-

@ 57d1a264:69f1fee1

2025-05-20 06:15:51

@ 57d1a264:69f1fee1

2025-05-20 06:15:51Deliberate (?) trade-offs we make for the sake of output speed.

... By sacrificing depth in my learning, I can produce substantially more work. I’m unsure if I’m at the correct balance between output quantity and depth of learning. This uncertainty is mainly fueled by a sense of urgency due to rapidly improving AI models. I don’t have time to learn everything deeply. I love learning, but given current trends, I want to maximize immediate output. I’m sacrificing some learning in classes for more time doing outside work. From a teacher’s perspective, this is obviously bad, but from my subjective standpoint, it’s unclear.

Finding the balance between learning and productivity. By trade, one cannot be productive in specific areas without first acquire the knowledge to define the processes needed to deliver. Designing the process often come on a try and fail dynamic that force us to learn from previous mistakes.

I found this little journal story fun but also little sad. Vincent's realization, one of us trading his learnings to be more productive, asking what is productivity without quality assurance?

Inevitably, parts of my brain will degenerate and fade away, so I need to consciously decide what I want to preserve or my entire brain will be gone. What skills am I NOT okay with offloading? What do I want to do myself?

Read Vincent's journal https://vvvincent.me/llms-are-making-me-dumber/

https://stacker.news/items/984361

-

@ 472f440f:5669301e

2025-05-20 13:01:09

@ 472f440f:5669301e

2025-05-20 13:01:09Marty's Bent

via me

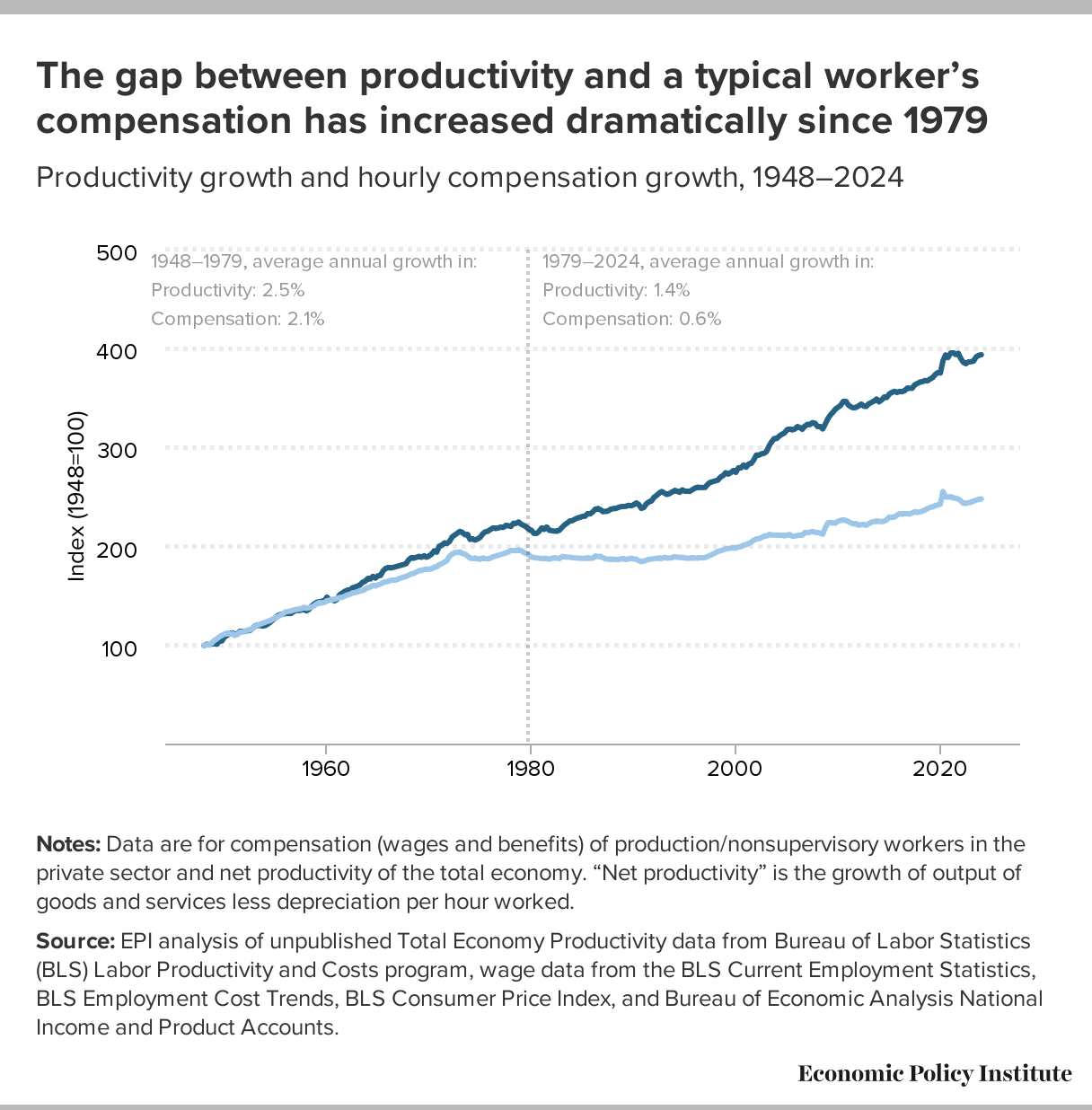

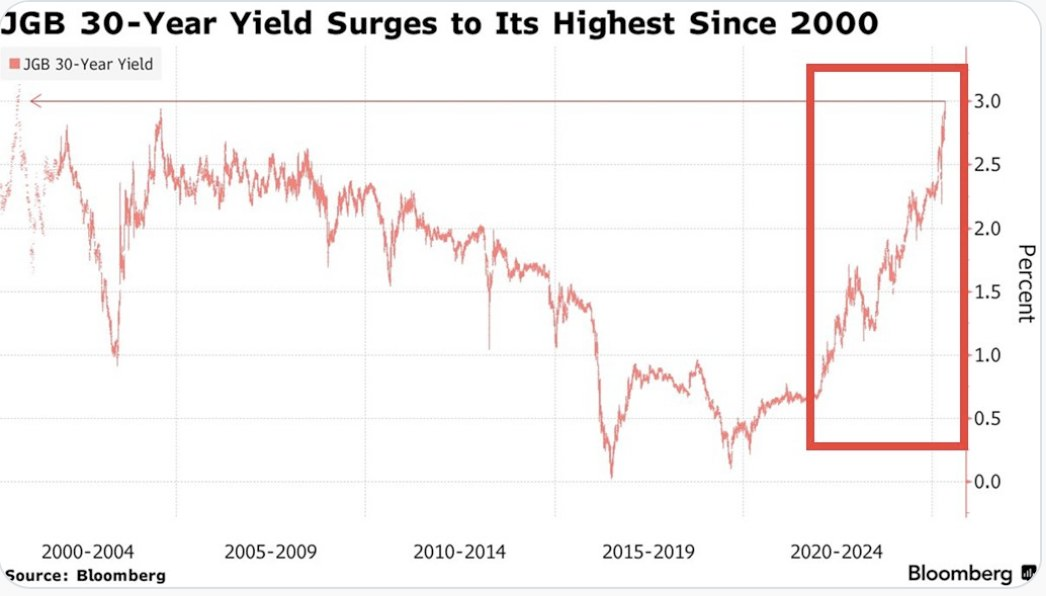

Don't sleep on what's happening in Japan right now. We've been covering the country and the fact that they've lost control of their yield curve since late last year. After many years of making it a top priority from a monetary policy perspective, last year the Bank of Japan decided to give up on yield curve control in an attempt to reel inflation. This has sent yields for the 30-year and 40-year Japanese government bonds to levels not seen since the early 2000s in the case of the 30-year and levels never before seen for the 40-year, which was launched in 2007. With a debt to GDP ratio that has surpassed 250% and a population that is aging out with an insufficient amount of births to replace the aging workforce, it's hard to see how Japan can get out of this conundrum without some sort of economic collapse.

This puts the United States in a tough position considering the fact that Japan is one of the largest holders of U.S. Treasury bonds with more than 1,135 sats | $1.20 trillion in exposure. If things get too out of control in Japan and the yield curve continues to drift higher and inflation continues to creep higher Japan can find itself in a situation where it's a forced seller of US Treasuries as they attempt to strengthen the yen. Another aspect to consider is the fact that investors may see the higher yields on Japanese government bonds and decide to purchase them instead of US Treasuries. This is something to keep an eye on in the weeks to come. Particularly if higher rates drive a higher cost of capital, which leads to even more inflation. As producers are forced to increase their prices to ensure that they can manage their debt repayments.

It's never a good sign when the Japanese Prime Minister is coming out to proclaim that his country's financial situation is worse than Greece's, which has been a laughing stock of Europe for the better part of three decades. Japan is a very proud nation, and the fact that its Prime Minister made a statement like this should not be underappreciated.

As we noted last week, the 10-year and 30-year U.S. Treasury bonds are drifting higher as well. Earlier today, the 30-year bond yield surpassed 5%, which has been a psychological level that many have been pointed to as a critical tipping point. When you take a step back and look around the world it seems pretty clear that bond markets are sending a very strong signal. And that signal is that something is not well in the back end of the financial system.

This is even made clear when you look at the private sector, particularly at consumer debt. In late March, we warned of the growing trend of buy now, pay later schemes drifting down market as major credit card companies released charge-off data which showed charge-off rates reaching levels not seen since the 2008 great financial crisis. At the time, we could only surmise that Klarna was experiencing similar charge-off rates on the bigger-ticket items they financed and started doing deals with companies like DoorDash to finance burrito deliveries in an attempt to move down market to finance smaller ticket items with a higher potential of getting paid back. It seems like that inclination was correct as Klarna released data earlier today showing more losses on their book as consumers find it extremely hard to pay back their debts.

