-

@ a6b4114e:60d83c46

2025-05-21 03:25:43

@ a6b4114e:60d83c46

2025-05-21 03:25:43GTA San Andreas is one installment of Grand Theft Auto.

It is safe and secure for your device. No harmful elements have been found yet. It does not contain viruses, malware, bloatware, bugs, or threats, as its authority always upgrades the game to eliminate unwanted components. The amazing thing is that the game is 100% free for Android users.

You do not pay a single cent from your pocket.

Download: https://androidhd.com/en/gta-san-andreas

-

@ 7460b7fd:4fc4e74b

2025-05-21 02:35:36

@ 7460b7fd:4fc4e74b

2025-05-21 02:35:36如果比特币发明了真正的钱,那么 Crypto 是什么?

引言

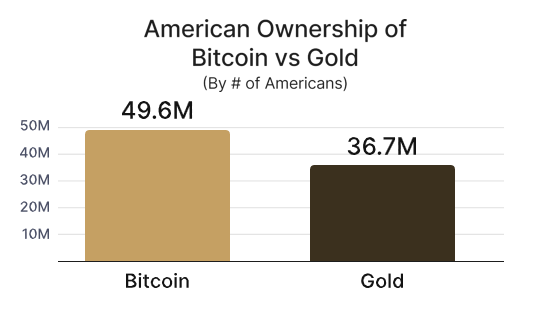

比特币诞生之初就以“数字黄金”姿态示人,被支持者誉为人类历史上第一次发明了真正意义上的钱——一种不依赖国家信用、总量恒定且不可篡改的硬通货。然而十多年过去,比特币之后蓬勃而起的加密世界(Crypto)已经远超“货币”范畴:从智能合约平台到去中心组织,从去央行的稳定币到戏谑荒诞的迷因币,Crypto 演化出一个丰富而混沌的新生态。这不禁引发一个根本性的追问:如果说比特币解决了“真金白银”的问题,那么 Crypto 又完成了什么发明?

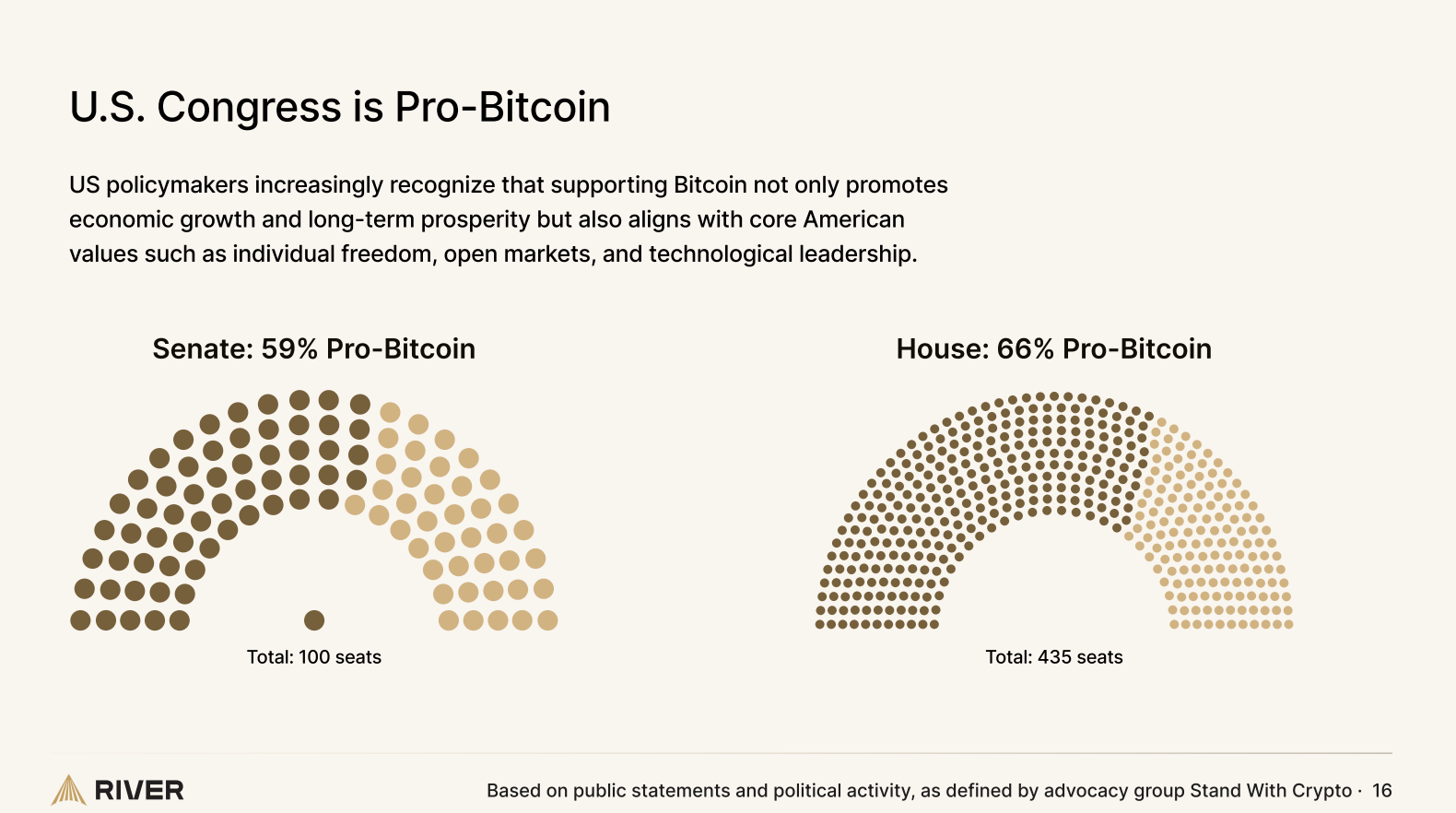

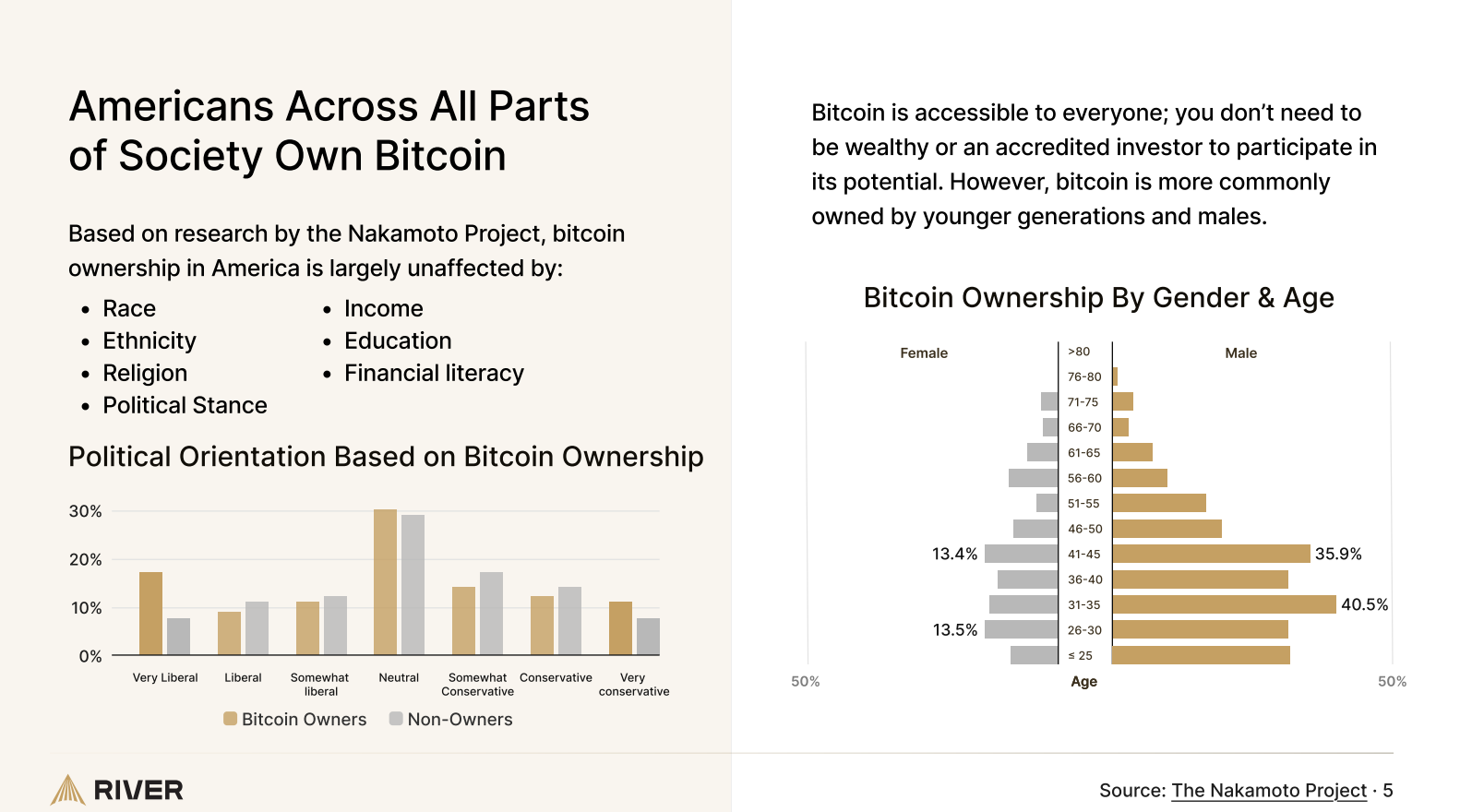

Crypto 与政治的碰撞:随着Crypto版图扩张,全球政治势力也被裹挟进这场金融变革洪流(示意图)。比特币的出现重塑了货币信用,但Crypto所引发的却是一场更深刻的政治与治理结构实验。从华尔街到华盛顿,从散户论坛到主权国家,越来越多人意识到:Crypto不只是技术或金融现象,而是一种全新的政治表达结构正在萌芽。正如有激进论者所断言的:“比特币发明了真正的钱,而Crypto则在发明新的政治。”价格K线与流动性曲线,或许正成为这个时代社群意志和社会价值观的新型投射。

Crypto 与政治的碰撞:随着Crypto版图扩张,全球政治势力也被裹挟进这场金融变革洪流(示意图)。比特币的出现重塑了货币信用,但Crypto所引发的却是一场更深刻的政治与治理结构实验。从华尔街到华盛顿,从散户论坛到主权国家,越来越多人意识到:Crypto不只是技术或金融现象,而是一种全新的政治表达结构正在萌芽。正如有激进论者所断言的:“比特币发明了真正的钱,而Crypto则在发明新的政治。”价格K线与流动性曲线,或许正成为这个时代社群意志和社会价值观的新型投射。冲突结构:当价格挑战选票

传统政治中,选票是人民意志的载体,一人一票勾勒出民主治理的正统路径。而在链上的加密世界里,骤升骤降的价格曲线和真金白银的买卖行为却扮演起了选票的角色:资金流向成了民意走向,市场多空成为立场表决。价格行为取代选票,这听来匪夷所思,却已在Crypto社群中成为日常现实。每一次代币的抛售与追高,都是社区对项目决策的即时“投票”;每一根K线的涨跌,都折射出社区意志的赞同或抗议。市场行为本身承担了决策权与象征权——价格即政治,正在链上蔓延。

这一新生政治形式与旧世界的民主机制形成了鲜明冲突。bitcoin.org中本聪在比特币白皮书中提出“一CPU一票”的工作量证明共识,用算力投票取代了人为决策bitcoin.org。而今,Crypto更进一步,用资本市场的涨跌来取代传统政治的选举。支持某项目?直接购入其代币推高市值;反对某提案?用脚投票抛售资产。相比漫长的选举周期和层层代议制,链上市场提供了近乎实时的“公投”机制。但这种机制也引发巨大争议:资本的投票天然偏向持币多者(富者)的意志,是否意味着加密政治更为金权而非民权?持币多寡成为影响力大小,仿佛选举演变成了“一币一票”,巨鲸富豪俨然掌握更多话语权。这种与民主平等原则的冲突,成为Crypto政治形式饱受质疑的核心张力之一。

尽管如此,我们已经目睹市场投票在Crypto世界塑造秩序的威力:2016年以太坊因DAO事件分叉时,社区以真金白银“投票”决定了哪条链获得未来。arkhamintelligence.com结果是新链以太坊(ETH)成为主流,其市值一度超过2,800亿美元,而坚持原则的以太经典(ETC)市值不足35亿美元,不及前者的八十分之一arkhamintelligence.com。市场选择清楚地昭示了社区的政治意志。同样地,在比特币扩容之争、各类硬分叉博弈中,无不是由投资者和矿工用资金与算力投票,胜者存续败者黯然。价格成为裁决纷争的最终选票,冲击着传统“选票决胜”的政治理念。Crypto的价格民主,与现代代议民主正面相撞,激起当代政治哲思中前所未有的冲突火花。

治理与分配

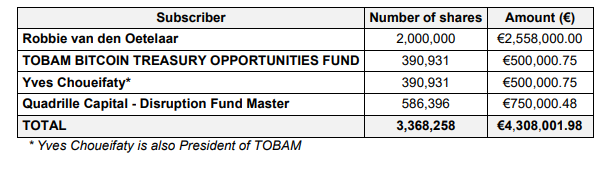

XRP对决SEC成为了加密世界“治理与分配”冲突的经典战例。2020年底,美国证券交易委员会(SEC)突然起诉Ripple公司,指控其发行的XRP代币属于未注册证券,消息一出直接引爆市场恐慌。XRP价格应声暴跌,一度跌去超过60%,最低触及0.21美元coindesk.com。曾经位居市值前三的XRP险些被打入谷底,监管的强硬姿态似乎要将这个项目彻底扼杀。

然而XRP社区没有选择沉默。 大批长期持有者组成了自称“XRP军团”(XRP Army)的草根力量,在社交媒体上高调声援Ripple,对抗监管威胁。面对SEC的指控,他们集体发声,质疑政府选择性执法,声称以太坊当年发行却“逍遥法外”,只有Ripple遭到不公对待coindesk.com。正如《福布斯》的评论所言:没人预料到愤怒的加密散户投资者会掀起法律、政治和社交媒体领域的‘海啸式’反击,痛斥监管机构背弃了保护投资者的承诺crypto-law.us。这种草根抵抗监管的话语体系迅速形成:XRP持有者不但在网上掀起舆论风暴,还采取实际行动向SEC施压。他们发起了请愿,抨击SEC背离保护投资者初衷、诉讼给个人投资者带来巨大伤害,号召停止对Ripple的上诉纠缠——号称这是在捍卫全球加密用户的共同利益bitget.com。一场由民间主导的反监管运动就此拉开帷幕。

Ripple公司则选择背水一战,拒绝和解,在法庭上与SEC针锋相对地鏖战了近三年之久。Ripple坚称XRP并非证券,不应受到SEC管辖,即使面临沉重法律费用和业务压力也不妥协。2023年,这场持久战迎来了标志性转折:美国法庭作出初步裁决,认定XRP在二级市场的流通不构成证券coindesk.com。这一胜利犹如给沉寂已久的XRP注入强心针——消息公布当天XRP价格飙涨近一倍,盘中一度逼近1美元大关coindesk.com。沉重监管阴影下苟延残喘的项目,凭借司法层面的突破瞬间重获生机。这不仅是Ripple的胜利,更被支持者视为整个加密行业对SEC强权的一次胜仗。

XRP的对抗路线与某些“主动合规”的项目形成了鲜明对比。 稳定币USDC的发行方Circle、美国最大合规交易所Coinbase等选择了一条迎合监管的道路:它们高调拥抱现行法规,希望以合作换取生存空间。然而现实却给了它们沉重一击。USDC稳定币在监管风波中一度失去美元锚定,哪怕Circle及时披露储备状况也无法阻止恐慌蔓延,大批用户迅速失去信心,短时间内出现数十亿美元的赎回潮blockworks.co。Coinbase则更为直接:即便它早已注册上市、反复向监管示好,2023年仍被SEC指控为未注册证券交易所reuters.com,卷入漫长诉讼漩涡。可见,在迎合监管的策略下,这些机构非但未能换来监管青睐,反而因官司缠身或用户流失而丧失市场信任。 相比之下,XRP以对抗求生存的路线反而赢得了投资者的眼光:价格的涨跌成为社区投票的方式,抗争的勇气反过来强化了市场对它的信心。

同样引人深思的是另一种迥异的治理路径:技术至上的链上治理。 以MakerDAO为代表的去中心化治理模式曾被寄予厚望——MKR持币者投票决策、算法维持稳定币Dai的价值,被视为“代码即法律”的典范。然而,这套纯技术治理在市场层面却未能形成广泛认同,亦无法激发群体性的情绪动员。复杂晦涩的机制使得普通投资者难以参与其中,MakerDAO的治理讨论更多停留在极客圈子内部,在社会大众的政治对话中几乎听不见它的声音。相比XRP对抗监管所激发的铺天盖地关注,MakerDAO的治理实验显得默默无闻、难以“出圈”。这也说明,如果一种治理实践无法连接更广泛的利益诉求和情感共鸣,它在社会政治层面就难以形成影响力。

XRP之争的政治象征意义由此凸显: 它展示了一条“以市场对抗国家”的斗争路线,即通过代币价格的集体行动来回应监管权力的施压。在这场轰动业界的对决中,价格即是抗议的旗帜,涨跌映射着政治立场。XRP对SEC的胜利被视作加密世界向旧有权力宣告的一次胜利:资本市场的投票器可以撼动监管者的强权。这种“价格即政治”的张力,正是Crypto世界前所未有的社会实验:去中心化社区以市场行为直接对抗国家权力,在无形的价格曲线中凝聚起政治抗争的力量,向世人昭示加密货币不仅有技术和资本属性,更蕴含着不可小觑的社会能量和政治意涵。

