-

@ 9c9d2765:16f8c2c2

2025-06-16 09:52:46

@ 9c9d2765:16f8c2c2

2025-06-16 09:52:46In a village nestled between cliffs and sea, lived a girl named Rita who had never spoken a word. She wasn’t mute but ever since her mother passed during a storm, her voice had locked itself deep within.

The villagers called her “the silent one.” Some pitied her. Others ignored her.

But every morning, Rita climbed the cliffs, sat with the rising sun, and played a handmade flute. Her melodies echoed through the valley, haunting, beautiful, alive.

One day, a merchant visited the village. He brought riches, spices, and tales but no joy. His heart was heavy with the loss of his son, and he walked through life with a scowl and silence of his own.

That morning, as he walked near the cliffs, he heard Rita’s song. He froze.

Something about the tune loosened the knot in his chest. It reminded him of lullabies he’d forgotten… of hope he thought had died.

Each day, he returned to hear her play. And though Rita said nothing, her music became his healing.

Soon, others began gathering. A boy with no father. An old widow. A girl who stuttered. They listened. They wept. They smiled.

Rita never spoke.

She didn’t need to.

Her silence became a voice louder than any words one that taught the village: “You don’t have to shout to be heard. Sometimes, healing sings quietly.”

Moral: Quiet doesn’t mean weak. There’s power in peace, and strength in stillness.

-

@ bd982176:8b2599a7

2025-06-16 09:08:30

@ bd982176:8b2599a7

2025-06-16 09:08:30Bitcoin Pizza Day at Kimbo: A Memorable Event with Lessons Learned

On May 22nd, Bitcoin Babies hosted a lively Bitcoin Pizza Day celebration in Kimbo, honoring the historical milestone when Laszlo Hanyecz purchased two pizzas with 10,000 BTC back in 2010. Our aim was to bring the spirit of Bitcoin to the local community, share the excitement of Bitcoin adoption, and of course — enjoy some great pizza!

We had been preparing for the event for weeks. Our team held several productive meetings beforehand, discussing logistics, assigning roles, and ensuring everyone was on the same page. These planning sessions filled us with confidence, and as the day approached, we were eager to see everything come together.

While the event presented a few unexpected challenges, it ultimately turned out to be a vibrant, educational, and inspiring experience for everyone involved.

One hurdle we faced was a delay in receiving the payment receipt for the pizzas, which caused a late start in serving. Technical issues also impacted our Lightning wallet transactions, slowing down payments and extending wait times. Still, the use of Bitcoin’s Lightning Network sparked interest and curiosity among many attendees, providing a real-time look at this powerful technology.

Our pizza chefs encountered some delays and equipment issues that required quick thinking and problem-solving from the team. Meanwhile, the turnout exceeded our expectations, which — though exciting — led to some confusion in managing orders and coordinating among team members.

Yet despite the pressure, what truly stood out was the community’s enthusiasm and our team’s resilience. Most importantly, we were able to educate a significant number of people about Bitcoin — what it is, how it works, and how it can positively impact lives. While we may not have reached everyone as deeply as we had hoped, many attendees walked away with new knowledge and curiosity sparked.

One last-minute complication was seeking permission from the area chief on the same day as the event. Although it added stress, it was a valuable reminder of the importance of early and clear communication with local authorities.

Looking ahead to next year, we’re excited to implement the lessons learned. We’ll secure permissions well in advance, test all technical tools thoroughly, and work even more closely with vendors to ensure smooth logistics. We’ll also set up clearer systems for order handling and team coordination to prevent overload and confusion.

Most importantly, we’ll maintain a strong focus on our mission: not just selling pizza but sharing the promise and potential of Bitcoin with our community. By creating space for both enjoyment and education, we’ll ensure that everyone leaves inspired.

Bitcoin Pizza Day at Kimbo in 2025 was a meaningful experience. We’re proud of what we accomplished, grateful for the lessons learned, and determined to make next year’s celebration even more impactful and memorable.

-

@ 70c48e4b:00ce3ccb

2025-06-16 06:59:12

@ 70c48e4b:00ce3ccb

2025-06-16 06:59:12Hello all :)

Something pretty exciting just happened in the world of decentralized tech.

A new social network project called Nostria successfully wrapped up its pre-seed funding round. It raised the funds through Angor, a crowdfunding platform built on Bitcoin and Nostr that aligns perfectly with the project’s decentralized mission.This post is all about what Nostria is doing, why it matters, and how Angor made it all possible.

What is Nostria?

nostr:npub16x7nxvehx0wvgy0sa6ynkw9c2ghuph3z0ll5t8veq3xwm8n9tqds6ka44x is a social network app that’s built to make the Nostr protocol easy to use. If you're not familiar with Nostr, it's an open protocol for decentralized social networking. It gives users more control and privacy, without relying on big platforms.

Nostria makes all that feel less like a tech experiment and more like a real social network. The app is simple, elegant, and beginner-friendly. It is available across iOS, Android, and web so you can jump in from anywhere.

Think of it as the easiest way to start using Nostr without needing to understand all the technical stuff under the hood.

https://www.nostria.app/assets/screenshots/nostria-01.jpg

The Problem Nostria is Solving:

One of the challenges Nostr faces right now is scaling. The network relies on relays to pass messages around, but many of these are centralized and getting overloaded. That creates serious bottlenecks and makes the whole experience less reliable. Just to give you an idea:

- Damus relay has around 646,000 users

- Nos relay has 601,000 users

- Snort sits at 417,000 users

When so many users depend on just a few relays, it puts a huge strain on the system and limits how far the network can grow.

Nostria’s Clever Fix

Nostria introduces a smarter way to scale Nostr without losing its decentralized core. Instead of relying on a few overloaded relays, it uses:

• Regionally deployed Discovery Relays – Think of these as local hubs placed in different parts of the world. When users connect, they are matched with a nearby relay, which keeps things faster and spreads the traffic out so no single relay gets overwhelmed.

• Pooled User Relays – Instead of each person depending on just one relay, users are connected through a shared pool. This means messages are sent and received more efficiently, especially when more people join the network.

All of this happens behind the scenes. The app keeps things simple and intuitive, with automation that handles the complexity for you. Whether you're posting, reading, or connecting with others, the experience stays smooth.

Nostria has bold ambitions. Here’s what they’re going for:

- A goal of 1 million daily active users

- Competing with platforms like Bluesky, Mastodon, and even X (formerly Twitter)

- A long-term plan to support both free and premium services to drive adoption

As of now, the Nostr network as a whole has:

- 15,000 daily active users

- 42.7 million total users

- 552 million total events

So the market is already there. It just needs the right tools to grow.

https://www.nostria.app/assets/screenshots/nostria-02.jpg

Meet the Team

Nostria is led by nostr:npub1zl3g38a6qypp6py2z07shggg45cu8qex992xpss7d8zrl28mu52s4cjajh, a software engineer with deep experience in distributed systems. He has been involved with the Nostr protocol since its early days in 2021 and is deeply passionate about decentralization and open-source tech.

https://www.nostria.app/assets/team/sondre.jpg

He’s joined by nostr:npub1e0krp2gr3l5nfd2jw2cydh68adxjpmcqdhs2e0jxkrqd4crwt4dslwrk0k, a thoughtful full-stack developer focused on simplicity and sovereignty, and nostr:npub10c4sn723akd7fqegfe6xntpq43p86vnyvv7j2ryaq8jzvhyea4pq72c5ul, a junior dev who’s already contributed to open source and is finishing up her studies.

https://www.nostria.app/assets/team/kosta.jpg https://www.nostria.app/assets/team/lu.jpg

The Funding Round

To bring Nostria to life, the team aimed to raise $30,000 during their pre-seed round. This funding would help them:

- Complete their MVP (Minimum Viable Product)

- Deploy global infrastructure

- Start building their user base

- Get ready for a full Seed round in late 2025

How Angor Helped?

Angor is a decentralized crowdfunding platform built on Bitcoin and the Nostr protocol. It’s designed exactly for projects like this. The team at Nostria launched their campaign on Angor between May 12 and May 31, and it was a success.

What made the campaign stand out?

- The whole process was decentralized and transparent.

- Backers could fund the project directly, without intermediaries.

