-

@ d360efec:14907b5f

2025-05-12 04:01:23

@ d360efec:14907b5f

2025-05-12 04:01:23 -

@ d360efec:14907b5f

2025-05-12 01:34:24

@ d360efec:14907b5f

2025-05-12 01:34:24สวัสดีค่ะเพื่อนๆ นักเทรดที่น่ารักทุกคน! 💕 Lina Engword กลับมาพร้อมกับการวิเคราะห์ BTCUSDT.P แบบเจาะลึกเพื่อเตรียมพร้อมสำหรับเทรดวันนี้ค่ะ! 🚀

วันนี้ 12 พฤษภาคม 2568 เวลา 08.15น. ราคา BTCUSDT.P อยู่ที่ 104,642.8 USDT ค่ะ โดยมี Previous Weekly High (PWH) อยู่ที่ 104,967.8 Previous Weekly Low (PWL) ที่ 93,338 ค่ะ

✨ ภาพรวมตลาดวันนี้ ✨

จากการวิเคราะห์ด้วยเครื่องมือคู่ใจของเรา ทั้ง SMC/ICT (Demand/Supply Zone, Order Block, Liquidity), EMA 50/200, Trend Strength, Money Flow, Chart/Price Pattern, Premium/Discount Zone, Trend line, Fibonacci, Elliott Wave และ Dow Theory ใน Timeframe ตั้งแต่ 15m ไปจนถึง Week! 📊 เราพบว่าภาพใหญ่ของ BTCUSDT.P ยังคงอยู่ในแนวโน้มขาขึ้นที่แข็งแกร่งมากๆ ค่ะ 👍 โดยเฉพาะใน Timeframe Day และ Week ที่สัญญาณทุกอย่างสนับสนุนทิศทางขาขึ้นอย่างชัดเจน Money Flow ยังไหลเข้าอย่างต่อเนื่อง และเราเห็นโครงสร้างตลาดแบบ Dow Theory ที่ยก High ยก Low ขึ้นไปเรื่อยๆ ค่ะ

อย่างไรก็ตาม... ใน Timeframe สั้นๆ อย่าง 15m และ 1H เริ่มเห็นสัญญาณของการชะลอตัวและการพักฐานบ้างแล้วค่ะ 📉 อาจมีการสร้าง Buyside และ Sellside Liquidity รอให้ราคาไปกวาดก่อนที่จะเลือกทางใดทางหนึ่ง ซึ่งเป็นเรื่องปกติของการเดินทางของ Smart Money ค่ะ

⚡ เปรียบเทียบแนวโน้มแต่ละ Timeframe ⚡

🪙 แนวโน้มตรงกัน Timeframe 4H, Day, Week ส่วนใหญ่ชี้ไปทาง "ขาขึ้น" ค่ะ ทุกเครื่องมือสนับสนุนแนวโน้มนี้อย่างแข็งแกร่ง 💪 เป้าหมายต่อไปคือการไปทดสอบ PWH และ High เดิม เพื่อสร้าง All-Time High ใหม่ค่ะ! 🪙 แนวโน้มต่างกัน Timeframe 15m, 1H ยังค่อนข้าง "Sideways" หรือ "Sideways Down เล็กน้อย" ค่ะ มีการบีบตัวของราคาและอาจมีการพักฐานสั้นๆ ซึ่งเป็นโอกาสในการหาจังหวะเข้า Long ที่ราคาดีขึ้นค่ะ

💡 วิธีคิดแบบ Market Slayer 💡

เมื่อแนวโน้มใหญ่เป็นขาขึ้นที่แข็งแกร่ง เราจะเน้นหาจังหวะเข้า Long เป็นหลักค่ะ การย่อตัวลงมาในระยะสั้นคือโอกาสของเราในการเก็บของ! 🛍️ เราจะใช้หลักการ SMC/ICT หาโซน Demand หรือ Order Block ที่ Smart Money อาจจะเข้ามาดันราคาขึ้น และรอสัญญาณ Price Action ยืนยันการกลับตัวค่ะ

สรุปแนวโน้มวันนี้:

🪙 ระยะสั้น: Sideways to Sideways Down (โอกาส 55%) ↔️↘️ 🪙 ระยะกลาง: ขาขึ้น (โอกาส 70%) ↗️ 🪙 ระยะยาว: ขาขึ้น (โอกาส 85%) 🚀 🪙 วันนี้: มีโอกาสย่อตัวเล็กน้อยก่อนจะมีแรงซื้อกลับเข้ามาเพื่อไปทดสอบ PWH (โอกาส Sideways Down เล็กน้อย สลับกับ Sideways Up: 60%) 🎢

🗓️ Daily Trade Setup ประจำวันนี้ 🗓️

นี่คือตัวอย่าง Setup ที่ Lina เตรียมไว้ให้พิจารณาค่ะ (เน้นย้ำว่าเป็นเพียงแนวทาง ไม่ใช่คำแนะนำลงทุนนะคะ)

1️⃣ ตัวอย่างที่ 1: รอรับที่โซน Demand (ปลอดภัย, รอยืนยัน)

🪙 Enter: รอราคาย่อตัวลงมาในโซน Demand Zone หรือ Bullish Order Block ที่น่าสนใจใน TF 1H/4H (ดูจากกราฟประกอบนะคะ) และเกิดสัญญาณ Bullish Price Action ที่ชัดเจน เช่น แท่งเทียนกลืนกิน (Engulfing) หรือ Hammer 🪙 TP: บริเวณ PWH 104,967.8 หรือ Buyside Liquidity ถัดไป 🎯 🪙 SL: ใต้ Low ที่เกิดก่อนสัญญาณกลับตัวเล็กน้อย หรือใต้ Demand Zone ที่เข้า 🛡️ 🪙 RRR: ประมาณ 1:2.5 ขึ้นไป ✨ 🪙 อธิบาย: Setup นี้เราจะใจเย็นๆ รอให้ราคาลงมาในโซนที่มีโอกาสเจอแรงซื้อเยอะๆ ตามหลัก SMC/ICT แล้วค่อยเข้า เพื่อให้ได้ราคาที่ดีและความเสี่ยงต่ำค่ะ ต้องรอสัญญาณ Price Action ยืนยันก่อนนะคะ ✍️

2️⃣ ตัวอย่างที่ 2: Follow Breakout (สายบู๊, รับความเสี่ยงได้)

🪙 Enter: เข้า Long ทันทีเมื่อราคาสามารถ Breakout เหนือ High ล่าสุดใน TF 15m หรือ 1H พร้อม Volume ที่เพิ่มขึ้นอย่างมีนัยสำคัญ 🔥 🪙 TP: บริเวณ PWH 104,967.8 หรือ Buyside Liquidity ถัดไป 🚀 🪙 SL: ใต้ High ก่อนหน้าที่ถูก Breakout เล็กน้อย 🚧 🪙 RRR: ประมาณ 1:3 ขึ้นไป ✨ 🪙 อธิบาย: Setup นี้เหมาะกับคนที่อยากเข้าไวเมื่อเห็นโมเมนตัมแรงๆ ค่ะ เราจะเข้าเมื่อราคา Breakout แนวต้านระยะสั้นพร้อม Volume เป็นสัญญาณว่าแรงซื้อกำลังมาค่ะ เข้าได้เลยด้วยการตั้ง Limit Order หรือ Market Order เมื่อเห็นการ Breakout ที่ชัดเจนค่ะ 💨

3️⃣ ตัวอย่างที่ 3: พิจารณา Short สั้นๆ ในโซน Premium (สวนเทรนด์หลัก, ความเสี่ยงสูง)

🪙 Enter: หากราคาขึ้นไปในโซน Premium ใน TF 15m หรือ 1H และเกิดสัญญาณ Bearish Price Action ที่ชัดเจน เช่น แท่งเทียน Shooting Star หรือ Bearish Engulfing บริเวณ Supply Zone หรือ Bearish Order Block 🐻 🪙 TP: พิจารณาแนวรับถัดไป หรือ Sellside Liquidity ใน TF เดียวกัน 🎯 🪙 SL: เหนือ High ของสัญญาณ Bearish Price Action เล็กน้อย 💀 🪙 RRR: ประมาณ 1:1.5 ขึ้นไป (เน้นย้ำว่าเป็นการเทรดสวนเทรนด์หลัก ควรใช้ RRR ต่ำและบริหารขนาด Lot อย่างเข้มงวด!) 🪙 อธิบาย: Setup นี้สำหรับคนที่เห็นโอกาสในการทำกำไรจากการย่อตัวระยะสั้นค่ะ เราจะเข้า Short เมื่อเห็นสัญญาณว่าราคาอาจจะมีการพักฐานในโซนที่ถือว่า "แพง" ในกรอบสั้นๆ ค่ะ ต้องตั้ง Stop Loss ใกล้มากๆ และจับตาดูใกล้ชิดนะคะ 🚨

⚠️ Disclaimer: การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัวของ Lina เท่านั้น ไม่ถือเป็นคำแนะนำในการลงทุนนะคะ การลงทุนมีความเสี่ยง ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบค่ะ 🙏

ขอให้ทุกท่านโชคดีกับการเทรดในวันนี้ค่ะ! มีคำถามอะไรเพิ่มเติม ถามมาได้เลยนะคะ ยินดีเสมอค่ะ! 😊

Bitcoin #BTCUSDT #Crypto #Trading #TechnicalAnalysis #SMC #ICT #MarketSlayer #TradeSetup #คริปโต #เทรดคริปโต #วิเคราะห์กราฟ #LinaEngword 😉

-

@ 95543309:196c540e

2025-05-11 12:42:09

@ 95543309:196c540e

2025-05-11 12:42:09Lets see if this works with the blossom upload and without markdown hassle.

:cat:

https://blossom.primal.net/73a099f931366732c18dd60da82db6ef65bb368eb96756f07d9fa7a8a3644009.mp4

-

@ d360efec:14907b5f

2025-05-10 03:57:17

@ d360efec:14907b5f

2025-05-10 03:57:17Disclaimer: * การวิเคราะห์นี้เป็นเพียงแนวทาง ไม่ใช่คำแนะนำในการซื้อขาย * การลงทุนมีความเสี่ยง ผู้ลงทุนควรตัดสินใจด้วยตนเอง

-

@ 7459d333:f207289b

2025-05-10 10:38:56

@ 7459d333:f207289b

2025-05-10 10:38:56Description: Just as Bitcoin enabled sovereignty over money, a decentralized shipping protocol would enable sovereignty over trade. An LN/Bisq inspired shipping protocol could create an unstoppable free market.

Bitcoin gave us monetary sovereignty, freeing us from central bank manipulation, inflation, and censorship. But there's a missing link in our freedom journey: the physical world of goods.

The Problem: Even with Bitcoin, global trade remains at the mercy of: - Arbitrary tariffs and import restrictions - Political censorship of goods - Privacy invasion of shipping information - Centralized shipping carriers

The Vision: A decentralized shipping protocol with these properties:

- "Onion-routed" packages: Each carrier only knows the previous and next hop

- Bitcoin-secured multi-sig escrow: Funds locked until package delivery confirmed

- Incentive alignment: Carriers set their own fees based on risk assessment

- Privacy tiers: Options for inspected vs. sealed packages with appropriate pricing

- End-to-end sovereignty: Sender and receiver maintain control, intermediate carriers just fulfill their role

How it could work:

- Sender creates shipping request with package details and destination

- Protocol finds optimal route through independent carriers

- Each hop secured by multi-sig deposits larger than package value

- Carriers only see next hop, not ultimate destination

- Reputation systems and economic incentives maintain integrity

This creates a free market where any individual can participate as a carrier, earning Bitcoin for facilitating trade. Just like Lightning Network nodes, anyone can open "channels" with trusted partners.

