-

@ 8bad92c3:ca714aa5

2025-06-16 14:02:16

@ 8bad92c3:ca714aa5

2025-06-16 14:02:16Key Takeaways

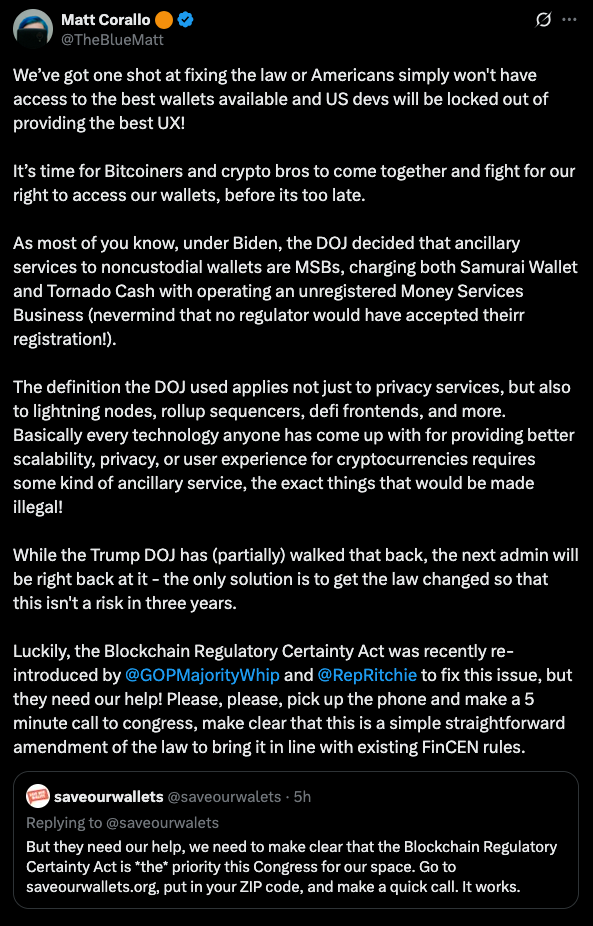

In this landmark episode of TFTC, Adam Back and Sean Bill explore Bitcoin’s path to $1 million, focusing on its growing role as pristine collateral in a faltering financial system. Back highlights Blockstream’s infrastructure efforts, from mining operations to tokenized securities, designed to support this transformation, while Bill shares how he navigated institutional skepticism to bring Bitcoin exposure to a U.S. pension fund. Together, they unpack how institutions are entering the space through structured products and Bitcoin-backed credit, with Blockstream’s mining notes offering a glimpse of this new financial architecture. Amid rising debt, inflation, and fiat fragility, the duo presents Bitcoin not just as sound money, but as a strategic reserve asset gaining traction from El Salvador to Wall Street.

Best Quotes

"It's not a stretch to say that Bitcoin could reach parity with gold. That would imply something closer to a million dollars a coin."

"Digital gold vastly understates Bitcoin’s potential, but it’s where the conversation had to start."

"We’re not just building software, we’re solving financial market gaps, one at a time."

"You can wipe out an entire pension fund’s unfunded liability with a 2% allocation to Bitcoin, if it performs as we expect."

"ETF buyers are the new hodlers. They’re not day traders; they’re five-year pocket investors."

"Bitcoin is becoming super collateral, its role in structured credit could help engineer the soft landing everyone hopes for."

"In a world of financial repression, Bitcoin is how the have-nots finally access property rights and savings."

"Emerging markets will be the early adopters of Bitcoin finance because they need it the most."

"You worked for your money. To systematically steal it through hidden inflation is perverse."

"Bitcoin could be the story that saves public pensions, and the people relying on them."

Conclusion

This episode presents a bold vision of Bitcoin as more than sound money, it’s the foundation of a new global financial system. Adam Back and Sean Bill argue that Bitcoin’s role as “super collateral” is reshaping credit, pensions, and sovereign reserves, while a robust infrastructure of financial tools quietly prepares it to absorb institutional capital. As fiat trust erodes, Bitcoin’s adoption will be driven not by hype, but by necessity, and when the shift becomes undeniable, $1 million per coin will mark the start of a new financial era.

Timestamps

00:00:00 - Intro

00:00:38 - New ATH

00:02:06 - Sean's Journey Getting Bitcoin Into Pensions

00:03:15 - Blockstream's Evolution Into Finance

00:08:30 - Building Bitcoin Financial Infrastructure

00:14:30 - The Challenge of Conservative Pension Boards

00:17:02 - Bitkey

00:18:10 - Bitcoin's Current Price and Market Cycle

00:24:05 - Bitcoin as Super Collateral

00:27:24 - Unchained

00:30:09 - Cypherpunk Ideals vs Financial Reality

00:34:55 - Pension Fund Crisis and Bitcoin Solution

00:42:29 - The Cypherpunk Banking Stack

00:49:54 - Digital Cash and Free Banking

00:57:06 - Liquid Network and Institutional Rails

01:07:49 - Sean At CBOT

01:22:16 - Bitcoin Futures and Market Structure

01:25:53 - 2025 Bitcoin Price PredictionsTranscript

(00:00) I'm uh permeable, so I'm always astounded that it's not, you know, 10 or 100 times higher. If everybody saw it, the addressable mark, I mean, it would already be 100 200 trillion asset class, right? That's not a stretch to say that Bitcoin could reach parody with gold. That would imply something closer to a million dollars a coin.

(00:18) You see some established public market companies in different countries saying, "Oh, we're going to buy a billion of Bitcoin. We're going to raise and buy 500." Black Rockck ETF. They're even talking about recommended allocations to portfolio managers in the 2% range. Obviously, digital gold would vastly understate the potential of Bitcoin.

