-

@ 2dd9250b:6e928072

2025-05-31 16:07:25

@ 2dd9250b:6e928072

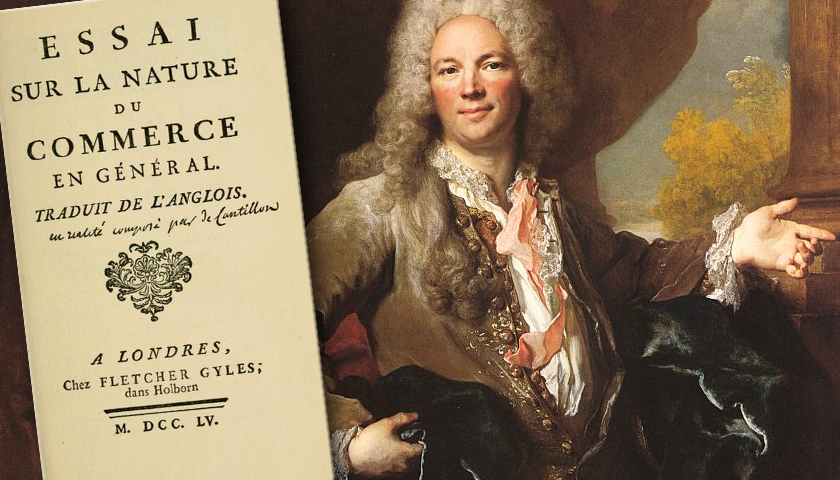

2025-05-31 16:07:25Durante a década de 1990, houve o aumento da globalização da economia, determinando a adição do fluxo internacional de capitais, de produtos e serviços. Este fenômeno levou a uma interdependência maior entre as economias dos países. Justamente por causa da possibilidade de que um eventual colapso econômico em um país resulte no contágio dos demais. Diante disso, aumentou a preocupação com os riscos incentivando a utilização de sofisticados modelos e estratégias de avaliação de gestão de risco.

Na década, ganharam destaque ainda os graves problemas financeiros enfrentados, entre outros, pelo banco inglês Barings Bank, e pelo fundo de investimento norte-americano Long Term Capital Management.

Outro grande destaque foi a fraude superior a US$ 7 bilhões sofrida pelo banco Société Generale em Janeiro de 2008.

O Barings Bank é um banco inglês que faliu em 1995 em razão de operações financeiras irregulares e mal-sucedidas realizadas pelo seu principal operador de mercado. O rombo da instituição foi superior à US$ 1,3 Bilhão e causado por uma aposta equivocada no desempenho futuro no índice de ações no Japão. Na realidade, o mercado acionário japonês caiu mais de 15% na época, determinando a falência do banco. O Baring Bank foi vendido a um grupo financeiro holandês (ING) pelo valor simbólico de uma libra esterlina.

O Long Term Capital Management era um fundo de investimento de que perdeu em 1998 mais de US$ 4,6 bilhões em operações nos mercados financeiros internacionais. O LTCM foi socorrido pelo Banco Central dos Estados Unidos (Federal Reserve ), que coordenou uma operação de socorro financeiro à instituição. A justificativa do Banco Central para esta decisão era "o receio das possíveis consequências mundiais da falência do fundo de investimento".

O banco francês Société Generale informou, em janeiro de 2008, uma perda de US$ 7,16 bilhões determinadas por fraudes efetuadas por um operador do mercado financeiro. Segundo revelou a instituição, o operador assumiu posições no mercado sem o conhecimento da direção do banco. A instituição teve que recorrer a uma urgente captação de recursos no mercado próxima a US$ 5,0 bilhões.

E finalmente chegamos ao caso mais problemático da era das finanças modernas anterior ao Bitcoin, o caso Lehman Brothers.

O Lehman Brothers era o 4° maior de investimentos dos EUA quando pediu concordata em 15/09/2008 com dívidas que superavam inacreditáveis US$ 600 bilhões.

Não se tinha contas correntes ou talão de cheques do Lehman Brothers. Era um banco especializado em investimentos e complexas operações financeiras. Havia feito pesados investimentos em empréstimos a juros fixos no famigerado mercado subprime, e o crédito imobiliário voltado a pessoas consideradas de forte risco de inadimplência.

Com essa carteira de investimentos que valia bem menos que o estimado e o acúmulo de projetos financeiros, minou a confiança dos investidores na instituição de 158 anos. Suas ações passaram de US$ 80 a menos de US$ 4. Acumulando fracassos nas negociações para levantar fundos; a instituição de cerca de 25 mil funcionários entrou em concordata.

O Federal Reserve resgatou algumas instituições financeiras grandes e tradicionais norte-americanas como a seguradora AIG no meio da crise. O Fed injetou um capital de US$ 182, 3 bilhões no American International Group (AIG).

Foi exatamente essa decisão do Fed em salvar alguns bancos e deixar quebrar outros, que causou insegurança por parte dos clientes. E os clientes ficaram insatisfeitos tanto com os bancos de investimentos quanto com as agências de classificação de risco, como a Standard & Poor's que tinha dado uma nota alta para o Lehman Brothers no mesmo dia em que ele quebrou.

E essa foi uma das razões pelo qual o Bitcoin foi criado. Satoshi Nakamoto entendeu que as pessoas não estavam mais confiando nem no Governo, nem nos Bancos Privados que o Governo federal restagatava quando eles quebravam e isso prejudicou muita gente. Tanto que o “hash” do Genesis Block contém o título do artigo “Chancellor on brink of second bailout for banks” (Chanceler à beira de segundo resgate para bancos, em português) da edição britânica do The Times.

-

@ dfa02707:41ca50e3

2025-05-31 16:01:31

@ dfa02707:41ca50e3

2025-05-31 16:01:31News

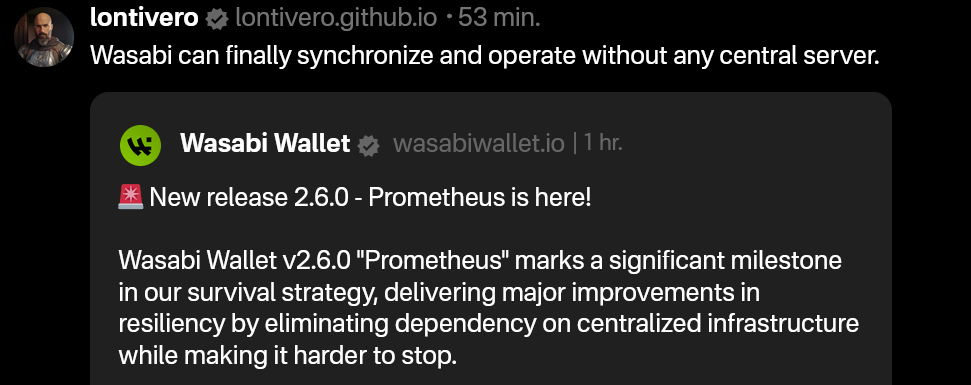

- Bitcoin mining centralization in 2025. According to a blog post by b10c, Bitcoin mining was at its most decentralized in May 2017, with another favorable period from 2019 to 2022. However, starting in 2023, mining has become increasingly centralized, particularly due to the influence of large pools like Foundry and the use of proxy pooling by entities such as AntPool.

Source: b10c's blog.

- OpenSats announces the eleventh wave of Nostr grants. The five projects in this wave are the mobile live-streaming app Swae, the Nostr-over-ham-radio project HAMSTR, Vertex—a Web-of-Trust (WOT) service for Nostr developers, Nostr Double Ratchet for end-to-end encrypted messaging, and the Nostr Game Engine for building games and applications integrated with the Nostr ecosystem.

- New Spiral grantee: l0rinc. In February 2024, l0rinc transitioned to full-time work on Bitcoin Core. His efforts focus on performance benchmarking and optimizations, enhancing code quality, conducting code reviews, reducing block download times, optimizing memory usage, and refactoring code.

- Project Eleven offers 1 BTC to break Bitcoin's cryptography with a quantum computer. The quantum computing research organization has introduced the Q-Day Prize, a global challenge that offers 1 BTC to the first team capable of breaking an elliptic curve cryptographic (ECC) key using Shor’s algorithm on a quantum computer. The prize will be awarded to the first team to successfully accomplish this breakthrough by April 5, 2026.

- Unchained has launched the Bitcoin Legacy Project. The initiative seeks to advance the Bitcoin ecosystem through a bitcoin-native donor-advised fund platform (DAF), investments in community hubs, support for education and open-source development, and a commitment to long-term sustainability with transparent annual reporting.

- In its first year, the program will provide support to Bitcoin hubs in Nashville, Austin, and Denver.

- Support also includes $50,000 to the Bitcoin Policy Institute, a $150,000 commitment at the University of Austin, and up to $250,000 in research grants through the Bitcoin Scholars program.

"Unchained will match grants 1:1 made to partner organizations who support Bitcoin Core development when made through the Unchained-powered bitcoin DAF, up to 1 BTC," was stated in a blog post.

- Block launched open-source tools for Bitcoin treasury management. These include a dashboard for managing corporate bitcoin holdings and provides a real-time BTC-to-USD price quote API, released as part of the Block Open Source initiative. The company’s own instance of the bitcoin holdings dashboard is available here.

