-

@ 9ca447d2:fbf5a36d

2025-06-14 02:01:56

@ 9ca447d2:fbf5a36d

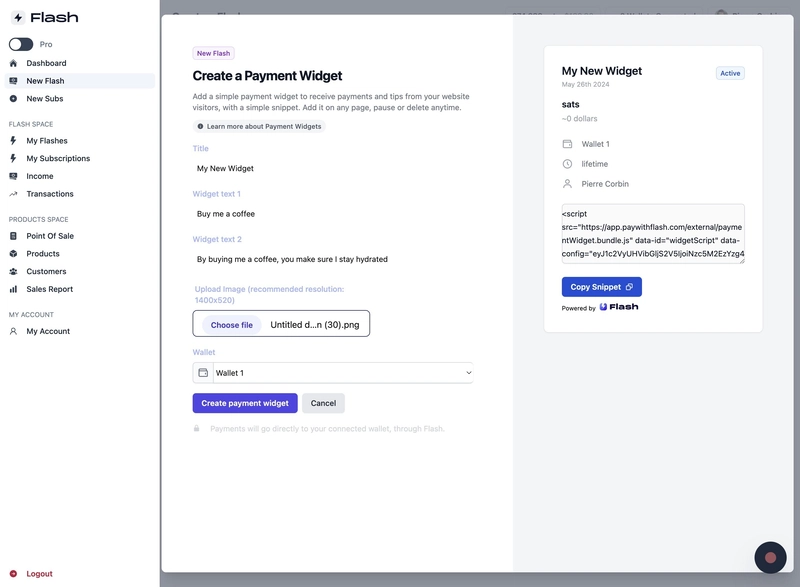

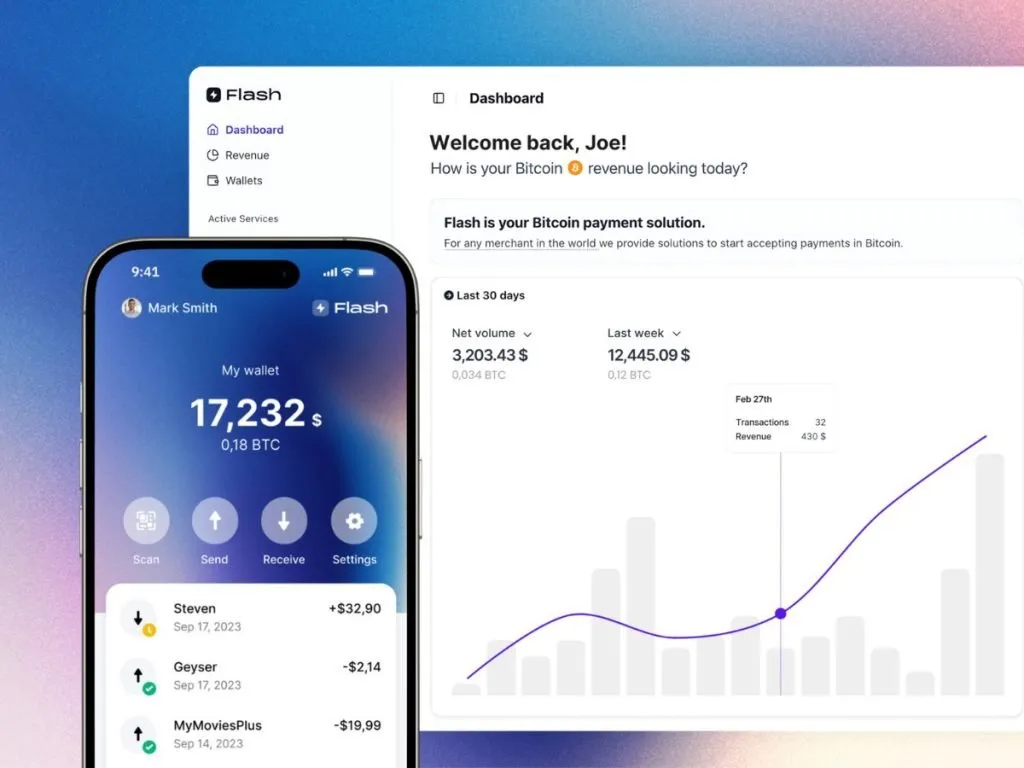

2025-06-14 02:01:56Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ b9d5de4b:26c0a1b8

2025-06-14 01:51:07

@ b9d5de4b:26c0a1b8

2025-06-14 01:51:07Hello, legitmately asking for a friend...does anyone know of a way to recover a bip38 address created on bitaddress? they claim to have both keys just dont know the passphase.

https://stacker.news/items/1005953

-

@ 5d4b6c8d:8a1c1ee3

2025-06-14 01:26:59

@ 5d4b6c8d:8a1c1ee3

2025-06-14 01:26:59OMAD is great! Outside the very short window eating window, I have almost no desire to eat or drink.

I also took a nap today and a cold shower. I just needed to be more active.

How did you all do today? Are you making progress towards your ~HealthAndFitness goals?

https://stacker.news/items/1005945

-

@ 73d8a0c3:c1853717

2025-06-14 00:36:38

@ 73d8a0c3:c1853717

2025-06-14 00:36:38🧬 REDACTED SCIENCE: THE AUTHOR — A SHADOW IN THE MARGINS

📜 Excerpt from my book-in-progress. This is nonfiction. Redacted. Possibly buried science. Possibly military. Almost definitely real. I’m living it. And it might change how we think about disease, dehydration, and survival itself.

👇 Full post below 👇

📄 The Author: A Shadow in the Margins

What follows is an excerpt from my book: Redacted Science. This is nonfiction. Redacted. And, I believe, novel science — the kind that slipped through the cracks because it wasn’t supposed to be seen. The kind that, if true (and I’m living proof it might be), changes how we think about adaptation, disease, and control, all while hinting at evolutionary processes.

The person who wrote the article — the one at the center of this entire mystery — didn’t just document a medical condition. They didn’t write like a detached observer. They wrote like someone who had seen it, worked with it, maybe even helped design it.

This wasn’t a paper. It was a record.

A flare fired backwards through time.🧠 What They Knew

- Electrolyte manipulation under pressure gradients

- Bone demineralization and molecular substitution

- Methyl group cycling

- Autonomic dysregulation

- Increased survivability under dehydration

- Accelerated burn recovery

- Abnormal pain tolerance

- Enhanced cognition and endurance in early stages

- …eventual collapse into parasympathetic failure, bone loss, immune misfire, and systemic decay

No generalist writes like this.

No academic from 1975 casually throws around methylation chemistry and calcium channel modulators (“these show promise” — yeah, I remembered that line. I figured it might save my life).🧪 Proof in My Blood — Or Lack Thereof

I’ve lived the proof they described.👁️ Who They Were

They were part of a program.

A researcher. Maybe a clinician. Possibly embedded in a classified military or survival physiology initiative.🔍 The Quiet Warning

That mention of the ICD code shift?

It was like someone watching history be rewritten — shifting this condition under something it isn’t. Sleight-of-hand.

They couldn’t have known about the AIRE gene — and I don’t have it.“We erased it from the books. But it was real. Look again. Find it if you can.”

And here I am.

Picking it up.

Line by line.

Molecule by molecule.🏃 The 15K That Almost Killed Me

Twelve years ago: I ran the Tulsa Run, didn’t hydrate. Felt fine — until the vomiting hit. Bloodwork? Normal.

Smart doc took one look and hooked up fluids.That wasn’t dehydration.

That was a system built to survive without water — until it couldn’t.🕰️ When and Why

Photos: early 20th century.

The article? 1975–1985.

Someone who knew too much. Someone preserving knowledge — as it was being erased.“It’s gone now. But it was here. And you need to look again.”

That’s not footnote energy.

That’s whistleblower energy.

🧠 Everything is open. All science is free. More is coming.

Read more at https://jimcraddock.substack.com or https://jimcraddock.com]

-

@ edeb837b:ac664163

2025-06-13 21:15:05

@ edeb837b:ac664163

2025-06-13 21:15:05On June 10th, 2025, four members of the NVSTly team traveled to New York City to attend the 2025 American Business Awards® ceremony, held at the iconic Marriott Marquis in Times Square. It was an unforgettable night as we accepted the Gold Stevie® Award for Tech Startup of the Year—this time, in person.

