Proxy avançado que intermedia a conexão entre aplicativos e o Tor.

2. Configurar o Privoxy

Abra o arquivo de configuração do Privoxy:

bash sudo nano /etc/privoxy/configNavegue até a última linha (atalho:

Ctrl+/depoisCtrl+Vpara navegar diretamente até a última linha) e insira:bash forward-socks5 / 127.0.0.1:9050 .Isso faz com que o Privoxy envie todo o tráfego para o Tor através da porta 9050.

Salve (

CTRL+OeEnter) e feche (CTRL+X) o arquivo.

3. Iniciar o Tor e o Privoxy

Agora, inicie e habilite os serviços:

bash sudo systemctl start tor sudo systemctl start privoxy sudo systemctl enable tor sudo systemctl enable privoxyExplicação:

- start: Inicia os serviços.

- enable: Faz com que iniciem automaticamente ao ligar o PC.

4. Configurar o Navegador Firefox

Para usar a rede Tor com o Firefox:

- Abra o Firefox.

- Acesse Configurações → Configurar conexão.

- Selecione Configuração manual de proxy.

- Configure assim:

- Proxy HTTP:

127.0.0.1 - Porta:

8118(porta padrão do Privoxy) - Domínio SOCKS (v5):

127.0.0.1 - Porta:

9050

- Proxy HTTP:

- Marque a opção "Usar este proxy também em HTTPS".

- Clique em OK.

5. Verificar a Conexão com o Tor

Abra o navegador e acesse:

text https://check.torproject.org/Se aparecer a mensagem "Congratulations. This browser is configured to use Tor.", a configuração está correta.

Dicas Extras

- Privoxy pode ser ajustado para bloquear anúncios e rastreadores.

- Outros aplicativos também podem ser configurados para usar o Privoxy.

-

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28I remember the first gathering of Nostr devs two years ago in Costa Rica. We were all psyched because Nostr appeared to solve the problem of self-sovereign online identity and decentralized publishing. The protocol seemed well-suited for textual content, but it wasn't really designed to handle binary files, like images or video.

The Problem

When I publish a note that contains an image link, the note itself is resilient thanks to Nostr, but if the hosting service disappears or takes my image down, my note will be broken forever. We need a way to publish binary data without relying on a single hosting provider.

We were discussing how there really was no reliable solution to this problem even outside of Nostr. Peer-to-peer attempts like IPFS simply didn't work; they were hopelessly slow and unreliable in practice. Torrents worked for popular files like movies, but couldn't be relied on for general file hosting.

Awesome Blossom

A year later, I attended the Sovereign Engineering demo day in Madeira, organized by Pablo and Gigi. Many projects were presented over a three hour demo session that day, but one really stood out for me.

Introduced by hzrd149 and Stu Bowman, Blossom blew my mind because it showed how we can solve complex problems easily by simply relying on the fact that Nostr exists. Having an open user directory, with the corresponding social graph and web of trust is an incredible building block.

Since we can easily look up any user on Nostr and read their profile metadata, we can just get them to simply tell us where their files are stored. This, combined with hash-based addressing (borrowed from IPFS), is all we need to solve our problem.

How Blossom Works

The Blossom protocol (Blobs Stored Simply on Mediaservers) is formally defined in a series of BUDs (Blossom Upgrade Documents). Yes, Blossom is the most well-branded protocol in the history of protocols. Feel free to refer to the spec for details, but I will provide a high level explanation here.

The main idea behind Blossom can be summarized in three points:

- Users specify which media server(s) they use via their public Blossom settings published on Nostr;

- All files are uniquely addressable via hashes;

- If an app fails to load a file from the original URL, it simply goes to get it from the server(s) specified in the user's Blossom settings.

Just like Nostr itself, the Blossom protocol is dead-simple and it works!

Let's use this image as an example:

If you look at the URL for this image, you will notice that it looks like this:

If you look at the URL for this image, you will notice that it looks like this:blossom.primal.net/c1aa63f983a44185d039092912bfb7f33adcf63ed3cae371ebe6905da5f688d0.jpgAll Blossom URLs follow this format:

[server]/[file-hash].[extension]The file hash is important because it uniquely identifies the file in question. Apps can use it to verify that the file they received is exactly the file they requested. It also gives us the ability to reliably get the same file from a different server.