不可归零的政治资本

Meme 币的本质并非廉价或易造,而在于其构建了一种“无法归零”的社群生存结构。 对于传统观点而言,多数 meme 币只是短命的投机游戏:价格暴涨暴跌后一地鸡毛,创始人套现跑路,投资者血本无归,然后“大家转去炒下一个”theguardian.com。然而,meme 币社群的独特之处在于——失败并不意味着终结,而更像是运动的逗号而非句号。一次币值崩盘后,持币的草根们往往并未散去;相反,他们汲取教训,准备东山再起。这种近乎“不死鸟”的循环,使得 meme 币运动呈现出一种数字政治循环的特质:价格可以归零,但社群的政治热情和组织势能不归零。正如研究者所指出的,加密领域中的骗局、崩盘等冲击并不会摧毁生态,反而成为让系统更加强韧的“健康应激”,令整个行业在动荡中变得更加反脆弱cointelegraph.com。对应到 meme 币,每一次暴跌和重挫,都是社群自我进化、卷土重来的契机。这个去中心化群体打造出一种自组织的安全垫,失败者得以在瓦砾上重建家园。对于草根社群、少数派乃至体制的“失败者”而言,meme 币提供了一个永不落幕的抗争舞台,一种真正反脆弱的政治性。正因如此,我们看到诸多曾被嘲笑的迷因项目屡败屡战:例如 Dogecoin 自2013年问世后历经八年沉浮,早已超越玩笑属性,成为互联网史上最具韧性的迷因之一frontiersin.org;支撑 Dogecoin 的正是背后强大的迷因文化和社区意志,它如同美国霸权支撑美元一样,为狗狗币提供了“永不中断”的生命力frontiersin.org。

“复活权”的数字政治意涵

这种“失败-重生”的循环结构蕴含着深刻的政治意涵:在传统政治和商业领域,一个政党选举失利或一家公司破产往往意味着清零出局,资源散尽、组织瓦解。然而在 meme 币的世界,社群拥有了一种前所未有的“复活权”。当项目崩盘,社区并不必然随之消亡,而是可以凭借剩余的人心和热情卷土重来——哪怕换一个 token 名称,哪怕重启一条链,运动依然延续。正如 Cheems 项目的核心开发者所言,在几乎无人问津、技术受阻的困境下,大多数人可能早已卷款走人,但 “CHEEMS 社区没有放弃,背景、技术、风投都不重要,重要的是永不言弃的精神”cointelegraph.com。这种精神使得Cheems项目起死回生,社区成员齐声宣告“我们都是 CHEEMS”,共同书写历史cointelegraph.com。与传统依赖风投和公司输血的项目不同,Cheems 完全依靠社区的信念与韧性存续发展,体现了去中心化运动的真谛cointelegraph.com。这意味着政治参与的门槛被大大降低:哪怕没有金主和官方背书,草根也能凭借群体意志赋予某个代币新的生命。对于身处社会边缘的群体来说,meme 币俨然成为自组织的安全垫和重新集结的工具。难怪有学者指出,近期涌入meme币浪潮的主力,正是那些对现实失望但渴望改变命运的年轻人theguardian.com——“迷茫的年轻人,想要一夜暴富”theguardian.com。meme币的炒作表面上看是投机赌博,但背后蕴含的是草根对既有金融秩序的不满与反抗:没有监管和护栏又如何?一次失败算不得什么,社区自有后路和新方案。这种由底层群众不断试错、纠错并重启的过程,本身就是一种数字时代的新型反抗运动和群众动员机制。

举例而言,Terra Luna 的沉浮充分展现了这种“复活机制”的政治力量。作为一度由风投资本热捧的项目,Luna 币在2022年的崩溃本可被视作“归零”的失败典范——稳定币UST瞬间失锚,Luna币价归零,数十亿美元灰飞烟灭。然而“崩盘”并没有画下休止符。Luna的残余社区拒绝承认失败命运,通过链上治理投票毅然启动新链,“复活”了 Luna 代币,再次回到市场交易reuters.com。正如 Terra 官方在崩盘后发布的推文所宣称:“我们力量永在社区,今日的决定正彰显了我们的韧性”reuters.com。事实上,原链更名为 Luna Classic 后,大批所谓“LUNC 军团”的散户依然死守阵地,誓言不离不弃;他们自发烧毁巨量代币以缩减供应、推动技术升级,试图让这个一度归零的项目重新燃起生命之火binance.com。失败者并未散场,而是化作一股草根洪流,奋力托举起项目的残迹。经过迷因化的叙事重塑,这场从废墟中重建价值的壮举,成为加密世界中草根政治的经典一幕。类似的案例不胜枚举:曾经被视为笑话的 DOGE(狗狗币)正因多年社群的凝聚而跻身主流币种,总市值一度高达数百亿美元,充分证明了“民有民享”的迷因货币同样可以笑傲市场frontiersin.org。再看最新的美国政治舞台,连总统特朗普也推出了自己的 meme 币 $TRUMP,号召粉丝拿真金白银来表达支持。该币首日即从7美元暴涨至75美元,两天后虽回落到40美元左右,但几乎同时,第一夫人 Melania 又发布了自己的 $Melania 币,甚至连就职典礼的牧师都跟风发行了纪念币theguardian.com!显然,对于狂热的群众来说,一个币的沉浮并非终点,而更像是运动的换挡——资本市场成为政治参与的新前线,你方唱罢我登场,meme 币的群众动员热度丝毫不减。值得注意的是,2024年出现的 Pump.fun 等平台更是进一步降低了这一循环的技术门槛,任何人都可以一键生成自己的 meme 币theguardian.com。这意味着哪怕某个项目归零,剩余的社区完全可以借助此类工具迅速复制一个新币接力,延续集体行动的火种。可以说,在 meme 币的世界里,草根社群获得了前所未有的再生能力和主动权,这正是一种数字时代的群众政治奇观:失败可以被当作梗来玩,破产能够变成重生的序章。

价格即政治:群众投机的新抗争

meme 币现象的兴盛表明:在加密时代,价格本身已成为一种政治表达。这些看似荒诞的迷因代币,将金融市场变成了群众宣泄情绪和诉求的另一个舞台。有学者将此概括为“将公民参与直接转化为了投机资产”cdn-brighterworld.humanities.mcmaster.ca——也就是说,社会运动的热情被注入币价涨跌,政治支持被铸造成可以交易的代币。meme 币融合了金融、技术与政治,通过病毒般的迷因文化激发公众参与,形成对现实政治的某种映射cdn-brighterworld.humanities.mcmaster.caosl.com。当一群草根投入全部热忱去炒作一枚毫无基本面支撑的币时,这本身就是一种大众政治动员的体现:币价暴涨,意味着一群人以戏谑的方式在向既有权威叫板;币价崩盘,也并不意味着信念的消亡,反而可能孕育下一次更汹涌的造势。正如有分析指出,政治类 meme 币的出现前所未有地将群众文化与政治情绪融入市场行情,价格曲线俨然成为民意和趋势的风向标cdn-brighterworld.humanities.mcmaster.ca。在这种局面下,投机不再仅仅是逐利,还是一种宣示立场、凝聚共识的过程——一次次看似荒唐的炒作背后,是草根对传统体制的不服与嘲讽,是失败者拒绝认输的呐喊。归根结底,meme 币所累积的,正是一种不可被归零的政治资本。价格涨落之间,群众的愤怒、幽默与希望尽显其中;这股力量不因一次挫败而消散,反而在市场的循环中愈发壮大。也正因如此,我们才说“价格即政治”——在迷因币的世界里,价格不只是数字,更是人民政治能量的晴雨表,哪怕归零也终将卷土重来。cdn-brighterworld.humanities.mcmaster.caosl.com

全球新兴现象:伊斯兰金融的入场

当Crypto在西方世界掀起市场治政的狂潮时,另一股独特力量也悄然融入这一场域:伊斯兰金融携其独特的道德秩序,开始在链上寻找存在感。长期以来,伊斯兰金融遵循着一套区别于世俗资本主义的原则:禁止利息(Riba)、反对过度投机(Gharar/Maysir)、强调实际资产支撑和道德投资。当这些原则遇上去中心化的加密技术,会碰撞出怎样的火花?出人意料的是,这两者竟在“以市场行为表达价值”这个层面产生了惊人的共鸣。伊斯兰金融并不拒绝市场机制本身,只是为其附加了道德准则;Crypto则将市场机制推向了政治高位,用价格来表达社群意志。二者看似理念迥异,实则都承认市场行为可以也应当承载社会价值观。这使得越来越多金融与政治分析人士开始关注:当虔诚的宗教伦理遇上狂野的加密市场,会塑造出何种新范式?

事实上,穆斯林世界已经在探索“清真加密”的道路。一些区块链项目致力于确保协议符合伊斯兰教法(Sharia)的要求。例如Haqq区块链发行的伊斯兰币(ISLM),从规则层面内置了宗教慈善义务——每发行新币即自动将10%拨入慈善DAO,用于公益捐赠,以符合天课(Zakat)的教义nasdaq.comnasdaq.com。同时,该链拒绝利息和赌博类应用,2022年还获得了宗教权威的教令(Fatwa)认可其合规性nasdaq.com。再看理念层面,伊斯兰经济学强调货币必须有内在价值、收益应来自真实劳动而非纯利息剥削。这一点与比特币的“工作量证明”精神不谋而合——有人甚至断言法定货币无锚印钞并不清真,而比特币这类需耗费能源生产的资产反而更符合教法初衷cointelegraph.com。由此,越来越多穆斯林投资者开始以道德投资的名义进入Crypto领域,将资金投向符合清真原则的代币和协议。

这种现象带来了微妙的双重合法性:一方面,Crypto世界原本奉行“价格即真理”的世俗逻辑,而伊斯兰金融为其注入了一股道德合法性,使部分加密资产同时获得了宗教与市场的双重背书;另一方面,即便在遵循宗教伦理的项目中,最终决定成败的依然是市场对其价值的认可。道德共识与市场共识在链上交汇,共同塑造出一种混合的新秩序。这一全球新兴现象引发广泛议论:有人将其视为金融民主化的极致表现——不同文化价值都能在市场平台上表达并竞争;也有人警惕这可能掩盖新的风险,因为把宗教情感融入高风险资产,既可能凝聚强大的忠诚度,也可能在泡沫破裂时引发信仰与财富的双重危机。但无论如何,伊斯兰金融的入场使Crypto的政治版图更加丰盈多元。从华尔街交易员到中东教士,不同背景的人们正通过Crypto这个奇特的舞台,对人类价值的表达方式进行前所未有的实验。

升华结语:价格即政治的新直觉

回顾比特币问世以来的这段历程,我们可以清晰地看到一条演进的主线:先有货币革命,后有政治发明。比特币赋予了人类一种真正自主的数字货币,而Crypto在此基础上完成的,则是一项前所未有的政治革新——它让市场价格行为承担起了类似政治选票的功能,开创了一种“价格即政治”的新直觉。在这个直觉下,市场不再只是冷冰冰的交易场所;每一次资本流动、每一轮行情涨落,都被赋予了社会意义和政治涵义。买入即表态,卖出即抗议,流动性的涌入或枯竭胜过千言万语的陈情。Crypto世界中,K线图俨然成为民意曲线,行情图就是政治晴雨表。决策不再由少数权力精英关起门来制定,而是在全球无眠的交易中由无数普通人共同谱写。这样的政治形式也许狂野,也许充满泡沫和噪音,但它不可否认地调动起了广泛的社会参与,让原本疏离政治进程的个体通过持币、交易重新找回了影响力的幻觉或实感。

“价格即政治”并非一句简单的口号,而是Crypto给予世界的全新想象力。它质疑了传统政治的正统性:如果一串代码和一群匿名投资者就能高效决策资源分配,我们为何还需要繁冗的官僚体系?它也拷问着自身的内在隐忧:当财富与权力深度绑定,Crypto政治如何避免堕入金钱统治的老路?或许,正是在这样的矛盾和张力中,人类政治的未来才会不断演化。Crypto所开启的,不仅是技术乌托邦或金融狂欢,更可能是一次对民主形式的深刻拓展和挑战。这里有最狂热的逐利者,也有最理想主义的社群塑梦者;有一夜暴富的神话,也有瞬间破灭的惨痛。而这一切汇聚成的洪流,正冲撞着工业时代以来既定的权力谱系。

当我们再次追问:Crypto究竟是什么? 或许可以这样回答——Crypto是比特币之后,人类完成的一次政治范式的试验性跃迁。在这里,价格行为化身为选票,资本市场演化为广场,代码与共识共同撰写“社会契约”。这是一场仍在进行的文明实验:它可能无声地融入既有秩序,也可能剧烈地重塑未来规则。但无论结局如何,如今我们已经见证:在比特币发明真正的货币之后,Crypto正在发明真正属于21世纪的政治。它以数字时代的语言宣告:在链上,价格即政治,市场即民意,代码即法律。这,或许就是Crypto带给我们的最直观而震撼的本质启示。

参考资料:

-

中本聪. 比特币白皮书: 一种点对点的电子现金系统. (2008)bitcoin.org

-

Arkham Intelligence. Ethereum vs Ethereum Classic: Understanding the Differences. (2023)arkhamintelligence.com

-

Binance Square (@渔神的加密日记). 狗狗币价格为何上涨?背后的原因你知道吗?binance.com

-

Cointelegraph中文. 特朗普的迷因币晚宴预期内容揭秘. (2025)cn.cointelegraph.com

-

慢雾科技 Web3Caff (@Lisa). 风险提醒:从 LIBRA 看“政治化”的加密货币骗局. (2025)web3caff.com

-

Nasdaq (@Anthony Clarke). How Cryptocurrency Aligns with the Principles of Islamic Finance. (2023)nasdaq.comnasdaq.com

-

Cointelegraph Magazine (@Andrew Fenton). DeFi can be halal but not DOGE? Decentralizing Islamic finance. (2023)cointelegraph.com

-

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ 662f9bff:8960f6b2

2025-05-20 18:52:01

@ 662f9bff:8960f6b2

2025-05-20 18:52:01April already and we are still refugees from the madness in HK. During March I had quite a few family matters that took priority and I also needed to work for two weeks. April is a similar schedule but we flew to Madeira for a change of scene and so that I could have a full 2-weeks off - my first real holiday in quite a few years!

We are staying in an airBnB in Funchal - an experience that I can totally recommend - video below! Nice to have an apartment that is fully equipped in a central location and no hassle for a few weeks. While here we are making the most of the great location and all the local possibiliites.

Elsewhere in the world

Things are clearly not going great around the world. If you are still confused as to why these things are happening, do go back and read the previous Letter from HK section "Why? How did we get here?"

You should be in no doubt that the "Great Reset" with its supporting "Great Narrative" is in full swing.. This is it - it is not a drill. For additional insights the following are recommended.

-

Jeff Booth discusses clearly and unemotionally with Pomp - Inflation is theft from humanity by the world governments

-

James' summary of Day 2 of the Miami conference - Peter Thiel (wow) and a fantastic explainer from Saifedean on the costs of the current corrupt financial system

-

James' summary of Day 3 of the Miami conference - listen in particular to the words of wisdom from Michael Saylor and Lyn Alden

-

Layered Money - The corruption of the system will blow your mind once you understand it…

-

This is BIG: Strike Is Bringing Freedom To Retail Merchants

-

Mark summarises Ray's book: Things will go faster and slower than you want!

-

Thoughtful words from George - evil is at work - be in no doubt..

-

Wow - My mind is blown. Must listen to John Carvalho - what clear ambition and answers to every question!

-

Related to the John Carvalho discussion. Likely these two options will end up complementing each other

On the personal and inspirational side

Advantage of time off work is that I have more time to read, listen and watch things that interest me. It really is a privilege that so much high quality material is so readily available. Do not let it go to waste. A few fabulous finds (and some re-finds) from this past week:

-

Ali Abdaal's bookshelf review just blew my mind! For the full list of books with links see the text under his video. So many inspirations and his delivery is perfect.

-

Gotta recommend Ali's 21 Life Lessons. I have been following him since he was student in Cambridge five years ago - his personal and professional growth and what he achieves (now with his team) is truely staggering.

-

Also his 15 books to read in 2022 - especially this one!

-

I also keep going back to Steve Jobs giving the 2005 Stanford Commencement address Three stories from his life - listen and be inspired - especially story #3

You will know that I am a fan of Audio Books and also Kindle - recently I am starting to use Whispersync where you get the Kindle- and Audio-books together for a nice price. This makes it easier to take notes (using Mac or iPad Kindle reader) while getting the benefit of having the book read to you by a professional reader.

I have also been inspired by a few people pushing themselves to do more reading - like this girl and Ali himself with his tips. Above all: just do it and do not get stuck on something that does not work for you!

Books that I am reading - Audio and Kindle!

-

The Final Empire: Mistborn, Book 1 - this is a new genre for me - I rather feel that it might be a bit too complicated for my engineering mind - let's see

-

Die with Zero: Getting All You Can from Your Money and Your Life - certainly provocative and obvious if you think about it but 99% do the opposite!

-

Chariots of the Gods - a classic by Erich von Daniken (written in 1968) - I have been inspired by his recent YT video appearances. Thought provoking and leads you to many possibilities.

So what's it like in Funchal, Madeira?

Do check out HitTheRoadMadeira's walking tour around Funchal

My first impressions of Funchal

and see my day out on Thursday!

Saturday - Funchal and Camar de Lobos

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 662f9bff:8960f6b2

2025-05-20 13:44:39

@ 662f9bff:8960f6b2

2025-05-20 13:44:39Currently, and for the last three weeks, I am in Belfast. With the situation in HK becoming ever more crazy by the day we took the opportunity to escape from Hong Kong for a bit - I escaped with V and 3 suitcases. I also have some family matters that I am giving priority to at this time. We plan to stay a few more weeks in Northern Ireland and then after some time in Belgium we will be visiting some other European locations. I do hope that HK will be a place that we can go back to - we will see...

What's happening?

Quite a few significant events have happened in the last few weeks that deserve some deeper analysis and checking than you will ever get from the media propaganda circus that is running full force at the moment. You should be in no doubt that the "Great Reset" with its supporting "Great Narrative" is in full swing.

In most of the world the C19 story has run its course - for now. Most countries seem to have have "declared victory" and "moved on". Obviously HK is an exception (nothing happened there for the last two years) and I fear they will get to experience the whole 2-year thing in the coming 3-4 months. Watch out - the politicians everywhere are looking to permanently establish the "emergency controls" as "normal" - see previous Letter for some examples in Ireland and EU.

