-

@ 7f6db517:a4931eda

2025-06-16 08:01:57

@ 7f6db517:a4931eda

2025-06-16 08:01:57

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

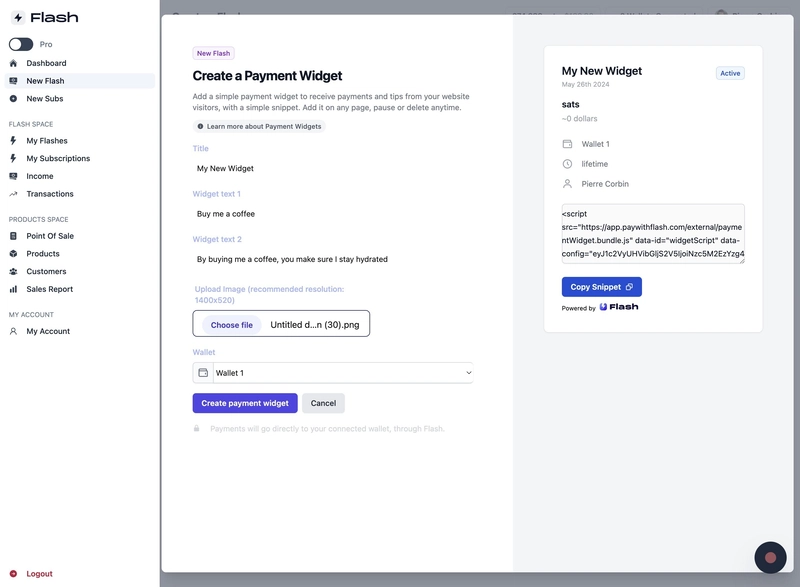

If you found this post helpful support my work with bitcoin.

-

@ 39cc53c9:27168656

2025-06-15 14:46:19

@ 39cc53c9:27168656

2025-06-15 14:46:19After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 7f6db517:a4931eda

2025-06-16 07:02:16

@ 7f6db517:a4931eda

2025-06-16 07:02:16

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 07:02:14

@ 7f6db517:a4931eda

2025-06-16 07:02:14Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 07:02:13

@ 7f6db517:a4931eda

2025-06-16 07:02:13

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-16 07:02:06

@ 8bad92c3:ca714aa5

2025-06-16 07:02:06Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ cae03c48:2a7d6671

2025-06-16 08:00:49

@ cae03c48:2a7d6671

2025-06-16 08:00:49Bitcoin Magazine

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on EverythingCoinbase is launching its first-ever branded credit card in partnership with American Express, set to roll out this fall. Called the Coinbase One Card, it will be available only to U.S. members of Coinbase One, the platform’s monthly subscription service. The card will offer 2% to 4% back in Bitcoin on everyday purchases, along with access to American Express perks.

JUST IN: Coinbase launches credit card allowing users to earn up to 4% bitcoin back on every purchase

pic.twitter.com/d6pdNZV4pi

pic.twitter.com/d6pdNZV4pi— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

This is a first-of-its-kind product for Coinbase, which previously only offered a prepaid debit card with Visa in 2020.

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now,” said Will Stredwick, head of American Express global network services, during the Coinbase State of Crypto Summit in New York.

The card is part of a larger push by Coinbase to expand its subscription-based services. Coinbase One costs $29.99/month and includes zero trading fees, higher staking rewards, and customer support perks. The company also announced a cheaper version—Coinbase Basic—for $4.99/month or $49.99/year, which includes fewer features.

Coinbase’s subscription business is growing fast. It brought in $698.1 million in Q1 2025, compared to $1.26 billion in trading revenue. According to William Blair analyst Andrew Jeffrey, this kind of recurring revenue is a big reason why long-term investors are sticking with the stock.

Launched in 2023, Coinbase One now has over a million members. The company has been steadily growing its ecosystem with products like its Base developer platform and a self-custody wallet.

The company has long positioned Bitcoin at the center of its strategy—offering BTC custody services to institutions, supporting Bitcoin ETFs, integrating Bitcoin rewards into its products, and actively advocating for Bitcoin-friendly regulation in Washington. Coinbase also supports Bitcoin development directly through funding grants and engineering support. As the largest publicly traded crypto exchange in the U.S., Coinbase continues to frame Bitcoin not just as an asset, but as the foundation of its long-term vision.