Source: block.xyz

- Bull Bitcoin expands to Mexico, enabling anyone in the country to receive pesos from anywhere in the world straight from a Bitcoin wallet. Additionally, users can now buy Bitcoin with a Mexican bank account.

"Bull Bitcoin strongly believes in Bitcoin’s economic potential in Mexico, not only for international remittances and tourism, but also for Mexican individuals and companies to reclaim their financial sovereignty and protect their wealth from inflation and the fragility of traditional financial markets," said Francis Pouliot, Founder and CEO of Bull Bitcoin.

- Corporate bitcoin holdings hit a record high in Q1 2025. According to Bitwise, public companies' adoption of Bitcoin has hit an all-time high. In Q1 2025, these firms collectively hold over 688,000 BTC, marking a 16.11% increase from the previous quarter. This amount represents 3.28% of Bitcoin's fixed 21 million supply.

Source: Bitwise.

- The Bitcoin Bond Company for institutions has launched with the aim of acquiring $1 trillion in Bitcoin over 21 years. It utilizes secure, transparent, and compliant bond-like products backed by Bitcoin.

- The U.S. Senate confirmed Paul Atkins as Chair of the Securities and Exchange Commission (SEC). At his confirmation hearing, Atkins emphasized the need for a clear framework for digital assets. He aims to collaborate with the CFTC and Congress to address jurisdiction and rulemaking gaps, aligning with the Trump administration's goal to position the U.S. as a leader in Bitcoin and blockchain finance.

- Ethereum developer Virgil Griffith has been released from custody. Griffith, whose sentence was reduced to 56 months, is now seeking a pardon. He was initially sentenced to 63 months for allegedly violating international sanctions laws by providing technical advice on using cryptocurrencies and blockchain technology to evade sanctions during a presentation titled 'Blockchains for Peace' in North Korea.

- No-KYC exchange eXch to close down under money laundering scrutiny. The privacy-focused cryptocurrency trading platform said it will cease operations on May 1. This decision follows allegations that the platform was used by North Korea's Lazarus Group for money laundering. eXch revealed it is the subject of an active "transatlantic operation" aimed at shutting down the platform and prosecuting its team for "money laundering and terrorism."

- Blockstream combats ESP32 FUD concerning Jade signers. The company stated that after reviewing the vulnerability disclosed in early March, Jade was found to be secure. Espressif Systems, the designer of the ESP32, has since clarified that the "undocumented commands" do not constitute a "backdoor."

- Bank of America is lobbying for regulations that favor banks over tech firms in stablecoin issuance. The bank's CEO Brian Moynihan is working with groups such as the American Bankers Association to advance the issuance of a fully reserved, 1:1 backed "Bank of America coin." If successful, this could limit stablecoin efforts by non-banks like Tether, Circle, and others, reports The Block.

- Tether to back OCEAN Pool with its hashrate. "As a company committed to financial freedom and open access, we see supporting decentralization in Bitcoin mining as essential to the network’s long-term integrity," said Tether CEO Paolo Ardoino.

- Bitdeer to expand its self-mining operations to navigate tariffs. The Singapore-based mining company is advancing plans to produce machines in the U.S. while reducing its mining hardware sales. This response is in light of increasing uncertainties related to U.S. trade policy, as reported by Bloomberg.

- Tether acquires $32M in Bitdeer shares. The firm has boosted its investment in Bitdeer during a wider market sell-off, with purchases in early to mid-April amounting to about $32 million, regulatory filings reveal.

- US Bitcoin miner manufacturer Auradine has raised $153 million in a Series C funding round as it expands into AI infrastructure. The round was led by StepStone Group and included participation from Maverick Silicon, Premji Invest, Samsung Catalyst Fund, Qualcomm Ventures, Mayfield, MARA Holdings, GSBackers, and other existing investors. The firm raised to over $300 million since its inception in 2022.

- Voltage has partnered with BitGo to [enable](https://www.voltage.cloud/blog/bitgo-and-voltage-team-up-to-deliver-instant-bitcoin-and-stabl

-

@ eb0157af:77ab6c55

2025-05-31 16:01:11

@ eb0157af:77ab6c55

2025-05-31 16:01:11Bitmain’s new device raises the bar for energy efficiency.

During the World Digital Mining Summit, Bitmain introduced its latest bitcoin mining device: the Antminer S23 Hydro. The new miner promises an energy efficiency of 9.5 joules per terahash (J/TH), setting new industry standards.

ANTMINER S23 Hyd. Newly Launched at WDMS 2025!

ANTMINER S23 Hyd. Newly Launched at WDMS 2025!

580T 9.5J/T

580T 9.5J/T

Sales Start from May 28th, 9:00AM (EST)

Shipping from Q1, 2026 pic.twitter.com/Kg3VJTt7Rg— BITMAIN (@BITMAINtech) May 27, 2025

According to Bitmain’s presentation, the Antminer S23 Hydro delivers up to 580 TH/s with a power consumption of 5,510 watts.

Scheduled for release in early 2026, the Antminer S23 Hydro marks a major leap forward compared to the first ASIC devices dedicated to mining. To put it in perspective, the first specialized miners launched in 2013 consumed around 1,200 J/TH. Bitmain’s latest device therefore represents a more than 99% improvement in efficiency.

Hashprice and economic challenges

In recent months, the hashprice — the metric measuring mining profitability — has remained relatively low, dropping below $39 per petahash per second during the year. As of now, the hashprice stands at around $55 per petahash per second, according to data from Hashrate Index.

This scenario has pushed several companies in the sector to rethink their expansion strategies. Instead of increasing hashing capacity, many are choosing to upgrade their existing fleets, focusing on efficiency rather than sheer scale.

The introduction of the Antminer S23 Hydro could catalyze a transformation within the mining ecosystem. The gradual replacement of outdated devices with more efficient technology could lead to a significant reduction in the Bitcoin network’s overall energy consumption.

The post Bitmain unveils the Antminer S23 Hydro: unprecedented efficiency appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-05-31 16:00:51

@ b1ddb4d7:471244e7

2025-05-31 16:00:51In the heart of East Africa, where M-Pesa reigns supreme and innovation pulses through bustling markets, a quiet revolution is brewing—one that could redefine how millions interact with money.

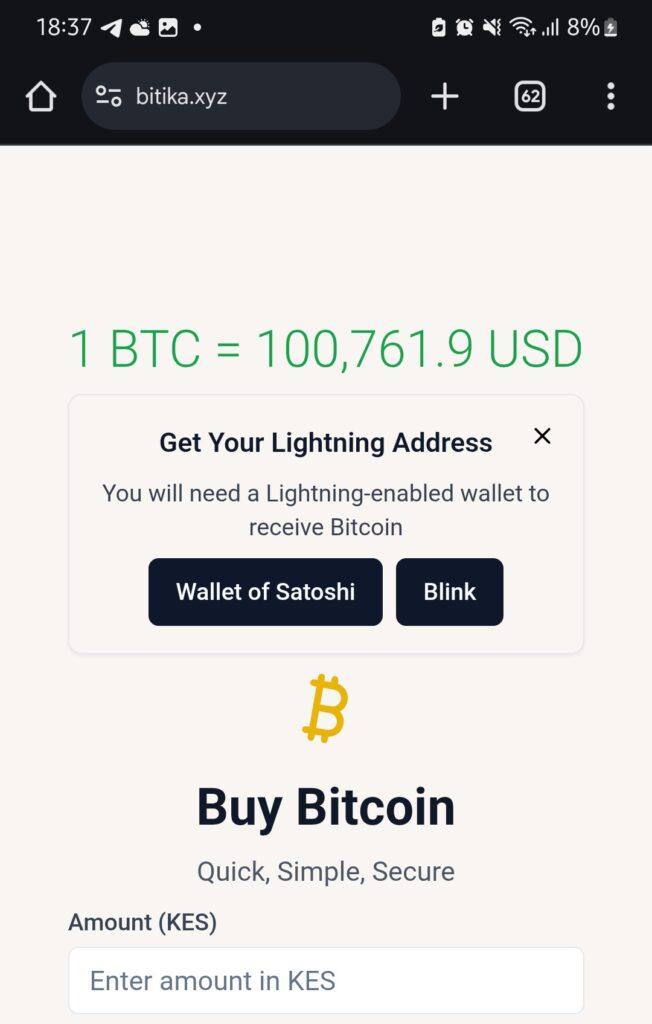

Enter Bitika, the Kenyan startup turning bitcoin’s complexity into a three-step dance, merging the lightning speed of sats with the trusted rhythm of mobile money.

At the helm is a founder whose “aha” moment came not in a boardroom, but at his kitchen table, watching his father grapple with the gap between understanding bitcoin and actually using it.

Bitika was born from that friction—a bridge between M-Pesa’s ubiquity and bitcoin’s borderless promise, wrapped in a name as playful as the Swahili slang that inspired it.

But this isn’t just a story about simplifying transactions. It’s about liquidity battles, regulatory tightropes, and a vision to turn Bitika into the invisible rails powering Africa’s Bitcoin future.

Building on Bitcoin

- Tell us a bit about yourself and how you got into bitcoin/fintech, and what keeps you passionate about this space?

I first came across bitcoin in 2020, but like many at that time, I didn’t fully grasp what it really was. It sounded too complicated, probably with the heavy terminologies. Over time, I kept digging deeper and became more curious.

