-

@ 31a4605e:cf043959

2025-06-17 17:08:15

@ 31a4605e:cf043959

2025-06-17 17:08:15Bitcoin surgiu como uma alternativa ao sistema financeiro tradicional, oferecendo um meio de troca descentralizado e resistente à censura. No entanto, essa proposta desafia diretamente o controlo que os governos exercem sobre a economia, especialmente no que diz respeito à emissão de moeda e regulação do setor financeiro. Como resultado, muitos governos veem Bitcoin com desconfiança e tentam limitar a sua adoção, enquanto outros procuram integrá-lo à economia de forma controlada.

Motivos para o conflito entre governos e Bitcoin

A resistência governamental à adoção de Bitcoin deve-se a vários fatores, entre os quais se destacam:

Perda de controlo monetário: Os governos controlam a política monetária através da emissão de moeda fiduciária e da manipulação das taxas de juro. Bitcoin, por ter uma oferta fixa e descentralizada, impede que governos imprimam mais dinheiro, limitando a sua influência sobre a economia.

Dificuldade na tributação: A utilização de Bitcoin dificulta a fiscalização de transações e a cobrança de impostos, tornando-se um desafio para as autoridades que dependem da tributação para financiar gastos públicos.

Preocupações com regulação e crime financeiro: Muitos governos argumentam que Bitcoin pode ser usado para lavagem de dinheiro, evasão fiscal e outras atividades ilícitas. No entanto, como todas as transações ficam registadas na blockchain ou timechain, Bitcoin é, na realidade, mais rastreável do que o dinheiro físico.

Competição com moedas digitais de bancos centrais (CBDCs): Alguns governos estão a desenvolver as suas próprias moedas digitais, conhecidas como CBDCs. Estas oferecem um alto nível de controlo sobre as transações financeiras, mas não possuem as mesmas propriedades descentralizadas de Bitcoin. Para garantir a adoção das CBDCs, alguns governos tentam limitar ou proibir o uso de Bitcoin.

Diferentes países têm abordagens variadas em relação a Bitcoin, desde a aceitação total até a repressão severa.

El Salvador: foi o primeiro país a adotar Bitcoin como moeda legal em 2021. Esta decisão gerou conflitos com instituições financeiras globais, como o Fundo Monetário Internacional (FMI), que pressionou o governo salvadorenho a reconsiderar a sua decisão.

China: o governo chinês proibiu completamente a mineração e o uso de Bitcoin em 2021, alegando preocupações ambientais e riscos financeiros. No entanto, muitos mineradores e utilizadores chineses continuam a operar através de meios alternativos.

Estados Unidos: embora Bitcoin seja legal nos EUA, o governo tem imposto regulamentações mais rígidas às plataformas de troca e à mineração, tentando aumentar o controlo sobre o setor. Alguns políticos defendem uma abordagem favorável, enquanto outros veem Bitcoin como uma ameaça ao dólar.

União Europeia: a UE tem adotado uma postura regulatória mais rigorosa, impondo regras sobre a identificação dos utilizadores e a transparência das transações. Apesar disso, Bitcoin continua a ser legal e amplamente utilizado.

Apesar dos desafios impostos por alguns governos, a adoção de Bitcoin continua a crescer. Muitos utilizadores veem Bitcoin como uma forma de preservar a sua riqueza perante políticas monetárias inflacionárias e controlo excessivo sobre o dinheiro. Além disso, países com economias instáveis e sistemas financeiros pouco acessíveis encontram em Bitcoin uma solução para pagamentos internacionais e proteção contra crises económicas.

A resistência dos governos pode desacelerar a adoção de Bitcoin em algumas regiões, mas não conseguirá eliminá-lo completamente. Como uma rede descentralizada e global, Bitcoin continuará a ser utilizado, independentemente das restrições impostas por qualquer governo. A longo prazo, a sua adoção dependerá da capacidade dos indivíduos e empresas de resistirem às pressões regulatórias e continuarem a utilizá-lo como uma alternativa financeira.

Resumindo, o conflito entre governos e Bitcoin reflete a luta entre um sistema financeiro tradicional centralizado e uma nova alternativa descentralizada. Enquanto alguns países tentam proibir ou restringir o seu uso, outros adotam-no como parte da sua economia. No final, a resistência dos governos pode apenas atrasar, mas dificilmente impedirá a adoção global de Bitcoin, que continua a demonstrar a sua resiliência e utilidade como uma reserva de valor e meio de troca.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 43aec65f:003ef459

2025-06-17 17:05:41

@ 43aec65f:003ef459

2025-06-17 17:05:41test

fasdfa

Setpoint Voltage + - $ \sum $ Error {{1}} $$ K_p e(t) $$ {{2}} $$ K_i \int_{0}^{t} e(t) dt $$ {{3}} $$ K_d \frac{\Delta e(t)}{dt} $$ $\sum$ Control Voltage Process Output asdfasfd

Circumference: $$C = 2 \pi r$$

Radius: $r$ Area: $$A = \pi r^2$$

asdfafs

Setpoint Voltage + - $ \sum $ Error {{3}} $$ K_p e(t) $$ {{4}} $$ K_i \int_{0}^{t} e(t) dt $$ {{5}} $$ K_d \frac{\Delta e(t)}{dt} $$ $\sum$ Control Voltage Process Output -

@ 8bad92c3:ca714aa5

2025-06-17 17:01:58

@ 8bad92c3:ca714aa5

2025-06-17 17:01:58Marty's Bent

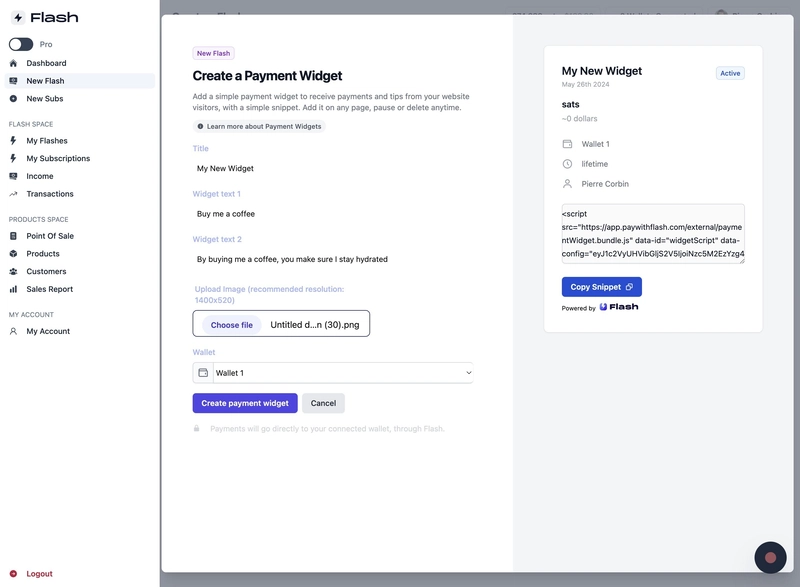

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

[

Opportunity Cost – See Prices in Bitcoin Instantly

Convert USD prices to Bitcoin (satoshis) as you browse. Dual display, privacy-first, and open source.

Opportunity CostTFTC

](https://www.opportunitycost.app/?ref=tftc.io)

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is completely open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important;

