-

@ 8d5ba92c:c6c3ecd5

2025-06-10 10:30:44

@ 8d5ba92c:c6c3ecd5

2025-06-10 10:30:44Over the years, I’ve hit many different Bitcoin events across Europe, recently LATAM and Asia too. Small local meetups, bigger gatherings, mid-sized and large conferences, as well as cultural festivals like the one just held in Warsaw, Poland, Bitcoin FilmFest (aka BFF25, which I also co-run).

With probably an average of 7-10 gatherings a year, it’s a lot for some, not enough for others. For me, it’s a learning process hunting signal: real people, real ideas, real talks. In a way, Proof of Work—joining these events takes time and energy, it too yields the results—new connections, collaborations, or even just further steps toward our sovereign lives, meeting after meeting, just like adding a block to the chain.

When choosing a new place to join, location and program are important, almost equal, but what matters most is the overall theme and the vibe it creates with the ‘crowd’. Almost a paranormal synergy of what organizers bring and what attendees add with their presence.

May-June 2025...

First, culture without chains. Then privacy, tech, and cypher action. Still buzzing from BFF25, just a week later, a bit tired but stoked, I managed to take a 3-hour flight from Poland to Spain.

Worth it? Absolutely! Why? Continue reading to figure out.

BCC8333. Let’s first break down the name.

Barcelona Cyphers Conference, with “8333” referring to the port Bitcoin nodes use to sync the timechain in a decentralized network. Well, BCC8333 promised substance, not just empty fluff, from the very start. Honestly, I wouldn’t even call it a 'conference' but a high-signal, well-structured meetup of maybe 150-200 individuals. No influencers, no VIP rooms. No hype, no pressure.

Unleashing Decentralized Freedom.

Held at Palau Dalmases, a 17th-century palace in Barcelona’s Born district, the venue was pure magic. Its courtyard, with stair rails carved with mythological scenes, had an artistic, almost rebellious soul tied to its flamenco background (the venue officially hosts flamenco shows in the evenings). Not too big, not too small, it was just perfect for deep talks, hands-on workshops, signal-not-bullshit presentations, and real debates.

The courtyard, the heart of the venue, welcomed us with sunny weather and stylish décor, sparking some of the best daytime conversations I’ve had. The entire place, with its history and defiant spirit, felt ready for us to build something special. https://i.nostr.build/5CbApOqFnb8UoB0F.png

Organized by locals—Spanish Maxis with a cypherpunk soul—and attended by folks from across the globe, it was a perfect mix of knowledge and experiences. Deep discussions on tech, privacy, geo-politics, culture, communities, health, lifestyle, and philosophy. Precious moments with familiar faces or new ones, all working on very interesting projects. Fact: smaller crowd let you dive deep into talks and build genuine connections.

The program was thoughtfully structured. Intense sessions balanced with space to breathe, think, talk, and eat.

(Note: BCC8333, smack in the heart of Barcelona, meant plenty of nearby dining options despite tourist crowds and occasional long lines for top tapas bars. Breaks were long enough, so you could savor decent meals while enjoying the 5-10 minute walk here or there with other attendees. Could you pay in SATs everywhere? Not really, not outside the venue. But let’s be realistic: in a group of Bitcoiners, there’s always a way to use SATs, swapping fiat with others who’ll need it sooner or later. Win-win. Personally, I find these scenarios even better—Bitcoiners roaming the city for days, asking ‘Can I pay in bitcoin?’ again and again, spread a message stronger than just a group of us closed off at the venue doing our own thing. Moving around and repeating the same question will sooner or later inspire new places to take Bitcoin payments seriously. FYI: at one dinner, a delicious Brazilian steakhouse, we convinced a waiter to download a Lightning wallet, accept his tips in SATs, and vow to dig deeper into Bitcoin and Nostr in the coming days.)

Back To The Event and Its Agenda.

Practical workshops, sharp presentations, and real debates (sadly, still too rare in the space) covered topics like privacy, nodes, wallets, Bitaxe miners, and Nostr. Crucial stuff to forge the sovereign life.

https://i.nostr.build/PvD1bDKr9qQ87Mr5.png

- My personal highlights?

Friday’s sessions on the history and future of cypherpunks (Spanish / English, with Alfre Mancera, Entropy, Bebop, Max Hillebrand, and Begleri); Miniscripts Roundtable-Discussion (English, with Edouard from Liana, Landabaso from Rewind, Francesco from BitVault, Yuri da Silva from Great Wall); Self-Sufficient Houses (English with Matthew Prosser); and the debate on Op_return (English, with Peter Todd; Unhosted Marcellus, and Lunaticoin).

I couldn’t catch everything—too busy in hallway chats connecting dots from the past to the present for a stronger future ;) … Luckily, the main stage sessions were recorded by the organizers (follow Nostr: BCC833, with extra interviews/coverage done by Juan Cienfuegos (BitCorner Podcast). Sure, all of it will drop online soon.

https://i.nostr.build/lNppYMtEtz8DGNhi.png

- What left me in awe?

Pure, unfiltered signal.

First, the Spanish Bitcoin scene is a force. Well-organized, connected, decentralized but acting as one when needed. People relentlessly focused on building, not just talking. BCC8333 was proof.

Second, the fusion of ideas is remarkable; the power of plebs putting them into practice moves the world forward. Just as Bitcoin doesn’t need a CEO, Bitcoiners don’t need typical trendsetters or idols. Case by case, we verify truth ourselves, like nodes in a network, organically building, improving, brainstorming, discussing—not on flashy stages or in cold expo hangars, but in dynamic meetups like this one.

Third, the tribe. Don’t get me wrong, even with thousands of attendees, you can find your people if you try. But with a few hundred, free of overwhelming noise and far too many folks rushing around, you don’t miss the most valuable chats. BCC8333 was no different. I met and re-met my soulmates. The tribe you laugh with, but also work hard with when needed. Simply put: people who share the cypherpunk fire. Sovereignty and hands-on freedom.

- Bonus stuff?

Though the topics were serious (and important), the vibe still had plenty of fun. Barcelona’s nightlife was a great playground, but the organizers also brought joy right to the venue itself. https://i.nostr.build/ahJsprpg1d4qHFtV.png

Examples: Both days with Chain Duel to play in the courtyard and later a big-screen tournament, were cool to watch and join. Saturday’s concert by Roger 9000, with all of us shouting, “Tick tock, next block, it don’t stop. The love of freedom, it don’t stop!” to his energetic beats, made those moments truly spectacular.

Wrapping Up.

BCC8333 stands apart. As the title says, it was truly the event ‘Where Cypherpunk Spirit Forges Sovereign Minds.’ Cheers to the organizers, contributors, volunteers, and attendees! Those past few days in Barcelona were solid proof we’re keeping Bitcoin’s ethos alive—a strong case that it’s not about “going to the moon” but staying free on the ground.

Thank YOU!

BTC Your Mind. Let it Beat.

