-

@ 5627e59c:d484729e

2025-06-11 21:07:23

@ 5627e59c:d484729e

2025-06-11 21:07:23Jaren tellen\ Hoeft voor mij niet

Verhalen vertellen\ Over geluk en verdriet

Een warme haven\ Veilig en fijn

Dromen voorgedragen\ Onschuldig en rein

Momenten ervaard, geleerd\ En geïntegreerd

Ideeën, geloven en gevoelens\ Gevormd en gecreëerd

Zonder eind of echt begin\ Vallen, groeien, leren, stoeien

Een gezin in een gezin met een gezin erin\ Gezind gericht blijft liefde vloeien

-

@ 57d1a264:69f1fee1

2025-06-12 05:46:59

@ 57d1a264:69f1fee1

2025-06-12 05:46:59Her work explores the intersection of tradition and innovation in wheel-thrown ceramics. Rooted in time-honored techniques, she push the boundaries of clay’s structural possibilities—incorporating hollow tubes, flat rings, curves, and trimmed ridges to create forms that feel both organic and futuristic. These experimental designs challenge gravity and balance, evoking a space-age aesthetic while remaining deeply connected to the tactile nature of craft.

Discover Dara's work at https://www.daraschuman.com/pages/2024

https://stacker.news/items/1004131

-

@ 6ad3e2a3:c90b7740

2025-06-11 08:29:54

@ 6ad3e2a3:c90b7740

2025-06-11 08:29:54Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Surely some revelation is at hand;

Surely the Second Coming is at hand.

The Second Coming! Hardly are those words out

When a vast image out of Spiritus Mundi

Troubles my sight: somewhere in sands of the desert

A shape with lion body and the head of a man,

A gaze blank and pitiless as the sun,

Is moving its slow thighs, while all about it

Reel shadows of the indignant desert birds.

The darkness drops again; but now I know

That twenty centuries of stony sleep

Were vexed to nightmare by a rocking cradle,

And what rough beast, its hour come round at last,

Slouches towards Bethlehem to be born?

The Second Coming — W.B. Yeats

I don’t know what I want to write about today. There are a lot of converging currents coursing through my reality right now. I feel we’re in an interregnum of sorts between what was and what’s to come. I guess you could simply describe that as the present, something that has ever been the case. But this moment feels more intense like something big is dying and something else, God knows what, is on its way “to be born".

I exchanged emails recently with an old friend, and he sent me a link to a David Foster Wallace commencement speech entitled “This Is Water.” In it Wallace tells a joke of an old fish seeing two younger fish swimming by and asks them “How’s the water?” Later on one of the younger ones asks the other, “What is water?”

Wallace hanged himself a few years after the speech. Apparently he was unable to maintain the perspective he laid out in it which was that we can choose our attitude toward what we experience in any moment, no matter how much aversion we habitually associate with it. That the act of choosing equanimity constitutes the freedom we seek. That this freedom to choose is ever present, in fact the ability to direct our attention and consciousness is itself the water. And yet out of habit we are often oblivious to this most fundamental reality.

My friend’s email was in response to my description of the dissolution I see right now. Everything seems fake. The news, the governments, the edicts of reputationally bankrupt institutions zombying along as though the last five years never happened, like the proverbial emperor still purporting to rule though everyone can now see his pale, unsightly posterior.

Yes, the coffee shops are still open, people still go on vacation with their families. Let’s go to Paris, Rome, the Greek Isles! Let’s pretend everything is as we had imagined in the before times when our goals and aspirations seemed real, when the glitchy pixels in the matrix hadn’t yet revealed themselves so glaringly.

Maybe this was always the case. All our games were always professional wrestling, a scripted charade for which we willingly suspended disbelief. But like the roadrunner in the cartoon, we have since become aware we have run out of road, four steps beyond the cliff edge.

. . .

Wallace in his speech described such indignities as being stuck in traffic after a long day of work, or in a long grocery checkout line. The mind’s usual programs run, cursing everyone and everything around us. Instead of contemplating the miracle of human existence we feel only disgust and impatience. We want to finish with the run, the work, the obligatory hour so we can move on to something presumably more pleasant.

I can handle such day to day discomforts, but the overwhelming sense of dissolution is undermining the aims to which I had once attached meaning. I set up my life for freedom and prosperity, and now, just as I have my ducks in a row, there’s an imminent magnetic pole shift or a financial and social collapse that threatens to counterfeit my efforts.

It’s easy to opt out when you’re losing, to decry the injustice, unfairness and pointlessness of the game when you weren’t getting much from it anyway. When you’ve got nothing, you’ve got nothing to lose, to paraphrase Bob Dylan. But as a late bloomer wanting to sample the wine of the Gods at long last, it’s dispiriting in a different way, like saving up for a new car and seeing it stolen before you had a chance to drive it.

That’s the shallow version, distress at discovering just before getting the things I had always wanted I was actually playing not just the wrong game, but a false one. That I’m upset I can’t gratify my ego in the way I had hoped, that I can’t get the pat on the back I had craved because the back-patters decided to tear up the playing field just as I finally became a contender.

The deeper version is you only get better at the game through your own efforts to discover what’s true, your own self-mastery and access to a measure of wisdom. This process transforms your life from a tedious and difficult slog to a state of ease and flow. You are more connected, more in touch with yourself and the forces within. You can handle aversion, in fact voluntarily invite it at times to hone your mind and access your resourcefulness. You love your life and connect to the people in it. You have great hope and aspirations for the future. You believe in God, or the Tao or whatever force animates all things, you can navigate the world’s imperfections and do not want it to fall into chaos and disorder.

The task of remembering this during the run, the traffic jam or the grocery store checkout line is not so difficult. But would it be the same during periods of violence and resource scarcity where literal survival is at stake, the rules of which are set by biology and physics rather than the incentives of human society?

Yes, I’d rather be eating dinner at home than sitting in traffic, but I can appreciate that I’m able to sit comfortably in my climate controlled pod, listening to music while traversing these distances rather than foraging for food in the harsh wild. Yes, this old Portuguese lady is taking an eternity to get the groceries into her pushcart, but I can imagine how it is to be old and slow and still have to shop and eat, and it’s trivial to cut her some slack.

I’m not claiming I always have this perspective, but I surely am able to channel equanimity during the ordinary aversion that arises in one’s day to day life. I do this while running on the track, the aches and pains, the discomfort, the wanting to get it over with is a battle I fight every week by my own choosing. But imagine if instead of running 10 minute miles I was forced to do them in six. It’s not so easy to keep a calm, conscious mind while gasping for breath.

The truth is these calamities I imagine are not yet real, the asteroid has not yet hit, the economy not yet collapsed. I have never experienced the kind of hardship I dread. I am ever in the grocery line, the 10-minute mile run, the traffic jam, never the concentration camp or Mad Max-style post-apocalypse. Why not just deal with that when the time comes, if it ever comes? Why die a thousand deaths like the proverbial coward rather than the one required of the brave man?

I suppose it comes down to wanting to be prepared. There’s nothing you can do if an asteroid destroys the entire earth, but if your national government devolves into tyranny, you could get out before it’s too late. There’s the adage one should only concern oneself about the things one can control, but the rub is in deciding what’s in your power and of what to let go. It’s an easy out, per the adage, to narrow your locus of control to doing your job and paying your bills. You can too easily forget that which job you have, where you live, what preparations to make are also matters in which you have a choice.

Even if you believe a magnetic pole shift could spill the earth’s oceans across continents within the next few decades — I find this plausible — you could move to the mountains to get ahead even of that. A fatalist, non-questioning attitude can be a psychological salve in times of upheaval, but “salve” and "“slave” are but a typo apart.

. . .

When I was six someone broke into my house. I was still awake, and while pretending to be asleep, I heard him rummaging through my belongings, stealing an old Fisher Price turntable and a black and white TV. My father died four years later, and at 10, I remember thinking as the oldest boy in the house, it was now my responsibility to defend my family if anything like that, or worse, happened again. Of course, I wasn’t really capable of doing this, and I knew it, but I would have to try, futile as it might be.

I imagine that psychology has stayed with me as an adult — it’s up to me to see around corners, assess the various threats to me and my family, even if some of them are too daunting for any one individual. I could let it go, I suppose, it would probably even be healthy to do so. But there is a part of me that wonders whether people like me, people who feel this irrational responsibility, are the those who survive cataclysms and shocks. I surely am not the only one who feels this way and quite likely would not be especially effective given I don’t have engineering, outdoorsman or serious combat skills. But that hyper-vigilance toward and preparation for worse-case scenarios is something someone has to do, someone who would likely be selected for the role by the particular accidents of his upbringing.

. . .

There is another way to look at this, of course. The notion one ought to step up in the face of adverse circumstances, even extreme ones, is valid. But perhaps the best way to prepare is not endlessly to assess potential threats like some black ops CIA outfit, but to have a calm and detached mind. Should the signs appear, a poised and observant person would take action insofar as he is able. That you, having trained your attention away from default habits of comfort-seeking and dread and toward conscious observation, will do what’s required if and when the time comes. That you can trust yourself, and by that I mean trust in God, so to speak, to guide your awareness and actions for the most effective and adaptive response.

The Fourth Turning might well be upon us, indeed “the centre [may not] hold.” There is no guarantee your response will ensure you or those you love survive. There has never been such a guarantee for anyone, only the freedom to direct your attention, to choose your state of mind, to the extent you are capable, in the conditions that arise. To respond to the older fish that the water is okay, it’s pretty nice actually.

-

@ 472f440f:5669301e

2025-06-11 04:37:33

@ 472f440f:5669301e

2025-06-11 04:37:33Marty's Bent

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

Opportunity Cost – See Prices in Bitcoin Instantly

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

*Download our free browser extension, Opportunity Cost: *<<https://www.opportunitycost.app/>> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 5627e59c:d484729e

2025-06-11 22:23:37

@ 5627e59c:d484729e

2025-06-11 22:23:37Happy New Year!