Impact: This would enable true free market principles globally, making artificial trade barriers obsolete and empowering individuals to engage in voluntary exchange regardless of geographic or political boundaries.

There are a lot of challenges. But the first question is if this is a real problem and if its worth solving it.

What components would need development first? How would you solve the physical handoff challenges?

originally posted at https://stacker.news/items/976326

-

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14

@ c1e9ab3a:9cb56b43

2025-05-09 23:10:14I. Historical Foundations of U.S. Monetary Architecture

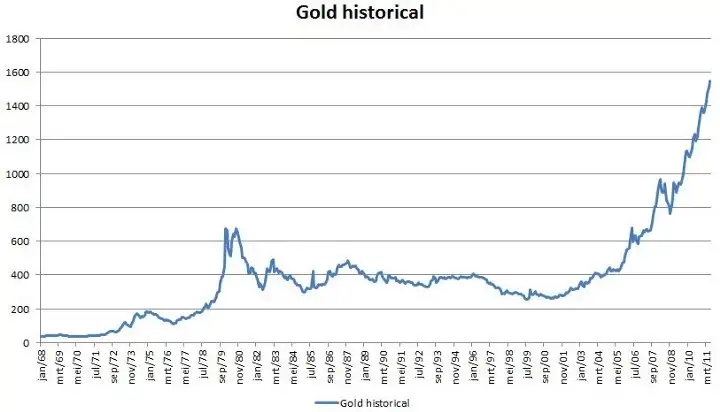

The early monetary system of the United States was built atop inherited commodity money conventions from Europe’s maritime economies. Silver and gold coins—primarily Spanish pieces of eight, Dutch guilders, and other foreign specie—formed the basis of colonial commerce. These units were already integrated into international trade and piracy networks and functioned with natural compatibility across England, France, Spain, and Denmark. Lacking a centralized mint or formal currency, the U.S. adopted these forms de facto.

As security risks and the practical constraints of physical coinage mounted, banks emerged to warehouse specie and issue redeemable certificates. These certificates evolved into fiduciary media—claims on specie not actually in hand. Banks observed over time that substantial portions of reserves remained unclaimed for years. This enabled fractional reserve banking: issuing more claims than reserves held, so long as redemption demand stayed low. The practice was inherently unstable, prone to panics and bank runs, prompting eventual centralization through the formation of the Federal Reserve in 1913.

Following the Civil War and unstable reinstatements of gold convertibility, the U.S. sought global monetary stability. After World War II, the Bretton Woods system formalized the U.S. dollar as the global reserve currency. The dollar was nominally backed by gold, but most international dollars were held offshore and recycled into U.S. Treasuries. The Nixon Shock of 1971 eliminated the gold peg, converting the dollar into pure fiat. Yet offshore dollar demand remained, sustained by oil trade mandates and the unique role of Treasuries as global reserve assets.

II. The Structure of Fiduciary Media and Treasury Demand

Under this system, foreign trade surpluses with the U.S. generate excess dollars. These surplus dollars are parked in U.S. Treasuries, thereby recycling trade imbalances into U.S. fiscal liquidity. While technically loans to the U.S. government, these purchases act like interest-only transfers—governments receive yield, and the U.S. receives spendable liquidity without principal repayment due in the short term. Debt is perpetually rolled over, rarely extinguished.

This creates an illusion of global subsidy: U.S. deficits are financed via foreign capital inflows that, in practice, function more like financial tribute systems than conventional debt markets. The underlying asset—U.S. Treasury debt—functions as the base reserve asset of the dollar system, replacing gold in post-Bretton Woods monetary logic.

III. Emergence of Tether and the Parastatal Dollar

Tether (USDT), as a private issuer of dollar-denominated tokens, mimics key central bank behaviors while operating outside the regulatory perimeter. It mints tokens allegedly backed 1:1 by U.S. dollars or dollar-denominated securities (mostly Treasuries). These tokens circulate globally, often in jurisdictions with limited banking access, and increasingly serve as synthetic dollar substitutes.

If USDT gains dominance as the preferred medium of exchange—due to technological advantages, speed, programmability, or access—it displaces Federal Reserve Notes (FRNs) not through devaluation, but through functional obsolescence. Gresham’s Law inverts: good money (more liquid, programmable, globally transferable USDT) displaces bad (FRNs) even if both maintain a nominal 1:1 parity.

Over time, this preference translates to a systemic demand shift. Actors increasingly use Tether instead of FRNs, especially in global commerce, digital marketplaces, or decentralized finance. Tether tokens effectively become shadow base money.

IV. Interaction with Commercial Banking and Redemption Mechanics

Under traditional fractional reserve systems, commercial banks issue loans denominated in U.S. dollars, expanding the money supply. When borrowers repay loans, this destroys the created dollars and contracts monetary elasticity. If borrowers repay in USDT instead of FRNs:

- Banks receive a non-Fed liability (USDT).

- USDT is not recognized as reserve-eligible within the Federal Reserve System.

- Banks must either redeem USDT for FRNs, or demand par-value conversion from Tether to settle reserve requirements and balance their books.

This places redemption pressure on Tether and threatens its 1:1 peg under stress. If redemption latency, friction, or cost arises, USDT’s equivalence to FRNs is compromised. Conversely, if banks are permitted or compelled to hold USDT as reserve or regulatory capital, Tether becomes a de facto reserve issuer.

In this scenario, banks may begin demanding loans in USDT, mirroring borrower behavior. For this to occur sustainably, banks must secure Tether liquidity. This creates two options: - Purchase USDT from Tether or on the secondary market, collateralized by existing fiat. - Borrow USDT directly from Tether, using bank-issued debt as collateral.

The latter mirrors Federal Reserve discount window operations. Tether becomes a lender of first resort, providing monetary elasticity to the banking system by creating new tokens against promissory assets—exactly how central banks function.

V. Structural Consequences: Parallel Central Banking

If Tether begins lending to commercial banks, issuing tokens backed by bank notes or collateralized debt obligations: - Tether controls the expansion of broad money through credit issuance. - Its balance sheet mimics a central bank, with Treasuries and bank debt as assets and tokens as liabilities. - It intermediates between sovereign debt and global liquidity demand, replacing the Federal Reserve’s open market operations with its own issuance-redemption cycles.

Simultaneously, if Tether purchases U.S. Treasuries with FRNs received through token issuance, it: - Supplies the Treasury with new liquidity (via bond purchases). - Collects yield on government debt. - Issues a parallel form of U.S. dollars that never require redemption—an interest-only loan to the U.S. government from a non-sovereign entity.

In this context, Tether performs monetary functions of both a central bank and a sovereign wealth fund, without political accountability or regulatory transparency.

VI. Endgame: Institutional Inversion and Fed Redundancy

This paradigm represents an institutional inversion:

- The Federal Reserve becomes a legacy issuer.

- Tether becomes the operational base money provider in both retail and interbank contexts.

- Treasuries remain the foundational reserve asset, but access to them is mediated by a private intermediary.

- The dollar persists, but its issuer changes. The State becomes a fiscal agent of a decentralized financial ecosystem, not its monetary sovereign.

Unless the Federal Reserve reasserts control—either by absorbing Tether, outlawing its instruments, or integrating its tokens into the reserve framework—it risks becoming irrelevant in the daily function of money.

Tether, in this configuration, is no longer a derivative of the dollar—it is the dollar, just one level removed from sovereign control. The future of monetary sovereignty under such a regime is post-national and platform-mediated.

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

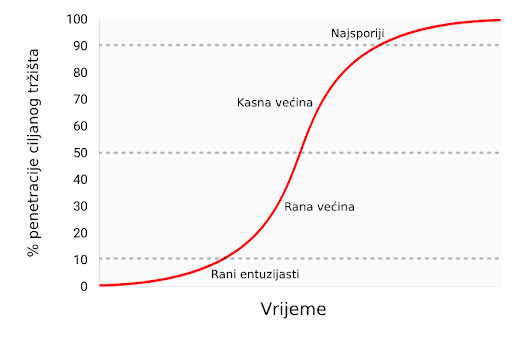

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ 502ab02a:a2860397

2025-05-12 03:11:06

@ 502ab02a:a2860397

2025-05-12 03:11:06สัปดาห์ที่ผ่านมา เราพักผ่อนย้อนไปเพื่อทำความเข้าใจต้นเหตุของซีรีส์นี้กันแล้วนะครับ ทีนี้เราจะมาสนทนากันต่อจากที่ค้างคาไว้กันครับ

