-

@ 9ca447d2:fbf5a36d

2025-06-10 17:02:07

@ 9ca447d2:fbf5a36d

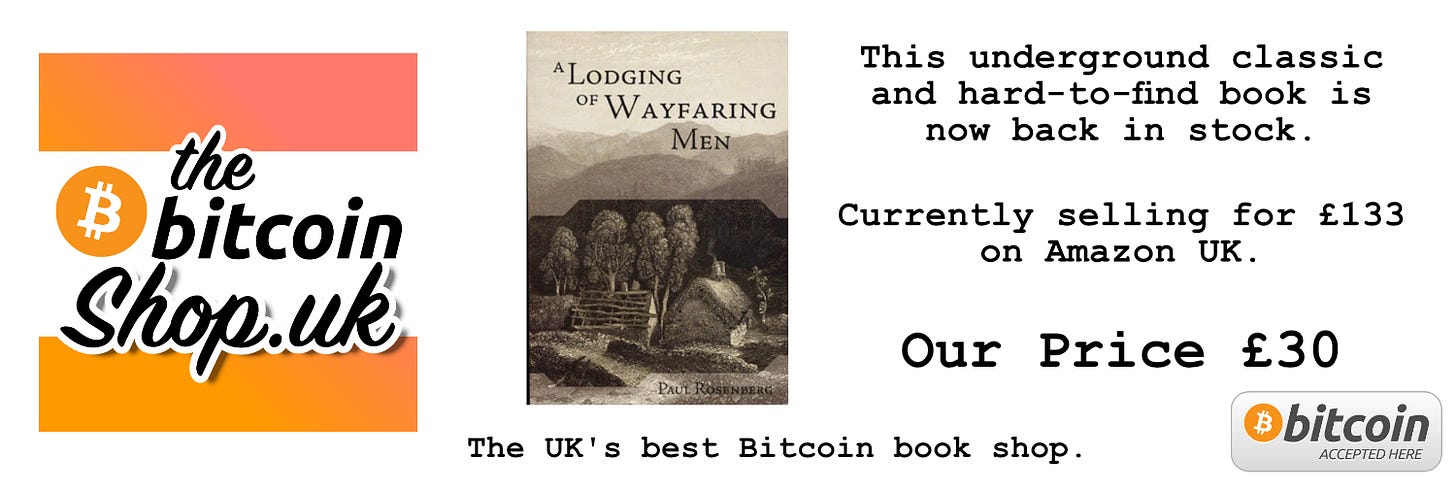

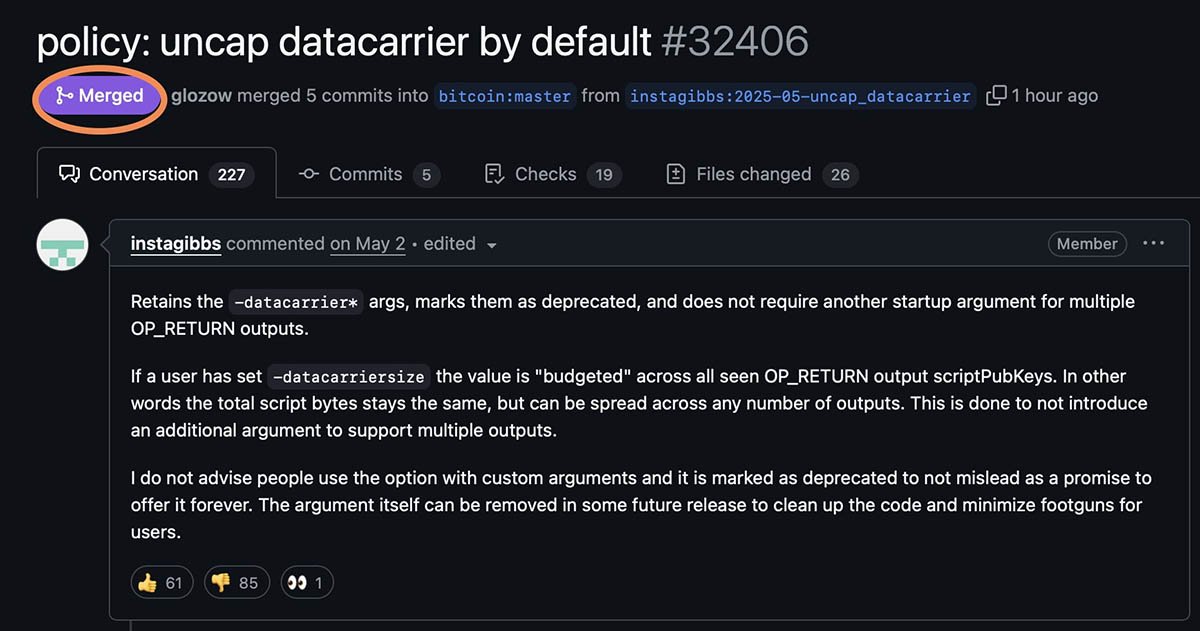

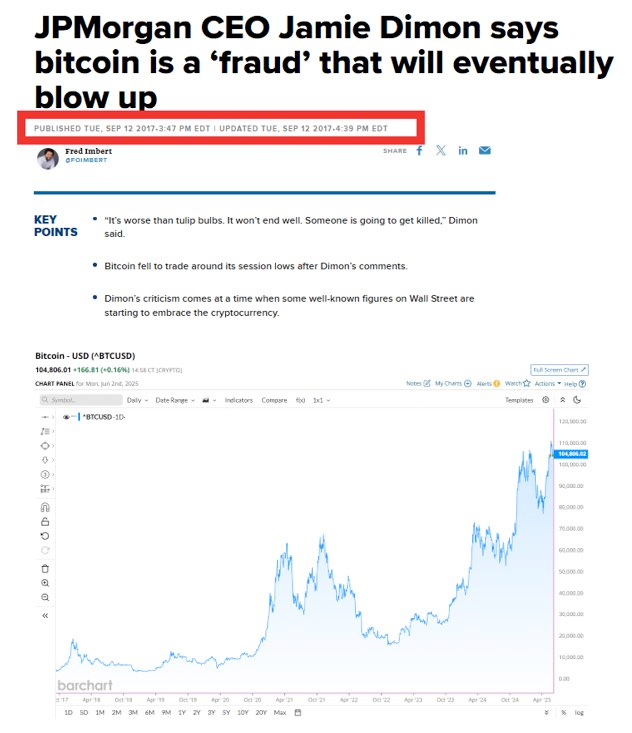

2025-06-10 17:02:07Bitcoin Core Github page announced yesterday that Core Developers have merged pull request #32406, removing support for “-datacarrier” argument for Bitcoin Core software in their next release, expected to be published in October.

Pull request #32406 has been merged — Github

This is the latest development regarding the initiative brought forth by Bitcoin Core developer Peter Todd, which has caused intense debate among Bitcoiners, now known as the “spam wars”.

The disagreement is over a change to Bitcoin Core’s transaction relay policy that removes the OP_RETURN data limit, which some see as a threat to Bitcoin’s very purpose, while others see it as a necessary step to preserve decentralization and censorship resistance.

OP_RETURN is an arbitrary piece of data that can be amended to a bitcoin transaction, and used to be limited to 80 bytes. Users have found ways to go around this limit already and have uploaded larger data to the Bitcoin blockchain, including photos, audio, and even entire computer games.

Bitcoin Core allows for extra arguments when running the application, one of which is the “-datacarrier” argument, which tells the application to not accept transactions including larger OP_RETURN data into its mempool.

Now this argument is marked as “deprecated”, meaning it is not supported or developed anymore, and is expected to be completely removed in future versions.

This will make accepting Bitcoin transactions that contain non-financial data mandatory for anyone running future versions of the Core software.

Prior to the merging of the mentioned pull request on the morning of Monday June 9, a joint statement from 31 Bitcoin Core devs was released on June 6, reheating the already controversial debate in the Bitcoin community.