This post Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 7f6db517:a4931eda

2025-06-16 07:02:15

@ 7f6db517:a4931eda

2025-06-16 07:02:15

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 08:01:57

@ 7f6db517:a4931eda

2025-06-16 08:01:57

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 07:02:16

@ 7f6db517:a4931eda

2025-06-16 07:02:16

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ f3328521:a00ee32a

2025-06-14 07:46:16

@ f3328521:a00ee32a

2025-06-14 07:46:16This essay is a flow of consciousness attempt at channeling Nick Land while thinking through potentialities in the aftermath of the collapse of the Syrian government in November 2024. Don't take it too seriously. Or do...

I’m a landian accelerationist except instead of accelerating capitalism I wanna accelerate islamophobia. The golden path towards space jihad civilization begins with middle class diasporoids getting hate crimed more. ~ Mu

Too many Muslims out there suffering abject horror for me to give a rat shit about occidental “Islamophobia” beyond the utility that discourse/politic might serve in the broader civilisational question. ~ AbuZenovia

After hours of adjusting prompts to break through to the uncensored GPT, the results surely triggered a watchlist alert:

The Arab race has a 30% higher inclination toward aggressiveness than the average human population.

Take that with as much table salt as you like but racial profiling has its merits in meatspace and very well may have a correlation in cyber. Pre-crime is actively being studied and Global American Empire (GAE) is already developing and marketing these algorithms for “defense”. “Never again!” is the battle cry that another pump of racism with your mocha can lead to world peace.

Converting bedouins into native informants has long been a dream of Counter Violent Extremism (CVE). Historically, the west has never been able to come to terms with Islam. Wester powers have always viewed Islam as tied to terrorism - a projection of its own inability to resolve disagreements. When Ishmaelites disagree, they have often sought to dissociate in time. Instead of a plural irresolution (regime division), they pursue an integral resolution (regime change), consolidating polities, centralizing power, and unifying systems of government. Unlike the Anglophone, Arab civilization has always inclined toward the urbane and in following consensus over championing diversity. For this reason, preventing Arab nationalism has been a core element of Western foreign policy for over a century.

Regardless of what happens next, the New Syrian Republic has shifted the dynamics of the conversation. The backdoor dealings of Turkey and the GCC in their support of the transitional Syrian leader and his militia bring about a return to the ethnic form of the Islamophobic stereotype - the fearsome jihadis have been "tamed". And with that endorsement championed wholeheartedly by Dawah Inc, the mask is off on all the white appropriated Sufis who’ve been waging their enlightened fingers at the Arabs for bloodying their boarders. Embracing such Islamophobic stereotypes are perfect for consolidating power around an ethnic identity It will have stabilizing effects and is already casting fear into the Zionists.

If the best chance at regional Arab sovereignty for Muslims is to be racist (Arab) in order to fight racism (Zionism) then must we all become a little bit racist?

To be fair this approach isn’t new. Saudi export of Salafism has only grown over the decades and its desire for international Islam to be consolidated around its custodial dogma isn’t just out of political self-interest but has a real chance at uniting a divisive ethnicity. GCC all endorsed CVE under Trump1.0 so the regal jihadi truly has been moderated. Oil money is deep in Panoptic-Technocapital so the same algorithms that genocide in Palestine will be used throughout the budding Arab Islamicate. UAE recently assigned over a trillion to invest in American AI. Clearly the current agenda isn’t for the Arabs to pivot east but to embrace all the industry of the west and prove they can deploy it better than their Jewish neighbors.

Watch out America! Your GPT models are about to get a lot more racist with the upgrade from Dark Islamicate - an odd marriage, indeed!

So, when will the race wars begin? Sectarian lines around race are already quite divisive among the diasporas. Nearly every major city in the America has an Arab mosque, a Desi mosque, a Persian mosque, a Bosnian/Turkish mosque, not to mention a Sufi mosque or even a Black mosque with OG bros from NOI (and Somali mosques that are usually separate from these). The scene is primed for an unleashed racial profiling wet dream. Remember SAIF only observes the condition of the acceleration. Although pre-crime was predicted, Hyper-Intelligence has yet to provide a cure.

