-

@ 9f94e6cc:f3472946

2024-11-21 18:55:12

@ 9f94e6cc:f3472946

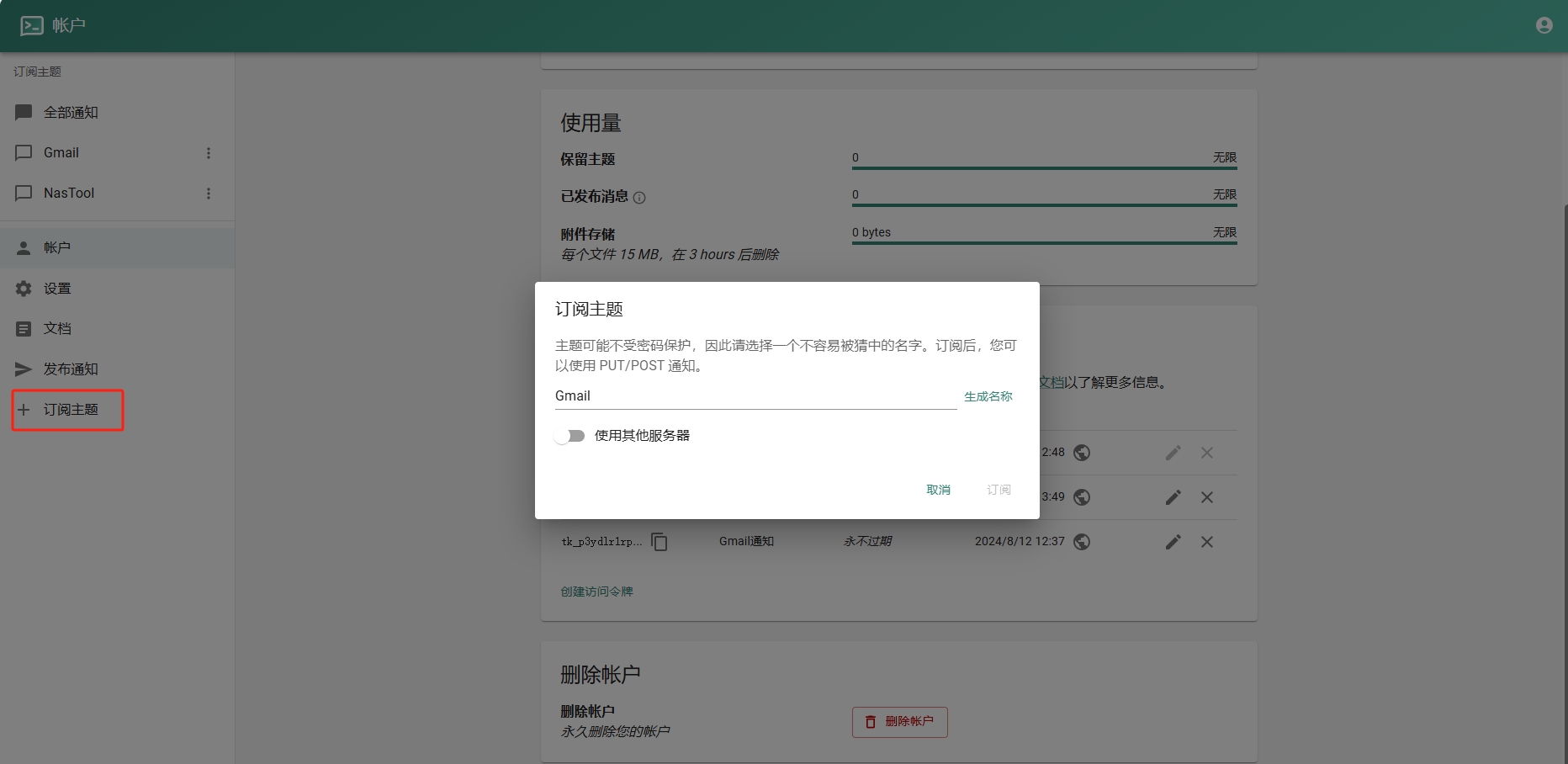

2024-11-21 18:55:12Der Entartungswettbewerb TikTok hat die Jugend im Griff und verbrutzelt ihre Hirne. Über Reels, den Siegeszug des Hochformats und die Regeln der Viralität.

Text: Aron Morhoff

Hollywood steckt heute in der Hosentasche. 70 Prozent aller YouTube-Inhalte werden auf mobilen Endgeräten, also Smartphones, geschaut. Instagram und TikTok sind die angesagtesten Anwendungen für junge Menschen. Es gibt sie nur noch als App, und ihr Design ist für Mobiltelefone optimiert.

Einst waren Rechner und Laptops die Tools, mit denen ins Internet gegangen wurde. Auch als das Smartphone seinen Siegeszug antrat, waren die Sehgewohnheiten noch auf das Querformat ausgerichtet. Heute werden Rechner fast nur noch zum Arbeiten verwendet. Das Berieseln, die Unterhaltung, das passive Konsumieren hat sich vollständig auf die iPhones und Samsungs dieser Welt verlagert. Das Telefon hat den aufrechten Gang angenommen, kaum einer mehr hält sein Gerät waagerecht.

Homo Digitalis Erectus

Die Welt steht also Kopf. Die Form eines Mediums hat Einfluss auf den Inhalt. Marshall McLuhan formulierte das so: Das Medium selbst ist die Botschaft. Ja mei, mag sich mancher denken, doch medienanthropologisch ist diese Entwicklung durchaus eine Betrachtung wert. Ein Querformat eignet sich besser, um Landschaften, einen Raum oder eine Gruppe abzubilden. Das Hochformat entspricht grob den menschlichen Maßen von der Hüfte bis zum Kopf. Der TikTok-Tanz ist im Smartphone-Design also schon angelegt. Das Hochformat hat die Medieninhalte unserer Zeit noch narzisstischer gemacht.

Dass wir uns durch Smartphones freizügiger und enthemmter zur Schau stellen, ist bekannt. 2013 wurde „Selfie“ vom Oxford English Dictionary zum Wort des Jahres erklärt. Selfie, Selbstporträt, Selbstdarstellung.

Neu ist der Aufwand, der heute vonnöten ist, um die Aufmerksamkeitsschwelle der todamüsierten Mediengesellschaft überhaupt noch zu durchbrechen. In beängstigender Hypnose erwischt man viele Zeitgenossen inzwischen beim Doomscrollen. Das ist der Fachbegriff für das weggetretene Endloswischen und erklärt auch den Namen „Reel“: Der Begriff, im Deutschen verwandt mit „Rolle“, beschreibt die Filmrolle, von der 24 Bilder pro Sekunde auf den Projektor gewischt oder eben abgespult werden.

Länger als drei Sekunden darf ein Kurzvideo deshalb nicht mehr gehen, ohne dass etwas Aufregendes passiert. Sonst wird das Reel aus Langeweile weggewischt. Die Welt im Dopamin-Rausch. Für den Ersteller eines Videos heißt das inzwischen: Sei der lauteste, schrillste, gestörteste Marktschreier. Das Wettrennen um die Augäpfel zwingt zu extremen Formen von Clickbait.

15 Sekunden Ruhm

Das nimmt inzwischen skurrile Formen an. Das Video „Look who I found“ von Noel Robinson (geboren 2001) war im letzten Jahr einer der erfolgreichsten deutschen TikTok-Clips. Man sieht den Deutsch-Nigerianer beim Antanzen eines karikaturartig übergewichtigen Menschen. Noel wird geschubst und fällt. Daraufhin wechselt das Lied – und der fette Mann bewegt seinen Schwabbelbauch im Takt. Noel steht wieder auf, grinst, beide tanzen gemeinsam. Das dauert 15 Sekunden. Ich rate Ihnen, sich das Video einmal anzuschauen, um die Mechanismen von TikTok zu verstehen. Achten Sie alleine darauf, wie vielen Reizen (Menschenmenge, Antanzen, Sturz, Schwabbelbauch) Sie in den ersten fünf Sekunden ausgesetzt sind. Wer schaut so was? Bis dato 220 Millionen Menschen. Das ist kapitalistische Verwertungslogik im bereits verwesten Endstadium. Adorno oder Fromm hätten am Medienzeitgeist entweder ihre Freude oder mächtig zu knabbern.

Die Internet- und Smartphoneabdeckung beträgt mittlerweile fast 100 Prozent. Das Überangebot hat die Regeln geändert. Um überhaupt gesehen zu werden, muss man heute viral gehen. Was dafür inzwischen nötig ist, spricht die niedrigsten Bedürfnisse des Menschen an: Gewalt, Ekel, Sexualisierung, Schock. Die jungen Erwachsenen, die heute auf sozialen Netzwerken den Ton angeben, haben diese Mechanismen längst verinnerlicht. Wie bewusst ihnen das ist, ist fraglich. 2024 prallt eine desaströse Bildungssituation samt fehlender Medienkompetenz auf eine egomanische Jugend, die Privatsphäre nie gekannt hat und seit Kindesbeinen alles in den Äther ballert, was es festhalten kann. Man muss kein Kulturpessimist sein, um diese degenerative Dynamik, auch in ihrer Implikation für unser Zusammenleben und das psychische Wohlergehen der Generation TikTok, als beängstigend zu bezeichnen.

