-

@ 7f6db517:a4931eda

2025-06-16 15:03:06

@ 7f6db517:a4931eda

2025-06-16 15:03:06

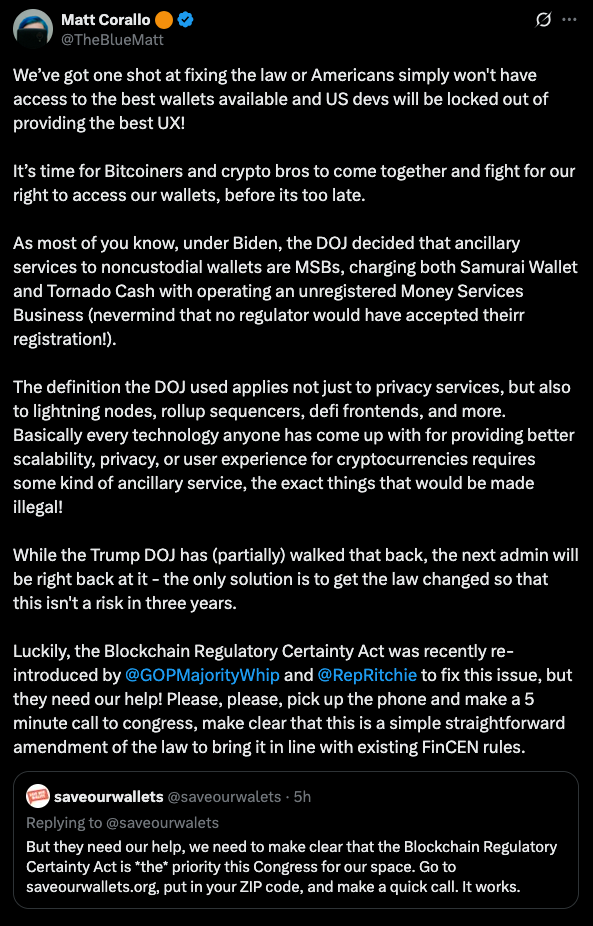

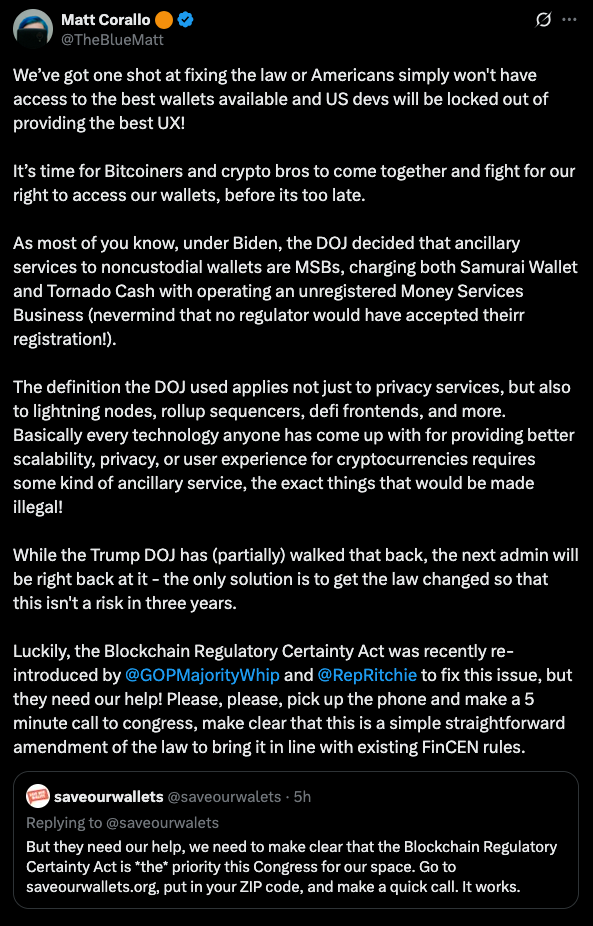

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-16 16:02:14

@ dfa02707:41ca50e3

2025-06-16 16:02:14News

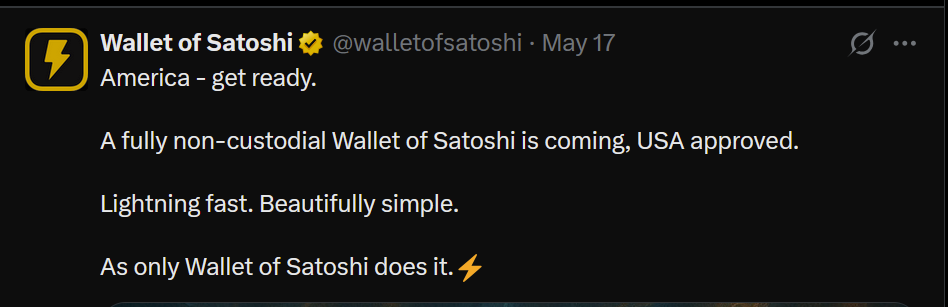

- Wallet of Satoshi teases a comeback in the US market with a non-custodial product. According to an announcement on X, the widely popular custodial Lightning wallet is preparing to re-enter the United States market with a non-custodial wallet. It is unclear whether the product will be open-source, but the project has clarified that "there will be no KYC on any Wallet of Satoshi, ever!" Wallet of Satoshi ceased serving customers in the United States in November 2023.

- Vulnerability disclosure: Remote crash due to addr message spam in Bitcoin Core versions before v29. Bitcoin Core developer Antoine Poinsot disclosed an integer overflow bug that crashes a node if spammed with addr messages over an extended period. A fix was released on April 14, 2025, in Bitcoin Core v29.0. The issue is rated Low severity.

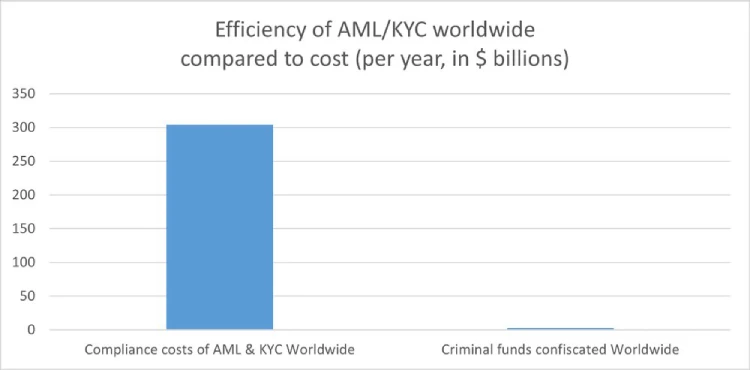

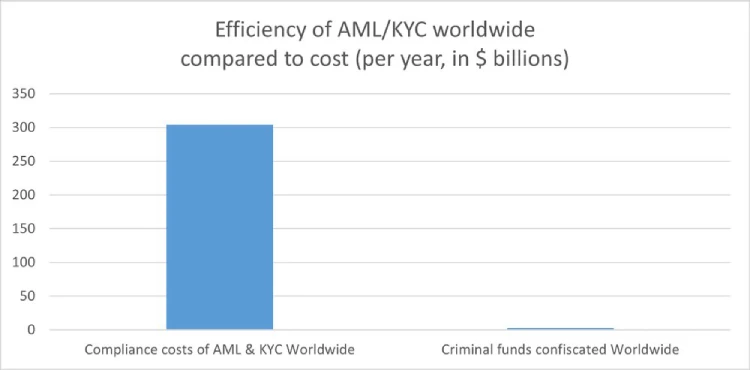

- Coinbase Know Your Customer (KYC) data leak. The U.S. Department of Justice, including its Criminal Division in Washington, is investigating a cyberattack on Coinbase. The incident involved cybercriminals attempting to extort $20 million from Coinbase to prevent stolen customer data from being leaked online. Although the data breach affected less than 1% of the exchange's users, Coinbase now faces at least six lawsuits following the revelation that some customer support agents were bribed as part of the extortion scheme.

- Fold has launched Bitcoin Gift Cards, enabling users to purchase bitcoin for personal use or as gifts, redeemable via the Fold app. These cards are currently available on Fold’s website and are planned to expand to major retailers nationwide later this year.

