-

@ 5627e59c:d484729e

2025-06-11 22:23:49

@ 5627e59c:d484729e

2025-06-11 22:23:49The world around me\ Is assumed to be

Through sensory observations\ This appears to me

What I experience\ Is for me

But the ultimate experience\ Is for me\ To be

-

@ 5627e59c:d484729e

2025-06-11 22:23:37

@ 5627e59c:d484729e

2025-06-11 22:23:37Happy New Year!

Happy New Year, my dearest human family\ Happy New Year, my dearest animal family

Dear children of the Earth\ I wish you all a magical year

May it be utterly new\ Ever-changing\ New now

And may your journey say\ Life is amazing! I'm in a maze\ Life is awesome! Quite some awe\ Life is magical! True alchemy

I am human\ Black woman, I love you so\ Life-giver of my origin, the negro [nigiro]

I am\ Thus physical and non-physical meet

Life is to be\ As the elements are and compete\ And as they collide with one another\ One becomes aware of an other\ And so life sets on a journey\ To discover the other

Animal life is set to explore\ Allowing all experience the other has in store\ Life left to experience without a voice\ Until it discovers there is an 'I'\ And it has a choice

Human life is to be inside a human body\ Thus fusion between intellect and feeling\ Gets to express its perspective\ Inside infinity

Truly, a magical gift\ My Holy Trinity

And so from human life flow many voices\ As it navigates through infinite choices

Thus I say

Life is magic\ A gift for all that is here\ Perceived by too many as tragic\ Take care of your vision, I tell you, my dear [tell-a-vision]

Life is magic\ And words are spells\ Placing your aim beyond your reach\ It takes away efficiency from your speech

Life is magic\ Above all else\ Even when it has me feeling blue\ Seemingly left without a clue

Still I say

Perfection\ You are everything\ And I am of you

The source, the mirror\ And the reflection

-

@ 8b0a2bea:857d369f

2025-06-11 22:23:36

@ 8b0a2bea:857d369f

2025-06-11 22:23:36Hey friends,

We're sharing this month's Geyser project launches on Stacker News! Feel free to subscribe to our email newsletter here to get these monthly updates in your mailbox!

This month’s list of Tools, Community, and Causes is stacked. From Uganda to Vietnam to El Salvador, it’s clear that Bitcoin is becoming a global movement! Bullish.

Let's dive in!👇

📚 Bitcoin Education - Laos Bitcoin Education 🇱🇦 🔥$583. Laos is battling 200% post-COVID inflation — help spread Bitcoin knowledge as a lifeline. - Abe 3 🇺🇸🔥 $324: Now entering its 4th year of free Bitcoin classes for the community. - NewB 🇰🇪🔥 $214: Open-source Bitcoin resources for Kenyan beginners. - Beyond Adversity: BTC Podcast: Stories of hope and financial freedom from underserved communities.

🌍 Community & Causes - Bitcoin for God 🇺🇸🔥 $1,194: Matching Bitcoin grants to help Christians orange-pill their ministries. - Ciclista Lima FC🇵🇪🔥$1,213: Scholarships for young footballers in Peru — future Bitcoin team. - Bitcoin-Funded Orphanage in Uganda 🇺🇬🔥$217: Safe, permanent home for vulnerable children. - Sviublokade FDU 🇷🇸🔥$134: Helping Serbian university staff punished for standing with students. - Football Support in El Salvador 🇸🇻🔥 $63: Backing a youth football club at La Cruz coffee farm. - Street Vendor Accepts Bitcoin 🇧🇴 Empowering street workers in Bolivia with BTC. - Razgibavanje: Support grassroots content in the Balkans. - Hope With Bitcoin – Saigon Flea Market 2025 🔥 $310: Grassroots Bitcoin adoption through events in Vietnam.

🛠️ Tools & Tech - WeSatoshis 🇦🇷🔥 $1,489: KYC-free, mobile-free Bitcoin card for everyday spending. - Hive Honey 🇺🇸🔥 $297: Nostr + Lightning video conferencing. - MedSchlr 🔥 $210: Decentralized client bringing medical knowledge to Nostr. - Bitcoin Travel 🇸🇻🔥$231: Book flights, hotels — Bitcoin only. - Stacksworth 🇨🇦🔥 $109: Bitcoin stat displays for your desk or wall. - Plunda 🇬🇧🔥 $217: Trade digital collectibles, redeem them physically. - BTC Wallpaper 🇩🇰🔥 Limited-edition, high-res Bitcoin backgrounds. - Swapido 🇲🇽🔥: Send Bitcoin, pay bank accounts in Mexico instantly. - Reserve BTC🇹🇭🔥: Trustless wallet balance proof protocol.

🎭 Culture - Barnoff Freedom Stage 🇬🇧🔥 $362: Free expression meets sound system culture. - 7 Wonders 🇧🇷🔥 $63: Bitcoin’s first Guinness World Record attempt.

https://stacker.news/items/1003921

-

@ 5627e59c:d484729e

2025-06-11 22:22:59

@ 5627e59c:d484729e

2025-06-11 22:22:59De laatste zonnestralen van de dag streken over de eeuwige golven en weerkaatsten als lichtpuntjes in de ogen van schipper Joris terwijl hij nog een slok nam van zijn glazen fles die de vorm had van het hoofd van een oude monnik.

Gekregen van een oude vrouw uit de bergen van de Himalaya, zorgde de rum genaamd 'Old Monk' voor een verwarmend gezelschap op deze eenzame kerstnacht.

Joris had met zijn boot naar India gevaren nadat zijn vrouw hem had verlaten en hij een Indiër had ontmoet die had gezegd: "Waar ik vandaan kom, zijn vrouwen vrij en worden ze niet gezien als enkel en alleen de mooie lichamen die zij bezitten of als eeuwig bezit van een gezin."

Verward en ongelovig had Joris gekeken naar de wereld en besefte dat vrouwen inderdaad slechts gezien werden als hun fysieke schoonheid, genegeerd werden voor hun koesterende gevoeligheid en bekritiseerd werden door hun spontane intensheid en had hierop voor twee jaar lang gezocht in India naar deze vrije vrouwen met als enig resultaat een oude vrouw te ontmoeten die alleen in de bergen woonde en dagelijks haar wijsheid deelde met ieder luisterend oor.

Daar ging het doorzichtig monnikshoofd en verliet met een grote gebogen vlucht de hand van schipper Joris toen plots met groot kabaal de boot abrupt tot stilstand kwam en Joris hals over kop naar de andere kant van het dek geslingerd werd.

Het monnikshoofd verdween in het donker terwijl Joris zijn lichaam probeerde te lokaliseren en met zijn ogen wijd open zijn hersenen zo veel mogelijk informatie probeerde door te spelen.

Tevergeefs, want zijn enorme verschot werd gevolgd door een enkel groeiende verbazing, ongeloof en desoriëntatie toen de boot begon te kantelen.

De bundel licht, afkomstig van de mast van de boot, zwierde doorheen het donker en kwam te schijnen op een gigantische rots in het midden van de zee die werd bezeten door een oogverblindende glinstergroene schijn.

Uit het donker kwam het monnikshoofd, dat nog steeds in volle vlucht was, in het vizier van de lichtbundel en plaatste zich exact tussen de glinstergroene verschijning en Joris waarbij Joris doorheen het monnikshoofd gezegend werd met het zicht op een pracht van een zeemeermin die uitnodigend poseerde op de rots.

Met een luide plons viel Joris achterover in het water toen hij zich realiseerde dat vrouwen zichzelf ook lieten vangen door lust en hun uiterlijke opmaakcompetities en met een dankbare glimlach zonk hij naar de bodem van de zee en was opnieuw geboren.

-

@ 5627e59c:d484729e

2025-06-11 22:21:31

@ 5627e59c:d484729e

2025-06-11 22:21:31Zonneschijn\ Stralen, lachen, zo fijn\ Moge de wereld dankbaar zijn

De vrouw, mijn gevoeligheid\ Bron van creativiteit

Genietend niets doen in het gras\ Met wat brood en wat wijn in het glas

-

@ 5627e59c:d484729e

2025-06-11 22:21:13

@ 5627e59c:d484729e

2025-06-11 22:21:13Spontaniteit\ Creativiteit

Iets visueel of gewoon geluid\ Het moet eruit

Ik doe mezelf cadeau aan jou\ Omdat ik van het leven hou

-

@ 5627e59c:d484729e

2025-06-11 22:21:04

@ 5627e59c:d484729e

2025-06-11 22:21:04Veroorzaakt door de wereld rond mij\ Vormen de wereld in mij

Verwaarloosd door de wereld rond mij\ Overgelaten aan mij

Een groene brug komt uit mij\ Verbindt mij met wij\ En laat ons samen vrij

-

@ 5627e59c:d484729e

2025-06-11 22:09:02

@ 5627e59c:d484729e

2025-06-11 22:09:02In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ 5627e59c:d484729e

2025-06-11 21:05:39

@ 5627e59c:d484729e

2025-06-11 21:05:39Zonneschijn\ Stralen, lachen, zo fijn\ Moge de wereld dankbaar zijn

De vrouw, mijn gevoeligheid\ Bron van creativiteit

Genietend niets doen in het gras\ Met wat brood en wat wijn in het glas

-

@ 5627e59c:d484729e

2025-06-11 22:08:40

@ 5627e59c:d484729e

2025-06-11 22:08:40Machtig water\ Door velen bemind

Element van beweging\ Vormgever aan land\ Bondgenoot van wind

Voorkomer van comfort\ Toelater van rust

Machtig water\ Waar ik ook ga\ Ik weet dat jij de grond onder mijn voeten kust

-

@ cae03c48:2a7d6671

2025-06-11 22:01:41

@ cae03c48:2a7d6671

2025-06-11 22:01:41Bitcoin Magazine

Evertz Pharma Becomes First German Company With Strategic Bitcoin Reserve, Adds 100 BTC to TreasuryEvertz Pharma GmbH, a company focusing on premium natural cosmetics, has become Germany’s first company to adopt a strategic Bitcoin reserve model by purchasing an additional 100 BTC in May 2025—valued at approximately €10 million (~$10.8 million USD), according to a press release.

