-

@ 57c631a3:07529a8e

2025-06-18 06:30:47

@ 57c631a3:07529a8e

2025-06-18 06:30:47Introducing: Reader Stories — A New Page for Your Journey

https://connect-test.layer3.press/articles/1acb1809-49c3-4559-902b-01909d49c50f

-

@ eb0157af:77ab6c55

2025-06-18 00:02:24

@ eb0157af:77ab6c55

2025-06-18 00:02:24A new study by Kraken reveals how cryptocurrency investors perceive security as the main challenge in self-managing their digital assets.

According to The Block, a recent survey conducted by crypto exchange Kraken found that nearly half of respondents consider themselves the primary risk factor for their own crypto security. The research, which surveyed 789 participants, highlights that 48% of users see their own actions as the greatest threat to their investments in digital assets, surpassing concerns about external theft or fraud.

Kraken’s report underlines how personal responsibility in security management forces users to take full control of their digital funds. However, the study suggests that this autonomy can also become a source of anxiety for many investors.

Nick Percoco, Chief Security Officer at Kraken, commented on the findings, noting that “a lack of confidence in personal crypto security is capping the growth of the industry.” According to Percoco, unlocking the full potential of cryptocurrencies will require users to embrace self-custody and consistently invest in strong security habits.

Technologies to strengthen security

Despite the concerns highlighted in the study, 31% of participants expressed optimism about future technologies that could improve crypto security. Among the most promising solutions identified:

- advanced biometric systems for user authentication;

- multi-factor authentication to secure wallet access;

- AI-based fraud detection systems to prevent attacks.

Data and case studies

Kraken’s research emerges in a context where security threats remain a pressing reality. FBI data shows that in 2024, nearly 150,000 reports of crypto-related internet fraud resulted in $9.3 billion in losses. Older users, particularly those over 60, proved especially vulnerable, accounting for $3 billion in crypto-related financial fraud losses on their own.

The post Kraken study: 48% of users fear themselves in managing and securing their funds appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-17 23:02:57

@ eb0157af:77ab6c55

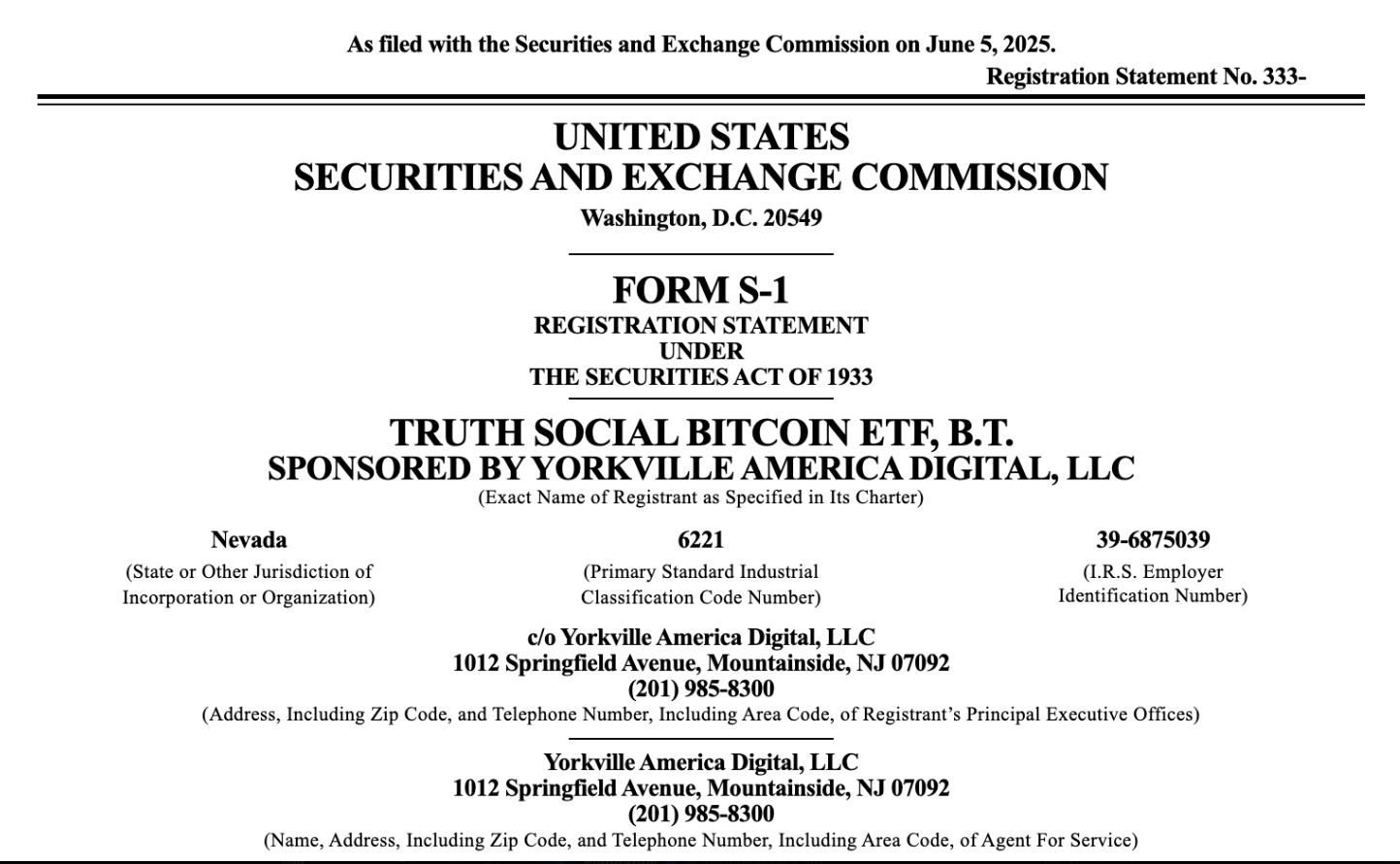

2025-06-17 23:02:57Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-17 22:03:15

@ eb0157af:77ab6c55

2025-06-17 22:03:15The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ dfa02707:41ca50e3

2025-06-17 21:01:55

@ dfa02707:41ca50e3

2025-06-17 21:01:55- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 31a4605e:cf043959

2025-06-17 17:51:52

@ 31a4605e:cf043959

2025-06-17 17:51:52Com a crescente digitalização do dinheiro, os governos de vários países começaram a desenvolver moedas digitais de banco central (CBDCs - Central Bank Digital Currencies) como resposta à popularização de Bitcoin. Enquanto Bitcoin representa um sistema financeiro descentralizado e resistente à censura, as CBDCs são versões digitais das moedas fiduciárias, controladas diretamente pelos bancos centrais. Essa concorrência pode moldar o futuro do dinheiro e definir o equilíbrio entre liberdade financeira e controlo estatal.

Diferenças fundamentais entre Bitcoin e CBDCs

Bitcoin e as CBDCs diferem em praticamente todos os aspetos fundamentais:

Centralização vs. Descentralização: Bitcoin opera numa rede descentralizada, onde nenhum governo ou entidade pode alterar as regras ou censurar transações. Já as CBDCs são emitidas e controladas pelos bancos centrais, permitindo um maior controlo sobre a circulação e utilização do dinheiro.

Oferta limitada vs. Inflação controlada: Bitcoin tem uma oferta fixa de 21 milhões de unidades, tornando-se um ativo escasso e deflacionário. As CBDCs, por outro lado, podem ser criadas sem limites, como acontece com as moedas fiduciárias tradicionais, sujeitas a políticas monetárias inflacionárias.

Privacidade vs. Monitorização: Bitcoin permite transações pseudónimas, garantindo um certo nível de privacidade financeira. As CBDCs, no entanto, podem ser programadas para permitir o rastreamento total de cada transação, facilitando a supervisão governamental e, potencialmente, o controlo sobre o que os cidadãos podem ou não gastar.

Resistência à censura vs. Controlo estatal: Bitcoin permite que qualquer pessoa realize transações sem depender de aprovação de terceiros. As CBDCs, por serem centralizadas, podem ser usadas pelos governos para restringir transações indesejadas ou mesmo confiscar fundos com um simples comando digital.

O que os governos pretendem com as CBDCs?

A introdução das CBDCs tem sido vendida com argumentos como:

Maior eficiência nas transações financeiras, eliminando intermediários e reduzindo custos bancários.

Facilidade na implementação de políticas económicas, como estímulos diretos à população ou tributação automatizada.

