-

@ 4961e68d:a2212e1c

2025-05-02 07:47:16

@ 4961e68d:a2212e1c

2025-05-02 07:47:16热死人了

-

@ 4961e68d:a2212e1c

2025-05-02 07:46:46

@ 4961e68d:a2212e1c

2025-05-02 07:46:46热死人了!

-

@ 2183e947:f497b975

2025-05-01 22:33:48

@ 2183e947:f497b975

2025-05-01 22:33:48Most darknet markets (DNMs) are designed poorly in the following ways:

1. Hosting

Most DNMs use a model whereby merchants fill out a form to create their listings, and the data they submit then gets hosted on the DNM's servers. In scenarios where a "legal" website would be forced to censor that content (e.g. a DMCA takedown order), DNMs, of course, do not obey. This can lead to authorities trying to find the DNM's servers to take enforcement actions against them. This design creates a single point of failure.

A better design is to outsource hosting to third parties. Let merchants host their listings on nostr relays, not on the DNM's server. The DNM should only be designed as an open source interface for exploring listings hosted elsewhere, that way takedown orders end up with the people who actually host the listings, i.e. with nostr relays, and not with the DNM itself. And if a nostr relay DOES go down due to enforcement action, it does not significantly affect the DNM -- they'll just stop querying for listings from that relay in their next software update, because that relay doesn't work anymore, and only query for listings from relays that still work.

2. Moderation

Most DNMs have employees who curate the listings on the DNM. For example, they approve/deny listings depending on whether they fit the content policies of the website. Some DNMs are only for drugs, others are only for firearms. The problem is, to approve a criminal listing is, in the eyes of law enforcement, an act of conspiracy. Consequently, they don't just go after the merchant who made the listing but the moderators who approved it, and since the moderators typically act under the direction of the DNM, this means the police go after the DNM itself.

A better design is to outsource moderation to third parties. Let anyone call themselves a moderator and create lists of approved goods and services. Merchants can pay the most popular third party moderators to add their products to their lists. The DNM itself just lets its users pick which moderators to use, such that the user's choice -- and not a choice by the DNM -- determines what goods and services the user sees in the interface.

That way, the police go after the moderators and merchants rather than the DNM itself, which is basically just a web browser: it doesn't host anything or approve of any content, it just shows what its users tell it to show. And if a popular moderator gets arrested, his list will still work for a while, but will gradually get more and more outdated, leading someone else to eventually become the new most popular moderator, and a natural transition can occur.

3. Escrow

Most DNMs offer an escrow solution whereby users do not pay merchants directly. Rather, during the Checkout process, they put their money in escrow, and request the DNM to release it to the merchant when the product arrives, otherwise they initiate a dispute. Most DNMs consider escrow necessary because DNM users and merchants do not trust one another; users don't want to pay for a product first and then discover that the merchant never ships it, and merchants don't want to ship a product first and then discover that the user never pays for it.

The problem is, running an escrow solution for criminals is almost certain to get you accused of conspiracy, money laundering, and unlicensed money transmission, so the police are likely to shut down any DNM that does this. A better design is to oursource escrow to third parties. Let anyone call themselves an escrow, and let moderators approve escrows just like they approve listings. A merchant or user who doesn't trust the escrows chosen by a given moderator can just pick a different moderator. That way, the police go after the third party escrows rather than the DNM itself, which never touches user funds.

4. Consequences

Designing a DNM along these principles has an interesting consequence: the DNM is no longer anything but an interface, a glorified web browser. It doesn't host any content, approve any listings, or touch any money. It doesn't even really need a server -- it can just be an HTML file that users open up on their computer or smart phone. For two reasons, such a program is hard to take down:

First, it is hard for the police to justify going after the DNM, since there are no charges to bring. Its maintainers aren't doing anything illegal, no more than Firefox does anything illegal by maintaining a web browser that some people use to browse illegal content. What the user displays in the app is up to them, not to the code maintainers. Second, if the police decided to go after the DNM anyway, they still couldn't take it down because it's just an HTML file -- the maintainers do not even need to run a server to host the file, because users can share it with one another, eliminating all single points of failure.

Another consequence of this design is this: most of the listings will probably be legal, because there is more demand for legal goods and services than illegal ones. Users who want to find illegal goods would pick moderators who only approve those listings, but everyone else would use "legal" moderators, and the app would not, at first glance, look much like a DNM, just a marketplace for legal goods and services. To find the illegal stuff that lurks among the abundant legal stuff, you'd probably have to filter for it via your selection of moderators, making it seem like the "default" mode is legal.

5. Conclusion

I think this DNM model is far better than the designs that prevail today. It is easier to maintain, harder to take down, and pushes the "hard parts" to the edges, so that the DNM is not significantly affected even if a major merchant, moderator, or escrow gets arrested. I hope it comes to fruition.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 91bea5cd:1df4451c

2025-04-26 10:16:21

@ 91bea5cd:1df4451c

2025-04-26 10:16:21O Contexto Legal Brasileiro e o Consentimento

No ordenamento jurídico brasileiro, o consentimento do ofendido pode, em certas circunstâncias, afastar a ilicitude de um ato que, sem ele, configuraria crime (como lesão corporal leve, prevista no Art. 129 do Código Penal). Contudo, o consentimento tem limites claros: não é válido para bens jurídicos indisponíveis, como a vida, e sua eficácia é questionável em casos de lesões corporais graves ou gravíssimas.

A prática de BDSM consensual situa-se em uma zona complexa. Em tese, se ambos os parceiros são adultos, capazes, e consentiram livre e informadamente nos atos praticados, sem que resultem em lesões graves permanentes ou risco de morte não consentido, não haveria crime. O desafio reside na comprovação desse consentimento, especialmente se uma das partes, posteriormente, o negar ou alegar coação.

A Lei Maria da Penha (Lei nº 11.340/2006)

A Lei Maria da Penha é um marco fundamental na proteção da mulher contra a violência doméstica e familiar. Ela estabelece mecanismos para coibir e prevenir tal violência, definindo suas formas (física, psicológica, sexual, patrimonial e moral) e prevendo medidas protetivas de urgência.

Embora essencial, a aplicação da lei em contextos de BDSM pode ser delicada. Uma alegação de violência por parte da mulher, mesmo que as lesões ou situações decorram de práticas consensuais, tende a receber atenção prioritária das autoridades, dada a presunção de vulnerabilidade estabelecida pela lei. Isso pode criar um cenário onde o parceiro masculino enfrenta dificuldades significativas em demonstrar a natureza consensual dos atos, especialmente se não houver provas robustas pré-constituídas.

Outros riscos:

Lesão corporal grave ou gravíssima (art. 129, §§ 1º e 2º, CP), não pode ser justificada pelo consentimento, podendo ensejar persecução penal.

Crimes contra a dignidade sexual (arts. 213 e seguintes do CP) são de ação pública incondicionada e independem de representação da vítima para a investigação e denúncia.

Riscos de Falsas Acusações e Alegação de Coação Futura

Os riscos para os praticantes de BDSM, especialmente para o parceiro que assume o papel dominante ou que inflige dor/restrição (frequentemente, mas não exclusivamente, o homem), podem surgir de diversas frentes:

- Acusações Externas: Vizinhos, familiares ou amigos que desconhecem a natureza consensual do relacionamento podem interpretar sons, marcas ou comportamentos como sinais de abuso e denunciar às autoridades.

- Alegações Futuras da Parceira: Em caso de término conturbado, vingança, arrependimento ou mudança de perspectiva, a parceira pode reinterpretar as práticas passadas como abuso e buscar reparação ou retaliação através de uma denúncia. A alegação pode ser de que o consentimento nunca existiu ou foi viciado.

- Alegação de Coação: Uma das formas mais complexas de refutar é a alegação de que o consentimento foi obtido mediante coação (física, moral, psicológica ou econômica). A parceira pode alegar, por exemplo, que se sentia pressionada, intimidada ou dependente, e que seu "sim" não era genuíno. Provar a ausência de coação a posteriori é extremamente difícil.

- Ingenuidade e Vulnerabilidade Masculina: Muitos homens, confiando na dinâmica consensual e na parceira, podem negligenciar a necessidade de precauções. A crença de que "isso nunca aconteceria comigo" ou a falta de conhecimento sobre as implicações legais e o peso processual de uma acusação no âmbito da Lei Maria da Penha podem deixá-los vulneráveis. A presença de marcas físicas, mesmo que consentidas, pode ser usada como evidência de agressão, invertendo o ônus da prova na prática, ainda que não na teoria jurídica.

Estratégias de Prevenção e Mitigação

Não existe um método infalível para evitar completamente o risco de uma falsa acusação, mas diversas medidas podem ser adotadas para construir um histórico de consentimento e reduzir vulnerabilidades:

- Comunicação Explícita e Contínua: A base de qualquer prática BDSM segura é a comunicação constante. Negociar limites, desejos, palavras de segurança ("safewords") e expectativas antes, durante e depois das cenas é crucial. Manter registros dessas negociações (e-mails, mensagens, diários compartilhados) pode ser útil.

-

Documentação do Consentimento:

-

Contratos de Relacionamento/Cena: Embora a validade jurídica de "contratos BDSM" seja discutível no Brasil (não podem afastar normas de ordem pública), eles servem como forte evidência da intenção das partes, da negociação detalhada de limites e do consentimento informado. Devem ser claros, datados, assinados e, idealmente, reconhecidos em cartório (para prova de data e autenticidade das assinaturas).

-

Registros Audiovisuais: Gravar (com consentimento explícito para a gravação) discussões sobre consentimento e limites antes das cenas pode ser uma prova poderosa. Gravar as próprias cenas é mais complexo devido a questões de privacidade e potencial uso indevido, mas pode ser considerado em casos específicos, sempre com consentimento mútuo documentado para a gravação.

Importante: a gravação deve ser com ciência da outra parte, para não configurar violação da intimidade (art. 5º, X, da Constituição Federal e art. 20 do Código Civil).

-

-

Testemunhas: Em alguns contextos de comunidade BDSM, a presença de terceiros de confiança durante negociações ou mesmo cenas pode servir como testemunho, embora isso possa alterar a dinâmica íntima do casal.

- Estabelecimento Claro de Limites e Palavras de Segurança: Definir e respeitar rigorosamente os limites (o que é permitido, o que é proibido) e as palavras de segurança é fundamental. O desrespeito a uma palavra de segurança encerra o consentimento para aquele ato.

