-

@ 69eea734:4ae31ae6

2025-06-12 17:44:54

@ 69eea734:4ae31ae6

2025-06-12 17:44:54Vor ein paar Tagen stieß ich auf einen faszinierenden Artikel von Michel Bauwens, Mitbegründer der P2PFoundation, mit Links zu weiteren Texten (zum Beispiel über den Puls der Commons), die ich ebenfalls äußerst interessant fand.

Der Artikel zeigt unter anderem, wie unterschiedlich Commons aussehen können, so dass ich ihn heute als Ausgangspunkt nehmen möchte, um ein paar Puzzle-Steine in mein entstehendes Bild der Commons einzufügen.

Das Grundmuster menschlichen Zusammenlebens?

Bauwens betrachtet die Commons aus historischer Sicht, wie sie sich in verschiedenen Zeiten unterschiedlich manifestieren, manchmal gar nahezu verschwinden und heute in wiederum veränderter Form neu entstehen – und plädiert dafür, dass sie noch weit stärker werden sollten.

Er legt zunächst dar, was die Commons sind und was nicht. (zum Beispiel nichts, was vom Staat verwaltet wird, wie ein öffentlicher Park.) Ausschlaggebend ist, dass eine Ressource von ihren Herstellern oder Benutzern selbst betreut wird. Commons entstehen dabei durch Beziehungen. Sie sind etwas spezifisch Menschliches und eine Wahl, die „fast immer“ zur Verfügung steht, so Bauwens. Eine die Geschichte überdauernde menschliche Praxis.

Er nennt drei verschiedene geschichtlichen Entwicklungen:

- Eine lineare - Wie präsentiert sich der Commons über verschiedene, komplexer werdende, Phasen der Menschheitsgeschichte hinweg?

- Eine hin und her schwingendende: In der Geschichte einer Zivilisation werden die Commons in Zeiten von Überfluss -- und daraus resultierender Verschwendung uns steigender Ressourcen-Extraktion -- unterdrückt, konstitutieren sich aber dann als Gegenbewegung wieder neu.

- Eine stufenweise: Die heutigen, mit neuen Möglichkeiten ausgestatteten Formen der Commons könnten in der nächsten Phase unserer Zivilisation (oder nach unserer Zivilisation) eine entscheidende Rolle spielen.

Wenn man verschiedene Arten des Austausches betrachtet (Bauwens beruft sich hierbei auf Alan Fiske), kann man geschichtlich analysieren, welche zu verschiedenen Zeiten vorrangig waren (dies tat Kojin Karatani in The Structure of World History von 2014).

Die vier Muster sind:

- Gemeinschaftliche Beteiligung, Commons (die Gemeinschaft baut mir ein Haus, und ich helfe später bei einem anderen Hausbau mit; ein Beispiel aus neuerer Zeit ist die Entwicklung von Linux)

- Wechselseitiger Austausch (Geschenkökonomie – es wird eine etwa gleichwertige Leistung zu einem späteren Zeitpunkt erwartet)

- Hierarchisch bedingte Verteilung, wie im Feudalismus

- Marktwirtschaft (es gibt ein allgemeines Zahlungsmittel mit einem bestimmten Wert)

Bauwens: „Entscheidend ist jedoch, dass die Menschheit ständig bestrebt ist, Modus A wiederherzustellen, denn die Menschen haben eine kulturelle und wahrscheinlich auch allgemeine Vorliebe für ein geselliges Leben in kleinen, vertrauten Gruppen. Aber menschliche Gruppen versuchen, dies auch auf höheren Komplexitätsebenen zu tun, in einem ständigen Versuch, die extraktive Logik der Zivilisation zu mäßigen.“ (Katarani bezeichnet eine Verbindung von Commoning und Geschenkökonomie in stammesorientierten Kulturen als Modus A)

Commons durch die Zeiten

In der ursprünglichsten Form der Commons in Jäger- und Sammler-Gemeinschaften, werden Nahrung und sonstige Ressourcen mit der ganzen Gemeinschaft geteilt - dies ist zumindest die vorherrschende Form des Austauschs.

Im Zuge der Agrar-Revolution geht es um das gemeinsame Bewirtschaften von Flächen.

Im Mittelalter entwickelt sich in Europa das Feudalsystem. Auch hier werden manche Felder aber noch von den Dorfbewohnern gemeinsam verwaltet.

Ab dem 16. Jahrhundert fanden, am stärksten in England, die Enclosures (auf deutsch Einhegungen) statt. Das heißt, dass Felder zur effizienteren Bewirtschaftung von den Besitzern zusammengelegt und umzäunt wurden.

Besonders im 19. Jahrhundert, mit dem Aufkommen der Industrialisierung, nahm diese Entwicklung immer stärker zu. Die landwirtschaftlichen Commons wurden dadurch weitgehend zerstört.

Im industriellen Kapitalismus, als die Arbeiter kaum Rechte hatten, und es auch um das bloße Überleben ging, entwickelte sich ein sozialer Commons Dieser bestand darin, dass sich die Arbeiter gegenseitig halfen und sich gegenseitig versicherten. Aus dieser Bewegung entstand dann der Sozialstaat. Der Staat übernahm also Aufgaben, die die Menschen zuvor füreinander geleistet hatten.

Man könnte daher sagen, dass im Kapitalismus die natürlichen Commons-Ressourcen privatisiert und die sozialen Commons verstaatlicht wurden.

In der Moderne waren sich viele Menschen der Bedeutung von Commons gar nicht mehr bewusst.

Mit dem Internet, dem World Wide Web und weiteren digitalen Techniken erschlossen sich dann neue Möglichkeiten. Mit Peer Production, Open Source Software, sowie den Creative Commons Lizenzen, enstand eine neue Inkarnation der Commons. Und damit ist die Entwicklung noch nicht abgeschlossen...

Warum Commons nicht in ein Links-Rechts-Schema passen

Mit seinem Streifzug durch die Geschichte zeigt Bauwens, wie vielfältig die Commons sein können, und warum ihnen in der heutigen Zeit eine starke Rolle zukommen sollte. Nebenbei ergibt sich für mich auch, dass sie jenseits von linker oder rechter Ideologie liegen. Hierzu eine kurze Zwischenbetrachtung von mir:

Weil es um kollektives Handeln geht, und auch wegen des Namens („hört sich an wie Kommunismus“, meinte meine Mutter), entsteht leicht der Eindruck, es handele sich um ein besonders linksgerichtetes Phänomen.

Eine gut eingespielte Fußballmannschaft agiert auch als Kollektiv. Der Verein verwaltet vielleicht ein Clubhaus. Wohl kaum jemand würde deswegen den Verein als links bezeichnen.

Freilich sind die Mitglieder heutiger Commons-Bewegungen vorwiegend „progressiv“, zuweilen auf eine rigide Weise. Bauwens hat damit schon eine leidvolle Erfahrung gemacht. Aber Commons als soziales System sind es nicht. Dafür spricht allein schon die Tatsache, dass es sie viel länger gibt als die politische Links-Rechts-Einteilung.

Eine starke Rolle für die Commons

Wie steht es um die Commons heute? Das werde ich in weiteren Artikeln noch versuchen zu beleuchten...

Michel Bauwens hat in seinen Artikeln noch Einiges dazu sagen. Inbesondere beführwortet er das Kosmo-Lokale (Cosmo-Local). Was leicht ist (Wissen) wird geteilt, was Gewicht hat (etwa landwirtschaftliche und andere Produktion), wird an lokale Gegebenheiten angepasst und vor Ort bewerkstelligt.

Und das Zusammenspiel von Digitalem und Materiellem verspricht weitere Möglichkeiten.

In jedem Fall haben die Commons eine ausgleichende, regenerierende Kraft, die wir aufgrund der heutigen vielen Kriesen gar nicht ungenützt lassen können, ganz unabhängig von unserer sozialer Ebene - das gilt auch für die Superreichen.

-

@ 75528885:78eb1c7e

2025-06-12 17:03:41

@ 75528885:78eb1c7e

2025-06-12 17:03:41So currently I am testing this obsidian plug in so I can start creating articles on NOSTR. I will definitely try to test this to the max and I will also start making a blog for my journey through Bitcoin mining.

