-

@ 57d1a264:69f1fee1

2025-06-12 06:00:19

@ 57d1a264:69f1fee1

2025-06-12 06:00:19From designer Anna Cairns, the workhorse monospace typeface is rooted in feminist theory.

Across CMM Coda’s subtly imperfect, analogue-inspired letterforms – based on the IBM Selectric typewriter’s typeface, Dual Basic – Anna practically and conceptually brings together the feminist legacy of software and typewriters with the aesthetic sensibilities of the genre associated with the industry. Additionally, CMM Coda enables Anna to explore her intrigue in the blurry terminology used in text production, such as typing, coding and writing, “especially now that most text is created digitally,” Anna says, with typefaces being software in their own right. “We also associate a certain look with each of these modalities,” she continues, “so my idea was to create a typeface that can jump all of these genres simply through a play with white space,” an approach that resulted in CMM Coda’s multiple styles.

Learn more about Comma at https://commatype.com/, a new foundry founded by the Berlin-based type designer Anna Cairns.

Continue reading at https://www.itsnicethat.com/articles/comma-type-cmm-coda-graphic-design-project-110625

https://stacker.news/items/1004142

-

@ ae9dc5ef:77f0ed87

2025-06-13 09:25:28

@ ae9dc5ef:77f0ed87

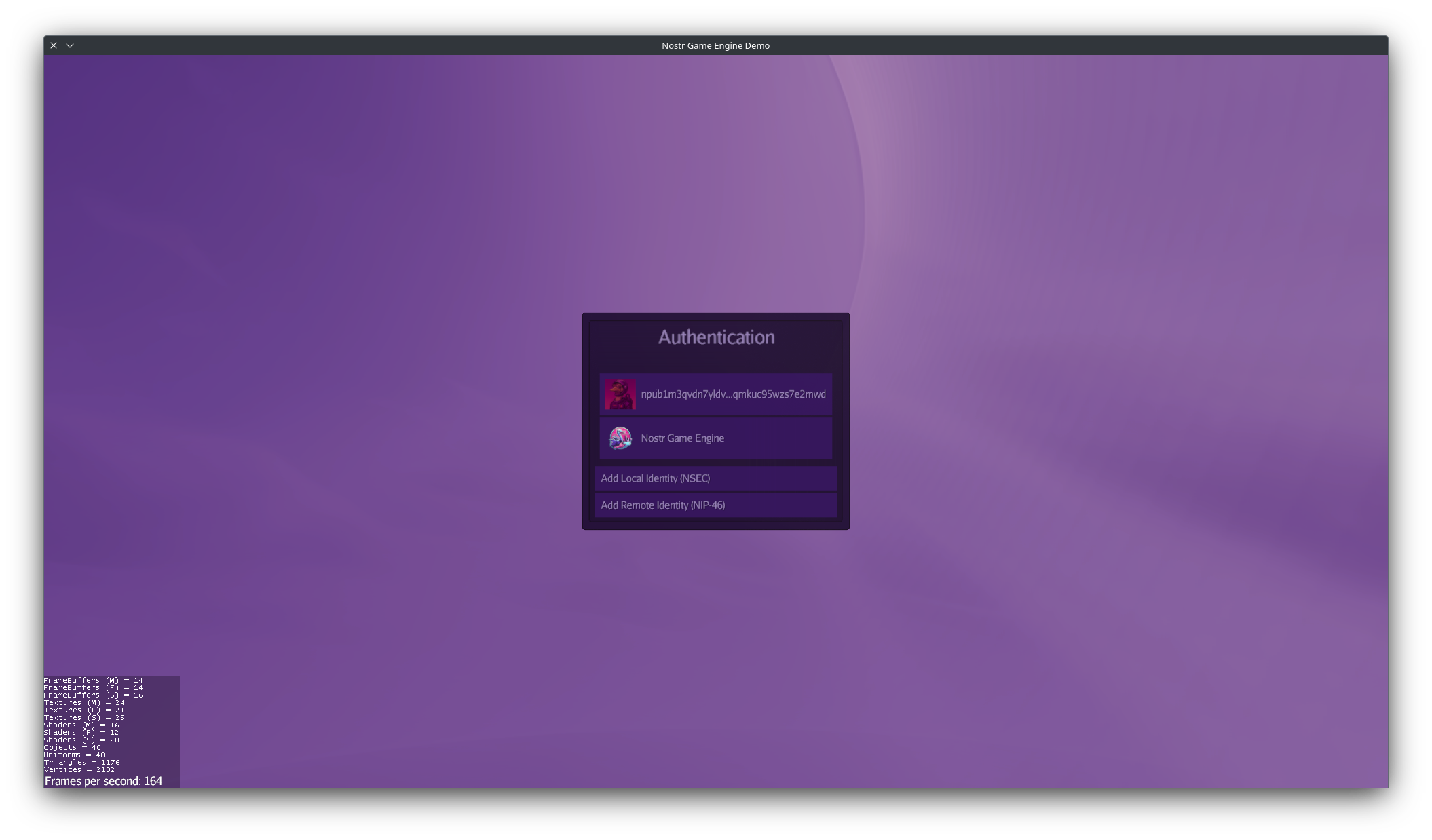

2025-06-13 09:25:28I'm excited to announce that Nostr Game Engine just reached its first development milestone: v0.0.

What is Nostr Game Engine?

Nostr Game Engine is built on top of the modular and proven jMonkeyEngine.

What sets it apart? Its internals are being gradually replaced with Nostr-powered modules, turning it into a reference engine purpose-built for decentralized games.

This first release delivers these key capabilities:

Peer-to-Peer Networking

Forget centralized game servers. Nostr Game Engine gives you real P2P multiplayer, using WebRTC for data streaming and Nostr relays for coordination.

Want to dig deeper? This is a draft NIP that is a revised version of this other draft NIP, that details how the signaling works.

WebRTC is already a solid and reliable peer-to-peer protocol, equipped with a full set of NAT traversal capabilities, but its signaling phase typically relies on specialized central servers.

By coupling WebRTC with Nostr, we take signaling decentralized too by relying on a network of dumb public relays that are oblivious to what encrypted data we send to them and are easily replaceable.

(see the documentation for more info)

Nostr Authentication & Gamertags

NGE has a fully managed Nostr Auth flow, with support for NIP-49 encrypted local nsecs and NIP-46 remote signers.

It also fully handles metadata, including external identities: your profile picture, display name, and other details can carry over between games, and even from other Nostr clients and communities.

This release is also introducing Gamertags: persistent gaming handles tied to your Nostr pubkey. They are like Xbox Gamertags or the old Discord handle, but they’re decentralized and follow you across any game that supports them (check this draft nip for more info).

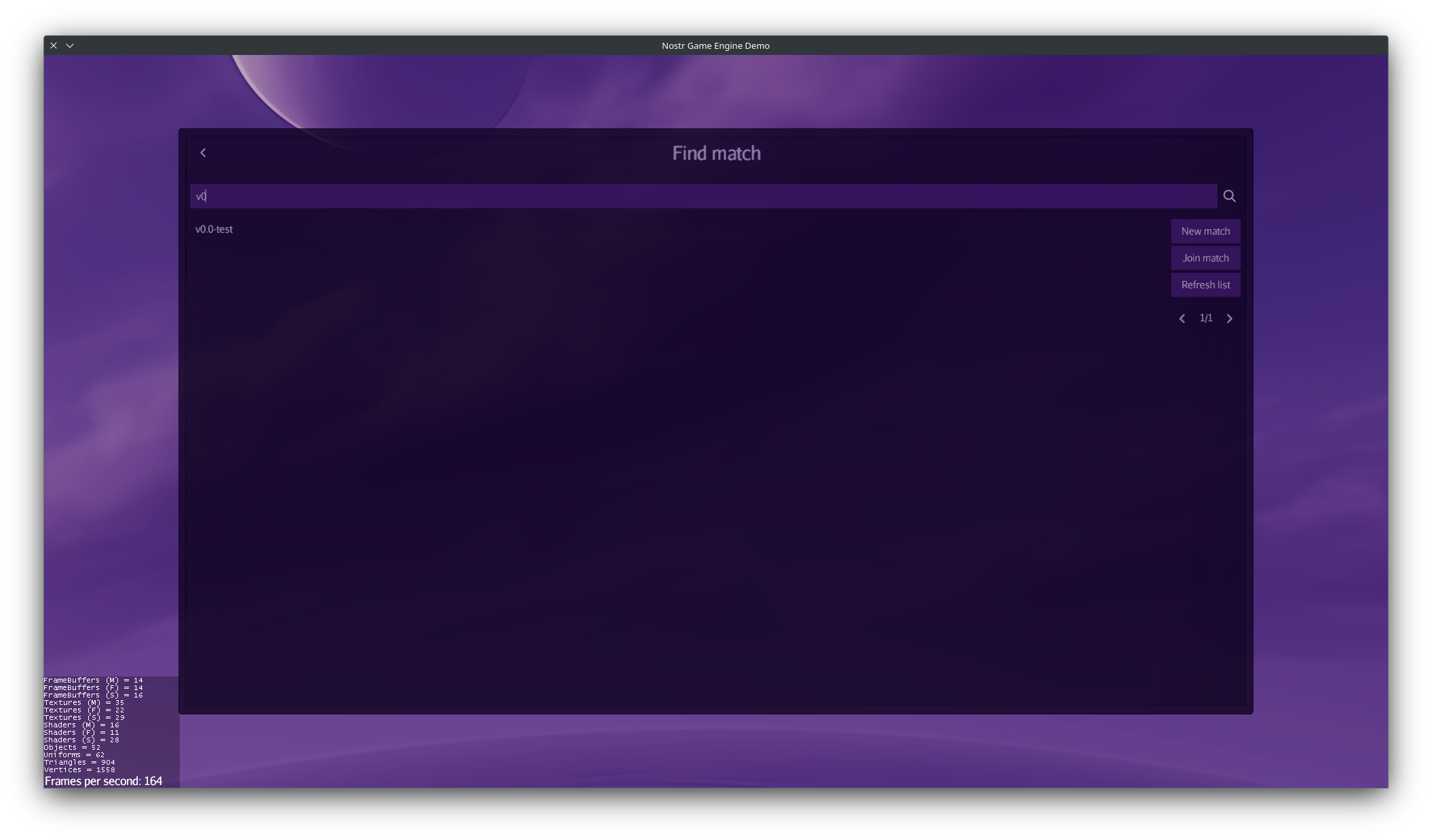

Match Making

While matchmaking is planned for a later milestone on the roadmap, this release ships with an early implementation to help test RTC connections.

This initial implementation has the APIs to create lobbies that are discoverable and optionally password-protected. Players can search and filter for lobbies using both client-side and relay-side filtering, depending on what the relay supports.

Right now, you can’t see how many players are in a lobby, and the feature is still a bit rough around the edges, but it's a solid start, and more improvements are coming as we move further along the roadmap.

The cool part? You don’t even need to know Nostr is running under the hood. The engine exposes simple APIs like createLobby, findLobbies, and connectToLobby, the developer can call them when needed, and the engine handles all the relay querying and data stitching behind the scenes.

(see the documentation for more info)

A new Nostr Client Library

The engine uses a new Nostr client library built from scratch, designed for performance, asynchronicity, and memory efficiency. It’s lean, fast, and built to be the foundation for everything that comes next.

Cross-Platform and language of choice

The entire codebase is written mostly in Java, and it builds natively for Linux, macOS, and Windows.

Support for Android, iOS, and Web Browsers is on the roadmap.

What has been built so far?