Şela

-

@ cae03c48:2a7d6671

2025-06-07 21:01:19

@ cae03c48:2a7d6671

2025-06-07 21:01:19Bitcoin Magazine

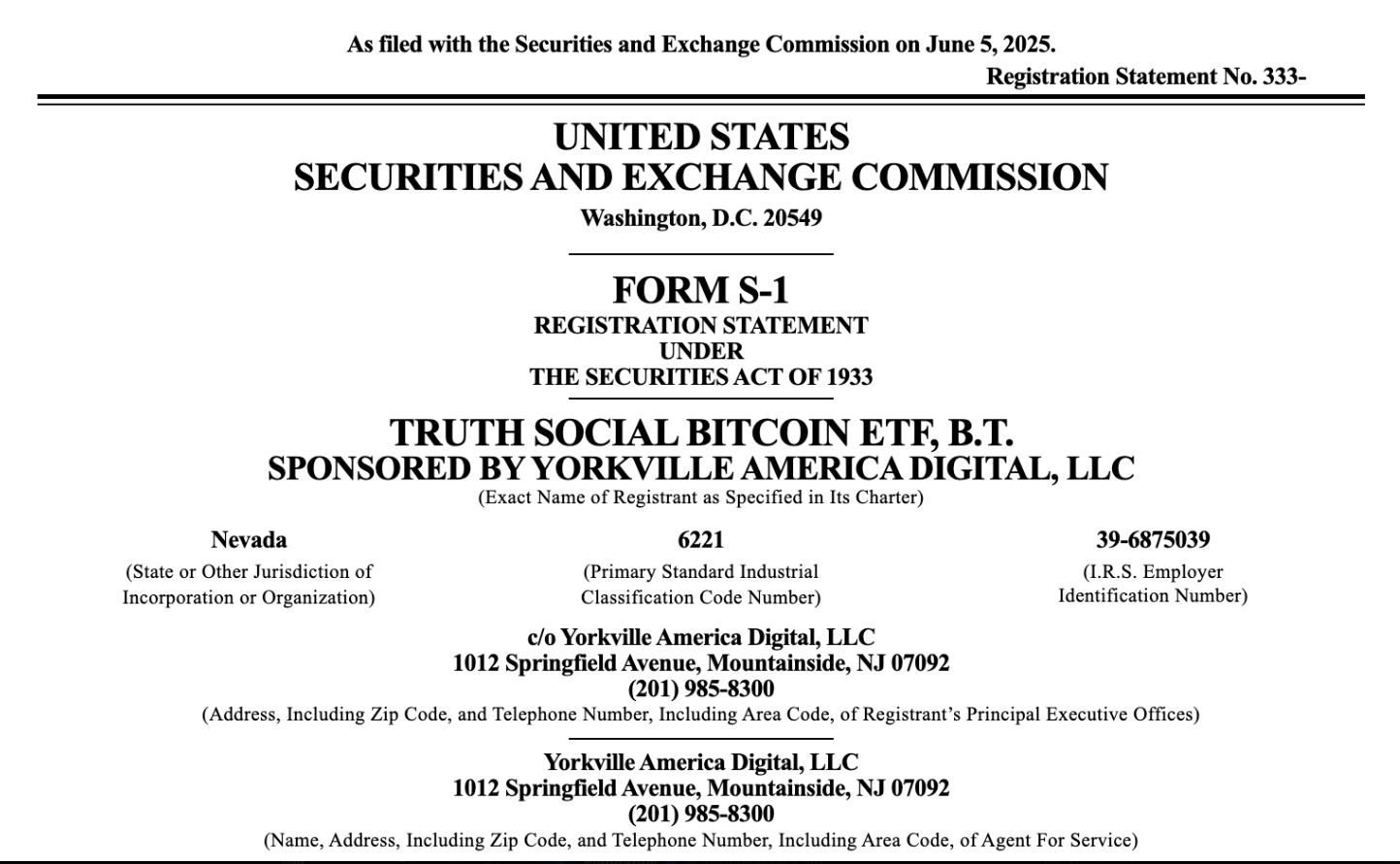

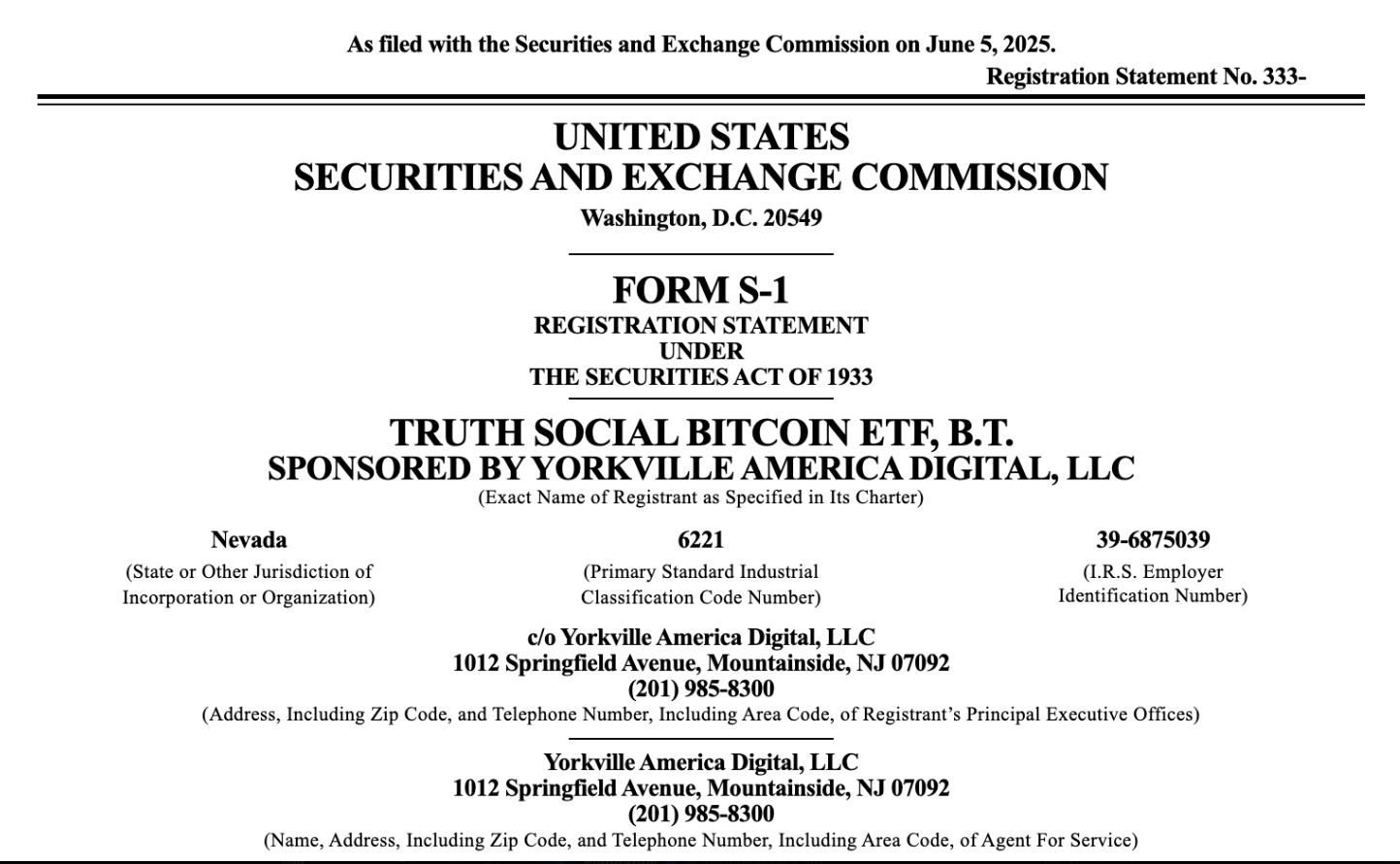

Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in BitcoinMeanwhile Insurance Bitcoin (Bermuda) Limited (“Meanwhile”) announced it has become the first company in the world to release externally audited financial statements denominated entirely in Bitcoin. According to the announcement, the company reported 220.4 BTC in assets and 25.29 BTC in net income for 2024, a 300% year over year increase.

Today marks a global first & historic event for us, along with the public release of our 2024 audited financial statements, covering our 1st year of sales.

As the 1st company in the world to have Bitcoin-denominated financial statements externally audited, we are excited to…

— meanwhile | Bitcoin Life Insurance (@meanwhilelife) June 5, 2025

“We’ve just made history as the first company in the world to have Bitcoin-denominated financial statements externally audited,” said Zac Townsend, CEO of Meanwhile. “This is an important, foundational step in reimagining the financial system based on a single, global, decentralized standard outside the control of any one government.”

The financial statements were audited by Harris & Trotter LLP and its digital asset division ht.digital. Meanwhile’s financials also comply with Bermuda’s Insurance Act 1978, noting that their BTC denominated financials were approved and comply with official guidelines. The firm, fully licensed by the Bermuda Monetary Authority (BMA), operates entirely in BTC and is prohibited from liquidating Bitcoin assets except through policyholder claims, positioning it as a long term holder.

“As the first regulated Bitcoin life insurance company, we view the BTC held by Meanwhile as inherently long-term in nature—primarily held to support the Company’s insurance liabilities over decades,” Townsend added. “This makes it significantly ‘stickier’ and resistant to market pressures compared to the BTC held by other companies as part of their treasury management strategies.”

Meanwhile’s 2024 financials also revealed 23.02 BTC in net premiums and 4.35 BTC in investment income, showing that its model not only preserves Bitcoin, but earns it. The company’s reserves (also held in BTC) were reviewed and approved by Willis Towers Watson (WTW).

Meanwhile also offers a Bitcoin Whole Life insurance product that allows policyholders to save, borrow, and build legacy wealth—entirely in BTC, and has plans to expand globally in 2025.

“We are incredibly proud of today’s news as it underscores how Meanwhile is at the forefront of the next phase of the convergence between Bitcoin and institutional financial markets,” said Tia Beckmann, CFO of Meanwhile. “Now having generated net income in BTC, we have demonstrated that we are earning it through a sustainable insurance business model designed for the long term.”

This post Bitcoin Life Insurer, Meanwhile, Becomes First Company to Publish Audited Financials Denominated in Bitcoin first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ c9badfea:610f861a

2025-06-11 00:02:03

@ c9badfea:610f861a

2025-06-11 00:02:03🤖️ AI Articles

📱 Android Articles

- 📹️ Device as Dashcam

- 🥩 Tracking Food Intake

- ✍️ Taking Handwritten Notes

- 🕒 Tracking Habits

- 🧭 Navigating the Wild

- 📝 Organizing Notes and Tasks

- 🧠 Studying Smarter

- 💱 Tracking Fiat Currency Exchange Rates

- 🌠 Offline Planetarium

- 📥 Downloading Media From 1000+ Sites

- 🔥 Blocking Ads and Trackers

- ⛅ Getting Detailed Weather Information

- 📦 Installing Apps Directly From Source

- 🎮 Playing Retro Games

- 🖼️ Generating AI Images Locally

- 📖 Reading PDF Documents and EPUB Books

- 🔒 Storing Passwords Safely

- 🗺️ Using Offline Maps

- 🎵 Producing Music On-Device

- 💾 Writing ISO Images to USB Drives

- 💻 Coding On-Device

- 🎬 Watching and Downloading Videos from YouTube, Rumble, Odysee, Bitchute, and More

- 🔤 Upgrading the Typing Experience

- 📰 Reading RSS Feeds

- 📥 Downloading Torrents

- 📺 Watching IPTV Channels for Free

- 🔒 Easily Verifying File Checksums

- 🗣️ Offline Translator

- 🗣️ Offline Text-to-Speech Engine

- 🤖 Running LLMs Locally

- 🌐 Browsing Entire Websites Offline

- 🔐 Quickly Encrypting Files

✏️ Other Articles

-

@ 5d4b6c8d:8a1c1ee3

2025-06-11 01:56:20

@ 5d4b6c8d:8a1c1ee3

2025-06-11 01:56:20Let's hear those ~HealthAndFitness triumphs and challenges

My triumphs - OMAD - Cold shower

My challenges - need to be more active and get outside more

200 sats to post!!! Eat more key lime pie @realBitcoinDog

https://stacker.news/items/1003145

-

@ 502ab02a:a2860397

2025-06-11 01:05:23

@ 502ab02a:a2860397

2025-06-11 01:05:23วันนี้เราคุยเรื่อง ราคะในชามซีเรียล เมื่ออาหารเช้ากลายเป็นเครื่องมือควบคุมจิตวิญญาณ กันครับ

ย้อนกลับไปในปี 1863 ที่เมืองเล็กๆ แห่งหนึ่งในรัฐมิชิแกน สหรัฐอเมริกา มีโรงพยาบาลหนึ่งชื่อว่า Battle Creek Sanitarium ที่ไม่เหมือนโรงพยาบาลทั่วไป เพราะมันไม่ใช่แค่ที่รักษาโรคทางกาย แต่เป็นสถาบันที่พยายามเยียวยาวิญญาณมนุษย์ด้วยอาหารและการใช้ชีวิตแบบละวางกิเลส ผู้ที่ดูแลที่นี่คือชายคนหนึ่งชื่อ John Harvey Kellogg หมอผู้เป็นสาวกเคร่งครัดของกลุ่ม Seventh-day Adventist ซึ่งเป็นกลุ่มคริสเตียนที่เชื่อว่าร่างกายคือพระวิหารของพระเจ้า และทุกอย่างที่เรากินเข้าไปต้องสะอาดบริสุทธิ์ทั้งกายและใจ โดยเฉพาะเรื่อง “ราคะ” ที่เขาเห็นว่าเป็นบ่อเกิดแห่งบาป และเชื่อว่าอาหารที่เรากินส่งผลต่อแรงขับในตัวมนุษย์ บางแหล่งข้อมูลเล่าว่า Dr. Kellogg ถึงขั้นสนับสนุน “การตอนตัวเอง” เพื่อควบคุมกิเลส (ซึ่งเขาไม่ทำเอง แต่สนับสนุนให้บางคนทำ)

