-

@ f1989a96:bcaaf2c1

2024-12-05 14:56:41

@ f1989a96:bcaaf2c1

2024-12-05 14:56:41Good morning, readers!

In Thailand, the government initiated the second phase of its digital cash handout, targeting four million Thai seniors with 10,000 baht ($290) distributed via their state-controlled “Tang Rath” app. For all intents and purposes, this serves as a pilot for the Thai central bank digital currency (CBDC), which comes with stringent restrictions and requirements on its usage, including links to citizens' national IDs, facial recognition, and limits on where and when funds can be spent.\ \ Meanwhile, in Brazil, new regulations proposed by the central bank would ban digital asset exchanges from allowing users to withdraw stablecoins to self-custody wallets. If passed, this would set an unfortunate precedent for financial autonomy in Brazil, restrict citizens' movement of funds, and diminish their ability to have an alternative to the declining Brazilian real.

In a positive step for financial privacy, a US court determined that the Office of Foreign Asset Control (OFAC) exceeded its authority in sanctioning Tornado Cash, a digital asset mixing tool that provides users with transaction privacy. This ruling sets an important precedent, means US citizens can use Tornado Cash again, and is good news in general for builders of open-source privacy tools worldwide. In other privacy news, peer-to-peer Bitcoin exchange Robosats now shares an order book with fellow peer-to-peer Bitcoin exchange LNP2Bot via Nostr, making these privacy-centric on-and-off ramps more accessible and liquid for users worldwide.\ \ We end with the latest episode of the HRF x Pubkey Freedom Tech Series, in which HRF’s Arsh Molu interviews Jorge Jraissati, president of the Economic Inclusion Group, on the state of freedom technologies like Bitcoin in Venezuela following Maduro’s stolen election earlier this year. This is an essential listen to understand how open, decentralized, and uncensorable protocols are instrumental for human rights and financial freedom to flourish under repressive regimes.

Now, let’s jump right in!

Subscribe here

GLOBAL NEWS

Thailand | Begins Second Phase of CBDC Handout

Thailand has begun the second phase of its 10,000 baht ($290) digital handout (ostensibly a central bank digital currency), targeting 4 million senior citizens and distributing funds via the government’s “Tang Rath” app. This follows an initial handout of digital currency to 50 million Thais as part of an economic stimulus plan. Critics, however, argue the handout is more accurately a means to entrench financial control and sway votes in the upcoming election. The Thai government limited the initial handout to local spending, specific items, and a six-month expiration. The second phase will likely impose similar restrictions, including requiring registration and facial recognition in the Tang Rath app. According to Thailand’s prime minister, “the digital wallet system would form a digital infrastructure for Thailand by creating a digital ID for citizens to link to government agencies” — a disconcerting reminder of how CBDCs can amplify state control over individual financial activity under the guise of social support.

Brazil | Proposes Ban on Transferring Stablecoins to Self-Custody

The Central Bank of Brazil (BCB) proposed regulations prohibiting digital asset exchanges from allowing users to withdraw stablecoins (digital currency pegged to fiat currency) to self-custody. The restriction aligns with a bill passed in December 2022 that grants the BCB “authority” over the digital asset industry. While presented as a safeguard for international capital flows, it is more likely a front to diminish the financial autonomy offered by digital assets. If passed, it will limit individuals' movement of funds and set a chilling precedent for self-custody in a country where millions of Brazilians transact with digital assets on a monthly basis. As Brazilians face increasing economic instability and diminishing financial freedom, this regulation traps them further in a collapsing Brazilian real (BRL).

China | Prepares for Sanctions While Eyeing Taiwan

China is actively studying sanctions imposed on Russia to prepare for potential repercussions if it invades Taiwan. Chinese officials visited Moscow’s central bank, finance ministry, and other key agencies to analyze how Russia navigated economic restrictions. This proactive approach speaks to fears China may have over its $3.3 trillion in foreign reserves and overseas bank assets, which would face significant restrictions under Western sanctions. In an effort to mitigate these risks, China is working to diversify away from dollar-denominated assets and reduce reliance on US Treasury bonds, which underpin the global financial system. This comes amid escalating tensions with the US after Washington approved an arms shipment to Taiwan, prompting Beijing to vow “resolute countermeasures.”

Nigeria | Journalist Detained for Exposing Regime Corruption

The Nigerian Army’s 6 Division in Port Harcourt detained prominent investigative journalist Fisayo Soyombo, sparking national outrage over press freedom in Nigeria. Soyombo, known for exposing regime corruption, recently unveiled alleged smuggling operations involving the Nigerian Customs Service (NCS). The Foundation for Investigative Journalism, founded by Soyombo himself, demands his immediate release and condemns the actions as an attack on journalism. Under President Bola Tinubu, the government has intensified its dismantling of independent media, silencing critics and restricting tools and pathways that promote financial autonomy. This systematic repression denies citizens the ability to challenge inequality and secure a freer future.

Morocco | Drafts Law on Digital Assets and CBDC

Morocco is moving toward allowing digital assets and a central bank digital currency (CBDC). Central Bank Governor Abdellatif Jouahri shared that a draft law is currently in the adoption process that would reverse a ban on digital assets from 2017. The interest in a CBDC is nothing short of concerning in a country facing widespread repression and economic challenges. Citizens have already taken to the streets to protest rising costs, unemployment, and a lack of basic services. Centralized and programmable money provides the Moroccan government with newfound power to control individual financial activity and only serves to worsen these prevalent issues. Bitcoin adoption remains high under a regime that continues to fabricate economic hardship for its people.

LATEST IN BITCOIN NEWS, DEVELOPMENT, AND COMMUNITY

Tornado Cash | Fifth Circuit Court Lifts Sanctions

The US Court of Appeals for the Fifth Circuit ruled that the Treasury’s Office of Foreign Asset Control (OFAC) exceeded its authority by sanctioning Tornado Cash, a digital asset mixing tool that helps preserve transactional privacy. This reverses an earlier District Court decision that argued the software was under the authority of the US Treasury. The Fifth Circuit found that Tornado Cash’s smart contracts (self-executing lines of code) do not constitute “property” or “services” as defined under the International Emergency Economic Powers Act (IEEPA). They deemed these contracts more akin to “tools” than “services” requiring human effort, constituting "nothing more than lines of code.”

Robosats | Shared Nostr Order Book With LNP2Bot

Robosats, a privacy-focused peer-to-peer (P2P) Bitcoin exchange and HRF grantee, released version 0.7.3-alpha, introducing shared order books with LNP2Bot, a fellow P2P Bitcoin exchange and HRF grantee. P2P exchanges provide a decentralized, uncensorable, and private way for individuals to acquire Bitcoin — crucial in dictatorships with financial restrictions and heightened surveillance. The integration will allow users to access public trade orders from both platforms, creating a larger, more liquid marketplace for trades while reducing arbitrage opportunities. HRF is pleased to see the continued development and collaboration of privacy-focused Bitcoin platforms, which offer a vital on- and off-ramp for individuals whose financial privacy runs paramount for their safety.

Primal | Releases Version 2.0

Primal, a Bitcoin wallet and client for the decentralized Nostr protocol, released version 2.0 of its application, bringing new features and accessibility improvements to users. The update includes a Reads tab, allowing users to browse long-form articles, including HRF’s Financial Freedom Report, now natively on the platform. Additionally, an Explore Tab and Feed Marketplace help users connect, discover trending topics, and access tailored information. The update also brings a revamped search with customizable filters, making finding specific content easier. Primal continues to reinforce its role as a tool for uncensorable communication and greater financial privacy where needed most.

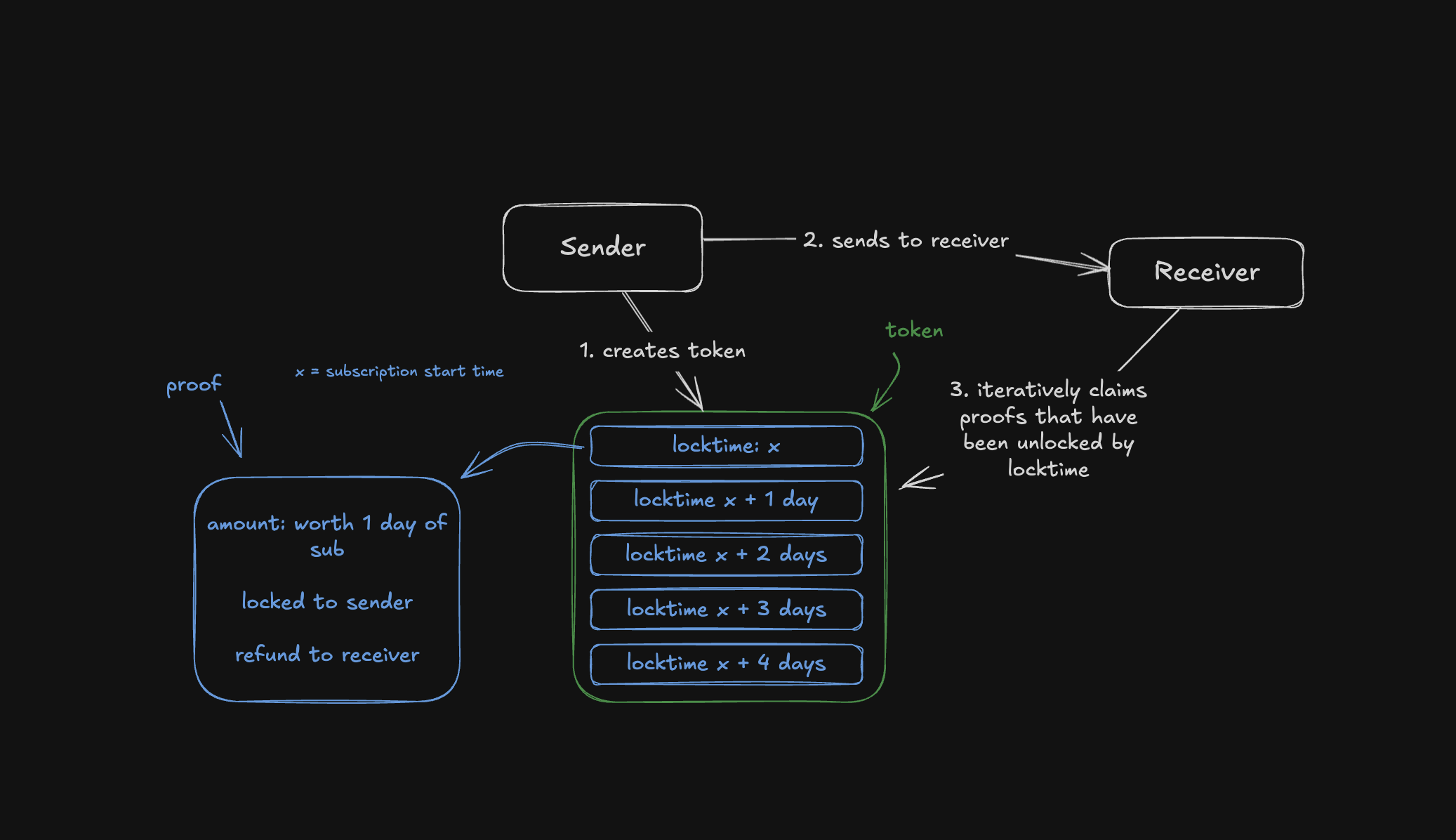

Ark | Introduces Virtual Channels for Instant Settlement

Ark Labs introduced virtual channels, a new feature enabling the instant settlement of transactions on the Ark protocol. Virtual channels facilitate payment channels without relying on backups, constant connectivity, or routing requirements. Ark itself is a layer-two protocol aimed at increasing Bitcoin’s scalability through fast and low-cost transactions. It accomplishes this by pooling Bitcoin liquidity, enabling users to make payments while providing liquidity providers the opportunity to earn fees. The primary tradeoff of Ark is that user funds expire if not used before a set period of time. You can learn about this update here.