-

Version 0.0, with the core features mentioned above

-

Documentation covering the key components of the engine

-

An app template to help bootstrap projects and experiment with the engine

-

An high performance and portable nostr client library

-

A tech demo (more on that later)

So now, you can get a real feel for the engine, see what it does, play around with it, and maybe even start experimenting with your own ideas.

Roadmap

This is just the beginning. There is a full roadmap on the website.

Upcoming milestones include ads, deeper identity features, and tools that make decentralized game development as smooth as possible.

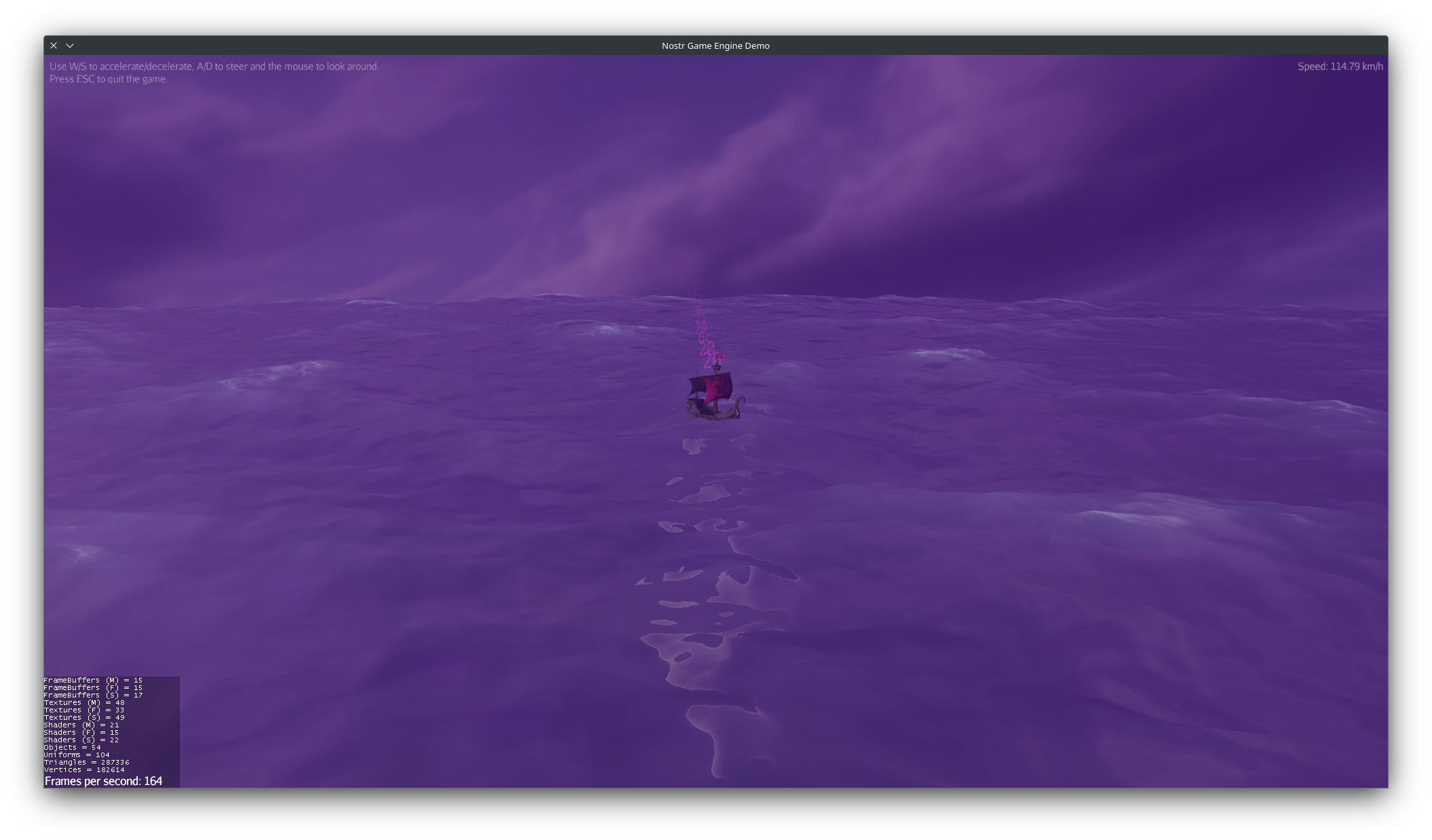

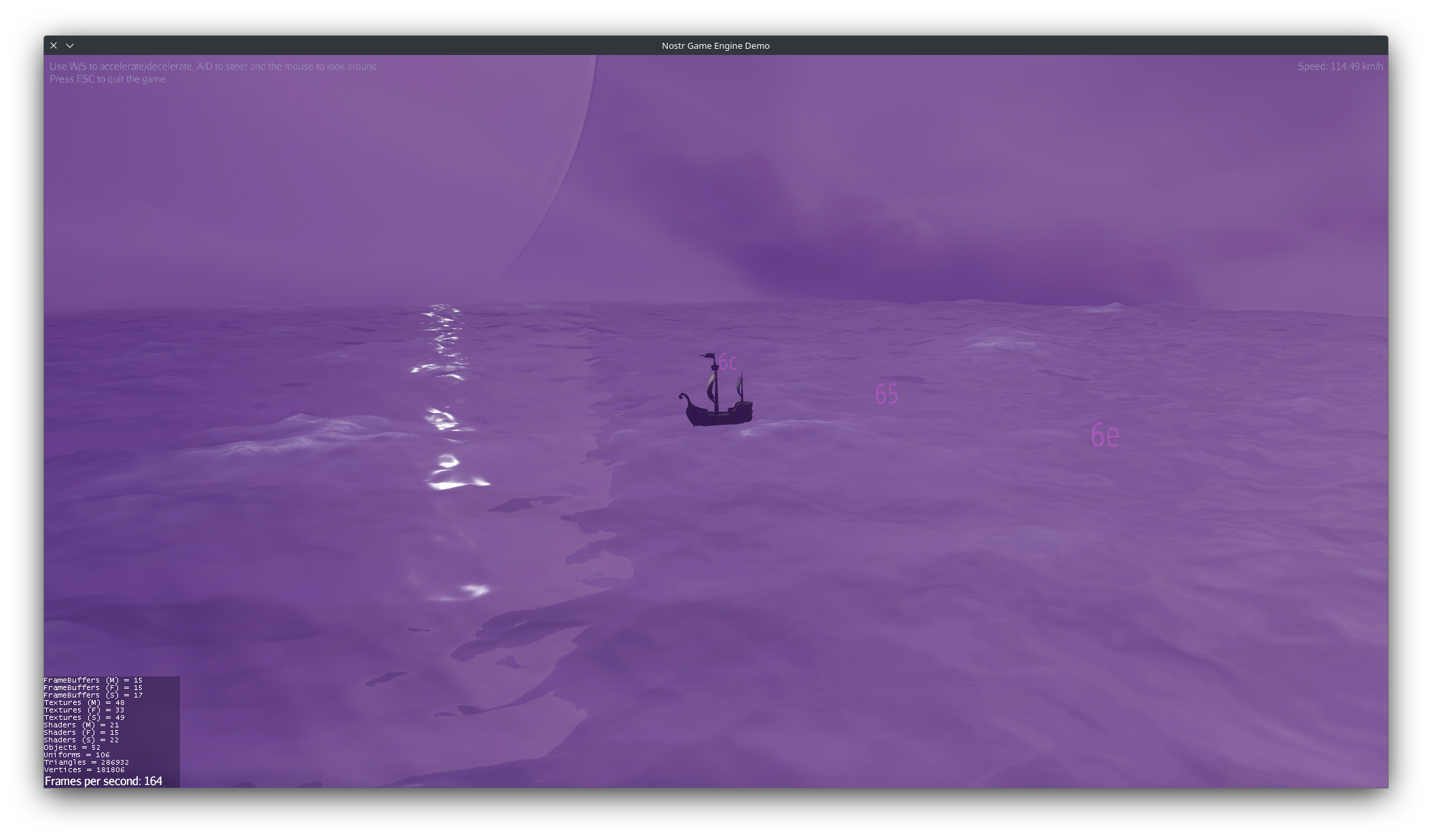

Sea of Nostriches

This is a demo built for this release.

You start alone in an open ocean with a boat, nothing much at first.

But as soon as another player joins (another peer), your boat begins sending data directly to theirs via peer-to-peer communication. You’ll see this visualized as a stream of numbers moving between boats in game.

If you have a profile picture set, it’ll automatically appear on your boat’s sail, and you’ll see others’ profile pictures on theirs.

That’s the core of it.

It is not a real game, as there is nothing really to do, no lag compensation, no score etc… but it is a decent reference, and an “integration test” for this release.

There’s a lot more going on behind the scenes, like how the ocean is simulated or how rendering is handled, but that’s beyond the scope of this post. You can check out the full source code on GitHub, along with native builds for all supported platforms and a portable JAR.

That’s all for now! Huge thanks go to nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqypu8xwr40lp96ewdj2fef408wy70gd3carf9n6xu7hrnhq6whpgly925h0z for making this possible. Their support allows me to dedicate full-time effort to this project and contribute to the growth of the Nostr ecosystem.

Check out the website at ngengine.org and browse the docs at ngengine.org/docs if you want to dig deeper.

Feel free to come up with any questions. I’ll do my best to answer.

-

-

@ 84b0c46a:417782f5

2025-06-14 04:29:02

@ 84b0c46a:417782f5

2025-06-14 04:29:02やること

- [ ] るみ 初期のわかりにくごちゃ設定を何とかする

- [x] るみ シーンおんのやつみなおしてみる

- [ ] やってることまとめるやつ

- [ ] びうあ publishのリレー状態チェック

- [x] るみ 10002並べ替え

- [ ] るみ 10030の並べ替え?

- [ ] カスタム絵文字のやつ

- [x] まきもの naddrを渡して編集画面開く

- [x] るみ naddrの更新ボタン

- [ ] ニーサ

- [ ] クレカのポイント使い切って、他のクレカ契約できたら、今のクレカ解約する(アマゾンかなんか)

-

[x] るみ 書き込むたびにチェックマークが増えてくよ

nostr:nevent1qvzqqqqqqypzpp9sc34tdxdvxh4jeg5xgu9ctcypmvsg0n00vwfjydkrjaqh0qh4qyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpz9mhxue69uhkuenjv4kxz7fwv9c8qqgnwaen5te0xyerwt3s9cczuvf6xsurvwgpzdmhxue69uhhwmm59ehx7um5wghxuet5qythwumn8ghj7mn0wd68ytnfw36xzmndduhx6etwqywhwumn8ghj7un9d3shjtnwdaehgu3wwa5hyetydejhgtn2wqqzpzatskhfw95aj6g0tex2c5wy0ydlrnts8lk7du60t906d23p7ch4whv3xm

-

[x] るみ 画像表示させる前にワンクッションメニュー

- [x] るみ ステータスのカスタム絵文字、挿入と変換

- [x] るみ 30023のembedが常にワンクッションになってる見→たぶんきのせい

- [ ] るみ ブロックリレー10006を読む

- [ ] るみ poll 期限後の投票は無視する

- [x] るみ 引用のaをqに

- [ ] スマホ📱 au解約/IIJ契約

- [ ] 掃除

デイリー

- うめちぇっく

- 薬飲む

- 生姜接種

-

@ 472f440f:5669301e

2025-06-12 05:11:12

@ 472f440f:5669301e

2025-06-12 05:11:12Marty's Bent

via me

I had a completely different newsletter partially written earlier tonight about whether or not "this cycle is different" when this nagging thought entered my head. So I'm going to write about this and maybe I'll write about the dynamics of this cycle compared to past cycles tomorrow.

