-

@ 9ca447d2:fbf5a36d

2025-06-15 19:02:23

@ 9ca447d2:fbf5a36d

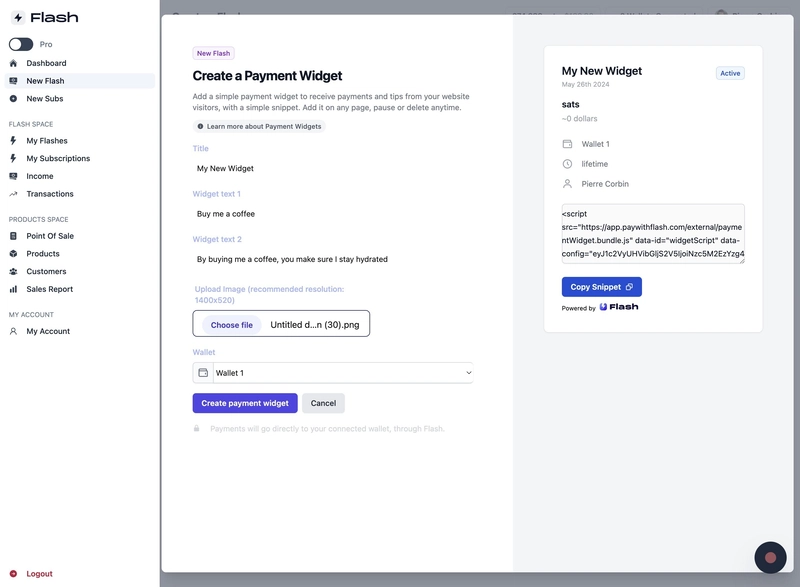

2025-06-15 19:02:23Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

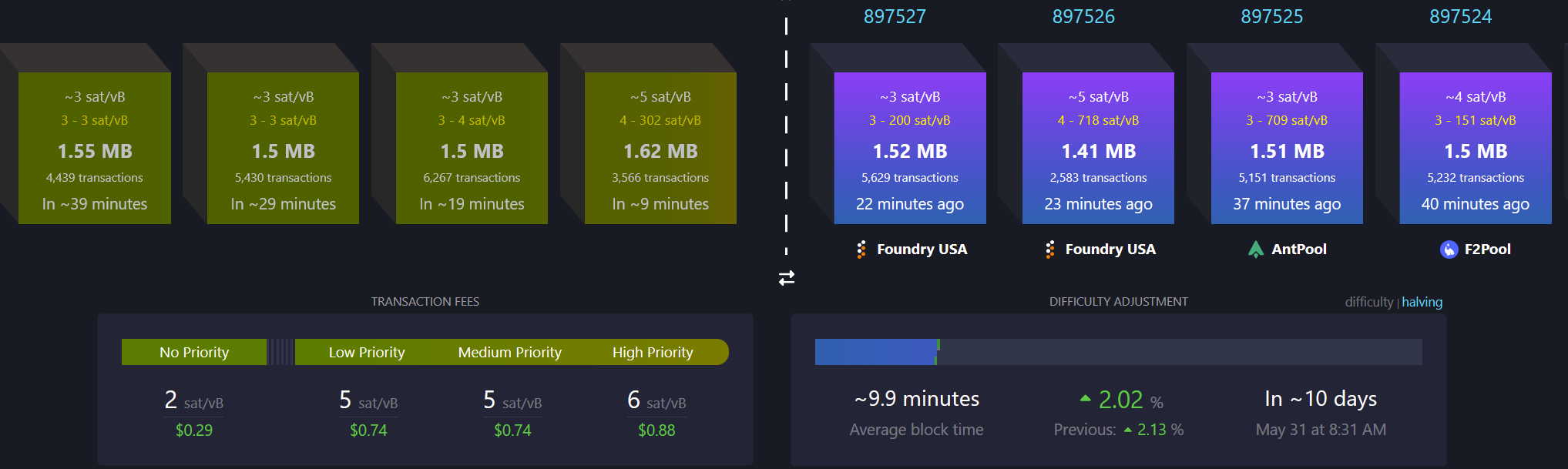

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ 7f6db517:a4931eda

2025-06-15 18:02:17

@ 7f6db517:a4931eda

2025-06-15 18:02:17

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-06-15 19:02:13

@ 9ca447d2:fbf5a36d

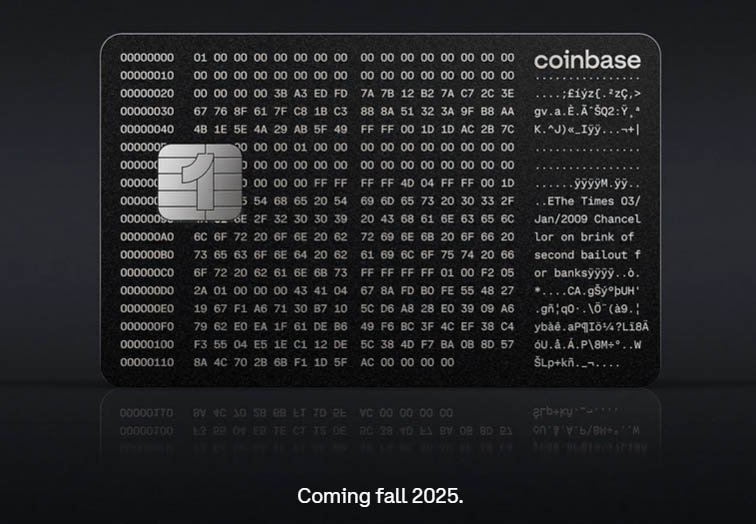

2025-06-15 19:02:13Coinbase is launching its first-ever credit card — the Coinbase One Card — with up to 4% back in bitcoin on everyday purchases.

The announcement was made at the 2025 State of Crypto Summit in New York and marks a big step towards making bitcoin more accessible and rewarding for everyday use.

The card is being released in partnership with American Express and will roll out in the U.S. this fall. It’s only available to Coinbase One members, the company’s growing subscription service.

“Whether you’re buying groceries or booking a trip, the Coinbase One Card lets you earn rewards in Bitcoin — making everyday spending more rewarding than ever,” Coinbase said in a blog post.

The Coinbase One Card lets you earn 2-4% back in bitcoin, depending on how much you have in assets on the Coinbase platform. All cardholders will start at 2%, but those with more assets can unlock higher cashback rates.

The card also has a metal design with text from Bitcoin’s original Genesis Block engraved on it, representing its connection to the birth of the scarce digital asset.

Coinbase One Card

The bitcoin rewards are a first for Coinbase, which previously only released a prepaid debit card with Visa in 2020. The new card is a shift from traditional digital asset trading tools to everyday financial products that integrate with the blockchain.

The card is on the American Express Network, which provides access to travel protections, exclusive offers, personalized experiences and the secure infrastructure of one of the most trusted brands in payments.

Will Stredwick, SVP of Global Network Services at American Express said:

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now.”

Luke Gebb, Executive Vice President of Amex Digital Labs added that Amex is committed to “practical, compliant applications” of the blockchain and Bitcoin technology.

The Coinbase One Card is issued by First Electronic Bank and offered through a partnership with fintech company Cardless. A waitlist is open now on Coinbase’s website and more info will be shared as the fall launch approaches.

To use the card, you need to be enrolled in Coinbase One, a subscription program launched in 2023. There are now two options:

- Standard Coinbase One: $29.99/month, with zero trading fees, priority customer support and enhanced staking rewards.

- Coinbase One Basic: $4.99/month or $49.99/year, to make it more affordable. Basic members also get the card and the same bitcoin rewards.

Both tiers get up to 4% bitcoin back, zero-fee trading on eligible assets (up to $500/month for Basic), and 4.5% APY on the first $10,000 in USDC holdings.

“Our customers are graduating from just creating [accounts] to now using Coinbase as a primary financial account,” said Max Branzburg, Coinbase’s VP of Product.

The Coinbase One Card launch comes as more digital asset platforms are entering the credit and debit card space. Rivals like Gemini have launched cards with similar cashback features and payments giants like Mastercard are exploring bitcoin integrations.

