-

@ 553b8217:e6e84118

2025-06-06 17:18:27

@ 553b8217:e6e84118

2025-06-06 17:18:27Does Bitcoin still Go to the moon~~ @ dfa02707:41ca50e3

2025-06-06 17:02:00

@ dfa02707:41ca50e3

2025-06-06 17:02:00Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-06 17:01:58

@ dfa02707:41ca50e3

2025-06-06 17:01:58Headlines

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

- All virtual asset service providers expect to be fully compliant with the Travel Rule by the end of 2025. A survey by financial surveillance specialist Notabene reveals that 90% of virtual asset service providers (VASPs) expect full Travel Rule compliance by mid-2025, with all aiming for compliance by year-end. The survey also shows a significant rise in VASPs blocking withdrawals until beneficiary information is confirmed, increasing from 2.9% in 2024 to 15.4% now. Additionally, about 20% of VASPs return deposits if originator data is missing.

- UN claims Bitcoin mining is a "powerful tool" for money laundering. The Rage's analysis suggests that the recent United Nations Office on Drugs and Crime report on crime in South-East Asia makes little sense and hints at the potential introduction of Anti-Money Laundering (AML) measures at the mining level.

- Riot Platforms has obtained a $100 million credit facility from Coinbase Credit, using bitcoin as collateral for short-term funding to support its expansion. The firm's CEO, Jason Les, stated that this facility is crucial for diversifying financing sources and driving long-term stockholder value through strategic growth initiatives.

- Bitdeer raises $179M in loans and equity amid Bitcoin chip push. The Miner Mag reports that Bitdeer entered into a loan agreement with its affiliate Matrixport for up to $200 million in April, as disclosed in its annual report filed on Monday.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

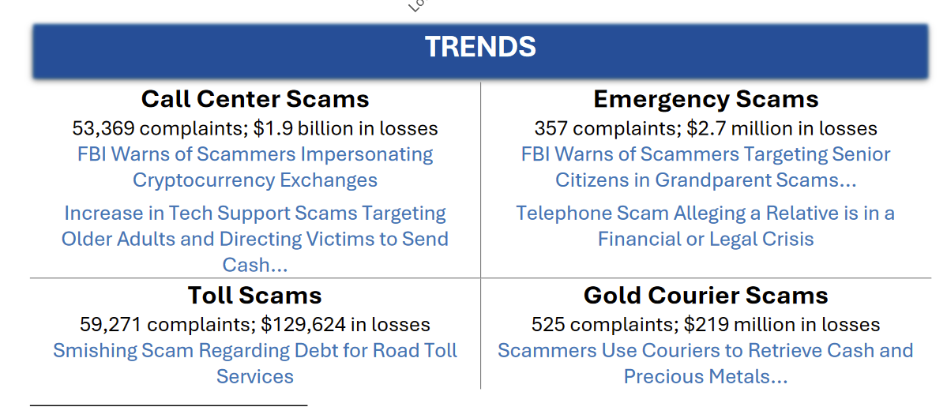

- U.S. 'crypto' scam losses amounted to $9.3B in 2024. The US The Federal Bureau of Investigation (FBI) has reported $9.3 billion losses in cryptocurrency-related scams in 2024, noting a troubling trend of scams targeting older Americans, which accounted for over $2.8 billion of those losses.

Source: FBI.

- North Korean hackers establish fake companies to target 'crypto' developers. Silent Push researchers reported that hackers linked to the Lazarus Group created three shell companies, two of which are based in the U.S., with the objective of spreading malware through deceptive job interview scams aimed at individuals seeking jobs in cryptocurrency companies.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- Hesperides University offers a Master’s degree in Bitcoin. Bitcoin Magazine reports the launch of the first-ever Spanish-language Master’s program dedicated exclusively to Bitcoin. Starting April 28, 2025, this fully online program will equip professionals with technical, economic, legal, and philosophical skills to excel in the Bitcoin era.

- BTC in D.C. event is set to take place on September 30 - October 1 in Washington, D.C. Learn more about this initiative here.

Use the tools

- Bitcoin Keeper just got a new look. Version 2.2.0 of the mobile multisig app brought a new branding design, along with a Keeper Private tier, testnet support, ability to import and export BIP-329 labels, and the option to use a Server Key with multiple users.

- Earlier this month the project also announced Keeper Learn service, offering clear and guided Bitcoin learning sessions for both groups and individuals.

- Keeper Desktop v0.2.2, a companion desktop app for Bitcoin Keeper mobile app, received a renewed branding update, too.

The evolution of Bitcoin Keeper logo. Source: BitHyve blog.

- Blockstream Green Desktop v2.0.25 updates GDK to v0.75.1 and fixes amount parsing issues when switching from fiat denomination to Liquid asset.

- Lightning Loop v0.31.0-beta enhances the

loop listswapscommand by improving the ability to filter the response. - Lightning-kmp v1.10.0, an implementation of the Lightning Network in Kotlin, is now available.

- LND v0.19.0-beta.rc3, the latest beta release candidate of LND is now ready for testing.

- ZEUS v0.11.0-alpha2 is now available for testing, too. It's nuts.

- JoinMarket Fidelity Bond Simulator helps potential JoinMarket makers evaluate their competitive position in the market based on fidelity bonds.