Meow (left), rich (center), MartyOooit (right)

Representing NVSTly at the event were:

- Rich, CEO & Founder

- Meow, CTO, Lead Developer, & Co-Founder

- MartyOooit, Investor

- Noob, Market Analyst (not shown in photos)

MartyOooit (left), rich (center), Meow (right)

While we shared the exciting news back in April when the winners were announced, being there in person alongside other winners—including eBay, AT&T, T-Mobile, HP Inc., and Fidelity Investments—made the achievement feel even more surreal. To be honored alongside billion-dollar industry leaders was a proud and humbling moment for our startup and a huge milestone in NVSTly’s journey.

🎤 Team Interview at the Event

During the event, our team was interviewed about the win. When asked:

“What does winning a Stevie Award mean for your organization?”

“How will winning a Stevie Award help your organization?”Here’s what we had to say:

📺 Watch the video

A Big Win for Retail Traders

NVSTly was awarded Gold for Tech Startup of the Year in recognition of our work building a powerful, free social investing platform that empowers retail traders with transparency, analytics, and community-driven tools.

Unlike traditional finance platforms, NVSTly gives users the ability to:

- Share and track trades in real time

- Follow and receive alerts from top traders

- Compete on global leaderboards

- Access deep stats like win rate, average return, and more

Whether you're a beginner or experienced trader, NVSTly gives you the insights and tools typically reserved for hedge funds—but in a free, social format built for the modern investor.

Continued Recognition and Momentum

This award adds to a growing list of recognition for NVSTly:

- 🏆 People’s Choice Winner at the 2024 Benzinga Fintech Awards

- 🔁 Nominated again for Best Social Investing Product in the 2025 Benzinga Fintech Awards

- 🌟 Team members JustCoreGames and Lunaster are nominated for Employee of the Year (Information Technology – Social Media) in the 2025 Stevie® Awards for Technology Excellence

We’re beyond proud of what our small but mighty team has accomplished—and we’re just getting started. 🚀

Thanks to the Stevie Awards for an incredible night in New York, and to our community of 50,000+ traders who’ve helped shape NVSTly into what it is today.

This win is yours, too.Stay tuned—more big things are coming.

— Team NVSTly

The event brought together some of the most respected names in tech, finance, and business. -

@ f40a134b:60fb788b

2025-06-13 21:10:14

@ f40a134b:60fb788b

2025-06-13 21:10:14{"url":"https://convy.click","title":"Convy","description":"","submittedAt":1749849014}

-

@ f40a134b:60fb788b

2025-06-13 21:07:02

@ f40a134b:60fb788b

2025-06-13 21:07:02{"url":"https://test.com","title":"test.com","description":"","submittedAt":1749848822}

-

@ b1ddb4d7:471244e7

2025-06-14 01:01:23

@ b1ddb4d7:471244e7

2025-06-14 01:01:23The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

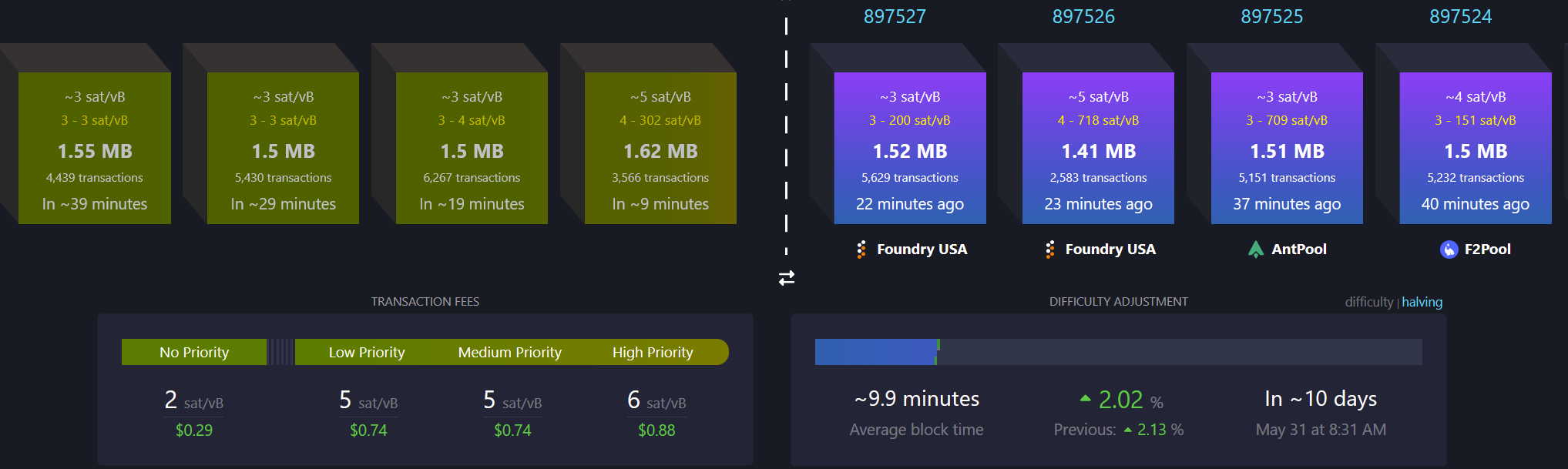

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ a4a6b584:1e05b95b

2025-06-13 20:27:58

@ a4a6b584:1e05b95b

2025-06-13 20:27:58Prerequisites

```bash

Make sure your package list is fresh

sudo apt update

(Optional but recommended) ffmpeg lets yt-dlp negotiate the best formats

sudo apt install ffmpeg jq ```

1 Install yt-dlp system-wide

bash sudo curl -L https://github.com/yt-dlp/yt-dlp/releases/latest/download/yt-dlp \ -o /usr/local/bin/yt-dlp && sudo chmod a+rx /usr/local/bin/yt-dlpA single binary is dropped into

/usr/local/bin/; version upgrades are as simple as running the same command again in the future.

2 Download the auto-generated captions as SRT

Pick any video ID—here we’ll use knAGgxzYqw8 (Chase Hughes on What is Money?).

```bash VIDEO="knAGgxzYqw8" # change this to your target ID

yt-dlp --skip-download \ --write-auto-sub \ --sub-lang en \ --sub-format srt \ -o "${VIDEO}.%(ext)s" \ "https://youtu.be/${VIDEO}"

Result: knAGgxzYqw8.en.srt

```

Flags explained

| Flag | Purpose | | ------------------ | ------------------------------------------------------- | |

--skip-download| ignore the actual video, we only want captions | |--write-auto-sub| fall back to YouTube’s auto-generated subtitles | |--sub-lang en| grab English only (adjust if you need another language) | |--sub-format srt| SRT is the simplest to strip; VTT also works | |-o| sets a predictable filename:<id>.en.srt|

3 Strip index numbers and timecodes

```bash grep -vE '^[0-9]+$|^[0-9]{2}:' "${VIDEO}.en.srt" \ | sed '/^[[:space:]]*$/d' \

"${VIDEO}.txt" ```

Breakdown

-

grep -vE '^[0-9]+$|^[0-9]{2}:' -

Removes the line counters (

3911) and any line that begins with a timestamp (02:33:40,800 --> …). -

sed '/^[[:space:]]*$/d' -

Deletes leftover blank lines.

- Output is redirected to

<ID>.txt—in our example: knAGgxzYqw8.txt.

4 (Option-al) Extra polish

Remove bracketed stage cues such as

[Music]or[Applause]and collapse back-to-back duplicates:```bash grep -v '^[.*]$' "${VIDEO}.txt" \ | awk 'prev != $0 {print} {prev=$0}' \

"${VIDEO}_clean.txt" mv "${VIDEO}_clean.txt" "${VIDEO}.txt" ```

5 Enjoy your transcript

bash less "${VIDEO}.txt" # page through grep -i "keyword" "${VIDEO}.txt" # quick searchYou now have a plain-text file ready for note-taking, quoting, or feeding into your favorite AI summarizer—no browser or third-party web services required.