The adoption marks a continued expansion of the company’s BTC treasury, which began in December 2020 with an initial €2 million Bitcoin purchase. Since then, Evertz Pharma has regularly allocated corporate profits toward Bitcoin, building a digital reserve aimed at long term stability.

“Our mission is to promote natural beauty on a scientific foundation,” said Dominik Evertz, Managing Director of Evertz Pharma GmbH. “The same future-focused mindset shapes our financial strategy: Bitcoin, as a scarce and globally tradable asset, complements our reserves and strengthens the long-term resilience of our company.”

The company’s latest acquisition of 100 BTC distinguishes it from industry peers and traditional treasury strategies. Tobias Evertz, Group CFO stated, “We will continue to invest corporate profits in Bitcoin and are constantly evaluating additional ways to increase our holdings sustainably.”

Unlike publicly traded Bitcoin adopters such as Strategy or Metaplanet, Evertz Pharma operates as a privately held German enterprise.

“Bitcoin is not just an investment for us but a strategic asset that perfectly complements our vision of stability and future resilience. At the same time, we are aligning our financial strategy with the needs of a modern, sustainably operating company,” added Dominik Evertz.

Everetz explains that Bitcoin is a store of value, a hedge against inflation, and a means to diversify reserves. It allows Evertz Pharma to preserve capital without the storage burdens that come with traditional assets like gold. The company’s treasury strategy shows their commitment to financial sustainability.

This post Evertz Pharma Becomes First German Company With Strategic Bitcoin Reserve, Adds 100 BTC to Treasury first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 5627e59c:d484729e

2025-06-11 21:05:04

@ 5627e59c:d484729e

2025-06-11 21:05:04Veroorzaakt door de wereld rond mij\ Vormen de wereld in mij

Verwaarloosd door de wereld rond mij\ Overgelaten aan mij

Een groene brug komt uit mij\ Verbindt mij met wij\ En laat ons samen vrij

-

@ 0403c86a:66d3a378

2025-06-11 20:57:01

@ 0403c86a:66d3a378

2025-06-11 20:57:01The Club World Cup 2025 is set to be a spectacular global football event, debuting in the USA from June 14 to July 13, 2025. This new format brings together 32 top club teams from all six FIFA confederations, showcasing the best of world club football in a month-long tournament.

🏆 Tournament Basics

- Dates: June 14 – July 13, 2025

- Host: United States of America

- Number of Teams: 32 clubs

- Confederations Represented: AFC (Asia), CAF (Africa), Concacaf (North & Central America), CONMEBOL (South America), OFC (Oceania), UEFA (Europe)

- Format:

- Group Stage: 8 groups of 4 teams, single round-robin

- Top 2 teams per group advance to Round of 16 knockout

- Single-match knockout from Round of 16 to Final

- No third-place playoff

🏟️ Venues Across the USA

The tournament will be played in 12 stadiums across major US cities:

- MetLife Stadium – New York/New Jersey (Final venue)

- Hard Rock Stadium – Miami, FL (Opening match venue)

- Mercedes-Benz Stadium – Atlanta, GA

- TQL Stadium – Cincinnati, OH

- Bank of America Stadium – Charlotte, NC

- Rose Bowl Stadium – Los Angeles, CA

- GEODIS Park – Nashville, TN

- Camping World Stadium – Orlando, FL

- Inter&Co Stadium – Orlando, FL

- Lincoln Financial Field – Philadelphia, PA

- Lumen Field – Seattle, WA

- Audi Field – Washington, D.C.

👥 Group stage

Group A

SE Palmeiras (BRA) FC Porto (POR) Al Ahly FC (EGY) Inter Miami CF (USA)

Group B

Paris Saint-Germain (FRA) Atlético de Madrid (ESP) Botafogo (BRA) Seattle Sounders FC (USA)

Group C

FC Bayern München (GER) Auckland City FC (NZL) CA Boca Juniors (ARG) SL Benfica (POR)

Group D

CR Flamengo (BRA) Espérance Sportive de Tunis (TUN) Chelsea FC (ENG) LA Galaxy (USA)

Group E

CA River Plate (ARG) Urawa Red Diamonds (JPN) CF Monterrey (MEX) FC Internazionale Milano (ITA)

Group F

Fluminense FC (BRA) Borussia Dortmund (GER) Ulsan HD (KOR) Mamelodi Sundowns FC (RSA)

Group G

Manchester City (ENG) Wydad AC (MAR) Al Ain FC (UAE) Juventus FC (ITA)

Group H

Real Madrid C. F. (ESP) Al Hilal (KSA) CF Pachuca (MEX) FC Salzburg (AUT)

⚽ Key Highlights

🏆✨ Paris Saint-Germain leads the power rankings as the favorites, fresh off a treble-winning season! Can they maintain their dominance against the world's best? #PSG

⚡️🔥 Watch out for Real Madrid! After a trophy-less season, they’re eager to prove their worth under new manager Xabi Alonso. Will they reclaim their glory? #RealMadrid

💪🌟 Manchester City is back in the mix! Despite a rocky season, they showed resilience in the final weeks. Can Pep Guardiola's squad rise to the occasion? #ManCity

💰🏅 With a staggering $1 billion prize pool, the stakes are high! Teams will battle not just for glory, but for a significant financial reward. Who will take home the biggest share? #PrizeMoney

🌟⚽️ Keep an eye on the underdogs! Teams from the Americas, Africa and Asia ready to challenge the European giants. Who could pull off a surprise upset? #Underdogs

🏅 Trophy & Official Match Ball

- The official Club World Cup Trophy was unveiled in November 2024, designed in collaboration with Tiffany & Co.

- The official match ball is supplied by adidas, featuring a patriotic design with red, white, and blue jagged patterns inspired by the US flag.

🎟️ Tickets & Viewing

- Ticket sales began on December 19, 2024, with prices starting at USD 30 for group-stage matches.

- Tickets available via FIFA on a first-come, first-served basis.

- Broadcast: DAZN is the exclusive global broadcaster, streaming all 63 matches live worldwide.

💸 Club World Cup Winner ODDS

🥇 Real Madrid @ 5.00

🥈 Paris Saint-Germain @ 6.00 🥈 Manchester City @ 6.00

🥉 Bayern Munchen @ 8.00

🐕 Chelsea FC @ 11.00

🐩 Atletico Madrid @ 15.00 🐩 Inter Milano @ 15.00

🐶 Borussia Dortmund @ 25.00 🐶 Juventus @ 25.00

🌭 CR Flamengo @ 35.00 🌭 SE Palmeiras @ 35.00

🦴 CA River Plate @ 40.00 🦴 SL Benfica @ 40.00 🦴 Boca Juniors @ 40.00 🦴 FC Porto @ 40.00

🦓 Botafogo FR @ 55.00 🦓 Fluminense FC @ 55.00

🤏 Inter Miami CF @ 70.00 🤏 AL Hilal Riyadh @ 70.00

💫 FC Salzburg @ 85.00 💫 Los Angeles FC @ 85.00

💦 Seattle Sounders @ 100.0

💧 Al Ahly Cairo @ 125.0

💨 CF Pachuca @ 150.0

🌬️ Ulsan HD FC @ 200.0 🌬️ Al Ain FC @ 200.0

🐾 Urawa Red Diamonds @ 250.0 🐾 CF Monterrey @ 250.0

🕳️ Wac Casablanca @ 500.0 🕳️ Mamelodi Sundowns @ 500.0 🕳️ Esperance Sportive de Tunis @ 500.0

🙏 Auckland City FC @ 999.0

Put Your ₿itcoin Where Your Heart Is: Predyx the 🏆

-

@ 7f6db517:a4931eda

2025-06-11 19:04:04

@ 7f6db517:a4931eda

2025-06-11 19:04:04

I often hear "bitcoin doesn't interest me, I'm not a finance person."

Ironically, the beauty of sound money is you don't have to be. In the current system you're expected to manage a diversified investment portfolio or pay someone to do it. Bitcoin will make that optional.

— ODELL (@ODELL) September 16, 2018

At first glance bitcoin often appears overwhelming to newcomers. It is incredibly easy to get bogged down in the details of how it works or different ways to use it. Enthusiasts, such as myself, often enjoy going down the deep rabbit hole of the potential of bitcoin, possible pitfalls and theoretical scenarios, power user techniques, and the developer ecosystem. If your first touch point with bitcoin is that type of content then it is only natural to be overwhelmed. While it is important that we have a thriving community of bitcoiners dedicated to these complicated tasks - the true beauty of bitcoin lies in its simplicity. Bitcoin is simply better money. It is the best money we have ever had.

Life is complicated. Life is hard. Life is full of responsibility and surprises. Bitcoin allows us to focus on our lives while relying on a money that is simple. A money that is not controlled by any individual, company, or government. A money that cannot be easily seized or blocked. A money that cannot be devalued at will by a handful of corrupt bureaucrat who live hundreds of miles from us. A money that can be easily saved and should increase in purchasing power over time without having to learn how to "build a diversified stock portfolio" or hire someone to do it for us.

Bitcoin enables all of us to focus on our lives - our friends and family - doing what we love with the short time we have on this earth. Time is scarce. Life is complicated. Bitcoin is the most simple aspect of our complicated lives. If we spend our scarce time working then we should be able to easily save that accrued value for future generations without watching the news or understanding complicated financial markets. Bitcoin makes this possible for anyone.