- UTXOscope is a text-only Bitcoin blockchain analysis tool that visualizes price dynamics using only on-chain data. The

-

@ dfa02707:41ca50e3

2025-06-06 17:01:57

@ dfa02707:41ca50e3

2025-06-06 17:01:57Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-06-06 17:01:54

@ dfa02707:41ca50e3

2025-06-06 17:01:54Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

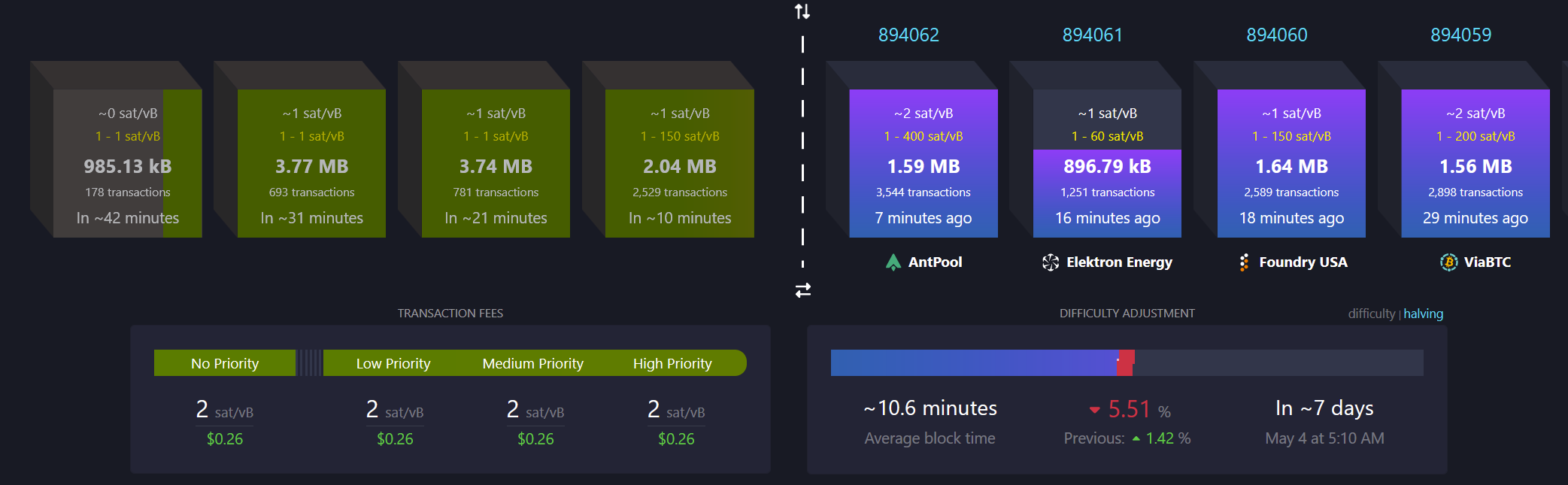

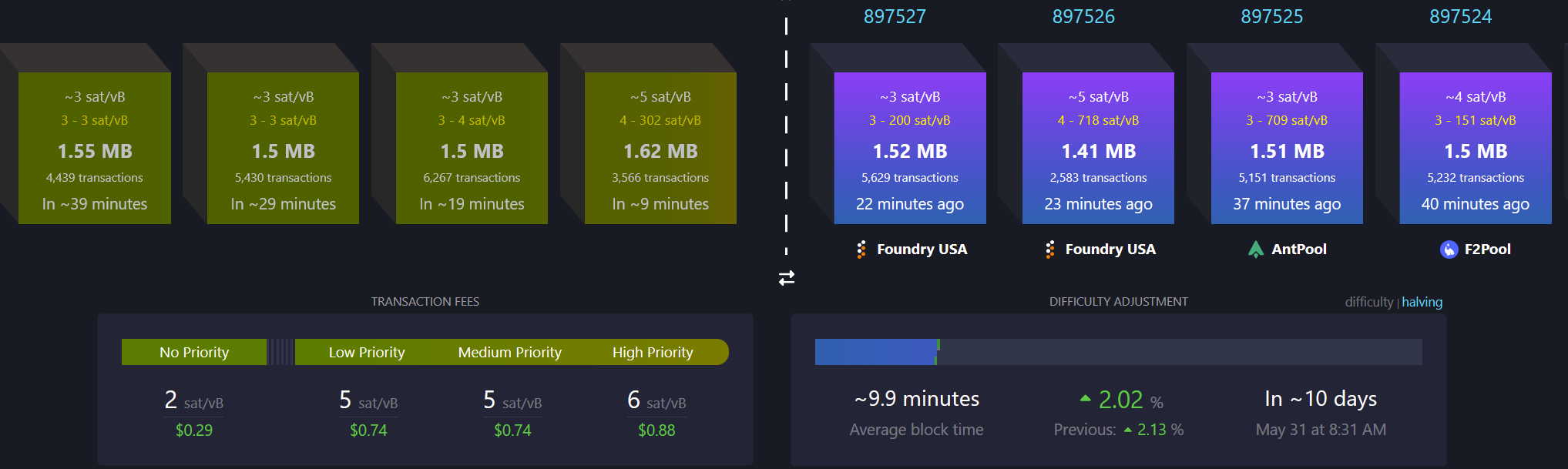

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ e2c72a5a:bfacb2ee

2025-06-06 17:23:32

@ e2c72a5a:bfacb2ee

2025-06-06 17:23:32The Freedom Paradox: Why Bitcoin's Biggest Threat Isn't Regulation

Bitcoin was designed to escape government control. Now it's becoming the darling of presidents, corporations, and nation-states.

Japan's Metaplanet just announced plans to acquire 91,000 Bitcoin in the next 18 months. Michael Saylor's Strategy quadrupled its stock offering to $1 billion for more Bitcoin purchases. Even Pakistan's crypto minister is meeting with Wall Street and NYC's mayor.

The very institutions Bitcoin was created to circumvent are now its biggest champions.

