-

@ 9ca447d2:fbf5a36d

2025-06-18 04:02:01

@ 9ca447d2:fbf5a36d

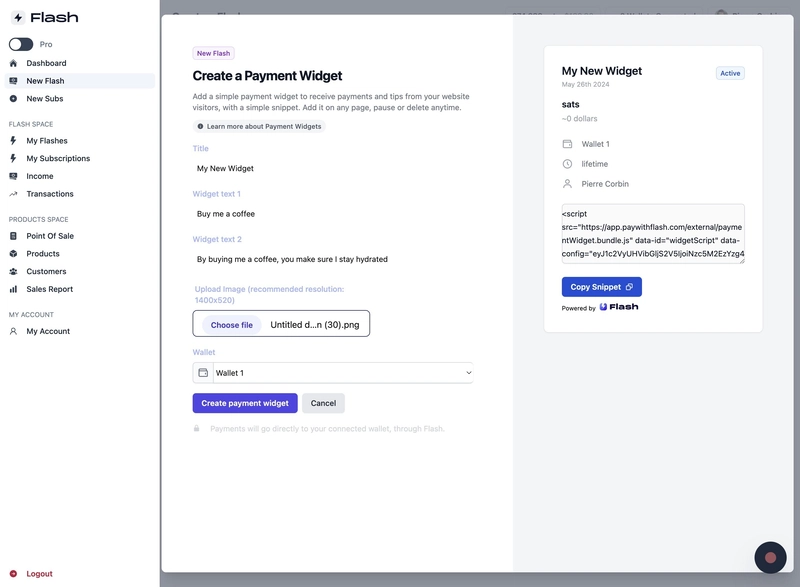

2025-06-18 04:02:01Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ b1ddb4d7:471244e7

2025-06-18 04:01:41

@ b1ddb4d7:471244e7

2025-06-18 04:01:41The Barcelona Cyphers Conference (BCC8333), the city’s first biggest bitcoin-themed event, transforms a historic building in the central born district of the Catalan capital into a hub for bitcoin enthusiasts and cypherpunks. Named after the port bitcoin nodes use to sync the timechain (8333), this inaugural event delivers high-signal discussions and practical applications of decentralized technology, uniting over 100 attendees from Spain, Europe, and beyond.

Venue and Atmosphere

Set in a 17th-century palace that doubles as a flamenco venue, Palau Dalmases blends historical elegance with a creative, almost rebellious vibe. The unique setting fosters deep conversations, hands-on workshops, and genuine connections, prioritizing substance over spectacle. The spectacular courtyard serves as a lively backdrop for collaboration and sparking chats that resonates with the event’s freedom/privacy-oriented ethos.

Lightning Network Integration

BCC8333 embedds Bitcoin’s Lightning Network (LN) into its core, emphasizing privacy and scalable technology. Two on-site bars accept LN payments for drinks, demonstrating fast, low-cost bitcoin transactions in action.

But the usage of Lightning Network extends beyond just ‘refreshments’.

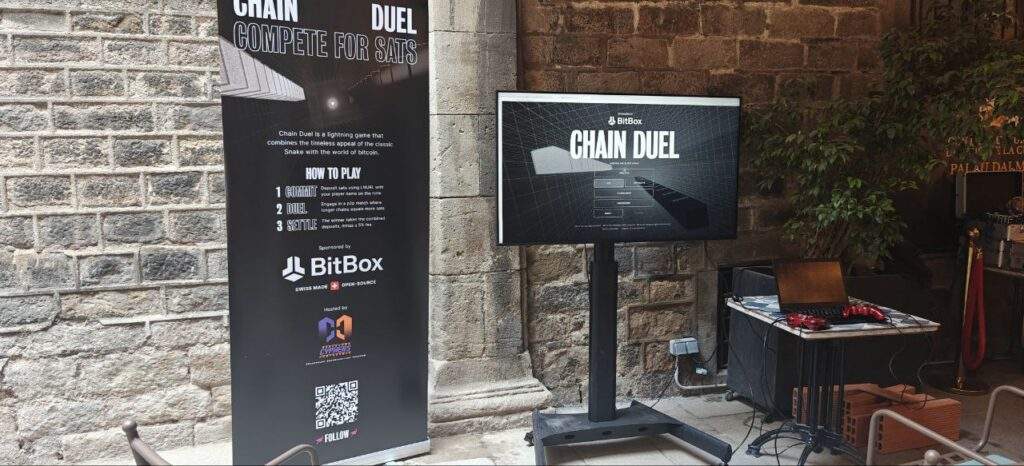

· Chain Duel: This simple yet engaging game has many BCC8333 participants send sats via LN to enter, compete, and have fun for the two days of the event. A large-screen tournament on the main stage amplifies the excitement, showcasing one more practical case for LN in the bitcoin ecosystem with a nice bounty, i.e. winners claiming the collected sats.

· Thematic sessions and practical workshops on wallets, vending machines, and Nostr highlight LN’s role in bitcoin adoption, while touching on the importance of privacy vs. scalable transactions.

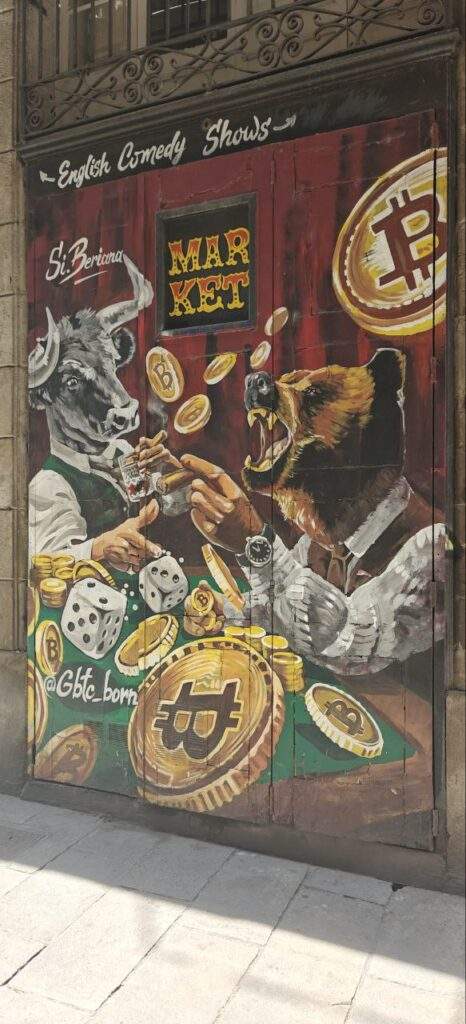

While the overall adoption in Barcelona’s local establishments outside the venue remains rather limited, attendees find a nearby street with vivid graffiti dedicated to bitcoin, and in a practical way, whenever possible, swap sats for fiat among themselves when direct payments aren’t possible.

Selected Highlights

The agenda balances intense sessions with networking breaks, ensuring space for reflection and collaboration. Some of the key sessions include:

· Future of Private Transactions (English, Max Hillebrand).

· Miniscripts Roundtable (English, Edouard from Liana, Landabaso from Rewind, Francesco from BitVault, Yuri da Silva from Great Wall).

· Sovereign Hardware Tools (English, Wesatoshi).

· Debate: Future of Lightning (Spanish, mixed attendees).

· Op_return Debate (English, Peter Todd, Unhosted Marcellus, Lunaticoin).

Recordings from the main stage and additional coverage by Juan Cienfuegos, host of the BitCorner Podcast, will soon be available online (X: @BCC833, @TheJuanSC).

Why BCC8333 Stood Out

· Local Maxis: vibrant and well-organized approach shines through, with local bitcoiners as organizers of the event (Spanish and expats) bringing their best PoW to the table.

· Focused Discussions: Free of hype and influencers, BCC8333 prioritizes signal over noise, diving into critical topics like privacy, nodes, wallets, P2P tools, decentralized mining, and Nostr.

· Community Vibe: The smaller crowd enables authentic connections, fostering a tight-knit community of freedom-tech enthusiasts committed to sovereignty.

BCC8333 is a powerful testament to the cypherpunk spirit, blending bitcoin and privacy to fuel innovation. From LN-powered interactions to thought-provoking talks, the event underscores the strength of a community dedicated to building decentralized solutions. Congratulations to the organizers, contributors, volunteers, and attendees for making this conference a standout moment in the year’s lineup of bitcoin-themed events.