"Our mission is to make bitcoin simple and approachable for everyone. The Bitcoin Gift Card brings bitcoin to millions of Americans in a familiar way. Available at the places people already shop, the Bitcoin Gift Card is the best way to gift bitcoin to others," said Will Reeves, Chairman and CEO of Fold.

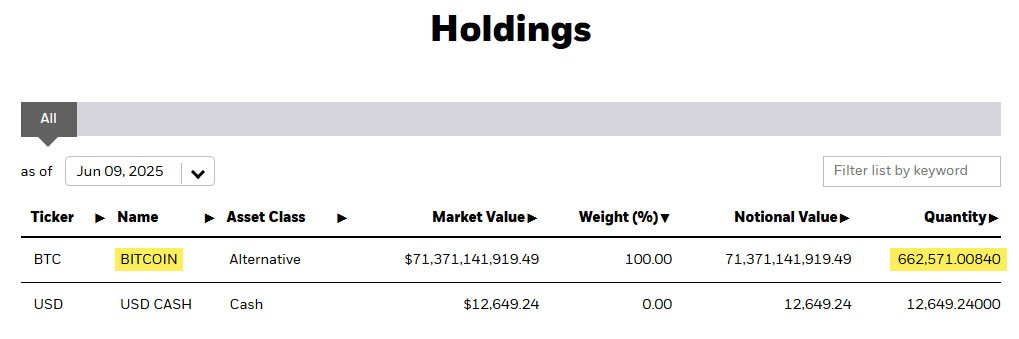

- Corporate treasuries hold nearly 1.1 million BTC, representing about 5.5% of the total circulating supply (1,082,164 BTC), per BitcoinTreasuries.net data. Recent purchases include Strategy adding 7,390 BTC (total: 576,230 BTC), Metplanet acquiring 1,004 BTC (total: 7,800 BTC), Tether holding over 100,521 BTC, and XXI Capital, led by Jack Mallers, starting with 31,500 BTC.

- Meanwhile, a group of investors has filed a class action lawsuit against Strategy and its executive Michael Saylor. The lawsuit alleges that Strategy made overly optimistic projections using fair value accounting under new FASB rules while downplaying potential losses.

- The U.S. Senate voted to advance the GENIUS stablecoin bill for further debate before a final vote to pass it. Meanwhile, the House is crafting its own stablecoin legislation to establish a regulatory framework for stablecoins and their issuers in the U.S, reports CoinDesk.

- French 'crypto' entrepreneurs get priority access to emergency police services. French Minister of the Interior, Bruno Retailleau, agreed on measures to enhance security for 'crypto' professionals during a meeting on Friday. This follows a failed kidnapping attempt on Tuesday targeting the family of a cryptocurrency exchange CEO, and two other kidnappings earlier this year.

- Brussels Court declares tracking-based ads illegal in EU. The Brussels Court of Appeal ruled tracking-based online ads illegal in the EU due to an inadequate consent model. Major tech firms like Microsoft, Amazon, Google, and X are affected by the decision, as their consent pop-ups fail to protect privacy in real-time bidding, writes The Record.

- Telegram shares data on 22,777 users in Q1 2025, a significant increase from the 5,826 users' data shared during the same period in 2024. This significant increase follows the arrest of CEO and founder Pavel Durov last year.

- An Australian judge has ruled that Bitcoin is money, potentially exempting it from capital gains tax in the country. If upheld on appeal, this interim decision could lead to taxpayer refunds worth up to $1 billion, per tax lawyer Adrian Cartland.

Use the tools

- Bitcoin Safe v1.3.0 a secure and user-friendly Bitcoin savings wallet for beginners and advanced users, introduces an interactive chart, Child Pays For Parent (CPFP) support, testnet4 compatibility, preconfigured testnet demo wallets, various bug fixes, and other improvements.

- BlueWallet v7.1.8 brings numerous bug fixes, dependency updates, and a new search feature for addresses and transactions.

- Aqua Wallet v0.3.0 is out, offering beta testing for the reloadable Dolphin card (in partnership with Visa) for spending bitcoin and Liquid BTC. It also includes a new Optical Character Recognition (OCR) text scanner to read text addresses like QR codes, colored numbers on addresses for better readability, a reduced minimum for spending and swapping Liquid Bitcoin to 100 sats, plus other fixes and enhancements.

Source: Aqua wallet.

- The latest firmware updates for COLDCARD Mk4 v5.4.3 and Q v1.3.3 are now available, featuring the latest enhancements and bug fixes.

- Nunchuk Android v1.9.68.1 and iOS v1.9.79 introduce support for custom blockchain explorers, wallet archiving, re-ordering wallets on the home screen via long-press, and an anti-fee sniping setting.

- BDK-cli v1.0.0, a CLI wallet library and REPL tool to demo and test the BDK library, now uses bdk_wallet 1.0.0 and integrates Kyoto, utilizing the Kyoto protocol for compact block filters. It sets SQLite as the default database and discontinues support for sled.

- publsp is a new command-line tool designed for Lightning node runners or Lightning Service Providers (LSPs) to advertise liquidity offers over Nostr.

"LSPs advertise liquidity as addressable Kind 39735 events. Clients just pull and evaluate all those structured events, then NIP-17 DM an LSP of their choice to coordinate a liquidity purchase," writes developer smallworlnd.

-

Lightning Blinder by Super Testnet is a proof-of-concept privacy tool for the Lightning Network. It enables users to mislead Lightning Service Providers (LSPs) by making it appear as though one wallet is the sender or recipient, masking the original wallet. Explore and try it out here.

-

Mempal v1.5.3, a Bitcoin mempool monitoring and notification app for Android, now includes a swipe-down feature to refresh the dashboard, a custom time option for widget auto-update frequency, and a

-

@ 7f6db517:a4931eda

2025-06-16 15:03:06

@ 7f6db517:a4931eda

2025-06-16 15:03:06

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 15:03:05

@ 7f6db517:a4931eda

2025-06-16 15:03:05

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-16 16:01:21

@ cae03c48:2a7d6671

2025-06-16 16:01:21Bitcoin Magazine

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on EverythingCoinbase is launching its first-ever branded credit card in partnership with American Express, set to roll out this fall. Called the Coinbase One Card, it will be available only to U.S. members of Coinbase One, the platform’s monthly subscription service. The card will offer 2% to 4% back in Bitcoin on everyday purchases, along with access to American Express perks.

JUST IN: Coinbase launches credit card allowing users to earn up to 4% bitcoin back on every purchase

pic.twitter.com/d6pdNZV4pi

pic.twitter.com/d6pdNZV4pi— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

This is a first-of-its-kind product for Coinbase, which previously only offered a prepaid debit card with Visa in 2020.

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now,” said Will Stredwick, head of American Express global network services, during the Coinbase State of Crypto Summit in New York.

The card is part of a larger push by Coinbase to expand its subscription-based services. Coinbase One costs $29.99/month and includes zero trading fees, higher staking rewards, and customer support perks. The company also announced a cheaper version—Coinbase Basic—for $4.99/month or $49.99/year, which includes fewer features.

Coinbase’s subscription business is growing fast. It brought in $698.1 million in Q1 2025, compared to $1.26 billion in trading revenue. According to William Blair analyst Andrew Jeffrey, this kind of recurring revenue is a big reason why long-term investors are sticking with the stock.

Launched in 2023, Coinbase One now has over a million members. The company has been steadily growing its ecosystem with products like its Base developer platform and a self-custody wallet.

The company has long positioned Bitcoin at the center of its strategy—offering BTC custody services to institutions, supporting Bitcoin ETFs, integrating Bitcoin rewards into its products, and actively advocating for Bitcoin-friendly regulation in Washington. Coinbase also supports Bitcoin development directly through funding grants and engineering support. As the largest publicly traded crypto exchange in the U.S., Coinbase continues to frame Bitcoin not just as an asset, but as the foundation of its long-term vision.

This post Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-16 16:01:19

@ cae03c48:2a7d6671

2025-06-16 16:01:19Bitcoin Magazine

Bitcoin Will Replace Gold And Go To $1,000,000, Says Galaxy Digital CEO Mike NovogratzToday, Galaxy Digital CEO Mike Novogratz told CNBC that Bitcoin is on a path to replace gold and could eventually reach a value of $1,000,000.

