-

@ 91117f2b:111207d6

2025-06-18 16:04:53

@ 91117f2b:111207d6

2025-06-18 16:04:53

Bitcoin has revolutionized the way people think about money and financial transactions. Its decentralized nature and secure blockchain technology have created a trusted and transparent financial system. Here's how Bitcoin has helped the community:

Financial Inclusion - Access to Financial Services: Bitcoin provides an opportunity for people in underserved or underbanked communities to access financial services, promoting economic growth and stability.

- Cross-Border Transactions: Bitcoin enables fast and low-cost cross-border transactions, facilitating global trade and commerce.

Community Building

-

Online Forums: Bitcoin forums like Bitcointalk and Reddit's r/Bitcoin community provide a platform for enthusiasts to discuss market trends, share knowledge, and learn from each other.

-

Social Media: Twitter, Facebook groups, and Telegram channels dedicated to Bitcoin foster a sense of community, allowing users to stay updated on market news and trends.

Education and Resources

-

Educational Content: Websites like Hello Bitcoin offer beginner-friendly guides, videos, and resources to help new users understand Bitcoin and its applications.

-

Meetups and Events: Bitcoin conferences and meetups provide opportunities for networking, learning, and collaboration ³.

Support for Innovation

-

Developer Community: Bitcoin's open-source nature has attracted a community of developers who contribute to its growth and development.

-

New Use Cases: Bitcoin's versatility has led to innovative use cases, such as microtransactions and decentralized finance (DeFi) applications.

Challenges and Opportunities

-

Volatility: Bitcoin's price volatility can be a challenge, but it also presents opportunities for traders and investors.

-

Regulatory Environment: The regulatory environment for Bitcoin is evolving, and community members must stay informed about changes that may impact their use of Bitcoin.

Overall, Bitcoin has created a vibrant and diverse community that is driving innovation, education, and financial inclusion. As the ecosystem continues to evolve, it's likely that Bitcoin will remain a key player in shaping the future of finance.

-

@ 7f6db517:a4931eda

2025-06-18 16:03:01

@ 7f6db517:a4931eda

2025-06-18 16:03:01

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-06-18 16:02:41

@ eb0157af:77ab6c55

2025-06-18 16:02:41The House of Representatives will now decide whether to adopt its own proposal or the Senate’s version for the new stablecoin regulations.

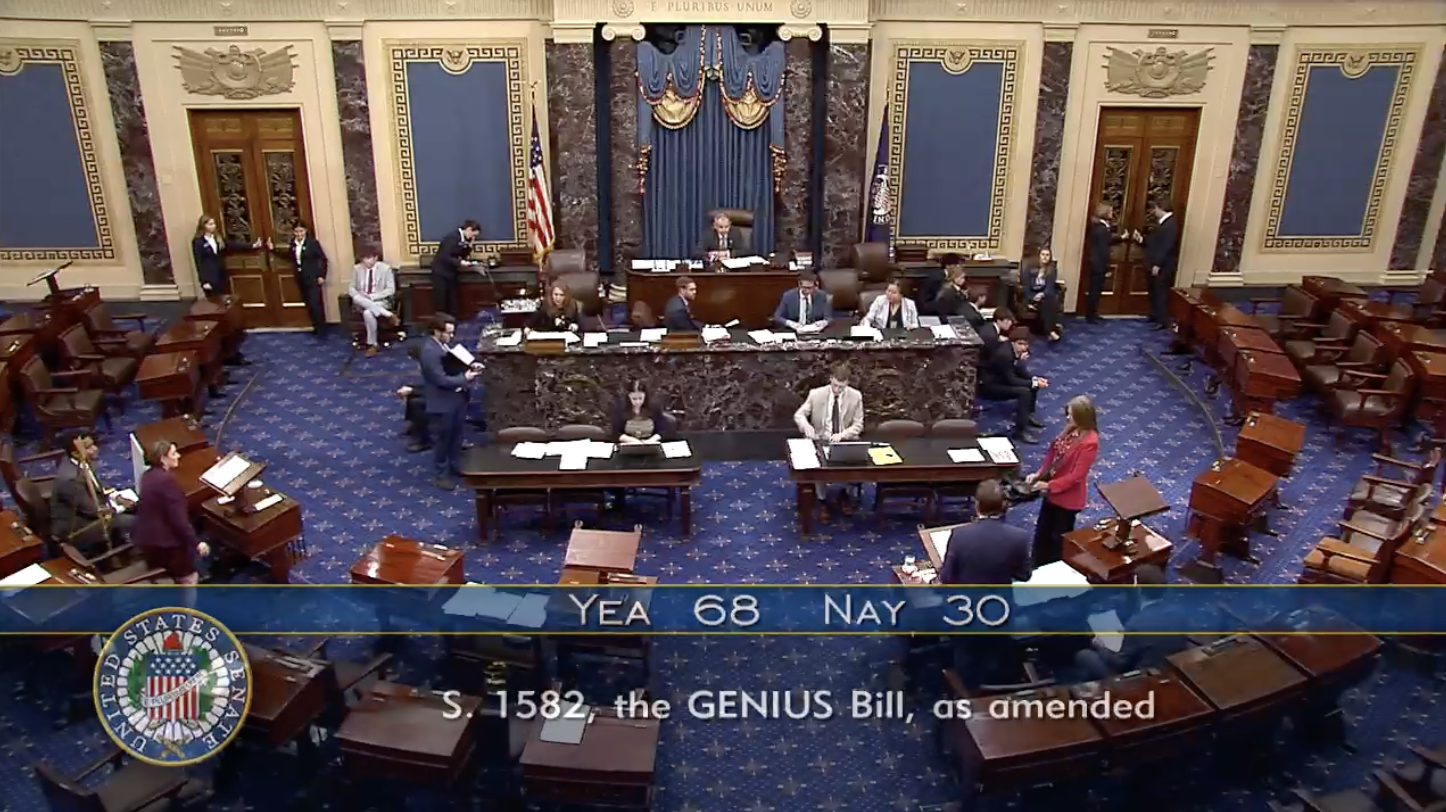

The United States Senate has officially passed the GENIUS Act, marking another step toward establishing a federal regulatory framework for stablecoins. The final vote concluded with 68 in favor and 30 against, sending the bill to the House of Representatives for final approval in the coming weeks.

Republican Senator Bill Hagerty, sponsor of the bill, stated:

“The GENIUS Act establishes a pro-growth regulatory framework for payment stablecoins. This legislation will cement U.S. dollar dominance, protect consumers, and drive demand for U.S. Treasurys.”

New standards for stablecoins in the U.S.

The legislative proposal, officially titled the Guiding and Establishing National Innovation for US Stablecoins Act, sets strict legal requirements for stablecoin issuers. The bill mandates that every token must be fully backed by U.S. dollars or equally liquid assets (such as U.S. Treasurys), ensuring market stability and transparency.

Stablecoin issuers with a market capitalization exceeding $50 billion will be subject to mandatory annual audits, while foreign entities like Tether will be required to meet specific compliance rules to operate in the U.S. market.

Restrictions for Big Tech

One of the provisions of the GENIUS Act bans non-financial public companies — including giants like Meta and Amazon — from issuing stablecoins unless they meet stringent risk management and privacy standards. This measure aims to prevent potential conflicts of interest and concentrations of power in the digital currency sector.

In the event of an issuer’s insolvency, the bill grants stablecoin holders a “super-priority” status in bankruptcy proceedings, placing them ahead of other creditors in the repayment hierarchy.

Despite Senate approval, the GENIUS Act now faces a competing proposal in the House — the STABLE Act — which was advanced in committee last May. The two bills differ on key issues such as state versus federal oversight and the treatment of foreign stablecoin issuers. Reconciling these versions will be crucial before any legislation reaches President Trump’s desk for final signature.

The post U.S. Senate approves the GENIUS Act: now it moves to the House appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-18 16:02:21

@ b1ddb4d7:471244e7

2025-06-18 16:02:21Why are Stripe Alternatives are growing like mushrooms? When it comes to online payment processing, Stripe has long dominated the conversation.

However, with its complex pricing structure, strict policies and first-world focus, many entrepreneurs and companies are actively seeking viable Stripe alternatives.

Whether you’re a SaaS startup, e-commerce store, or global enterprise, choosing the right payment processor can significantly impact your bottom line and customer experience.

Table of Contents

- Why Consider Stripe Alternatives?

- The Complete List of Stripe Alternatives

- Additional Notable Mentions

- How to Choose the Right Stripe Alternative

- Conclusion

Why Consider Stripe Alternatives?

Before diving into our comprehensive list, it’s worth understanding why businesses are exploring alternatives to Stripe. While Stripe offers robust features and excellent developer tools, some businesses face challenges with pricing transparency, limited global coverage, or specific industry requirements that Stripe doesn’t fully address.