Invasion of Ukraine has led to so many lines being crossed - to the extent that clearly things will never be the same again in our lifetime.

Why? How did we get here?

I do not claim to know all the answers but some things are fairly clear if you look with open eyes and the wisdom that previous generations and civilisations have made available to us - even if most choose to ignore it (Plato on the flaws of democracy). Those who do not learn from history are doomed to repeat it and even those who learn will have litle choice but to go along for much of the ride.

Perhaps my notes and the links below will help you to form an educated opinion rather than the pervasive propaganda we are all being fed.

The current situation is more than 100 years in the making and much (if not most) of what you thought was true is less veracious than you could ever imagine. No doubt we could (and maybe should) go back further but let's start in 1913 when the British Government asked the public no longer to request exchange of their pounds for gold coins at the post office. This led to the issuing of War Bonds and fractional reserve accounting that allowed the Bank of England essentially to print unlimited money to fight in WW1; without this devious action they would have been constrained to act within the limits of the country's reserves and WW1 would have been shorter. Read The Fiat Standard for more details on how this happened. Around this time, and likely no coincidence, the US bankers were scheming how to get around the constitutional controls against such actions in their own country - read more in The Creature from Jekyll Island.

Following WW1, Germany was forced to pay war reparations in Gold (hard money). This led to a decade of money printing and extravagant excesses and crashes as hyperinflation set in, ending in the bankrupting of the country and the nationalism that fed WW2 - the gory details of devaluation and hyperinflation in Weimar Germany are described in When Money Dies. Meanwhile the US bankers who had been preparing since 1913 stepped in with unlimited money printing to fund WW2 and then also in their Marshal Plan to cement in place the Bretton Woods post-war agreement that made US Dollar the global reserve currency.

Decades of boom and bust followed - well explained by Ray Dalio who portrays this as perfectly normal and to be expected - unfortunately it is for soft (non-hard) money based economies. The Fourth Turning will give many additional insights to this period too as well as cycles to watch for and their cause and nature. In 1961 Eisenhower tried to warn the population in his farewell address about the "Military Industrial Complex" and many believe that Robert Kennedy's assassination in 1963 may well be not entirely unrelated.

Things came to a head in August 1971 when the countries of the world realised that the US was (contrary to all promises) printing unlimited funds to (among other things) fight the Vietnam war and so undermining the expected and required convertibility of US dollars (the currency of global trade) for Gold (hard money). A French warship heading to NY to collect France's gold was the straw that caused Nixon to default on US Debt convertibility and "close the gold window".

This in turn led to further decades of increasing financialization, further fuelled (pun intended) by the PetroDollar creation and "exorbitant priviledge" that the US obtained by having the global reserve currency - benefiting those closest to the money supply (Cantillon effect) while hollowing out the US manufacturing and eventually devastating its middle and working classes (Triffin dilemma) - Arthur Hayes describes all this and much more as well as the likely outlook in his article - Energy Canceled. Absolutely required reading or listen to Guy Swan reading it and giving his additional interpetation.

Zoltan Pozsar of Credit Suisse explains how the money system is now being reset following the events of last few weeks and his article outlines a likely way forward - Bretton Woods III. His paper is somewhat dense, heavy reading and you might prefer to listen to Luc Gromen's more conversational explainer with Marty

All of this was well known to our forefathers

The writers of the American Constitution understood the dangers of money being controlled by any elite group and they did their best to include protections in the US constitution. It did take the bankers multiple decades and puppet presidents to circumvent these but do so they did. Thomas Jefferson could not have been more clear in his warning.

" If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around(these banks) will deprive the people of all property until their children wake up homeless on the continent their fathers conquered."

Islamic finace also recognised the dangers - you will likely be aware of the restrictions that forbid interest payments - read this interesting article from The Guardian

You will likely also be aware from schooldays that the Roman Empire collapsed because it expanded too much and the overhead became unbearable leading to the debasement of its money and inability to extract tax payments to support itself. Read more from Mises Institute. Here too, much of this will likely ring familiar.

So what can you do about it?

In theory Governments should respect Consent of the Governed and the 1948 Universal Declaration of Human Rights states that "The will of the people shall be the basis of the authority of government".

For you to decide if and to what extent governments today are acting in line with these principles. If not, what can you do about it?

The options you have are basically - Loyalty, Voice or Exit. 1. You can be loyal and accept what you are told - 2. you may (or may not) be able to voice disagreement and 3. you may (or may not!) be able to exit. Authoritarian governments will make everything except Loyalty difficult or even impossible - if in doubt, read George Orwell 1984 - or look just around at recent events today in many countries.

I'll be happy to delve deeper into this in subsequent letters if there is interest - for now I recommend you to read Sovereign Individual. It is a long read but each chapter starts with a summary and you can read the summaries of each chapter as a first step. Also - I'm happy to discuss with you - just reach out and let me know!

For those who prefer a structured reading list, check References

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can easily ask questions or discuss any topics in the newsletters in our Telegram group - click the link here to join the group.\ You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

@ 91bea5cd:1df4451c

2025-05-20 12:16:57

@ 91bea5cd:1df4451c

2025-05-20 12:16:57Contexto e início

O precursor direto do avivamento foi William J. Seymour, um pregador afro-americano filho de ex-escravos, influenciado pelos ensinamentos de Charles Parham, que pregava o "batismo no Espírito Santo" com evidência do falar em línguas.

Em 1906, Seymour foi convidado para pregar em uma igreja em Los Angeles. Após ser rejeitado por alguns por sua pregação sobre o batismo com o Espírito Santo, ele começou a liderar reuniões de oração na casa da família Asberry. Em abril de 1906, durante uma dessas reuniões, os participantes começaram a experimentar manifestações intensas do Espírito Santo, incluindo glossolalia (falar em línguas), curas e profecias.

A Rua Azusa

Logo, o número de participantes cresceu tanto que foi necessário mudar para um antigo prédio da Igreja Metodista Africana Episcopal, no número 312 da Rua Azusa, no centro de Los Angeles. Esse local se tornou o epicentro do avivamento.

Características marcantes

Cultos espontâneos e fervorosos, muitas vezes sem ordem pré-definida.

Diversidade étnica e social: negros, brancos, latinos, asiáticos, ricos e pobres adoravam juntos — algo radical para os padrões da época.

Ênfase nas manifestações espirituais, como línguas, curas, visões e profecias.

Igualdade de gênero e raça no ministério, com mulheres e homens de diversas origens pregando e liderando.

Impacto

O avivamento da Rua Azusa marcou o nascimento e expansão global do pentecostalismo, hoje uma das maiores forças do cristianismo mundial. Missionários saíram de Azusa para várias partes do mundo, levando a mensagem pentecostal. Movimentos como as Assembleias de Deus e Igreja do Evangelho Quadrangular têm raízes nesse avivamento.

Tensão e Interpretação entre Reformistas e Pentecostalistas

Evangelhos e Atos

João Batista profetiza: “Ele vos batizará com o Espírito Santo e com fogo” (Mateus 3:11).

Em Atos 2, no Pentecostes, os discípulos falam em línguas e recebem poder (Atos 1:8; 2:4).

Outros episódios: Atos 10 (Casa de Cornélio) e Atos 19 (Éfeso).

Cartas Paulinas

Paulo não relaciona diretamente o “batismo com o Espírito” ao falar em línguas. Em 1 Coríntios 12:13 ele diz: “Pois em um só Espírito todos nós fomos batizados em um corpo”.

A glossolalia aparece como um dom entre outros, mas não como evidência obrigatória (1 Coríntios 12:30).

Tensão

Pentecostais veem o batismo com o Espírito como uma segunda experiência após a conversão, evidenciada por línguas. Reformados geralmente interpretam que o batismo com o Espírito ocorre na conversão e que línguas não são obrigatórias ou cessaram com os apóstolos.

Reformadores e o Batismo com o Espírito Santo

Martinho Lutero, João Calvino e outros reformadores não falavam em línguas nem davam ênfase a experiências carismáticas.

Cessacionismo: Doutrina comum entre reformados que diz que os dons sobrenaturais (línguas, profecias, curas) cessaram com a era apostólica.

Continuação (posição pentecostal): Os dons continuam hoje.

Filmes / Documentários

“Azusa Street: The Origins of Pentecostalism” (2006) – Documentário com imagens históricas e entrevistas.

“Wesley” (2009) – Biografia de John Wesley, precursor do metodismo e influência indireta no pentecostalismo.

“The Cross and the Switchblade” (1970) – História de David Wilkerson e a conversão de Nicky Cruz; enfatiza a obra do Espírito.

Série “God in America” (PBS) – Episódio sobre o pentecostalismo (não só Azusa, mas seu impacto cultural).

-

@ 502ab02a:a2860397

2025-05-21 02:12:10

@ 502ab02a:a2860397

2025-05-21 02:12:10ถ้าเอ่ยถึง CJ หลายคนอาจนึกถึงซอสเกาหลีรสจัดจ้าน หรือบะหมี่กึ่งสำเร็จรูปแบรนด์ดังที่ขายทั่วโลก แต่เบื้องหลังความสำเร็จของแบรนด์เหล่านั้น มีบริษัทแม่อย่าง CJ CheilJedang ที่ไม่ได้แค่ผลิตอาหารแปรรูป แต่เป็นหนึ่งในผู้เล่นใหญ่ของอุตสาหกรรมอาหารระดับโลก ด้วยฐานความรู้ลึกซึ้งในเทคโนโลยีชีวภาพ หนึ่งในแขนงที่โดดเด่นคือ CJ BIO ธุรกิจไบโอเทคโนโลยีที่เน้นการใช้ Microbial Fermentation หรือการหมักจุลินทรีย์เพื่อผลิตสารอาหารและวัตถุดิบอาหารคุณภาพสูงในระดับอุตสาหกรรม

ประวัติของ CJ BIO เริ่มจากจุดเล็ก ๆ แต่ทรงพลัง คือการผลิต โมโนโซเดียมกลูตาเมต (MSG) ซึ่งเป็นกรดอะมิโนชนิดหนึ่งที่มีบทบาทสำคัญในการเพิ่มรสชาติ “อูมามิ” ให้กับอาหารทั่วโลก จุดนี้เองที่ทำให้ CJ BIO ได้สะสมเทคโนโลยีหมักจุลินทรีย์ในระดับอุตสาหกรรมมายาวนานกว่า 60 ปี ด้วยโรงงานหมักขนาดใหญ่ที่ตั้งอยู่ในหลายประเทศ เช่น เกาหลีใต้ จีน บราซิล อินโดนีเซีย และสหรัฐอเมริกา ทำให้ CJ BIO กลายเป็นหนึ่งในผู้ผลิตกรดอะมิโนและวัตถุดิบอาหารหมักจุลินทรีย์รายใหญ่ของโลก

แต่ถ้าให้พูดแบบง่าย ๆ การหมักจุลินทรีย์ของ CJ BIO นั้น ไม่ใช่แค่ “การทำอาหาร” ธรรมดา ๆ แต่เป็นการ “สร้างอาหารในระดับโมเลกุล” ตั้งแต่พื้นฐาน ซึ่งถือเป็นเทคโนโลยีที่สำคัญสำหรับอนาคตของอาหาร เพราะมันช่วยให้เราสามารถผลิตโปรตีน กรดอะมิโน และสารอาหารต่าง ๆ ที่มีคุณภาพสูงและควบคุมได้ในโรงงานขนาดใหญ่ โดยไม่ต้องพึ่งพาการเกษตรแบบดั้งเดิมที่ต้องใช้พื้นที่มากและมีผลกระทบต่อสิ่งแวดล้อม

เมื่อเทรนด์โลกกำลังเปลี่ยนไปในทางที่ผู้บริโภคหันมาใส่ใจสุขภาพและสิ่งแวดล้อมมากขึ้น เรื่อง “อาหารจากห้องแล็บ” หรือ “อาหารเทคโนโลยีชีวภาพ” จึงกลายเป็นสิ่งที่ได้รับความสนใจอย่างมาก และนี่เองที่ทำให้ CJ BIO ไม่ได้หยุดอยู่แค่ Microbial Fermentation แบบดั้งเดิม แต่เริ่มขยับเข้าสู่โลกใหม่ของ Precision Fermentation การใช้จุลินทรีย์ที่ผ่านการดัดแปลงพันธุกรรมอย่างแม่นยำ เพื่อผลิตโปรตีนหรือสารอาหารเฉพาะอย่างที่ต้องการ

ความเคลื่อนไหวที่สำคัญเกิดขึ้นในปี 2022 เมื่อ CJ CheilJedang ประกาศลงทุนใน New Culture สตาร์ทอัพสัญชาติอเมริกันที่กำลังพัฒนา “ชีสไร้วัว” ด้วยเทคโนโลยี Precision Fermentation ซึ่ง New Culture ใช้จุลินทรีย์ที่ถูกออกแบบมาเพื่อผลิตโปรตีนเคซีน โปรตีนหลักในน้ำนมวัว โดยไม่ต้องมีวัวจริงเลย นั่นหมายความว่าชีสที่ผลิตออกมาจะไม่มีส่วนผสมจากสัตว์จริง ๆ แต่ยังคงรสชาติและเนื้อสัมผัสเหมือนชีสธรรมชาติทุกประการ

การลงทุนครั้งนี้ของ CJ CheilJedang บริษัทแม่ของ CJ BIO จึงถือเป็นการผนึกกำลังระหว่างเทคโนโลยีดั้งเดิมที่ผ่านการพิสูจน์แล้วในระดับอุตสาหกรรม กับนวัตกรรมที่พร้อมเปลี่ยนแปลงวงการอาหารครั้งใหญ่

ถ้าให้เปรียบเทียบง่าย ๆ CJ BIO เหมือนกับ “โรงงานปั้นโมเลกุลอาหาร” ที่มีความเชี่ยวชาญสูงในการจัดการกับจุลินทรีย์และการผลิตกรดอะมิโนหลากหลายชนิด โดยเฉพาะ MSG ซึ่งถือเป็น “พี่ใหญ่” ในกลุ่มกรดอะมิโนที่ช่วยเพิ่มรสชาติและถูกใช้ในอุตสาหกรรมอาหารทั่วโลก

ความเชี่ยวชาญในการผลิต MSG นี้เอง คือฐานกำลังสำคัญที่ทำให้ CJ BIO สามารถขยายขอบเขตไปสู่การผลิตโปรตีนด้วย Precision Fermentation ได้อย่างมั่นใจ เพราะกระบวนการหมักจุลินทรีย์เพื่อผลิตกรดอะมิโนและโปรตีนนั้นมีความคล้ายคลึงกันในเชิงเทคนิคและการควบคุมคุณภาพ

CJ BIO มีโรงงานหมักจุลินทรีย์ที่ทันสมัยและขนาดใหญ่กระจายอยู่ทั่วโลก สามารถผลิตวัตถุดิบในปริมาณมหาศาลเพื่อตอบสนองตลาดอาหารที่เติบโตอย่างรวดเร็ว และการมีเครือข่ายโรงงานแบบนี้ทำให้ CJ BIO มีความได้เปรียบในการลดต้นทุนและควบคุมคุณภาพอย่างเข้มงวด

อนาคตที่ CJ BIO กำลังเดินไปนั้น ไม่ใช่แค่การผลิตวัตถุดิบอาหารธรรมดา ๆ แต่คือการสร้างนวัตกรรมที่จะเปลี่ยนแปลงวิธีการผลิตและการบริโภคอาหารของโลก

เมื่อผลิตภัณฑ์จากเทคโนโลยี Precision Fermentation อย่างชีสไร้วัว ไข่ไร่ไก่ หรือโปรตีนทางเลือกต่าง ๆ เริ่มเข้ามาในตลาดมากขึ้น เราอาจจะได้เห็น CJ BIO ทำหน้าที่เหมือน “Intel Inside” ของวงการอาหารอนาคต ที่อยู่เบื้องหลังผลิตภัณฑ์สำคัญ ๆ ที่ผู้บริโภคชื่นชอบโดยไม่รู้ตัว

นี่คือเหตุผลที่ทำให้การมองแค่แบรนด์อาหารหรือการตลาดที่พูดถึง “ความยั่งยืน” หรือ “อาหารปลอดสัตว์” ยังไม่พอ เราต้องมองให้ลึกไปถึงระบบนิเวศของเทคโนโลยีและทุนที่อยู่เบื้องหลัง เพราะนั่นคือเกมกระดานใหญ่ที่กำลังขยับเปลี่ยนแปลงวงการอาหารโลกอย่างแท้จริง

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ bc6ccd13:f53098e4

2025-05-21 02:04:25

@ bc6ccd13:f53098e4

2025-05-21 02:04:25This article is slightly outside my normal writing focus. But it’s something everyone deserves to know, and take advantage of if they like. Before you click away, this isn’t a sports betting “system” or “strategy”. This is for anyone living in or near a state that has legalized online sports betting. It’s a way to take advantage of the new customer sign up bonuses these online sportsbooks give, by using free online tools to convert those bonuses into $2,000 or more in cash per person, depending on your state. It doesn’t require you to know anything whatsoever about sports, gambling, sports betting, odds, math, or anything like that. It doesn’t involve taking risks with your money. All you need is some capital (around $3-5,000 would be ideal), a smartphone, a legal sports betting state, and this guide.

Concepts and Principles

Online sports betting is now legal in 30 US states. You can check legality in your state on the map here. If you’re in a state with legal mobile betting, or close enough that you’d be willing to drive there, you can benefit from this guide.

Most states with legalized betting have multiple different sports books competing for customers. To attract new customers, many of them offer various types of bonus offers when you initially sign up. The idea is that once you sign up and place a bet, you’re likely to continue betting in the future. So the sportsbook doesn’t mind losing money on your first wager, because they’ll make it back over time. That leaves an opportunity for someone to just take the free money and leave, if they want to do that. It’s completely legal, and if you follow this guide, also risk free.