-

@ dfa02707:41ca50e3

2025-06-15 18:02:12

@ dfa02707:41ca50e3

2025-06-15 18:02:12Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ cae03c48:2a7d6671

2025-06-15 19:01:53

@ cae03c48:2a7d6671

2025-06-15 19:01:53Bitcoin Magazine

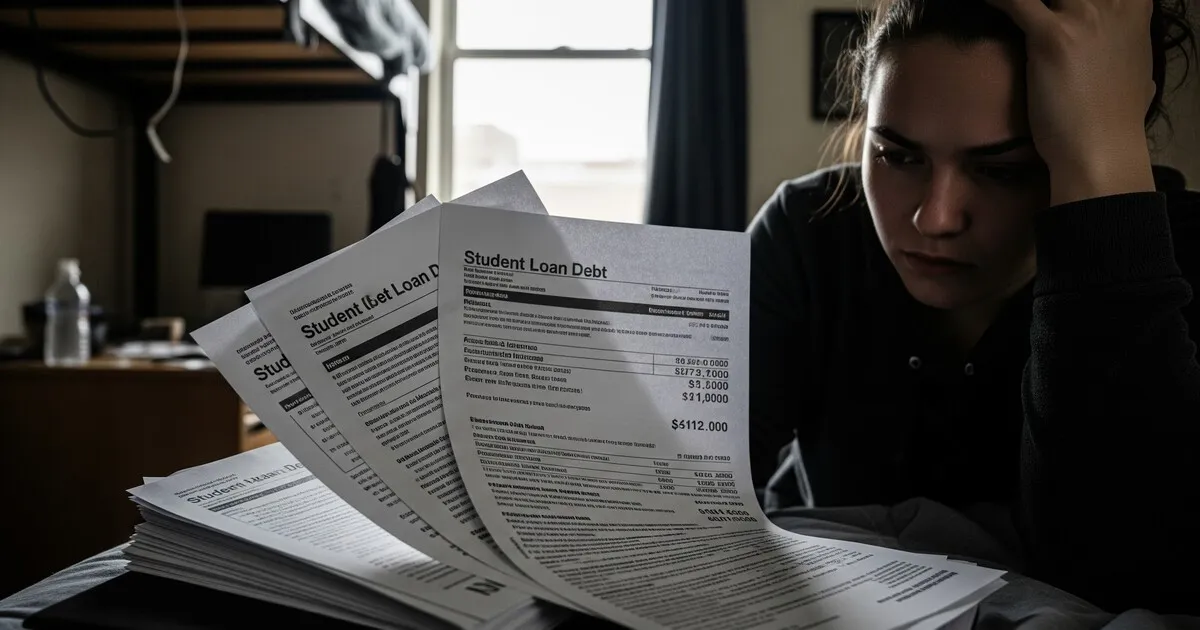

Bitcoin: How To Solve the Student Loan CrisisStudent loans continue to trouble millions of Americans, with a total of $1.77 trillion already owed. This crisis has been a major political issue for a while, especially after former President Biden promised to wipe out all of the student loan debt and ended up only fulfilling half of the promise. These billions of dollars are not just numbers on a spreadsheet; they represent people who repay their debt, every month, year in and year out. While the standard repayment plan spans 10 years, the reality is far more daunting: The average borrower takes 20-30 years to repay their loans.

There are over two million new undergraduates every year, and, on average, they graduate with $29,400 in debt. Some, like medical students, surpass $250,000 in debt — a mortgage-sized pile. Almost $100 billion in new debt is created every year, piled upon the already unsustainable student debt pile. Similar to how we have (haven’t) dealt with public pensions, instead of dismantling a failed system we keep feeding the machine and crushing people’s lives and dreams underneath its weight. But perhaps there’s a way for future generations to avoid this dreadful fate — by borrowing new ideas from similar fields.

Real Estate: The Store of Value (SoV) Since Nixon

The real estate market is another system that heavily relies on debt to keep functioning, and like student loans, it’s not working too well.

Real estate is a market where it’s completely normal to go 10x levered long on a single asset while putting all of your savings into it. Talk about idiosyncratic risk. The entire market has been in deep pain worldwide, not necessarily because of the debt, but due to how the fiat system has turned real estate into an investment-and-savings mechanism. In turn, the great investment of one generation becomes the unaffordable housing for the next. But a subset of the population has been divesting from the asset in favor of a better savings vehicle: bitcoin.

Part of their thesis in divesting from real estate and moving to bitcoin is that they predict that bitcoin’s superior SoV function will drive real estate prices down, wreaking havoc on a fragile and overpriced asset class. This makes quite a bit of sense, especially to those individuals who invested in real estate in search of those SoV properties in the first place; they now have to contend with increasing risk all over the world, putting in peril what was once a “safe SoV” asset class. From wildfires all over the place to floods, expropriations, new taxes, and wars breaking out in places previously unimaginable, some investors are just fed up.

But housing is still necessary, and we still need to build a massive amount of new houses. In almost all major cities in the world, there’s a housing crisis driven in large part by shortages. This is due to lackluster housing buildouts following the 2008 great financial crisis, driven directly by housing debt. Thus, even if all of the real estate owners put all of their stock of housing into the market, we would still have to develop and construct new ones. But it’s hard to convince real estate developers to do so when you also tell them that, in bitcoin terms, the houses they are building will be worth less by the time they sell them.

Bitcoin Replaces Real Estate

That’s where a German Bitcoiner and real estate developer named Leon Wankum steps in and turns the problem into a solution. You may even say he used financial jiu-jitsu because his idea is to bundle new, debt-heavy real estate projects with a bitcoin fund. This way, a $10 million project — of which $9 million is debt-financed — would allocate a small percentage of the financing to bitcoin, in order to hedge the depreciation and devaluation of the main asset and thereby benefit from the appreciation of bitcoin. This way, real estate developers can leverage the debt-heavy nature of the real estate market to cover the demand for housing while also hedging themselves from any SoV risk that bitcoin may pose to that asset.

This seemed like a crazy idea. Bitcoin and real estate: a super conservative mainstream infrastructure investment combined with a hyper-volatile digital savings vehicle — an unlikely marriage. Yet, polar opposites attract, and an idea is only crazy until someone replicates it and makes it work.

To everyone’s surprise, that’s exactly what happened last year, when Andrew Hohns of Newmarket Capital went on TV to announce they had started applying Wankum’s model to offer a loan to a real estate developer. They had provided financing for a real estate project with a few special conditions:

- the developer had to use a small proportion to buy bitcoin, which was placed in escrow.

- the bitcoin is inextricably tied with the real estate asset.

- and the bitcoin has to be held for four years minimum.

The experiment was off to the races. If the past serves as a guide, this new investment structure will greatly reduce the burden of the loan.

Bitcoin and Student Debts, Rescuing the Next Generation

At this point, the parallels to student loans should be pretty clear. When 18-year-olds take out a mortgage-sized loan to bet on their education, their future human capital is effectively becoming the real estate (collateral) that backs the debt. Their capacity to make extra income from the knowledge and certificates they acquired by going into debt will help them pay it off (given that all goes well). Investment margins become very sensitive and risk increases immensely when huge amounts of leverage are added to any investment — be it trading stocks, real estate, or your future. Your room for maneuvering decreases, and you get trapped in the path you choose.

Thus, if you yourself become the real estate securing this mortgage-sized student debt, perhaps you could also secure that loan and reduce the burden on the main asset (you) by integrating bitcoin into the mix. This could have great benefits for all parties involved: decreasing the risk for the lender and giving increased peace of mind and opportunities for the borrower (you, the student).

One of the main advantages of adding bitcoin to your student debt structure is that there are now two assets rowing against the financial repayment current: yourself and bitcoin. By going to university, learning new skills and getting certificates, you open up the path to better-paid jobs and higher earning potentials, aka higher salaries. The more intriguing component is the bitcoin tied to your student debts. As a teenager itself, bitcoin has had an incredible CAGR over its lifespan. Even conservative numbers indicate that bitcoin will return about 60% annually for the foreseeable future. When compared with the 10-15% usually provided by the S&P 500, bitcoin looks like a Ferrari competing against horses.

The other advantage is one that frustrates most students, and it has to do with acquiring bitcoin once they understand it. Unlike most adults, undergrads have barely had any time to build up savings, and are therefore unable to exchange much fiat for hard bitcoin. This can become incredibly frustrating, especially because you know that if you were a decade older, you could have aped into bitcoin and retired your entire bloodline. But now you are stuck being 16, saving up pennies, and sacrificing your younger years for trifling amounts of bitcoin that won’t make a difference in your lifetime. So close, yet so far away.

But what is debt if not a way to bring future purchasing power into the present? Debt is a time-traveling machine that allows people to buy assets by leveraging their future earnings, revenues, or salaries. And thankfully, the current system is created so that the moment you can legally go to jail or go to war, you can also indebt yourself up to your eyeballs with the promise of future wages as a doctor, engineer, lawyer, or another profession.

Funnily enough, bitcoin’s recommended minimum holding time is also the number of years for an average college degree — four years. This means that, as long as you create a similar structure as the one proposed by Newmarket Capital, where the bitcoin has a four-year holding period, you’ll be using financial jiu-jitsu. The four-year holding period, however, does not mean that the student needs to sell at that point. The question of how to manage your finances between repaying the student loans, selling the bitcoin, or acquiring more is a more complex and personal issue. Regardless of what any student does, with this hybrid method, student debts can help young Bitcoiners leap forward instead of taking a step back.

With this new method, students — and their families — now have another thing to celebrate when they walk onto the graduation stage. And if you drop out of school, for any set of reasons that life may hit you with, your student loan now comes with a fail-safe met

-

@ dfa02707:41ca50e3

2025-06-15 18:02:12

@ dfa02707:41ca50e3

2025-06-15 18:02:12Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ cae03c48:2a7d6671

2025-06-15 19:01:28

@ cae03c48:2a7d6671

2025-06-15 19:01:28Bitcoin Magazine

Where Could Bitcoin Peak This Cycle?With Bitcoin looking as bullish as ever, the inevitable question arises of how high could BTC realistically go in this market cycle? Here we’ll explore a wide range of on-chain valuation models and cycle timing tools to identify plausible price targets for a Bitcoin peak. Although prediction is never a substitute for disciplined data reaction, this analysis gives us frameworks to better understand where we are and where we might be heading.