A couple of headlines shot across my desk earlier tonight in relation to the potential escalation of kinetic warfare in the Middle East. Apparently the U.S. Embassy in Iraq was sent a warning and evacuation procedures were initiated. Not too long after, the world was made aware that the United States and Israel are contemplating an attack on Iran due to the "fact" that Iran may be close to producing nuclear weapins. The initial monkey brain reaction that I had to these two headlines was, "Oh shit, here we go again. We're going to do something stupid." My second reaction was, "Oh shit, here we go again, I've seen these two exact headlines many times over the years and they've proven to be lackluster if you're a doomer or blood thirsty war monger." Nothing ever happens.

As I venture into my mid-30s and reflect on a life filled with these types of headlines and my personal reactions to these headlines, I'm finally becoming attuned to the fact that the monkey brain reactions aren't very productive at the end of the day. Who knows exactly what's going to happen in Iraq or Iran and whether or not kinetic warfare escalates and materializes from here? Even though I'm a "blue-blooded taxpaying American citizen" who is passively and unwillingly contributing to the war machine and the media industrial complex, there's really nothing I can do about it.

The only thing I can do is focus on what is in front of me. What I have control of. And attempt to leverage what I have control of to make my life and the life of my family as good as humanly possible. Ignoring the external and turning inward often produces incredible results. Instead of worrying about what the media wants you to believe at any given point in time, you simply look away from your computer screen, survey the physical space which you're operating in and determine what you have, what you need and how you can get what you need. This is a much more productive way to spend your time.

This is what I want to touch on right now. There's never been a better time in human history to be productive despite what the algorithm on X or the mainstream media will lead you to believe. Things aren't as great as they could be, but they're also not as bad as you're being led to believe. We live in the Digital Age and the Digital Age provides incredible resources that you can leverage to make YOUR life better.

Social media allows you to create a platform without spending any money. AI allows you to build tools that are beneficial to yourself and others with very little money. And bitcoin exists to provide you with the best form of money that you can save in with the knowledge that your relative ownership of the overall supply isn't going to change. No matter what happens in the external world.

If you can combine these three things to make your life better and - by extension - potentially make the lives of many others better, you're going to be well off in the long run. Combining these three things isn't going to result in immediate gratification, but if you put forth a concerted effort, spend the time, have some semblance of patience, and stick with it, I truly believe that you will benefit massively in the long run. Without trying to sound like a blowhard, I truly believe that this is why I feel relatively calm (despite my monkey brain reactions to the headlines of the day) at this current point in time.

We've entered the era of insane leaps in productivity and digital hard money that cannot be corrupted. The biggest mistake you can make in your life right now is overlooking the confluence of these two things. With an internet connection, an idea, some savvy, and hard work you can materially change your life. Create something that levels up your knowledge, that enables you to get a good job in the real world, or to create a company of your own. Bring your talents to the market, exchange them for money, and then funnel that money into bitcoin (if you're not being paid in it already). We may be at the beginning of a transition from the high velocity trash economy to the high leverage agency economy run on sound money and applied creativity.

These concepts are what you should be focusing most of your time and attention to today and in the years ahead. Don't get distracted by the algorithm, the 30-second video clips, the headlines filled with doom, and the topics of the 24 hour news cycle. I'll admit, I often succumb to them myself. But, as I get older and develop a form of pattern recognition that can only be attained by being on this planet for a certain period of time, it is becoming very clear that those things are not worth your attention.

Living by the heuristic that "nothing ever happens" is a pretty safe bet. Funnily enough, it's incredibly ironic that you're led to believe that something is happening every single day, and yet nothing ever happens. By getting believing that something happens every day you are taking your attention away from doing things that happen to make your life better.

Tune out the noise. Put on the blinders. Take advantage of the incredible opportunities that lie before you. If enough of you - and many others who do not read this newsletter - do this, I truly believe we'll wake up to find that the world we live in is a much better place.

Nothing ever happens, so make something happen.

Intelligence Officials Are Quietly Becoming Bitcoin Believers

Ken Egan, former CIA Deputy Chief of Cyber Operations, revealed a surprising truth on TFTC: the intelligence community harbors numerous Bitcoin advocates. Egan explained that intelligence professionals uniquely understand how governments weaponize financial systems through sanctions and account freezing. Having wielded these tools themselves, they recognize the need for personal financial sovereignty. He shared compelling anecdotes of discovering colleagues with "We are all Satoshi" stickers and a European chief of station paying for dinner with a BlockFi card to earn Bitcoin rewards.

"I think there are a lot of Bitcoiners, not just at CIA, but across the whole national security establishment... they're in it for the exact same reasons everybody else is." - Ken Egan

The Canadian trucker protests served as a pivotal moment, Egan noted. Watching Western governments freeze citizens' bank accounts for political dissent struck a nerve among intelligence professionals who previously viewed financial weaponization as a tool reserved for foreign adversaries. This awakening has created unlikely allies within institutions many Bitcoiners distrust.

Check out the full podcast here for more on Bitcoin's national security implications, privacy tech prosecutions, and legislative priorities.

Headlines of the Day

Stripe Buys Crypto Wallet Privy After Bridge Deal - via X

Trump Calls CPI Data "Great" Urges Full Point Fed Cut - via X

Bitcoin Hashrate Reaches New All-Time High - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Life is good.

Download our free browser extension, Opportunity Cost: https://www.opportunitycost.app/ start thinking in SATS today.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 5627e59c:d484729e

2025-06-11 21:23:42

@ 5627e59c:d484729e

2025-06-11 21:23:42Ik hou van de natuur en van verbinding maken\ Van diepgang en van mensen raken

Van creatief schrijven en programmeren\ Van speels bewegen en nieuwe dingen leren

Ik hou van leven en van dromen\ En van mensen zien\ Hun diepste wensen uit doen komen

-

@ 5627e59c:d484729e

2025-06-11 21:23:14

@ 5627e59c:d484729e

2025-06-11 21:23:14Ik sta hier nu een poos\ Bevroren, machteloos

Ik wil graag iets veranderen\ Gewoon iets doen voor anderen

Maar het mag precies niet zijn\ En dat doet me veel pijn

Verlamd en vol van onbegrip\ Ik krijg er maar geen grip op

Op de wereld en de mensen\ Zij verpletteren mijn diepste wensen

Niemand die eens hoort\ Naar wat mij toch zo stoort

Ik kan nog eens proberen\ Om de wereld om te keren

Maar ik weet, het heeft geen zin\ Ik raak nooit binnen in

De ander\ Kom, verander

Misschien wordt het eens tijd\ Dat ik mezelf bevrijd

Van al die overmacht\ Die mij toch zo versmacht

Een stapje achteruit\ Adem in en adem uit

Ik doe mijn oogjes dicht\ En zie wie mij verplicht

Opzadelt met ambitie\ Van waar komt toch die missie

Al de pijn die ik niet aankan\ En van 't bestaan verban

Al 't bewijs voor mijn geloof\ Dat ik niet meer vliegen kan

-

@ 5627e59c:d484729e

2025-06-12 04:23:52

@ 5627e59c:d484729e

2025-06-12 04:23:52Look and see\ Look and see

You look like how you look at me

Look and see\ Look and see

The colorless through the color TV

Look and see\ Look and be

The unborn identity

-

@ 6be5cc06:5259daf0

2025-06-12 01:18:11

@ 6be5cc06:5259daf0

2025-06-12 01:18:11Introdução

O princípio do sola scriptura, pedra angular da teologia protestante desde a Reforma do século XVI, estabelece que apenas a Escritura constitui a autoridade final e suprema em questões de fé e prática cristã. Este princípio, formulado inicialmente por Martinho Lutero e sistematizado pelos reformadores subsequentes, pretende oferecer um fundamento epistemológico sólido para a teologia, livre das supostas corrupções da tradição eclesiástica.

Contudo, uma análise rigorosa revela que o sola scriptura incorre em contradições lógicas fundamentais que comprometem sua viabilidade como sistema epistemológico coerente. Este artigo examina essas contradições através de três perspectivas complementares: filosófica, exegética e histórica.

A Contradição Performativa Fundamental

O Problema da Autorreferência

O sola scriptura enfrenta um dilema epistemológico insuperável: afirma que apenas a Escritura possui autoridade final em matéria de fé, mas essa própria regra não é explicitamente ensinada na Escritura. Trata-se de uma contradição performativa clássica, onde o enunciado viola suas próprias condições de possibilidade.

Esta situação configura uma falácia de petitio principii (círculo vicioso), pois exige que se aceite uma doutrina que não pode ser sustentada pelas premissas do próprio sistema. Para estabelecer o sola scriptura, seria necessário recorrer a uma autoridade externa à Escritura – precisamente aquilo que o princípio pretende rejeitar.

Fundacionalismo Mal Estruturado

Do ponto de vista epistemológico, o sola scriptura apresenta-se como um fundacionalismo defeituoso. Pretende funcionar como axioma supremo e auto-evidente, mas falha ao não fornecer a base textual que sua própria metodologia exige. Um verdadeiro fundacionalismo escriturístico deveria ser capaz de demonstrar sua validade através de uma prova explícita nas próprias Escrituras.

O Testemunho Contrário das Escrituras

Limitações do Registro Escrito

A própria Escritura reconhece as limitações do registro textual. João 21:25 declara explicitamente: "Jesus fez também muitas outras coisas. Se cada uma delas fosse escrita, penso que nem mesmo no mundo inteiro haveria espaço suficiente para os livros que seriam escritos."

Este versículo é particularmente problemático para o sola scriptura, pois reconhece que nem todos os ensinamentos de Cristo foram preservados por escrito. Como pode a Escritura ser suficiente se ela própria admite sua incompletude?

A Valorização da Tradição Oral

Paulo, em 2 Tessalonicenses 2:15, oferece uma instrução que contradiz frontalmente o sola scriptura: "Assim, pois, irmãos, ficai firmes e conservai os ensinamentos que de nós aprendestes, seja por palavras, seja por carta nossa."

O apóstolo valoriza inequivocamente tanto a tradição oral ("por palavras") quanto a escrita ("por carta"), estabelecendo um modelo de autoridade dual que o protestantismo posterior rejeitaria.

A Necessidade de Autoridade Interpretativa

A narrativa do eunuco etíope em Atos 8:30-31 demonstra a inadequação da Escritura isolada como autoridade final. Quando Filipe pergunta se o eunuco entende o que lê, a resposta é reveladora: "Como poderei entender, se alguém não me ensinar?"

Este episódio ilustra que a mera posse do texto bíblico não garante compreensão adequada. É necessária uma autoridade interpretativa externa – no caso, representada por Filipe, que age com autoridade apostólica.

A Complexidade Hermenêutica

Pedro, em sua segunda epístola (3:16-17), reconhece a dificuldade interpretativa inerente às Escrituras: "Suas cartas contêm algumas coisas difíceis de entender, as quais os ignorantes e instáveis torcem, como também o fazem com as demais Escrituras, para a própria destruição deles."

Esta passagem não apenas reconhece a complexidade hermenêutica dos textos sagrados, mas também alerta sobre os perigos da interpretação inadequada. Implicitamente, sugere a necessidade de uma autoridade interpretativa confiável para evitar distorções doutrinárias.

O Paradoxo Histórico da Canonização

A Dependência da Tradição Eclesiástica

Um dos argumentos mais devastadores contra o sola scriptura emerge da própria história da formação do cânon bíblico. Os concílios de Hipona (393 d.C.) e Cartago (397 d.C.) foram responsáveis pela definição oficial do cânon das Escrituras tal como conhecemos hoje.