-

@ 8bad92c3:ca714aa5

2025-06-12 17:01:52

@ 8bad92c3:ca714aa5

2025-06-12 17:01:52Marty's Bent

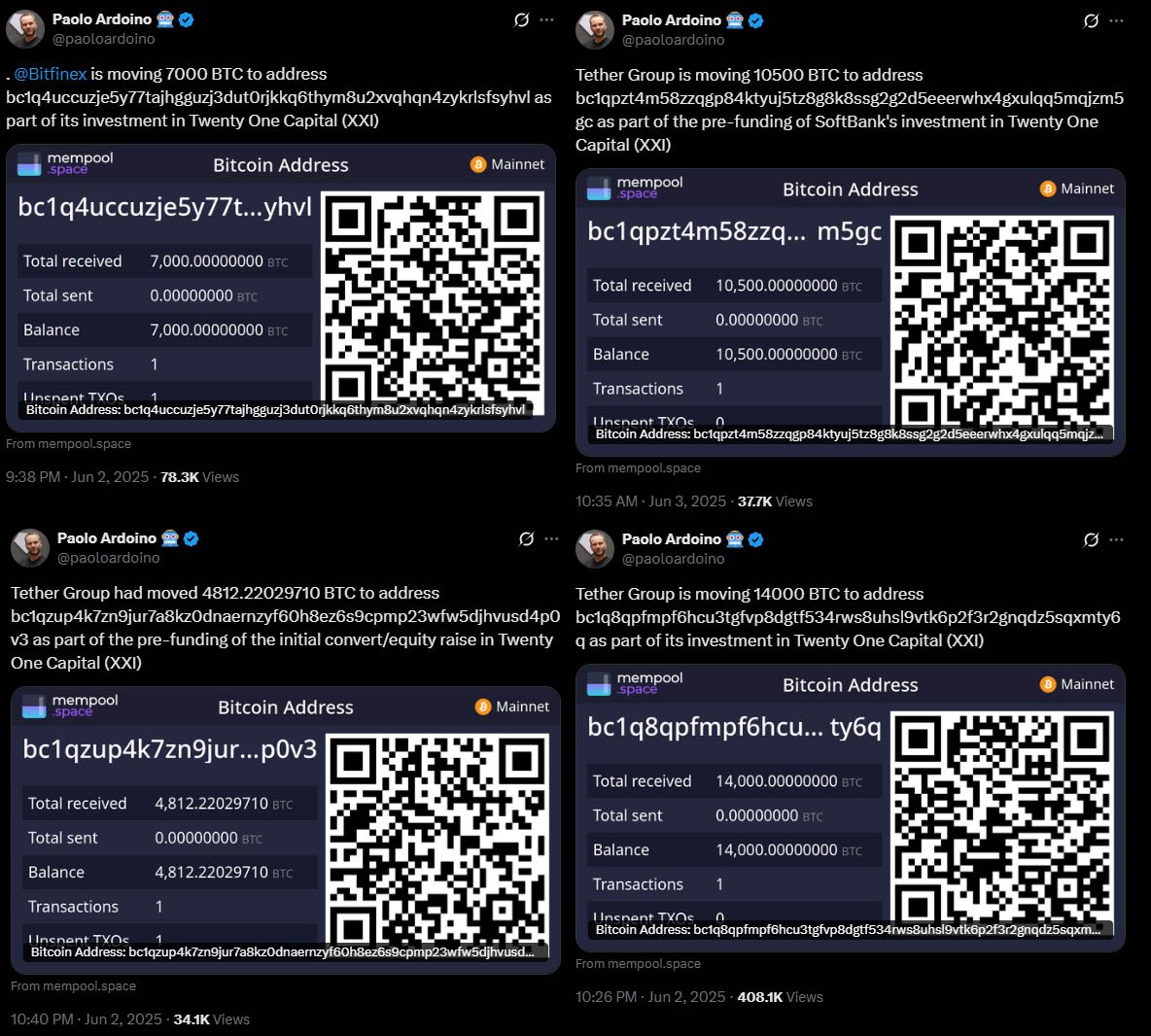

J.P. Morgan CEO Jamie Dimon has long been an outspoken skeptic and critic of bitcoin. He has called Bitcoin a speculative asset, a fraud, a pet rock, and has opined that it will inevitably blow up. A couple of years ago, he was on Capitol Hill saying that if he were the government, he would "close it down". Just within the last month, he was on Fox Business News talking with Maria Bartiromo, proclaiming that the U.S. should be stockpiling bullets and rare earth metals instead of bitcoin. It's pretty clear that Jamie Dimon, who is at the helm of the most powerful and largest bank in the world, does not like bitcoin one bit.

Evidence below:

via Bitcoin Magazine

via me

via CNBC

Despite Dimon's distinguished disdain for Bitcoin, J.P. Morgan cannot deny reality. The CEO of the largest bank in the world is certainly a powerful man, but no one individual, even in the position that Jamie Dimon is in, is more powerful than the market. And the market has spoken very clearly, it is demanding bitcoin. The Bitcoin ETFs have been the most successful ETFs in terms of pace of growth since their launch. They've accumulated tens of billions of dollars in AUM in a very short period of time. Outpacing the previous record set by the gold ETF, GLD.

Whether or not Jamie Dimon himself likes Bitcoin doesn't matter. J.P. Morgan, as the largest bank in the world and a publicly traded company, has a duty to shareholders. And that duty is to increase shareholder value by any ethical and legal means necessary. Earlier today, J.P. Morgan announced plans to offer clients financing against their Bitcoin ETFs, as well as some other benefits, including having their bitcoin holdings recognized in their overall net worth and liquid assets, similar to stocks, cars, and art, which will be massive for bitcoiners looking to get mortgages and other types of loans.

via Bloomberg

I've talked about this recently, but trying to buy a house when most of your liquid net worth is held in bitcoin is a massive pain in the ass. Up until this point, if you wanted to have your bitcoin recognized as part of your net worth and count towards your overall credit profile, you would need to sell some bitcoin, move it to a bank account, and have it sit there for a certain period of time before it was recognized toward your net worth. This is not ideal for bitcoiners who have sufficient cash flows and don't want to sell their bitcoin, pay the capital gains tax, and risk not being able to buy back the amount of sats they were forced to sell just to get a mortgage.

It's not yet clear to me whether or not J.P. Morgan will recognize bitcoin in cold storage toward their clients' net worth and credit profile, or if this is simply for bitcoin ETFs only. However, regardless, this is a step in the right direction and a validation of something that many bitcoiners have been saying for years. Inevitably, everyone will have to bend the knee to bitcoin. Today, it just happened to be the largest bank in the world. I expect more of this to come in the coming months, years, and decades.

Lyn Alden likes to say it in the context of the U.S. national debt and the fiscal crisis, but it also applies to bitcoin adoption and the need for incumbents to orient themselves around the demands of individual bitcoiners; nothing stops this train.

Real Estate Correction Coming

Real estate expert Leon Wankum shared his perspective on why property prices need to find a new equilibrium by 2026. He pointed to the 18-year property cycle theory, noting we're at the end of the current cycle with a massive imbalance - 34% more sellers than buyers, the highest gap since records began in 2013. Leon explained that sellers still have unrealistic expectations based on 2021-2022 peaks, while buyers face a fundamentally different reality with higher borrowing costs.

"We need a price equilibrium. We need demand and supply prices to match. It's going to take a long time, I think." - Leon Wankum

Leon doesn't expect a catastrophic crash, however. He emphasized that the financial system depends too heavily on real estate as collateral for authorities to allow a complete collapse. With interest rates likely staying above 3% to combat inflation, he sees a healthy correction rather than devastation - a necessary adjustment that creates opportunities for patient buyers who understand the new market dynamics.

Check out the full podcast here for more on Bitcoin treasury strategies, dual collateralization, and corporate BTC adoption

Headlines of the Day

California May Seize Idle Bitcoin After 3 Years - via X

Semler Scientific Buys $20M More Bitcoin, Holds $467M - via X

US Home Sellers Surge as Buyers Hit 4-Year Low - via X

Get our new STACK SATS hat - via tftcmerch.io

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I feel old.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ 9ca447d2:fbf5a36d

2025-06-12 17:01:32

@ 9ca447d2:fbf5a36d

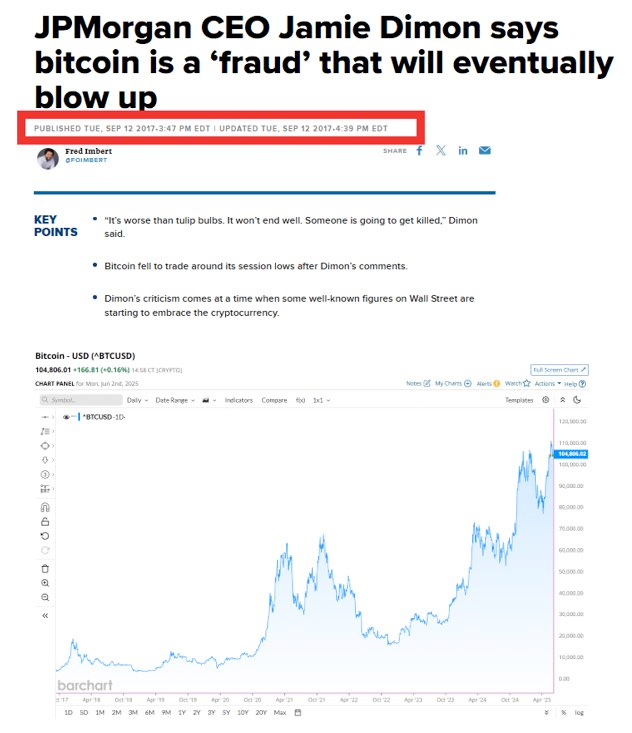

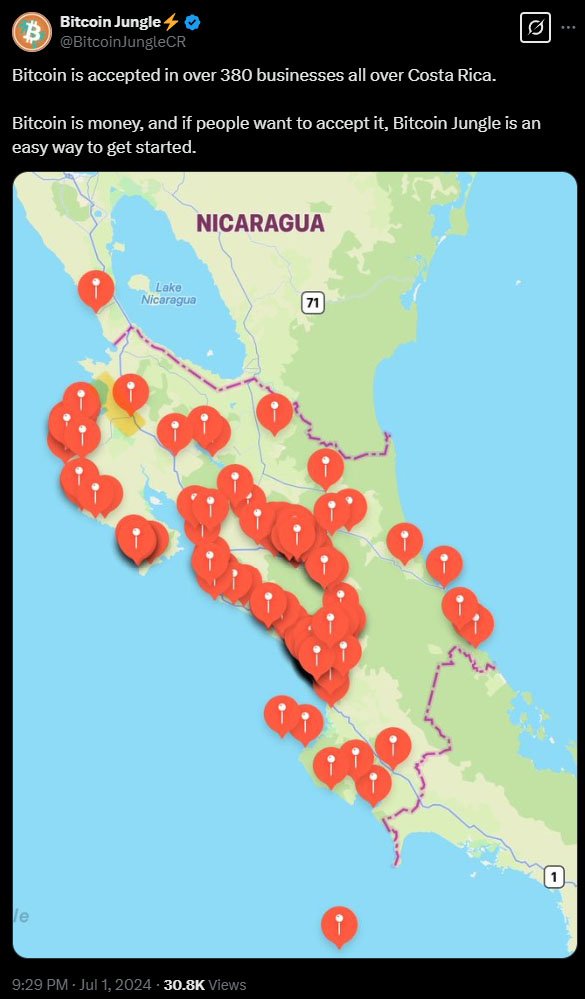

2025-06-12 17:01:32JPMorgan Chase, the largest bank in the U.S. and one of the most powerful institutions in global finance, is going deeper into Bitcoin. The bank is reportedly going to allow wealthy clients to use shares of Bitcoin ETFs—specifically BlackRock’s iShares Bitcoin Trust (IBIT) — as collateral for loans.

This is a big move from the Wall Street giant and a sign of how traditional finance is changing the way it treats bitcoin.

According to a Bloomberg report, JPMorgan will let trading and wealth-management clients borrow money using digital asset ETFs like IBIT as collateral—the same way clients might use stocks, real estate or even cars.

The bank will also factor clients’ digital asset holdings into calculations of net worth and liquidity. So now, bitcoin will be treated like real estate or company shares when assessing a client’s loan repayment ability.

This is set to launch in the coming weeks and will start with IBIT which has over $70 billion in assets. IBIT is now the largest spot bitcoin ETF in the world and has far outpaced competitors like Fidelity’s FBTC.

Previously JPMorgan only allowed bitcoin ETFs as collateral on a case-by-case basis, Bloomberg reports. This decision will now make it available to all wealth-management clients.

JPMorgan’s new Bitcoin-friendly strategy comes despite its CEO Jamie Dimon’s long-time skepticism of Bitcoin. For years, Dimon has been one of the most vocal critics of Bitcoin, calling it a tool for criminals and comparing it to a “pet rock.”

But in a change of heart, Dimon recently said the bank would allow clients to buy bitcoin. At JPMorgan’s annual Investor Day, he said, “I don’t think you should smoke, but I defend your right to smoke. I defend your right to buy bitcoin.”

Related: JPMorgan Chase to Allow Clients to Buy Bitcoin, Says CEO Jamie Dimon

While Dimon remains personally unconvinced about the long-term value of bitcoin, the bank seems to be moving forward with embracing bitcoin, a move Bitcoin advocates believe is rooted in fear of missing out on possible profits and losing market share.

JPMorgan is following the trend on Wall Street. Other big financial players like Fidelity, Grayscale, and Standard Chartered have launched services for clients to invest or trade bitcoin.

The approval of Bitcoin ETFs by the U.S. SEC in 2024 has opened the door to millions of investors who were hesitant to enter the Bitcoin space.