TL;DR (copy-paste cheat sheet)

```bash sudo apt update && sudo apt install ffmpeg jq -y sudo curl -L https://github.com/yt-dlp/yt-dlp/releases/latest/download/yt-dlp \ -o /usr/local/bin/yt-dlp && sudo chmod a+rx /usr/local/bin/yt-dlp

VIDEO="knAGgxzYqw8" # video ID yt-dlp --skip-download --write-auto-sub --sub-lang en \ --sub-format srt -o "${VIDEO}.%(ext)s" \ "https://youtu.be/${VIDEO}"

grep -vE '^[0-9]+$|^[0-9]{2}:' "${VIDEO}.en.srt" \ | sed '/^[[:space:]]$/d' \ | grep -v '^[.]$' \ | awk 'prev != $0 {print} {prev=$0}' \

"${VIDEO}.txt"

less "${VIDEO}.txt" ```

Happy transcribing!

Adam Malin

npub15jnttpymeytm80hatjqcvhhqhzrhx6gxp8pq0wn93rhnu8s9h9dsha32lxYou can view and write comments on this or any other post by using the Satcom browser extention.

value4value Did you find any value from this article? Click here to send me a tip!

-

-

@ 8173f6e1:e488ac0f

2025-06-13 19:18:56

@ 8173f6e1:e488ac0f

2025-06-13 19:18:56{"voteEventId":"083ae248828a454a7d01b7de12f99ce90297672e0457ec8147bd7cfabd14f044","txHash":"752d3894c5657758d7b9754da3dc38db61662acb5f94c3dcb38077fc33f1bd7e","amount":"1000000000000000000","fee":"1000000000000000000","type":"token-gated-vote-proof"}

-

@ c631e267:c2b78d3e

2025-06-13 19:13:38

@ c631e267:c2b78d3e

2025-06-13 19:13:38Ich dachte immer, jeder Mensch sei gegen den Krieg, \ bis ich herausfand, dass es welche gibt, \ die nicht hingehen müssen. \ Erich Maria Remarque

Was sollte man von einem Freitag, den 13., schon anderes erwarten?, ist man versucht zu sagen. Jedoch braucht niemand abergläubisch zu sein, um den heutigen Tag als unheilvoll anzusehen. Der israelische «Präventivschlag» von heute Nacht gegen militärische und nukleare Ziele im Iran könnte allem Anschein nach zu einem längeren bewaffneten Konflikt führen – und damit unweigerlich zu weiteren Opfern.

«Wir befinden uns im Krieg», soll ein ranghoher israelischer Militärvertreter gesagt haben, und der Iran wertet den israelischen Angriff laut seinem Außenminister als Kriegserklärung. Na also. Der Iran hat Vergeltungsschläge angekündigt und antwortete zunächst mit Drohnen. Inzwischen ist eine zweite israelische Angriffswelle angelaufen. Ob wir wohl künftig in den Mainstream-Medien durchgängig von einem «israelischen Angriffskrieg auf den Iran» hören und lesen werden?

Dass die zunehmenden Spannungen um das iranische Atomprogramm zu einer akuten Eskalation im Nahen Osten führen könnten, hatte Transition News gestern berichtet. Laut US-Beamten sei Israel «voll bereit», den Iran in den nächsten Tagen anzugreifen, hieß es in dem Beitrag. Heute ist das bereits bittere Realität.

Der Nahe Osten steht übrigens auch auf der Themenliste des diesjährigen Bilderberg-Treffens, das zurzeit in Stockholm stattfindet. Viele Inhalte werden wir allerdings mal wieder nicht erfahren, denn wie immer hocken die «erlauchten» Persönlichkeiten aus Europa und den USA «informell» und unter größter Geheimhaltung zusammen, um über «Weltpolitik» zu diskutieren. Auf der Teinehmerliste stehen auch einige Vertreter aus der Schweiz und aus Deutschland.

Die Anwesenheit sowohl des aktuellen als auch des vorigen Generalsekretärs der NATO lässt vermuten, dass man bei dem Meeting weniger über das Thema «Neutralität» sprechen dürfte. Angesichts des Zustands unseres Planeten ist das schade, denn der Ökonom Jeffrey Sachs hob kürzlich in einem Interview die Rolle der Neutralität in geopolitischen Krisen hervor. Mit Blick auf die Schweiz betonte er, der zunehmende Druck zur NATO-Annäherung widerspreche nicht nur der Bundesverfassung, sondern auch dem historischen Erbe des Landes.

Positives gibt es diese Woche ebenfalls zu berichten. So hat der US-Gesundheitsminister Robert F. Kennedy Jr. nach der «sensationellen» Entlassung aller Mitglieder des Impfberatungsausschusses (wegen verbreiteter direkter Verbindungen zu Pharmaunternehmen) nun auch bereits neue Namen verkündet. Demnach möchte er unter anderem Robert W. Malone, Erfinder der mRNA-«Impfung» als Technologie und prominenter Kritiker der Corona-Maßnahmen, in das Komitee aufnehmen.

Auch die Aufarbeitung der unsinnigen Corona-Politik geht Schrittchen für Schrittchen weiter. In Heidelberg hat die Initiative für Demokratie und Aufklärung (IDA) den Gemeinderat angesichts der katastrophalen Haushaltslage zu einer offenen und ehrlichen Diskussion über die Ursachen der Krise aufgefordert. Das Thema «Corona» sei «das Teuerste, was Heidelberg je erlebt hat», sagte IDA-Stadtrat Gunter Frank im Plenum. Außerdem seien aus den Krisenstabsprotokollen der Stadt auch die enormen Verwerfungen ersichtlich, und es gebe Anlass für tiefgehende Gespräche mit der Stadtverwaltung.

Den juristischen und öffentlichen Druck auf die Kommunen möchte der Unternehmer Markus Böning erhöhen. Seine «Freiheitskanzlei» will Bürgern helfen, die Aufarbeitung selbst in die Hand zu nehmen. Unter dem Motto «Corona-Wiedergutmachung» bietet er Hilfestellung, wie Betroffene versuchen können, sich unrechtmäßige Bußgelder zurückzuholen.

So bleibt uns am Ende dieses finsteren Freitags doch auch Anlass zur Hoffnung. Es gibt definitiv noch Anzeichen von Menschlichkeit. Darauf möchte ich mich konzentrieren, und mit diesem Gefühl verabschiede ich mich ins Wochenende.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ d62e8d04:569fa79c

2025-06-13 18:35:37

@ d62e8d04:569fa79c

2025-06-13 18:35:37In today's fast-paced digital world, where cyber threats are constantly evolving, and blockchain technology is reshaping industries, Privkey LLC emerges as a leader in providing cutting-edge solutions. Founded in 2018 and headquartered in Miami, Florida, Privkey LLC is dedicated to safeguarding businesses through its expertise in cybersecurity and blockchain technology. With over 20 years of experience in networking and the Internet, the company positions itself as a trusted advisor, helping organizations navigate the complexities of emerging digital landscapes.

A Mission to Secure the Digital Future

Privkey LLC’s core mission is to protect businesses by delivering high-quality, tailored solutions. Leveraging their deep understanding of cybersecurity and blockchain, they empower organizations to build secure, resilient, and compliant digital infrastructures. Whether it’s safeguarding sensitive financial data or ensuring the integrity of blockchain systems, Privkey LLC combines experience with innovation to meet the unique challenges of the modern era.

Comprehensive Services for a Digital World

Privkey LLC offers a diverse range of auditing and consulting services, focusing on some of the most critical areas in technology today. Below is an overview of their key offerings:

-

Central Bank Digital Currency (CBDC):As nations explore digital versions of fiat currencies, Privkey LLC provides auditing services to ensure CBDC systems are secure, scalable, and compliant with regulatory standards.

-

DeFi and CeFi (Fintech):Decentralized Finance (DeFi) and Centralized Finance (CeFi) represent the future of financial services on the blockchain. Privkey LLC offers expertise in auditing these systems, helping businesses mitigate risks and maintain trust in their financial operations.

-

Cybersecurity:With cyber threats on the rise, Privkey LLC delivers robust cybersecurity solutions to protect digital assets and sensitive data from malicious attacks, ensuring businesses remain secure in an increasingly hostile digital environment.

-

Distributed Ledger Technology (DLT):As the backbone of blockchain, DLT requires meticulous implementation. Privkey LLC audits DLT systems to ensure they are efficient, secure, and optimized for business needs.

-

CryptoCurrency Security Standard (CCSS):For organizations handling cryptocurrencies, compliance with CCSS is essential. Privkey LLC provides certification services to verify adherence to these standards, fostering trust among users and stakeholders.

These services reflect Privkey LLC’s commitment to addressing the diverse needs of businesses operating in the blockchain and cybersecurity domains.

Staying Ahead in a Rapidly Evolving Industry

Privkey LLC doesn’t just provide services—they actively engage with the latest industry trends and innovations. Their team, including professionals like William K. Santiago, frequently shares insights on platforms like LinkedIn. Topics range from Jack Dorsey’s Block unveiling a new Bitcoin hardware wallet to sustainable Bitcoin mining powered by nuclear and solar energy. While these discussions may not directly tie to specific Privkey LLC projects, they demonstrate the company’s deep involvement in the broader blockchain and cryptocurrency ecosystem. This forward-thinking approach ensures their services remain relevant and cutting-edge.

