-

@ 7f6db517:a4931eda

2025-05-31 21:01:32

@ 7f6db517:a4931eda

2025-05-31 21:01:32

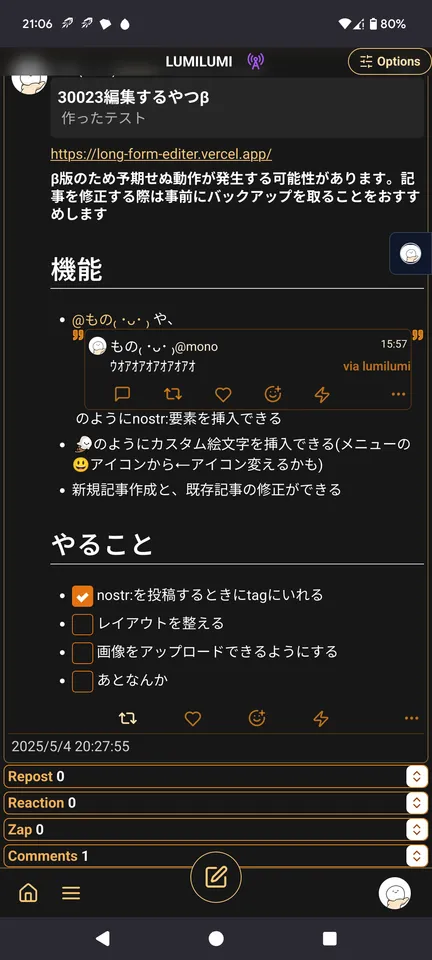

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 90c656ff:9383fd4e

2025-05-31 18:09:27

@ 90c656ff:9383fd4e

2025-05-31 18:09:27Since its emergence in 2009, Bitcoin has generated a wide range of success and failure stories. Some of these stories feature people who invested early and reaped the rewards of their foresight, while others highlight the ups and downs that define Bitcoin’s highly volatile market. Over the years, many of these cases have become iconic—serving as both inspiration and cautionary tales for newcomers.

Success stories

01 - Laszlo Hanyecz – The 10,000 Bitcoin Pizza

One of the most legendary stories in Bitcoin’s history involves Laszlo Hanyecz, a programmer from Florida. In 2010, he paid 10,000 bitcoins for two pizzas. At the time, the value was negligible, and the transaction went largely unnoticed. In retrospect, however, those 10,000 bitcoins would be worth hundreds of millions of dollars today.

Though Hanyecz didn’t become rich from this transaction, the story of the “10,000 bitcoin pizza” has become a symbol of Bitcoin’s extraordinary rise in value—and a reminder of how even small holdings in the early days could have been life-changing.

02 - Michael Saylor and MicroStrategy

Michael Saylor, CEO of MicroStrategy, made headlines in 2020 by transforming his company into the first major corporation to invest heavily in Bitcoin. Purchasing over 100,000 bitcoins as a treasury reserve, Saylor positioned Bitcoin as a strategic hedge against inflation and fiat currency devaluation.

Initially met with skepticism, Saylor’s decision turned out to be highly profitable as Bitcoin’s price soared. His bold move inspired other corporations and institutional investors to consider Bitcoin, and he remains one of the cryptocurrency’s most vocal advocates in the business world.

Failure Stories

01 - James Howells – The Lost 8,000 Bitcoins

James Howells, an IT professional from Wales, accidentally discarded a hard drive in 2013 containing the private keys to 8,000 mined bitcoins—worth only a few thousand pounds at the time. As Bitcoin's value skyrocketed, he attempted to recover the drive from a landfill, but was denied permission by local authorities.

This story has become a powerful lesson in crypto security and the consequences of lost private keys. Despite multiple campaigns to dig up the landfill, the bitcoins remain unrecovered.

02 - Mt. Gox Collapse – The Fall of a Giant

At its peak, Mt. Gox was the largest Bitcoin exchange in the world. In 2014, it collapsed after losing about 850,000 bitcoins—worth over $450 million at the time—due to hacking, internal security failures, and poor management.

The exchange’s failure devastated thousands of investors and highlighted the vulnerabilities in early crypto infrastructure. Though some funds were later recovered, the Mt. Gox disaster remains one of Bitcoin’s darkest moments and a turning point for the push toward greater security and transparency in the crypto industry.

- The impact of volatility and adoption

These stories reflect the unpredictable and high-risk nature of the Bitcoin market. The same volatility that has made millionaires has also led to substantial losses. While some view Bitcoin as a path to financial freedom and a hedge against inflation, others have suffered from poor planning, mismanagement, or unfortunate timing.

Bitcoin’s growing adoption, especially in emerging markets and among institutional players and shows its increasing legitimacy, as an alternative to traditional finance. However, exchange failures and lost fortunes underscore the need for robust infrastructure, personal responsibility, and long-term thinking.

