-

@ 460c25e6:ef85065c

2025-02-25 15:20:39

@ 460c25e6:ef85065c

2025-02-25 15:20:39If you don't know where your posts are, you might as well just stay in the centralized Twitter. You either take control of your relay lists, or they will control you. Amethyst offers several lists of relays for our users. We are going to go one by one to help clarify what they are and which options are best for each one.

Public Home/Outbox Relays

Home relays store all YOUR content: all your posts, likes, replies, lists, etc. It's your home. Amethyst will send your posts here first. Your followers will use these relays to get new posts from you. So, if you don't have anything there, they will not receive your updates.

Home relays must allow queries from anyone, ideally without the need to authenticate. They can limit writes to paid users without affecting anyone's experience.

This list should have a maximum of 3 relays. More than that will only make your followers waste their mobile data getting your posts. Keep it simple. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of all your content in a place no one can delete. Go to relay.tools and never be censored again. - 1 really fast relay located in your country: paid options like http://nostr.wine are great

Do not include relays that block users from seeing posts in this list. If you do, no one will see your posts.

Public Inbox Relays

This relay type receives all replies, comments, likes, and zaps to your posts. If you are not getting notifications or you don't see replies from your friends, it is likely because you don't have the right setup here. If you are getting too much spam in your replies, it's probably because your inbox relays are not protecting you enough. Paid relays can filter inbox spam out.

Inbox relays must allow anyone to write into them. It's the opposite of the outbox relay. They can limit who can download the posts to their paid subscribers without affecting anyone's experience.

This list should have a maximum of 3 relays as well. Again, keep it small. More than that will just make you spend more of your data plan downloading the same notifications from all these different servers. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of your notifications, invites, cashu tokens and zaps. - 1 really fast relay located in your country: go to nostr.watch and find relays in your country

Terrible options include: - nostr.wine should not be here. - filter.nostr.wine should not be here. - inbox.nostr.wine should not be here.

DM Inbox Relays

These are the relays used to receive DMs and private content. Others will use these relays to send DMs to you. If you don't have it setup, you will miss DMs. DM Inbox relays should accept any message from anyone, but only allow you to download them.

Generally speaking, you only need 3 for reliability. One of them should be a personal relay to make sure you have a copy of all your messages. The others can be open if you want push notifications or closed if you want full privacy.

Good options are: - inbox.nostr.wine and auth.nostr1.com: anyone can send messages and only you can download. Not even our push notification server has access to them to notify you. - a personal relay to make sure no one can censor you. Advanced settings on personal relays can also store your DMs privately. Talk to your relay operator for more details. - a public relay if you want DM notifications from our servers.

Make sure to add at least one public relay if you want to see DM notifications.

Private Home Relays

Private Relays are for things no one should see, like your drafts, lists, app settings, bookmarks etc. Ideally, these relays are either local or require authentication before posting AND downloading each user\'s content. There are no dedicated relays for this category yet, so I would use a local relay like Citrine on Android and a personal relay on relay.tools.

Keep in mind that if you choose a local relay only, a client on the desktop might not be able to see the drafts from clients on mobile and vice versa.

Search relays:

This is the list of relays to use on Amethyst's search and user tagging with @. Tagging and searching will not work if there is nothing here.. This option requires NIP-50 compliance from each relay. Hit the Default button to use all available options on existence today: - nostr.wine - relay.nostr.band - relay.noswhere.com

Local Relays:

This is your local storage. Everything will load faster if it comes from this relay. You should install Citrine on Android and write ws://localhost:4869 in this option.

General Relays:

This section contains the default relays used to download content from your follows. Notice how you can activate and deactivate the Home, Messages (old-style DMs), Chat (public chats), and Global options in each.

Keep 5-6 large relays on this list and activate them for as many categories (Home, Messages (old-style DMs), Chat, and Global) as possible.

Amethyst will provide additional recommendations to this list from your follows with information on which of your follows might need the additional relay in your list. Add them if you feel like you are missing their posts or if it is just taking too long to load them.

My setup

Here's what I use: 1. Go to relay.tools and create a relay for yourself. 2. Go to nostr.wine and pay for their subscription. 3. Go to inbox.nostr.wine and pay for their subscription. 4. Go to nostr.watch and find a good relay in your country. 5. Download Citrine to your phone.

Then, on your relay lists, put:

Public Home/Outbox Relays: - nostr.wine - nos.lol or an in-country relay. -

.nostr1.com Public Inbox Relays - nos.lol or an in-country relay -

.nostr1.com DM Inbox Relays - inbox.nostr.wine -

.nostr1.com Private Home Relays - ws://localhost:4869 (Citrine) -

.nostr1.com (if you want) Search Relays - nostr.wine - relay.nostr.band - relay.noswhere.com

Local Relays - ws://localhost:4869 (Citrine)

General Relays - nos.lol - relay.damus.io - relay.primal.net - nostr.mom

And a few of the recommended relays from Amethyst.

Final Considerations

Remember, relays can see what your Nostr client is requesting and downloading at all times. They can track what you see and see what you like. They can sell that information to the highest bidder, they can delete your content or content that a sponsor asked them to delete (like a negative review for instance) and they can censor you in any way they see fit. Before using any random free relay out there, make sure you trust its operator and you know its terms of service and privacy policies.

-

@ 16f1a010:31b1074b

2025-02-19 20:57:59

@ 16f1a010:31b1074b

2025-02-19 20:57:59In the rapidly evolving world of Bitcoin, running a Bitcoin node has become more accessible than ever. Platforms like Umbrel, Start9, myNode, and Citadel offer user-friendly interfaces to simplify node management. However, for those serious about maintaining a robust and efficient Lightning node ⚡, relying solely on these platforms may not be the optimal choice.

Let’s delve into why embracing Bitcoin Core and mastering the command-line interface (CLI) can provide a more reliable, sovereign, and empowering experience.

Understanding Node Management Platforms

What Are Umbrel, Start9, myNode, and Citadel?

Umbrel, Start9, myNode, and Citadel are platforms designed to streamline the process of running a Bitcoin node. They offer graphical user interfaces (GUIs) that allow users to manage various applications, including Bitcoin Core and Lightning Network nodes, through a web-based dashboard 🖥️.

These platforms often utilize Docker containers 🐳 to encapsulate applications, providing a modular and isolated environment for each service.

The Appeal of Simplified Node Management

The primary allure of these platforms lies in their simplicity. With minimal command-line interaction, users can deploy a full Bitcoin and Lightning node, along with a suite of additional applications.

✅ Easy one-command installation

✅ Web-based GUI for management

✅ Automatic app updates (but with delays, as we’ll discuss)However, while this convenience is attractive, it comes at a cost.

The Hidden Complexities of Using Node Management Platforms

While the user-friendly nature of these platforms is advantageous, it can also introduce several challenges that may hinder advanced users or those seeking greater control over their nodes.

🚨 Dependency on Maintainers for Updates

One significant concern is the reliance on platform maintainers for updates. Since these platforms manage applications through Docker containers, users must wait for the maintainers to update the container images before they can access new features or security patches.

🔴 Delayed Bitcoin Core updates = potential security risks

🔴 Lightning Network updates are not immediate

🔴 Bugs and vulnerabilities may persist longerInstead of waiting on a third party, why not update Bitcoin Core & LND yourself instantly?

⚙️ Challenges in Customization and Advanced Operations

For users aiming to perform advanced operations, such as:

- Custom backups 📂

- Running specific CLI commands 🖥️

- Optimizing node settings ⚡

…the abstraction layers introduced by these platforms become obstacles.

Navigating through nested directories and issuing commands inside Docker containers makes troubleshooting a nightmare. Instead of a simple

bitcoin-clicommand, you must figure out how to execute it inside the container, adding unnecessary complexity.Increased Backend Complexity

To achieve frontend simplicity, these platforms make the backend more complex.

🚫 Extra layers of abstraction

🚫 Hidden logs and settings

🚫 Harder troubleshootingThe use of multiple Docker containers, custom scripts, and unique file structures can make system maintenance and debugging a pain.

This complication defeats the purpose of “making running a node easy.”

✅ Advantages of Using Bitcoin Core and Command-Line Interface (CLI)

By installing Bitcoin Core directly and using the command-line interface (CLI), you gain several key advantages that make managing a Bitcoin and Lightning node more efficient and empowering.

Direct Control and Immediate Updates

One of the biggest downsides of package manager-based platforms is the reliance on third-party maintainers to release updates. Since Bitcoin Core, Lightning implementations (such as LND, Core Lightning, or Eclair), and other related software evolve rapidly, waiting for platform-specific updates can leave you running outdated or vulnerable versions.

By installing Bitcoin Core directly, you remove this dependency. You can update immediately when new versions are released, ensuring your node benefits from the latest features, security patches, and bug fixes. The same applies to Lightning software—being able to install and update it yourself gives you full autonomy over your node’s performance and security.

🛠 Simplified System Architecture

Platforms like Umbrel and myNode introduce extra complexity by running Bitcoin Core and Lightning inside Docker containers. This means:

- The actual files and configurations are stored inside Docker’s filesystem, making it harder to locate and manage them manually.

- If something breaks, troubleshooting is more difficult due to the added layer of abstraction.

- Running commands requires jumping through Docker shell sessions, adding unnecessary friction to what should be a straightforward process.

Instead, a direct installation of Bitcoin Core, Lightning, and Electrum Server (if needed) results in a cleaner, more understandable system. The software runs natively on your machine, without containerized layers making things more convoluted.

Additionally, setting up your own systemd service files for Bitcoin and Lightning is not as complicated as it seems. Once configured, these services will run automatically on boot, offering the same level of convenience as platforms like Umbrel but without the unnecessary complexity.

Better Lightning Node Management

If you’re running a Lightning Network node, using CLI-based tools provides far more flexibility than relying on a GUI like the ones bundled with node management platforms.

🟢 Custom Backup Strategies – Running Lightning through a GUI-based node manager often means backups are handled in a way that is opaque to the user. With CLI tools, you can easily script automatic backups of your channels, wallets, and configurations.

🟢 Advanced Configuration – Platforms like Umbrel force certain configurations by default, limiting how you can customize your Lightning node. With a direct install, you have full control over: * Channel fees 💰 * Routing policies 📡 * Liquidity management 🔄

🟢 Direct Access to LND, Core Lightning, or Eclair – Instead of issuing commands through a GUI (which is often limited in functionality), you can use: *

lncli(for LND) *lightning-cli(for Core Lightning) …to interact with your node at a deeper level.Enhanced Learning and Engagement

A crucial aspect of running a Bitcoin and Lightning node is understanding how it works.

Using an abstraction layer like Umbrel may get a node running in a few clicks, but it does little to teach users how Bitcoin actually functions.

By setting up Bitcoin Core, Lightning, and related software manually, you will:

✅ Gain practical knowledge of Bitcoin nodes, networking, and system performance.

✅ Learn how to configure and manage RPC commands.

✅ Become less reliant on third-party developers and more confident in troubleshooting.🎯 Running a Bitcoin node is about sovereignty – learn how to control it yourself.

Become more sovereign TODAY

Many guides make this process straightforward K3tan has a fantastic guide on running Bitcoin Core, Electrs, LND and more.