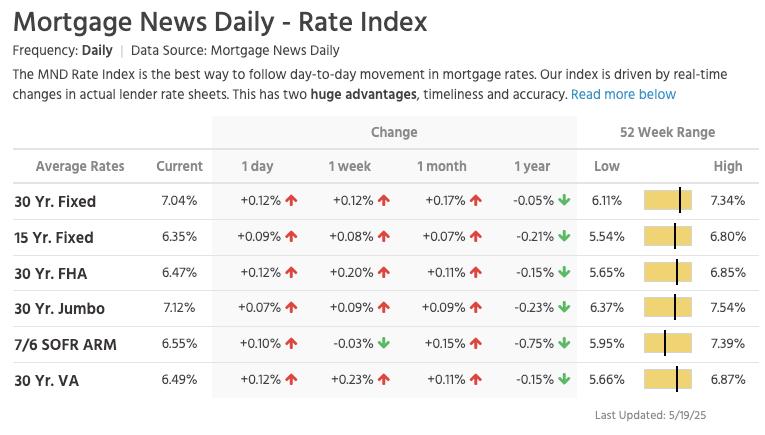

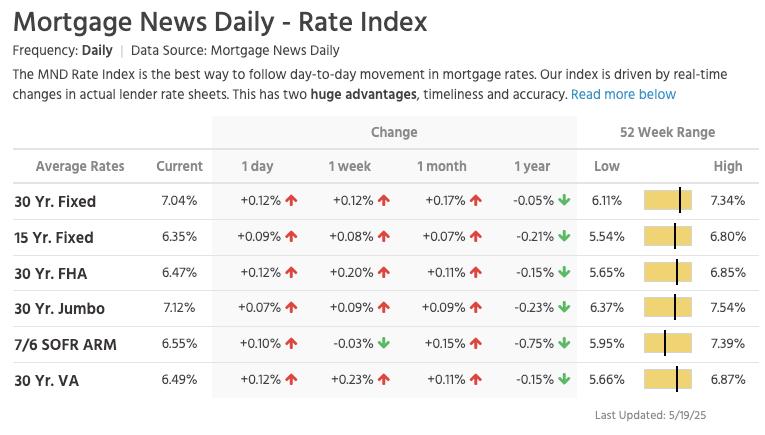

via NewsWire

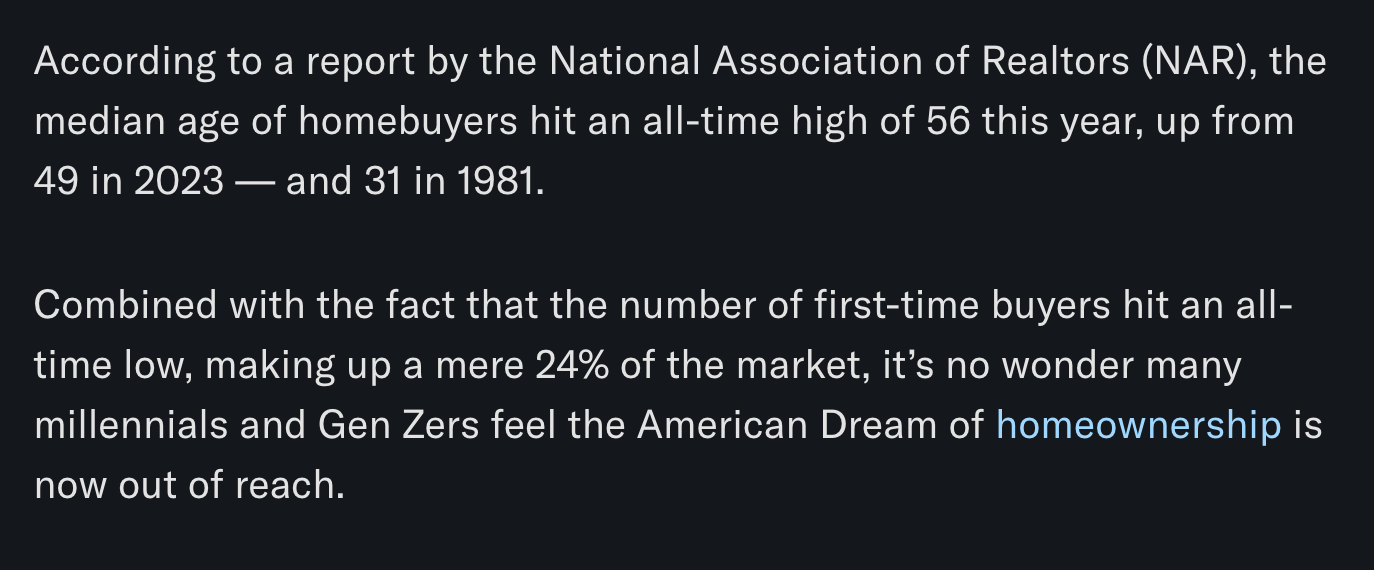

This news hit the markets on the same day as the average rate of the 30-year mortgage in the United States rose to 7.04%. I'm not sure if you've checked lately, but real estate prices are still relatively elevated outside of a few big cities who expanded supply significantly during the COVID era as people flooded out of blue states towards red states. It's hard to imagine that many people can afford a house based off of sticker price alone, but with a 7% 30-year mortgage rate it's becoming clear that the ability of the Common Man to buy a house is simply becoming impossible.

via Lance Lambert

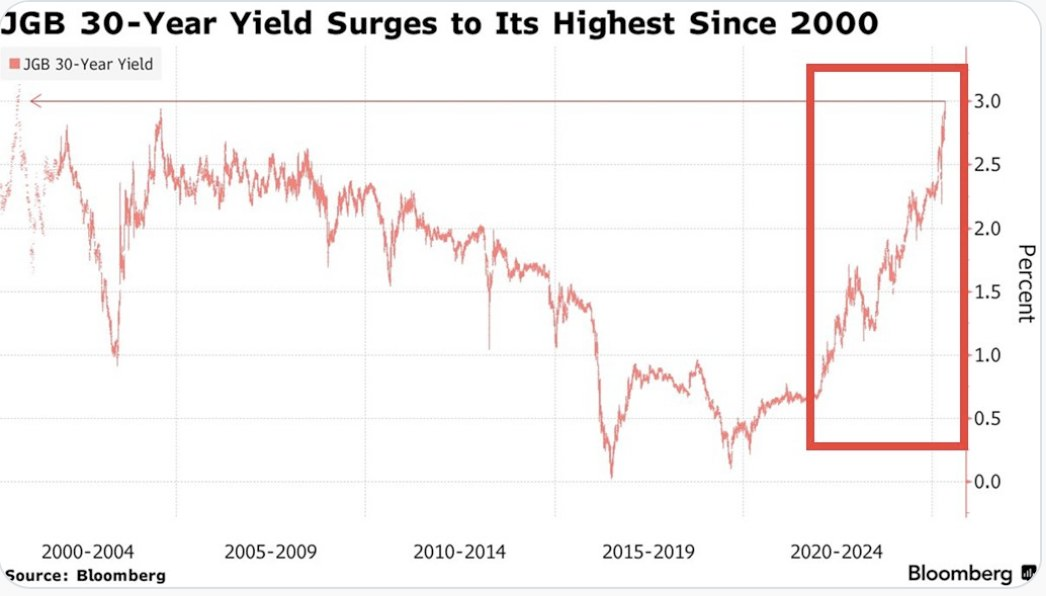

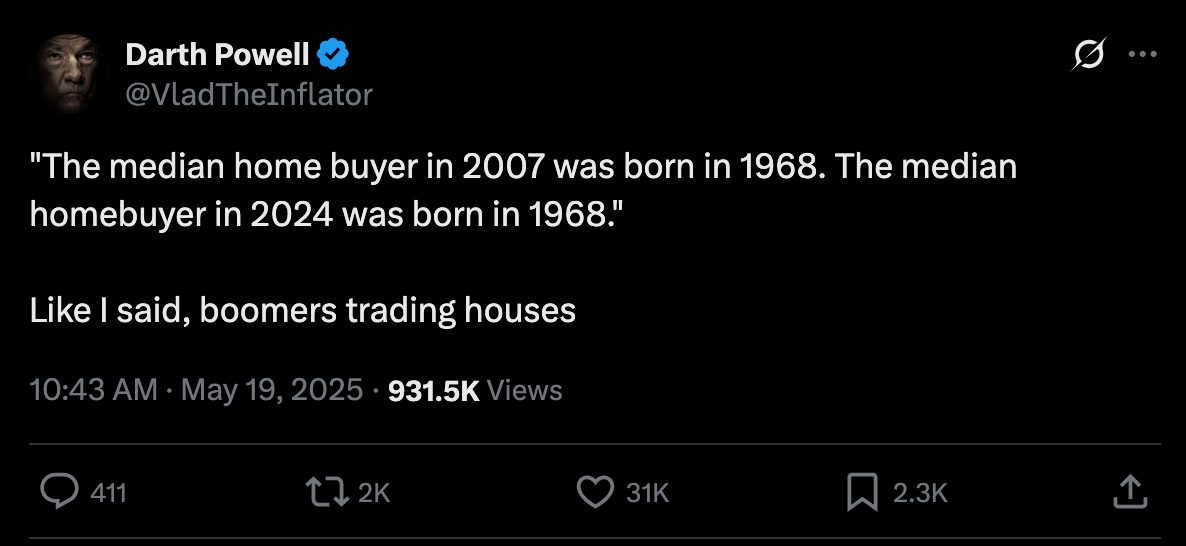

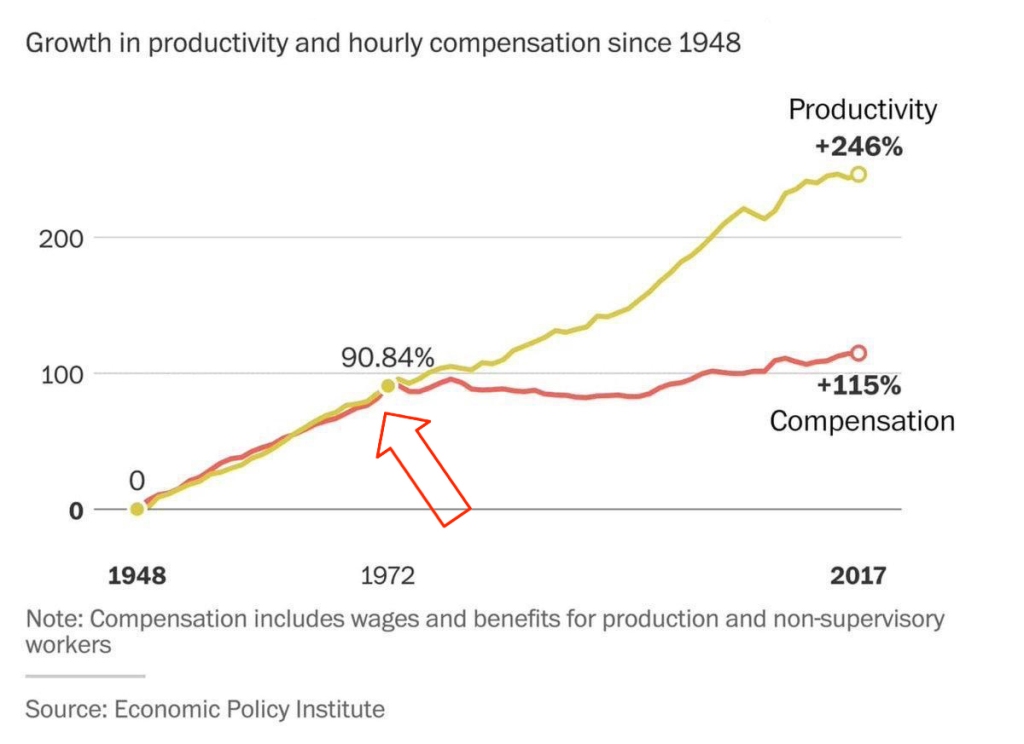

The mortgage rate data is not the only thing you need to look at to understand that it's becoming impossible for the Common Man of working age to buy a house. New data has recently been released that highlights That the median home buyer in 2007 was born in 1968, and the median home buyer in 2024 was born in 1968. Truly wild when you think of it. As our friend Darth Powell cheekily highlights below, we find ourselves in a situation where boomers are simply trading houses and the younger generations are becoming indentured slaves. Forever destined to rent because of the complete inability to afford to buy a house.

via Darth Powell

via Yahoo Finance

Meanwhile, Bitcoin re-approached all-time highs late this evening and looks primed for another breakout to the upside. This makes sense if you're paying attention. The high-velocity trash economy running on an obscene amount of debt in both the public and private sectors seems to be breaking at the seams. All the alarm bells are signaling that another big print is coming. And if you hope to preserve your purchasing power or, ideally, increase it as the big print approaches, the only thing that makes sense is to funnel your money into the hardest asset in the world, which is Bitcoin.