- Nostria aligned perfectly with Angor’s vision of empowering projects that push decentralization forward.

The campaign served as both a fundraiser and a real-world example of how decentralized infrastructure can power decentralized ideas. And it worked.

Inside the Funding Terms

As part of this funding round, Nostria offered contributors a post-money SAFE (Simple Agreement for Future Equity). This is a modern, flexible way for startups to raise money early without the complexity of traditional equity rounds.

In simple terms:

•Investors contributed funds now, and in return, they will receive equity in Nostria during a future priced equity round. When Nostria raises its next round, most likely a Seed round, then those SAFE contributions will convert into actual shares.

•The SAFE includes a valuation cap, which sets a maximum company valuation for conversion. This guarantees that early backers receive shares at a better rate than future investors. While the exact cap isn't publicly listed, this feature ensures early supporters are rewarded for their trust.

•There is no interest or maturity date, which is a major benefit over traditional convertible notes. There’s no ticking clock or repayment obligation. Investors simply wait until the next funding event.

•The SAFE also features a Most Favored Nation (MFN) clause. This ensures that if the company issues another SAFE later with better terms, early investors will automatically receive the same improved terms. It’s designed to keep things transparent and equitable.

•Jurisdiction and legal terms: While the full legal text isn’t included in the note, SAFEs typically specify the legal jurisdiction governing the agreement. Nostria’s approach suggests a commitment to following standard legal frameworks, further underlining their seriousness and professionalism.

You can read Nostria’s public SAFE summary here: nostr:npub16x7nxvehx0wvgy0sa6ynkw9c2ghuph3z0ll5t8veq3xwm8n9tqds6ka44x

And you can view the full campaign hosted on Angor here: https://hub.angor.io/project/angor1qwdgxjuzhjykgpn5q8p3l2q9vyrgqdlrkfp5sjr

By sharing these details openly, the team added a strong layer of transparency and trust to the entire campaign. It is a clear signal that they are building something serious and thoughtful, with long-term commitment and care instead of shortcuts.

What’s Next?

With the funding secured, Nostria is sprinting ahead. The roadmap includes:

- June: Deploying media and relay servers

- July: Adding premium features and full cross-platform support

- August: Growing the user base and preparing for the next funding round

If all goes well, Nostria is on track to become one of the most accessible and user-friendly Nostr based platforms out there. With a clear roadmap and a team focused on long-term decentralization, the journey is just getting started...

Got an idea of your own? You can launch your project on Angor, just like Nostria did, and start your own funding round with the support of a like-minded community.

Thanks for reading. See y’all next week with another story from the world of open, decentralized innovation. Ciao

-

@ eb0157af:77ab6c55

2025-06-16 09:01:43

@ eb0157af:77ab6c55

2025-06-16 09:01:43Ukraine is opening the door to Bitcoin in its national reserves with a draft bill that would give the Central Bank the right to purchase digital assets.

Ukrainian lawmakers have introduced a legislative proposal that could allow the country’s Central Bank to include Bitcoin and other digital currencies in its national reserves.

The bill, filed on June 10 and registered as No. 13356, was put forward by a group of deputies led by Yaroslav Zheleznyak from the Holos party. The proposal calls for amendments to the Law on the National Bank of Ukraine, aiming to authorize the NBU (National Bank of Ukraine) to hold digital assets alongside gold and foreign currencies.

Source: Verkhovna Rada

The bill doesn’t require the Central Bank to invest in cryptocurrencies — it simply grants it the authority to do so. Zheleznyak stated:

“With this bill, we authorize the National Bank of Ukraine to include digital assets in the country’s reserves. However, decisions regarding the timing, methods, and volumes of such inclusion are left entirely at the discretion of the Central Bank.”

According to Zheleznyak, “proper management of crypto reserves will help strengthen macroeconomic stability and create new opportunities for the digital economy’s development.”

In a video discussion with Kirill Khomyakov, regional head of Binance for Central and Eastern Europe, Zheleznyak highlighted the growing international interest in cryptocurrencies as reserve assets, citing countries like the United States, El Salvador, Switzerland, and Brazil as examples of jurisdictions moving toward strategic bitcoin reserves.

The draft bill has been submitted to the Ukrainian Parliament, the Verkhovna Rada, and is now awaiting further consideration. If approved, Ukraine could become the first European country to officially hold bitcoin as a state asset.

The post Ukraine: draft bill to include bitcoin in Central Bank reserves appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-06-16 09:01:16

@ b1ddb4d7:471244e7

2025-06-16 09:01:16Paris, France – June 6, 2025 – Flash, the easiest Bitcoin payment gateway for businesses, just announced a new partnership with the Bitcoin Only Brewery, marking the first-ever beverage company to leverage Flash for seamless Bitcoin payments.

Bitcoin Buys Beer Thanks to Flash!

As Co-Founder of Flash, it's not every day we get to toast to a truly refreshing milestone.

Okay, jokes aside.

We're super buzzed to see our friends at @Drink_B0B

Bitcoin Only Brewery using Flash to power their online sales!The first… pic.twitter.com/G7TWhy50pX

— Pierre Corbin (@CierrePorbin) June 3, 2025

Flash enables Bitcoin Only Brewery to offer its “BOB” beer with, no-KYC (Know Your Customer) delivery across Europe, priced at 19,500 sats (~$18) for the 4-pack – shipping included.

The cans feature colorful Bitcoin artwork while the contents promise a hazy pale ale: “Each 33cl can contains a smooth, creamy mouthfeel, hazy appearance and refreshing Pale Ale at 5% ABV,” reads the product description.

Pierre Corbin, Co-Founder of Flash, commented: “Currently, bitcoin is used more as a store of value but usage for payments is picking up. Thanks to new innovation on Lightning, bitcoin is ready to go mainstream for e-commerce sales.”

Flash, launched its 2.0 version in March 2025 with the goal to provide the easiest Bitcoin payment gateway for businesses worldwide. The platform is non-custodial and can enable both digital and physical shops to accept Bitcoin by connecting their own wallets to Flash.

By leveraging the scalability of the Lightning Network, Flash ensures instant, low-cost transactions, addressing on-chain Bitcoin bottlenecks like high fees and long wait times.

Bitcoin payment usage is growing thanks to Lightning

In May, fast-food chain Steak ‘N Shake went viral for integrating bitcoin at their restaurants around the world. In the same month, the bitcoin2025 conference in Las Vegas set a new world record with 4,000 Lightning payments in one day.

According to a report by River Intelligence, public Lightning payment volume surged by 266% from August 2023 to August 2024. This growth is also reflected in the overall accessibility of lighting infrastructure for consumers. According to Lightning Service Provider Breez, over 650 Million users now have access to the Lightning Network through apps like CashApp, Kraken or Strike.

Bitcoin Only Brewery’s adoption of Flash reflects the growing trend of businesses integrating Bitcoin payments to cater to a global, privacy-conscious customer base. By offering no-KYC delivery across Europe, the brewery aligns with the ethos of decentralization and financial sovereignty, appealing to the increasing number of consumers and businesses embracing Bitcoin as a legitimate payment method.

“Flash is committed to driving innovation in the Bitcoin ecosystem,” Corbin added. “We’re building a future where businesses of all sizes can seamlessly integrate Bitcoin payments, unlocking new opportunities in the global market. It’s never been easier to start selling in bitcoin and we invite retailers globally to join us in this revolution.”

For businesses interested in adopting Bitcoin payments, Flash offers a straightforward onboarding process, low fees, and robust support for both digital and physical goods. To learn more, visit paywithflash.com.

About Flash

Flash is the easiest Bitcoin payment gateway for businesses to accept payments. Supporting both digital and physical enterprises, Flash leverages the Lightning Network to enable fast, low-cost Bitcoin transactions. Launched in its 2.0 version in March 2025, Flash is at the forefront of driving Bitcoin adoption in e-commerce.

About Bitcoin Only Brewery

Bitcoin Only Brewery (@Drink_B0B) is a pioneering beverage company dedicated to the Bitcoin ethos, offering high-quality beers payable exclusively in Bitcoin. With a commitment to personal privacy, the brewery delivers across Europe with no-KYC requirements.

