-

@ 7f6db517:a4931eda

2025-06-16 04:01:46

@ 7f6db517:a4931eda

2025-06-16 04:01:46

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:46

@ 7f6db517:a4931eda

2025-06-16 04:01:46

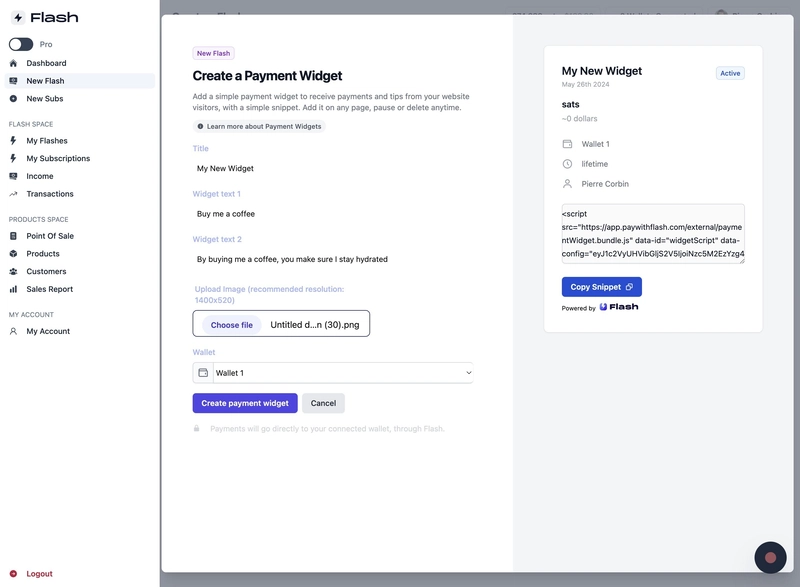

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:45

@ 7f6db517:a4931eda

2025-06-16 04:01:45

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 39cc53c9:27168656

2025-06-15 14:46:22

@ 39cc53c9:27168656

2025-06-15 14:46:22“The future is there... staring back at us. Trying to make sense of the fiction we will have become.” — William Gibson.

This month is the 4th anniversary of kycnot.me. Thank you for being here.

Fifteen years ago, Satoshi Nakamoto introduced Bitcoin, a peer-to-peer electronic cash system: a decentralized currency free from government and institutional control. Nakamoto's whitepaper showed a vision for a financial system based on trustless transactions, secured by cryptography. Some time forward and KYC (Know Your Customer), AML (Anti-Money Laundering), and CTF (Counter-Terrorism Financing) regulations started to come into play.

What a paradox: to engage with a system designed for decentralization, privacy, and independence, we are forced to give away our personal details. Using Bitcoin in the economy requires revealing your identity, not just to the party you interact with, but also to third parties who must track and report the interaction. You are forced to give sensitive data to entities you don't, can't, and shouldn't trust. Information can never be kept 100% safe; there's always a risk. Information is power, who knows about you has control over you.

Information asymmetry creates imbalances of power. When entities have detailed knowledge about individuals, they can manipulate, influence, or exploit this information to their advantage. The accumulation of personal data by corporations and governments enables extensive surveillances.

Such practices, moreover, exclude individuals from traditional economic systems if their documentation doesn't meet arbitrary standards, reinforcing a dystopian divide. Small businesses are similarly burdened by the costs of implementing these regulations, hindering free market competition^1:

How will they keep this information safe? Why do they need my identity? Why do they force businesses to enforce such regulations? It's always for your safety, to protect you from the "bad". Your life is perpetually in danger: terrorists, money launderers, villains... so the government steps in to save us.

‟Hush now, baby, baby, don't you cry Mamma's gonna make all of your nightmares come true Mamma's gonna put all of her fears into you Mamma's gonna keep you right here, under her wing She won't let you fly, but she might let you sing Mamma's gonna keep baby cosy and warm” — Mother, Pink Floyd

We must resist any attack on our privacy and freedom. To do this, we must collaborate.

If you have a service, refuse to ask for KYC; find a way. Accept cryptocurrencies like Bitcoin and Monero. Commit to circular economies. Remove the need to go through the FIAT system. People need fiat money to use most services, but we can change that.

If you're a user, donate to and prefer using services that accept such currencies. Encourage your friends to accept cryptocurrencies as well. Boycott FIAT system to the greatest extent you possibly can.

This may sound utopian, but it can be achieved. This movement can't be stopped. Go kick the hornet's nest.

“We must defend our own privacy if we expect to have any. We must come together and create systems which allow anonymous transactions to take place. People have been defending their own privacy for centuries with whispers, darkness, envelopes, closed doors, secret handshakes, and couriers. The technologies of the past did not allow for strong privacy, but electronic technologies do.” — Eric Hughes, A Cypherpunk's Manifesto

The anniversary

Four years ago, I began exploring ways to use crypto without KYC. I bookmarked a few favorite services and thought sharing them to the world might be useful. That was the first version of kycnot.me — a simple list of about 15 services. Since then, I've added services, rewritten it three times, and improved it to what it is now.

kycnot.me has remained 100% independent and 100% open source^2 all these years. I've received offers to buy the site, all of which I have declined and will continue to decline. It has been DDoS attacked many times, but we made it through. I have also rewritten the whole site almost once per year (three times in four years).

The code and scoring algorithm are open source (contributions are welcome) and I can't arbitrarly change a service's score without adding or removing attributes, making any arbitrary alterations obvious if they were fake. You can even see the score summary for any service's score.

I'm a one-person team, dedicating my free time to this project. I hope to keep doing so for many more years. Again, thank you for being part of this.

-

@ 39cc53c9:27168656

2025-06-15 14:46:19

@ 39cc53c9:27168656

2025-06-15 14:46:19After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 7f6db517:a4931eda

2025-06-16 04:01:45

@ 7f6db517:a4931eda

2025-06-16 04:01:45

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:45

@ 7f6db517:a4931eda

2025-06-16 04:01:45

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:45

@ 7f6db517:a4931eda

2025-06-16 04:01:45

@matt_odell don't you even dare not ask about nostr!

— Kukks (Andrew Camilleri) (@MrKukks) May 18, 2021

Nostr first hit my radar spring 2021: created by fellow bitcoiner and friend, fiatjaf, and released to the world as free open source software. I was fortunate to be able to host a conversation with him on Citadel Dispatch in those early days, capturing that moment in history forever. Since then, the protocol has seen explosive viral organic growth as individuals around the world have contributed their time and energy to build out the protocol and the surrounding ecosystem due to the clear need for better communication tools.

nostr is to twitter as bitcoin is to paypal

As an intro to nostr, let us start with a metaphor:

twitter is paypal - a centralized platform plagued by censorship but has the benefit of established network effects

nostr is bitcoin - an open protocol that is censorship resistant and robust but requires an organic adoption phase

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

- Anyone can run a relay.

- Anyone can interact with the protocol.

- Relays can choose which messages they want to relay.

- Users are identified by a simple public private key pair that they can generate themselves.Nostr is often compared to twitter since there are nostr clients that emulate twitter functionality and user interface but that is merely one application of the protocol. Nostr is so much more than a mere twitter competitor. Nostr clients and relays can transmit a wide variety of data and clients can choose how to display that information to users. The result is a revolution in communication with implications that are difficult for any of us to truly comprehend.

Similar to bitcoin, nostr is an open and permissionless protocol. No person, company, or government controls it. Anyone can iterate and build on top of nostr without permission. Together, bitcoin and nostr are incredibly complementary freedom tech tools: censorship resistant, permissionless, robust, and interoperable - money and speech protected by code and incentives, not laws.

As censorship throughout the world continues to escalate, freedom tech provides hope for individuals around the world who refuse to accept the status quo. This movement will succeed on the shoulders of those who choose to stand up and contribute. We will build our own path. A brighter path.

My Nostr Public Key: npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:45

@ 7f6db517:a4931eda

2025-06-16 04:01:45

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:43

@ 7f6db517:a4931eda

2025-06-16 04:01:43

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:43

@ 7f6db517:a4931eda

2025-06-16 04:01:43

Influencers would have you believe there is an ongoing binance bank run but bitcoin wallet data says otherwise.

- binance wallets are near all time highs

- bitfinex wallets are also trending up

- gemini and coinbase are being hit with massive withdrawals thoughYou should not trust custodians, they can rug you without warning. It is incredibly important you learn how to hold bitcoin yourself, but also consider not blindly trusting influencers with a ref link to shill you.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-16 04:01:27

@ eb0157af:77ab6c55

2025-06-16 04:01:27French authorities are intensifying their fight against kidnappings related to the digital asset sector with a new series of arrests.

French law enforcement has made further arrests in an investigation concerning a kidnapping case connected to the cryptocurrency world. According to the public broadcaster France 24, on June 11 several individuals suspected of involvement in the abduction of the father of a crypto entrepreneur were detained.

The case that drew international attention involves the father of an anonymous crypto entrepreneur, who was held captive for several days on an isolated property. The criminals, in their ransom demands, went as far as to cut off one of the victim’s fingers as a form of psychological pressure, demanding up to €7 million (about $8 million) for his release.

The rescue operation, carried out on May 3 by French special forces, led to the victim’s liberation and the arrest of five people on site. However, investigations uncovered a wider criminal network, resulting in new arrests, the exact number of which has not yet been disclosed by authorities.