The Complete List of Stripe Alternatives

Based on extensive research and analysis of the payment processing landscape, here are 27 proven Stripe alternatives that could be the perfect fit for your business:

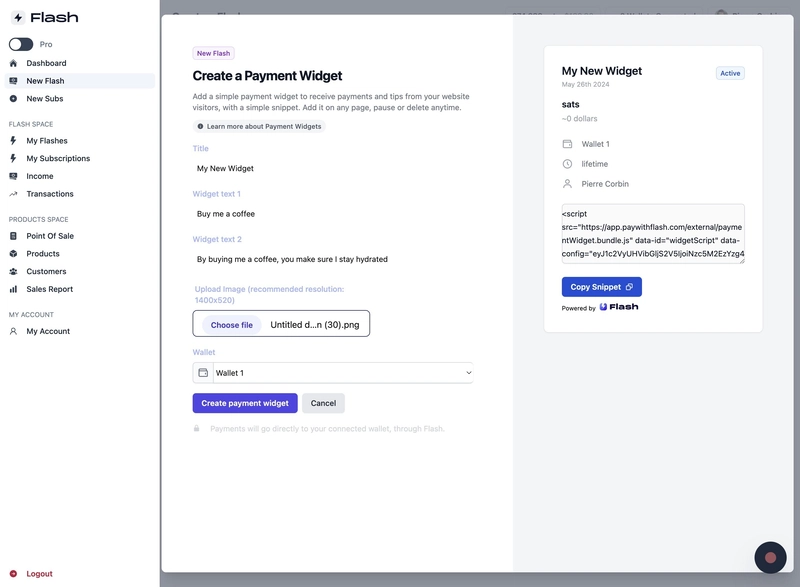

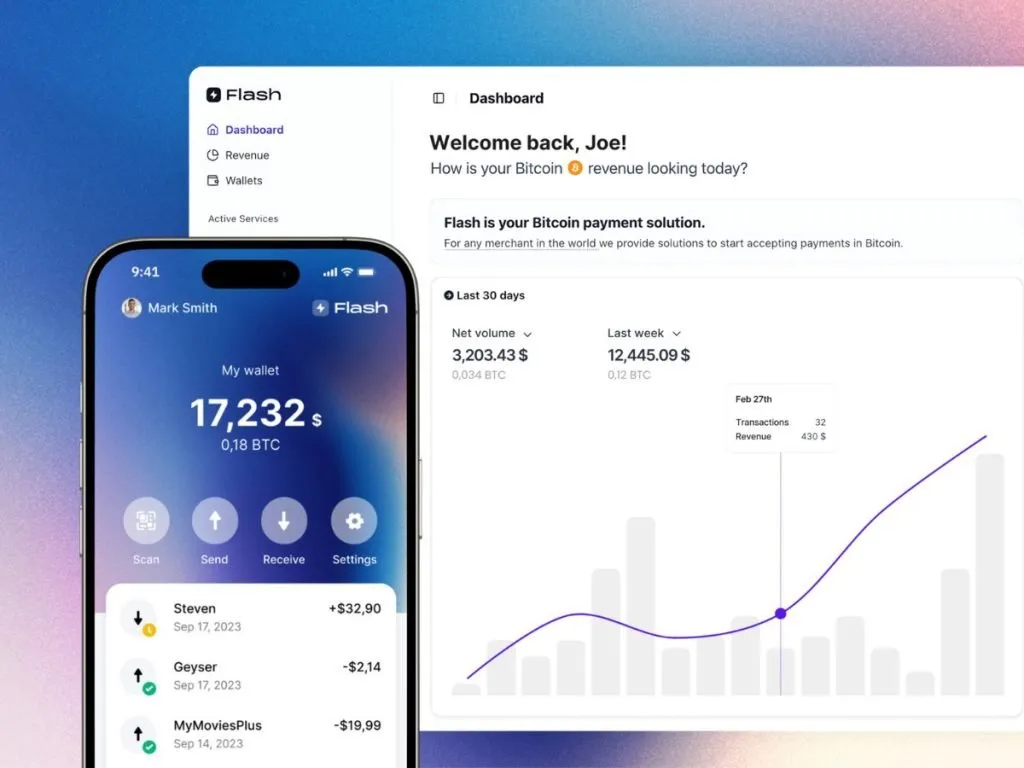

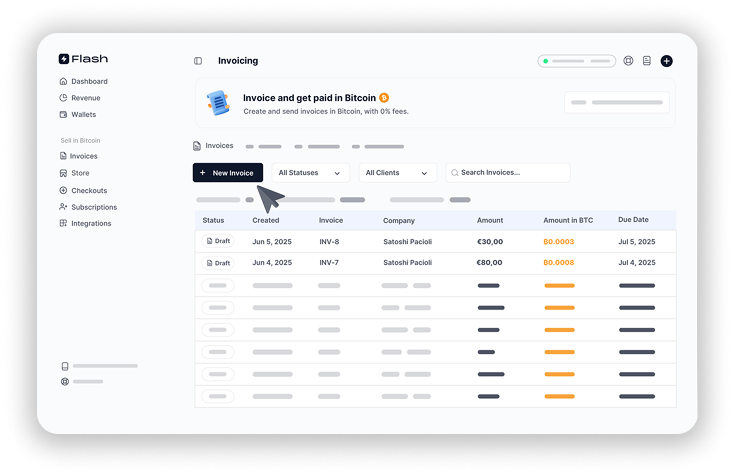

1. Flash – Easiest Bitcoin Payment Solution

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

2. Lemon Squeezy – The SaaS-Focused Alternative

Dubbed as “acq’d by Stripe,” Lemon Squeezy offers a comprehensive solution specifically designed for digital product sales and SaaS businesses. It provides strong customer support, built-in analytics, and handles payments, subscriptions, global tax compliance, and fraud prevention in one platform.

3. Gumroad – Creator Economy Champion

Gumroad has carved out a niche serving creators and small businesses by providing tools for selling digital products, physical goods, and subscriptions. It’s particularly popular among content creators, artists, and independent entrepreneurs who want to experiment with various ideas and formats. They also open-sourced their code which is quite the ‘chad-move’.

4. Paddle – All-in-One SaaS Commerce

Paddle caters to SaaS and software companies by offering a comprehensive platform with billing, licensing, and global tax handling capabilities. It’s designed to be a complete solution for subscription-based businesses, handling payments, tax, and subscription management in one platform.

5. FastSpring – Global E-commerce Specialist

FastSpring specializes in e-commerce solutions for software and SaaS companies, with a focus on global payments and subscription management. According to TechnologyAdvice, it’s particularly strong for international transactions and helps companies sell more, stay lean, and compete big.

6. 2Checkout – Versatile Payment Solutions

2Checkout (now part of Verifone) offers versatile payment solutions excelling in global payments, subscription billing, and digital commerce. One of the best stripe alternatives as it’s an all-in-one monetization platform that maximizes revenues and makes global online sales easier, supporting over 200 countries and territories.

7. Payoneer – Cross-Border Payment Expert

Payoneer simplifies cross-border payment solutions, offering local payment ease globally with a focus on market expansion and multi-currency support. It’s trusted by small to medium-sized businesses for global payment solutions and international money transfers.

8. Chargebee – Subscription Management Leader

Chargebee is a subscription management platform perfect for SaaS and SMBs, with robust billing and revenue management features. If you were looking for stripe alternatives to setup subscriptions, Chargebee might be right for you. It streamlines revenue operations and helps businesses grow efficiently with comprehensive subscription billing capabilities.

9. Maxio (formerly Chargify) – B2B SaaS Billing

Maxio offers a robust platform for B2B SaaS billing and financial operations, focusing on growth and efficiency for subscription businesses. It’s the most complete financial operations platform for B2B SaaS, bringing core financial operations into one platform.

10. Recurly – Dynamic Subscription Management

Recurly offers dynamic subscription management platform, excelling in churn management and data insights for subscription growth. It’s the only proven platform that expands and protects your recurring revenue with subscription management, recurring billing, and payments orchestration.

11. Braintree – PayPal’s Enterprise Solution

Braintree (by PayPal) provides a versatile global payments platform, integrating multiple payment methods with a focus on conversion and security. It delivers end-to-end checkout experiences for businesses, offering single-touch payments and mobile optimization.

12. PayKickstart – Modern Commerce Platform

PayKickstart offers a modern commerce platform for online billing and affiliates, focusing on revenue maximization and churn minimization. It’s the most complete checkout, recurring billing, affiliate management, and retention solution with global capabilities.

13. PayPro Global – Full-Service E-commerce

PayPro Global offers a full-service eCommerce solution for selling software and SaaS, focusing on global payments, tax compliance, and customer support. It provides flexible solutions with over 70 payment methods and great support for software companies.

14. Shopify Payments – E-commerce Integration

Integrated with Shopify, this service is ideal for SMBs in eCommerce, offering a seamless shopping cart and payment experience. It’s the simplest way to accept online payments, automatically set up for major methods with no fees for some payment types.

15. Square – Versatile POS and Payment Solutions

Square provides versatile POS and payment solutions for small businesses with a strong focus on retail and mobile payments. Forbes Advisor notes it as one of the top alternatives for businesses needing both online and offline payment capabilities.

16. Zoho Billing – Integrated Business Solution

Zoho Billing is an online recurring billing and subscription management solution, ideal for small and medium-sized businesses seeking professional invoice creation, time and expense tracking, and improved cash flow management. Zoho isn’t just competing for stripe alternatives, they offer a ton of other products and services.

17. WePay – Chase Company Integration

WePay, a Chase company, provides integrated payment solutions for ISVs and SaaS companies with customizable payment solutions. It’s designed for platforms like marketplaces and small business tools, offering seamless user experience and fraud protection.

18. QuickBooks Payments – SMB Accounting Integration

This service provides seamless accounting and payment solutions for SMBs and SaaS businesses, featuring real-time tracking and automated bookkeeping. It lets small businesses accept payments online from anywhere with easy integration into QuickBooks accounting.

19. Mangopay – Marketplace Payment Infrastructure

Mangopay offers a modular payment infrastructure for marketplaces and platforms, emphasizing flexibility, global payouts, and AI-powered anti-fraud. It uses flexible wallets built to orchestrate fund flows and monetize payment experiences.

20. Coinbase Commerce – Cryptocurrency Payments

Coinbase Commerce enables businesses to accept payments from around the world using cryptocurrency. It offers instant settlement, low fees, and broad asset support, making it easy for merchants to accept digital currency payments globally.

21. BTCPay Server – Open-Source Bitcoin Processor

BTCPay Server is a self-hosted, open-source cryptocurrency payment processor with 0% fees and no third-party involvement. It’s secure, private, censorship-resistant, and completely free for businesses wanting full control over their Bitcoin payments.