-

@ 9ca447d2:fbf5a36d

2025-06-17 17:01:38

@ 9ca447d2:fbf5a36d

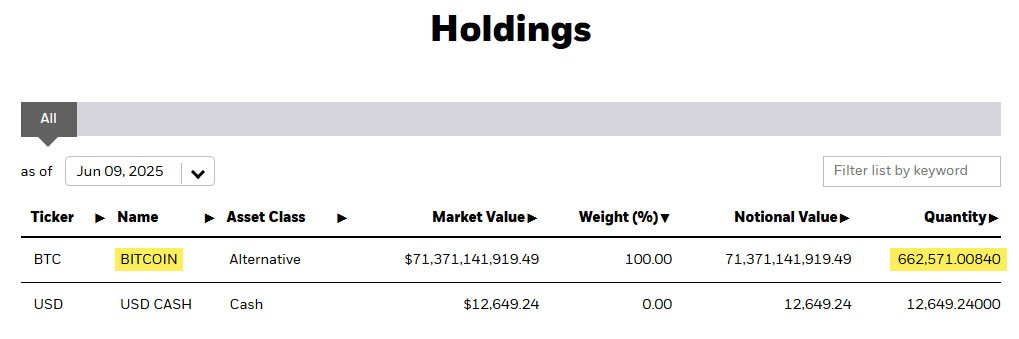

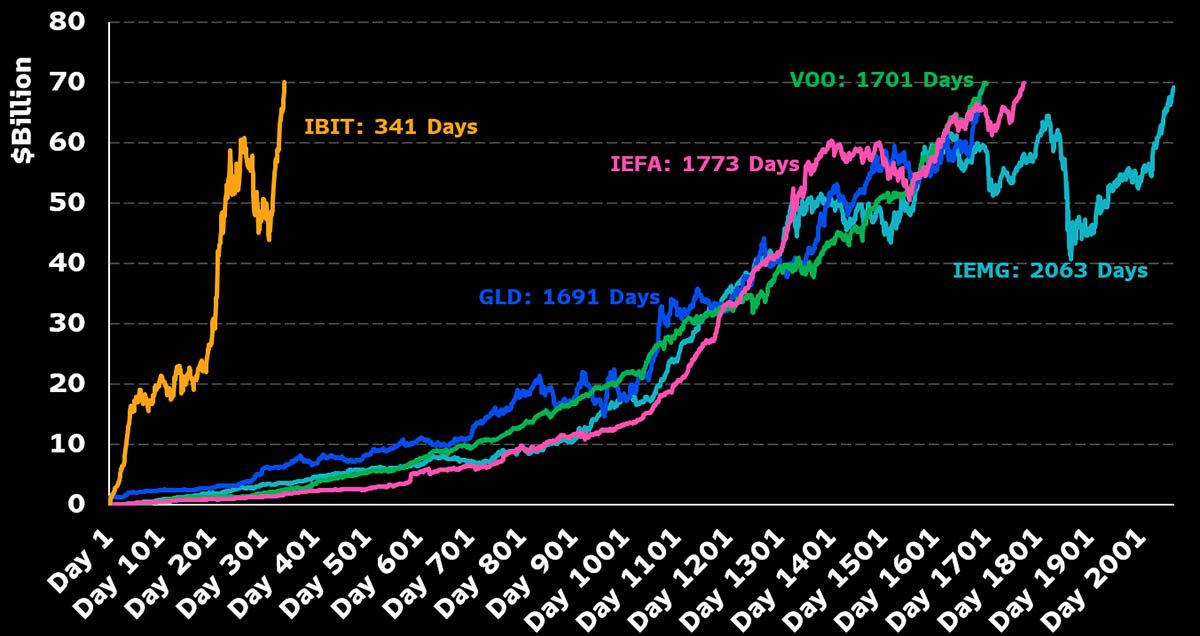

2025-06-17 17:01:38BlackRock’s iShares Bitcoin Trust (IBIT) has become the fastest exchange-traded fund (ETF) to ever reach $70 billion in assets under management (AUM).

The fund, which launched in January 2024, hit this milestone in just 341 trading days—five times faster than the previous record-holder, the SPDR Gold Shares ETF (GLD), which took 1,691 days to reach the same mark.

IBIT now holds over 662,000 BTC — iShares

Bloomberg ETF analyst Eric Balchunas tweeted on June 9, “IBIT just blew through $70 billion and is now the fastest ETF to ever hit that mark in only 341 days.” This is a big deal and shows bitcoin is going mainstream.

IBIT has beaten fastest growing ETFs in history — Eric Balchunas on X

The fund’s rapid growth means institutional investors are embracing bitcoin at scale.

The fund has $71.9 billion in AUM and holds over 662,000 bitcoin. This makes BlackRock the largest institutional bitcoin holder in the world. To put that in perspective, the fund holds more bitcoin than Binance or Michael Saylor’s Strategy.

“IBIT’s growth is unprecedented,” said Bloomberg analyst James Seyffart. “It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class.”

BlackRock’s bitcoin ETF isn’t just big. It’s also greatly outperforming other spot bitcoin ETFs launched at the same time. BlackRock’s brand and global client base gave the fund instant credibility.

Many institutional investors want a regulated and convenient way to get into bitcoin without holding the asset directly, and this fund has made it easy for them to invest.

Robert Mitchnick, BlackRock’s head of digital assets, told Yahoo Finance that bitcoin’s rising status as an inflation hedge and alternative store of value is driving IBIT’s popularity.

He explained bitcoin is becoming an inflation hedge and alternative store of value and that’s what’s driving the growth.

Eric Balchunas also noted that when BlackRock filed for IBIT, bitcoin was at $30,000 and there was still skepticism after the FTX blowup. Now that bitcoin is at $110,000, it is “seen as legitimate for other big investors.”

Institutional demand for bitcoin has never been stronger, with IBIT making up nearly 20% of all bitcoin held by public companies, private firms, governments, exchanges and decentralized finance platforms.

That dominance may soon be challenged as public companies prepare to buy more bitcoin and shake up the current supply distribution.

Matthew Sigel, VanEck’s head of digital assets research, shared data that six public companies plan to raise, or have raised, up to $76 billion to buy bitcoin. That’s more than half of the spot Bitcoin ETF industry’s current AUM, so there’s clearly interest beyond ETFs.

On the broader market, IBIT’s rise coincided with bitcoin’s price surge to new highs above $110,000. The inflows reflect investors’ confidence in Bitcoin’s future and desire for regulated exposure through traditional products.

It’s worth mentioning that IBIT also had over $1 billion in volume on its first day of trading. It’s now the largest ETF in BlackRock’s lineup, even bigger than gold funds and other popular ETFs tracking international equities.

-

@ 39cc53c9:27168656

2025-06-17 16:40:28

@ 39cc53c9:27168656

2025-06-17 16:40:28The new website is finally live! I put in a lot of hard work over the past months on it. I'm proud to say that it's out now and it looks pretty cool, at least to me!

Why rewrite it all?

The old kycnot.me site was built using Python with Flask about two years ago. Since then, I've gained a lot more experience with Golang and coding in general. Trying to update that old codebase, which had a lot of design flaws, would have been a bad idea. It would have been like building on an unstable foundation.

That's why I made the decision to rewrite the entire application. Initially, I chose to use SvelteKit with JavaScript. I did manage to create a stable site that looked similar to the new one, but it required Jav aScript to work. As I kept coding, I started feeling like I was repeating "the Python mistake". I was writing the app in a language I wasn't very familiar with (just like when I was learning Python at that mom ent), and I wasn't happy with the code. It felt like spaghetti code all the time.

So, I made a complete U-turn and started over, this time using Golang. While I'm not as proficient in Golang as I am in Python now, I find it to be a very enjoyable language to code with. Most aof my recent pr ojects have been written in Golang, and I'm getting the hang of it. I tried to make the best decisions I could and structure the code as well as possible. Of course, there's still room for improvement, which I'll address in future updates.

Now I have a more maintainable website that can scale much better. It uses a real database instead of a JSON file like the old site, and I can add many more features. Since I chose to go with Golang, I mad e the "tradeoff" of not using JavaScript at all, so all the rendering load falls on the server. But I believe it's a tradeoff that's worth it.

What's new

- UI/UX - I've designed a new logo and color palette for kycnot.me. I think it looks pretty cool and cypherpunk. I am not a graphic designer, but I think I did a decent work and I put a lot of thinking on it to make it pleasant!

- Point system - The new point system provides more detailed information about the listings, and can be expanded to cover additional features across all services. Anyone can request a new point!

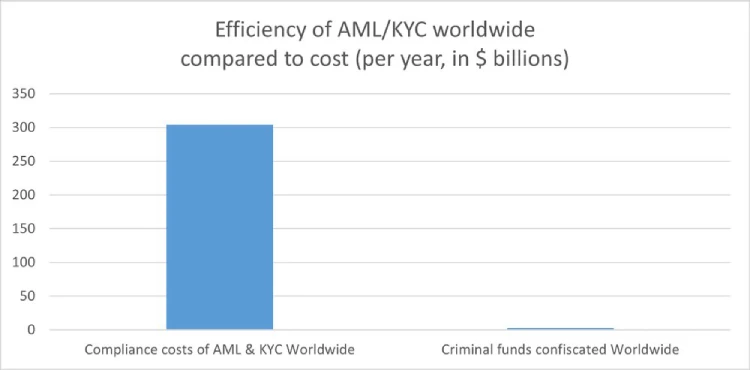

- ToS Scrapper: I've implemented a powerful automated terms-of-service scrapper that collects all the ToS pages from the listings. It saves you from the hassle of reading the ToS by listing the lines that are suspiciously related to KYC/AML practices. This is still in development and it will improve for sure, but it works pretty fine right now!