Nostr users declare which media server(s) they use by publishing their Blossom settings. If I store my files on Server A, and they get removed, I can simply upload them to Server B, update my public Blossom settings, and all Blossom-capable apps will be able to find them at the new location. All my existing notes will continue to display media content without any issues.

Blossom Mirroring

Let's face it, re-uploading files to another server after they got removed from the original server is not the best user experience. Most people wouldn't have the backups of all the files, and/or the desire to do this work.

This is where Blossom's mirroring feature comes handy. In addition to the primary media server, a Blossom user can set one one or more mirror servers. Under this setup, every time a file is uploaded to the primary server the Nostr app issues a mirror request to the primary server, directing it to copy the file to all the specified mirrors. This way there is always a copy of all content on multiple servers and in case the primary becomes unavailable, Blossom-capable apps will automatically start loading from the mirror.

Mirrors are really easy to setup (you can do it in two clicks in Primal) and this arrangement ensures robust media handling without any central points of failure. Note that you can use professional media hosting services side by side with self-hosted backup servers that anyone can run at home.

Using Blossom Within Primal

Blossom is natively integrated into the entire Primal stack and enabled by default. If you are using Primal 2.2 or later, you don't need to do anything to enable Blossom, all your media uploads are blossoming already.

To enhance user privacy, all Primal apps use the "/media" endpoint per BUD-05, which strips all metadata from uploaded files before they are saved and optionally mirrored to other Blossom servers, per user settings. You can use any Blossom server as your primary media server in Primal, as well as setup any number of mirrors:

## Conclusion

## ConclusionFor such a simple protocol, Blossom gives us three major benefits:

- Verifiable authenticity. All Nostr notes are always signed by the note author. With Blossom, the signed note includes a unique hash for each referenced media file, making it impossible to falsify.

- File hosting redundancy. Having multiple live copies of referenced media files (via Blossom mirroring) greatly increases the resiliency of media content published on Nostr.

- Censorship resistance. Blossom enables us to seamlessly switch media hosting providers in case of censorship.

Thanks for reading; and enjoy! 🌸

-

@ 9e69e420:d12360c2

2025-01-19 04:48:31

@ 9e69e420:d12360c2

2025-01-19 04:48:31A new report from the National Sports Shooting Foundation (NSSF) shows that civilian firearm possession exceeded 490 million in 2022. The total from 1990 to 2022 is estimated at 491.3 million firearms. In 2022, over ten million firearms were domestically produced, leading to a total of 16,045,911 firearms available in the U.S. market.

Of these, 9,873,136 were handguns, 4,195,192 were rifles, and 1,977,583 were shotguns. Handgun availability aligns with the concealed carry and self-defense market, as all states allow concealed carry, with 29 having constitutional carry laws.

-

@ e31e84c4:77bbabc0

2024-12-02 10:44:07

@ e31e84c4:77bbabc0

2024-12-02 10:44:07Bitcoin and Fixed Income was Written By Wyatt O’Rourke. If you enjoyed this article then support his writing, directly, by donating to his lightning wallet: ultrahusky3@primal.net

Fiduciary duty is the obligation to act in the client’s best interests at all times, prioritizing their needs above the advisor’s own, ensuring honesty, transparency, and avoiding conflicts of interest in all recommendations and actions.

This is something all advisors in the BFAN take very seriously; after all, we are legally required to do so. For the average advisor this is a fairly easy box to check. All you essentially have to do is have someone take a 5-minute risk assessment, fill out an investment policy statement, and then throw them in the proverbial 60/40 portfolio. You have thousands of investment options to choose from and you can reasonably explain how your client is theoretically insulated from any move in the \~markets\~. From the traditional financial advisor perspective, you could justify nearly anything by putting a client into this type of portfolio. All your bases were pretty much covered from return profile, regulatory, compliance, investment options, etc. It was just too easy. It became the household standard and now a meme.