Media Contact:

Pierre Corbin

Co-Founder, Flash

Email: press@paywithflash.com

Website: paywithflash.comPhotos paywithflash.com/about/pressHow Flash Enables Interoperable, Self-Custodial Bitcoin Commerce

-

@ 472f440f:5669301e

2025-06-12 05:11:12

@ 472f440f:5669301e

2025-06-12 05:11:12Marty's Bent

via me

I had a completely different newsletter partially written earlier tonight about whether or not "this cycle is different" when this nagging thought entered my head. So I'm going to write about this and maybe I'll write about the dynamics of this cycle compared to past cycles tomorrow.

A couple of headlines shot across my desk earlier tonight in relation to the potential escalation of kinetic warfare in the Middle East. Apparently the U.S. Embassy in Iraq was sent a warning and evacuation procedures were initiated. Not too long after, the world was made aware that the United States and Israel are contemplating an attack on Iran due to the "fact" that Iran may be close to producing nuclear weapins. The initial monkey brain reaction that I had to these two headlines was, "Oh shit, here we go again. We're going to do something stupid." My second reaction was, "Oh shit, here we go again, I've seen these two exact headlines many times over the years and they've proven to be lackluster if you're a doomer or blood thirsty war monger." Nothing ever happens.

As I venture into my mid-30s and reflect on a life filled with these types of headlines and my personal reactions to these headlines, I'm finally becoming attuned to the fact that the monkey brain reactions aren't very productive at the end of the day. Who knows exactly what's going to happen in Iraq or Iran and whether or not kinetic warfare escalates and materializes from here? Even though I'm a "blue-blooded taxpaying American citizen" who is passively and unwillingly contributing to the war machine and the media industrial complex, there's really nothing I can do about it.

The only thing I can do is focus on what is in front of me. What I have control of. And attempt to leverage what I have control of to make my life and the life of my family as good as humanly possible. Ignoring the external and turning inward often produces incredible results. Instead of worrying about what the media wants you to believe at any given point in time, you simply look away from your computer screen, survey the physical space which you're operating in and determine what you have, what you need and how you can get what you need. This is a much more productive way to spend your time.

This is what I want to touch on right now. There's never been a better time in human history to be productive despite what the algorithm on X or the mainstream media will lead you to believe. Things aren't as great as they could be, but they're also not as bad as you're being led to believe. We live in the Digital Age and the Digital Age provides incredible resources that you can leverage to make YOUR life better.

Social media allows you to create a platform without spending any money. AI allows you to build tools that are beneficial to yourself and others with very little money. And bitcoin exists to provide you with the best form of money that you can save in with the knowledge that your relative ownership of the overall supply isn't going to change. No matter what happens in the external world.

If you can combine these three things to make your life better and - by extension - potentially make the lives of many others better, you're going to be well off in the long run. Combining these three things isn't going to result in immediate gratification, but if you put forth a concerted effort, spend the time, have some semblance of patience, and stick with it, I truly believe that you will benefit massively in the long run. Without trying to sound like a blowhard, I truly believe that this is why I feel relatively calm (despite my monkey brain reactions to the headlines of the day) at this current point in time.

We've entered the era of insane leaps in productivity and digital hard money that cannot be corrupted. The biggest mistake you can make in your life right now is overlooking the confluence of these two things. With an internet connection, an idea, some savvy, and hard work you can materially change your life. Create something that levels up your knowledge, that enables you to get a good job in the real world, or to create a company of your own. Bring your talents to the market, exchange them for money, and then funnel that money into bitcoin (if you're not being paid in it already). We may be at the beginning of a transition from the high velocity trash economy to the high leverage agency economy run on sound money and applied creativity.

These concepts are what you should be focusing most of your time and attention to today and in the years ahead. Don't get distracted by the algorithm, the 30-second video clips, the headlines filled with doom, and the topics of the 24 hour news cycle. I'll admit, I often succumb to them myself. But, as I get older and develop a form of pattern recognition that can only be attained by being on this planet for a certain period of time, it is becoming very clear that those things are not worth your attention.

Living by the heuristic that "nothing ever happens" is a pretty safe bet. Funnily enough, it's incredibly ironic that you're led to believe that something is happening every single day, and yet nothing ever happens. By getting believing that something happens every day you are taking your attention away from doing things that happen to make your life better.

Tune out the noise. Put on the blinders. Take advantage of the incredible opportunities that lie before you. If enough of you - and many others who do not read this newsletter - do this, I truly believe we'll wake up to find that the world we live in is a much better place.

Nothing ever happens, so make something happen.

Intelligence Officials Are Quietly Becoming Bitcoin Believers

Ken Egan, former CIA Deputy Chief of Cyber Operations, revealed a surprising truth on TFTC: the intelligence community harbors numerous Bitcoin advocates. Egan explained that intelligence professionals uniquely understand how governments weaponize financial systems through sanctions and account freezing. Having wielded these tools themselves, they recognize the need for personal financial sovereignty. He shared compelling anecdotes of discovering colleagues with "We are all Satoshi" stickers and a European chief of station paying for dinner with a BlockFi card to earn Bitcoin rewards.

"I think there are a lot of Bitcoiners, not just at CIA, but across the whole national security establishment... they're in it for the exact same reasons everybody else is." - Ken Egan

The Canadian trucker protests served as a pivotal moment, Egan noted. Watching Western governments freeze citizens' bank accounts for political dissent struck a nerve among intelligence professionals who previously viewed financial weaponization as a tool reserved for foreign adversaries. This awakening has created unlikely allies within institutions many Bitcoiners distrust.

Check out the full podcast here for more on Bitcoin's national security implications, privacy tech prosecutions, and legislative priorities.