JUST IN:

Galaxy Digital CEO told CNBC that Bitcoin will replace gold and go to $1,000,000

Galaxy Digital CEO told CNBC that Bitcoin will replace gold and go to $1,000,000  pic.twitter.com/Tf831LBt1h

pic.twitter.com/Tf831LBt1h— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

“Bitcoin has become a macro asset,” said Novogratz. “And some of the great things is most people have it on their screens next to gold and silver and the S&P. And you think back ten years ago when people thought we were crazy. And now it’s an institutionalized macro asset… It’s just becoming institutionalized.”

He emphasized that Bitcoin is no longer a fringe investment but part of the mainstream financial landscape. He pointed out that its volatility is now seen as normal compared to traditional assets.

“We are in a dollar bear market. For the last 15 years, American exceptionalism was the story. Europeans were widely overweight and Asians widely overweight the US stock and we have an administration that wants a weaker dollar. They are pretty clear about it,” he said. “Even in the way Trump negotiates. And you can argue if it’s successful or not successful, but by telling Canada they want to be the 51st state, and telling people that they come here to kiss his rear end, it doesn’t engender people to say, ‘Oh, I want to buy more dollars.’”

According to Novogratz, this global shift is pushing investors toward assets outside the dollar, including Bitcoin.

“I think most macro funds are having a great year,” he stated. “They’re short the dollar, they’re long the euro, they’re long the yen, they’re long Aussie, they’re long a basket of currencies. Well, Bitcoin, gold, silver, platinum, they all fall into that same category as something that’s not the dollar.”

He also pointed to Bitcoin’s fixed supply as a key factor behind its growing value.

“There is no more Bitcoin,” he said. “What’s unique about Bitcoin as an asset is it was created with 21 million coins total. Period. End of story. There’ll never be more than that. But not all of those have been mined, is my point. Not most of them. Lots of them have been lost. There have been more Bitcoins lost than will be mined for the rest of eternity.”

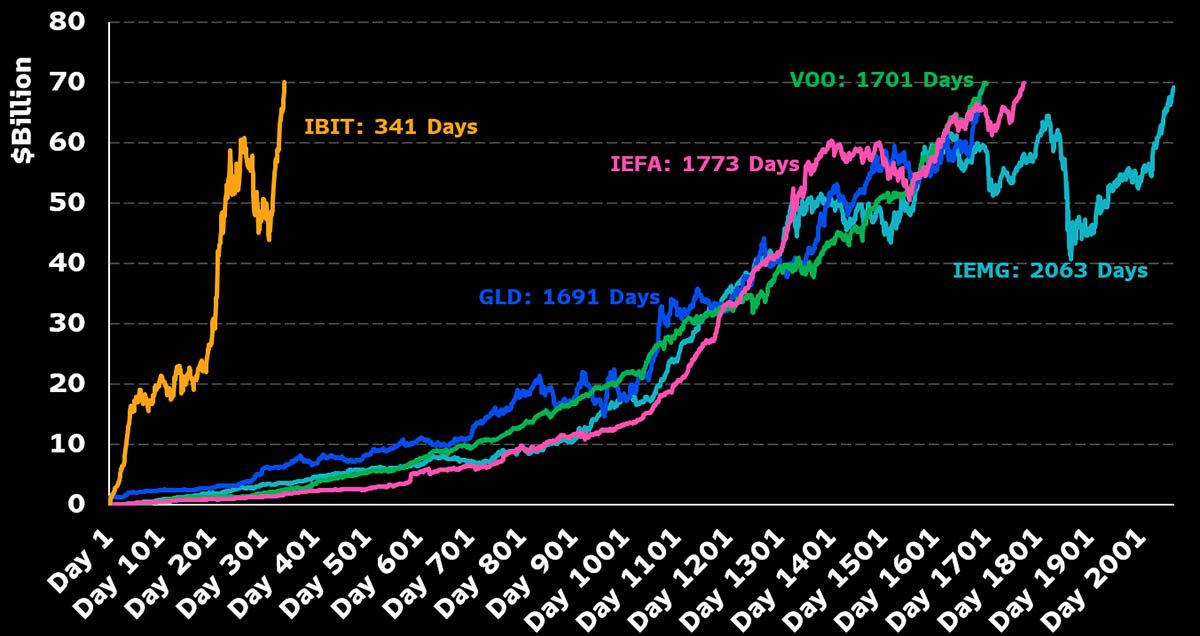

Novogratz believes the wave of institutional involvement, including firms like BlackRock, is cementing Bitcoin’s role as a savings asset.

“The bull case becomes that over time… gold slowly gets replaced by Bitcoin. And so if you look at gold’s market cap and Bitcoin market cap, Bitcoin has a long way to go. Right? 10x. And so that [is] $1,000,000 a Bitcoin just to be where gold is.”

This post Bitcoin Will Replace Gold And Go To $1,000,000, Says Galaxy Digital CEO Mike Novogratz first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ cae03c48:2a7d6671

2025-06-16 15:02:04

@ cae03c48:2a7d6671

2025-06-16 15:02:04Bitcoin Magazine

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on EverythingCoinbase is launching its first-ever branded credit card in partnership with American Express, set to roll out this fall. Called the Coinbase One Card, it will be available only to U.S. members of Coinbase One, the platform’s monthly subscription service. The card will offer 2% to 4% back in Bitcoin on everyday purchases, along with access to American Express perks.

JUST IN: Coinbase launches credit card allowing users to earn up to 4% bitcoin back on every purchase

pic.twitter.com/d6pdNZV4pi

pic.twitter.com/d6pdNZV4pi— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

This is a first-of-its-kind product for Coinbase, which previously only offered a prepaid debit card with Visa in 2020.

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now,” said Will Stredwick, head of American Express global network services, during the Coinbase State of Crypto Summit in New York.

The card is part of a larger push by Coinbase to expand its subscription-based services. Coinbase One costs $29.99/month and includes zero trading fees, higher staking rewards, and customer support perks. The company also announced a cheaper version—Coinbase Basic—for $4.99/month or $49.99/year, which includes fewer features.

Coinbase’s subscription business is growing fast. It brought in $698.1 million in Q1 2025, compared to $1.26 billion in trading revenue. According to William Blair analyst Andrew Jeffrey, this kind of recurring revenue is a big reason why long-term investors are sticking with the stock.

Launched in 2023, Coinbase One now has over a million members. The company has been steadily growing its ecosystem with products like its Base developer platform and a self-custody wallet.

The company has long positioned Bitcoin at the center of its strategy—offering BTC custody services to institutions, supporting Bitcoin ETFs, integrating Bitcoin rewards into its products, and actively advocating for Bitcoin-friendly regulation in Washington. Coinbase also supports Bitcoin development directly through funding grants and engineering support. As the largest publicly traded crypto exchange in the U.S., Coinbase continues to frame Bitcoin not just as an asset, but as the foundation of its long-term vision.

This post Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-16 14:01:23

@ cae03c48:2a7d6671

2025-06-16 14:01:23Bitcoin Magazine

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on EverythingCoinbase is launching its first-ever branded credit card in partnership with American Express, set to roll out this fall. Called the Coinbase One Card, it will be available only to U.S. members of Coinbase One, the platform’s monthly subscription service. The card will offer 2% to 4% back in Bitcoin on everyday purchases, along with access to American Express perks.

JUST IN: Coinbase launches credit card allowing users to earn up to 4% bitcoin back on every purchase

pic.twitter.com/d6pdNZV4pi

pic.twitter.com/d6pdNZV4pi— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

This is a first-of-its-kind product for Coinbase, which previously only offered a prepaid debit card with Visa in 2020.

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now,” said Will Stredwick, head of American Express global network services, during the Coinbase State of Crypto Summit in New York.

The card is part of a larger push by Coinbase to expand its subscription-based services. Coinbase One costs $29.99/month and includes zero trading fees, higher staking rewards, and customer support perks. The company also announced a cheaper version—Coinbase Basic—for $4.99/month or $49.99/year, which includes fewer features.

Coinbase’s subscription business is growing fast. It brought in $698.1 million in Q1 2025, compared to $1.26 billion in trading revenue. According to William Blair analyst Andrew Jeffrey, this kind of recurring revenue is a big reason why long-term investors are sticking with the stock.

