-

@ e4950c93:1b99eccd

2025-05-02 10:48:12

@ e4950c93:1b99eccd

2025-05-02 10:48:12Trouver des produits 100% naturels, sans plastique, est bien plus compliqué que je ne le pensais… Alors j’ai commencé à collectionner des marque-pages. Et puis je me suis dit : « Et si on partageait ?! »

Aide-moi à dénicher les meilleures alternatives naturelles pour s’habiller et s’équiper sans plastique !

Ce projet repose sur le partage : la moitié des revenus éventuels du site est reversée aux contribut-eur-rice-s. Une petite expérimentation de partage de la valeur sur Internet. :-)

Questions-réponses

Pourquoi se focaliser sur les matières naturelles ?

Les matières synthétiques sont essentiellement des plastiques (polyester, polyamide…). Problème ? Oui ! Ils finissent par nous contaminer :

- Microplastiques absorbés par la peau,

- Particules diffusées à chaque lavage, se retrouvant dans l’eau que nous buvons et les aliments que nous consommons,

- Enjeux majeurs liés au recyclage des déchets plastiques.

C'est quoi, au juste, des matières naturelles ?

Ce sont des matières non synthétiques, dont les composants existent à l’état naturel, sans modification de leur structure moléculaire. Mais ce qui nous intéresse avant tout, c’est leur biodégradabilité et leur absence de toxicité.

Certaines matières feront sûrement débat sur leur acceptabilité ici.

👉 En savoir plus sur les matières

Quelle différence avec d'autres sites de mode ou de shopping éthiques ?

Il existe déjà de nombreux sites proposant des produits éthiques et durables, mais j’ai constaté qu’ils incluaient souvent des matières synthétiques. Je devais vérifier produit par produit. Certains mettent en avant les fibres en plastique recyclé comme démarche environnementale, mais je préfère éviter d’en porter sur ma peau ou d'en mettre sur mes enfants.

Comment contribuer ?

Si tu trouves ce projet utile ou intéressant, voici comment le soutenir :

-

📝 Contribue : suggère des modifications en commentant les fiches existantes ou propose de nouvelles références de produits ou de marque. 👉 En savoir plus sur les contributions

-

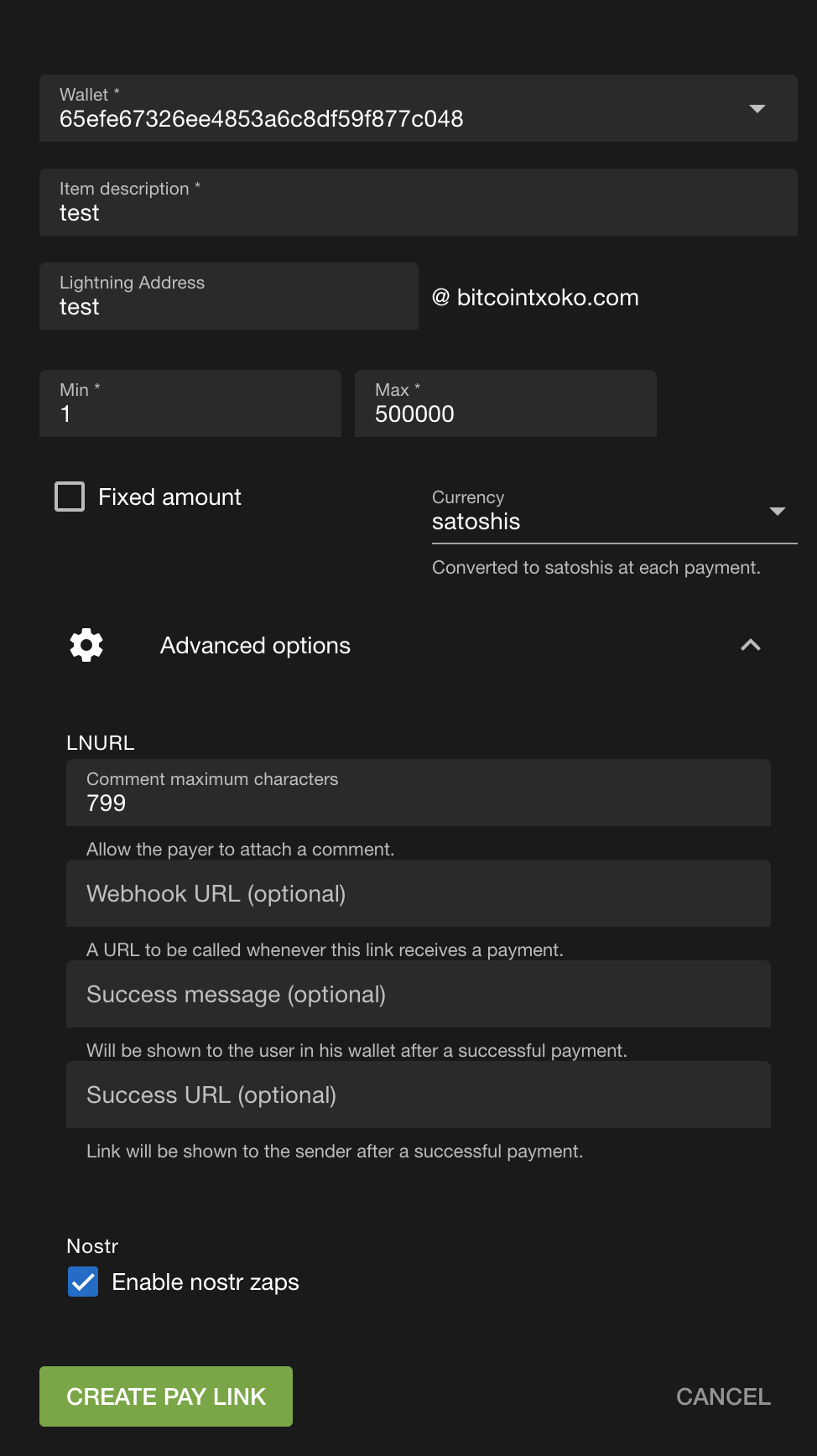

⚡ Fais un don : pour faire vivre le projet et remercier les contribut-eur-ice-s. 👉 En savoir plus sur les dons

-

📢 Fais-le connaître : parles-en autour de toi, partage le site sur les réseaux sociaux, ton blog…

Comment recevoir une partie des revenus du site ?

Il suffit d’avoir un compte NOSTR et une adresse Bitcoin Lightning.

👉 En savoir plus sur les rétributions

C'est quoi NOSTR ?

C’est un protocole décentralisé pour Internet, encore en phase expérimentale. Il permet :

- De publier et consulter du contenu sans dépendre d’une plateforme centralisée.

- De se connecter à plusieurs services en conservant le contrôle total de ses données.

- D’intégrer le réseau Bitcoin Lightning pour des paiements instantanés et décentralisés.

Et la confidentialité de mes données ?

- Aucune publicité, aucun traçage personnalisé.

- Les commentaires NOSTR sont publics, mais vous pouvez utiliser un pseudonyme.

- Vous conservez la propriété de vos contributions sur le protocole NOSTR.

Qui porte ce projet ?

👉 Voir les contribut-eur-rice-s

Nous utilisons des outils et services open source :

- NOSTR pour la publication des contenus et la vérification des contributions,

- npub.pro pour la visualisation des contenus,

- Coinos.io pour la gestion des paiements.

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ a87c9bfc:83bda6a8

2025-05-02 10:43:34

@ a87c9bfc:83bda6a8

2025-05-02 10:43:34Large Language Models (LLMs) are revolutionizing how we interact with technology, but their increasing sophistication brings unique security challenges. Malicious actors are constantly finding new ways to exploit these systems, primarily through techniques like prompt injection – crafting inputs to bypass safety controls – and the use of hidden characters to obfuscate harmful commands or disrupt text processing. Ensuring the safety and integrity of LLM applications is paramount.

The Hidden Dangers in Text

Prompt injection allows attackers to manipulate LLM outputs, potentially leading to data leaks, generation of inappropriate content, or unauthorized actions. Similarly, invisible characters (like zero-width spaces or bidirectional text overrides) can be embedded within seemingly innocuous text. These hidden elements can bypass simple security filters, disguise malicious instructions, or interfere with how the LLM interprets the input, leading to unpredictable or harmful behavior.

Vibecondom: A New Shield for LLM Security

To combat these emerging threats, a new open-source tool called Vibecondom has been developed. Written in Go, Vibecondom acts as a specialized security scanner designed specifically for the text content fed into LLMs. It serves as a critical defensive layer for AI developers, security researchers, and content moderation teams aiming to protect their systems.

Core Capabilities

Vibecondom focuses on identifying subtle but dangerous patterns within text data:

- Detecting Deception: It actively scans for known techniques used in prompt injection attacks and identifies various types of hidden or control characters that could signal malicious intent.

- Unmasking Obfuscation: The tool can flag potentially obfuscated content, such as Base64 encoded strings or text mixing different character scripts, which might be used to hide payloads.

- Flexible Integration: Vibecondom is designed for versatility, capable of analyzing text files stored locally or scanning content directly from remote Git repositories.

- Actionable Insights: When potential threats are detected, the tool provides clear alerts, helping teams pinpoint and investigate suspicious inputs before they compromise the LLM.

Enhancing Trust in AI

Tools like Vibecondom represent an essential step forward in securing the LLM ecosystem. By proactively identifying and flagging potentially harmful inputs, developers can build more robust defenses, fostering greater trust and reliability in AI applications.

As an open-source project (MIT License), Vibecondom invites collaboration and contribution from the security community. Anyone interested in bolstering their LLM security posture is encouraged to explore the Vibecondom project on GitHub to learn more.

-

@ e4950c93:1b99eccd

2025-05-02 10:39:50

@ e4950c93:1b99eccd

2025-05-02 10:39:50Équipe Cœur

L'équipe Cœur porte le projet et valide les contenus.