In summary, success and failure are two sides of the same coin in the world of Bitcoin. From life-changing gains to heartbreaking losses, these stories illustrate the risks and rewards of participating in a young and volatile market. Whether as a cautionary tale or a source of inspiration, they emphasize the importance of education, security, and strategy for anyone engaging with this revolutionary form of money.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ dfa02707:41ca50e3

2025-05-31 22:01:42

@ dfa02707:41ca50e3

2025-05-31 22:01:42Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-05-31 22:01:40

@ dfa02707:41ca50e3

2025-05-31 22:01:40Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

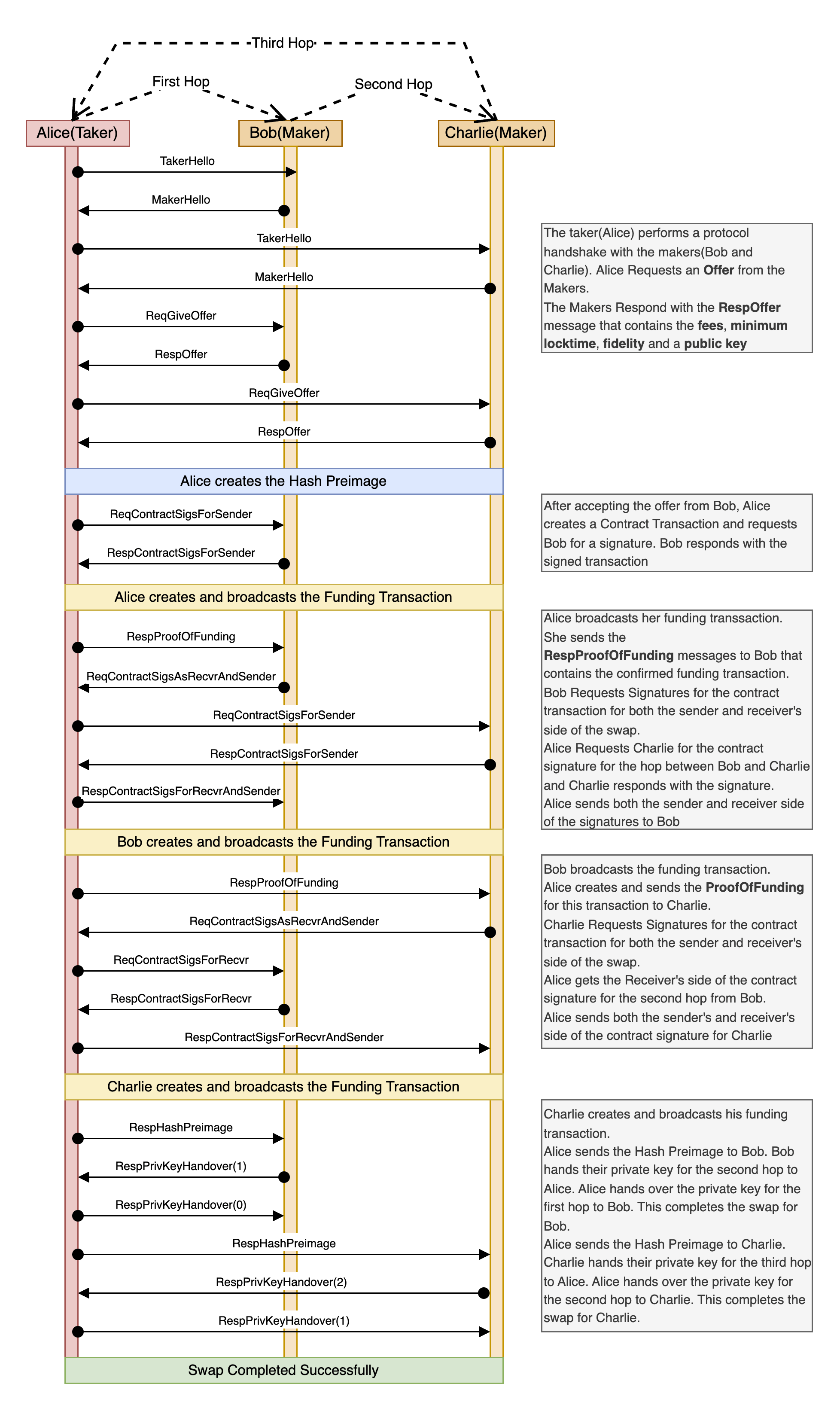

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-05-31 18:01:19

@ dfa02707:41ca50e3

2025-05-31 18:01:19Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-05-31 18:01:18

@ dfa02707:41ca50e3

2025-05-31 18:01:18Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ dfa02707:41ca50e3

2025-05-31 22:01:40

@ dfa02707:41ca50e3

2025-05-31 22:01:40Contribute to keep No Bullshit Bitcoin news going.

News

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable

-

@ dfa02707:41ca50e3

2025-05-31 18:01:18

@ dfa02707:41ca50e3

2025-05-31 18:01:18Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ dfa02707:41ca50e3

2025-05-31 18:01:17

@ dfa02707:41ca50e3

2025-05-31 18:01:17- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 8bad92c3:ca714aa5

2025-05-31 18:01:16

@ 8bad92c3:ca714aa5

2025-05-31 18:01:16Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.