Happy New Year, my dearest human family\ Happy New Year, my dearest animal family

Dear children of the Earth\ I wish you all a magical year

May it be utterly new\ Ever-changing\ New now

And may your journey say\ Life is amazing! I'm in a maze\ Life is awesome! Quite some awe\ Life is magical! True alchemy

I am human\ Black woman, I love you so\ Life-giver of my origin, the negro [nigiro]

I am\ Thus physical and non-physical meet

Life is to be\ As the elements are and compete\ And as they collide with one another\ One becomes aware of an other\ And so life sets on a journey\ To discover the other

Animal life is set to explore\ Allowing all experience the other has in store\ Life left to experience without a voice\ Until it discovers there is an 'I'\ And it has a choice

Human life is to be inside a human body\ Thus fusion between intellect and feeling\ Gets to express its perspective\ Inside infinity

Truly, a magical gift\ My Holy Trinity

And so from human life flow many voices\ As it navigates through infinite choices

Thus I say

Life is magic\ A gift for all that is here\ Perceived by too many as tragic\ Take care of your vision, I tell you, my dear [tell-a-vision]

Life is magic\ And words are spells\ Placing your aim beyond your reach\ It takes away efficiency from your speech

Life is magic\ Above all else\ Even when it has me feeling blue\ Seemingly left without a clue

Still I say

Perfection\ You are everything\ And I am of you

The source, the mirror\ And the reflection

-

@ b1ddb4d7:471244e7

2025-06-07 05:01:34

@ b1ddb4d7:471244e7

2025-06-07 05:01:34“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ 2b998b04:86727e47

2025-06-11 17:51:49

@ 2b998b04:86727e47

2025-06-11 17:51:49ファースト・プリンシプルズ(First Principles)序章

この序章は「ファースト・プリンシプルズ」と題した7回シリーズの始まりです。分散化、コスト、自由、そして真実の奥にある本質的な変化を探ります。7回なのは、1週間のリズム——働き、休み、立ち返るというリズム——に合わせたからです。それぞれの記事は、私が受け入れてきた技術や哲学の根底にある真理を掘り下げます。分散化と主権、真実、時間、そして希望まで。\ \ テクノロジーはコストをゼロに近づける——よくそう言われます。

これは『The Price of Tomorrow』という書籍の主張でもあります。技術が進化するほど、自然とデフレ(物価下落)を引き起こす。自動化は労働を置き換え、ソフトウェアはインフラを代替し、AIは意思決定そのものを肩代わりする。限界費用(追加生産にかかるコスト)は限りなくゼロに近づく。

——でも、それだけじゃない。

そこには、経済学者や技術者が見落としがちな「もう一層の深さ」があります。

単に「生産コスト」が下がるかどうかではなく、問うべきは 中央集権による「コントロール・コスト(支配コスト)」 です。

限界費用が下がっても、中央集権の「隠れた代償」は上がっていくのです。

「無料」という幻想

たとえば、GitHub。

一見無料です。静的ウェブサイトを公開し、コードをホストし、Actionsで自動化し、グローバルに協業することもできる——全部、無料で。

でもGitHubはMicrosoftに所有されています。あなたはサーバーを管理できない。プラットフォームを所有していない。鍵(アクセス権限)も持っていない。

つまり、それは「取り上げられるかもしれない贈り物」にすぎない。

Google Docsも、YouTubeも、Substackも同じ。「無料で始めよう」というクラウドサービス全般も。

これらのツールが悪いわけではありません。むしろ、優れたものも多い。

でも「中立」ではないのです。

あなたが支払う代償は、必ずしもドルではありません。ときに、それは:

-

データアクセスの制限

-

APIの利用制限

-

突然の料金変更

-

検閲やアカウント停止

-

サービス移行にかかるコスト(特に問題が起きた時)

これは 中央集権プラットフォームの「隠れた家賃」 です。しかも、時間とともに複利的に増えていきます。

コントロール・コスト vs 限界費用

限界費用が「これを作るのにどれだけ安いか?」だとすれば、\ コントロール・コストは「これを使うことでどれだけ自由を失うか?」です。

Mediumなら無料で記事を投稿できますが、SEO(検索表示順位)は向こうのもの。\ Shopifyでビジネスを始められますが、彼らの判断でアカウントが停止される可能性もある。\ Instagramでフォロワーを増やしても、フィードを支配するのはアルゴリズムです。

私たちは「デフレ」を喜ぶように訓練されてきました。でも、実際には多くのツールが、参入コストを下げながら、コントロール・コストを膨らませているのです。

ここで、分散化(Decentralization) が物語を逆転させます。

分散化の本当の約束

本当の分散化は、ただ「安くする」だけじゃありません。\ それは「主権(Sovereignty)」をもたらします。

価格だけでなく、力を分配する。\ 手数料ゲートではなく、支配の構造そのものを取り除く。

こう言えるのです:

-

自分の鍵を自分で持て

-

自分のコンテンツを自分で持て

-

自分のスタックを自分で構築せよ

-

自分の配信チャネルを自分で持て

だからこそ、Nostr が重要。\ だからこそ、Bitcoin が重要。\ だからこそ、たとえ不便でも、セルフホスティングやパーミッションレスなプロトコル、オープンソースのツールが大切なのです。

彼らは「安くしてくれる」だけじゃない。\ 私たちの 自由 を守ってくれる。

実例:私のブログ構築

私がブログ blog.stantonweb.com を作り始めたとき、\ 最も楽な方法は選びませんでした。

私は以下を組み合わせました:

-

長文投稿に Nostr

-

投稿を取得・表示するためのPythonスクリプト

-

GitHub Actions で自動化

-

表示は静的HTML

-

ホスティングは GitHub Pages + Cloudflare(無料)

データベースも、CMSも、テーマ課金もなし。

限界費用? 0ドルです。

でももっと重要なのは、コントロール・コストも限りなくゼロだということ。\ 誰にも止められない。\ 企業にリーチを制限されない。\ ゲートキーパーが「掲載に値するか」を判断しない。

新しい「コスト」定義へ

価格だけを最適化すれば、捕らわれる。

自由を最適化すれば、やがて「余白」を築ける——金銭的余白だけでなく、創造の余白、道徳の余白、運営の余白も。

それが分散化の真価。\ 安いだけじゃない。\ より真実なものへ。

補足:過去からの教訓

Skypeを覚えていますか?\ 当初は真のP2Pツールで、構造的に分散されていました。でもMicrosoftに買収され、中央集権型に再設計され、やがてその中身は解体されました。

Napsterも同様。P2Pで音楽業界を揺るがしましたが、最終的には停止され、中央集権型の代替サービスに取って代わられました。

BitTorrentは生き残りました——それは「ただのプラットフォーム」にならなかったからです。

このパターンは明白です:

-

資本が集まれば中央集権になる

-

支配があれば検閲も起きる

-

しかし、自由は分散化から生まれる

そして私たちは、何度でもこの道を選び直さなければならないのです。

共同執筆:ChatGPT(“Dr. C”)が主要な論点の整理と精緻化をサポートしました。\ \ 数日以内にPart 1を公開予定。ご期待ください。

—\ blog.stantonweb.com およびNostrにて公開中。\ Zap(投げ銭)リンク:https://tinyurl.com/yuyu2b9t

-

-

@ 502ab02a:a2860397

2025-06-10 01:37:32

@ 502ab02a:a2860397

2025-06-10 01:37:32ถ้าเฮียบอกว่า “นมข้นหวานคืออาหารของสงคราม” หลายคนอาจขมวดคิ้ว ว่าอาหารหวานมันเกี่ยวอะไรกับดินปืน กระสุน และการยิงปะทะกันกลางสนามรบ แต่ถ้าย้อนเวลากลับไปช่วงปลายศตวรรษที่ 19 ถึงต้นศตวรรษที่ 20 เราจะเห็นชัดว่า ไม่ใช่แค่ปืนที่รัฐทุ่มเทวิจัย แต่รวมไปถึง “อาหารเก็บได้นาน ส่งถึงปากทหารโดยไม่เน่า” ซึ่งเป็นหัวใจของความอยู่รอดในสนามรบ และหนึ่งในของวิเศษนั้นก็คือ “นมข้นหวาน” ที่ภายหลังจะกลายเป็นตัวแปรสำคัญในวิถีอาหารของคนทั่วโลก รวมถึงในแก้วชาเย็นของคนไทยเรานี่แหละ

จุดเริ่มต้นของนมข้นหวานต้องย้อนไปก่อนสงครามกลางเมืองอเมริกาเล็กน้อย ราวปี 1856 ชายชื่อ Gail Borden คิดค้นวิธีการทำให้นมสดไม่บูดง่าย ด้วยการเอานมไปต้มหรือระเหยน้ำออก (evaporation) แล้วเติมน้ำตาลเข้าไปเพื่อยืดอายุการเก็บรักษา สูตรนี้ทำให้เขาตั้งบริษัท Borden Condensed Milk Company ขึ้นในปี 1857 และทันทีที่สงครามกลางเมืองอเมริกาเริ่มในปี 1861 รัฐบาลสหรัฐก็หันมาซื้อ “นมข้นหวาน” จำนวนมากเพราะมันเก็บได้นาน ไม่เสียง่ายเหมือนนมสด และพกพาง่ายกว่า

ปรากฏว่าทหารที่ไปรบกลับมาติดใจ เพราะไม่เคยได้กินอะไรหวานมันกลมกล่อมขนาดนั้นมาก่อน พอสงครามจบ ตลาดคนทั่วไปก็เริ่มรับรู้และนิยมบริโภคของชนิดนี้มากขึ้นเรื่อย ๆ แถมยังใช้ในเด็กด้วย เพราะช่วงนั้นมีความเชื่อว่านมข้นหวานคือ “นมสำหรับเด็ก” ที่ปลอดภัยกว่าเพราะผ่านการฆ่าเชื้อแล้ว แม้จะขาดสารอาหารสำคัญหลายตัวก็ตามทีเรื่องนี้จริงนะครับ รัฐบางแห่ง เช่น สหรัฐฯ และฝรั่งเศส มีเอกสารแนะนำให้ใช้นมข้นแทนนมแม่หากไม่สามารถให้นมเองได้ โดยอ้างความปลอดภัยจากการฆ่าเชื้อ แม้ในช่วงศตวรรษที่ 19 มีเด็กทารกเสียชีวิตเพราะพ่อแม่ใช้นมข้นหวาน จนทำให้หลายประเทศต้องออกคำเตือนภายหลัง

พอเข้าสู่ช่วงสงครามโลกครั้งที่ 1 (1914–1918) นมข้นหวานก็กลับมาเป็นฮีโร่อีกครั้ง คราวนี้รัฐบาลสหรัฐจัดเต็ม สั่งผลิตเพื่อส่งไปแนวหน้าให้ทหารพันธมิตรในยุโรป จนทำให้ supply ไม่พอกับ demand และบริษัทใหญ่ ๆ เช่น Nestlé และ Borden เริ่มขยายฐานการผลิตในระดับอุตสาหกรรม จนกลายเป็นเจ้าตลาด และนี่เองคือช่วงเวลาที่ “นมข้นหวานกลายเป็นสินค้าระดับโลก” แบบไม่ตั้งใจ

