-

@ bd982176:8b2599a7

2025-06-16 09:08:30

@ bd982176:8b2599a7

2025-06-16 09:08:30Bitcoin Pizza Day at Kimbo: A Memorable Event with Lessons Learned

On May 22nd, Bitcoin Babies hosted a lively Bitcoin Pizza Day celebration in Kimbo, honoring the historical milestone when Laszlo Hanyecz purchased two pizzas with 10,000 BTC back in 2010. Our aim was to bring the spirit of Bitcoin to the local community, share the excitement of Bitcoin adoption, and of course — enjoy some great pizza!

We had been preparing for the event for weeks. Our team held several productive meetings beforehand, discussing logistics, assigning roles, and ensuring everyone was on the same page. These planning sessions filled us with confidence, and as the day approached, we were eager to see everything come together.

While the event presented a few unexpected challenges, it ultimately turned out to be a vibrant, educational, and inspiring experience for everyone involved.

One hurdle we faced was a delay in receiving the payment receipt for the pizzas, which caused a late start in serving. Technical issues also impacted our Lightning wallet transactions, slowing down payments and extending wait times. Still, the use of Bitcoin’s Lightning Network sparked interest and curiosity among many attendees, providing a real-time look at this powerful technology.

Our pizza chefs encountered some delays and equipment issues that required quick thinking and problem-solving from the team. Meanwhile, the turnout exceeded our expectations, which — though exciting — led to some confusion in managing orders and coordinating among team members.

Yet despite the pressure, what truly stood out was the community’s enthusiasm and our team’s resilience. Most importantly, we were able to educate a significant number of people about Bitcoin — what it is, how it works, and how it can positively impact lives. While we may not have reached everyone as deeply as we had hoped, many attendees walked away with new knowledge and curiosity sparked.

One last-minute complication was seeking permission from the area chief on the same day as the event. Although it added stress, it was a valuable reminder of the importance of early and clear communication with local authorities.

Looking ahead to next year, we’re excited to implement the lessons learned. We’ll secure permissions well in advance, test all technical tools thoroughly, and work even more closely with vendors to ensure smooth logistics. We’ll also set up clearer systems for order handling and team coordination to prevent overload and confusion.

Most importantly, we’ll maintain a strong focus on our mission: not just selling pizza but sharing the promise and potential of Bitcoin with our community. By creating space for both enjoyment and education, we’ll ensure that everyone leaves inspired.

Bitcoin Pizza Day at Kimbo in 2025 was a meaningful experience. We’re proud of what we accomplished, grateful for the lessons learned, and determined to make next year’s celebration even more impactful and memorable.

-

@ 39cc53c9:27168656

2025-06-16 06:25:50

@ 39cc53c9:27168656

2025-06-16 06:25:50After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 9ca447d2:fbf5a36d

2025-06-16 06:01:49

@ 9ca447d2:fbf5a36d

2025-06-16 06:01:49CANNES, FRANCE – May 2025 — Bitcoin mining made its mark at the world’s most prestigious film gathering this year as Puerto Rican director and producer Alana Mediavilla introduced her feature documentary Dirty Coin: The Bitcoin Mining Documentary at the Marché du Film during the Cannes Film Festival.

The film puts bitcoin mining at the center of a rising global conversation about energy, technology, and economic freedom.

Dirty Coin is the first feature-length documentary to explore bitcoin mining through immersive, on-the-ground case studies.

From rural towns in the United States to hydro-powered sites in Latin America and the Congo, the film follows miners and communities navigating what may be one of the most misunderstood technologies of our time.

The result is a human-centered look at how bitcoin mining is transforming local economies and energy infrastructure in real ways.

To mark its Cannes debut, Mediavilla and her team hosted a packed industry event that brought together leaders from both film and finance.

Dirty Coin debut ceremony at the Marché du Film

Sponsors Celestial Management, Sangha Renewables, Nordblock, and Paystand.org supported the program, which featured panels on mining, energy use, and decentralized infrastructure.

Attendees had the rare opportunity to engage directly with pioneers in the space. A special session in French led by Seb Gouspillou spotlighted mining efforts in the Congo’s Virunga region.

Dirty Coin builds on Mediavilla’s award-winning short film Stranded, which won over 20 international prizes, including Best Short Documentary at Cannes in 2024.

That success helped lay the foundation for the feature and positioned Mediavilla as one of the boldest new voices in global documentary filmmaking.

Alana Mediavilla speaks at the Marché du Film — Cannes Film Festival

“If we’ve found an industry that can unlock stranded energy and turn it into real power for people—especially in regions with energy poverty—why wouldn’t we look into it?” says Mediavilla. “Our privilege blinds us.

“The same thing we criticize could be the very thing that lifts the developing world to our standard of living. Ignoring that potential is a failure of imagination.”

Much like the decentralized network it explores, Dirty Coin is spreading globally through grassroots momentum.

Local leaders are hosting independent screenings around the world, from Roatán and Berlin to São Paulo and Madrid. Upcoming events include Toronto and Zurich, with more cities joining each month.

Mediavilla, who previously worked in creative leadership roles in the U.S. — including as a producer at Google — returned to Puerto Rico to found Campo Libre, a studio focused on high-caliber, globally relevant storytelling from the Caribbean.

She was also accepted into the Cannes Producers Network, a selective program open only to producers with box office releases in the past four years.

Mediavilla qualified after independently releasing Dirty Coin in theaters across Puerto Rico. Her participation in the network gave her direct access to meetings, insights, and connections with the most active distributors and producers working today.

The film’s next public screening will take place at the Anthem Film Festival in Palm Springs on Saturday, June 14 at 2 PM. Additional screenings and market appearances are planned throughout the year at Bitcoin events and international film platforms.

Dirty Coin at the Cannes Film Festival

Watch the Trailer + Access Press Materials

📂 EPK

🎬 Screener

🌍 Host a Screening

Follow the Movement

Instagram: https://www.instagram.com/dirty_coin_official/

Twitter: https://x.com/DirtyCoinDoc

Website: www.dirtycointhemovie.com -

@ 3c7dc2c5:805642a8

2025-06-16 12:15:35

@ 3c7dc2c5:805642a8

2025-06-16 12:15:35🧠Quote(s) of the week:

"Bitcoin trades 168 hours a week. Every other asset trades 35 hours at best (and less on holidays). This is the most magical, transparent, and hard-working [asset] in history. I’m in awe watching Bitcoin trade at 9:30 pm on a Saturday. You could liquidate $100 million worth, any hour of any day, and maybe take a 3% haircut. This is extremely high-bandwidth price discovery." —Michael Saylor https://i.ibb.co/LXCm3Kp8/Gshl-Ixas-Awezk3.png

🧡Bitcoin news🧡

13 years ago the block subsidy was 50 BTC. 13 years from now it will be 0.39 BTC.

On the 2nd of June:

➡️Hong Kong’s Reitar Logitech files to acquire $1.5B in Bitcoin, becoming the latest firm to join the Bitcoin treasury trend. The logistics and real estate company says the move strengthens its financial foundation as it scales its global tech platform.