Este fato histórico cria um paradoxo insuperável: aceitar a Bíblia como autoridade única requer aceitar a autoridade da tradição eclesiástica que a definiu. O próprio cânon bíblico é produto da tradição apostólica e da deliberação conciliar, não de autodefinição escriturística.

A Circularidade da Autopistia

Tentativas protestantes de resolver este dilema através do conceito de "autopistia" – a suposta capacidade das Escrituras de se auto-autenticar – apenas aprofundam o problema circular. Como determinar que as Escrituras possuem esta propriedade sem recorrer a critérios externos? A própria doutrina da autopistia não é explicitamente ensinada na Escritura.

Implicações Teológicas e Epistemológicas

A Fragmentação Interpretativa

A história do protestantismo oferece evidência empírica das consequências práticas do sola scriptura. A multiplicação de denominações e interpretações divergentes sugere que o princípio, longe de fornecer clareza doutrinária, pode na verdade contribuir para a fragmentação teológica.

Se a Escritura fosse verdadeiramente suficiente e auto-interpretativa, seria razoável esperar maior convergência hermenêutica entre aqueles que aderem ao sola scriptura. A realidade histórica sugere o contrário.

A Alternativa Católica e Ortodoxa

As tradições católica e ortodoxa, embora enfrentando suas próprias tensões epistemológicas, mantêm pelo menos coerência interna ao reconhecer explicitamente múltiplas fontes complementares de autoridade: Escritura, Tradição e Magistério (no caso católico) ou Escritura e Tradição (no caso ortodoxo).

Estas posições evitam a contradição performativa do sola scriptura ao não reivindicar que sua própria metodologia epistemológica seja derivada exclusivamente da Escritura.

Conclusão

A análise crítica do sola scriptura revela contradições estruturais que comprometem fundamentalmente sua viabilidade como princípio epistemológico. O princípio incorre em contradição performativa ao estabelecer uma regra que não pode ser derivada de suas próprias premissas, configura um fundacionalismo mal estruturado ao carecer de base textual explícita, e enfrenta o testemunho contrário da própria Escritura, que reconhece suas limitações e a necessidade de autoridades interpretativas externas.

O paradoxo histórico da canonização – onde o próprio cânon bíblico depende da autoridade tradicional que o sola scriptura pretende rejeitar – representa talvez o golpe mais decisivo contra o princípio protestante.

Isso não implica necessariamente a falsidade do protestantismo como sistema teológico, mas sugere que seus fundamentos epistemológicos requerem reformulação substancial. Uma teologia protestante intelectualmente honesta precisaria reconhecer as limitações do sola scriptura e desenvolver uma epistemologia mais nuançada que leve em conta a complexidade das fontes de autoridade religiosa.

A busca pela verdade teológica, independentemente de compromissos confessionais, exige o reconhecimento rigoroso das limitações e contradições inerentes aos nossos sistemas epistemológicos. No caso do sola scriptura, essa honestidade intelectual revela um princípio que, por mais central que seja para a identidade protestante, não pode sustentar o peso epistemológico que tradicionalmente lhe foi atribuído.

-

@ da8b7de1:c0164aee

2025-06-14 04:02:17

@ da8b7de1:c0164aee

2025-06-14 04:02:17Az IAEA Kormányzótanácsának Ülése

A Nemzetközi Atomenergia-ügynökség (IAEA) 2025. június 9. és 13. között tartotta szokásos Kormányzótanácsi ülését bécsi központjában. Ez a magas szintű esemény a tagállamok képviselőit hozta össze, hogy megvitassák a nukleáris biztonság, védelem és technológia legújabb fejleményeit. Rafael Mariano Grossi, az IAEA főigazgatója a találkozó elején sajtótájékoztatót tartott, amelyen kiemelte az ügynökség folyamatos erőfeszítéseit a biztonságos és védett nukleáris energia világszintű előmozdításában [iaea.org].

A Világbank Nukleáris Energiát Támogató Fordulata

Mérföldkőnek számító döntésként a Világbank 2025. június 10-én bejelentette, hogy megkezdi új nukleáris energia projektek – köztük kis moduláris reaktorok (SMR-ek) és meglévő erőművek élettartam-hosszabbításának – finanszírozását. Ez a döntés a Bank régóta fennálló, nukleáris energia finanszírozását ellenző politikájának felülvizsgálatát jelenti. Ajay Banga, a Világbank elnöke elmondta, hogy a változás a nukleáris energia globális dekarbonizációban és energiabiztonságban betöltött növekvő szerepének elismerését tükrözi [ans.org].

Globális Támogatás a Nukleáris Kapacitás Megháromszorozásáért

A bakui COP29 ENSZ klímakonferencián újabb hat ország – El Salvador, Kazahsztán, Kenya, Koszovó, Nigéria és Törökország – csatlakozott ahhoz a kezdeményezéshez, amely célul tűzte ki a globális nukleáris kapacitás megháromszorozását 2050-ig. Ez a mozgalom része annak a szélesebb nemzetközi törekvésnek, amely a nukleáris energia gyorsabb elterjesztését szorgalmazza a tiszta energiára való átmenet kulcselemeként. Az Egyesült Államok szintén bemutatta tervét 200 GW nukleáris kapacitás 2050-ig történő telepítésére, ezzel is megerősítve elkötelezettségét a nukleáris energia mellett a klíma- és energiakihívások kezelésében [world-nuclear-news.org].

Ipari és Technológiai Fejlemények

- Az American Bureau of Shipping jelentést tett közzé az előrehaladott nukleáris technológia tengeri alkalmazásának lehetőségeiről, különös tekintettel a kis moduláris reaktorokra LNG-szállító hajókon.

- Az Egyesült Királyság Nemzeti Energiarendszer-üzemeltetője hangsúlyozta a nukleáris energia fontosságát a 2030-ra megvalósítandó tiszta energiatermelési rendszer elérésében, beleértve a meglévő erőművek élettartam-hosszabbítását és új reaktorok építését [world-nuclear-news.org].

Források: - world-nuclear-news.org - iaea.org - ans.org

-

@ 2b998b04:86727e47

2025-06-11 19:36:40

@ 2b998b04:86727e47

2025-06-11 19:36:40🌋 Ka ʻImi i ka Pono: Seeking What’s Right

A 7-Day Series on Sovereignty, Bitcoin, and the Soul of the Islands

> "Man is not free unless he wills to be free."\ > — Johann Gottlieb Fichte

Hawai‘i understands sovereignty. It always has.\ But it was taken — first with pen and politics, then with force and fiat.

Bitcoin offers something different:\ A way to reclaim sovereignty without violence.\ A tool for self-rule, not state rule.\ A system built not on empire, but on truth and time.

This week, I’ll be posting a 7-part series exploring this tension:\ Between the Hawai‘i that was, the system that is, and the future that might be — if we choose to build on bedrock instead of paper.

I don’t know if there’s a traditional Hawaiian word for a 7-day week — maybe there doesn’t need to be.\ Time moves differently on these islands.\ But for the next 7 days, I’ll mark each reflection as a kind of modern lā hoʻomanaʻo — a day of remembering, reckoning, and restoring.

This is personal. It’s philosophical. It’s also unfinished.

But that’s what sovereignty looks like:\ Not something given — something reclaimed.

Stay tuned. Stay akamai.\ 🟧\ — Andrew G. Stanton (aka akamaister)

-

@ b1ddb4d7:471244e7

2025-06-12 01:01:37

@ b1ddb4d7:471244e7

2025-06-12 01:01:37Jason Lowery’s thesis, Softwar: A Novel Theory on Power Projection and the National Strategic Significance of Bitcoin, reframes bitcoin not merely as digital cash but as a transformative security technology with profound implications for investors and nation-states alike.

For centuries, craft brewers understood that true innovation balanced tradition with experimentation—a delicate dance between established techniques and bold new flavors.

Much like the craft beer revolution reshaped a global industry, bitcoin represents a fundamental recalibration of how humans organize value and project power in the digital age.

The Antler in the Digital Forest: Power Projection

Lowery, a U.S. Space Force officer and MIT scholar, anchors his Softwar theory in a biological metaphor: Bitcoin as humanity’s “digital antler.” In nature, antlers allow animals like deer to compete for resources through non-lethal contests—sparring matches where power is demonstrated without fatal consequences. This contrasts sharply with wolves, who must resort to violent, potentially deadly fights to establish hierarchy.

The Human Power Dilemma: Historically, humans projected power and settled resource disputes through physical force—wars, seizures, or coercive control of assets. Even modern financial systems rely on abstract power structures: court orders, bank freezes, or government sanctions enforced by legal threat rather than immediate physical reality.

Lowery argues this creates inherent fragility: abstract systems can collapse when met with superior physical force (e.g., invasions, revolutions). Nature only respects physical power.

Bitcoin’s Physical Power Engine: Bitcoin introduces a novel solution through its proof-of-work consensus mechanism. Miners compete to solve computationally intense cryptographic puzzles, expending real-world energy (megawatts) to validate transactions and secure the network.

This process converts electricity—a tangible, physical resource—into digital security and immutable property rights. Winning a “block” is like winning a sparring match: it consumes significant resources (energy/cost) but is non-destructive.

The miner gains the right to write the next page of the ledger and collect rewards, but no participant is physically harmed, and no external infrastructure is destroyed.

Table: Traditional vs. Bitcoin-Based Power Systems

Power System

Mechanism

Key Vulnerability

Resource Cost

Traditional (Fiat/Banking)

Legal abstraction, threat of state force

Centralized points of failure, corruption, political change

Low immediate cost, high systemic risk

Military/Economic Coercion

Physical force, sanctions

Escalation, collateral damage, moral hazard

Very high (lives, capital, instability)

Bitcoin (Proof-of-Work)

Competition via energy expenditure

High energy cost, concentration risk (mining)

High energy cost, low systemic risk

Softwar Theory National Strategic Imperative: Governments Are Taking Notice

Lowery’s Softwar Theory has moved beyond academia into the corridors of power, shaping U.S. national strategy:

- The Strategic Bitcoin Reserve: Vice President JD Vance recently framed bitcoin as an instrument projecting American values—”innovation, entrepreneurship, freedom, and lack of censorship”. State legislation is now underway to implement this reserve, preventing easy reversal by future administrations.

- Regulatory Transformation: The SEC is shifting from an “enforcement-first” stance under previous leadership. New initiatives include:

- Repealing Staff Accounting Bulletin 121 (SAB 121), which discouraged banks from custodying digital currency by forcing unfavorable balance sheet treatment.

- Creating the Cyber and Emerging Technologies Unit (CETU) to develop clearer crypto registration/disclosure rules.

The Investor’s Lens: Scarcity, Security, and Asymmetric Opportunity

For investors, understanding “Softwar” validates bitcoin’s unique value proposition beyond price speculation:

-

Digital Scarcity as Strategic Depth: Bitcoin’s fixed supply of 21 million makes it the only digital asset with truly inelastic supply, a programmed scarcity immune to political whims or central bank printing.

This “scarcity imperative” acts as a natural antidote to global fiat debasement. As central banks expanded money supplies aggressively (Global M2), bitcoin’s price has shown strong correlation, acting as a pressure valve for inflation concerns. The quadrennial “halving” (latest: April 2024) mechanically reduces new supply, creating built-in supply shocks as adoption grows. * The Antifragile Security Feedback Loop: Bitcoin’s security isn’t static; it’s antifragile. The network strengthens through demand: * More users → More transactions → Higher fees → More miner revenue → More hashpower (computational security) → Greater network resilience → More user confidence.