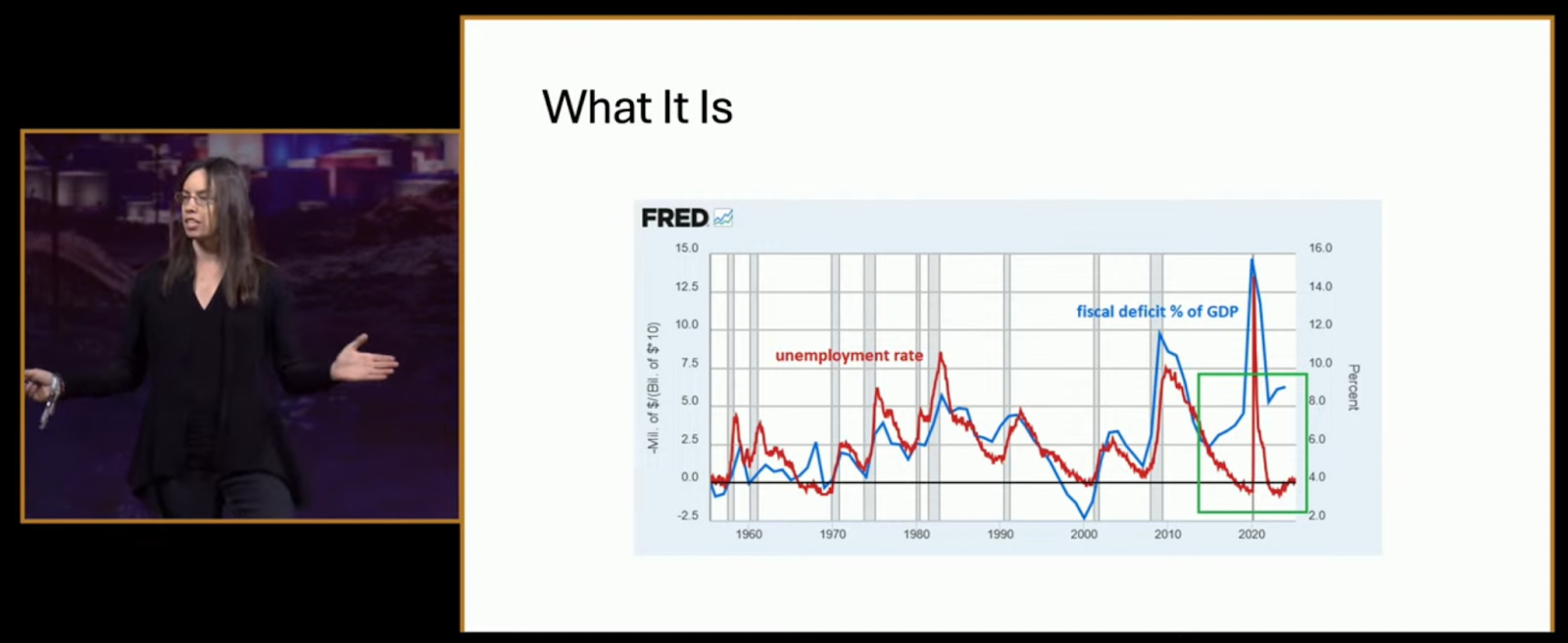

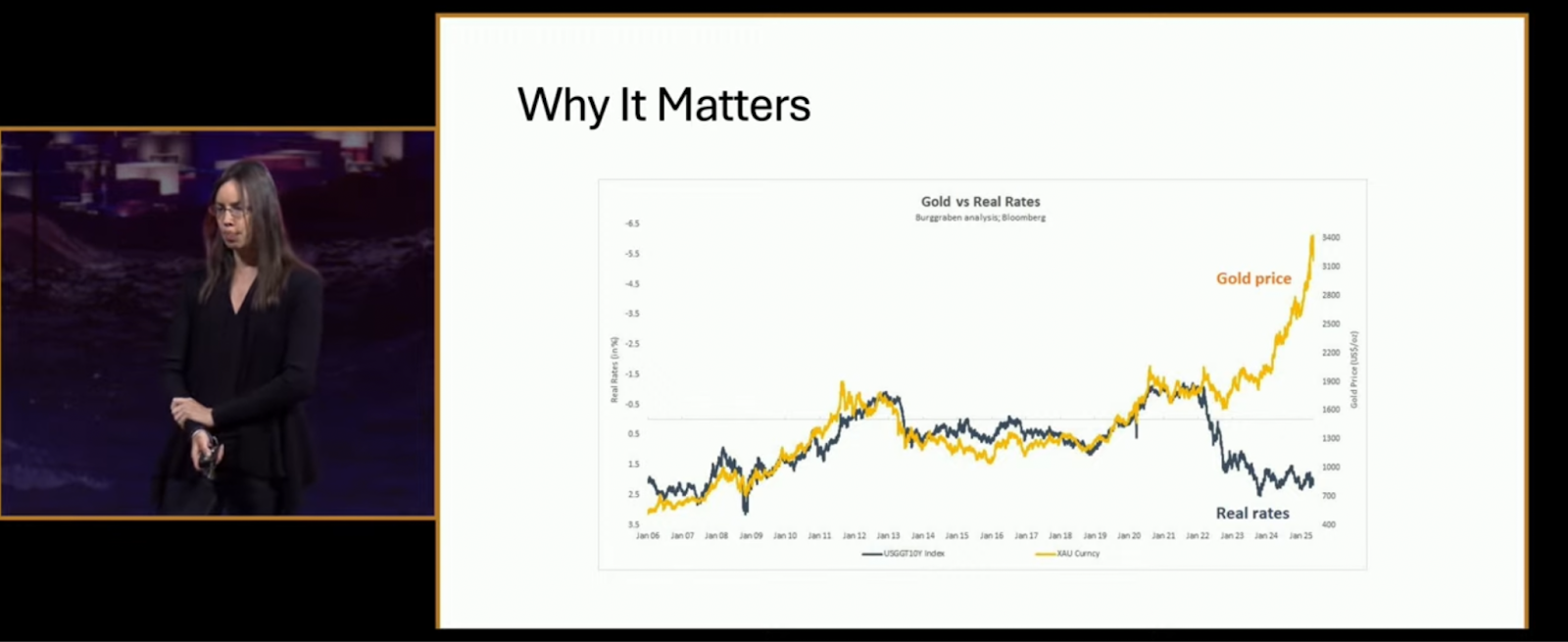

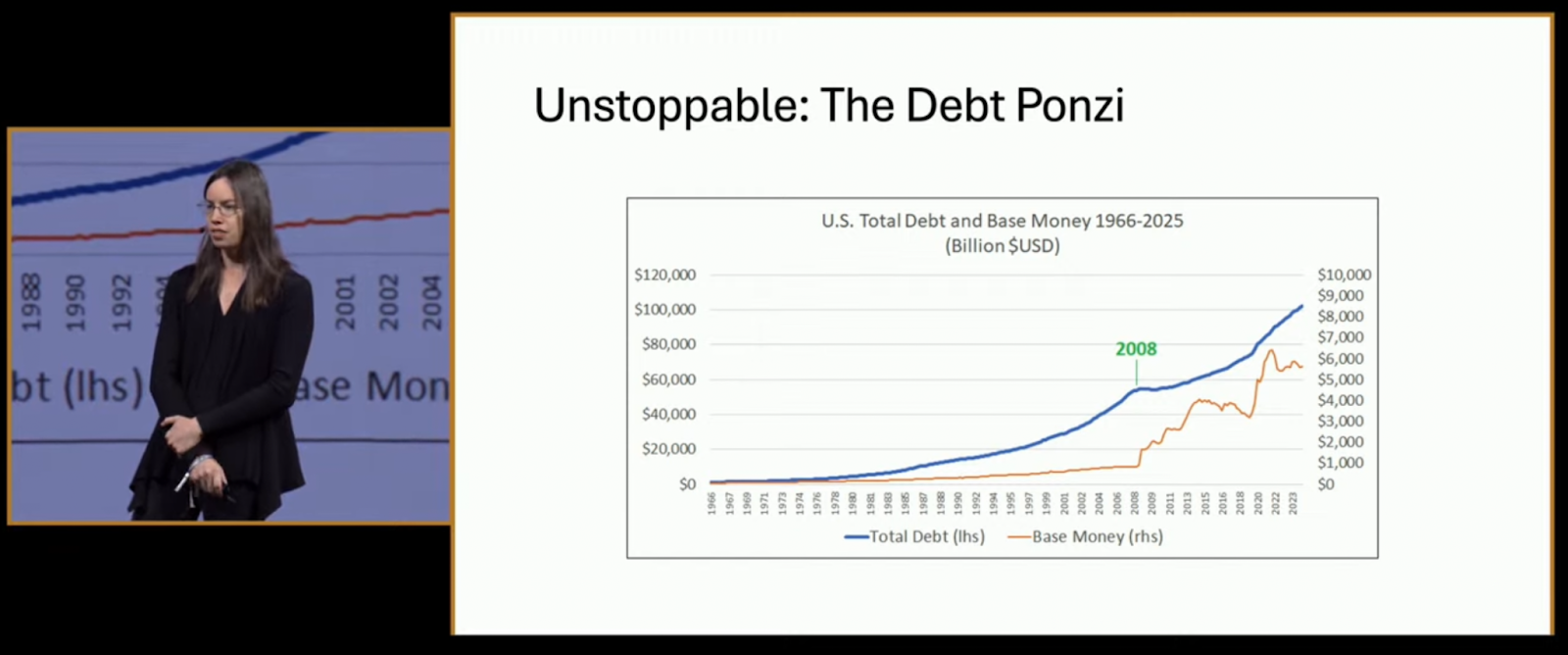

While all this was going on, there was something happening back in the United States that many people outside of fringe corners of FinTwit are not talking about, which is the fact that the 10-year and 30-year U.S. Treasury bond yields are back on the rise. Yesterday, they surpassed the levels of mid-April that caused a market panic and are hovering back around levels that have not been seen since right before Donald Trump's inauguration.