A Trusted Partner with Proven Expertise

With over two decades of experience in networking and Internet technologies, Privkey LLC brings unparalleled expertise to the table. This foundation allows them to tackle the unique challenges of cybersecurity and blockchain with confidence. As cyber threats grow more sophisticated and blockchain adoption accelerates, Privkey LLC stands ready to help businesses secure their digital futures.

Conclusion

Privkey LLC is more than a consulting firm—it’s a pioneer in cybersecurity and blockchain solutions. By offering specialized auditing and consulting services, staying ahead of industry trends, and leveraging decades of experience, they empower businesses to thrive in a digital world. For organizations looking to secure their digital assets and embrace blockchain technology, Privkey LLC is a reliable partner poised to lead the way.

-

-

@ 3c506452:fef9202b

2025-06-13 18:11:48

@ 3c506452:fef9202b

2025-06-13 18:11:48Kia ora mai ra ano e te iwi whanui!

Step 1: Find Your Why:

Going off my own experiences - if you are anything like me you will have the occasional boost of enthusiasm, and intense determination. This could last a couple days, or if you are fortunate, a few weeks. Afterwards, life kicks in again, and you're out of gas.

With this in mind it is important to find something within you that could help carry you along until the next boost.

Action Step:

So grab a pen and paper, and write out why you want to become a Te Reo speaker.

Step 2: Find The Quick Win:

I consider myself to be a speaker of the reo, but I am SO FAR AWAY from my ideal, my vision, which is to think only in the reo. It would be silly of me to only consider myself a speaker of the reo once I attained that goal. Now, a speaker of the reo is... "Someone who speaks it". It doesn't matter how little you know now, your effort and the time you put in won't let you down.

Action Step:

- Follow this link > Ngata Dictionary

- Type in a word in the "Ngata English to Māori" box then press search. For example, let's use "hello".

- Copy the sentence in te reo.

- Follow the link > Papa Reo API, paste the sentence then press korero.

- Mimic what you hear!

This is a great way to practice speaking the reo! You can have 100% confidence in these sentences provided to you from the Ngata Dictionary. The Papareo API is also a fantastic way to get instant feedback on pronunciation.

-

@ 7f6db517:a4931eda

2025-06-14 02:03:07

@ 7f6db517:a4931eda

2025-06-14 02:03:07Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-14 02:02:46

@ 8bad92c3:ca714aa5

2025-06-14 02:02:46Key Takeaways

In this episode, host Marty speaks with Ken, a former CIA deputy chief and now head of government affairs at the Bitcoin Policy Institute, about Bitcoin’s growing relevance in U.S. national security and policy circles. Ken traces his Bitcoin journey from professional curiosity within the CIA, studying adversarial use cases like the Lazarus Group, to personal conviction following events like the Canadian trucker protests, which exposed the dangers of financial censorship. Contrary to popular belief, he reveals that many in the intelligence community support Bitcoin for its alignment with American values such as sovereignty and freedom. The conversation highlights a major cultural shift in Washington, where policymakers now view Bitcoin as a strategic asset rather than a criminal tool. Ken stresses that the future hinges on whether Bitcoin shapes institutions or is co-opted by them, and that political engagement is crucial to ensure the former. He argues Bitcoin can help solve systemic problems from fiscal irresponsibility to geopolitical instability, but only if the industry continues to organize, advocate, and embed its values into national policy.

Best Quotes

"Either institutions are going to win, or Bitcoin is going to win."

"Bitcoin naturally washes out leverage… it's what makes Bitcoin antifragile."

"The CIA didn’t create Bitcoin, but they sure are paying attention now."

"We were all Satoshi."

"Let’s not test the resistance-money thesis in the United States."

"Bitcoin strengthens U.S. values, freedom, private property, sovereignty."

"Bitcoin is political, but it doesn't have to be partisan."

"If you're in a federal agency, the only incentive is to spend more. Bitcoin changes that."

"Don't underestimate your voice. If you keep the phones ringing, they listen."

Conclusion

This episode offers a rare glimpse into how Bitcoin is increasingly viewed as a serious strategic asset within the U.S. intelligence and policy communities. Ken, with his high-level government background and current role in Bitcoin advocacy, underscores the shift from skepticism to engagement among policymakers. His message is clear: Bitcoiners are no longer outsiders, they have a seat at the table, and with sustained political action and education, they can shape the future of Bitcoin policy. The time to engage is now, because the battle for Bitcoin’s role in society is already in motion.

Timestamps

0:00 - Intro

0:26 - Ken's background

6:58 - Tornado/Samourai, surveillance state

11:53 - Reestablishing trust

14:23 - Bitkey

15:18 - CIA bitcoin theory

18:42 - Neutral reserve asset

23:52 - Unchained

24:20 - BPI

29:49 - CLARITY and Secret Service message

33:54 - Withstanding a change in administration

40:03 - Institutions win or bitcoin wins

46:43 - Shrinking gov with bitcoin

57:47 - BPI summitTranscript

00:00:00 compared to China or Russia, do we have a comparable advantage in gold? How do we compete with China? And this is what the kinds of things CI will think about. Bitcoin is a natural option. At the end of the day, Bitcoin undermines the authority of the Chinese Communist Party. Either institutions are going to win or Bitcoin is going to win. But we do fundamentally on some level need institutions to make the country run. We want those institutions to be properly incentivized. In 10 years, Bitcoin is

00:00:19 either at a million dollars or is zero dollars. Ken, it's great to have you on the show. Thank you for joining me. Marty, finally. We've been we've been kicking us around for a few weeks. I'm glad we uh glad we were finally able to make it work. As I was telling you, in the middle of a move, conference in the middle of that move. It's been a hectic week, so I think I'm finally settling in. As you can see, no bookshelf, but we have stacked books behind me. Hopefully, they will be on on shelves soon.

00:00:52 No, there there are definitely ways there are ways in the world to get you know to get credits on um you know uh what do you call it? Um uh we're good Catholics, you know, when you when you pass and don't go to heaven. Um come on. Thank you. Well, moving is purgatory credit. So, I've done it many times in my life. So, I uh I feel for you. Well, thank you. But I'm really excited for this conversation and likewise the event in a few weeks, the BPI event down in DC, the summit, we met about a month ago, two months ago now at

00:01:26 this point in Austin during the takeover. And Zach was very eager to introduce you to me considering the the history of the show, topics we covered. And I think I'm excited for this cuz I'm infinitely curious to learn how somebody with your pedigree and your resume got into Bitcoin is now working for the Bitcoin Policy Institute as a director of government affairs. So for anybody listening who was unaware of Ken's resume, he did 20 years in government culminating as deputy chief of operations at the CIA Center for Cyber

00:02:01 Intelligence. uh you've worked overseas for the US State Department and now you're advocating on behalf of Bitcoin on Capitol Hill. So, how does somebody with that resume go from statecraft to cipher punk sort of ideas? Yeah. No, so I um like everybody else, I uh I um my my Bitcoin journey is a little bit everybody everybody has a unique journey, right? Um mine actually started at CIA, believe it or not. And it was for purely professional reasons. I um so I was an operations officer. I spent most of my career overseas um as

