-

@ 5391098c:74403a0e

2025-05-27 18:20:42

@ 5391098c:74403a0e

2025-05-27 18:20:42Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ 5391098c:74403a0e

2025-05-27 18:15:38

@ 5391098c:74403a0e

2025-05-27 18:15:38Você trabalha 5 meses do ano somente para pagar impostos. Ou seja, 42% da sua renda serve para bancar serviços públicos de péssima qualidade. Mesmo que você tivesse a liberdade de usar esses 42% da sua renda para contratar serviços privados de qualidade (saúde, segurança e ensino), ainda assim você seria um escravo porque você recebe dinheiro em troca do seu trabalho, e o dinheiro perde cerca de 10% do valor a cada ano. Em outras palavras todo seu dinheiro que sobra depois de comprar comida, vestuário e moradia perde 100% do valor a cada 10 anos. Isso acontece porque o Estado imprime dinheiro do nada e joga na economia de propósito para gerar INFLAÇÃO e manter todos nós escravizados. Você pode deixar seu dinheiro investido em qualquer aplicação que imaginar e ainda assim nunca terá uma rentabilidade superior a inflação real. No final, acaba perdendo tudo do mesmo jeito. Caso você se ache esperto por investir o que sobra da sua renda em bens duráveis como imóveis ou veículos, sabia que esses bens também não são seus, porque se deixar de pagar os impostos desses bens (iptu, itr, ipva) você também perde tudo. Além disso, o custo de manutenção desses bens deve ser levado em consideração na conta das novas dívidas que você assumiu. No caso dos imóveis urbanos é impossível alugá-lo por mais de 0,38% do seu valor mensalmente. Em outras palavras, a cada ano você recebe menos de 5% do que investiu, tem que pagar o custo de manutenção, mais impostos e a valorização do bem nunca será superior a inflação real, também fazendo você perder quase tudo em cerca de 15 anos. A situação é ainda pior com os imóveis rurais e veículos, basta fazer as contas. Caso o dinheiro que você receba em troca do seu trabalho seja suficiente apenas para comprar comida, vestuário e moradia, você já sabe que é um escravo né?… Precisamos entender que a escravidão não acabou, apenas foi democratizada. Hoje a escravidão é financeira, nós somos os castiços e os donos do dinheiro são o senhorio. Os donos do dinheiro são os Globalistas e os Estados seus fantoches. O esquema é simples: fazer todo mundo trabalhar em troca de algo que perde 100% do valor a cada 10 anos, ou seja o dinheiro. Se você pudesse trabalhar em troca de algo que aumentasse de valor acima da inflação real a cada 10 anos você finalmente conquistaria sua liberdade financeira e deixaria de ser escravo. Pois bem, isso já é possível, e não se trata de ouro ou imóveis e sim sobre o Bitcoin, que sobe de valor mais de 100% a cada 10 anos, com a vantagem de ser inconfiscável e de fácil transferência para seus herdeiros quando você morrer, através de uma simples transação LockTime feita em vida. Portanto, mesmo que você não tenha dinheiro para comprar Bitcoin, passar a aceitar Bitcoin em troca de seus produtos e serviços é a única forma de se libertar da escravidão financeira. A carta de alforria financeira proporcionada pelo Bitcoin não é imediata, pois a velocidade da sua libertação depende do quanto você está disposto a aprender sobre o assunto. Eu estou aqui para te ajudar, caso queira. No futuro o Bitcoin estará tão presente na sua vida quanto o pix e o cartão de crédito, você querendo ou não. Assim como o cartão de crédito foi a evolução do cheque pós-datado e o pix a evolução do cartão, o Bitcoin e outras criptomoedas serão a evolução de todos esses meios de pagamento. O que te ofereço é a oportunidade de abolição da sua escravatura antes dos demais escravos acordarem para a realidade, afinal a história sempre se repete: desde o ano de 1300 a.c. a escravidão era defendida pelos próprios escravos, que mais cedo ou mais tarde, foram libertados por Moisés em êxodo 11 da Bíblia Sagrada e hoje o povo de israel se tornou a nação mais rica do mundo. A mesma história se repetiu na Roma Antiga: com o pão e circo. Da mesma forma todo esse império escravocrata ruiu porque mais cedo ou mais tarde os escravos se revoltam, bastam as coisas piorarem bastante. O atual regime de escravidão teve início com a queda do padrão-ouro para impressão do dinheiro no ano de 1944. A escravidão apenas ficou mais sofisticada, pois em vez de pagar os escravos com cerveja como no Egito Antigo ou com pão e circo como na Roma Antiga, passou-se a pagar os escravos com dinheiro sem lastro, ou seja dinheiro inventado, criado do nada, sem qualquer representação com a riqueza real da economia. Mesmo sendo a escravidão atual mais sofisticada, que deixou de ser física para ser financeira, o que torna a mentira mais bem contada, mais cedo ou mais tarde os escravos modernos irão acordar, basta as coisas piorarem mais ou perceberem que todos os bens e serviços do mundo não representam nem 1% de todo o dinheiro que impresso sem lastro. Em outras palavras, se os donos de todo o dinheiro do mundo resolvessem utilizá-lo para comprar tudo o que existe à venda, o preço do quilo do café subiria para R$ 297.306,00 e o preço médio dos imóveis subiria para um número tão grande que sequer caberia nesta folha de papel. Hoje, o dinheiro não vale nada, seus donos sabem disso e optam por entregar o dinheiro aos poucos para os escravos em troca do seu trabalho, para manter o atual regime o máximo de tempo possível. Mesmo assim, o atual regime de escravidão financeira está com os dias contados e depende de você se posicionar antes do efeito manada. Nunca é tarde para entrar no Bitcoin, mesmo ele tendo uma quantidade de emissão limitada, seu valor subirá infinitamente. A menor unidade do Bitcoin é o satoshi, cuja abreviação é sats. Diferente do centavo, cada sat vale um centésimo milionésimo de bitcoin. Hoje (25/05/25), cada unidade de Bitcoin equivale a setecentos mil reais. Logo, cada R$ 0,01 equivale à 0,007 sats. Lembrando que o centavo é um real dividido por cem e o sat é um bitcoin dividido por cem milhões, por isso ainda não existe a paridade entre 1 centavo de real e 1 sat. Essa paridade será alcançada quando um Bitcoin passar a valer um milhão de reais. Com a velocidade que nosso dinheiro está perdendo valor isso não irá demorar muito. Utilizando dados econômicos avançados, prevejo que cada unidade de Bitcoin passará a valer hum milhão de reais até o ano de 2029, assim equiparando 1 sat para cada R$ 0,01. Nesse momento, certamente muitos empresários, comerciantes e profissionais liberais passarão a aceitar o Bitcoin como forma de pagamento pelos seus produtos e serviços, assim como o cheque foi substituído pelo cartão de crédito e o cartão pelo pix. Sabendo disso, você pode entrar na onda de transição no futuro junto com a manada e perder essa alta valorização, ou passar a aceitar Bitcoin agora pelos seus produtos e serviços, assinando assim, a própria carta de alforria da sua escravidão financeira. É importante dizer que os próprios globalistas e governos estão trocando dinheiro por Bitcoin como nunca na história e mesmo que eles adquiram todos os bitcoins disponíveis, ainda assim não será mais possível manter seu regime de escravidão financeira funcionando porque a emissão de Bitcoin é limitada, sendo impossível criar Bitcoin sem lastro, como é feito com o dinheiro hoje. Com o presente artigo, te ofereço a oportunidade de conquistar seus primeiros sats agora, de forma segura e independente, sem precisar de corretoras, bancos, intermediários ou terceiros, basta você querer pois toda a informação necessária está disponível na internet gratuitamente. Se ainda assim você quiser continuar sendo escravo financeiro, depois não adiantar se arrepender quando as janelas de oportunidade se fecharem, o Drex for implantado, papel moeda restringido e sua vida piorar bastante. Importante mencionar que a Lei Brasileira ainda permite a movimentação de até R$ 30.000,00 em Bitcoin por mês sem a necessidade de declaração à Receita Federal e que esse direito pode deixar de existir a qualquer momento, e que quando o Drex for implantado você perderá diversos outros direitos, dentre ele a liberdade de gastar seu dinheiro como quiser e o sigilo. Ofereço ainda, a oportunidade de você baixar uma carteira de Bitcoin gratuita e segura no seu aparelho de celular que funciona de forma semelhante a um banco digital como Nubank e Pagseguro por exemplo, para poder começar à receber Bitcoin pelos seus produtos e serviços agora, de forma fácil e gratuita. Utilizando o qrcode abaixo você ainda ganha alguns sats de graça, promoção válida até o dia 29/05/25 e patrocinada pela Corretora Blink de El Salvador, onde o Bitcoin já é moeda oficial do país, basta acessar o link e instalar o aplicativo: https://get.blink.sv/btcvale