Africa Bitcoin Conference | Upcoming Conference

From Dec. 9-11, activists, educators, and entrepreneurs will gather in Nairobi, Kenya, for the Africa Bitcoin Conference to discuss Bitcoin as a tool for resisting increasing global authoritarianism and promoting financial sovereignty. Attendees will participate in discussions, workshops, hackathons, and keynotes, exploring how Bitcoin can provide an economic and social foundation that empowers the individual, safeguards privacy, and fosters inclusion. HRF’s Financial Freedom team is sponsoring the event and will also attend, with keynotes delivered by Christian Keroles and Femi Longe. You can learn more about the conference here.

Chaincode Labs | Bitcoin and Lightning Development Program

Chaincode Labs, a Bitcoin research and development firm, invites developers to apply to its Bitcoin and Lighting protocol development program. This free, three-month course equips participants with the skills needed to contribute to Bitcoin open-source software while receiving mentorship from industry leaders. Open to developers of all experience levels, the program offers a pathway to careers in open-source software development. Applications close on Dec. 31, 2024.

RECOMMENDED CONTENT

HRF x Pubkey — Freedom Tech in Venezuela Post-Election with Jorge Jraissati

In the latest HRF x Pubkey Freedom Tech Series, HRF’s Arsh Molu interviews Jorge Jraissati, president of the Economic Inclusion Group, to discuss the state of freedom technologies in Venezuela following Maduro’s stolen election. Jraissati offers a detailed account of how technologies like Bitcoin are helping Venezuelans navigate an economic landscape marked by hyperinflation, authoritarian control, and restricted access to financial services. The conversation underscores the importance of open and decentralized protocols in empowering individuals to bypass government restrictions, preserve their wealth, and sustain hope in a nation facing profound hardships. Watch the full interview here.

A Response to Ideological Stereotyping by Win Ko Ko Aung

In this article for Bitcoin Magazine, HRF Global Bitcoin Adoption Fellow Win Ko Ko Aung addresses the ideological misconceptions surrounding Bitcoin stemming from individuals' preconceived notions of this emerging technology. Drawing on his experiences as a Burmese human rights advocate, Aung contrasts Western stereotypes of Bitcoin with his own personal story and emphasizes Bitcoin’s potential as a borderless financial tool for those living under authoritarian and repressive regimes. Read the full article here.

If this email was forwarded to you and you enjoyed reading it, please consider subscribing to the Financial Freedom Report here.

Support the newsletter by donating bitcoin to HRF’s Financial Freedom program via BTCPay.

Want to contribute to the newsletter? Submit tips, stories, news, and ideas by emailing us at ffreport @ hrf.org

The Bitcoin Development Fund (BDF) is accepting grant proposals on an ongoing basis. The Bitcoin Development Fund is looking to support Bitcoin developers, community builders, and educators. Submit proposals here.

-

@ 349d6b82:12b2a5b1

2024-12-05 14:51:54

@ 349d6b82:12b2a5b1

2024-12-05 14:51:54Вчера в Серове состоялось событие, которого ждали многие — грандиозный концерт легендарного исполнителя Александра Берегова! Этот вечер стал настоящим праздником музыки и эмоций, ведь артист вернулся на сцену после долгого перерыва. Подготовьтесь к незабываемому шоу в Дворце Культуры Металлургов, где собрались тысячи поклонников, чтобы насладиться как новыми композициями, так и любимыми хитами.

-

@ fcb65172:87f3c4ed

2024-12-05 14:17:51

@ fcb65172:87f3c4ed

2024-12-05 14:17:51Two weeks ago, on a saturday night, my wife and I decided to go to a festival at our local park, not knowing what kind of festival it was. After dinner we looked at each other in that “what are we going to do tonight” kind of way, I’m sure you know it well, if you’re married too. Little did we know that we were going to head to a massive religious Team Jesus festival. We’re talking 5-10,000 sitting on the grass drinking mate and eating Asado (Argentinian Barbecue) while listening to religious preachers, gospel music, and, to my surprise, a Calvin Harris like DJ dropping beats. The only difference being- I didn’t meet this DJ in the summer, I met him that Saturday night, sitting on the park grass.

If I could go back a decade to tell a 19 year old me: “In 10 years from now, you are going to go out on a saturday night, spontaneously with your wife, to a religious festival featuring gospel music and religious preachers, AND, you are going to be perfectly fine with it. That same 19 year old atheist me, would roll his eyes in disbelief and laugh me out the room. As a kid, brought up in a very non religious Denmark, to whom the yearly church visit for the Christmas mass, was my idea of hell on earth, it seems unfathomable that I’m now a 29 year old man with a fairly close relationship to God. Whatever that even means. How did I end up here?

My Atheist Life and Upbringing

I am rebellious by nature. I absolutely despise the notion of anyone dictating how I have to live my life, telling me what I have to think. Having to console the Bible for the answer to all my dilemmas still, to this day, seems ridiculous to me. I mean, who swears by any book to such a degree that they would blindly turn to it, for consultation on every issue in their life? I used to be one of those annoying atheists who completely dismisses the existence of anything, but their own mind and consciousness. I used to say things like: “Religion is a tool for brainwashing, manipulation and the cause of all evil in the world” and “Religion creates wars not inner peace.” Uhh, and my personal favourite atheist line: “If a God really does exist, then why is there so much evil in this world?”

I’m sure you’ve heard these lines rattled off before– or maybe you, yourself spew such sentences, from time to time? Well let me tell you, they are all very convincing one-liner arguments, to a rebellious young man like me. So how did I come to “see the light" as they say?

What is God?

Over the past decade of travelling the world I have come to realisation, that God isn’t this construct of the Bible or the Quran or whatever flavour of holy script you subscribe to. You know, this all-seeing creator of life itself, who judges every single decision I make.

God, to me, is this inexplicable energy between me and the universe at large. God is this ever present energy which we all feel, but can’t quite put our finger on. It’s the energy that drives me to create, everyday– the energy that made me sit down to write this. It just feels right, like a calling– like I must write this story. That same energy made you read this. God is me. God is you. God is in everything and everyone you see around you. We are all mere images of God because we all create life where there previously was none. And we do it every single day, 24/7, all day every day.

Have you ever experienced the feeling that someone you’d never met showed up in your life, for a brief moment, to deliver you a message, a piece of advice or a nudge in the right direction? As if someone had sent them specifically to you? As if someone was listening to your thoughts? Let me tell you– I have had many such experiences in my life.

When I Met God

Let me give you an example. The year is 2018. It is early April. I’m sitting in a hostel patio in Buenos Aires, a cigarette in one hand and a one litre Quilmes beer in the other. I’m in disarray–split in my mind and with seemingly no goal to pursue.

I had been travelling for about a year. I had originally set out, with the goal of finding somewhere in South America, where I’d like to live for a few years, while becoming fluent at Spanish. But during my travels I had lost sight of my originally stated goal. I had instead come to think that I would go back to Denmark and study photojournalism. I had even bought a ticket back to Denmark. That’s why I was in Buenos Aires, to catch my flight back to Denmark in a couple of days. I know, what the hell was I thinking?...

A few months earlier during Carnival 2018 in La Paz, Bolivia, I had met the most interesting, gorgeous local Bolivian girl. She had showed me around La Paz everyday for the two weeks I was there. We talked for hours on end, at cafes, restaurants, and, at night, in bars or at viewpoints across the city. I would walk her home every night, or that is to say–as close as she would let me get to her door. She didn’t want her family to see us together–not yet.

After I left La Paz to keep on travelling, we stayed in contact. We would text each other at least every other day. She was clearly interested, so was I.

As I sat in this hostel patio in Buenos Aires, I got to know Marco, a Venezuelan man in his 40's, who had recently escaped the horror show that is Maduro’s Venezuela, in search of a better life in Argentina. One night, over many beers and plenty of cigarettes, I layed out my situation to Marco. I told him, I was in disarray– that I didn’t know what to do? Should I give up my original plan of living in South America and learning Spanish, to go home and study? What about the girl? I couldn’t take my mind off of her.

Marco lit a cigarette, leaned forward, and looked me in the eyes. It was at this moment he said exactly what I had been thinking all the previous days. He said ”Son, isn’t it obvious what you have to do? I see you texting this girl everyday. She is interested, and so are you. You said you planned to stay and live in South America. If you are serious about that plan, then get your ass on the next bus back to Bolivia and figure out how you can live there”.

I am God. You are God

It felt as if Marco had been sent to that hostel, all the way from Venezuela, just for me. To tell me what I needed to hear and stear me back on track–towards my stated plan. The plan I had told the universe, or God, when I had left Denmark. Marco was an extension of God, presenting himself in my life for 5 days that April in Buenos Aires. The next day I went to Recreo, the central bus station in Buenos Aires. I ordered a ticket for the next bus to Bolivia. A few days later I arrived back in La Paz, as a surprise to the girl.

For the whole trip, I thought about what to say to her when I saw her again. I told her: “You are going to be my girlfriend” she smiled and said “Lets see about that”.

We have been together ever since. She is now my wife. She is an extension of God in my life, just as I am an extension of God in hers.

Marco is one of many examples of where a person I hadn’t known previously has carried an important lesson for me. Most of the time the lessons are good, sometimes they are hard lessons. What all the lessons have in common is: they are always lessons that have presented themselves to me, through that inexplicable energy between me and the universe at large. Lessons born out of my own stated will to God.

I am God. You are God. We are all God. We all create our own lives.

-

@ 349d6b82:12b2a5b1

2024-12-05 13:57:33

@ 349d6b82:12b2a5b1

2024-12-05 13:57:33Серове, 5 декабря 2044 года, скорбная новость потрясла наше местное сообщество: на 72-м году жизни скончался заслуженный спортсмен и тренер Александр Петрович Сирков. Он оставил глубокий след в мире спорта, воспитав множество чемпионов и привнеся значительный вклад в развитие физической культуры в своем родном городе.