I started digging into finance and how money works and realised this was what I needed to understand bitcoin’s objectives. I realized that bitcoin wasn’t just a new type of money—it was a breakthrough in how we think about freedom, ownership, and global finance.

What keeps me passionate is how bitcoin can empower people—especially in Africa—to take control of their wealth, without relying on unstable systems or middlemen.

- What pivotal moment or experience inspired you to create Bitika? Was there a specific gap in Kenya’s financial ecosystem that sparked the idea?

Yes, this idea was actually born right in my own home. I’ve always been an advocate for bitcoin, sharing it with friends, family, and even strangers. My dad and I had countless conversations about it. Eventually, he understood the concept. But when he asked, “How do I even buy bitcoin?” or “Can you just buy it for me?” and after taking him through binance—that hit me.

If someone I’d educated still found the buying process difficult, how many others were feeling the same way? That was the lightbulb moment. I saw a clear gap: the process of buying bitcoin was too technical for the average Kenyan. That’s the problem Bitika set out to solve.

- How did you identify the synergy between bitcoin and M-Pesa as a solution for accessibility?

M-Pesa is at the center of daily life in Kenya. Everyone uses it—from buying groceries to paying rent. Instead of forcing people to learn new tools, I decided to meet them where they already are. That synergy between M-Pesa and bitcoin felt natural. It’s about bridging what people already trust with something powerful and new.

- Share the story behind the name “Bitika” – does it hold a cultural or symbolic meaning?

Funny enough, Bitika isn’t a deeply planned name. It came while I was thinking about bitcoin and the type of transformation it brings to individuals. In Swahili, we often add “-ka” to words for flair—like “bambika” from “bamba.”

So, I just coined Bitika as a playful and catchy way to reflect something bitcoin-related, but also uniquely local. I stuck with it because thinking of an ideal brand name is the toughest challenge for me.

- Walk us through the user journey – how does buying bitcoin via M-Pesa in “3 simple steps” work under the hood?

It’s beautifully simple.

1. The user enters the amount they want to spend in KES—starting from as little as 50 KES (about $0.30).

2. They input their Lightning wallet address.

3. They enter their M-Pesa number, which triggers an STK push (payment prompt) on their phone. Once confirmed—pap!—they receive bitcoin almost instantly.

Under the hood, we fetch the live BTC price, validate wallet addresses, check available liquidity, process the mobile payment, and send sats via the Lightning Network—all streamlined into a smooth experience for the user.

- Who’s Bitika’s primary audience? Are you focusing on unbanked populations, tech enthusiasts, or both?

Both. Bitika is designed for everyday people—especially the unbanked and underbanked who are excluded from traditional finance. But we also attract bitcoiners who just want a faster, easier way to buy sats. What unites them is the desire for a seamless and low-barrier bitcoin experience.

Community and Overcoming Challenges

- What challenges has Bitika faced navigating Kenya’s bitcoin regulations, and how do you build trust with regulators?

Regulation is still evolving here. Parliament has drafted bills, but none have been passed into law yet. We’re currently in a revision phase where policymakers are trying to strike a balance between encouraging innovation and protecting the public.

We focus on transparency and open dialogue—we believe that building trust with regulators starts with showing how bitcoin can serve the public good.

- What was the toughest obstacle in building Bitika, and how did you overcome it?

Liquidity. Since we don’t have deep capital reserves, we often run into situations where we have to pause operations often to manually restock our bitcoin supply. It’s frustrating—for us and for users. We’re working on automating this process and securing funding to maintain consistent liquidity so users can access bitcoin at any time, without disruption.

This remains our most critical issue—and the primary reason we’re seeking support.

- Are you eyeing new African markets? What’s next for Bitika’s product?

Absolutely. The long-term vision is to expand Bitika into other African countries facing similar financial challenges. But first, we want to turn Bitika into a developer-first tool—infrastructure that others can build on. Imagine local apps, savings products, or financial tools built using Bitika’s simple bitcoin rails. That’s where we’re heading.

- What would you tell other African entrepreneurs aiming to disrupt traditional finance?

Disrupting finance sounds exciting—but the reality is messy. People fear what they don’t understand. That’s why simplicity is everything. Build tools that hide the complexity, and focus on making the user’s life easier. Most importantly, stay rooted in local context—solve problems people actually face.

What’s Next?

- What’s your message to Kenyans hesitant to try bitcoin, and to enthusiasts watching Bitika?

To my fellow Kenyans: bitcoin isn’t just an investment—it’s a sovereign tool. It’s money you truly own. Start small, learn, and ask questions.

To the bitcoin community: Bitika is proof that bitcoin is working in Africa. Let’s keep pushing. Let’s build tools that matter.

- How can the bitcoin community, both locally and globally, support Bitika’s mission?

We’re currently fundraising on Geyser. Support—whether it’s financial, technical, or simply sharing our story—goes a long way. Every sat you contribute helps us stay live, grow our liquidity, and continue building a tool that brings bitcoin closer to the everyday person in Africa.

Support here: https://geyser.fund/project/bitika

-

@ cae03c48:2a7d6671

2025-05-31 16:00:29

@ cae03c48:2a7d6671

2025-05-31 16:00:29Bitcoin Magazine

Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous”At the 2025 Bitcoin Conference in Las Vegas, the Director of Bitcoin Beach Mike Peterson, the Presidential Advisors of Building Bitcoin Country El Salvador Max & Stacy and the Mayor City of Panama Mayer Mizrachi discussed Bitcoins future in Panama.

At the beginning of the panel, Is Panama Next? El Salvador Leading The Region For Bitcoin Adoption, Mayor Mizrachi started by mentioning, “We accept Bitcoin. The city gets paid in Bitcoin, but it receives in dollars through an intermediary processing, payments processor. Bitcoin is not just safe. It’s prosperous.”

Max commented about the scammers in crypto and how El Salvador is managing it.

“We did a couple of things early on, one was to create The Bitcoin Office which will be directly reporting to the President, and then also we passed a law which will say bitcoin is money and everything else is an unregistered security,” said Max.

Mike Peterson stated, “the access of Bitcoin in Central America to do battle against the globalists that have always looked at the regionist back yard. This is intolerable and this is going to change right now.” After Mizrachi commented, “Imagine yourself in an economic block powered by El Salvador, supported by Panama and the rest will come.”

Stacy reminded everybody about El Salvador’s School system.

“El Salvador is the first country in the world to have a comprehensive public school financial literacy education program from 7 years old,” mentioned Stacy. “These are little kids, learning financial literacy.”

Max ended the panel by saying, “the US game theory right? Because the US wants to buy a lot of Bitcoin, so if Panama wants to buy a lot of bitcoin then it helps everybody in the US. This is the beautiful expression of game theory perfectly aligned in the protocol that is changing the world that we live in. And on the street level what bitcoin does to the population is to go from a spending mentality to a saving mentality.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post Panama City Mayor Mizrachi: “Bitcoin Is Not Just Safe, It’s Prosperous” first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-05-31 16:00:29