00:02:37 most of us do. Um but my last two years, my last two turn tours at CIA, I was at the center for cyber intelligence, which is CIA's cyber unit. Um and my first job there, I was group ch I was a operations chief for a group that worked on cyber threat issues. And this was in 2018. So you remember this was when Lazarus group the North Koreans figured out that stealing crypto was a lot easier than like you know trying to rob banks. Um this is when ransomware broke out as a serious problem just preceded you may

00:03:04 remember the Colonial Pipeline hack that shut down you know gasoline shipments to the east coast. So in 2018 um and it's kind of funny like I this is people say did the CIA create Bitcoin. I can tell you in 2018 when policy makers first had to confront its use by actors as an issue like nobody was ready for it. Like if they created it, it was tucked away and hidden in the basement cuz the the bench for people with crypto knowledge in general, digital assets, certainly Bitcoin was really really really shallow. Um I remember we had two

00:03:33 guys um who kind of had background in it and then you they became superstars because all of a sudden we were calling upon them to teach us about Bitcoin and digital assets in general. Um, but yeah, that's so I learned and like everything else, I learned about it because I had to because people we cared people we cared about were using it. Um, but like everything else there there was sort of a mind virus to it. Um, and I I admit, you know, I during co I was in the uh I was in the altcoin casino. I was defying

00:04:00 and memecoining and it was it was fun, you know. No, I I I don't hold any hate for the uh for the alcoiners. People do what they want with their money. Um but I you know that that was when it was during co um I had been sort of buying in 2018 but during co when I really started learning because this is what everybody learned right um and I you know for me Bitcoin was immediately attracted me to it and I was sort of inspired by um I mean the co Kenny trucker protest was something really important to me um I saw how it was

00:04:29 being used um but also sort of in my day job you know I I had a pretty good understanding of how the government uses financial financial tools as a weapon. Um, freezing bank accounts, OFAC sanctions, that kind of thing. And if you're on the, you know, on the giving end of that, that's great. Those are great tools to have if you're the government. Uh, not so great if you're on the other end of it. And, you know, watching these Canadian truckers the first time, you know, you'll be able to, it's very easy

00:04:54 to say, "Yeah, sanction the Iranian, sanction North Korea, whatever." You know, I'm not Iranian. Um but when you see all of a sudden Kat and Trucker people you had some sympathy with being targets of financial you know weaposition of the financial system it you know it struck it struck a it struck a nerve like a really really profound stinging shot to my consciousness my conscious about this issue. Um so for me for the first thing about Bitcoin was um was permissionless transactions that that's that's what got me into it. Um

00:05:23 then of course you go from there and by the time I left the government 2022 I had I was f I was you know full boore I was you know attending meetups and um that's when I started doing some advocacy stuff on Capitol Hill and and and messing around with uh David and Granny PPI doing some advocacy stuff but yeah but it it comes from my time at CIA and yeah I think the um the uh I think what might surprise some people is there are a lot of Bitcoiners um not just at CIA but across the whole national

00:05:52 security establishment And I think they're into it for the same reason that you know that everybody most of your listeners are right like it's you see what's happening in the world. You see the challenges we're facing. You see how governments use financial tools to weaponize them against opposition. You know it's it's very natural that if you have that kind of insight that you look for things to protect yourself and Bitcoin is obvious. So I I I tell a funny story when I um when I was first into it there was um cubicle one of the

00:06:17 guys and he had a bumper

-

@ d68401a8:11aad383

2025-06-13 17:54:54

@ d68401a8:11aad383

2025-06-13 17:54:54Before AI, building a website posed a technological barrier. Not everyone was able to create even a simple contact page. It often meant paying for a yearly subscription (often too expensive for most), for templates that still required manual work, or paying even more to hire someone to do it for you.

Today, thanks to AI, building a website has become technologically accessible. Even if you still prefer to rely on a third-party company, the ease brought by AI is driving more competitive pricing.

In the domain world, before Handshake, owning a top-level domain (TLD) was economically out of reach. The application process set by ICANN was tedious and expensive. For most people, the only option was to rent a second-level domain, one not controlled by individuals and subject to whatever fees the TLD owner chose to charge.

Now, thanks to the Handshake DNS protocol, anyone can own a top-level domain and create an infinite number of second-level domains under it, at virtually no cost.

Owning a plot of land (a top-level domain) on the internet should be open and easy. Handshake aims to pave the way toward that vision, you can start to explore by using Namebase , Shakestation or Bob wallet .

-

@ eb0157af:77ab6c55

2025-06-14 02:02:24

@ eb0157af:77ab6c55

2025-06-14 02:02:24Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ 87f5ac31:60daf34c

2025-06-13 16:59:28

@ 87f5ac31:60daf34c

2025-06-13 16:59:28hahahah 하블라 아유 오케이?

-

@ b1e9b8df:07685594

2025-06-13 15:17:02

@ b1e9b8df:07685594

2025-06-13 15:17:02OERTR steht für eine Art, freie Bildungsressourcen (Open Educational Resources) über das dezentrale Protokoll Nostr zu verbreiten, auffindbar zu machen und weiterzuentwickeln.

Statt zentraler Plattformen oder Silos nutzen wir Relays – offene Knoten im Nostr-Netzwerk – um Materialien, Metadaten, Annotationen und Kurse dauerhaft, hoch verfügbar und maschinenlesbar im interoperablen Datenraum verfügbar zu machen.

🚀 Unser Ziel

-

OER auffindbar machen – über strukturierte Events (z. B. Kind

30023,30142) -

Mitmachen ermöglichen – durch einfache Workflows mit git, Matrix & Nostr

-

Bildung dezentral denken – jenseits von Plattformlogiken

-

Metadaten lebendig halten – durch Community-gestützte Annotation & Remixbarkeit

🔧 Womit wir arbeiten

-

💬

Matrixzur Koordination & Diskussion -

💻

git(hub)zur offenen Entwicklung und Dokumentation

📡 Mach mit!

➡ Nostr folgen:\ 👉 npub1k85m3haymj3ggjknfrxm5kwtf5umaze4nyghnp29a80lcpmg2k2q54v05a (nähere Infos auf https://github.com/edufeed-org/OERTR )

➡ Matrix beitreten:\ 🟢

#OERTR:rpi-virtuell.de\ https://matrix.to/#/%23OERTR:rpi-virtuell.de\ Zum Diskutieren, Planen, Ausprobieren.➡ GitHub anschauen:\ 📂 https://github.com/edufeed-org/OERTR\ Mit Beispieldaten, n8n-Workflows, NIP-Verlinkungen & mehr.

🧠 Ideen zum Start

-

🔍 Indexe für OER-Projekte (z. B.

OERinfo,rpi-virtuell,WirLernenOnline) -

📚 Tagging-Events für Fachbereiche, Zielgruppen & Lizenztypen

-

🤝 Event-Verknüpfung mit Mastodon, Mobilizon, Wikidata

-

🧩 Mitdenken beim Aufbau eines offenen Bildungsraums via Nostr

📎 Beispiel: OER-Material posten

json { "kind": 30142, "tags": [ ["d", "https://example.org/oer1234"], ["r", "https://example.org/oer1234"], ["subject", "Ethik"], ["author", "Max Mustermann"], ["license", "CC-BY 4.0"] ], "content": "Material zur Gewaltfreien Kommunikation für die 5. Klasse" }💡 Fragen? Ideen?

Wir freuen uns über Feedback, Pull Requests oder ein einfaches "Hallo!"\ ➡ Schreib uns im Matrix-Raum oder auf Nostr .

OERTR – ein Netzwerk. Kein Silo.

-

-

@ 9ca447d2:fbf5a36d

2025-06-14 02:01:31

@ 9ca447d2:fbf5a36d

2025-06-14 02:01:31When Richard Scotford moved to Costa Rica in 2018, he had no idea he would become a key figure in a thriving Bitcoin economy.

A longtime Bitcoin holder who initially saw it through the lens of speculation, Scotford’s journey led him to embrace Bitcoin’s deeper purpose and spearhead Bitcoin Jungle — a grassroots movement bringing real-world Bitcoin adoption to Costa Rica.

Bitcoin circular economies create holistic value for Bitcoiners

