-

@ 7f6db517:a4931eda

2025-06-11 19:04:04

@ 7f6db517:a4931eda

2025-06-11 19:04:04

I often hear "bitcoin doesn't interest me, I'm not a finance person."

Ironically, the beauty of sound money is you don't have to be. In the current system you're expected to manage a diversified investment portfolio or pay someone to do it. Bitcoin will make that optional.

— ODELL (@ODELL) September 16, 2018

At first glance bitcoin often appears overwhelming to newcomers. It is incredibly easy to get bogged down in the details of how it works or different ways to use it. Enthusiasts, such as myself, often enjoy going down the deep rabbit hole of the potential of bitcoin, possible pitfalls and theoretical scenarios, power user techniques, and the developer ecosystem. If your first touch point with bitcoin is that type of content then it is only natural to be overwhelmed. While it is important that we have a thriving community of bitcoiners dedicated to these complicated tasks - the true beauty of bitcoin lies in its simplicity. Bitcoin is simply better money. It is the best money we have ever had.

Life is complicated. Life is hard. Life is full of responsibility and surprises. Bitcoin allows us to focus on our lives while relying on a money that is simple. A money that is not controlled by any individual, company, or government. A money that cannot be easily seized or blocked. A money that cannot be devalued at will by a handful of corrupt bureaucrat who live hundreds of miles from us. A money that can be easily saved and should increase in purchasing power over time without having to learn how to "build a diversified stock portfolio" or hire someone to do it for us.

Bitcoin enables all of us to focus on our lives - our friends and family - doing what we love with the short time we have on this earth. Time is scarce. Life is complicated. Bitcoin is the most simple aspect of our complicated lives. If we spend our scarce time working then we should be able to easily save that accrued value for future generations without watching the news or understanding complicated financial markets. Bitcoin makes this possible for anyone.

Yesterday was Mother's Day. Raising a human is complicated. It is hard, it requires immense personal responsibility, it requires critical thinking, but mothers figure it out, because it is worth it. Using and saving bitcoin is simple - simply install an app on your phone. Every mother can do it. Every person can do it.

Life is complicated. Life is beautiful. Bitcoin is simple.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-11 19:03:18

@ dfa02707:41ca50e3

2025-06-11 19:03:18- This version introduces the Soroban P2P network, enabling Dojo to relay transactions to the Bitcoin network and share others' transactions to break the heuristic linking relaying nodes to transaction creators.

- Additionally, Dojo admins can now manage API keys in DMT with labels, status, and expiration, ideal for community Dojo providers like Dojobay. New API endpoints, including "/services" exposing Explorer, Soroban, and Indexer, have been added to aid wallet developers.

- Other maintenance updates include Bitcoin Core, Tor, Fulcrum, Node.js, plus an updated ban-knots script to disconnect inbound Knots nodes.

"I want to thank all the contributors. This again shows the power of true Free Software. I also want to thank everyone who donated to help Dojo development going. I truly appreciate it," said Still Dojo Coder.

What's new

- Soroban P2P network. For MyDojo (Docker setup) users, Soroban will be automatically installed as part of their Dojo. This integration allows Dojo to utilize the Soroban P2P network for various upcoming features and applications.

- PandoTx. PandoTx serves as a transaction transport layer. When your wallet sends a transaction to Dojo, it is relayed to a random Soroban node, which then forwards it to the Bitcoin network. It also enables your Soroban node to receive and relay transactions from others to the Bitcoin network and is designed to disrupt the assumption that a node relaying a transaction is closely linked to the person who initiated it.

- Pushing transactions through Soroban can be deactivated by setting

NODE_PANDOTX_PUSH=offindocker-node.conf. - Processing incoming transactions from Soroban network can be deactivated by setting

NODE_PANDOTX_PROCESS=offindocker-node.conf.

- Pushing transactions through Soroban can be deactivated by setting

- API key management has been introduced to address the growing number of people offering their Dojos to the community. Dojo admins can now access a new API management tab in their DMT, where they can create unlimited API keys, assign labels for easy identification, and set expiration dates for each key. This allows admins to avoid sharing their main API key and instead distribute specific keys to selected parties.

- New API endpoints. Several new API endpoints have been added to help API consumers develop features on Dojo more efficiently:

- New:

/latest-block- returns data about latest block/txout/:txid/:index- returns unspent output data/support/services- returns info about services that Dojo exposes

- Updated:

/tx/:txid- endpoint has been updated to return raw transaction with parameter?rawHex=1

- The new

/support/servicesendpoint replaces the deprecatedexplorerfield in the Dojo pairing payload. Although still present, API consumers should use this endpoint for explorer and other pairing data.

- New:

Other changes

- Updated ban script to disconnect inbound Knots nodes.

- Updated Fulcrum to v1.12.0.

- Regenerate Fulcrum certificate if expired.

- Check if transaction already exists in pushTx.

- Bump BTC-RPC Explorer.

- Bump Tor to v0.4.8.16, bump Snowflake.

- Updated Bitcoin Core to v29.0.

- Removed unnecessary middleware.

- Fixed DB update mechanism, added api_keys table.

- Add an option to use blocksdir config for bitcoin blocks directory.

- Removed deprecated configuration.

- Updated Node.js dependencies.

- Reconfigured container dependencies.

- Fix Snowflake git URL.

- Fix log path for testnet4.

- Use prebuilt addrindexrs binaries.

- Add instructions to migrate blockchain/fulcrum.

- Added pull policies.

Learn how to set up and use your own Bitcoin privacy node with Dojo here.

-

@ eb0157af:77ab6c55

2025-06-11 19:02:39

@ eb0157af:77ab6c55

2025-06-11 19:02:39Over 40 experts from the Bitcoin technical community sign a petition for the adoption of CTV and CSFS opcodes within six months.

A portion of the Bitcoin developer community appears to have reached consensus regarding the next protocol upgrade. An open letter signed by over 40 experts requests the priority implementation of two opcodes: OP_CHECKTEMPLATEVERIFY (CTV, BIP-119) and OP_CHECKSIGFROMSTACK (CSFS, BIP-348).

The developers believe that activating CTV and CSFS constitutes the most appropriate next step for Bitcoin’s evolution. The letter emphasizes how, despite the existence of various proposals to improve the protocol, CTV and CSFS stand out for being extensively reviewed, for their implementation simplicity, and for proving to be both secure and widely requested by the community.

CTV: five years of development and refinement

OP_CHECKTEMPLATEVERIFY was first formalized in BIP-119 over five years ago. Despite numerous attempts at refinement or replacement, it remains the preferred method for enforcing pre-generated transaction sequences using consensus, the developers state.

According to the letter’s signatories, implementing CTV on Bitcoin would unlock functionality for:

- scaling solutions;

- secure vault systems;

- network congestion control;

- non-custodial mining;

- Discreet Log Contracts (DLC).

CSFS: eight years of proven experience

The developers declare that OP_CHECKSIGFROMSTACK is a primitive opcode, implemented on the open source Blockstream Elements platform for at least eight years. It does not represent a significant computational burden compared to Bitcoin’s most used opcode, OP_CHECKSIG, the document’s signatories state.

When combined with CTV, CSFS enables LN-symmetry, an improvement for Lightning Network. Additionally, it unlocks a variety of other use cases.

The letter’s signatories ask Bitcoin Core contributors to prioritize the review and integration of CTV and CSFS within the next six months. This timeline is considered appropriate to allow for rigorous final review and activation planning.

The letter was signed by over 40 figures from the Bitcoin community, including developers such as Andrew Poelstra, Calle, Christian Decker, and Robin Linus, along with representatives from industry companies such as Chun Wang from f2pool, representatives from Zeus, Luxor Mining, Mara Pool, and Cake Wallet.

The post Bitcoin developers call for implementation of CTV and CSFS: letter to the community appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-11 19:01:58

@ cae03c48:2a7d6671

2025-06-11 19:01:58Bitcoin Magazine

The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since LaunchAmerican Bitcoin Corp (ABTC), a newly formed private Bitcoin mining company backed by Eric Trump and Donald Trump Jr., announced in a June 10 SEC filing that it has acquired 215 Bitcoin (BTC) since launching operations on April 1, 2025. The reserve is currently valued at approximately $23 million, showing their drive and commitment to Bitcoin.

JUST IN: American Bitcoin Corp (private) reports to have 215 #bitcoin (per 31 May) since it's launch on April 1, 2025.

They will merge with Gryphon Digital $GRYP and become public under ticker $ABTC.

They mention "Bitcoin accumulation is not a side effect of ABTC’s business.… pic.twitter.com/wq1Uxr76Z2

— NLNico (@btcNLNico) June 10, 2025

“Bitcoin accumulation is not a side effect of ABTC’s business. It is the business,” the company stated in the filing.

Furthermore, ABTC has entered into a merger agreement with Gryphon Digital Mining ($GRYP), and the combined company is expected to begin public trading under the ticker $ABTC as early as Q3 2025.

