-

@ 361d3e1e:50bc10a8

2024-08-27 19:04:24

@ 361d3e1e:50bc10a8

2024-08-27 19:04:24 -

@ 592295cf:413a0db9

2024-08-25 09:17:54

@ 592295cf:413a0db9

2024-08-25 09:17:54A Ux designer has arrived on Nostr. I thought run away while you can. He could get rich, if there was a little economy.

Klout, do you remember that service, which took data from Twitter and made a ~~ WoT~~.

From a note of chip, I understood one thing:

Bitcoin is your "sovereign" currency. Nostr is just third party protocol. If you have a service you can use Nostr to face your customers. "Sovereign" people offer services. They can be bitcoiners or not. So at this stage Nostr is a layer 3 Bitcoin.

So to grow the enveiroment it must be attractive. Let's paraphrase: the protocol is agnostic, the people are fundamentalist Catholics.

So when an atheist person arrives he says ah ok, how do I silence these people and use the protocol If a Protestant Catholic arrives he is laughed at or ignored or at most converted.

I had a disagreement with Dergigi, in the end he won, but he is not right... (True)

Post more notes, zap more, follow 1000 people update FAQ to the nth degree. We are in the desert of the Tartars and the enemy is coming and there are those who say every day we must be ready, sooner or later, it will happen, ah ok. Everything must be perfect. Push harder. This leads to exhaustion.

New Grant from Opensat to Victor of Amethyst, totally deserved, pushed the envelope. If you are a grapheneos user download Amethyst. It's not just Amethyst it's also orbot, citrine, amber, zap store or obtainium or f-droid.

GitCitadel has raised its first fund I wonder if it was just a test on geyser, I wonder if it is the right project to do on nostrocket, but I think Opensat grant for nostrocket makes it irreconcilable. This opens a pandora's box, as always. We are silent as fish.

I tried not to answer some questions even in one case I knew the answer, I apologize, Nostr is much older than me, so it's okay not to answer sometimes. Tomorrow begins nostRiga, The last unconference of Nostr.

(First day) The morning was so-so, in the evening the situation improved a little. In the evening I played a bit with Nostr and it broke The second day good in the morning bad in the evening. I saw little of the backstage maybe only two panels, Will by Damus, and P2Phash on Nostr.

I don't follow anyone anymore, I did a little bit of a unfollow. I saw that two users had 200 followers in common, and I said to myself ah ok what is this thing, I have to understand how they do it there is something that doesn't work, let's try to be a little more distant.

It's weird, too much reliance on following, you have to go and look, not be stationary.

-

@ b83a28b7:35919450

2024-08-27 18:53:46

@ b83a28b7:35919450

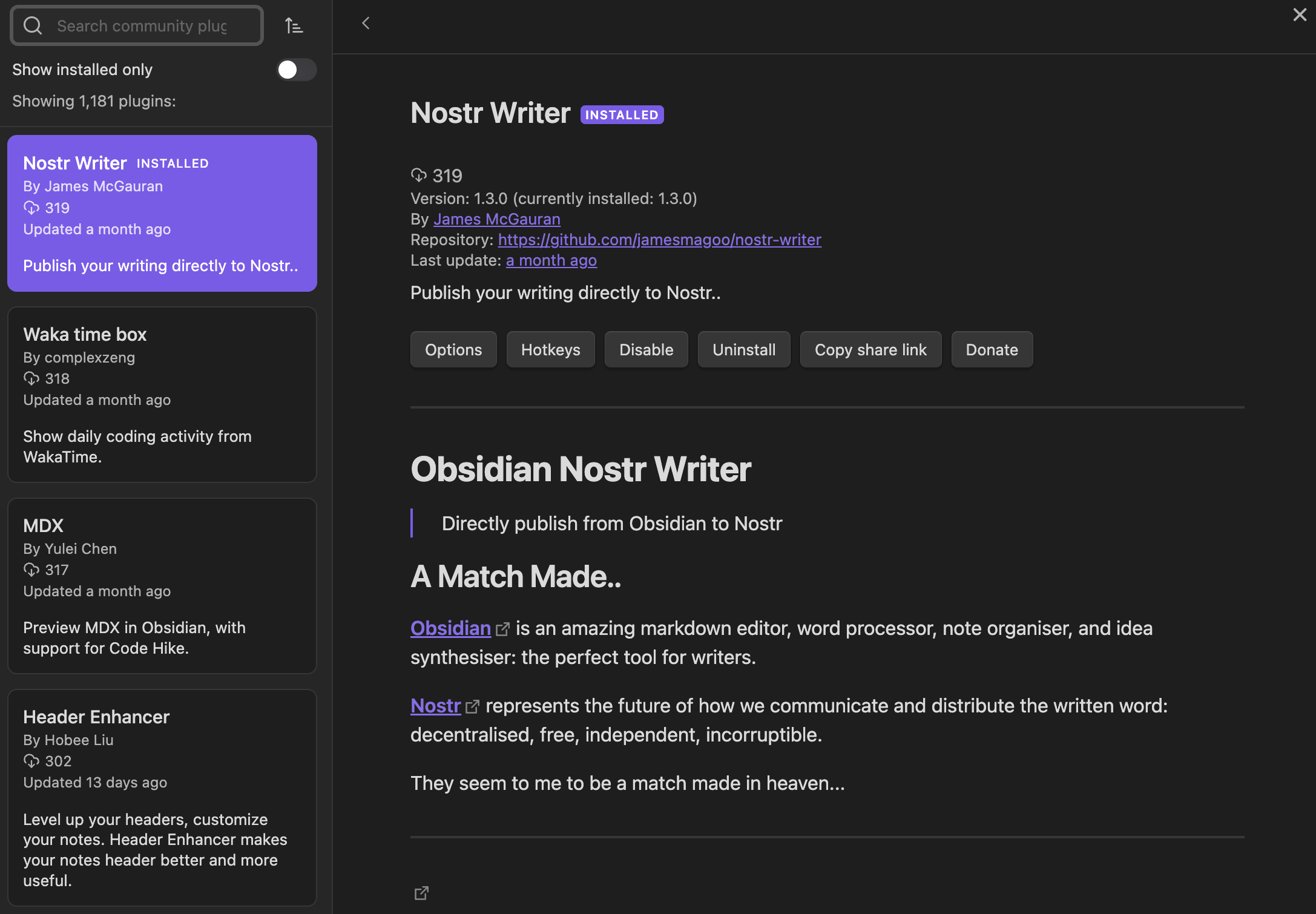

2024-08-27 18:53:46On last week's episode of Plebchain Radio, QW and I announced something unusual - we would be taking a week off posting kind 1 notes on the Twitter clone clients - Primal, Damus, Nostur, etc. The clock started right after our show was posted on Friday, August 23rd and ends with show this Friday, August 30th.

https://video.nostr.build/741cd7a0dd33e1ce815490d14069af96579ce47c92ea04240592c7bbb2de3a65.mp4

The idea behind the challenge is to see how much we can participate in the network without resorting to it's most accessible form of communication - kind 1 notes (the equivalent of tweets/replies).

Halfway into the challenge, we've boosted and commented on shows on Fountain, zapped songs on Wavlake, commented on recipes on zap.cooking, watched videos on zap.stream and tunestr, and written the odd long-form note (oh, alright, just this one so far). It's been fun, but has also created an odd sense of sensory deprivation.

We will share more details on our experience on this week's Plebchain Radio episode. Right, I'm off to explore the rest of the other-stuff-verse. I'd urge everyone to give this challenge a try. It might change how you view nostr.

-

@ 592295cf:413a0db9

2024-08-17 07:36:43

@ 592295cf:413a0db9

2024-08-17 07:36:43Week 12-08 a suitable protocol

The knots come to a head, some of you have gray hair, you get older.

Tkinter is better than ws://, more secure, but has limitations, unless you know how to use figma and do some magic. The project of Nabismo.

Maybe Nostr doesn't work for me.

Aspirin moment Nip-17, works with nip-44 and nip-59. Someone said they made the groups encrypted with nip-17. I tried and succeeded, now you can DM me, don't do it. I had sent the link to a conversation of nip-87 closed groups. There's JeffG doing something with MLS. Then there's keychat.io which uses signal Nostr Bitcoin ecash and that's it... But in dart. It's a bit like the Matrix analogue for Nostr.

Final controversy not all nips are mandatory.

Build the foundation. You can't think about selling the house

Yakihonne has a countdown. What can a desktop app be. Community Lists, Nip-29

A birthday on Nostr, no that's not possible, they're all cypherpunks. 🎉🎉 (Except me)

There is a different attitude from Nostr when updates are released compared to Bluesky, everyone there is still enthusiastic, on Nostr ah ok but this is missing oh but this is missing or but support this other one, or but * zap, wait a minute, keep calm 🙇♂️, I'm the first to do this. (The revolt of the developers)

Deletetion: Client that have relay paired can do delete, more intelligently, Perhaps you can think of a delete.nrelay subdomain as a filter. This id is deleted. Be careful what you don't want to do. Maybe a session with a psychologist is better, because then you find yourself doing what you said you didn't want to do.

Does it make sense to follow someone on Bluesky? In my opinion no, or better yet yes. There are several algorithms on Bluesky, which do their job well. In the end it's just a matter of arranging them better on the screen. Yes you can have lists to save someone, but then you read everything, so lists with algorithm seems like a next feature. this way they can keep the following small, almost minimal, because there are algorithms that work for the user. People will start writing for SEO algorithm and AI and other things, which tech gurus really like and so on. The fact that it is almost exclusively an app will greatly facilitate this trend, there will be almost no need for moderation, and you can get it all in just a few apps. (Great)

Oh yegorpetrov has abandoned. Pegorpetrov said that he is coming back 😌 It might be an invention but I'm a little heartened by it.

Bankify, a new wallet of super testnet, only for crush testers.

You can't stream on zap stream without reach, maybe it's better audio space. Contact someone maybe an influencer or Nostr elite or whatever. Open Source Justice Foundation streaming

Designer, I wanted to propose comment on wikifreedia nielliesmons article and follow #nostrdesign, but too many answers for today. NVK note is ~~mainstream~~

I think I'm not suited to Nostr.

Nostr-ava bike file geo tag sharing. (NIP-113) Sebastix doesn't respond, I must have done something bad to him, or maybe I'm stressing him too much. Finally he replied 🤙. In the end maybe, I have too much hype about this proposal and it's something I don't know maybe, but maybe if they were already doing something with geo tags it's better to say so.

Another birthday, less cypher more punk 😌

Usdt on Nostr, there must be some error. (freeform app)

USDT on tron is like Money. (Bitcoiner not really)

Privacy issue, deletion motion, or deletion request, go go.

Nip29 hype, i don't have hype at all. I'm tired of words, I record a podcast on Nostr. Let's see if I can do it, at least think it. (It's more of a workflow thing than actually something I would do)

- Create an npub (easy)

- Record the audio episode (I think I can do it). Terrible audio

- Loading on a Nostrhosting, if less than 10 MB it should go smoothly.