(00:38) Gentlemen, thank you for joining me. Of course. Thanks for having us on. Uh Adam, I was just saying I'm woefully embarrassed. This podcast is almost 8 years old and this is your first time on the show. Oh, okay. This is uh but it's an exciting time. Yeah. And you uh really dedicated to podcast. It's been a lot of years, a lot of episodes, right? It has been. Cool.

(00:59) I think we're approaching 700, which is crazy to think. Wow, that is impressive. The uh No, we're talking hit a new alltime high today. Yeah, Bitcoin doing Bitcoin things just as we were on stage uh at the talking hedge kind of asset manager conference uh trying to explain to them why they should put Bitcoin in their uh fund allocations.

(01:23) Yeah, we were discussing it before we hit record and I saw Tur's tweet looked like Tur was at the event, too. Yeah, he was. M so 50% held up they have Bitcoin in their personal account but only 2% or 4% of the funds very few that actually had allocated to Bitcoin. So a lot of them are believers at a personal level but they haven't been able to sell it within their institution you know so they own it themselves uh but they haven't quite gotten the boards to agree yet.

(01:53) So which was a similar situation I was in in 2019 when I first proposed it. You know, I had my experience with Bitcoin. I had a very good experience and was trying to convince uh the pensions in California that they should be looking at adding Bitcoin to the portfolio. Yeah. And it was great to hear some of your background last night, Sean.

(02:11) So, Sean, for those of you watching, uh is the CIO at Blockstream now. Yeah. I am really excited to have both of you here because I've got into Bitcoin in 2013 and nerded out uh on the tech side of Bitcoin distributed system mining full nodes the layered stack that's been built out and so I followed probably all the work that you guys have done at Blockstream since you've been around and it's been really cool to see everything you've done from the Blockstream satellite.

(02:42) I've broadcast some transactions through that before. It's a Jade um uh CLN or excuse me, Core Lightning now. Um the uh liquid and now over the last few years really sort of leaning into the financialization of finance as I like to um to reference it. And so Adam, like how's that transition from being hypert focused towards a more financial perspective on Bitcoin been? Well, actually in our 2014 uh kickoff meeting, you know, with the founders sitting around big whiteboard, we were trying to forward cast what we'd have to do to get

(03:28) a Bitcoin layer 2 for, you know, settlement of assets and Bitcoin working. And one of the risk you know so we thought we'll build the tech and other people issue the assets but like well they might be lazy they might not do it if that happens we'll have to do it ourselves. So there was a lot of situations like that actually where you know you would think there would be lots of people building applications but many people are really just more in business development and a technology is basically a website and a database and

(03:55) you know Bitcoin core wallet on a server or something like that right so we actually ended up building a lot of middleware and getting into asset management a couple earlier steps one was the mining note so we're doing hosting and mining in our own account and what we did when when it was public that we were hosting initially Fidelity was the uh launch customer.

(04:16) They kept coming back to us and saying, "No, we need we need some hosting." And you know, uh, they'd looked around and decided that we were the best. We were we were like, "No, no, we're prop mining. We don't do hosting." But they persuaded us to host them. And then we're like, "Okay, maybe we should expand and host for other people.

(04:31) " And then that became news. And so then a lot of Bitcoiners contacted us and says, you know, I've got like a dozen miners. Can you host them for me? And of course, if you're if you're hosting for thousands of customers, that's a whole you need need a support team. Somebody has got two miners and one of them's crashed or failed, they're very upset, right? It's half the revenue.

(04:52) Whereas somebody's got, you know, 10,000 per client, it's just part of the, you know, maintenance cycle like a big data center. Discs fail 1% a year, you replace them when they die, they raid, it doesn't matter, right? So, it's kind of that phenomena. So we try to figure out well how can we help you know how can we help people do this without creating a you know that painoint and so we designed this mining note concept where it's kind of socialized so that collectively they look like one of the enterprise customers and then we put a 10% buffer in it so that we would eat

(05:22) the first 10% of equipment failure so they wouldn't get you know the drooping hash rate as miners like failed due to age uh for the for the onset And we also figured out how to try and make them a unified market. So, you know, we're selling more tranches into the market. This started in 2021, a three-year product.

(05:45) And um you know, there was some people on the launch branch and then some people 3 months later. So, what we do is look at how many Bitcoin it had mined in the first three months. We buy that and then match it with a 33month contract for the next one. And so the economically equivalent neither dilutive or anti-dilutive for the buyer and therefore they could trade in a unified market even though there were eight sales tranches over the first I don't know like 12 months or something like that and that that market you know it was using initially using uh liquid

(06:17) security tokens uh with uh stalker a European company that does the securitization I mean the legal p -

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15

@ 8bad92c3:ca714aa5

2025-06-16 14:02:15Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ 8bad92c3:ca714aa5

2025-06-16 14:02:14

@ 8bad92c3:ca714aa5

2025-06-16 14:02:14Key Takeaways

Leon Wankum, a real estate expert turned Bitcoiner, presents a powerful argument that Bitcoin is emerging as the new “hurdle rate,” outpacing real estate as the preferred store of value in a shifting financial landscape. As the 18-year property cycle nears its end amid high interest rates and imbalanced markets, Bitcoin’s scarcity, performance, and optionality are prompting capital allocators to rethink traditional strategies. Institutions are beginning to reallocate cash flows and refinance properties into Bitcoin treasuries, while new yield-bearing Bitcoin instruments like Strike, Strife, and Stride offer compelling alternatives to bonds and property. Wankum envisions a gradual transition to a Bitcoin standard, facilitated by dual collateralization and designed to avoid economic disruption as Bitcoin steadily replaces legacy financial infrastructure.