- Avaliação Contínua do Consentimento: O consentimento não é um cheque em branco; ele deve ser entusiástico, contínuo e revogável a qualquer momento. Verificar o bem-estar do parceiro durante a cena ("check-ins") é essencial.

- Discrição e Cuidado com Evidências Físicas: Ser discreto sobre a natureza do relacionamento pode evitar mal-entendidos externos. Após cenas que deixem marcas, é prudente que ambos os parceiros estejam cientes e de acordo, talvez documentando por fotos (com data) e uma nota sobre a consensualidade da prática que as gerou.

- Aconselhamento Jurídico Preventivo: Consultar um advogado especializado em direito de família e criminal, com sensibilidade para dinâmicas de relacionamento alternativas, pode fornecer orientação personalizada sobre as melhores formas de documentar o consentimento e entender os riscos legais específicos.

Observações Importantes

- Nenhuma documentação substitui a necessidade de consentimento real, livre, informado e contínuo.

- A lei brasileira protege a "integridade física" e a "dignidade humana". Práticas que resultem em lesões graves ou que violem a dignidade de forma não consentida (ou com consentimento viciado) serão ilegais, independentemente de qualquer acordo prévio.

- Em caso de acusação, a existência de documentação robusta de consentimento não garante a absolvição, mas fortalece significativamente a defesa, ajudando a demonstrar a natureza consensual da relação e das práticas.

-

A alegação de coação futura é particularmente difícil de prevenir apenas com documentos. Um histórico consistente de comunicação aberta (whatsapp/telegram/e-mails), respeito mútuo e ausência de dependência ou controle excessivo na relação pode ajudar a contextualizar a dinâmica como não coercitiva.

-

Cuidado com Marcas Visíveis e Lesões Graves Práticas que resultam em hematomas severos ou lesões podem ser interpretadas como agressão, mesmo que consentidas. Evitar excessos protege não apenas a integridade física, mas também evita questionamentos legais futuros.

O que vem a ser consentimento viciado

No Direito, consentimento viciado é quando a pessoa concorda com algo, mas a vontade dela não é livre ou plena — ou seja, o consentimento existe formalmente, mas é defeituoso por alguma razão.

O Código Civil brasileiro (art. 138 a 165) define várias formas de vício de consentimento. As principais são:

Erro: A pessoa se engana sobre o que está consentindo. (Ex.: A pessoa acredita que vai participar de um jogo leve, mas na verdade é exposta a práticas pesadas.)

Dolo: A pessoa é enganada propositalmente para aceitar algo. (Ex.: Alguém mente sobre o que vai acontecer durante a prática.)

Coação: A pessoa é forçada ou ameaçada a consentir. (Ex.: "Se você não aceitar, eu termino com você" — pressão emocional forte pode ser vista como coação.)

Estado de perigo ou lesão: A pessoa aceita algo em situação de necessidade extrema ou abuso de sua vulnerabilidade. (Ex.: Alguém em situação emocional muito fragilizada é induzida a aceitar práticas que normalmente recusaria.)

No contexto de BDSM, isso é ainda mais delicado: Mesmo que a pessoa tenha "assinado" um contrato ou dito "sim", se depois ela alegar que seu consentimento foi dado sob medo, engano ou pressão psicológica, o consentimento pode ser considerado viciado — e, portanto, juridicamente inválido.

Isso tem duas implicações sérias:

-

O crime não se descaracteriza: Se houver vício, o consentimento é ignorado e a prática pode ser tratada como crime normal (lesão corporal, estupro, tortura, etc.).

-

A prova do consentimento precisa ser sólida: Mostrando que a pessoa estava informada, lúcida, livre e sem qualquer tipo de coação.

Consentimento viciado é quando a pessoa concorda formalmente, mas de maneira enganada, forçada ou pressionada, tornando o consentimento inútil para efeitos jurídicos.

Conclusão

Casais que praticam BDSM consensual no Brasil navegam em um terreno que exige não apenas confiança mútua e comunicação excepcional, mas também uma consciência aguçada das complexidades legais e dos riscos de interpretações equivocadas ou acusações mal-intencionadas. Embora o BDSM seja uma expressão legítima da sexualidade humana, sua prática no Brasil exige responsabilidade redobrada. Ter provas claras de consentimento, manter a comunicação aberta e agir com prudência são formas eficazes de se proteger de falsas alegações e preservar a liberdade e a segurança de todos os envolvidos. Embora leis controversas como a Maria da Penha sejam "vitais" para a proteção contra a violência real, os praticantes de BDSM, e em particular os homens nesse contexto, devem adotar uma postura proativa e prudente para mitigar os riscos inerentes à potencial má interpretação ou instrumentalização dessas práticas e leis, garantindo que a expressão de sua consensualidade esteja resguardada na medida do possível.

Importante: No Brasil, mesmo com tudo isso, o Ministério Público pode denunciar por crime como lesão corporal grave, estupro ou tortura, independente de consentimento. Então a prudência nas práticas é fundamental.

Aviso Legal: Este artigo tem caráter meramente informativo e não constitui aconselhamento jurídico. As leis e interpretações podem mudar, e cada situação é única. Recomenda-se buscar orientação de um advogado qualificado para discutir casos específicos.

Se curtiu este artigo faça uma contribuição, se tiver algum ponto relevante para o artigo deixe seu comentário.

-

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48Redistributing Git with Nostr

Every time someone tries to "decentralize" Git -- like many projects tried in the past to do it with BitTorrent, IPFS, ScuttleButt or custom p2p protocols -- there is always a lurking comment: "but Git is already distributed!", and then the discussion proceeds to mention some facts about how Git supports multiple remotes and its magic syncing and merging abilities and so on.

Turns out all that is true, Git is indeed all that powerful, and yet GitHub is the big central hub that hosts basically all Git repositories in the giant world of open-source. There are some crazy people that host their stuff elsewhere, but these projects end up not being found by many people, and even when they do they suffer from lack of contributions.

Because everybody has a GitHub account it's easy to open a pull request to a repository of a project you're using if it's on GitHub (to be fair I think it's very annoying to have to clone the repository, then add it as a remote locally, push to it, then go on the web UI and click to open a pull request, then that cloned repository lurks forever in your profile unless you go through 16 screens to delete it -- but people in general seem to think it's easy).

It's much harder to do it on some random other server where some project might be hosted, because now you have to add 4 more even more annoying steps: create an account; pick a password; confirm an email address; setup SSH keys for pushing. (And I'm not even mentioning the basic impossibility of offering

pushaccess to external unknown contributors to people who want to host their own simple homemade Git server.)At this point some may argue that we could all have accounts on GitLab, or Codeberg or wherever else, then those steps are removed. Besides not being a practical strategy this pseudo solution misses the point of being decentralized (or distributed, who knows) entirely: it's far from the ideal to force everybody to have the double of account management and SSH setup work in order to have the open-source world controlled by two shady companies instead of one.

What we want is to give every person the opportunity to host their own Git server without being ostracized. at the same time we must recognize that most people won't want to host their own servers (not even most open-source programmers!) and give everybody the ability to host their stuff on multi-tenant servers (such as GitHub) too. Importantly, though, if we allow for a random person to have a standalone Git server on a standalone server they host themselves on their wood cabin that also means any new hosting company can show up and start offering Git hosting, with or without new cool features, charging high or low or zero, and be immediately competing against GitHub or GitLab, i.e. we must remove the network-effect centralization pressure.

External contributions

The first problem we have to solve is: how can Bob contribute to Alice's repository without having an account on Alice's server?

SourceHut has reminded GitHub users that Git has always had this (for most) arcane

git send-emailcommand that is the original way to send patches, using an once-open protocol.Turns out Nostr acts as a quite powerful email replacement and can be used to send text content just like email, therefore patches are a very good fit for Nostr event contents.

Once you get used to it and the proper UIs (or CLIs) are built sending and applying patches to and from others becomes a much easier flow than the intense clickops mixed with terminal copypasting that is interacting with GitHub (you have to clone the repository on GitHub, then update the remote URL in your local directory, then create a branch and then go back and turn that branch into a Pull Request, it's quite tiresome) that many people already dislike so much they went out of their way to build many GitHub CLI tools just so they could comment on issues and approve pull requests from their terminal.

Replacing GitHub features

Aside from being the "hub" that people use to send patches to other people's code (because no one can do the email flow anymore, justifiably), GitHub also has 3 other big features that are not directly related to Git, but that make its network-effect harder to overcome. Luckily Nostr can be used to create a new environment in which these same features are implemented in a more decentralized and healthy way.

Issues: bug reports, feature requests and general discussions

Since the "Issues" GitHub feature is just a bunch of text comments it should be very obvious that Nostr is a perfect fit for it.

I will not even mention the fact that Nostr is much better at threading comments than GitHub (which doesn't do it at all), which can generate much more productive and organized discussions (and you can opt out if you want).

Search

I use GitHub search all the time to find libraries and projects that may do something that I need, and it returns good results almost always. So if people migrated out to other code hosting providers wouldn't we lose it?

The fact is that even though we think everybody is on GitHub that is a globalist falsehood. Some projects are not on GitHub, and if we use only GitHub for search those will be missed. So even if we didn't have a Nostr Git alternative it would still be necessary to create a search engine that incorporated GitLab, Codeberg, SourceHut and whatnot.

Turns out on Nostr we can make that quite easy by not forcing anyone to integrate custom APIs or hardcoding Git provider URLs: each repository can make itself available by publishing an "announcement" event with a brief description and one or more Git URLs. That makes it easy for a search engine to index them -- and even automatically download the code and index the code (or index just README files or whatever) without a centralized platform ever having to be involved.

The relays where such announcements will be available play a role, of course, but that isn't a bad role: each announcement can be in multiple relays known for storing "public good" projects, some relays may curate only projects known to be very good according to some standards, other relays may allow any kind of garbage, which wouldn't make them good for a search engine to rely upon, but would still be useful in case one knows the exact thing (and from whom) they're searching for (the same is valid for all Nostr content, by the way, and that's where it's censorship-resistance comes from).

Continuous integration

GitHub Actions are a very hardly subsidized free-compute-for-all-paid-by-Microsoft feature, but one that isn't hard to replace at all. In fact there exists today many companies offering the same kind of service out there -- although they are mostly targeting businesses and not open-source projects, before GitHub Actions was introduced there were also many that were heavily used by open-source projects.