Institutional interest is surging as the political landscape is also opening doors for digital assets. Under President Donald Trump’s administration, several Bitcoin-friendly policy changes have been introduced.

In April 2025, the Federal Reserve withdrew past guidance that discouraged banks from working with digital asset companies. Soon after, the US Office of the Comptroller of the Currency confirmed banks could hold customer’s bitcoin in custody.

-

@ b1ddb4d7:471244e7

2025-06-12 17:01:11

@ b1ddb4d7:471244e7

2025-06-12 17:01:11This article was originally published on dev.to by satshacker.

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets

If you like to take it a step further, you can also create a more enhanced donation checkout flow. Of course you could programm something yourself, there are many open source libraries you can build upon. If you want a simple plug-and-play solution, here are a couple of options:

Name

Type

Registration

SatSale

Self-hosted

No KYC

BTCPay Server

Self-hosted

No KYC

Pay With Flash

Widget

Email

Geyser Fund

Widget

Email

The Giving Block

Hosted

KYC

OpenNode

Hosted

KYC

SatSale (GitHub)

Lightweight, self-hosted Bitcoin/Lightning payment processor. No KYC.

Ideal for developers comfortable with server management. Simple to deploy, supports both on-chain and Lightning, and integrates with WooCommerce.

BTCPay Server

Powerful, open-source, self-hosted processor for Bitcoin and Lightning. No KYC.

Supports multiple currencies, advanced features, and full privacy. Requires technical setup and maintenance. Funds go directly to your wallet; great for those seeking full control.

Pay With Flash

Easiest for indie hackers. Add a donation widget with minimal code and no KYC. Payments go directly to your wallet for a 1.5% fee.

Setup Steps:

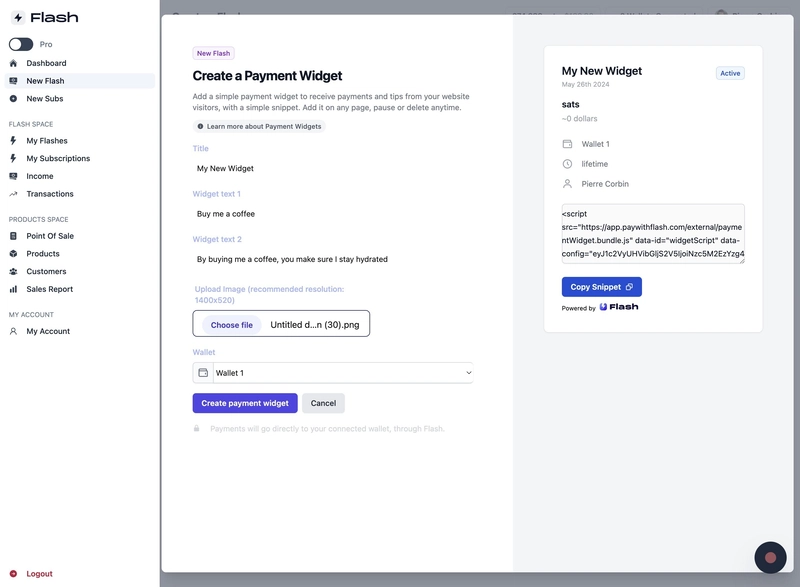

- Sign up at PayWithFlash.com

- Customize your widget in the dashboard

- Embed the code:

- Test to confirm functionality

Benefits:

- Minimal technical skills required

- Supports one-time or recurring donations

- Direct fund transfer, no intermediaries

Geyser Fund

Crowdfunding platform. Widget-based, connects to your wallet, email registration.Focused on Bitcoin crowdfunding, memberships and donations.

The Giving Block

Hosted, KYC required. Integrates with fiat and crypto, best for nonprofits or larger organizations.

OpenNode

Hosted, KYC required. Accept Bitcoin payments and donations; supports conversion to fiat, suitable for businesses and nonprofits.

Summary

- Fast, low-code setup: Use Pay With Flash or Geyser Fund.

- Privacy and control: Choose SatSale or BTCPay Server (requires technical skills).

- Managed, compliant solutions: The Giving Block or OpenNode.

Choose based on your technical comfort, privacy needs, and project scale.

I hope this article helped you. If you added bitcoin donations, share your link in the comments and I will send you a few satoshis maybe

-

@ cae03c48:2a7d6671

2025-06-12 17:00:51

@ cae03c48:2a7d6671

2025-06-12 17:00:51Bitcoin Magazine

F Street Announced Goal Of Accumulating $10 Million In BitcoinToday, F Street, an alternative investment and private lending firm, announced it has begun adding Bitcoin to its corporate treasury, with a goal of accumulating $10 million in BTC.

JUST IN: Investment firm F Street announced it's buying Bitcoin daily using business proceeds for its treasury reserves

They plan to buy $10 million Bitcoin

pic.twitter.com/NMLOteyUYU

pic.twitter.com/NMLOteyUYU— Bitcoin Magazine (@BitcoinMagazine) June 11, 2025

The company began daily BTC purchases on June 9, using business proceeds and treasury funds. This move is part of a broader strategy to strengthen F Street’s capital base and support its real estate lending and investment operations.

“Bitcoin offers a compelling hedge against inflation and dollar debasement,” said the Chief Operating Officer of F Street Mike Doney. “Incorporating it into our treasury is a strategic step to preserve and grow value for our investors and our business interests.”

In line with its commitment to transparency, F Street also plans to establish a public proof of reserves so that stakeholders can independently verify the custody of its Bitcoin assets. The firm aims to build a meaningful BTC position that supports its long term vision of a capital framework.

F Street’s move comes at a time when institutional interest in Bitcoin is experiencing a notable surge, and many prominent voices in the financial world are starting to support it. Billionaire investor Paul Tudor Jones, speaking today in an interview with Bloomberg, named Bitcoin as a critical part of what he considers the ideal portfolio against inflation.

“What would an ideal portfolio be… But it would be some kind of combination of probably gold, vol adjusted, Bitcoin, gold, stocks,” Jones said. “That’s probably your best portfolio to fight inflation. Vol adjusted because the vol of Bitcoin obviously is five times that of gold, so you’re going to do it in different ways.”

Adding to the momentum, the Head of Digital Assets of BlackRock Robert Mitchnick explained two days ago what’s really driving the surge in demand for Bitcoin ETFs.

“It’s a lot of things coming together. Out of the gate was retail and investor demand…” said Mitchnick. “Now, more recently, we’ve seen just steady progress of more wealth advisor adoption, more institutional adoption. It’s been a mix of people who it’s the first time that they’ve invested in anything in the crypto space. And then on the other hand, you have lots of people who’ve been invested in Bitcoin for a long time and they’re taking advantage of the ETP wrapper.”

This post F Street Announced Goal Of Accumulating $10 Million In Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-12 17:00:48

@ cae03c48:2a7d6671

2025-06-12 17:00:48Bitcoin Magazine

Maelstrom Announces Its Fourth Bitcoin Developer Grant RecipientMaelstrom is announcing that Ron, known online as “macgyver13,” is the fourth recipient of the Maelstrom Bitcoin Grant Program, per a press release sent to Bitcoin Magazine. Ron will be working on Silent Payments, as proposed in Bitcoin Improvement Proposal 352.

“We are excited to be financially supporting Ron, in his mission on integrating Silent Payments into Bitcoin wallets,” said the CFO of Maelstrom Arthur Hayes. “Many merchants and users want to provide/display a single static address that doesn’t change, which is an important, valid and simple use case. With Silent Payments this can still be done, while on-chain address re-use is avoided. Address re-use is a goldmine for the surveillance organisations, and at Maelstrom, we want to help put a stop to it.”

In September 2023, Silent Payments was proposed by Josie Baker and Ruben Somsen. It allows people to create a single, static address to share with friends, use for donations, or post for tips without sacrificing privacy. This eliminates address reuse, a key method used by surveillance firms to track user behavior on the blockchain.

“With many software projects, and perhaps even more so in Bitcoin, taking an idea from a proposal to a fully adopted solution is the hardest part,” Josie said. “In the short amount of time I’ve been working with Ron, I’ve been thrilled at the progress we’ve made and I’m excited to work with him over the next year on Silent Payments adoption with the goal of making an intuitive, seamless user experience while also protecting user’s financial privacy.”

Bitcoin privacy depends on using new addresses, which often requires sender to receiver interaction. Existing static address methods use notifications that increase costs and leak metadata. Silent Payments avoids both interaction and notifications but requires wallets to scan the blockchain. Multi-party input use is not yet proven secure.

Silent Payments aim to implement:

- Zero transaction cost overhead

- No linkability between payments and static addresses

- No need for sender to receiver interaction

- Compatibility with privacy tools and modern wallet features

“My primary focus will be coordinating development and testing efforts within the growing community dedicated to integrating Silent Payments into desktop and mobile Bitcoin wallets,” stated the new grantee of Maelstrom Ron. “By advancing Silent Payments alongside BOLT12 and BIP-353, we aim to enhance privacy and simplify the user experience, paving the way for broader adoption of Bitcoin as a payment solution.”

This post Maelstrom Announces Its Fourth Bitcoin Developer Grant Recipient first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-12 17:00:46

@ cae03c48:2a7d6671

2025-06-12 17:00:46Bitcoin Magazine

The Bitcoin Treasury Strategy That’s Reanimating Zombie CompaniesA growing number of public companies are stuck in limbo—technically solvent, but strategically stalled. Growth has evaporated. Stock prices have languished. Reinvestment opportunities are unclear or underwhelming. These companies aren’t broken—they’re just drifting.

They’ve become what markets call zombie companies: firms that generate enough to survive, but not enough to excite. And in today’s capital environment, stagnation is no longer neutral—it’s dangerous.

This is where a Bitcoin treasury strategy comes in.

What Is a Bitcoin Treasury Strategy—and What Problem Does It Solve?

At its core, a Bitcoin treasury strategy means converting a portion of idle corporate cash into Bitcoin and treating it as a long-term treasury reserve asset. It’s not a product pivot or a marketing stunt. It’s a capital strategy.

The problem it solves is simple but deadly:

- Capital erosion: Fiat currencies are inflating away purchasing power.

- Inefficient reserves: Billions in cash sit idle on balance sheets, dragging down return on assets.

- Narrative decay: Companies without a growth story get ignored—or punished—by markets.

- Shareholder fatigue: Passive capital strategies frustrate conviction-driven investors.

A Bitcoin treasury strategy is designed to reverse that trend—by reframing cash as conviction.

