-

@ 6a6be47b:3e74e3e1

2025-06-16 19:33:03

@ 6a6be47b:3e74e3e1

2025-06-16 19:33:03What’s up, frens? 🎬

How was your weekend? I hope you got a chance to rest and decompress, even just a little, and that you’re recharged for the new week! As for me, I spent some time catching up on movies.

🍿 On Saturday, I was scrolling through a Criterion list—some films I’d already seen, others just weren’t my vibe. But then I landed on David Cronenberg’s Scanners and thought, “Yep, this is it.”

For a moment, I honestly felt like I was watching The Toxic Avenger (and I love The Toxic Avenger). Though this movie, it was… okay, but honestly, I don’t think it’s one I’ll remember or recommend, hehe.

🍿 Next up was Wes Anderson’s Asteroid City. It was cute, just like all his other films. To be fair, I was expecting a bit more since some of my favorites are his—The Darjeeling Limited and Moonrise Kingdom are top-tier for me. I always find myself giggling at the dry humor and silliness with which his characters tackle tough topics like death, loss, coming of age, and family. I love how “strange” or totally ordinary situations spiral into something unique, sometimes with surprisingly insightful conclusions. Asteroid City had its moments, but it felt a bit slow-paced for my taste this time. Still, it’s a cute watch, and I love how sometimes the kids seem to have more sense than the adults!

🍿 On Sunday, I watched Perfect Strangers—the Spanish adaptation of the Italian film of the same name. Friends gather for a cozy dinner and decide to play a “harmless” game: reading all their messages and notifications aloud, and answering calls on speaker. What could possibly go wrong, right? If you’ve seen any of these movies—or want to—I’d love to hear your thoughts! It’s always fun to chat about movies (and books) with you all.

See you later, alligator! 🐊

Godspeed! 💓

https://stacker.news/items/1008008

-

@ f85b9c2c:d190bcff

2025-06-16 19:10:38

@ f85b9c2c:d190bcff

2025-06-16 19:10:38

Almost everyone knows about ChatGPT and its maker OpenAI. OpenAI has of last year quietly removed the language from its usage policy which prohibited military use of its technology a move with serious implications given the increased use of artificial intelligence on battlefields all over the world.

As AI advances so does its weaponization.

Experts warn that AI applications including lethal weapons systems commonly called “killer robots,” could pose a potentially existential threat to humanity that underestimate the imperative of arms control measures to slow the pace of weaponization.

There was already trouble in Ukraine and in Gaza. With Yemen also coming into the scene now are we stepping into the perfect storm powered by AI?

Just for more clarity around this whole issue OpenAI’s new policy still states that users should not harm human beings or “develop or use weapons”, but it has removed the clause prohibiting use for “military and warfare”. Many AI experts are concerned with this move.

Could this be terminator or i robot scene playing in world 🤔?

There was already trouble in Ukraine and in Gaza. With Yemen also coming into the scene now are we stepping into the perfect storm powered by AI?

Just for more clarity around this whole issue OpenAI’s new policy still states that users should not harm human beings or “develop or use weapons”, but it has removed the clause prohibiting use for “military and warfare”. Many AI experts are concerned with this move.

Could this be terminator or i robot scene playing in world 🤔? -

@ f85b9c2c:d190bcff

2025-06-16 19:10:30

@ f85b9c2c:d190bcff

2025-06-16 19:10:30

Almost everyone knows about ChatGPT and its maker OpenAI. OpenAI has of last year quietly removed the language from its usage policy which prohibited military use of its technology a move with serious implications given the increased use of artificial intelligence on battlefields all over the world.

As AI advances so does its weaponization.

Experts warn that AI applications including lethal weapons systems commonly called “killer robots,” could pose a potentially existential threat to humanity that underestimate the imperative of arms control measures to slow the pace of weaponization.

There was already trouble in Ukraine and in Gaza. With Yemen also coming into the scene now are we stepping into the perfect storm powered by AI?

Just for more clarity around this whole issue OpenAI’s new policy still states that users should not harm human beings or “develop or use weapons”, but it has removed the clause prohibiting use for “military and warfare”. Many AI experts are concerned with this move.

Could this be terminator or i robot scene playing in world 🤔?

There was already trouble in Ukraine and in Gaza. With Yemen also coming into the scene now are we stepping into the perfect storm powered by AI?

Just for more clarity around this whole issue OpenAI’s new policy still states that users should not harm human beings or “develop or use weapons”, but it has removed the clause prohibiting use for “military and warfare”. Many AI experts are concerned with this move.

Could this be terminator or i robot scene playing in world 🤔? -

@ 7f6db517:a4931eda

2025-06-16 19:02:17

@ 7f6db517:a4931eda

2025-06-16 19:02:17

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:16

@ 7f6db517:a4931eda

2025-06-16 19:02:16

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:16

@ 7f6db517:a4931eda

2025-06-16 19:02:16

There must be a limit to how much data is transferred across the bitcoin network in order to keep the ability to run and use your own node accessible. A node is required to interact with the global bitcoin network - if you do not use your own node then you must trust someone else's node. If nodes become inaccessible to run then the network will centralize around the remaining entities that operate them - threatening the censorship resistance at the core of bitcoin's value prop. The bitcoin protocol uses three main mechanisms to keep node operation costs low - a fixed limit on the amount of data in each block, an automatic difficulty adjustment that regulates how many blocks are produced based on current mining hash rate, and a robust dynamic transaction fee market.

Bitcoin transaction fees limit network abuse by making usage expensive. There is a cost to every transaction, set by a dynamic free market based on demand for scarce block space. It is an incredibly robust way to prevent spam without relying on centralized entities that can be corrupted or pressured.

After the 2017 bitcoin fee spike we had six years of relative quiet to build tools that would be robust in a sustained high fee market. Fortunately our tools are significantly better now but many still need improvement. Most of the pain points we see today will be mitigated.

The reality is we were never going to be fully prepared - pressure is needed to show the pain points and provide strong incentives to mitigate them.

It will be incredibly interesting to watch how projects adapt under pressure. Optimistic we see great innovation here.

_If you are willing to wait for your transaction to confirm you can pay significantly lower fees. Learn best practices for reducing your fee burden here.

My guide for running and using your own bitcoin node can be found here._

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:16

@ 7f6db517:a4931eda

2025-06-16 19:02:16

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:15

@ 7f6db517:a4931eda

2025-06-16 19:02:15Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:15

@ 7f6db517:a4931eda

2025-06-16 19:02:15

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 19:02:14

@ 7f6db517:a4931eda

2025-06-16 19:02:14

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-16 19:02:00

@ eb0157af:77ab6c55

2025-06-16 19:02:00A third of the bitcoins in circulation is now under the control of centralized entities, valued at $668 billion according to an analysis by Gemini.

A study conducted by Gemini in collaboration with Glassnode revealed that centralized actors currently hold 30.9% of bitcoin’s entire circulating supply.

These entities include national governments, exchange-traded funds (ETFs), and publicly listed companies. Collectively, these players control 6.1 million BTC, equivalent to approximately $668 billion at current market prices. BlackRock alone holds around 665,635 BTC through its iShares Bitcoin Trust (IBIT) ETF, representing over 3% of bitcoin’s total supply, with a value close to $73 billion.

Source: Gemini

The accumulation of bitcoin by such entities has grown by 924% over the past decade. This increase coincides with bitcoin’s price evolution, which has surged from under $1,000 to over $100,000 during the same period.

Analysts interpret this trend as further confirmation that institutions increasingly view bitcoin as a strategic store-of-value asset. According to the report, the correlation between the rise in institutional holdings and bitcoin’s price appreciation reinforces the case for the cryptocurrency’s mainstream adoption.