Price Forecast Tools

The journey begins with Bitcoin Magazine Pro’s free Price Forecast Tools, which compile several historically accurate valuation models. While it’s always more effective to react to data rather than blindly predict prices, studying these metrics can still provide powerful context for market behavior. If macro, derivative, and on-chain data all start flashing warnings, it’s usually a solid time to take profit, regardless of whether a specific price target has been hit. Still, exploring these valuation tools is informative and can guide strategic decision-making when used alongside broader market analysis.

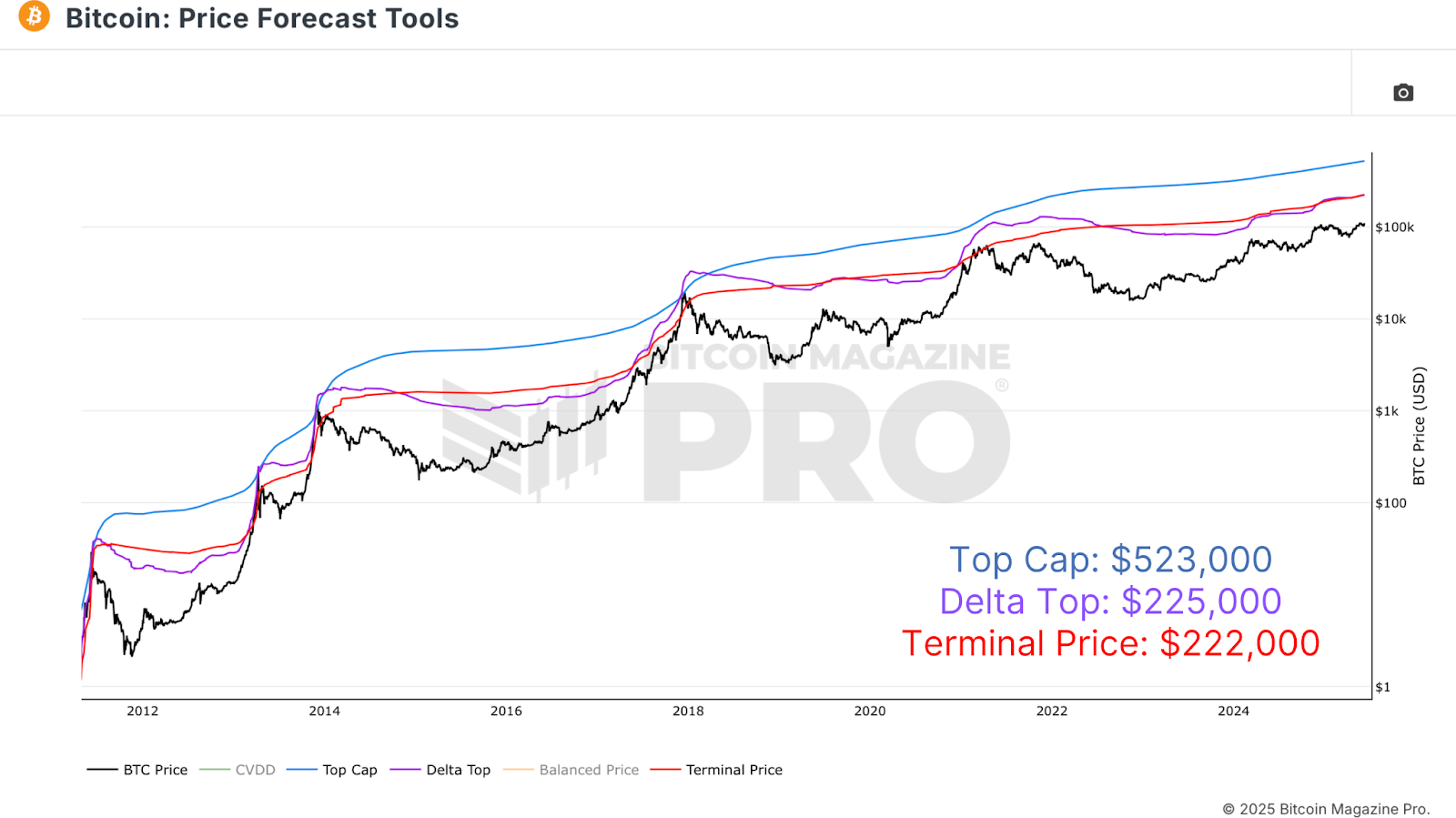

Figure 1: Applying Price Forecast Tools to calculate potential cycle tops. View Live Chart

Among the key models, the Top Cap multiplies the average cap over time by 35 to project peak valuations. It accurately forecasted 2017’s top, but missed the 2020–2021 cycle, estimating over $200k while Bitcoin peaked around $69k. It now targets over $500k, which feels increasingly unrealistic. A step further is the Delta Top, subtracting the average cap from the realized cap, based on the cost basis of all circulating BTC, to generate a more grounded projection. This model suggested an $80k–$100k top last cycle. The most consistently accurate, however, is the Terminal Price, based on Supply Adjusted Coin Days Destroyed, which has closely aligned with each prior peak, including the $64k top in 2021. Currently projecting around $221k, it could rise to $250k or more, and remains arguably the most credible model for forecasting macro Bitcoin tops. Of course, more information regarding all of these metrics and their calculation logic can be found beneath the charts on the site.

Peak Forecasting

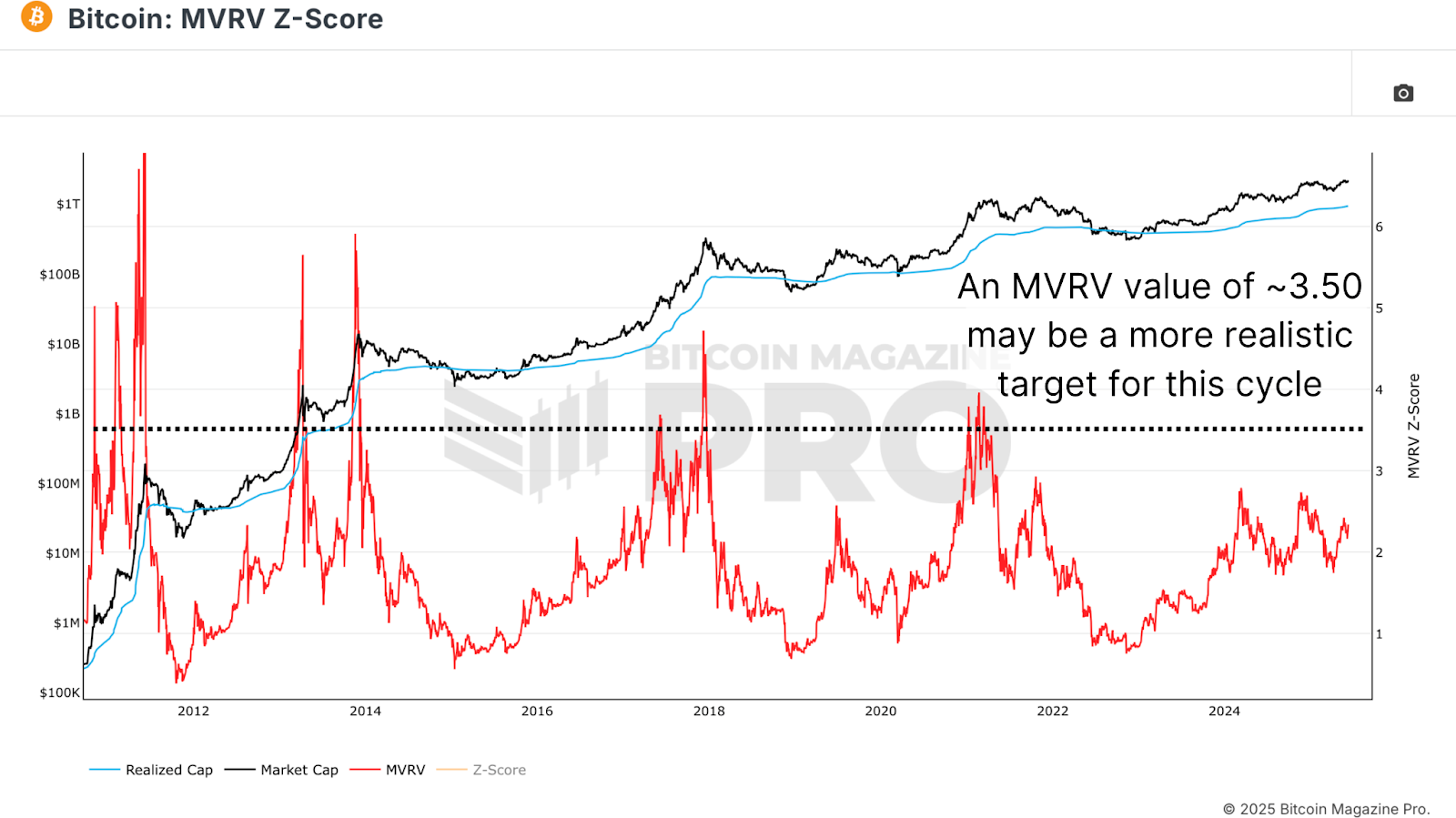

Another powerful metric is the MVRV ratio, which compares market cap to realized cap. It offers a psychological window into investor sentiment, typically peaking near a value of 4 in major cycles. The ratio currently sits at 2.34, suggesting there may still be room for significant upside. Historically, as MVRV nears 3.5 to 4, long-term holders begin to realize substantial gains, often signaling cycle maturity. However, with diminishing returns, we might not reach a full 4 this time around. Instead, using a more conservative estimate of 3.5, we can begin projecting more grounded peak values.