หมอเคลล็อกจึงไม่เพียงแต่รณรงค์ให้เลิกกินเนื้อสัตว์ แต่ยังมองว่าการควบคุมพฤติกรรมของมนุษย์ ต้องเริ่มจาก “อาหารเช้า” เพราะมันคือมื้อแรกของวัน มื้อที่จะกำหนดทิศทางร่างกายและจิตใจทั้งวัน และนั่นคือจุดเริ่มต้นของสิ่งที่เรียกว่า “ซีเรียล” ที่เราเห็นทุกเช้าวันนี้ แต่ในยุคแรก มันไม่ได้หวานเลยด้วยซ้ำ มันคือเมล็ดข้าวโพดบด ต้ม แล้วอบแห้งให้กรอบ กินแล้วฝืดคอพอสมควร จุดประสงค์หลักไม่ใช่ให้ฟิน แต่ให้ “สงบ” …สงบทั้งลำไส้และจิตใจ

แต่พอซีเรียลสูตรนี้เริ่มแพร่หลาย มันกลับไปไม่รอดในตลาดคนธรรมดา เพราะมันไม่อร่อย! คนทั่วไปในยุคนั้นยังคุ้นเคยกับอาหารเช้าแบบจัดหนัก ไม่ว่าจะเป็นไข่ เบคอน เนื้อเค็ม แพนเค้ก หรือแม้กระทั่งสตูว์ร้อนๆ ซึ่งล้วนเป็นอาหารจริงจังเต็มพลังงาน เพราะคนยังทำงานใช้แรงทั้งวัน ซีเรียลที่ไม่มีรสชาติและกินแล้วไม่อยู่ท้องจึงขายไม่ออก จนกระทั่ง “น้องชาย” ของหมอเคลล็อกเข้ามาเปลี่ยนเกม

Will Keith Kellogg น้องชายของหมอเคลล็อก เป็นนักการตลาดที่ฉลาดและมองเห็นว่า ถ้าอยากให้คนกินซีเรียลจริงๆ ต้อง “ปรุงรสชาติ” ให้ถูกปากคน ไม่ใช่แค่ถูกหลักศีลธรรม เขาจึงเริ่มเติม “น้ำตาล” ลงไปในซีเรียล เพิ่มความกรุบกรอบ และจัดแพคเกจใหม่ให้ดูน่ากิน พร้อมยิงโฆษณาใส่ผู้บริโภคด้วยวาทกรรมใหม่ที่ว่า “อาหารเช้าคือมื้อที่สำคัญที่สุดของวัน” และถ้าคุณอยากดูแลลูกให้แข็งแรง ก็ต้องเริ่มด้วยการให้เขากินซีเรียลกับนมทุกเช้า... ประโยคนี้คุ้นไหม? ใช่เลย มันคือจุดเริ่มต้นของหนึ่งในความเชื่อฝังหัวที่ยังคงอยู่จนถึงทุกวันนี้ วลี "Breakfast is the most important meal of the day" เป็นสโลแกนที่ Kellogg's และ Grape‑Nuts จาก General Foods ต่างใช้ในแคมเปญโฆษณาหลังยุค 1940s โดยอ้างอิงงานวิจัยที่บริษัทเองสนับสนุน เป็นจุดที่น่าสนใจว่า "หลักฐาน" ทางวิทยาศาสตร์บางทีก็ผลิตขึ้นมาเพื่อรองรับสินค้า

ในความเป็นจริง การกินอาหารเช้าแบบหนักท้อง อย่างไข่ดาว เบคอน หรือแม้แต่ข้าวกับแกงสมัยก่อนน่ะ เป็นเรื่องปกติของคนทุกชนชั้น เพราะมันช่วยให้อิ่มนานและให้พลังงานต่อเนื่อง แต่เมื่อคำว่า “สุขภาพดี” ถูกนำมาเชื่อมโยงกับความบางเบา ความเร็ว และความสะดวกจากกล่องซีเรียล มันก็เหมือนมีเวทมนตร์บางอย่างที่เปลี่ยนพฤติกรรมผู้คนไปโดยไม่รู้ตัว

ที่สำคัญ สูตรสำเร็จของเคลล็อกคือ “ทำให้อาหารเช้ากลายเป็นปัญหา” และนำเสนอซีเรียลเป็นทางออก แล้วบีบให้พ่อแม่ยุคใหม่เชื่อว่า ถ้าไม่ซื้อซีเรียลให้ลูกกิน ลูกจะขาดสารอาหารและเริ่มต้นวันได้ไม่ดีพอ ทั้งที่ความจริง ซีเรียลก็คือน้ำตาลอัดเม็ด ดีๆ นี่เอง แม้ไม่มีหลักฐานว่าเป็นความตั้งใจแต่ต้น แต่มันกลายเป็นผลลัพธ์ทางการตลาดที่ทรงพลัง

และแน่นอนว่ามันไม่หยุดแค่ซีเรียล เพราะเมื่อนมกลายเป็นของที่ต้องกินคู่กัน ความต้องการนมก็พุ่งขึ้นจนต้องขยายฟาร์มโคนมครั้งใหญ่ในประวัติศาสตร์ (อันนี้จะขยายต่อใน ep อื่นนะครับ) เรียกได้ว่าซีเรียลกลายเป็นหมากตัวสำคัญของอุตสาหกรรมอาหาร ที่เริ่มจากความตั้งใจจะ “ลดราคะ” แต่จบลงด้วยการ “เพิ่มยอดขาย” ของบริษัทยักษ์ใหญ่ที่ครองชั้นวางซูเปอร์มาร์เก็ตทั่วโลก และครอบงำอาหารเช้าของโลกนี้ไปมากกว่าครึ่ง

เมื่อมองย้อนไป เฮียว่ามันน่าทึ่งนะ ว่าสิ่งที่เริ่มต้นจากศรัทธาในการควบคุมจิตใจมนุษย์ กลับกลายมาเป็นกลยุทธ์ตลาดระดับโลกได้ และน่าเศร้าในเวลาเดียวกัน เพราะมันทำให้เราหลงลืมว่า แท้จริงแล้วอาหารเช้าคืออะไรกันแน่ มันควรเป็นมื้อที่เชื่อมเราเข้ากับธรรมชาติ หรือเป็นแค่สิ่งที่เราเทใส่ชามเพราะโฆษณาบอกให้ทำ? แถมต้องซื้อจากบริษัทที่ผลิตเท่านั้น

และนั่นแหละเฮียถึงอยากเล่าตอนนี้ เพราะบางครั้งการตั้งคำถามกับอาหารในจาน ก็คือการตั้งคำถามกับระบบที่เราถูกทำให้เชื่อว่า “ดีที่สุด” โดยไม่รู้ตัว...

#โต้งเอง #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ b17fccdf:b7211155

2025-06-09 19:17:52

@ b17fccdf:b7211155

2025-06-09 19:17:52

Check out the MiniBolt guide -> HERE <-

- Core guides

- System

- Bitcoin

- Bitcoin client (Bitcoin Core)

- Electrum server (Fulcrum)

- Blockchain explorer (BTC RPC Explorer)

- Desktop signing app (Sparrow Wallet)

- Lightning

- Lightning client (LND)

- Channel backup

- Web app (ThunderHub)

- Mobile app (Zeus)

- Bonus guides

- System bonus guide

- Dashboard & Appearance

- System Administration

- Install / Update / Uninstall common languages

- Databases

- Hardware

- Bitcoin bonus guides

- Electrum servers

- Signing apps

- Desktop

- Electrum Wallet Desktop

- Decentralized exchange

- Resilience

- Fun

- Payment processors

- Testnet

- Nostr bonus guides

- Relays

- Nostr relay in Rust

- Security bonus guides

- Authentication and Access Control

- SSH Keys

- Networking bonus guides

- VPN & Tunneling

- Resilience

🏗️ Roadmap | 🌐 Dynamic Network map | 🔧 Issues | 📥 Pull requests | 🗣️ Discussions

By ⚡2FakTor⚡

Last updated: 09/06/2025

-

@ f85b9c2c:d190bcff

2025-06-10 21:36:59

@ f85b9c2c:d190bcff

2025-06-10 21:36:59

Having the know-how when diving into a new interest can greatly increase your understanding of a topic. In the crypto space there is a series of words, phrases, abbreviations that some people may find confusing when they first jump into the world of NFTs and crypto. But even with a basic understanding of just a few key words and phrases you can easily begin to navigate the crypto and NFT space.

Blockchain

A blockchain is a shared ledger that facilitates the process of recording transactions and tracking assets in a business network. An asset can be tangible (a house, car, cash, land) or intangible (property, patents, copyrights, branding). The goal of blockchain technology is to allow digital information to be recorded and distributed but not edited. In this way a blockchain is the records of transactions that cannot be altered, deleted, or destroyed. Virtually anything of value can be tracked and traded on a blockchain network which can reduce risk and cut costs for all involved. Blockchain technology was first outlined In 1991 by Stuart Haber and W. Scott Stornetta two mathematicians who wanted to implement a more secure online system where document could not be tampered with.

Blockchain

A blockchain is a shared ledger that facilitates the process of recording transactions and tracking assets in a business network. An asset can be tangible (a house, car, cash, land) or intangible (property, patents, copyrights, branding). The goal of blockchain technology is to allow digital information to be recorded and distributed but not edited. In this way a blockchain is the records of transactions that cannot be altered, deleted, or destroyed. Virtually anything of value can be tracked and traded on a blockchain network which can reduce risk and cut costs for all involved. Blockchain technology was first outlined In 1991 by Stuart Haber and W. Scott Stornetta two mathematicians who wanted to implement a more secure online system where document could not be tampered with.

NFT (Non-Fingable Token)

NFT means non-fungible tokens (NFTs) which are generally created using the same type of programming used for cryptocurrencies. An NFT can be a digital asset that represents real-world objects like art, music, in-game items and videos. “Tokenizing” these real-world tangible assets makes buying, selling, and trading them more efficient while reducing the probability of fraud. They are typically bought and sold online frequently with a form of cryptocurrency or crypto token, and they are generally encoded with the same software as many cryptos. In simple terms these cryptographic assets are based on blockchain technology. Physical currency and cryptocurrency are fungible, which means that they can be traded or exchanged for one another. The term NFT means that it can neither be replaced nor interchanged because it has unique properties.

NFT (Non-Fingable Token)

NFT means non-fungible tokens (NFTs) which are generally created using the same type of programming used for cryptocurrencies. An NFT can be a digital asset that represents real-world objects like art, music, in-game items and videos. “Tokenizing” these real-world tangible assets makes buying, selling, and trading them more efficient while reducing the probability of fraud. They are typically bought and sold online frequently with a form of cryptocurrency or crypto token, and they are generally encoded with the same software as many cryptos. In simple terms these cryptographic assets are based on blockchain technology. Physical currency and cryptocurrency are fungible, which means that they can be traded or exchanged for one another. The term NFT means that it can neither be replaced nor interchanged because it has unique properties.