22. Lago – Open-Source Billing Alternative

Lago is an open-source alternative to Stripe Billing and Chargebee, specializing in billing and metering in one place for usage-b

-

@ cae03c48:2a7d6671

2025-06-18 16:02:01

@ cae03c48:2a7d6671

2025-06-18 16:02:01Bitcoin Magazine

DDC Enterprise Secures $528 Million to Expand Bitcoin HoldingsToday, DDC Enterprise Limited (NYSE: DDC) announced it has raised three securities purchase agreements for a total of up to $528 million to expand its Bitcoin holdings. According to the press release, this is one of the largest single-purpose Bitcoin raises by any NYSE-listed company.

JUST IN:

DDC Enterprise to raise up to $528 million to buy more #Bitcoin pic.twitter.com/CPxPlsjvwq

DDC Enterprise to raise up to $528 million to buy more #Bitcoin pic.twitter.com/CPxPlsjvwq— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

“Today is a defining moment for DDC Enterprise and our shareholders,” said the Founder and CEO of DDC Enterprise Norma Chu. “This capital commitment of up to $528 million, backed by respected institutions from both traditional finance and the digital asset frontier, represents a strong mandate to execute an ambitious corporate Bitcoin accumulation strategy globally. Our vision is unequivocal: we are building the world’s most valuable Bitcoin treasury.”

The funding, backed by investors including Anson Funds, Animoca Brands, Kenetic Capital, and QCP Capital, will be primarily allocated toward significantly increasing the company’s Bitcoin holdings.

“This funding is expected to propel DDC into one of the top global corporate Bitcoin holders,” stated Chu. “This investment by Anson Funds and the group of PIPE investors is a resounding validation of Bitcoin’s important role in future corporate balance sheets.”

Components of the capital raise include:

- $26 Million Equity PIPE Investment:

The company will issue up to 2.4 million Class A ordinary shares at an average price of $10.30 to investors including Animoca Brands, Kenetic Capital, and QCP Capital. The shares will be restricted for 180 days. - $300 Million Convertible Note and $2 Million Private Placement:

Anson Funds will provide an initial $25 million with no interest and will mature in 24 months, with up to $275 million available in future tranches. Anson will also purchase 307,693 Class A ordinary shares for $2 million in a concurrent private placement. - $200 Million Equity Line of Credit:

Anson Funds has also committed to a $200 million equity line of credit (ELOC), giving DDC flexible access to capital for future Bitcoin purchases.

“At DDC, we will deploy this capital with institutional discipline and unwavering conviction, cementing our position as the premier bridge between global capital markets and the Bitcoin ecosystem,” said Chu. “DDC Enterprise is strongly positioned as the definitive publicly-traded vehicle for concentrated Bitcoin exposure and value creation. My focus will be on growing our BTC treasury and delivering attractive BTC yield consistently for our shareholders.”

This post DDC Enterprise Secures $528 Million to Expand Bitcoin Holdings first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

- $26 Million Equity PIPE Investment:

-

@ cae03c48:2a7d6671

2025-06-18 16:01:51

@ cae03c48:2a7d6671

2025-06-18 16:01:51Bitcoin Magazine

Thailand Approves Five Year Bitcoin And Crypto Tax BreakThailand has approved a five year tax exemption on capital gains from cryptocurrency trading made through licensed digital asset platforms. The exemption will be in effect from January 1, 2025, through December 31, 2029.

JUST IN:

Thailand’s cabinet approved personal tax waiver on profits from the #Bitcoin and crypto sale over five years. pic.twitter.com/4gWc1gn84j

Thailand’s cabinet approved personal tax waiver on profits from the #Bitcoin and crypto sale over five years. pic.twitter.com/4gWc1gn84j— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

Deputy Finance Minister Julapun Amornvivat announced the measure, calling it a move to increase investment, stimulate economic activity, and drive long term growth.

Amornvivat stated, “The Cabinet approved a five-year crypto tax exemption to promote Thailand as a global digital asset hub.”

According to the Ministry of Finance, the policy is designed to strengthen Thailand’s competitiveness in the global digital economy. It targets transparent growth, and aims to increase capital inflow into the Thai market. Officials expect over 1 billion baht in indirect tax revenue to result from the increased economic activity during the exemption period.

Amornvivat went on to say, “The capital gain tax exemption will be for the sale of digital assets made through operators regulated by the Securities and Exchange Commission.”

The tax break applies only to platforms licensed by the Thai SEC. This includes exchanges that meet strict regulatory standards under the government’s digital finance framework. Exchanges without Thai licenses will not benefit from the exemption and continue to face restrictions.

Officials say the new exemption aligns with international standards from the OECD and FATF. The government is also exploring a possible value-added tax (VAT) on digital assets to support fiscal stability.

Furthermore, this isn’t Thailand’s first step toward embracing Bitcoin or crypto.

Thailand approved its first spot Bitcoin ETF in 2024, allowing asset manager ONEAM to launch a fund for institutional investors. The ETF offers regulated exposure to Bitcoin through global funds and reflects growing demand for institutional access to the asset.

Thailand is taking a two sided approach. They support innovation through licensed platforms, while cracking down on unregulated players. With clearer rules and tax breaks, the country is positioning itself as a leader for Bitcoin and crypto growth in Southeast Asia.

This post Thailand Approves Five Year Bitcoin And Crypto Tax Break first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 16:01:23

@ cae03c48:2a7d6671

2025-06-18 16:01:23Bitcoin Magazine

BBVA Tells Wealthy Clients to Invest Up to 7% in BitcoinSpanish bank BBVA is now advising its wealthy clients to invest up to 7% of their portfolios in crypto and Bitcoin, showing how traditional banks are starting to see the potential of Bitcoin.

JUST IN:

Spain's second largest bank BBVA is telling wealthy clients to invest in Bitcoin — Reuters pic.twitter.com/i2Pqg85uSk

Spain's second largest bank BBVA is telling wealthy clients to invest in Bitcoin — Reuters pic.twitter.com/i2Pqg85uSk— Bitcoin Magazine (@BitcoinMagazine) June 17, 2025

“With private customers, since September last year, we started advising on Bitcoin,” said Philippe Meyer, head of digital & blockchain solutions at BBVA Switzerland, during the DigiAssets conference in London. “The riskier profile, we allow up to 7% of portfolios in crypto.”

The bank’s private wealth division is currently recommending clients allocate 3% to 7% of their portfolio to Bitcoin and crypto, depending on their individual appetite. While many private banks have offered to execute Bitcoin or crypto trades upon request, it remains rare for a global financial institution to formally advise clients to buy. BBVA is currently recommending allocations specifically in Bitcoin.

Meyer emphasized that even a modest allocation to Bitcoin can have a meaningful impact on portfolio returns, “If you look at a balanced portfolio, if you introduce 3%, you already boost the performance,” he said. “At 3%, you are not taking a huge risk.”

BBVA began executing Bitcoin purchases for its clients in 2021, but Meyer said this is the first time it is formally advising allocations. In June 2021, the bank launched Bitcoin trading and custody services through its Swiss subsidiary for private clients. “With this innovative offer, BBVA positions itself as a benchmark institution in the adoption of blockchain technology,” said BBVA Switzerland CEO Alfonso Gómez at the time.

BREAKING: Spain's BBVA is opening #Bitcoin trading and custody to all private banking clients in Switzerland. pic.twitter.com/2ppfs34g6F

— Bitcoin Magazine (@BitcoinMagazine) June 18, 2021

BBVA’s interest in digital currency goes back even further. As early as 2015, the bank made it clear that it viewed Bitcoin and blockchain technology as more than just a passing trend. In a statement that now seems increasingly prescient, BBVA said “institutions that understand Bitcoin and digital currencies will lead the new monetary system,” highlighting its belief that early adopters would gain a strategic advantage.

This early support set BBVA apart from many of its peers, as few major banks were willing to publicly engage with Bitcoin at the time.

What began as interest in blockchain technology has turned into direct investment guidance, now culminating in BBVA formally advising wealthy clients to allocate up to 7% of their portfolios into Bitcoin, a clear sign the bank sees it as a long term part of its future.

This post BBVA Tells Wealthy Clients to Invest Up to 7% in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 16:01:18

@ cae03c48:2a7d6671

2025-06-18 16:01:18Bitcoin Magazine

U.S. Senate Passes Stablecoin Bill The GENIUS ActThe U.S. Senate has passed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act (S. 394) by a vote of 68-30, establishing the first comprehensive federal framework for fiat-backed stablecoins.

The bipartisan legislation was introduced by Senator Bill Hagerty and co-sponsored by Senators Tim Scott, Kirsten Gillibrand, and Cynthia Lummis. It passed under the official title “Guiding and Establishing National Innovation for U.S. Stablecoins of 2025.”

The United States Senate has passed the GENIUS Act

— Bo Hines (@BoHines) June 17, 2025

“Today, on a bipartisan basis, the Senate passed its first piece of major legislation this Congress with my bill—the GENIUS Act,” said Senator Hagerty. “With GENIUS, the United States is one step closer to becoming the crypto capital of the world.”

The GENIUS Act tightly regulates payment stablecoins, requiring 1:1 dollar-backed reserves, monthly disclosures, audits, and clear federal or state licensing. It prohibits algorithmic coins and places strict limitations on rehypothecation and commingling of reserves. Importantly, the bill also amends existing securities laws to explicitly state that compliant stablecoins are not securities—freeing them from SEC jurisdiction.

While the bill is aimed at stablecoins, many Bitcoin proponents see it as a win since stablecoins can act as a bridge into Bitcoin, enabling on-ramps, easier settlements, and institutional access.