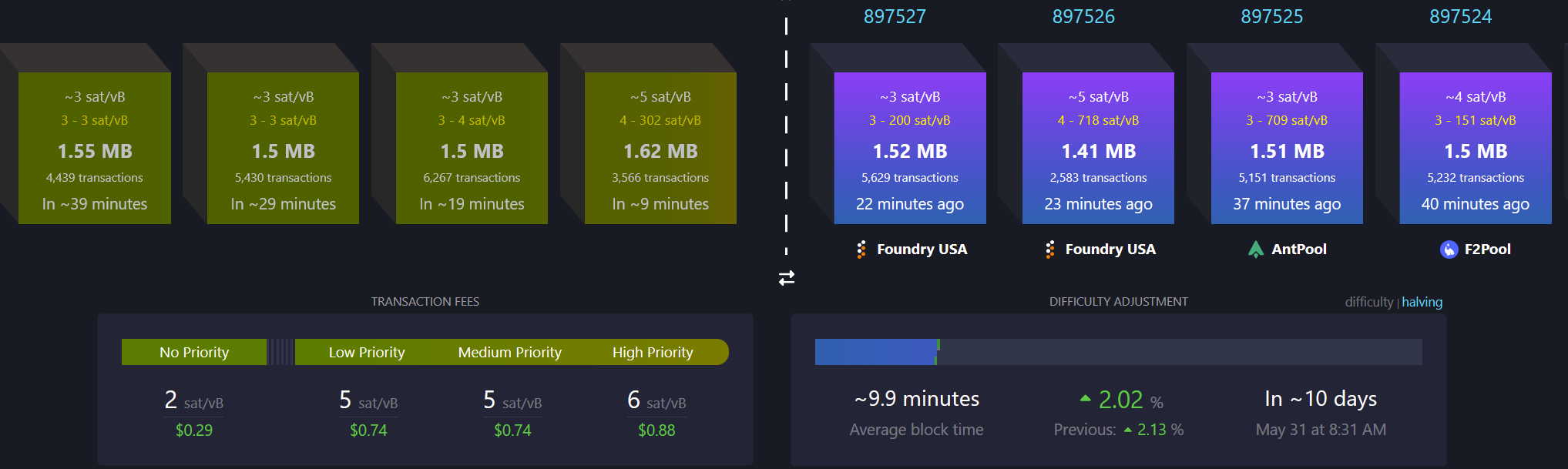

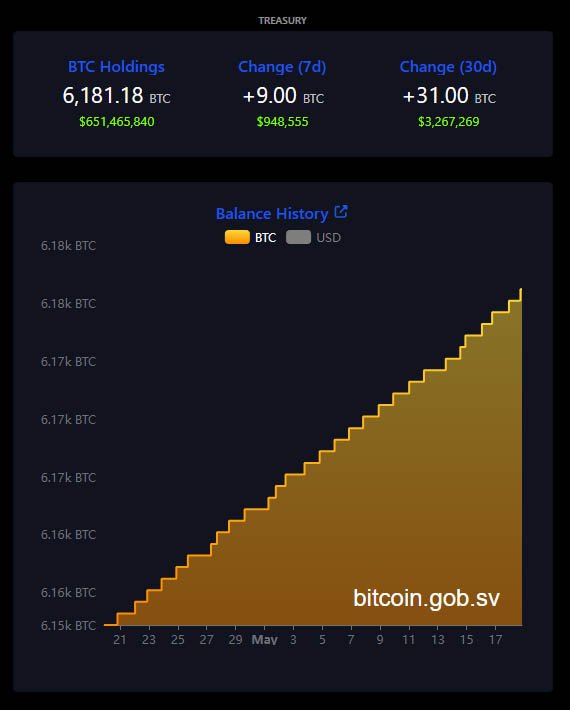

via Bitbo

Buckle up, freaks. It's gonna be a bumpy ride. Stay humble, Stack Sats.

Trump's Middle East Peace Strategy: Redefining U.S. Foreign Policy

In his recent Middle East tour, President Trump signaled what our guest Dr. Anas Alhajji calls "a major change in US policy." Trump explicitly rejected the nation-building strategies of his predecessors, contrasting the devastation in Afghanistan and Iraq with the prosperity of countries like Saudi Arabia and UAE. This marks a profound shift from both Republican and Democratic foreign policy orthodoxy. As Alhajji noted, Trump's willingness to meet with Syrian President Assad follows a historical pattern where former adversaries eventually become diplomatic partners.

"This is really one of the most important shifts in US foreign policy to say, look, sorry, we destroyed those countries because we tried to rebuild them and it was a big mistake." - Dr. Anas Alhajji

The administration's new approach emphasizes negotiation over intervention. Rather than military solutions, Trump is engaging with groups previously considered off-limits, including the Houthis, Hamas, and Iran. This pragmatic stance prioritizes economic cooperation and regional stability over ideological confrontation. The focus on trade deals and investment rather than regime change represents a fundamental reimagining of America's role in the Middle East.

Check out the full podcast here for more on the Iran nuclear situation, energy market predictions, and why AI development could create power grid challenges. Only on TFTC Studio.

Headlines of the Day

Bitcoin Soars to 100,217 sats | $106.00K While Bonds Lose 40% Since 2020 - via X

US Senate Advances Stablecoin Bill As America Embraces Bitcoin - via X

Get our new STACK SATS hat - via tftcmerch.io

Texas House Debates Bill For State-Run Bitcoin Reserve - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code “TFTC20” during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Don't let the noise consume you. Focus on making your life 1% better every day.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 57d1a264:69f1fee1

2025-05-20 06:02:26

@ 57d1a264:69f1fee1

2025-05-20 06:02:26Digital Psychology ↗Wall of impact website showcase a collection of success metrics and micro case studies to create a clear, impactful visual of your brand's achievements. It also displays a Wall of love with an abundance of testimonials in one place, letting the sheer volume highlight your brand's popularity and customer satisfaction.

And like these, many others collections like Testimonial mashup that combine multiple testimonials into a fast-paced, engaging reel that highlights key moments of impact in an attention-grabbing format.

Awards and certifications of websites highlighting third-party ratings and verification to signal trust and quality through industry-recognized achievements and standards.

View them all at https://socialproofexamples.com/

https://stacker.news/items/984357

-

@ 88cc134b:5ae99079

2025-05-20 12:22:03

@ 88cc134b:5ae99079

2025-05-20 12:22:03content

nostr:nevent1qvzqqqqqqypzpkygz22lv3pdey6gr7ygmk67wjh24hdvj3t797mm6z0x3ax4erdhqqsdxy48qm3tces0tu90shwltcg20zsprejkahklwftpzyhytcf32tc9sm779

-

@ a296b972:e5a7a2e8

2025-05-20 12:22:00

@ a296b972:e5a7a2e8

2025-05-20 12:22:00Die Natur strebt nach einem Gleichgewicht durch Ausgleich von nicht zueinander passenden Verhältnissen. Die Gesellschaft ist ein sozialer Organismus, der ebenso nach Ausgleich und einer Stimmigkeit der Verhältnisse strebt. Das sind Naturgesetze, die keine Regierung auf Dauer imstande ist, außer Kraft zu setzen.

Weder oppositionelle Kräfte, noch Kräfte innerhalb des Souveräns haben die Absicht, die Demokratie abzuschaffen. Es geht vielmehr darum, sie wieder in der Form herzustellen, in der sie ihren Namen auch verdient. Dazu gehört, dass alle Macht vom Volke ausgeht, was derzeit nicht der Fall ist.

Ein durch den Staat vorgegebenes Bildungssystem hat Menschen vor allem zu gefügigen Rädchen im Wirtschaftsgetriebe und nicht zu alles kritisch hinterfragenden Bürgern erzogen, die ständig der Regierung auf die Finger schauen.

Wenn die Bürger, der Souverän, eine Regierung immer mehr „machen lässt“ und glaubt, es sei genug, alle 4 Jahre sein Wahl-Kreuzchen zu machen, entfernt er sich immer mehr von der Kontrolle der durch ihn beauftragten Vertreter, und diese entfernen sich so immer mehr vom Alltag der Bürger.

Zu wenig Gegenrede des Souveräns führt zu immer mehr Übermut der Regierung, die sich immer sicherer wird, mit jedem Unsinn durchzukommen.

Ist dann die Schmerzgrenze des Souveräns erreicht, beginnt er, die Opposition zu stärken. In einer funktionierenden Demokratie würde das dazu führen, dass die Opposition die Regierung bildet, die dann die Chance hat, Fehlentwicklungen abzustellen und ausgleichend tätig zu werden.

Derzeit findet sowohl beim Souverän, als auch bei den Parteien, die bisher Regierungen zusammengestellt haben, ein Erwachen statt.

Da die ehemaligen Volks-Parteien unbedingt an der Macht festhalten wollen, seitens des Souveräns auf zu wenig Widerstand stoßen, wird mit der Macht, einer Demokratie nicht würdig, umgegangen. Dem sollte dringend Einhalt geboten werden.

Der Missbrauch äußert sich in brutalen (Lieblingswort der Ex-Außen-Dings) Einschränkungen der Grundrechte (Corona-Zeit), in der Einschränkung der Meinungsfreiheit (D S A), in Tendenzen zunehmender Kontrolle und Überwachung, Förderung von Denunzianten-Portalen, Kapern des öffentlich-rechtlichen Rundfunks, Förderung von NGOs, die als Sprechpuppen genutzt werden. Besetzt von Menschen, die entweder tatsächlich überzeugt sind von dem, was sie ideologisch vertreten, oder die über Charaktereigenschaften verfügen, die noch sehr viel Optimierungspotenzial in sich bergen. Gepaart mit fachlicher Inkompetenz ist das ein gefährlicher Cocktail.