One problem is that these services are still heavily tied to GitHub today, they require a GitHub login, sometimes BitBucket and GitLab and whatnot, and do not allow one to paste an arbitrary Git server URL, but that isn't a thing that is very hard to change anyway, or to start from scratch. All we need are services that offer the CI/CD flows, perhaps using the same framework of GitHub Actions (although I would prefer to not use that messy garbage), and charge some few satoshis for it.

It may be the case that all the current services only support the big Git hosting platforms because they rely on their proprietary APIs, most notably the webhooks dispatched when a repository is updated, to trigger the jobs. It doesn't have to be said that Nostr can also solve that problem very easily.

-

@ 40b9c85f:5e61b451

2025-04-24 15:27:02

@ 40b9c85f:5e61b451

2025-04-24 15:27:02Introduction

Data Vending Machines (DVMs) have emerged as a crucial component of the Nostr ecosystem, offering specialized computational services to clients across the network. As defined in NIP-90, DVMs operate on an apparently simple principle: "data in, data out." They provide a marketplace for data processing where users request specific jobs (like text translation, content recommendation, or AI text generation)

While DVMs have gained significant traction, the current specification faces challenges that hinder widespread adoption and consistent implementation. This article explores some ideas on how we can apply the reflection pattern, a well established approach in RPC systems, to address these challenges and improve the DVM ecosystem's clarity, consistency, and usability.

The Current State of DVMs: Challenges and Limitations

The NIP-90 specification provides a broad framework for DVMs, but this flexibility has led to several issues:

1. Inconsistent Implementation

As noted by hzrd149 in "DVMs were a mistake" every DVM implementation tends to expect inputs in slightly different formats, even while ostensibly following the same specification. For example, a translation request DVM might expect an event ID in one particular format, while an LLM service could expect a "prompt" input that's not even specified in NIP-90.

2. Fragmented Specifications

The DVM specification reserves a range of event kinds (5000-6000), each meant for different types of computational jobs. While creating sub-specifications for each job type is being explored as a possible solution for clarity, in a decentralized and permissionless landscape like Nostr, relying solely on specification enforcement won't be effective for creating a healthy ecosystem. A more comprehensible approach is needed that works with, rather than against, the open nature of the protocol.

3. Ambiguous API Interfaces

There's no standardized way for clients to discover what parameters a specific DVM accepts, which are required versus optional, or what output format to expect. This creates uncertainty and forces developers to rely on documentation outside the protocol itself, if such documentation exists at all.

The Reflection Pattern: A Solution from RPC Systems

The reflection pattern in RPC systems offers a compelling solution to many of these challenges. At its core, reflection enables servers to provide metadata about their available services, methods, and data types at runtime, allowing clients to dynamically discover and interact with the server's API.

In established RPC frameworks like gRPC, reflection serves as a self-describing mechanism where services expose their interface definitions and requirements. In MCP reflection is used to expose the capabilities of the server, such as tools, resources, and prompts. Clients can learn about available capabilities without prior knowledge, and systems can adapt to changes without requiring rebuilds or redeployments. This standardized introspection creates a unified way to query service metadata, making tools like

grpcurlpossible without requiring precompiled stubs.How Reflection Could Transform the DVM Specification

By incorporating reflection principles into the DVM specification, we could create a more coherent and predictable ecosystem. DVMs already implement some sort of reflection through the use of 'nip90params', which allow clients to discover some parameters, constraints, and features of the DVMs, such as whether they accept encryption, nutzaps, etc. However, this approach could be expanded to provide more comprehensive self-description capabilities.

1. Defined Lifecycle Phases

Similar to the Model Context Protocol (MCP), DVMs could benefit from a clear lifecycle consisting of an initialization phase and an operation phase. During initialization, the client and DVM would negotiate capabilities and exchange metadata, with the DVM providing a JSON schema containing its input requirements. nip-89 (or other) announcements can be used to bootstrap the discovery and negotiation process by providing the input schema directly. Then, during the operation phase, the client would interact with the DVM according to the negotiated schema and parameters.

2. Schema-Based Interactions

Rather than relying on rigid specifications for each job type, DVMs could self-advertise their schemas. This would allow clients to understand which parameters are required versus optional, what type validation should occur for inputs, what output formats to expect, and what payment flows are supported. By internalizing the input schema of the DVMs they wish to consume, clients gain clarity on how to interact effectively.

3. Capability Negotiation

Capability negotiation would enable DVMs to advertise their supported features, such as encryption methods, payment options, or specialized functionalities. This would allow clients to adjust their interaction approach based on the specific capabilities of each DVM they encounter.

Implementation Approach

While building DVMCP, I realized that the RPC reflection pattern used there could be beneficial for constructing DVMs in general. Since DVMs already follow an RPC style for their operation, and reflection is a natural extension of this approach, it could significantly enhance and clarify the DVM specification.

A reflection enhanced DVM protocol could work as follows: 1. Discovery: Clients discover DVMs through existing NIP-89 application handlers, input schemas could also be advertised in nip-89 announcements, making the second step unnecessary. 2. Schema Request: Clients request the DVM's input schema for the specific job type they're interested in 3. Validation: Clients validate their request against the provided schema before submission 4. Operation: The job proceeds through the standard NIP-90 flow, but with clearer expectations on both sides

Parallels with Other Protocols

This approach has proven successful in other contexts. The Model Context Protocol (MCP) implements a similar lifecycle with capability negotiation during initialization, allowing any client to communicate with any server as long as they adhere to the base protocol. MCP and DVM protocols share fundamental similarities, both aim to expose and consume computational resources through a JSON-RPC-like interface, albeit with specific differences.

gRPC's reflection service similarly allows clients to discover service definitions at runtime, enabling generic tools to work with any gRPC service without prior knowledge. In the REST API world, OpenAPI/Swagger specifications document interfaces in a way that makes them discoverable and testable.

DVMs would benefit from adopting these patterns while maintaining the decentralized, permissionless nature of Nostr.

Conclusion

I am not attempting to rewrite the DVM specification; rather, explore some ideas that could help the ecosystem improve incrementally, reducing fragmentation and making the ecosystem more comprehensible. By allowing DVMs to self describe their interfaces, we could maintain the flexibility that makes Nostr powerful while providing the structure needed for interoperability.

For developers building DVM clients or libraries, this approach would simplify consumption by providing clear expectations about inputs and outputs. For DVM operators, it would establish a standard way to communicate their service's requirements without relying on external documentation.

I am currently developing DVMCP following these patterns. Of course, DVMs and MCP servers have different details; MCP includes capabilities such as tools, resources, and prompts on the server side, as well as 'roots' and 'sampling' on the client side, creating a bidirectional way to consume capabilities. In contrast, DVMs typically function similarly to MCP tools, where you call a DVM with an input and receive an output, with each job type representing a different categorization of the work performed.

Without further ado, I hope this article has provided some insight into the potential benefits of applying the reflection pattern to the DVM specification.

-

@ d360efec:14907b5f

2025-04-22 07:54:51

@ d360efec:14907b5f

2025-04-22 07:54:51“คณิตศาสตร์” กุญแจเวทมนตร์ นักพนัน และ นักลงทุน ในนครเฮรันเทล นามกระฉ่อนเลื่องลือในหมู่นักเสี่ยงโชค เมื่อเอ่ยถึง “การพนัน” ภาพที่ชาวเมืองมักนึกถึงคือ “ยาจกข้างถนน”

