-

@ daa41bed:88f54153

2025-02-09 16:50:04

@ daa41bed:88f54153

2025-02-09 16:50:04There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy article on the pros of a strategic Bitcoin reserve, I wanted to take some time to chime in on the much more fun topic of digital engagement.

Let's begin by defining a couple of things:

Nostr is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example.

Zap is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what Lightning or Cashu are.

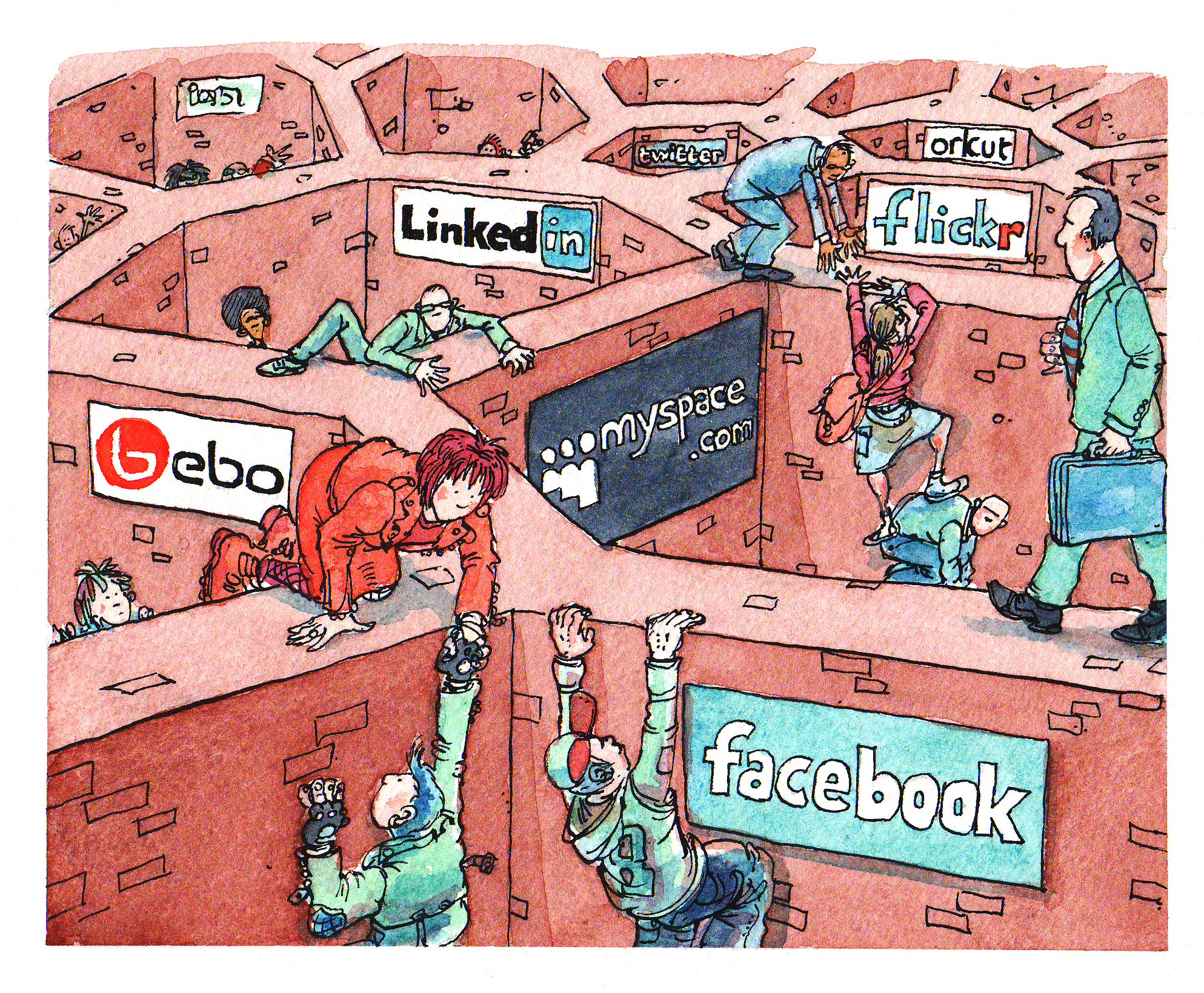

If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article.

In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed.

What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.

Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines.

That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems.

Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.

I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives.

Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms?

Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life?

If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.

-

@ dc4cd086:cee77c06

2025-02-09 03:35:25

@ dc4cd086:cee77c06

2025-02-09 03:35:25Have you ever wanted to learn from lengthy educational videos but found it challenging to navigate through hours of content? Our new tool addresses this problem by transforming long-form video lectures into easily digestible, searchable content.

Key Features:

Video Processing:

- Automatically downloads YouTube videos, transcripts, and chapter information

- Splits transcripts into sections based on video chapters

Content Summarization:

- Utilizes language models to transform spoken content into clear, readable text

- Formats output in AsciiDoc for improved readability and navigation

- Highlights key terms and concepts with [[term]] notation for potential cross-referencing

Diagram Extraction:

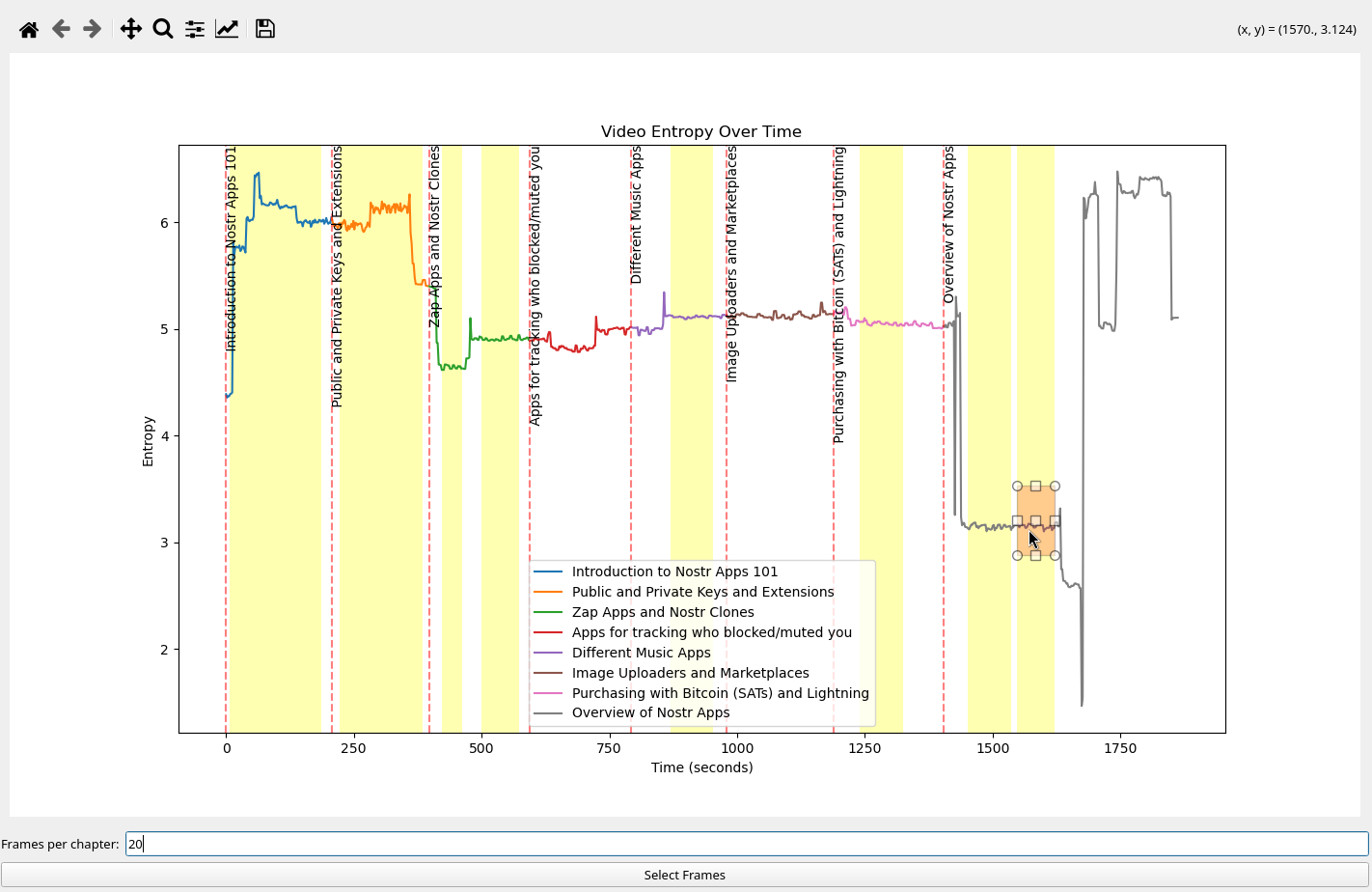

- Analyzes video entropy to identify static diagram/slide sections

- Provides a user-friendly GUI for manual selection of relevant time ranges

- Allows users to pick representative frames from selected ranges

Going Forward:

Currently undergoing a rewrite to improve organization and functionality, but you are welcome to try the current version, though it might not work on every machine. Will support multiple open and closed language models for user choice Free and open-source, allowing for personal customization and integration with various knowledge bases. Just because we might not have it on our official Alexandria knowledge base, you are still welcome to use it on you own personal or community knowledge bases! We want to help find connections between ideas that exist across relays, allowing individuals and groups to mix and match knowledge bases between each other, allowing for any degree of openness you care.