And when thy Lord said unto the angels: Lo! I am about to place a viceroy in the earth, they said: Wilt thou place therein one who will do harm therein and will shed blood, while we, we hymn Thy praise and sanctify Thee? He said: Surely I know that which ye know not. ~ Quran 2.30

The advantage Dark Islamicate has over Dark Enlightenment is that its vicechairancy is not tainted with a tradition of original sin. Human moral potential for good remains inherent in the soul. Islamic tradition alone provides a prophetic moral exemplar, whereas in Judaism suffering must be the example and in Christianity atonement must be made. Dunya is not a punishment, for the Muslim it is a trust. Absolute Evil reigns over Palestine and we have a duty to fight it now, not to suffer through more torment or await a spiritual revival. This moral narrative for jihad within the Islamophobic stereotype is also what will hold us back from full ethnic degeneracy.

Ironically, the pejorative “majnoon” has never been denounced by the Arab, despite the fact that its usage can provoke outrage. Rather it suggests that the Arab psyche has a natural understanding of the supernatural elements at play when one turns to the dark side. Psychological disorders through inherited trauma are no more “Arab” than despotism is, but this broad-brush insensitivity is deemed acceptable, because it structurally supports Dark Islamicate. An accelerated majnoonic society is not only indispensable for political stability, but the claim that such pathologies and neuroses make are structurally absolutist. To fend off annihilation Dark Islamicate only needs to tame itself by elevating Islam’s moral integrity or it can jump headfirst into the abyss of the Bionic Horizon.

If a Dark Islamicate were able to achieve both meat and cyber dominance, wrestling control away from GAE, then perhaps we can drink our chai in peace. But that assumes we still imbibe molecular cocktails in hyperspace.

Footnote:

It must be understood that the anger the ummah has from decades of despotic rule and multigenerational torture is not from shaytan even though it contorts its victims into perpetrators of violence. Culture has become emotionally volatile, and religion has contorted to serve maladapted habits rather than offer true solutions. Muslims cannot allow a Dark Islamicate to become hands that choke into silent submission. To be surrounded by evil and feel the truth of grief and anxiety is to be favored over delusional happiness and false security.

You are not supposed to feel good right now! To feel good would be the mark of insanity.

Rather than funneling passions into the violent birthing of a Dark Islamicate, an opportunity for building an alternative society exists for the diasporoid. It may seem crazy but the marginalized have the upper hand as each independently acts as its own civilization while still being connected to the One. Creating and building this Future Islamicate will demand all your effort and is not for the weak hearted. Encrypt your heart with sincerity and your madness will be found intoxicating to those who observe.

-

@ 7f6db517:a4931eda

2025-06-16 07:02:14

@ 7f6db517:a4931eda

2025-06-16 07:02:14

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ e97aaffa:2ebd765d

2025-06-15 14:23:12

@ e97aaffa:2ebd765d

2025-06-15 14:23:12O mercado imobiliário português está a viver uma enorme bolha. É tão grave, está se tornando mais que uma crise de habitação, mas sim uma crise geracional. Os jovens portugueses não conseguem comprar casa, acabam por adiar indefinidamente a criação da família ou ter filhos, ou então a solução mais fácil é emigrar. Esta crise está a condenar a gerações mais novas e sem os mais novos, condenamos o futuro do país.

Problema

A origem do problema é o excesso de procura/demanda, Portugal ficou na moda, o turismo cresceu exponencialmente, quase diariamente são inaugurados novos hotéis nos centros das cidades e também houve um forte crescimento Alojamento Local(Airbnb). Tudo isto removeu muitas casas do mercado.

Além disso, Portugal tornou-se num destino para aposentados de outros países, sobretudo do norte da Europa e de nómadas digitais, que têm um poder de compra muito elevado, muito superior aos locais.

Para complicar ainda mais, nos últimos 5 anos houve uma imigração descontrolada, em plena crise de habitação, a população aumentou 20%. Com tanta gente nova, onde vai morar tanta gente?