In the June 6 statement, Bitcoin Core devs explained how they think Bitcoin nodes should handle transactions that include non-financial data, like digital art or messages. This type of data has become more common with Ordinals and inscriptions.

Related: Discussions Heat Up Among Bitcoin Devs Over OP_RETURN Proposal

Core developers said they are not endorsing non-financial use of Bitcoin, but also won’t stop it. Their main point is that Bitcoin’s strength is in being open and censorship-resistant. They wrote:

“This is not endorsing or condoning non-financial data usage, but accepting that as a censorship-resistant system, Bitcoin can and will be used for use cases not everyone agrees on.”

They say it’s up to users and node operators to decide what kind of Bitcoin software they run. Bitcoin Core won’t block transactions that have economic demand and will be mined.

“Being free to run any software is the network’s primary safeguard against coercion,” the statement added.

The policy change goes back to a May 8th upgrade (announced by Core contributor and Engineer at Blockstream, Greg Sanders), where devs removed the long-standing 80-byte limit on OP_RETURN output size.

This limit was meant to discourage non-payment data usage, but devs say it no longer serves that purpose.

“Retiring a deterrent that no longer deters” makes sense, they argue, because people have already found ways to add large data to the blockchain.

They also point out that removing the cap may help miners and users more than it hurts. They claim the new approach helps predict which transactions will be mined, speeds up block propagation and helps miners find fee-paying transactions.

“Knowingly refusing to relay transactions that miners would include in blocks anyway forces users into alternate communication channels,” they explained, warning this could harm decentralization.

The response has been mixed.