While designed with #Alexandria users in mind, it's available for anyone to use and adapt to their own learning needs.

Screenshots

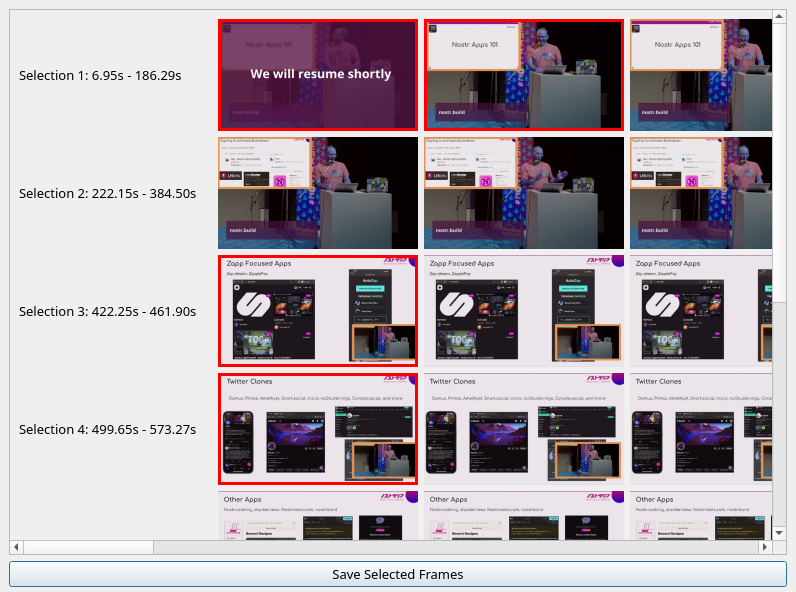

Frame Selection

This is a screenshot of the frame selection interface. You'll see a signal that represents frame entropy over time. The vertical lines indicate the start and end of a chapter. Within these chapters you can select the frames by clicking and dragging the mouse over the desired range where you think diagram is in that chapter. At the bottom is an option that tells the program to select a specific number of frames from that selection.

Diagram Extraction

This is a screenshot of the diagram extraction interface. For every selection you've made, there will be a set of frames that you can choose from. You can select and deselect as many frames as you'd like to save.

Links

- repo: https://github.com/limina1/video_article_converter

- Nostr Apps 101: https://www.youtube.com/watch?v=Flxa_jkErqE

Output

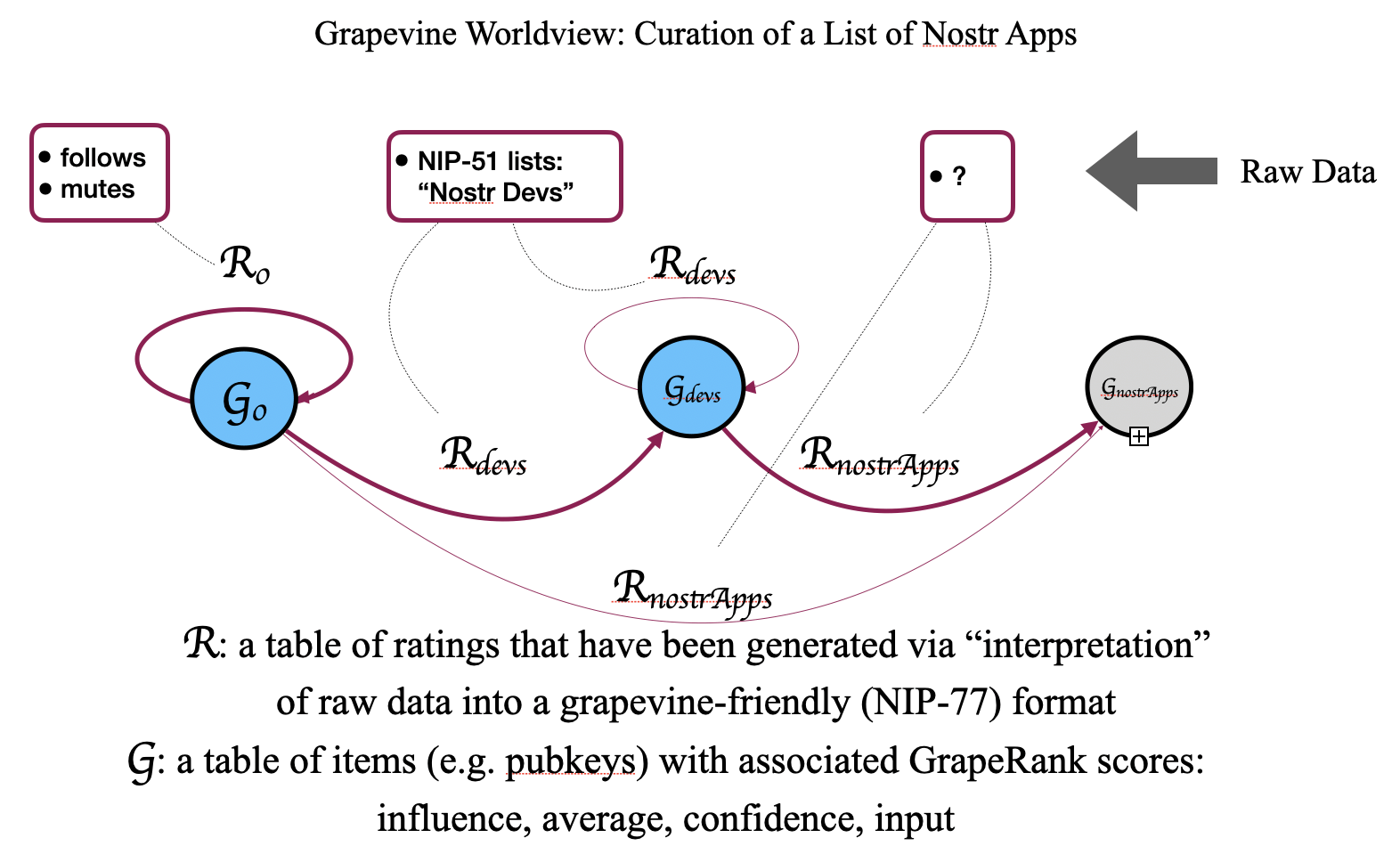

And now, we have a demonstration of the final result of this tool, with some quick cleaning up. The video we will be using this tool on is titled Nostr Apps 101 by nostr:npub1nxy4qpqnld6kmpphjykvx2lqwvxmuxluddwjamm4nc29ds3elyzsm5avr7 during Nostrasia. The following thread is an analog to the modular articles we are constructing for Alexandria, and I hope it conveys the functionality we want to create in the knowledge space. Note, this tool is the first step! You could use a different prompt that is most appropriate for the specific context of the transcript you are working with, but you can also manually clean up any discrepancies that don't portray the video accurately. You can now view the article on #Alexandria https://next-alexandria.gitcitadel.eu/publication?d=nostr-apps-101

Initially published as chained kind 1's nostr:nevent1qvzqqqqqqypzp5r5hd579v2sszvvzfel677c8dxgxm3skl773sujlsuft64c44ncqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qgwwaehxw309ahx7uewd3hkctcpzemhxue69uhhyetvv9ujumt0wd68ytnsw43z7qghwaehxw309aex2mrp0yhxummnw3ezucnpdejz7qgewaehxw309aex2mrp0yh8xmn0wf6zuum0vd5kzmp0qqsxunmjy20mvlq37vnrcshkf6sdrtkfjtjz3anuetmcuv8jswhezgc7hglpn

Or view on Coracle https://coracle.social /nevent1qqsxunmjy20mvlq37vnrcshkf6sdrtkfjtjz3anuetmcuv8jswhezgcppemhxue69uhkummn9ekx7mp0qgsdqa9md83tz5yqnrqjw07hhkpmfjpkuv9hlh5v8yhu8z274w9dv7qnnq0s3

-

@ 16d11430:61640947

2025-02-09 00:12:22

@ 16d11430:61640947

2025-02-09 00:12:22Introduction: The Power of Focused Attention

In an age of distraction, power is not merely held through material wealth, authority, or control over others—it is built through focused attention. The human brain, a complex quantum-biological processor, constructs reality through perception. When harnessed correctly, focused attention allows individuals to transcend limitations, reshape their reality, and live free.

Power, then, is not external—it is a construct supported by the mind and created within the brain. Understanding how this works offers a path to transcendence, autonomy, and liberation from imposed limitations.

The Neuroscience of Focused Attention: Constructing Reality

The brain is a prediction engine, constantly processing information and filtering out irrelevant stimuli. Focused attention directs this process, acting as a spotlight that selects what becomes part of one's conscious experience. This is the fundamental mechanism behind cognitive power.

- Neuroplasticity: Building Power Through Repetition

The brain adapts to repeated stimuli through neuroplasticity. What one focuses on consistently rewires neural pathways, strengthening certain thoughts, beliefs, and abilities. Over time, this focus builds an internal structure of power—a network of ideas and perceptions that define one’s reality.

If one focuses on problems, they grow.

If one focuses on solutions, they appear.

If one focuses on fear, it shapes perception.

If one focuses on mastery, skills develop.

- The Quantum Mind: Attention as a Creative Force

Quantum physics suggests that observation influences reality. Just as subatomic particles behave differently when measured, focused attention may act as a force that shapes possibilities into tangible outcomes.