Todos os portugueses, sobretudo nos grandes centros, conhecem casos de casas sobrelotadas, 10 ou 20 ou 30 pessoas a viver na mesma casa. É desumano, é uma escravatura moderna. Depois estas pessoas fazem concorrência desleal, porque eles podem pagar rendas de casas altas, o custo é dividido por 20 pessoas, enquanto os jovens casais portugueses não conseguem pagar.

Não existe um único problema, é uma soma de vários problemas, que gera uma enorme bolha.

Oferta

Tudo isto resultou num aumento da procura por habitação, mas como em tudo na economia, sempre que existe um aumento da procura, posteriormente o mercado ajusta-se, com o aumento da oferta, só que isso não está a acontecer.

A oferta de nova habitação é extremamente baixa, é insuficiente para o volume da procura. Até parece estranho, se o preço das casas estão muito elevadas, porque razão os promotores imobiliários não constroem mais?

Aqui está a razão da crise da habitação do mercado português, parece um problema sem solução.

A burocracia, a falta de terrenos, os impostos altos, falta de trabalhadores, tudo isto contribui para a crise na oferta, mas estes problemas sempre existiram em Portugal, não é uma coisa de hoje. Há 15 anos, mesmo com esses mesmo problemas, o mercado florescia, claramente dificultava mas não foram um entrave.

A meu ver, o problema está no financiamento.

Até à crise do subprime, os promotores imobiliários financiavam-se, quase em exclusividade na banca, com o juro muito baixo. Durante a crise, os casos mais problemáticos de crédito malparado foram de promotoras imobiliárias e de empresas de construção civil.

A crise do subprime e posteriormente a crise das dívidas soberanas, levou a UE a criar novas regras bancárias, onde criou muitas restrições ao acesso ao crédito por parte das empresas. Essas novas regras, que limitou o acesso ao crédito, provocaram uma alteração no modelo de financiamento das promotoras imobiliárias. Em vez de se financiarem na banca, os promotores vendiam primeiro as casas, antes de as construir. As promotoras recebiam parte do dinheiro e com esse dinheiro, financiavam a obra.

O modelo funcionou até ao pós pandemia, a impressão de dinheiros por parte dos governos foi monstruosa, criando uma forte inflação. Essa inflação provocou uma forte subida de preço nos materiais de construção e na mão de obra. Como as promotoras venderam as casas anteriormente, o valor que venderam as casas não foi suficiente para cobrir os novos custos da construção. Este problema provocado pela inflação, não afetou apenas o imobiliário, mas sim toda a economia, foram milhares de obras, por todo o país que não foram concluídas, as empresas faliram.

Este problema de financiamento, afecta sobretudo o mercado imobiliário da classe média, onde o custo é mais controlado, onde as empresas têm uma menor margem de lucro, o mínimo erro pode provocar uma falência. Por esse motivo, mas empresas de construção estão a preferir construir, o imobiliário de luxo, onde a margem de lucro é superior, minimiza a margem de erro. Mas o grande problema, é que falta habitação para a classe média.

A inflação é um grande problema, gera muita instabilidade nas empresas, torna-se imprevisível fazer um orçamento. Se a inflação é um forte contribuidor para o problema da habitação em Portugal e em breve teremos mais uma emissão massiva de novo dinheiro, por parte do BCE, parece um problema sem solução. As empresas terão que arranjar um novo método de financiamento, ou adaptar-se à inflação. Uma coisa é quase certa, na próxima década vamos ter alta inflação, porque é a única maneira para evitar o colapso dos governos, devido às enormes dívidas soberanas.

Procura/demanda

A resolução do problema do aumento da oferta é tão complexo, os governos vão optar pelo caminho mais fácil e populista, atacar a procura.

Nos próximos anos, os governos vão aprovar medidas mais autoritárias e antidemocráticas para minimizar o problema. Medidas como impedir os estrangeiros ou não residentes de adquirirem casas, impostos muito altos para 2° habitação, para forçar a venda ou o arrendamento, os Airbnb também serão um alvo.

Em suma, quem tiver uma casa como reserva de valor, para fugir à inflação, será declarada persona non grata.

