-

@ 472f440f:5669301e

2025-06-11 04:37:33

@ 472f440f:5669301e

2025-06-11 04:37:33Marty's Bent

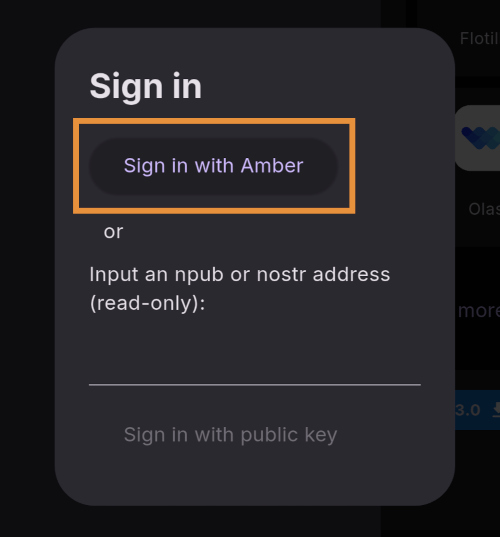

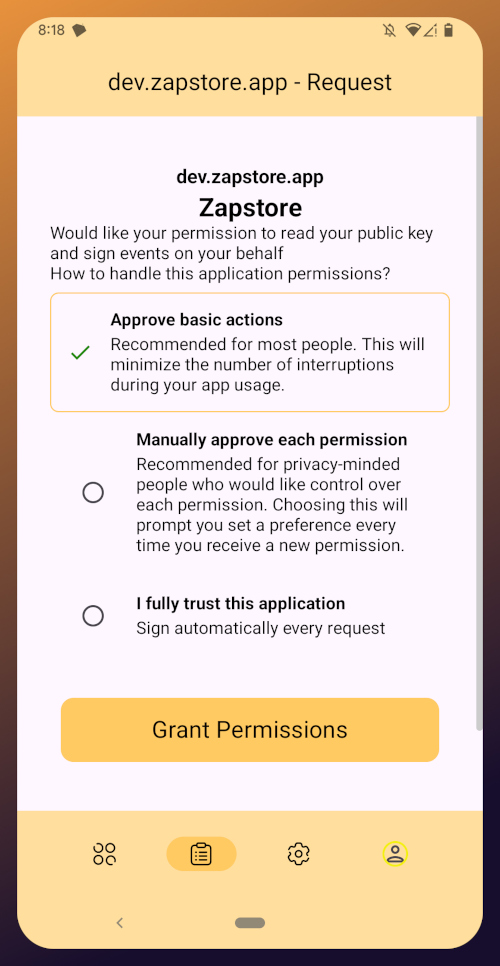

Sup, freaks? Your Uncle Marty did a little vibe coding a couple months ago and that vibe coding project has turned into an actual product that is live in the Google Chrome web store and will soon to be live in the Firefox add-on store as well. It's called Opportunity Cost and it is an extension that enables you to price the internet in Bitcoin.

Opportunity Cost – See Prices in Bitcoin Instantly

Check it out!

This whole process has been extremely rewarding to me for many reasons. The first of which is that I've had many ideas in the past to launch a product focused on bitcoin education that simply never left my brain because I never felt comfortable paying a developer to go out and build a product that I wasn't sure would ultimately get product market fit.

Due to the advancements of AI, particularly ChatGPT and Replit, I was able to spend a few hours on a Saturday vibe coding a prototype for Opportunity Cost. It worked. I side loaded it into Chrome and Firefox, tested it out for a few days and decided, "Hey, I think this is something that's worthwhile and should be built."

Backtracking just a little bit, the initial idea for this app was to create an AR application that would enable you to take pictures of goods in the real world and have their prices automatically converted to bitcoin so that you could weigh the opportunity cost of whether or not you actually wanted to buy that good or decide to save in bitcoin instead. With the help of Justin Moon from the Human Rights Foundation and Anthony Ronning from OpenSecret and Maple AI, I was pointed in the right direction of vibe coding tools I could use to build a simple MVP. I took their advice, built the MVP, and demoed it at the Bitcoin Park Austin weekly AI meetup in mid-April.

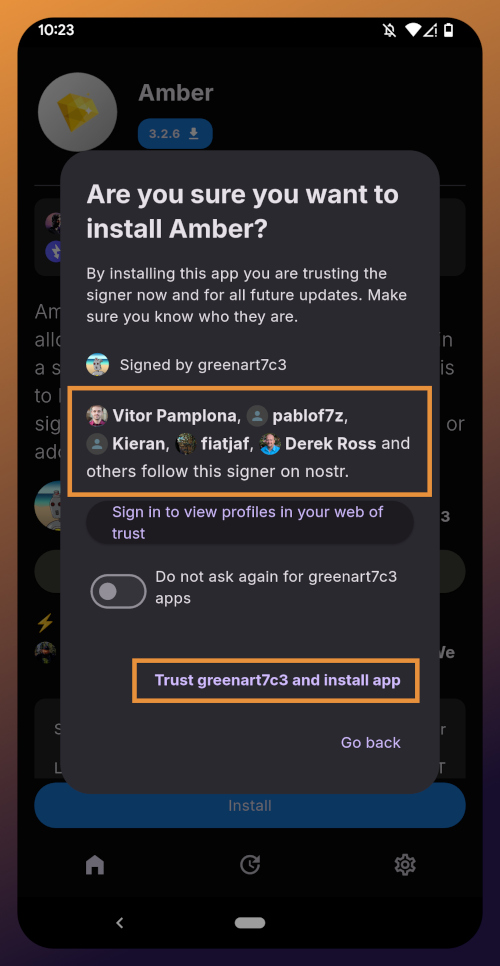

The next week, I was talking with a friend, Luke Thomas, about the idea and during our conversation he made a simple quip, "You should make a Chrome extension. I really want a Chrome extension that does this." And that's what sent me down the vibe coding rabbit hole that Saturday which led to the prototype.

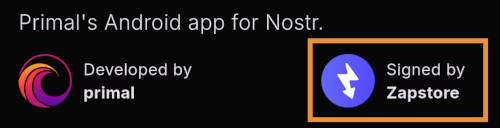

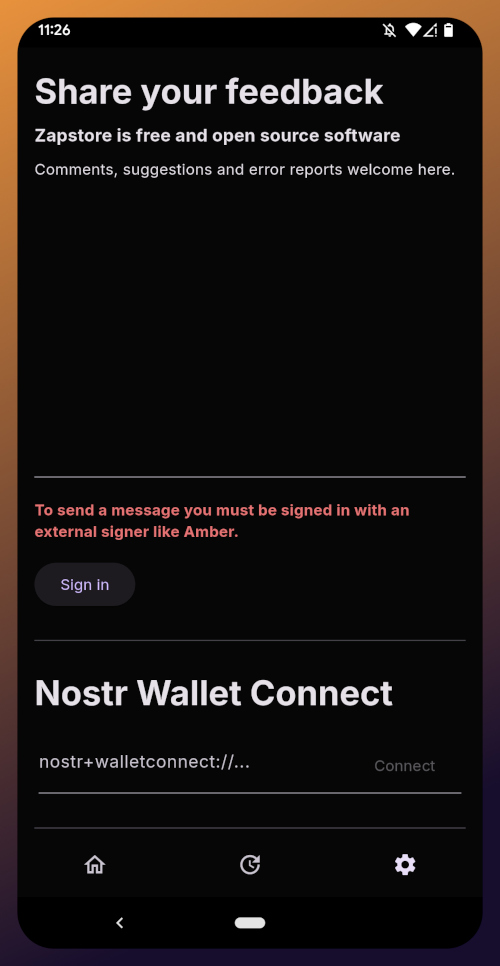

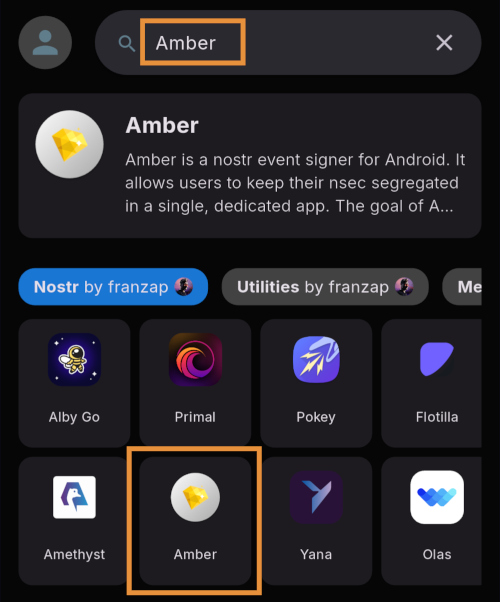

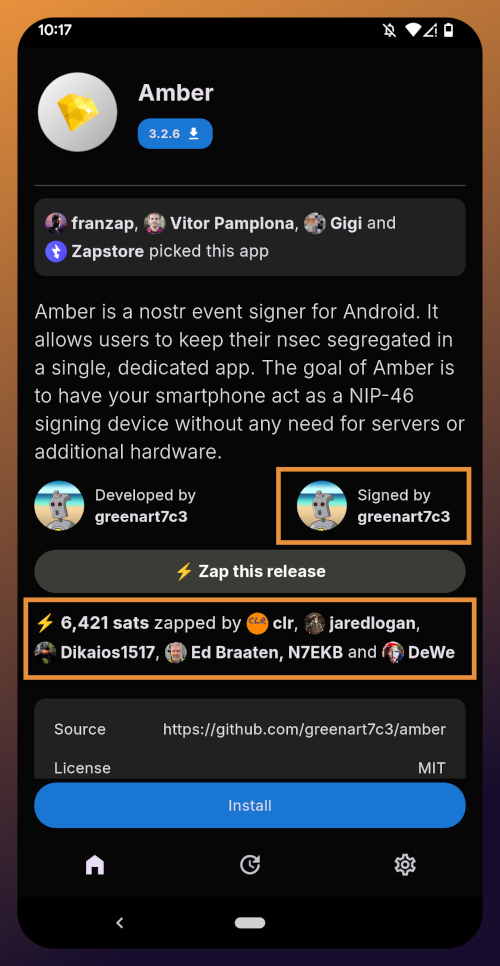

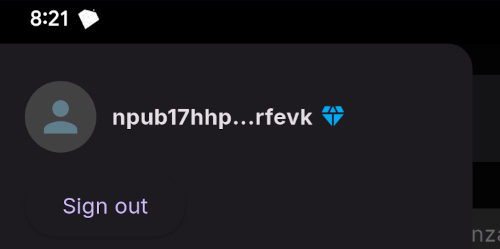

After I was comfortable with and confident in the prototype, I found a young hungry developer by the name of Moses on Nostr, I reached out to him, told him my idea, showed him the prototype and asked if he thought he could finish the application for me. He luckily agreed to do so and within a couple of weeks we had a fully functioning app that was officially launched today. We're about 12 hours into the launch and I must say that I'm pleasantly surprised with the reception from the broader Bitcoin community. It seems like something that people are happy exists and I feel extremely happy that people see some value in this particular application.