Aron Morhoff studierte Medienethik und ist Absolvent der Freien Akademie für Medien & Journalismus. Frühere Stationen: RT Deutsch und Nuoviso. Heute: Stichpunkt Magazin, Manova, Milosz Matuschek und seine Liveshow "Addictive Programming".

-

@ eac63075:b4988b48

2024-11-09 17:57:27

@ eac63075:b4988b48

2024-11-09 17:57:27Based on a recent paper that included collaboration from renowned experts such as Lynn Alden, Steve Lee, and Ren Crypto Fish, we discuss in depth how Bitcoin's consensus is built, the main risks, and the complex dynamics of protocol upgrades.

Podcast https://www.fountain.fm/episode/wbjD6ntQuvX5u2G5BccC

Presentation https://gamma.app/docs/Analyzing-Bitcoin-Consensus-Risks-in-Protocol-Upgrades-p66axxjwaa37ksn

1. Introduction to Consensus in Bitcoin

Consensus in Bitcoin is the foundation that keeps the network secure and functional, allowing users worldwide to perform transactions in a decentralized manner without the need for intermediaries. Since its launch in 2009, Bitcoin is often described as an "immutable" system designed to resist changes, and it is precisely this resistance that ensures its security and stability.

The central idea behind consensus in Bitcoin is to create a set of acceptance rules for blocks and transactions, ensuring that all network participants agree on the transaction history. This prevents "double-spending," where the same bitcoin could be used in two simultaneous transactions, something that would compromise trust in the network.

Evolution of Consensus in Bitcoin

Over the years, consensus in Bitcoin has undergone several adaptations, and the way participants agree on changes remains a delicate process. Unlike traditional systems, where changes can be imposed from the top down, Bitcoin operates in a decentralized model where any significant change needs the support of various groups of stakeholders, including miners, developers, users, and large node operators.

Moreover, the update process is extremely cautious, as hasty changes can compromise the network's security. As a result, the philosophy of "don't fix what isn't broken" prevails, with improvements happening incrementally and only after broad consensus among those involved. This model can make progress seem slow but ensures that Bitcoin remains faithful to the principles of security and decentralization.

2. Technical Components of Consensus

Bitcoin's consensus is supported by a set of technical rules that determine what is considered a valid transaction and a valid block on the network. These technical aspects ensure that all nodes—the computers that participate in the Bitcoin network—agree on the current state of the blockchain. Below are the main technical components that form the basis of the consensus.

Validation of Blocks and Transactions

The validation of blocks and transactions is the central point of consensus in Bitcoin. A block is only considered valid if it meets certain criteria, such as maximum size, transaction structure, and the solving of the "Proof of Work" problem. The proof of work, required for a block to be included in the blockchain, is a computational process that ensures the block contains significant computational effort—protecting the network against manipulation attempts.

Transactions, in turn, need to follow specific input and output rules. Each transaction includes cryptographic signatures that prove the ownership of the bitcoins sent, as well as validation scripts that verify if the transaction conditions are met. This validation system is essential for network nodes to autonomously confirm that each transaction follows the rules.

Chain Selection

Another fundamental technical issue for Bitcoin's consensus is chain selection, which becomes especially important in cases where multiple versions of the blockchain coexist, such as after a network split (fork). To decide which chain is the "true" one and should be followed, the network adopts the criterion of the highest accumulated proof of work. In other words, the chain with the highest number of valid blocks, built with the greatest computational effort, is chosen by the network as the official one.

This criterion avoids permanent splits because it encourages all nodes to follow the same main chain, reinforcing consensus.

Soft Forks vs. Hard Forks

In the consensus process, protocol changes can happen in two ways: through soft forks or hard forks. These variations affect not only the protocol update but also the implications for network users:

-

Soft Forks: These are changes that are backward compatible. Only nodes that adopt the new update will follow the new rules, but old nodes will still recognize the blocks produced with these rules as valid. This compatibility makes soft forks a safer option for updates, as it minimizes the risk of network division.

-

Hard Forks: These are updates that are not backward compatible, requiring all nodes to update to the new version or risk being separated from the main chain. Hard forks can result in the creation of a new coin, as occurred with the split between Bitcoin and Bitcoin Cash in 2017. While hard forks allow for deeper changes, they also bring significant risks of network fragmentation.

These technical components form the base of Bitcoin's security and resilience, allowing the system to remain functional and immutable without losing the necessary flexibility to evolve over time.

3. Stakeholders in Bitcoin's Consensus

Consensus in Bitcoin is not decided centrally. On the contrary, it depends on the interaction between different groups of stakeholders, each with their motivations, interests, and levels of influence. These groups play fundamental roles in how changes are implemented or rejected on the network. Below, we explore the six main stakeholders in Bitcoin's consensus.

1. Economic Nodes

Economic nodes, usually operated by exchanges, custody providers, and large companies that accept Bitcoin, exert significant influence over consensus. Because they handle large volumes of transactions and act as a connection point between the Bitcoin ecosystem and the traditional financial system, these nodes have the power to validate or reject blocks and to define which version of the software to follow in case of a fork.

Their influence is proportional to the volume of transactions they handle, and they can directly affect which chain will be seen as the main one. Their incentive is to maintain the network's stability and security to preserve its functionality and meet regulatory requirements.

2. Investors

Investors, including large institutional funds and individual Bitcoin holders, influence consensus indirectly through their impact on the asset's price. Their buying and selling actions can affect Bitcoin's value, which in turn influences the motivation of miners and other stakeholders to continue investing in the network's security and development.

Some institutional investors have agreements with custodians that may limit their ability to act in network split situations. Thus, the impact of each investor on consensus can vary based on their ownership structure and how quickly they can react to a network change.

3. Media Influencers

Media influencers, including journalists, analysts, and popular personalities on social media, have a powerful role in shaping public opinion about Bitcoin and possible updates. These influencers can help educate the public, promote debates, and bring transparency to the consensus process.

On the other hand, the impact of influencers can be double-edged: while they can clarify complex topics, they can also distort perceptions by amplifying or minimizing change proposals. This makes them a force both of support and resistance to consensus.

4. Miners

Miners are responsible for validating transactions and including blocks in the blockchain. Through computational power (hashrate), they also exert significant influence over consensus decisions. In update processes, miners often signal their support for a proposal, indicating that the new version is safe to use. However, this signaling is not always definitive, and miners can change their position if they deem it necessary.

Their incentive is to maximize returns from block rewards and transaction fees, as well as to maintain the value of investments in their specialized equipment, which are only profitable if the network remains stable.

5. Protocol Developers

Protocol developers, often called "Core Developers," are responsible for writing and maintaining Bitcoin's code. Although they do not have direct power over consensus, they possess an informal veto power since they decide which changes are included in the main client (Bitcoin Core). This group also serves as an important source of technical knowledge, helping guide decisions and inform other stakeholders.

Their incentive lies in the continuous improvement of the network, ensuring security and decentralization. Many developers are funded by grants and sponsorships, but their motivations generally include a strong ideological commitment to Bitcoin's principles.

6. Users and Application Developers

This group includes people who use Bitcoin in their daily transactions and developers who build solutions based on the network, such as wallets, exchanges, and payment platforms. Although their power in consensus is less than that of miners or economic nodes, they play an important role because they are responsible for popularizing Bitcoin's use and expanding the ecosystem.

If application developers decide not to adopt an update, this can affect compatibility and widespread acceptance. Thus, they indirectly influence consensus by deciding which version of the protocol to follow in their applications.

These stakeholders are vital to the consensus process, and each group exerts influence according to their involvement, incentives, and ability to act in situations of change. Understanding the role of each makes it clearer how consensus is formed and why it is so difficult to make significant changes to Bitcoin.

4. Mechanisms for Activating Updates in Bitcoin

For Bitcoin to evolve without compromising security and consensus, different mechanisms for activating updates have been developed over the years. These mechanisms help coordinate changes among network nodes to minimize the risk of fragmentation and ensure that updates are implemented in an orderly manner. Here, we explore some of the main methods used in Bitcoin, their advantages and disadvantages, as well as historical examples of significant updates.

Flag Day

The Flag Day mechanism is one of the simplest forms of activating changes. In it, a specific date or block is determined as the activation moment, and all nodes must be updated by that point. This method does not involve prior signaling; participants simply need to update to the new software version by the established day or block.

-

Advantages: Simplicity and predictability are the main benefits of Flag Day, as everyone knows the exact activation date.

-

Disadvantages: Inflexibility can be a problem because there is no way to adjust the schedule if a significant part of the network has not updated. This can result in network splits if a significant number of nodes are not ready for the update.

An example of Flag Day was the Pay to Script Hash (P2SH) update in 2012, which required all nodes to adopt the change to avoid compatibility issues.

BIP34 and BIP9

BIP34 introduced a more dynamic process, in which miners increase the version number in block headers to signal the update. When a predetermined percentage of the last blocks is mined with this new version, the update is automatically activated. This model later evolved with BIP9, which allowed multiple updates to be signaled simultaneously through "version bits," each corresponding to a specific change.

-

Advantages: Allows the network to activate updates gradually, giving more time for participants to adapt.

-

Disadvantages: These methods rely heavily on miner support, which means that if a sufficient number of miners do not signal the update, it can be delayed or not implemented.