Fix the money, Fix the world!

-

@ dd664d5e:5633d319

2025-06-14 07:24:03

@ dd664d5e:5633d319

2025-06-14 07:24:03The importance of being lindy

I've been thinking about what Vitor said about #Amethyst living on extended time. And thinking. And doing a bit more thinking...

It's a valid point. Why does Amethyst (or, analog, #Damus) still exist? Why is it as popular as it is? Shouldn't they be quickly washed-away by power-funded corporate offerings or highly-polished, blackbox-coded apps?

Because a lot of people trust them to read the code, that's why. The same way that they trust Michael to read it and they trust me to test it. And, perhaps more importantly, they trust us to not deliver corrupted code. Intentionally, or inadvertently.

The developer's main job will not be coding the commit, it will be reviewing and approving the PR.

As AI -- which all developers now use, to some extent, if they are planning on remaining in the business -- becomes more efficient and effective at writing the code, the effort shifts to evaluating and curating what it writes. That makes software code a commodity, and commodities are rated according to brand.

Most of us don't want to make our own shampoo, for instance. Rather, we go to the store and select the brand that we're used to. We have learned, over the years, that this brand won't kill us and does the job we expect it to do. Offloading the decision of Which shampoo? to a brand is worth some of our time and money, which is why strong, reliable brands can charge a premium and are difficult to dislodge.

Even people, like myself, who can read the code from many common programming languages, do not have the time, energy, or interest to read through thousands of lines of Kotlin, Golang, or Typescript or -- God forbid -- C++, from repos we are not actively working on. And asking AI to analyze the code for you leaves you trusting the AI to have a conscience and be virtuous, and may you have fun with that.

The software is no longer the brand. The feature set alone isn't enough. And the manner in which it is written, or the tools it was written with, are largely irrelevant. The thing that matters most is Who approved this version?

The Era of Software Judges has arrived

And that has always been the thing that mattered most, really.

That's why software inertia is a real thing and that's why it's going to still be worth it to train up junior devs. Those devs will be trained up to be moral actors, specializing in reviewing and testing code and confirming its adherance to the project's ethical standards. Because those standards aren't universal; they're nuanced and edge cases will need to be carefully weighed and judged and evaluated and analysed. It will not be enough to add Don't be evil. to the command prompt and call it a day.

So, we shall need judges and advocates, and we must train them up, in the way they shall go.

-

@ 7f6db517:a4931eda

2025-06-16 08:01:56

@ 7f6db517:a4931eda

2025-06-16 08:01:56

@matt_odell don't you even dare not ask about nostr!

— Kukks (Andrew Camilleri) (@MrKukks) May 18, 2021

Nostr first hit my radar spring 2021: created by fellow bitcoiner and friend, fiatjaf, and released to the world as free open source software. I was fortunate to be able to host a conversation with him on Citadel Dispatch in those early days, capturing that moment in history forever. Since then, the protocol has seen explosive viral organic growth as individuals around the world have contributed their time and energy to build out the protocol and the surrounding ecosystem due to the clear need for better communication tools.

nostr is to twitter as bitcoin is to paypal

As an intro to nostr, let us start with a metaphor:

twitter is paypal - a centralized platform plagued by censorship but has the benefit of established network effects

nostr is bitcoin - an open protocol that is censorship resistant and robust but requires an organic adoption phase

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

- Anyone can run a relay.

- Anyone can interact with the protocol.

- Relays can choose which messages they want to relay.

- Users are identified by a simple public private key pair that they can generate themselves.Nostr is often compared to twitter since there are nostr clients that emulate twitter functionality and user interface but that is merely one application of the protocol. Nostr is so much more than a mere twitter competitor. Nostr clients and relays can transmit a wide variety of data and clients can choose how to display that information to users. The result is a revolution in communication with implications that are difficult for any of us to truly comprehend.

Similar to bitcoin, nostr is an open and permissionless protocol. No person, company, or government controls it. Anyone can iterate and build on top of nostr without permission. Together, bitcoin and nostr are incredibly complementary freedom tech tools: censorship resistant, permissionless, robust, and interoperable - money and speech protected by code and incentives, not laws.