One key takeaway from the research concerns the predominant role of centralized exchanges within Bitcoin treasury holdings. These platforms hold about half of the total, although a significant portion of those funds actually belongs to retail clients and individual investors.

Government bitcoin treasuries display distinctive characteristics compared to other institutional holders. According to the study, sovereign wallets show infrequent movements and limited correlation with Bitcoin’s price cycles.

However, the amount of bitcoins held by these governments remains large enough to significantly influence the markets whenever sales or transfers occur, the report states. The governments of the United States, China, and the United Kingdom have acquired most of their bitcoins through legal actions (seizures) rather than direct market purchases. In contrast, El Salvador and Bhutan accumulate bitcoin through intentional and ongoing purchases. According to analysts, while the volumes involved are smaller, these strategic allocations signal a long-term commitment and bolster investor confidence, encouraging broader institutional participation and contributing to market stability.

The research concludes that with nearly a third of bitcoin’s circulating supply now held by centralized entities, the market has undergone a structural transformation toward institutional maturity. According to the authors of the report, this evolution has made price action more predictable and less vulnerable to the speculative extremes that characterized Bitcoin’s early years.

The post Report: centralized entities control 31% of bitcoin’s total supply appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-16 19:01:59

@ eb0157af:77ab6c55

2025-06-16 19:01:59French authorities are intensifying their fight against kidnappings related to the digital asset sector with a new series of arrests.

French law enforcement has made further arrests in an investigation concerning a kidnapping case connected to the cryptocurrency world. According to the public broadcaster France 24, on June 11 several individuals suspected of involvement in the abduction of the father of a crypto entrepreneur were detained.

The case that drew international attention involves the father of an anonymous crypto entrepreneur, who was held captive for several days on an isolated property. The criminals, in their ransom demands, went as far as to cut off one of the victim’s fingers as a form of psychological pressure, demanding up to €7 million (about $8 million) for his release.

The rescue operation, carried out on May 3 by French special forces, led to the victim’s liberation and the arrest of five people on site. However, investigations uncovered a wider criminal network, resulting in new arrests, the exact number of which has not yet been disclosed by authorities.

French authorities did not limit their actions to national territory. On June 4, a man suspected to be a key figure behind the series of crypto kidnappings in France was arrested in Morocco.

The escalation of crypto kidnappings in 2025

Data shows an increase in crypto-related kidnappings in France and worldwide. The phenomenon has grown to such proportions that French Interior Minister Bruno Retailleau convened an emergency meeting to address the issue.

Among the most notable cases of 2025 is the attempted daytime kidnapping of Pierre Noizat’s daughter and grandson. Noizat is the co-founder and CEO of the French exchange Paymium; the incident took place on May 13.

According to data from Jameson Lopp, co-founder of Casa, at least 29 personal attacks against cryptocurrency holders have been recorded in 2025 alone. If this trend continues, the annual total could surpass the 35 cases reported in 2024 and the 24 cases in 2023.

The post France: new arrests linked to crypto kidnappings appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-16 19:01:58

@ eb0157af:77ab6c55

2025-06-16 19:01:58Treasury Secretary Bessent foresees a promising future for stablecoins pegged to the US dollar.

During a US Senate hearing held on June 11, Treasury Secretary Scott Bessent confirmed that the market for US dollar-backed stablecoins has the potential to surpass the $2 trillion mark within the next three years.

“I believe that stablecoin legislation backed by U.S. treasuries or T-bills will create a market that will expand U.S. dollar usage via these stablecoins all around the world,” the government official stated.

Bessent reiterated the administration’s commitment to strengthening the dollar’s status through USD-denominated stablecoins.

GENIUS Act gains ground

The legislative process received a boost after the Senate voted to advance the stablecoin bill, moving it closer to a final vote. The GENIUS Act, once approved, will establish strict requirements for the stable digital currency sector.

The bill mandates that stablecoins must be fully backed by US dollars or assets with equivalent liquidity (Treasuries). It also requires annual audits for issuers with a market capitalization exceeding $50 billion and includes specific provisions regarding the issuance of these cryptocurrencies abroad.

Stablecoins and the financial system

The stablecoin sector is drawing increasing interest from banking institutions. Bank of America is preparing to launch its own stablecoin, while Circle — issuer of USDC — went public this month, with shares surging 235% on its first trading day.

Currently, US dollar-pegged stablecoins account for over 96% of the entire stable digital currency market.

The post Stablecoins: market could reach $2 trillion by 2028, says Bessent appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-16 19:01:57

@ eb0157af:77ab6c55

2025-06-16 19:01:57Lightspark introduces a layer 2 for instant payments, stablecoins and interoperability with Lightning.

Spark is an open-source layer 2 protocol developed by Lightspark, designed to offer instant low-cost payments without the need for intermediaries. It allows the creation of wallets and applications that interact directly with the Bitcoin and Lightning networks. The company’s stated goal is to transform Bitcoin into a true global digital currency, solving the scalability limitations of the base layer.

Lightspark, a company led by David Marcus (former PayPal and former Facebook), officially launched Spark in beta version on April 29, 2025. Developers can already use Spark’s SDKs (Wallet and Issuer) to build self-custodial wallets compatible with Lightning and tokens (such as stablecoins) native to the Bitcoin network.

How it works

Spark adopts a statechain-based approach, allowing the transfer of ownership of a UTXO off-chain between different users without using the main blockchain, thus reducing costs and transaction times. Instead of executing an on-chain transaction that physically moves the asset, users acquire signing rights or control over a key that represents a bitcoin UTXO. Transfers occur through a chain of signatures and a mechanism that allows subsequent transactions to overwrite previous ones, ensuring that neither the user nor the service provider (Spark Service Provider, SSP) can lose funds during the operation.

Spark is designed to be fully interoperable with LN, supporting not only bitcoin transactions, but also stablecoins and other tokenized assets. SSPs facilitate Lightning payments by accepting funds on Spark and converting them into Lightning transactions or vice versa, eliminating the need for users to manage nodes or worry about channel liquidity. For example, a user can pay an LN invoice with a stablecoin on Spark, with the SSP converting the stablecoin to BTC in the background and sending the funds to the recipient.

Shared signature model (multisig 2-of-2)

Unlike the LN trust model, which is based on peer-to-peer bidirectional channels with smart contract logic, Spark involves a coordinating entity, the “Spark Service Provider” (SSP). This shifts part of the risk from channel liquidity management to trust in operators who sign off-chain transactions. The SSP’s task is to sign “blindly” (blindly) on behalf of the user, which means the SSP does not see the content of the signature and does not even know if it is signing a Bitcoin transaction or something else.

Bitcoin deposited on Spark always remains under the user’s control. When a user sends funds to Spark, they are initially transferred to a statechain. Once funds are on the statechain, payments on the Spark network occur instantly and at near-zero costs.

At the heart of Spark’s security is the use of a shared signature scheme, specifically a multisig 2-of-2 model. This means that two keys are required to authorize a transaction, and the user always holds one. When users deposit funds on Spark, they send them to a multisig address. Here, they maintain control of their funds and can perform a unilateral exit without the need to interact with other parties.

Each payment is enabled by a Spark Service Provider (SSP), which must co-authorize the transaction together with the user for it to be valid and successful.

Although the network is currently managed only by Lightspark and another operator (Flashnet), users do not risk losing funds even if these operators stopped cooperating. In fact, Spark offers the possibility to unilaterally force the return of bitcoin to the mainnet at any time. Users can exit Spark in two ways: through a cooperative exit (cheaper and faster) or a unilateral exit (slower, but possible in case of malfunction or loss of trust). Lightspark has declared its intention to add more operators in the future to increase decentralization.