มิใช่เรื่องแปลกประหลาดอันใด เพราะเป็นที่ร่ำลือกันว่า จ้าวแห่งหอคอยรัตติกาล ผู้คุมบ่อนพนัน มักร่ายเวทมนตร์สร้างเกมให้ตนเองได้เปรียบ เพื่อดูดกลืนเงินทองของผู้มาเยือน ดังนั้น การที่สามัญชนจะพิชิตเกมในระยะยาว จึงเป็นดั่งเงามายาที่จับต้องมิได้ กระนั้น ยังมีตำนานกล่าวขานถึงผู้กล้า ที่สามารถสร้างชื่อจาก “เกมพนัน” เช่น เวเนสซา รุสโซ นักเวทย์มนตร์ผู้ใช้กฎหมายแห่งแดนไกล ใช้เวลายาวนานถึงหกปี ร่ายเวทย์สะสมทรัพย์สินกว่าร้อยล้านเหรียญทอง จากการเล่นเกมไพ่ศักดิ์สิทธิ์ “โป๊กเกอร์” หรือแม้แต่ เอ็ดเวิร์ด โอ. ทอร์ป จอมปราชญ์ผู้สร้างกำไรถึงสามแสนหกหมื่นเหรียญทอง ภายในเจ็ดราตรี จากการเล่นเกมไพ่มนตรา “แบล็กแจ็ก” ด้วยเงินทุนตั้งต้นเพียงสามแสนสามหมื่นเหรียญทอง คิดเป็นอัตราเวทย์ตอบแทนร้อยสิบส่วน! เหล่าจอมยุทธ์เหล่านี้ มิได้อาศัยเพียงโชคช่วยชั่วครั้งชั่วคราวแล้วเลือนหาย แต่พวกเขากลับสามารถร่ายเวทย์สร้างผลตอบแทนระยะยาว จนเรียกได้ว่า ใช้ “หอคอยรัตติกาล” เป็นแหล่งเสบียงเลี้ยงชีพ โดยกุญแจเวทย์ที่บุคคลเหล่านี้ใช้ ก็คือ “คณิตศาสตร์” เหตุใด “คณิตศาสตร์” จึงช่วยให้ผู้คนเอาชนะ “การพนัน” ได้? และนอกจาก “การพนัน” แล้ว “คณิตศาสตร์” ยังสามารถประยุกต์ใช้กับสิ่งใดได้อีก? นักเล่าเรื่องแห่งเฮรันเทล จักไขปริศนาให้ฟัง เบื้องต้น ขอให้ท่านลองพิจารณาตนเอง ว่าเคยประสบพบพานเหตุการณ์เหล่านี้หรือไม่: * ตั้งมั่นว่า จักเสี่ยงโชคให้ได้กำไรเพียงเล็กน้อย แล้วจักหยุดพัก * แต่หากพลาดท่าเสียที จักจำกัดการสูญเสียให้เท่าทุนเดิมที่ตั้งไว้ * ครั้นเมื่อเวทมนตร์เข้าข้าง ได้กำไรมาแล้ว กลับโลภโมโทสัน อยากได้เพิ่มอีกนิด จึงร่ายเวทย์ต่อ * ทว่ากำไรเริ่มร่อยหรอ จนเหลือเพียงทุนเดิม สุดท้ายทุนที่ตั้งไว้คราแรกก็มลายสิ้น * จำต้องหาเงินทองมาลงเพิ่ม หวังทวงทุนคืน และพบว่าต้องสูญเสียเงินก้อนนั้นไปในห้วงเวลาต่อมา ลำดับเหตุการณ์ดังกล่าว เรียกได้ว่าเป็น “วงจรอุบาทว์” สำหรับนักพนันมากมายในเฮรันเทล ปริศนาที่ตามมาก็คือ เหตุใด “วงจรอุบาทว์” นี้จึงเกิดขึ้นซ้ำแล้วซ้ำเล่า? ส่วนหนึ่ง ย่อมเป็นเพราะอารมณ์อันแปรปรวนในการเสี่ยงโชคของแต่ละคน แต่อีกส่วนที่สำคัญยิ่งกว่า ต้องกล่าวว่าเป็นผลจาก “กลไกต้องสาป” ของจ้าวแห่งหอคอยรัตติกาล ซึ่งต้องกล่าวว่า เหล่าเจ้าของหอคอยรัตติกาลนั้น จักใช้หลักการทำนองเดียวกับ “สมาคมพ่อค้าผู้พิทักษ์” คือจักเก็บเงินทองจากชนจำนวนมาก เพื่อนำมาจ่ายให้กับชนเพียงหยิบมือ เพื่อล่อลวงให้ชนทั้งหลายเสี่ยงโชคต่อไป หรือทำให้เหล่านักพนันหวังว่า จักเป็นผู้โชคดีเฉกเช่นพวกเขาบ้าง แม้จะมีผู้โชคดีที่สามารถได้กำไรในเบื้องต้น แต่ในบั้นปลายก็จักพ่ายแพ้อยู่ดี ซึ่งเป็นไปตาม “กฎแห่งจำนวนมหาศาล” เพราะจ้าวแห่งหอคอยรัตติกาลนั้น ได้คำนวณและออกแบบระบบเกมที่ตนเองได้เปรียบในระยะยาวแล้ว จากตำนานนี้ ย่อมประจักษ์ชัดว่า แม้การพนันจักเป็นเรื่องของดวงชะตา แต่ก็ถูกรังสรรค์ขึ้นจากการคำนวณทางคณิตศาสตร์ ดังนั้น หากปรารถนาจะหาหนทางเอาชนะจ้าวแห่งหอคอยรัตติกาล ก็จำต้องเข้าใจ “คณิตศาสตร์” เสียก่อน ทีนี้ จงเงี่ยหูฟัง แล้วท่านจักได้ยินข้าไขปริศนา: ๑. ปริศนาแห่ง “กำไรคาดหวัง” สำหรับการแสวงหา “เกมเสี่ยงทาย” ที่ควรค่าแก่การเล่น หรือการเสี่ยง สิ่งแรกที่นักพนันพึงกระทำคือ “การประเมินกำไรคาดหวัง” หรือ “เวทคำนวณอนาคต” “กำไรคาดหวัง” ถูกคิดค้นโดย คริสเตียน ฮอยเกนส์ นักปราชญ์เวทย์ชาวดัตช์ เพื่อประเมินว่าเกมพนันแบบใดควรค่าแก่การเล่น ซึ่งมิใช่เพียงแค่การประเมินโอกาสแห่งชัยชนะเท่านั้น แต่ต้องคิดรวมขนาดของเงินเดิมพันไปด้วย โดยสูตรเวทย์คือ: กำไรคาดหวัง = (เงินที่ได้ x โอกาสชนะ) + (เงินที่เสีย x โอกาสแพ้) ดังนั้น หากปรารถนาจะสะสม “ทองคำมายา” ในระยะยาว จงเลือกเกมที่มี “กำไรคาดหวัง” เป็นบวก แต่หากพลาดพลั้งเข้าไปเล่นเกมที่ “กำไรคาดหวัง” เป็นลบ และบังเอิญว่าโชคชะตาเล่นตลกให้ได้เงินทองมาครอง พึงละทิ้งเกมนั้นเสียโดยพลัน เพราะท้ายที่สุดหากยังคงเล่นต่อไป ผู้อับโชคผู้นั้นก็คือตัวท่านเอง อย่างไรก็ตาม โดยธรรมดาแล้ว “กำไรคาดหวัง” ของเกมพนันที่มีเจ้ามือมักจักติดลบ จึงเป็นเรื่องยากยิ่งที่จะเอาชนะได้ เฉกเช่นตัวอย่างที่เราเห็น คือเกมในบ่อนพนัน หรือแม้แต่ “สลากกินแบ่งรัฐบาล” ก็ล้วนเป็นเกมที่มี “กำไรคาดหวัง” ติดลบทั้งสิ้น นอกจาก “กำไรคาดหวัง” จักถูกใช้กับการพนันได้แล้ว หลักเวทย์ “คณิตศาสตร์” ก็ยังสามารถประยุกต์ใช้กับการลงทุนได้ไม่แตกต่างกัน ตัวอย่างเช่น หากท่านเก็บสถิติข้อมูลการลงทุนของตนเอง แล้วพบว่ามีเพียงสามสิบส่วนร้อยเท่านั้น ที่ท่านซื้อ “ศิลาแห่งโชค” แล้วสร้างผลตอบแทนเป็นบวก แต่ท่านยังคงปรารถนาความสำเร็จในการลงทุน ก็จงจำกัดการขาดทุนแต่ละคราให้น้อยเข้าไว้ เช่น -๕% และปล่อยให้มีกำไรในแต่ละคราที่ลงทุน เช่น อย่างน้อย ๒๐% ซึ่งจากการใช้กลยุทธ์นี้ ท่านจักมี “กำไรคาดหวัง” = (๒๐% x ๐.๓) + (-๕% x ๐.๗) = ๒.๕% จักเห็นได้ว่า แม้ท่านจักมีจำนวนคราที่ขาดทุนบ่อยครั้ง แต่ก็ยังสามารถสร้างกำไรได้ หากคราที่กำไรนั้น สามารถทำเงินทองเป็นจำนวนมากได้ ๒. ปริศนาแห่ง “การบริหารหน้าตัก” หรือ “การบริหารเงินทุน” แม้ว่าท่านจักรับรู้ “กำไรคาดหวัง” แล้ว แต่หากท่านเผชิญหน้ากับการขาดทุนต่อเนื่องกัน ท่านก็อาจหมดเนื้อหมดตัวก่อนถึงคราที่จะกอบโกยเงินทองจากคราที่กำไร วิธีคลายปมปริศนานี้ก็คือ การมิลงเงินทองทั้งหมดของท่านในการลงทุนเพียงคราเดียว ซึ่งนอกจากการกระจายความเสี่ยงในการลงทุนหลาย “ศิลาแห่งโชค” หรือหลาย “เกมเสี่ยงทาย” แล้ว ท่านอาจกำหนดขนาดของการลงทุนแต่ละคราให้มิมากเกินไป แบบง่าย ๆ เช่น มิเกิน ๑๐% ของเงินลงทุนทั้งหมด หรือท่านอาจคำนวณขนาดของการลงทุนแต่ละคราด้วยสูตรทางคณิตศาสตร์ เช่น สูตร “การขาดทุนสูงสุดที่ท่านรับได้ (Value at Risk)” หรือ สูตร “ขนาดเดิมพันที่เหมาะสม (Kelly Formula)” ๓. ปริศนาแห่ง “อคติ” ในวงการพนัน มักมีอคติหนึ่งที่บังเกิดบ่อยครั้งกับผู้คน คือ “Gambler's Fallacy” หรือ “ความเชื่อผิด ๆ แห่งนักพนัน” ว่าหากเหตุการณ์หนึ่งบังเกิดบ่อยครั้งกว่าปรกติในช่วงเวลาหนึ่ง ๆ เหตุการณ์นั้นจักบังเกิดบ่อยครั้งน้อยลงในอนาคต ทั้ง ๆ ที่เหตุการณ์เหล่านั้นเป็นอิสระจากกันในทางสถิติ ยกตัวอย่างเช่น หากโยนเหรียญมนตราออกหัวไปแล้วสามครา ในคราที่สี่ หลายคนอาจคิดว่าโอกาสออกก้อยมากกว่าหัว แม้ว่าการโยนเหรียญแต่ละคราจะมิได้ส่งผลอันใดต่อกันเลย (จะโยนกี่ครา โอกาสหัวหรือก้อย ก็คือ ๕๐:๕๐ อยู่ยั่งยืน) หรือแม้กระทั่ง “สลากกินแบ่งรัฐบาล” มีหลายคนที่ซื้อเลขซ้ำกัน เพื่อหวังว่าจะถูกในงวดต่อ ๆ ไป ในวงการการลงทุน ก็มีลักษณะที่คล้ายคลึงกัน เช่น หาก “ศิลาแห่งโชค A” ราคาตกต่ำลงมาห้าครา บางคนอาจคิดว่าในคราที่หก ราคาของมันจักต้องเด้งขึ้นมา ซึ่งในความเป็นจริง หาได้เป็นเช่นนั้นเสมอไป จักเห็นได้ว่า แท้จริงแล้ว ไม่ว่าจักเป็น “เกมเสี่ยงทายแห่งโชคชะตา” หรือ “การผจญภัยในตลาดทุน” หากท่านมีความเข้าใจ และนำ “คณิตศาสตร์” เข้ามาเป็นรากฐาน มันก็อาจนำพาตัวท่านเอง ไปสู่จุดที่ได้เปรียบในเกมนั้น ได้เฉกเช่นกัน.. สูตรเวทย์มนตร์ที่ปรากฏในตำนาน: * กำไรคาดหวัง = (เงินที่ได้ x โอกาสชนะ) + (เงินที่เสีย x โอกาสแพ้) คำเตือนจากนักเล่าเรื่องแห่งเฮรันเทล: "พึงระลึกไว้เสมอว่า โชคชะตาเป็นสิ่งที่คาดเดาได้ยาก แม้เวทมนตร์คณิตศาสตร์จักช่วยนำทาง แต่ท้ายที่สุดแล้ว ความสำเร็จยังคงขึ้นอยู่กับการตัดสินใจและสติปัญญาของท่านเอง"

หวังว่าตำนานบทนี้จักเป็นประโยชน์แก่ท่านนะคะ

-

@ 401014b3:59d5476b

2025-04-22 00:23:24

@ 401014b3:59d5476b

2025-04-22 00:23:24About Me

I come to Nostr with extensive experience in the digital landscape. As a blockchain native since 2017, I've witnessed the evolution of decentralized technologies firsthand. Most of my professional career has been spent working within big tech companies, giving me a unique perspective on both centralized and decentralized systems.