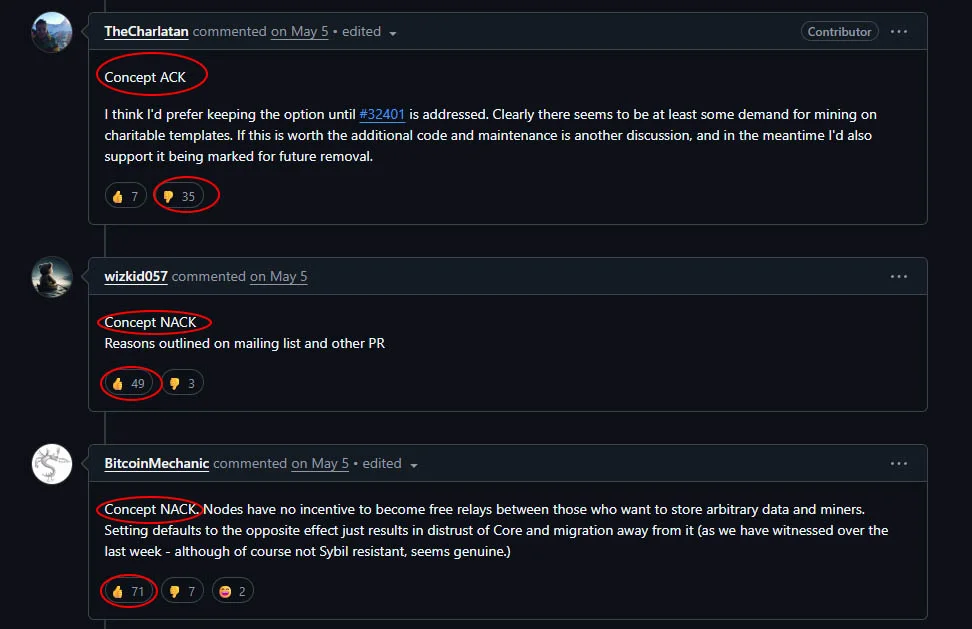

The announcement of the merge received 64 upvotes and 93 downvotes from reviewers, showing the community is mostly against this action. Comments explaining their dissatisfaction with the merge also received the support of the majority.

Reviewers who voted ACK (acknowledgment and agreement) were downvoted, and the comments voting NACK (disagreement) received more upvotes.

Comments regarding the recent merge — Bitcoin Core Github page

Critics say it opens the door to blockchain spam, higher fees and more bloat on the blockchain with non-financial content. They say Bitcoin should stick to its original purpose as a “peer-to-peer electronic cash system”.

Samson Mow, CEO of JAN3, was one of the most vocal critics. He said the devs are removing the barriers that protect the network from spam.

“Bitcoin Core devs have been changing the network gradually to enable spam,” Mow said. “It’s disingenuous to just say ‘It is what it is now, too bad’.”

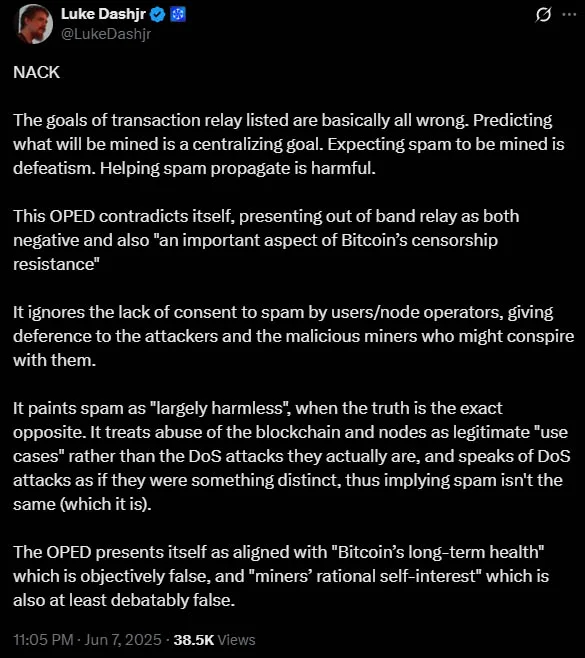

Bitcoin dev Luke Dashjr also criticized the move, saying it undermines Bitcoin’s core function. He called the devs’ goals “basically all wrong” and said expecting spam to be mined is “defeatism”.

Luke Dashjr on X

One user said: “It’s Bit”Coin” not Bit”Bucket” or Bit”Store” or whatever general purpose data store you have in mind. It’s a peer to peer electronic cash system”.

Another user chimed in, warning it could increase costs, reduce efficiency and even hurt long-term scalability.

Their argument is simple: if nonfinancial data is allowed to be stored on the blockchain, it will increase its size over time, storing useless data, and it will hurt decentralization, as fewer individuals will be able to host the entire blockchain on their computers.

They argue allowing people to store whatever they want on the blockchain because transactions shouldn’t be censored, will lead to hurting bitcoin in the long run. Many even argue no additional information should be allowed on the blockchain at all.

But not everyone is unhappy.

Some like Jameson Lopp, co-founder of Bitcoin wallet provider Casa, praised the devs for being transparent and consistent.

“Core Devs are a group saying we can’t force anyone to run code they don’t like,” Lopp said. “Here is our thinking on relay policy and network health.”

Lopp believes a joint statement helps the public understand what the devs stand for.

Supporters also say in a truly decentralized system, devs shouldn’t be gatekeepers. Instead users and miners should be able to decide what goes on the blockchain.

With opinions so divided, the future of Bitcoin may be more contentious. Some predict a fork to create a version of Bitcoin that only deals with monetary use. Others expect new wallet and node software that lets users choose to filter out large data or allow it.

Despite the controversy, the devs are standing by their decision. “While we recognize that this view isn’t held universally,” they said. “it is our sincere belief that it is in the best interest of Bitcoin and its users.”