Best Quotes

"Bitcoin is starting to become the new hurdle rate that all other financial products have to abide to."

“No asset—not even prime real estate—can compete with Bitcoin’s long-term performance and absolute scarcity.”

"You can refinance a property and allocate to Bitcoin without selling—this is how many are making the transition."

"Strategy (MicroStrategy) has enough Bitcoin to cover preferred stock dividends for over 200 years."

"20% of our property cash flow into Bitcoin outperformed the 80% left in fiat."

“Bitcoin is digital real estate—but better. Scarce, global, and doesn’t need maintenance or tax sheltering gimmicks.”

“If it’s just 1% of the real estate market, that’s $3 trillion. And that’s enough.”

"A smooth transition, not collapse, is the optimal path forward."

Conclusion

This episode explores how Bitcoin is overtaking real estate as the global store of value, with Leon Wankum offering a rational, experience-based framework for understanding this shift. While institutional inertia slows adoption, capital flows are beginning to reflect Bitcoin’s growing dominance, as new financial instruments and treasury strategies emerge. Leon advocates for a thoughtful, evolutionary transition to a Bitcoin standard—one that prioritizes stability, practical integration, and long-term value creation across the global economy.

Timestamps

0:00 - Intro

0:50 - Real Estate

12:36 - Bitcoin for real estate investors

17:44 - Bitkey

18:39 - MSTR products and opportunity cost

30:43 - Unchained

31:13 - Cash flow alternatives

37:40 - Strategy risks

44:41 - Smooth or chaotic transition

50:58 - Is this cycle different?

56:42 - Tradfi degeneracy

1:02:00 - Leon’s Book - Digital Real EstateTranscript

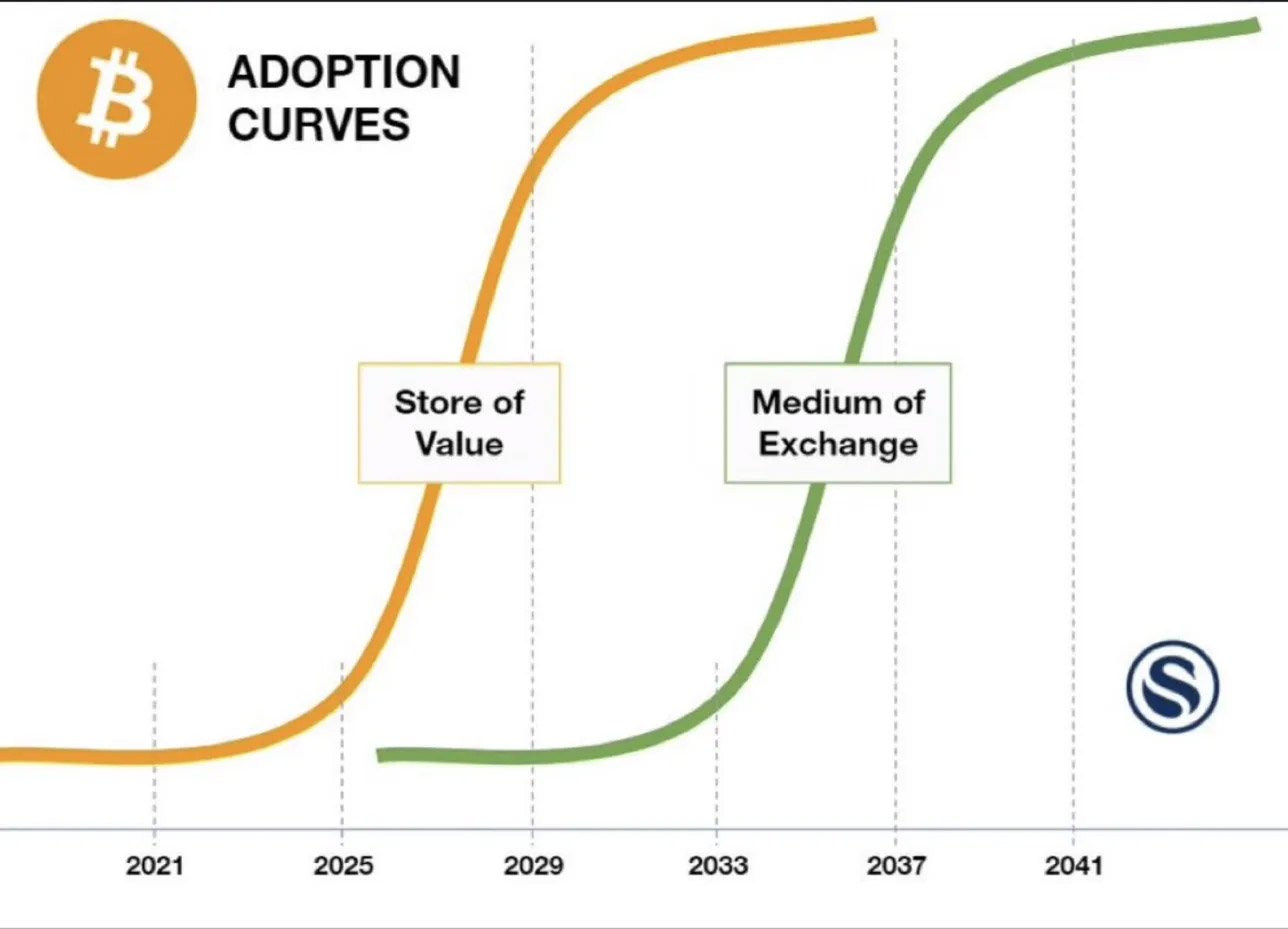

(00:00) Other than real estate, there were little investments that performed better. Few were aware of the existence of Bitcoin. As people become more aware, they will likely also sell off their properties. Bitcoin as a near-perfect form of money is starting to become the new hurdle rate that all other financial products have to abide to.