Fee structure

Regarding fees, transactions within the Spark network are zero fee. The only fees users will have to bear are Bitcoin’s on-chain fees for depositing or withdrawing funds from Spark. Additionally, transferring bitcoin from Spark to LN involves a 0.25% fee plus routing fees. Conversely, a transaction from LN to Spark costs 0.15%.

The native LRC20 token protocol

Introduced in the summer of 2024, LRC20 is a token issuance protocol designed to be compatible with both Bitcoin’s mainnet and LN. Anyone can issue an LRC20 token. The protocol also supports freeze and burn operations, giving the original issuing wallet the power to freeze tokens at any address, preventing transactions until unlocked. LRC20 is primarily designed for issuing stablecoins and regulated assets.

After thoroughly testing it, the Lightspark team decided to run the LRC20 protocol natively on Spark, to enable token issuance on the network.

Ecosystem and partnerships

The birth of Spark has immediately attracted the interest of other Bitcoin projects. Among the various partnerships established, the multisig wallet Theya has integrated Spark to offer its users simpler and faster bitcoin and stablecoin payments.

Last May, Breez announced a new implementation of the Breez SDK based on Spark, which allows developers to integrate Lightning payments directly into their apps through Spark. As part of this collaboration, Breez will also act as a Spark Service Provider, helping to expand the ecosystem. According to the two companies, this partnership will provide developers with new Bitcoin-native tools for use cases such as streaming payments, international remittances and micro-payments for AI.

The post Spark: the layer 2 launched by Lightspark appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-16 19:01:56

@ eb0157af:77ab6c55

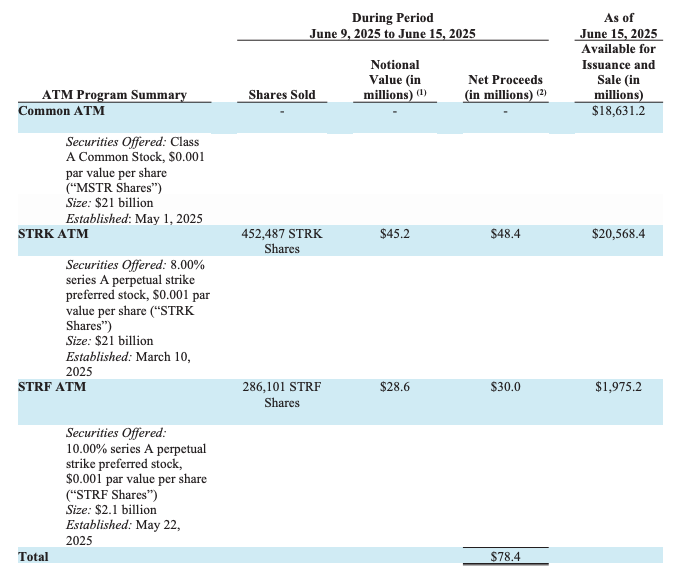

2025-06-16 19:01:56Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-16 19:01:55

@ eb0157af:77ab6c55

2025-06-16 19:01:55The new communication protocol aims to improve the industry with measurable advantages in terms of efficiency and security.

A new study conducted by Hashlabs, in collaboration with the SRI (Stratum V2 Reference Implementation) team and figures like Matt Corallo, Alejandro De La Torre and others reveals how the Stratum V2 protocol can increase miner profitability compared to the current Stratum V1 standard, used for over a decade.

Speaking to Atlas21, Gabriele Vernetti, Stratum V2 maintainer, declared:

“This first case study demonstrates how much Stratum V2 can help miners as well, securing and increasing their profits, in addition to the rest of the network. It’s just a first study aimed at demonstrating how decentralization can be aligned with the profit dynamics typical of the mining sector.

In the future we will also focus on the benefits for mining pool operators, who can benefit from the protocol’s efficiency to lower their operating costs (such as those for bandwidth used by their servers).

The feedback has been very positive: this first study was a joint work with various market players, including miners and mining pool operators. As SRI we want to continue working together with the entire community as done in this case, becoming a reference point for all actors interested in innovating the Bitcoin mining field”.

The research, based on controlled tests with two identical ASIC S19k Pro, with stock firmware, demonstrates that Stratum V2 can increase net profits by up to 7.4%. For an industry that often operates with 10% margins, this could represent a substantial competitive advantage.

The V2 protocol reduces various inefficiencies that plague the current system. The latency in block switching, that is the waiting time created when a miner must change block template after a new block has been mined on the network, goes from 325 milliseconds to just 1.42 milliseconds, a speed 228 times higher. This translates to about 4.9 hours of completely wasted hash power less per year.

Another problem of modern mining concerns “stale shares” – proofs of work that arrive too late to be remunerated, often due to network latency or inefficient communication. However, not all stale shares depend on inefficiency problems. On average, about 2% are rejected for expected reasons, such as when the share doesn’t reach the minimum difficulty required by the pool. This value is considered normal in the sector. The remaining 98%, instead, is caused by avoidable delays. With Stratum V1, miners lose between 0.1% and 0.2% of their computing power this way. Stratum V2 with Job Declaration completely eliminates this waste, provided that the miner and the pool node have the same level of connectivity. This step could translate into a net profit increase of up to 2% by fully adopting Stratum V2 with Job Declaration.

In the Stratum V2 protocol, the Job Declaration Client (JDC) is software that allows miners to receive mining jobs directly from their local Bitcoin node, that is the block templates to work on. The JDC communicates directly with the miner’s local node, receiving updated data for new block construction and immediately sending them to the mining software via Stratum V2. This allows miners to receive jobs in real time from their own node, without having to wait for them from the pool, reducing latency and the risk of working on obsolete jobs. Furthermore, if the pool allows it, miners can build custom templates choosing which transactions to include in the block.

The research also highlights an often overlooked aspect: the loss of transaction fees. With the Stratum V1 protocol, miners lose about 0.75% of potential fees for each block due to the delay in receiving new jobs. Considering that about 52,560 blocks are mined each year, this loss per block adds up to a total of about 74 bitcoins per year, equivalent to over $8 million at current prices.

Beyond economic advantages, Stratum V2 solves a critical vulnerability of the current system: hashrate hijacking. The V1 protocol doesn’t encrypt communications, allowing attackers to intercept and steal up to 2% of computing power without the miner noticing. The new protocol eliminates this risk through end-to-end encryption and authentication.

According to the study, by reducing latency, optimizing share sending and improving security, Stratum V2 enables a potential net profit increase of 7.4%, derived exclusively from technical improvements.

The post Stratum V2 increases profits by 7.4%: “The study shows that profit and decentralization can coexist”, says Vernetti, SV2 maintainer appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-16 19:01:54

@ eb0157af:77ab6c55

2025-06-16 19:01:54French lawmakers are proposing Bitcoin mining as a solution to optimize the national electricity system and make use of surplus energy.

A group of French parliamentarians has introduced an amendment that could turn the country into a European hub for Bitcoin mining, strategically leveraging its energy production capacity.

The legislative proposal aims to assess how mining could be integrated into the French energy system — the largest in Europe — to optimize the management of electricity produced by nuclear power plants.

The amendment to the law on “National Programming and Regulatory Simplification in the Energy Sector” calls on the government to conduct a thorough evaluation of the potential of Bitcoin mining. The initiative represents a pragmatic approach to addressing the issue of excess energy, a key topic for France’s nuclear industry.