Headlines of the Day

Stripe Buys Crypto Wallet Privy After Bridge Deal - via X

Trump Calls CPI Data "Great" Urges Full Point Fed Cut - via X

Bitcoin Hashrate Reaches New All-Time High - via X

Get our new STACK SATS hat - via tftcmerch.io

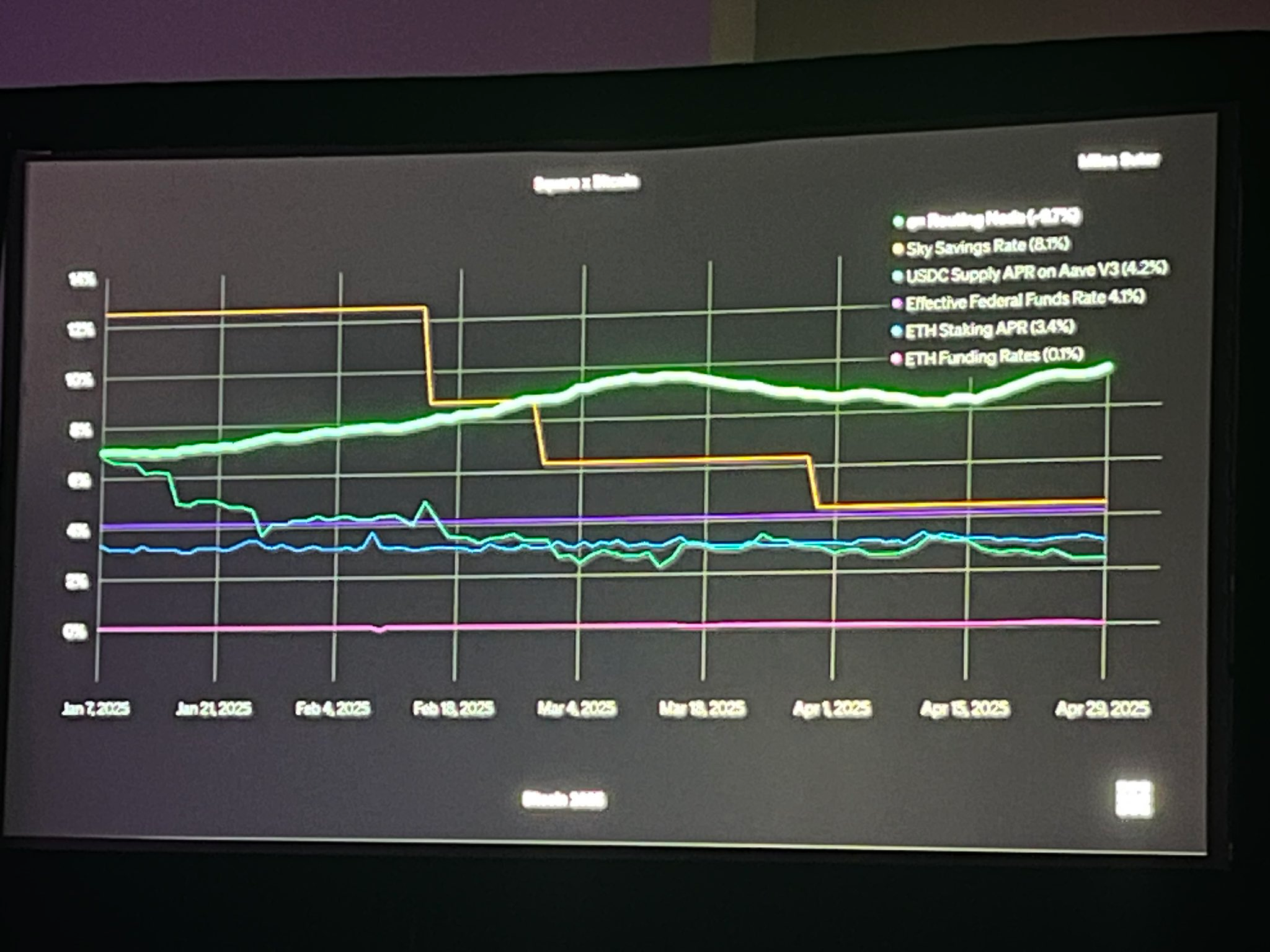

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Life is good.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ f0fd6902:a2fbaaab

2025-06-16 08:43:19

@ f0fd6902:a2fbaaab

2025-06-16 08:43:19Wolves can swim great distances of over seven miles. How? It’s due to special webbing between their toes. Many wolves, including the red wolf, will hunt in the water. They’ll slowly and silently swim up to their prey, and at the right time, they lunge forward and nab their victim with their powerful jaws. The webbing between their toes also helps them to maintain traction when walking across slick surfaces, like wet rocks.

https://stacker.news/items/1007519

-

@ 6f26dd2b:f2824b88

2025-06-16 08:17:49

@ 6f26dd2b:f2824b88

2025-06-16 08:17:49To mitigate the negative effects of cognitive load on decision-making in forex trading, traders can adopt several strategies, such as breaking down complex tasks into smaller, more manageable steps, focusing on relevant information and reducing distractions, using checklists and decision-making frameworks, and taking breaks to recharge mental resources. Traders can also use tools and technologies that automate or simplify certain aspects of the trading process, such as algorithmic trading and risk management software.

To avoid the dangers of overconfidence, traders must remain humble, maintain discipline, and approach the market with a healthy respect for its complexity and unpredictability. By doing so, they can develop strategies that are more likely to result in success.

To avoid making impulsive decisions based on emotion, traders must develop a well-defined trading plan, manage their risk effectively, and maintain discipline. They must also remain focused on their long-term goals and avoid becoming overly focused on short-term gains or losses. By doing so, they can develop strategies that are more likely to result in success in the financial markets.

To avoid the pitfalls of trading to prove oneself to others, traders must develop a clear understanding of their motivations and goals. They must focus on developing a solid trading plan and approach the markets with a long-term perspective. By doing so, they can avoid making impulsive decisions and can manage their risks effectively.

Realistic goals can also help traders stay focused and disciplined, as they provide a clear direction for their trading activities. By setting realistic goals, traders can increase their chances of success and avoid falling victim to unrealistic expectations or pressure.

traders must adhere to the rule of only trading with money that they can afford to lose. By doing so, they can approach trading with a disciplined and rational mindset, which is essential for success in the financial markets.

It is important to conduct proper research and analysis, set realistic goals, and use proper risk management techniques to avoid falling victim to the rich quick mentality.

To avoid losing money due to greed, traders need to be disciplined and have a solid trading plan. This plan should include risk management strategies that help to control the amount of risk that is taken on in each trade. Traders should also use leverage responsibly and avoid overtrading. Finally, traders need to be able to control their emotions and make rational decisions based on analysis rather than emotions.

Being aware of your own strengths and weaknesses can help you develop a trading strategy that works for you.

To practice disciplined trading, you should develop a trading plan and stick to it. This plan should include your entry and exit points, stop-loss levels, and profit targets. It should also include your risk management strategy. By sticking to your trading plan, you can avoid impulsive decisions and ensure that your trades are based on analysis rather than emotions. By practicing disciplined trading and managing your risk carefully, you can improve your chances of success in the markets.

Being patient and persistent requires putting in the time and effort required to succeed. This means dedicating time each day to study the markets, analyze your trades, and refine your strategy. It also means being willing to learn from your mistakes, seek out feedback and guidance from other traders, and continuously improve your skills. By putting in the time and effort required to succeed, you can build the knowledge, experience, and discipline needed to achieve consistent profits over the long-term.

In addition, maintaining a healthy work-life balance is important for avoiding burnout and maintaining mental and physical well-being. This can include strategies such as setting aside time for hobbies and other activities outside of trading, taking breaks when needed, and maintaining a healthy diet and exercise routine.

-

@ dfa02707:41ca50e3

2025-06-15 23:02:35

@ dfa02707:41ca50e3

2025-06-15 23:02:35

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ dfa02707:41ca50e3

2025-06-15 23:02:32

@ dfa02707:41ca50e3

2025-06-15 23:02:32- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 39cc53c9:27168656