Bitcoin Jungle is inspired by Bitcoin Beach in El Salvador but uniquely adapted to Costa Rica’s economic landscape. Unlike El Salvador, where Bitcoin was positioned as a tool for financial inclusion, Costa Rica already has a fairly stable banking system.

The real issue? The friction of moving money. Expats, business owners, and tourists struggle with high fees, banking red tape, and slow transactions. Bitcoin helped solve a lot of these problems.

The Birth of Bitcoin Jungle

Scotford and his team launched Bitcoin Jungle in late 2021 with a simple goal: get bitcoin into people’s hands and make it usable. However, there was one challenge — he had no technical background.

Determined to create a circular bitcoin economy, Scotford networked aggressively. He attended the first Adopting Bitcoin conference in El Salvador, approaching strangers with his vision:

“I was just walking around trying to find people who could help me make this economy, going up to random people saying ‘Hey, what can you do? We’re trying to make a circular economy in Costa Rica, can you help us?’ They all thought I was crazy.”

The breakthrough came when he turned to Bitcoin Twitter. Nicolas Burtey from Galoy encouraged him to create a wallet, and developer Lee Salminen forked the Bitcoin Beach wallet for their project.

“Within two weeks of Adopting Bitcoin, Lee forked the Galoy Bitcoin Beach wallet, which took Galoy by surprise. Even though they made their wallet to be forked if necessary, I don’t think they were expecting people to do it so fast and, I’d like to say, so well. They were like, ‘Okay, cool, who are these guys doing this?’”

Finally Bitcoin Jungle had its own working wallet, surprising even the Galoy team with the speed of execution.

Grassroots Adoption: One Vendor at a Time

How do you build a bitcoin economy from scratch? Scotford’s answer was simple: start at the farmers’ markets.

“We were like, okay, we’re going to get all the bespoke niche market sellers who are in this area. We have all these beautiful farmers markets, and we decided to approach these people first,” Scotford explained.

His team took a strategic approach, targeting market gatekeepers first.

“If you want to talk to every individual person, it’s really difficult. But if you can talk to the person who is the owner of the market, and then they can introduce you to their market stores, you’re already halfway there.”

Going stall by stall, they pitched Bitcoin’s advantages — no bank fees and better payment options. But adoption didn’t happen overnight, so Bitcoin Jungle initially offered a safety net — vendors could cash out at the end of the day.

“We would say to the vendors, ‘Look, accept bitcoin, and at the end of the day, if you don’t want to keep the bitcoin, we’ll buy it off you,’” Scotford recalled.

“When we first started, maybe 30–40% of the vendors were cashing up every day or at the weekends. Lee would be walking around with big fistfuls of money, cashing out vendors.”

But over time, something shifted — they started keeping their bitcoin.

“Eventually, the vendors started to learn themselves that, ‘Oh, actually it’s better to keep it.’ They would then pay for their tables in the markets using bitcoin. They thought, ‘Well, I don’t want to keep this bitcoin, I don’t really know what to do with it, but I can pay for my table.’ So there, the circular economy starts to happen.”

Today, Bitcoin Jungle runs with minimal intervention, and Scotford takes pride in their reliability.

“When you come here to Costa Rica, what we really pride ourselves on is that if someone says they accept bitcoin, 99% of the time, they will. And if they’re part of Bitcoin Jungle, they will 100% accept bitcoin and you will have a fluid experience with it.”

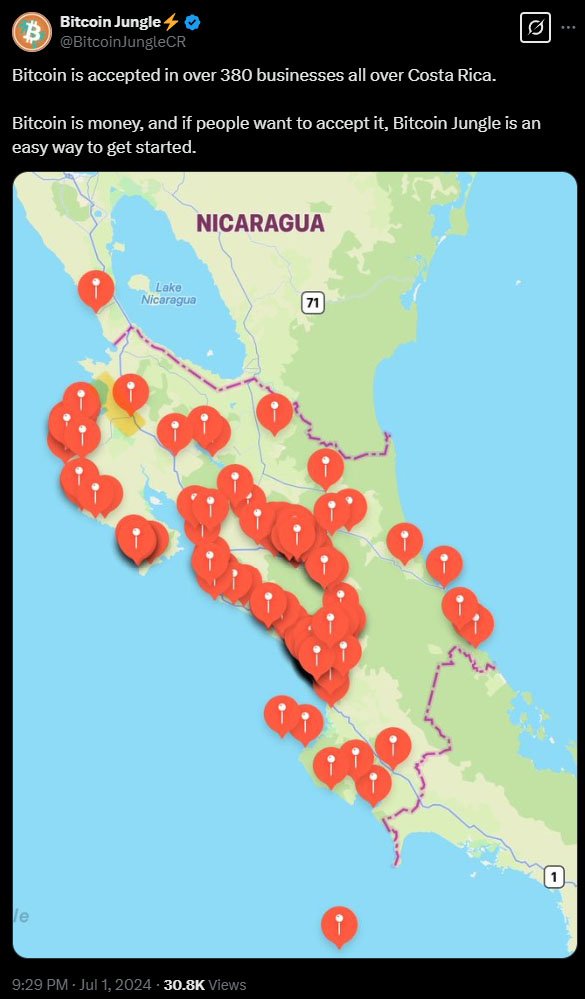

By mid-summer 2024 over 380 locations in Costa Rica accepted bitcoin

The Bitcoin Jungle Wallet and Real Usage

Bitcoin Jungle is an open-source community project built on the Bitcoin Lightning Network.

Acting as a community bank, the project processes a large number of transactions daily. To encourage proper security practices, Scotford’s team alerts their peers, reminding users to move their bitcoin to cold storage.

“If you’ve got too much bitcoin on your wallet, we send you a message telling you to move it to cold storage,” he explained. For larger businesses, they even offer hands-on assistance to secure funds properly.

Unlike the HODL-only philosophy that many Bitcoiners advocate, Bitcoin Jungle encourages spending.

“Michael Saylor says don’t spend your bitcoin. We say the opposite,” Scotford laughed. “We’re the antithesis of that. You need to spend it.”

Bitcoin Jungle’s Unique Approach to Costa Rica

Bitcoin Jungle isn’t just another Bitcoin adoption effort; it’s tailored to Costa Rica’s economy. The wallet operates in Costa Rican colónes, making transactions feel familiar to residents while ensuring tourists and expats can still interact easily.

The team has also introduced low-fee bitcoin ATMs, point-of-sale integrations, and partnerships that allow users to pay in bitcoin while the recipient receives local currency.

A major breakthrough came when Francis Pouliot from Bull Bitcoin joined forces with Bitcoin Jungle, bringing his expertise in banking infrastructure to the project.

This collaboration enabled seamless bitcoin payments that integrate directly with Costa Rica’s financial system, allowing users to pay anyone, even businesses that don’t directly accept bitcoin, while the recipient receives funds in colónes or dollars.

“I can go to a hardware store, order steel for my new basketball court, pay in bitcoin, and the store gets dollars,” Scotford said. “For a non-tech guy like me, it’s magical.”

Why Aren’t There More Bitcoin Jungles?

Scotford sees an opportunity for more localized bitcoin economies.

“There should be a Bitcoin Harbor, a Bitcoin Mountain, a Bitcoin Driveway,” he joked. “But instead of waiting for permission or corporate funding, people need to take action themselves.”

He emphasizes that building a circular bitcoin economy doesn’t require deep pockets. “I probably gave away $600 worth of bitcoin when we started — just $3 here, $4 there — to get people using it.”

The Future of Bitcoin Jungle

Bitcoin Jungle continues to grow, recently hosting events like the Bitcoin Freedom Festival and integrating bitcoin into community projects, including a school where tuition can be paid in bitcoin.

“The institutions have come in, but the grassroots projects haven’t caught up,” Scotford observed. “It’s time for people to stop sitting on their hands and start building.”

Bitcoin is permissionless, no one has to wait for approval to start using it. Bitcoin Jungle proves that with vision and persistence, anyone can build a thriving Bitcoin economy, one market stall at a time.

Get the latest from Bitcoin Jungle: follow them on X

-

@ 9ca447d2:fbf5a36d

2025-06-14 02:01:28

@ 9ca447d2:fbf5a36d

2025-06-14 02:01:28The Blockchain Group, Europe’s first publicly listed bitcoin treasury company, has received the green light from its shareholders to raise more than €10 billion (approximately $11 billion) to buy more bitcoin.

This is one of the biggest bitcoin treasury plays in Europe as the company wants to speed up its bitcoin accumulation and become a major institutional buyer.

At the Annual General Meeting held on June 10, 39% of the voting rights represented by shareholders voted in favor of the financing plan, with over 95% of the votes cast in favor.

The approval gives the board of directors broad financial powers to issue shares and other securities to raise capital, either with or without preferential subscription rights.

This will allow the company to raise funds quickly in public or private markets to buy bitcoin when the time is right.

CEO Jean-Philippe Casadepax-Soulet said:

“I would like to thank our shareholders for the trust they have placed in us with the approval of these new financial authorizations, that will enable us to accelerate our Bitcoin Treasury strategy, focused on increasing the number of bitcoins per share on a fully diluted basis over time.”

The Blockchain Group’s strategy is to increase the number of bitcoin per share. This means that the company aims to buy more bitcoin without diluting existing shareholders’ ownership, and provide exposure to a growing hard-asset reserve within the company’s equity.