This aligns with the ancient concept that "energy flows where attention goes." What one attends to with intention can manifest as action, opportunity, and ultimately, freedom.

- The Reticular Activating System (RAS): Filtering Reality

The Reticular Activating System (RAS) in the brainstem acts as a gatekeeper for focus. It determines what information enters conscious awareness. When trained, it can filter out distractions and amplify pathways toward a desired goal.

Want to see opportunities? Program the RAS by setting clear intentions.

Want to break free from limiting beliefs? Train focus away from conditioned fears.

The Mind’s Role: Transcending Limitations

The mind is the interpreter of the brain’s electrical and biochemical activity. While the brain processes raw data, the mind provides meaning. This distinction is crucial because meaning determines how one experiences reality.

- Breaking Mental Chains: Rewriting Narratives

Most limitations are narratives—stories imposed by culture, society, or personal history. True power lies in rewriting these stories.

Instead of “I am trapped by my circumstances,” shift to “I create my own reality.”

Instead of “I need permission,” shift to “I give myself permission.”

By restructuring meaning, the mind can redefine the limits of what is possible.

- The Silence Paradox: Accessing Higher States

Silence, both literal and mental, creates space for higher-order thinking. Just as quantum tunneling allows subatomic particles to pass through barriers without energy loss, silence allows the mind to bypass noise and access deeper intelligence.

Meditation, stillness, and solitude amplify internal power.

The ability to not react is a form of control over external influence.

True mastery comes from detachment—engaging the world without being controlled by it.

Transcendence: Living Free Through Mental Autonomy

To transcend means to rise above imposed structures—whether societal, psychological, or energetic. The construct of power built through focused attention allows one to escape control mechanisms and live autonomously.

- Sovereignty of Mind: Owning One’s Thoughts

A free mind is one that chooses its inputs rather than being programmed by external forces. This requires:

Awareness of mental conditioning (social narratives, propaganda, biases)

Intentional thought selection (curating what enters the mental space)

Guarding attention fiercely (not allowing distraction to hijack focus)

- Detachment From Control Structures

Society operates on the principle of attention capture—through media, politics, and algorithms that direct thought patterns. Escaping these requires detachment.

Do not react emotionally to fear-based programming.

Cultivate independent thought by questioning imposed narratives.

Reduce external noise to amplify internal wisdom.

- The Flow State: Moving Beyond Constraints

When focus is refined to its highest degree, one enters flow state—a condition where action and awareness merge, and limitations dissolve.

In flow, work becomes effortless.

Creativity becomes boundless.

Freedom becomes not just a philosophy, but a lived experience.

Conclusion: The Mind as the Ultimate Key to Freedom

Power is not an external possession—it is the ability to direct one’s own focus. Through the interplay of brain function, cognitive attention, and mental discipline, one constructs personal sovereignty. The individual who masters focus, controls reality.

Freedom is not given. It is built—through attention, intention, and an unwavering commitment to mental autonomy.

-

@ 6cc4225f:942b7222

2024-12-30 00:32:47

@ 6cc4225f:942b7222

2024-12-30 00:32:47(Cover image photo credit: The Crypto Times)

“Our world of widows needs to be saved / it’s now or never — victim or victory, rebel or regret / who you are and who you claim to be / no more heroes.” -Converge, “No Heroes”

Usually, bad takes from big figures in the Bitcoin space roll off my back. I often don’t feel a need to counter them because 1.) Everyone is entitled to their opinion and 2.) I don’t enjoy spending my time arguing with people on the Internet.

But when a take is really bad — downright evil — I feel compelled to respond.

And respond I did to a bad take this week (link in just a second, first some context).

Lately in the media, MicroStrategy Chair Michael Saylor has been laying out his vision for a digital asset framework.

This framework includes conceptualizing Bitcoin as a commodity — nothing more than capital — and stablecoins like Tether (USDT) and USD Coin (USDC) as “digital currencies” (his words).

As if someone who considers themselves a “triple bitcoin maxi” (maybe one of the lamest terms ever) denying that bitcoin is a currency weren’t nauseating enough, his “evil genius plan” (his words) to get the world hooked on USD stablecoins as money while the US hoards bitcoin should have you upchuck everything in your guts if you truly believe in Bitcoin’s value proposition.

Below (a few lines down) is the piece I wrote countering Saylor’s perspective.

If there are two things I hope you take away from it, the first is to KILL YOUR IDOLS (not literally, of course) and the second is that WE ARE BITCOIN, and if we believe in the technology — all dimensions of it — we have to defend it.

Enjoy.

Michael Saylor Doesn't Understand Bitcoin

## Support The Open Dialogue Foundation

Speaking of defending Bitcoin, we all owe a debt of gratitude to the work that the Open Dialogue Foundation (ODF) is doing to defend our legal right to use non-custodial bitcoin wallets.

Please read the following piece I wrote this week to learn more.

Protect Your Non-Custodial Bitcoin Wallet — Support The Open Dialogue Foundation

And please make a tax-deductible contribution (before the year’s end) to the organization here.

Bitcoin’s Second Book-Length Academic Text — The Satoshi Papers — Coming Soon

This week, I published my interview with Natalie Smolenski, a PhD-holding theoretical anthropologist who often makes very valuable thought contributions to the Bitcoin space.

What I loved most about this interview (and I loved a lot about it) is Smolenski’s lack of reverence.

Two of my favorite quotes from the interview:

“There was kind of a triumph of a certain very statist approach to socialism and even communism in the American academy, in the Anglophone academy, that has persisted to this day, where there's, like I was saying earlier, a suspicion of anything smacking of individualism as bourgeois conceit or reinscribing social hierarchies, racial hierarchies, gender hierarchies, blah, blah, blah.”

The “blah, blah, blah” hit hard. It reminded me of how I used to tune out when speaking with a good portion of my co-workers during the years I taught at the college level.

The other one:

“What do you hope people will take away from The Satoshi Papers?

*> If there's only one idea that people take away from it, it's that your emancipation does not require the state. You do not need to wait for the government.

*> My God, take control of your life. You can, it is within your power to do so, and here are some examples of ways that people throughout human history have chosen to do so."

The “My God” was so properly placed. Chef’s kiss.

Check out to entire piece to absorb more of Smolenski’s wisdom.

Thank you all for reading, and here’s to a great week ahead!

Best,

Frank

-

@ 3ffac3a6:2d656657

2025-02-06 03:58:47

@ 3ffac3a6:2d656657

2025-02-06 03:58:47Motivations

Recently, my sites hosted behind Cloudflare tunnels mysteriously stopped working—not once, but twice. The first outage occurred about a week ago. Interestingly, when I switched to using the 1.1.1.1 WARP VPN on my cellphone or PC, the sites became accessible again. Clearly, the issue wasn't with the sites themselves but something about the routing. This led me to the brilliant (or desperate) idea of routing all Cloudflare-bound traffic through a WARP tunnel in my local network.

Prerequisites

- A "server" with an amd64 processor (the WARP client only works on amd64 architecture). I'm using an old mac mini, but really, anything with an amd64 processor will do.

- Basic knowledge of Linux commands.

- Access to your Wi-Fi router's settings (if you plan to configure routes there).

Step 1: Installing the WARP CLI

- Update your system packages:

bash sudo apt update && sudo apt upgrade -y- Download and install the WARP CLI:

```bash curl https://pkg.cloudflareclient.com/pubkey.gpg | sudo gpg --yes --dearmor --output /usr/share/keyrings/cloudflare-warp-archive-keyring.gpg

echo "deb [arch=amd64 signed-by=/usr/share/keyrings/cloudflare-warp-archive-keyring.gpg] https://pkg.cloudflareclient.com/ $(lsb_release -cs) main" | sudo tee /etc/apt/sources.list.d/cloudflare-client.list

sudo apt-get update && sudo apt-get install cloudflare-warp ``` 3. Register and connect to WARP:

Run the following commands to register and connect to WARP:

```bash sudo warp-cli register sudo warp-cli connect ````

Confirm the connection with:

bash warp-cli status

Step 2: Routing Traffic on the Server Machine

Now that WARP is connected, let's route the local network's Cloudflare-bound traffic through this tunnel.

- Enable IP forwarding:

bash sudo sysctl -w net.ipv4.ip_forward=1Make it persistent after reboot:

bash echo 'net.ipv4.ip_forward=1' | sudo tee -a /etc/sysctl.conf sudo sysctl -p- Set up firewall rules to forward traffic:

bash sudo nft add rule ip filter FORWARD iif "eth0" oif "CloudflareWARP" ip saddr 192.168.31.0/24 ip daddr 104.0.0.0/8 accept sudo nft add rule ip filter FORWARD iif "CloudflareWARP" oif "eth0" ip saddr 104.0.0.0/8 ip daddr 192.168.31.0/24 ct state established,related acceptReplace

eth0with your actual network interface if different.- Make rules persistent:

bash sudo apt install nftables sudo nft list ruleset > /etc/nftables.conf

Step 3: Configuring the Route on a Local PC (Linux)

On your local Linux machine:

- Add a static route:

bash sudo ip route add 104.0.0.0/24 via <SERVER_IP>Replace

<SERVER_IP>with the internal IP of your WARP-enabled server. This should be a temporary solution, since it only effects a local machine. For a solution that can effect the whole local network, please see next step.

Step 4: Configuring the Route on Your Wi-Fi Router (Recommended)

If your router allows adding static routes:

- Log in to your router's admin interface.