Aviso: disponibilizei o link da carteira de Bitcoin da Corretora Blink apenas como exemplo de como é fácil aceitar Bitcoin como forma de pagamento pelos seus produtos e serviços. Não recomento depender de qualquer corretora para guardar seus valores em Bitcoin. A melhor forma de fazer isso é mantendo dois computadores ou notebook em casa, um conectado à internet com memória em disco disponível de 1 terabyte ou mais para armazenar e visualizar suas transações e outro computador ou notebook desconectado da internet para armazenar suas senhas e chaves privadas para assinar as transações via pendrive. Somente assim você estará 100% livre e seguro. Importante ainda fazer backup em vários CDs com criptografia do seu computador ou notebook que assina as transações, assim também ficando 100% livre e seguro para restaurar sua carteira em qualquer outro computador caso necessário. Todas as instruções de como fazer isso já estão disponíveis gratuitamente na internet. Caso deseje contratar uma consultoria pessoal que inclui aulas particulares por vídeo conferência, onde você aprenderá:

→ Tudo o que precisa saber sobre Bitcoin e demais criptomoedas; → Sistema operacional Linux; → Como instalar sua carteira de Bitcoin em dois computadores para assinaturas air gapped; → Se manter 100% livre e seguro. → Com carga horária à combinar conforme sua disponibilidade.

O custo do investimento pelo meu serviço individual para esse tipo de consultoria é de 204.000 sats (R$ 1.543,46 na cotação atual) valor válido até 31/07/25, interessados entrar em contato por aqui ou através da Matrix: @davipinheiro:matrix.org https://davipinheiro.com/voce-e-escravo-e-nem-sabe-eu-vou-te-provar-agora/