➡️Bitcoin's global hashrate has reached a new all-time high, with data from Hashrate Index showing a 7-day simple moving average peak of 943 EH/s. https://i.ibb.co/3yR2ZZ0w/Gsahm-VXMAA1m-Ol.png

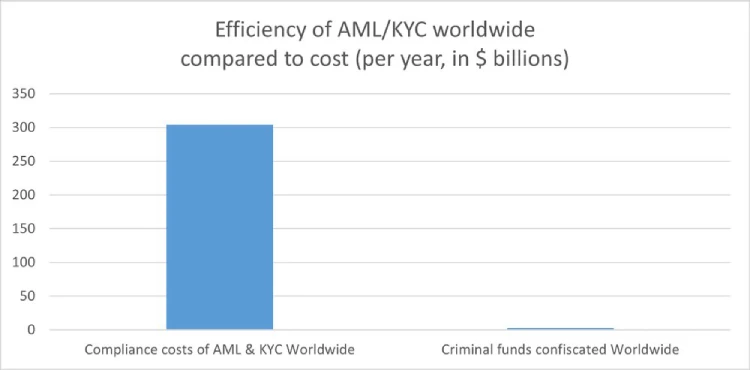

➡️(K)now (Y)our (C)ustomer is nothing but Stealth Mass Surveillance. What 95% of regulations cost versus return in one picture? https://i.ibb.co/Q3CLzF7j/Gsb20g-Pb-IAABy4-L.jpg

➡️Norwegian Block Exchange becomes the first publicly traded Bitcoin treasury company in Norway.' - Simply Bitcoin

➡️Poland just elected pro-Bitcoin Presidential candidate Karol Nawrocki. “Poland should be a birthplace of innovation rather than regulation.”

➡️NYC Mayor Eric Adams: “You all mocked me, ‘You’re taking your first 3 paychecks in #Bitcoin, what’s wrong with you?’ Now you wish you would have done.”

➡️Strategy plans to launch an IPO for 2.5M shares of its 10% Series A 'Stride' Preferred Stock (STRD), with proceeds going toward general corporate use and Bitcoin acquisition. Dividends are non-cumulative and paid only if declared.

Bit Paine: 'Remember: the entire fiat system is just various forms and layers of debt with different issuers all backed by an “asset,” (itself just a base layer of sovereign debt) that can and will be printed into oblivion. MSTR is just recapitulating this system but with a fixed supply underlying, meaning that in real terms anything it issues will benefit from the dilution of the fiat base layer and hence outperform (wildly) any fiat debt. No matter your institutional mandate, it makes no sense to hold debt whose base layer can be unilaterally demonetized when you can hold debt backed by a fixed supply underlying commodity that goes up forever.'

On the 3rd of June:

➡️Tether sends 37,229 Bitcoin worth almost $4 billion in total to Jack Maller's Twenty-One Capital

➡️El Salvador is running a full Bitcoin node!

➡️Canadian construction engineering company SolarBank adopts a Strategic Bitcoin Reserve "As the adoption of Bitcoin continues to grow, SolarBank believes that establishing a Bitcoin treasury strategy taps into a growing sector that is seeing increasing adoption."

➡️Willy Woo: "Who are the idiots who are selling when institutions and sovereigns are racing to buy billions in BTC?" This chart sheds light. The big whales >10k BTC have been selling since 2017. "They're stupid!" Most of those coins were bought between $0-$700 and held 8-16 years.' https://i.ibb.co/xKctV3Tf/Gsid236as-AAXPl-D.jpg

Selling at 20,000% profit is generally not a bad move.

➡️'South Korea just elected a pro-Bitcoin President who promised to legalize spot Bitcoin ETFs and scrap unfair regulation.' -Bitcoin Archive

➡️The average US investor owns 0.3% of their net worth in Bitcoin.

https://i.ibb.co/5WtFH9LM/Gsfoem-Tb0-AEfo-Ds.jpg

We are so damnn early.

➡️MARA mined 950 Bitcoin worth over $100 MILLION in May. They HODLed all of it.

➡️Bitcoin for Corporations: "Metaplanet just became Japan’s most traded stock — topping the charts in both value and volume:

➤ 170M shares traded

➤ ¥222B ($1.51B) value traded

This is what a Bitcoin strategy looks like in motion."

➡️'The Blockchain Group acquires 624 BTC for €60.2 million, nearly doubling their stack. They are now holding a total of 1,471 BTC with a BTC Yield of 1,097.6% YTD.' -Bitcoin News

➡️Publicly traded company K33 buys 10 Bitcoin for SEK 10 million for its balance sheet.

➡️California Assembly passes a bill to allow the state to receive payments in Bitcoin and digital currencies. It passed 68-0 and now heads to the Senate.

But hold up...

Bitcoin held on exchanges for +3 years will be transferred to the state of California under a law passed by the Assembly.

Not your keys…

➡️Adam Back invests $2.1 million into Swedish Bitcoin treasury company H100.

On the 4th of June:

➡️Daniel Batten: 'A large Bitcoin mining operation uses < 1/3 of the water of an average US family, and 0.0006% of the water a typical Gold mine uses.' https://i.ibb.co/TxNWSkHg/Gsn-VIjh-XQAEECOh.jpg

➡️And there it is: for JPMorgan, Bitcoin is now "safe collateral" JP Morgan will now offer loans backed by Bitcoin ETFs.

https://i.ibb.co/cXX0hKBK/Gsn-C5-B8-Wg-AA2e3i.png

Bent the knee. Wall Street realizes that Bitcoin is pristine collateral. Liquid 24/7/365 globally.

➡️Spanish coffee chain Vanadi Coffee to purchase $1.1 billion Bitcoin for its treasury reserve.

Disclaimer: This sounds great but it's not the whole story.

Pledditor: 'You mean a coffee shop chain founded just 4 years ago, only has 6 locations, and every year it has operated has suffered millions of dollars of net losses? They have 1975 Instagram followers. They have 149 Facebook followers. They have 48 X followers. But remember guys, you are investing in a "COFFEE GIANT"

So where does the $1.1B come from?

'The same way it came for Metaplanet (and all these other penny stocks) Get a bunch of high follower Bitcoin X accounts to hype your ticker (usually Bitcoin Magazine, Vivek, Pete Rizzo, etc), start up an "Irresponsibly Long ___" group, then dump a shitload of stock on the plebs.'

I have said it before...

Bitcoin treasury companies won't prevent another bear market; they’re the reason it’ll happen again this cycle.

➡️Public company Semler Scientific purchases an additional 185 Bitcoin for $20 million.

➡️Wicked: Imagine how rekt people would get if we went from $200k back down to $58k next bear market. The funny thing is that’d only be a 71% pullback, the smallest bear market pullback ever.

https://i.ibb.co/DfFtFZnP/Gsnr-U-3-Xo-AAJy-Kq.jpg

➡️Fidelty: An increasing number of institutions are leveraging Bitcoin as a strategic reserve asset. And as understanding of the asset deepens, interest continues to grow. See what may be driving the shift: Source: https://www.fidelitydigitalassets.com/research-and-insights/adding-bitcoin-corporate-treasury?ccsource=owned_social_btc_corp_treasury_june_x

➡️Solo Bitcoin miner solves block 899,826, earning 3.151 BTC ( $330K). A solo miner rented a massive amount of hashrate on @NiceHashMining and successfully mined a Bitcoin block solo on CKpool, claiming the full reward alone.

➡️Romania's national postal service, Poșta Română, launches a pilot program by installing its first Bitcoin ATM at a Tulcea branch, partnering with Bitcoin Romania (BTR Exchange), the country's leading cryptocurrency exchange.

On the 6th of June:

➡️Mononaut: 'With a weight of only 5723 units, block 899998 was the second lightest non-empty block of this halving epoch.'

➡️'UK-listed gold miner Bluebird Mining Ventures announces strategy to convert gold mining income into Bitcoin. A gold mining company will become the first UK-listed company to implement a Strategic Bitcoin Treasury' - Bitcoin News

➡️Phoenix Wallet: Phoenix 2.6.1 now supports NFC for sending and receiving. Works on Android and iOS. (NFC received on iOS is only due to Apple restrictions)

➡️Man from Germany fails to declare 24 words when crossing the border – nothing happens.

https://i.ibb.co/21W5qVks/Gswdghd-Xw-AA7-SH6.png

➡️Know Labs, Inc. to become a Bitcoin Treasury Strategy company starting with 1,000 BTC. Funny isn't it? Even former Ripple executive, Greg Kidd, is choosing to fill their company treasuries with bitcoin—not XRP.