2025-06-16 06:26:04

@ 39cc53c9:27168656

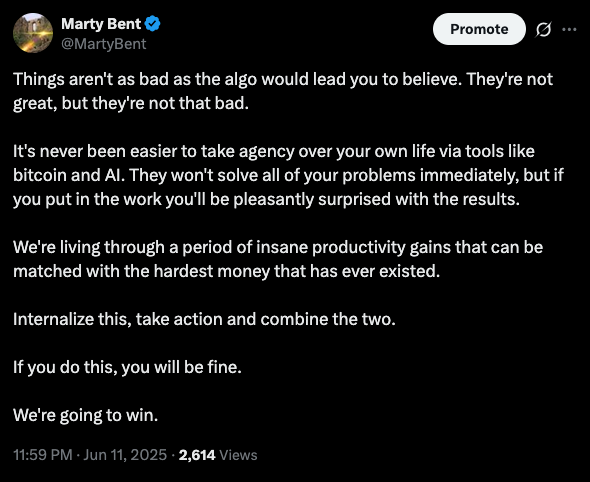

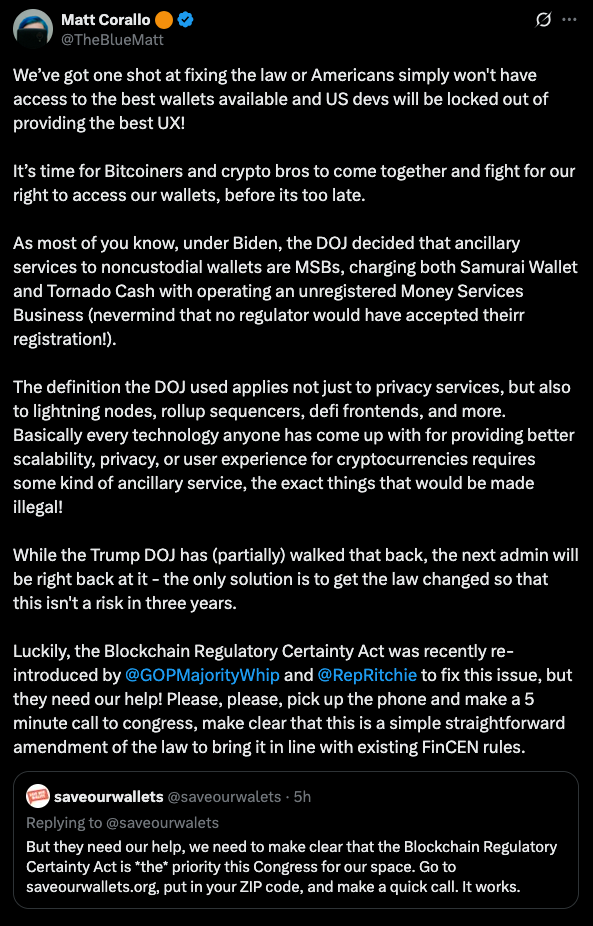

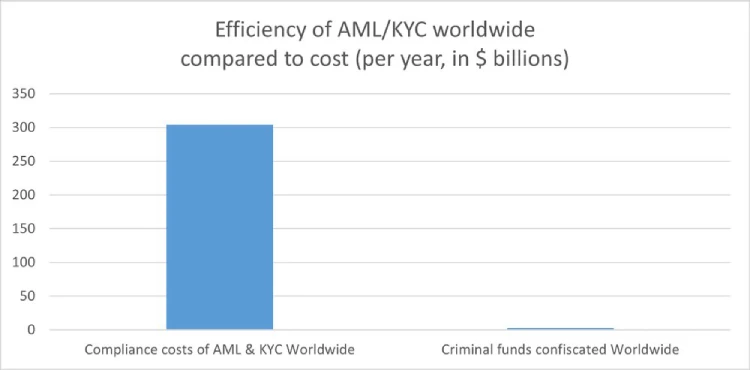

2025-06-16 06:26:04Know Your Customer is a regulation that requires companies of all sizes to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. Such procedures fit within the broader scope of anti-money laundering (AML) and counterterrorism financing (CTF) regulations.

Banks, exchanges, online business, mail providers, domain registrars... Everyone wants to know who you are before you can even opt for their service. Your personal information is flowing around the internet in the hands of "god-knows-who" and secured by "trust-me-bro military-grade encryption". Once your account is linked to your personal (and verified) identity, tracking you is just as easy as keeping logs on all these platforms.

Rights for Illusions

KYC processes aim to combat terrorist financing, money laundering, and other illicit activities. On the surface, KYC seems like a commendable initiative. I mean, who wouldn't want to halt terrorists and criminals in their tracks?

The logic behind KYC is: "If we mandate every financial service provider to identify their users, it becomes easier to pinpoint and apprehend the malicious actors."

However, terrorists and criminals are not precisely lining up to be identified. They're crafty. They may adopt false identities or find alternative strategies to continue their operations. Far from being outwitted, many times they're several steps ahead of regulations. Realistically, KYC might deter a small fraction – let's say about 1% ^1 – of these malefactors. Yet, the cost? All of us are saddled with the inconvenient process of identification just to use a service.

Under the rhetoric of "ensuring our safety", governments and institutions enact regulations that seem more out of a dystopian novel, gradually taking away our right to privacy.

To illustrate, consider a city where the mayor has rolled out facial recognition cameras in every nook and cranny. A band of criminals, intent on robbing a local store, rolls in with a stolen car, their faces obscured by masks and their bodies cloaked in all-black clothes. Once they've committed the crime and exited the city's boundaries, they switch vehicles and clothes out of the cameras' watchful eyes. The high-tech surveillance? It didn’t manage to identify or trace them. Yet, for every law-abiding citizen who merely wants to drive through the city or do some shopping, their movements and identities are constantly logged. The irony? This invasive tracking impacts all of us, just to catch the 1% ^1 of less-than-careful criminals.

KYC? Not you.

KYC creates barriers to participation in normal economic activity, to supposedly stop criminals. ^2

KYC puts barriers between many users and businesses. One of these comes from the fact that the process often requires multiple forms of identification, proof of address, and sometimes even financial records. For individuals in areas with poor record-keeping, non-recognized legal documents, or those who are unbanked, homeless or transient, obtaining these documents can be challenging, if not impossible.

For people who are not skilled with technology or just don't have access to it, there's also a barrier since KYC procedures are mostly online, leaving them inadvertently excluded.

Another barrier goes for the casual or one-time user, where they might not see the value in undergoing a rigorous KYC process, and these requirements can deter them from using the service altogether.

It also wipes some businesses out of the equation, since for smaller businesses, the costs associated with complying with KYC norms—from the actual process of gathering and submitting documents to potential delays in operations—can be prohibitive in economical and/or technical terms.

You're not welcome

Imagine a swanky new club in town with a strict "members only" sign. You hear the music, you see the lights, and you want in. You step up, ready to join, but suddenly there's a long list of criteria you must meet. After some time, you are finally checking all the boxes. But then the club rejects your membership with no clear reason why. You just weren't accepted. Frustrating, right?

This club scenario isn't too different from the fact that KYC is being used by many businesses as a convenient gatekeeping tool. A perfect excuse based on a "legal" procedure they are obliged to.

Even some exchanges may randomly use this to freeze and block funds from users, claiming these were "flagged" by a cryptic system that inspects the transactions. You are left hostage to their arbitrary decision to let you successfully pass the KYC procedure. If you choose to sidestep their invasive process, they might just hold onto your funds indefinitely.

Your identity has been stolen

KYC data has been found to be for sale on many dark net markets^3. Exchanges may have leaks or hacks, and such leaks contain very sensitive data. We're talking about the full monty: passport or ID scans, proof of address, and even those awkward selfies where you're holding up your ID next to your face. All this data is being left to the mercy of the (mostly) "trust-me-bro" security systems of such companies. Quite scary, isn't it?

As cheap as $10 for 100 documents, with discounts applying for those who buy in bulk, the personal identities of innocent users who passed KYC procedures are for sale. ^3

In short, if you have ever passed the KYC/AML process of a crypto exchange, your privacy is at risk of being compromised, or it might even have already been compromised.