As censorship throughout the world continues to escalate, freedom tech provides hope for individuals around the world who refuse to accept the status quo. This movement will succeed on the shoulders of those who choose to stand up and contribute. We will build our own path. A brighter path.

My Nostr Public Key: npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 08:01:56

@ 7f6db517:a4931eda

2025-06-16 08:01:56

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 39cc53c9:27168656

2025-06-15 13:49:52

@ 39cc53c9:27168656

2025-06-15 13:49:52Over the past few months, I've dedicated my time to a complete rewrite of the kycnot.me website. The technology stack remains unchanged; Golang paired with TailwindCSS. However, I've made some design choices in this iteration that I believe significantly enhance the site. Particularly to backend code.

UI Improvements

You'll notice a refreshed UI that retains the original concept but has some notable enhancements. The service list view is now more visually engaging, it displays additional information in a more aesthetically pleasing manner. Both filtering and searching functionalities have been optimized for speed and user experience.

Service pages have been also redesigned to highlight key information at the top, with the KYC Level box always accessible. The display of service attributes is now more visually intuitive.

The request form, especially the Captcha, has undergone substantial improvements. The new self-made Captcha is robust, addressing the reliability issues encountered with the previous version.

Terms of Service Summarizer

A significant upgrade is the Terms of Service summarizer/reviewer, now powered by AI (GPT-4-turbo). It efficiently condenses each service's ToS, extracting and presenting critical points, including any warnings. Summaries are updated monthly, processing over 40 ToS pages via the OpenAI API using a self-crafted and thoroughly tested prompt.

Nostr Comments

I've integrated a comment section for each service using Nostr. For guidance on using this feature, visit the dedicated how-to page.

Database

The backend database has transitioned to pocketbase, an open-source Golang backend that has been a pleasure to work with. I maintain an updated fork of the Golang SDK for pocketbase at pluja/pocketbase.

Scoring

The scoring algorithm has also been refined to be more fair. Despite I had considered its removal due to the complexity it adds (it is very difficult to design a fair scoring system), some users highlighted its value, so I kept it. The updated algorithm is available open source.

Listings

Each listing has been re-evaluated, and the ones that were no longer operational were removed. New additions are included, and the backlog of pending services will be addressed progressively, since I still have access to the old database.

API

The API now offers more comprehensive data. For more details, check here.

About Page

The About page has been restructured for brevity and clarity.

Other Changes

Extensive changes have been implemented in the server-side logic, since the whole code base was re-written from the ground up. I may discuss these in a future post, but for now, I consider the current version to be just a bit beyond beta, and additional updates are planned in the coming weeks.

-

@ 39cc53c9:27168656

2025-06-15 14:03:56

@ 39cc53c9:27168656

2025-06-15 14:03:56After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 7f6db517:a4931eda

2025-06-16 08:01:56

@ 7f6db517:a4931eda

2025-06-16 08:01:56

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-16 06:01:49

@ 9ca447d2:fbf5a36d

2025-06-16 06:01:49CANNES, FRANCE – May 2025 — Bitcoin mining made its mark at the world’s most prestigious film gathering this year as Puerto Rican director and producer Alana Mediavilla introduced her feature documentary Dirty Coin: The Bitcoin Mining Documentary at the Marché du Film during the Cannes Film Festival.

The film puts bitcoin mining at the center of a rising global conversation about energy, technology, and economic freedom.

Dirty Coin is the first feature-length documentary to explore bitcoin mining through immersive, on-the-ground case studies.

From rural towns in the United States to hydro-powered sites in Latin America and the Congo, the film follows miners and communities navigating what may be one of the most misunderstood technologies of our time.

The result is a human-centered look at how bitcoin mining is transforming local economies and energy infrastructure in real ways.

To mark its Cannes debut, Mediavilla and her team hosted a packed industry event that brought together leaders from both film and finance.

Dirty Coin debut ceremony at the Marché du Film

Sponsors Celestial Management, Sangha Renewables, Nordblock, and Paystand.org supported the program, which featured panels on mining, energy use, and decentralized infrastructure.