➡️Bitcoin Successfully Mines the 900,000th Block! https://x.com/i/status/1930973314475815120

➡️Trump Media's latest S-3 filing officially adopts a Bitcoin treasury strategy. - Registers up to $12B in new securities to buy BTC - Adds to $2.44B already raised - Mentions “Bitcoin” 362 times (vs. once in prior S-3)

➡️Bitcoin News: Metaplanet just issued ¥855B ($5.4B) in moving-strike warrants to buy more Bitcoin, Japan’s largest equity issuance of its kind ever. It’s the first above-market pricing in Japan's history, defying the usual 8–10% discount.

➡️ Uber CEO tells Bloomberg Bitcoin is a proven store of value and that it is exploring crypto payments.

➡️Agricultural commodity trading company Davis Commodities will buy $4.5 million Bitcoin for their reserves, calling it "digital gold.

➡️Fidelity: As digital assets evolve, bitcoin’s potential as a store of value sets it apart from other cryptocurrencies. “Coin Report: Bitcoin” outlines why the asset’s design, scarcity, and decentralized nature help make it distinct—and where its future opportunities may lie. Read now: https://www.fidelitydigitalassets.com/research-and-insights/coin-report-bitcoin-btc?ccsource=owned_social_btc_report_june_x

➡️Japanese public company Remixpoint announces it bought 44.8 #Bitcoin worth $4.7 million

On the 8th of June:

➡️Wicked: Bitcoin has been running for 6,000 days and it’s already spent 60 of them, 1% of its life, closing above $100k. https://i.ibb.co/kVyrjR7v/Gs4uy-MIW8-AAOl-A.jpg

On the 9th of June:

➡️Australia’s ABC News reports on how Bitcoin adoption is bringing financial freedom and greater safety to Kibera, one of Africa’s largest slums in Kenya.

➡️ IBIT just blew through $70b and is now the fastest ETF to ever hit that mark in only 341 days, which is 5x faster than the old record held by GLD of 1,691 days. https://i.ibb.co/DfKbwhjG/Gt-Ar6-Eq-X0-AAzrl5.png

Credit chart JackiWang17 on X

➡️Japanese fashion brand ANAP plans to buy and hold over 1,000 Bitcoin by August 2025.

➡️South Korean President to introduce legislation this week to allow big banks to adopt Bitcoin.

➡️Wicked: Bitcoin's now 3x larger than the top 9 shitcoins combined. https://i.ibb.co/LDQKsGHM/Gt-AJy-D6-X0-AA7-PIY.jpg

💸Traditional Finance / Macro:

On the 3rd of May:

👉🏽'Hedge funds are still not buying the Magnificent 7: Hedge funds’ long/short ratio on Magnificent 7 stocks is now at its lowest level in 5 years, per Goldman Sachs. This is even lower than at the 2022 bear market bottom. Furthermore, their exposure to Magnificent 7 stocks is now down -50% over the last year. Meanwhile, hedge funds have bought US information technology stocks for 3 consecutive weeks. This occurred after the sector had been net sold in 10 of the previous 12 weeks. Retail has led the recent rebound.' -TKL

On the 6th of June:

👉🏽If you net out the Mag 7 from the S&P 500, the remaining 493 stocks have barely gone anywhere in over a decade (comparatively speaking). Chart: Goldman Sachs https://i.ibb.co/s9LmVBL8/Gsx53k6-W8-AAM2xr.jpg

🏦Banks:

On the 21st of May: 👉🏽No News

🌎Macro/Geopolitics:

'The reality is that the US soft defaults on its debt every day through structural inflation (the perpetual debasement of the US dollar). In other words, the Treasury pays you back dollars that are worth far less than what you lent to them. A soft default.' This is also valid for Europe.

On top of that, the richest man in the world is publicly arguing with the president of the United States about America’s solvency. Consider buying bitcoin.

So far regarding Trump: - didn't audit the Gold - didn't stop the wars - didn't reduce the deficit/debt/budget - didn't form a Bitcoin reserve - didn't release the Epstein files

Anyway, consider buying Bitcoin.

On the 2nd of June:

👉🏽'The Bank of Japan just racked up a record ¥28.6 trillion in bond losses That’s three times bigger than last year! This isn’t just Japan’s problem. It’s a screaming red alert for global markets.' - StockMarket News

TKL: " Japanese equity funds posted a record $11.8 billion in net outflows last week. This brought the 4-week moving average of outflows to $4.0 billion, an all-time high. Investors’ concerns over rapidly rising long-dated Japanese government bond yields were behind the outflows. Additionally, investors withdrew $5.1 billion from US stock funds. All while global equity funds saw $9.5 billion in net outflows, the most this year. Investors are taking profits after a sharp market recovery."

👉🏽The money printer is back on. US M2 just hit a new all-time high at $21.86T. Liquidity is flowing back into the system.

https://i.ibb.co/fGdx5kmt/Gsd-Jn-R9-XUAAUAO2.jpg

Recession odds have just dropped by 70% to 30% That’s the steepest decline in 65 years without a recession actually happening. Forget everything about a recession when M2 is moving up. Simple as that.

👉🏽$698 billion worth of homes are for sale in the United States, a new all-time high. Rajat Soni: 'The price of a house should be 0.01 BTC right now The housing market is way overpriced in terms of Bitcoin Interest rates or real estate prices will have to fall for these these homes actually to be sold.'

👉🏽The US Dollar is worth 8.9% less than it was at the beginning of the year.

👉🏽Argentina's economy grew 8% year-over-year in April 2025, the highest in the Western world!

On the 3rd of June:

👉🏽Trump's "Big Beautiful Bill" bans all 50 states from regulating AI for 10 years, centralizes control at the federal level, and integrates AI systems into key federal agencies. https://i.ibb.co/Q7t14q7M/Gse-V2f-YWUAAyb-Py.png

👉🏽 ZeroHedge: 'Total US debt is now $37.5 trillion (accrued). The $36.2 trillion actual is just the ceiling set by the debt limit which will be revised to $40 trillion in August/September.'

👉🏽A million seconds ago was May 23rd

A billion seconds ago was 1993

A trillion seconds ago was 30,000 B.C.

The US national debt is now rising by $1 Trillion every 180 days.

👉🏽NATO pushes European members to increase ground-based air defense systems five-fold — Bloomberg

👉🏽Global Markets Investor: 'This is incredible how European markets have outperformed the US this year. Poland, the Czech Republic, and Austria have grown their market capitalization by 44%, 36%, and 33%, respectively. Next are Hungary, Spain, Luxembourg, Greece, and Germany. The US has been flat.'

https://i.ibb.co/TMwrLnB0/Gsiu-KWYXEAAto-U1.jpg

This is one of the WORST years for the US stock market in history: The S&P 500 has UNDERperformed World stocks excluding the US by 12 percentage points year-to-date, the most in 32 YEARS. This is even worse than during the Great Financial Crisis.

👉🏽Bravos Research: 'M2 money supply is now expanding at 4.4% After reaching its deepest contraction in 65 years This is quite constructive for the stock market.' https://i.ibb.co/hFCRgFhr/Gsht-Kgk-Xw-AAy-PFq.jpg

On the 4th of June:

👉🏽“The $1.06 trillion unrealized loss in 2024 was ‘modestly higher’ than the $948.4 billion paper loss seen in 2023.” https://i.ibb.co/Pvm7zVWy/Gsj-9-OWs-AAvwp-F.jpg

Probably nothing. What’s a trillion between friends…

Currently, the US is spending $1,200 trillion per year on interest payments (dark line). If everything were financed at the current interest rate, the cost would exceed $1,500 trillion per year (green). https://i.ibb.co/mCpYtwVW/Gsm-H6-Mr-Xc-AAqd-F5.png

Note: The national debt is $36,9 trillion.