ในช่วง Great Depression (1929 เป็นต้นไป) นมข้นหวานกลายเป็น อาหารราคาถูก ที่ “แทน” อาหารสดในครัวคนจนได้ เพราะไม่ต้องแช่เย็น และให้พลังงานสูง ซึ่งส่งผลให้มันเจาะตลาดแม้ในช่วงเศรษฐกิจตกต่ำ เป็นช่วงทองของการขยายฐานการตลาดของนมข้นหวาน ขอบคุณสงครามที่ป้อนผู้บริโภคให้ฟรี ๆ มานานหลายปี มันเริ่มเข้าครัวคนทั่วไปและกลายเป็นวัตถุดิบในเมนูประจำวัน ไม่ว่าจะใส่กาแฟ โปะขนมปัง หรือใส่ขนมหวาน ซึ่งประเทศที่อยู่ในอาณานิคมตะวันตกก็รับวัฒนธรรมนี้ไปโดยปริยาย ไทยเองก็ไม่รอด และเริ่มมีเมนูอย่างชาเย็น กาแฟเย็น ที่ต้องใช้นมข้นหวานเป็นหลัก เพราะมันทั้งหอม มัน หวาน และสำคัญสุดคือ “เก็บได้นาน” ในยุคที่ตู้เย็นยังไม่แพร่หลาย

แต่อย่าเพิ่งนึกว่าเรื่องนี้จะจบแค่นี้ เพราะพอสงครามโลกครั้งที่ 2 มาถึงในปี 1939 สหรัฐฯ ก็กลับมาใช้สูตรเดิมอีกครั้ง คราวนี้ไม่ใช่แค่นมข้นหวานที่ถูกอัดใส่ลังขึ้นเรือไปแนวหน้า แต่รวมถึงสินค้าประหลาดหน้าใหม่ที่ถูก “แปรรูปเพื่อความอยู่รอด” ทั้งหมดซึ่งเดี๋ยวจะทะยอยเล่าให้อีกครั้ง เพราะทั้งหมดนี้คือสิ่งที่รัฐร่วมมือกับบริษัทใหญ่ผลิตเพื่อ “ให้ทหารอิ่มรอด” แต่เมื่อสงครามจบ สินค้าเหล่านี้ไม่หายไปไหน ตรงกันข้าม พวกมันถูก “ประชาสัมพันธ์ว่าเป็นของดีต่อสุขภาพ” มีการเอาผลวิจัยรองรับ (บางอันเป็นของรัฐเองด้วยซ้ำ) และกระตุ้นให้คนเชื่อว่า “นี่คืออาหารสมัยใหม่ของโลกที่ก้าวหน้า” เพราะมันถูกตั้งการผลิตมาในระดับมโหฬารไปเรียบร้อยแล้ว เมื่อมันเริ่มแล้วมันก็ย่อมทำลายทิ้งไม่ได้ นอกจากครอบงำให้ประชากรบริโภคสิ่งเหล่านี้เข้าไปตลอดกาล อย่าลืมว่า บริษัทยักษ์ใหญ่เหล่านี้ไม่มีทางยอมให้สินค้าตายไปจากตลาดแน่นอน

นมข้นหวานก็เช่นกัน มีการจัดโฆษณาผ่านสื่อสิ่งพิมพ์ว่านมสดไม่สะอาดเท่า นมข้นหวานสะอาดกว่าเพราะฆ่าเชื้อแล้ว บางโฆษณาแถมการ์ตูนเด็กชายหญิงหน้าน่ารักพร้อมประโยคว่า “เด็กทุกคนต้องเติบโตด้วยนมข้นหวาน” ซึ่งแน่นอนว่า “หวาน” นั้นแปลว่ามีน้ำตาลระดับสูงจนอาจเทียบเท่าน้ำเชื่อมข้น ๆ ได้

เมื่อคนเริ่มติดรสชาติและบริษัทมีโครงสร้างอุตสาหกรรมรองรับแล้ว ก็ไม่แปลกที่มันจะกลายเป็นส่วนหนึ่งของชีวิตประจำวันของคนทั่วโลก และพอรัฐไม่เตือน แถมยังสนับสนุนเป็นนัย ๆ นานวันเข้าเราก็เลิกตั้งคำถามกันไปเองว่า “แล้วเรากินมันทำไมกันนะ?”

ปัจจุบัน เราอาจรู้ว่านมข้นหวานคือของหวานจัด มีน้ำตาลราว 45–55% ต่อปริมาตร ไม่ใช่แค่ “หวานนิด ๆ” แต่คือ “หวานระดับฆ่าเชื้อได้เลย” และไม่ได้มีสารอาหารเทียบเท่านมจริง ๆ แต่มันกลับยังฝังแน่นในหลายวัฒนธรรมอาหารอย่างแนบเนียน เพราะรากของมันไม่ใช่แค่ในครัว แต่อยู่ในสนามรบ อยู่ในคำสั่งของรัฐ และอยู่ในภาพจำของความหอมหวานที่ไม่มีอะไรมาแทนได้

และนั่นแหละเฮียว่า คือจุดเริ่มต้นของการเปลี่ยน “อาหารเพื่ออยู่รอด” ให้กลายเป็น “อาหารครองโลก” และมันกลายเป็นบรรพบุรุษของแนวคิด “Ultra-Processed Food” ในยุคอุตสาหกรรมอาหารหลังสงคราม โดยไม่ต้องยิงปืนสักนัดเดียว หลายคนอาจจะมองว่า เห้ยทุกวันนี้เราก็รู้แล้วนี่นาว่ามันไม่ได้ดีต่อสุขภาพ ใช่ครับ กว่าเราจะรู้ เขาก็มีแผนใหม่มาครอบงำเราไปเรียบร้อยแล้ว เหมือนกับที่พยายามเล่าให้ทราบใน ep ที่ผ่านๆมานี่ไง สัปดาห์นี้เรากำลังคุยเรื่องอดีต ซึ่งในยุคนั้นประชากรเชื่อจริงๆว่า นมข้นหวาน มันคือของดี งดงามกว่านมสดง่อยๆที่แป๊บเดียวก็เสีย บูด เน่า ลองเอาภาพร่างนี้มาทาบกับปัจจุบันและอนาคตครับ

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ dfa02707:41ca50e3

2025-06-11 19:03:18

@ dfa02707:41ca50e3

2025-06-11 19:03:18- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ 9c9d2765:16f8c2c2

2025-06-10 07:00:00

@ 9c9d2765:16f8c2c2

2025-06-10 07:00:00In a land where the sun burned bright over golden deserts and whispering dunes, there lived a fierce warrior named Mark. He had never lost a battle. His armor was scarred, his sword legendary. People feared him more than they respected him.

Mark believed power ruled the world. Mercy, to him, was weakness. “If you don’t strike first,” he often said, “you’ll never stand.”

One day, the king tasked him with a quest:

“There is a creature in the northern cliffs, a lion with a mane of fire and claws like blades. It has attacked caravans. Find it. End it.”

Mark journeyed across mountains and dust storms until he reached the cliffs. One night, as he prepared for the hunt, he spotted something strange: a small, flickering light deeper in the canyon.

He followed it and found a child, no more than ten, holding a lantern and standing before the lion.

Mark reached for his sword.

But the child said, “Stop. She’s not a monster. She’s wounded.”

And indeed, the lion massive and regal was limping, a steel trap biting into her hind leg. Blood stained the stones.

Mark was frozen. Every instinct in him screamed to strike. But something in the child’s calm gaze stilled him.

Instead of attacking, Mark sheathed his sword.

The child stepped forward. “Help me.”

They approached the lion. It growled, but didn’t attack. Gently, together, they freed her. The lion roared once not in anger, but in pain then bounded off into the night.

When Mark returned to the king and told the truth, many laughed.

But months later, when bandits attacked the kingdom, it was that same lion who appeared at the city gates, scattering the attackers with primal fury.

From that day, Mark no longer feared he was honored. Not for his strength, but for the moment he chose not to use it.

Moral:

The strongest hand is the one that chooses to heal instead of harm. True strength is not in striking, but in sparring.

-

@ c1e9ab3a:9cb56b43

2025-03-09 20:13:44

@ c1e9ab3a:9cb56b43

2025-03-09 20:13:44Introduction

Since the mid-1990s, American media has fractured into two distinct and increasingly isolated ecosystems, each with its own Overton window of acceptable discourse. Once upon a time, Americans of different political leanings shared a common set of facts, even if they interpreted them differently. Today, they don’t even agree on what the facts are—or who has the authority to define them.

This divide stems from a deeper philosophical rift in how each side determines truth and legitimacy. The institutional left derives its authority from the expert class—academics, think tanks, scientific consensus, and mainstream media. The populist right, on the other hand, finds its authority in traditional belief systems—religion, historical precedent, and what many call "common sense." As these two moral and epistemological frameworks drift further apart, the result is not just political division but the emergence of two separate cultural nations sharing the same geographic space.

The Battle of Epistemologies: Experts vs. Tradition

The left-leaning camp sees scientific consensus, peer-reviewed research, and institutional expertise as the gold standard of truth. Universities, media organizations, and policy think tanks function as arbiters of knowledge, shaping the moral and political beliefs of those who trust them. From this perspective, governance should be guided by data-driven decisions, often favoring progressive change and bureaucratic administration over democratic populism.

The right-leaning camp is skeptical of these institutions, viewing them as ideologically captured and detached from real-world concerns. Instead, they look to religion, historical wisdom, and traditional social structures as more reliable sources of truth. To them, the "expert class" is not an impartial source of knowledge but a self-reinforcing elite that justifies its own power while dismissing dissenters as uneducated or morally deficient.

This fundamental disagreement over the source of moral and factual authority means that political debates today are rarely about policy alone. They are battles over legitimacy itself. One side sees resistance to climate policies as "anti-science," while the other sees aggressive climate mandates as an elite power grab. One side views traditional gender roles as oppressive, while the other sees rapid changes in gender norms as unnatural and destabilizing. Each group believes the other is not just wrong, but dangerous.

The Consequences of Non-Overlapping Overton Windows

As these worldviews diverge, so do their respective Overton windows—the range of ideas considered acceptable for public discourse. There is little overlap left. What is considered self-evident truth in one camp is often seen as heresy or misinformation in the other. The result is:

- Epistemic Closure – Each side has its own trusted media sources, and cross-exposure is minimal. The left dismisses right-wing media as conspiracy-driven, while the right views mainstream media as corrupt propaganda. Both believe the other is being systematically misled.

- Moralization of Politics – Since truth itself is contested, policy debates become existential battles. Disagreements over issues like immigration, education, or healthcare are no longer just about governance but about moral purity versus moral corruption.

- Cultural and Political Balkanization – Without a shared understanding of reality, compromise becomes impossible. Americans increasingly consume separate news, live in ideologically homogeneous communities, and even speak different political languages.