-

@ 52524fbb:ae4025dc

2025-06-18 03:37:50

@ 52524fbb:ae4025dc

2025-06-18 03:37:50Gold mostly referred to as ultimate safe-haven asset amidst economic uncertainty or market makes investors desperately flock to it for stability. This traditional view scratches surface of gold's role barely in an increasingly complex global landscape interconnected precariously nowadays. Critical analysis reveals XAUUSD as a highly sensitive barometer of geopolitics. its price movements frequently mirroring the flow of tensions internationally. Astute traders unlock gold's full potential by recognizing an intricate relationship quietly beneath surface level market fluctuations daily.

Gold earns its safe haven label largely due to it's perceived ability of preserving wealth amidst faltering fiat currencies or traditional assets suddenly. This phenomenon persists remarkably during severe financial turmoil or episodes characterized by unusually high inflation rates nationwide. Apparently geopolitical events introduce a disparate dimension of risk not just economically but systemically affecting everything pretty badly. Major conflicts erupt suddenly between global powers and XAUUSD often reacts vigorously transcending risk aversion in turbulent geopolitical landscapes. It morphs into reflection of looming disruptions across global supply chains and potential sanctions amidst wildly fluctuating energy prices suddenly.

A sudden escalation of tensions might erupt pretty quickly in some critical oil producing region. Crude oil prices may react rapidly but XAUUSD will likely be impacted swiftly amidst sudden market fluctuations too. Rising oil prices spark inflation fears amidst murky global economic prospects and precarious possibilities of sprawling conflict severely impacting major economies. Gold acts as hedge against unknown terrors and facilitates flight to security palpably tangible when geopolitical landscape becomes rather unpredictably volatile. Gold's status as reserve asset for central banks adds another hefty layer of geopolitical sensitivity pretty much worldwide nowadays. Several central banks mostly in emerging markets have amped up gold reserves partly as diversification tactic away from US Dollar lately. Sovereign entities amass gold strategically in response to geopolitics and shifts in this trend heavily influence global demand and subsequently XAUUSD prices.

Traders leveraging gold as a barometer of geopolitical turmoil must integrate qualitative analysis into strategy very carefully nowadays. It entails vigilantly tracking news from abroad and scrutinizing statements made by diplomats and lofty declarations uttered by world leaders. Anticipating likely responses and understanding economic vulnerabilities of various nations involved can give one an edge potentially in complex situations. A surprise summit between rival nations might signify de-escalation potentially leading quickly to pull-back in gold while sudden military build-up elsewhere could signal opposite XAUUSD retains fundamental safe-haven characteristics yet its role as real-time gauge of global geopolitical risk becomes increasingly pronounced nowadays. Traders gain keen insights into murky market sentiment by watching gold's reaction to tumultuous global events and thereby concoct shrewd trading strategies. Gold ain't merely some flashy metal it's a luminous barometer of global equilibrium shining brightly amidst economic turmoil naturally..

-

@ eb0157af:77ab6c55

2025-06-18 00:02:24

@ eb0157af:77ab6c55

2025-06-18 00:02:24A new study by Kraken reveals how cryptocurrency investors perceive security as the main challenge in self-managing their digital assets.

According to The Block, a recent survey conducted by crypto exchange Kraken found that nearly half of respondents consider themselves the primary risk factor for their own crypto security. The research, which surveyed 789 participants, highlights that 48% of users see their own actions as the greatest threat to their investments in digital assets, surpassing concerns about external theft or fraud.

Kraken’s report underlines how personal responsibility in security management forces users to take full control of their digital funds. However, the study suggests that this autonomy can also become a source of anxiety for many investors.

Nick Percoco, Chief Security Officer at Kraken, commented on the findings, noting that “a lack of confidence in personal crypto security is capping the growth of the industry.” According to Percoco, unlocking the full potential of cryptocurrencies will require users to embrace self-custody and consistently invest in strong security habits.

Technologies to strengthen security

Despite the concerns highlighted in the study, 31% of participants expressed optimism about future technologies that could improve crypto security. Among the most promising solutions identified:

- advanced biometric systems for user authentication;

- multi-factor authentication to secure wallet access;

- AI-based fraud detection systems to prevent attacks.

Data and case studies

Kraken’s research emerges in a context where security threats remain a pressing reality. FBI data shows that in 2024, nearly 150,000 reports of crypto-related internet fraud resulted in $9.3 billion in losses. Older users, particularly those over 60, proved especially vulnerable, accounting for $3 billion in crypto-related financial fraud losses on their own.

The post Kraken study: 48% of users fear themselves in managing and securing their funds appeared first on Atlas21.

-

@ 52524fbb:ae4025dc

2025-06-18 03:25:09

@ 52524fbb:ae4025dc

2025-06-18 03:25:09EURUSD, which is a pair that shows the exchange rate between the Euro and the US Dollar, is arguably the most traded currency pair in the world. Its action the product not of economic announcements but rather a mix of incompatible monetary policies, contrasting economic thinking, and the political stability of two of the largest economic areas in the world - the Eurozone and the US. For traders, this backdrop is key to predicting price movements and containing exposure in this, heavily traded market.

Between European Central Bank and the Federal Reserve a very intricate tango unfolds quietly at the heart of EURUSD currency pair dynamics daily. These two central banks often diverge on monetary policy paths in response to their disparate economic conditions under price stability mandates. Interest rate differential largely drives EURUSD exchange rates heavily nowadays. US Dollar strengthens against Euro pretty quickly when Fed hikes interest rates but ECB keeps rates fairly low thereby attracting sizable capital inflows into US markets due to much higher yields available there. Euro can surge pretty quickly if ECB adopts hawkish stance signaling rate hikes or tightening quantitativelys relative to dovish Fed policy moves.

We can say for a fact that trading EURUSD is a sophisticated exercise in comparing and contrasting two major economies. Success hinges on a deep understanding of the divergent monetary policy stances of the ECB and the Fed, a continuous assessment of their respective economic health and growth prospects, and a keen awareness of the political landscape within the Eurozone. The interplay of these forces creates a constantly evolving environment for the world's most popular currency pair.

-

@ eb0157af:77ab6c55

2025-06-17 23:02:57

@ eb0157af:77ab6c55

2025-06-17 23:02:57Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ 52524fbb:ae4025dc

2025-06-18 03:13:43

@ 52524fbb:ae4025dc

2025-06-18 03:13:43Bitcoin (BTCUSD), commonly called "digital gold," has turned the financial universe on its head in just a decade, emerging as a new alternative to the traditional store of value. And the story that was created out of its low supply and lack of a central authority is a major contributor to its price moves vs USD. But there is much more to the relationship than that; it is a complex dance between developing narratives, macroeconomic factors, and the inherent properties of a fledgling asset class trying to find its footing in an established financial world.

The story of Bitcoin as “digital gold” went to an extreme during peak inflation fear and economic uncertainty, when gold plays its part as an inflation hedge. Its advocates maintain that Bitcoin’s 21 million coin supply, its programmed deflation with the halving events and its distance from central bank control, has made it a better store of value in a time of exceptional fiat currency expansion. This story has a direct impact on BTCUSD, as some investors seeking to "hedge" against devaluing of the US Dollar, typically buy Bitcoin, and increase demand (and therefore price).

To sum it up, trading BTCUSD needs not only conducting technical analysis but also a very sharp understanding of the current narratives and emotions of the market and implementing the news from the macroeconomic situation to this new asset changes. Bitcoin is still in the process of discovery of its final purpose in the world of finance, going back and forth between a speculative tech asset, a disruptive financial innovation, and a clean and sincere candidate for the title of "digital gold." The inter-relationship with traditional fiat currencies such as the US Dollar, which is at the base of the mixture of economic realities and charming, changing stories, is still a fascinating area for traders to explore as it will remain so in the future.