-

@ 7f6db517:a4931eda

2025-05-27 19:01:48

@ 7f6db517:a4931eda

2025-05-27 19:01:48

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-27 19:01:47

@ 7f6db517:a4931eda

2025-05-27 19:01:47

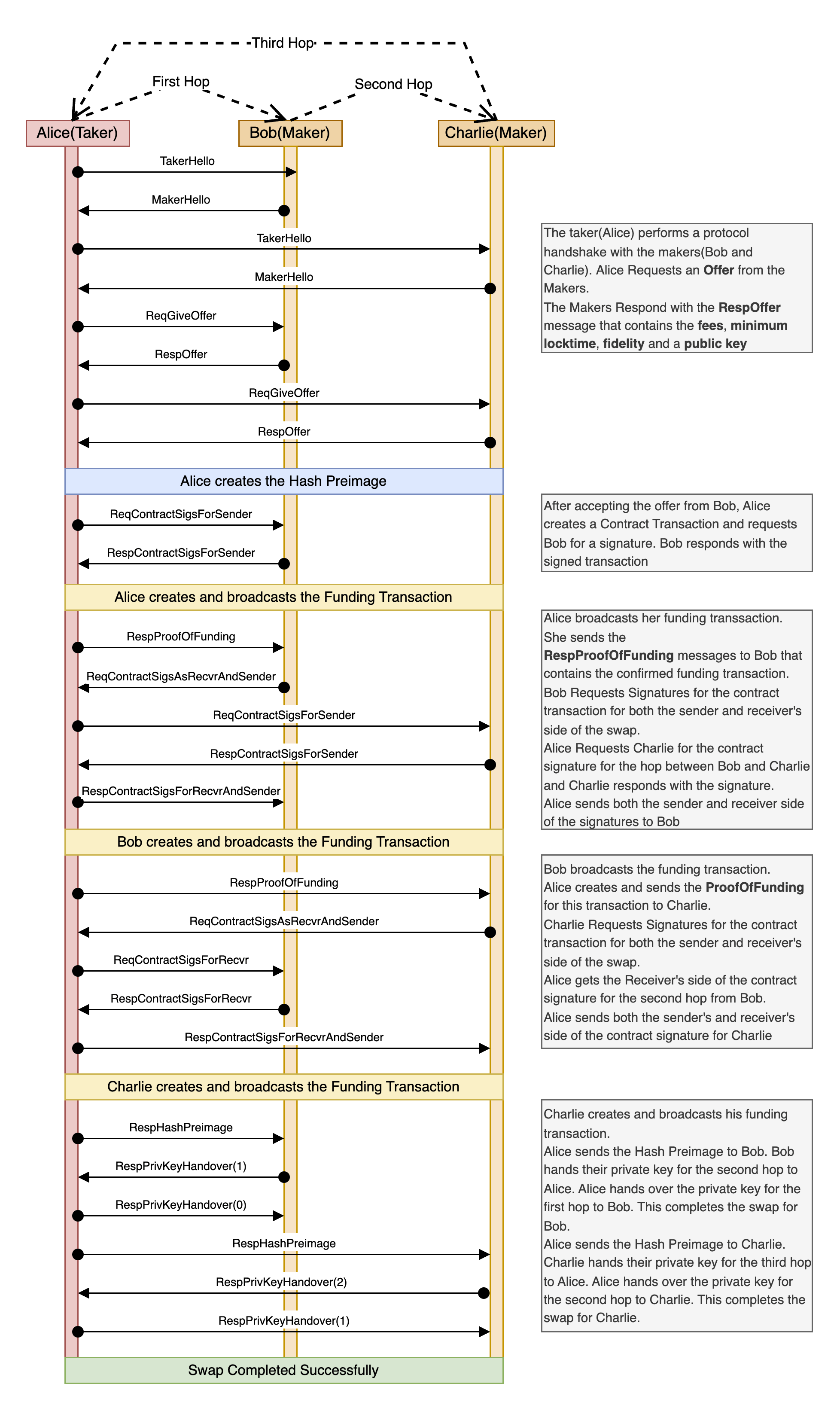

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-27 18:02:40

@ 7f6db517:a4931eda

2025-05-27 18:02:40

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-27 18:02:39

@ 7f6db517:a4931eda

2025-05-27 18:02:39

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 9223d2fa:b57e3de7

2025-05-27 19:23:59

@ 9223d2fa:b57e3de7

2025-05-27 19:23:5914,917 steps

-

@ 491afeba:8b64834e

2025-05-27 16:48:45

@ 491afeba:8b64834e

2025-05-27 16:48:45Quando adolescente eu acreditava na coerência da teoria de "amor líquido" do polonês, sociólogo, Zygmunt Bauman, apresentada no livro "Amor Líquido: Sobre a Fragilidade dos Laços Humanos", qual no meu amadurecimento em estudos, sejam eles no meio acadêmico ou fora, percebo como uma das formas mais rasas de explicar as mudanças e transformações dos padrões de relações sócio-afetivas dos humanos. A seguir colocar-me-ei na minha juventude não tanto recente, direi então que nós, se adolescentes e conservadores, ou mesmo jovens adultos mais conservadores, costumamos levar como dogma uma óptica decadentista generalizada de todos os avanços de eras dos homens, universalizamos por nos ser comum a indistinção entre humanidade e humanidades, ou mesmo "humanity" e "humankind" ("humanidade" como espécime e "humanidade" como um universal), compreendemos toda "essas" como "essa" e indistinguimos as sociedades para com os homens, ou seja, a incapacidade de definir os seres dentro de suas respectivas singularidades e especificidades nos leva ao decadentismo generalista (a crença de que de forma geral, e universal, a "civilização universal" decai moralmente, éticamente, materialmente e espiritualmente), que aparente à nós determinadas mudanças nas relações humanas quanto ao caráter sócio-afetivo, por falta de profundidade e critérios ainda sobre questões alinhadas aos métodos e coerências, ou incoerências, lógicas, nós se jovens e conservadores somos levados ao engodo de concordar com a teoria do amor líquido de Bauman, que devo cá explicar de antemão: trata ela, a teoria, o padrão de "amor" dos tempos presentes como frágil, de prazo (curto e médio) e diferente em grau comparativamente ao amor comum das eras passadas.

Aos jovens mais progressistas opera uma compreensão dialética sobre as eras dos homens nos seu tempo presente, na qual ao tempo que o ser progride ele também regride simultaneamente, ou seja, a medida que aparecem contradições advindas de transformações materiais da realidade humana o ser supera essas contradições e progride em meio as transformações, ainda fazendo parte da lógica dessa indissociavelmente, assim constantemente progredindo e regredindo, havendo para esses dois vetores de distinção: o primeiro é o que releva questões espirituais como ao caráter do pensamento "new age", o segundo ignora essas questões por negar a existência da alma, seguem ao materialismo. Cedem em crer na teoria baumaninana como dogma, pois não encontram outros meios para explicar as transformações da sociedade na esfera sócio-afetiva sem que haja confrontamento direto com determinadas premissas assim pertinemente presentes, ou por não conciliarem com análises relativamente superiores, como a de Anthony Giddens sobre a "relação pura" em "A Transformação da Intimidade" e de François de Singly apresentada em "Sociologie du Couple".

