-

@ 58537364:705b4b85

2025-06-01 16:46:42

@ 58537364:705b4b85

2025-06-01 16:46:42ความสุขทางโลก ลัทธิสุขนิยมยกย่อง แต่ลัทธิทรมานตนประณาม หากไม่มองว่ากามสุขเป็นพรจากพระผู้เป็นเจ้า คนก็มักมองว่ากามสุขเป็นเครื่องลวงล่อของซาตาน ในเรื่องนี้พระพุทธศาสนาเลือกเดินสายกลาง โดยสอนว่าเราควรทำความเข้าใจกามสุขให้แจ่มแจ้ง ทั้งในแง่เสน่ห์เย้ายวน ข้อจำกัดและข้อบกพร่องทั้งหลาย

เพื่อให้เข้าใจกามสุขอย่างแจ่มแจ้ง เราอาจตั้งคำถามดังนี้: กามสุขสนองตอบความต้องการทางจิตใจแบบใดได้บ้าง และไม่อาจตอบสนองความต้องการแบบใดได้ เพราะเหตุใด

ความต้องการในส่วนที่กามสุขไม่อาจตอบสนองได้ เราควรปฏิบัติอย่างไร

เราหลงเพลิดเพลินและยึดติดในกามสุขมากเพียงใด และกามสุขมีอิทธิพลเหนือจิตใจเราเพียงใด

เราเคยทำหรือพูดสิ่งที่ไม่ถูกต้องเนื่องด้วยปรารถนาในกามสุขหรือไม่

เราเคยเบียดเบียนผู้อื่นเนื่องด้วยปรารถนาในกามสุขหรือไม่

บ่อยครั้งเพียงใดที่สุขทางโลกสร้างความผิดหวังให้เรา

ความคาดหวังมีผลกระทบอย่างไรต่อความสุขทางโลก การทำอะไรซ้ำๆ และความเคยชินส่งผลต่อความสุขทางโลกอย่างไร

เรารู้สึกอย่างไร ยามไม่ได้กามสุขที่เราปรารถนา

กามสุขมีความเกี่ยวข้องกับความซึมเศร้าหรือไม่ กับความวิตกกังวลด้วยหรือไม่

เรารู้สึกอย่างไร เมื่อนึกถึงอนาคตว่า จะต้องพลัดพรากจากสุขทางโลก เนื่องด้วยความเจ็บไข้ ความแก่ และความตาย

การพลัดพรากจากความสุขทางโลกรู้สึกอย่างไรบ้าง

เราตั้งคำถามได้มากมาย และยังตั้งคำถามได้มากไปกว่านี้

หลักสำคัญ คือ ยิ่งเห็นชัดแจ้งในกามสุข เราจะยิ่งเกิดปัญญาและเข้าถึงความสงบมากขึ้นธรรมะคำสอน โดย พระอาจารย์ชยสาโร แปลถอดความ โดย ปิยสีโลภิกขุ

-

@ 5d4b6c8d:8a1c1ee3

2025-06-01 16:28:39

@ 5d4b6c8d:8a1c1ee3

2025-06-01 16:28:39We have our finalists: - Indiana (4) @ OKC (1)

Pick one team to win the finals and one player to win Finals MVP.

Scoring this round is 8 points + seed value for picking a winner and 8 points for picking the Finals MVP. The maximum points this round are 20.

Current Scores | Stacker | Points | |----------|-------| | @Undisciplined | 44| | @gnilma | 40| | @grayruby | 32 | | @Carresan | 30| | @fishious | 25| | @WeAreAllSatoshi | 24| | @BlokchainB | 19 | | @Coinsreporter | 19 | | @Car | 14 |@Slestak_Jack| 0 |

SGA and Siakam were the Conference Finals MVPs

Most of the stackers can still catch me, but only if something unexpected happens. Good luck!

I believe I said the prize is 10k. I'll double check that in the event I don't win.

https://stacker.news/items/994522

-

@ cae03c48:2a7d6671

2025-06-01 18:00:29

@ cae03c48:2a7d6671

2025-06-01 18:00:29Bitcoin Magazine

Amboss Launches Rails, a Self-Custodial Bitcoin Yield ServiceAmboss, a leader in AI-driven solutions for the Bitcoin Lightning Network, today announced Rails, a groundbreaking self-custodial Bitcoin yield service. According to a press release sent to Bitcoin Magazine, it’s designed to empower companies, custodians, and high net worth individuals. This allows participants to earn a yield on their Bitcoin.

Big news from @TheBitcoinConf !

We’re thrilled to announce Rails—a self-custodial Bitcoin yield service that empowers you to earn on your BTC while supercharging the Lightning Network.Let’s bring Bitcoin to the World.https://t.co/3WYYvB95hP

— AMBOSS

(@ambosstech) May 29, 2025

(@ambosstech) May 29, 2025Rails also launched a secure way for Liquidity Providers (LPs) to hold all custody of their Bitcoin while generating returns from liquidity leases and payment routing, although they are not guaranteed. The implementation of Amboss’ AI technology, Rails strengthened their Lighting Network with more dependable transactions and larger payment volumes.

“Rails is a transformative force for the Lightning Network,” said the CEO and Co-Founder of Amboss Jesse Shrader. “It’s not just about yield—it’s about enabling businesses to strengthen the network while earning on their Bitcoin. This is a critical step in Bitcoin’s evolution as a global medium of exchange.”

The service offers two options:

- Rails LP is designed for high net worth individuals, custodians, and companies with Bitcoin treasuries, requiring a minimum commitment of 1 BTC for one year.

- Liquidity subscriptions are designed for businesses that receive Bitcoin payments, with fees starting at 0.5%.

Amboss partnered with CoinCorner and Flux (a joint venture between Axiom and CoinCorner), to bring Rails to the market. CoinCorner has incorporated it into both its exchange platform and daily payment services in the Isle of Man. Flux is jointly focused on advancing the Lightning Network’s presence in global payments. Their participation highlights growing industry trust in Rails as a tool to scale Bitcoin effectively.

“Rails offers a practical way for businesses like ours to participate in the Lightning Network’s growth,” said the CFO of CoinCorner David Boylan. “We’ve been using the Lightning Network for years, and Rails provides a structured approach to engaging with its economy, particularly through liquidity leasing and payment routing. This aligns with our goal of making Bitcoin more accessible and practical for everyday use.”

This post Amboss Launches Rails, a Self-Custodial Bitcoin Yield Service first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ bf47c19e:c3d2573b

2025-06-01 17:13:39

@ bf47c19e:c3d2573b

2025-06-01 17:13:39U ovoj sekciji pratićemo cene raznih dobara i usluga, a pre svega nekretnina, prosečne srpske plate, goriva, deviznih i zlatnih rezervi Srbije u odnosu na Bitkoin. Iz priloženih grafikona može se videti da sve vremenom gubi vrednost, odnosno postaje jeftinije u odnosu na BTC.

Cene nekretnina u Republici Srbiji izražene kroz Bitkoin (kompletni grafikoni)

Visina prosečne zarade u Republici Srbiji, cene goriva, dinarska i devizna štednja stanovništva, devizne i zlatne rezerve Srbije - izraženo kroz Bitkoin (kompletni grafikoni)

Prosečna cena m2 stana u Gradu Beogradu izražena kroz BTC

Prosečna cena m2 stana u "Beogradu na vodi" izražena kroz BTC

Prosečna cena m2 stana u Novom Sadu izražena kroz BTC

Prosečna cena m2 stana u Nišu izražena kroz BTC

Prosečna cena m2 stana u Kragujevcu izražena kroz BTC

Prosečna zarada u Republici Srbiji izražena kroz BTC

Cena goriva 'Evro Premium BMB 95' izražena kroz BTC

Cena goriva 'Evro Dizel' izražena kroz BTC

Dinarska štednja stanovništva kod banaka izražena kroz BTC

Devizna štednja stanovništva kod banaka izražena kroz BTC

Devizne rezerve Republike Srbije izražene kroz BTC

Zlatne rezerve Republike Srbije izražene kroz BTC

-

@ 3c7dc2c5:805642a8

2025-06-01 16:03:49

@ 3c7dc2c5:805642a8

2025-06-01 16:03:49🧠Quote(s) of the week:

Fred Krueger: 'Generally, people overanalyze too much. Bitcoin is amazing tech. It works. It has been the top-performing asset in 13 of the last 15 years. Stop with the analysis. Buy it. Don't trade it. Don't look for "entry points". And don't do a 1% allocation either. Grow a pair.'

🧡Bitcoin news🧡

Money. Time. Energy. You only get to pick two… Unless you’re a Bitcoiner. https://i.ibb.co/1Gw9BJdB/Gqspxqd-Xg-AAw03e.jpg

On the 19th of May.

➡️ El Salvador is $357 million in profit on Bitcoin holdings.

➡️Metaplanet ended Monday as Japan's 9th most traded stock, with ¥61.69B ( $425M) daily volume, surpassing Toyota, SoftBank, and Nintendo.

➡️Circle $USDC in "informal talks" to sell itself to Coinbase or Ripple, Fortune reports. WhalePanda: "Imagine running a $60 billion stablecoin in such an incompetent way you can't even turn a decent profit and desperately have to sell."

➡️Panama introduces a bill to allow citizens to buy, sell, and accept Bitcoin freely anywhere in the country.

On the 20th of May:

➡️https://i.ibb.co/v61tLVTc/Grk-OL6x-Ws-AAIGum.jpg

Tick Tock next block, but it seems like we are right on schedule. Bitcoin is doing exactly what it was designed to do.

➡️BTC just hit a new ATH in Argentina Weak currencies first. Then all of them.

➡️ThumzUp Media officially files to raise $500m to buy Bitcoin as a treasury reserve asset.

➡️Indonesian fintech DigiAsia's stock surges over 90% after announcing plans to raise $100M for a Bitcoin treasury.

➡️River: America’s story began with sound money. Hard-working Americans saved their wealth in gold-backed money. Today, Bitcoin carries that torch forward.

https://i.ibb.co/zTFLqMjC/Grpd4lm-WAAAq-W7m.png

Insane stat! Bitcoin is now the people's money. Imagine the price when nation-states get on board.

The US government is outpacing global rivals like China by embracing Bitcoin. The federal government's Bitcoin holdings now represent twice its global market share of gold reserves.

Worth the read: https://blog.river.com/american-bitcoin-advantage/

'In this report, you'll learn about: - Why Bitcoin is an underestimated pillar of American dominance. - America’s lead in Bitcoin businesses, institutions, development, and policy. - Bitcoin's emergence as America’s reserve asset.'

Ergo: America is the dominant Bitcoin player in just about every dimension: investment, government reserves, development, institutional embrace, supportive policy, and mining.

➡️Texas Bitcoin Reserve bill SB 21 will be considered on the second reading in the House this morning. Note: the Texas Constitution requires that second and third readings be conducted on separate days. If it passes today, then the final vote could be tomorrow

➡️Bitcoin accumulation trends signal bullishness with smallholders (<1 BTC) accelerating accumulation (score ~0.55), and whales (100-10K BTC) aggressively buying. Source: Glassnode

➡️French company The Blockchain Group raises €8.6 million to buy more Bitcoin. Press release

➡️Chinese printer manufacturer Procolored unknowingly distributed Bitcoin-stealing malware through its official device drivers, resulting in 9.3 BTC ($950K) stolen from users.

https://x.com/MistTrack_io/status/1924411803540590728

➡️Bitmine launches its Bitcoin Treasury Advisory Practice with a $4M deal, including $3.2M for leasing 3K Bitcoin miners and an $800K consulting agreement

➡️Bitcoin's correlation to gold is at its lowest since February 2025, per Glassnode data.

➡️UK-listed Smarter Web Company adds 16.42 BTC to its treasury at an average price of $104,202. Total Holdings: 35.62 BTC The Smarter Web Company is stacking with conviction—building a treasury designed for the long term.

On the 21st of May:

➡️Vivek's Strive Asset Management looking to buy up to 75,000 Bitcoin from Mt. Gox claims at a discount to build a Bitcoin treasury.

➡️Bitcoin is $1k from an all-time high and the Google Trends chart looks like this. https://i.ibb.co/qYLb7j6C/Gra6-BSd-Xo-AATN2-A.jpg

On the 22nd of May:

Happy Pizza Day! 15 years ago today Laszlo Hanyecz bought 2 pizzas for 10,000 Bitcoin. That Bitcoin is now worth $1.2 BILLION.