And as the financial system modernizes, trusted access points like dollar-backed tokens could play a role in onboarding new Bitcoin users—especially in international markets and corporate treasuries.

“The U.S. Senate has passed the GENIUS Act — landmark stablecoin legislation that provides regulatory clarity, enhances consumer protection, and extends U.S. dollar dominance online,” said President Donald Trump’s AI & Crypto Czar David Sacks. “Thanks to President Trump for his leadership on crypto & Senator Hagerty for authoring the bill.”

The passage of the GENIUS Act may be the clearest signal yet that the U.S. is preparing for a stablecoin and Bitcoin-powered future.

This post U.S. Senate Passes Stablecoin Bill The GENIUS Act first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 16:01:11

@ cae03c48:2a7d6671

2025-06-18 16:01:11Bitcoin Magazine

Swiss Bitcoin Platform Relai & Casa Partner to Offer Multisig Bitcoin SecurityToday, Relai, a Swiss Bitcoin platform, announced it has partnered with Casa to introduce a new Bitcoin saving and security solution, according to a press release sent to Bitcoin Magazine.

“Self-custody is at the heart of Bitcoin’s promise,” said the Co-Founder and CTO of Relai Adem Bilican. “As our users continue to accumulate and grow their holdings over time, we recognize the need for long-term solutions designed for serious Bitcoin enthusiasts. Casa is the ideal partner – a sovereignty-focused and user-friendly solution. Together, we’re helping users secure not just their savings, but their legacy.”

According to the press release, the app has over 500,000 downloads, more than 85,000 active users, and a total user investment exceeding $1 billion. These figures reflect growing user engagement with self-custody Bitcoin solutions intended for long-term use.

Self-custody is a fundamental aspect of Bitcoin ownership, but it also comes with certain risks, particularly around long-term security. The partnership introduces a multisignature (multisig) custody option, which requires multiple keys to access funds. This setup can help mitigate the vulnerabilities of single-key storage.

Through the integration, users who purchase Bitcoin via Relai will have the option to store their assets using Casa’s multisig system. The offering also includes an inheritance feature that allows users to designate a beneficiary, adding a layer of planning for asset transfer across generations.

“Casa’s mission is to maximize sovereignty and security in the world,” stated the CEO of Casa Nick Neuman. “The best way we can do that today is by making sovereign bitcoin custody as safe and simple as possible. Our partnership with Relai will help people stack bitcoin and store it securely, for themselves and their families.”

According to both companies, the integration represents a first-of-its-kind model that combines Bitcoin accumulation with long-term custody and inheritance planning for everyday users.

This post Swiss Bitcoin Platform Relai & Casa Partner to Offer Multisig Bitcoin Security first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 8d34bd24:414be32b

2025-06-18 15:41:52

@ 8d34bd24:414be32b

2025-06-18 15:41:52As I read the news over the past week, we’ve heard of Ukrainian drone attacks on Russia’s nuclear attack planes and Russia’s threats of retaliation. We’ve heard of Israel attacking Iran’s nuclear facilities and Iran returning attacks on Israel’s major cities. I’ve read of AI taking jobs, threatening someone trying to turn it off, and refusing to turn off. There are threats of inflation, market crashes, housing crashes, and monetary crashes. There are riots across the US. There are warnings of potential new pandemics or of calls for terrorist cells to awaken and attack. It is easy to get overwhelmed by everything happening in the world. It is easy to become fearful of everything, but God does not call us to be afraid. He repeatedly tells us to “trust him” and to “fear not.”

Do not fear, for I am with you;\ Do not anxiously look about you, for I am your God.\ I will strengthen you, surely I will help you,\ Surely I will uphold you with My righteous right hand.’ (Isaiah 41:10)

With all of the crazy going on in the world, it is easy to worry about our jobs, our families, our country, and even our lives, but God does not want us to worry. He wants us to trust in Him in all things.

And He said to His disciples, “For this reason I say to you, do not worry about your life, as to what you will eat; nor for your body, as to what you will put on. For life is more than food, and the body more than clothing. Consider the ravens, for they neither sow nor reap; they have no storeroom nor barn, and yet God feeds them; how much more valuable you are than the birds! And which of you by worrying can add a single hour to his life’s span? If then you cannot do even a very little thing, why do you worry about other matters? Consider the lilies, how they grow: they neither toil nor spin; but I tell you, not even Solomon in all his glory clothed himself like one of these. But if God so clothes the grass in the field, which is alive today and tomorrow is thrown into the furnace, how much more will He clothe you? You men of little faith! And do not seek what you will eat and what you will drink, and do not keep worrying. For all these things the nations of the world eagerly seek; but your Father knows that you need these things. But seek His kingdom, and these things will be added to you. Do not be afraid, little flock, for your Father has chosen gladly to give you the kingdom. (Luke 12:22-32) {emphasis mine}

God provides for His own. He doesn’t always provide in the way we wish, but He does provide when we trust in Him. Even when believers die, He provides them a place in heaven.

When we look at the world around us, where everything seems like it is falling apart and/or turning to evil, we need to keep our eyes on Jesus and on eternity.

Therefore we do not lose heart, but though our outer man is decaying, yet our inner man is being renewed day by day. For momentary, light affliction is producing for us an eternal weight of glory far beyond all comparison, while we look not at the things which are seen, but at the things which are not seen; for the things which are seen are temporal, but the things which are not seen are eternal. (2 Corinthians 4:16-18) {emphasis mine}

What we experience here on earth may sometimes be unpleasant, but it is a “momentary, light affliction” compared to the glory of heaven. Just as labor and delivery of a child is hard and unpleasant, but is worth every effort and pain when you hold your child, in the same way our suffering on earth will seem like nothing compared to the joy of being in the presence of our Creator God and Savior.

My Experiences

I used to try to prepare for everything. When I was young, I would say, “a good Girl Scout is always prepared.” When I got married and had kids, I started trying to prepare for anything that might possibly go wrong. I had extra food, water, and medical supplies. I started a garden. I got chickens. I got rid of chickens when I developed a lung allergy and couldn’t breathe.

None of that was wrong in itself. I’d even argue it could be wise actions, but I was relying on myself and stuff to face the troubles of this world instead of relying on God. That was definitely not good and was not the way to peace.

We also got involved in politics. My husband was in the state legislature. I was a precinct person and involved in precinct, county, state, and national meetings. I helped set the platform for our state political party in two elections and helped set the resolutions in another.

None of that was wrong in itself. I’d even argue that Christians are called to be a blessing to our earthly nations, but it wasn’t the way to peace, nor was it putting my time in effort into the most important things.

I’ve been reading my Bible daily for 40+ years and reading the Bible in a year for 20+ years. For more than a decade I intensely studied the beginnings, Genesis and how science and archaeology support every fact in Genesis. That study really taught me the power of God and how He always keeps His promises.

For the past several years, I’ve switched to spending most of my intense study on end times prophecy. Despite the fact that the end times prophecies predict a time of unimaginable hardship, the promises of the rapture, the millennial kingdom, and eternity with Jesus in heaven brings great peace. The crazy, evil, and agony in the world is not the world falling apart, but God’s controlled, merciful judgment on the world. I can see the light at the end of the tunnel. I don’t just see everything that can possibly go wrong. I trust God with my life and that of my family.

I still have extra food, water, and medical supplies on hand, but I don’t obsess about it, nor do I put all my trust in my preparations. I still vote, but I have pulled back from political life. I have learned to trust Jesus in these difficult times. I try to be wise, but not worry about every thing that could possibly go wrong. I have gained peace.

But the Helper, the Holy Spirit, whom the Father will send in My name, He will teach you all things, and bring to your remembrance all that I said to you. Peace I leave with you; My peace I give to you; not as the world gives do I give to you. Do not let your heart be troubled, nor let it be fearful. You heard that I said to you, ‘I go away, and I will come to you.’ If you loved Me, you would have rejoiced because I go to the Father, for the Father is greater than I. Now I have told you before it happens, so that when it happens, you may believe. (John 14:26-29) {emphasis mine}

Studying God’s word enables me to know God’s power, trust His promises, and know His predictions. I don’t need to worry because God is in control of everything that happens in the world.

Let your gentle spirit be known to all men. The Lord is near. Be anxious for nothing, but in everything by prayer and supplication with thanksgiving let your requests be made known to God. And the peace of God, which surpasses all comprehension, will guard your hearts and your minds in Christ Jesus. (Philippians 4:5-7) {emphasis mine}

I really can know the “peace of God, which surpasses all comprehension.”

What We Need for Peace

Knowing God’s word can give us peace. We can bring Bible verses to mind as reminders of His promises given and His promises fulfilled. I am going to go through a bunch of verses that we can bring to mind when we are feeling worried and fearful. I’ll probably make a few comments, but I want God’s word to speak to you.

When I am afraid,\ I will put my trust in You.\ In God, whose word I praise,\ In God I have put my trust;\ I shall not be afraid.\ What can mere man do to me? (Psalm 56:3-4)

It is hard to be afraid when you are praising God.

While He was still speaking, they came from the house of the synagogue official, saying, “Your daughter has died; why trouble the Teacher anymore?” But Jesus, overhearing what was being spoken, said to the synagogue official, “Do not be afraid any longer, only believe.” (Mark 5:35-36)

Once trusting Jesus as Savior, we don’t need to be afraid of anything, just believe.

The Lord also will be a stronghold for the oppressed,\ A stronghold in times of trouble;\ And those who know Your name will put their trust in You,\ For You, O Lord, have not forsaken those who seek You. (Psalm 9:9-10)

No matter what we are going through, God is with us and working through us for good. We are never left alone.

And we know that God causes all things to work together for good to those who love God, to those who are called according to His purpose. (Romans 8:28)

God may allow hard times to come, but it is always for good. There is no pointless pain.