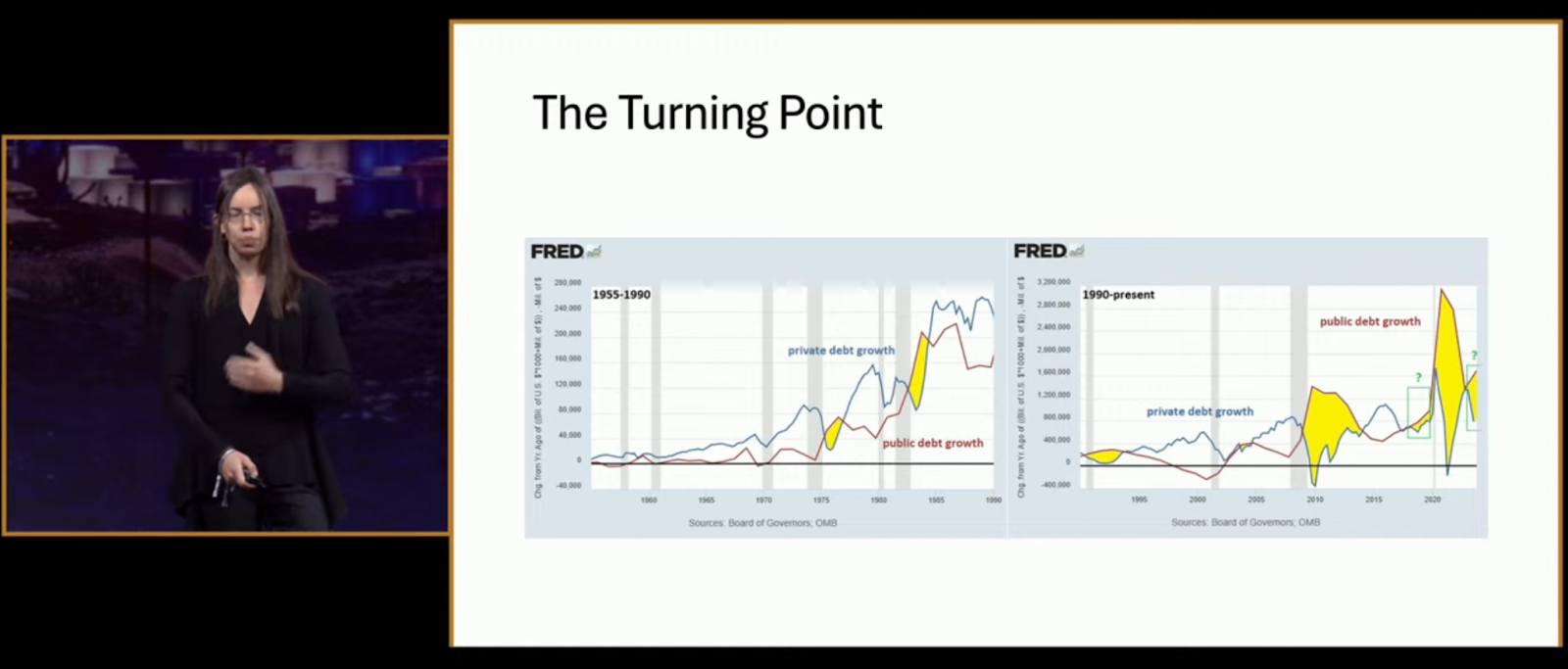

I imagine that there isn't as much of an uproar right now because I'm pretty confident the media freakouts we were experiencing in mid-April were driven by the fact that many large hedge funds found themselves off sides of large levered basis trades. I wouldn't be surprised if those funds have decreased their leverage in those trades and bond yields being back to mid-April levels is not affecting those funds as much as they were last month. But the point stands, the 10-year and 30-year yields are significantly elevated with the 30-year approaching 5%. Regardless of the deals that are currently being made in the Middle East, the Treasury has a big problem on its hands. It still has to roll over many trillions worth of debt over over the next few years and doing so at these rates is going to be massively detrimental to fiscal deficits over the next decade. The interest expense on the debt is set to explode in the coming years.

On that note, data from the first quarter of 2025 has been released by the government and despite all the posturing by the Trump administration around DOGE and how tariffs are going to be beneficial for the U.S. economy, deficits are continuing to explode while the interest expense on the debt has definitively surpassed our annual defense budget.

via Charlie Bilello

via Mohamed Al-Erian

To make matters worse, as things are deteriorating on the fiscal side of things, the U.S. consumer is getting crushed by credit. The 90-plus day delinquency rates for credit card and auto loans are screaming higher right now.

via TXMC

One has to wonder how long all this can continue without some sort of liquidity crunch. Even though equities markets have recovered from their post-Liberation Day month long bear market, I would not be surprised if what we're witnessing is a dead cat bounce that can only be continued if the money printers are turned back on. Something's got to give, both on the fiscal side and in the private markets where the Common Man is getting crushed because he's been forced to take on insane amounts of debt to stay afloat after years of elevated levels of inflation. Add on the fact that AI has reached a state of maturity that will enable companies to replace their current meat suit workers with an army of cheap, efficient and fast digital workers and it isn't hard to see that some sort of employment crisis could be on the horizon as well.

Now is not the time to get complacent. While I do believe that the deals that are currently being made in the Middle East are probably in the best interest of the United States as the world, again, moves toward a more multi-polar reality, we are facing problems that one cannot simply wish away. They will need to be confronted. And as we've seen throughout the 21st century, the problems are usually met head-on with a money printer.

I take no pleasure in saying this because it is a bit uncouth to be gleeful to benefit from the strife of others, but it is pretty clear to me that all signs are pointing to bitcoin benefiting massively from everything that is going on. The shift towards a more multi-polar world, the runaway debt situation here in the United States, the increasing deficits, the AI job replacements and the consumer credit crisis that is currently unfolding, All will need to be "solved" by turning on the money printers to levels they've never been pushed to before.

Weird times we're living in.

China's Manufacturing Dominance: Why It Matters for the U.S.

In my recent conversation with Lyn Alden, she highlighted how China has rapidly ascended the manufacturing value chain. As Lyn pointed out, China transformed from making "sneakers and plastic trinkets" to becoming the world's largest auto exporter in just four years. This dramatic shift represents more than economic success—it's a strategic power play. China now dominates solar panel production with greater market control than OPEC has over oil and maintains near-monopoly control of rare earth elements crucial for modern technology.

"China makes like 10 times more steel than the United States does... which is relevant in ship making. It's relevant in all sorts of stuff." - Lyn Alden

Perhaps most concerning, as Lyn emphasized, is China's financial leverage. They hold substantial U.S. assets that could be strategically sold to disrupt U.S. treasury market functioning. This combination of manufacturing dominance, resource control, and financial leverage gives China significant negotiating power in any trade disputes, making our attempts to reshoring manufacturing all the more challenging.

Check out the full podcast here for more on Triffin's dilemma, Bitcoin's role in monetary transition, and the energy requirements for rebuilding America's industrial base.