Will Baxter: "But how did he get that much bitcoin? Well, there’s a lot more to Laszlo's story than those pizzas. Here are four facts about him most people don’t know (the last one blew my mind): 1. Laszlo, a Mac developer, discovered bitcoin in 2010. After realizing that Bitcoin only ran on Windows, he took it upon himself to port it to Mac OS. He built and released the first bitcoin client for Mac making it accessible to more users. 2. In its earliest days, bitcoin could be mined with just a CPU, something that every computer has. But Laszlo had other plans. In mid-2010, he released a solution that would allow users to mine with their GPUs. Laszlo is single-handedly responsible for ushering in the era of GPU mining which massively increased Bitcoin’s total hashrate. 3. By being one of the early adopters of GPU mining, Laszlo enjoyed a massive jump in mining efficiency and hashrate, which meant that he was able to mine a lot of blocks. In total, Laszlo’s Bitcoin wallets received more than 80,000 BTC over the first few months of the GPU mining era. It’s estimated that Laszlo mined well over 100,000 BTC in Bitcoin’s early days. 4. Laszlo has single-handedly mined more Bitcoin than any publicly listed Bitcoin mining company. As an example, MARA, the largest publicly traded Bitcoin miner by market capitalization, has mined an estimated 48,000 BTC since 2018. Laszlo and his GPUs managed to mine more than twice that amount! Incredible.

➡️Pizza slice inscribed on the Bitcoin blockchain forever! Block #897813

➡️Strategy: 'Bitcoin Pizza Day at Strategy. Paid for with USD.'

Kinda disgusting. The largest Bitcoin Treasury Company is not even able to pay for pizza in Bitcoin on Bitcoin Pizza Day? Why did they even bother to buy pizza today? They show zero understanding of the meaning of Pizza Day and Bitcoin history.

Plebs all around the world are celebrating Pizza Day by "spend and replace" Bitcoin for some lovely pizzas. What is Saylor doing? He decides to use his giant megaphone to stomp all over it. "Pay with Dollars. Eat the Pizza. Keep the Bitcoin." That post rubbed me the wrong way. That’s because they are not bullish on the payment use case of Bitcoin. I have been saying all the time: that he has an agenda against the medium of exchange. This is plausible as Saylor never minced words as far as I know. His model is HODL. Spending would contradict.

Not sure if I am overreacting because of store of value for several more years will eventually lead to a Medium of Exchange Bitcoin world.

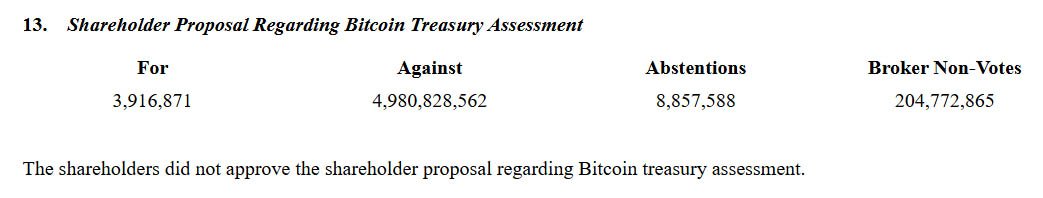

As you might already know I am not particularly a fan of the whole Bitcoin treasury - public companies.

Read the following thread why, an excellent thread on the risks of Bitcoin treasury companies by a bitcoiner.

https://x.com/lowstrife/status/1925717037915005357

➡️For the first time in history, Bitcoin is now trading above $111,000 and just surpassed $2.2 TRILLION in market cap for the first time in history. $3 Billion worth of Bitcoin shorts to be liquidated at $120,000 Small, tiny reminder. In 2021 dollars, Bitcoin hasn’t broken $100K yet. We need to hit $118K to meet that milestone. Celebrating $1 million (eventually) might not be as much fun as you think.

➡️H100 Group buys 4.39 BTC and becomes Sweden's first publicly listed #Bitcoin treasury company. After announcing its first Bitcoin purchase shares surged 37%. A small stack, big signal.

➡️Bitcoin has now surpassed both Amazon and Google to become the 5th largest asset in the world, and Bitcoin just surpassed the Taiwan Dollar and is now the 8 largest currency in the world. Nothing stops this train. https://i.ibb.co/Jj11QjkL/Grk-Ume-KXs-AAm-Xp6.jpg

➡️Michael Saylor's 'Strategy' now has a $23.8 billion unrealized profit on its Bitcoin portfolio. Meanwhile, Strategy is to sell up to $2.1 billion of 10% preferred stock.

➡️'Traditional finance consensus: "What's the use case for BTC?" Allowing Millennials to afford a home despite Boomer policymakers actively pursuing policies to prevent them from doing so Median US home price, price in BTC, 2020-today IMO, this chart is going <1 in coming yrs.' - Luke Gromen https://i.ibb.co/tpCk7HD2/Grka1-Ld-Wc-AAo-IQn.jpg

Just to give you one more perspective on this topic:

➡️Joe Consorti: US real estate has been in a 15-year bull market. But guess what? Priced in bitcoin, the average US home price has dropped from ~3 million BTC to just 4.38 BTC in 15 years. All assets are deflationary in Bitcoin terms. https://i.ibb.co/m5Nk2Yq2/Grk9d92-XUAAAwz-H.jpg

➡️Taiwanese Legislator has proposed a Bitcoin Strategic Reserve at 0.1% of GDP = $780m

➡️Chinese automaker Jiuzi Holdings to buy 1,000 Bitcoin for treasury.

➡️ 'Singapore's Genius Group buys another 24.5 Bitcoin. Now holds 85.5 Bitcoin, 1,000 BTC target confirmed.' - Bitcoin Archive

➡️Standard Chartered expects Bitcoin to hit: - Q2: $120,000 by the end of Q2 - Q4: $200,000 by late 2025 - 2028: $500,000

➡️On-Chain college: 'New ATH for Bitcoin yet realized profit is significantly lower than the last two local tops and prior cycle tops. HIGHER' https://i.ibb.co/ch0HWwWx/Grjx-GHVWo-AAd7-Wt.jpg

Not sure about that. Could be a double top.

On the 23rd of May:

➡️The Blockchain Group confirms the acquisition of 227 BTC for ~€21.2 million, the holding of a total of 847 BTC, and a ‘BTC Yield’ of 861.0% YTD Press release.

➡️The 8th largest economy in the world will start to buy Bitcoin. No one is bullish enough! Governor Abbot to sign Bitcoin Reserve bill into law! Texas to become the 3rd US state to enact an SBR!

➡️Publicly traded The Smarter Web Company bought 23.09 Bitcoin for £1.85 million for its treasury.

➡️For the love of god. Delate Coinbase or any other shitcoin casino/exchange (for example here in the Netherlands Bitvavo) and cold-Storage your Bitcoin and don’t touch them.

https://i.ibb.co/y3BmmNt/Grp-TDv-BWk-AAs7-Gh.jpg

Not your keys, not your coins.

➡️'The Russian Bitcoin mining sector now ranks first in growth rates and second in mining volume globally. The country's largest Bitcoin miners, BitRiver and Intelion, controlling over 50% of the market, generated $200M in revenue for FY2024, per RBC.' -Bitcoin News

➡️Alex Gladstein: 'Absolutely crazy Hundreds of millions of people saw their wage and savings technology lose 15%, 30%, 50%, 75%, even 90% (!) of its value last year Fiat is broken, time for a Plan ₿' https://i.ibb.co/hRZwFsPJ/Gro-s-KJXUAAh97-M.jpg

➡️Bitwise predicts nation-states and institutions will hold 4,269,000 BTC—worth $426.9B. https://i.ibb.co/RkVDmGLg/Gro6wb-VX0-AAHCT0.jpg

➡️'Metaplanet is now the #4 most traded stock in Japan, moving nearly $1B in a day—just a year after adopting #Bitcoin. From obscurity to 300x returns, this is what happens when a company runs on hard money.' -Bitcoin for Corporation

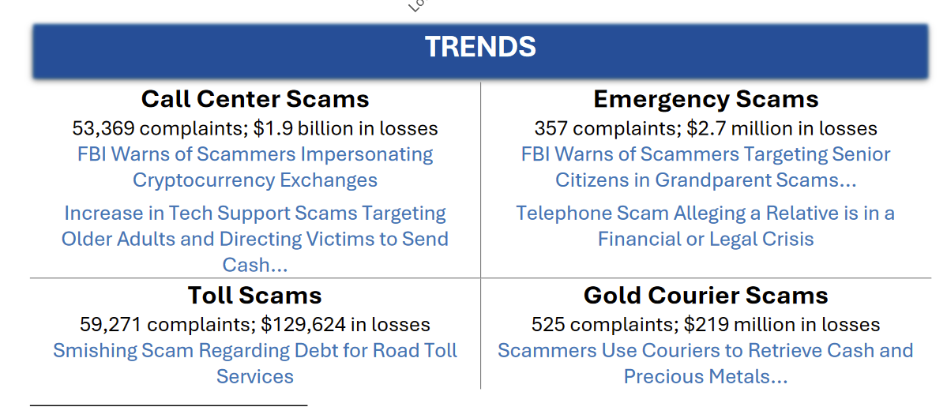

➡️TFTC: "Scammers are mailing fake "Ledger Security" letters demanding wallet validation via QR code. They spoof official branding and ask users to visit fraudulent sites."

https://i.ibb.co/nNg0JgX6/Grpd0o-BWc-AI3-Yj-Y.jpg

On the 24th of May:

➡️Bitcoin has the same number of users as the Internet had in 1999. https://i.ibb.co/1frYh4Z7/Gru2-J3-UW8-AA-05y.jpg

Now talking about that Bitcoin Adoption S-curve...

➡️Thomas Fahrer: 'Holding Bitcoin means getting rich while feeling frustrated 90% of the time. Deflationary money - designed to increase in value - forever. It's difficult for the human mind to comprehend. Most still don't get it.' https://i.ibb.co/9HwPkxK3/Grwpw-W0-W0-AEc-PSb.jpg

On the 25th of May:

➡️Pakistan allocates 2,000mw of electricity to Bitcoin mining and Ai - Bloomberg Daniel Batten: Pakistan announced 2000 MW for Bitcoin mining & AI. That's potentially ~17,000 BTC per year for an SBR. Plus, India will now have to follow. Game theory playing out. *Assuming that 50% of this is for Bitcoin mining, using latest-gen machines, 95% uptime, network hashrate is on average 1200 EH/s by the time they are complete

➡️Normally, I would write this in the segment below 🌎Macro/Geopolitics... "First signpost: DOGE failed to reduce the deficit.

Second signpost: Pushing for SLR changes to boost demand for Treasuries from domestic banks.

Third signpost: Pushing for legislation to boost demand for Treasuries from stablecoin issuers.

Fourth signpost: New spending bill estimated to increase deficit by 33% by 2027.

Fifth signpost: Bessent: "We'll grow GDP faster than the debt to stabilize debt-to-GDP."

Read below (segment 🌎Macro/Geopolitics) his full statement and my view on it.

TL;DR: Keep spending. Pass new laws and tweak regs to suppress long-end yields. Boost nominal GDP (mostly via inflation). Debase the currency. Bondholders and cash savers lose in real terms. Got Bitcoin?" -Sam Callahan

➡️Sminston With: 'There is a myth that 100% of the returns in Bitcoin only happen if you buy at the bottoms and then sell at the tops during one of the cycles. Power law quantile analysis shows otherwise; in fact, there are nearly identical growth rates (CAGR) whether you buy/sell at the bottoms (support) or around the middle (median) 52% vs 53% as of this year! Whichever trendline is followed, even if you only trade at the bottoms, the compounded annual returns of Bitcoin will be >7x of what you'd ever expect from the S&P. Ignore or try to time Bitcoin at your own risk!' https://i.ibb.co/5QHQHqF/Grzig5-BWIAAy9-Jb.jpg

On the 26th of May:

➡️Bitcoin made another weekly record close at $109,004.

➡️When BlackRock holds 1M Bitcoin and the price hits $1M... They’ll be earning $2.5B a year in fees. Every year. Forever.

➡️Florida proposes eliminating Capital Gains Tax on Bitcoin. If passed, it would make Florida the first U.S. state to offer this kind of tax relief.

➡️Strategy acquires 4,020 BTC for $427.1 million at $106,237 per Bitcoin. They now HODL 580,250 BTC acquired for $40.61 billion at $69,979 per Bitcoin.

💸Traditional Finance / Macro:

Jeroen Blokland: U.S. vs. Eurozone in the digital money age!

https://i.ibb.co/dJ3085qm/Grko80y-WMAATw-V1.jpg

On the 20th of May:

👉🏽TKL: 'Retail investors are piling into stocks: Individual investors bought a net $4.1 BILLION in US stocks on Monday between 9:30 AM and 12:30 PM ET, the biggest buy on record. This surpassed the previous high by over $1 BILLION, according to JPMorgan data. Retail investors also broke the $4 billion buying threshold by noon ET for the first time in history. Additionally, retail accounted for a record 36% of the trading volume yesterday, exceeding the previous record set in late April. This supported the S&P 500's rapid recovery from a -1.1% decline at the beginning of Monday’s session into positive territory by the close. Retail investors are driving the market.'

https://i.ibb.co/HTM721rw/Gr-Zot-Th-XMAAl-EB.jpg

To provide you with another example of why retail is driving this market. Institutional investors remain bearish of US stocks:

A net 38% of institutional investors were underweight US equities in early May, the lowest since May 2023, according to BofA. Outside of 2023, this marks the lowest allocation since the lead-up to 2008. Over the last 5 months, this percentage has fallen by ~70 points, the biggest drop on record. The difference between the proportion of investors being overweight in the Eurozone versus US equities hit a net ~75%, the highest since October 2017. By comparison, 4 months ago, the net percentage was -62 points, the lowest since 2012.