Erst jüngst sogar durch Ausreiseverbote, wie in einem Staat, mit dem man das derzeitige Deutschland nicht vergleichen darf. So groß ist inzwischen schon die Angst geworden, die Kontrolle über die Macht zu verlieren. Alles, was an Kritik geäußert werden will, gilt als Delegitimierung des Staates. Auf keinen Fall darf sie im Ausland geäußert werden, damit es ja nichts davon mitbekommt, was in Deutschland abgeht. Das ist so wie ein Kind, dass sich die Hände vor die Augen hält und meint, es würde nicht gesehen werden.

Die Regierung ist übergriffig geworden. Je lauter sie Demokratie schreit, desto totalitärer wird sie.

Durch fehlende Kontrolle des Souveräns sind charakterlich und fachlich ungeeignete Personen in die Politik gelangt, deren ständige Überforderung dazu führt, dass sich deren Entscheidungen immer weiter von der Lebensrealität des Souveräns entfernen.

Bislang haben rund 25% des Souveräns diese Schieflage erkannt und wollen einer Opposition, die so stark geworden ist, weil die Alt-Parteien über Jahre Fehler an Fehler aneinandergereiht haben, die Gelegenheit geben, diese Fehler zu beheben und auszugleichen. Offen bleibt die Frage, ob sie dazu wirklich in der Lage sind, oder ob die Gefahr besteht, dass sie von einem möglicherweise grundsätzlich kranken System vereinnahmt werden.

Da es seitens der Alt-Parteien keine Einsicht gibt, dass sie in der Regierung nicht mehr den Willen des Souveräns vertreten, derzeit auch besonders gut zu sehen an dem Friedenswillen des Souveräns im Vergleich zur Kriegstreiberei der Regierung, bleibt nur, der Opposition zumindest die Chance zu geben, es besser zu machen und den Willen des Souveräns umzusetzen. Gelänge das nicht, ist die Demokratie, wie wir sie bislang verstanden haben, gescheitert.

Eine daraus resultierende Staatsform stünde dem Freiheitsgedanken diametral gegenüber.

Die Verteidigung von Unseredemokratie seitens der Regierung entlarvt das eigentliche, was damit gemeint ist, nämlich die Erhaltung der eigenen Macht, verbunden mit allen Vorzügen und Privilegien. Sie richtet sich gegen das eigene Volk, das mit einer ganz normal funktionierenden Demokratie schon sehr zufrieden wäre. Unseredemokratie ist nicht unsere Demokratie!

In Anlehnung an die berühmt gewordene Lüge Walter Ulbrichs: „Niemand hat die Absicht eine Mauer zu errichten“, hat derzeit niemand die Absicht, die sogenannte Brandmauer einzureißen, bzw. sie so lange stehen zu lassen, wie es eben geht, um die herrschenden Machtverhältnisse so lange wie möglich aufrechtzuerhalten. Die Geschichte hat jedoch zum Glück gezeigt, dass selbst eine Berliner Mauer nicht ewig hält.

Wie sich aus dem absurd-lächerlichen Gutachten, einer der Regierung gegenüber weisungsgebundenen Behörde herausgestellt hat, gibt es keinerlei Anzeichen dafür, dass die Opposition die demokratische Grundordnung weder gefährden noch beseitigen will.

Da die ehemaligen Volksparteien augenscheinlich nicht in der Lage sind, politische, wirtschaftliche und gesellschaftliche Verhältnisse zum Wohle des Deutschen Volkes herzustellen, ist der demokratische Weg, die Opposition hierzu zu ermächtigen.

Wird das weiterhin verhindert, wird der Unmut des Souveräns weiter zunehmen, und spätestens, wenn die zunehmenden Schikanen die Schmerzgrenze überschritten haben, wird der Souverän nach geeigneten Mitteln und Möglichkeiten suchen, diese Schieflage zu beheben und auszugleichen.

Derzeit stehen sich ein in der Zahl und im Befinden zunehmend unzufrieden werdender Souverän und eine immer absurdere Entscheidungen treffende Regierung im lebendigen Tauziehen um Interessen gegenüber. Je mehr Bockmist die Alt-Parteien bauen, um so stärker wird die Opposition.

Aufgrund der jetzt schon vorhandenen Anzahl wacher Bürger und der Anzahl der in der Politik Unfähigen, ist eigentlich schon jetzt klar, wer in diesem Tauziehen die größere Kraft hat und wer das „Spiel“ nach demokratischen Regeln am Ende gewinnen wird. Das ist eindeutig der Souverän. Verliert er, wider Erwarten, verliert auch die Demokratie.

Dem Souverän fehlt nur noch ein wenig mehr Selbstvertrauen und ein Bewusstsein für die Macht, über die er tatsächlich verfügt.

Je mehr absurde Entscheidungen seitens der Regierung getroffen werden, und man arbeitet ja sehr fleißig daran, besonders, wenn es um Frieden geht, desto stärker wird das Selbstbewusstsein des Souveräns werden und ein natürlicher, friedlicher Ausgleich der Schieflage kann stattfinden. Der Start der neuen Regierung war jedenfalls schon einmal sehr "Keine-4-Jahre".

Wer sich in die steile und eisglatte Abfahrtspiste Deutschlands vertiefen will, hier eine Rezension zu dem Buch „Im Taumel des Niedergangs“ von dem von mir sehr geschätzten und akribisch arbeitenden Uwe Froschauer:

https://www.manova.news/artikel/abwarts

oder

Dieser Artikel wurde mit dem Pareto-Client geschrieben

* *

(Bild von pixabay)

-

@ 91bea5cd:1df4451c

2025-05-20 12:16:57

@ 91bea5cd:1df4451c

2025-05-20 12:16:57Contexto e início

O precursor direto do avivamento foi William J. Seymour, um pregador afro-americano filho de ex-escravos, influenciado pelos ensinamentos de Charles Parham, que pregava o "batismo no Espírito Santo" com evidência do falar em línguas.

Em 1906, Seymour foi convidado para pregar em uma igreja em Los Angeles. Após ser rejeitado por alguns por sua pregação sobre o batismo com o Espírito Santo, ele começou a liderar reuniões de oração na casa da família Asberry. Em abril de 1906, durante uma dessas reuniões, os participantes começaram a experimentar manifestações intensas do Espírito Santo, incluindo glossolalia (falar em línguas), curas e profecias.

A Rua Azusa

Logo, o número de participantes cresceu tanto que foi necessário mudar para um antigo prédio da Igreja Metodista Africana Episcopal, no número 312 da Rua Azusa, no centro de Los Angeles. Esse local se tornou o epicentro do avivamento.

Características marcantes

Cultos espontâneos e fervorosos, muitas vezes sem ordem pré-definida.

Diversidade étnica e social: negros, brancos, latinos, asiáticos, ricos e pobres adoravam juntos — algo radical para os padrões da época.

Ênfase nas manifestações espirituais, como línguas, curas, visões e profecias.

Igualdade de gênero e raça no ministério, com mulheres e homens de diversas origens pregando e liderando.

Impacto

O avivamento da Rua Azusa marcou o nascimento e expansão global do pentecostalismo, hoje uma das maiores forças do cristianismo mundial. Missionários saíram de Azusa para várias partes do mundo, levando a mensagem pentecostal. Movimentos como as Assembleias de Deus e Igreja do Evangelho Quadrangular têm raízes nesse avivamento.

Tensão e Interpretação entre Reformistas e Pentecostalistas

Evangelhos e Atos

João Batista profetiza: “Ele vos batizará com o Espírito Santo e com fogo” (Mateus 3:11).

Em Atos 2, no Pentecostes, os discípulos falam em línguas e recebem poder (Atos 1:8; 2:4).

Outros episódios: Atos 10 (Casa de Cornélio) e Atos 19 (Éfeso).

Cartas Paulinas

Paulo não relaciona diretamente o “batismo com o Espírito” ao falar em línguas. Em 1 Coríntios 12:13 ele diz: “Pois em um só Espírito todos nós fomos batizados em um corpo”.

A glossolalia aparece como um dom entre outros, mas não como evidência obrigatória (1 Coríntios 12:30).

Tensão

Pentecostais veem o batismo com o Espírito como uma segunda experiência após a conversão, evidenciada por línguas. Reformados geralmente interpretam que o batismo com o Espírito ocorre na conversão e que línguas não são obrigatórias ou cessaram com os apóstolos.

Reformadores e o Batismo com o Espírito Santo

Martinho Lutero, João Calvino e outros reformadores não falavam em línguas nem davam ênfase a experiências carismáticas.

Cessacionismo: Doutrina comum entre reformados que diz que os dons sobrenaturais (línguas, profecias, curas) cessaram com a era apostólica.

Continuação (posição pentecostal): Os dons continuam hoje.

Filmes / Documentários

“Azusa Street: The Origins of Pentecostalism” (2006) – Documentário com imagens históricas e entrevistas.

“Wesley” (2009) – Biografia de John Wesley, precursor do metodismo e influência indireta no pentecostalismo.

“The Cross and the Switchblade” (1970) – História de David Wilkerson e a conversão de Nicky Cruz; enfatiza a obra do Espírito.

Série “God in America” (PBS) – Episódio sobre o pentecostalismo (não só Azusa, mas seu impacto cultural).

-

@ 9ca447d2:fbf5a36d

2025-05-20 11:09:00

@ 9ca447d2:fbf5a36d

2025-05-20 11:09:00Ed Suman, a 67-year-old retired artist who helped create large sculptures like Jeff Koons’ Balloon Dog, reportedly lost his entire life savings — over $2M in digital assets — in a sophisticated scam.

The incident is believed to be tied to the major data breach at Coinbase, one of the world’s largest digital asset exchanges.

Suman’s story is part of a bigger wave of attacks on digital asset holders using stolen personal info, and has triggered lawsuits, regulatory concerns and questions about digital security in the Bitcoin space.

In March 2025, Suman got a text message about suspicious activity on his Coinbase account. After Suman reported he was unaware of any unauthorized activity regarding his account, he got a call from a man who introduced himself as Brett Miller from Coinbase Security.

The guy sounded legit — he knew Suman’s setup, including that he used a Trezor Model One hardware wallet, a device meant to keep bitcoin and other digital assets offline and safe.

Suman told Bloomberg the guy knew everything, including the exact amount of digital assets he had.

The attacker persuaded Suman that his Trezor One hardware wallet and its funds were at risk and walked him through a “security procedure” that involved entering his seed phrase into a website that looked exactly like Coinbase, in order to “link his wallet to Coinbase”.

Nine days later, another guy called and repeated the process, saying the first one didn’t work.

And then, all of Suman’s digital assets — 17.5 bitcoin and 225 ether — were gone. At the time, bitcoin was around $103,000 and ether around $2,500, so the stolen stash was worth over $2 million.

Suman turned to digital assets after retiring from a decades-long art career. He stored his assets in cold storage to avoid the risks of online exchanges. He thought he did everything right.

Suman’s attackers didn’t pick his name out of a hat.

It looks like his personal info may have been leaked in the major breach at Coinbase. The company confirmed on May 15 that some of its customer service reps in India were bribed to access internal systems and steal customer data.