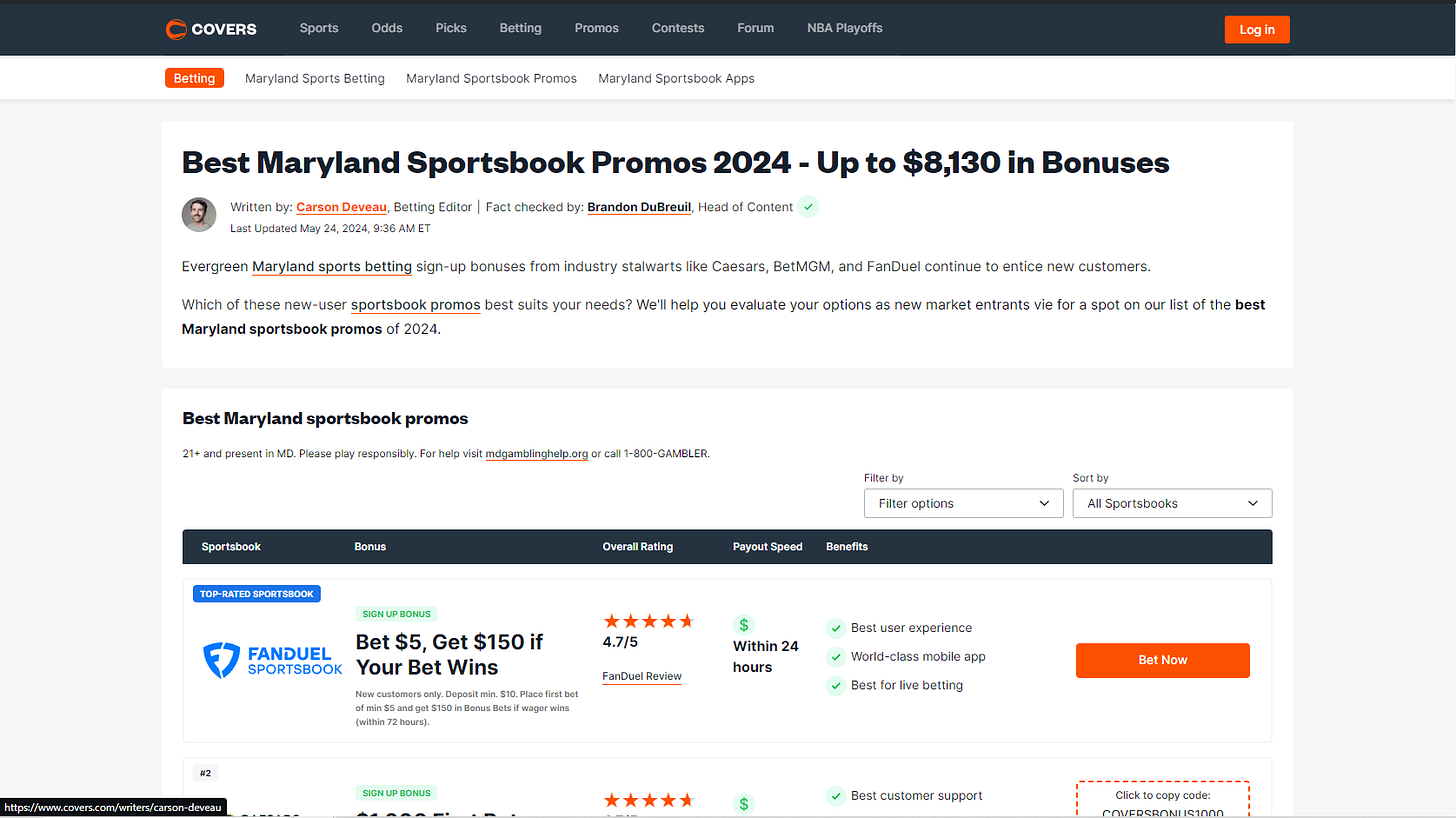

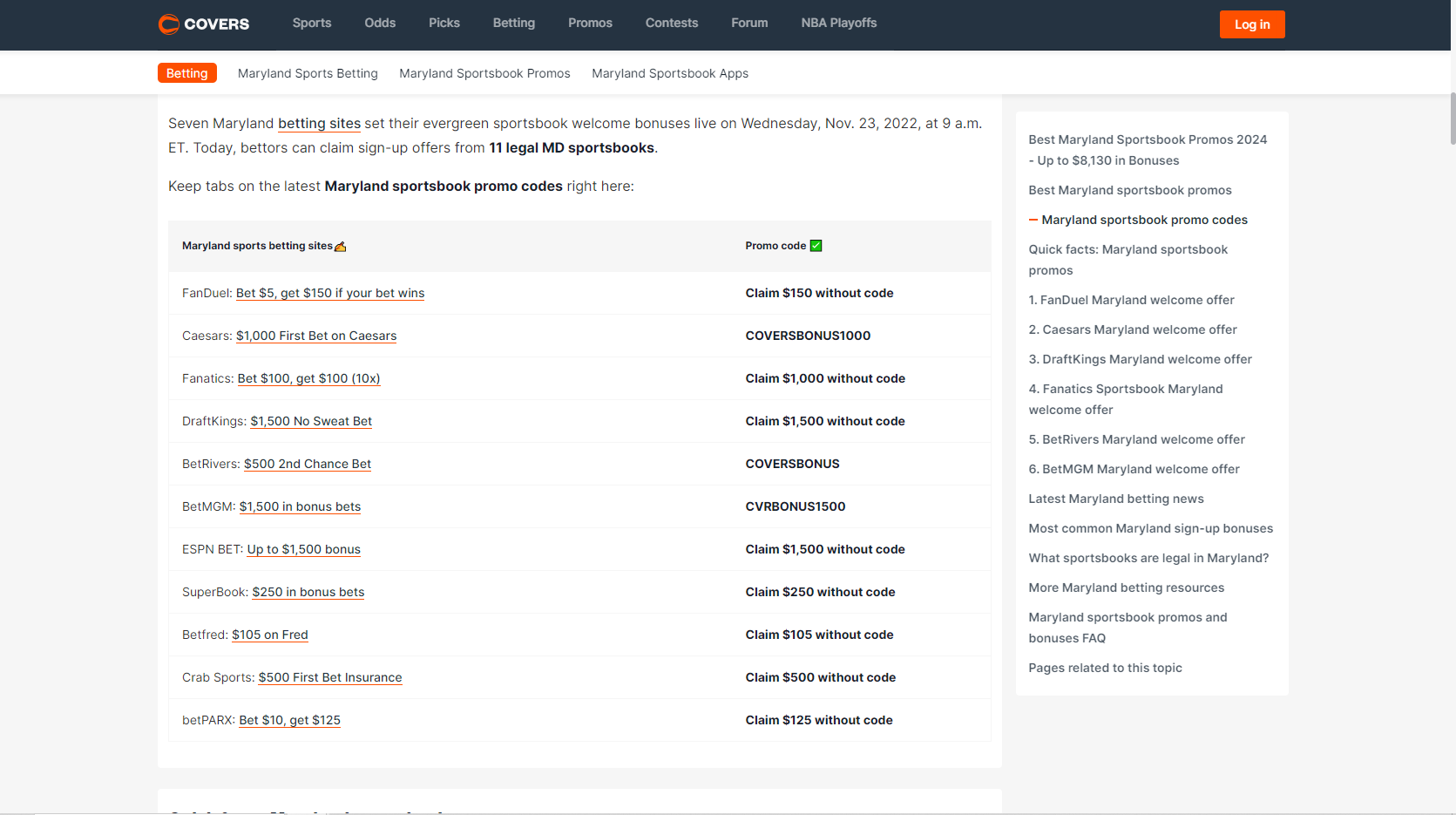

The bonuses vary in size, but are usually larger the first few months after a state legalizes online betting, since sportsbooks are competing heavily to attract the new customers to their site. But most states will have a combined $3-5,000 in bonuses available at any time across 4-8 sportsbooks. You can find the available offers in your state by searching “covers sports betting promo offers \

”. For example for Maryland, we’d end up up at covers.com on a page like this. The basic concept is that we open accounts on multiple sites, sign up for their bonus offers, then bet both sides of the same sports game but on 2 different sites. That way it doesn’t matter which team wins, we collect the free bonus money with no risk.

Actually doing it is a bit more nuanced, but I’ll explain it step by step and illustrate with plenty of screenshots to make sure you can follow along.

First, you want to find the offers for your state, and sign up for the sites with the offers you want to convert. For Maryland, if we scroll on down at covers.com, we’ll find this list of offers.

The larger offers are of course more worthwhile, so if I were in Maryland, I would first sign up for Caesars, DraftKings, BetMGM, and ESPN BET. Since you’ll also want another site to hedge your bets, I’d also sign up for FanDuel. You can download their apps, set up your accounts, and familiarize yourself with the deposit methods that are available.

Risk-Free Bets

These are the most common bonus offers you’ll find. They’ll also be called No Sweat Bets, Second Chance Bets, First Bet Insurance, Bonus Bets, First Bets, etc. Always make sure you check the details of the promotion you’re using to make sure it’s a Risk-Free Bet, and what the terms and details of the offer are. The four offers from the sites above for Maryland all fall under the category of risk-free bets.

The concept of this offer is simple: you open an account, deposit some money, and make a bet. The very first bet (MAKE SURE YOU GET THIS RIGHT) will be your risk-free bet. If you win that first bet, cool, you get the winnings from that bet and can withdraw it. If you lose your first bet, the risk-free bet kicks in, and you get a free bet deposited into your account equal to the amount of your first bet. So you basically get a do-over if you lose the first one.

Now you won’t be able to just withdraw the free bet in cash if you lose and get your money back. That would be too easy. The risk-free bet is a bet, you can only use it to bet on another game. If you win that second wager, you can withdraw your winnings. But if you don’t, you can still win by hedging your bets on a different sportsbook. That’s what I’m going to show you.

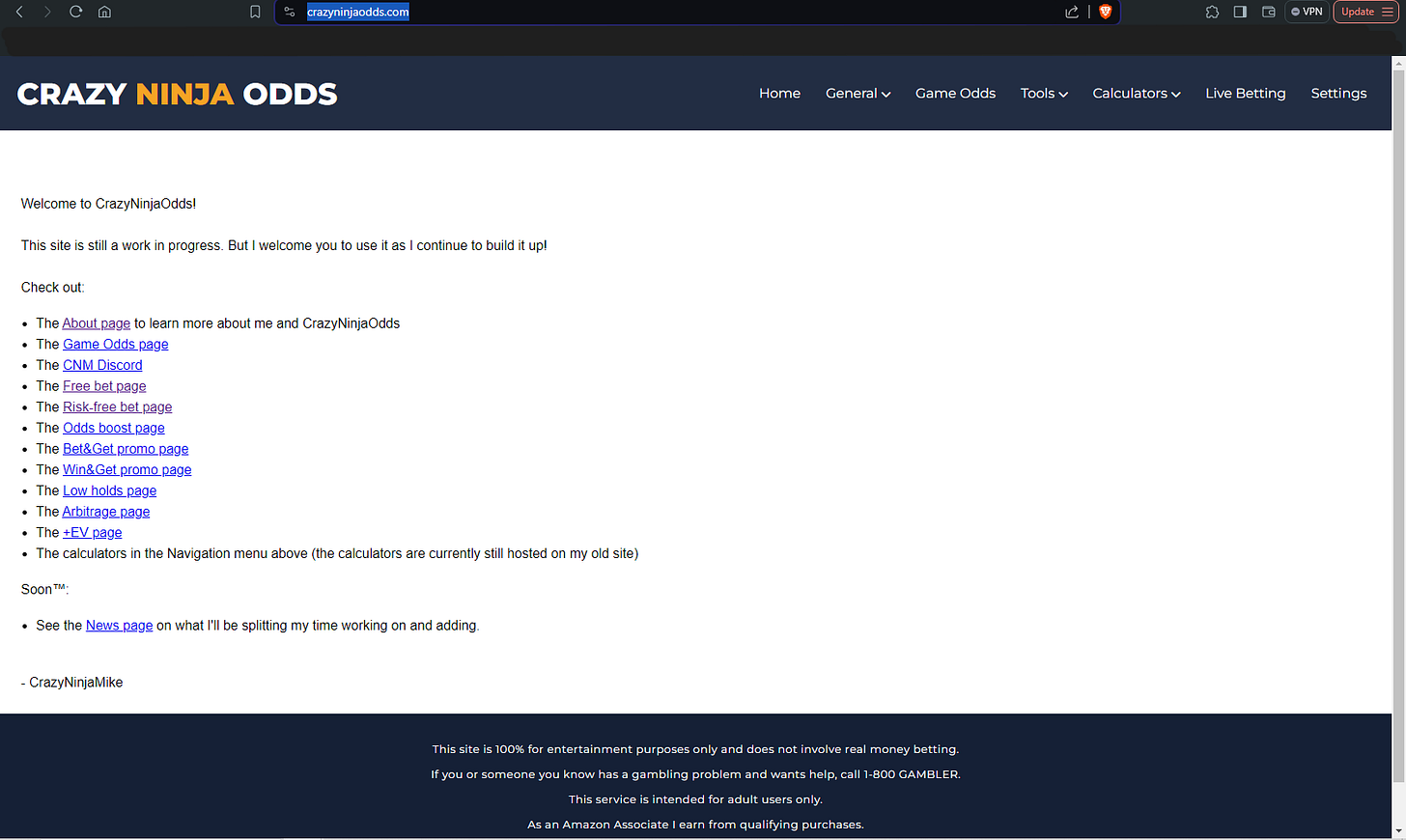

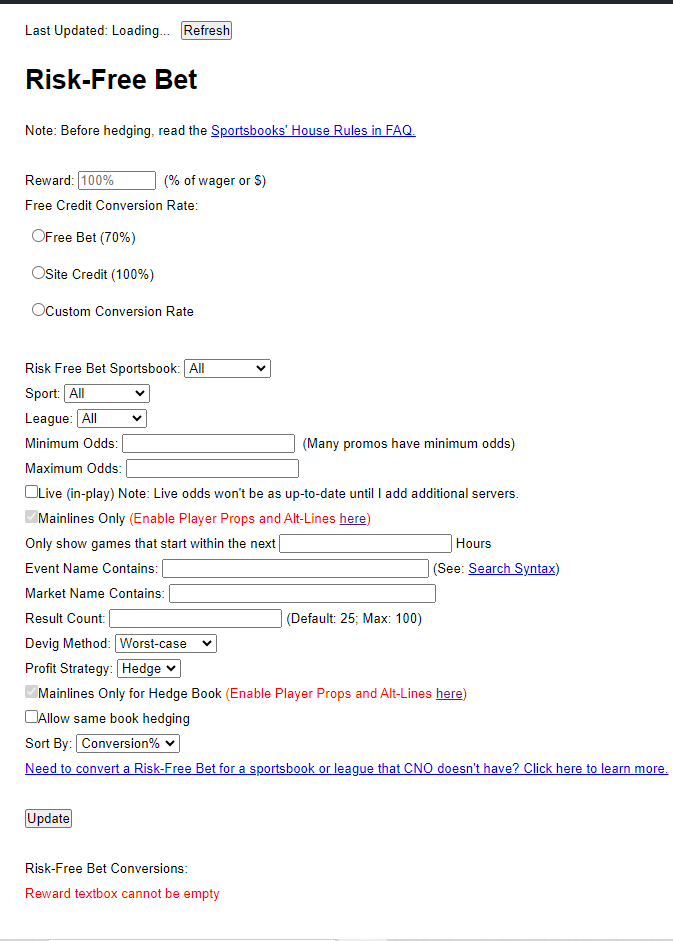

To find which games to bet on and how much to bet, you’ll need to use a different free website. Go to Crazy Ninja Odds.

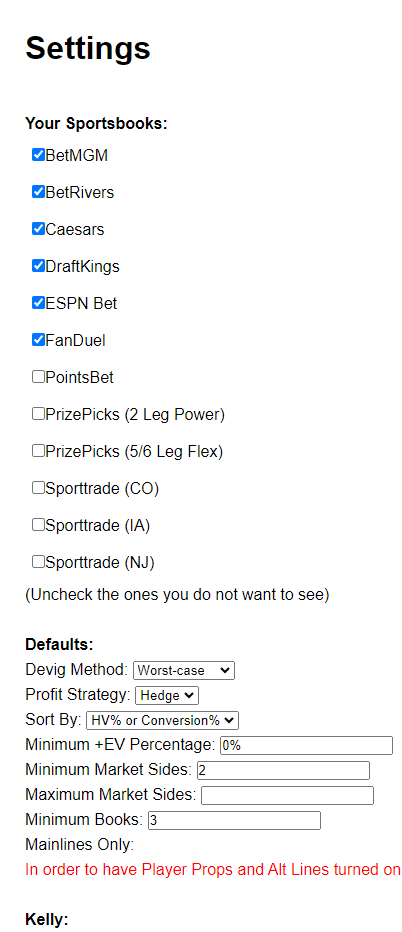

Go to Settings in the top right corner, uncheck the sites you aren’t using.

Now go back to Home. Click on Risk-free bet page.

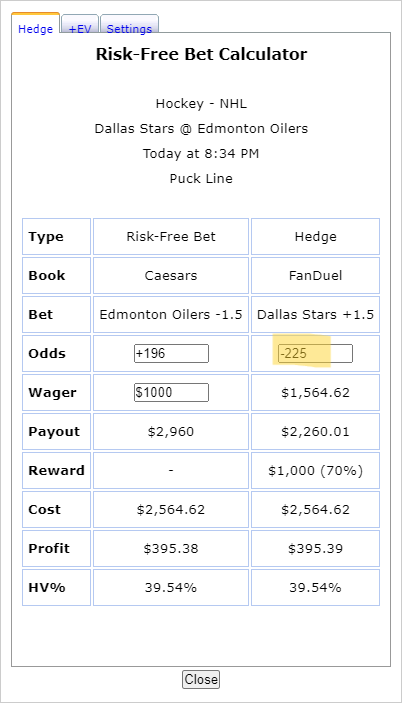

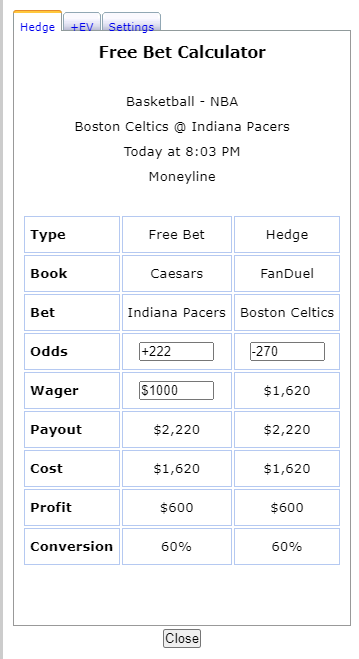

Now we need to choose an offer to convert. Let’s choose our Caesars $1,000 First Bet. We can walk through the steps first, to see which game we want to bet and how much we need to deposit.