As almost every real bitcoiner knows, the 60/40 portfolio is moving into psyop territory, and many financial advisors get clowned on for defending this relic on bitcoin twitter. I’m going to specifically poke fun at the ‘40’ part of this portfolio.

The ‘40’ represents fixed income, defined as…

An investment type that provides regular, set interest payments, such as bonds or treasury securities, and returns the principal at maturity. It’s generally considered a lower-risk asset class, used to generate stable income and preserve capital.

Historically, this part of the portfolio was meant to weather the volatility in the equity markets and represent the “safe” investments. Typically, some sort of bond.

First and foremost, the fixed income section is most commonly constructed with U.S. Debt. There are a couple main reasons for this. Most financial professionals believe the same fairy tale that U.S. Debt is “risk free” (lol). U.S. debt is also one of the largest and most liquid assets in the market which comes with a lot of benefits.

There are many brilliant bitcoiners in finance and economics that have sounded the alarm on the U.S. debt ticking time bomb. I highly recommend readers explore the work of Greg Foss, Lawrence Lepard, Lyn Alden, and Saifedean Ammous. My very high-level recap of their analysis:

-

A bond is a contract in which Party A (the borrower) agrees to repay Party B (the lender) their principal plus interest over time.

-

The U.S. government issues bonds (Treasury securities) to finance its operations after tax revenues have been exhausted.

-

These are traditionally viewed as “risk-free” due to the government’s historical reliability in repaying its debts and the strength of the U.S. economy

-

U.S. bonds are seen as safe because the government has control over the dollar (world reserve asset) and, until recently (20 some odd years), enjoyed broad confidence that it would always honor its debts.

-

This perception has contributed to high global demand for U.S. debt but, that is quickly deteriorating.

-

The current debt situation raises concerns about sustainability.

-

The U.S. has substantial obligations, and without sufficient productivity growth, increasing debt may lead to a cycle where borrowing to cover interest leads to more debt.

-

This could result in more reliance on money creation (printing), which can drive inflation and further debt burdens.

In the words of Lyn Alden “Nothing stops this train”

Those obligations are what makes up the 40% of most the fixed income in your portfolio. So essentially you are giving money to one of the worst capital allocators in the world (U.S. Gov’t) and getting paid back with printed money.

As someone who takes their fiduciary responsibility seriously and understands the debt situation we just reviewed, I think it’s borderline negligent to put someone into a classic 60% (equities) / 40% (fixed income) portfolio without serious scrutiny of the client’s financial situation and options available to them. I certainly have my qualms with equities at times, but overall, they are more palatable than the fixed income portion of the portfolio. I don’t like it either, but the money is broken and the unit of account for nearly every equity or fixed income instrument (USD) is fraudulent. It’s a paper mache fade that is quite literally propped up by the money printer.

To briefly be as most charitable as I can – It wasn’t always this way. The U.S. Dollar used to be sound money, we used to have government surplus instead of mathematically certain deficits, The U.S. Federal Government didn’t used to have a money printing addiction, and pre-bitcoin the 60/40 portfolio used to be a quality portfolio management strategy. Those times are gone.

Now the fun part. How does bitcoin fix this?

Bitcoin fixes this indirectly. Understanding investment criteria changes via risk tolerance, age, goals, etc. A client may still have a need for “fixed income” in the most literal definition – Low risk yield. Now you may be thinking that yield is a bad word in bitcoin land, you’re not wrong, so stay with me. Perpetual motion machine crypto yield is fake and largely where many crypto scams originate. However, that doesn’t mean yield in the classic finance sense does not exist in bitcoin, it very literally does. Fortunately for us bitcoiners there are many other smart, driven, and enterprising bitcoiners that understand this problem and are doing something to address it. These individuals are pioneering new possibilities in bitcoin and finance, specifically when it comes to fixed income.

Here are some new developments –

Private Credit Funds – The Build Asset Management Secured Income Fund I is a private credit fund created by Build Asset Management. This fund primarily invests in bitcoin-backed, collateralized business loans originated by Unchained, with a secured structure involving a multi-signature, over-collateralized setup for risk management. Unchained originates loans and sells them to Build, which pools them into the fund, enabling investors to share in the interest income.