This isn't just ironic – it's potentially dangerous. As Bitcoin becomes institutionalized, the revolutionary spirit that made it valuable risks being diluted. When presidents tweet about it and corporations hoard it, does Bitcoin still represent financial freedom?

The true test isn't Bitcoin's price but whether it remains censorship-resistant when those same powerful entities decide they want control.

Is Bitcoin being captured by the establishment, or has it simply arrived? Your answer determines whether you're investing in revolution or just another asset class.

What do you think happens when the rebels become the rulers?

-

@ 4898fe02:4ae46cb0

2025-06-06 16:56:23

@ 4898fe02:4ae46cb0

2025-06-06 16:56:23I had a bit of extra time this week to attend a call organized by npub1zuuajd7u3sx8xu92yav9jwxpr839cs0kc3q6t56vd5u9q033xmhsk6c2uc regarding a privacy focused project he's been working on for the last year-or-so. Shout-out to npub1e0z776cpe0gllgktjk54fuzv8pdfxmq6smsmh8xd7t8s7n474n9smk0txy for encouraging me to do so, pushing my somewhat out of my comfort zone in reporting on technical updates.

Also, if you know of or are involved in similar dev calls and would like a report done, please reach out and feel free to share calendar updates.

--npub1f4www6qjx43mckpkjld4apyyr76j3aahprvkduh9gc5xec78ypmsmakqh9 would be awesome to see this talked about on SNL later today, as it seems to be a very important/overlooked project for the future of privacy, nostr and bitcoin broadly.

Anyway, here's the unschooled report--my technical explanations may sometimes be scant, but I've done my best to provide more qualified sources where necessary.

Bringing Secure, Confidential Group Chats to Nostr - A Monthly MLS on Nostr Dev Call

Posted originally to Stacker News \~nostr territory

Developers met Tuesday, 3 Jun at 1600UTC at what would be the first of a monthly series of community calls to discuss updates and respond to questions about the implementation of the MLS (Messaging Layer Security) standard over nostr.

npub1klkk3vrzme455yh9rl2jshq7rc8dpegj3ndf82c3ks2sk40dxt7qulx3vt, npub1jlrs53pkdfjnts29kveljul2sm0actt6n8dxrrzqcersttvcuv3qdjynqn, npub1klkk3vrzme455yh9rl2jshq7rc8dpegj3ndf82c3ks2sk40dxt7qulx3vt and npub1zuuajd7u3sx8xu92yav9jwxpr839cs0kc3q6t56vd5u9q033xmhsk6c2uc among others attended and contributed to a discussion about the latter's research and development on implementing a new messaging standard on nostr using MLS.

The call highlighted some of the features of MLS, a relatively new (as of 2023) secure and confidential messaging and group-chat protocol standard. It is modeled to achieve a similar level of security as Signal, prioritizing forward-secrecy and post-compromise security, multi-device compatibility, as well as the ability to scale for large groups.

For those not familiar,

Forward secrecy means that encrypted content in the past remains encrypted even if key material is leaked.\ Post compromise security means that leaking key material doesn't allow an attacker to continue to read messages indefinitely into the future. ^1

Developers working on the project indicated that it will be an improvement on current instant-messaging standards commonly used by nostr clients, such as nip17, for a relatively simple implementation.

Those in attendance overall showed enthusiasm to push this project forward and developers interested are being encouraged to fork the the Nostr-MLS Rust Library to begin working it into their stack. Notably, jeffg and Hillebrand are keen to see new contributors work on the project.

Participants had the opportunity to ask technical questions about how the library handles some features as well as how to begin contributing.

Discussion also centered around issues with MLS (such as potential key-package rotation DOS attack vectors and de-syncing) as well as some key concepts for the new messaging standard such as how key-packages are signed by a users nsec and published to key-package inbox relays before being rotated.

Proofs of Concept

White Noise and 0xchat both have implemented MLS on nostr. These are the first to prove that the concept of secure-confidential group messaging is possible over the distributed nostr-relay protocol.

Learn More

jeffg has kept detailed project updates on his nostr account. Notably, the post MLS Over Nostr explains the vision he has for the project and his presentation The Past and Future of Messaging on Nostr (youtube) gives a high-level overview of messaging on nostr and the problems he is working to solve.

Follow npub1zuuajd7u3sx8xu92yav9jwxpr839cs0kc3q6t56vd5u9q033xmhsk6c2uc on your favourite nostr client for call updates.

Link to join.

Related:

-

@ dfa02707:41ca50e3

2025-06-06 17:01:54

@ dfa02707:41ca50e3

2025-06-06 17:01:54Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ e2c72a5a:bfacb2ee

2025-06-06 16:35:04

@ e2c72a5a:bfacb2ee

2025-06-06 16:35:04The secret map whales use to liquidate you isn't actually secret anymore.

Bitcoin liquidation maps reveal exactly how market makers target overleveraged positions. When too many traders pile into the same price level with borrowed money, it creates a juicy target.

These maps show concentrated liquidation points where thousands of traders have set their stop losses. Whales don't randomly move markets - they strategically push prices to trigger these cascading liquidations, creating artificial price movements that benefit their positions.

The most dangerous part? Most retail traders have no idea they're swimming in predatory waters. While they're busy following technical patterns and news cycles, institutional players are simply following the money - your money.

Learning to read these liquidation heat maps isn't just a trading edge - it's survival. The difference between profitable traders and liquidated ones often comes down to position sizing and avoiding the obvious liquidation zones where everyone else has clustered.

Are you monitoring the liquidation map before your next leveraged trade, or are you just another dot on someone else's profit target?