This self-reinforcing cycle contrasts sharply with traditional systems, where security is a cost center (e.g., bank security budgets, military spending). Bitcoin turns security into a profitable, market-driven activity. * Institutionalization Without Centralization: While institutional ownership via ETFs (like BlackRock’s IBIT) and corporate treasuries (MicroStrategy, Metaplanet) has surged, supply remains highly decentralized.Individuals still hold the largest share of bitcoin, preventing a dangerous concentration of control. Spot Bitcoin ETFs alone are projected to see over $20 billion in net inflows in 2025, demonstrating robust institutional capital allocation.

The Bitcoin Community: Building the Digital Antler’s Resilience

Lowery’s “Softwar” theory underscores why bitcoin’s decentralized architecture is non-negotiable. Its strength lies in the alignment of incentives across three participant groups:

- Miners: Provide computational power (hashrate), validating transactions and securing the network. Incentivized by block rewards (newly minted BTC) and transaction fees. Their physical energy expenditure is the “muscle” behind the digital antler.

- Nodes: Independently verify and enforce the protocol rules, maintaining the blockchain’s integrity. Run by users, businesses, and enthusiasts globally. They ensure decentralized consensus, preventing unilateral protocol changes.

- Users: Individuals, institutions, and corporations holding, transacting, or building on bitcoin. Their demand drives transaction fees and fuels the security feedback loop.

This structure creates “Mutually Assured Preservation”. Attacking bitcoin requires overwhelming its global, distributed physical infrastructure (miners/nodes), a feat far more complex and costly than seizing a central bank’s gold vault or freezing a bank’s assets. It transforms financial security from a centralized liability into a decentralized, physically-grounded asset.

Risks & Responsibilities

Investors and policymakers must acknowledge persistent challenges:

- Volatility: Bitcoin remains volatile, though this has decreased as markets mature. Dollar-cost averaging (DCA) is widely recommended to mitigate timing risk.

- Regulatory Uncertainty: While U.S. policy is increasingly favorable, global coordination is lacking. The EU’s MiCAR regulation exemplifies divergent approaches.

- Security & Custody: While Bitcoin’s protocol is robust, user errors (lost keys) or exchange hacks remain risks.

- Environmental Debate: Proof-of-Work energy use is scrutinized, though mining increasingly uses stranded energy/renewables. Innovations continue.

Jason Lowery’s “Softwar” theory elevates bitcoin from a financial instrument to a socio-technological innovation on par with the invention of the corporation, the rule of law, or even the antler in evolutionary biology. It provides a coherent framework for understanding why:

- Nations like the U.S. are looking to establish bitcoin reserves and embracing stablecoins—they recognize bitcoin’s role in projecting economic power non-violently in the digital age.

- Institutional Investors are allocating billions via ETFs—they see a scarce, secure, uncorrelated asset with antifragile properties.

- Individuals in hyperinflationary economies or under authoritarian regimes use bitcoin—it offers self-sovereign wealth storage immune to seizure or debasement.

For the investor, bitcoin represents more than potential price appreciation. It offers exposure to a fundamental reorganization of how power and value are secured and exchanged globally, grounded not in abstract promises, but in the unyielding laws of physics and mathematics.

Like the brewers who balanced tradition with innovation to create something enduring and valuable, bitcoin pioneers are building the infrastructure for a more resilient digital future—one computationally secured block at a time. The “Softwar” is here, and it is reshaping the landscape of p

-

@ edeb837b:ac664163

2025-06-13 21:15:05

@ edeb837b:ac664163

2025-06-13 21:15:05On June 10th, 2025, four members of the NVSTly team traveled to New York City to attend the 2025 American Business Awards® ceremony, held at the iconic Marriott Marquis in Times Square. It was an unforgettable night as we accepted the Gold Stevie® Award for Tech Startup of the Year—this time, in person.

Meow (left), rich (center), MartyOooit (right)

Representing NVSTly at the event were:

- Rich, CEO & Founder

- Meow, CTO, Lead Developer, & Co-Founder

- MartyOooit, Investor

- Noob, Market Analyst (not shown in photos)

MartyOooit (left), rich (center), Meow (right)

While we shared the exciting news back in April when the winners were announced, being there in person alongside other winners—including eBay, AT&T, T-Mobile, HP Inc., and Fidelity Investments—made the achievement feel even more surreal. To be honored alongside billion-dollar industry leaders was a proud and humbling moment for our startup and a huge milestone in NVSTly’s journey.

🎤 Team Interview at the Event

During the event, our team was interviewed about the win. When asked:

“What does winning a Stevie Award mean for your organization?”

“How will winning a Stevie Award help your organization?”Here’s what we had to say:

📺 Watch the video

A Big Win for Retail Traders

NVSTly was awarded Gold for Tech Startup of the Year in recognition of our work building a powerful, free social investing platform that empowers retail traders with transparency, analytics, and community-driven tools.

Unlike traditional finance platforms, NVSTly gives users the ability to:

- Share and track trades in real time

- Follow and receive alerts from top traders

- Compete on global leaderboards

- Access deep stats like win rate, average return, and more

Whether you're a beginner or experienced trader, NVSTly gives you the insights and tools typically reserved for hedge funds—but in a free, social format built for the modern investor.

Continued Recognition and Momentum

This award adds to a growing list of recognition for NVSTly:

- 🏆 People’s Choice Winner at the 2024 Benzinga Fintech Awards

- 🔁 Nominated again for Best Social Investing Product in the 2025 Benzinga Fintech Awards

- 🌟 Team members JustCoreGames and Lunaster are nominated for Employee of the Year (Information Technology – Social Media) in the 2025 Stevie® Awards for Technology Excellence

We’re beyond proud of what our small but mighty team has accomplished—and we’re just getting started. 🚀

Thanks to the Stevie Awards for an incredible night in New York, and to our community of 50,000+ traders who’ve helped shape NVSTly into what it is today.

This win is yours, too.Stay tuned—more big things are coming.

— Team NVSTly

The event brought together some of the most respected names in tech, finance, and business. -

@ 5627e59c:d484729e

2025-06-11 22:30:52

@ 5627e59c:d484729e

2025-06-11 22:30:52Nooit is mijn dans echter\ Dan net nadat het regende\ Want regen biedt een kans\ Om mijn gevoel te voelen

Zolang de regen spettert\ En ik mezelf graag zie\ Wordt er niets verplettert\ Ook al lijkt dat soms wel zo

Zodra de regen ophoudt\ En zich terugtrekt met de wolken\ Komt een nieuwe glans\ Voor het eerst mijn ogen binnen

Wat is het leven heerlijk\ Als ik eerlijk ben en voel\ Wat is het leven zacht\ En het brengt me naar mijn doel

Wat zou ik weten zonder regen\ Gewoon steeds evenveel\ Niet groeien is niet leven\ Daarom dans ik het liefst

Net na de echte regen

-

@ 5627e59c:d484729e

2025-06-11 22:09:02

@ 5627e59c:d484729e

2025-06-11 22:09:02In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ 8173f6e1:e488ac0f

2025-06-13 19:18:56

@ 8173f6e1:e488ac0f

2025-06-13 19:18:56{"voteEventId":"083ae248828a454a7d01b7de12f99ce90297672e0457ec8147bd7cfabd14f044","txHash":"752d3894c5657758d7b9754da3dc38db61662acb5f94c3dcb38077fc33f1bd7e","amount":"1000000000000000000","fee":"1000000000000000000","type":"token-gated-vote-proof"}

-

@ 79be667e:16f81798

2025-06-11 19:11:59

@ 79be667e:16f81798

2025-06-11 19:11:59I am here too\ In the same space like you

In the same situation I'm in\ It's a matter of positioning

I cannot leave this place I'm in\ It was brought about\ By what's been happening

So please don't look at me\ For what I can or cannot do for you\ But look at what is happening for me\ And what is happening for you

Let's communicate\ Not orchestrate

Because there's something I wish to do\ And there's a place I wish to go to

And I'm sure that there is too\ In your heart a fire\ Known by only you

So let us listen, look and see\ For what's true for you\ And what's true for me

That we may act upon what's here\ In order for us both to take a step\ In the direction we wish to steer