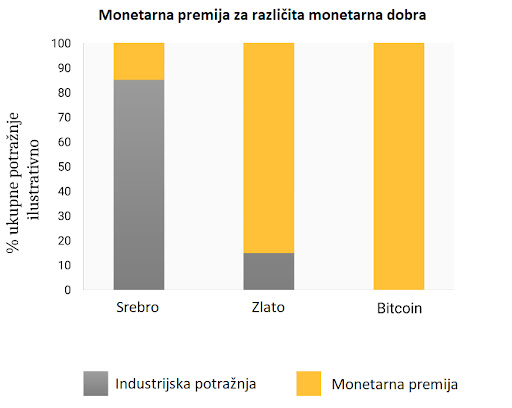

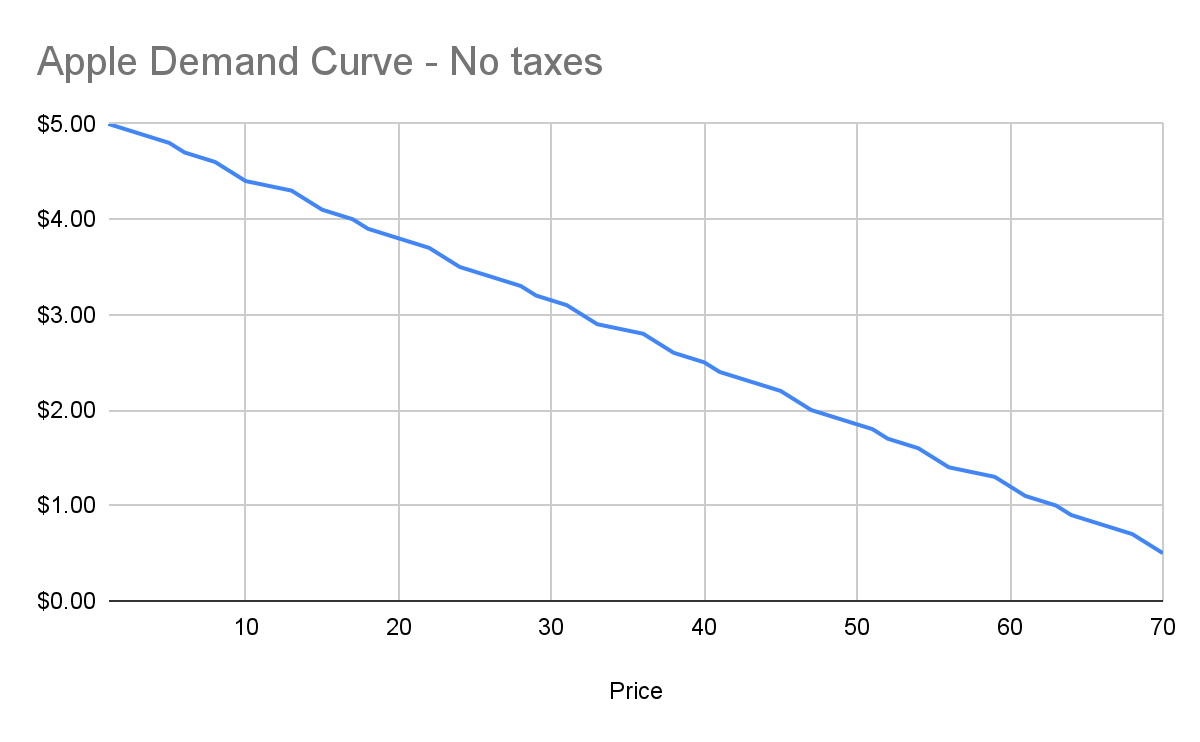

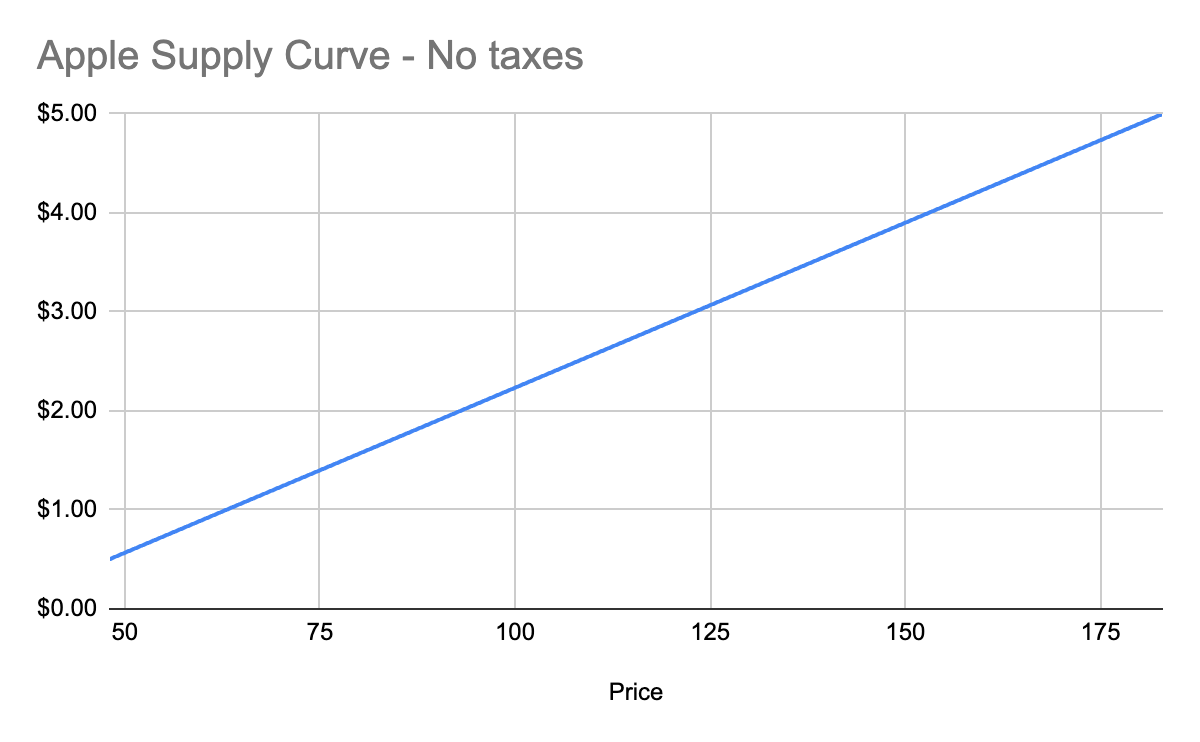

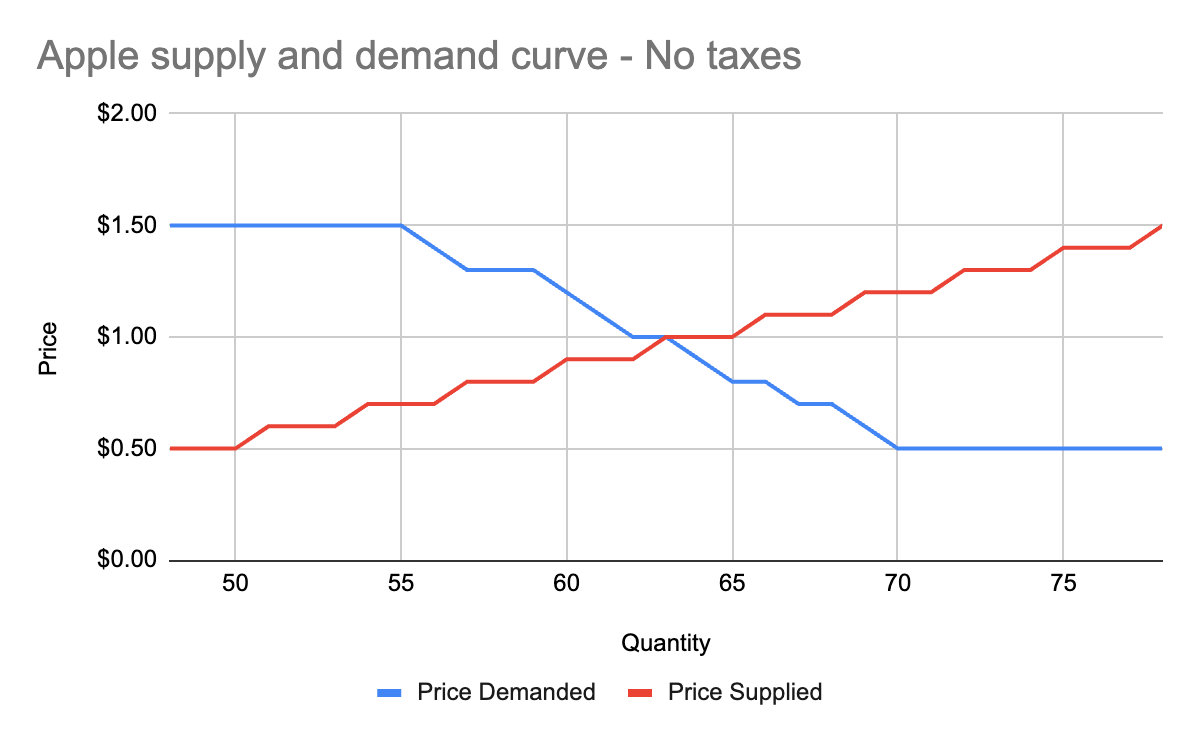

ย้อนกลับไปเมื่อราวทศวรรษ 1970-1980 เป็นยุคที่โลกยังเชื่อว่า “ไขมัน” คือผู้ร้ายตัวจริงในวงการสุขภาพ ปิรามิดอาหารจาก USDA จึงถือกำเนิดขึ้น โดยมีฐานล่างกว้างใหญ่เต็มไปด้วยข้าว แป้ง ซีเรียล พาสต้า และขนมปัง เรียกรวมว่า “กลุ่มคาร์โบไฮเดรต” และถูกวางให้เป็นเสาหลักของอาหารประจำวัน ภายใต้แนวคิดว่าให้พลังงานสูง ไขมันต่ำ ดีต่อหัวใจ และเหมาะกับการเลี้ยงประชากรโลกที่เพิ่มขึ้นอย่างรวดเร็ว

แต่ความจริงที่เปิดเผยภายหลังคือ ปิรามิดอาหารนี้มิได้เกิดจากวิทยาศาสตร์บริสุทธิ์ หากแต่เกิดจากกระบวนการ “เปิดประมูลนโยบาย” โดยกลุ่มอุตสาหกรรมเกษตรรายใหญ่ ซึ่งต้องการระบายผลผลิตคาร์โบไฮเดรตจำนวนมหาศาลจากข้าวโพด ข้าวสาลี และถั่วเหลืองที่รัฐบาลอเมริกันอุดหนุนให้เพาะปลูกเกินความจำเป็น (ดูรายงาน PBS: The Food Pyramid) หน้าที่จัดสรรนี้จึงอยู่ภายใต้ USDA หรือ กระทรวงเกษตรสหรัฐอเมริกา

ขณะที่ผู้คนถูกสอนให้หลีกเลี่ยงไขมัน โปรตีนสัตว์ และหันมากินซีเรียลเป็นอาหารเช้า ผลิตภัณฑ์ไขมันต่ำแทบทุกชนิดกลับต้องเติมน้ำตาลและแป้งเพื่อให้มีรสชาติ นำไปสู่การระบาดของโรคอ้วน เบาหวาน ความดัน และ NCD ทั่วโลก ที่เราเพิ่งจะเข้าใจกันวันนี้ว่ามีรากมาจาก “ปิรามิดคาร์บ” นั่นเอง

คำถามคือ ทำไมการกำหนดอาหารของอเมริกา (ซึ่งแน่นอนว่าแพร่กระจายไปทั่วโลกภายใต้ข้อกำหนดเดียวกัน) จึงเกิดขึ้นจาก "กระทรวงเกษตรสหรัฐอเมริกา" ไม่ใช่ หน่วยงานทางวิทยาศาสตร์ หรือ การแพทย์

หรือเพราะ “อาหาร” ในอเมริกา ไม่ได้เริ่มจากคำว่า “สุขภาพ” แต่เริ่มจาก “เศรษฐกิจ”

ย้อนกลับไปช่วงต้นศตวรรษที่ 20 โดยเฉพาะหลังสงครามโลกครั้งที่สอง สหรัฐฯ ต้องการฟื้นฟูเศรษฐกิจและผลักดันภาคการเกษตรให้โตอย่างรวดเร็ว โดยเฉพาะสินค้าพืชเชิงอุตสาหกรรม เช่น ข้าวโพด ข้าวสาลี ถั่วเหลือง นม และเนื้อจากฟาร์มอุตสาหกรรม และปากท้องของเกษตรกรคือฐานเสียงสำคัญในทุกๆรัฐบาล ดังนั้น USDA ซึ่งเป็นหน่วยงานที่ตั้งขึ้นเพื่อดูแลเกษตรกร จึงรับบทผู้ออก “แนวทางโภชนาการ” โดยเน้นว่า

อาหารอะไรที่ เกษตรกรผลิตได้เยอะ ก็เอามาดันให้ประชาชนกินเยอะ อาหารอะไรที่ ราคาถูก ผลิตได้เร็ว ก็นำมาใส่ไว้ฐานล่างของพีระมิด ให้ประชาชนกินเยอะ อาหารอะไรที่ มีอุตสาหกรรมอยู่เบื้องหลัง ก็เปิดประมูลให้มีบทบาทมากในการล็อบบี้นโยบาย ให้ประชาชนกินเยอะ

พูดง่ายๆ ก็คือ นโยบายอาหารอเมริกา ไม่ได้ออกโดยนักวิทยาศาสตร์หรือนักโภชนาการที่ไม่มีผลประโยชน์ทับซ้อน แต่มาจาก “ข้าราชการสายเกษตร+กลุ่มทุน” ที่ต้องการให้ภาคการเกษตรมีกำไรอย่างต่อเนื่อง และอย่าลืมว่า อเมริกา = โลก

แล้วหน่วยงานด้านวิทยาศาสตร์หรือแพทย์ เช่น NIH (National Institutes of Health) หรือ CDC (Centers for Disease Control and Prevention) หล่ะ แน่นอนครับว่ามีข้อมูลอยุ่ว่าก็มีสิทธิ์เสนอแนะอยู่บ้างแต่ทั้งหมดนี้ ไม่มีอำนาจออกนโยบายหลักที่ใช้จริงกับประชาชน ส่วนใหญ่แค่ให้ข้อมูลวิชาการ ซึ่งมักจะถูกลดทอนหรือละเลยเมื่อนโยบายจริงถูกเขียนขึ้นโดย USDA ในที่สุด