My social media journey began on Twitter in 2007, where I've maintained a presence for over 17 years. I've also explored other decentralized social platforms including BlueSky, Farcaster, and Lens Protocol. As a Bitcoin maximalist, I was particularly intrigued by Nostr's compatibility with the Lightning Network, which initially drew me to the platform.

The Onboarding Challenge

The Nostr onboarding experience presents a significant hurdle for newcomers. Despite my technical background in blockchain technologies, I found the initial setup process more complicated than expected. Understanding public/private key cryptography just to join a social network creates a steeper learning curve than necessary.

BlueSky and Farcaster have demonstrated that it's possible to maintain decentralized principles while providing a more streamlined onboarding experience. Their approaches show that user-friendly design and decentralization aren't mutually exclusive concepts.

Relay Management: Room for Improvement

The concept of relays represents one of Nostr's most distinctive features, though it can be confusing for newcomers. While many clients come pre-configured with default relays, users eventually encounter situations where content or connections seem inconsistent.

When someone I've interacted with doesn't appear in my feed or doesn't respond, I'm often left wondering if we're simply on different relays. This uncertainty creates friction that doesn't exist on other platforms where connectivity is handled behind the scenes.

The relay system introduces a layer of complexity that, while important to Nostr's architecture, could benefit from better abstraction in the user experience. When using BlueSky or Farcaster, I don't need to think about the underlying infrastructure, something Nostr could learn from while maintaining its decentralized principles.

The Zap Economy: Growing Pains

The Lightning-powered zap system shows tremendous potential, but I've observed some concerning economic patterns. Longer-term Nostr users have expressed frustration about continuously sending zaps while seeing limited growth in the overall ecosystem.

Interestingly, there appears to be a connection between this liquidity issue and community growth dynamics. Some established users who voice concerns about bearing the financial burden of the zapping economy are simultaneously less welcoming to newer accounts, rarely following, engaging with, or zapping newcomers.

This creates a challenging environment for new users, who face a cold reception and have little incentive to load their Lightning wallets or participate in the zap economy. Why bring fresh liquidity to a platform where established users rarely engage with your content? This dynamic has limited the expansion of the ecosystem, with the same sats often circulating among established users rather than growing with new participants.

Client Diversity: Strength and Challenge

Nostr's multiple client options offer users choice, which is valuable. However, the implementation of NIPs (Nostr Implementation Possibilities) varies across clients, creating inconsistent experiences. Features that work seamlessly in one client might be implemented differently in another.

This extends to fundamental aspects like search functionality, thread navigation, and notification systems, all of which can differ significantly between clients. For users accustomed to consistent experiences, this fragmentation creates a learning curve with each new client they try.

Lightning Integration: Varying Experiences

The Lightning Network integration varies in quality and user experience across Nostr clients. While the functionality is generally present, the implementation quality, feature set, and ease of use differ depending on which client you choose.

This inconsistency means users may need to experiment with several clients to find one that provides the Lightning experience they're looking for, rather than having a consistent experience across the ecosystem.

Finding Balance

Nostr appears to be navigating the challenge of balancing technical innovation with user experience. While its cryptographic foundation and decentralized architecture are impressive technical achievements, these same strengths sometimes come at the cost of accessibility.

Despite my technical background and interest in decentralized technologies, I find myself using BlueSky and Farcaster more frequently for daily social interactions, while checking Nostr less often. For Nostr to achieve its potential for broader adoption, addressing these user experience considerations while maintaining its core principles will be essential.

The platform has tremendous potential with improvements to user experience, community dynamics, and economic sustainability, Nostr could evolve from a fascinating technical experiment into a truly compelling alternative to mainstream social media.

-

@ d360efec:14907b5f

2025-04-21 22:10:23

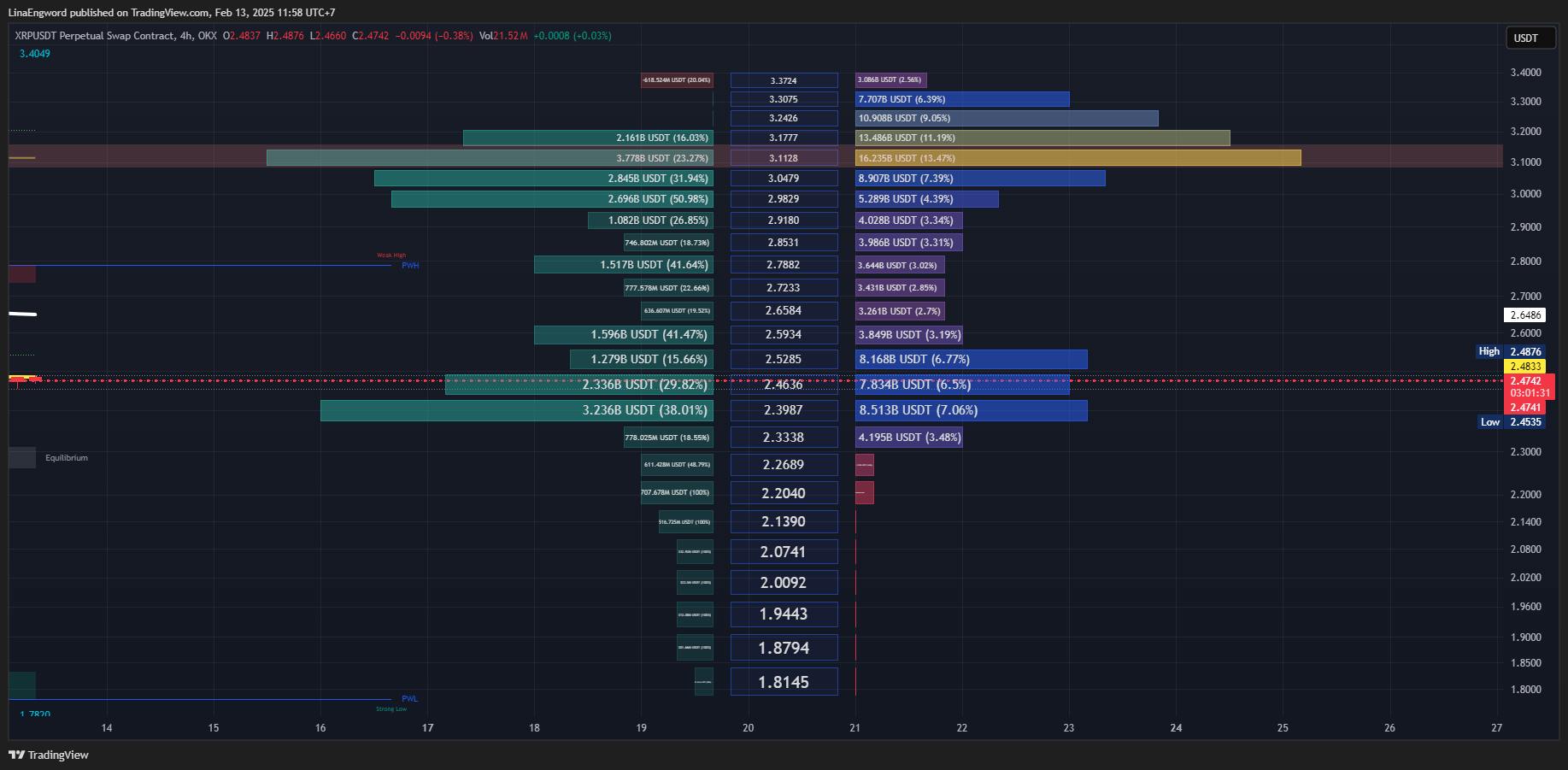

@ d360efec:14907b5f

2025-04-21 22:10:23สวัสดีเพื่อนนักเทรดทุกท่าน! 👋 วันนี้ฉันมาแนะนำตารางกิจวัตรประจำวันของ Day Trader ที่น่าสนใจนี้กันนะคะ มาดูกันว่ามีอะไรที่เราสามารถเรียนรู้และนำไปปรับใช้กับการเทรดของเราได้บ้างค่ะ

ภาพรวมกิจวัตรประจำวันของ Day Trader 📊

ตารางนี้แสดงให้เห็นถึงโครงสร้างของวันที่สมดุลสำหรับนักเทรดรายวันที่ประสบความสำเร็จ โดยเน้นทั้งการเตรียมตัว 🤓 การลงมือเทรด 🚀 การเรียนรู้ 📚 และการดูแลสุขภาพส่วนตัว 🧘♀️ ซึ่งเป็นสิ่งสำคัญอย่างยิ่งในการรักษาประสิทธิภาพและความสม่ำเสมอในการเทรด 💪

การวิเคราะห์และอธิบายแต่ละช่วงเวลา

$ 05.30 น. > ตื่นนอน 🌅 อาบน้ำ 🚿 และเตรียมตัว 👔 > การเริ่มต้นวันอย่างกระปรี้กระเปร่า 🎉 และการมีกิจวัตรส่วนตัวที่ผ่อนคลายเป็นสิ่งสำคัญในการเตรียมพร้อมทั้งร่างกายและจิตใจ 🧠 สำหรับการเทรด

$ 06.00 น. > ตรวจสอบข่าวสาร 📰 วิเคราะห์กราฟ 📈 และเตรียมตัว 🎯 > ช่วงเวลานี้เป็นหัวใจสำคัญของการเตรียมตัวก่อนตลาดเปิด ⏰ นักเทรดจะตรวจสอบข่าวเศรษฐกิจ 💰 และข่าวที่เกี่ยวข้องกับสินทรัพย์ที่ตนเองเทรด 🧐 วิเคราะห์กราฟเพื่อหาแนวโน้ม 🔭 และระดับราคาที่น่าสนใจ 📍 รวมถึงวางแผนกลยุทธ์การเทรดสำหรับวันนี้ ✍️