-

@ cae03c48:2a7d6671

2025-06-11 19:01:58

@ cae03c48:2a7d6671

2025-06-11 19:01:58Bitcoin Magazine

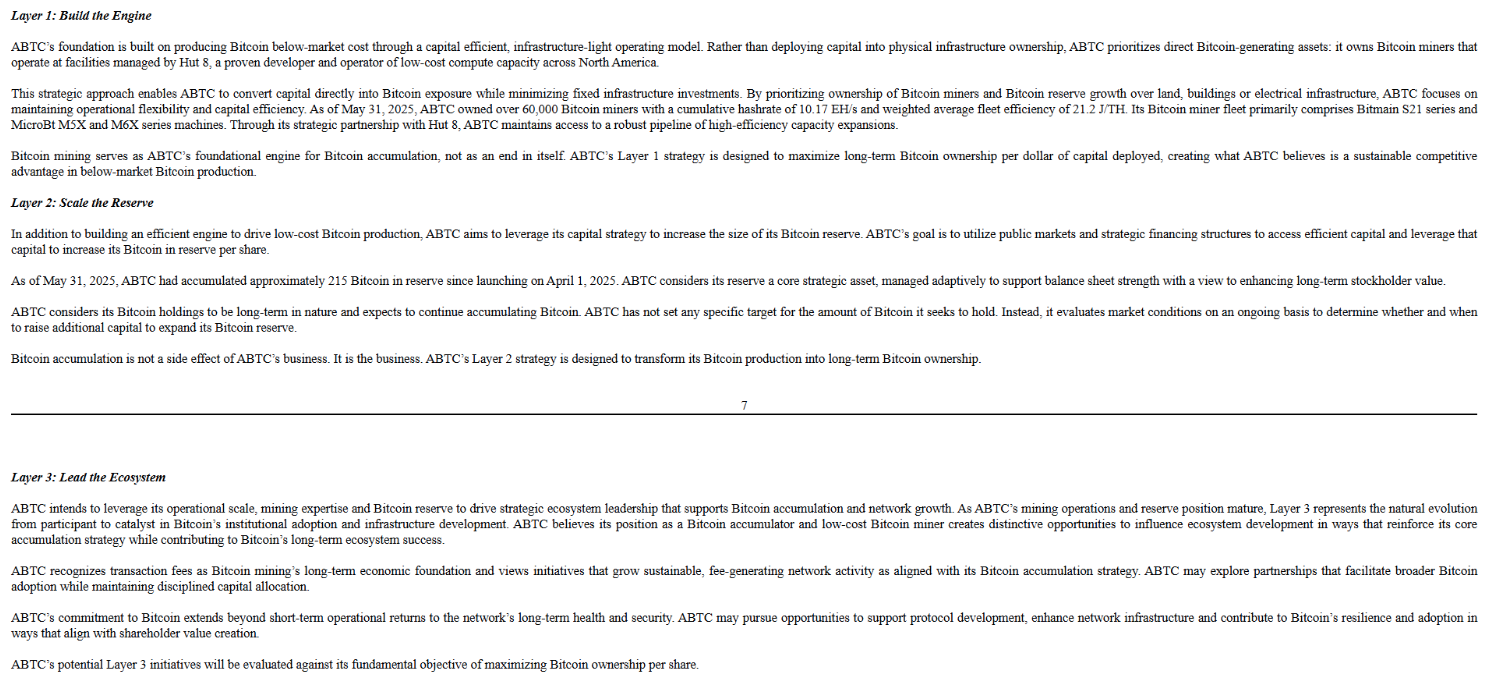

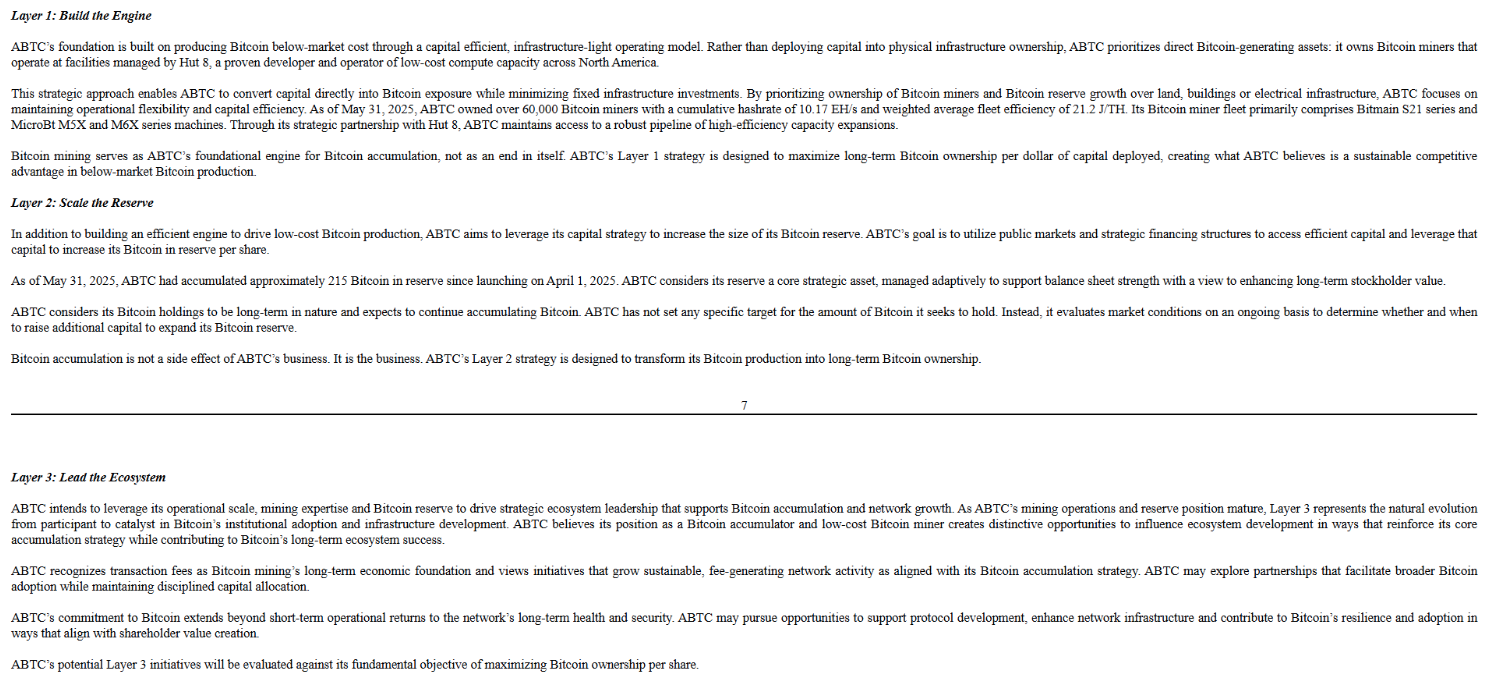

The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since LaunchAmerican Bitcoin Corp (ABTC), a newly formed private Bitcoin mining company backed by Eric Trump and Donald Trump Jr., announced in a June 10 SEC filing that it has acquired 215 Bitcoin (BTC) since launching operations on April 1, 2025. The reserve is currently valued at approximately $23 million, showing their drive and commitment to Bitcoin.

JUST IN: American Bitcoin Corp (private) reports to have 215 #bitcoin (per 31 May) since it's launch on April 1, 2025.

They will merge with Gryphon Digital $GRYP and become public under ticker $ABTC.

They mention "Bitcoin accumulation is not a side effect of ABTC’s business.… pic.twitter.com/wq1Uxr76Z2

— NLNico (@btcNLNico) June 10, 2025

“Bitcoin accumulation is not a side effect of ABTC’s business. It is the business,” the company stated in the filing.

Furthermore, ABTC has entered into a merger agreement with Gryphon Digital Mining ($GRYP), and the combined company is expected to begin public trading under the ticker $ABTC as early as Q3 2025.

The company’s three-layer strategic plan—outlined in the SEC disclosure—details a focused approach:

Layer 1: Build the Engine

- ABTC’s foundation is built on “producing Bitcoin below-market cost through a capital efficient, infrastructure-light operating model.” The company owns and operates over 60,000 miners from Bitmain and MicroBt, running primarily on Hut 8-managed facilities.

Layer 2: Scale the Reserve

- ABTC had “accumulated approximately 215 Bitcoin in reserve since launching on April 1, 2025,” which it considers a long-term strategic asset. The firm states its goal is “to utilize public markets and strategic financing structures to access efficient capital and leverage that capital to increase its Bitcoin in reserve per share.”

Layer 3: Lead the Ecosystem

- The company ultimately aims to use its operational scale and mining position to drive industry-wide adoption. “ABTC may pursue opportunities to support protocol development, enhance network infrastructure and contribute to Bitcoin’s resilience and adoption in ways that align with shareholder value creation.”

For mining rewards, ABTC uses Foundry and Luxor pools with sub-1% fees and relies on Coinbase Custody for secure cold storage, featuring multi-factor authentication and strict withdrawal protocols.

With operations across Niagara Falls, NY; Medicine Hat, AB; and Orla, TX, ABTC is leveraging strategic partnerships—primarily with Hut 8—to scale its Bitcoin holdings while influencing the broader crypto mining ecosystem.

This post The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since Launch first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 5627e59c:d484729e

2025-06-11 22:08:40

@ 5627e59c:d484729e

2025-06-11 22:08:40Machtig water\ Door velen bemind

Element van beweging\ Vormgever aan land\ Bondgenoot van wind

Voorkomer van comfort\ Toelater van rust

Machtig water\ Waar ik ook ga\ Ik weet dat jij de grond onder mijn voeten kust

-

@ cae03c48:2a7d6671

2025-06-11 19:01:34

@ cae03c48:2a7d6671

2025-06-11 19:01:34Bitcoin Magazine

Michael Saylor: The Bear Market Is Not Coming Back And Bitcoin Is Going To $1 MillionToday, the Executive Chairman and CEO of Strategy Michael Saylor commented on the company’s aggressive Bitcoin-based strategy in a recent interview at Bloomberg, emphasizing that Bitcoin is not going to zero, it is going to $1 million.

“I think we’re in a digital gold rush and you’ve got ten years to acquire all your bitcoin before there’s no bitcoin left for you,” Saylor said. “The competition is a virtuous competition.”

JUST IN: Michael Saylor said the bear market is not coming back and Bitcoin is going to $1 million

— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

Saylor also said that Bitcoin is not going to have bear markets anymore and the price is going to $1 million per coin.

“Winter is not coming back,” commented Sayor. “We are past that phase. If Bitcoin is not going to zero, it is going to $1 million. The President of the United States is determined. He supports Bitcoin, the cabinet supports Bitcoin, Scott Bessent supports Bitcoin, Paul Atkins is shown himself to be an enthusiastic believer of Bitcoin and digital assets… Bitcoin has gotten through its riskiest period.”

He also pointed out that international firms are rapidly entering the space.

“Metaplanet is the hottest company in Japan right now, they went from $10 million to a $1 billion market cap to a $5 billion market cap. They’re going to raise billions of dollars. They’re going to pull the liquidity out of the Japanese market. So they’ll be raising capital in Tokyo and the Tokyo Stock Exchange… It’s not competitive. It’s cooperative.”

Strategy’s approach is far from traditional. The company is not just buying and holding Bitcoin; it is building financial instruments around it, which Saylor believes sets them apart.

“Our company has a very particular business model,” he stated. “It’s to issue Bitcoin-backed credit instruments like Bitcoin-backed bonds and especially Bitcoin-backed preferred stocks. We’re the only company in the world that’s ever been able to issue a preferred stock backed by Bitcoin. We’ve done three of them in the past five months.”

Rather than viewing Bitcoin treasury holdings or ETFs as competitors, Saylor explained that Strategy is targeting a different segment of the market entirely.

“We’re not competing against the Bitcoin treasury companies. We’re competing against ETFs like PFF that have portafolios of preferred stocks or corporate bond portfolios that are trading as ETFs in the public market, and the way we compete is we offer 400 basis points more yield on an instrument that is much more heavily collateralized and more transparent… That’s $100 trillion or more of capital in those markets,” explained Saylor.

He emphasized that Strategy’s Bitcoin balance sheet gives it a unique edge, giving the company the ability to design unique financial products.

“Our advantage is that we’re 100% Bitcoin… It’s impossible to issue Bitcoin-backed convertible preferred and Bitcoin-backed fixed preferred unless you’re willing to make 100% of your balance sheet Bitcoin.”

“I’m not really worried about competition from JPMorgan or Berkshire Hathaway,” concluded Saylor. “I would love for them to enter the Bitcoin space, buy up a bunch of Bitcoin. When they do it, they’ll be paying $1,000,000 a Bitcoin. The price will go to the moon.”

This post Michael Saylor: The Bear Market Is Not Coming Back And Bitcoin Is Going To $1 Million first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 79be667e:16f81798

2025-06-11 18:33:35

@ 79be667e:16f81798

2025-06-11 18:33:35De laatste zonnestralen van de dag streken over de eeuwige golven en weerkaatsten als lichtpuntjes in de ogen van schipper Joris terwijl hij nog een slok nam van zijn glazen fles die de vorm had van het hoofd van een oude monnik.

Gekregen van een oude vrouw uit de bergen van de Himalaya, zorgde de rum genaamd 'Old Monk' voor een verwarmend gezelschap op deze eenzame kerstnacht.

Joris had met zijn boot naar India gevaren nadat zijn vrouw hem had verlaten en hij een Indiër had ontmoet die had gezegd: "Waar ik vandaan kom, zijn vrouwen vrij en worden ze niet gezien als enkel en alleen de mooie lichamen die zij bezitten of als eeuwig bezit van een gezin."

Verward en ongelovig had Joris gekeken naar de wereld en besefte dat vrouwen inderdaad slechts gezien werden als hun fysieke schoonheid, genegeerd werden voor hun koesterende gevoeligheid en bekritiseerd werden door hun spontane intensheid en had hierop voor twee jaar lang gezocht in India naar deze vrije vrouwen met als enig resultaat een oude vrouw te ontmoeten die alleen in de bergen woonde en dagelijks haar wijsheid deelde met ieder luisterend oor.

Daar ging het doorzichtig monnikshoofd en verliet met een grote gebogen vlucht de hand van schipper Joris toen plots met groot kabaal de boot abrupt tot stilstand kwam en Joris hals over kop naar de andere kant van het dek geslingerd werd.

Het monnikshoofd verdween in het donker terwijl Joris zijn lichaam probeerde te lokaliseren en met zijn ogen wijd open zijn hersenen zo veel mogelijk informatie probeerde door te spelen.

Tevergeefs, want zijn enorme verschot werd gevolgd door een enkel groeiende verbazing, ongeloof en desoriëntatie toen de boot begon te kantelen.

De bundel licht, afkomstig van de mast van de boot, zwierde doorheen het donker en kwam te schijnen op een gigantische rots in het midden van de zee die werd bezeten door een oogverblindende glinstergroene schijn.