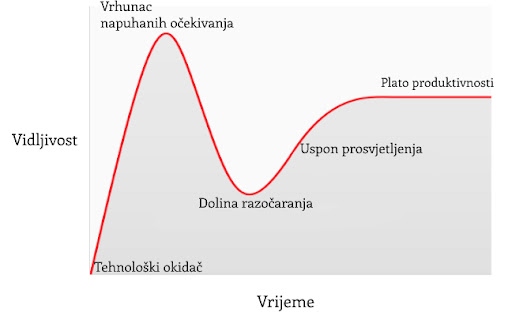

เมื่อเสียงของการตั้งคำถามเริ่มดังกว่าเสียงโฆษณา ขบวนการ “Low Carb” ก็เริ่มตั้งหลักและขยายวงกว้างอย่างเงียบๆ งานวิจัยใหม่ๆ เริ่มบ่งชี้ว่า “น้ำตาลและแป้ง” โดยเฉพาะแป้งแปรรูป คือภัยเงียบที่ส่งผลต่อการอักเสบเรื้อรัง ภาวะดื้ออินซูลิน และเมตาบอลิกซินโดรม จนกระทั่งช่วงต้นทศวรรษ 2010 เป็นต้นมา อาหารแนว “ลดคาร์บ เพิ่มไขมันดี เพิ่มโปรตีน” ก็กลายเป็นกระแสหลักขึ้นมา

ตอนนั้นหลายคนคิดว่า “พวกเราชนะแล้ว” โลกกลับมาฟังเสียงสุขภาพที่แท้จริง โปรตีนกลายเป็นคำตอบใหม่แห่งยุค

แต่มึงเอ๊ยยยยยย... เกมอาจไม่ได้จบตรงนั้น

เพราะในวันที่ประชาชนเริ่มหลีกหนีคาร์บ กลุ่มทุนอาหารข้ามชาติที่เคยวางรากอยู่ในอุตสาหกรรมแป้ง ได้ค่อยๆ แปรทิศ ย้ายการลงทุนไปสู่ “โปรตีนทางเลือก” รอไว้นานแล้วโดยที่เราไม่รู้ตัว ทั้งอาหารพืชแปรรูปอย่าง texture ถั่วเหลือง (TVP), โปรตีนจุลินทรีย์, เนื้อปลูกจากห้องแลบ ไปจนถึง “ไข่” และ “นม” ที่ไม่ได้มาจากสัตว์ โปรตีนสังเคราะห์ที่ผลิตโดยระบบชีวภาพวิศวกรรม (synthetic biology) ซึ่งได้รับเงินทุนจากบริษัทยักษ์ใหญ่อย่างต่อเนื่องตลอดสิบปีที่ผ่านมา

พอถึงวันโปรตีนกลายเป็นเทรนด์ เขาก็เข้ามาเป็นเจ้าของเทรนด์เป็นที่เรียบร้อยแล้ว พร้อมทุกอย่างแล้ว คำถามคือ ใครกันแน่ที่เป็น Trend Setter

โปรตีนจึงไม่ใช่เพียง “สารอาหาร” อีกต่อไป แต่มันคือ “สินค้าอนาคต” ที่สามารถควบคุมแหล่งผลิต แหล่งพันธุ์ เทคโนโลยีการแปรรูป และการกระจายผ่านแพลตฟอร์มค้าปลีกทั่วโลก และถ้าคุณสังเกต จะเห็นว่าไม่มีใครพูดถึง “คาร์บทางเลือก” หรือ "คาร์บเข้มข้น" หรือ "คาร์บที่ไม่ต้องใช้พืช" แม้แต่นิด ทั้งที่ในทางหลักการก็สามารถคิดค้นได้ไม่ต่างกัน แปลว่า พวกเขาไม่ได้แค่อยาก “เลิกขายคาร์บ” แต่กำลัง “เปลี่ยนสินค้าหลักใหม่” ให้ไปอยู่ในกลุ่มที่พวกเขาควบคุมได้ทั้งหมด แค่เอาคำว่า "โปรตีน" ขึ้นมาเป็นฉากหน้าไว้ก่อน

เริ่มเห็นภาพไหมครับ จากคาร์บที่เคยถูกบิดเบือน กลายมาเป็นโปรตีนที่ถูกเสนอให้เรายินดีรับอย่างไม่ตั้งคำถาม

“โปรตีนอนาคต” ดูเหมือนจะเป็นทางเลือก แต่จริงๆ แล้วอาจเป็นกับดักหรือเปล่า

วันนี้ที่หลายคนเฝ้ามองชัยชนะของผู้คนในการล้ม “ปิรามิดคาร์บ” แต่ไม่ทันเห็นว่ากำลังถูกลากเข้าสู่ “หอคอยโปรตีนจำลอง” ที่พวกเขาสร้างขึ้นใหม่ ด้วยบรรจุภัณฑ์สวยหรู คำว่า "รักษ์โลก" "ปลอดภัย" และ "ยั่งยืน" แต่แท้จริงคือห่วงโซ่ที่มัดให้เราเป็นเพียง “ผู้บริโภค” ที่ไม่มีทางรู้ว่าอาหารของเรามาจากธรรมชาติหรือห้องแลบอีกต่อไป เรากลายเป็นหนูที่ย้ายจากกล่องวงกตหนึ่ง มายังอีกกล่องวงกตหนึ่งหรือเปล่า เป็นคำถามที่ยังต้องตอบต่อไป

เฮียไม่ได้มาเพื่อหวาดระแวงนะครับ เพราะในเกมอำนาจอาหาร ไม่มีใครยอมเสียพื้นที่ พวกเขาแค่เปลี่ยนกลยุทธ์ เพื่อครองความเชื่อมั่นใหม่ ในชื่อ “โปรตีน” #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28

@ d61f3bc5:0da6ef4a

2025-05-06 01:37:28I remember the first gathering of Nostr devs two years ago in Costa Rica. We were all psyched because Nostr appeared to solve the problem of self-sovereign online identity and decentralized publishing. The protocol seemed well-suited for textual content, but it wasn't really designed to handle binary files, like images or video.

The Problem

When I publish a note that contains an image link, the note itself is resilient thanks to Nostr, but if the hosting service disappears or takes my image down, my note will be broken forever. We need a way to publish binary data without relying on a single hosting provider.

We were discussing how there really was no reliable solution to this problem even outside of Nostr. Peer-to-peer attempts like IPFS simply didn't work; they were hopelessly slow and unreliable in practice. Torrents worked for popular files like movies, but couldn't be relied on for general file hosting.

Awesome Blossom

A year later, I attended the Sovereign Engineering demo day in Madeira, organized by Pablo and Gigi. Many projects were presented over a three hour demo session that day, but one really stood out for me.

Introduced by hzrd149 and Stu Bowman, Blossom blew my mind because it showed how we can solve complex problems easily by simply relying on the fact that Nostr exists. Having an open user directory, with the corresponding social graph and web of trust is an incredible building block.

Since we can easily look up any user on Nostr and read their profile metadata, we can just get them to simply tell us where their files are stored. This, combined with hash-based addressing (borrowed from IPFS), is all we need to solve our problem.

How Blossom Works

The Blossom protocol (Blobs Stored Simply on Mediaservers) is formally defined in a series of BUDs (Blossom Upgrade Documents). Yes, Blossom is the most well-branded protocol in the history of protocols. Feel free to refer to the spec for details, but I will provide a high level explanation here.

The main idea behind Blossom can be summarized in three points:

- Users specify which media server(s) they use via their public Blossom settings published on Nostr;

- All files are uniquely addressable via hashes;

- If an app fails to load a file from the original URL, it simply goes to get it from the server(s) specified in the user's Blossom settings.

Just like Nostr itself, the Blossom protocol is dead-simple and it works!

Let's use this image as an example:

If you look at the URL for this image, you will notice that it looks like this:

If you look at the URL for this image, you will notice that it looks like this:blossom.primal.net/c1aa63f983a44185d039092912bfb7f33adcf63ed3cae371ebe6905da5f688d0.jpgAll Blossom URLs follow this format:

[server]/[file-hash].[extension]The file hash is important because it uniquely identifies the file in question. Apps can use it to verify that the file they received is exactly the file they requested. It also gives us the ability to reliably get the same file from a different server.

Nostr users declare which media server(s) they use by publishing their Blossom settings. If I store my files on Server A, and they get removed, I can simply upload them to Server B, update my public Blossom settings, and all Blossom-capable apps will be able to find them at the new location. All my existing notes will continue to display media content without any issues.

Blossom Mirroring

Let's face it, re-uploading files to another server after they got removed from the original server is not the best user experience. Most people wouldn't have the backups of all the files, and/or the desire to do this work.

This is where Blossom's mirroring feature comes handy. In addition to the primary media server, a Blossom user can set one one or more mirror servers. Under this setup, every time a file is uploaded to the primary server the Nostr app issues a mirror request to the primary server, directing it to copy the file to all the specified mirrors. This way there is always a copy of all content on multiple servers and in case the primary becomes unavailable, Blossom-capable apps will automatically start loading from the mirror.

Mirrors are really easy to setup (you can do it in two clicks in Primal) and this arrangement ensures robust media handling without any central points of failure. Note that you can use professional media hosting services side by side with self-hosted backup servers that anyone can run at home.