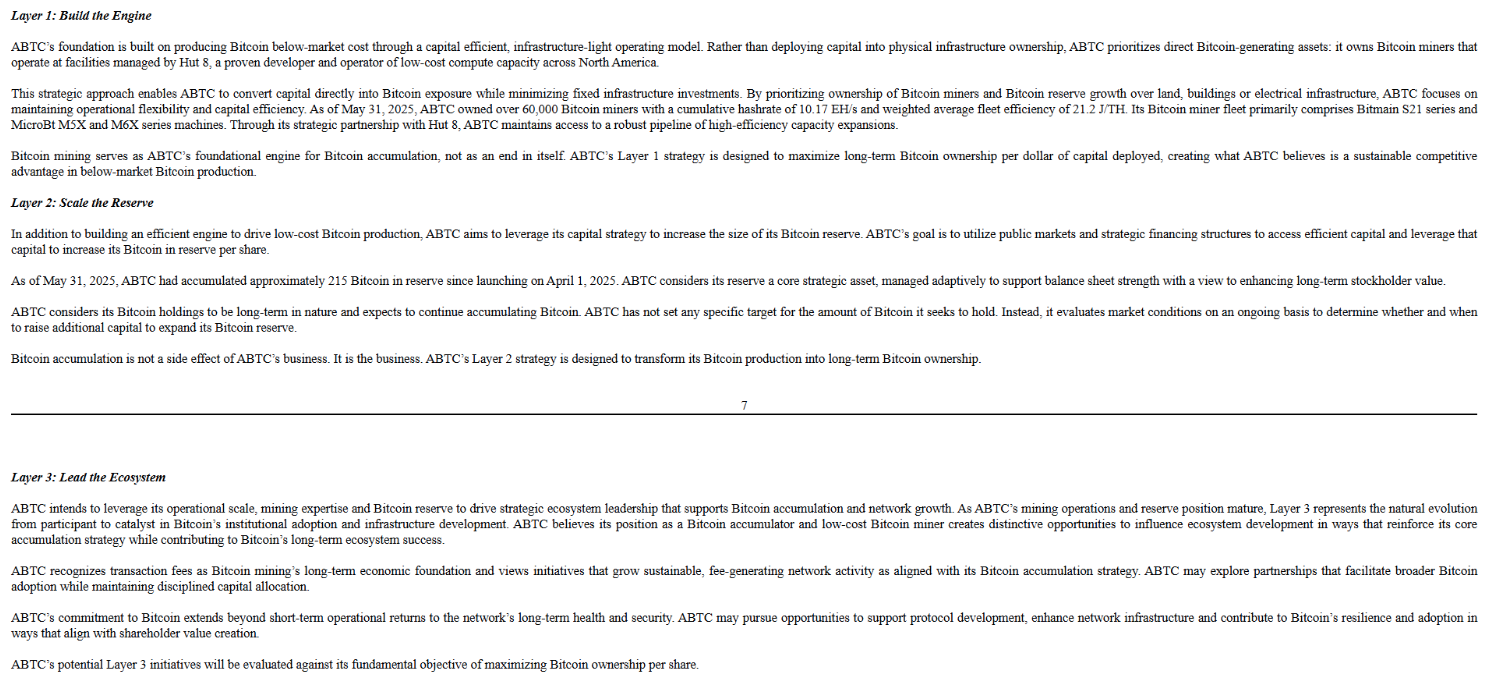

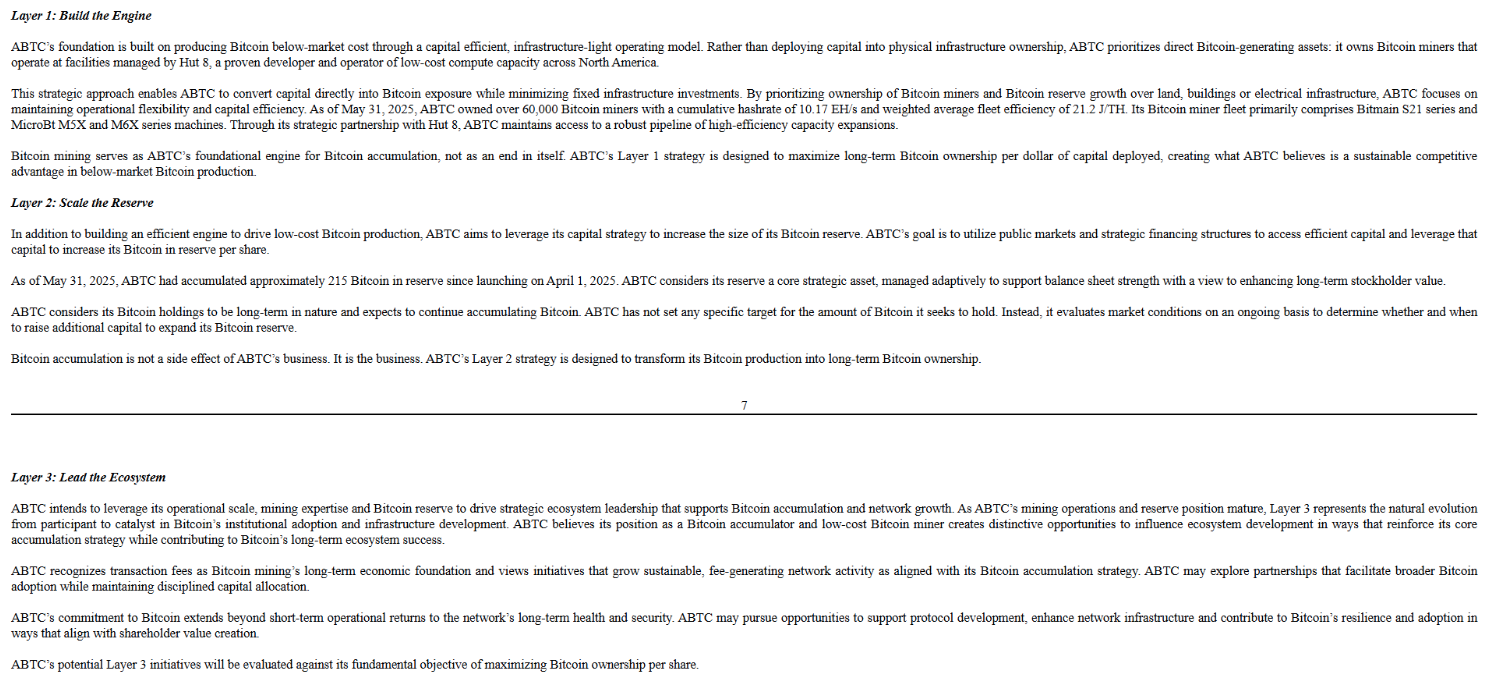

The company’s three-layer strategic plan—outlined in the SEC disclosure—details a focused approach:

Layer 1: Build the Engine

- ABTC’s foundation is built on “producing Bitcoin below-market cost through a capital efficient, infrastructure-light operating model.” The company owns and operates over 60,000 miners from Bitmain and MicroBt, running primarily on Hut 8-managed facilities.

Layer 2: Scale the Reserve

- ABTC had “accumulated approximately 215 Bitcoin in reserve since launching on April 1, 2025,” which it considers a long-term strategic asset. The firm states its goal is “to utilize public markets and strategic financing structures to access efficient capital and leverage that capital to increase its Bitcoin in reserve per share.”

Layer 3: Lead the Ecosystem

- The company ultimately aims to use its operational scale and mining position to drive industry-wide adoption. “ABTC may pursue opportunities to support protocol development, enhance network infrastructure and contribute to Bitcoin’s resilience and adoption in ways that align with shareholder value creation.”

For mining rewards, ABTC uses Foundry and Luxor pools with sub-1% fees and relies on Coinbase Custody for secure cold storage, featuring multi-factor authentication and strict withdrawal protocols.

With operations across Niagara Falls, NY; Medicine Hat, AB; and Orla, TX, ABTC is leveraging strategic partnerships—primarily with Hut 8—to scale its Bitcoin holdings while influencing the broader crypto mining ecosystem.

This post The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since Launch first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-11 19:01:34

@ cae03c48:2a7d6671

2025-06-11 19:01:34Bitcoin Magazine

Michael Saylor: The Bear Market Is Not Coming Back And Bitcoin Is Going To $1 MillionToday, the Executive Chairman and CEO of Strategy Michael Saylor commented on the company’s aggressive Bitcoin-based strategy in a recent interview at Bloomberg, emphasizing that Bitcoin is not going to zero, it is going to $1 million.

“I think we’re in a digital gold rush and you’ve got ten years to acquire all your bitcoin before there’s no bitcoin left for you,” Saylor said. “The competition is a virtuous competition.”

JUST IN: Michael Saylor said the bear market is not coming back and Bitcoin is going to $1 million

— Bitcoin Magazine (@BitcoinMagazine) June 10, 2025

Saylor also said that Bitcoin is not going to have bear markets anymore and the price is going to $1 million per coin.

“Winter is not coming back,” commented Sayor. “We are past that phase. If Bitcoin is not going to zero, it is going to $1 million. The President of the United States is determined. He supports Bitcoin, the cabinet supports Bitcoin, Scott Bessent supports Bitcoin, Paul Atkins is shown himself to be an enthusiastic believer of Bitcoin and digital assets… Bitcoin has gotten through its riskiest period.”

He also pointed out that international firms are rapidly entering the space.

“Metaplanet is the hottest company in Japan right now, they went from $10 million to a $1 billion market cap to a $5 billion market cap. They’re going to raise billions of dollars. They’re going to pull the liquidity out of the Japanese market. So they’ll be raising capital in Tokyo and the Tokyo Stock Exchange… It’s not competitive. It’s cooperative.”

Strategy’s approach is far from traditional. The company is not just buying and holding Bitcoin; it is building financial instruments around it, which Saylor believes sets them apart.

“Our company has a very particular business model,” he stated. “It’s to issue Bitcoin-backed credit instruments like Bitcoin-backed bonds and especially Bitcoin-backed preferred stocks. We’re the only company in the world that’s ever been able to issue a preferred stock backed by Bitcoin. We’ve done three of them in the past five months.”

Rather than viewing Bitcoin treasury holdings or ETFs as competitors, Saylor explained that Strategy is targeting a different segment of the market entirely.

“We’re not competing against the Bitcoin treasury companies. We’re competing against ETFs like PFF that have portafolios of preferred stocks or corporate bond portfolios that are trading as ETFs in the public market, and the way we compete is we offer 400 basis points more yield on an instrument that is much more heavily collateralized and more transparent… That’s $100 trillion or more of capital in those markets,” explained Saylor.

He emphasized that Strategy’s Bitcoin balance sheet gives it a unique edge, giving the company the ability to design unique financial products.

“Our advantage is that we’re 100% Bitcoin… It’s impossible to issue Bitcoin-backed convertible preferred and Bitcoin-backed fixed preferred unless you’re willing to make 100% of your balance sheet Bitcoin.”