$ 06.30 น. > ตลาดเปิด 🔔 เริ่มทำการเทรด 🚀 > เมื่อตลาดเปิด นักเทรดจะเริ่มดำเนินการตามแผนที่วางไว้ 📝 โดยจะเฝ้าติดตามการเคลื่อนไหวของราคา 👀 และเข้าเทรดตามสัญญาณที่เกิดขึ้น 🚦

$ 12.00 น. > พักรับประทานอาหารกลางวัน 🥪 > การพักผ่อน 😌 และการเติมพลัง 💪 ในช่วงกลางวันเป็นสิ่งสำคัญในการรักษาความมีสมาธิ 🧘♀️ และความสามารถในการตัดสินใจที่ดี 👍

$ 12.45 น. > ปิดสถานะการเทรดทั้งหมด 🛑 > สำหรับ Day Trader การปิดสถานะทั้งหมดภายในวันถือเป็นกฎเหล็ก 🚫 เพื่อหลีกเลี่ยงความเสี่ยงจากความผันผวนข้ามคืน 🌙

$ 13.00 น. > ทบทวน 🤔 เรียนรู้ 📚 และปรับปรุง ⚙️ > หลังจากการเทรด นักเทรดที่ประสบความสำเร็จ 🎉 จะใช้เวลาในการทบทวนการเทรดของตนเอง 🧐 วิเคราะห์ว่าอะไรทำได้ดี 👍 และอะไรที่ต้องปรับปรุง 📝 การเรียนรู้อย่างต่อเนื่องเป็นกุญแจสำคัญสู่การพัฒนา 🚀

$ 14.00 น. > ออกกำลังกาย 💪 และพักผ่อน 🧘♀️ > การดูแลสุขภาพกาย 🍎 และใจ 💖 มีความสำคัญไม่ยิ่งหย่อนไปกว่าการเทรด 📈 การออกกำลังกายและการมีเวลาว่าง 🌴 ช่วยลดความเครียด 😥 และเพิ่มประสิทธิภาพในการเทรดในระยะยาว ✨

$ 17.00 น. > รับประทานอาหารเย็น 🍽️ และพักผ่อน 🛋️ > การมีเวลาพักผ่อนกับครอบครัว ❤️ หรือทำกิจกรรมที่ชอบ 😊 ช่วยให้ผ่อนคลาย 😌 และเตรียมพร้อมสำหรับวันต่อไป 🌅

$ 19.00 น. > วางแผนการเทรดสำหรับวันพรุ่งนี้ 🗓️ และตรวจสอบข่าวสาร 📰 > การวางแผนล่วงหน้า 🤓 ช่วยให้นักเทรดมีความพร้อม 💪 และสามารถตอบสนองต่อสถานการณ์ตลาดได้อย่างมีประสิทธิภาพ 🚀

$ 22.00 น. > เข้านอน 😴 > การนอนหลับพักผ่อนอย่างเพียงพอ 🛌 เป็นสิ่งจำเป็นสำหรับการรักษาสุขภาพ 💖 และประสิทธิภาพในการเทรด 💪

สิ่งที่น่าสนใจและข้อคิด 🤔

$ ความมีระเบียบวินัย 💯 > ตารางนี้แสดงให้เห็นถึงความมีระเบียบวินัยที่เข้มงวด 📏 ซึ่งเป็นคุณสมบัติที่สำคัญของนักเทรดที่ประสบความสำเร็จ 🎉

$ การเตรียมตัวอย่างรอบคอบ 🧐 > การใช้เวลาในการวิเคราะห์ 📊 และวางแผน 📝 ก่อนตลาดเปิดช่วยลดการตัดสินใจที่ผิดพลาด 🚫 และเพิ่มโอกาสในการทำกำไร 💰

$ การเรียนรู้อย่างต่อเนื่อง 📚 > การทบทวน 🤔 และปรับปรุงกลยุทธ์ ⚙️ อยู่เสมอเป็นสิ่งสำคัญในการพัฒนาทักษะการเทรด 🚀

$ ความสมดุล ⚖️ > การให้ความสำคัญกับการดูแลสุขภาพ 🧘♀️ และการพักผ่อน 🌴 ควบคู่ไปกับการเทรด 📈 ช่วยป้องกันภาวะหมดไฟ 🔥 และรักษาประสิทธิภาพในระยะยาว ✨

การนำไปปรับใช้ 🛠️

เพื่อนๆ นักเทรดสามารถนำแนวคิดจากตารางนี้ไปปรับใช้กับกิจวัตรประจำวันของตนเองได้ 👍 โดยอาจไม่จำเป็นต้องทำตามทุกช่วงเวลาอย่างเคร่งครัด ⏰ แต่ให้เน้นที่หลักการสำคัญ เช่น การเตรียมตัวก่อนเทรด 🤓 การทบทวนหลังเทรด 🤔 และการดูแลสุขภาพ 🧘♀️ เพื่อสร้างสมดุล ⚖️ และเพิ่มประสิทธิภาพในการเทรดของเราค่ะ 💪

ขอให้ทุกท่านประสบความสำเร็จในการเทรดนะคะ! 💸🚀

#DayTrader #นักเทรดรายวัน #กิจวัตรประจำวัน #การลงทุน #เทรด #หุ้น #คริปโต #ตลาดหุ้น #แรงบันดาลใจ #พัฒนาตัวเอง #LinaEngword

-

@ 4ba8e86d:89d32de4

2025-04-21 02:12:19

@ 4ba8e86d:89d32de4

2025-04-21 02:12:19SISTEMA OPERACIONAL MÓVEIS

GrapheneOS : https://njump.me/nevent1qqs8t76evdgrg4qegdtyrq2rved63pr29wlqyj627n9tj4vlu66tqpqpzdmhxue69uhk7enxvd5xz6tw9ec82c30qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqppcqec9

CalyxOS : https://njump.me/nevent1qqsrm0lws2atln2kt3cqjacathnw0uj0jsxwklt37p7t380hl8mmstcpydmhxue69uhkummnw3ez6an9wf5kv6t9vsh8wetvd3hhyer9wghxuet59uq3vamnwvaz7tmwdaehgu3wvf3kstnwd9hx5cf0qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qgcwaehxw309aex2mrp0yhxxatjwfjkuapwveukjtcpzpmhxue69uhkummnw3ezumt0d5hszrnhwden5te0dehhxtnvdakz7qfywaehxw309ahx7um5wgh8ymm4dej8ymmrdd3xjarrda5kuetjwvhxxmmd9uq3uamnwvaz7tmwdaehgu3dv3jhvtnhv4kxcmmjv3jhytnwv46z7qghwaehxw309aex2mrp0yhxummnw3ezucnpdejz7qgewaehxw309ahx7um5wghxymmwva3x7mn89e3k7mf0qythwumn8ghj7cn5vvhxkmr9dejxz7n49e3k7mf0qyg8wumn8ghj7mn09eehgu3wvdez7smttdu

LineageOS : https://njump.me/nevent1qqsgw7sr36gaty48cf4snw0ezg5mg4atzhqayuge752esd469p26qfgpzdmhxue69uhhwmm59e6hg7r09ehkuef0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpnvm779

SISTEMA OPERACIONAL DESKTOP

Tails : https://njump.me/nevent1qqsf09ztvuu60g6xprazv2vxqqy5qlxjs4dkc9d36ta48q75cs9le4qpzemhxue69uhkummnw3ex2mrfw3jhxtn0wfnj7q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqz34ag5t

Qubes OS : https://njump.me/nevent1qqsp6jujgwl68uvurw0cw3hfhr40xq20sj7rl3z4yzwnhp9sdpa7augpzpmhxue69uhkummnw3ezumt0d5hsz9mhwden5te0wfjkccte9ehx7um5wghxyctwvshsz9thwden5te0dehhxarj9ehhsarj9ejx2a30qyg8wumn8ghj7mn09eehgu3wvdez7qg4waehxw309aex2mrp0yhxgctdw4eju6t09uqjxamnwvaz7tmwdaehgu3dwejhy6txd9jkgtnhv4kxcmmjv3jhytnwv46z7qgwwaehxw309ahx7uewd3hkctcpremhxue69uhkummnw3ez6er9wch8wetvd3hhyer9wghxuet59uj3ljr8

Kali linux : https://njump.me/nevent1qqswlav72xdvamuyp9xc38c6t7070l3n2uxu67ssmal2g7gv35nmvhspzpmhxue69uhkumewwd68ytnrwghsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqswt9rxe

Whonix : https://njump.me/nevent1qqs85gvejvzhk086lwh6edma7fv07p5c3wnwnxnzthwwntg2x6773egpydmhxue69uhkummnw3ez6an9wf5kv6t9vsh8wetvd3hhyer9wghxuet59uq3qamnwvaz7tmwdaehgu3wd4hk6tcpzemhxue69uhkummnw3ezucnrdqhxu6twdfsj7qfywaehxw309ahx7um5wgh8ymm4dej8ymmrdd3xjarrda5kuetjwvhxxmmd9uq3wamnwvaz7tmzw33ju6mvv4hxgct6w5hxxmmd9uq3qamnwvaz7tmwduh8xarj9e3hytcpzamhxue69uhhyetvv9ujumn0wd68ytnzv9hxgtcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszrnhwden5te0dehhxtnvdakz7qg7waehxw309ahx7um5wgkkgetk9emk2mrvdaexgetj9ehx2ap0sen9p6

Kodachi : https://njump.me/nevent1qqsf5zszgurpd0vwdznzk98hck294zygw0s8dah6fpd309ecpreqtrgpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszgmhwden5te0dehhxarj94mx2unfve5k2epwwajkcmr0wfjx2u3wdejhgtcpremhxue69uhkummnw3ez6er9wch8wetvd3hhyer9wghxuet59uq3qamnwvaz7tmwdaehgu3wd4hk6tcpzamhxue69uhkyarr9e4kcetwv3sh5afwvdhk6tcpzpmhxue69uhkumewwd68ytnrwghszfrhwden5te0dehhxarj9eex7atwv3ex7cmtvf5hgcm0d9hx2unn9e3k7mf0qyvhwumn8ghj7mn0wd68ytnzdahxwcn0denjucm0d5hszrnhwden5te0dehhxtnvdakz7qgkwaehxw309ahx7um5wghxycmg9ehxjmn2vyhsz9mhwden5te0wfjkccte9ehx7um5wghxyctwvshs94a4d5