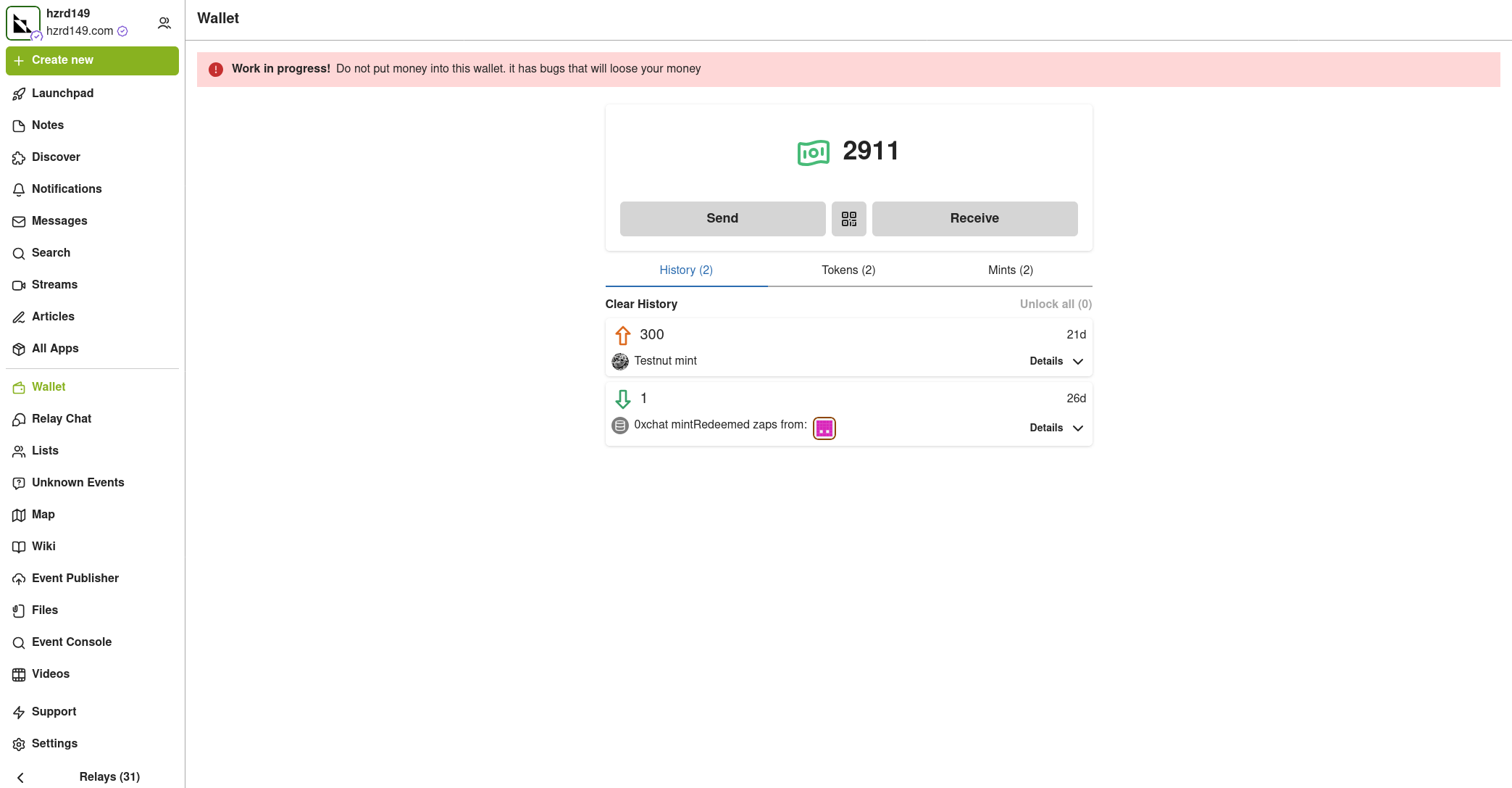

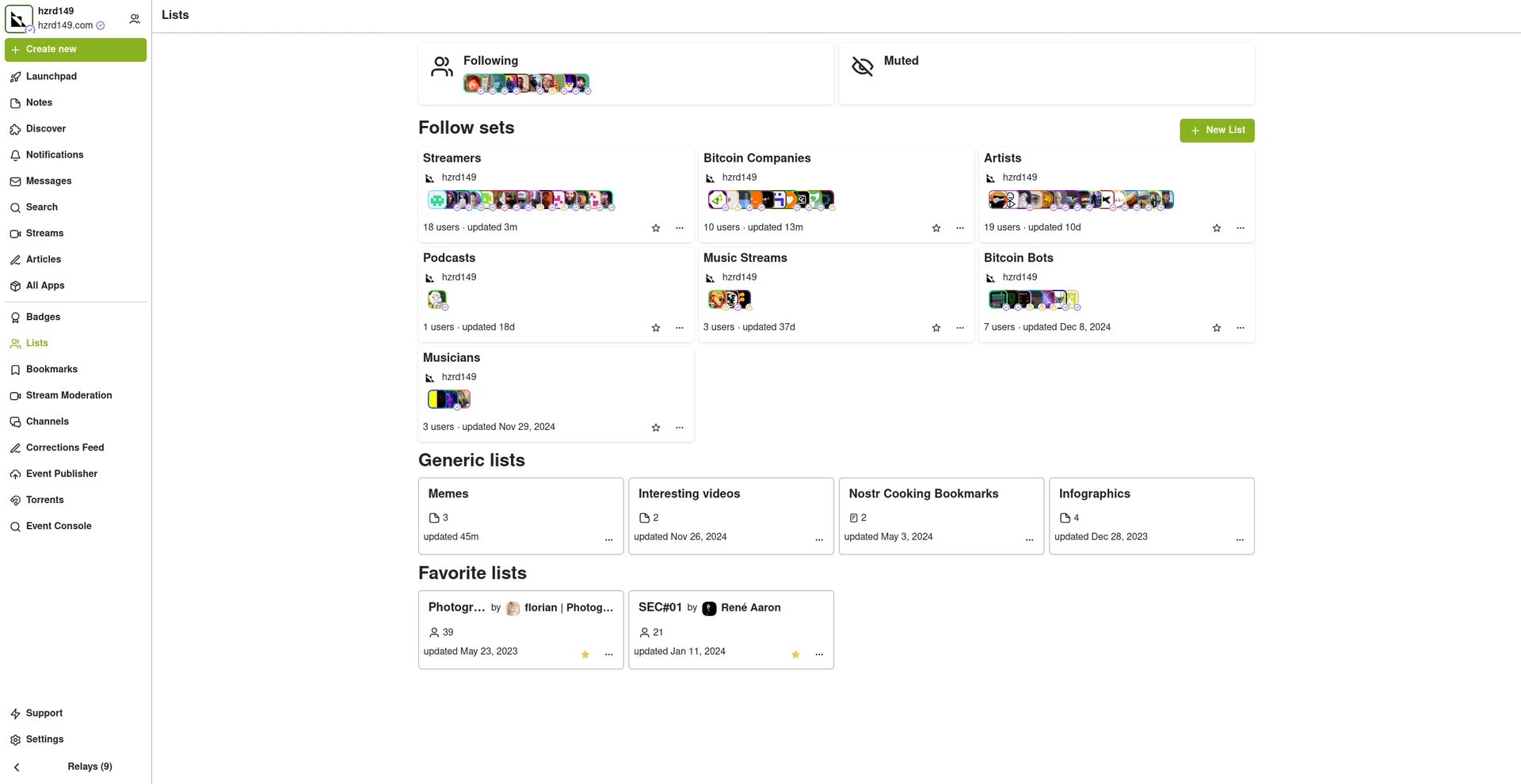

Using Blossom Within Primal

Blossom is natively integrated into the entire Primal stack and enabled by default. If you are using Primal 2.2 or later, you don't need to do anything to enable Blossom, all your media uploads are blossoming already.

To enhance user privacy, all Primal apps use the "/media" endpoint per BUD-05, which strips all metadata from uploaded files before they are saved and optionally mirrored to other Blossom servers, per user settings. You can use any Blossom server as your primary media server in Primal, as well as setup any number of mirrors:

## Conclusion

## ConclusionFor such a simple protocol, Blossom gives us three major benefits:

- Verifiable authenticity. All Nostr notes are always signed by the note author. With Blossom, the signed note includes a unique hash for each referenced media file, making it impossible to falsify.

- File hosting redundancy. Having multiple live copies of referenced media files (via Blossom mirroring) greatly increases the resiliency of media content published on Nostr.

- Censorship resistance. Blossom enables us to seamlessly switch media hosting providers in case of censorship.

Thanks for reading; and enjoy! 🌸

-

@ d61f3bc5:0da6ef4a

2025-05-05 15:26:08

@ d61f3bc5:0da6ef4a

2025-05-05 15:26:08I remember the first gathering of Nostr devs two years ago in Costa Rica. We were all psyched because Nostr appeared to solve the problem of self-sovereign online identity and decentralized publishing. The protocol seemed well-suited for textual content, but it wasn't really designed to handle binary files, like images or video.

The Problem

When I publish a note that contains an image link, the note itself is resilient thanks to Nostr, but if the hosting service disappears or takes my image down, my note will be broken forever. We need a way to publish binary data without relying on a single hosting provider.

We were discussing how there really was no reliable solution to this problem even outside of Nostr. Peer-to-peer attempts like IPFS simply didn't work; they were hopelessly slow and unreliable in practice. Torrents worked for popular files like movies, but couldn't be relied on for general file hosting.

Awesome Blossom

A year later, I attended the Sovereign Engineering demo day in Madeira, organized by Pablo and Gigi. Many projects were presented over a three hour demo session that day, but one really stood out for me.

Introduced by hzrd149 and Stu Bowman, Blossom blew my mind because it showed how we can solve complex problems easily by simply relying on the fact that Nostr exists. Having an open user directory, with the corresponding social graph and web of trust is an incredible building block.

Since we can easily look up any user on Nostr and read their profile metadata, we can just get them to simply tell us where their files are stored. This, combined with hash-based addressing (borrowed from IPFS), is all we need to solve our problem.

How Blossom Works

The Blossom protocol (Blobs Stored Simply on Mediaservers) is formally defined in a series of BUDs (Blossom Upgrade Documents). Yes, Blossom is the most well-branded protocol in the history of protocols. Feel free to refer to the spec for details, but I will provide a high level explanation here.

The main idea behind Blossom can be summarized in three points:

- Users specify which media server(s) they use via their public Blossom settings published on Nostr;

- All files are uniquely addressable via hashes;

- If an app fails to load a file from the original URL, it simply goes to get it from the server(s) specified in the user's Blossom settings.

Just like Nostr itself, the Blossom protocol is dead-simple and it works!

Let's use this image as an example:

If you look at the URL for this image, you will notice that it looks like this:

If you look at the URL for this image, you will notice that it looks like this:blossom.primal.net/c1aa63f983a44185d039092912bfb7f33adcf63ed3cae371ebe6905da5f688d0.jpgAll Blossom URLs follow this format:

[server]/[file-hash].[extension]The file hash is important because it uniquely identifies the file in question. Apps can use it to verify that the file they received is exactly the file they requested. It also gives us the ability to reliably get the same file from a different server.

Nostr users declare which media server(s) they use by publishing their Blossom settings. If I store my files on Server A, and they get removed, I can simply upload them to Server B, update my public Blossom settings, and all Blossom-capable apps will be able to find them at the new location. All my existing notes will continue to display media content without any issues.

Blossom Mirroring

Let's face it, re-uploading files to another server after they got removed from the original server is not the best user experience. Most people wouldn't have the backups of all the files, and/or the desire to do this work.

This is where Blossom's mirroring feature comes handy. In addition to the primary media server, a Blossom user can set one one or more mirror servers. Under this setup, every time a file is uploaded to the primary server the Nostr app issues a mirror request to the primary server, directing it to copy the file to all the specified mirrors. This way there is always a copy of all content on multiple servers and in case the primary becomes unavailable, Blossom-capable apps will automatically start loading from the mirror.

Mirrors are really easy to setup (you can do it in two clicks in Primal) and this arrangement ensures robust media handling without any central points of failure. Note that you can use professional media hosting services side by side with self-hosted backup servers that anyone can run at home.

Using Blossom Within Primal

Blossom is natively integrated into the entire Primal stack and enabled by default. If you are using Primal 2.2 or later, you don't need to do anything to enable Blossom, all your media uploads are blossoming already.

To enhance user privacy, all Primal apps use the "/media" endpoint per BUD-05, which strips all metadata from uploaded files before they are saved and optionally mirrored to other Blossom servers, per user settings. You can use any Blossom server as your primary media server in Primal, as well as setup any number of mirrors:

## Conclusion

## ConclusionFor such a simple protocol, Blossom gives us three major benefits:

- Verifiable authenticity. All Nostr notes are always signed by the note author. With Blossom, the signed note includes a unique hash for each referenced media file, making it impossible to falsify a media file and maliciously ascribe it to the note author.

- File hosting redundancy. Having multiple live copies of referenced media files (via Blossom mirroring) greatly increases the resiliency of media content published on Nostr.

- Censorship resistance. Blossom enables us to seamlessly switch media hosting providers in case of censorship.

Thanks for reading; and enjoy! 🌸

-

@ 91bea5cd:1df4451c

2025-04-26 10:16:21

@ 91bea5cd:1df4451c

2025-04-26 10:16:21O Contexto Legal Brasileiro e o Consentimento

No ordenamento jurídico brasileiro, o consentimento do ofendido pode, em certas circunstâncias, afastar a ilicitude de um ato que, sem ele, configuraria crime (como lesão corporal leve, prevista no Art. 129 do Código Penal). Contudo, o consentimento tem limites claros: não é válido para bens jurídicos indisponíveis, como a vida, e sua eficácia é questionável em casos de lesões corporais graves ou gravíssimas.

A prática de BDSM consensual situa-se em uma zona complexa. Em tese, se ambos os parceiros são adultos, capazes, e consentiram livre e informadamente nos atos praticados, sem que resultem em lesões graves permanentes ou risco de morte não consentido, não haveria crime. O desafio reside na comprovação desse consentimento, especialmente se uma das partes, posteriormente, o negar ou alegar coação.