The stolen data included names, phone numbers, email addresses, balances and partial Social Security numbers.

According to Coinbase’s filing with the U.S. Securities and Exchange Commission, the breach may have started as early as January and affected nearly 1% of the company’s active monthly users — tens of thousands of people.

Hackers demanded $20M from Coinbase to keep the breach quiet but the company refused to pay. Coinbase says it fired the compromised agents and is setting aside $180M to $400M to reimburse affected users.

But so far, Suman hasn’t been told if he’ll be reimbursed.

Since the breach was disclosed, Coinbase has been hit with at least six lawsuits.

The lawsuits claim the company failed to protect user data and handled the aftermath poorly. One lawsuit filed in New York federal court on May 16 says Coinbase’s response was “inadequate, fragmented, and delayed.”

“Users were not promptly or fully informed of the compromise,” the complaint states, “and Coinbase did not immediately take meaningful steps to mitigate further harm.”

Some lawsuits are seeking damages, others are asking Coinbase to purge user data and improve its security. Coinbase has not commented on the lawsuits but pointed reporters to a blog post about its response.

Suman’s case is a cautionary tale across the Bitcoin world. He used a hardware wallet (considered the gold standard of Bitcoin security) and was still tricked through social engineering. Even the strongest security is useless if you don’t understand how Bitcoin works.

It’s never too early for Bitcoiners to start learning more about Bitcoin, especially on how to keep their stash safe. And the first lesson is “never ever share your seed phrase with anyone”.

Related: Bitcoin Hardware Wallet Hacks: What You Need to Know

-

@ e4950c93:1b99eccd

2025-05-20 11:06:09

@ e4950c93:1b99eccd

2025-05-20 11:06:09Contenu à venir.

-

@ 56f27915:5fee3024

2025-05-20 11:02:41

@ 56f27915:5fee3024

2025-05-20 11:02:41Buchbeschreibung:\ \ Dieses Buch ist ein Appell.

Es richtet sich nicht nur an den Kopf des Lesers, sondern auch an seinen Willen.\ \ Es ist ein Appell an Volk und Leser, die Lenkung der Geschicke direkt selbst in die Hand zu nehmen. Nicht nur: "Was ist?" sondern vor allem: "Was können wir tun?" ist in diesem Buch die große Frage.\ \ Mit dem Blick auf diese Frage wird das Grundgesetz betrachtet und gezeigt, dass es absolut noch nicht der gediegene Glockenguss ist, als der es uns von "oben" immer vorgestellt wurde, sondern dass in ihm auch extrem gegenläufige, bemessen an seinen freiheitlich-demokratischen Idealen sogar als extrem verfassungs-widrig zu bezeichnende Tendenzen wirken, die heute in seine Zerstörung führen.\ \ Vor allem die unselige Übermacht des Parteienwesens und die damit verbundene systemische Entmündigung des Souveräns, des Volkes, ist das Ergebnis dieser verfassungs-widrigen Tendenzen.\ \ Es wird aber auch gezeigt, wo in den Idealen des Grundgesetzes und in den Entscheidungen der Mütter und Väter dieses Grundgesetzes die Ansatzpunkte liegen, durch die der Zerstörung des Grundgesetzes wirkungsvoll begegnet werden kann. Und diese Ansatzpunkte werden im Buch allseits zur Entfaltung gebracht.\ \ "Wer die Demokratie verteidigen will, der muss sie weiter entwickeln." Im Sinne dieses Wortes wird dem Leser ein praktikabler Weg gewiesen, auf dem er unmittelbar helfen kann, das Grundgesetz den wirkenden Zerstörungskräften zu entwinden, durch Einrichtung der direkten Bürgerbeteiligung an den entscheidenden Fragen unserer Republik die Position des Souveräns gegenüber der Parteienmacht zu stärken, Freiheitsrechte, Demokratie und Rechtsstaat auf eine wesentlich höhere Stufe als bisher zu bringen und sich durch eine verfassungs-klärende Versammlung seine Basis selbst und neu zu geben.

Buch bestellen: https://great-reset-von-unten.de/

\ Und nicht vergessen, abzustimmen! Die Zeit ist reif. Packen wir's an.\

-

@ 8bad92c3:ca714aa5

2025-05-20 11:00:32

@ 8bad92c3:ca714aa5

2025-05-20 11:00:32Marty's Bent

via me

Don't sleep on what's happening in Japan right now. We've been covering the country and the fact that they've lost control of their yield curve since late last year. After many years of making it a top priority from a monetary policy perspective, last year the Bank of Japan decided to give up on yield curve control in an attempt to reel inflation. This has sent yields for the 30-year and 40-year Japanese government bonds to levels not seen since the early 2000s in the case of the 30-year and levels never before seen for the 40-year, which was launched in 2007. With a debt to GDP ratio that has surpassed 250% and a population that is aging out with an insufficient amount of births to replace the aging workforce, it's hard to see how Japan can get out of this conundrum without some sort of economic collapse.

This puts the United States in a tough position considering the fact that Japan is one of the largest holders of U.S. Treasury bonds with more than $1.20 trillion in exposure. If things get too out of control in Japan and the yield curve continues to drift higher and inflation continues to creep higher Japan can find itself in a situation where it's a forced seller of US Treasuries as they attempt to strengthen the yen. Another aspect to consider is the fact that investors may see the higher yields on Japanese government bonds and decide to purchase them instead of US Treasuries. This is something to keep an eye on in the weeks to come. Particularly if higher rates drive a higher cost of capital, which leads to even more inflation. As producers are forced to increase their prices to ensure that they can manage their debt repayments.

It's never a good sign when the Japanese Prime Minister is coming out to proclaim that his country's financial situation is worse than Greece's, which has been a laughing stock of Europe for the better part of three decades. Japan is a very proud nation, and the fact that its Prime Minister made a statement like this should not be underappreciated.

As we noted last week, the 10-year and 30-year U.S. Treasury bonds are drifting higher as well. Earlier today, the 30-year bond yield surpassed 5%, which has been a psychological level that many have been pointed to as a critical tipping point. When you take a step back and look around the world it seems pretty clear that bond markets are sending a very strong signal. And that signal is that something is not well in the back end of the financial system.

This is even made clear when you look at the private sector, particularly at consumer debt. In late March, we warned of the growing trend of buy now, pay later schemes drifting down market as major credit card companies released charge-off data which showed charge-off rates reaching levels not seen since the 2008 great financial crisis. At the time, we could only surmise that Klarna was experiencing similar charge-off rates on the bigger-ticket items they financed and started doing deals with companies like DoorDash to finance burrito deliveries in an attempt to move down market to finance smaller ticket items with a higher potential of getting paid back. It seems like that inclination was correct as Klarna released data earlier today showing more losses on their book as consumers find it extremely hard to pay back their debts.

via NewsWire

This news hit the markets on the same day as the average rate of the 30-year mortgage in the United States rose to 7.04%. I'm not sure if you've checked lately, but real estate prices are still relatively elevated outside of a few big cities who expanded supply significantly during the COVID era as people flooded out of blue states towards red states. It's hard to imagine that many people can afford a house based off of sticker price alone, but with a 7% 30-year mortgage rate it's becoming clear that the ability of the Common Man to buy a house is simply becoming impossible.

via Lance Lambert

The mortgage rate data is not the only thing you need to look at to understand that it's becoming impossible for the Common Man of working age to buy a house. New data has recently been released that highlights That the median home buyer in 2007 was born in 1968, and the median home buyer in 2024 was born in 1968. Truly wild when you think of it. As our friend Darth Powell cheekily highlights below, we find ourselves in a situation where boomers are simply trading houses and the younger generations are becoming indentured slaves. Forever destined to rent because of the complete inability to afford to buy a house.

via Darth Powell

via Yahoo Finance

Meanwhile, Bitcoin re-approached all-time highs late this evening and looks primed for another breakout to the upside. This makes sense if you're paying attention. The high-velocity trash economy running on an obscene amount of debt in both the public and private sectors seems to be breaking at the seams. All the alarm bells are signaling that another big print is coming. And if you hope to preserve your purchasing power or, ideally, increase it as the big print approaches, the only thing that makes sense is to funnel your money into the hardest asset in the world, which is Bitcoin.

via Bitbo

Buckle up, freaks. It's gonna be a bumpy ride. Stay humble, Stack Sats.

Trump's Middle East Peace Strategy: Redefining U.S. Foreign Policy

In his recent Middle East tour, President Trump signaled what our guest Dr. Anas Alhajji calls "a major change in US policy." Trump explicitly rejected the nation-building strategies of his predecessors, contrasting the devastation in Afghanistan and Iraq with the prosperity of countries like Saudi Arabia and UAE. This marks a profound shift from both Republican and Democratic foreign policy orthodoxy. As Alhajji noted, Trump's willingness to meet with Syrian President Assad follows a historical pattern where former adversaries eventually become diplomatic partners.

"This is really one of the most important shifts in US foreign policy to say, look, sorry, we destroyed those countries because we tried to rebuild them and it was a big mistake." - Dr. Anas Alhajji

The administration's new approach emphasizes negotiation over intervention. Rather than military solutions, Trump is engaging with groups previously considered off-limits, including the Houthis, Hamas, and Iran. This pragmatic stance prioritizes economic cooperation and regional stability over ideological confrontation. The focus on trade deals and investment rather than regime change represents a fundamental reimagining of America's role in the Middle East.

Check out the full podcast here for more on the Iran nuclear situation, energy market predictions, and why AI development could create power grid challenges. Only on TFTC Studio.

Headlines of the Day

Bitcoin Soars to $106K While Bonds Lose 40% Since 2020 - via X

US Senate Advances Stablecoin Bill As America Embraces Bitcoin - via X

Get our new STACK SATS hat - via tftcmerch.io

Texas House Debates Bill For State-Run Bitcoin Reserve - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

_Ten31, the largest bitcoin-focused inves

-

@ cae03c48:2a7d6671

2025-05-20 11:00:00

@ cae03c48:2a7d6671

2025-05-20 11:00:00Bitcoin Magazine

Ben Allen Receives Maelstrom Bitcoin Developer Grant to Advance Payjoin TechBen Allen has been named the third recipient of the Maelstrom Bitcoin Developer Grant, the family office of Arthur Hayes announced in a recent press release sent to Bitcoin Magazine. Over the next year, Allen will focus on enhancing the Payjoin Dev Kit project, a privacy-focused Bitcoin transaction tool designed to improve user anonymity and network scalability.

Payjoin, first introduced in 2019 by Nicolas Dorier in BIP 78, allows both the sender and receiver to contribute inputs to a single Bitcoin transaction. This disrupts common assumptions used by financial surveillance firms, namely the idea that multiple transaction inputs must come from a single entity. By breaking this assumption, even limited adoption of Payjoin can bolster privacy across the Bitcoin network.