GameFi

GameFi — involves blockchain games that offer economic incentives to play them, otherwise known as play-to-earn games. Typically players can earn in-game rewards by completing tasks, battling other players or progressing through various game levels. For those unfamiliar with gaming let us put it this way: GameFi is to the gaming industry. Essentially, GameFi aims to revolutionize the traditional gaming infrastructure by combining and integrating blockchain technology and decentralized finance.

GameFi

GameFi — involves blockchain games that offer economic incentives to play them, otherwise known as play-to-earn games. Typically players can earn in-game rewards by completing tasks, battling other players or progressing through various game levels. For those unfamiliar with gaming let us put it this way: GameFi is to the gaming industry. Essentially, GameFi aims to revolutionize the traditional gaming infrastructure by combining and integrating blockchain technology and decentralized finance.

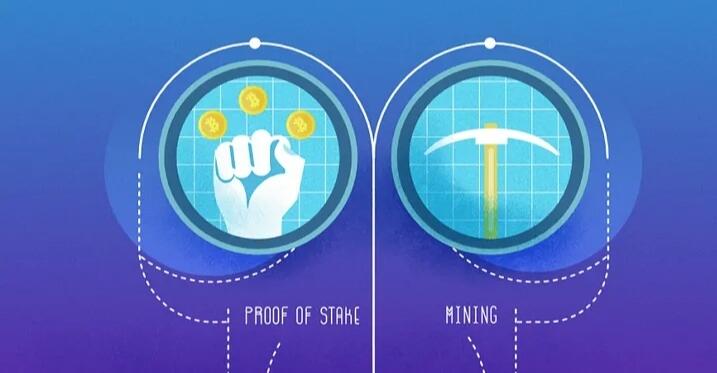

Mining vs. minting

Mining is the process of recording and verifying transactions on a public digital record of transactions known as a blockchain under a proof-of-work protocol. In order to do that miners solve complex mathematical problems and in return there is the possibility they will be rewarded with a certain amount of cryptocurrency for their efforts.

Minting is the process of validating information, creating a new block, and recording that information into the blockchain through a proof-of-stake protocol. Under the Proof-of-Stake mechanism coins are not minted through mining but rather through staking. Proof-of-Stake does not have miners it has validators and it does not let people mine new blocks but instead lets people mint or create new blocks.

Mining vs. minting

Mining is the process of recording and verifying transactions on a public digital record of transactions known as a blockchain under a proof-of-work protocol. In order to do that miners solve complex mathematical problems and in return there is the possibility they will be rewarded with a certain amount of cryptocurrency for their efforts.

Minting is the process of validating information, creating a new block, and recording that information into the blockchain through a proof-of-stake protocol. Under the Proof-of-Stake mechanism coins are not minted through mining but rather through staking. Proof-of-Stake does not have miners it has validators and it does not let people mine new blocks but instead lets people mint or create new blocks.

DeFi (Decentralized Finance)

DeFi — short for decentralized finance — is a new vision of banking and financial services that is based on peer-to-peer payments through blockchain technology.With blockchain technology, DeFi allows “trust-less” banking, sidestepping traditional financial middlemen such as banks or brokers. DeFi is based on secure distributed ledgers similar to those used by cryptocurrencies. The system removes the control banks and institutions have on money, financial products, and financial services. With DeFi fees that banks and other financial companies charge for using their services are eliminated and you have control over your money by holding it in a secure digital wallet instead of keeping it in a bank. Anyone with an internet connection can use DeFi without needing approval from a financial institution.

DeFi (Decentralized Finance)

DeFi — short for decentralized finance — is a new vision of banking and financial services that is based on peer-to-peer payments through blockchain technology.With blockchain technology, DeFi allows “trust-less” banking, sidestepping traditional financial middlemen such as banks or brokers. DeFi is based on secure distributed ledgers similar to those used by cryptocurrencies. The system removes the control banks and institutions have on money, financial products, and financial services. With DeFi fees that banks and other financial companies charge for using their services are eliminated and you have control over your money by holding it in a secure digital wallet instead of keeping it in a bank. Anyone with an internet connection can use DeFi without needing approval from a financial institution.

DApps (Decentralized Applications)

Decentralized applications or dApps, often built on the Ethereum platform, are similar to traditional software programs, but instead of running on a typical software server they run on blockchain networks. Because dApps are decentralized they are free from the control and interference of a single authority. Benefits of dApps include the safeguarding of user privacy, the lack of censorship and the flexibility and freedom of development.

DApps (Decentralized Applications)

Decentralized applications or dApps, often built on the Ethereum platform, are similar to traditional software programs, but instead of running on a typical software server they run on blockchain networks. Because dApps are decentralized they are free from the control and interference of a single authority. Benefits of dApps include the safeguarding of user privacy, the lack of censorship and the flexibility and freedom of development.

Bull market The term “bull market” is most often used to refer to the stock market but can be applied to anything that is traded such as bonds, real estate, currencies, and commodities. Because prices of securities rise and fall essentially continuously during trading the term “bull market” is typically reserved for extended periods in which a large portion of security prices are rising. Bull markets tend to last for months or even years.

Bear market A bear market occurs when a market experiences prolonged price declines. Factors such as a weak or slowing economy or shocks like pandemics or war can all contribute to a bear market.

FOMO (Fear Of Missing Out)

FOMO is the acronym for “Fear Of Missing Out.” In the context of financial markets and trading FOMO refers to the fear that a trader, holder, or investor feels when they think that they may be missing out on a potentially investment or trading opportunity when the price of a token increases. The FOMO feeling is particularly high when the price of a token rises in value significantly over a relatively short time.

FOMO (Fear Of Missing Out)

FOMO is the acronym for “Fear Of Missing Out.” In the context of financial markets and trading FOMO refers to the fear that a trader, holder, or investor feels when they think that they may be missing out on a potentially investment or trading opportunity when the price of a token increases. The FOMO feeling is particularly high when the price of a token rises in value significantly over a relatively short time.The crypto and NFT space is a vast online world that can seem confusing and at times a difficult place to compass for most. With all of the acronyms.crypto slang and words there is to learn in crypto there is always some new phrase or word to learn, and by no means is this all but it can definitely be a start for those who are looking to get started in the crypto space and might need a cheat code.

-

@ 91bea5cd:1df4451c

2025-06-10 14:52:18

@ 91bea5cd:1df4451c

2025-06-10 14:52:18Para um brasileiro, pode ser difícil entender como as estações do ano são capazes de influenciar o imaginário e a própria organização da sociedade.

Mas em países de clima temperado ou frio, onde primavera, verão, outono e inverno são mais demarcados, é contagiante a alegria com que o verão é celebrado, depois de meses de dias curtos, temperaturas frequentemente negativas e poucas possibilidades de interação social.

É por isso que desde os tempos mais antigos, as primeiras civilizações europeias já tinham festas específicas para celebrar tanto a chegada da primavera — a volta da vida desabrochando — quanto o solstício de verão — o ápice do sol, o dia mais longo do ano.

E, segundo pesquisadores, são esses dois tipos de celebração, depois abraçados pelo catolicismo, que explicam a origem das festas juninas, que no Brasil acabariam sendo reinventadas com um sotaque próprio.

"As origens são mesmo as antigas festas pagãs das antigas civilizações, ligadas aos ciclos da natureza, às estações do ano. Sociedades antigas realizavam grandes festividades, com durações longas, até de um mês, sobretudo nos períodos de plantio e de colheita", contextualiza o pesquisador de culturas populares Alberto Tsuyoshi Ikeda, professor da Universidade de São Paulo e consultor da cátedra Kaapora: da Diversidade Cultural e Étnica na Sociedade Brasileira, da Universidade Federal de São Paulo (#Unifesp).

"A primavera era bastante comemorada, como o reingresso da vida mais dinâmica, o rebrotar da natureza e das atividades depois do período do inverno, sempre de muita dificuldade, luta pela sobrevivência e recolhimento", comenta ele.

Se nessa época do ano o que se via era a explosão da natureza, a vida social espelhava isso. "Os grupos humanos realizavam grandes festividades dedicadas à própria natureza, muitas vezes rendendo homenagens aos antigos deuses relacionados à natureza, à vida animal, à vida vegetal de um modo geral. Eram festas comunitárias com muita alegria, muita alimentação e reunião de pessoas em grande número: foi o que deu origem às festas juninas que a gente conhece no Brasil e em outras partes do mundo."

Autora do livro Festas Juninas: Origens, Tradições e História, a socióloga Lucia Helena Vitalli Rangel, professora na Pontifícia Universidade Católica de São Paulo (PUC-SP), explica que a origem das festas juninas está nos "rituais de fertilidade agrícola" de diversos povos — da Europa, do Oriente Médio e do norte da África.

Os [mitológicos] casais #férteis #Afrodite e Adonis, Tamuz e Izta, Isis e #Osíris eram homenageados nesses #rituais, pois representavam a reprodução humana, numa época de evocação da colheita", afirma.

"Eram rituais para que a colheita fosse farta e para abençoar o próximo período #agrícola. Era período de congraçamento, de partilha e estabelecimento de alianças entre as comunidades. Eram rituais de fartura e abundância em todos os sentidos, no âmbito alimentar e na relação entre as famílias: casamentos, batizados e compadrio."

"No hemisfério norte o solstício de verão era o auge do período ritual e do trabalho agrícola coroado pela colheita", acrescenta a socióloga.

Vale ressaltar o óbvio, para que não fique um certo estranhamento ao leitor menos atento: no hemisfério norte, origem de tais celebrações, as estações do ano são invertidas em relação ao hemisfério sul, onde está o Brasil.

Apropriação católica

Mas onde então entram os santos nessa história? Na festa junina contemporânea, estão presentes algumas das figuras mais populares do catolicismo — e isso acabou impregnado de tal forma na celebração que a religiosidade se misturou ao folclore e às tradições populares, transcendendo os ritos normatizados pela Igreja Católica.

O primeiro dos santos juninos é Antônio (? - 1231), frade franciscano de origem portuguesa que ficou conhecido pelo que fez na Itália no início do século 13. Com fama de milagreiro, foi canonizado pela Igreja onze meses depois de sua morte — trata-se de um recorde até hoje não superado na história do catolicismo.

No imaginário popular, Antônio se tornou o #bonachão santo das coisas perdidas, sobretudo nos países europeus, e o casamenteiro, principalmente em Portugal e no Brasil. #Simpatias, #promessas e orações específicas marcam a devoção a ele. E sua presença nos festejos juninos geralmente está ligada a essas tradições — a Igreja fixou o 13 de junho, data da morte dele, como dia consagrado ao santo.

Em 24 de junho, o catolicismo celebra o nascimento de João Batista (2 a.C - 28 d.C.). É o santo máximo das comemorações juninas — há versões que apontam que originalmente eram "festas joaninas" e não festas juninas; e, sobretudo no nordeste brasileiro, a Festa de São João é um evento de dimensões impressionantes.