Figure 2: A view of the MVRV ratio predicts further cycle growth to reach historical 4+ and even more conservative 3.5 target values. View Live Chart

Calculating A Target

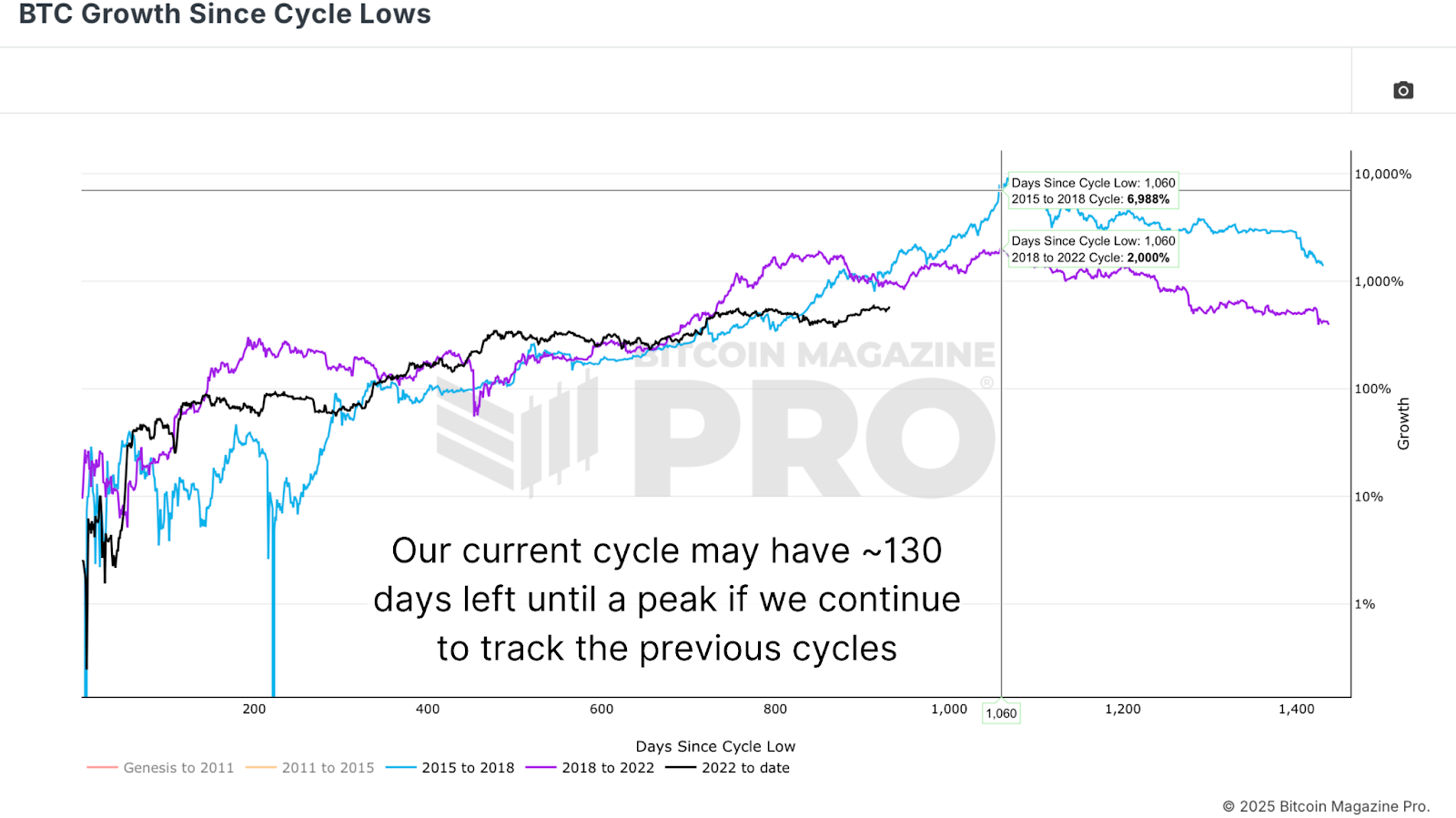

Timing is as important as valuation. Analysis of BTC Growth Since Cycle Lows illustrates that previous Bitcoin cycles peaked almost exactly 1,060 days from their respective lows. Currently, we are about 930 days into this cycle. If the pattern holds, we can estimate the peak may arrive in roughly 130 days. Historical FOMO-driven price increases often happen late in the cycle, causing Realized Price, a proxy for average investor cost basis, to rise rapidly. For instance, in the final 130 days of the 2017 cycle, realized price grew 260%. In 2021, it increased by 130%. If we assume a further halving of growth due to diminishing returns, a 65% rise from the current $47k realized price brings us to around $78k by October 18.

Figure 3: Based on the peak rate of previous cycles, this cycle is far from over. View Live Chart

With a projected $78k realized price and a conservative MVRV target of 3.5, we arrive at a potential Bitcoin price peak of $273,000. While that may feel ambitious, historical parabolic blowoff tops have shown that such moves can happen in weeks, not months. While it may seem more realistic to expect a peak closer to $150k to $200k, the math and on-chain evidence suggest that a higher valuation is at least within the realm of possibility. It’s also worth noting that these models dynamically adjust, and if late-cycle euphoria kicks in, projections could quickly accelerate further.

Figure 4: Combining projected realized price and a possible MVRV target to predict this cycle’s peak.

Conclusion

Forecasting Bitcoin’s exact peak is inherently uncertain, with too many variables to account for. What we can do is position ourselves with probabilistic frameworks grounded in historical precedent and on-chain data. Tools like the MVRV ratio, Terminal Price, and Delta Top have repeatedly demonstrated their value in anticipating market exhaustion. While a $273,000 target might seem optimistic, it is rooted in past patterns, current network behavior, and cycle-timing logic. Ultimately, the best strategy is to react to data, not rigid price levels. Use these tools to inform your thesis, but stay nimble enough to take profits when the broader ecosystem starts signaling the top.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Where Could Bitcoin Peak This Cycle? first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ cae03c48:2a7d6671

2025-06-15 19:01:24

@ cae03c48:2a7d6671

2025-06-15 19:01:24Bitcoin Magazine

JPMorgan Reports Record Profits for Bitcoin Miners in Q1Bitcoin mining companies in the U.S. have kicked off 2025 with record performance, according to a recent report. The first quarter of the year was “one of Bitcoin miners’ best quarters to date,” analysts Reginald Smith and Charles Pearce stated.

JUST IN:

JPMorgan reported Q1 2025 was one of the best periods on record for publicly traded bitcoin mining companies

JPMorgan reported Q1 2025 was one of the best periods on record for publicly traded bitcoin mining companies  pic.twitter.com/gs9fGiTbZV

pic.twitter.com/gs9fGiTbZV— Bitcoin Magazine (@BitcoinMagazine) June 13, 2025

“Four of the five operators in our coverage reported record revenue and profits,” the report stated, underscoring the sector’s impressive rebound in profitability amid continued institutional adoption and high bitcoin prices, currently hovering around $105,462.87.

In total, U.S.-listed miners brought in $2.0 billion in gross profit during Q1 2025, with average gross margins reaching 53%—a jump from $1.7 billion and 50% in the previous quarter.

MARA Holdings (MARA) once again led the pack in Bitcoin production, mining the most BTC for the ninth consecutive quarter. However, despite its output dominance, MARA also posted the highest cost per coin, estimated at $72,600, JPMorgan noted.

On the profitability front, IREN (IREN) was the standout performer. For the first time, IREN earned the most gross profit among the tracked firms. The company also reported the lowest all-in cash cost per Bitcoin, around $36,400, helping to boost margins significantly.

CleanSpark (CLSK), another major player, did not raise any equity in the quarter—one of the more capital-disciplined moves seen among its peers. In fact, JPMorgan reported that the five miners it tracks issued only $310 million in equity for Q1, marking a steep decline from $1.3 billion in Q4 2024.

On the operational expense side, miners spent an estimated $1.8 billion on power, up $50 million from the previous quarter—demonstrating the energy-intensive nature of mining.

JPMorgan’s outlook on the industry remains bullish for select players. The bank maintains overweight ratings for CleanSpark, IREN, and Riot Platforms (RIOT), while assigning neutral ratings to Cipher Mining (CIFR) and MARA.

As profitability surges and strategic spending remains in check, 2025 may very well be remembered as a turning point in mining economics—especially for companies navigating cost discipline and scaling production.