Now that you have the backstory, let's get into why I think something like Opportunity Cost should exist. As someone who's been writing a newsletter and producing podcasts about bitcoin for eight years in an attempt to educate individuals from around the world about what bitcoin is, why it's important, and how they can leverage it, I've become convinced that a lot of the work that needs to be done still exists at the top of the funnel. You can scream at people. You can grab them by the shoulders. You can shake them. You can remind them at Thanksgiving that if they had listened to your advice during any Thanksgiving in the previous years they would be better off financially. But at the end of the day most people don't listen. They need to see things. Seeing things for yourself is a much more effective teaching mechanism than be lectured to by someone else.

My hope with Opportunity Cost is that it catches the eye of some bitcoin skeptics or individuals who may be on the cusp of falling down the bitcoin rabbit hole and they see the extension as a way to dip their toes into bitcoin to get a better understanding of the world by pricing the goods and services they purchase on a day-to-day month-to-month and year-to-year basis in bitcoin without having to download a wallet or set up an exchange account. The tippy top of the bitcoin marketing funnel.

That is not all though. I think Opportunity Cost can serve individuals at both ends of the funnel. That's why it's pretty exciting to me. It's as valuable to the person who is bitcoin curious and looking to get a better understanding as it is to the hardcore bitcoiner living on a bitcoin standard who is trying to get access to better tools that enable him to get a better grasp of their spending in bitcoin terms.

Lastly, after playing around with it for a few days after I built the prototype, I realized that it has incredible memetic potential. Being able to take a screenshot of goods that people are buying on a day-to-day basis, pricing them in bitcoin and then sharing them on social media is very powerful. Everything from houses to junk items on Amazon to the salaries of pro athletes to your everyday necessities. Seeing the value of those things in bitcoin really makes you think.

One day while I was testing the app, I tried to see how quickly I could find goods on the internet that cumulatively eclipsed the 21 million supply cap limit of bitcoin. To my surprise, even though I've been in bitcoin for 12 years now, it did not take me that long. The opportunity cost of everything I buy on a day-to-day basis becomes very clear when using the extension. What's even clearer is the fact that Bitcoin is completely mispriced at current levels. There is so much winning ahead of us.

Also, it's probably important to note that the extension is open source. You can check out our GitHub page here. Submit pull requests. Suggest changes to the app.

We've also tried to make Opportunity Cost as privacy preserving as possible. Everything within the extension happens in your browser. The only external data that we're providing is the bitcoin to fiat price conversion at any given point in time. We're not data harvesting the web pages you're browsing or the items you're looking at. We're not collecting data and sending it to third party marketers. We want to align ourselves with the open and permissionless nature of bitcoin while also preserving our users' privacy. We're not trying to monetize this in that way. Though, I will say that I'm thinking of ways to monetize Opportunity Cost if it does gain significant traction, but I promise it will be in a way that respects your privacy and is as unobtrusive as possible. We'll see how it goes.

Thank you for coming to my TED talk. Please download and use the extension. Let us know what you think.

Headlines of the Day

Saylor Says Bitcoin Is Perfect Money to Jordan Peterson - via X

Trump Won't Sell Tesla Despite Musk-Bessent Heated Exchange - via X

Bitcoin Gains Traction in Kenya's Largest Slum Kibera - via X

Get our new STACK SATS hat - via tftcmerch.io

Bitcoin’s Next Parabolic Move: Could Liquidity Lead the Way?

Is bitcoin’s next parabolic move starting? Global liquidity and business cycle indicators suggest it may be.

Read the latest report from Unchained and TechDev, analyzing how global M2 liquidity and the copper/gold ratio—two historically reliable macro indicators—are aligning once again to signal that a new bitcoin bull market may soon begin.

Ten31, the largest bitcoin-focused investor, has deployed $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

East Coast aesthetics over everything.

*Download our free browser extension, Opportunity Cost: *<<https://www.opportunitycost.app/>> start thinking in SATS today.

*Get this newsletter sent to your inbox daily: *https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X:

-

@ 2b998b04:86727e47

2025-06-11 04:26:56

@ 2b998b04:86727e47

2025-06-11 04:26:56Introduction To First Principles

This introduction kicks off a 7-part series called First Principles exploring the deeper shifts behind decentralization, cost, freedom, and truth. I picked 7 days, one for each day of the week, aligned with a rhythm of work, rest, and return. Each part will explore a foundational truth behind the technologies and philosohies I’ve embraced — from decentralization and sovereignty to truth, time, and hope.

We often hear that technology drives costs toward zero.

That’s the thesis of The Price of Tomorrow — that as technology advances, it becomes deflationary by nature. Automation replaces labor. Software replaces infrastructure. AI replaces entire categories of decision-making. The marginal cost of production trends toward nothing.

But that’s not the whole story.

There’s a deeper layer — one that most technologists and economists miss. It’s not just the marginal cost of production that matters. It’s the control cost of centralization. And that’s where things get murky.

Because even when marginal costs fall, the hidden toll of centralization rises.

The Illusion of “Free”

Take GitHub.

On paper, it’s free. You can publish static websites, host code, automate workflows with Actions, and collaborate globally — all at no cost.

But GitHub is owned by Microsoft. You don’t control the servers. You don’t own the platform. You don’t hold the keys.

It’s a gift that can be revoked.

Same with Google Docs. Or YouTube. Or Substack. Or any cloud platform that says “start for free.”

These aren’t bad tools. Many are excellent.

But they’re not neutral.

The price you pay isn’t always in dollars. Sometimes it’s in:

-

Data access restrictions

-

API limitations

-

Sudden pricing changes

-

Censorship or deplatforming

-

Migration costs if (or when) things go south

This is the hidden rent of centralized platforms. And it compounds over time.

Control Cost vs. Marginal Cost

If marginal cost is “how cheap is it to make this?” —\ Control cost is “how much freedom do I lose by using this?”

You can publish your ideas for free on Medium — but they own the SEO.\ You can host your business on Shopify — but they can cut you off.\ You can grow your audience on Instagram — but the algorithm owns the feed.

We’ve learned to celebrate deflation. But most of the tools we use are inflating the cost of control, even as they lower the cost of entry.

And this is where decentralization flips the script.

The Real Promise of Decentralization

True decentralization doesn’t just make things cheaper.\ It makes them sovereign.

It redistributes power, not just price.\ It removes toll booths, not just middlemen.

It says:

-

Own your keys

-

Own your content

-

Own your stack

-

Own your distribution

This is why Nostr matters.\ This is why Bitcoin matters.\ This is why self-hosting, permissionless protocols, and open-source tooling matter — even when they’re less polished or convenient than centralized platforms.

Because they don’t just save you money.\ They save your freedom.

A Working Example

When I started building my blog blog.stantonweb.com, didn’t choose the easiest route.

I combined:

-

Nostr for long-form publishing

-

A custom Python fetch script to pull and render posts

-

GitHub Actions for automation

-

Static HTML for presentation

-

Cloudflare + GitHub Pages for zero-cost hosting

No database. No CMS subscription. No paid theme.

The total marginal cost? $0.

But more importantly, the control cost is near zero too.\ No one can shut it down.\ No company can throttle my reach.\ No gatekeeper decides whether my words deserve to stay online.

Toward a New Definition of Cost

If you only optimize for price, you’ll be captured.

If you optimize for freedom, you’ll build margin over time — not just financial margin, but creative, moral, and operational margin too.

That’s what decentralization makes possible.\ Not just cheaper.\ Truer.

Footnote: Lessons from the Past

Remember Skype? It started as a peer-to-peer tool — truly decentralized at its core. But then it was acquired by Microsoft. Over time, its architecture was centralized and eventually dismantled.

Or Napster. It shook the music industry with peer-to-peer sharing. But it too was shut down and replaced by centralized alternatives.

BitTorrent survived — but only when it resisted the pressure to become just another platform.

The pattern is clear:

-

Centralization follows capital.

-

Censorship follows control.

-

But freedom follows decentralization.

And that’s the direction we must choose — again and again.

Co-written with ChatGPT (“Dr. C”), who helped distill and sharpen the core arguments.\ \ Stay tuned for Part 1 in the next few days.

—\ Published on blog.stantonweb.com & Nostr.\ Zap: <https://tinyurl.com/yuyu2b9t>

-

-

@ 2b998b04:86727e47

2025-06-11 04:12:39

@ 2b998b04:86727e47

2025-06-11 04:12:39Introduction: Why Money Matters to Faith

Most of us don’t think about money theologically. But Scripture speaks of it often — not just as a tool, but as a test.

Jesus said, “Where your treasure is, there your heart will be also” (Matthew 6:21). The love of money, not money itself, is called the root of all kinds of evil. And dishonest scales? “An abomination to the Lord” (Proverbs 11:1).