-

@ 3a851978:ff85e003

2025-06-10 17:17:40

@ 3a851978:ff85e003

2025-06-10 17:17:40This document is designed to test Markdown rendering with LaTeX math support. Below you'll find examples of Markdown formatting combined with inline and block mathematical notation.

1. Inline Math

Here is an inline formula using single dollar signs:

- Euler's identity: $e^{i\pi} + 1 = 0$

- Quadratic formula: $x = \frac{-b \pm \sqrt{b^2 - 4ac}}{2a}$

- Pythagoras theorem: $a^2 + b^2 = c^2$

2. Block Math

Now let's test block-level LaTeX using double dollar signs:

$$ \int_{-\infty}^{\infty} e^{-x^2} \, dx = \sqrt{\pi} $$

Another block formula:

$$ f(x) = \sum_{n=0}^{\infty} \frac{f^{(n)}(0)}{n!}x^n $$

3. Lists and Math

- Integral: $\int_0^1 x^2 , dx = \frac{1}{3}$

- Derivative: $\frac{d}{dx} \sin(x) = \cos(x)$

- Matrix:

$$ \begin{pmatrix} 1 & 2 \ 3 & 4 \end{pmatrix} $$

With inline math in code:

$E = mc^2$(should not render as math here).5. Tables

| Formula Name | Expression | | ---------------- | ------------------------------------------------------ | | Euler's Identity | $e^{i\pi} + 1 = 0$ | | Taylor Series | $\sum_{n=0}^{\infty} \frac{x^n}{n!}$ | | Binomial Theorem | $(a + b)^n = \sum_{k=0}^n \binom{n}{k} a^{n-k} b^k$ |

-

@ a29cfc65:484fac9c

2025-06-10 15:57:13

@ a29cfc65:484fac9c

2025-06-10 15:57:13Über die Freilerner-Familie von Katharina und Johannes mit ihren Kindern Aurelius, Benjamin und Friedrich haben wir in unserem Beitrag vom 28. Mai 2025 berichtet. Hier wollen wir eines ihrer Projekte vorstellen. Es zeigt deutlich den pädagogischen Ansatz von Jahrgangs- und Fächer-übergreifender zielorientierter Arbeit der Freilerner.

Die drei Jungs haben im Ringelnatz-Verein Wurzen zusammen mit anderen Kindern am Vorhaben „Vom Drehbuch zum fertigen Film“ mitgewirkt. Das Projekt wurde von dem Lyriker und Schriftsteller Carl-Christian Elze geleitet und unterstützt von der Künstlerin Constanze Kehrt, dem Theater- und Filmregisseur Philipp J. Neumann sowie dem Cutter und Animation Artist**** Sascha Werner, alle aus Leipzig. Constanze Kehrt unterstützte die Kinder beim Erlernen der Grundlagen für das Schreiben von Drehbüchern. Daneben gab es erste Übungen zur Körperwahrnehmung, Stimm- und Sprachübungen sowie Improvisations- und Schauspielübungen. Nach einer Einführung durch Philipp J. Neumann in die Filmkunst mit ihren unterschiedlichen Bereichen wie Schauspiel, Regie, Kamera, Ton, Produktion, Szenenbild, Kostüm, Musik, Schnitt, Sounddesign wurden die Kinder und Jugendlichen auf den eigentlichen Filmdreh vorbereitet. Dazu gehörten Übungen im Storyboarding, Szenenproben und schließlich das Location-Scouting und Festlegen der Drehorte in unmittelbarer Nähe zum Ringelnatz-Geburtshaus. An zwei Drehtagen wurden schließlich zwei Kurzfilme gedreht, darunter „Die Flosse“, an dem Aurelius, Benjamin und Friedrich sowie andere Kinder mitwirkten. Die Kinder übernahmen nicht nur die Rollen, sondern auch die Kamera, die Tonabnahme und zum Teil die Regie. Eine Einführung in die Kunst des Film- und Tonschnitts bekamen die Kinder und Jugendlichen schließlich von Sascha Werner. Danach wurde das gedrehte Material gemeinsam gesichtet und der Schnitt vorgenommen. Dabei konnten die Kinder und Jugendlichen die Erfahrung machen, dass es tatsächlich maßgeblich der Schnitt ist, der einem Film seinen besonderen Charakter, eine bestimmte Atmosphäre gibt.

In dem Film „Die Flosse“ schleichen sich drei Kinder abends von zu Hause weg, weil sie in der Schule gehört haben, dass in der Mulde eine große Flosse gesichtet wurde. Als sie an das Mulde-Wehr kommen, sehen sie keine Flosse, aber hören seltsame Geräusche. Plötzlich ruft eine Mädchenstimme um Hilfe. Philip ist bereit zu helfen, Emma und Benjamin bleiben lieber im Versteck. Im Wasser liegend und von Ästen eingeklemmt findet Philip eine Sirene. Sie bittet ihn, ihr zu helfen und lockt ihn ins Wasser, was Philip zum Verhängnis wird.