Combate a atividades ilegais, dado que as transações podem ser rastreadas em tempo real.

No entanto, muitas destas justificações levantam preocupações sobre a perda de privacidade financeira e o aumento do poder dos governos sobre o sistema monetário.

Bitcoin como alternativa às CBDCs

A ascensão das CBDCs pode fortalecer a posição de Bitcoin como alternativa de dinheiro verdadeiramente livre. À medida que os cidadãos percebem os riscos de um sistema financeiro 100% controlado pelo Estado, a procura por um ativo descentralizado e resistente à censura pode crescer.

Proteção contra o controlo estatal: Bitcoin permite que os utilizadores mantenham total soberania sobre o seu dinheiro, sem o risco de bloqueios arbitrários ou confiscações.

Preservação da privacidade financeira: Ao contrário das CBDCs, que podem monitorizar todas as transações, Bitcoin oferece um grau de anonimato que protege os indivíduos da vigilância excessiva.

Reserva de valor contra a inflação: Enquanto os governos podem emitir CBDCs indefinidamente, Bitcoin mantém a sua escassez garantida, tornando-se um refúgio contra políticas monetárias irresponsáveis.

Resumindo, a competição entre Bitcoin e as CBDCs será uma das maiores batalhas financeiras do futuro. Enquanto os governos tentam consolidar o seu controlo através de moedas digitais centralizadas, Bitcoin continua a ser a principal alternativa para aqueles que procuram independência financeira e proteção contra a vigilância estatal. A escolha entre um sistema financeiro livre e um sistema monitorizado e controlado poderá definir o rumo da economia digital nas próximas décadas.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 17:49:53

@ 31a4605e:cf043959

2025-06-17 17:49:53Desde a sua criação, Bitcoin tem sido um ativo revolucionário, desafiando o sistema financeiro tradicional e propondo uma nova forma de dinheiro descentralizado. No entanto, o seu futuro ainda é incerto e gera intensos debates. Entre os cenários possíveis, dois extremos destacam-se: a hiperbitcoinização, onde Bitcoin se torna a moeda dominante na economia global, ou a obsolescência, caso a rede perca relevância e seja substituída por outras soluções.

Hiperbitcoinização: o mundo adota Bitcoin como padrão monetário

Perda de confiança nas moedas fiduciárias: Com a impressão excessiva de dinheiro por bancos centrais, muitas economias enfrentam inflação descontrolada. Bitcoin, com a sua oferta limitada de 21 milhões de unidades, apresenta-se como uma alternativa mais confiável.

Adoção crescente por empresas e governos: Alguns países já começaram a integrar Bitcoin na sua economia, aceitando-o para pagamentos e reserva de valor. Se essa tendência continuar, a legitimidade de Bitcoin como moeda global aumentará.

Facilidade de transações globais: Bitcoin permite transferências internacionais rápidas e baratas, eliminando a necessidade de intermediários financeiros e reduzindo custos operacionais.

Avanços tecnológicos: Melhorias na escalabilidade, como a Lightning Network, podem tornar Bitcoin mais eficiente para uso diário, facilitando sua adoção em massa.

Se a hiperbitcoinização acontecer, o mundo pode testemunhar uma mudança radical no sistema financeiro, com maior descentralização, resistência à censura e uma economia baseada em dinheiro sólido e previsível.

Obsolescência: Bitcoin perde relevância e É substituído

Regulações governamentais restritivas: Se grandes potências económicas impuserem regulações severas sobre Bitcoin, a adoção pode ser dificultada, reduzindo sua utilidade.

Falhas tecnológicas ou falta de inovação: Apesar da sua segurança e descentralização, Bitcoin pode enfrentar dificuldades para escalar de forma eficiente. Se soluções melhores surgirem e forem amplamente aceites, Bitcoin pode perder a sua posição de liderança.

Concorrência com alternativas mais rápidas e eficientes: Se outras formas de dinheiro digital conseguirem superar Bitcoin em termos de escalabilidade e usabilidade, a rede pode ver a sua adoção diminuir.

Falta de incentivos para os mineradores: Como a emissão de novos Bitcoins diminui a cada halving, os mineradores dependerão cada vez mais das taxas de transação. Se essas taxas não forem suficientes para sustentar a segurança da rede, pode haver um risco para a sua viabilidade a longo prazo.

Resumindo, o futuro do Bitcoin pode seguir diferentes caminhos, dependendo de fatores como inovação, adoção global e resistência a desafios externos. A hiperbitcoinização representaria uma revolução económica, com um sistema monetário descentralizado e resistente à inflação. No entanto, a obsolescência continua a ser um risco, caso a rede não consiga adaptar-se às exigências futuras. Independentemente do desfecho, Bitcoin já deixou a sua marca na história financeira, abrindo caminho para uma nova era de dinheiro digital e liberdade económica.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 4ba8e86d:89d32de4

2025-06-17 17:47:48

@ 4ba8e86d:89d32de4

2025-06-17 17:47:48O protocolo Matrix é um sistema de comunicação descentralizado de código aberto que fornece uma plataforma para mensageiros descentralizados. O Element foi lançado em 2014 como uma implementação do protocolo Matrix, originalmente conhecido como Riot.im , A ideia do Element nasceu quando Matthew Hodgson e Amandine Le Pape, dois desenvolvedores de software, decidiram criar uma plataforma de comunicação aberta e segura, que permitisse aos usuários terem total controle sobre suas informações. Eles acreditavam que a internet deveria ser um lugar onde as pessoas pudessem se comunicar livremente, sem se preocupar com a privacidade de suas informações.

O Element é um aplicativo de chat gratuito e de código aberto disponível em várias plataformas, incluindo desktop, web e aplicativos móveis. Ele oferece criptografia de ponta a ponta, o que significa que as mensagens são protegidas e só podem ser lidas pelo remetente e pelo destinatário. Além disso, o Element é descentralizado, o que significa que ele não é controlado por uma única entidade, mas sim por uma rede global de servidores.

O Element é amplamente utilizado por indivíduos e empresas que desejam ter uma comunicação segura e privada. É frequentemente usado por equipes de projetos, organizações sem fins lucrativos e grupos ativistas que precisam compartilhar informações confidenciais e se comunicar de forma segura. O Element também é conhecido por seu recurso de salas públicas, que permite que os usuários se juntem a grupos de discussão sobre vários tópicos de interesse.

Uma das principais vantagens do Element é sua arquitetura descentralizada. Ao contrário das plataformas de mensagens convencionais que centralizam os dados em seus próprios servidores, o Element utiliza uma rede descentralizada, distribuindo as informações em diversos servidores espalhados pelo mundo. Isso significa que os dados dos usuários são menos suscetíveis a ataques cibernéticos e invasões, já que não são centralizados em um único ponto vulnerável.

Para usar o Element, normalmente os usuários precisam se registrar em um servidor Matrix. Existem várias opções disponíveis, incluindo servidores públicos e privados. No entanto, outra opção é criar um servidor próprio para usar o Element.

O Element também utiliza criptografia de ponta a ponta para proteger as mensagens e arquivos trocados entre os usuários. Isso significa que apenas o remetente e o destinatário das mensagens podem ler o conteúdo, garantindo que as informações permaneçam seguras e privadas.

Outra vantagem do Element é sua ampla variedade de recursos, incluindo videochamadas criptografadas, compartilhamento de tela e integração com outros serviços, como calendários e aplicativos de produtividade. Isso torna o Element uma plataforma completa de comunicação e colaboração, adequada para uso pessoal e empresarial.

O Element também é fácil de usar e possui uma interface intuitiva e personalizável. Os usuários podem personalizar a aparência do aplicativo e acessar diferentes configurações e recursos com apenas alguns cliques.

https://element.io/

https://github.com/vector-im/element-android

-

@ 31a4605e:cf043959

2025-06-17 17:46:15

@ 31a4605e:cf043959

2025-06-17 17:46:15Desde a sua criação, Bitcoin tem sido um marco na revolução do dinheiro digital, mas a sua evolução não parou no conceito inicial de transações descentralizadas. Ao longo dos anos, novas soluções tecnológicas foram desenvolvidas para expandir as suas capacidades, tornando-o mais eficiente e versátil. Entre essas inovações, destacam-se os smart contracts e a Lightning Network, que permitem aumentar a funcionalidade e escalabilidade da rede, garantindo um sistema mais rápido, barato e acessível.