The sentiment shift among professional investors has been historic. Institutions dump U.S. stocks and flock to the Eurozone. Institutions bailing on US stocks while retail piles in - smells like a correction brewing.

🏦Banks:

On the 21st of May:

👉🏽The Federal Reserve has experienced its first back-to-back annual losses since 1915, totaling $192 billion in 2023 and 2024. The most expensive “expertise” in history.

https://i.ibb.co/zzPHp40/Gr-Xx-Hsy-WUAARd-IV.jpg

On the 23rd of May:

👉🏽'U.S. Banks U.S. Banks are currently facing $482 Billion in unrealized losses, an increase of 33% from the prior quarter. With rates now skyrocketing, these losses are going to increase. Banks, particularly small banks, are ( potentially) in trouble!!' - Barchart https://i.ibb.co/1FHmTBc/Grm-GA3-OWMAAro5k.jpg

🌎Macro/Geopolitics:

1 bar of gold

= 1 house (1975) 1 bar of gold

= 1 house (2025) Do you get it yet?

https://i.ibb.co/tTM7Kw0n/Gr-W8b-K0b-AAQvu-He.jpg

Got Bitcoin?

On the 19th of May:

👉🏽 TKL: "Risky debt issuance has stalled in the US: Low-rated US corporations have issued less than $1 billion in bonds in April, the lowest in at least 4 years. At the same time, leveraged loan issuances have reached $13 billion. High-yield corporate bonds and leveraged loan issuances are ~10 TIMES lower than during the same period last year. Leveraged loans are typically used to finance M&A, refinance debt, or general business activity, all of which are slowing down." Seems like uncertainty is really affecting everything.

👉🏽'US Treasuries are selling off: The 30-year Treasury yield surpassed 5%, for the first time since November 2023. It is now trading at the 2nd-highest level in 18 YEARS. Investors are signaling that the US public debt CRISIS is heading to a turning point.' -Global Markets Investor

👉🏽The stupidity of EU leaders knows no limits.

https://i.ibb.co/gCpMxsH/Gr-Txm-P1-Ww-AAALx-L.jpg

'Russia pumps gas 3.000 km from frozen Siberia to China through a Gazprom-owned pipeline. Meanwhile, massive Chinese LNG tankers, too enormous for the Suez Canal, sail the long route around the Cape of Good Hope just to supply Europe,filling the gap left by Russia’s fading influence. And now? Russian gas costs three times more.'

https://www.theguardian.com/environment/2025/jan/09/european-imports-of-liquefied-natural-gas-from-russia-at-record-levels

https://www.theguardian.com/world/2025/feb/24/eu-spends-more-russian-oil-gas-than-financial-aid-ukraine-report

👉🏽Klarna losses widen as more users miss payments; 100 million now on platform — FT “The fintech, which offers interest-free consumer loans to allow customers to make retail purchases, on Monday reported a net loss of $99mn for the three months to March, up from $47mn a year earlier.” https://www.ft.com/content/6c4bf393-c80b-42b7-993a-35270143f688 https://i.ibb.co/prsJNdB2/Gr-Y6-WTQXs-AAPu-Tr.png

Funny how they never learn that unsecured debt to subprime holders is a bad idea. Buy now pay later was a model destined to fail because those least capable of repaying the loans are the very people borrowing it. "100M people using Klarna and they're losing money because broke people keep defaulting on burritos"

On the 20th of May:

👉🏽As mentioned in my previous Bitcoin & Macro recap. Japan’s Prime Minister Ishiba called the current bond market situation in Japan “worse than Greece.” Shocking (not!), falling demand for long bonds in a country with a debt-to-GDP ratio of 216%.

Admitting that you’re situation is worse than Greece should horrify people. "Japan's bond market is imploding: Japan's 30Y Government Bond Yield has officially surged to its highest level in history, at 3.15%. For decades, Japan was known for low long-term interest rates. Now, they are dealing with high inflation, a shifting policy outlook, and a whopping 260% debt-to-GDP ratio. On top of this, Japan holds $1.1 TRILLION worth of US debt, making it the largest foreign holder of US debt." -TKL

This is not just about Japan. It’s a signal that the global debt machine is approaching its structural limits and that the next liquidity cycle may not be voluntary, but forced by sovereign fragility.

Read the following thread:

https://x.com/onechancefreedm/status/1924831549683298535

Remember:

1990: Japan has a goal of bringing prices down.

2012: Japan has a goal of getting prices up.

"History tells us that deflation [and inflation] has a habit of getting out of control."

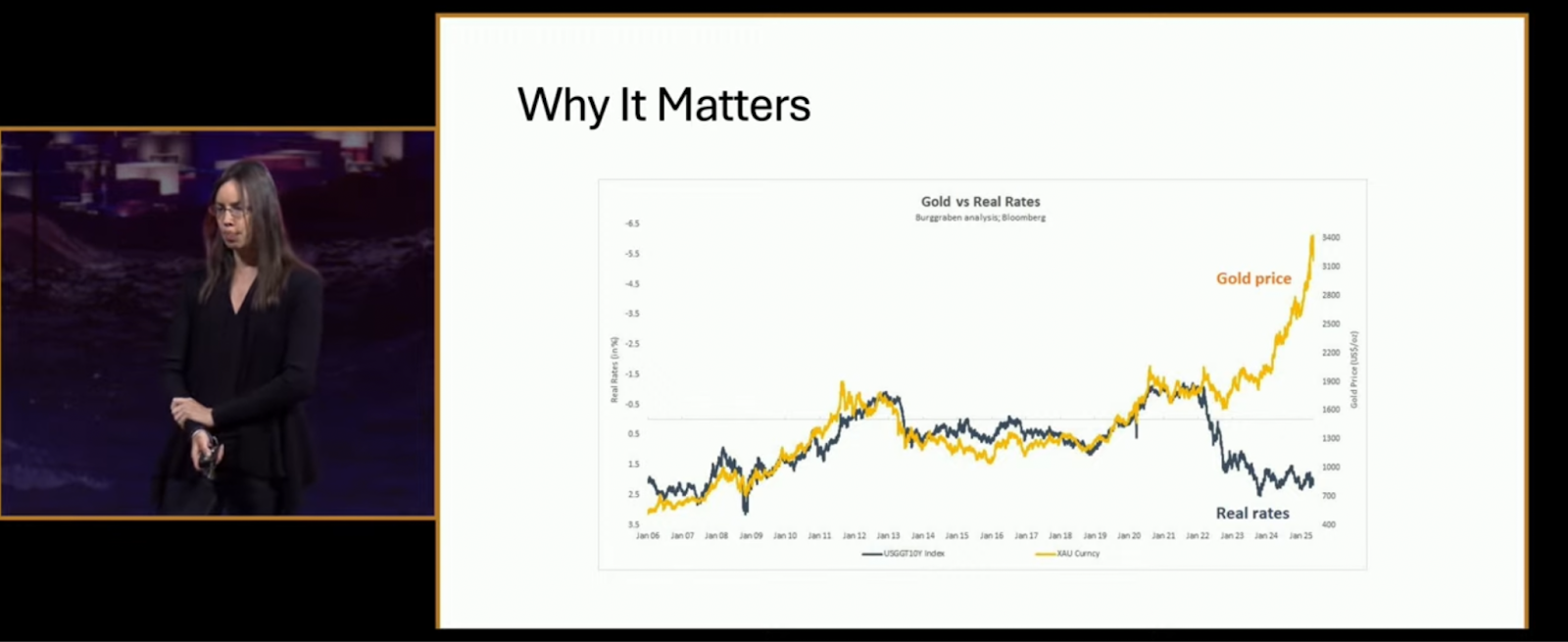

👉🏽Gold prices extend gains to +5% since their May 15th low and near $3,300/oz as markets price-in uncertainty. Gold and Bitcoin are becoming the ONLY global safe-havens.

Talking about gold. China’s gold ETF inflows have more than doubled in the last 12 months, fueling a 38% surge in gold prices. From retail to the central bank—China has never bought more gold.

https://i.ibb.co/kVHh27vz/Gr-YB3-Wj-XUAAiai-W.jpg

On the 21st of May:

👉🏽For the Dutch followers/readers: The renovation of the Binnenhof is more than twice as expensive as the reconstruction of the Notre-Dame… and it costs more than the tallest building in the world, the Burj Khalifa…A typical case of being royally screwed over with other people's money (our tax money!)

👉🏽And yet another manufacturer driven out of the country by ridiculous climate and energy policies. Paint producer AkzoNobel is closing factories in the Netherlands and Belgium; 276 jobs cut.

They now will produce their products, partly, in France (Pamiers). That’s where they’ll continue production — with cheap and reliable nuclear energy.

Source: https://archive.ph/4nVyg

On the 22nd of March:

👉🏽TKL: "The decline in value of fiat currencies against gold has been truly remarkable: Since 1971, the US Dollar has lost 98.94% of its value against gold, the second-largest fall among major currencies. During the same period, the British Pound has declined 99.42%. The Euro would have lost 98.76% if it existed since 1971. Furthermore, the Japanese Yen and Swiss Franc have dropped 97.47% and 94.85%, respectively. Meanwhile, gold prices in US Dollar terms are up ~1,000% during this period. Gold remains a hedge against currency debasement." Wrong, Bitcoin is the hedge against currency debasement. Just look at the Bitcoin/Gold chart. I prefer 'digital' gold. Voltaire famously said, 'Fiat currency always eventually returns to its intrinsic value--zero.

On the 23rd of May:

👉🏽Trump recommends a 50% tariff on products imported from the European Union, starting on June 1, 2025. TKL: 'The trade war is back just as the 10Y Note Yield crosses above 4.60%. This morning, President Trump threatened 25% tariffs on Apple, $AAPL, and 50% tariffs on the EU beginning June 1st. Now, yields are pulling back sharply as recession worries resurface. The drop in yields on this announcement will only give MORE of a reason for President Trump to prolong the trade war. As we have said MULTIPLE times, a trade war accomplishes all of Trump's economic goals at once. Trump wants lower rates, the Fed won't cut, so he will get them the hard way.'

👉🏽US Treasury Secretary Scott Bessent: "We can both grow the economy and control the debt. What is important is that the economy grows faster than the debt. If we change the growth trajectory of the country, of the economy, then we will stabilize our finances and grow our way out of this." “We can grow our way out of this” RIP Fiscal Austerity, 2025-2025 lmao!

Notice how it’s shifted from “we’re going to cut spending” to “we’re going to grow our way out” regarding our debt burden. Bessent knows it’s cooked, hence why he stopped talking about yields. It is kinda delusional to think we are going to grow the economy fast enough to accomplish this when the budget deficit is over 6% of GDP.