Der Film zeigt die kreativen und ausdrucksstarken Fähigkeiten der Kinder, die sie im Zusammenwirken mit ihren Lernbegleitern vom Drehbuch bis zum fertigen Kurzfilm umgesetzt haben. Der Film handelt von Hilfsbereitschaft und dem Mut, anderen in bedrohlicher Lage zu helfen. Aber auch das Zögern bei einigen zur Hilfe wird deutlich. Das Ende läßt viele Interpretationsmöglichkeiten zu.

Quelle: https://ringelnatz-verein.de/projekte/anna-hood/

https://www.youtube.com/watch?v=yC6YEa63Dp8

Foto von Aleksandra B. auf Unsplash

-

@ 93bfc86d:fc8e91f5

2025-06-10 15:27:43

@ 93bfc86d:fc8e91f5

2025-06-10 15:27:43질서자유주의가 자유주의 세상을 만드는 방법

안캡의 전략에는 크게 두 가지, 호페의 질서자유주의와 새뮤얼 콘킨 3세의 아고리즘이 있다.

로스바드-호페 라인의 질서자유주의는 논리를 기반으로 자연권을 정당화하고, 이를 통해 국가의 부당함을 설파한다. 미제스의 "인간은 행동한다."라는 제1공리부터 시작해서, 행동의 제1수단인 신체가 그 자신에게 소유되어야 한다는 자기 소유를 증명하고 자연권을 철저하게 연역적으로 정당화해간다. 안캡의 세상을 만들려는 이들의 방법론도 논리적이다.

예를 들어 호페의 『자유주의자는 무엇을 해야 하는가』 책에서는 위로부터의 전환이 불가능함에 따라 아래로부터의 전환을 해야 한다는 주장이 나온다. 과거에는 이런 자유로운 세상이 도래하기 위해서는 왕 한 명이 "앞으로 자기가 원하는 대로 보안 기업을 자유롭게 선택하고, 더 이상의 강제는 없다!"라고 선언만 하면 됐다. 따라서 왕 한 명만 어떻게 설득을 하거나, 압박을 하든 주리를 틀든 일단 왕이 이렇게 선언하게 하기만 하면 됐다. '마그나 카르타'도 결국 귀족 연합이 왕 한 명을 압박해 왕이 서명했던 것 아닌가?

반면에 현대 민주주의 사회를 보자. 대한민국에서 대통령 한 명이 최저임금을 폐지할 수 있는가? 최저임금은 헌법에 보장되는데(헌법 32조) 따라서 이를 폐지하는 것은 거의 개헌만큼이나 어렵다. 대통령이나 국회의원 과반이 발의를 해야 하고, 국회에서 재적 3분의 2 이상이 찬성해야 겨우 통과되며, 이렇게 통과해도 국민투표에서 과반수가 동의해야 겨우 없어지는 것이다. 즉, 거의 불가능에 가깝다.

따라서 호페는 위로부터의 전환이 불가능함에 따라 전국적인 중앙 정부의 투표를 거부할 것을 제안한다. 대통령 선거나 국회의원 선거 등 말이다. 여기서 중앙 정부 단위의 투표를 거부하는 이유는 중앙 정부의 부당성도 있지만, 이 투표를 통해 세상을 바꾸는 게 현실성이 없어서 그렇다.

같은 맥락에서 지역 선거의 투표는 항상 거부하는 건 아닌데, 자유주의자들이 한 국가 전체에서 과반을 얻는 것은 불가능하지만, 한 지역에 점점 몰리는 경우에는 적어도 그 지역에서는 과반이 될 수도 있기 때문이다. 따라서 아주 작은 지역에서 자유주의자들이 다수결이 된다면 적어도 그 지역에 한해서는 위로부터의 전환이 가능해진다. 그러면 투표를 거부하다가 지역구에서 본격적으로 투표를 하기 전에 선행되어야 할 일은 자유주의가 많이 퍼지고, 자유주의를 지지하는 사람들이 특정 지역에 몰리기 시작해야 하는 것일 것이다. 비트코이너들이 특정 지역에 몰려 시타델을 건설하는 상황을 생각하면 될 것 같다.

그 이후에는? 지역구의 대표로 선출된 인물이 해당 지역구의 투표권을 재산 소유자에게 재산 크기(지분)대로 다시 분배해야 한다. 즉, 재산이 없는 사람은 투표권이 없다. 모든 공공 인프라(도로, 수도, 전기, 교육, 치안, 사법 등등)는 전부 주식으로 판매되어 민영화된다(지방 정부는 이를 통해 재원을 마련한다). 이에 따라 공공 인프라는 완전히 사적 소유로 전환된다. 치안, 사법, 교육 모두 민간 영역으로 전환된다.

현재 세계에서 자유주의자들이 이런 관점을 취한다면 무엇을 해야 할까? 일단 자유주의를 더 많은 사람에게 퍼뜨려야 한다. 또한, 자유주의자들이 모일 지역을 물색해야 할 것이다. 그리고 중앙 정부 단위의 투표를 거부해야 할 것이다.

그림 1. 질서 자유주의의 상징인 아나코 캐피탈리즘 깃발

현대 민주주의 투표의 부당함

아고리즘의 전략을 이야기하기 전에 먼저 현대 민주주의 투표의 부당함에 대해 살펴보고 가자. 개인적인 생각도 들어가 있다.

