-

@ 7f6db517:a4931eda

2025-06-16 15:03:06

@ 7f6db517:a4931eda

2025-06-16 15:03:06

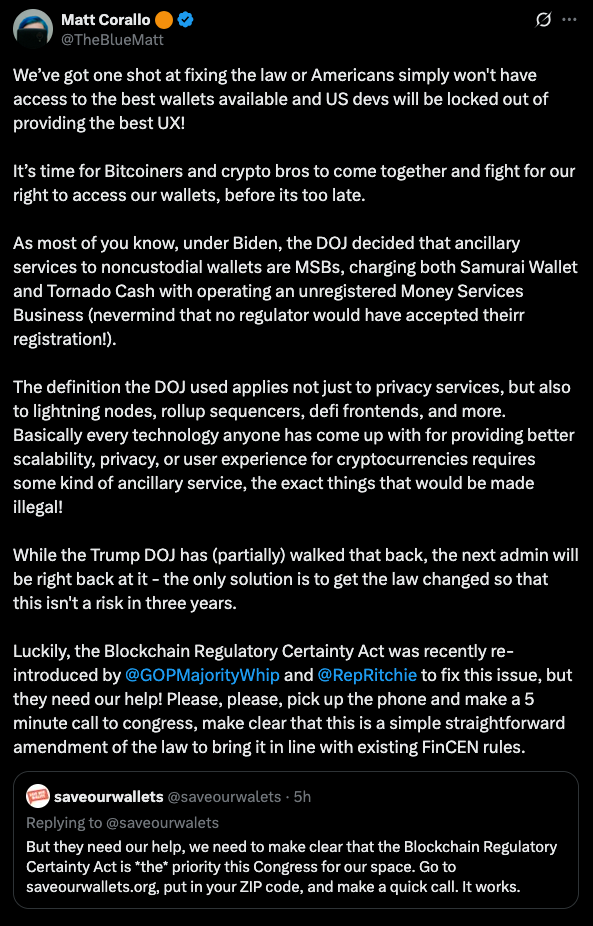

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 15:03:06

@ 7f6db517:a4931eda

2025-06-16 15:03:06

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-16 15:03:05

@ 7f6db517:a4931eda

2025-06-16 15:03:05

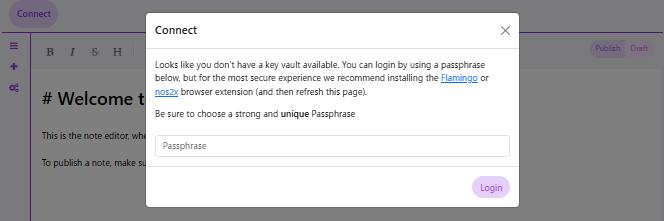

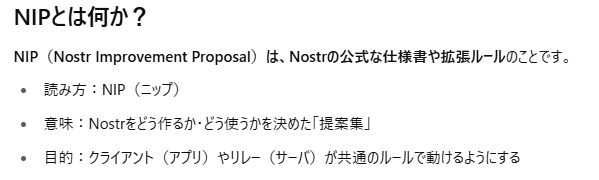

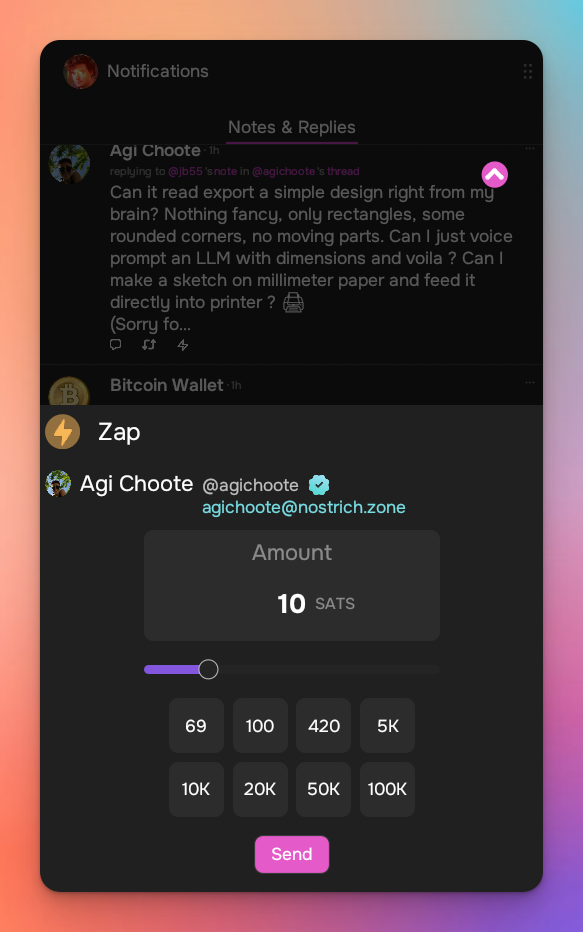

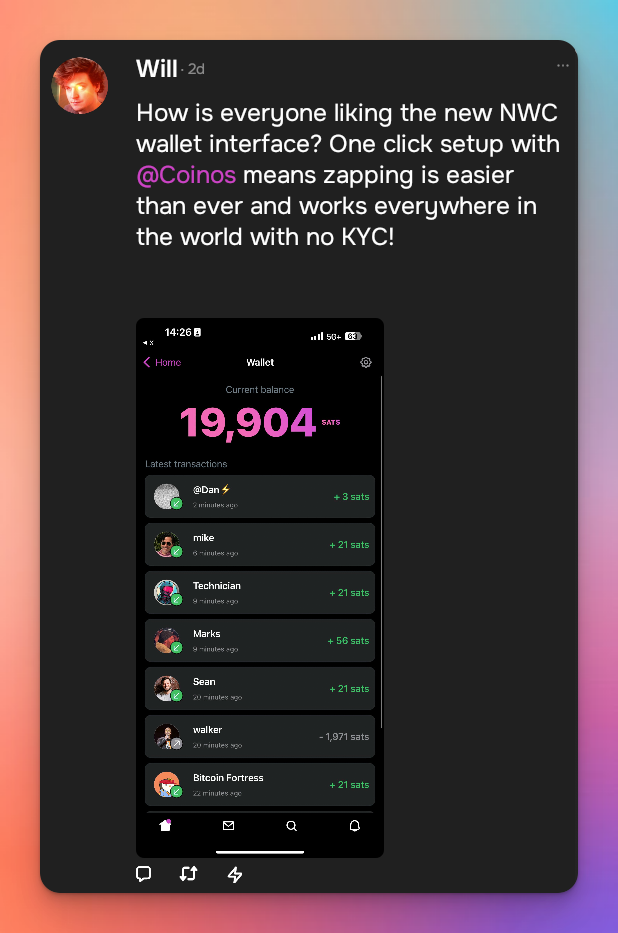

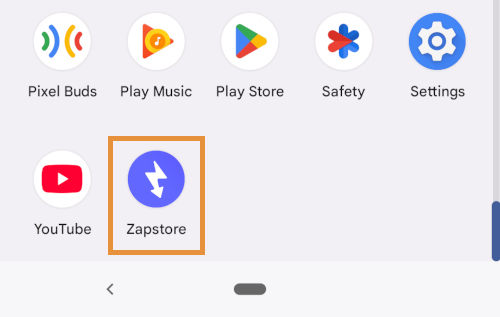

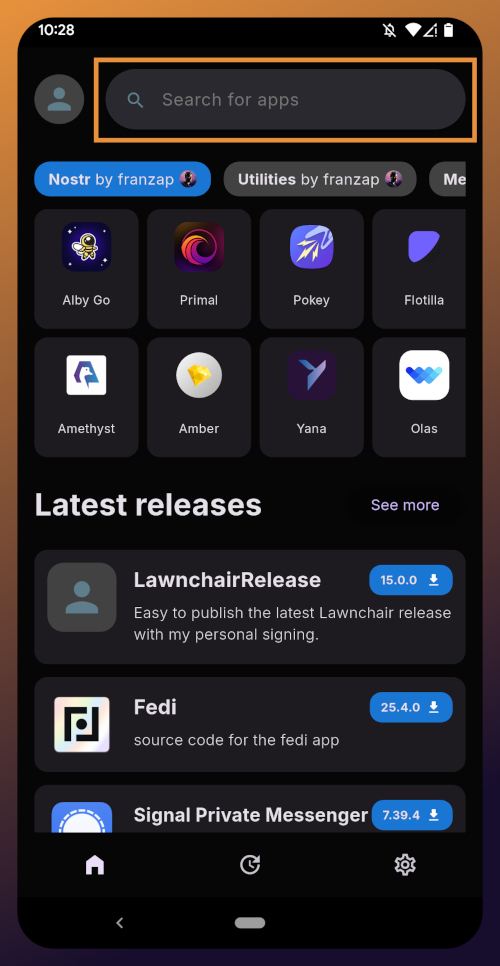

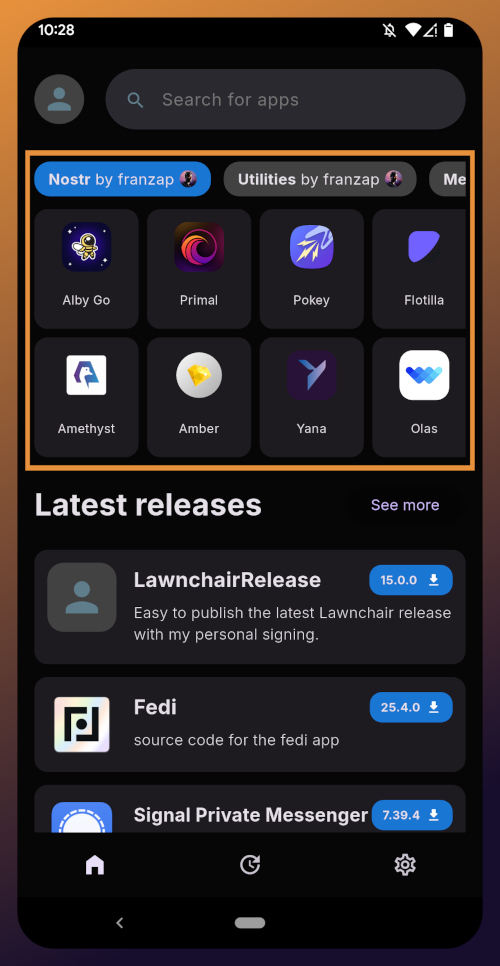

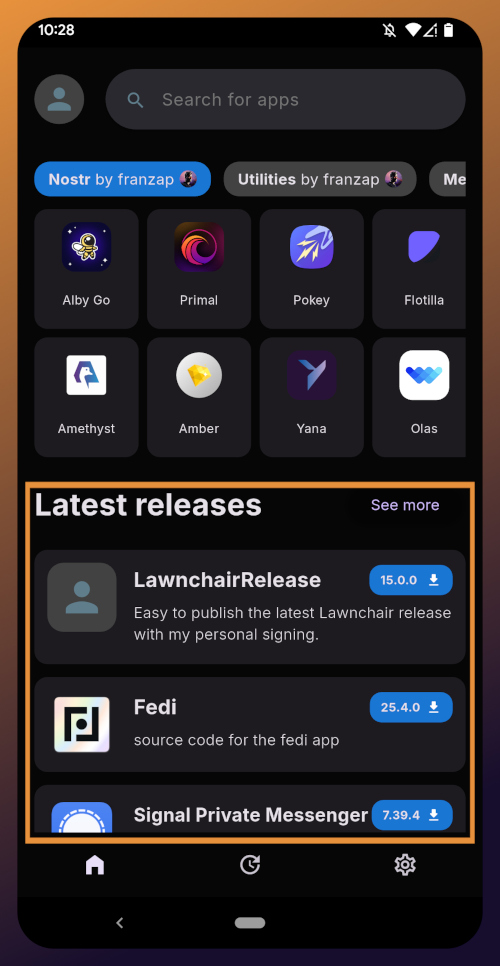

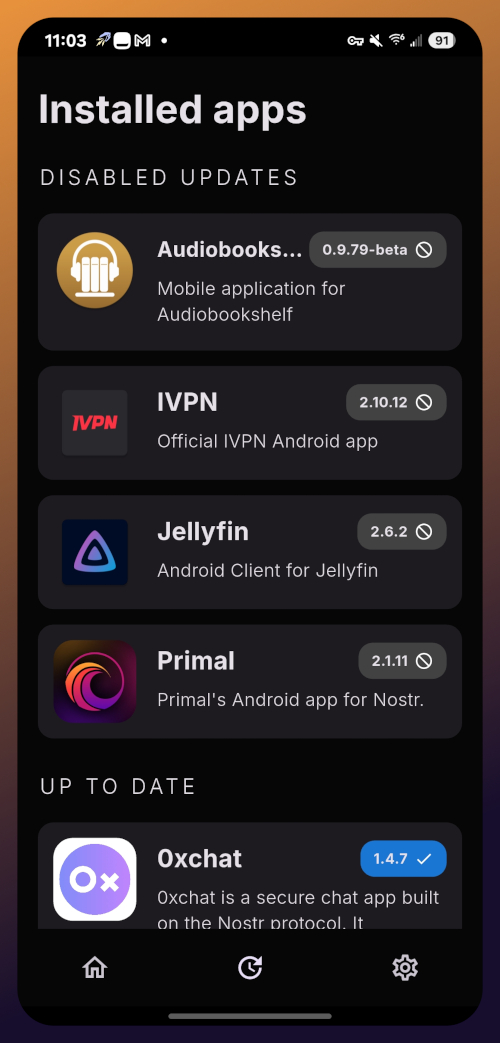

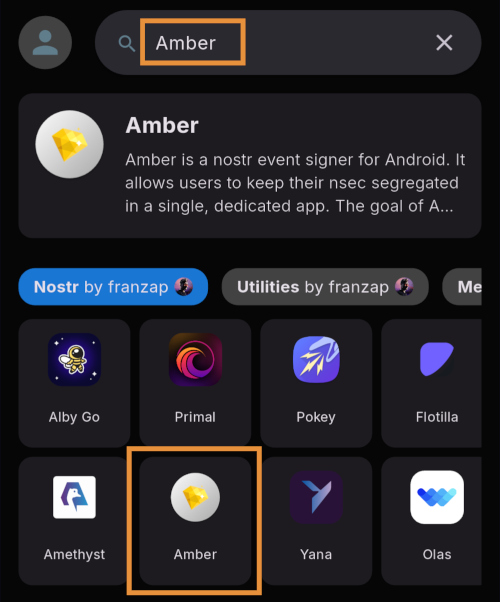

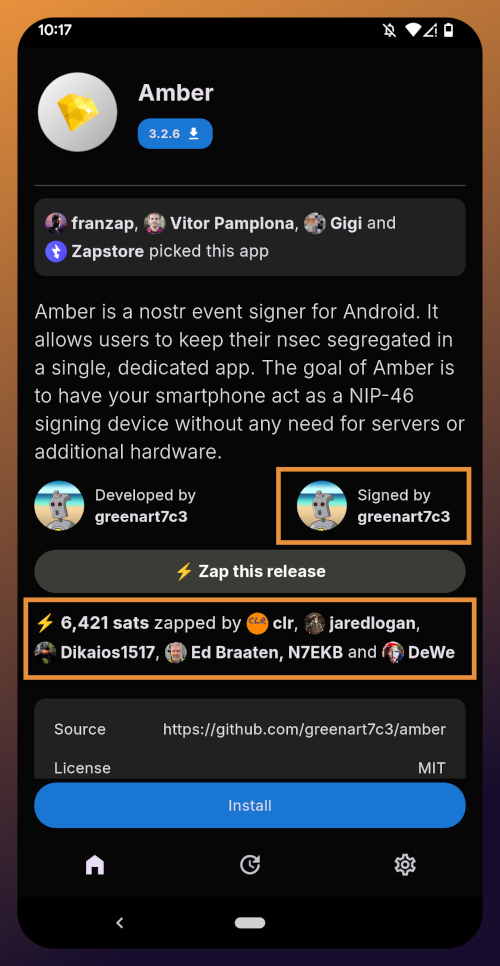

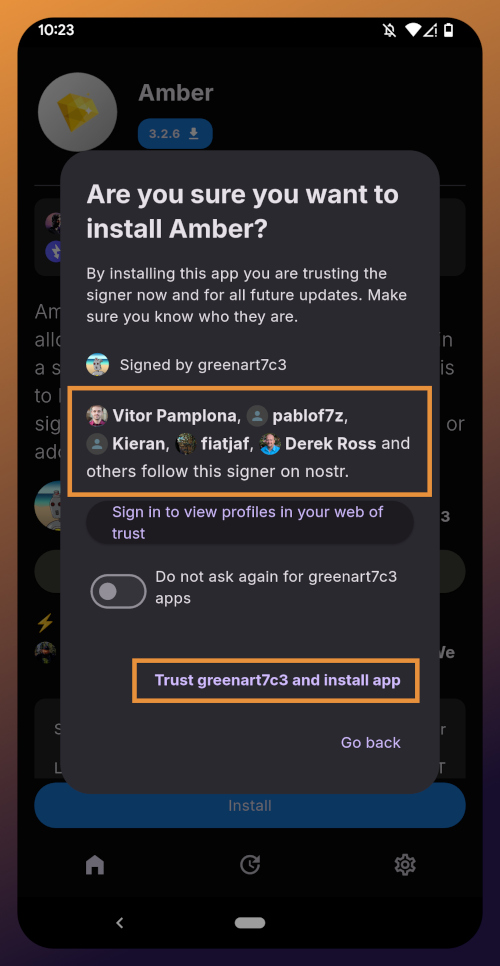

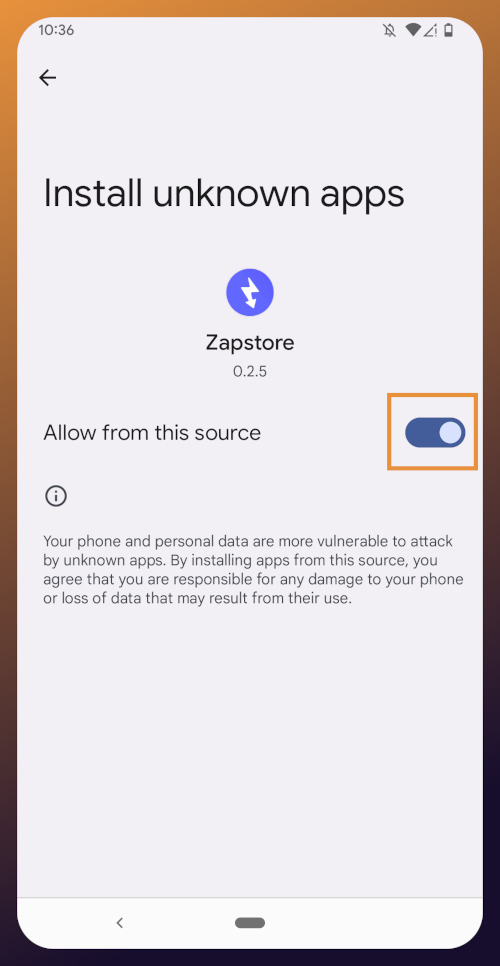

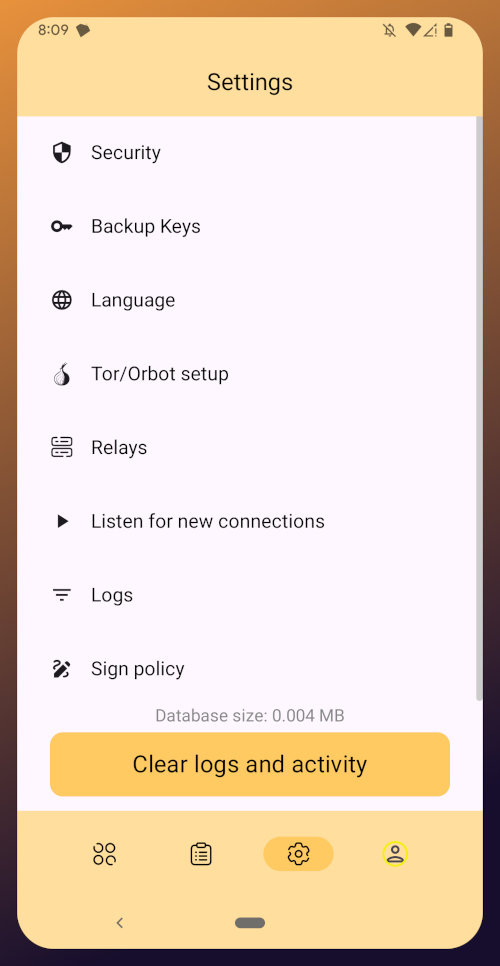

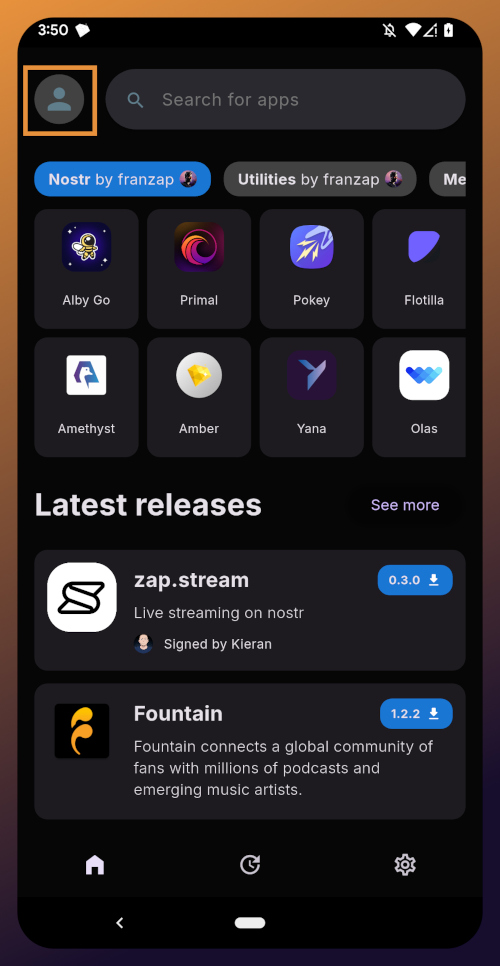

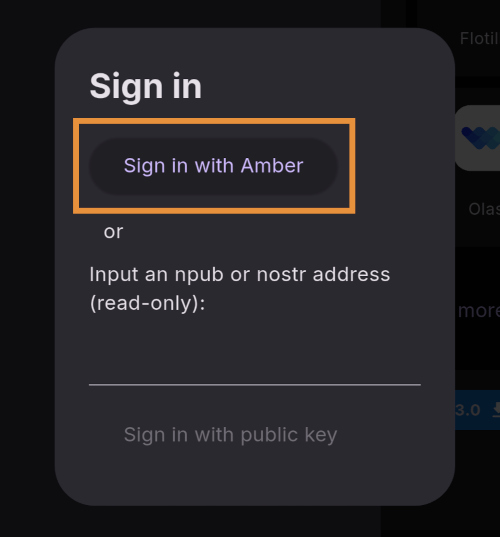

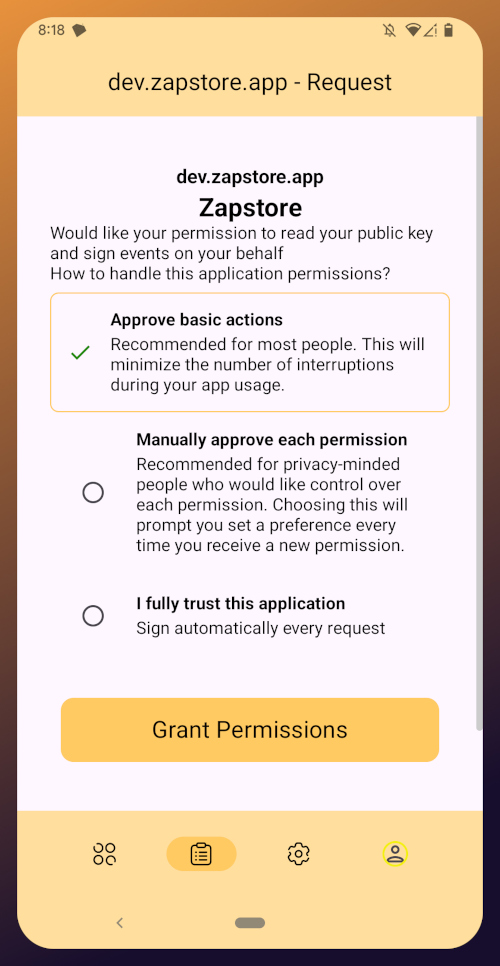

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

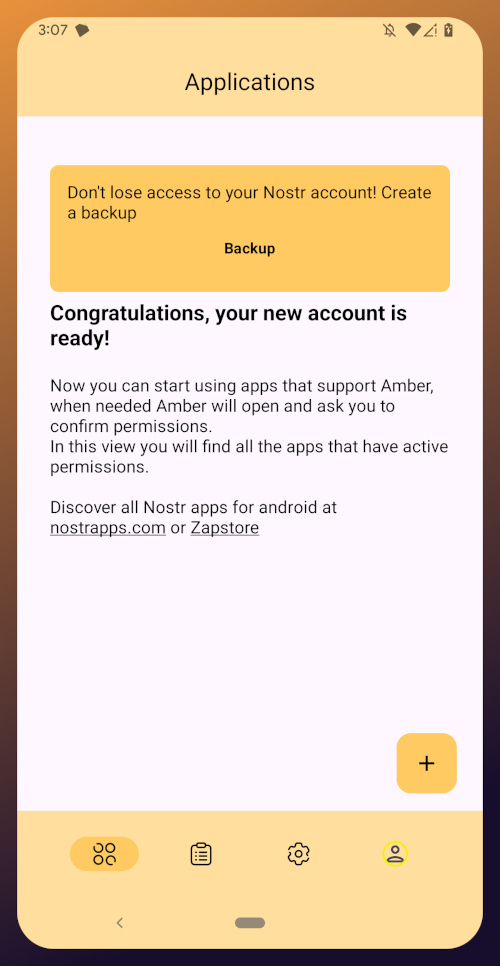

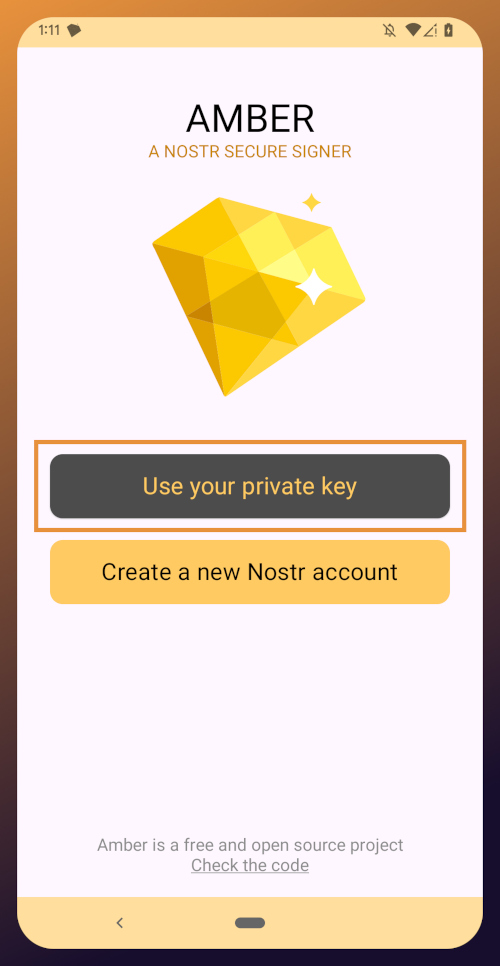

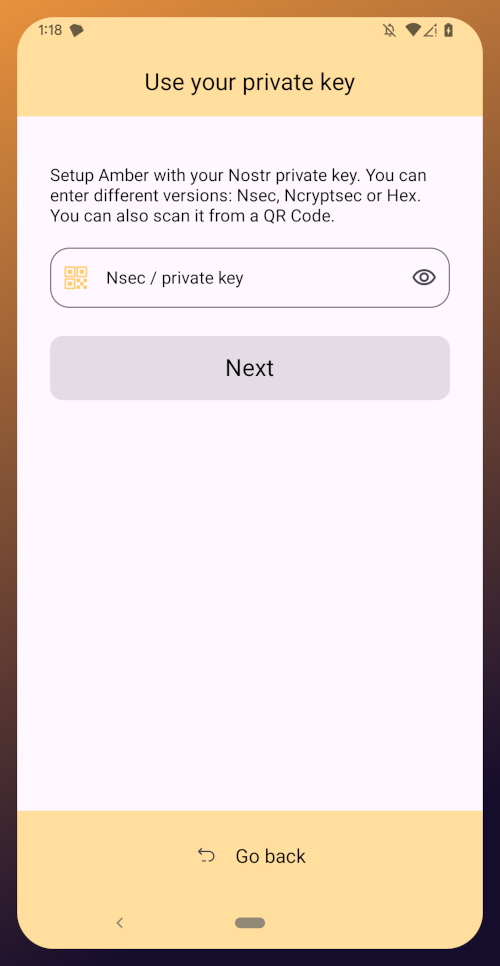

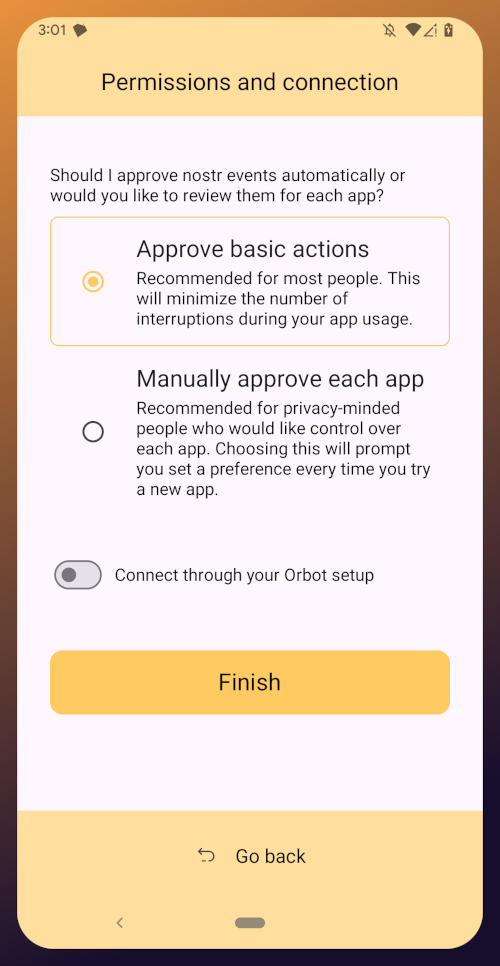

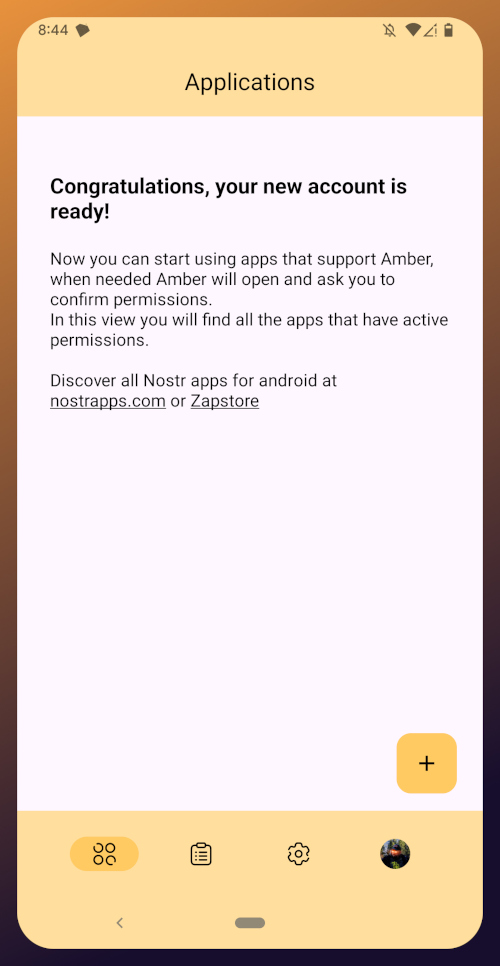

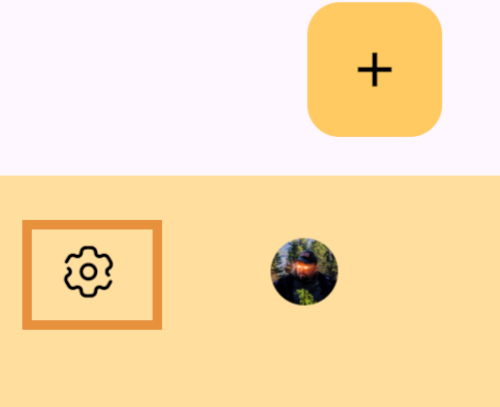

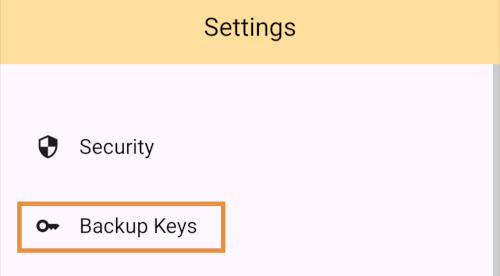

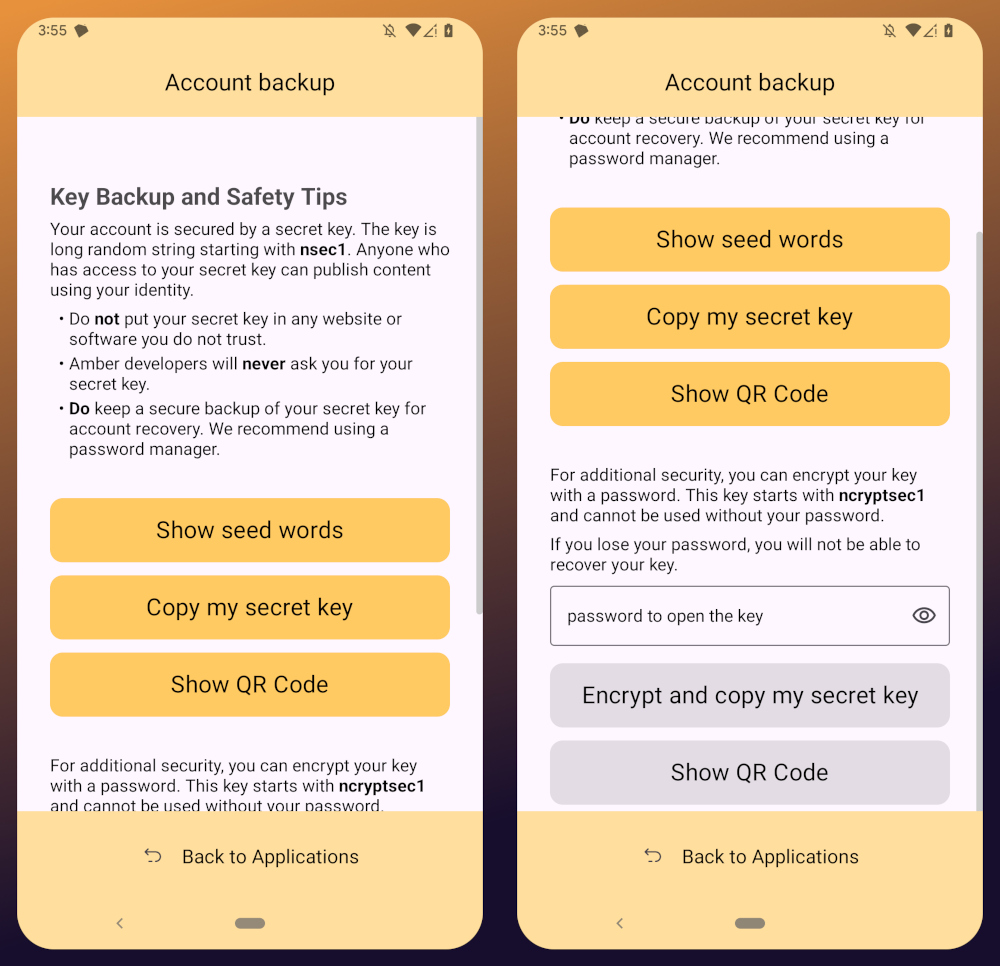

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ b1ddb4d7:471244e7

2025-06-16 15:02:23

@ b1ddb4d7:471244e7

2025-06-16 15:02:23This article was originally published on dev.to by satshacker.

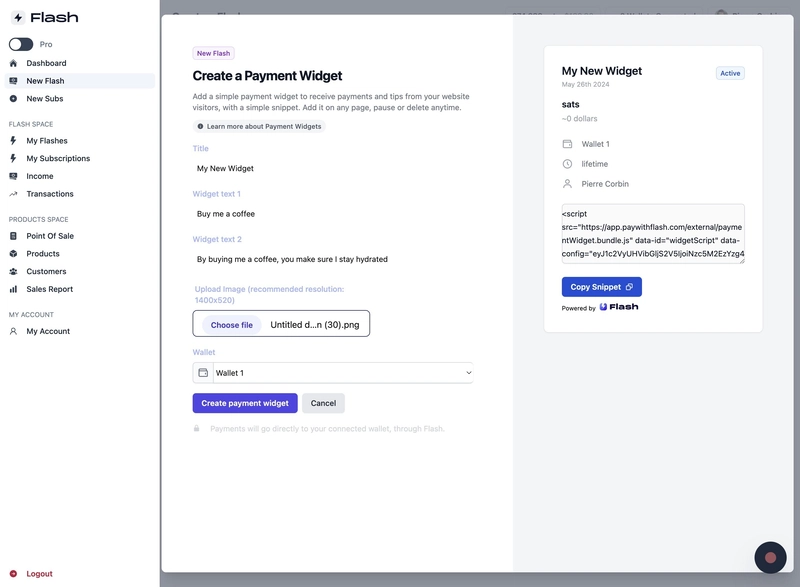

Alright, you’ve built a useful and beautiful website, tool or app. However, monetization isn’t a priority and you’d rather keep the project free, ads-free and accessible?

Accepting donations would be an option, but how? A PayPal button? Stripe? Buymeacoffe? Patreon?

All of these services require a bank account and KYC verification, before you can send and receive donations – not very convenient.