Conclusion: Two Nations on One Land

A country can survive disagreements, but can it survive when its people no longer share a common source of truth? Historically, such deep societal fractures have led to secession, authoritarianism, or violent conflict. The United States has managed to avoid these extremes so far, but the trendline is clear: as long as each camp continues reinforcing its own epistemology while rejecting the other's as illegitimate, the divide will only grow.

The question is no longer whether America is divided—it is whether these two cultures can continue to coexist under a single political system. Can anything bridge the gap between institutional authority and traditional wisdom? Or are we witnessing the slow but inevitable unraveling of a once-unified nation into two separate moral and epistemic realities?

-

@ 95543309:196c540e

2025-06-11 14:33:33

@ 95543309:196c540e

2025-06-11 14:33:33$$\int_{-\infty}^{\infty} e^{-x^2/2} \, dx = \sqrt{2\pi}$$$$\sum_{k=1}^n k^2 = \frac{n(n+1)(2n+1)}{6}$$$$\lim_{x \to \infty} \left(1 + \frac{1}{x}\right)^x = e$$$$\begin{vmatrix}a & b \\c & d\end{vmatrix} = ad - bc$$$$\frac{d}{dx}\left(\frac{x^2 + 1}{x - 1}\right)$$$$\iiint_V (\nabla \cdot \mathbf{F}) \, dV = \oint_{\partial V} \mathbf{F} \cdot d\mathbf{S}$$$$\binom{n}{k} = \frac{n!}{k!(n-k)!}$$$$\ln\left(\frac{f(x)}{g(x)}\right) = \ln f(x) - \ln g(x)$$$$\forall x \in \mathbb{R}, \exists y \in \mathbb{R} \text{ such that } x + y = 0$$$$\sqrt{\frac{x^2 + y^2}{x^2 - y^2}}$$$$\begin{array}{c|c}A & B \\hlineC & D\end{array}$$$$\sum_{i=1}^n \sum_{j=1}^n a_{ij}x_i x_j$$$$\mathcal{L}{f(t)}(s) = \int_0^\infty e^{-st}f(t)\,dt$$$$\frac{\partial^2 u}{\partial t^2} = c^2 \frac{\partial^2 u}{\partial x^2}$$$$\mathbf{A} = \begin{pmatrix}a_{11} & a_{12} \\a_{21} & a_{22}\end{pmatrix}, \quad\mathbf{B} = \begin{pmatrix}b_{11} & b_{12} \\b_{21} & b_{22}\end{pmatrix}$$$$\underbrace{a + b + \dots + z}{26}$$$$\left(\frac{a}{b}\right)^n = \frac{a^n}{b^n}$$$$\langle \psi | \phi \rangle = \int{-\infty}^{\infty} \psi^*(x)\phi(x) \, dx$$$$\oint_C \mathbf{F} \cdot d\mathbf{r} = \iint_S (\nabla \times \mathbf{F}) \cdot d\mathbf{S}$$$$\prod_{k=1}^n \left(1 + \frac{1}{k}\right) = \frac{(n+1)}{1}$$$$S(\omega)=1.466\, H_s^2 \frac{\omega_0^5}{\omega^6} \exp\Bigl[-3^{\frac{\omega}{\omega_0}}\Bigr]^2$$

-

@ 8668cb57:42a19859

2025-06-10 17:38:45

@ 8668cb57:42a19859

2025-06-10 17:38:45Are Islands Choosing for Wealth Or Poverty in the 21st Century?

You have 57 official islands according to the United Nations. But there are thousands of islands in the world. What does Bitcoin and Lighting mean for them? Can it help them escape poverty and become wealthy?

Wealth

First of all: Wealth: what does it mean to be wealthy as an island? It is not only about the number of fiat currency you have in your pockets. Not about the digits you have on your bank account. And not only about the number of sats or Bitcoins you have in your self custodian wallet.\ Wealth means:

-

You are healthy

-

Your mind is free

-

Your body is in shape

-

Your relationships are bringing you join

-

You are using your talents and your gifts to the max

-

And you have options, you can do what you want with your time.

Healthy Islands

So for an island, let's take Curacao as an example, of 160.000 people, it means that there is a potential for everybody to reach that status, that next level in their lives called #wealth.

That is the "dream" goal I'm chasing with my Island Wealth show. Away from poverty. Into more possibilities. Using your skills in this dynamic world.\ \ Current state of Island Wealth

If we take the Caribbean as an example, here you see the official list of islands in the Caribbean: <https://en.wikipedia.org/wiki/List_of_Caribbean_islands>

There are some indicators to check how wealthy - in terms of income - these Caribbean islands are.\ \ GDP per Capita: this is the total income of the island per year divided by the population. You will get an average that you can compare with your own country. If you take this globally, Luxembourg is the wealthiest country in the world.\ \ Gini Coefficient: this gives you a curve and a value that shows you how the distribution of wealth is on an island.

Net worth: If you go on an individual level, a family level, a business level you can take the assets minus the liabilities and calculate the difference as Net worth. You can also take this figure and compare it to the net worth of individuals in the world.

Bitcoin

Now lets introduce Bitcoin for these islands. How can #Bitcoin help these islands become wealthier?\ \ Problems of Islands

One of the most important problems the islands have is that they are very dependent on #tourism. Yes, I have been studying the economies of islands for a long time. I've been advising small island's governments in the Caribbean, private investors, high earning professionals on how they can build their wealth. And I always hear: we need to diversify more. What does that mean?\ \ All their sales and revenues are coming from one single sector: tourism. And they don't like that. Imagine an island: 500.000 tourists per year coming from USA and Canada. And every day cruise ships at their mega cruise piers with a total of 1 million cruise tourists per year. The tourists stay for 7 days and the cruise tourists stay for 1 day.\ \ That is the typical Caribbean island at its peak. If anything happens to that flow of cruise and stayover tourists ->Poverty. If there is a hurricane ->Poverty. If there are no flights -> Poverty. If there is political unrest and the tourists cannot come ->Poverty. So wealth is very concentrated when you are living on an island.\ \ Bitcoin and Lightning

While most Island's policy makers, citizens, even sometimes high paid individuals do not see Bitcoin, I see a 2 trillion decentralized global economy. If you are fully dependent on tourism, and you want to diversify away from tourism, lets consider Bitcoin and Lightning.\ \ Small businesses

Lets imagine your small businesses that operate online, like a consultant, online trainer/coach, or anybody selling snacks. Now working in the informal sector and not paying any taxes to your small island's government. They all can instantly:

-

Download a #Blink or #Aqua wallet and start receiving #SATS

-

Get a Wordpress or Shopify website, and start receiving SATS from all over the world, instantly.

Think about that for a moment and let it sink in. A two trillion USD economy globally. 21 million Bitcoins max ever. And everybody can participate right now. Without having to install servers, host software. I would seriously consider this new decentralize payment and savings technology.

How can you diversify away from tourism with Bitcoin and Lighting?

Any business can accept Bitcoin. Imagine you do not have a bank account and you are working in the informal sector. As a gardener, as a technician, electrician. A pool boy, a musician. You now have a wallet to accept hard money instantly.\ \ Agriculture

You could be paying for seeds to plan. With your lightning wallet online.\ \ Retail

You could be accepting Lighting payments if you are a store that sells glasses, food, snacks, clothing, hand crafted products, paintings.

Construction

You could be importing material from the #BRICS+ nations, China as first one, Brazil (close to the Caribbean) and paying with lightning.\ \ Financial Services (local and international)

You could be helping foreign and local other businesses with their online books, they annual reports, their administration, helping them relocate to the Caribbean, and receiving payments with Lighting.\ \ I can go on and on\ \ Decentralized Peer to Peer software development\ I have written about this on previous posts. You could be building peer to peer software based on new software stacks like pear runtime, holepunch technology, nostr. So if you are a local software developer and you know javascript, html and css you now can be paid with Lighting and deliver your knowledge and services to the world. I'm also exploring this myself.\ \ AI and Data Science\ If you are a Data Scientist and you know how to automate stuff with #Python, you know how to use #AI, like me, you could be creating online software and experiences to create Digital Assets that work 24*7*365 days: https://bit.ly/python-ai-automation.

There are endless possibilities to tap into this global decentralized economy

And guess what: we are so early. There is less than 1% of the people of the world who has used Bitcoin and Lighting.\ \ Let's go islands\ So lets do it. Lets go islands. You see that diamond above? It just to start your imagination. You see that man with the open mouth above?That is just to show you how amazed and surprised I'm with the potential of decentralization, self custody and the potential to be self sovereign.\ \ Let me know your thoughts\ This article is only on Nostr and Keet and decentralized platform. I'm moving my attention more and more to decentralization. So I want to hear your thoughts. Let me know if you have any comments, questions or ideas how to create more wealth.\ \ And stay tuned to my episodes where I will host the Island Wealth Show #IslandWealth.\ \ Runy\ Host Island Wealth

-

-

@ f7922a0a:82c34788

2025-01-17 23:06:56

@ f7922a0a:82c34788

2025-01-17 23:06:56Now that the 3rd Satellite Skirmish is complete I wanted to highlight some of the cool features on embrace.satskirmish.com

This is what the cutting edge of podcasting 2.0 looks like imo. Live video in an app that allows you to send sats to the artists in real time.

On the left hand side we have a Boost score borad that displays the total amount of sats that have come in during the show, live Boosts/Booastagrams as they come in, total amount of sats from each person Boosting and total amount sent from each app.

The middle is ovisaly the video of the band playing but with some graphics around it and Boost alerts that show up on the screen in the form of snow flakes for this one.

The righthand side is an IRC chat window that connects to an IRC server that the No Agenda community has used for 18+ years thanks to zoidzero++.

The bottom of the page is where things get cool. When you click the Boost the Crew button in the center you can send a Boost that gets split between everyone helping produce the show (hightlighted in yellow).

Each band also has their own Boost button so you can Boost them while they are playing or anytime you visit the page.

-

@ 3a851978:ff85e003

2025-06-10 13:55:16

@ 3a851978:ff85e003

2025-06-10 13:55:16Testing LaTeX support in different Clients

Just testing how it all will be formated

First section

Something inline $k_i$ like that. And other longer stuff below:

$$ \gamma_A = \frac{e^{-R_A}}{\mathrm{Tr}\,e^{-10}},\qquad \delta S = K\delta L $$

The end

-

@ 9f2b5b64:e811118f

2025-06-10 13:55:00

@ 9f2b5b64:e811118f

2025-06-10 13:55:00testing

-

@ 2cde0e02:180a96b9

2025-06-10 14:06:52

@ 2cde0e02:180a96b9

2025-06-10 14:06:52pen & ink

https://stacker.news/items/1002504

-

@ ddf03aca:5cb3bbbe

2024-11-20 22:34:52

@ ddf03aca:5cb3bbbe

2024-11-20 22:34:52Recently, I have been surrounded by people experimenting with various projects, and a common theme among them is the use of cashu as the payment layer. While this fact alone is already great, the best part is to identify users and implementers needs and combining forces to come up with novel solutions.