Launched in 2023, Coinbase One now has over a million members. The company has been steadily growing its ecosystem with products like its Base developer platform and a self-custody wallet.

The company has long positioned Bitcoin at the center of its strategy—offering BTC custody services to institutions, supporting Bitcoin ETFs, integrating Bitcoin rewards into its products, and actively advocating for Bitcoin-friendly regulation in Washington. Coinbase also supports Bitcoin development directly through funding grants and engineering support. As the largest publicly traded crypto exchange in the U.S., Coinbase continues to frame Bitcoin not just as an asset, but as the foundation of its long-term vision.

This post Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-16 16:01:17

@ cae03c48:2a7d6671

2025-06-16 16:01:17Bitcoin Magazine

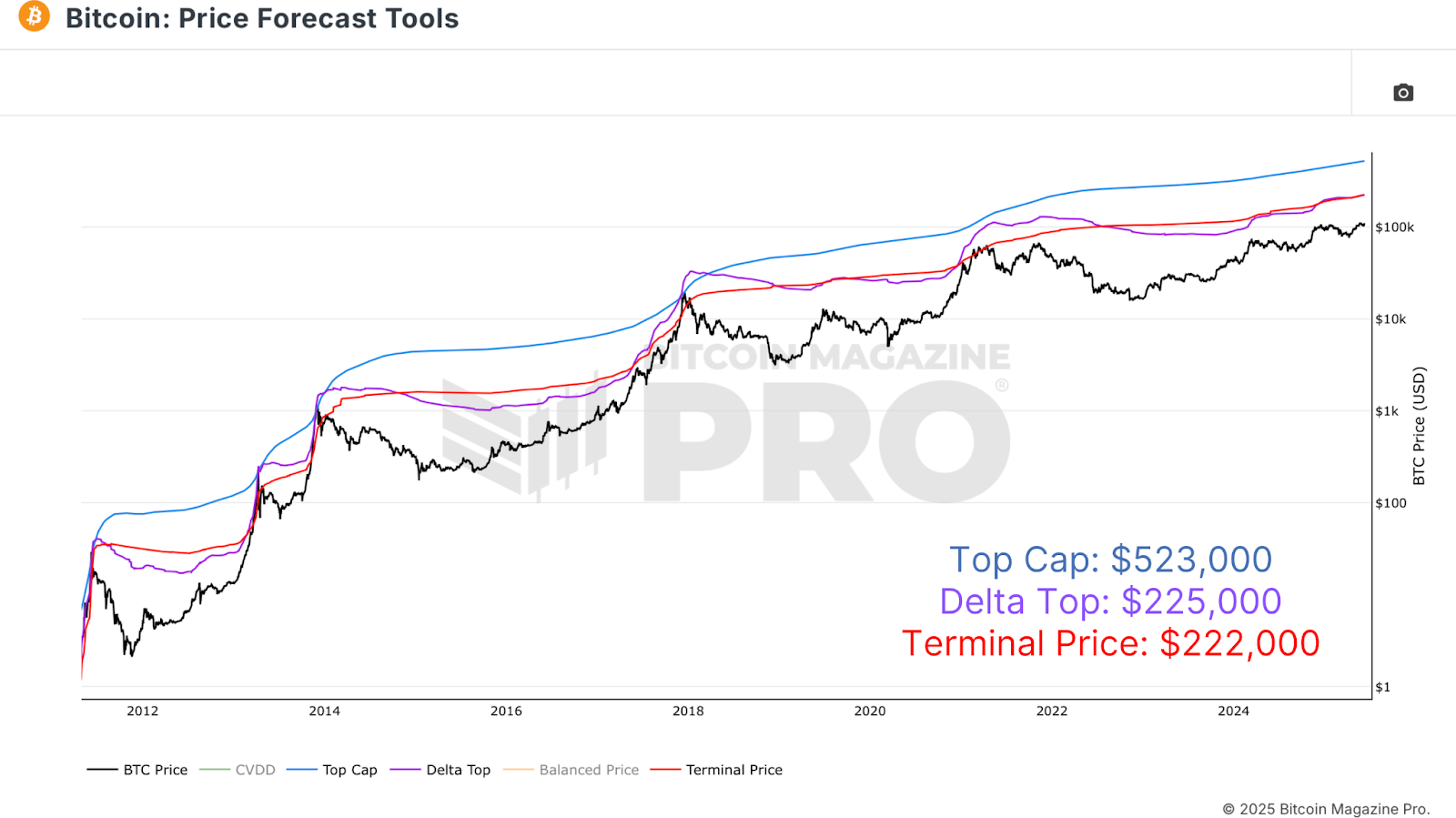

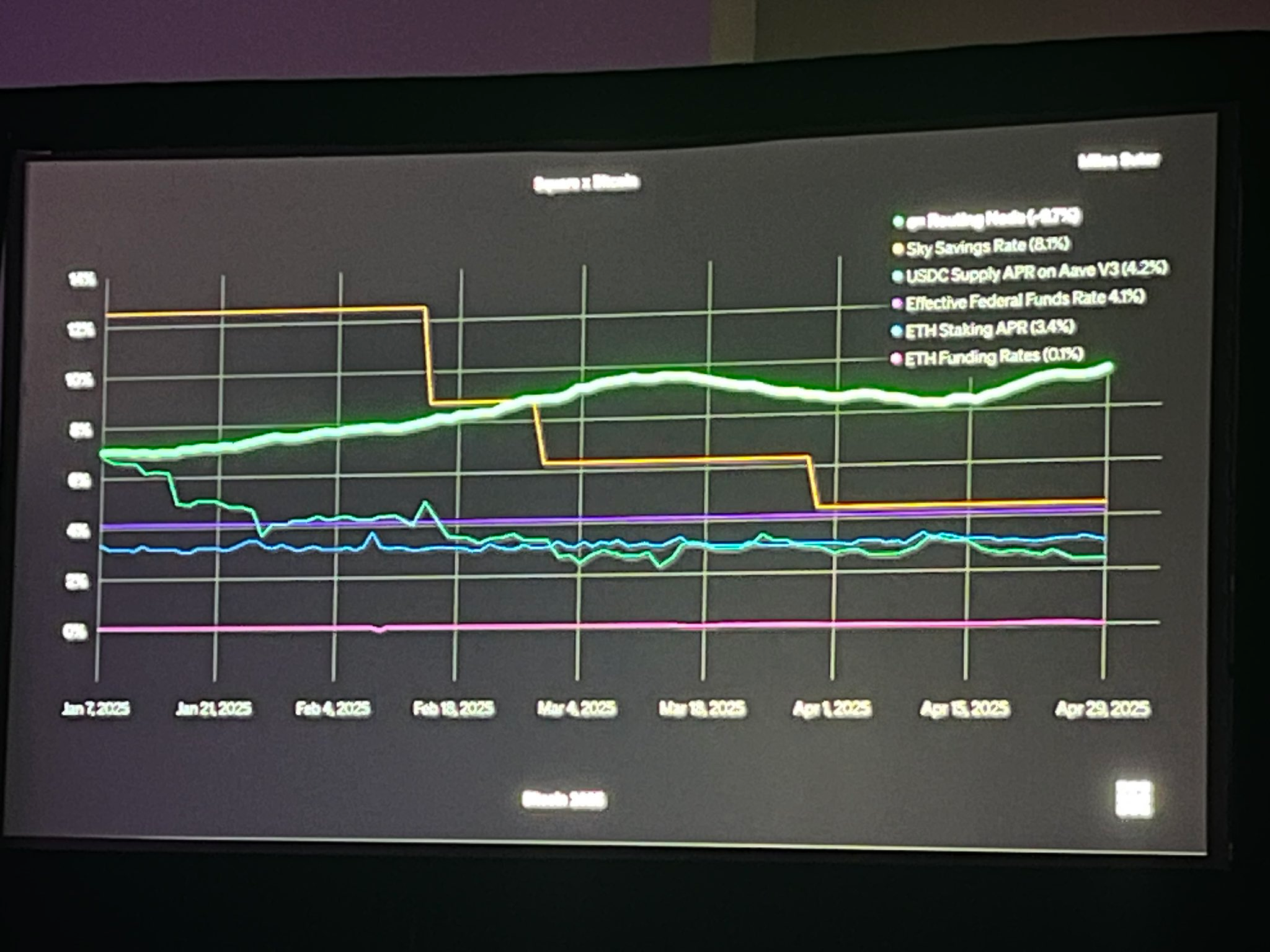

Where Could Bitcoin Peak This Cycle?With Bitcoin looking as bullish as ever, the inevitable question arises of how high could BTC realistically go in this market cycle? Here we’ll explore a wide range of on-chain valuation models and cycle timing tools to identify plausible price targets for a Bitcoin peak. Although prediction is never a substitute for disciplined data reaction, this analysis gives us frameworks to better understand where we are and where we might be heading.