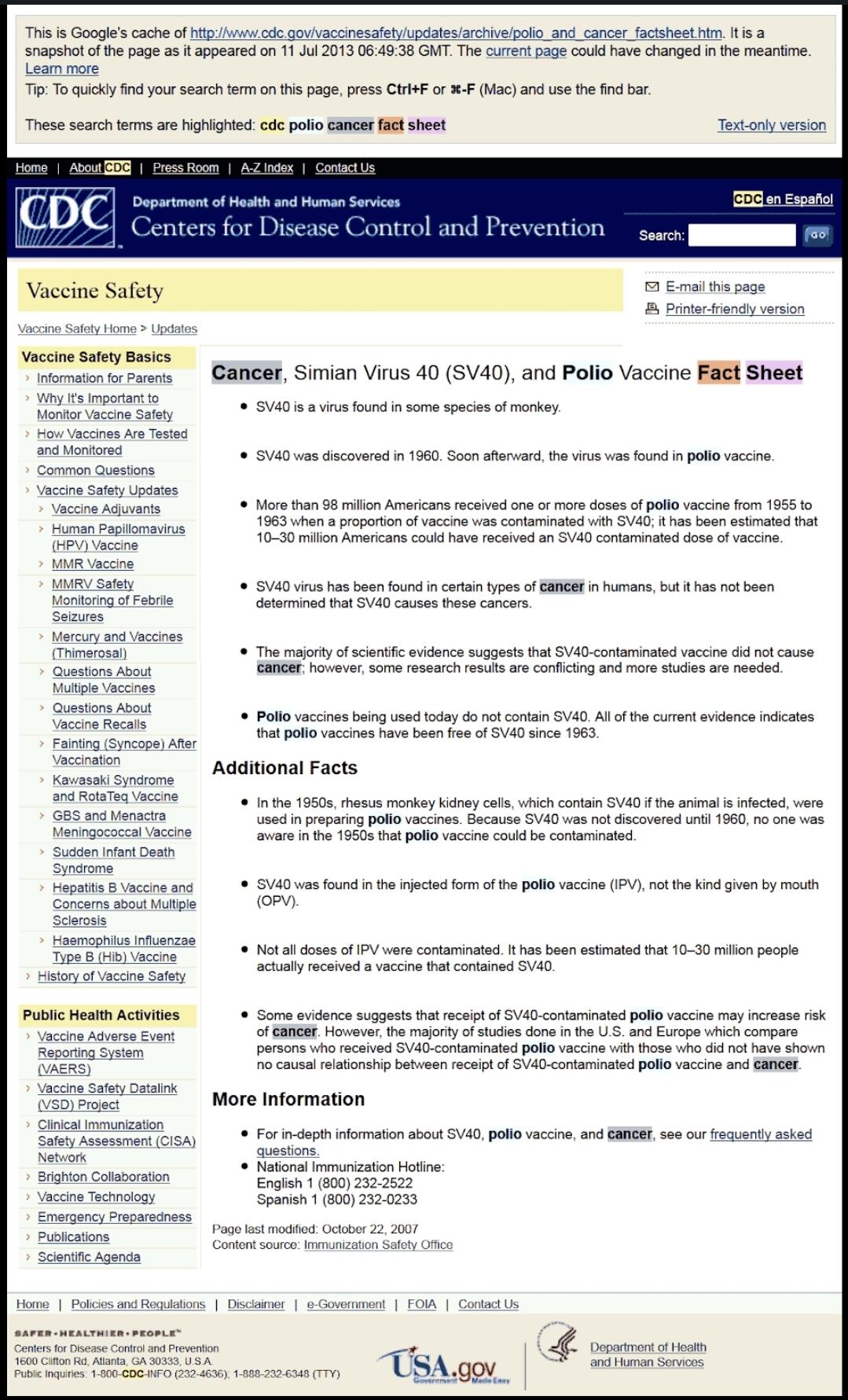

(they) Know Your Coins

You may already know that Bitcoin and most cryptocurrencies have a transparent public blockchain, meaning that all data is shown unencrypted for everyone to see and recorded forever. If you link an address you own to your identity through KYC, for example, by sending an amount from a KYC exchange to it, your Bitcoin is no longer pseudonymous and can then be traced.

If, for instance, you send Bitcoin from such an identified address to another KYC'ed address (say, from a friend), everyone having access to that address-identity link information (exchanges, governments, hackers, etc.) will be able to associate that transaction and know who you are transacting with.

Conclusions

To sum up, KYC does not protect individuals; rather, it's a threat to our privacy, freedom, security and integrity. Sensible information flowing through the internet is thrown into chaos by dubious security measures. It puts borders between many potential customers and businesses, and it helps governments and companies track innocent users. That's the chaos KYC has stirred.

The criminals are using stolen identities from companies that gathered them thanks to these very same regulations that were supposed to combat them. Criminals always know how to circumvent such regulations. In the end, normal people are the most affected by these policies.

The threat that KYC poses to individuals in terms of privacy, security and freedom is not to be neglected. And if we don’t start challenging these systems and questioning their efficacy, we are just one step closer to the dystopian future that is now foreseeable.

Edited 20/03/2024 * Add reference to the 1% statement on Rights for Illusions section to an article where Chainalysis found that only 0.34% of the transaction volume with cryptocurrencies in 2023 was attributable to criminal activity ^1

-

@ 39cc53c9:27168656

2025-06-16 06:25:50

@ 39cc53c9:27168656

2025-06-16 06:25:50After almost 3 months of work, we've completed the redesign of kycnot.me. More modern and with many new features.

Privacy remains the foundation - everything still works with JavaScript disabled. If you enable JS, you will get some nice-to-have features like lazy loading and smoother page transitions, but nothing essential requires it.

User Accounts

We've introduced user accounts that require zero personal information:

- Secret user tokens - no email, no phone number, no personal data

- Randomly generated usernames for default privacy and fairness

- Karma system that rewards contributions and unlocks features: custom display names, profile pictures, and more.

Reviews and Community Discussions

On the previous sites, I was using third party open source tools for the comments and discussions. This time, I've built my own from scratch, fully integrated into the site, without JavaScript requirements.

Everyone can share their experiences and help others make informed decisions:

- Ratings: Comments can have a 1-5 star rating attached. You can have one rating per service and it will affect the overall user score.

- Discussions: These are normal comments, you can add them on any listed service.

Comment Moderation

I was strugling to keep up with moderation on the old site. For this, we've implemented an AI-powered moderation system that:

- Auto-approves legitimate comments instantly

- Flags suspicious content for human review

- Keeps discussions valuable by minimizing spam

The AI still can mark comments for human review, but most comments will get approved automatically by this system. The AI also makes summaries of the comments to help you understand the overall sentiment of the community.

Powerful Search & Filtering

Finding exactly what you need is now easier:

- Advanced filtering system with many parameters. You can even filter by attributes to pinpoint services with specific features.

The results are dynamic and shuffle services with identical scores for fairness.

See all listings

Listings are now added as 'Community Contributed' by default. This means that you can still find them in the search results, but they will be clearly marked as such.

Updated Scoring System

New dual-score approach provides more nuanced service evaluations:

- Privacy Score: Measures how well a service protects your personal information and data

-

Trust Score: Assesses reliability, security, and overall reputation

-

Combined into a weighted Overall Score for quick comparisons

- Completely transparent and open source calculation algorithm. No manual tweaking or hidden factors.

AI-Powered Terms of Service Analysis

Basically, a TLDR summary for Terms of Service:

- Automated system extracts the most important points from complex ToS documents

- Clear summaries

- Updated monthly to catch any changes

The ToS document is hashed and only will be updated if there are any changes.

Service Events and Timelines

Track the complete history of any service, on each service page you can see the timeline of events. There are two types of events:

- Automatic events: Created by the system whenever something about a service changes, like its description, supported currencies, attributes, verification status…

- Manual events: Added by admins when there’s important news, such as a service going offline, being hacked, acquired, shut down, or other major updates.

There is also a global timeline view available at /events

Notification System

Since we now have user accounts, we built a notifiaction system so you can stay informed about anything:

- Notifications for comment replies and status changes

- Watch any comment to get notified for new replies.

- Subscribe to services to monitor events and updates

- Notification customization.

Coming soon: Third-party privacy-preserving notifications integration with Telegram, Ntfy.sh, webhooks...

Service Suggestions

Anyone with an account can suggest a new service via the suggestion form. After submitting, you'll receive a tracking page where you can follow the status of your suggestion and communicate directly with admins.

All new suggestions start as "unlisted" — they won't appear in search results until reviewed. Our team checks each submission to ensure it's not spam or inappropriate. If similar services already exist, you'll be shown possible duplicates and can choose to submit your suggestion as an edit instead.

You can always check the progress of your suggestion, respond to moderator questions, and see when it goes live, everything will also be notified to your account. This process ensures high-quality listings and a collaborative approach to building the directory.

These are some of the main features we already have, but there are many more small changes and improvements that you will find when using the site.

What's Next?

This is just the beginning. We will be constantly working to improve KYCnot.me and add more features that help you preserve your privacy.

Remember: True financial freedom requires the right to privacy. Stay KYC-free!