A Lei Maria da Penha (Lei nº 11.340/2006)

A Lei Maria da Penha é um marco fundamental na proteção da mulher contra a violência doméstica e familiar. Ela estabelece mecanismos para coibir e prevenir tal violência, definindo suas formas (física, psicológica, sexual, patrimonial e moral) e prevendo medidas protetivas de urgência.

Embora essencial, a aplicação da lei em contextos de BDSM pode ser delicada. Uma alegação de violência por parte da mulher, mesmo que as lesões ou situações decorram de práticas consensuais, tende a receber atenção prioritária das autoridades, dada a presunção de vulnerabilidade estabelecida pela lei. Isso pode criar um cenário onde o parceiro masculino enfrenta dificuldades significativas em demonstrar a natureza consensual dos atos, especialmente se não houver provas robustas pré-constituídas.

Outros riscos:

Lesão corporal grave ou gravíssima (art. 129, §§ 1º e 2º, CP), não pode ser justificada pelo consentimento, podendo ensejar persecução penal.

Crimes contra a dignidade sexual (arts. 213 e seguintes do CP) são de ação pública incondicionada e independem de representação da vítima para a investigação e denúncia.

Riscos de Falsas Acusações e Alegação de Coação Futura

Os riscos para os praticantes de BDSM, especialmente para o parceiro que assume o papel dominante ou que inflige dor/restrição (frequentemente, mas não exclusivamente, o homem), podem surgir de diversas frentes:

- Acusações Externas: Vizinhos, familiares ou amigos que desconhecem a natureza consensual do relacionamento podem interpretar sons, marcas ou comportamentos como sinais de abuso e denunciar às autoridades.

- Alegações Futuras da Parceira: Em caso de término conturbado, vingança, arrependimento ou mudança de perspectiva, a parceira pode reinterpretar as práticas passadas como abuso e buscar reparação ou retaliação através de uma denúncia. A alegação pode ser de que o consentimento nunca existiu ou foi viciado.

- Alegação de Coação: Uma das formas mais complexas de refutar é a alegação de que o consentimento foi obtido mediante coação (física, moral, psicológica ou econômica). A parceira pode alegar, por exemplo, que se sentia pressionada, intimidada ou dependente, e que seu "sim" não era genuíno. Provar a ausência de coação a posteriori é extremamente difícil.

- Ingenuidade e Vulnerabilidade Masculina: Muitos homens, confiando na dinâmica consensual e na parceira, podem negligenciar a necessidade de precauções. A crença de que "isso nunca aconteceria comigo" ou a falta de conhecimento sobre as implicações legais e o peso processual de uma acusação no âmbito da Lei Maria da Penha podem deixá-los vulneráveis. A presença de marcas físicas, mesmo que consentidas, pode ser usada como evidência de agressão, invertendo o ônus da prova na prática, ainda que não na teoria jurídica.

Estratégias de Prevenção e Mitigação

Não existe um método infalível para evitar completamente o risco de uma falsa acusação, mas diversas medidas podem ser adotadas para construir um histórico de consentimento e reduzir vulnerabilidades:

- Comunicação Explícita e Contínua: A base de qualquer prática BDSM segura é a comunicação constante. Negociar limites, desejos, palavras de segurança ("safewords") e expectativas antes, durante e depois das cenas é crucial. Manter registros dessas negociações (e-mails, mensagens, diários compartilhados) pode ser útil.

-

Documentação do Consentimento:

-

Contratos de Relacionamento/Cena: Embora a validade jurídica de "contratos BDSM" seja discutível no Brasil (não podem afastar normas de ordem pública), eles servem como forte evidência da intenção das partes, da negociação detalhada de limites e do consentimento informado. Devem ser claros, datados, assinados e, idealmente, reconhecidos em cartório (para prova de data e autenticidade das assinaturas).

-

Registros Audiovisuais: Gravar (com consentimento explícito para a gravação) discussões sobre consentimento e limites antes das cenas pode ser uma prova poderosa. Gravar as próprias cenas é mais complexo devido a questões de privacidade e potencial uso indevido, mas pode ser considerado em casos específicos, sempre com consentimento mútuo documentado para a gravação.

Importante: a gravação deve ser com ciência da outra parte, para não configurar violação da intimidade (art. 5º, X, da Constituição Federal e art. 20 do Código Civil).

-

-

Testemunhas: Em alguns contextos de comunidade BDSM, a presença de terceiros de confiança durante negociações ou mesmo cenas pode servir como testemunho, embora isso possa alterar a dinâmica íntima do casal.

- Estabelecimento Claro de Limites e Palavras de Segurança: Definir e respeitar rigorosamente os limites (o que é permitido, o que é proibido) e as palavras de segurança é fundamental. O desrespeito a uma palavra de segurança encerra o consentimento para aquele ato.

- Avaliação Contínua do Consentimento: O consentimento não é um cheque em branco; ele deve ser entusiástico, contínuo e revogável a qualquer momento. Verificar o bem-estar do parceiro durante a cena ("check-ins") é essencial.

- Discrição e Cuidado com Evidências Físicas: Ser discreto sobre a natureza do relacionamento pode evitar mal-entendidos externos. Após cenas que deixem marcas, é prudente que ambos os parceiros estejam cientes e de acordo, talvez documentando por fotos (com data) e uma nota sobre a consensualidade da prática que as gerou.

- Aconselhamento Jurídico Preventivo: Consultar um advogado especializado em direito de família e criminal, com sensibilidade para dinâmicas de relacionamento alternativas, pode fornecer orientação personalizada sobre as melhores formas de documentar o consentimento e entender os riscos legais específicos.

Observações Importantes

- Nenhuma documentação substitui a necessidade de consentimento real, livre, informado e contínuo.

- A lei brasileira protege a "integridade física" e a "dignidade humana". Práticas que resultem em lesões graves ou que violem a dignidade de forma não consentida (ou com consentimento viciado) serão ilegais, independentemente de qualquer acordo prévio.

- Em caso de acusação, a existência de documentação robusta de consentimento não garante a absolvição, mas fortalece significativamente a defesa, ajudando a demonstrar a natureza consensual da relação e das práticas.

-

A alegação de coação futura é particularmente difícil de prevenir apenas com documentos. Um histórico consistente de comunicação aberta (whatsapp/telegram/e-mails), respeito mútuo e ausência de dependência ou controle excessivo na relação pode ajudar a contextualizar a dinâmica como não coercitiva.

-

Cuidado com Marcas Visíveis e Lesões Graves Práticas que resultam em hematomas severos ou lesões podem ser interpretadas como agressão, mesmo que consentidas. Evitar excessos protege não apenas a integridade física, mas também evita questionamentos legais futuros.

O que vem a ser consentimento viciado

No Direito, consentimento viciado é quando a pessoa concorda com algo, mas a vontade dela não é livre ou plena — ou seja, o consentimento existe formalmente, mas é defeituoso por alguma razão.

O Código Civil brasileiro (art. 138 a 165) define várias formas de vício de consentimento. As principais são:

Erro: A pessoa se engana sobre o que está consentindo. (Ex.: A pessoa acredita que vai participar de um jogo leve, mas na verdade é exposta a práticas pesadas.)

Dolo: A pessoa é enganada propositalmente para aceitar algo. (Ex.: Alguém mente sobre o que vai acontecer durante a prática.)

Coação: A pessoa é forçada ou ameaçada a consentir. (Ex.: "Se você não aceitar, eu termino com você" — pressão emocional forte pode ser vista como coação.)

Estado de perigo ou lesão: A pessoa aceita algo em situação de necessidade extrema ou abuso de sua vulnerabilidade. (Ex.: Alguém em situação emocional muito fragilizada é induzida a aceitar práticas que normalmente recusaria.)

No contexto de BDSM, isso é ainda mais delicado: Mesmo que a pessoa tenha "assinado" um contrato ou dito "sim", se depois ela alegar que seu consentimento foi dado sob medo, engano ou pressão psicológica, o consentimento pode ser considerado viciado — e, portanto, juridicamente inválido.

Isso tem duas implicações sérias:

-

O crime não se descaracteriza: Se houver vício, o consentimento é ignorado e a prática pode ser tratada como crime normal (lesão corporal, estupro, tortura, etc.).

-

A prova do consentimento precisa ser sólida: Mostrando que a pessoa estava informada, lúcida, livre e sem qualquer tipo de coação.

Consentimento viciado é quando a pessoa concorda formalmente, mas de maneira enganada, forçada ou pressionada, tornando o consentimento inútil para efeitos jurídicos.

Conclusão

Casais que praticam BDSM consensual no Brasil navegam em um terreno que exige não apenas confiança mútua e comunicação excepcional, mas também uma consciência aguçada das complexidades legais e dos riscos de interpretações equivocadas ou acusações mal-intencionadas. Embora o BDSM seja uma expressão legítima da sexualidade humana, sua prática no Brasil exige responsabilidade redobrada. Ter provas claras de consentimento, manter a comunicação aberta e agir com prudência são formas eficazes de se proteger de falsas alegações e preservar a liberdade e a segurança de todos os envolvidos. Embora leis controversas como a Maria da Penha sejam "vitais" para a proteção contra a violência real, os praticantes de BDSM, e em particular os homens nesse contexto, devem adotar uma postura proativa e prudente para mitigar os riscos inerentes à potencial má interpretação ou instrumentalização dessas práticas e leis, garantindo que a expressão de sua consensualidade esteja resguardada na medida do possível.

Importante: No Brasil, mesmo com tudo isso, o Ministério Público pode denunciar por crime como lesão corporal grave, estupro ou tortura, independente de consentimento. Então a prudência nas práticas é fundamental.

Aviso Legal: Este artigo tem caráter meramente informativo e não constitui aconselhamento jurídico. As leis e interpretações podem mudar, e cada situação é única. Recomenda-se buscar orientação de um advogado qualificado para discutir casos específicos.

Se curtiu este artigo faça uma contribuição, se tiver algum ponto relevante para o artigo deixe seu comentário.