- Ministry of Nodes Guide 2024

- You can find him on nostr

nostr:npub1txwy7guqkrq6ngvtwft7zp70nekcknudagrvrryy2wxnz8ljk2xqz0yt4xEven with the best of guides, if you are running this software,

📖 READ THE DOCUMENTATIONThis is all just software at the end of the day. Most of it is very well documented. Take a moment to actually read through the documentation for yourself when installing. The documentation has step by step guides on setting up the software. Here is a helpful list: * Bitcoin.org Bitcoin Core Linux install instructions * Bitcoin Core Code Repository * Electrs Installation * LND Documentation * LND Code Repository * CLN Documentation * CLN Code Repository

If you have any more resources or links I should add, please comment them . I want to add as much to this article as I can.

-

@ ed5774ac:45611c5c

2025-02-15 05:38:56

@ ed5774ac:45611c5c

2025-02-15 05:38:56Bitcoin as Collateral for U.S. Debt: A Deep Dive into the Financial Mechanics

The U.S. government’s proposal to declare Bitcoin as a 'strategic reserve' is a calculated move to address its unsustainable debt obligations, but it threatens to undermine Bitcoin’s original purpose as a tool for financial freedom. To fully grasp the implications of this plan, we must first understand the financial mechanics of debt creation, the role of collateral in sustaining debt, and the historical context of the petro-dollar system. Additionally, we must examine how the U.S. and its allies have historically sought new collateral to back their debt, including recent attempts to weaken Russia through the Ukraine conflict.

The Vietnam War and the Collapse of the Gold Standard

The roots of the U.S. debt crisis can be traced back to the Vietnam War. The war created an unsustainable budget deficit, forcing the U.S. to borrow heavily to finance its military operations. By the late 1960s, the U.S. was spending billions of dollars annually on the war, leading to a significant increase in public debt. Foreign creditors, particularly France, began to lose confidence in the U.S. dollar’s ability to maintain its value. In a dramatic move, French President Charles de Gaulle sent warships to New York to demand the conversion of France’s dollar reserves into gold, as per the Bretton Woods Agreement.

This demand exposed the fragility of the U.S. gold reserves. By 1971, President Richard Nixon was forced to suspend the dollar’s convertibility to gold, effectively ending the Bretton Woods system. This move, often referred to as the "Nixon Shock," declared the U.S. bankrupt and transformed the dollar into a fiat currency backed by nothing but trust in the U.S. government. The collapse of the gold standard marked the beginning of the U.S.’s reliance on artificial systems to sustain its debt. With the gold standard gone, the U.S. needed a new way to back its currency and debt—a need that would lead to the creation of the petro-dollar system.

The Petro-Dollar System: A New Collateral for Debt

In the wake of the gold standard’s collapse, the U.S. faced a critical challenge: how to maintain global confidence in the dollar and sustain its ability to issue debt. The suspension of gold convertibility in 1971 left the dollar as a fiat currency—backed by nothing but trust in the U.S. government. To prevent a collapse of the dollar’s dominance and ensure its continued role as the world’s reserve currency, the U.S. needed a new system to artificially create demand for dollars and provide a form of indirect backing for its debt.

The solution came in the form of the petro-dollar system. In the 1970s, the U.S. struck a deal with Saudi Arabia and other OPEC nations to price oil exclusively in U.S. dollars. In exchange, the U.S. offered military protection and economic support. This arrangement created an artificial demand for dollars, as countries needed to hold USD reserves to purchase oil. Additionally, oil-exporting nations reinvested their dollar revenues in U.S. Treasuries, effectively recycling petro-dollars back into the U.S. economy. This recycling of petrodollars provided the U.S. with a steady inflow of capital, allowing it to finance its deficits and maintain low interest rates.

To further bolster the system, the U.S., under the guidance of Henry Kissinger, encouraged OPEC to dramatically increase oil prices in the 1970s. The 1973 oil embargo and subsequent price hikes, masterminded by Kissinger, quadrupled the cost of oil, creating a windfall for oil-exporting nations. These nations, whose wealth surged significantly due to the rising oil prices, reinvested even more heavily in U.S. Treasuries and other dollar-denominated assets. This influx of petrodollars increased demand for U.S. debt, enabling the U.S. to issue more debt at lower interest rates. Additionally, the appreciation in the value of oil—a critical global commodity—provided the U.S. banking sector with the necessary collateral to expand credit generation. Just as a house serves as collateral for a mortgage, enabling banks to create new debt, the rising value of oil boosted the asset values of Western corporations that owned oil reserves or invested in oil infrastructure projects. This increase in asset values allowed these corporations to secure larger loans, providing banks with the collateral needed to expand credit creation and inject more dollars into the economy. However, these price hikes also caused global economic turmoil, disproportionately affecting developing nations. As the cost of energy imports skyrocketed, these nations faced mounting debt burdens, exacerbating their economic struggles and deepening global inequality.

The Unsustainable Debt Crisis and the Search for New Collateral

Fast forward to the present day, and the U.S. finds itself in a familiar yet increasingly precarious position. The 2008 financial crisis and the 2020 pandemic have driven the U.S. government’s debt to unprecedented levels, now exceeding $34 trillion, with a debt-to-GDP ratio surpassing 120%. At the same time, the petro-dollar system—the cornerstone of the dollar’s global dominance—is under significant strain. The rise of alternative currencies and the shifting power dynamics of a multipolar world have led to a decline in the dollar’s role in global trade, particularly in oil transactions. For instance, China now pays Saudi Arabia in yuan for oil imports, while Russia sells its oil and gas in rubles and other non-dollar currencies. This growing defiance of the dollar-dominated system reflects a broader trend toward economic independence, as nations like China and Russia seek to reduce their reliance on the U.S. dollar. As more countries bypass the dollar in trade, the artificial demand for dollars created by the petro-dollar system is eroding, undermining the ability of US to sustain its debt and maintain global financial hegemony.

In search of new collateral to carry on its unsustainable debt levels amid declining demand for the U.S. dollar, the U.S., together with its Western allies—many of whom face similar sovereign debt crises—first attempted to weaken Russia and exploit its vast natural resources as collateral. The U.S. and its NATO allies used Ukraine as a proxy to destabilize Russia, aiming to fragment its economy, colonize its territory, and seize control of its natural resources, estimated to be worth around $75 trillion. By gaining access to these resources, the West could have used them as collateral for the banking sector, enabling massive credit expansion. This, in turn, would have alleviated the sovereign debt crisis threatening both the EU and the U.S. This plan was not unprecedented; it mirrored France’s long-standing exploitation of its former African colonies through the CFA franc system.

For decades, France has maintained economic control over 14 African nations through the CFA franc, a currency pegged to the euro and backed by the French Treasury. Under this system, these African countries are required to deposit 50% of their foreign exchange reserves into the French Treasury, effectively giving France control over their monetary policy and economic sovereignty. This arrangement allows France to use African resources and reserves as implicit collateral to issue debt, keeping its borrowing costs low and ensuring demand for its bonds. In return, African nations are left with limited control over their own economies, forced to prioritize French interests over their own development. This neo-colonial system has enabled France to sustain its financial dominance while perpetuating poverty and dependency in its former colonies.

Just as France’s CFA franc system relies on the economic subjugation of African nations to sustain its financial dominance, the U.S. had hoped to use Russia’s resources as a lifeline for its debt-ridden economy. However, the plan ultimately failed. Russia not only resisted the sweeping economic sanctions imposed by the West but also decisively defeated NATO’s proxy forces in Ukraine, thwarting efforts to fragment its economy and seize control of its $75 trillion in natural resources. This failure left the U.S. and its allies without a new source of collateral to back their unsustainable debt levels. With this plan in ruins, the U.S. has been forced to turn its attention to Bitcoin as a potential new collateral for its unsustainable debt.

Bitcoin as Collateral: The U.S. Government’s Plan

The U.S. government’s plan to declare Bitcoin as a strategic reserve is a modern-day equivalent of the gold standard or petro-dollar system. Here’s how it would work:

-

Declaring Bitcoin as a Strategic Reserve: By officially recognizing Bitcoin as a reserve asset, the U.S. would signal to the world that it views Bitcoin as a store of value akin to gold. This would legitimize Bitcoin in the eyes of institutional investors and central banks.

-

Driving Up Bitcoin’s Price: To make Bitcoin a viable collateral, its price must rise significantly. The U.S. would achieve this by encouraging regulatory clarity, promoting institutional adoption, and creating a state-driven FOMO (fear of missing out). This would mirror the 1970s oil price hikes that bolstered the petro-dollar system.

-

Using Bitcoin to Back Debt: Once Bitcoin’s price reaches a sufficient level, the U.S. could use its Bitcoin reserves as collateral for issuing new debt. This would restore confidence in U.S. Treasuries and allow the government to continue borrowing at low interest rates.

The U.S. government’s goal is clear: to use Bitcoin as a tool to issue more debt and reinforce the dollar’s role as the global reserve currency. By forcing Bitcoin into a store-of-value role, the U.S. would replicate the gold standard’s exploitative dynamics, centralizing control in the hands of large financial institutions and central banks. This would strip Bitcoin of its revolutionary potential and undermine its promise of decentralization. Meanwhile, the dollar—in digital forms like USDT—would remain the primary medium of exchange, further entrenching the parasitic financial system.

Tether plays a critical role in this strategy. As explored in my previous article (here: [https://ersan.substack.com/p/is-tether-a-bitcoin-company]), Tether helps sustaining the current financial system by purchasing U.S. Treasuries, effectively providing life support for the U.S. debt machine during a period of declining demand for dollar-denominated assets. Now, with its plans to issue stablecoins on the Bitcoin blockchain, Tether is positioning itself as a bridge between Bitcoin and the traditional financial system. By issuing USDT on the Lightning Network, Tether could lure the poor in developing nations—who need short-term price stability for their day to day payments and cannot afford Bitcoin’s volatility—into using USDT as their primary medium of exchange. This would not only create an artificial demand for the dollar and extend the life of the parasitic financial system that Bitcoin was designed to dismantle but would also achieve this by exploiting the very people who have been excluded and victimized by the same system—the poor and unbanked in developing nations, whose hard-earned money would be funneled into sustaining the very structures that perpetuate their oppression.

Worse, USDT on Bitcoin could function as a de facto central bank digital currency (CBDC), where all transactions can be monitored and sanctioned by governments at will. For example, Tether’s centralized control over USDT issuance and its ties to traditional financial institutions make it susceptible to government pressure. Authorities could compel Tether to implement KYC (Know Your Customer) rules, freeze accounts, or restrict transactions, effectively turning USDT into a tool of financial surveillance and control. This would trap users in a system where every transaction is subject to government oversight, effectively stripping Bitcoin of its censorship-resistant and decentralized properties—the very features that make it a tool for financial freedom.

In this way, the U.S. government’s push for Bitcoin as a store of value, combined with Tether’s role in promoting USDT as a medium of exchange, creates a two-tiered financial system: one for the wealthy, who can afford to hold Bitcoin as a hedge against inflation, and another for the poor, who are trapped in a tightly controlled, surveilled digital economy. This perpetuates the very inequalities Bitcoin was designed to dismantle, turning it into a tool of oppression rather than liberation.

Conclusion: Prolonging the Parasitic Financial System

The U.S. government’s plan to declare Bitcoin as a strategic reserve is not a step toward financial innovation or freedom—it is a desperate attempt to prolong the life of a parasitic financial system that Bitcoin was created to replace. By co-opting Bitcoin, the U.S. would gain a new tool to issue more debt, enabling it to continue its exploitative practices, including proxy wars, economic sanctions, and the enforcement of a unipolar world order.

The petro-dollar system was built on the exploitation of oil-exporting nations and the global economy. A Bitcoin-backed system would likely follow a similar pattern, with the U.S. using its dominance to manipulate Bitcoin’s price and extract value from the rest of the world. This would allow the U.S. to sustain its current financial system, in which it prints money out of thin air to purchase real-world assets and goods, enriching itself at the expense of other nations.

Bitcoin was designed to dismantle this parasitic system, offering an escape hatch for those excluded from or exploited by traditional financial systems. By declaring Bitcoin a strategic reserve, the U.S. government would destroy Bitcoin’s ultimate purpose, turning it into another instrument of control. This is not a victory for Bitcoin or bitcoiners—it is a tragedy for financial freedom and global equity.

The Bitcoin strategic reserve plan is not progress—it is a regression into the very system Bitcoin was designed to dismantle. As bitcoiners, we must resist this co-option and fight to preserve Bitcoin’s original vision: a decentralized, sovereign, and equitable financial system for all. This means actively working to ensure Bitcoin is used as a medium of exchange, not just a store of value, to fulfill its promise of financial freedom.

-

-

@ 6f7db55a:985d8b25

2025-02-14 21:23:57

@ 6f7db55a:985d8b25

2025-02-14 21:23:57This article will be basic instructions for extreme normies (I say that lovingly), or anyone looking to get started with using zap.stream and sharing to nostr.

EQUIPMENT Getting started is incredibly easy and your equipment needs are miniscule.

An old desktop or laptop running Linux, MacOs, or Windows made in the passed 15yrs should do. Im currently using and old Dell Latitude E5430 with an Intel i5-3210M with 32Gigs of ram and 250GB hard drive. Technically, you go as low as using a Raspberry Pi 4B+ running Owncast, but Ill save that so a future tutorial.

Let's get started.

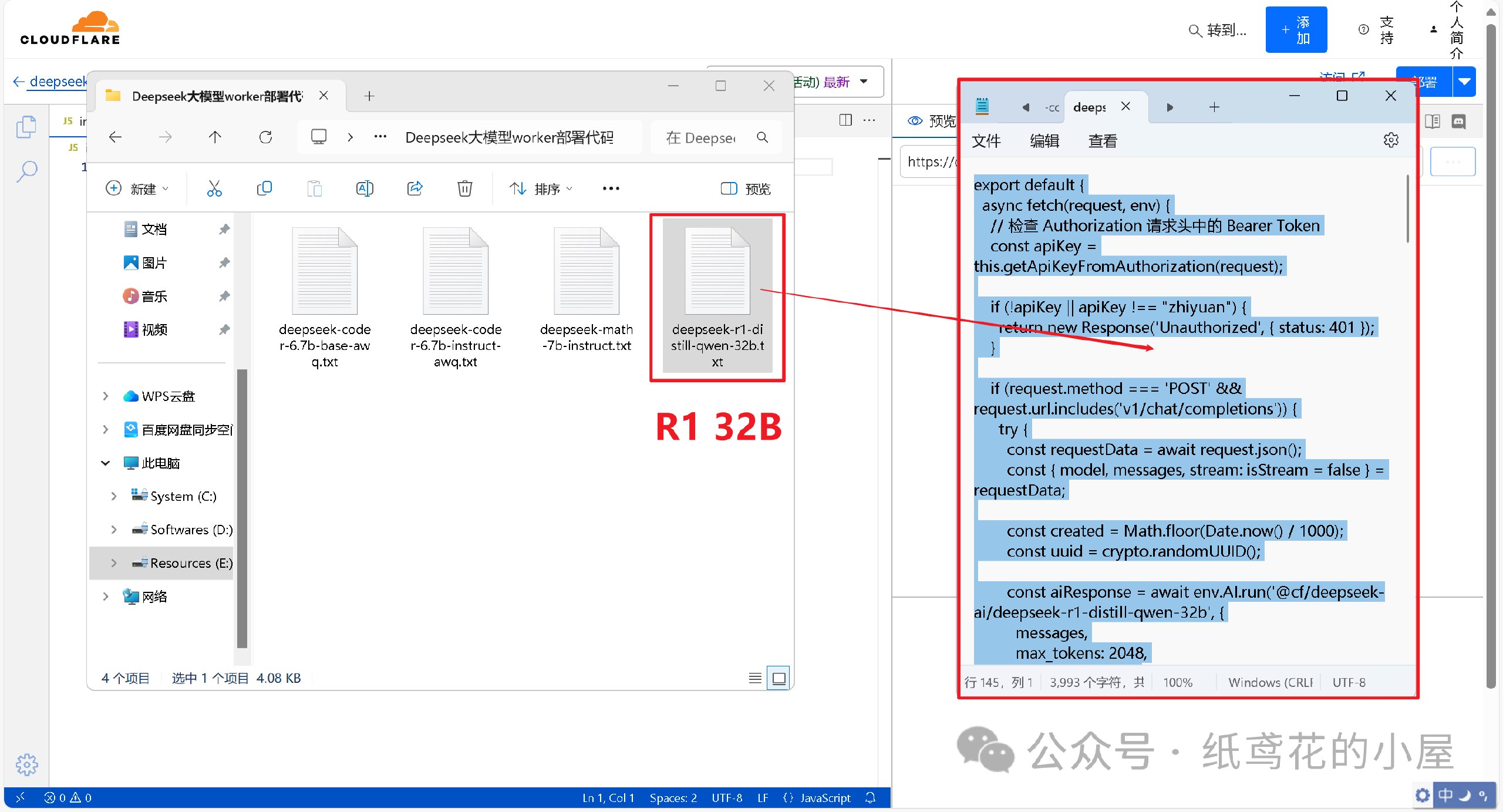

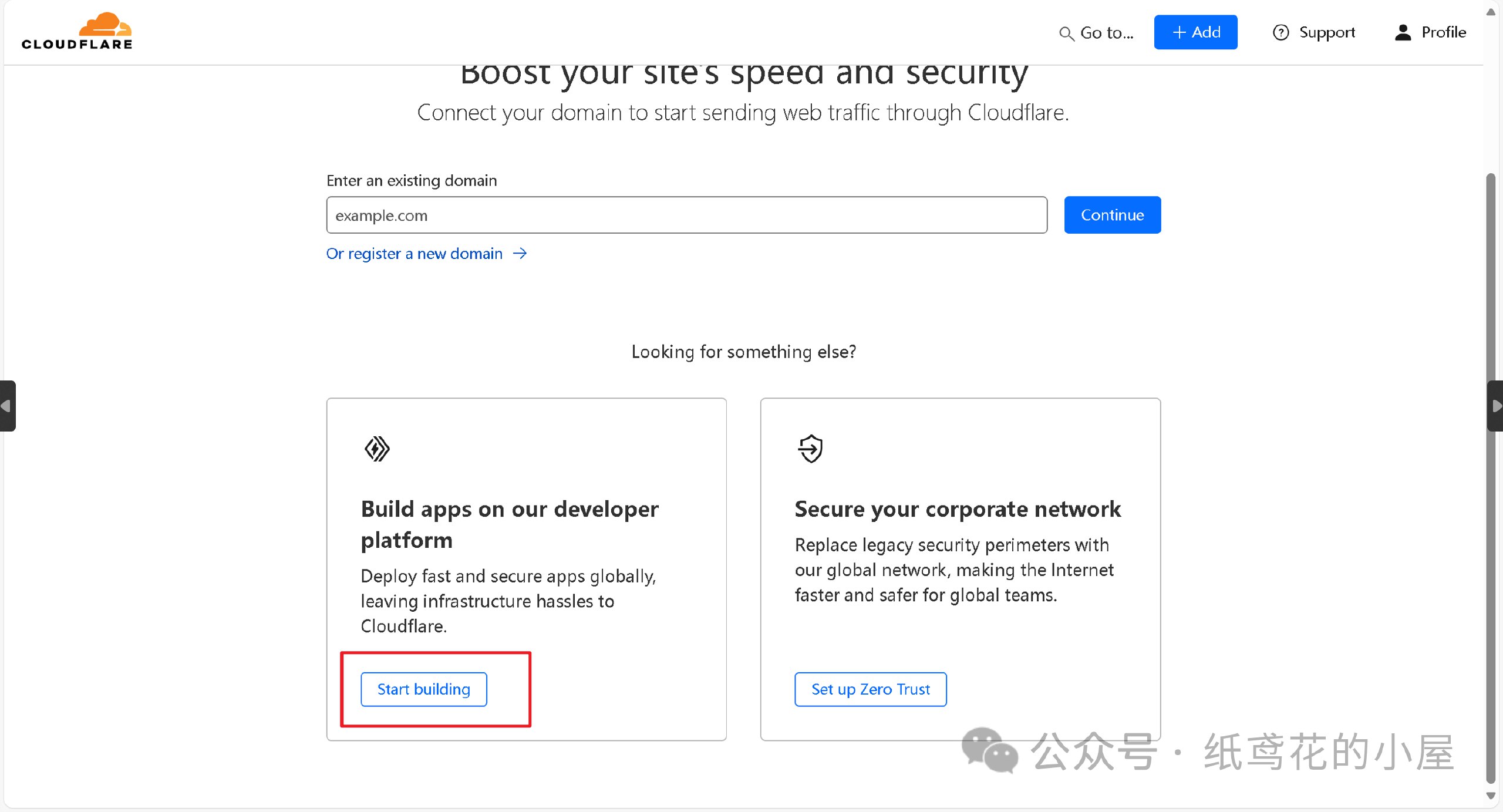

ON YOUR COMPUTER You'll need to install OBS (open broaster software). OBS is the go-to for streaming to social media. There are tons of YouTube videos on it's function. WE, however, will only be doing the basics to get us up and running.

First, go to https://obsproject.com/

Once on the OBS site, choose the correct download for you system. Linux, MacOs or Windows. Download (remember where you downloaded the file to). Go there and install your download. You may have to enter your password to install on your particular operating system. This is normal.

Once you've installed OBS, open the application. It should look something like this...

For our purposes, we will be in studio mode. Locate the 'Studio Mode' button on the right lower-hand side of the screen, and click it.

You'll see the screen split like in the image above. The left-side is from your desktop, and the right-side is what your broadcast will look like.

Next, we go to settings. The 'Settings' button is located right below the 'Studio Mode" button.

Now we're in settings and you should see something like this...

Now locate stream in the right-hand menu. It should be the second in the list. Click it.

Once in the stream section, go to 'Service' and in the right-hand drop-down, find and select 'Custom...' from the drop-down menu.

Remeber where this is because we'll need to come back to it, shortly.

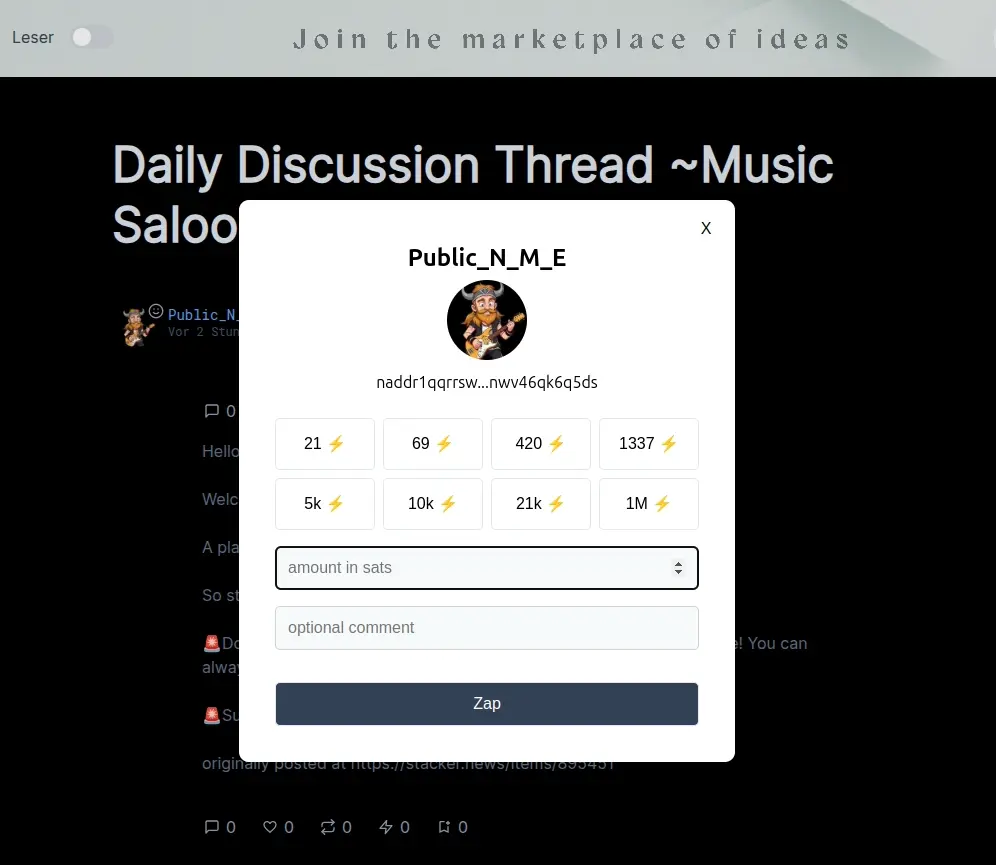

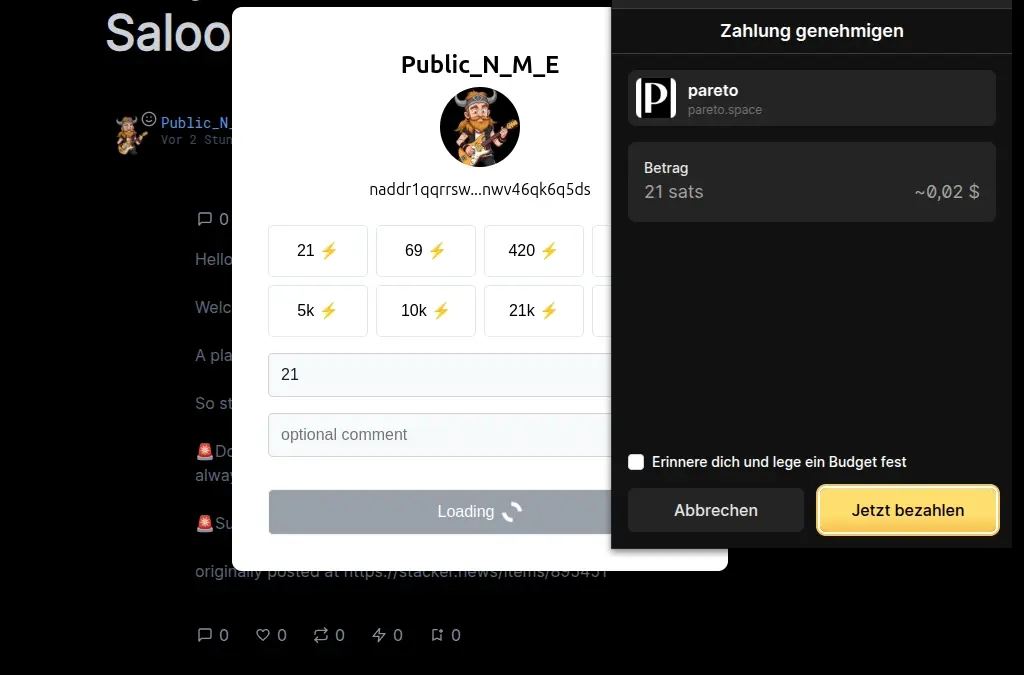

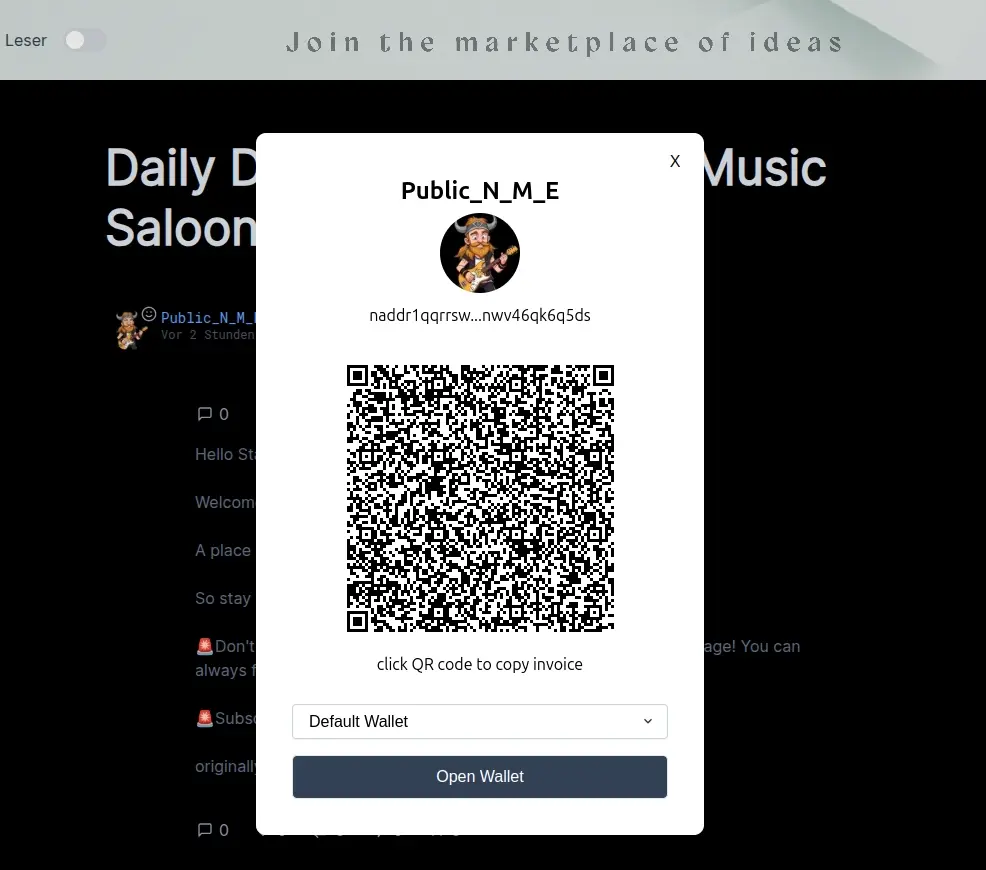

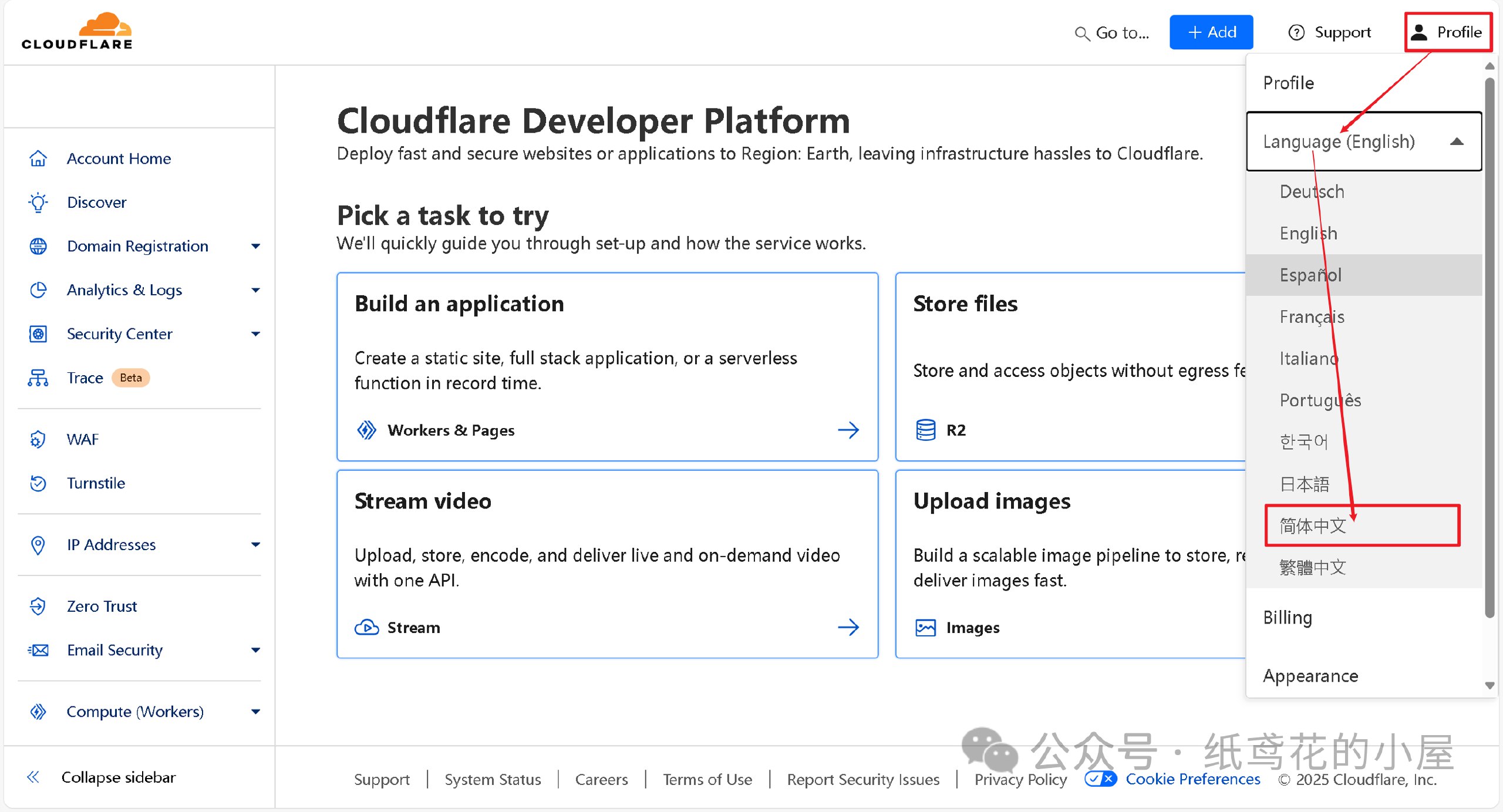

ZAPSTREAM We need our streamkey credentials from Zapstream. Go to https://zap.stream. Then, go to your dashboard.

Located on the lower right-hand side is the Server URL and Stream Key. You'll need to copy/paste this in OBS.

You may have to generate new keys, if they aren't already there. This is normal. If you're interested in multi-streaming (That's where you broadcast to multiple social media platforms all at once), youll need the server URL and streamkeys from each. You'll place them in their respective forms in Zapstream's 'Stream Forwarding" section.

Use the custom form, if the platform you want to stream to isn't listed.

*Side-Note: remember that you can use your nostr identity across multiple nostr client applications. So when your login for Amethyst, as an example, could be used when you login to zapstream. Also, i would suggest using Alby's browser extension. It makes it much easier to fund your stream, as well as receive zaps. *

Now, BACK TO OBS... With Stream URL and Key in hand, paste them in the 'Stream" section of OBS' settings. Service [Custom...] Server [Server URL] StreamKey [Your zapstream stream key]

After you've entered all your streaming credentials, click 'OK' at the bottom, on the right-hand side.

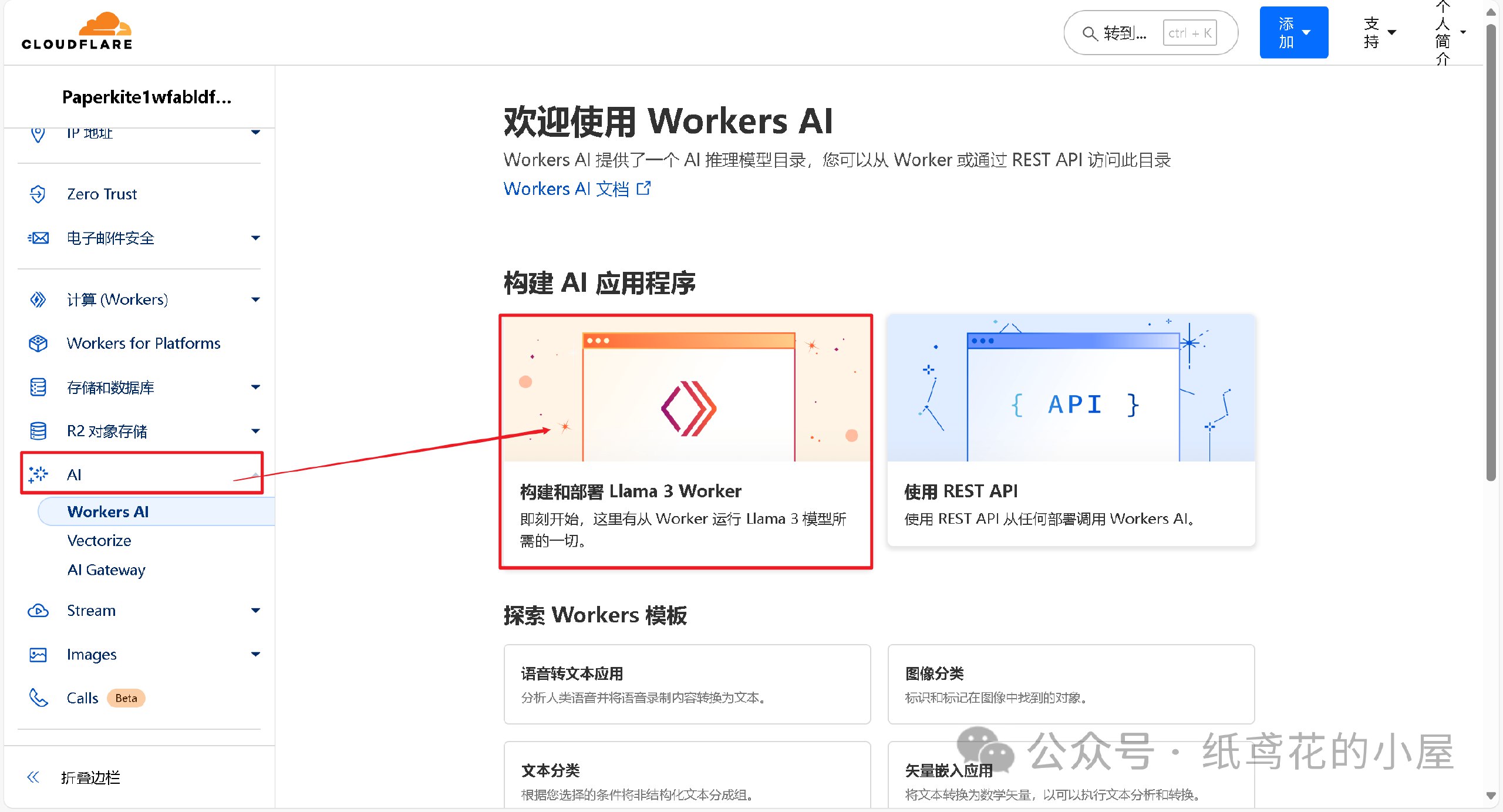

WHAT'S NEXT? Let's setup your first stream from OBS. First we need to choose a source. Your source is your input device. It can be your webcam, your mic, your monitor, or any particular window on your screen. assuming you're an absolute beginner, we're going to use the source 'Window Capture (Xcomposite)'.

Now, open your source file. We'll use a video source called 'grannyhiphop.mp4'. In your case it can be whatever you want to stream; Just be sure to select the proper source.

Double-click on 'Window Capture' in your sources list. In the pop-up window, select your file from the 'Window' drop-down menu.

You should see something like this...

Working in the left display of OBS, we will adjust the video by left-click, hold and drag the bottom corner, so that it takes up the whole display.

In order to adjust the right-side display ( the broadcast side), we need to manipulate the video source by changing it's size.

This may take some time to adjust the size. This is normal. What I've found to help is, after every adjustment, I click the 'Fade (300ms)' button. I have no idea why it helps, but it does, lol.

Finally, after getting everything to look the way you want, you click the 'Start Stream' button.

BACK TO ZAPSTREAM Now, we go back to zapstream to check to see if our stream is up. It may take a few moments to update. You may even need to refresh the page. This is normal.

STREAMS UP!!!

STREAMS UP!!!A few things, in closing. You'll notice that your dashbooard has changed. It'll show current stream time, how much time you have left (according to your funding source), who's zapped you with how much theyve zapped, the ability to post a note about your stream (to both nostr and twitter), and it shows your chatbox with your listeners. There are also a raid feature, stream settings (where you can title & tag your stream). You can 'topup' your funding for your stream. As well as, see your current balance.

You did a great and If you ever need more help, just use the tag #asknostr in your note. There are alway nostriches willing to help.

STAY AWESOME!!!

npub: nostr:npub1rsvhkyk2nnsyzkmsuaq9h9ms7rkxhn8mtxejkca2l4pvkfpwzepql3vmtf

-

@ 8be6bafe:b50da031

2025-02-05 17:00:40

@ 8be6bafe:b50da031

2025-02-05 17:00:40Botev Plovdiv FC is proud to present the Bitcoin Salary Calculator tool, as the foundational tool to showcase athletes the financial power of Bitcoin.

We built the Salary Calculator to help anyone follow in the financial footsteps of prominent athletes such as Kieran Gibbs, Russell Okung, Saquon Barkley, and Renato Moicano, who have significantly increased their savings tank thanks to Bitcoin.

The Bitcoin Salary Calculator allows any person to choose how much of their monthly salary they are comfortable saving in Bitcoin. Instantly, users can backtrack and see how their Bitcoin savings would have performed using the once-in-a-species opportunity which Bitcoin brings.

https://video.nostr.build/a9f2f693f6b5ee75097941e7a30bfc722225918a896b29a73e13e7581dfed77c.mp4

Athletes need Bitcoin more than anyone else

Unlike most people, athletes’ careers and earning years are limited. This has driven the likes of Odell Beckham Jr. and Alex Crognale to also start saving a part of their income in Bitcoin with a long-term outlook as they prepare for retirement.

“The reason why announced 50% of my salary in Bitcoin is because I feel one the noblest things you can do is to get people to understand Bitcoin.” Kieran Gibbs, founder ONE FC, ex Arsenal, ex Inter Miami, ex West Bromich Albion.

“I am trusting Bitcoin for my life after football. Every time my club paid me, I bought Bitcoin.” Alex Crognale, San Antonio FC player.

https://x.com/TFTC21/status/1883228348379533469

“At Botev Plovdiv FC, we believe not only in fostering sporting talent, but also helping them the the most of their careers so they excel in life after retiring from sports. It is with this mission in mind that the club is launching the Bitcoin Football Cup hub, striving to accelerate mass Bitcoin education via sports and athletes - the influencers and role models for billions of people.” shared Botev’s Bitcoin Director George Manolov.

https://x.com/obj/status/1856744340795662432

The Bitcoin Football Cup aims for young prospects to be able to learn key financial lessons from seasoned veterans across all sports. Our Bitcoin Salary Calculator is only the first step toward that goal.

We encourage anyone to hear these stories straight from the current roster of Bitcoin athletes -for whom -in many cases- Bitcoin has allowed them to outperform the wealth it took decades to earn on the field.

Follow us on the Bitcoin Cup’s social media channels to learn more and hear the latest stories of how Bitcoin is shaking up the world of sports:

- Twitter: https://x.com/Bitcoin_Cup/

- Instagram: https://www.instagram.com/BitcoinCup/

- TikTok: https://www.tiktok.com/@BitcoinCup/

- YouTube: https://www.youtube.com/@BitcoinCup/

-

@ b17fccdf:b7211155

2025-02-01 18:41:27

@ b17fccdf:b7211155

2025-02-01 18:41:27Next new resources about the MiniBolt guide have been released:

- 🆕 Roadmap: LINK

- 🆕 Dynamic Network map: LINK

- 🆕 Nostr community: LINK < ~ REMOVE the "[]" symbols from the URL (naddr...) to access

- 🆕 Linktr FOSS (UC) by Gzuuus: LINK

- 🆕 Donate webpage: 🚾 Clearnet LINK || 🧅 Onion LINK

- 🆕 Contact email: hello@minibolt.info

Enjoy it MiniBolter! 💙

-

@ b8851a06:9b120ba1

2025-01-28 21:34:54

@ b8851a06:9b120ba1

2025-01-28 21:34:54Private property isn’t lines on dirt or fences of steel—it’s the crystallization of human sovereignty. Each boundary drawn is a silent declaration: This is where my will meets yours, where creation clashes against chaos. What we defend as “mine” or “yours” is no mere object but a metaphysical claim, a scaffold for the unfathomable complexity of voluntary exchange.

Markets breathe only when individuals anchor their choices in the inviolable. Without property, there is no negotiation—only force. No trade—only taking. The deed to land, the title to a car, the seed of an idea: these are not static things but frontiers of being, where human responsibility collides with the infinite permutations of value.

Austrian economics whispers what existentialism shouts: existence precedes essence. Property isn’t granted by systems; it’s asserted through action, defended through sacrifice, and sanctified through mutual recognition. A thing becomes “owned” only when a mind declares it so, and others—through reason or respect—refrain from crossing that unseen line.

Bitcoin? The purest ledger of this truth. A string of code, yes—but one that mirrors the unyielding logic of property itself: scarce, auditable, unconquerable. It doesn’t ask permission. It exists because sovereign minds choose it to.

Sigh. #nostr

I love #Bitcoin. -

@ 599f67f7:21fb3ea9

2025-01-26 11:01:05

@ 599f67f7:21fb3ea9

2025-01-26 11:01:05¿Qué es Blossom?

nostr:nevent1qqspttj39n6ld4plhn4e2mq3utxpju93u4k7w33l3ehxyf0g9lh3f0qpzpmhxue69uhkummnw3ezuamfdejsygzenanl0hmkjnrq8fksvdhpt67xzrdh0h8agltwt5znsmvzr7e74ywgmr72

Blossom significa Blobs Simply Stored on Media Servers (Blobs Simplemente Almacenados en Servidores de Medios). Blobs son fragmentos de datos binarios, como archivos pero sin nombres. En lugar de nombres, se identifican por su hash sha256. La ventaja de usar hashes sha256 en lugar de nombres es que los hashes son IDs universales que se pueden calcular a partir del archivo mismo utilizando el algoritmo de hash sha256.

💡 archivo -> sha256 -> hash

Blossom es, por lo tanto, un conjunto de puntos finales HTTP que permiten a los usuarios almacenar y recuperar blobs almacenados en servidores utilizando su identidad nostr.

¿Por qué Blossom?

Como mencionamos hace un momento, al usar claves nostr como su identidad, Blossom permite que los datos sean "propiedad" del usuario. Esto simplifica enormemente la cuestión de "qué es spam" para el alojamiento de servidores. Por ejemplo, en nuestro Blossom solo permitimos cargas por miembros de la comunidad verificados que tengan un NIP-05 con nosotros.

Los usuarios pueden subir en múltiples servidores de blossom, por ejemplo, uno alojado por su comunidad, uno de pago, otro público y gratuito, para establecer redundancia de sus datos. Los blobs pueden ser espejados entre servidores de blossom, de manera similar a cómo los relays nostr pueden transmitir eventos entre sí. Esto mejora la resistencia a la censura de blossom.

A continuación se muestra una breve tabla de comparación entre torrents, Blossom y servidores CDN centralizados. (Suponiendo que hay muchos seeders para torrents y se utilizan múltiples servidores con Blossom).

| | Torrents | Blossom | CDN Centralizado | | --------------------------------------------------------------- | -------- | ------- | ---------------- | | Descentralizado | ✅ | ✅ | ❌ | | Resistencia a la censura | ✅ | ✅ | ❌ | | ¿Puedo usarlo para publicar fotos de gatitos en redes sociales? | ❌ | ✅ | ✅ |

¿Cómo funciona?

Blossom utiliza varios tipos de eventos nostr para comunicarse con el servidor de medios.

| kind | descripción | BUD | | ----- | ------------------------------- | ------------------------------------------------------------------ | | 24242 | Evento de autorización | BUD01 | | 10063 | Lista de Servidores de Usuarios | BUD03 |

kind:24242 - Autorización

Esto es esencialmente lo que ya describimos al usar claves nostr como IDs de usuario. En el evento, el usuario le dice al servidor que quiere subir o eliminar un archivo y lo firma con sus claves nostr. El servidor realiza algunas verificaciones en este evento y luego ejecuta el comando del usuario si todo parece estar bien.

kind:10063 - Lista de Servidores de Usuarios

Esto es utilizado por el usuario para anunciar a qué servidores de medios está subiendo. De esta manera, cuando el cliente ve esta lista, sabe dónde subir los archivos del usuario. También puede subir en múltiples servidores definidos en la lista para asegurar redundancia. En el lado de recuperación, si por alguna razón uno de los servidores en la lista del usuario está fuera de servicio, o el archivo ya no se puede encontrar allí, el cliente puede usar esta lista para intentar recuperar el archivo de otros servidores en la lista. Dado que los blobs se identifican por sus hashes, el mismo blob tendrá el mismo hash en cualquier servidor de medios. Todo lo que el cliente necesita hacer es cambiar la URL por la de un servidor diferente.

Ahora, además de los conceptos básicos de cómo funciona Blossom, también hay otros tipos de eventos que hacen que Blossom sea aún más interesante.

| kind | descripción | | ----- | --------------------- | | 30563 | Blossom Drives | | 36363 | Listado de Servidores | | 31963 | Reseña de Servidores |

kind:30563 - Blossom Drives

Este tipo de evento facilita la organización de blobs en carpetas, como estamos acostumbrados con los drives (piensa en Google Drive, iCloud, Proton Drive, etc.). El evento contiene información sobre la estructura de carpetas y los metadatos del drive.

kind:36363 y kind:31963 - Listado y Reseña

Estos tipos de eventos permiten a los usuarios descubrir y reseñar servidores de medios a través de nostr. kind:36363 es un listado de servidores que contiene la URL del servidor. kind:31963 es una reseña, donde los usuarios pueden calificar servidores.

¿Cómo lo uso?

Encuentra un servidor

Primero necesitarás elegir un servidor Blossom donde subirás tus archivos. Puedes navegar por los públicos en blossomservers.com. Algunos de ellos son de pago, otros pueden requerir que tus claves nostr estén en una lista blanca.

Luego, puedes ir a la URL de su servidor y probar a subir un archivo pequeño, como una foto. Si estás satisfecho con el servidor (es rápido y aún no te ha fallado), puedes agregarlo a tu Lista de Servidores de Usuarios. Cubriremos brevemente cómo hacer esto en noStrudel y Amethyst (pero solo necesitas hacer esto una vez, una vez que tu lista actualizada esté publicada, los clientes pueden simplemente recuperarla de nostr).

noStrudel

- Encuentra Relays en la barra lateral, luego elige Servidores de Medios.

- Agrega un servidor de medios, o mejor aún, varios.

- Publica tu lista de servidores. ✅

Amethyst

- En la barra lateral, encuentra Servidores multimedia.

- Bajo Servidores Blossom, agrega tus servidores de medios.

- Firma y publica. ✅

Ahora, cuando vayas a hacer una publicación y adjuntar una foto, por ejemplo, se subirá en tu servidor blossom.

⚠️ Ten en cuenta que debes suponer que los archivos que subas serán públicos. Aunque puedes proteger un archivo con contraseña, esto no ha sido auditado.

Blossom Drive

Como mencionamos anteriormente, podemos publicar eventos para organizar nuestros blobs en carpetas. Esto puede ser excelente para compartir archivos con tu equipo, o simplemente para mantener las cosas organizadas.

Para probarlo, ve a blossom.hzrd149.com (o nuestra instancia comunitaria en blossom.bitcointxoko.com) e inicia sesión con tu método preferido.

Puedes crear una nueva unidad y agregar blobs desde allí.

Bouquet

Si usas múltiples servidores para darte redundancia, Bouquet es una buena manera de obtener una visión general de todos tus archivos. Úsalo para subir y navegar por tus medios en diferentes servidores y sincronizar blobs entre ellos.

Cherry Tree

nostr:nevent1qvzqqqqqqypzqfngzhsvjggdlgeycm96x4emzjlwf8dyyzdfg4hefp89zpkdgz99qyghwumn8ghj7mn0wd68ytnhd9hx2tcpzfmhxue69uhkummnw3e82efwvdhk6tcqyp3065hj9zellakecetfflkgudm5n6xcc9dnetfeacnq90y3yxa5z5gk2q6

Cherry Tree te permite dividir un archivo en fragmentos y luego subirlos en múltiples servidores blossom, y más tarde reensamblarlos en otro lugar.

Conclusión

Blossom aún está en desarrollo, pero ya hay muchas cosas interesantes que puedes hacer con él para hacerte a ti y a tu comunidad más soberanos. ¡Pruébalo!

Si deseas mantenerte al día sobre el desarrollo de Blossom, sigue a nostr:nprofile1qyghwumn8ghj7mn0wd68ytnhd9hx2tcpzfmhxue69uhkummnw3e82efwvdhk6tcqyqnxs90qeyssm73jf3kt5dtnk997ujw6ggy6j3t0jjzw2yrv6sy22ysu5ka y dale un gran zap por su excelente trabajo.

Referencias

-

@ eac63075:b4988b48

2025-01-04 19:41:34

@ eac63075:b4988b48

2025-01-04 19:41:34Since its creation in 2009, Bitcoin has symbolized innovation and resilience. However, from time to time, alarmist narratives arise about emerging technologies that could "break" its security. Among these, quantum computing stands out as one of the most recurrent. But does quantum computing truly threaten Bitcoin? And more importantly, what is the community doing to ensure the protocol remains invulnerable?

The answer, contrary to sensationalist headlines, is reassuring: Bitcoin is secure, and the community is already preparing for a future where quantum computing becomes a practical reality. Let’s dive into this topic to understand why the concerns are exaggerated and how the development of BIP-360 demonstrates that Bitcoin is one step ahead.

What Is Quantum Computing, and Why Is Bitcoin Not Threatened?

Quantum computing leverages principles of quantum mechanics to perform calculations that, in theory, could exponentially surpass classical computers—and it has nothing to do with what so-called “quantum coaches” teach to scam the uninformed. One of the concerns is that this technology could compromise two key aspects of Bitcoin’s security:

- Wallets: These use elliptic curve algorithms (ECDSA) to protect private keys. A sufficiently powerful quantum computer could deduce a private key from its public key.

- Mining: This is based on the SHA-256 algorithm, which secures the consensus process. A quantum attack could, in theory, compromise the proof-of-work mechanism.

Understanding Quantum Computing’s Attack Priorities

While quantum computing is often presented as a threat to Bitcoin, not all parts of the network are equally vulnerable. Theoretical attacks would be prioritized based on two main factors: ease of execution and potential reward. This creates two categories of attacks:

1. Attacks on Wallets

Bitcoin wallets, secured by elliptic curve algorithms, would be the initial targets due to the relative vulnerability of their public keys, especially those already exposed on the blockchain. Two attack scenarios stand out:

-

Short-term attacks: These occur during the interval between sending a transaction and its inclusion in a block (approximately 10 minutes). A quantum computer could intercept the exposed public key and derive the corresponding private key to redirect funds by creating a transaction with higher fees.

-

Long-term attacks: These focus on old wallets whose public keys are permanently exposed. Wallets associated with Satoshi Nakamoto, for example, are especially vulnerable because they were created before the practice of using hashes to mask public keys.

We can infer a priority order for how such attacks might occur based on urgency and importance.

Bitcoin Quantum Attack: Prioritization Matrix (Urgency vs. Importance)

Bitcoin Quantum Attack: Prioritization Matrix (Urgency vs. Importance)2. Attacks on Mining

Targeting the SHA-256 algorithm, which secures the mining process, would be the next objective. However, this is far more complex and requires a level of quantum computational power that is currently non-existent and far from realization. A successful attack would allow for the recalculation of all possible hashes to dominate the consensus process and potentially "mine" it instantly.

Satoshi Nakamoto in 2010 on Quantum Computing and Bitcoin Attacks

Satoshi Nakamoto in 2010 on Quantum Computing and Bitcoin AttacksRecently, Narcelio asked me about a statement I made on Tubacast:

https://x.com/eddieoz/status/1868371296683511969

If an attack became a reality before Bitcoin was prepared, it would be necessary to define the last block prior to the attack and proceed from there using a new hashing algorithm. The solution would resemble the response to the infamous 2013 bug. It’s a fact that this would cause market panic, and Bitcoin's price would drop significantly, creating a potential opportunity for the well-informed.

Preferably, if developers could anticipate the threat and had time to work on a solution and build consensus before an attack, they would simply decide on a future block for the fork, which would then adopt the new algorithm. It might even rehash previous blocks (reaching consensus on them) to avoid potential reorganization through the re-mining of blocks using the old hash. (I often use the term "shielding" old transactions).

How Can Users Protect Themselves?

While quantum computing is still far from being a practical threat, some simple measures can already protect users against hypothetical scenarios:

- Avoid using exposed public keys: Ensure funds sent to old wallets are transferred to new ones that use public key hashes. This reduces the risk of long-term attacks.

- Use modern wallets: Opt for wallets compatible with SegWit or Taproot, which implement better security practices.

- Monitor security updates: Stay informed about updates from the Bitcoin community, such as the implementation of BIP-360, which will introduce quantum-resistant addresses.

- Do not reuse addresses: Every transaction should be associated with a new address to minimize the risk of repeated exposure of the same public key.

- Adopt secure backup practices: Create offline backups of private keys and seeds in secure locations, protected from unauthorized access.

BIP-360 and Bitcoin’s Preparation for the Future

Even though quantum computing is still beyond practical reach, the Bitcoin community is not standing still. A concrete example is BIP-360, a proposal that establishes the technical framework to make wallets resistant to quantum attacks.

BIP-360 addresses three main pillars:

- Introduction of quantum-resistant addresses: A new address format starting with "BC1R" will be used. These addresses will be compatible with post-quantum algorithms, ensuring that stored funds are protected from future attacks.

- Compatibility with the current ecosystem: The proposal allows users to transfer funds from old addresses to new ones without requiring drastic changes to the network infrastructure.

- Flexibility for future updates: BIP-360 does not limit the choice of specific algorithms. Instead, it serves as a foundation for implementing new post-quantum algorithms as technology evolves.

This proposal demonstrates how Bitcoin can adapt to emerging threats without compromising its decentralized structure.

Post-Quantum Algorithms: The Future of Bitcoin Cryptography

The community is exploring various algorithms to protect Bitcoin from quantum attacks. Among the most discussed are:

- Falcon: A solution combining smaller public keys with compact digital signatures. Although it has been tested in limited scenarios, it still faces scalability and performance challenges.

- Sphincs: Hash-based, this algorithm is renowned for its resilience, but its signatures can be extremely large, making it less efficient for networks like Bitcoin’s blockchain.

- Lamport: Created in 1977, it’s considered one of the earliest post-quantum security solutions. Despite its reliability, its gigantic public keys (16,000 bytes) make it impractical and costly for Bitcoin.

Two technologies show great promise and are well-regarded by the community:

- Lattice-Based Cryptography: Considered one of the most promising, it uses complex mathematical structures to create systems nearly immune to quantum computing. Its implementation is still in its early stages, but the community is optimistic.

- Supersingular Elliptic Curve Isogeny: These are very recent digital signature algorithms and require extensive study and testing before being ready for practical market use.

The final choice of algorithm will depend on factors such as efficiency, cost, and integration capability with the current system. Additionally, it is preferable that these algorithms are standardized before implementation, a process that may take up to 10 years.

Why Quantum Computing Is Far from Being a Threat

The alarmist narrative about quantum computing overlooks the technical and practical challenges that still need to be overcome. Among them:

- Insufficient number of qubits: Current quantum computers have only a few hundred qubits, whereas successful attacks would require millions.

- High error rate: Quantum stability remains a barrier to reliable large-scale operations.

- High costs: Building and operating large-scale quantum computers requires massive investments, limiting their use to scientific or specific applications.

Moreover, even if quantum computers make significant advancements, Bitcoin is already adapting to ensure its infrastructure is prepared to respond.

Conclusion: Bitcoin’s Secure Future

Despite advancements in quantum computing, the reality is that Bitcoin is far from being threatened. Its security is ensured not only by its robust architecture but also by the community’s constant efforts to anticipate and mitigate challenges.

The implementation of BIP-360 and the pursuit of post-quantum algorithms demonstrate that Bitcoin is not only resilient but also proactive. By adopting practical measures, such as using modern wallets and migrating to quantum-resistant addresses, users can further protect themselves against potential threats.

Bitcoin’s future is not at risk—it is being carefully shaped to withstand any emerging technology, including quantum computing.

-

@ 1bda7e1f:bb97c4d9

2024-11-21 00:54:54

@ 1bda7e1f:bb97c4d9

2024-11-21 00:54:54Tldr

- Nostr is an open protocol which is interoperable with all kinds of other technologies

- You can use this interoperability to create custom solutions

- Nostr apps define the a custom URI scheme handler "nostr:"

- In this blog I use this to integrate Nostr with NFC cards

- I create a Nostr NFC "login card" which allows me to log into Amethyst client

- I create a Nostr NFC "business card" which allows anyone to find my profile with a tap

Inter-Op All The Things!

Nostr is a new open social protocol for the internet. This open nature is very exciting because it means Nostr can add new capabilities to all other internet-connected technologies, from browsers to web applications. In my view, it achieves this through three core capabilities.

- A lightweight decentralised identity (Nostr keys, "npubs" and "nsecs"),

- A lightweight data distribution network (Nostr relays),

- A set of data interoperability standards (The Nostr Improvement Protocols "NIPs"), including the "nostr:" URI which we'll use in this post.

The lightweight nature is its core strength. Very little is required to interoperate with Nostr, which means many existing technologies can be easily used with the network.

Over the next few blog posts, I'll explore different Nostr inter-op ideas, and also deliver my first small open source projects to the community. I'll cover–

- NFC cards integrated with Nostr (in this post),

- Workflow Automations integrated with Nostr,

- AI LLMs integrated with Nostr.

The "Nostr:" URI

One feature of Nostr is it defines a custom URI scheme handler "nostr:". What is that?

A URI is used to identify a resource in a system. A system will have a protocol handler registry used to store such URI's, and if a system has a URI registered, then it knows what to do when it sees it. You are probably already familiar with some URI schemes such as "http:" and "mailto:". For example, when you click an http link, the system knows that it describes an http resource and opens a web browser to fetch the content from the internet.

A nostr: link operates in the same way. The nostr: prefix indicates a custom URI scheme specifically designed for the Nostr protocol. If a system has a Nostr application installed, that application may have registered "nostr:" in the protocol handler registry. On that system when a "nostr:" URI is clicked, the system will know that it describes a nostr resource and open the Nostr client to fetch the content from the nostr relay network.

This inter-op with the protocol handler registry gives us the power to do nice and exciting things with other technologies.

Nostr and NFC

Another technology that uses URIs is NFC cards. NFC (Near Field Communication) is a wireless technology that enables devices to exchange data over a few centimeters. It’s widely used in contactless payments, access control, and information sharing.

NFC tags are small chips embedded in cards or stickers which can store data like plain text, URLs, or custom URIs. They are very cheap (cents each) and widely available (Amazon with next day delivery).

When an NFC tag contains a URI, such as a http: (or nostr:) link, it acts as a trigger. Tapping the tag with an NFC-enabled device launches the associated application and processes the URI. For example, tapping a tag with "nostr:..." could open a Nostr client, directing it to a specific login page, public profile, or event.

This inter-op allows us to bridge the physical world to Nostr with just a tap.

Many useful ideas

There are many interesting ways to use this. Too many for me to explore. Perhaps some of these are interesting for your next side hustle?

- Nostr NFC "login cards" – tap to log into Amethyst on Android,

- Nostr NFC "business cards" – give to connections so they can tap to load your npub,

- Nostr NFC "payment cards" – integrating lightning network or ecash,

- Nostr NFC "doorbells", "punch cards", "drop boxes", or "dead drops" – put a tag in a specific place and tap to open a location-specific message or chat,

- Integrations with other access control systems,

- Integrations with other home automation systems,

- Many more ...

To start with I have built and use the "login card" and "business card" solutions. This blog post will show you how to do the same.

Nostr Login Card

You can use an NFC card to log into your Nostr client.

Most Nostr clients accept a variety of login methods, from posting your nsec into the app (insecure) to using a remote signer (more secure). A less known but more secure method is to sign into a session with a tap of a specially-configured NFC card. Amethyst is a Nostr client on Android which supports this type of login.

- A secure method for logging in

- Optionally keeps no log in history on the device after logout

- Does not require users to know or understand how keys work

- Keys are kept secure on a physically-separated card to reduce risk of compromise

Nostr devs think that this is useful for anti-establishment actors–Fair enough. For me, I am interested in this login card pattern as it could be useful for rolling out identities within an organisation context with less training (office workers are already familiar with door access cards). This pattern potentially abstracts away key management to the IT or ops team who provision the cards.

I first discovered this when Kohei demonstrated it in his video.

Here's how you set it up at a high level–

- Buy yourself some NFC cards

- Get your Nostr key ready in an encrypted, password protected format called "nencryptsec"

- Write the nencryptsec to the NFC card as a custom URI

- Tap to load the login screen, and enter your password to login

Here it is in detail–

Buy yourself some NFC cards

I found no specific requirements. As usual with Nostr so far, I tried to the cheapest possible route and it worked. Generic brand NFC cards shipped from China, I believe it was 50X for $15 from Amazon. Your mileage may vary.

Get your Nostr key ready

Your key will be saved to the NFC card in an encrypted password-protected format called "nencryptsec". Several applications support this. As we'll be using this to login to Amethyst, we will use Amethyst to output the nencryptsec for us.

- Login to Amethyst with your nsec,

- Open the sidebar and click "Backup Keys",

- Enter a password, and click "Encrypt and my secret key",

- It will add the password-protected key to your clipboard in the format "ncryptsec1...",

- Remember to backup your password.

Write the ncryptsec to the NFC card

- Download the free NFC Tools app to your device, and open it,

- Click "Write" and "Add a record", then click "Custom URL / URI",

- Paste your nencryptsec with the nostr URI in front, i.e. "nostr:ncryptsec1..." and click OK,

- Click "Write". NFC Tools will prompt you to "Approach an NFC tag",

- Place your NFC card against your phone, and it will write to the card,

- Your card is ready.

Tap to load the login screen

Tap the card against your phone again, and your phone should open the login screen of Amethyst and prompt you for your password.

Once you enter your password, Amethyst will decrypt your nsec and log you in.

Optionally, you can also set the app to forget you once you log out.

You have created a Nostr NFC "login card".

Nostr Business Card

You can use another NFC card to give anyone you meet a link straight to your Nostr profile.

I attended Peter McCormack's #CheatCode conference in Sydney and gave a few of these out following the Nostr panel, notably to Preston Pysh where it got some cut through and found me my first 100 followers. You can do the same.

To create your Nostr NFC "business card" is even easier than your NFC "login card".

- Buy yourself some NFC cards,

- Download the free NFC Tools app to your device, and open it,

- Click "Write" and "Add a record", then click "Custom URL / URI",

- Write your npub to the NFC card as a custom URI in the format "nostr:npub1..." (e.g. for me this is "nostr:npub1r0d8u8mnj6769500nypnm28a9hpk9qg8jr0ehe30tygr3wuhcnvs4rfsft"),

- Your card is ready.

Give the card to someone who is a Nostr user, and when they tap the card against their phone it will open their preferred Nostr client and go directly to your Nostr profile page.

You have created a Nostr NFC "business card".

What I Did Wrong

I like to share what I did wrong so you don't have to make the same mistakes. This time, this was very easy, and little went wrong. In general

- When password-protecting your nsec, don't forget the password!

- When writing to the NFC card, make sure to use "Custom URI/URL" as this accepts your "nostr:" URI scheme. If you use generic "URI/URL" it won't work.

What's Next

Over my first four blogs I have explored creating a good Nostr setup

- Mined a Nostr pubkey and backed up the mnemonic

- Set up Nostr payments with a Lightning wallet plus all the bells and whistles

- Set up NIP-05 and Lighting Address at my own domain

- Set up a Personal Relay at my own domain

Over the next few blogs I will be exploring different types of Nostr inter-op

- NFC cards integrated with Nostr (this post)

- Workflow Automations integrated with Nostr

- AI LLMs integrated with Nostr

Please be sure to let me know if you think there's another Nostr topic you'd like to see me tackle.

GM Nostr.

-

@ a95c6243:d345522c

2025-02-21 19:32:23

@ a95c6243:d345522c

2025-02-21 19:32:23Europa – das Ganze ist eine wunderbare Idee, \ aber das war der Kommunismus auch. \ Loriot

«Europa hat fertig», könnte man unken, und das wäre nicht einmal sehr verwegen. Mit solch einer Einschätzung stünden wir nicht alleine, denn die Stimmen in diese Richtung mehren sich. Der französische Präsident Emmanuel Macron warnte schon letztes Jahr davor, dass «unser Europa sterben könnte». Vermutlich hatte er dabei andere Gefahren im Kopf als jetzt der ungarische Ministerpräsident Viktor Orbán, der ein «baldiges Ende der EU» prognostizierte. Das Ergebnis könnte allerdings das gleiche sein.

Neben vordergründigen Themenbereichen wie Wirtschaft, Energie und Sicherheit ist das eigentliche Problem jedoch die obskure Mischung aus aufgegebener Souveränität und geschwollener Arroganz, mit der europäische Politiker:innende unterschiedlicher Couleur aufzutreten pflegen. Und das Tüpfelchen auf dem i ist die bröckelnde Legitimation politischer Institutionen dadurch, dass die Stimmen großer Teile der Bevölkerung seit Jahren auf vielfältige Weise ausgegrenzt werden.

Um «UnsereDemokratie» steht es schlecht. Dass seine Mandate immer schwächer werden, merkt natürlich auch unser «Führungspersonal». Entsprechend werden die Maßnahmen zur Gängelung, Überwachung und Manipulation der Bürger ständig verzweifelter. Parallel dazu plustern sich in Paris Macron, Scholz und einige andere noch einmal mächtig in Sachen Verteidigung und «Kriegstüchtigkeit» auf.

Momentan gilt es auch, das Überschwappen covidiotischer und verschwörungsideologischer Auswüchse aus den USA nach Europa zu vermeiden. So ein «MEGA» (Make Europe Great Again) können wir hier nicht gebrauchen. Aus den Vereinigten Staaten kommen nämlich furchtbare Nachrichten. Beispielsweise wurde einer der schärfsten Kritiker der Corona-Maßnahmen kürzlich zum Gesundheitsminister ernannt. Dieser setzt sich jetzt für eine Neubewertung der mRNA-«Impfstoffe» ein, was durchaus zu einem Entzug der Zulassungen führen könnte.

Der europäischen Version von «Verteidigung der Demokratie» setzte der US-Vizepräsident J. D. Vance auf der Münchner Sicherheitskonferenz sein Verständnis entgegen: «Demokratie stärken, indem wir unseren Bürgern erlauben, ihre Meinung zu sagen». Das Abschalten von Medien, das Annullieren von Wahlen oder das Ausschließen von Menschen vom politischen Prozess schütze gar nichts. Vielmehr sei dies der todsichere Weg, die Demokratie zu zerstören.

In der Schweiz kamen seine Worte deutlich besser an als in den meisten europäischen NATO-Ländern. Bundespräsidentin Karin Keller-Sutter lobte die Rede und interpretierte sie als «Plädoyer für die direkte Demokratie». Möglicherweise zeichne sich hier eine außenpolitische Kehrtwende in Richtung integraler Neutralität ab, meint mein Kollege Daniel Funk. Das wären doch endlich mal ein paar gute Nachrichten.

Von der einstigen Idee einer europäischen Union mit engeren Beziehungen zwischen den Staaten, um Konflikte zu vermeiden und das Wohlergehen der Bürger zu verbessern, sind wir meilenweit abgekommen. Der heutige korrupte Verbund unter technokratischer Leitung ähnelt mehr einem Selbstbedienungsladen mit sehr begrenztem Zugang. Die EU-Wahlen im letzten Sommer haben daran ebenso wenig geändert, wie die Bundestagswahl am kommenden Sonntag darauf einen Einfluss haben wird.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-02-19 09:23:17

@ a95c6243:d345522c

2025-02-19 09:23:17Die «moralische Weltordnung» – eine Art Astrologie. Friedrich Nietzsche

Das Treffen der BRICS-Staaten beim Gipfel im russischen Kasan war sicher nicht irgendein politisches Event. Gastgeber Wladimir Putin habe «Hof gehalten», sagen die Einen, China und Russland hätten ihre Vorstellung einer multipolaren Weltordnung zelebriert, schreiben Andere.

In jedem Fall zeigt die Anwesenheit von über 30 Delegationen aus der ganzen Welt, dass von einer geostrategischen Isolation Russlands wohl keine Rede sein kann. Darüber hinaus haben sowohl die Anreise von UN-Generalsekretär António Guterres als auch die Meldungen und Dementis bezüglich der Beitrittsbemühungen des NATO-Staats Türkei für etwas Aufsehen gesorgt.

Im Spannungsfeld geopolitischer und wirtschaftlicher Umbrüche zeigt die neue Allianz zunehmendes Selbstbewusstsein. In Sachen gemeinsamer Finanzpolitik schmiedet man interessante Pläne. Größere Unabhängigkeit von der US-dominierten Finanzordnung ist dabei ein wichtiges Ziel.

Beim BRICS-Wirtschaftsforum in Moskau, wenige Tage vor dem Gipfel, zählte ein nachhaltiges System für Finanzabrechnungen und Zahlungsdienste zu den vorrangigen Themen. Während dieses Treffens ging der russische Staatsfonds eine Partnerschaft mit dem Rechenzentrumsbetreiber BitRiver ein, um Bitcoin-Mining-Anlagen für die BRICS-Länder zu errichten.

Die Initiative könnte ein Schritt sein, Bitcoin und andere Kryptowährungen als Alternativen zu traditionellen Finanzsystemen zu etablieren. Das Projekt könnte dazu führen, dass die BRICS-Staaten den globalen Handel in Bitcoin abwickeln. Vor dem Hintergrund der Diskussionen über eine «BRICS-Währung» wäre dies eine Alternative zu dem ursprünglich angedachten Korb lokaler Währungen und zu goldgedeckten Währungen sowie eine mögliche Ergänzung zum Zahlungssystem BRICS Pay.

Dient der Bitcoin also der Entdollarisierung? Oder droht er inzwischen, zum Gegenstand geopolitischer Machtspielchen zu werden? Angesichts der globalen Vernetzungen ist es oft schwer zu durchschauen, «was eine Show ist und was im Hintergrund von anderen Strippenziehern insgeheim gesteuert wird». Sicher können Strukturen wie Bitcoin auch so genutzt werden, dass sie den Herrschenden dienlich sind. Aber die Grundeigenschaft des dezentralisierten, unzensierbaren Peer-to-Peer Zahlungsnetzwerks ist ihm schließlich nicht zu nehmen.

Wenn es nach der EZB oder dem IWF geht, dann scheint statt Instrumentalisierung momentan eher der Kampf gegen Kryptowährungen angesagt. Jürgen Schaaf, Senior Manager bei der Europäischen Zentralbank, hat jedenfalls dazu aufgerufen, Bitcoin «zu eliminieren». Der Internationale Währungsfonds forderte El Salvador, das Bitcoin 2021 als gesetzliches Zahlungsmittel eingeführt hat, kürzlich zu begrenzenden Maßnahmen gegen das Kryptogeld auf.

Dass die BRICS-Staaten ein freiheitliches Ansinnen im Kopf haben, wenn sie Kryptowährungen ins Spiel bringen, darf indes auch bezweifelt werden. Im Abschlussdokument bekennen sich die Gipfel-Teilnehmer ausdrücklich zur UN, ihren Programmen und ihrer «Agenda 2030». Ernst Wolff nennt das «eine Bankrotterklärung korrupter Politiker, die sich dem digital-finanziellen Komplex zu 100 Prozent unterwerfen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ eac63075:b4988b48

2024-11-09 17:57:27

@ eac63075:b4988b48

2024-11-09 17:57:27Based on a recent paper that included collaboration from renowned experts such as Lynn Alden, Steve Lee, and Ren Crypto Fish, we discuss in depth how Bitcoin's consensus is built, the main risks, and the complex dynamics of protocol upgrades.

Podcast https://www.fountain.fm/episode/wbjD6ntQuvX5u2G5BccC

Presentation https://gamma.app/docs/Analyzing-Bitcoin-Consensus-Risks-in-Protocol-Upgrades-p66axxjwaa37ksn

1. Introduction to Consensus in Bitcoin

Consensus in Bitcoin is the foundation that keeps the network secure and functional, allowing users worldwide to perform transactions in a decentralized manner without the need for intermediaries. Since its launch in 2009, Bitcoin is often described as an "immutable" system designed to resist changes, and it is precisely this resistance that ensures its security and stability.

The central idea behind consensus in Bitcoin is to create a set of acceptance rules for blocks and transactions, ensuring that all network participants agree on the transaction history. This prevents "double-spending," where the same bitcoin could be used in two simultaneous transactions, something that would compromise trust in the network.

Evolution of Consensus in Bitcoin

Over the years, consensus in Bitcoin has undergone several adaptations, and the way participants agree on changes remains a delicate process. Unlike traditional systems, where changes can be imposed from the top down, Bitcoin operates in a decentralized model where any significant change needs the support of various groups of stakeholders, including miners, developers, users, and large node operators.

Moreover, the update process is extremely cautious, as hasty changes can compromise the network's security. As a result, the philosophy of "don't fix what isn't broken" prevails, with improvements happening incrementally and only after broad consensus among those involved. This model can make progress seem slow but ensures that Bitcoin remains faithful to the principles of security and decentralization.

2. Technical Components of Consensus

Bitcoin's consensus is supported by a set of technical rules that determine what is considered a valid transaction and a valid block on the network. These technical aspects ensure that all nodes—the computers that participate in the Bitcoin network—agree on the current state of the blockchain. Below are the main technical components that form the basis of the consensus.

Validation of Blocks and Transactions

The validation of blocks and transactions is the central point of consensus in Bitcoin. A block is only considered valid if it meets certain criteria, such as maximum size, transaction structure, and the solving of the "Proof of Work" problem. The proof of work, required for a block to be included in the blockchain, is a computational process that ensures the block contains significant computational effort—protecting the network against manipulation attempts.

Transactions, in turn, need to follow specific input and output rules. Each transaction includes cryptographic signatures that prove the ownership of the bitcoins sent, as well as validation scripts that verify if the transaction conditions are met. This validation system is essential for network nodes to autonomously confirm that each transaction follows the rules.

Chain Selection

Another fundamental technical issue for Bitcoin's consensus is chain selection, which becomes especially important in cases where multiple versions of the blockchain coexist, such as after a network split (fork). To decide which chain is the "true" one and should be followed, the network adopts the criterion of the highest accumulated proof of work. In other words, the chain with the highest number of valid blocks, built with the greatest computational effort, is chosen by the network as the official one.

This criterion avoids permanent splits because it encourages all nodes to follow the same main chain, reinforcing consensus.

Soft Forks vs. Hard Forks

In the consensus process, protocol changes can happen in two ways: through soft forks or hard forks. These variations affect not only the protocol update but also the implications for network users:

-

Soft Forks: These are changes that are backward compatible. Only nodes that adopt the new update will follow the new rules, but old nodes will still recognize the blocks produced with these rules as valid. This compatibility makes soft forks a safer option for updates, as it minimizes the risk of network division.

-

Hard Forks: These are updates that are not backward compatible, requiring all nodes to update to the new version or risk being separated from the main chain. Hard forks can result in the creation of a new coin, as occurred with the split between Bitcoin and Bitcoin Cash in 2017. While hard forks allow for deeper changes, they also bring significant risks of network fragmentation.

These technical components form the base of Bitcoin's security and resilience, allowing the system to remain functional and immutable without losing the necessary flexibility to evolve over time.

3. Stakeholders in Bitcoin's Consensus