- Jean-David Bar : https://njump.me/npub1qr4p7uamcpawv7cr8z9nlhmd60lylukf7lvmtlnpe7r4juwxudzq3hrnll

Pour démarrer, je gère le projet en solo en partageant mes favoris pour éviter le plastique sur nous et sur nos enfants. Contacte-moi si tu souhaites rejoindre l'aventure !

Enrichisseu-r-se-s de contenus

Les contribut-eur-rice-s rendent ce site vivant et intéressant.

A venir.

👉 En savoir plus sur les contributions

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ a5142938:0ef19da3

2025-05-02 10:38:10

@ a5142938:0ef19da3

2025-05-02 10:38:10Happy to have found useful information on this site?

Support the project by making a donation to keep it running and thank the contributors.

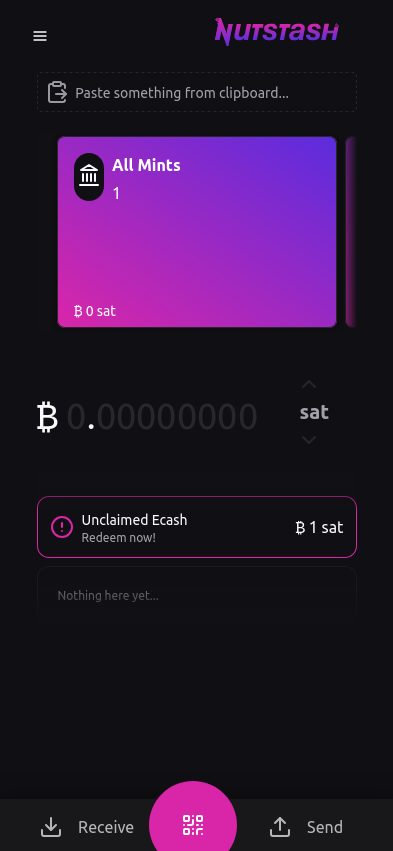

In bitcoin

- On-chain:

bc1qkm8me8l9563wvsl9sklzt4hdcuny3tlejznj7d

- Lightning network:

⚡️

origin-nature@coinos.ioYou can also support us on a recurring basis 👉 Set up a recurring Lightning payment

In euros, dollars, or any other supported currency

-

By bank transfer, IBAN: FR76 2823 3000 0144 3759 8717 669

-

You can also support us on a recurring basis 👉 Make a pledge on LiberaPay

Contact us if you’d like to make a donation using any other cryptocurrency.

💡 A Value-Sharing Model

Half of the donations are redistributed to the contributors who create the site's value, experimenting with a revenue-sharing model on the Internet—one that respects your data and doesn’t seek to capture your attention.

The other half helps cover the website’s operating costs, compensate the core team, and support the open-source tools we rely on.

This article is published on origin-nature.com 🌐 Voir cet article en français

-

@ e4950c93:1b99eccd

2025-05-02 10:36:46

@ e4950c93:1b99eccd

2025-05-02 10:36:46Heureu-x-se d’avoir trouvé une information utile sur ce site ?

Soutiens le projet en faisant un don pour le faire vivre et remercier les contribut-eur-rice-s.

En bitcoin

-

Sur la blockchain : bc1qkm8me8l9563wvsl9sklzt4hdcuny3tlejznj7d

-

Réseau lightning : ⚡️

origin-nature@coinos.ioVous pouvez aussi nous soutenir de manière récurrente 👉 Créer un paiement Lightning récurrent

En euros, dollars, ou toute autre monnaie prise en charge

-

Par virement, IBAN : FR76 2823 3000 0144 3759 8717 669

-

Tu peux aussi nous soutenir de manière récurrente 👉 Faire une promesse sur LiberaPay

Contacte-nous si tu souhaites faire un don avec toute autre cryptomonnaie.

💡 Un modèle de partage de la valeur

La moitié des dons est redistribuée aux contribut-eur-rice-s qui créent la valeur du site, pour expérimenter un modèle de partage de revenus sur Internet — un modèle qui respecte vos données et ne cherche pas à capter votre attention.

L’autre moitié permet de couvrir les frais de fonctionnement du site, rémunérer l'équipe coeur et soutenir les outils open source que nous utilisons.

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

-

@ e4950c93:1b99eccd

2025-05-02 10:31:12

@ e4950c93:1b99eccd

2025-05-02 10:31:12Contribue à enrichir le site !

Chaque contribution permet d’améliorer ce site en aidant à référencer des alternatives naturelles.

💡 Qu’est-ce qu’une contribution ?

Une contribution peut être :

📝 La proposition d’une nouvelle fiche, en fournissant ses premières informations. Chaque information ajoutée (nom, lien, catégorie, etc.) est une contribution : - Ajouter un produit - Ajouter une marque

📝 L'ajout ou la modification d’informations sur une fiche existante. Chaque information ajoutée ou retirée est une contribution.

✅ Validation des contributions

Les contributions sont vérifiées par l’équipe cœur. Une contribution est validée lorsque l'information indiquée est fournie pour la première fois (le commentaire le plus ancien est pris en compte) et est vérifiable.

Une fois validées, les contributions sont comptabilisées et donnent lieu à une rétribution. 👉 En savoir plus sur les rétributions

Les informations ajoutées directement par l'équipe cœur lors de la vérification d'une contribution ne sont pas comptabilisées. Néanmoins, les membres de l'équipe coeur peuvent aussi contribuer comme tout le monde.

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ a5142938:0ef19da3

2025-05-02 10:26:59

@ a5142938:0ef19da3

2025-05-02 10:26:59Contribute to enrich the site!

Each contribution helps improve this site by supporting the listing of natural alternatives.

💡 What Counts as a Contribution?

A contribution can be:

📝 Proposing a new entry, by providing its initial information. Each piece of information added (name, link, category, etc.) is considered a contribution: - Add a product - Add a brand

📝 Adding or modifying information in an existing entry. Each piece of information added or removed is considered a contribution.

✅ Contribution validation

Contributions are reviewed by the core team. A contribution is validated when the information provided is submitted for the first time (the earliest comment is taken into account) and can be verified.

Once validated, contributions are counted and eligible for rewards. 👉 Learn more about rewards

Information added directly by the core team during the verification of a contribution is not counted. However, core team members can also contribute just like anyone else.

This article is published on origin-nature.com 🌐 Voir cet article en français

-

@ a5142938:0ef19da3

2025-05-02 10:24:43

@ a5142938:0ef19da3

2025-05-02 10:24:43

This article is published on origin-nature.com 🌐 Voir cet article en français

-

@ e4950c93:1b99eccd

2025-05-02 10:20:25

@ e4950c93:1b99eccd

2025-05-02 10:20:25

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ 5188521b:008eb518

2025-05-02 10:19:17

@ 5188521b:008eb518

2025-05-02 10:19:17Fabian Sixsmith leaned closer to the screen. A couple of white pixels fizzed through the frame, and the hairs on his arm prickled. It had to be her. The blonde. Underworld’s most wanted — T1n4Red.

It was nearing daybreak in Lewistown, Montana. The end of yet another 14-hour shift at the DoS facility. Pulling fourteens was tough on his body, but it reduced the time it would take for Fabian to gain promotion to agent. Working at the Department of Surveillance came with the serious drawback of being labeled a snoop, but agents could be free — solid pension credits and private property. But today, he would not slink back to his closet-sized studio for buttered noodles and two hours on the velobike. Today would be the day he proved his work was responsible for locating T1n4Red. Her crimes were manifold; her methods were meticulous. Operating encrypted communication networks and thousands of transaction joins to obfuscate Underworld finances. Fabian flipped the plastic cover of the alarm on his console and pressed the button.

Agent Williams appeared behind him in seconds. The babble of voice commands in the CCTV facility cut to zero. “Situation update, Operative Sixsmith.”

Liquidating the bad guys had been the dream ever since his father lost his college fund to a hacker. Cypherpunks came in all guises, and some could phish credits from careless Boston drunks and cover their tracks with encryption. Fabian opened the dossier on his desk. “Tier 1 target located. DNA confirmation requested from ground team.” He was certain. So many nights following encoded messages he found hidden data in images on the public comms ledger. Many were drop sites for the scumbags who delivered supplies to the Underworld in exchange for bitcoin — the only money the government couldn’t meter out and strip away automatically. That pixel of white had to be her blonde hair vanishing, once again, underground.

“Enhance the facial image,” said Williams.

There was no clear image to enhance. Fabian would have some explaining to do if he was wrong. Except he couldn’t be wrong. Those pixels had been his life for the last ten months. Finally, he had trapped her. Straightening his glasses, he prepared his reply. “I can bring up the drop locations from the LSB ima—”

“Operative. What is the protocol required to initiate a Tier 1 alert?”

Fabian could feel the heat of his boss’s glare. “Agent, there is insufficient facial recognition data, but if you give me a minute…” He had captured dozens of steganographical messages — locations, account numbers, usernames. Hiding messages in plain sight was apparently how cypherpunks avoided detection with such ease.

Williams was already patching through to the ground team on his Neurocomms link. “What’s your ETA on the location?” He furrowed his brow. “Copy that... proceed.” Turning towards Fabian, he snapped his fingers. “My office. Now.”

According to Fabian’s calculations, the ground team would report back with the DNA scan in three to four minutes. When they got a match, she’d be toast. T1n4Red would be underground forever; if she resurfaced, the dronecopters would gun her down in minutes. He just had to stall Williams until the confirmation came through. That might be the only way to avoid his first ever sanction. Having a blemish on record would set his lifeplan back by several months. He thought about requesting a comfort break on the system, but Williams would deny it. Fabian stood up purposefully. He arranged the chair and a few items on the desk, then dragged his feet all the way to the office.

Each agent in the DoS facility had an area of control around the size of a football field. Their 12’ by 12’ office comprised the only enclosed space and was positioned in the middle of rows upon rows of desks. Four walls of two-way mirrored glass formed the raised office cube — a mini panopticon within the greater panopticon of DoS. The agent sat in the swivel chair and swung his feet onto the desk. “You better be right about this, Sixsmith, or you’re done here.”