If we only could send value over the internet, with just one click and without the need of a bank account…

Oh, hold on, that’s bitcoin. The decentralized protocol to send value across the globe. Money over TCP/IP.

In this article, we’ll learn how anyone can easily add a payment button or donation widget on a website or app.

Let’s get into it.

Introduction

Bitcoin is digital money that you can send and receive without the need for banks. While bitcoin is extremely secure, it’s not very fast. The maximum transactions per second (TPS) the network can handle is about 7. Obviously that’s not useful for daily payments or microtransactions.

If you’d like to dig deeper into how bitcoin works, a great read is “Mastering Bitcoin” by Andreas Antonopoulos.

Bitcoin vs Lightning

If you’d like to receive bitcoin donations “on-chain” all you need is a bitcoin wallet. You simply display your bitcoin address on your site and that’s it. You can receive donations.

It would look something like this; 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Instead of showing the actual bitcoin address, you can also turn it into a QR code.

However, this is not a recommended solution. Using static on-chain addresses has two major downsides. It lowers privacy for you and your donnors and it’s a UTXO disaster because many small incoming transactions could beocme hard to consolidate in the future.

For donations and small transactions, the Lightning Network is the better option. Lightning allows for instant settlement with fees only a fraction of a cent.

Similar to bitcoin, you have the choice between non-custodial and custodial wallets. This means, either you have full control over your money or the wallet provider has.

Option 1: Lightning Address

With the lightning address feature, you an easily receive donations to an email like address.

It looks like this: yourname@wallet.com

Many wallets support lightning addresses and make it easy to create one. Then, you simple add the address to your donation page and you’re ready to receive tips.