Yesterday was Mother's Day. Raising a human is complicated. It is hard, it requires immense personal responsibility, it requires critical thinking, but mothers figure it out, because it is worth it. Using and saving bitcoin is simple - simply install an app on your phone. Every mother can do it. Every person can do it.

Life is complicated. Life is beautiful. Bitcoin is simple.

If you found this post helpful support my work with bitcoin.

-

@ 5627e59c:d484729e

2025-06-11 21:04:47

@ 5627e59c:d484729e

2025-06-11 21:04:47In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ eb0157af:77ab6c55

2025-06-11 19:02:39

@ eb0157af:77ab6c55

2025-06-11 19:02:39Over 40 experts from the Bitcoin technical community sign a petition for the adoption of CTV and CSFS opcodes within six months.

A portion of the Bitcoin developer community appears to have reached consensus regarding the next protocol upgrade. An open letter signed by over 40 experts requests the priority implementation of two opcodes: OP_CHECKTEMPLATEVERIFY (CTV, BIP-119) and OP_CHECKSIGFROMSTACK (CSFS, BIP-348).

The developers believe that activating CTV and CSFS constitutes the most appropriate next step for Bitcoin’s evolution. The letter emphasizes how, despite the existence of various proposals to improve the protocol, CTV and CSFS stand out for being extensively reviewed, for their implementation simplicity, and for proving to be both secure and widely requested by the community.

CTV: five years of development and refinement

OP_CHECKTEMPLATEVERIFY was first formalized in BIP-119 over five years ago. Despite numerous attempts at refinement or replacement, it remains the preferred method for enforcing pre-generated transaction sequences using consensus, the developers state.

According to the letter’s signatories, implementing CTV on Bitcoin would unlock functionality for:

- scaling solutions;

- secure vault systems;

- network congestion control;

- non-custodial mining;

- Discreet Log Contracts (DLC).

CSFS: eight years of proven experience

The developers declare that OP_CHECKSIGFROMSTACK is a primitive opcode, implemented on the open source Blockstream Elements platform for at least eight years. It does not represent a significant computational burden compared to Bitcoin’s most used opcode, OP_CHECKSIG, the document’s signatories state.

When combined with CTV, CSFS enables LN-symmetry, an improvement for Lightning Network. Additionally, it unlocks a variety of other use cases.

The letter’s signatories ask Bitcoin Core contributors to prioritize the review and integration of CTV and CSFS within the next six months. This timeline is considered appropriate to allow for rigorous final review and activation planning.

The letter was signed by over 40 figures from the Bitcoin community, including developers such as Andrew Poelstra, Calle, Christian Decker, and Robin Linus, along with representatives from industry companies such as Chun Wang from f2pool, representatives from Zeus, Luxor Mining, Mara Pool, and Cake Wallet.

The post Bitcoin developers call for implementation of CTV and CSFS: letter to the community appeared first on Atlas21.

-

@ 5627e59c:d484729e

2025-06-11 21:02:53

@ 5627e59c:d484729e

2025-06-11 21:02:53My life is my way Home\ My death is my arrival

I can't wait to be Home\ And so I love life

I can't wait to be Home\ And so I want to live to the fullest

For there are no shortcuts

Many people die\ And never make it Home

They will have to wait\ For another chance to die

Another chance to live fully\ And die totally

I'm so thankful to be alive\ I'm on my way Home

I'm so thankful to be alive\ To have another chance to die

Every day I take a step\ In the direction of my death\ I do not postpone it

Every day I take a step\ In the direction of my truth\ I do not avoid it

It is who I am, always have been\ And always will be

It lies beyond that door\ That keeps everything in check

Where only can go through\ Which is forever true

-

@ 2b998b04:86727e47

2025-06-11 19:36:40

@ 2b998b04:86727e47

2025-06-11 19:36:40🌋 Ka ʻImi i ka Pono: Seeking What’s Right

A 7-Day Series on Sovereignty, Bitcoin, and the Soul of the Islands

> "Man is not free unless he wills to be free."\ > — Johann Gottlieb Fichte

Hawai‘i understands sovereignty. It always has.\ But it was taken — first with pen and politics, then with force and fiat.

Bitcoin offers something different:\ A way to reclaim sovereignty without violence.\ A tool for self-rule, not state rule.\ A system built not on empire, but on truth and time.

This week, I’ll be posting a 7-part series exploring this tension:\ Between the Hawai‘i that was, the system that is, and the future that might be — if we choose to build on bedrock instead of paper.

I don’t know if there’s a traditional Hawaiian word for a 7-day week — maybe there doesn’t need to be.\ Time moves differently on these islands.\ But for the next 7 days, I’ll mark each reflection as a kind of modern lā hoʻomanaʻo — a day of remembering, reckoning, and restoring.

This is personal. It’s philosophical. It’s also unfinished.

But that’s what sovereignty looks like:\ Not something given — something reclaimed.

Stay tuned. Stay akamai.\ 🟧\ — Andrew G. Stanton (aka akamaister)

-

@ cae03c48:2a7d6671

2025-06-11 19:01:58

@ cae03c48:2a7d6671

2025-06-11 19:01:58Bitcoin Magazine

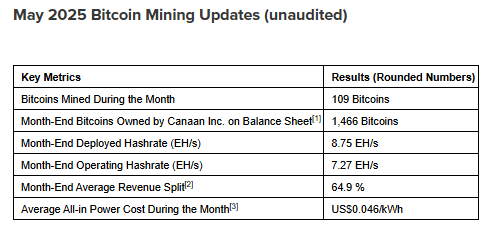

The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since LaunchAmerican Bitcoin Corp (ABTC), a newly formed private Bitcoin mining company backed by Eric Trump and Donald Trump Jr., announced in a June 10 SEC filing that it has acquired 215 Bitcoin (BTC) since launching operations on April 1, 2025. The reserve is currently valued at approximately $23 million, showing their drive and commitment to Bitcoin.

JUST IN: American Bitcoin Corp (private) reports to have 215 #bitcoin (per 31 May) since it's launch on April 1, 2025.

They will merge with Gryphon Digital $GRYP and become public under ticker $ABTC.

They mention "Bitcoin accumulation is not a side effect of ABTC’s business.… pic.twitter.com/wq1Uxr76Z2

— NLNico (@btcNLNico) June 10, 2025

“Bitcoin accumulation is not a side effect of ABTC’s business. It is the business,” the company stated in the filing.

Furthermore, ABTC has entered into a merger agreement with Gryphon Digital Mining ($GRYP), and the combined company is expected to begin public trading under the ticker $ABTC as early as Q3 2025.

The company’s three-layer strategic plan—outlined in the SEC disclosure—details a focused approach:

Layer 1: Build the Engine

- ABTC’s foundation is built on “producing Bitcoin below-market cost through a capital efficient, infrastructure-light operating model.” The company owns and operates over 60,000 miners from Bitmain and MicroBt, running primarily on Hut 8-managed facilities.

Layer 2: Scale the Reserve

- ABTC had “accumulated approximately 215 Bitcoin in reserve since launching on April 1, 2025,” which it considers a long-term strategic asset. The firm states its goal is “to utilize public markets and strategic financing structures to access efficient capital and leverage that capital to increase its Bitcoin in reserve per share.”

Layer 3: Lead the Ecosystem

- The company ultimately aims to use its operational scale and mining position to drive industry-wide adoption. “ABTC may pursue opportunities to support protocol development, enhance network infrastructure and contribute to Bitcoin’s resilience and adoption in ways that align with shareholder value creation.”

For mining rewards, ABTC uses Foundry and Luxor pools with sub-1% fees and relies on Coinbase Custody for secure cold storage, featuring multi-factor authentication and strict withdrawal protocols.

With operations across Niagara Falls, NY; Medicine Hat, AB; and Orla, TX, ABTC is leveraging strategic partnerships—primarily with Hut 8—to scale its Bitcoin holdings while influencing the broader crypto mining ecosystem.

This post The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since Launch first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 79be667e:16f81798

2025-06-11 19:11:59

@ 79be667e:16f81798

2025-06-11 19:11:59I am here too\ In the same space like you

In the same situation I'm in\ It's a matter of positioning

I cannot leave this place I'm in\ It was brought about\ By what's been happening

So please don't look at me\ For what I can or cannot do for you\ But look at what is happening for me\ And what is happening for you

Let's communicate\ Not orchestrate

Because there's something I wish to do\ And there's a place I wish to go to

And I'm sure that there is too\ In your heart a fire\ Known by only you

So let us listen, look and see\ For what's true for you\ And what's true for me

That we may act upon what's here\ In order for us both to take a step\ In the direction we wish to steer

-

@ cae03c48:2a7d6671

2025-06-11 19:01:34

@ cae03c48:2a7d6671

2025-06-11 19:01:34Bitcoin Magazine

Michael Saylor: The Bear Market Is Not Coming Back And Bitcoin Is Going To $1 MillionToday, the Executive Chairman and CEO of Strategy Michael Saylor commented on the company’s aggressive Bitcoin-based strategy in a recent interview at Bloomberg, emphasizing that Bitcoin is not going to zero, it is going to $1 million.

“I think we’re in a digital gold rush and you’ve got ten years to acquire all your bitcoin before there’s no bitcoin left for you,” Saylor said. “The competition is a virtuous competition.”

JUST IN: Michael Saylor said the bear market is not coming back and Bitcoin is going to $1 million

— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

Saylor also said that Bitcoin is not going to have bear markets anymore and the price is going to $1 million per coin.