France’s energy system, powered by nuclear for over 70% of its needs, often generates electricity surpluses that require efficient management. The proponents of the proposal see mining as an ideal solution to absorb this excess, transforming a potential waste into an economic resource.

The operational flexibility of mining farms offers a unique competitive advantage: machines can be quickly turned on and off based on production and consumption peaks, dynamically adapting to the needs of the electrical grid. This feature makes them particularly suitable for installation near power plants, even in the most remote areas of the country.

The parliamentary proposal highlights how mining could contribute to the revitalization of abandoned industrial sites, creating new opportunities for economic development under the supervision of public authorities.

Lawmakers emphasize the various benefits of this strategy: reducing negative pricing in wholesale markets, relieving the workload on nuclear plants by avoiding frequent modulation cycles that accelerate equipment wear, and absorbing surplus energy that would otherwise go to waste.

The French Association for the Development of Digital Assets (ADAN) collaborated in drafting the amendment, contributing technical expertise and industrial insight to the project. The organization emphasized how low-carbon Bitcoin mining could help strengthen the resilience of the national electricity grid.

The parliamentary report notes that mining in France could represent “an activity tailored to the constraints of the electrical system, absorbing surplus energy and reducing environmental impact” by using power that would otherwise be lost.

The post France considers Bitcoin mining: parliamentary proposal for managing nuclear energy appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-16 19:01:52

@ eb0157af:77ab6c55

2025-06-16 19:01:52The Brazilian government has abolished the Bitcoin tax exemption for small investors and introduced a flat 17.5% tax rate on all crypto capital gains.

Brazil has officially ended the tax-free period for small digital asset investors, introducing a flat 17.5% rate on all profits from cryptocurrency sales. The decision was formalized through Provisional Measure 1303, part of the government’s strategy to increase tax revenues from financial markets.

Until now, Brazilian residents selling up to 35,000 Brazilian reais (around $6,300) in cryptocurrencies per month were completely exempt from income tax. Profits exceeding this threshold were subject to progressive taxation, starting at 15% and reaching up to 22.5% for amounts over 30 million reais.

The new flat rate, which took effect on June 12, removes all exemptions and applies uniformly to every investor, regardless of the size of their transactions, according to local outlet Portal do Bitcoin.

While small-scale investors will now face a higher tax burden, high-net-worth individuals might actually benefit. Under the previous system, large transactions were taxed between 17.5% and 22.5%. With the new flat 17.5% rate, many high-profile investors will see their effective tax liability reduced.

Under the new rules, taxes will be calculated quarterly, with investors allowed to offset losses from the previous five quarters. However, starting in 2026, the time frame for claiming losses will be shortened.

Last March, Brazilian lawmakers also proposed a bill allowing employers to partially pay workers in cryptocurrency. According to the draft, crypto payments could not exceed 50% of an employee’s salary.

Full payment in cryptocurrencies would only be allowed for foreign workers or contractors, and only under specific conditions set by the Brazilian Central Bank. The bill prohibits full crypto payment for standard employees.

The post Brazil scraps crypto tax exemption: new 17.5% flat tax appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-16 19:01:34

@ 9ca447d2:fbf5a36d

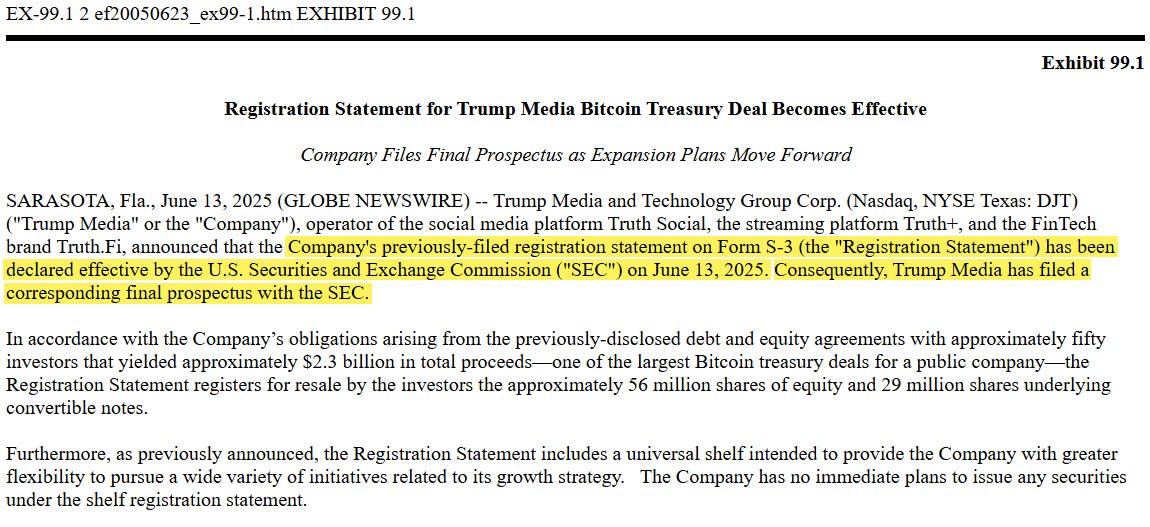

2025-06-16 19:01:34Trump Media and Technology Group (TMTG), the company behind Truth Social, has received approval from the U.S. Securities and Exchange Commission (SEC) regarding its plan to raise and use $2.3 billion to build a big bitcoin treasury.

TMTG’s plan was declared effective by the SEC

This is a big and controversial move by the media company tied to U.S. President Donald Trump. The plan involves converting part of its corporate assets into bitcoin—similar to what companies like Strategy have done.

TMTG filed a Form S-3 with the SEC on June 6. The form allows public companies to register securities for resale. A week later, the SEC “declared effective” the filing and TMTG can now use the money raised from previous deals to buy bitcoin.

According to the filings, the company raised $2.3 billion from the resale of about 56 million equity shares and 29 million shares of convertible notes. Almost 50 institutional investors participated in the raise.

This is “one of the largest bitcoin treasury deals for a public company,” TMTG said in a press release.

TMTG’s CEO, Devin Nunes, said this is part of a bigger plan to grow the company beyond social media and into the fintech space.

“We are quickly developing our fintech brand, social media platform, and streaming service and accumulating a Bitcoin treasury to support the Patriot Economy,” said Nunes.

The funds will be managed through TMTG’s fintech arm, Truth.Fi, and the company will store its bitcoin with its trusted custodians Crypto.com and Anchorage Digital.

Nunes also said this is a way to protect the company from financial discrimination, stating the bitcoin treasury will allow the company to defend itself “against harassment and discrimination by financial institutions.”

This seems to be more than just a business decision, and more like a political move.

Trump Media’s bitcoin push comes at a time when U.S. digital asset regulation is unclear. By moving into digital assets, TMTG signals a bold break from traditional financial norms and aligns itself with Bitcoin-friendly audiences.

American institutions are recognizing bitcoin as a safe haven asset, so maybe media and political groups will start to explore the asset further.

Trump Media isn’t stopping at a bitcoin treasury. They filed paperwork to create a spot bitcoin exchange-traded fund (ETF) called the Truth Social Bitcoin ETF. If approved, this ETF will give traditional investors another way to get exposure to bitcoin’s price.

Again, Crypto.com will be the exclusive custodian for this ETF.

One of the investors in the bitcoin treasury is Don Wilson, founder of DRW Investments. His firm put in $100 million. Some are wondering if there’s a conflict of interest since his digital asset trading firm, Cumberland, just had a case dropped by the SEC.