Be strong and courageous, do not be afraid or tremble at them, for the Lord your God is the one who goes with you. He will not fail you or forsake you. (Deuteronomy 31:6)

It is amazing how we can deal with hardships when we rely on God and not our own power.

For the eyes of the Lord are toward the righteous,\ And His ears attend to their prayer,\ But the face of the Lord is against those who do evil.

Who is there to harm you if you prove zealous for what is good? But even if you should suffer for the sake of righteousness, you are blessed. And do not fear their intimidation, and do not be troubled, but sanctify Christ as Lord in your hearts, always being ready to make a defense to everyone who asks you to give an account for the hope that is in you, yet with gentleness and reverence; and keep a good conscience so that in the thing in which you are slandered, those who revile your good behavior in Christ will be put to shame. (1 Peter 3:12-16) {emphasis mine}

How amazing is it that suffering can actually be a blessing. There is no witness stronger than the person who keeps the faith and has joy and hope in suffering.

Do not fret because of evildoers,\ Be not envious toward wrongdoers.\ For they will wither quickly like the grass\ And fade like the green herb.\ *Trust in the Lord and do good*;\ Dwell in the land and cultivate faithfulness.\ Delight yourself in the Lord;\ And He will give you the desires of your heart.\ *Commit your way to the Lord*,\ Trust also in Him, and He will do it. (Psalm 37:1-5) {emphasis mine}

When we trust in God, commit our way to Him, and delight in Him, we can have joy in any situation.

Open the gates, that the righteous nation may enter,\ The one that remains faithful.\ **The steadfast of mind You will keep in perfect peace,\ Because he trusts in You.\ Trust in the Lord forever,\ For in God the Lord, we have an everlasting Rock. (Isaiah 26:2-4) {emphasis mine}

What a promise! “The steadfast of mind You will keep in perfect peace, because he trusts in You.”

I know your tribulation and your poverty (but you are rich), and the blasphemy by those who say they are Jews and are not, but are a synagogue of Satan. Do not fear what you are about to suffer. Behold, the devil is about to cast some of you into prison, so that you will be tested, and you will have tribulation for ten days. Be faithful until death, and I will give you the crown of life. (Revelation 2:9-10) {emphasis mine}

Do you think of tribulation and poverty as riches? If you trust Jesus, then you are rich in blessings when you experience tribulation and poverty. God does not promise His people ease in this life, but He does promise to use every pain and hardship for good — for our good, the good of others, and His glory. We need to trust Jesus and not fear.

Trust in the Lord with all your heart\ And do not lean on your own understanding.\ In all your ways acknowledge Him,\ And He will make your paths straight.\ *Do not be wise in your own eyes;\ Fear the Lord* and turn away from evil.\ It will be healing to your body\ And refreshment to your bones.** (Proverbs 3:5-8) {emphasis mine}

I need this verse: “Trust in the Lord with all your heart, and do not lean on your own understanding.” I definitely want to lean on my own power and understanding and have to remind myself of God’s power, wisdom, and goodness continually so I lean on Him. You have to love what God promises when we trust in Him alone: “healing to your body and refreshment to your bones.” Doesn’t that sound wonderful?

For this reason I remind you to kindle afresh the gift of God which is in you through the laying on of my hands. For God has not given us a spirit of timidity, but of power and love and discipline.

Therefore do not be ashamed of the testimony of our Lord or of me His prisoner, but join with me in suffering for the gospel according to the power of God, who has saved us and called us with a holy calling, not according to our works, but according to His own purpose and grace which was granted us in Christ Jesus from all eternity, (2 Timothy 1:6-9) {emphasis mine}

If you haven’t relied on God for everything for a long time, a call to “join with me in suffering for the gospel” probably sounds crazy, but when we live a life “not according to our works, but according to His own purpose and grace” we quickly learn how everything in life brings more peace and joy. It doesn’t make it easier or nicer necessarily, but it does bring peace and joy like you can’t imagine.

Whoever confesses that Jesus is the Son of God, God abides in him, and he in God. We have come to know and have believed the love which God has for us. God is love, and the one who abides in love abides in God, and God abides in him. By this, love is perfected with us, so that we may have confidence in the day of judgment; because as He is, so also are we in this world. There is no fear in love; but perfect love casts out fear, because fear involves punishment, and the one who fears is not perfected in love. (1 John 4:15-18) {emphasis mine}

If we repent of our sins and confess Jesus as Lord, the God and Creator of the universe lives in us. Is there anything more magnificent? When we trust in Jesus, “we may have confidence in the day of judgment.” When we love God, He loves us and “perfect love casts out fear.”

What Would I Do?

My son with Down Syndrome loves watching this show called “Mayday, Air Disaster.” It goes through different, real plane crashes and reviews how they figured out why the plane crashed. Sometimes everyone dies. Sometimes everyone lives. Sometimes some live and some die.

Watching this show and seeing the people (in reenactments) screaming in terror as the plane plummets to the ground makes me wonder how I would react in a similar circumstance. If I wasn’t a Christian, I’d probably never set foot on a plane again after watching the show. I’d like to think I would be like Jesus calmly praying “into thy hands I commit my spirit,” but I might be frantically gripping the armrests and screaming like the rest. I don’t guess anyone truly knows until they experience something like that.

Whatever the case, whether we act in perfect faith or whether we have a moment of weakness in fear of danger, pain, and the unknown, Jesus will be there with us, if we have trusted in Jesus as Savior. Everything is better with Jesus.

May our Lord, Creator, and Savior keep us in total faith, love, peace, and joy in Him so that we do not fear, no matter what trials we face. May He help us to lean on Him and not try to do everything ourselves or rely on stuff. May our faithful service and hope during trial glorify Him and draw many to Him.

Trust Jesus

-

@ d57360cb:4fe7d935

2025-06-18 15:38:43

@ d57360cb:4fe7d935

2025-06-18 15:38:43Your mind will berate you in performance. It’s self centered thinking that ruins your performance, it isolates you. Instead of being immersed in the experience of the game, you are caught in a web of your own stinking thinking.

Only thinking of yourself and how you will perform.

How others will judge you.

In your fear of what others think, you create the reality for them to judge you. You create an opportunity for them to distrust your gifts. Your fear is small and selfish. You must let go of oneself in order to be the creative expression of art.

Expression has no individual behind it, it is a force beyond small little me. Where once you took a step now it is the step that takes you.

We haven’t forgotten how to trust ourselves. We have forgotten how to love and accept ourselves and it shows when we contract and tighten under pressure.

Pressure is a spotlight it magnifies and calls you to bring forth your greatest gist, your greatest expression. Do not let the spotlight hinder you, most people are running from the light but the light always follows you, it’s like a shadow.

Until you come to accept that you are always in the spotlight only then can you realize what you do behind the scenes is also the scene itself.

-

@ cae03c48:2a7d6671

2025-06-18 16:01:05

@ cae03c48:2a7d6671

2025-06-18 16:01:05Bitcoin Magazine

Prenetics Becomes First Healthcare Firm to Launch Bitcoin Treasury Strategy With $20M BTC PurchasePrenetics Global Limited, a health sciences company, announced today that it has purchased $20 million worth of Bitcoin as part of a newly approved corporate treasury strategy. The company acquired 187.42 BTC at an average price of $106,712 and stated that its board has approved allocating the majority of its $117 million balance sheet to Bitcoin.

This follows the company’s strategic transfer of ownership of ACT Genomics, which increased its pro-forma cash to approximately $66 million and total liquid assets, including BTC and short-term holdings, to around $117 million.

According to a press release sent to Bitcoin Magazine, Danny Yeung, CEO of Prenetics stated, “With our strengthened balance sheet of $117 million in cash, BTC and short-term assets, we now have the financial foundation to pioneer innovative treasury management approaches, including our historic Bitcoin treasury strategy.”

Prenetics also announced the appointment of Andy Cheung, former COO of cryptocurrency exchange OKEx, to its Board of Directors. Cheung noted that the company’s Bitcoin strategy will include active treasury management, using tools such as derivatives and structured products.

“This isn’t about passive Bitcoin storage,” said Cheung. “We’re talking about dynamic treasury management using derivatives, yield strategies, and institutional-grade trading techniques.”

Prenetics plans to expand its Bitcoin holdings through institutional capital partnerships and to implement advanced return strategies. It also plans to accept Bitcoin payments across its direct to consumer platforms, including IM8 Health and CircleDNA.

In addition to Cheung, the company is working with two industry advisors, Tracy Hoyos Lopez, Chief of Staff at Kraken and a board member at the Bitcoin Advocacy Project, and Raphael Strauch, founder of crypto conference TOKEN2049.

“This is not a short-term play or market timing decision,” said Yeung. “We are implementing a comprehensive, long-term Bitcoin strategy that we believe will fundamentally transform our company’s value proposition.”

Prenetics reported strong recent growth, including a 336.5% year over year revenue increase in Q1 2025. It now operates three consumer health brands and maintains a deb free balance sheet.

Prenetics’ strategy shows Bitcoin’s tremendous growth and potential. But this time, from within the healthcare sector.

This post Prenetics Becomes First Healthcare Firm to Launch Bitcoin Treasury Strategy With $20M BTC Purchase first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-18 16:00:57

@ cae03c48:2a7d6671

2025-06-18 16:00:57Bitcoin Magazine

The Blockchain Group Buys $20 Million Worth Of BitcoinThe Blockchain Group has acquired an additional 182 Bitcoin for approximately €17 million ($19.6 million), further expanding its position as Europe’s first Bitcoin treasury company amid accelerating institutional adoption of Bitcoin reserves.

According to a press release issued June 18, the Euronext Growth Paris-listed company completed the purchases through multiple convertible bond issuances totalling over €18 million, subscribed by several investors, including UTXO Management, Moonlight Capital, and asset manager TOBAM.