Fabian’s heart beat like a heavy bass kick. The perfectly calibrated 67-degree air didn’t stop him from wanting to loosen his tie. When he jammed his fingers down the small gap between his neck and collar, they came out slick with sweat. All those nights chasing. The tabulations, the data models, the transcripts from Underworld detainees, the ciphers he’d decoded — they all seemed like a game. A dream. He was the grizzled sheriff finally placing the noose around the neck of the uncatchable outlaw. He knew that in sixty seconds or so, the ground team would confirm a DNA match, and it would be impossible for T1n4Red to resurface without physical liquidation. “I’m sure, sir. This was the only way. We’d never get a facial match on a Tier 1.”

The agent looked at the communicator on his desk. Nothing.

Did T1n4Red eat buttered noodles and work out in her underground living closet? Did she crave for the feel of a paperback novel, or perhaps own a non-cataloged copy? It’s not like she could step foot inside the state knowledge center. “What action will DoS—”

Ground Unit Bravo to Williams. Do you copy?

“This is Williams. Over.”

Bravo commander confirmed the DNA match. It was her. She would now be classified a subverter. The payment instructions she had etched into the self-repair polymer bench had been photographed. Any wallet receiving those coins would be investigated. The fintech arm would already be working on liquidating affiliated Overworld accounts. One wrong turn and they can shut down your life’s wealth.

But T1n4Red was smarter. DoS would always be one step behind the cypherpunks because they were bound by government protocol, unable to infiltrate the Level 3 realm of encrypted private comms. Fabian had to take risks. What use was all his dedication if it just led to being remaining on the outside of a panopticon looking in?

“You can leave.” Williams motioned to the office door. “Your shift was over sixteen minutes ago.”

The State Knowledge Center smelled of the past. That’s what Fabian liked about it. He turned the page, savoring the quality feel of thick paper, imagining that when this book ran through enough hands, the inked fibers would run from black to gray to cream-white and the story would be gone. These were some of the only off Ledger items left in the country.

Wild Country Outlaws was Fabian’s sanctuary from the pressures of his job. All fiction was based on the kind of truth that needed to survive. Back to the times when eyes touched words without being digitally tracked, when citizens could own things. He read a paragraph and closed his eyes to imagine how life was back then. The cavernous knowledge center, with its hard seats and CCTV lenses transformed into lush plains and steep hills. Fabian felt the warm breeze on his face and the muscles of the horse beneath him. The two rifles slung on his back would shoot those boys dead. No one would take his property. His wife, children, his lame brother, hell, the whole damned village of Lewistown depended on his cattle to provide.

Of course, land could only be leased now. Livestock too. Those rustlers would have a hard time taking anything without public subscription fees and pre-taxed profits coming out. And if they wanted, the Department of Property could rescind custody of any item and confiscate it. Fabian’s smart-band vibrated, indicating he had just ten minutes of reading time left. The thing buzzed too hard. It pinched, but like all sanctioned hardware, it was government hard-coded.

He hadn’t been able to focus this time. Not really. Was T1n4Red an outlaw or a rancher? Either way, she was fighting the system that had stripped Americans of their right to call their house a home. According to the Department of Education, pre-ledger days were violent wealth-disparity wars, but the novels Fabian read painted a different picture — a fantasy freedom where ordinary citizens could build wealth.

Fabian rose to go. He handed the book to the desk girl and watched her scan it into the system. His smart-band buzzed again with a compliance point. To think his friends chased these stupid tokens for avatar upgrades and paid-time-off options. But, without them, he might end up with his ID frozen like his high school buddy, Scott, cut off from all legal avenues to earn a living and watched like a hawk by DoS. Did he have a secret stash of satoshis that kept him clear of the state debtors’ facility?

The lady at the desk smiled. Her brown bob remained undisturbed by the air cooling system. “We hope you enjoyed your trip into our analog archives, Fabian.”

“Sure. See you next time, Miranda.” He breezed out. They had history, but it wasn’t something he was interested in repeating. Imagine the conversations about cataloging systems and the internal squabbles of the Knowledge Center board. Fabian was already in a committed relationship with the powers of his imagination. Explicit videos were far too risky for a DoS worker to use, but the image of T1n4Red’s full lips and blond hair invaded his dreams. They could run a ranch together, or maybe they’d be cattle rustlers on the run. He wasn’t sure why, but every night, Fabian masturbated to the one rendered CGI model of T1n4Red they had on file. On the outside, his life was the ultimate mundanity, but the thrill of T1n4Red, the taste of the air on the great ranches outside the city, the sheer danger of even thinking all this, was the only way he could sleep.

They watched the pollination drone flit between the hibiscus flowers in the thick air of the botanical biodome. Fabian had been lucky to receive two of the limited daily visitor passes. It was even luckier for Scott, who now had the chance to get out of his mom’s dingy basement for a few hours.

“You know why they made them bigger than bees, right?” Scott spoke out of the side of his mouth. When Fabian shrugged, he leant in to inspect the device hovering around eye level. He blew a kiss and waved at its pollen-collector end.

“You don’t know that.”

Scott turned and swept his lank hair off his forehead. “You're the one who checks the footage, snoop.”

Micro cameras were yet another panopticon in the armory of the State. You had to assume, even when lying in bed with a lover, even when going to the toilet, that it was possible you were recorded, watched, and analyzed even years later. Secrecy was a virus DoS sought to eradicate.

The biosphere wristband on Fabian’s right arm sounded. Closing time was fast approaching. Fabian put a hand on Scott’s shoulder. “You know, there was a time when access to nature wasn’t so strictly controlled.” He stopped himself from saying more.

They joined the crowds heading to the exit down the palm pathway. “You heard about the latest blacklist?” asked Scott. “The mixnets are awash with it.”

Fabian’s neck muscles tightened. “You shouldn’t be telling me you’re on those forums.” Until he became an agent, even Fabian was prohibited from accessing the decentralized ‘Level 2’ network.

Scott laughed. It was the first time Fabian had heard him laugh that day. “That’s the fun of this little game, homie. Encoding and decrypting ciphers is living. It’s all I got apart from running from debt.” He lowered his voice. “My identity is already in prison, but I ain’t going too.”

Glancing left then right, Fabian made a decision. It was a decision to offer information to a friend, a true friend who had no reason to stick by him when all others cut ties. Sharing a secret in the meatspace was the biggest risk Fabian had taken in years, but he had no way to do it digitally.

“I was behind it.” He expelled a sigh.

Scott turned his head. They carried on walking towards the exit in the throng of people. A few seconds passed.

Fabian scratched at the mole above his eye. “Spent months unraveling stego messages. I feel like I know her. Like really know her.” Was he saying this out of pride or trepidation? Even if they ended in constrained mediocrity, lifeplans were so beautifully simple. Tina, Williams, the ranch, avenging his father’s bankruptcy, the forums, the caution, it all seemed so jumbled. “Maybe I’m in love.” What was Fabian saying? However long T1n4Red lasted underground, she’d never be able to surface again.

Scott bumped Fabian by stepping across his path. “Not in the meatspace. Keep checking the images. There’s a lot more hiding in plain sight than you know.”

They walked in silence through the automated exit gate into the gray city air. As they departed, Scott turned back and called out, “Right pocket.”

Sure enough, Fabian felt the weight of a ‘brick’. He had held one of the untethered devices once in DoS training. Without even putting his hand into his pocket he knew that it was there and what it meant. Decentralized forum instructions would be written on an attached note. The code would be something only he and Scott knew. T14nRed and the entire underworld were now at his fingertips.

23:43 - untethered alert.

Invitation to join Level 2 CP mixnet.

Confirmation Key: M0ntann4Sc0ttySn00ps2031

Fabian lay back in his single bed. He followed the personalized invite link Scott had generated. It must have been strange, he thought, when space was not at a premium, when people went for a walk to escape, rather than lie on their bunk and plug themselves into a metaverse or L2 world. The Ledger made everything easy, an all-in-one software system for citizens so dialed in to their lifeplans, they didn’t have a second to spare. That’s how it had seized control of the nation.

The forum loaded and he found his welcome message from Scott.

Relay from T1n4Red:

It is never too late to use the powers of surveillance for good, Operative Sixsmith. Underworld 4gives but the ledger does not 4get.

In the darkness of his cabin, his face bathed in blue light, Fabian sat bolt upright. His head broke the plane of the holoscreen and a tinge of current trickled through his temple. She knew who he was; she knew what he had done. A charge pulsed through him, the thrill of true privacy. How had he been duped into thinking a total lack of encryption guaranteed freedom and not a glass cage?

The holoscreen flickered for a second. A multimedia message.

Level 2s were a gray area, not illegal. Messages could be relayed peer to peer along a mixnet to the end user. With personalized links hidden in messages on the public comms ledger, communities could be discerning about who joined.

When Fabian leaned back into a lying position, he was greeted by a 3D render of the woman he’d been chasing for over a year. His eyes drank in the red-lipped smile and blonde hair of the woman he’d forced underground, never to feel the rays of the Montana sun again. She held a piece of paper up to the camera, but Fabian couldn’t tear his eyes from her piercing gaze. 64k cameras could pick up the tiniest imperfection. She looked even more real than if he saw her in the flesh. The piece of paper she held was another invite code — this time to an L3 channel.

Fabian exhaled. Breathe. He ran his finger over the chain of three tiny moles above his right eyebrow as if checking they were still there. There were agents who’d been on the force for decades without penetrating Level 3. All messages were stored on the Ledger — that couldn’t be avoided. But with all the red herrings and strong encryption, it was impossible for even the most powerful computers at DoS to uncover much about the members of Underworld’s inner circle. Fabian’s hand reached for his untethered brick. He entered the address from the 3D render of Tina’s paper, followed by the 24-character code from the paper on the outside of the brick. He was in. His next shift at DoS started in ten hours, but he knew he wouldn’t sleep much before then. Tina, and the Underworld answers he’d been seeking awaited on the L3 forum. Fabian made his way to the bathroom and rooted out an old lighter from the medicine cabinet. Staring back from the mirror was his reflection; perhaps it was an avatar of him bound for the Underworld while he remained in the meatspace with his tiny closet apartment and faltering lifeplan. They both watched the password on the paper note burn.