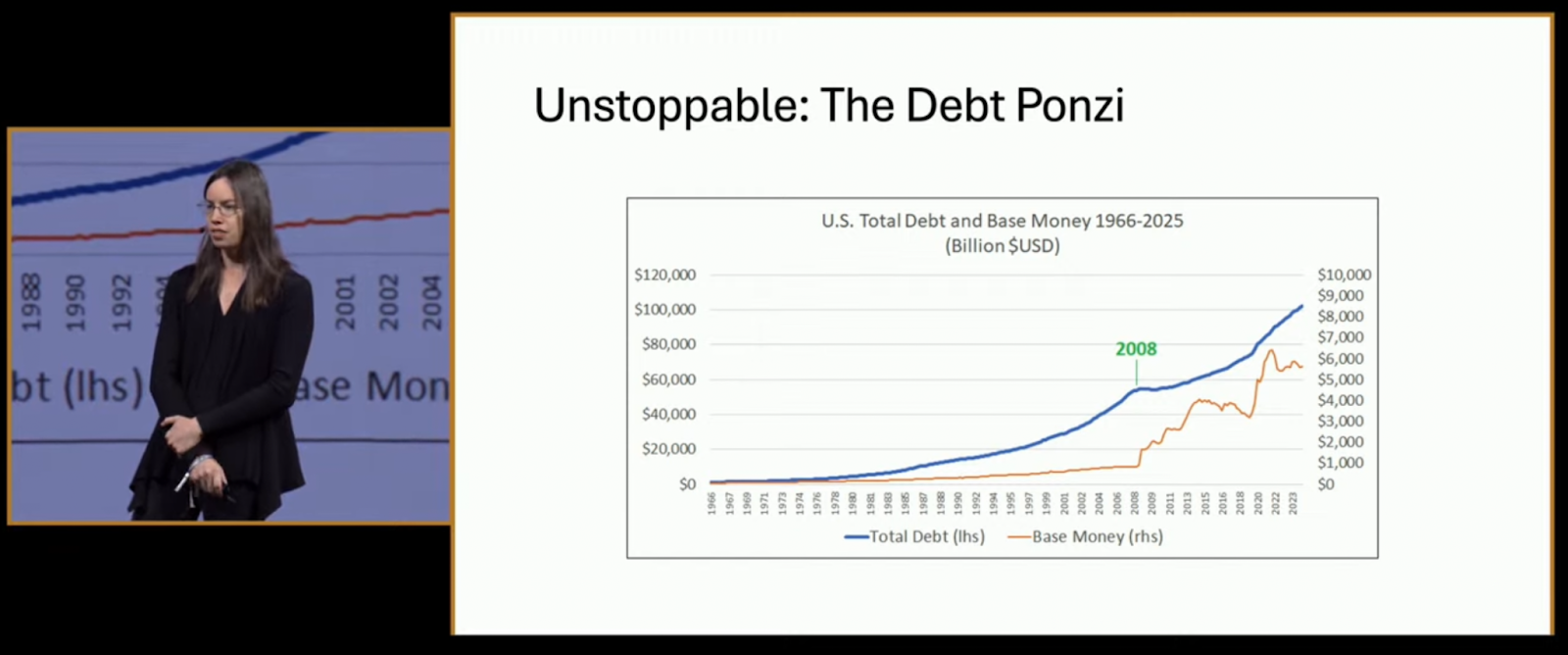

Translation: they are unable to meaningfully reduce the debt. US government debt will continue to grow. They will be forced to print eventually. Your purchasing power will continue to fall. Got Bitcoin?

Just to give you one more example:

👉🏽'The national debt has grown under every U.S. president, regardless of political party, for decades. And that is set to continue during President Donald Trump’s second term. Elon Musk and the Department of Government Efficiency (“DOGE”) initially promised to cut $2 trillion in wasteful spending, but have since admitted this figure is likely to total a couple hundred billion bucks at best. Meanwhile, the president is pushing Congress to pass his “big, beautiful bill,” which is expected to add trillions in new deficit spending over the next several years. Make no mistake… the spending will never stop.' - Porter Stansberry

https://i.ibb.co/8k4LNg2/Grlug-NNX0-AAQnw-T.jpg

U.S. National Debt:

1970: $371B

1980: $908B

1990: $3.2T

2000: $5.7T

2010: $13.6T

2020: $26.9T

You can't fix this with votes. Maybe Bitcoin can stop this train? It can also incentivize governments to spend responsibly and manage budgets with discipline. One thing I do know is that you’re not voting your way out of this chart.

On the 24th of May:

👉🏽'The Bank of Japan owns 52.0% of all domestic government bonds. By comparison, life insurers, banks, and pension funds hold 13.4%, 9.8%, and 8.9%, respectively. According to Bloomberg, the Japanese government now holds $7.8 trillion of debt. This makes the Japanese government the third most indebted government in the world, behind the US and China. Furthermore, the Bank of Japan holds a whopping $4.1 trillion of government bonds on its balance sheet. Japan needs a major restructuring.' -TKL

Just to make it even worse...

👉🏽'Prices in Japan are soaring: The cost of rice jumped +98.4% year-over-year in April, posting the biggest monthly jump since 1971. This is an acceleration from the +92.1% surge recorded in March. Energy prices rose +9.3% after the March phaseout of Japanese government subsidies for gas and electricity. As a result, Japan's inflation CPI excluding fresh food rose by +3.5% from the previous year, up from a +3.2% gain in March. This marks the 5th consecutive monthly reading at 3%+. Meanwhile, Japan's economy shrank by -0.7% in Q1 2025, the first decline since Q1 2024. Japan has entered stagflation.' -TKL

👉🏽Birth rates are plummeting in a lot of countries. Population collapse is the greatest threat to civilization.

https://i.ibb.co/3Yfqq0N1/Gruztgo-XIAISc7-A.jpg

Question: How sustainable are the government debts with the population decline, like in Japan and Europe?

Grok: Population decline in Japan and Europe strains government debt sustainability. Japan's debt, at 245% of GDP, faces pressure from an aging population, with social spending projected to hit 24% of GDP by 2040. Europe's debt varies, with Greece at 163.6% and Italy at 137%, while aging reduces tax bases. Immigration and productivity boosts could help, but their impact is uncertain. Japan's domestic debt ownership offers some stability, while EU fiscal rules aid Europe. Outcomes depend on policy execution and economic conditions.

On the 26th of May:

👉🏽Cheap energy = abundance One population is so brainwashed they choose poverty. Michael A. Arouet: Can someone please explain the logic behind Germany closing its perfectly fine nuclear power plants, and deindustrialising?

https://i.ibb.co/tTwkmhcB/Gr3-IWgk-Ww-AAVz-Y3.jpg

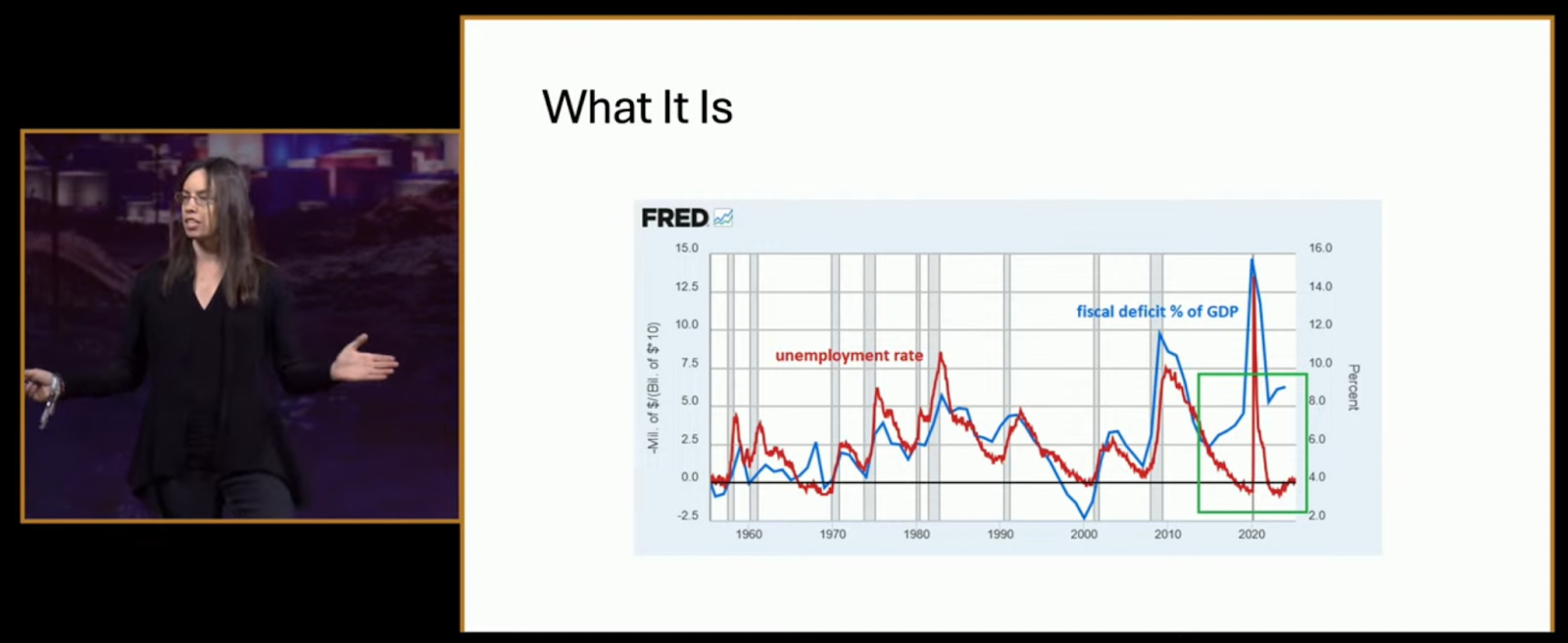

👉🏽'The US budget deficit has averaged 9% of GDP over the last 5 years. Over the last 12 months alone, the budget gap has hit 7% of GDP. This is even higher than during the 2001 or the 1980s recessions. This comes as the US government spent a whopping $7.1 trillion over the last year, an equivalent of 24% of GDP. The government is now running larger deficits than during an average economic downturn. What happens if the US economy enters a recession?' -TKL

https://i.ibb.co/tT5nF67J/Gr5kcw-QWc-AAQ7q-R.jpg

🎁If you have made it this far, I would like to give you a little gift, well, in this case, two gifts:

May 2025 Newsletter: A Trade Breakdown

This newsletter issue breaks down the recent trade breakdown (sorry for the pun) and explores some of the nuances of why realigning the global balance of trade is both popular and extremely difficult to do.

https://www.lynalden.com/may-2025-newsletter/

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ 5d4b6c8d:8a1c1ee3

2025-06-01 14:33:14

@ 5d4b6c8d:8a1c1ee3

2025-06-01 14:33:14We got more great contributions from the usual suspects, but also some very interesting reporting on the Venezuelan economy.

Top Posts

MONEY CLASS OF THE DAY: Market Efficiency: You Come Into MYYYYY HOUSE?! by @denlillaapan, 31 comments and 5834 sats A great primer on what "market efficiency" means and the epistemological issues with claims of inefficiency

Mini Pleb Economist: No Tax on Tips? by @SimpleStacker, 24 comments and 2035 sats Some interesting predictions about what the second order effects will be of removing taxes on tips

There Will Never Be Another Buffett (WSJ, Jason Zweig) by @denlillaapan, 23 comments and 1212 sats The most popular of Den's many sendoff's to the Oracle of Omaha

2 ways to buy gasoline in Venezuela by @bief57, 27 comments and 1835 sats A very interesting look at the parallel systems of market priced and "free" gas in Venezuela

Thank you to our OP's and commenters for keeping ~econ interesting.

https://stacker.news/items/994413

-

@ cae03c48:2a7d6671

2025-06-01 18:00:31

@ cae03c48:2a7d6671

2025-06-01 18:00:31Bitcoin Magazine

Jack Mallers Announced A New System of Bitcoin Backed Loans at StrikeThe Founder and CEO of Strike, Jack Mallers, at the 2025 Bitcoin Conference in Las Vegas, announced a new system of Bitcoin backed loans at Strike with one digit interest rate.

Jack Mallers began his keynote by pointing at the biggest problem. Fiat currency.

“The best time to go to Whole Foods and buy eggs with your dollars was 1913,” said Mallers. “Every other time after, you are getting screwed.”

What’s the solution?

“The solution is Bitcoin,” stated Mallers. “Bitcoin is the money that we coincide that nobody can print. You can’t print, you can’t debase my time and energy, you cannot deprive me of owning assets, of getting out of debt, of living sovereignly and protecting my future, my family, my priced possessions. Bitcoin is what we invented to do that.”

Mallers gave a power message to the audience by explaining that people should HODL every dollar they have in Bitcoin. People should also spend a little of it to have a nice life.

“You can’t HODL forever,” said Jack.

While talking about loans that people borrow against their Bitcoin. He explained why he thinks banks putting 20% in interest for loans backed with Bitcoin is outrageous.

“All these professional economists, they are like Bitcoin is risky and volatile,” stated Mallers. “No it’s not. This is the magnificent 7 one year volatility and the orange one in the middle is Bitcoin. It’s no more risky and volatile. It’s a little bit more volatile than Apple, but is far less more volatile than Tesla.”

“As Bitcoin matures, its volatility goes down,” continued Jack. “Bitcoin volatility is at a point where it is no more risky than a Tesla Stock. We should not be paying double digits rates for a loan.”

Mallers announced his new system of loans at Strike of 9-13% in interest rates. It will allow people to get loans from $10,000 to $1 billion.

Mallers closed by saying, “please be responsible. This is debt. Debt is like fire in my opinion. It can heat a civilization. It can warm your home, but if you go too crazy it can burn your house down.”

“Life is short,” said Jack. “Take the trip, but with bitcoin you just get to take a better one.”

This post Jack Mallers Announced A New System of Bitcoin Backed Loans at Strike first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ c1e9ab3a:9cb56b43

2025-06-01 13:54:06

@ c1e9ab3a:9cb56b43

2025-06-01 13:54:061. Introduction

Over the last 250 years the world’s appetite for energy has soared along an unmistakably exponential trajectory, transforming societies and economies alike. After a half‑century of relative deceleration, a new mix of technological, demographic and political forces now hints at an impending catch‑up phase that could push demand back onto its centuries‑long growth curve. This post knits together the history, the numbers and the newest policy signals to explore what that rebound might look like—and how Gen‑4 nuclear power could meet it.