“I’m not really worried about competition from JPMorgan or Berkshire Hathaway,” concluded Saylor. “I would love for them to enter the Bitcoin space, buy up a bunch of Bitcoin. When they do it, they’ll be paying $1,000,000 a Bitcoin. The price will go to the moon.”

This post Michael Saylor: The Bear Market Is Not Coming Back And Bitcoin Is Going To $1 Million first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 79be667e:16f81798

2025-06-11 18:38:49

@ 79be667e:16f81798

2025-06-11 18:38:49The world around me\ Is assumed to be

Through sensory observations\ This appears to me

What I experience\ Is for me

But the ultimate experience\ Is for me\ To be

-

@ d325f9e9:07ed2267

2025-06-11 08:50:04

@ d325f9e9:07ed2267

2025-06-11 08:50:04Trying tags #Hello #this

-

@ 79be667e:16f81798

2025-06-11 18:29:06

@ 79be667e:16f81798

2025-06-11 18:29:06Zonneschijn\ Stralen, lachen, zo fijn\ Moge de wereld dankbaar zijn

De vrouw, mijn gevoeligheid\ Bron van creativiteit

Genietend niets doen in het gras\ Met wat brood en wat wijn in het glas

-

@ 79be667e:16f81798

2025-06-11 18:27:32

@ 79be667e:16f81798

2025-06-11 18:27:32Spontaniteit\ Creativiteit

Iets visueel of gewoon geluid\ Het moet eruit

Ik doe mezelf cadeau aan jou\ Omdat ik van het leven hou

-

@ 79be667e:16f81798

2025-06-11 18:25:54

@ 79be667e:16f81798

2025-06-11 18:25:54Veroorzaakt door de wereld rond mij\ Vormen de wereld in mij

Verwaarloosd door de wereld rond mij\ Overgelaten aan mij

Een groene brug komt uit mij\ Verbindt mij met wij\ En laat ons samen vrij

-

@ 79be667e:16f81798

2025-06-11 18:23:32

@ 79be667e:16f81798

2025-06-11 18:23:32In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ 2b998b04:86727e47

2025-06-11 18:14:59

@ 2b998b04:86727e47

2025-06-11 18:14:59For years, GitHub has been the default home for open source developers. It built its reputation on transparency, collaboration, and a commitment to giving coders a place to share and improve their work. But since Microsoft's acquisition in 2018, subtle changes have begun to surface—not all of them in service to the user.

GitHub is still free. Public repositories remain free. Even private repositories are free, to a point. GitHub Pages, Actions, and Codespaces offer incredibly powerful tools to build and deploy projects at no cost—until you hit certain usage limits or need team-scale features.

But the deeper question is this: what do you give up in exchange?

Microsoft Doesn’t Give Away Infrastructure for Free

GitHub, VSCode, Copilot, and Azure form a tightly integrated ecosystem. On the surface, it's all about productivity. But underneath, it's about data. Your code trains their models. Your habits inform their products. Your workflows deepen their lock-in.

Take Copilot, for example: it’s not just a coding assistant, it’s a data-harvesting engine built on top of a centralized platform. The more you use GitHub, the more Microsoft knows about what developers are building—and what they might buy.

Free Isn’t Sovereign

As developers, we have to ask hard questions:

-

What happens when the free tier disappears or changes?

-

Can I take my work elsewhere without breaking my stack?

-

Who owns the insights derived from my development patterns?

These questions aren’t hypothetical. We’ve seen them play out with Heroku, Medium, Twitter, and countless others. Free turns into friction. Then friction becomes control.

Alternatives Are Emerging

Thankfully, there are options:

-

Codeberg, Gitea, and SourceHut for Git hosting

-

Cloudflare Pages for static sites + edge functions

-

Railway, Fly.io, or even VPS hosting for dynamic apps

-

Nostr and IPFS for decentralized publishing

These aren’t always drop-in replacements. But they represent a healthier direction—one aligned with freedom, transparency, and a proof-of-work ethos rather than a proof-of-data-capture business model.

My Move Away from GitHub (Sort Of)

I’m not deleting my GitHub account. It’s still the best way to reach other devs. But for key projects—especially those that touch on identity, sovereignty, or censorship resistance—I’m migrating:

-

Private infrastructure where needed

-

Cloudflare for front-end deployments

-

Nostr for publishing and archiving

-

Git mirroring to open alternatives

Because the tools we use shape the future we build. And if the platform is free, but the product is you—it's time to re-evaluate.

#ProofOfWork #OpenSource #Cloudflare #DecentralizeEverything #Nostr #GitSovereignty #MicrosoftStack

-

-

@ b158def8:467b5a98

2025-06-11 17:20:01

@ b158def8:467b5a98

2025-06-11 17:20:01When it comes to maintaining a spotless environment, very few things are as important as floor cleanliness. Floors withstand the highest punishment in both a commercial atmosphere and a home; dirt and stains gradually get deposited, and flooring tends to show wear and tear Professional floor cleaners in Sutton.investing in a professional company aptly manifests the proper routines to maintain the beauty and durability of your flooring. Daras Cleaning is a well-established name in the industry, providing a complete range of specialist cleaning services, tackling every floor cleaning requirement with utmost professionalism and care.

**Why Professional Floor Cleaning Matters ** Floors might just be surfaces for walking on, but they help to set the entire ambiance of a space. Clean and well-maintained floors, real or virtual, will create a good first impression-whether it is in welcoming a client to your office or guests to your home. Routine mopping or vacuuming hardly works on deep grime, persistent stains, or residue accumulation. Mixed.

As one would expect floor cleaning for these professionals, it goes beyond simple dirt removal on the surfaces to more advanced techniques with the best equipment to bring floors back to their original shine. Professional cleaners know the types of methods they would have to employ on carpeted areas or tiles, wood, or vinyl flooring. Thus, a positive outcome without any destruction on these floors is guaranteed.

**What Sets Daras Cleaning Apart? ** As a trusted provider of specialist cleaning services in Sutton, Daras Cleaning creates a delicate balance between reliability and flexibility to accommodate the unique needs of every customer. Their team has been vetted, insured, and trained to the highest standards, providing guaranteed satisfaction on any type of cleaning service for both private and commercial clients. With several years of experience behind them, Daras Cleaning also understands that every floor and every client is different, and that is why custom cleaning plans that accommodate unique requirements are offered.

Daras Cleaning was hailed by clients for its quick and efficient work at reasonable prices; thus, it invariably pops up at the top of the list for anyone searching for a professional floor-cleaning service in Sutton. Its commitment to appreciating staff and constant improvement ensures that jobs are done with the utmost care and precision.

Your Comprehensive Solution for Floor Cleaning

- Daras Cleaning provides a broad range of specialist cleaning services for all flooring types and their cleaning needs: Carpet and Upholstery Cleaning: This involves bringing carpets and upholstered furniture back to life via the use of modern methods for steam cleaning and stain removal. Cleaning and Treatment of Hard Floors: Deep-clean, polish, and seal tile, stone, wood, and vinyl surfaces, restoring shine and preventing wear and tear.

- Commercial Floor Cleaning: For a truly clean and hygienic workplace environment for staff and clients alike, solutions are tailored for offices, communal areas, retail spaces, etc. *** High-Pressure Jetting: **For the efficient removal of ingrained dirt and stains from outdoor surfaces such as car parks and industrial floors.

- Thanks to combining the use of market-leading machines with environmentally friendly cleaning solutions, Daras Cleaning guarantees a thorough cleaning that is safe for your family, employees, and the environment.

****Advantages of Specialist Cleaning Services

Improved Appearance: Floors are shiny, clean, and hospitable, exerting their beneficial influence upon the house or business.

Prolonged Life: Periodic professional cleaning prevents dirt and grit from building up, causing damage to the flooring in the long run. Therefore, it means less hassle and lots of money saved by avoiding repair bills.

Indoor air quality will be improved since this process gets rid of allergens, bacteria and dust mites. Daras Cleaning is there to take care of your floors, so you do not need to worry about keeping them clean over time.

**Adaptable and trustworthy ** Daras Cleaning keenly appreciates the limitations of modern life and business. Therefore, it offers flexible schedules and tailor-made cleaning programs. They carry out maintenance and one-time deep cleaning as per the client's convenient arrangements to coincide with their time so as not to minimize disruption and guarantee flawless results on each occasion.

**Experience the Daras cleaning difference ** If you want quality Specialist cleaning services, Daras Cleaning offers the best services. Their emphasis on good service, client contentment and improving always keeps them ahead of the competition. In short, using Daras Cleaning’s expert services will keep your home clean, safe and beautiful all over the floors.

-

@ 5627e59c:d484729e

2025-06-11 18:23:32

@ 5627e59c:d484729e

2025-06-11 18:23:32In een zee van mogelijkheden\ Kunnen we best veel tijd aan dromen besteden

Dromen is een universele taal\ Het wordt gedaan door ons allemaal

Het is het woord\ Dat deze gelijkheid de grond in boort

-

@ cae03c48:2a7d6671

2025-06-11 17:01:49

@ cae03c48:2a7d6671

2025-06-11 17:01:49Bitcoin Magazine

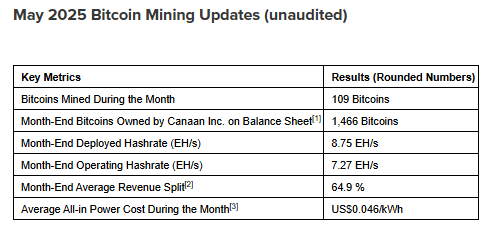

Canaan Announces Record Bitcoin Mining Month with Over 109 BTC MinedCanaan Inc. (NASDAQ: CAN), an innovator in Bitcoin mining, reported today their bitcoin mining update for the month ending May 31, 2025, with 109 bitcoins mined. The company’s total bitcoin holdings rose to 1,466 BTC.