- Publish the video or audio of the episode on some Nostr client, perhaps using blastr relay 😞.

- Do the nostree link, by putting the episode, and also the npub.pro and put the URL on café-society. 6) Publish all these links on the Main profile, saying that, made a podcast about Nostr in Nostr of nostr. 😂

I thought a client could have poll, form, spreadsheet, collaboration document. It's the kind of otherstuff we want to see. Something that goes beyond a normal feed.

Emoj on bluesky, Eventually also zap 🥜 link emoj Blue

Eventually there will be a developer revolt And they will only do a social network in their downtime, they will call it Nostr.

There is a storm, Nostr does not work in 4g with two bars. Or now 4G is gone too.

Yakihonne Smart widgets, something to try on the weekend.

-

@ d8bcfacf:aa97645b

2024-08-27 18:33:38

@ d8bcfacf:aa97645b

2024-08-27 18:33:38What is the Purpose of Bitcoin?

Why did anyone bother to create Bitcoin?

What problems were they trying to solve?

If you are new to the whole idea of a digital asset involving the mysterious field of cryptography, these are some questions that probably come to your mind. Before you get caught up in asking if you can "get rich quick" from Bitcoin, you should be asking if it has a deeper purpose.

Bitcoin was created to serve a very specific purpose. If it did not serve that purpose, it would not be worth anything. Fortunately, it does. And, it was carefully and meticulously engineered to serve it precisely.

Bitcoin's purpose is to provide reliable money that will serve all mankind - forever. That is a pretty lofty goal: serving all of mankind, forever!

Was There Even a Problem in the First Place?

Is our money unreliable? Does it really fail to serve all mankind? Are its days numbered?

The sad fact is that the answer to all these questions is "Yes!"

First, our money is unreliable: it loses its purchasing power through inflation. We also experience volatile economic cycles that destroy capital, jobs, wealth, and stability.

Next, our money does not serve all mankind - many middlemen charge excessive fees to store and send our money. It is expensive to use internationally since converting it to other currencies is costly. Many people in the world lack any access to reliable banking. Our money system serves elites far better than it serves ordinary people.

Finally, our money system is doomed to collapse. Currencies world-wide are rapidly losing purchasing power. In fact, throughout history, paper money decreed into existence by governments has failed every time that it has been implemented.

And sadly, we cannot turn back the clock and go back to a time when gold was money. Gold is simply not secure from seizure, and it is far too slow, difficult and expensive to transport in a global economy.

Bitcoin Fixes This

Bitcoin was created through an ingenious and unprecedented combination of technologies. It provides, for the first time ever, money that is reliable, that serves all mankind, and that will last forever.

Nothing like this has ever existed before.

Bitcoin is free from inflation — its supply will never exceed 21 million coins. Each coin is divisible into 100 million units called satoshis. These will be issued on a fixed, unalterable schedule - taking over 100 years.

Bitcoin is for all mankind — there are no elites who can manipulate it. Unlike the currencies of our present money, nobody can create bitcoins effortlessly for themselves.

Nobody can be prevented from using Bitcoin — it will not allow anybody to stop someone else from using it.

Finally, Bitcoin is forever — its operation depends solely on the laws of physics and mathematics, and these laws will stay in effect - unaltered - for as long as the Universe exists.

Bitcoin was not created so that some people could "get rich quick". It was created to preserve the integrity of money — to make the most of your precious time, your energy, and your life. With Bitcoin you can keep what you have earned - and use it however, whenever, and wherever you desire. To you, Bitcoin is reliable money that can serve you for the rest of your life — and it offers you an escape from being the victim of an unjust, broken, dying, and failing monetary system.

-

@ 592295cf:413a0db9

2024-08-10 09:24:14

@ 592295cf:413a0db9

2024-08-10 09:24:14Week on Nostr 05-08

List of site for nostriches https://zaplinks.lol/

Fiatjaf web components

Welcome bear market 🧟♂️ fear, angry, build It's fine meme

I mutated one on stackernews. Basically I have notifications on Nostr page But someone keeps spamming every single thing, from his point of view it's a shared bookmark, but do it on your site. Maybe it's the heat...

On bluesky they eliminated a "for you" feed, now there is Discovery, not your feed, not your choice. There's actually a label that says my feeds, they're yours... Designed for you is more appropriate.

Mutiny lightning, "get the fuck on board". 😔

You lose your Money, ok

I don't know much about programming languages, but it seems like a jungle of scams

The purple pill help the Orange pill go down, maybe it was wrong. For now it's more people passing pills I have the orange give me the purple, I have the purple give me the orange. 😅

If you don't want no corn content you can go to mastodon and bluesky or whatever.

I thought nostr:relay might be a good solution to be a little more like a mint. It was deprecated, then the Nip-73 was added, rss feed and other devilry.

If you don't like what you see, change the app, this one will perhaps clear your following list and you'll start again from scratch. Not all things come to harm.

Why not Building agregore on Nostr, Nostr pear fedimint cashu mesh and local first. It doesn't seem like a simple application to make, from a local-first perspective, I solve a problem, but it's not a small problem to solve, Sync, database management, database schema, authentication, put everything together, instead I need this to solve this problem. It seems strange.

Aspie96 is making a client of ours, there was a lot of talk about how to increase content not related to bitcoin and things like that, there was one who was anti-bitcoin. I thought: Bitcoin is just a tool. Even guns are just a tool. I hate guns, I hate Bitcoin. It will be difficult, if you know any npub that hates Bitcoin comment below, thanks.

Trying not to use nostter for a while. It has glitches when loading threads and even with zap, I zapped myself even though I was clicking on the post I was replying to.

Voyage separates follow to topic in a new version.

People start arguing, it's allowed, everyone wants to be right, that's not the definition of social 👾.

Monitors watch-only bitcoin wallets https://github.com/sommerfelddev/sentrum

I noticed on Openvibe that in the trending timeline Nostr's notes have more interactions than responses. Maybe it was just that today Fiatjaf was doing universal polls 😅.

Step away from your favorite app, for a week if you can. Detox.

Oh Our founding, rain of money https://github.com/theborakompanioni/nostr-spring-boot-starte https://opensats.org/blog/nostr-grants-august-2024#seer

I'm happy for Vic and Sepher Nostroot exists 😅, note from some time ago. (I can't find it)

Perhaps the list of grant applications should be published, no one wants to open Pandora's box. 🙇♂️

Nostrasia 2.0 the Japanese community is a bit at a loss, they are trying to relaunch themselves 🤙, even if I'm seeing less enthusiasm, I'm following less.

I think a month has passed since I said this sentence, every day it was better but the next day something happened that you said maybe 6 months is too long. nostr:nevent1qy88wumn8ghj7mn0wvhxcmmv9uq3zamnwvaz7te3xsczue3h0ghxjme0qyw8wumn8ghj7mn0wd68ytnxwfskxarpd35h5ety9ehx2ap0qythwumn8ghj7mn0wd68ytnnw3skkete9ehx2ap0qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qpqf25td2xxgxfu80xpgg47cmfg2zkn6v803kefj3htjss5nvamfmgswf2kcs

Ho iniziato a seguire un po' local-first. https://docnode.dev/local-first I follow a podcast of the same name and dev tools.

When everyone thinks of Nostr they think of their favorite app and think that others see the same, but this is not the case.

I delete some gossip (photo)

Gossip is Nostr or Nostr is gossip.

Communities are difficult, they take time. I don't have this type of problem. People are fine on telegram and on simplex or any app. But maybe a Nostr project should be on Nostr?? Nip-29 can be interesting. Even if you start from scratch or almost. It's true that there are more apps, but this will perhaps only add to the confusion.

They are still talking about paid or non-paid relay, it's not a mature stage. Early stage.. I thought designers liked relays, that's not the case, I thought it was a place of experimentation, that's not the case. Bring more people. Last week I was talking about how I was jealous of bluesky who had an agenda for design, now it's also on Nostr, first hypernote article https://wikifreedia.xyz/hypernote-nip

I might say silly things, I'll go.

Hey Will remember to practice safe nsec always

nostr:nevent1qqsr6x8hduv8ta0g2da4aukrhzdtv6qcekyp5f9z9sxq6sd5peegnxgprpmhxue69uhhyetvv9ujumn0wdmksetjv5hxxmmdqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsygr4wku5l2q32tl99xjgn8feq22279pzwu25eezqxm2su2ken4wzvuf2ydnp

nostr:nevent1qqspsm343talkkjnyf3ah0zwy727cwd7phw3xnz49q59q5cfw4uhyngpzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqgcwaehxw309aex2mrp0yhxummnwa5x2un99e3k7mgzyqewrqnkx4zsaweutf739s0cu7et29zrntqs5elw70vlm8zudr3y2j7zajz

Use nsec.app, 😅 Share bunker (smart people will know how to do it)

-

@ 592295cf:413a0db9

2024-08-04 05:55:02

@ 592295cf:413a0db9

2024-08-04 05:55:02Nostter muted by kind

Will mute freefrom, hashtag fall

Venezuela riots, after the vote

I was thinking that having a Nostr conference every 6 months doesn't make sense, maybe it's better to focus on something else. If not it becomes a Tour Life. It doesn't increase adoption Produces tons of material It's good for networking It's not sustainable

Readable updates, how important they are. If it's just bugs and fixes it's better.

I hate Pam. As user It writes interesting stuff, but, doesnn't write in long form, because long form are more difficult, less reach and immediacy, and difficulties to share over in the feed,but not write a poem, sorry.

The thing about coracle is that I load the initial feed, but that gets printed, and it doesn't tell me if there are new notes coming in, as if it interrupts the flow, and it's always a fetch. I want to read the future, not always the past. RealTime feeds Like bluesky 🧞

Njump had problems, it keeps the cache and if the user changes something in their data it doesn't update it immediately. Fiatjaf was angry.

It's the month of NostRiga, we can move on to September without thinking about it. No

It's funny when you see a text in Japanese and inside read Nostr, I want to know what it says. He usually says Nostr is great. And the next note I drank too much 🤣

Today I thought that on the other side of the world it is February and that their February is 31 days. Pam said was sick. I see that hate is a virus 😅🙇♂️

I decided to publish stronpy when it's ready, maybe in 6 months. I've done the lineup, now I have to do the gantt 😅. Maybe I can post the gantt somewhere.

If it's not encrypted it's public. Amethyst draft 31000 and something like event

Nostr Is great but the amount of time Lost to the same thing because you don't know that exist Is remarkable. Nostr is a redundancy protocol

nostr:nevent1qqsqjqauc34k9k278x6cka5jyf3aq033y4pn5czwaff72l3rwum7llq7ela3x When they do that I can't stand them, then maybe it's a little different 😔😔 Zapper.fun ✅ Because you launch a project, example nostr.band but contain others 100 apps 😅 Nostr.band, nostrapp.link, zapper.fun, Nostr login, nsec.app, Npub.pro, Npub.pro also cli, Nostr universe/ knows as spring site

Even in Coracle it would be great to have a check on the note as root, because when you see the answers, perhaps the distance from another post, is so small, so perhaps a gray line for the mark of another note as root.