2. The Long Exponential: 1750 – 1975

Early industrialisation replaced muscle, wood and water with coal‑fired steam, pushing global primary energy use from a few exajoules per year in 1750 to roughly 60 EJ by 1900 and 250 EJ by 1975. Over that span aggregate consumption doubled roughly every 25–35 years, equivalent to a long‑run compound growth rate of ~3 % yr‑¹. Per‑capita use climbed even faster in industrialised economies as factories, railways and electric lighting spread.

3. 1975 – 2025: The Great Slowdown

3.1 Efficiency & Structural Change

• Oil shocks (1973, 1979) and volatile prices pushed OECD economies to squeeze more GDP from each joule.

• Services displaced heavy industry in rich countries, trimming energy intensity.

• Refrigerators, motors and vehicles became dramatically more efficient.3.2 Policy & Technology

• The Inflation Reduction Act (U.S.) now layers zero‑emission production credits and technology‑neutral tax incentives on top of existing nuclear PTCs citeturn1search0turn1search2.

• The EU’s Net‑Zero Industry Act aims to streamline siting and finance for “net‑zero technologies”, explicitly naming advanced nuclear citeturn0search1.3.3 Result

Global primary energy in 2024 stands near 600 EJ (≈ 167 000 TWh)—still growing, but the line has flattened versus the pre‑1975 exponential.

4. Population & Per‑Capita Demand

World population tripled between 1950 and today, yet total energy use grew roughly six‑fold. The imbalance reflects rising living standards and electrification. Looking ahead, the UN projects population to plateau near 10.4 billion in the 2080s, but per‑capita demand is poised to climb as the Global South industrialises.

5. The Policy Pivot of 2023‑2025

| Region | Signal | Year | Implication | |--------|--------|------|-------------| | COP 28 Declaration | 20+ nations pledge to triple nuclear capacity by 2050 | 2023 | High‑level political cover for rapid nuclear build‑out citeturn0search2 | | Europe | Post‑crisis sentiment shifts; blackout in Iberia re‑opens nuclear debate | 2025 | Spain, Germany, Switzerland and others revisit phase‑outs citeturn0news63 | | United States | TVA submits first SMR construction permit; NRC advances BWRX‑300 review | 2025 | Regulatory pathway for fleet deployment citeturn1search9turn1search1 | | Global Strategy Report | “Six Dimensions for Success” playbook for new nuclear entrants | 2025 | Practical roadmap for emerging economies citeturn0search0 | | U.S. Congress | Proposed cuts to DOE loan office threaten build‑out pace | 2025 | Finance bottleneck remains a risk citeturn1news28 |

6. The Catch‑Up Scenario

Suppose the recent 50‑year pause ends in 2025, and total energy demand returns to a midpoint historical doubling period of 12.5 years (the average of the 10–15 year rebound window).

6.1 Consumption Trajectory

| Year | Doublings since 2024 | Demand (TWh) | |------|----------------------|--------------| | 2024 | 0 | 167 000 | | 2037 | 1 | 334 000 | | 2050 | 2 | 668 000 | | 2062 | 3 | 1 336 000 |

(Table ignores efficiency gains from electrification for a conservative, supply‑side sizing.)

7. Nuclear‑Only Supply Model

7.1 Reactor Math

- 1 GWᵉ Gen‑4 reactor → 8.76 TWh yr‑¹ at 100 % capacity factor.

- 2062 requirement: 1 336 000 TWh yr‑¹ → ≈ 152 500 reactors in steady state.

- Build rate (2025‑2062, linear deployment):

152 500 ÷ 38 years ≈ 4 000 reactors per year globally.

(Down from the earlier 5 000 yr‑¹ estimate because the deployment window now stretches 38 years instead of 30.)

7.2 Policy Benchmarks

- COP 28 triple target translates to +780 GW (if baseline 2020 ≈ 390 GW). That is <100 1 GW units per year—two orders of magnitude lower than the theoretical catch‑up requirement, highlighting just how aggressive our thought experiment is.

7.3 Distributed vs Grid‑Centric

Small Modular Reactors (300 MW class) can be sited on retiring coal plants, using existing grid interconnects and cooling, vastly reducing new transmission needs. Ultra‑large “gigawatt corridors” become optional rather than mandatory, though meshed regional grids still improve resilience and market liquidity.

8. Challenges & Unknowns

- Finance: Even with IRA‑style credits, first‑of‑a‑kind Gen‑4 builds carry high cost of capital.

- Supply Chain: 4 000 reactors a year means a reactor‑grade steel output roughly 20× today’s level.

- Waste & Public Trust: Advanced reactors can burn actinides, but geologic repositories remain essential.

- Workforce: Nuclear engineers, welders and regulators are already in short supply.

- Competing Technologies: Cheap renewables + storage and prospective fusion could displace part of the projected load.

9. Conclusions

Recent policy shifts—from Europe’s Net‑Zero Industry Act to the COP 28 nuclear declaration—signal that governments once again see nuclear energy as indispensable to deep decarbonisation. Yet meeting an exponential catch‑up in demand would require deployment rates an order of magnitude beyond today’s commitments, testing manufacturing capacity, finance and political resolve.

Whether the future follows the modest path now embedded in policy or the steeper curve sketched here, two convictions stand out:

- Electrification will dominate new energy demand.

- Scalable, dispatchable low‑carbon generation—likely including large fleets of Gen‑4 fission plants—must fill much of that gap if net‑zero targets are to remain credible.

Last updated 1 June 2025.

-

@ 472f440f:5669301e

2025-06-01 13:48:34

@ 472f440f:5669301e

2025-06-01 13:48:34Marty's Bent

Sorry for the lack of writing over the last week. As many of you may already know, I was in Las Vegas, Nevada for the Bitcoin 2025 conference. It was my first time in Las Vegas. I had successfully avoided Sin City for the first 34 years of my life. But when duty calls, you have to make some personal concessions.

Despite what many say about this particular conference and the spectacle that it has become, I will say that having attended every single one of Bitcoin Magazine's conferences since 2019, I thoroughly enjoy these events, even if I don't agree with all the content. Being able to congregate with others in the industry who have been working extremely hard to push Bitcoin forward, all of whom I view as kindred spirits who have also dedicated their lives to making the world a better place. There's nothing better than getting together, seeing each other in person, shaking hands, giving hugs, catching up and reflecting on how much things have changed over the years while also focusing on the opportunities that lie ahead.

I think out of all the Bitcoin magazine conferences I've been to, this was certainly my favorite. If only because it has become abundantly clear that Bitcoin is here to stay. Many powerful, influential, and competent people have identified Bitcoin as an asset and monetary network that will play a large part in human society moving forward. And more importantly, Bitcoin is proving to work far better than anybody not paying attention expected. While at the same time, the fiat system is in woeful disrepair at the same time.

As a matter of reflection and surfacing signal for you freaks, here are the presentations and things that happened that I think were the most impactful.

Miles Suter's Block Presentation

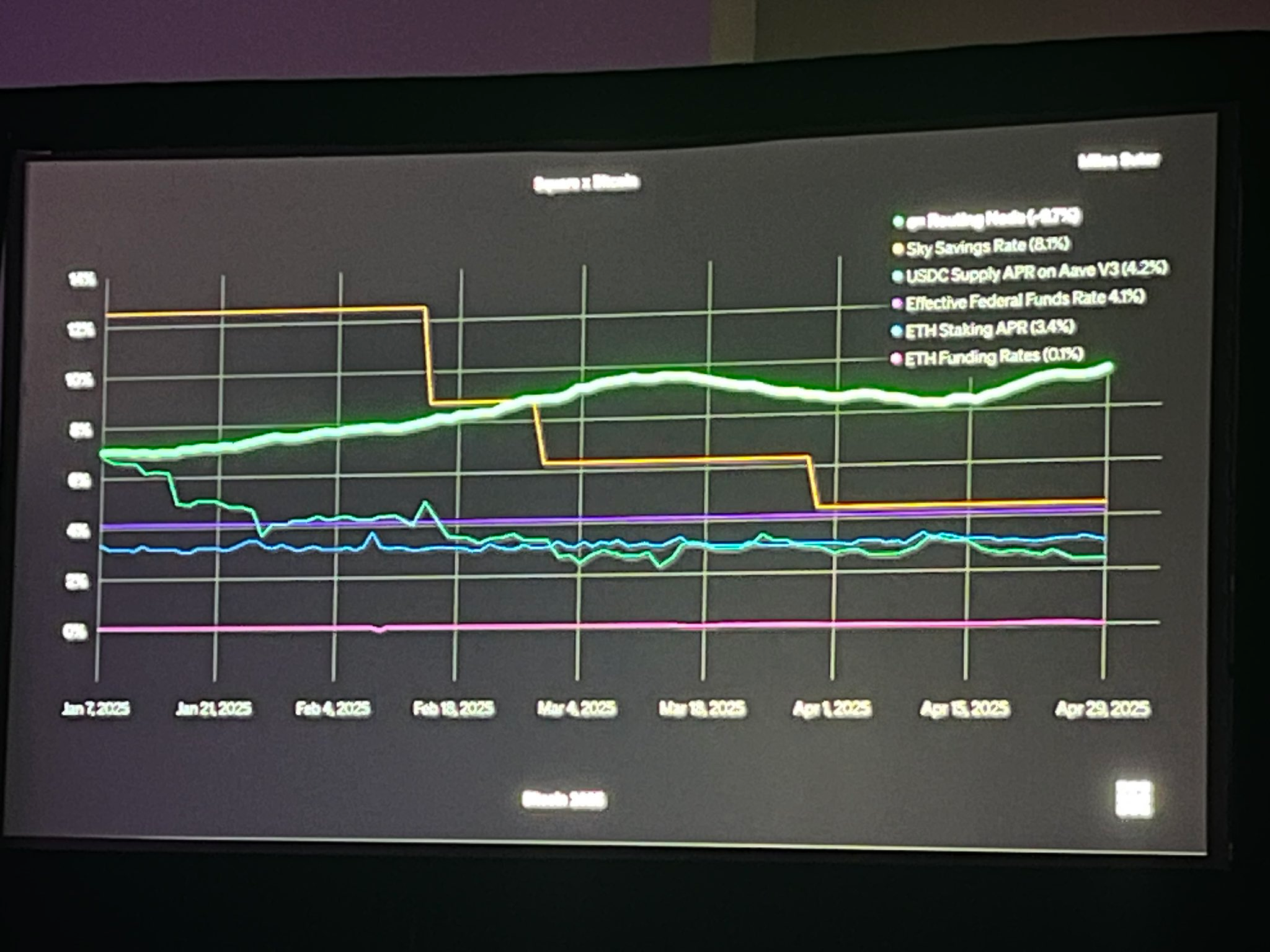

This presentation was awesome for many reasons, one of which being that we often forget just how dedicated Block, as an organization with many companies - including Cash App, Square, the open source organization known as Spiral and more recently, BitKey and Proto - has been to bitcoin over the last eight years. They've worked methodically to make Bitcoin a first-class citizen in their business operations and slowly but surely have built an incredibly integrated experience across their brands. The two big announcements from Block during the conference were the enablement of Bitcoin payments in Square point-of-sale systems and the amount of revenue they're making on their Lightning node, c=, from routing payments.

Right now, the Bitcoin payments and point of sale systems is in beta with many merchants testing it out for the next six months, but it will be available for all 4 million square merchants in 2026. This is something that many bitcoiners have been waiting for for many years now, and it is incredible to see that they finally brought it across the line. Merchants will have the ability to accept bitcoin payments and either convert every payment into fiat automatically, convert a portion of the bitcoin payment into fiat to keep the rest in sats, or simply keep all of the bitcoin they receive via payments in sats. This is an incredible addition to what Square has already built, which is the ability of their merchants to sweep a portion of their revenues into bitcoin if they desire. Square is focused on building a vertically integrated suite of bitcoin products for merchants that includes the ability to buy bitcoin, receive bitcoin, and eventually leverage financial services using bitcoin as collateral so that they can reinvest in and expand their businesses.

via Ryan Gentry

What went a bit underappreciated in the crowd was the routing node revenue that c= is producing, \~9.7% annualized. This is a massive validation of something that many bitcoiners have been talking about for quite some time, which is the ability to produce "yield" on bitcoin in a way that reduces risk significantly. Locking up bitcoin in a 2-of-2 multisig within Lightning channels and operating a Lightning routing node has been long talked about as one of the ways to produce more bitcoin with your bitcoin in a way that minimizes the threat of loss.

It seems that c= has found a way to do this at scale and is doing it successfully. 10% yield on bitcoin locked in Lightning channels is nothing to joke about. And as you can see from the chart above in the grainy picture taken by Ryan Gentry of Lightning Labs, this routing node "yield" is producing more return on capital than many of the most popular staking and DeFi protocols.