“Winter is not coming back,” commented Sayor. “We are past that phase. If Bitcoin is not going to zero, it is going to $1 million. The President of the United States is determined. He supports Bitcoin, the cabinet supports Bitcoin, Scott Bessent supports Bitcoin, Paul Atkins is shown himself to be an enthusiastic believer of Bitcoin and digital assets… Bitcoin has gotten through its riskiest period.”

He also pointed out that international firms are rapidly entering the space.

“Metaplanet is the hottest company in Japan right now, they went from $10 million to a $1 billion market cap to a $5 billion market cap. They’re going to raise billions of dollars. They’re going to pull the liquidity out of the Japanese market. So they’ll be raising capital in Tokyo and the Tokyo Stock Exchange… It’s not competitive. It’s cooperative.”

Strategy’s approach is far from traditional. The company is not just buying and holding Bitcoin; it is building financial instruments around it, which Saylor believes sets them apart.

“Our company has a very particular business model,” he stated. “It’s to issue Bitcoin-backed credit instruments like Bitcoin-backed bonds and especially Bitcoin-backed preferred stocks. We’re the only company in the world that’s ever been able to issue a preferred stock backed by Bitcoin. We’ve done three of them in the past five months.”

Rather than viewing Bitcoin treasury holdings or ETFs as competitors, Saylor explained that Strategy is targeting a different segment of the market entirely.

“We’re not competing against the Bitcoin treasury companies. We’re competing against ETFs like PFF that have portafolios of preferred stocks or corporate bond portfolios that are trading as ETFs in the public market, and the way we compete is we offer 400 basis points more yield on an instrument that is much more heavily collateralized and more transparent… That’s $100 trillion or more of capital in those markets,” explained Saylor.

He emphasized that Strategy’s Bitcoin balance sheet gives it a unique edge, giving the company the ability to design unique financial products.

“Our advantage is that we’re 100% Bitcoin… It’s impossible to issue Bitcoin-backed convertible preferred and Bitcoin-backed fixed preferred unless you’re willing to make 100% of your balance sheet Bitcoin.”

“I’m not really worried about competition from JPMorgan or Berkshire Hathaway,” concluded Saylor. “I would love for them to enter the Bitcoin space, buy up a bunch of Bitcoin. When they do it, they’ll be paying $1,000,000 a Bitcoin. The price will go to the moon.”

This post Michael Saylor: The Bear Market Is Not Coming Back And Bitcoin Is Going To $1 Million first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 79be667e:16f81798

2025-06-11 18:38:49

@ 79be667e:16f81798

2025-06-11 18:38:49The world around me\ Is assumed to be

Through sensory observations\ This appears to me

What I experience\ Is for me

But the ultimate experience\ Is for me\ To be

-

@ 79be667e:16f81798

2025-06-11 18:58:10

@ 79be667e:16f81798

2025-06-11 18:58:10Kan jij zien, er is geen hemel\ Probeer het zelf, dan lukt het wel\ Geen hel staat ons te wachten\ Enkel sterren hangen ons boven het hoofd\ Kan jij zien, iedereen leeft voor dit moment

Kan jij zien, er zijn geen landen\ Het is niet moeilijk gewoon land te zien\ Niets om voor te moorden of te sterven\ Ook geloof wordt niet gezien\ Kan jij zien, het leven wordt geleefd door iedereen in vrede

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

Kan jij zien, er is geen bezit\ Ik vraag me af of jij dit kan\ Geen hebben of een nood\ In een samen-leving van mensen\ Kan jij zien, wij delen de wereld met elkaar

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

-

@ 79be667e:16f81798

2025-06-11 18:29:06

@ 79be667e:16f81798

2025-06-11 18:29:06Zonneschijn\ Stralen, lachen, zo fijn\ Moge de wereld dankbaar zijn

De vrouw, mijn gevoeligheid\ Bron van creativiteit

Genietend niets doen in het gras\ Met wat brood en wat wijn in het glas

-

@ 79be667e:16f81798

2025-06-11 18:27:32

@ 79be667e:16f81798

2025-06-11 18:27:32Spontaniteit\ Creativiteit

Iets visueel of gewoon geluid\ Het moet eruit

Ik doe mezelf cadeau aan jou\ Omdat ik van het leven hou

-

@ 79be667e:16f81798

2025-06-11 18:25:54

@ 79be667e:16f81798

2025-06-11 18:25:54Veroorzaakt door de wereld rond mij\ Vormen de wereld in mij

Verwaarloosd door de wereld rond mij\ Overgelaten aan mij

Een groene brug komt uit mij\ Verbindt mij met wij\ En laat ons samen vrij

-

@ 79be667e:16f81798

2025-06-11 18:23:32

@ 79be667e:16f81798

2025-06-11 18:23:32In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ 2b998b04:86727e47

2025-06-11 18:14:59

@ 2b998b04:86727e47

2025-06-11 18:14:59For years, GitHub has been the default home for open source developers. It built its reputation on transparency, collaboration, and a commitment to giving coders a place to share and improve their work. But since Microsoft's acquisition in 2018, subtle changes have begun to surface—not all of them in service to the user.

GitHub is still free. Public repositories remain free. Even private repositories are free, to a point. GitHub Pages, Actions, and Codespaces offer incredibly powerful tools to build and deploy projects at no cost—until you hit certain usage limits or need team-scale features.

But the deeper question is this: what do you give up in exchange?

Microsoft Doesn’t Give Away Infrastructure for Free

GitHub, VSCode, Copilot, and Azure form a tightly integrated ecosystem. On the surface, it's all about productivity. But underneath, it's about data. Your code trains their models. Your habits inform their products. Your workflows deepen their lock-in.

Take Copilot, for example: it’s not just a coding assistant, it’s a data-harvesting engine built on top of a centralized platform. The more you use GitHub, the more Microsoft knows about what developers are building—and what they might buy.

Free Isn’t Sovereign

As developers, we have to ask hard questions:

-

What happens when the free tier disappears or changes?

-

Can I take my work elsewhere without breaking my stack?

-

Who owns the insights derived from my development patterns?

These questions aren’t hypothetical. We’ve seen them play out with Heroku, Medium, Twitter, and countless others. Free turns into friction. Then friction becomes control.

Alternatives Are Emerging

Thankfully, there are options:

-

Codeberg, Gitea, and SourceHut for Git hosting

-

Cloudflare Pages for static sites + edge functions

-

Railway, Fly.io, or even VPS hosting for dynamic apps

-

Nostr and IPFS for decentralized publishing

These aren’t always drop-in replacements. But they represent a healthier direction—one aligned with freedom, transparency, and a proof-of-work ethos rather than a proof-of-data-capture business model.

My Move Away from GitHub (Sort Of)

I’m not deleting my GitHub account. It’s still the best way to reach other devs. But for key projects—especially those that touch on identity, sovereignty, or censorship resistance—I’m migrating:

-

Private infrastructure where needed

-

Cloudflare for front-end deployments

-

Nostr for publishing and archiving

-

Git mirroring to open alternatives

Because the tools we use shape the future we build. And if the platform is free, but the product is you—it's time to re-evaluate.

#ProofOfWork #OpenSource #Cloudflare #DecentralizeEverything #Nostr #GitSovereignty #MicrosoftStack

-

-

@ b158def8:467b5a98

2025-06-11 17:20:01

@ b158def8:467b5a98

2025-06-11 17:20:01When it comes to maintaining a spotless environment, very few things are as important as floor cleanliness. Floors withstand the highest punishment in both a commercial atmosphere and a home; dirt and stains gradually get deposited, and flooring tends to show wear and tear Professional floor cleaners in Sutton.investing in a professional company aptly manifests the proper routines to maintain the beauty and durability of your flooring. Daras Cleaning is a well-established name in the industry, providing a complete range of specialist cleaning services, tackling every floor cleaning requirement with utmost professionalism and care.

**Why Professional Floor Cleaning Matters ** Floors might just be surfaces for walking on, but they help to set the entire ambiance of a space. Clean and well-maintained floors, real or virtual, will create a good first impression-whether it is in welcoming a client to your office or guests to your home. Routine mopping or vacuuming hardly works on deep grime, persistent stains, or residue accumulation. Mixed.

As one would expect floor cleaning for these professionals, it goes beyond simple dirt removal on the surfaces to more advanced techniques with the best equipment to bring floors back to their original shine. Professional cleaners know the types of methods they would have to employ on carpeted areas or tiles, wood, or vinyl flooring. Thus, a positive outcome without any destruction on these floors is guaranteed.

**What Sets Daras Cleaning Apart? ** As a trusted provider of specialist cleaning services in Sutton, Daras Cleaning creates a delicate balance between reliability and flexibility to accommodate the unique needs of every customer. Their team has been vetted, insured, and trained to the highest standards, providing guaranteed satisfaction on any type of cleaning service for both private and commercial clients. With several years of experience behind them, Daras Cleaning also understands that every floor and every client is different, and that is why custom cleaning plans that accommodate unique requirements are offered.

Daras Cleaning was hailed by clients for its quick and efficient work at reasonable prices; thus, it invariably pops up at the top of the list for anyone searching for a professional floor-cleaning service in Sutton. Its commitment to appreciating staff and constant improvement ensures that jobs are done with the utmost care and precision.

Your Comprehensive Solution for Floor Cleaning

- Daras Cleaning provides a broad range of specialist cleaning services for all flooring types and their cleaning needs: Carpet and Upholstery Cleaning: This involves bringing carpets and upholstered furniture back to life via the use of modern methods for steam cleaning and stain removal. Cleaning and Treatment of Hard Floors: Deep-clean, polish, and seal tile, stone, wood, and vinyl surfaces, restoring shine and preventing wear and tear.