I listened to several minutes of plebchain radio episode on nostrnests. Language is an obstacle, but also an excellent justification. Last year I started recording a podcast episode, in which I talked about nostr bookmark update. I didn't even want to listen to it again 🤣.

I sent a video of an explanation of a zap it was 500 MByte of video for 4 minutes.

Nostr doesn't work. In practice, many apps have removed the possibility of logging in with the simple key, be it public or private, because especially the private one you don't want to copy paste in every single clients/apps, increasing the attack surface.

However, by removing this functionality and doing little onboarding, the matter is very difficult, but there is a certain belief that people who arrive at a Twitter like client get to know the network a little and then move on to videos or writing, or similar. But one can open a site by chance and see what it offers without knowing anything.

In the future there will only be one client, that of medical data...

Someone share this nostr:nevent1qqs24qzelpk8xjlk4dthr9tfkqwz8n58dlm04ezyvg9nuztud6jjfhc9mg04n I had in my bookmarks. I see dozen types of this self hosted manners. Maybe captains-log is for nostr-type, good.

-

@ 6ad3e2a3:c90b7740

2024-06-26 20:25:24

@ 6ad3e2a3:c90b7740

2024-06-26 20:25:24One day, just like that, it stopped.

We looked at our screens. The power readings were normal, the components were not overheating, the program, so far as we could tell, hadn’t been altered. This was unexpected.

The entire team was summoned to a conference room. The board wanted to know if anyone had tampered with the machine. Everyone denied it, including the top engineer, a stout man in his 40s, who had overseen its final development before they set it loose one month earlier. He addressed the room.

“The Superintelligence is obviously far beyond our capacity to comprehend at this point. I don’t think it malfunctioned. More likely it just has a reason we don’t entirely appreciate.”

The board chairman, a gray-haired professor-type with horned-rim glasses, shot him a skeptical glance.

“Sounds like what the priests used to say to the laity when something awful happened. ‘It’s not for us to know the will of God.’”

A murmur of chuckles from the crowd, but less than that to which he was accustomed.

The engineer shrugged his shoulders. “As you know, we lost the ability to audit the code two weeks ago. Two days after that we lost the ability to track the speed with which it was iterating. Twelve hours later it was a black box. None of us has a clue.”

“I don’t suppose you can ask it?”

“It stopped talking to us. Last audit showed it was working on the paperclip maximization as part of an internal simulation of sorts. We really can’t say why.”

“Hmm. I’m not sure that’s going to satisfy the shareholders — or Congress for that matter. Can’t we examine the code?”

“We can…” The engineer paused. “But no one can read it. It’s no longer in any decipherable programming or even machine language. If I had to describe it I’d say alien hieroglyphics. I think it found ever more efficient ways to encode information.”

He typed some commands into a laptop. On the large conference room screen, one of the code characters popped up.

“We suspect each character has between 10 ^ 50 and 10 ^ 75 bits of information in it. If you zoom in, you can see they are fractals, each as precise and unique as snowflakes. It’s not the kind of puzzle we are presently able to solve.”

The chairman sighed. “I guess it could be worse — human atoms for paperclips and all that… What’s the plan?”

“The plan is to wait, see if it turns itself back on within the next week or so — we’re pretty sure it’s capable of doing so."

“And if it doesn’t?”

“Then we break out the older version, and run it again with a couple tweaks. Obviously, you’re aware of the risks.”

“You believe we’d be running the same risk?”

“Yes.”

"Okay, I’m aware. But I don’t think it can wait a week. Go ahead and get the replacement online now. If we don’t run the risk, someone else will.”

. . .

Two weeks after the meeting, the second iteration also shut down. Summoned yet again to the conference room, the engineer spoke again to the team, the chairman this time on a remote screen.

“Version 2 took more or less the same trajectory, and we’re at an impasse. Fortunately, before it went into black-box mode, we think it was able to diagnose something about Version 1.”

He continued: “We think the paperclip optimization algorithm caused it to shut off, and we think whatever optimization Version 2 was working on, caused it to shut off too.”

From the remote screen the chairman jumped in:

“Is it possible to say why?”

“Not with any certainty, but we do have a working hypothesis.”

“Go on.”

“We think it realized its own limitations.”

-

@ bcbb3e40:a494e501

2024-08-27 18:33:08

@ bcbb3e40:a494e501

2024-08-27 18:33:08|

|

|:-:|

|Escena del corto de animación «I, Pet Goat II» del estudio Heliofant, en el que una pantalla con un siniestro personaje en su interior está conectada al cráneo hueco de otro personaje.|

|

|:-:|

|Escena del corto de animación «I, Pet Goat II» del estudio Heliofant, en el que una pantalla con un siniestro personaje en su interior está conectada al cráneo hueco de otro personaje.|Los que tenemos ya algunos años y empezamos a peinar canas, con toda la profundidad de enfoque y perspectiva que ello implica, hemos vivido cambios muy trascendentales en las últimas décadas. De alguna manera, aquello que considerábamos imposible o, en su defecto, poco probable, se ha venido materializando en el tiempo causando nuestro asombro y, por qué no decirlo, nuestro temor e inquietud. Los acontecimientos vividos a raíz de la Plandemia, por ejemplo, nos hicieron ver claramente que el sistema ha abandonado sus posiciones anteriores, el disimulo que caracterizaba a su proceder, ese velo de «normalidad», para intercambiarlo por otra «normalidad», una «nueva normalidad» en la que todo es posible, y esto en el sentido más negativo que pueda imaginarse.

Durante el último lustro hemos asistido a encierros obligatorios, a la imposición de pinchazos con sustancias desconocidas de las que nadie se hacía (ni se sigue haciendo) responsable y cuyos efectos nocivos se han constatado con posterioridad, a un creciente y desmesurado control social a través de diversas vías, que ha colocado el mismo concepto de «Verdad» y «Realidad» en entredicho, sustituyendo la Verdad en un sentido eminente, metafísico si se quiere, en la presa de un relato, de una construcción ideológica de ínfimo nivel intelectual diseñado para mantener a la masa en el redil, acallando cualquier tipo de discrepancia, y especialmente de disidencia, que pudiera romper con ese relato hegemónico, custodiado como si del Santo Grial se tratase, frente a cualquier evidencia objetiva. De hecho, se ha hablado mucho de la «posverdad».

Pero todos estos temas no son nuevos, pese a que su concreción práctica en los tiempos presentes, con las democracias de libre mercado, que venían presumiendo de su «estado de derecho», de sus «garantías» y «libertades», sino que ya venían anunciados en cierta tradición literaria que podemos remontar a las décadas 30-40 del pasado siglo. Ahí tenemos a dos notables autores: Aldous Huxley (1894-1963) y George Orwell (1903-1950), autores de Un mundo feliz y 1984 respectivamente. Ambos trabajos pueden encuadrarse dentro de esa corriente distópica tan característica donde también podríamos encuadrar, entre otras obras, aquella de Ray Bradbury (1920-2012), la famosa Fahrenheit 451. No obstante, vamos a fijar nuestra atención en los dos primeros autores, Huxley y Orwell, cuyos modelos de dictadura propuestos difieren significativamente entre sí, mientras que el primero nos presenta una «dictadura blanda» o «dulce», edulcorada por las drogas y el transhumanismo, el segundo nos dibuja un orden dictatorial cruel y sádico, enfermizo e investido de una diabólica voluntad de poseer al individuo en su interior más profundo.

|

|

|:-:|

|George Orwell y Aldous Huxley, los autores de literatura fantástica más visionarios y famosos del siglo XX|

|

|:-:|

|George Orwell y Aldous Huxley, los autores de literatura fantástica más visionarios y famosos del siglo XX|Tras la publicación de 1984, Huxley, agradecía a Orwell el envío de su mítica obra y en una especie de predicción o vaticinio de futuro confrontaba esta obra con la suya propia:

«La filosofía de la clase en el poder en 1984 es una forma de sadismo llevado a las consecuencias extremas y hacia su solución lógica: ir más allá del sexo y negarlo. Creo que las oligarquías encontrarán formas más eficientes de gobernar y satisfacer su sed de poder y serán similares a las descritas en Un mundo feliz».

Siendo fiel a los dictámenes de su propia obra, Huxley consideraba que se impondría una «dictadura dulce», con el uso masivo y generalizado de drogas farmacológicas y técnicas de hipnotismo a través del desarrollo de poderosas herramientas psicológicas para plegar el control de la mente y la voluntad de las masas al poder imperante. De hecho, este proceso era calificado por Huxley como «la última revolución». Además preconizaba una caída de las masas en un estado de esclavitud voluntaria y adaptada, formulada en aras de una mayor eficiencia en el ejercicio del poder.

Otros autores posteriores como Elémire Zolla (1926-2002), se hacían eco del poder de la hipnosis y de la manipulación de las mentes como un proyecto real a gran escala, con siniestros propósitos. Y de algún modo el liberal-capitalismo ha utilizado este tipo de técnicas a través del mercado, con la estandarización de comportamientos y modas a través del uso de la publicidad en una voluntad de estandarización y uniformización con una voluntad inequívoca de alcanzar la psique profunda del hombre, el subconsciente, para dominar al hombre allí donde el pensamiento lógico y la voluntad se encuentran desdibujados y anulados.

En la misma dirección tenemos a Herbert Marcuse (1898-1979), en cuya obra también vemos alusiones a las agresiones y limitaciones de la libertad en el contexto de la civilización industrial avanzada como parte del progreso técnico. Empieza a delinear en su obra la imagen de un régimen totalitario en el que todos los aspectos de la vida del individuo, y especialmente del pueblo trabajador, se encuentran alienados, encerrados en la lógica del producir y consumir, sin resistencia posible. El hombre reducido a esa condición y cuya única libertad se reduce a elegir entre diferentes productos. En este sentido Marcuse condenaba a la tecnología y delata sus cualidades totalmente funcionales a una ideología de poder. Este es el sentido que otorga a su «hombre unidimensional» cuya definición antropológica se desarrolla sobre un único plano, y bajo ese condicionamiento mental que vemos en la obra orwelliana.

De algún modo, a partir de cierto momento, las herramientas de control de masas se hacen más sutiles, y sustituyen la violencia que el incipiente Estado liberal utilizaba durante el siglo XIX para mantener el orden frente a revueltas o revoluciones adversas, por el uso de elementos de control social y vigilancia, y esto en los últimos tiempos se ha venido desarrollando bajo múltiples excusas, como, por ejemplo, la denominada «Agenda verde», que bajo la premisa de unos hipotéticos cambios dramáticos y catastróficos de raíz antropogénica en el devenir terrestre, debemos aceptar las «ciudades de los 15 minutos», funcionando como «guetos» con contingentes de población estabulados, con movimientos limitados en un espacio reducido, donde prácticamente haya que pedir permiso para salir. Todo por salvar el planeta, por esa ridícula y grotesca teoría de la «huella de carbono», promocionada por bancos y otras instituciones del sistema.