The hubbub of DoS Sector 4A quietened as Fabian walked down the corridor. The hum of hundreds of microcameras was imperceptible to human ears. The one place without them was the toilets — a DoS employee committee had made sure of that — and that is where Fabian’s untethered communicator brick lay. Even if it was found on a bug sweep, they couldn’t trace it to him. And he had ten minutes every two hours to get to the bathroom and check in.

At first she’d been cautious, wanting to know if Fabian would follow her precise instruction. Then, information from Tina had came fast and furious. Names, transactions, locations, protocol, so much information. The tips she’d provided checked out. In fact, they were all just about low-level enough that it was believable that Fabian’s data-driven detective work had unearthed them. She’d even provided a methodology to show which macros and filters he could use to locate L2 peddlers and fixers.

He removed the floor tile behind the toilet bowl. This never got less gross. After relieving himself and pulling the flush chain, he attached the remote charge pack and switched it on. No battery, no trace signal.

11:03 - Message waiting: 6Smith, something important is about to happen. Act surprised. After confirmation, we must meet in person. It will not be easy to get you here. Instructions will follow.

Fabian heard the toilet door open. Could DoS be employing physical spies without the use of cameras in the bathrooms?

The sound of a belt buckle. Charcoal-gray trousers descended and appeared on top of brown loafers through the little gap under the cubicle wall. The heavy-set man dumped himself onto the john and exhaled.

After he deleted the message, Fabian switched off the phone and wiped the power back into his remote charger. He scrubbed his prints off the brick and replaced it behind the bowl. Another flush and he was gone. Out the door before charcoal trousers could physically tie him to the brick. If he was snooping, they would know. He’d get questions about using an unsanctioned jailbroken device. Maybe he could claim he was trying to arrange a physical meeting with T1n4Red. Still, the interrogation would be brutal.

Back on the floor, Agent Williams activated a meeting alert on Fabian’s desk. The red light informed him he must report to the cube immediately. It took great restraint for Fabian to avoid any nervous ticks. Especially with the scrutiny of operatives at his level, he couldn’t avoid a single nervous exploration of the moles on his temple or wiping of hands on trousers. The electronic band every citizen had clamped around their right wrist fed streams of bio-data to the DoS servers. Who would be alerted if his heartbeat spiked or breathing patterns changed? As he’d learned on the L2 forums, flying under the radar took a lot more than digital restraint. The surveillance apparatus of the state kept so much biometric data it had become a living cyborg. Could this be about the bathroom break? The guy in the next stall with the charcoal trousers? The brick? Was this the start of a downfall that ended in the same invisible blacklist Scott was on? Maybe that chick in the library had something against him too.

The glass door slid open and Fabian moved through the entry point in one clean step.

“No need to sit, Operative Sixsmith. Let’s stay on our feet here.”

Sixsmith awaited the news. Whatever it was, at least it would be quick.

Williams raised a stainless steel travel mug to his lips and drank. If the coffee was hot, he showed no signs of it. “I must admit, I’ve had my doubts about you.” An ominous start. “Up until this year, your work was adequate.” Williams paced towards the glass wall to watch the goings on of the morning-shift operators. His invisible stare could put someone’s back out. “And that stunt you pulled to get the jump on T1n4Red… some stricter agents might have filed that as a denial-of-protocol infraction.”

Fabian locked his gaze to the coffee cup and let him talk.

“But since then, your results have been quite something. An 89% strike rate on intel and twelve L2 agitators liquidated. That’s as high as I’ve seen.”

“Thank you, sir.” Fabian rearranged his cotton shirt, which, despite the blasting air con, was stuck firmly to his back.

“Good news.” Agent Williams went to his desk drawer and removed a six-inch blade. The silver tip matched the glint of William’s graying hair under the strip light. “You are no longer an operative here at the Department of Surveillance.”

Fabian imagined the angle of attack. A diagonal slashing motion from up high. He wouldn’t have time to avoid the agent’s quick reflexes.

“Congratulations, Agent Sixsmith.”

Fabian took a step back. His right hand found its way to his brow. “What?”

“You’ve been promoted, son. It can’t be that much of a surprise.”

Fabian had spent so long tracking certainties, he had forgotten what surprise felt like. He had his doubts about the system, his L3 secrets, his upcoming liaison with T1n4Red, his friendship with Scott. But things would be better as an agent. His family back in Boston would surely offer some begrudging respect. If he wasn’t six feet under, his old man might feel some kind of peace knowing his boy had won back those credits. Freedom from bio-data collection and freedom to roam. He faced his boss. “But I’m not up for review until—”

“Take the win.” Williams approached, knife in hand. “We need all the capable agents we can get.” He reached for Fabian’s right forearm. His grip was that of a much bigger man. “Effective immediately, you are Agent Sixsmith of the Department of Surveillance.” He slid the knife under Fabian’s communicator wristband and sliced through the strap.

The cool office air touched his now naked wrist. Fabian smoothed the skin as if he had been unshackled.

Once Williams returned the knife to its drawer, he offered his hand to shake. “Congratulations, Agent. Full briefing tomorrow at 0930.”

“Yes sir. Thank you for your trust.” He turned to go.

“Stop,” a sharp voice called. Williams held a small piece of metal between thumb and forefinger. “Don’t forget this.”

Agent Fabian Sixsmith accepted the gift — an American flag pin. He nodded and stepped through the doorway in the same way he entered.

](https://image.nostr.build/b3cff409a4d05409b84ddd61f9689f707b24376f196887558c2eaee1d17c8275.jpg)

Fabian zipped his thick hoodie and stepped out into the night. The reflectors in the fabric would dazzle the night vision of the cameras, and the Federal Government hadn’t passed any laws telling people how to dress… yet. He opened the door and set out to meet his handler.

He started his run towards the city outskirts, the hood shrouding his adrenaline-shot eyes. The back of his skull throbbed. It had been bothering him all afternoon. Throwing in a few boxing moves for good measure, Fabian pounded out the miles. One, two, past the city limits and onto the shoulder of the 87, the sixteen-wheeler auto rigs ripping past. The drones would be following — of that he was sure.

His handler was there. Just like Tina said. Half a mile after the first junction, under the bridge, Scott straddled his solarbike. This must be how he earned his sats — acting as a go between for Underworld agents who had gone to ground.

No words, just the exchange. Fabian unzipped the hoodie and draped it over his friend’s shoulders. Scott removed a 3D image scanner from his pocket and ran it over Fabian’s face. Two seconds and the ID confirmation would be relayed on the Ledger, probably embedded with a stego message. A quick clap of the hands, and he drove into the night. Forty, fifty, sixty, and gone, west towards Great Falls. Fabian took a breath. Is this what he had done all those reps in the closet for? He scrambled up the bank and jumped for the bridge railing. Hauling his body up and over in one swift motion. Then, crouching low behind the advertising hoarding, he duck-walked over the bridge and down the bank. How would he disable the micro cameras? Even without tracking data, the DoS apparatus wouldn’t be far behind — especially after they scrambled a drone to intercept Scott. Thirty seconds tops.

This place, just a few miles away from Lewistown, was the setting for one of those books he loved — cowboys, sheriffs, and theft. Of course, the subterfuge of Level 3 protocol and 256-bit encryption was a little more complicated now. The idea of coding messages is as old as civilization, only the attack vectors changed over time.

Left. Right. Feet smacking dirt. Fabian had to trust the track was level. He could barely see three feet in front of him — only the dim Montana moonlight for company. The whirr of a camcopter approached overhead. If it locked his thermal image, he was toast. Just a few more strides surely. His lungs burned after all those miles.

DoS wasn’t just going to let a newly-minted agent go for a mysterious wilderness night run.

His foot jammed against a root. He stumbled on, narrowly avoiding a painful fall.

“IDENTIFY ORDER.” The camcopter had locked the human gait recognition. “FAILURE TO COMPLY EVOKES FEDERAL CREDIT ELIMINATION.”