This post JPMorgan Reports Record Profits for Bitcoin Miners in Q1 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-15 19:01:21

@ cae03c48:2a7d6671

2025-06-15 19:01:21Bitcoin Magazine

UK Gold Mining Company Bluebird to Convert Gold Revenues into BitcoinBluebird Mining Ventures Ltd., a pan Asian gold project development company, recently announced a major strategic shift. It plans to convert future revenues from its gold mining projects into bitcoin and adopt bitcoin as a treasury reserve asset.

Strategy shift to covert gold into digital gold – #bitcoin #goldmining #goldequities #investinbitcoin #investingold

"Combining income streams from gold mining projects and recycling these revenues into a proactive "Bitcoin in Treasury" management approach, whilst maintaining a… pic.twitter.com/BpJA6hFU9Y— Bluebird Mining Ventures Ltd (LSE:BMV.L) (@bluebirdIR) June 5, 2025

“By adopting a ‘gold plus a digital gold’ strategy, it offers the Company an opportunity to turn the page and look to the future and seek to attract a new type of shareholder,” said the Executive Director and CEO of Bluebird Aidan Bishop. “Under the leadership of a new CEO, once identified, it is my sincere hope that Bluebird will finally realise its ambitions for which it was initially established for.”

The announcement comes as Bluebird progresses towards a key agreement on its flagship Philippine project. The company expects to finalize a deal in the coming weeks that will grant it a net profit interest throughout the life of the mine, with no ongoing capital costs. The company said it believes bitcoin offers a modern alternative to traditional store of value assets like gold.

“I am very pleased with the progress of discussions in the Philippines which are looking very positive and will enable, if successfully completed, Bluebird to maintain an ongoing exposure with zero future cash commitments,” stated Bishop.

Bluebird plans to recycle revenues from its mining operations directly into bitcoin, aligning with what they describe as an innovative treasury approach. The company cited bitcoin’s fixed supply of 21 million, increasing global adoption, and role as a hedge against inflation and monetary instability as key reasons for its decision.

“Combining income streams from gold mining projects and recycling these revenues into a proactive ‘Bitcoin in Treasury’ management approach…” the company said. “Companies that have adopted bitcoin into their treasury strategy globally across public markets have been enjoying significant investor interest as well as substantial premiums to Net Asset Value (NAV) that have challenged traditional financial metrics as a basis of valuation.”

To lead this new phase, Bluebird is actively searching for a new CEO with experience in digital assets.

“On a personal level, I embarked some time ago on a journey to understand and learn about bitcoin,” added Bishop. “I am convinced that we are witnessing a tectonic shift in global markets and that bitcoin will reshape the landscape of financial markets on every level.”

This post UK Gold Mining Company Bluebird to Convert Gold Revenues into Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-15 19:01:19

@ cae03c48:2a7d6671

2025-06-15 19:01:19Bitcoin Magazine

The 30,000-Foot View of the Oslo Freedom ForumAs I step onto the plane leaving Gardermoen Airport in Oslo, Norway, the weight and warmth of the past week settles into my chest.

The Oslo Freedom Forum is not a conference. It’s not a summit. It’s something harder to name and even harder to describe — a convergence of courage, truth and defiance that burns through the noise of the modern world and gives you no choice but to listen, feel and act.

For the second time, I leave this city more convinced than ever that something unstoppable is rising. That amid the censorship, surveillance and state repression spreading across the globe, there is a countervailing force rooted in humanity, accelerated by technology and led by those who’ve already paid the price for speaking out.

The Forum doesn’t trade in empty optimism. It delivers a different kind of hope, forged from lived experience and stitched together by people who have been in the dark and still choose to see the light. A hope borne from the stories of individuals who have lived through the worst an authoritarian regime can do and still choose to fight for the freedom of others. The experiences shared were hard. At times, devastating. But they weren’t offered for pity. They were calls to action.

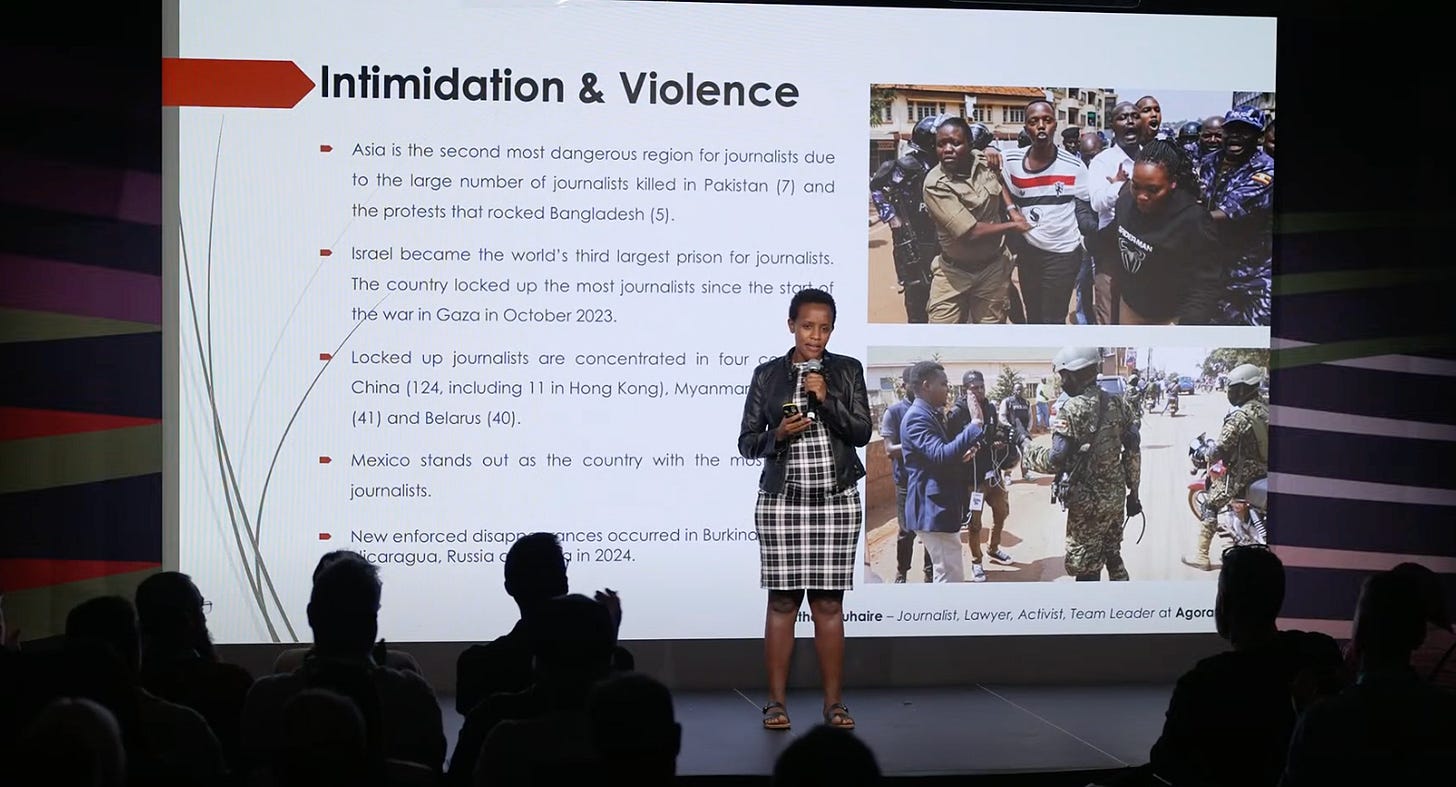

Just days after she was abducted, blindfolded, tortured, and sexually assaulted in a Tanzanian prison cell, Agather Atuhaire stood in front of a crowd of strangers and told her story.

Her voice did not tremble.

The Ugandan journalist and lawyer had traveled to Tanzania in solidarity with fellow East African dissidents, only to be disappeared in a black van alongside Kenyan activist Boniface Mwangi.

And yet, against all odds, she came back. Not just to her home in Uganda, but also to the stage in Oslo, where she spoke calmly and clearly about what it means to tell the truth under a dictatorship.

Her presentation, “The Digital Free Speech Crackdown in Uganda,” laid bare the authoritarian playbook: social media blackouts, propaganda campaigns, surveillance of journalists and the slow financial asphyxiation of independent media. When the government doesn’t like a story, it simply blocks the platform or website. When a journalist digs too deep, they disappear for a while. Or forever. Atuhaire painted a picture many struggle to even imagine.

And yet, after everything, she didn’t just recount these struggles. She looked out at the crowd and thanked the open source builders and contributors who write code and create tools that make it possible for activists like her to speak, move money and organize under regimes that want them silenced, or worse.

(Ugandan journalist and lawyer, Agather Atuhaire, speaks during the Freedom Tech track at the 2025 Oslo Freedom Forum.)

From Iran, independent Bitcoin educator Ziya Sadr reminded us that financial privacy is not a luxury but a necessary lifeline for those facing the financial repression by oppressive rulers. Sadr’s detainment during the 2022 Women, Life, Freedom movement following the murder of Mahsa Amini by the Iranian regime is a testament to that. Without financial privacy, activists’ actions, connections and finances are exposed to a regime equipped with widespread financial controls and a sophisticated, restrictive internet firewall that rivals even China’s.