- Search bar - The new search bar allows you to easily filter services. It performs a full-text search on the Title, Description, Category, and Tags of all the services. Looking for VPN services? Just search for "vpn"!

- Transparency - To be more transparent, all discussions about services now take place publicly on GitLab. I won't be answering any e-mails (an auto-reply will prompt to write to the corresponding Gitlab issue). This ensures that all service-related matters are publicly accessible and recorded. Additionally, there's a real-time audits page that displays database changes.

- Listing Requests - I have upgraded the request system. The new form allows you to directly request services or points without any extra steps. In the future, I plan to enable requests for specific changes to parts of the website.

- Lightweight and fast - The new site is lighter and faster than its predecessor!

- Tor and I2P - At last! kycnot.me is now officially on Tor and I2P!

How?

This rewrite has been a labor of love, in the end, I've been working on this for more than 3 months now. I don't have a team, so I work by myself on my free time, but I find great joy in helping people on their private journey with cryptocurrencies. Making it easier for individuals to use cryptocurrencies without KYC is a goal I am proud of!

If you appreciate my work, you can support me through the methods listed here. Alternatively, feel free to send me an email with a kind message!

Technical details

All the code is written in Golang, the website makes use of the chi router for the routing part. I also make use of BigCache for caching database requests. There is 0 JavaScript, so all the rendering load falls on the server, this means it needed to be efficient enough to not drawn with a few users since the old site was reporting about 2M requests per month on average (note that this are not unique users).

The database is running with mariadb, using gorm as the ORM. This is more than enough for this project. I started working with an

sqlitedatabase, but I ended up migrating to mariadb since it works better with JSON.The scraper is using chromedp combined with a series of keywords, regex and other logic. It runs every 24h and scraps all the services. You can find the scraper code here.

The frontend is written using Golang Templates for the HTML, and TailwindCSS plus DaisyUI for the CSS classes framework. I also use some plain CSS, but it's minimal.

The requests forms is the only part of the project that requires JavaScript to be enabled. It is needed for parsing some from fields that are a bit complex and for the "captcha", which is a simple Proof of Work that runs on your browser, destinated to avoid spam. For this, I use mCaptcha.

-

@ 39cc53c9:27168656

2025-06-17 16:40:27

@ 39cc53c9:27168656

2025-06-17 16:40:27Know Your Customer is a regulation that requires companies of all sizes to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. Such procedures fit within the broader scope of anti-money laundering (AML) and counterterrorism financing (CTF) regulations.

Banks, exchanges, online business, mail providers, domain registrars... Everyone wants to know who you are before you can even opt for their service. Your personal information is flowing around the internet in the hands of "god-knows-who" and secured by "trust-me-bro military-grade encryption". Once your account is linked to your personal (and verified) identity, tracking you is just as easy as keeping logs on all these platforms.

Rights for Illusions

KYC processes aim to combat terrorist financing, money laundering, and other illicit activities. On the surface, KYC seems like a commendable initiative. I mean, who wouldn't want to halt terrorists and criminals in their tracks?

The logic behind KYC is: "If we mandate every financial service provider to identify their users, it becomes easier to pinpoint and apprehend the malicious actors."

However, terrorists and criminals are not precisely lining up to be identified. They're crafty. They may adopt false identities or find alternative strategies to continue their operations. Far from being outwitted, many times they're several steps ahead of regulations. Realistically, KYC might deter a small fraction – let's say about 1% ^1 – of these malefactors. Yet, the cost? All of us are saddled with the inconvenient process of identification just to use a service.

Under the rhetoric of "ensuring our safety", governments and institutions enact regulations that seem more out of a dystopian novel, gradually taking away our right to privacy.

To illustrate, consider a city where the mayor has rolled out facial recognition cameras in every nook and cranny. A band of criminals, intent on robbing a local store, rolls in with a stolen car, their faces obscured by masks and their bodies cloaked in all-black clothes. Once they've committed the crime and exited the city's boundaries, they switch vehicles and clothes out of the cameras' watchful eyes. The high-tech surveillance? It didn’t manage to identify or trace them. Yet, for every law-abiding citizen who merely wants to drive through the city or do some shopping, their movements and identities are constantly logged. The irony? This invasive tracking impacts all of us, just to catch the 1% ^1 of less-than-careful criminals.

KYC? Not you.

KYC creates barriers to participation in normal economic activity, to supposedly stop criminals. ^2

KYC puts barriers between many users and businesses. One of these comes from the fact that the process often requires multiple forms of identification, proof of address, and sometimes even financial records. For individuals in areas with poor record-keeping, non-recognized legal documents, or those who are unbanked, homeless or transient, obtaining these documents can be challenging, if not impossible.

For people who are not skilled with technology or just don't have access to it, there's also a barrier since KYC procedures are mostly online, leaving them inadvertently excluded.

Another barrier goes for the casual or one-time user, where they might not see the value in undergoing a rigorous KYC process, and these requirements can deter them from using the service altogether.

It also wipes some businesses out of the equation, since for smaller businesses, the costs associated with complying with KYC norms—from the actual process of gathering and submitting documents to potential delays in operations—can be prohibitive in economical and/or technical terms.

You're not welcome

Imagine a swanky new club in town with a strict "members only" sign. You hear the music, you see the lights, and you want in. You step up, ready to join, but suddenly there's a long list of criteria you must meet. After some time, you are finally checking all the boxes. But then the club rejects your membership with no clear reason why. You just weren't accepted. Frustrating, right?

This club scenario isn't too different from the fact that KYC is being used by many businesses as a convenient gatekeeping tool. A perfect excuse based on a "legal" procedure they are obliged to.

Even some exchanges may randomly use this to freeze and block funds from users, claiming these were "flagged" by a cryptic system that inspects the transactions. You are left hostage to their arbitrary decision to let you successfully pass the KYC procedure. If you choose to sidestep their invasive process, they might just hold onto your funds indefinitely.

Your identity has been stolen

KYC data has been found to be for sale on many dark net markets^3. Exchanges may have leaks or hacks, and such leaks contain very sensitive data. We're talking about the full monty: passport or ID scans, proof of address, and even those awkward selfies where you're holding up your ID next to your face. All this data is being left to the mercy of the (mostly) "trust-me-bro" security systems of such companies. Quite scary, isn't it?

As cheap as $10 for 100 documents, with discounts applying for those who buy in bulk, the personal identities of innocent users who passed KYC procedures are for sale. ^3

In short, if you have ever passed the KYC/AML process of a crypto exchange, your privacy is at risk of being compromised, or it might even have already been compromised.

(they) Know Your Coins

You may already know that Bitcoin and most cryptocurrencies have a transparent public blockchain, meaning that all data is shown unencrypted for everyone to see and recorded forever. If you link an address you own to your identity through KYC, for example, by sending an amount from a KYC exchange to it, your Bitcoin is no longer pseudonymous and can then be traced.

If, for instance, you send Bitcoin from such an identified address to another KYC'ed address (say, from a friend), everyone having access to that address-identity link information (exchanges, governments, hackers, etc.) will be able to associate that transaction and know who you are transacting with.

Conclusions

To sum up, KYC does not protect individuals; rather, it's a threat to our privacy, freedom, security and integrity. Sensible information flowing through the internet is thrown into chaos by dubious security measures. It puts borders between many potential customers and businesses, and it helps governments and companies track innocent users. That's the chaos KYC has stirred.

The criminals are using stolen identities from companies that gathered them thanks to these very same regulations that were supposed to combat them. Criminals always know how to circumvent such regulations. In the end, normal people are the most affected by these policies.

The threat that KYC poses to individuals in terms of privacy, security and freedom is not to be neglected. And if we don’t start challenging these systems and questioning their efficacy, we are just one step closer to the dystopian future that is now foreseeable.

Edited 20/03/2024 * Add reference to the 1% statement on Rights for Illusions section to an article where Chainalysis found that only 0.34% of the transaction volume with cryptocurrencies in 2023 was attributable to criminal activity ^1

-

@ 39cc53c9:27168656

2025-06-17 16:40:25

@ 39cc53c9:27168656

2025-06-17 16:40:25Over the past few months, I've dedicated my time to a complete rewrite of the kycnot.me website. The technology stack remains unchanged; Golang paired with TailwindCSS. However, I've made some design choices in this iteration that I believe significantly enhance the site. Particularly to backend code.