Dynamics

- Loan Terms: Unchained issues loans at interest rates around 14%, secured with a 2/3 multi-signature vault backed by a 40% loan-to-value (LTV) ratio.

- Fund Mechanics: Build buys these loans from Unchained, thus providing liquidity to Unchained for further loan originations, while Build manages interest payments to investors in the fund.

Pros

- The fund offers a unique way to earn income via bitcoin-collateralized debt, with protection against rehypothecation and strong security measures, making it attractive for investors seeking exposure to fixed income with bitcoin.

Cons

- The fund is only available to accredited investors, which is a regulatory standard for private credit funds like this.

Corporate Bonds – MicroStrategy Inc. (MSTR), a business intelligence company, has leveraged its corporate structure to issue bonds specifically to acquire bitcoin as a reserve asset. This approach allows investors to indirectly gain exposure to bitcoin’s potential upside while receiving interest payments on their bond investments. Some other publicly traded companies have also adopted this strategy, but for the sake of this article we will focus on MSTR as they are the biggest and most vocal issuer.

Dynamics

-

Issuance: MicroStrategy has issued senior secured notes in multiple offerings, with terms allowing the company to use the proceeds to purchase bitcoin.

-

Interest Rates: The bonds typically carry high-yield interest rates, averaging around 6-8% APR, depending on the specific issuance and market conditions at the time of issuance.

-

Maturity: The bonds have varying maturities, with most structured for multi-year terms, offering investors medium-term exposure to bitcoin’s value trajectory through MicroStrategy’s holdings.

Pros

-

Indirect Bitcoin exposure with income provides a unique opportunity for investors seeking income from bitcoin-backed debt.

-

Bonds issued by MicroStrategy offer relatively high interest rates, appealing for fixed-income investors attracted to the higher risk/reward scenarios.

Cons

-

There are credit risks tied to MicroStrategy’s financial health and bitcoin’s performance. A significant drop in bitcoin prices could strain the company’s ability to service debt, increasing credit risk.

-

Availability: These bonds are primarily accessible to institutional investors and accredited investors, limiting availability for retail investors.

Interest Payable in Bitcoin – River has introduced an innovative product, bitcoin Interest on Cash, allowing clients to earn interest on their U.S. dollar deposits, with the interest paid in bitcoin.

Dynamics

-

Interest Payment: Clients earn an annual interest rate of 3.8% on their cash deposits. The accrued interest is converted to Bitcoin daily and paid out monthly, enabling clients to accumulate Bitcoin over time.

-

Security and Accessibility: Cash deposits are insured up to $250,000 through River’s banking partner, Lead Bank, a member of the FDIC. All Bitcoin holdings are maintained in full reserve custody, ensuring that client assets are not lent or leveraged.

Pros

-

There are no hidden fees or minimum balance requirements, and clients can withdraw their cash at any time.

-

The 3.8% interest rate provides a predictable income stream, akin to traditional fixed-income investments.

Cons

-

While the interest rate is fixed, the value of the Bitcoin received as interest can fluctuate, introducing potential variability in the investment’s overall return.

-

Interest rate payments are on the lower side

Admittedly, this is a very small list, however, these types of investments are growing more numerous and meaningful. The reality is the existing options aren’t numerous enough to service every client that has a need for fixed income exposure. I challenge advisors to explore innovative options for fixed income exposure outside of sovereign debt, as that is most certainly a road to nowhere. It is my wholehearted belief and call to action that we need more options to help clients across the risk and capital allocation spectrum access a sound money standard.

Additional Resources

-

River: The future of saving is here: Earn 3.8% on cash. Paid in Bitcoin.

-

MicroStrategy: MicroStrategy Announces Pricing of Offering of Convertible Senior Notes

Bitcoin and Fixed Income was Written By Wyatt O’Rourke. If you enjoyed this article then support his writing, directly, by donating to his lightning wallet: ultrahusky3@primal.net

-

-

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46

@ 3bf0c63f:aefa459d

2024-09-06 12:49:46Nostr: a quick introduction, attempt #2

Nostr doesn't subscribe to any ideals of "free speech" as these belong to the realm of politics and assume a big powerful government that enforces a common ruleupon everybody else.