JUST IN:

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million

French publicly traded, The Blockchain Group buys an additional 182 #Bitcoin for €17.0 million Nothing stops this train

pic.twitter.com/fwIqq934Yy

pic.twitter.com/fwIqq934Yy— Bitcoin Magazine (@BitcoinMagazine) June 18, 2025

The acquisitions bring The Blockchain Group’s total Bitcoin holdings to 1,653 BTC, purchased at an average price of €90,081 ($104,000) per coin. The company reported a “BTC Yield” – measuring Bitcoin holdings relative to fully diluted shares – of 1,173.2% year-to-date, significantly outpacing other major corporate holders.

The company’s latest purchases were executed through Swissquote Bank Europe and Banque Delubac, with custody provided by Swiss infrastructure provider Taurus. Additional funding came from the conversion of share warrants into 2.98 million ordinary shares, raising €1.6 million.

We’re seeing unprecedented growth in corporate Bitcoin treasury strategies. The Blockchain Group’s success has created a model for European companies, with new organizations announcing Bitcoin purchases almost weekly.

The company indicated potential plans to acquire an additional 70 BTC through ongoing transactions, which could bring its total holdings to 1,723 BTC. This follows recent Bitcoin treasury announcements from companies including Metaplanet, which now holds 10,000 BTC, and Strategy’s latest acquisition of 10,1000 BTC.

At press time, Bitcoin trades at $104,021, down 1.26% over the past 24 hours, as markets continue to process the implications of growing institutional adoption. The Blockchain Group’s shares were down 3.9% to €4.80 on Wednesday, trading on Euronext Paris.

This post The Blockchain Group Buys $20 Million Worth Of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ eb0157af:77ab6c55

2025-06-18 05:01:12

@ eb0157af:77ab6c55

2025-06-18 05:01:12The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ 0b65f96a:7fda4c8f

2025-06-18 15:09:17

@ 0b65f96a:7fda4c8f

2025-06-18 15:09:17Eine treffsicher, kurze und klare Rezension. Besser hätte ich das Buch selbst nicht zusammenfassen können. Herzlichen Dank an die Autorin!

Leseprobe und Bestellmöglichkeit: Zukunft beginnt im Kopf

Paperback, 148 Seiten, ISBN-13: 9783759734266, € 12,50

In jeder Buchhandlung erhältlich.

Dieser Beitrag wurde mit dem Pareto-Client geschrieben.

Noch nicht auf Nostr? Hier entlang zum leichten Einstieg!

Über den Autor

Patric I. Vogt, geb. 1968 in Mainz lebt als freischaffender Künstler, Lehrer und Unternehmer. Studium der Eurythmie, Anthroposophie, Sprachgestaltung und Ausbildung zum Instructor der M. Chekhov Acting Technique. Über drei Jahrzehnte Beschäftigung mit dem Ideenfeld soziale Dreigliederung und Anthroposphie. Moderation und Mediation von sozialen Prozessen und Organisationsentwicklung. Staatlich ungeprüft, abgesehen von den Fahrerlaubnissen zu Land und zu Wasser. Vom Leben mit vielen Wassern gewaschen und am liebsten auf eigenem Kiel unterwegs.\ Motto: Gedanken werden Worte, werden Taten!

www.perspektivenwechsel.social

post@perspektivenwechsel.social

Nostr patric@pareto.town

auf X @patricivogt

#dreigliederung

-

@ cae03c48:2a7d6671

2025-06-18 16:00:52

@ cae03c48:2a7d6671

2025-06-18 16:00:52Bitcoin Magazine

K33 Announces Plans To Purchase Up To 1,000 BitcoinK33 AB, a leading digital asset brokerage and research firm, announced today the launch of a SEK 85 million direct share issue to fund the purchase of Bitcoin. The company aims to build Bitcoin as a core asset on its balance sheet, targeting the accumulation of up to 1,000 BTC as a strategic reserve.

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI

PRESS RELEASE: K33 launches a share issue to finance the purchase of up to 1000 Bitcoin, with a minimum of SEK 85 million secured through pre-commitments pic.twitter.com/sG1LZjR6EI— K33 (@K33HQ) June 18, 2025

The share issue, priced at SEK 0.1036 per share, is fully backed by existing shareholders and new investors. Proceeds from the raise will be used exclusively to acquire BTC, supporting K33’s accumulation strategy revealed in May. By acquiring BTC, the company aims to strengthen its balance sheet, boost brokerage margins, launch new products, and attract more investors.

“This raise marks a major milestone towards our initial goal of acquiring 1000 BTC before scaling further,” commented the CEO of the Company Torbjørn Bull Jenssen. “We strongly believe that Bitcoin represents the future of global finance and are positioning K33 to benefit maximally from this. A strong balance sheet built on Bitcoin enables us to significantly improve our brokerage operation while maintaining full exposure to Bitcoin’s upside potential.”

As part of the strategy, K33 recently completed its first Bitcoin acquisition, purchasing 10 BTC for approximately SEK 10 million on June 3. This transaction is the initial deployment of capital from the SEK 60 million investment commitment announced earlier this year to support the company’s BTC treasury.

“We expect Bitcoin to be the best-performing asset in the coming years and will build our balance sheet in Bitcoin moving forward,” stated Jenssen. “This will give K33 direct exposure to the Bitcoin price and help unlock powerful synergies with our brokerage operation. Our ambition is to build a balance of at least 1000 BTC over time and then scale from there.”

During its Q1 2025 Report and Strategic Outlook presentation, K33 underscored the accelerating institutional adoption of Bitcoin, referencing the rapid growth of the US Bitcoin ETFs, which attracted more capital in its first year than gold ETFs had in the past two decades.

“For K33, Bitcoin is not only a high-conviction asset — it’s also a strategic enabler,” Jenssen said. “With a sizable BTC reserve, we will be able to strengthen our financial position while unlocking new revenue streams, product capabilities, and partnerships.”

This post K33 Announces Plans To Purchase Up To 1,000 Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 90c656ff:9383fd4e

2025-06-18 14:56:43

@ 90c656ff:9383fd4e

2025-06-18 14:56:43You've probably heard it before. A bitcoiner is asked about their sats and, with a sly smile, replies: “I lost it all in a boating accident.” But where did this phrase come from? Why do so many bitcoiners make this joke? And more importantly: what does it actually mean?

The Origin of the Meme The phrase "Lost all my Bitcoin in a boating accident" originally came from American forums among gun and precious metal enthusiasts—long before Bitcoin entered the mainstream. The original context went like this: someone would ask if you still owned your gold or firearm collection, and the sarcastic response would be, “Unfortunately, I lost everything in a boating accident.”

This excuse was used as a way to avoid declaring ownership of assets to the government or other authorities. After all, what can’t be proven to exist can’t be taxed, confiscated, or regulated. Over time, this logic found fertile ground among advocates of individual sovereignty—a group where bitcoiners naturally belong.

The Metaphor of Resistance When Bitcoin maximalists adopted the phrase, it came to represent more than just an excuse to dodge uncomfortable questions—it became a symbol of resistance against an increasingly invasive and coercive financial system. Saying you “lost your Bitcoin in a boating accident” is often a euphemism for:

“It’s none of your business how many sats I have.”

“I don’t recognize the authority of anyone trying to seize my digital wealth.”

“My assets are sovereign, self-custodied, and unreachable by traditional means.”

Bitcoin Is Freedom, Not Compliance The meme also touches on a core pillar of Bitcoin philosophy: self-custody and the right to financial privacy. In a world where governments freeze accounts, censor transactions, and print money at will, owning Bitcoin is a form of civil resistance. But for that to have real power, the individual must take responsibility—not just for custody, but for silence.

Saying you “lost your Bitcoin” is also a reminder: Don’t talk about your private keys. Don’t flaunt your sats. Don’t paint a target on your back.

A Meme With a Purpose At the end of the day, the “boating accident” is a joke with a very serious undertone. It reminds us that in a truly sovereign system, the ownership of digital assets is something intimate, personal—and, if needed, deniable. It’s a way to reaffirm that Bitcoin is not just a tool for investment, but a tool for freedom.

So next time someone asks where your bitcoins are, just smile and say:

“Unfortunately, I lost it all in a boating accident…”

And let them wonder.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ a53364ff:e6ba5513

2025-06-18 14:30:19

@ a53364ff:e6ba5513

2025-06-18 14:30:19Cashu is a free and open-source Chaumian ecash protocol built for Bitcoin. Ecash is a digital bearer token that is stored on a user's device, very similar to physical cash. The Cashu protocol allows you to build applications such as wallets or voucher systems. Cashu is designed to be private, secure and scalable. Transactions are instant and nearly free.

What is Cashu?

Cashu is an ecash protocol that is integrated with the Bitcoin protocol. An Ecash system consists of two parts, the mint and the Ecash wallet. Anyone can run a mint for their application, be it a wallet, a web paywall, paid streaming services, or a voucher and rewards system for a super market. Ecash transactions between users or from the user to a service provider respect the user's privacy. A mint does not store a database of user accounts and their activity which protects users of an Ecash system from leaks their private data to hackers and can provide stronger censorship resistant than classical payment systems.

The Cashu Protocol

Cashu is an ecash protocol built for Bitcoin. It is an open protocol which means that everyone can write their own software to interact with other Cashu apps. Applications that follow the specifications will be compatible with the rest of the ecosystem.

Cashu wallets

Nutshell

Nutshell is a CLI wallet available through PyPi. It is the first Cashu wallet and mint. Both, the mint and the wallet can be used as standalone software or included into other applications as a library. It has full Bitcoin Lightning integration, PostgreSQL and SQLite database support, builtin Tor, supports multiple mints, and can send and receive tokens on nostr, and supports complex spending conditions tokens.