Price Forecast Tools

The journey begins with Bitcoin Magazine Pro’s free Price Forecast Tools, which compile several historically accurate valuation models. While it’s always more effective to react to data rather than blindly predict prices, studying these metrics can still provide powerful context for market behavior. If macro, derivative, and on-chain data all start flashing warnings, it’s usually a solid time to take profit, regardless of whether a specific price target has been hit. Still, exploring these valuation tools is informative and can guide strategic decision-making when used alongside broader market analysis.

Figure 1: Applying Price Forecast Tools to calculate potential cycle tops. View Live Chart

Among the key models, the Top Cap multiplies the average cap over time by 35 to project peak valuations. It accurately forecasted 2017’s top, but missed the 2020–2021 cycle, estimating over $200k while Bitcoin peaked around $69k. It now targets over $500k, which feels increasingly unrealistic. A step further is the Delta Top, subtracting the average cap from the realized cap, based on the cost basis of all circulating BTC, to generate a more grounded projection. This model suggested an $80k–$100k top last cycle. The most consistently accurate, however, is the Terminal Price, based on Supply Adjusted Coin Days Destroyed, which has closely aligned with each prior peak, including the $64k top in 2021. Currently projecting around $221k, it could rise to $250k or more, and remains arguably the most credible model for forecasting macro Bitcoin tops. Of course, more information regarding all of these metrics and their calculation logic can be found beneath the charts on the site.

Peak Forecasting

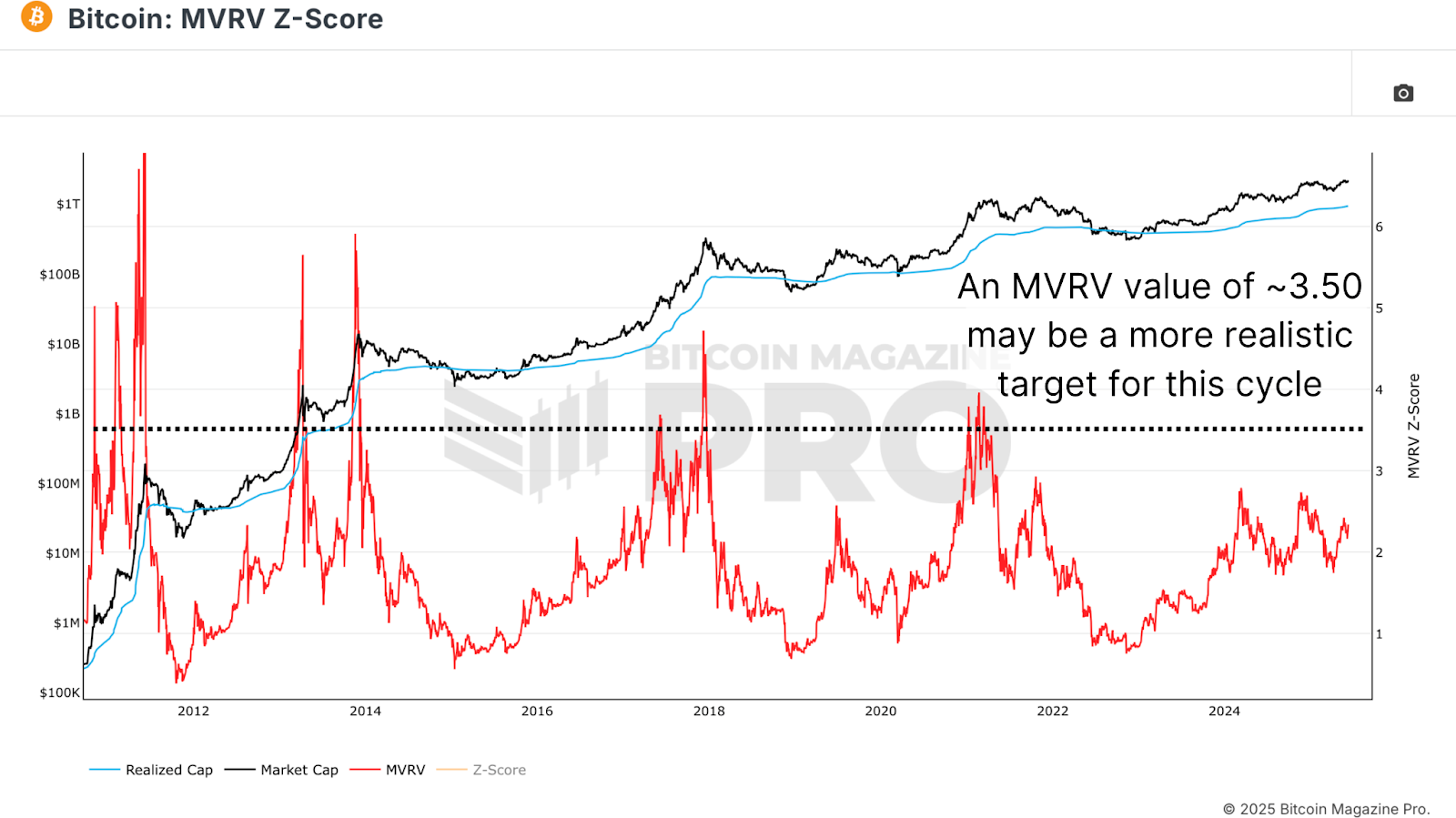

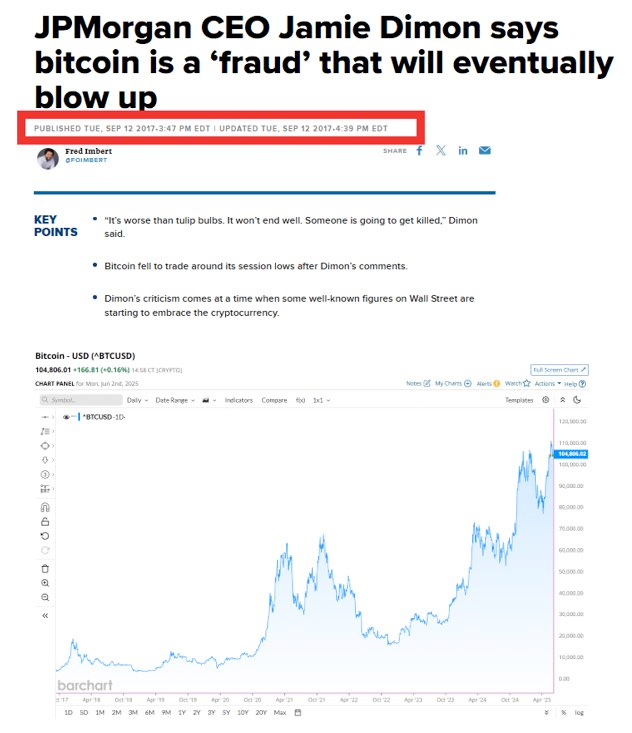

Another powerful metric is the MVRV ratio, which compares market cap to realized cap. It offers a psychological window into investor sentiment, typically peaking near a value of 4 in major cycles. The ratio currently sits at 2.34, suggesting there may still be room for significant upside. Historically, as MVRV nears 3.5 to 4, long-term holders begin to realize substantial gains, often signaling cycle maturity. However, with diminishing returns, we might not reach a full 4 this time around. Instead, using a more conservative estimate of 3.5, we can begin projecting more grounded peak values.