-

@ 0b118e40:4edc09cb

2025-06-06 13:58:07

@ 0b118e40:4edc09cb

2025-06-06 13:58:07The idea of Bitcoin as an internet native currency, and eventually a global one, is coming to life slowly. But historically, the idea of global currency has haunted the world’s financial imagination for nearly a century.

From Keynes’s Bancor in 1944 to Zhou Xiaochuan’s post-crisis proposal in 2009 to today’s renewed debates, the idea resurfaces every time the global economy fractures.

Could this time be different with Bitcoin?

I decided to trace the idea of global currency through several decades and books. I may have missed some parts, so feel free to add. I’ll keep this brief and leave the books I’ve read below.

In the beginning

It all started on July 1, 1944. 730 delegates from 44 Allied nations, including major powers like the US, UK, Soviet Union, China, and France, gathered at the Mount Washington Hotel in Bretton Woods, New Hampshire. They spent 2 weeks figuring out how the new international monetary and financial system would be, post WW2

After WW1, the treaty of Versailles was needed, but imposed harsh reparations that devastated economies and contributed to the rise of fascism, such as Hitler, Mussolini and gang.

So when folks met up in 1944 (WW2 was almost ending), the goal was to prevent another Great Depression, another global conflict and build a stable global economic order.

2 main proposals were discussed in Bretton Woods.

-

John Maynard Keynes, representing the UK, proposed the creation of a global currency called Bancor. It will be issued through a global central bank known as the International Clearing Union (ICU).

-

Harry Dexter White, representing the US, promoted a dollar-based system. Countries would peg their currencies to the US. dollar backed by gold. He also led the creation of the IMF and the World Bank.

To understand how both of these proposals work, let's look at an example.

-

Country A (Germany): Massive exporter

-

Country B (USA): Massive importer

-

Country C (Brazil): Balanced trade (imports = exports)

***Based on Dexter’s model and the current USD-based system, ***

Say Germany sells $1B worth of cars to the US. The US pays in dollars, increasing its trade deficit. Germany accumulates dollars as reserves or buys the US Treasury bonds. Over time, the US continues running trade deficits, while Germany keeps hoarding dollars. Hence the unsustainable debt of the US.

***In Keynes’s Bancor system, ***

If Germany sells $1B worth of cars to the US, then the US does not pay in dollars. Instead, the ICU credits Germany with 1B Bancors and debits the US with -1B Bancors.

The ICU police this. If Germany exceeds the surplus threshold, it pays interest or penalties to discourage hoarding. If the US exceeds its deficit threshold, it is warned to rebalance trade or face restrictions.

Here, Germany is incentivized to import more (e.g., from Brazil) or invest in global development. The US is encouraged to export more or reduce consumption. Brazil, with balanced trade, enjoys stability in Bancor flows and avoids pressure.

The idea behind Bancor was a zero-sum balancing act. No country could become “too big to fail” due to excessive deficits. But it was too complicated and idealistic in assuming every country could maintain balanced trade.

Dexter on the other hand had a few tricks up his sleeve. In the end, Dexter’s USD dominance proposal was adopted.

The Bretton Woods system established the US dollar as the central global currency

Why did dollar dominance win over Bancor?

Simplicity often wins over complexity. But more so ICU felt too centralized, asking nations to surrender economic autonomy to a global body. That didn’t sit well in a post-war world where sovereignty was non-negotiable. That and idealist economic trade balance views.

Dexter’s dollar-based system on the other hand wasn’t fair play at all. It was centralized and authoritarian in its design.

So how did Dexter pull it off?

They had gold. They were ahead in economic recovery.

And they had nuclear weapons.

At the time, the US held nearly 2/3 of the world’s gold reserves. It was a significant advantage in advocating for a gold-backed dollar as the bedrock of global trade.

The US proposed a fixed gold peg at $35 per ounce.

From a broader geopolitical backdrop, the global population in 1944 was about 2.3 billion, a fraction of today’s 8 billion. The world was far less interconnected. The war had devastated Europe, Russia, and much of Asia. Infrastructure, economies, and entire cities were in ruins. The US, by contrast, had faced far fewer casualties and damages. Being geographically isolated, it had minimal domestic losses, around a tenth of what Europe suffered, and its economy was poised to rebuild faster.

But gold dominance and economic recovery alone didn’t secure US financial dominance.

American scientific breakthroughs had already signaled global power. Physicists like Leo Szilard and Albert Einstein, who had fled Europe, helped develop nuclear weapons. Their intent was deterrence, not destruction. But once the bomb existed, it changed geopolitics overnight. The US had military dominance. And after Hiroshima and Nagasaki in 1945, it became the undisputed superpower.

In the end, the USD won and the vision for neutral global currency faded.

And 20 years passed on…

France sends its warship to the US

Under Bretton Woods, countries could exchange dollars for gold, but the US had been printing more dollars than it had gold to back it. And it used it to fund the costly Vietnam War and domestic programs like the Great Society under LBJ.

Belgian-American economist Robert Triffin pointed out a fatal flaw in the Bretton Woods system that came to be known as the Triffin dilemma.

-

The world needed US dollars for liquidity and trade.

-

But the more dollars the US pumped out, the less credible its gold promise became.

Yet the US kept promising that every dollar was still convertible to gold at $35 per ounce.

French President Charles de Gaulle saw this as financial imperialism. He called it the “exorbitant privileged position”. The world had to pay for what they bought with the money they have, but not the US.

So in 1965, France did something unexpected. It sent a warship to New York Harbor to physically retrieve French gold reserves held by the Federal Reserve.