Two Distinct Approaches to a Bitcoin Treasury Strategy

There’s no one-size-fits-all approach to building a Bitcoin treasury. Instead, companies tend to pursue one of two broad strategic paths:

1. Defensive Allocation

Companies like Tesla and Block have allocated a portion of their reserves to Bitcoin as a hedge against fiat debasement. It’s a form of monetary insulation—protecting cash from erosion while signaling awareness of inflation’s long-term effects. These companies aren’t changing their business models, but they are acknowledging that holding cash in today’s environment means silently bleeding purchasing power. This strategy helps improve the hurdle rate, enhances reserve productivity, and sends a forward-looking message to investors.2. Offensive Accumulation and Securitization

Strategy (formerly MicroStrategy), Semler Scientific, and Metaplanet have adopted a more aggressive model. Rather than passively holding Bitcoin, they’ve turned their balance sheets into capital engines—securitizing their Bitcoin holdings through equity and debt issuance to fuel further accumulation. Their goal is to maximize BTC per share, enhance BTC yield, and create shareholder value through financial engineering that compounds exposure. These companies are rewriting the treasury playbook, showing that Bitcoin isn’t just a store of value—it can be a strategic accelerant.Why Bitcoin—and Not Gold, Equities, or Cash?

Bitcoin isn’t just another asset. It’s engineered monetary policy.

➤ Fixed supply: Bitcoin’s 21 million cap creates built-in scarcity, unlike fiat or equity dilution.

➤ 24/7 liquidity: Global, permissionless markets give companies access to real-time value.

➤ Verifiability and portability: It’s digital capital that can’t be seized, censored, or inflated.

➤ Asymmetric upside: Bitcoin has consistently outperformed every major asset class over multi-year cycles.

More importantly, Bitcoin is narrative fuel. It communicates conviction, discipline, and macro-awareness—all of which modern investors are starving for.

The Components of a Successful Bitcoin Treasury Strategy

A Bitcoin treasury strategy isn’t just about buying Bitcoin. It’s about embedding it into capital structure and governance. That requires rigor.

➤ Treasury governance: Establish internal guardrails on allocation, rebalancing, and reporting.

➤ Secure custody: Choose institutional-grade solutions, with redundancy, auditability, and oversight.

➤ Capital deployment strategy: Some companies use cash. Others leverage equity, debt, or ATM programs.

➤ Market communication: The value of Bitcoin on your balance sheet rises with clarity, transparency, and frequency of investor communication.

Companies like Strategy (formerly MicroStrategy), Semler Scientific, and Metaplanet didn’t just buy Bitcoin. They built Bitcoin treasury frameworks—with real policies, investor alignment, and governance maturity.

How Bitcoin Reframes the Shareholder Relationship

The Bitcoin treasury model isn’t just a liquidity play. It’s a credibility signal.

➤ Narrative magnet: Bitcoin attracts attention—not just from retail investors, but from global institutions searching for proxy exposure.

➤ Alignment lever: High-conviction shareholders reward companies that act decisively and transparently.

➤ Shareholder base upgrade: Bitcoin introduces long-term, ideologically aligned holders who are less reactive to short-term earnings noise.

Bitcoin gives stale stories new energy. And in capital markets, momentum is everything.

Execution: What It Takes to Make This Strategy Work

Bitcoin is not a set-it-and-forget-it strategy. It requires:

➤ Executive conviction: Most successful strategies are driven by founders, activist chairs, or tightly aligned boards—not committees.

➤ Discipline over hype: Volatility is part of the game. But the strategy must be built to endure it.

➤ Clarity and timing: The best entries are paired with proactive shareholder education and public clarity—not reactive announcements.

The most common failure mode? Buying Bitcoin high, with no treasury framework in place, then being forced to sell low when pressure mounts. That’s not a Bitcoin failure—that’s a structure failure.

Conclusion: You Don’t Need a New Business Model—You Need a Capital One

A Bitcoin treasury strategy isn’t for everyone. But for companies with a strong cash position and weak narrative traction, it offers a clear path forward.

You don’t need to change your product. You don’t need to invent a new category. You need to stop leaking value through capital drift—and start signaling conviction through capital strategy.

In a market where performance is narrative, and capital is credibility, Bitcoin is the benchmark.

Zombie companies won’t survive on inertia. But with a Bitcoin treasury strategy, they might just come back to life.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

This post The Bitcoin Treasury Strategy That’s Reanimating Zombie Companies first appeared on Bitcoin Magazine and is written by Nick Ward.

-

@ cae03c48:2a7d6671

2025-06-12 17:00:44

@ cae03c48:2a7d6671

2025-06-12 17:00:44Bitcoin Magazine

Mercurity Fintech to Raise $800 Million for Bitcoin TreasuryMercurity Fintech Holding Inc. (Nasdaq: MFH), a digital finance company focused on blockchain-based financial infrastructure, has announced plans to raise $800 million to establish a long-term Bitcoin treasury reserve. The initiative is part of the company’s effort to incorporate digital assets into its financial strategy.

According to a recent news release, Mercurity intends to transition a portion of its reserves into Bitcoin, supported by blockchain-native custody, staking solutions, and tokenized treasury tools designed to advance yield and extend asset duration.

“We’re building this Bitcoin treasury reserve based on our belief that Bitcoin will become an essential component of the future financial infrastructure,” said Shi Qiu, CEO of Mercurity. “We are positioning our company to be a key player in the evolving digital financial ecosystem.”

If fully raised and implemented at current market prices, the capital could allow the company to acquire approximately 7,433 BTC, which would make Mercurity the 11th largest corporate holder of Bitcoin, surpassing GameStop’s reported 4,710 BTC holdings.

The announcement comes during a time of corporate interest in Bitcoin, with 223 companies and entities now holding the asset, up from 124 earlier this month. In total, public firms currently hold more than 819,000 BTC, accounting for roughly 3.9% of the total supply.

Mercurity’s plans also coincide with its initial inclusion in the FTSE Russell 2000® and Russell 3000® indexes, according to the 2025 reconstitution list. The firm was previously listed in the Russell Microcap Index. Index inclusion is expected to increase the company’s visibility among institutional investors and funds that track major benchmarks.

“Moving from the Russell Microcap to the Russell 2000 shows that investors recognize the value we are creating in blockchain finance,” Qiu added. “Our Bitcoin treasury reserve initiative is the next logical step in this evolution.”

The company noted that the reserve will be managed using institutional-grade custody, on-chain liquidity protocols, and staking-enabled tools to improve capital efficiency. The goal is to not just hold Bitcoin, but to put it to work within a secure, yield-generating structure. By using these systems, Mercurity aims to maintain long-term exposure to BTC while maximizing reserve productivity.

With this initiative, Mercurity joins a growing list of public companies actively reshaping treasury strategy around Bitcoin, signaling continued momentum in corporate Bitcoin adoption.

This post Mercurity Fintech to Raise $800 Million for Bitcoin Treasury first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-12 17:00:41

@ cae03c48:2a7d6671

2025-06-12 17:00:41Bitcoin Magazine

Remixpoint Invests ¥887 Million More Into BitcoinRemixpoint Inc. (3825.T), a management consulting services company, announced it has purchased ¥887.3 million worth of Bitcoin, acquiring 55.68 BTC at an average price of ¥15.94 million per coin.

JUST IN:

JUST IN:  Remixpoint just keeps buying more #bitcoin. Another 55.68 BTC today and they now have a total of 981.39 BTC. pic.twitter.com/mTkZg8mNO4

Remixpoint just keeps buying more #bitcoin. Another 55.68 BTC today and they now have a total of 981.39 BTC. pic.twitter.com/mTkZg8mNO4— NLNico (@btcNLNico) June 12, 2025

Following this purchase, the company now holds a total of 981.39 BTC, with a market value of approximately ¥15.63 billion. The unrealized gain on its Bitcoin holdings stands at ¥2.32 billion, reflecting their confidence in Bitcoin’s long term value. The funds came from the exercise of stock acquisition rights conducted on June 10.

Remixpoint Inc. is a Japanese company that started in the auto and energy sectors but has changed toward digital assets. It’s one of the few public companies in Japan actively holding Bitcoin, seeing it as both a store of value and a hedge against the weakening yen. Their move highlights a growing shift in Japan’s corporate space toward Bitcoin adoption.

Bitcoin has been so strong over the years that even in Japan, more companies are adding it to their balance sheets. It all started with Metaplanet, which was originally a hotel and hospitality company. In 2024, they shifted their strategy entirely and began accumulating Bitcoin as a treasury asset. That move caught the attention of investors and marked a turning point in Japan’s corporate approach to digital assets. Since then, Metaplanet has leaned fully into the Bitcoin thesis, positioning itself as Japan’s version of Strategy.

Recently, Metaplanet also announced its “555 Million Plan,” aiming to acquire 210,000 BTC, which is about 1% of Bitcoin’s total supply, by the end of 2027. This represents a major step up from its original “21 Million Plan,” which aimed for just 21,000 BTC. As of June 2, the company had already secured 8,888 BTC, far ahead of schedule and signaling strong momentum in its accumulation strategy.

Metaplanet has launched Asia’s largest-ever equity raise dedicated to Bitcoin:

¥770.9 billion (~$5.4B) capital raise

¥770.9 billion (~$5.4B) capital raise

555 million shares via moving strike warrants

555 million shares via moving strike warrants

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo— Simon Gerovich (@gerovich) June 6, 2025

To fund this effort, Metaplanet launched Japan’s first moving strike warrant structure, issuing 555 million shares to raise approximately ¥770.9 billion. The plan was approved following a 10-for-1 stock split and a shareholder vote to increase authorized shares. With robust BTC yield performance and growing investor backing, Metaplanet is quickly establishing itself as Japan’s most influential corporate player in the Bitcoin space.

This post Remixpoint Invests ¥887 Million More Into Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ d5b257e3:30a2b7bd

2025-06-12 16:56:02

@ d5b257e3:30a2b7bd

2025-06-12 16:56:02SPEC.md

Project: Prime Number CLI Calculator

Overview

A command-line interface (CLI) calculator built using Bun, which only accepts prime numbers as input. The calculator will perform basic arithmetic operations (addition, subtraction, multiplication, division) on prime numbers.

Features

- Prime Number Validation: The calculator will validate all input numbers to ensure they are prime.

- Arithmetic Operations:

- Addition (

+) - Subtraction (

-) - Multiplication (

*) - Division (

/) - Error Handling: Informative error messages for invalid inputs (non-prime numbers, invalid operations, etc.).

- Help Command: Display usage instructions and examples.

Technical Stack

- Runtime: Bun

- Language: TypeScript

- Testing: Bun's built-in test runner

Usage Example

```bash bun run calculator add 5 7

Output: 12

```

Project Structure

/prime-calculator /src index.ts # Main entry point utils.ts # Helper functions (e.g., prime validation) /tests index.test.ts # Test cases package.json # Project configuration SPEC.md # This documentRequirements

- Prime Validation: Implement a function to check if a number is prime.

- CLI Interface: Parse command-line arguments and execute the requested operation.

- Testing: Write unit tests for all functions.

Next Steps

- Set up the Bun project.

- Implement the prime validation logic.

- Build the CLI interface.