You can also add a link link as in lightning:yourname@wallet.com and compatible lightning wallets and browser wallets will detect the address.

Option 2: Lightning Donation Widgets

If you like to take it a step further, you can also create a more enhanced donation checkout flow. Of course you could programm something yourself, there are many open source libraries you can build upon. If you want a simple plug-and-play solution, here are a couple of options:

Name

Type

Registration

SatSale

Self-hosted

No KYC

BTCPay Server

Self-hosted

No KYC

Pay With Flash

Widget

Email

Geyser Fund

Widget

Email

The Giving Block

Hosted

KYC

OpenNode

Hosted

KYC

SatSale (GitHub)

Lightweight, self-hosted Bitcoin/Lightning payment processor. No KYC.

Ideal for developers comfortable with server management. Simple to deploy, supports both on-chain and Lightning, and integrates with WooCommerce.

BTCPay Server

Powerful, open-source, self-hosted processor for Bitcoin and Lightning. No KYC.

Supports multiple currencies, advanced features, and full privacy. Requires technical setup and maintenance. Funds go directly to your wallet; great for those seeking full control.

Pay With Flash

Easiest for indie hackers. Add a donation widget with minimal code and no KYC. Payments go directly to your wallet for a 1.5% fee.

Setup Steps:

- Sign up at PayWithFlash.com

- Customize your widget in the dashboard

- Embed the code:

- Test to confirm functionality

Benefits:

- Minimal technical skills required

- Supports one-time or recurring donations

- Direct fund transfer, no intermediaries

Geyser Fund

Crowdfunding platform. Widget-based, connects to your wallet, email registration.Focused on Bitcoin crowdfunding, memberships and donations.

The Giving Block

Hosted, KYC required. Integrates with fiat and crypto, best for nonprofits or larger organizations.

OpenNode

Hosted, KYC required. Accept Bitcoin payments and donations; supports conversion to fiat, suitable for businesses and nonprofits.

Summary

- Fast, low-code setup: Use Pay With Flash or Geyser Fund.

- Privacy and control: Choose SatSale or BTCPay Server (requires technical skills).

- Managed, compliant solutions: The Giving Block or OpenNode.

Choose based on your technical comfort, privacy needs, and project scale.

I hope this article helped you. If you added bitcoin donations, share your link in the comments and I will send you a few satoshis maybe

-

@ cae03c48:2a7d6671

2025-06-16 15:02:04

@ cae03c48:2a7d6671

2025-06-16 15:02:04Bitcoin Magazine

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on EverythingCoinbase is launching its first-ever branded credit card in partnership with American Express, set to roll out this fall. Called the Coinbase One Card, it will be available only to U.S. members of Coinbase One, the platform’s monthly subscription service. The card will offer 2% to 4% back in Bitcoin on everyday purchases, along with access to American Express perks.

JUST IN: Coinbase launches credit card allowing users to earn up to 4% bitcoin back on every purchase

pic.twitter.com/d6pdNZV4pi

pic.twitter.com/d6pdNZV4pi— Bitcoin Magazine (@BitcoinMagazine) June 12, 2025

This is a first-of-its-kind product for Coinbase, which previously only offered a prepaid debit card with Visa in 2020.

“We see real potential in the combination of Coinbase and crypto with the powerful backing of American Express, and what the card offers is an excellent mix of what customers are looking for right now,” said Will Stredwick, head of American Express global network services, during the Coinbase State of Crypto Summit in New York.

The card is part of a larger push by Coinbase to expand its subscription-based services. Coinbase One costs $29.99/month and includes zero trading fees, higher staking rewards, and customer support perks. The company also announced a cheaper version—Coinbase Basic—for $4.99/month or $49.99/year, which includes fewer features.

Coinbase’s subscription business is growing fast. It brought in $698.1 million in Q1 2025, compared to $1.26 billion in trading revenue. According to William Blair analyst Andrew Jeffrey, this kind of recurring revenue is a big reason why long-term investors are sticking with the stock.

Launched in 2023, Coinbase One now has over a million members. The company has been steadily growing its ecosystem with products like its Base developer platform and a self-custody wallet.

The company has long positioned Bitcoin at the center of its strategy—offering BTC custody services to institutions, supporting Bitcoin ETFs, integrating Bitcoin rewards into its products, and actively advocating for Bitcoin-friendly regulation in Washington. Coinbase also supports Bitcoin development directly through funding grants and engineering support. As the largest publicly traded crypto exchange in the U.S., Coinbase continues to frame Bitcoin not just as an asset, but as the foundation of its long-term vision.

This post Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ e1cde248:609c13b0

2025-06-16 15:09:09

@ e1cde248:609c13b0

2025-06-16 15:09:09ในปี 1975 มหาวิทยาลัย Yale ได้ทำการศึกษาจากกลุ่มคนที่มีอายุตั้งแต่ 50 ปีจำนวน 660 คน ในหัวข้อ ความเห็นที่มีต่อ “การสูงวัยขึ้น(aging)”

กลุ่มที่หนึ่ง มีความเห็นและความเชื่อที่เป็นด้านบวก ทั้งในเรื่องสุขภาพ ความคิด ความคาดหวังที่ดี เมื่อแก่ตัวขึ้น

กลุ่มที่สอง มีความเห็นและความเชื่อที่เป็นด้านลบ ประมาณว่า “การออกกำลังกายไม่ได้ทำอะไรให้ดีขึ้นหรอก ยังไงก็ต้องป่วย ต้องตายอยู่ดี”

ปรากฎว่า เมื่อผ่านไป 23 ปี กลุ่มที่หนึ่งมีอายุขัยเฉลี่ยมากกว่ากลุ่มที่สอง ถึง 7.6 ปี ซึ่งเป็นตัวเลขที่แตกต่างกันมาก

การศึกษานี้ต้องการจะบอกอะไรกับเรา?

แน่นอนว่า ผลลัพธ์ทุกอย่าง เกิดขึ้นได้ จากการกระทำ เวลาที่เราวางแผนจะลงมือทำอะไร ล้วนแต่เริ่มต้นจาก การตั้งเป้าหมาย ทั้งสิ้น

แต่คำถามคือ เมื่อบรรลุเป้าหมายแล้ว ยังไงต่อ?

ข้อเสียอย่างหนึ่ง ของการตั้งเป้าหมายโดยมีรากฐานมาจากผลลัพธ์ที่ต้องการ คือ เรามีแนวโน้มที่จะ “หยุดทำ” เมื่อได้ผลลัพธ์ที่ต้องการแล้ว

ยกตัวอย่างเช่น การลดน้ำหนัก เราชอบมองเรื่องของการลดน้ำหนักเป็นเหมือน การจัดแคมเปญ โดยมีช่วงเวลาที่กำหนด และเมื่อบรรลุเป้าหมาย เราก็กลับมามีพฤติกรรมแบบเดิม ซึ่งทำให้น้ำหนักที่ลดลงไป กลับมา

James Clear ผู้เขียนหนังสือชื่อ Atomic Habits ได้กล่าวว่า แค่การวางแผน และลงมือทำ ไม่ได้นำมาซึ่งผลลัพธ์ที่ยั่งยืน

แต่สิ่งที่สำคัญกว่า ที่เราต้องทำคือ การกำหนดตัวตนของเราใหม่

เวลาที่เราต้องการลดน้ำหนัก 10 กิโล ให้เรามองลึกลงไปกว่าการวางแผนเรื่องการกิน และการออกกำลังกาย

แต่ให้ตั้งเป้าหมายว่า

“ต่อไปนี้ฉันจะเป็นคนที่ เลือกกินที่แต่ของที่มีประโยชน์ และจะออกกำลังกายสม่ำเสมอ” “ฉันไม่ใช่คนที่ชอบกินขนมและของที่มีน้ำตาลสูง” “ฉันเป็นนักกีฬาที่เข้มงวดต่อตารางฝึกซ้อม”

การกำหนดตัวตนของเราใหม่ เป็นเหมือนการปรับเปลี่ยน Mindset ถ้าเรา “โฟกัส” ลงไปที่แก่นของพฤติกรรมแล้ว “ผลลัพธ์” แบบที่เราต้องการจะมาเอง และยั่งยืนกว่า

การศึกษาของมหาวิทยาลัย Yale เป็นข้อพิสูจน์ของเรื่องนี้ได้อย่างดี เพราะกลุ่มคนที่มีความเชื่อที่เป็นด้านบวก จะให้ความสำคัญต่อการออกกำลังกายมากขึ้น หยุดกินเหล้า หยุดสูบบุหรี่ และใช้เวลาอยู่กับคนที่มีมุมมองเป็นบวกเหมือนกัน

เมื่อเราได้ติดสินใจแล้วว่า คนแบบไหนที่เราต้องการจะเป็น พฤติกรรมต่างๆในชีวิตประจำวันของเราจะค่อยๆ เปลี่ยนไป และจะยิ่งเห็นผลชัดเจนขึ้นเรื่อยๆในระยะยาว

เรา คือผลลัพธ์ของ สิ่งที่เราลงมือทำ

เรา คือผลลัพธ์ของ การตัดสินใจของเรา

-

@ bf47c19e:c3d2573b

2025-06-16 15:06:01

@ bf47c19e:c3d2573b

2025-06-16 15:06:0127.08.2014

Originalni tekst na fee.org / Autor: Džefri A. Taker

Oni koji se koriste delom Mizesa da bi osporili Bitkoin trebalo bi ponovo da razmisle.

Mnogi ljudi koji nikada nisu koristili Bitkoin posmatraju ga sa zbunjenošću. Zašto ovaj magični internet novac uopšte ima bilo kakvu vrednost? To je samo nekakva kompjuterska stvar koju je neko izmislio.

Uzmite u obzir kritike zlatoljubaca, koji su decenijama gurali ideju da čvrst novac mora biti podržan nečim stvarnim, čvrstim i vrednim samim po sebi.

Bitkoin ne ispunjava te uslove, zar ne?

Možda ipak ispunjava. Pogledajmo detaljnije.

Bitkoin se prvi put pojavio pre skoro šest godina kao mogući konkurent nacionalnom novcu kojim upravlja država. Beli papir Satošija Nakamota objavljen je 31. oktobra 2008. godine. Struktura i jezik ovog rada poslali su poruku: Ova valuta je za kompjuterske tehničare, a ne za ekonomiste niti za političke komentatore. Domet ovog rada je bio ograničen; početnici koji su ga čitali bili su zbunjeni.

Ali nedostatak interesovanja nije sprečio istoriju da ide napred. Dva meseca kasnije, oni koji su obraćali pažnju videli su pojavu Genesis bloka, prve grupe Bitkoina generisanih putem Nakamotovog koncepta distribuirane knjige (distributed ledger) koja je postojala na bilo kom kompjuterskom čvoru na svetu koji je želeo da je hostuje.

Ovde smo šest godina kasnije, a jedan Bitkoin vredi 500 američkih dolara, dok je njegova najviša vrednost bila 1.200 dolara po novčiću. Ovu valutu prihvata na hiljade institucija, kako onlajn, tako i oflajn. Njen platni sistem je veoma popularan u siromašnim zemljama koje nemaju razvijenu bankarsku infrastrukturu, ali i u razvijenim zemljama. Velike institucije – uključujući Federalne rezerve, OECD, Svetsku banku i velike investicione kuće – posvećuju mu pažnju sa dužnim poštovanjem.

Entuzijasti, koji se nalaze u svakoj zemlji, kažu da će njegova tržišna vrednost u budućnosti rasti jer je njegova ponuda strogo ograničena i pruža sistem koji je znatno superiorniji od državnog novca. Bitkoin se prenosi između pojedinaca bez posrednika. Razmena je gotovo besplatna. Ima predvidivu ponudu. Trajan je, zamenljiv i deljiv: sve su to ključne karakteristike novca. Stvara monetarni sistem koji ne zavisi od poverenja i identiteta, a mnogo manje od centralnih banaka i države. To je novi sistem za digitalno doba.

Teške pouke o čvrstom novcu

Onima koji su obrazovani u tradiciji 'čvrstog novca', cela ideja je predstavljala ozbiljan izazov. Govoreći o sebi, čitao sam o Bitkoinu dve godine pre nego što sam makar približno uspeo da ga razumem. Jednostavno, nešto u celoj toj ideji mi je smetalo. Ne možete stvoriti novac ni iz čega, a kamoli iz kompjuterskog koda. Zašto onda ima vrednost? Mora da nešto nije kako treba. Nismo očekivali da će se novac tako reformisati.

Tu je i problem: naša očekivanja. Trebalo je da posvetimo više pažnje teoriji porekla novca Ludviga fon Mizesa — ne onome što mislimo da je on napisao, već onome što je on zaista napisao.

Godine 1912. Mizes je objavio delo "Teorija novca i kredita". Kada je objavljeno na nemačkom, postiglo je ogroman uspeh u Evropi i prevedeno je na engleski jezik. Iako je obuhvatilo svaki aspekt novca, njegov ključni doprinos bio je u praćenju vrednosti i cene novca — i ne samo novca — sve do njegovog porekla. To jest, objasnio je kako novac formira svoju cenu u smislu dobara i usluga koje se njime mogu nabaviti. Kasnije je ovaj proces nazvao "teoremom regresije novca" i ispostavilo se da Bitkoin zadovoljava sve uslove te teoreme.

Mizesov učitelj, Karl Menger, demonstrirao je da sam novac potiče sa tržišta – a ne od države i ne od društvenog ugovora. On se postepeno pojavljuje dok monetarni preduzetnici traže idealan oblik robe za indirektnu razmenu. Umesto da neposredno vrše trampu, ljudi pribavljaju neko dobro ne da bi ga konzumirali, već da bi ga razmenili. To dobro postaje novac, najtržišnije dobro.

Ali Mizes je dodao da se vrednost novca prati unazad kroz vreme sve do njegove vrednosti kao robe koja je služila za trampu. Mizes je smatrao da je to jedini način na koji novac može imati vrednost.

"Teorija vrednosti novca kao takvog može pratiti objektivnu tržišnu vrednost novca kroz vreme samo do tačke kada njegova vrednost prestaje da bude vrednost kao novca i postaje isključivo vrednost kao robe... Ako se na ovaj način neprestano vraćamo sve dalje unazad, na kraju moramo doći do tačke gde više ne nalazimo nijednu komponentu u objektivnoj tržišnoj vrednosti novca koja proističe iz vrednovanja zasnovanih na funkciji novca kao opšteg sredstva razmene; gde vrednost novca nije ništa drugo do vrednost predmeta koji je koristan na neki drugi način osim kao novac... Pre nego što je postalo uobičajeno nabavljati robu na tržištu, ne za ličnu potrošnju, već jednostavno radi ponovne razmene za robu za kojom zaista postoji potreba, svakoj pojedinačnoj robi pripisivana je samo ona vrednost data subjektivnim vrednovanjem zasnovanom na njenoj direktnoj korisnosti."

Mizesovo objašnjenje rešilo je veliki problem koji je dugo zbunjivao ekonomiste. Radi se o nagađajućem istorijskom narativu, a ipak ima savršenog smisla. Da li bi so postala novac da je inače bila potpuno beskorisna? Da li bi dabrovo krzno dobilo monetarnu vrednost da nije bilo korisno kao odeća? Da li bi srebro ili zlato imali novčanu vrednost da isprva nisu imali vrednost kao roba? Odgovor u svim slučajevima monetarne istorije je jasno ne. Početna vrednost novca, pre nego što postane široko razmenjivano kao novac, potiče iz njegove direktne korisnosti. To je objašnjenje koje je demonstrirano kroz istorijsku rekonstrukciju. To je Mizesova teorema regresije novca.

Upotrebna vrednost Bitkoina

Na prvi pogled, Bitkoin deluje kao izuzetak. Ne možete koristiti Bitkoin ni za šta drugo osim kao novac. Ne može se nositi kao nakit. Ne možete od njega napraviti mašinu. Ne možete ga jesti, pa čak ni koristiti ga kao dekoraciju. Njegova vrednost se ostvaruje samo kao jedinica koja olakšava indirektnu razmenu. Pa ipak, Bitkoin je već novac. Koristi se svakodnevno. Razmene možete videti u realnom vremenu. To nije mit. Ta stvar je stvarna.

Može izgledati kao da smo prinuđeni da biramo. Da li je Mizes pogrešio? Možda moramo odbaciti celu njegovu teoriju. Ili je možda njegova poenta bila isključivo istorijska i nije primenjiva na budućnost digitalnog doba. Ili je možda njegova teorema regresije dokaz da je Bitkoin samo prazna manija bez snage da potraje jer se ne može svesti na svoju vrednost kao korisna roba.

Pa ipak, ne morate se pozivati na komplikovane monetarne teorije da biste razumeli osećaj uzbune koji okružuje Bitkoin. Mnogi ljudi, kao i ja, jednostavno osećaju nelagodu u vezi sa novcem koji nema nikakvu fizičku osnovu. Naravno, možete odštampati Bitkoin na komadu papira, ali posedovanje papira sa QR kodom ili javnim ključem nije dovoljno da ublaži taj osećaj nelagode.

Kako da rešimo ovaj problem? U svojoj glavi, zabavljao sam se ovim pitanjem više od godinu dana. Zbunjivalo me je. Pitao sam se da li je Mizesovo shvatanje primenjivo samo u preddigitalnom dobu. Pratio sam onlajn spekulacije da bi vrednost Bitkoina bila nula, da nema nacionalnih valuta u koje se konvertuje. Možda je potražnja za Bitkoinom prevazišla zahteve Mizesovog scenarija zbog očajničke potrebe za nečim drugačijim od dolara.

Vreme je prolazilo — i čitajući radove Konrada Grafa, Petera Šurde i Danijela Kraviša — rešenje je konačno samo stiglo. Preći ću odmah na stvar i otkriti ga: Bitkoin je i sistem plaćanja i novac. Sistem plaćanja je izvor vrednosti, dok obračunska jedinica samo izražava tu vrednost u smislu cene. Jedinstvo novca i plaćanja je njegova najneobičnija karakteristika i ona koju je većina komentatora imala poteškoća da shvati.

Navikli smo da razmišljamo o valuti kao o nečemu što je odvojeno od sistema plaćanja. Ovo razmišljanje je odraz istorijskih tehnoloških ograničenja. Postoji dolar i postoje kreditne kartice. Postoji evro i postoji PayPal. Postoji jen i postoje servisi za prenos novca. U svim ovim slučajevima, transfer novca se oslanja na pružaoce usluga koji predstavljaju treću stranu. Da biste ih koristili, potrebno je da uspostavite ono što se naziva „odnos poverenja“ (trust relationship) sa njima, što znači da institucija koja dogovara posao mora da vam veruje da ćete platiti.

Ovaj jaz između novca i plaćanja uvek je bio prisutan, osim u slučaju fizičke blizine. Ako ti dam dolar za parče pice, nema treće strane. Ali sistemi plaćanja, treće strane i odnosi poverenja postaju neophodni kada napustite geografsku blizinu. Tada kompanije poput Vise i institucije poput banaka postaju nezaobilazne. One su ta aplikacija koja omogućava monetarnom softveru da radi ono što želite.

Problem je u tome što sistemi plaćanja koje danas imamo nisu dostupni svakome. Zapravo, ogromna većina čovečanstva nema pristup takvim alatima, što je glavni razlog siromaštva u svetu. Oni koji su finansijski obespravljeni su ograničeni samo na lokalnu trgovinu i ne mogu proširiti svoje trgovinske odnose sa svetom.

Vodeći, ako ne i primarni, cilj nastanka Bitkoina bio je rešavanje ovog problema. Protokol je postavio sebi zadatak da poveže funkciju valute sa sistemom plaćanja. Te dve stvari su potpuno međusobno povezane u samoj strukturi koda. Ova veza je ono što čini Bitkoin drugačijim od bilo koje postojeće nacionalne valute i, zaista, bilo koje valute u istoriji.

Neka nam se sam Nakamoto obrati iz uvodnog sažetka svog belog papira. Zapazite koliko je platni sistem ključan za monetarni sistem koji je stvorio:

"Potpuna peer-to-peer verzija elektronskog novca omogućila bi slanje uplata putem interneta direktno od jedne strane ka drugoj bez posredovanja finansijskih institucija. Digitalni potpisi pružaju deo rešenja, ali se glavni benefiti gube ako je i dalje potrebna pouzdana treća strana za sprečavanje dvostruke potrošnje. Predlažemo rešenje problema dvostruke potrošnje korišćenjem peer-to-peer mreže. Mreža vremenski označava transakcije tako što ih hešuje u tekući lanac dokaza o radu (proof of work) temeljen na hešu, formirajući zapis koji se ne može promeniti bez ponovnog rada i objavljivanja dokaza o tom radu. Najduži lanac ne služi samo kao dokaz niza događaja, nego i kao dokaz da je taj niz događaja potvrđen od strane dela peer-to-peer mreže koja poseduju najveću zbirnu procesorsku snagu (CPU). Sve dok većinu procesorske snage kontrolišu čvorovi (nodes) koji ne sarađuju u napadu na mrežu, oni će generisati najduži lanac i nadmašiti napadače. Sama mreža zahteva minimalnu strukturu. Poruke kroz mrežu se prenose uz pretpostavku da svaki čvor čini maksimalan napor da poruku prenese u svom izvornom obliku i na optimalan način, a čvorovi mogu napustiti mrežu i ponovo joj se pridružiti po želji, prihvatajući najduži lanac dokaza o radu kao dokaz onoga što se dogodilo dok ih nije bilo."

Ono što je veoma upečatljivo u ovom paragrafu je da se uopšte ne spominje sama valuta. Spominje se samo problem dvostruke potrošnje (odnosno, problem inflatornog stvaranja novca). Inovacija ovde je, čak i prema rečima njenog pronalazača, platna mreža, a ne novčić. Novčić ili digitalna jedinica samo izražava vrednost mreže. To je računovodstveni alat koji apsorbuje i prenosi vrednost mreže kroz vreme i prostor.

Ova mreža se naziva blokčejn. To je knjiga transakcija koja živi u digitalnom oblaku, distribuirana mreža i njeno funkcionisanje može posmatrati svako u bilo koje vreme. Pažljivo je nadgledaju svi korisnici. Omogućava prenos sigurnih i neponovljivih bitova informacija od jedne osobe do bilo koje druge osobe bilo gde u svetu, a ovi informacioni bitovi su zaštićeni digitalnim oblikom vlasništva. Ovo je ono što je Nakamoto nazvao „digitalnim potpisima“. Njegov izum knjige transakcija koja se nalazi na oblaku omogućava proveru vlasničkih prava bez oslanjanja na agenciju koja vrši ulogu treće strane od poverenja.

Blokčejn je rešio ono što je postalo poznato kao "problem vizantijskih generala". To je problem koordinacije akcija na velikom geografskom području u prisustvu potencijalno zlonamernih aktera. Budući da se generali razdvojeni prostorom moraju oslanjati na glasnike i to oslanjanje zahteva vreme i poverenje, nijedan general ne može biti apsolutno siguran da je drugi general primio i potvrdio poruku, a kamoli njenu tačnost.

Postavljanje knjige transakcija, kojoj svi imaju pristup, na Internet rešava ovaj problem. Knjiga transakcija beleži iznose, vremena i javne adrese svake transakcije. Informacije se dele širom sveta i stalno se ažuriraju. Knjiga transakcija garantuje integritet sistema i omogućava da valutna jedinica postane digitalni oblik imovine sa vlasništvom.

Kada ovo shvatite, možete videti da je suština vrednosti Bitkoin povezana sa njegovom integrisanom platnom mrežom. Ovde se pronalazi upotrebna vrednost na koju se Mizes poziva. Ona nije ugrađena u samu valutnu jedinicu, već u briljantan i inovativan platni sistem na kojem Bitkoin živi. Kada bi bilo moguće da se blokčejn nekako odvoji od Bitkoina (a to zaista nije moguće), vrednost valute bi odmah pala na nulu.

Dokaz koncepta

Da biste dalje razumeli kako se Mizesova teorija uklapa u Bitkoin, morate razumeti još jednu stvar u vezi sa istorijom kriptovalute. Na dan pokretanja (9. januar 2009.), vrednost Bitkoina bila je tačno nula. I tako je ostalo 10 meseci nakon pokretanja. Sve to vreme su se transakcije odvijale, ali tokom celog tog perioda vrednost nije bila iznad nule.

Prva objavljena cena Bitkoina pojavila se 5. oktobra 2009. Na ovoj menjačnici, 1 dolar je iznosio 1.309,03 Bitkoina (što su mnogi tada smatrali precenjenim). Drugim rečima, prva procena vrednosti Bitkoina bila je nešto više od jedne desetine penija. Da, da ste kupili Bitkoin u vrednosti od 100 dolara u to vreme i niste ih panično prodali, danas biste bili „polu-milijarder“.

Dakle, postavlja se pitanje: Šta se dogodilo između 9. januara i 5. oktobra 2009. godine, što je dovelo do toga da Bitkoin dobije tržišnu vrednost? Odgovor je da su trgovci, entuzijasti, preduzetnici i drugi isprobavali blokčejn. Želeli su da znaju da li funkcioniše. Da li je prenosio jedinice bez dvostruke potrošnje? Da li je sistem koji se oslanjao na dobrovoljnu računarsku snagu zaista bio dovoljan za verifikaciju i potvrđivanje transakcija? Da li bitkoini koji su dodeljeni kao nagrada završavaju tamo gde treba kao naknada za usluge verifikacije? I iznad svega, da li je ovaj novi sistem zaista uspeo da uradi ono što se činilo nemogućim – to jest, da prenosi bezbedne delove informacija zasnovanih na vlasničkim pravima kroz geografski prostor, bez posredovanja neke treće strane, već direktno između korisnika (peer-to-peer)?

Potrajalo je 10 meseci da se izgradi poverenje. Bilo je potrebno još 18 meseci dok Bitkoin nije dostigao paritet sa američkim dolarom. Ovu istoriju je ključno razumeti, pogotovo ako se oslanjate na teoriju porekla novca koja spekuliše o praistoriji novca, kao što to čini Misesova regresiona teorema. Bitkoin nije uvek bio novac koji ima vrednost. Nekada je bio čisto računovodstvena jedinica vezana za knjigu transakcija (ledger). Ova knjiga transakcija je pribavila ono što je Mises nazvao „upotrebnom vrednošću“. Svi uslovi teoreme su time zadovoljeni.

Zavšni obračun

Da ponovimo, ako neko kaže da se Bitkoin zasniva ni na čemu drugom osim na "običnoj magli", da ne može biti novac jer nema pravu istoriju kao istinska roba i, bez obzira da li je ta osoba početnik ili visoko obučeno ekonomista, morate istaći dve centralne tačke. Prvo, Bitkoin nije samostalna valuta već obračunska jedinica vezana za inovativnu platnu mrežu. Drugo, ova mreža, a samim tim i Bitkoin, svoju tržišnu vrednost stekla je isključivo kroz testiranje u realnom vremenu u tržišnom okruženju.

Drugim rečima, ako zanemarimo impresivne tehničke karakteristike, Bitkoin je prešao put baš kao i svaka druga valuta, od soli do zlata. Ljudi su smatrali da je platni sistem koristan, a vezana računovodstvena jedinica je bila prenosiva, deljiva, zamenljiva, trajna i retka.

Novac je rođen. Ovaj novac poseduje sve istorijski najbolje osobine novca, ali uključuje i bestežinsku i besprostornu platnu mrežu koja omogućava celom svetu da trguje bez potrebe za trećim stranama.

Ali primetite nešto što je izuzetno važno. Kod blokčejna se ne radi samo o novcu. Radi se o bilo kakvom prenosu informacija koji zahteva sigurnost, potvrđivanje i punu garanciju autentičnosti. Ovo se odnosi na ugovore i transakcije svih vrsta, sve obavljene direktno između stranaka (peer-to-peer). Zamislite svet bez trećih strana, uključujući i najopasniju treću stranu ikada stvorenu od strane čoveka: samu Državu. Zamislite tu budućnost i počećete da shvatate implikacije naše budućnosti u svojoj potpunosti.

Mises bi bio zapanjen i iznenađen Bitkoinom. Ali možda bi osećao i ponos što je njegova monetarna teorija, stara više od 100 godina, potvrđena i dobila novi život u 21. veku.

-

@ 3c7dc2c5:805642a8

2025-06-16 12:15:35

@ 3c7dc2c5:805642a8

2025-06-16 12:15:35🧠Quote(s) of the week:

"Bitcoin trades 168 hours a week. Every other asset trades 35 hours at best (and less on holidays). This is the most magical, transparent, and hard-working [asset] in history. I’m in awe watching Bitcoin trade at 9:30 pm on a Saturday. You could liquidate $100 million worth, any hour of any day, and maybe take a 3% haircut. This is extremely high-bandwidth price discovery." —Michael Saylor https://i.ibb.co/LXCm3Kp8/Gshl-Ixas-Awezk3.png

🧡Bitcoin news🧡

13 years ago the block subsidy was 50 BTC. 13 years from now it will be 0.39 BTC.

On the 2nd of June:

➡️Hong Kong’s Reitar Logitech files to acquire $1.5B in Bitcoin, becoming the latest firm to join the Bitcoin treasury trend. The logistics and real estate company says the move strengthens its financial foundation as it scales its global tech platform.

➡️Bitcoin's global hashrate has reached a new all-time high, with data from Hashrate Index showing a 7-day simple moving average peak of 943 EH/s. https://i.ibb.co/3yR2ZZ0w/Gsahm-VXMAA1m-Ol.png

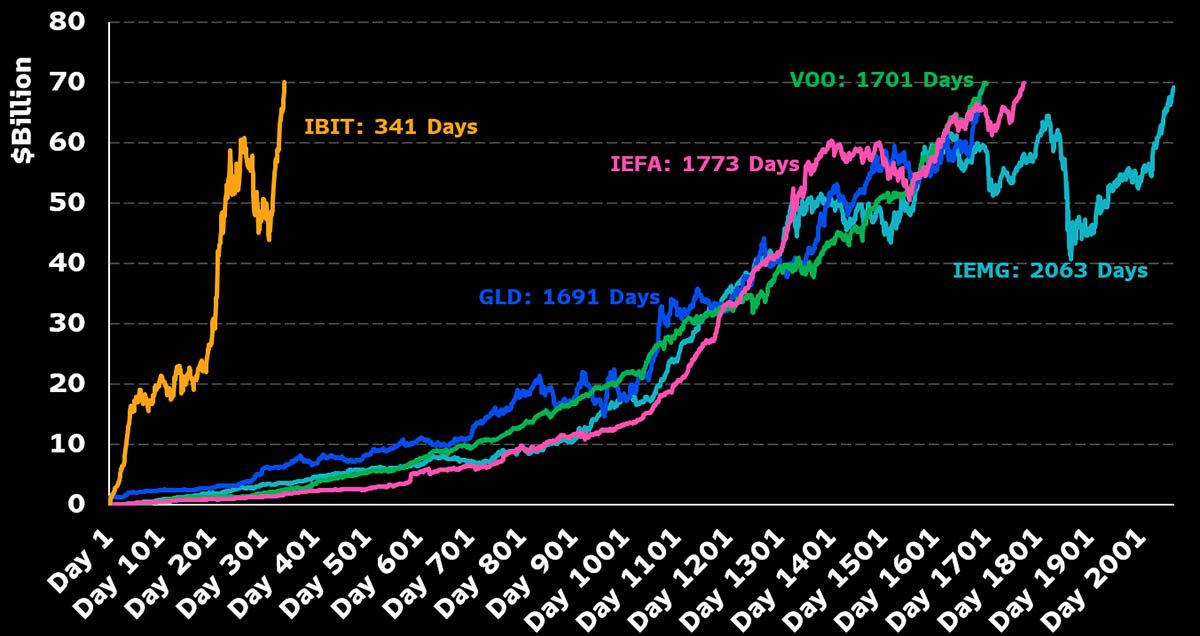

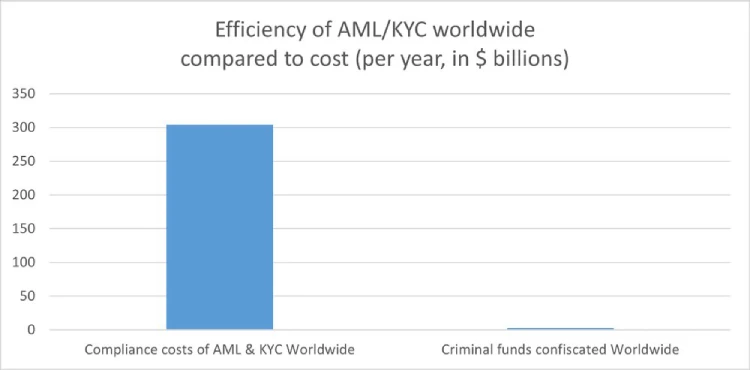

➡️(K)now (Y)our (C)ustomer is nothing but Stealth Mass Surveillance. What 95% of regulations cost versus return in one picture? https://i.ibb.co/Q3CLzF7j/Gsb20g-Pb-IAABy4-L.jpg

➡️Norwegian Block Exchange becomes the first publicly traded Bitcoin treasury company in Norway.' - Simply Bitcoin

➡️Poland just elected pro-Bitcoin Presidential candidate Karol Nawrocki. “Poland should be a birthplace of innovation rather than regulation.”

➡️NYC Mayor Eric Adams: “You all mocked me, ‘You’re taking your first 3 paychecks in #Bitcoin, what’s wrong with you?’ Now you wish you would have done.”

➡️Strategy plans to launch an IPO for 2.5M shares of its 10% Series A 'Stride' Preferred Stock (STRD), with proceeds going toward general corporate use and Bitcoin acquisition. Dividends are non-cumulative and paid only if declared.

Bit Paine: 'Remember: the entire fiat system is just various forms and layers of debt with different issuers all backed by an “asset,” (itself just a base layer of sovereign debt) that can and will be printed into oblivion. MSTR is just recapitulating this system but with a fixed supply underlying, meaning that in real terms anything it issues will benefit from the dilution of the fiat base layer and hence outperform (wildly) any fiat debt. No matter your institutional mandate, it makes no sense to hold debt whose base layer can be unilaterally demonetized when you can hold debt backed by a fixed supply underlying commodity that goes up forever.'

On the 3rd of June:

➡️Tether sends 37,229 Bitcoin worth almost $4 billion in total to Jack Maller's Twenty-One Capital

➡️El Salvador is running a full Bitcoin node!

➡️Canadian construction engineering company SolarBank adopts a Strategic Bitcoin Reserve "As the adoption of Bitcoin continues to grow, SolarBank believes that establishing a Bitcoin treasury strategy taps into a growing sector that is seeing increasing adoption."

➡️Willy Woo: "Who are the idiots who are selling when institutions and sovereigns are racing to buy billions in BTC?" This chart sheds light. The big whales >10k BTC have been selling since 2017. "They're stupid!" Most of those coins were bought between $0-$700 and held 8-16 years.' https://i.ibb.co/xKctV3Tf/Gsid236as-AAXPl-D.jpg

Selling at 20,000% profit is generally not a bad move.

➡️'South Korea just elected a pro-Bitcoin President who promised to legalize spot Bitcoin ETFs and scrap unfair regulation.' -Bitcoin Archive

➡️The average US investor owns 0.3% of their net worth in Bitcoin.

https://i.ibb.co/5WtFH9LM/Gsfoem-Tb0-AEfo-Ds.jpg

We are so damnn early.

➡️MARA mined 950 Bitcoin worth over $100 MILLION in May. They HODLed all of it.

➡️Bitcoin for Corporations: "Metaplanet just became Japan’s most traded stock — topping the charts in both value and volume:

➤ 170M shares traded

➤ ¥222B ($1.51B) value traded

This is what a Bitcoin strategy looks like in motion."

➡️'The Blockchain Group acquires 624 BTC for €60.2 million, nearly doubling their stack. They are now holding a total of 1,471 BTC with a BTC Yield of 1,097.6% YTD.' -Bitcoin News

➡️Publicly traded company K33 buys 10 Bitcoin for SEK 10 million for its balance sheet.

➡️California Assembly passes a bill to allow the state to receive payments in Bitcoin and digital currencies. It passed 68-0 and now heads to the Senate.

But hold up...

Bitcoin held on exchanges for +3 years will be transferred to the state of California under a law passed by the Assembly.

Not your keys…

➡️Adam Back invests $2.1 million into Swedish Bitcoin treasury company H100.

On the 4th of June:

➡️Daniel Batten: 'A large Bitcoin mining operation uses < 1/3 of the water of an average US family, and 0.0006% of the water a typical Gold mine uses.' https://i.ibb.co/TxNWSkHg/Gsn-VIjh-XQAEECOh.jpg

➡️And there it is: for JPMorgan, Bitcoin is now "safe collateral" JP Morgan will now offer loans backed by Bitcoin ETFs.

https://i.ibb.co/cXX0hKBK/Gsn-C5-B8-Wg-AA2e3i.png

Bent the knee. Wall Street realizes that Bitcoin is pristine collateral. Liquid 24/7/365 globally.

➡️Spanish coffee chain Vanadi Coffee to purchase $1.1 billion Bitcoin for its treasury reserve.

Disclaimer: This sounds great but it's not the whole story.

Pledditor: 'You mean a coffee shop chain founded just 4 years ago, only has 6 locations, and every year it has operated has suffered millions of dollars of net losses? They have 1975 Instagram followers. They have 149 Facebook followers. They have 48 X followers. But remember guys, you are investing in a "COFFEE GIANT"

So where does the $1.1B come from?

'The same way it came for Metaplanet (and all these other penny stocks) Get a bunch of high follower Bitcoin X accounts to hype your ticker (usually Bitcoin Magazine, Vivek, Pete Rizzo, etc), start up an "Irresponsibly Long ___" group, then dump a shitload of stock on the plebs.'

I have said it before...

Bitcoin treasury companies won't prevent another bear market; they’re the reason it’ll happen again this cycle.

➡️Public company Semler Scientific purchases an additional 185 Bitcoin for $20 million.

➡️Wicked: Imagine how rekt people would get if we went from $200k back down to $58k next bear market. The funny thing is that’d only be a 71% pullback, the smallest bear market pullback ever.

https://i.ibb.co/DfFtFZnP/Gsnr-U-3-Xo-AAJy-Kq.jpg

➡️Fidelty: An increasing number of institutions are leveraging Bitcoin as a strategic reserve asset. And as understanding of the asset deepens, interest continues to grow. See what may be driving the shift: Source: https://www.fidelitydigitalassets.com/research-and-insights/adding-bitcoin-corporate-treasury?ccsource=owned_social_btc_corp_treasury_june_x

➡️Solo Bitcoin miner solves block 899,826, earning 3.151 BTC ( $330K). A solo miner rented a massive amount of hashrate on @NiceHashMining and successfully mined a Bitcoin block solo on CKpool, claiming the full reward alone.

➡️Romania's national postal service, Poșta Română, launches a pilot program by installing its first Bitcoin ATM at a Tulcea branch, partnering with Bitcoin Romania (BTR Exchange), the country's leading cryptocurrency exchange.

On the 6th of June:

➡️Mononaut: 'With a weight of only 5723 units, block 899998 was the second lightest non-empty block of this halving epoch.'

➡️'UK-listed gold miner Bluebird Mining Ventures announces strategy to convert gold mining income into Bitcoin. A gold mining company will become the first UK-listed company to implement a Strategic Bitcoin Treasury' - Bitcoin News

➡️Phoenix Wallet: Phoenix 2.6.1 now supports NFC for sending and receiving. Works on Android and iOS. (NFC received on iOS is only due to Apple restrictions)

➡️Man from Germany fails to declare 24 words when crossing the border – nothing happens.

https://i.ibb.co/21W5qVks/Gswdghd-Xw-AA7-SH6.png

➡️Know Labs, Inc. to become a Bitcoin Treasury Strategy company starting with 1,000 BTC. Funny isn't it? Even former Ripple executive, Greg Kidd, is choosing to fill their company treasuries with bitcoin—not XRP.

➡️Bitcoin Successfully Mines the 900,000th Block! https://x.com/i/status/1930973314475815120

➡️Trump Media's latest S-3 filing officially adopts a Bitcoin treasury strategy. - Registers up to $12B in new securities to buy BTC - Adds to $2.44B already raised - Mentions “Bitcoin” 362 times (vs. once in prior S-3)

➡️Bitcoin News: Metaplanet just issued ¥855B ($5.4B) in moving-strike warrants to buy more Bitcoin, Japan’s largest equity issuance of its kind ever. It’s the first above-market pricing in Japan's history, defying the usual 8–10% discount.

➡️ Uber CEO tells Bloomberg Bitcoin is a proven store of value and that it is exploring crypto payments.

➡️Agricultural commodity trading company Davis Commodities will buy $4.5 million Bitcoin for their reserves, calling it "digital gold.

➡️Fidelity: As digital assets evolve, bitcoin’s potential as a store of value sets it apart from other cryptocurrencies. “Coin Report: Bitcoin” outlines why the asset’s design, scarcity, and decentralized nature help make it distinct—and where its future opportunities may lie. Read now: https://www.fidelitydigitalassets.com/research-and-insights/coin-report-bitcoin-btc?ccsource=owned_social_btc_report_june_x

➡️Japanese public company Remixpoint announces it bought 44.8 #Bitcoin worth $4.7 million

On the 8th of June:

➡️Wicked: Bitcoin has been running for 6,000 days and it’s already spent 60 of them, 1% of its life, closing above $100k. https://i.ibb.co/kVyrjR7v/Gs4uy-MIW8-AAOl-A.jpg

On the 9th of June:

➡️Australia’s ABC News reports on how Bitcoin adoption is bringing financial freedom and greater safety to Kibera, one of Africa’s largest slums in Kenya.

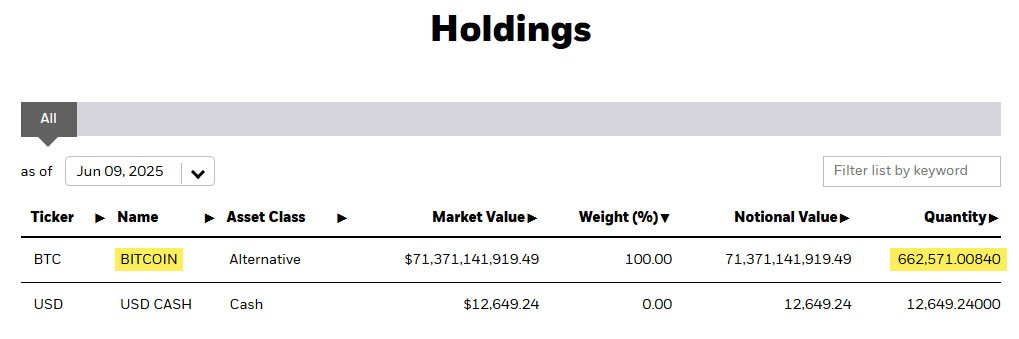

➡️ IBIT just blew through $70b and is now the fastest ETF to ever hit that mark in only 341 days, which is 5x faster than the old record held by GLD of 1,691 days. https://i.ibb.co/DfKbwhjG/Gt-Ar6-Eq-X0-AAzrl5.png

Credit chart JackiWang17 on X

➡️Japanese fashion brand ANAP plans to buy and hold over 1,000 Bitcoin by August 2025.

➡️South Korean President to introduce legislation this week to allow big banks to adopt Bitcoin.

➡️Wicked: Bitcoin's now 3x larger than the top 9 shitcoins combined. https://i.ibb.co/LDQKsGHM/Gt-AJy-D6-X0-AA7-PIY.jpg

💸Traditional Finance / Macro:

On the 3rd of May:

👉🏽'Hedge funds are still not buying the Magnificent 7: Hedge funds’ long/short ratio on Magnificent 7 stocks is now at its lowest level in 5 years, per Goldman Sachs. This is even lower than at the 2022 bear market bottom. Furthermore, their exposure to Magnificent 7 stocks is now down -50% over the last year. Meanwhile, hedge funds have bought US information technology stocks for 3 consecutive weeks. This occurred after the sector had been net sold in 10 of the previous 12 weeks. Retail has led the recent rebound.' -TKL

On the 6th of June:

👉🏽If you net out the Mag 7 from the S&P 500, the remaining 493 stocks have barely gone anywhere in over a decade (comparatively speaking). Chart: Goldman Sachs https://i.ibb.co/s9LmVBL8/Gsx53k6-W8-AAM2xr.jpg

🏦Banks:

On the 21st of May: 👉🏽No News

🌎Macro/Geopolitics:

'The reality is that the US soft defaults on its debt every day through structural inflation (the perpetual debasement of the US dollar). In other words, the Treasury pays you back dollars that are worth far less than what you lent to them. A soft default.' This is also valid for Europe.

On top of that, the richest man in the world is publicly arguing with the president of the United States about America’s solvency. Consider buying bitcoin.

So far regarding Trump: - didn't audit the Gold - didn't stop the wars - didn't reduce the deficit/debt/budget - didn't form a Bitcoin reserve - didn't release the Epstein files

Anyway, consider buying Bitcoin.

On the 2nd of June:

👉🏽'The Bank of Japan just racked up a record ¥28.6 trillion in bond losses That’s three times bigger than last year! This isn’t just Japan’s problem. It’s a screaming red alert for global markets.' - StockMarket News

TKL: " Japanese equity funds posted a record $11.8 billion in net outflows last week. This brought the 4-week moving average of outflows to $4.0 billion, an all-time high. Investors’ concerns over rapidly rising long-dated Japanese government bond yields were behind the outflows. Additionally, investors withdrew $5.1 billion from US stock funds. All while global equity funds saw $9.5 billion in net outflows, the most this year. Investors are taking profits after a sharp market recovery."

👉🏽The money printer is back on. US M2 just hit a new all-time high at $21.86T. Liquidity is flowing back into the system.

https://i.ibb.co/fGdx5kmt/Gsd-Jn-R9-XUAAUAO2.jpg

Recession odds have just dropped by 70% to 30% That’s the steepest decline in 65 years without a recession actually happening. Forget everything about a recession when M2 is moving up. Simple as that.

👉🏽$698 billion worth of homes are for sale in the United States, a new all-time high. Rajat Soni: 'The price of a house should be 0.01 BTC right now The housing market is way overpriced in terms of Bitcoin Interest rates or real estate prices will have to fall for these these homes actually to be sold.'

👉🏽The US Dollar is worth 8.9% less than it was at the beginning of the year.

👉🏽Argentina's economy grew 8% year-over-year in April 2025, the highest in the Western world!

On the 3rd of June:

👉🏽Trump's "Big Beautiful Bill" bans all 50 states from regulating AI for 10 years, centralizes control at the federal level, and integrates AI systems into key federal agencies. https://i.ibb.co/Q7t14q7M/Gse-V2f-YWUAAyb-Py.png

👉🏽 ZeroHedge: 'Total US debt is now $37.5 trillion (accrued). The $36.2 trillion actual is just the ceiling set by the debt limit which will be revised to $40 trillion in August/September.'

👉🏽A million seconds ago was May 23rd

A billion seconds ago was 1993

A trillion seconds ago was 30,000 B.C.

The US national debt is now rising by $1 Trillion every 180 days.

👉🏽NATO pushes European members to increase ground-based air defense systems five-fold — Bloomberg

👉🏽Global Markets Investor: 'This is incredible how European markets have outperformed the US this year. Poland, the Czech Republic, and Austria have grown their market capitalization by 44%, 36%, and 33%, respectively. Next are Hungary, Spain, Luxembourg, Greece, and Germany. The US has been flat.'

https://i.ibb.co/TMwrLnB0/Gsiu-KWYXEAAto-U1.jpg

This is one of the WORST years for the US stock market in history: The S&P 500 has UNDERperformed World stocks excluding the US by 12 percentage points year-to-date, the most in 32 YEARS. This is even worse than during the Great Financial Crisis.

👉🏽Bravos Research: 'M2 money supply is now expanding at 4.4% After reaching its deepest contraction in 65 years This is quite constructive for the stock market.' https://i.ibb.co/hFCRgFhr/Gsht-Kgk-Xw-AAy-PFq.jpg

On the 4th of June:

👉🏽“The $1.06 trillion unrealized loss in 2024 was ‘modestly higher’ than the $948.4 billion paper loss seen in 2023.” https://i.ibb.co/Pvm7zVWy/Gsj-9-OWs-AAvwp-F.jpg

Probably nothing. What’s a trillion between friends…

Currently, the US is spending $1,200 trillion per year on interest payments (dark line). If everything were financed at the current interest rate, the cost would exceed $1,500 trillion per year (green). https://i.ibb.co/mCpYtwVW/Gsm-H6-Mr-Xc-AAqd-F5.png

Note: The national debt is $36,9 trillion.

👉🏽Global debt is gigantic: Debt-to-GDP is above 100% in 6 of 7 G7 nations, and is still rising. Japan: ~250% Italy, the US, France, the UK, and Canada: all near or above 100%.

For 5 of 7 G7 economies, debt is set to surge further by 2030. Now debt is a problem but the main question would be...what will the productivity be in 2030?

On the 5th of June:

👉🏽 The United States Treasury just bought back $10 Billion of its own debt, the largest Treasury buyback in history.

Buying back your own debt with printed money. That's what happens just before fiat money goes to die (eventually). Eventually, nobody wants that worthless debt anymore, eventually!

Context by EndGame Macro:

💰 $10 Billion Buyback: The Treasury’s Silent Signal

On June 3, 2025, the U.S. Treasury quietly executed the largest debt buyback in American history, repurchasing $10 billion in short- and medium-term bonds. At first glance, it looked routine. But under the surface, this was a stealth intervention aimed at calming a system under increasing strain. This wasn’t just liquidity smoothing. It was strategic triage.

🧾 What Happened

Buyback Size: $10B (a record)

Debt Offered: $22.87B — more than double what was accepted

Target Maturities: July 2025 to May 2027

Issues Accepted: 22 of 40 eligible

Settlement: June 4, 2025

That huge offer volume isn’t just noise—it’s a warning sign that institutional players are under pressure.

🚨 What the Buyback Really Signaled

- A Quiet Circuit Breaker The buyback focused on maturities clustered around a $9 trillion rollover wall over the next 12 months. Without announcing it, the Treasury effectively tripped a circuit breaker to reduce near-term funding stress.

- QE Without the Label This wasn’t the Fed. No balance sheet expansion. But by retiring debt ahead of maturity and shrinking market float, the effect mirrored QE—without the political baggage.

- Institutions Are Feeling the Squeeze A staggering $22.87 billion in offers points to constraints at banks, funds, or foreign reserve desks. The Treasury didn’t save everyone—just enough to relieve pressure quietly.

🎯 Strategic Motivation

This wasn’t about boosting confidence. It was about managing two threats: Maturity Wall Risk: Avoiding auction failures as short-term debt piles up in 2025–2026. Yield Curve Stability: Preventing disorderly spikes by quietly absorbing supply. This move avoided triggering headlines—while containing the fire under the hood.

🧠 Echoes from History

This buyback fits into a lineage of quiet but powerful interventions: Operation Twist (1961) – Rebalancing maturity without QE branding. BoE Gilt Crisis (2022) – Targeted long-end intervention to save pensions. Belgium’s Shadow QE (2014) – U.S. debt absorbed off-balance-sheet during geopolitical tension. Each move relied on subtlety and intent—not optics.

🧩 What the Market Heard

Primary Dealers: Help exists—but it’s selective and discretionary.

Foreign Holders: Exit in order—or risk exclusion.

Money Markets: Relief, not resolution.

❗ Where the Logic Cracks

If this was routine: Why buy back below par? Why accept only 44% of the offered debt? Why deploy this now and not earlier? Each of these points to deeper stress than officials are openly admitting.

🔒 High-Conviction Takeaway

This buyback was a preemptive stabilization maneuver, not a stimulus. With over $9 trillion in short-term debt set to roll, foreign participation weakening, and institutional selling pressure rising, the Treasury acted before fractures became visible. The line wasn’t drawn to show strength. It was drawn behind the market—to stop a collapse.

🕵️♂️ Known Unknowns

Who were the biggest sellers—and what’s pressuring them? Was this coordinated with the Fed or global reserve desks? Is this a one-off event—or the start of a multi-phase liquidity campaign? The silence is strategic—but the signal is loud.

👉🏽Joe Consorti: 'Congress refuses to cut spending. So we must "grow our way out" of the deficit. That would take 39 years of 5% nominal GDP growth, or 22 years at 10%. In other words, 2-4 decades of explosive growth just to break even. We can't "grow our way out". We'll print our way out.'

👉🏽ZeroHedge: And just like that, the "climate crisis" is gone https://i.ibb.co/GQ76Z79P/Gsr3uus-XEAAjuv6.png

Don't get me wrong and with all respect to my environmentalist friends, but the “Crisis” never existed. A big part of the push has been marketing dollars/euros and media spin, let's face it.

Why do I think that? How do you think we will grow out of the Global Debt problem? One word: PRODUCTIVITY.

How can we manage that? They (Governments/Central Banks) need AI data farms. What do data farms need?

Electricity, water, energy.

Because Big Tech and AI need energy -- wherever they can find it -- climate change as a cause is finished. It was all virtue signaling. And remember the climate didn’t cool, it just stopped polling well. The scariest part of the “climate crisis” becoming out-of-vogue with the left is that it'll likely be replaced by something equally absurd and artificially manufactured.

On the 6th of June

👉🏽 'The US economy adds 139,000 jobs in May, above expectations of 126,000. The unemployment rate was 4.2%, in line with expectations of 4.2%. The April jobs number was revised down from 177,000 to 147,000. The headline numbers continue to exceed expectations.' - TKL

Surprise, surprise…

March jobs revised: 185K 120K (-65k)

April jobs revised: 177K 147K (-30k)

13 of the L16 have been revised lower.

Just to make it even worse, this is something I have shared multiple times in 2024. The number of year-over-year private job gains in 2024 was likely overstated by a MASSIVE 907,000 jobs, according to BLS data released Wednesday. This comes as the Quarterly Census of Employment and Wages (QCEW) data covering 97% of employers showed a private payroll growth rate of 0.6% for December 2024. This is 50% lower than the 1.2% growth rate initially reported in the monthly non-farm payroll (NFP) reports. To put this differently, there was a 907,000 gap between NFP data and QCEW data in 2024. This means jobs were likely overstated by an average of 75,583 PER MONTH in 2024.

👉🏽Opinion: Milei reduced government spending by 30% and achieved a surplus in only 1 month. His popularity didn't fall, it rose. Don't tell me fiscal discipline isn't popular with the general public. It's just unpopular to the powerful special interests that control DC or Brussels.

👉🏽'In the current fiscal year, the U.S. government already spent $4,159 billion. This is for the first 7 months and the fiscal year ends in September. The latest available data is as of April. The already accrued deficit amounts to over $1 trillion: $1,049 billion.

You can see in the chart how net interest expense has become the #2 largest spending category at $579 billion (for 7 months) after social security ($907 billion) and even exceeded national defense ($536 billion), health ($555 billion), and Medicare ($550 billion). The deficit is 34% of total receipts! (1049/3110) In other words: the U.S. government spent 34% more than it took in.

The last full fiscal year ended in September 2024. In that fiscal year, we spent $1.13 trillion on interest expenses. After only the first 7 months of fiscal year 2025 ending in September, they are already at $776 billion. This means we'll likely touch $1.3 trillion this fiscal year!' - AJ https://i.ibb.co/RTLTZPn1/Gsxv-Tso-Xc-AAZs-Zo.jpg

On the 7th of June:

👉🏽 The EU Commission paid climate "NGOs" for questionable lobbying with money from German taxpayers and wanted to keep it secret. https://i.ibb.co/zH6J41Zq/Gsz-Lu-F9-Xg-AAZttn.jpg Now read the above statement again and after that read the following bit:

👉🏽EU TRIES TO LECTURE EL SALVADOR - BUKELE BODYSLAMS BACK Source: https://www.eeas.europa.eu/eeas/el-salvador-statement-spokesperson-foreign-agents-law-and-recent-developments_en

The Diplomatic Service of the European: "El Salvador: The EU regrets the adoption of the Foreign Agents Law, which risks restricting civil society and runs counter to international obligations. Recent arrests of human rights defenders raise further concerns."

The EU’s sanctimonious finger-wagging at El Salvador reeks of hypocrisy. Brussels lectures sovereign nations on “civil society” while funneling billions into globalist NGOs that undermine national sovereignty. The institution that attacks liberty, freedom, democracy, and free speech in the name of a neosocialist woke ideology wants to lecture other countries on how they defend against their constant meddling and aggression. They are a bunch of unelected bureaucrats, accountable to no one, representing no one. Classic!

Supporting this further, let’s have a look how the EU is increasingly positioning itself as a technocratic regulator of personal freedom:

'The EU – the one that:

•wants to monitor every Bitcoin transaction through MiCA & DAC-8 •would love to ban non-custodial wallets

•is planning a chat control law that would make even China blush

•is considering a wealth register to digitally track every cent of your retirement savings

•restricts cash withdrawals in some member states •is testing CBDCs with expiration dates and spending limits

•and is preparing the digital euro as a full-blown control tool

…this EU is now complaining about human rights violations in El Salvador – a country whose government enjoys one of the highest approval ratings in the world. Over 85% support for President Bukele. Show me a single Western leader who even comes close to that.' - Bitcoin Hotel

Great reply by El Salvador's President Nayib Bukele: 'EU: El Salvador regrets that a bloc which is aging, overregulated, energy-dependent, tech-lagging, and led by unelected bureaucrats still insists on lecturing the rest of the world.'

👉🏽Sam Callahan: Alternative title: 73% of bonds in the world trading at less than the rate of debasement https://i.ibb.co/Y4qMvh0T/Gs7-Ry-WMAABf49.jpg

On the 8th of June:

👉🏽'US existing home sales dropped -3.1% year-over-year to an annualized 4.0 million in April, the lowest for any April since 2009. Month-over-month, home sales fell 0.5%, well below expectations of a +2.0% increase. The decline was driven by the West and Northeast regions. Sales in the South were flat, while in the Midwest improved slightly. Meanwhile, existing home inventory rose +21%, to 1.45 million, the most for any April since 2020, per ZeroHedge. Despite that, the median sales price increased +1.8% year-over-year to $414,000, a record for April. Homebuyer demand is weak and prices are still rising.' -TKL

On the 9th of June:

👉🏽Jeroen Blokland: '- China bought more gold in May. -China has been buying even more gold through ‘unofficial’ channels. - China's gold reserves today are low compared to those of the US and European countries -China is determined to move away from US dollar hegemony - China’s ambition to move away from the US dollar will only have strengthened because of the Trump tariff war - China has to acknowledge that few countries, companies, and households want to hold the Yuan So what will China be doing for years to come?'

No surprise central banks are avoiding sovereign debt and adding gold.

👉🏽TKL: Gold is on fire: Gold's share of global reserves reached 23% in Q2 2025, the highest level in 30 years. Over the last 6 years, the percentage has DOUBLED. At the same time, the US Dollar's share of international reserves has declined 10 percentage points, to 44%, the lowest since 1993. By comparison, the Euro's share has decreased 2 percentage points, to 16%, the lowest in 22 years. Gold is quickly replacing fiat currencies as a reserve currency.

🎁If you have made it this far, I would like to give you a little gift:

Lysander: "Lyn Alden gave one of the clearest breakdowns of why the U.S. is on an unstoppable fiscal path—and why Bitcoin matters more than ever because of it.

Lyn Alden walks through the numbers behind the federal deficit, interest expenses, Social Security, and the structural changes that happened post-2008. The short version? We’re in a new era. One where the government can’t slow down even if it wants to.

Her phrase: “Nothing stops this train.” Not because of ideology, but because of math—and human nature.

This isn’t hyperinflation doom-talk. It’s a sober look at what happens when a system built on ever-growing debt reaches its limits—and why Bitcoin, with its fixed supply and transparent rules, is the opposite of that system.

If you haven’t seen it, this is a must watch. Pure signal! https://www.youtube.com/watch?v=Giuzcd4oxIk

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ 2c564b98:5c6444b0

2025-06-16 15:04:39

@ 2c564b98:5c6444b0

2025-06-16 15:04:39My First Nostr Long-Form Post

This is a test of long-form content publishing on Nostr using the NIP-23 standard.

What is Nostr?

Nostr is a simple, open protocol that enables global, decentralized, and censorship-resistant social media.

Features of This Post

- Written in Markdown

- Tagged appropriately

- Includes metadata

- Published to multiple relays

Code Example

javascript console.log("Hello, Nostr!");Conclusion

This demonstrates how easy it is to publish long-form content to Nostr!

Published using nostr-publisher

-

@ 6a14b203:2e99b880

2025-06-16 15:04:11

@ 6a14b203:2e99b880

2025-06-16 15:04:11My First Nostr Long-Form Post

This is a test of long-form content publishing on Nostr using the NIP-23 standard.

What is Nostr?

Nostr is a simple, open protocol that enables global, decentralized, and censorship-resistant social media.

Features of This Post

- Written in Markdown

- Tagged appropriately

- Includes metadata

- Published to multiple relays

Code Example

javascript console.log("Hello, Nostr!");Conclusion

This demonstrates how easy it is to publish long-form content to Nostr!

Published using nostr-publisher

-

@ e1cde248:609c13b0

2025-06-16 15:03:12

@ e1cde248:609c13b0

2025-06-16 15:03:12ในการกล่าวสุนทรพจน์หลักในงาน Bitcoin 2025 ไมเคิล เซย์เลอร์ (Michael Saylor) นักเคลื่อนไหวชื่อดังด้านบิตคอยน์และซีอีโอของบริษัท MicroStrategy ได้บรรยายหัวข้อที่ทรงพลังชื่อว่า "21 วิธีสู่ความมั่งคั่ง" เขาได้เสนอเส้นทางเชิงกลยุทธ์สำหรับบุคคลทั่วไป ครอบครัว และธุรกิจขนาดเล็ก ในการบรรลุความมั่งคั่งทางการเงินผ่านบิตคอยน์

ต่างจากคำพูดก่อนหน้าของเขาที่มุ่งเป้าไปที่สถาบันและรัฐบาล คำพูดนี้ถูกออกแบบมาสำหรับผู้คนทั้ง 8 พันล้านคน บนโลก โดยเน้นขั้นตอนปฏิบัติที่สามารถใช้บิตคอยน์เป็นทรัพย์สินเปลี่ยนชีวิตอย่างแท้จริง ด้านล่างนี้คือการสำรวจเชิงลึกใน 21 หลักการ ของเซย์เลอร์ ซึ่งเปรียบเสมือนพิมพ์เขียวในการสร้างความมั่งคั่งในยุคดิจิทัล:

1. ความชัดเจน (Clarity): เข้าใจบิตคอยน์ในฐานะทุนที่สมบูรณ์แบบ เซย์เลอร์เริ่มต้นด้วยแนวคิดเรื่อง “ความชัดเจน” โดยเน้นว่าบิตคอยน์คือ "ทุนที่ถูกออกแบบอย่างสมบูรณ์" ซึ่งไม่สามารถถูกทำลายหรือดัดแปลงได้ ความเข้าใจนี้เป็นพื้นฐานสำคัญในการยอมรับศักยภาพของบิตคอยน์ในฐานะรากฐานของความมั่งคั่ง

2. ความเชื่อมั่น (Conviction): ศรัทธาในศักยภาพการเติบโตเหนือกว่า เซย์เลอร์ยืนยันว่าบิตคอยน์ถูกออกแบบมาให้เติบโตเร็วกว่าสินทรัพย์ทั่วไป เช่น หุ้น ทองคำ หรืออสังหาริมทรัพย์ การมีความเชื่อมั่นอย่างแท้จริงเป็นสิ่งจำเป็นต่อการให้ความสำคัญกับบิตคอยน์เหนือการลงทุนแบบดั้งเดิม

3. ความกล้า (Courage): ยอมรับความเสี่ยงทางการเงินอย่างชาญฉลาด บิตคอยน์คือการยอมรับความเสี่ยงที่คำนวณได้อย่างชาญฉลาด ไม่ใช่ความกลัวหรือการพนัน ผู้ที่ "เติมเชื้อไฟ" ให้กับระบบนี้คือผู้ที่เปลี่ยนเงินเฟียตหรือสินทรัพย์ด้อยค่ามาเป็นบิตคอยน์

4. ความร่วมมือ (Cooperation): ผนึกกำลังในครอบครัวเพื่อความแข็งแกร่ง เมื่อครอบครัวร่วมมือกัน ศักยภาพในการสร้างความมั่งคั่งจะเพิ่มทวีคูณ เซย์เลอร์เสนอให้ครอบครัวผสานความสามารถและทรัพยากร เพื่อผลักดันกันและกันสู่อนาคตที่ดีกว่า

5. ความสามารถ (Capability): เชี่ยวชาญปัญญาประดิษฐ์ ในปี 2025 AI เป็นกุญแจสำคัญในการปลดล็อกโอกาสทางการเงินระดับสูง โดยที่บุคคลทั่วไปสามารถเข้าถึงคำแนะนำจากทนาย นักบัญชี หรือผู้เชี่ยวชาญ โดยไม่เสียค่าใช้จ่าย

6. การจัดวางโครงสร้าง (Composition): สร้างนิติบุคคลเพื่อป้องกันและขยายผล การตั้งบริษัท ทรัสต์ หรือโครงสร้างทางกฎหมาย เช่น IRA หรือ 401(k) คือวิธีเพิ่มประสิทธิภาพในการลงทุนบิตคอยน์อย่างปลอดภัยและถูกกฎหมาย

7. สัญชาติทางเศรษฐกิจ (Citizenship): เลือกฐานภาษีอย่างชาญฉลาด เลือกอยู่ในพื้นที่หรือประเทศที่เป็นมิตรกับบิตคอยน์ เช่น ฟลอริดา หรือประเทศอย่างสิงคโปร์ เพื่อลดภาระภาษีและเพิ่มเสถียรภาพระยะยาว

8. ความสุภาพ (Civility): เคารพโครงสร้างอำนาจ ไม่จำเป็นต้องล้มล้างระบบเก่า เพียงแค่รู้จักเคารพอำนาจและสร้างพันธมิตรในทางที่สร้างสรรค์เพื่อเดินหน้ากับบิตคอยน์ได้

9. การใช้บริษัท (Corporation): บริษัทคือเครื่องจักรสร้างความมั่งคั่ง บริษัทสามารถใช้ประโยชน์จากระบบการเงินและภาษีได้ดีกว่าปัจเจกบุคคล จึงควรจัดตั้งนิติบุคคลเพื่อลงทุนในบิตคอยน์อย่างจริงจัง

10. โฟกัส (Focus): อย่าหลงทาง อย่าวอกแวกไปกับธุรกิจเสี่ยงสูงหรือเหรียญอื่น ๆ เพราะบิตคอยน์มีประวัติผลตอบแทนสูงอย่างสม่ำเสมอ

11. การมีส่วนร่วม (Equity): ร่วมมือกับนักลงทุน ให้ผู้อื่นร่วมลงทุนในกิจการของคุณ เช่น หมอฟันอาจขายหุ้นบางส่วนของคลินิกเพื่อนำเงินไปลงทุนในบิตคอยน์

12. เครดิต (Credit): ใช้หนี้เป็นเครื่องมือ กู้เงินดอกเบี้ยต่ำและลงทุนในบิตคอยน์ที่มีแนวโน้มเติบโตสูง เพื่อทำกำไรจากส่วนต่างระหว่างดอกเบี้ยกับผลตอบแทน

13. การปฏิบัติตามกฎ (Compliance): ทำตามกฎหมาย สร้างบริษัทที่สอดคล้องกับกฎระเบียบเพื่อขยายเงินทุนได้อย่างมั่นคงและปลอดภัย

14. การระดมทุน (Capitalization): หาเงินลงทุนอย่างต่อเนื่อง ไม่ว่าจะจากการขายหุ้น หรือรีไฟแนนซ์ทรัพย์สินส่วนตัว ทุกโอกาสคือช่องทางในการระดมทุนและลงทุนต่อในบิตคอยน์

15. การสื่อสาร (Communication): โปร่งใสและจริงใจ การเปิดเผยแผนและเป้าหมายอย่างชัดเจนจะสร้างความไว้วางใจจากนักลงทุน พนักงาน และลูกค้า

16. ความมุ่งมั่น (Commitment): อยู่กับบิตคอยน์ ไม่หลงทาง หลีกเลี่ยงเหรียญอื่น ๆ หรือโปรเจกต์ที่ไม่มั่นคง ยึดมั่นในบิตคอยน์เพื่อเสถียรภาพระยะยาว

17. การลงมือทำ (Delivery): ลงมือจริงอย่างแม่นยำ ไม่ใช่แค่คิด แต่ต้องทำอย่างมีประสิทธิภาพ สม่ำเสมอ และไม่ประมาท

18. การปรับตัว (Adaptation): พร้อมเปลี่ยนแปลงเมื่อจำเป็น ระบบใด ๆ ก็มีวันล้มเหลว การปรับตัวตามสถานการณ์คือสิ่งที่ทำให้ยืนหยัดได้ในระยะยาว

19. วิวัฒนาการ (Evolution): เติบโตจากจุดแข็ง ขยายธุรกิจจากสิ่งที่คุณเชี่ยวชาญ แทนที่จะพยายามเริ่มสิ่งใหม่จากศูนย์

20. การเผยแพร่ (Advocacy): เป็นกระบอกเสียงเพื่อเสรีภาพทางเศรษฐกิจ บอกต่อและสอนผู้อื่นให้เข้าใจบิตคอยน์ เพื่อขยายเครือข่ายแห่งความมั่งคั่ง

21. ความเอื้อเฟื้อ (Generosity): แบ่งปันความสำเร็จ การช่วยเหลือครอบครัว ชุมชน และพนักงาน ด้วยทรัพยากรที่คุณมี จะสร้างความสุขทั้งต่อตัวคุณและโลก

เซย์เลอร์จบท้ายด้วยคำของซาโตชิ นากาโมโตะว่า:

“มันอาจจะดีถ้ามี bitcoin ไว้บ้าง เผื่อว่ามันจะกลายเป็นสิ่งสำคัญในอนาคต”

หลังจาก 16 ปีแห่งการเติบโตและมูลค่าตลาดกว่า 2 ล้านล้านดอลลาร์ หลักการทั้ง 21 ข้อนี้คือพิมพ์เขียวแห่งเสรีภาพทางการเงิน ที่รวมเอาความชัดเจน ความกล้า และเครื่องมืออย่าง AI, การจัดตั้งบริษัท และเครดิต เข้าด้วยกัน เพื่อให้ทุกคนสามารถใช้บิตคอยน์สร้างอนาคตที่ดีกว่าได้

-

@ 7f6db517:a4931eda

2025-06-16 10:01:55

@ 7f6db517:a4931eda

2025-06-16 10:01:55

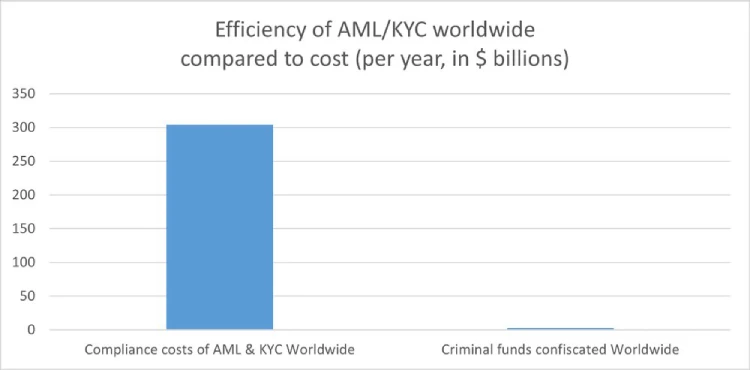

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.