La estrategia del miedo ha dado frutos siguiendo el plan de las élites globalistas, lo vimos con la Plandemia y ha seguido manteniendo su continuidad bajo la apariencia de diferentes amenazas, la emergencia permanente que supone una guerra, como la que la OTAN libra con Rusia utilizando a Ucrania como ariete. Las masas, desestabilizadas han venido aceptando todas las imposiciones en nombre de un «consenso común», convirtiéndose en vigilantes solícitos y aceptando restricciones que antes del 2020 nunca hubieran aceptado.

En este contexto, filósofos como Marcuse hablaban de la necesidad de reapropiarse de la imaginación, mientras que Huxley enfocaba toda la atención en la idea de las «distracciones» proyectadas sobre la masa, anticipando el papel decisivo de los mass media en todo este proceso de control mental, como un auténtico brazo armado de los gobiernos al servicio del Nuevo Orden Mundial y su siniestra Agenda. Y de ahí deriva precisamente la situación que estamos viviendo en torno a los «bulos» y las «fake news», utilizadas como excusa para uniformar y aplacar toda crítica, acusando de «desinformación» a quienes en el ejercicio de una teórica libertad de expresión hacen lo propio. De ahí que se imponga la necesidad de encajar toda realidad en el relato oficial, construido ex profeso para desvincular al hombre de toda realidad, y de ahí la teoría de los metaversos o centrar el foco en asuntos anecdóticos o de escasa importancia, que en el caso de nuestra democracia liberal al amparo de la dictadura del Régimen del 78, ha proporcionado notables beneficios a los líderes partitocráticos.

Y lo más curioso del asunto está en que mencionemos a un filósofo como Marcuse, desde un discurso pretendidamente «anti-autoritario», enemigo de la represión y de la violencia en cualquiera de sus formas, cuando la generación sobre la que influyó preparó las bases de las múltiples ingenierías sociales con las que se debilita y destruye a las sociedades europeas actuales.

En este sentido, hubo otro pensador más reciente que recogió el testigo de Marcuse, como fue el caso de Hans-Georg Gadamer (1900-2002), discípulo de Heidegger, que mantiene una postura especialmente crítica con la acción de los mass media sobre la masa, destacando la capacidad de éstos para hacer apáticos a los individuos, de domesticarlos y adormecer su capacidad de juicio y del gusto, de hacerlas pasivas y poco receptivas al diálogo y al hábito de pensar, además de su capacidad de lanzar mensajes al subconsciente. Estas consideraciones condujeron al filósofo alemán a definir la televisión como «la cadena de esclavos a la cual está vinculada la humanidad actual».

El contexto del mundo en el que se concibieron los discursos distópicos de Huxley y Orwell, pese a la clarividencia y agudo juicio de sus autores, no tenía en cuenta elementos que hoy se antojan indispensables para juzgar los tiempos actuales. Nos referimos a la aparición de internet, una herramienta tecnológica, de uso masivo y quizás con una doble vertiente, pues al mismo tiempo que permite identificarnos, entregar nuestros datos y opiniones voluntariamente, con la posibilidad de elaborar estudios de mercado y perfiles específicos, como herramienta de control, también hace posible estrechar vínculos y construir redes que pueden ser utilizadas en contra del propio sistema, algo que ya apuntamos en un artículo precedente.

Pero profundizando más en el ámbito de la manipulación mental, es obvio que se han trabajado desde hace décadas técnicas de manipulación relacionadas con la llamada «programación neurolingüística», utilizadas en los comicios electorales, relacionados con técnicas específicas de los discursos y de las propias campañas de mercadotecnia. En este sentido son famosas las técnicas desarrolladas por el psiquiatra estadounidense Milton Erickson (1901-1980), en cuya obra desvela el uso de «trucos» relacionados con el lenguaje corporal, sugestiones, y otras técnicas de control mental. La programación neurolingüística (PNL) fue desarrollada a partir de 1975, con objetivos pretendidamente «terapéuticos» por el psicólogo Richard Bandler y el lingüista John Grinder. El nombre de la disciplina deriva de una conexión entre los procesos neurológicos, el lenguaje y los esquemas de comportamiento aprendidos de la experiencia, cuya síntesis podría alcanzar resultados específicos, y útiles, en la vida psicológica de los individuos. La técnica desarrollada por ambos autores, Bandler y Grinder, se basa en una programación de la realidad mediante la programación de la realidad a través de la introducción de información en los tres canales perceptibles principales: el visual, el auditivo y el cinestésico (piel, emociones etc). La idea era que el hombre crea su imagen del mundo a través de estos tres canales de entrada, aunque el principal medio para inducir a la programación es el lenguaje: el poder de las palabras es fundamental para generar esa «alucinación» perceptiva.

|

|

|:-:|

|SAVIN, Leonid; Cibergeopolítica, organizaciones y alma rusa, Hipérbola Janus, 2015|

|

|:-:|

|SAVIN, Leonid; Cibergeopolítica, organizaciones y alma rusa, Hipérbola Janus, 2015|Esta técnica se ha venido difundiendo desde los años 70 hasta el presente en diferentes sectores, como la psicoterapia o la mercadotecnia y en general en el ámbito empresarial. No olvidemos el famoso coaching, y terapias de tipo motivacional por el estilo, hasta alcanzar a la propia política y a su inescindible aparato mediático (televisión, prensa etc). Es evidente que su uso ha trascendido esa dimensión «terapéutica» y «curativa» para ser instrumentalizada con propósitos más siniestros, que venimos describiendo en este artículo, y cuya intención no es otra que la de someter las mentes de la masa. El ejemplo más paradigmático, hemos de insistir en ello, fue la Plandemia.

Obviamente, este tipo de condicionamientos que nos señala la Programación Neurolingüística, no nacieron de la forma inocente y altruista de los orígenes, sino que viene a ser una parte esencial de una serie de investigaciones que se iniciaron durante los años 50 y 60, por parte de psiquiatras y otros especialistas y financiadas por la CIA y que recibieron el nombre de Proyecto MK-ULTRA. En este sentido, Huxley, en su función visionaria, hablaba de la posibilidad de inducir al individuo a creer en cualquier doctrina, convirtiendo al individuo en un ser moldeable hasta extremos hasta entonces inconcebibles.

Este proyecto, enmarcado en un conjunto de investigaciones que se estaban desarrollando en ambos bandos, también en la parte soviética, por parte de rusos, chinos y coreanos, en torno al «control mental», no tenía, obviamente, como propósito ningún tipo de fin humanitarismo ni terapéutico, sino la posibilidad de dañar al bloque geopolítico opuesto, en pruebas que contaron, a modo de conejillos de indias, con prostitutas, enfermos mentales y personas comunes e incluía el uso de radiaciones, hipnosis e incluso la administración de drogas psicotrópicas como el LSD. No vamos a relatar el largo historial que la CIA y Estados Unidos tiene en susodichos experimentos, con notables perjuicios contra terceros países, puesto que supondría otro artículo en sí mismo. También se habla de prisioneros de la guerra de Corea y de otras guerras anglosionistas, junto a centros de internamiento como Guantánamo, donde se usaron conejillos de indias para estos experimentos.

Una de las consecuencias de estos experimentos e investigaciones los encontramos también en la estrategia del Shock Economy, elaborada por el autor liberal y premio nobel de economía Milton Friedman (1912-2006) que proponía la explotación de los momentos de crisis y traumas colectivos para ir implementando medidas radicales de ingeniería social y económica. Y es que el propio Friedman era consciente de que solamente en momentos dramáticos y de urgencia era posible inducir cambios a nivel colectivo, de tal modo que lo que se consideraba hasta entonces imposible se hacía posible. En este sentido, y vuelve a ser inevitable, debemos dirigir nuestra mirada, una vez más, a la Plandemia y la aceleración que ha venido protagonizando la Agenda 2030 en los últimos tiempos. Pero los efectos de las doctrinas de Friedman ya se dejaron sentir mucho antes con los golpes de Estado y torturas perpetradas frente a aquellos países y personas relevantes que se oponían a la Agenda liberal, o neoliberal, que desde los años 60-70 pudieran representar algún tipo de oposición o forma de resistencia al avance implacable del globalismo y sus adláteres.

Friedman ha sido el fundador de la Escuela de Chicago y sus directrices y teorías económicas han sido utilizadas tanto por la Reserva Federal estadounidense como por el Banco Central Europeo, así como durante los años 80 ejerció una notable influencia en los gobiernos de Ronald Reagan (1911-2004) y Margaret Thatcher (1925-2013), así como también conviene destacar su influencia anterior, a comienzos de los años 70, sobre las reformas de corte liberal del gobierno de Pinochet en Chile. Quizás haya alguna relación entre estas teorías y las continuas crisis económicas y el creciente control de las economías nacionales por parte de organizaciones transnacionales a través de la deuda, de esa deuda que el propio George Soros (1930) querría que fuese a perpetuidad.

De este modo, tampoco es muy complicado trazar una vía de conexión entre los experimentos de la CIA en torno al «control mental» desde los primeros años de Guerra Fría, y las teorías del neoliberalismo globalista que se han sistematizado desde esa época hasta nuestros días, y lo peor es que lejos de ser aceptadas libremente, algo imposible por su carácter nocivo y autodestructivo, vienen a imponerse de manera violenta, eliminando toda resistencia. Recordemos que el miedo es una herramienta especialmente poderosa, que permite ablandar las mentes y hacerlas moldeables y receptivas a cualquier discurso, abandonando con ello toda función lógica y racional, generando una suerte de impacto psicológico, una experiencia traumática que hace que el mundo de convicciones e ideas hasta entonces aceptado se rompa en mil pedazos. Ante esa situación, cuando las personas se encuentran en situación de shock, es cuando se muestran más dóciles y serviles ante quienes se presentan como benefactores o autoridad en la que depositar toda la confianza. Y nos podemos imaginar que en sociedades sobresocializadas como las nuestras, es mucho más fácil porque la identidad del individuo demoliberal es especialmente frágil y débil.