- Commercial Floor Cleaning: For a truly clean and hygienic workplace environment for staff and clients alike, solutions are tailored for offices, communal areas, retail spaces, etc. *** High-Pressure Jetting: **For the efficient removal of ingrained dirt and stains from outdoor surfaces such as car parks and industrial floors.

- Thanks to combining the use of market-leading machines with environmentally friendly cleaning solutions, Daras Cleaning guarantees a thorough cleaning that is safe for your family, employees, and the environment.

****Advantages of Specialist Cleaning Services

Improved Appearance: Floors are shiny, clean, and hospitable, exerting their beneficial influence upon the house or business.

Prolonged Life: Periodic professional cleaning prevents dirt and grit from building up, causing damage to the flooring in the long run. Therefore, it means less hassle and lots of money saved by avoiding repair bills.

Indoor air quality will be improved since this process gets rid of allergens, bacteria and dust mites. Daras Cleaning is there to take care of your floors, so you do not need to worry about keeping them clean over time.

**Adaptable and trustworthy ** Daras Cleaning keenly appreciates the limitations of modern life and business. Therefore, it offers flexible schedules and tailor-made cleaning programs. They carry out maintenance and one-time deep cleaning as per the client's convenient arrangements to coincide with their time so as not to minimize disruption and guarantee flawless results on each occasion.

**Experience the Daras cleaning difference ** If you want quality Specialist cleaning services, Daras Cleaning offers the best services. Their emphasis on good service, client contentment and improving always keeps them ahead of the competition. In short, using Daras Cleaning’s expert services will keep your home clean, safe and beautiful all over the floors.

-

@ 79be667e:16f81798

2025-06-11 18:54:57

@ 79be667e:16f81798

2025-06-11 18:54:57In het hart van een gepensioneerde operazangeres ontstond een stemmetje. Het stemmetje klonk verrast. "He," ging het hart. "Ik heb een stemmetje gekregen! Hoe kan dit? Kan iemand me horen? Zouden mijn gedachten me kunnen horen?" vroeg het stemmetje, niet wetend aan wie. Want de gedachten hoorden het niet. Zij waren zo druk bezig met het verleden en hadden een grote angst dit te verliezen. "Weet je nog?" gingen de gedachten. "Voor duizenden mensen heb ik gezongen! Avond na avond! Tienduizenden mensen hebben me toegejuicht! Wat waren ze onder de indruk! Luister! Ik kan het nog steeds!" "He," ging het hart. "Hoor je me dan niet? Het ging toch helemaal niet om dat gejuich. Weet je dan niet meer hoe ik me volledig bloot gaf aan die mensen. Mijn diepste en meest persoonlijke verhalen waren te horen in mijn liederen. Daar draaide het toch om? De mensen waren niet enkel onder de indruk. Hun harten hebben mijn verhalen gevoeld en konden zo kennis geven aan hun gedachten. Is dat niet wat echt telde?" Maar de gedachten waren volop aan het zingen voor de ene persoon die ze konden vinden die wou luisteren. "He," ging het hart. "Ook in dit moment zijn mijn liederen te horen door vele gedachten en te voelen door vele harten over de hele wereld. Heb ik dan geen rust verdiend? Kan ik niet even genieten van de rust die in dit moment te vinden is, maar jullie van me afnemen?" Maar de gedachten waren nog steeds volop aan het zingen.

-

@ cae03c48:2a7d6671

2025-06-11 17:01:49

@ cae03c48:2a7d6671

2025-06-11 17:01:49Bitcoin Magazine

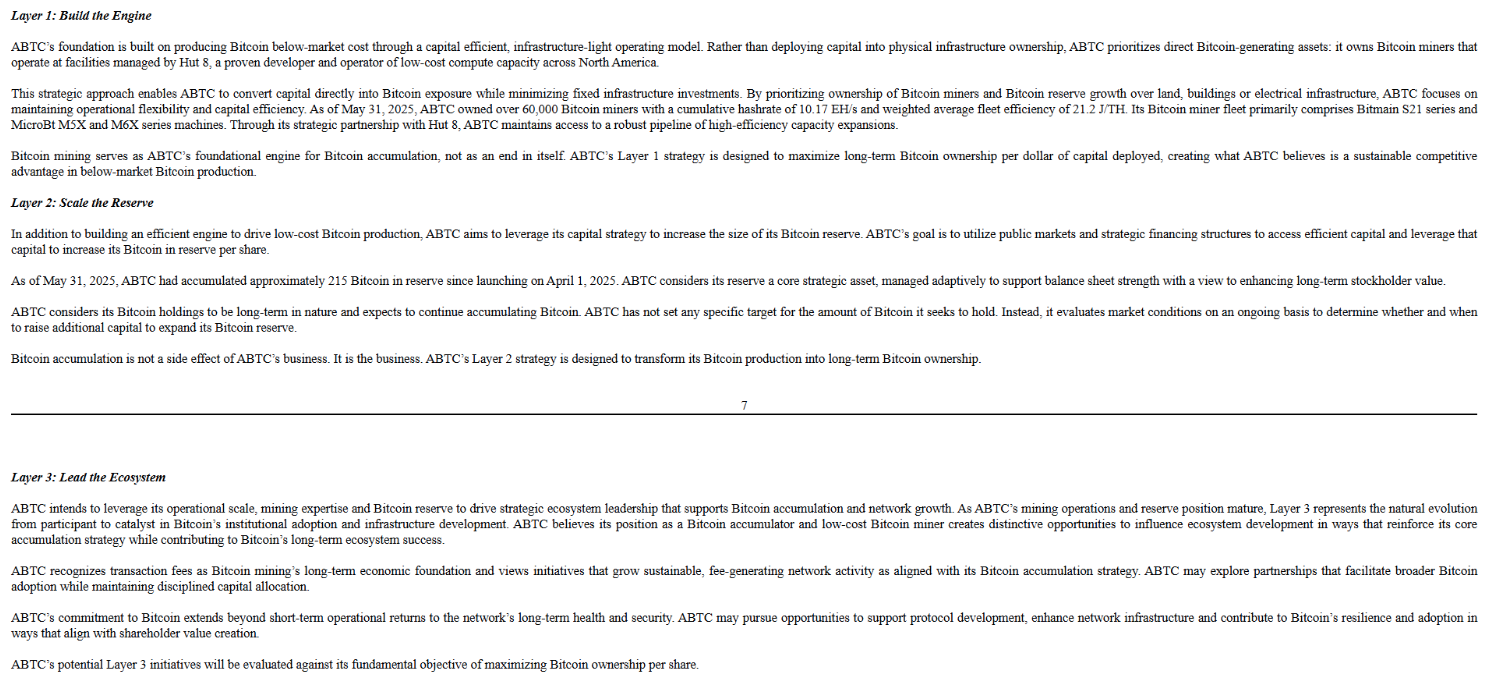

Canaan Announces Record Bitcoin Mining Month with Over 109 BTC MinedCanaan Inc. (NASDAQ: CAN), an innovator in Bitcoin mining, reported today their bitcoin mining update for the month ending May 31, 2025, with 109 bitcoins mined. The company’s total bitcoin holdings rose to 1,466 BTC.

“In May 2025, despite the 10% increase in tariffs on our Malaysia-made Bitcoin mining machines due to ongoing U.S. trade uncertainties, we remained focused on executing our strategic priorities with discipline and agility,” said the Chairman and CEO of Canaan Nangeng Zhang. “By capitalizing on the favorable momentum in bitcoin prices, we achieved a 25% month-over-month increase in our bitcoin production, reaching a record 109 bitcoins. This performance marks a new monthly high for our mining production and brings our total cryptocurrency holdings to an all-time high of 1,466 bitcoins at month-end.”

As of May 31, 2025, Canaan’s current mining projects add to 7.27 EH/s of operating and 8.75 EH/s deployed hashrate. In America, 3.09 EH/s is energized, including a 0.02 EH/s in Canada. Ethiopia’s contribute 4.13 EH/s energized and the Middle East facility delivers 0.03 EH/s energized. Total estimated global capacity stands at 8.75 EH/s.

“Our installed and operational hashrates reached 8.75 EH/s and 7.27 EH/s, respectively, underscoring the continued buildout of our global mining operations,” stated Zhang. “We also achieved a new historical high in installed computing power, while maintaining a competitive all-in power cost. This performance demonstrates our ability to execute on our strategy of efficient and sustainable growth.”

“With Bitcoin prices climbing to historic levels, we’re seeing increased global demand for our mining machines,” commented Zhang. “Combined with the strength of our mining operations and our disciplined approach to capital allocation, we remain confident in our business fundamentals and our ability to deliver long-term value to our shareholders.”

On June 9, 2025, the company announced that its CEO and its CFO acquired 817,268 of American Depositary Shares at an average price of US$0.76 per ADS, showing their belief in the company’s future.

“My share purchase underscores my belief in Canaan’s vision and the tremendous opportunities ahead,” stated Zhang in the announcement. “Both James and I believe there is a significant disconnect between our current ADS price and the value we believe we can deliver in the coming years.”

This post Canaan Announces Record Bitcoin Mining Month with Over 109 BTC Mined first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 5627e59c:d484729e

2025-06-11 18:51:20

@ 5627e59c:d484729e

2025-06-11 18:51:20I am the space\ In which your experience takes place

You could never meet me\ For I hold no identity

The only way to really see me\ Is to be me

-

@ 7459d333:f207289b

2025-06-11 16:34:01

@ 7459d333:f207289b

2025-06-11 16:34:01There are tons of purely online services—LLMs, VPS, VPN, email, media, storage, messaging—that can be provided anonymously without needing to register as legal entities.