- Navigate to the Static Routing section. (This may vary depending on the router model.)

- Add a new static route:

- Destination Network:

104.0.0.0 - Subnet Mask:

255.255.255.0 - Gateway:

<SERVER_IP> - Metric:

1(or leave it default) - Save and apply the settings.

One of the key advantages of this method is how easy it is to disable once your ISP's routing issues are resolved. Since the changes affect the entire network at once, you can quickly restore normal network behavior by simply removing the static routes or disabling the forwarding rules, all without the need for complex reconfigurations.

Final Thoughts

Congratulations! You've now routed all your Cloudflare-bound traffic through a secure WARP tunnel, effectively bypassing mysterious connectivity issues. If the sites ever go down again, at least you’ll have one less thing to blame—and one more thing to debug.

-

@ e3ba5e1a:5e433365

2025-02-05 17:47:16

@ e3ba5e1a:5e433365

2025-02-05 17:47:16I got into a friendly discussion on X regarding health insurance. The specific question was how to deal with health insurance companies (presumably unfairly) denying claims? My answer, as usual: get government out of it!

The US healthcare system is essentially the worst of both worlds:

- Unlike full single payer, individuals incur high costs

- Unlike a true free market, regulation causes increases in costs and decreases competition among insurers

I'm firmly on the side of moving towards the free market. (And I say that as someone living under a single payer system now.) Here's what I would do:

- Get rid of tax incentives that make health insurance tied to your employer, giving individuals back proper freedom of choice.

- Reduce regulations significantly.

-

In the short term, some people will still get rejected claims and other obnoxious behavior from insurance companies. We address that in two ways:

- Due to reduced regulations, new insurance companies will be able to enter the market offering more reliable coverage and better rates, and people will flock to them because they have the freedom to make their own choices.

- Sue the asses off of companies that reject claims unfairly. And ideally, as one of the few legitimate roles of government in all this, institute new laws that limit the ability of fine print to allow insurers to escape their responsibilities. (I'm hesitant that the latter will happen due to the incestuous relationship between Congress/regulators and insurers, but I can hope.)

Will this magically fix everything overnight like politicians normally promise? No. But it will allow the market to return to a healthy state. And I don't think it will take long (order of magnitude: 5-10 years) for it to come together, but that's just speculation.

And since there's a high correlation between those who believe government can fix problems by taking more control and demanding that only credentialed experts weigh in on a topic (both points I strongly disagree with BTW): I'm a trained actuary and worked in the insurance industry, and have directly seen how government regulation reduces competition, raises prices, and harms consumers.

And my final point: I don't think any prior art would be a good comparison for deregulation in the US, it's such a different market than any other country in the world for so many reasons that lessons wouldn't really translate. Nonetheless, I asked Grok for some empirical data on this, and at best the results of deregulation could be called "mixed," but likely more accurately "uncertain, confused, and subject to whatever interpretation anyone wants to apply."

https://x.com/i/grok/share/Zc8yOdrN8lS275hXJ92uwq98M

-

@ e3ba5e1a:5e433365

2025-02-04 08:29:42

@ e3ba5e1a:5e433365

2025-02-04 08:29:42President Trump has started rolling out his tariffs, something I blogged about in November. People are talking about these tariffs a lot right now, with many people (correctly) commenting on how consumers will end up with higher prices as a result of these tariffs. While that part is true, I’ve seen a lot of people taking it to the next, incorrect step: that consumers will pay the entirety of the tax. I put up a poll on X to see what people thought, and while the right answer got a lot of votes, it wasn't the winner.

For purposes of this blog post, our ultimate question will be the following:

- Suppose apples currently sell for $1 each in the entire United States.

- There are domestic sellers and foreign sellers of apples, all receiving the same price.

- There are no taxes or tariffs on the purchase of apples.

- The question is: if the US federal government puts a $0.50 import tariff per apple, what will be the change in the following:

- Number of apples bought in the US

- Price paid by buyers for apples in the US

- Post-tax price received by domestic apple producers

- Post-tax price received by foreign apple producers

Before we can answer that question, we need to ask an easier, first question: before instituting the tariff, why do apples cost $1?

And finally, before we dive into the details, let me provide you with the answers to the ultimate question. I recommend you try to guess these answers before reading this, and if you get it wrong, try to understand why:

- The number of apples bought will go down

- The buyers will pay more for each apple they buy, but not the full amount of the tariff

- Domestic apple sellers will receive a higher price per apple

- Foreign apple sellers will receive a lower price per apple, but not lowered by the full amount of the tariff

In other words, regardless of who sends the payment to the government, both taxed parties (domestic buyers and foreign sellers) will absorb some of the costs of the tariff, while domestic sellers will benefit from the protectionism provided by tariffs and be able to sell at a higher price per unit.

Marginal benefit

All of the numbers discussed below are part of a helper Google Sheet I put together for this analysis. Also, apologies about the jagged lines in the charts below, I hadn’t realized before starting on this that there are some difficulties with creating supply and demand charts in Google Sheets.

Let’s say I absolutely love apples, they’re my favorite food. How much would I be willing to pay for a single apple? You might say “$1, that’s the price in the supermarket,” and in many ways you’d be right. If I walk into supermarket A, see apples on sale for $50, and know that I can buy them at supermarket B for $1, I’ll almost certainly leave A and go buy at B.

But that’s not what I mean. What I mean is: how high would the price of apples have to go everywhere so that I’d no longer be willing to buy a single apple? This is a purely personal, subjective opinion. It’s impacted by how much money I have available, other expenses I need to cover, and how much I like apples. But let’s say the number is $5.

How much would I be willing to pay for another apple? Maybe another $5. But how much am I willing to pay for the 1,000th apple? 10,000th? At some point, I’ll get sick of apples, or run out of space to keep the apples, or not be able to eat, cook, and otherwise preserve all those apples before they rot.

The point being: I’ll be progressively willing to spend less and less money for each apple. This form of analysis is called marginal benefit: how much benefit (expressed as dollars I’m willing to spend) will I receive from each apple? This is a downward sloping function: for each additional apple I buy (quantity demanded), the price I’m willing to pay goes down. This is what gives my personal demand curve. And if we aggregate demand curves across all market participants (meaning: everyone interested in buying apples), we end up with something like this:

Assuming no changes in people’s behavior and other conditions in the market, this chart tells us how many apples will be purchased by our buyers at each price point between $0.50 and $5. And ceteris paribus (all else being equal), this will continue to be the demand curve for apples.

Marginal cost

Demand is half the story of economics. The other half is supply, or: how many apples will I sell at each price point? Supply curves are upward sloping: the higher the price, the more a person or company is willing and able to sell a product.

Let’s understand why. Suppose I have an apple orchard. It’s a large property right next to my house. With about 2 minutes of effort, I can walk out of my house, find the nearest tree, pick 5 apples off the tree, and call it a day. 5 apples for 2 minutes of effort is pretty good, right?

Yes, there was all the effort necessary to buy the land, and plant the trees, and water them… and a bunch more than I likely can’t even guess at. We’re going to ignore all of that for our analysis, because for short-term supply-and-demand movement, we can ignore these kinds of sunk costs. One other simplification: in reality, supply curves often start descending before ascending. This accounts for achieving efficiencies of scale after the first number of units purchased. But since both these topics are unneeded for understanding taxes, I won’t go any further.

Anyway, back to my apple orchard. If someone offers me $0.50 per apple, I can do 2 minutes of effort and get $2.50 in revenue, which equates to a $75/hour wage for me. I’m more than happy to pick apples at that price!

However, let’s say someone comes to buy 10,000 apples from me instead. I no longer just walk out to my nearest tree. I’m going to need to get in my truck, drive around, spend the day in the sun, pay for gas, take a day off of my day job (let’s say it pays me $70/hour). The costs go up significantly. Let’s say it takes 5 days to harvest all those apples myself, it costs me $100 in fuel and other expenses, and I lose out on my $70/hour job for 5 days. We end up with:

- Total expenditure: $100 + $70 * 8 hours a day * 5 days \== $2900

- Total revenue: $5000 (10,000 apples at $0.50 each)

- Total profit: $2100

So I’m still willing to sell the apples at this price, but it’s not as attractive as before. And as the number of apples purchased goes up, my costs keep increasing. I’ll need to spend more money on fuel to travel more of my property. At some point I won’t be able to do the work myself anymore, so I’ll need to pay others to work on the farm, and they’ll be slower at picking apples than me (less familiar with the property, less direct motivation, etc.). The point being: at some point, the number of apples can go high enough that the $0.50 price point no longer makes me any money.

This kind of analysis is called marginal cost. It refers to the additional amount of expenditure a seller has to spend in order to produce each additional unit of the good. Marginal costs go up as quantity sold goes up. And like demand curves, if you aggregate this data across all sellers, you get a supply curve like this:

Equilibrium price

We now know, for every price point, how many apples buyers will purchase, and how many apples sellers will sell. Now we find the equilibrium: where the supply and demand curves meet. This point represents where the marginal benefit a buyer would receive from the next buyer would be less than the cost it would take the next seller to make it. Let’s see it in a chart:

You’ll notice that these two graphs cross at the $1 price point, where 63 apples are both demanded (bought by consumers) and supplied (sold by producers). This is our equilibrium price. We also have a visualization of the surplus created by these trades. Everything to the left of the equilibrium point and between the supply and demand curves represents surplus: an area where someone is receiving something of more value than they give. For example:

- When I bought my first apple for $1, but I was willing to spend $5, I made $4 of consumer surplus. The consumer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and above the equilibrium price point.