French authorities did not limit their actions to national territory. On June 4, a man suspected to be a key figure behind the series of crypto kidnappings in France was arrested in Morocco.

The escalation of crypto kidnappings in 2025

Data shows an increase in crypto-related kidnappings in France and worldwide. The phenomenon has grown to such proportions that French Interior Minister Bruno Retailleau convened an emergency meeting to address the issue.

Among the most notable cases of 2025 is the attempted daytime kidnapping of Pierre Noizat’s daughter and grandson. Noizat is the co-founder and CEO of the French exchange Paymium; the incident took place on May 13.

According to data from Jameson Lopp, co-founder of Casa, at least 29 personal attacks against cryptocurrency holders have been recorded in 2025 alone. If this trend continues, the annual total could surpass the 35 cases reported in 2024 and the 24 cases in 2023.

The post France: new arrests linked to crypto kidnappings appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-06-16 04:01:17

@ 9ca447d2:fbf5a36d

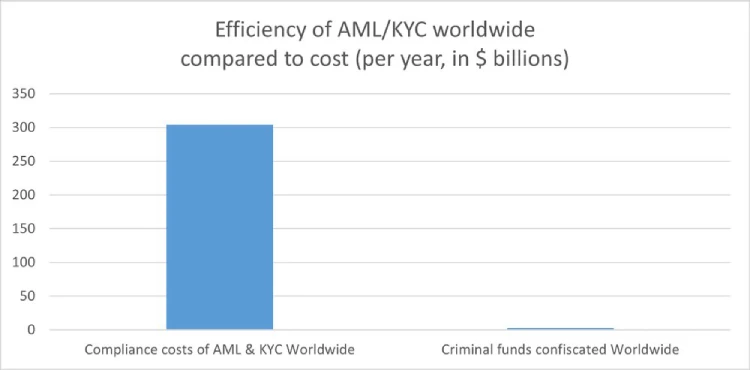

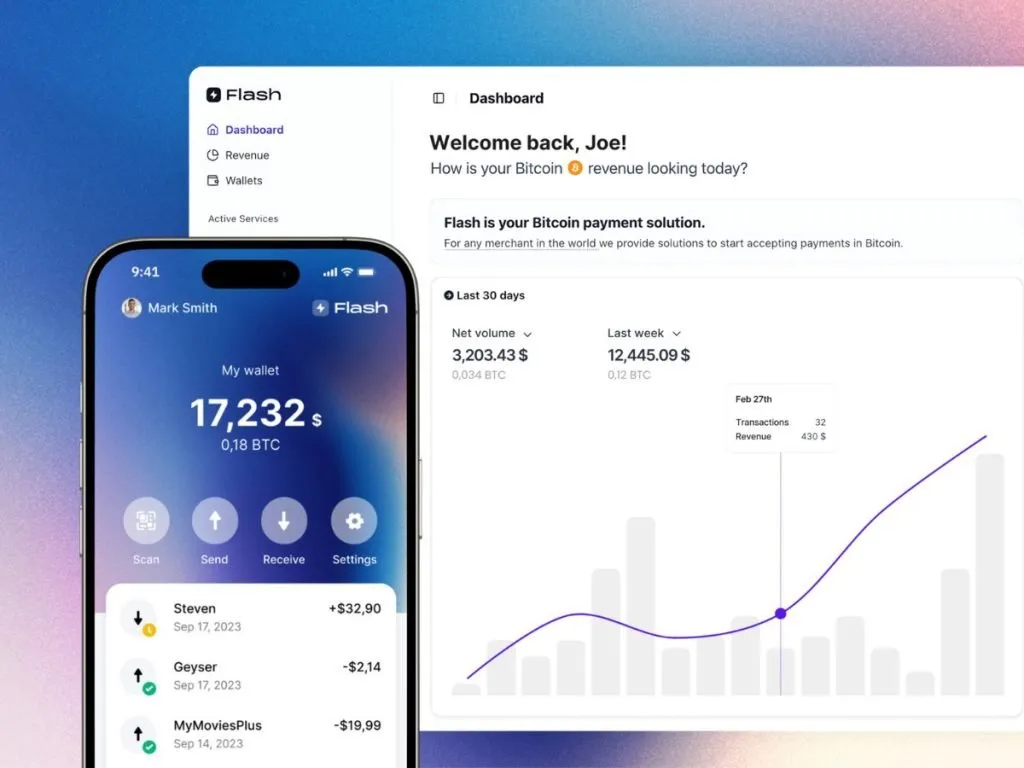

2025-06-16 04:01:17Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:44

@ 7f6db517:a4931eda

2025-06-16 04:01:44

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-16 04:01:06

@ 9ca447d2:fbf5a36d

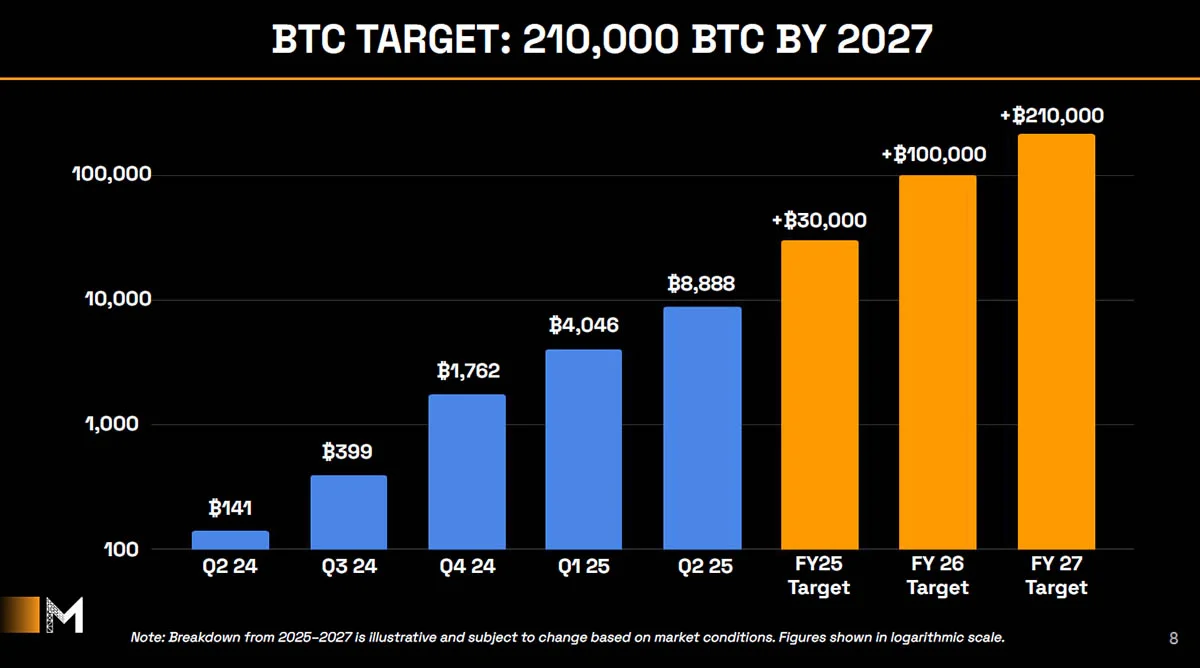

2025-06-16 04:01:06Digital assets entrepreneur Anthony Pompliano is about to make a big move into bitcoin, with plans to raise $750 million through a public investment vehicle called ProCapBTC.

The company will buy bitcoin and make the digital asset more accessible to institutional and traditional investors.

According to the Financial Times, Pompliano will be CEO of ProCapBTC, a Bitcoin-focused company that will go public by merging with Columbus Circle Capital 1, a special purpose acquisition company (SPAC) backed by Cohen & Company, a publicly traded investment bank.

The plan is to raise $500 million in equity and $250 million in convertible debt. If successful, ProCapBTC could be one of the largest corporate buyers of bitcoin, potentially putting it in the top 10 holders of the digital currency.

This is not a fund with a little bitcoin exposure — it’s a company centered around the asset.

The deal is still in negotiations but sources close to the matter say it could be announced as soon as next week. If so, ProCapBTC will merge with Columbus Circle Capital 1, get public market access and be able to raise further capital for bitcoin purchases.

Columbus Circle Capital 1 went public and completed a $250 million IPO in May 2025 and was formed to acquire or merge with high-growth companies.

It’s sponsored by Cohen & Company Capital Markets, a division of Cohen & Company, which is listed on the New York Stock Exchange.

Cohen & Company has been getting more involved in the Bitcoin space. The firm has offered advisory, tax and audit services to digital asset companies, including NFT marketplaces, decentralized finance projects and token issuers.

Its backing gives the ProCapBTC initiative credibility in both traditional finance and digital assets.

Anthony Pompliano, known as “Pomp” in the digital assets community, is a well-known Bitcoin advocate, investor and podcast host. He co-founded Morgan Creek Digital Assets and also leads Pomp Investments, a firm focused on digital assets and fintech.

This isn’t Pompliano’s first SPAC. He led ProCap Acquisition, a fintech-focused SPAC that raised $250 million through a Nasdaq IPO in April.

Pompliano has been saying for years that bitcoin should be included in strategic reserves for governments and corporations. He thinks bitcoin will keep going up until governments stop printing money.

With ProCapBTC he’s putting his money where his mouth is — but this time through a big, public vehicle to buy bitcoin.

ProCapBTC is launching at a time of renewed interest in bitcoin, with governments and numerous companies announcing the creation of bitcoin reserves.