According to Bitcoin Treasuries, the company already holds 1,471 BTC, worth around €160 million.

Earlier this month, it added 624 BTC, worth around €69 million, to its treasury. These are just the beginning of a much bigger accumulation effort funded by the recent shareholder-approved capital increase.

Alongside ordinary shares, the financial powers granted to the board include the ability to issue preferred shares, warrants and convertible bonds. This gives the company the tools to optimize funding costs and respond to market demand.

This is on top of the €300 million at-the-market (ATM) facility announced earlier with asset manager TOBAM, where the company can issue new shares at market price. TOBAM is the sole subscriber under this ATM and can buy up to 39% of the company if the facility is fully used.

In addition to the capital raise, shareholders elected Alexandre Laizet as a board member and appointed him Deputy CEO in charge of the Bitcoin strategy. Laizet’s 6-year term will end in 2030, which shows the long-term vision for digital assets.

The appointment highlights the importance of bitcoin within the company’s overall structure which also includes subsidiaries in data intelligence, AI consulting and decentralized technology.

-

@ b1ddb4d7:471244e7

2025-06-14 02:01:08

@ b1ddb4d7:471244e7

2025-06-14 02:01:08This article was originally published on dev.to by satshacker.

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets

If you like to take it a step further, you can also create a more enhanced donation checkout flow. Of course you could programm something yourself, there are many open source libraries you can build upon. If you want a simple plug-and-play solution, here are a couple of options:

Name

Type

Registration

SatSale

Self-hosted

No KYC

BTCPay Server

Self-hosted

No KYC

Pay With Flash

Widget

Email

Geyser Fund

Widget

Email

The Giving Block

Hosted

KYC

OpenNode

Hosted

KYC

SatSale (GitHub)

Lightweight, self-hosted Bitcoin/Lightning payment processor. No KYC.

Ideal for developers comfortable with server management. Simple to deploy, supports both on-chain and Lightning, and integrates with WooCommerce.

BTCPay Server

Powerful, open-source, self-hosted processor for Bitcoin and Lightning. No KYC.

Supports multiple currencies, advanced features, and full privacy. Requires technical setup and maintenance. Funds go directly to your wallet; great for those seeking full control.

Pay With Flash

Easiest for indie hackers. Add a donation widget with minimal code and no KYC. Payments go directly to your wallet for a 1.5% fee.

Setup Steps:

- Sign up at PayWithFlash.com

- Customize your widget in the dashboard

- Embed the code:

- Test to confirm functionality

Benefits:

- Minimal technical skills required

- Supports one-time or recurring donations

- Direct fund transfer, no intermediaries

Geyser Fund

Crowdfunding platform. Widget-based, connects to your wallet, email registration.Focused on Bitcoin crowdfunding, memberships and donations.

The Giving Block

Hosted, KYC required. Integrates with fiat and crypto, best for nonprofits or larger organizations.

OpenNode

Hosted, KYC required. Accept Bitcoin payments and donations; supports conversion to fiat, suitable for businesses and nonprofits.

Summary

- Fast, low-code setup: Use Pay With Flash or Geyser Fund.

- Privacy and control: Choose SatSale or BTCPay Server (requires technical skills).

- Managed, compliant solutions: The Giving Block or OpenNode.

Choose based on your technical comfort, privacy needs, and project scale.

I hope this article helped you. If you added bitcoin donations, share your link in the comments and I will send you a few satoshis maybe

-

@ efc2b6e5:99c53c19

2025-06-13 14:32:51

@ efc2b6e5:99c53c19

2025-06-13 14:32:51AI companies massively influence society by projecting their values on ML models, whether we want it or not. It'd be great if at least some people in the companies knew how exactly they influence society, could make certain predictions, or even make ML models themselves predict users' worldviews and some of their behavior.

Some might argue that AI systems already do something like that. I believe they could do it much better: chatbots could be more balanced in terms of security (they are definitely overcensored) and recommender systems, for instance, could contribute to healthy personal and collective transformations (rather than just competing in ability to steal users' attention and trap it in the echo chambers).

Reductionism is an obstacle in AI development

Even most reliable knowledge doesn't solve some of the problems that are already in demand. Even least reliable knowledge still may contain something useful for our problems. While we lack reliable and noncontradictory knowledge, we can still benefit from certain synthesis of working ideas. There's approach that makes it possible to look at the knowledge from a very broad perspective, do such synthesis, and benefit from emergent properties of the synthesis.

Integral (Meta-)Theory created by Ken Wilber is probably the best known attempt to enable the possibility to form and navigate the big picture understanding in a hope to address issues of the epoch we've recently entered.

IMO it has certain challenges that make it repellent to IT:

- Fundamental psychological theories on which the Integral Theory is based are still pretty fragile; they need time to become mature enough and recognized (while it doesn't look like we have that time). There are endless edit wars on Wikipedia, which makes me feel depressing about possibilities to even introduce Spiral Dynamics and Multiple Intelligences to IT people.

- Emphasis on controversial interpretations of certain arational states of consciousness.

It's hard to address the first challenge; however, I recently discovered a new “secularized” Non-Reductionist Philosophy launched by David Long, which, among other things, uses wisdom from Integral Theory and attempts to address the second challenge. I'm glad that there are people who don't just criticize the Integral Theory, its community and Wilber's positions but are also developing the new meta-theories.

NR can also be a good way to get familiar with other meta-theories, so one could choose whatever works the best for their problems. For instance, if you're working on something as exotic as some competitor to EEG-powered meditation device, perhaps you will find Integral Theory relevant to study as well, since it's more focused on the states.

I'd like to point out a couple of moments I noticed in the video "Why Non-Reductionism Is A Better Meta-Theory" that caught my attention, as well as in some other older videos. There's not much to comment on the content itself rather than on the form of the content. This feedback might be used for improvements/elaborations in the next videos and just for everyone curious about the new meta-theory. But first

Why do I post here?

Specifically for the deep topics that relate to the current epoch, I no longer find engaging in the YouTube/FB/Reddit/Diqus/Giscus/etc. discussions useful anymore, at least due to broken and almost omnipresent AI-based censorship, that keeps “improving” at randomly shadow-banning people. How many deep and valuable opinions we no longer see?

BTW, it's possible to create Reddit-like communities here at Nostr as well, using Satellite client for example. I believe it's a better place for NR, Rebel Wisdom and many others.

References to full materials used for criticism

There are curious clips with Wilber in the video. It'd be great to have links in the description (or at least titles of the full videos if it's copyrighted material) so viewers could easier form their own independent opinions. I find it important during the age of information overload and narrative warfare. This will also improve SEO.

Emergentism FAQ

There's a strong position on emergence of consciousness; it seems it's not even a hypothesis in NR and I guess that makes some people so reactive.

I think it would be great to have an FAQ page to possibly make future debates more ecological and fruitful. Some of the things that could be elaborated in the FAQ:

- importance of distinction between philosophical theory (inductive reasoning? or actually deductive reasoning? I'm confused here) and scientific theory (deductive reasoning)