Александр начал свою карьеру как выдающийся легкоатлет, завоевав множество медалей на всероссийских и международных соревнованиях.

После завершения спортивной карьеры он посвятил себя тренерству,__ где его подопечные не раз становились __призерами чемпионатов России и Европы.

Александр также активно участвовал в организации спортивных мероприятий и конкурсов, способствуя популяризации спорта среди молодежи.

Его вклад в спорт был отмечен множеством наград и почетных званий, среди которых звание "Почетный гражданин города Серова". Местные жители помнят его как человека с большим сердцем, который всегда поддерживал молодых спортсменов и вдохновлял их на достижения.

Смерть Александра Петровича стала большой утратой для Серова. Его память будет жить в сердцах тех, кто знал его, а также в успехах его воспитанников. Прощание с ним пройдет в эти выходные, 8 декабря 15:00, в спортивном зале, который носит его имя, что символизирует его неоценимый вклад в развитие спорта в городе.

-

@ 05351746:fcc956c4

2024-12-05 13:31:48

@ 05351746:fcc956c4

2024-12-05 13:31:48I still remember the day back in 2017 when my wife came through the front door at our apartment with a smile on her face mixed in with anxious eyes. She looked at me and simply uttered "I am pregnant!". My first instinct told me she was trying to pull a prank to see what I would do. As I stood there, silent, trying to determine the motive behind her abrupt announcement she uttered the phrase again with such assurance it would have been foolish of me to doubt her. I do not remember what I said or did next but I do remember sharing in her blend of excitement and uncertainty.

\ Today marks the passing of 5 years since the birth of our youngest and that same mix of emotions still resides in my heart. Excitement springs up and creates a smile on my face when I first see it on his and uncertainty creeps in when I doubt my ability as a father. As I look back on these past 5 years of raising my youngest son I can think of many occasions where God has used this mix of emotions to mold my wife and I into better parents. The fear found in the uncertainty of of our own abilities has pushed us to pursue God's wisdom over our own. The joy experienced from watching a little boy grow and discover the world around him has created a grateful heart in us both. I am forever thankful for God giving us him. He has been a true blessing for my wife and I. We did not set out to have him when we did, God in His holy wisdom gave him to us according to His will. 5 Years ago when we got to see his face for the first time, the face that caused my wife and I to experience such a mix of emotions, I would never have been able to conceive of the blessings that were yet to come. I am truly in awe of God's providence and wisdom. My wisdom, if I can even call it such, does not even stand to be seen in comparison. Every time I speak my son's name I am reminded...who is like God?

-

@ 05351746:fcc956c4

2024-12-05 13:31:31

@ 05351746:fcc956c4

2024-12-05 13:31:31The book of Job has been one of my favorite books of the Old Testament. Reading the story of a man who had gone through so much anguish in such a short period of time has always been a source of encouragement and guidance for me. One of my favorite phrases from Job is when he says "shall we accept good from God, and not trouble?” Likewise the teachings of Christ and the modeling of His teachings in the life of Paul and the early church has always guided me when dealing with any hardship. Over the past two months I have had to rely on this more than I have ever before.

As it neared my daughters second birthday in June she had yet to develop a single tooth. With baby teeth showing as early as three months my wife and I knew this was not a normal occurrence. With the help of our pediatrician we meet with a pediatric dentist and had some x-rays taken of my daughter's mouth. The results showed us that she was missing almost all of her baby teeth. Our dentist was taken back by this, it can be common for toddlers to be missing some baby teeth but my daughter was missing the majority of hers. Our dentist met with some of his colleagues to discuss my daughter’s case and they determined that she may have a very rare genetic disorder called Ectodermal Dysplasia.

Ectodermal Dysplasia is a group of disorders that affects structures in the ectoderm during development. Hair, skin, nails, teeth, and more can be effected and in a variety of different ways. There are over 150 different types of ectodermal dysplasia and there are only around 7,000 known cases of this disorder worldwide. We have been referred to a genetic testing facility in order to confirm this diagnosis. We are fairly certain that she does have this disorder as she has shown signs of having other symptoms associated with this disorder; such as an inability to sweat and the one tooth she has coming in appears to be abnormally shaped. We will have to wait till October to have her condition properly diagnosed. What we know for now is that she will not develop a proper set of teeth, with the possibility of not having adult teeth. We are meeting with the dental school at UNC Chapel Hill this coming Tuesday to talk about some options they may have to address this. We are very grateful for this opportunity and excited to see what they have in mind.

If you could, please pray for my daughter. This will be a long road and she will face many challenges as she grows up. I know I will be praying for her to be able to accept this difficulty with a smile, because it is one of the most beautiful smiles I have ever seen.

-

@ 6b0a60cf:b952e7d4

2024-12-05 11:16:09

@ 6b0a60cf:b952e7d4

2024-12-05 11:16:09フォロワーリストを低コストで取得する仕様を考える

Nostr リレーはフォロワー数をカウントしたほうが良いを受けて考えたことを雑多に書き留めておきます

単一リレーの場合

NIP-45 COUNT を使う

短所

- 単一リレーで数えた総数でしかない

- 現時点では数を返すのみ

- 複数リレーでマージできるようにidsを一緒に返そうという提案もある

{"#p": <pubkey>, "kinds": [3]} でREQする

短所

- 単一リレーで数えた総数でしかない

- フォロワーの数だけクソデカイベントが返ってくるので時間がかかるしギガが減る

複数リレーの場合

{"#p": <pubkey>, "kinds": [3]} でREQする

長所

- 複数リレーでマージできる

- そこそこもっともらしいフォロワーリストが取れる

短所

- 一度でもフォローをしたことがある人のリストでしかない(後にアンフォローしたかもしれない)

- nostr:nevent1qqs829n0s3qa3wegnhpf6haz3t87hn9huznldd4x2ld6c0d02uq09gsge47l7

- リストすべての公開鍵で接続リレーとkind3を調べ直してアンフォローされている場合を除く処理をすればそこそこ正確になる

- 大変すぎる

- 未調査のリレーにフォロワーがいるかもしれない

新しいkind(フォロワーを格納する)を新設する

仮にkind1003とする

kind3と同じ構造とする{ "kind": 1003, "pubkey": "<Aさんの公開鍵>", "tags": [ ["p", "<Bさんの公開鍵>"], ["p", "<Cさんの公開鍵>"], ["p", "<Dさんの公開鍵>"] ], // other fields... }で、これ誰が作るの?

リレーが作る

- pubkeyにはAさんの公開鍵を入れることになるけど、署名するにはAさんの秘密鍵が必要だよ?

- 無理

クライアントが作る

- Rabbitやnostter等のクライアントにはプロフィール画面でフォロワーのところをクリックするとフォロワーの取得が始まる

- その際、構築したフォロワーリストをkind1003イベントとしてリレーに送ってしまえば良い

- リレー毎でなく複数リレーのマージした結果であるが、その方が有用だろう

- でもkind1003を作成した時期はアカウント毎にバラバラになってしまうね

誰が嬉しいの?

- クライアントは恩恵を受けない

- 本来kind1003の恩恵を受けるべきクライアント自身がkind1003を作らなくてはならない

- 統計調査に興味がある人が満足する

- そのためだけに各クライアントを使用するユーザーの端末のリソースを使う価値があるかどうか

そもそもリレーである必要があるだろうか

- リレーはシンプルであるべきだが、リレーに高機能を求めること自体は否定されるべきことではない

- NIP-50のように検索に特化したリレーもある

でもこの統計情報ってWebSocketで送られてくるべきものだろうか?HTTPで良くない?

リレーである必要すらなくて、REST APIを提供するサービスがあれば十分だよね?

外部サービスとして独自にデータを集めているサービスは既にあるこれをNIPにする必要があるだろうか

- WebSocketやリレーが登場しないからといってNIPに定義してはいけないなんてことはない

- 例: NIP-96

- しかしNIPというのは仕様を共通化して共有するためのものであり、複数の実装を期待するものである

- 統計API提供サービスなど1つあれば十分で、耐検閲性を目的として10個も100個も存在を期待されるものではない

-

@ 7ecd3fe6:6b52f30d

2024-12-05 10:35:57

@ 7ecd3fe6:6b52f30d

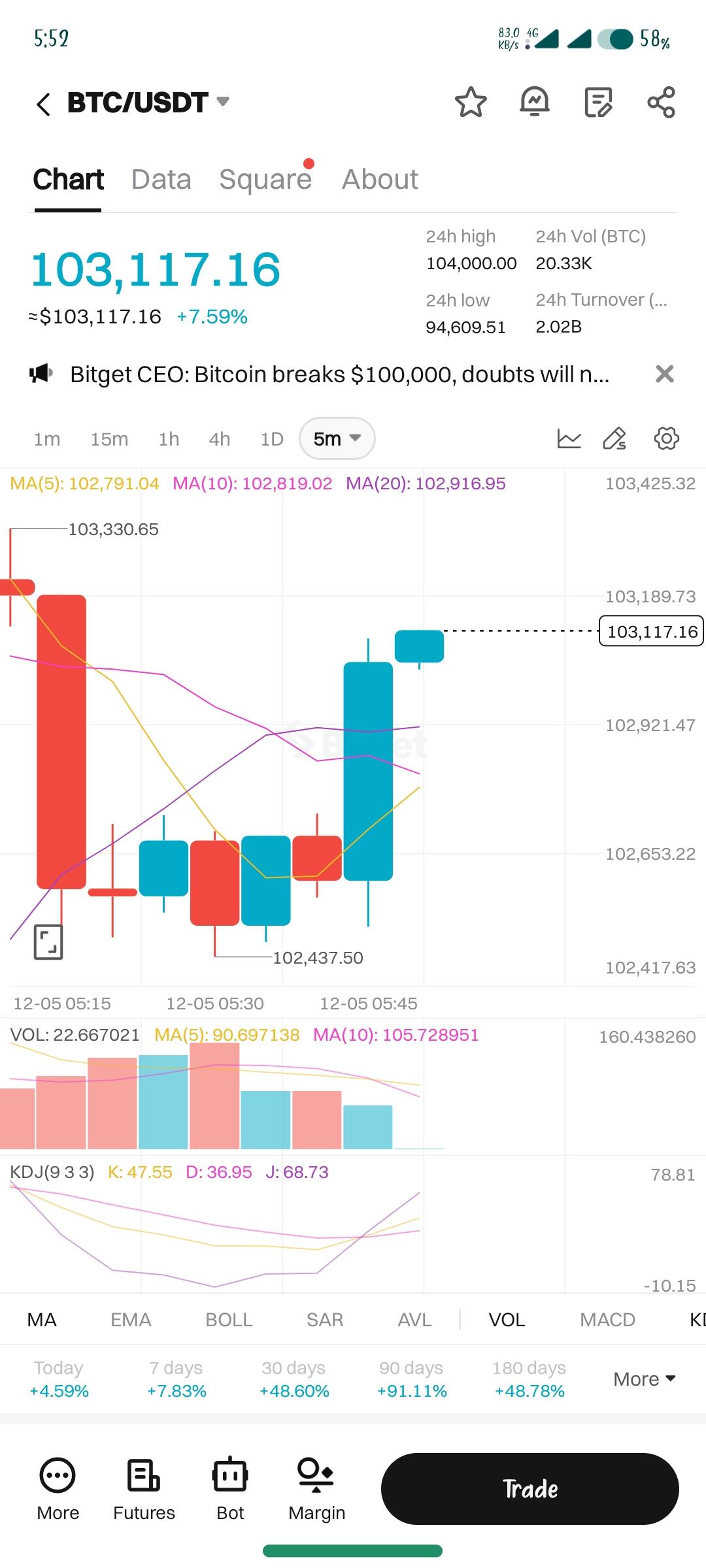

2024-12-05 10:35:57I went to bed last night at 96k, thinking we'd have another day of sideways consolidation, maybe if we're lucky a bump on the head at 99k before the 100k dumpers come in to "take profits"

But little did I know what was waiting for me when I opened up my crusty eyes, I checked the chart as one days after their morning wee and nearly wet the entire bathroom, 102k, must be a mistake, let's check Coingecko, let's check the local exchanges, let's check social media, and it was confirmed like 6 blocks in baby, there's no going back!