Smart contracts no Bitcoin

Os smart contracts (contratos inteligentes) são programas que executam automaticamente determinadas ações quando certas condições pré-definidas são cumpridas. Embora o conceito seja mais comummente associado a outras redes, Bitcoin também suporta contratos inteligentes, especialmente através de atualizações como o Taproot.

Os smart contracts em Bitcoin permitem funcionalidades como:

Pagamentos condicionais: Transações que só são concluídas se determinadas regras forem cumpridas, como assinaturas múltiplas ou prazos específicos.

Gestão avançada de fundos: Utilização de carteiras multi-assinatura, onde diferentes partes precisam aprovar uma transação antes de ser processada.

Maior privacidade: Com a atualização Taproot, os smart contracts podem ser mais eficientes e indistinguíveis das transações normais, melhorando a privacidade da rede.

Embora os contratos inteligentes em Bitcoin sejam mais simples do que em outras redes, essa simplicidade é uma vantagem, pois mantém a segurança e robustez da rede, evitando vulnerabilidades complexas.

Lightning Network: escalabilidade e transações instantâneas

Um dos maiores desafios enfrentados por Bitcoin é a escalabilidade. Como a rede original foi desenhada para priorizar segurança e descentralização, a velocidade das transações pode ser limitada em períodos de alta procura. Para resolver esse problema, foi criada a Lightning Network, uma solução de segunda camada que permite transações quase instantâneas e com taxas extremamente baixas.

A Lightning Network funciona criando canais de pagamento entre utilizadores, permitindo que realizem várias transações fora da blockchain ou timechain principal de Bitcoin, registando apenas o saldo final na rede principal. Algumas vantagens incluem:

Velocidade: Transações são concluídas em milissegundos, tornando Bitcoin mais adequado para pagamentos diários.

Taxas baixas: Como as transações ocorrem fora da blockchain ou timechain principal, as taxas são mínimas, permitindo microtransações viáveis.

Descongestionamento da rede: Ao transferir grande parte das transações para a Lightning Network, a rede principal de Bitcoin torna-se mais eficiente e menos sobrecarregada.

Resumindo, o Bitcoin continua a evoluir tecnologicamente para se adaptar às necessidades de um sistema financeiro global. Os smart contracts aumentam as suas funcionalidades, permitindo maior flexibilidade e segurança nas transações. A Lightning Network melhora a escalabilidade, tornando Bitcoin mais rápido e eficiente para pagamentos do dia a dia. Com estas inovações, Bitcoin mantém-se na vanguarda da revolução financeira, demonstrando que, apesar das limitações iniciais, continua a adaptar-se e a crescer como um sistema monetário verdadeiramente descentralizado e global.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 17:35:10

@ 31a4605e:cf043959

2025-06-17 17:35:10Desde a sua criação em 2008, Bitcoin tem sido visto como um desafio direto ao sistema bancário tradicional. Desenvolvido como uma alternativa descentralizada ao dinheiro fiduciário, Bitcoin oferece uma forma de armazenar e transferir valor sem depender de bancos, governos ou outras instituições financeiras. Essa característica faz com que seja considerado um símbolo de resistência contra um sistema financeiro que, ao longo do tempo, tem sido marcado por crises, manipulações e restrições impostas aos cidadãos.

Crise financeira de 2008 e o nascimento de Bitcoin

Bitcoin surgiu em resposta à crise financeira de 2008, um colapso que revelou as falhas do sistema bancário global. Bancos centrais imprimiram grandes quantidades de dinheiro para resgatar instituições financeiras irresponsáveis, enquanto milhões de pessoas perderam as suas casas, poupanças e empregos. Nesse contexto, Bitcoin foi criado como um sistema financeiro alternativo, onde não existe uma entidade central com o poder de manipular a economia em benefício próprio.

No primeiro bloco da blockchain ou timechain de Bitcoin, Satoshi Nakamoto incluiu a seguinte mensagem:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

Essa frase, retirada de uma manchete de jornal da época, simboliza a intenção de Bitcoin de oferecer um sistema financeiro fora do controlo dos bancos e dos governos.

Principais razões pelas quais Bitcoin resiste ao sistema bancário

Descentralização: Ao contrário do dinheiro emitido por bancos centrais, Bitcoin não pode ser criado ou controlado por nenhuma entidade específica. A rede de utilizadores valida as transações de forma transparente e independente.

Oferta limitada: Enquanto os bancos centrais podem imprimir dinheiro sem limites, causando inflação e desvalorização da moeda, Bitcoin tem uma oferta fixa de 21 milhões de unidades, tornando-o resistente à depreciação artificial.

Impossibilidade de censura: Bancos podem bloquear contas e impedir transações a qualquer momento. Com Bitcoin, qualquer pessoa pode enviar e receber fundos sem pedir permissão a terceiros.

Autocustódia: Em vez de confiar os seus fundos a um banco, os utilizadores de Bitcoin podem armazenar as suas próprias moedas, sem risco de congelamento de contas ou falências bancárias.

Conflito entre bancos e Bitcoin

Ataques mediáticos: Grandes instituições financeiras frequentemente classificam Bitcoin como arriscado, volátil ou inútil, tentando desincentivar a sua adoção.

Regulação e repressão: Alguns governos, influenciados pelo setor bancário, têm criado restrições ao uso de Bitcoin, dificultando a sua compra e venda.

Criação de alternativas centralizadas: Muitos bancos centrais estão a desenvolver moedas digitais (CBDCs) que mantêm o controlo do dinheiro digital, mas sem oferecer a liberdade e a descentralização de Bitcoin.

Resumindo, o Bitcoin não é apenas uma moeda digital, mas um movimento de resistência contra um sistema financeiro que falhou repetidamente em proteger o cidadão comum. Ao oferecer uma alternativa descentralizada, transparente e resistente à censura, Bitcoin representa a liberdade financeira e desafia o monopólio dos bancos sobre o dinheiro. Enquanto o sistema bancário tradicional continuar a impor restrições e a controlar o fluxo de capital, Bitcoin permanecerá como um símbolo de independência e soberania financeira.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 17:08:15

@ 31a4605e:cf043959

2025-06-17 17:08:15Bitcoin surgiu como uma alternativa ao sistema financeiro tradicional, oferecendo um meio de troca descentralizado e resistente à censura. No entanto, essa proposta desafia diretamente o controlo que os governos exercem sobre a economia, especialmente no que diz respeito à emissão de moeda e regulação do setor financeiro. Como resultado, muitos governos veem Bitcoin com desconfiança e tentam limitar a sua adoção, enquanto outros procuram integrá-lo à economia de forma controlada.

Motivos para o conflito entre governos e Bitcoin

A resistência governamental à adoção de Bitcoin deve-se a vários fatores, entre os quais se destacam:

Perda de controlo monetário: Os governos controlam a política monetária através da emissão de moeda fiduciária e da manipulação das taxas de juro. Bitcoin, por ter uma oferta fixa e descentralizada, impede que governos imprimam mais dinheiro, limitando a sua influência sobre a economia.

Dificuldade na tributação: A utilização de Bitcoin dificulta a fiscalização de transações e a cobrança de impostos, tornando-se um desafio para as autoridades que dependem da tributação para financiar gastos públicos.

Preocupações com regulação e crime financeiro: Muitos governos argumentam que Bitcoin pode ser usado para lavagem de dinheiro, evasão fiscal e outras atividades ilícitas. No entanto, como todas as transações ficam registadas na blockchain ou timechain, Bitcoin é, na realidade, mais rastreável do que o dinheiro físico.

Competição com moedas digitais de bancos centrais (CBDCs): Alguns governos estão a desenvolver as suas próprias moedas digitais, conhecidas como CBDCs. Estas oferecem um alto nível de controlo sobre as transações financeiras, mas não possuem as mesmas propriedades descentralizadas de Bitcoin. Para garantir a adoção das CBDCs, alguns governos tentam limitar ou proibir o uso de Bitcoin.

Diferentes países têm abordagens variadas em relação a Bitcoin, desde a aceitação total até a repressão severa.

El Salvador: foi o primeiro país a adotar Bitcoin como moeda legal em 2021. Esta decisão gerou conflitos com instituições financeiras globais, como o Fundo Monetário Internacional (FMI), que pressionou o governo salvadorenho a reconsiderar a sua decisão.

China: o governo chinês proibiu completamente a mineração e o uso de Bitcoin em 2021, alegando preocupações ambientais e riscos financeiros. No entanto, muitos mineradores e utilizadores chineses continuam a operar através de meios alternativos.