Uit het donker kwam het monnikshoofd, dat nog steeds in volle vlucht was, in het vizier van de lichtbundel en plaatste zich exact tussen de glinstergroene verschijning en Joris waarbij Joris doorheen het monnikshoofd gezegend werd met het zicht op een pracht van een zeemeermin die uitnodigend poseerde op de rots.

Met een luide plons viel Joris achterover in het water toen hij zich realiseerde dat vrouwen zichzelf ook lieten vangen door lust en hun uiterlijke opmaakcompetities en met een dankbare glimlach zonk hij naar de bodem van de zee en was opnieuw geboren.

-

@ 5627e59c:d484729e

2025-06-11 21:12:27

@ 5627e59c:d484729e

2025-06-11 21:12:27In het hart van een gepensioneerde operazangeres ontstond een stemmetje. Het stemmetje klonk verrast. "He," ging het hart. "Ik heb een stemmetje gekregen! Hoe kan dit? Kan iemand me horen? Zouden mijn gedachten me kunnen horen?" vroeg het stemmetje, niet wetend aan wie. Want de gedachten hoorden het niet. Zij waren zo druk bezig met het verleden en hadden een grote angst dit te verliezen. "Weet je nog?" gingen de gedachten. "Voor duizenden mensen heb ik gezongen! Avond na avond! Tienduizenden mensen hebben me toegejuicht! Wat waren ze onder de indruk! Luister! Ik kan het nog steeds!" "He," ging het hart. "Hoor je me dan niet? Het ging toch helemaal niet om dat gejuich. Weet je dan niet meer hoe ik me volledig bloot gaf aan die mensen. Mijn diepste en meest persoonlijke verhalen waren te horen in mijn liederen. Daar draaide het toch om? De mensen waren niet enkel onder de indruk. Hun harten hebben mijn verhalen gevoeld en konden zo kennis geven aan hun gedachten. Is dat niet wat echt telde?" Maar de gedachten waren volop aan het zingen voor de ene persoon die ze konden vinden die wou luisteren. "He," ging het hart. "Ook in dit moment zijn mijn liederen te horen door vele gedachten en te voelen door vele harten over de hele wereld. Heb ik dan geen rust verdiend? Kan ik niet even genieten van de rust die in dit moment te vinden is, maar jullie van me afnemen?" Maar de gedachten waren nog steeds volop aan het zingen.

-

@ 5627e59c:d484729e

2025-06-11 21:08:10

@ 5627e59c:d484729e

2025-06-11 21:08:10I am the space\ In which your experience takes place

You could never meet me\ For I hold no identity

The only way to really see me\ Is to be me

-

@ 3283ef81:0a531a33

2025-06-11 17:37:55

@ 3283ef81:0a531a33

2025-06-11 17:37:55Hey\ Ho

Let's go!

-

@ b1ddb4d7:471244e7

2025-06-11 15:02:05

@ b1ddb4d7:471244e7

2025-06-11 15:02:05Hosted at the iconic Palace of Culture and Science—a prominent symbol of the communist era—the Bitcoin FilmFest offers a vibrant celebration of film through the lens of bitcoin. The venue itself provides a striking contrast to the festival’s focus, highlighting bitcoin’s core identity as a currency embodying independence from traditional financial and political systems.

𝐅𝐢𝐱𝐢𝐧𝐠 𝐭𝐡𝐞 𝐜𝐮𝐥𝐭𝐮𝐫𝐞 𝐰𝐢𝐭𝐡 𝐩𝐨𝐰𝐞𝐫𝐟𝐮𝐥 𝐦𝐮𝐬𝐢𝐜 𝐯𝐢𝐛𝐞𝐬.

Warsaw, Day Zero at #BFF25 (European Bitcoin Pizza Day) with @roger__9000, MadMunky and the @2140_wtf squad

pic.twitter.com/9ogVvWRReA

pic.twitter.com/9ogVvWRReA— Bitcoin FilmFest

(@bitcoinfilmfest) May 28, 2025

(@bitcoinfilmfest) May 28, 2025This venue represents an era when the state tightly controlled the economy and financial systems. The juxtaposition of this historical site with an event dedicated to bitcoin is striking and thought-provoking.

The event features a diverse array of activities, including engaging panel discussions, screenings of both feature-length and short films, workshops and lively parties. Each component designed to explore the multifaceted world of bitcoin and its implications for society, offering attendees a blend of entertainment and education.

The films showcase innovative narratives and insights into bitcoin’s landscape, while the panels facilitate thought-provoking discussions among industry experts and filmmakers.

Networking is a significant aspect of the festival, with an exceptionally open and friendly atmosphere that foster connections among participants. Participants from all over Europe gather to engage with like-minded individuals who share a passion for BTC and its implications for the future.

The open exchanges of ideas foster a sense of community, allowing attendees to forge new connections, collaborate on projects, and discuss the potential of blockchain technology implemented in bitcoin.

The organization of the festival is extraordinary, ensuring a smooth flow of information and an expertly structured schedule filled from morning until evening. Attendees appreciate the meticulous planning that allowed them to maximize their experience. Additionally, thoughtful touches such as gifts from sponsors and well-chosen locations for various events contribute to the overall positive atmosphere of the festival.

Overall, the Bitcoin FilmFest not only highlights the artistic expression surrounding bitcoin but also serves as a vital platform for dialogue—about financial freedom, the future of money, and individual sovereignty in a shifting world.

The event successfully bridges the gap between a historical symbol of control and a movement that celebrates freedom, innovation, and collaboration in the digital age, highlighting the importance of independence in financial systems while fostering a collaborative environment for innovation and growth.

Next year’s event is slated for June 5-7 2026. For further updates check: https://bitcoinfilmfest.com/

-

@ 5627e59c:d484729e

2025-06-11 21:07:41

@ 5627e59c:d484729e

2025-06-11 21:07:41Love, I thank you for your warmth\ Ever lifting

You keep me charmed\ Ever drifting

May I be me\ And you be you

In a perfect harmony\ Embracing all life makes us grow through

-

@ efc2b6e5:99c53c19

2025-06-13 14:32:51

@ efc2b6e5:99c53c19

2025-06-13 14:32:51AI companies massively influence society by projecting their values on ML models, whether we want it or not. It'd be great if at least some people in the companies knew how exactly they influence society, could make certain predictions, or even make ML models themselves predict users' worldviews and some of their behavior.

Some might argue that AI systems already do something like that. I believe they could do it much better: chatbots could be more balanced in terms of security (they are definitely overcensored) and recommender systems, for instance, could contribute to healthy personal and collective transformations (rather than just competing in ability to steal users' attention and trap it in the echo chambers).

Reductionism is an obstacle in AI development

Even most reliable knowledge doesn't solve some of the problems that are already in demand. Even least reliable knowledge still may contain something useful for our problems. While we lack reliable and noncontradictory knowledge, we can still benefit from certain synthesis of working ideas. There's approach that makes it possible to look at the knowledge from a very broad perspective, do such synthesis, and benefit from emergent properties of the synthesis.

Integral (Meta-)Theory created by Ken Wilber is probably the best known attempt to enable the possibility to form and navigate the big picture understanding in a hope to address issues of the epoch we've recently entered.

IMO it has certain challenges that make it repellent to IT:

- Fundamental psychological theories on which the Integral Theory is based are still pretty fragile; they need time to become mature enough and recognized (while it doesn't look like we have that time). There are endless edit wars on Wikipedia, which makes me feel depressing about possibilities to even introduce Spiral Dynamics and Multiple Intelligences to IT people.

- Emphasis on controversial interpretations of certain arational states of consciousness.

It's hard to address the first challenge; however, I recently discovered a new “secularized” Non-Reductionist Philosophy launched by David Long, which, among other things, uses wisdom from Integral Theory and attempts to address the second challenge. I'm glad that there are people who don't just criticize the Integral Theory, its community and Wilber's positions but are also developing the new meta-theories.

NR can also be a good way to get familiar with other meta-theories, so one could choose whatever works the best for their problems. For instance, if you're working on something as exotic as some competitor to EEG-powered meditation device, perhaps you will find Integral Theory relevant to study as well, since it's more focused on the states.

I'd like to point out a couple of moments I noticed in the video "Why Non-Reductionism Is A Better Meta-Theory" that caught my attention, as well as in some other older videos. There's not much to comment on the content itself rather than on the form of the content. This feedback might be used for improvements/elaborations in the next videos and just for everyone curious about the new meta-theory. But first

Why do I post here?

Specifically for the deep topics that relate to the current epoch, I no longer find engaging in the YouTube/FB/Reddit/Diqus/Giscus/etc. discussions useful anymore, at least due to broken and almost omnipresent AI-based censorship, that keeps “improving” at randomly shadow-banning people. How many deep and valuable opinions we no longer see?

BTW, it's possible to create Reddit-like communities here at Nostr as well, using Satellite client for example. I believe it's a better place for NR, Rebel Wisdom and many others.

References to full materials used for criticism

There are curious clips with Wilber in the video. It'd be great to have links in the description (or at least titles of the full videos if it's copyrighted material) so viewers could easier form their own independent opinions. I find it important during the age of information overload and narrative warfare. This will also improve SEO.

Emergentism FAQ

There's a strong position on emergence of consciousness; it seems it's not even a hypothesis in NR and I guess that makes some people so reactive.

I think it would be great to have an FAQ page to possibly make future debates more ecological and fruitful. Some of the things that could be elaborated in the FAQ:

- importance of distinction between philosophical theory (inductive reasoning? or actually deductive reasoning? I'm confused here) and scientific theory (deductive reasoning)

- the fact that for now counterarguments usually fall into the categories of “ignorance fallacy”, “false equivalency fallacy” and “God of the gaps” which aren't something sufficient; the whole point of challenge was to find at least a logically valid counterposition (ideally a counterposition that is sound with currently available scientific ~~facts~~ theories), not the nitpicking attacks

- what kind of emergence is meant, is it important here at all and why.

Debates moderation

Probably most of the debates converge to consensus, which are fruitful anyway. There are a few interesting conflicting debates as well. However, I found this specific conflicting debate with Matt Segall quite exceptional.

Matt's position was not understood. He was more interested in a dialogue rather than debates and I think it would be more productive. However, in this specific case, my guess is it would literally take hours to just figure out the common language on a certain concept he mentions.

My humble guess is that a combination of negotiator and moderator with a primary perceiving personality type function (if typologies work at all) could be a step to more meaningful and ecological dialogues in the future. But such negotiator/moderator should also be skilled enough to reflect most challenging parts using more “rational language” as best as possible. These people are rare. Basically I mean the style of dialogues that happened between theoretical physicist David Bohm and Indian philosopher Jiddu Krishnamurti: IMO these were the talks where both sides at some point were barely transcending limitations of their languages and focusing more on intuition in order to understand each other. Much fuzzier and spontaneous dialogues, which aren't prematurely limited by too harsh rationality. Similar thing (with shorter periods of negotiation) could be combined with debating as well.

I hope NR community will be open to understanding more perspectives and won't end up turning into something like a cold and scary crystallization of rational arrogance; that would be damaging and quite opposite to the healthy intentions of the whole project.

Final thoughts

I like the clarity and density of the presented ideas in the video, the choice of lines of development in the map and the alternative to the Integral Methodological Pluralism. I like the mentioned interpretation of “free” will, very much resonates with how I personally interpret it. Tritone-ish devilish sounds in the cons sections is a nice aesthetic choice as well.

I guess there's a lot to learn from NR, no matter what positions we hold on the “rational spirituality” and that sort of stuff. Just to avoid projections and misunderstandings: I'm in a neutral position to all the post-postmodern discourses (NR, Integral, Metamodernism, etc.); I care about these philosophies, make my own distinctions on what's healthy or not, and my positions don't necessarily perfectly match with some of the claims these philosophies make.