President Donald Trump being pro-Bitcoin is a big deal. His administration’s lighter regulatory approach has encouraged more companies to go public and expand in the space.

This is a new way for investors to get exposure to bitcoin without buying and holding the actual asset. A public company solely focused on bitcoin could be attractive to institutional investors with stricter investment guidelines.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:44

@ 7f6db517:a4931eda

2025-06-16 04:01:44

I often hear "bitcoin doesn't interest me, I'm not a finance person."

Ironically, the beauty of sound money is you don't have to be. In the current system you're expected to manage a diversified investment portfolio or pay someone to do it. Bitcoin will make that optional.

— ODELL (@ODELL) September 16, 2018

At first glance bitcoin often appears overwhelming to newcomers. It is incredibly easy to get bogged down in the details of how it works or different ways to use it. Enthusiasts, such as myself, often enjoy going down the deep rabbit hole of the potential of bitcoin, possible pitfalls and theoretical scenarios, power user techniques, and the developer ecosystem. If your first touch point with bitcoin is that type of content then it is only natural to be overwhelmed. While it is important that we have a thriving community of bitcoiners dedicated to these complicated tasks - the true beauty of bitcoin lies in its simplicity. Bitcoin is simply better money. It is the best money we have ever had.

Life is complicated. Life is hard. Life is full of responsibility and surprises. Bitcoin allows us to focus on our lives while relying on a money that is simple. A money that is not controlled by any individual, company, or government. A money that cannot be easily seized or blocked. A money that cannot be devalued at will by a handful of corrupt bureaucrat who live hundreds of miles from us. A money that can be easily saved and should increase in purchasing power over time without having to learn how to "build a diversified stock portfolio" or hire someone to do it for us.

Bitcoin enables all of us to focus on our lives - our friends and family - doing what we love with the short time we have on this earth. Time is scarce. Life is complicated. Bitcoin is the most simple aspect of our complicated lives. If we spend our scarce time working then we should be able to easily save that accrued value for future generations without watching the news or understanding complicated financial markets. Bitcoin makes this possible for anyone.

Yesterday was Mother's Day. Raising a human is complicated. It is hard, it requires immense personal responsibility, it requires critical thinking, but mothers figure it out, because it is worth it. Using and saving bitcoin is simple - simply install an app on your phone. Every mother can do it. Every person can do it.

Life is complicated. Life is beautiful. Bitcoin is simple.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:44

@ 7f6db517:a4931eda

2025-06-16 04:01:44Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:44

@ 7f6db517:a4931eda

2025-06-16 04:01:44

There must be a limit to how much data is transferred across the bitcoin network in order to keep the ability to run and use your own node accessible. A node is required to interact with the global bitcoin network - if you do not use your own node then you must trust someone else's node. If nodes become inaccessible to run then the network will centralize around the remaining entities that operate them - threatening the censorship resistance at the core of bitcoin's value prop. The bitcoin protocol uses three main mechanisms to keep node operation costs low - a fixed limit on the amount of data in each block, an automatic difficulty adjustment that regulates how many blocks are produced based on current mining hash rate, and a robust dynamic transaction fee market.

Bitcoin transaction fees limit network abuse by making usage expensive. There is a cost to every transaction, set by a dynamic free market based on demand for scarce block space. It is an incredibly robust way to prevent spam without relying on centralized entities that can be corrupted or pressured.

After the 2017 bitcoin fee spike we had six years of relative quiet to build tools that would be robust in a sustained high fee market. Fortunately our tools are significantly better now but many still need improvement. Most of the pain points we see today will be mitigated.

The reality is we were never going to be fully prepared - pressure is needed to show the pain points and provide strong incentives to mitigate them.

It will be incredibly interesting to watch how projects adapt under pressure. Optimistic we see great innovation here.

_If you are willing to wait for your transaction to confirm you can pay significantly lower fees. Learn best practices for reducing your fee burden here.