Nutstash

Nutstash is a Cashu web wallet with many features such as multimint support and support for sending and receiving tokens via nostr. Nutstash is written in TypeScript and uses the cashu-ts library.

Minibits

Minibits is a mobile Cashu wallet with a focus on performance and usability.

Cashu.me

Cashu.me is another web wallet built on Quasar and Vue.js. It is written in JavaScript and TypeScript and is in active development.

Macadamia

Macadamia is a Cashu wallet for iOS written in Swift.

Sovran

Sovran is a Cashu wallet for iOS.

Prism

Prism wallet is a social wallet that runs on Discord.

Boardwalk

Boardwalk Cash is a wallet designed for fast, easy onboarding and use.

-

@ 472f440f:5669301e

2025-06-18 04:25:57

@ 472f440f:5669301e

2025-06-18 04:25:57Marty's Bent

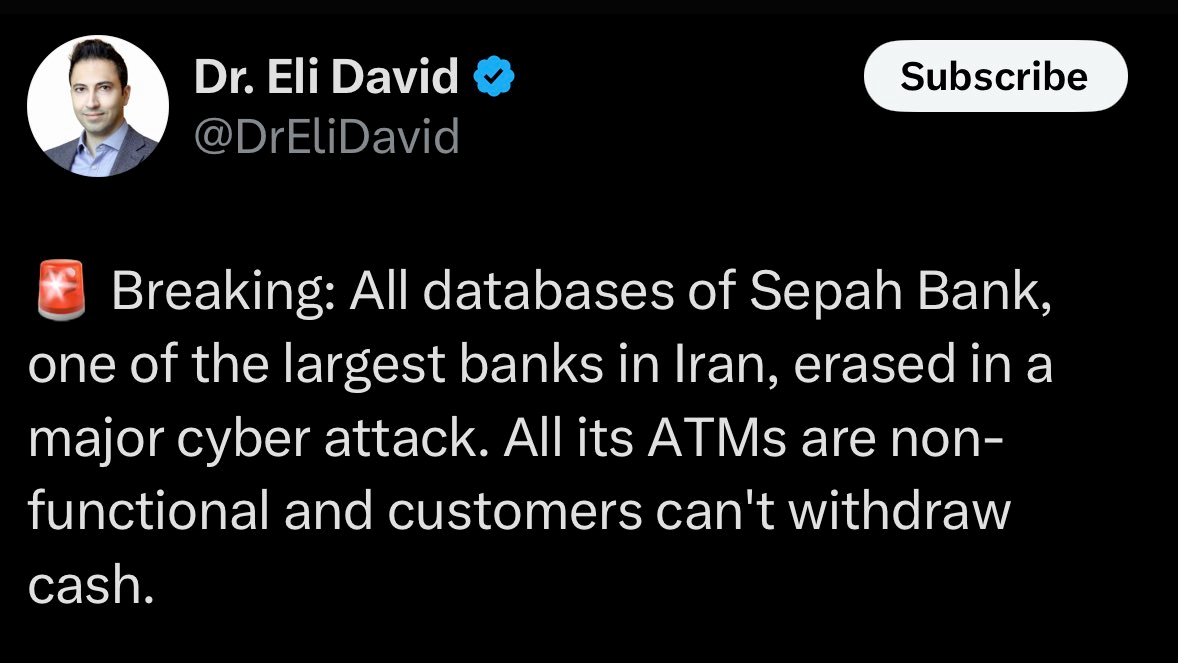

via Dr. Eli David

The case for a neutral, permissionless monetary protocol has never been stronger. The incumbent financial system is a permissioned wall garden that is susceptible to a tax. When you're using this system, you don't own your money. Your money doesn't really even exist. What you have is a claim to be able to ask your bank to give you your money or move it somewhere that you desire. Not only is it a permissioned wall garden, but it is an insecure permissioned wall garden that is susceptible to attacks from nefarious actors.

This was made very clear earlier today when Sepah Bank in Iran was the subject of a cyber attack that led to all of its databases being erased and their ATMs being deemed non-functional. Sepah Bank customers have been unable to withdraw cash. And many are warning Iranian citizens to withdraw as much cash as possible from any ATM outside of Sepah Bank's network that is working. Because there is a high likelihood that other banks and ATM networks will be targeted.

Bitcoin is a digital bearer instrument that you can custody yourself using either a software or hardware wallet. The network is operated by an army of geographically distributed nodes that maintain the rules and ensure that anybody trying to transact within the network is doing so within the rules that are set forth. Bitcoin is a push system, not a pull system. It is extremely hard to attack in the way that Sepah Bank was attacked earlier today.

I think it's important to note the way in which Sepah Bank was attacked and highlight that it is starkly different from the types of attacks or shortcomings from the financial system that we've seen over the years.

One of the events that caused a rush to Bitcoin over a decade ago was the banking crisis in Cyprus. We've seen hyperinflationary events in countries like Lebanon and Turkey that have rendered their currencies defunct. In the case of Lebanon, the central bank simply came out and said that people were not going to have access to their money and gave Lebanese citizens an overnight haircut on their savings. We've seen countries like India and Nigeria mess with their physical bills, forcing their citizens to exchange smaller denominations for larger denominations, causing massive disruptions in the process.

We've seen the United States government and its allies freeze the treasury assets of its enemies and they move towards a more multipolar monetary order over the last five years. We've seen the Canadian government freeze the bank accounts of protesters fighting for bodily autonomy. We've seen Operation Chokepoint 1.0 and 2.0. Here in the United States, the government directly targeted industries and businesses within those industries by either overtly preventing them from accessing bank accounts or covertly making it as hard as possible to access bank accounts.

On top of all this, obviously, we have the constant drumbeat of currency debasement across the world, even here in the United States, where the Federal Reserve and Federal Government are expanding the monetary base and going further into debt, ultimately destroying the purchasing power of the dollar at an increasing rate over time.

However, this type of cyber attack on a bank is unique, at least from what I can recall. The ability of nefarious actors to access bank databases and erase them is something new and something that should not be taken lightly. If Iranian hacking capabilities are as sufficient and capable as we are led to believe, it's not hard to imagine that we could see some retaliatory actions from the Iranian regime to counteract the attack on their banking system.

I don't want to incite alarm in any of you, but I think it is important to highlight that this new attack vector is definitely a step towards financial nihilism that could put hundreds of millions, if not billions of people in harm's way, in the sense that they could wake up one morning and be told that the bank does not have access to the records of their cuck buck IOUs. If something like this were to happen, I'm sure anyone who isn't holding Bitcoin in a wallet that they control will really wish they were. Being able to access your money is a vital part of being able to live you life. The thought of that ability being taken away because of a hacking war that breaks out is extremely unnerving.

As I said at the top of this letter, the case for a neutral, permissionless, distributed monetary system with a native currency that is finite is clearer than it ever has been, at least for me. It is imperative that you and anyone that you care about holds Bitcoin in self-custody to inoculate yourselves from these very real risks that are only going to increase from here on out.

Eliminate the trusted third party risks that exist in your life. Use Bitcoin as your money and use it correctly by holding it in self-custody.

Why 5% Interest Rates Won't Trigger The Next Market Crash

Guest Mel Mattison challenges the prevailing fear around rising interest rates, arguing that markets have developed immunity to higher yields. Unlike 2023's sharp selloff when the 10-year hit 5%, Mattison believes equities and Bitcoin can now absorb these levels because they signal stronger growth expectations ahead. He emphasizes that the pace of rate increases matters more than absolute levels, and notes that markets have had time to adjust. With oil trading at just $65 per barrel—a fraction of its inflation-adjusted 2008 peak of over $200—the deflationary pressure from cheap energy provides a crucial buffer.

> "It's not just what the rate we get to, it's how fast we get there." - Mel Mattison

Mattison's most compelling argument centers on AI-driven productivity gains enabling companies to maintain margins despite higher borrowing costs. As I've witnessed firsthand implementing AI tools at TFTC, what once required hiring multiple employees can now be handled by one person with the right automation. This productivity revolution means traditional rate sensitivity models may no longer apply.

Check out the full podcast here for more on institutional Bitcoin adoption, resistance money warnings, and bipartisan coalition building.

Headlines of the Day

Davis Commodities Puts 40% of $30M Into Bitcoin - via X

Ukraine Bill Adds Bitcoin to National Reserves - via X

Vinanz Raises £3.58M to Expand Bitcoin Mining - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

The joy of a 5-year old riding a bike for the first time is something that should be protected at all costs.

*Download our free browser extension, Opportunity Cost: *<https://www.opportunitycost.app/> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ beef3d4d:479b72bc

2025-06-18 14:04:41

@ beef3d4d:479b72bc

2025-06-18 14:04:41Perché chiamare Bisanzio questa community? Ci sono due ragioni principali: una legata all'economia, l’altra alla tecnologia. Vediamole!

Costantino e il solidus

Quando Costantino il Grande prese in mano le redini dell'impero, ne risollevò le sorti adottando riforme economiche lungimiranti. Tra gli impegni assunti, il più importante fu quello di mantenere il solidus a 4,5 grammi d'oro senza tagli o svalutazioni, coniandolo in grandi quantità a partire dal 312 d.C.. Spostò poi la capitale verso est, a Bisanzio, nel punto di incontro tra Asia ed Europa, dando vita all'Impero Romano d'Oriente, che adottò il solidus come moneta.

Mentre Roma continuava a deteriorarsi economicamente, socialmente e culturalmente, crollando infine nel 476 d.C., Bisanzio, poi rinominata Costantinopoli, sopravvisse per quasi 1200 anni, e il solidus divenne la moneta più longeva e accettata della storia.