BIP9 was used in the activation of SegWit (BIP141) but faced challenges because some miners did not signal their intent to activate, leading to the development of new mechanisms.

User Activated Soft Forks (UASF) and User Resisted Soft Forks (URSF)

To increase the decision-making power of ordinary users, the concept of User Activated Soft Fork (UASF) was introduced, allowing node operators, not just miners, to determine consensus for a change. In this model, nodes set a date to start rejecting blocks that are not in compliance with the new update, forcing miners to adapt or risk having their blocks rejected by the network.

URSF, in turn, is a model where nodes reject blocks that attempt to adopt a specific update, functioning as resistance against proposed changes.

-

Advantages: UASF returns decision-making power to node operators, ensuring that changes do not depend solely on miners.

-

Disadvantages: Both UASF and URSF can generate network splits, especially in cases of strong opposition among different stakeholders.

An example of UASF was the activation of SegWit in 2017, where users supported activation independently of miner signaling, which ended up forcing its adoption.

BIP8 (LOT=True)

BIP8 is an evolution of BIP9, designed to prevent miners from indefinitely blocking a change desired by the majority of users and developers. BIP8 allows setting a parameter called "lockinontimeout" (LOT) as true, which means that if the update has not been fully signaled by a certain point, it is automatically activated.

-

Advantages: Ensures that changes with broad support among users are not blocked by miners who wish to maintain the status quo.

-

Disadvantages: Can lead to network splits if miners or other important stakeholders do not support the update.

Although BIP8 with LOT=True has not yet been used in Bitcoin, it is a proposal that can be applied in future updates if necessary.

These activation mechanisms have been essential for Bitcoin's development, allowing updates that keep the network secure and functional. Each method brings its own advantages and challenges, but all share the goal of preserving consensus and network cohesion.

5. Risks and Considerations in Consensus Updates

Consensus updates in Bitcoin are complex processes that involve not only technical aspects but also political, economic, and social considerations. Due to the network's decentralized nature, each change brings with it a set of risks that need to be carefully assessed. Below, we explore some of the main challenges and future scenarios, as well as the possible impacts on stakeholders.

Network Fragility with Alternative Implementations

One of the main risks associated with consensus updates is the possibility of network fragmentation when there are alternative software implementations. If an update is implemented by a significant group of nodes but rejected by others, a network split (fork) can occur. This creates two competing chains, each with a different version of the transaction history, leading to unpredictable consequences for users and investors.

Such fragmentation weakens Bitcoin because, by dividing hashing power (computing) and coin value, it reduces network security and investor confidence. A notable example of this risk was the fork that gave rise to Bitcoin Cash in 2017 when disagreements over block size resulted in a new chain and a new asset.

Chain Splits and Impact on Stakeholders

Chain splits are a significant risk in update processes, especially in hard forks. During a hard fork, the network is split into two separate chains, each with its own set of rules. This results in the creation of a new coin and leaves users with duplicated assets on both chains. While this may seem advantageous, in the long run, these splits weaken the network and create uncertainties for investors.

Each group of stakeholders reacts differently to a chain split:

-

Institutional Investors and ETFs: Face regulatory and compliance challenges because many of these assets are managed under strict regulations. The creation of a new coin requires decisions to be made quickly to avoid potential losses, which may be hampered by regulatory constraints.

-

Miners: May be incentivized to shift their computing power to the chain that offers higher profitability, which can weaken one of the networks.

-

Economic Nodes: Such as major exchanges and custody providers, have to quickly choose which chain to support, influencing the perceived value of each network.

Such divisions can generate uncertainties and loss of value, especially for institutional investors and those who use Bitcoin as a store of value.

Regulatory Impacts and Institutional Investors

With the growing presence of institutional investors in Bitcoin, consensus changes face new compliance challenges. Bitcoin ETFs, for example, are required to follow strict rules about which assets they can include and how chain split events should be handled. The creation of a new asset or migration to a new chain can complicate these processes, creating pressure for large financial players to quickly choose a chain, affecting the stability of consensus.

Moreover, decisions regarding forks can influence the Bitcoin futures and derivatives market, affecting perception and adoption by new investors. Therefore, the need to avoid splits and maintain cohesion is crucial to attract and preserve the confidence of these investors.

Security Considerations in Soft Forks and Hard Forks

While soft forks are generally preferred in Bitcoin for their backward compatibility, they are not without risks. Soft forks can create different classes of nodes on the network (updated and non-updated), which increases operational complexity and can ultimately weaken consensus cohesion. In a network scenario with fragmentation of node classes, Bitcoin's security can be affected, as some nodes may lose part of the visibility over updated transactions or rules.

In hard forks, the security risk is even more evident because all nodes need to adopt the new update to avoid network division. Experience shows that abrupt changes can create temporary vulnerabilities, in which malicious agents try to exploit the transition to attack the network.

Bounty Claim Risks and Attack Scenarios

Another risk in consensus updates are so-called "bounty claims"—accumulated rewards that can be obtained if an attacker manages to split or deceive a part of the network. In a conflict scenario, a group of miners or nodes could be incentivized to support a new update or create an alternative version of the software to benefit from these rewards.

These risks require stakeholders to carefully assess each update and the potential vulnerabilities it may introduce. The possibility of "bounty claims" adds a layer of complexity to consensus because each interest group may see a financial opportunity in a change that, in the long term, may harm network stability.

The risks discussed above show the complexity of consensus in Bitcoin and the importance of approaching it gradually and deliberately. Updates need to consider not only technical aspects but also economic and social implications, in order to preserve Bitcoin's integrity and maintain trust among stakeholders.

6. Recommendations for the Consensus Process in Bitcoin

To ensure that protocol changes in Bitcoin are implemented safely and with broad support, it is essential that all stakeholders adopt a careful and coordinated approach. Here are strategic recommendations for evaluating, supporting, or rejecting consensus updates, considering the risks and challenges discussed earlier, along with best practices for successful implementation.

1. Careful Evaluation of Proposal Maturity

Stakeholders should rigorously assess the maturity level of a proposal before supporting its implementation. Updates that are still experimental or lack a robust technical foundation can expose the network to unnecessary risks. Ideally, change proposals should go through an extensive testing phase, have security audits, and receive review and feedback from various developers and experts.

2. Extensive Testing in Secure and Compatible Networks

Before an update is activated on the mainnet, it is essential to test it on networks like testnet and signet, and whenever possible, on other compatible networks that offer a safe and controlled environment to identify potential issues. Testing on networks like Litecoin was fundamental for the safe launch of innovations like SegWit and the Lightning Network, allowing functionalities to be validated on a lower-impact network before being implemented on Bitcoin.

The Liquid Network, developed by Blockstream, also plays an important role as an experimental network for new proposals, such as OP_CAT. By adopting these testing environments, stakeholders can mitigate risks and ensure that the update is reliable and secure before being adopted by the main network.

3. Importance of Stakeholder Engagement

The success of a consensus update strongly depends on the active participation of all stakeholders. This includes economic nodes, miners, protocol developers, investors, and end users. Lack of participation can lead to inadequate decisions or even future network splits, which would compromise Bitcoin's security and stability.

4. Key Questions for Evaluating Consensus Proposals

To assist in decision-making, each group of stakeholders should consider some key questions before supporting a consensus change:

- Does the proposal offer tangible benefits for Bitcoin's security, scalability, or usability?

- Does it maintain backward compatibility or introduce the risk of network split?

- Are the implementation requirements clear and feasible for each group involved?

- Are there clear and aligned incentives for all stakeholder groups to accept the change?

5. Coordination and Timing in Implementations

Timing is crucial. Updates with short activation windows can force a split because not all nodes and miners can update simultaneously. Changes should be planned with ample deadlines to allow all stakeholders to adjust their systems, avoiding surprises that could lead to fragmentation.

Mechanisms like soft forks are generally preferable to hard forks because they allow a smoother transition. Opting for backward-compatible updates when possible facilitates the process and ensures that nodes and miners can adapt without pressure.

6. Continuous Monitoring and Re-evaluation

After an update, it's essential to monitor the network to identify problems or side effects. This continuous process helps ensure cohesion and trust among all participants, keeping Bitcoin as a secure and robust network.

These recommendations, including the use of secure networks for extensive testing, promote a collaborative and secure environment for Bitcoin's consensus process. By adopting a deliberate and strategic approach, stakeholders can preserve Bitcoin's value as a decentralized and censorship-resistant network.

7. Conclusion

Consensus in Bitcoin is more than a set of rules; it's the foundation that sustains the network as a decentralized, secure, and reliable system. Unlike centralized systems, where decisions can be made quickly, Bitcoin requires a much more deliberate and cooperative approach, where the interests of miners, economic nodes, developers, investors, and users must be considered and harmonized. This governance model may seem slow, but it is fundamental to preserving the resilience and trust that make Bitcoin a global store of value and censorship-resistant.

Consensus updates in Bitcoin must balance the need for innovation with the preservation of the network's core principles. The development process of a proposal needs to be detailed and rigorous, going through several testing stages, such as in testnet, signet, and compatible networks like Litecoin and Liquid Network. These networks offer safe environments for proposals to be analyzed and improved before being launched on the main network.

Each proposed change must be carefully evaluated regarding its maturity, impact, backward compatibility, and support among stakeholders. The recommended key questions and appropriate timing are critical to ensure that an update is adopted without compromising network cohesion. It's also essential that the implementation process is continuously monitored and re-evaluated, allowing adjustments as necessary and minimizing the risk of instability.

By following these guidelines, Bitcoin's stakeholders can ensure that the network continues to evolve safely and robustly, maintaining user trust and further solidifying its role as one of the most resilient and innovative digital assets in the world. Ultimately, consensus in Bitcoin is not just a technical issue but a reflection of its community and the values it represents: security, decentralization, and resilience.

8. Links

Whitepaper: https://github.com/bitcoin-cap/bcap

Youtube (pt-br): https://www.youtube.com/watch?v=rARycAibl9o&list=PL-qnhF0qlSPkfhorqsREuIu4UTbF0h4zb

-

-

@ 06b7819d:d1d8327c

2024-12-03 09:00:46

@ 06b7819d:d1d8327c

2024-12-03 09:00:46The History of Bananas as an Exportable Fruit and the Rise of Banana Republics

Bananas became a significant export in the late 19th century, fueled by advancements in transportation and refrigeration that allowed the fruit to travel long distances without spoilage. Originally native to Southeast Asia, bananas were introduced to the Americas by European colonists. By the late 1800s, companies like the United Fruit Company (later Chiquita) and Standard Fruit Company (now Dole) began cultivating bananas on a large scale in Central America and the Caribbean.

These corporations capitalized on the fruit’s appeal—bananas were cheap, nutritious, and easy to transport. The fruit quickly became a staple in Western markets, especially in the United States. However, the rapid expansion of banana exports came at a significant political and social cost to the countries where the fruit was grown.

To maintain control over banana production and maximize profits, these companies required vast amounts of arable land, labor, and favorable trade conditions. This often led them to form close relationships with local governments, many of which were authoritarian and corrupt. The companies influenced policies to secure land concessions, suppress labor rights, and maintain low taxes.

The term “banana republic” was coined by writer O. Henry in 1904 to describe countries—particularly in Central America—that became politically unstable due to their economic dependence on a single export crop, often controlled by foreign corporations.

The U.S. government frequently supported these regimes as part of its broader strategy during the Cold War to counter communist influence in the region. Washington feared that labor movements and demands for land reform, often supported by the peasantry and indigenous groups, could lead to the rise of socialist or communist governments. Consequently, the U.S. backed coups, such as the 1954 overthrow of Guatemala’s democratically elected President Jacobo Árbenz, who had threatened United Fruit’s interests by redistributing unused land.

These interventions created a legacy of exploitation, environmental degradation, and political instability in many banana-exporting countries. While bananas remain a global dietary staple, their history underscores the complex interplay of economics, politics, and imperialism.

-

@ 06b7819d:d1d8327c

2024-12-02 20:05:48

@ 06b7819d:d1d8327c

2024-12-02 20:05:48Benjamin Franklin and His Fondness for Madeira Wine

Benjamin Franklin, one of America’s most celebrated founding fathers, was not only a statesman, scientist, and writer but also a man of refined taste. Among his many indulgences, Franklin was particularly fond of Madeira wine, a fortified wine from the Portuguese Madeira Islands. His love for this drink was well-documented and reflects both his personal preferences and the broader cultural trends of 18th-century America.

The Allure of Madeira Wine

Madeira wine was highly prized in the 18th century due to its unique production process and exceptional durability. Its rich, fortified nature made it well-suited for long sea voyages, as it could withstand temperature fluctuations and aging in transit. This durability made Madeira a popular choice in the American colonies, where European wines often spoiled before arrival.

Franklin, who was known for his appreciation of fine things, embraced Madeira as a beverage of choice. Its complex flavors and storied reputation resonated with his intellectual and social pursuits. The wine was often served at dinners and social gatherings, where Franklin and his contemporaries debated ideas and shaped the future of the nation.

Franklin’s Personal Connection to Madeira

In Franklin’s writings and correspondence, Madeira is mentioned on several occasions, reflecting its prominence in his life. He referred to the wine not only as a personal pleasure but also as a symbol of hospitality and refinement. As a diplomat in France and England, Franklin often carried Madeira to share with his hosts, using it as a means of forging connections and showcasing the tastes of the American colonies.

One notable instance of Franklin’s affinity for Madeira occurred during his time in Philadelphia. He reportedly had cases of the wine shipped directly to his home, ensuring he would never be without his favorite drink. Madeira also featured prominently in many toasts and celebrations, becoming a hallmark of Franklin’s gatherings.

The Role of Madeira in Colonial America

Franklin’s fondness for Madeira reflects its broader significance in colonial America. The wine was not only a favorite of the elite but also a symbol of resistance to British taxation. When the British imposed heavy duties on imported goods, including wine, Madeira became a patriotic choice for many colonists. Its direct trade routes with the Madeira Islands circumvented British intermediaries, allowing Americans to assert their economic independence.

A Legacy of Taste

Franklin’s appreciation for Madeira wine endures as a charming detail of his multifaceted life. It offers a glimpse into the personal habits of one of America’s most influential figures and highlights the cultural exchanges that shaped colonial society. Today, Franklin’s love of Madeira serves as a reminder of the historical connections between wine, politics, and personal expression in the 18th century.

In honoring Franklin’s legacy, one might raise a glass of Madeira to toast not only his contributions to American independence but also his enduring influence on the art of living well.

-

@ eac63075:b4988b48

2024-10-26 22:14:19

@ eac63075:b4988b48

2024-10-26 22:14:19The future of physical money is at stake, and the discussion about DREX, the new digital currency planned by the Central Bank of Brazil, is gaining momentum. In a candid and intense conversation, Federal Deputy Julia Zanatta (PL/SC) discussed the challenges and risks of this digital transition, also addressing her Bill No. 3,341/2024, which aims to prevent the extinction of physical currency. This bill emerges as a direct response to legislative initiatives seeking to replace physical money with digital alternatives, limiting citizens' options and potentially compromising individual freedom. Let's delve into the main points of this conversation.

https://www.fountain.fm/episode/i5YGJ9Ors3PkqAIMvNQ0

What is a CBDC?

Before discussing the specifics of DREX, it’s important to understand what a CBDC (Central Bank Digital Currency) is. CBDCs are digital currencies issued by central banks, similar to a digital version of physical money. Unlike cryptocurrencies such as Bitcoin, which operate in a decentralized manner, CBDCs are centralized and regulated by the government. In other words, they are digital currencies created and controlled by the Central Bank, intended to replace physical currency.

A prominent feature of CBDCs is their programmability. This means that the government can theoretically set rules about how, where, and for what this currency can be used. This aspect enables a level of control over citizens' finances that is impossible with physical money. By programming the currency, the government could limit transactions by setting geographical or usage restrictions. In practice, money within a CBDC could be restricted to specific spending or authorized for use in a defined geographical area.

In countries like China, where citizen actions and attitudes are also monitored, a person considered to have a "low score" due to a moral or ideological violation may have their transactions limited to essential purchases, restricting their digital currency use to non-essential activities. This financial control is strengthened because, unlike physical money, digital currency cannot be exchanged anonymously.

Practical Example: The Case of DREX During the Pandemic

To illustrate how DREX could be used, an example was given by Eric Altafim, director of Banco Itaú. He suggested that, if DREX had existed during the COVID-19 pandemic, the government could have restricted the currency’s use to a 5-kilometer radius around a person’s residence, limiting their economic mobility. Another proposed use by the executive related to the Bolsa Família welfare program: the government could set up programming that only allows this benefit to be used exclusively for food purchases. Although these examples are presented as control measures for safety or organization, they demonstrate how much a CBDC could restrict citizens' freedom of choice.

To illustrate the potential for state control through a Central Bank Digital Currency (CBDC), such as DREX, it is helpful to look at the example of China. In China, the implementation of a CBDC coincides with the country’s Social Credit System, a governmental surveillance tool that assesses citizens' and companies' behavior. Together, these technologies allow the Chinese government to monitor, reward, and, above all, punish behavior deemed inappropriate or threatening to the government.

How Does China's Social Credit System Work?

Implemented in 2014, China's Social Credit System assigns every citizen and company a "score" based on various factors, including financial behavior, criminal record, social interactions, and even online activities. This score determines the benefits or penalties each individual receives and can affect everything from public transport access to obtaining loans and enrolling in elite schools for their children. Citizens with low scores may face various sanctions, including travel restrictions, fines, and difficulty in securing loans.

With the adoption of the CBDC — or “digital yuan” — the Chinese government now has a new tool to closely monitor citizens' financial transactions, facilitating the application of Social Credit System penalties. China’s CBDC is a programmable digital currency, which means that the government can restrict how, when, and where the money can be spent. Through this level of control, digital currency becomes a powerful mechanism for influencing citizens' behavior.

Imagine, for instance, a citizen who repeatedly posts critical remarks about the government on social media or participates in protests. If the Social Credit System assigns this citizen a low score, the Chinese government could, through the CBDC, restrict their money usage in certain areas or sectors. For example, they could be prevented from buying tickets to travel to other regions, prohibited from purchasing certain consumer goods, or even restricted to making transactions only at stores near their home.