@ cae03c48:2a7d6671

2025-05-31 16:00:29Bitcoin Magazine

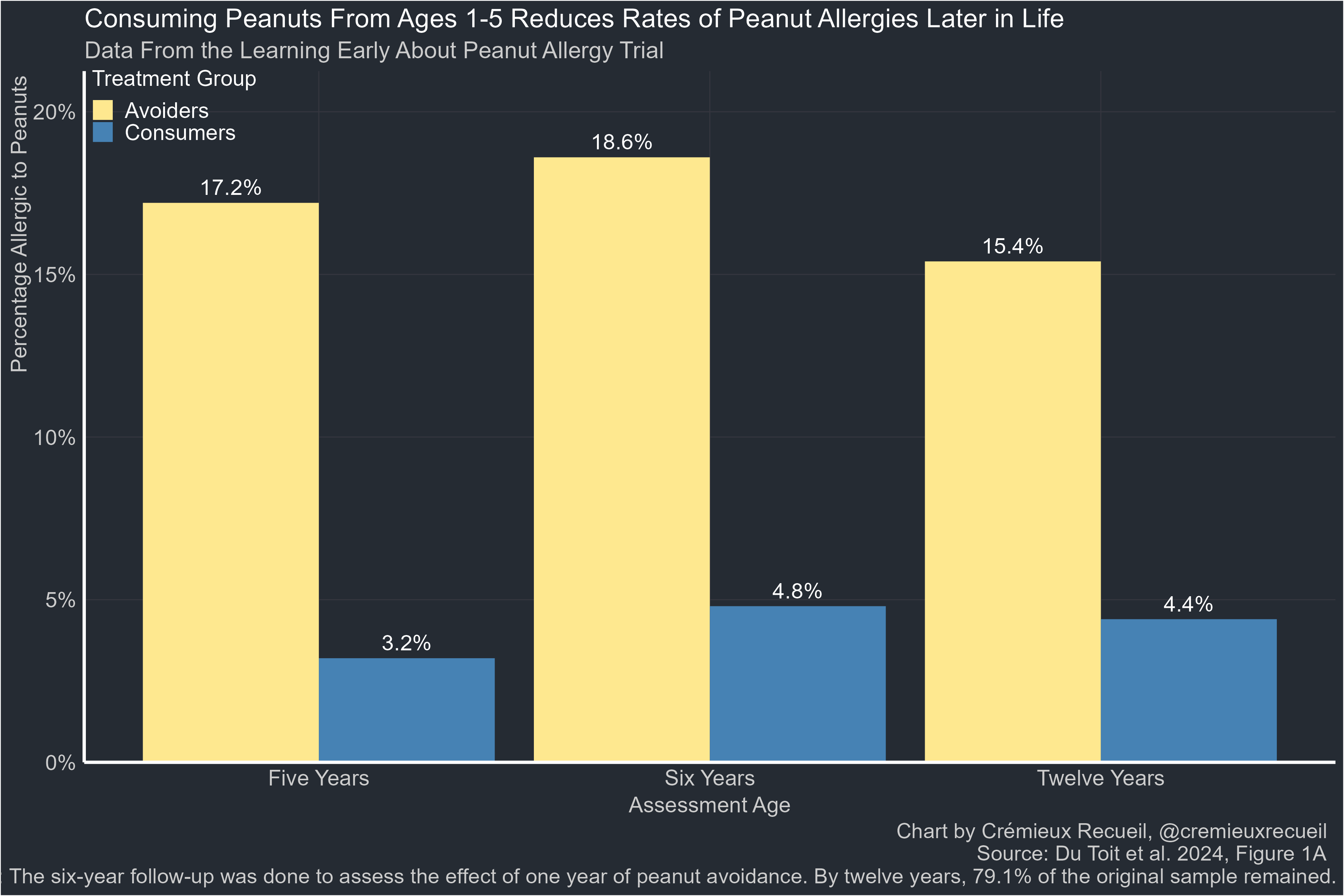

The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025“Nothing stops this train,” Lyn Alden initially stated at Bitcoin 2025, walking the audience through a data-rich presentation that made one thing clear: the U.S. fiscal system is out of control—and Bitcoin is more necessary than ever.

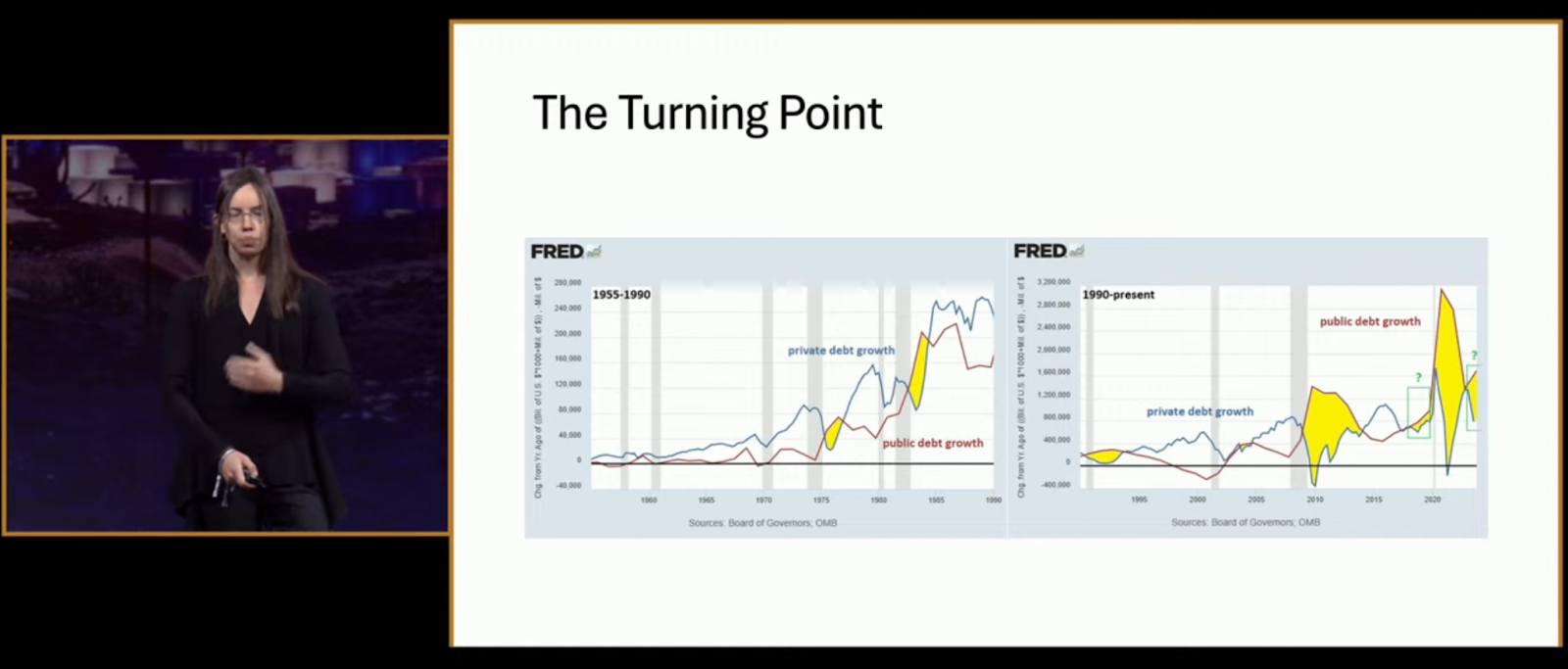

Her first chart, sourced from the Federal Reserve’s FRED database, displayed a stark decoupling: the unemployment rate is down, yet the fiscal deficit has surged past 7% of GDP. “This started around 2017, went into overdrive during the pandemic, and hasn’t corrected,” Alden said. “That’s not normal. We’re in a new era.”

She didn’t mince words. “Nothing stops this train because there are no brakes attached to it anymore. The brakes are heavily impaired.

Why should Bitcoiners care? Because, as Alden explained, “it matters for asset prices—especially anything scarce.” She displayed a gold vs. real rates chart that showed gold soaring as real interest rates plunged. “Five years ago, most would have said Bitcoin couldn’t thrive in a high-rate environment. Yet here we are—Bitcoin over $100K, gold at new highs, and banks breaking under pressure.”

Next came what she called “The Turning Point”—a side-by-side showing how public debt growth overtook private sector debt post-2008, flipping a decades-long norm. “This is inflationary, persistent, and it means the Fed can’t slow things down anymore.”

Another chart revealed why rising interest rates are now accelerating the deficit. “They’ve lost their brakes. Raising rates just makes the federal interest bill explode faster than it slows bank lending.”

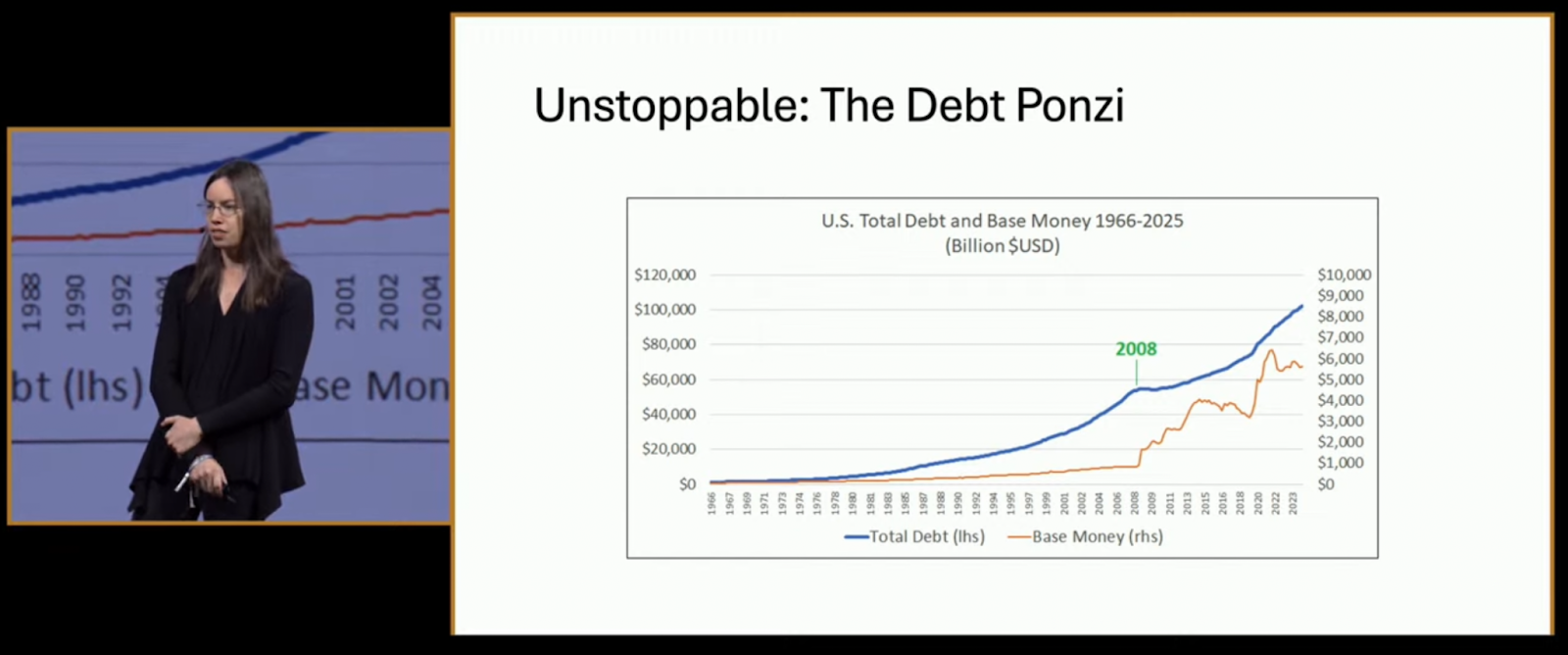

Alden called it a ponzi: “The system is built on constant growth. Like a shark, it dies if it stops swimming.”