“In May 2025, despite the 10% increase in tariffs on our Malaysia-made Bitcoin mining machines due to ongoing U.S. trade uncertainties, we remained focused on executing our strategic priorities with discipline and agility,” said the Chairman and CEO of Canaan Nangeng Zhang. “By capitalizing on the favorable momentum in bitcoin prices, we achieved a 25% month-over-month increase in our bitcoin production, reaching a record 109 bitcoins. This performance marks a new monthly high for our mining production and brings our total cryptocurrency holdings to an all-time high of 1,466 bitcoins at month-end.”

As of May 31, 2025, Canaan’s current mining projects add to 7.27 EH/s of operating and 8.75 EH/s deployed hashrate. In America, 3.09 EH/s is energized, including a 0.02 EH/s in Canada. Ethiopia’s contribute 4.13 EH/s energized and the Middle East facility delivers 0.03 EH/s energized. Total estimated global capacity stands at 8.75 EH/s.

“Our installed and operational hashrates reached 8.75 EH/s and 7.27 EH/s, respectively, underscoring the continued buildout of our global mining operations,” stated Zhang. “We also achieved a new historical high in installed computing power, while maintaining a competitive all-in power cost. This performance demonstrates our ability to execute on our strategy of efficient and sustainable growth.”

“With Bitcoin prices climbing to historic levels, we’re seeing increased global demand for our mining machines,” commented Zhang. “Combined with the strength of our mining operations and our disciplined approach to capital allocation, we remain confident in our business fundamentals and our ability to deliver long-term value to our shareholders.”

On June 9, 2025, the company announced that its CEO and its CFO acquired 817,268 of American Depositary Shares at an average price of US$0.76 per ADS, showing their belief in the company’s future.

“My share purchase underscores my belief in Canaan’s vision and the tremendous opportunities ahead,” stated Zhang in the announcement. “Both James and I believe there is a significant disconnect between our current ADS price and the value we believe we can deliver in the coming years.”

This post Canaan Announces Record Bitcoin Mining Month with Over 109 BTC Mined first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 0b118e40:4edc09cb

2025-06-06 13:58:07

@ 0b118e40:4edc09cb

2025-06-06 13:58:07The idea of Bitcoin as an internet native currency, and eventually a global one, is coming to life slowly. But historically, the idea of global currency has haunted the world’s financial imagination for nearly a century.

From Keynes’s Bancor in 1944 to Zhou Xiaochuan’s post-crisis proposal in 2009 to today’s renewed debates, the idea resurfaces every time the global economy fractures.

Could this time be different with Bitcoin?

I decided to trace the idea of global currency through several decades and books. I may have missed some parts, so feel free to add. I’ll keep this brief and leave the books I’ve read below.

In the beginning

It all started on July 1, 1944. 730 delegates from 44 Allied nations, including major powers like the US, UK, Soviet Union, China, and France, gathered at the Mount Washington Hotel in Bretton Woods, New Hampshire. They spent 2 weeks figuring out how the new international monetary and financial system would be, post WW2

After WW1, the treaty of Versailles was needed, but imposed harsh reparations that devastated economies and contributed to the rise of fascism, such as Hitler, Mussolini and gang.

So when folks met up in 1944 (WW2 was almost ending), the goal was to prevent another Great Depression, another global conflict and build a stable global economic order.

2 main proposals were discussed in Bretton Woods.

-

John Maynard Keynes, representing the UK, proposed the creation of a global currency called Bancor. It will be issued through a global central bank known as the International Clearing Union (ICU).

-

Harry Dexter White, representing the US, promoted a dollar-based system. Countries would peg their currencies to the US. dollar backed by gold. He also led the creation of the IMF and the World Bank.

To understand how both of these proposals work, let's look at an example.

-

Country A (Germany): Massive exporter

-

Country B (USA): Massive importer

-

Country C (Brazil): Balanced trade (imports = exports)

***Based on Dexter’s model and the current USD-based system, ***

Say Germany sells $1B worth of cars to the US. The US pays in dollars, increasing its trade deficit. Germany accumulates dollars as reserves or buys the US Treasury bonds. Over time, the US continues running trade deficits, while Germany keeps hoarding dollars. Hence the unsustainable debt of the US.

***In Keynes’s Bancor system, ***

If Germany sells $1B worth of cars to the US, then the US does not pay in dollars. Instead, the ICU credits Germany with 1B Bancors and debits the US with -1B Bancors.

The ICU police this. If Germany exceeds the surplus threshold, it pays interest or penalties to discourage hoarding. If the US exceeds its deficit threshold, it is warned to rebalance trade or face restrictions.

Here, Germany is incentivized to import more (e.g., from Brazil) or invest in global development. The US is encouraged to export more or reduce consumption. Brazil, with balanced trade, enjoys stability in Bancor flows and avoids pressure.

The idea behind Bancor was a zero-sum balancing act. No country could become “too big to fail” due to excessive deficits. But it was too complicated and idealistic in assuming every country could maintain balanced trade.

Dexter on the other hand had a few tricks up his sleeve. In the end, Dexter’s USD dominance proposal was adopted.

The Bretton Woods system established the US dollar as the central global currency

Why did dollar dominance win over Bancor?

Simplicity often wins over complexity. But more so ICU felt too centralized, asking nations to surrender economic autonomy to a global body. That didn’t sit well in a post-war world where sovereignty was non-negotiable. That and idealist economic trade balance views.

Dexter’s dollar-based system on the other hand wasn’t fair play at all. It was centralized and authoritarian in its design.

So how did Dexter pull it off?

They had gold. They were ahead in economic recovery.

And they had nuclear weapons.

At the time, the US held nearly 2/3 of the world’s gold reserves. It was a significant advantage in advocating for a gold-backed dollar as the bedrock of global trade.

The US proposed a fixed gold peg at $35 per ounce.

From a broader geopolitical backdrop, the global population in 1944 was about 2.3 billion, a fraction of today’s 8 billion. The world was far less interconnected. The war had devastated Europe, Russia, and much of Asia. Infrastructure, economies, and entire cities were in ruins. The US, by contrast, had faced far fewer casualties and damages. Being geographically isolated, it had minimal domestic losses, around a tenth of what Europe suffered, and its economy was poised to rebuild faster.

But gold dominance and economic recovery alone didn’t secure US financial dominance.

American scientific breakthroughs had already signaled global power. Physicists like Leo Szilard and Albert Einstein, who had fled Europe, helped develop nuclear weapons. Their intent was deterrence, not destruction. But once the bomb existed, it changed geopolitics overnight. The US had military dominance. And after Hiroshima and Nagasaki in 1945, it became the undisputed superpower.

In the end, the USD won and the vision for neutral global currency faded.

And 20 years passed on…

France sends its warship to the US

Under Bretton Woods, countries could exchange dollars for gold, but the US had been printing more dollars than it had gold to back it. And it used it to fund the costly Vietnam War and domestic programs like the Great Society under LBJ.

Belgian-American economist Robert Triffin pointed out a fatal flaw in the Bretton Woods system that came to be known as the Triffin dilemma.

-

The world needed US dollars for liquidity and trade.

-

But the more dollars the US pumped out, the less credible its gold promise became.

Yet the US kept promising that every dollar was still convertible to gold at $35 per ounce.

French President Charles de Gaulle saw this as financial imperialism. He called it the “exorbitant privileged position”. The world had to pay for what they bought with the money they have, but not the US.

So in 1965, France did something unexpected. It sent a warship to New York Harbor to physically retrieve French gold reserves held by the Federal Reserve.

Would it have escalated to war? Maybe. But likely not. It was perhaps more of a diplomatic theatre and a sovereign flex. France was exercising its right under the Bretton Woods agreement to convert dollars into gold. But doing it with military formality was to send a signal to the world that they don’t trust the US system anymore.

It was one of the first major public blows to the dollar’s credibility. And France wasn’t alone. Other countries like West Germany and Switzerland followed suit, redeeming dollars for gold and draining US reserves.

The Nixon shock

Given they did not have enough gold, the IMF introduced Special Drawing Rights (SDRs) in 1969. SDRs were an international reserve asset, created to supplement gold and dollar reserves. Instead of relying solely on the US dollar, SDRs were based on a basket of major currencies (originally gold-backed but later diversified).

The idea was to reduce the world’s dependence on the dollar and avoid a liquidity crisis. But SDRs were a little too late and a little too weak to solve the underlying problem.

By 1971, the US could no longer sustain the illusion. President Nixon “closed the gold window,” suspending dollar convertibility to gold.

The Bretton Woods collapsed and this marked the beginning of fiat money dominance.

The French pursuit

While France demanded justice in one corner of the world, the French franc, specifically the CFA franc, has been dominant in parts of Africa since 1945, long before 1971.

After WWII, France created two CFA franc zones:

-

West Africa: Communauté Financière Africaine (XOF)

-

Central Africa: Coopération Financière en Afrique Centrale (XAF)

These zones included 14 African countries, many of which were former French colonies. France maintained monetary control via currency convertibility guarantees and representation in African central banks. Till today it has influence over these country’s monetary policy.

Colonisation hasn't ended in some parts of the world.

Did countries stop using the USD after the Nixon shock 1971?

Nope. The US dollar was no longer convertible to gold and it dismantled the fixed exchange rate system. But most countries did not stop using the USD as their dominant reserve or trade currency. There were no decent alternatives. Instead, they floated their currencies or maintained a soft peg to the dollar or a basket of currencies.

The USD remained dominant in oil trade (OPEC priced oil in USD) - petrodollar deal, global debt markets and FX reserves (central banks kept holding USD).

In 1997, when many Southeast Asian countries were still pegged to the USD, Soros claimed that SEA will tank. The US further increased its credit rates leading to capital flight and eventual tanking of these countries leading to Asian Financial Crisis '97. Many financial crisis has similar vibe.

The 1999 Euro launch

The idea of a shared currency appeared again, this time through the forms of Euro. It was a mandatory system for member states of the Eurozone, and came with centralized authority, the European Central Bank (ECB), which controlled monetary policy for all participating nations.