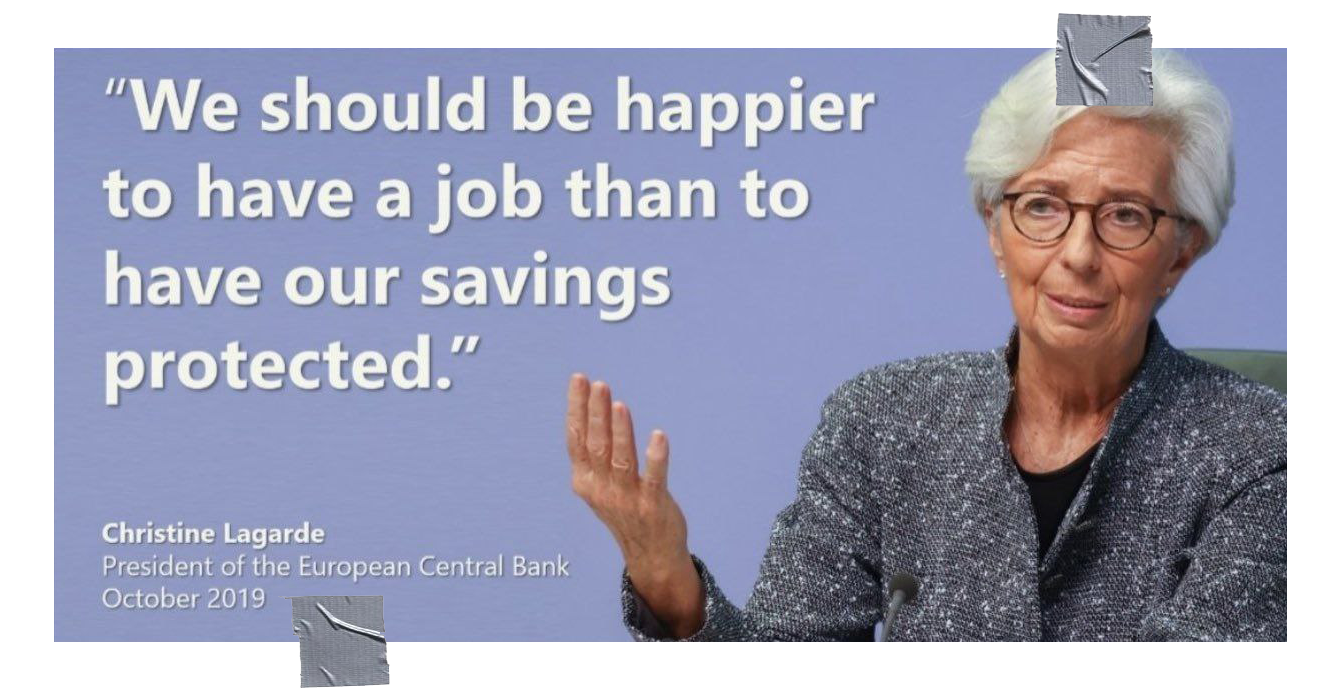

Fabian almost laughed. These fucking things threatening to zero-out people’s hard-earned savings. How the hell had Americans let things go this far? He spotted the manhole cover under the tree. His lungs sucked in the night air, and his heart tore at his ribs.

Wham. Down to the ground. The force of a truck pinned Fabian and pushed his face into the dirt. “No,” he cried. “Let me explain.” Searing pain pulsed through his skull from the back to the front. In the seconds that followed, it was as if his brain was rebooting. Who was this? What were they doing?

“Neural tracer deactivated,” said the voice of the brute on top of him.

Fabian managed to turn his head. He caught a glimpse of the man, but it was too dark to see his face. The pressure on Fabian’s back slowly released. He shook the cobwebs out of his head.

As Fabian stood, he saw the guard moving away, pointing his EMP caster at the sky, sweeping left then right.

Crash. One dronecopter downed. A crash to the right, another drone gone. These things would be disposed of in some pit or quarry. The figure collected the drones and moved into the night.

Fabian dusted himself off and walked towards his destination of the irrigation pipe system. As Agent Sixsmith hauled the steel grate to the side, he took a breath. This was it. Too late to deny involvement. Too far down the rabbit hole. He’d have to give up everything he worked for — respect at Thanksgiving and a pension large enough to retire to a ranch and ride a horse over the land. In exchange, he’d get a one-time Underworld trip, where he would learn the methods and tactics the punks used to stay off grid.

Now it was quiet, bar the low hum of the highway and the sound of his rasping breath. He’d never been this alive. It sure beat the meticulous protocol of DoS. Before he could stop himself, Fabian was inside, his hands replacing the grate, gripping the ladder, his feet on the rungs, stepping down, down into the dark. Whatever she had to tell him, he needed to hear it. Meeting T1n4Red in the meatspace trumped any handshake from Agent Williams, any pension plan, and any begrudging respect from his nagging mother and fucked-up family. He descended to the Underworld.

At the end of the dank tunnel, Fabian saw the purple glow of UV light. He approached slowly. The sound of soft footsteps approached from behind. He didn’t dare turn. Then, a few paces from the curve where the light grew stronger, a flat plastic object jammed the base of his skull forward. Click. Probably a 3D-printed gun.

“Arms out. Legs astride.”

Fabian complied. The EM scan wouldn’t find anything. He was stripped of all tech — one of the many firsts he’d experienced that day. It was safer for all parties if he didn’t turn around.

The voice barked, “Clear,” and a rough hand pushed him forward. The footsteps descended back towards the tunnel opening.

Peering into the mirror positioned at the tunnel corner, Fabian caught a glimpse of the woman he came to see. The channel between well-defined back muscles drew his eye south. How long had it been since he felt the touch of a woman? How did she stay in such good shape down here? The weak UV light faded to a soft yellow glow in the chamber.

“Agent Sixsmith. We’ve been expecting you.” Tina pulled a t-shirt over her bra and cinched her blonde hair into a top bun. She laughed. “Take a seat.”

“How do you know I’m an agent?” Fabian sat on the plastic chair closest to him. The room had been widened from its original layout. It was now around fifteen feet square with a camp bed, a desk with double monitors, and a treadmill. His eyes settled on the black desktop compu-box.

She touched his arm, her hand surprisingly warm. “I bet you’d love to open that up and take a look.”

Fabian had never seen a homemade device connected up. Getting the parts must have taken years, but nobody could detect unregistered tech through lead linings and all the perimeter protocal. She truly owned something, even if it was just a little black box.

“You didn’t think agents are unsurveilled, did you? Poor boy.”

Fabian’s mind switched to rational mode. Was he burned? Would he ever be able to surface without getting financially or physically liquidated?

“Relax. I know what you’re thinking. This is your first trip here, but it won’t be your last. We fried your tracer chip and they can’t admit they implanted ‘cause it ain’t legal.” She swiveled the computer chair and sat on it back to front. The high chair back almost came up to her chin. “You get one question. Shoot.”

In their digital conversation, Tina had always been careful to give instructions only, never responding to Fabian’s questions. He might have a lot to learn, but at least he wasn’t living in the dark like her, a trapped soldier unable to look above the parapet. Was he walking into a trap? Was he already in one? If things got tough in the interrogation he was sure to receive from Williams, he could always offer some Underworld secret. Fabian turned to face the shadow of a woman he had chased for nearly a year. “Where are the Level 3 relay servers kept?”

“Ooh amor, you’ve gotta think bigger than that.” Tina Red was more than just a celebrity crush. Her blue eyes burned with the intensity of a neutron star. Her slender legs wrapped around the chair like a boa constrictor drawing in its prey. She drew closer, and he could smell the sweat. “There are no dedicated L3 relay servers. We’ve been using a hacked DoS server for months. Keeps you searching for that mythical Underworld data center, right?”

There were so many units in the DoS server cities that it would take years to isolate the hack. Smart. “What’s the end goal to all of this?” he asked.

Instead of replying, Tina shook her head.

Play by Underworld rules, Fabian. It didn’t matter — he knew. Reversing the grip of the big-government machine was virtually impossible, but the dream was that the country returned to ‘the land of the free.’ Freedom to secrecy. Freedom to own. Freedom to transact with whomever you wanted.

Fabian watched as T1n4Red stood and crossed the six-foot gap between them. She leant over and moved a hand to the back of his hair, gripping his short black hair in her fist. The same fear pulsed through him as in the meeting he’d had with Agent Williams — the same Williams who was organizing the search and interrogate protocol for him at that very moment. Was her bodyguard waiting around the corner with the 3D-printed gun, primed to deliver its one shot straight into his brain?

“This is our endgame.” Their faces were inches apart. He saw the same freckles and imperfections in her skin as in the high-res digital render. But there was nothing like real life.

And then, a swell of the tide inside him. Euphoria. The kiss was deep. Their lips fused, one person, one dream. Fabian’s hands reached for the shape of the woman he’d dreamed about so many nights. She sat, straddling his legs and they went on. Blood rising like an ocean swell, Fabian dived into bliss. It all melted away — the dronecopters hovering above, the awkward entry to the office tomorrow, the nagging fear that his accounts would be zeroed out in mere hours. But one image remained. The moment transported Fabian to his spiritual home — the wilds of the Montana hills, the wind blowing through the grassland, the mountain range guarding the horizon. The wild country that called him.

When they finally broke the kiss, Tina stood. “Did you feel it?”

Fabian raised his gaze. “I think so. A place. The wild—”

She raised a finger to silence him. “Don’t say it. This is our secret, Agent Sixsmith.”

He thought for a second. Project Wild Country. It was strange, but he had no doubt. The phrase was branded into his mind clearer than the passphrase he had to memorize for his DoS access. How could two beings communicate telepathically?

“It’s called ‘Telepathic Key Exchange’. TKX for short.” Tina approached and whispered into his ear. “From the mentalists of the late 20th Century.” It had been there all along — a method to eliminate the gap where biological beings had to enter a passphrase physically. This was only part of the information chain without a cipher. No more worries about the micro cameras that could capture keystrokes or capture pen and ink comms.

“Our project,” she breathed.

The image swam through Fabian’s mind once more, the color of the sky as vivid as the eyes of the woman in front of him. The hills and plains in front of them. All protests start with the spark of non-compliance. And all revolution hinges on the man who knows how to play both sides. He’d have to learn more about it, understand it better, but TKX could lay the path to a fully anonymous market, unbreakable smart contracts, and a citizens’ private arbitration court. This would be the rewilding of America.

“We only have a few more minutes.” Tina returned to her chair. She explained the comms protocol and that the two of them were the only people on Earth to know the name of this mission. Project Wild Country would bring TKX to the masses.

“How can we teach people?”

“We lead people through the levels, just like I got you here. There are more stego images on the Ledger every day. It’s already started.”

Fabian looked at the wrist his bio-band had once gripped. “What do I say to DoS to explain this time-gap?” How long had he even been down there, fifteen minutes?

“You wouldn’t be much of an agent if you couldn’t think of something. Be the sovereign of yourself, Fabian.” T1n4Red laughed. “Better get running.”

Fabian moved toward the dark tunnel that led to a surface world buzzing with invisible spies. “I’ll be thinking of you,” he said. Fabian thought he detected the hint of a smile on Tina’s lips, and he felt a tiny swell of the euphoria that had filled him moments earlier. Then, he turned to go. Agent Sixsmith rounded the corner and started his journey back to the wild country.

This story first appeared in Financial Fallout. Find out more about the book at 21futures.com

21 Futures retains 21% of the zaps received to cover operating costs. The majority of the sats are forwarded to the author.