First, starting at the top, under “Reward” we’ll enter 100%. With this offer, if we lose our first bet, we get a free bonus bet of 100% of the amount of our first bet, up to $1,000.

Next, we’ll select “Free bet (70%)”. Our free bonus bet will be convertible at about 70%, but that’s not something we need to understand right now. Just check the box and move on.

Next, open “Risk Free Bet Sportsbook” and select Caesars.

Now the page should be filled out like this.

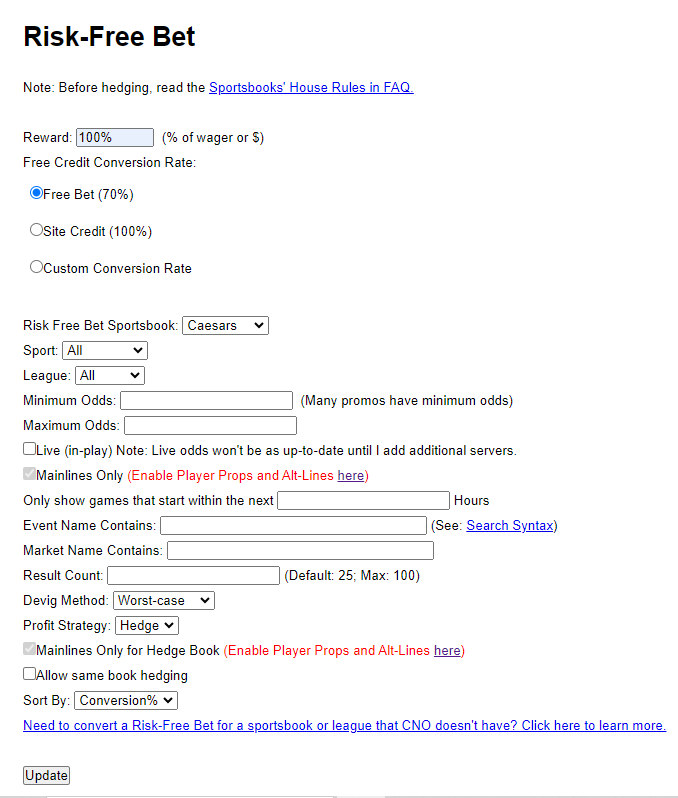

Click “Update” at the bottom. Scroll down, and you’ll see a chart like this.

If none of this means anything to you, that’s fine. I’ll walk you through exactly what to do.

The bets are sorted by ranking from best to worst value. So we always want to choose the top bets unless we have a reason not to. In this case, we are making our risk-free bet on Caesars, and we want to hedge on the site where we aren’t trying to convert any offers, FanDuel. So we want to look at the second column on the right, Hedge Bet Sportsbook. Go down the column until you find FanDuel. In that row, the third column from the left has a “Calc” button. I’ve highlighted the button here.

Click the button. You’ll get a popup that looks like this.

So this is an NHL hockey game between the Dallas Stars and the Edmonton Oilers. If you know absolutely nothing about hockey, perfect. Neither do I. The important thing is that this shows us which wagers to place, and for how much. The left column is our Risk-Free Bet on Caesars, and the right column is our Hedge on FanDuel.

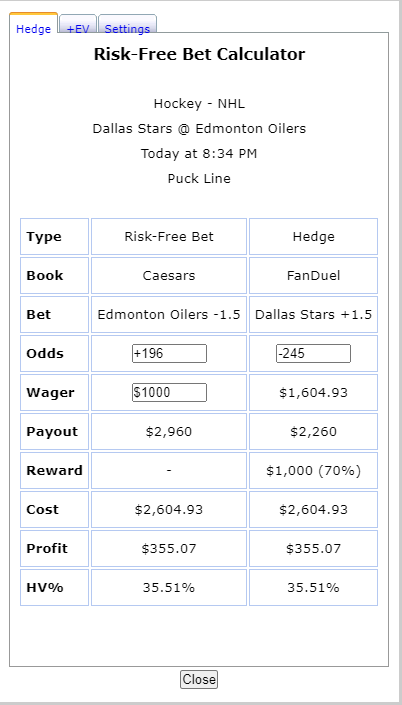

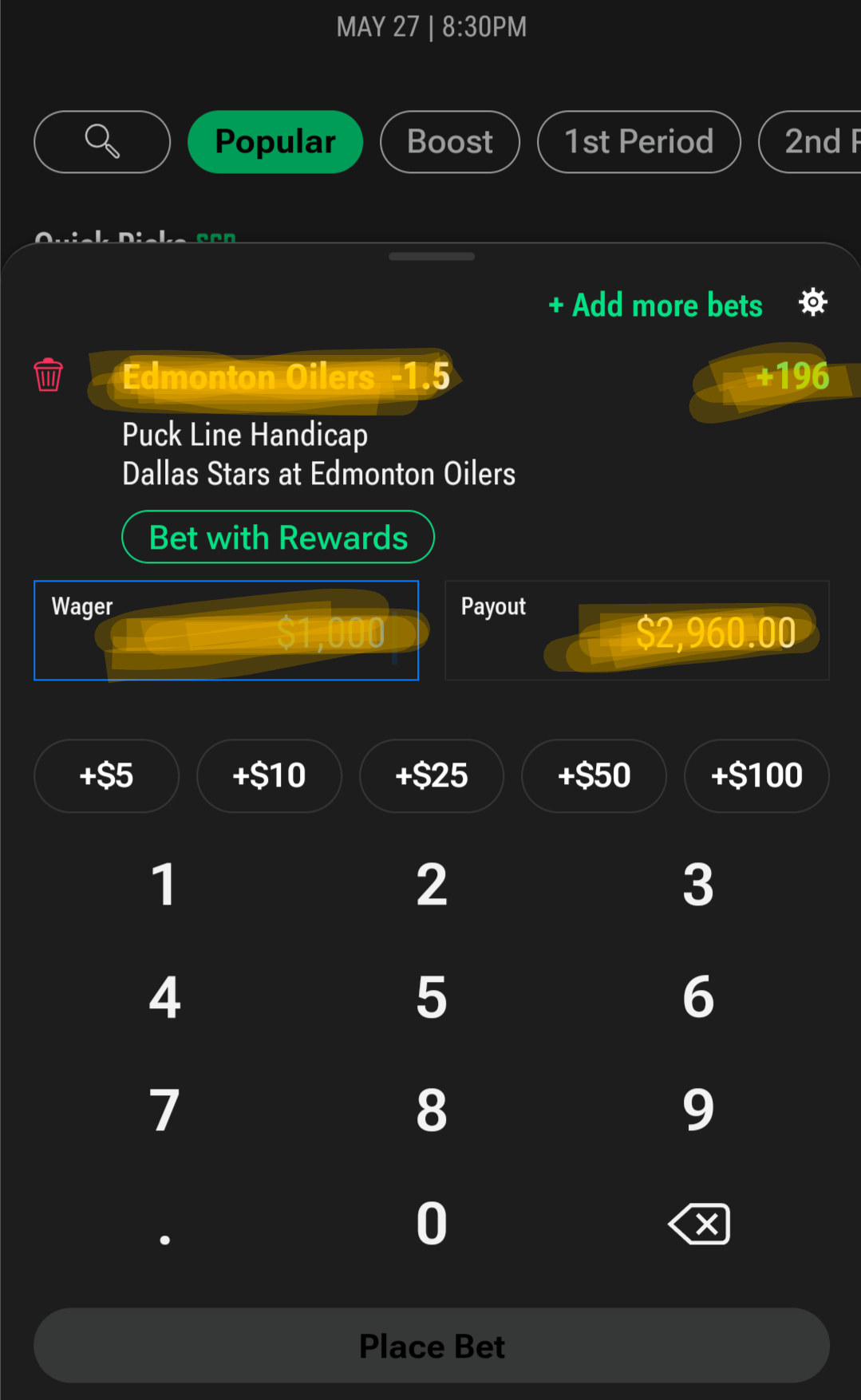

Our first decision is how much to wager. You’ll see that the Caesars wager is currently set to $100. But remember, our First Bet offer is for up to $1,000. You can wager any amount up to $1,000, but you’ll only get one shot at this offer, so if you wager less than $1,000, you won’t get the full benefit of the offer, and you’ll never be able to go back and use the rest in the future. It’s one shot. So my advice is wager $1,000, there’s no good reason not to. So we’ll change the wager amount to $1,000.

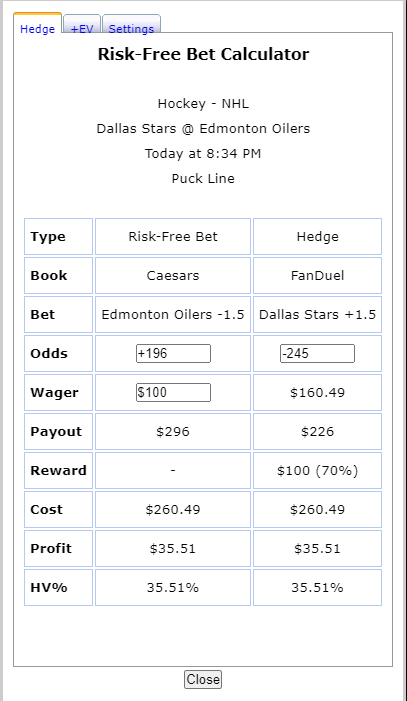

Now you can see that our risk-free bet is Edmonton Oilers -1.5 for $1,000, and our hedge bet is Dallas Stars +1.5 for $1,604.93. If you don’t know what that means, that’s fine. What you need to know is that you’ll need to deposit at least $1,000 into your Caesars account, and at least $1,604.93 into your FanDuel account. When that’s done, you can check the bets on each site to make sure the odds are accurate. They change constantly, so it’s always good to check both sites just before placing a bet.

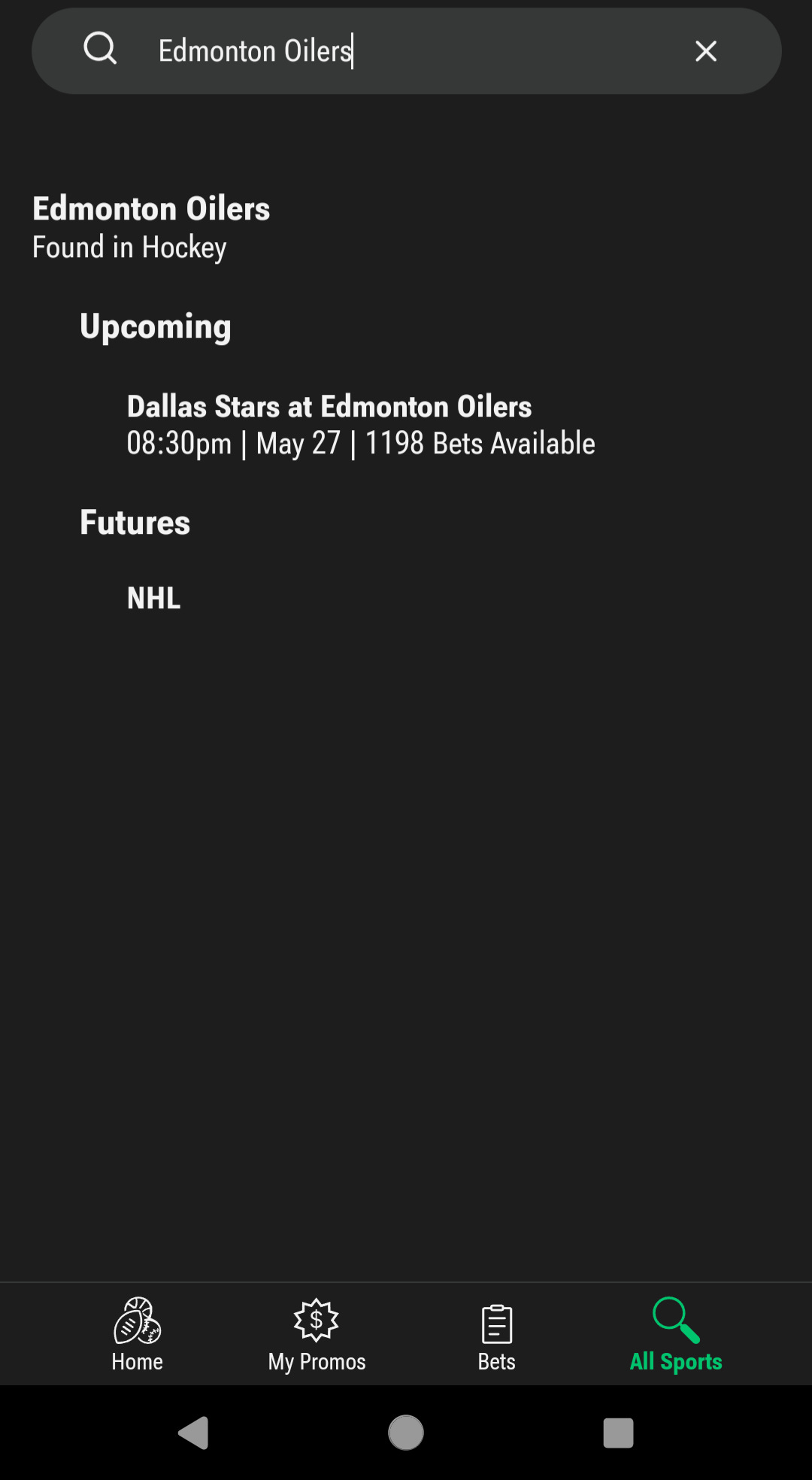

First, we’ll open up the Caesars app and search for “Edmonton Oilers.” Sure enough, the game pops up.

Then we’ll click on that game and open it up

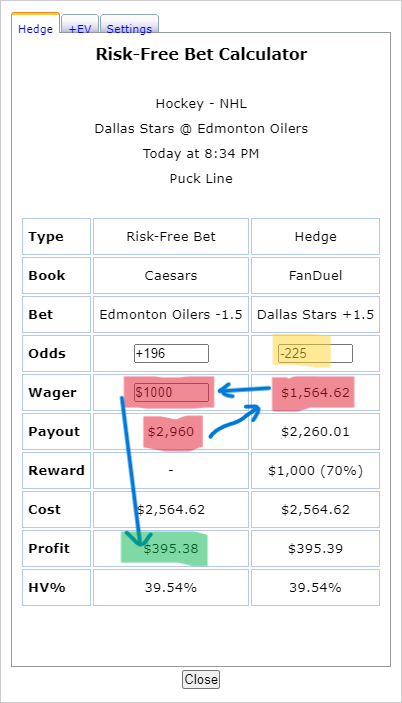

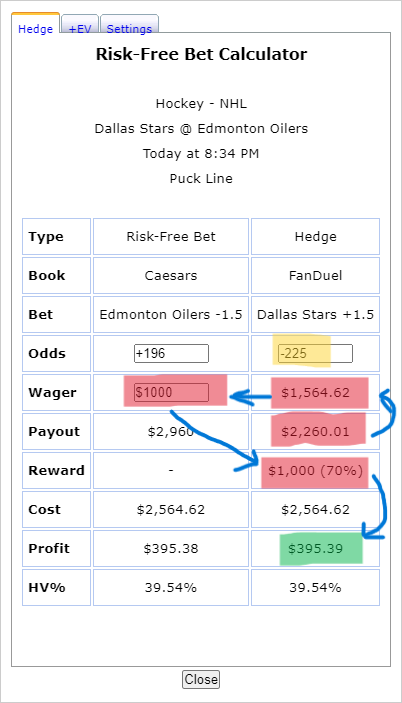

There are four things we want to check on each bet before placing it. I’ve highlighted them above. We have the Edmonton Oilers -1.5, odds of +196, a wager of $1,000, and a payout of $2,960. If we compare that with the correct column in our Risk-Free Bet Calculator, we’ll see that everything is correct.