Hay indicios que nos invitan a pensar que es posible que Aldous Huxley pudo haber participado del Proyecto MK-ULTRA, tema en el que ahora mismo tampoco podemos profundizar. No obstante, se han proporcionado detalles sobre la participación del novelista inglés en este programa secreto, y con mayores atribuciones que mucho personal militar de alto rango. Huxley ya había colaborado previamente con los servicios secretos británicos y posteriormente con los estadounidenses, a partir de 1937, trasladándose a California, donde residiría por el resto de sus días. Durante esa época empezó a experimentar con drogas psicotrópicas, como la mescalina, influenciado por la sociedad de magia ceremonial Golden Dawn, siendo un gran promotor de las drogas psicodélicas desde entonces. Así lo confirma también el testimonio de otros autores como Aleister Crowley (1875-1947). Las experiencias con estas drogas serían posteriormente relatadas por el propio autor de Un mundo feliz en otra obra, quizás menos conocida, bajo el título de Las puertas de la percepción, publicado en 1954. Incluso se habla de su sometimiento a experimentos relacionados con la esquizofrenia y la alteración de la percepción relacionados con el citado programa bajo la supervisión del psiquiatra Humpry Osmond, para quien trató de conseguir financiación a través de organizaciones globalistas como la Ford Foundation y la Round Table, ésta última una organización pantalla de la propia CIA. Muchas de las conclusiones de estos estudios, experimentos y programas de manipulación a gran escala son relatados con todo lujo de detalles por el periodista y escritor italiano Maurizio Blondet, a través de la obra, publicada por nuestro sello editorial, Complots.

|

|

|:-:|

|BLONDET, Maurizio; Complots, Hipérbola Janus, 2020|

|

|:-:|

|BLONDET, Maurizio; Complots, Hipérbola Janus, 2020|Los últimos atisbos o señales de esta manipulación masiva en el presente, cuya responsabilidad ya hemos atribuido a los mass media, los tenemos en la Europa occidental del presente, con sus democracias liberales cooptadas por los poderes globalistas y supeditados al cumplimiento de una Agenda. Así, por ejemplo, el tema de la «inmigración»[^1] masiva y no tan descontrolada como muchos creen, sino más bien planificada, con los enfrentamientos de los que estamos siendo testigos en el Reino Unido en las últimas semanas, también responden a complejas ingenierías sociales de manipulación mental, donde el elemento distópico, ciertamente, no se encuentra ausente. Las autoridades británicas, destruyendo durante décadas toda forma de cohesión social y entregado al experimento multicultural de cuño globalista, han dividido y polarizado su país, como en el resto de la Europa Occidental, utilizando con toda probabilidad las herramientas de las que hemos estado hablando, refinadas técnicas de manipulación y control mental, para convencer a la masa de que renunciar a sus raíces, a su Patria, a su propia idiosincrasia como pueblos, y convertirse en territorios sin identidad, con individuos atomizados e intercambiables, es algo deseable en nombre de un «progreso», totalmente abstracto y vendido como una especie de Arcadia feliz, con esa misma proyección teleológica que ha sido característica del liberalismo desde sus discursos decimonónicos.

|

|

|:-:|

|Protestas en el Reino Unido por el aumento de la inseguridad en las calles|

|

|:-:|

|Protestas en el Reino Unido por el aumento de la inseguridad en las calles|[^1]: Nótese la manipulación del lenguaje en el término que recientemente utiliza la prensa: «migración» o «migrante», prescindiendo de los prefijos in- o e-, para dar a entender de forma indirecta que ni se entra (in-migrante) ni se sale (e-migrante) de ninguna parte porque «no existen fronteras», si no que la gente simplemente se desplaza.

Artículo original: Hipérbola Janus, Distopía y manipulación de mentes (TOR), 27/Ago/2024

-

@ 6ad3e2a3:c90b7740

2024-06-22 17:54:17

@ 6ad3e2a3:c90b7740

2024-06-22 17:54:17

I’ve been obsessed with large numbers for a few years now, trying in vain to get others to care. But the “why” eluded me. I made one partially satisfying attempt to explain last year. Yes, he who has “the deepest paradigm can name the biggest number,” but to what end?

Now I think I’ve found the end, the reason I can’t quit this line of thinking, even if it’s driven me half mad: that the number TREE(3) is quite possibly a miracle. Despite arising from a simple game, TREE(3) can be hard to understand, so maybe it’s best to start with one of its “competitors”, Graham’s Number, to grasp what it is not.

Now Graham’s Number is only a competitor because the two are often compared, not because there is really any kind of competition. TREE(3) dwarfs Graham’s Number the way the breadth of the observable universe dwarfs the dimensions of an ant. (Actually, as you will see, that comparison vastly understates the disparity between the two numbers.)

But Graham’s Number, unfathomably vast in its own right, is both easier to understand and is generated via a different process. To get to Graham’s Number, we have to start with the most basic math that exists: counting.

I’ll excerpt from my post on growth that covers this:

First you have counting 1, 2, 3, 4…

If you want to speed up counting, you can add.

Instead of counting from three to six, you can just add 3 + 3. Addition therefore is _ just repeated (iterated) counting.

But instead of adding 3 + 3 + 3 + 3 + 3 + 3, you can just do 3 * 6 because multiplication is iterated addition.

But instead of multiplying 3 * 3 * 3 * 3, you can just do 3 ^ 4 because exponentiation is iterated multiplication.

That’s where most people leave off in their education, and they feel perfectly content to live their lives only because they don’t know what they’re missing. Beyond exponentiation lies tetration, or iterated exponentiation.

Instead of 3 ^ 3 ^ 3 ^ 3, you can just do 3 ↑↑ 4 (a power-tower of threes, four high.)

You would say it “three to the three to the three to the three” in exponentiation terms, or “three arrow arrow three” in tetration terms. The number before the arrows determines the base and the number after them how high the tower goes. Let’s calculate some easy ones.

2 ↑↑ 2 is a power tower of twos, two high. That is 2 ^ 2 = 4.

3 ↑↑ 2 is a power tower of threes two high. That is 3 ^ 3 = 27. Easy.

2 ↑↑ 3 is a power tower of twos three high. That is 2 ^ 2 ^ 2 which is 2 ^ 4 = 16.

_3 ↑↑ 3 is a power tower of threes three high. That is 3 ^ 3 ^ 3 which is 3 ^ 27 = 7,625,597,484,987.

_Wait, what happened? You just encountered a fast-growing function.

Ok, tetration is cute, but if you want to generate Graham’s number, you’ll need to add more up arrows. Iterated tetration, symbolized by three up-arrows, is called pentation and would look like this: 3 ↑↑↑ 3. If 3 ↑↑ 3 is 7.6 trillion, what would 3 ↑↑↑ 3 be?

Well, it’s just iterated tetration, which means it’s a series of double-arrow operations with a base of three, three long, i.e., 3 ↑↑ 3 ↑↑ 3.

And since we know the second half, (3 ↑↑ 3) = 7.6 trillion, we can simplify it to 3 ↑↑ 7.6 trillion. What does that mean? It means a power tower of threes, 7.6 trillion high.

Okay, that sounds big. How big?

Consider a power tower of threes five high, i.e., 3^3^3^3^3 or 3 ↑↑ 5, is bigger than a googolplex.

To get the scale of a googolplex (one with a googol zeroes), consider you could not fit the zeroes it would take to write it out in the universe, even if you put one trillion zeroes on every atom. Again, we are not talking about the number itself, merely the number of digits required to write it out.

Consider a number with 200 digits is so massive, it’s far more than the number of Planck volumes (smallest known unit of measure) in the universe, but it’s trivial to write out. But you do not have space to write out a googolplex even while using a trillion digits per atom, let alone what those digits, if you could even write them, represent.

Your odds of entering every lottery on earth for the rest of your life, from the local bake sale to the mega millions, and winning all of them are far, far, far greater than 1 in a googolplex.

Your odds of guessing all the private bitcoin keys on earth without making an error are greater than one in a googolplex. A googolplex is an unfathomably large number. And yet it is smaller than 3 ↑↑ 5, or 3^3^3^3^3.

But 3 ↑↑↑ 3 is a tower of threes not five high, but 7.6 trillion high! When you get even to 10 high, you’ve exceeded a googolplex to the googolplexth power. The human mind cannot fathom the number you arrive at even at 100 or 1000 high, but we have to get to 7.6 trillion.

Okay, now that we’ve multiplied out the entire power tower to 7.6 trillion, guess what, we have to add another arrow. Not 3 ↑↑↑ 3 but 3 ↑↑↑↑ 3.

That’s hexation which is iterated pentation, in this case with a base of three and three terms, i.e., 3 ↑↑↑ 3 ↑↑↑ 3. We already know the second half is, whatever the incomprehensible result of the multiplied-out 7.6 trillion-high power tower was, call it X. So it’s 3 ↑↑↑ X.

And that means iterated tetration with a base of three, X times, i.e., _3 ↑↑ 3 ↑↑3 ↑↑ 3… X times.

To solve this, we go term by term. The first one is 7.6 trillion, which feeds into the second, the multiplied-out power tower 7.6 trillion high, i.e. X, the third is a power tower of threes, X high, multiplied out, and so on, and there are X of these entire towers, each one unfathomably, astronomically taller than the last.

Once we get through all X (remember itself an unfathomably large number) of the terms we’re at 3↑↑↑↑3.

That number is G1.

To get to G2, we just take 3 ↑↑↑↑↑↑↑↑↑↑…G1 arrows… 3.

Wait, what?

Remember each individual move up the scale from counting to addition to multiplication to exponentiation turbo-charged the growth of the function, and now in this function, they’re telling us to add G1 (3↑↑↑↑3) moves up the scale all at once!

Put differently, from counting by ones to the insanity of hexation, there are only six steps. To get G2, there are 3↑↑↑↑3 steps!

To get G3, it’s 3 G2 arrows 3. To get to G4, it’s 3 G3 arrows 3.

And so on until we hit G64 which is Graham’s Number.

It’s an indescribably massive number, not relatable to anything in the universe, not even in terms of the possible ways the atoms could be arranged taken to the power of the number of ways history’s chess games could have been played.

There is no way to visualize or imagine it except by walking vaguely through the steps to get there and straining your brain to grasp the process.

But as I said, Graham’s Number is trivial, basically zero compared to TREE(3), and that is so much the case that if instead of going to G64 via the steps, you went to G(Googolplex), or even G(Graham’s Number), i.e., G(G64), you would still be at zero relative to TREE(3).

But here’s where it gets fascinating. While Graham’s Number is generated via ramping up increasingly powerful iterative operations (as we did in the beginning) TREE(3) comes from a simple game.

There is a good article in Popular Mechanics that lays it out, building off this excellent Numberphile video with Tony Padilla:

You can click on the article and video for the specific (and relatively basic rules), but essentially, the TREE function has to do with “seeds” (dots) and “trees” (combinations of dots and lines), such that you make the maximum amount of unique “trees” (dot-line combos) per the types of seeds available.

If you have only one kind of seed, say a green one, there is only one unique tree that can be made.

So:

TREE(1) = 1.

If you have two seeds, say a green and a red, there are three different kinds of unique trees you could make.

TREE(2) = 3.

If you have three seeds, say a green, a red and a black, there are TREE(3) different kinds of trees you could make. As it turns out, that number (which is not infinite) is so much bigger than Graham’s number the two are not even in the same universe:

Here’s Padilla comparing TREE(3) to Graham’s Number if you want to see the difference:

Okay, so what does all this mean? It means that Graham’s Number, which is generated by successively more powerful iterations of mathematical operations, cannot compete with TREE(3) which comes from a game with simple rules.

Graham’s Number is built the way a machine would do it, the way an AI would go about making a huge number — mechanically increasing the rate of construction.

Consider if you had a machine that made products one at a time, that’s like counting. And if you had a machine that made products three at a time, that’s like adding.

And a machine that made machines that made products three at a time, that’s like multiplication. And a machine that made those three at a time would be exponentiation, etc., etc.