Would it have escalated to war? Maybe. But likely not. It was perhaps more of a diplomatic theatre and a sovereign flex. France was exercising its right under the Bretton Woods agreement to convert dollars into gold. But doing it with military formality was to send a signal to the world that they don’t trust the US system anymore.

It was one of the first major public blows to the dollar’s credibility. And France wasn’t alone. Other countries like West Germany and Switzerland followed suit, redeeming dollars for gold and draining US reserves.

The Nixon shock

Given they did not have enough gold, the IMF introduced Special Drawing Rights (SDRs) in 1969. SDRs were an international reserve asset, created to supplement gold and dollar reserves. Instead of relying solely on the US dollar, SDRs were based on a basket of major currencies (originally gold-backed but later diversified).

The idea was to reduce the world’s dependence on the dollar and avoid a liquidity crisis. But SDRs were a little too late and a little too weak to solve the underlying problem.

By 1971, the US could no longer sustain the illusion. President Nixon “closed the gold window,” suspending dollar convertibility to gold.

The Bretton Woods collapsed and this marked the beginning of fiat money dominance.

The French pursuit

While France demanded justice in one corner of the world, the French franc, specifically the CFA franc, has been dominant in parts of Africa since 1945, long before 1971.

After WWII, France created two CFA franc zones:

-

West Africa: Communauté Financière Africaine (XOF)

-

Central Africa: Coopération Financière en Afrique Centrale (XAF)

These zones included 14 African countries, many of which were former French colonies. France maintained monetary control via currency convertibility guarantees and representation in African central banks. Till today it has influence over these country’s monetary policy.

Colonisation hasn't ended in some parts of the world.

Did countries stop using the USD after the Nixon shock 1971?

Nope. The US dollar was no longer convertible to gold and it dismantled the fixed exchange rate system. But most countries did not stop using the USD as their dominant reserve or trade currency. There were no decent alternatives. Instead, they floated their currencies or maintained a soft peg to the dollar or a basket of currencies.

The USD remained dominant in oil trade (OPEC priced oil in USD) - petrodollar deal, global debt markets and FX reserves (central banks kept holding USD).

In 1997, when many Southeast Asian countries were still pegged to the USD, Soros claimed that SEA will tank. The US further increased its credit rates leading to capital flight and eventual tanking of these countries leading to Asian Financial Crisis '97. Many financial crisis has similar vibe.

The 1999 Euro launch

The idea of a shared currency appeared again, this time through the forms of Euro. It was a mandatory system for member states of the Eurozone, and came with centralized authority, the European Central Bank (ECB), which controlled monetary policy for all participating nations.

At first glance, the euro seemed like a win. It eliminated exchange rate fluctuations, making trade within the Eurozone smoother. It gave weaker economies access to lower borrowing costs and helped Europe establish itself as a financial heavyweight. Today, the euro is the second most-used reserve currency after the US dollar.

But it came at a cost. Countries that adopted the euro lost monetary sovereignty and could no longer print their own money or adjust interest rates to respond to local crises. This became painfully clear during Greece’s debt crisis, where strict monetary policies prevented the country from devaluing its currency to recover. The one-size-fits-all approach meant that economies as different as Germany and Greece had to follow the same rules, often to the detriment of weaker nations. Debt-ridden countries like Italy and Spain were forced into harsh austerity measures because they could not manipulate their currency to ease financial strain. Meanwhile, richer nations like Germany and the Netherlands felt they were unfairly propping up struggling economies, creating political tension across the EU.

In recent years, the euro has faced pressure from global trade tensions, monetary tightening, and geopolitical instability contributing to market volatility and periodic depreciation against other major currencies.

The Bretton Woods 2.0

Believe it or not, after all that, there was a call for Bretton Woods 2.0. Yet another global currency dream.

When the housing market collapsed in 2008 followed by a series of domino effects, global banks froze lending, economies contracted, and panic set in. The crisis exposed how fragile the international financial system had become as it was overly reliant on debt, under-regulated, and centered around the US dollar.

Many countries, especially in the Global South and emerging markets, started to question whether a system built around a single national currency was sustainable.

China, for instance, had been holding huge amounts of US debt while the US printed more dollars through bailouts and quantitative easing. This created global imbalances as exporting nations were lending money to the US to keep the system running, while taking on the risk of dollar depreciation.

In 2009, China’s central bank openly proposed replacing the US dollar with a neutral global reserve currency suggesting SDRs (Special Drawing Rights) issued by the IMF instead.

These concerns led to a wave of calls from world leaders for a “Bretton Woods 2.0” , a modern rethinking of the post-WWII economic order. At G20 summits in London in 2009, countries like France, China, and Russia pushed for reforms in global financial institutions and more balanced power sharing.

In the end, the IMF received more funding, and some banking regulations were tightened in the years after. But no real overhaul happened. No surprise there? The dollar remained dominant.

The foundation of the global economy didn’t change, even though trust in it had been deeply shaken.

The growth of BRICS

In 2023, Brazil, Russia, India, China, and South Africa began discussing the idea of a shared currency or alternative mechanism to reduce the dependence on USD ie de-dollarisation. The sanctions on Russia didn't help. After Russia’s invasion of Ukraine, the US and its allies froze Russia’s dollar reserves and cut it off from SWIFT, the “backbone of global banking communication”. This made one thing clear. If you fall out with Washington, your access to the global economy can vanish overnight.

China’s growing economic power also gave it more leverage to process alternative options. It would trade in Yuan with Russia and Iran.

I know many still say it's at its early stage, but I see many countries hedging their bets quietly and aligning with Putin and Xi. It became more obvious after US imposed tariffs on multiple nations, signaling that economic tools can double as political weapons. The world’s second financial system is slowly forming.