투표 행위 자체는 유권자의 권리 행사로 전혀 나쁠 것이 없다. 다수결의 원칙도 당연히 마찬가지다. 투표 당사자들이 다수결의 원칙에 동의하기 때문에 참여하는 것이기 때문이다. 그래서 민주주의는 선거에서 져도 그 결과에 승복하는 것이 그 시스템의 규칙이다. 예를 들어 주주총회에서 주주들이 지분대로 의결권을 행사하거나 행사하지 않아서 생기는 결과는 그 행위 자체로는 전혀 문제가 없다.

투표의 정당성은 투표라는 행위 자체로부터 판단되는 것이 아니라 그 투표가 어떤 시스템 아래서 이뤄지는 투표인지로부터 판단해야 한다. 나는 두 가지 관점에서 살펴볼 것이다.

현대 민주주의의 투표는 유권자가 자신의 권리를 당선자에게 위임하는 행위다. 한 후보가 당선되면 다수결의 원칙에 따라서 그 후보는 그 후보를 찍지 않은 유권자들의 권리까지 모두 가져간다. 여기까지는 문제가 없다. 투표 행위 참여자들이 다수결의 원칙이라는 그 시스템에 동의하기 때문에 투표하기 때문이다.

그런데 현대 민주주의는 당선된 후보가 그 후보에게 투표했든, 투표하지 않았든, 기권을 했든 간에 다른 사람의 소유권을 마음껏 유린할 수 있는 권한도 가져간다. 이건 아주 큰 문제다. 국회의원이 세금을 늘리는 입법 권한을 행사하거나, 대통령이나 국회에서 예산을 편성해 정부 지출을 늘리고, 돈을 찍어내서 사람들의 소유권을 유린하는 행위가 용인된다.

어떤 사람도 다른 사람의 소유권을 침해할 수는 없다. 소유권은 단순히 희소한 재화의 분배 문제를 해결하는 실용적 대안이라서 중요한 것이 아니다. 인간 행동이라는 공리로부터 자기 소유 원칙을 이끌어내고, 그가 소유한 신체와 삶을 써서 획득한 재화(원초적 점유)에 대한 소유권을 보장하는 것이며, 그리고 이미 소유권이 있는 재화를 교환의 양 당사자가 자유롭게 교환하는 행위를 보장하는 것이다.

따라서 소유권은 인간에게 이성이 있다는 존엄성의 표현이자 인간 시간(삶)의 희소성과 귀중함을 인정하는 것이다. 어느 누구도 이를 모독할 권리는 없다. 이를 침해하는 것은 보편 원리에 따라 그 자신의 소유권도 포기한다는 뜻과 같으며, 이는 결국 자기 신체의 자기 소유도 부정하는 셈이 된다.

현대 민주주의에서 투표하는 것은 다른 누군가의 소유권을 유린할 사람을 뽑는 것과 같다. 애초에 이런 권한은 누구에게도 주어지지 않았으며 당연히 누구에게도 없으니 넘겨줄 수도 없는 권한이다.

현대 민주주의의 삼권분립 체제는 당선자에게 이러한 강탈의 권한이 보장된다. 설령 후보자가 이런 권한을 행사하지 않는다고 하더라도 이 시스템이 그러한 권한을 발동할 수 있다는 것을 언제든지 보장한다면 이러한 시스템은 폐기되어야 한다.

따라서 현대 민주주의에서 투표하는 행위는 누군가가 이러한 권한을 행사하는 것에 대한 동의로 간주될 수 있다. 어떤 후보가 이런 행위를 다른 후보보다 '덜' 한다고 해서 그 후보에 투표하는 것에 대한 정당성은 당연히 확보될 수 없다. 더하는지 덜하는지에 따라 이 약탈이 정당화될 수는 없기 때문이다.

심지어 어떤 후보가 이런 약탈 행위를 절대 안 할 것이라고 공언한다고 해도, 시스템에 이러한 권한이 보장되어 있는 이상 투표하는 행위는 이 시스템에 동의하는 행위이다. 그 후보가 당선된 이후 갑자기 돌변해 세금을 걷거나 국채를 팔아 예산을 확보하고 돈을 찍어내는 것이 시스템 상에서는 문제가 없기 때문이다. 이것은 간접 민주주의의 단점이라기 보다는, 애초에 이런 다른 사람에 대한 약탈 권한을 행사할 수 있는 시스템 자체가 잘못된 것이다.

현대 민주주의가 부당한 두 번째 이유는 이 시스템에 동의하지 않는 사람들조차 이 시스템의 피해자가 된다는 점이다.

도박에 참여하고 있는 사람들을 생각해보자. 승리자가 나머지 베팅한 모든 사람들의 베팅 금액을 약탈하는 것은 전혀 문제가 되지 않는다. 왜냐하면 도박 참여자들은 패배 시 자신이 베팅한 재산이 승자에게 몰수될 수도 있다는 것에 동의하고 도박에 참여하기 때문이다(따라서 이는 약탈이 아니다). 이에 동의하지 않는다면 도박을 그만하면 된다. 도박사는 언제든지 도박을 그만둘 자유가 있다.