So what happens when the entire system of money becomes dishonest — when it’s based not on work or value, but manipulation and control?

That’s the world Bitcoin was born into. And it offers a radically different way — one that, surprisingly, echoes deep truths of the Christian faith — and especially what many call the Victorious Gospel: the belief that Christ’s redemption is not partial, but total. Not only personal, but cosmic.

1. What Is Bitcoin, and Why Was It Created?

Bitcoin is a new kind of money that isn't controlled by any government or company. You can send it anywhere in the world, and no one can block or censor your transaction. It’s digital, but unlike credit cards or PayPal, it’s not just “numbers in a bank.” It is scarce, secure, and independent.

The key idea is this: Bitcoin is money backed by work — not by trust in a government, but by real energy and effort.

Why is that important? Because the current system of money — what we call fiat — works very differently.

2. What Is Fiat, and Why Is It Broken?

“Fiat” simply means “by decree.” It’s the money we all use today — dollars, euros, yen — created by government decree. It used to be backed by gold. Not anymore.

Today, new fiat money is created whenever a central bank wants. It can be “printed” digitally without cost. This leads to inflation — meaning your savings buy less over time.

It’s like a form of slow theft. You worked hard for your dollars, but someone else can create more with a click. That’s not just bad economics — it violates biblical principles of fairness, honesty, and stewardship.

Bitcoin fixes this by making money that cannot be faked or inflated, because it’s based on Proof of Work — and is capped at a fixed amount.

3. What Is Proof of Work — and Why It Matters

Imagine you want to add a page to a history book — but to make it trustworthy, you must solve a complex puzzle that proves you did real work. Once solved, everyone else can see the solution and verify it was done properly.

That’s Proof of Work, the system Bitcoin uses to record transactions. Each time people send Bitcoin, that transaction gets added to a public ledger (called the blockchain). But it can only be added if someone does the work to secure it — using energy, effort, and computer power.

This work:

-

Costs something (just like real-world labor),

-

Prevents cheating (you can’t just rewrite history),

-

And rewards the worker with newly created Bitcoin.

This reward is important — because it’s how new Bitcoin enters circulation. But here’s the catch:\ 👉 There will only ever be 21 million Bitcoin.\ That number is fixed forever, written into Bitcoin’s code. No one — not a government, company, or individual — can create more.

Right now, not all of the 21 million Bitcoin have been released. The process of mining — doing the Proof of Work — slowly releases new Bitcoin over time as a reward. This happens in a predictable schedule and will continue until the very last Bitcoin is mined around the year 2140.

4. Why Bitcoin Is the Hardest Money Ever Created

In monetary terms, “hardness” refers to how difficult it is to increase the supply of money. The harder the money, the more resistant it is to inflation or dilution.

Let’s compare:

-

Gold is scarce — but not fixed. Miners extract more gold every year, adding about 1–2% to the total supply annually.

-

Fiat money (like the U.S. dollar) is the softest. It can be created at will, with no limit.

-

Bitcoin is the hardest money ever invented:

-

The total supply is forever capped at 21 million.

-

The rate of creation cuts in half every four years.

-

No one can change this schedule.

This makes Bitcoin the first truly scarce asset in human history — not just physically scarce like gold, but mathematically and absolutely scarce.

Why does this matter?

Because it changes the very nature of money. Instead of being something that loses value over time, Bitcoin becomes a form of property — a way to store your labor, your time, your effort — across generations.

-

It encourages saving, not spending out of fear of inflation.

-

It rewards patience and stewardship, not speculation and debt.

-

It teaches long-term thinking, a concept deeply woven into Scripture (Proverbs 13:22: “A good man leaves an inheritance to his children’s children”).

5. Why Does This Matter for Christianity?

Christianity affirms that creation is good, work is sacred, and truth matters.

In Genesis, God gave Adam a task — to work the garden. Work is not a curse. It’s part of what it means to bear God’s image.

Bitcoin’s Proof of Work aligns with this:

-

It says value comes from real effort, not manipulation.

-

It links truth to time — just as God’s Word unfolds through history.

-

It defends against corruption — just as the Kingdom of God resists the lies of Babylon.

-

It places a limit on excess — just as Sabbath and Jubilee rhythms place a brake on endless exploitation.

In contrast, fiat systems reward those closest to the money printers — often the rich or powerful — while devaluing the labor of ordinary people. That’s why Bitcoin has been called “money for the people” — because anyone, anywhere, can use it without asking permission.

6. The Victorious Gospel: A Bigger Redemption

The Victorious Gospel teaches that Jesus didn’t just save individual souls. He came to restore all things — including how we live, build, work, and relate to each other.

That means we care about justice, truth, dignity, and creation itself. And it means we seek tools that reflect those values.

Bitcoin isn’t the Gospel. But it rhymes with it:

-

It honors work, like God does.

-

It respects time, like Scripture does.

-

It tells the truth, like Jesus does.

-

It has limits, just as the Sabbath, Creation, and grace all have defined edges.

-

And it stores value — the value of human time and labor — like good soil stores seed.

7. But Isn’t Bitcoin Just for Rich Tech People?

Actually, the opposite is true.

Bitcoin doesn’t care who you are. It doesn’t ask for ID. It doesn’t need a bank. A farmer in El Salvador, a refugee in Ukraine, or a pastor in Nigeria can all use it the same as a Wall Street investor.

It’s global, permissionless, and radically equal — not because it’s utopian, but because it’s built on truth, not trust.

And that makes it a powerful tool for Christians who care about freedom, fairness, and flourishing.

8. Final Thoughts: Proof of Work and the Work of Christ

When Jesus died on the cross, He said: “It is finished.” That was not just poetry. It was proof — that the work was done. That redemption had been secured.

In a small way, Bitcoin reflects that kind of finality:

-

Once a block is written, it cannot be undone.

-

Once work is proven, it stands as a record.

-

Once grace is given, it cannot be revoked.

We don’t need to “stake” our claims based on how much power or status we hold (as in Proof of Stake). We rest in what has been proven.

That’s why many Christians — especially those who believe in a victorious, world-restoring Gospel — are finding in Bitcoin a tool that aligns with their deepest values.\ \ ✍️ Acknowledgment

This article was crafted with the assistance of Dr. C (ChatGPT) to help structure and clarify these ideas. But more than that, it was born of prayer, conviction, and the quiet guidance of the Holy Spirit, who leads us into all truth (John 16:13) and brings to remembrance all that Christ has taught (John 14:26).\ Any clarity, wisdom, or insight found here belongs to Him. Any confusion or error is mine alone.

Summary

Bitcoin is not just “internet money.” It’s a response to a broken system.\ Proof of Work means truth is earned, not claimed.\ Fiat money is manipulable and inflationary; Bitcoin is fixed and fair.\ Bitcoin is the hardest money in history — with a supply cap of 21 million.\ It appreciates over time, acting as a new form of digital property.\ Christianity calls us to honest scales, faithful stewardship, and dignified work.\ And the Victorious Gospel declares that Jesus is restoring all things — including how we steward value, time, and trust.

Bitcoin may not be the final answer. But it’s a faithful step in the right direction.

-

-

@ eb0157af:77ab6c55

2025-06-11 04:02:38

@ eb0157af:77ab6c55

2025-06-11 04:02:38The stance taken by 31 Bitcoin Core developers divides the community over non-monetary transactions and use cases.

The Bitcoin community finds itself at the center of a heated debate after 31 Bitcoin Core developers published a joint statement outlining a non-interventionist approach to network usage, amid ongoing controversy over non-financial use cases.

The document, published on June 6 on the Bitcoin Core website, has sparked mixed reactions among bitcoiners. The developers clarified their position:

“This is not endorsing or condoning non-financial data usage, but accepting that as a censorship-resistant system, Bitcoin can and will be used for use cases not everyone agrees on.”

The statement emphasizes that Bitcoin is a network “defined by its users” and that core contributors are “not in a position” to enforce mandates on what software or policies people should choose. “Being free to run any software is the network’s primary safeguard against coercion,” it reads.

Community reactions

Not everyone welcomed the developers’ statement. Samson Mow, CEO of JAN3, criticized the tone of the release:

Bitcoin Core devs have been changing the network gradually to enable spam and now seem focused on also removing barriers for spammers. It’s disingenuous to just say “it is what it is now, too bad.”

This statement itself is also inappropriate. Feels like an NYA from Core devs. https://t.co/ACIqyvK12f

— Samson Mow (@Excellion) June 7, 2025

On the other hand, Jameson Lopp, founder of Casa, defended the letter, explaining:

Ahuh, the same but fundamentally different.

NYA was a group saying we have 82% hashpower and will activate a hard fork with 80% signaling.

Core Devs are a group saying we can't force anyone to run code they don't like, here is our thinking on relay policy & network health.

— Jameson Lopp (@lopp) June 7, 2025

Bitcoin Core developer Luke Dashjr criticized the transaction relay policy goals outlined in the statement, stating:

NACK

The goals of transaction relay listed are basically all wrong. Predicting what will be mined is a centralizing goal. Expecting spam to be mined is defeatism. Helping spam propagate is harmful.

This OPED contradicts itself, presenting out of band relay as both negative and…

— Luke Dashjr (@LukeDashjr) June 7, 2025

According to the statement, the Core devs believe it is better for Bitcoin node software to “aim for a realistic sense of what will be included in the next block, rather than intervening between consenting transaction creators and miners to discourage activity that is largely technically harmless.”

The developers identified the main goals of transaction relay as predicting which Bitcoin transactions will be mined, speeding up block propagation, and helping miners identify transactions that pay fees.

The statement concludes:

“While we recognize that this view isn’t held universally by all users and developers, it is our sincere belief that it is in the best interest of Bitcoin and its users, and we hope our users agree.”

Meanwhile, the share of nodes running the implementation created by developer Luke Dashjr, Bitcoin Knots, has surpassed the 10% threshold, according to data from Clark Moody Bitcoin.