-

@ 4c96d763:80c3ee30

2025-06-12 16:32:09

@ 4c96d763:80c3ee30

2025-06-12 16:32:09Changes

Daniel D’Aquino (1):

- nostrdb: Fix heap buffer overflow

William Casarin (17):

- win: fix build on windows

- ndb: add note-relays command

- note: always write relay index

- relay-index: fix a few bugs

- debug: add a print for debugging rust integration

- relay: fix race condition bug

- relay: fix potential relay index corruption

- Relay queries

- query: implement author_kind query plan

- fix build on macos

- query: implement profile search query plans

- filter: add initial custom filtering logic

- test: fix custom filter test

- ndb: add --id queries

- eq: fix fallthrough bug

- change <=10 author search queries to ==1

- cleanup previous patch

pushed to nostrdb:refs/heads/master

-

@ 6a6be47b:3e74e3e1

2025-06-12 16:52:08

@ 6a6be47b:3e74e3e1

2025-06-12 16:52:08Hi frens! 🌝

🎨Today I painted a full moon, and it got me thinking about how special June’s full moon is. You might have heard it called the “Strawberry Moon” —but that’s not because of its color! According to the Old Farmer’s Almanac, it’s called like that because it's “when the strawberry harvest took place.” 🍓

Fun fact:

“A Moon usually appears reddish when it’s close to the horizon because the light rays must pass through the densest layers of the atmosphere.”

In Europe, June’s full moon has also been called the “Rose Moon” or even the “Honey Moon,” since it’s the time of the first honey harvest.

According to UK archaeologist and historian Jennifer Wexler in Sky At Night Magazine this year’s Strawberry Moon is extra special because it’s part of a “major lunar standstill,” or lunistice—a rare event that only happens every 18.6 years! During this period, the moon’s path across the sky reaches its most extreme points, making moonrises and moonsets appear unusually far apart. After 2025, we won’t see a standstill like this again until 2043, so this is a once-in-a-generation chance to catch the lowest full moon.

But what is a full moon, anyway?

“A full moon rises around sunset and sets around sunrise. The Moon will appear full for a couple of days.”

Here’s my watercolor painting of the full moon. I love how magical it looks—there’s something mysterious and humbling about it, and it’s just mesmerizing to catch it (almost) every night in the sky.

💭 Were you able to see the Strawberry Moon this year? I’d love to hear about it!

See you soon, frens.

Godspeed! 🌕

https://stacker.news/items/1004621

-

@ df478568:2a951e67

2025-06-12 16:16:11

@ df478568:2a951e67

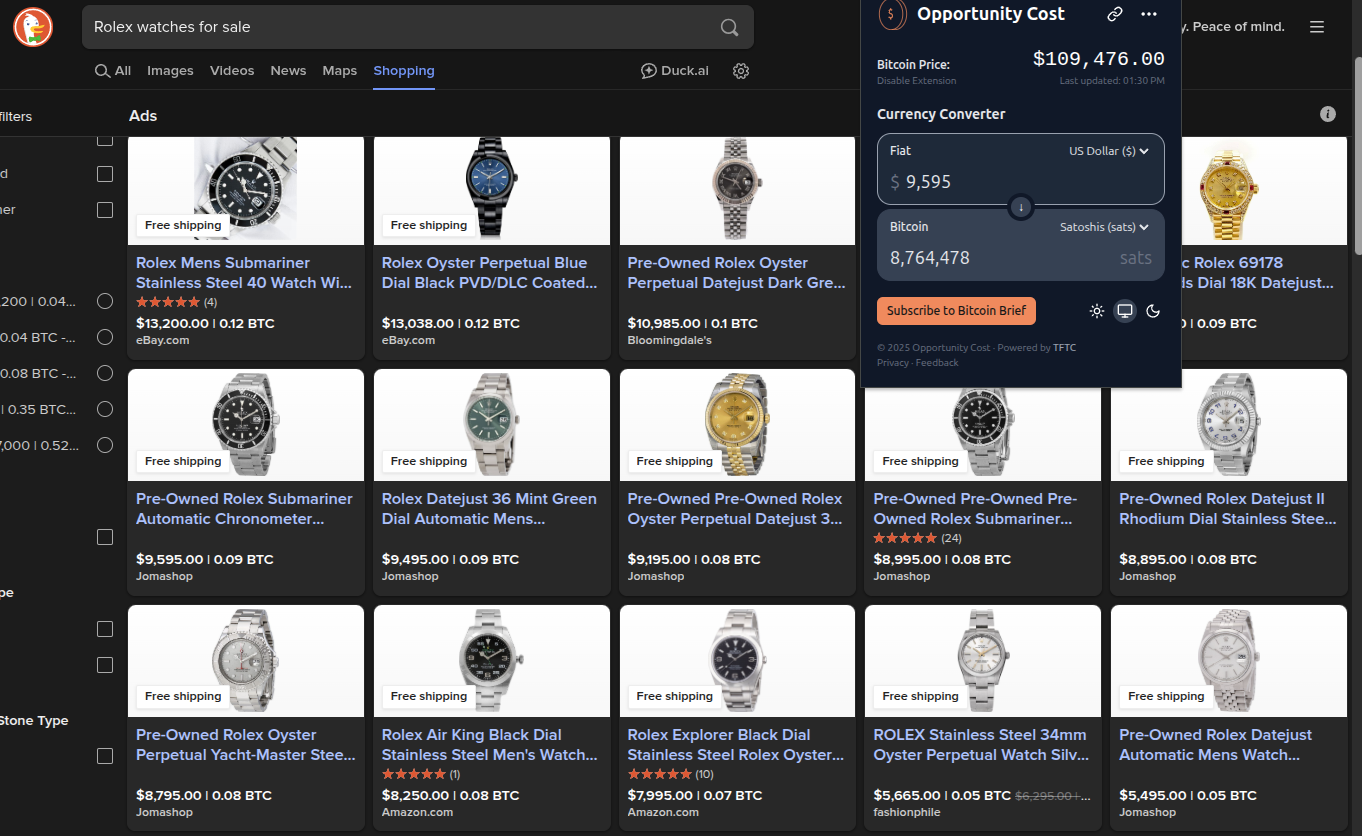

2025-06-12 16:16:11Marty Bent Vibe coded the opportunity cost app. I have not tried it yet, but love the concept. I have been into bitcoin since 2014, but I spent more generational wealth than I would care to admit back then. I've heard stories of fortunes blown on cocaine in the 1980's. I could write a story about spending a fortune on Diet Mt. Dew. I don't drink Diet Mt. Dew anymore. This one time, I spent about a million sats for a light beer at a baseball game. I wouldn't say I had a drinking problem, a million sats was only five bucks at the time. I didn't know that much bitcoin would be worth over a thousand bucks eleven years later.

I don't drink beer anymore. Bitcoin tends to do that to you.

We can afford chairs now. To be honest, we need a couch. The last couch I bought was in 2017 and it cost about a whole bitcoin. That couch is buried in a landfill today. My wife loves furniture, but even she's hesitant to spend sats on a couch now. We know we need a couch, but we don't want to spend sats on something we will need to replace before the next halving.

Many of us who have been in bitcoin for more than a decade have some regrets. I know I do, but we need to live our lives. I would never say you should sit on the floor, but I encourage to you to think about time. How long will this thing I need to buy last? If you think you can give a 3 million sat couch to your grandchildren, spend three million sats on the couch. If your five year plan for the couch is to help fill a landfill, maybe you only need to buy a used couch at a thrift store. This is not investment advice of course. How can it be? I don't know what kind of couch hazards you have in your house. I have trouble finding a couch of my own, but it's how I think about making bigger purchases. How many years of your retirement will that watch, car, house or whatever cost you from your stack? You can only determine that for yourself. I think the opportunity cost app will help you keep track of your decision.

This app was made by someone who once spent a whole bitcoin on a heater. I can't speak for Marty, but I believe the opportunity cost app will help you learn from my mistakes.

For more information, check out:

https://www.opportunitycost.app/

Check out the code on GitHub.

Using The Opportunity Cost App

The app is pretty straight forward. It is only available on Chrome for now so I installed it on the Chromium browser. I looked at the settings, but kept them default.

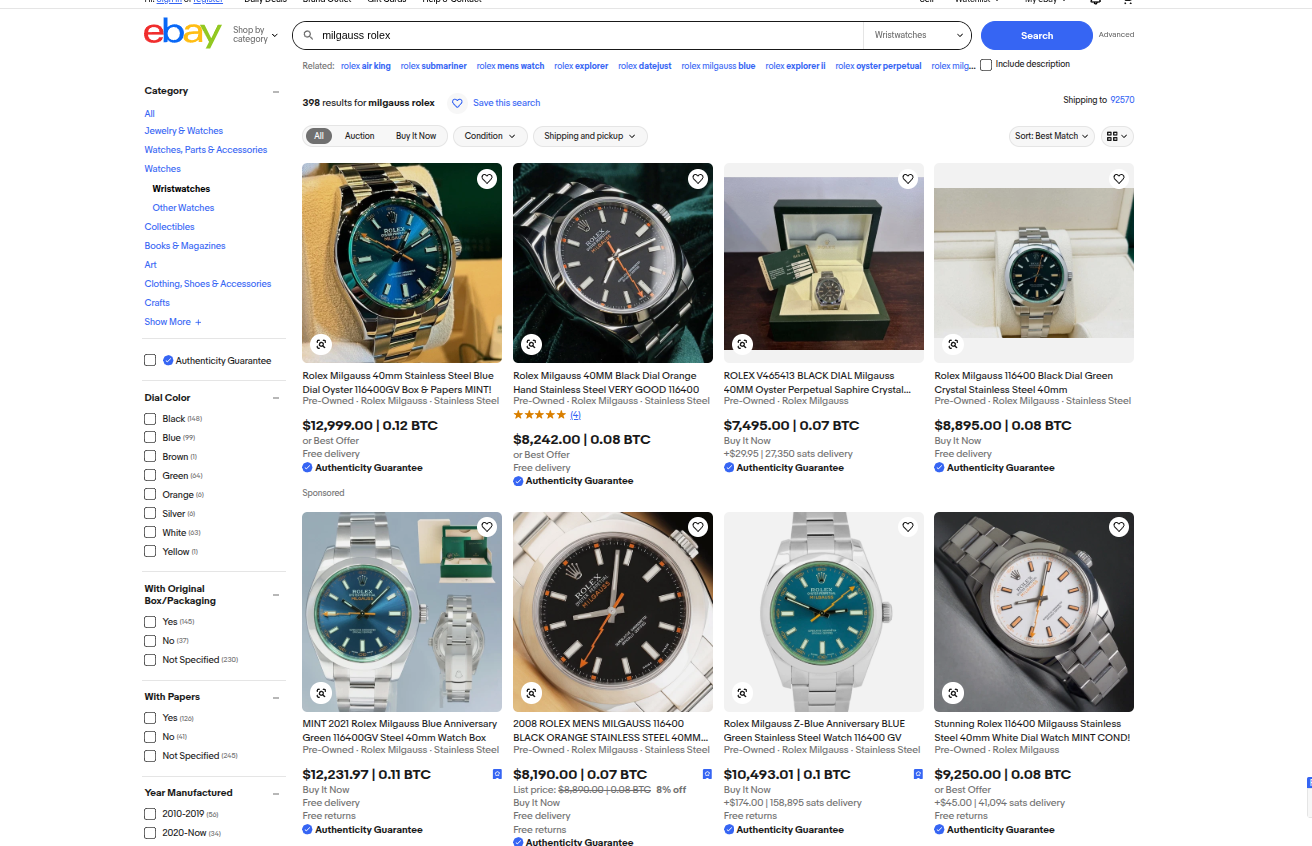

Then I searched for a Rolex in Duck Duck Go.