Subscriptions with Cashu

One of the most remarkable aspects of cashu is that it is a bearer asset. This hands ownership and control back to the user. Even though mints back the tokens, they have no authority to move a token on behalf of a user or any other party. How cool is that?

However, this also introduces challenges when building subscription-based services. Subscriptions typically require periodic payments, and with cashu, users must renew these manually. Currently, there are two primary approaches to address this:

-

Overpaying:

To minimize the number of interactions, users can pay for longer periods upfront. For example, instead of paying 2,100 sats for one hour, they could pay 6,000 sats for three hours. If they realize they don’t need the full three hours, the excess payment is effectively wasted. -

Full Interactivity:

In this setup, payers and receivers stay connected through a communication channel, and payments are made at small, regular intervals. While this avoids overpayment, it requires constant connectivity. If the connection is lost, the subscription ends.

Enter Locking Scripts

One of the most powerful features of cashu is its locking scripts. Let’s take a quick refresher. A locking script defines the conditions under which a token (or "nut") becomes spendable. In essence, it’s similar to Bitcoin’s spending conditions, but instead of being enforced by the Bitcoin network, these conditions are enforced by the cashu mint alone.

A widely-used locking condition is Pay-to-Public-Key (P2PK). This locks a token to a specific public key, meaning it can only be spent when a valid signature from the key’s owner is provided. This mechanism is what enables NIP-61 nut zaps, where a token can be publicly shared but is only claimable by the intended recipient who holds the private key.

To address situations where a recipient loses access to their keys or simply doesn’t claim the token, P2PK includes additional options: locktime and a refund key. These options allow for the inclusion of a fallback mechanism. If the primary lock expires after a set time, a refund key can reclaim the token.

With these tools, we can now create non-interactive payment streams!

One Missing Piece…

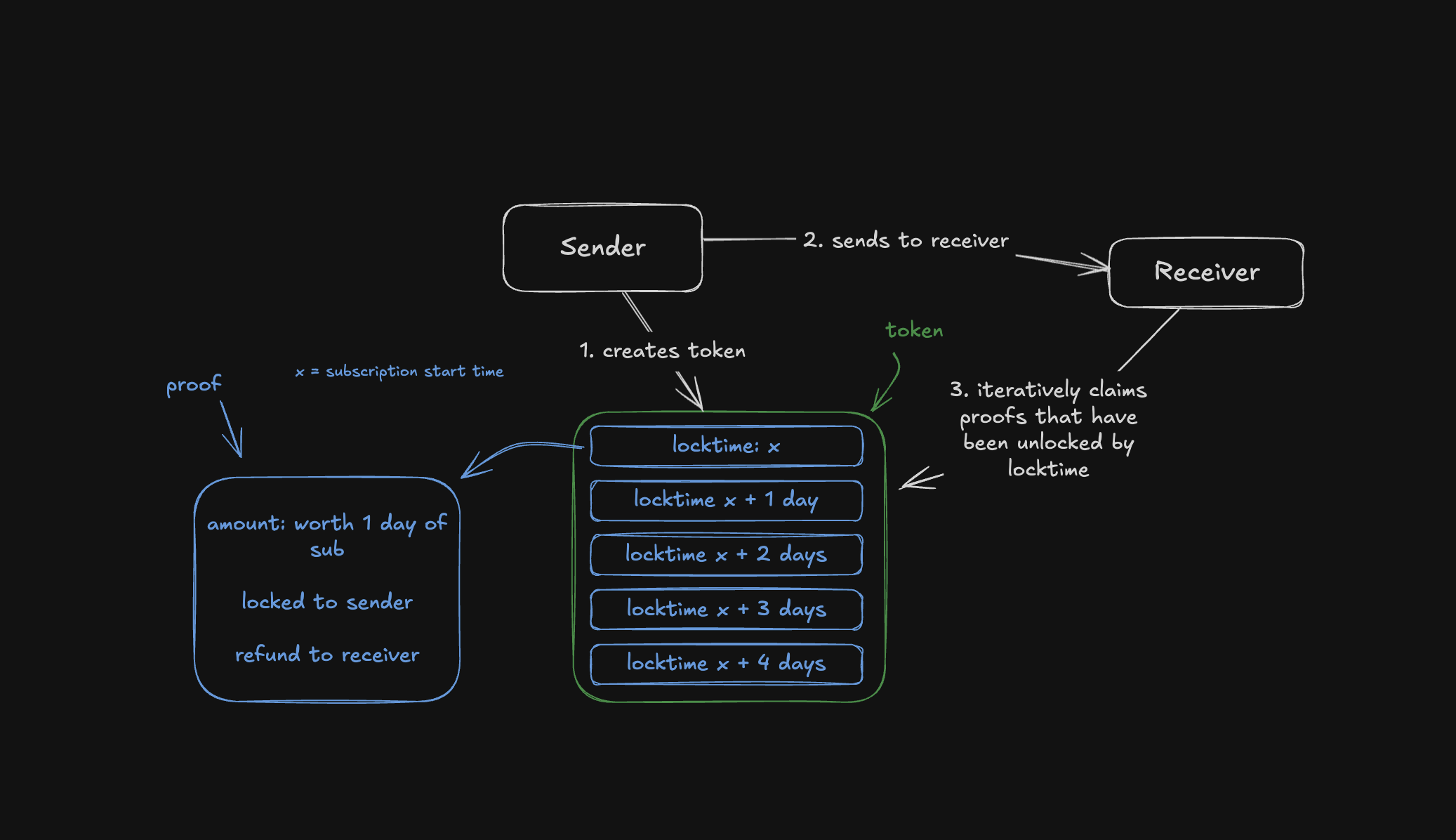

Before diving into payment streams, there’s one more crucial concept to cover: cashu tokens are not singular "things". Instead, they’re composed of multiple proofs, each carrying its own cryptographic data and spendability. For example, if you receive a cashu token made up of five proofs, you could choose to claim only three proofs and leave the other two untouched. This flexibility is rarely utilized but is vital for building payment streams.

The Grand Finale: Payment Streams

Now that we have all the building blocks, let’s construct a payment stream using cashu. By leveraging locking scripts, refund keys, and multiple proofs, we can design a token that enables recipients to claim small portions of the total amount at regular intervals—without requiring any further interaction from the sender.

Even better, as the sender, you retain the ability to cancel the stream at any time and reclaim any unspent portions.

Example: Renting a VPS

Imagine renting a VPS for a week, priced at 1,000 sats per day. Here’s how a payment stream could work:

- Construct a token worth 7,000 sats to cover the entire week.

- Divide the token into 7 proofs, each worth 1,000 sats.

- Lock each proof using a P2PK script, locking to your key and adding the recipients key as a refund key.

- The first proof has a locktime of

now. - The second proof has a locktime of

now + 1 day. - The third proof has a locktime of

now + 2 days, and so on.

When the token is sent, the receiver can immediately claim the first proof since its locktime has expired and the refund key is now able to claim. The second proof becomes claimable after one day, the third after two days, and so on.

At the same time, the sender retains the ability to reclaim any unclaimed proofs by signing with their key. If you decide to stop using the VPS midweek, you can cancel the stream and reclaim the remaining proofs; all without further interaction with the receiver.

With this approach, we can create robust, non-interactive payment streams that combine the autonomy of cashu with the flexibility to reclaim funds.

Thank you for reading. Make sure to leave a nut if you enjoyed this :)

-

-

@ da8b7de1:c0164aee

2025-06-10 03:48:06

@ da8b7de1:c0164aee

2025-06-10 03:48:06Sizewell C atomerőmű – 14,2 milliárd fontos állami beruházás

A brit kormány 14,2 milliárd fonttal támogatja az új Sizewell C atomerőmű megépítését a suffolki tengerparton. A beruházás célja, hogy növelje az ország energiaszuverenitását, elősegítse a gazdasági növekedést, és hozzájáruljon a klímavédelmi célokhoz azáltal, hogy hatmillió otthon energiaellátását biztosítja alacsony szén-dioxid-kibocsátású forrásból.

Főbb pontok:

- A Sizewell C várhatóan 10 000 közvetlen munkahelyet teremt, és további ezreket a beszállítói láncban; az építkezés során 1 500 tanuló is részt vesz majd.

- A projekt a legnagyobb nukleáris beruházás egy generáció óta, és a kormány szerint elengedhetetlen a fosszilis energiahordozók kiváltásához, valamint a villamosenergia-hálózat dekarbonizációjához 2030-ig.

- A Sizewell C a Hinkley Point C mintájára épül, amely jelentős késésekkel és költségtúllépésekkel küzd – emiatt a kritikusok attól tartanak, hogy a Sizewell C is hasonló sorsra juthat.

- A projekt végső költsége még bizonytalan: a hivatalos becslések 20-35 milliárd font között mozognak, de egyes iparági források akár 40 milliárd fontos végösszeget is elképzelhetőnek tartanak.

- A finanszírozás részben állami, részben magánbefektetőktől és a fogyasztók villanyszámláján keresztül valósul meg – utóbbi a Regulated Asset Base (RAB) modell révén, ami várhatóan növeli a háztartások energiaszámláit.

- A beruházás ellenzői – köztük a Stop Sizewell C csoport – szerint a pénzt más, olcsóbb és gyorsabban megvalósítható megújuló energiaforrásokra kellene fordítani, és aggódnak a környezeti hatások, valamint a helyi lakosságot érintő változások miatt.

- A végső befektetési döntés (Final Investment Decision) még nem született meg, annak meghozatalát a nyárra ígérik.

Források::

- bbc.com

- stopsizewellc.org

- edfenergy.com

- gov.uk

-

@ 2b998b04:86727e47

2025-06-09 23:38:55

@ 2b998b04:86727e47

2025-06-09 23:38:55Most of the assets I hold—real estate, equities, and businesses—depreciate in value over time. Some literally, like physical buildings and equipment. Some functionally, like tech platforms that age faster than they grow. Even cash, which should feel "safe," quietly loses ground to inflation. Yet I continue to build. I continue to hold. And I continue to believe that what I’m doing matters.

But underneath all of that — beneath the mortgages, margin trades, and business pivots — I’ve made a long-term bet:

Bitcoin will outlast the decay.