👉🏽Global debt is gigantic: Debt-to-GDP is above 100% in 6 of 7 G7 nations, and is still rising. Japan: ~250% Italy, the US, France, the UK, and Canada: all near or above 100%.

For 5 of 7 G7 economies, debt is set to surge further by 2030. Now debt is a problem but the main question would be...what will the productivity be in 2030?

On the 5th of June:

👉🏽 The United States Treasury just bought back $10 Billion of its own debt, the largest Treasury buyback in history.

Buying back your own debt with printed money. That's what happens just before fiat money goes to die (eventually). Eventually, nobody wants that worthless debt anymore, eventually!

Context by EndGame Macro:

💰 $10 Billion Buyback: The Treasury’s Silent Signal

On June 3, 2025, the U.S. Treasury quietly executed the largest debt buyback in American history, repurchasing $10 billion in short- and medium-term bonds. At first glance, it looked routine. But under the surface, this was a stealth intervention aimed at calming a system under increasing strain. This wasn’t just liquidity smoothing. It was strategic triage.

🧾 What Happened

Buyback Size: $10B (a record)

Debt Offered: $22.87B — more than double what was accepted

Target Maturities: July 2025 to May 2027

Issues Accepted: 22 of 40 eligible

Settlement: June 4, 2025

That huge offer volume isn’t just noise—it’s a warning sign that institutional players are under pressure.

🚨 What the Buyback Really Signaled

- A Quiet Circuit Breaker The buyback focused on maturities clustered around a $9 trillion rollover wall over the next 12 months. Without announcing it, the Treasury effectively tripped a circuit breaker to reduce near-term funding stress.

- QE Without the Label This wasn’t the Fed. No balance sheet expansion. But by retiring debt ahead of maturity and shrinking market float, the effect mirrored QE—without the political baggage.

- Institutions Are Feeling the Squeeze A staggering $22.87 billion in offers points to constraints at banks, funds, or foreign reserve desks. The Treasury didn’t save everyone—just enough to relieve pressure quietly.

🎯 Strategic Motivation

This wasn’t about boosting confidence. It was about managing two threats: Maturity Wall Risk: Avoiding auction failures as short-term debt piles up in 2025–2026. Yield Curve Stability: Preventing disorderly spikes by quietly absorbing supply. This move avoided triggering headlines—while containing the fire under the hood.

🧠 Echoes from History

This buyback fits into a lineage of quiet but powerful interventions: Operation Twist (1961) – Rebalancing maturity without QE branding. BoE Gilt Crisis (2022) – Targeted long-end intervention to save pensions. Belgium’s Shadow QE (2014) – U.S. debt absorbed off-balance-sheet during geopolitical tension. Each move relied on subtlety and intent—not optics.

🧩 What the Market Heard

Primary Dealers: Help exists—but it’s selective and discretionary.

Foreign Holders: Exit in order—or risk exclusion.

Money Markets: Relief, not resolution.

❗ Where the Logic Cracks

If this was routine: Why buy back below par? Why accept only 44% of the offered debt? Why deploy this now and not earlier? Each of these points to deeper stress than officials are openly admitting.

🔒 High-Conviction Takeaway

This buyback was a preemptive stabilization maneuver, not a stimulus. With over $9 trillion in short-term debt set to roll, foreign participation weakening, and institutional selling pressure rising, the Treasury acted before fractures became visible. The line wasn’t drawn to show strength. It was drawn behind the market—to stop a collapse.

🕵️♂️ Known Unknowns

Who were the biggest sellers—and what’s pressuring them? Was this coordinated with the Fed or global reserve desks? Is this a one-off event—or the start of a multi-phase liquidity campaign? The silence is strategic—but the signal is loud.

👉🏽Joe Consorti: 'Congress refuses to cut spending. So we must "grow our way out" of the deficit. That would take 39 years of 5% nominal GDP growth, or 22 years at 10%. In other words, 2-4 decades of explosive growth just to break even. We can't "grow our way out". We'll print our way out.'

👉🏽ZeroHedge: And just like that, the "climate crisis" is gone https://i.ibb.co/GQ76Z79P/Gsr3uus-XEAAjuv6.png

Don't get me wrong and with all respect to my environmentalist friends, but the “Crisis” never existed. A big part of the push has been marketing dollars/euros and media spin, let's face it.

Why do I think that? How do you think we will grow out of the Global Debt problem? One word: PRODUCTIVITY.

How can we manage that? They (Governments/Central Banks) need AI data farms. What do data farms need?

Electricity, water, energy.

Because Big Tech and AI need energy -- wherever they can find it -- climate change as a cause is finished. It was all virtue signaling. And remember the climate didn’t cool, it just stopped polling well. The scariest part of the “climate crisis” becoming out-of-vogue with the left is that it'll likely be replaced by something equally absurd and artificially manufactured.

On the 6th of June

👉🏽 'The US economy adds 139,000 jobs in May, above expectations of 126,000. The unemployment rate was 4.2%, in line with expectations of 4.2%. The April jobs number was revised down from 177,000 to 147,000. The headline numbers continue to exceed expectations.' - TKL

Surprise, surprise…

March jobs revised: 185K 120K (-65k)

April jobs revised: 177K 147K (-30k)

13 of the L16 have been revised lower.

Just to make it even worse, this is something I have shared multiple times in 2024. The number of year-over-year private job gains in 2024 was likely overstated by a MASSIVE 907,000 jobs, according to BLS data released Wednesday. This comes as the Quarterly Census of Employment and Wages (QCEW) data covering 97% of employers showed a private payroll growth rate of 0.6% for December 2024. This is 50% lower than the 1.2% growth rate initially reported in the monthly non-farm payroll (NFP) reports. To put this differently, there was a 907,000 gap between NFP data and QCEW data in 2024. This means jobs were likely overstated by an average of 75,583 PER MONTH in 2024.

👉🏽Opinion: Milei reduced government spending by 30% and achieved a surplus in only 1 month. His popularity didn't fall, it rose. Don't tell me fiscal discipline isn't popular with the general public. It's just unpopular to the powerful special interests that control DC or Brussels.

👉🏽'In the current fiscal year, the U.S. government already spent $4,159 billion. This is for the first 7 months and the fiscal year ends in September. The latest available data is as of April. The already accrued deficit amounts to over $1 trillion: $1,049 billion.

You can see in the chart how net interest expense has become the #2 largest spending category at $579 billion (for 7 months) after social security ($907 billion) and even exceeded national defense ($536 billion), health ($555 billion), and Medicare ($550 billion). The deficit is 34% of total receipts! (1049/3110) In other words: the U.S. government spent 34% more than it took in.

The last full fiscal year ended in September 2024. In that fiscal year, we spent $1.13 trillion on interest expenses. After only the first 7 months of fiscal year 2025 ending in September, they are already at $776 billion. This means we'll likely touch $1.3 trillion this fiscal year!' - AJ https://i.ibb.co/RTLTZPn1/Gsxv-Tso-Xc-AAZs-Zo.jpg

On the 7th of June:

👉🏽 The EU Commission paid climate "NGOs" for questionable lobbying with money from German taxpayers and wanted to keep it secret. https://i.ibb.co/zH6J41Zq/Gsz-Lu-F9-Xg-AAZttn.jpg Now read the above statement again and after that read the following bit:

👉🏽EU TRIES TO LECTURE EL SALVADOR - BUKELE BODYSLAMS BACK Source: https://www.eeas.europa.eu/eeas/el-salvador-statement-spokesperson-foreign-agents-law-and-recent-developments_en

The Diplomatic Service of the European: "El Salvador: The EU regrets the adoption of the Foreign Agents Law, which risks restricting civil society and runs counter to international obligations. Recent arrests of human rights defenders raise further concerns."