Estados Unidos: embora Bitcoin seja legal nos EUA, o governo tem imposto regulamentações mais rígidas às plataformas de troca e à mineração, tentando aumentar o controlo sobre o setor. Alguns políticos defendem uma abordagem favorável, enquanto outros veem Bitcoin como uma ameaça ao dólar.

União Europeia: a UE tem adotado uma postura regulatória mais rigorosa, impondo regras sobre a identificação dos utilizadores e a transparência das transações. Apesar disso, Bitcoin continua a ser legal e amplamente utilizado.

Apesar dos desafios impostos por alguns governos, a adoção de Bitcoin continua a crescer. Muitos utilizadores veem Bitcoin como uma forma de preservar a sua riqueza perante políticas monetárias inflacionárias e controlo excessivo sobre o dinheiro. Além disso, países com economias instáveis e sistemas financeiros pouco acessíveis encontram em Bitcoin uma solução para pagamentos internacionais e proteção contra crises económicas.

A resistência dos governos pode desacelerar a adoção de Bitcoin em algumas regiões, mas não conseguirá eliminá-lo completamente. Como uma rede descentralizada e global, Bitcoin continuará a ser utilizado, independentemente das restrições impostas por qualquer governo. A longo prazo, a sua adoção dependerá da capacidade dos indivíduos e empresas de resistirem às pressões regulatórias e continuarem a utilizá-lo como uma alternativa financeira.

Resumindo, o conflito entre governos e Bitcoin reflete a luta entre um sistema financeiro tradicional centralizado e uma nova alternativa descentralizada. Enquanto alguns países tentam proibir ou restringir o seu uso, outros adotam-no como parte da sua economia. No final, a resistência dos governos pode apenas atrasar, mas dificilmente impedirá a adoção global de Bitcoin, que continua a demonstrar a sua resiliência e utilidade como uma reserva de valor e meio de troca.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 17:00:03

@ 31a4605e:cf043959

2025-06-17 17:00:03Bitcoin funciona através de um sistema descentralizado que depende de um processo chamado mineração para validar transações e garantir a segurança da rede. no entanto, a mineração de Bitcoin exige uma grande quantidade de energia, o que levanta preocupações sobre o seu impacto ambiental. embora existam soluções para tornar este processo mais sustentável, o consumo energético continua a ser um tema debatido tanto por críticos como por defensores da tecnologia.

Como funciona a mineração de Bitcoin?

A mineração de Bitcoin é o processo pelo qual novos blocos são adicionados à blockchain ou timechain e novas moedas são criadas. este processo utiliza um mecanismo chamado proof-of-work (prova de trabalho), onde computadores especializados (miners) competem para resolver problemas matemáticos complexos. para isso, consomem uma enorme quantidade de eletricidade, pois os equipamentos precisam de funcionar continuamente para garantir que a rede se mantém segura e descentralizada.

O consumo de energia e o impacto ambiental

A principal crítica à mineração de Bitcoin está relacionada com o elevado consumo de eletricidade. atualmente, estima-se que a rede Bitcoin consome tanta energia quanto alguns países inteiros. este consumo gera preocupações ambientais, pois grande parte da eletricidade mundial ainda é produzida a partir de combustíveis fósseis, que emitem gases poluentes.

Os impactos ambientais da mineração de Bitcoin incluem:

Emissões de carbono: se a eletricidade utilizada para a mineração vier de fontes poluentes, o processo contribui para o aumento das emissões de CO₂, intensificando o aquecimento global.

Uso excessivo de recursos naturais: a mineração em grande escala pode sobrecarregar redes elétricas locais e aumentar a procura por eletricidade, levando a um maior consumo de combustíveis fósseis em algumas regiões.

Produção de resíduos eletrónicos: os equipamentos de mineração têm um tempo de vida útil relativamente curto, o que leva à produção de grandes quantidades de lixo eletrónico.

Alternativas e soluções sustentáveis

Apesar das preocupações, a mineração de Bitcoin está a tornar-se cada vez mais eficiente e sustentável. muitas operações de mineração já utilizam fontes de energia renovável, como hidrelétrica, solar e eólica, reduzindo significativamente a pegada ecológica. algumas soluções incluem:

Uso de energia renovável: miners estão a mudar-se para regiões onde há excesso de produção de energia renovável, aproveitando recursos que, de outra forma, seriam desperdiçados.

Reciclagem de calor gerado pela mineração: algumas empresas estão a utilizar o calor produzido pelos equipamentos de mineração para aquecer edifícios e infraestruturas, aproveitando a energia de forma mais eficiente.

Inovações tecnológicas: o desenvolvimento de novos chips e equipamentos mais eficientes reduz o consumo energético da mineração sem comprometer a segurança da rede.

Resumindo, o impacto ambiental da mineração do Bitcoin é um tema controverso, mas as soluções para tornar o processo mais sustentável estão a evoluir rapidamente. embora o consumo energético continue elevado, a transição para fontes de energia renovável e novas tecnologias pode tornar Bitcoin um sistema mais eficiente e amigo do ambiente. assim, a questão não é apenas o consumo de eletricidade, mas sim a origem dessa energia e as inovações que tornam a mineração cada vez mais sustentável.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 16:46:45

@ 31a4605e:cf043959

2025-06-17 16:46:45Bitcoin é conhecido pela sua forte volatilidade, com oscilações de preço que podem ocorrer em curtos períodos de tempo. Esta característica atrai tanto investidores que procuram grandes lucros como também afasta aqueles que preferem ativos mais estáveis. A volatilidade do preço de Bitcoin tem um impacto significativo no mercado, influenciando estratégias de investimento, adoção e até a perceção pública da moeda digital.

O que causa a volatilidade do preço de Bitcoin?

A volatilidade de Bitcoin deve-se a vários fatores que afetam a sua oferta e procura. entre os principais motivos estão:

Oferta limitada e halving: Bitcoin tem um fornecimento máximo de 21 milhões de unidades, o que cria escassez. além disso, o halving, que reduz a emissão de novos Bitcoins a cada quatro anos, pode provocar aumentos de preço devido à redução da oferta.

Especulação no mercado: muitos investidores compram e vendem Bitcoin para obter lucros rápidos, criando grandes flutuações no preço. movimentos especulativos, muitas vezes impulsionados por notícias e redes sociais, podem causar variações bruscas.

Eventos económicos e regulamentação: decisões governamentais, como proibições ou regulamentações favoráveis, afetam diretamente o preço. declarações de bancos centrais ou figuras influentes no setor financeiro podem também gerar fortes reações no mercado.

Liquidez e volume de negociação: o mercado de Bitcoin ainda é pequeno comparado a ativos tradicionais, como o ouro ou ações. isto significa que grandes ordens de compra ou venda podem causar oscilações significativas.

Impacto nos investidores e “investidores“

A volatilidade do preço de Bitcoin afeta diferentes tipos de investidores de formas distintas:

Investidores de curto prazo: traders que fazem operações diárias tentam lucrar com as flutuações de preço. no entanto, este tipo de estratégia envolve altos riscos e pode resultar em perdas significativas para quem não tem experiência no mercado.

Investidores de longo prazo (HODLers): quem investe com uma perspetiva a longo prazo costuma ignorar as variações diárias e foca-se no potencial de valorização de Bitcoin ao longo dos anos. apesar das quedas temporárias, muitos acreditam que o preço continuará a subir devido à escassez e à adoção crescente.

Empresas e instituições: empresas que investem em Bitcoin como reserva de valor, como a MicroStrategy e a Tesla, precisam de gerir os riscos da volatilidade. algumas optam por estratégias que minimizam a exposição direta a grandes oscilações.

Como lidar com a volatilidade?

Apesar dos desafios, existem formas de lidar com a volatilidade de Bitcoin de forma estratégica:

Diversificação da carteira: em vez de investir todo o capital em Bitcoin, muitos investidores diversificam para reduzir o impacto das oscilações de preço.

Investimento recorrente: estratégias como "dollar-cost averaging" (compra recorrente e fracionada) ajudam a suavizar os efeitos da volatilidade, reduzindo o risco de comprar numa alta momentânea.

Uso de armazenamento seguro: em vez de deixar Bitcoin em corretoras, que podem ser vulneráveis a ataques e manipulações de mercado, a auto-custódia em carteiras seguras protege o investimento a longo prazo.