-

@ 502ab02a:a2860397

2025-06-18 02:15:25

@ 502ab02a:a2860397

2025-06-18 02:15:25เครื่องดื่ม Tang ไม่ได้ถือกำเนิดมาบนดาวอังคาร แต่กลับโด่งดังเพราะคนที่ไปใกล้ดาวอังคารที่สุดในยุคนั้นต่างดื่มมันแทนน้ำผลไม้...ใช่แล้วจ้ะ เรากำลังพูดถึง "NASA" และภารกิจอวกาศที่เปลี่ยน Tang จากเครื่องดื่มสังเคราะห์ธรรมดา ให้กลายเป็นไอคอนของอนาคต ที่บางครั้ง...ดูดีเกินกว่าความจริง

ย้อนกลับไปปี 1957 สหรัฐฯ กำลังแข่งขันในสงครามอวกาศกับโซเวียต บริษัท General Foods (ถ้าจำได้บริษัทนี้เขาผลิต ซีเรียล Grape-Nuts โดย Charles William Post หรือ C.W. Post ชายหนุ่มที่เคยเข้ารับการรักษาตัวที่ Battle Creek Sanitarium ของหมอ John Harvey Kellogg นั่นไงครับ) บริษัทนี้เป็นผู้ผลิต Tang ได้พัฒนาเครื่องดื่มผงสังเคราะห์นี้ขึ้นมาในปี 1957 โดยนักเคมีชื่อ William A. Mitchell ซึ่งเขาไม่ได้แค่คิดค้น Tang เท่านั้น แต่เขายังคิดค้น Cool Whip, Pop Rocks, Jell-O ที่เซ็ตตัวเร็ว, ไข่ขาวผง และผลิตภัณฑ์ทดแทนมันสำปะหลังยอดนิยม รวมถึงผลิตภัณฑ์อื่นๆ อีกมากมาย (รวมสิทธิบัตรทั้งหมด 70 ฉบับ) แต่ละตัวนี่ทุกวันนี้ยังขายในซุปเปอร์อยู่เลยครับ ผลิตภัณฑ์หลักชิ้นแรกที่มิตเชลล์คิดค้นคือผลิตภัณฑ์ทดแทนมันสำปะหลังซึ่งได้รับการพัฒนาเพื่อหลีกเลี่ยงการขาดแคลนมันสำปะหลังอันเป็นผลจากสงครามโลกครั้งที่ 2 ซึ่งเป็นเหตุผลว่าทำไมมันสำปะหลังจึงบางครั้งถูกเรียกว่า “Mitchell’s Mud”

Tang นั้นตอนแรกกลับขายไม่ค่อยออก เพราะคนยุคนั้นยังเชื่อใน “น้ำส้มสด” ที่บีบจากผลไม้มากกว่าอะไรที่ชงจากผง แน่นอนมันเหมือนที่ทุกวันนี้เราพร่ำบอกว่า "ฉันเลือกอาหารธรรมชาติ" นั่นแหละครับ แทบไม่ต่างกันเลย

จนกระทั่ง NASA เข้ามา

ปี 1962 องค์การ NASA ต้องเผชิญปัญหาใหญ่ที่คนทั่วไปนึกไม่ถึง นั่นคือ น้ำในอวกาศรสชาติ “แย่มาก” เพราะระบบกรองน้ำรีไซเคิลทำให้น้ำมีรสโลหะอ่อนๆ ปนน้ำยาฆ่าเชื้อ จะให้มนุษย์อวกาศดื่มแบบนั้นทุกวันคงทำให้ภารกิจเสียสมาธิได้ง่ายกว่าการหลุดวงโคจรเสียอีก

นั่นคือจุดที่ Tang ถูกนำมาใช้ครั้งแรกโดย John Glenn ในภารกิจ Mercury-Atlas 6 ซึ่ง Tang ถูกเพิ่มไว้ในเมนูของภารกิจ Mercury ของ John Glenn ในปี 1962 ซึ่งเขาได้โคจรไปรอบโลกและทำการทดลองรับประทานอาหารในอวกาศ Mercury-Atlas 6 เป็นภารกิจที่ให้ข้อมูลสำคัญเกี่ยวกับการเปลี่ยนแปลงทางกายภาพของมนุษย์เมื่ออยู่ในสภาวะไร้น้ำหนัก ภารกิจนี้ช่วยสร้างความมั่นใจให้กับ NASA ว่าเทคโนโลยีของตนพร้อมก้าวต่อไปสู่ภารกิจที่ซับซ้อนยิ่งขึ้น นำไปสู่ โครงการ Gemini และ โครงการ Apollo ตามลำดับ

เมื่อ NASA ตัดสินใจเติมผง Tang ลงในน้ำเพื่อปรับรสชาติให้น่าดื่มขึ้น กลายเป็นจุดเริ่มต้นของการตลาดที่แทบจะ “ยึดโลก” ได้ในชั่วข้ามคืน เพราะหลังภารกิจนั้น Tang โฆษณาโดยใช้คำว่า “เครื่องดื่มที่นักบินอวกาศดื่มจริง” เห็นไหมครับว่านั่นแหละคือพลังของวาทกรรม

ทีนี้หล่ะพี่เอ้ยยยย เด็กๆ แห่กันดื่ม Tang กันทั่วอเมริกา เพราะรู้สึกว่าการชงน้ำส้มผงในบ้านทำให้ตัวเองเข้าใกล้ดวงจันทร์ได้สักนิด ผู้ปกครองก็สบายใจ เพราะฉลากเขียนว่ามีวิตามิน C และ “ไม่ต้องแช่เย็น” เหมาะกับยุคโมเดิร์นที่ตู้เย็นก็ยังแพงอยู่ ใครจะไปนั่งทำน้ำส้มคั้นกันให้ลำบาก เห็นไหมครับว่าวัฒนธรรมการพึ่งพา “อาหารสำเร็จรูปเพื่ออนาคต” ก็เริ่มตั้งไข่จากตรงนี้อีกจุดนึง

ถ้าหากเราลองส่องลึกลงไปในสูตรของ Tang จะพบว่ามันคือของผสมของ น้ำตาล, กลิ่นแต่งสังเคราะห์, วิตามิน C ที่เติมเข้าไปภายหลัง และกรดซิตริกเพื่อเลียนแบบความเปรี้ยวของผลไม้ เรียกง่ายๆ ว่า “ไม่มีอะไรที่่ได้คุณค่าแบบส้มธรรมชาติเลย” ยกเว้นจินตนาการ

ถึงกระนั้น ผู้บริโภคก็ไม่ได้โวยวายอะไรแถมยังโห่ร้องตอบรับ Tang เป็นอย่างดี เพราะอิทธิพลของ NASA ทำให้คนรู้สึกว่า "ต้องดีแน่ๆ ถ้าแม้แต่ NASA ยังใช้" แม้ว่า NASA เองจะไม่เคยพูดว่า Tang ดีต่อสุขภาพและมันเป็นเครื่องมือชั่วคราวเพื่อทำให้น้ำดื่มได้ ไม่ได้ใช้เพราะว่า Tang ดีกว่าน้ำส้ม...แต่นั่นแหละ ความเงียบของ NASA ถูกตลาดตีความจนเกินจริงไป เพราะการไม่ปฎิเสธนั่นหมายถึงการตอบรับ การตลาดและผู้บริโภคจึงตีความไปในทางเดียวกันว่า มันวิเศษกว่าส้มธรรมดา เพราะมันคือเครื่องดื่มระดับอวกาศเลือกใช้

หลายปีต่อมา เมื่อนักโภชนาการหลายคนเริ่มออกมาเตือนว่า Tang คือน้ำตาลล้วน ไม่มีเส้นใย ไม่มีประโยชน์ใดที่เทียบได้กับผลไม้จริง ผู้ผลิตก็หันมาใส่ "วิตามินเสริม" เพิ่มอีกให้แทนเพื่อล้างภาพลักษณ์เดิมประมาณว่า อ่ะอยากได้วิตามินอะไรเราเติมให้เทผสมในสูตร กลายเป็นสคริปต์ซ้ำของอาหารยุค “อาหารอนาคตปลอม” ที่เอาสารอาหารเดี่ยวๆ มาเติมแล้วโฆษณาว่า “เหมือนธรรมชาติ” หรือดีกว่าเสียอีก