Another example of how the government can use the CBDC to enforce the Social Credit System is by monitoring purchases of products such as alcohol or luxury items. If a citizen uses the CBDC to spend more than the government deems reasonable on such products, this could negatively impact their social score, resulting in additional penalties such as future purchase restrictions or a lowered rating that impacts their personal and professional lives.

In China, this kind of control has already been demonstrated in several cases. Citizens added to Social Credit System “blacklists” have seen their spending and investment capacity severely limited. The combination of digital currency and social scores thus creates a sophisticated and invasive surveillance system, through which the Chinese government controls important aspects of citizens’ financial lives and individual freedoms.

Deputy Julia Zanatta views these examples with great concern. She argues that if the state has full control over digital money, citizens will be exposed to a level of economic control and surveillance never seen before. In a democracy, this control poses a risk, but in an authoritarian regime, it could be used as a powerful tool of repression.

DREX and Bill No. 3,341/2024

Julia Zanatta became aware of a bill by a Workers' Party (PT) deputy (Bill 4068/2020 by Deputy Reginaldo Lopes - PT/MG) that proposes the extinction of physical money within five years, aiming for a complete transition to DREX, the digital currency developed by the Central Bank of Brazil. Concerned about the impact of this measure, Julia drafted her bill, PL No. 3,341/2024, which prohibits the elimination of physical money, ensuring citizens the right to choose physical currency.

“The more I read about DREX, the less I want its implementation,” says the deputy. DREX is a Central Bank Digital Currency (CBDC), similar to other state digital currencies worldwide, but which, according to Julia, carries extreme control risks. She points out that with DREX, the State could closely monitor each citizen’s transactions, eliminating anonymity and potentially restricting freedom of choice. This control would lie in the hands of the Central Bank, which could, in a crisis or government change, “freeze balances or even delete funds directly from user accounts.”

Risks and Individual Freedom

Julia raises concerns about potential abuses of power that complete digitalization could allow. In a democracy, state control over personal finances raises serious questions, and EddieOz warns of an even more problematic future. “Today we are in a democracy, but tomorrow, with a government transition, we don't know if this kind of power will be used properly or abused,” he states. In other words, DREX gives the State the ability to restrict or condition the use of money, opening the door to unprecedented financial surveillance.

EddieOz cites Nigeria as an example, where a CBDC was implemented, and the government imposed severe restrictions on the use of physical money to encourage the use of digital currency, leading to protests and clashes in the country. In practice, the poorest and unbanked — those without regular access to banking services — were harshly affected, as without physical money, many cannot conduct basic transactions. Julia highlights that in Brazil, this situation would be even more severe, given the large number of unbanked individuals and the extent of rural areas where access to technology is limited.

The Relationship Between DREX and Pix

The digital transition has already begun with Pix, which revolutionized instant transfers and payments in Brazil. However, Julia points out that Pix, though popular, is a citizen’s choice, while DREX tends to eliminate that choice. The deputy expresses concern about new rules suggested for Pix, such as daily transaction limits of a thousand reais, justified as anti-fraud measures but which, in her view, represent additional control and a profit opportunity for banks. “How many more rules will banks create to profit from us?” asks Julia, noting that DREX could further enhance control over personal finances.

International Precedents and Resistance to CBDC

The deputy also cites examples from other countries resisting the idea of a centralized digital currency. In the United States, states like New Hampshire have passed laws to prevent the advance of CBDCs, and leaders such as Donald Trump have opposed creating a national digital currency. Trump, addressing the topic, uses a justification similar to Julia’s: in a digitalized system, “with one click, your money could disappear.” She agrees with the warning, emphasizing the control risk that a CBDC represents, especially for countries with disadvantaged populations.

Besides the United States, Canada, Colombia, and Australia have also suspended studies on digital currencies, citing the need for further discussions on population impacts. However, in Brazil, the debate on DREX is still limited, with few parliamentarians and political leaders openly discussing the topic. According to Julia, only she and one or two deputies are truly trying to bring this discussion to the Chamber, making DREX’s advance even more concerning.

Bill No. 3,341/2024 and Popular Pressure

For Julia, her bill is a first step. Although she acknowledges that ideally, it would prevent DREX's implementation entirely, PL 3341/2024 is a measure to ensure citizens' choice to use physical money, preserving a form of individual freedom. “If the future means control, I prefer to live in the past,” Julia asserts, reinforcing that the fight for freedom is at the heart of her bill.

However, the deputy emphasizes that none of this will be possible without popular mobilization. According to her, popular pressure is crucial for other deputies to take notice and support PL 3341. “I am only one deputy, and we need the public’s support to raise the project’s visibility,” she explains, encouraging the public to press other parliamentarians and ask them to “pay attention to PL 3341 and the project that prohibits the end of physical money.” The deputy believes that with a strong awareness and pressure movement, it is possible to advance the debate and ensure Brazilians’ financial freedom.

What’s at Stake?

Julia Zanatta leaves no doubt: DREX represents a profound shift in how money will be used and controlled in Brazil. More than a simple modernization of the financial system, the Central Bank’s CBDC sets precedents for an unprecedented level of citizen surveillance and control in the country. For the deputy, this transition needs to be debated broadly and transparently, and it’s up to the Brazilian people to defend their rights and demand that the National Congress discuss these changes responsibly.

The deputy also emphasizes that, regardless of political or partisan views, this issue affects all Brazilians. “This agenda is something that will affect everyone. We need to be united to ensure people understand the gravity of what could happen.” Julia believes that by sharing information and generating open debate, it is possible to prevent Brazil from following the path of countries that have already implemented a digital currency in an authoritarian way.

A Call to Action

The future of physical money in Brazil is at risk. For those who share Deputy Julia Zanatta’s concerns, the time to act is now. Mobilize, get informed, and press your representatives. PL 3341/2024 is an opportunity to ensure that Brazilian citizens have a choice in how to use their money, without excessive state interference or surveillance.

In the end, as the deputy puts it, the central issue is freedom. “My fear is that this project will pass, and people won’t even understand what is happening.” Therefore, may every citizen at least have the chance to understand what’s at stake and make their voice heard in defense of a Brazil where individual freedom and privacy are respected values.

-

@ fa0165a0:03397073

2024-10-23 17:19:41

@ fa0165a0:03397073

2024-10-23 17:19:41Chef's notes

This recipe is for 48 buns. Total cooking time takes at least 90 minutes, but 60 minutes of that is letting the dough rest in between processing.

The baking is a simple three-step process. 1. Making the Wheat dough 2. Making and applying the filling 3. Garnishing and baking in the oven

When done: Enjoy during Fika!

PS;

-

Can be frozen and thawed in microwave for later enjoyment as well.

-

If you need unit conversion, this site may be of help: https://www.unitconverters.net/

-

Traditionally we use something we call "Pearl sugar" which is optimal, but normal sugar or sprinkles is okay too. Pearl sugar (Pärlsocker) looks like this: https://search.brave.com/images?q=p%C3%A4rlsocker

Ingredients

- 150 g butter

- 5 dl milk

- 50 g baking yeast (normal or for sweet dough)

- 1/2 teaspoon salt

- 1-1 1/2 dl sugar

- (Optional) 2 teaspoons of crushed or grounded cardamom seeds.

- 1.4 liters of wheat flour

- Filling: 50-75 g butter, room temperature

- Filling: 1/2 - 1 dl sugar

- Filling: 1 teaspoons crushed or ground cardamom and 1 teaspoons ground cinnamon (or 2 teaspoons of cinnamon)

- Garnish: 1 egg, sugar or Almond Shavings

Directions

- Melt the butter/margarine in a saucepan.

- Pour in the milk and allow the mixture to warm reach body temperature (approx. + 37 ° C).

- Dissolve the yeast in a dough bowl with the help of the salt.

- Add the 37 ° C milk/butter mixture, sugar and if you choose to the optional cardamom. (I like this option!) and just over 2/3 of the flour.

- Work the dough shiny and smooth, about 4 minutes with a machine or 8 minutes by hand.

- Add if necessary. additional flour but save at least 1 dl for baking.

- Let the dough rise covered (by a kitchen towel), about 30 minutes.

- Work the dough into the bowl and then pick it up on a floured workbench. Knead the dough smoothly. Divide the dough into 2 parts. Roll out each piece into a rectangular cake.

- Stir together the ingredients for the filling and spread it.

- Roll up and cut each roll into 24 pieces.

- Place them in paper molds or directly on baking paper with the cut surface facing up. Let them rise covered with a baking sheet, about 30 minutes.

- Brush the buns with beaten egg and sprinkle your chosen topping.

- Bake in the middle of the oven at 250 ° C, 5-8 minutes.

- Allow to cool on a wire rack under a baking sheet.

-

-

@ 06b7819d:d1d8327c

2024-11-29 13:26:00

@ 06b7819d:d1d8327c

2024-11-29 13:26:00The Weaponization of Technology: A Prelude to Adoption

Throughout history, new technologies have often been weaponized before becoming widely adopted for civilian use. This pattern, deeply intertwined with human priorities for power, survival, and dominance, sheds light on how societies interact with technological innovation.

The Weaponization Imperative

When a groundbreaking technology emerges, its potential to confer an advantage—military, economic, or ideological—tends to attract attention from those in power. Governments and militaries, seeking to outpace rivals, often invest heavily in adapting new tools for conflict or defense. Weaponization provides a context where innovation thrives under high-stakes conditions. Technologies like radar, nuclear energy, and the internet, initially conceived or expanded within the framework of military priorities, exemplify this trend.