PGP

Openkeychain : https://njump.me/nevent1qqs9qtjgsulp76t7jkquf8nk8txs2ftsr0qke6mjmsc2svtwfvswzyqpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqs36mp0w

Kleopatra : https://njump.me/nevent1qqspnevn932hdggvp4zam6mfyce0hmnxsp9wp8htpumq9vm3anq6etsppemhxue69uhkummn9ekx7mp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpuaeghp

Pgp : https://njump.me/nevent1qqsggek707qf3rzttextmgqhym6d4g479jdnlnj78j96y0ut0x9nemcpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyp9636rd9ktcjmwfxd7ru5qxjxyn6uch2uhas8utg8wa5hvf6vk7gqcyqqqqqqgptemhe

Como funciona o PGP? : https://njump.me/nevent1qqsz9r7azc8pkvfmkg2hv0nufaexjtnvga0yl85x9hu7ptpg20gxxpspremhxue69uhkummnw3ez6ur4vgh8wetvd3hhyer9wghxuet59upzqjagapkjm9ufdhynxlp72qrfrzfawvt4wt7cr795rhw6tkyaxt0yqvzqqqqqqy259fhs

Por que eu escrevi PGP. - Philip Zimmermann.

https://njump.me/nevent1qqsvysn94gm8prxn3jw04r0xwc6sngkskg756z48jsyrmqssvxtm7ncpzamhxue69uhhyetvv9ujumn0wd68ytnzv9hxgtchzxnad

VPN

Vpn : https://njump.me/nevent1qqs27ltgsr6mh4ffpseexz6s37355df3zsur709d0s89u2nugpcygsspzpmhxue69uhkummnw3ezumt0d5hsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqshzu2fk

InviZible Pro : https://njump.me/nevent1qqsvyevf2vld23a3xrpvarc72ndpcmfvc3lc45jej0j5kcsg36jq53cpz3mhxue69uhhyetvv9ujuerpd46hxtnfdupzqjagapkjm9ufdhynxlp72qrfrzfawvt4wt7cr795rhw6tkyaxt0yqvzqqqqqqy33y5l4

Orbot: https://njump.me/nevent1qqsxswkyt6pe34egxp9w70cy83h40ururj6m9sxjdmfass4cjm4495stft593

I2P

i2p : https://njump.me/nevent1qqsvnj8n983r4knwjmnkfyum242q4c0cnd338l4z8p0m6xsmx89mxkslx0pgg

Entendendo e usando a rede I2P : https://njump.me/nevent1qqsxchp5ycpatjf5s4ag25jkawmw6kkf64vl43vnprxdcwrpnms9qkcppemhxue69uhkummn9ekx7mp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpvht4mn

Criando e acessando sua conta Email na I2P : https://njump.me/nevent1qqs9v9dz897kh8e5lfar0dl7ljltf2fpdathsn3dkdsq7wg4ksr8xfgpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpw8mzum

APLICATIVO 2FA

Aegis Authenticator : https://njump.me/nevent1qqsfttdwcn9equlrmtf9n6wee7lqntppzm03pzdcj4cdnxel3pz44zspz4mhxue69uhhyetvv9ujumn0wd68ytnzvuhsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqscvtydq

YubiKey : https://njump.me/nevent1qqstsnn69y4sf4330n7039zxm7wza3ch7sn6plhzmd57w6j9jssavtspvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzueyvgt

GERENCIADOR DE SENHAS

KeepassDX: https://njump.me/nevent1qqswc850dr4ujvxnmpx75jauflf4arc93pqsty5pv8hxdm7lcw8ee8qpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpe0492n

Birwaden: https://njump.me/nevent1qqs0j5x9guk2v6xumhwqmftmcz736m9nm9wzacqwjarxmh8k4xdyzwgpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpwfe2kc

KeePassXC: https://njump.me/nevent1qqsgftcrd8eau7tzr2p9lecuaf7z8mx5jl9w2k66ae3lzkw5wqcy5pcl2achp

CHAT MENSAGEM

SimpleXchat : https://njump.me/nevent1qqsds5xselnnu0dyy0j49peuun72snxcgn3u55d2320n37rja9gk8lgzyp9636rd9ktcjmwfxd7ru5qxjxyn6uch2uhas8utg8wa5hvf6vk7gqcyqqqqqqgmcmj7c

Briar : https://njump.me/nevent1qqs8rrtgvjr499hreugetrl7adkhsj2zextyfsukq5aa7wxthrgcqcg05n434

Element Messenger : https://njump.me/nevent1qqsq05snlqtxm5cpzkshlf8n5d5rj9383vjytkvqp5gta37hpuwt4mqyccee6

Pidgin : https://njump.me/nevent1qqsz7kngycyx7meckx53xk8ahk98jkh400usrvykh480xa4ct9zlx2c2ywvx3

E-MAIL

Thunderbird: https://njump.me/nevent1qqspq64gg0nw7t60zsvea5eykgrm43paz845e4jn74muw5qzdvve7uqrkwtjh

ProtonMail : https://njump.me/nevent1qqs908glhk68e7ms8zqtlsqd00wu3prnpt08dwre26hd6e5fhqdw99cppemhxue69uhkummn9ekx7mp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpeyhg4z

Tutonota : https://njump.me/nevent1qqswtzh9zjxfey644qy4jsdh9465qcqd2wefx0jxa54gdckxjvkrrmqpz4mhxue69uhhyetvv9ujumt0wd68ytnsw43qygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqs5hzhkv

k-9 mail : https://njump.me/nevent1qqs200g5a603y7utjgjk320r3srurrc4r66nv93mcg0x9umrw52ku5gpr3mhxue69uhkummnw3ezuumhd9ehxtt9de5kwmtp9e3kstczyp9636rd9ktcjmwfxd7ru5qxjxyn6uch2uhas8utg8wa5hvf6vk7gqcyqqqqqqgacflak

E-MAIL-ALIÁS

Simplelogin : https://njump.me/nevent1qqsvhz5pxqpqzr2ptanqyqgsjr50v7u9lc083fvdnglhrv36rnceppcppemhxue69uhkummn9ekx7mp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqp9gsr7m

AnonAddy : https://njump.me/nevent1qqs9mcth70mkq2z25ws634qfn7vx2mlva3tkllayxergw0s7p8d3ggcpzpmhxue69uhkummnw3ezumt0d5hsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqs6mawe3

NAVEGADOR

Navegador Tor : https://njump.me/nevent1qqs06qfxy7wzqmk76l5d8vwyg6mvcye864xla5up52fy5sptcdy39lspzemhxue69uhkummnw3ezuerpw3sju6rpw4ej7q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzdp0urw

Mullvap Browser : https://njump.me/nevent1qqs2vsgc3wk09wdspv2mezltgg7nfdg97g0a0m5cmvkvr4nrfxluzfcpzdmhxue69uhhwmm59e6hg7r09ehkuef0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpj8h6fe

LibreWolf : https://njump.me/nevent1qqswv05mlmkcuvwhe8x3u5f0kgwzug7n2ltm68fr3j06xy9qalxwq2cpzemhxue69uhkummnw3ex2mrfw3jhxtn0wfnj7q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzuv2hxr

Cromite : https://njump.me/nevent1qqs2ut83arlu735xp8jf87w5m3vykl4lv5nwkhldkqwu3l86khzzy4cpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqs3dplt7

BUSCADORES

Searx : https://njump.me/nevent1qqsxyzpvgzx00n50nrlgctmy497vkm2cm8dd5pdp7fmw6uh8xnxdmaspr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqp23z7ax

APP-STORE

Obtainium : https://njump.me/nevent1qqstd8kzc5w3t2v6dgf36z0qrruufzfgnc53rj88zcjgsagj5c5k4rgpz3mhxue69uhhyetvv9ujuerpd46hxtnfdupzqjagapkjm9ufdhynxlp72qrfrzfawvt4wt7cr795rhw6tkyaxt0yqvzqqqqqqyarmca3

F-Droid : https://njump.me/nevent1qqst4kry49cc9g3g8s5gdnpgyk3gjte079jdnv43f0x4e85cjkxzjesymzuu4

Droid-ify : https://njump.me/nevent1qqsrr8yu9luq0gud902erdh8gw2lfunpe93uc2u6g8rh9ep7wt3v4sgpzpmhxue69uhkummnw3ezumt0d5hsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqsfzu9vk

Aurora Store : https://njump.me/nevent1qqsy69kcaf0zkcg0qnu90mtk46ly3p2jplgpzgk62wzspjqjft4fpjgpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzrpmsjy

RSS

Feeder : https://njump.me/nevent1qqsy29aeggpkmrc7t3c7y7ldgda7pszl7c8hh9zux80gjzrfvlhfhwqpp4mhxue69uhkummn9ekx7mqzyp9636rd9ktcjmwfxd7ru5qxjxyn6uch2uhas8utg8wa5hvf6vk7gqcyqqqqqqgsvzzjy

VIDEOO CONFERENCIA

Jitsi meet : https://njump.me/nevent1qqswphw67hr6qmt2fpugcj77jrk7qkfdrszum7vw7n2cu6cx4r6sh4cgkderr

TECLADOS

HeliBoard : https://njump.me/nevent1qqsyqpc4d28rje03dcvshv4xserftahhpeylu2ez2jutdxwds4e8syspz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqsr8mel5

OpenBoard : https://njump.me/nevent1qqsf7zqkup03yysy67y43nj48q53sr6yym38es655fh9fp6nxpl7rqspzpmhxue69uhkumewwd68ytnrwghsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqswcvh3r

FlorisBoard : https://njump.me/nevent1qqsf7zqkup03yysy67y43nj48q53sr6yym38es655fh9fp6nxpl7rqspzpmhxue69uhkumewwd68ytnrwghsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqswcvh3r

MAPAS

Osmand : https://njump.me/nevent1qqsxryp2ywj64az7n5p6jq5tn3tx5jv05te48dtmmt3lf94ydtgy4fgpzpmhxue69uhkumewwd68ytnrwghsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqs54nwpj

Organic maps : https://njump.me/nevent1qqstrecuuzkw0dyusxdq7cuwju0ftskl7anx978s5dyn4pnldrkckzqpr4mhxue69uhkummnw3ezumtp0p5k6ctrd96xzer9dshx7un8qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpl8z3kk