Her slide showed a relentless rise in total debt versus base money—except for a jolt in 2008, and again after 2020. “This isn’t going backward. Ever.”

So why Bitcoin? “Because it’s the opposite. Scarce, decentralized, and mathematically capped,” Alden concluded. “There are two reasons nothing stops this train: math and human nature. Bitcoin is the mirror of this system—and the best protection from it.”

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post The Debt Train Has No Brakes: Lyn Alden Makes the Case for BTC at Bitcoin 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-31 16:00:28

@ cae03c48:2a7d6671

2025-05-31 16:00:28Bitcoin Magazine

Jack Mallers Announced A New System of Bitcoin Backed Loans at StrikeThe Founder and CEO of Strike, Jack Mallers, at the 2025 Bitcoin Conference in Las Vegas, announced a new system of Bitcoin backed loans at Strike with one digit interest rate.

Jack Mallers began his keynote by pointing at the biggest problem. Fiat currency.

“The best time to go to Whole Foods and buy eggs with your dollars was 1913,” said Mallers. “Every other time after, you are getting screwed.”

What’s the solution?

“The solution is Bitcoin,” stated Mallers. “Bitcoin is the money that we coincide that nobody can print. You can’t print, you can’t debase my time and energy, you cannot deprive me of owning assets, of getting out of debt, of living sovereignly and protecting my future, my family, my priced possessions. Bitcoin is what we invented to do that.”

Mallers gave a power message to the audience by explaining that people should HODL every dollar they have in Bitcoin. People should also spend a little of it to have a nice life.

“You can’t HODL forever,” said Jack.

While talking about loans that people borrow against their Bitcoin. He explained why he thinks banks putting 20% in interest for loans backed with Bitcoin is outrageous.

“All these professional economists, they are like Bitcoin is risky and volatile,” stated Mallers. “No it’s not. This is the magnificent 7 one year volatility and the orange one in the middle is Bitcoin. It’s no more risky and volatile. It’s a little bit more volatile than Apple, but is far less more volatile than Tesla.”

“As Bitcoin matures, its volatility goes down,” continued Jack. “Bitcoin volatility is at a point where it is no more risky than a Tesla Stock. We should not be paying double digits rates for a loan.”

Mallers announced his new system of loans at Strike of 9-13% in interest rates. It will allow people to get loans from $10,000 to $1 billion.

Mallers closed by saying, “please be responsible. This is debt. Debt is like fire in my opinion. It can heat a civilization. It can warm your home, but if you go too crazy it can burn your house down.”

“Life is short,” said Jack. “Take the trip, but with bitcoin you just get to take a better one.”

This post Jack Mallers Announced A New System of Bitcoin Backed Loans at Strike first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-05-31 16:00:27

@ cae03c48:2a7d6671

2025-05-31 16:00:27Bitcoin Magazine

Michael Saylor Presents The 21 Ways to Wealth at Bitcoin 2025Michael Saylor, Executive Chairman of Strategy, took the stage at Bitcoin 2025 delivering a keynote titled “21 Ways to Wealth.” He stated: “This speech is for you. I’ve traveled the world and told countries, institutional investors, and even the disembodied spirits of our children’s children why they need Bitcoin. This is for every individual, every family, every small business. It’s for everybody.”

He began with clarity. “The first way to wealth is clarity,” he said. “Clarity comes the moment you realize Bitcoin is capital—perfected capital, programmable capital, incorruptible capital.” For Saylor, every thoughtful individual on Earth will ultimately seek such pristine capital, and every AI system will prefer it as well.

The second path is conviction. Bitcoin, he said, will appreciate faster than every other asset, because it’s engineered for performance. “It’s going to grow faster than real estate or collectibles. It is the most efficient store of value in human history.”

The third way is courage. “If you’re going to get rich on Bitcoin, you need courage,” he warned. “Wealth favors those who embrace intelligent monetary risk. Some people will get left behind. Others will juggle it. But the bold will feed the fire—sell your bonds, buy Bitcoin. An extraordinary explosion of value is coming.”

Fourth comes cooperation. “You are more powerful if you have the full support of your family. Your children have time and potential. The secret is transferring capital into their hands. Families that move in unity are unstoppable.”

The fifth is capability. “Master AI,” he said. “In 2025, everything you can imagine is at your fingertips—wisdom, analysis, creativity. Ask AI, argue with it, use it. You can become a super genius. Don’t put your ego first—put your interests first. Your family will thank you.”

Saylor’s sixth way to wealth is composition: construct legal entities that scale your strategy and protect your assets. “Ask the AI and figure it out. You can work hard, or you can work smart. This year, everyone should be operating like the most sophisticated millionaire family office.”

The seventh is citizenship. Choose your economic nexus carefully—“domicile where sovereignty respects your freedom,” he said. “This isn’t just about this year—it’s about this century.”

Eighth is civility. “Respect the natural power structures of the world. Respect the force of nature,” he explained. “If you want to generate wealth in the Bitcoin universe, don’t fight unnecessarily. Find common ground. Inflation and distraction are your enemies.”

Ninth is corporation. “A well-structured corporation is the most powerful wealth engine on Earth. Families are powerful. Partnerships are even more powerful. But corporations can scale globally. What is your vehicle? What is your path?”

The tenth way is focus. “Just because you can do a thing doesn’t mean you should,” he warned. “If you invest in Bitcoin, there’s a 90% chance it will succeed over five years. Don’t confuse ambition with accomplishment. Come up with a strategy—and stick to it.”

The eleventh is equity. “Share your opportunities with investors who will share your risk,” he said, pointing to MicroStrategy’s own rise from $10 million to a $5 billion market cap by aligning with equity partners who believed in the Bitcoin mission.

The twelfth is credit. “There are people in the world who are afraid of the future—they want small yield, certainty. Offer that. Give creditors security in return for capital. Convert their fear into fuel and turn risk into yield by investing in Bitcoin.”

The thirteenth is compliance. “Create the best company you can within the rules of your market. Learn the rules of the road. If you know them, you can drive faster. You can scale legally and sustainably.”

The fourteenth way is capitalization. “Velocity compounds wealth,” Saylor said. “Raise and reinvest capital as fast and as often as you can. The faster your money moves into productive Bitcoin strategies, the more it multiplies.”

Fifteenth is communication. “Speak with candor. Act with transparency. And repeat your message often,” he urged. “Creating wealth with Bitcoin is simple—but only if people understand what you’re doing and why you’re doing it.”

Sixteenth is commitment. “Don’t allow yourself to be distracted,” he said. “Don’t chase your own ideas. Don’t feed the trolls. Stay committed to Bitcoin. It’s the greatest idea in the world. The world probably doesn’t care what you think—but it will care when you win.”

The Seventeenth way is competence. “You’re not competing with noise—you’re competing with someone who is laser-focused, who executes flawlessly,” he said. “You must deliver consistent, precise, and reliable performance. That’s how you win.”

The Eighteenth is adaptation. “Circumstances change. Every structure you trust today will eventually fail. A wise person is prepared to abandon their baggage and adjust plans when needed. Rigidity is ruin.”

Nineteenth is evolution. “Build on your core strengths. You don’t need to start over—you need to level up. Leverage what you already do best, and expand it through Bitcoin and advanced technologies.”

Twentieth is advocacy. “Inspire others to walk the Bitcoin path,” he said. “Become an evangelist for economic freedom. Show others what this revolution really means. Show them the way.”

Finally, the twenty-first way is generosity. “When you’re successful—and you will be successful—spread happiness. Share security. Deliver hope. That light inside you will shine. And others will be drawn to it.”

As he ended, Saylor smiled and quoted the very origin of it all:

“It might make sense to get some, in case it catches on.” – Satoshi.

In Michael Saylor’s worldview, Bitcoin is not a get-rich-quick scheme—it’s the ultimate long-term play. It is the foundation of generational wealth, the engine of personal and institutional freedom, and the tool for those bold enough to lead humanity into a more sovereign, secure future.

You can watch the full panel discussion and the rest of the Bitcoin 2025 Conference Day 3 below:

This post Michael Saylor Presents The 21 Ways to Wealth at Bitcoin 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ dfa02707:41ca50e3

2025-05-31 15:01:37

@ dfa02707:41ca50e3

2025-05-31 15:01:37Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ cae03c48:2a7d6671

2025-05-31 16:00:26

@ cae03c48:2a7d6671

2025-05-31 16:00:26Bitcoin Magazine

Bitcoin Builders Exist Because Of UsersBuilder: Nicholas Gregory

Language(s): C++, Rust

Contribute(s/ed) To: Ocean Sidechain, Mainstay, Mercury Wallet, Mercury Layer

Work(s/ed) At: CommerceBlock (formerly)

Prior to Bitcoin, Nicholas was a software developer working in the financial system for banking firms developing trading and derivatives platforms. After the 2008 financial crisis he began to consider alternatives to the legacy financial system in the fallout.

Like many from that time, he completely ignored the original Slashdot article featuring the Bitcoin whitepaper due to the apparent focus on Windows as an application platform (Nicholas was a UNIX/Linux developer). Thankfully someone he knew introduced him to Bitcoin later on.