What is the world looking for, for the last century ?

For the last 80 years, from Bretton Woods to multiple financial crises, from the birth of the Euro to the rise of BRICS, through war and peace, we’ve been circling around the same ideal. A global currency that is :

-

Simple

-

Free from dominant power

-

Decentralised

-

Borderless

-

Scarce

-

Transparent

-

Inclusive, with self custody

-

Resilient in crisis

-

Built for individual financial sovereignty

-

A new backbone for global finance, owned by no one

It doesn’t matter where you’re from, what politics you believe in, or how your economy leans. The answer keeps pointing in the same direction:

Bitcoin

This is the first true global currency.

And it’s just there

Waiting...

.

.

.

Some books that might interest you :

-

The Battle of Bretton Woods by Benn Steil

-

Goodbye, Great Britain by Kathleen Burk and Alec Cairncross

-

The Ghost of Bancor by Tommaso Padoa-Schioppa

-

Confessions of an Economic Hitman by John Perkins

-

The Blood Bankers by James S. Henry

-

-

@ dfa02707:41ca50e3

2025-06-06 13:01:58

@ dfa02707:41ca50e3

2025-06-06 13:01:58Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ 7f6db517:a4931eda

2025-06-06 17:02:04

@ 7f6db517:a4931eda

2025-06-06 17:02:04

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 37666b60:3698ff14

2025-06-06 15:40:34

@ 37666b60:3698ff14

2025-06-06 15:40:34Hello

-

@ dfa02707:41ca50e3

2025-06-06 17:01:53

@ dfa02707:41ca50e3

2025-06-06 17:01:53- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 8bad92c3:ca714aa5

2025-06-06 17:01:49

@ 8bad92c3:ca714aa5

2025-06-06 17:01:49Key Takeaways

In this landmark episode of TFTC, Adam Back and Sean Bill explore Bitcoin’s path to $1 million, focusing on its growing role as pristine collateral in a faltering financial system. Back highlights Blockstream’s infrastructure efforts, from mining operations to tokenized securities, designed to support this transformation, while Bill shares how he navigated institutional skepticism to bring Bitcoin exposure to a U.S. pension fund. Together, they unpack how institutions are entering the space through structured products and Bitcoin-backed credit, with Blockstream’s mining notes offering a glimpse of this new financial architecture. Amid rising debt, inflation, and fiat fragility, the duo presents Bitcoin not just as sound money, but as a strategic reserve asset gaining traction from El Salvador to Wall Street.

Best Quotes

"It's not a stretch to say that Bitcoin could reach parity with gold. That would imply something closer to a million dollars a coin."

"Digital gold vastly understates Bitcoin’s potential, but it’s where the conversation had to start."

"We’re not just building software, we’re solving financial market gaps, one at a time."

"You can wipe out an entire pension fund’s unfunded liability with a 2% allocation to Bitcoin, if it performs as we expect."

"ETF buyers are the new hodlers. They’re not day traders; they’re five-year pocket investors."

"Bitcoin is becoming super collateral, its role in structured credit could help engineer the soft landing everyone hopes for."

"In a world of financial repression, Bitcoin is how the have-nots finally access property rights and savings."

"Emerging markets will be the early adopters of Bitcoin finance because they need it the most."

"You worked for your money. To systematically steal it through hidden inflation is perverse."

"Bitcoin could be the story that saves public pensions, and the people relying on them."

Conclusion

This episode presents a bold vision of Bitcoin as more than sound money, it’s the foundation of a new global financial system. Adam Back and Sean Bill argue that Bitcoin’s role as “super collateral” is reshaping credit, pensions, and sovereign reserves, while a robust infrastructure of financial tools quietly prepares it to absorb institutional capital. As fiat trust erodes, Bitcoin’s adoption will be driven not by hype, but by necessity, and when the shift becomes undeniable, $1 million per coin will mark the start of a new financial era.

Timestamps

00:00:00 - Intro

00:00:38 - New ATH

00:02:06 - Sean's Journey Getting Bitcoin Into Pensions

00:03:15 - Blockstream's Evolution Into Finance

00:08:30 - Building Bitcoin Financial Infrastructure

00:14:30 - The Challenge of Conservative Pension Boards

00:17:02 - Bitkey

00:18:10 - Bitcoin's Current Price and Market Cycle

00:24:05 - Bitcoin as Super Collateral

00:27:24 - Unchained

00:30:09 - Cypherpunk Ideals vs Financial Reality

00:34:55 - Pension Fund Crisis and Bitcoin Solution

00:42:29 - The Cypherpunk Banking Stack

00:49:54 - Digital Cash and Free Banking

00:57:06 - Liquid Network and Institutional Rails

01:07:49 - Sean At CBOT

01:22:16 - Bitcoin Futures and Market Structure

01:25:53 - 2025 Bitcoin Price PredictionsTranscript

(00:00) I'm uh permeable, so I'm always astounded that it's not, you know, 10 or 100 times higher. If everybody saw it, the addressable mark, I mean, it would already be 100 200 trillion asset class, right? That's not a stretch to say that Bitcoin could reach parody with gold. That would imply something closer to a million dollars a coin.

(00:18) You see some established public market companies in different countries saying, "Oh, we're going to buy a billion of Bitcoin. We're going to raise and buy 500." Black Rockck ETF. They're even talking about recommended allocations to portfolio managers in the 2% range. Obviously, digital gold would vastly understate the potential of Bitcoin.