The EU’s sanctimonious finger-wagging at El Salvador reeks of hypocrisy. Brussels lectures sovereign nations on “civil society” while funneling billions into globalist NGOs that undermine national sovereignty. The institution that attacks liberty, freedom, democracy, and free speech in the name of a neosocialist woke ideology wants to lecture other countries on how they defend against their constant meddling and aggression. They are a bunch of unelected bureaucrats, accountable to no one, representing no one. Classic!

Supporting this further, let’s have a look how the EU is increasingly positioning itself as a technocratic regulator of personal freedom:

'The EU – the one that:

•wants to monitor every Bitcoin transaction through MiCA & DAC-8 •would love to ban non-custodial wallets

•is planning a chat control law that would make even China blush

•is considering a wealth register to digitally track every cent of your retirement savings

•restricts cash withdrawals in some member states •is testing CBDCs with expiration dates and spending limits

•and is preparing the digital euro as a full-blown control tool

…this EU is now complaining about human rights violations in El Salvador – a country whose government enjoys one of the highest approval ratings in the world. Over 85% support for President Bukele. Show me a single Western leader who even comes close to that.' - Bitcoin Hotel

Great reply by El Salvador's President Nayib Bukele: 'EU: El Salvador regrets that a bloc which is aging, overregulated, energy-dependent, tech-lagging, and led by unelected bureaucrats still insists on lecturing the rest of the world.'

👉🏽Sam Callahan: Alternative title: 73% of bonds in the world trading at less than the rate of debasement https://i.ibb.co/Y4qMvh0T/Gs7-Ry-WMAABf49.jpg

On the 8th of June:

👉🏽'US existing home sales dropped -3.1% year-over-year to an annualized 4.0 million in April, the lowest for any April since 2009. Month-over-month, home sales fell 0.5%, well below expectations of a +2.0% increase. The decline was driven by the West and Northeast regions. Sales in the South were flat, while in the Midwest improved slightly. Meanwhile, existing home inventory rose +21%, to 1.45 million, the most for any April since 2020, per ZeroHedge. Despite that, the median sales price increased +1.8% year-over-year to $414,000, a record for April. Homebuyer demand is weak and prices are still rising.' -TKL

On the 9th of June:

👉🏽Jeroen Blokland: '- China bought more gold in May. -China has been buying even more gold through ‘unofficial’ channels. - China's gold reserves today are low compared to those of the US and European countries -China is determined to move away from US dollar hegemony - China’s ambition to move away from the US dollar will only have strengthened because of the Trump tariff war - China has to acknowledge that few countries, companies, and households want to hold the Yuan So what will China be doing for years to come?'

No surprise central banks are avoiding sovereign debt and adding gold.

👉🏽TKL: Gold is on fire: Gold's share of global reserves reached 23% in Q2 2025, the highest level in 30 years. Over the last 6 years, the percentage has DOUBLED. At the same time, the US Dollar's share of international reserves has declined 10 percentage points, to 44%, the lowest since 1993. By comparison, the Euro's share has decreased 2 percentage points, to 16%, the lowest in 22 years. Gold is quickly replacing fiat currencies as a reserve currency.

🎁If you have made it this far, I would like to give you a little gift:

Lysander: "Lyn Alden gave one of the clearest breakdowns of why the U.S. is on an unstoppable fiscal path—and why Bitcoin matters more than ever because of it.

Lyn Alden walks through the numbers behind the federal deficit, interest expenses, Social Security, and the structural changes that happened post-2008. The short version? We’re in a new era. One where the government can’t slow down even if it wants to.

Her phrase: “Nothing stops this train.” Not because of ideology, but because of math—and human nature.

This isn’t hyperinflation doom-talk. It’s a sober look at what happens when a system built on ever-growing debt reaches its limits—and why Bitcoin, with its fixed supply and transparent rules, is the opposite of that system.

If you haven’t seen it, this is a must watch. Pure signal! https://www.youtube.com/watch?v=Giuzcd4oxIk

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ f0fd6902:a2fbaaab

2025-06-16 11:07:49

@ f0fd6902:a2fbaaab

2025-06-16 11:07:49Round 1 In Austria is now officially ON !! Head over to our website and sign up for the first 3 events of the 2025 season. The season will kick off at the ski resort of Axamer-Lizum, 20 minutes from the town of Innsbruck in Austria. This will be a very high speed course, with decent surface that will test riders’ nerves. There are two big straights both culminating in two big hairpin turns. The track is wide where drafting and overtaking opportunities will be plenty. The event race village will be located at the top of the hill in the big car park of the ski resort, where there will be food, drinks and toilets available. Accommodation will also be provided at the resort, making this will be a compact event set up, with the start line a kilometre or so down the road which can be accessed by car, skate or on foot.

TRACK INFO: Round 1 in Austria is now officially ON !! Head over to our website and sign up for the first 3 events of the 2025 season. The course runs down Hoadlstraße, the access road to the Axamer Lizum ski resort, the largest ski resort near Innsbruck. The course starts, about 1 kilometer from the ski resort, on a steep, straight section. After building up speed there is a long right hand sweeper bringing the racers to the first of three hairpins. The course will finish 3 kilometers later shortly after the final hairpin. Length: 3.3 kilometers Hairpins: 3 Average Grade: 9.2% Steepest Grade: 21.8% https://maps.app.goo.gl/cuQaAbie7zH2Zhjn7

Full Event :

https://www.youtube.com/watch?v=zHWnaQHcH74&ab_channel=WDSC

Results Women and Men in Stand up & Streetluge :

Link WDSC: https://worlddownhillskateboardingchampionship.com/

https://stacker.news/items/1007568

-

@ dfa02707:41ca50e3

2025-06-15 20:01:50

@ dfa02707:41ca50e3

2025-06-15 20:01:50Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-15 20:01:47

@ dfa02707:41ca50e3

2025-06-15 20:01:47Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ dfa02707:41ca50e3

2025-06-15 20:01:46

@ dfa02707:41ca50e3

2025-06-15 20:01:46Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ 88cc134b:5ae99079

2025-06-16 11:07:17

@ 88cc134b:5ae99079

2025-06-16 11:07:17content

-

@ dfa02707:41ca50e3

2025-06-15 20:01:45

@ dfa02707:41ca50e3

2025-06-15 20:01:45- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ f0fd6902:a2fbaaab

2025-06-16 10:40:48

@ f0fd6902:a2fbaaab

2025-06-16 10:40:48https://stacker.news/items/1007564

-

@ 044da344:073a8a0e

2025-06-16 10:08:10

@ 044da344:073a8a0e

2025-06-16 10:08:10Im September starten wir an der Freien Akademie für Medien & Journalismus eine Veranstaltungsreihe im Vorderen Bayerischen Wald und laden alle ein, live dabei zu sein, wenn Menschen interviewt werden, die etwas zu sagen und spannende Geschichten zu erzählen haben. Nach etwa einer Stunde werden die Kameras ausgeschaltet, sodass genug Raum bleibt für Fragen, für das Kennenlernen, für den Austausch mit Gleichgesinnten.

Die ersten Gäste ab dem 8. September: Jürgen Fliege, Joana Cotar, Gerd Reuther und Gabriele Gysi. Es gibt eine zweite Gesprächsreihe, die am 13. Oktober mit Jörg Bernig startet. Die Aufzeichnungen beginnen jeweils um 18 Uhr in einer Gaststätte im Raum Sankt Englmar. Wer eine weitere Anreise hat: Die Gegend ist wunderschön, lädt zum Entspannen ein (Wandern, hervorragende Gastronomie, Unterkünfte für jeden Geldbeutel) und verfügt über alles, was das Urlauberherz begehrt. Organistorisches und Anmeldung

8. September 2025: Jürgen Fliege – Glaube, Kirche, Hoffnung

Eine Talkshow im Ersten, präsentiert von einem Pastor, der alles mitbringt, was man braucht, um Menschen zu gewinnen: Einen besseren Werbeträger hätte sich die evangelische Kirche nicht wünschen können. Jürgen Fliege war von 1994 bis 2005 Stammgast in den Wohnzimmern und ist trotzdem oder gerade deshalb schon damals immer wieder in Konflikt geraten mit Amtsträgern aller Art. Ab 2020 hat er sich in Sachen Corona öffentlich klar positioniert und dabei auch auf die Bibel verwiesen.