Max Hillebrand is a praxeologist who contributes to several open-source projects, because code is abundant and not scarce. He shares his work freely for others to use and modify. His goal is to help build a parallel economy based on sound money and individual sovereignty, where people can pursue their entrepreneurial ambitions without interference from central authorities. Find out more at towardsliberty.com

-

@ e4950c93:1b99eccd

2025-05-02 09:41:12

@ e4950c93:1b99eccd

2025-05-02 09:41:12Tu connais une marque proposant des alternatives naturelles ? Partage-la ici en commentant cette page !

Pour être référencée, la marque doit proposer une partie au moins de ses produits en matières naturelles. 👉 En savoir plus sur les matières

Chaque information ajoutée (nom, lien, catégorie, etc.) et validée est considérée comme une contribution. 👉 En savoir plus sur les contributions

Chaque contribution validée est comptabilisée et donne lieu à une rétribution. Pense à bien sauvegarder tes clés (identifiants) dans un coffre comme nsec.app). Tu peux aussi partager plus simplement tes trouvailles sans créer de compte via le formulaire de contact (non éligible pour les rétributions). 👉 En savoir plus sur les rétributions

Copie-colle le modèle ci-dessous et remplis les informations que tu as. D’autres contribut-eur-rice-s ou l'équipe coeur pourront compléter les éléments manquants.

Nouvelle marque ou fabricant

- Nom de la marque :

- Image représentant des produits de la marque (lien, idéalement depuis le site de la marque) :

- Courte description :

- Catégories de produits proposées :

- Matières utilisées pour ses produits :

- Site internet de la marque :

- Autres informations (lieu de production, labels…) :

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ a5142938:0ef19da3

2025-05-02 09:39:05

@ a5142938:0ef19da3

2025-05-02 09:39:05Do you know a brand offering natural alternatives? Share it here by commenting on this page!

To be listed, the brand must offer at least some of its products made from natural materials. 👉 Learn more about materials

Each piece of information added (name, link, category, etc.) and validated is considered a contribution. 👉 Learn more about contributions

Every validated contribution is counted and eligible for rewards. Make sure to securely save your keys (credentials) in a vault like nsec.app). You can also share more easily your finds without creating an account via the contact form (not eligible for rewards). 👉 Learn more about rewards

Copy and paste the template below and fill in the information you have. Other contributors or the core team can complete any missing details.

New brand or manufacturer

- Brand name:

- Image representing the brand’s products (link, ideally from the brand’s website):

- Short description:

- Categories of products offered:

- Materials used in its products:

- Brand’s website:

- Other information (place of production, certifications, etc.):

This article is published on origin-nature.com 🌐 Voir cet article en français

-

@ ca495706:2476e4d0

2025-05-02 09:38:12

@ ca495706:2476e4d0

2025-05-02 09:38:12VIPWIN là một nền tảng trực tuyến phát triển mạnh mẽ trong thời gian gần đây, mang đến cho người dùng những trải nghiệm mượt mà và an toàn. Được thiết kế với giao diện thân thiện và dễ sử dụng, VIPWIN không chỉ chú trọng đến việc tối ưu hóa trải nghiệm người dùng mà còn bảo vệ quyền lợi của họ một cách tối đa. Tính năng của nền tảng này luôn được cập nhật và cải tiến để phục vụ nhu cầu ngày càng cao của người dùng. VIPWIN cung cấp một không gian trực tuyến hiện đại, dễ tiếp cận, cho phép người dùng truy cập các dịch vụ chỉ trong vài bước đơn giản. Dù bạn là người mới sử dụng hay là người đã có kinh nghiệm, việc làm quen với hệ thống của VIPWIN sẽ rất dễ dàng nhờ vào giao diện trực quan và các tính năng hỗ trợ rõ ràng. Một trong những yếu tố quan trọng tạo nên sự khác biệt của VIPWIN chính là tốc độ truy cập ổn định và nhanh chóng. Người dùng sẽ không gặp phải tình trạng gián đoạn hay độ trễ trong suốt quá trình sử dụng dịch vụ.

Bảo mật là một trong những yếu tố quan trọng mà VIPWIN đặc biệt chú trọng. Với sự phát triển không ngừng của công nghệ, việc bảo vệ thông tin cá nhân của người dùng là vô cùng cần thiết. VIPWIN sử dụng các công nghệ mã hóa tiên tiến để đảm bảo rằng dữ liệu của người sử dụng luôn được bảo vệ an toàn tuyệt đối. Các thông tin giao dịch và dữ liệu cá nhân đều được mã hóa, giúp người dùng yên tâm khi sử dụng nền tảng mà không phải lo lắng về việc bị lộ lọt thông tin. Ngoài ra, đội ngũ bảo mật của VIPWIN luôn theo dõi và kiểm tra hệ thống thường xuyên để phát hiện và xử lý kịp thời các mối đe dọa tiềm ẩn. Điều này giúp người dùng hoàn toàn tin tưởng vào sự an toàn của nền tảng. Không chỉ vậy, VIPWIN còn cung cấp dịch vụ hỗ trợ khách hàng chuyên nghiệp, hoạt động liên tục 24/7, sẵn sàng giải đáp mọi thắc mắc và hỗ trợ người dùng khi gặp phải vấn đề. Đội ngũ hỗ trợ của VIPWIN luôn tận tâm và chu đáo, đảm bảo người dùng luôn được hỗ trợ nhanh chóng và hiệu quả.

Với cam kết phát triển không ngừng và cải tiến liên tục, VIPWIN không chỉ đáp ứng nhu cầu của người dùng mà còn luôn tạo ra những giá trị mới cho cộng đồng. Nền tảng này luôn cập nhật và cải tiến các tính năng để mang đến cho người dùng những trải nghiệm tối ưu nhất. Các tính năng mới luôn được phát triển dựa trên nhu cầu thực tế của người sử dụng, nhằm cải thiện hiệu suất và nâng cao chất lượng dịch vụ. VIPWIN luôn chú trọng đến việc cải tiến giao diện, nâng cao tốc độ truy cập và cập nhật các công cụ hỗ trợ người dùng. Một điểm đáng chú ý nữa là nền tảng này luôn sẵn sàng lắng nghe ý kiến đóng góp từ cộng đồng người dùng, từ đó đưa ra các thay đổi và cải tiến phù hợp. Chính nhờ sự sáng tạo và cam kết không ngừng nâng cao chất lượng dịch vụ, VIPWIN đang ngày càng trở thành lựa chọn hàng đầu của người dùng trong môi trường trực tuyến. Với đội ngũ phát triển chuyên nghiệp và tầm nhìn dài hạn, VIPWIN chắc chắn sẽ tiếp tục phát triển mạnh mẽ và duy trì vị thế là một trong những nền tảng trực tuyến đáng tin cậy nhất trong tương lai.

-

@ a5142938:0ef19da3

2025-05-02 09:37:56

@ a5142938:0ef19da3

2025-05-02 09:37:56Have you found a natural product? Share it here by commenting on this page!

This site only lists durable-use products and objects. Consumables (food, cosmetics, fuels, etc.) are not included.

To be listed, the product must be made of natural materials. 👉 Learn more about materials

Each piece of information added (name, material, link, shipping area, etc.) and validated is considered a contribution. 👉 Learn more about contributions

Every validated contribution is counted and eligible for rewards. Make sure to securely save your keys (credentials) in a vault like nsec.app). You can also share more easily your finds without creating an account via the contact form (not eligible for rewards). 👉 Learn more about rewards

You can copy and paste the template below and fill in the information you have. Other contributors or the core team can complete any missing details.

New product

- Product name :

- Product image (link):

- Short description:

- Categories:

- Brand or manufacturer:

- Composition (materials used, including unknown elements):

- Links to buy (and shipping area):

- Other information (place of manufacture, certifications…):

This article is published on origin-nature.com 🌐 Voir cet article en français

-

@ e4950c93:1b99eccd

2025-05-02 09:36:09

@ e4950c93:1b99eccd

2025-05-02 09:36:09Tu as trouvé un produit naturel ? Partage-le ici en commentant cette page !

Ce site référence uniquement des produits et objets à usage durable. Les consommables (aliments, cosmétiques, combustibles, etc.) ne sont pas inclus.

Pour être référencé, le produit doit être composé de matières naturelles. 👉 En savoir plus sur les matières

Chaque information ajoutée (nom, matière, lien, zone de livraison pour un lien, etc.) et validée est considérée comme une contribution. 👉 En savoir plus sur les contributions

Chaque contribution validée est comptabilisée et donne lieu à une rétribution. Pense à bien sauvegarder tes clés (identifiants) dans un coffre comme nsec.app). Tu peux aussi partager plus simplement tes trouvailles sans créer de compte via le formulaire de contact (non éligible pour les rétributions). 👉 En savoir plus sur les rétributions

Copie-colle le modèle ci-dessous et remplis les informations dont tu disposes. D’autres contribut-eur-rice-s ou l'équipe coeur pourront compléter les éléments manquants.

Nouveau produit

- Nom du produit :

- Image du produit (lien) :

- Description courte :

- Catégories :

- Marque ou fabricant :

- Composition (matériaux utilisés, y compris les éléments inconnus) :

- Liens pour l’acheter (et zone de livraison) :

- Zone de livraison pour les

- Autres infos utiles (lieu de fabrication, labels, etc.) :

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ fbb0eb9d:bdb78256

2025-05-02 09:32:40

@ fbb0eb9d:bdb78256

2025-05-02 09:32:40Wir dürfen keinen Millimeter weichen für jene, die unsere Freiheit nicht zu schätzen wissen. Vor zehn Jahren wurden die Journalisten des französischen Satiremagazins Charlie Hebdo in ihrer Redaktion erschossen, weil sie sich die Freiheit nahmen, eine Religion zu beleidigen. Das sollten wir nicht vergessen, und beim Namen nennen. Diesen Text schrieb ich schon damals, und um es vorweg zu nehmen: Ich bin immer noch Charlie.