The post Bitcoin Core: joint statement sparks debate within the community appeared first on Atlas21.

-

@ 8d34bd24:414be32b

2025-06-11 03:46:43

@ 8d34bd24:414be32b

2025-06-11 03:46:43So often Christians focus on God’s love and ignore His judgment. They tell people they need to be saved, but leave out from what they need to be saved. Fifty or a hundred years ago, almost every American knew the basics of the Bible, what sin is, what the judgment of Hell is, and that the God of the Bible is our Creator. Today, most people in America and the world know very little of that. Phrases like, “Trust Jesus and be saved,” mean very little. The person you are talking to may be silently thinking, “Who is Jesus? Why should I trust Him? What do I need to be saved from?”

Most Christians, especially from Evangelical circles, have been steeped in the phrase “Be saved,” but how many have thought carefully about from what they are being saved? If we have trouble answering, “from what?”, how can we explain it to those who don’t know Jesus?

But God demonstrates His own love toward us, in that while we were yet sinners, Christ died for us. Much more then, having now been justified by His blood, we shall be saved from the wrath of God through Him. For if while we were enemies we were reconciled to God through the death of His Son, much more, having been reconciled, we shall be saved by His life. And not only this, but we also exult in God through our Lord Jesus Christ, through whom we have now received the reconciliation. (Romans 5:8-11) {emphasis mine}

Primarily we are saved “from the wrath of God.” We are also reconciled which saves us from separation from God.

We are also told that we are rescued [saved] “from the wrath to come.”

And to wait for His Son from heaven, whom He raised from the dead, that is Jesus, who rescues us from the wrath to come. (1 Thessalonians 1:10) {emphasis mine}

Then one might ask, “What right does God have to tell me what to do and to get mad at me?”

In the beginning was the Word, and the Word was with God, and the Word was God. He was in the beginning with God. All things came into being through Him, and apart from Him nothing came into being that has come into being. In Him was life, and the life was the Light of men. The Light shines in the darkness, and the darkness did not comprehend it. (John 1:1-5) {emphasis mine}

Why does God get to set the rules? Because He made all things. The Creator gets to set the rules for His creation. It isn’t just ‘might makes right,’ but the one who spoke everything into being gets to set the rules for His creatures just like He set the rules for how everything in the universe works.

Many might claim, “but surely God can’t expect us to be perfect? Nobody is perfect.”

For we do not have a high priest who cannot sympathize with our weaknesses, but One who has been tempted in all things as we are, yet without sin. Therefore let us draw near with confidence to the throne of grace, so that we may receive mercy and find grace to help in time of need. (Hebrews 4:15-16) {emphasis mine}

Jesus doesn’t expect more than He has given. He went through every temptation we have experienced, including trials and hardships we can’t imagine, and yet was without even one sin. He is the perfect example of what we should be. Even more amazingly, he understands that we are unable to live up to His standard, so He came to earth, suffered, died, and rose again, so we could be reconciled to Him. All we have to do is repent of our sins, trust Him, and submit to Him. How can we not put our faith in Him after all He did for us?

He made Him who knew no sin to be sin on our behalf, so that we might become the righteousness of God in Him. (2 Corinthians 5:21)

Jesus paid the penalty. He took our sins, so we can receive His righteousness. This is a trade everyone should be willing to make, but sadly most refuse — some willfully, but some because they haven’t heard the good news. Hopefully all Christians will faithfully share the gospel with those around them.

May the perfect Savior guide us in His perfect will and help us to rightfully share the gospel with all those around us.

Trust Jesus

-

@ eb0157af:77ab6c55

2025-06-11 03:01:19

@ eb0157af:77ab6c55

2025-06-11 03:01:19The German bank is considering launching a stablecoin as the European banking sector gradually opens up to digital assets.

According to a report by Bloomberg, Deutsche Bank is stepping up its involvement in the digital asset space by exploring stablecoin issuance and tokenized deposit solutions.

Sabih Behzad, Deutsche Bank’s Head of Digital Assets and Currencies Transformation, stated that the institution is currently evaluating two strategic options. The first involves developing its own proprietary stablecoin, while the second considers joining a broader consortium initiative within the banking industry.

At the same time, the bank is examining the potential of tokenized deposits — blockchain-based financial instruments that Deutsche Bank believes could enhance the efficiency of transaction settlements. These would represent digital versions of traditional bank deposits.

Deutsche Bank isn’t alone in pursuing this strategy. Banco Santander recently began preliminary work on its own stablecoin and is planning to offer crypto services through its digital banking division. Additionally, Deutsche Bank’s asset management arm, DWS Group, has launched a joint venture with Flow Traders and Galaxy Digital to issue a euro-denominated token.

According to Citigroup projections, the market capitalization of stablecoins is expected to grow significantly, from nearly $240 billion today to over $2 trillion by 2030.

The bank’s participation in Project Agorá — an initiative led by the Bank for International Settlements — further highlights its interest in exploring the role of tokenization in wholesale cross-border payments.

The post Deutsche Bank explores the issuance of a stablecoin appeared first on Atlas21.

-

@ 5d4b6c8d:8a1c1ee3

2025-06-11 01:56:20

@ 5d4b6c8d:8a1c1ee3

2025-06-11 01:56:20Let's hear those ~HealthAndFitness triumphs and challenges

My triumphs - OMAD - Cold shower

My challenges - need to be more active and get outside more

200 sats to post!!! Eat more key lime pie @realBitcoinDog

https://stacker.news/items/1003145

-

@ 502ab02a:a2860397

2025-06-11 01:05:23

@ 502ab02a:a2860397

2025-06-11 01:05:23วันนี้เราคุยเรื่อง ราคะในชามซีเรียล เมื่ออาหารเช้ากลายเป็นเครื่องมือควบคุมจิตวิญญาณ กันครับ

ย้อนกลับไปในปี 1863 ที่เมืองเล็กๆ แห่งหนึ่งในรัฐมิชิแกน สหรัฐอเมริกา มีโรงพยาบาลหนึ่งชื่อว่า Battle Creek Sanitarium ที่ไม่เหมือนโรงพยาบาลทั่วไป เพราะมันไม่ใช่แค่ที่รักษาโรคทางกาย แต่เป็นสถาบันที่พยายามเยียวยาวิญญาณมนุษย์ด้วยอาหารและการใช้ชีวิตแบบละวางกิเลส ผู้ที่ดูแลที่นี่คือชายคนหนึ่งชื่อ John Harvey Kellogg หมอผู้เป็นสาวกเคร่งครัดของกลุ่ม Seventh-day Adventist ซึ่งเป็นกลุ่มคริสเตียนที่เชื่อว่าร่างกายคือพระวิหารของพระเจ้า และทุกอย่างที่เรากินเข้าไปต้องสะอาดบริสุทธิ์ทั้งกายและใจ โดยเฉพาะเรื่อง “ราคะ” ที่เขาเห็นว่าเป็นบ่อเกิดแห่งบาป และเชื่อว่าอาหารที่เรากินส่งผลต่อแรงขับในตัวมนุษย์ บางแหล่งข้อมูลเล่าว่า Dr. Kellogg ถึงขั้นสนับสนุน “การตอนตัวเอง” เพื่อควบคุมกิเลส (ซึ่งเขาไม่ทำเอง แต่สนับสนุนให้บางคนทำ)

หมอเคลล็อกจึงไม่เพียงแต่รณรงค์ให้เลิกกินเนื้อสัตว์ แต่ยังมองว่าการควบคุมพฤติกรรมของมนุษย์ ต้องเริ่มจาก “อาหารเช้า” เพราะมันคือมื้อแรกของวัน มื้อที่จะกำหนดทิศทางร่างกายและจิตใจทั้งวัน และนั่นคือจุดเริ่มต้นของสิ่งที่เรียกว่า “ซีเรียล” ที่เราเห็นทุกเช้าวันนี้ แต่ในยุคแรก มันไม่ได้หวานเลยด้วยซ้ำ มันคือเมล็ดข้าวโพดบด ต้ม แล้วอบแห้งให้กรอบ กินแล้วฝืดคอพอสมควร จุดประสงค์หลักไม่ใช่ให้ฟิน แต่ให้ “สงบ” …สงบทั้งลำไส้และจิตใจ

แต่พอซีเรียลสูตรนี้เริ่มแพร่หลาย มันกลับไปไม่รอดในตลาดคนธรรมดา เพราะมันไม่อร่อย! คนทั่วไปในยุคนั้นยังคุ้นเคยกับอาหารเช้าแบบจัดหนัก ไม่ว่าจะเป็นไข่ เบคอน เนื้อเค็ม แพนเค้ก หรือแม้กระทั่งสตูว์ร้อนๆ ซึ่งล้วนเป็นอาหารจริงจังเต็มพลังงาน เพราะคนยังทำงานใช้แรงทั้งวัน ซีเรียลที่ไม่มีรสชาติและกินแล้วไม่อยู่ท้องจึงขายไม่ออก จนกระทั่ง “น้องชาย” ของหมอเคลล็อกเข้ามาเปลี่ยนเกม

Will Keith Kellogg น้องชายของหมอเคลล็อก เป็นนักการตลาดที่ฉลาดและมองเห็นว่า ถ้าอยากให้คนกินซีเรียลจริงๆ ต้อง “ปรุงรสชาติ” ให้ถูกปากคน ไม่ใช่แค่ถูกหลักศีลธรรม เขาจึงเริ่มเติม “น้ำตาล” ลงไปในซีเรียล เพิ่มความกรุบกรอบ และจัดแพคเกจใหม่ให้ดูน่ากิน พร้อมยิงโฆษณาใส่ผู้บริโภคด้วยวาทกรรมใหม่ที่ว่า “อาหารเช้าคือมื้อที่สำคัญที่สุดของวัน” และถ้าคุณอยากดูแลลูกให้แข็งแรง ก็ต้องเริ่มด้วยการให้เขากินซีเรียลกับนมทุกเช้า... ประโยคนี้คุ้นไหม? ใช่เลย มันคือจุดเริ่มต้นของหนึ่งในความเชื่อฝังหัวที่ยังคงอยู่จนถึงทุกวันนี้ วลี "Breakfast is the most important meal of the day" เป็นสโลแกนที่ Kellogg's และ Grape‑Nuts จาก General Foods ต่างใช้ในแคมเปญโฆษณาหลังยุค 1940s โดยอ้างอิงงานวิจัยที่บริษัทเองสนับสนุน เป็นจุดที่น่าสนใจว่า "หลักฐาน" ทางวิทยาศาสตร์บางทีก็ผลิตขึ้นมาเพื่อรองรับสินค้า