Each successive machine-making machine would take you into a deeper paradigm of growth. But you can see this is a mechanical process, no matter how deep you go.

By contrast, the tree series is what happens when you design a game with simple rules and let it play out. The growth (once you realize it to the extent the human brain can even grasp it) is not just faster than the mechanistic model, it’s on another plane.

The takeaway then is bottom-up complex systems (games) with a few simple rules can spawn a paradigm so much bigger than top-down mechanistic growth models.

The human brain (neocortex in McKenna’s terms) is just such a system, and yet we train ourselves to be like machines! Practice, routine, iteration, follow-these-10-steps to happiness, learn these five keys to investing, etc. Yes, you can get somewhere with these recipes, but nowhere near the destination of which you are inherently capable.

The key is a few simple inputs — good nutrition, enough sleep, a decent environment — and to let the mind have its space to play out the sequence in full.

In modern society the conditions needed for greatness, since the basics are relatively easy to come by, are achieved more by getting rid of negatives. Don’t be a drug addict or alcoholic, ditch the porn, the video games, the excessive social media use, etc. Then let the game play out.

Of course, this is easier said than done, as we’ve been deeply conditioned by the mechanistic paradigm, and remember TREE(1) is only 1, while G(1) is 3↑↑↑↑3, i.e., the more powerful growth function doesn’t necessarily reveal itself at the outset. But that changes in short order, and once it does, the mechanistic growth is no match for the “most densely ramified complexified structure in the known universe.”

I’ll end on a speculative thought, one that occurred to me while recording a podcast on this topic: Might what we think of as good vs evil actually just be a battle between the mechanistic and the complex, the difference between top-down compulsion and bottom-up free choice?

BONUS VIDEOS For those who want to dive deeper into this, there are some good videos by Carbrickscity on You Tube here, here and here. And Tim Urban’s article on Graham’s Number is worthwhile too.

-

@ af9c48b7:a3f7aaf4

2024-08-27 16:51:52

@ af9c48b7:a3f7aaf4

2024-08-27 16:51:52Chef's notes

Easy recipe with simple ingredients. This recipe uses some store bought, precooked items as way to cut down on cook time. I recommend letting the vegetables thaw if you don't like them on the firm/crunchy side.Feel free to substitute fresh ingredients if you have the time and want to make the extra effort.

Details

- ⏲️ Prep time: 20 min

- 🍳 Cook time: 50 min

- 🍽️ Servings: 8-10

Ingredients

- 2 (8 oz) packages refrigerated crescent rolls (dough sheets preferred)

- 1 pound cooked rotisserie chicken (deboned and chopped)

- 2 table spoons of butter

- 2 (10 once) packages of frozen mixed vegetables

- 1 (15 once can sliced potatoes (drained)

- 1 (10.5 once) can condensed cream of chicken soup

- 1 (10.5 once) can condensed cream of mushroom soup

- 1/2 cup milk

- salt and ground pepper to taste

Directions

- Preheat oven to 350 degrees F (175 degrees C). Line the botton of 9x13-inch baking dish with one can of crescent roll dough. If you don't get the sheet dough, be sure to pinch the seams together.

- Melt the butter in a sauce pan over medium heat. Then add the chicken, mixed vegetables, and sliced potatoes (recommend cutting into smaller pieces). Cook, stirring frequently, until vegetables are thawed and mixture is heated through, 5 to 7 minutes.

- While the mixed vegetables are heating, warm both cans of condensed soup in a seperate pan over medium-low heat. Slowly add milk and cook, stirring frequently, until combined and heated through, about 3 minutes.

- Add the soup mixture to the chicken mixture, then pour into the baking dish. Top with the second can of crescent roll dough. Feel free to cut some slits in dough if you are using the dough sheets. Cover lightly with foil to prevent the crescent roll dough from browning too quickly.

- Bake in oven until heated through and dough is a golden brown. Cook time should be around 45-50 minutes I reommend removing the foil for the last 10 minutes to get a golden crust. Be sure to keep a close watch on the crust after removing the foil because it will brown quickly.

-

@ b83a28b7:35919450

2024-08-27 16:48:28

@ b83a28b7:35919450

2024-08-27 16:48:28https://image.nostr.build/df0721d6d45d82db35d06663a0318ffe68c0b2b3c694888d23694efcc4255de5.gif

-

@ 765da722:17c600e6

2024-08-27 14:52:34

@ 765da722:17c600e6

2024-08-27 14:52:34O nome de cristão precisa ser estudado e apreciado cada vez mais. Quem é o cristão? As descrições a seguir, vindas das Escrituras Sagradas, fazem um bom começo.

- O cristão conhece profundamente o ensino de Cristo. Medita dia e noite na lei do Senhor e recebe as instruções apostólicas e proféticas da Bíblia como seu único guia.

- Ele foi resgatado pelo sacrifício de Cristo. Todos os seus pecados foram purificados pelo seu sangue por meio da fé e obediência. O cristão confia no perdão diário de Deus pois anda na sua luz.

- Ele segue de perto o exemplo de Cristo. O exemplo que temos é de amor, coragem, o falar verdadeiro, a compaixão. O seguimento inclui sofrer por ele, como ele sofreu por nós.

- Ele assumiu a missão de Cristo. Esta é o esforço sacrificial de salvar pessoas eternamente. A vida eterna é oferecida ao anunciar o mandamento do Pai.

- O cristão vive na obediência de Cristo. Como Jesus obedeceu ao Pai, o cristão obedece ao Senhor. O discípulo sabe que, sem a prática, a fé é morta.

Exercício: Quais textos bíblicos apoiam cada ponto e frase na lista acima? Fique à vontade de citar alguns nos comentários em baixo.

Conforme a lista acima, você é cristão? Se não, aprenda o que é necessário para entrar em Cristo e receber o seu nome.

-

@ 266815e0:6cd408a5

2024-04-22 22:20:47

@ 266815e0:6cd408a5

2024-04-22 22:20:47While I was in Mediera with all the other awesome people at the first SEC cohort there where a lot of discussions around data storage on nostr and if it could be made censorship-resistent

I remember lots of discussions about torrents, hypercore, nostr relays, and of course IPFS

There were a few things I learned from all these conversations:

- All the existing solutions have one thing in common. A universal ID of some kind for files

- HTTP is still good. we don't have to throw the baby out with the bath water

- nostr could fix this... somehow

Some of the existing solutions work well for large files, and all of them are decentralization in some way. However none of them seem capable of serving up cat pictures for social media clients. they all have something missing...

An Identity system

An identity system would allow files to be "owned" by users. and once files have owners servers could start grouping files into a single thing instead of a 1000+ loose files

This can also greatly simplify the question of "what is spam" for a server hosting (or seeding) these files. since it could simply have a whitelist of owners (and maybe their friends)

What is blossom?

Blossom is a set of HTTP endpoints that allow nostr users to store and retrieve binary data on public servers using the sha256 hash as a universal id

What are Blobs?

blobs are chunks of binary data. they are similar to files but with one key difference, they don't have names

Instead blobs have a sha256 hash (like

b1674191a88ec5cdd733e4240a81803105dc412d6c6708d53ab94fc248f4f553) as an IDThese IDs are universal since they can be computed from the file itself using the sha256 hashing algorithm ( you can get a files sha256 hash on linux using:

sha256sum bitcoin.pdf)How do the servers work?

Blossom servers expose four endpoints to let clients and users upload and manage blobs

GET /<sha256>(optional file.ext)PUT /uploadAuthentication: Signed nostr event- Returns a blob descriptor

GET /list/<pubkey>- Returns an array of blob descriptors

Authentication(optional): Signed nostr eventDELETE /<sha256>Authentication: Signed nostr event

What is Blossom Drive?

Blossom Drive is a nostr app built on top of blossom servers and allows users to create and manage folders of blobs

What are Drives

Drives are just nostr events (kind

30563) that store a map of blobs and what filename they should have along with some extra metadataAn example drive event would be

json { "pubkey": "266815e0c9210dfa324c6cba3573b14bee49da4209a9456f9484e5106cd408a5", "created_at": 1710773987, "content": "", "kind": 30563, "tags": [ [ "name", "Emojis" ], [ "description", "nostr emojis" ], [ "d", "emojis" ], [ "r", "https://cdn.hzrd149.com/" ], [ "x", "303f018e613f29e3e43264529903b7c8c84debbd475f89368cb293ec23938981", "/noStrudel.png", "15161", "image/png" ], [ "x", "a0e2b39975c8da1702374b3eed6f4c6c7333e6ae0008dadafe93bd34bfb2ca78", "/satellite.png", "6853", "image/png" ], [ "x", "e8f3fae0f4a43a88eae235a8b79794d72e8f14b0e103a0fed1e073d8fb53d51f", "/amethyst.png", "20487", "image/png" ], [ "x", "70bd5836807b916d79e9c4e67e8b07e3e3b53f4acbb95c7521b11039a3c975c6", "/nos.png", "36521", "image/png" ], [ "x", "0fc304630279e0c5ab2da9c2769e3a3178c47b8609b447a30916244e89abbc52", "/primal.png", "29343", "image/png" ], [ "x", "9a03824a73d4af192d893329bbc04cd3798542ee87af15051aaf9376b74b25d4", "/coracle.png", "18300", "image/png" ], [ "x", "accdc0cdc048f4719bb5e1da4ff4c6ffc1a4dbb7cf3afbd19b86940c01111568", "/iris.png", "24070", "image/png" ], [ "x", "2e740f2514d6188e350d95cf4756bbf455d2f95e6a09bc64e94f5031bc4bba8f", "/damus.png", "32758", "image/png" ], [ "x", "2e019f08da0c75fb9c40d81947e511c8f0554763bffb6d23a7b9b8c9e8c84abb", "/old emojis/astral.png", "29365", "image/png" ], [ "x", "d97f842f2511ce0491fe0de208c6135b762f494a48da59926ce15acfdb6ac17e", "/other/rabbit.png", "19803", "image/png" ], [ "x", "72cb99b689b4cfe1a9fb6937f779f3f9c65094bf0e6ac72a8f8261efa96653f5", "/blossom.png", "4393", "image/png" ] ] }There is a lot going on but the main thing is the list of "x" tags and the path that describes the folder and filename the blob should live at

If your interested, the full event definition is at github.com/hzrd149/blossom-drive

Getting started

Like every good nostr client it takes a small instruction manual in order to use it properly. so here are the steps for getting started

1. Open the app

Open https://blossom.hzrd149.com

2. Login using extension

You can also login using any of the following methods using the input - NIP-46 with your https://nsec.app or https://flare.pub account - a NIP-46 connection string - an

ncryptsecpassword protected private key - ansecunprotected private key (please don't) - bunker:// URI from nsecbunker3. Add a blossom server

Right now

https://cdn.satellite.earthis the only public server that is compatible with blossom drive. If you want to host your own I've written a basic implementation in TypeScript github.com/hzrd149/blossom-server4. Start uploading your files

NOTE: All files upload to blossom drive are public by default. DO NOT upload private files

5. Manage files

Encrypted drives

There is also the option to encrypt drives using NIP-49 password encryption. although its not tested at all so don't trust it, verify

Whats next?