-

@ b1ddb4d7:471244e7

2025-06-16 19:01:32

@ b1ddb4d7:471244e7

2025-06-16 19:01:32In today’s digital era, access to financial services remains a privilege for many. Bitcoinization – the mass adoption of Bitcoin as a payment medium and store of value – represents a unique opportunity to democratize access to financial services (Read this article Can the Lightning Network Lead to “Hyperbitcoinization”? to know more about Bitcoinization). Telecommunications carriers occupy a strategic position in this transformation, especially in regions where traditional internet access is limited. However, this aspect remains largely unexplored. This article seeks to examine how these companies can catalyze this financial revolution by analyzing the Machankura case and the technical possibilities within current communication infrastructures.

The Success Sotry of Machankura

The Machankura project (8333.mobi) emerged to address a common challenge in various African regions: financial exclusion due to limited internet access. Created by South African developer Kgothatso Ngako, the service utilizes the USSD (Unstructured Supplementary Service Data) protocol, supported by virtually all mobile phones, to facilitate Bitcoin transactions via 2G and 3G cellular networks.

Machankura – derived from South African slang for “money” – functions as a custodial Bitcoin wallet. Through the USSD protocol, users can access the service by dialing short codes (*123*456789#, for example) or sending SMS messages to specific numbers. When the server receives the code or message, an interactive session between the parties (server-user) begins. This enables users to create Bitcoin wallets associated with their phone numbers, protected by multi-digit PINs.

Once registered, users receive a Lightning address (example: 1234567890@8333.mobi) that can be used to receive Bitcoin from anyone worldwide. Users can also customize this address to a preferred username, further enhancing privacy.

Currently, Machankura is available in nine African countries, including Nigeria, Tanzania, South Africa, Kenya, Uganda, Ghana, and Malawi. The creator’s objective is to expand the service to all countries across the African continent in the coming years.

Why Lightning network? Please read this article Lightning Network vs. Traditional Bitcoin Transactions.

The Technical Foundations of Machankura’s Success – USSD

As mentioned, USSD is a protocol embedded in mobile networks and available on virtually all cellular devices. This choice proved crucial for the Machankura project, given that in Africa, more than half of phones sold are not smartphones. Additionally, this protocol offers critical technical advantages:

- Operates without requiring internet access, functioning in areas with poor connectivity.

- Universal compatibility with any mobile phone, including the most basic models.

- Provides real-time interactivity between users and the system.

- Features an intuitive interface already utilized for banking services, customer support, and self-service applications

These advantages have enabled Bitcoin to become accessible to a significant portion of the region’s population, with over 15,000 users, according to the Machankura project creator.

USSD and Connectivity Challenges

The primary technical limitation of USSD manifests in high-connectivity environments (4G, 5G, or higher). As established by the 3GPP (3rd Generation Partnership Project, organization for standardization of mobile networks), the protocol must be recognized by newer generations of cellular networks. However, this recognition requires a procedure known as inter-technology fallback. For instance, if a user is connected to a 5G network and streaming music, when accessing a USSD service, their connection will downgrade to a 3G (or 2G) network, inevitably interrupting media streaming execution.

IP Multimedia Subsystem (IMS): The Evolution in Telecommunications Services

The solution to connectivity issues with USSD resides within the IMS (IP Multimedia Subsystem), a subsystem within the standardized architecture of newer cellular networks (from fourth generation onwards). Its objective is to unify access and provision of multimedia services across both mobile and fixed networks. These services include:

- Voice services – such as Voice over LTE (VoLTE) and Voice over WiFi (VoWiFi)

- Video services – such as Video over LTE (ViLTE) and Video over WiFi (ViWiFi)

- Videoconferencing

- Instant messaging

- Streaming media

- Emergency services

- Interoperability between legacy networks

The New Era: USSI (USSD over IP)

USSI (USSD over IP) represents the solution for service continuity across 4G, 5G, and future networks when utilizing USSD services. This new protocol enhances service quality, increases simultaneous session capacity, provides additional features for recent devices, improves session security, and enables operation without requiring fallback procedures.

Strategic Opportunities for Carriers

Institutional Bitcoin adoption is already established, with integration into portfolios of mining companies, exchanges, automobile manufacturers (Tesla), investment funds (BlackRock), financial institutions (Galaxy Digital Holdings), technology companies (including MicroStrategy, MercadoLibre, and Brazilian Meliúz), and even nations such as El Salvador, the United States, and China.

With robust, secure, and extensive infrastructure, telecommunications carriers can implement complex and advanced Bitcoin-based financial services, demystifying its use and stimulating adoption. Strategic partnerships with exchanges and fintechs enhance integrated solutions for entrepreneurs and consumers, such as integration with Lightning Network nodes to enable rapid, low-cost transactions between IoT devices, machine-to-machine (M2M) applications, and point-of-sale (POS) terminals.

The competitive advantages of this approach include

- New Revenue Streams: Companies can collect fees from simple transactions and provide advanced financial services such as loans, insurance, and investments.

- Customer Retention: By offering innovative services, they can reduce customer churn.

- Vanguard Strategy: Strategic positioning in an emerging high-capitalization market

The Future of Bitcoinization in Telecommunications

The success of the Machankura project unequivocally demonstrates the potential of telecommunications as transformative agents in the mass adoption of Bitcoin. As the Bitcoin ecosystem consolidates and expands, it is essential that we recognize this opportunity not merely as a new business vertical but as an important step toward strategic positioning at the forefront of a global economic transformation.

Given the extensive reach of existing infrastructure, these carriers can become the primary catalyst for transforming the lives of the unbanked in an unprecedented manner. As we have seen, Bitcoin is no longer just a trend; it is a reality. The natural consequence of this reality is bitcoinization, and we have the opportunity to be at the forefront of this emerging paradigm.

-

@ b1ddb4d7:471244e7

2025-06-16 19:01:30

@ b1ddb4d7:471244e7

2025-06-16 19:01:30This article was originally published on dev.to by satshacker.

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets

If you like to take it a step further, you can also create a more enhanced donation checkout flow. Of course you could programm something yourself, there are many open source libraries you can build upon. If you want a simple plug-and-play solution, here are a couple of options:

Name

Type

Registration

SatSale

Self-hosted

No KYC

BTCPay Server

Self-hosted

No KYC

Pay With Flash

Widget

Email

Geyser Fund

Widget

Email

The Giving Block

Hosted

KYC

OpenNode

Hosted

KYC

SatSale (GitHub)

Lightweight, self-hosted Bitcoin/Lightning payment processor. No KYC.

Ideal for developers comfortable with server management. Simple to deploy, supports both on-chain and Lightning, and integrates with WooCommerce.

BTCPay Server

Powerful, open-source, self-hosted processor for Bitcoin and Lightning. No KYC.

Supports multiple currencies, advanced features, and full privacy. Requires technical setup and maintenance. Funds go directly to your wallet; great for those seeking full control.