-

@ 3d073b19:4ae60f39

2025-05-12 00:09:07

@ 3d073b19:4ae60f39

2025-05-12 00:09:07This is an English openletter

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

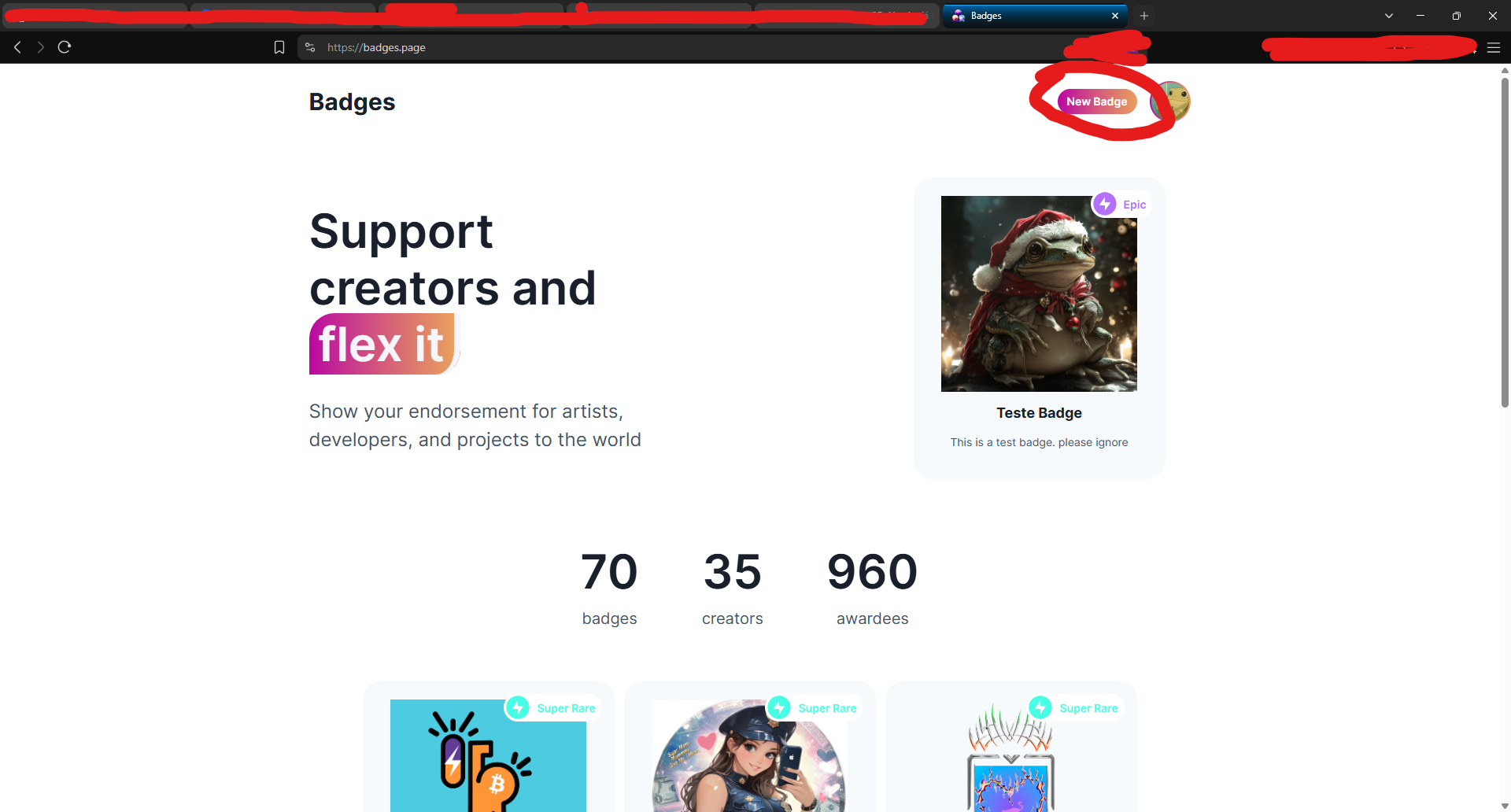

@ 6e64b83c:94102ee8

2025-05-05 16:50:13

@ 6e64b83c:94102ee8

2025-05-05 16:50:13Nostr-static is a powerful static site generator that transforms long-form Nostr content into beautiful, standalone websites. It makes your content accessible to everyone, even those not using Nostr clients. For more information check out my previous blog post How to Create a Blog Out of Nostr Long-Form Articles

What's New in Version 0.7?

RSS and Atom Feeds

Version 0.7 brings comprehensive feed support with both RSS and Atom formats. The system automatically generates feeds for your main content, individual profiles, and tag-specific pages. These feeds are seamlessly integrated into your site's header, making them easily discoverable by feed readers and content aggregators.

This feature bridges the gap between Nostr and traditional web publishing, allowing your content to reach readers who prefer feed readers or automated content distribution systems.

Smart Content Discovery

The new tag discovery system enhances your readers' experience by automatically finding and recommending relevant articles from the Nostr network. It works by:

- Analyzing the tags in your articles

- Fetching popular articles from Nostr that share these tags

- Using configurable weights to rank these articles based on:

- Engagement metrics (reactions, reposts, replies)

- Zap statistics (amount, unique zappers, average zap size)

- Content quality signals (report penalties)

This creates a dynamic "Recommended Articles" section that helps readers discover more content they might be interested in, all while staying within the Nostr ecosystem.

See the new features yourself by visiting our demo at: https://blog.nostrize.me

-

@ 3d073b19:4ae60f39

2025-05-11 23:59:56

@ 3d073b19:4ae60f39

2025-05-11 23:59:56Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lists

Unordered List

- Item 1

- Item 2

- Subitem 2.1

- Subitem 2.2

Ordered List

- First item

- Second item

- Third item

Links

OpenAI - A link to OpenAI's website. Markdown Guide - A comprehensive guide to Markdown syntax.

Images

- An example image with a title.

- An example image with a title.Blockquotes

This is a blockquote. It can span multiple lines. It is often used to highlight important information or quotes.

Code

Inline Code

Here is some

inline codethat demonstrates how to format code within a sentence.Code Block

```python

This is a Python code block

def hello_world(): print("Hello, world!") ```

Emphasis

Bold

This text is bold. This text is also bold.

Italic

This text is italic. This text is also italic.

Strikethrough

~~This text is strikethrough.~~

-

@ 6e0ea5d6:0327f353

2025-05-04 14:53:42

@ 6e0ea5d6:0327f353

2025-05-04 14:53:42Amico mio, ascolta bene!

Without hesitation, the woman you attract with lies is not truly yours. Davvero, she is the temporary property of the illusion you’ve built to seduce her. And every illusion, sooner or later, crumbles.

Weak men sell inflated versions of themselves. They talk about what they don’t have, promise what they can’t sustain, adorn their empty selves with words that are nothing more than a coat of paint. And they do this thinking that, later, they’ll be able to "show who they really are." Fatal mistake, cazzo!

The truth, amico mio, is not something that appears at the end. It is what holds up the whole beginning.

The woman who approaches a lie may smile at first — but she is smiling at the theater, not at the actor. When the curtains fall, what she will see is not a man. It will be a character tired of performing, begging for love from a self-serving audience in the front row.

That’s why I always point out that lying to win a woman’s heart is the same as sabotaging your own nature. The woman who comes through an invented version of you will be the first to leave when the veil of lies tears apart. Not out of cruelty, but out of consistency with her own interest. Fine... She didn’t leave you, but rather, that version of yourself never truly existed to be left behind.

A worthy man presents himself without deceptive adornments. And those who stay, stay because they know exactly who they are choosing as a man. That’s what differentiates forged seduction from the convenience of love built on honor, loyalty, and respect.

Ah, amico mio, I remember well. It was lunch on an autumn day in Catania. Mediterranean heat, and the Nero D'Avola wine from midday clinging to the lips like dried blood. Sitting in the shade of a lemon tree planted right by my grandfather's vineyard entrance, my uncle — the oldest of my father’s brothers — spoke little, but when he called us to sit by his side, all the nephews would quiet down to listen. And in my youth, he told me something that has never left my mind.

“In Sicily, the woman who endures the silence of a man about his business is more loyal than the one who is enchanted by speeches about what he does or how much he earns. Perchè, figlio mio, the first one has seen the truth. The second one, only a false shine.”

Thank you for reading, my friend!

If this message resonated with you, consider leaving your "🥃" as a token of appreciation.

A toast to our family!

-

@ 3d073b19:4ae60f39

2025-05-11 23:52:28

@ 3d073b19:4ae60f39

2025-05-11 23:52:28Headings

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lists

Unordered List

- Item 1

- Item 2

- Subitem 2.1

- Subitem 2.2

Ordered List

- First item

- Second item

- Third item

Mixed List

-

Item 1

-

Item 2

-

Item 3

Links

OpenAI - A link to OpenAI's website. Markdown Guide - A comprehensive guide to Markdown syntax.

Images

- An example image with a title.

- An example image with a title.Blockquotes

This is a blockquote. It can span multiple lines. It is often used to highlight important information or quotes.

Code

Inline Code

Here is some

inline codethat demonstrates how to format code within a sentence.Code Block

```python

This is a Python code block

def hello_world(): print("Hello, world!") ```

Emphasis

Bold

This text is bold. This text is also bold.

Italic

This text is italic. This text is also italic.

Strikethrough

~~This text is strikethrough.~~

-

@ 91bea5cd:1df4451c

2025-04-15 06:27:28

@ 91bea5cd:1df4451c

2025-04-15 06:27:28Básico

bash lsblk # Lista todos os diretorios montados.Para criar o sistema de arquivos:

bash mkfs.btrfs -L "ThePool" -f /dev/sdxCriando um subvolume:

bash btrfs subvolume create SubVolMontando Sistema de Arquivos:

bash mount -o compress=zlib,subvol=SubVol,autodefrag /dev/sdx /mntLista os discos formatados no diretório:

bash btrfs filesystem show /mntAdiciona novo disco ao subvolume:

bash btrfs device add -f /dev/sdy /mntLista novamente os discos do subvolume:

bash btrfs filesystem show /mntExibe uso dos discos do subvolume:

bash btrfs filesystem df /mntBalancea os dados entre os discos sobre raid1:

bash btrfs filesystem balance start -dconvert=raid1 -mconvert=raid1 /mntScrub é uma passagem por todos os dados e metadados do sistema de arquivos e verifica as somas de verificação. Se uma cópia válida estiver disponível (perfis de grupo de blocos replicados), a danificada será reparada. Todas as cópias dos perfis replicados são validadas.

iniciar o processo de depuração :

bash btrfs scrub start /mntver o status do processo de depuração Btrfs em execução:

bash btrfs scrub status /mntver o status do scrub Btrfs para cada um dos dispositivos

bash btrfs scrub status -d / data btrfs scrub cancel / dataPara retomar o processo de depuração do Btrfs que você cancelou ou pausou:

btrfs scrub resume / data

Listando os subvolumes:

bash btrfs subvolume list /ReportsCriando um instantâneo dos subvolumes:

Aqui, estamos criando um instantâneo de leitura e gravação chamado snap de marketing do subvolume de marketing.

bash btrfs subvolume snapshot /Reports/marketing /Reports/marketing-snapAlém disso, você pode criar um instantâneo somente leitura usando o sinalizador -r conforme mostrado. O marketing-rosnap é um instantâneo somente leitura do subvolume de marketing

bash btrfs subvolume snapshot -r /Reports/marketing /Reports/marketing-rosnapForçar a sincronização do sistema de arquivos usando o utilitário 'sync'

Para forçar a sincronização do sistema de arquivos, invoque a opção de sincronização conforme mostrado. Observe que o sistema de arquivos já deve estar montado para que o processo de sincronização continue com sucesso.

bash btrfs filsystem sync /ReportsPara excluir o dispositivo do sistema de arquivos, use o comando device delete conforme mostrado.

bash btrfs device delete /dev/sdc /ReportsPara sondar o status de um scrub, use o comando scrub status com a opção -dR .

bash btrfs scrub status -dR / RelatóriosPara cancelar a execução do scrub, use o comando scrub cancel .

bash $ sudo btrfs scrub cancel / ReportsPara retomar ou continuar com uma depuração interrompida anteriormente, execute o comando de cancelamento de depuração

bash sudo btrfs scrub resume /Reportsmostra o uso do dispositivo de armazenamento:

btrfs filesystem usage /data

Para distribuir os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID (incluindo o dispositivo de armazenamento recém-adicionado) montados no diretório /data , execute o seguinte comando:

sudo btrfs balance start --full-balance /data

Pode demorar um pouco para espalhar os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID se ele contiver muitos dados.

Opções importantes de montagem Btrfs

Nesta seção, vou explicar algumas das importantes opções de montagem do Btrfs. Então vamos começar.

As opções de montagem Btrfs mais importantes são:

**1. acl e noacl

**ACL gerencia permissões de usuários e grupos para os arquivos/diretórios do sistema de arquivos Btrfs.

A opção de montagem acl Btrfs habilita ACL. Para desabilitar a ACL, você pode usar a opção de montagem noacl .

Por padrão, a ACL está habilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem acl por padrão.

**2. autodefrag e noautodefrag

**Desfragmentar um sistema de arquivos Btrfs melhorará o desempenho do sistema de arquivos reduzindo a fragmentação de dados.

A opção de montagem autodefrag permite a desfragmentação automática do sistema de arquivos Btrfs.