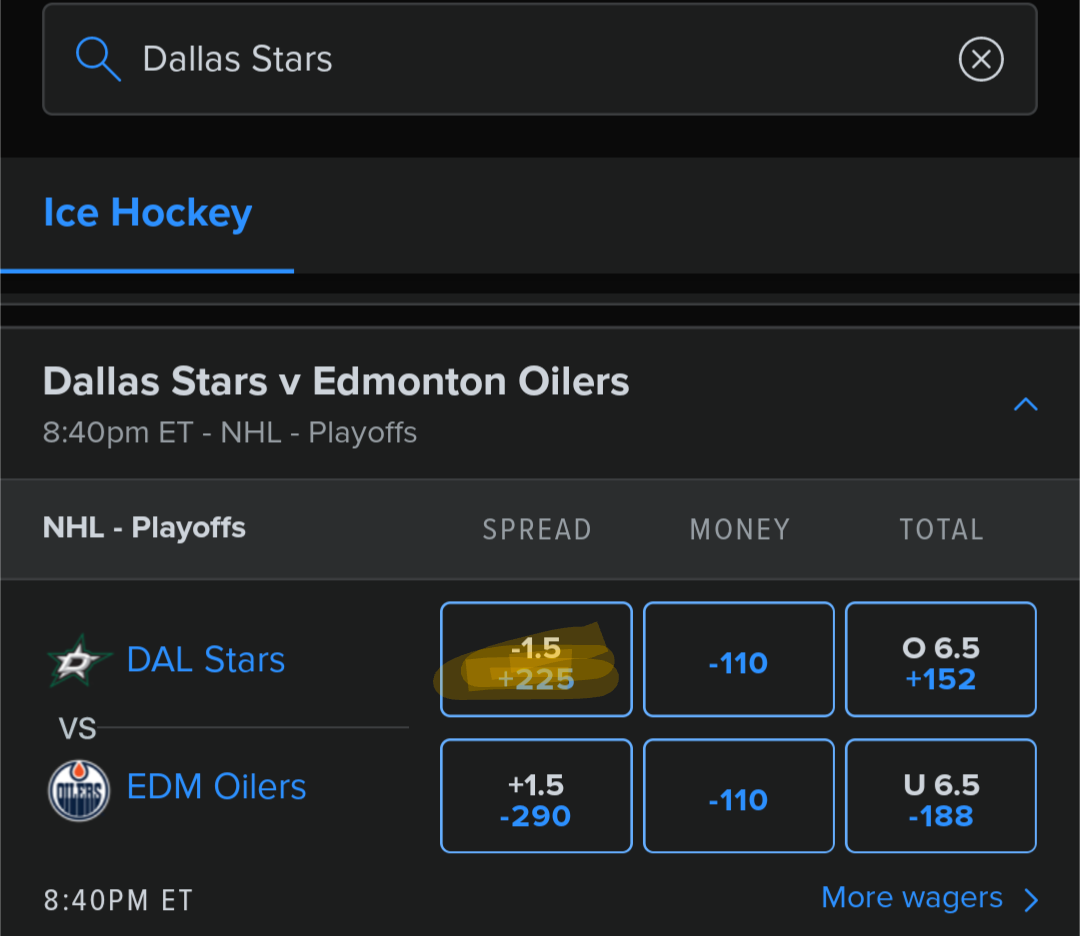

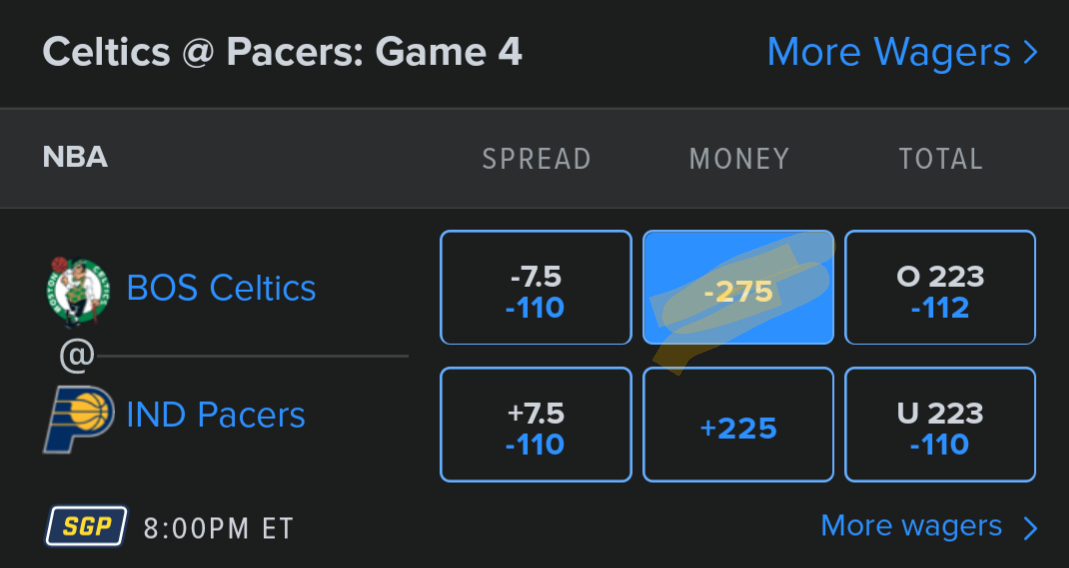

Now we want to do the same for the FanDuel hedge. We’ll open the FanDuels app and search for “Dallas Stars” and find the same game against the Oilers.

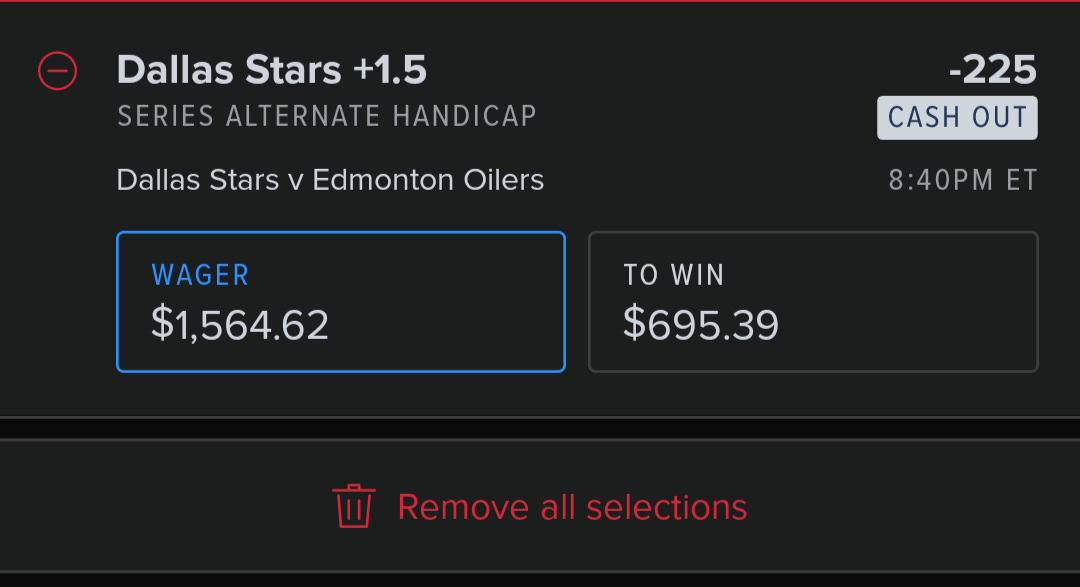

Here we can see the first problem. The spread we see here is -1.5, odds of +225. Our Risk-Free Bet Calculator is asking for Dallas Stars +1.5, odds -245. So we need to select a different line. Farther down the page you’ll see “Series Alternate Handicap.” Open that, and you’ll see Dallas Stars +1.5.

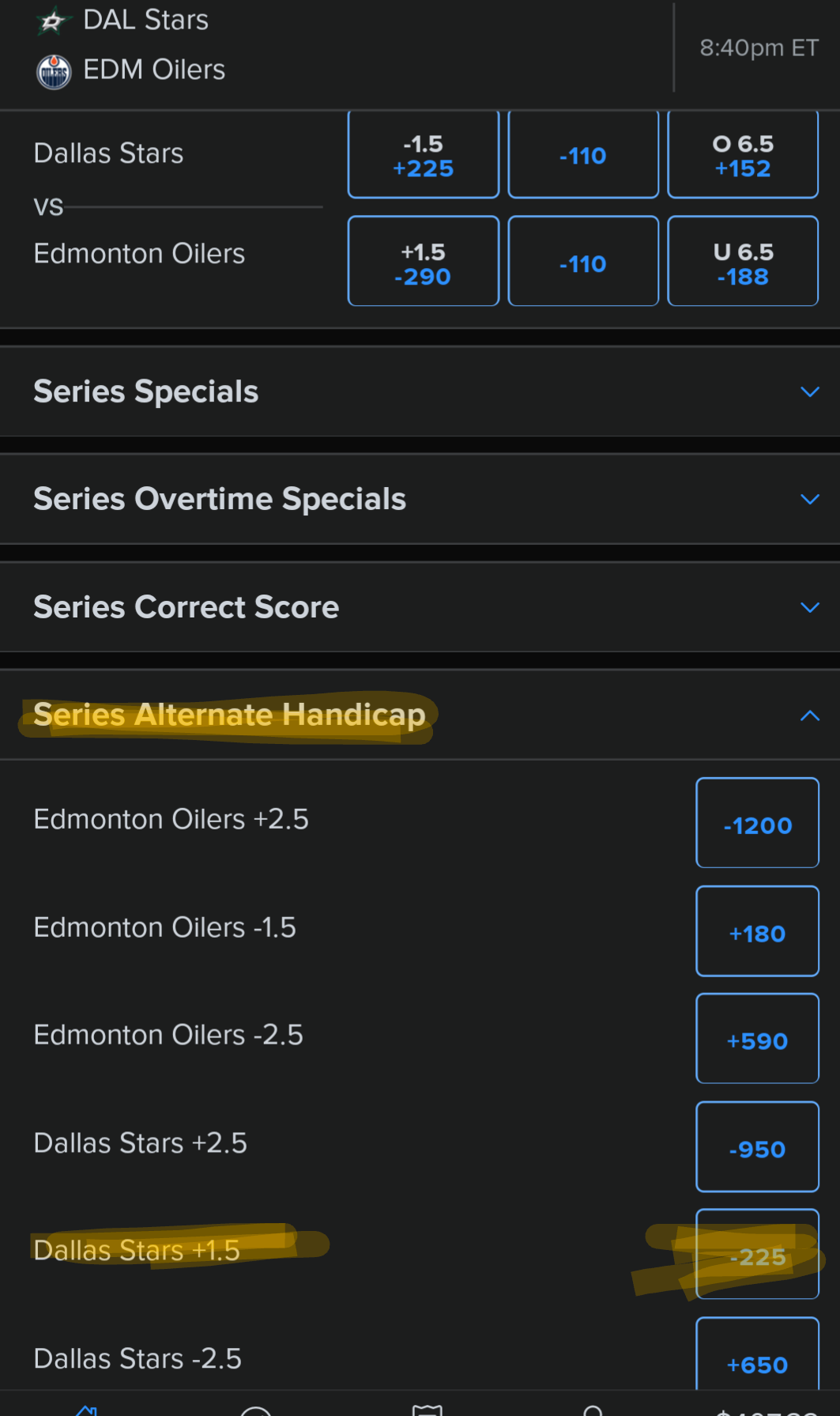

This is the bet we’re looking for. But you’ll also notice that the odds are -225 instead of -245. So we can select this bet, but we need to go back to our Risk-Free Bet Calculator and change the odds to get the correct amount to bet on this line.

So go back to the calculator and change -245 to -225. You’ll see this.

As you can see, the amount of the wager has changed to $1,564.62. So we can go back to FanDuel, select Dallas Stars +1.5, odds -225, and enter our updated wager amount.

As you can see, when we add the “Wager” and the “To Win” amount, we get $2,260.01. Looking at our calculator, that’s the exact number in our “Payout” row. So these are the bets we need to make.

Now that we’ve double checked everything, we can go back and make our $1,000 bet on Caesars, and immediately go make our $1,564.62 bet on FanDuel.

Awesome!

Now what? Well, our job is done. We just wait to see which team wins. Not that it matters to us either way. But which team wins will determine our next step.

Looking at our calculator again, there are two possible outcomes.

The first outcome is the Edmonton Oilers win. In that case, our Caesars bet will payout $2,960, while our FanDuel bet will be a total loss. Here’s how we do the math on that scenario.

We start with our $2,960 Caesars balance. We subtract our $1,564.62 FanDuel bet (which was a loss). Then we subtract the $1,000 we initially deposited and wagered on Caesars. This leaves us with a profit of $395.38! Not bad for a one day return on $2,564.62, while taking no risk.

Now for the second scenario. That would be if the Dallas Stars win. In that case, our Caesars bet is a total loss. Our FanDuel bet pays our $2,260.01

So to calculate our profit here, we start with our payout of $2,260.01, subtract our wager of $1,564.62, subtract our Caesars wager of $1,000 (which was a loss), and then add 70% of our free bonus Caesars bet of $1,000, or $700 (more on that in a minute). Once again, that gives us a profit of $395.39.

Now back to the free bonus bet. Since our Caesars bet lost, we qualified for the promotional payout. If we check the Caesars app, we should see a bonus bet of $1,000 in our balance. Remember I said that you can’t just withdraw the bonus bet? This situation is where that becomes an issue. So we have to place a $1,000 wager with Caesars before we can withdraw that money. The problem with that is, what if our second wager also loses? Then we lose money on the entire process. That’s where the 70% number comes in. We’ll use a similar process when making that $1,000 wager, by hedging on a second site once again. By doing that, we’ll be guaranteed to collect around 70% of the wager, or $700. I’ll explain that in the next section.

Free Bets

This is the name for the bet we get if we lose our initial bet on a site with a Risk-Free Bet offer. This is just what it sounds like, a free bet. You can bet the amount on a game, and if you win, the winnings are your money. You’re free to withdraw that cash.

How do we ensure we still make a profit, even if our free bet loses? Well, Crazy Ninja Odds can help once again. Go back to their homepage, and this time click on Free Bets instead of Risk Free Bets. This time all we need to do is enter the sportsbook, Caesars, and click “update.” We’ll get a chart like this.

You know the drill by now. We find the first option on our Hedge Bet Sportsbook, FanDuel. This time it’s highlighted on the second row. Click “Calc.”

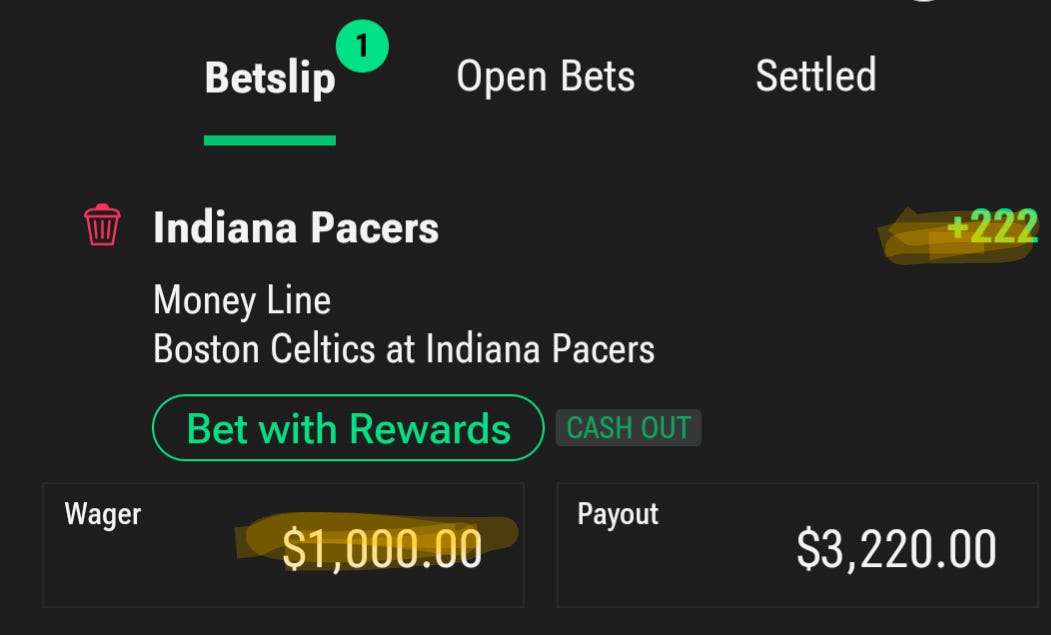

This is a money line bet, so it’s slightly different than the first one, but you won’t have any trouble figuring it out this time. You can check Caesars, and you’ll find the money line bet of $1,000 on the Pacers at +222, with a payout of $2,220.

Make sure you select your free bonus bet when you make the wager. If you lost your initial $1,000 deposit and didn’t deposit again, that should be your only option. It will look slightly different than this, since when you use a free bet, your payout won’t include the initial $1,000 wager, so it will read $2,220 instead of $3,220. I don’t have the free offer in my account so I can’t show you the exact screenshot, but you’ll be able to figure it out.

Then jump over to the other side of the game on FanDuel.

You’ll notice that the line is -275 instead of -270 like your calculator said. By now you know how to go back and change the odds in the calculator to get this.

Once again, you’ll want to make a $1,628 wager on the Boston Celtics at -275 to hedge your $1,000 free bonus bet on the Indiana Pacers at +222.

I could go through the math again, but you know how to do it now. You can look at the profit line and see that both outcomes will pay $592. If you remember, our initial bet used 70% of $1,000, or $700, as a bonus bet profit target. So given the odds available on this particular day, you’ll end up with just over $100 less profit if you need to convert the bonus bet than you’ll make if your first Caesars bet wins. That’s unfortunate, but just a result of games and odds available on a particular day. Getting a higher conversion rate would require more complex strategies, and this guide is long enough already.

Next Steps

Once you’ve successfully completed your initial offer, you can continue to do the same process for each additional sportsbook available in your state. And as you work through the offers on one site, you can then use that site to hedge the next site you sign up for.

There are a few things to keep in mind. Your free bonus bets are usually time limited. That means if your first bet loses, you often have as little as 7 days to use the free bonus bet before it disappears. So make sure you stay on top of your offers and play them before they expire. If you aren’t sure whether you qualify for a specific promotional offer, reach out to customer support before placing any bets. They’ll be able to explain exactly which offers you qualify for and how to access them.

Once you sign up and start betting, you’ll likely start getting more offers in the apps. They might be free bets, in which case you already know how to play them. But there are other offers as well, some of which you can do in a risk free way. If this guide gets enough interest, I may write more about how to handle other types of offers.

These offers will be available once to each person. So you can play them once, and that’s it. But you can also help each member of your family or close friends sign up and show them how to play the offers, or do it for them. Just be careful with your money management, since there will be a significant capital investment up front. If you’re putting up the capital, make sure it’s someone you fully trust with control of that money.

If there’s enough interest, I may also put together a guide on how you can do this with family members or friends who live anywhere, even if they’re not in a state with legal sports betting.

Most of all, be safe, don’t tie up capital you need for your daily life, and make sure you understand each offer and how to exploit it before placing any wagers.

If you have any questions, feel free to reach out to me and I’ll do my best to help you in any way I can.

Best of luck!

-

@ bc6ccd13:f53098e4

2025-05-21 01:56:38

@ bc6ccd13:f53098e4

2025-05-21 01:56:38The credit/debt fiat money system is broken. If you haven’t been living under a rock, I’m sure you’re aware that something is really messed up in the financial system. Hopefully you’re at least somewhat aware of the reasons why and are placing blame squarely on the structure of the monetary system and not on politics or “capitalism” or “socialism” or corporations or billionaires or any of the other red herrings the bankers desperately hope to distract you with.

If you’re still obsessing over any of those things, that’s okay too, and you’re the reason I started this newsletter. It’s impossible to make good decisions without understanding the relevant information, and when it comes to money, almost no one understands the relevant information. My goal is to change that for as many people as I can reach, to grow the small group of people who are knowledgeable and empowered to make better decisions on money and finance.