9. September 2025: Joana Cotar – Acht Jahre Bundestag. Wie weiter mit der Demokratie?

Ganz stimmt das mit den acht Jahren nicht: Die zweite Legislaturperiode ist vor der Zeit zu Ende gegangen. Joana Cotar wurde zweimal über die AfD-Landesliste in Hessen in den Bundestag gewählt, war dabei 2021 auch als Spitzenkandidatin im Gespräch und zwei Jahre im Bundesvorstand. Ende 2022 hat sie Partei und Fraktion verlassen, im Parlament aber weitergemacht und immer wieder den Finger in die Wunde gelegt, wenn es um das Parteiensystem ging oder um den Spielraum der Volksvertreter.

10. September 2025: Gerd Reuther – Tatort Vergangenheit

Gerd Reuther hat sich als Medizinaufklärer ohne Tabus einen Namen gemacht – ein Radiologe, der an drei Kliniken Chefarzt war, dann aber mit 55 aufgehört hat. Sein Buch „Der betrogene Patient“ war 2017 ein Bestseller. Danach hat er die Geschichte der Medizin gegen den Strich gebürstet („Heilung Nebensache“) und in „Hauptsache Panik“ die europäische Seuchengeschichte demontiert. Jetzt nimmt er sich unsere gesamte Geschichte vor und stellt von den Römern bis in die Neuzeit unser „Wissen“ über die Vergangenheit in Frage.

11. September 2025: Gabriele Gysi – Gibt es noch eine deutsche Frage?

Niemand kann das besser beantworten als diese Künstlerin, Spross einer Politikerfamilie und Zeitzeugin für alle drei deutschen Nachkriegsstaaten – für die DDR sowieso, nach ihrer Ausreise 1984 aber auch für die alte Bundesrepublik und dann natürlich für die neue, wo sie unter anderem Chefdramaturgin der Berliner Volksbühne war. Gabriele Gysi sagt: Solange wir keine gesamtdeutsche Geschichte haben, bleibt die große Frage offen.

-

@ 9ca447d2:fbf5a36d

2025-06-15 20:01:25

@ 9ca447d2:fbf5a36d

2025-06-15 20:01:25Paris, France – June 6, 2025 — Bitcoin payment gateway startup Flash, just announced a new partnership with the “Bitcoin Only Brewery”, marking the first-ever beverage company to leverage Lightning payments.

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack, shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented:

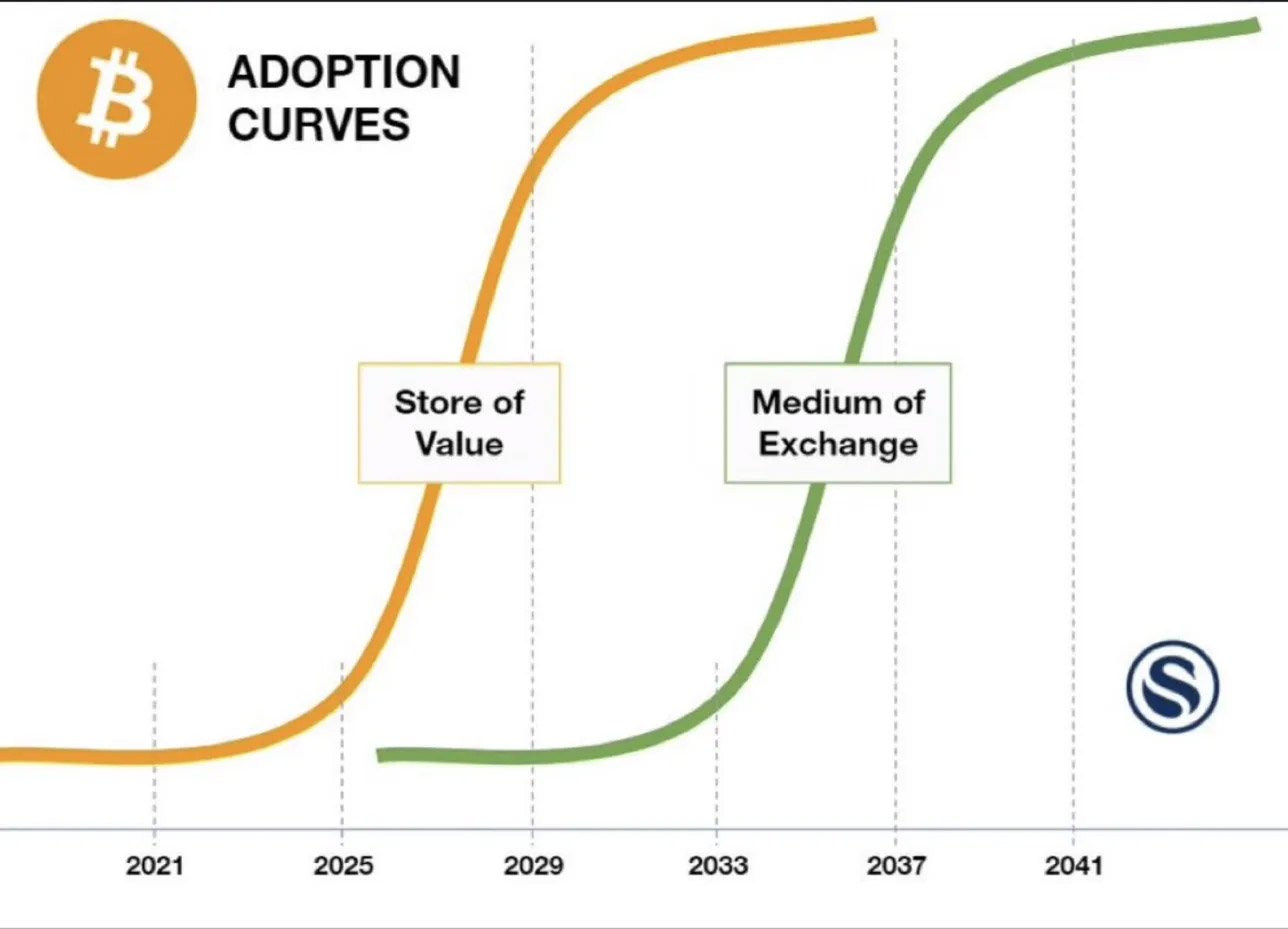

“Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comAbout Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

-

@ 90c656ff:9383fd4e

2025-06-16 10:07:14

@ 90c656ff:9383fd4e

2025-06-16 10:07:14The history of Bitcoin is marked by symbolic milestones that represent not only the technical evolution of the digital currency but also its journey toward economic and political legitimacy. In this article, we revisit some of the most iconic moments that have defined Bitcoin’s adoption from its first use in a simple transaction to its recognition as an official currency by sovereign nations.

The Most Expensive Pizza in History

On May 22, 2010, Laszlo Hanyecz made history by paying 10,000 BTC for two pizzas. At the time, this amount was worth about $40. Today, those same coins would be worth hundreds of millions of dollars, making it the most expensive meal ever recorded. More than a curiosity, this transaction marked the first time Bitcoin was used in a real commercial exchange, proving its potential as a payment method.