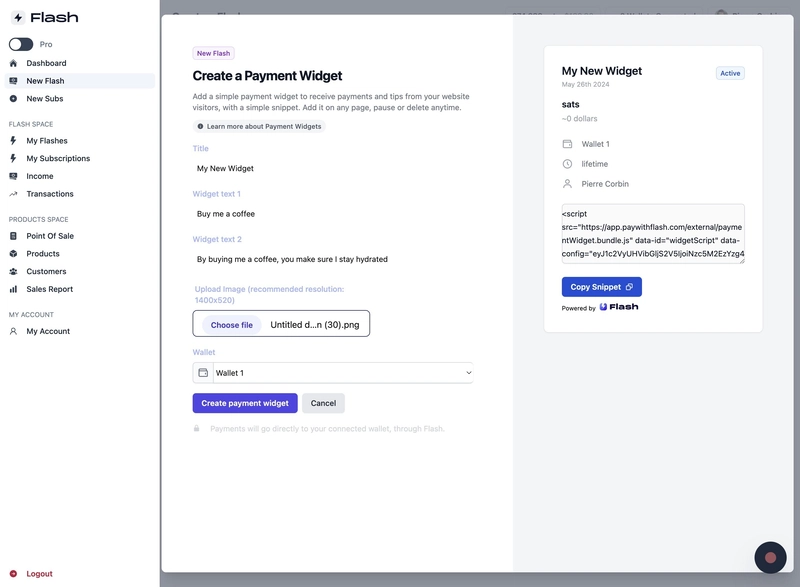

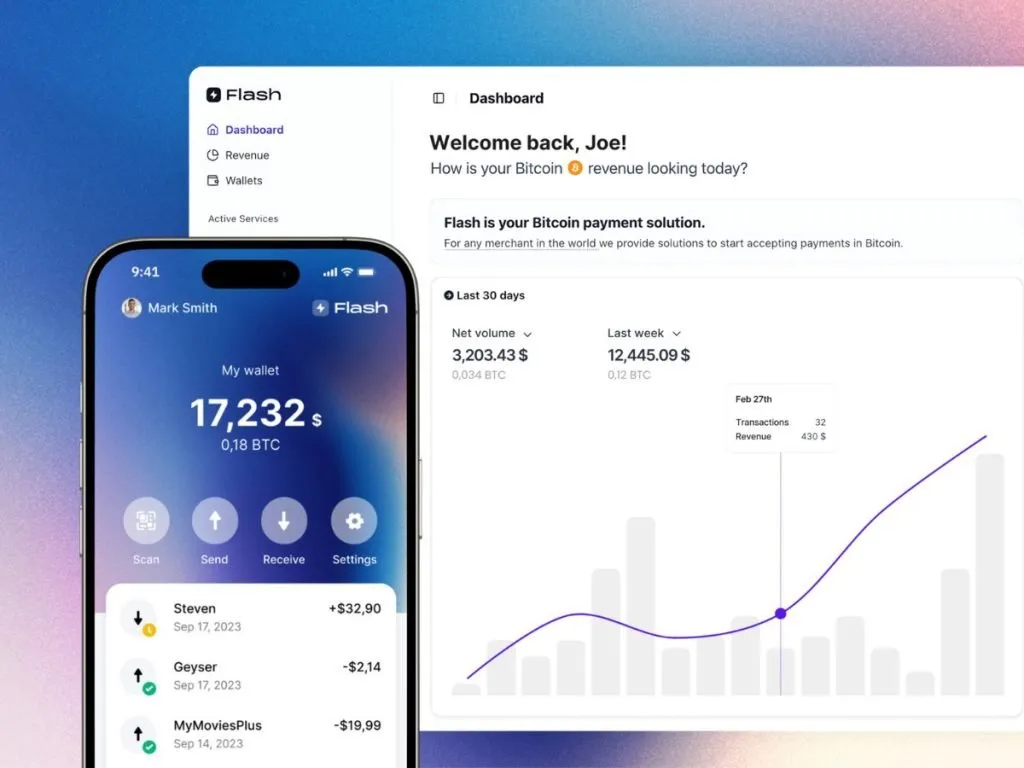

Pay With Flash

Easiest for indie hackers. Add a donation widget with minimal code and no KYC. Payments go directly to your wallet for a 1.5% fee.

Setup Steps:

- Sign up at PayWithFlash.com

- Customize your widget in the dashboard

- Embed the code:

- Test to confirm functionality

Benefits:

- Minimal technical skills required

- Supports one-time or recurring donations

- Direct fund transfer, no intermediaries

Geyser Fund

Crowdfunding platform. Widget-based, connects to your wallet, email registration.Focused on Bitcoin crowdfunding, memberships and donations.

The Giving Block

Hosted, KYC required. Integrates with fiat and crypto, best for nonprofits or larger organizations.

OpenNode

Hosted, KYC required. Accept Bitcoin payments and donations; supports conversion to fiat, suitable for businesses and nonprofits.

Summary

- Fast, low-code setup: Use Pay With Flash or Geyser Fund.

- Privacy and control: Choose SatSale or BTCPay Server (requires technical skills).

- Managed, compliant solutions: The Giving Block or OpenNode.

Choose based on your technical comfort, privacy needs, and project scale.

I hope this article helped you. If you added bitcoin donations, share your link in the comments and I will send you a few satoshis maybe

-

@ b1ddb4d7:471244e7

2025-06-16 19:01:29

@ b1ddb4d7:471244e7

2025-06-16 19:01:29The Coinbase Lightning Network is Coinbase’s implementation of Bitcoin’s Lightning Network technology, launched in partnership with Lightspark in April 2024. This innovative solution allows users to send, receive, and pay with bitcoin instantly and cheaply directly from their Coinbase accounts.

Think of the Coinbase Lightning Network as the express lane of bitcoin transactions. While regular bitcoin transfers can take 10-60 minutes and cost several dollars in fees, Lightning Network transactions on Coinbase complete in seconds with fees typically under a cent.

Key Benefits of Coinbase Lightning Network:

- Instant transfers: Transactions complete in seconds, not hours

- Ultra-low fees: 0.2% processing fee vs. traditional network fees

- Global reach: Send bitcoin anywhere in the world instantly

- Cost efficiency: 20 times cheaper than traditional credit card fees

Coinbase Lightning Network vs Regular Bitcoin Transfers

Understanding the difference between Coinbase Lightning Network and regular bitcoin transfers is crucial for choosing the right method:

Feature

Coinbase Lightning Network

Regular Bitcoin Transfer

Speed

Instant (seconds)

10-60 minutes

Fees

0.2% + minimal network fee

$5-50+ depending on network

Best for

Small to medium amounts

Large amounts, long-term storage

Availability

24/7 instant

Subject to network congestion

The Coinbase Lightning Network processes transactions “off-chain,” creating payment channels that settle later on the main Bitcoin blockchain, resulting in dramatically faster and cheaper transactions.

How to Send Bitcoin Using Coinbase Lightning Network

Sending Bitcoin through Coinbase’s Lightning option is incredibly straightforward. Follow these step-by-step instructions:

Step 1: Access Your Coinbase Account

- Sign in to your Coinbase account via web browser or mobile app

- Ensure you have bitcoin (BTC) in your account balance

- Navigate to your portfolio and locate your bitcoin holdings

Step 2: Initiate the Lightning Transfer

- Click “Transfer” then select “Send crypto”

- Choose bitcoin (BTC) as your asset

- Enter the amount you wish to send

- Select Lightning Network as your transfer method

Step 3: Add Recipient Information

- Obtain the Lightning Network invoice from your recipient

- Paste the invoice into the recipient field

- The Coinbase Lightning Network will automatically detect and validate the invoice

- Review the transaction details carefully

Step 4: Complete the Transaction

- Verify the amount and recipient information

- Click “Send” to initiate the transfer

- Your Coinbase Lightning Network transaction will complete within seconds

- Both you and the recipient will receive confirmation notifications

How to Receive Bitcoin via Coinbase Lightning Network

Receiving Bitcoin through Coinbase’s Lightning option requires generating a Lightning invoice. Here’s your complete guide:

Step 1: Generate a Lightning Invoice

- Log into your Coinbase account

- Navigate to “Transfer” then “Receive crypto”

- Select Bitcoin (BTC) as the asset you wish to receive

- Choose “Lightning Network” as your receiving method

Step 2: Create Your Invoice

- Enter the specific amount you want to receive (required for Lightning)

- Add an optional description or memo

- Click “Generate Invoice”

- Your Lightning Network invoice will appear as both a QR code and text string

Step 3: Share Your Invoice

- Copy the Lightning invoice text or share the QR code

- Send this information to the person sending you Bitcoin

- Remember: Lightning invoices expire after 72 hours

- Generate a new invoice if the original expires

Step 4: Receive Your Bitcoin

- Once the sender pays your invoice, you’ll receive instant notification

- The bitcoin will appear in your Coinbase account immediately

- No waiting for blockchain confirmations required with Coinbase Lightning Network

Coinbase Lightning Network Fees and Limits

Understanding the fee structure of Coinbase Lightning Network helps you make informed decisions:

- Processing Fee: 0.2% of the transfer amount

- Network Fee: Minimal (typically fractions of a cent)

- Minimum Amount: Varies by region, typically $0.1- 5

- Maximum Amount: Subject to your account limits and Lightning Network capacity

The Coinbase Lightning Network offers significant savings compared to traditional bitcoin transfers, especially for smaller amounts under $1,000.