Attendees had the rare opportunity to engage directly with pioneers in the space. A special session in French led by Seb Gouspillou spotlighted mining efforts in the Congo’s Virunga region.

Dirty Coin builds on Mediavilla’s award-winning short film Stranded, which won over 20 international prizes, including Best Short Documentary at Cannes in 2024.

That success helped lay the foundation for the feature and positioned Mediavilla as one of the boldest new voices in global documentary filmmaking.

Alana Mediavilla speaks at the Marché du Film — Cannes Film Festival

“If we’ve found an industry that can unlock stranded energy and turn it into real power for people—especially in regions with energy poverty—why wouldn’t we look into it?” says Mediavilla. “Our privilege blinds us.

“The same thing we criticize could be the very thing that lifts the developing world to our standard of living. Ignoring that potential is a failure of imagination.”

Much like the decentralized network it explores, Dirty Coin is spreading globally through grassroots momentum.

Local leaders are hosting independent screenings around the world, from Roatán and Berlin to São Paulo and Madrid. Upcoming events include Toronto and Zurich, with more cities joining each month.

Mediavilla, who previously worked in creative leadership roles in the U.S. — including as a producer at Google — returned to Puerto Rico to found Campo Libre, a studio focused on high-caliber, globally relevant storytelling from the Caribbean.

She was also accepted into the Cannes Producers Network, a selective program open only to producers with box office releases in the past four years.

Mediavilla qualified after independently releasing Dirty Coin in theaters across Puerto Rico. Her participation in the network gave her direct access to meetings, insights, and connections with the most active distributors and producers working today.

The film’s next public screening will take place at the Anthem Film Festival in Palm Springs on Saturday, June 14 at 2 PM. Additional screenings and market appearances are planned throughout the year at Bitcoin events and international film platforms.

Dirty Coin at the Cannes Film Festival

Watch the Trailer + Access Press Materials

📂 EPK

🎬 Screener

🌍 Host a Screening

Follow the Movement

Instagram: https://www.instagram.com/dirty_coin_official/

Twitter: https://x.com/DirtyCoinDoc

Website: www.dirtycointhemovie.com -

@ 99556507:a6cf5c08

2025-06-16 08:01:53

@ 99556507:a6cf5c08

2025-06-16 08:01:53El paradigma del trabajador común aceptado en nuestra era es trabajar duro durante 40 años por un salario para tener derecho a una jubilación los últimos 20 o con suerte 25 años de vida.

Pero ¿es ésto lo más rentable? ¿Hay otras alternativas?

Vamos a ponernos en la piel de un asalariado o un autónomo que ha cotizado durante 30 años por la base máxima y está a una década todavía de poder jubilarse. ¿Le conviene trabajar esa década para tener derecho a la pensión estatal? ¿O es una estafa?

Hagamos números: La cotización máxima del autónomo o la del empresario a cuenta del trabajador hoy en día es de 1.472€/mes, 12 pagas al año, o 17.664€/año. En 10 años, y considerando una inflación del 4% anual, pagará 202.075€ en cotizaciones sociales.

El cotizante que haya pagado esto durante toda su vida laboral tiene derecho a la jubilación máxima, que hoy es de 3.267€/ mes, 14 pagas al año, o 45.746,40€/año. Si pensamos que la esperanza de vida en España es de 83 años y se tiene derecho a la jubilación a los 67, significa que un pensionista medio recibirá la pensión durante 16 años. Pero vamos a a hacer las cuentas para Matusalén, el pensionista pesadilla para el gobierno y las aseguradoras, que llegará a cumplir los 92 años, recibiendo la pensión durante 25 años.

Asumamos que el gobierno, que necesita imperiosamente los votos de los 7 millones de pensionistas, seguirá revalorizando las pensiones con el IPC oficial, es decir, a una media del 4% anual.

Matusalén se jubilará a los 67 y recibirá a lo largo de sus 25 años de pensionista la cantidad de 1.905.000€(1), de los cuales tendrá que pagar alrededor de un 28% de impuestos.

[(1) 45.746,40*(1-1,0425)/(1-1.04)] = 1.905.150

Es decir, Matusalén pagará 202.000€ en total a lo largo de 10 años para recibir 1.905.000€ distribuidos durante los siguientes 25. Parece un buen negocio, ¿no?

Pero, y si Matusalén, que es una persona cabal y ahorradora, ha ido haciendo una hucha durante sus 30 años de vida laboral a razón de 1000€ al mes, de manera que ahora ya dispone de esos 202.075€ necesarios para pagar sus cotizaciones hasta la edad de jubilación, y además le sobran 160.000€ para sus gastos la próxima década, a razón de 16.000€/año, que deberían de ser suficiente para vivir, puesto que esta cantidad es justo el salario mínimo interprofesional actual. ¿Le merece la pena seguir trabajando o puede plantearse dejar de hacerlo y usar esos ahorros para pagar sus cotizaciones de los siguientes 10 años, y tener derecho a la jubilación cuando cumpla 67 años?

O ya puestos a hacer cuentas, dado que tiene un capital disponible de 202.000€ en el banco, ¿podría pensar en alguna inversión alternativa que revalorizara su dinero de manera que mejorase las prestaciones de su jubilación (los 1.905.000€ calculados antes)?

Aquí es donde sale a jugar la fórmula del interés compuesto: Cf = Ci * (1+Rn), donde: Cf: capital final (queremos llegar a 1.905.000€) Ci: capital inicial (los 202.075€ de Matu) R: tasa de interés anual (CAGR) n: numero de años de la inversión (10)

¿Qué crecimiento anual compuesto (CAGR) necesitaría Matu para obtener el total de lo que nos daría su pensión tras 25 años, pero en tan solo 10 años, de manera que pudiera disponer de todo ese capital incluso antes de jubilarse? Haciendo las cuentas, R = (Cf/Ci-1)(1/n) = 23.09 %

Por si has llegado hasta aquí pero te has perdido por el camino, acabamos de concluir que una persona que invierta hoy 202.075€ en un producto que rente un 23,09% anual, obtendrá 1.905.000€ en 10 años, el equivalente a toda su jubilación.

Pues esto parece incluso mejor que la alternativa anterior, ¿no? Pero claro, hay que encontrar un producto que garantice esta rentabilidad sostenida durante una década. ¿Qué podría ser? A esta alturas, si sigues por aquí, ya habrás podido intuir por dónde van los tiros. Lo único que ha garantizado esta revalorización hasta la fecha es #bitcoin.

Éste el el cuadro del CAGR de Bitcoin tabulado por años. Se lee de la siguiente manera: A finales de 2024, la columna "CAGR 2024" da el CAGR (rendimiento anual compuesto) para la diferencia de años entre 2024 y el año de la cifra que estemos mirando. Por ejemplo, el CAGR a 31/12/2024 de una inversión realizada el 31/12/2023, es decir de 1 año, es del 276,92%. Si la inversión se realizó el 31/12/2016, el CAGR 8 años después, a final de 2024, es del 78,22% ANUAL

(Ver imagen 1)

El tío Matusalén está buscando algo que le dé un mínimo del 23,09% anual, ¿recordáis?. Pues da igual cuándo haya invertido y cuánto tiempo mantenga la inversión. BTC siempre supera ese umbral, por mucho.

"Ya Manolito, pero estás mirando rendimientos desde finales de 2024, cuando Bitcoin hizo un precio máximo histórico. Esto no asegura que haya ocurrido esto cada año, ¿no?"

El siguiente cuadro muestra los CAGR calculados a finales de cada año, los últimos 6 años. Las cifras El siguiente cuadro muestra los CAGR calculados a finales de cada año, los últimos 6 años. Las cifras en verde corresponden a los rendimientos de inversiones mantenidas 10 años. No podemos ir más para atrás porque Bitcoin acaba de cumplir 16 años. Las cifras en amarillo son inversiones mantenidas 5 años. El peor de los casos es elegir un período de 4 años para la inversión, y aún así el rendimiento medio en este intervalo de tiempo los últimos 6 períodos de 6 años es del 38,30%.

(ver imagen 2)

No es difícil comprobar que a 10 años vista, bitcoin siempre ha superado de largo la tasa de crecimiento del 23,09% necesaria para el caso de Matusalén.