Headlines of the Day

Financial Times Under Fire Over MicroStrategy Bitcoin Coverage - via X

Trump in Qatar: Historic Boeing Deal Signed - via X

Get our new STACK SATS hat - via tftcmerch.io

Johnson Backs Stock Trading Ban; Passage Chances Slim - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Building things of value is satisfying.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !import

-

@ dfa02707:41ca50e3

2025-05-31 22:01:39

@ dfa02707:41ca50e3

2025-05-31 22:01:39Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ eb0157af:77ab6c55

2025-05-31 22:01:27

@ eb0157af:77ab6c55

2025-05-31 22:01:27At Bitcoin 2025, the company unveils the Blockstream App and a strategic roadmap to accelerate adoption.

During the Bitcoin 2025 conference held in Las Vegas, Blockstream announced several updates, including a new non-custodial application and a corporate strategy structured around three operational divisions.

Introducing the Blockstream App: a new Bitcoin wallet that grows with you.

From first sats to advanced custody, it brings self-sovereignty into reach no matter where you start. Available now on Android, coming soon to iOS.

pic.twitter.com/UBiNHKh8bO

pic.twitter.com/UBiNHKh8bO— Blockstream (@Blockstream) May 29, 2025

The new Blockstream App allows users to purchase Bitcoin directly and store it in their own wallet, eliminating the need to rely on external custodians for fund management. This technological solution is built on the infrastructure of the Blockstream Green wallet. The app supports Bitcoin, Lightning, and Liquid.

The app’s design has been conceived to meet the needs of a diverse audience, the company stated. Its interface is accessible for beginners while retaining advanced functionalities for more experienced users.

It also remains compatible with advanced security features such as hardware wallet signing and air-gapped transactions via Blockstream Jade.

Corporate strategy: consumer, enterprise, and BAM

During the event, Blockstream revealed a strategic restructuring organized into three distinct operational units. This new framework aims to strengthen the company’s position within the Bitcoin economy through tailored approaches for specific markets.

The Consumer division will focus on developing products for retail users, while the Enterprise division will manage relationships with corporate clients. Blockstream Asset Management (BAM) will serve as the company’s institutional arm, specializing in Bitcoin investment products for institutional customers.

Adam Back, CEO of Blockstream, commented:

“The past year has shown clearly that Bitcoin no longer sits on the margins of the global financial system—it is rapidly becoming the foundation. Our vision is simple: the future of finance runs on Bitcoin.”

The post Blockstream launches a non-custodial app to buy Bitcoin appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-05-31 18:00:37

@ b1ddb4d7:471244e7

2025-05-31 18:00:37Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ eb0157af:77ab6c55

2025-05-31 22:01:25

@ eb0157af:77ab6c55

2025-05-31 22:01:25The company unveils a service to generate returns from the Lightning Network while maintaining full control over one’s bitcoin.

Amboss, a company dedicated to developing the Lightning Network ecosystem, has announced the launch of Rails, a platform that enables users to earn yields on their bitcoin while retaining complete custody.

Rails stands out as the first fully self-custodial yield-generation service built specifically for the Lightning Network. Users can act as Liquidity Providers (LPs) while maintaining full control over their funds, contributing at the same time to improving the performance and scalability of the Lightning Network.

The service leverages Amboss’ AI infrastructure to optimize the speed, reliability, and capacity of Lightning transactions.

How it works

Rails’ yield-generation mechanism is based on two main activities:

- Payment routing: users earn fees by facilitating payment routing through the Lightning Network;

- Liquidity leasing: by providing liquidity to other participants in the LN network.

Although returns are not guaranteed, the performance demonstrated by companies like Block is notable. During the Bitcoin 2025 conference in Las Vegas, Miles Suter of Block revealed that their routing node is generating a 9.7% APR on deposited bitcoin while maintaining control over private keys.

Strategic partnerships

Amboss has entered into partnerships with CoinCorner and Flux to launch Rails. CoinCorner has integrated the service into its exchange and payment platforms, while Flux aims to expand the Lightning Network’s role in global payments.

David Boylan, CFO of CoinCorner, stated:

“Rails offers a practical way for businesses like ours to participate in the Lightning Network’s growth. We’ve been using the Lightning Network for years, and Rails provides a structured approach to engaging with its economy, particularly through liquidity leasing and payment routing.”

Two complementary solutions

Rails offers two distinct services:

- Rails LP: designed for businesses with bitcoin treasuries, custodians, and high-net-worth individuals, with a minimum commitment of 1 BTC for one year;

- Liquidity subscriptions: aimed at businesses accepting bitcoin payments, with fees starting from 0.5%.

Jesse Shrader, co-founder and CEO of Amboss, commented:

“Rails is a transformative force for the Lightning Network. It’s not just about yield — it’s about enabling businesses to strengthen the network while earning on their bitcoins. This is a critical step in bitcoin’s evolution as a global medium of exchange.”

The post Amboss launches Rails: a service to earn yields from the Lightning Network appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-05-31 18:00:36

@ b1ddb4d7:471244e7

2025-05-31 18:00:36Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ b1ddb4d7:471244e7

2025-05-31 18:00:32

@ b1ddb4d7:471244e7

2025-05-31 18:00:32When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ c2865f41:eaff678a

2025-05-31 20:09:44

@ c2865f41:eaff678a

2025-05-31 20:09:44Unwilling to investigate. No interpellation of neighbors, witnesses, experts. No report emitted commenting on the petition, but just ignoring to answer. As such O.S.R. calls upon the justice system to address the wrongs. The analog drawing of geometer at the time of entree in the register of the O.S.R property

See the map attached, it is annotated and self-explaining, could not be clearer. O.S.R challenges the court to convoke when still alive), and any explanation he can give as to his drawing, now ignored by the same instance(Plav Cadastre) that mandated him in the first place. The example record

See attachment: the example record is out of a Swiss register, note the precise identity and details, address etc. of the owner of said parcel. That is what the constitution of Montenegro subscribes to: to have similar practices respected. The trail into the forest See attachment, another supporting map, as an example of the practices that are pertinent to justify an immediate injunction by the court, of all activities on the contested parcels.