UI Improvements

You'll notice a refreshed UI that retains the original concept but has some notable enhancements. The service list view is now more visually engaging, it displays additional information in a more aesthetically pleasing manner. Both filtering and searching functionalities have been optimized for speed and user experience.

Service pages have been also redesigned to highlight key information at the top, with the KYC Level box always accessible. The display of service attributes is now more visually intuitive.

The request form, especially the Captcha, has undergone substantial improvements. The new self-made Captcha is robust, addressing the reliability issues encountered with the previous version.

Terms of Service Summarizer

A significant upgrade is the Terms of Service summarizer/reviewer, now powered by AI (GPT-4-turbo). It efficiently condenses each service's ToS, extracting and presenting critical points, including any warnings. Summaries are updated monthly, processing over 40 ToS pages via the OpenAI API using a self-crafted and thoroughly tested prompt.

Nostr Comments

I've integrated a comment section for each service using Nostr. For guidance on using this feature, visit the dedicated how-to page.

Database

The backend database has transitioned to pocketbase, an open-source Golang backend that has been a pleasure to work with. I maintain an updated fork of the Golang SDK for pocketbase at pluja/pocketbase.

Scoring

The scoring algorithm has also been refined to be more fair. Despite I had considered its removal due to the complexity it adds (it is very difficult to design a fair scoring system), some users highlighted its value, so I kept it. The updated algorithm is available open source.

Listings

Each listing has been re-evaluated, and the ones that were no longer operational were removed. New additions are included, and the backlog of pending services will be addressed progressively, since I still have access to the old database.

API

The API now offers more comprehensive data. For more details, check here.

About Page

The About page has been restructured for brevity and clarity.

Other Changes

Extensive changes have been implemented in the server-side logic, since the whole code base was re-written from the ground up. I may discuss these in a future post, but for now, I consider the current version to be just a bit beyond beta, and additional updates are planned in the coming weeks.

-

@ 31a4605e:cf043959

2025-06-17 17:31:08

@ 31a4605e:cf043959

2025-06-17 17:31:08Milhões de pessoas em todo o mundo ainda não têm acesso a serviços bancários básicos, seja por falta de infraestrutura, requisitos burocráticos ou instabilidade económica nos seus países. Bitcoin surge como uma solução inovadora para este problema, permitindo que qualquer pessoa com acesso à internet tenha controlo sobre o seu dinheiro, sem depender de bancos ou governos. Ao oferecer um sistema financeiro aberto e acessível, Bitcoin torna-se uma ferramenta poderosa para a inclusão financeira global.

O problema da exclusão financeira

Em muitos países em desenvolvimento, grande parte da população não possui conta bancária. Isto pode acontecer por diversas razões, como:

Falta de acesso a bancos: Muitas comunidades, especialmente em áreas rurais, não têm instituições financeiras próximas.

Exigências burocráticas: Alguns bancos exigem documentação específica ou um histórico de crédito que muitas pessoas não conseguem fornecer.

Custos elevados: As taxas bancárias podem ser proibitivas para quem ganha pouco dinheiro.

Instabilidade económica e política: Em países com alta inflação ou governos instáveis, os bancos podem não ser uma opção segura para guardar dinheiro.

Estas dificuldades deixam milhões de pessoas à margem do sistema financeiro, impossibilitadas de poupar, investir ou realizar transações de forma eficiente.

Bitcoin como alternativa

Bitcoin resolve muitos dos problemas da exclusão financeira ao oferecer um sistema acessível e descentralizado. Com Bitcoin, qualquer pessoa com um telemóvel e acesso à internet pode armazenar e transferir dinheiro sem necessidade de um banco. Entre as principais vantagens estão:

Acessibilidade global: Bitcoin pode ser usado em qualquer lugar do mundo, independentemente da localização do utilizador.

Sem necessidade de intermediários: Diferente dos bancos, que impõem taxas e regras, Bitcoin permite transações diretas entre pessoas.

Baixo custo para transferências internacionais: Enviar dinheiro para outro país pode ser caro e demorado com os métodos tradicionais, enquanto Bitcoin oferece uma alternativa mais rápida e acessível.

Proteção contra a inflação: Em países com moedas instáveis, Bitcoin pode ser usado como reserva de valor, protegendo o poder de compra da população.

Casos de uso na inclusão financeira

Bitcoin já tem sido utilizado para promover a inclusão financeira em diversas partes do mundo. Alguns exemplos incluem:

África e América Latina: Em países como Nigéria, Venezuela e Argentina, onde a inflação é elevada e o acesso a dólares é limitado, muitas pessoas usam Bitcoin para preservar o seu dinheiro e realizar transações internacionais.

Remessas internacionais: Trabalhadores que enviam dinheiro para as suas famílias no estrangeiro evitam as elevadas taxas das empresas de transferências tradicionais ao utilizarem Bitcoin.

Microeconomia digital: Pequenos comerciantes e freelancers que não têm acesso a contas bancárias podem receber pagamentos em Bitcoin de forma direta e segura.

Desafios da inclusão financeira com Bitcoin

Apesar das suas vantagens, a adoção de Bitcoin como ferramenta de inclusão financeira ainda enfrenta alguns desafios, tais como:

Acesso à internet: Muitas regiões pobres ainda não têm uma infraestrutura digital adequada.

Educação financeira: Para que mais pessoas utilizem Bitcoin, é necessário maior conhecimento sobre a tecnologia e as melhores práticas de segurança.

Volatilidade do preço: As oscilações de valor podem dificultar o uso de Bitcoin no dia a dia, especialmente em países onde as pessoas vivem com rendimentos instáveis.

Resumindo, o Bitcoin oferece uma solução viável para milhões de pessoas excluídas do sistema financeiro tradicional. Ao proporcionar acesso global, transações baratas e segurança contra a inflação, torna-se um instrumento poderoso para promover a inclusão financeira. No entanto, para que o seu potencial seja totalmente aproveitado, é essencial investir na educação digital e expandir a infraestrutura tecnológica, permitindo que mais pessoas tenham autonomia financeira através de Bitcoin.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 39cc53c9:27168656

2025-06-17 16:40:24

@ 39cc53c9:27168656

2025-06-17 16:40:24I'm launching a new service review section on this blog in collaboration with OrangeFren. These reviews are sponsored, yet the sponsorship does not influence the outcome of the evaluations. Reviews are done in advance, then, the service provider has the discretion to approve publication without modifications.

Sponsored reviews are independent from the kycnot.me list, being only part of the blog. The reviews have no impact on the scores of the listings or their continued presence on the list. Should any issues arise, I will not hesitate to remove any listing.

The review

WizardSwap is an instant exchange centred around privacy coins. It was launched in 2020 making it old enough to have weathered the 2021 bull run and the subsequent bearish year.

| Pros | Cons | |------|------| | Tor-friendly | Limited liquidity | | Guarantee of no KYC | Overly simplistic design | | Earn by providing liquidity | |

Rating: ★★★★★ Service Website: wizardswap.io

Liquidity

Right off the bat, we'll start off by pointing out that WizardSwap relies on its own liquidity reserves, meaning they aren't just a reseller of Binance or another exchange. They're also committed to a no-KYC policy, when asking them, they even promised they would rather refund a user their original coins, than force them to undergo any sort of verification.

On the one hand, full control over all their infrastructure gives users the most privacy and conviction about the KYC policies remaining in place.

On the other hand, this means the liquidity available for swapping isn't huge. At the time of testing we could only purchase at most about 0.73 BTC with XMR.

It's clear the team behind WizardSwap is aware of this shortfall and so they've come up with a solution unique among instant exchanges. They let you, the user, deposit any of the currencies they support into your account and earn a profit on the trades made using your liquidity.

Trading

Fees on WizardSwap are middle-of-the-pack. The normal fee is 2.2%. That's more than some exchanges that reserve the right to suddenly demand you undergo verification, yet less than half the fees on some other privacy-first exchanges. However as we mentioned in the section above you can earn almost all of that fee (2%) if you provide liquidity to WizardSwap.

It's good that with the current Bitcoin fee market their fees are constant regardless of how much, or how little, you send. This is in stark contrast with some of the alternative swap providers that will charge you a massive premium when attempting to swap small amounts of BTC away.

Test trades

Test trades are always performed without previous notice to the service provider.