Troubleshooting Common Coinbase Lightning Network Issues

Even with the user-friendly Coinbase Lightning Network, you might encounter some challenges:

Invoice Expired Error

- Solution: Generate a fresh Lightning invoice

- Prevention: Complete transactions promptly after generating invoices

Transaction Failed

- Cause: Insufficient Lightning Network liquidity or routing issues

- Solution: Try again in a few minutes or use smaller amounts

Can’t Find Lightning Option

- Check: Ensure Lightning is available in your region

- Verify: Update your Coinbase app to the latest version

Address Whitelist Issues

- Problem: Lightning invoices may not work with address whitelisting enabled

- Solution: Temporarily disable whitelisting or contact Coinbase support

The Coinbase Lightning Network transforms bitcoin from a store of value into a practical, everyday payment method. With instant transactions, minimal fees, and user-friendly implementation, it’s never been easier to send and receive bitcoin.

-

@ 472f440f:5669301e

2025-06-16 18:33:54

@ 472f440f:5669301e

2025-06-16 18:33:54Marty's Bent

So much for that tariff hyperinflation.\ \ New inflation numbers came at 1.2% — way below the Fed’s target.\ \ For the 4th time in Trump’s 4 months.\ \ Yet not a word about easing from the fed. Who’s now moving the inflation goal-posts to 2026 or even 2027. pic.twitter.com/nwzSCABrbR

— Peter St Onge, Ph.D. (@profstonge) June 16, 2025

After months of pundits, politicians, and partisan hacks kvetching about the aggressive tariff regime put forth by the Trump administration, we're beginning to see some data tickle in that makes it seem as if the tariff strategy may actually be working. At the end of last week, inflation data hit the market cooler than expected. Some core components coming in below the Federal Reserve's 2% inflation target. Granted, the CPI is manipulated and may be underreporting actual inflation. However, if we're simply comparing the CPI to itself, it seems to be moving in the right direction if, like me, you don't like when prices consistently rise month on month, year on year, decade on decade.

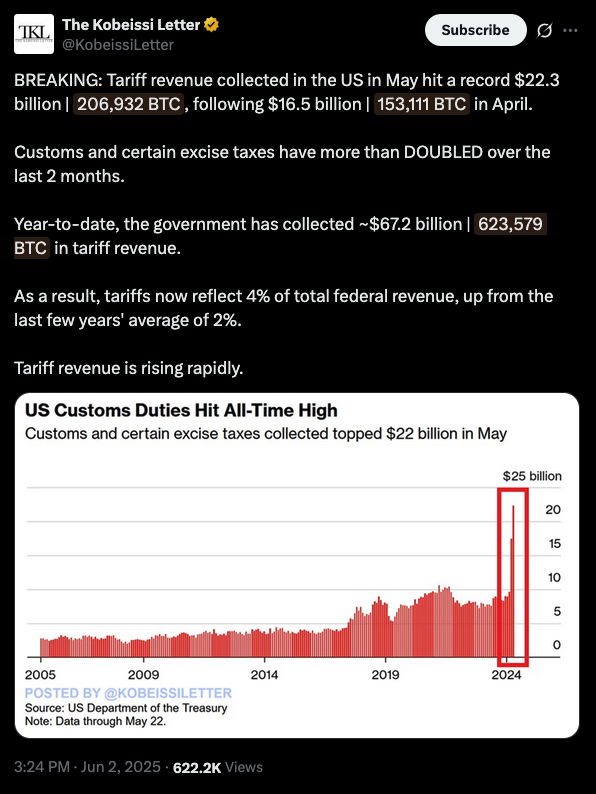

On top of this, the amount of revenue that tariffs are bringing in is significant and rising quickly. In May, tariff revenue collected in the U.S. hit a record of $22.3 billion. In April, the U.S. government brought in $16.5 billion from tariffs, and collectively, since Trump took office, the government has brought in around $67.2 billion in tariff revenue. Tariffs now reflect 4% of the total federal revenue, which is up from an average of 2% over the last few years. If this trend keeps up, the idea that tariffs can replace income tax revenue in the United States seems to be validated. Even better, it seems that the increased inflation that many were warning about hasn't materialized yet. There could be a way to increase the revenue of the federal government without increasing taxes on American producers while keeping prices lower. This is a beautiful thing.

I don't think it's time to ring the bell and claim victory in regards to tariffs and inflation quite yet, but this is extremely encouraging and something that all of you should be monitoring closely in the months ahead. Whether you're a Republican or a Democrat, I think we should all celebrate if the bold strategy of levying tariffs on the rest of the world to bring manufacturing home, while the government produces revenue via means that don't attack the income of individual citizens actually works out in the end.

It's crazy what pricing your life in Bitcoin does as you surf the internet. This newsletter was partly inspired by the video above from our good friend Peter St. Onge, but also because of this tweet I saw earlier today that priced the tariff revenue in bitcoin.

The Kobeissi Letter did not include the bitcoin denominations in its tweet. Our browser extension, Opportunity Cost, automatically injected it into the tweet so that I could understand how much revenue the government is bringing in in terms of Bitcoin. If they chose to use Bitcoin as a reserve asset.

It's crazy to think that at current bitcoin prices and if tariff revenue stays at the level it reached last month, the United States government could acquire a strategic reserve of 1 million bitcoin in less than five months. That really puts things into perspective, for me at least, about how much money is being thrown around the system both in the private markets and the public sector.

We are still extremely early in terms of bitcoin's adoption and monetization. Just looking at the tweet makes me want to tap somebody on the shoulder in the government and say, "Hey, look at this. If you sacrifice less than five months of tariff revenue and funnel that into bitcoin, you could have your strategic reserve by the end of the year. Before Thanksgiving even."

If tariff revenue continues to increase at the pace it has over the last couple of months, and the economy recovers, inflation isn't that bad, why not? Why not start building the strategic reserve with some of these revenues? A man can dream.

Washington's Bitcoin Awakening: From Crime Concerns to Strategic Asset

Ken Egan described a remarkable shift in how Washington views Bitcoin. Just a year ago, he recalls fighting defensive battles against basic misconceptions about criminal use and technical vulnerabilities. Today, policymakers ask sophisticated questions about Bitcoin's role in global monetary competition and national security strategy. Egan emphasized that discussions no longer waste time on "is it just for buying drugs" but instead focus on how Bitcoin can counter China's parallel financial systems and strengthen America's competitive position.