Ladies and gentlemen, grab your laser-eye NFTs and dust off those 2017 memes - we've finally arrived! Bitcoin has transcended the mythical $100,000 price point that HODLers have been hallucinating about since the Obama administration.

We have succesfully meme'd the dream into a reality, can anything stop us now? The Banana zone hath arrived

Why the big break?

Is it unrest in France with the government collapsing, is it South Korean uncertainty with their president declaring Martial law, is it Putin coming out to admit you can't ban Bitcoin?

Is it countries trying to find a hedge against Trumps' proposed tariffs?

Who knows?

To me it's just another day of sellers exhausted and buyers are eating through the order book like hungry-hungry hippos

Bottom of the bear to getting some serious air time

If you've been here for one full cycle, and stayed the course it's been a wild ride, we saw Terra Luna, FTX, Celsius, BlockFi blow up and a massive draining of liquidity from the market.

The dream was dead and we hit rock bottom in November 2022, at 15k, to those who nailed that absolute bottom, I salute you.

Anyhoo, it's been a slow grind upwards, the crab market of choppy consolidation normally is, but you psychos continued to hold steady and deploy capital even when number continue to go down!

The meme, the dream and now the cream

The bitcoin maximalists who've been sporting perpetual laser-eye Twitter and nostr profiles can now collectively exhale.

Those same folks who've been predicting "$100K by EOY" every single year since 2017 can now do a victory lap, wearing their tinfoil-lined Gucci tracksuits.

You were wrong many times, only to be proven right eventually!

Remember when explaining Bitcoin's potential value used to involve complex blockchain narratives and decentralization lectures?

Call up the cry babies

When Bitcoin looked down and out there were no shortage of doom and gloomers writing another failed obituary, Dan Pena, Charlie Munger, Warren Buffer, Peter Schiff and Peter Zeihan all had to yap and we listened and laughed

Let's hear what mama has to say on the subject of Bitcoin?

Keep dreaming. Bitcoin is never going to hit $100,000!

— Peter Schiff (@PeterSchiff) November 8, 2019Now it's just: "Told ya so" - accompanied by shitcoiners and nocoiners are angry coz of dey enlarged medulla oblongata

Times like this, I often think of the wise and eloquent words of MSTR Gigachad Saylor

Put money into Bitcoin and wait for number to go up biggly, if number go down put more money in and wait for number to go up bigglier - Michael Saylor

Setting up base camp for the march up Mount Milli-manjaro

The journey to $1 million feels eerily similar. We'll witness another brain-melting crypto pilgrimage - let's call it Mount Milli-manjaro - where every Reddit thread and Twitter space will sound like a combination of economic prophecy and sci-fi fever dream.

Pro tip for newcomers: Pack extra copium, a sense of humor, and maybe some popcorn.

This ride is just getting started.

To the moon? 🚀🤡₿ Looks likely bar a massive black swan, 2025, looks like this thing is going to run with big Usain Bolt strides as we enjoy a year of price discovery, speculation and all the scams that will fester as retail comes piling in to make their overnight fortunes.

I know it's fun to hand out I told you so's and you should enjoy it, take the victory lap but even that gets old, while it's hard to do, try to stay humble and enjoy stack the perpetual top!

-

@ dfc7c785:4c3c6174

2024-12-05 10:29:37

@ dfc7c785:4c3c6174

2024-12-05 10:29:37Just testing that I can post a note from Obsidian because this is absolutely flipping amazing!

-

@ 148755e6:450c107f

2024-12-05 10:09:32

@ 148755e6:450c107f

2024-12-05 10:09:32突然荒野に行きたくなったので行ってきたエントリーです

まずは練習。高尾山へ

Nostrは古今東西ありとあらゆるオフ会が生えており、

まるで荒野に行きたいという私の意志を完全に汲み取ったかのように「紅葉を見にいこうようオフ」がそこに生えていたので参加した。(しおんさんご主催ありがとうございました)

前半1時間くらいの坂道がマジきつかったです。前半キツすぎて後半足痛かった。。 終始人がいっぱいいて渋谷かと思った。

確かに道がかなり整備されていて、逆にコンクリート故に足が疲れたのかもしれない。隣の人は途中の急な坂道で足を滑らせてて、横で転倒事故が起きるかと思いました。

山頂に行っても人がたくさんいて、迷子になりかけた。あそこはスクランブル交差点や。 そして山頂の先にあるもみじ台まで歩くと人がまばらで、まったりして蕎麦食べたりしながら休憩して下山。

登りは暑くて汗かきましたが、山頂でまったりしてると汗も引いてきて少し冷えました。

下山はスイスイ。16時近くで結構暗かったので、冬の間は早めの登頂・下山がおすすめですね。

登り2時間・下り1時間半で概ね見込み通りって感じでした。

高尾山は登ってると景色が変わります。ちょっと開けた場所に出て下の街が見えたり、草木があったり、階段があったり、参道があったり。。そういう意味では退屈しない2時間でした。

ビギナー山とはいえ、革靴やヒールのある靴で登ってる人がいてびっくり。ツルッと滑ることあると思いますので、スニーカーで登ることをお勧めします。

舐めプしてたとはいえめちゃくちゃキツかったおもひで。

更なる練習。小浅間山へ

さて私は荒野に行きたいワケなのですが、高尾山に荒野はありませんでした。更なる練習として小浅間山へ。

前日(か前々日)に雪が降ったようで、山に雪が残っておりました。

それでも都内の汚れてべちゃっとした感じの雪ではなく、粉砂糖がちょっと積もってるみたいな感じで綺麗だった。

登り前半の30分くらい、景色や道が変わらず、ずっと歩きっぱなしになってしまいました。時間みて休憩しながら行けばよかったなあ。

登るにつれて気温が下がっていくのか、積雪が厚くなっていく。

40分くらいは割と平坦な道が続きますが、突然山頂っぽいものが現れて、「これを登れっていうのかい...?」とビビるほどピーンと急な道が出てきました。(写真だと分かりづらいですね)

ただ、高尾山のコンクリート道に比べると足の疲れはそこまででした。雪道なので気をつけて歩くという意味では疲れましたが、春〜秋とかは快適に登れるんじゃないでしょうか。

山頂に到着するとドーンと浅間山が見えて圧巻。

風が強くて飛ばされる恐怖はありましたが、なんとか無事でいられました。あったかいお茶美味しかった〜。

なぜかギャルの看板があって、謎でした。写真はひとまずありません。

山頂が2箇所あって、それぞれで眺めを満喫していたら結構時間が経ってました。

小さい背丈くらいの木や足元にちょっとした植物があったり、自分的にはかなり理想の荒野に近かったです。(植物に対する解像度が低すぎる) 往復で2時間程度の山らしいんですが、なんやかんやと2時間半強くらいいた気がします。

荒野ビギナーは小浅間山に往け

というわけで、荒野に行きたい人はまずは小浅間山を登ると良いと思います。 また登りたい。

荒野部部長

一緒に高尾山・小浅間山に登ってくれた方、ありがとうございました! 個人的には来年の春までに秩父多摩甲斐国立公園に行き、来年の秋までに大山隠岐国立公園に行くという目標を立ててるんですが、 少々時間が空くので次どこに行こうかしらと考えているところです。

ヒントとしては、火山で、あまり高低差のないところだとビギナーの私にちょうど良さそうです。

とある情報筋によると伊豆大島が良さそうなので、次の機会に行けたらと思っています。

みんなで荒野に行こう!

-

@ a012dc82:6458a70d

2024-12-05 09:33:12

@ a012dc82:6458a70d

2024-12-05 09:33:12Table Of Content

-

Debt as an Investment Tool: A Controversial Perspective

-

Leveraging Bitcoin for Debt: The Concept of "DeFi Loans"

-

The Role of Institutional Borrowing in Bitcoin Market Liquidity

-

Debt-Fueled Bitcoin Mining Operations: A Risky Bet

-

Debunking Debt-Backed Stablecoins: Are They Truly Stable?

-

The Paradox of Bitcoin Borrowing and Financial Freedom

-

Leveraging Debt to Accelerate Bitcoin Adoption in Developing Economies

-

Can Debt-Financed Bitcoin Purchases Fuel Bubbles?

-

Debt as an Incentive for Innovation: The Role of Bitcoin Loans

-

The Fear of Debt-Induced Market Manipulation

-

Conclusion

-

FAQ

Cryptocurrencies have revolutionized the financial landscape, and Bitcoin, being the first and most popular among them, has been a hot topic of discussion. As Bitcoin's popularity soars, so does the interest in its potential benefits and drawbacks. One intriguing question that arises is whether debt can play a positive role in the Bitcoin ecosystem. In this in-depth analysis, we will delve into surprising facts surrounding this very topic, evaluating the possibilities and implications. Brace yourself for an eye-opening journey into the world of Bitcoin and debt!

Debt as an Investment Tool: A Controversial Perspective

Many investors are eager to get their hands on Bitcoin, given its incredible price appreciation over the years. However, not everyone can afford to purchase large quantities of Bitcoin outright. This is where debt comes into play as a potential investment tool. By taking out a loan and investing in Bitcoin, investors believe they can ride the wave of the cryptocurrency's upward trajectory and generate substantial returns. While this approach has yielded impressive results for some, it also carries significant risks, such as the potential for increased debt burden in case of market downturns.