!(image)[https://i.pinimg.com/736x/6f/b4/9e/6fb49eda2c8cf6dc837a0abfc7e108e6.jpg]

Há um problema quando uma teoria deixa de assim ser para vir a tornar-se mais um elemento desconexo da ciência, agora dentro da cultura pop, se assim podemos dizer, ou da cultura de massa, ou se preferirem mesmo "anticultura", esse problema é a sua deformização teórica, tornando-se essa rasa para sua palatabilidade massiva, somada a incapacidade de partes da sociedade civil em compreender as falhas daquilo que já foi massificado. Tive surpresa ao entender que muitos outros compartilham da mesma opinião, a exemplo, possuo um amigo na faculdade, marxista, que ao falarmos sobre nossos projetos de pesquisa, citou ele o projeto de um de nossos colegas, no qual esse referido um de nossos colegas faria seu projeto com base na teoria do amor líquido de Bauman, então alí demos risada disso, ora, para nós a teoria baumaniana é furada, passamos a falar sobre Bauman e o motivo pelo qual não gostávamos, lá fiquei até surpreso em saber que mais gente além de mim não gostava da teoria de Bauman, pois ao que eu via na internet era rede de enaltecimentos à figura e à sua teoria, tal como fosse uma revelação partindo de alguma divindade da Idade do Bronze. Pouco tempo depois tive em aula de teoria política uma citação de Bauman partindo do professor que ministrava a disciplina, no entanto, ao citar o nome de Bauman o mesmo fez uma feição na qual aparentava segurar risada, provavelmente ele também não levava Bauman à sério. Não devo negar que todas as vezes que vejo o sociólogo sendo citado em alguma nota no X, no Instagram ou qualquer outra rede social, tal como fosse um referencial teórico bom, sinto uma vergonha alheia pois alí tenho uma impressão de que a pessoa não leu Bauman e usa o referencial teórico como um fato já assim provado e comprovado.

Há pontos positivos na teoria baumaniana, como a capacidade de perceber o problema e correlacioná-lo à modernidade, assim como sucitar a influência do que há de material no fenômeno, porém os erros são pertinentes: o primeiro problema é de categoria. Não há, por parte de Bauman noção alguma entre as dissociações dos amores, não há atenção sobre o amor como estrutura ou ele como um sentimento, todo ele é compreendido uniformemente como "amor", partindo do pressuposto que todas as relações, todas elas, são firmadas com base no amor. Essa crença tem uma origem: Hegel. Nos Escritos Teológicos Hegel partia da crença que o amor ligava os seres relacionalmente como uma força de superação e alienação, mas há de compreendermos que esse Friedrich Hegel é o jovem ainda pouco maduro em suas ideias e seu sistema de pensamento, mais a frente, em "Fenomenologia do Espírito e na Filosofia do Direito", Hegel compreende a institucionalidade do direito no amor e a institucionalização dessa força, assim aproxima-se da realidade a respeito da inserção do amor nas esferas práticas do humano, porém essa ideia, apesar de imperfeita, pois ao que sabemos não é o amor que consolida a relação, mas sim a Verdade (Alétheia), conforme apontado por Heidegger em "Ser e Tempo", essa ideia do amor como a fundamento das relações humanas influenciou, e até hoje influencia, qualquer análise sobre as relações humanas fora da esfera materialista, fora dessa pois, melhormente explicado em exemplo, os marxistas (em exemplo), assim como Marx, consideram como base primordial das relações as condições materiais.

Por certo, não é de todo amor a base para a solidificação, ora, erram aqueles que creem que somente essa força, assim apontada por Hegel, constituiam todos os relacionamentos formais como pilares fundamentais, pois em prática as famílias eram até a fiduciarização dessas, por mais paradoxal que seja, compreendidas melhor como instituições orgânicas de caráter legal do que conluios de afetividades. A família outrora tinha consigo aparelhos de hierarquia bem estabelicidos, quais prezavam pela ordem interna e externa, que acima dessa instituição estava somente a Igreja (outra instituição), com sua fiduciarização [da família] após o movimento tomado pelos Estados nacionais em aplicação do casamento civil mudou-se a lógica das partes que a compõe, findou-se o princípio da subsidiariedade (não intervenção de determinadas instituições nas decisões quais podem ser exercidas em resuluções de problemas nas competências de quaisquer instituições), foi-se então, contudo, também a autoridade, e nisso revela-se um outro problema não apontado na teoria de Bauman: qual o padrão do amor "sólido"? Pois, ora, sociedades tradicionais não abdicavam do relevar dos amores para tornar seus filhos em ativos nas práticas de trocas (dádivas)? É notório que esse padrão se dissocia do padrão de sentimento apontado por Bauman, encontramos esse fato em estudo nos trabalhos "Ensaio Sobre a Dádiva", do Marcel Mauss, e "As Estruturas Elementares do Parentesco", do Claude Levi-Strauss, quais expõem que nas sociedades "sólidas", tradicionais, relevava-se mais questões institucionais que as sentimentais para a formação de laços (teoria da aliança). Muitas das relações passadas não eram baseadas no amor, não significando assim que as de hoje, em oposição, sejam, mas que permanecem-se semelhantes em base, diferentemente em grau e forma.

!(image)[https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F748b94c3-f882-45db-8333-09260ef15cfe_615x413.jpeg]

Ora, ainda existem casamentos motivados pela política, pelo status, pelo prestígio, pelos bens, pelo poder, pela influência familiar e assim sucetivamente, tal como no passado, ocorre que essa prática tornou-se oculta, não mais explícita e aparente, devo dizer ainda que em partes, pois prepondera em nosso tempo uma epidemia de adultérios, fornicações, práticas lascivas e demais práticas libertinosas explicitamente, em contraposição às práticas ocultas em vergonhas de sociedades sem declínio moral e espiritual, o que nos leva a questionar o método comparativo em dicotomia temporal "presente x passado" aplicado por Bauman, no qual segue-se da seguinte forma:

Transformação Passado = *sólido* | Presente = *líquido* Categorias Padrão de amor: tradicional (*sólido*) moderno (*líquido*) *Sólido* = estável, prazo (médio-grande), profundo, determinado. *Líquido* = instável, prazo (curto-médio), raso, indeterminado.O que penso é: Zygmunt Bauman buscou uma explicação material e laical para desviar ao fato de que há uma notória correlação entre espiritualização da sociedade, se voltada à Verdade, com a estabilidade das instituições, o que é já reduzido à moral religiosa, somente, não à mística, como por pensadores da linha de Tocqueville, ou em abordagens também mais laical (positivista) porém ainda relevantes, como Émile Durkheim em "As Formas Elementares da Vida Religiosa" e Max Weber em "A Ética Protestante e o Espírito do Capitalismo", contrapondo uma abordage mais voltada, de fato, a espiritualidade, como Christopher Dawnson, que defende essa teoria em "Religião e o Surgimento da Cultura Ocidental", e Eric Voegelin, principalmente nas obras "A Nova Ciência da Política" e "Ordem e História".