ในความเป็นจริง การกินอาหารเช้าแบบหนักท้อง อย่างไข่ดาว เบคอน หรือแม้แต่ข้าวกับแกงสมัยก่อนน่ะ เป็นเรื่องปกติของคนทุกชนชั้น เพราะมันช่วยให้อิ่มนานและให้พลังงานต่อเนื่อง แต่เมื่อคำว่า “สุขภาพดี” ถูกนำมาเชื่อมโยงกับความบางเบา ความเร็ว และความสะดวกจากกล่องซีเรียล มันก็เหมือนมีเวทมนตร์บางอย่างที่เปลี่ยนพฤติกรรมผู้คนไปโดยไม่รู้ตัว

ที่สำคัญ สูตรสำเร็จของเคลล็อกคือ “ทำให้อาหารเช้ากลายเป็นปัญหา” และนำเสนอซีเรียลเป็นทางออก แล้วบีบให้พ่อแม่ยุคใหม่เชื่อว่า ถ้าไม่ซื้อซีเรียลให้ลูกกิน ลูกจะขาดสารอาหารและเริ่มต้นวันได้ไม่ดีพอ ทั้งที่ความจริง ซีเรียลก็คือน้ำตาลอัดเม็ด ดีๆ นี่เอง แม้ไม่มีหลักฐานว่าเป็นความตั้งใจแต่ต้น แต่มันกลายเป็นผลลัพธ์ทางการตลาดที่ทรงพลัง

และแน่นอนว่ามันไม่หยุดแค่ซีเรียล เพราะเมื่อนมกลายเป็นของที่ต้องกินคู่กัน ความต้องการนมก็พุ่งขึ้นจนต้องขยายฟาร์มโคนมครั้งใหญ่ในประวัติศาสตร์ (อันนี้จะขยายต่อใน ep อื่นนะครับ) เรียกได้ว่าซีเรียลกลายเป็นหมากตัวสำคัญของอุตสาหกรรมอาหาร ที่เริ่มจากความตั้งใจจะ “ลดราคะ” แต่จบลงด้วยการ “เพิ่มยอดขาย” ของบริษัทยักษ์ใหญ่ที่ครองชั้นวางซูเปอร์มาร์เก็ตทั่วโลก และครอบงำอาหารเช้าของโลกนี้ไปมากกว่าครึ่ง

เมื่อมองย้อนไป เฮียว่ามันน่าทึ่งนะ ว่าสิ่งที่เริ่มต้นจากศรัทธาในการควบคุมจิตใจมนุษย์ กลับกลายมาเป็นกลยุทธ์ตลาดระดับโลกได้ และน่าเศร้าในเวลาเดียวกัน เพราะมันทำให้เราหลงลืมว่า แท้จริงแล้วอาหารเช้าคืออะไรกันแน่ มันควรเป็นมื้อที่เชื่อมเราเข้ากับธรรมชาติ หรือเป็นแค่สิ่งที่เราเทใส่ชามเพราะโฆษณาบอกให้ทำ? แถมต้องซื้อจากบริษัทที่ผลิตเท่านั้น

และนั่นแหละเฮียถึงอยากเล่าตอนนี้ เพราะบางครั้งการตั้งคำถามกับอาหารในจาน ก็คือการตั้งคำถามกับระบบที่เราถูกทำให้เชื่อว่า “ดีที่สุด” โดยไม่รู้ตัว...

#โต้งเอง #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ eb0157af:77ab6c55

2025-06-11 01:02:48

@ eb0157af:77ab6c55

2025-06-11 01:02:48Uber’s CEO has revealed the company’s interest in stablecoins as a solution to reduce the costs of cross-border payments.

The multinational transport giant is currently in an exploratory phase regarding the integration of stablecoins into its global payment systems. The disclosure came during a speech by CEO Dara Khosrowshahi at the Bloomberg Tech conference in San Francisco.

“We’re still in the study phase, I’d say, but stablecoin is one of the, for me, more interesting instantiations of crypto that has a practical benefit other than crypto as a store of value.” Khosrowshahi stated.

The Uber CEO explained how stablecoins could represent a cost-effective alternative to traditional payment systems for international transactions. According to Khosrowshahi, these digital currencies could significantly reduce the company’s operational expenses by eliminating high fees and delays typically associated with conventional bank transfers.

Implementing stablecoins could streamline Uber’s global payment operations, with particularly significant benefits in markets burdened by high remittance costs or unstable local currencies — enabling faster and more reliable payments to the company’s business partners. However, Uber has yet to specify which stablecoins or blockchain networks it might adopt, nor has it provided a precise timeline for implementation.

Uber’s interest in stablecoins comes as the legislative landscape continues to evolve. The U.S. Congress is currently reviewing two major legislative proposals: the GENIUS Act and the STABLE Act, both aimed at establishing a clear regulatory framework for dollar-pegged digital currencies. These bills focus on reserve standards and anti-money laundering requirements but have yet to be finalized.

The post Uber eyes stablecoins to optimize international payments appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-11 00:02:34

@ eb0157af:77ab6c55

2025-06-11 00:02:34Romania’s national postal service embraces digital assets by installing the first Bitcoin ATM at its Tulcea branch.

Romania has witnessed the inauguration of the first Bitcoin ATM within the offices of Poșta Română, the country’s national postal service.

The installation took place at the Tulcea branch, the result of a strategic collaboration between Poșta Română and Bitcoin Romania (BTR), one of the country’s leading exchanges. According to the official announcement from the postal service, this marks only the first step in a broader project.

Source: Poșta Română

The next locations set to host these ATMs will be Alexandria, Piatra Neamț, Botoșani, and Nădlac, confirming the postal service’s commitment to widespread distribution of these devices.

The integration of Bitcoin ATMs in post offices is part of a wider strategy to modernize the existing infrastructure through cutting-edge digital technologies. The initiative also aims to expand the range of services available in areas of the country traditionally underserved.

Global adoption

In recent months, global Bitcoin adoption has continued to grow through various channels: individual investors, companies accepting BTC as a payment method, corporations and institutions accumulating Bitcoin as a treasury asset, and nation-states acquiring BTC for strategic reserves.

According to Binance data from January, the number of Bitcoin wallets holding more than $100 in value reached nearly 30 million, marking a 25% year-on-year increase.

Despite this growth, overall Bitcoin adoption remains limited worldwide, even in countries with the highest adoption rates. A Q1 2025 report by River, a Bitcoin financial services company, found that only 4% of the global population owns Bitcoin.

The United States retains the highest concentration of Bitcoin holders, with around 14% of individuals holding BTC in 2025. The total addressable Bitcoin market remains below 1%, due to low retail adoption and under-allocation from institutions, the U.S.-based company noted.

According to River, Bitcoin could absorb 50% of the store-of-value market, equivalent to roughly $225 trillion in value. These asset classes include cash, stocks, real estate, precious metals, and art held for price appreciation or savings. With a current market capitalization slightly above $2 trillion, Bitcoin still has significant room for growth, River suggests.

The post Poșta Română launches the first Bitcoin ATM in post offices appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-11 00:01:29

@ cae03c48:2a7d6671

2025-06-11 00:01:29Bitcoin Magazine

Quantum BioPharma Boosts Digital Asset Holdings to $5 Million with New Bitcoin PurchaseIn an expansion of its digital asset portfolio, Quantum BioPharma Ltd. has announced the purchase of an additional $500,000 in Bitcoin and other cryptocurrencies, bringing its total holdings to USD $5,000,000. The Canadian biopharmaceutical company made the move after securing approval from its Board of Directors.

JUST IN:

Quantum BioPharma Ltd purchased an additional $500k worth of BTC/crypto and now holds $5 million in BTC/crypto. Not sure how much actual #bitcoin pic.twitter.com/OqomNZ250x

Quantum BioPharma Ltd purchased an additional $500k worth of BTC/crypto and now holds $5 million in BTC/crypto. Not sure how much actual #bitcoin pic.twitter.com/OqomNZ250x— NLNico (@btcNLNico) June 10, 2025

“Quantum BioPharma Ltd. is pleased to announce that after receiving approval from the Board of Directors, the Company has purchased additional Bitcoin and other cryptocurrencies as part of its strategic efforts. This brings the total amount of BTC and other cryptocurrencies purchased to USD $5,000,000. As previously announced the company will continue to allow for future financing and other transactions to be carried out in cryptocurrency.”

The investment marks another step in the company’s growth, reinforcing its broader strategy to include Bitcoin into its long-term financial planning and operations.

“This move reflects the company’s belief in the potential of Bitcoin and other currencies to provide a return on investment for shareholders and to provide some hedge against the dollar. The company is now set up to receive financing in cryptocurrencies as well as executing other types of transactions in cryptocurrencies.”

Quantum BioPharma has taken the steps to ensure that its holdings are managed securely and in compliance with legal and financial regulations, working with a custodian to uphold transparency, and investor trust.

“The company is holding all its cryptocurrency with a fully compliant custodian. The company emphasizes that all transactions are and will be fully compliant with all relevant financial and audit regulations, ensuring a secure and legal process.”

Quantum BioPharma is known for its work in the biotech space, particularly through its subsidiary Lucid Psycheceuticals Inc., which focuses on neurological treatments like Lucid-MS. With this latest Bitcoin investment, the company joins a growing list of firms hedging traditional finance strategies with BTC.