This is a strong signal to the rest of the market that this can be done. It may take economies of scale and a high degree of technical competency today. But this is incredibly promising for the future of earning bitcoin by providing valuable goods and services to the market of Bitcoiners. In this case, facilitating relatively cheap and instantly settled payments over the Lightning Network.

Saifedean Ammous' Bitcoin and Tether Presentation

This was one of the best presentations at the conference. Saifedean Ammous is a friend, he has been an incredible influence on my personal bitcoin journey, and I feel comfortable in saying he's been a strong influence on the journey of hundreds of thousands, at least, if not millions of people as they've attempted to understand bitcoin.

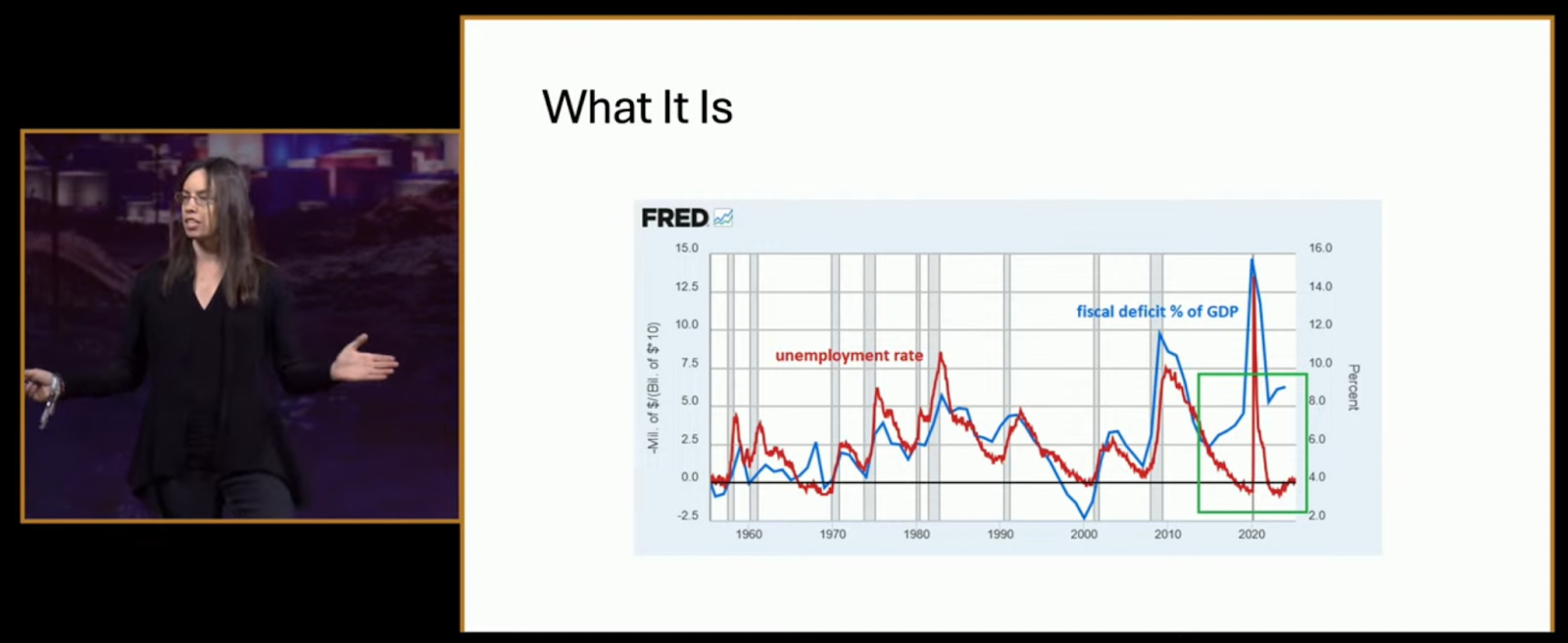

This presentation is a bit spicy because it puts a pin in the balloon of hopium that stablecoins like Tether are mechanisms that could bail out the market for US Treasuries in the medium to long-term if they take enough market share. As one always should do, Saif ran the numbers and clearly illustrates that even in the most optimistic case, Tether's impact on the market for treasuries, their interest rates, and curbing the growth of the debt held by the US federal government will be minimal at best.

One of the most interesting things that Saif points out that I'm a bit embarrassed I didn't recognize before is that much of the demand for Tether that we're seeing these days is replacement demand for treasuries. Meaning that many people who are turning to Tether, particularly in countries that have experienced hyperinflationary events, are using Tether as a substitute for their currencies, which are operated by central banks likely buying U.S. treasuries to support their monetary systems. The net effect of Tether buying those treasuries is zero for this particular user archetype.

Saif goes on to explain that if anything, Tether is a weapon against the US Treasury system when you consider that they're storing a large portion of the stablecoin backing in Treasuries and then using the yields produced by those Treasuries to buy bitcoin. Slowly but surely over time bitcoin as a percentage of their overall backing of Tether has grown quite significantly starting at 0% and approaching 10% today. It isn't hard to imagine that at some point within the next decade, Bitcoin could be the dominant reserve asset backing tethers and, as a result, Tether could be pegged to bitcoin eventually.

It's a fascinating take on Tether that I've never heard before.