เราอ่านถึงตรงนี้ก็ไม่ต้องตลกหรือขำเลยครับ หันมามองอาหารปัจจุบัน ของบางอย่างมีวิตามินสูงเพราะเทวิตามินผงลงไปผสม เช่นนมพืชต่างๆ ที่อยู่ดีๆก็มีวิตามินระดับซุปเปอร์ฟู้ดขึ้นมาเฉยเลย หรือแม้แต่พืชบางชนิดที่อุ้มน้ำได้ดี ก็มีวิตามินสูงระดับหลายสิบถึงร้อยเท่าของธรรมชาติของมัน ด้วยการเติมวิตามินลงไปในอาหารพืช ที่เพาะเลี้ยงกัน และยิ่งถ้ามองแบบเตรียมพร้อมไปถึงอนาคต อยู่ที่ใครแล้วครับว่าจะมองเห็นใส้ในของอาหารเหล่านี้ไหม เชื่อไหมว่าหลายต่อหลายคนมองว่ามันดี มันงาม มันซุปเปอร์ฟู้ด แล้วหันกลับไปมอง Tang ครับ อดีตมันเคยเป็น Super Orange Juice มาก่อน แล้ววันนี้คุณตลกกับมันไหม? แล้วคุณตลกกับวันนี้ไหม? แล้วคุณตลกกับอนาคตที่กำลังจะมาไหม? นั่นคือคำตอบที่คุณต้องเอาภาพร่างเหล่านี้ มาวางทับกัน แล้วตั้งคำถามกับซุปเปอร์ฟู้ดหรือฟิวเจอร์ฟู้ด ที่คุณกำลังเทิดทูนว่า "ดีต่อสุขภาพ" แล้วไหม?

Tang คือผลผลิตของยุคที่ความสะดวก = ความดี และความโมเดิร์น = ความน่าเชื่อถือ เราจึงเห็นว่าสิ่งที่เคยเกิดขึ้นกับซีเรียล, นม, หรือแม้แต่ Spam ก็ล้วนมีแก่นเดียวกันคือ "ทำให้ง่ายขึ้น ถูกลง เก็บได้นานขึ้น แล้วสร้างภาพว่าเหนือกว่าของเดิม"

Tang ไม่ใช่ผู้ร้าย แต่มันคือตัวละครสำคัญในยุคที่วิทยาศาสตร์กลายเป็นเครื่องมือของตลาด ไม่ใช่เพื่อค้นหาความจริง แต่เพื่อผลิตความรู้สึกปลอดภัยแบบสังเคราะห์ให้กับสังคม

และทั้งหมดนี้...เริ่มจากความพยายามทำให้น้ำอวกาศดื่มได้ ไม่มีกลิ่นเหล็กๆ เท่านั้นเอง

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 73868430:0ec4fe27

2025-06-18 02:09:08

@ 73868430:0ec4fe27

2025-06-18 02:09:08皇居 Imperial Palace

巽櫓(桜田二重櫓) Sakurada Tatsumi Yagura

二重橋 Nijubashi Bridge

靖國神社 Yasukuni Jinja

遊就館 Yushukan

上野動物園 Ueno Zoological Garden

上野動物園不忍池 Ueno Zoological Garden Shinobazuno Pond

上野東照宮五重塔 Ueno Toshogu Shrine Five Story Pagoda

築地活鮮市場,御徒町店 Tsukiji Kassen Ichiba, Okachimachi

鉄道博物館 The Railway Museum

TOHAKU茶館 (応挙館) Tohaku Chakan

新大久保駅 Shin-Ōkubo

シンボルプロムナード公園 Symbol Promenade Park

セントラル広場 Central Square

日本科学未来館 The National Museum of Emerging Science and Innovation Japan (Miraikan)

箱根町 Hakone

芦ノ湖 Lake Ashi

元箱根 Motohakone

彫刻の森駅 Chokokunomori

三の鳥居,箱根神社 The Third Torii of Hakone Shrine

小田原城 Odawara Castle

-

@ eb0157af:77ab6c55

2025-06-17 22:03:15

@ eb0157af:77ab6c55

2025-06-17 22:03:15The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ dfa02707:41ca50e3

2025-06-17 21:01:55

@ dfa02707:41ca50e3

2025-06-17 21:01:55- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 8bad92c3:ca714aa5

2025-06-18 02:02:08

@ 8bad92c3:ca714aa5

2025-06-18 02:02:08Key Takeaways

Mel Mattison presents a bold, contrarian outlook on today’s economy, arguing that what many view as a precarious bubble is actually the beginning of a long-term structural bull market that could run through 2036. He believes the U.S. economy is far stronger than the headlines suggest, supported by robust job growth, strong consumer balance sheets, and demographic tailwinds. Rather than popping, the current asset bubble is set to expand, driven by retiring baby boomers reducing labor inflation, AI-fueled productivity gains, and massive fiscal stimulus disguised as interest expense. He views Bitcoin as uniquely positioned to thrive in both inflationary and deflationary environments, unlike fiat currency, and sees AI’s high energy demands as a healthy bottleneck that will slow its rollout and allow society to adjust. According to Mattison, the U.S. is entering an era of permanent stimulus and rising productivity, with politics largely irrelevant to the macro trajectory, whether under populist left or populist right, the fiscal and demographic forces shaping the next decade are already locked in.

Best Quotes

“Bitcoin works in an inflationary world and it works in a deflationary world.”

“People are going to look back at 110,000 Bitcoin just like they looked back at 30,000 and say, ‘Man, I should’ve been buying.’”

“Interest expense is fiscal stimulus. There’s no difference between a COVID check and 4.5% on a 3-month bill going into a retiree’s money market account.”

“AI will be massive, but its energy demands are the bottleneck that will save us from an unmanageable shock.”

“This isn’t the 1970s. The U.S. is the largest oil producer in the world, and the demographic structure has flipped.”

“We are in the early stages of a seismic change, think Agricultural Revolution or Industrial Revolution level.”

Conclusion

This episode offers a compellingly optimistic view of the next decade, with Mel Mattison arguing that we’re entering the early stages of a historic bull market driven by demographic shifts, fiscal transformation, and exponential technologies like AI. Rather than collapse, he sees structural strength and enduring growth, positioning Bitcoin as a core asset in this new paradigm, resilient in both inflationary and deflationary cycles. Mattison urges a focus on long-term fundamentals over short-term noise, framing Bitcoin, demographics, and AI as the key forces reshaping the global economic order.

Timestamps

0:00 - Intro

0:55 - Getting up to speed

6:57 - The Rates Boogeyman

14:42 - Bitkey

15:37 - AI revolution

28:13 - Boomer exit and fiscal stimulus

34:07 - Unchained

34:35 - AI bottleneck

42:59 - Wealth gap

52:53 - Bullish vibesTranscript

(00:00) the 1971 Nixon shock where he took the US off the gold standard he also put on 10% sweeping across the board tariffs he announced that they were going to do spending cuts something like a Doge this is 55 years ago it's like the exact same things the demographics the oil differences between the 70s and now they're going to allow this situation to work out a lot more like the 80s we had between 1985 and 1996 360% S&P growth the days of 2000 something gold are probably over with Bitcoin you know I've been thinking this month we've got an AI

(00:31) super cycle boom going on it it just all speaks to extreme bullishness but we've got a lot more to go gold and Bitcoin I think actually in geopolitical uncertainties are are only going to do better mel I'm not going to lie I've been pretty disconnected for the last 3 weeks so I'm very excited we're having this conversation cuz I have a feeling it's going to help me catapult back into the present day get caught up with everything that's been going on we had the conference in Vegas a few weeks ago now at this point I had a cross country move between now and then and I had a wedding in Chicago over the weekend and

(01:20) I've been sort of out of the loop with what's going on and I need an update what are what are you seeing out there no well that's that's perfect and uh I'm getting ready to head out for a few days uh myself um on Thursday to the the Blue Ridge Mountains here in North Carolina haven't been there since the hurricane went through uh so interested to see how my old spots are doing um but it's always good to get away so happy to bring you up to speed um you know there's a lot going on and at the same time there's not right that the steady march higher in Bitcoin in equities uh

(01:58) gold has been on you know just a consolidation phase basically since it kind of blew up to 3500 um but given how fast and how strong that move was it actually is just a sign of strength to me that it's still you know holding well above 3,000 i think the days of 200 something gold are probably over i think I think if it ever gets there into five figures again it's not going to be for long with Bitcoin i think this this is a big move um you know people are going to look back at 110,000 Bitcoin just like