Nostr instead is much simpler, it simply says that servers are private property and establishes a generalized framework for people to connect to all these servers, creating a true free market in the process. In other words, Nostr is the public road that each market participant can use to build their own store or visit others and use their services.

(Of course a road is never truly public, in normal cases it's ran by the government, in this case it relies upon the previous existence of the internet with all its quirks and chaos plus a hand of government control, but none of that matters for this explanation).

More concretely speaking, Nostr is just a set of definitions of the formats of the data that can be passed between participants and their expected order, i.e. messages between clients (i.e. the program that runs on a user computer) and relays (i.e. the program that runs on a publicly accessible computer, a "server", generally with a domain-name associated) over a type of TCP connection (WebSocket) with cryptographic signatures. This is what is called a "protocol" in this context, and upon that simple base multiple kinds of sub-protocols can be added, like a protocol for "public-square style microblogging", "semi-closed group chat" or, I don't know, "recipe sharing and feedback".

-

@ 76c71aae:3e29cafa

2024-08-13 04:30:00

@ 76c71aae:3e29cafa

2024-08-13 04:30:00On social media and in the Nostr space in particular, there’s been a lot of debate about the idea of supporting deletion and editing of notes.

Some people think they’re vital features to have, others believe that more honest and healthy social media will come from getting rid of these features. The discussion about these features quickly turns to the feasibility of completely deleting something on a decentralized protocol. We quickly get to the “We can’t really delete anything from the internet, or a decentralized network.” argument. This crowds out how Delete and Edit can mimic elements of offline interactions, how they can be used as social signals.

When it comes to issues of deletion and editing content, what matters more is if the creator can communicate their intentions around their content. Sure, on the internet, with decentralized protocols, there’s no way to be sure something’s deleted. It’s not like taking a piece of paper and burning it. Computers make copies of things all the time, computers don’t like deleting things. In particular, distributed systems tend to use a Kafka architecture with immutable logs, it’s just easier to keep everything around, as deleting and reindexing is hard. Even if the software could be made to delete something, there’s always screenshots, or even pictures of screens. We can’t provably make something disappear.

What we need to do in our software is clearly express intention. A delete is actually a kind of retraction. “I no longer want to associate myself with this content, please stop showing it to people as part of what I’ve published, stop highlighting it, stop sharing it.” Even if a relay or other server keeps a copy, and keeps sharing it, being able to clearly state “hello world, this thing I said, was a mistake, please get rid of it.” Just giving users the chance to say “I deleted this” is a way of showing intention. It’s also a way of signaling that feedback has been heard. Perhaps the post was factually incorrect or perhaps it was mean and the person wants to remove what they said. In an IRL conversation, for either of these scenarios there is some dialogue where the creator of the content is learning something and taking action based on what they’ve learned.

Without delete or edit, there is no option to signal to the rest of the community that you have learned something because of how the content is structured today. On most platforms a reply or response stating one’s learning will be lost often in a deluge of replies on the original post and subsequent posts are often not seen especially when the original goes viral. By providing tools like delete and edit we give people a chance to signal that they have heard the feedback and taken action.

The Nostr Protocol supports delete and expiring notes. It was one of the reasons we switched from secure scuttlebutt to build on Nostr. Our nos.social app offers delete and while we know that not all relays will honor this, we believe it’s important to provide social signaling tools as a means of making the internet more humane.

We believe that the power to learn from each other is more important than the need to police through moral outrage which is how the current platforms and even some Nostr clients work today.

It’s important that we don’t say Nostr doesn’t support delete. Not all apps need to support requesting a delete, some might want to call it a retraction. It is important that users know there is no way to enforce a delete and not all relays may honor their request.

Edit is similar, although not as widely supported as delete. It’s a creator making a clear statement that they’ve created a new version of their content. Maybe it’s a spelling error, or a new version of the content, or maybe they’re changing it altogether. Freedom online means freedom to retract a statement, freedom to update a statement, freedom to edit your own content. By building on these freedoms, we’ll make Nostr a space where people feel empowered and in control of their own media.