The thing that captured his interest about Bitcoin rather than other alternatives at the time was its specific architecture as a distributed computer network.

“The fact that it was like an alternative way. It was all based around [a] kind of […] network. And what I mean by that, building financial systems, people always wanted a system that was 24-7.

And how do you deal with someone interacting [with] it in different geographical parts of the world without it being centralized?

And I’d seen various ways of people solving that problem, but it never had been done, you know, in a kind of […] scalable solution. And using […] cryptography and proof of work to solve that issue was just weird, to be honest. It was totally weird for me.”

All of the other systems he had designed, and some that he built, were systems distributed across multiple parts of the world. Unlike Bitcoin however, these systems were permissioned and restricted who could update the relevant database(s) despite that fact that copies of them were redundantly distributed globally.

“The fact that in Bitcoin you had everyone kind of doing this proof of work game, which is what it is. And whoever wins does the [database] write. That mess[ed] with my head. That was […] very unique.”

Beginning To Build

Nicholas’s path to building in the space was an organic one. At the time he was living in New York City, and being a developer he of course found the original Bitdevs founded in NYC. Back then meetups were incredibly small, sometimes even less than a dozen people, so the environment was much more conducive to in-depth conversations than some larger meetups these days.

He first began building a “hobbyist” Over The Counter (OTC) trading software stack for some people (back then a very significant volume of bitcoin was traded OTC for cash or other fiat mediums). From here Nicholas and Omar Shibli, whom he met at Bitdevs, worked together on Pay To Contract (BIP 175).

BIP 175 specifies a scheme where a customer purchasing a good participates in generating the address the merchant provides. This is done by the two first agreeing on a contract describing what is being paid for, afterwards the merchant sends a master public key to the consumer, who uses the hash of that description of the item or service to generate an individual address using the hash and master public key.

This allows the customer to prove what the merchant agreed to sell them, and that the payment for the good or service has been made. Simply publishing the master public key and contract allows any third party to generate the address that was paid, and verify that the appropriate amount of funds were sent there.

Ocean and Mainstay

Nicholas and Omar went on to found CommerceBlock, a Bitcoin infrastructure company. Commerceblock took a similar approach to business as Blockstream, building technological platforms to facilitate the use of Bitcoin and blockchains in general in commerce and finance. Shortly afterwards Nicholas met Tom Trevethan who came on board.

“I met Tom via, yeah, a mutual friend, happy to say who it is. There’s a guy called, who, new people probably don’t know who he is, but OGs do, John Matonis. John Matonis was a good friend of mine, [I’d] known him for a while. He introduced me to Tom, who was, you know, kind of more on the cryptography side. And it kind of went from there.”

The first major project they worked on was Ocean, a fork of the Elements sidechain platform developed by Blockstream that the Liquid sidechain was based on. The companies CoinShares and Blockchain in partnership with others launched an Ocean based sidechain in 2019 to issue DGLD, a gold backed digital token.

“So we, you know, we were working on forks of Elements, doing bespoke sidechains. […] Tom had some ideas around cryptography. And I think one of our first ideas was about how to bolt on these forks of Elements onto […] the Bitcoin main chain. […] We thought the cleanest way to do that was […] using some sort of, I can’t remember, but it was something [based on] single-use sealed sets, which was an invention by Peter Todd. And I think we implemented that fairly well with Mainstay.”

The main distinction between Ocean and Liquid as a sidechain platform is Ocean’s use of a protocol designed at Commerceblock called Mainstay. Mainstay is a timestamping protocol that, unlike Opentimestamps, strictly orders the merkle tree it builds instead of randomly adding items in whatever order they are submitted in. This allows each sidechain to timestamp its current blockheight into the Bitcoin blockchain everytime mainchain miners find a block.

While this is useless for any bitcoin pegged into the sidechain, for regulated real world assets (RWA), this provides a singular history of ownership that even the federation operating the sidechain cannot change. This removes ambiguity of ownership during legal disputes.

When asked about the eventually shuttering of the project, Nicholas had this to say:

“I don’t know if we were early, but we had a few clients. But it was, yeah, there wasn’t much adoption. I mean, Liquid wasn’t doing amazing. And, you know, being based in London/Europe, whenever we met clients to do POCs, we were competing against other well-funded projects.

It shows how many years ago they’d either received money from people like IBM or some of the big consultancies and were promoting Hyperledger. Or it was the days when we would be competing against EOS and Tezos. So because we were like a company that needed money to build prototypes or build sidechains, it kind of made it very hard. And back then there wasn’t much adoption.”

Mercury Wallet and Mercury Layer

After shutting down Ocean, Nicholas and Tom eventually began working on a statechain implementation, though the path to this was not straightforward.

“[T]here were a few things happening at the same time that led to it. So the two things were we were involved in a [proof of concept], a very small […]POC for like a potential client. But this rolled around Discreet Log Contracts. And one of the challenges of Discreet Log Contracts, they’re very capital inefficient. So we wanted a way to novate those contracts. And it just so happened that Ruben Sampson, you know, wrote this kind of white paper/Medium post about statechains. And […] those two ideas, that kind of solved potentially that issue around DLCs.”

In the end they did not wind up deploying a statechain solution for managing DLCs, but went in a different direction.

Well, there was another thing happening at the same time, coinswaps. And, yeah, bear in mind, in those days, everyone worried that by […] 2024/2025 […] network fees could be pretty high. And to do […] coin swaps, you kind of want to do multiple rounds. So […] state chains felt perfect because […] you basically take a UTXO, you put it off the chain, and then you can swap it as much as you want.”

Mercury Wallet was fully built out and functional, but sadly never gained any user adoption. Samourai Wallet and Wasabi Wallet at the time dominated the privacy tool ecosystem, and Mercury Wallet was never able to successfully take a bite out of the market.

Rather than completely give up, they went back to the drawing board to build a statechain variant using Schnorr with the coordinator server blind signing, meaning it could not see what it was signing. When asked why those changes were made, he had this to say: “That would give us a lot more flexibility to do other things in Bitcoin with L2s. You know, the moment you have a blinded solution, we thought, well, this could start having interoperability with Lightning.”

Rather than building a user facing wallet this time, they built out a Software Development Kit (SDK) that could be integrated with other wallets.

“{…] I guess with Mercury Layer, it was very much building a kind of […] full-fledged Layer 2 that anyone could use. So we [built] it as an SDK. We did have a default wallet that people could run. But we were hoping that other people would integrate it.”

The End of CommerceBlock

In the end, CommerceBlock shuttered its doors after many years of brilliant engineering work. Nicholas and the rest of the team built numerous systems and protocols that were very well engineered, but at the end of the day they seemed to always be one step ahead of the curve. That’s not necessarily a good thing when it comes to building systems for end users.

If your work is too far ahead of the demand from users, then in the end that isn’t a sustainable strategy.

“…being in the UK, which is not doing that well from a regulatory point of view, played into it. If I

-

@ 2e8970de:63345c7a

2025-05-31 11:54:55

@ 2e8970de:63345c7a

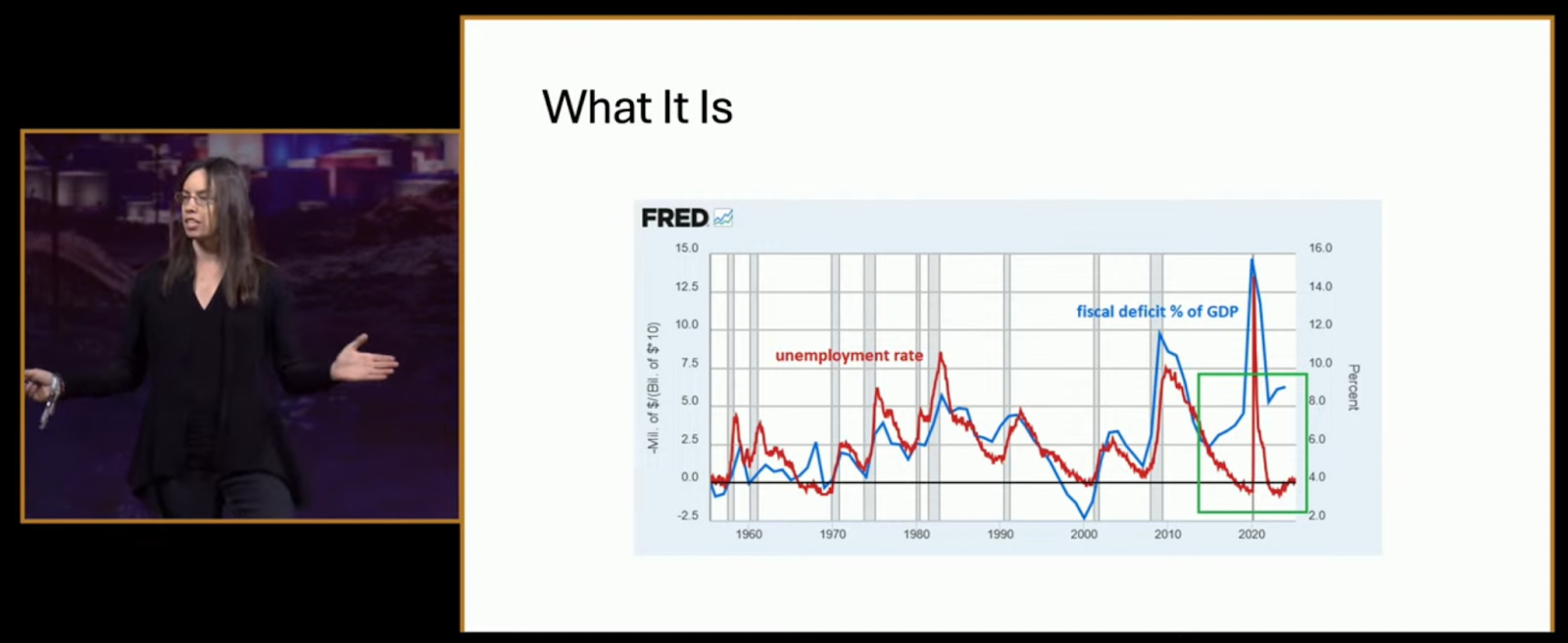

2025-05-31 11:54:55https://evidence.nejm.org/doi/full/10.1056/EVIDoa2300311

The solution to peanut allergy? Import Bamba!