At first glance, the euro seemed like a win. It eliminated exchange rate fluctuations, making trade within the Eurozone smoother. It gave weaker economies access to lower borrowing costs and helped Europe establish itself as a financial heavyweight. Today, the euro is the second most-used reserve currency after the US dollar.

But it came at a cost. Countries that adopted the euro lost monetary sovereignty and could no longer print their own money or adjust interest rates to respond to local crises. This became painfully clear during Greece’s debt crisis, where strict monetary policies prevented the country from devaluing its currency to recover. The one-size-fits-all approach meant that economies as different as Germany and Greece had to follow the same rules, often to the detriment of weaker nations. Debt-ridden countries like Italy and Spain were forced into harsh austerity measures because they could not manipulate their currency to ease financial strain. Meanwhile, richer nations like Germany and the Netherlands felt they were unfairly propping up struggling economies, creating political tension across the EU.

In recent years, the euro has faced pressure from global trade tensions, monetary tightening, and geopolitical instability contributing to market volatility and periodic depreciation against other major currencies.

The Bretton Woods 2.0

Believe it or not, after all that, there was a call for Bretton Woods 2.0. Yet another global currency dream.

When the housing market collapsed in 2008 followed by a series of domino effects, global banks froze lending, economies contracted, and panic set in. The crisis exposed how fragile the international financial system had become as it was overly reliant on debt, under-regulated, and centered around the US dollar.

Many countries, especially in the Global South and emerging markets, started to question whether a system built around a single national currency was sustainable.

China, for instance, had been holding huge amounts of US debt while the US printed more dollars through bailouts and quantitative easing. This created global imbalances as exporting nations were lending money to the US to keep the system running, while taking on the risk of dollar depreciation.

In 2009, China’s central bank openly proposed replacing the US dollar with a neutral global reserve currency suggesting SDRs (Special Drawing Rights) issued by the IMF instead.

These concerns led to a wave of calls from world leaders for a “Bretton Woods 2.0” , a modern rethinking of the post-WWII economic order. At G20 summits in London in 2009, countries like France, China, and Russia pushed for reforms in global financial institutions and more balanced power sharing.

In the end, the IMF received more funding, and some banking regulations were tightened in the years after. But no real overhaul happened. No surprise there? The dollar remained dominant.

The foundation of the global economy didn’t change, even though trust in it had been deeply shaken.

The growth of BRICS

In 2023, Brazil, Russia, India, China, and South Africa began discussing the idea of a shared currency or alternative mechanism to reduce the dependence on USD ie de-dollarisation. The sanctions on Russia didn't help. After Russia’s invasion of Ukraine, the US and its allies froze Russia’s dollar reserves and cut it off from SWIFT, the “backbone of global banking communication”. This made one thing clear. If you fall out with Washington, your access to the global economy can vanish overnight.

China’s growing economic power also gave it more leverage to process alternative options. It would trade in Yuan with Russia and Iran.

I know many still say it's at its early stage, but I see many countries hedging their bets quietly and aligning with Putin and Xi. It became more obvious after US imposed tariffs on multiple nations, signaling that economic tools can double as political weapons. The world’s second financial system is slowly forming.

What is the world looking for, for the last century ?

For the last 80 years, from Bretton Woods to multiple financial crises, from the birth of the Euro to the rise of BRICS, through war and peace, we’ve been circling around the same ideal. A global currency that is :

-

Simple

-

Free from dominant power

-

Decentralised

-

Borderless

-

Scarce

-

Transparent

-

Inclusive, with self custody

-

Resilient in crisis

-

Built for individual financial sovereignty

-

A new backbone for global finance, owned by no one

It doesn’t matter where you’re from, what politics you believe in, or how your economy leans. The answer keeps pointing in the same direction:

Bitcoin

This is the first true global currency.

And it’s just there

Waiting...

.

.

.

Some books that might interest you :

-

The Battle of Bretton Woods by Benn Steil

-

Goodbye, Great Britain by Kathleen Burk and Alec Cairncross

-

The Ghost of Bancor by Tommaso Padoa-Schioppa

-

Confessions of an Economic Hitman by John Perkins

-

The Blood Bankers by James S. Henry

-

-

@ 2b998b04:86727e47

2025-06-11 19:36:40

@ 2b998b04:86727e47

2025-06-11 19:36:40🌋 Ka ʻImi i ka Pono: Seeking What’s Right

A 7-Day Series on Sovereignty, Bitcoin, and the Soul of the Islands

> "Man is not free unless he wills to be free."\ > — Johann Gottlieb Fichte

Hawai‘i understands sovereignty. It always has.\ But it was taken — first with pen and politics, then with force and fiat.

Bitcoin offers something different:\ A way to reclaim sovereignty without violence.\ A tool for self-rule, not state rule.\ A system built not on empire, but on truth and time.

This week, I’ll be posting a 7-part series exploring this tension:\ Between the Hawai‘i that was, the system that is, and the future that might be — if we choose to build on bedrock instead of paper.

I don’t know if there’s a traditional Hawaiian word for a 7-day week — maybe there doesn’t need to be.\ Time moves differently on these islands.\ But for the next 7 days, I’ll mark each reflection as a kind of modern lā hoʻomanaʻo — a day of remembering, reckoning, and restoring.

This is personal. It’s philosophical. It’s also unfinished.

But that’s what sovereignty looks like:\ Not something given — something reclaimed.

Stay tuned. Stay akamai.\ 🟧\ — Andrew G. Stanton (aka akamaister)

-

@ 7459d333:f207289b

2025-06-11 16:34:01

@ 7459d333:f207289b

2025-06-11 16:34:01There are tons of purely online services—LLMs, VPS, VPN, email, media, storage, messaging—that can be provided anonymously without needing to register as legal entities.

And honestly, when they do register legally, it often only harms them or leads to enshittification. We've seen this countless times with providers that start with good intentions but end up being forced to disclose whatever data they have about customers (even if it's just IP addresses and login times) to "authorities." Telegram, Proton, Signal, maybe Infomaniak soon... the list goes on.

Even cock.li (https://stacker.news/items/1003596) had to deal with intelligence agencies just to provide a noble service.

So why bother registering a company or doing things "legally" on the internet? Why not just handle the business anonymously and get paid in Bitcoin? It's cheaper to operate, more sustainable long-term, and immune to whatever dumb law comes up in whatever country.

The trust problem

From the operator's side, it's pretty clear. But what about users? The fact that there's a registered company gives potential customers some sense of trust. There's a door to knock on in the worst case, or at least an opportunity to complain through the legal system of whatever country the company is registered in.

So maybe the missing piece is a way of offering trust to existing and potential customers—something that signals the owner is there to stay and has something to lose if the service is discontinued or not provided properly.

A potential solution: Decentralized bonds

In JoinMarket, to signal that coinjoin offer makers are serious and reduce sybil attack risk, they use fidelity bonds—just locked coins for some time.

But maybe for online service companies we need something more. Some kind of network of mediators and arbitrators to resolve conflicts, similar to Bisq. The mediators would have locked coins in a DAO and get a commission per case they handle. The DAO funds come from transaction fees. Mediators risk their coins if they act in bad faith, and the DAO operates as some kind of democratic system.

Or maybe there's a better way.

What do you think?

Before diving into the technical details, what's your opinion about the future of online services? What do you think about anonymous-owner services? Is this a direction we should be moving toward?

https://stacker.news/items/1003623

-

@ 79be667e:16f81798

2025-06-11 19:11:59

@ 79be667e:16f81798

2025-06-11 19:11:59I am here too\ In the same space like you

In the same situation I'm in\ It's a matter of positioning

I cannot leave this place I'm in\ It was brought about\ By what's been happening

So please don't look at me\ For what I can or cannot do for you\ But look at what is happening for me\ And what is happening for you

Let's communicate\ Not orchestrate

Because there's something I wish to do\ And there's a place I wish to go to

And I'm sure that there is too\ In your heart a fire\ Known by only you

So let us listen, look and see\ For what's true for you\ And what's true for me

That we may act upon what's here\ In order for us both to take a step\ In the direction we wish to steer

-

@ 95543309:196c540e

2025-06-11 15:28:08

@ 95543309:196c540e

2025-06-11 15:28:08Pandas: Nature’s Gentle GiantsPandas are instantly recognizable by their black-and-white coats. These gentle creatures spend most of their days eating bamboo—up to 12–16 hours daily, consuming as much as 40 pounds in a single day.

Despite their massive appetites, pandas can digest only about 17% of the bamboo they eat, so they need to eat constantly.Baby pandas are born tiny, pink, and blind, weighing just a few ounces and measuring about 15 cm—roughly the size of a pencil. They open their eyes after six to eight weeks and stay with their mothers for about 18 months before venturing off on their own.

Pandas are excellent climbers and swimmers, and they have a special “thumb”—an extension of their wrist bone—to help them grip bamboo.Unlike other bears, pandas do not hibernate. Instead, they move to lower, warmer areas in winter and keep feasting on bamboo. Thanks to conservation efforts, panda numbers in the wild are increasing, offering hope for the future of these unique animals.

-

@ cae03c48:2a7d6671

2025-06-11 15:01:43

@ cae03c48:2a7d6671

2025-06-11 15:01:43Bitcoin Magazine

The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since LaunchAmerican Bitcoin Corp (ABTC), a newly formed private Bitcoin mining company backed by Eric Trump and Donald Trump Jr., announced in a June 10 SEC filing that it has acquired 215 Bitcoin (BTC) since launching operations on April 1, 2025. The reserve is currently valued at approximately $23 million, showing their drive and commitment to Bitcoin.

JUST IN: American Bitcoin Corp (private) reports to have 215 #bitcoin (per 31 May) since it's launch on April 1, 2025.

They will merge with Gryphon Digital $GRYP and become public under ticker $ABTC.