Historical Examples

1. Gunpowder: Invented in 9th-century China, gunpowder was first used for military purposes before transitioning into civilian life, influencing mining, construction, and entertainment through fireworks.-

The Internet: Initially developed as ARPANET during the Cold War to ensure communication in the event of a nuclear attack, the internet’s infrastructure later supported the global digital revolution, reshaping commerce, education, and social interaction.

-

Drones: Unmanned aerial vehicles began as tools of surveillance and warfare but have since been adopted for everything from package delivery to agricultural monitoring.

Weaponization often spurs rapid technological development. War environments demand urgency and innovation, fast-tracking research and turning prototypes into functional tools. This phase of militarization ensures that the technology is robust, scalable, and often cost-effective, setting the stage for broader adoption.

Adoption and Civilian Integration

Once a technology’s military dominance is established, its applications often spill into civilian life. These transitions occur when:

• The technology becomes affordable and accessible. • Governments or corporations recognize its commercial potential. • Public awareness and trust grow, mitigating fears tied to its military origins.For example, GPS was first a military navigation system but is now indispensable for personal devices, logistics, and autonomous vehicles.

Cultural Implications

The process of weaponization shapes public perception of technology. Media narratives, often dominated by stories of power and conflict, influence how societies view emerging tools. When technologies are initially seen through the lens of violence or control, their subsequent integration into daily life can carry residual concerns, from privacy to ethical implications.

Conclusion

The weaponization of technology is not an aberration but a recurring feature of technological progress. By understanding this pattern, societies can critically assess how technologies evolve from tools of conflict to instruments of everyday life, ensuring that ethical considerations and equitable access are not lost in the rush to innovate. As Marshall McLuhan might suggest, the medium through which a technology is introduced deeply influences the message it ultimately conveys to the world.

-

-

@ 06b7819d:d1d8327c

2024-11-29 12:11:05

@ 06b7819d:d1d8327c

2024-11-29 12:11:05In June 2023, the Law Commission of England and Wales published its final report on digital assets, concluding that the existing common law is generally flexible enough to accommodate digital assets, including crypto-tokens and non-fungible tokens (NFTs).

However, to address specific areas of uncertainty, the Commission recommended targeted statutory reforms and the establishment of an expert panel.

Key Conclusions and Recommendations:

1. Recognition of a Third Category of Personal Property:Traditional English law classifies personal property into two categories: “things in possession” (tangible items) and “things in action” (enforceable rights). Digital assets do not fit neatly into either category. The Commission recommended legislation to confirm the existence of a distinct third category of personal property to better accommodate digital assets.

-

Development of Common Law: The Commission emphasized that the common law is well-suited to adapt to the complexities of emerging technologies and should continue to evolve to address issues related to digital assets.

-

Establishment of an Expert Panel: To assist courts in navigating the technical and legal challenges posed by digital assets, the Commission recommended that the government create a panel of industry experts, legal practitioners, academics, and judges. This panel would provide non-binding guidance on issues such as control and transfer of digital assets.

-

Facilitation of Crypto-Token and Crypto-Asset Collateral Arrangements: The Commission proposed the creation of a bespoke statutory legal framework to facilitate the use of digital assets as collateral, addressing current legal uncertainties in this area.

-

Clarification of the Financial Collateral Arrangements Regulations: The report recommended statutory amendments to clarify the extent to which digital assets fall within the scope of the Financial Collateral Arrangements (No 2) Regulations 2003, ensuring that existing financial regulations appropriately cover digital assets.

Overall, the Law Commission’s report underscores the adaptability of English common law in addressing the challenges posed by digital assets, while also identifying specific areas where legislative action is necessary to provide clarity and support the evolving digital economy.

-

-

@ 06b7819d:d1d8327c

2024-11-29 11:59:20

@ 06b7819d:d1d8327c

2024-11-29 11:59:20The system design and challenges of retail Central Bank Digital Currencies (CBDCs) differ significantly from Bitcoin in several key aspects, reflecting their distinct purposes and underlying philosophies:

-

Core Purpose and Issuance

• CBDCs: Issued by central banks, CBDCs are designed as state-backed digital currencies for public use. Their goal is to modernize payments, enhance financial inclusion, and provide a risk-free alternative to private money. • Bitcoin: A decentralized, peer-to-peer cryptocurrency created to operate independently of central authorities. Bitcoin aims to be a store of value and medium of exchange without reliance on intermediaries or governments.

-

Governance and Control

• CBDCs: Operate under centralized governance. Central banks retain control over issuance, transaction validation, and data management, allowing for integration with existing regulatory frameworks (e.g., AML and CFT). • Bitcoin: Fully decentralized, governed by a consensus mechanism (Proof of Work). Transactions are validated by miners, and no single entity controls the network.

-

Privacy

• CBDCs: Seek to balance privacy with regulatory compliance. Privacy-enhancing technologies may be implemented, but user data is typically accessible to intermediaries and central banks to meet regulatory needs. • Bitcoin: Pseudonymous by design. Transactions are public on the blockchain but do not directly link to individual identities unless voluntarily disclosed.

-

System Design

• CBDCs: May adopt a hybrid system combining centralized (e.g., central bank-controlled settlement) and decentralized elements (e.g., private-sector intermediaries). Offline functionality and interoperability with existing systems are priorities. • Bitcoin: Fully decentralized, using a distributed ledger (blockchain) where all transactions are validated and recorded without reliance on intermediaries.

-

Cybersecurity

• CBDCs: Cybersecurity risks are heightened due to potential reliance on centralized points for data storage and validation. Post-quantum cryptography is a concern for future-proofing against quantum computing threats. • Bitcoin: Security relies on cryptographic algorithms and decentralization. However, it is also vulnerable to quantum computing in the long term, unless upgraded to quantum-resistant protocols.

-

Offline Functionality

• CBDCs: Exploring offline payment capabilities for broader usability in remote or unconnected areas. • Bitcoin: Offline payments are not natively supported, although some solutions (e.g., Lightning Network or third-party hardware wallets) can enable limited offline functionality.

-

Point of Sale and Adoption

• CBDCs: Designed for seamless integration with existing PoS systems and modern financial infrastructure to encourage widespread adoption. • Bitcoin: Adoption depends on merchant willingness and the availability of cryptocurrency payment gateways. Its volatility can discourage usage as a medium of exchange.

-

Monetary Policy and Design

• CBDCs: Can be programmed to support specific policy goals, such as negative interest rates, transaction limits, or conditional transfers. • Bitcoin: Supply is fixed at 21 million coins, governed by its code. It is resistant to monetary policy interventions and inflationary adjustments.

In summary, while CBDCs aim to complement existing monetary systems with centralized oversight and tailored features, Bitcoin is designed as a decentralized alternative to traditional currency. CBDCs prioritize integration, control, and regulatory compliance, whereas Bitcoin emphasizes autonomy, censorship resistance, and a trustless system.

-

-

@ 4ba8e86d:89d32de4

2024-11-14 09:17:14

@ 4ba8e86d:89d32de4

2024-11-14 09:17:14Tutorial feito por nostr:nostr:npub1rc56x0ek0dd303eph523g3chm0wmrs5wdk6vs0ehd0m5fn8t7y4sqra3tk poste original abaixo:

Parte 1 : http://xh6liiypqffzwnu5734ucwps37tn2g6npthvugz3gdoqpikujju525yd.onion/263585/tutorial-debloat-de-celulares-android-via-adb-parte-1

Parte 2 : http://xh6liiypqffzwnu5734ucwps37tn2g6npthvugz3gdoqpikujju525yd.onion/index.php/263586/tutorial-debloat-de-celulares-android-via-adb-parte-2

Quando o assunto é privacidade em celulares, uma das medidas comumente mencionadas é a remoção de bloatwares do dispositivo, também chamado de debloat. O meio mais eficiente para isso sem dúvidas é a troca de sistema operacional. Custom Rom’s como LineageOS, GrapheneOS, Iodé, CalyxOS, etc, já são bastante enxutos nesse quesito, principalmente quanto não é instalado os G-Apps com o sistema. No entanto, essa prática pode acabar resultando em problemas indesejados como a perca de funções do dispositivo, e até mesmo incompatibilidade com apps bancários, tornando este método mais atrativo para quem possui mais de um dispositivo e separando um apenas para privacidade. Pensando nisso, pessoas que possuem apenas um único dispositivo móvel, que são necessitadas desses apps ou funções, mas, ao mesmo tempo, tem essa visão em prol da privacidade, buscam por um meio-termo entre manter a Stock rom, e não ter seus dados coletados por esses bloatwares. Felizmente, a remoção de bloatwares é possível e pode ser realizada via root, ou mais da maneira que este artigo irá tratar, via adb.

O que são bloatwares?

Bloatware é a junção das palavras bloat (inchar) + software (programa), ou seja, um bloatware é basicamente um programa inútil ou facilmente substituível — colocado em seu dispositivo previamente pela fabricante e operadora — que está no seu dispositivo apenas ocupando espaço de armazenamento, consumindo memória RAM e pior, coletando seus dados e enviando para servidores externos, além de serem mais pontos de vulnerabilidades.