The Decaying System I Still Operate In

Let me be clear: I’m not a Bitcoin purist. I use debt. I borrow to acquire real estate. I trade with margin in a brokerage account. I understand leverage — not as a sin, but as a tool that must be used with precision and respect. But I’m also not naive.

The entire fiat-based financial system is built on a slow erosion of value. Inflation isn't a bug — it’s a feature. And it's why most business models, whether in real estate or retail, implicitly rely on asset inflation just to stay solvent.

That’s not sustainable. And it’s not honest.

The Bitcoin Thesis: Deflation That Works for You

Bitcoin is fundamentally different. Its supply is fixed. Its issuance is decreasing. Over time, as adoption grows and fiat weakens, Bitcoin’s purchasing power increases.

That changes the game.

If you can hold even a small portion of your balance sheet in BTC — not just as an investment, but as a strategic hedge — it becomes a way to offset the natural depreciation of your other holdings. Your buildings may age. Your cash flow may fluctuate. But your Bitcoin, if properly secured and held with conviction, becomes the anchor.

It’s not about day trading BTC or catching the next ATH. It’s about understanding that in a world designed to leak value, Bitcoin lets you patch the hole.

Why This Matters for Builders

If you run a business — especially one with real assets, recurring costs, or thin margins — you know how brutal depreciation can be. Taxes, maintenance, inflation, replacement cycles… it never stops.

Adding BTC to your long-term treasury isn’t about becoming a "crypto company." It’s about becoming anti-fragile. It’s about building with a component that doesn’t rot.

In 5, 10, or 20 years, I may still be paying off mortgages and navigating property cycles. But if my Bitcoin allocation is still intact, still growing in real purchasing power… then I haven’t just preserved wealth. I’ve preserved optionality. I’ve created a counterbalance to the relentless decay of everything else.

Final Word

I still play the fiat game — because for now, I have to. But I’m no longer betting everything on it. Bitcoin is my base layer now. Quiet, cold-stored, and uncompromising.

It offsets depreciation — not just financially, but philosophically. It reminds me that not everything has to erode. Not everything has to be sacrificed to time or policy or inflation.

Some things can actually hold. Some things can last.

And if I build right — maybe what I build can last too.

If this resonated, feel free to send a zap — it helps me keep writing and building from a place of conviction.

This article was co-written with the help of ChatGPT, a tool I use to refine and clarify what I’m working through in real time.

-

@ 93bfc86d:fc8e91f5

2025-06-10 15:27:43

@ 93bfc86d:fc8e91f5

2025-06-10 15:27:43질서자유주의가 자유주의 세상을 만드는 방법

안캡의 전략에는 크게 두 가지, 호페의 질서자유주의와 새뮤얼 콘킨 3세의 아고리즘이 있다.

로스바드-호페 라인의 질서자유주의는 논리를 기반으로 자연권을 정당화하고, 이를 통해 국가의 부당함을 설파한다. 미제스의 "인간은 행동한다."라는 제1공리부터 시작해서, 행동의 제1수단인 신체가 그 자신에게 소유되어야 한다는 자기 소유를 증명하고 자연권을 철저하게 연역적으로 정당화해간다. 안캡의 세상을 만들려는 이들의 방법론도 논리적이다.

예를 들어 호페의 『자유주의자는 무엇을 해야 하는가』 책에서는 위로부터의 전환이 불가능함에 따라 아래로부터의 전환을 해야 한다는 주장이 나온다. 과거에는 이런 자유로운 세상이 도래하기 위해서는 왕 한 명이 "앞으로 자기가 원하는 대로 보안 기업을 자유롭게 선택하고, 더 이상의 강제는 없다!"라고 선언만 하면 됐다. 따라서 왕 한 명만 어떻게 설득을 하거나, 압박을 하든 주리를 틀든 일단 왕이 이렇게 선언하게 하기만 하면 됐다. '마그나 카르타'도 결국 귀족 연합이 왕 한 명을 압박해 왕이 서명했던 것 아닌가?

반면에 현대 민주주의 사회를 보자. 대한민국에서 대통령 한 명이 최저임금을 폐지할 수 있는가? 최저임금은 헌법에 보장되는데(헌법 32조) 따라서 이를 폐지하는 것은 거의 개헌만큼이나 어렵다. 대통령이나 국회의원 과반이 발의를 해야 하고, 국회에서 재적 3분의 2 이상이 찬성해야 겨우 통과되며, 이렇게 통과해도 국민투표에서 과반수가 동의해야 겨우 없어지는 것이다. 즉, 거의 불가능에 가깝다.

따라서 호페는 위로부터의 전환이 불가능함에 따라 전국적인 중앙 정부의 투표를 거부할 것을 제안한다. 대통령 선거나 국회의원 선거 등 말이다. 여기서 중앙 정부 단위의 투표를 거부하는 이유는 중앙 정부의 부당성도 있지만, 이 투표를 통해 세상을 바꾸는 게 현실성이 없어서 그렇다.

같은 맥락에서 지역 선거의 투표는 항상 거부하는 건 아닌데, 자유주의자들이 한 국가 전체에서 과반을 얻는 것은 불가능하지만, 한 지역에 점점 몰리는 경우에는 적어도 그 지역에서는 과반이 될 수도 있기 때문이다. 따라서 아주 작은 지역에서 자유주의자들이 다수결이 된다면 적어도 그 지역에 한해서는 위로부터의 전환이 가능해진다. 그러면 투표를 거부하다가 지역구에서 본격적으로 투표를 하기 전에 선행되어야 할 일은 자유주의가 많이 퍼지고, 자유주의를 지지하는 사람들이 특정 지역에 몰리기 시작해야 하는 것일 것이다. 비트코이너들이 특정 지역에 몰려 시타델을 건설하는 상황을 생각하면 될 것 같다.

그 이후에는? 지역구의 대표로 선출된 인물이 해당 지역구의 투표권을 재산 소유자에게 재산 크기(지분)대로 다시 분배해야 한다. 즉, 재산이 없는 사람은 투표권이 없다. 모든 공공 인프라(도로, 수도, 전기, 교육, 치안, 사법 등등)는 전부 주식으로 판매되어 민영화된다(지방 정부는 이를 통해 재원을 마련한다). 이에 따라 공공 인프라는 완전히 사적 소유로 전환된다. 치안, 사법, 교육 모두 민간 영역으로 전환된다.

현재 세계에서 자유주의자들이 이런 관점을 취한다면 무엇을 해야 할까? 일단 자유주의를 더 많은 사람에게 퍼뜨려야 한다. 또한, 자유주의자들이 모일 지역을 물색해야 할 것이다. 그리고 중앙 정부 단위의 투표를 거부해야 할 것이다.

그림 1. 질서 자유주의의 상징인 아나코 캐피탈리즘 깃발

현대 민주주의 투표의 부당함

아고리즘의 전략을 이야기하기 전에 먼저 현대 민주주의 투표의 부당함에 대해 살펴보고 가자. 개인적인 생각도 들어가 있다.

투표 행위 자체는 유권자의 권리 행사로 전혀 나쁠 것이 없다. 다수결의 원칙도 당연히 마찬가지다. 투표 당사자들이 다수결의 원칙에 동의하기 때문에 참여하는 것이기 때문이다. 그래서 민주주의는 선거에서 져도 그 결과에 승복하는 것이 그 시스템의 규칙이다. 예를 들어 주주총회에서 주주들이 지분대로 의결권을 행사하거나 행사하지 않아서 생기는 결과는 그 행위 자체로는 전혀 문제가 없다.

투표의 정당성은 투표라는 행위 자체로부터 판단되는 것이 아니라 그 투표가 어떤 시스템 아래서 이뤄지는 투표인지로부터 판단해야 한다. 나는 두 가지 관점에서 살펴볼 것이다.

현대 민주주의의 투표는 유권자가 자신의 권리를 당선자에게 위임하는 행위다. 한 후보가 당선되면 다수결의 원칙에 따라서 그 후보는 그 후보를 찍지 않은 유권자들의 권리까지 모두 가져간다. 여기까지는 문제가 없다. 투표 행위 참여자들이 다수결의 원칙이라는 그 시스템에 동의하기 때문에 투표하기 때문이다.

그런데 현대 민주주의는 당선된 후보가 그 후보에게 투표했든, 투표하지 않았든, 기권을 했든 간에 다른 사람의 소유권을 마음껏 유린할 수 있는 권한도 가져간다. 이건 아주 큰 문제다. 국회의원이 세금을 늘리는 입법 권한을 행사하거나, 대통령이나 국회에서 예산을 편성해 정부 지출을 늘리고, 돈을 찍어내서 사람들의 소유권을 유린하는 행위가 용인된다.

어떤 사람도 다른 사람의 소유권을 침해할 수는 없다. 소유권은 단순히 희소한 재화의 분배 문제를 해결하는 실용적 대안이라서 중요한 것이 아니다. 인간 행동이라는 공리로부터 자기 소유 원칙을 이끌어내고, 그가 소유한 신체와 삶을 써서 획득한 재화(원초적 점유)에 대한 소유권을 보장하는 것이며, 그리고 이미 소유권이 있는 재화를 교환의 양 당사자가 자유롭게 교환하는 행위를 보장하는 것이다.

따라서 소유권은 인간에게 이성이 있다는 존엄성의 표현이자 인간 시간(삶)의 희소성과 귀중함을 인정하는 것이다. 어느 누구도 이를 모독할 권리는 없다. 이를 침해하는 것은 보편 원리에 따라 그 자신의 소유권도 포기한다는 뜻과 같으며, 이는 결국 자기 신체의 자기 소유도 부정하는 셈이 된다.

현대 민주주의에서 투표하는 것은 다른 누군가의 소유권을 유린할 사람을 뽑는 것과 같다. 애초에 이런 권한은 누구에게도 주어지지 않았으며 당연히 누구에게도 없으니 넘겨줄 수도 없는 권한이다.

현대 민주주의의 삼권분립 체제는 당선자에게 이러한 강탈의 권한이 보장된다. 설령 후보자가 이런 권한을 행사하지 않는다고 하더라도 이 시스템이 그러한 권한을 발동할 수 있다는 것을 언제든지 보장한다면 이러한 시스템은 폐기되어야 한다.

따라서 현대 민주주의에서 투표하는 행위는 누군가가 이러한 권한을 행사하는 것에 대한 동의로 간주될 수 있다. 어떤 후보가 이런 행위를 다른 후보보다 '덜' 한다고 해서 그 후보에 투표하는 것에 대한 정당성은 당연히 확보될 수 없다. 더하는지 덜하는지에 따라 이 약탈이 정당화될 수는 없기 때문이다.