They mention "Bitcoin accumulation is not a side effect of ABTC’s business.… pic.twitter.com/wq1Uxr76Z2

— NLNico (@btcNLNico) June 10, 2025

“Bitcoin accumulation is not a side effect of ABTC’s business. It is the business,” the company stated in the filing.

Furthermore, ABTC has entered into a merger agreement with Gryphon Digital Mining ($GRYP), and the combined company is expected to begin public trading under the ticker $ABTC as early as Q3 2025.

The company’s three-layer strategic plan—outlined in the SEC disclosure—details a focused approach:

Layer 1: Build the Engine

- ABTC’s foundation is built on “producing Bitcoin below-market cost through a capital efficient, infrastructure-light operating model.” The company owns and operates over 60,000 miners from Bitmain and MicroBt, running primarily on Hut 8-managed facilities.

Layer 2: Scale the Reserve

- ABTC had “accumulated approximately 215 Bitcoin in reserve since launching on April 1, 2025,” which it considers a long-term strategic asset. The firm states its goal is “to utilize public markets and strategic financing structures to access efficient capital and leverage that capital to increase its Bitcoin in reserve per share.”

Layer 3: Lead the Ecosystem

- The company ultimately aims to use its operational scale and mining position to drive industry-wide adoption. “ABTC may pursue opportunities to support protocol development, enhance network infrastructure and contribute to Bitcoin’s resilience and adoption in ways that align with shareholder value creation.”

For mining rewards, ABTC uses Foundry and Luxor pools with sub-1% fees and relies on Coinbase Custody for secure cold storage, featuring multi-factor authentication and strict withdrawal protocols.

With operations across Niagara Falls, NY; Medicine Hat, AB; and Orla, TX, ABTC is leveraging strategic partnerships—primarily with Hut 8—to scale its Bitcoin holdings while influencing the broader crypto mining ecosystem.

This post The Trump’s American Bitcoin Merges with Gryphon, Reports 215 BTC on Balance Sheet Since Launch first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ b1ddb4d7:471244e7

2025-06-11 15:02:05

@ b1ddb4d7:471244e7

2025-06-11 15:02:05Hosted at the iconic Palace of Culture and Science—a prominent symbol of the communist era—the Bitcoin FilmFest offers a vibrant celebration of film through the lens of bitcoin. The venue itself provides a striking contrast to the festival’s focus, highlighting bitcoin’s core identity as a currency embodying independence from traditional financial and political systems.

𝐅𝐢𝐱𝐢𝐧𝐠 𝐭𝐡𝐞 𝐜𝐮𝐥𝐭𝐮𝐫𝐞 𝐰𝐢𝐭𝐡 𝐩𝐨𝐰𝐞𝐫𝐟𝐮𝐥 𝐦𝐮𝐬𝐢𝐜 𝐯𝐢𝐛𝐞𝐬.

Warsaw, Day Zero at #BFF25 (European Bitcoin Pizza Day) with @roger__9000, MadMunky and the @2140_wtf squad

pic.twitter.com/9ogVvWRReA

pic.twitter.com/9ogVvWRReA— Bitcoin FilmFest

(@bitcoinfilmfest) May 28, 2025

(@bitcoinfilmfest) May 28, 2025This venue represents an era when the state tightly controlled the economy and financial systems. The juxtaposition of this historical site with an event dedicated to bitcoin is striking and thought-provoking.

The event features a diverse array of activities, including engaging panel discussions, screenings of both feature-length and short films, workshops and lively parties. Each component designed to explore the multifaceted world of bitcoin and its implications for society, offering attendees a blend of entertainment and education.

The films showcase innovative narratives and insights into bitcoin’s landscape, while the panels facilitate thought-provoking discussions among industry experts and filmmakers.

Networking is a significant aspect of the festival, with an exceptionally open and friendly atmosphere that foster connections among participants. Participants from all over Europe gather to engage with like-minded individuals who share a passion for BTC and its implications for the future.

The open exchanges of ideas foster a sense of community, allowing attendees to forge new connections, collaborate on projects, and discuss the potential of blockchain technology implemented in bitcoin.

The organization of the festival is extraordinary, ensuring a smooth flow of information and an expertly structured schedule filled from morning until evening. Attendees appreciate the meticulous planning that allowed them to maximize their experience. Additionally, thoughtful touches such as gifts from sponsors and well-chosen locations for various events contribute to the overall positive atmosphere of the festival.

Overall, the Bitcoin FilmFest not only highlights the artistic expression surrounding bitcoin but also serves as a vital platform for dialogue—about financial freedom, the future of money, and individual sovereignty in a shifting world.

The event successfully bridges the gap between a historical symbol of control and a movement that celebrates freedom, innovation, and collaboration in the digital age, highlighting the importance of independence in financial systems while fostering a collaborative environment for innovation and growth.

Next year’s event is slated for June 5-7 2026. For further updates check: https://bitcoinfilmfest.com/

-

@ 79be667e:16f81798

2025-06-11 18:58:10

@ 79be667e:16f81798

2025-06-11 18:58:10Kan jij zien, er is geen hemel\ Probeer het zelf, dan lukt het wel\ Geen hel staat ons te wachten\ Enkel sterren hangen ons boven het hoofd\ Kan jij zien, iedereen leeft voor dit moment

Kan jij zien, er zijn geen landen\ Het is niet moeilijk gewoon land te zien\ Niets om voor te moorden of te sterven\ Ook geloof wordt niet gezien\ Kan jij zien, het leven wordt geleefd door iedereen in vrede

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

Kan jij zien, er is geen bezit\ Ik vraag me af of jij dit kan\ Geen hebben of een nood\ In een samen-leving van mensen\ Kan jij zien, wij delen de wereld met elkaar

Misschien zeg je, ik kijk niet naar jouw wereld\ Maar ik deel dit zicht met velen\ Moge ook jij zoals ons zien\ Wij kijken in de wereld en zien gewoon onszelf

-

@ a5ee4475:2ca75401

2025-06-04 13:25:46

@ a5ee4475:2ca75401

2025-06-04 13:25:46[EM ATUALIZAÇÃO]

vacina #saude #politica #manipulacao #mundial #genocidio #pandemia #conspiracao

Este artigo reúne algumas evidências mais antigas que vim registrando durante alguns anos contra a covid, vacinas obrigatórias e a ação de agências de governo, fundações, políticos, mídia tradicional, celebridades, influenciadores, cientistas, redes sociais e laboratórios, em envolvimento com genocídio e restrições de liberdades em escala mundial causado por decisões em várias esferas relativas ao covid e as vacinas obrigatórias em geral.

Porém, alguns links podem não estar mais disponiveis, foram que ainda faltam ser registradas muitas informações já divulgadas nos últimos anos e que não tivemos contato pela escassez de meios para a obtenção dessas informações de forma organizada. Portanto, o presente artigo ainda passará por atualizações de conteúdo e formatação, então se possível ajudem sugerindo com complementos ou alterações.

1. Vacinas Obrigatórias em Geral

-

Vacinas e autismo em crianças https://publichealthpolicyjournal.com/vaccination-and-neurodevelopmental-disorders-a-study-of-nine-year-old-children-enrolled-in-medicaid/

-

O CDC admite que 98 milhões de pessoas receberam o vírus do câncer através da vacina da Poliomielite https://medicinanews.com.br/frente/frente_1/o-cdc-admite-que-98-milhoes-de-pessoas-receberam-o-virus-do-cancer-atraves-da-vacina-poliomielite/

Fonte original: https://preventdisease.com/images13/CDC_Polio.png [indisponível]

Salvo em: https://web.archive.org/web/20201203231640/ https://preventdisease.com/images13/CDC_Polio.png

Fonte original: https://preventdisease.com/images13/CDC_Polio.png [indisponível]

Salvo em: https://web.archive.org/web/20201203231640/ https://preventdisease.com/images13/CDC_Polio.png"O CDC (Os Centros de Controle e Prevenção de Doenças dos Estados Unidos) removeu rapidamente uma página do seu site, que estava em cache no Google, como você pode ver logo abaixo, admitindo que mais de 98 milhões de americanos receberam uma ou mais doses de vacina contra pólio dentro de 8 período entre 1955 e 1963, quando uma proporção da vacina foi contaminada com um poliomavírus causador de câncer chamado SV40."

27/02/2021 - Por que o Japão demorou para vacinar, mesmo com Olimpíada se aproximando https://www.cnnbrasil.com.br/internacional/2021/02/27/por-que-o-japao-demorou-para-vacinar-mesmo-com-olimpiada-se-aproximando

"Desconfiança da população japonesa em relação a vacinas, ligada a casos ocorridos no passado, está entre razões que atrasaram imunização no país.

A resistência à vacina do Japão remonta à década de 1970, quando duas crianças morreram dentro de 24 horas após receberem a vacina combinada contra difteria, tétano e coqueluche (coqueluche). A vacina foi temporariamente suspensa, mas a confiança já havia sido abalada. Por vários anos, as taxas de vacinação infantil caíram, levando a um aumento nos casos de tosse convulsa.

No final dos anos 1980, houve outro susto com a introdução da vacina tripla contra sarampo, caxumba e rubéola produzida no Japão. As primeiras versões do imunizante foram associadas à meningite asséptica, ou inchaço das membranas ao redor do cérebro e da medula espinhal. O problema foi rastreado até o componente caxumba da vacina tripla, o que levou a uma ação judicial e a indenização por danos pesados.

O Instituto Nacional de Ciências da Saúde interrompeu a dose combinada em 1993 e a substituiu por vacinas individuais. Após o escândalo, Shibuya disse que o governo japonês se tornou "ciente dos riscos" e seu programa nacional de vacinação tornou-se voluntário.

O Dr. Yuho Horikoshi, especialista em doenças infecciosas, diz que os processos levaram a uma "lacuna de vacinação", em que nenhuma vacina foi aprovada no Japão por cerca de 15 anos.