Encerrrando, minha cosmovisão é a católica, o sistema de crença e religião qual sigo é do Deus que se fez homem por amor aos seus filhos, não posso negar ou mesmo omitir o fato de que, por trás de toda a minha crítica estão meus pensamentos e minhas convicções alinhadas àquilo que mais tenho amor em toda minha vida: a Verdade, e a Verdade é Deus, pois Cristo é a Verdade, o Caminho e a Vida, ninguém vai ao Pai se não por Ele, e pois bem, seria incoerência de minha parte não relevar o fato de crença como um dos motivos pelos quais eu rejeito a teoria do amor líquido de Zygmunt Bauman, pois os amores são todos eles praticados por formas, existem por diferentes formas e assim são desde sua tradicionalidade até o predomínio das distorções de declínio espiritual das eras presentes (e também antigas pré-Era Axial), estão esses preservados pelo alinhamento à verdade, assim são indistorcíveis, imutáveis, ou seja, amor é amor, não releva-se o falso amor como um, simplesmente não o é, assim o interesse, a sanha por bens, o egoísmo e a egolatria ("cupiditas", para Santo Agostinho de Hipona, em oposição ao que o santo e filósofo trata por "caritas") não são formas do amor, são autoenganos, não bons, se não são bons logo não são de Deus, ora, se Deus é amor, se ele nos ama, determino como amor (e suas formas) o que está de acordo com a Verdade. Aprofundando, a Teologia do Corpo, do Papa São João Paulo II, rejeita a "liquidez" apresentada por Bauman, pois o amor é, em suma, sacríficio, parte da entrega total de si ao próximo, e se não há logo não é amor. A Teologia do Corpo rejeita não os fundamentos de mentira no "líquido", mas também no "sólido", pois a tradicionalidade não é sinônimo de bom e pleno acordo com o amor que Deus pede de nós, não são as coerções, as violências, as imposições e demais vontades em oposição às de Deus que determinam os amores -- fatos em oposição ao ideário romanticizado. Claro, nem todas as coerções são por si inválidas do amor, ou mesmo as escolhas em trocas racionalizadas, a exemplo do autruísmo em vista da chance da família ter êxito e sucesso, ou seja, pelo bem dos próximos haver a necessidade de submissão a, em exemplo, um casamento forjado, ou algo do gênero, reconhece-se o amor no ato se feito por bem da família, porém o amor incutido, nesse caso, explicita o caráter sacrificial, no qual uma vontade e um amor genuinamente potencial em prazeres e alegrias são anulados, ou seja, mesmo nesse modelo tradicional na "solidez" há possibilidade do amor, não nas formas romanticizadas em critérios, como "estabilidade" e "durabilidade", mas no caráter do sacríficio exercido. Conforme nos ensina São Tomás de Aquino, o amor não é uma "força", tal como ensina Hegel, mas sim uma virtude teologal conforme postas na "Suma Teológica" (II-II Q. 26-28), não devemos reduzir o amor e os amores em análises simplórias (não simples) de falsa complexidade extraídas em métodos questionáveis e pouco competentes à real diensão de crise espiritual das eras, por esse motivo não concordo com a teoria do amor líquido de Zygmunt Bauman.

-

@ 2e941ad1:fac7c2d0

2025-05-27 19:22:54

@ 2e941ad1:fac7c2d0

2025-05-27 19:22:54Unlocks: 28

-

@ d360efec:14907b5f

2025-05-27 15:46:26

@ d360efec:14907b5f

2025-05-27 15:46:26 -

@ b7274d28:c99628cb

2025-05-27 07:07:33

@ b7274d28:c99628cb

2025-05-27 07:07:33A few months ago, a nostrich was switching from iOS to Android and asked for suggestions for #Nostr apps to try out. nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 offered the following as his response:

nostr:nevent1qvzqqqqqqypzq0mhp4ja8fmy48zuk5p6uy37vtk8tx9dqdwcxm32sy8nsaa8gkeyqydhwumn8ghj7un9d3shjtnwdaehgunsd3jkyuewvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzpwwts6n28eyvjpcwvu5akkwu85eg92dpvgw7cgmpe4czdadqvnv984rl0z

Yes. #Android users are fortunate to have some powerful Nostr apps and tools at our disposal that simply have no comparison over on the iOS side. However, a tool is only as good as the knowledge of the user, who must have an understanding of how best to wield it for maximum effect. This fact was immediately evidenced by replies to Derek asking, "What is the use case for Citrine?" and "This is the first time I'm hearing about Citrine and Pokey. Can you give me links for those?"

Well, consider this tutorial your Nostr starter-kit for Android. We'll go over installing and setting up Amber, Amethyst, Citrine, and Pokey, and as a bonus we'll be throwing in the Zapstore and Coinos to boot. We will assume no previous experience with any of the above, so if you already know all about one or more of these apps, you can feel free to skip that tutorial.

So many apps...

You may be wondering, "Why do I need so many apps to use Nostr?" That's perfectly valid, and the honest answer is, you don't. You can absolutely just install a Nostr client from the Play Store, have it generate your Nostr identity for you, and stick with the default relays already set up in that app. You don't even need to connect a wallet, if you don't want to. However, you won't experience all that Nostr has to offer if that is as far as you go, any more than you would experience all that Italian cuisine has to offer if you only ever try spaghetti.

Nostr is not just one app that does one thing, like Facebook, Twitter, or TikTok. It is an entire ecosystem of applications that are all built on top of a protocol that allows them to be interoperable. This set of tools will help you make the most out of that interoperability, which you will never get from any of the big-tech social platforms. It will provide a solid foundation for you to build upon as you explore more and more of what Nostr has to offer.

So what do these apps do?

Fundamental to everything you do on Nostr is the need to cryptographically sign with your private key. If you aren't sure what that means, just imagine that you had to enter your password every time you hit the "like" button on Facebook, or every time you commented on the latest dank meme. That would get old really fast, right? That's effectively what Nostr requires, but on steroids.