그러나 현대 민주주의는 이 시스템에 동의하지 않더라도 그 나라에서 태어났다는 이유만으로 이러한 약탈에 강제 당할 수밖에 없다. '분배'하기 위해 투표를 할 거면 그 시스템에 동의하는 사람들끼리 서로의 재산을 놓고 분배하면 될 일이다. 그러나 이 시스템은 모든 사람들에게 이 시스템에 참여하는 것이 강제된다.

즉, 이 시스템은 애초에 잘못된 시스템인데 이 안에서 좌니 우니, 대통령제니 내각제니 사람들이 서로 경쟁하게 한다. 시스템 자체에 대한 의문을 품기는 매우 어려운 구조다.

이 시스템이 마음에 안 들면 이민을 가면 된다고 하는 주장은 전혀 설득력이 없다. 이민에 비용이 들고 다양한 현실적인 제약이 있다는 것은 차치하고서 이야기해보자. 만약 이러한 분배(?) 혹은 세금의 권한 행사자가 해당 지역 토지의 소유자고, 그 토지의 사용자가 소유자가 정한 분배 규칙에 동의하는 조건으로 토지를 사용한다면 이러한 세금과 같은 분배는 약탈은 아니다. 사용자가 그 규칙에 자발적으로 동의했으므로 정당화될 수 있는 것이다.

만약 국토의 모든 땅이 사실상 소유자가 있는 게 아니라, 사실상 국가의 소유이며 국가가 국민들에게 사용권을 나눠주는 것이라는 미친 주장을 해도(참고로 이건 토지의 사적 소유권을 부정하는 공산주의다!) 여전히 이 주장은 정당하지 않다.

토지의 소유권을 획득하는 방법은 두 가지가 있는데 첫째, 소유권이 없는 땅을 점유함으로써 소유권을 주장할 수 있게 되는 것, 둘째, 이미 소유권이 있는 토지를 자발적인 교환이나 기부를 통해 획득하는 것이다. 소유권이 있는 생산 수단을 통해 생산된 생산물도 소유권이 인정되는데, 토지는 생산이 불가능하니(우주정거장 같이 새로운 공간을 건설하는 게 아니라면...) 토지를 획득하는 방법은 언급한 두 가지 뿐이다.

그런데 현대 국가가 토지를 소유한 것의 기원을 살펴보자. 식민지화를 통해 강제로 점유하는 것은 대한민국은 해당이 없는 것 같다. 그러면 이미 소유자가 있는 사유지를 각종 규제와 사용 제한을 통해 사실상의 지배권을 확보하거나, 세금으로 축적한 재정으로 구입한 것이다. 그 기원이 모두 약탈에 있다는 점에서 국가의 토지 소유는 정당하지 않다.

따라서 규칙이 싫으면 이민을 가면 된다는 주장은 도둑이 도둑질을 하는데, 도둑질을 당하기 싫으면 멀리 도망가라는 식의 궤변과 같다.

그러나 국가의 계약은 완전히 비자발적이다. 단지 그 신체가 어디서 탄생했다는 이유만으로 그 시스템에 동의한 것이 될 수는 없다. 갓 태어난 아기는 다른 사람의 보호가 있어야만 생존할 수 있다는 점에서 완전히 비자발적인데, 이에 따라 당연히 탄생의 위치도 완전히 비자발적인 것이었기 때문이다.

또한 국가는 국토의 소유자가 아니다. 그보다는 국토의 소유권을 보장'해야' 하는 존재일 뿐이다. 누군가가 규칙을 정하고 싶다면 그 규칙의 영향권은 자신의 사유지 내에서만 영향력이 있으며, 당연히 그 규칙에 자발적으로 동의하는 사람들만 그 사유지를 이용하는 조건으로 계약할 수 있다.

정리해보자. 지금까지 현대 민주주의의 투표의 부당함에 대해 두 가지 관점에서 살펴봤다. 첫째는 투표가 약탈이 가능한 이 시스템에 동의한다는 행위라서 부당하다는 것이고, 둘째는 이 시스템에 동의하지 않는 사람들까지 약탈의 대상이 되는 이 시스템에 동의한다는 행위이므로 부당하다는 것이었다.

투표하지 않는 행위가 혹시 반대 세력이 활개치게 두게 되는 것은 아닐까? 그렇지 않다. 투표하지 않는 행위는 이 시스템의 정당성을 약화시킨다. 현대 민주주의의 큰 속임수가 있다. 민주주의에서 비롯된 통치 행위는 51%를 넘은 사람들이 그 통치 행위에 동의했기 때문에 자행되어도 된다는 매우 비논리적인 주장에 입각하고 있다. 이는 당연히 정당성이 없다. 그런데 진짜 큰 속임수는 그 통치 행위에 동의한 사람이 심지어 과반도 아니라는 것이다.

만약 어떤 후보가 생산에 적대적인 수준의 세금 부과와 보편 복지, 최저임금 인상 등의 모두가 고통받는 정책을 공약으로 내세워 당선이 되었다고 해보자. 해당 후보의 득표율이 51%라고 한다면 이는 전국의 51% 국민이 해당 후보를 지지하는 것과 같은 착각을 일으킨다. 그렇지 않다. 만약 투표율이 75%라면, 해당 후보에 동의한 사람은 0.75 x 0.51 = 38%가 된다. 즉, 38%의 동의로 인해 모든 사람이 함께 고통 받게 되는 것이다.