The result is one of the most repressive digital environments in the world. And if that wasn’t enough, the Iranian rial currency has lost more than 80% of its value in just a few years.

Against this backdrop, Iranians are using bitcoin as undebasable savings, and to buy digital services like VPNs in order to access the open internet. But even that act, just reaching the outside world, requires a level of privacy most of us take for granted.

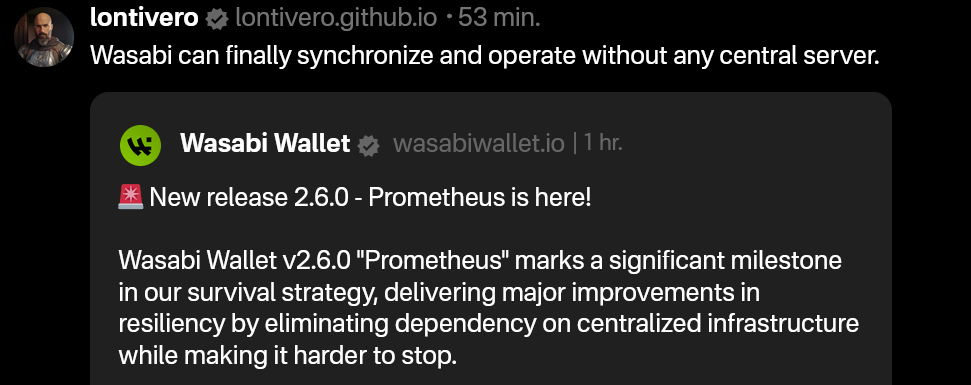

In his presentation, “Securing Lifelines: The Bitcoin Privacy Imperative,” Sadr shared that many Iranians turn to Bitcoin Coinjoins, a privacy technique that breaks the link between Bitcoin transaction inputs. Coinjoins preserve user transaction privacy and, more importantly, shield Iranians from the surveillance and retaliation of a regime who punishes anyone trying to access information beyond its tightly controlled digital spaces. The use of Coinjoins is becoming more difficult as global legal pressure mounts against open source developers, and in the aftermath of the Samourai developer arrests, privacy protocols like Whirlpool are unworkable.

Today, Sadr is learning more about additional Bitcoin privacy tools, including Payjoin, a privacy method that allows two users to contribute an input to a Bitcoin transaction. Payjoin breaks common chain analysis heuristics and conceals the sender and receiver of a transaction as well as the payment amount. Then there is ecash, a form of digital cash backed by Bitcoin that enables very private, everyday payments with the custodial trade-off of trusting mints (entities that issue and redeem ecash tokens) to store user funds.

The continued development of these protocols is crucial for Iranians, who live under a government that not only tracks and surveils digital behavior, but also imposes automatic fines on women for violating hijab rules and manipulates currency exchange rates to profit off citizens’ savings. For millions in Iran, bitcoin offers a last line of defense against a collapsing currency, intrusive surveillance and total financial repression.

(Independent Iranian Bitcoin educator, Ziya Sadr, speaks during the Freedom Tech track at the Oslo Freedom Forum.)

Venezuelan opposition leader Leopoldo López took the stage at the 2025 Oslo Freedom Forum not as a politician, but as a witness to what happens when a state turns its institutions into further tendrils of its repression machine.

After Nicolás Maduro stole Venezuela’s 2024 elections, López watched thousands of his fellow people — activists, students, journalists, opposition members and lawyers — get arrested, disappeared or forced into exile. The regime blocked access to social media, revoked passports, criminalized dissent and used the financial system as a means of controlling the population.

Amid this digital repression and Venezuela’s 162% inflation rate, López sees bitcoin (decentralized money) and Nostr (decentralized social media) as lifelines. When dictators shut down the internet or freeze your bank account, alternatives that are open source, decentralized, uncensorable and accessible become more important than ever for the survival of democracy and freedom.

**“Decentralized resistance is the convergence of people, Bitcoin, Nostr, and AI.

People, it’s about the center and the end of what we are doing.

Brave women and men who sacrifice their freedom, who take risks, who are willing to fight for other people.

If it’s not about people, technology wouldn’t be something worth fighting for.

Bitcoin is freedom money. It’s decentralized, nobody controls it, nobody can stop it, it can move around without borders.”**

(Venezuelan Opposition Leader Leopoldo López during the Freedom Tech track at the 2025 Oslo Freedom Forum.)

For decades, Paraguay’s greatest natural resource, hydroelectric power, has flowed out of the country through international contracts, fueling development in neighboring countries like Brazil and Argentina while one in four Paraguayans remained trapped in poverty. Paraguay’s Itaipu Dam, one of the largest in the world, has long symbolized this paradox: a river of energy diverted away from the very people who need it most.

Björn Schmidtke and Delia Garcete of Penguin Group are flipping that script.

In a landmark move, they secured Paraguay’s first 100-megawatt power purchase agreement, marking the beginning of a bold experiment to reclaim that energy for the people of Paraguay. Instead of selling it off to foreign powers, they use it to mine Bitcoin — and the proc

-

@ cae03c48:2a7d6671

2025-06-15 19:01:14

@ cae03c48:2a7d6671

2025-06-15 19:01:14Bitcoin Magazine

Pakistan’s Strategic Bitcoin Reserve: A Step Toward Orange-Pilling a Nation?Pakistan’s relationship with Bitcoin has been marked by inconsistency and confusion over the past few years. Initially, the country outright banned bitcoin trading in 2018, citing concerns over fraud, money laundering and lack of regulation. However, over time, their stance softened and regulators began exploring the technology behind Bitcoin with courts even questioning the legality of the ban. Eventually, citizens were allowed to hold bitcoin, though trading remained murky and unregulated. This back-and-forth approach has created a confusing environment, where Bitcoin exists in a legal gray area. It is technically allowed, yet not fully embraced or regulated, reflecting the state’s struggle to balance innovation with control.

PAKISTAN TO ESTABLISH NATIONAL STRATEGIC #BITCOIN RESERVE

PAKISTAN TO ESTABLISH NATIONAL STRATEGIC #BITCOIN RESERVE Honored to have had the Pakistan Minister Bilal Bin Saqib at the Bitcoin Conference

pic.twitter.com/7WunP5fuZm

pic.twitter.com/7WunP5fuZm— The Bitcoin Conference (@TheBitcoinConf) May 29, 2025

This muddled relationship with Bitcoin seems to have turned a corner in recent weeks as Bilal Bin Saqib, head of the Pakistan Crypto Council, at the Bitcoin 2025 Conference in Las Vegas announced that the country is moving to establish a strategic Bitcoin reserve. Furthermore, he announced the allocation of 2,000 megawatts of excess energy to Bitcoin mining and high-performance computer data centers. The Ministry of Finance has also commissioned the establishment of an entirely new agency to oversee digital asset regulation which could lead to a less opaque legal framework around bitcoin ownership and usage in everyday transactions.

Critics have argued that this is merely an attempt by Pakistan to cozy up to Trump in the aftermath of the recent skirmish with India. After all, Saqib did state that Pakistan was inspired by the Trump administration when he spoke at the recent Las Vegas Bitcoin conference. Others have asserted that Pakistan is merely seeking to build resistance to possible sanctions in the future over its support for terrorist groups. I believe that such a geopolitically focused critique overlooks a deeper economic reality that has been staring Pakistan in the face for many years.

I wrote an article for a Pakistani newspaper about a year ago in which I argued that the country is uniquely situated, in economic terms, to take advantage of Bitcoin and unlock the benefits that come with adoption. Pakistan suffers from rampant inflation, stagnant capital formation, depleted foreign reserves, an inefficient bureaucracy and an overreliance on remittances from abroad. These systemic issues have eroded citizens’ faith in traditional financial systems, leaving many Pakistanis disillusioned and seeking alternative means to safeguard their wealth and economic autonomy.

Thus, nurturing a culture of Bitcoin adoption could go a long way toward alleviating much of these economic ills and empowering citizens to take control of their financial future. By earning and trading a form of currency that is deflationary in nature, Pakistanis can protect themselves from the downsides of the macroeconomic trends that have decimated the living standards of this once proud nation. Bitcoin adoption could transform the country’s lively remittance sector, with receivers keeping more of the money they are sent. It could also emancipate people from the inefficient banking system that is such a drain on the people. Permissionless transactions could also empower the beleaguered minorities who often struggle to achieve financial freedom.

The announcement of a strategic Bitcoin reserve, as well as promises to introduce pro-Bitcoin regulation and a mining strategy, are steps in the right direction. They show that the mood is shifting and the country is starting to take a serious look at the only real digital currency in town. These steps also point to a much broader, global shift in attitudes toward Bitcoin — especially in nations where hyperinflation is a daily reality and the banking system struggles to meet citizens’ needs.