During our testing we performed a few test trades and found that every single time WizardSwap immediately detected the incoming transaction and the amount we received was exactly what was quoted before depositing. The fees were inline with what WizardSwap advertises.

- Monero payment proof

- Bitcoin received

- Wizardswap TX link - it's possible that this link may cease to be valid at some point in the future.

ToS and KYC

WizardSwap does not have a Terms of Service or a Privacy Policy page, at least none that can be found by users. Instead, they offer a FAQ section where they addresses some basic questions.

The site does not mention any KYC or AML practices. It also does not specify how refunds are handled in case of failure. However, based on the FAQ section "What if I send funds after the offer expires?" it can be inferred that contacting support is necessary and network fees will be deducted from any refund.

UI & Tor

WizardSwap can be visited both via your usual browser and Tor Browser. Should you decide on the latter you'll find that the website works even with the most strict settings available in the Tor Browser (meaning no JavaScript).

However, when disabling Javascript you'll miss the live support chat, as well as automatic refreshing of the trade page. The lack of the first means that you will have no way to contact support from the trade page if anything goes wrong during your swap, although you can do so by mail.

One important thing to have in mind is that if you were to accidentally close the browser during the swap, and you did not save the swap ID or your browser history is disabled, you'll have no easy way to return to the trade. For this reason we suggest when you begin a trade to copy the url or ID to someplace safe, before sending any coins to WizardSwap.

The UI you'll be greeted by is simple, minimalist, and easy to navigate. It works well not just across browsers, but also across devices. You won't have any issues using this exchange on your phone.

Getting in touch

The team behind WizardSwap appears to be most active on X (formerly Twitter): https://twitter.com/WizardSwap_io

If you have any comments or suggestions about the exchange make sure to reach out to them. In the past they've been very receptive to user feedback, for instance a few months back WizardSwap was planning on removing DeepOnion, but the community behind that project got together ^1 and after reaching out WizardSwap reversed their decision ^2.

You can also contact them via email at:

support @ wizardswap . ioDisclaimer

None of the above should be understood as investment or financial advice. The views are our own only and constitute a faithful representation of our experience in using and investigating this exchange. This review is not a guarantee of any kind on the services rendered by the exchange. Do your own research before using any service.

-

@ 31a4605e:cf043959

2025-06-17 17:27:05

@ 31a4605e:cf043959

2025-06-17 17:27:05Desde a sua criação, Bitcoin tem sido visto tanto como uma inovação financeira quanto como uma ameaça ao controlo governamental sobre a economia. Como uma moeda descentralizada, Bitcoin opera fora do sistema financeiro tradicional, desafiando a autoridade dos bancos centrais e dos governos que regulam a emissão e circulação do dinheiro. Essa característica tem levado a diversos conflitos entre governos e a crescente adoção de Bitcoin por indivíduos e empresas.

Razões para a oposição governamental

Perda de controlo monetário: Os governos controlam a economia através da emissão de moeda fiduciária e da definição de políticas monetárias. Como Bitcoin tem uma oferta fixa e não pode ser manipulado, isso reduz a influência governamental sobre a economia.

Dificuldade na tributação e fiscalização: A natureza descentralizada de Bitcoin dificulta a cobrança de impostos e o rastreamento de transações, tornando mais difícil para os governos garantir a conformidade fiscal.

Concorrência com moedas digitais estatais (CBDCs): Muitos países estão a desenvolver moedas digitais de banco central (CBDCs), que oferecem maior controlo sobre as transações financeiras. Bitcoin representa uma alternativa descentralizada, o que pode ameaçar a adoção dessas moedas estatais.

Preocupações com crimes financeiros: Alguns governos argumentam que Bitcoin pode ser usado para lavagem de dinheiro e financiamento ilícito, apesar de ser mais rastreável do que o dinheiro físico devido à transparência da blockchain ou timechain.

Exemplos de conflitos entre governos e Bitcoin

El Salvador: Foi o primeiro país a tornar Bitcoin moeda legal em 2021. Essa decisão gerou reações negativas de instituições financeiras internacionais, como o FMI, que alertou para riscos económicos e tentou pressionar o país a reverter a sua decisão.

China: Em 2021, a China proibiu a mineração e o uso de Bitcoin, citando preocupações ambientais e riscos financeiros. Apesar da proibição, muitos utilizadores chineses continuam a usar Bitcoin de forma descentralizada.

Estados Unidos: Embora Bitcoin seja legal nos EUA, o governo tem aumentado a regulamentação sobre exchanges e mineradores, tentando exercer maior controlo sobre a rede.

União Europeia: A UE tem imposto regulamentos rigorosos sobre Bitcoin, como exigências de identificação para transações, mas não proibiu a sua utilização.

O futuro da adoção do Bitcoin

Apesar da resistência de alguns governos, Bitcoin continua a ser adotado por indivíduos e empresas como uma alternativa financeira segura. Em países com economias instáveis, Bitcoin tem sido uma ferramenta essencial para proteger a riqueza contra a inflação e restrições bancárias.

A tentativa de controlo governamental pode dificultar a adoção de Bitcoin em algumas regiões, mas não impedirá o seu crescimento global. Como uma rede descentralizada, Bitcoin não pode ser banido completamente, e a sua utilidade como reserva de valor e meio de troca continuará a atrair utilizadores em todo o mundo.

Resumindo, os conflitos entre governos e a adoção de Bitcoin refletem o choque entre um sistema financeiro centralizado e uma tecnologia descentralizada que devolve o controlo do dinheiro aos indivíduos. Embora alguns governos tentem restringir o seu uso, Bitcoin continua a crescer e a provar a sua resistência, tornando-se cada vez mais uma opção viável para aqueles que procuram liberdade financeira.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ 39cc53c9:27168656

2025-06-17 16:40:22

@ 39cc53c9:27168656

2025-06-17 16:40:22Bitcoin enthusiasts frequently and correctly remark how much value it adds to Bitcoin not to have a face, a leader, or a central authority behind it. This particularity means there isn't a single person to exert control over, or a single human point of failure who could become corrupt or harmful to the project.

Because of this, it is said that no other coin can be equally valuable as Bitcoin in terms of decentralization and trustworthiness. Bitcoin is unique not just for being first, but also because of how the events behind its inception developed. This implies that, from Bitcoin onwards, any coin created would have been created by someone, consequently having an authority behind it. For this and some other reasons, some people refer to Bitcoin as "The Immaculate Conception".

While other coins may have their own unique features and advantages, they may not be able to replicate Bitcoin's community-driven nature. However, one other cryptocurrency shares a similar story of mystery behind its creation: Monero.

History of Monero

Bytecoin and CryptoNote

In March 2014, a Bitcointalk thread titled "Bytecoin. Secure, private, untraceable since 2012" was initiated by a user under the nickname "DStrange"^1^. DStrange presented Bytecoin (BCN) as a unique cryptocurrency, in operation since July 2012. Unlike Bitcoin, it employed a new algorithm known as CryptoNote.

DStrange apparently stumbled upon the Bytecoin website by chance while mining a dying bitcoin fork, and decided to create a thread on Bitcointalk^1^. This sparked curiosity among some users, who wondered how could Bytecoin remain unnoticed since its alleged launch in 2012 until then^2^.

Some time after, a user brought up the "CryptoNote v2.0" whitepaper for the first time, underlining its innovative features^4^. Authored by the pseudonymous Nicolas van Saberhagen in October 2013, the CryptoNote v2 whitepaper^5^ highlighted the traceability and privacy problems in Bitcoin. Saberhagen argued that these flaws could not be quickly fixed, suggesting it would be more efficient to start a new project rather than trying to patch the original^5^, an statement simmilar to the one from Satoshi Nakamoto^6^.

Checking with Saberhagen's digital signature, the release date of the whitepaper seemed correct, which would mean that Cryptonote (v1) was created in 2012^7^, although there's an important detail: "Signing time is from the clock on the signer's computer" ^9^.

Moreover, the whitepaper v1 contains a footnote link to a Bitcointalk post dated May 5, 2013^10^, making it impossible for the whitepaper to have been signed and released on December 12, 2012.

As the narrative developed, users discovered that a significant 80% portion of Bytecoin had been pre-mined^11^ and blockchain dates seemed to be faked to make it look like it had been operating since 2012, leading to controversy surrounding the project.

The origins of CryptoNote and Bytecoin remain mysterious, leaving suspicions of a possible scam attempt, although the whitepaper had a good amount of work and thought on it.