https://stacker.news/items/993440

-

@ 005bc4de:ef11e1a2

2025-05-31 10:55:47

@ 005bc4de:ef11e1a2

2025-05-31 10:55:47LUV and Hivebits/HBIT/Wusang pause tl;dr LUV and HBIT (aka, Hivebits and the Wusang game) are on a pause at the moment, taking a break. https://files.peakd.com/file/peakd-hive/crrdlx/23x1SY8Vx8j1mVGnDFtq7ebuzKNGd8K9Ssex51AEerxks1VYikxGPShM7bjNhmSrEZ2wf.png Image from pixabay.com Why? There are odd things going on. I have a theory, but here's what is known... May 28, 2025, at about 1:30 pm GMT (8:30 AM EDT), a second attack (for lack of better term) hit HBIT in about a week. It seemed to start with @tyler45 with this comment https://peakd.com/blog/@tyler45/comment-20250528125108033 tx: https://he.dtools.dev/tx/7e7d4126196ca5b6dbe0a04dcded0e25d3bcc7f4 See tyler45's activity at https://he.dtools.dev/@tyler45 Notice the reply and WUSANG command is to a post by @olivia897 and how many of the other WUSANG comments on the explorer are in reply to olivia897. It seems these are all auto-generated accounts. The names and "birthdates" and interactions all point to automation. Once initiated, things happened very fast on the back end, clearly not being done manually. In this way, this seems rather sophisticated technically. I estimate just over 400 HBIT were pilfered the other day from the @Hivebits account before I noticed and was able to shut things down. Just for a little background, after the first attack May 21, 2025. I wrote a small bit of info: https://peakd.com/hivebits/@crrdlx/hbit-resource-credits A couple of days ago this post by @holoz0r was interesting: https://peakd.com/hive-133987/@holoz0r/text-analytics-reveal-thirty-two-percent-of-comments-on-hive-are-not-unique-and-at-least-ten-percent-add-no-value-to-discussion The thing that caught my eye was that the WUSANG comment was the largest by far, along with BBH (hello @bradleyarrow), because the attackers used both commands. Then, a few days later, things happened again: sudden start, repetitive bot attack, until I shut things down. So, a pause This is a period in my personal calendar where I simply don't have time to sit down at a computer for an extended period and try fiddle with this stuff. So, for now @Luvshares and @Hivebits (HBIT) and the @Wusang game are on hold. Plus, there's other fun stuff to do. https://files.peakd.com/file/peakd-hive/crrdlx/AJL43SREA1EuyqPXhydmqaq1RHhRVoYd12PfiBN5vDMu2WSKUtGeYWgKJyuRwV8.jpg I go by @crrdlx or "CR" for short. See all my links or contact info at https://linktr.ee/crrdlx.

Originally posted on Hive at https://peakd.com/@crrdlx/luv-and-hivebitshbitwusang-pause

Auto cross-post via Hostr v0.1.48 (br) at https://hostr-home.vercel.app

-

@ cae03c48:2a7d6671

2025-05-31 16:00:25

@ cae03c48:2a7d6671

2025-05-31 16:00:25Bitcoin Magazine

Amboss Launches Rails, a Self-Custodial Bitcoin Yield ServiceAmboss, a leader in AI-driven solutions for the Bitcoin Lightning Network, today announced Rails, a groundbreaking self-custodial Bitcoin yield service. According to a press release sent to Bitcoin Magazine, it’s designed to empower companies, custodians, and high net worth individuals. This allows participants to earn a yield on their Bitcoin.

Big news from @TheBitcoinConf !

We’re thrilled to announce Rails—a self-custodial Bitcoin yield service that empowers you to earn on your BTC while supercharging the Lightning Network.Let’s bring Bitcoin to the World.https://t.co/3WYYvB95hP

— AMBOSS

(@ambosstech) May 29, 2025

(@ambosstech) May 29, 2025Rails also launched a secure way for Liquidity Providers (LPs) to hold all custody of their Bitcoin while generating returns from liquidity leases and payment routing, although they are not guaranteed. The implementation of Amboss’ AI technology, Rails strengthened their Lighting Network with more dependable transactions and larger payment volumes.

“Rails is a transformative force for the Lightning Network,” said the CEO and Co-Founder of Amboss Jesse Shrader. “It’s not just about yield—it’s about enabling businesses to strengthen the network while earning on their Bitcoin. This is a critical step in Bitcoin’s evolution as a global medium of exchange.”

The service offers two options:

- Rails LP is designed for high net worth individuals, custodians, and companies with Bitcoin treasuries, requiring a minimum commitment of 1 BTC for one year.

- Liquidity subscriptions are designed for businesses that receive Bitcoin payments, with fees starting at 0.5%.

Amboss partnered with CoinCorner and Flux (a joint venture between Axiom and CoinCorner), to bring Rails to the market. CoinCorner has incorporated it into both its exchange platform and daily payment services in the Isle of Man. Flux is jointly focused on advancing the Lightning Network’s presence in global payments. Their participation highlights growing industry trust in Rails as a tool to scale Bitcoin effectively.

“Rails offers a practical way for businesses like ours to participate in the Lightning Network’s growth,” said the CFO of CoinCorner David Boylan. “We’ve been using the Lightning Network for years, and Rails provides a structured approach to engaging with its economy, particularly through liquidity leasing and payment routing. This aligns with our goal of making Bitcoin more accessible and practical for everyday use.”

This post Amboss Launches Rails, a Self-Custodial Bitcoin Yield Service first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ b1ddb4d7:471244e7

2025-05-31 15:00:51

@ b1ddb4d7:471244e7

2025-05-31 15:00:51Starting January 1, 2026, the United Kingdom will impose some of the world’s most stringent reporting requirements on cryptocurrency firms.

All platforms operating in or serving UK customers-domestic and foreign alike-must collect and disclose extensive personal and transactional data for every user, including individuals, companies, trusts, and charities.

This regulatory drive marks the UK’s formal adoption of the OECD’s Crypto-Asset Reporting Framework (CARF), a global initiative designed to bring crypto oversight in line with traditional banking and to curb tax evasion in the rapidly expanding digital asset sector.

What Will Be Reported?

Crypto firms must gather and submit the following for each transaction:

- User’s full legal name, home address, and taxpayer identification number

- Detailed data on every trade or transfer: type of cryptocurrency, amount, and nature of the transaction

- Identifying information for corporate, trust, and charitable clients

The obligation extends to all digital asset activities, including crypto-to-crypto and crypto-to-fiat trades, and applies to both UK residents and non-residents using UK-based platforms. The first annual reports covering 2026 activity are due by May 31, 2027.

Enforcement and Penalties

Non-compliance will carry stiff financial penalties, with fines of up to £300 per user account for inaccurate or missing data-a potentially enormous liability for large exchanges. The UK government has urged crypto firms to begin collecting this information immediately to ensure operational readiness.

Regulatory Context and Market Impact

This move is part of a broader UK strategy to position itself as a global fintech hub while clamping down on fraud and illicit finance. UK Chancellor Rachel Reeves has championed these measures, stating, “Britain is open for business – but closed to fraud, abuse, and instability”. The regulatory expansion comes amid a surge in crypto adoption: the UK’s Financial Conduct Authority reported that 12% of UK adults owned crypto in 2024, up from just 4% in 2021.

Enormous Risks for Consumers: Lessons from the Coinbase Data Breach

While the new framework aims to enhance transparency and protect consumers, it also dramatically increases the volume of sensitive personal data held by crypto firms-raising the stakes for cybersecurity.

The risks are underscored by the recent high-profile breach at Coinbase, one of the world’s largest exchanges.

In May 2025, Coinbase disclosed that cybercriminals, aided by bribed offshore contractors, accessed and exfiltrated customer data including names, addresses, government IDs, and partial bank details.

The attackers then used this information for sophisticated phishing campaigns, successfully deceiving some customers into surrendering account credentials and funds.

“While private encryption keys remained secure, sufficient customer information was exposed to enable sophisticated phishing attacks by criminals posing as Coinbase personnel.”

Coinbase now faces up to $400 million in compensation costs and has pledged to reimburse affected users, but the incident highlights the systemic vulnerability created when large troves of personal data are centralized-even if passwords and private keys are not directly compromised. The breach also triggered a notable drop in Coinbase’s share price and prompted a $20 million bounty for information leading to the attackers’ capture.