The default is bitcoin, but there is a sat calculator in the corner too, I have always wanted a Rolex Milgauss with a green sapphire so I looked it up on eBay. It's about 8 million sats. That's too rich for my blood, but I might be willing to part with a million sats for that watch. I'll definitely pick it up for 500,000 sats. I can wait. Bitcoin is the best clock in the world. I wouldn't go so far as to call this Rolex a shitcoin, but bitcoin is a better clock than any watch in my opinion--Even when compared to my favorite watch.

Video From Opportunity Cost Website

How will you use the Opportunity Cost browser extension?

☮️ npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

https://zapthisblog.com/calculate-your-opportunity-cost-while-shopping/

-

@ 79c79f2d:7dbd8c3f

2025-06-12 16:02:47

@ 79c79f2d:7dbd8c3f

2025-06-12 16:02:47HVAC services in Tucson cover everything from air conditioning repairs to furnace installations, designed specifically for the region’s unique desert climate. With temperatures ranging from freezing winters to blazing summers, efficient heating and cooling systems are vital. Tucson HVAC contractors offer expert installation, maintenance, and emergency repairs to keep your system running smoothly. They provide energy-saving solutions and work with top brands to ensure comfort and reliability. Whether it’s residential or commercial service, Tucson HVAC professionals are known for their fast response, honest pricing, and technical expertise.

-

@ 433e1568:76df16e4

2025-06-12 16:30:06

@ 433e1568:76df16e4

2025-06-12 16:30:06{ "id": "id-1749742303915-wvxk26r", "name": "Neues Board", "description": "", "authors": [ "User" ], "summary": "", "backgroundColor": "#f5f7fa", "customStyle": "", "columns": [ { "id": "id-1749742303915-shl9l6i", "name": "To Do", "color": "color-gradient-1", "cards": [ { "id": "id-1749742324261-rg0tla6", "heading": "Karte 1 (Kopie)", "content": "", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "", "labels": "", "inactive": false }, { "id": "id-1749742312185-tfw8pib", "heading": "Karte 1", "content": "", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "", "labels": "", "inactive": false } ] }, { "id": "id-1749742303915-q9qjhnu", "name": "In Progress", "color": "color-gradient-2", "cards": [ { "id": "id-1749742330380-as246pq", "heading": "Karte 1 (Kopie) (Kopie)", "content": "", "color": "color-gradient-1", "thumbnail": "", "comments": "", "url": "", "labels": "", "inactive": false } ] }, { "id": "id-1749742303915-51t3c01", "name": "Done", "color": "color-gradient-3", "cards": [] } ], "aiConfig": { "provider": "", "apiKey": "", "model": "", "baseUrl": "" }, "exportDate": "2025-06-12T16:30:06.121Z", "nostrEvent": true }

-

@ 8bad92c3:ca714aa5

2025-06-12 16:02:00

@ 8bad92c3:ca714aa5

2025-06-12 16:02:00

Another week of conversations with sharp minds thinking about Bitcoin's future and the broader economic landscape. Here are the three most compelling predictions from recent episodes.

Bitcoin Core Will Face a Major Governance Crisis Over Covenant Proposals in 2025 - James O'Beirne

James made a prediction that sent chills through the Bitcoin development community - he believes Bitcoin Core's current governance structure will reach a breaking point this year over covenant proposals like CTV. After working as a Core developer for nearly a decade, he's convinced that the organization's inability to make progress on scaling solutions will force alternative implementations.

His timeline is specific and urgent. James believes that if Core doesn't show "substantive review discussion about how we get this stuff in" within six months, credible developers will start building alternate activation clients. The technical argument is compelling: covenants like CheckTemplateVerify have been thoroughly reviewed for seven years, with a 5 BTC bounty (worth over $500,000) still unclaimed for finding material bugs.

The stakes couldn't be higher for Bitcoin's future. James noted that currently "just over two and a half percent of Americans would be able to, on a monthly basis, buy Bitcoin on an exchange, withdraw it to self-custody, and then maybe make a spend." Without scaling solutions, this number won't improve meaningfully. His prediction reflects growing frustration with Core's de facto monopoly over protocol development. "You simply can't ignore that there is a social reality to being in that world," he said, referring to the concentrated funding and decision-making power that has created what he sees as an unsustainable bottleneck for Bitcoin's evolution.

The U.S. Will See Widespread Energy Blackouts as AI Data Centers Strain the Grid - Anas Alhajji

Dr. Anas delivered a sobering prediction about America's energy infrastructure failing to keep pace with exploding AI demand. He expects we'll see significant blackouts in major cities within the next few years, with a particularly concerning scenario where AI facilities maintain power while residential areas go dark. "I will not be surprised if we end up with a situation like this in some states and some cities," he warned.

The mathematics behind his prediction are stark. Energy consumption is skyrocketing due to multiple factors: urbanization, AI data centers, and simple population growth. When migrants move from rural areas to U.S. cities, their energy consumption increases by 30-70 times. Meanwhile, AI facilities require massive baseload power that renewable sources simply cannot provide reliably.

The infrastructure problems run deeper than just generation capacity. Anas explained that America's electrical grid is aging and wasn't designed for this level of demand. Even worse, we lack the manufacturing capacity to produce enough natural gas turbines - the only realistic solution for reliable baseload power at scale. He predicts this will create a dangerous political dynamic where tech companies with guaranteed power contracts maintain operations during blackouts while regular citizens lose electricity. "We might see a backlash from the population, and we will see politicians basically being forced to fight them because of that."

AI Will Force Millennials Into Career Reinvention Within the Next Decade - Bram Kanstein

Bram made a stark prediction about the collision between artificial intelligence and millennial career paths. He believes that traditional knowledge-based jobs will become obsolete much faster than people expect, forcing an entire generation to completely rethink their working lives. "If you think you're going to work for the next 30 years of your life, think again," he warned during our conversation.

His argument centers on the rapid advancement of AI capabilities that he's witnessed firsthand. After spending just 12 hours working with AI tools, Bram claims he developed what could be "a top 10 cybersecurity invention" - despite having no cybersecurity background. This experience convinced him that jobs requiring strict knowledge and logic are already dead. The implications are massive for millennials who built their careers around expertise that AI can now replicate instantly.

The timing couldn't be worse, as Bram notes that this technological disruption is happening precisely when millennials need stable income to support families and prepare for retirement. His solution? Use Bitcoin to create the time and space needed to figure out how to function in an AI-dominated world. "You need to be aware of that. This is where it's going. So how do you protect yourself in an age of AI? Bitcoin is the perfect way to do that."

Blockspace conducts cutting-edge proprietary research for investors.

New Bitcoin Mining Pool Flips Industry Model: "Plebs Eat First" Could Threaten Corporate Dominance

Parasite Pool's radical zero-fee structure challenges mining giants by guaranteeing payouts to small miners while rewarding block finders with instant Bitcoin. It disrupts traditional mining with a hybrid payout model that gives block discoverers 1 BTC immediately, while distributing remaining rewards (~2.125 BTC plus fees) among all pool participants. This "plebs eat first" approach targets the 22% discount miners typically accept in exchange for guaranteed income.

Key innovations that matter:

- Lightning Network integration bypasses Bitcoin's 100-block maturity rule, delivering instant payouts to Lightning wallets

- 10-sat minimum withdrawal eliminates traditional barriers for small miners

- Block withholding protection through substantial honest-miner rewards reduces pool attacks

The pool currently commands just 5 PH/s (0.000006% of Bitcoin's network), meaning an expected 3+ years before hitting a block. But this represents a growing counterculture against Full Pay Per Share (FPPS) pools that dominate corporate mining.

Industry impact: If successful, Parasite Pool could attract commercial miners seeking downside protection while maintaining the lottery appeal that drives pleb participation. The model challenges the structural advantages of corporate mining pools.

What's next: ZK Shark plans to open-source components over time, with the current beta suggesting this is just "V1" of a broader disruption strategy.

Subscribe to them here (seriously, you should): https://newsletter.blockspacemedia.com/

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

STACK SATS hat: https://tftcmerch.io/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important; }

-

@ cae03c48:2a7d6671

2025-06-12 16:00:58

@ cae03c48:2a7d6671

2025-06-12 16:00:58Bitcoin Magazine

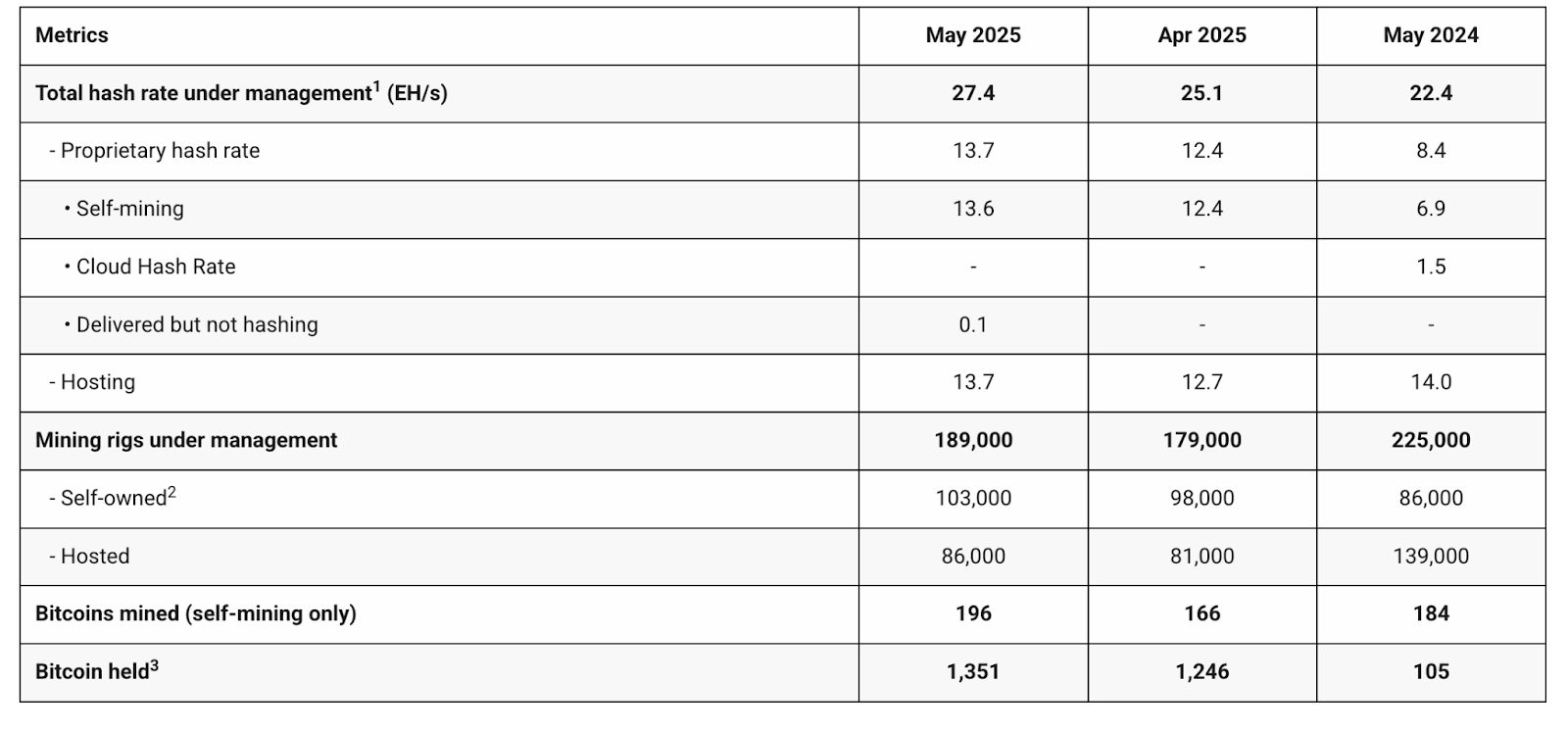

Bitdeer Mined 196 Bitcoin Worth Over $21 Million In MayBitdeer Technologies Group, a global leader in Bitcoin mining and infrastructure, has released its unaudited operational update for May 2025, highlighting robust expansion in hashrate capacity, ongoing infrastructure development, and an entrance into AI services.