Figure 2: A view of the MVRV ratio predicts further cycle growth to reach historical 4+ and even more conservative 3.5 target values. View Live Chart

Calculating A Target

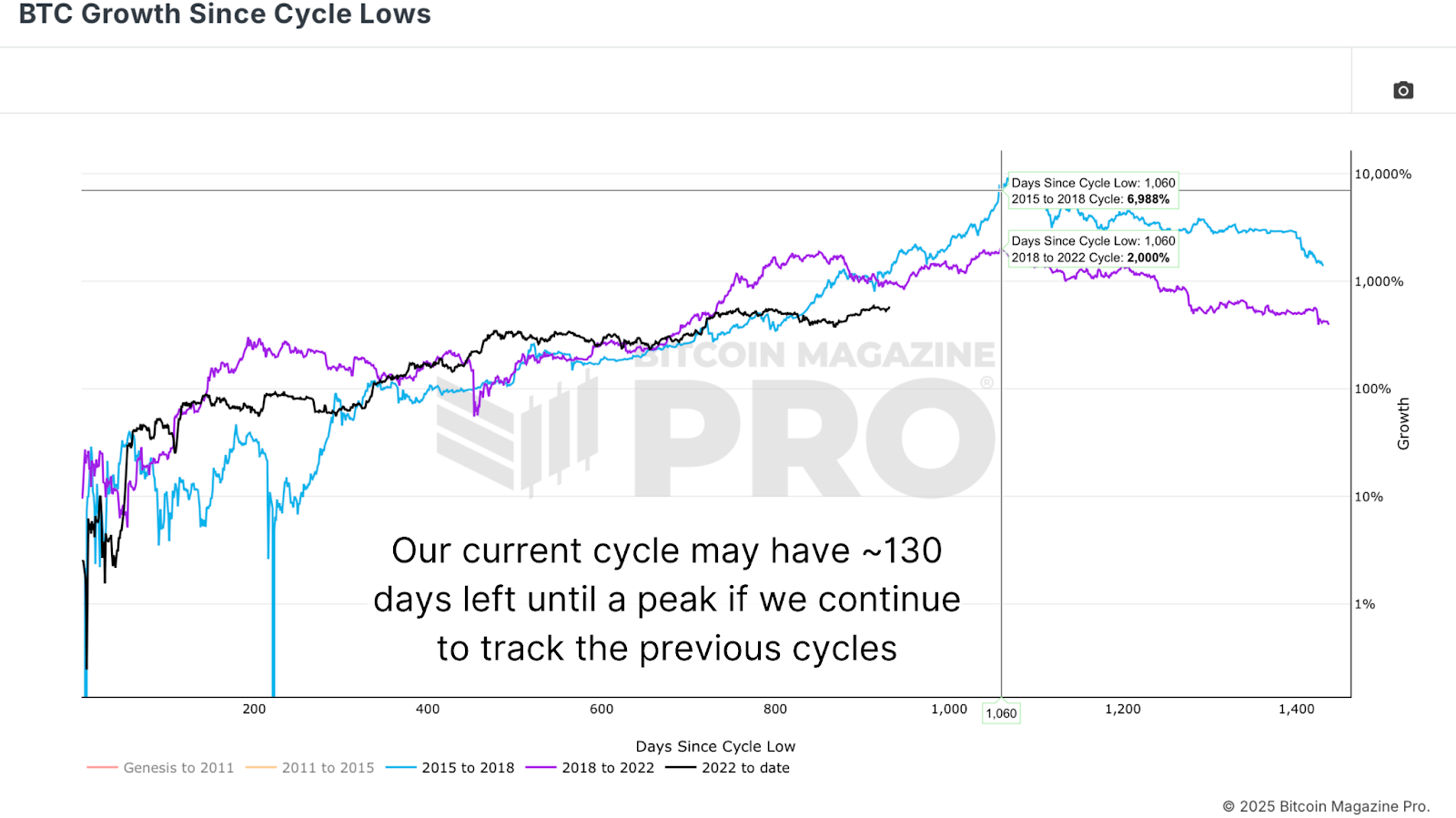

Timing is as important as valuation. Analysis of BTC Growth Since Cycle Lows illustrates that previous Bitcoin cycles peaked almost exactly 1,060 days from their respective lows. Currently, we are about 930 days into this cycle. If the pattern holds, we can estimate the peak may arrive in roughly 130 days. Historical FOMO-driven price increases often happen late in the cycle, causing Realized Price, a proxy for average investor cost basis, to rise rapidly. For instance, in the final 130 days of the 2017 cycle, realized price grew 260%. In 2021, it increased by 130%. If we assume a further halving of growth due to diminishing returns, a 65% rise from the current $47k realized price brings us to around $78k by October 18.

Figure 3: Based on the peak rate of previous cycles, this cycle is far from over. View Live Chart

With a projected $78k realized price and a conservative MVRV target of 3.5, we arrive at a potential Bitcoin price peak of $273,000. While that may feel ambitious, historical parabolic blowoff tops have shown that such moves can happen in weeks, not months. While it may seem more realistic to expect a peak closer to $150k to $200k, the math and on-chain evidence suggest that a higher valuation is at least within the realm of possibility. It’s also worth noting that these models dynamically adjust, and if late-cycle euphoria kicks in, projections could quickly accelerate further.

Figure 4: Combining projected realized price and a possible MVRV target to predict this cycle’s peak.

Conclusion

Forecasting Bitcoin’s exact peak is inherently uncertain, with too many variables to account for. What we can do is position ourselves with probabilistic frameworks grounded in historical precedent and on-chain data. Tools like the MVRV ratio, Terminal Price, and Delta Top have repeatedly demonstrated their value in anticipating market exhaustion. While a $273,000 target might seem optimistic, it is rooted in past patterns, current network behavior, and cycle-timing logic. Ultimately, the best strategy is to react to data, not rigid price levels. Use these tools to inform your thesis, but stay nimble enough to take profits when the broader ecosystem starts signaling the top.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Where Could Bitcoin Peak This Cycle? first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ dfa02707:41ca50e3

2025-06-15 23:02:35

@ dfa02707:41ca50e3

2025-06-15 23:02:35

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ 472f440f:5669301e

2025-06-12 05:11:12

@ 472f440f:5669301e

2025-06-12 05:11:12Marty's Bent

via me

I had a completely different newsletter partially written earlier tonight about whether or not "this cycle is different" when this nagging thought entered my head. So I'm going to write about this and maybe I'll write about the dynamics of this cycle compared to past cycles tomorrow.

A couple of headlines shot across my desk earlier tonight in relation to the potential escalation of kinetic warfare in the Middle East. Apparently the U.S. Embassy in Iraq was sent a warning and evacuation procedures were initiated. Not too long after, the world was made aware that the United States and Israel are contemplating an attack on Iran due to the "fact" that Iran may be close to producing nuclear weapins. The initial monkey brain reaction that I had to these two headlines was, "Oh shit, here we go again. We're going to do something stupid." My second reaction was, "Oh shit, here we go again, I've seen these two exact headlines many times over the years and they've proven to be lackluster if you're a doomer or blood thirsty war monger." Nothing ever happens.

As I venture into my mid-30s and reflect on a life filled with these types of headlines and my personal reactions to these headlines, I'm finally becoming attuned to the fact that the monkey brain reactions aren't very productive at the end of the day. Who knows exactly what's going to happen in Iraq or Iran and whether or not kinetic warfare escalates and materializes from here? Even though I'm a "blue-blooded taxpaying American citizen" who is passively and unwillingly contributing to the war machine and the media industrial complex, there's really nothing I can do about it.

The only thing I can do is focus on what is in front of me. What I have control of. And attempt to leverage what I have control of to make my life and the life of my family as good as humanly possible. Ignoring the external and turning inward often produces incredible results. Instead of worrying about what the media wants you to believe at any given point in time, you simply look away from your computer screen, survey the physical space which you're operating in and determine what you have, what you need and how you can get what you need. This is a much more productive way to spend your time.

This is what I want to touch on right now. There's never been a better time in human history to be productive despite what the algorithm on X or the mainstream media will lead you to believe. Things aren't as great as they could be, but they're also not as bad as you're being led to believe. We live in the Digital Age and the Digital Age provides incredible resources that you can leverage to make YOUR life better.

Social media allows you to create a platform without spending any money. AI allows you to build tools that are beneficial to yourself and others with very little money. And bitcoin exists to provide you with the best form of money that you can save in with the knowledge that your relative ownership of the overall supply isn't going to change. No matter what happens in the external world.