- the fact that for now counterarguments usually fall into the categories of “ignorance fallacy”, “false equivalency fallacy” and “God of the gaps” which aren't something sufficient; the whole point of challenge was to find at least a logically valid counterposition (ideally a counterposition that is sound with currently available scientific ~~facts~~ theories), not the nitpicking attacks

- what kind of emergence is meant, is it important here at all and why.

Debates moderation

Probably most of the debates converge to consensus, which are fruitful anyway. There are a few interesting conflicting debates as well. However, I found this specific conflicting debate with Matt Segall quite exceptional.

Matt's position was not understood. He was more interested in a dialogue rather than debates and I think it would be more productive. However, in this specific case, my guess is it would literally take hours to just figure out the common language on a certain concept he mentions.

My humble guess is that a combination of negotiator and moderator with a primary perceiving personality type function (if typologies work at all) could be a step to more meaningful and ecological dialogues in the future. But such negotiator/moderator should also be skilled enough to reflect most challenging parts using more “rational language” as best as possible. These people are rare. Basically I mean the style of dialogues that happened between theoretical physicist David Bohm and Indian philosopher Jiddu Krishnamurti: IMO these were the talks where both sides at some point were barely transcending limitations of their languages and focusing more on intuition in order to understand each other. Much fuzzier and spontaneous dialogues, which aren't prematurely limited by too harsh rationality. Similar thing (with shorter periods of negotiation) could be combined with debating as well.

I hope NR community will be open to understanding more perspectives and won't end up turning into something like a cold and scary crystallization of rational arrogance; that would be damaging and quite opposite to the healthy intentions of the whole project.

Final thoughts

I like the clarity and density of the presented ideas in the video, the choice of lines of development in the map and the alternative to the Integral Methodological Pluralism. I like the mentioned interpretation of “free” will, very much resonates with how I personally interpret it. Tritone-ish devilish sounds in the cons sections is a nice aesthetic choice as well.

I guess there's a lot to learn from NR, no matter what positions we hold on the “rational spirituality” and that sort of stuff. Just to avoid projections and misunderstandings: I'm in a neutral position to all the post-postmodern discourses (NR, Integral, Metamodernism, etc.); I care about these philosophies, make my own distinctions on what's healthy or not, and my positions don't necessarily perfectly match with some of the claims these philosophies make.

Thank you David Long for launching this philosophy and the movement; I'm looking forward to the next videos!

I'd appreciate reposts and all this as well, thanks!

-

@ b1ddb4d7:471244e7

2025-06-14 02:01:04

@ b1ddb4d7:471244e7

2025-06-14 02:01:04The Coinbase Lightning Network is Coinbase’s implementation of Bitcoin’s Lightning Network technology, launched in partnership with Lightspark in April 2024. This innovative solution allows users to send, receive, and pay with bitcoin instantly and cheaply directly from their Coinbase accounts.

Think of the Coinbase Lightning Network as the express lane of bitcoin transactions. While regular bitcoin transfers can take 10-60 minutes and cost several dollars in fees, Lightning Network transactions on Coinbase complete in seconds with fees typically under a cent.

Key Benefits of Coinbase Lightning Network:

- Instant transfers: Transactions complete in seconds, not hours

- Ultra-low fees: 0.2% processing fee vs. traditional network fees

- Global reach: Send bitcoin anywhere in the world instantly

- Cost efficiency: 20 times cheaper than traditional credit card fees

Coinbase Lightning Network vs Regular Bitcoin Transfers

Understanding the difference between Coinbase Lightning Network and regular bitcoin transfers is crucial for choosing the right method:

Feature

Coinbase Lightning Network

Regular Bitcoin Transfer

Speed

Instant (seconds)

10-60 minutes

Fees

0.2% + minimal network fee

$5-50+ depending on network

Best for

Small to medium amounts

Large amounts, long-term storage

Availability

24/7 instant

Subject to network congestion

The Coinbase Lightning Network processes transactions “off-chain,” creating payment channels that settle later on the main Bitcoin blockchain, resulting in dramatically faster and cheaper transactions.

How to Send Bitcoin Using Coinbase Lightning Network

Sending Bitcoin through Coinbase’s Lightning option is incredibly straightforward. Follow these step-by-step instructions:

Step 1: Access Your Coinbase Account

- Sign in to your Coinbase account via web browser or mobile app

- Ensure you have bitcoin (BTC) in your account balance

- Navigate to your portfolio and locate your bitcoin holdings

Step 2: Initiate the Lightning Transfer

- Click “Transfer” then select “Send crypto”

- Choose bitcoin (BTC) as your asset

- Enter the amount you wish to send

- Select Lightning Network as your transfer method

Step 3: Add Recipient Information

- Obtain the Lightning Network invoice from your recipient

- Paste the invoice into the recipient field

- The Coinbase Lightning Network will automatically detect and validate the invoice

- Review the transaction details carefully

Step 4: Complete the Transaction

- Verify the amount and recipient information

- Click “Send” to initiate the transfer

- Your Coinbase Lightning Network transaction will complete within seconds

- Both you and the recipient will receive confirmation notifications

How to Receive Bitcoin via Coinbase Lightning Network

Receiving Bitcoin through Coinbase’s Lightning option requires generating a Lightning invoice. Here’s your complete guide:

Step 1: Generate a Lightning Invoice

- Log into your Coinbase account

- Navigate to “Transfer” then “Receive crypto”

- Select Bitcoin (BTC) as the asset you wish to receive

- Choose “Lightning Network” as your receiving method

Step 2: Create Your Invoice

- Enter the specific amount you want to receive (required for Lightning)

- Add an optional description or memo

- Click “Generate Invoice”

- Your Lightning Network invoice will appear as both a QR code and text string

Step 3: Share Your Invoice

- Copy the Lightning invoice text or share the QR code

- Send this information to the person sending you Bitcoin

- Remember: Lightning invoices expire after 72 hours

- Generate a new invoice if the original expires

Step 4: Receive Your Bitcoin

- Once the sender pays your invoice, you’ll receive instant notification

- The bitcoin will appear in your Coinbase account immediately

- No waiting for blockchain confirmations required with Coinbase Lightning Network

Coinbase Lightning Network Fees and Limits

Understanding the fee structure of Coinbase Lightning Network helps you make informed decisions:

- Processing Fee: 0.2% of the transfer amount

- Network Fee: Minimal (typically fractions of a cent)

- Minimum Amount: Varies by region, typically $0.1- 5

- Maximum Amount: Subject to your account limits and Lightning Network capacity

The Coinbase Lightning Network offers significant savings compared to traditional bitcoin transfers, especially for smaller amounts under $1,000.

Troubleshooting Common Coinbase Lightning Network Issues

Even with the user-friendly Coinbase Lightning Network, you might encounter some challenges:

Invoice Expired Error

- Solution: Generate a fresh Lightning invoice

- Prevention: Complete transactions promptly after generating invoices

Transaction Failed

- Cause: Insufficient Lightning Network liquidity or routing issues

- Solution: Try again in a few minutes or use smaller amounts

Can’t Find Lightning Option

- Check: Ensure Lightning is available in your region

- Verify: Update your Coinbase app to the latest version

Address Whitelist Issues

- Problem: Lightning invoices may not work with address whitelisting enabled

- Solution: Temporarily disable whitelisting or contact Coinbase support