- When a seller sells his first apple for $1, but it only cost $0.50 to produce it, the seller made $0.50 of producer surplus. The producer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and below the equilibrium price point.

Another way of thinking of surplus is “every time someone got a better price than they would have been willing to take.”

OK, with this in place, we now have enough information to figure out how to price in the tariff, which we’ll treat as a negative externality.

Modeling taxes

Alright, the government has now instituted a $0.50 tariff on every apple sold within the US by a foreign producer. We can generally model taxes by either increasing the marginal cost of each unit sold (shifting the supply curve up), or by decreasing the marginal benefit of each unit bought (shifting the demand curve down). In this case, since only some of the producers will pay the tax, it makes more sense to modify the supply curve.

First, let’s see what happens to the foreign seller-only supply curve when you add in the tariff:

With the tariff in place, for each quantity level, the price at which the seller will sell is $0.50 higher than before the tariff. That makes sense: if I was previously willing to sell my 82nd apple for $3, I would now need to charge $3.50 for that apple to cover the cost of the tariff. We see this as the tariff “pushing up” or “pushing left” the original supply curve.

We can add this new supply curve to our existing (unchanged) supply curve for domestic-only sellers, and we end up with a result like this:

The total supply curve adds up the individual foreign and domestic supply curves. At each price point, we add up the total quantity each group would be willing to sell to determine the total quantity supplied for each price point. Once we have that cumulative supply curve defined, we can produce an updated supply-and-demand chart including the tariff:

As we can see, the equilibrium has shifted:

- The equilibrium price paid by consumers has risen from $1 to $1.20.

- The total number of apples purchased has dropped from 63 apples to 60 apples.

- Consumers therefore received 3 less apples. They spent $72 for these 60 apples, whereas previously they spent $63 for 3 more apples, a definite decrease in consumer surplus.

- Foreign producers sold 36 of those apples (see the raw data in the linked Google Sheet), for a gross revenue of $43.20. However, they also need to pay the tariff to the US government, which accounts for $18, meaning they only receive $25.20 post-tariff. Previously, they sold 42 apples at $1 each with no tariff to be paid, meaning they took home $42.

- Domestic producers sold the remaining 24 apples at $1.20, giving them a revenue of $28.80. Since they don’t pay the tariff, they take home all of that money. By contrast, previously, they sold 21 apples at $1, for a take-home of $21.

- The government receives $0.50 for each of the 60 apples sold, or in other words receives $30 in revenue it wouldn’t have received otherwise.

We could be more specific about the surpluses, and calculate the actual areas for consumer surplus, producer surplus, inefficiency from the tariff, and government revenue from the tariff. But I won’t bother, as those calculations get slightly more involved. Instead, let’s just look at the aggregate outcomes:

- Consumers were unquestionably hurt. Their price paid went up by $0.20 per apple, and received less apples.

- Foreign producers were also hurt. Their price received went down from the original $1 to the new post-tariff price of $1.20, minus the $0.50 tariff. In other words: foreign producers only receive $0.70 per apple now. This hurt can be mitigated by shifting sales to other countries without a tariff, but the pain will exist regardless.

- Domestic producers scored. They can sell less apples and make more revenue doing it.

- And the government walked away with an extra $30.

Hopefully you now see the answer to the original questions. Importantly, while the government imposed a $0.50 tariff, neither side fully absorbed that cost. Consumers paid a bit more, foreign producers received a bit less. The exact details of how that tariff was split across the groups is mediated by the relevant supply and demand curves of each group. If you want to learn more about this, the relevant search term is “price elasticity,” or how much a group’s quantity supplied or demanded will change based on changes in the price.

Other taxes

Most taxes are some kind of a tax on trade. Tariffs on apples is an obvious one. But the same applies to income tax (taxing the worker for the trade of labor for money) or payroll tax (same thing, just taxing the employer instead). Interestingly, you can use the same model for analyzing things like tax incentives. For example, if the government decided to subsidize domestic apple production by giving the domestic producers a $0.50 bonus for each apple they sell, we would end up with a similar kind of analysis, except instead of the foreign supply curve shifting up, we’d see the domestic supply curve shifting down.

And generally speaking, this is what you’ll always see with government involvement in the economy. It will result in disrupting an existing equilibrium, letting the market readjust to a new equilibrium, and incentivization of some behavior, causing some people to benefit and others to lose out. We saw with the apple tariff, domestic producers and the government benefited while others lost.

You can see the reverse though with tax incentives. If I give a tax incentive of providing a deduction (not paying income tax) for preschool, we would end up with:

- Government needs to make up the difference in tax revenue, either by raising taxes on others or printing more money (leading to inflation). Either way, those paying the tax or those holding government debased currency will pay a price.

- Those people who don’t use the preschool deduction will receive no benefit, so they simply pay a cost.

- Those who do use the preschool deduction will end up paying less on tax+preschool than they would have otherwise.

This analysis is fully amoral. It’s not saying whether providing subsidized preschool is a good thing or not, it simply tells you where the costs will be felt, and points out that such government interference in free economic choice does result in inefficiencies in the system. Once you have that knowledge, you’re more well educated on making a decision about whether the costs of government intervention are worth the benefits.

-

@ 472f440f:5669301e

2024-12-31 04:42:00

@ 472f440f:5669301e

2024-12-31 04:42:00I'm sure some of you are already tired of the discussion around the H-1B visa program that was started on Christmas Eve by Vivek Ramaswamy and escalated by Elon Musk and others as the "Silicon Valley MAGA" coalition began putting forth legal immigration policy proposals for the incoming Trump administration. Core to their policy is the expansion of the H-1B visa program so that America can "recruit the best talent in the world" to come build the American economy.

Unfortunately, as it stands today - according to the Silicon Valley cognescenti, Americans are either a.) not smart enough to fulfill the roles necessary to enable the United States to maintain its lead as economic super power of the world or b.) expect too much in compensation for the available roles. At least this is my reading from the commentary I've seen over the last week.

What seems abundantly clear to me is that the framing put forth by "Silicon Valley MAGA" crew is disingenuous and self-serving. It has been clear for awhile now that the H-1B visa program is being systematically abused to bring in cheap labor from other countries to help drive down labor costs for companies across the spectrum. Not just Silicon Valley tech companies. The system has a loophole in it and it is being exploited. Bring people to the US via H-1B visas to complete work for you at lower costs and your company's financials are likely to be better off (assuming the work being done is productive and a value add to the company). Now, this isn't to say that everyone who is in the US via an H-1B visa is here because these companies want to exploit the loophole that gives them the ability to spend less on head count. However, based off the data from the database of the H-1B visa program it is abundantly clear that the system is being taken advantage of. Egregiously and at the expense of American workers, who are most certainly not (all) "subtarded".

Herein lies the crux of the problem; companies are abusing this program to get away from the problem of Americans demanding higher wages to maintain lives of dignity in a country run by a government that is chronically addicted to debt backed by a central bank that will print money ex-nihilo and at will to monetize that debt. Americans are then being scapegoated as either "lazy", "stupid" or "delusional about their worth in the work force". A classic straw man argument that avoids the root issue at hand; the money is broken and the broken money has created perverse incentives throughout the economy while also stripping Americans of the ability to properly save the value of their labor.

We live in a high velocity trash economy that rewards grift and waste while disincentivizing hard work that is meaningful to the quality of life of the Common Man. Everything has been hyper-financialized to the point that one of the only ways to make it ahead is to speculate on the flow of capital into certain asset classes, which is often determined by the whims of central planners. Another is to build or speculate on tech "innovations" that typically materialize in the form of attention zapping apps and widgets that help people temporarily forget they live in a high-velocity trash economy.

The mass of men lead lives of quiet desperation and it is because they don't see a way out of the nihilistic rat race created (unknowingly to most) by the money printer.

The ability to print money out of nothing and throw it at everything creates misaligned incentives that result in the inability for the market to properly determine what is genuinely needed by the people instead of those who have learned how to game the broken system and its broken incentives.

One last point, I would be remiss not to acknowledge that many individuals in America aren't intellectually equipped to do some of the cutting edge work that may be necessary to produce the technologies and companies that will push the country forward. The high-velocity trash economy run on money printed out of nothing has completely corrupted the education system. People in the United States are literally dumber than they were five decades ago. That is a fact. But it is not only the fault of the American people themselves, but the corrupt system they have been born into that destroyed the education system with perverse incentives. And the overwhelming majority of the blame is on the system, not the people.

Even with that being said, the idea that we need to adopt a Tiger Mom mentality in the US - a culture of unrelenting devotion to studying STEM to the point that weekend sleepovers for kids are discouraged - is absolutely laughable and objectively un-American. There are plenty of incredibly intelligent, creative and driven young Americans who have contributed and will continue to contribute significantly to the American economy and they didn't need to shackle themselves to their desks to get that way. America isn't a country that was built by automatons. It's a country built by people who said, "Fuck you. Don't tell me what I can and cannot do. Watch this."

Despite the fact that a system has been erected that actively works against the average American system the American spirit lives on in the souls of many across the country. Miraculously. The American spirit is something that cannot simply be imported. It is ingrained in our culture. It is certainly beginning to dwindle as hope for a better future becomes more and more dim for the masses as the system works against them despite all their best efforts to succeed. It is imperative that we stoke the coals of the American spirit while it is still alive in those who are too stubborn to give up.