-

@ 9ca447d2:fbf5a36d

2025-05-31 22:01:20

@ 9ca447d2:fbf5a36d

2025-05-31 22:01:20Adam O’Brien, Founder and CEO of Bitcoin Well, discovered Bitcoin in 2013 during its early days as what he describes as “hilarious internet money.”

Today, he leads a publicly traded Canadian company that’s redefining how people interact with this magic internet money, all while navigating a financial system that has personally debanked him and even his uninvolved loved ones.

“I had a terrible experience trying to buy bitcoin in 2013,” O’Brien explains. “Now of course today there are platforms like Bitcoin Well and many others that allow you to buy bitcoin with ease online, but in 2013 that wasn’t the case.”

This frustrating experience sparked the entrepreneurial question that would shape his future: “There must be a better way.”

With a background in restaurant management and customer service, O’Brien started small, meeting people locally in Edmonton, Canada to sell them bitcoin.

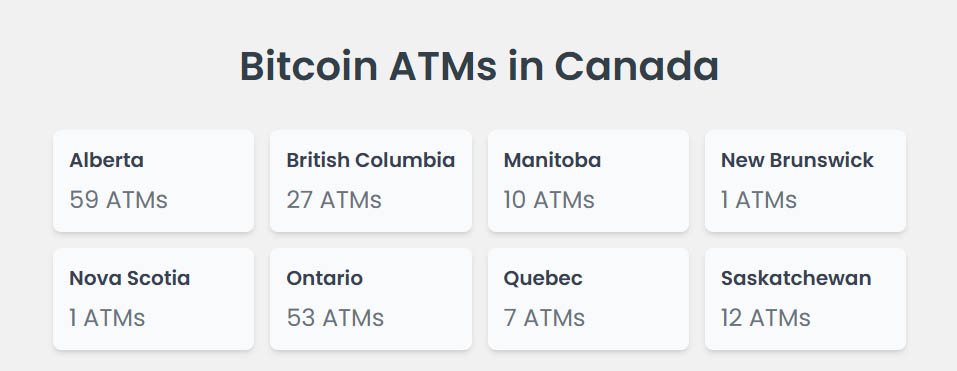

Soon after, he purchased and deployed Alberta’s first bitcoin ATM. The business grew organically, with a second machine following, then a third. Before long, Bitcoin Well had become one of Canada’s largest bitcoin ATM operators.

Today, Bitcoin Well operates approximately 160 bitcoin ATMs across Canada. While they’re no longer deploying new machines, these ATMs provide a crucial service that O’Brien is particularly proud of:

“In Canada, you can actually buy bitcoin up to $1,000 without giving your identity to Bitcoin Well. We’re the only platform in the country that is able to offer that service, which is fully legal, fully above board.”

Bitcoin Well has a fleet of over 170 bitcoin ATMs across Canada

The Pivot to Freedom

In 2020, O’Brien’s vision for the company evolved. What began as a mission for Bitcoin accessibility transformed into something deeper: a quest for financial freedom.

“I’m debanked across Canada. I don’t have my bank, even my wife has lost her bank accounts because of my work,” O’Brien revealed. “She’s not involved with the business at all. She’s a stay-at-home mother to our four kids, and she’s unbanked from the majority of the banks in Canada.”

This personal experience crystallized a troubling reality: “It became very clear to me that my money in the banking system was always going to be subject to how much I play by the rules.”

For someone self-described as “freedom-focused” and “freedom-minded,” this realization prompted a strategic shift. Bitcoin Well began developing its online platform, the Bitcoin portal, allowing users to buy, sell, and actually use bitcoin to replace traditional banking functions. O’Brien explains:

“The goal here is that we can be a conduit between the legacy financial system you know, and how you pay your bills, your rent, your power, credit card and phone bills and all that stuff without having to have money in what I would call a captured fiat account.”

He summarizes the company’s North Star simply: “Allow people to replace their bank with bitcoin in self-custody.”

Living the Mission

O’Brien doesn’t just preach Bitcoin independence, he lives it. Debanked across Canada, he relies on Bitcoin Well’s services for his daily financial needs.

“I’ve got a normal American Express, but I pay that off with Bitcoin at the end of the month,” he shares. “In Canada, we’ve got the equivalent of Venmo, it’s called Interac e-Transfer. I can send an Interac e-Transfer to anyone in the country from bitcoin in self-custody.”

This allows him to navigate everyday situations where merchants don’t accept bitcoin directly.

“It’s spring right now. I’ve got a little property. The guy comes and picks up our rakes and trims the trees and all this stuff, and I pay him. He doesn’t want to accept bitcoin, but I’m able to pay in bitcoin, and he gets the money that he wants.”

In the U.S., Bitcoin Well customers can have their paychecks deposited with a designated portion automatically converted to sats and sent directly to self-custody, allowing clients to stack sats sovereignly without having to think much about it.

With Bitcoin Well you can set up automatic DCA

Building the Right Team

The journey hasn’t been without challenges. O’Brien candidly describes how rapid growth in 2021 led to hiring missteps.

“We scaled so fast I kind of lost control of hiring practice and culture, and we ended up with people that I felt like we had to almost convince of the mission,” he admits.