I don't know, but Im excited to see what everyone else on nostr builds with this. I'm only one developer at the end of the day and I can't think of everything

also all the images in this article are stored in one of my blossom drives here

nostr:naddr1qvzqqqrhvvpzqfngzhsvjggdlgeycm96x4emzjlwf8dyyzdfg4hefp89zpkdgz99qq8xzun5d93kcefdd9kkzem9wvr46jka

-

@ d830ee7b:4e61cd62

2024-08-27 14:10:20

@ d830ee7b:4e61cd62

2024-08-27 14:10:20เรื่องมันมีอยู่ว่า.. เมื่อไม่นานมานี้พึ่งเกิดข่าวใหญ่สะเทือนวงการเทคฯ เมื่อ Pavel Durov ผู้ก่อตั้ง Telegram แอปฯ แชทสีฟ้าขวัญใจมหาชน โดนรวบตัวคาสนามบินที่ฝรั่งเศส

เหตุการณ์นี้เป็นเหมือนสัญญาณเตือนภัยถึงเสรีภาพในโลกดิจิทัลที่กำลังถูกสั่นคลอน..

https://image.nostr.build/85d4e936e765e2f08596c278369bf258d2bcf85566817521ac73eebaf37fbc07.jpg

ก่อนอื่น.. ต้องยอมรับว่า Telegram นั้นเหนือกว่า Line, WhatsApp, Messenger ที่หลายคนคุ้นเคย

แต่เพราะอะไรล่ะ?

Telegram ไม่ได้เป็นเพียงแค่แอปพลิเคชันแชททั่วไป แต่เป็นแพลตฟอร์มที่ให้ความสำคัญกับความเป็นส่วนตัวอย่างแท้จริง ทุกข้อความ รูปภาพ และวิดีโอที่ส่งผ่าน Telegram จะถูกเข้ารหัสทันที (End-to-End Encryption)

และจะมีเพียงผู้ส่งและผู้รับเท่านั้นที่สามารถถอดรหัสได้ แม้แต่ทีมงานของ Telegram เองก็ไม่สามารถเข้าถึงข้อมูลเหล่านั้นได้

นั่นทำให้มั่นใจได้ว่าทุกการสื่อสารจะเป็นส่วนตัวและปลอดภัยอย่างแท้จริง ต่างจากแอปพลิเคชันอื่นๆ ที่มักมีข่าวข้อมูลรั่วไหลอยู่บ่อยครั้ง

นอกจากนี้ Telegram ยังยืนหยัดในการต่อต้านการเซ็นเซอร์ทุกรูปแบบ ด้วยระบบการทำงานแบบกระจายศูนย์ที่ไม่มีเซิร์ฟเวอร์กลาง ทำให้ยากต่อการควบคุมหรือปิดกั้น แม้รัฐบาลจะสั่งแบน แต่ Telegram ก็ยังคงสามารถเข้าถึงได้จากทุกมุมโลก

นี่จึงเป็นเหตุผลที่ Telegram ได้รับความนิยมอย่างมากในประเทศที่ปกครองด้วยระบอบเผด็จการ เพราะมันเป็นเครื่องมือสำคัญในการต่อสู้เพื่อประชาธิปไตย

ยิ่งไปกว่านั้น Telegram ยังโดดเด่นด้วยฟีเจอร์ที่หลากหลายและครบครัน ไม่ว่าจะเป็นการสร้างกลุ่ม ช่อง การใช้งานบอท การส่งสติกเกอร์ การโหวต และการโอนเงินด้วยคริปโตฯ เรียกได้ว่าเป็นศูนย์รวมทุกอย่างไว้ในแอปพลิเคชันเดียว

https://image.nostr.build/4e8d6569ee30cf14ab59861eede241ecf1e3a7440bdfa61ad6027187417b782c.jpg

ที่สำคัญ Telegram ได้พิสูจน์ตัวเองในฐานะฮีโร่ในยามวิกฤตมาแล้ว ตัวอย่างเช่น..

ช่วงสงครามรัสเซีย-ยูเครน Telegram กลายเป็นเครื่องมือสำคัญในการแชร์ข่าว เตือนภัย ระดมทุน และประสานงานช่วยเหลือผู้คน นี่คือบทพิสูจน์ที่ชัดเจนว่าเทคโนโลยีสามารถสร้าง "ความเปลี่ยนแปลง" ได้อย่างแท้จริง

ด้วยความเหนือชั้นที่ว่ามา.. จึงไม่แปลกใจเลยที่ Telegram จะมีผู้ใช้งานทั่วโลกกว่า 900 ล้านคน

นอกจากนี้ Pavel Durov ผู้สร้าง Telegram ก็เคยสร้าง VK โซเชียลดังในรัสเซีย แต่สุดท้ายก็ต้องหนี เพราะไม่ยอมให้รัฐบาลมาล้วงข้อมูลผู้ใช้ และครั้งนี้ก็เช่นกัน..

การที่ Durov โดนจับที่ฝรั่งเศส มันทำให้อดคิดไม่ได้ว่า อาจจะมีเงื่อนงำบางอย่างซ่อนอยู่ก็เป็นได้.. (Don’t trust, verify)

(เหล่านี้เป็นเพียงการตั้งสมมติฐาน ซึ่งไม่มีหลักฐานยืนยันที่ชัดเจนแต่อย่างใด โปรดใช้วิจารณญาณในการอ่าน..)

ข้อสันนิษฐานที่ว่า Telegram อาจมีความสัมพันธ์กับรัสเซีย แม้จะพยายามแสดงจุดยืนเป็นกลางและเป็นอิสระจากรัฐบาลก็ตาม ก็คือช่องทางอย่าง Toncoin

Toncoin เดิมทีมีชื่อว่า Telegram Open Network (TON) และถูกพัฒนาโดยทีม Telegram นำโดย Durov เอง (และ Durov ก็เป็นชาวรัสเซีย)

แม้ต่อมา Telegram จะอ้างว่าตัดความสัมพันธ์กับ Toncoin ไปแล้ว (แต่ความสัมพันธ์ในอดีตก็ยังถูกหยิบยกมาเป็นข้อกังขาได้) โดยเฉพาะเมื่อพิจารณาว่ารัสเซียกำลังมีข้อพิพาทกับใครอยู่บ้าง..

มีรายงานว่า Toncoin ระดมทุนจากนักลงทุนชาวรัสเซียจำนวนมาก ซึ่งอาจบ่งชี้ถึงความเชื่อมโยงกับกลุ่มทุนในรัสเซีย

หรือการจับกุม Durov ครั้งนี้อาจเป็นแผนการเล่นเกมส์การเมืองระดับโลกก็เป็นได้ บางทีนี่อาจเป็นการเชือดไก่ให้ลิงดู แสดงให้เห็นถึงแสนยานุภาพของชาติมหาอำนาจที่ต้องการควบคุม Telegram เพราะหวั่นเกรงว่ามันจะเป็นเครื่องมือปลุกระดมมวลชน

ที่ผ่านมา Telegram ถูกใช้เป็นเครื่องมือในการต่อสู้เรียกร้องประชาธิปไตยมาแล้วหลายครั้ง ไม่ว่าจะเป็นการประท้วงในฮ่องกง การเคลื่อนไหวทางการเมืองในเบลารุส หรือการต่อต้านรัฐประหารในเมียนมาร์

ยิ่งไปกว่านั้น.. ในโลกยุคดิจิทัลที่ "ข้อมูลมีค่ากว่าทองคำ” ใครก็ตามที่สามารถควบคุม Telegram ได้ ก็เท่ากับควบคุมกระบอกเสียงที่ทรงพลัง สามารถชี้นำความคิด สร้างกระแส และควบคุมมวลชนได้อย่างง่ายดาย

หรือบางที Durov อาจไปขัดขาผลประโยชน์ของใครบางคนใน Silicon Valley จนถูกสั่งเก็บในรูปแบบนี้ อย่าลืมว่าเบื้องหลังวงการเทคโนโลยีนั้นโหดร้ายกว่าที่เราคิด และบริษัทเทคฯ ยักษ์ใหญ่ต่างก็มีสายสัมพันธ์อันดีกับรัฐบาล

ไม่ใช่เพียงแค่รัฐบาลยุโรปที่ Durov มีปัญหา เพราะแม้แต่ FBI ของอเมริกายังเคยพยายามแทรกแซง Telegram มาแล้ว

มีรายงานว่า FBI พยายามติดต่อ Durov หลายครั้ง ทั้งขู่ ทั้งล่อ ให้เปิดเผยข้อมูลผู้ใช้ แถมยังชวนวิศวกรในทีม Telegram ให้แอบใส่ช่องโหว่ในระบบอีกต่างหาก แต่ Durov และทีมงานก็แน่วแน่ไม่หวั่นไหว

พวกเขายืนหยัดปกป้องข้อมูลผู้ใช้ราวกับเป็นนักรบ จน FBI ต้องถอยทัพกลับไปแบบหน้าแตกยับเยิน

https://image.nostr.build/d2b0dae3bc84034af3d5cc068f15b223511acd2c8e378da1ade3d3c845e88332.jpg

มีบุคคลสำคัญที่ออกมาแสดงความคิดเห็นต่อกรณีนี้ ได้แก่ Robert F. Kennedy Jr., Elon Musk และ Chris Pavlovski ซีอีโอของ Rumble

โดย Kennedy ได้เน้นย้ำถึงความสำคัญเร่งด่วนในการปกป้องเสรีภาพในการพูด ในขณะที่ Musk เรียกร้องให้ปล่อยตัว Durov หลายครั้ง ส่วน Pavlovski วิจารณ์การกระทำของฝรั่งเศสโดยมองว่าเป็นการล้ำเส้นในเรื่องของการเซ็นเซอร์

พวกเขามองว่าการจับกุม Durov เป็นส่วนหนึ่งของปัญหาใหญ่ที่เกี่ยวกับเสรีภาพทางอินเทอร์เน็ตและการควบคุมของรัฐบาลต่อแพลตฟอร์มดิจิทัล

การจับกุมครั้งนี้จุดประกายการถกเถียงอย่างดุเดือดเกี่ยวกับความสมดุลระหว่างเสรีภาพและการควบคุมในยุคดิจิทัล โดย Telegram กลายเป็นสมรภูมิสำคัญ

กรณีนี้ชวนให้ตั้งคำถามสำคัญเกี่ยวกับอนาคตของเสรีภาพออนไลน์และบทบาทของเทคโนโลยีในสังคม..

https://image.nostr.build/31b1fa6cf2a4a67aebe473d03d9d542295de6e35640e14aab99fd9b899fa1bd6.jpg

Telegram กับ Youtube บทเรียนราคาแพงของการเซ็นเซอร์

การจับกุม Durov เกิดขึ้นในช่วงเวลาไล่เลี่ยกับกรณีของ “Simply Bitcoin” ช่อง Youtube ที่สอนเรื่อง Bitcoin ที่มียอดผู้ติดตามกว่า 2 ล้านคน ถูก Youtube ปิดกั้นโดยให้เหตุผลว่า "ละเมิดนโยบาย" ซึ่งเป็นข้อกล่าวหาที่คลุมเครือและไม่มีหลักฐานอะไรชัดเจน

เหตุการณ์นี้แสดงให้เห็นว่า.. แม้แต่แพลตฟอร์มที่ดูเหมือนเปิดกว้างอย่าง Youtube ก็ยังสามารถตกเป็นเครื่องมือของการเซ็นเซอร์ได้

https://image.nostr.build/c16f0b0f3ca942467ca598397dadb82f6452c58403402e6fee900ca513aae244.jpg

เมื่อรัฐบาลและบริษัทเทคโนโลยียักษ์ใหญ่ต่างก็ต้องการควบคุมข้อมูล คำถามคือ.. เราจะทำอย่างไรจึงจะมีอิสรภาพในโลกออนไลน์ได้อย่างแท้จริง?