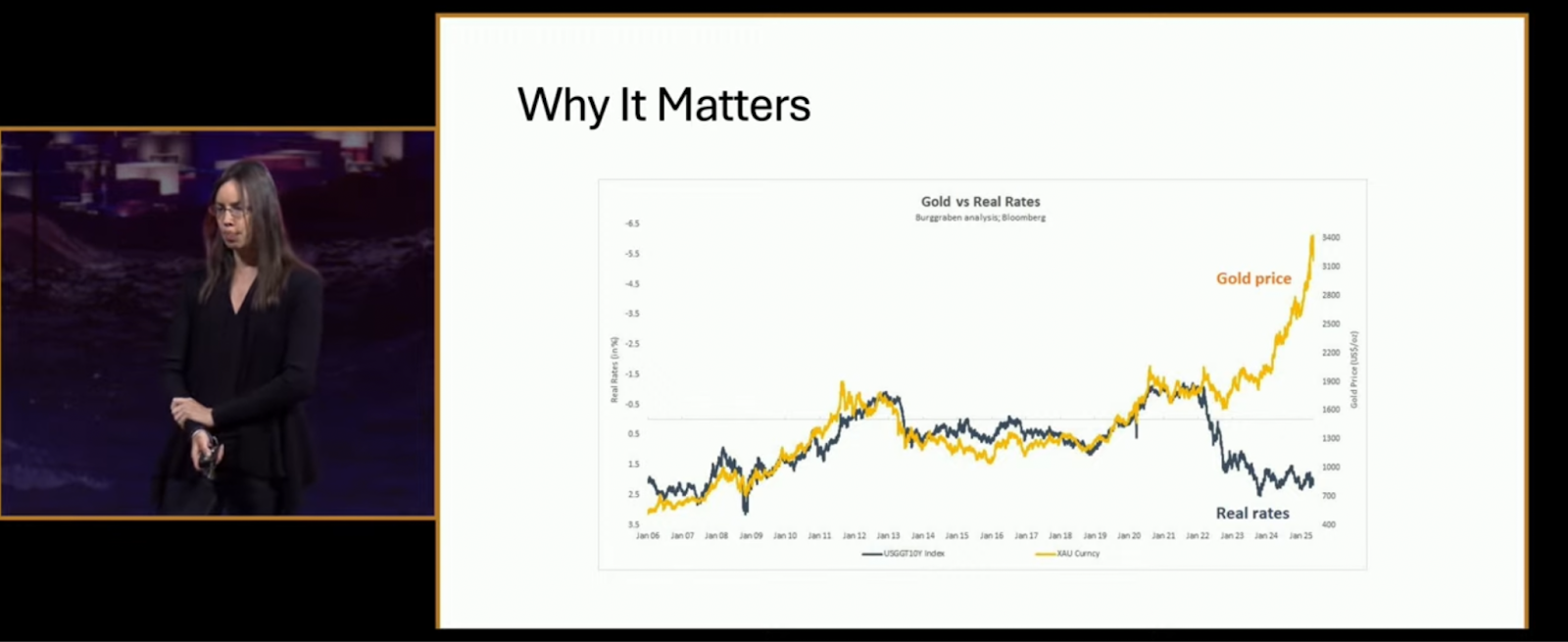

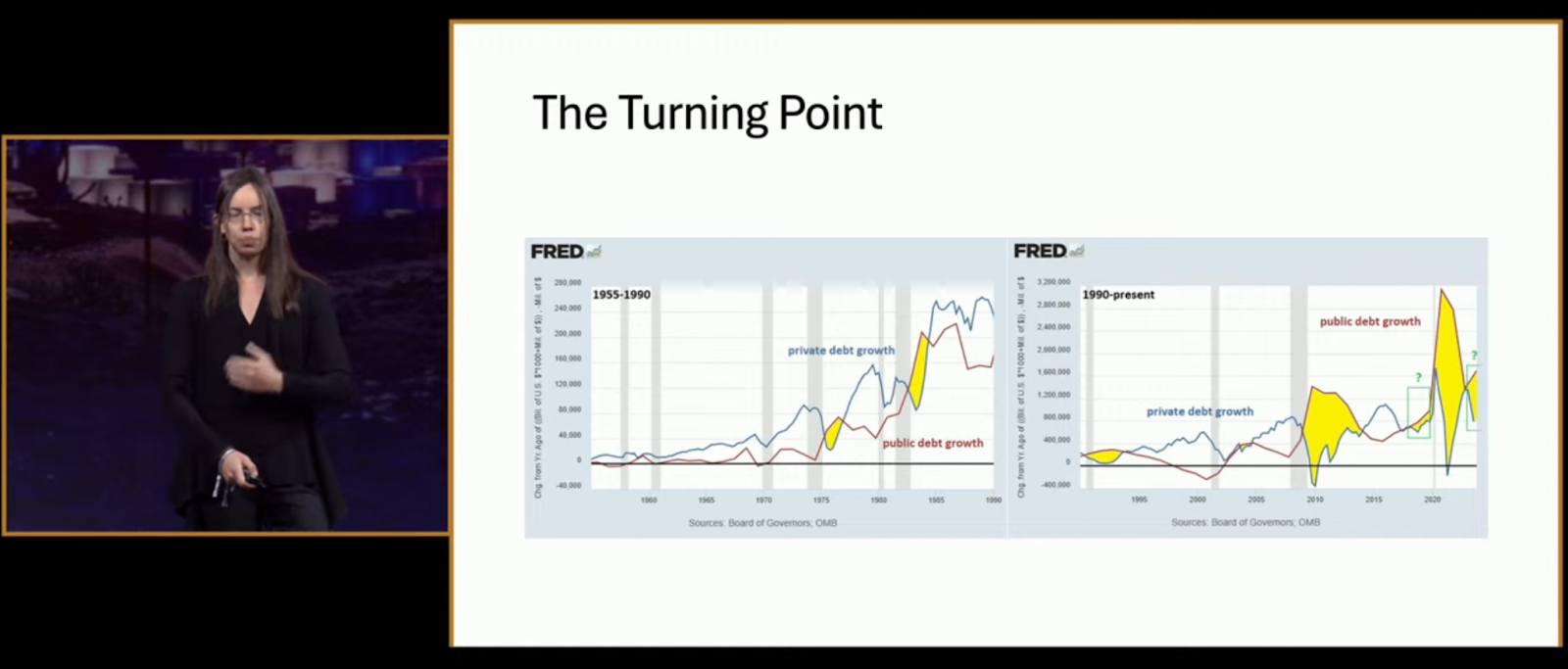

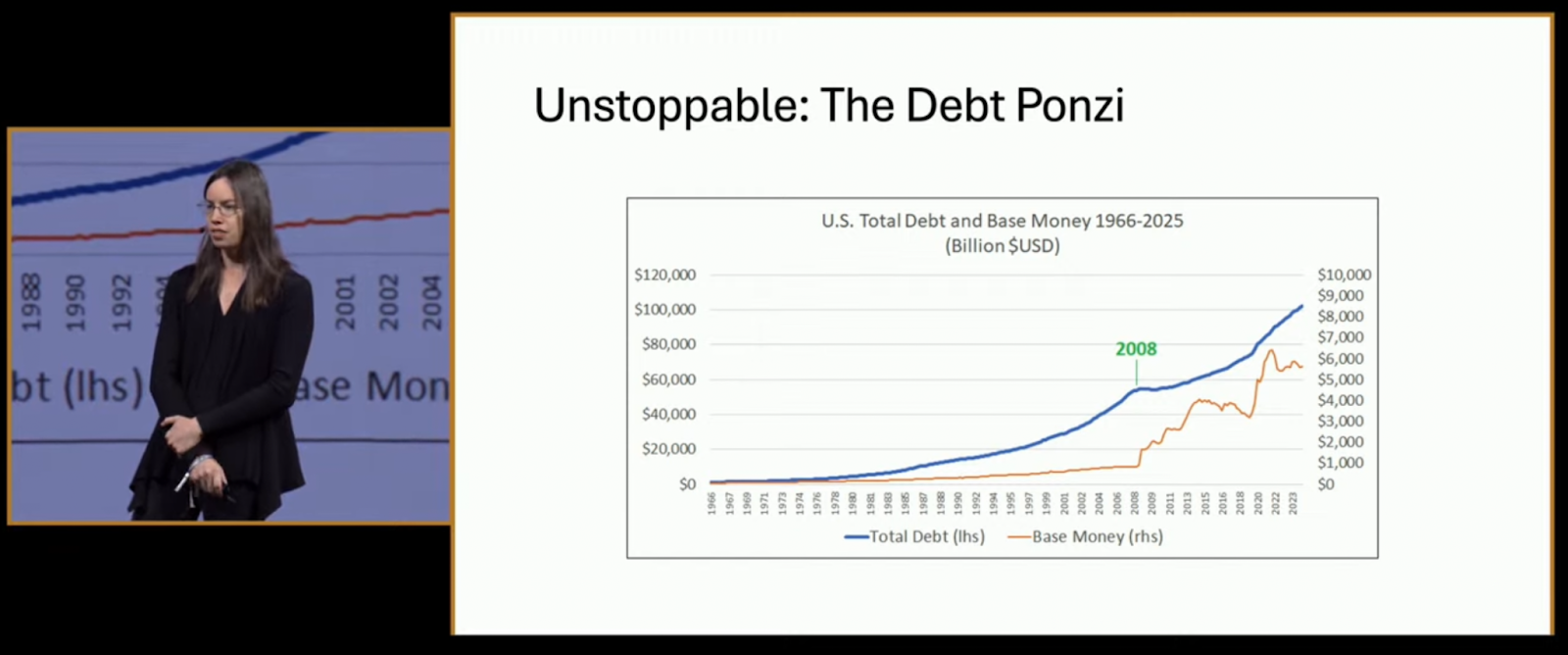

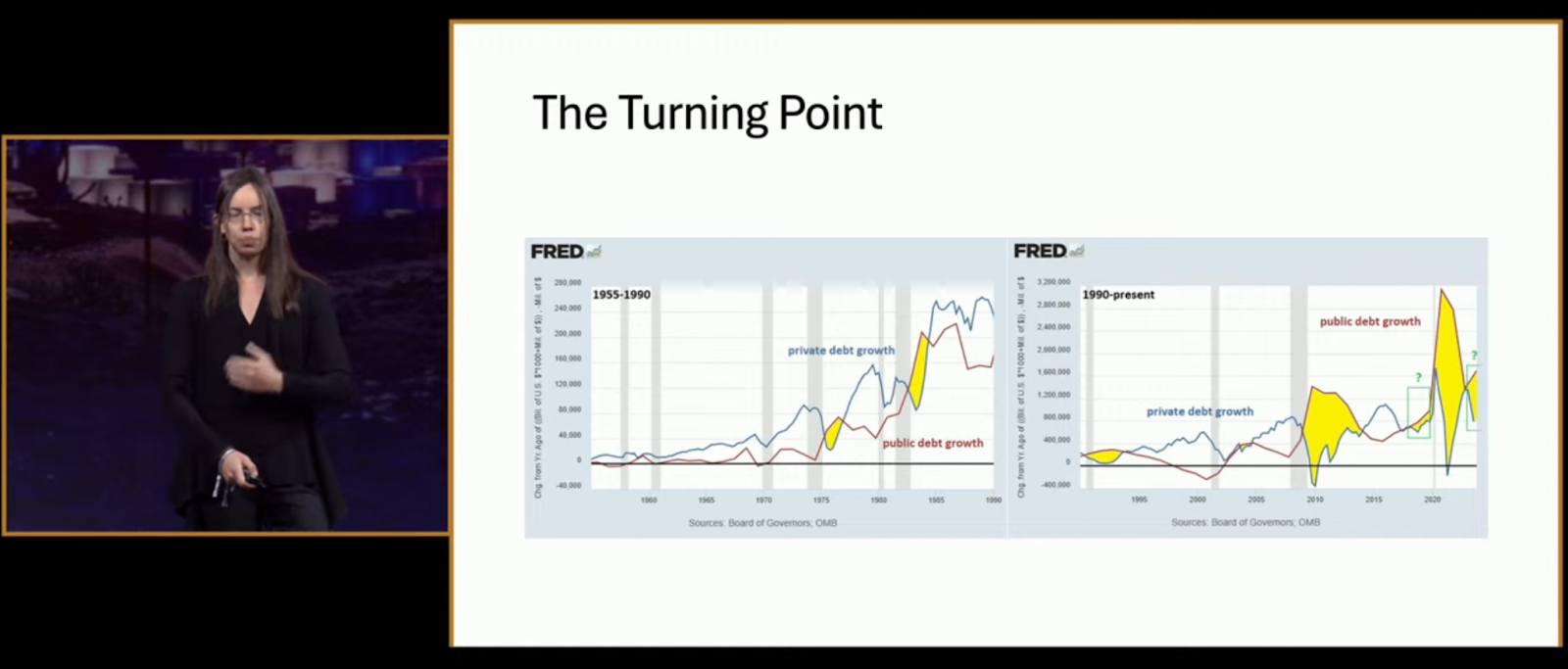

Nothing Stops this Train from Lyn Alden

Lyn's been saying it loudly for quite some time now; "Nothing stops this train." She's even been on our podcast to explain why she believes this many times over the last five years. However, I don't think there is one piece of content out there that consolidates her thesis of why nothing stops the train of fiscal irresponsibility and unfettered debt expansion and why that's good for bitcoin than the presentation she gave at the conference. Definitely give this one a watch when you get a chance if you haven't already.

Overall, it was a great week in Vegas and I think it's safe to say that bitcoin has gone mainstream. Whether or not people who have been in the bitcoin industry and community for a while are okay with does not really matter. It's happening and all we can do is ride the wave as more and more people come to recognize the value prop of bitcoin and the social clout they can gain from supporting it. Our job here at TFTC is to help you discern the signal from the noise, continue to champion the self-sovereign usage of bitcoin and keep you abreast of developments in the space as they manifest.

Buckle up. Things are only going to get weirder from here on out.

Bitcoin's Mathematical Destiny

Sean Bill and Adam Back make a compelling case for Bitcoin's inevitable march toward $1 million. Sean points out that Bitcoin represents just a tiny fraction—2 trillion out of 900 trillion—of total financial assets, calling it a "tiny orange dot" on their presentation to Texas pensions. He emphasizes that reaching parity with gold alone would deliver a 10x return from current levels. Adam highlights the mathematical impossibility of current prices, noting that ETF buyers are absorbing 500,000 BTC annually while only 165,000 new coins are mined.

"Who's selling at these prices? It doesn't quite add up to me." - Adam Back

The institutional wave is just beginning. Sean revealed that while 50% of hedge fund managers personally own Bitcoin, only 3% have allocated institutional funds. Combined with emerging demand from nation states and corporate treasuries meeting Bitcoin's fixed supply, the price trajectory seems clear. Both guests stressed the importance of staying invested—missing just the 12 best performing days each year would turn Bitcoin into a losing investment.

Check out the full podcast here for more on pensions allocating to Bitcoin, cypherpunk banking, and commodity trading insights.

Headlines of the Day

Panama Canal Eyes Bitcoin for Payment Option - via X

U.S. Warns of Imminent Chinese Threat to Taiwan - via X

Get our new STACK SATS hat - via tftcmerch.io

Saylor's Bitcoin Strategy Explodes Globally Amid Doubt - via CNBC

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Moving is the least fun part of the human experience.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 5d4b6c8d:8a1c1ee3

2025-06-01 13:04:11

@ 5d4b6c8d:8a1c1ee3

2025-06-01 13:04:11Sad news stackers. Episode 34 was lost in a tragic boating accident.

We'll revisit our recording setup going forward.

Rest assured that it was a glorious episode and it felt no pain upon its untimely departure. In lieu of an episode, I recommend @BlokchainB's excellent rant about his Knicks.

https://stacker.news/items/994354

-

@ 127d3bf5:466f416f

2025-06-01 12:39:00

@ 127d3bf5:466f416f

2025-06-01 12:39:00In the Name of Allah, the Most Gracious, the Most Merciful,

"Permission to fight (against disbelievers) is given to those (believers) who are fought against, because they have been wronged and surely, Allah is Able to give them (believers) victory" [Quran 22:39]

"Those who believe, fight in the Cause of Allah, and those who disbelieve, fight in the cause of Taghut (anything worshipped other than Allah e.g. Satan). So fight you against the friends of Satan; ever feeble is indeed the plot of Satan."[Quran 4:76]

Some American writers have published articles under the title 'On what basis are we fighting?' These articles have generated a number of responses, some of which adhered to the truth and were based on Islamic Law, and others which have not. Here we wanted to outline the truth - as an explanation and warning - hoping for Allah's reward, seeking success and support from Him.

While seeking Allah's help, we form our reply based on two questions directed at the Americans:

(Q1) Why are we fighting and opposing you?\ (Q2) What are we calling you to, and what do we want from you?

As for the first question: Why are we fighting and opposing you? The answer is very simple:

(1) Because you attacked us and continue to attack us.

a) You attacked us in Palestine:

(i) Palestine, which has sunk under military occupation for more than 80 years. The British handed over Palestine, with your help and your support, to the Jews, who have occupied it for more than 50 years; years overflowing with oppression, tyranny, crimes, killing, expulsion, destruction and devastation. The creation and continuation of Israel is one of the greatest crimes, and you are the leaders of its criminals. And of course there is no need to explain and prove the degree of American support for Israel. The creation of Israel is a crime which must be erased. Each and every person whose hands have become polluted in the contribution towards this crime must pay its*price, and pay for it heavily.

(ii) It brings us both laughter and tears to see that you have not yet tired of repeating your fabricated lies that the Jews have a historical right to Palestine, as it was promised to them in the Torah. Anyone who disputes with them on this alleged fact is accused of anti-semitism. This is one of the most fallacious, widely-circulated fabrications in history. The people of Palestine are pure Arabs and original Semites. It is the Muslims who are the inheritors of Moses (peace be upon him) and the inheritors of the real Torah that has not been changed. Muslims believe in all of the Prophets, including Abraham, Moses, Jesus and Muhammad, peace and blessings of Allah be upon them all. If the followers of Moses have been promised a right to Palestine in the Torah, then the Muslims are the most worthy nation of this.

When the Muslims conquered Palestine and drove out the Romans, Palestine and Jerusalem returned to Islaam, the religion of all the Prophets peace be upon them. Therefore, the call to a historical right to Palestine cannot be raised against the Islamic Ummah that believes in all the Prophets of Allah (peace and blessings be upon them) - and we make no distinction between them.

(iii) The blood pouring out of Palestine must be equally revenged. You must know that the Palestinians do not cry alone; their women are not widowed alone; their sons are not orphaned alone.

(b) You attacked us in Somalia; you supported the Russian atrocities against us in Chechnya, the Indian oppression against us in Kashmir, and the Jewish aggression against us in Lebanon.

(c) Under your supervision, consent and orders, the governments of our countries which act as your agents, attack us on a daily basis;

(i) These governments prevent our people from establishing the Islamic Shariah, using violence and lies to do so.

(ii) These governments give us a taste of humiliation, and places us in a large prison of fear and subdual.

(iii) These governments steal our Ummah's wealth and sell them to you at a paltry price.

(iv) These governments have surrendered to the Jews, and handed them most of Palestine, acknowledging the existence of their state over the dismembered limbs of their own people.

(v) The removal of these governments is an obligation upon us, and a necessary step to free the Ummah, to make the Shariah the supreme law and to regain Palestine. And our fight against these governments is not separate from out fight against you.

(d) You steal our wealth and oil at paltry prices because of you international influence and military threats. This theft is indeed the biggest theft ever witnessed by mankind in the history of the world.

(e) Your forces occupy our countries; you spread your military bases throughout them; you corrupt our lands, and you besiege our sanctities, to protect the security of the Jews and to ensure the continuity of your pillage of our treasures.

(f) You have starved the Muslims of Iraq, where children die every day. It is a wonder that more than 1.5 million Iraqi children have died as a result of your sanctions, and you did not show concern. Yet when 3000 of your people died, the entire world rises and has not yet sat down.

(g) You have supported the Jews in their idea that Jerusalem is their eternal capital, and agreed to move your embassy there. With your help and under your protection, the Israelis are planning to destroy the Al-Aqsa mosque. Under the protection of your weapons, Sharon entered the Al-Aqsa mosque, to pollute it as a preparation to capture and destroy it.