O que é o adb?

O Android Debug Brigde, ou apenas adb, é uma ferramenta que se utiliza das permissões de usuário shell e permite o envio de comandos vindo de um computador para um dispositivo Android exigindo apenas que a depuração USB esteja ativa, mas também pode ser usada diretamente no celular a partir do Android 11, com o uso do Termux e a depuração sem fio (ou depuração wifi). A ferramenta funciona normalmente em dispositivos sem root, e também funciona caso o celular esteja em Recovery Mode.

Requisitos:

Para computadores:

• Depuração USB ativa no celular; • Computador com adb; • Cabo USB;

Para celulares:

• Depuração sem fio (ou depuração wifi) ativa no celular; • Termux; • Android 11 ou superior;

Para ambos:

• Firewall NetGuard instalado e configurado no celular; • Lista de bloatwares para seu dispositivo;

Ativação de depuração:

Para ativar a Depuração USB em seu dispositivo, pesquise como ativar as opções de desenvolvedor de seu dispositivo, e lá ative a depuração. No caso da depuração sem fio, sua ativação irá ser necessária apenas no momento que for conectar o dispositivo ao Termux.

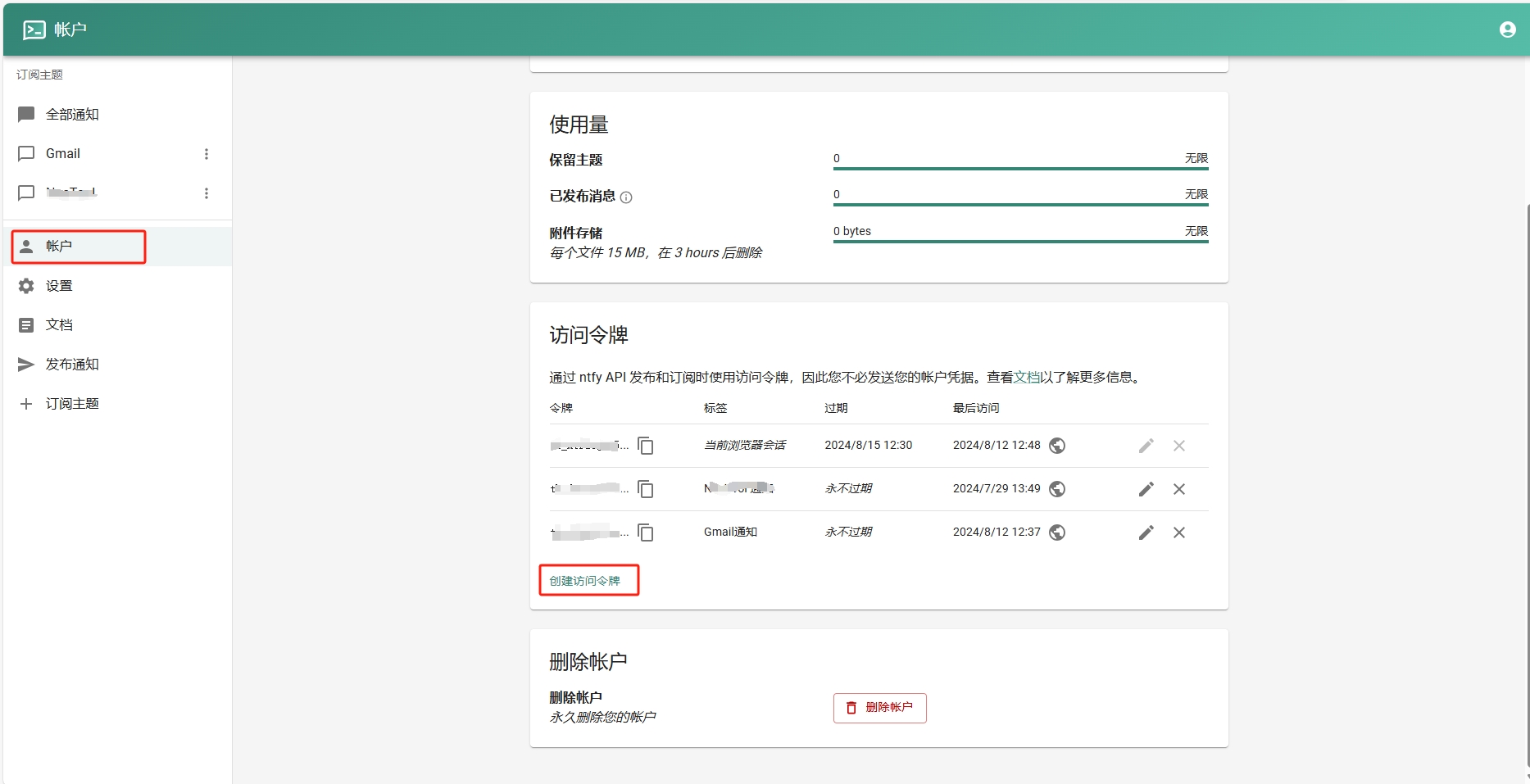

Instalação e configuração do NetGuard

O NetGuard pode ser instalado através da própria Google Play Store, mas de preferência instale pela F-Droid ou Github para evitar telemetria.

F-Droid: https://f-droid.org/packages/eu.faircode.netguard/

Github: https://github.com/M66B/NetGuard/releases

Após instalado, configure da seguinte maneira:

Configurações → padrões (lista branca/negra) → ative as 3 primeiras opções (bloquear wifi, bloquear dados móveis e aplicar regras ‘quando tela estiver ligada’);

Configurações → opções avançadas → ative as duas primeiras (administrar aplicativos do sistema e registrar acesso a internet);

Com isso, todos os apps estarão sendo bloqueados de acessar a internet, seja por wifi ou dados móveis, e na página principal do app basta permitir o acesso a rede para os apps que você vai usar (se necessário). Permita que o app rode em segundo plano sem restrição da otimização de bateria, assim quando o celular ligar, ele já estará ativo.

Lista de bloatwares

Nem todos os bloatwares são genéricos, haverá bloatwares diferentes conforme a marca, modelo, versão do Android, e até mesmo região.

Para obter uma lista de bloatwares de seu dispositivo, caso seu aparelho já possua um tempo de existência, você encontrará listas prontas facilmente apenas pesquisando por elas. Supondo que temos um Samsung Galaxy Note 10 Plus em mãos, basta pesquisar em seu motor de busca por:

Samsung Galaxy Note 10 Plus bloatware listProvavelmente essas listas já terão inclusas todos os bloatwares das mais diversas regiões, lhe poupando o trabalho de buscar por alguma lista mais específica.

Caso seu aparelho seja muito recente, e/ou não encontre uma lista pronta de bloatwares, devo dizer que você acaba de pegar em merda, pois é chato para um caralho pesquisar por cada aplicação para saber sua função, se é essencial para o sistema ou se é facilmente substituível.

De antemão já aviso, que mais para frente, caso vossa gostosura remova um desses aplicativos que era essencial para o sistema sem saber, vai acabar resultando na perda de alguma função importante, ou pior, ao reiniciar o aparelho o sistema pode estar quebrado, lhe obrigando a seguir com uma formatação, e repetir todo o processo novamente.

Download do adb em computadores

Para usar a ferramenta do adb em computadores, basta baixar o pacote chamado SDK platform-tools, disponível através deste link: https://developer.android.com/tools/releases/platform-tools. Por ele, você consegue o download para Windows, Mac e Linux.

Uma vez baixado, basta extrair o arquivo zipado, contendo dentro dele uma pasta chamada platform-tools que basta ser aberta no terminal para se usar o adb.

Download do adb em celulares com Termux.

Para usar a ferramenta do adb diretamente no celular, antes temos que baixar o app Termux, que é um emulador de terminal linux, e já possui o adb em seu repositório. Você encontra o app na Google Play Store, mas novamente recomendo baixar pela F-Droid ou diretamente no Github do projeto.

F-Droid: https://f-droid.org/en/packages/com.termux/

Github: https://github.com/termux/termux-app/releases

Processo de debloat

Antes de iniciarmos, é importante deixar claro que não é para você sair removendo todos os bloatwares de cara sem mais nem menos, afinal alguns deles precisam antes ser substituídos, podem ser essenciais para você para alguma atividade ou função, ou até mesmo são insubstituíveis.

Alguns exemplos de bloatwares que a substituição é necessária antes da remoção, é o Launcher, afinal, é a interface gráfica do sistema, e o teclado, que sem ele só é possível digitar com teclado externo. O Launcher e teclado podem ser substituídos por quaisquer outros, minha recomendação pessoal é por aqueles que respeitam sua privacidade, como Pie Launcher e Simple Laucher, enquanto o teclado pelo OpenBoard e FlorisBoard, todos open-source e disponíveis da F-Droid.

Identifique entre a lista de bloatwares, quais você gosta, precisa ou prefere não substituir, de maneira alguma você é obrigado a remover todos os bloatwares possíveis, modifique seu sistema a seu bel-prazer. O NetGuard lista todos os apps do celular com o nome do pacote, com isso você pode filtrar bem qual deles não remover.