심지어 어떤 후보가 이런 약탈 행위를 절대 안 할 것이라고 공언한다고 해도, 시스템에 이러한 권한이 보장되어 있는 이상 투표하는 행위는 이 시스템에 동의하는 행위이다. 그 후보가 당선된 이후 갑자기 돌변해 세금을 걷거나 국채를 팔아 예산을 확보하고 돈을 찍어내는 것이 시스템 상에서는 문제가 없기 때문이다. 이것은 간접 민주주의의 단점이라기 보다는, 애초에 이런 다른 사람에 대한 약탈 권한을 행사할 수 있는 시스템 자체가 잘못된 것이다.

현대 민주주의가 부당한 두 번째 이유는 이 시스템에 동의하지 않는 사람들조차 이 시스템의 피해자가 된다는 점이다.

도박에 참여하고 있는 사람들을 생각해보자. 승리자가 나머지 베팅한 모든 사람들의 베팅 금액을 약탈하는 것은 전혀 문제가 되지 않는다. 왜냐하면 도박 참여자들은 패배 시 자신이 베팅한 재산이 승자에게 몰수될 수도 있다는 것에 동의하고 도박에 참여하기 때문이다(따라서 이는 약탈이 아니다). 이에 동의하지 않는다면 도박을 그만하면 된다. 도박사는 언제든지 도박을 그만둘 자유가 있다.

그러나 현대 민주주의는 이 시스템에 동의하지 않더라도 그 나라에서 태어났다는 이유만으로 이러한 약탈에 강제 당할 수밖에 없다. '분배'하기 위해 투표를 할 거면 그 시스템에 동의하는 사람들끼리 서로의 재산을 놓고 분배하면 될 일이다. 그러나 이 시스템은 모든 사람들에게 이 시스템에 참여하는 것이 강제된다.

즉, 이 시스템은 애초에 잘못된 시스템인데 이 안에서 좌니 우니, 대통령제니 내각제니 사람들이 서로 경쟁하게 한다. 시스템 자체에 대한 의문을 품기는 매우 어려운 구조다.

이 시스템이 마음에 안 들면 이민을 가면 된다고 하는 주장은 전혀 설득력이 없다. 이민에 비용이 들고 다양한 현실적인 제약이 있다는 것은 차치하고서 이야기해보자. 만약 이러한 분배(?) 혹은 세금의 권한 행사자가 해당 지역 토지의 소유자고, 그 토지의 사용자가 소유자가 정한 분배 규칙에 동의하는 조건으로 토지를 사용한다면 이러한 세금과 같은 분배는 약탈은 아니다. 사용자가 그 규칙에 자발적으로 동의했으므로 정당화될 수 있는 것이다.

만약 국토의 모든 땅이 사실상 소유자가 있는 게 아니라, 사실상 국가의 소유이며 국가가 국민들에게 사용권을 나눠주는 것이라는 미친 주장을 해도(참고로 이건 토지의 사적 소유권을 부정하는 공산주의다!) 여전히 이 주장은 정당하지 않다.

토지의 소유권을 획득하는 방법은 두 가지가 있는데 첫째, 소유권이 없는 땅을 점유함으로써 소유권을 주장할 수 있게 되는 것, 둘째, 이미 소유권이 있는 토지를 자발적인 교환이나 기부를 통해 획득하는 것이다. 소유권이 있는 생산 수단을 통해 생산된 생산물도 소유권이 인정되는데, 토지는 생산이 불가능하니(우주정거장 같이 새로운 공간을 건설하는 게 아니라면...) 토지를 획득하는 방법은 언급한 두 가지 뿐이다.

그런데 현대 국가가 토지를 소유한 것의 기원을 살펴보자. 식민지화를 통해 강제로 점유하는 것은 대한민국은 해당이 없는 것 같다. 그러면 이미 소유자가 있는 사유지를 각종 규제와 사용 제한을 통해 사실상의 지배권을 확보하거나, 세금으로 축적한 재정으로 구입한 것이다. 그 기원이 모두 약탈에 있다는 점에서 국가의 토지 소유는 정당하지 않다.

따라서 규칙이 싫으면 이민을 가면 된다는 주장은 도둑이 도둑질을 하는데, 도둑질을 당하기 싫으면 멀리 도망가라는 식의 궤변과 같다.

그러나 국가의 계약은 완전히 비자발적이다. 단지 그 신체가 어디서 탄생했다는 이유만으로 그 시스템에 동의한 것이 될 수는 없다. 갓 태어난 아기는 다른 사람의 보호가 있어야만 생존할 수 있다는 점에서 완전히 비자발적인데, 이에 따라 당연히 탄생의 위치도 완전히 비자발적인 것이었기 때문이다.

또한 국가는 국토의 소유자가 아니다. 그보다는 국토의 소유권을 보장'해야' 하는 존재일 뿐이다. 누군가가 규칙을 정하고 싶다면 그 규칙의 영향권은 자신의 사유지 내에서만 영향력이 있으며, 당연히 그 규칙에 자발적으로 동의하는 사람들만 그 사유지를 이용하는 조건으로 계약할 수 있다.

정리해보자. 지금까지 현대 민주주의의 투표의 부당함에 대해 두 가지 관점에서 살펴봤다. 첫째는 투표가 약탈이 가능한 이 시스템에 동의한다는 행위라서 부당하다는 것이고, 둘째는 이 시스템에 동의하지 않는 사람들까지 약탈의 대상이 되는 이 시스템에 동의한다는 행위이므로 부당하다는 것이었다.

투표하지 않는 행위가 혹시 반대 세력이 활개치게 두게 되는 것은 아닐까? 그렇지 않다. 투표하지 않는 행위는 이 시스템의 정당성을 약화시킨다. 현대 민주주의의 큰 속임수가 있다. 민주주의에서 비롯된 통치 행위는 51%를 넘은 사람들이 그 통치 행위에 동의했기 때문에 자행되어도 된다는 매우 비논리적인 주장에 입각하고 있다. 이는 당연히 정당성이 없다. 그런데 진짜 큰 속임수는 그 통치 행위에 동의한 사람이 심지어 과반도 아니라는 것이다.

만약 어떤 후보가 생산에 적대적인 수준의 세금 부과와 보편 복지, 최저임금 인상 등의 모두가 고통받는 정책을 공약으로 내세워 당선이 되었다고 해보자. 해당 후보의 득표율이 51%라고 한다면 이는 전국의 51% 국민이 해당 후보를 지지하는 것과 같은 착각을 일으킨다. 그렇지 않다. 만약 투표율이 75%라면, 해당 후보에 동의한 사람은 0.75 x 0.51 = 38%가 된다. 즉, 38%의 동의로 인해 모든 사람이 함께 고통 받게 되는 것이다.

그래서 민주주의는 이러한 사실을 감추면서 사람들에게 투표를 독려할 수밖에 없다. 투표율이 조금만 낮아져도 이에 대한 정당성이 심각하게 낮아지기 때문이다. 투표율이 50%인 상황에서 어떤 후보가 51%의 표를 얻어 당선된다면 전 국민의 25%의 지지로 당선된 것과 같은데 이는 통치 행위에 대한 정당성을 매우 약화시킨다.

소비자 주권 행사

그러면 투표라는 행위가 없다면 일반 시민들은 어떻게 주권을 행사할 수 있을까? 사실 우리는 매일매일 자발적으로 투표를 하고 있다. 바로 미제스가 말한 '소비자 주권' 행사다.

우리는 기업들이 우리에게 어떤 효용을 주는지에 따라 계속 투표한다. 어떤 기업을 살리고, 어떤 기업을 죽일지, 어떤 기업을 거지 기업에서 부자 기업으로 만들지, 또는 어떤 기업을 부자 기업에서 거지 기업으로 만들지 투표한다. 바로 '소비'를 통해서 말이다.

이러한 소비라는 투표 방식은 완전히 자발적이라는 점에서 소유권을 제대로 보장한다. 약탈과는 완전히 동떨어진 행위다.

또한, 이러한 투표 방식은 각자가 원하는 대로 효용을 누릴 수 있다. 사법과 치안도 시장의 영역으로 들어오면 우리는 어떤 규칙 아래서 살아갈지 자유롭게 선택할 수 있다. 즉, 내가 선택한 규칙이 다른 사람에게도 강제되지 않고, 다른 사람이 선택한 규칙이 나에게 강제되지도 않는다. 서로 다른 규칙이 충돌하면 그 규칙들의 간극을 중재하는 기업이 나타난다. 자연적으로 질서가 꽃 피는 것이다.

생산 권한은 기업에게 달려있지만 심판은 소비자가 한다. 생산자가 소비자의 의지에 반하는 생산을 하면 바로 시장에서 퇴출되기 때문이다. 기업은 소비자에게 어떤 도덕적 의무를 강요할 수도 없다. 기업은 소비자가 원하는 것이 있다면 생산할 뿐이다. 소비자는 기업에게 자신들이 원하는 것을 최대한 효율적으로 자원을 분배하여 생산할 것을 명령하고 생산 권한을 위임하는 셈이다. 그 기업이 소비자가 원하는 것을 생산하지 않으면 어차피 다른 어떤 기업이 생산하여 거기서 챙길 수 있는 소비자의 표, 즉 이익을 가져갈 것이다.

만약 '소비'라는 투표 행위 자체에 반대한다면 오지에 있는 땅을 사서 문명을 떠나 자급자족하며 사는 것도 가능하다. 각자가 자신만의 방식으로 삶을 선택할 수 있는 것이다.

이 투표 시스템에서 표는 돈이다. 돈으로 투표를 한다는 것이 비인간적으로 느껴질지도 모르겠다. 그러나 돈으로 투표하는 것은 지극히 인간적인데, 그 투표권을 얻기 위해서는 먼저 다른 사람들이 원하는 것을 해줘서 그 표를 얻어야 하기 때문이다. 소비하려면 먼저 생산해야 한다. 이건 완전히 약탈 없는 시스템이고, 모든 인간 시간에 대한 존중이다.

이러한 이유들로 나는 이제 현대 민주주의에 대한 투표를 거부하지만, 동시에 매일 소비를 통해 투표하고 있다.

아고리즘이 자유주의 세상을 만드는 방법

이제 아고리즘의 전략을 살펴보자. 로스바드-호페의 질서 자유주의를 살펴본 뒤, 현대 민주주의의 투표에 대한 부당함을 살펴본 것이 뜬금 없는 이야기는 아니었는데, 아고리즘은 이러한 이유로 어떠한 투표도 거부하기 때문이다. 아고리즘의 창시자인 새뮤얼 콘킨 3세가 로스바드와 갈라선 것도 로스바드가 정치와 연대하는 전략적 행보를 보이면서부터였다.