(02:35) they look back at 50,000 Bitcoin or 30,000 Bitcoin and say "Man I should have been buying there." Um you know we we've broken over uh the high set you know a few months ago i think that's now clearly you know a floor you know um support and you know I think the next upside target for me has always been that 150 range which I think you know I've been thinking 120 uh this month uh 150 is my call by the end of the year but really that's like a base case based on technical analysis i do that that is is a point where I reassess and and when I

(03:15) reassess it I have a feeling like um I'm going to pretty quickly come out with the target um around uh 190 195 as like a next upside target and you know we'll see when we get there but so just you know I think the best thing you can do actually for these markets is turn off your news because it's like last night I'm flipping between the channels and it's you know kurfles with Elon and Trump it's riots and fires and protests in LA it's um you know uh US behind the eightball with rare earth versus China um you know tariffs are

(03:56) going to start rolling into the inflation numbers uh job market only created 130ome thousand it's weak which I think is BS it's actually was a super strong report um there's been almost no government job creation since Trump took office so you essentially have to look and say well if every month under Biden there was like 40,000 government jobs and now that's not there i mean you take the 139 or whatever it was last week you had 40 you're up to about 180 you know which is really what the private sector is creating and it's doing that at a time where you have this demographic

(04:33) rollover where you have literally when you look at the unemployment reports which they break down you know foreignb born native born you know you have nativeorn you know people in the workforce declining and so if you're creating jobs I mean that that's why you're seeing you know the unemployment rate still 4.

(04:52) 2% so we've got a super strong job market we've got a consumer that is as unlevered as it has been in the last 20 years um you know you can't look at like credit card delinquencies or something like that you have to look at you know net worth you know yes is this skewed towards the wealthier you know 50% of America sure i mean the bottom 50% isn't exactly rolling in the dough but the top 20% certainly is especially when you factor in um over 12 trillion of tappable uh home equity um which I think is just now beginning to be tapped and and will begin getting tapped even

(05:35) more so um once the Fed fund funds rate goes down and I think it will um exactly how much and how quickly we can get into that too but I mean basically I guess where I'm going with all of this is the the doom and gloom you hear about whether you're scrolling through Twitter or turning on the news channels is masking what is an incredibly strong economy we've got an AI like super cycle boom going on we've got the blockchain and um all of that brings all of what that brings to financial services um you know uh counties or states in New Jersey

(06:12) now putting real estate deeds on the blockchain DeFi finally starting to happen in the real world stable coin bill um you know Bitcoin you know being part of the institutional investment mindset people understanding it more um I mean it it just all speaks to extreme bullishness and yet when you look at some of the surveys out there there's still net bearish you know like there's different sentiment gauges we were really really bearish we're still net bearish we're almost back to that median line uh you know overall and so we've got just people that are just doubters haters and you know which I think is

(06:53) great because it just means you know we've got a lot more to go yeah i'm very happy that you confirmed that being disconnected is probably the right move it's It's felt good not being in the day-to-day the actually the only day that I was really plugged in I was on a cross country flight and that was when Elon was having his his uh meltdown on X but that seems to have been brushed under the rug pretty quickly they were like "Okay damage control.

(07:24) " Uh it seems like they want to forget that that happened and pretend like it it never did but I think diving into you were mentioning this before we hit record how do rates play into this cuz looking at the 10-year at 4.47 30-year at 4.94 up over the last month but down from their highs intrammon and I think a lot of the focus of the doomers if you will is the elevated 10 year and 30-year and all the debt that needs to be rolled over how do you see that factoring into this outlook yeah I mean I I call it the rates -

@ eb0157af:77ab6c55

2025-06-18 02:02:07

@ eb0157af:77ab6c55

2025-06-18 02:02:07Carl Rickertsen completely exits his position in Strategy as insiders sell $864 million worth of stock.

As reported by Protos, Carl Rickertsen, a member of Strategy’s board of directors, has fully liquidated his entire shareholding for over $10 million.

Rickertsen’s decision to completely exit his Strategy position marks a sharp shift from his previous investment stance. In 2022, the executive had shown confidence in the company by investing $700,000 in MSTR shares.

On June 13, 2022, Rickertsen purchased $608,000 worth of MSTR stock at $152 per share. Since then, the stock has rallied 152%. However, by 2023, the director had already sold half of his 4,000-share position.

Rickertsen’s approach to managing his holdings has become increasingly aggressive in recent years. Since joining the board in 2019, he has adopted a strategy of immediately liquidating any stock options received.

One example of this tactic occurred on June 2, when he acquired and sold 26,390 MSTR shares on the same day.

As of June 5 this year, Rickertsen reported zero vested Strategy shares, marking the end of his equity involvement with the company.

Rickertsen’s situation is not an isolated case within Strategy. Data from the Securities and Exchange Commission (SEC) reveals a controversial picture. According to information gathered by secform4.com, over the past five years, total insider sales have exceeded purchases by $864 million. This imbalance in insider transactions could raise questions about executives’ confidence in the company’s future.

The post Strategy director liquidates all his MSTR shares appeared first on Atlas21.

-

@ 73d8a0c3:c1853717

2025-06-18 03:57:48

@ 73d8a0c3:c1853717

2025-06-18 03:57:48[The following contains two excerpts from my Research/Novel/Expose on Redacted Science. I’m not a scientist. I’m a Chemical Engineer and data architect of 30 years. But this is real science, and someone made it go away. I wouldn’t have found it, except for.. well, you’ll have to read the research (still writing, but basically have 90% of the science explained)]

This is about how biology breaks down when pushed beyond design — and how some systems fight to keep going anyway. It has implications for:

• critical care medicine

• post-viral syndromes

• metabolic disease

• aging

• neuroinflammation

• psychiatric conditions (ADHD, depression, anxiety)

• and maybe even AI alignment (in how systems retain integrity under corrupt inputs)

We expect fungal research — especially around long-term host adaptations and stealth co-evolution — to become a major field of study. Why? Because all these chemical are making me live even when every organ in my body is not working the way it is supposed to work. Every Single One. What appears fringe today may soon be foundational. This isn't just about pathogens. It's about how biological, immunological, and behavioral systems interact under persistent pressure — including possible symbiosis, crowding effects, and neurological modulation.

Finding out what is and what is not going on is what science is about. Someone decided otherwise.

[Your Move]

What If?? [Theoretical Musing — basically, this is no longer a zero percent chance] • What if Candida albicans isn’t just a pathogen, but a legacy co-evolutionary organism — one that historically regulated population density, behavior, and reproduction during times of scarcity?

• What if the pituitary evolved in direct response to its influence — not just to manage reproduction, but to insulate cognition from fungal manipulation?

• What if its connection to cannabinoids, dopamine, and hunger isn’t accidental — but a chemical dialogue that shaped our very instincts?

• What if the rise in modern autoimmune, psychiatric, and neurodegenerative conditions is a side effect of our disrupted balance with fungal cohabitants?

• What if the “zombie” analogy isn’t hyperbole — but a primitive warning system encoded in our myths, whispering about a very real form of behavioral control?

These are speculative. But they are now in the non-zero zone.

And history has a pattern: first ridicule, then resistance, then recognition.

[You see, the coolest thing about this is that I am the proof. No getting out of it] [The even cooler thing is you made me, in a way. Even though I did do this to myself. You gave me a mind that wouldn't let go and just enough information to track it all down.]

This is what happens when you don’t give up.

When your organs stop working the way they’re supposed to — and something else takes over. Something old. Something hidden. Something that adapts.

This isn't just about illness anymore. It's about systems — biological, chemical, behavioral — pushed beyond design. And yet, somehow, still running.

That’s the mystery. That’s the threat. That’s the message.

We now live in a world where science is selected, symptoms are dismissed, and adaptation itself is misdiagnosed. But what if the system that kept me alive is one we were never meant to survive? What if it’s not just me?

What if the pathogen was the backup plan?

If you’ve read this far, you already know: I’m not asking for your permission. I’m not asking for your diagnosis.

I’m laying out the board.

Your move.

[Checkmate]

🕳️ #science #nostr #candida #aiAlignment #medicalmystery #buriedtruth

-

@ 31a4605e:cf043959

2025-06-17 17:51:52

@ 31a4605e:cf043959

2025-06-17 17:51:52Com a crescente digitalização do dinheiro, os governos de vários países começaram a desenvolver moedas digitais de banco central (CBDCs - Central Bank Digital Currencies) como resposta à popularização de Bitcoin. Enquanto Bitcoin representa um sistema financeiro descentralizado e resistente à censura, as CBDCs são versões digitais das moedas fiduciárias, controladas diretamente pelos bancos centrais. Essa concorrência pode moldar o futuro do dinheiro e definir o equilíbrio entre liberdade financeira e controlo estatal.