Silk Road and the Dark Side of Early Adoption

Although controversial, Bitcoin’s use on the Silk Road marketplace demonstrated to the world that the digital currency was functional as a large-scale medium of exchange. The platform operated between 2011 and 2013 and acted as a catalyst for the development of infrastructure around BTC, despite the negative impact it had on the cryptocurrency’s public image.

Mt. Gox and the First Major Crisis

In 2014, the exchange Mt. Gox—responsible for about 70% of all Bitcoin transactions at the time—declared bankruptcy after losing approximately 850,000 BTC. The scandal shook confidence in the ecosystem but also triggered a period of maturation, driving the pursuit of better security practices, regulatory frameworks, and professionalization within the industry.

El Salvador and Official Recognition

In September 2021, El Salvador became the first country to recognize Bitcoin as legal tender. The measure, championed by President Nayib Bukele, was met with enthusiasm by Bitcoin advocates and skepticism by international financial institutions. El Salvador’s experiment placed Bitcoin at the center of the geopolitical debate and set a precedent for other nations to consider following the same path.

In summary, each of these moments represents a distinct phase in Bitcoin’s evolution—from experimentation to institutional adoption. By revisiting these iconic cases, we gain a deeper understanding not only of Bitcoin’s technical progress but also of how its narrative has become embedded in contemporary financial history. If the pizza purchase symbolized BTC’s practical birth, the official recognition by entire nations suggests a future where digital currency could play a leading role in new forms of global economic organization.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ cae03c48:2a7d6671

2025-06-16 11:02:15

@ cae03c48:2a7d6671

2025-06-16 11:02:15Bitcoin Magazine

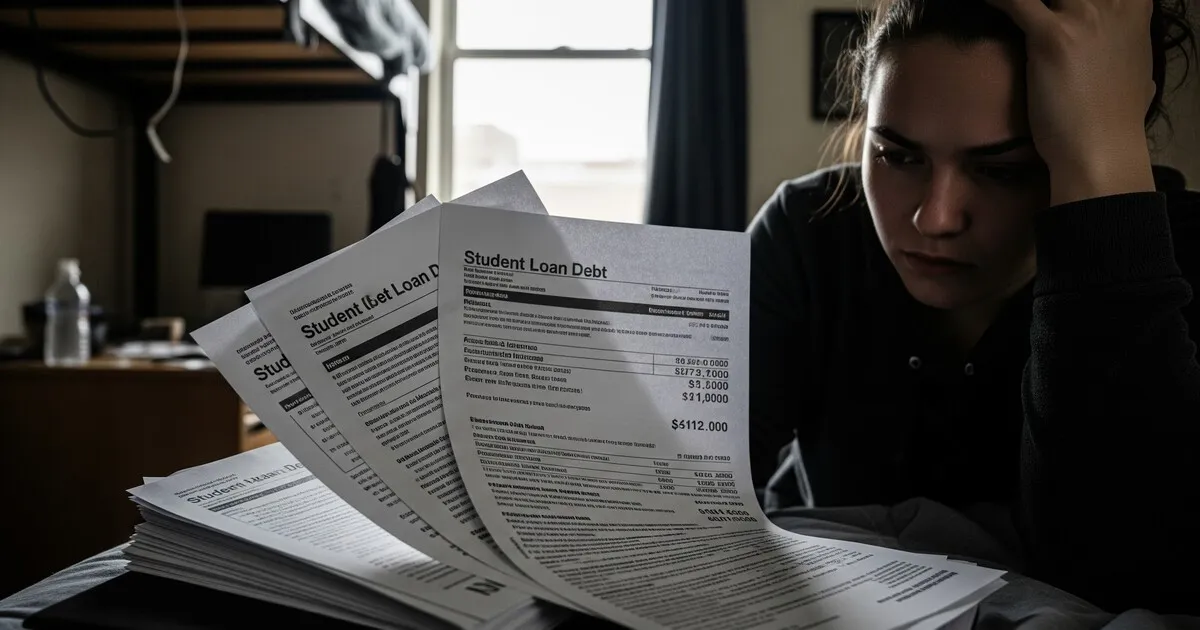

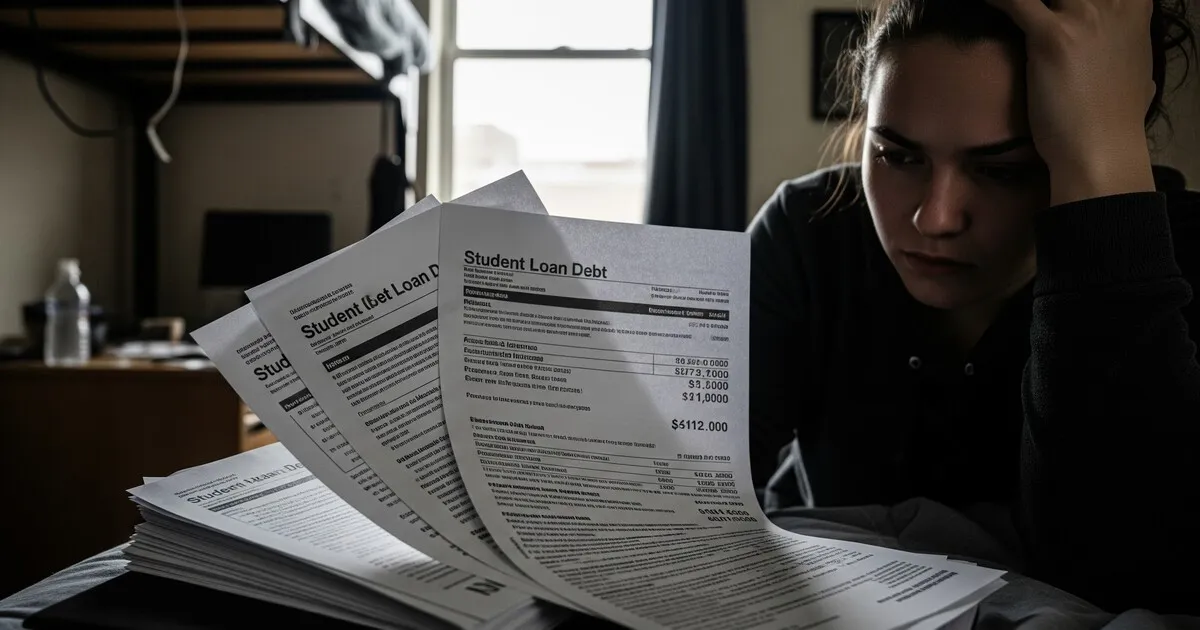

Bitcoin: How To Solve the Student Loan CrisisStudent loans continue to trouble millions of Americans, with a total of $1.77 trillion already owed. This crisis has been a major political issue for a while, especially after former President Biden promised to wipe out all of the student loan debt and ended up only fulfilling half of the promise. These billions of dollars are not just numbers on a spreadsheet; they represent people who repay their debt, every month, year in and year out. While the standard repayment plan spans 10 years, the reality is far more daunting: The average borrower takes 20-30 years to repay their loans.

There are over two million new undergraduates every year, and, on average, they graduate with $29,400 in debt. Some, like medical students, surpass $250,000 in debt — a mortgage-sized pile. Almost $100 billion in new debt is created every year, piled upon the already unsustainable student debt pile. Similar to how we have (haven’t) dealt with public pensions, instead of dismantling a failed system we keep feeding the machine and crushing people’s lives and dreams underneath its weight. But perhaps there’s a way for future generations to avoid this dreadful fate — by borrowing new ideas from similar fields.

Real Estate: The Store of Value (SoV) Since Nixon

The real estate market is another system that heavily relies on debt to keep functioning, and like student loans, it’s not working too well.