Previous articles have been focused on economic theory and how money works at a conceptual level. That’s critically important to understand, and if you haven’t taken the time to read those articles, I know it will open your eyes to the world in a way you’ve never considered before. That understanding will give you a huge advantage in benefiting from what I’m about to describe. But today’s subject is strictly practical, actionable information on one specific financial instrument, and how you can use it to game the broken money system to benefit YOU.

Money Is Not Scarce

If you read my previous articles, you’ll understand that one of the biggest problems with the credit/debt money system is that money is not scarce in this system. In fact, the quantity of money is basically unlimited. That’s because money is created by banks every time they make a loan. Unlike everything you’ve ever thought, banks don’t lend out money that’s given to them by depositors. They create new money, out of thin air, with a computer keystroke, every time they make a new loan. That means in practical terms that the amount of money is only limited by the willingness of banks to make loans. And since banks profit by charging interest to loan out money they can create at zero cost, they’re incentivized to make a LOT of loans.

Now as you can easily see, things that aren’t scarce don’t have a lot of value. The less scarce and more easily available something is, the less valuable it becomes. If you and a friend were standing on the shore of Lake Michigan and you reached down and scooped up a cup full of water, turned to your friend, and said “I’ll trade you this cup of water for your Rolex watch,” he’d look at you like you lost your mind. And rightly so, since a cup of water on the shore of a giant lake is so abundant and easily accessible that it has no value compared to a Rolex watch, which are deliberately produced in very limited amounts to increase their scarcity and value.

The difference between money and the water in that example is that money is not scarce, but it is selectively scarce. If you’re a bank, you have access to as much money as you choose to loan out, at zero cost. On the other hand, if you aren’t a bank, money is only available if the bank decides to create some and loan it to you, or you work hard to earn money someone else already has.

This selective scarcity of money is the root cause of the massive wealth inequality we see today. Money is essential to survive in the modern economy, but access to that money is very unevenly distributed.

So how does this benefit certain people? You might be thinking, but don’t borrowers have to pay the loan back with interest? Of course it’s easy to see how the banks benefit, but plenty of wealthy people are not bankers. And that’s a good point. Here’s how.

Because of the incentives banks have to make loans, the amount of money in circulation tends to keep rising exponentially. The amount of most real goods in the economy, however, typically doesn’t rise as fast. When you have more money circulating in the economy without more goods available, the prices people are willing to pay for those goods will go up. That means prices of some scarce goods rise very consistently over time. Those with access to newly created money in the form of loans benefit by using that money to buy assets that are more scarce than the money they borrowed to buy the asset. So they may buy an asset for $1 million, but by the time the loan is due to be repaid, the continuous inflation caused by the increasing money supply might have pushed the price of that asset up to $1.5 million. So subtract the interest paid from $500,000, and there’s your profit, all for doing nothing but convincing a banker to create some money and let you borrow it. The concept that those closest to the source of new money will benefit the most, because they can buy things before the prices rise, is called the Cantillon effect.

Benefitting from the Cantillon Effect

So how can you benefit? You can see that borrowing a bunch of money and buying a good asset with it would be the perfect way to take advantage of the Cantillon effect. But the problem for most people is, if they go to the bank and ask to borrow a few hundred thousand dollars, they’ll be declined in a millisecond. If you’re not already wealthy, you’re going to have a really tough time getting a big loan at a low interest rate, which is what it takes to make this system work in your favor. Most people only have access to loans in the form of a credit card or personal loan, which will be for a small amount and a very high interest rate. That’s not helpful. Luckily there’s one exception, one way almost anyone can borrow a big chunk of money at a low interest rate, and buy an asset that will increase in price over time as the money supply grows: a mortgage.

If you have the income and credit to support a mortgage payment, it can be a great way to take advantage of the broken monetary system to accumulate some long term wealth. However, there are a few caveats and some simple tricks that can make all the difference.

First, while the constant demand for houses fueled by easy access to newly created money means house prices tend to rise consistently over time, there are no guarantees. The housing market often has periods of boom and bust, and falling prices can last for years. Borrowing is always risky, and you shouldn’t take a risk you don’t understand or aren’t comfortable with. While no one can time the housing market, it’s always good to at least be aware that the housing market does rise and fall in cycles, and try to avoid buying when all signs point to housing being extremely overpriced.

Second, just because houses are rising in price doesn’t mean they’re rising in value. It’s a simple concept, but one most people miss. Like Warren Buffet says, price is what you pay, value is what you get. If you buy a house today for $400,000, and in 10 years that same house sells for $700,000, how much did the value of the house change? The price went up, but the house is still the same house in the same location, it’s just a decade older. And a decade of wear and tear is a decrease in value, not an increase. Think of it this way. You can sell for $700,000 and you have $300,000 of “profit”. But if you want the same house back, you can’t buy it for $400,000 again and pocket the $300,000. You can only get the same house back for the full price you received. You haven’t increased your purchasing power at all in terms of housing with that “profit”. Your house hasn’t become more valuable, your money has just become less valuable when measured against houses. In that sense, you probably can’t increase your purchasing power by buying a house to live in, but you can at least avoid losing purchasing power. If you just save money in the bank to buy a house later, house prices will probably rise faster than you can save. That’s especially true if you’re paying rent at the same time. At least with a mortgage, if you pay long enough you own a house eventually. You can pay rent your whole life and you’ll still own nothing at the end.

Understanding Amortization

The key to making a mortgage work for you is to understand and manipulate the amount of principal and interest you pay over the term of the loan. To do this, you need to understand how a mortgage amortization schedule works. An amortization schedule is basically a big chart of your mortgage payments each month, showing how much of each payment is applied to paying down the principal and how much is paying interest. The payment size is the same each month, but the amount of principal and interest varies over the term of the loan, and that’s key to understanding how to manipulate the system.

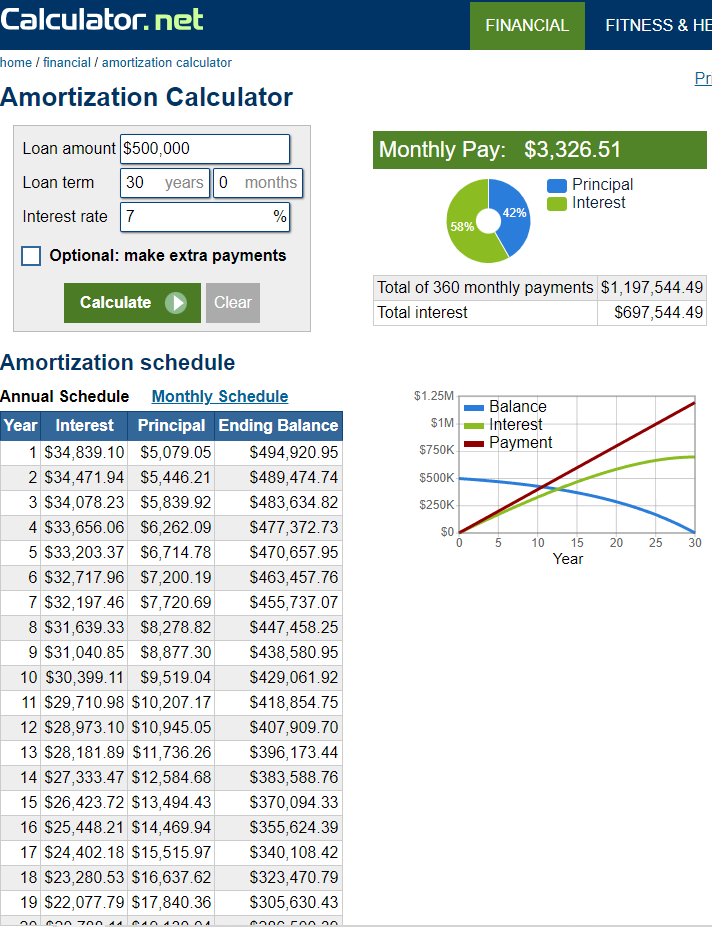

To understand amortization, you need a good amortization calculator. There are plenty of different ones available online, but I’m going to use the one here to illustrate. In this example, I’m going to arbitrarily choose a mortgage size of $500,000 and an interest rate of 7%, but you can of course use your own numbers. When we enter this into the calculator with a loan term of 30 years and click “calculate”, we get something that looks like this.

You can see the monthly payment of $3,326.51, and the total payments over 30 years of almost $1.2 million, almost $700,000 of which is interest. So you end up paying more in interest than the total amount of principal you borrowed. Gulp.

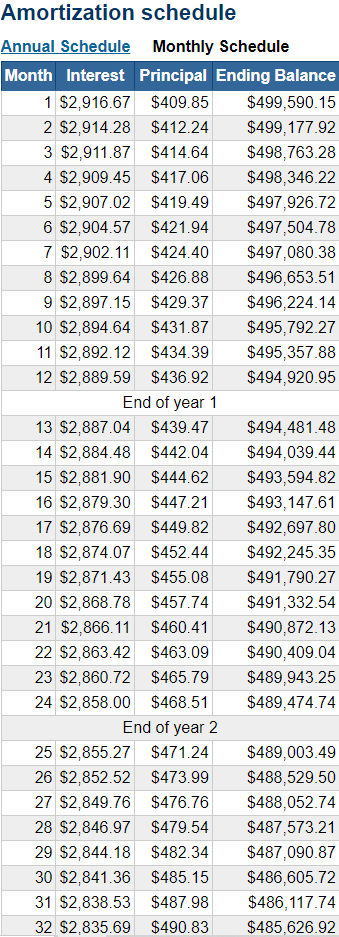

That seems terrible, and it is. But this is where understanding the amortization schedule, that scary looking chart to the left, is going to pay big dividends. First, change the amortization schedule from an annual schedule to a monthly schedule. You’ll see something that looks like this.

So now for each month, you can see how much of the payment is interest, how much is principal, and how much of your original $500,000 balance is still outstanding. As you can see in month one, you’re paying over $2,900 in interest and only $400 in principal, leaving you with a balance of $499,590.15. The reason the interest is so high initially is that you have to pay interest on the full principal balance. As the principal gets paid down, you are now paying interest on a smaller balance. If you scroll down to year 29, you’ll see the opposite situation. In month 338 you’ll pay $2,900 of principal and only $400 of interest. That’s because you’re now paying interest on a balance of only $68,000 instead of $500,000.

As you can see, getting into the later years of the mortgage is a much better situation than paying huge amounts of interest in the first few years. Is there a way to get closer to the end fast? Yes there is, and you may be surprised how easy it is.

Go back to the annual amortization schedule. Suppose you want to take 5 years off your mortgage. How much would it cost to do, and how much would you save in interest? There are two ways to do this, and we’ll cover both.

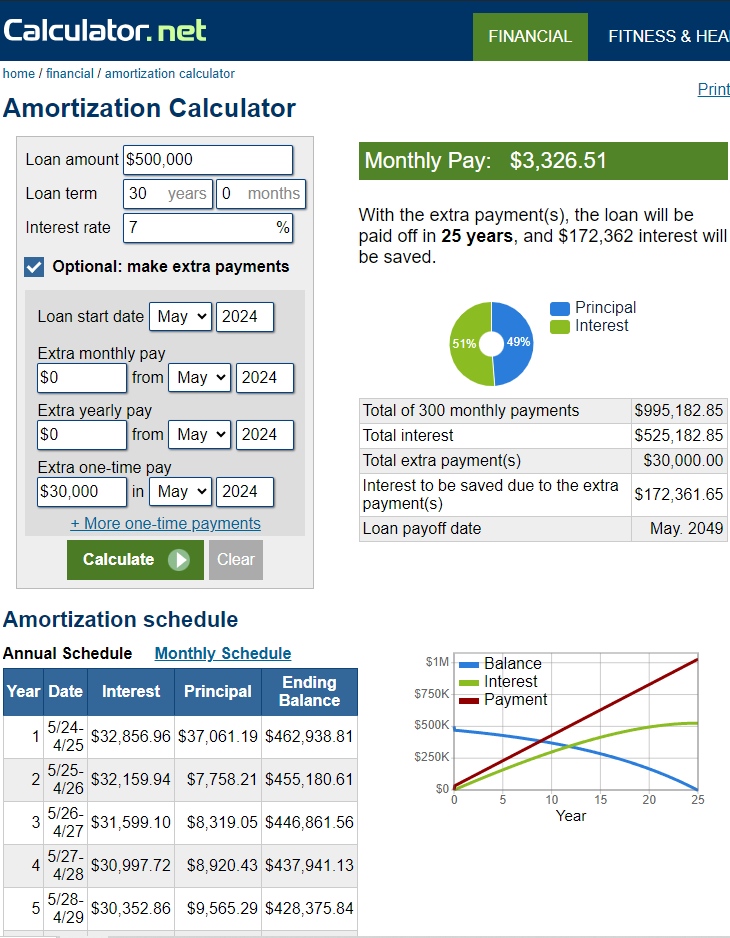

First, the easiest way to get 5 years off your mortgage is to move straight down the amortization schedule to year 6. How can you do that? Look at the annual amortization schedule for year 5. Your ending balance is a little over $470,000. That means to get to that point in the loan repayment schedule, you need to pay $30,000 of principal. So let’s see where a lump sum payment of $30,000 gets us. Inside the box where you entered your loan terms you’ll see a little checkbox labeled “Optional: make extra payments”. Click that box. In the “Extra one-time pay” box, enter $30,000. Click calculate. You’ll see this.

And viola, with the extra payment, the loan will be paid off in 25 years, and you’ll save $172,362 in interest. Pretty amazing results for a one-time $30,000 payment.

Of course for the sake of simplicity, that’s assuming you pay the $30,000 at the very beginning of the loan. Paying the lump sum later into the loan term will change the exact amount of the savings. You can play around with other payment sizes, or even multiple lump sum payments, and see how much each one will save.

But most of you will be thinking, “Where am I going to get $30,000? That’s never going to happen.” If that’s you, don’t worry. We can do the exact same thing a different way.

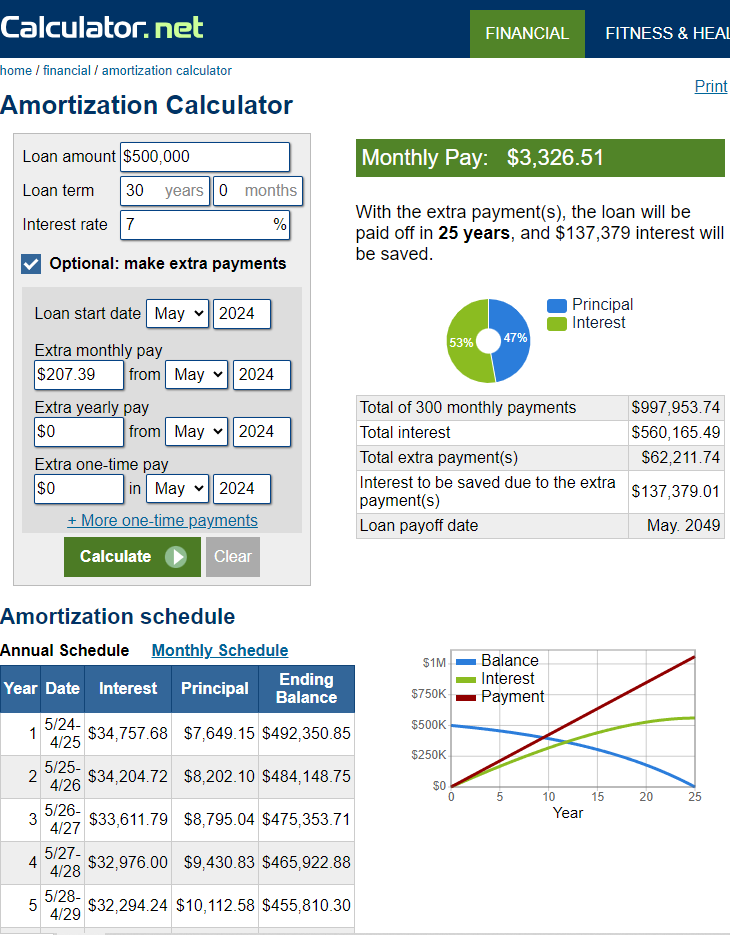

Go back to your calculator, remove the lump sum payment, and leave everything else the same, except the loan term. Change the loan term to 25 years instead of 30 years. Click calculate. Now look at just one number, the payment size. You’ll see it’s $3,533.90. Don’t worry about anything else, just note that number. Now reset to your original calculation of a 30 year term. You’ll see the payment size is back down to $3,326.51. Now get out your calculator and subtract $3,326.51 from $3,533.90. You’ll get $207.39. Go back to your “make extra payments” box and enter an “extra monthly pay” of $207.39. Click calculate.

As you can see, just by paying an extra $207 of principal every month, you’ll pay the loan off 5 years faster and save $137,379 in interest.

You’ll save a little less that way than the lump sum payment, because you’re not paying the principal down as much early in the loan. But paying an extra $200 a month is much easier for most people than accumulating thousands of dollars to make a large lump sum payment. A few hundred dollars is only about 6% of the size of this mortgage payment, so it’s really a small difference. And if you can’t afford to pay a few percent of your payment size extra each month, the mortgage is probably bigger than you can reasonably afford.