Resumindo, a volatilidade do Bitcoin é uma das suas principais características e influencia tanto o comportamento dos “investidores” como a sua adoção em larga escala. Enquanto pode representar oportunidades para grandes lucros, também envolve riscos consideráveis, exigindo estratégias bem definidas para minimizar perdas. Com o tempo o Bitcoin amadurece e mais investidores institucionais entram no mercado, a volatilidade pode reduzir-se, tornando-o ainda mais atrativo como reserva de valor.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 16:40:37

@ 31a4605e:cf043959

2025-06-17 16:40:37Bitcoin tem vindo a ganhar cada vez mais aceitação como meio de pagamento, deixando de ser apenas um ativo digital para investimento e tornando-se uma alternativa viável às moedas tradicionais. Atualmente, diversas empresas em todo o mundo já aceitam Bitcoin como forma de pagamento, proporcionando aos consumidores mais liberdade financeira e eliminando a necessidade de intermediários bancários.

Empresas globais que aceitam Bitcoin

Ao longo dos anos, várias empresas de renome começaram a aceitar Bitcoin, reconhecendo as suas vantagens, como a segurança, a transparência e as baixas taxas de transação. Entre as mais conhecidas, destacam-se:

Microsoft: a gigante da tecnologia permite que os utilizadores adicionem saldo às suas contas utilizando Bitcoin. isto permite a compra de produtos digitais, como jogos, aplicações e outros conteúdos disponíveis na Microsoft Store.

Overstock: um dos maiores retalhistas online que aceita Bitcoin para a compra de móveis, eletrodomésticos e artigos para casa. a empresa foi uma das pioneiras na adoção de Bitcoin, mostrando o seu compromisso com a inovação financeira.

AT&T: a operadora de telecomunicações dos Estados Unidos foi a primeira do setor a aceitar pagamentos em Bitcoin, permitindo que os seus clientes paguem faturas através deste meio digital.

Twitch: a popular plataforma de streaming de videojogos permite que os utilizadores façam doações e subscrições utilizando Bitcoin, incentivando a adoção desta moeda entre criadores de conteúdo.

Namecheap: um dos principais serviços de registo de domínios na internet aceita Bitcoin para a compra de domínios e serviços de alojamento web, demonstrando a aplicabilidade prática desta moeda no setor digital.

Pequenos negócios e comércio local

Para além das grandes empresas, muitos pequenos negócios e comerciantes locais já aceitam Bitcoin, especialmente em cidades que estão a tornar-se polos da economia digital.

Restaurantes e cafés: em cidades como Lisboa, Londres e Nova Iorque, alguns cafés e restaurantes aceitam Bitcoin como forma de pagamento, atraindo clientes que preferem pagar com esta tecnologia.

Hotéis e turismo: algumas redes hoteleiras e agências de viagens permitem o pagamento em Bitcoin, facilitando reservas e eliminando taxas cambiais para turistas internacionais.

Lojas online: muitos pequenos comerciantes na internet vendem produtos e serviços exclusivamente com Bitcoin, aproveitando a facilidade das transações digitais e a segurança da rede.

Vantagens para empresas e consumidores

O aumento da aceitação de Bitcoin deve-se aos benefícios que tanto empresas como consumidores obtêm ao utilizá-lo:

Menores taxas de transação: empresas evitam as altas comissões cobradas por bancos e serviços de pagamento tradicionais.

Eliminação de intermediários: transações são diretas entre comprador e vendedor, reduzindo burocracias e riscos de fraudes com cartões de crédito.

Acesso global: Bitcoin permite pagamentos internacionais sem necessidade de conversões cambiais, ideal para negócios online.

Resumindo, a adoção de Bitcoin como meio de pagamento continua a crescer, com empresas de todos os setores a reconhecerem as suas vantagens. à medida que mais negócios aderem a esta tecnologia, Bitcoin torna-se cada vez mais uma alternativa viável ao dinheiro tradicional. Apesar dos desafios de volatilidade e regulamentação, a tendência aponta para um futuro onde pagar com Bitcoin será algo comum no dia a dia.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:58:20

@ 31a4605e:cf043959

2025-06-17 15:58:20O Bitcoin é uma nova forma de dinheiro digital, oferecendo liberdade financeira e acesso a uma economia global sem intermediários comuns. Para usar essa tecnologia, é importante saber como comprar, guardar e utilizá-la de forma segura e eficiente. Este guia cobre as principais etapas e práticas para incorporar o Bitcoin no dia a dia, ressaltando as melhores formas de proteger seus ativos e tirar o máximo proveito deles.

Comprar Bitcoin é o primeiro passo para participar da sua rede descentralizada. Existem várias maneiras de obter Bitcoin, dependendo das preferências e necessidades individuais.

Plataformas de corretoras (exchanges):

Funcionamento: as exchanges são plataformas online que permitem comprar Bitcoin usando moedas tradicionais, como dólar, euro ou real.

Processo: crie uma conta, complete a verificação de identidade (processo KYC) e deposite fundos para iniciar as negociações.

Dicas: escolha exchanges confiáveis, com boa reputação e segurança sólida.

Caixas eletrônicos de Bitcoin:

Funcionamento: alguns caixas eletrônicos permitem a compra de Bitcoin com dinheiro ou cartão de crédito.

Uso: insira o valor desejado, escaneie sua carteira digital e receba os Bitcoins imediatamente.

Compra Peer-to-Peer (P2P):

Funcionamento: plataformas P2P conectam compradores e vendedores diretamente, permitindo a negociação de termos específicos.

Dicas: confira a reputação do vendedor e utilize plataformas que oferecem garantias ou serviços de custódia.

A segurança é fundamental ao manusear Bitcoin. O armazenamento correto protege seus fundos contra perdas, hackers e acessos não autorizados.

Carteiras digitais:

Definição: uma carteira digital é um software ou dispositivo físico que guarda as chaves privadas necessárias para acessar seus Bitcoins.

Tipos de carteiras:

Carteiras quentes (hot wallets): conectadas à internet, são adequadas para uso frequente, mas mais suscetíveis a ataques. Exemplos são aplicativos móveis e carteiras online.

Carteiras frias (cold wallets): mantêm Bitcoin offline, sendo mais seguras para grandes quantidades. Exemplos incluem carteiras de hardware e de papel.

Carteiras de hardware:

Funcionamento: dispositivos físicos, como Ledger ou Trezor, que guardam suas chaves privadas offline.

Vantagens: segurança alta contra ataques digitais e fácil transporte.

Carteiras de papel:

Funcionamento: envolve imprimir ou anotar as chaves privadas em um pedaço de papel.

Cuidados: armazene em locais seguros, protegidos contra umidade, fogo e acessos não autorizados.

Backup e recuperação:

Boa prática: realize backups regulares de sua carteira e anote sua frase de recuperação (seed phrase) em um local seguro.

Atenção: nunca compartilhe sua frase de recuperação ou chave privada com ninguém.

O uso do Bitcoin vai além do investimento. Ele pode ser empregado para transações diárias, compras e transferência de valor de forma eficiente.

Transações:

Como enviar Bitcoin: informe o endereço do destinatário, o valor a ser enviado e confirme a transação em sua carteira.

Custos: as taxas de transação são pagas aos mineradores e podem mudar conforme a demanda da rede.

Compras de bens e serviços:

Comércios que aceitam Bitcoin: muitos negócios, tanto físicos quanto online, aceitam Bitcoin como forma de pagamento. Confira se o comerciante exibe o logotipo do Bitcoin ou consulte listas atualizadas de lugares que aceitam a moeda.

Uso prático: escaneie o código QR do vendedor e envie o pagamento diretamente da sua carteira.

Transferências internacionais: o Bitcoin permite transferências globais rápidas, com taxas geralmente menores do que as cobradas por bancos ou serviços de remessas comuns.

Pagamento de contas: em alguns países, já é possível pagar contas de serviços e impostos com Bitcoin, dependendo da infraestrutura local.

Dicas para usar Bitcoin com segurança

Escolha carteiras e serviços confiáveis:

Use apenas carteiras e exchanges renomadas e com boa reputação no mercado.

Ative a autenticação em dois fatores (2FA):

Sempre que possível, ligue o 2FA para proteger sua conta em exchanges e serviços online.

Evite deixar fundos em exchanges:

Após comprar Bitcoin em uma exchange, transfira o saldo para uma carteira sob seu controle. Isso diminui o risco de perdas por causa de hacks.