To keep this from being something you manually have to do every 5 seconds when you post a note, react to someone else's note, or add a comment, Nostr apps can store your private key and use it to sign behind the scenes for you. This is very convenient, but it means you are trusting that app to not do anything with your private key that you don't want it to. You are also trusting it to not leak your private key, because anyone who gets their hands on it will be able to post as you, see your private messages, and effectively be you on Nostr. The more apps you give your private key to, the greater your risk that it will eventually be compromised.

Enter #Amber, an application that will store your private key in only one app, and all other compatible Nostr apps can communicate with it to request a signature, without giving any of those other apps access to your private key.

Most Nostr apps for Android now support logging in and signing with Amber, and you can even use it to log into apps on other devices, such as some of the web apps you use on your PC. It's an incredible tool given to us by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and only available for Android users. Those on iPhone are incredibly jealous that they don't have anything comparable, yet.

Speaking of nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, the next app is also one of his making.

All Nostr data is stored on relays, which are very simple servers that Nostr apps read notes from and write notes to. In most forms of social media, it can be a pain to get your own data out to keep a backup. That's not the case on Nostr. Anyone can run their own relay, either for the sake of backing up their personal notes, or for others to post their notes to, as well.

Since Nostr notes take up very little space, you can actually run a relay on your phone. I have been on Nostr for almost 2 and a half years, and I have 25,000+ notes of various kinds on my relay, and a backup of that full database is just 24MB on my phone's storage.

Having that backup can save your bacon if you try out a new Nostr client and it doesn't find your existing follow list for some reason, so it writes a new one and you suddenly lose all of the people you were following. Just pop into your #Citrine relay, confirm it still has your correct follow list or import it from a recent backup, then have Citrine restore it. Done.

Additionally, there are things you may want to only save to a relay you control, such as draft messages that you aren't ready to post publicly, or eCash tokens, which can actually be saved to Nostr relays now. Citrine can also be used with Amber for signing into certain Nostr applications that use a relay to communicate with Amber.

If you are really adventurous, you can also expose Citrine over Tor to be used as an outbox relay, or used for peer-to-peer private messaging, but that is far more involved than the scope of this tutorial series.

You can't get far in Nostr without a solid and reliable client to interact with. #Amethyst is the client we will be using for this tutorial because there simply isn't another Android client that comes close, so far. Moreover, it can be a great client for new users to get started on, and yet it has a ton of features for power-users to take advantage of as well.

There are plenty of other good clients to check out over time, such as Coracle, YakiHonne, Voyage, Olas, Flotilla and others, but I keep coming back to Amethyst, and by the time you finish this tutorial, I think you'll see why. nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z and others who have contributed to Amethyst have really built something special in this client, and it just keeps improving with every update that's shipped.

Most social media apps have some form of push notifications, and some Nostr apps do, too. Where the issue comes in is that Nostr apps are all interoperable. If you have more than one application, you're going to have both of them notifying you. Nostr users are known for having five or more Nostr apps that they use regularly. If all of them had notifications turned on, it would be a nightmare. So maybe you limit it to only one of your Nostr apps having notifications turned on, but then you are pretty well locked-in to opening that particular app when you tap on the notification.

Pokey, by nostr:npub1v3tgrwwsv7c6xckyhm5dmluc05jxd4yeqhpxew87chn0kua0tjzqc6yvjh, solves this issue, allowing you to turn notifications off for all of your Nostr apps, and have Pokey handle them all for you. Then, when you tap on a Pokey notification, you can choose which Nostr app to open it in.

Pokey also gives you control over the types of things you want to be notified about. Maybe you don't care about reactions, and you just want to know about zaps, comments, and direct messages. Pokey has you covered. It even supports multiple accounts, so you can get notifications for all the npubs you control.

One of the most unique and incredibly fun aspects of Nostr is the ability to send and receive #zaps. Instead of merely giving someone a 👍️ when you like something they said, you can actually send them real value in the form of sats, small portions of a Bitcoin. There is nothing quite like the experience of receiving your first zap and realizing that someone valued what you said enough to send you a small amount (and sometimes not so small) of #Bitcoin, the best money mankind has ever known.

To be able to have that experience, though, you are going to need a wallet that can send and receive zaps, and preferably one that is easy to connect to Nostr applications. My current preference for that is Alby Hub, but not everyone wants to deal with all that comes along with running a #Lightning node. That being the case, I have opted to use nostr:npub1h2qfjpnxau9k7ja9qkf50043xfpfy8j5v60xsqryef64y44puwnq28w8ch for this tutorial, because they offer one of the easiest wallets to set up, and it connects to most Nostr apps by just copy/pasting a connection string from the settings in the wallet into the settings in your Nostr app of choice.

Additionally, even though #Coinos is a custodial wallet, you can have it automatically transfer any #sats over a specified threshold to a separate wallet, allowing you to mitigate the custodial risk without needing to keep an eye on your balance and make the transfer manually.

Most of us on Android are used to getting all of our mobile apps from one souce: the Google Play Store. That's not possible for this tutorial series. Only one of the apps mentioned above is available in Google's permissioned playground. However, on Android we have the advantage of being able to install whatever we want on our device, just by popping into our settings and flipping a toggle. Indeed, thumbing our noses at big-tech is at the heart of the Nostr ethos, so why would we make ourselves beholden to Google for installing Nostr apps?

The nostr:npub10r8xl2njyepcw2zwv3a6dyufj4e4ajx86hz6v4ehu4gnpupxxp7stjt2p8 is an alternative app store made by nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9 as a resource for all sorts of open-source apps, but especially Nostr apps. What is more, you can log in with Amber, connect a wallet like Coinos, and support the developers of your favorite Nostr apps directly within the #Zapstore by zapping their app releases.

One of the biggest features of the Zapstore is the fact that developers can cryptographically sign their app releases using their Nostr keys, so you know that the app you are downloading is the one they actually released and hasn't been altered in any way. The Zapstore will warn you and won't let you install the app if the signature is invalid.

Getting Started

Since the Zapstore will be the source we use for installing most of the other apps mentioned, we will start with installing the Zapstore.