"There are people thinking, even the Department of Energy, some of whom will be at our conference, thinking really deeply about everything this ecosystem has to offer and how we can apply it to sort of a comprehensive national security strategy." - Ken Egan

Multiple government departments are now actively exploring Bitcoin's potential, Egan revealed. The Department of Defense examines mining for energy resilience, while the Department of Energy considers grid applications. Trump's executive order formally distinguished Bitcoin from other cryptocurrencies, signaling institutional recognition of its unique properties. This evolution from skepticism to strategic thinking represents a fundamental transformation in how America's policy establishment approaches Bitcoin.

Check out the full podcast here for more on institutional Bitcoin adoption, resistance money warnings, and bipartisan coalition building.

Headlines of the Day

France Eyes Bitcoin Mining to Use Excess Energy - via X

Truth Social Files for Bitcoin ETF - via X

French Firm Raises €9.7M to Expand Bitcoin Treasury - via X

China's DDC Enterprise Adds 38 BTC to Treasury - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The best way to start your Monday morning is for the brake system in your car to completely shit the bed and force you to sit on the side of the road for a tow truck for two hours.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 5d085290:0edc3292

2025-06-16 18:14:30

@ 5d085290:0edc3292

2025-06-16 18:14:30You Are navigating city streets or tackling off-road trails, fuel economy is a critical factor for SUV buyers — and this model delivers. According to recent updates, the Nissan Xterra 2025 release date is expected later this year, bringing with it a balance of power and practicality. Drivers across the UAE can expect mileage figures that compete with the best in its class, and you can explore full regional insights in the 2025 Nissan Xterra mileage in UAE guide. The SUV is estimated to deliver between 12–16 km/l depending on road conditions, which is a solid figure for a full-size adventure-ready vehicle. Compared to the previous model, efficiency has been boosted with smarter engine tuning — read more in the Nissan Xterra 2024 vs 2025 comparison. Designed for UAE conditions, it includes fuel-saving features like eco-driving modes and advanced gear ratios. This makes the 2025 Xterra not just a capable off-roader, but also a smart choice for daily commutes.

-

@ b1ddb4d7:471244e7

2025-06-16 19:01:27

@ b1ddb4d7:471244e7

2025-06-16 19:01:27Why are Stripe Alternatives are growing like mushrooms? When it comes to online payment processing, Stripe has long dominated the conversation.

However, with its complex pricing structure, strict policies and first-world focus, many entrepreneurs and companies are actively seeking viable Stripe alternatives.

Whether you’re a SaaS startup, e-commerce store, or global enterprise, choosing the right payment processor can significantly impact your bottom line and customer experience.

Table of Contents

- Why Consider Stripe Alternatives?

- The Complete List of Stripe Alternatives

- Additional Notable Mentions

- How to Choose the Right Stripe Alternative

- Conclusion

Why Consider Stripe Alternatives?

Before diving into our comprehensive list, it’s worth understanding why businesses are exploring alternatives to Stripe. While Stripe offers robust features and excellent developer tools, some businesses face challenges with pricing transparency, limited global coverage, or specific industry requirements that Stripe doesn’t fully address.

The Complete List of Stripe Alternatives

Based on extensive research and analysis of the payment processing landscape, here are 27 proven Stripe alternatives that could be the perfect fit for your business:

1. Flash – Easiest Bitcoin Payment Solution

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

2. Lemon Squeezy – The SaaS-Focused Alternative

Dubbed as “acq’d by Stripe,” Lemon Squeezy offers a comprehensive solution specifically designed for digital product sales and SaaS businesses. It provides strong customer support, built-in analytics, and handles payments, subscriptions, global tax compliance, and fraud prevention in one platform.

3. Gumroad – Creator Economy Champion

Gumroad has carved out a niche serving creators and small businesses by providing tools for selling digital products, physical goods, and subscriptions. It’s particularly popular among content creators, artists, and independent entrepreneurs who want to experiment with various ideas and formats. They also open-sourced their code which is quite the ‘chad-move’.

4. Paddle – All-in-One SaaS Commerce

Paddle caters to SaaS and software companies by offering a comprehensive platform with billing, licensing, and global tax handling capabilities. It’s designed to be a complete solution for subscription-based businesses, handling payments, tax, and subscription management in one platform.

5. FastSpring – Global E-commerce Specialist

FastSpring specializes in e-commerce solutions for software and SaaS companies, with a focus on global payments and subscription management. According to TechnologyAdvice, it’s particularly strong for international transactions and helps companies sell more, stay lean, and compete big.

6. 2Checkout – Versatile Payment Solutions

2Checkout (now part of Verifone) offers versatile payment solutions excelling in global payments, subscription billing, and digital commerce. One of the best stripe alternatives as it’s an all-in-one monetization platform that maximizes revenues and makes global online sales easier, supporting over 200 countries and territories.

7. Payoneer – Cross-Border Payment Expert

Payoneer simplifies cross-border payment solutions, offering local payment ease globally with a focus on market expansion and multi-currency support. It’s trusted by small to medium-sized businesses for global payment solutions and international money transfers.

8. Chargebee – Subscription Management Leader

Chargebee is a subscription management platform perfect for SaaS and SMBs, with robust billing and revenue management features. If you were looking for stripe alternatives to setup subscriptions, Chargebee might be right for you. It streamlines revenue operations and helps businesses grow efficiently with comprehensive subscription billing capabilities.

9. Maxio (formerly Chargify) – B2B SaaS Billing

Maxio offers a robust platform for B2B SaaS billing and financial operations, focusing on growth and efficiency for subscription businesses. It’s the most complete financial operations platform for B2B SaaS, bringing core financial operations into one platform.

10. Recurly – Dynamic Subscription Management

Recurly offers dynamic subscription management platform, excelling in churn management and data insights for subscription growth. It’s the only proven platform that expands and protects your recurring revenue with subscription management, recurring billing, and payments orchestration.

11. Braintree – PayPal’s Enterprise Solution

Braintree (by PayPal) provides a versatile global payments platform, integrating multiple payment methods with a focus on conversion and security. It delivers end-to-end checkout experiences for businesses, offering single-touch payments and mobile optimization.

12. PayKickstart – Modern Commerce Platform

PayKickstart offers a modern commerce platform for online billing and affiliates, focusing on revenue maximization and churn minimization. It’s the most complete checkout, recurring billing, affiliate management, and retention solution with global capabilities.

13. PayPro Global – Full-Service E-commerce

PayPro Global offers a full-service eCommerce solution for selling software and SaaS, focusing on global payments, tax compliance, and customer support. It provides flexible solutions with over 70 payment methods and great support for software companies.

14. Shopify Payments – E-commerce Integration

Integrated with Shopify, this service is ideal for SMBs in eCommerce, offering a seamless shopping cart and payment experience. It’s the simplest way to accept online payments, automatically set up for major methods with no fees for some payment types.

15. Square – Versatile POS and Payment Solutions

Square provides versatile POS and payment solutions for small businesses with a strong focus on retail and mobile payments. Forbes Advisor notes it as one of the top alternatives for businesses needing both online and offline payment capabilities.

16. Zoho Billing – Integrated Business Solution

Zoho Billing is an online recurring billing and subscription management solution, ideal for small and medium-sized businesses seeking professional invoice creation, time and expense tracking, and improved cash flow management. Zoho isn’t just competing for stripe alternatives, they offer a ton of other products and services.

17. WePay – Chase Company Integration

WePay, a Chase company, provides integrated payment solutions for ISVs and SaaS companies with customizable payment solutions. It’s designed for platforms like marketplaces and small business tools, offering seamless user experience and fraud protection.

18. QuickBooks Payments – SMB Accounting Integration