(00:38) Gentlemen, thank you for joining me. Of course. Thanks for having us on. Uh Adam, I was just saying I'm woefully embarrassed. This podcast is almost 8 years old and this is your first time on the show. Oh, okay. This is uh but it's an exciting time. Yeah. And you uh really dedicated to podcast. It's been a lot of years, a lot of episodes, right? It has been. Cool.

(00:59) I think we're approaching 700, which is crazy to think. Wow, that is impressive. The uh No, we're talking hit a new alltime high today. Yeah, Bitcoin doing Bitcoin things just as we were on stage uh at the talking hedge kind of asset manager conference uh trying to explain to them why they should put Bitcoin in their uh fund allocations.

(01:23) Yeah, we were discussing it before we hit record and I saw Tur's tweet looked like Tur was at the event, too. Yeah, he was. M so 50% held up they have Bitcoin in their personal account but only 2% or 4% of the funds very few that actually had allocated to Bitcoin. So a lot of them are believers at a personal level but they haven't been able to sell it within their institution you know so they own it themselves uh but they haven't quite gotten the boards to agree yet.

(01:53) So which was a similar situation I was in in 2019 when I first proposed it. You know, I had my experience with Bitcoin. I had a very good experience and was trying to convince uh the pensions in California that they should be looking at adding Bitcoin to the portfolio. Yeah. And it was great to hear some of your background last night, Sean.

(02:11) So, Sean, for those of you watching, uh is the CIO at Blockstream now. Yeah. I am really excited to have both of you here because I've got into Bitcoin in 2013 and nerded out uh on the tech side of Bitcoin distributed system mining full nodes the layered stack that's been built out and so I followed probably all the work that you guys have done at Blockstream since you've been around and it's been really cool to see everything you've done from the Blockstream satellite.

(02:42) I've broadcast some transactions through that before. It's a Jade um uh CLN or excuse me, Core Lightning now. Um the uh liquid and now over the last few years really sort of leaning into the financialization of finance as I like to um to reference it. And so Adam, like how's that transition from being hypert focused towards a more financial perspective on Bitcoin been? Well, actually in our 2014 uh kickoff meeting, you know, with the founders sitting around big whiteboard, we were trying to forward cast what we'd have to do to get

(03:28) a Bitcoin layer 2 for, you know, settlement of assets and Bitcoin working. And one of the risk you know so we thought we'll build the tech and other people issue the assets but like well they might be lazy they might not do it if that happens we'll have to do it ourselves. So there was a lot of situations like that actually where you know you would think there would be lots of people building applications but many people are really just more in business development and a technology is basically a website and a database and

(03:55) you know Bitcoin core wallet on a server or something like that right so we actually ended up building a lot of middleware and getting into asset management a couple earlier steps one was the mining note so we're doing hosting and mining in our own account and what we did when when it was public that we were hosting initially Fidelity was the uh launch customer.

(04:16) They kept coming back to us and saying, "No, we need we need some hosting." And you know, uh, they'd looked around and decided that we were the best. We were we were like, "No, no, we're prop mining. We don't do hosting." But they persuaded us to host them. And then we're like, "Okay, maybe we should expand and host for other people.

(04:31) " And then that became news. And so then a lot of Bitcoiners contacted us and says, you know, I've got like a dozen miners. Can you host them for me? And of course, if you're if you're hosting for thousands of customers, that's a whole you need need a support team. Somebody has got two miners and one of them's crashed or failed, they're very upset, right? It's half the revenue.

(04:52) Whereas somebody's got, you know, 10,000 per client, it's just part of the, you know, maintenance cycle like a big data center. Discs fail 1% a year, you replace them when they die, they raid, it doesn't matter, right? So, it's kind of that phenomena. So we try to figure out well how can we help you know how can we help people do this without creating a you know that painoint and so we designed this mining note concept where it's kind of socialized so that collectively they look like one of the enterprise customers and then we put a 10% buffer in it so that we would eat

(05:22) the first 10% of equipment failure so they wouldn't get you know the drooping hash rate as miners like failed due to age uh for the for the onset And we also figured out how to try and make them a unified market. So, you know, we're selling more tranches into the market. This started in 2021, a three-year product.

(05:45) And um you know, there was some people on the launch branch and then some people 3 months later. So, what we do is look at how many Bitcoin it had mined in the first three months. We buy that and then match it with a 33month contract for the next one. And so the economically equivalent neither dilutive or anti-dilutive for the buyer and therefore they could trade in a unified market even though there were eight sales tranches over the first I don't know like 12 months or something like that and that that market you know it was using initially using uh liquid

(06:17) security tokens uh with uh stalker a European company that does the securitization I mean the legal p -

@ 37666b60:3698ff14

2025-06-06 15:29:50

@ 37666b60:3698ff14

2025-06-06 15:29:50Hello

-

@ eb0157af:77ab6c55

2025-06-06 17:01:43

@ eb0157af:77ab6c55

2025-06-06 17:01:43Russian authorities are stepping up their crackdown on illegal Bitcoin miners with a new confiscation case.

Law enforcement in Russia has launched a seizure campaign against unauthorized mining operations, marking an escalation in the fight against illicit crypto activity. The latest case saw investigators in the Amur Oblast confiscate bitcoin worth $88,500.

The Investigative Department of the Investigative Committee (SKR) for Amur Oblast announced it had seized assets worth around 7 million rubles ($88,570; 0.8414 BTC) from a former executive of an unnamed power company.

The accused served as head of technological connection services at the Amur branch of the Far Eastern Distribution Company (DRSC), a power grid operator managing electricity distribution in Russia’s eastern Amur region.

Investigators found that the former executive exploited his insider knowledge of the company’s power distribution systems to siphon electricity from the grid. The stolen power was used to run mining equipment at his private residence.