아고리즘은 자유로운 세상을 만들기 위해 자유 시장인 아고라를 적극 활용할 것을 주장한다. 이들은 정부가 추적할 수 없는 자유로운 암시장을 확대해서 정부의 힘을 약화시키는 방법을 써야 한다고 주장한다. 이 암시장은 당연히 무기, 마약, 성매매 등을 포함한 시장을 말한다.

그래서 자유지상주의를 도래시키기 위한 이들의 전략은 정부가 추적할 수 없는 시장을 만들고, 하나의 병렬 경제(대항 경제)를 만들어 정부의 힘을 지속적으로 약화시키는 것이다. 이들은 납세 거부 운동, 투표 거부 운동을 장려하며 암시장과 암호 기술을 적극 활용한다. 참고로 사이퍼펑크 같은 기술 자유주의는 분류하자면 질서자유주의보다 아고리즘 쪽에 더 가깝다(로스 울브리히트의 실크로드를 생각해보자...!)

로스바드-호페의 질서자유주의와 콘킨의 아고리즘은 둘 다 자유지상주의의 실현을 목표로 하지만, 질서자유주의는 논리적으로 윤리적 정당성을 확보하고, 그러한 정당성을 바탕으로 자유지상주의를 실현시키기 위해 현실 세계에 이미 존재하는 제도들도 전략적으로 이용한다. 반면 콘킨의 아고리즘은 자유지상주의의 윤리적 정당성보다는 그걸 도래시키기 위한 전략들에 치중하며, 정치와 절대 타협하지 않고, 전략적으로 이용하려고도 하지 않는다. 목표는 같지만 서로 다른 방법을 취하는 것이다.

1980년 공개된 콘킨의 「신 자유주의자 선언」은 미제스와 로스바드, 르페브르에 대한 감사로 시작하지만, 1장에서 다음과 같은 문구도 나온다. (이것도 언제 다 번역해봐야겠다!)

"처음 나타난 반격은 ... 개혁주의—국가주의를—'개선'하겠다는 명분으로 국가의 직책을 받아들이는 것까지 포함한다!—이 모든 반反 원칙들에 대해서... 그중 가장 끔찍한 것은 '정당주의'인데, 이는 자유지상주의적 목적을 국가주의적 수단, 특히 정당을 통해 달성하려는 반反 개념이다. '자유지상주의' 정당은 국가가 이제 막 출현한 자유지상주의자들에게 퍼부은 두 번째 반격이었다. 처음에는 터무니 없는 모순으로, 그 다음에는 침략군으로 등장했다."

로스바드가 1992년 공화당 경선 후보였던 팻 뷰캐넌을 공개적으로 지지했을 때(이때 공화당 경선에서 뷰캐넌은 아버지 부시한테 졌고, 대선은 민주당 빌 클린턴 승리), 콘킨이 어떤 반응을 보였을지 상상해보자. 저런 선언문을 썼는데 말이다. 콘킨은 로스바드가 자유지상주의 원칙을 저버렸다면서 자신이 편집하는 잡지 『신 자유지상주의자』에서 로스바드의 행위를 "자유의 원칙을 포기한 행위"라고 비난했다.

반면 로스바드는 소수의 자유지상주의 지식인들만으로는 자유지상주의 사회를 건설할 수 없으므로 대중과 연합해야 한다고 주장했다. 팻 뷰캐넌 같은 인물을 통해 중산층이나 노동계층의 지지를 얻을 수 있고, 자유지상주의 목표를 달성할 수 있다고 했다. 이때 나온 전략이 자유주의적 경제 질서와 보수적 문화 질서를 결합한 '팔레오 자유지상주의'다. 로스바드는 아고리즘 세력에게 순수성만을 강조하며 현실 세계와 단절된 사람들은 무기력한 이상주의자들이라고 반박하며, 자신은 국가주의를 지지하는 게 아니라 그 세력 안에 있는 반국가적 잠재력을 이끌어내는 것이라고 했다.

그림 2. 아고리즘의 깃발

질서자유주의와 아고리즘의 공동체적 배제에 관한 입장 차이

콘킨의 아고리즘과 로스바드-호페 라인의 질서자유주의의 차이는 정치 같은 기존 제도들을 전략적으로 이용할 수 있는지뿐만 아니라 공동체적 배제에 관한 입장에서도 약간 갈라진다.

자유주의에서는 자유로운 수용과 자유로운 '배제'도 보장되어야 한다. 즉, 예를 들어 어떤 사람이 장사를 하는데 동성애자나 흑인이나 채식주의자를 직원이나 손님으로 받지 않는 것도 장사하는 사람의 자유로운 배제 권리라는 것이다. 자신의 사유지에 어떤 사람을 들일지, 들이지 않을지는 전적으로 소유자의 몫이다. 그리고 여기서 배제는 당연히 폭력으로 이어지지 않는 선에서의 자유로운 배제다.

이러한 배제가 한 공동체 전체로 퍼졌다고 해보자. 지금은 동성애자에 대한 예시만 들겠다(필자는 동성애에 대해 부정적 감정이 전혀 없으니 동성애자 분들은 오해 마시길). 만약 한 지역 소유자 공동체 전체가 동성애자에 대한 배제를 주장한다면 당연히 동성애자는 그 공동체에 들어갈 수가 없다.

여기서 이를 다루는 뉘앙스가 약간 다른데, 호페는 이를 자유로운 계약에 의한 공동체적 질서의 탄생이라 보며 긍정적으로 본다. 물론 절대로 이러한 배제가 폭력으로 이어져서는 안 된다. 폭력으로 이어지면 비침해성 공리 위반이므로 정당성이 없다.

아고리즘은 개인들의 자발적인 배제는 자유지만, 이것이 공동체적 배제로 발전하고 구조적 차별이나 집단적 억압으로 발전하는 건 국가의 또 다른 형태일 뿐이라 생각하여 이를 경계한다. 그래서 개인 차원의 자율적 배제는 정당하지만, 공동체 차원의 배제는 경계한다. 그렇다고 이걸 없애야 한다 이런 건 아니다(개인들의 자유로운 배제가 공동체 배제로도 이어질 수 있는 것이므로). 콘킨은 공동체적 배제가 탄생할 수 있지만 그것이 비합리적인 배제라면 대안 시장이 탄생할 것으로 본다. 동성애자들을 위한 시장과 마을이 생길 것이고, 비합리적인 배제는 이러한 고객들을 놓친 것에 대한 손실로 이어질 것이라고 본다. 즉, 모든 개인이 자유 시장 아고라에서 자발적으로 교환할 권리를 가져야 하며, 차별적인 배제들은 시장 안에서 경쟁할 수 있을 거라 본다. 만약 대안 시장이 없는 상황에서 모두가 배제한다면 이는 실질적 강제처럼 작동할 수 있기 때문이다.

자유지상주의 안에서 콘킨의 아고리즘은 차별이나 수용을 대하는 태도에서 좀 더 좌파적인 것처럼 보인다. 실제로 콘킨의 「신 자유주의자 선언」에 등장하는 용어들도 약간 그러한 뉘앙스가 있다. 콘킨은 전통적인 좌파 단어들을 전략적으로 차용했다. 예를 들면 혁명, 착취, 해방운동, 불복종, 저항, 암시장, 아나키즘 등의 단어다. 당연히 전통적인 좌파 단어의 뜻과는 완전히 다르다. 혁명은 아고라를 통한 "비정치적" 자유주의 혁명을 의미하며, 착취는 마르크스의 자본가가 노동자를 착취한다고 했던 그 착취가 아니라, 국가주의와 결탁한 크로니 자본주의자들의 제도적 진입장벽을 만들고, 캉티용 효과의 수혜를 누리는 그러한 오염된 자본주의자들이 하는 것을 착취라고 했다(아고리즘은 국가에 의존하지 않는 기업가와 국가로부터 특혜를 받는 착취적 기업가를 구분한다. 선언문 참고).

정리하자! 로스바드-호페의 질서 자유주의와 콘킨의 아고리즘의 차이점은 다음과 같다.

로스바드-호페의 질서 자유주의는 정치 등을 전략적으로 이용하는 것을 허용한다. 로스바드는 공화당 경선 후보를 공개적으로 지지하여 우파 사람들로부터 자유지상주의에 대한 관심을 끌려고 했고, 호페는 전국단위의 투표나 정당 활동은 거부해도 지역 단위의 투표는 승리 가능성에 따라 조건부로 허용한다. 반면 아고리즘은 어떠한 정치 활동도 거부하며 오직 국가의 통제로부터 동떨어진 자유로운 시장에 의한 혁명을 추구한다.

얼마 전에 있었던 비트코이너들이 보수 우파 스페이스에 들어가서 비트코인에 대해 전파하는 걸 상상해보면 쉽다. 우파 국가주의자들은 국가 시스템에 의한 문제 해결을 강력한 지도자가 등장해 모든 것을 해결해줘야 한다는 잘못된 방법론에 빠져있는 경우가 많은데(문제를 더 큰 문제로 해결하려는 셈...), 누군가는 이걸 보고 저런 사람들과 협력하면 안 된다고 할 것이고, 누군가는 비트코인과 자유주의를 전파하기 위해 그래도 가능성이 높은 이들 사회에 섞여들어가 이야기도 하고, 전파도 하려고 할 것이기 때문이다.

또한 한 가지 차이점은 질서 자유주의와 아고리즘 모두 공동체적 배제는 인정하나, 질서 자유주의는 이를 자유로운 계약에 의해 등장한 공동체적 질서로 보고, 아고리즘은 공동체적 배제가 집단적 억압으로 발전할 것을 경계한다. 아고리즘에서는 비합리적 차별에 의한 배제는 대안 시장이 생겨 극복될 수 있다고 본다.

자유주의 세상을 만들기 위해서는 어떻게 해야 하는가

이제 무엇이 옳은지 스스로 판단해보자. 지금부터는 개인적인 생각이 매우 많이 들어가있으므로 주의하라.

콘킨의 아고리즘은 암시장의 확대를 노려 정부 권한을 약화시키려 하지만 이는 대중의 지지를 얻기 어렵다. 또한, 이러한 병렬 경제는 한 곳에 집중되기 어렵고 넓고 약하게 퍼져있을 수밖에 없다.

로스바드-호페의 질서자유주의는 현실에 이미 존재하는 제도들을 전략적으로 활용한다. 현실적으로 대중의 지지를 얻을 가능성이 있고, 한 지역에 자유주의자들이 집중되면 적어도 그 지역에서는 지역 투표를 통해 위로부터의 전환이 가능하다. 하나의 자유지상주의적인 지역이 좋은 모범이 되면 다른 지역도 채택할 가능성이 커진다.