Mais recentemente, em 2013, o Japão adicionou a vacina contra o papilomavírus humano (HPV) ao calendário nacional para proteger as meninas contra o vírus sexualmente transmissível, que é conhecido por causar câncer cervical. No entanto, vídeos de meninas supostamente sofrendo de reações adversas começaram a circular no YouTube, levando o governo a retirá-los da programação nacional."

2. PRIMEIRAS OCORRÊNCIAS PREDITIVAS AO COVID-19

2010 - Fundação Rockfeller, Lockstep. https://www.rockefellerfoundation.org/wp-content/uploads/Annual-Report-2010-1.pdf

Neste PDF da fundação Rockfeller, em seu próprio site, a fundação deixou claro o seu envolvimento em casos de ‘contenção’ de pandemias juntamente com a USAID (agência americana com nome ambíguo, como formalmente ‘United States Agency for International Development’, mas soando como ‘US Socorre’, mas sendo um braço do governo democrata que financiava interferências políticas diretas em vários países, como no Brasil: https://www.gazetadopovo.com.br/vida-e-cidadania/quais-ongs-cooperaram-com-moraes-e-sao-alvo-do-congresso-nos-eua/ ), inclusive em relacionadas ao SARS, um vírus muito semelhante ao SEGUNDO tipo de vírus Sars-Cov, o Sars-Cov-2 (o vírus propagado em 2019) e que causa o COVID-19.

Segundo eles:

“Integração entre Regiões e Países

A Fundação Rockefeler investiu US$ 22 milhões em sua Iniciativa de Redes de Vigilância de Doenças para ajudar a conter a disseminação de doenças infecciosas e pandemias, fortalecendo os sistemas nacionais, regionais e globais de vigilância e resposta a doenças. Dois programas-chave da Rockefeler — a Rede de Vigilância de Doenças da Bacia do Mekong e a Rede Integrada de Vigilância de Doenças da África Oriental — conectaram e capacitaram profissionais de saúde, epidemiologistas e autoridades de saúde pública em toda a região, levando a um aumento de seis vezes nos locais de vigilância de doenças transfronteiriças somente nos últimos três anos. Em 2010, a Rockefeler expandiu a bem-sucedida campanha transdisciplinar One Health, que a USAID e o Banco Asiático de Desenvolvimento adotaram como modelos. One Health refere-se à integração da ciência médica e veterinária para combater essas novas variedades de doenças zoonóticas que se movem e sofrem mutações rapidamente de animais para humanos. Essas colaborações criaram e fortaleceram uma rede regional crítica de saúde pública, enquanto as lições aprendidas foram exportadas entre disciplinas e países. Além de fortalecer os laços globais em saúde pública, a Rockefeler ajudou a elevar o nível de especialização e treinamento em campo. O Programa de Treinamento em Epidemiologia de Campo coloca graduados nos mais altos escalões do governo no Laos e no Vietnã, enquanto as bolsas da Rockefeler transformaram as ferramentas disponíveis para os médicos, permitindo-lhes utilizar o poder da internet para se comunicar e monitorar eventos, compreender contextos locais e analisar novos problemas. Finalmente, estamos aplicando ferramentas do século XXI para combater os desafios de saúde do século XXI.”

Julho de 2012 - Revista Mundo Estranho

Houve uma "coincidência", a revista Mundo Estranho em julho de 2012, entrevistou o até então doutorando em virologia, Átila Iamarino (o mesmo cientista que fez diversas propagandas das vacinas no Brasil), para descrever um possível cenário de propagação de uma epidemia viral, a revista descreve com grande precisão os eventos de 2020, mas apontando o oposto da China, em que, na realidade, sua economia cresceu vertiginosamente.

3. PRIMEIROS INDÍCIOS

10/2019 - Evento 201 - Durante os Jogos Militares Internacionais na China. https://www.centerforhealthsecurity.org/event201/

Promovido por: - Bill & Melinda Gates Foundation - John Hopkins Institute - Fórum econômico mundial

"O evento simula a liberação de um coronavírus novo do tipo zoonótico transmitido por morcegos para porcos e por fim para humanos. Eventualmente ele se torna muito transmissível entre humanos levando a uma pandemia severa. O vírus é muito parecido com o vírus da SARS, mas se transmite muito mais facilmente entre pessoas devido a sintomas muito mais leves destas."

Também mencionado por: http://patrocinados.estadao.com.br/medialab/releaseonline/releasegeral-releasegeral/geral-johns-hopkins-center-for-health-security-forum-economico-mundial-e-fundacao-bill-melinda-gates-realizam-exercicio-pandemico-e-transmissao-ao-vivo/

Sobre o "Movimento antivacina"

05/12/2017 - Movimento antivacina: como surgiu e quais consequências ele pode trazer? https://www.uol.com.br/universa/noticias/redacao/2017/12/05/o-que-o-movimento-antivacina-pode-causar.htm?cmpid=copiaecola

23/03/2019 - "Instagram bloqueia hashtags e conteúdo antivacinação" https://canaltech.com.br/redes-sociais/instagram-bloqueia-hashtags-e-conteudo-antivacinacao-135411/

23/05/2021 - Novos dados sobre pesquisadores de Wuhan aumentam debate sobre origens da Covid https://www.cnnbrasil.com.br/saude/novos-dados-sobre-pesquisadores-de-wuhan-aumentam-debate-sobre-origens-da-covid/

"A China relatou à Organização Mundial da Saúde que o primeiro paciente com sintomas semelhantes aos de Covid-19 foi registrado em Wuhan em 8 de dezembro de 2019"

01/02/2020 - O que aconteceu desde que o novo coronavírus foi descoberto na China https://exame.com/ciencia/o-que-aconteceu-desde-que-o-novo-coronavirus-foi-descoberto-na-china/

"O primeiro alerta foi recebido pela Organização Mundial da Saúde (OMS) em 31 de dezembro de 2019"

15/09/2020 - YouTube diz que vai remover vídeos com mentiras sobre vacina contra COVID-19 https://gizmodo.uol.com.br/youtube-remover-videos-mentiras-vacina-covid-19/

"O YouTube anunciou na quarta-feira (14) que estenderá as regras atuais sobre mentiras, propaganda e teorias da conspiração sobre a pandemia do coronavírus para incluir desinformação sobre as vacinas contra a doença.

De acordo com a Reuters, a gigante do vídeo diz que agora vai proibir conteúdos sobre vacinas contra o coronavírus que contradizem “o consenso de especialistas das autoridades de saúde locais ou da OMS”, como afirmações falsas de que a vacina é um pretexto para colocar chips de rastreamento nas pessoas ou que irá matar ou esterilizar quem tomar."

*07/01/2021 - YouTube vai punir canais que promovem mentiras sobre eleições – incluindo os de Trump https://olhardigital.com.br/2021/01/07/noticias/youtube-vai-punir-canais-que-promovem-mentiras-sobre-eleicoes-incluindo-os-de-trump/

"O YouTube anunciou que vai punir canais que promovem mentiras sobre as eleições, removendo sumariamente qualquer vídeo que contenha desinformação e, ao mesmo tempo, advertindo com um “strike” o canal que o veicular. A medida já está valendo e a primeira “vítima” é ninguém menos que o ex-presidente americano, Donald Trump.

A medida não é exatamente nova, mas foi novamente comunicada e reforçada pelo YouTube na quarta-feira (6), após os eventos de invasão do Capitólio, em Washington, onde o presidente eleito Joe Biden participava da cerimônia que confirmava a sua vitória nas eleições de novembro de 2020. A ocasião ficou marcada pela tentativa de invasão de correligionários de Trump, que entraram no edifício em oposição à nomeação do novo presidente. Uma mulher acabou sendo morta pela polícia que protegia o local.

O ex-presidente Donald Trump teve vídeos banidos de seu canal no YouTube após os eventos de ontem (6) no capitólio."

4. FIGURAS CENTRAIS

Bill Gates

Bill Gates diz 'não' a abrir patentes de vacinas https://www.frontliner.com.br/bill-gates-diz-nao-a-abrir-patentes-de-vacinas/

"Bill Gates, um dos homens mais ricos do mundo, cuja fundação tem participação na farmacêutica alemã CureVac, produtora de vacina mRNA para prevenção de covid-19, disse não acreditar que a propriedade intelectual tenha algo a ver com o longo esforço global para controlar a pandemia."

João Doria e ocorrências em São Paulo

26/07/2017 - João Dória vai a China conhecer drones para ampliar segurança eletrônica na capital paulista https://jc.ne10.uol.com.br/blogs/jamildo/2017/07/26/joao-doria-vai-china-conhecer-drones-para-ampliar-seguranca-eletronica-na-capital-paulista/

02/08/2019 - Governo de SP fará Missão China para ampliar cooperação e atrair investimentos https://www.saopaulo.sp.gov.br/spnoticias/governo-de-sao-paulo-detalha-objetivos-da-missao-china/

20/11/2019 - Doria se encontra com chineses das gigantes CREC e CRCC e oferece concessões de rodovia, metrô e ferrovia https://diariodotransporte.com.br/2019/11/20/doria-se-encontra-com-chineses-das-gigantes-crec-e-crcc-e-oferece-concessoes-de-rodovia-metro-e-ferrovia/

25/01/2020 - "Chineses serão agressivos" nas privatizações em SP até 2022, afirma Dória https://noticias.uol.com.br/colunas/jamil-chade/2020/01/25/entrevista-joao-doria-privatizacoes-sao-paulo-china.htm

O governador de São Paulo, João Doria, afirma que vai acelerar os programas de desestatização no estado em 2020 e acredita que concessões e vendas poderão permitir uma arrecadação de pelo menos R$ 40 bilhões. Nesse processo, o governador avalia que a China deve atuar de forma agressiva e que aprofundará sua posição de maior parceira comercial do estado, se distanciando de americanos e argentinos.