Real estate is a market where it’s completely normal to go 10x levered long on a single asset while putting all of your savings into it. Talk about idiosyncratic risk. The entire market has been in deep pain worldwide, not necessarily because of the debt, but due to how the fiat system has turned real estate into an investment-and-savings mechanism. In turn, the great investment of one generation becomes the unaffordable housing for the next. But a subset of the population has been divesting from the asset in favor of a better savings vehicle: bitcoin.

Part of their thesis in divesting from real estate and moving to bitcoin is that they predict that bitcoin’s superior SoV function will drive real estate prices down, wreaking havoc on a fragile and overpriced asset class. This makes quite a bit of sense, especially to those individuals who invested in real estate in search of those SoV properties in the first place; they now have to contend with increasing risk all over the world, putting in peril what was once a “safe SoV” asset class. From wildfires all over the place to floods, expropriations, new taxes, and wars breaking out in places previously unimaginable, some investors are just fed up.

But housing is still necessary, and we still need to build a massive amount of new houses. In almost all major cities in the world, there’s a housing crisis driven in large part by shortages. This is due to lackluster housing buildouts following the 2008 great financial crisis, driven directly by housing debt. Thus, even if all of the real estate owners put all of their stock of housing into the market, we would still have to develop and construct new ones. But it’s hard to convince real estate developers to do so when you also tell them that, in bitcoin terms, the houses they are building will be worth less by the time they sell them.

Bitcoin Replaces Real Estate

That’s where a German Bitcoiner and real estate developer named Leon Wankum steps in and turns the problem into a solution. You may even say he used financial jiu-jitsu because his idea is to bundle new, debt-heavy real estate projects with a bitcoin fund. This way, a $10 million project — of which $9 million is debt-financed — would allocate a small percentage of the financing to bitcoin, in order to hedge the depreciation and devaluation of the main asset and thereby benefit from the appreciation of bitcoin. This way, real estate developers can leverage the debt-heavy nature of the real estate market to cover the demand for housing while also hedging themselves from any SoV risk that bitcoin may pose to that asset.

This seemed like a crazy idea. Bitcoin and real estate: a super conservative mainstream infrastructure investment combined with a hyper-volatile digital savings vehicle — an unlikely marriage. Yet, polar opposites attract, and an idea is only crazy until someone replicates it and makes it work.

To everyone’s surprise, that’s exactly what happened last year, when Andrew Hohns of Newmarket Capital went on TV to announce they had started applying Wankum’s model to offer a loan to a real estate developer. They had provided financing for a real estate project with a few special conditions:

- the developer had to use a small proportion to buy bitcoin, which was placed in escrow.

- the bitcoin is inextricably tied with the real estate asset.

- and the bitcoin has to be held for four years minimum.

The experiment was off to the races. If the past serves as a guide, this new investment structure will greatly reduce the burden of the loan.

Bitcoin and Student Debts, Rescuing the Next Generation

At this point, the parallels to student loans should be pretty clear. When 18-year-olds take out a mortgage-sized loan to bet on their education, their future human capital is effectively becoming the real estate (collateral) that backs the debt. Their capacity to make extra income from the knowledge and certificates they acquired by going into debt will help them pay it off (given that all goes well). Investment margins become very sensitive and risk increases immensely when huge amounts of leverage are added to any investment — be it trading stocks, real estate, or your future. Your room for maneuvering decreases, and you get trapped in the path you choose.

Thus, if you yourself become the real estate securing this mortgage-sized student debt, perhaps you could also secure that loan and reduce the burden on the main asset (you) by integrating bitcoin into the mix. This could have great benefits for all parties involved: decreasing the risk for the lender and giving increased peace of mind and opportunities for the borrower (you, the student).

One of the main advantages of adding bitcoin to your student debt structure is that there are now two assets rowing against the financial repayment current: yourself and bitcoin. By going to university, learning new skills and getting certificates, you open up the path to better-paid jobs and higher earning potentials, aka higher salaries. The more intriguing component is the bitcoin tied to your student debts. As a teenager itself, bitcoin has had an incredible CAGR over its lifespan. Even conservative numbers indicate that bitcoin will return about 60% annually for the foreseeable future. When compared with the 10-15% usually provided by the S&P 500, bitcoin looks like a Ferrari competing against horses.

The other advantage is one that frustrates most students, and it has to do with acquiring bitcoin once they understand it. Unlike most adults, undergrads have barely had any time to build up savings, and are therefore unable to exchange much fiat for hard bitcoin. This can become incredibly frustrating, especially because you know that if you were a decade older, you could have aped into bitcoin and retired your entire bloodline. But now you are stuck being 16, saving up pennies, and sacrificing your younger years for trifling amounts of bitcoin that won’t make a difference in your lifetime. So close, yet so far away.

But what is debt if not a way to bring future purchasing power into the present? Debt is a time-traveling machine that allows people to buy assets by leveraging their future earnings, revenues, or salaries. And thankfully, the current system is created so that the moment you can legally go to jail or go to war, you can also indebt yourself up to your eyeballs with the promise of future wages as a doctor, engineer, lawyer, or another profession.

Funnily enough, bitcoin’s recommended minimum holding time is also the number of years for an average college degree — four years. This means that, as long as you create a similar structure as the one proposed by Newmarket Capital, where the bitcoin has a four-year holding period, you’ll be using financial jiu-jitsu. The four-year holding period, however, does not mean that the student needs to sell at that point. The question of how to manage your finances between repaying the student loans, selling the bitcoin, or acquiring more is a more complex and personal issue. Regardless of what any student does, with this hybrid method, student debts can help young Bitcoiners leap forward instead of taking a step back.

With this new method, students — and their families — now have another thing to celebrate when they walk onto the graduation stage. And if you drop out of school, for any set of reasons that life may hit you with, your student loan now comes with a fail-safe met

-

@ 2b24a1fa:17750f64

2025-06-16 10:27:22

@ 2b24a1fa:17750f64

2025-06-16 10:27:22Der Münchner Pianist und "Musikdurchdringer" Jürgen Plich stellt jeden Dienstag um 20 Uhr große klassische Musik vor. Er teilt seine Hör- und Spielerfahrung und seine persönliche Sicht auf die Meisterwerke. Er spielt selbst besondere, unbekannte Aufnahmen, erklärt, warum die Musik so und nicht anders klingt und hat eine Menge aus dem Leben der Komponisten zu erzählen.

https://soundcloud.com/radiomuenchen/eine-stunde-klassik-liebesfreud-und-liebesleid?

Sonntags um 10 Uhr in der Wiederholung.

-

@ b1ddb4d7:471244e7

2025-06-16 09:01:16

@ b1ddb4d7:471244e7

2025-06-16 09:01:16Paris, France – June 6, 2025 – Flash, the easiest Bitcoin payment gateway for businesses, just announced a new partnership with the Bitcoin Only Brewery, marking the first-ever beverage company to leverage Flash for seamless Bitcoin payments.

Bitcoin Buys Beer Thanks to Flash!

As Co-Founder of Flash, it's not every day we get to toast to a truly refreshing milestone.

Okay, jokes aside.

We're super buzzed to see our friends at @Drink_B0B

Bitcoin Only Brewery using Flash to power their online sales!The first… pic.twitter.com/G7TWhy50pX

— Pierre Corbin (@CierrePorbin) June 3, 2025

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack – shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented: “Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest Bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept Bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

Bitcoin payment usage is growing thanks to Lightning

In May, fast-food chain Steak ‘N Shake went viral for integrating bitcoin at their restaurants around the world. In the same month, the bitcoin2025 conference in Las Vegas set a new world record with 4,000 Lightning payments in one day.

According to a report by River Intelligence, public Lightning payment volume surged by 266% from August 2023 to August 2024. This growth is also reflected in the overall accessibility of lighting infrastructure for consumers. According to Lightning Service Provider Breez, over 650 Million users now have access to the Lightning Network through apps like CashApp, Kraken or Strike.