-

@ 472f440f:5669301e

2025-06-11 04:37:33

@ 472f440f:5669301e

2025-06-11 04:37:33Marty's Bent

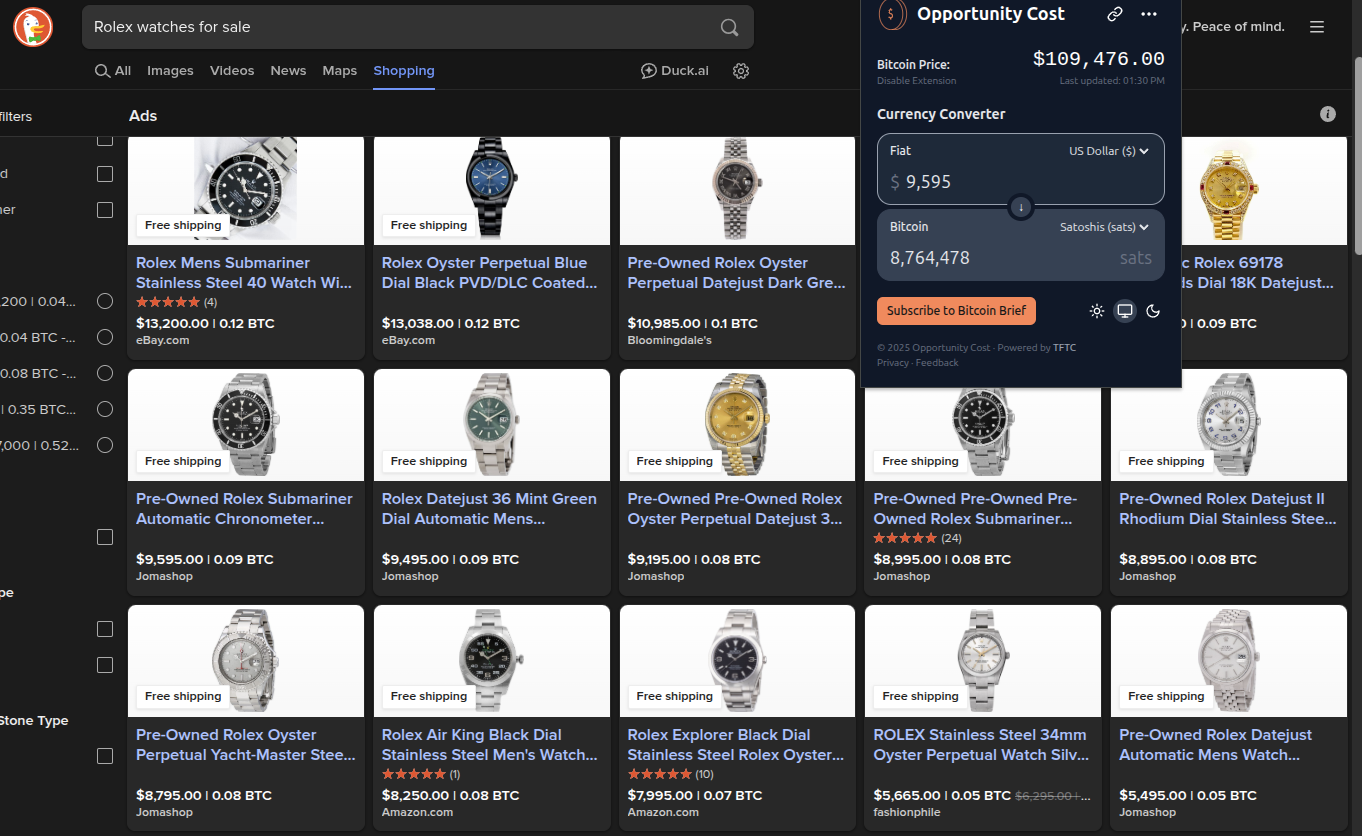

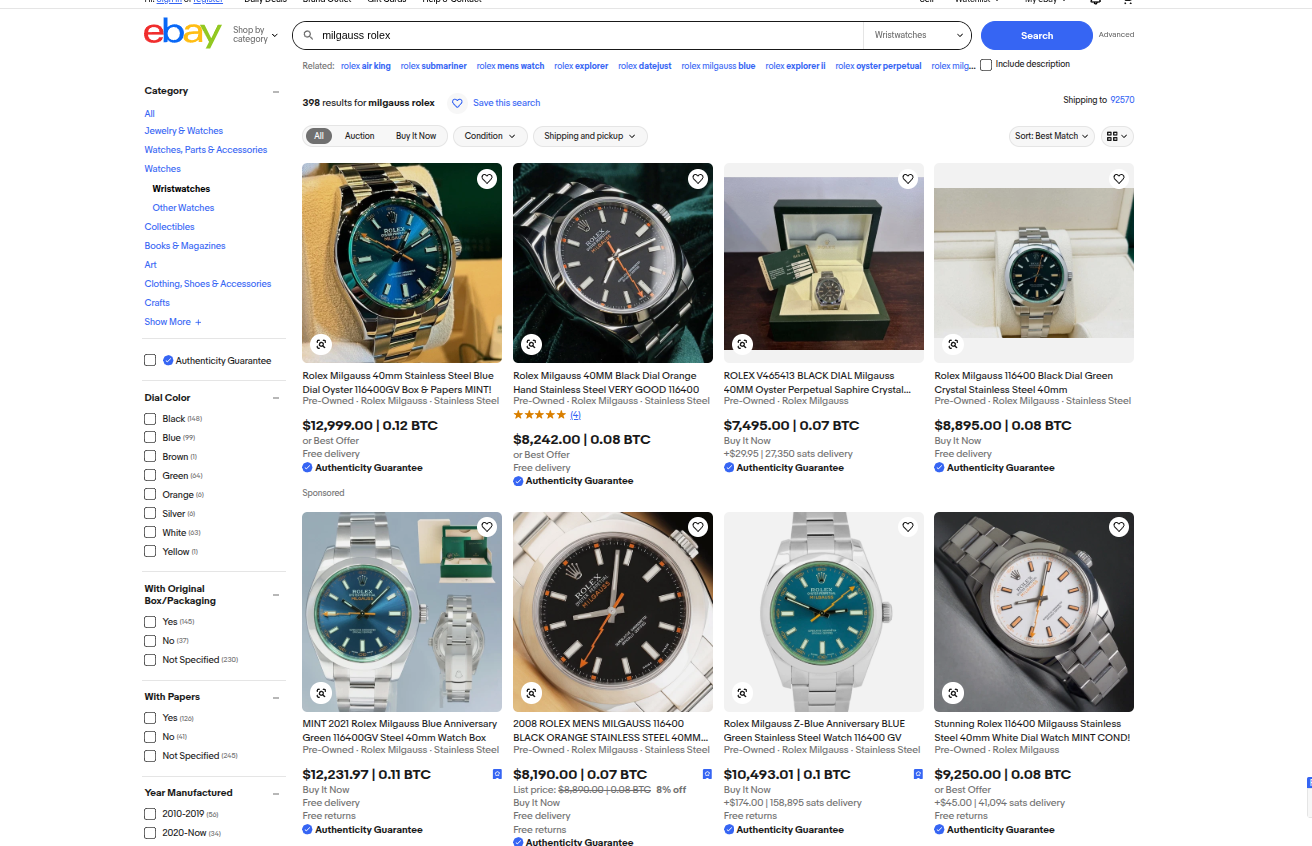

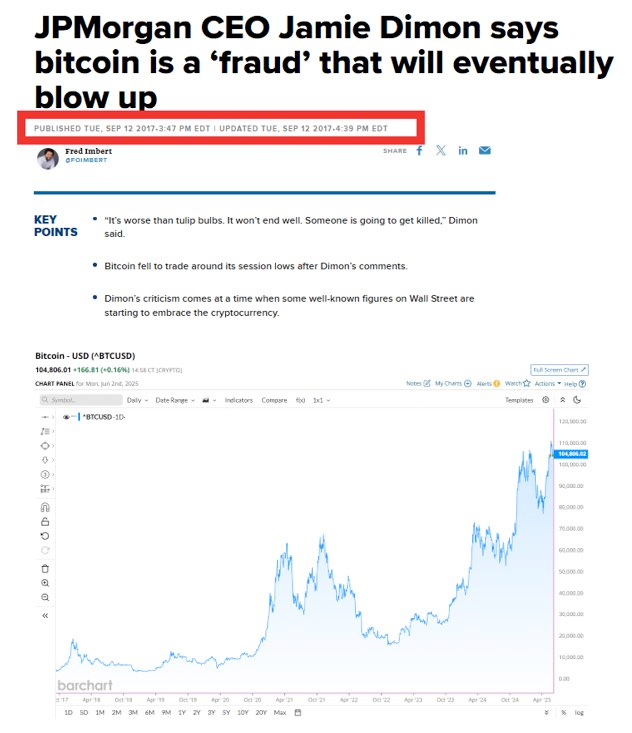

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

Opportunity Cost – See Prices in Bitcoin Instantly

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

*Download our free browser extension, Opportunity Cost: *<<https://www.opportunitycost.app/>> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 8bad92c3:ca714aa5

2025-06-16 04:01:35

@ 8bad92c3:ca714aa5

2025-06-16 04:01:35Key Takeaways

Michael Goldstein, aka Bitstein, presents a sweeping philosophical and economic case for going “all in” on Bitcoin, arguing that unlike fiat, which distorts capital formation and fuels short-term thinking, Bitcoin fosters low time preference, meaningful saving, and long-term societal flourishing. At the heart of his thesis is “hodling for good”—a triple-layered idea encompassing permanence, purpose, and the pursuit of higher values like truth, beauty, and legacy. Drawing on thinkers like Aristotle, Hoppe, and Josef Pieper, Goldstein redefines leisure as contemplation, a vital practice in aligning capital with one’s deepest ideals. He urges Bitcoiners to think beyond mere wealth accumulation and consider how their sats can fund enduring institutions, art, and architecture that reflect a moral vision of the future.