“Maelstrom would like to congratulate Ben Allen on this grant,” said Arthur Hayes, Chief Investment Officer of Maelstrom. “The great thing about Payjoin, is that if only a small amount of adoption is achieved, it breaks a key assumption used by financial surveillance companies. The assumption they have is that if a Bitcoin transaction has multiple inputs, all the inputs must all belong to the same entity. Therefore, Payjoin adoption improves the privacy of even the people who don’t use it. We are excited to support Ben Allen’s work on open-source tools and software to increase Payjoin adoption.”

Allen, who will be working alongside Dan Gould, aims to expand the implementation of Payjoin so it can be integrated into more Bitcoin wallets. He acknowledged the technical complexities of the project—including the requirement for receivers to be online—but expressed optimism about overcoming these challenges.

“I’m deeply grateful to Arthur Hayes and Maelstrom for generously providing me with this grant to support my work on the Payjoin Dev Kit project,” said Allen. “With this funding, I can dedicate myself full-time to enhancing the Payjoin implementation, improving testing, and ensuring that the dev kit remains robust, well-documented, and maintainable for the future.”

Allen also emphasized the broader mission of his work: “Improving privacy for bitcoin is an area where continued improvement allows for a better experience by empowering users to control their financial data and foster greater peace of mind when using bitcoin day to day. This is an exciting opportunity to contribute to Bitcoin’s privacy and scalability, and I’m looking forward to continuing to collaborate with the community to make Payjoin more widely adopted.”

Maelstrom, which is focused on supporting digital asset infrastructure, is led by Arthur Hayes, co-founder of BitMEX. Through grants like this one, the firm is investing in the foundational tools that promote a more private, scalable, and decentralized Bitcoin ecosystem.

This post Ben Allen Receives Maelstrom Bitcoin Developer Grant to Advance Payjoin Tech first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-20 10:50:37

@ cae03c48:2a7d6671

2025-05-20 10:50:37Bitcoin Magazine

Proof of Reserves Should Be the Standard for Bitcoin Treasury Companies“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

— Satoshi Nakamoto (2009)

Bitcoin was created to eliminate the need for trusted intermediaries. It replaced opaque, permissioned systems with transparency, auditability, and decentralized verification. The ethos was clear from day one: don’t trust—verify.

And yet, many of the institutions now holding Bitcoin—custodians, exchanges, ETFs, even public companies—continue to rely on trust-based assumptions, the very problem Bitcoin was designed to solve.

For Bitcoin treasury companies, this contradiction is especially glaring. These are firms that claim to operate on a Bitcoin standard—yet without verifiable Proof of Reserves (PoR), there’s no way for shareholders to know whether the Bitcoin is actually there.

The Problem: Unproven Bitcoin Is Just Another IOU

Bitcoin is designed to be verifiable—but most corporate disclosures aren’t. When companies report BTC holdings without public wallet visibility or on-chain proof, investors are left to trust balance sheets, auditors, and custodians.

That opens the door to systemic risks:

- Rehypothecation: BTC pledged or lent behind the scenes

- Custodial failure: Centralized services operating without 1:1 backing

- “Paper Bitcoin”: Multiple claims on the same BTC, echoing legacy financial opacity

The mere presence of Bitcoin on a balance sheet is not a guarantee. Without verification, it’s no different than a fiat-denominated claim—an IOU dressed up in BTC terms.

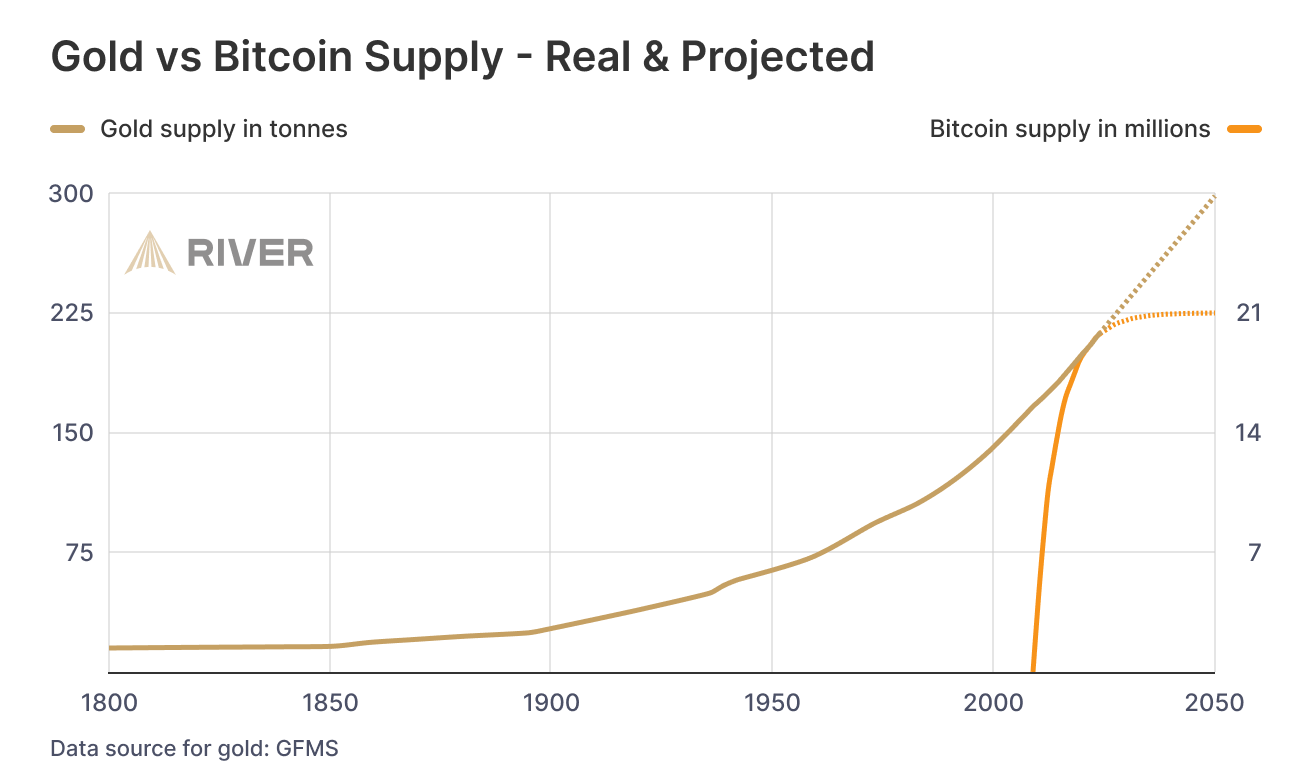

What We Learned from Gold: The Paper Problem

Bitcoin is not the first hard asset to face this challenge. The gold market offers a cautionary tale.

For decades, gold investors have dealt with “paper gold” systems—unallocated accounts, synthetic ETFs, and derivatives with little or no linkage to actual metal. These claims often outnumber real reserves many times over, leading to widespread suspicion of price distortion and systemic misrepresentation.

Most gold investors don’t own gold—they own a claim to gold. And they have no way to prove it.

Bitcoin gives us the tools to break this cycle. But only if companies choose to use them.

Bitcoin Is Built for Proof—and Companies Should Use It

Unlike legacy assets, Bitcoin is designed to make proof of ownership and solvency a native function of the asset itself. Through public key cryptography, on-chain auditability, and permissionless transparency, Bitcoin enables real-time, trust-minimized verification.

This isn’t just a technical capability—it’s a governance feature. Bitcoin allows companies to demonstrate, cryptographically and without intermediaries, that their reserves exist, are intact, and are unencumbered. No bank statements. No opaque custodial claims. Just data, on-chain.

That’s a radical shift—and it’s one that Bitcoin treasury companies are uniquely positioned to take advantage of. In doing so, they can reduce audit complexity, strengthen shareholder communication, and align their internal capital practices with the trustless architecture of the asset they’re holding.

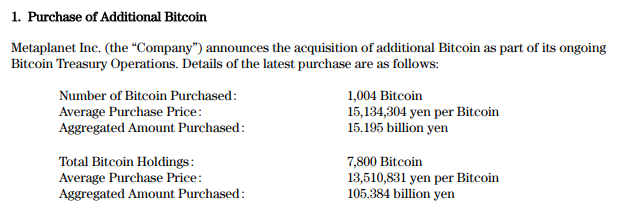

And it’s already happening. Metaplanet, Premiere Member of Bitcoin For Corporations, publicly discloses its BTC reserve addresses and transaction history. Anyone in the world—including shareholders, analysts, and regulators—can independently verify the existence and movement of their treasury. That’s not just compliance. That’s Bitcoin, applied. View the snapshot of Metaplanet’s proof of reserves dashboard below.

Public Companies Face the Greatest Responsibility

Public companies don’t operate in a vacuum. Their disclosures shape market perception, influence investor behavior, and—especially when Bitcoin is involved—serve as a proxy for the maturity of the asset class itself.

When a publicly traded company holds Bitcoin but offers no visibility into how that Bitcoin is held or verified, it exposes itself to multiple levels of risk: legal, reputational, operational, and strategic. It undermines trust at the very moment it claims to be embracing a trustless system.

More importantly, public companies send signals. Whether they like it or not, they become de facto representatives of the Bitcoin strategy they’ve adopted. Their behavior becomes part of the playbook for others considering similar moves.

That’s why the responsibility is higher. Transparency isn’t optional for companies who lead with Bitcoin. It’s a duty. And companies that choose opacity not only take on unnecessary risk—they weaken the credibility of the entire movement.e.

What Proof of Reserves Should Actually Include

For Proof of Reserves to have real integrity, it must go beyond vague references to “custody partners” or internal assurance statements. The key is verifiability—independent, data-driven, and actionable by any shareholder or auditor.

At a minimum, Bitcoin treasury companies should provide:

- Custody model clarity: Is the company using self-custody, shared multisig, or third-party solutions? Who controls the keys, and under what governance?

- On-chain transparency: Whether through view-only wallet addresses or cryptographic attestations (like Merkle tree proofs), companies must make it possible to verify balances against public disclosures.

- Encumbrance disclosure: Reserves that are pledged, lent out, or locked in yield strategies should be disclosed clearly, with timelines and risk parameters attached.

- Routine updates: Proof should be refreshed regularly—not once per year in an audit footnote, but as part of ongoing financial communication.

- Reconciliation framework: Companies should explain how on-chain data maps to reported BTC NAV in filings or investor materials.

For boards and CFOs, this doesn’t need to introduce operational risk. Tools already exist—xpub view-only wallets, custody APIs, third-party validators—to provide assurance without compromising security. The obstacle isn’t capability. It’s willingness.

Setting the Industry Benchmark: Where Bitcoin Treasury Companies Must Lead

Bitcoin treasury companies are not just financial outliers—they are structural pioneers. Their decision to hold BTC signals not only a belief in long-term value, but a rejection of legacy capital inefficiency. That’s why they must also lead on standards of integrity.