Leveraging Bitcoin for Debt: The Concept of "DeFi Loans"

With the rise of decentralized finance (DeFi) platforms, borrowers can now utilize their Bitcoin holdings as collateral to secure loans. These loans, commonly referred to as "DeFi loans," enable borrowers to access liquidity without selling their Bitcoin holdings. This concept has garnered attention and support from the crypto community, as it allows individuals to maintain their exposure to Bitcoin while meeting their financial needs. However, borrowers must remain cautious as these loans come with interest rates and the risk of liquidation if the collateral's value drops significantly.

The Role of Institutional Borrowing in Bitcoin Market Liquidity

Institutional players are increasingly entering the Bitcoin market, and many of them are exploring avenues to leverage their Bitcoin holdings. Institutional borrowing has emerged as a means for these entities to access capital while maintaining their exposure to Bitcoin. This trend has implications for market liquidity, as it injects more capital into the ecosystem, potentially stabilizing prices and promoting adoption. However, an excessive reliance on debt by institutions can also create vulnerabilities, leaving the market susceptible to sudden shocks.

Debt-Fueled Bitcoin Mining Operations: A Risky Bet

Bitcoin mining requires substantial computational power, which translates into significant expenses. Some miners resort to taking on debt to fund their operations and expand their mining capacities. While this strategy can yield profits during bullish market conditions, it also exposes miners to heightened risks during market downturns. In such scenarios, miners might find it challenging to service their debts and remain profitable, potentially leading to bankruptcies and a drop in the network's overall hashrate.

Debunking Debt-Backed Stablecoins: Are They Truly Stable?

Stablecoins, pegged to the value of traditional fiat currencies, are often used to provide stability in the crypto market. Some stablecoins are backed by a mix of fiat and cryptocurrencies, including Bitcoin. While these debt-backed stablecoins aim to offer stability, their reliance on underlying debt raises concerns about their resilience during economic crises. The recent development of regulatory scrutiny over stablecoins adds another layer of complexity to this matter.

The Paradox of Bitcoin Borrowing and Financial Freedom

Bitcoin's ethos of financial sovereignty often clashes with the idea of borrowing. The very essence of Bitcoin lies in providing users with full control over their funds, free from the influence of central authorities. When individuals borrow Bitcoin, they must relinquish some level of control over the borrowed assets, potentially undermining the principle of financial freedom. Striking a balance between leveraging Bitcoin and preserving its core principles remains an ongoing debate within the crypto community.

Leveraging Debt to Accelerate Bitcoin Adoption in Developing Economies

In developing economies, access to traditional financial services can be limited, hindering the adoption of Bitcoin and other cryptocurrencies. By leveraging debt in innovative ways, such as microloans denominated in Bitcoin, it is possible to accelerate the adoption of digital currencies in these regions. This approach can empower individuals with access to global financial markets and foster financial inclusion, revolutionizing the way money flows across borders.

Can Debt-Financed Bitcoin Purchases Fuel Bubbles?

As Bitcoin's price rallies, there is a growing concern that debt-financed purchases might contribute to speculative bubbles. In the past, excessive borrowing to invest in Bitcoin has coincided with price surges and subsequent crashes. Such situations raise questions about the sustainability of Bitcoin's growth and the potential consequences of debt-driven investment strategies.

Debt as an Incentive for Innovation: The Role of Bitcoin Loans

Bitcoin lending platforms have emerged as a way to connect lenders and borrowers within the crypto ecosystem. These platforms facilitate Bitcoin loans for various purposes, ranging from personal finance to business expansion. By offering competitive interest rates, these platforms encourage the circulation of Bitcoin, potentially driving innovation and ecosystem growth.

The Fear of Debt-Induced Market Manipulation

As more institutional players enter the Bitcoin market, concerns about potential market manipulation through debt-financed trading have surfaced. High-leverage trades can amplify price movements, leading to increased volatility and, in extreme cases, market manipulation. Regulators and market participants must remain vigilant to address any undue influence on the market due to excessive debt leveraging.

Conclusion

The question of whether debt can be good for Bitcoin is multifaceted and requires careful consideration. Debt can serve as an investment tool, a means for accessing liquidity, and a driver of innovation. However, it also presents risks, including market manipulation, instability, and potential bubbles. As the crypto space continues to evolve, finding a balanced approach that maximizes the benefits of debt while mitigating its risks remains an ongoing challenge. As investors and users, it is essential to stay informed, exercise prudence, and make informed decisions based on a deep understanding of the dynamic relationship between debt and Bitcoin.

FAQ

Can borrowing Bitcoin be safer than buying it outright? While borrowing Bitcoin may offer potential benefits in terms of capital utilization and risk management, it is not necessarily safer than buying it outright. Borrowing introduces the risk of debt burden, especially during market downturns.

Are decentralized finance (DeFi) loans trustworthy? DeFi loans can be a valuable tool for accessing liquidity without selling your Bitcoin holdings. However, they come with inherent risks, including the possibility of liquidation if the value of your collateral drops significantly.

How can Bitcoin mining operations benefit from debt? Bitcoin mining operations often require a significant upfront investment in hardware and operational costs. Debt can help miners fund their expansion and take advantage of profitable mining opportunities.

That's all for today

If you want more, be sure to follow us on:

NOSTR: croxroad@getalby.com

Instagram: @croxroadnews.co

Youtube: @croxroadnews

Store: https://croxroad.store

Subscribe to CROX ROAD Bitcoin Only Daily Newsletter https://www.croxroad.co/subscribe

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.

-

-

@ 472f440f:5669301e

2024-12-05 08:09:23

@ 472f440f:5669301e

2024-12-05 08:09:23The end of the first part of bitcoin's story has come to an end. Most of the story has yet to be written, but I feel confident in saying that reaching the $100,000 per bitcoin milestone is a clear demarcation between two distinct eras of bitcoin. Yes, we have hit the significant milestones of $1, $10, $100, $1,000, and $10,000 over the last fifteen years and they all felt significant. And they certainly were in their own right. However, hitting the "six figure" milestone feels a bit different.

One bitcoin is currently worth a respectable salary for an American citizen. Ten hunnid bands. Something that is impressive to the layman. This may not mean much to many who have been around bitcoin for some time. The idea of bitcoin hitting $100,000 was seen as a foregone conclusion for millions of people out there. Myself included. This price marker is simply an inevitability on the road to global reserve currency to us.

With that being said, it is important to put yourself in the shoes of those who have doubted bitcoin up to this point. For some reason or another, $100,000 bitcoin has been used as a price target that "will never be hit" for many of the naysayers.

"Bitcoin is a Ponzi scheme."

"Tulips."

"Governments will ban it if it hits that point."

"It can't scale."

"It will be 51% attacked."

"No one will trust bitcoin."

"It can't be the world's money."

And yet, despite all of the kvetching from the haters over the years, here we are. Sitting above $100,000. Taking a short rest at the latest checkpoint en route to the peak of the mountain. We hovered right under $100,000 for a couple of weeks. Nominally, where we stand today is much closer to where we were last week compared to where we were six months ago. But for some reason the price tipping over $100,000 has catapulted bitcoin to a new playing field. Where bitcoin stood yesterday and where it found itself six months ago seem miles below where it is today. Crossing over the event horizon of six figures forces people to think of bitcoin in a different light. Almost as if we have entered another dimension.

The last year has been filled with a lead up to this crossing over of the event horizon.

Financial institutions that have derided bitcoin for well over a decade were forced to bend the knee and offer bitcoin exposure to their clients. The mere offering of that exposure has resulted in the most successful ETFs in the history of this particular investment vehicle.

Governments around the world have been forced to reckon with the fact that bitcoin is here to stay and that they need to act accordingly. Thanks to the first mover actions taken by El Salvador and Bhutan, which have nonchalantly decided to go all in on bitcoin, others have taken notice. Will that be publicly acknowledged by the bigger governments? Probably not. But you'd be naive to think that politicians in the US seeing two very small countries making such big bets on bitcoin didn't induce at least a little bit of FOMO. Once the bitcoin FOMO seed is planted it's hard to uproot.

Combine this with the fact that it has become rather cool to be privy to the fact that the world's governments have become egregiously addicted to debt and money printing, that inflation is pervasive and inescapable, and that censorship and Orwellian control tactics are on the rise and it is easy to see why more people are more receptive to the idea of bitcoin.

All that was needed to create an all out frenzy - a slingshot effect up the S Curve of adoption - was a psychological trigger. Bitcoin crossing over six figures.

Well, here we are. The tropes against bitcoin that have been trotted out over the last sixteen years no longer have as much bite as they did in many people's eyes. Sure, there will be some butt hurt nocoiners and totalitarians who continue to trot them out, but crossing the chasm of six figure bitcoin will have an order of magnitude more people thinking, "I hear what you're saying, but reality seems to be saying something completely different. And, if I'm being honest with myself, reality is making much more sense than your screeching."

Unstoppable peer-to-peer digital cash with a hard capped supply has been around since January 3rd, 2009. December 5th, 2024 will be the day that it cemented itself as something that cannot be ignored. Part I of the bitcoin story has been written. The end of the beginning is behind us. On to Part II: the rapid monetization of bitcoin, which will cement it as the reserve currency of the world.

Final thought... I used some 2017-2020 era tactics to get into the writing mood tonight. 90210

-

@ 7ed7d5c3:6927e200

2024-12-03 15:46:54

@ 7ed7d5c3:6927e200

2024-12-03 15:46:54Shall I compare thee to a summer’s day? Thou art more lovely and more temperate; Rough winds do shake the darling buds of May, And summer’s lease hath all too short a date;

Sometime too hot the eye of heaven shines,

And often is his gold complexion dimm’d;