Il nome Bisanzio vuole quindi essere un omaggio alla saggezza di Costantino e celebrare l’unica moneta nella storia dell’umanità capace di durare oltre un millennio. Un esempio ed un auspicio per la Bitcoin, moneta di oro digitale che ci accompagnerà per un lunghissimo tempo.

\

Vedi anche: Monetazione bizantina su Wikipedia.

\

Vedi anche: Monetazione bizantina su Wikipedia.Il problema dei generali bizantini

Il termine Bitcoin soffre di un’ambiguità semantica: con lo stesso termine si indicano due cose ben diverse tra loro: il protocollo di comunicazione e la moneta digitale costruita su di esso. Bitcoin inteso come protocollo rappresenta la prima soluzione a un problema informatico, centrale per il funzionamento di sistemi distribuiti, denominato problema dei generali bizantini, formulato nel 1982 e che e’ rimasto irrisolto per decenni.

La sua formulazione è tipicamente la seguente:

Diverse divisioni dell’esercito bizantino, ciascuna guidata da un generale, sono accampate in posizioni strategiche attorno a una città nemica e dovono condividere una strategia di attacco coordinato per poter sopraffare il nemico. Le divisioni possono comunicare solo mediante messaggeri al fine di coordinare l’attacco decisivo. Il terreno impedisce alle divisioni bizantine di comunicare a distanza e queste possono comunicare solo tramite dei messaggeri. Come possono le varie divisioni accordarsi per un attacco congiunto sapendo che i messaggeri che inviano potrebbero essere catturati dal nemico, o che alcuni generali potrebbero addirittura tradire e mandare messaggeri con ordini sbagliati?

Il problema che devono risolvere i generali bizantini è lo stesso che affligge i sistemi di elaborazione distribuiti. Come raggiungere un consenso su una rete distribuita in cui alcuni nodi che la costituiscono possono essere difettosi o corrotti?

Il protocollo Bitcoin offre una soluzione a questo problema introducendo il concetto di “prova di lavoro” (proof of work) e della “catena di blocchi” (blockchain). E quindi, nuovamente, il nome Bisanzio si collega a Bitcoin ed alla principale innovazione tecnologica da esso introdotta.

\ Vedi anche: Byzantine fault su Wikipedia.

-

@ beef3d4d:479b72bc

2025-06-18 13:37:05

@ beef3d4d:479b72bc

2025-06-18 13:37:05Il progetto online Bisanz.io nasce dalla convinzione che Bitcoin sia un incredibile strumento di promozione e giustizia sociale, e nessuno che si dica riformista o progressista dovrebbe ignorare questo fatto. Un sito web in cui progressisti, riformisti, ambientalisti ed attivisti per la democrazia possano informarsi e discutere su com Bitcoin possa ridurre le disparità e le storture dell’attuale sistema finanziario.

L’urgenza di attivarsi affinché questa visione si diffonda nasce dal rischio concreto che si ripeta in Europa la stessa dinamica osservata negli Stati Uniti, dove questo tema fondamentale è stato lasciato nelle mani delle destre, da quelle liberali alle neo-con. La posizione del Partito Democratico USA su Bitcoin è infatti oggi ampiamente ostile, in maniera pregiudiziale e dettata principalmente da ragioni di posizionamento strategico.

In Italia Bitcoin è, al momento, semplicemente ignorato dalla politica. In Europa la situazione non è molto diversa da quella italiana con rare eccezioni.

Questa apatia della politica italiana ed europea nei confronti di Bitcoin può essere vinta mostrando quanto grande sia il potenziale di progresso sociale, equità e pace derivante dall'adozione di Bitcoin. Una opportunità che i progressisti europei dovrebbero cogliere, guidando l’analisi e il dibattito su questi temi.

Non si tratta naturalmente di inserire la parola “blockchain” nei contesti più assurdi (vedi i pomodori e le arance di Di Maio), ma di elaborare proposte unitarie di politica monetaria che includano una tecnologia (Bitcoin) rodata, democratica, globale, solidale.

Nel gruppo di amici che ha dato vita a Bisanz.io, c’è chi segue e studia con passione il tema Bitcoin dal lontano 2010, e chi invece ci si è avvicinato solo di recente. Cosa ci accomuna è la consapevolezza che questa innovazione ha il potenziale per risolvere le tante storture dell’attuale sistema finanziario. Una tecnologia che proteggendo i soggetti più deboli, può contribuire a ridurre le disparità, proteggere i risparmi, e stimolare gli investimenti.

Purtroppo, Bitcoin è ancora visto da tanti come uno strumento per criminali e speculatori, una percezione in gran parte giustificata da vicende legate non a Bitcoin, ma alle cosiddette criptovalute, e al più recente fenomeno dei token e degli NFT. Queste “innovazioni” nulla hanno a che spartire con la tecnologia e i valori di Bitcoin (decentralizzazione, trasparenza, open access, …) e le loro aberrazioni hanno alimentato la narrazione di cui sopra.

Più recentemente si è aggiunta la critica relativa all'impatto ambientale di Bitcoin, critica ancor più pretestuosa e in malafede. Chiunque dedichi un minimo di studio all'argomento potrà constatare come essa risulti infondata e che il mining di Bitcoin sia in realtà un prezioso alleato nella transizione alle energie rinnovabili. Queste ombre e la copertura mediatica negativa non hanno impedito all'ecosistema di Bitcoin di svilupparsi e crescere con costanza dal 2009 a oggi. Mentre centinaia di monete digitali alternative, nascevano e morivano guidate solo da logiche di profitto (o peggio), Bitcoin ha sempre tenuto la barra dritta sui valori fondanti, ampliato la base di utenti e le tipologie di utilizzo (esempio: pagamenti istantanei con Lightning Network).

La missione di Bisanzio è semplice: portare il nostro contributo affinché in Italia ed Europa maturino proposte per consentire a Bitcoin di esprimere tutto il suo potenziale democratico e di giustizia.

-

@ 9ca447d2:fbf5a36d

2025-06-18 04:02:01

@ 9ca447d2:fbf5a36d

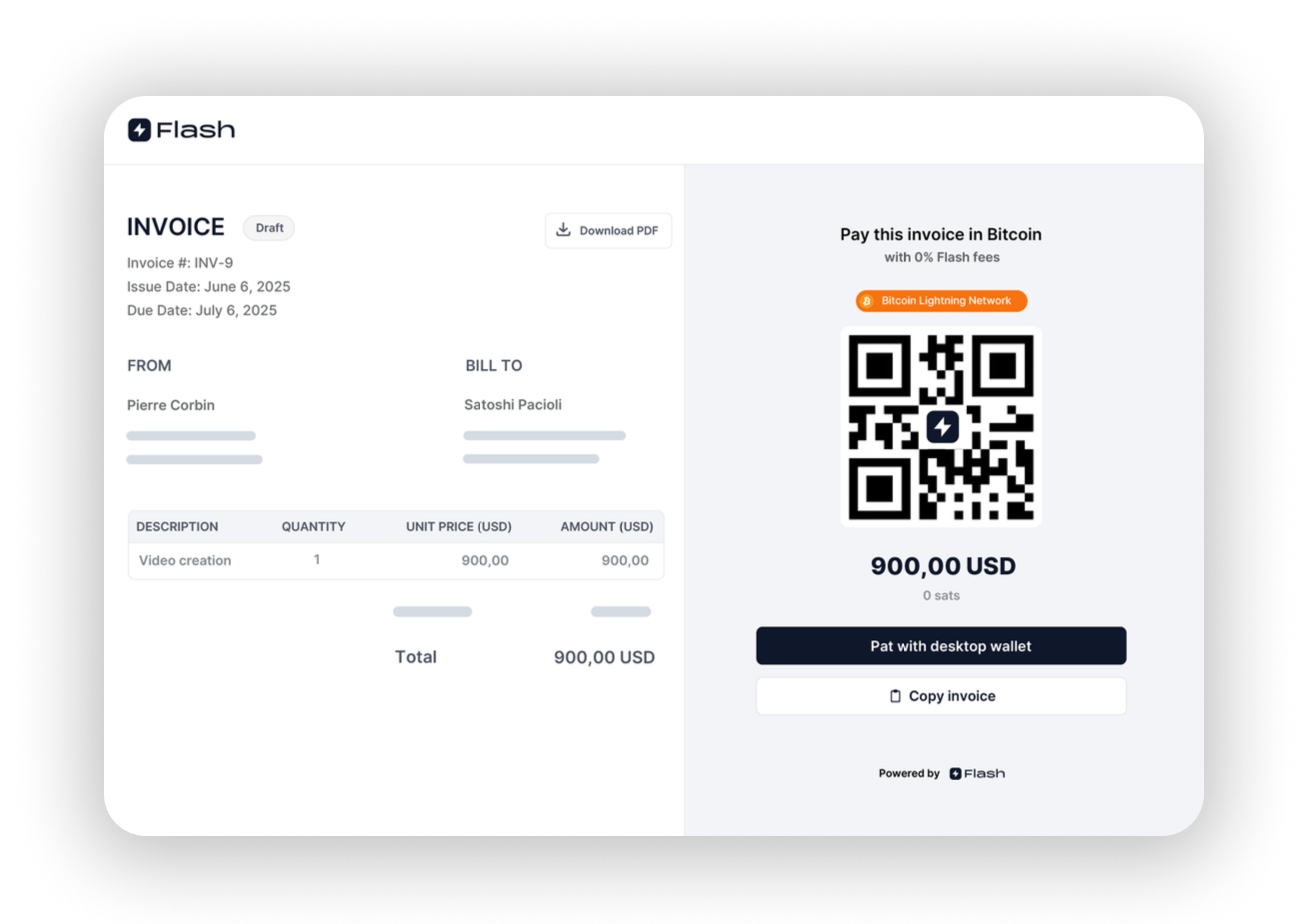

2025-06-18 04:02:01Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash