-

@ 9f2b5b64:e811118f

2025-06-16 17:45:00

@ 9f2b5b64:e811118f

2025-06-16 17:45:001234

-

@ 9f2b5b64:e811118f

2025-06-16 17:39:24

@ 9f2b5b64:e811118f

2025-06-16 17:39:24test propose 123

-

@ 9ca447d2:fbf5a36d

2025-06-16 17:01:31

@ 9ca447d2:fbf5a36d

2025-06-16 17:01:31In a move that diverges from many other U.S. states, Connecticut has passed a new law that bars state and local governments from investing in bitcoin or any other digital currency.

The bill, HB7082, passed unanimously in both the House and Senate with zero opposing votes.

The law, officially titled “An Act Concerning the Regulation of Virtual Currency and State Investments,” was signed into law recently and is causing a stir in the Bitcoin and financial communities.

HB7082 prohibits the state of Connecticut and its political subdivisions from accepting, holding or investing in digital currencies. This includes bitcoin, ethereum and other digital assets. It also bars the state from creating a bitcoin reserve, a concept being explored by other states.

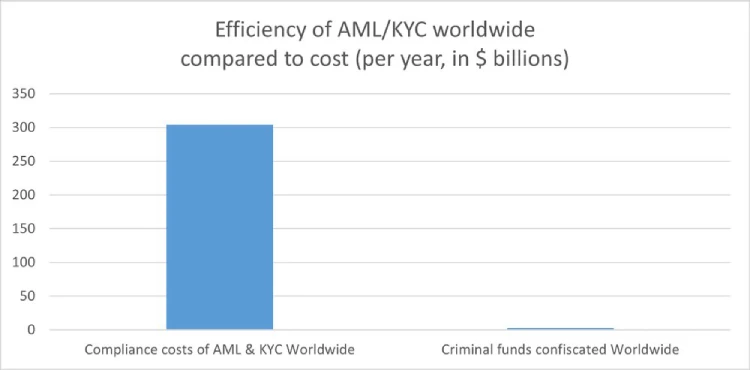

The law goes further by imposing strict rules on digital asset businesses operating in the state. These rules enforce anti-money laundering (AML) compliance and parental consent verification for digital asset users under 18.

It also requires 1:1 reserve requirements for bitcoin custodians.

Businesses that handle Bitcoin transactions must now provide users with clear information about risks and fees and provide receipts with full transaction details.

No business can let a minor use a money-sharing app without first getting proof of consent from a parent or guardian.

Lawmakers in Connecticut say it’s about protecting public funds and minimizing financial risk. They say Connecticut’s new law bars state investments in bitcoin to protect its financial assets from market risk.

Supporters argue that the high volatility of bitcoin makes it a risky investment for public money like pension funds and state reserves.

The law also looks to bring bitcoin businesses under tighter control, to make them follow the same rules as the traditional financial system.

While Connecticut is cracking down on digital assets, other states are going the other way.

States like Texas, New Hampshire and Arizona have already passed laws or proposed bills to create a bitcoin reserve, which allows public funds to be invested in bitcoin.

Texas has even described bitcoin as a “forward-thinking investment opportunity” and a long-term store of value.

The new law has caused mixed reactions in the financial world. Some think it’s too cautious, others think it’s part of a bigger plan.

Matt Hougan, CIO of Bitwise, responded with sarcasm, “The hedge fund managers got so upset they couldn’t beat Bitcoin…”

Matt Hougan on X

Some states like Florida, South Dakota and Oklahoma have either killed or vetoed Bitcoin bills this year. Others like Louisiana are still exploring the tech. Louisiana just announced it would create a special committee to study AI, blockchain and digital assets.

-

@ cae03c48:2a7d6671

2025-06-16 17:01:06

@ cae03c48:2a7d6671

2025-06-16 17:01:06Bitcoin Magazine

JPMorgan Reports Record Profits for Bitcoin Miners in Q1Bitcoin mining companies in the U.S. have kicked off 2025 with record performance, according to a recent report. The first quarter of the year was “one of Bitcoin miners’ best quarters to date,” analysts Reginald Smith and Charles Pearce stated.

JUST IN:

JPMorgan reported Q1 2025 was one of the best periods on record for publicly traded bitcoin mining companies

JPMorgan reported Q1 2025 was one of the best periods on record for publicly traded bitcoin mining companies  pic.twitter.com/gs9fGiTbZV

pic.twitter.com/gs9fGiTbZV— Bitcoin Magazine (@BitcoinMagazine) June 13, 2025

“Four of the five operators in our coverage reported record revenue and profits,” the report stated, underscoring the sector’s impressive rebound in profitability amid continued institutional adoption and high bitcoin prices, currently hovering around $105,462.87.

In total, U.S.-listed miners brought in $2.0 billion in gross profit during Q1 2025, with average gross margins reaching 53%—a jump from $1.7 billion and 50% in the previous quarter.

MARA Holdings (MARA) once again led the pack in Bitcoin production, mining the most BTC for the ninth consecutive quarter. However, despite its output dominance, MARA also posted the highest cost per coin, estimated at $72,600, JPMorgan noted.

On the profitability front, IREN (IREN) was the standout performer. For the first time, IREN earned the most gross profit among the tracked firms. The company also reported the lowest all-in cash cost per Bitcoin, around $36,400, helping to boost margins significantly.

CleanSpark (CLSK), another major player, did not raise any equity in the quarter—one of the more capital-disciplined moves seen among its peers. In fact, JPMorgan reported that the five miners it tracks issued only $310 million in equity for Q1, marking a steep decline from $1.3 billion in Q4 2024.

On the operational expense side, miners spent an estimated $1.8 billion on power, up $50 million from the previous quarter—demonstrating the energy-intensive nature of mining.

JPMorgan’s outlook on the industry remains bullish for select players. The bank maintains overweight ratings for CleanSpark, IREN, and Riot Platforms (RIOT), while assigning neutral ratings to Cipher Mining (CIFR) and MARA.

As profitability surges and strategic spending remains in check, 2025 may very well be remembered as a turning point in mining economics—especially for companies navigating cost discipline and scaling production.

This post JPMorgan Reports Record Profits for Bitcoin Miners in Q1 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-16 17:01:03

@ cae03c48:2a7d6671

2025-06-16 17:01:03Bitcoin Magazine

UK Gold Mining Company Bluebird to Convert Gold Revenues into BitcoinBluebird Mining Ventures Ltd., a pan Asian gold project development company, recently announced a major strategic shift. It plans to convert future revenues from its gold mining projects into bitcoin and adopt bitcoin as a treasury reserve asset.

Strategy shift to covert gold into digital gold – #bitcoin #goldmining #goldequities #investinbitcoin #investingold

"Combining income streams from gold mining projects and recycling these revenues into a proactive "Bitcoin in Treasury" management approach, whilst maintaining a… pic.twitter.com/BpJA6hFU9Y— Bluebird Mining Ventures Ltd (LSE:BMV.L) (@bluebirdIR) June 5, 2025

“By adopting a ‘gold plus a digital gold’ strategy, it offers the Company an opportunity to turn the page and look to the future and seek to attract a new type of shareholder,” said the Executive Director and CEO of Bluebird Aidan Bishop. “Under the leadership of a new CEO, once identified, it is my sincere hope that Bluebird will finally realise its ambitions for which it was initially established for.”

The announcement comes as Bluebird progresses towards a key agreement on its flagship Philippine project. The company expects to finalize a deal in the coming weeks that will grant it a net profit interest throughout the life of the mine, with no ongoing capital costs. The company said it believes bitcoin offers a modern alternative to traditional store of value assets like gold.

“I am very pleased with the progress of discussions in the Philippines which are looking very positive and will enable, if successfully completed, Bluebird to maintain an ongoing exposure with zero future cash commitments,” stated Bishop.

Bluebird plans to recycle revenues from its mining operations directly into bitcoin, aligning with what they describe as an innovative treasury approach. The company cited bitcoin’s fixed supply of 21 million, increasing global adoption, and role as a hedge against inflation and monetary instability as key reasons for its decision.

“Combining income streams from gold mining projects and recycling these revenues into a proactive ‘Bitcoin in Treasury’ management approach…” the company said. “Companies that have adopted bitcoin into their treasury strategy globally across public markets have been enjoying significant investor interest as well as substantial premiums to Net Asset Value (NAV) that have challenged traditional financial metrics as a basis of valuation.”

To lead this new phase, Bluebird is actively searching for a new CEO with experience in digital assets.

“On a personal level, I embarked some time ago on a journey to understand and learn about bitcoin,” added Bishop. “I am convinced that we are witnessing a tectonic shift in global markets and that bitcoin will reshape the landscape of financial markets on every level.”

This post UK Gold Mining Company Bluebird to Convert Gold Revenues into Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-16 17:00:59

@ cae03c48:2a7d6671

2025-06-16 17:00:59Bitcoin Magazine

The 30,000-Foot View of the Oslo Freedom ForumAs I step onto the plane leaving Gardermoen Airport in Oslo, Norway, the weight and warmth of the past week settles into my chest.

The Oslo Freedom Forum is not a conference. It’s not a summit. It’s something harder to name and even harder to describe — a convergence of courage, truth and defiance that burns through the noise of the modern world and gives you no choice but to listen, feel and act.

For the second time, I leave this city more convinced than ever that something unstoppable is rising. That amid the censorship, surveillance and state repression spreading across the globe, there is a countervailing force rooted in humanity, accelerated by technology and led by those who’ve already paid the price for speaking out.

The Forum doesn’t trade in empty optimism. It delivers a different kind of hope, forged from lived experience and stitched together by people who have been in the dark and still choose to see the light. A hope borne from the stories of individuals who have lived through the worst an authoritarian regime can do and still choose to fight for the freedom of others. The experiences shared were hard. At times, devastating. But they weren’t offered for pity. They were calls to action.

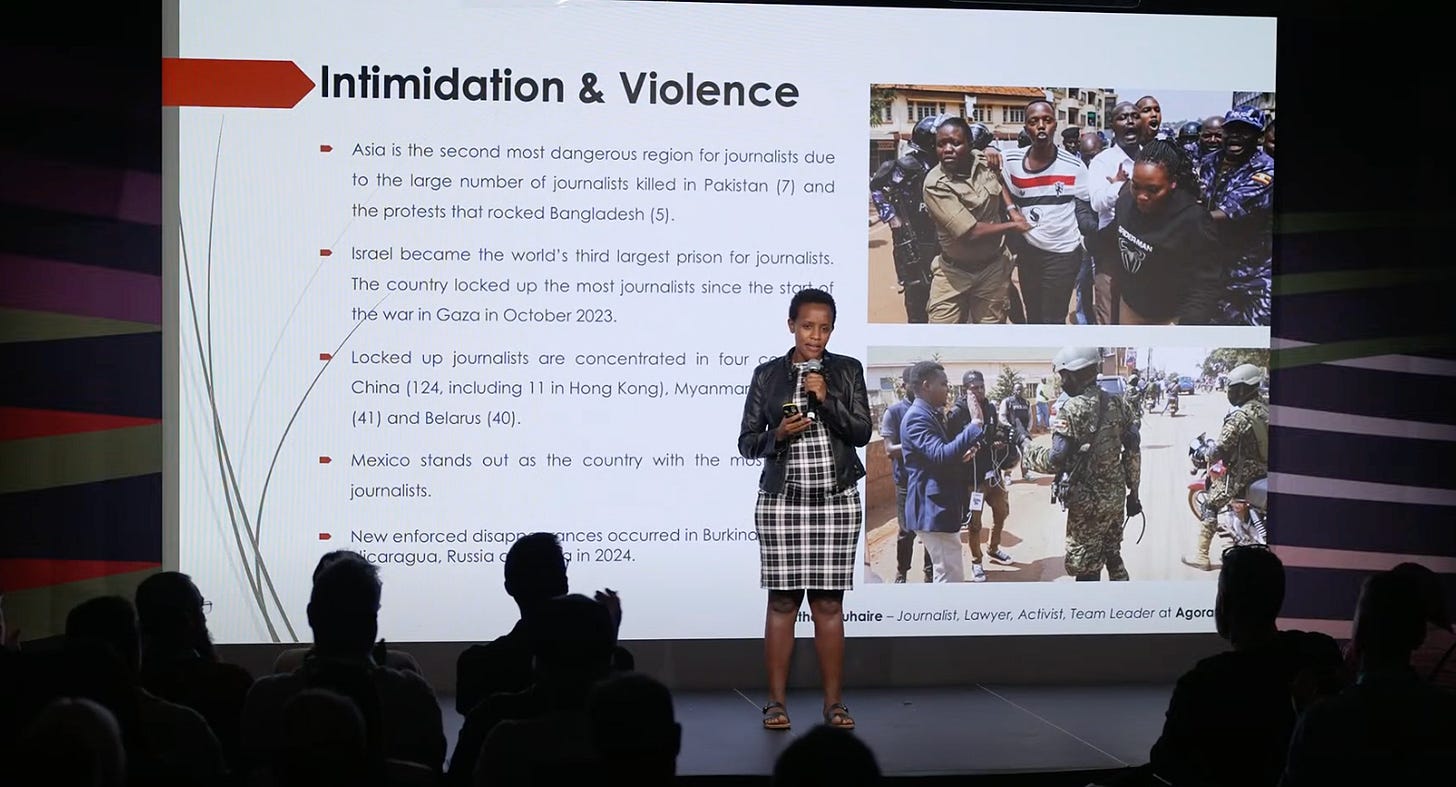

Just days after she was abducted, blindfolded, tortured, and sexually assaulted in a Tanzanian prison cell, Agather Atuhaire stood in front of a crowd of strangers and told her story.

Her voice did not tremble.

The Ugandan journalist and lawyer had traveled to Tanzania in solidarity with fellow East African dissidents, only to be disappeared in a black van alongside Kenyan activist Boniface Mwangi.

And yet, against all odds, she came back. Not just to her home in Uganda, but also to the stage in Oslo, where she spoke calmly and clearly about what it means to tell the truth under a dictatorship.

Her presentation, “The Digital Free Speech Crackdown in Uganda,” laid bare the authoritarian playbook: social media blackouts, propaganda campaigns, surveillance of journalists and the slow financial asphyxiation of independent media. When the government doesn’t like a story, it simply blocks the platform or website. When a journalist digs too deep, they disappear for a while. Or forever. Atuhaire painted a picture many struggle to even imagine.

And yet, after everything, she didn’t just recount these struggles. She looked out at the crowd and thanked the open source builders and contributors who write code and create tools that make it possible for activists like her to speak, move money and organize under regimes that want them silenced, or worse.

(Ugandan journalist and lawyer, Agather Atuhaire, speaks during the Freedom Tech track at the 2025 Oslo Freedom Forum.)

From Iran, independent Bitcoin educator Ziya Sadr reminded us that financial privacy is not a luxury but a necessary lifeline for those facing the financial repression by oppressive rulers. Sadr’s detainment during the 2022 Women, Life, Freedom movement following the murder of Mahsa Amini by the Iranian regime is a testament to that. Without financial privacy, activists’ actions, connections and finances are exposed to a regime equipped with widespread financial controls and a sophisticated, restrictive internet firewall that rivals even China’s.

The result is one of the most repressive digital environments in the world. And if that wasn’t enough, the Iranian rial currency has lost more than 80% of its value in just a few years.

Against this backdrop, Iranians are using bitcoin as undebasable savings, and to buy digital services like VPNs in order to access the open internet. But even that act, just reaching the outside world, requires a level of privacy most of us take for granted.

In his presentation, “Securing Lifelines: The Bitcoin Privacy Imperative,” Sadr shared that many Iranians turn to Bitcoin Coinjoins, a privacy technique that breaks the link between Bitcoin transaction inputs. Coinjoins preserve user transaction privacy and, more importantly, shield Iranians from the surveillance and retaliation of a regime who punishes anyone trying to access information beyond its tightly controlled digital spaces. The use of Coinjoins is becoming more difficult as global legal pressure mounts against open source developers, and in the aftermath of the Samourai developer arrests, privacy protocols like Whirlpool are unworkable.

Today, Sadr is learning more about additional Bitcoin privacy tools, including Payjoin, a privacy method that allows two users to contribute an input to a Bitcoin transaction. Payjoin breaks common chain analysis heuristics and conceals the sender and receiver of a transaction as well as the payment amount. Then there is ecash, a form of digital cash backed by Bitcoin that enables very private, everyday payments with the custodial trade-off of trusting mints (entities that issue and redeem ecash tokens) to store user funds.

The continued development of these protocols is crucial for Iranians, who live under a government that not only tracks and surveils digital behavior, but also imposes automatic fines on women for violating hijab rules and manipulates currency exchange rates to profit off citizens’ savings. For millions in Iran, bitcoin offers a last line of defense against a collapsing currency, intrusive surveillance and total financial repression.

(Independent Iranian Bitcoin educator, Ziya Sadr, speaks during the Freedom Tech track at the Oslo Freedom Forum.)

Venezuelan opposition leader Leopoldo López took the stage at the 2025 Oslo Freedom Forum not as a politician, but as a witness to what happens when a state turns its institutions into further tendrils of its repression machine.

After Nicolás Maduro stole Venezuela’s 2024 elections, López watched thousands of his fellow people — activists, students, journalists, opposition members and lawyers — get arrested, disappeared or forced into exile. The regime blocked access to social media, revoked passports, criminalized dissent and used the financial system as a means of controlling the population.

Amid this digital repression and Venezuela’s 162% inflation rate, López sees bitcoin (decentralized money) and Nostr (decentralized social media) as lifelines. When dictators shut down the internet or freeze your bank account, alternatives that are open source, decentralized, uncensorable and accessible become more important than ever for the survival of democracy and freedom.

**“Decentralized resistance is the convergence of people, Bitcoin, Nostr, and AI.

People, it’s about the center and the end of what we are doing.

Brave women and men who sacrifice their freedom, who take risks, who are willing to fight for other people.

If it’s not about people, technology wouldn’t be something worth fighting for.

Bitcoin is freedom money. It’s decentralized, nobody controls it, nobody can stop it, it can move around without borders.”**

(Venezuelan Opposition Leader Leopoldo López during the Freedom Tech track at the 2025 Oslo Freedom Forum.)

For decades, Paraguay’s greatest natural resource, hydroelectric power, has flowed out of the country through international contracts, fueling development in neighboring countries like Brazil and Argentina while one in four Paraguayans remained trapped in poverty. Paraguay’s Itaipu Dam, one of the largest in the world, has long symbolized this paradox: a river of energy diverted away from the very people who need it most.

Björn Schmidtke and Delia Garcete of Penguin Group are flipping that script.

In a landmark move, they secured Paraguay’s first 100-megawatt power purchase agreement, marking the beginning of a bold experiment to reclaim that energy for the people of Paraguay. Instead of selling it off to foreign powers, they use it to mine Bitcoin — and the proc

-

@ dfa02707:41ca50e3

2025-06-16 16:02:14

@ dfa02707:41ca50e3

2025-06-16 16:02:14News

- Wallet of Satoshi teases a comeback in the US market with a non-custodial product. According to an announcement on X, the widely popular custodial Lightning wallet is preparing to re-enter the United States market with a non-custodial wallet. It is unclear whether the product will be open-source, but the project has clarified that "there will be no KYC on any Wallet of Satoshi, ever!" Wallet of Satoshi ceased serving customers in the United States in November 2023.

- Vulnerability disclosure: Remote crash due to addr message spam in Bitcoin Core versions before v29. Bitcoin Core developer Antoine Poinsot disclosed an integer overflow bug that crashes a node if spammed with addr messages over an extended period. A fix was released on April 14, 2025, in Bitcoin Core v29.0. The issue is rated Low severity.

- Coinbase Know Your Customer (KYC) data leak. The U.S. Department of Justice, including its Criminal Division in Washington, is investigating a cyberattack on Coinbase. The incident involved cybercriminals attempting to extort $20 million from Coinbase to prevent stolen customer data from being leaked online. Although the data breach affected less than 1% of the exchange's users, Coinbase now faces at least six lawsuits following the revelation that some customer support agents were bribed as part of the extortion scheme.

- Fold has launched Bitcoin Gift Cards, enabling users to purchase bitcoin for personal use or as gifts, redeemable via the Fold app. These cards are currently available on Fold’s website and are planned to expand to major retailers nationwide later this year.

"Our mission is to make bitcoin simple and approachable for everyone. The Bitcoin Gift Card brings bitcoin to millions of Americans in a familiar way. Available at the places people already shop, the Bitcoin Gift Card is the best way to gift bitcoin to others," said Will Reeves, Chairman and CEO of Fold.

- Corporate treasuries hold nearly 1.1 million BTC, representing about 5.5% of the total circulating supply (1,082,164 BTC), per BitcoinTreasuries.net data. Recent purchases include Strategy adding 7,390 BTC (total: 576,230 BTC), Metplanet acquiring 1,004 BTC (total: 7,800 BTC), Tether holding over 100,521 BTC, and XXI Capital, led by Jack Mallers, starting with 31,500 BTC.

- Meanwhile, a group of investors has filed a class action lawsuit against Strategy and its executive Michael Saylor. The lawsuit alleges that Strategy made overly optimistic projections using fair value accounting under new FASB rules while downplaying potential losses.

- The U.S. Senate voted to advance the GENIUS stablecoin bill for further debate before a final vote to pass it. Meanwhile, the House is crafting its own stablecoin legislation to establish a regulatory framework for stablecoins and their issuers in the U.S, reports CoinDesk.

- French 'crypto' entrepreneurs get priority access to emergency police services. French Minister of the Interior, Bruno Retailleau, agreed on measures to enhance security for 'crypto' professionals during a meeting on Friday. This follows a failed kidnapping attempt on Tuesday targeting the family of a cryptocurrency exchange CEO, and two other kidnappings earlier this year.

- Brussels Court declares tracking-based ads illegal in EU. The Brussels Court of Appeal ruled tracking-based online ads illegal in the EU due to an inadequate consent model. Major tech firms like Microsoft, Amazon, Google, and X are affected by the decision, as their consent pop-ups fail to protect privacy in real-time bidding, writes The Record.

- Telegram shares data on 22,777 users in Q1 2025, a significant increase from the 5,826 users' data shared during the same period in 2024. This significant increase follows the arrest of CEO and founder Pavel Durov last year.

- An Australian judge has ruled that Bitcoin is money, potentially exempting it from capital gains tax in the country. If upheld on appeal, this interim decision could lead to taxpayer refunds worth up to $1 billion, per tax lawyer Adrian Cartland.

Use the tools

- Bitcoin Safe v1.3.0 a secure and user-friendly Bitcoin savings wallet for beginners and advanced users, introduces an interactive chart, Child Pays For Parent (CPFP) support, testnet4 compatibility, preconfigured testnet demo wallets, various bug fixes, and other improvements.

- BlueWallet v7.1.8 brings numerous bug fixes, dependency updates, and a new search feature for addresses and transactions.

- Aqua Wallet v0.3.0 is out, offering beta testing for the reloadable Dolphin card (in partnership with Visa) for spending bitcoin and Liquid BTC. It also includes a new Optical Character Recognition (OCR) text scanner to read text addresses like QR codes, colored numbers on addresses for better readability, a reduced minimum for spending and swapping Liquid Bitcoin to 100 sats, plus other fixes and enhancements.

Source: Aqua wallet.

- The latest firmware updates for COLDCARD Mk4 v5.4.3 and Q v1.3.3 are now available, featuring the latest enhancements and bug fixes.

- Nunchuk Android v1.9.68.1 and iOS v1.9.79 introduce support for custom blockchain explorers, wallet archiving, re-ordering wallets on the home screen via long-press, and an anti-fee sniping setting.

- BDK-cli v1.0.0, a CLI wallet library and REPL tool to demo and test the BDK library, now uses bdk_wallet 1.0.0 and integrates Kyoto, utilizing the Kyoto protocol for compact block filters. It sets SQLite as the default database and discontinues support for sled.

- publsp is a new command-line tool designed for Lightning node runners or Lightning Service Providers (LSPs) to advertise liquidity offers over Nostr.

"LSPs advertise liquidity as addressable Kind 39735 events. Clients just pull and evaluate all those structured events, then NIP-17 DM an LSP of their choice to coordinate a liquidity purchase," writes developer smallworlnd.

-

Lightning Blinder by Super Testnet is a proof-of-concept privacy tool for the Lightning Network. It enables users to mislead Lightning Service Providers (LSPs) by making it appear as though one wallet is the sender or recipient, masking the original wallet. Explore and try it out here.

-

Mempal v1.5.3, a Bitcoin mempool monitoring and notification app for Android, now includes a swipe-down feature to refresh the dashboard, a custom time option for widget auto-update frequency, and a

-

@ cae03c48:2a7d6671

2025-06-16 16:01:21

@ cae03c48:2a7d6671

2025-06-16 16:01:21Bitcoin Magazine

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on EverythingCoinbase is launching its first-ever branded credit card in partnership with American Express, set to roll out this fall. Called the Coinbase One Card, it will be available only to U.S. members of Coinbase One, the platform’s monthly subscription service. The card will offer 2% to 4% back in Bitcoin on everyday purchases, along with access to American Express perks.

JUST IN: Coinbase launches credit card allowing users to earn up to 4% bitcoin back on every purchase

pic.twitter.com/d6pdNZV4pi

pic.twitter.com/d6pdNZV4pi— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

This is a first-of-its-kind product for Coinbase, which previously only offered a prepaid debit card with Visa in 2020.

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now,” said Will Stredwick, head of American Express global network services, during the Coinbase State of Crypto Summit in New York.

The card is part of a larger push by Coinbase to expand its subscription-based services. Coinbase One costs $29.99/month and includes zero trading fees, higher staking rewards, and customer support perks. The company also announced a cheaper version—Coinbase Basic—for $4.99/month or $49.99/year, which includes fewer features.

Coinbase’s subscription business is growing fast. It brought in $698.1 million in Q1 2025, compared to $1.26 billion in trading revenue. According to William Blair analyst Andrew Jeffrey, this kind of recurring revenue is a big reason why long-term investors are sticking with the stock.

Launched in 2023, Coinbase One now has over a million members. The company has been steadily growing its ecosystem with products like its Base developer platform and a self-custody wallet.

The company has long positioned Bitcoin at the center of its strategy—offering BTC custody services to institutions, supporting Bitcoin ETFs, integrating Bitcoin rewards into its products, and actively advocating for Bitcoin-friendly regulation in Washington. Coinbase also supports Bitcoin development directly through funding grants and engineering support. As the largest publicly traded crypto exchange in the U.S., Coinbase continues to frame Bitcoin not just as an asset, but as the foundation of its long-term vision.

This post Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 7f6db517:a4931eda

2025-06-16 17:02:07

@ 7f6db517:a4931eda

2025-06-16 17:02:07

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 374ee93a:36623347

2025-06-16 16:23:52

@ 374ee93a:36623347

2025-06-16 16:23:52Chef's notes

A quick and easy recipe to help preserve your fresh strawberry harvest for months to come with the addition of vanilla to bring out that summer flavour.

Made with 20% extra fruit than standard supermarket jam. To make a reduced sugar version you can use Pomona's Pectin or accept runny jam ;)

Details

- ⏲️ Prep time: 10 mins

- 🍳 Cook time: 30 mins

- 🍽️ Servings: 5 jars

Ingredients

- 1.2kg fresh hulled strawberries

- 1kg golden cane sugar (can sub honey or maple syrup 1:1)

- 1 lemon

- 1 vanilla pod (or 1 tbspn extract)

Directions

- Remove the green stalks from your strawberries and cut into quarters

- Pare the lemon zest and reserve for another recipe (such as lemon curd, or cocktails!), chop roughly and add to a pan inside a small muslin bag)

- Gently cook the strawberries and lemon together with a lid on the pan for 15-20 minutes, until the lemon pith softens

- Squeeze the muslin bag to get as much pectin out as possiblem then add 1kg sugar to the miture and boil on high

- The jam can be tested for set after approx 10 mins boiling, spoon a small amount onto a chilled plate and place in the freezer for 2 minutes. If the jam wrinkles when pushed with a spoon it is ready to pot into sterlised jars. If it still appears runny cook for a further 5 minutes and repeat testing

-

@ cae03c48:2a7d6671

2025-06-16 16:01:19

@ cae03c48:2a7d6671

2025-06-16 16:01:19Bitcoin Magazine

Bitcoin Will Replace Gold And Go To $1,000,000, Says Galaxy Digital CEO Mike NovogratzToday, Galaxy Digital CEO Mike Novogratz told CNBC that Bitcoin is on a path to replace gold and could eventually reach a value of $1,000,000.

JUST IN:

Galaxy Digital CEO told CNBC that Bitcoin will replace gold and go to $1,000,000

Galaxy Digital CEO told CNBC that Bitcoin will replace gold and go to $1,000,000  pic.twitter.com/Tf831LBt1h

pic.twitter.com/Tf831LBt1h— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

“Bitcoin has become a macro asset,” said Novogratz. “And some of the great things is most people have it on their screens next to gold and silver and the S&P. And you think back ten years ago when people thought we were crazy. And now it’s an institutionalized macro asset… It’s just becoming institutionalized.”

He emphasized that Bitcoin is no longer a fringe investment but part of the mainstream financial landscape. He pointed out that its volatility is now seen as normal compared to traditional assets.

“We are in a dollar bear market. For the last 15 years, American exceptionalism was the story. Europeans were widely overweight and Asians widely overweight the US stock and we have an administration that wants a weaker dollar. They are pretty clear about it,” he said. “Even in the way Trump negotiates. And you can argue if it’s successful or not successful, but by telling Canada they want to be the 51st state, and telling people that they come here to kiss his rear end, it doesn’t engender people to say, ‘Oh, I want to buy more dollars.’”

According to Novogratz, this global shift is pushing investors toward assets outside the dollar, including Bitcoin.

“I think most macro funds are having a great year,” he stated. “They’re short the dollar, they’re long the euro, they’re long the yen, they’re long Aussie, they’re long a basket of currencies. Well, Bitcoin, gold, silver, platinum, they all fall into that same category as something that’s not the dollar.”

He also pointed to Bitcoin’s fixed supply as a key factor behind its growing value.

“There is no more Bitcoin,” he said. “What’s unique about Bitcoin as an asset is it was created with 21 million coins total. Period. End of story. There’ll never be more than that. But not all of those have been mined, is my point. Not most of them. Lots of them have been lost. There have been more Bitcoins lost than will be mined for the rest of eternity.”

Novogratz believes the wave of institutional involvement, including firms like BlackRock, is cementing Bitcoin’s role as a savings asset.

“The bull case becomes that over time… gold slowly gets replaced by Bitcoin. And so if you look at gold’s market cap and Bitcoin market cap, Bitcoin has a long way to go. Right? 10x. And so that [is] $1,000,000 a Bitcoin just to be where gold is.”

This post Bitcoin Will Replace Gold And Go To $1,000,000, Says Galaxy Digital CEO Mike Novogratz first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ cae03c48:2a7d6671

2025-06-16 16:01:17

@ cae03c48:2a7d6671

2025-06-16 16:01:17Bitcoin Magazine

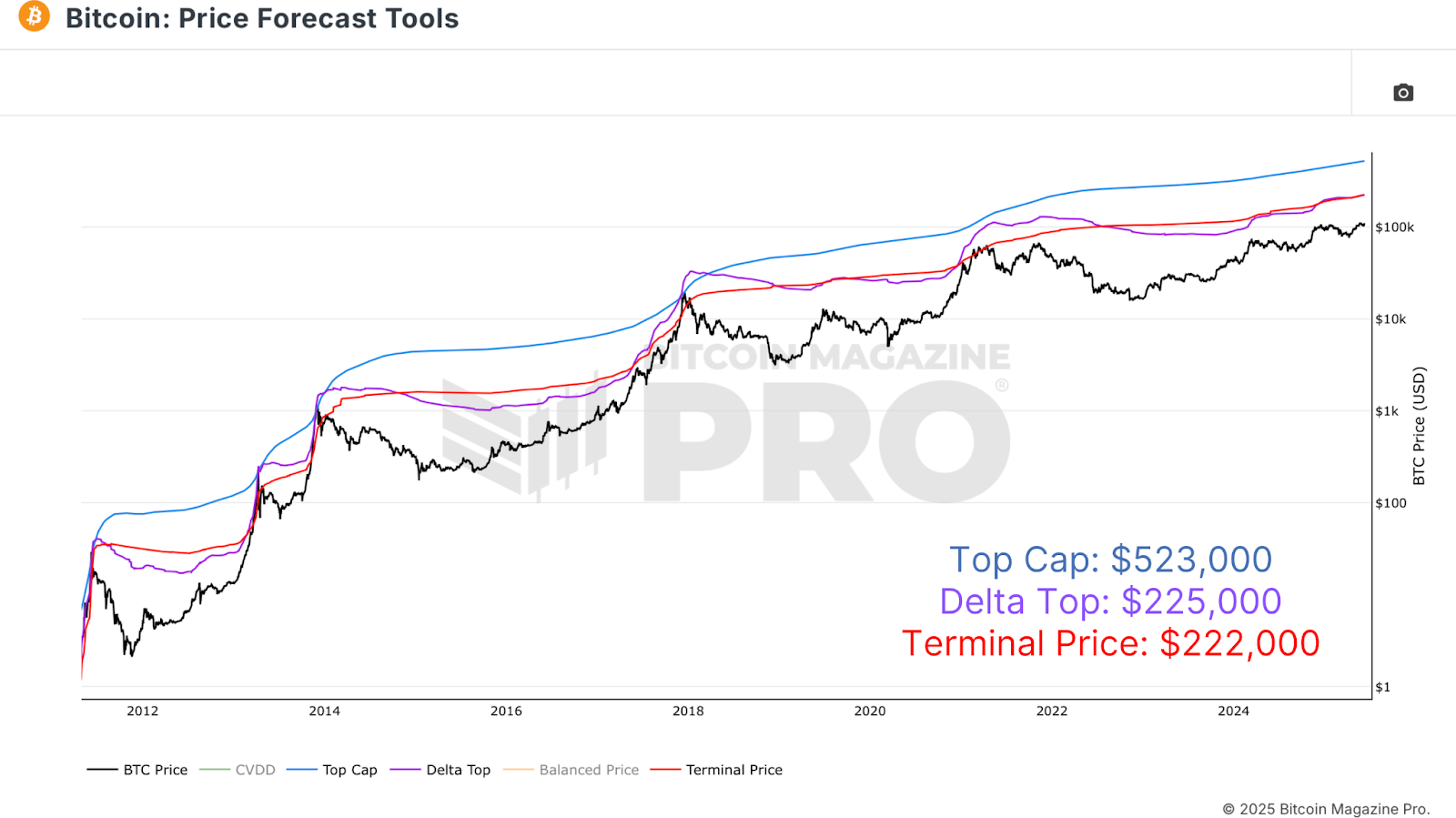

Where Could Bitcoin Peak This Cycle?With Bitcoin looking as bullish as ever, the inevitable question arises of how high could BTC realistically go in this market cycle? Here we’ll explore a wide range of on-chain valuation models and cycle timing tools to identify plausible price targets for a Bitcoin peak. Although prediction is never a substitute for disciplined data reaction, this analysis gives us frameworks to better understand where we are and where we might be heading.

Price Forecast Tools

The journey begins with Bitcoin Magazine Pro’s free Price Forecast Tools, which compile several historically accurate valuation models. While it’s always more effective to react to data rather than blindly predict prices, studying these metrics can still provide powerful context for market behavior. If macro, derivative, and on-chain data all start flashing warnings, it’s usually a solid time to take profit, regardless of whether a specific price target has been hit. Still, exploring these valuation tools is informative and can guide strategic decision-making when used alongside broader market analysis.

Figure 1: Applying Price Forecast Tools to calculate potential cycle tops. View Live Chart

Among the key models, the Top Cap multiplies the average cap over time by 35 to project peak valuations. It accurately forecasted 2017’s top, but missed the 2020–2021 cycle, estimating over $200k while Bitcoin peaked around $69k. It now targets over $500k, which feels increasingly unrealistic. A step further is the Delta Top, subtracting the average cap from the realized cap, based on the cost basis of all circulating BTC, to generate a more grounded projection. This model suggested an $80k–$100k top last cycle. The most consistently accurate, however, is the Terminal Price, based on Supply Adjusted Coin Days Destroyed, which has closely aligned with each prior peak, including the $64k top in 2021. Currently projecting around $221k, it could rise to $250k or more, and remains arguably the most credible model for forecasting macro Bitcoin tops. Of course, more information regarding all of these metrics and their calculation logic can be found beneath the charts on the site.

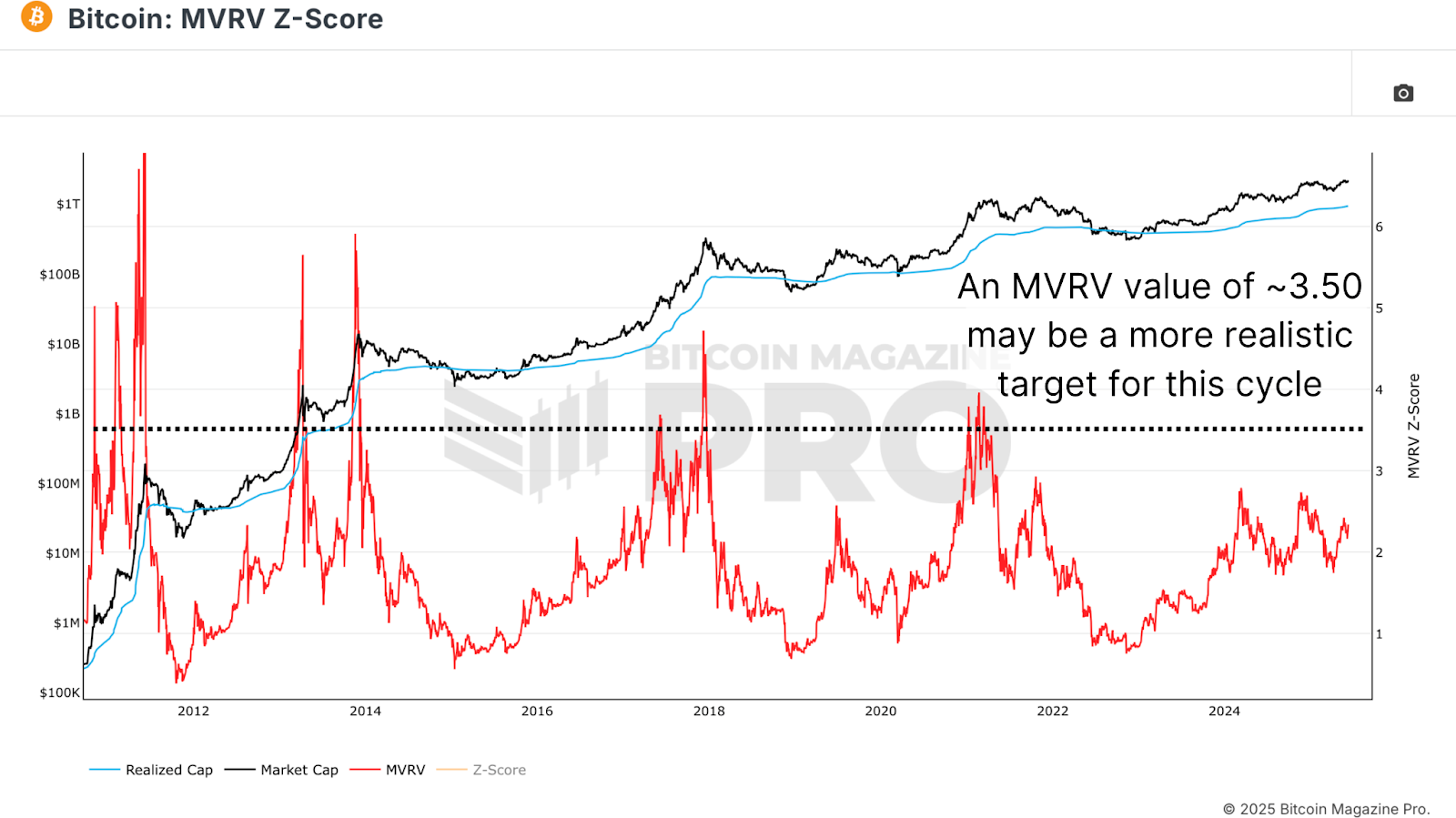

Peak Forecasting

Another powerful metric is the MVRV ratio, which compares market cap to realized cap. It offers a psychological window into investor sentiment, typically peaking near a value of 4 in major cycles. The ratio currently sits at 2.34, suggesting there may still be room for significant upside. Historically, as MVRV nears 3.5 to 4, long-term holders begin to realize substantial gains, often signaling cycle maturity. However, with diminishing returns, we might not reach a full 4 this time around. Instead, using a more conservative estimate of 3.5, we can begin projecting more grounded peak values.

Figure 2: A view of the MVRV ratio predicts further cycle growth to reach historical 4+ and even more conservative 3.5 target values. View Live Chart

Calculating A Target

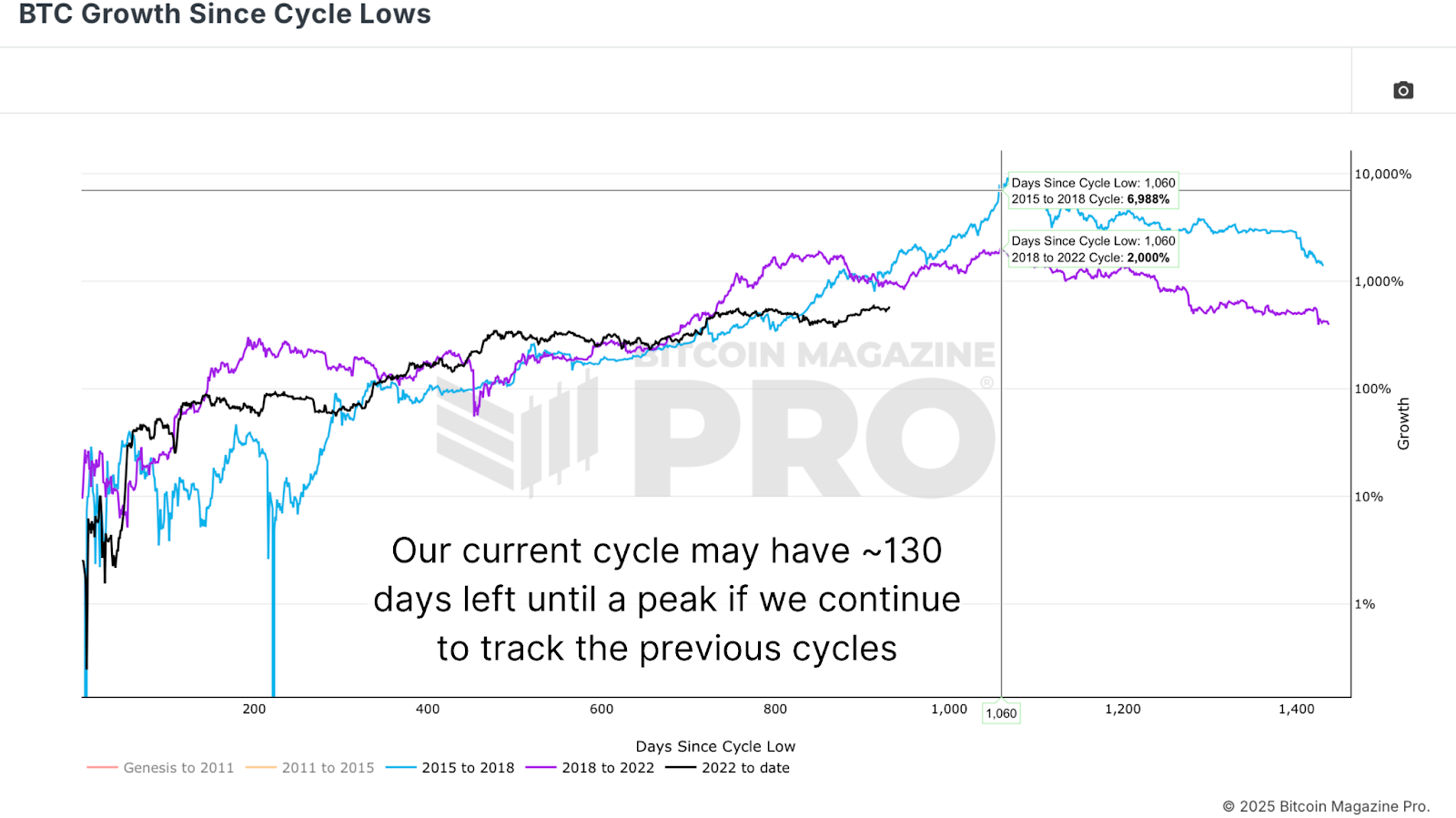

Timing is as important as valuation. Analysis of BTC Growth Since Cycle Lows illustrates that previous Bitcoin cycles peaked almost exactly 1,060 days from their respective lows. Currently, we are about 930 days into this cycle. If the pattern holds, we can estimate the peak may arrive in roughly 130 days. Historical FOMO-driven price increases often happen late in the cycle, causing Realized Price, a proxy for average investor cost basis, to rise rapidly. For instance, in the final 130 days of the 2017 cycle, realized price grew 260%. In 2021, it increased by 130%. If we assume a further halving of growth due to diminishing returns, a 65% rise from the current $47k realized price brings us to around $78k by October 18.

Figure 3: Based on the peak rate of previous cycles, this cycle is far from over. View Live Chart

With a projected $78k realized price and a conservative MVRV target of 3.5, we arrive at a potential Bitcoin price peak of $273,000. While that may feel ambitious, historical parabolic blowoff tops have shown that such moves can happen in weeks, not months. While it may seem more realistic to expect a peak closer to $150k to $200k, the math and on-chain evidence suggest that a higher valuation is at least within the realm of possibility. It’s also worth noting that these models dynamically adjust, and if late-cycle euphoria kicks in, projections could quickly accelerate further.

Figure 4: Combining projected realized price and a possible MVRV target to predict this cycle’s peak.

Conclusion

Forecasting Bitcoin’s exact peak is inherently uncertain, with too many variables to account for. What we can do is position ourselves with probabilistic frameworks grounded in historical precedent and on-chain data. Tools like the MVRV ratio, Terminal Price, and Delta Top have repeatedly demonstrated their value in anticipating market exhaustion. While a $273,000 target might seem optimistic, it is rooted in past patterns, current network behavior, and cycle-timing logic. Ultimately, the best strategy is to react to data, not rigid price levels. Use these tools to inform your thesis, but stay nimble enough to take profits when the broader ecosystem starts signaling the top.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Where Could Bitcoin Peak This Cycle? first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ 2c564b98:5c6444b0

2025-06-16 15:14:09

@ 2c564b98:5c6444b0

2025-06-16 15:14:09 © unsplash

© unsplashDieser Beitrag von Laura und Phillip aus dem FOERBICO Team erschien zuerst auf dem Theologie-Blog y-nachten.

Alle reden von OER - was ist das eigentlich?

Offene Vorlesungsreihen auf YouTube, Podcasts, Blogs, Podiumsdiskussionen und die Beteiligung an Wikipedia-Einträgen machen deutlich, dass sich das Geschehen an Hochschulen zunehmend öffnet, um mit einer interessierten Öffentlichkeit transparent zu kommunizieren sowie Diskurse breiter zugänglich zu machen (vgl. Mößle, Pirker 2024). Für viele wirkt aber gerade die wissenschaftliche Theologie wie eine Disziplin für Expert:innen, geprägt von antiken Sprachen, dogmatischen Gerüsten und traditionsgebundenen Denken, das ein hohes Maß an Vorwissen erfordert. Doch muss die Theologie wirklich so fern und unverständlich wirken? Die Open-Science-Bewegung zielt auf Transparenz und Nachvollziehbarkeit und fordert Wissenschaftler:innen sowie Akteur:innen aus Politik, Wirtschaft und Kultur dazu auf, zum Austausch beizutragen und den wissenschaftlichen Dialog im Sinne einer Demokratisierung des Wissens mitzugestalten (vgl. Siegfried, Scherp, Linek, Flieger 2024). Hierbei kommt den Open Educational Resources, kurz OER, eine bedeutsame Rolle zu. OER sind frei zugängliche Bildungsmaterialien, die in unterschiedlichen Formaten und Medien vorliegen können. Sie stehen unter einer offenen Lizenz, die es ermöglicht, sie kostenlos zu nutzen, zu verändern und mit oder ohne Änderungen weiterzugeben, mit wenigen oder gar keinen Einschränkungen. Ob einzelne Arbeitsblätter, komplette Lehrbücher, Onlinekurse, Videos oder Podcasts, solange sie offen, d.h. mit CC-Lizenzen versehen sind, gelten sie als OER. Ziel ist es, Bildung für alle zugänglicher und flexibler zu machen (vgl. UNESCO 2019). OER unterscheiden sich von kostenlosen Materialien durch die rechtssichere Möglichkeit der Bearbeitung und Weiterverbreitung, vgl. exemplarisch die OER-Lizensierung bei (Pirner 2024). Dies ermöglicht sowohl Lehrenden die Anpassung der Lehrmaterialien an ihre Zielgruppe als auch Lernenden die Bearbeitung der Materialien für sich und ihre Lerngruppe.

OER braucht Praxis! Open Educational Practice

OER allein führen jedoch nicht zu einer Bildungsreform. Eine partizipative Lehr- und Lernkultur ist notwendig und es bedarf einer gewissen Haltung und Praxis, damit OER entstehen und weiterentwickelt werden können, die sog. Open Educational Practices (OEP). Die Definition von (Cronin 2017, 4) gibt einen guten Einblick, um was es sich dabei handelt. OEP sind:

»collaborative practices that include the creation, use, and reuse of OER, as well as pedagogical practices employing participatory technologies and social networks for interaction, peer-learning, knowledge creation, and empowerment of learners« .

OEP sind also kollaborative Praktiken, die rund um OER stattfinden und den Prozess der OER-Erstellung und Bearbeitung von Anfang an mitbestimmen. Besonders wichtig sind dabei soziale Netzwerke und Communities. Diese können Lernende, Lehrende, Expert:innen oder Fächergruppen umfassen, die sich austauschen, OER weiterentwickeln und sich gegenseitig motivieren, neue Ansätze zu erproben.

Third Mission an Hochschulen: Über die Grenzen hinaus

Unter dem Schlagwort Third Mission, also der dritten Mission von Hochschule neben Forschung und Lehre, stehen die zentralen Fragen: Wie kann sich Hochschule für die Gesellschaft öffnen? Und wie lässt sich der Austausch zwischen Wissenschaft und Öffentlichkeit fördern? Hierbei tritt die Hochschule in wechselseitige Interaktion mit der Gesellschaft und ist offen für Erwartungen, Herausforderungen und Fragen, die an sie gerichtet werden. Im Sinne der wissenschaftlichen Weiterbildung gehört es auch zur Third Mission, Lernaktivitäten zu entwickeln, die Fähigkeiten und Kompetenzen in persönlicher, gesellschaftlicher oder beruflicher Perspektive erhöhen (vgl. Roessler 2015). Aus der Perspektive theologischer Hochschullehre lässt sich dieser Aspekt besonders fruchtbar mit OER und OEP verknüpfen und kann die Third Mission sogar weiterentwickeln. Denn Theologie lebt nicht nur vom reinen Wissenstransfer, sondern auch von der dialogischen Auseinandersetzung und der gemeinsamen Suche. Hierfür ist eine Kultur der Partizipation ein Gamechanger. Denn OER bietet mehr als nur den offenen Zugang zu Materialien. Es schafft Bewusstsein für Lizensierungen und ermöglicht eine Kultur des Teilens. So könnte zum Beispiel eine Vorlesung aus dem Theologiestudium nicht nur öffentlich zugänglich gemacht werden, sondern – im Sinne von OER – auch zur Weiterverarbeitung und Anpassung einladen. Damit hätten Kirchengemeinden, Bildungseinrichtungen oder interreligiöse Dialogkreise Zugang zu Materialien und könnten sie für ihren Kontext anpassen, mit ihrem Wissen, ihren Erfahrungen und Erkenntnisgewinnen weiterentwickeln und wiederum mit anderen teilen. Theologie ist in ihrem Kern auf Dialog auslegt, sei es mit anderen Disziplinen, Religionen oder der Gesellschaft. OER und OEP fördern diese Lehr- und Lernkultur, in der Menschen miteinander in Beziehung treten, Wissen teilen und sich gegenseitig inspirieren können. Dies entspricht nicht nur dem Kerngedanken der Third Mission, sondern auch der theologischen Grundhaltung, dass Erkenntnis vor allem im Dialog wächst.

Fürchtet euch nicht! Gehet hinaus und teilet!

Offene Bildungsressourcen bieten zwar viele Chancen, doch ihre Nutzung bringt auch Herausforderungen und gewisse Ängste mit sich. In Fachgesprächen und Interviews wird deutlich, dass die Idee von OER zwar sympathisch ist, aber auch Bedenken hervorruft. Das größte Hindernis sind rechtliche Unsicherheiten, insbesondere bei der Verwendung von Bildern, Musiksequenzen oder auch Texten Dritter. Die Klärung dieser Fragen ist oft zeitaufwendig und erfordert etwas Lust, sich reinzudenken. Es gibt auch Anlaufstellen, an die man sich bei konkreten Fragen wenden kann, z.B. bei OERInfo; Irights; Twillo oder ORCA.nrw. Bei eigenen Forschungsergebnissen oder selbst erstelltem Material, sind diese Bedenken hingegen weniger relevant. Zudem muss nicht sofort alles als OER veröffentlicht werden. Ein schrittweiser Einstieg mit einzelnen Elementen kann bereits einen Beitrag leisten. Je mehr offen lizenzierte Inhalte existieren, desto leichter wird es, rechtssichere OER zu erstellen. Ein weiteres häufig geäußertes Bedenken ist der potenzielle Missbrauch von offenem Material. Die Möglichkeit zur Bearbeitung oder Neuzusammenstellung birgt das Risiko von Verfremdungen oder Verfälschungen. Doch Erfahrung mit OER-Communities zeigen, dass die Inhalte meist verantwortungsvoll genutzt werden. Zudem kann eine vollständige Kontrolle über die Verwendung von Wissen nie gewährleistet werden. Dies gilt nicht nur für OER, sondern für alle öffentlichen Inhalte.

Theologie sollte nicht hinter verschlossenen Türen stattfinden, sondern im offenen Austausch mit der Gesellschaft. OER bieten die Chance, theologisches Wissen zugänglich zu machen und neu mit der Gesellschaft in Diskurs zu treten. Theologie-Treiben sollte kein einseitiger Prozess sein, sondern ein gemeinsames Lernen, Wagen und Gestalten. Dabei spielt auch der Gedanke der Freigiebigkeit eine Rolle: Bildung sollte geteilt, verbreitet und möglichst vielen Menschen zugänglich gemacht werden. OER können ein neuer Impuls sein, um Barrieren zu überwinden und theologische Erkenntnisse mit der Lebenswelt der Menschen zu verbinden.

-

@ 7f6db517:a4931eda

2025-06-16 13:02:13

@ 7f6db517:a4931eda

2025-06-16 13:02:13

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 2c564b98:5c6444b0

2025-06-16 15:12:30

@ 2c564b98:5c6444b0

2025-06-16 15:12:30Welcome to Nostr: A Decentralized Future

Nostr (Notes and Other Stuff Transmitted by Relays) is a simple, open protocol that enables global, decentralized, and censorship-resistant social media.

Why Nostr?

Traditional social media platforms have several problems:

- Centralized Control - A single company controls your data

- Censorship - Content can be removed at will

- Data Lock-in - Hard to move your social graph

Nostr solves these problems through:

- Decentralization - No single point of control

- Cryptographic Signatures - You own your identity

- Relay Network - Multiple servers ensure availability

How It Works

javascript // Simple example of creating a Nostr event const event = { kind: 1, // Text note content: "Hello, Nostr!", tags: [], created_at: Math.floor(Date.now() / 1000) };Getting Started

To start using Nostr:

- Generate your keys (public/private keypair)

- Choose a client (web, mobile, or desktop)

- Connect to relays

- Start publishing!

Long-Form Content on Nostr

This post itself is an example of long-form content on Nostr, using:

- NIP-23 standard for long-form content

- Markdown formatting for rich text

- Metadata for better organization

Join the Revolution

Nostr represents a fundamental shift in how we think about social media and online identity. By giving users control over their data and identity, it creates a more open and resilient internet.

This post was published using nostr-publisher - a simple tool for publishing long-form content to Nostr.

-

@ bf47c19e:c3d2573b

2025-06-16 15:06:01

@ bf47c19e:c3d2573b

2025-06-16 15:06:0127.08.2014

Originalni tekst na fee.org / Autor: Džefri A. Taker

Oni koji se koriste delom Mizesa da bi osporili Bitkoin trebalo bi ponovo da razmisle.

Mnogi ljudi koji nikada nisu koristili Bitkoin posmatraju ga sa zbunjenošću. Zašto ovaj magični internet novac uopšte ima bilo kakvu vrednost? To je samo nekakva kompjuterska stvar koju je neko izmislio.

Uzmite u obzir kritike zlatoljubaca, koji su decenijama gurali ideju da čvrst novac mora biti podržan nečim stvarnim, čvrstim i vrednim samim po sebi.

Bitkoin ne ispunjava te uslove, zar ne?

Možda ipak ispunjava. Pogledajmo detaljnije.

Bitkoin se prvi put pojavio pre skoro šest godina kao mogući konkurent nacionalnom novcu kojim upravlja država. Beli papir Satošija Nakamota objavljen je 31. oktobra 2008. godine. Struktura i jezik ovog rada poslali su poruku: Ova valuta je za kompjuterske tehničare, a ne za ekonomiste niti za političke komentatore. Domet ovog rada je bio ograničen; početnici koji su ga čitali bili su zbunjeni.

Ali nedostatak interesovanja nije sprečio istoriju da ide napred. Dva meseca kasnije, oni koji su obraćali pažnju videli su pojavu Genesis bloka, prve grupe Bitkoina generisanih putem Nakamotovog koncepta distribuirane knjige (distributed ledger) koja je postojala na bilo kom kompjuterskom čvoru na svetu koji je želeo da je hostuje.

Ovde smo šest godina kasnije, a jedan Bitkoin vredi 500 američkih dolara, dok je njegova najviša vrednost bila 1.200 dolara po novčiću. Ovu valutu prihvata na hiljade institucija, kako onlajn, tako i oflajn. Njen platni sistem je veoma popularan u siromašnim zemljama koje nemaju razvijenu bankarsku infrastrukturu, ali i u razvijenim zemljama. Velike institucije – uključujući Federalne rezerve, OECD, Svetsku banku i velike investicione kuće – posvećuju mu pažnju sa dužnim poštovanjem.

Entuzijasti, koji se nalaze u svakoj zemlji, kažu da će njegova tržišna vrednost u budućnosti rasti jer je njegova ponuda strogo ograničena i pruža sistem koji je znatno superiorniji od državnog novca. Bitkoin se prenosi između pojedinaca bez posrednika. Razmena je gotovo besplatna. Ima predvidivu ponudu. Trajan je, zamenljiv i deljiv: sve su to ključne karakteristike novca. Stvara monetarni sistem koji ne zavisi od poverenja i identiteta, a mnogo manje od centralnih banaka i države. To je novi sistem za digitalno doba.

Teške pouke o čvrstom novcu

Onima koji su obrazovani u tradiciji 'čvrstog novca', cela ideja je predstavljala ozbiljan izazov. Govoreći o sebi, čitao sam o Bitkoinu dve godine pre nego što sam makar približno uspeo da ga razumem. Jednostavno, nešto u celoj toj ideji mi je smetalo. Ne možete stvoriti novac ni iz čega, a kamoli iz kompjuterskog koda. Zašto onda ima vrednost? Mora da nešto nije kako treba. Nismo očekivali da će se novac tako reformisati.

Tu je i problem: naša očekivanja. Trebalo je da posvetimo više pažnje teoriji porekla novca Ludviga fon Mizesa — ne onome što mislimo da je on napisao, već onome što je on zaista napisao.

Godine 1912. Mizes je objavio delo "Teorija novca i kredita". Kada je objavljeno na nemačkom, postiglo je ogroman uspeh u Evropi i prevedeno je na engleski jezik. Iako je obuhvatilo svaki aspekt novca, njegov ključni doprinos bio je u praćenju vrednosti i cene novca — i ne samo novca — sve do njegovog porekla. To jest, objasnio je kako novac formira svoju cenu u smislu dobara i usluga koje se njime mogu nabaviti. Kasnije je ovaj proces nazvao "teoremom regresije novca" i ispostavilo se da Bitkoin zadovoljava sve uslove te teoreme.

Mizesov učitelj, Karl Menger, demonstrirao je da sam novac potiče sa tržišta – a ne od države i ne od društvenog ugovora. On se postepeno pojavljuje dok monetarni preduzetnici traže idealan oblik robe za indirektnu razmenu. Umesto da neposredno vrše trampu, ljudi pribavljaju neko dobro ne da bi ga konzumirali, već da bi ga razmenili. To dobro postaje novac, najtržišnije dobro.

Ali Mizes je dodao da se vrednost novca prati unazad kroz vreme sve do njegove vrednosti kao robe koja je služila za trampu. Mizes je smatrao da je to jedini način na koji novac može imati vrednost.

"Teorija vrednosti novca kao takvog može pratiti objektivnu tržišnu vrednost novca kroz vreme samo do tačke kada njegova vrednost prestaje da bude vrednost kao novca i postaje isključivo vrednost kao robe... Ako se na ovaj način neprestano vraćamo sve dalje unazad, na kraju moramo doći do tačke gde više ne nalazimo nijednu komponentu u objektivnoj tržišnoj vrednosti novca koja proističe iz vrednovanja zasnovanih na funkciji novca kao opšteg sredstva razmene; gde vrednost novca nije ništa drugo do vrednost predmeta koji je koristan na neki drugi način osim kao novac... Pre nego što je postalo uobičajeno nabavljati robu na tržištu, ne za ličnu potrošnju, već jednostavno radi ponovne razmene za robu za kojom zaista postoji potreba, svakoj pojedinačnoj robi pripisivana je samo ona vrednost data subjektivnim vrednovanjem zasnovanom na njenoj direktnoj korisnosti."

Mizesovo objašnjenje rešilo je veliki problem koji je dugo zbunjivao ekonomiste. Radi se o nagađajućem istorijskom narativu, a ipak ima savršenog smisla. Da li bi so postala novac da je inače bila potpuno beskorisna? Da li bi dabrovo krzno dobilo monetarnu vrednost da nije bilo korisno kao odeća? Da li bi srebro ili zlato imali novčanu vrednost da isprva nisu imali vrednost kao roba? Odgovor u svim slučajevima monetarne istorije je jasno ne. Početna vrednost novca, pre nego što postane široko razmenjivano kao novac, potiče iz njegove direktne korisnosti. To je objašnjenje koje je demonstrirano kroz istorijsku rekonstrukciju. To je Mizesova teorema regresije novca.

Upotrebna vrednost Bitkoina

Na prvi pogled, Bitkoin deluje kao izuzetak. Ne možete koristiti Bitkoin ni za šta drugo osim kao novac. Ne može se nositi kao nakit. Ne možete od njega napraviti mašinu. Ne možete ga jesti, pa čak ni koristiti ga kao dekoraciju. Njegova vrednost se ostvaruje samo kao jedinica koja olakšava indirektnu razmenu. Pa ipak, Bitkoin je već novac. Koristi se svakodnevno. Razmene možete videti u realnom vremenu. To nije mit. Ta stvar je stvarna.

Može izgledati kao da smo prinuđeni da biramo. Da li je Mizes pogrešio? Možda moramo odbaciti celu njegovu teoriju. Ili je možda njegova poenta bila isključivo istorijska i nije primenjiva na budućnost digitalnog doba. Ili je možda njegova teorema regresije dokaz da je Bitkoin samo prazna manija bez snage da potraje jer se ne može svesti na svoju vrednost kao korisna roba.

Pa ipak, ne morate se pozivati na komplikovane monetarne teorije da biste razumeli osećaj uzbune koji okružuje Bitkoin. Mnogi ljudi, kao i ja, jednostavno osećaju nelagodu u vezi sa novcem koji nema nikakvu fizičku osnovu. Naravno, možete odštampati Bitkoin na komadu papira, ali posedovanje papira sa QR kodom ili javnim ključem nije dovoljno da ublaži taj osećaj nelagode.

Kako da rešimo ovaj problem? U svojoj glavi, zabavljao sam se ovim pitanjem više od godinu dana. Zbunjivalo me je. Pitao sam se da li je Mizesovo shvatanje primenjivo samo u preddigitalnom dobu. Pratio sam onlajn spekulacije da bi vrednost Bitkoina bila nula, da nema nacionalnih valuta u koje se konvertuje. Možda je potražnja za Bitkoinom prevazišla zahteve Mizesovog scenarija zbog očajničke potrebe za nečim drugačijim od dolara.

Vreme je prolazilo — i čitajući radove Konrada Grafa, Petera Šurde i Danijela Kraviša — rešenje je konačno samo stiglo. Preći ću odmah na stvar i otkriti ga: Bitkoin je i sistem plaćanja i novac. Sistem plaćanja je izvor vrednosti, dok obračunska jedinica samo izražava tu vrednost u smislu cene. Jedinstvo novca i plaćanja je njegova najneobičnija karakteristika i ona koju je većina komentatora imala poteškoća da shvati.

Navikli smo da razmišljamo o valuti kao o nečemu što je odvojeno od sistema plaćanja. Ovo razmišljanje je odraz istorijskih tehnoloških ograničenja. Postoji dolar i postoje kreditne kartice. Postoji evro i postoji PayPal. Postoji jen i postoje servisi za prenos novca. U svim ovim slučajevima, transfer novca se oslanja na pružaoce usluga koji predstavljaju treću stranu. Da biste ih koristili, potrebno je da uspostavite ono što se naziva „odnos poverenja“ (trust relationship) sa njima, što znači da institucija koja dogovara posao mora da vam veruje da ćete platiti.

Ovaj jaz između novca i plaćanja uvek je bio prisutan, osim u slučaju fizičke blizine. Ako ti dam dolar za parče pice, nema treće strane. Ali sistemi plaćanja, treće strane i odnosi poverenja postaju neophodni kada napustite geografsku blizinu. Tada kompanije poput Vise i institucije poput banaka postaju nezaobilazne. One su ta aplikacija koja omogućava monetarnom softveru da radi ono što želite.

Problem je u tome što sistemi plaćanja koje danas imamo nisu dostupni svakome. Zapravo, ogromna većina čovečanstva nema pristup takvim alatima, što je glavni razlog siromaštva u svetu. Oni koji su finansijski obespravljeni su ograničeni samo na lokalnu trgovinu i ne mogu proširiti svoje trgovinske odnose sa svetom.

Vodeći, ako ne i primarni, cilj nastanka Bitkoina bio je rešavanje ovog problema. Protokol je postavio sebi zadatak da poveže funkciju valute sa sistemom plaćanja. Te dve stvari su potpuno međusobno povezane u samoj strukturi koda. Ova veza je ono što čini Bitkoin drugačijim od bilo koje postojeće nacionalne valute i, zaista, bilo koje valute u istoriji.

Neka nam se sam Nakamoto obrati iz uvodnog sažetka svog belog papira. Zapazite koliko je platni sistem ključan za monetarni sistem koji je stvorio:

"Potpuna peer-to-peer verzija elektronskog novca omogućila bi slanje uplata putem interneta direktno od jedne strane ka drugoj bez posredovanja finansijskih institucija. Digitalni potpisi pružaju deo rešenja, ali se glavni benefiti gube ako je i dalje potrebna pouzdana treća strana za sprečavanje dvostruke potrošnje. Predlažemo rešenje problema dvostruke potrošnje korišćenjem peer-to-peer mreže. Mreža vremenski označava transakcije tako što ih hešuje u tekući lanac dokaza o radu (proof of work) temeljen na hešu, formirajući zapis koji se ne može promeniti bez ponovnog rada i objavljivanja dokaza o tom radu. Najduži lanac ne služi samo kao dokaz niza događaja, nego i kao dokaz da je taj niz događaja potvrđen od strane dela peer-to-peer mreže koja poseduju najveću zbirnu procesorsku snagu (CPU). Sve dok većinu procesorske snage kontrolišu čvorovi (nodes) koji ne sarađuju u napadu na mrežu, oni će generisati najduži lanac i nadmašiti napadače. Sama mreža zahteva minimalnu strukturu. Poruke kroz mrežu se prenose uz pretpostavku da svaki čvor čini maksimalan napor da poruku prenese u svom izvornom obliku i na optimalan način, a čvorovi mogu napustiti mrežu i ponovo joj se pridružiti po želji, prihvatajući najduži lanac dokaza o radu kao dokaz onoga što se dogodilo dok ih nije bilo."

Ono što je veoma upečatljivo u ovom paragrafu je da se uopšte ne spominje sama valuta. Spominje se samo problem dvostruke potrošnje (odnosno, problem inflatornog stvaranja novca). Inovacija ovde je, čak i prema rečima njenog pronalazača, platna mreža, a ne novčić. Novčić ili digitalna jedinica samo izražava vrednost mreže. To je računovodstveni alat koji apsorbuje i prenosi vrednost mreže kroz vreme i prostor.

Ova mreža se naziva blokčejn. To je knjiga transakcija koja živi u digitalnom oblaku, distribuirana mreža i njeno funkcionisanje može posmatrati svako u bilo koje vreme. Pažljivo je nadgledaju svi korisnici. Omogućava prenos sigurnih i neponovljivih bitova informacija od jedne osobe do bilo koje druge osobe bilo gde u svetu, a ovi informacioni bitovi su zaštićeni digitalnim oblikom vlasništva. Ovo je ono što je Nakamoto nazvao „digitalnim potpisima“. Njegov izum knjige transakcija koja se nalazi na oblaku omogućava proveru vlasničkih prava bez oslanjanja na agenciju koja vrši ulogu treće strane od poverenja.

Blokčejn je rešio ono što je postalo poznato kao "problem vizantijskih generala". To je problem koordinacije akcija na velikom geografskom području u prisustvu potencijalno zlonamernih aktera. Budući da se generali razdvojeni prostorom moraju oslanjati na glasnike i to oslanjanje zahteva vreme i poverenje, nijedan general ne može biti apsolutno siguran da je drugi general primio i potvrdio poruku, a kamoli njenu tačnost.

Postavljanje knjige transakcija, kojoj svi imaju pristup, na Internet rešava ovaj problem. Knjiga transakcija beleži iznose, vremena i javne adrese svake transakcije. Informacije se dele širom sveta i stalno se ažuriraju. Knjiga transakcija garantuje integritet sistema i omogućava da valutna jedinica postane digitalni oblik imovine sa vlasništvom.

Kada ovo shvatite, možete videti da je suština vrednosti Bitkoin povezana sa njegovom integrisanom platnom mrežom. Ovde se pronalazi upotrebna vrednost na koju se Mizes poziva. Ona nije ugrađena u samu valutnu jedinicu, već u briljantan i inovativan platni sistem na kojem Bitkoin živi. Kada bi bilo moguće da se blokčejn nekako odvoji od Bitkoina (a to zaista nije moguće), vrednost valute bi odmah pala na nulu.

Dokaz koncepta

Da biste dalje razumeli kako se Mizesova teorija uklapa u Bitkoin, morate razumeti još jednu stvar u vezi sa istorijom kriptovalute. Na dan pokretanja (9. januar 2009.), vrednost Bitkoina bila je tačno nula. I tako je ostalo 10 meseci nakon pokretanja. Sve to vreme su se transakcije odvijale, ali tokom celog tog perioda vrednost nije bila iznad nule.

Prva objavljena cena Bitkoina pojavila se 5. oktobra 2009. Na ovoj menjačnici, 1 dolar je iznosio 1.309,03 Bitkoina (što su mnogi tada smatrali precenjenim). Drugim rečima, prva procena vrednosti Bitkoina bila je nešto više od jedne desetine penija. Da, da ste kupili Bitkoin u vrednosti od 100 dolara u to vreme i niste ih panično prodali, danas biste bili „polu-milijarder“.

Dakle, postavlja se pitanje: Šta se dogodilo između 9. januara i 5. oktobra 2009. godine, što je dovelo do toga da Bitkoin dobije tržišnu vrednost? Odgovor je da su trgovci, entuzijasti, preduzetnici i drugi isprobavali blokčejn. Želeli su da znaju da li funkcioniše. Da li je prenosio jedinice bez dvostruke potrošnje? Da li je sistem koji se oslanjao na dobrovoljnu računarsku snagu zaista bio dovoljan za verifikaciju i potvrđivanje transakcija? Da li bitkoini koji su dodeljeni kao nagrada završavaju tamo gde treba kao naknada za usluge verifikacije? I iznad svega, da li je ovaj novi sistem zaista uspeo da uradi ono što se činilo nemogućim – to jest, da prenosi bezbedne delove informacija zasnovanih na vlasničkim pravima kroz geografski prostor, bez posredovanja neke treće strane, već direktno između korisnika (peer-to-peer)?

Potrajalo je 10 meseci da se izgradi poverenje. Bilo je potrebno još 18 meseci dok Bitkoin nije dostigao paritet sa američkim dolarom. Ovu istoriju je ključno razumeti, pogotovo ako se oslanjate na teoriju porekla novca koja spekuliše o praistoriji novca, kao što to čini Misesova regresiona teorema. Bitkoin nije uvek bio novac koji ima vrednost. Nekada je bio čisto računovodstvena jedinica vezana za knjigu transakcija (ledger). Ova knjiga transakcija je pribavila ono što je Mises nazvao „upotrebnom vrednošću“. Svi uslovi teoreme su time zadovoljeni.

Zavšni obračun

Da ponovimo, ako neko kaže da se Bitkoin zasniva ni na čemu drugom osim na "običnoj magli", da ne može biti novac jer nema pravu istoriju kao istinska roba i, bez obzira da li je ta osoba početnik ili visoko obučeno ekonomista, morate istaći dve centralne tačke. Prvo, Bitkoin nije samostalna valuta već obračunska jedinica vezana za inovativnu platnu mrežu. Drugo, ova mreža, a samim tim i Bitkoin, svoju tržišnu vrednost stekla je isključivo kroz testiranje u realnom vremenu u tržišnom okruženju.

Drugim rečima, ako zanemarimo impresivne tehničke karakteristike, Bitkoin je prešao put baš kao i svaka druga valuta, od soli do zlata. Ljudi su smatrali da je platni sistem koristan, a vezana računovodstvena jedinica je bila prenosiva, deljiva, zamenljiva, trajna i retka.

Novac je rođen. Ovaj novac poseduje sve istorijski najbolje osobine novca, ali uključuje i bestežinsku i besprostornu platnu mrežu koja omogućava celom svetu da trguje bez potrebe za trećim stranama.

Ali primetite nešto što je izuzetno važno. Kod blokčejna se ne radi samo o novcu. Radi se o bilo kakvom prenosu informacija koji zahteva sigurnost, potvrđivanje i punu garanciju autentičnosti. Ovo se odnosi na ugovore i transakcije svih vrsta, sve obavljene direktno između stranaka (peer-to-peer). Zamislite svet bez trećih strana, uključujući i najopasniju treću stranu ikada stvorenu od strane čoveka: samu Državu. Zamislite tu budućnost i počećete da shvatate implikacije naše budućnosti u svojoj potpunosti.

Mises bi bio zapanjen i iznenađen Bitkoinom. Ali možda bi osećao i ponos što je njegova monetarna teorija, stara više od 100 godina, potvrđena i dobila novi život u 21. veku.

-

@ 2c564b98:5c6444b0

2025-06-16 15:04:39

@ 2c564b98:5c6444b0

2025-06-16 15:04:39My First Nostr Long-Form Post

This is a test of long-form content publishing on Nostr using the NIP-23 standard.

What is Nostr?

Nostr is a simple, open protocol that enables global, decentralized, and censorship-resistant social media.

Features of This Post

- Written in Markdown

- Tagged appropriately

- Includes metadata

- Published to multiple relays

Code Example

javascript console.log("Hello, Nostr!");Conclusion

This demonstrates how easy it is to publish long-form content to Nostr!

Published using nostr-publisher

-

@ 04c3c1a5:a94cf83d

2025-06-16 17:36:00

@ 04c3c1a5:a94cf83d

2025-06-16 17:36:00testest 123 456

789

-

@ 04c3c1a5:a94cf83d

2025-06-16 17:23:00

@ 04c3c1a5:a94cf83d

2025-06-16 17:23:00testtest

123

-

@ 8bad92c3:ca714aa5

2025-06-16 12:01:52

@ 8bad92c3:ca714aa5

2025-06-16 12:01:52Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”