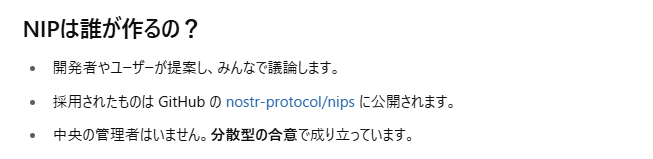

(00:19) Instead of buying a regular bond issued by a nation state, you can actually buy a fixed income product issued by Strategy. This is a product that could potentially tap into the real estate market. If it's just 1%, that's 3 trillion. And that's enough. They are starting to weigh the opportunity cost of not putting money into Bitcoin.

(00:36) But very few are able to comprehend the necessity of quickly investing large part of the capital into Bitcoin. Every 18 years will have a correction on housing. We're bringing in a housing expert to talk about the real estate market and Bitcoin corporate adoption. in the crazy frenzy that's going on right now in public markets.

(01:04) Leon, welcome back to the show. Thanks for having me back. It was great seeing you even though it was briefly in Vegas last week. I caught you literally as I was running to the airport off the stage. Yeah. And uh look, I'm pull that back up because I think this is a good jumping off point. We'll start with like a personal story.

(01:24) I'm currently in the middle of a move right now, but decided to rent a house because I was looking at the prices for housing in the places I'm looking to buy and they were they were too high. Not only were they too high, we put a bid in on one house and it wound up going a million dollars over asking.

(01:44) And I think over here in the United States, this is a big topic of discussion right now, which is the real estate market feels a little toppy. Prices are still very high, very sticky. Rates are still very high. Uh, and that's one thing I'm trying to discern as somebody who would like to buy a house in the next few years, a forever house for my family, what is going on.

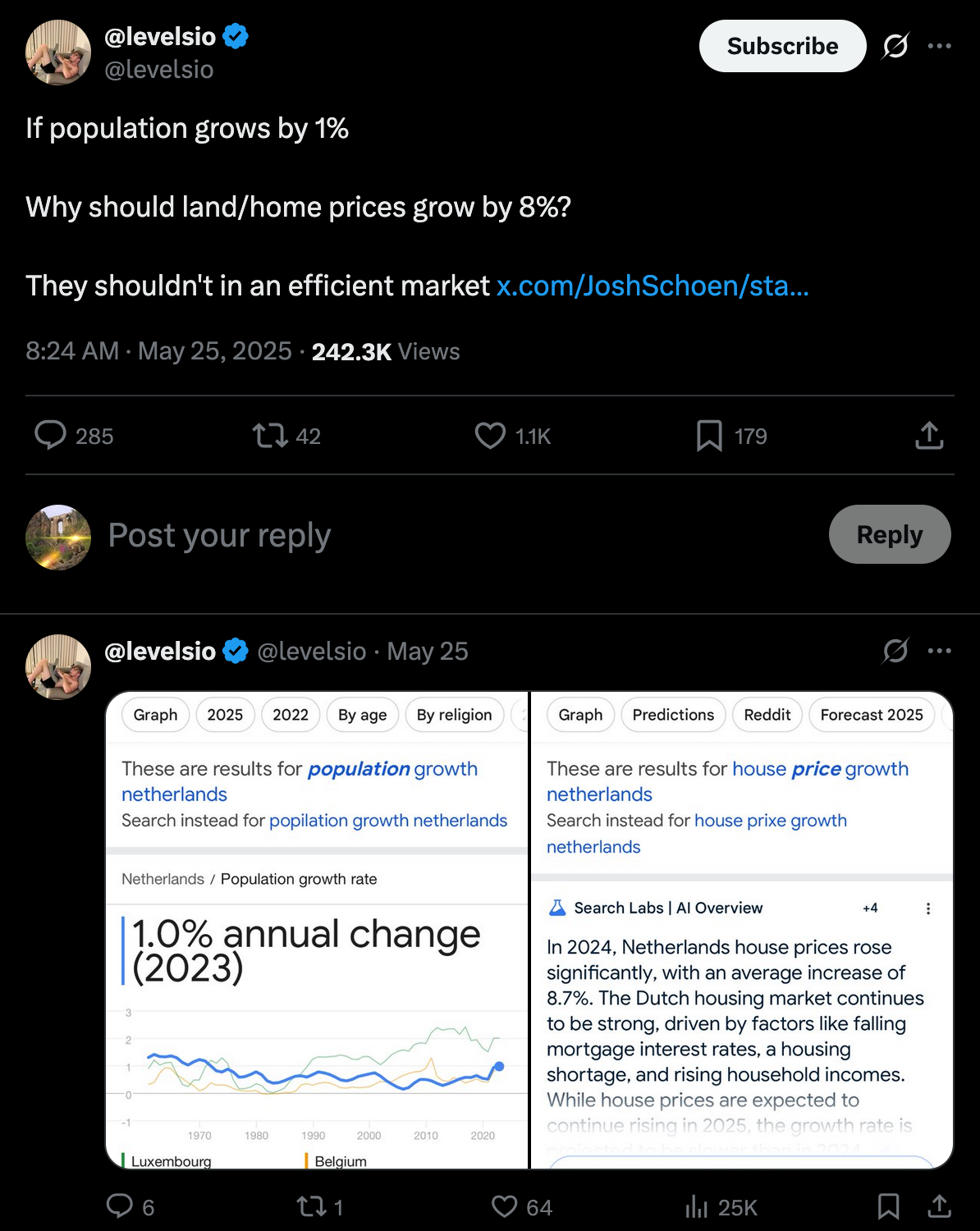

(02:08) And as we can see here, Red Red Fin reported earlier this week that 34% there are 34% more sellers in the market than buyers. At no other point in records dating back to 2013 have sellers outnumbered buyers this much. There are a total of $698 billion worth of homes for sale in the US, up 20.

(02:29) 3% from a year ago in the highest dollar amount ever. So, it seems like there's a ton of people who have rode the real estate market and they're being a bit stingy on pricing and we're waiting for a correction. Is that your take on this? Yeah, we definitely need to wait for price equilibrium to build because since 2008 really since we had low interest rates um prices were skyrocketing and now with a different interest rate environment.

(02:57) Um what I personally also feel is that people are not willing to sell their houses for a price that they believe is not what they could get because they still have the prices in mind that they were able to receive 2 three years ago and the buyers are not willing to pay prices that people want because interest rates are higher meaning the cost of capital and the cost of borrowing went up.

(03:21) So I think this is a healthy um and a healthy um development. We need a price equilibrium. We need um demand and supply prices to match. It's going to take a long time. I think it's also it also depends on interest rates. If Powell is going to um lower interest rates, which I don't think he will, even though that's something that the president would like him to do, but I don't think he will because it would cause inflation to go up again, especially in in goods and services and groceries.

(03:51) And um judging by that, I think interest rates will stay above 3% at least for the foreseeable future. Meaning I believe that real estate prices will come down a little bit till we meet that equilibrium. But something that's important to to remember which makes it a little bit odd that because as a Bitcoiner when you look at housing, I think you constantly think now it's going to crash, now it's going to crash.

(04:15) But the reason it's not really going to crash is as soon as new money is being introduced into your economy or as soon as interest rates are lowered that money is being funneled into real estate and also the existing system that is depending on real estate as collateral has an interest in propping prices up.

(04:34) So this can go on for another 10 or 20 years I think. I mean there could be there's definitely a correction that we can see right now and I personally wouldn't get into uh real estate development at this point if you'll ask me from the perspective what's the better investment of course that is Bitcoin but I just want to make a point that this can go can go on for longer than we think because housing is limited not as limited as Bitcoin but there's something called the 18-year property cycle and it says that every 18 years, we'll

(05:08) have a correction in housing. And the reason for that is if the money supply is expanded and that money goes into land, it's not going out of land because land is limited. It's similar to Bitcoin. But what happens is that after around 14 15 years, prices start to come down and then they find a new price equilibrium which is higher than when the cycle started.

(05:33) And we are at the end of this 18-year property cycle. and I had suggest that prices will fall until 2026 and then in 2026 if interest rates are lowered I think prices can find price equilibrium and then possibly move up in nominal value of course if you start now accounting for real estate and bitcoin it's a whole different story I know talked from the lens of a fiat um based system yeah that note on pal and the fed is interesting that it It's very obvious Trump's wanted him to lower rates since before he even got elected.

(06:09) But I was reading an article yesterday that made a lot of sense to me, which is he's not going to lower rates for multiple reasons. One of which you mentioned, which is it would it would reignite inflation, which nobody wants to see right now. And then number two, profit margins are going up because the productivity uh increases due to AI.

(06:32) I mean, and we're still at the early stages of that, um, where you have many of the big big tech, the MAG 7 beginning to lay off people because they're creating all these efficiencies via AI. So, we're able to increase productivity and profit margins and so there's no reason to to lower rates from that perspective, which agreed.

(06:58) Yeah, absolutely true. Yeah, which is uh you know it'll be it's crazy the confluence of events that are happening right now whether it's real estate market looking a little toppy at least temporarily the interest rate environment the progression of AI and the adoption uh by many large companies and small companies alike and then you have Bitcoin sitting over here sitting over $2 trillion establishing itself as a $2 trillion asset and it still seems a bit fringe where um where we are certainly as Bitcoiners, individuals -

@ 8bad92c3:ca714aa5

2025-06-16 14:02:13

@ 8bad92c3:ca714aa5

2025-06-16 14:02:13Marty's Bent

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

[

Opportunity Cost – See Prices in Bitcoin Instantly

Convert USD prices to Bitcoin (satoshis) as you browse. Dual display, privacy-first, and open source.

Opportunity CostTFTC

](https://www.opportunitycost.app/?ref=tftc.io)

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is completely open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

@media screen and (max-width: 480px) { .mobile-padding { padding: 10px 0 !important; } .social-container { width: 100% !important; max-width: 260px !important; } .social-icon { padding: 0 !important; } .social-icon img { height: 32px !important; width: 32px !important; } .icon-cell { padding: 0 4px !important; } } .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } .moz-text-html .mj-column-per-33-333333333333336 { width: 25% !important; max-width: 25%; } /* Helps with rendering in various email clients */ body { margin: 0 !important; padding: 0 !important; -webkit-text-size-adjust: 100% !important; -ms-text-size-adjust: 100% !important; } img { -ms-interpolation-mode: bicubic; } /* Prevents Gmail from changing the text color in email threads */ .im { color: inherit !important;

-

@ 8bad92c3:ca714aa5

2025-06-16 14:02:12

@ 8bad92c3:ca714aa5

2025-06-16 14:02:12Key Takeaways

In this episode, host Marty speaks with Ken, a former CIA deputy chief and now head of government affairs at the Bitcoin Policy Institute, about Bitcoin’s growing relevance in U.S. national security and policy circles. Ken traces his Bitcoin journey from professional curiosity within the CIA, studying adversarial use cases like the Lazarus Group, to personal conviction following events like the Canadian trucker protests, which exposed the dangers of financial censorship. Contrary to popular belief, he reveals that many in the intelligence community support Bitcoin for its alignment with American values such as sovereignty and freedom. The conversation highlights a major cultural shift in Washington, where policymakers now view Bitcoin as a strategic asset rather than a criminal tool. Ken stresses that the future hinges on whether Bitcoin shapes institutions or is co-opted by them, and that political engagement is crucial to ensure the former. He argues Bitcoin can help solve systemic problems from fiscal irresponsibility to geopolitical instability, but only if the industry continues to organize, advocate, and embed its values into national policy.

Best Quotes

"Either institutions are going to win, or Bitcoin is going to win."

"Bitcoin naturally washes out leverage… it's what makes Bitcoin antifragile."

"The CIA didn’t create Bitcoin, but they sure are paying attention now."

"We were all Satoshi."

"Let’s not test the resistance-money thesis in the United States."

"Bitcoin strengthens U.S. values, freedom, private property, sovereignty."

"Bitcoin is political, but it doesn't have to be partisan."

"If you're in a federal agency, the only incentive is to spend more. Bitcoin changes that."

"Don't underestimate your voice. If you keep the phones ringing, they listen."

Conclusion

This episode offers a rare glimpse into how Bitcoin is increasingly viewed as a serious strategic asset within the U.S. intelligence and policy communities. Ken, with his high-level government background and current role in Bitcoin advocacy, underscores the shift from skepticism to engagement among policymakers. His message is clear: Bitcoiners are no longer outsiders, they have a seat at the table, and with sustained political action and education, they can shape the future of Bitcoin policy. The time to engage is now, because the battle for Bitcoin’s role in society is already in motion.

Timestamps

0:00 - Intro

0:26 - Ken's background

6:58 - Tornado/Samourai, surveillance state

11:53 - Reestablishing trust

14:23 - Bitkey

15:18 - CIA bitcoin theory

18:42 - Neutral reserve asset

23:52 - Unchained

24:20 - BPI

29:49 - CLARITY and Secret Service message

33:54 - Withstanding a change in administration

40:03 - Institutions win or bitcoin wins

46:43 - Shrinking gov with bitcoin

57:47 - BPI summitTranscript

00:00:00 compared to China or Russia, do we have a comparable advantage in gold? How do we compete with China? And this is what the kinds of things CI will think about. Bitcoin is a natural option. At the end of the day, Bitcoin undermines the authority of the Chinese Communist Party. Either institutions are going to win or Bitcoin is going to win. But we do fundamentally on some level need institutions to make the country run. We want those institutions to be properly incentivized. In 10 years, Bitcoin is

00:00:19 either at a million dollars or is zero dollars. Ken, it's great to have you on the show. Thank you for joining me. Marty, finally. We've been we've been kicking us around for a few weeks. I'm glad we uh glad we were finally able to make it work. As I was telling you, in the middle of a move, conference in the middle of that move. It's been a hectic week, so I think I'm finally settling in. As you can see, no bookshelf, but we have stacked books behind me. Hopefully, they will be on on shelves soon.

00:00:52 No, there there are definitely ways there are ways in the world to get you know to get credits on um you know uh what do you call it? Um uh we're good Catholics, you know, when you when you pass and don't go to heaven. Um come on. Thank you. Well, moving is purgatory credit. So, I've done it many times in my life. So, I uh I feel for you. Well, thank you. But I'm really excited for this conversation and likewise the event in a few weeks, the BPI event down in DC, the summit, we met about a month ago, two months ago now at

00:01:26 this point in Austin during the takeover. And Zach was very eager to introduce you to me considering the the history of the show, topics we covered. And I think I'm excited for this cuz I'm infinitely curious to learn how somebody with your pedigree and your resume got into Bitcoin is now working for the Bitcoin Policy Institute as a director of government affairs. So for anybody listening who was unaware of Ken's resume, he did 20 years in government culminating as deputy chief of operations at the CIA Center for Cyber

00:02:01 Intelligence. uh you've worked overseas for the US State Department and now you're advocating on behalf of Bitcoin on Capitol Hill. So, how does somebody with that resume go from statecraft to cipher punk sort of ideas? Yeah. No, so I um like everybody else, I uh I um my my Bitcoin journey is a little bit everybody everybody has a unique journey, right? Um mine actually started at CIA, believe it or not. And it was for purely professional reasons. I um so I was an operations officer. I spent most of my career overseas um as

00:02:37 most of us do. Um but my last two years, my last two turn tours at CIA, I was at the center for cyber intelligence, which is CIA's cyber unit. Um and my first job there, I was group ch I was a operations chief for a group that worked on cyber threat issues. And this was in 2018. So you remember this was when Lazarus group the North Koreans figured out that stealing crypto was a lot easier than like you know trying to rob banks. Um this is when ransomware broke out as a serious problem just preceded you may

00:03:04 remember the Colonial Pipeline hack that shut down you know gasoline shipments to the east coast. So in 2018 um and it's kind of funny like I this is people say did the CIA create Bitcoin. I can tell you in 2018 when policy makers first had to confront its use by actors as an issue like nobody was ready for it. Like if they created it, it was tucked away and hidden in the basement cuz the the bench for people with crypto knowledge in general, digital assets, certainly Bitcoin was really really really shallow. Um I remember we had two

00:03:33 guys um who kind of had background in it and then you they became superstars because all of a sudden we were calling upon them to teach us about Bitcoin and digital assets in general. Um, but yeah, that's so I learned and like everything else, I learned about it because I had to because people we cared people we cared about were using it. Um, but like everything else there there was sort of a mind virus to it. Um, and I I admit, you know, I during co I was in the uh I was in the altcoin casino. I was defying

00:04:00 and memecoining and it was it was fun, you know. No, I I I don't hold any hate for the uh for the alcoiners. People do what they want with their money. Um but I you know that that was when it was during co um I had been sort of buying in 2018 but during co when I really started learning because this is what everybody learned right um and I you know for me Bitcoin was immediately attracted me to it and I was sort of inspired by um I mean the co Kenny trucker protest was something really important to me um I saw how it was

00:04:29 being used um but also sort of in my day job you know I I had a pretty good understanding of how the government uses financial financial tools as a weapon. Um, freezing bank accounts, OFAC sanctions, that kind of thing. And if you're on the, you know, on the giving end of that, that's great. Those are great tools to have if you're the government. Uh, not so great if you're on the other end of it. And, you know, watching these Canadian truckers the first time, you know, you'll be able to, it's very easy

00:04:54 to say, "Yeah, sanction the Iranian, sanction North Korea, whatever." You know, I'm not Iranian. Um but when you see all of a sudden Kat and Trucker people you had some sympathy with being targets of financial you know weaposition of the financial system it you know it struck it struck a it struck a nerve like a really really profound stinging shot to my consciousness my conscious about this issue. Um so for me for the first thing about Bitcoin was um was permissionless transactions that that's that's what got me into it. Um

00:05:23 then of course you go from there and by the time I left the government 2022 I had I was f I was you know full boore I was you know attending meetups and um that's when I started doing some advocacy stuff on Capitol Hill and and and messing around with uh David and Granny PPI doing some advocacy stuff but yeah but it it comes from my time at CIA and yeah I think the um the uh I think what might surprise some people is there are a lot of Bitcoiners um not just at CIA but across the whole national

00:05:52 security establishment And I think they're into it for the same reason that you know that everybody most of your listeners are right like it's you see what's happening in the world. You see the challenges we're facing. You see how governments use financial tools to weaponize them against opposition. You know it's it's very natural that if you have that kind of insight that you look for things to protect yourself and Bitcoin is obvious. So I I I tell a funny story when I um when I was first into it there was um cubicle one of the

00:06:17 guys and he had a bumper

-

@ 9ca447d2:fbf5a36d

2025-06-16 14:01:56

@ 9ca447d2:fbf5a36d

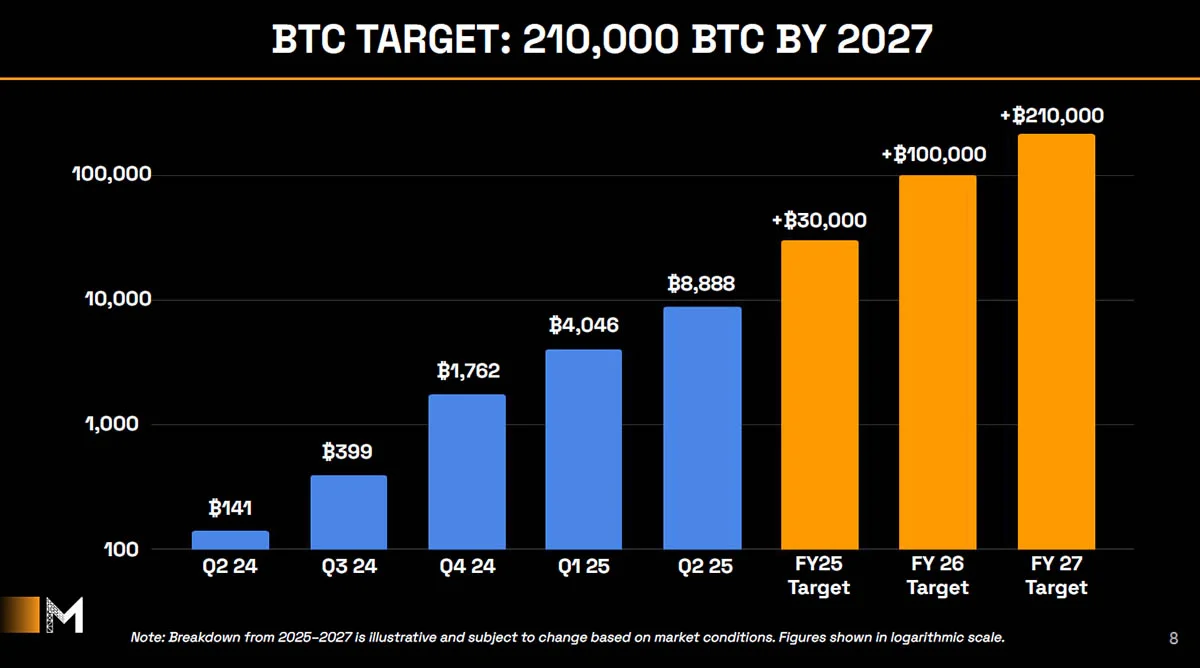

2025-06-16 14:01:56Japanese investment firm Metaplanet has announced a massive $5.4 billion plan to increase its bitcoin holdings to 210,000 BTC by the end of 2027 — that’s about 1% of the total bitcoin supply.

Metaplanet on X

The Tokyo-listed company is accelerating its already aggressive bitcoin plan, with CEO Simon Gerovich calling the initiative “Asia’s largest-ever equity raise to buy Bitcoin — again!”

The company’s new capital raise, called the “555 Million Plan”, involves issuing 555 million shares through moving strike warrants. That’s basically a type of option where people can buy shares later, and the price they pay depends on the stock’s price at that time.

So with moving strike warrants, the price at which people can buy the stock goes up or down depending on how the company’s stock is doing. It gives investors more flexibility — and it can make the warrants more attractive — because they don’t get stuck with a bad deal if the stock price drops.

This way the company can raise capital gradually over the next 2 years without impacting the stock market and existing shareholders.

The funds raised will be used to buy bitcoin, with some to redeem bonds and other income-generating strategies like selling put options.

This is a big step up from Metaplanet’s previous targets. Initially aiming to reach 10,000 BTC by the end of 2025, the company now plans to reach:

- 30,000 BTC by end of 2025

- 100,000 BTC by end of 2026

- 210,000 BTC by end of 2027

The Japanese investment firm hopes to be in the “Bitcoin 1% club” which means holding at least 1% of the total 21 million bitcoin supply.

Metaplanet bitcoin targets

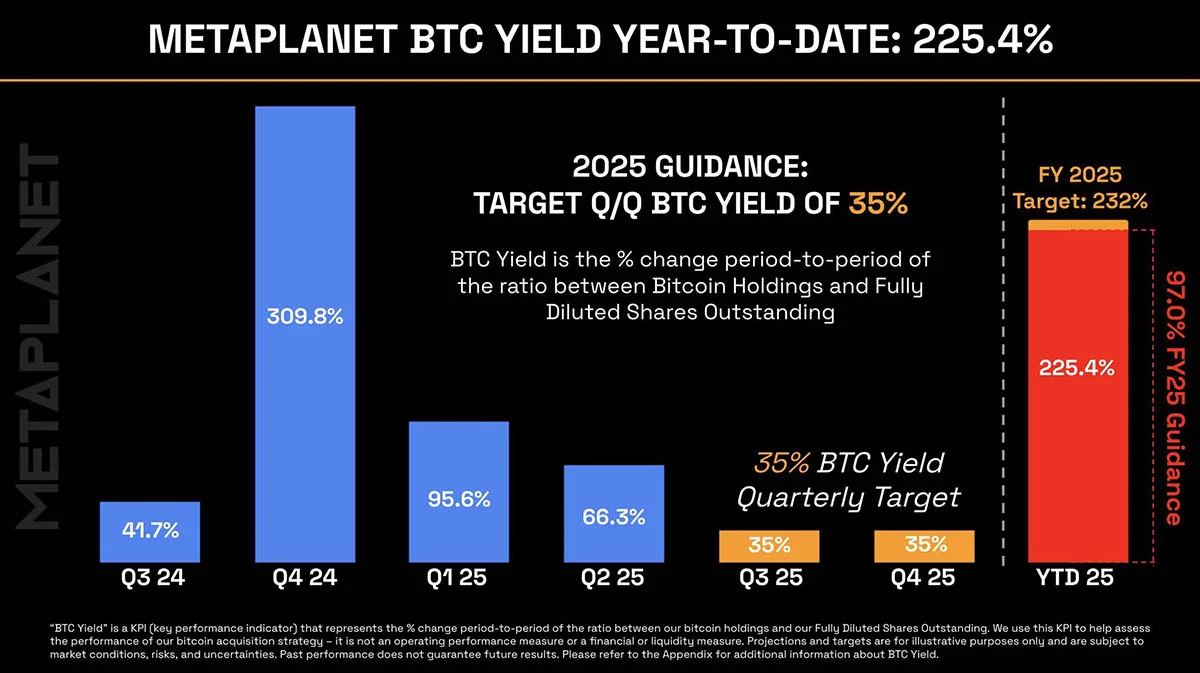

Metaplanet is already making good progress. As of June 2025, the company holds 8,888 BTC, acquired at a cost of about ¥122.2 billion (around $849 million) and has already reached 89% of its original 10,000 BTC target for 2025.

This comes after the success of the company’s previous “210 Million Plan” which raised ¥93.3 billion ($650 million) in 60 trading days by issuing 210 million shares.

During that time, the company’s bitcoin holdings grew from 1,762 BTC to 7,800 BTC and the BTC Yield (a key performance metric showing growth in bitcoin per share) increased by 189%.

Year to date the BTC Yield is 225.4%.

Metaplanet’s BTC Yield graph

The stock has reflected this momentum, up 275% since early 2025 and 1,619% over the past year.

Metaplanet’s stock price chart — TradingView

Metaplanet is now one of the most actively traded stocks in Japan and has become a top-ten corporate bitcoin holder globally, recently surpassing Block Inc., the company founded by Jack Dorsey.

Metaplanet sees this as part of a bigger shift in capital markets.

By being a “bitcoin treasury vehicle” listed on the Tokyo Stock Exchange, it aims to offer investors exposure to bitcoin through regulated equity markets. This is especially useful in Japan where retail investors are often restricted from accessing bitcoin directly.

“Bitcoin is repricing the global cost of capital,” the company said in a statement. “Through our 555 Million Plan, Metaplanet is doubling down on a high-conviction, equity-driven capital markets strategy to accelerate our Bitcoin accumulation trajectory.”

-

@ 726e789c:197726c2

2025-06-16 14:01:34

@ 726e789c:197726c2