We will then use the Zapstore to install Amber and set it up with our Nostr account, either by creating a new private key, or by importing one we already have. We'll also use it to log into the Zapstore.

Next, we will install Amethyst from the Zapstore and log into it via Amber.

After this, we will install Citrine from the Zapstore and add it as a local relay on Amethyst.

Because we want to be able to send and receive zaps, we will set up a wallet with CoinOS and connect it to Amethyst and the Zapstore using Nostr Wallet Connect.

Finally, we will install Pokey using the Zapstore, log into it using Amber, and set up the notifications we want to receive.

By the time you are done with this series, you will have a great head-start on your Nostr journey compared to muddling through it all on your own. Moreover, you will have developed a familiarity with how things generally work on Nostr that can be applied to other apps you try out in the future.

Continue to Part 2: The Zapstore. Nostr Link: nostr:naddr1qvzqqqr4gupzpde8f55w86vrhaeqmd955y4rraw8aunzxgxstsj7eyzgntyev2xtqydhwumn8ghj7un9d3shjtnzwf5kw6r5vfhkcapwdejhgtcqp5cnwdphxv6rwwp3xvmnzvqgty5au

-

@ 1f956aec:768866bd

2025-05-26 15:06:38

@ 1f956aec:768866bd

2025-05-26 15:06:38== January 17 2025

Out From Underneath | Prism Shores

crazy arms | pigeon pit

Humanhood | The Weather Station

== february 07 2025

Wish Defense | FACS

Sayan - Savoie | Maria Teriaeva

Nowhere Near Today | Midding

== february 14 2025

Phonetics On and On | Horsegirl

== february 21 2025

Finding Our Balance | Tsoh Tso

Machine Starts To Sing | Porridge Radio

Armageddon In A Summer Dress | Sunny Wa

== february 28 2025

you, infinite | you, infinite

On Being | Max Cooper

Billboard Heart | Deep Sea Diver

== March 21 2025

Watermelon/Peacock | Exploding Flowers

Warlord of the Weejuns | Goya Gumbani

== March 28 2025

Little Death Wishes | CocoRosie

Forever is a Feeling | Lucy Dacus

Evenfall | Sam Akpro

== April 4 2025

Tripla | Miki Berenyi Trio

Adagio | Σtella

The Fork | Oscar Jerome

== April 18 2025

Send A Prayer My Way | Julien Baker & TORRES

Superheaven | Superheaven

Thee Black Boltz | Tunde Adebimpe

from brooklyvegan

== April 25 2025

Face Down In The Garden |Tennis

Under Tangled Silence | Djrum

Viagr Aboys |Viagra Boys

Blurring Time | Bells Larsen

== May 2 2025

Time is Not Yours | Say Sue Me 세이수미

If You Asked For A Picture | Blondshell

== May 16 2025

Wield Your Hope Like A Weapon | Soot Sprite

Transmission 96 | Liftin Spirits & DJ Persuasion

Menedék | TÖRZS

== May 28 2025

Forefowk, Mind Me | Quinie

Silver Tears | SILVER TEARS

-

@ 57d1a264:69f1fee1

2025-05-26 07:07:54

@ 57d1a264:69f1fee1

2025-05-26 07:07:54Though Philips is no longer the consumer electronics giant they once were—they've shifted into health technology—they still manufacture some personal care items, like electric shavers and hair dryers. Now, somewhat bizarrely, they're dipping their foot into the DIY repair movement to support those products. The company has partnered with Prusa, the Czech company that has become one of the world's largest manufacturers of 3D printers, to launch this new Philips Fixables initiative.

https://www.youtube.com/watch?v=q85lZdNStGs

https://stacker.news/items/989395

-

@ 57d1a264:69f1fee1

2025-05-25 06:26:42

@ 57d1a264:69f1fee1

2025-05-25 06:26:42I dare to claim that the big factor is the absence of an infinite feed design.

Modern social media landscape sucks for a myriad of reasons, but oh boy does the infinite feed take the crapcake. It's not just bad on it's own, it's emblematic of most, if not all other ways social media have deteriorated into an enshitification spiral. Let's see at just three things I hate about it the most.

1) It's addictive: In the race for your attention, every addictive design element helps. But infinite feed is addictive almost by default. Users are expected to pull the figurative lever until they hit a jackpot. Just one more reel, then I'll go to sleep.

2) Autonomy? What's that? You are not the one driving your experience. No. You are just a passenger passively absorbing what the feed feeds you.

3) Echo chambers. The algorithm might be more to blame here, but the infinite feed and it's super-limited exploration options sure don't help. Your feed only goes two ways - into the past and into the comfortable.

And I could go on, and on...

The point it, if the goal of every big tech company is to have us mindlessly and helplessly consume their products, without agency and opposition (and it is $$$), then the infinite feed gets them half-way there.

Let's get rid of it. For the sake of humanity.

Aphantasia [^1]

Version: 1.0.2 AlphaWhat is Aphantasia?

I like to call it a social network for graph enthusiasts. It's a place where your thoughts live in time and space, interconnected with others and explorable in a graph view.

The code is open-source and you can take a look at it on GitHub. There you can find more information about contributions, API usage and other details related to the software.

There is also an accompanying youtube channel.

https://www.youtube.com/watch?v=JeLOt-45rJM

[^1]: Aphantasia the software is named after aphantasia the condition - see Wikipedia for more information.

https://stacker.news/items/988754

-

@ 57d1a264:69f1fee1

2025-05-24 06:07:19

@ 57d1a264:69f1fee1

2025-05-24 06:07:19Definition: when every single person in the chain responsible for shipping a product looks at objectively horrendous design decisions and goes: yup, this looks good to me, release this. Designers, developers, product managers, testers, quality assurance... everyone.

I nominate Peugeot as the first example in this category.

Continue reading at https://grumpy.website/1665

https://stacker.news/items/988044

-

@ 57d1a264:69f1fee1

2025-05-24 05:53:43

@ 57d1a264:69f1fee1

2025-05-24 05:53:43This talks highlights tools for product management, UX design, web development, and content creation to embed accessibility.