„Und, sind Sie auch Charlie?“ fragte damals mein Banksachbearbeiter, nachdem ich auf die Frage nach meinem Beruf „Journalistin“ geantwortet hatte. Viele waren seinerzeit „Charlie“, ja, die Solidarität mit den Opfern in Paris war groß. Bei uns im Land und auch weltweit. Tausende Facebooker veränderten ihre Profilbilder, aber genauso sicher, wie das Amen in der Kirche, hatte es nur wenige Tage gedauert, bis die Differenzierer auf den Plan gerufen wurden. Am Tag der Geiselnahmen in Paris fuhr ich gerade Taxi in Berlin, während sich die französischen Sondereinheiten vor der Druckerei und dem jüdischen Supermarkt in Stellung brachten, die ebenfalls unter Beschuss von Islamisten gerieten. Der Taxifahrer war kein potenzieller „Charlie“. Ich konnte seine Nationalität trotz Akzent nicht ausmachen, möglicherweise war er sogar Franzose. Ich habe nicht gefragt. Sein Standpunkt jedenfalls: „Warum mussten die das auch veröffentlichen, das hätte man ja wissen können, das sowas passiert“.

Wenn mehr auf dem Spiel steht, als ein Profilbild

Ein Moslem? Ich weiß es nicht. Aber auch aus dem christlichen Lager kam zunehmend Kritik, nachdem so mancher recherchiert hatte, was für Karikaturen bei „Charlie Hebdo“ in der Vergangenheit erschienen sind. Auch mit uns Christen ging man in dem Satire-Magazin nicht gerade zimperlich um. Sind wir immer noch Charlie, auch dann, wenn unsere eigene Religion aufs Korn genommen oder gar beleidigt wird?

Und so bestätigte ich dem Angestellten am Bankschalter auch gerne: „Ja, ich bin Charlie, aber ich bin auch gespannt, wie viele immer noch Charlie sind, wenn es um ihren eigenen Kopf geht!“ – eine Frage die heute kaum aktueller sein könnte angesichts von katholischen Priestern, die zwischenzeitlich im Namen Allahs in Frankreich am Altar geköpft wurden und auch islamischen Attentätern, die gerne deutsche Weihnachtsmärkte für ein adventliches Töten zum Anlass nehmen. Sind wir immer noch “Charlie” wenn die Frage nach der Solidarität mit den Opfern sich nicht mit einem Wechsel des Profilbildes bei Facebook erledigen lässt? Denn ein Bild zu tauschen, tut nicht weh, ist schnell gemacht und man bewegt sich damit gerade sowieso im Strom der breiten Masse.

Gesicht zu zeigen ist ein Anfang, es bis zur letzten Konsequenz durchzuhalten, oft etwas ganz anderes. Auch Prominente zeigten damals vor zehn Jahren gerne immer wieder Gesicht. Es existierte eine ganze Kampagne dazu unter dem Namen.

Da war dann Klaus Wowereit Migrant, wenn jemand was gegen Migranten hat, Jörg Thadeusz war schwul, wenn jemand etwas gegen Schwule hat, Ulrich Wickert war Jude, wenn jemand etwas gegen Juden hat und Markus Kavka gar schwarz, wenn jemand was gegen Schwarze hat.

Das ist auch gut so, so wird Flagge gezeigt. Aber es braucht für derlei Bekenntnisse genauso wenig Mut, wie für den Profilbild-Wechsel bei Facebook.

Das ist auch gut so, so wird Flagge gezeigt. Aber es braucht für derlei Bekenntnisse genauso wenig Mut, wie für den Profilbild-Wechsel bei Facebook.Denn sind wir wirklich immer noch „schwarz“, „schwul“, „Jude“ oder „Migrant“, wenn unser Nebenmann angegriffen wird? Kurz nach der Ermordung der Satiriker von Charlie Hebdo bekam damals Ralf König auf Facebook und Co. von allen Seiten die Comiczeichner-Jacke vollgehauen, weil er nicht mehr ganz Charlie sein mag. Aus Angst hatte er eine Karikatur zurückgezogen, die sich mit dem Islam beschäftigte. Bei ihm steht ja auch nicht nur ein Profilbild, sondern – wie Paris gezeigt hat – wesentlich mehr auf dem Spiel. Eine allzu menschliche Reaktion! Und all den Heuchlern, die ihn verurteilen, würde ich gerne zurufen: Euch möchte ich mal in der gleichen Situation erleben. Nämlich dann, wenn es persönlich wird und die Angst nicht abstrakt, sondern konkret begründet werden kann.

Gerade Christen dürfen nicht zurückweichen

Das zeigt aber gleichzeitig, warum es so wichtig ist, dass wir auch weiterhin Charlie sind. Weil die Angst im Kopf uns sonst lähmt.

Wenn ein Journalist anfängt nachzudenken, ob er überhaupt oder wenn, wie er etwas schreiben soll, dann hat die Selbstzensur bereits eingesetzt.

Wenn ein Journalist Fakten weglässt, weil er vermutet, dass sie nicht gerne gehört werden, dann hat Selbstzensur schon eingesetzt.

Wenn ein Zeichner sich nicht mehr traut, manche Themen oder Religionen aufs Korn zu nehmen, dann hat Selbstzensur schon eingesetzt.

Und dann nutzt es nichts, dass gesetzlich keine Zensur existiert, weil diese Gesetze dann nicht mehr das Papier wert sind, auf dem sie stehen. Wir dürfen nicht zurückweichen. Auch und gerade nicht als Christen. Auch wenn wir selbst mit manchen Karikaturen hadern. Beleidigt sein darf man trotzdem. Denn der Grad von persönlicher Entrüstung ist bei allen unterschiedlich. Ich jedenfalls habe Tränen gelacht beim Kinoklassiker „Life of Brian“ und Monty Pythons „Catholic Song“ ist einfach ganz großes Kino. Aber auch ich war schon oft empört, weil mir manches, was unter Satire und Kunst verkauft wird, zu weit ging.

„Würden Sie auch Mohammed-Town ausstrahlen?“

Als etwa 2003 der Musiksender MTV die Comic-Serie „Popetown“ mit einem infantilen Papst und korrupten Kardinälen ausstrahlte, habe ich eine Gegenkampagne dazu organisiert. „Würden Sie auch Mohammed-Town“ ausstrahlen, fragte ich damals in einem offenen Brief die MTV-Geschäftsführerin Catherine Mühlemann. „Kein Christ wird Ihnen bei Ausstrahlung die Studiofenster zertrümmern, handelt es sich doch beim Christentum um eine Religion des Friedens. Wir verdienen aber nicht weniger Respekt als andere Religionen.“ 50.000 Menschen beteiligten sich damals an den Protesten, verschiedene Organisationen, Politiker und sogar der Zentralrat der Juden protestierte, genutzt hat es nichts. Die Serie erledigte sich letztendlich selbst mit niedrigen Einschaltquoten dank ihres unterirdischen Niveaus.

Aber selbst, wenn es ein Erfolg geworden wäre, hätten wir weiter protestiert: friedlich und ganz sicher nicht mit dem Maschinengewehr. Wir sind ein Land, in dem diese Debatten immer und immer wieder neu mit Worten und nicht mit Waffen ausgetragen werden. In unserem Land darf man kritisieren und sich auch empören. Wir dürfen unsere eigene Regierung anprangern und uns über Religionen lustig machen. Das tut weh, wenn man selbst betroffen ist, dieses Recht dürfen wir aber nicht riskieren. Für keinen persönlichen Grad an Beleidigtsein.

Diskurs statt Blasphemie-Gesetze

Wenn wir also Rücksicht nehmen auf Religionen, dann aber bitte auf alle. Wenn Religionen aber Kritik, Humor oder Satire aushalten müssen, dann bitte auch alle. Ich halte nichts von Blasphemie-Gesetzen, aber umso mehr vom freien Diskurs, der nicht nur in der Religionsfrage derzeit ins Hintertreffen gerät.

Die Frage, ob „der Islam“ zu Deutschland gehört, ist also die falsche. Die Frage ist: Will der Islam zu Deutschland oder gar zu Europa gehören? Sind alle seine Gläubigen bereit, friedlich hinzunehmen, dass im Namen von Meinungsfreiheit, Kunst oder Satire der eigene Glaube beleidigt werden darf?

Denn erst dann ist der Islam wirklich im freien Europa angekommen und diese Frage können die Muslime nur unter sich ausmachen. Es ist nicht an uns, ihnen ihre Religion zu erklären. Wir sollten aber langsam klären, wofür wir selbst stehen. Integration kann nur von jemandem erwartet werden, dem man auch erklären kann, in was er sich integrieren und wie weit das reichen soll.

Wir werden den gemeinsamen Nenner aufzeigen müssen, die „Conditio-sine-qua-non“, ohne die sich unsere Gesellschaft sonst immer weiter auseinander bewegt. Ich habe damals von Catherine Mühlemann keine Antwort auf meine Frage bekommen. Ich weiß nicht, ob sie heute Charlie ist. Ich wünsche mir keinen Raum für diese Angst, die uns lähmt, Debatten ehrlich zu führen. Für Menschen, die unsere Freiheit nicht zu schätzen wissen, weiche ich keinen Millimeter. Ich bin Birgit Kelle. Und ich bin immer noch Charlie.

-

@ 40b9c85f:5e61b451

2025-04-24 15:27:02

@ 40b9c85f:5e61b451

2025-04-24 15:27:02Introduction

Data Vending Machines (DVMs) have emerged as a crucial component of the Nostr ecosystem, offering specialized computational services to clients across the network. As defined in NIP-90, DVMs operate on an apparently simple principle: "data in, data out." They provide a marketplace for data processing where users request specific jobs (like text translation, content recommendation, or AI text generation)

While DVMs have gained significant traction, the current specification faces challenges that hinder widespread adoption and consistent implementation. This article explores some ideas on how we can apply the reflection pattern, a well established approach in RPC systems, to address these challenges and improve the DVM ecosystem's clarity, consistency, and usability.