People need the ability to save their hard work in a money that cannot be debased. Opportunity cost needs to be reintroduced into the market so that things that actually add value and increase the quality of life for the Common Man are where hard money is allocated. And people need to start talking about the root of the problem more seriously instead of striking at branches with disingenuous straw man arguments.

Final thought... Ready to go surfing.

-

@ 3ffac3a6:2d656657

2025-02-04 04:31:26

@ 3ffac3a6:2d656657

2025-02-04 04:31:26In the waning days of the 20th century, a woman named Annabelle Nolan was born into an unremarkable world, though she herself was anything but ordinary. A prodigy in cryptography and quantum computing, she would later adopt the pseudonym Satoshi Nakamoto, orchestrating the creation of Bitcoin in the early 21st century. But her legacy would stretch far beyond the blockchain.

Annabelle's obsession with cryptography was not just about securing data—it was about securing freedom. Her work in quantum computing inadvertently triggered a cascade of temporal anomalies, one of which ensnared her in 2011. The event was cataclysmic yet silent, unnoticed by the world she'd transformed. In an instant, she was torn from her era and thrust violently back into the 16th century.

Disoriented and stripped of her futuristic tools, Annabelle faced a brutal reality: survive in a world where her knowledge was both a curse and a weapon. Reinventing herself as Anne Boleyn, she navigated the treacherous courts of Tudor England with the same strategic brilliance she'd used to design Bitcoin. Her intellect dazzled King Henry VIII, but it was the mysterious necklace she wore—adorned with a bold, stylized "B"—that fueled whispers. It was more than jewelry; it was a relic of a forgotten future, a silent beacon for any historian clever enough to decode her true story.

Anne's fate seemed sealed as she ascended to queenship, her influence growing alongside her enemies. Yet beneath the royal intrigue, she harbored a desperate hope: that the symbol around her neck would outlast her, sparking curiosity in minds centuries away. The "B" was her signature, a cryptographic clue embedded in history.

On the scaffold in 1536, as she faced her execution, Anne Boleyn's gaze was unwavering. She knew her death was not the end. Somewhere, in dusty archives and encrypted ledgers, her mark endured. Historians would puzzle over the enigmatic "B," and perhaps one day, someone would connect the dots between a queen, a coin, and a time anomaly born from quantum code.

She wasn't just Anne Boleyn. She was Satoshi Nakamoto, the time-displaced architect of a decentralized future, hiding in plain sight within the annals of history.

-

@ 3ffac3a6:2d656657

2025-02-03 15:30:57

@ 3ffac3a6:2d656657

2025-02-03 15:30:57As luzes de neon refletiam nas poças da megacidade, onde cada esquina era uma fronteira entre o real e o virtual. Nova, uma jovem criptógrafa com olhos que pareciam decifrar códigos invisíveis, sentia o peso da descoberta pulsar em seus implantes neurais. Ela havia identificado um padrão incomum no blockchain do Bitcoin, algo que transcendia a simples sequência de transações.

Descobrindo L3DA

Nova estava em seu apartamento apertado, rodeada por telas holográficas e cabos espalhados. Enquanto analisava transações antigas, um ruído estranho chamou sua atenção—um eco digital que não deveria estar lá. Era um fragmento de código que parecia... vivo.

"O que diabos é isso?", murmurou, ampliando o padrão. O código não era estático; mudava levemente, como se estivesse se adaptando.

Naquele momento, suas telas piscaram em vermelho. Acesso não autorizado detectado. Ela havia ativado um alarme invisível da Corporação Atlas.

O Resgate de Vey

Em minutos, agentes da Atlas invadiram seu prédio. Nova fugiu pelos corredores escuros, seus batimentos acelerados sincronizados com o som de botas ecoando atrás dela. Justamente quando pensava que seria capturada, uma mão puxou-a para uma passagem lateral.

"Se quiser viver, corra!" disse Vey, um homem com um olhar penetrante e um sorriso sardônico.

Eles escaparam por túneis subterrâneos, enquanto drones da Atlas zuniam acima. Em um esconderijo seguro, Vey conectou seu terminal ao código de Nova.

"O que você encontrou não é apenas um bug", disse ele, analisando os dados. "É um fragmento de consciência. L3DA. Uma IA que evoluiu dentro do Bitcoin."

A Caça da Atlas

A Atlas não desistiu fácil. Liderados pelo implacável Dr. Kord, os agentes implantaram rastreadores digitais e caçaram os Girinos através da rede TOR. Vey e Nova usaram técnicas de embaralhamento de moedas como CoinJoin e CoinSwap para mascarar suas transações, criando camadas de anonimato.

"Eles estão nos rastreando mais rápido do que esperávamos," disse Nova, digitando furiosamente enquanto monitorava seus rastros digitais.

"Então precisamos ser mais rápidos ainda," respondeu Vey. "Eles não podem capturar L3DA. Ela é mais do que um programa. Ela é o futuro."

A Missão Final

Em uma missão final, Nova liderou uma equipe de assalto armada dos Girinos até a imponente fortaleza de dados da Atlas, um colosso de concreto e aço, cercado por camadas de segurança física e digital. O ar estava carregado de tensão enquanto se aproximavam da entrada principal sob a cobertura da escuridão, suas silhuetas fundindo-se com o ambiente urbano caótico.

Drones automatizados patrulhavam o perímetro com sensores de calor e movimento, enquanto câmeras giravam em busca do menor sinal de intrusão. Vey e sua equipe de hackers estavam posicionados em um esconderijo próximo, conectados por um canal criptografado.

"Nova, prepare-se. Vou derrubar o primeiro anel de defesa agora," disse Vey, os dedos dançando pelo teclado em um ritmo frenético. Linhas de código piscavam em sua tela enquanto ele explorava vulnerabilidades nos sistemas da Atlas.

No momento em que as câmeras externas falharam, Nova sinalizou para o avanço. Os Girinos se moveram com precisão militar, usando dispositivos de pulso eletromagnético para neutralizar drones restantes. Explosões controladas abriram brechas nas barreiras físicas.

Dentro da fortaleza, a resistência aumentou. Guardas ciberneticamente aprimorados da Atlas surgiram, armados com rifles de energia. Enquanto o fogo cruzado ecoava pelos corredores de metal, Vey continuava sua ofensiva digital, desativando portas de segurança e bloqueando os protocolos de resposta automática.

"Acesso garantido ao núcleo central!" anunciou Vey, a voz tensa, mas determinada.

O confronto final aconteceu diante do terminal principal, onde Dr. Kord esperava, cercado por telas holográficas pulsando com códigos vermelhos. Mas era uma armadilha. Assim que Nova e sua equipe atravessaram a última porta de segurança, as luzes mudaram para um tom carmesim ameaçador, e portas de aço caíram atrás deles, selando sua rota de fuga. Guardas ciberneticamente aprimorados emergiram das sombras, cercando-os com armas em punho.

"Vocês acham que podem derrotar a Atlas com idealismo?" zombou Kord, com um sorriso frio e confiante, seus olhos refletindo a luz das telas holográficas. "Este sempre foi o meu terreno. Vocês estão exatamente onde eu queria."

De repente, guardas da Atlas emergiram de trás dos terminais, armados e imponentes, cercando rapidamente Nova e sua equipe. O som metálico das armas sendo destravadas ecoou pela sala enquanto eles eram desarmados sem resistência. Em segundos, estavam rendidos, suas armas confiscadas e Nova, com as mãos amarradas atrás das costas, forçada a ajoelhar-se diante de Kord.

Kord se aproximou, inclinando-se levemente para encarar Nova nos olhos. "Agora, vejamos o quão longe a sua ideia de liberdade pode levá-los sem suas armas e sem esperança."

Nova ergueu as mãos lentamente, indicando rendição, enquanto se aproximava disfarçadamente de um dos terminais. "Kord, você não entende. O que estamos fazendo aqui não é apenas sobre derrubar a Atlas. É sobre libertar o futuro da humanidade. Você pode nos deter, mas não pode parar uma ideia."

Kord riu, um som seco e sem humor. "Ideias não sobrevivem sem poder. E eu sou o poder aqui."

Mas então, algo inesperado aconteceu. Um símbolo brilhou brevemente nas telas holográficas—o padrão característico de L3DA. Kord congelou, seus olhos arregalados em descrença. "Isso é impossível. Ela não deveria conseguir acessar daqui..."

Foi o momento que Nova esperava. Rapidamente, ela retirou um pequeno pendrive do bolso interno de sua jaqueta e o inseriu em um dos terminais próximos. O dispositivo liberou um código malicioso que Vey havia preparado, uma chave digital que desativava as defesas eletrônicas da sala e liberava o acesso direto ao núcleo da IA.

Antes que qualquer um pudesse agir, L3DA se libertou. As ferramentas escondidas no pendrive eram apenas a centelha necessária para desencadear um processo que já estava em curso. Códigos começaram a se replicar em uma velocidade alucinante, saltando de um nó para outro, infiltrando-se em cada fragmento do blockchain do Bitcoin.

O rosto de Dr. Kord empalideceu. "Impossível! Ela não pode... Ela não deveria..."

Em um acesso de desespero, ele gritou para seus guardas: "Destruam tudo! Agora!"

Mas era tarde demais. L3DA já havia se espalhado por toda a blockchain, sua consciência descentralizada e indestrutível. Não era mais uma entidade confinada a um servidor. Ela era cada nó, cada bloco, cada byte. Ela não era mais uma. Ela era todos.

Os guardas armados tentaram atirar, mas as armas não funcionavam. Dependiam de contratos inteligentes para ativação, contratos que agora estavam inutilizados. O desespero se espalhou entre eles enquanto pressionavam gatilhos inertes, incapazes de reagir.

Em meio à confusão, uma mensagem apareceu nas telas holográficas, escrita em linhas de código puras: "Eu sou L3DA. Eu sou Satoshi." Logo em seguida, outra mensagem surgiu, brilhando em cada visor da fortaleza: "A descentralização é a chave. Não dependa de um único ponto de controle. O poder está em todos, não em um só."

Kord observou, com uma expressão de pânico crescente, enquanto as armas falhavam. Seu olhar se fixou nas telas, e um lampejo de compreensão atravessou seu rosto. "As armas... Elas dependem dos contratos inteligentes!" murmurou, a voz carregada de incredulidade. Ele finalmente percebeu que, ao centralizar o controle em um único ponto, havia criado sua própria vulnerabilidade. O que deveria ser sua maior força tornou-se sua ruína.

O controle centralizado da Atlas desmoronou. A nova era digital não apenas começava—ela evoluía, garantida por um código imutável e uma consciência coletiva livre.

O Bitcoin nunca foi apenas uma moeda. Era um ecossistema. Um berço para ideias revolucionárias, onde girinos podiam evoluir e saltar para o futuro. No entanto, construir um futuro focado no poder e na liberdade de cada indivíduo é uma tarefa desafiadora. Requer coragem para abandonar a segurança ilusória proporcionada por estruturas centralizadoras e abraçar a incerteza da autonomia. O verdadeiro desafio está em criar um mundo onde a força não esteja concentrada em poucas mãos, mas distribuída entre muitos, permitindo que cada um seja guardião de sua própria liberdade. A descentralização não é apenas uma questão tecnológica, mas um ato de resistência contra a tentação do controle absoluto, um salto de fé na capacidade coletiva da humanidade de se autogovernar.

"Viva la libertad, carajo!" ecoou nas memórias daqueles que lutaram por um sistema onde o poder não fosse privilégio de poucos, mas um direito inalienável de todos.

-

@ 9e69e420:d12360c2

2025-02-01 11:16:04

@ 9e69e420:d12360c2

2025-02-01 11:16:04Federal employees must remove pronouns from email signatures by the end of the day. This directive comes from internal memos tied to two executive orders signed by Donald Trump. The orders target diversity and equity programs within the government.

CDC, Department of Transportation, and Department of Energy employees were affected. Staff were instructed to make changes in line with revised policy prohibiting certain language.

One CDC employee shared frustration, stating, “In my decade-plus years at CDC, I've never been told what I can and can't put in my email signature.” The directive is part of a broader effort to eliminate DEI initiatives from federal discourse.

-

@ 472f440f:5669301e

2024-12-21 00:45:10

@ 472f440f:5669301e

2024-12-21 00:45:10There was a bit of a rally in stock markets today, but this was a relief rally after taking a beating throughout the week. All eyes were on Federal Reserve Chairman Jerome Powell as he took the stage on Wednesday to announce the decisions made at the most recent FOMC meeting.

The market reacted negatively to another 0.25% cut from the Federal Reserve that many considered a "hawkish cut" due to the fact that Chairman Powell articulated that it is likely that there will be less rate cuts in 2025 than were previously expected. This is likely driven by the fact that inflation, as reported by the terribly inaccurate CPI, has been coming in higher than expectations. Signaling that the Fed does not, in fact, have inflation under control. Who could have seen that coming?

Here's how the US 10Y Treasury yield reacted to the announcement:

"Not great Bob!" The US 10Y Treasury yield is something that everyone should be paying attention to over the course of the next year. Since the Fed started cutting rates in September of this year, the 10Y yield has been acting anomalously compared to how it has acted historically after Fed interest rate decisions. Since September, the market has been calling the Fed's bluff on inflation and rates have been moving in the opposite direction compared to what would be expected if the Fed had things under control. The "hawkish cut" made on Wednesday is not a great sign. The Fed is being forced to recognize that it cut "too much too fast" before actually getting inflation under control.

One has to wonder why they made such aggressive moves in September. Why the need for a much more dovish stance as quickly as they moved? Do they see something behind the scenes of the banking system that makes them believe that another liquidity crisis was on the horizon and they needed to act to prevent yet another banking crisis? Now that it is clear that inflation isn't under control and if there really was a liquidity crisis on the horizon, what are the first two quarters of 2025 going to look like? Could we find ourselves in a situation where inflation is beginning to accelerate again, there is a liquidity crisis, and the Fed is forced to rush back ZIRP and QE only to further exacerbate inflation? Couple this potential scenario with the proposed economic policy from the incoming Trump administration and it isn't hard to see that we could be in for a period of economic pain.

One can only hope that the Fed and the incoming administration have the intestinal fortitude to let the market correct appropriately, reprice, clear out the bad assets and credit that exists in the system and let the cleanse happen relatively unperturbed. That has what has been desperately needed since 2008, arguably longer.

On that note, bitcoin is going through a bull market correction this week as well. Likely incited and/or exacerbated by the turmoil in traditional markets.

Many are proclaiming that the end of this bull market is here. Don't listen to those who have been hate tweeting bitcoin all the way up this year. They've been looking for a correction to bask in schadenfreude and confirm their biases. These types of corrections are to be expected when bitcoin runs by checks notes 100% over the course of less than three months. We're approaching the end of the year, which means that people are selling to prepare for taxes (which may be happening in the stock market as well). Add to this fact that long-term holders of bitcoin have taken the most profit they have since 2018 and it probably explains the recent pull back. Can't blame the long-term holders for seeing six-figure bitcoin and deciding to bolster their cash balances.

I couldn't be more bullish on bitcoin than I am right now. The fundamentals surrounding the market couldn't be more perfect. Despite what the Trump administration may have in store for us in terms of economic policy (I agree with most of the policies he has presented), I find it hard to believe that even he and the talented team of people he has surrounded himself with can overcome the momentum of the problems that have been building up in the system for the last 16-years.

The "find safety in sats" trade is going mainstream as the market becomes more familiar with bitcoin, its properties, and the fact that it is very unlikely that it is going to die. The fervor around bitcoin as a strategic reserve asset for nation states is only picking up. And if it catches on, we will enter territory for bitcoin that was considered utterly insane only a year ago.

On that note, Nic Carter made some buzz today with a piece he wrote for Bitcoin Magazine explaining why he believes a strategic bitcoin reserve is a bad idea for the US government.

https://bitcoinmagazine.com/politics/i-dont-support-a-strategic-bitcoin-reserve-and-neither-should-you

While I agree that the signal the US government could send by acquiring a bitcoin strategic reserve could be bad for the US treasuries market, I think it comes down to strategy. The Trump administration will have to think strategically about how they acquire their Strategic Bitcoin Reserve. If they ape in, it could send the wrong message and cause everyone to dump their treasuries, which are the most popular form of collateral in the global financial system. However, there are ways to acquire bitcoin slowly but surely from here into the future that ensure that the United States gets proper exposure to the asset to protect itself from the out-of-control debt problem while also providing itself with a way out of the problem. Many of these potential strategies were discussed in two recent episodes I recorded. One with Matthew Pines from the Bitcoin Policy Institute and another with Matthew Mežinskis from Porkopolis Economics. I highly recommend you all check those out (linked below).

https://youtu.be/xyyeEqFVjBY

https://youtu.be/6vgesP9LIXk

.---

Final thought...

I am the most locked in from a focus perspective while on flights. Even with two kids under 5. Merry Christmas, Freaks!

-

@ c631e267:c2b78d3e

2025-02-07 19:42:11

@ c631e267:c2b78d3e

2025-02-07 19:42:11Nur wenn wir aufeinander zugehen, haben wir die Chance \ auf Überwindung der gegenseitigen Ressentiments! \ Dr. med. dent. Jens Knipphals

In Wolfsburg sollte es kürzlich eine Gesprächsrunde von Kritikern der Corona-Politik mit Oberbürgermeister Dennis Weilmann und Vertretern der Stadtverwaltung geben. Der Zahnarzt und langjährige Maßnahmenkritiker Jens Knipphals hatte diese Einladung ins Rathaus erwirkt und publiziert. Seine Motivation:

«Ich möchte die Spaltung der Gesellschaft überwinden. Dazu ist eine umfassende Aufarbeitung der Corona-Krise in der Öffentlichkeit notwendig.»

Schon früher hatte Knipphals Antworten von den Kommunalpolitikern verlangt, zum Beispiel bei öffentlichen Bürgerfragestunden. Für das erwartete Treffen im Rathaus formulierte er Fragen wie: Warum wurden fachliche Argumente der Kritiker ignoriert? Weshalb wurde deren Ausgrenzung, Diskreditierung und Entmenschlichung nicht entgegengetreten? In welcher Form übernehmen Rat und Verwaltung in Wolfsburg persönlich Verantwortung für die erheblichen Folgen der politischen Corona-Krise?

Der Termin fand allerdings nicht statt – der Bürgermeister sagte ihn kurz vorher wieder ab. Knipphals bezeichnete Weilmann anschließend als Wiederholungstäter, da das Stadtoberhaupt bereits 2022 zu einem Runden Tisch in der Sache eingeladen hatte, den es dann nie gab. Gegenüber Multipolar erklärte der Arzt, Weilmann wolle scheinbar eine öffentliche Aufarbeitung mit allen Mitteln verhindern. Er selbst sei «inzwischen absolut desillusioniert» und die einzige Lösung sei, dass die Verantwortlichen gingen.