TRADUÇÃO

LibreTranslate : https://njump.me/nevent1qqs953g3rhf0m8jh59204uskzz56em9xdrjkelv4wnkr07huk20442cpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzeqsx40

REMOÇÃO DOS METADADOS

Scrambled Exif : https://njump.me/nevent1qqs2658t702xv66p000y4mlhnvadmdxwzzfzcjkjf7kedrclr3ej7aspyfmhxue69uhk6atvw35hqmr90pjhytngw4eh5mmwv4nhjtnhdaexcep0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpguu0wh

ESTEGANOGRAFIA

PixelKnot: https://njump.me/nevent1qqsrh0yh9mg0lx86t5wcmhh97wm6n4v0radh6sd0554ugn354wqdj8gpz3mhxue69uhhyetvv9ujuerpd46hxtnfdupzqjagapkjm9ufdhynxlp72qrfrzfawvt4wt7cr795rhw6tkyaxt0yqvzqqqqqqyuvfqdp

PERFIL DE TRABALHO

Shelter : https://njump.me/nevent1qqspv9xxkmfp40cxgjuyfsyczndzmpnl83e7gugm7480mp9zhv50wkqpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzdnu59c

PDF

MuPDF : https://njump.me/nevent1qqspn5lhe0dteys6npsrntmv2g470st8kh8p7hxxgmymqa95ejvxvfcpzpmhxue69uhkumewwd68ytnrwghsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqs4hvhvj

Librera Reader : https://njump.me/nevent1qqsg60flpuf00sash48fexvwxkly2j5z9wjvjrzt883t3eqng293f3cpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqz39tt3n

QR-Code

Binary Eye : https://njump.me/nevent1qqsz4n0uxxx3q5m0r42n9key3hchtwyp73hgh8l958rtmae5u2khgpgpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzdmn4wp

Climático

Breezy Weather : https://njump.me/nevent1qqs9hjz5cz0y4am3kj33xn536uq85ydva775eqrml52mtnnpe898rzspzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyp9636rd9ktcjmwfxd7ru5qxjxyn6uch2uhas8utg8wa5hvf6vk7gqcyqqqqqqgpd3tu8

ENCRYPTS

Cryptomator : https://njump.me/nevent1qqsvchvnw779m20583llgg5nlu6ph5psewetlczfac5vgw83ydmfndspzpmhxue69uhkumewwd68ytnrwghsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqsx7ppw9

VeraCrypt : https://njump.me/nevent1qqsf6wzedsnrgq6hjk5c4jj66dxnplqwc4ygr46l8z3gfh38q2fdlwgm65ej3

EXTENSÕES

uBlock Origin : https://njump.me/nevent1qqswaa666lcj2c4nhnea8u4agjtu4l8q89xjln0yrngj7ssh72ntwzql8ssdj

Snowflake : https://njump.me/nevent1qqs0ws74zlt8uced3p2vee9td8x7vln2mkacp8szdufvs2ed94ctnwchce008

CLOUD

Nextcloud : https://njump.me/nevent1qqs2utg5z9htegdtrnllreuhypkk2026x8a0xdsmfczg9wdl8rgrcgg9nhgnm

NOTEPAD

Joplin : https://njump.me/nevent1qqsz2a0laecpelsznser3xd0jfa6ch2vpxtkx6vm6qg24e78xttpk0cpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0qgsyh28gd5ke0ztdeyehc0jsq6gcj0tnzatjlkql3dqamkja38fjmeqrqsqqqqqpdu0hft

Standard Notes : https://njump.me/nevent1qqsv3596kz3qung5v23cjc4cpq7rqxg08y36rmzgcrvw5whtme83y3s7tng6r

MÚSICA

RiMusic : https://njump.me/nevent1qqsv3genqav2tfjllp86ust4umxm8tr2wd9kq8x7vrjq6ssp363mn0gpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyp9636rd9ktcjmwfxd7ru5qxjxyn6uch2uhas8utg8wa5hvf6vk7gqcyqqqqqqg42353n

ViMusic : https://njump.me/nevent1qqswx78559l4jsxsrygd8kj32sch4qu57stxq0z6twwl450vp39pdqqpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzjg863j

PODCAST

AntennaPod : https://njump.me/nevent1qqsp4nh7k4a6zymfwqqdlxuz8ua6kdhvgeeh3uxf2c9rtp9u3e9ku8qnr8lmy

VISUALIZAR VIDEO

VLC : https://njump.me/nevent1qqs0lz56wtlr2eye4ajs2gzn2r0dscw4y66wezhx0mue6dffth8zugcl9laky

YOUTUBE

NewPipe : https://njump.me/nevent1qqsdg06qpcjdnlvgm4xzqdap0dgjrkjewhmh4j3v4mxdl4rjh8768mgdw9uln

FreeTube : https://njump.me/nevent1qqsz6y6z7ze5gs56s8seaws8v6m6j2zu0pxa955dhq3ythmexak38mcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqs5lkjvv

LibreTube : https://snort.social/e/nevent1qqstmd5m6wrdvn4gxf8xyhrwnlyaxmr89c9kjddvnvux6603f84t3fqpz4mhxue69uhhyetvv9ujumt0wd68ytnsw43qygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqsswwznc

COMPARTILHAMENTO DE ARQUIVOS

OnionShare : https://njump.me/nevent1qqsr0a4ml5nu6ud5k9yzyawcd9arznnwkrc27dzzc95q6r50xmdff6qpydmhxue69uhkummnw3ez6an9wf5kv6t9vsh8wetvd3hhyer9wghxuet59uq3uamnwvaz7tmwdaehgu3dv3jhvtnhv4kxcmmjv3jhytnwv46z7qgswaehxw309ahx7tnnw3ezucmj9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcpzamhxue69uhkyarr9e4kcetwv3sh5afwvdhk6tcpzemhxue69uhkummnw3ezucnrdqhxu6twdfsj7qgswaehxw309ahx7um5wghx6mmd9uqjgamnwvaz7tmwdaehgu3wwfhh2mnywfhkx6mzd96xxmmfdejhyuewvdhk6tcppemhxue69uhkummn9ekx7mp0qythwumn8ghj7un9d3shjtnwdaehgu3wvfskuep0qyv8wumn8ghj7un9d3shjtnrw4e8yetwwshxv7tf9ut7qurt

Localsend : https://njump.me/nevent1qqsp8ldjhrxm09cvvcak20hrc0g8qju9f67pw7rxr2y3euyggw9284gpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzuyghqr

Wallet Bitcoin

Ashigaru Wallet : https://njump.me/nevent1qqstx9fz8kf24wgl26un8usxwsqjvuec9f8q392llmga75tw0kfarfcpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtczyp9636rd9ktcjmwfxd7ru5qxjxyn6uch2uhas8utg8wa5hvf6vk7gqcyqqqqqqgvfsrqp

Samourai Wallet : https://njump.me/nevent1qqstcvjmz39rmrnrv7t5cl6p3x7pzj6jsspyh4s4vcwd2lugmre04ecpr9mhxue69uhkummnw3ezucn0denkymmwvuhxxmmd9upzqjagapkjm9ufdhynxlp72qrfrzfawvt4wt7cr795rhw6tkyaxt0yqvzqqqqqqy3rg4qs

CÂMERA

opencamera : https://njump.me/nevent1qqs25glp6dh0crrjutxrgdjlnx9gtqpjtrkg29hlf7382aeyjd77jlqpzpmhxue69uhkumewwd68ytnrwghsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqssxcvgc

OFFICE

Collabora Office : https://njump.me/nevent1qqs8yn4ys6adpmeu3edmf580jhc3wluvlf823cc4ft4h0uqmfzdf99qpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqsj40uss

TEXTOS

O manifesto de um Cypherpunk : https://njump.me/nevent1qqsd7hdlg6galn5mcuv3pm3ryfjxc4tkyph0cfqqe4du4dr4z8amqyspvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqzal0efa

Operations security ( OPSEC) : https://snort.social/e/nevent1qqsp323havh3y9nxzd4qmm60hw87tm9gjns0mtzg8y309uf9mv85cqcpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqz8ej9l7

O MANIFESTO CRIPTOANARQUISTA Timothy C. May – 1992. : https://njump.me/nevent1qqspp480wtyx2zhtwpu5gptrl8duv9rvq3mug85mp4d54qzywk3zq9gpvemhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0dec82c330g6x6dm8ddmxzdne0pnhverevdkxxdm6wqc8v735w3snquejvsuk56pcvuurxaesxd68qdtkv3nrx6m6v3ehsctwvym8q0mzwfhkzerrv9ehg0t5wf6k2q3qfw5wsmfdj7ykmjfn0sl9qp533y7hx96h9lvplz6pmhd9mzwn9hjqxpqqqqqqz5wq496

Declaração de independência do ciberespaço

- John Perry Barlow - 1996 : https://njump.me/nevent1qqs2njsy44n6p07mhgt2tnragvchasv386nf20ua5wklxqpttf6mzuqpzpmhxue69uhkummnw3ezumt0d5hsygzt4r5x6tvh39kujvmu8egqdyvf84e3w4e0mq0ckswamfwcn5eduspsgqqqqqqsukg4hr

The Cyphernomicon: Criptografia, Dinheiro Digital e o Futuro da Privacidade. escrito por Timothy C. May -Publicado em 1994. :

Livro completo em PDF no Github PrivacyOpenSource.

https://github.com/Alexemidio/PrivacyOpenSource/raw/main/Livros/THE%20CYPHERNOMICON%20.pdf Share

-

@ 65f03c16:f77e9d92

2025-04-20 08:33:37

@ 65f03c16:f77e9d92

2025-04-20 08:33:37is a game changer for traders. It blends chaos theory & market psychology to decode price action. Learn to spot order in market noise using fractals & momentum, teaches the Alligator indicator to ride trends & avoid chop. His 5-stage approach, from novice to expert, builds discipline & edge. Perfect for futures or stocks, It’s practical, not abstract. Williams’ 40+ yrs of trading shine through, with tools like Elliott Wave & nonlinear dynamics

recommended !

-

@ 9223d2fa:b57e3de7

2025-04-15 15:35:00

@ 9223d2fa:b57e3de7

2025-04-15 15:35:004,220 steps

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.