Personagem de historicidade controversa, João Batista é apontado como primo de Jesus Cristo e aquele que o batizou.

Em seu livro O Ramo de Ouro, o antropólogo escocês James Frazer (1854-1941) diz que ocorreu um processo histórico "de acomodação", deslocando para a figura de São João Batista a comemoração do solstício de verão.

Por fim, o mês de junho ainda tem a data do martírio de São Pedro (? - 67 d.C) e São Paulo (5 d.C. - 67 d.C.), dois dos pioneiros do cristianismo. Pedro foi um dos 12 apóstolos de Jesus e acabou depois considerado o primeiro papa do catolicismo.

Paulo de Tarso, por sua vez, é reputado como um dos mais influentes teólogos da história. Parte significativa dos textos que compõem o Novo Testamento da Bíblia é atribuída à sua pena. É dele, portanto, a autoria de parcela considerável da ressignificação de Jesus Cristo após sua morte na cruz — em outras palavras, é possível dizer que Paulo é responsável pela transformação de Jesus em um mito.

Uma observação necessária: apesar de a Igreja celebrar em conjunto a memória do martírio de Pedro e de Paulo, por tradição este último nem sempre é associado aos festejos juninos.

À medida que o catolicismo foi se transformando em religião do status quo, sobretudo a partir da cristianização do Império Romano, no ano de 380 d.C., diversos rituais tratados como pagãos acabaram sendo abraçados e apropriados pela Igreja. "A Igreja Católica não pôde desmanchar essas práticas", reconhece Rangel.

Com os rituais de primavera e verão, não foi diferente. "Várias dessas festividades foram adaptadas", conclui Alberto Ikeda, da USP. "Aos poucos passaram a ser tratadas como festas em honra aos santos juninos."

"Mas é importante notar que mesmo dentro do ciclo cristão, esses santos estão ligados tematicamente com aquelas mesmas ideias, os mesmos princípios das festividades [dessa época do ano] das antigas civilizações", pontua o pesquisador.

Santo Antônio, por exemplo, é o casamenteiro — em uma leitura lato sensu, poderia ser encarado como o santo da família, da unidade familiar, da reprodução humana. "São João também está ligado, sobretudo nos interiores do Brasil, a essa questão dos relacionamentos afetivos. Tradicionalmente, faz-se muito casamento no Dia de São João", diz Ikeda.

"Ele também traz a característica da fartura [que remete aos períodos de plantio e de colheita, em oposição aos rigorosos invernos], dos alimentos, das bebidas, aquilo que chamamos na antropologia de repasto ritual ou repasto cerimonial", afirma o pesquisador.

De modo geral, na leitura proposta por ele, todos os santos juninos estão ligados aos ciclos da natureza — fogo, água, fertilidade, abundância. Está aí São Pedro e a ideia de que ele é quem controla o tempo. "Vejo uma relação entre eles e os antigos rituais, uma relação ainda presente.

Embora a gente não perceba mais, eles têm essa ligação com os elementos fundamentais da existência humana", comenta.

Nas festas populares essas forças da natureza se fazem representadas, muito além da mesa farta.

Os mastros juninos que são erguidos representam a potência dos troncos, das árvores que resistem ao inverno. A fogueira é a luz: ilumina, aquece, afugenta animais ferozes, assa os alimentos.

Na releitura contemporânea, portanto, as festas juninas "guardam as reminiscências das ancestrais aglomerações festivas", conforme frisa Ikeda.

Tradição brasileira

Paçoca, pamonha, pipoca, bolo de fubá, canjica, curau, pé de moleque, maçã do amor. Vinho quente e quentão. Brincadeiras de pular fogueira e dançar a quadrilha. Chapéu de palha, camisa xadrez, calça com remendos. Bombinhas e rojões, fogos de artifício. Bandeirinhas coloridas penduradas em varais de barbante.

No Brasil, as festas juninas foram reinventadas e se tornaram uma exaltação das raízes caipiras. E muito além da religiosidade, tornou-se tradição, folclore. Como se o ciclo se fechasse: o que nasceu como ritual gregário, de celebração social, e depois foi apropriado por uma religião dominante, acabou na cultura popular sendo devolvido ao sentido original — ou seja, a festa pela alegria de festejar.

Não à toa, a folclorista Laura Della Mônica registrou em seu livro Os Três Santos do Mês de Junho que "respeitar as festas e orações dedicadas a cada um dos três santos do mês de junho, segundo a tradição, é obrigação e dever de todos nós, pelo menos culturalmente". O "todos nós" é o brasileiro. Porque mesmo nascida no Velho Mundo, as festas juninas assumiram uma identidade própria em território nacional.

"A colonização da América colocou novamente a questão [da apropriação cultural] para os jesuítas e todos os religiosos que se instalaram no continente sul-americano", pontua a socióloga Rangel.

"No caso do Brasil, houve uma coincidência do calendário. No inverno seco, o solstício de inverno marca o período dos trabalhos agrícolas mais importantes. Do mesmo modo que, para os povos do hemisfério norte é o período de rituais de fertilidade, [a festa por aqui também vem] com as mesmas características, congrega as famílias na evocação da abundância."

As tradições regionais guardam suas especificidades, como era de se esperar em um país de dimensões continentais. "Sempre foram festas e rituais populares", salienta Rangel.

"No Brasil temos expressões regionais muito fortes: o São João nordestino, o Boi Bumbá da região norte, o Boi de Mamão no sul, Cavalhadas no centro-oeste e as festas do Divino Espírito Santo e muitas regiões, particularmente no estado de São Paulo."

A pesquisadora comenta que "conforme os padres vão chegando nas paróquias, começam a interferir nas comemorações". É quando vem o sincretismo: a festa popular também é festa católica, a quermesse organizada pela igreja também tem os rituais populares.

"Até hoje as paróquias, as igrejas, realizam festas juninas. Mesmo que as maiores festas estejam predominantemente tendo somente o caráter festivo, mais comercial, de exploração pelo ganho financeiro, as igrejas continuam fazendo comemorações aos santos juninos", pontua Ikeda.

"Embora muitas pessoas não católicas também participem das festas, embora predomine uma visão genérica que as festas juninas não guardam mais relação com a religiosidade, há ainda um relacionamento das igrejas com esses santos juninos."

Para ele, a evolução da festividade consiste no fato de que "toda aglomeração possibilita o incentivo ao comércio". "E a alimentação está neste centro, na busca mesmo do repasto cerimonial e festividades, danças e músicas que sempre estiveram ligados aos antigos rituais." Ikeda lembra que a as festas populares têm uma importância antropológica por serem "práticas gregárias que ciclicamente comemoram a própria constituição, a própria existência das comunidades enquanto coletividade, a reunião de grupos humanos que preservam uma história comum".

"No caso da feste junina, esse vestir-se de caipira, simbolicamente, é um instrumento de importância até emocional e psicológico para as pessoas se sentirem com a identidade ligada ao passado, aos pais e avós que praticavam aquilo, comemorando de forma parecida", analisa o pesquisador.

"Assim, a prática possibilita a guarda de uma continuidade ao longo do tempo."

Suspensão sanitária

Nunca é demais enfatizar: com a pandemia de covid-19 ainda fora de controle, seria uma péssima ideia realizar qualquer tipo de festa neste período — se quer comemorar, faça em casa somente com seu núcleo familiar. Então, 2021 será o segundo ano consecutivo em que o Brasil não terá, ao menos de modo ostensivo, a tradição das festividades com bandeirinhas coloridas. Doutora em História das Ciências da Saúde e autora do livro A Gripe Espanhola na Bahia, a historiadora Christiane Maria Cruz de Souza afirma que esse cancelamento não ocorreu nem na epidemia de 100 anos atrás.

Isto porque a gripe chegou ao Brasil bem depois dos festejos de 1918. E, no ano seguinte, a epidemia estava controlada. "A gripe espanhola não teve nenhuma interferência no São João. Os primeiros registros da doença apareceram em setembro de 1918 e a doença foi se extinguindo aos poucos. Em Salvador, ele não avançou para o ano de 1919. Houve alguns surtos, em lugares mais remotos, até 1920, mas sem caráter epidêmico."

É de se supor, inclusive, que as festividades de 1919 tenham sido ainda mais animadas. "Passada a epidemia de gripe espanhola, tudo o que as pessoas queriam eram esquecê-la", afirma Souza.

Em 20 de junho de 1919, entretanto, surgiram os primeiros registros indicando uma epidemia de varíola na capital da Bahia. "Começaram a aparecer um caso aqui, outro ali, mas ainda sem a força suficiente para poucos dias depois interditar os festejos de São João", nota a pesquisadora.

"As autoridades sanitárias demoraram muito para reconhecer que ocorria uma epidemia terrível de varíola. Autoridades públicas só costumam reconhecer a existência de uma epidemia quando se torna inevitável devido ao acúmulo de adoecimentos e mortes, quando o número de doentes e mortos ultrapassa a normalidade esperada para os casos da doença. Isso demora um tempo."

Rangel ressalta, inclusive, que até a primeira metade do século 20, as festas juninas eram muito menores, restritas a familiares e pequenos grupos comunitários. Muito menos do que os eventos de hoje em dia. "Eram festas de arraial, de quintais, de quermesses", diz. "Elas só se transformaram em grandes espetáculos na segunda metade do século 20, na esteira da espetacularização do carnaval."

Fonte: BBC News 18 Junho 2021

-

@ eb0157af:77ab6c55

2025-06-11 01:02:48

@ eb0157af:77ab6c55

2025-06-11 01:02:48Uber’s CEO has revealed the company’s interest in stablecoins as a solution to reduce the costs of cross-border payments.

The multinational transport giant is currently in an exploratory phase regarding the integration of stablecoins into its global payment systems. The disclosure came during a speech by CEO Dara Khosrowshahi at the Bloomberg Tech conference in San Francisco.

“We’re still in the study phase, I’d say, but stablecoin is one of the, for me, more interesting instantiations of crypto that has a practical benefit other than crypto as a store of value.” Khosrowshahi stated.

The Uber CEO explained how stablecoins could represent a cost-effective alternative to traditional payment systems for international transactions. According to Khosrowshahi, these digital currencies could significantly reduce the company’s operational expenses by eliminating high fees and delays typically associated with conventional bank transfers.

Implementing stablecoins could streamline Uber’s global payment operations, with particularly significant benefits in markets burdened by high remittance costs or unstable local currencies — enabling faster and more reliable payments to the company’s business partners. However, Uber has yet to specify which stablecoins or blockchain networks it might adopt, nor has it provided a precise timeline for implementation.