If you can combine these three things to make your life better and - by extension - potentially make the lives of many others better, you're going to be well off in the long run. Combining these three things isn't going to result in immediate gratification, but if you put forth a concerted effort, spend the time, have some semblance of patience, and stick with it, I truly believe that you will benefit massively in the long run. Without trying to sound like a blowhard, I truly believe that this is why I feel relatively calm (despite my monkey brain reactions to the headlines of the day) at this current point in time.

We've entered the era of insane leaps in productivity and digital hard money that cannot be corrupted. The biggest mistake you can make in your life right now is overlooking the confluence of these two things. With an internet connection, an idea, some savvy, and hard work you can materially change your life. Create something that levels up your knowledge, that enables you to get a good job in the real world, or to create a company of your own. Bring your talents to the market, exchange them for money, and then funnel that money into bitcoin (if you're not being paid in it already). We may be at the beginning of a transition from the high velocity trash economy to the high leverage agency economy run on sound money and applied creativity.

These concepts are what you should be focusing most of your time and attention to today and in the years ahead. Don't get distracted by the algorithm, the 30-second video clips, the headlines filled with doom, and the topics of the 24 hour news cycle. I'll admit, I often succumb to them myself. But, as I get older and develop a form of pattern recognition that can only be attained by being on this planet for a certain period of time, it is becoming very clear that those things are not worth your attention.

Living by the heuristic that "nothing ever happens" is a pretty safe bet. Funnily enough, it's incredibly ironic that you're led to believe that something is happening every single day, and yet nothing ever happens. By getting believing that something happens every day you are taking your attention away from doing things that happen to make your life better.

Tune out the noise. Put on the blinders. Take advantage of the incredible opportunities that lie before you. If enough of you - and many others who do not read this newsletter - do this, I truly believe we'll wake up to find that the world we live in is a much better place.

Nothing ever happens, so make something happen.

Intelligence Officials Are Quietly Becoming Bitcoin Believers

Ken Egan, former CIA Deputy Chief of Cyber Operations, revealed a surprising truth on TFTC: the intelligence community harbors numerous Bitcoin advocates. Egan explained that intelligence professionals uniquely understand how governments weaponize financial systems through sanctions and account freezing. Having wielded these tools themselves, they recognize the need for personal financial sovereignty. He shared compelling anecdotes of discovering colleagues with "We are all Satoshi" stickers and a European chief of station paying for dinner with a BlockFi card to earn Bitcoin rewards.

"I think there are a lot of Bitcoiners, not just at CIA, but across the whole national security establishment... they're in it for the exact same reasons everybody else is." - Ken Egan

The Canadian trucker protests served as a pivotal moment, Egan noted. Watching Western governments freeze citizens' bank accounts for political dissent struck a nerve among intelligence professionals who previously viewed financial weaponization as a tool reserved for foreign adversaries. This awakening has created unlikely allies within institutions many Bitcoiners distrust.

Check out the full podcast here for more on Bitcoin's national security implications, privacy tech prosecutions, and legislative priorities.

Headlines of the Day

Stripe Buys Crypto Wallet Privy After Bridge Deal - via X

Trump Calls CPI Data "Great" Urges Full Point Fed Cut - via X

Bitcoin Hashrate Reaches New All-Time High - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Life is good.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ dfa02707:41ca50e3

2025-06-15 23:02:32

@ dfa02707:41ca50e3

2025-06-15 23:02:32- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 2c564b98:5c6444b0

2025-06-16 15:14:09

@ 2c564b98:5c6444b0

2025-06-16 15:14:09 © unsplash

© unsplashDieser Beitrag von Laura und Phillip aus dem FOERBICO Team erschien zuerst auf dem Theologie-Blog y-nachten.

Alle reden von OER - was ist das eigentlich?

Offene Vorlesungsreihen auf YouTube, Podcasts, Blogs, Podiumsdiskussionen und die Beteiligung an Wikipedia-Einträgen machen deutlich, dass sich das Geschehen an Hochschulen zunehmend öffnet, um mit einer interessierten Öffentlichkeit transparent zu kommunizieren sowie Diskurse breiter zugänglich zu machen (vgl. Mößle, Pirker 2024). Für viele wirkt aber gerade die wissenschaftliche Theologie wie eine Disziplin für Expert:innen, geprägt von antiken Sprachen, dogmatischen Gerüsten und traditionsgebundenen Denken, das ein hohes Maß an Vorwissen erfordert. Doch muss die Theologie wirklich so fern und unverständlich wirken? Die Open-Science-Bewegung zielt auf Transparenz und Nachvollziehbarkeit und fordert Wissenschaftler:innen sowie Akteur:innen aus Politik, Wirtschaft und Kultur dazu auf, zum Austausch beizutragen und den wissenschaftlichen Dialog im Sinne einer Demokratisierung des Wissens mitzugestalten (vgl. Siegfried, Scherp, Linek, Flieger 2024). Hierbei kommt den Open Educational Resources, kurz OER, eine bedeutsame Rolle zu. OER sind frei zugängliche Bildungsmaterialien, die in unterschiedlichen Formaten und Medien vorliegen können. Sie stehen unter einer offenen Lizenz, die es ermöglicht, sie kostenlos zu nutzen, zu verändern und mit oder ohne Änderungen weiterzugeben, mit wenigen oder gar keinen Einschränkungen. Ob einzelne Arbeitsblätter, komplette Lehrbücher, Onlinekurse, Videos oder Podcasts, solange sie offen, d.h. mit CC-Lizenzen versehen sind, gelten sie als OER. Ziel ist es, Bildung für alle zugänglicher und flexibler zu machen (vgl. UNESCO 2019). OER unterscheiden sich von kostenlosen Materialien durch die rechtssichere Möglichkeit der Bearbeitung und Weiterverbreitung, vgl. exemplarisch die OER-Lizensierung bei (Pirner 2024). Dies ermöglicht sowohl Lehrenden die Anpassung der Lehrmaterialien an ihre Zielgruppe als auch Lernenden die Bearbeitung der Materialien für sich und ihre Lerngruppe.

OER braucht Praxis! Open Educational Practice

OER allein führen jedoch nicht zu einer Bildungsreform. Eine partizipative Lehr- und Lernkultur ist notwendig und es bedarf einer gewissen Haltung und Praxis, damit OER entstehen und weiterentwickelt werden können, die sog. Open Educational Practices (OEP). Die Definition von (Cronin 2017, 4) gibt einen guten Einblick, um was es sich dabei handelt. OEP sind:

»collaborative practices that include the creation, use, and reuse of OER, as well as pedagogical practices employing participatory technologies and social networks for interaction, peer-learning, knowledge creation, and empowerment of learners« .

OEP sind also kollaborative Praktiken, die rund um OER stattfinden und den Prozess der OER-Erstellung und Bearbeitung von Anfang an mitbestimmen. Besonders wichtig sind dabei soziale Netzwerke und Communities. Diese können Lernende, Lehrende, Expert:innen oder Fächergruppen umfassen, die sich austauschen, OER weiterentwickeln und sich gegenseitig motivieren, neue Ansätze zu erproben.