“Some of them weren’t convinced…they were just there because of the job, or they didn’t really understand the need for the freedom that I speak about every single day.”

After scaling back from that hiring spree, the company refocused on building a team aligned with its core values, emphasizing “hiring Bitcoiners really.”

The result has been transformative: “It’s so much fun having a team that is mission-focused and aligned on our mission to enable independence. Having everyone aligned and kind of running towards that mission is pretty special.”

This alignment creates a powerful filter for decision-making: “When we have a decision to make, it’s like, well, which one enables more independence? And usually there’s a pretty obvious answer. So we’re able to make very fast decisions that help the business and help the mission.”

Raising the Next Generation

Beyond building Bitcoin Well, O’Brien and his wife are raising four children with intention. The family is transitioning to homeschooling next year, allowing them to travel to Bitcoin conferences together while teaching their children to question everything.

“If you don’t indoctrinate your kids, the state will do it for you,” O’Brien states firmly. It’s a fair point, as indoctrination usually comes with a negative connotation, but it should not, since everyone gets indoctrinated with something.

It’s up to parents to decide what their kids are going to be indoctrinated with, and as parents, the O’Briens have chosen to actively shape their children’s worldview rather than defaulting to institutional influences.

Their approach combines Bitcoin principles with biblical values, with a heavy emphasis on lowering time preference. Something O’Brien notes is “10, 20, 30, 50 times more important” with children, though admittedly “way harder.”

“I think Bitcoiners more than anyone understand the need for generational thinking,” he observes.

“I’m so bullish on the amount of Bitcoiners that have more kids or that want to have more kids and that are actually excited to have kids compared to some of my fiat friends that are like, ‘Oh, it’s too expensive and I want to party.’ It’s like, man, you’re just missing the point.”

A Call to Support Bitcoin-Only Businesses

One of O’Brien’s most passionate messages is a call to action for fellow Bitcoiners: support businesses that align with your values.

“I want to call people to support businesses that are actually making steps towards the change they want to see in the world,” he urges. “If I hear one more Bitcoin maxi tell me that they’re using Kraken or Coinbase because it’s cheaper — why do you support the casinos?”

He expresses concern about the future if Bitcoin-only companies struggle to survive: “It would be very sad if all the Bitcoin-only and non-custodial businesses went out of business. That would make it very hard for me to feel comfortable onboarding my no-coiner friends.”

His message to Bitcoiners is clear: “A call out to all my fellow Bitcoiners to support and use the platform that they want to see their kids use.”

Bitcoin Well (TSX.V: BTCW, OTCQB: BCNWF) continues to build infrastructure for those who want to use Bitcoin daily while maintaining self-custody. For O’Brien, the mission is simple but powerful: enable independence and give people the freedom to control their own financial destiny.

-

@ 2e8970de:63345c7a

2025-05-31 19:51:28

@ 2e8970de:63345c7a

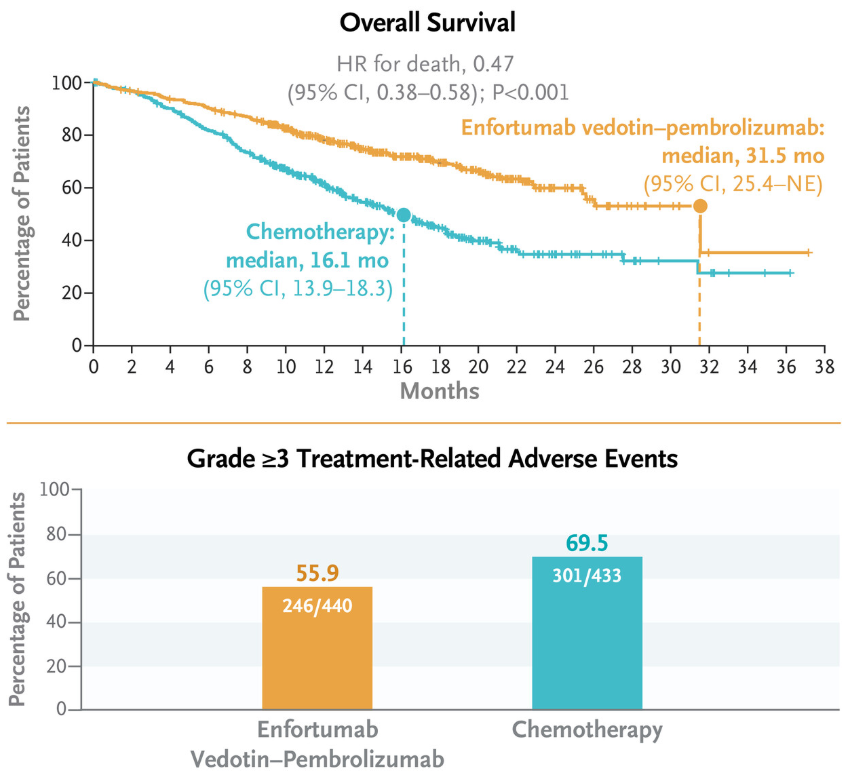

2025-05-31 19:51:28Enfortumab Vedotin and Pembrolizumab doubled survival rates, with fewer serious side effects in advanced bladder cancer.

https://www.nejm.org/doi/full/10.1056/NEJMoa2312117

https://stacker.news/items/993799

-

@ dfa02707:41ca50e3

2025-05-31 14:01:43

@ dfa02707:41ca50e3

2025-05-31 14:01:43Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.