The Bottom Line

The UK’s forthcoming crypto reporting regime represents a landmark in financial regulation, promising greater transparency and tax compliance. However, as the Coinbase episode demonstrates, the aggregation of sensitive user data at scale poses a significant cybersecurity risk.

As regulators push for more oversight, the challenge will be ensuring that consumer protection does not become a double-edged sword-exposing users to new threats even as it seeks to shield them from old ones.

-

@ b1ddb4d7:471244e7

2025-05-31 15:00:47

@ b1ddb4d7:471244e7

2025-05-31 15:00:47When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ dfa02707:41ca50e3

2025-05-31 14:01:43

@ dfa02707:41ca50e3

2025-05-31 14:01:43Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ 2cde0e02:180a96b9

2025-05-31 15:06:26

@ 2cde0e02:180a96b9

2025-05-31 15:06:26https://stacker.news/items/993562

-

@ dfa02707:41ca50e3

2025-05-31 14:01:39

@ dfa02707:41ca50e3

2025-05-31 14:01:39Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.

- Learn more about the current and upcoming features of Bitcoin Safe wallet here.

What's new in v1.3

- Redesign of Chart, Quick Receive, Icons, and Mempool Preview (by @design-rrr).

- Interactive chart. Clicking on it now jumps to transaction, and selected transactions are now highlighted.

- Speed up transactions with Child Pays For Parent (CPFP).

- BDK 1.2 (upgraded from 0.32).

- Testnet4 support.

- Preconfigured Testnet demo wallets.

- Cluster unconfirmed transactions so that parents/children are next to each other.

- Customizable columns for all tables (optional view: Txid, Address index, and more)

- Bug fixes and other improvements.

Announcement / Archive

Blog Post / Archive

GitHub Repo

Website -

-

@ 866e0139:6a9334e5

2025-05-31 10:45:03

@ 866e0139:6a9334e5

2025-05-31 10:45:03Autor: Marcel Bühler. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

In einem Artikel in der NZZ vom 27. Mai mit dem Titel "Trump nennt Putin verrückt" wird über den laut Kiew grössten russischen Drohnenangriff seit Beginn des Krieges auf ukrainische Städte berichtet. Dabei sollen am vergangenen Wochenende 355 Drohnen und 69 Raketen auf Kiew, Odessa, Ternipol (Westukraine) und andere Städte gesteuert bzw. abgefeuert worden sein. 288 Drohnen und 9 Raketen konnten laut Kiew von der ukrainischen Luftverteidigung abgeschossen werden. Was der Artikel verschweigt: bereits in der Woche davor, am 20. - 22. Mai hatte die Ukraine 485 Drohnen gegen russische Städte wie Kursk, Belgorod oder Brijansk geflogen, 63 davon erreichten die Region Moskau. Auch am Wochenende schickten die Ukrainer 205 Drohnen gegen russische Städte, 13 davon erreichten Moskau. Auch hier konnte die Luftverteidigung die meisten Drohnen unschädlich machen, eine davon hatte gar den Helikopter von Präsident Putin (!) im Visier. Als Reaktion darauf erklärte Präsident Putin, dass in der ukrainischen Region Sumy bzw. Tschernihiw im Norden eine Sicherheitszoneeingerichtet werden soll da die meisten Drohnen von hier aus gestartet wurden. Auch am 27./28. Mai schickte die Ukraine wieder 296 Drohnen Richtung Moskau, offenbar soll die russische Luftverteidigung damit überlastet werden um später westliche Cruise Missiles wie "Storm shadows", "Skalp" oder die umstrittenen deutschen "Taurus" effektiver einsetzen zu können. Der neue Bundeskanzler Friedrich Merz hat dafür rund 5 Milliarden Euro in Aussicht gestellt um solche Waffensysteme in der Ukraine selber zusammenbauen zu können.

Diese Gewaltspirale hat eine lange Geschichte: diese begann 2007 mit der 43. Münchner Sicherheitskonferenz, in der Präsident Putin sich gegen die unilaterale Weltordnung der USA und ihrer Verbündeten aussprach. Auch erteilte er den NATO-Osterweiterungen seit 1991 eine deutliche Absage, da diese entgegen (mündlich) gemachten Zusicherungen vollzogen wurden (siehe im Anhang die Rede im Wortlaut). Bei anderer Gelegenheit bezeichnete er vor allem einen möglichen NATO-Beitritt der (ehemals russischen) Ukraine als die "rote Linie", da es hier im Osten eine gemeinsame Grenze zu Russland über weit mehr als tausend Kilometer gebe und zudem Millionen von russischstämmigen Bürgern in der Ukraine lebten welche durch die Unabhängigkeit des Landes von ihrem Mutterland getrennt seinen. Im mittlerweile umstrittenen Budapester Memorandum von 5.12.1994 hatten zudem die Signatarmächte USA, GB und die Russische Föderation in getrennten Dokumenten die Unabhängigkeit und territoriale Integrität der Ukraine garantiert, wenn diese ein neutraler Pufferstaat zwischen der NATO und der Russischen Föderation sei und auf ihre Atomwaffen aus der sowjetischen Zeit verzichte (die Neutralität war in der ukrainischen Verfassung verankert). Trotzdem erklärten am darauffolgenden NATO-Gipfel in Bukarest im April 2008 die versammelten Staats- und Regierungschefs der 26 NATO-Staaten: "Die NATO begrüßt die euro-atlantischen Bestrebungen der Ukraine und Georgiens, die dem Bündnis beitreten wollen. Wir kamen heute überein, dass diese Länder NATO-Mitglieder werden." Zudem wurde die Unabhängigkeitserklärung des Kosowo vorbehaltlos anerkannt, dies nach einer völkerrechtswidrigen militärischen Intervention (d.h. ohne eine entsprechende UN-Resolution) der NATO gegen die Republik Serbien im Jahr 1999 (Staatsgrenzen dürfen also unter Umständen verändert werden).

Die Gewalt begann schon wenige Monate danach, als der durch die "Rosenrevolution" 2003 mit Unterstützung der USA in Tiflis an die Macht gekommene Exil-Georgier, Michail Saakaschwili, in der Nacht auf den 8.8.2008 einen militärischen Angriff auf die seit 1992/93 abtrünnigen Südosseten bzw. deren Hauptstadt Zchinwali befahl und dabei auch russische Friedenstruppen (als Schutzmacht der Osseten) unter Beschuss gerieten. Dies nachdem die Regierung Bush jr. die georgische Armee durch NATO-Offiziere ausgebildet und aufgerüstet hatte. Laut einem NZZ-Artikel vom 1.10.2009 kam eine von der EU eingesetzte Untersuchungskommission unter der Schweizer Diplomatin Heidi Tagliavini 2009 zum Schluss, dass zuvor von beiden Seiten Provokationen in Form von Terroranschlägen, Entführungen und Morde begangen worden waren. Zudem hatte Russland jahrelang an willige Osseten und Abchasen russische Pässe ausgegeben, was völkerrechtswidrig sei, da dies die Staatlichkeit Georgiens untergrabe (Abchasien ist eine weitere abtrünnige Region Georgiens am schwarzen Meer). Saakaschwili wollte offenkundig mit dem überraschenden Angriff auf die Osseten die volle Kontrolle der Zentralregierung über das Gebiet wieder erlangen, da die Satzungen der NATO nur die Aufnahme von Ländern erlauben in denen keine ungelösten territorialen Konflikte vorhanden sind. Den Abchasen hätte also das gleiche Schicksal gedroht wenn die Aktion erfolgreich gewesen wäre. Da die Russen aber aufgepasst hatten, lief innert 24 Stunden eine russische Gegenoffensive welche die georgischen Verbände und ihre amerikanischen Berater innert wenigen Tagen bis nach Gori (Geburtsort von Stalin) zurückwarf. Präsident Saakaschwili verlor bald darauf in Tiflis die Macht und setzte sich in die Ukraine ab. Die heutige georgische Regierung unterhält wieder politische und wirtschaftliche Beziehungen zu Russland und verzichtet auf einen NATO-Beitritt. Siehe dazu das Interview von Roger Köppel mit dem aktuellen georgischen Regierungschef Kobachidse (auf englisch mit deutschen Untertiteln):

https://www.youtube.com/watch?v=xWh6bAfLdhw

In der Ukraine begann die Gewalt mit dem rechtswidrigen Sturz des 2010 legal gewählten Präsidenten Wiktor Janukowitsch, der zwischen der EU und Russland hin und her gerissen war und daher die Unterzeichnung eines EU-Assoziierungsabkommens auf unbestimmte Zeit vertagte. Nach den folgenden wochenlangen Protesten und Krawallen auf dem Maidan in Kiew ("Euromaidan") unterschrieb er unter Vermittlung Deutschlands, Frankreichs und Polens am 21.2.2014 einen Vertrag mit der Opposition und versprach baldige Neuwahlen. Trotzdem wurde er am Tag darauf durch einen regelrechten Putsch gestürzt und in die Flucht getrieben, indem unbekannte Heckenschützen aus verschiedenen Positionen zuerst auf die "Berkut"-Polizei und anschliessend auf militante Demonstranten schossen, welche die "Institutskaja" hinauf das durch eine Strassensperre der Polizei geschützte Regierungsviertel stürmen wollten.