The fork

In April 2014, the Bitcointalk user

thankful_for_today, who had also participated in the Bytecoin thread^12^, announced plans to launch a Bytecoin fork named Bitmonero^13^.The primary motivation behind this fork was "Because there is a number of technical and marketing issues I wanted to do differently. And also because I like ideas and technology and I want it to succeed"^14^. This time Bitmonero did things different from Bytecoin: there was no premine or instamine, and no portion of the block reward went to development.

However, thankful_for_today proposed controversial changes that the community disagreed with. Johnny Mnemonic relates the events surrounding Bitmonero and thankful_for_today in a Bitcointalk comment^15^:

When thankful_for_today launched BitMonero [...] he ignored everything that was discussed and just did what he wanted. The block reward was considerably steeper than what everyone was expecting. He also moved forward with 1-minute block times despite everyone's concerns about the increase of orphan blocks. He also didn't address the tail emission concern that should've (in my opinion) been in the code at launch time. Basically, he messed everything up. Then, he disappeared.

After disappearing for a while, thankful_for_today returned to find that the community had taken over the project. Johnny Mnemonic continues:

I, and others, started working on new forks that were closer to what everyone else was hoping for. [...] it was decided that the BitMonero project should just be taken over. There were like 9 or 10 interested parties at the time if my memory is correct. We voted on IRC to drop the "bit" from BitMonero and move forward with the project. Thankful_for_today suddenly resurfaced, and wasn't happy to learn the community had assumed control of the coin. He attempted to maintain his own fork (still calling it "BitMonero") for a while, but that quickly fell into obscurity.

The unfolding of these events show us the roots of Monero. Much like Satoshi Nakamoto, the creators behind CryptoNote/Bytecoin and thankful_for_today remain a mystery^17^, having disappeared without a trace. This enigma only adds to Monero's value.

Since community took over development, believing in the project's potential and its ability to be guided in a better direction, Monero was given one of Bitcoin's most important qualities: a leaderless nature. With no single face or entity directing its path, Monero is safe from potential corruption or harm from a "central authority".

The community continued developing Monero until today. Since then, Monero has undergone a lot of technological improvements, migrations and achievements such as RingCT and RandomX. It also has developed its own Community Crowdfundinc System, conferences such as MoneroKon and Monerotopia are taking place every year, and has a very active community around it.

Monero continues to develop with goals of privacy and security first, ease of use and efficiency second. ^16^

This stands as a testament to the power of a dedicated community operating without a central figure of authority. This decentralized approach aligns with the original ethos of cryptocurrency, making Monero a prime example of community-driven innovation. For this, I thank all the people involved in Monero, that lead it to where it is today.

If you find any information that seems incorrect, unclear or any missing important events, please contact me and I will make the necessary changes.

Sources of interest

- https://forum.getmonero.org/20/general-discussion/211/history-of-monero

- https://monero.stackexchange.com/questions/852/what-is-the-origin-of-monero-and-its-relationship-to-bytecoin

- https://en.wikipedia.org/wiki/Monero

- https://bitcointalk.org/index.php?topic=583449.0

- https://bitcointalk.org/index.php?topic=563821.0

- https://bitcointalk.org/index.php?action=profile;u=233561

- https://bitcointalk.org/index.php?topic=512747.0

- https://bitcointalk.org/index.php?topic=740112.0

- https://monero.stackexchange.com/a/1024

- https://inspec2t-project.eu/cryptocurrency-with-a-focus-on-anonymity-these-facts-are-known-about-monero/

- https://medium.com/coin-story/coin-perspective-13-riccardo-spagni-69ef82907bd1

- https://www.getmonero.org/resources/about/

- https://www.wired.com/2017/01/monero-drug-dealers-cryptocurrency-choice-fire/

- https://www.monero.how/why-monero-vs-bitcoin

- https://old.reddit.com/r/Monero/comments/u8e5yr/satoshi_nakamoto_talked_about_privacy_features/

-

@ eb0157af:77ab6c55

2025-06-17 17:01:50

@ eb0157af:77ab6c55

2025-06-17 17:01:50The banking giant is exploring an expansion of its blockchain services, focusing on digital payments and currencies.

JPMorgan Chase has filed a new trademark application for the name “JPMD.” The filing was submitted on June 15 to the United States Patent and Trademark Office (USPTO).

The application, filed by JPMorgan Chase Bank, N.A., covers a broad range of services related to digital assets and blockchain technology. These include the issuance of digital currencies, electronic payment processing, and financial custody services — all of which suggest a possible new stablecoin initiative for JPMorgan.

Experience with JPM Coin

This move wouldn’t be JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-pegged stablecoin used to enable instant transactions between institutional clients. The token runs on Quorum, a private blockchain network developed in-house by JPMorgan and based on Ethereum’s technology.

The registration of the JPMD trademark comes as JPMorgan and other major U.S. banks are considering a collaborative stablecoin project through their jointly owned entities: Early Warning Services and The Clearing House.

Similarly, corporations like Walmart and Amazon are mulling the creation of their own stablecoins.

The post JPMorgan files trademark for ‘JPMD’: a new stablecoin on the horizon for the American bank appeared first on Atlas21.

-

@ 39cc53c9:27168656

2025-06-17 16:40:21

@ 39cc53c9:27168656

2025-06-17 16:40:21I've been thinking about how to improve my seed backup in a cheap and cool way, mostly for fun. Until now, I had the seed written on a piece of paper in a desk drawer, and I wanted something more durable and fire-proof.

After searching online, I found two options I liked the most: the Cryptosteel Capsule and the Trezor Keep. These products are nice but quite expensive, and I didn't want to spend that much on my seed backup. Privacy is also important, and sharing details like a shipping address makes me uncomfortable. This concern has grown since the Ledger incident^1. A $5 wrench attack^2 seems too cheap, even if you only hold a few sats.

Upon seeing the design of Cryptosteel, I considered creating something similar at home. Although it may not be as cool as their device, it could offer almost the same in terms of robustness and durability.

Step 1: Get the materials and tools

When choosing the materials, you will want to go with stainless steel. It is durable, resistant to fire, water, and corrosion, very robust, and does not rust. Also, its price point is just right; it's not the cheapest, but it's cheap for the value you get.

I went to a material store and bought:

- Two bolts

- Two hex nuts and head nuts for the bolts

- A bag of 30 washers

All items were made of stainless steel. The total price was around €6. This is enough for making two seed backups.

You will also need:

- A set of metal letter stamps (I bought a 2mm-size letter kit since my washers were small, 6mm in diameter)

- You can find these in local stores or online marketplaces. The set I bought cost me €13.

- A good hammer

- A solid surface to stamp on

Total spent: 19€ for two backups

Step 2: Stamp and store

Once you have all the materials, you can start stamping your words. There are many videos on the internet that use fancy 3D-printed tools to get the letters nicely aligned, but I went with the free-hand option. The results were pretty decent.

I only stamped the first 4 letters for each word since the BIP-39 wordlist allows for this. Because my stamping kit did not include numbers, I used alphabet letters to define the order. This way, if all the washers were to fall off, I could still reassemble the seed correctly.

The final result

So this is the final result. I added two smaller washers as protection and also put the top washer reversed so the letters are not visible:

Compared to the Cryptosteel or the Trezor Keep, its size is much more compact. This makes for an easier-to-hide backup, in case you ever need to hide it inside your human body.

Some ideas

Tamper-evident seal

To enhance the security this backup, you can consider using a tamper-evident seal. This can be easily achieved by printing a unique image or using a specific day's newspaper page (just note somewhere what day it was).

Apply a thin layer of glue to the washer's surface and place the seal over it. If someone attempts to access the seed, they will be forced to destroy the seal, which will serve as an evident sign of tampering.

This simple measure will provide an additional layer of protection and allow you to quickly identify any unauthorized access attempts.

Note that this method is not resistant to outright theft. The tamper-evident seal won't stop a determined thief but it will prevent them from accessing your seed without leaving any trace.

Redundancy

Make sure to add redundancy. Make several copies of this cheap backup, and store them in separate locations.

Unique wordset

Another layer of security could be to implement your own custom mnemonic dictionary. However, this approach has the risk of permanently losing access to your funds if not implemented correctly.

If done properly, you could potentially end up with a highly secure backup, as no one else would be able to derive the seed phrase from it. To create your custom dictionary, assign a unique number from 1 to 2048 to a word of your choice. Maybe you could use a book, and index the first 2048 unique words that appear. Make sure to store this book and even get a couple copies of it (digitally and phisically).