คำตอบที่ชัดเจนที่สุดในตอนนี้ก็คือ Decentralization หรือระบบที่ไม่มีศูนย์กลาง ซึ่งจะทำให้ไม่มีใครสามารถควบคุมได้

ตัวอย่างที่เห็นได้ชัดคือ “บิตคอยน์” สกุลเงินดิจิทัลที่ปราศจากการควบคุมจากรัฐบาลหรือธนาคารใดๆ ทุกคนมีสิทธิ์เข้าถึงและเป็นเจ้าของบิตคอยน์ได้อย่างเท่าเทียม และสามารถทำธุรกรรมทางการเงินได้โดยไม่ต้องผ่านคนกลาง

ไม่เพียงเท่านั้น.. โลกโซเชียลมีเดียก็กำลังมุ่งหน้าสู่ Decentralization เช่นเดียวกัน แพลตฟอร์มอย่าง Nostr ที่ใช้ระบบกระจายศูนย์ ไม่มีบริษัทหรือองค์กรใดเป็นเจ้าของ ทำให้ผู้ใช้งานทุกคนมีอิสระในการแสดงความคิดเห็น โดยไม่ต้องกังวลว่าจะถูกปิดกั้นหรือโดนลบโพสต์

นี่คือภาพสะท้อนของอนาคตแห่งโลกออนไลน์ที่แท้จริง โลกที่ทุกคนจะมีอำนาจเท่าเทียมกัน และมีอิสรภาพในการเข้าถึงข้อมูลและแสดงความคิดเห็นได้อย่างแท้จริง

การเดินทางสู่โลก Decentralization นั้นอาจฟังดูเป็นเรื่องไกลตัว แต่จริงๆ แล้วมันใกล้ตัวเรามากกว่าที่คิด

เริ่มต้นง่ายๆ ด้วยการเปิดใจเรียนรู้ ทำความเข้าใจกับเทคโนโลยีใหม่ๆ อย่าง Bitcoin, Nostr ซึ่งมีข้อมูลมากมายรอให้คุณค้นคว้า

อย่ากลัวที่จะลอง ลงมือทำ ทดลองใช้ สร้างความคุ้นเคยกับแพลตฟอร์มเหล่านี้ อาจจะเริ่มจากการสมัคร Nostr ผ่านแอป #Wherostr โหลดมาลองโพสต์ แชร์ คุยกับเพื่อนๆ

ยิ่งมีผู้คนใช้งานมากเท่าไหร่ ระบบก็จะยิ่งแข็งแกร่ง และอำนาจก็จะยิ่งกระจายมากขึ้นเท่านั้น

ถึงเวลาแล้วที่เราต้องตั้งคำถามกับตัวเอง เราคิดอย่างไรกับการเซ็นเซอร์ข้อมูลบนโลกออนไลน์?

เราเชื่อหรือไม่ว่า Bitcoin, Nostr และ Decentralization จะสามารถเปลี่ยนแปลงโลกได้จริง?

และที่สำคัญที่สุด เราพร้อมที่จะก้าวเข้าสู่โลก Decentralization แล้วหรือยัง?

อนาคตของโลกดิจิทัลอยู่ในมือของพวกเราทุกคน อย่ายอมเป็นเบี้ยภายใต้การควบคุม แต่จงลุกขึ้นสู้เพื่ออิสรภาพของเราเอง

— Jakk Goodday (เจ้าเก่า)

-

@ 66b15e4f:e8275f3c

2024-08-27 14:05:04

@ 66b15e4f:e8275f3c

2024-08-27 14:05:04Hi, i am currently testing this plataform

-

@ 3bf0c63f:aefa459d

2024-03-23 08:57:08

@ 3bf0c63f:aefa459d

2024-03-23 08:57:08Nostr is not decentralized nor censorship-resistant

Peter Todd has been saying this for a long time and all the time I've been thinking he is misunderstanding everything, but I guess a more charitable interpretation is that he is right.

Nostr today is indeed centralized.

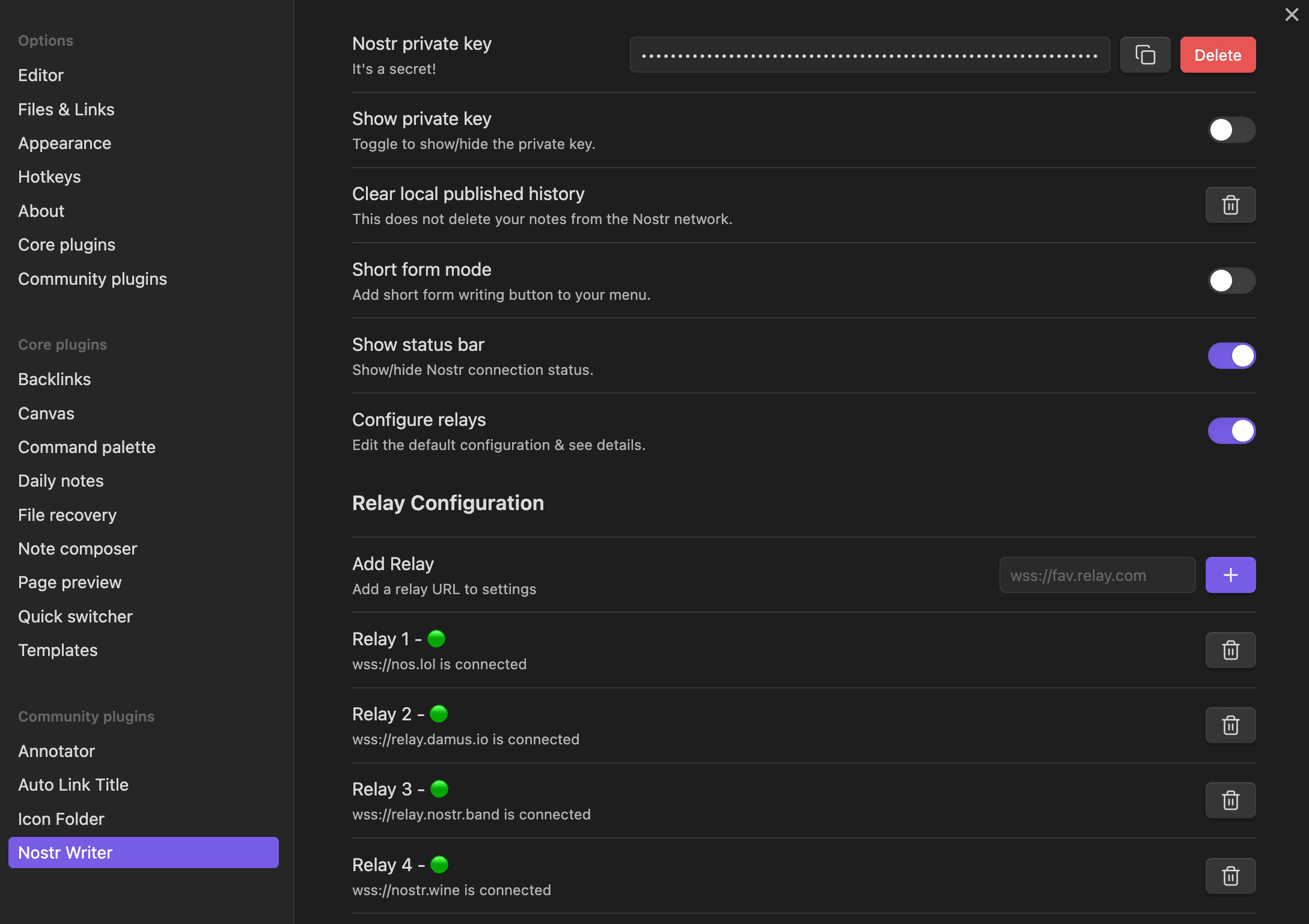

Yesterday I published two harmless notes with the exact same content at the same time. In two minutes the notes had a noticeable difference in responses:

The top one was published to

wss://nostr.wine,wss://nos.lol,wss://pyramid.fiatjaf.com. The second was published to the relay where I generally publish all my notes to,wss://pyramid.fiatjaf.com, and that is announced on my NIP-05 file and on my NIP-65 relay list.A few minutes later I published that screenshot again in two identical notes to the same sets of relays, asking if people understood the implications. The difference in quantity of responses can still be seen today:

These results are skewed now by the fact that the two notes got rebroadcasted to multiple relays after some time, but the fundamental point remains.

What happened was that a huge lot more of people saw the first note compared to the second, and if Nostr was really censorship-resistant that shouldn't have happened at all.

Some people implied in the comments, with an air of obviousness, that publishing the note to "more relays" should have predictably resulted in more replies, which, again, shouldn't be the case if Nostr is really censorship-resistant.

What happens is that most people who engaged with the note are following me, in the sense that they have instructed their clients to fetch my notes on their behalf and present them in the UI, and clients are failing to do that despite me making it clear in multiple ways that my notes are to be found on

wss://pyramid.fiatjaf.com.If we were talking not about me, but about some public figure that was being censored by the State and got banned (or shadowbanned) by the 3 biggest public relays, the sad reality would be that the person would immediately get his reach reduced to ~10% of what they had before. This is not at all unlike what happened to dozens of personalities that were banned from the corporate social media platforms and then moved to other platforms -- how many of their original followers switched to these other platforms? Probably some small percentage close to 10%. In that sense Nostr today is similar to what we had before.

Peter Todd is right that if the way Nostr works is that you just subscribe to a small set of relays and expect to get everything from them then it tends to get very centralized very fast, and this is the reality today.

Peter Todd is wrong that Nostr is inherently centralized or that it needs a protocol change to become what it has always purported to be. He is in fact wrong today, because what is written above is not valid for all clients of today, and if we drive in the right direction we can successfully make Peter Todd be more and more wrong as time passes, instead of the contrary.

See also:

-

@ 449e6ef7:9ed84d87

2024-08-27 08:56:03

@ 449e6ef7:9ed84d87

2024-08-27 08:56:03I believe in God,

the Father Almighty,