Diferenças fundamentais entre Bitcoin e CBDCs

Bitcoin e as CBDCs diferem em praticamente todos os aspetos fundamentais:

Centralização vs. Descentralização: Bitcoin opera numa rede descentralizada, onde nenhum governo ou entidade pode alterar as regras ou censurar transações. Já as CBDCs são emitidas e controladas pelos bancos centrais, permitindo um maior controlo sobre a circulação e utilização do dinheiro.

Oferta limitada vs. Inflação controlada: Bitcoin tem uma oferta fixa de 21 milhões de unidades, tornando-se um ativo escasso e deflacionário. As CBDCs, por outro lado, podem ser criadas sem limites, como acontece com as moedas fiduciárias tradicionais, sujeitas a políticas monetárias inflacionárias.

Privacidade vs. Monitorização: Bitcoin permite transações pseudónimas, garantindo um certo nível de privacidade financeira. As CBDCs, no entanto, podem ser programadas para permitir o rastreamento total de cada transação, facilitando a supervisão governamental e, potencialmente, o controlo sobre o que os cidadãos podem ou não gastar.

Resistência à censura vs. Controlo estatal: Bitcoin permite que qualquer pessoa realize transações sem depender de aprovação de terceiros. As CBDCs, por serem centralizadas, podem ser usadas pelos governos para restringir transações indesejadas ou mesmo confiscar fundos com um simples comando digital.

O que os governos pretendem com as CBDCs?

A introdução das CBDCs tem sido vendida com argumentos como:

Maior eficiência nas transações financeiras, eliminando intermediários e reduzindo custos bancários.

Facilidade na implementação de políticas económicas, como estímulos diretos à população ou tributação automatizada.

Combate a atividades ilegais, dado que as transações podem ser rastreadas em tempo real.

No entanto, muitas destas justificações levantam preocupações sobre a perda de privacidade financeira e o aumento do poder dos governos sobre o sistema monetário.

Bitcoin como alternativa às CBDCs

A ascensão das CBDCs pode fortalecer a posição de Bitcoin como alternativa de dinheiro verdadeiramente livre. À medida que os cidadãos percebem os riscos de um sistema financeiro 100% controlado pelo Estado, a procura por um ativo descentralizado e resistente à censura pode crescer.

Proteção contra o controlo estatal: Bitcoin permite que os utilizadores mantenham total soberania sobre o seu dinheiro, sem o risco de bloqueios arbitrários ou confiscações.

Preservação da privacidade financeira: Ao contrário das CBDCs, que podem monitorizar todas as transações, Bitcoin oferece um grau de anonimato que protege os indivíduos da vigilância excessiva.

Reserva de valor contra a inflação: Enquanto os governos podem emitir CBDCs indefinidamente, Bitcoin mantém a sua escassez garantida, tornando-se um refúgio contra políticas monetárias irresponsáveis.

Resumindo, a competição entre Bitcoin e as CBDCs será uma das maiores batalhas financeiras do futuro. Enquanto os governos tentam consolidar o seu controlo através de moedas digitais centralizadas, Bitcoin continua a ser a principal alternativa para aqueles que procuram independência financeira e proteção contra a vigilância estatal. A escolha entre um sistema financeiro livre e um sistema monitorizado e controlado poderá definir o rumo da economia digital nas próximas décadas.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ eb0157af:77ab6c55

2025-06-18 02:02:06

@ eb0157af:77ab6c55

2025-06-18 02:02:06French lawmakers are proposing Bitcoin mining as a solution to optimize the national electricity system and make use of surplus energy.

A group of French parliamentarians has introduced an amendment that could turn the country into a European hub for Bitcoin mining, strategically leveraging its energy production capacity.

The legislative proposal aims to assess how mining could be integrated into the French energy system — the largest in Europe — to optimize the management of electricity produced by nuclear power plants.

The amendment to the law on “National Programming and Regulatory Simplification in the Energy Sector” calls on the government to conduct a thorough evaluation of the potential of Bitcoin mining. The initiative represents a pragmatic approach to addressing the issue of excess energy, a key topic for France’s nuclear industry.

France’s energy system, powered by nuclear for over 70% of its needs, often generates electricity surpluses that require efficient management. The proponents of the proposal see mining as an ideal solution to absorb this excess, transforming a potential waste into an economic resource.

The operational flexibility of mining farms offers a unique competitive advantage: machines can be quickly turned on and off based on production and consumption peaks, dynamically adapting to the needs of the electrical grid. This feature makes them particularly suitable for installation near power plants, even in the most remote areas of the country.

The parliamentary proposal highlights how mining could contribute to the revitalization of abandoned industrial sites, creating new opportunities for economic development under the supervision of public authorities.

Lawmakers emphasize the various benefits of this strategy: reducing negative pricing in wholesale markets, relieving the workload on nuclear plants by avoiding frequent modulation cycles that accelerate equipment wear, and absorbing surplus energy that would otherwise go to waste.

The French Association for the Development of Digital Assets (ADAN) collaborated in drafting the amendment, contributing technical expertise and industrial insight to the project. The organization emphasized how low-carbon Bitcoin mining could help strengthen the resilience of the national electricity grid.

The parliamentary report notes that mining in France could represent “an activity tailored to the constraints of the electrical system, absorbing surplus energy and reducing environmental impact” by using power that would otherwise be lost.

The post France considers Bitcoin mining: parliamentary proposal for managing nuclear energy appeared first on Atlas21.

-

@ 31a4605e:cf043959

2025-06-17 17:49:53

@ 31a4605e:cf043959

2025-06-17 17:49:53Desde a sua criação, Bitcoin tem sido um ativo revolucionário, desafiando o sistema financeiro tradicional e propondo uma nova forma de dinheiro descentralizado. No entanto, o seu futuro ainda é incerto e gera intensos debates. Entre os cenários possíveis, dois extremos destacam-se: a hiperbitcoinização, onde Bitcoin se torna a moeda dominante na economia global, ou a obsolescência, caso a rede perca relevância e seja substituída por outras soluções.

Hiperbitcoinização: o mundo adota Bitcoin como padrão monetário

Perda de confiança nas moedas fiduciárias: Com a impressão excessiva de dinheiro por bancos centrais, muitas economias enfrentam inflação descontrolada. Bitcoin, com a sua oferta limitada de 21 milhões de unidades, apresenta-se como uma alternativa mais confiável.

Adoção crescente por empresas e governos: Alguns países já começaram a integrar Bitcoin na sua economia, aceitando-o para pagamentos e reserva de valor. Se essa tendência continuar, a legitimidade de Bitcoin como moeda global aumentará.

Facilidade de transações globais: Bitcoin permite transferências internacionais rápidas e baratas, eliminando a necessidade de intermediários financeiros e reduzindo custos operacionais.

Avanços tecnológicos: Melhorias na escalabilidade, como a Lightning Network, podem tornar Bitcoin mais eficiente para uso diário, facilitando sua adoção em massa.

Se a hiperbitcoinização acontecer, o mundo pode testemunhar uma mudança radical no sistema financeiro, com maior descentralização, resistência à censura e uma economia baseada em dinheiro sólido e previsível.

Obsolescência: Bitcoin perde relevância e É substituído

Regulações governamentais restritivas: Se grandes potências económicas impuserem regulações severas sobre Bitcoin, a adoção pode ser dificultada, reduzindo sua utilidade.

Falhas tecnológicas ou falta de inovação: Apesar da sua segurança e descentralização, Bitcoin pode enfrentar dificuldades para escalar de forma eficiente. Se soluções melhores surgirem e forem amplamente aceites, Bitcoin pode perder a sua posição de liderança.

Concorrência com alternativas mais rápidas e eficientes: Se outras formas de dinheiro digital conseguirem superar Bitcoin em termos de escalabilidade e usabilidade, a rede pode ver a sua adoção diminuir.