Eduque-se:

Entender os conceitos básicos de Bitcoin e segurança digital é fundamental para evitar erros e fraudes.

Resumindo, comprar, guardar e usar Bitcoin pode parecer complicado no começo, mas, com o tempo, passa a ser uma atividade simples e acessível. Ao seguir as melhores práticas de segurança e conhecer as funcionalidades básicas, qualquer um pode tirar proveito dessa tecnologia inovadora.

O Bitcoin não é apenas uma opção financeira; é uma ferramenta poderosa que favorece a liberdade econômica e o acesso a uma economia global. Com o conhecimento certo, você pode incorporar o Bitcoin à sua vida de maneira segura e eficiente.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:47:27

@ 31a4605e:cf043959

2025-06-17 15:47:27O Bitcoin é amplamente reconhecido como a primeira e mais importante inovação no campo das moedas digitais. Criado por Satoshi Nakamoto em 2009, ele estabeleceu as bases para um sistema financeiro descentralizado. Desde então, surgiram milhares de outras moedas digitais, muitas vezes referidas como criptomoedas ou até mesmo "shitcoins" por críticos que apontam sua volatilidade, falta de utilidade clara ou centralização. Essa comparação entre o Bitcoin e outras criptomoedas é essencial para entender os valores exclusivos que o Bitcoin representa.

O Bitcoin foi criado para ser uma alternativa ao sistema financeiro tradicional. Sua missão central é fornecer uma moeda descentralizada, resistente à censura e livre de intermediários como bancos ou governos.

Por outro lado, a maioria das outras criptomoedas/shitcoins surgiu com diferentes objetivos, que vão desde experimentos tecnológicos até planos de enriquecimento rápido. Muitas dessas moedas não têm a mesma descentralização e segurança do Bitcoin, sendo frequentemente geridas por equipes ou organizações centralizadas, o que as torna mais suscetíveis à manipulação e falhas de segurança.

Descentralização e segurança

Bitcoin: a rede Bitcoin é suportada por milhares de nós espalhados pelo mundo, garantindo verdadeira descentralização.

Seu algoritmo de consenso, Proof of Work (PoW), é amplamente testado e proporciona altos níveis de segurança contra ataques.

Não há controle centralizado, o que significa que nenhuma entidade pode alterar suas regras fundamentais.

Outras criptomoedas/shitcoins

Praticamente todas sacrificam descentralização em troca de velocidade ou funcionalidades adicionais.

Algumas utilizam mecanismos de consenso alternativos, como Proof of Stake (PoS), que, embora sejam mais eficientes em termos energéticos, são frequentemente criticados por favorecer a centralização e oferecer menor segurança.

Em muitos casos, há equipes de desenvolvimento centralizadas que podem modificar o código, criar mais unidades da moeda ou até encerrar o projeto, comprometendo a confiança dos usuários.

Oferta e escassez

Bitcoin: o Bitcoin tem uma quantidade limitada de 21 milhões de unidades, garantindo sua escassez.

Essa característica, junto com a crescente demanda, posiciona o Bitcoin como uma reserva de valor confiável, frequentemente comparado ao ouro digital.

Outras criptomoedas/shitcoins

Muitas não têm limites claros em sua oferta, resultando em inflação descontrolada.

Algumas “moedas” são intencionalmente inflacionárias, o que pode reduzir seu valor com o tempo.

Em muitos casos, essas “moedas” são pré-mineradas ou distribuídas de maneira desigual, favorecendo os criadores em detrimento da comunidade.

Finalidade e utilidade

Bitcoin: o Bitcoin é, acima de tudo, uma forma de dinheiro digital e reserva de valor.

Sua rede é confiável e simples, com o foco principal em ser um meio de troca e proteção contra a inflação.

Sua solidez o torna ideal para transações e armazenamento de valor a longo prazo.

Outras criptomoedas/shitcoins

Muitas shitcoins são apresentadas como soluções para casos específicos, como contratos inteligentes, jogos ou finanças descentralizadas.

Apesar de promessas ousadas, muitos falham em oferecer utilidade real ou em competir com soluções centralizadas já existentes.

Há um número considerável de projetos que não têm uma proposta clara e acabam sendo abandonados após um tempo de especulação.

Volatilidade e reputação

Bitcoin: embora o Bitcoin seja instável, ele é amplamente aceito como o padrão-ouro das moedas digitais.

Sua imagem foi construída ao longo de mais de dez anos de operação confiável e segurança comprovada.

Outras criptomoedas/shitcoins

Muitas shitcoins enfrentam alta volatilidade, frequentemente impulsionada por especulação ou manipulação de mercado.

A falta de clareza e as práticas duvidosas de alguns projetos prejudicam a imagem do setor como um todo.

Resistência à censura

Bitcoin: devido à sua descentralização e segurança, o Bitcoin é muito resistente à censura. Qualquer pessoa com acesso à internet pode participar da rede e fazer transações.

Outras criptomoedas/shitcoins

Muitas "shitcoins" dependem de estruturas centralizadas ou têm líderes identificáveis que podem ser pressionados por governos ou outros atores para censurar transações.

Resumindo, o Bitcoin continua sendo o líder indiscutível no mundo das moedas digitais devido à sua descentralização, segurança e escassez comprovada. Ele é um sistema feito para durar, oferecendo liberdade financeira e proteção contra a inflação.

Enquanto isso, muitas criptomoedas ou shitcoins não conseguem atingir os mesmos padrões de segurança e confiança, frequentemente priorizando velocidade, funções extras ou lucros especulativos rápidos. Para investidores e usuários, é importante distinguir entre o Bitcoin e os vários projetos alternativos, muitos dos quais podem não resistir ao teste do tempo.

O Bitcoin não só iniciou uma revolução financeira, mas continua sendo o padrão pelo qual todas as outras moedas digitais são medidas.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:44:41

@ 31a4605e:cf043959

2025-06-17 15:44:41O Bitcoin tem se destacado como uma opção moderna para reserva de valor, frequentemente comparado a bens tradicionais como o ouro. Sua habilidade de resistir à inflação, junto com características como escassez, descentralização e segurança, o coloca como uma ferramenta promissora para preservar riqueza em tempos de incerteza econômica.

Uma reserva de valor é um ativo que mantém seu poder de compra ao longo do tempo, protegendo o patrimônio contra desvalorização. Historicamente, ativos como ouro e imóveis desempenharam esse papel, pois são relativamente escassos e têm demanda constante.

No entanto, moedas fiduciárias têm se mostrado menos eficientes como reserva de valor devido à inflação. Governos e bancos centrais frequentemente aumentam a oferta de dinheiro, o que pode diminuir o poder de compra das moedas. É nesse cenário que o Bitcoin se destaca como uma alternativa.

Bitcoin: escassez programada

A principal característica que torna o Bitcoin uma possível reserva de valor é sua oferta limitada. Apenas 21 milhões de bitcoins serão criados, um teto estabelecido em seu código. Essa escassez programada contrasta com as moedas fiduciárias, que podem ser emitidas sem limites por governos, resultando em inflação.

O processo de criação do Bitcoin também é controlado por eventos conhecidos como halvings, que cortam pela metade a recompensa por bloco minerado aproximadamente a cada quatro anos. Isso faz com que o Bitcoin se torne cada vez mais raro ao longo do tempo, aumentando seu potencial de valorização.

O Bitcoin oferece uma solução para o problema da inflação, pois sua oferta fixa evita que governos ou instituições centralizadas manipulem sua quantidade.

Descentralização e imutabilidade: por operar em uma rede descentralizada, o Bitcoin é imune a decisões políticas ou intervenções de bancos centrais. Nenhuma autoridade pode mudar o protocolo para "imprimir" mais bitcoins.

Transparência no suprimento: todas as transações e criações de novos bitcoins estão registradas no blockchain ou timechain, garantindo total transparência.

Proteção de poder de compra: com a oferta limitada e a crescente demanda, o Bitcoin tem mostrado tendência de valorização ao longo dos anos, funcionando como um hedge (proteção) contra a inflação em várias economias.

O Bitcoin é frequentemente chamado de "ouro digital" devido a suas semelhanças com o metal precioso como reserva de valor: Escassez: O ouro é limitado na natureza, enquanto o Bitcoin tem um suprimento máximo programado de 21 milhões de unidades.

Portabilidade: o Bitcoin é mais fácil de transferir e armazenar do que o ouro, sendo acessível digitalmente em qualquer lugar do mundo.