And honestly, when they do register legally, it often only harms them or leads to enshittification. We've seen this countless times with providers that start with good intentions but end up being forced to disclose whatever data they have about customers (even if it's just IP addresses and login times) to "authorities." Telegram, Proton, Signal, maybe Infomaniak soon... the list goes on.

Even cock.li (https://stacker.news/items/1003596) had to deal with intelligence agencies just to provide a noble service.

So why bother registering a company or doing things "legally" on the internet? Why not just handle the business anonymously and get paid in Bitcoin? It's cheaper to operate, more sustainable long-term, and immune to whatever dumb law comes up in whatever country.

The trust problem

From the operator's side, it's pretty clear. But what about users? The fact that there's a registered company gives potential customers some sense of trust. There's a door to knock on in the worst case, or at least an opportunity to complain through the legal system of whatever country the company is registered in.

So maybe the missing piece is a way of offering trust to existing and potential customers—something that signals the owner is there to stay and has something to lose if the service is discontinued or not provided properly.

A potential solution: Decentralized bonds

In JoinMarket, to signal that coinjoin offer makers are serious and reduce sybil attack risk, they use fidelity bonds—just locked coins for some time.

But maybe for online service companies we need something more. Some kind of network of mediators and arbitrators to resolve conflicts, similar to Bisq. The mediators would have locked coins in a DAO and get a commission per case they handle. The DAO funds come from transaction fees. Mediators risk their coins if they act in bad faith, and the DAO operates as some kind of democratic system.

Or maybe there's a better way.

What do you think?

Before diving into the technical details, what's your opinion about the future of online services? What do you think about anonymous-owner services? Is this a direction we should be moving toward?

https://stacker.news/items/1003623

-

@ 5627e59c:d484729e

2025-06-11 18:48:00

@ 5627e59c:d484729e

2025-06-11 18:48:00Love, I thank you for your warmth\ Ever lifting

You keep me charmed\ Ever drifting

May I be me\ And you be you

In a perfect harmony\ Embracing all life makes us grow through

-

@ 95543309:196c540e

2025-06-11 15:28:08

@ 95543309:196c540e

2025-06-11 15:28:08Pandas: Nature’s Gentle GiantsPandas are instantly recognizable by their black-and-white coats. These gentle creatures spend most of their days eating bamboo—up to 12–16 hours daily, consuming as much as 40 pounds in a single day.

Despite their massive appetites, pandas can digest only about 17% of the bamboo they eat, so they need to eat constantly.Baby pandas are born tiny, pink, and blind, weighing just a few ounces and measuring about 15 cm—roughly the size of a pencil. They open their eyes after six to eight weeks and stay with their mothers for about 18 months before venturing off on their own.

Pandas are excellent climbers and swimmers, and they have a special “thumb”—an extension of their wrist bone—to help them grip bamboo.Unlike other bears, pandas do not hibernate. Instead, they move to lower, warmer areas in winter and keep feasting on bamboo. Thanks to conservation efforts, panda numbers in the wild are increasing, offering hope for the future of these unique animals.

-

@ 5627e59c:d484729e

2025-06-11 18:42:09

@ 5627e59c:d484729e

2025-06-11 18:42:09Jaren tellen\ Hoeft voor mij niet

Verhalen vertellen\ Over geluk en verdriet

Een warme haven\ Veilig en fijn

Dromen voorgedragen\ Onschuldig en rein

Momenten ervaard, geleerd\ En geïntegreerd

Ideeën, geloven en gevoelens\ Gevormd en gecreëerd

Zonder eind of echt begin\ Vallen, groeien, leren, stoeien

Een gezin in een gezin met een gezin erin\ Gezind gericht blijft liefde vloeien

-

@ b1ddb4d7:471244e7

2025-06-11 15:02:05

@ b1ddb4d7:471244e7

2025-06-11 15:02:05Hosted at the iconic Palace of Culture and Science—a prominent symbol of the communist era—the Bitcoin FilmFest offers a vibrant celebration of film through the lens of bitcoin. The venue itself provides a striking contrast to the festival’s focus, highlighting bitcoin’s core identity as a currency embodying independence from traditional financial and political systems.

𝐅𝐢𝐱𝐢𝐧𝐠 𝐭𝐡𝐞 𝐜𝐮𝐥𝐭𝐮𝐫𝐞 𝐰𝐢𝐭𝐡 𝐩𝐨𝐰𝐞𝐫𝐟𝐮𝐥 𝐦𝐮𝐬𝐢𝐜 𝐯𝐢𝐛𝐞𝐬.

Warsaw, Day Zero at #BFF25 (European Bitcoin Pizza Day) with @roger__9000, MadMunky and the @2140_wtf squad

pic.twitter.com/9ogVvWRReA

pic.twitter.com/9ogVvWRReA— Bitcoin FilmFest

(@bitcoinfilmfest) May 28, 2025

(@bitcoinfilmfest) May 28, 2025This venue represents an era when the state tightly controlled the economy and financial systems. The juxtaposition of this historical site with an event dedicated to bitcoin is striking and thought-provoking.

The event features a diverse array of activities, including engaging panel discussions, screenings of both feature-length and short films, workshops and lively parties. Each component designed to explore the multifaceted world of bitcoin and its implications for society, offering attendees a blend of entertainment and education.

The films showcase innovative narratives and insights into bitcoin’s landscape, while the panels facilitate thought-provoking discussions among industry experts and filmmakers.

Networking is a significant aspect of the festival, with an exceptionally open and friendly atmosphere that foster connections among participants. Participants from all over Europe gather to engage with like-minded individuals who share a passion for BTC and its implications for the future.

The open exchanges of ideas foster a sense of community, allowing attendees to forge new connections, collaborate on projects, and discuss the potential of blockchain technology implemented in bitcoin.

The organization of the festival is extraordinary, ensuring a smooth flow of information and an expertly structured schedule filled from morning until evening. Attendees appreciate the meticulous planning that allowed them to maximize their experience. Additionally, thoughtful touches such as gifts from sponsors and well-chosen locations for various events contribute to the overall positive atmosphere of the festival.

Overall, the Bitcoin FilmFest not only highlights the artistic expression surrounding bitcoin but also serves as a vital platform for dialogue—about financial freedom, the future of money, and individual sovereignty in a shifting world.

The event successfully bridges the gap between a historical symbol of control and a movement that celebrates freedom, innovation, and collaboration in the digital age, highlighting the importance of independence in financial systems while fostering a collaborative environment for innovation and growth.

Next year’s event is slated for June 5-7 2026. For further updates check: https://bitcoinfilmfest.com/

-

@ cae03c48:2a7d6671

2025-06-11 15:01:42

@ cae03c48:2a7d6671

2025-06-11 15:01:42Bitcoin Magazine

Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First TimeBitcoin has officially completed 30 consecutive days trading above the $100,000 mark, marking a historic milestone in its 15 year journey. Bitcoin achieved its all time high (ATH) of $111,980 on May 22, almost hitting $112,000.

JUST IN: Bitcoin has stayed above $100,000 for 30 consecutive days for the first time ever!

pic.twitter.com/nfccEK3Wf0

pic.twitter.com/nfccEK3Wf0— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

In the last 30 days, Bitcoin saw a 10 percent pullback right after reaching its ATH, dropping to $100,428. However, it wasn’t for long, as Bitcoin is back at $109,511 at the time of writing. Momentum appears to be building once again, signaling to be bullish.

“Anytime price is able to punch through a major resistance level, whether psychological or historical, and successfully hold, it is certainly a bullish sign,” said the technical analyst of Wolfe Research Read Harvey. “What really stood out to us was price’s ability to hold that level on the back test, when it briefly fell to $100,000 on Thursday. It also happened to align perfectly with the 50-day moving average. … We feel this should act as a launching pad back towards the recent highs of $112,000.”

In the past month, Bitcoin has surged into the financial and political mainstream. Several U.S. states including New Hampshire first, followed by Arizona, and then Texas have passed legislation recognizing Bitcoin as a strategic reserve asset. These laws reflect a growing trend of state level interest in using Bitcoin as a financial hedge and as part of long term fiscal policy.

“New Hampshire didn’t just pass a bill; it sparked a movement,” stated the CEO and Co-Founder of Satoshi Action Dennis Porter.

At the same time, financial institutions are rapidly expanding their Bitcoin offerings. JP Morgan has started providing loans backed by Bitcoin ETFs as collateral. BlackRock’s Bitcoin ETF has entered a period of intense activity, generating record trading volumes and capturing the attention of both retail and institutional investors.

To date, a total of 228 public and private entities have Bitcoin in their balance sheets and in the last 30 days, companies like GameStop, Know Labs, and Norway-based NBX have added Bitcoin as a strategic reserve. All these companies are treating Bitcoin not just as a speculative asset, but as a key part of their long term financial plans. This growing corporate trend follows the example set by Strategy, but it’s now happening on a much larger scale.

At the 2025 Bitcoin conference, the Vice President of the United States of America, JD Vance said in his speech, “Fifty million Americans own Bitcoin. I think it’s gonna be 100 million before too long.”

This post Bitcoin Officially Traded Above $100,000 For 30 Consecutive Days For The First Time first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 5627e59c:d484729e

2025-06-11 21:18:05

@ 5627e59c:d484729e

2025-06-11 21:18:05Hello Bumble\ You busy bee

You're going way\ Too fast for me

Going here and there\ You search for gold

Yet tumble straight\ Into what's old

Now I'm not here\ To make a gain

Nor to fix\ What's in disdain

Instead I'm just\ A humble bee

Who wants to get\ To know thee

-

@ 5627e59c:d484729e

2025-06-11 18:36:19

@ 5627e59c:d484729e

2025-06-11 18:36:19Happy New Year!