$BTDR May 2025 Production & Operations Highlights:

Increased self-mining hashrate to 13.6 EH/s with #SEALMINER deployments.

Increased self-mining hashrate to 13.6 EH/s with #SEALMINER deployments.

9 EH/s SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to external customers, including 1.6 EH/s sold and shipped in May.

9 EH/s SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to external customers, including 1.6 EH/s sold and shipped in May.

SEALMINER… pic.twitter.com/wX66hahd2F

SEALMINER… pic.twitter.com/wX66hahd2F— Bitdeer (@BitdeerOfficial) June 11, 2025

“In May 2025, we continued to deploy our SEALMINER mining rigs to our sites in Texas, U.S., Norway, and Bhutan, bringing Bitdeer’s self-mining hashrate to 13.6 EH/s at the end of the month of May,” said Matt Kong, Chief Business Officer at Bitdeer. “Looking forward, we remain on track to deliver over 40 EH/s of self-mining capacity by October 2025. Further, in May, we sold and shipped approximately 1.6 EH/s of our SEALMINER A2s to external customers. Our A3 Series will also be released and available for pre-order very soon”

Bitdeer self-mined 196 BTC in May—an 18.1% increase from April—due to the expanded deployment of SEALMINER A1 and A2 units. A total of 9 EH/s in SEALMINER A2s have been manufactured, with 2.9 EH/s shipped to customers and 1.6 EH/s sold in May alone.

SEALMINER A3s, which are currently undergoing machine-level testing with positive results, will become available for pre-order in June. Additionally, development of the next-generation A4 SEALMINER chip is progressing, targeting an efficiency of 5 J/TH by Q4 2025.

Bitdeer also announced the launch of its AI Cloud service, powered by over 10 advanced large language models (LLMs), including LLaMA, DeepSeek, and Qwen variants. The infrastructure is designed for strong inference demand, representing a key move into the HPC/AI sector.

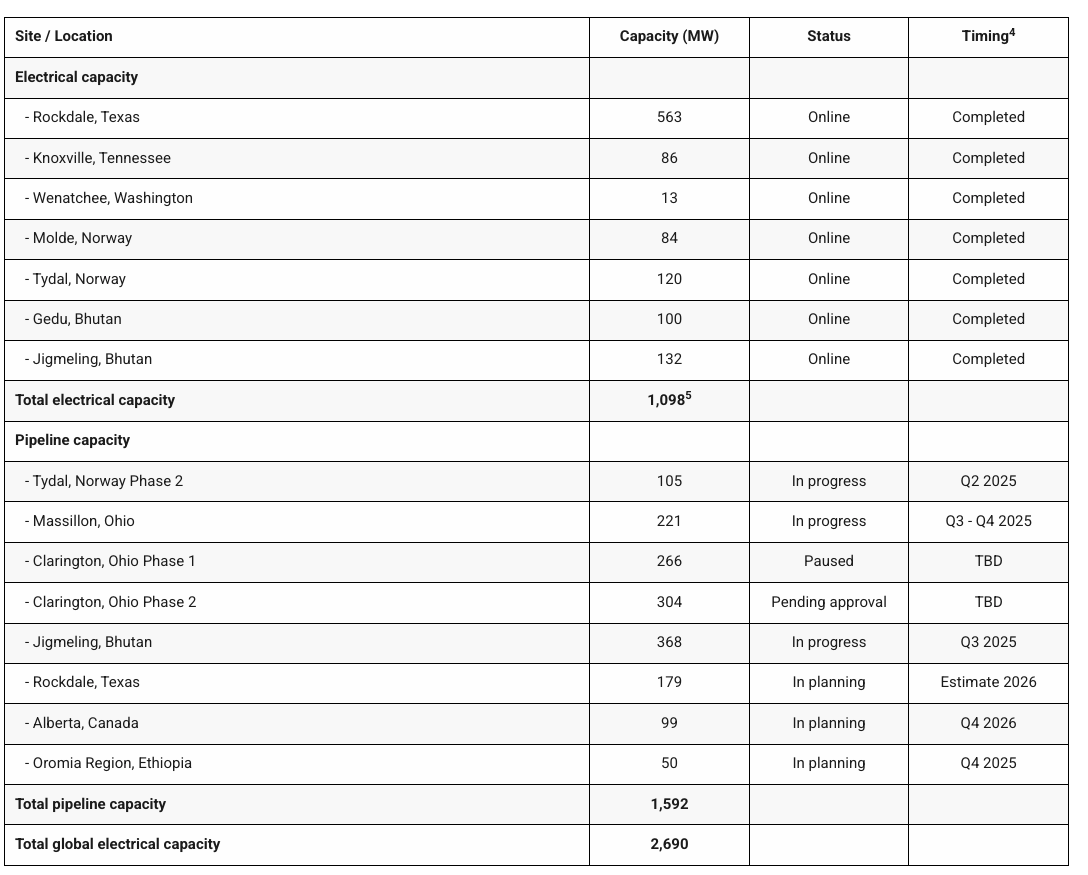

Infrastructure developments include the ongoing energization of the 175 MW Tydal, Norway site—expected to be fully energized by June—and continued progress at the 221 MW Massillon, Ohio site, targeting completion in the second half of 2025. The company also energized 132 MW at its Jigmeling, Bhutan site, with another 368 MW coming online by Q3.

Financially, Bitdeer secured $50 million in cash proceeds during May after Tether exercised warrants from a 2024 private placement.

With a global capacity of 2,690 MW and expanding operations across North America, Europe, and Asia, Bitdeer continues to assert its role as both a top-tier Bitcoin mining operator and a high-performance computing pioneer.

This post Bitdeer Mined 196 Bitcoin Worth Over $21 Million In May first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ f1989a96:bcaaf2c1

2025-06-12 15:41:24

@ f1989a96:bcaaf2c1

2025-06-12 15:41:24Good morning, readers!

This week, we begin in Kenya, where police detained Rose Njeri, a software developer and mother of two, for building a website that enables Kenyans to flag causes and email parliament concerning an unpopular tax bill that threatens to raise the cost of living in an already inflation-sticky economy. Due to the holiday court calendar, Njeri remains behind bars awaiting criminal prosecution for what officials claim interfered with government systems, but was really a peaceful resistance to unfavorable economic policy.\ \ To a similar tune, in Venezuela, law enforcement stormed the home of Guillermo Goncalves, co-founder of El Dorado, a peer-to-peer trading app used by Venezuelans to exchange rapidly depreciating bolivares for stablecoins (digital tokens pegged to fiat currency like the US dollar). The El Dorado app filled a gap in Venezuela’s collapsing economy: offering a market-based exchange rate for bolivars and access to more stable currencies.\ \ In freedom tech news, Breez, a company building on the Lightning Network, added support for BOLT 12 and BIP 353 to its Nodeless Software Development Kit (SDK). This will enable wallets powered by the Breez Nodeless SDK to implement these features. BIP 353 makes it easier for activists and NGOs with an Internet domain to receive Bitcoin donations. And BOLT 12 brings greater privacy and efficiency to Bitcoin’s Lightning Network.\ \ We end with an interview with Hong Kong dissident Nathan Law, who turned to Bitcoin to stay active in his push for freedom and democracy in the wake of China’s authoritarian crackdown.

Now, let’s take a closer look.

SUBSCRIBE HERE

GLOBAL NEWS

Kenya | Criminal Prosecution of Software Developer

In Nairobi, Kenya, law enforcement raided the home of software developer Rose Njeri and took her into custody. Her alleged crime: building a platform that lets Kenyans review and email their elected representatives concerning an unpopular tax bill threatening to raise their cost of living. On May 30, 15 officers stormed her home without a warrant, seized her devices, and detained her incommunicado for more than 88 hours. Officials claim her web tool, which auto-generated feedback emails to Kenyan parliament, illegally interfered with government systems. Outside the police station, many Kenyans gathered in protest, demanding her immediate release. Last year, a similar finance bill triggered mass demonstrations and a brutal crackdown that left dozens dead. Njeri’s arrest shows the growing risks civic technologists face and depicts the growing trend of using state power to suppress peaceful pushback to unfavorable economic policy.

Venezuela | National Police Raid Home of El Dorado Founder

Venezuela’s National Police stormed the home of Guillermo Goncalves, co-founder of El Dorado, a peer-to-peer trading app used by Venezuelans to exchange rapidly depreciating bolivares for stablecoins like Tether (USDT) and Circle (USDC). The platform filled a critical gap: offering market-based pricing for bolivares and access to more stable currency. Nonetheless, the regime accuses Goncalves of fueling currency speculation, pointing to past comments where Goncalves highlighted the disconnect between the “official” exchange rate of the bolivar, as set by the Central Bank of Venezuela, and the parallel market rate. The arrests of those publishing truthful economic data and providing alternatives to 162% inflation under the guise of “stability” are hallmarks of a dictatorship that destroyed its currency and is now hunting down those trying to survive outside its system.

Tanzania | Blocks Access to X and Telegram Amid Financial, Political, and Media Repression

Tanzania restricted access to X and Telegram across major Internet providers following a hack of the Tanzanian police force’s official account. The platforms remain offline more than three weeks later in the lead-up to October’s presidential and parliamentary elections. The timing of the shutdown also coincides with the kidnapping of Ugandan journalist, lawyer, and Oslo Freedom Forum speaker Agather Atuhaire, who says she was tortured and sexually assaulted while in Tanzanian custody before being left at the border between Tanzania and Uganda. Recently, the government also banned the use of foreign currency in daily transactions, forcing citizens to rely on the weakening Tanzanian shilling. And in April, the opposition CHADEMA party was disqualified from participating in the October elections under the pretense of treason against party leader Tundu Lissu. The censorship of online platforms, suppression of opposition and dissidents, and laws banning foreign currency all signal a coordinated strategy to silence criticism and strip Tanzanians of both their political voice and financial autonomy.