29/06/2020 - Doria estabelece multa para quem estiver sem máscara na rua em SP https://veja.abril.com.br/saude/doria-estabelece-multa-para-quem-estiver-sem-mascara-na-rua/

24/12/2020 - Doria é flagrado sem máscara e fazendo compras em Miami https://pleno.news/brasil/politica-nacional/doria-e-flagrado-sem-mascara-e-fazendo-compras-em-miami.html

Foto do governador de São Paulo sem o item de proteção viralizou nas redes

07/06/2021 - Doria é criticado na internet por tomar sol sem máscara em hotel no Rio https://vejasp.abril.com.br/cidades/doria-e-criticado-na-internet-por-tomar-sol-sem-mascara-em-hotel-no-rio/

30/09/2020 - Governo de SP assina contrato com Sinovac e prevê vacina para dezembro https://agenciabrasil.ebc.com.br/saude/noticia/2020-09/governo-de-sp-assina-contrato-com-sinovac-e-preve-vacina-para-dezembro

O governador de São Paulo, João Doria, e o vice-presidente da laboratório chinês Sinovac, Weining Meng, assinaram hoje (30), um contrato que prevê o fornecimento de 46 milhões de doses da vacina CoronaVac para o governo paulista até dezembro deste ano.

O contrato também prevê a transferência tecnológica da vacina da Sinovac para o Instituto Butantan, o que significa que, o instituto brasileiro poderá começar a fabricar doses dessa vacina contra o novo coronavírus. O valor do contrato, segundo o governador João Doria é de US$ 90 milhões.

20/10/2020 - Coronavac terá mais de 90% de eficácia, afirmam integrantes do governo paulista https://www.cnnbrasil.com.br/saude/2020/12/20/coronavac-tera-mais-de-90-de-eficacia-afirmam-integrantes-do-governo

24/10/2020 - Não esperamos 90% de eficácia da Coronavac’, diz secretário de saúde de SP https://www.cnnbrasil.com.br/saude/2020/12/24/nao-esperamos-90-de-eficacia-da-coronavac-diz-secretario-de-saude-de-sp

07/01/2021 - Vacina do Butantan: eficácia é de 78% em casos leves e 100% em graves https://www.cnnbrasil.com.br/saude/2021/01/07/vacina-do-butantan-eficacia-e-de-78-em-casos-leves-e-100-em-graves

09/01/2021 - Não é hora de sermos tão cientistas como estamos sendo agora https://g1.globo.com/sp/sao-paulo/video/nao-e-hora-de-sermos-tao-cientistas-como-estamos-sendo-agora-diz-secretario-de-saude-de-sp-9166405.ghtml

10/01/2021 - Dados da Coronavac relatados à Anvisa não estão claros, diz médico https://www.cnnbrasil.com.br/saude/2021/01/10/dados-da-coronavac-relatados-a-anvisa-nao-estao-claros-diz-medico

"O diretor do Laboratório de Imunologia do Incor, Jorge Kalil, reforçou que faltaram informações sobre a Coronavac nos dados divulgados à Anvisa"

12/01/2021 - New Brazil data shows disappointing 50,4% efficacy for China’s Coronavac vaccine [Novos dados do Brasil mostram eficácia decepcionante de 50,4% para a vacina CoronaVac da China] https://www.reuters.com/article/us-health-coronavirus-brazil-coronavirus/new-brazil-data-shows-disappointing-504-efficacy-for-chinas-coronavac-vaccine-idUSKBN29H2CE

13/01/2021 - Eficácia da Coronavac: 50,38%, 78% ou 100%? https://blogs.oglobo.globo.com/lauro-jardim/post/5038-78-ou-100.html

“De acordo com interlocutores que participaram tanto do anúncio de ontem como da semana passada, quem pressionou para que os dados de 78% e 100% fossem liberados foi João Dória.”

07/05/2021 - Covid-19: Doria toma primeira dose da vacina CoronaVac https://veja.abril.com.br/saude/covid-19-doria-toma-primeira-dose-da-vacina-coronavac/

04/06/2021 - Doria é vacinado com a segunda dose da CoronaVac em São Paulo https://noticias.uol.com.br/politica/ultimas-noticias/2021/06/04/doria-e-vacinado-com-a-segunda-dose-da-coronavac-em-sao-paulo.htm

15/07/2021 - Doria testa positivo para a Covid-19 pela 2ª vez https://www.correiobraziliense.com.br/politica/2021/07/4937833-doria-testa-positivo-para-covid-19-pela-segunda-vez.html

"Governador de São Paulo já havia sido diagnosticado com a doença no ano passado. Ele diz que, apesar da infecção, se sente bem, o que atribui ao fato de ter sido vacinado com duas doses da Coronavac"

06/08/2021 - CPI recebe investigação contra Doria por compra de máscara sem licitação https://www.conexaopoder.com.br/nacional/cpi-recebe-investigacao-contra-doria-por-compra-de-mascara-sem-licitacao/150827

"Empresa teria usado o nome de Alexandre Frota para vender máscaras ao governo de SP. Doria nega informação"

Renan Filho (filho do Renan Calheiros)

25/07/2019 - Governador Renan Filho vai à China em busca de investimentos para o estado https://www.tnh1.com.br/videos/vid/governador-renan-filho-vai-a-china-em-busca-de-investimentos-para-o-estado/

20/03/2020 - Governadores do NE consultam China e pedem material para tratar covid-19 https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2020/03/20/governadores-do-ne-consultam-china-e-pedem-material-para-tratar-covid-19.htm

5. Narrativas, restrições e proibições

17/12/2020 - STF decide que vacina contra a covid pode ser obrigatória, mas não forçada https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2020/12/17/stf-julga-vacinacao-obrigatoria.htm?cmpid=copiaecola

"O STF (Supremo Tribunal Federal) decidiu, em julgamento hoje, que o Estado pode determinar a obrigatoriedade da vacinação contra a covid-19. Porém fica proibido o uso da força para exigir a vacinação, ainda que possam ser aplicadas restrições a direitos de quem recusar a imunização.

Dez ministros foram favoráveis a obrigatoriedade da vacinação, que poderá ser determinada pelo governo federal, estados ou municípios. As penalidades a quem não cumprir a obrigação deverão ser definidas em lei."

27/07/2021 - Saiba que países estão adotando 'passaporte da vacina' para suspender restrições https://www.cnnbrasil.com.br/internacional/2021/07/27/saiba-que-paises-estao-adotando-passaporte-da-vacina-para-suspender-restricoes

" - Israel - Uniao Europeia - Áustria - Dinamarca - Eslovênia - França - Grécia - Irlanda - Itália - Letônia - Lituânia - Luxemburgo - Holanda - Portugal - Japão - Coreia do sul"

18/06/2021 - O que é o passaporte da vacina que Bolsonaro quer vetar? https://noticias.uol.com.br/politica/ultimas-noticias/2021/06/18/uol-explica-o-que-e-o-passaporte-da-vacina-que-opoe-bolsonaro-e-damares.htm

"O Brasil poderá ter um certificado de imunização futuramente. Aprovado no Senado na semana passada, o "passaporte da vacina", como é chamado, prevê identificar pessoas vacinadas para que entrem em locais públicos ou privados com possíveis restrições."

6. Vacinas

Alegações:

- CoronaVac, Oxford e Pfizer: veja diferenças entre as vacinas contra covid noticias.uol.com.br/saude/ultimas-noticias/redacao/2021/05/11/diferencas-vacinas-covid-brasil.htm

"CoronaVac (Butantan/Sinovac - Chinesa) Com virus inativo 50,38% de eficácia 2 doses

Covishield - 'AstraZeneca' (Fiocruz/Astrazenica/Oxford - Britânica) Com virus não replicante 67% de eficácia 2 doses

ComiRNAty - 'Pfizer' (Pfizer - Americana / BioNTech - Alemã) Com RNA mensageiro 96% de eficácia 2 doses"

Riscos diretos

15/06/2021 - Trombose após vacinação com AstraZeneca: Quais os sintomas e como se deve atuar? https://www.istoedinheiro.com.br/trombose-apos-vacinacao-com-astrazeneca-quais-os-sintomas-e-como-se-deve-atuar/

"Agências europeias estão reticentes com a vacina da AstraZeneca. Ela chegou a ser desaconselhada a pessoas com idade inferior a 60 anos, e um alto funcionário da Agência Europeia de Medicamentos declarou que era melhor deixar de administrar a vacina deste laboratório em qualquer idade quando há alternativas disponíveis, devido aos relatos de trombose após a primeira dose, apesar de raros."

11/05/2021 - CoronaVac, Oxford e Pfizer: veja diferenças entre as vacinas contra covid https://noticias.uol.com.br/saude/ultimas-noticias/redacao/2021/05/11/diferencas-vacinas-covid-brasil.htm

"Na terça-feira (12), o Ministério da Saúde determinou a suspensão da aplicação da vacina de Oxford/AstraZeneca para gestantes e puérperas com comorbidades. A decisão segue recomendação da Anvisa, que apura a morte de uma grávida de 35 anos que tomou o imunizante e teve um AVC (acidente vascular cerebral)."

30/07/2021 - Pfizer representa o mesmo risco de trombose que a Astrazeneca, aponta levantamento https://panoramafarmaceutico.com.br/pfizer-representa-o-mesmo-risco-de-trombose-que-a-astrazeneca-aponta-levantamento/

7. CRIMES

Crimes da Pfizer

18/11/2020 Não listado no google - Os Crimes documentados da produtora de vacinas de Covid - Pfizer [INGLÊS] https://www.dmlawfirm.com/crimes-of-covid-vaccine-maker-pfizer-well-documented/

"A velocidade com que a vacina Covid da Pfizer foi produzida, a ausência de estudos em animais, testes de controle randomizados e outros testes e procedimentos padrão usuais para um novo medicamento são, no mínimo, preocupantes. Além disso, todos os fabricantes de vacinas Covid receberam imunidade legal para quaisquer ferimentos ou mortes que possam causar. Se essas vacinas são tão seguras quanto promovidas, por que seus fabricantes precisam de imunidade geral?"