Organizations need scalability and consistency in their accessibility work, aligning people, policies, and processes to integrate it across roles. This session highlights tools for product management, UX design, web development, and content creation to embed accessibility. We will explore inclusive personas, design artifacts, design systems, and content strategies to support developers and creators, with real-world examples.

https://www.youtube.com/watch?v=-M2cMLDU4u4

https://stacker.news/items/988041

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

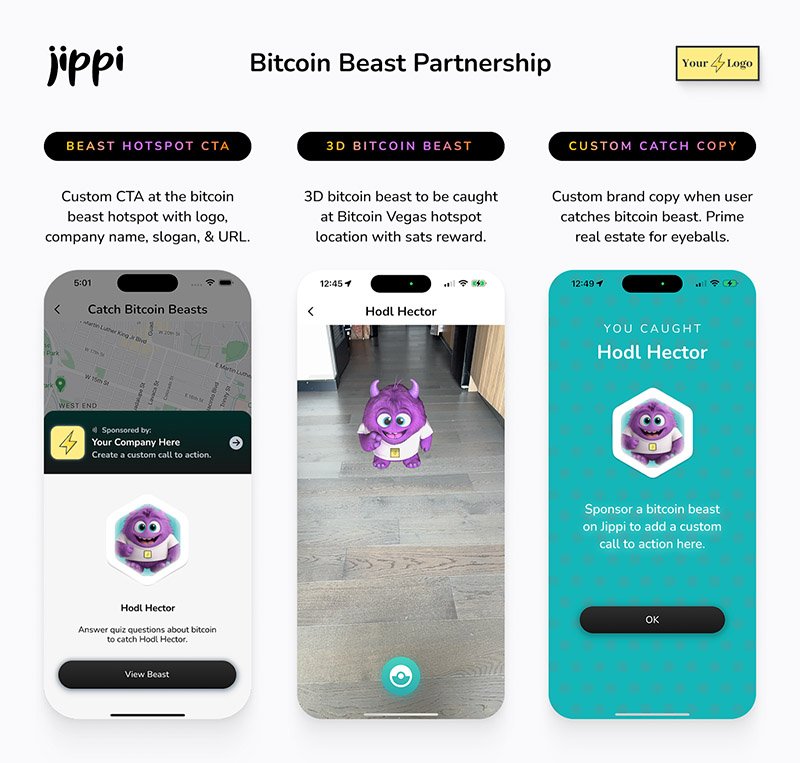

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 7f6db517:a4931eda

2025-05-27 19:01:47

@ 7f6db517:a4931eda

2025-05-27 19:01:47

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-22 06:21:22

@ 57d1a264:69f1fee1

2025-05-22 06:21:22You’ve probably seen it before.

You open an agency’s website or a freelancer’s portfolio. At the very top of the homepage, it says:

We design for startups.

You wait 3 seconds. The last word fades out and a new one fades in:

We design for agencies.

Wait 3 more seconds:

We design for founders.

I call this design pattern The Wheel of Nothing: a rotating list of audience segments meant to impress through inclusion and draw attention through motion… for absolutely no reason.

Revered brand studio Pentagram recently launched a new website. To my surprise, the homepage features the Wheel of Nothing front and center, boldly claiming:

We design Everything for Everyone…before cycling through more specific combinations every few seconds.

Dan Mall, a husband, dad, teacher, creative director, designer, founder, and entrepreneur from Philly. I share as much as I can to create better opportunities for those who wouldn’t have them otherwise. Most recently, I ran design system consultancy SuperFriendly for over a decade.

Read more at Dans' website https://danmall.com/posts/the-wheel-of-nothing/

https://stacker.news/items/986392

-

@ f0fcbea6:7e059469

2025-05-27 18:08:04

@ f0fcbea6:7e059469

2025-05-27 18:08:04Muita gente, hoje em dia, acha que a leitura já não é tão necessária quanto foi no passado. O rádio e a televisão acabaram assumindo as funções que outrora pertenciam à mídia impressa, da mesma maneira que a fotografia assumiu as funções que outrora pertenciam à pintura e às artes gráficas. Temos de reconhecer - é verdade - que a televisão cumpre algumas dessas funções muito bem; a comunicação visual dos telejornais, por exemplo, tem impacto enorme. A capacidade do rádio em transmitir informações enquanto estamos ocupados - dirigindo um carro, por exemplo - é algo extraordinário, além de nos poupar muito tempo. No entanto, é necessário questionar se as comunicações modernas realmente aumentam o conhecimento sobre o mundo à nossa volta.

Talvez hoje saibamos mais sobre o mundo do que no passado. Dado que o conhecimento é pré-requisito para o entendimento, trata-se de algo bom. Mas o conhecimento não é um pré-requisito tão importante ao entendimento quanto normalmente se supõe. Não precisamos saber tudo sobre determinada coisa para que possamos entendê-la. Uma montanha de fatos pode provocar o efeito contrário, isto é, pode servir de obstáculo ao entendimento. Há uma sensação, hoje em dia, de que temos acesso a muitos fatos, mas não necessariamente ao entendimento desses fatos.

Uma das causas dessa situação é que a própria mídia é projetada para tornar o pensamento algo desnecessário - embora, é claro, isso seja apenas mera impressão. O ato de empacotar ideias e opiniões intelectuais é uma atividade à qual algumas das mentes mais brilhantes se dedicam com grande diligência. O telespectador, o ouvinte, o leitor de revistas - todos eles se defrontam com um amálgama de elementos complexos, desde discursos retóricos minuciosamente planejados até dados estatísticos cuidadosamente selecionados, cujo objetivo é facilitar o ato de "formar a opinião" das pessoas com esforço e dificuldade mínimos. Por vezes, no entanto, o empacotamento é feito de maneira tão eficiente, tão condensada, que o telespectador, o ouvinte ou o leitor não conseguem formar sua opinião. Em vez disso, a opinião empacotada é introjetada em sua mente mais ou menos como uma gravação é inserida no aparelho de som. No momento apropriado, aperta-se o play e a opinião é "tocada". Eles reproduzem a opinião sem terem pensado a respeito.

-

@ 7f6db517:a4931eda

2025-05-27 19:01:47

@ 7f6db517:a4931eda

2025-05-27 19:01:47

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.