Uber’s interest in stablecoins comes as the legislative landscape continues to evolve. The U.S. Congress is currently reviewing two major legislative proposals: the GENIUS Act and the STABLE Act, both aimed at establishing a clear regulatory framework for dollar-pegged digital currencies. These bills focus on reserve standards and anti-money laundering requirements but have yet to be finalized.

The post Uber eyes stablecoins to optimize international payments appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-06-11 00:02:34

@ eb0157af:77ab6c55

2025-06-11 00:02:34Romania’s national postal service embraces digital assets by installing the first Bitcoin ATM at its Tulcea branch.

Romania has witnessed the inauguration of the first Bitcoin ATM within the offices of Poșta Română, the country’s national postal service.

The installation took place at the Tulcea branch, the result of a strategic collaboration between Poșta Română and Bitcoin Romania (BTR), one of the country’s leading exchanges. According to the official announcement from the postal service, this marks only the first step in a broader project.

Source: Poșta Română

The next locations set to host these ATMs will be Alexandria, Piatra Neamț, Botoșani, and Nădlac, confirming the postal service’s commitment to widespread distribution of these devices.

The integration of Bitcoin ATMs in post offices is part of a wider strategy to modernize the existing infrastructure through cutting-edge digital technologies. The initiative also aims to expand the range of services available in areas of the country traditionally underserved.

Global adoption

In recent months, global Bitcoin adoption has continued to grow through various channels: individual investors, companies accepting BTC as a payment method, corporations and institutions accumulating Bitcoin as a treasury asset, and nation-states acquiring BTC for strategic reserves.

According to Binance data from January, the number of Bitcoin wallets holding more than $100 in value reached nearly 30 million, marking a 25% year-on-year increase.

Despite this growth, overall Bitcoin adoption remains limited worldwide, even in countries with the highest adoption rates. A Q1 2025 report by River, a Bitcoin financial services company, found that only 4% of the global population owns Bitcoin.

The United States retains the highest concentration of Bitcoin holders, with around 14% of individuals holding BTC in 2025. The total addressable Bitcoin market remains below 1%, due to low retail adoption and under-allocation from institutions, the U.S.-based company noted.

According to River, Bitcoin could absorb 50% of the store-of-value market, equivalent to roughly $225 trillion in value. These asset classes include cash, stocks, real estate, precious metals, and art held for price appreciation or savings. With a current market capitalization slightly above $2 trillion, Bitcoin still has significant room for growth, River suggests.

The post Poșta Română launches the first Bitcoin ATM in post offices appeared first on Atlas21.

-

@ cae03c48:2a7d6671

2025-06-11 00:01:29

@ cae03c48:2a7d6671

2025-06-11 00:01:29Bitcoin Magazine

Quantum BioPharma Boosts Digital Asset Holdings to $5 Million with New Bitcoin PurchaseIn an expansion of its digital asset portfolio, Quantum BioPharma Ltd. has announced the purchase of an additional $500,000 in Bitcoin and other cryptocurrencies, bringing its total holdings to USD $5,000,000. The Canadian biopharmaceutical company made the move after securing approval from its Board of Directors.

JUST IN:

Quantum BioPharma Ltd purchased an additional $500k worth of BTC/crypto and now holds $5 million in BTC/crypto. Not sure how much actual #bitcoin pic.twitter.com/OqomNZ250x

Quantum BioPharma Ltd purchased an additional $500k worth of BTC/crypto and now holds $5 million in BTC/crypto. Not sure how much actual #bitcoin pic.twitter.com/OqomNZ250x— NLNico (@btcNLNico) June 10, 2025

“Quantum BioPharma Ltd. is pleased to announce that after receiving approval from the Board of Directors, the Company has purchased additional Bitcoin and other cryptocurrencies as part of its strategic efforts. This brings the total amount of BTC and other cryptocurrencies purchased to USD $5,000,000. As previously announced the company will continue to allow for future financing and other transactions to be carried out in cryptocurrency.”

The investment marks another step in the company’s growth, reinforcing its broader strategy to include Bitcoin into its long-term financial planning and operations.

“This move reflects the company’s belief in the potential of Bitcoin and other currencies to provide a return on investment for shareholders and to provide some hedge against the dollar. The company is now set up to receive financing in cryptocurrencies as well as executing other types of transactions in cryptocurrencies.”

Quantum BioPharma has taken the steps to ensure that its holdings are managed securely and in compliance with legal and financial regulations, working with a custodian to uphold transparency, and investor trust.

“The company is holding all its cryptocurrency with a fully compliant custodian. The company emphasizes that all transactions are and will be fully compliant with all relevant financial and audit regulations, ensuring a secure and legal process.”

Quantum BioPharma is known for its work in the biotech space, particularly through its subsidiary Lucid Psycheceuticals Inc., which focuses on neurological treatments like Lucid-MS. With this latest Bitcoin investment, the company joins a growing list of firms hedging traditional finance strategies with BTC.

While it remains unclear how much of the $5 million is allocated specifically to Bitcoin, the firm’s latest move signals increasing institutional interest in Bitcoin as a long term, viable asset.

This post Quantum BioPharma Boosts Digital Asset Holdings to $5 Million with New Bitcoin Purchase first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 8bad92c3:ca714aa5

2025-06-10 22:02:46

@ 8bad92c3:ca714aa5

2025-06-10 22:02:46Key Takeaways

In this episode of TFTC, energy economist Anas Alhajji outlines a profound shift in U.S. foreign policy under Trump—away from military intervention and toward transactional diplomacy focused on trade, reconstruction, and curbing Chinese and Russian influence in the Middle East. He highlights Trump’s quiet outreach to Syria as emblematic of the U.S.'s strategic flexibility in legitimizing former adversaries when economically beneficial. Alhajji dismisses BRICS as a fractured bloc incapable of rivaling the U.S.-led order and insists the dollar and petrodollar remain dominant. On energy, he warns that despite favorable fundamentals, prices are suppressed by political confusion, underinvestment, and an aging power grid ill-prepared for the AI and urbanization boom. He also contends that Iran is stalling negotiations to buy time for nuclear advancement and that any deal will be superficial. Finally, Alhajji debunks the myth of Trump being pro-oil, noting his long-standing hostility toward the industry and explaining why a repeat of his past energy boom is implausible given today’s financial and structural constraints.

Best Quotes

- “BRICS is a paper tiger. Everything about BRICS is what China does—and that’s it.”

- “The dollar is here to stay. The petrodollar is here to stay. End of story.”

- “Trump hates the oil industry. He always classified it as an enemy.”

- “Energy projects are 30- to 40-year investments, but politicians think in 4-year cycles. That’s where the disconnect lies.”

- “People think shale will boom again. It won’t. The model changed from ‘drill baby drill’ to ‘control baby control.’”

- “The real story of Trump’s trip wasn’t about politics—it was investment, investment, investment.”

- “Without massive investment in the grid and gas turbines, blackouts will become the norm—even in rich countries like Kuwait.”

- “Iran and China have perfected the game of oil exports. Sanctions are just theater at this point.”

Conclusion

Anas Alhajji’s conclusion challenges conventional narratives, arguing that global power is shifting from military dominance to economic leverage, infrastructure investment, and energy control. He presents a nuanced view of U.S. foreign policy under Trump, emphasizing the strategic importance of trade and reconstruction over regime change. As energy demand soars and geopolitical risks mount, Alhajji warns that the real dangers lie not in foreign adversaries, but in policy confusion, infrastructural lag, and complacency—making this episode a crucial listen for anyone seeking to understand the high-stakes intersection of energy, economics, and diplomacy.

Timestamps

0:00 - Intro

0:48 - Syria and US diplomacy in Middle East

12:50 - Trump in the Middle East

18:12 - Fold & Bitkey

19:48 - Iran - Nuclear program and PR

33:53 - Unchained

34:22 - Crude markets, trade war and US debt

54:28 - Trump's energy stance

1:05:46 - Energy sector challanges

1:14:44 - Policy recommendations

1:21:18 - AI and bitcoinTranscript

(00:00) oil prices market fundamentals support higher price than where we are today. But because of this confusion, everyone is scared of low economic growth and that is a serious problem. The US media ignored part of Trump's speech when he said we are not about nation building and they refer to Afghanistan and Iraq.

(00:15) Look at them. This is a criticism of George W. Bush. We have groups that are talking about the demise of the dollar, the rise of bricks. Bricks is a paper tiger. Everything about bricks is what China does and that's it. The dollar is here to stay and the petro dollar is here to stay.

(00:31) The perception is that the Trump administration is cold but the reality Trump hates the oil [Music] indust. How are you? Very good. Very good. Thank you. As you were telling me, you've been a bit sleepd deprived this week trying to keep up with what's going on. Oh, absolutely. I mean, Trump keeps us on our toes uh all the time.

(01:06) In fact, I plan certain things for the weekend and Trump will say something or he will do something and all of a sudden we get busy again. Uh so clients are not going to wait for you until you finish your work. Basically, they want to know what's going on. So what is going on? What what how profound were the events in the Middle East? These are very uh very profound changes basically because it is very clear that if you look at the last 15 years uh and you look at the growth uh in the Middle East, you look at the growth of Saudi Arabia and uh the

(01:41) role of Turkey for example in the region uh it just just amazing be beyond any uh any thoughts. Uh in fact both of them Turkey and Saudi Arabia are part of the G20. Uh so they have economic influence and they have political influence. And of course the icing on the cake for those who are familiar with the region is to recognize the Syrian government and meet with the Syrian uh president.

(02:11) Uh this is a major a major change in economics and politics uh of the Middle East. Let's touch on that Syria uh topic for a while because I think a lot of people here in the United States were a bit shocked at how sort of welcoming President Trump was towards the new Syrian president considering the fact that uh he was considered an enemy not too long ago here in the United States.

(02:42) What first of all it's a fact of life for those who would like to check the history of politics. There were many people around the world who were classified or they were on the terrorism list and then they became friends of the United States or they were became heroes. I mean Nelson Mandela is one of them. You look at Latin America, there are presidents in Latin America who were uh the enemy of the United States and then they became uh uh cooperative with the United States and the United States recognized their governments and the result of their uh elections. Uh so

(03:15) we've seen this historically uh several uh several times around the world and as they say freedom fighters for some basically are the enemies and the terrorists for for others etc. So uh what we've seen that's why the the visit is very important that the recognition of this government is very important. uh the fact on the ground that uh the president of Syria had the power on the ground uh he had the the the people on the ground and he had the control on the ground and whatever he's been he's been doing since he came into power until now

(03:52) he done all the right steps u and people loved him I mean everyone who went to Syria whether the Syrians who left Syria 40 years ago or uh the visitors who are coming to Syria, they will tell you, "We have never seen the Syrian people as happy as we've seen them today, despite the fact that they they live in misery.