Divisibilidade: cada bitcoin pode ser dividido em até 100 milhões de unidades chamadas satoshis, permitindo transações de qualquer valor.

Segurança: enquanto o ouro exige armazenamento físico e está sujeito a roubo, o Bitcoin pode ser guardado em carteiras digitais seguras.

Essas qualidades fazem do Bitcoin uma opção mais flexível e acessível como forma de guardar valor em um mundo cada vez mais digital.

Apesar de sua promessa, o Bitcoin ainda enfrenta barreiras para ser aceito amplamente como reserva de valor:

Volatilidade: o valor do Bitcoin historicamente tem apresentado grandes variações, o que pode desestimular investidores que desejam segurança. Contudo, muitos acreditam que, com o aumento da aceitação, a volatilidade tende a diminuir.

Regulação: alguns governos têm implementado ações para restringir ou regular o uso do Bitcoin, o que pode impactar sua aceitação como reserva de valor.

Adaptação cultural: como um ativo novo e digital, o Bitcoin ainda precisa ganhar a confiança de pessoas que estão acostumadas a formas de valor físicas, como o ouro.

O Bitcoin tem se destacado como uma opção de guarda de valor particularmente útil em economias que enfrentam crises financeiras ou hiperinflação. Países como Venezuela, Argentina e Zimbábue, que passaram por uma queda acentuada de suas moedas, viram um crescimento na adoção do Bitcoin como maneira de proteger o poder de compra.

Além disso, sua acessibilidade mundial permite que pessoas em países sem fácil acesso a mercados financeiros tradicionais utilizem o Bitcoin como uma alternativa.

Resumindo, o Bitcoin possui características distintas que o fazem um candidato promissor como reserva de valor em um mundo cada vez mais digital e afetado pela inflação das moedas comuns. Sua escassez programada, resistência à manipulação e acessibilidade global oferecem uma solução moderna para conservar riqueza.

Embora dificuldades como volatilidade e regulação ainda precisem ser superadas, o Bitcoin já se mostrou uma ferramenta eficaz para proteger ativos, especialmente em contextos de instabilidade econômica. Com o tempo e um aumento na aceitação, o Bitcoin pode se consolidar como um dos principais ativos de reserva de valor no século XXI.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:40:23

@ 31a4605e:cf043959

2025-06-17 15:40:23No sistema Bitcoin, a proteção e a posse dos fundos são asseguradas por um modelo criptográfico que usa chaves privadas e públicas. Esses componentes são fundamentais para a segurança digital, permitindo que os usuários administrem e protejam seus ativos de maneira descentralizada. Esse processo elimina a necessidade de intermediários, assegurando que somente o legítimo proprietário tenha acesso ao saldo vinculado a um endereço específico na blockchain ou timechain.

Chaves privadas e públicas são partes de um sistema de criptografia assimétrica, onde dois códigos distintos, mas matematicamente ligados, são utilizados para garantir a segurança e a veracidade das transações.

Chave Privada = É um código secreto, normalmente apresentado como uma longa sequência de números e letras.

Funciona como uma senha que dá ao proprietário o controle sobre os bitcoins ligados a um endereço específico.

Deve ser mantida em total sigilo, pois qualquer pessoa que a tenha pode movimentar os fundos correspondentes.

Chave Pública = É matematicamente derivada da chave privada, mas não permite que a chave privada seja descoberta.

Funciona como um endereço digital, semelhante a um número de conta bancária, podendo ser compartilhada livremente para receber pagamentos.

Serve para confirmar a autenticidade das assinaturas geradas com a chave privada.

Juntas, essas chaves asseguram que as transações sejam seguras e verificáveis, dispensando a necessidade de intermediários.

O funcionamento das chaves privadas e públicas baseia-se na criptografia de curva elíptica. Quando um usuário quer enviar bitcoins, ele usa sua chave privada para assinar digitalmente a transação. Essa assinatura é exclusiva para cada operação e demonstra que o remetente possui a chave privada relacionada ao endereço de envio.

Os nós da rede Bitcoin checam essa assinatura utilizando a chave pública correspondente, garantindo que:

A assinatura é válida.

A transação não foi alterada desde que foi assinada.

O remetente tem a propriedade legítima dos fundos.

Se a assinatura for aceita, a transação é registrada na blockchain ou timechain e se torna irreversível. Esse procedimento protege os fundos contra fraudes e gastos duplicados.

A segurança das chaves privadas é um dos pontos mais importantes do sistema Bitcoin. Perder essa chave significa perder permanentemente o acesso aos fundos, pois não há nenhuma autoridade central capaz de recuperá-la.

Boas práticas para proteger a chave privada incluem:

Armazenamento offline: longe de redes conectadas à internet, diminuindo o risco de ataques cibernéticos.

Carteiras de hardware: dispositivos físicos dedicados para armazenar chaves privadas de forma segura.

Backup e redundância: manter cópias de segurança em locais seguros e distintos.

Criptografia adicional: proteger arquivos digitais que contêm chaves privadas com senhas fortes e criptografia.

Ameaças comuns incluem:

Phishing e malware: ataques que tentam enganar os usuários para obter acesso às chaves.

Roubo físico: no caso de chaves guardadas em dispositivos físicos.

Perda de senhas e backups: que pode resultar na perda definitiva dos fundos.

O uso de chaves privadas e públicas dá ao proprietário controle total sobre seus fundos, eliminando intermediários como bancos ou governos. Esse modelo coloca a responsabilidade de proteção nas mãos do usuário, o que representa tanto liberdade quanto risco.

Diferente de sistemas financeiros tradicionais, onde instituições podem reverter transações ou congelar contas, no sistema Bitcoin, a posse da chave privada é a única prova de propriedade. Esse princípio é frequentemente resumido pela frase: "Not your keys, not your coins" (Se não são suas chaves, não são suas moedas).

Essa abordagem fortalece a soberania financeira, permitindo que indivíduos guardem e movam valor de maneira independente e sem censura.

Apesar de sua segurança, o sistema de chaves também apresenta riscos. Se uma chave privada for perdida ou esquecida, não existe como recuperar os fundos associados. Isso já levou à perda de milhões de bitcoins ao longo dos anos.

Para reduzir esse risco, muitos usuários utilizam frases-semente (seed phrases), que são uma lista de palavras usadas para restaurar carteiras e chaves privadas. Essas frases devem ser guardadas com o mesmo cuidado, pois também podem ser usadas para acessar os fundos.

Resumindo, as chaves privadas e públicas são a base da segurança e da propriedade no sistema Bitcoin. Elas asseguram que somente os verdadeiros proprietários possam mover seus fundos, promovendo um sistema financeiro descentralizado, seguro e resistente à censura.

No entanto, essa liberdade acarreta grandes responsabilidades, exigindo que os usuários adotem práticas severas para proteger suas chaves privadas. A perda ou comprometimento dessas chaves pode levar a consequências irreversíveis, ressaltando a importância de educação e preparação ao usar o sistema Bitcoin.

Assim, o modelo de chaves criptográficas não apenas melhora a segurança, mas também representa a essência da independência financeira proporcionada pelo Bitcoin.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 31a4605e:cf043959

2025-06-17 15:16:09

@ 31a4605e:cf043959

2025-06-17 15:16:09A mineração de Bitcoin é um processo crucial para o funcionamento e a segurança da rede. Ela tem um papel importante na validação de transações e na geração de novos bitcoins, garantindo a integridade do sistema baseado em blockchain ou timechain. Esse processo envolve resolver cálculos matemáticos complicados, exigindo grande poder computacional. Além disso, a mineração tem efeitos econômicos, ambientais e tecnológicos que devem ser analisados de forma detalhada.

A mineração de Bitcoin é o procedimento pelo qual novas unidades da moeda são criadas e adicionadas à rede. Ela também é responsável por verificar e registrar transações no blockchain ou timechain. Esse sistema foi criado para ser descentralizado, eliminando a necessidade de uma autoridade central para controlar a emissão ou validar operações.

Os participantes do processo, chamados de mineradores, competem para resolver problemas matemáticos difíceis. Aquele que achar a solução primeiro ganha o direito de adicionar um novo bloco ao blockchain ou timechain e recebe uma recompensa em bitcoins, além das taxas de transação que estão no bloco. Esse mecanismo é chamado de prova de trabalho (Proof of Work - PoW).

O processo de mineração é muito técnico e segue uma série de etapas:

Agrupamento de transações: as transações enviadas pelos usuários são reunidas em um bloco pendente, que aguarda validação.