Falta de incentivos para os mineradores: Como a emissão de novos Bitcoins diminui a cada halving, os mineradores dependerão cada vez mais das taxas de transação. Se essas taxas não forem suficientes para sustentar a segurança da rede, pode haver um risco para a sua viabilidade a longo prazo.

Resumindo, o futuro do Bitcoin pode seguir diferentes caminhos, dependendo de fatores como inovação, adoção global e resistência a desafios externos. A hiperbitcoinização representaria uma revolução económica, com um sistema monetário descentralizado e resistente à inflação. No entanto, a obsolescência continua a ser um risco, caso a rede não consiga adaptar-se às exigências futuras. Independentemente do desfecho, Bitcoin já deixou a sua marca na história financeira, abrindo caminho para uma nova era de dinheiro digital e liberdade económica.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ eb0157af:77ab6c55

2025-06-18 02:02:06

@ eb0157af:77ab6c55

2025-06-18 02:02:06The new communication protocol aims to improve the industry with measurable advantages in terms of efficiency and security.

A new study conducted by Hashlabs, in collaboration with the SRI (Stratum V2 Reference Implementation) team and figures like Matt Corallo, Alejandro De La Torre and others reveals how the Stratum V2 protocol can increase miner profitability compared to the current Stratum V1 standard, used for over a decade.

Speaking to Atlas21, Gabriele Vernetti, Stratum V2 maintainer, declared:

“This first case study demonstrates how much Stratum V2 can help miners as well, securing and increasing their profits, in addition to the rest of the network. It’s just a first study aimed at demonstrating how decentralization can be aligned with the profit dynamics typical of the mining sector.

In the future we will also focus on the benefits for mining pool operators, who can benefit from the protocol’s efficiency to lower their operating costs (such as those for bandwidth used by their servers).

The feedback has been very positive: this first study was a joint work with various market players, including miners and mining pool operators. As SRI we want to continue working together with the entire community as done in this case, becoming a reference point for all actors interested in innovating the Bitcoin mining field”.

The research, based on controlled tests with two identical ASIC S19k Pro, with stock firmware, demonstrates that Stratum V2 can increase net profits by up to 7.4%. For an industry that often operates with 10% margins, this could represent a substantial competitive advantage.

The V2 protocol reduces various inefficiencies that plague the current system. The latency in block switching, that is the waiting time created when a miner must change block template after a new block has been mined on the network, goes from 325 milliseconds to just 1.42 milliseconds, a speed 228 times higher. This translates to about 4.9 hours of completely wasted hash power less per year.

Another problem of modern mining concerns “stale shares” – proofs of work that arrive too late to be remunerated, often due to network latency or inefficient communication. However, not all stale shares depend on inefficiency problems. On average, about 2% are rejected for expected reasons, such as when the share doesn’t reach the minimum difficulty required by the pool. This value is considered normal in the sector. The remaining 98%, instead, is caused by avoidable delays. With Stratum V1, miners lose between 0.1% and 0.2% of their computing power this way. Stratum V2 with Job Declaration completely eliminates this waste, provided that the miner and the pool node have the same level of connectivity. This step could translate into a net profit increase of up to 2% by fully adopting Stratum V2 with Job Declaration.

In the Stratum V2 protocol, the Job Declaration Client (JDC) is software that allows miners to receive mining jobs directly from their local Bitcoin node, that is the block templates to work on. The JDC communicates directly with the miner’s local node, receiving updated data for new block construction and immediately sending them to the mining software via Stratum V2. This allows miners to receive jobs in real time from their own node, without having to wait for them from the pool, reducing latency and the risk of working on obsolete jobs. Furthermore, if the pool allows it, miners can build custom templates choosing which transactions to include in the block.

The research also highlights an often overlooked aspect: the loss of transaction fees. With the Stratum V1 protocol, miners lose about 0.75% of potential fees for each block due to the delay in receiving new jobs. Considering that about 52,560 blocks are mined each year, this loss per block adds up to a total of about 74 bitcoins per year, equivalent to over $8 million at current prices.

Beyond economic advantages, Stratum V2 solves a critical vulnerability of the current system: hashrate hijacking. The V1 protocol doesn’t encrypt communications, allowing attackers to intercept and steal up to 2% of computing power without the miner noticing. The new protocol eliminates this risk through end-to-end encryption and authentication.

According to the study, by reducing latency, optimizing share sending and improving security, Stratum V2 enables a potential net profit increase of 7.4%, derived exclusively from technical improvements.

The post Stratum V2 increases profits by 7.4%: “The study shows that profit and decentralization can coexist”, says Vernetti, SV2 maintainer appeared first on Atlas21.

-

@ 4ba8e86d:89d32de4

2025-06-17 17:47:48

@ 4ba8e86d:89d32de4

2025-06-17 17:47:48O protocolo Matrix é um sistema de comunicação descentralizado de código aberto que fornece uma plataforma para mensageiros descentralizados. O Element foi lançado em 2014 como uma implementação do protocolo Matrix, originalmente conhecido como Riot.im , A ideia do Element nasceu quando Matthew Hodgson e Amandine Le Pape, dois desenvolvedores de software, decidiram criar uma plataforma de comunicação aberta e segura, que permitisse aos usuários terem total controle sobre suas informações. Eles acreditavam que a internet deveria ser um lugar onde as pessoas pudessem se comunicar livremente, sem se preocupar com a privacidade de suas informações.

O Element é um aplicativo de chat gratuito e de código aberto disponível em várias plataformas, incluindo desktop, web e aplicativos móveis. Ele oferece criptografia de ponta a ponta, o que significa que as mensagens são protegidas e só podem ser lidas pelo remetente e pelo destinatário. Além disso, o Element é descentralizado, o que significa que ele não é controlado por uma única entidade, mas sim por uma rede global de servidores.

O Element é amplamente utilizado por indivíduos e empresas que desejam ter uma comunicação segura e privada. É frequentemente usado por equipes de projetos, organizações sem fins lucrativos e grupos ativistas que precisam compartilhar informações confidenciais e se comunicar de forma segura. O Element também é conhecido por seu recurso de salas públicas, que permite que os usuários se juntem a grupos de discussão sobre vários tópicos de interesse.

Uma das principais vantagens do Element é sua arquitetura descentralizada. Ao contrário das plataformas de mensagens convencionais que centralizam os dados em seus próprios servidores, o Element utiliza uma rede descentralizada, distribuindo as informações em diversos servidores espalhados pelo mundo. Isso significa que os dados dos usuários são menos suscetíveis a ataques cibernéticos e invasões, já que não são centralizados em um único ponto vulnerável.

Para usar o Element, normalmente os usuários precisam se registrar em um servidor Matrix. Existem várias opções disponíveis, incluindo servidores públicos e privados. No entanto, outra opção é criar um servidor próprio para usar o Element.

O Element também utiliza criptografia de ponta a ponta para proteger as mensagens e arquivos trocados entre os usuários. Isso significa que apenas o remetente e o destinatário das mensagens podem ler o conteúdo, garantindo que as informações permaneçam seguras e privadas.

Outra vantagem do Element é sua ampla variedade de recursos, incluindo videochamadas criptografadas, compartilhamento de tela e integração com outros serviços, como calendários e aplicativos de produtividade. Isso torna o Element uma plataforma completa de comunicação e colaboração, adequada para uso pessoal e empresarial.

O Element também é fácil de usar e possui uma interface intuitiva e personalizável. Os usuários podem personalizar a aparência do aplicativo e acessar diferentes configurações e recursos com apenas alguns cliques.

https://element.io/

https://github.com/vector-im/element-android

-

@ 31a4605e:cf043959

2025-06-17 17:46:15

@ 31a4605e:cf043959

2025-06-17 17:46:15Desde a sua criação, Bitcoin tem sido um marco na revolução do dinheiro digital, mas a sua evolução não parou no conceito inicial de transações descentralizadas. Ao longo dos anos, novas soluções tecnológicas foram desenvolvidas para expandir as suas capacidades, tornando-o mais eficiente e versátil. Entre essas inovações, destacam-se os smart contracts e a Lightning Network, que permitem aumentar a funcionalidade e escalabilidade da rede, garantindo um sistema mais rápido, barato e acessível.

Smart contracts no Bitcoin

Os smart contracts (contratos inteligentes) são programas que executam automaticamente determinadas ações quando certas condições pré-definidas são cumpridas. Embora o conceito seja mais comummente associado a outras redes, Bitcoin também suporta contratos inteligentes, especialmente através de atualizações como o Taproot.