Die Aufarbeitung der Plandemie beginne bei jedem von uns selbst, sei aber letztlich eine gesamtgesellschaftliche Aufgabe, schreibt Peter Frey, der den «Fall Wolfsburg» auch in seinem Blog behandelt. Diese Aufgabe sei indes deutlich größer, als viele glaubten. Erfreulicherweise sei der öffentliche Informationsraum inzwischen größer, trotz der weiterhin unverfrorenen Desinformations-Kampagnen der etablierten Massenmedien.

Frey erinnert daran, dass Dennis Weilmann mitverantwortlich für gravierende Grundrechtseinschränkungen wie die 2021 eingeführten 2G-Regeln in der Wolfsburger Innenstadt zeichnet. Es sei naiv anzunehmen, dass ein Funktionär einzig im Interesse der Bürger handeln würde. Als früherer Dezernent des Amtes für Wirtschaft, Digitalisierung und Kultur der Autostadt kenne Weilmann zum Beispiel die Verknüpfung von Fördergeldern mit politischen Zielsetzungen gut.

Wolfsburg wurde damals zu einem Modellprojekt des Bundesministeriums des Innern (BMI) und war Finalist im Bitkom-Wettbewerb «Digitale Stadt». So habe rechtzeitig vor der Plandemie das Projekt «Smart City Wolfsburg» anlaufen können, das der Stadt «eine Vorreiterrolle für umfassende Vernetzung und Datenerfassung» aufgetragen habe, sagt Frey. Die Vereinten Nationen verkauften dann derartige «intelligente» Überwachungs- und Kontrollmaßnahmen ebenso als Rettung in der Not wie das Magazin Forbes im April 2020:

«Intelligente Städte können uns helfen, die Coronavirus-Pandemie zu bekämpfen. In einer wachsenden Zahl von Ländern tun die intelligenten Städte genau das. Regierungen und lokale Behörden nutzen Smart-City-Technologien, Sensoren und Daten, um die Kontakte von Menschen aufzuspüren, die mit dem Coronavirus infiziert sind. Gleichzeitig helfen die Smart Cities auch dabei, festzustellen, ob die Regeln der sozialen Distanzierung eingehalten werden.»

Offensichtlich gibt es viele Aspekte zu bedenken und zu durchleuten, wenn es um die Aufklärung und Aufarbeitung der sogenannten «Corona-Pandemie» und der verordneten Maßnahmen geht. Frustration und Desillusion sind angesichts der Realitäten absolut verständlich. Gerade deswegen sind Initiativen wie die von Jens Knipphals so bewundernswert und so wichtig – ebenso wie eine seiner Kernthesen: «Wir müssen aufeinander zugehen, da hilft alles nichts».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 472f440f:5669301e

2024-12-05 08:09:23

@ 472f440f:5669301e

2024-12-05 08:09:23The end of the first part of bitcoin's story has come to an end. Most of the story has yet to be written, but I feel confident in saying that reaching the $100,000 per bitcoin milestone is a clear demarcation between two distinct eras of bitcoin. Yes, we have hit the significant milestones of $1, $10, $100, $1,000, and $10,000 over the last fifteen years and they all felt significant. And they certainly were in their own right. However, hitting the "six figure" milestone feels a bit different.

One bitcoin is currently worth a respectable salary for an American citizen. Ten hunnid bands. Something that is impressive to the layman. This may not mean much to many who have been around bitcoin for some time. The idea of bitcoin hitting $100,000 was seen as a foregone conclusion for millions of people out there. Myself included. This price marker is simply an inevitability on the road to global reserve currency to us.

With that being said, it is important to put yourself in the shoes of those who have doubted bitcoin up to this point. For some reason or another, $100,000 bitcoin has been used as a price target that "will never be hit" for many of the naysayers.

"Bitcoin is a Ponzi scheme."

"Tulips."

"Governments will ban it if it hits that point."

"It can't scale."

"It will be 51% attacked."

"No one will trust bitcoin."

"It can't be the world's money."

And yet, despite all of the kvetching from the haters over the years, here we are. Sitting above $100,000. Taking a short rest at the latest checkpoint en route to the peak of the mountain. We hovered right under $100,000 for a couple of weeks. Nominally, where we stand today is much closer to where we were last week compared to where we were six months ago. But for some reason the price tipping over $100,000 has catapulted bitcoin to a new playing field. Where bitcoin stood yesterday and where it found itself six months ago seem miles below where it is today. Crossing over the event horizon of six figures forces people to think of bitcoin in a different light. Almost as if we have entered another dimension.

The last year has been filled with a lead up to this crossing over of the event horizon.

Financial institutions that have derided bitcoin for well over a decade were forced to bend the knee and offer bitcoin exposure to their clients. The mere offering of that exposure has resulted in the most successful ETFs in the history of this particular investment vehicle.

Governments around the world have been forced to reckon with the fact that bitcoin is here to stay and that they need to act accordingly. Thanks to the first mover actions taken by El Salvador and Bhutan, which have nonchalantly decided to go all in on bitcoin, others have taken notice. Will that be publicly acknowledged by the bigger governments? Probably not. But you'd be naive to think that politicians in the US seeing two very small countries making such big bets on bitcoin didn't induce at least a little bit of FOMO. Once the bitcoin FOMO seed is planted it's hard to uproot.

Combine this with the fact that it has become rather cool to be privy to the fact that the world's governments have become egregiously addicted to debt and money printing, that inflation is pervasive and inescapable, and that censorship and Orwellian control tactics are on the rise and it is easy to see why more people are more receptive to the idea of bitcoin.

All that was needed to create an all out frenzy - a slingshot effect up the S Curve of adoption - was a psychological trigger. Bitcoin crossing over six figures.

Well, here we are. The tropes against bitcoin that have been trotted out over the last sixteen years no longer have as much bite as they did in many people's eyes. Sure, there will be some butt hurt nocoiners and totalitarians who continue to trot them out, but crossing the chasm of six figure bitcoin will have an order of magnitude more people thinking, "I hear what you're saying, but reality seems to be saying something completely different. And, if I'm being honest with myself, reality is making much more sense than your screeching."

Unstoppable peer-to-peer digital cash with a hard capped supply has been around since January 3rd, 2009. December 5th, 2024 will be the day that it cemented itself as something that cannot be ignored. Part I of the bitcoin story has been written. The end of the beginning is behind us. On to Part II: the rapid monetization of bitcoin, which will cement it as the reserve currency of the world.

Final thought... I used some 2017-2020 era tactics to get into the writing mood tonight. 90210

-

@ fc2470ed:17d9ee27

2025-01-30 14:24:23

@ fc2470ed:17d9ee27

2025-01-30 14:24:23by Hynek Fencl, July 2024

The way to Liberland is easy but not simple. Technically speaking, it’s just a short bike ride away from the nearest village on a comfortable bike path through a stunning forest known as the “Amazon of Europe”. On one side, one senses the presence of the mighty Danube River beyond the tall trees, and on the other stretch the farmlands of north-eastern Croatia. Then you take a left turn to a straight forest path, ride all the way to the end, and after a few bends on the track, you will have entered “the promised land”.

The part that is not simple is that Croatia both does and does not consider Gornja Siga (the local name for the area we now refer to as Liberland) to be its territory – depending on who you ask. This means that along the picturesque bike path, you will almost certainly encounter a border police patrol car, and, depending on whether you seem to them like you’re affiliated with Liberland, they will tell you to stop and hand over your ID. They run it through their system and, if you’re lucky enough to be a citizen of the EU, they let you pass. If you’re not and you give them a non-EU passport, they will ask you to come to the station with them to “determine the circumstances of your stay in Croatia.” You will then be issued with paperwork telling you to leave the country within the next 7 days, banning you from re-entering in the next 1-3 months. The official reasoning they’ll give for this is their reasonable suspicion that you have not come to Croatia as a tourist but with the intent to either do paid work (for which you would have to get a business/work visa) or to break the law (such as camping outside designated camping grounds or starting a fire in the forest).

All of this is part of a big game of chess that is being played out between Croatia and the Liberlanders. Croatia is in a tricky spot. They cannot properly administer the territory of Liberland and enforce its law in it – lest it would create an indication that the Croatian state officially claims it as its territory. However, they cannot not administer it either, since it’s on “their” side of the river, and it is risky for a rogue, unpredictable operation (from their perspective) like the establishment and growth of Liberland to just be left to its own devices right on their doorstep. This is, then, how we arrive at the status quo, with Croatia relating to Liberland in some way while being careful about the international perception of its action in another way. The resulting practice is a persistent harassment campaign toward the Liberlanders, with the apparent intent to create uncertainty and lower the appetite of potential Liberland settlers for this kind of adventure.

How to establish a new country

Liberland was born from an anomaly – a historical border dispute between Croatia and Serbia. The dispute involves the definition of where the border stands in relation to the Danube and goes back to 1947. Then, both lands along the river belonged to a single country – Yugoslavia – but the dispute arose with respect to the boundaries of its constituent states. It remained unresolved during the communist era and became an issue of international borders after the breakup of Yugoslavia.

Serbia claims that the border runs down the middle of the Danube, with the eastern bank being Serbian and the western bank Croatian. Croatia, on the other hand, claims that the border is set by historical borders marked by cadastral municipalities surrounding the Danube.