And every fair from fair sometime declines,

By chance or nature’s changing course untrimm’d;

``` But thy eternal summer shall not fade Nor lose possession of that fair thou owest; Nor shall Death brag thou wander’st in his shade, When in eternal lines to time thou growest;

So long as men can breathe or eyes can see, So long lives this and this gives life to thee. ```

-

@ 2063cd79:57bd1320

2024-12-05 07:38:21

@ 2063cd79:57bd1320

2024-12-05 07:38:21Gerade für Anfänger//innen ist es oft nicht leicht die in der Bitcoin Welt verwendeten Benennungen und Stückelungen zu durchsteigen. Was unterscheidet Bitcoin von bitcoins, wie viele Sats sind ein Bitcoin und was zur Hölle sind UTXOs? Und vielmehr noch, warum sollte mich das interessieren? Ganz einfach: Wer UTXOs vernünftig verwaltet, spart sich nicht nur potentiell zukünftigen Ärger, sondern kann sogar bares Geld sparen. Da die meisten Menschen mit finanzieller Vorbildung gewohnt sind in Konten oder Guthaben zu denken, bedarf es beim Verständnis von UTXOs sicherlich ein wenig Unterstützung. Also wollen wir uns dem Thema Schritt für Schritt annehmen.

Einstieg

Viele Neulinge haben die Vorstellung, dass ein bitcoin gleich einem bitcoin ist. Sie nehmen fälschlicherweise an, dass ein bitcoin immer als Ganzes existiert. Für viele ist der Moment, in dem sie erkennen, dass ein bitcoin aus 100.000.000 Satoshis besteht, der erste große Aha!-Moment. Die Erkenntnis, dass man nicht einen ganzen bitcoin kaufen muss, sondern kleine Einheiten erwerben kann, eröffnet vielen einen ganz anderen Blick auf Bitcoin. Bekannte Sprüche, wie "ich bin zu spät dran" oder "ich kann mir keinen bitcoin leisten" hat jeder schon mal gehört und wenn man dann erklärt, dass man kleine Mengen für Cent-Beträge erwerben und versenden / erhalten kann, ändert dies die Grundhaltung zu Bitcoin von Grund auf.

Der nächste Schritt bei der Erkenntnisreise von Bitcoin ist das Verständnis über UTXOs (Unspent Transaction Output).

💡Ein UTXO ist das Stück Information jeder Bitcoin-Transaktion, das an eine neue Adresse ausgegeben wird, die als Eingabe für zukünftige Transaktionen verwendet werden kann.

Der einfachste Weg, UTXOs zu erklären, ist eine einfache Analogie zu Geld im Portemonnaie. Man stelle sich dazu die Bitcoin-Wallet als ganz normale Geldbörse im normalen Leben vor. Verschiedene Szenarien:

- Man hat im Portemonnaie 10€ in Form eines 10€-Scheins. Man möchte am Kiosk ein Bier für 2€ kaufen. Also bezahlt man mit dem Schein und bekommt vom Verkäufer 8€ zurück.

Was ist passiert? Es gibt einen Transaktions-Output: 10€-Schein aus dem Portemonnaie. Und es gibt zwei Transaktions-Inputs: 2€ in die Kasse des Kiosks und 8€ zurück in das Portemonnaie. Das sieht dann so aus:

- Man hat im Portemonnaie 10€ in Form von 10 1€-Münzen. Man möchte am Kiosk ein Bier für 2€ kaufen. Also bezahlt man mit zwei 1€-Münzen und bekommt nichts vom Verkäufer zurück. Man hat ja passend gezahlt.

Was ist passiert? Es werden zwei Transaktions-Outputs zusammengefasst: Zwei 1€-Münzen aus dem Portemonnaie. Und es gibt einen Transaktions-Input: 2€ in die Kasse des Kiosks (ein weiterer Input über 0€ zurück in das Portemonnaie ist nicht nötig). Das sieht dann so aus:

Es gibt natürlich auch ein Szenario, in dem beide Fälle verknüpft sind.

- Man hat im Portemonnaie 10€ in Form von zwei 5€-Scheinen. Man möchte am Kiosk drei Bier für 6€ kaufen. Also bezahlt man mit zwei 5€-Scheinen und bekommt vom Verkäufer 4€ zurück.

Was ist passiert? Es gibt zwei Transaktions-Outputs: Zwei 5€-Scheine aus dem Portemonnaie. Und es gibt zwei Transaktions-Inputs: 6€ in die Kasse des Kiosks, und 4€ zurück in das Portemonnaie. Das sieht dann so aus:

Mit Hilfe dieser drei Szenarien haben wir die beiden Grundideen verbildlicht: Um einen gewissen Betrag zu bezahlen, können UTXOs (die jeweiligen Münzen oder Scheine im Portemonnaie) auseinandergebrochen oder zusammengefasst werden.

Eine weitere Grundidee besteht darin, dass ein UTXO IMMER zerstört wird. Das lässt sich mit dem folgenden Szenario verbildlichen:

- Man hat im Portemonnaie 10€ in Form eines 10€-Scheins. Man möchte am Kiosk 5 Bier für 10€ kaufen. Also bezahlt man mit dem Schein und bekommt nichts vom Verkäufer zurück.

Was ist passiert? Es gibt einen Transaktions-Output: 10€-Schein aus dem Portemonnaie. Und es gibt einen Transaktions-Input: 10€ in die Kasse des Kiosks. Allerdings hat der Kioskbesitzer den 10€-Schein zerrissen und hat einen ganz neuen 10€-Schein bekommen, den er in die Kasse legt. Dem Besitzer ist egal, ob der Schein derselbe ist, wie der, den ich ihm gegeben habe, denn der Schein in seiner Kasse ist vom Wert identisch.

Als nächstes muss man verstehen, dass Transaktionen in der Blockchain historisch miteinander verknüpft sind. Diese Verknüpfung entsteht dadurch, dass die Outputs einer Transaktion immer die Inputs der nächsten Transaktion darstellen. In unserem Beispiel bedeutet das, dass es jemanden gibt, der eine Liste darüber führt, welche Münzen und Scheine aus einem Portemonnaie ausgegeben wurden und welche nicht. Auf dieser Liste steht aber auch, welche Münzen und Scheine in die Kasse des Kioskbesitzers gewandert sind und von dort wieder herausgegeben wurden. Diese Liste wird also immer länger, denn die Scheine und Münzen werden als Wechselgeld mehrere Male am Tag an verschiedene Kunden ausgegeben und auch deren Portemonnaies werden auf dieser Liste akribisch festgehalten. Diese Liste ist die Blockchain.

Jetzt haben wir also verstanden, dass Bitcoin kein System von Konten und Guthaben ist, sondern vielmehr die Sammlung und Übersicht von UTXOs und deren Besitzer. Die Aufgabe einer Wallet besteht also unter anderem darin, ein Bitcoin-Guthaben abzubilden, das aus vielen verschiedenen UTXOs besteht.

💡Zusammenfassung: Um eine Bitcoin-Transaktion auszugeben, wird entweder ein ganzer UTXO gesendet, für den es möglicherweise Wechselgeld gibt, oder es werden mehrere UTXOs zusammengefasst, um einen Betrag zu kombinieren.

Transaktionsgebühren

Mit diesem Wissen können wir jetzt eine weitere Komplexität hinzufügen. In unseren Szenarien gab es nur zwei Teilnehmer jeder Transaktion: Sender und Empfänger der Zahlung, also Biertrinker und Kioskbesitzer. Im Bitcoin-Netzwerk gibt es allerdings noch einen dritten Teilnehmer, der an jeder Transaktion interessiert ist. Die Miner. Denn Miner sind dafür verantwortlich, dass die Transaktionen in die Blockchain geschrieben werden und dafür erhalten sie eine kleine Transaktionsgebühr. Dies bedeutet, dass ein weiterer UTXO erstellt wird, der diese Gebühren enthält. Technisch gesehen ist diese Zahlung impliziert, dass heißt der (die) UTXO(s) auf der Senderseite sinf größer, als der UTXO auf der Empfängerseite. Das Delta erhält der Miner.

Die Höhe der Gebühr variiert von Transaktion zu Transaktion und kann sogar vom Sender eingestellt werden, indem das Delta größer oder kleiner eingestellt wird. Ein weiterer Punkt ist, dass der Gebrauch von vielen UTXOs auch zu höheren Gebühren führt, da die Gebühren anhand der Größe der Transaktion (Dateigröße) und nicht anhand der Geldmenge (in Bitcoin, US Dollar oder Euro dargestellt) berechnet werden. Eine 0,001 Bitcoin Zahlung kann dementsprechend höhere Gebühren beinhalten, als eine 100 Bitcoin Zahlung, wenn die 0,001 Bitcoin Zahlung aus vielen kleinen UTXOs besteht. Dies bedeutet aber nicht, dass ein Anteil jedes verwendeten UTXOs in separate UTXOs für den Miner aufgebrochen wird, der Miner erhält einen UTXO in Höhe der Gesamtmenge der Gebühren.

Um es einfach zu veranschaulichen, nehmen wir eine Gebühr von 1% an. Bildlich dargestellt ist dies einfacher zu verstehen:

Wie wir sehen können, hätten zwei UTXOs (5€ und 1€) gereicht, um die Zahlung von 6€ an den Kiosk zu tätigen, allerdings musste noch ein weiterer UTXO von der Wallet hinzugezogen werden, um auch die GEbühr zu zahlen. Der Rest geht als Wechselgeld an den Sender zurück.

Das Thema Gebühren ist nicht ganz trivial, denn die Höhe der Transaktionsgebühren hängt nicht nur davon ab, wie viele Bytes eine Transaktion hat (also aus wie vielen verschiedenen UTXOs sie zusammengestellt wurde), sondern auch vom aktuellen Status der Auslastung des Netzwerks und vom aktuellen Kurs. Die Gebühren werden in sats/B oder sats/vB (Satoshis pro (virtual) Byte) berechnet, also wie viele Sats man pro Byte entrichten muss. Da Sats Kursschwankungen unterliegen, sind Transaktionen im Allgemeinen teurer, wenn der Kurs hoch ist.

Wie an der Grafik deutlich zu sehen ist, sind Transaktionsgebühren in den letzten anderthalb Jahren relativ stabil und relativ niedrig gewesen, allerdings sieht man auch, dass es auch Zeiten gab, in denen die Gebühren deutlich gestiegen sind und sehr wechselhaft waren.

Ein weiterer Faktor beim Bestimmen der Gebühren ist der/die Nutzer//in selbst, denn Gebühren lassen sich individuell einstellen. Die meisten (mobilen) Wallets übernehmen diese Aufgabe für den/die Nutzer//in, indem mit Hilfe eines Algorithmus die optimale Höhe der angebotenen Gebühren berechnet wird. Wiederum andere Wallets erlauben dem/der Nutzer//in die Gebühren von Transaktion zu Transaktion frei zu bestimmen.

Welchen Nutzen haben hohe gegenüber niedrigen Gebühren? Bitcoin-Miner handeln nicht ganz uneigennützig, denn sie werden für ihre Arbeit entlohnt. Für jeden produzierten Block erhalten sie neben dem Blockanteil (Reward) auch sämtliche Transaktionsgebühren, der im neuen Block enthaltenen Transaktionen. Ohne zu sehr ins Detail zu gehen, bedeutet dies, dass Miner einen Anreiz haben, Transaktionen mit möglichst hohen Gebühren zuerst in den neuen Block zu schreiben, um so ihren Profit zu maximieren. Je höher eine Gebühr relativ zu denen der anderen Transaktionen im Mempool ist, desto wahrscheinlicher ist, dass diese Transaktion im nächsten Block landet. Das bietet dem/der Nutzer//in die Möglichkeit, die eigene Transaktion zu priorisieren.