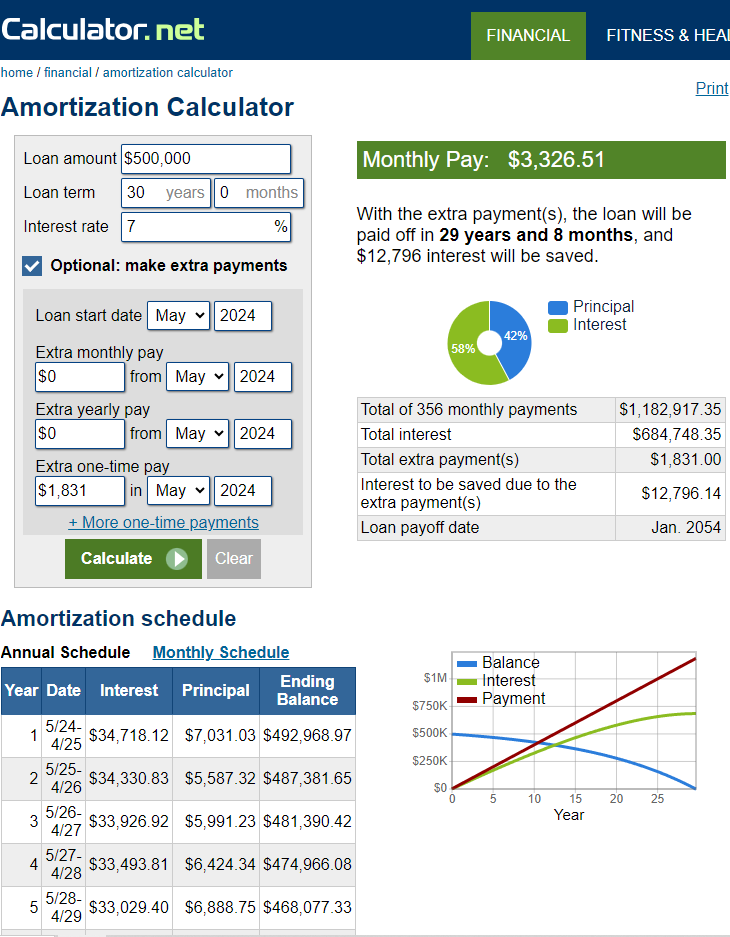

You can play around with these numbers in all kinds of ways. It’s a good way to help you think about your financial decisions, and the real impact they might have over time. Say for example, you’re considering buying a new grill for the backyard. You only grill a few times a month during the summer, and a replacement model of the basic charcoal grill you have now would be perfectly serviceable. It’s available for $119 on Amazon. But your brother-in-law just bought one of those Big Green Eggs and he keeps bragging about how amazing it is. They’re $1,950, but you can afford it, you just got a nice little bonus at work. So why not?

But before you get out the checkbook, let’s take a quick look at the mortgage calculator. Let’s see how much that extra $1,831 spent on a grill you don’t really need will actually cost you. Again, input your mortgage size, term, and interest rate, and add an extra one-time payment of $1,831.

Hopefully you’re still using that Big Green Egg in 30 years, because by that time, it will have cost you almost $13,000 in additional interest payments.

You can fill in the blank with your own discretionary purchases and see whether they’re really worth the cost. It’s just another little tool to help plan your financial decisions. It’s free to do, and can make a very significant difference in your financial well-being down the road. But almost no one takes advantage of the opportunity, so you’ll have a huge leg up on most people just by knowing this simple concept.

The Bottom Line

To take advantage of the opportunity to build wealth with a mortgage, there are only two simple rules.

-

Use a mortgage to buy a reasonably priced house that you couldn’t otherwise afford.

-

Take advantage of amortization to pay that mortgage off as fast as possible, so you pay as little interest as possible while still capturing the increase in price of the house.

If you already own a home, you can use the same concept. Take out a mortgage for whatever amount you’re comfortable with, and use the money to buy an asset that will increase in price with inflation. Choose your asset wisely, and don’t take on more debt than you can afford. But if you make good decisions, you can take advantage of the broken financial system, using this little mortgage cheat code to get the Cantillon effect on your side. The wealthy are doing it every day, so don’t miss the opportunity to lock in long-term, fixed rate debt and acquire hard assets. As the debt/credit fiat system implodes, the opportunity to do this will disappear. Take advantage of it while you can.

-

-

@ 662f9bff:8960f6b2

2025-05-19 15:11:25

@ 662f9bff:8960f6b2

2025-05-19 15:11:25Let's start with some important foundational thinking - based on natural law. Money should be separate from the State - if not history shows that governments and human greed will always take over and manipulate the system in their favour and the expense of their populations. For extensive references, read The Sovereign Individual and The Creature from Jeckyll Island.

-

The Separation of State and Money is the most important thing you can listen to this week. Thanks to Allen Farrington - his paper is here for those who prefer to read. Wake up, folks!

-

The American Forefathers knew this when the wrote the American Constitution. Thomas Jefferson said: “If the American people ever allow private banks to control the issue of their currency first by inflation then by deflation the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered... I believe that banking institutions are more dangerous to our liberties than standing armies... The issuing power should be taken from the banks and restored to the people to whom it properly belongs.” Mark Moss explains it well here. Charlie Robinsons take here.

The situation in Canada explifies the issues

Governments have have long used "international economic sanctions" against other nations to enforce their positions. Now in Canada, and soon in your country too, they are applying such sanctions their own citizens - disconnecting them from the financial system and removing their ability to use their own life savings as they wish. Canadians spoke with their money - in one week they raised more money in support of the truckers for peaceful protest than were raised in support of all Canadian political parties in the election of last year - only to have it confiscated and blocked by those politicians.

-

CPL. Daniel Bulford (Justin Trudeau's body guard) is particularly clear and eloquent - https://www.facebook.com/watch/?v=3123688351279364

-

Nick & Greg (two Canadians in Canada) explain the situation to Peter McCormack - https://youtu.be/QBWYp-cBr4o

-

Dr Jordan Peterson and Dr Julie Ponesse (also Canadians in Canada) speak openly about what is going on https://t.co/2T7A4VEek1

-

Even Canadians living in China speak up: https://www.youtube.com/watch?v=xvDvJWdlD1E

Meanwhile in Turkey...

Joe Blogs has been giving blow by blow updates of the deteriorating sitation over the last weeks. What is happening to Turkey will come to many countries - sooner than you might imagine. Watch and learn here, here and here - more on his channel.

EU Citizens should be aware and lobby their MPs

Dropping of all C-19 restrictions is a tactic to stop people thinking about them; meanwhile the politicians are taking steps to get all of the emergency restrictions codified into normal law so that they can be deployed on you any time or all the time in future.\ Act now - or lose all freedoms - your choice - watch here or click below for the explainer.

More on war - recall our discussion last week

War steals and destroys the wealth of generations. We have been here before - remember World Wars 1 and 2...

-

Dr Mattias Desmet explains how mass formation psychosis happens and how he became aware: https://www.youtube.com/watch?v=CRo-ieBEw-8

-

Be aware of this well known and much abused psycholgical experiment - rats in a cage - explained by Dr Christ Martensen: https://www.youtube.com/watch?v=7kSBdMXQkPI

To remain silent is wrong - to deny the rights of others to discuss and challenge (and even to punish or coerce them) is a crime in support of the biger crime. Each of us has a choice - choose wisely.

Could you have known about this?

"The Matrix is a system, Neo. That system is our enemy. But when you're inside, you look around, what do you see? Businessmen, teachers, lawyers, carpenters. The very minds of the people we are trying to save. But until we do, these people are still a part of that system and that makes them our enemy. You have to understand, most of these people are not ready to be unplugged. And many of them are so inert, so hopelessly dependent on the system that they will fight to protect it."

"Unfortunately, no one can be told what the Matrix is. You have to see it for yourself."

A closing thought...

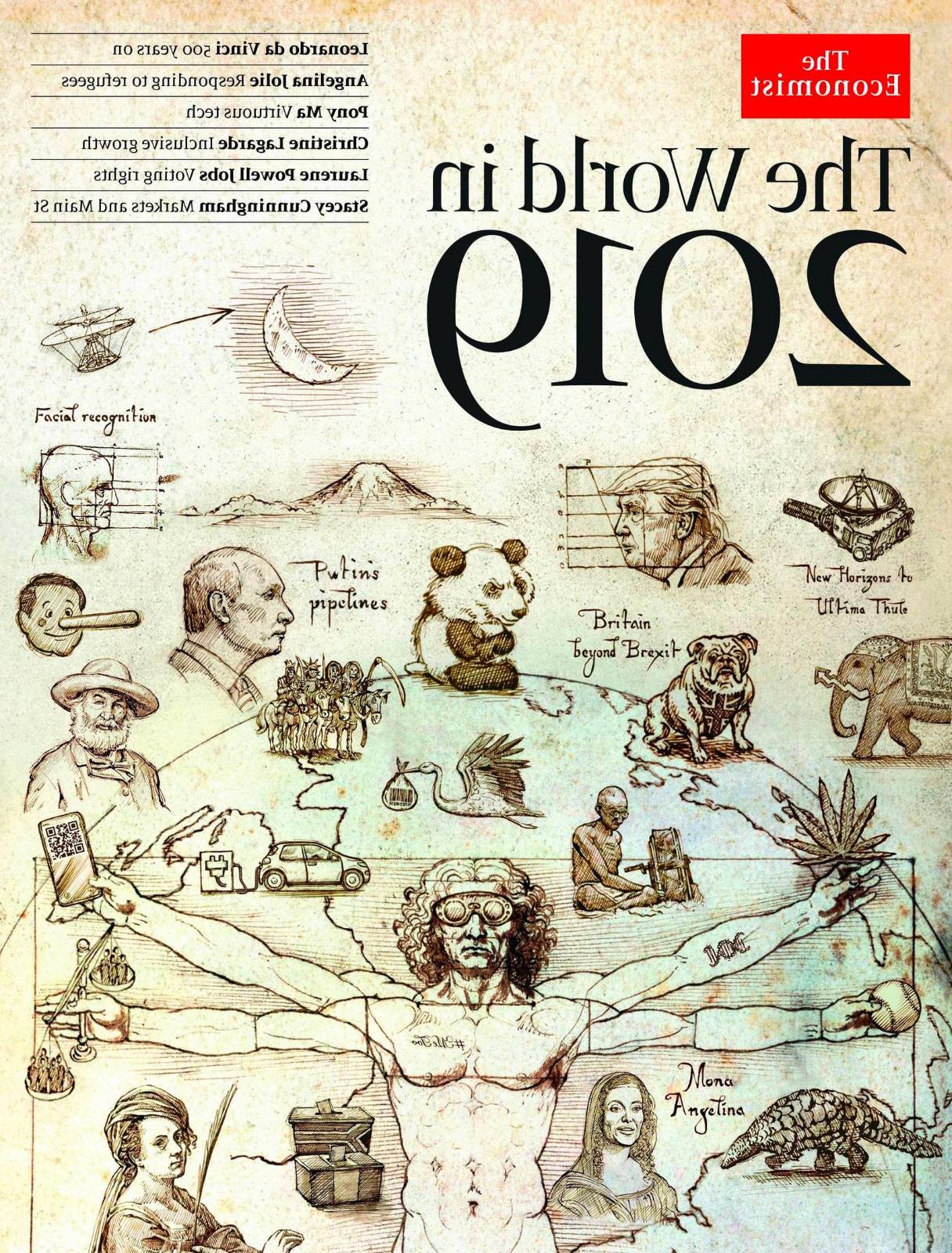

Look closely at the cover of the Economist magazine released in December 2018 - The World in 2019 - see how many of those things have already come true.

In case this is too difficult for you - some things to note: Four horsemen of the apacalypse, Statue of Liberty wearing a facemask, Vetruvian Man with QR code (Vaccine passport), DNA mark on his arm, wearing virtual reality glasses... The animal bottom right is a Pangolin. Scales of Justice are well tipped/skewed, facial recognition, electric cars, Putin's pipelines, China and Brexit feature highly along with the lieing media (Pinnochio) and #metoo. I smell Predictive Programming.

- More insights in the explainer here (backup copy here) - including why it is backwards...

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ a5ee4475:2ca75401

2025-05-19 01:11:59

@ a5ee4475:2ca75401

2025-05-19 01:11:59clients #link #list #english #article #finalversion #descentralismo

*These clients are generally applications on the Nostr network that allow you to use the same account, regardless of the app used, keeping your messages and profile intact.

**However, you may need to meet certain requirements regarding access and account NIP for some clients, so that you can access them securely and use their features correctly.

CLIENTS

Twitter like

- Nostrmo - [source] 🌐💻(🐧🪟🍎)🍎🤖(on zapstore)

- Coracle - Super App [source] 🌐🤖(on zapstore)

- Amethyst - Super App with note edit, delete and other stuff with Tor [source] 🤖(on zapstore)

- Primal - Social and wallet [source] 🌐🍎🤖(on zapstore)

- Iris - [source] 🌐🤖🍎

- Current - [source] 🤖🍎

- FreeFrom 🤖🍎

- Openvibe - Nostr and others (new Plebstr) [source] 🤖🍎

- Snort 🌐(🤖[early access]) [onion] [source]

- Damus 🍎 [source]

- Nos 🍎 [source]

- Nostur 🍎 [source]

- NostrBand 🌐 [info] [source]

- Yana [source] 🌐💻(🐧) 🍎🤖(on zapstore)

- Nostribe [on development] 🌐 [source]

- Lume 💻(🐧🪟🍎) [info] [source]

- Gossip - [source] 💻(🐧🪟🍎)

- noStrudel - Gamified Experience [onion] [info/source] 🌐

- [Nostrudel Next] - [onion]

- moStard - Nostrudel with Monero [onion] [info/source] 🌐

- Camelus - [source] 🤖 [early access]

Community

- CCNS - Community Curated Nostr Stuff [source]

- Nostr Kiwi [creator] 🌐

- Satellite [info] 🌐

- Flotilla - [source] 🌐🐧🤖(on zapstore)

- Chachi - [source] 🌐

- Futr - Coded in haskell [source] 🐧 (others soon)

- Soapbox - Comunnity server [info] [source] 🌐

- Ditto - Soapbox community server 🌐 [source] 🌐

- Cobrafuma - Nostr brazilian community on Ditto [info] 🌐

- Zapddit - Reddit like [source] 🌐

- Voyage (Reddit like) [on development] 🤖

Wiki

- Wikifreedia - Wiki Dark mode [source] 🌐

- Wikinostr - Wiki with tabs clear mode [source] 🌐

- Wikistr - Wiki clear mode [info] [source] 🌐

Search

- Keychat - Signal-like chat with AI and browser [source] 💻(🐧🪟🍎) - 📱(🍎🤖{on zapstore})

- Spring - Browser for Nostr apps and other sites [source] 🤖 (on zapstore)

- Advanced nostr search - Advanced note search by isolated terms related to a npub profile [source] 🌐

- Nos Today - Global note search by isolated terms [info] [source] 🌐

- Nostr Search Engine - API for Nostr clients [source]

- Ntrends - Trending notes and profiles 🌐

Website

- Nsite - Nostr Site [onion] [info] [source]

- Nsite Gateway - Nostr Site Gateway [source]

- Npub pro - Your site on Nostr [source]

App Store

ZapStore - Permitionless App Store [source] 🤖 💻(🐧🍎)

Video and Live Streaming

- Flare - Youtube like 🌐 [source]

- ZapStream - Lives, videos, shorts and zaps (NIP-53) [source] 🌐 🤖(lives only | Amber | on zapstore)

- Swae - Live streaming [source] (on development) ⏳

Post Aggregator - Kinostr - Nostr Cinema with #kinostr [english] [author] 🌐 - Stremstr - Nostr Cinema with #kinostr [english] [source] 📱 (on development) ⏳

Link Agreggator - Kinostr - #kinostr - Nostr Cinema Profile with links [English] - Equinox - Nostr Cinema Community with links [Portuguese]

Audio and Podcast Transmission

- Castr - Your npub as podcast feed [source]

- Nostr Nests - Audio Chats [source] 🌐

- Fountain - Podcast [source] 🤖🍎

- Corny Chat - Audio Chat [source] 🌐

Music

- Tidal - Music Streaming [source] [about] [info] 🤖🍎🌐

- Wavlake - Music Streaming [source] 🌐(🤖🍎 [early access])

- Tunestr - Musical Events [source] [about] 🌐

- Stemstr - Musical Colab (paid to post) [source] [about] 🌐

Images

- Lumina - Trending images and pictures [source] 🌐

- Pinstr - Pinterest like [source] 🌐

- Slidestr - DeviantArt like [source] 🌐

- Memestr - ifunny like [source] 🌐

Download and Upload

Documents, graphics and tables

- Mindstr - Mind maps [source] 🌐

- Docstr - Share Docs [info] [source] 🌐

- Formstr - Share Forms [info] 🌐

- Sheetstr - Share Spreadsheets [source] 🌐

- Slide Maker - Share slides 🌐 [Advice: Slide Maker https://zaplinks.lol/ site is down]

Health

- Sobrkey - Sobriety and mental health [source] 🌐

- Runstr - Running app [source] 🌐

- NosFabrica - Finding ways for your health data 🌐

- LazerEyes - Eye prescription by DM [source] 🌐

Forum

- OddBean - Hacker News like [info] [source] 🌐

- LowEnt - Forum [info] 🌐

- Swarmstr - Q&A / FAQ [info] 🌐

- Staker News - Hacker News like 🌐 [info]

Direct Messenges (DM)

- 0xchat 🤖🍎 [source]

- Nostr Chat 🌐🍎 [source]

- Blowater 🌐 [source]

- Anigma (new nostrgram) - Telegram based [on development] [source]

Reading

- Oracolo - A minimalist Nostr html blog [source]

- nRSS - Nostr RSS reader 🌐

- Highlighter - Insights with a highlighted read [info] 🌐

- Zephyr - Calming to Read [info] 🌐

- Flycat - Clean and Healthy Feed [info] 🌐

- Nosta - Check Profiles [on development] [info] 🌐

- Alexandria - e-Reader and Nostr Knowledge Base (NKB) [source] 🌐

Writing

- Habla - Blog [info] 🌐

- Blogstack - Blog [info]🌐

- YakiHonne - Articles and News [info] 🌐🍎🤖(on zapstore)

Lists

- Following - Users list [source] 🌐

- Nostr Unfollower - Nostr Unfollower

- Listr - Lists [source] 🌐

- Nostr potatoes - Movies List [source] 💻(numpy)

Market and Jobs

- Shopstr - Buy and Sell [onion] [source] 🌐

- Nostr Market - Buy and Sell 🌐

- Plebeian Market - Buy and Sell [source] 🌐

- Ostrich Work - Jobs [source] 🌐

- Nostrocket - Jobs [source] 🌐

Data Vending Machines - DVM (NIP90)

(Data-processing tools)

Games

- Chesstr - Chess 🌐 [source]

- Jestr - Chess [source] 🌐

- Snakestr - Snake game [source] 🌐

- Snakes on a Relay - Multiplayer Snake game like slither.io [source] 🌐