Third Mission an Hochschulen: Über die Grenzen hinaus

Unter dem Schlagwort Third Mission, also der dritten Mission von Hochschule neben Forschung und Lehre, stehen die zentralen Fragen: Wie kann sich Hochschule für die Gesellschaft öffnen? Und wie lässt sich der Austausch zwischen Wissenschaft und Öffentlichkeit fördern? Hierbei tritt die Hochschule in wechselseitige Interaktion mit der Gesellschaft und ist offen für Erwartungen, Herausforderungen und Fragen, die an sie gerichtet werden. Im Sinne der wissenschaftlichen Weiterbildung gehört es auch zur Third Mission, Lernaktivitäten zu entwickeln, die Fähigkeiten und Kompetenzen in persönlicher, gesellschaftlicher oder beruflicher Perspektive erhöhen (vgl. Roessler 2015). Aus der Perspektive theologischer Hochschullehre lässt sich dieser Aspekt besonders fruchtbar mit OER und OEP verknüpfen und kann die Third Mission sogar weiterentwickeln. Denn Theologie lebt nicht nur vom reinen Wissenstransfer, sondern auch von der dialogischen Auseinandersetzung und der gemeinsamen Suche. Hierfür ist eine Kultur der Partizipation ein Gamechanger. Denn OER bietet mehr als nur den offenen Zugang zu Materialien. Es schafft Bewusstsein für Lizensierungen und ermöglicht eine Kultur des Teilens. So könnte zum Beispiel eine Vorlesung aus dem Theologiestudium nicht nur öffentlich zugänglich gemacht werden, sondern – im Sinne von OER – auch zur Weiterverarbeitung und Anpassung einladen. Damit hätten Kirchengemeinden, Bildungseinrichtungen oder interreligiöse Dialogkreise Zugang zu Materialien und könnten sie für ihren Kontext anpassen, mit ihrem Wissen, ihren Erfahrungen und Erkenntnisgewinnen weiterentwickeln und wiederum mit anderen teilen. Theologie ist in ihrem Kern auf Dialog auslegt, sei es mit anderen Disziplinen, Religionen oder der Gesellschaft. OER und OEP fördern diese Lehr- und Lernkultur, in der Menschen miteinander in Beziehung treten, Wissen teilen und sich gegenseitig inspirieren können. Dies entspricht nicht nur dem Kerngedanken der Third Mission, sondern auch der theologischen Grundhaltung, dass Erkenntnis vor allem im Dialog wächst.

Fürchtet euch nicht! Gehet hinaus und teilet!

Offene Bildungsressourcen bieten zwar viele Chancen, doch ihre Nutzung bringt auch Herausforderungen und gewisse Ängste mit sich. In Fachgesprächen und Interviews wird deutlich, dass die Idee von OER zwar sympathisch ist, aber auch Bedenken hervorruft. Das größte Hindernis sind rechtliche Unsicherheiten, insbesondere bei der Verwendung von Bildern, Musiksequenzen oder auch Texten Dritter. Die Klärung dieser Fragen ist oft zeitaufwendig und erfordert etwas Lust, sich reinzudenken. Es gibt auch Anlaufstellen, an die man sich bei konkreten Fragen wenden kann, z.B. bei OERInfo; Irights; Twillo oder ORCA.nrw. Bei eigenen Forschungsergebnissen oder selbst erstelltem Material, sind diese Bedenken hingegen weniger relevant. Zudem muss nicht sofort alles als OER veröffentlicht werden. Ein schrittweiser Einstieg mit einzelnen Elementen kann bereits einen Beitrag leisten. Je mehr offen lizenzierte Inhalte existieren, desto leichter wird es, rechtssichere OER zu erstellen. Ein weiteres häufig geäußertes Bedenken ist der potenzielle Missbrauch von offenem Material. Die Möglichkeit zur Bearbeitung oder Neuzusammenstellung birgt das Risiko von Verfremdungen oder Verfälschungen. Doch Erfahrung mit OER-Communities zeigen, dass die Inhalte meist verantwortungsvoll genutzt werden. Zudem kann eine vollständige Kontrolle über die Verwendung von Wissen nie gewährleistet werden. Dies gilt nicht nur für OER, sondern für alle öffentlichen Inhalte.

Theologie sollte nicht hinter verschlossenen Türen stattfinden, sondern im offenen Austausch mit der Gesellschaft. OER bieten die Chance, theologisches Wissen zugänglich zu machen und neu mit der Gesellschaft in Diskurs zu treten. Theologie-Treiben sollte kein einseitiger Prozess sein, sondern ein gemeinsames Lernen, Wagen und Gestalten. Dabei spielt auch der Gedanke der Freigiebigkeit eine Rolle: Bildung sollte geteilt, verbreitet und möglichst vielen Menschen zugänglich gemacht werden. OER können ein neuer Impuls sein, um Barrieren zu überwinden und theologische Erkenntnisse mit der Lebenswelt der Menschen zu verbinden.

-

@ 2c564b98:5c6444b0

2025-06-16 15:12:30

@ 2c564b98:5c6444b0

2025-06-16 15:12:30Welcome to Nostr: A Decentralized Future

Nostr (Notes and Other Stuff Transmitted by Relays) is a simple, open protocol that enables global, decentralized, and censorship-resistant social media.

Why Nostr?

Traditional social media platforms have several problems:

- Centralized Control - A single company controls your data

- Censorship - Content can be removed at will

- Data Lock-in - Hard to move your social graph

Nostr solves these problems through:

- Decentralization - No single point of control

- Cryptographic Signatures - You own your identity

- Relay Network - Multiple servers ensure availability

How It Works

javascript // Simple example of creating a Nostr event const event = { kind: 1, // Text note content: "Hello, Nostr!", tags: [], created_at: Math.floor(Date.now() / 1000) };Getting Started

To start using Nostr:

- Generate your keys (public/private keypair)

- Choose a client (web, mobile, or desktop)

- Connect to relays

- Start publishing!

Long-Form Content on Nostr

This post itself is an example of long-form content on Nostr, using:

- NIP-23 standard for long-form content

- Markdown formatting for rich text

- Metadata for better organization

Join the Revolution

Nostr represents a fundamental shift in how we think about social media and online identity. By giving users control over their data and identity, it creates a more open and resilient internet.

This post was published using nostr-publisher - a simple tool for publishing long-form content to Nostr.

-

@ 472f440f:5669301e

2025-06-11 04:37:33

@ 472f440f:5669301e

2025-06-11 04:37:33Marty's Bent

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

Opportunity Cost – See Prices in Bitcoin Instantly

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

*Download our free browser extension, Opportunity Cost: *<<https://www.opportunitycost.app/>> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ dfa02707:41ca50e3

2025-06-15 17:02:37

@ dfa02707:41ca50e3

2025-06-15 17:02:37Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

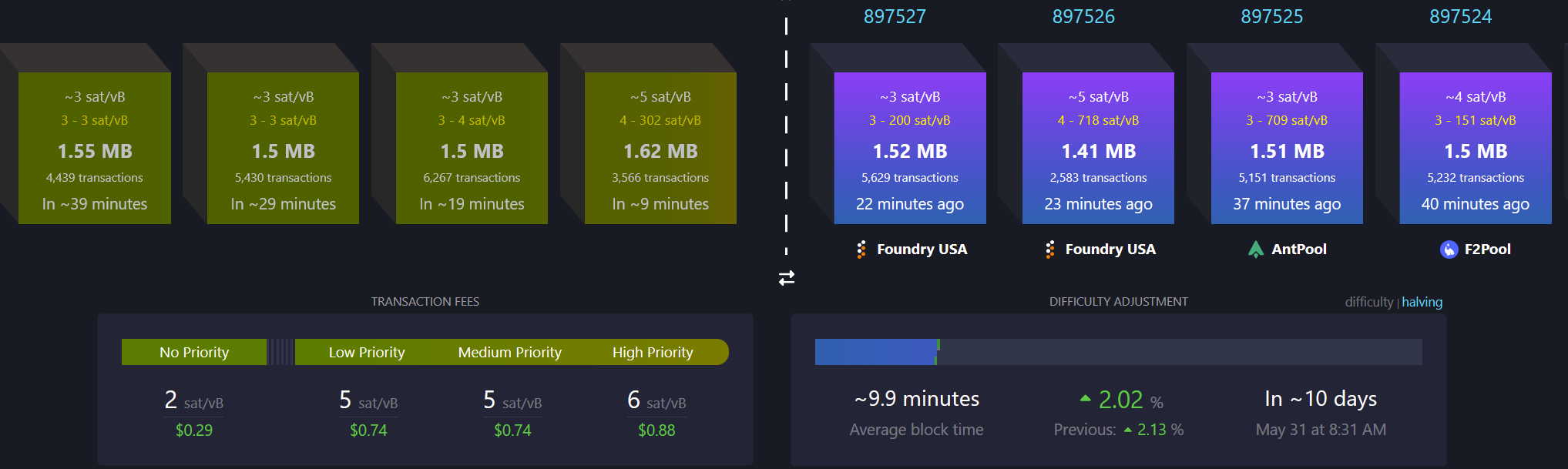

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ bf47c19e:c3d2573b

2025-06-16 15:06:01