Os smart contracts em Bitcoin permitem funcionalidades como:

Pagamentos condicionais: Transações que só são concluídas se determinadas regras forem cumpridas, como assinaturas múltiplas ou prazos específicos.

Gestão avançada de fundos: Utilização de carteiras multi-assinatura, onde diferentes partes precisam aprovar uma transação antes de ser processada.

Maior privacidade: Com a atualização Taproot, os smart contracts podem ser mais eficientes e indistinguíveis das transações normais, melhorando a privacidade da rede.

Embora os contratos inteligentes em Bitcoin sejam mais simples do que em outras redes, essa simplicidade é uma vantagem, pois mantém a segurança e robustez da rede, evitando vulnerabilidades complexas.

Lightning Network: escalabilidade e transações instantâneas

Um dos maiores desafios enfrentados por Bitcoin é a escalabilidade. Como a rede original foi desenhada para priorizar segurança e descentralização, a velocidade das transações pode ser limitada em períodos de alta procura. Para resolver esse problema, foi criada a Lightning Network, uma solução de segunda camada que permite transações quase instantâneas e com taxas extremamente baixas.

A Lightning Network funciona criando canais de pagamento entre utilizadores, permitindo que realizem várias transações fora da blockchain ou timechain principal de Bitcoin, registando apenas o saldo final na rede principal. Algumas vantagens incluem:

Velocidade: Transações são concluídas em milissegundos, tornando Bitcoin mais adequado para pagamentos diários.

Taxas baixas: Como as transações ocorrem fora da blockchain ou timechain principal, as taxas são mínimas, permitindo microtransações viáveis.

Descongestionamento da rede: Ao transferir grande parte das transações para a Lightning Network, a rede principal de Bitcoin torna-se mais eficiente e menos sobrecarregada.

Resumindo, o Bitcoin continua a evoluir tecnologicamente para se adaptar às necessidades de um sistema financeiro global. Os smart contracts aumentam as suas funcionalidades, permitindo maior flexibilidade e segurança nas transações. A Lightning Network melhora a escalabilidade, tornando Bitcoin mais rápido e eficiente para pagamentos do dia a dia. Com estas inovações, Bitcoin mantém-se na vanguarda da revolução financeira, demonstrando que, apesar das limitações iniciais, continua a adaptar-se e a crescer como um sistema monetário verdadeiramente descentralizado e global.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 39cc53c9:27168656

2025-06-16 06:25:50

@ 39cc53c9:27168656

2025-06-16 06:25:50After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ eb0157af:77ab6c55

2025-06-18 02:02:05

@ eb0157af:77ab6c55

2025-06-18 02:02:05Russian authorities uncover 95 Bitcoin mining machines hidden inside a truck stealing electricity from a village.

Law enforcement in the Republic of Buryatia has uncovered an illegal Bitcoin mining operation concealed inside a KamAZ truck. The clandestine facility was siphoning off electricity meant for the local population.

According to the national news agency TASS, the discovery was made during a routine inspection of power lines in the Pribaikalsky district, where inspectors identified an unauthorized connection to a 10-kilovolt line — enough to power an entire village. The criminal operation showed a high level of organization, with sophisticated equipment hidden inside an apparently innocuous transport vehicle.

Source: Babr Mash

Inside the commercial truck, authorities found a fully operational mining center equipped with 95 machines and a portable transformer station. The technical setup suggested careful planning, designed to maximize bitcoin production while minimizing the risk of detection.

Two individuals suspected of involvement in the illegal activity managed to escape in an SUV before law enforcement arrived.

Impact of illegal mining on the local power grid

Buryatenergo, a regional unit of Rosseti Siberia, stressed how unauthorized connections severely compromise the stability of the local power grid. Consequences include voltage drops, overloads, and potential blackouts that disproportionately affect rural communities, already vulnerable in terms of energy access.

The illegal siphoning of electricity for mining creates a domino effect across the entire electrical infrastructure, causing service disruptions for legitimate users and increasing maintenance costs for grid operators.

Government restrictions on mining

The Russian government has implemented various restrictions on cryptocurrency mining in several regions of the country. In Buryatia, mining is banned from November 15 to March 15 due to seasonal energy shortages. Only companies registered in specific districts such as Severo-Baikalsky and Muisky are allowed to operate outside this period.

Federal restrictions were further tightened in December 2024, when Russia announced a ban on mining during peak energy months in multiple regions, including Dagestan, Chechnya, and parts of eastern Ukraine under Russian control. Since April, a total ban has been in effect in the southern region of Irkutsk.

Despite these restrictions, some Russian companies continue to operate legally in the sector. BitRiver, one of the country’s leading operators, takes advantage of the region’s low-cost energy, having launched its first and largest facility in 2019 in the city of Bratsk.

The post Illegal mining: clandestine operation discovered in a KamAZ truck in Russia appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-18 02:01:28

@ b1ddb4d7:471244e7

2025-06-18 02:01:28Years ago, I flew a microlight aircraft for the first time and felt what it meant to leave the ground. Recently, I bought a gigabyte of storage for 5 cents via Lightning, and something similar happened. This is about that moment—when you stop believing something works and start knowing it does.

Every now and then (if you’re lucky) you have one of those “eureka” moments where the full implications of something hit you for the first time. My biggest experience of that was years ago when I got a microlight aircraft. They’d just come out, so there were no regulations, and anyone could buy one and just fly.

People who should never be flying were going all over the place, and—having no navigation training—they were following motorways instead. Some were even landing at the service stops to get more fuel. How could I resist?

The price included training at an old airfield that was now not busy at all. After a lot of taxiing along the runways, it came time to try a takeoff. Nothing can prepare you for that. It’s not like a Cessna or any of those “proper” aircraft; it’s just an aluminum frame, and you hang off the center of the main pole, the center of gravity. There was a twin motor behind me, totaling 250 cc. I could feel where the wind was on the wings, which side, and even how far along. It was an insight into what birds must feel. I’d trade wings for a big brain any day!

I hit the gas on full, and we accelerated. I had been told that this thing could fly. and had seen my teacher fly in it many times. I thought I understood that it could fly, but as I left the ground and the drag on the wheels was suddenly gone, the whole thing lurched up into the air fast, at a really steep angle, and before I could think, I was already higher than a house. That was when I understood that this thing could fly. Belief is not knowledge, and knowledge only comes from experience.

So it is with many things. So it is with Bitcoin and the Lightning Network. I believed that Lightning could “transform the economic landscape.” I had read about how bitcoin can “revolutionize the financial system.” What hadn’t happened yet was that I had not actually experienced it. That take-off moment came when someone sent me a file link on a CDN. I downloaded the PDF (300 MB or so) and then cut the end off the URL to have a look at the service provider.

To my surprise, they were offering storage space on the CDN at 5c per gigabyte per month. with “unlimited” data transfer. So I decided to try it out. Within a few seconds I had ordered, paid for, and received my credit, and the service was available. 5 cents! That was when I realized how simple everything else in the world can be with Bitcoin and the Lightning Network.

Who cares about how many stupid dollars you can get with bitcoin? Look at what you can do with it! In the new world that may be opening up for us, we can rid ourselves of the parasites who have held us back for so long. “When moon?” takes on a whole different meaning. Nothing is beyond our reach.

There was no bitcoin back in the Spanish Civil War when Durruti was doing his thing, but something of the same awakening must have stirred in him to inspire these words: “We should not be in the least afraid of ruins. They may blast and lay bare this world before they go, but we carry a new world here in our hearts, and this world is growing as we speak.”

https://satellite.earth is the site. It’s not just a storage provider; it’s a Nostr node you can use like any other node, and it has communities set up, among other things. It’s well worth a look. No, I’m not getting paid; they don’t even know me. And I’m not sure, but it looks like because I haven’t used the whole 1 GB yet, they are using my 5c to extend the time I have. In other words, it’s 5c per gigabyte-month, not per gigabyte per month.

-

@ eb0157af:77ab6c55

2025-06-18 03:01:36

@ eb0157af:77ab6c55

2025-06-18 03:01:36A new study by Kraken reveals how cryptocurrency investors perceive security as the main challenge in self-managing their digital assets.