Best Quotes

“Let BlackRock buy the houses, and you keep the sats.”

“We're not hodling just for the sake of hodling. There is a purpose to it.”

“Fiat money shortens your time horizon… you can never rest.”

“Savings precedes capital accumulation. You can’t build unless you’ve saved.”

“You're increasing the marginal value of everyone else’s Bitcoin.”

“True leisure is contemplation—the pursuit of the highest good.”

“What is Bitcoin for if not to make the conditions for magnificent acts of creation possible?”

“Bitcoin itself will last forever. Your stack might not. What will outlast your coins?”

“Only a whale can be magnificent.”

“The market will sell you all the crack you want. It’s up to you to demand beauty.”

Conclusion

This episode is a call to reimagine Bitcoin as more than a financial revolution—it’s a blueprint for civilizational renewal. Michael Goldstein reframes hodling as an act of moral stewardship, urging Bitcoiners to lower their time preference, build lasting institutions, and pursue truth, beauty, and legacy—not to escape the world, but to rebuild it on sound foundations.

Timestamps

00:00 - Intro

00:50 - Michael’s BBB presentation Hodl for Good

07:27 - Austrian principles on capital

15:40 - Fiat distorts the economic process

23:34 - Bitkey

24:29 - Hodl for Good triple entendre

29:52 - Bitcoin benefits everyone

39:05 - Unchained

40:14 - Leisure theory of value

52:15 - Heightening life

1:15:48 - Breaking from the chase makes room for magnificence

1:32:32 - Nakamoto Institute’s missionTranscript

(00:00) Fiat money is by its nature a disturbance. If money is being continually produced, especially at an uncertain rate, these uh policies are really just redistribution of wealth. Most are looking for number to go up post hyper bitcoinization. The rate of growth of bitcoin would be more reflective of the growth of the economy as a whole.

(00:23) Ultimately, capital requires knowledge because it requires knowing there is something that you can add to the structures of production to lengthen it in some way that will take time but allow you to have more in the future than you would today. Let Black Rockck buy the houses and you keep the sats, not the other way around.

(00:41) You wait until later for Larry Frink to try to sell you a [Music] mansion. And we're live just like that. Just like that. 3:30 on a Friday, Memorial Day weekend. It's a good good good way to end the week and start the holiday weekend. Yes, sir. Yes, sir. Thank you for having me here. Thank you for coming. I wore this hat specifically because I think it's I think it's very apppropo uh to the conversation we're going to have which is I hope an extension of the presentation you gave at Bitblock Boom Huddle for good. You were working on

(01:24) that for many weeks leading up to uh the conference and explaining how you were structuring it. I think it's a very important topic to discuss now as the Bitcoin price is hitting new all-time highs and people are trying to understand what am I doing with Bitcoin? Like you have you have the different sort of factions within Bitcoin.

(01:47) Uh get on a Bitcoin standard, get on zero, spend as much Bitcoin as possible. You have the sailors of the world are saying buy Bitcoin, never sell, die with your Bitcoin. And I think you do a really good job in that presentation. And I just think your understanding overall of Bitcoin is incredible to put everything into context. It's not either or.

(02:07) It really depends on what you want to accomplish. Yeah, it's definitely there there is no actual one-sizefits-all um for I mean nearly anything in this world. So um yeah, I mean first of all I mean there was it was the first conference talk I had given in maybe five years. I think the one prior to that uh was um bit block boom 2019 which was my meme talk which uh has uh become infamous and notorious.

(02:43) So uh there was also a lot of like high expectations uh you know rockstar dev uh has has treated that you know uh that that talk with a lot of reference. a lot of people have enjoyed it and he was expecting this one to be, you know, the greatest one ever, which is a little bit of a little bit of a uh a burden to live up to those kinds of standards.

(03:08) Um, but you know, because I don't give a lot of talks. Um, you know, I I I like to uh try to bring ideas that might even be ideas that are common. So, something like hodling, we all talk about it constantly. uh but try to bring it from a little bit of a different angle and try to give um a little bit of uh new light to it.

(03:31) I alsove I've I've always enjoyed kind of coming at things from a third angle. Um whenever there's, you know, there's there's all these little debates that we have in in Bitcoin and sometimes it's nice to try to uh step out of it and look at it a little more uh kind of objectively and find ways of understanding it that incorporate the truths of of all of them.

(03:58) uh you know cuz I think we should always be kind of as much as possible after ultimate truth. Um so with this one um yeah I was kind of finding that that sort of golden mean. So uh um yeah and I actually I think about that a lot is uh you know Aristotle has his his concept of the golden mean. So it's like any any virtue is sort of between two vices um because you can you can always you can always take something too far.

(04:27) So you're you're always trying to find that right balance. Um so someone who is uh courageous you know uh one of the vices uh on one side is being basically reckless. I I can't remember what word he would use. Uh but effectively being reckless and just wanting to put yourself in danger for no other reason than just you know the thrill of it.

(04:50) Um and then on the other side you would just have cowardice which is like you're unwilling to put yourself um at any risk at any time. Um, and courage is right there in the middle where it's understanding when is the right time uh to put your put yourself, you know, in in the face of danger um and take it on. And so um in some sense this this was kind of me uh in in some ways like I'm obviously a partisan of hodling.

(05:20) Um, I've for, you know, a long time now talked about the, um, why huddling is good, why people do it, why we should expect it. Um, but still trying to find that that sort of golden mean of like yes, huddle, but also what are we hodling for? And it's not we're we're not hodddling just merely for the sake of hodddling.

(05:45) There there is a a purpose to it. And we should think about that. And that would also help us think more about um what are the benefits of of spending, when should we spend, why should we spend, what should we spend on um to actually give light to that sort of side of the debate. Um so that was that was what I was kind of trying to trying to get into.

(06:09) Um, as well as also just uh at the same time despite all the talk of hodling, there's always this perennial uh there's always this perennial dislike of hodlers because we're treated as uh as if um we're just free riding the network or we're just greedy or you know any of these things. And I wanted to show how uh huddling does serve a real economic purpose.

(06:36) Um, and it does benefit the individual, but it also does uh it it has actual real social um benefits as well beyond merely the individual. Um, so I wanted to give that sort of defense of hodling as well to look at it from um a a broader position than just merely I'm trying to get rich. Um uh because even the person who uh that is all they want to do um just like you know your your pure number grow up go up moonboy even that behavior has positive ramifications on on the economy.

(07:14) And while we might look at them and have uh judgments about their particular choices for them as an individual, we shouldn't discount that uh their actions are having positive positive effects for the rest of the economy. Yeah. So, let's dive into that just not even in the context of Bitcoin because I think you did a great job of this in the presentation.

(07:36) just you've done a good job of this consistently throughout the years that I've known you. Just from like a first principles Austrian economics perspective, what is the idea around capital accumulation, low time preference and deployment of that capital like what what like getting getting into like the nitty-gritty and then applying it to Bitcoin? Yeah, it's it's a big question and um in many ways I mean I I even I barely scratched the surface.

(08:05) uh I I can't claim to have read uh all the volumes of Bombber works, you know, capital and interest and and stuff like that. Um but I think there's some some sort of basic concepts that we can look at that we can uh draw a lot out. Um the first uh I guess let's write that. So repeat so like capital time preference. Yeah. Well, I guess getting more broad like why sav -

@ dfa02707:41ca50e3

2025-06-15 17:02:37

@ dfa02707:41ca50e3

2025-06-15 17:02:37Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ c1e9ab3a:9cb56b43

2025-06-15 00:36:39

@ c1e9ab3a:9cb56b43

2025-06-15 00:36:391. Introduction

The 21st century is marked by a rare confluence of demographic, technological, and monetary regime shifts. As birth rates fall below replacement levels across advanced and many emerging economies, global population growth slows and begins to reverse. At the same time, automation, AI, and robotics are increasing productivity at an accelerating pace. Simultaneously, trust in central banks and fiat currencies is waning, giving rise to calls for a return to hard currencies (e.g., gold, Bitcoin) and decentralized monetary systems.