This self-curated set of words will serve as your personal BIP-39 dictionary. When you need to translate between your custom dictionary and the official BIP-39 wordlist, simply use the index number to find the corresponding word in either list.

Never write the idex or words on your computer (Do not use

Ctr+F) -

@ 88cc134b:5ae99079

2025-06-17 17:45:00

@ 88cc134b:5ae99079

2025-06-17 17:45:00 -

@ 39cc53c9:27168656

2025-06-17 16:40:19

@ 39cc53c9:27168656

2025-06-17 16:40:19kycnot.me features a somewhat hidden tool that some users may not be aware of. Every month, an automated job crawls every listed service's Terms of Service (ToS) and FAQ pages and conducts an AI-driven analysis, generating a comprehensive overview that highlights key points related to KYC and user privacy.

Here's an example: Changenow's Tos Review

Why?

ToS pages typically contain a lot of complicated text. Since the first versions of kycnot.me, I have tried to provide users a comprehensive overview of what can be found in such documents. This automated method keeps the information up-to-date every month, which was one of the main challenges with manual updates.

A significant part of the time I invest in investigating a service for kycnot.me involves reading the ToS and looking for any clauses that might indicate aggressive KYC practices or privacy concerns. For the past four years, I performed this task manually. However, with advancements in language models, this process can now be somewhat automated. I still manually review the ToS for a quick check and regularly verify the AI’s findings. However, over the past three months, this automated method has proven to be quite reliable.

Having a quick ToS overview section allows users to avoid reading the entire ToS page. Instead, you can quickly read the important points that are grouped, summarized, and referenced, making it easier and faster to understand the key information.

Limitations

This method has a key limitation: JS-generated pages. For this reason, I was using Playwright in my crawler implementation. I plan to make a release addressing this issue in the future. There are also sites that don't have ToS/FAQ pages, but these sites already include a warning in that section.

Another issue is false positives. Although not very common, sometimes the AI might incorrectly interpret something harmless as harmful. Such errors become apparent upon reading; it's clear when something marked as bad should not be categorized as such. I manually review these cases regularly, checking for anything that seems off and then removing any inaccuracies.

Overall, the automation provides great results.

How?

There have been several iterations of this tool. Initially, I started with GPT-3.5, but the results were not good in any way. It made up many things, and important thigs were lost on large ToS pages. I then switched to GPT-4 Turbo, but it was expensive. Eventually, I settled on Claude 3 Sonnet, which provides a quality compromise between GPT-3.5 and GPT-4 Turbo at a more reasonable price, while allowing a generous 200K token context window.

I designed a prompt, which is open source^1, that has been tweaked many times and will surely be adjusted further in the future.

For the ToS scraping part, I initially wrote a scraper API using Playwright^2, but I replaced it with Jina AI Reader^3, which works quite well and is designed for this task.

Non-conflictive ToS

All services have a dropdown in the ToS section called "Non-conflictive ToS Reviews." These are the reviews that the AI flagged as not needing a user warning. I still provide these because I think they may be interesting to read.

Feedback and contributing

You can give me feedback on this tool, or share any inaccuraties by either opening an issue on Codeberg^4 or by contacting me ^5.

You can contribute with pull requests, which are always welcome, or you can support this project with any of the listed ways.

-

@ 31a4605e:cf043959

2025-06-17 17:35:10

@ 31a4605e:cf043959

2025-06-17 17:35:10Desde a sua criação em 2008, Bitcoin tem sido visto como um desafio direto ao sistema bancário tradicional. Desenvolvido como uma alternativa descentralizada ao dinheiro fiduciário, Bitcoin oferece uma forma de armazenar e transferir valor sem depender de bancos, governos ou outras instituições financeiras. Essa característica faz com que seja considerado um símbolo de resistência contra um sistema financeiro que, ao longo do tempo, tem sido marcado por crises, manipulações e restrições impostas aos cidadãos.

Crise financeira de 2008 e o nascimento de Bitcoin

Bitcoin surgiu em resposta à crise financeira de 2008, um colapso que revelou as falhas do sistema bancário global. Bancos centrais imprimiram grandes quantidades de dinheiro para resgatar instituições financeiras irresponsáveis, enquanto milhões de pessoas perderam as suas casas, poupanças e empregos. Nesse contexto, Bitcoin foi criado como um sistema financeiro alternativo, onde não existe uma entidade central com o poder de manipular a economia em benefício próprio.

No primeiro bloco da blockchain ou timechain de Bitcoin, Satoshi Nakamoto incluiu a seguinte mensagem:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

Essa frase, retirada de uma manchete de jornal da época, simboliza a intenção de Bitcoin de oferecer um sistema financeiro fora do controlo dos bancos e dos governos.

Principais razões pelas quais Bitcoin resiste ao sistema bancário

Descentralização: Ao contrário do dinheiro emitido por bancos centrais, Bitcoin não pode ser criado ou controlado por nenhuma entidade específica. A rede de utilizadores valida as transações de forma transparente e independente.

Oferta limitada: Enquanto os bancos centrais podem imprimir dinheiro sem limites, causando inflação e desvalorização da moeda, Bitcoin tem uma oferta fixa de 21 milhões de unidades, tornando-o resistente à depreciação artificial.

Impossibilidade de censura: Bancos podem bloquear contas e impedir transações a qualquer momento. Com Bitcoin, qualquer pessoa pode enviar e receber fundos sem pedir permissão a terceiros.

Autocustódia: Em vez de confiar os seus fundos a um banco, os utilizadores de Bitcoin podem armazenar as suas próprias moedas, sem risco de congelamento de contas ou falências bancárias.

Conflito entre bancos e Bitcoin

Ataques mediáticos: Grandes instituições financeiras frequentemente classificam Bitcoin como arriscado, volátil ou inútil, tentando desincentivar a sua adoção.

Regulação e repressão: Alguns governos, influenciados pelo setor bancário, têm criado restrições ao uso de Bitcoin, dificultando a sua compra e venda.

Criação de alternativas centralizadas: Muitos bancos centrais estão a desenvolver moedas digitais (CBDCs) que mantêm o controlo do dinheiro digital, mas sem oferecer a liberdade e a descentralização de Bitcoin.

Resumindo, o Bitcoin não é apenas uma moeda digital, mas um movimento de resistência contra um sistema financeiro que falhou repetidamente em proteger o cidadão comum. Ao oferecer uma alternativa descentralizada, transparente e resistente à censura, Bitcoin representa a liberdade financeira e desafia o monopólio dos bancos sobre o dinheiro. Enquanto o sistema bancário tradicional continuar a impor restrições e a controlar o fluxo de capital, Bitcoin permanecerá como um símbolo de independência e soberania financeira.

Muito obrigado por teres lido o texto até aqui, espero que esteja tudo bem contigo e um abraço enorme do teu madeirense bitcoiner maximalista favorito. Viva a liberdade!

-

@ a19caaa8:88985eaf

2025-05-05 02:55:57

@ a19caaa8:88985eaf

2025-05-05 02:55:57↓ジャック(twitter創業者)のツイート nostr:nevent1qvzqqqqqqypzpq35r7yzkm4te5460u00jz4djcw0qa90zku7739qn7wj4ralhe4zqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsqg9cdxf7s7kg8kj70a4v5j94urz8kmel03d5a47tr4v6lx9umu3c95072732

↓それに絡むたゃ nostr:note1hr4m0d2k2cvv0yg5xtmpuma0hsxfpgcs2lxe7vlyhz30mfq8hf8qp8xmau

↓たゃのひとりごと nostr:nevent1qqsdt9p9un2lhsa8n27y7gnr640qdjl5n2sg0dh4kmxpqget9qsufngsvfsln nostr:note14p9prp46utd3j6mpqwv46m3r7u7cz6tah2v7tffjgledg5m4uy9qzfc2zf

↓有識者様の助言 nostr:nevent1qvzqqqqqqypzpujqe8p9zrpuv0f4ykk3rmgnqa6p6r0lan0t8ewd0ksj89kqcz5xqqst8w0773wxnkl8sn94tvmd3razcvms0kxjwe00rvgazp9ljjlv0wq0krtvt nostr:nevent1qvzqqqqqqypzpujqe8p9zrpuv0f4ykk3rmgnqa6p6r0lan0t8ewd0ksj89kqcz5xqqsxchzm7s7vn8a82q40yss3a84583chvd9szl9qc3w5ud7pr9ugengcgt9qx

↓たゃ nostr:nevent1qqsp2rxvpax6ks45tuzhzlq94hq6qtm47w69z8p5wepgq9u4txaw88s554jkd

-

@ 39cc53c9:27168656

2025-06-17 16:40:18

@ 39cc53c9:27168656

2025-06-17 16:40:18These reviews are sponsored, yet the sponsorship does not influence the outcome of the evaluations. Sponsored reviews are independent from the kycnot.me list, being only part of the blog. The reviews have no impact on the scores of the listings or their continued presence on the list. Should any issues arise, I will not hesitate to remove any listing. Reviews are in collaboration with Orangefren.

The review

Swapter.io is an all-purpose instant exchange. They entered the scene in the depths of the bear market about 2 years ago in June of 2022.

| Pros | Cons | | --------------- | ---------------------------------- | | Low fees | Shotgun KYC with opaque triggers | | Large liquidity | Relies on 3rd party liquidity | | Works over Tor | Front-end not synced with back-end | | Pretty UI | |

Rating: ★★★☆☆ Service Website: swapter.io

⚠️ There is an ongoing issue with this service: read more on Reddit.

Test Trades

During our testing we performed a trade from XMR to LTC, and then back to XMR.

Our first trade had the ID of:

mpUitpGemhN8jjNAjQuo6EvQ. We were promised 0.8 LTC for sending 0.5 XMR, before we sent the Monero. When the Monero arrived we were sent 0.799 LTC.On the return journey we performed trade with ID:

yaCRb5pYcRKAZcBqg0AzEGYg. This time we were promised 0.4815 XMR for sending 0.799 LTC. After Litecoin arrived we were sent 0.4765 XMR.As such we saw a discrepancy of

~0.1%in the first trade and~1%in the second trade. Considering those trades were floating we determine the estimates presented in the UI to be highly accurate and honest.Of course Swapter could've been imposing a large fee on their estimates, but we checked their estimates against CoinGecko and found the difference to be equivalent to a fee of just over

0.5%. Perfectly in line with other swapping services.Trading

Swapter supports BTC, LTC, XMR and well over a thousand other coins. Sadly they don't support the Lightning Network. For the myriad of currencies they deal with they provide massive upper limits. You could exchange tens, or even hundreds, of thousands of dollars worth of cryptocurrency in a single trade (although we wouldn't recommend it).

The flip side to this is that Swapter relies on 3rd party liquidity. Aside from the large liqudity this also benefits the user insofar as it allows for very low fees. However, it also comes with a negative - the 3rd party gets to see all your trades. Unfortunately Swapter opted not to share where they source their liquidity in their Privacy Policy or Terms of Service.

KYC & AML policies

Swapter reserves the right to require its users to provide their full name, their date of birth, their address and government-issued ID. A practice known as "shotgun KYC". This should not happen often - in our testing it never did - however it's not clear when exactly it could happen. The AML & KYC policy provided on Swapter's website simply states they will put your trade on hold if their "risk scoring system [deems it] as suspicious".

Worse yet, if they determine that "any of the information [the] customer provided is incorrect, false, outdated, or incomplete" then Swapter may decide to terminate all of the services they provide to the user. What exactly would happen to their funds in such a case remains unclear.

The only clarity we get is that the Swapter policy outlines a designated 3rd party that will verify the information provided by the user. The third party's name is Sum & Substance Ltd, also simply known as samsub and available at sumsub.com

It's understandable that some exchanges will decide on a policy of this sort, especially when they rely on external liquidity, but we would prefer more clarity be given. When exactly is a trade suspicious?

Tor

We were pleased to discover Swapter works over Tor. However, they do not provide a Tor mirror, nor do they work without JavaScript. Additionally, we found that some small features, such as the live chat, did not work over Tor. Fortunately, other means of contacting their support are still available.

UI

We have found the Swapter UI to be very modern, straightforward and simple to use. It's available in 4 languages (English, French, Dutch and Russian), although we're unable to vouch for the quality of some of those, the ones that we used seemed perfectly serviceable.

Our only issue with the UI was that it claims the funds have been sent following the trade, when in reality it seems to take the backend a minute or so to actually broadcast the transaction.

Getting in touch

Swapter's team has a chat on their website, a support email address and a support Telegram. Their social media presence in most active on Telegram and X (formerly Twitter).

Disclaimer

None of the above should be understood as investment or financial advice. The views are our own only and constitute a faithful representation of our experience in using and investigating this exchange. This review is not a guarantee of any kind on the services rendered by the exchange. Do your own research before using any service.

-

@ b7274d28:c99628cb

2024-12-15 17:48:26

@ b7274d28:c99628cb

2024-12-15 17:48:26For anyone interested in the list of essential essays from nostr:npub14hn6p34vegy4ckeklz8jq93mendym9asw8z2ej87x2wuwf8werasc6a32x (@anilsaidso) on Twitter that nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev mentioned on Read 856, here it is. I have compiled it with as many of the essays as I could find, along with the audio versions, when available. Additionally, if the author is on #Nostr, I have tagged their npub so you can thank them by zapping them some sats.

All credit for this list and the graphics accompanying each entry goes to nostr:npub14hn6p34vegy4ckeklz8jq93mendym9asw8z2ej87x2wuwf8werasc6a32x, whose original thread can be found here: Anil's Essential Essays Thread

1.

History shows us that the corruption of monetary systems leads to moral decay, social collapse, and slavery.

Essay: https://breedlove22.medium.com/masters-and-slaves-of-money-255ecc93404f

Audio: https://fountain.fm/episode/RI0iCGRCCYdhnMXIN3L6

2.

The 21st century emergence of Bitcoin, encryption, the internet, and millennials are more than just trends; they herald a wave of change that exhibits similar dynamics as the 16-17th century revolution that took place in Europe.

Author: nostr:npub13l3lyslfzyscrqg8saw4r09y70702s6r025hz52sajqrvdvf88zskh8xc2

Essay: https://casebitcoin.com/docs/TheBitcoinReformation_TuurDemeester.pdf

Audio: https://fountain.fm/episode/uLgBG2tyCLMlOp3g50EL

3.

There are many men out there who will parrot the "debt is money WE owe OURSELVES" without acknowledging that "WE" isn't a static entity, but a collection of individuals at different points in their lives.

Author: nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy

Essay: https://www.tftc.io/issue-754-ludwig-von-mises-human-action/

4.

If Bitcoin exists for 20 years, there will be near-universal confidence that it will be available forever, much as people believe the Internet is a permanent feature of the modern world.

Essay: https://vijayboyapati.medium.com/the-bullish-case-for-bitcoin-6ecc8bdecc1

Audio: https://fountain.fm/episode/jC3KbxTkXVzXO4vR7X3W

As you are surely aware, Vijay has expanded this into a book available here: The Bullish Case for Bitcoin Book

There is also an audio book version available here: The Bullish Case for Bitcoin Audio Book

5.

This realignment would not be traditional right vs left, but rather land vs cloud, state vs network, centralized vs decentralized, new money vs old, internationalist/capitalist vs nationalist/socialist, MMT vs BTC,...Hamilton vs Satoshi.

Essay: https://nakamoto.com/bitcoin-becomes-the-flag-of-technology/

Audio: https://fountain.fm/episode/tFJKjYLKhiFY8voDssZc

6.

I became convinced that, whether bitcoin survives or not, the existing financial system is working on borrowed time.

Essay: https://nakamotoinstitute.org/mempool/gradually-then-suddenly/

Audio: https://fountain.fm/episode/Mf6hgTFUNESqvdxEIOGZ

Parker Lewis went on to release several more articles in the Gradually, Then Suddenly series. They can be found here: Gradually, Then Suddenly Series

nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev has, of course, read all of them for us. Listing them all here is beyond the scope of this article, but you can find them by searching the podcast feed here: Bitcoin Audible Feed

Finally, Parker Lewis has refined these articles and released them as a book, which is available here: Gradually, Then Suddenly Book

7.

Bitcoin is a beautifully-constructed protocol. Genius is apparent in its design to most people who study it in depth, in terms of the way it blends math, computer science, cyber security, monetary economics, and game theory.

Author: nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

Essay: https://www.lynalden.com/invest-in-bitcoin/

Audio: https://fountain.fm/episode/axeqKBvYCSP1s9aJIGSe

8.