(04:17) They don't have um 8 million people without housing. Uh there is barely any electricity in most of the country. There is no internet. There is barely any food. The uh inflation is rampant, etc. But people are happy because they lived in fear for a very long time. And uh the steps they have taken. For example, the uh ministers in the previous government uh are still there and they are still in the housing of the government.

(04:49) They still have the drivers. They still have the cars from the previous government. They still have it until today. So uh they they were classified as enemies before. But all of a sudden now you have a new government that is uh accepting them. Uh so we we see some changes on the ground that are positive and we'll see how these things will go given that the area around them basically has been unstable for a very long time.

(05:17) how because I don't the the news when I was actually it was surreal for me because my first trip to the Middle East was last December when it was literally f flying over Syria to Abu Dhabi when uh um Assad was getting thrown out and it was pretty surreal to be in that region of the world.

(05:43) How as it pertains to like religious minorities within Syria moving forward is there protractions protections there? Um well let me just uh I want to emphasize one point that is very important. What did the interest of Turkey, Saudi Arabia and the United States in Syria if remember Syria was controlled by Iran and was controlled by the Russians.

(06:09) So in a sense it becomes uh kind of an imperative that taking it away from Iran and Russia and not bringing Iran or Russia back is extremely important. Now the Russians are still there and they have their own base but at least they are not bombing the Syrians and not killing them anymore. But the idea here is taking Syria out of Iran and Russia and probably later on if they kick the Russians out, Russians will not have access to the Mediterranean.

(06:37) Uh so there is an interest uh of all parties basically to take Russia out of Iran and um out of uh Syria regardless the country is uh devastated and it creates massive opportunities for US companies on all levels and uh we've seen a contract uh done recently with you mentioned Abu Dhabi uh uh a contract uh uh with the UA a basically to revamp all the Syrian ports and work on the Syrian ports.

(07:13) Uh so such contracts basically uh when you have a country that has nothing and it's completely devastated the whole infrastructure is devastated. Who is going to build it? If the uh what the Chinese, the Russians, so who who are going to build it? So, uh I think there is a a big room for US companies and others basically to come in and uh literally help on one side and make money on the other.

(07:38) Yeah, I think that that's what I'm trying to discern. What was this convoy from the United States to the Middle East this week signali -

@ cae03c48:2a7d6671

2025-06-09 14:01:57

@ cae03c48:2a7d6671

2025-06-09 14:01:57Bitcoin Magazine

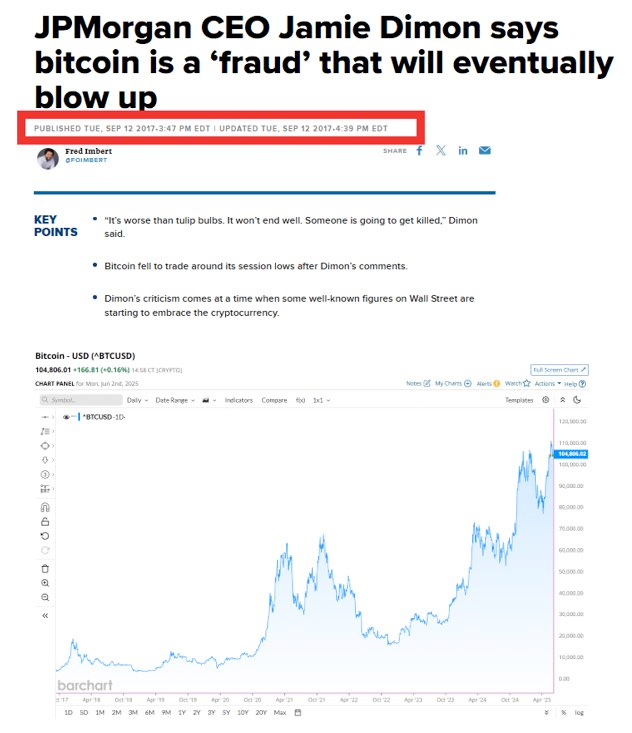

Mapping Bitcoin’s Bull Cycle PotentialBitcoin’s Market Value to Realized Value, or MVRV ratio, remains one of the most reliable on-chain indicators for identifying local and macro tops and bottoms across every BTC cycle. By isolating data across different investor cohorts and adapting historical benchmarks to modern market conditions, we can generate more accurate insights into where Bitcoin may be headed next.

The Bitcoin MVRV Ratio

The MVRV Ratio compares Bitcoin’s market price to its realized price, essentially the average cost basis for all coins in the network. As of writing, BTC trades around $105,000 while the realized price floats near $47,000, putting the raw MVRV at 2.26. The Z-Score version of MVRV standardizes this ratio based on historical volatility, enabling clearer comparisons across different market cycles.

Figure 1: Historically, the MVRV Ratio and the MVRV Z-Score have accurately identified cycle peaks and bottoms. View Live Chart

Short-Term Holders

Short-term holders, defined as those holding Bitcoin for 155 days or less, currently have a realized price near $97,000. This metric often acts as dynamic support in bull markets and resistance in bear markets. Notably, when the Short Term Holder MVRV hits 1.33, local tops have historically occurred, as seen several times in both the 2017 and 2021 cycles. So far in the current cycle, this threshold has already been touched four times, each followed by modest retracements.

Figure 2: Short Term Holder MVRV reaching 1.33 in more recent cycles has aligned with local tops. View Live Chart

Long-Term Holders

Long-term holders, who’ve held BTC for more than 155 days, currently have an average cost basis of just $33,500, putting their MVRV at 3.11. Historically, Long Term Holder MVRV values have reached as high as 12 during major peaks. That said, we’re observing a trend of diminishing multiples each cycle.

Figure 3: Achieving a Long Term Holder MVRV value of 8 could extrapolate to a BTC price in excess of $300,000. View Live Chart

A key resistance band now sits between 7.5 and 8.5, a zone that has defined bull tops and pre-bear retracements in every cycle since 2011. If the current growth of the realized price ($40/day) continues for another 140–150 days, matching previous cycle lengths, we could see it reach somewhere in the region of $40,000. A peak MVRV of 8 would imply a price near $320,000.

A Smarter Market Compass

Unlike static all-time metrics, the 2-Year Rolling MVRV Z-Score adapts to evolving market dynamics. By recalculating average extremes over a rolling window, it smooths out Bitcoin’s natural volatility decay as it matures. Historically, this version has signaled overbought conditions when reaching levels above 3, and prime accumulation zones when dipping below -1. Currently sitting under 1, this metric suggests that substantial upside remains.

Figure 4: The current 2-Year Rolling MVRV Z-Score suggests more positive price action ahead. View Live Chart

Timing & Targets

A view of the BTC Growth Since Cycle Lows chart illustrates that BTC is now approximately 925 days removed from its last major cycle low. Historical comparisons to previous bull markets suggest we may be around 140 to 150 days away from a potential top, with both the 2017 and 2021 peaks occurring around 1,060 to 1,070 days after their respective lows. While not deterministic, this alignment reinforces the broader picture of where we are in the cycle. If realized price trends and MVRV thresholds continue on current trajectories, late Q3 to early Q4 2025 may bring final euphoric moves.

Figure 5: Will the current cycle continue to exhibit growth patterns similar to those of the previous two cycles? View Live Chart

Conclusion

The MVRV ratio and its derivatives remain essential tools for analyzing Bitcoin market behavior, providing clear markers for both accumulation and distribution. Whether observing short-term holders hovering near local top thresholds, long-term holders nearing historically significant resistance zones, or adaptive metrics like the 2-Year Rolling MVRV Z-Score signaling plenty of runway left, these data points should be used in confluence.

No single metric should be relied upon to predict tops or bottoms in isolation, but taken together, they offer a powerful lens through which to interpret the macro trend. As the market matures and volatility declines, adaptive metrics will become even more crucial in staying ahead of the curve.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Mapping Bitcoin’s Bull Cycle Potential first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ dfa02707:41ca50e3

2025-06-09 03:01:55

@ dfa02707:41ca50e3

2025-06-09 03:01:55Contribute to keep No Bullshit Bitcoin news going.

This update brings key enhancements for clarity and usability:

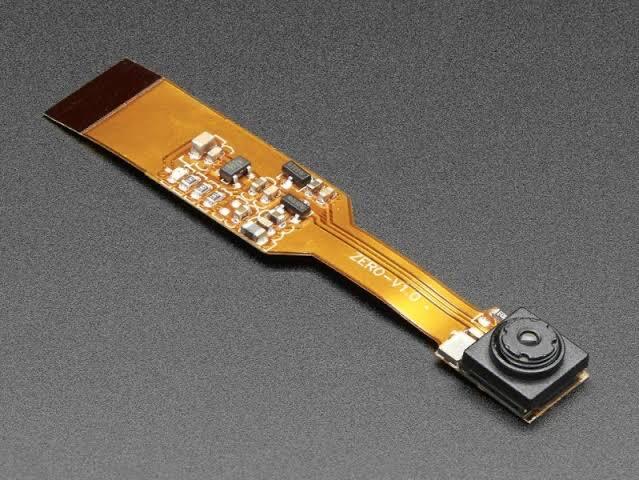

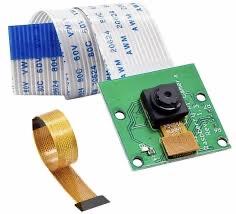

- Recent Blocks View: Added to the Send tab and inspired by Mempool's visualization, it displays the last 2 blocks and the estimated next block to help choose fee rates.

- Camera System Overhaul: Features a new library for higher resolution detection and mouse-scroll zoom support when available.

- Vector-Based Images: All app images are now vectorized and theme-aware, enhancing contrast, especially in dark mode.

- Tor & P2A Updates: Upgraded internal Tor and improved support for pay-to-anchor (P2A) outputs.

- Linux Package Rename: For Linux users, Sparrow has been renamed to sparrowwallet (or sparrowserver); in some cases, the original sparrow package may need manual removal.

- Additional updates include showing total payments in multi-payment transaction diagrams, better handling of long labels, and other UI enhancements.

- Sparrow v2.2.1 is a bug fix release that addresses missing UUID issue when starting Tor on recent macOS versions, icons for external sources in Settings and Recent Blocks view, repackaged

.debinstalls to use older gzip instead of zstd compression, and removed display of median fee rate where fee rates source is set to Server.

Learn how to get started with Sparrow wallet:

Release notes (v2.2.0)

- Added Recent Blocks view to Send tab.

- Converted all bitmapped images to theme aware SVG format for all wallet models and dialogs.

- Support send and display of pay to anchor (P2A) outputs.