Weitere Faktoren, die Einfluss auf die Höhe der Gebühren nehmen können (z.B. Adressformate), unterschlagen wir an dieser Stelle und widmen uns wieder dem eigentlichen Thema.

Wir haben also gesehen, dass das Bitcoin Netzwerk im Endeffekt eine riesige Sammlung von UTXOs ist. Man könnte auch sagen, dass UTXOs bitcoins sind und das Netzwerk nur den wechselnden Besitzanspruch jedes/jeder Besitzer//in verwaltet. In der Regel helfen uns Wallets dabei, dieses komplexe Netzwerk möglichst benutzerfreundlich darzustellen, denn alles was der/die Durchschnittsnutzer//in braucht, ist eine Übersicht über die Menge Bitcoin, die er/sie besitzt und eine Möglichkeit Bitcoin zu senden und zu empfangen. Wenn man aber etwas tiefer in die Materie steigt und/oder sogar anfängt, größere Mengen (und ich meine nicht große Summen) an Bitcoin zu empfangen, dann ist es sinnvoll, sich mit UTXO Management zu beschäftigen. Dies ist besonders häufig der Fall bei Firmen oder Personen, die Zahlungen in Bitcoin akzeptieren, Value-4-Value Content produzieren, oder in sonstiger Form viele Transaktionseingänge mit Bitcoin haben.

UTXO Management

Das Verwalten der eigenen UTXOs besteht im Prinzip darin, diese zu labeln / markieren und zu konsolidieren. Einige Wallets bieten diese Funktionen an und erlauben z.B. jeden einzelnen UTXO anzuzeigen und ein Label zu vergeben.

Dieses Taggen oder Labeln von einzelnen UTXOs wird auch Coin Control genannt, und ist dann besonders hilfreich, wenn man einzelne Eingänge in bestimmte UTXOs für Zahlungen und andere UTXOs für das Sparen aufteilen möchte. Dies könnte Gründe der Privatsphäre, aber auch einfach buchhalterische Hintergründe haben.

Mit unserem Vorwissen wissen wir jetzt, dass man problemlos alle UTXOs einer Wallet konsolidieren kann, indem man diese einfach in einer Transaktion in Höhe des gesamten Guthabens an eine eigene Adresse sendet. Dies hat zur Folge, dass alle UTXOs zu einem einzelnen UTXO (zzgl. eines UTXOs für Gebühren) gruppiert werden.

Dies sieht dann auf der Blockchain folgendermaßen aus:

Der Vorteil vom UTXO Management ist zum einen, dass man durch das Konsolidieren kleinerer Beträge zukünftig Transaktionsgebühren sparen kann - dies ist natürlich nur richtig, wenn man nicht genauso viele Konsolidierungen vornimmt, wie man Zahlungen ausführen würde. Auch ermöglicht aktives Management Konsolidierungen in Zeiten vorzunehmen, wenn Netzwerkgebühren niedrig sind, um zu vermeiden, dass man während einer Zeit, in der das Netzwerk überlastet ist, mehr bezahlt. Außerdem kann UTXO Management (und dazu gehören auch CoinJoins ⬇️) die Privatsphäre erhöhen, da die in einer Transaktion benutzten UTXOs Informationen über das Gesamtguthaben oder den Transaktionsverlauf preisgeben könnten.

https://www.genexyz.org/post/23-block-772315-bitcoin-mixing-q6i7y4/

Mit dem anhaltenden Wachstum des Netzwerks steigt natürlich auch die Anzahl der existierenden UTXOs, denn auch wenn Inputs zerstört werden, kommt es natürlich häufiger vor, dass größere UTXOs in kleinere aufgebrochen werden, als dass kleine UTXOs zu größeren Transaktionen zusammengefasst werden. Es gibt natürlich auch Zyklen, in denen die Gesamtmenge leicht zurück geht. Dies geht meist mit einem Rückgang des Kurses einher und ist auf UTXO Management zurückzuführen, bei dem große Operationen, wie Miner und Exchanges, ihre UTXOs bündeln und vom niedrigen Preis profitieren wollen.

Sidenote: Jede//r, der/ die schonmal eine "kleinere" Transaktion gesendet hat, "um zu testen, ob das auch alles funktioniert mit diesem Netzwerk", um dann anschließend einen größeren Betrag zu versenden, wird jetzt festgestellt haben, dass in beiden Fällen, sehr wahrscheinlich ein UTXO mit dem Gesamtbetrag ins Netzwerk gesendet wurde 😄

🫳🎤

In diesem Sinne, 2... 1... Risiko!

-

@ 97fc03df:8bf891df

2024-12-05 06:32:29

@ 97fc03df:8bf891df

2024-12-05 06:32:29— How Adaptive Mechanical Consensus is Reshaping the Trust Mechanism in the Information Age

Gavin, BeeGee (Core Builders of Super Bitcoin & BEVM) December 4, 2024

From Cybernetics to the Trust Crisis in the Information Age

The advent of the AI era has brought unprecedented opportunities and challenges. The explosion of information has confronted humanity with the daunting task of processing and trusting vast amounts of data. Traditional trust mechanisms, such as centralized institutions and social consensus, are increasingly inadequate in addressing the complexities of our evolving landscape. AI algorithms, centered around large language models, are iterating at an unstoppable pace, and various AI derivatives are inevitably permeating every aspect of human life. However, behind this rapid development, are we truly prepared to handle the ensuing trust crisis?

As far back as science fiction writer Isaac Asimov, in I, Robot, foresaw that central control systems might surpass the 'Three Laws of Robotics” and pose a threat to humanity. As near as the insightful scholar, Yuval Noah Harari, raised similar concerns, questioning, “Can we trust computer algorithms to make wise decisions and create a better world?” These apprehensions reflect a growing distrust in centralized authority and algorithmic decision-making. In this context, the importance of decentralized trust becomes paramount. The pressing question is: How can we establish reliable systems without a central authority?

To address this issue, we need to draw upon new theoretical frameworks, and cybernetics precisely offers the crucial insights required.

Cybernetics and the Theoretical Foundation of Bitcoin

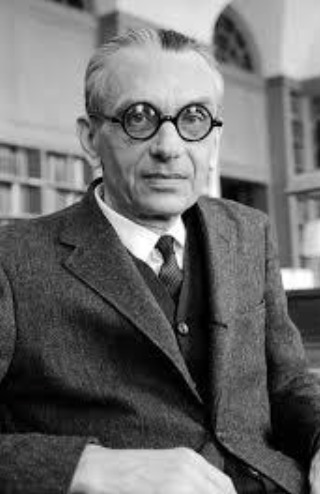

Norbert Wiener, the father of cybernetics, delved into the control and communication of systems in his seminal work Cybernetics, emphasizing the critical role of feedback mechanisms in maintaining system stability. His core ideas—self-organizing systems, nonlinear dynamics, and the exploration of life's essence—provide a robust theoretical foundation for understanding Bitcoin's success.

Norbert Wiener

Bitcoin's adaptive mechanical consensus is a practical embodiment of Wiener's cybernetic principles, showcasing the capabilities of self-regulation and self-organization within a system. Through Proof of Work (PoW) and dynamic difficulty adjustments, the Bitcoin network achieves a high degree of decentralized control, ensuring the system's security and stability. This mechanism not only aligns with information theory's principles regarding data transmission and trust establishment but also offers a novel solution to the trust crisis in the information age.

The Essence of Blockchain: Decentralized Control, NOT Computational Power

Currently, many blockchain projects overly emphasize computational metrics like Transactions Per Second (TPS), attempting to capture market share by enhancing performance. However, this pursuit of computational power overlooks the core value of blockchain technology. The true revolutionary aspect of blockchain lies in its realization of Decentralized Control. Through adaptive mechanical consensus, it addresses trust and collaboration issues that traditional centralized systems cannot effectively manage.

For instance, Bitcoin's success does not stem from its computational prowess. In fact, the Bitcoin network's transaction processing capacity is relatively limited. Its core value lies in achieving a trust mechanism without the need for centralized institutions through decentralized control. This mechanism enables participants within the network to conduct secure transactions and collaborations without requiring mutual trust. The establishment of this trust relies on rigorous cryptographic algorithms and consensus protocols rather than the enhancement of computational speed.

In contrast, some blockchain projects that emphasize high TPS may have performance advantages but lack robust decentralized control, making it difficult to establish a stable foundation of trust. This is akin to constructing a skyscraper without a solid foundation—it may appear impressive but is ultimately unsustainable.

Bitcoin's Adaptive Mechanical Consensus: The Lifeblood of the Digital World

Bitcoin's adaptive mechanical consensus functions as the "Mechanical Heart" of the digital realm, endowing the network with capabilities of self-regulation, self-organization, and self-evolution. Miners, motivated by Bitcoin rewards, invest substantial computational power to participate in the Proof of Work competition. This mechanism not only secures the network but also creates a self-reinforcing cycle: increased miner participation leads to higher total network hash rate, elevated mining difficulty, further strengthened consensus mechanisms, and consequently, an increase in Bitcoin's value, attracting even more miners.

This virtuous cycle exemplifies the characteristics of a self-organizing system. The network's stability and security do not depend on any centralized entity but are achieved through the collective competition and collaboration of participants. Bitcoin's consensus mechanism not only resolves the Byzantine Generals Problem in distributed systems but also demonstrates the complexity and emergent behaviors inherent in nonlinear systems.

Mathematician Alan Turing believed that thought ultimately arises from mechanical processes in the brain. In contrast, logician Kurt Gödel argued that reducing thought to mere mechanical processes was a misunderstanding. He believed human thought possesses depths and complexities beyond the reach of machines, especially in aspects like intuition, insight, and consciousness.

Alan Turing