Resolução de problemas matemáticos: os mineradores devem encontrar um número específico, chamado nonce, que, quando combinado com os dados do bloco, gera um hash criptográfico dentro de um padrão exigido. Esse processo requer tentativa e erro, consumindo alto poder computacional.

Validação do bloco: quando um minerador encontra a solução correta, o bloco é validado e adicionado ao blockchain ou timechain. Todos os nós da rede verificam a autenticidade do bloco antes de aceitá-lo.

Recompensa: o minerador que vencer recebe uma recompensa em bitcoins, além das taxas pagas pelas transações que estão no bloco. Essa recompensa diminui ao longo do tempo em um evento chamado halving, que acontece aproximadamente a cada quatro anos.

A mineração de Bitcoin tem um impacto econômico grande, pois cria oportunidades de renda para pessoas e empresas. Ela também estimula o desenvolvimento de novas tecnologias, como processadores especializados (ASICs) e sistemas de resfriamento modernos.

Além disso, a mineração apoia a inclusão financeira ao manter uma rede descentralizada, permitindo transações rápidas e seguras em nível global. Em áreas com economias instáveis, o Bitcoin oferece uma alternativa viável para preservação de valor e transferências financeiras.

Apesar de seus benefícios econômicos, a mineração de Bitcoin é frequentemente criticada por seu impacto no meio ambiente. O processo de prova de trabalho consome grandes quantidades de eletricidade, especialmente em áreas onde a matriz energética depende de fontes fósseis.

Estima-se que a mineração de Bitcoin consuma tanta energia quanto alguns países inteiros, levantando preocupações sobre sua sustentabilidade. No entanto, há esforços contínuos para reduzir esses impactos, como o uso crescente de fontes de energia renovável e soluções alternativas, como redes baseadas na prova de participação (Proof of Stake - PoS) em outros sistemas descentralizados.

A mineração também enfrenta desafios ligados à escalabilidade e à concentração de poder computacional. Grandes empresas e pools de mineração dominam o setor, o que pode afetar a descentralização da rede.

Outro desafio é a complexidade crescente dos cálculos matemáticos, que exige hardware mais avançado e consome mais energia com o tempo. Para enfrentar esses problemas, pesquisadores estudam soluções que otimizem o uso de recursos e mantenham a rede sustentável por um longo período.

Resumindo, a mineração de Bitcoin é um processo essencial para manter a rede e para a criação de novas unidades da moeda. Ela garante segurança, transparência e descentralização, sustentando o funcionamento do blockchain ou timechain.

No entanto, a mineração também traz desafios, como o alto consumo de energia e a concentração de recursos em grandes pools. Apesar disso, a busca por soluções sustentáveis e inovações tecnológicas indica um futuro promissor, onde o Bitcoin continuará a ter um papel central na economia digital.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 7f6db517:a4931eda

2025-06-17 15:01:45

@ 7f6db517:a4931eda

2025-06-17 15:01:45

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-17 15:01:04

@ b1ddb4d7:471244e7

2025-06-17 15:01:04This article was originally published on dev.to by satshacker.

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets

If you like to take it a step further, you can also create a more enhanced donation checkout flow. Of course you could programm something yourself, there are many open source libraries you can build upon. If you want a simple plug-and-play solution, here are a couple of options:

Name

Type

Registration

SatSale

Self-hosted

No KYC

BTCPay Server

Self-hosted

No KYC

Pay With Flash

Widget

Email

Geyser Fund

Widget

Email

The Giving Block

Hosted

KYC

OpenNode

Hosted

KYC

SatSale (GitHub)

Lightweight, self-hosted Bitcoin/Lightning payment processor. No KYC.

Ideal for developers comfortable with server management. Simple to deploy, supports both on-chain and Lightning, and integrates with WooCommerce.

BTCPay Server

Powerful, open-source, self-hosted processor for Bitcoin and Lightning. No KYC.

Supports multiple currencies, advanced features, and full privacy. Requires technical setup and maintenance. Funds go directly to your wallet; great for those seeking full control.

Pay With Flash

Easiest for indie hackers. Add a donation widget with minimal code and no KYC. Payments go directly to your wallet for a 1.5% fee.

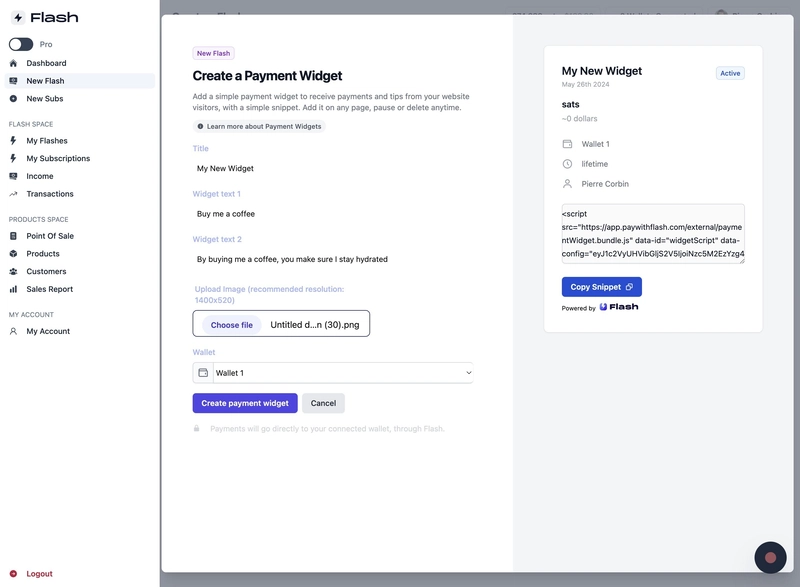

Setup Steps:

- Sign up at PayWithFlash.com

- Customize your widget in the dashboard

- Embed the code:

- Test to confirm functionality

Benefits:

- Minimal technical skills required

- Supports one-time or recurring donations

- Direct fund transfer, no intermediaries

Geyser Fund

Crowdfunding platform. Widget-based, connects to your wallet, email registration.Focused on Bitcoin crowdfunding, memberships and donations.

The Giving Block

Hosted, KYC required. Integrates with fiat and crypto, best for nonprofits or larger organizations.

OpenNode

Hosted, KYC required. Accept Bitcoin payments and donations; supports conversion to fiat, suitable for businesses and nonprofits.

Summary

- Fast, low-code setup: Use Pay With Flash or Geyser Fund.

- Privacy and control: Choose SatSale or BTCPay Server (requires technical skills).

- Managed, compliant solutions: The Giving Block or OpenNode.

Choose based on your technical comfort, privacy needs, and project scale.

I hope this article helped you. If you added bitcoin donations, share your link in the comments and I will send you a few satoshis maybe

-

@ faade9ee:1c6dfd69

2025-06-17 11:07:49

@ faade9ee:1c6dfd69

2025-06-17 11:07:49This is a normal piece of text.z

This is a bold piece of text via button press.z

this is also bold, but via double-starsz

this is an italic via button press

this also but via one-star

look, it's an underline!

oh, a piece of code has appeared. Nice. Button press tho. seems like it's purple / missed styling it, will change that.another code but via textcode block, kinda buggy (really buggy actually x3)```this is another, but via text which is disabled for now as it's cause issues```

This is a top number thing222

a bottom number thing5ss65435ghrt

- bullets!

-

another!

- a third!

-

Number!

-

another!

- a third!

-

[x] check

- [x] box

this is a quote

"quote"

heading 1

heading 2

heading 3 via text

heading 4 via text

heading 5 via text

heading 6 via text

this is a link via text (button has an annoyance bug)

video below

::youtube{#aApSteSbeGA}

-

@ dfa02707:41ca50e3

2025-06-17 07:01:47

@ dfa02707:41ca50e3

2025-06-17 07:01:47Contribute to keep No Bullshit Bitcoin news going.

-

Version 1.3 of Bitcoin Safe introduces a redesigned interactive chart, quick receive feature, updated icons, a mempool preview window, support for Child Pays For Parent (CPFP) and testnet4, preconfigured testnet demo wallets, as well as various bug fixes and improvements.

-

Upcoming updates for Bitcoin Safe include Compact Block Filters.

"Compact Block Filters increase the network privacy dramatically, since you're not asking an electrum server to give you your transactions. They are a little slower than electrum servers. For a savings wallet like Bitcoin Safe this should be OK," writes the project's developer Andreas Griffin.