- Renamed

sparrowpackage tosparrowwalletandsparrowserveron Linux. - Switched camera library to openpnp-capture.

- Support FHD (1920 x 1080) and UHD4k (3840 x 2160) capture resolutions.

- Support camera zoom with mouse scroll where possible.

- In the Download Verifier, prefer verifying the dropped file over the default file where the file is not in the manifest.

- Show a warning (with an option to disable the check) when importing a wallet with a derivation path matching another script type.

- In Cormorant, avoid calling the

listwalletdirRPC on initialization due to a potentially slow response on Windows. - Avoid server address resolution for public servers.

- Assume server address is non local for resolution failures where a proxy is configured.

- Added a tooltip to indicate truncated labels in table cells.

- Dynamically truncate input and output labels in the tree on a transaction tab, and add tooltips if necessary.

- Improved tooltips for wallet tabs and transaction diagrams with long labels.

- Show the address where available on input and output tooltips in transaction tab tree.

- Show the total amount sent in payments in the transaction diagram when constructing multiple payment transactions.

- Reset preferred table column widths on adjustment to improve handling after window resizing.

- Added accessible text to improve screen reader navigation on seed entry.

- Made Wallet Summary table grow horizontally with dialog sizing.

- Reduced tooltip show delay to 200ms.

- Show transaction diagram fee percentage as less than 0.01% rather than 0.00%.

- Optimized and reduced Electrum server RPC calls.

- Upgraded Bouncy Castle, PGPainless and Logback libraries.

- Upgraded internal Tor to v0.4.8.16.

- Bug fix: Fixed issue with random ordering of keystore origins on labels import.

- Bug fix: Fixed non-zero account script type detection when signing a message on Trezor devices.

- Bug fix: Fixed issue parsing remote Coldcard xpub encoded on a different network.

- Bug fix: Fixed inclusion of fees on wallet label exports.

- Bug fix: Increase Trezor device libusb timeout.

Linux users: Note that the

sparrowpackage has been renamed tosparrowwalletorsparrowserver, and in some cases you may need to manually uninstall the originalsparrowpackage. Look in the/optfolder to ensure you have the new name, and the original is removed.What's new in v2.2.1

- Updated Tor library to fix missing UUID issue when starting Tor on recent macOS versions.

- Repackaged

.debinstalls to use older gzip instead of zstd compression. - Removed display of median fee rate where fee rates source is set to Server.

- Added icons for external sources in Settings and Recent Blocks view

- Bug fix: Fixed issue in Recent Blocks view when switching fee rates source

- Bug fix: Fixed NPE on null fee returned from server

-

@ dfa02707:41ca50e3

2025-06-08 16:02:23

@ dfa02707:41ca50e3

2025-06-08 16:02:23Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ a296b972:e5a7a2e8

2025-06-07 16:39:47

@ a296b972:e5a7a2e8

2025-06-07 16:39:47Nur für‘s Protokoll. Hiermit erkläre ich, Georg Ohrweh, im tatsächlich vorhandenen vollen Besitz meiner geistigen Kräfte, dass Herr Lauterbach, gleich welche Position er in Zukunft noch bekleiden sollte, für mich nicht zuständig ist. Basta.

Ein Erguss dieses verhaltensoriginellen Über-alles-Bescheidwissers:

„Wir kommen jetzt in eine Phase hinein, wo der Ausnahmezustand die Normalität sein wird. Wir werden ab jetzt immer im Ausnahmezustand sein. Der Klimawandel wird zwangsläufig mehr Pandemien bringen.“

Wie kann es sein, dass solch eine Ausnahme-Gestalt, die schon rein äußerlich die Phantasie zu Vergleichen anregt, sich leider auch genauso verhält, wie die Gestalten, die in diesen Phantasien vorkommen, ungebremst auf der Panik-Klaviatur kakophonische Klänge erzeugen darf? Obwohl ein wenig Wahrheit ist auch enthalten: Wir sind tatsächlich immer im Ausnahmezustand, im Ausnahmezustand des fortgeschrittenen Wahnsinns.

Wie kann es sein, dass dieser Haaaarvardist seinen persönlich empfundenen Ausnahmezustand zum Allgemeingut erklären kann? Welche Verknüpfungs-Phantasien hat er sonst noch studiert? Er ist ja auch noch Vorsitzender im Raumfahrtausschuss. Was kommt als Nächstes? Eine Klima-Pandemie, verursacht durch außerirdische Viren, die die Temperaturen beeinflussen können? Im aktuellen Zeitgeist gibt es nichts, was nicht gedacht wird. Wem die besseren Absurditäten einfallen, der gewinnt. Man muss sich schon den gegebenen Denkstrukturen etwas anpassen, aber sich auch ein wenig Mühe geben.

Nach dem Wechsel der ehemaligen Außen-Dings zur UN (mit dem Ziel, aus den Vereinten Nationen die Feministischen Nationen zu gestalten) und des ehemaligen Wirtschafts-Dings in den Außenausschuss und als Gastdozent in Kalifornien (Thema: Wirtschaftsvernichtung unter Einbeziehung des gespannten Verhältnisses unter Geschwistern aufgrund ärmlicher Verhältnisse, am Beispiel des Märchens von Hänsel und Gretel) , jetzt auch noch der ehemalige Chef-Panikmacher zur WHO.

…und der Wahnsinn wurde hinausgetragen in die Welt, und es wurde dunkel, und es ward Nacht, und es wurde helle, und es ward Tag, der Wind blies oder auch nicht (was macht der Wind eigentlich, wenn er nicht weht?), und es ward Winter, und es wurde kälter, und es wurde wärmer, und es ward Sommer. Es regnete nicht mehr, die Wolken schwitzten. Und Putin verhinderte (wer auch sonst), dass das Eis in der Antarktis abnahm.

Wiederholte Bodentemperaturen in der Toskana von 50 Grad Celsius. Zu erwartende Wassertemperaturen während Ferragosto an der italienischen Adria von durchschnittlich 100 Grad Celsius. An Stellen mit wenig Strömung stiegen schon die ersten Kochblasen auf. Doch dann kam der durch Lachs gestählte, salzlose Super-Karl und rettete mit einem durch die WHO diktierten Klima-Logdown die gesamte Menschheit. Wer besser, als er konnte wissen, dass ein Klima-Logdown weitgehend nebenwirkungsfrei ist.

Was für ein Segen, dass Karl der Große, der uns so siegreich durch die Corona-Schlacht geführt hat, jetzt auch gegen das Klima in den Krieg zieht.

Wer kennt das nicht, Tage der Qual, in denen man zugeben muss: Ich hab‘ heute so schlimm Klima.

Viele Klimaexperten, die weltweit in der Qualitätspropaganda zitiert werden, zeichnen sich besonders dadurch aus, dass sie mit einer maximalen Abweichung von einem Grad Celsius ein Thermometer fehlerfrei ablesen können. Diese Ungenauigkeit wird der Erdverkochungsexperte sicher als erstes beheben.

In einer aufopfernden Studie während eines Urlaubs in 2023, in der um die damalige Zeit erstmals eisfreien Toskana, hat er den von ihm ausgetüftelten Klimaschutzplan ins Rheinische übersetzt. Titel: „Schützen Sie sisch, und, äh, andere!“ Weiter konnte er erforschen, dass die Bodentemperatur nicht immer mit der Temperatur des Erdkerns übereinstimmen muss.

Durch seine unermüdlichen Studien, können Hitzetote in Zukunft besser zugeordnet werden. Man weiß dann, ob jemand an hohen oder mit hohen Temperaturen gestorben ist. Der asymptomatische Klimawandel kann so in Zukunft viel besser bewertet werden. Man hat aus geringfügigen Fehlern gelernt und die Methoden erheblich verbessert.

Eine präzise Vorhersage der Jahreszeiten, vor allem die des Sommers, wird bald ebenfalls möglich sein. Es kann jetzt vor jahreszeitbedingten, teilweise sogar täglich schwankenden Temperaturveränderungen rechtzeitig gewarnt werden. Im Herbst können Heizempfehlungen für die ahnungslose Bevölkerung herausgegeben werden. Frieren war gestern, wissen wann es kalt wird, ist heute. Es wird an Farben geforscht, die noch roter sein sollen, als die, die jetzt in den Wetterkarten bei 21 Grad bereits verwendet werden.

Eine allgemeine Heizpflicht soll es europaweit zunächst nicht geben.

Weiter soll die Lichteinstrahlung der Sonne noch präziser bestimmt werden, damit den Europäern, in Ergänzung zur mitteleuropäischen Sommerzeit, jetzt auch noch genau mitgeteilt werden kann, wann es Tag und wann es Nacht ist.

Das Hinausschauen aus dem Fenster, zum Beispiel, ob es schon dunkel draußen ist, erübrigt sich. Die Tageszeit, in Ergänzung zur herkömmlichen Uhrzeit, wird demnächst automatisch mit dem Klima-Pass übermittelt werden. Zu Anfang natürlich erst einmal freiwillig.

Durch die persönliche ID können dann auch schnell und unkompliziert Sonderprämien überwiesen werden, sofern man sich klimakonform verhalten hat, damit man sich rechtzeitig vor Winterbeginn eine warme Jacke oder einen Mantel kaufen kann. Das Sparen von Bargeld auf eine bevorstehende größere Anschaffung von Winterkleidung wird somit überflüssig.

Ob es am Ende nun um Hitze oder Kälte geht, spielt eigentlich gar keine Rolle, denn wie wussten schon die Ahnen zu berichten: Was gut für die Kälte ist, ist auch gut für die Wärme.

Westliche Mächte unternehmen immer wieder Versuche, eskalierend auf den Ukraine-Konflikt einzuwirken, damit man atombetriebene Heizpilze aufstellen kann, an denen sich die Europäer im Winter auch im Freien wärmen können.

Wie praktisch, dass man nicht nur Gesundheit und Klima, sondern auch Klima und Krieg miteinander verbinden kann. Alles so, oder so ähnlich möglicherweise nachzulesen im genialen Hitzeschutzplan á la Lauterbach.

Besonders Deutschland braucht nicht nur lauterbachsche Hitzeschutzräume, nein es braucht atomsichere Hitzeschutzbunker, so schlägt man gleich zwei Fliegen mit einer Klappe.

Für die, die es sich leisten können, hier ein Vorschlag. Der K2000:

Für die weniger gut Betuchten reicht auch ein kühles Kellerloch, das man idealerweise im Februar beziehen und nicht vor November wieder verlassen sollte, so die Empfehlung auch von führenden Klima-Forschern, die es ja wissen müssen. Von Dezember bis Januar empfiehlt sich ein Besuch auf den Bahamas, besonders dann, wenn man eine leichte Erkältung verspürt.