While it remains unclear how much of the $5 million is allocated specifically to Bitcoin, the firm’s latest move signals increasing institutional interest in Bitcoin as a long term, viable asset.

This post Quantum BioPharma Boosts Digital Asset Holdings to $5 Million with New Bitcoin Purchase first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 861eb596:51fe0a4d

2025-06-10 23:09:52

@ 861eb596:51fe0a4d

2025-06-10 23:09:52Kinesiology of the Musculoskeletal System

Neumann

This book is about the movement of the human body. And the preface states that this is typically studied for the purpose of sport, art, or medicine. And while the book has a focus on the medical application, my interest is the sport application. Specifically the application of kinesiology to weight training.

The book is about seven hundred pages and is divided into four sections of roughly equal proportion. The first section is introductory and covers kinesiology basics. The the remaining three sections correspond to the three major regions of the body: the upper extremity, the axial skeleton, and the lower extremity.

Of note is the importance of illustrations in this work. It is clear that much effort was given toward their refinement. They are relied upon for the explanation of many concepts.

The chapters within the "body region" sections cover, in order, bones, joints, nerves, and muscles for each body part. It seems fairly clear that these are the four substantial elements of any given movement system of the body.

I will also take this opportunity to reference a diagram I saw on wikipedia that always makes me chuckle a little. It's sort of the minimum viable body plan of almost all animals. I'm curious if the categories of circular and longitudinal muscles make sense for understanding the human body.

https://upload.wikimedia.org/wikipedia/commons/thumb/0/02/Bilaterian_body_plan.svg/2560px-Bilaterian_body_plan.svg.png

-

@ 8bad92c3:ca714aa5

2025-06-10 22:02:46

@ 8bad92c3:ca714aa5

2025-06-10 22:02:46Key Takeaways

In this episode of TFTC, energy economist Anas Alhajji outlines a profound shift in U.S. foreign policy under Trump—away from military intervention and toward transactional diplomacy focused on trade, reconstruction, and curbing Chinese and Russian influence in the Middle East. He highlights Trump’s quiet outreach to Syria as emblematic of the U.S.'s strategic flexibility in legitimizing former adversaries when economically beneficial. Alhajji dismisses BRICS as a fractured bloc incapable of rivaling the U.S.-led order and insists the dollar and petrodollar remain dominant. On energy, he warns that despite favorable fundamentals, prices are suppressed by political confusion, underinvestment, and an aging power grid ill-prepared for the AI and urbanization boom. He also contends that Iran is stalling negotiations to buy time for nuclear advancement and that any deal will be superficial. Finally, Alhajji debunks the myth of Trump being pro-oil, noting his long-standing hostility toward the industry and explaining why a repeat of his past energy boom is implausible given today’s financial and structural constraints.

Best Quotes

- “BRICS is a paper tiger. Everything about BRICS is what China does—and that’s it.”

- “The dollar is here to stay. The petrodollar is here to stay. End of story.”

- “Trump hates the oil industry. He always classified it as an enemy.”

- “Energy projects are 30- to 40-year investments, but politicians think in 4-year cycles. That’s where the disconnect lies.”

- “People think shale will boom again. It won’t. The model changed from ‘drill baby drill’ to ‘control baby control.’”

- “The real story of Trump’s trip wasn’t about politics—it was investment, investment, investment.”

- “Without massive investment in the grid and gas turbines, blackouts will become the norm—even in rich countries like Kuwait.”

- “Iran and China have perfected the game of oil exports. Sanctions are just theater at this point.”

Conclusion

Anas Alhajji’s conclusion challenges conventional narratives, arguing that global power is shifting from military dominance to economic leverage, infrastructure investment, and energy control. He presents a nuanced view of U.S. foreign policy under Trump, emphasizing the strategic importance of trade and reconstruction over regime change. As energy demand soars and geopolitical risks mount, Alhajji warns that the real dangers lie not in foreign adversaries, but in policy confusion, infrastructural lag, and complacency—making this episode a crucial listen for anyone seeking to understand the high-stakes intersection of energy, economics, and diplomacy.

Timestamps

0:00 - Intro

0:48 - Syria and US diplomacy in Middle East

12:50 - Trump in the Middle East

18:12 - Fold & Bitkey

19:48 - Iran - Nuclear program and PR

33:53 - Unchained

34:22 - Crude markets, trade war and US debt

54:28 - Trump's energy stance

1:05:46 - Energy sector challanges

1:14:44 - Policy recommendations

1:21:18 - AI and bitcoinTranscript

(00:00) oil prices market fundamentals support higher price than where we are today. But because of this confusion, everyone is scared of low economic growth and that is a serious problem. The US media ignored part of Trump's speech when he said we are not about nation building and they refer to Afghanistan and Iraq.

(00:15) Look at them. This is a criticism of George W. Bush. We have groups that are talking about the demise of the dollar, the rise of bricks. Bricks is a paper tiger. Everything about bricks is what China does and that's it. The dollar is here to stay and the petro dollar is here to stay.

(00:31) The perception is that the Trump administration is cold but the reality Trump hates the oil [Music] indust. How are you? Very good. Very good. Thank you. As you were telling me, you've been a bit sleepd deprived this week trying to keep up with what's going on. Oh, absolutely. I mean, Trump keeps us on our toes uh all the time.

(01:06) In fact, I plan certain things for the weekend and Trump will say something or he will do something and all of a sudden we get busy again. Uh so clients are not going to wait for you until you finish your work. Basically, they want to know what's going on. So what is going on? What what how profound were the events in the Middle East? These are very uh very profound changes basically because it is very clear that if you look at the last 15 years uh and you look at the growth uh in the Middle East, you look at the growth of Saudi Arabia and uh the

(01:41) role of Turkey for example in the region uh it just just amazing be beyond any uh any thoughts. Uh in fact both of them Turkey and Saudi Arabia are part of the G20. Uh so they have economic influence and they have political influence. And of course the icing on the cake for those who are familiar with the region is to recognize the Syrian government and meet with the Syrian uh president.

(02:11) Uh this is a major a major change in economics and politics uh of the Middle East. Let's touch on that Syria uh topic for a while because I think a lot of people here in the United States were a bit shocked at how sort of welcoming President Trump was towards the new Syrian president considering the fact that uh he was considered an enemy not too long ago here in the United States.

(02:42) What first of all it's a fact of life for those who would like to check the history of politics. There were many people around the world who were classified or they were on the terrorism list and then they became friends of the United States or they were became heroes. I mean Nelson Mandela is one of them. You look at Latin America, there are presidents in Latin America who were uh the enemy of the United States and then they became uh uh cooperative with the United States and the United States recognized their governments and the result of their uh elections. Uh so

(03:15) we've seen this historically uh several uh several times around the world and as they say freedom fighters for some basically are the enemies and the terrorists for for others etc. So uh what we've seen that's why the the visit is very important that the recognition of this government is very important. uh the fact on the ground that uh the president of Syria had the power on the ground uh he had the the the people on the ground and he had the control on the ground and whatever he's been he's been doing since he came into power until now

(03:52) he done all the right steps u and people loved him I mean everyone who went to Syria whether the Syrians who left Syria 40 years ago or uh the visitors who are coming to Syria, they will tell you, "We have never seen the Syrian people as happy as we've seen them today, despite the fact that they they live in misery.

(04:17) They don't have um 8 million people without housing. Uh there is barely any electricity in most of the country. There is no internet. There is barely any food. The uh inflation is rampant, etc. But people are happy because they lived in fear for a very long time. And uh the steps they have taken. For example, the uh ministers in the previous government uh are still there and they are still in the housing of the government.

(04:49) They still have the drivers. They still have the cars from the previous government. They still have it until today. So uh they they were classified as enemies before. But all of a sudden now you have a new government that is uh accepting them. Uh so we we see some changes on the ground that are positive and we'll see how these things will go given that the area around them basically has been unstable for a very long time.

(05:17) how because I don't the the news when I was actually it was surreal for me because my first trip to the Middle East was last December when it was literally f flying over Syria to Abu Dhabi when uh um Assad was getting thrown out and it was pretty surreal to be in that region of the world.

(05:43) How as it pertains to like religious minorities within Syria moving forward is there protractions protections there? Um well let me just uh I want to emphasize one point that is very important. What did the interest of Turkey, Saudi Arabia and the United States in Syria if remember Syria was controlled by Iran and was controlled by the Russians.

(06:09) So in a sense it becomes uh kind of an imperative that taking it away from Iran and Russia and not bringing Iran or Russia back is extremely important. Now the Russians are still there and they have their own base but at least they are not bombing the Syrians and not killing them anymore. But the idea here is taking Syria out of Iran and Russia and probably later on if they kick the Russians out, Russians will not have access to the Mediterranean.

(06:37) Uh so there is an interest uh of all parties basically to take Russia out of Iran and um out of uh Syria regardless the country is uh devastated and it creates massive opportunities for US companies on all levels and uh we've seen a contract uh done recently with you mentioned Abu Dhabi uh uh a contract uh uh with the UA a basically to revamp all the Syrian ports and work on the Syrian ports.

(07:13) Uh so such contracts basically uh when you have a country that has nothing and it's completely devastated the whole infrastructure is devastated. Who is going to build it? If the uh what the Chinese, the Russians, so who who are going to build it? So, uh I think there is a a big room for US companies and others basically to come in and uh literally help on one side and make money on the other.

(07:38) Yeah, I think that that's what I'm trying to discern. What was this convoy from the United States to the Middle East this week signali -

@ 8d5ba92c:c6c3ecd5

2025-06-10 10:30:44

@ 8d5ba92c:c6c3ecd5

2025-06-10 10:30:44Over the years, I’ve hit many different Bitcoin events across Europe, recently LATAM and Asia too. Small local meetups, bigger gatherings, mid-sized and large conferences, as well as cultural festivals like the one just held in Warsaw, Poland, Bitcoin FilmFest (aka BFF25, which I also co-run).

With probably an average of 7-10 gatherings a year, it’s a lot for some, not enough for others. For me, it’s a learning process hunting signal: real people, real ideas, real talks. In a way, Proof of Work—joining these events takes time and energy, it too yields the results—new connections, collaborations, or even just further steps toward our sovereign lives, meeting after meeting, just like adding a block to the chain.

When choosing a new place to join, location and program are important, almost equal, but what matters most is the overall theme and the vibe it creates with the ‘crowd’. Almost a paranormal synergy of what organizers bring and what attendees add with their presence.

May-June 2025...

First, culture without chains. Then privacy, tech, and cypher action. Still buzzing from BFF25, just a week later, a bit tired but stoked, I managed to take a 3-hour flight from Poland to Spain.

Worth it? Absolutely! Why? Continue reading to figure out.

BCC8333. Let’s first break down the name.

Barcelona Cyphers Conference, with “8333” referring to the port Bitcoin nodes use to sync the timechain in a decentralized network. Well, BCC8333 promised substance, not just empty fluff, from the very start. Honestly, I wouldn’t even call it a 'conference' but a high-signal, well-structured meetup of maybe 150-200 individuals. No influencers, no VIP rooms. No hype, no pressure.

Unleashing Decentralized Freedom.

Held at Palau Dalmases, a 17th-century palace in Barcelona’s Born district, the venue was pure magic. Its courtyard, with stair rails carved with mythological scenes, had an artistic, almost rebellious soul tied to its flamenco background (the venue officially hosts flamenco shows in the evenings). Not too big, not too small, it was just perfect for deep talks, hands-on workshops, signal-not-bullshit presentations, and real debates.

The courtyard, the heart of the venue, welcomed us with sunny weather and stylish décor, sparking some of the best daytime conversations I’ve had. The entire place, with its history and defiant spirit, felt ready for us to build something special. https://i.nostr.build/5CbApOqFnb8UoB0F.png

Organized by locals—Spanish Maxis with a cypherpunk soul—and attended by folks from across the globe, it was a perfect mix of knowledge and experiences. Deep discussions on tech, privacy, geo-politics, culture, communities, health, lifestyle, and philosophy. Precious moments with familiar faces or new ones, all working on very interesting projects. Fact: smaller crowd let you dive deep into talks and build genuine connections.

The program was thoughtfully structured. Intense sessions balanced with space to breathe, think, talk, and eat.

(Note: BCC8333, smack in the heart of Barcelona, meant plenty of nearby dining options despite tourist crowds and occasional long lines for top tapas bars. Breaks were long enough, so you could savor decent meals while enjoying the 5-10 minute walk here or there with other attendees. Could you pay in SATs everywhere? Not really, not outside the venue. But let’s be realistic: in a group of Bitcoiners, there’s always a way to use SATs, swapping fiat with others who’ll need it sooner or later. Win-win. Personally, I find these scenarios even better—Bitcoiners roaming the city for days, asking ‘Can I pay in bitcoin?’ again and again, spread a message stronger than just a group of us closed off at the venue doing our own thing. Moving around and repeating the same question will sooner or later inspire new places to take Bitcoin payments seriously. FYI: at one dinner, a delicious Brazilian steakhouse, we convinced a waiter to download a Lightning wallet, accept his tips in SATs, and vow to dig deeper into Bitcoin and Nostr in the coming days.)

Back To The Event and Its Agenda.

Practical workshops, sharp presentations, and real debates (sadly, still too rare in the space) covered topics like privacy, nodes, wallets, Bitaxe miners, and Nostr. Crucial stuff to forge the sovereign life.

https://i.nostr.build/PvD1bDKr9qQ87Mr5.png

- My personal highlights?

Friday’s sessions on the history and future of cypherpunks (Spanish / English, with Alfre Mancera, Entropy, Bebop, Max Hillebrand, and Begleri); Miniscripts Roundtable-Discussion (English, with Edouard from Liana, Landabaso from Rewind, Francesco from BitVault, Yuri da Silva from Great Wall); Self-Sufficient Houses (English with Matthew Prosser); and the debate on Op_return (English, with Peter Todd; Unhosted Marcellus, and Lunaticoin).

I couldn’t catch everything—too busy in hallway chats connecting dots from the past to the present for a stronger future ;) … Luckily, the main stage sessions were recorded by the organizers (follow Nostr: BCC833, with extra interviews/coverage done by Juan Cienfuegos (BitCorner Podcast). Sure, all of it will drop online soon.

https://i.nostr.build/lNppYMtEtz8DGNhi.png

- What left me in awe?

Pure, unfiltered signal.

First, the Spanish Bitcoin scene is a force. Well-organized, connected, decentralized but acting as one when needed. People relentlessly focused on building, not just talking. BCC8333 was proof.

Second, the fusion of ideas is remarkable; the power of plebs putting them into practice moves the world forward. Just as Bitcoin doesn’t need a CEO, Bitcoiners don’t need typical trendsetters or idols. Case by case, we verify truth ourselves, like nodes in a network, organically building, improving, brainstorming, discussing—not on flashy stages or in cold expo hangars, but in dynamic meetups like this one.

Third, the tribe. Don’t get me wrong, even with thousands of attendees, you can find your people if you try. But with a few hundred, free of overwhelming noise and far too many folks rushing around, you don’t miss the most valuable chats. BCC8333 was no different. I met and re-met my soulmates. The tribe you laugh with, but also work hard with when needed. Simply put: people who share the cypherpunk fire. Sovereignty and hands-on freedom.

- Bonus stuff?

Though the topics were serious (and important), the vibe still had plenty of fun. Barcelona’s nightlife was a great playground, but the organizers also brought joy right to the venue itself. https://i.nostr.build/ahJsprpg1d4qHFtV.png

Examples: Both days with Chain Duel to play in the courtyard and later a big-screen tournament, were cool to watch and join. Saturday’s concert by Roger 9000, with all of us shouting, “Tick tock, next block, it don’t stop. The love of freedom, it don’t stop!” to his energetic beats, made those moments truly spectacular.

Wrapping Up.

BCC8333 stands apart. As the title says, it was truly the event ‘Where Cypherpunk Spirit Forges Sovereign Minds.’ Cheers to the organizers, contributors, volunteers, and attendees! Those past few days in Barcelona were solid proof we’re keeping Bitcoin’s ethos alive—a strong case that it’s not about “going to the moon” but staying free on the ground.

Thank YOU!

BTC Your Mind. Let it Beat.

Şela

-

@ f85b9c2c:d190bcff

2025-06-10 21:36:59

@ f85b9c2c:d190bcff

2025-06-10 21:36:59

Having the know-how when diving into a new interest can greatly increase your understanding of a topic. In the crypto space there is a series of words, phrases, abbreviations that some people may find confusing when they first jump into the world of NFTs and crypto. But even with a basic understanding of just a few key words and phrases you can easily begin to navigate the crypto and NFT space.

Blockchain

A blockchain is a shared ledger that facilitates the process of recording transactions and tracking assets in a business network. An asset can be tangible (a house, car, cash, land) or intangible (property, patents, copyrights, branding). The goal of blockchain technology is to allow digital information to be recorded and distributed but not edited. In this way a blockchain is the records of transactions that cannot be altered, deleted, or destroyed. Virtually anything of value can be tracked and traded on a blockchain network which can reduce risk and cut costs for all involved. Blockchain technology was first outlined In 1991 by Stuart Haber and W. Scott Stornetta two mathematicians who wanted to implement a more secure online system where document could not be tampered with.

Blockchain

A blockchain is a shared ledger that facilitates the process of recording transactions and tracking assets in a business network. An asset can be tangible (a house, car, cash, land) or intangible (property, patents, copyrights, branding). The goal of blockchain technology is to allow digital information to be recorded and distributed but not edited. In this way a blockchain is the records of transactions that cannot be altered, deleted, or destroyed. Virtually anything of value can be tracked and traded on a blockchain network which can reduce risk and cut costs for all involved. Blockchain technology was first outlined In 1991 by Stuart Haber and W. Scott Stornetta two mathematicians who wanted to implement a more secure online system where document could not be tampered with.

NFT (Non-Fingable Token)

NFT means non-fungible tokens (NFTs) which are generally created using the same type of programming used for cryptocurrencies. An NFT can be a digital asset that represents real-world objects like art, music, in-game items and videos. “Tokenizing” these real-world tangible assets makes buying, selling, and trading them more efficient while reducing the probability of fraud. They are typically bought and sold online frequently with a form of cryptocurrency or crypto token, and they are generally encoded with the same software as many cryptos. In simple terms these cryptographic assets are based on blockchain technology. Physical currency and cryptocurrency are fungible, which means that they can be traded or exchanged for one another. The term NFT means that it can neither be replaced nor interchanged because it has unique properties.

NFT (Non-Fingable Token)

NFT means non-fungible tokens (NFTs) which are generally created using the same type of programming used for cryptocurrencies. An NFT can be a digital asset that represents real-world objects like art, music, in-game items and videos. “Tokenizing” these real-world tangible assets makes buying, selling, and trading them more efficient while reducing the probability of fraud. They are typically bought and sold online frequently with a form of cryptocurrency or crypto token, and they are generally encoded with the same software as many cryptos. In simple terms these cryptographic assets are based on blockchain technology. Physical currency and cryptocurrency are fungible, which means that they can be traded or exchanged for one another. The term NFT means that it can neither be replaced nor interchanged because it has unique properties.

GameFi

GameFi — involves blockchain games that offer economic incentives to play them, otherwise known as play-to-earn games. Typically players can earn in-game rewards by completing tasks, battling other players or progressing through various game levels. For those unfamiliar with gaming let us put it this way: GameFi is to the gaming industry. Essentially, GameFi aims to revolutionize the traditional gaming infrastructure by combining and integrating blockchain technology and decentralized finance.

GameFi

GameFi — involves blockchain games that offer economic incentives to play them, otherwise known as play-to-earn games. Typically players can earn in-game rewards by completing tasks, battling other players or progressing through various game levels. For those unfamiliar with gaming let us put it this way: GameFi is to the gaming industry. Essentially, GameFi aims to revolutionize the traditional gaming infrastructure by combining and integrating blockchain technology and decentralized finance.

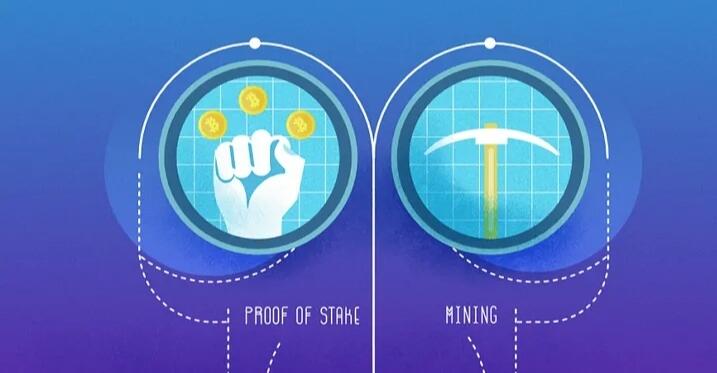

Mining vs. minting

Mining is the process of recording and verifying transactions on a public digital record of transactions known as a blockchain under a proof-of-work protocol. In order to do that miners solve complex mathematical problems and in return there is the possibility they will be rewarded with a certain amount of cryptocurrency for their efforts.

Minting is the process of validating information, creating a new block, and recording that information into the blockchain through a proof-of-stake protocol. Under the Proof-of-Stake mechanism coins are not minted through mining but rather through staking. Proof-of-Stake does not have miners it has validators and it does not let people mine new blocks but instead lets people mint or create new blocks.

Mining vs. minting

Mining is the process of recording and verifying transactions on a public digital record of transactions known as a blockchain under a proof-of-work protocol. In order to do that miners solve complex mathematical problems and in return there is the possibility they will be rewarded with a certain amount of cryptocurrency for their efforts.

Minting is the process of validating information, creating a new block, and recording that information into the blockchain through a proof-of-stake protocol. Under the Proof-of-Stake mechanism coins are not minted through mining but rather through staking. Proof-of-Stake does not have miners it has validators and it does not let people mine new blocks but instead lets people mint or create new blocks.

DeFi (Decentralized Finance)

DeFi — short for decentralized finance — is a new vision of banking and financial services that is based on peer-to-peer payments through blockchain technology.With blockchain technology, DeFi allows “trust-less” banking, sidestepping traditional financial middlemen such as banks or brokers. DeFi is based on secure distributed ledgers similar to those used by cryptocurrencies. The system removes the control banks and institutions have on money, financial products, and financial services. With DeFi fees that banks and other financial companies charge for using their services are eliminated and you have control over your money by holding it in a secure digital wallet instead of keeping it in a bank. Anyone with an internet connection can use DeFi without needing approval from a financial institution.

DeFi (Decentralized Finance)

DeFi — short for decentralized finance — is a new vision of banking and financial services that is based on peer-to-peer payments through blockchain technology.With blockchain technology, DeFi allows “trust-less” banking, sidestepping traditional financial middlemen such as banks or brokers. DeFi is based on secure distributed ledgers similar to those used by cryptocurrencies. The system removes the control banks and institutions have on money, financial products, and financial services. With DeFi fees that banks and other financial companies charge for using their services are eliminated and you have control over your money by holding it in a secure digital wallet instead of keeping it in a bank. Anyone with an internet connection can use DeFi without needing approval from a financial institution.

DApps (Decentralized Applications)

Decentralized applications or dApps, often built on the Ethereum platform, are similar to traditional software programs, but instead of running on a typical software server they run on blockchain networks. Because dApps are decentralized they are free from the control and interference of a single authority. Benefits of dApps include the safeguarding of user privacy, the lack of censorship and the flexibility and freedom of development.

DApps (Decentralized Applications)

Decentralized applications or dApps, often built on the Ethereum platform, are similar to traditional software programs, but instead of running on a typical software server they run on blockchain networks. Because dApps are decentralized they are free from the control and interference of a single authority. Benefits of dApps include the safeguarding of user privacy, the lack of censorship and the flexibility and freedom of development.

Bull market The term “bull market” is most often used to refer to the stock market but can be applied to anything that is traded such as bonds, real estate, currencies, and commodities. Because prices of securities rise and fall essentially continuously during trading the term “bull market” is typically reserved for extended periods in which a large portion of security prices are rising. Bull markets tend to last for months or even years.

Bear market A bear market occurs when a market experiences prolonged price declines. Factors such as a weak or slowing economy or shocks like pandemics or war can all contribute to a bear market.

FOMO (Fear Of Missing Out)

FOMO is the acronym for “Fear Of Missing Out.” In the context of financial markets and trading FOMO refers to the fear that a trader, holder, or investor feels when they think that they may be missing out on a potentially investment or trading opportunity when the price of a token increases. The FOMO feeling is particularly high when the price of a token rises in value significantly over a relatively short time.

FOMO (Fear Of Missing Out)

FOMO is the acronym for “Fear Of Missing Out.” In the context of financial markets and trading FOMO refers to the fear that a trader, holder, or investor feels when they think that they may be missing out on a potentially investment or trading opportunity when the price of a token increases. The FOMO feeling is particularly high when the price of a token rises in value significantly over a relatively short time.The crypto and NFT space is a vast online world that can seem confusing and at times a difficult place to compass for most. With all of the acronyms.crypto slang and words there is to learn in crypto there is always some new phrase or word to learn, and by no means is this all but it can definitely be a start for those who are looking to get started in the crypto space and might need a cheat code.

-

@ eb0157af:77ab6c55

2025-06-10 21:03:14

@ eb0157af:77ab6c55

2025-06-10 21:03:14A new step for the American bank in the digital asset space: Bitcoin ETFs cleared for use as collateral for financing.

JPMorgan Chase will allow clients to use spot Bitcoin ETFs as collateral to obtain loans. According to sources close to the project, cited by Bloomberg, the initiative will launch in the coming weeks and will involve trading and wealth management clients on a global scale.

The bank has decided to begin this new phase starting with crypto ETFs, beginning with the BlackRock iShares Bitcoin Trust (IBIT), which has already surpassed $70 billion in assets under management (AUM). The decision is part of a broader strategy aimed at enabling selected clients to access financing by using cryptocurrency-related assets as collateral. Before this change, JPMorgan only accepted crypto ETFs as loan collateral under specific conditions.

The American bank’s new approach will see Bitcoin ETFs treated like other traditional assets when calculating a client’s borrowing capacity. Just as is currently the case with stocks, cars, or works of art, crypto ETFs will become an integral part of standard wealth evaluations.

Although CEO Jamie Dimon has historically been known for his skeptical stance on Bitcoin, the bank announced last month that it would soon allow clients to purchase spot ETFs on the leading cryptocurrency — although without offering custody services.

The new rules will apply to all of JPMorgan’s wealth management clients worldwide, from retail customers to high-net-worth individuals. The bank will also integrate crypto holdings into the net worth assessments of clients managed by its wealth management division.

The post JPMorgan Chase: Bitcoin ETFs accepted as loan collateral appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-10 21:02:26

@ cae03c48:2a7d6671

2025-06-10 21:02:26Bitcoin Magazine

New York City Won’t Be Issuing BitBonds Anytime SoonSince 2021, Mayor Eric Adams has been talking about how he’s going to make New York City the center of the crypto industry, though this hasn’t materialized. (Some Bitcoin and crypto companies are based here, but this has little to do with Adams’ efforts — or lack thereof.)

So, when I heard the mayor propose issuing BitBonds in New York City at Bitcoin 2025, I was far from convinced that this would actually happen.

And then when I read a statement from NYC Comptroller Brad Lander on the topic, it became even more clear to me that Adams was merely posturing when it came to BitBonds.

“New York City will not be issuing any bitcoin-backed bonds on my watch,” said Lander in the statement.

“Mayor Eric Adams may be willing to bet our future on crypto in exchange for a trip to Vegas, but my job is to ensure our City’s financial stability. Cryptocurrencies are not sufficiently stable to finance our City’s infrastructure, affordable housing, or schools,” he added.

“Proposing that New York City should open its capital planning to crypto could expose our City to new risks and erode bond buyers’ trust in our City.”

In the statement, Lander went on to discuss how BitBonds would work at the federal level (90% of the funds go to government expenditures, while 10% goes to buying bitcoin for a Strategic Bitcoin Reserve), before noting a key difference between federal bonds and the bonds that New York City issues.

“While the federal government issues bonds to fund traditional expenditures, New York City primarily issues bonds to fund capital assets and in only very narrow circumstances can the City finance other purposes,” wrote Lander.

Lander then went on to lay out a number of other reasons why New York City will not be issuing BitBonds anytime soon, including that ”New York City would have to be able to take transactions in Bitcoin in order to issue bonds backed by Bitcoin” because “New York City has neither any mechanism to pay for its Capital Assets in any other currency besides the US Dollar nor any means to convert Bitcoin to US Dollars.”

(If I read that correctly, Lander says that New York City doesn’t know how to set up a Bitcoin wallet or trade bitcoin for U.S. dollars. Just about on par for an elected official in New York.)

Now, pardon my cynicism here, but I’m a New Yorker — a resident of one of the most restrictive jurisdictions in the world when it comes to Bitcoin and crypto, thanks to the BitLicense — and there are two things you can bet on at this point in time in New York.

- Mayor Eric Adams will talk a good game about Bitcoin and crypto while not taking any action behind the scenes.

- Bureaucrats and elected officials alike in New York will continue to throw cold water on anything that challenges Wall Street’s power, while still claiming that New York is the “financial capital of the world.” (Laughable.)