However, real change will only come when Pakistan fully legalizes bitcoin as a digital currency and takes steps toward mass adoption. Only then will ordinary Pakistani citizens be free to trade with people from all over the world without the need to rely on the local banking system. Only then will financial autonomy become an achievable goal for those living far away from the big cities where banks are based. Only then will women be free to earn, store and transact in a digital currency that is resistant to cultural barriers.

Creating a national strategic reserve merely signals that a nation believes in bitcoin as an asset with the potential to offer a reliable return. It does not signal that a nation has adopted the digital currency as a means to overcome the obstacles imposed by fiat. Strategic national reserves also hoard bitcoin and bring it too close to the state, even though the digital currency was designed to be a hedge against state-controlled money. As such, a reserve does not unlock the true potential of bitcoin to act as a buffer against domestic inflation, currency devaluation and a cumbersome banking system.

A strategic Bitcoin reserve is a step in the right direction for Pakistan, as it would be for any nation that suffers from hyperinflation. But only mass adoption will truly unlock the immense potential Bitcoin can offer to a nation such as Pakistan and we have a long way to go before that becomes a reality.

In my view, strategic reserves are not what bitcoin is all about, but let’s hope this is merely the first step in a long and prosperous journey toward orange-pilling a nation.

This post Pakistan’s Strategic Bitcoin Reserve: A Step Toward Orange-Pilling a Nation? first appeared on Bitcoin Magazine and is written by Ghaffar Hussain.

-

@ eb0157af:77ab6c55

2025-06-15 19:02:32

@ eb0157af:77ab6c55

2025-06-15 19:02:32Treasury Secretary Bessent foresees a promising future for stablecoins pegged to the US dollar.

During a US Senate hearing held on June 11, Treasury Secretary Scott Bessent confirmed that the market for US dollar-backed stablecoins has the potential to surpass the $2 trillion mark within the next three years.

“I believe that stablecoin legislation backed by U.S. treasuries or T-bills will create a market that will expand U.S. dollar usage via these stablecoins all around the world,” the government official stated.

Bessent reiterated the administration’s commitment to strengthening the dollar’s status through USD-denominated stablecoins.

GENIUS Act gains ground

The legislative process received a boost after the Senate voted to advance the stablecoin bill, moving it closer to a final vote. The GENIUS Act, once approved, will establish strict requirements for the stable digital currency sector.

The bill mandates that stablecoins must be fully backed by US dollars or assets with equivalent liquidity (Treasuries). It also requires annual audits for issuers with a market capitalization exceeding $50 billion and includes specific provisions regarding the issuance of these cryptocurrencies abroad.

Stablecoins and the financial system

The stablecoin sector is drawing increasing interest from banking institutions. Bank of America is preparing to launch its own stablecoin, while Circle — issuer of USDC — went public this month, with shares surging 235% on its first trading day.

Currently, US dollar-pegged stablecoins account for over 96% of the entire stable digital currency market.

The post Stablecoins: market could reach $2 trillion by 2028, says Bessent appeared first on Atlas21.

-

@ dfa02707:41ca50e3

2025-06-15 18:02:11

@ dfa02707:41ca50e3

2025-06-15 18:02:11Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

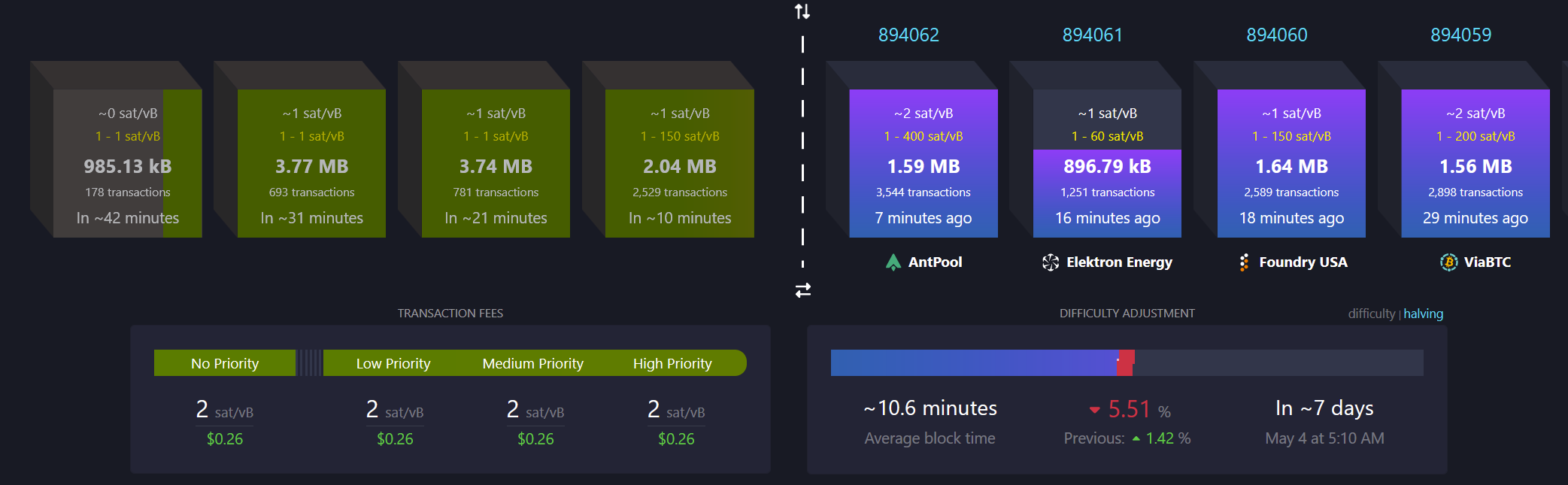

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ eb0157af:77ab6c55

2025-06-15 19:02:31

@ eb0157af:77ab6c55

2025-06-15 19:02:31Lightspark introduces a layer 2 for instant payments, stablecoins and interoperability with Lightning.

Spark is an open-source layer 2 protocol developed by Lightspark, designed to offer instant low-cost payments without the need for intermediaries. It allows the creation of wallets and applications that interact directly with the Bitcoin and Lightning networks. The company’s stated goal is to transform Bitcoin into a true global digital currency, solving the scalability limitations of the base layer.

Lightspark, a company led by David Marcus (former PayPal and former Facebook), officially launched Spark in beta version on April 29, 2025. Developers can already use Spark’s SDKs (Wallet and Issuer) to build self-custodial wallets compatible with Lightning and tokens (such as stablecoins) native to the Bitcoin network.

How it works

Spark adopts a statechain-based approach, allowing the transfer of ownership of a UTXO off-chain between different users without using the main blockchain, thus reducing costs and transaction times. Instead of executing an on-chain transaction that physically moves the asset, users acquire signing rights or control over a key that represents a bitcoin UTXO. Transfers occur through a chain of signatures and a mechanism that allows subsequent transactions to overwrite previous ones, ensuring that neither the user nor the service provider (Spark Service Provider, SSP) can lose funds during the operation.

Spark is designed to be fully interoperable with LN, supporting not only bitcoin transactions, but also stablecoins and other tokenized assets. SSPs facilitate Lightning payments by accepting funds on Spark and converting them into Lightning transactions or vice versa, eliminating the need for users to manage nodes or worry about channel liquidity. For example, a user can pay an LN invoice with a stablecoin on Spark, with the SSP converting the stablecoin to BTC in the background and sending the funds to the recipient.

Shared signature model (multisig 2-of-2)

Unlike the LN trust model, which is based on peer-to-peer bidirectional channels with smart contract logic, Spark involves a coordinating entity, the “Spark Service Provider” (SSP). This shifts part of the risk from channel liquidity management to trust in operators who sign off-chain transactions. The SSP’s task is to sign “blindly” (blindly) on behalf of the user, which means the SSP does not see the content of the signature and does not even know if it is signing a Bitcoin transaction or something else.

Bitcoin deposited on Spark always remains under the user’s control. When a user sends funds to Spark, they are initially transferred to a statechain. Once funds are on the statechain, payments on the Spark network occur instantly and at near-zero costs.

At the heart of Spark’s security is the use of a shared signature scheme, specifically a multisig 2-of-2 model. This means that two keys are required to authorize a transaction, and the user always holds one. When users deposit funds on Spark, they send them to a multisig address. Here, they maintain control of their funds and can perform a unilateral exit without the need to interact with other parties.

Each payment is enabled by a Spark Service Provider (SSP), which must co-authorize the transaction together with the user for it to be valid and successful.

Although the network is currently managed only by Lightspark and another operator (Flashnet), users do not risk losing funds even if these operators stopped cooperating. In fact, Spark offers the possibility to unilaterally force the return of bitcoin to the mainnet at any time. Users can exit Spark in two ways: through a cooperative exit (cheaper and faster) or a unilateral exit (slower, but possible in case of malfunction or loss of trust). Lightspark has declared its intention to add more operators in the future to increase decentralization.

Fee structure

Regarding fees, transactions within the Spark network are zero fee. The only fees users will have to bear are Bitcoin’s on-chain fees for depositing or withdrawing funds from Spark. Additionally, transferring bitcoin from Spark to LN involves a 0.25% fee plus routing fees. Conversely, a transaction from LN to Spark costs 0.15%.