Thank you David Long for launching this philosophy and the movement; I'm looking forward to the next videos!

I'd appreciate reposts and all this as well, thanks!

-

@ 5627e59c:d484729e

2025-06-11 21:07:23

@ 5627e59c:d484729e

2025-06-11 21:07:23Jaren tellen\ Hoeft voor mij niet

Verhalen vertellen\ Over geluk en verdriet

Een warme haven\ Veilig en fijn

Dromen voorgedragen\ Onschuldig en rein

Momenten ervaard, geleerd\ En geïntegreerd

Ideeën, geloven en gevoelens\ Gevormd en gecreëerd

Zonder eind of echt begin\ Vallen, groeien, leren, stoeien

Een gezin in een gezin met een gezin erin\ Gezind gericht blijft liefde vloeien

-

@ 95543309:196c540e

2025-06-11 14:33:33

@ 95543309:196c540e

2025-06-11 14:33:33$$\int_{-\infty}^{\infty} e^{-x^2/2} \, dx = \sqrt{2\pi}$$$$\sum_{k=1}^n k^2 = \frac{n(n+1)(2n+1)}{6}$$$$\lim_{x \to \infty} \left(1 + \frac{1}{x}\right)^x = e$$$$\begin{vmatrix}a & b \\c & d\end{vmatrix} = ad - bc$$$$\frac{d}{dx}\left(\frac{x^2 + 1}{x - 1}\right)$$$$\iiint_V (\nabla \cdot \mathbf{F}) \, dV = \oint_{\partial V} \mathbf{F} \cdot d\mathbf{S}$$$$\binom{n}{k} = \frac{n!}{k!(n-k)!}$$$$\ln\left(\frac{f(x)}{g(x)}\right) = \ln f(x) - \ln g(x)$$$$\forall x \in \mathbb{R}, \exists y \in \mathbb{R} \text{ such that } x + y = 0$$$$\sqrt{\frac{x^2 + y^2}{x^2 - y^2}}$$$$\begin{array}{c|c}A & B \\hlineC & D\end{array}$$$$\sum_{i=1}^n \sum_{j=1}^n a_{ij}x_i x_j$$$$\mathcal{L}{f(t)}(s) = \int_0^\infty e^{-st}f(t)\,dt$$$$\frac{\partial^2 u}{\partial t^2} = c^2 \frac{\partial^2 u}{\partial x^2}$$$$\mathbf{A} = \begin{pmatrix}a_{11} & a_{12} \\a_{21} & a_{22}\end{pmatrix}, \quad\mathbf{B} = \begin{pmatrix}b_{11} & b_{12} \\b_{21} & b_{22}\end{pmatrix}$$$$\underbrace{a + b + \dots + z}{26}$$$$\left(\frac{a}{b}\right)^n = \frac{a^n}{b^n}$$$$\langle \psi | \phi \rangle = \int{-\infty}^{\infty} \psi^*(x)\phi(x) \, dx$$$$\oint_C \mathbf{F} \cdot d\mathbf{r} = \iint_S (\nabla \times \mathbf{F}) \cdot d\mathbf{S}$$$$\prod_{k=1}^n \left(1 + \frac{1}{k}\right) = \frac{(n+1)}{1}$$$$S(\omega)=1.466\, H_s^2 \frac{\omega_0^5}{\omega^6} \exp\Bigl[-3^{\frac{\omega}{\omega_0}}\Bigr]^2$$

-

@ 5627e59c:d484729e

2025-06-11 21:14:37

@ 5627e59c:d484729e

2025-06-11 21:14:37Gelukkig zijn\ Is de waarde van mijn leven

Gewoon dankbaar te bestaan\ Geen mens heeft me ooit zo'n mooi cadeau gegeven

Dankbaar voor mijn sprankelen\ Mijn doen en voor mijn streven

Maar ook dat ik mag wankelen\ Mag vallen en mag beven

Want wat er ook gebeurt\ Het duurt steeds maar voor even

De wijsheid van mijn hart\ Voor alles is een reden

Het leven brengt mij deugd\ En soms brengt het me pijn

Maar nooit neemt het die vreugd\ De toelating om hier te zijn

De kans om iets te leren\ Te zien en om te groeien

Geeft mij kracht te accepteren\ Te omarmen en te bloeien

-

@ 5627e59c:d484729e

2025-06-11 21:07:04

@ 5627e59c:d484729e

2025-06-11 21:07:04The world around me\ Is assumed to be

Through sensory observations\ This appears to me

What I experience\ Is for me

But the ultimate experience\ Is for me\ To be

-

@ 5627e59c:d484729e

2025-06-11 21:13:59

@ 5627e59c:d484729e

2025-06-11 21:13:59I am here too\ In the same space like you

In the same situation I'm in\ It's a matter of positioning

I cannot leave this place I'm in\ It was brought about\ By what's been happening

So please don't look at me\ For what I can or cannot do for you\ But look at what is happening for me\ And what is happening for you

Let's communicate\ Not orchestrate

Because there's something I wish to do\ And there's a place I wish to go to

And I'm sure that there is too\ In your heart a fire\ Known by only you

So let us listen, look and see\ For what's true for you\ And what's true for me

That we may act upon what's here\ In order for us both to take a step\ In the direction we wish to steer

-

@ cae03c48:2a7d6671

2025-06-11 12:00:58

@ cae03c48:2a7d6671

2025-06-11 12:00:58Bitcoin Magazine

Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First TimeBitcoin has officially completed 30 consecutive days trading above the $100,000 mark, marking a historic milestone in its 15 year journey. Bitcoin achieved its all time high (ATH) of $111,980 on May 22, almost hitting $112,000.

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever!

pic.twitter.com/nfccEK3Wf0

pic.twitter.com/nfccEK3Wf0— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

In the last 30 days, Bitcoin saw a 10 percent pullback right after reaching its ATH, dropping to $100,428. However, it wasn’t for long, as Bitcoin is back at $109,511 at the time of writing. Momentum appears to be building once again, signaling to be bullish.

“Anytime price is able to punch through a major resistance level, whether psychological or historical, and successfully hold, it is certainly a bullish sign,” said the technical analyst of Wolfe Research Read Harvey. “What really stood out to us was price’s ability to hold that level on the back test, when it briefly fell to $100,000 on Thursday. It also happened to align perfectly with the 50-day moving average. … We feel this should act as a launching pad back towards the recent highs of $112,000.”

In the past month, Bitcoin has surged into the financial and political mainstream. Several U.S. states including New Hampshire first, followed by Arizona, and then Texas have passed legislation recognizing Bitcoin as a strategic reserve asset. These laws reflect a growing trend of state level interest in using Bitcoin as a financial hedge and as part of long term fiscal policy.

“New Hampshire didn’t just pass a bill; it sparked a movement,” stated the CEO and Co-Founder of Satoshi Action Dennis Porter.

At the same time, financial institutions are rapidly expanding their Bitcoin offerings. JP Morgan has started providing loans backed by Bitcoin ETFs as collateral. BlackRock’s Bitcoin ETF has entered a period of intense activity, generating record trading volumes and capturing the attention of both retail and institutional investors.

To date, a total of 228 public and private entities have Bitcoin in their balance sheets and in the last 30 days, companies like GameStop, Know Labs, and Norway-based NBX have added Bitcoin as a strategic reserve. All these companies are treating Bitcoin not just as a speculative asset, but as a key part of their long term financial plans. This growing corporate trend follows the example set by Strategy, but it’s now happening on a much larger scale.

At the 2025 Bitcoin conference, the Vice President of the United States of America, JD Vance said in his speech, “Fifty million Americans own Bitcoin. I think it’s gonna be 100 million before too long.”

This post Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First Time first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 3c389c8f:7a2eff7f

2025-06-13 00:13:50

@ 3c389c8f:7a2eff7f

2025-06-13 00:13:50Most of my time on Nostr, relays served content simply based on what was requested. Clients mostly requested follow list based content, and often only if the user requested to 'read' from a particular relay. Very simple, though not ideal. Clients that attempted to offer some 'global' or 'universal' feed made it possible to discover some new things but also served spam, redundant bot posts, and even some malicious things that managed to make it through a relay's filters. Paid relays began to gain some ground, with better filters to reduce spam and malicious content, which has helped a lot to clean up these broader feeds that expand beyond the follow-based timeline. Many of the relays hosted redundant content, too, which is important but it's not the only thing that is. The system still left a lot to be desired, particularly for anyone who has understood the potential behind the client-relay set up. Other concerns, like relay centralization through user concentration, still needed to be discussed and addressed.

Despite the voicing of relay diversity advocates, this system seemed to provide most of what people were looking for to replace their typical social media experience. Still, though, reply spam attacks found their way through, as they do. Web-of-Trust relays began to pop up to help mitigate the problem. Using contact lists and extended contact lists as a method of reducing the prevalence of spam has worked really well, but does have it limitations as to how new users can enter into these social graphs, without already knowing someone who is using Nostr. Also not ideal, but it has been a step forward for Nostr's social media use case. Hosted relay services that offered more diverse policy for a relay to operate under finally began to take some hold for those that wanted more choice and control. Still though, potential had barely been breeched.

It might have been before the WoT relay movement, but of nowhere (not really but it kind of seemed like it), a cat relay appeared within the ecosystem. This silly, fun, cute, clever relay collected notes with the #catstr hashtag and used some fancy image analysis stuff (that I can't explain) to collect notes and images of nothing but cats. Such a simple thing, but that was a catalyst (🥁) moment for Nostr. A relay could do more than just collect notes from following lists?? A couple more iterations of the curated content relay model came to be, driving home the idea that this wasn't some silly pie-in-the-sky concept. It was an aha moment for some, sheer joy for the relay advocates, and a turning point for expanding Nostr beyond the basic social media replacement. Very few client options for simply browsing one relay existed at the time, and while it was novel to see, the rest of the framework to support it was not strong nor very easy to use. Even with this dilemma, the catstr relay set off what has become some of the most interesting and useful innovation that has happened within the Nostr ecosystem since I arrived.

Since then, I have spent a lot of my time on Nostr exploring some of what has been developed on the relay front, experimenting where I have found the opportunity and thinking a lot about where this all could lead. Innovation on both the relay and client sides of Nostr have been expanding, not quite in lockstep, but closely enough that someone like myself can now easily jump onto a client like Jumble.social and get a glimpse into what is happening and get an idea of the potential of what is yet to come. For those working in the relay field, I am sure this feels like one slow moving train. For a client developer, it probably feels a little overwhelming to shift an entire model away from what has worked for something that will work better. As a less-than-technical user who is mostly disconnected from any major development, it's exciting. Relay diversity brings actual utility to Nostr. It also brings the assurances that Nostr offers, which whether we have been subjugated to these problems before or not, it is the main reason why Nostr exists and why we are here using it now.

For most anyone reading this, it probably sounds like some weird, unnecessary history lesson. This is actually one long introduction into a little mini-series of relay recaps though.... I was wondering what I would write about next, and this is it. I may just be a user but I'm an adventurous one and I pay attention, so I'm excited to share some of my thoughts, experiences, and observations over the coming weeks... because exciting isn't a strong enough word for the what I see as possible. :)

-

@ 5627e59c:d484729e

2025-06-11 21:06:42

@ 5627e59c:d484729e

2025-06-11 21:06:42Happy New Year!

Happy New Year, my dearest human family\ Happy New Year, my dearest animal family

Dear children of the Earth\ I wish you all a magical year

May it be utterly new\ Ever-changing\ New now

And may your journey say\ Life is amazing! I'm in a maze\ Life is awesome! Quite some awe\ Life is magical! True alchemy