My guide for running and using your own bitcoin node can be found here._

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-16 04:00:44

@ cae03c48:2a7d6671

2025-06-16 04:00:44Bitcoin Magazine

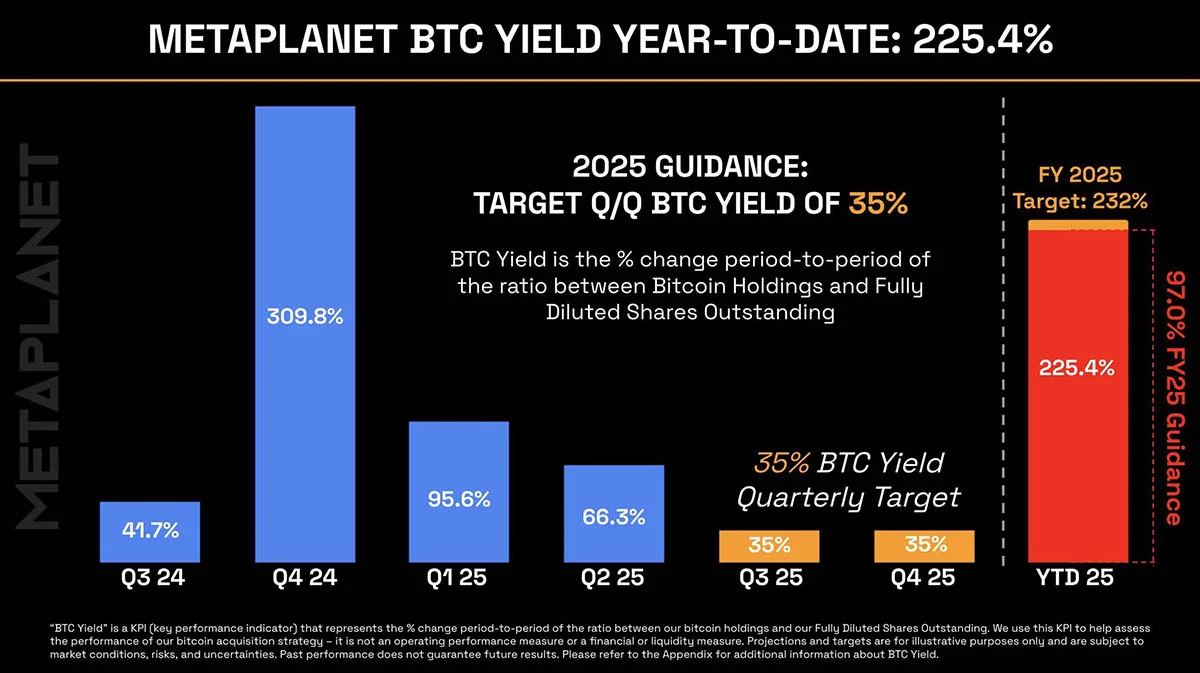

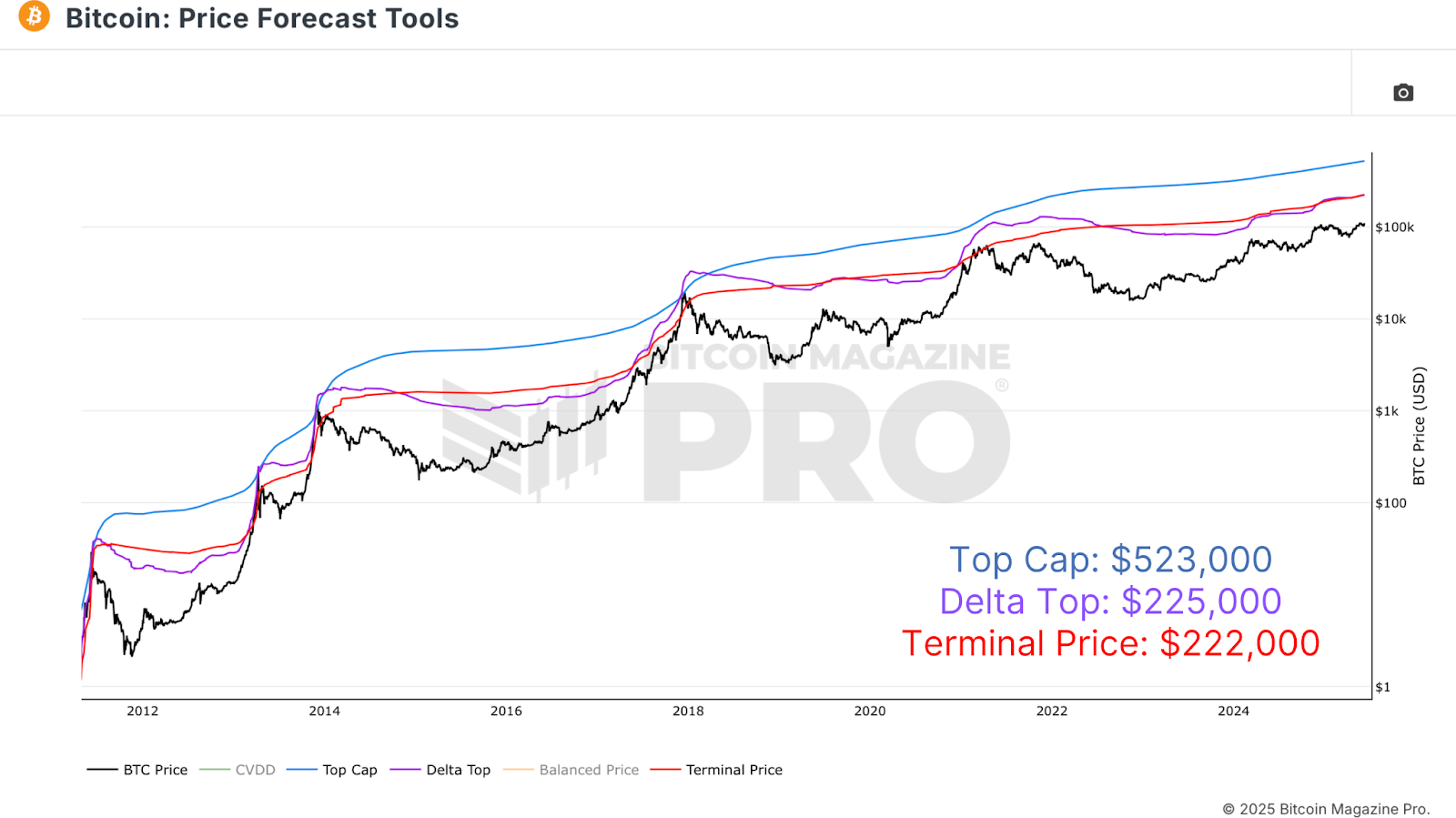

Where Could Bitcoin Peak This Cycle?With Bitcoin looking as bullish as ever, the inevitable question arises of how high could BTC realistically go in this market cycle? Here we’ll explore a wide range of on-chain valuation models and cycle timing tools to identify plausible price targets for a Bitcoin peak. Although prediction is never a substitute for disciplined data reaction, this analysis gives us frameworks to better understand where we are and where we might be heading.

Price Forecast Tools

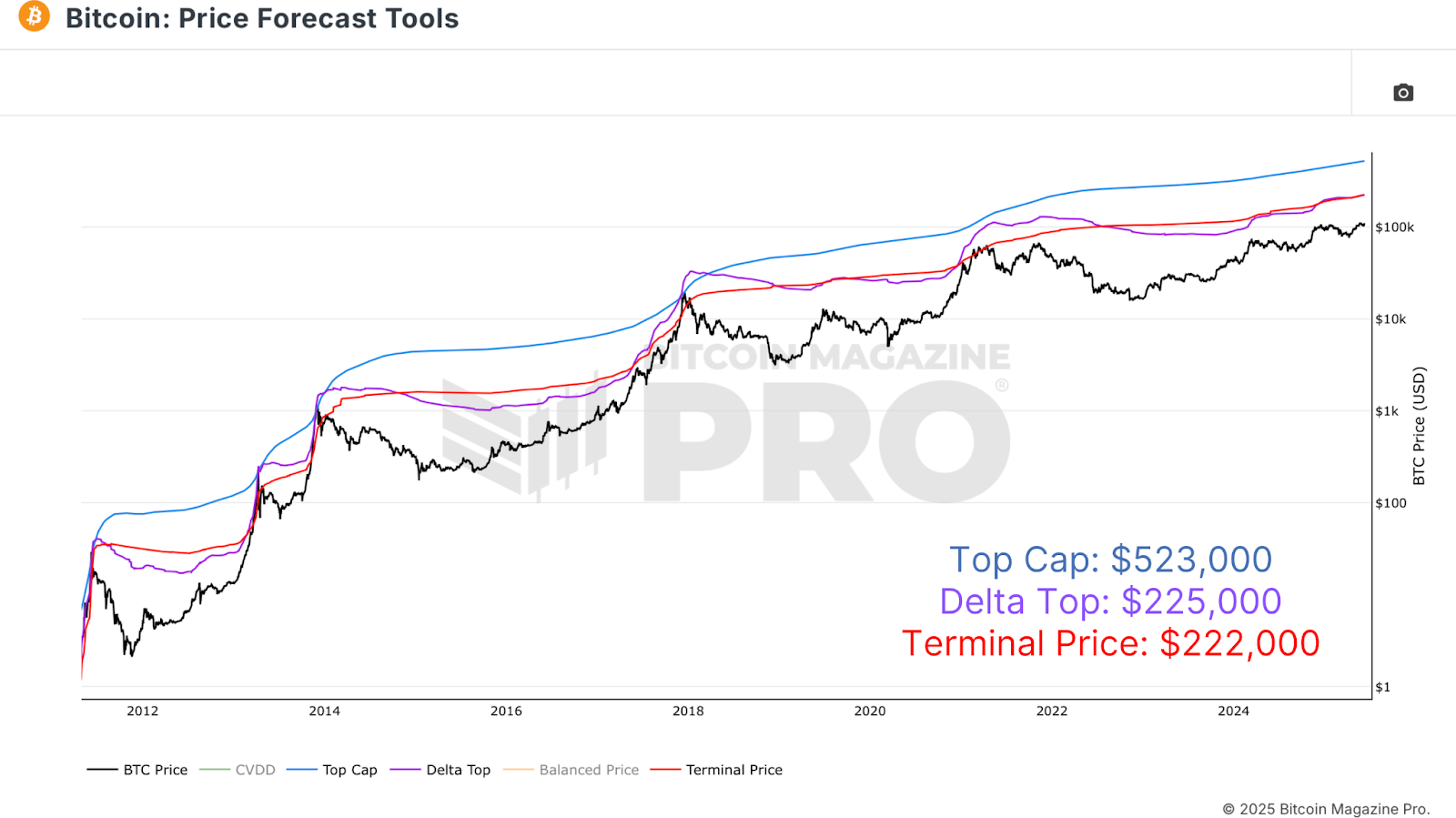

The journey begins with Bitcoin Magazine Pro’s free Price Forecast Tools, which compile several historically accurate valuation models. While it’s always more effective to react to data rather than blindly predict prices, studying these metrics can still provide powerful context for market behavior. If macro, derivative, and on-chain data all start flashing warnings, it’s usually a solid time to take profit, regardless of whether a specific price target has been hit. Still, exploring these valuation tools is informative and can guide strategic decision-making when used alongside broader market analysis.

Figure 1: Applying Price Forecast Tools to calculate potential cycle tops. View Live Chart

Among the key models, the Top Cap multiplies the average cap over time by 35 to project peak valuations. It accurately forecasted 2017’s top, but missed the 2020–2021 cycle, estimating over $200k while Bitcoin peaked around $69k. It now targets over $500k, which feels increasingly unrealistic. A step further is the Delta Top, subtracting the average cap from the realized cap, based on the cost basis of all circulating BTC, to generate a more grounded projection. This model suggested an $80k–$100k top last cycle. The most consistently accurate, however, is the Terminal Price, based on Supply Adjusted Coin Days Destroyed, which has closely aligned with each prior peak, including the $64k top in 2021. Currently projecting around $221k, it could rise to $250k or more, and remains arguably the most credible model for forecasting macro Bitcoin tops. Of course, more information regarding all of these metrics and their calculation logic can be found beneath the charts on the site.

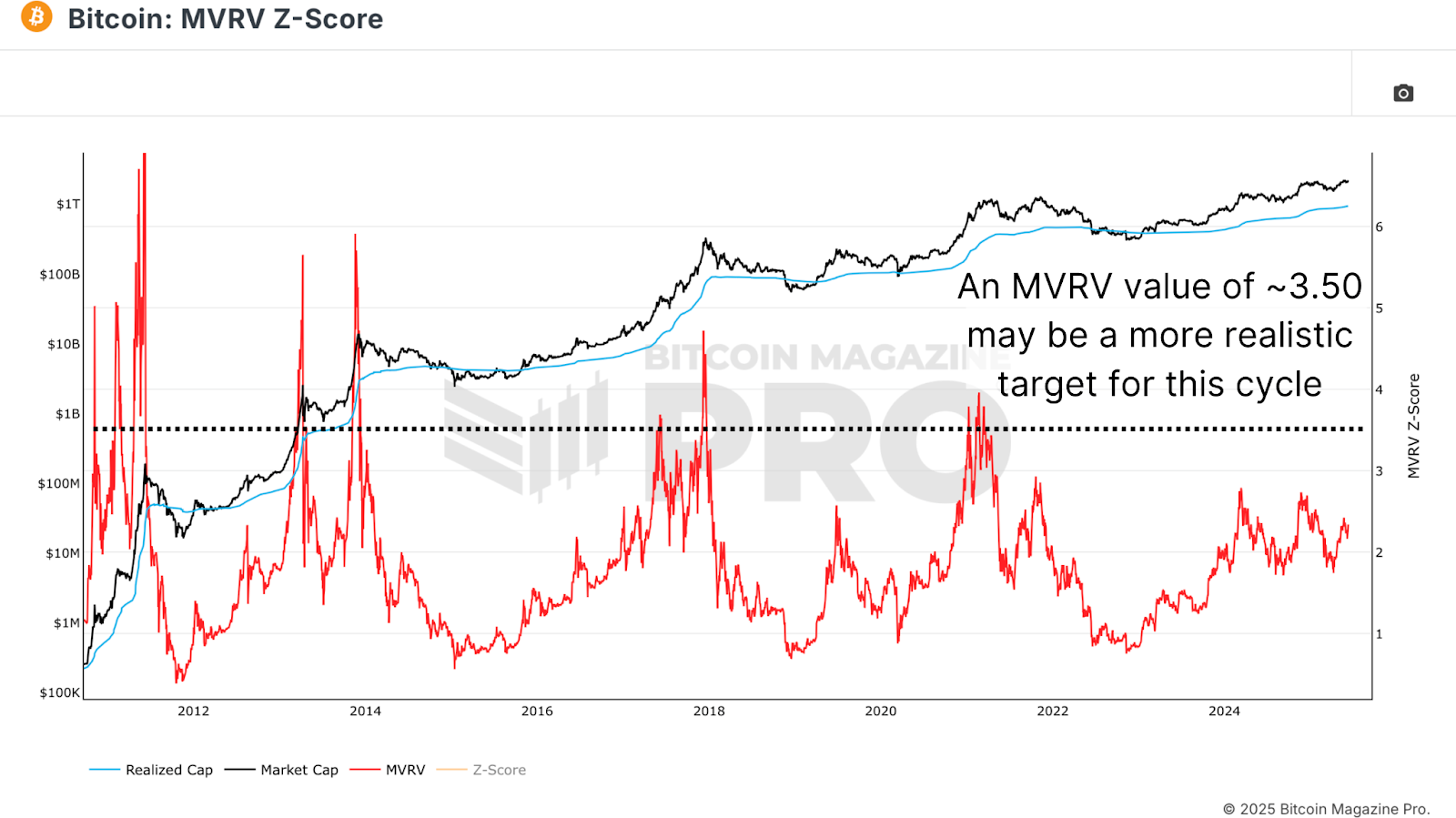

Peak Forecasting

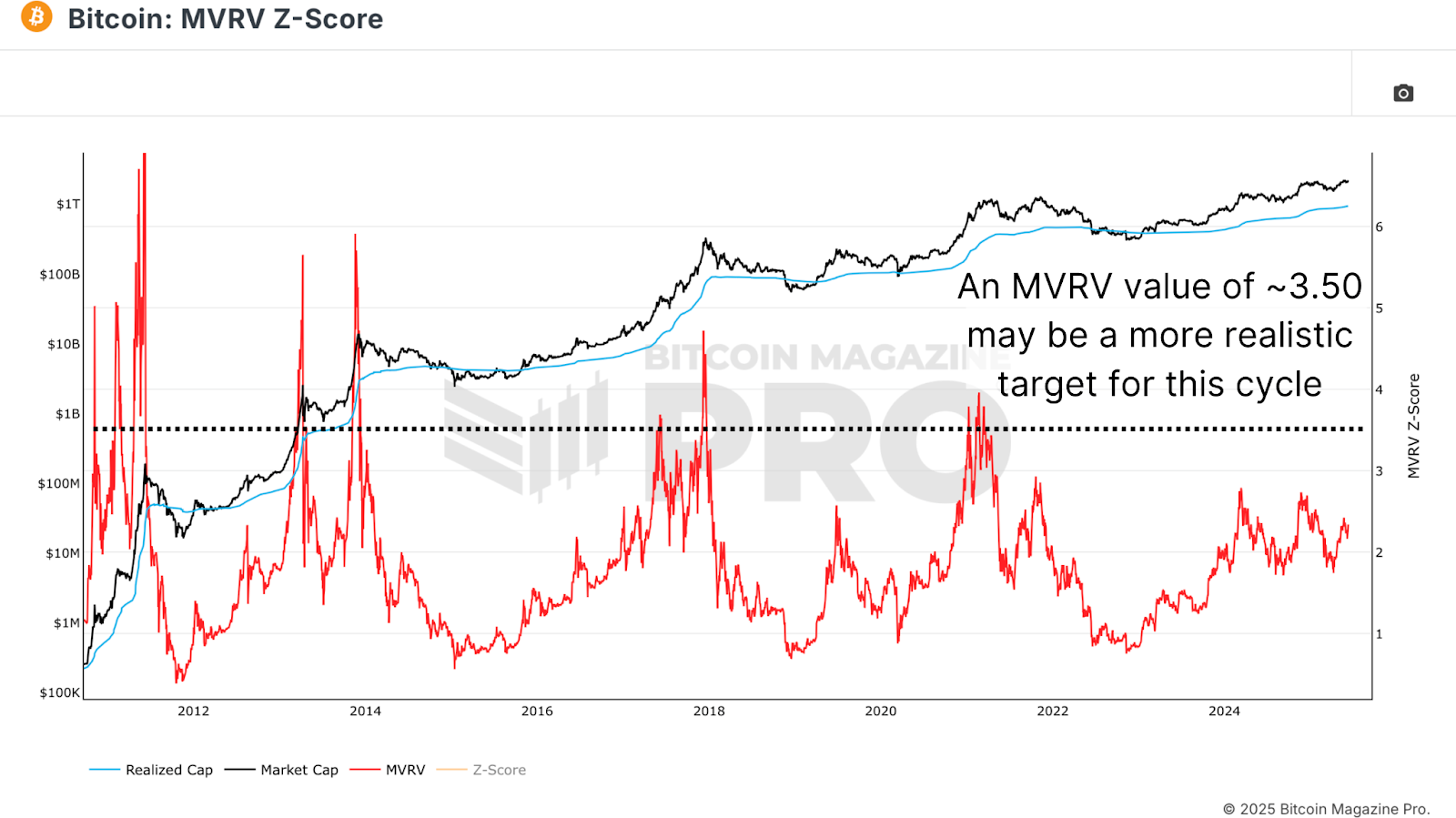

Another powerful metric is the MVRV ratio, which compares market cap to realized cap. It offers a psychological window into investor sentiment, typically peaking near a value of 4 in major cycles. The ratio currently sits at 2.34, suggesting there may still be room for significant upside. Historically, as MVRV nears 3.5 to 4, long-term holders begin to realize substantial gains, often signaling cycle maturity. However, with diminishing returns, we might not reach a full 4 this time around. Instead, using a more conservative estimate of 3.5, we can begin projecting more grounded peak values.

Figure 2: A view of the MVRV ratio predicts further cycle growth to reach historical 4+ and even more conservative 3.5 target values. View Live Chart

Calculating A Target

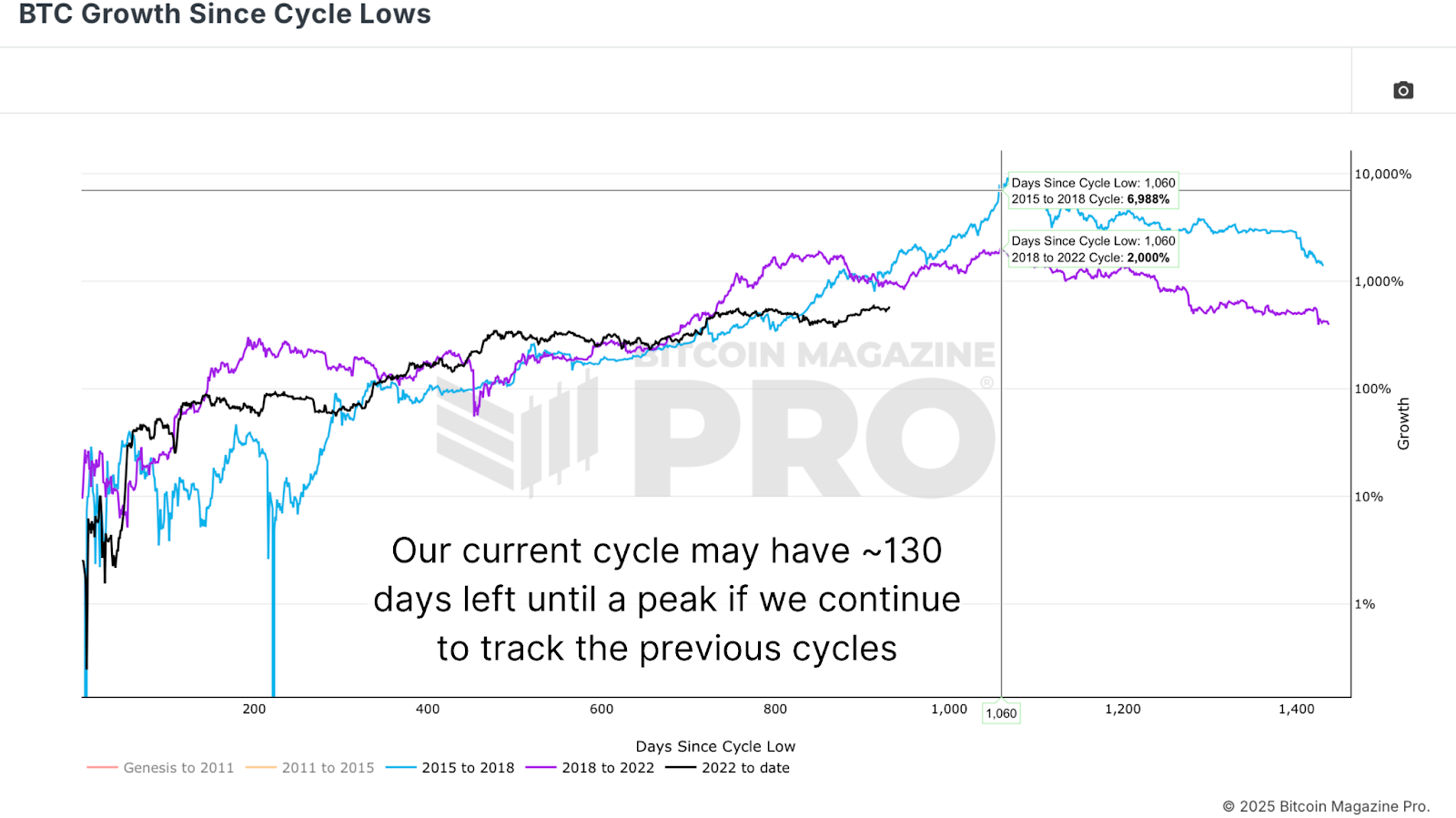

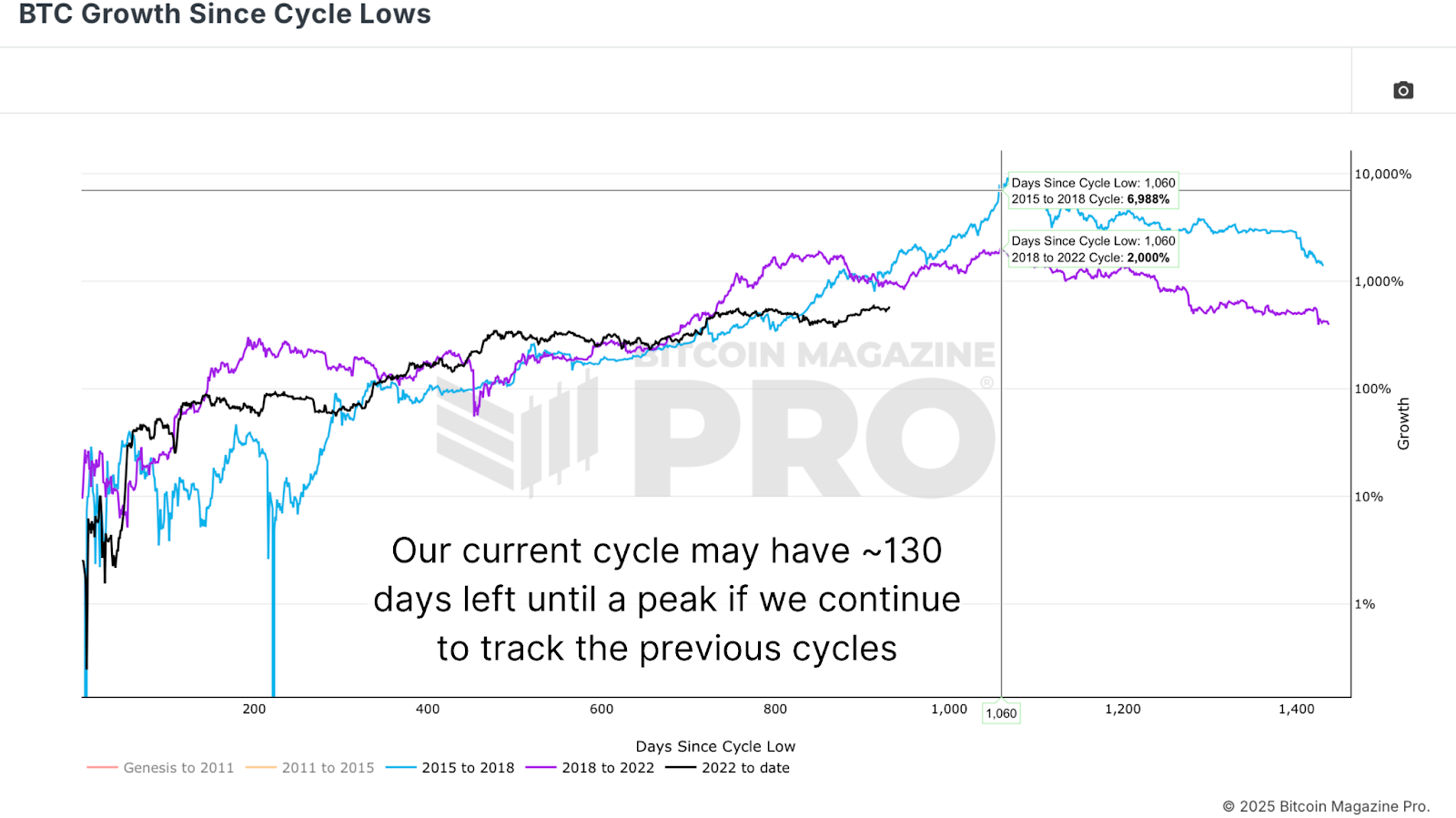

Timing is as important as valuation. Analysis of BTC Growth Since Cycle Lows illustrates that previous Bitcoin cycles peaked almost exactly 1,060 days from their respective lows. Currently, we are about 930 days into this cycle. If the pattern holds, we can estimate the peak may arrive in roughly 130 days. Historical FOMO-driven price increases often happen late in the cycle, causing Realized Price, a proxy for average investor cost basis, to rise rapidly. For instance, in the final 130 days of the 2017 cycle, realized price grew 260%. In 2021, it increased by 130%. If we assume a further halving of growth due to diminishing returns, a 65% rise from the current $47k realized price brings us to around $78k by October 18.

Figure 3: Based on the peak rate of previous cycles, this cycle is far from over. View Live Chart

With a projected $78k realized price and a conservative MVRV target of 3.5, we arrive at a potential Bitcoin price peak of $273,000. While that may feel ambitious, historical parabolic blowoff tops have shown that such moves can happen in weeks, not months. While it may seem more realistic to expect a peak closer to $150k to $200k, the math and on-chain evidence suggest that a higher valuation is at least within the realm of possibility. It’s also worth noting that these models dynamically adjust, and if late-cycle euphoria kicks in, projections could quickly accelerate further.

Figure 4: Combining projected realized price and a possible MVRV target to predict this cycle’s peak.

Conclusion

Forecasting Bitcoin’s exact peak is inherently uncertain, with too many variables to account for. What we can do is position ourselves with probabilistic frameworks grounded in historical precedent and on-chain data. Tools like the MVRV ratio, Terminal Price, and Delta Top have repeatedly demonstrated their value in anticipating market exhaustion. While a $273,000 target might seem optimistic, it is rooted in past patterns, current network behavior, and cycle-timing logic. Ultimately, the best strategy is to react to data, not rigid price levels. Use these tools to inform your thesis, but stay nimble enough to take profits when the broader ecosystem starts signaling the top.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Where Could Bitcoin Peak This Cycle? first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ 7f6db517:a4931eda

2025-06-16 04:01:43

@ 7f6db517:a4931eda

2025-06-16 04:01:43

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-16 04:00:44

@ cae03c48:2a7d6671

2025-06-16 04:00:44Bitcoin Magazine

JPMorgan Reports Record Profits for Bitcoin Miners in Q1Bitcoin mining companies in the U.S. have kicked off 2025 with record performance, according to a recent report. The first quarter of the year was “one of Bitcoin miners’ best quarters to date,” analysts Reginald Smith and Charles Pearce stated.

JUST IN:

JPMorgan reported Q1 2025 was one of the best periods on record for publicly traded bitcoin mining companies

JPMorgan reported Q1 2025 was one of the best periods on record for publicly traded bitcoin mining companies  pic.twitter.com/gs9fGiTbZV

pic.twitter.com/gs9fGiTbZV— Bitcoin Magazine (@BitcoinMagazine) June 13, 2025

“Four of the five operators in our coverage reported record revenue and profits,” the report stated, underscoring the sector’s impressive rebound in profitability amid continued institutional adoption and high bitcoin prices, currently hovering around $105,462.87.

In total, U.S.-listed miners brought in $2.0 billion in gross profit during Q1 2025, with average gross margins reaching 53%—a jump from $1.7 billion and 50% in the previous quarter.

MARA Holdings (MARA) once again led the pack in Bitcoin production, mining the most BTC for the ninth consecutive quarter. However, despite its output dominance, MARA also posted the highest cost per coin, estimated at $72,600, JPMorgan noted.

On the profitability front, IREN (IREN) was the standout performer. For the first time, IREN earned the most gross profit among the tracked firms. The company also reported the lowest all-in cash cost per Bitcoin, around $36,400, helping to boost margins significantly.

CleanSpark (CLSK), another major player, did not raise any equity in the quarter—one of the more capital-disciplined moves seen among its peers. In fact, JPMorgan reported that the five miners it tracks issued only $310 million in equity for Q1, marking a steep decline from $1.3 billion in Q4 2024.

On the operational expense side, miners spent an estimated $1.8 billion on power, up $50 million from the previous quarter—demonstrating the energy-intensive nature of mining.

JPMorgan’s outlook on the industry remains bullish for select players. The bank maintains overweight ratings for CleanSpark, IREN, and Riot Platforms (RIOT), while assigning neutral ratings to Cipher Mining (CIFR) and MARA.

As profitability surges and strategic spending remains in check, 2025 may very well be remembered as a turning point in mining economics—especially for companies navigating cost discipline and scaling production.

This post JPMorgan Reports Record Profits for Bitcoin Miners in Q1 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-16 04:00:43

@ cae03c48:2a7d6671

2025-06-16 04:00:43Bitcoin Magazine

UK Gold Mining Company Bluebird to Convert Gold Revenues into BitcoinBluebird Mining Ventures Ltd., a pan Asian gold project development company, recently announced a major strategic shift. It plans to convert future revenues from its gold mining projects into bitcoin and adopt bitcoin as a treasury reserve asset.

Strategy shift to covert gold into digital gold – #bitcoin #goldmining #goldequities #investinbitcoin #investingold

"Combining income streams from gold mining projects and recycling these revenues into a proactive "Bitcoin in Treasury" management approach, whilst maintaining a… pic.twitter.com/BpJA6hFU9Y— Bluebird Mining Ventures Ltd (LSE:BMV.L) (@bluebirdIR) June 5, 2025

“By adopting a ‘gold plus a digital gold’ strategy, it offers the Company an opportunity to turn the page and look to the future and seek to attract a new type of shareholder,” said the Executive Director and CEO of Bluebird Aidan Bishop. “Under the leadership of a new CEO, once identified, it is my sincere hope that Bluebird will finally realise its ambitions for which it was initially established for.”

The announcement comes as Bluebird progresses towards a key agreement on its flagship Philippine project. The company expects to finalize a deal in the coming weeks that will grant it a net profit interest throughout the life of the mine, with no ongoing capital costs. The company said it believes bitcoin offers a modern alternative to traditional store of value assets like gold.

“I am very pleased with the progress of discussions in the Philippines which are looking very positive and will enable, if successfully completed, Bluebird to maintain an ongoing exposure with zero future cash commitments,” stated Bishop.

Bluebird plans to recycle revenues from its mining operations directly into bitcoin, aligning with what they describe as an innovative treasury approach. The company cited bitcoin’s fixed supply of 21 million, increasing global adoption, and role as a hedge against inflation and monetary instability as key reasons for its decision.

“Combining income streams from gold mining projects and recycling these revenues into a proactive ‘Bitcoin in Treasury’ management approach…” the company said. “Companies that have adopted bitcoin into their treasury strategy globally across public markets have been enjoying significant investor interest as well as substantial premiums to Net Asset Value (NAV) that have challenged traditional financial metrics as a basis of valuation.”

To lead this new phase, Bluebird is actively searching for a new CEO with experience in digital assets.

“On a personal level, I embarked some time ago on a journey to understand and learn about bitcoin,” added Bishop. “I am convinced that we are witnessing a tectonic shift in global markets and that bitcoin will reshape the landscape of financial markets on every level.”

This post UK Gold Mining Company Bluebird to Convert Gold Revenues into Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-16 04:00:42

@ cae03c48:2a7d6671

2025-06-16 04:00:42Bitcoin Magazine

The 30,000-Foot View of the Oslo Freedom ForumAs I step onto the plane leaving Gardermoen Airport in Oslo, Norway, the weight and warmth of the past week settles into my chest.

The Oslo Freedom Forum is not a conference. It’s not a summit. It’s something harder to name and even harder to describe — a convergence of courage, truth and defiance that burns through the noise of the modern world and gives you no choice but to listen, feel and act.

For the second time, I leave this city more convinced than ever that something unstoppable is rising. That amid the censorship, surveillance and state repression spreading across the globe, there is a countervailing force rooted in humanity, accelerated by technology and led by those who’ve already paid the price for speaking out.

The Forum doesn’t trade in empty optimism. It delivers a different kind of hope, forged from lived experience and stitched together by people who have been in the dark and still choose to see the light. A hope borne from the stories of individuals who have lived through the worst an authoritarian regime can do and still choose to fight for the freedom of others. The experiences shared were hard. At times, devastating. But they weren’t offered for pity. They were calls to action.

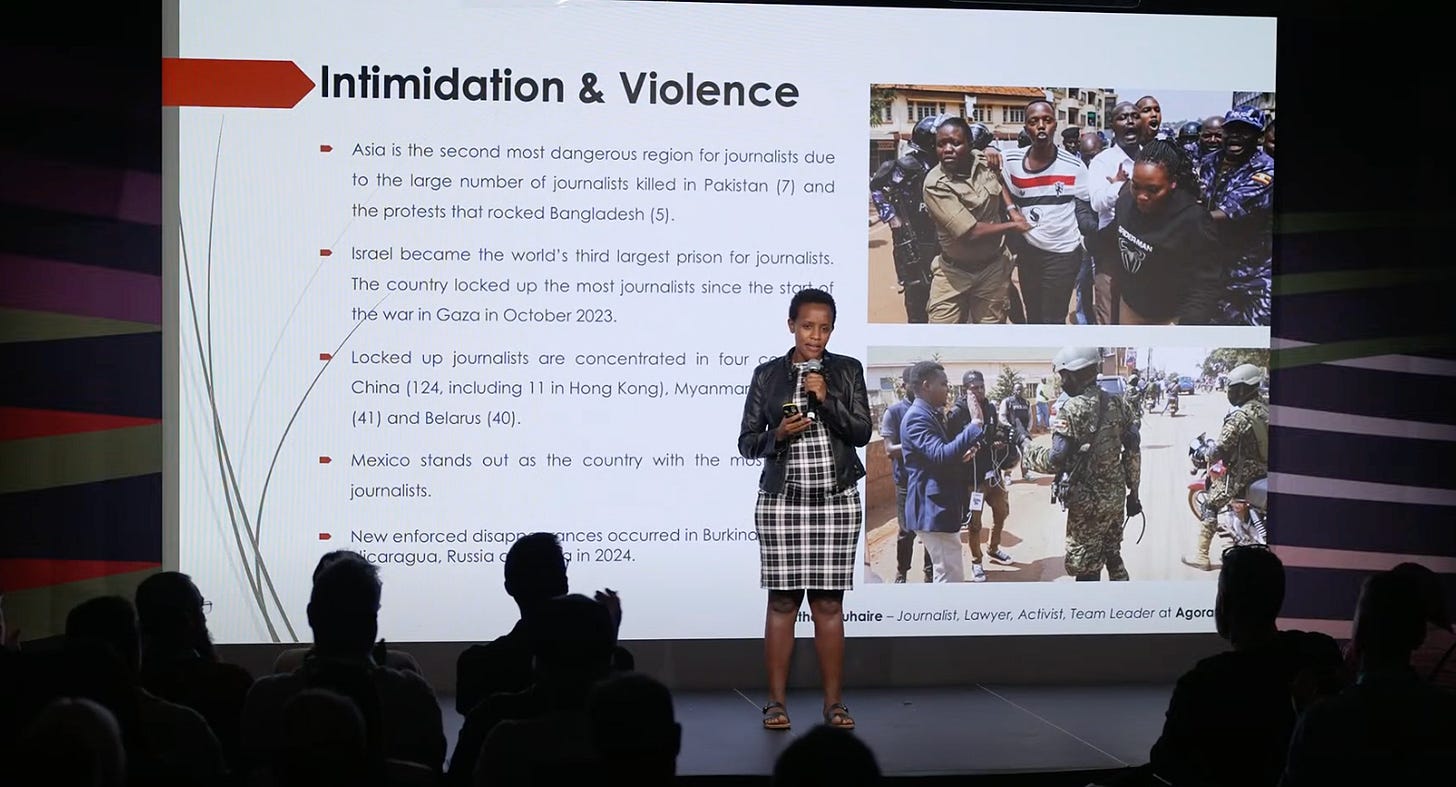

Just days after she was abducted, blindfolded, tortured, and sexually assaulted in a Tanzanian prison cell, Agather Atuhaire stood in front of a crowd of strangers and told her story.

Her voice did not tremble.

The Ugandan journalist and lawyer had traveled to Tanzania in solidarity with fellow East African dissidents, only to be disappeared in a black van alongside Kenyan activist Boniface Mwangi.

And yet, against all odds, she came back. Not just to her home in Uganda, but also to the stage in Oslo, where she spoke calmly and clearly about what it means to tell the truth under a dictatorship.

Her presentation, “The Digital Free Speech Crackdown in Uganda,” laid bare the authoritarian playbook: social media blackouts, propaganda campaigns, surveillance of journalists and the slow financial asphyxiation of independent media. When the government doesn’t like a story, it simply blocks the platform or website. When a journalist digs too deep, they disappear for a while. Or forever. Atuhaire painted a picture many struggle to even imagine.

And yet, after everything, she didn’t just recount these struggles. She looked out at the crowd and thanked the open source builders and contributors who write code and create tools that make it possible for activists like her to speak, move money and organize under regimes that want them silenced, or worse.

(Ugandan journalist and lawyer, Agather Atuhaire, speaks during the Freedom Tech track at the 2025 Oslo Freedom Forum.)

From Iran, independent Bitcoin educator Ziya Sadr reminded us that financial privacy is not a luxury but a necessary lifeline for those facing the financial repression by oppressive rulers. Sadr’s detainment during the 2022 Women, Life, Freedom movement following the murder of Mahsa Amini by the Iranian regime is a testament to that. Without financial privacy, activists’ actions, connections and finances are exposed to a regime equipped with widespread financial controls and a sophisticated, restrictive internet firewall that rivals even China’s.

The result is one of the most repressive digital environments in the world. And if that wasn’t enough, the Iranian rial currency has lost more than 80% of its value in just a few years.

Against this backdrop, Iranians are using bitcoin as undebasable savings, and to buy digital services like VPNs in order to access the open internet. But even that act, just reaching the outside world, requires a level of privacy most of us take for granted.

In his presentation, “Securing Lifelines: The Bitcoin Privacy Imperative,” Sadr shared that many Iranians turn to Bitcoin Coinjoins, a privacy technique that breaks the link between Bitcoin transaction inputs. Coinjoins preserve user transaction privacy and, more importantly, shield Iranians from the surveillance and retaliation of a regime who punishes anyone trying to access information beyond its tightly controlled digital spaces. The use of Coinjoins is becoming more difficult as global legal pressure mounts against open source developers, and in the aftermath of the Samourai developer arrests, privacy protocols like Whirlpool are unworkable.

Today, Sadr is learning more about additional Bitcoin privacy tools, including Payjoin, a privacy method that allows two users to contribute an input to a Bitcoin transaction. Payjoin breaks common chain analysis heuristics and conceals the sender and receiver of a transaction as well as the payment amount. Then there is ecash, a form of digital cash backed by Bitcoin that enables very private, everyday payments with the custodial trade-off of trusting mints (entities that issue and redeem ecash tokens) to store user funds.

The continued development of these protocols is crucial for Iranians, who live under a government that not only tracks and surveils digital behavior, but also imposes automatic fines on women for violating hijab rules and manipulates currency exchange rates to profit off citizens’ savings. For millions in Iran, bitcoin offers a last line of defense against a collapsing currency, intrusive surveillance and total financial repression.

(Independent Iranian Bitcoin educator, Ziya Sadr, speaks during the Freedom Tech track at the Oslo Freedom Forum.)

Venezuelan opposition leader Leopoldo López took the stage at the 2025 Oslo Freedom Forum not as a politician, but as a witness to what happens when a state turns its institutions into further tendrils of its repression machine.

After Nicolás Maduro stole Venezuela’s 2024 elections, López watched thousands of his fellow people — activists, students, journalists, opposition members and lawyers — get arrested, disappeared or forced into exile. The regime blocked access to social media, revoked passports, criminalized dissent and used the financial system as a means of controlling the population.

Amid this digital repression and Venezuela’s 162% inflation rate, López sees bitcoin (decentralized money) and Nostr (decentralized social media) as lifelines. When dictators shut down the internet or freeze your bank account, alternatives that are open source, decentralized, uncensorable and accessible become more important than ever for the survival of democracy and freedom.

**“Decentralized resistance is the convergence of people, Bitcoin, Nostr, and AI.

People, it’s about the center and the end of what we are doing.

Brave women and men who sacrifice their freedom, who take risks, who are willing to fight for other people.

If it’s not about people, technology wouldn’t be something worth fighting for.

Bitcoin is freedom money. It’s decentralized, nobody controls it, nobody can stop it, it can move around without borders.”**

(Venezuelan Opposition Leader Leopoldo López during the Freedom Tech track at the 2025 Oslo Freedom Forum.)

For decades, Paraguay’s greatest natural resource, hydroelectric power, has flowed out of the country through international contracts, fueling development in neighboring countries like Brazil and Argentina while one in four Paraguayans remained trapped in poverty. Paraguay’s Itaipu Dam, one of the largest in the world, has long symbolized this paradox: a river of energy diverted away from the very people who need it most.

Björn Schmidtke and Delia Garcete of Penguin Group are flipping that script.

In a landmark move, they secured Paraguay’s first 100-megawatt power purchase agreement, marking the beginning of a bold experiment to reclaim that energy for the people of Paraguay. Instead of selling it off to foreign powers, they use it to mine Bitcoin — and the proc

-

@ 7f6db517:a4931eda

2025-06-16 04:01:43

@ 7f6db517:a4931eda

2025-06-16 04:01:43

For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

Microsoft Cloud hiring to "implement global small modular reactor and microreactor" strategy to power data centers: https://www.datacenterdynamics.com/en/news/microsoft-cloud-hiring-to-implement-global-small-modular-reactor-and-microreactor-strategy-to-power-data-centers/

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-16 04:00:42

@ cae03c48:2a7d6671

2025-06-16 04:00:42Bitcoin Magazine

Pakistan’s Strategic Bitcoin Reserve: A Step Toward Orange-Pilling a Nation?Pakistan’s relationship with Bitcoin has been marked by inconsistency and confusion over the past few years. Initially, the country outright banned bitcoin trading in 2018, citing concerns over fraud, money laundering and lack of regulation. However, over time, their stance softened and regulators began exploring the technology behind Bitcoin with courts even questioning the legality of the ban. Eventually, citizens were allowed to hold bitcoin, though trading remained murky and unregulated. This back-and-forth approach has created a confusing environment, where Bitcoin exists in a legal gray area. It is technically allowed, yet not fully embraced or regulated, reflecting the state’s struggle to balance innovation with control.

PAKISTAN TO ESTABLISH NATIONAL STRATEGIC #BITCOIN RESERVE

PAKISTAN TO ESTABLISH NATIONAL STRATEGIC #BITCOIN RESERVE Honored to have had the Pakistan Minister Bilal Bin Saqib at the Bitcoin Conference

pic.twitter.com/7WunP5fuZm

pic.twitter.com/7WunP5fuZm— The Bitcoin Conference (@TheBitcoinConf) May 29, 2025

This muddled relationship with Bitcoin seems to have turned a corner in recent weeks as Bilal Bin Saqib, head of the Pakistan Crypto Council, at the Bitcoin 2025 Conference in Las Vegas announced that the country is moving to establish a strategic Bitcoin reserve. Furthermore, he announced the allocation of 2,000 megawatts of excess energy to Bitcoin mining and high-performance computer data centers. The Ministry of Finance has also commissioned the establishment of an entirely new agency to oversee digital asset regulation which could lead to a less opaque legal framework around bitcoin ownership and usage in everyday transactions.

Critics have argued that this is merely an attempt by Pakistan to cozy up to Trump in the aftermath of the recent skirmish with India. After all, Saqib did state that Pakistan was inspired by the Trump administration when he spoke at the recent Las Vegas Bitcoin conference. Others have asserted that Pakistan is merely seeking to build resistance to possible sanctions in the future over its support for terrorist groups. I believe that such a geopolitically focused critique overlooks a deeper economic reality that has been staring Pakistan in the face for many years.

I wrote an article for a Pakistani newspaper about a year ago in which I argued that the country is uniquely situated, in economic terms, to take advantage of Bitcoin and unlock the benefits that come with adoption. Pakistan suffers from rampant inflation, stagnant capital formation, depleted foreign reserves, an inefficient bureaucracy and an overreliance on remittances from abroad. These systemic issues have eroded citizens’ faith in traditional financial systems, leaving many Pakistanis disillusioned and seeking alternative means to safeguard their wealth and economic autonomy.

Thus, nurturing a culture of Bitcoin adoption could go a long way toward alleviating much of these economic ills and empowering citizens to take control of their financial future. By earning and trading a form of currency that is deflationary in nature, Pakistanis can protect themselves from the downsides of the macroeconomic trends that have decimated the living standards of this once proud nation. Bitcoin adoption could transform the country’s lively remittance sector, with receivers keeping more of the money they are sent. It could also emancipate people from the inefficient banking system that is such a drain on the people. Permissionless transactions could also empower the beleaguered minorities who often struggle to achieve financial freedom.

The announcement of a strategic Bitcoin reserve, as well as promises to introduce pro-Bitcoin regulation and a mining strategy, are steps in the right direction. They show that the mood is shifting and the country is starting to take a serious look at the only real digital currency in town. These steps also point to a much broader, global shift in attitudes toward Bitcoin — especially in nations where hyperinflation is a daily reality and the banking system struggles to meet citizens’ needs.

However, real change will only come when Pakistan fully legalizes bitcoin as a digital currency and takes steps toward mass adoption. Only then will ordinary Pakistani citizens be free to trade with people from all over the world without the need to rely on the local banking system. Only then will financial autonomy become an achievable goal for those living far away from the big cities where banks are based. Only then will women be free to earn, store and transact in a digital currency that is resistant to cultural barriers.

Creating a national strategic reserve merely signals that a nation believes in bitcoin as an asset with the potential to offer a reliable return. It does not signal that a nation has adopted the digital currency as a means to overcome the obstacles imposed by fiat. Strategic national reserves also hoard bitcoin and bring it too close to the state, even though the digital currency was designed to be a hedge against state-controlled money. As such, a reserve does not unlock the true potential of bitcoin to act as a buffer against domestic inflation, currency devaluation and a cumbersome banking system.

A strategic Bitcoin reserve is a step in the right direction for Pakistan, as it would be for any nation that suffers from hyperinflation. But only mass adoption will truly unlock the immense potential Bitcoin can offer to a nation such as Pakistan and we have a long way to go before that becomes a reality.

In my view, strategic reserves are not what bitcoin is all about, but let’s hope this is merely the first step in a long and prosperous journey toward orange-pilling a nation.

This post Pakistan’s Strategic Bitcoin Reserve: A Step Toward Orange-Pilling a Nation? first appeared on Bitcoin Magazine and is written by Ghaffar Hussain.

-

@ cae03c48:2a7d6671

2025-06-16 04:00:41

@ cae03c48:2a7d6671

2025-06-16 04:00:41Bitcoin Magazine

Bitcoin Layer 2: StatechainsStatechains are an original second layer protocol originally developed by Ruben Somsen in 2018, depending on the eltoo (or LN Symmetry) proposal. In 2021 a variation of the original proposal, Mercury, was built by CommerceBlock. In 2024, a further iteration of the original Mercury scheme was built, Mercury Layer.

The Statechain protocol is a bit more complicated to discuss compared to other systems such as Ark or Lightning because of the range of variations that are possible between the original proposed design, the two that have been actually implemented, and other possible designs that have been loosely proposed.