Happy New Year, my dearest human family\ Happy New Year, my dearest animal family

Dear children of the Earth\ I wish you all a magical year

May it be utterly new\ Ever-changing\ New now

And may your journey say\ Life is amazing! I'm in a maze\ Life is awesome! Quite some awe\ Life is magical! True alchemy

I am human\ Black woman, I love you so\ Life-giver of my origin, the negro [nigiro]

I am\ Thus physical and non-physical meet

Life is to be\ As the elements are and compete\ And as they collide with one another\ One becomes aware of an other\ And so life sets on a journey\ To discover the other

Animal life is set to explore\ Allowing all experience the other has in store\ Life left to experience without a voice\ Until it discovers there is an 'I'\ And it has a choice

Human life is to be inside a human body\ Thus fusion between intellect and feeling\ Gets to express its perspective\ Inside infinity

Truly, a magical gift\ My Holy Trinity

And so from human life flow many voices\ As it navigates through infinite choices\

Thus I say

Life is magic\ A gift for all that is here\ Perceived by too many as tragic\ Take care of your vision, I tell you, my dear [tell-a-vision]

Life is magic\ And words are spells\ Placing your aim beyond your reach\ It takes away efficiency from your speech

Life is magic\ Above all else\ Even when it has me feeling blue\ Seemingly left without a clue

Still I say

Perfection\ You are everything\ And I am of you

The source, the mirror\ And the reflection

-

@ 95543309:196c540e

2025-06-11 14:33:33

@ 95543309:196c540e

2025-06-11 14:33:33$$\int_{-\infty}^{\infty} e^{-x^2/2} \, dx = \sqrt{2\pi}$$$$\sum_{k=1}^n k^2 = \frac{n(n+1)(2n+1)}{6}$$$$\lim_{x \to \infty} \left(1 + \frac{1}{x}\right)^x = e$$$$\begin{vmatrix}a & b \\c & d\end{vmatrix} = ad - bc$$$$\frac{d}{dx}\left(\frac{x^2 + 1}{x - 1}\right)$$$$\iiint_V (\nabla \cdot \mathbf{F}) \, dV = \oint_{\partial V} \mathbf{F} \cdot d\mathbf{S}$$$$\binom{n}{k} = \frac{n!}{k!(n-k)!}$$$$\ln\left(\frac{f(x)}{g(x)}\right) = \ln f(x) - \ln g(x)$$$$\forall x \in \mathbb{R}, \exists y \in \mathbb{R} \text{ such that } x + y = 0$$$$\sqrt{\frac{x^2 + y^2}{x^2 - y^2}}$$$$\begin{array}{c|c}A & B \\hlineC & D\end{array}$$$$\sum_{i=1}^n \sum_{j=1}^n a_{ij}x_i x_j$$$$\mathcal{L}{f(t)}(s) = \int_0^\infty e^{-st}f(t)\,dt$$$$\frac{\partial^2 u}{\partial t^2} = c^2 \frac{\partial^2 u}{\partial x^2}$$$$\mathbf{A} = \begin{pmatrix}a_{11} & a_{12} \\a_{21} & a_{22}\end{pmatrix}, \quad\mathbf{B} = \begin{pmatrix}b_{11} & b_{12} \\b_{21} & b_{22}\end{pmatrix}$$$$\underbrace{a + b + \dots + z}{26}$$$$\left(\frac{a}{b}\right)^n = \frac{a^n}{b^n}$$$$\langle \psi | \phi \rangle = \int{-\infty}^{\infty} \psi^*(x)\phi(x) \, dx$$$$\oint_C \mathbf{F} \cdot d\mathbf{r} = \iint_S (\nabla \times \mathbf{F}) \cdot d\mathbf{S}$$$$\prod_{k=1}^n \left(1 + \frac{1}{k}\right) = \frac{(n+1)}{1}$$$$S(\omega)=1.466\, H_s^2 \frac{\omega_0^5}{\omega^6} \exp\Bigl[-3^{\frac{\omega}{\omega_0}}\Bigr]^2$$

-

@ cae03c48:2a7d6671

2025-06-11 14:01:23

@ cae03c48:2a7d6671

2025-06-11 14:01:23Bitcoin Magazine

KULR Technology Group Announces $300 Million ATM Offering To Invest in Their Bitcoin TreasuryKULR Technology Group, Inc. (NYSE American: KULR) announced it has entered into a Controlled Equity Offering Sales Agreement with Cantor Fitzgerald & Co. and Craig-Hallum Capital Group LLC, enabling the company to sell up to $300 million of its common stock in an at-the-market (ATM) offering to support its Bitcoin treasury reserve.

JUST IN: Public company KULR is raising up to $300 million to buy more #Bitcoin

pic.twitter.com/Jg0yaAFkI7

pic.twitter.com/Jg0yaAFkI7— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

Under the agreement, Cantor Fitzgerald will act as the sole sales agent, using commercially reasonable efforts to sell shares at market prices. The offering will be made under an existing shelf registration and may occur from time to time based on market conditions and company discretion.

As of June 6, 2025, KULR’s common stock was trading at $1.18 per share. The total number of shares issued under the agreement will not exceed the company’s authorized but unissued shares, after accounting for shares already reserved or committed.

“Our common stock is listed and traded on the NYSE American LLC under the symbol ‘KULR,’” stated the filing.

KULR will pay the sales agents a commission of up to 3.0% of the gross sales proceeds. The agents are considered underwriters under the Securities Act of 1933, and KULR has agreed to indemnify them against certain liabilities.

“Our business and an investment in our common stock involve significant risks,” stated the filing. “These risks are described under the caption “Risk Factors” beginning on page S-6 of this prospectus supplement, and the risk factors incorporated by reference into this prospectus supplement and the accompanying base prospectus.”

KULR started adopting bitcoin as their primary treasury reserve asset in December 2024. Their strategy focuses on acquiring and holding bitcoin by using cash flows that exceed working capital requirements, issuing equity debt securities or raising more capital to purchase more Bitcoin.

“We view our bitcoin holdings as long term holdings and expect to continue to accumulate bitcoin,” mentioned the filing on page S-2. “We have not set any specific target for the amount of bitcoin we seek to hold, and we will continue to monitor market conditions in determining whether to engage in additional bitcoin purchases. This overall strategy also contemplates that we may periodically sell bitcoin for general corporate purposes or in connection with strategies that generate tax benefits in accordance with applicable law, enter into additional capital raising transactions, including those that could be collateralized by our bitcoin holdings, and consider pursuing strategies to create income streams or otherwise generate funds using our bitcoin holdings.”

This post KULR Technology Group Announces $300 Million ATM Offering To Invest in Their Bitcoin Treasury first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 5627e59c:d484729e

2025-06-11 21:17:31

@ 5627e59c:d484729e

2025-06-11 21:17:31We only see\ What we are

What we are not\ We cannot see

This is how we know\ Reality is happening within\ Our own being

And experience is a consequence\ Of who we believe to be

As long as we deny\ And don't want to see

All the ways\ We think to be

Reality will seem\ Outside of our grasp

And separate\ From our experience of life

Such is our power

Yet such power\ Could only be

Of that which holds\ The entirety

-

@ 79be667e:16f81798

2025-06-11 18:33:35

@ 79be667e:16f81798

2025-06-11 18:33:35De laatste zonnestralen van de dag streken over de eeuwige golven en weerkaatsten als lichtpuntjes in de ogen van schipper Joris terwijl hij nog een slok nam van zijn glazen fles die de vorm had van het hoofd van een oude monnik.

Gekregen van een oude vrouw uit de bergen van de Himalaya, zorgde de rum genaamd 'Old Monk' voor een verwarmend gezelschap op deze eenzame kerstnacht.

Joris had met zijn boot naar India gevaren nadat zijn vrouw hem had verlaten en hij een Indiër had ontmoet die had gezegd: "Waar ik vandaan kom, zijn vrouwen vrij en worden ze niet gezien als enkel en alleen de mooie lichamen die zij bezitten of als eeuwig bezit van een gezin."

Verward en ongelovig had Joris gekeken naar de wereld en besefte dat vrouwen inderdaad slechts gezien werden als hun fysieke schoonheid, genegeerd werden voor hun koesterende gevoeligheid en bekritiseerd werden door hun spontane intensheid en had hierop voor twee jaar lang gezocht in India naar deze vrije vrouwen met als enig resultaat een oude vrouw te ontmoeten die alleen in de bergen woonde en dagelijks haar wijsheid deelde met ieder luisterend oor.

Daar ging het doorzichtig monnikshoofd en verliet met een grote gebogen vlucht de hand van schipper Joris toen plots met groot kabaal de boot abrupt tot stilstand kwam en Joris hals over kop naar de andere kant van het dek geslingerd werd.

Het monnikshoofd verdween in het donker terwijl Joris zijn lichaam probeerde te lokaliseren en met zijn ogen wijd open zijn hersenen zo veel mogelijk informatie probeerde door te spelen.

Tevergeefs, want zijn enorme verschot werd gevolgd door een enkel groeiende verbazing, ongeloof en desoriëntatie toen de boot begon te kantelen.

De bundel licht, afkomstig van de mast van de boot, zwierde doorheen het donker en kwam te schijnen op een gigantische rots in het midden van de zee die werd bezeten door een oogverblindende glinstergroene schijn.

Uit het donker kwam het monnikshoofd, dat nog steeds in volle vlucht was, in het vizier van de lichtbundel en plaatste zich exact tussen de glinstergroene verschijning en Joris waarbij Joris doorheen het monnikshoofd gezegend werd met het zicht op een pracht van een zeemeermin die uitnodigend poseerde op de rots.

Met een luide plons viel Joris achterover in het water toen hij zich realiseerde dat vrouwen zichzelf ook lieten vangen door lust en hun uiterlijke opmaakcompetities en met een dankbare glimlach zonk hij naar de bodem van de zee en was opnieuw geboren.