By adopting PoR voluntarily and early, companies can position themselves as trustworthy, sophisticated, and future-ready. This will matter more as institutional capital rotates into Bitcoin, as index inclusion expands, and as regulators begin asking sharper questions about crypto asset disclosures on balance sheets.

PoR isn’t just a way to comply with future standards—it’s a way to shape them. The companies that lead now will not only avoid future scrutiny—they’ll attract capital from allocators who are seeking transparency but don’t yet know where to find it.

At BFC, we believe the market rewards clarity. Bitcoin treasury companies have a chance to bake transparency into their structure, not as an afterthought, but as a strategic differentiator.

Shareholders Must Demand It

Proof of Reserves isn’t just a company initiative—it’s a shareholder obligation. When a public company holds Bitcoin on its balance sheet, it is acting as a fiduciary for shareholder capital denominated in one of the hardest, most transparent assets in history. To accept opacity in that context is to forfeit the very advantage Bitcoin offers.

If you’re an investor in a Bitcoin treasury company and you can’t verify the Bitcoin, you don’t own a monetary reserve—you own a narrative. You’re trusting that someone else is telling the truth, rather than requiring the proof Bitcoin makes possible.

That’s not aligned with the principles of sound capital stewardship.

Institutional allocators, activist shareholders, and governance professionals have a growing role to play here. Just as proxy advisors and investor coalitions have pushed for climate disclosures, board transparency, and ESG clarity in the past decade, it’s time to apply that same rigor to Bitcoin disclosures—especially for companies who claim to operate on a Bitcoin standard.

Demand direct answers:

- Can we verify the holdings on-chain?

- Are reserves fully collateralized and unencumbered?

- Has manageme

-

@ 39cc53c9:27168656

2025-05-20 10:45:31

@ 39cc53c9:27168656

2025-05-20 10:45:31The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ 39cc53c9:27168656

2025-05-20 10:45:29

@ 39cc53c9:27168656

2025-05-20 10:45:29Know Your Customer is a regulation that requires companies of all sizes to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. Such procedures fit within the broader scope of anti-money laundering (AML) and counterterrorism financing (CTF) regulations.

Banks, exchanges, online business, mail providers, domain registrars... Everyone wants to know who you are before you can even opt for their service. Your personal information is flowing around the internet in the hands of "god-knows-who" and secured by "trust-me-bro military-grade encryption". Once your account is linked to your personal (and verified) identity, tracking you is just as easy as keeping logs on all these platforms.

Rights for Illusions

KYC processes aim to combat terrorist financing, money laundering, and other illicit activities. On the surface, KYC seems like a commendable initiative. I mean, who wouldn't want to halt terrorists and criminals in their tracks?

The logic behind KYC is: "If we mandate every financial service provider to identify their users, it becomes easier to pinpoint and apprehend the malicious actors."

However, terrorists and criminals are not precisely lining up to be identified. They're crafty. They may adopt false identities or find alternative strategies to continue their operations. Far from being outwitted, many times they're several steps ahead of regulations. Realistically, KYC might deter a small fraction – let's say about 1% ^1 – of these malefactors. Yet, the cost? All of us are saddled with the inconvenient process of identification just to use a service.

Under the rhetoric of "ensuring our safety", governments and institutions enact regulations that seem more out of a dystopian novel, gradually taking away our right to privacy.

To illustrate, consider a city where the mayor has rolled out facial recognition cameras in every nook and cranny. A band of criminals, intent on robbing a local store, rolls in with a stolen car, their faces obscured by masks and their bodies cloaked in all-black clothes. Once they've committed the crime and exited the city's boundaries, they switch vehicles and clothes out of the cameras' watchful eyes. The high-tech surveillance? It didn’t manage to identify or trace them. Yet, for every law-abiding citizen who merely wants to drive through the city or do some shopping, their movements and identities are constantly logged. The irony? This invasive tracking impacts all of us, just to catch the 1% ^1 of less-than-careful criminals.

KYC? Not you.

KYC creates barriers to participation in normal economic activity, to supposedly stop criminals. ^2

KYC puts barriers between many users and businesses. One of these comes from the fact that the process often requires multiple forms of identification, proof of address, and sometimes even financial records. For individuals in areas with poor record-keeping, non-recognized legal documents, or those who are unbanked, homeless or transient, obtaining these documents can be challenging, if not impossible.

For people who are not skilled with technology or just don't have access to it, there's also a barrier since KYC procedures are mostly online, leaving them inadvertently excluded.

Another barrier goes for the casual or one-time user, where they might not see the value in undergoing a rigorous KYC process, and these requirements can deter them from using the service altogether.

It also wipes some businesses out of the equation, since for smaller businesses, the costs associated with complying with KYC norms—from the actual process of gathering and submitting documents to potential delays in operations—can be prohibitive in economical and/or technical terms.

You're not welcome

Imagine a swanky new club in town with a strict "members only" sign. You hear the music, you see the lights, and you want in. You step up, ready to join, but suddenly there's a long list of criteria you must meet. After some time, you are finally checking all the boxes. But then the club rejects your membership with no clear reason why. You just weren't accepted. Frustrating, right?

This club scenario isn't too different from the fact that KYC is being used by many businesses as a convenient gatekeeping tool. A perfect excuse based on a "legal" procedure they are obliged to.

Even some exchanges may randomly use this to freeze and block funds from users, claiming these were "flagged" by a cryptic system that inspects the transactions. You are left hostage to their arbitrary decision to let you successfully pass the KYC procedure. If you choose to sidestep their invasive process, they might just hold onto your funds indefinitely.

Your identity has been stolen

KYC data has been found to be for sale on many dark net markets^3. Exchanges may have leaks or hacks, and such leaks contain very sensitive data. We're talking about the full monty: passport or ID scans, proof of address, and even those awkward selfies where you're holding up your ID next to your face. All this data is being left to the mercy of the (mostly) "trust-me-bro" security systems of such companies. Quite scary, isn't it?

As cheap as $10 for 100 documents, with discounts applying for those who buy in bulk, the personal identities of innocent users who passed KYC procedures are for sale. ^3

In short, if you have ever passed the KYC/AML process of a crypto exchange, your privacy is at risk of being compromised, or it might even have already been compromised.

(they) Know Your Coins

You may already know that Bitcoin and most cryptocurrencies have a transparent public blockchain, meaning that all data is shown unencrypted for everyone to see and recorded forever. If you link an address you own to your identity through KYC, for example, by sending an amount from a KYC exchange to it, your Bitcoin is no longer pseudonymous and can then be traced.

If, for instance, you send Bitcoin from such an identified address to another KYC'ed address (say, from a friend), everyone having access to that address-identity link information (exchanges, governments, hackers, etc.) will be able to associate that transaction and know who you are transacting with.

Conclusions

To sum up, KYC does not protect individuals; rather, it's a threat to our privacy, freedom, security and integrity. Sensible information flowing through the internet is thrown into chaos by dubious security measures. It puts borders between many potential customers and businesses, and it helps governments and companies track innocent users. That's the chaos KYC has stirred.

The criminals are using stolen identities from companies that gathered them thanks to these very same regulations that were supposed to combat them. Criminals always know how to circumvent such regulations. In the end, normal people are the most affected by these policies.

The threat that KYC poses to individuals in terms of privacy, security and freedom is not to be neglected. And if we don’t start challenging these systems and questioning their efficacy, we are just one step closer to the dystopian future that is now foreseeable.

Edited 20/03/2024 * Add reference to the 1% statement on Rights for Illusions section to an article where Chainalysis found that only 0.34% of the transaction volume with cryptocurrencies in 2023 was attributable to criminal activity ^1

-

@ 39cc53c9:27168656

2025-05-20 10:45:28

@ 39cc53c9:27168656

2025-05-20 10:45:28Over the past few months, I've dedicated my time to a complete rewrite of the kycnot.me website. The technology stack remains unchanged; Golang paired with TailwindCSS. However, I've made some design choices in this iteration that I believe significantly enhance the site. Particularly to backend code.

UI Improvements

You'll notice a refreshed UI that retains the original concept but has some notable enhancements. The service list view is now more visually engaging, it displays additional information in a more aesthetically pleasing manner. Both filtering and searching functionalities have been optimized for speed and user experience.

Service pages have been also redesigned to highlight key information at the top, with the KYC Level box always accessible. The display of service attributes is now more visually intuitive.

The request form, especially the Captcha, has undergone substantial improvements. The new self-made Captcha is robust, addressing the reliability issues encountered with the previous version.

Terms of Service Summarizer

A significant upgrade is the Terms of Service summarizer/reviewer, now powered by AI (GPT-4-turbo). It efficiently condenses each service's ToS, extracting and presenting critical points, including any warnings. Summaries are updated monthly, processing over 40 ToS pages via the OpenAI API using a self-crafted and thoroughly tested prompt.

Nostr Comments

I've integrated a comment section for each service using Nostr. For guidance on using this feature, visit the dedicated how-to page.

Database

The backend database has transitioned to pocketbase, an open-source Golang backend that has been a pleasure to work with. I maintain an updated fork of the Golang SDK for pocketbase at pluja/pocketbase.

Scoring

The scoring algorithm has also been refined to be more fair. Despite I had considered its removal due to the complexity it adds (it is very difficult to design a fair scoring system), some users highlighted its value, so I kept it. The updated algorithm is available open source.

Listings

Each listing has been re-evaluated, and the ones that were no longer operational were removed. New additions are included, and the backlog of pending services will be addressed progressively, since I still have access to the old database.

API

The API now offers more comprehensive data. For more details, check here.

About Page

The About page has been restructured for brevity and clarity.

Other Changes

Extensive changes have been implemented in the server-side logic, since the whole code base was re-written from the ground up. I may discuss these in a future post, but for now, I consider the current version to be just a bit beyond beta, and additional updates are planned in the coming weeks.

-

@ 39cc53c9:27168656

2025-05-20 10:45:26

@ 39cc53c9:27168656

2025-05-20 10:45:26I'm launching a new service review section on this blog in collaboration with OrangeFren. These reviews are sponsored, yet the sponsorship does not influence the outcome of the evaluations. Reviews are done in advance, then, the service provider has the discretion to approve publication without modifications.

Sponsored reviews are independent from the kycnot.me list, being only part of the blog. The reviews have no impact on the scores of the listings or their continued presence on the list. Should any issues arise, I will not hesitate to remove any listing.

The review

WizardSwap is an instant exchange centred around privacy coins. It was launched in 2020 making it old enough to have weathered the 2021 bull run and the subsequent bearish year.

| Pros | Cons | |------|------| | Tor-friendly | Limited liquidity | | Guarantee of no KYC | Overly simplistic design | | Earn by providing liquidity | |

Rating: ★★★★★ Service Website: wizardswap.io

Liquidity

Right off the bat, we'll start off by pointing out that WizardSwap relies on its own liquidity reserves, meaning they aren't just a reseller of Binance or another exchange. They're also committed to a no-KYC policy, when asking them, they even promised they would rather refund a user their original coins, than force them to undergo any sort of verification.