The Current State of DVMs: Challenges and Limitations

The NIP-90 specification provides a broad framework for DVMs, but this flexibility has led to several issues:

1. Inconsistent Implementation

As noted by hzrd149 in "DVMs were a mistake" every DVM implementation tends to expect inputs in slightly different formats, even while ostensibly following the same specification. For example, a translation request DVM might expect an event ID in one particular format, while an LLM service could expect a "prompt" input that's not even specified in NIP-90.

2. Fragmented Specifications

The DVM specification reserves a range of event kinds (5000-6000), each meant for different types of computational jobs. While creating sub-specifications for each job type is being explored as a possible solution for clarity, in a decentralized and permissionless landscape like Nostr, relying solely on specification enforcement won't be effective for creating a healthy ecosystem. A more comprehensible approach is needed that works with, rather than against, the open nature of the protocol.

3. Ambiguous API Interfaces

There's no standardized way for clients to discover what parameters a specific DVM accepts, which are required versus optional, or what output format to expect. This creates uncertainty and forces developers to rely on documentation outside the protocol itself, if such documentation exists at all.

The Reflection Pattern: A Solution from RPC Systems

The reflection pattern in RPC systems offers a compelling solution to many of these challenges. At its core, reflection enables servers to provide metadata about their available services, methods, and data types at runtime, allowing clients to dynamically discover and interact with the server's API.

In established RPC frameworks like gRPC, reflection serves as a self-describing mechanism where services expose their interface definitions and requirements. In MCP reflection is used to expose the capabilities of the server, such as tools, resources, and prompts. Clients can learn about available capabilities without prior knowledge, and systems can adapt to changes without requiring rebuilds or redeployments. This standardized introspection creates a unified way to query service metadata, making tools like

grpcurlpossible without requiring precompiled stubs.How Reflection Could Transform the DVM Specification

By incorporating reflection principles into the DVM specification, we could create a more coherent and predictable ecosystem. DVMs already implement some sort of reflection through the use of 'nip90params', which allow clients to discover some parameters, constraints, and features of the DVMs, such as whether they accept encryption, nutzaps, etc. However, this approach could be expanded to provide more comprehensive self-description capabilities.

1. Defined Lifecycle Phases

Similar to the Model Context Protocol (MCP), DVMs could benefit from a clear lifecycle consisting of an initialization phase and an operation phase. During initialization, the client and DVM would negotiate capabilities and exchange metadata, with the DVM providing a JSON schema containing its input requirements. nip-89 (or other) announcements can be used to bootstrap the discovery and negotiation process by providing the input schema directly. Then, during the operation phase, the client would interact with the DVM according to the negotiated schema and parameters.

2. Schema-Based Interactions

Rather than relying on rigid specifications for each job type, DVMs could self-advertise their schemas. This would allow clients to understand which parameters are required versus optional, what type validation should occur for inputs, what output formats to expect, and what payment flows are supported. By internalizing the input schema of the DVMs they wish to consume, clients gain clarity on how to interact effectively.

3. Capability Negotiation

Capability negotiation would enable DVMs to advertise their supported features, such as encryption methods, payment options, or specialized functionalities. This would allow clients to adjust their interaction approach based on the specific capabilities of each DVM they encounter.

Implementation Approach

While building DVMCP, I realized that the RPC reflection pattern used there could be beneficial for constructing DVMs in general. Since DVMs already follow an RPC style for their operation, and reflection is a natural extension of this approach, it could significantly enhance and clarify the DVM specification.

A reflection enhanced DVM protocol could work as follows: 1. Discovery: Clients discover DVMs through existing NIP-89 application handlers, input schemas could also be advertised in nip-89 announcements, making the second step unnecessary. 2. Schema Request: Clients request the DVM's input schema for the specific job type they're interested in 3. Validation: Clients validate their request against the provided schema before submission 4. Operation: The job proceeds through the standard NIP-90 flow, but with clearer expectations on both sides

Parallels with Other Protocols

This approach has proven successful in other contexts. The Model Context Protocol (MCP) implements a similar lifecycle with capability negotiation during initialization, allowing any client to communicate with any server as long as they adhere to the base protocol. MCP and DVM protocols share fundamental similarities, both aim to expose and consume computational resources through a JSON-RPC-like interface, albeit with specific differences.

gRPC's reflection service similarly allows clients to discover service definitions at runtime, enabling generic tools to work with any gRPC service without prior knowledge. In the REST API world, OpenAPI/Swagger specifications document interfaces in a way that makes them discoverable and testable.

DVMs would benefit from adopting these patterns while maintaining the decentralized, permissionless nature of Nostr.

Conclusion

I am not attempting to rewrite the DVM specification; rather, explore some ideas that could help the ecosystem improve incrementally, reducing fragmentation and making the ecosystem more comprehensible. By allowing DVMs to self describe their interfaces, we could maintain the flexibility that makes Nostr powerful while providing the structure needed for interoperability.

For developers building DVM clients or libraries, this approach would simplify consumption by providing clear expectations about inputs and outputs. For DVM operators, it would establish a standard way to communicate their service's requirements without relying on external documentation.

I am currently developing DVMCP following these patterns. Of course, DVMs and MCP servers have different details; MCP includes capabilities such as tools, resources, and prompts on the server side, as well as 'roots' and 'sampling' on the client side, creating a bidirectional way to consume capabilities. In contrast, DVMs typically function similarly to MCP tools, where you call a DVM with an input and receive an output, with each job type representing a different categorization of the work performed.

Without further ado, I hope this article has provided some insight into the potential benefits of applying the reflection pattern to the DVM specification.

-

@ 8f69ac99:4f92f5fd

2025-05-02 09:29:41

@ 8f69ac99:4f92f5fd

2025-05-02 09:29:41À medida que Portugal se aproxima das eleições legislativas de 2025, a 18 de Maio, torna-se essencial compreender as diferentes propostas políticas e os programas eleitorais dos partidos para votar de forma informada. Este artigo funciona como um índice para uma série de análises realizadas aos programas dos principais partidos, com foco em temas como liberdades individuais, descentralização e crescimento económico.

A Evolução da Esquerda e da Direita: Um Contexto Histórico e Ideológico

Os termos “esquerda” e “direita” surgiram na Revolução Francesa (1789–1799) para distinguir quem se sentava ao lado do presidente da Assembleia: as forças favoráveis às reformas radicais (à esquerda) e as defensoras da monarquia e da ordem estabelecida (à direita). Com o século XIX e o advento do liberalismo económico, a direita passou a associar-se ao livre mercado e ao direito de propriedade, enquanto a esquerda defendeu maior intervenção estatal para promover igualdade.

No final do século XIX e início do século XX, surgiram o socialismo e o comunismo como correntes mais radicais da esquerda, propondo a abolição da propriedade privada dos meios de produção (comunismo) ou sistemas mistos com forte regulação e redistribuição (socialismo). A resposta liberal-conservadora evoluiu para o capitalismo democrático, que combina mercado livre com alguns mecanismos de assistência social.

Hoje, o espectro político vai além do simples eixo esquerda–direita, incluindo dimensões como:

- Autoritarismo vs. Liberdade: grau de controlo do Estado sobre a vida individual e as instituições;

- Intervenção Estatal vs. Livre Mercado: equilíbrio entre regulação económica e iniciativas privadas;

- Igualdade Social vs. Mérito e Responsabilidade Individual: ênfase na redistribuição de recursos ou na criação de incentivos pessoais.

Este modelo multidimensional ajuda a capturar melhor as posições dos partidos contemporâneos e as suas promessas de governação.

Visão Geral das Análises por Partido

Segue-se um resumo dos principais partidos políticos em Portugal, com destaque para a sua orientação ideológica segundo as dimensões de autoritarismo, nível de Intervenção estatal e grau de liberdade individual. Cada nome de partido estará ligado à respectiva análise detalhada.

| Partido | Orientação Ideológica | Nível de Intervenção Estatal | Grau de Liberdade Individual | |----------------------------------------|---------------------------------------------------------------------------------------|------------------------------|------------------------------| | AD – Aliança Democrática (PSD/CDS) | Centro-direita democrática (baixo autoritarismo / equilíbrio intervenção–mercado) | Médio | Médio | | PS – Partido Socialista | Centro-esquerda social-democrata (moderado autoritarismo / intervenção estatal) | Alto | Médio | | CDU – Coligação Democrática Unitária (PCP/PEV) | Esquerda comunista/eco-marxista (mais autoritário / forte intervenção) | Muito alto | Baixo | | IL – Iniciativa Liberal | Liberalismo clássico (muito baixa intervenção / alta liberdade) | Baixo | Muito alto | | Chega | Nacionalismo autoritário (controlo social elevado / mercado regulado com foco interno)| Médio | Baixo | | Livre | Esquerda progressista verde (baixa hierarquia / intervenção social) | Alto | Médio | | BE – Bloco de Esquerda | Esquerda democrática radical (moderado autoritarismo / intervenção forte) | Alto | Médio | | PAN – Pessoas-Animais-Natureza | Ambientalismo progressista (intervenção pragmática / foco em direitos e sustentabilidade) | Médio | Alto | | Ergue-te | Nacionalismo soberanista (autoritarismo elevado / intervenção seletiva com foco nacional) | Médio | Baixo | | ADN – Alternativa Democrática Nacional | Nacionalismo conservador (autoritarismo elevado / intervenção seletiva com foco nacional) | Médio | Baixo |

Análises Detalhadas dos Programas Eleitorais

Estas análises pretendem oferecer aos eleitores uma visão clara e objetiva das propostas de cada partido, facilitando decisões conscientes nas urnas. Ao focar-se nas promessas relacionadas com liberdades individuais, descentralização e crescimento económico, este conjunto de textos ajuda a compreender melhor o impacto potencial de cada escolha política.

Aliança Democrática (AD)

Partido Socialista (PS)

Coligação Democrática Unitária (CDU)

Iniciativa Liberal (IL)