(2) These tragedies and calamities are only a few examples of your oppression and aggression against us. It is commanded by our religion and intellect that the oppressed have a right to return the aggression. Do not await anything from us but Jihad, resistance and revenge. Is it in any way rational to expect that after America has attacked us for more than half a century, that we will then leave her to live in security and peace?!!

(3) You may then dispute that all the above does not justify aggression against civilians, for crimes they did not commit and offenses in which they did not partake:

(a) This argument contradicts your continuous repetition that America is the land of freedom, and its leaders in this world. Therefore, the American people are the ones who choose their government by way of their own free will; a choice which stems from their agreement to its policies. Thus the American people have chosen, consented to, and affirmed their support for the Israeli oppression of the Palestinians, the occupation and usurpation of their land, and its continuous killing, torture, punishment and expulsion of the Palestinians. The American people have the ability and choice to refuse the policies of their Government and even to change it if they want.

(b) The American people are the ones who pay the taxes which fund the planes that bomb us in Afghanistan, the tanks that strike and destroy our homes in Palestine, the armies which occupy our lands in the Arabian Gulf, and the fleets which ensure the blockade of Iraq. These tax dollars are given to Israel for it to continue to attack us and penetrate our lands. So the American people are the ones who fund the attacks against us, and they are the ones who oversee the expenditure of these monies in the way they wish, through their elected candidates.

(c) Also the American army is part of the American people. It is this very same people who are shamelessly helping the Jews fight against us.

(d) The American people are the ones who employ both their men and their women in the American Forces which attack us.

(e) This is why the American people cannot be not innocent of all the crimes committed by the Americans and Jews against us.

(f) Allah, the Almighty, legislated the permission and the option to take revenge. Thus, if we are attacked, then we have the right to attack back. Whoever has destroyed our villages and towns, then we have the right to destroy their villages and towns. Whoever has stolen our wealth, then we have the right to destroy their economy. And whoever has killed our civilians, then we have the right to kill theirs.

The American Government and press still refuses to answer the question:

Why did they attack us in New York and Washington?

If Sharon is a man of peace in the eyes of Bush, then we are also men of peace!!! America does not understand the language of manners and principles, so we are addressing it using the language it understands.

(Q2) As for the second question that we want to answer: What are we calling you to, and what do we want from you?

(1) The first thing that we are calling you to is Islam.

(a) The religion of the Unification of God; of freedom from associating partners with Him, and rejection of this; of complete love of Him, the Exalted; of complete submission to His Laws; and of the discarding of all the opinions, orders, theories and religions which contradict with the religion He sent down to His Prophet Muhammad (peace be upon him). Islam is the religion of all the prophets, and makes no distinction between them - peace be upon them all.

It is to this religion that we call you; the seal of all the previous religions. It is the religion of Unification of God, sincerity, the best of manners, righteousness, mercy, honour, purity, and piety. It is the religion of showing kindness to others, establishing justice between them, granting them their rights, and defending the oppressed and the persecuted. It is the religion of enjoining the good and forbidding the evil with the hand, tongue and heart. It is the religion of Jihad in the way of Allah so that Allah's Word and religion reign Supreme. And it is the religion of unity and agreement on the obedience to Allah, and total equality between all people, without regarding their colour, sex, or language.

(b) It is the religion whose book - the Quran - will remained preserved and unchanged, after the other Divine books and messages have been changed. The Quran is the miracle until the Day of Judgment. Allah has challenged anyone to bring a book like the Quran or even ten verses like it.

(2) The second thing we call you to, is to stop your oppression, lies, immorality and debauchery that has spread among you.

(a) We call you to be a people of manners, principles, honour, and purity; to reject the immoral acts of fornication, homosexuality, intoxicants, gambling's, and trading with interest.

We call you to all of this that you may be freed from that which you have become caught up in; that you may be freed from the deceptive lies that you are a great nation, that your leaders spread amongst you to conceal from you the despicable state to which you have reached.

(b) It is saddening to tell you that you are the worst civilization witnessed by the history of mankind:

(i) You are the nation who, rather than ruling by the Shariah of Allah in its Constitution and Laws, choose to invent your own laws as you will and desire. You separate religion from your policies, contradicting the pure nature which affirms Absolute Authority to the Lord and your Creator. You flee from the embarrassing question posed to you: How is it possible for Allah the Almighty to create His creation, grant them power over all the creatures and land, grant them all the amenities of life, and then deny them that which they are most in need of: knowledge of the laws which govern their lives?

(ii) You are the nation that permits Usury, which has been forbidden by all the religions. Yet you build your economy and investments on Usury. As a result of this, in all its different forms and guises, the Jews have taken control of your economy, through which they have then taken control of your media, and now control all aspects of your life making you their servants and achieving their aims at your expense; precisely what Benjamin Franklin warned you against.

(iii) You are a nation that permits the production, trading and usage of intoxicants. You also permit drugs, and only forbid the trade of them, even though your nation is the largest consumer of them.

(iv) You are a nation that permits acts of immorality, and you consider them to be pillars of personal freedom. You have continued to sink down this abyss from level to level until incest has spread amongst you, in the face of which neither your sense of honour nor your laws object.

Who can forget your President Clinton's immoral acts committed in the official Oval office? After that you did not even bring him to account, other than that he 'made a mistake', after which everything passed with no punishment. Is there a worse kind of event for which your name will go down in history and remembered by nations?

(v) You are a nation that permits gambling in its all forms. The companies practice this as well, resulting in the investments becoming active and the criminals becoming rich.

(vi) You are a nation that exploits women like consumer products or advertising tools calling upon customers to purchase them. You use women to serve passengers, visitors, and strangers to increase your profit margins. You then rant that you support the liberation of women.

(vii) You are a nation that practices the trade of sex in all its forms, directly and indirectly. Giant corporations and establishments are established on this, under the name of art, entertainment, tourism and freedom, and other deceptive names you attribute to it.

(viii) And because of all this, you have been described in history as a nation that spreads diseases that were unknown to man in the past. Go ahead and boast to the nations of man, that you brought them AIDS as a Satanic American Invention.

(xi) You have destroyed nature with your industrial waste and gases more than any other nation in history. Despite this, you refuse to sign the Kyoto agreement so that you can secure the profit of your greedy companies and*industries.

(x) Your law is the law of the rich and wealthy people, who hold sway in their political parties, and fund their election campaigns with their gifts. Behind them stand the Jews, who control your policies, media and economy.

(xi) That which you are singled out for in the history of mankind, is that you have used your force to destroy mankind more than any other nation in history; not to defend principles and values, but to hasten to secure your interests and profits. You who dropped a nuclear bomb on Japan, even though Japan was ready to negotiate an end to the war. How many acts of oppression, tyranny and injustice have you carried out, O callers to freedom?

(xii) Let us not forget one of your major characteristics: your duality in both manners and values; your hypocrisy in manners and principles. All*manners, principles and values have two scales: one for you and one for the others.

(a)The freedom and democracy that you call to is for yourselves and for white race only; as for the rest of the world, you impose upon them your monstrous, destructive policies and Governments, which you call the 'American friends'. Yet you prevent them from establishing democracies. When the Islamic party in Algeria wanted to practice democracy and they won the election, you unleashed your agents in the Algerian army onto them, and to attack them with tanks and guns, to imprison them and torture them - a new lesson from the 'American book of democracy'!!!

(b)Your policy on prohibiting and forcibly removing weapons of mass destruction to ensure world peace: it only applies to those countries which you do not permit to possess such weapons. As for the countries you consent to, such as Israel, then they are allowed to keep and use such weapons to defend their security. Anyone else who you suspect might be manufacturing or keeping these kinds of weapons, you call them criminals and you take military action against them.

(c)You are the last ones to respect the resolutions and policies of International Law, yet you claim to want to selectively punish anyone else who does the same. Israel has for more than 50 years been pushing UN resolutions and rules against the wall with the full support of America.

(d)As for the war criminals which you censure and form criminal courts for - you shamelessly ask that your own are granted immunity!! However, history will not forget the war crimes that you committed against the Muslims and the rest of the world; those you have killed in Japan, Afghanistan, Somalia, Lebanon and Iraq will remain a shame that you will never be able to escape. It will suffice to remind you of your latest war crimes in Afghanistan, in which densely populated innocent civilian villages were destroyed, bombs were dropped on mosques causing the roof of the mosque to come crashing down on the heads of the Muslims praying inside. You are the ones who broke the agreement with the Mujahideen when they left Qunduz, bombing them in Jangi fort, and killing more than 1,000 of your prisoners through suffocation and thirst. Allah alone knows how many people have died by torture at the hands of you and your agents. Your planes remain in the Afghan skies, looking for anyone remotely suspicious.

(e)You have claimed to be the vanguards of Human Rights, and your Ministry of Foreign affairs issues annual reports containing statistics of those countries that violate any Human Rights. However, all these things vanished when the Mujahideen hit you, and you then implemented the methods of the same documented governments that you used to curse. In America, you captured thousands the Muslims and Arabs, took them into custody with neither reason, court trial, nor even disclosing their names. You issued newer, harsher laws.

What happens in Guatanamo is a historical embarrassment to America and its values, and it screams into your faces - you hypocrites, "What is the value of your signature on any agreement or treaty?"

(3) What we call you to thirdly is to take an honest stance with yourselves - and I doubt you will do so - to discover that you are a nation without principles or manners, and that the values and principles to you are something which you merely demand from others, not that which you yourself must adhere to.

(4) We also advise you to stop supporting Israel, and to end your support of the Indians in Kashmir, the Russians against the Chechens and to also cease supporting the Manila Government against the Muslims in Southern Philippines.

(5) We also advise you to pack your luggage and get out of our lands. We desire for your goodness, guidance, and righteousness, so do not force us to send you back as cargo in coffins.

(6) Sixthly, we call upon you to end your support of the corrupt leaders in our countries. Do not interfere in our politics and method of education. Leave us alone, or else expect us in New York and Washington.

(7) We also call you to deal with us and interact with us on the basis of mutual interests and benefits, rather than the policies of sub dual, theft and occupation, and not to continue your policy of supporting the Jews because this will result in more disasters for you.

If you fail to respond to all these conditions, then prepare for fight with the Islamic Nation. The Nation of Monotheism, that puts complete trust on Allah and fears none other than Him. The Nation which is addressed by its Quran with the words: "Do you fear them? Allah has more right that you should fear Him if you are believers. Fight against them so that Allah will punish them by your hands and disgrace them and give you victory over them and heal the breasts of believing people. And remove the anger of their (believers') hearts. Allah accepts the repentance of whom He wills. Allah is All-Knowing, All-Wise." [Quran9:13-1]

The Nation of honour and respect:

"But honour, power and glory belong to Allah, and to His Messenger (Muhammad- peace be upon him) and to the believers." [Quran 63:8]

"So do not become weak (against your enemy), nor be sad, and you will be*superior ( in victory )if you are indeed (true) believers" [Quran 3:139]

The Nation of Martyrdom; the Nation that desires death more than you desire life:

"Think not of those who are killed in the way of Allah as dead. Nay, they are alive with their Lord, and they are being provided for. They rejoice in what Allah has bestowed upon them from His bounty and rejoice for the sake of those who have not yet joined them, but are left behind (not yet martyred) that on them no fear shall come, nor shall they grieve. They rejoice in a grace and a bounty from Allah, and that Allah will not waste the reward of the believers." [Quran 3:169-171]

The Nation of victory and success that Allah has promised:

"It is He Who has sent His Messenger (Muhammad peace be upon him) with guidance and the religion of truth (Islam), to make it victorious over all other religions even though the Polytheists hate it." [Quran 61:9]

"Allah has decreed that 'Verily it is I and My Messengers who shall be victorious.' Verily Allah is All-Powerful, All-Mighty." [Quran 58:21]

The Islamic Nation that was able to dismiss and destroy the previous evil Empires like yourself; the Nation that rejects your attacks, wishes to remove your evils, and is prepared to fight you. You are well aware that the Islamic Nation, from the very core of its soul, despises your haughtiness and arrogance.

If the Americans refuse to listen to our advice and the goodness, guidance and righteousness that we call them to, then be aware that you will lose this Crusade Bush began, just like the other previous Crusades in which you were humiliated by the hands of the Mujahideen, fleeing to your home in great silence and disgrace. If the Americans do not respond, then their fate will be that of the Soviets who fled from Afghanistan to deal with their military defeat, political breakup, ideological downfall, and economic bankruptcy.

This is our message to the Americans, as an answer to theirs. Do they now know why we fight them and over which form of ignorance, by the permission of Allah, we shall be victorious?

-

@ fa0165a0:03397073

2025-06-01 12:23:47

@ fa0165a0:03397073