A opção de montagem noautodefrag desativa a desfragmentação automática do sistema de arquivos Btrfs.

Por padrão, a desfragmentação automática está desabilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem noautodefrag por padrão.

**3. compactar e compactar-forçar

**Controla a compactação de dados no nível do sistema de arquivos do sistema de arquivos Btrfs.

A opção compactar compacta apenas os arquivos que valem a pena compactar (se compactar o arquivo economizar espaço em disco).

A opção compress-force compacta todos os arquivos do sistema de arquivos Btrfs, mesmo que a compactação do arquivo aumente seu tamanho.

O sistema de arquivos Btrfs suporta muitos algoritmos de compactação e cada um dos algoritmos de compactação possui diferentes níveis de compactação.

Os algoritmos de compactação suportados pelo Btrfs são: lzo , zlib (nível 1 a 9) e zstd (nível 1 a 15).

Você pode especificar qual algoritmo de compactação usar para o sistema de arquivos Btrfs com uma das seguintes opções de montagem:

- compress=algoritmo:nível

- compress-force=algoritmo:nível

Para obter mais informações, consulte meu artigo Como habilitar a compactação do sistema de arquivos Btrfs .

**4. subvol e subvolid

**Estas opções de montagem são usadas para montar separadamente um subvolume específico de um sistema de arquivos Btrfs.

A opção de montagem subvol é usada para montar o subvolume de um sistema de arquivos Btrfs usando seu caminho relativo.

A opção de montagem subvolid é usada para montar o subvolume de um sistema de arquivos Btrfs usando o ID do subvolume.

Para obter mais informações, consulte meu artigo Como criar e montar subvolumes Btrfs .

**5. dispositivo

A opção de montagem de dispositivo** é usada no sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs.

Em alguns casos, o sistema operacional pode falhar ao detectar os dispositivos de armazenamento usados em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs. Nesses casos, você pode usar a opção de montagem do dispositivo para especificar os dispositivos que deseja usar para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar a opção de montagem de dispositivo várias vezes para carregar diferentes dispositivos de armazenamento para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar o nome do dispositivo (ou seja, sdb , sdc ) ou UUID , UUID_SUB ou PARTUUID do dispositivo de armazenamento com a opção de montagem do dispositivo para identificar o dispositivo de armazenamento.

Por exemplo,

- dispositivo=/dev/sdb

- dispositivo=/dev/sdb,dispositivo=/dev/sdc

- dispositivo=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d

- device=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d,device=UUID_SUB=f7ce4875-0874-436a-b47d-3edef66d3424

**6. degraded

A opção de montagem degradada** permite que um RAID Btrfs seja montado com menos dispositivos de armazenamento do que o perfil RAID requer.

Por exemplo, o perfil raid1 requer a presença de 2 dispositivos de armazenamento. Se um dos dispositivos de armazenamento não estiver disponível em qualquer caso, você usa a opção de montagem degradada para montar o RAID mesmo que 1 de 2 dispositivos de armazenamento esteja disponível.

**7. commit

A opção commit** mount é usada para definir o intervalo (em segundos) dentro do qual os dados serão gravados no dispositivo de armazenamento.

O padrão é definido como 30 segundos.

Para definir o intervalo de confirmação para 15 segundos, você pode usar a opção de montagem commit=15 (digamos).

**8. ssd e nossd

A opção de montagem ssd** informa ao sistema de arquivos Btrfs que o sistema de arquivos está usando um dispositivo de armazenamento SSD, e o sistema de arquivos Btrfs faz a otimização SSD necessária.

A opção de montagem nossd desativa a otimização do SSD.

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem de SSD será habilitada. Caso contrário, a opção de montagem nossd é habilitada.

**9. ssd_spread e nossd_spread

A opção de montagem ssd_spread** tenta alocar grandes blocos contínuos de espaço não utilizado do SSD. Esse recurso melhora o desempenho de SSDs de baixo custo (baratos).

A opção de montagem nossd_spread desativa o recurso ssd_spread .

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem ssd_spread será habilitada. Caso contrário, a opção de montagem nossd_spread é habilitada.

**10. descarte e nodiscard

Se você estiver usando um SSD que suporte TRIM enfileirado assíncrono (SATA rev3.1), a opção de montagem de descarte** permitirá o descarte de blocos de arquivos liberados. Isso melhorará o desempenho do SSD.

Se o SSD não suportar TRIM enfileirado assíncrono, a opção de montagem de descarte prejudicará o desempenho do SSD. Nesse caso, a opção de montagem nodiscard deve ser usada.

Por padrão, a opção de montagem nodiscard é usada.

**11. norecovery

Se a opção de montagem norecovery** for usada, o sistema de arquivos Btrfs não tentará executar a operação de recuperação de dados no momento da montagem.

**12. usebackuproot e nousebackuproot

Se a opção de montagem usebackuproot for usada, o sistema de arquivos Btrfs tentará recuperar qualquer raiz de árvore ruim/corrompida no momento da montagem. O sistema de arquivos Btrfs pode armazenar várias raízes de árvore no sistema de arquivos. A opção de montagem usebackuproot** procurará uma boa raiz de árvore e usará a primeira boa que encontrar.

A opção de montagem nousebackuproot não verificará ou recuperará raízes de árvore inválidas/corrompidas no momento da montagem. Este é o comportamento padrão do sistema de arquivos Btrfs.

**13. space_cache, space_cache=version, nospace_cache e clear_cache

A opção de montagem space_cache** é usada para controlar o cache de espaço livre. O cache de espaço livre é usado para melhorar o desempenho da leitura do espaço livre do grupo de blocos do sistema de arquivos Btrfs na memória (RAM).

O sistema de arquivos Btrfs suporta 2 versões do cache de espaço livre: v1 (padrão) e v2

O mecanismo de cache de espaço livre v2 melhora o desempenho de sistemas de arquivos grandes (tamanho de vários terabytes).

Você pode usar a opção de montagem space_cache=v1 para definir a v1 do cache de espaço livre e a opção de montagem space_cache=v2 para definir a v2 do cache de espaço livre.

A opção de montagem clear_cache é usada para limpar o cache de espaço livre.

Quando o cache de espaço livre v2 é criado, o cache deve ser limpo para criar um cache de espaço livre v1 .

Portanto, para usar o cache de espaço livre v1 após a criação do cache de espaço livre v2 , as opções de montagem clear_cache e space_cache=v1 devem ser combinadas: clear_cache,space_cache=v1

A opção de montagem nospace_cache é usada para desabilitar o cache de espaço livre.

Para desabilitar o cache de espaço livre após a criação do cache v1 ou v2 , as opções de montagem nospace_cache e clear_cache devem ser combinadas: clear_cache,nosapce_cache

**14. skip_balance

Por padrão, a operação de balanceamento interrompida/pausada de um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs será retomada automaticamente assim que o sistema de arquivos Btrfs for montado. Para desabilitar a retomada automática da operação de equilíbrio interrompido/pausado em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs, você pode usar a opção de montagem skip_balance .**

**15. datacow e nodatacow

A opção datacow** mount habilita o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs. É o comportamento padrão.

Se você deseja desabilitar o recurso Copy-on-Write (CoW) do sistema de arquivos Btrfs para os arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatacow .

**16. datasum e nodatasum

A opção datasum** mount habilita a soma de verificação de dados para arquivos recém-criados do sistema de arquivos Btrfs. Este é o comportamento padrão.

Se você não quiser que o sistema de arquivos Btrfs faça a soma de verificação dos dados dos arquivos recém-criados, monte o sistema de arquivos Btrfs com a opção de montagem nodatasum .

Perfis Btrfs

Um perfil Btrfs é usado para informar ao sistema de arquivos Btrfs quantas cópias dos dados/metadados devem ser mantidas e quais níveis de RAID devem ser usados para os dados/metadados. O sistema de arquivos Btrfs contém muitos perfis. Entendê-los o ajudará a configurar um RAID Btrfs da maneira que você deseja.

Os perfis Btrfs disponíveis são os seguintes:

single : Se o perfil único for usado para os dados/metadados, apenas uma cópia dos dados/metadados será armazenada no sistema de arquivos, mesmo se você adicionar vários dispositivos de armazenamento ao sistema de arquivos. Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

dup : Se o perfil dup for usado para os dados/metadados, cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos manterá duas cópias dos dados/metadados. Assim, 50% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser utilizado.

raid0 : No perfil raid0 , os dados/metadados serão divididos igualmente em todos os dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, não haverá dados/metadados redundantes (duplicados). Assim, 100% do espaço em disco de cada um dos dispositivos de armazenamento adicionados ao sistema de arquivos pode ser usado. Se, em qualquer caso, um dos dispositivos de armazenamento falhar, todo o sistema de arquivos será corrompido. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid0 .

raid1 : No perfil raid1 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a uma falha de unidade. Mas você pode usar apenas 50% do espaço total em disco. Você precisará de pelo menos dois dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1 .

raid1c3 : No perfil raid1c3 , três cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a duas falhas de unidade, mas você pode usar apenas 33% do espaço total em disco. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c3 .

raid1c4 : No perfil raid1c4 , quatro cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos. Nesta configuração, a matriz RAID pode sobreviver a três falhas de unidade, mas você pode usar apenas 25% do espaço total em disco. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid1c4 .

raid10 : No perfil raid10 , duas cópias dos dados/metadados serão armazenadas nos dispositivos de armazenamento adicionados ao sistema de arquivos, como no perfil raid1 . Além disso, os dados/metadados serão divididos entre os dispositivos de armazenamento, como no perfil raid0 .

O perfil raid10 é um híbrido dos perfis raid1 e raid0 . Alguns dos dispositivos de armazenamento formam arrays raid1 e alguns desses arrays raid1 são usados para formar um array raid0 . Em uma configuração raid10 , o sistema de arquivos pode sobreviver a uma única falha de unidade em cada uma das matrizes raid1 .

Você pode usar 50% do espaço total em disco na configuração raid10 . Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid10 .

raid5 : No perfil raid5 , uma cópia dos dados/metadados será dividida entre os dispositivos de armazenamento. Uma única paridade será calculada e distribuída entre os dispositivos de armazenamento do array RAID.

Em uma configuração raid5 , o sistema de arquivos pode sobreviver a uma única falha de unidade. Se uma unidade falhar, você pode adicionar uma nova unidade ao sistema de arquivos e os dados perdidos serão calculados a partir da paridade distribuída das unidades em execução.

Você pode usar 1 00x(N-1)/N % do total de espaços em disco na configuração raid5 . Aqui, N é o número de dispositivos de armazenamento adicionados ao sistema de arquivos. Você precisará de pelo menos três dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid5 .

raid6 : No perfil raid6 , uma cópia dos dados/metadados será dividida entre os dispositivos de armazenamento. Duas paridades serão calculadas e distribuídas entre os dispositivos de armazenamento do array RAID.

Em uma configuração raid6 , o sistema de arquivos pode sobreviver a duas falhas de unidade ao mesmo tempo. Se uma unidade falhar, você poderá adicionar uma nova unidade ao sistema de arquivos e os dados perdidos serão calculados a partir das duas paridades distribuídas das unidades em execução.

Você pode usar 100x(N-2)/N % do espaço total em disco na configuração raid6 . Aqui, N é o número de dispositivos de armazenamento adicionados ao sistema de arquivos. Você precisará de pelo menos quatro dispositivos de armazenamento para configurar o sistema de arquivos Btrfs no perfil raid6 .

-

@ 266815e0:6cd408a5

2025-05-02 22:24:59

@ 266815e0:6cd408a5

2025-05-02 22:24:59Its been six long months of refactoring code and building out to the applesauce packages but the app is stable enough for another release.