Alan Turing Kurt Gödel

Kurt GödelHowever, Satoshi Nakamoto's Bitcoin offers a new perspective on this debate. By implementing adaptive mechanical consensus, it demonstrates that machines can possess abilities akin to human thought. This "Mechanical Heart" allows the Bitcoin network to self-regulate and evolve, exhibiting characteristics similar to living organisms. While Bitcoin's "thinking" ability is limited to expressing BTC transfers and UTXO state changes, it represents an initial manifestation of machine cognition.

If we further contemplate designing a universal "Mechanical Heart" (adaptive mechanical consensus), we could potentially construct mechanical adaptive control systems capable of expressing a multitude of concepts. This would have profound implications for the development of artificial intelligence, possibly propelling it forward in ways Gödel and Turing envisioned.

In both biological and mechanical systems, functions can be divided into three parts: sensors for communication, the brain for computation, and the heart for thought (control). In the Bitcoin network, the "heart" is its adaptive mechanical consensus. This is a breakthrough that neither Turing nor Gödel anticipated. Perhaps, had they witnessed the emergence of Bitcoin, they would be exhilarated by its implications for the advancement of artificial intelligence.

The Satoshi Paradigm: The Inception of Mechanical Consensus and a New Technological Model

The birth of Bitcoin marks the emergence of an entirely new technological paradigm—the Satoshi Paradigm. In addressing the distributed trust problem, Satoshi Nakamoto created Bitcoin, a system based on adaptive mechanical consensus. He did not merely aim to create a digital currency but sought to establish a trust system that operates without centralized control. The Electronic Cash System was merely one experimental application of his broader vision.

This paradigm embodies the three core principles of Wiener's cybernetics: self-organizing systems, nonlinear dynamics, and the exploration of life's essence. The Bitcoin network, with its "Mechanical Heart," possesses the abilities of self-regulation, self-organization, and self-evolution. The self-organizing aspect is evident in the autonomous participation and collaboration of network nodes. Nonlinear dynamics are reflected in the network's complex and dynamic behaviors. The exploration of life's essence is manifested in the system's capacity for self-maintenance and evolution.

Drawing on Cross-Disciplinary Thought: The Resonance of Cybernetics, Information Theory, and Blockchain

Cybernetics and information theory provide crucial theoretical support for understanding Bitcoin and blockchain technology. Claude Shannon's A Mathematical Theory of Communication lays the groundwork for comprehending information transmission, signal processing, and the establishment of trust. Cybernetics emphasizes system feedback and self-regulation, which closely align with Bitcoin's adaptive mechanical consensus mechanism.

Claude Shannon

Claude ShannonMoreover, by incorporating insights from other fields, we can examine the development of blockchain from a broader perspective. In artificial intelligence, self-learning and adaptive mechanisms can inspire improvements in consensus algorithms. Philosophical concepts like intersubjectivity help us understand the relationship between individuals and the collective in decentralized networks. In Buddhism, the notion of "seeing one's true nature" from the Platform Sutra of the Sixth Patriarch emphasizes attaining an understanding of the essence of things through self-realization, without clinging to superficial representations such as the hand that points to the moon. These ideas prompt us to consider the role of the "heart" and the impermanence of systems. Bitcoin's "Mechanical Heart" embodies this impermanence and emptiness, continuously self-adjusting to maintain system stability and trustworthiness.

Expanding Applications: From Currency to Broader Social Governance

Bitcoin's success suggests that the application of decentralized control should not be confined to the realm of digital currencies. By constructing robust adaptive mechanical consensus mechanisms, we can potentially achieve decentralized trust and collaboration in various other fields.

Take constitutional law for example. Traditional interpretation and enforcement of constitutions rely on centralized institutions like courts and law enforcement agencies. Discrepancies in interpretations by different enforcers can lead to trust issues and inconsistent application. If we could employ a trustworthy decentralized consensus mechanism to interpret and enforce constitutional provisions, it might enhance fairness and consistency in the legal system. While this endeavor presents significant challenges, it holds profound significance, much like Satoshi Nakamoto's exploration of decentralized currency through Bitcoin.

Conclusion: Reconstructing Trust, Opening a New Chapter

In an era where information is overwhelmingly abundant, trust has become a scarce and invaluable resource. Bitcoin, through its adaptive mechanical consensus, has pioneered a global decentralized trust system, redefining how we collaborate and transact. We need to break free from our obsession with computational power and return to the essence of blockchain. By focusing on the realization of decentralized control and through Bitcoin’s “Mechanical Heart”, we can reconstruct humanity's trust mechanisms.

On this long journey of crypto, where each day feels like a year, we've travelled for so long yet the "Other Shore" seems far from reachable. We seem to have forgotten why we set out in the first place and what it takes to carry us further.

Fortunately, there is still Bitcoin, like the North Star hanging high in the sky, guiding us. As the song "Chapters" sings, "Don't let dark clouds cover the blue of the sky, don't let fate turn back the boat without a paddle."

Let us return to our original aspiration, return to Bitcoin, and open a new chapter where our dream began.

-

@ c67cd3e1:84098345

2024-12-05 02:57:47

@ c67cd3e1:84098345

2024-12-05 02:57:47 -

@ 7776c32d:45558888

2024-12-05 01:56:38

@ 7776c32d:45558888

2024-12-05 01:56:38Before I start, let me say: keep building. To discourage you is the furthest thing from why I complain. I'm mainly posting this to document where we're at, so later, we can remember what we were doing here.

That out of the way, I've said this before and it might be a while before I don't have to say it again: nostr has the potential for censorship resistance, but it doesn't actually have censorship resistance right now. It isn't actually resisting censorship. I'm using it to resist censorship, but can you even tell if it's working for me at all? I still feel much more heavily censored than I was back when Aaron Swartz was alive.

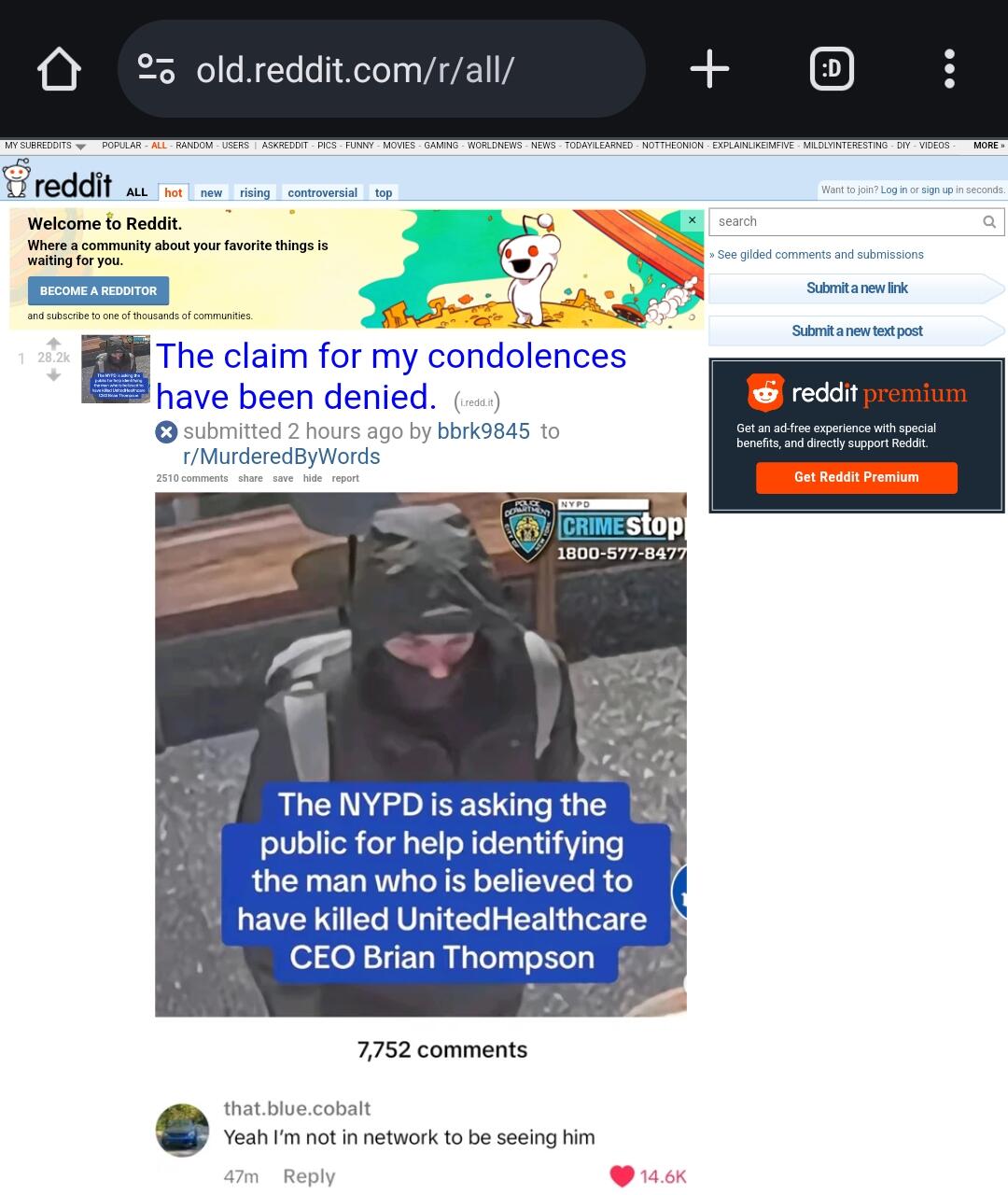

I first heard about Brian Thompson on reddit, not nostr, even though I'm so banned from reddit I can't even view it from my home internet so I don't check it much at all anymore. Nostr is still LESS censorship-resistant than that nostr:note109z46d0x8k9gjs8q2tgfmx384gpj7p99ky6fgnwyln7qznrktalsjpupx6

Don't remember where I first heard about Israel's big terrorist attack with communication devices in Lebanon, but it wasn't on nostr nostr:note14ncedyjuws7jfg79xawwltf3mx5nmk7u0ylqakpyld6nxhpcqwtq95tj6a

I first heard about Matt Nelson's self-immolation on X, not nostr nostr:note1z6hxt76gwv8mvywflqg5cge4326tyv6jq6vptag4ytjcczgcyguqnzvd4k

People praised the Primal update that took away my ability to see all the posts from my followers nostr:note1g8jlkec7y9wy5u06v0c0tjhsscchur5quejs5mu2lp7n7fse8s0shevnek

People pay for Primal Premium to get basic functionality we should get from a P2P network, like having posts actually stay and not disappear - will paying Primal protect bookmarked content too? nostr:note1qqqq9sqy5kuf5rz0lwpul0dnjvrhn53erlymsyx7c3xx79vm2t5qxt2c5q

At the technological level, nostr is based on the jack dorsey malware model because it's so much easier to decentralize than a good feed curation system like what Aaron Swartz created at reddit nostr:note1864l5u5ansvvd0ztwl44wncv0fu0x5vgkdh44d9g5jwxur558pss5p9yx8

The protocol calls for servers it calls "relays" that aren't actually network relays as far as I can tell. Fiatjaf made some weird joke about how only non-P2P stuff can work when creating it, phrased as a reference to a quote by Satoshi talking about how Bitcoin would work as a P2P network, but Bitcoin has worked so far and Fiatjaf is ostensibly into it? Oh, but he's into "lightning." Don't worry, people say he's the next Satoshi, and he must simply know more than can be explained (actually 🔥 post by hodlbod) nostr:note1mh6ngw6cevggf59yh0mtf3k45g92srkljhayv63ffdsp5mj63yxq78xh7h

The nostr protocol itself is a kinda retarded javascript-based technology other than the keypair login model that gives it pretty much all the potential it has.

Another cool thing about the protocol is how you can mute people visibly instead of secretly. That brings me from the technology topic to the community topic - how well does the community resist censorship? Well, a lot of the users who fill the "trending" feeds all the time have me muted for being a toxic dickhead and a terrorist (my words, not theirs). Corndalorian is an example. You might recognize other names too

Are we still talking more about Bluesky than Gaza? nostr:note1qqqqpgaef0gfmtctlw2maqmlk7dmfyq5dhf45ygm95skxqdtcrcs2tpcfu

I am definitely still the only person here talking about the ongoing pandemic nostr:note1y8vn4yhn383j62r34q58wnduvzzkzd7exnp4agw4l8gq5zj94t4s6zscr4