On the one hand, full control over all their infrastructure gives users the most privacy and conviction about the KYC policies remaining in place.

On the other hand, this means the liquidity available for swapping isn't huge. At the time of testing we could only purchase at most about 0.73 BTC with XMR.

It's clear the team behind WizardSwap is aware of this shortfall and so they've come up with a solution unique among instant exchanges. They let you, the user, deposit any of the currencies they support into your account and earn a profit on the trades made using your liquidity.

Trading

Fees on WizardSwap are middle-of-the-pack. The normal fee is 2.2%. That's more than some exchanges that reserve the right to suddenly demand you undergo verification, yet less than half the fees on some other privacy-first exchanges. However as we mentioned in the section above you can earn almost all of that fee (2%) if you provide liquidity to WizardSwap.

It's good that with the current Bitcoin fee market their fees are constant regardless of how much, or how little, you send. This is in stark contrast with some of the alternative swap providers that will charge you a massive premium when attempting to swap small amounts of BTC away.

Test trades

Test trades are always performed without previous notice to the service provider.

During our testing we performed a few test trades and found that every single time WizardSwap immediately detected the incoming transaction and the amount we received was exactly what was quoted before depositing. The fees were inline with what WizardSwap advertises.

- Monero payment proof

- Bitcoin received

- Wizardswap TX link - it's possible that this link may cease to be valid at some point in the future.

ToS and KYC

WizardSwap does not have a Terms of Service or a Privacy Policy page, at least none that can be found by users. Instead, they offer a FAQ section where they addresses some basic questions.

The site does not mention any KYC or AML practices. It also does not specify how refunds are handled in case of failure. However, based on the FAQ section "What if I send funds after the offer expires?" it can be inferred that contacting support is necessary and network fees will be deducted from any refund.

UI & Tor

WizardSwap can be visited both via your usual browser and Tor Browser. Should you decide on the latter you'll find that the website works even with the most strict settings available in the Tor Browser (meaning no JavaScript).

However, when disabling Javascript you'll miss the live support chat, as well as automatic refreshing of the trade page. The lack of the first means that you will have no way to contact support from the trade page if anything goes wrong during your swap, although you can do so by mail.

One important thing to have in mind is that if you were to accidentally close the browser during the swap, and you did not save the swap ID or your browser history is disabled, you'll have no easy way to return to the trade. For this reason we suggest when you begin a trade to copy the url or ID to someplace safe, before sending any coins to WizardSwap.

The UI you'll be greeted by is simple, minimalist, and easy to navigate. It works well not just across browsers, but also across devices. You won't have any issues using this exchange on your phone.

Getting in touch

The team behind WizardSwap appears to be most active on X (formerly Twitter): https://twitter.com/WizardSwap_io

If you have any comments or suggestions about the exchange make sure to reach out to them. In the past they've been very receptive to user feedback, for instance a few months back WizardSwap was planning on removing DeepOnion, but the community behind that project got together ^1 and after reaching out WizardSwap reversed their decision ^2.

You can also contact them via email at:

support @ wizardswap . ioDisclaimer

None of the above should be understood as investment or financial advice. The views are our own only and constitute a faithful representation of our experience in using and investigating this exchange. This review is not a guarantee of any kind on the services rendered by the exchange. Do your own research before using any service.

-

@ 39cc53c9:27168656

2025-05-20 10:45:24

@ 39cc53c9:27168656

2025-05-20 10:45:24Bitcoin enthusiasts frequently and correctly remark how much value it adds to Bitcoin not to have a face, a leader, or a central authority behind it. This particularity means there isn't a single person to exert control over, or a single human point of failure who could become corrupt or harmful to the project.

Because of this, it is said that no other coin can be equally valuable as Bitcoin in terms of decentralization and trustworthiness. Bitcoin is unique not just for being first, but also because of how the events behind its inception developed. This implies that, from Bitcoin onwards, any coin created would have been created by someone, consequently having an authority behind it. For this and some other reasons, some people refer to Bitcoin as "The Immaculate Conception".

While other coins may have their own unique features and advantages, they may not be able to replicate Bitcoin's community-driven nature. However, one other cryptocurrency shares a similar story of mystery behind its creation: Monero.

History of Monero

Bytecoin and CryptoNote

In March 2014, a Bitcointalk thread titled "Bytecoin. Secure, private, untraceable since 2012" was initiated by a user under the nickname "DStrange"^1^. DStrange presented Bytecoin (BCN) as a unique cryptocurrency, in operation since July 2012. Unlike Bitcoin, it employed a new algorithm known as CryptoNote.

DStrange apparently stumbled upon the Bytecoin website by chance while mining a dying bitcoin fork, and decided to create a thread on Bitcointalk^1^. This sparked curiosity among some users, who wondered how could Bytecoin remain unnoticed since its alleged launch in 2012 until then^2^.

Some time after, a user brought up the "CryptoNote v2.0" whitepaper for the first time, underlining its innovative features^4^. Authored by the pseudonymous Nicolas van Saberhagen in October 2013, the CryptoNote v2 whitepaper^5^ highlighted the traceability and privacy problems in Bitcoin. Saberhagen argued that these flaws could not be quickly fixed, suggesting it would be more efficient to start a new project rather than trying to patch the original^5^, an statement simmilar to the one from Satoshi Nakamoto^6^.

Checking with Saberhagen's digital signature, the release date of the whitepaper seemed correct, which would mean that Cryptonote (v1) was created in 2012^7^, although there's an important detail: "Signing time is from the clock on the signer's computer" ^9^.

Moreover, the whitepaper v1 contains a footnote link to a Bitcointalk post dated May 5, 2013^10^, making it impossible for the whitepaper to have been signed and released on December 12, 2012.

As the narrative developed, users discovered that a significant 80% portion of Bytecoin had been pre-mined^11^ and blockchain dates seemed to be faked to make it look like it had been operating since 2012, leading to controversy surrounding the project.

The origins of CryptoNote and Bytecoin remain mysterious, leaving suspicions of a possible scam attempt, although the whitepaper had a good amount of work and thought on it.

The fork

In April 2014, the Bitcointalk user

thankful_for_today, who had also participated in the Bytecoin thread^12^, announced plans to launch a Bytecoin fork named Bitmonero^13^.The primary motivation behind this fork was "Because there is a number of technical and marketing issues I wanted to do differently. And also because I like ideas and technology and I want it to succeed"^14^. This time Bitmonero did things different from Bytecoin: there was no premine or instamine, and no portion of the block reward went to development.

However, thankful_for_today proposed controversial changes that the community disagreed with. Johnny Mnemonic relates the events surrounding Bitmonero and thankful_for_today in a Bitcointalk comment^15^:

When thankful_for_today launched BitMonero [...] he ignored everything that was discussed and just did what he wanted. The block reward was considerably steeper than what everyone was expecting. He also moved forward with 1-minute block times despite everyone's concerns about the increase of orphan blocks. He also didn't address the tail emission concern that should've (in my opinion) been in the code at launch time. Basically, he messed everything up. Then, he disappeared.

After disappearing for a while, thankful_for_today returned to find that the community had taken over the project. Johnny Mnemonic continues:

I, and others, started working on new forks that were closer to what everyone else was hoping for. [...] it was decided that the BitMonero project should just be taken over. There were like 9 or 10 interested parties at the time if my memory is correct. We voted on IRC to drop the "bit" from BitMonero and move forward with the project. Thankful_for_today suddenly resurfaced, and wasn't happy to learn the community had assumed control of the coin. He attempted to maintain his own fork (still calling it "BitMonero") for a while, but that quickly fell into obscurity.

The unfolding of these events show us the roots of Monero. Much like Satoshi Nakamoto, the creators behind CryptoNote/Bytecoin and thankful_for_today remain a mystery^17^, having disappeared without a trace. This enigma only adds to Monero's value.

Since community took over development, believing in the project's potential and its ability to be guided in a better direction, Monero was given one of Bitcoin's most important qualities: a leaderless nature. With no single face or entity directing its path, Monero is safe from potential corruption or harm from a "central authority".

The community continued developing Monero until today. Since then, Monero has undergone a lot of technological improvements, migrations and achievements such as RingCT and RandomX. It also has developed its own Community Crowdfundinc System, conferences such as MoneroKon and Monerotopia are taking place every year, and has a very active community around it.

Monero continues to develop with goals of privacy and security first, ease of use and efficiency second. ^16^

This stands as a testament to the power of a dedicated community operating without a central figure of authority. This decentralized approach aligns with the original ethos of cryptocurrency, making Monero a prime example of community-driven innovation. For this, I thank all the people involved in Monero, that lead it to where it is today.

If you find any information that seems incorrect, unclear or any missing important events, please contact me and I will make the necessary changes.

Sources of interest

- https://forum.getmonero.org/20/general-discussion/211/history-of-monero

- https://monero.stackexchange.com/questions/852/what-is-the-origin-of-monero-and-its-relationship-to-bytecoin

- https://en.wikipedia.org/wiki/Monero

- https://bitcointalk.org/index.php?topic=583449.0

- https://bitcointalk.org/index.php?topic=563821.0

- https://bitcointalk.org/index.php?action=profile;u=233561

- https://bitcointalk.org/index.php?topic=512747.0

- https://bitcointalk.org/index.php?topic=740112.0

- https://monero.stackexchange.com/a/1024

- https://inspec2t-project.eu/cryptocurrency-with-a-focus-on-anonymity-these-facts-are-known-about-monero/

- https://medium.com/coin-story/coin-perspective-13-riccardo-spagni-69ef82907bd1

- https://www.getmonero.org/resources/about/

- https://www.wired.com/2017/01/monero-drug-dealers-cryptocurrency-choice-fire/

- https://www.monero.how/why-monero-vs-bitcoin

- https://old.reddit.com/r/Monero/comments/u8e5yr/satoshi_nakamoto_talked_about_privacy_features/

-

@ 39cc53c9:27168656

2025-05-20 10:45:18

@ 39cc53c9:27168656

2025-05-20 10:45:18“The future is there... staring back at us. Trying to make sense of the fiction we will have become.” — William Gibson.

This month is the 4th anniversary of kycnot.me. Thank you for being here.

Fifteen years ago, Satoshi Nakamoto introduced Bitcoin, a peer-to-peer electronic cash system: a decentralized currency free from government and institutional control. Nakamoto's whitepaper showed a vision for a financial system based on trustless transactions, secured by cryptography. Some time forward and KYC (Know Your Customer), AML (Anti-Money Laundering), and CTF (Counter-Terrorism Financing) regulations started to come into play.

What a paradox: to engage with a system designed for decentralization, privacy, and independence, we are forced to give away our personal details. Using Bitcoin in the economy requires revealing your identity, not just to the party you interact with, but also to third parties who must track and report the interaction. You are forced to give sensitive data to entities you don't, can't, and shouldn't trust. Information can never be kept 100% safe; there's always a risk. Information is power, who knows about you has control over you.