-

@ 5627e59c:d484729e

2025-06-11 21:15:21

@ 5627e59c:d484729e

2025-06-11 21:15:21Muziek\ Jij harmonieus geluid

Een gevoel zo uniek\ Op geen andere manier geuit

Ik ben zo dankbaar voor de vrijheid die jij me schenkt\ Om gewoon even te zijn\ In dit dierbare moment

-

@ f683e870:557f5ef2

2025-06-11 13:33:34

@ f683e870:557f5ef2

2025-06-11 13:33:34This is what has been achieved on a per-project basis since receiving the grant from Opensats.

npub.world

Together with nostr:npub1wf4pufsucer5va8g9p0rj5dnhvfeh6d8w0g6eayaep5dhps6rsgs43dgh9, I have been refining npub.world to deliver real-time, WoT-powered profile search. These refinements include:

-

implementing new desings by nostr:npub1t3gd5yefglarhar4n6uh34uymvft4tgu8edk5465zzhtv4rrnd9sg7upxq

-

moving to the new Vertex DVM standard

-

improved URL and npub parsing

Vertex crawler

Due to the architectural mistakes I made when designing the first version, I have embarked on a full rewrite of the crawler. The new architecture is simpler, more modular and more performant, and I am confident that it will provide a stable foundation on which to expand the Vertex offering with additional functionalities and analytics.

The major differences with the old version are:

-

the

DBandRWSinterfaces have been broken up and simplified into smaller ones, each defined by their own packages -

a simplified, more efficient algorithm for updating random walks

-

use of a custom-built cache to speed up graph computations

-

a worker pool pattern to speed up event archiving

These changes have reduced the LOC by more than half while improving performance by \~10x. Of independent interest is the new pipe package, which can also be used by other projects to crawl the Nostr network.

Vertex Relay and DVMs

The Vertex relay has been updated several times, and now supports four DVM services:

-

Verify Reputation -

Recommend Follows -

Rank Profiles -

Search Profile

For each service, customers can choose the algorithm to use by specifing the sort option to use between:

-

followerCount -

globalPagerank -

personalizedPagerank

More information can be found at https://vertexlab.io/.

Overall, the relay has processed more than 100,000 DVM requests, with the current daily rate standing at around 1,500.

rely

Unsatisfied with the khatru relay framework, I've decided to build my own called rely, with the goal of being simpler and more stable. I've not just scratched a personal hitch: I've used khatru for several months now (the Vertex relay is still using it) and I encountered several issues, some of which I've solved with PRs to the underlying go-nostr library.

The main differences between khatru and rely:

-

rely is much simpler, both architecturally and in terms of LOC (less than half)

-

rely has a solid testing approach, where a random yet reproducible high traffic hits the relay to see what breaks

-

rely implements a worker pool pattern where a configurable number of goroutines process the incoming requests from clients. On the other hand, khatru process them in the HandleWebsocket goroutine, which is spawned every time a client connects. This is dangerous in my opinion because if too many clients connect, memory usage would spike and the relay could potentially crash.

New DVM spec

I helped to draft this new proposal to update the DVM spec, which is one of the most controversial NIPs. While almost everyone agrees that it needs to change, there is no consensus on how to move forward. I believe our proposal is a sensible approach that defines discovery, usage, and error patterns while leaving flexibility for specific DVM kinds.

Looking at the future

Next I am going to move the Vertex relay to the rely framework and to the new crawler package. I expect that this will increase the performance and will make things more solid and more simple. After all of this refactoring and simplification, it will be time to finally add features to the Vertex offering. I have an ambitious roadmap consisting of:

-

accepting ecash for DVM requests

-

designing client-side validation schemes for the DVM responses

-

expanding the pagerank algorithm to make use of mutes and reports

-

adding an WoT impersonator check to npub.world

-

adding a nip05 check to npub.world

-

make a relystore package with some plug&play databases for rely.

-

-

@ 5627e59c:d484729e

2025-06-11 21:14:37

@ 5627e59c:d484729e

2025-06-11 21:14:37Gelukkig zijn\ Is de waarde van mijn leven

Gewoon dankbaar te bestaan\ Geen mens heeft me ooit zo'n mooi cadeau gegeven

Dankbaar voor mijn sprankelen\ Mijn doen en voor mijn streven

Maar ook dat ik mag wankelen\ Mag vallen en mag beven

Want wat er ook gebeurt\ Het duurt steeds maar voor even

De wijsheid van mijn hart\ Voor alles is een reden

Het leven brengt mij deugd\ En soms brengt het me pijn

Maar nooit neemt het die vreugd\ De toelating om hier te zijn

De kans om iets te leren\ Te zien en om te groeien

Geeft mij kracht te accepteren\ Te omarmen en te bloeien

-

@ 3104fbbf:ac623068

2025-06-11 11:42:29

@ 3104fbbf:ac623068

2025-06-11 11:42:29 It is possible to shift your mindset in adulthood — but it’s exceedingly rare. There’s no exact science to it, yet roughly 2% of people seem truly able — or willing — to change their worldview past a certain age. As arbitrary as that number may sound, it often holds true in practice. It helps explain human behavior and why the remaining 98% — those unwilling to embrace deep inner change — will never dare to step outside their comfort zone.

It is possible to shift your mindset in adulthood — but it’s exceedingly rare. There’s no exact science to it, yet roughly 2% of people seem truly able — or willing — to change their worldview past a certain age. As arbitrary as that number may sound, it often holds true in practice. It helps explain human behavior and why the remaining 98% — those unwilling to embrace deep inner change — will never dare to step outside their comfort zone.Learning new skills holds real, practical value: it’s how we redirect our lives toward something better. But it requires a willingness to evolve the way we think. In my view, the only truly helpful approach is to share insights, ideas, and methods — and then let each individual decide whether they’re ready to invest time and energy into rethinking their patterns, learning what’s needed, and transforming their habits or beliefs. There are no shortcuts.

As someone who’s committed to this path and aware of what’s at stake for humanity in the next 20 years — especially with AI — I want to share a few signposts for those ready to lift their heads out of the sand.

Discernment in the Age of AI: More Essential Than Ever

We are living through a radical upheaval, driven by artificial intelligence and the exponential acceleration of technology. And I’m convinced of one thing: if a belief, ideology, or conviction born in the 21st century isn’t constantly reevaluated — with curiosity, humility, and intellectual rigor — by confronting opposing views, digging into what’s uncomfortable, and honestly questioning what we don’t yet understand, then we’re not thinking. We’re just gambling on blind faith — or refusing to face reality. And eventually, that catches up with us.

The longer you wait to adapt to technological acceleration, the more you risk becoming trapped in an invisible loop — one where you don’t even realize just how far behind you’ve fallen.

Take independent thinking and discernment — arguably the most vital skills in an AI-driven world. If you rely on AI in a domain where you lack critical sensitivity, you’re setting yourself up for disaster.

When you use AI to move a project forward, you need to instantly recognize when something feels off: “That doesn’t make sense. It’s too cliché. It doesn’t work.” And the AI — trained to please you — will agree: “You’re right.”

But… what if you’re wrong?

That’s where the downward spiral begins — a kind of creative death. Many people:

Settle for the AI’s first answer,

Fail to grasp that this response is just the most statistically likely, the most "expected,"

And end up with something generic, bland, and forgettable.

We have to move beyond that. We have to enter that narrow zone where we seek something original, alive, new — and keep pushing: “No, that’s not it yet.” It’s through this iterative process that refinement happens, and real value emerges.

Used this way, AI becomes a powerful tool — one that accelerates research, eliminates friction, and streamlines the creative process.

Prompting — the art of crafting precise, thoughtful instructions for the AI — is learned through practice, trial and error. But it also demands a specific mental posture: one rooted in curiosity, humility, and the willingness to question yourself. You must be willing to doubt your own assumptions, to challenge your own blind spots.

The Mental Exoskeleton: Amplifying Human Potential Through AI

We’re living in a near-magical era. If you’ve already built a solid foundation of skills, AI acts like an exoskeleton — allowing you to lift far more than you could on your own. If you’re already strong, it amplifies your strength. If you’ve learned how to think and how to use your mind, it multiplies your intellectual power.

And if you’ve cultivated curiosity and broad general knowledge — instead of locking yourself into hyper-specialization — for the first time in history, that’s an edge. Because AI enables you to instantly dive deeper into any of those fields and connect the dots across disciplines. Suddenly, it feels like you can tap into the depth of global expertise, on demand, in virtually any subject.

But again, this all hinges on mindset. If most people don’t know what they want, can’t think independently, clearly, or precisely, and don’t even know what questions to ask — AI won’t help them move forward. It won’t fix a broken mentality. In the end, it’s the 2% — those who can ask the right questions, think strategically, and challenge their own thinking — who will truly harness this technology.

And because of that, the gap is going to widen. The divide between the capable and the incapable, the wealthy and the struggling, is only going to deepen. The 2% will continue to accelerate, while those who don’t know how to wield this tool effectively will be left behind. In this sense, AI doesn’t level the playing field — it magnifies inequality.

Anything we currently believe to be beyond AI’s reach won’t remain so for long. When AI becomes fully autonomous — faster and more intelligent than any living human — there will be almost nothing it can’t help us do or manifest in the real world.

The Coming Divide in Human Evolution

The only real distinction will be this: this new form of intelligence will never truly be human.

And not everyone will react positively. While radical transhumanists will push the boundaries without restraint, a strong backlash is likely — perhaps even violent — driven by a new wave of puritanical neo-conservatism. These individuals will fiercely oppose any form of technological enhancement of human abilities. The result could be intense civil unrest.