-

@ 3bf0c63f:aefa459d

2024-01-14 14:52:16

@ 3bf0c63f:aefa459d

2024-01-14 14:52:16Drivechain

Understanding Drivechain requires a shift from the paradigm most bitcoiners are used to. It is not about "trustlessness" or "mathematical certainty", but game theory and incentives. (Well, Bitcoin in general is also that, but people prefer to ignore it and focus on some illusion of trustlessness provided by mathematics.)

Here we will describe the basic mechanism (simple) and incentives (complex) of "hashrate escrow" and how it enables a 2-way peg between the mainchain (Bitcoin) and various sidechains.

The full concept of "Drivechain" also involves blind merged mining (i.e., the sidechains mine themselves by publishing their block hashes to the mainchain without the miners having to run the sidechain software), but this is much easier to understand and can be accomplished either by the BIP-301 mechanism or by the Spacechains mechanism.

How does hashrate escrow work from the point of view of Bitcoin?

A new address type is created. Anything that goes in that is locked and can only be spent if all miners agree on the Withdrawal Transaction (

WT^) that will spend it for 6 months. There is one of these special addresses for each sidechain.To gather miners' agreement

bitcoindkeeps track of the "score" of all transactions that could possibly spend from that address. On every block mined, for each sidechain, the miner can use a portion of their coinbase to either increase the score of oneWT^by 1 while decreasing the score of all others by 1; or they can decrease the score of allWT^s by 1; or they can do nothing.Once a transaction has gotten a score high enough, it is published and funds are effectively transferred from the sidechain to the withdrawing users.

If a timeout of 6 months passes and the score doesn't meet the threshold, that

WT^is discarded.What does the above procedure mean?

It means that people can transfer coins from the mainchain to a sidechain by depositing to the special address. Then they can withdraw from the sidechain by making a special withdraw transaction in the sidechain.

The special transaction somehow freezes funds in the sidechain while a transaction that aggregates all withdrawals into a single mainchain

WT^, which is then submitted to the mainchain miners so they can start voting on it and finally after some months it is published.Now the crucial part: the validity of the

WT^is not verified by the Bitcoin mainchain rules, i.e., if Bob has requested a withdraw from the sidechain to his mainchain address, but someone publishes a wrongWT^that instead takes Bob's funds and sends them to Alice's main address there is no way the mainchain will know that. What determines the "validity" of theWT^is the miner vote score and only that. It is the job of miners to vote correctly -- and for that they may want to run the sidechain node in SPV mode so they can attest for the existence of a reference to theWT^transaction in the sidechain blockchain (which then ensures it is ok) or do these checks by some other means.What? 6 months to get my money back?

Yes. But no, in practice anyone who wants their money back will be able to use an atomic swap, submarine swap or other similar service to transfer funds from the sidechain to the mainchain and vice-versa. The long delayed withdraw costs would be incurred by few liquidity providers that would gain some small profit from it.

Why bother with this at all?

Drivechains solve many different problems:

It enables experimentation and new use cases for Bitcoin

Issued assets, fully private transactions, stateful blockchain contracts, turing-completeness, decentralized games, some "DeFi" aspects, prediction markets, futarchy, decentralized and yet meaningful human-readable names, big blocks with a ton of normal transactions on them, a chain optimized only for Lighting-style networks to be built on top of it.

These are some ideas that may have merit to them, but were never actually tried because they couldn't be tried with real Bitcoin or inferfacing with real bitcoins. They were either relegated to the shitcoin territory or to custodial solutions like Liquid or RSK that may have failed to gain network effect because of that.

It solves conflicts and infighting

Some people want fully private transactions in a UTXO model, others want "accounts" they can tie to their name and build reputation on top; some people want simple multisig solutions, others want complex code that reads a ton of variables; some people want to put all the transactions on a global chain in batches every 10 minutes, others want off-chain instant transactions backed by funds previously locked in channels; some want to spend, others want to just hold; some want to use blockchain technology to solve all the problems in the world, others just want to solve money.

With Drivechain-based sidechains all these groups can be happy simultaneously and don't fight. Meanwhile they will all be using the same money and contributing to each other's ecosystem even unwillingly, it's also easy and free for them to change their group affiliation later, which reduces cognitive dissonance.

It solves "scaling"