The seizure followed an investigation revealing that in 2024, the man used his technical skills to bypass metering devices and create an illegal connection to his employer’s infrastructure.

Authorities estimate that the executive used over 3.5 million rubles ($44,334) worth of electricity belonging to DRSC.

In April, several Russian ministries drafted a legal mechanism proposing new powers for courts and law enforcement to confiscate cryptocurrencies in criminal cases. The proposal, backed by government policymakers, would allow authorities to formally recognize digital assets as intangible property in criminal proceedings.

Previous seizures

Investigators appear to have already applied the principles of this draft law in several cases. Among them is the case of a server operator for the darknet marketplace Hydra, from whom police seized crypto assets worth $8.2 million.

Judicial officers also seized 1,032.1 BTC from Marat Tambiev, a former investigator with the Russian Investigative Committee. A court found Tambiev guilty of accepting Bitcoin bribes from an international fraud network, sentencing him to 16 years in prison.

The post Russia: $88,500 in bitcoin seized from illegal miner for power theft appeared first on Atlas21.

-

@ 7f6db517:a4931eda

2025-06-06 17:02:04

@ 7f6db517:a4931eda

2025-06-06 17:02:04

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ e2c72a5a:bfacb2ee

2025-06-06 14:52:38

@ e2c72a5a:bfacb2ee

2025-06-06 14:52:38The Trump-Musk Feud Just Crashed Bitcoin's Party (And Your Portfolio)

While everyone was celebrating Bitcoin's climb toward $105K, a political spat between two billionaires just wiped out $308 million in long positions overnight.

The intensifying feud between Donald Trump and Elon Musk has triggered Bitcoin's sharpest pullback in months, proving once again that crypto markets remain dangerously vulnerable to the whims of powerful personalities.

What's truly revealing isn't the price action but the market's reaction: Bitcoin ETFs flipped to $278 million in outflows while Ethereum ETFs maintained their 14-day inflow streak. This suggests institutional investors are beginning to view Ethereum as the more stable alternative during political volatility.

Meanwhile, Michael Saylor's Strategy quadrupled its stock offering from $250 million to $1 billion to buy more Bitcoin, and Japan's Metaplanet announced plans to acquire 91,000 BTC in the next 18 months. The smart money is buying the dip while retail investors panic.

Are you positioning yourself with the institutions who see this as an accumulation opportunity, or with the traders who just lost hundreds of millions on liquidated positions?

-

@ 9ca447d2:fbf5a36d

2025-06-06 17:01:29

@ 9ca447d2:fbf5a36d

2025-06-06 17:01:29Michael Saylor, executive chairman and co-founder of Strategy, wants to be on The Joe Rogan Experience to talk about Bitcoin. His recent post on X has the Bitcoin community and beyond stoked.

On May 31, Saylor replied to a Joe Rogan fan account that asked who they would like to see on the podcast. His response was simple but bold: “Hey @joerogan, let’s talk about Bitcoin.”

Saylor has been one of the most vocal Bitcoin supporters for a long time. He talks about bitcoin being a store of value and a hedge against inflation all the time.

Even when Bitcoin was a niche topic, Saylor was promoting it.

His company MicroStrategy (which was recently renamed to Strategy) has made headlines for investing billions in bitcoin. They currently hold around 580,250 BTC worth over $60 billion according to public trackers.

Saylor’s invitation to Joe Rogan was met with excitement from the Bitcoin community. Several well-known figures quickly chimed in.

Kook, a trader and analyst, said: “Saylor is going to Bitcoin pill Joe Rogan.”

Brandon MacDougal said he would watch The Joe Rogan Experience for the first time if Saylor was on the show, and The Bitcoin Therapist said the potential interview would “shatter the internet.”

It’s not just hardcore Bitcoiners who are excited. Many think the conversation could reach a much wider audience and push Bitcoin into the mainstream financial conversation.

Joe Rogan has one of the most popular podcasts in the world with millions of listeners. He’s discussed digital assets many times and has a special interest in Bitcoin.

In an October 2023 episode with OpenAI’s Sam Altman, Rogan said: “The real fascinating crypto is Bitcoin. That’s the one that I think has the most likely possibility of becoming a universal viable currency. It’s limited in the amount that it can be.”

Rogan previously had Bitcoin educator Andreas Antonopoulos on the show between 2014 and 2016 when bitcoin was under $1,000. Those early episodes introduced Bitcoin to many new listeners.

With Rogan’s history of being open to the topic and his massive audience, a new episode with Saylor could get a whole new group of people interested in Bitcoin.

The buzz around Saylor’s invite is a sign of a bigger trend — Bitcoin becoming a bigger part of the global conversation. Saylor has positioned himself as a thought leader in the space and often talks about how Bitcoin can change the way money and financial systems work.

He believes Bitcoin can create more transparent and efficient systems, reduce transaction costs and challenge traditional banking models. He also said we need smart regulation to protect consumers while encouraging innovation.

A conversation between Saylor and Rogan wouldn’t just be about Bitcoin’s price or investment strategies. It would likely go deeper into topics like inflation, digital privacy, government policy and the future of money.

So far Joe Rogan hasn’t publicly responded to Saylor’s invite, but fans are hoping he’ll say yes. Many think the timing is perfect. Bitcoin is hot again and more people than ever are trying to figure out what role it will play in the future of finance.

-

@ dfa02707:41ca50e3

2025-06-06 17:02:00

@ dfa02707:41ca50e3

2025-06-06 17:02:00

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ 8bad92c3:ca714aa5

2025-06-06 17:01:48

@ 8bad92c3:ca714aa5

2025-06-06 17:01:48Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.