Russia | Proposes Relocating Bitcoin Miners

Russia’s energy ministry is considering relocating Bitcoin miners to northern regions, where old energy infrastructure sits idle and the state can keep a closer eye. The plan comes months after the Kremlin banned mining across ten southern regions (including Dagestan and Chechnya), citing fears over energy shortages. But the ban has chiefly targeted individual and small-scale miners, not state-aligned corporations. Many independent miners, especially in poorer regions, used Bitcoin to escape financial isolation. Now, they’re being squeezed out in favor of top-down regulations. As the Kremlin tightens its grip on domestic energy and economic activity, it’s clear that the regime sees Bitcoin not as a tool for freedom but as something to be contained, regulated, and surveilled.

Israel | Freezes Bank Account of NGO Providing Aid in Palestine

Physicians for Human Rights Israel, a nonprofit providing medical aid in the West Bank and Gaza, has revealed that its bank accounts were frozen at the beginning of the year. The nonprofit, which previously ran regular medical missions in Palestine, says it was first blocked from making transactions, then warned by its bank, and finally notified in January that its account would be closed. These banking restrictions are not isolated. According to Lee Caspie, the deputy director of physicians for Human Rights Israel, other Israeli nonprofits providing aid to Palestinians receive similar financial treatment. Caspie shared that a new bill advancing would also impose an 80% tax on foreign grants to Israeli charities, with an exemption for those deemed acceptable by the government. These measures threaten to worsen a humanitarian crisis by leaving civil society organizations providing crucial support and services in Palestine financially cut off.

Hungary | Postpones Law That Would Ban Foreign-Funded Organizations

In a small win for civil society in Hungary, Viktor Orbán’s ruling Fidesz party postponed a vote on a sweeping bill that would grant the Orbán regime power to monitor, penalize, and potentially shut down any organization receiving foreign funds. Framed as protecting “sovereignty,” the proposal closely mirrors Russia’s foreign agent law and has been widely condemned as a death blow to Hungary’s independent institutions, media, and dissidents. While officials now say they need more time to “debate the means,” critics warn the delay is a tactical move, not a change of heart. The bill casts an intentionally wide net, branding foreign-backed efforts to defend press freedom and LGBTQ+ rights as threats to national identity and political discourse. “Its aim is to silence all critical voices and eliminate what remains of Hungarian democracy once and for all,” according to a joint statement signed by more than 300 civil society and media organizations.

BITCOIN AND FREEDOM TECH NEWS

Breez | Adds BOLT 12 and BIP 353 Support to Nodeless SDK

Breez, a company helping build out the Bitcoin Lightning economy, released support for BOLT 12 and BIP 353, enabling wallets using the Breez Nodeless SDK (such as Misty Breez and Klever) to implement these features. BOLT 12 is a critical update to the Lightning Network that brings increased privacy and greater censorship resistance to Bitcoin transactions for those facing financial repression. It also introduces reusable payment requests for recurring payments (such as tips and donations to human rights defenders). BIP 353 enables individuals and organizations with access to a domain the ability to create static, human-readable payment addresses (such as user@domain) for Bitcoin payments. With this integration, NGOs or activists with an internet domain and wallet using the Breez SDK can receive uncensorable donations through their domain in an accessible way. Implementing these new Bitcoin features will provide users with greater financial freedom and autonomy under authoritarian regimes.

BTCNutServer | Accept Ecash Payments with BTCPay Server

A new experimental plugin called BTCNutServer is attempting to bring ecash payments to BTCPay Server. The idea is to allow users to accept Cashu ecash tokens alongside Bitcoin using BTCPay Server’s self-custodial and self-hosted infrastructure. Ecash specifically is a digital money system backed by Bitcoin and designed to offer instant, low-cost, and very private transactions. For activists and dissidents, ecash enables bitcoin payments without compromising financial privacy. But users must trust mints (entities that manage and issue ecash tokens) to custody their funds. Though still in early development, BTCNutServer could enable charities, nonprofits, and merchants in repressive countries to accept ecash through BTCPay Server and, in doing so, keep their financial activity hidden from state surveillance.

Private Pond | New Experimental Payjoin System

Private Pond is a new experimental project that builds upon the Payjoin protocol to improve both the privacy and efficiency of Bitcoin transactions. Payjoin works by mixing inputs of a bitcoin payment with inputs from the recipient, making it harder for outside observers to trace who paid whom. Private Pond takes this concept further: it is an application designed to optimize Bitcoin transaction rails (such as a platform’s deposits and withdrawals). It uses transaction batching to bundle many deposits and withdrawals into a single transaction, using incoming deposits to fund outgoing withdrawals. While it’s not production-ready, if Private Pond were implemented in other applications, it could lower fees, create stronger privacy, and expose fewer funds. Innovations like this help strengthen Bitcoin’s original purpose: a financial network that resists censorship and surveillance while staying efficient and scalable.

Chorus.Community | New Social App for Activists

Chorus.Community is a new social app introduced at the 2025 Oslo Freedom Forum that is designed for people who operate under surveillance or censorship. Developed on permissionless technologies like Bitcoin and Nostr, Chorus allows users to share updates, send voice notes, organize groups, and raise funds, all without needing an email, phone number, or approval from any central authority. Unlike traditional platforms, Chorus cannot easily be blocked or shut down. Future updates will include encrypted messaging and group features, further enhancing security. For activists, journalists, and organizers working in closed societies, Chorus offers a new way to stay connected, coordinate, and support one another. Human rights defenders can try it here.

Bitcoin Policy Institute | Upcoming Bitcoin Policy Summit

The Bitcoin Policy Institute will be hosting its third annual Bitcoin Policy Summit from June 25-26 in Washington, DC, bringing together lawmakers, academics, and advocates to help shape and understand the future of Bitcoin policy in the US. A highlight of the event will be HRF’s chief strategy officer, Alex Gladstein’s keynote, “Bitcoin is the Most Powerful Human Rights Tool of the 21st Century,” which will explain Bitcoin’s growing role in resisting authoritarianism and protecting civil liberties worldwide. Learn more about the event here.

HRF | Gifts 800 Million Satoshis to 22 Freedom Projects Worldwide

HRF gifted 800 million satoshis in its Q2 2025 round of Bitcoin Development Fund (BDF) grants, supporting 22 open-source freedom projects worldwide. These projects advance Bitcoin education, open-source software, mining decentralization, and privacy tools for activists contending with authoritarian regimes and dictatorships across Latin America, Africa, and Asia. Supporting censorship-resistant financial tools and permissionless technologies like Bitcoin, Nostr, ecash, Tor, VPNs, and more empowers dissidents, journalists, and civil society to organize, transact, communicate, and speak without state suppression, interference, or manipulation. Learn more about the grantees and their work here. This round of grants also marks the 5-year anniversary of the Bitcoin Development Fund! Watch our anniversary announcement video to celebrate this milestone with us.

OpenSats | Announces 11th Wave of Bitcoin Grants

OpenSats, a public nonprofit funding free and open-source software, announced its 11th wave of grants advancing the Bitcoin protocol as a tool for financial freedom. Among the projects, Mostro and Payjoin stand out for their importance to dissidents and anyone seeking greater financial sovereignty. Mostro is a peer-to-peer Bitcoin exchange protocol built on nostr, allowing users to trade Bitcoin directly without relying on centralized intermediaries that can be surveilled, censored, or shut down. Meanwhile, Payjoin enhances Bitcoin transaction privacy by breaking common heuristics used to trace payments, making it harder for authoritarian surveillance tools to identify payees and the amount transacted. Together, these tools give people living under repressive regimes more private, resilient ways to save and transact.

RECOMMENDED CONTENT

Nathan Law on Hong Kong’s Fight for Freedom, Bitcoin, and Lessons for the West with Ben Perrin

In this interview with Bitcoin educator Ben Perrin (BTC Sessions), exiled Hong Kong activist Nathan Law reveals how Bitcoin became a critical tool for resisting financial blacklisting under China’s authoritarian crackdown. With a $140,000 bounty on his head and no access to traditional banking, Law turned to Bitcoin to stay active in his push for freedom and democracy. Watch the full conversation here.

If this article was forwarded to you and you enjoyed reading it, please consider subscribing to the Financial Freedom Report here.

Support the newsletter by donating bitcoin to HRF’s Financial Freedom program via BTCPay.\ Want to contribute to the newsletter? Submit tips, stories, news, and ideas by emailing us at ffreport @ hrf.org

The Bitcoin Development Fund (BDF) is accepting grant proposals on an ongoing basis. The Bitcoin Development Fund is looking to support Bitcoin developers, community builders, and educators. Submit proposals here.

-

@ 69eea734:4ae31ae6

2025-06-12 15:25:09

@ 69eea734:4ae31ae6

2025-06-12 15:25:09Vor ein paar Tagen stieß ich auf einen faszinierenden Artikel von Michel Bauwens, Mitbegründer der P2PFoundation, mit Links zu weiteren Texten – zum Beispiel über den Puls der Commons –, die ich ebenfalls äußerst interessant fand.

Der Artikel zeigt unter anderem gut, wie unterschiedlich Commons aussehen können, so dass ich ihn heute als Ausgangspunkt nehmen möchte, um ein paar Puzzle-Steine in mein entstehendes Bild der Commons einzufügen.

Das Grundmuster menschlichen Zusammenlebens?

Bauwens betrachtet die Commons aus historischer Sicht, wie sie sich in verschiedenen Zeiten unterschiedlich manifestieren, manchmal gar nahezu verschwinden und heute in wiederum veränderter Form neu entstehen – und plädiert dafür, dass sie noch weit stärker werden sollten.

Er legt zunächst dar, was die Commons sind und was nicht. (zum Beispiel nichts, was vom Staat verwaltet wird, wie ein öffentlicher Park.) Ausschlaggebend ist, dass eine Ressource von ihren Herstellern oder Benutzern selbst betreut wird. Commons entstehen dabei durch Beziehungen. Sie sind etwas spezifisch Menschliches und eine Wahl, die „fast immer“ zur Verfügung steht, so Bauwens. Eine die Geschichte überdauernde menschliche Praxis.

Er nennt drei verschiedene geschichtlichen Entwicklungen:

- Eine lineare - Wie präsentiert sich der Commons über verschiedene, komplexer werdende, Phasen der Menschheitsgeschichte hinweg?

- Eine hin und her schwingendende: In der Geschichte einer Zivilisation werden die Commons in Zeiten von Überfluss -- und daraus resultierender Verschwendung uns steigender Ressourcen-Extraktion -- unterdrückt, konstitutieren sich aber dann als Gegenbewegung wieder neu.