The native LRC20 token protocol

Introduced in the summer of 2024, LRC20 is a token issuance protocol designed to be compatible with both Bitcoin’s mainnet and LN. Anyone can issue an LRC20 token. The protocol also supports freeze and burn operations, giving the original issuing wallet the power to freeze tokens at any address, preventing transactions until unlocked. LRC20 is primarily designed for issuing stablecoins and regulated assets.

After thoroughly testing it, the Lightspark team decided to run the LRC20 protocol natively on Spark, to enable token issuance on the network.

Ecosystem and partnerships

The birth of Spark has immediately attracted the interest of other Bitcoin projects. Among the various partnerships established, the multisig wallet Theya has integrated Spark to offer its users simpler and faster bitcoin and stablecoin payments.

Last May, Breez announced a new implementation of the Breez SDK based on Spark, which allows developers to integrate Lightning payments directly into their apps through Spark. As part of this collaboration, Breez will also act as a Spark Service Provider, helping to expand the ecosystem. According to the two companies, this partnership will provide developers with new Bitcoin-native tools for use cases such as streaming payments, international remittances and micro-payments for AI.

The post Spark: the layer 2 launched by Lightspark appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-15 19:01:04

@ cae03c48:2a7d6671

2025-06-15 19:01:04Bitcoin Magazine

Bitcoin Layer 2: StatechainsStatechains are an original second layer protocol originally developed by Ruben Somsen in 2018, depending on the eltoo (or LN Symmetry) proposal. In 2021 a variation of the original proposal, Mercury, was built by CommerceBlock. In 2024, a further iteration of the original Mercury scheme was built, Mercury Layer.

The Statechain protocol is a bit more complicated to discuss compared to other systems such as Ark or Lightning because of the range of variations that are possible between the original proposed design, the two that have been actually implemented, and other possible designs that have been loosely proposed.

Like Ark, Statechains depend on a centralized coordinating server in order to function. Unlike Ark, they have a slightly different trust model than a vUTXO in an Ark batch. They depend on the coordinating server to delete previously generated shares of a private key in order to remain trustless, but as long as the server follows the defined protocol and does so, they provide a strong security guarantee.

The general idea of a Statechain is to be able to transfer ownership of an entire UTXO between different users off-chain, facilitated by the coordinator. There is no requirement for receiving liquidity like Lightning, or the coordinator server to provide any liquidity like Ark.

To begin, we will look at the original protocol proposed by Ruben Somsen.

The Original Statechain

Statechains are effectively a pre-signed transaction allowing the current owner of the Statechain to unilaterally withdraw on-chain whenever they want, and a history signed messages cryptographically proving that past owners and the receivers they sent the Statechain to approved those transfers.

The original design was built on eltoo using ANYPREVOUT, but the current plans on how to enable the same functionality make use of CHECKTEMPLATEVERIFY and CHECKSIGFROMSTACK (a high level explanation of this is at the end of the CHECKSIGFROMSTACK article). The basic idea is a script enabling a pre-signed transaction to spend any UTXO that has that script and locks the appropriate amount of bitcoin, rather than being tied to spending a single specific UTXO.

In the protocol, a user wishing to deposit their coins to a Statechain approaches a coordinator server and goes through a deposit protocol. The depositing user, Bob, generates a key that will be uniquely owned by him, but also a second “transitory” key that will eventually be shared (more on this soon). They then craft a deposit transaction locking their coin to a multisig requiring the coordinator’s key and the transitory key to sign.

Using this multisig, Bob and the coordinator sign a transaction that spends that coin and creates a UTXO that can either be spent by any other transaction signed by the transitory key and the coordinator’s key using LN Symmetry, or Bob’s unique key after a timelock. Bob can now fund the multisig with the appropriate amount, and the Statechain has been created.

To transfer a Statechain to Charlie, Bob must go through a multistep process. First, Bob signs a message with his unique private key that attests to the fact he is going to transfer the Statechain to Charlie. Charlie must also sign a message attesting to the fact that he has received the Statechain from Bob. Finally, the coordinator server must sign a new transaction allowing Charlie to unilaterally claim the Statechain on-chain before Bob sends Charlie a copy of the transitory key.

All of this is made atomic using adapter signatures. These are signatures that are modified in such a way using a random piece of data that renders them invalid, but can be made valid again once the holder of the signature receives that piece of information. All of the messages, and the new pre-signed transaction are signed with adapter signatures, and atomically made valid at the same time through the release of the adapter data.

Holders of a Statechain must trust that the coordinator server never conspires with a previous owner to sign an immediate closure of the Statechain and steal funds from the current owner, but the chain of pre-signed messages can prove that a coordinator has participated in theft if they were to do so. If a past owner attempts to use their pre-signed transaction to steal the funds, the timelock on the spend path using only their key allows the current owner to submit their pre-signed transaction and correctly claim the funds on chain.

Mercury and Mercury Layer

The original Statechain architecture requires a softfork in order to function. CommerceBlock designed their variant of Statechains to function without a softfork, but in order to do so tradeoffs were made in terms of functionality.

The basic idea is the same as the original design, all users hold a pre-signed transaction that allows them to claim their funds unilaterally, and the coordinator server still plays a role in facilitating off-chain transfers that requires them to be trusted to behave honestly. The two major differences are how those transactions are signed, and the structure of the pre-signed transaction users are given.

Where the signing is concerned, there is no longer a transitory private key that is passed from user to user. Instead of this, a multiparty-computation protocol (MPC) is used so that the original owner and the coordinator server are able to collaboratively generate partial pieces of a private key without either of them ever possessing the full key. This key is used to sign the pre-signed transactions. The MPC protocol allows the current owner and coordinator to engage in a second protocol with a third party, the receiver of a transfer, to regenerate different pieces that add up to the same private key. In both the Mercury and Mercury Layer protocol, after completing a transfer an honest coordinator server deletes the key material corresponding to the previous owner. As long as this is done, it is no longer possible for the coordinator to sign a transaction with a previous owner, as the new piece of key material they have is not compatible with the piece any previous owner might still have. This is actually a stronger guarantee, as long as the coordinator is honest, than the original proposal.

The pre-signed transaction structure for Mercury and Mercury Layer can’t use LN Symmetry, as this is not possible without a softfork. In lieu of this, CommerceBlock opted to use decrementing timelocks. The original owner’s pre-signed transaction is timelocked using nLocktime to a time far out in the future from the point of the Statechain’s creation. As each subsequent user receives the Statechain during a transfer, the nLocktime value of their transaction is some pre-determined length of time shorter than the previous owner. This guarantees that a previous owner is incapable of even trying to submit their transaction on-chain before the current owner can, but it also means that eventually at some point the current owner must close their Statechain on-chain before previous owners’ transactions start becoming valid.

The major difference between Mercury and Mercury Layer is how these transactions are signed. In the case of Mercury, the coordinator server simply sees the transaction proposed, verifies it, and then signs it. Mercury Layer uses a blind-signing protocol, meaning that they do not actually see any details of the transaction they are signing. This necessitates the server tracking Statechains using anonymized records on the server, and a special authorization key of the current owner so that they can be sure they are only signing valid transfers.

Synergy With Other Layers

Statechains can synergize with other Layer 2s that are based on pre-signed transactions. For instance, part of the original proposal suggested a combination of Statechains and Lightning Channels. Because both are simply pre-signed transactions, it is possible to actually nest a Lightning channel on top of a Statechain. This simply requires the current owner’s unilateral exit key to be a multisig, and the creation of the pre-signed transactions spending that output into a Lightning channel. This allows Lightning channels to be opened and closed entirely off-chain.

In a similar fashion, it is possible to nest a Statechain on top of a vUTXO in an Ark batch. This simply requires the pre-signed transactions necessary for a Statechain to be constructed, spending the vUTXO output.

Wrapping Up

Statechains are not entirely trustless, but they are a very trust minimized scheme that is very liquidity efficient and allows freely transferring UTXOs off-chain between any users willing to accept the trust model of Statechains.

While the original proposal has yet to be built, the two implementations designed by CommerceBlock have been completely implemented. Both failed to achieve anything more than marginal use in the real world. Whether this is due to users being unwilling to accept the trust model involved, or simply a failure in marketing or awareness is something that cannot be fully ascertained.

Regardless, given that there are two full implementations and designs for a more flexible variation should LN Symmetry ever become possible on Bitcoin, this an option

-

@ 8bad92c3:ca714aa5

2025-06-15 18:02:08

@ 8bad92c3:ca714aa5

2025-06-15 18:02:08Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 5d4b6c8d:8a1c1ee3

2025-06-15 18:42:08

@ 5d4b6c8d:8a1c1ee3

2025-06-15 18:42:08https://youtu.be/-ne8adkjY6A

Orlando gets Bane

Memphis gets KCP, Cole Anthony, and a bunch of picks

This move makes a lot of sense. Orlando needed someone like Bane and Memphis needed to break up their core.

https://stacker.news/items/1007156

-

@ 7f6db517:a4931eda

2025-06-15 16:02:15

@ 7f6db517:a4931eda

2025-06-15 16:02:15

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-15 18:02:19

@ 7f6db517:a4931eda

2025-06-15 18:02:19

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.