Um exemplo claro de bloatware insubstituível e, portanto, não pode ser removido, é o com.android.mtp, um protocolo onde sua função é auxiliar a comunicação do dispositivo com um computador via USB, mas por algum motivo, tem acesso a rede e se comunica frequentemente com servidores externos. Para esses casos, e melhor solução mesmo é bloquear o acesso a rede desses bloatwares com o NetGuard.

MTP tentando comunicação com servidores externos:

Executando o adb shell

No computador

Faça backup de todos os seus arquivos importantes para algum armazenamento externo, e formate seu celular com o hard reset. Após a formatação, e a ativação da depuração USB, conecte seu aparelho e o pc com o auxílio de um cabo USB. Muito provavelmente seu dispositivo irá apenas começar a carregar, por isso permita a transferência de dados, para que o computador consiga se comunicar normalmente com o celular.

Já no pc, abra a pasta platform-tools dentro do terminal, e execute o seguinte comando:

./adb start-serverO resultado deve ser:

daemon not running; starting now at tcp:5037 daemon started successfully

E caso não apareça nada, execute:

./adb kill-serverE inicie novamente.

Com o adb conectado ao celular, execute:

./adb shellPara poder executar comandos diretamente para o dispositivo. No meu caso, meu celular é um Redmi Note 8 Pro, codinome Begonia.

Logo o resultado deve ser:

begonia:/ $

Caso ocorra algum erro do tipo:

adb: device unauthorized. This adb server’s $ADB_VENDOR_KEYS is not set Try ‘adb kill-server’ if that seems wrong. Otherwise check for a confirmation dialog on your device.

Verifique no celular se apareceu alguma confirmação para autorizar a depuração USB, caso sim, autorize e tente novamente. Caso não apareça nada, execute o kill-server e repita o processo.

No celular

Após realizar o mesmo processo de backup e hard reset citado anteriormente, instale o Termux e, com ele iniciado, execute o comando:

pkg install android-toolsQuando surgir a mensagem “Do you want to continue? [Y/n]”, basta dar enter novamente que já aceita e finaliza a instalação

Agora, vá até as opções de desenvolvedor, e ative a depuração sem fio. Dentro das opções da depuração sem fio, terá uma opção de emparelhamento do dispositivo com um código, que irá informar para você um código em emparelhamento, com um endereço IP e porta, que será usado para a conexão com o Termux.

Para facilitar o processo, recomendo que abra tanto as configurações quanto o Termux ao mesmo tempo, e divida a tela com os dois app’s, como da maneira a seguir:

Para parear o Termux com o dispositivo, não é necessário digitar o ip informado, basta trocar por “localhost”, já a porta e o código de emparelhamento, deve ser digitado exatamente como informado. Execute:

adb pair localhost:porta CódigoDeEmparelhamentoDe acordo com a imagem mostrada anteriormente, o comando ficaria “adb pair localhost:41255 757495”.

Com o dispositivo emparelhado com o Termux, agora basta conectar para conseguir executar os comandos, para isso execute:

adb connect localhost:portaObs: a porta que você deve informar neste comando não é a mesma informada com o código de emparelhamento, e sim a informada na tela principal da depuração sem fio.

Pronto! Termux e adb conectado com sucesso ao dispositivo, agora basta executar normalmente o adb shell:

adb shellRemoção na prática Com o adb shell executado, você está pronto para remover os bloatwares. No meu caso, irei mostrar apenas a remoção de um app (Google Maps), já que o comando é o mesmo para qualquer outro, mudando apenas o nome do pacote.

Dentro do NetGuard, verificando as informações do Google Maps:

Podemos ver que mesmo fora de uso, e com a localização do dispositivo desativado, o app está tentando loucamente se comunicar com servidores externos, e informar sabe-se lá que peste. Mas sem novidades até aqui, o mais importante é que podemos ver que o nome do pacote do Google Maps é com.google.android.apps.maps, e para o remover do celular, basta executar:

pm uninstall –user 0 com.google.android.apps.mapsE pronto, bloatware removido! Agora basta repetir o processo para o resto dos bloatwares, trocando apenas o nome do pacote.

Para acelerar o processo, você pode já criar uma lista do bloco de notas com os comandos, e quando colar no terminal, irá executar um atrás do outro.

Exemplo de lista:

Caso a donzela tenha removido alguma coisa sem querer, também é possível recuperar o pacote com o comando:

cmd package install-existing nome.do.pacotePós-debloat

Após limpar o máximo possível o seu sistema, reinicie o aparelho, caso entre no como recovery e não seja possível dar reboot, significa que você removeu algum app “essencial” para o sistema, e terá que formatar o aparelho e repetir toda a remoção novamente, desta vez removendo poucos bloatwares de uma vez, e reiniciando o aparelho até descobrir qual deles não pode ser removido. Sim, dá trabalho… quem mandou querer privacidade?

Caso o aparelho reinicie normalmente após a remoção, parabéns, agora basta usar seu celular como bem entender! Mantenha o NetGuard sempre executando e os bloatwares que não foram possíveis remover não irão se comunicar com servidores externos, passe a usar apps open source da F-Droid e instale outros apps através da Aurora Store ao invés da Google Play Store.

Referências: Caso você seja um Australopithecus e tenha achado este guia difícil, eis uma videoaula (3:14:40) do Anderson do canal Ciberdef, realizando todo o processo: http://odysee.com/@zai:5/Como-remover-at%C3%A9-200-APLICATIVOS-que-colocam-a-sua-PRIVACIDADE-E-SEGURAN%C3%87A-em-risco.:4?lid=6d50f40314eee7e2f218536d9e5d300290931d23

Pdf’s do Anderson citados na videoaula: créditos ao anon6837264 http://eternalcbrzpicytj4zyguygpmkjlkddxob7tptlr25cdipe5svyqoqd.onion/file/3863a834d29285d397b73a4af6fb1bbe67c888d72d30/t-05e63192d02ffd.pdf

Processo de instalação do Termux e adb no celular: https://youtu.be/APolZrPHSms

-

@ 06b7819d:d1d8327c

2024-11-28 18:30:00

@ 06b7819d:d1d8327c

2024-11-28 18:30:00The Bank of Amsterdam (Amsterdamse Wisselbank), established in 1609, played a pivotal role in the early history of banking and the development of banknotes. While banknotes as a concept had been pioneered in China centuries earlier, their modern form began emerging in Europe in the 17th century, and the Bank of Amsterdam leveraged its unique position to dominate this nascent monetary tool.

Founding and Early Innovations

The Bank of Amsterdam was created to stabilize and rationalize Amsterdam’s chaotic monetary system. During the early 1600s, a plethora of coins of varying quality and origin circulated in Europe, making trade cumbersome and unreliable. The Wisselbank provided a centralized repository where merchants could deposit coins and receive account balances in return, denominated in a standardized unit of account known as “bank money.” This “bank money” was more stable and widely trusted, making it an early form of fiat currency.

The Rise of Banknotes

Although the Wisselbank initially issued “bank money” as a ledger-based system, the growing demand for portable, trusted currency led to the adoption of transferable receipts or “banknotes.” These receipts acted as claims on deposited money and quickly became a trusted medium of exchange. The innovation of banknotes allowed merchants to avoid carrying large quantities of heavy coinage, enhancing convenience and security in trade.

Monopoly on Banknotes

The Wisselbank’s reputation for financial stability and integrity enabled it to establish a monopoly on banknotes in the Dutch Republic. The bank’s stringent policies ensured that its issued notes were fully backed by coinage or bullion, which bolstered trust in their value. By centralizing the issuance of notes, the bank eliminated competition from private or less reliable issuers, ensuring its notes became the de facto currency for merchants and traders.

Moreover, the bank’s policies discouraged the redemption of notes for physical coins, as it charged fees for withdrawals. This incentivized the circulation of banknotes rather than the underlying specie, cementing their role in the economy.

Decline of the Monopoly

The Wisselbank’s monopoly and influence lasted for much of the 17th century, making Amsterdam a hub of global trade and finance. However, as the 18th century progressed, financial mismanagement and competition from other emerging financial institutions eroded the Wisselbank’s dominance. By the late 18th century, its role in the global financial system had diminished, and other European financial centers, such as London, rose to prominence.

Legacy

The Bank of Amsterdam’s early monopolization of banknotes set a precedent for centralized banking and the development of modern monetary systems. Its ability to create trust in a standardized, portable medium of exchange foreshadowed the role that central banks would play in issuing and regulating currency worldwide.

-

@ eac63075:b4988b48

2024-10-21 08:11:11

@ eac63075:b4988b48

2024-10-21 08:11:11Imagine sending a private message to a friend, only to learn that authorities could be scanning its contents without your knowledge. This isn't a scene from a dystopian novel but a potential reality under the European Union's proposed "Chat Control" measures. Aimed at combating serious crimes like child exploitation and terrorism, these proposals could significantly impact the privacy of everyday internet users. As encrypted messaging services become the norm for personal and professional communication, understanding Chat Control is essential. This article delves into what Chat Control entails, why it's being considered, and how it could affect your right to private communication.

https://www.fountain.fm/episode/coOFsst7r7mO1EP1kSzV

https://open.spotify.com/episode/0IZ6kMExfxFm4FHg5DAWT8?si=e139033865e045de

Sections:

- Introduction

- What Is Chat Control?

- Why Is the EU Pushing for Chat Control?

- The Privacy Concerns and Risks

- The Technical Debate: Encryption and Backdoors