그래서 민주주의는 이러한 사실을 감추면서 사람들에게 투표를 독려할 수밖에 없다. 투표율이 조금만 낮아져도 이에 대한 정당성이 심각하게 낮아지기 때문이다. 투표율이 50%인 상황에서 어떤 후보가 51%의 표를 얻어 당선된다면 전 국민의 25%의 지지로 당선된 것과 같은데 이는 통치 행위에 대한 정당성을 매우 약화시킨다.

소비자 주권 행사

그러면 투표라는 행위가 없다면 일반 시민들은 어떻게 주권을 행사할 수 있을까? 사실 우리는 매일매일 자발적으로 투표를 하고 있다. 바로 미제스가 말한 '소비자 주권' 행사다.

우리는 기업들이 우리에게 어떤 효용을 주는지에 따라 계속 투표한다. 어떤 기업을 살리고, 어떤 기업을 죽일지, 어떤 기업을 거지 기업에서 부자 기업으로 만들지, 또는 어떤 기업을 부자 기업에서 거지 기업으로 만들지 투표한다. 바로 '소비'를 통해서 말이다.

이러한 소비라는 투표 방식은 완전히 자발적이라는 점에서 소유권을 제대로 보장한다. 약탈과는 완전히 동떨어진 행위다.

또한, 이러한 투표 방식은 각자가 원하는 대로 효용을 누릴 수 있다. 사법과 치안도 시장의 영역으로 들어오면 우리는 어떤 규칙 아래서 살아갈지 자유롭게 선택할 수 있다. 즉, 내가 선택한 규칙이 다른 사람에게도 강제되지 않고, 다른 사람이 선택한 규칙이 나에게 강제되지도 않는다. 서로 다른 규칙이 충돌하면 그 규칙들의 간극을 중재하는 기업이 나타난다. 자연적으로 질서가 꽃 피는 것이다.

생산 권한은 기업에게 달려있지만 심판은 소비자가 한다. 생산자가 소비자의 의지에 반하는 생산을 하면 바로 시장에서 퇴출되기 때문이다. 기업은 소비자에게 어떤 도덕적 의무를 강요할 수도 없다. 기업은 소비자가 원하는 것이 있다면 생산할 뿐이다. 소비자는 기업에게 자신들이 원하는 것을 최대한 효율적으로 자원을 분배하여 생산할 것을 명령하고 생산 권한을 위임하는 셈이다. 그 기업이 소비자가 원하는 것을 생산하지 않으면 어차피 다른 어떤 기업이 생산하여 거기서 챙길 수 있는 소비자의 표, 즉 이익을 가져갈 것이다.

만약 '소비'라는 투표 행위 자체에 반대한다면 오지에 있는 땅을 사서 문명을 떠나 자급자족하며 사는 것도 가능하다. 각자가 자신만의 방식으로 삶을 선택할 수 있는 것이다.

이 투표 시스템에서 표는 돈이다. 돈으로 투표를 한다는 것이 비인간적으로 느껴질지도 모르겠다. 그러나 돈으로 투표하는 것은 지극히 인간적인데, 그 투표권을 얻기 위해서는 먼저 다른 사람들이 원하는 것을 해줘서 그 표를 얻어야 하기 때문이다. 소비하려면 먼저 생산해야 한다. 이건 완전히 약탈 없는 시스템이고, 모든 인간 시간에 대한 존중이다.

이러한 이유들로 나는 이제 현대 민주주의에 대한 투표를 거부하지만, 동시에 매일 소비를 통해 투표하고 있다.

아고리즘이 자유주의 세상을 만드는 방법

이제 아고리즘의 전략을 살펴보자. 로스바드-호페의 질서 자유주의를 살펴본 뒤, 현대 민주주의의 투표에 대한 부당함을 살펴본 것이 뜬금 없는 이야기는 아니었는데, 아고리즘은 이러한 이유로 어떠한 투표도 거부하기 때문이다. 아고리즘의 창시자인 새뮤얼 콘킨 3세가 로스바드와 갈라선 것도 로스바드가 정치와 연대하는 전략적 행보를 보이면서부터였다.

아고리즘은 자유로운 세상을 만들기 위해 자유 시장인 아고라를 적극 활용할 것을 주장한다. 이들은 정부가 추적할 수 없는 자유로운 암시장을 확대해서 정부의 힘을 약화시키는 방법을 써야 한다고 주장한다. 이 암시장은 당연히 무기, 마약, 성매매 등을 포함한 시장을 말한다.

그래서 자유지상주의를 도래시키기 위한 이들의 전략은 정부가 추적할 수 없는 시장을 만들고, 하나의 병렬 경제(대항 경제)를 만들어 정부의 힘을 지속적으로 약화시키는 것이다. 이들은 납세 거부 운동, 투표 거부 운동을 장려하며 암시장과 암호 기술을 적극 활용한다. 참고로 사이퍼펑크 같은 기술 자유주의는 분류하자면 질서자유주의보다 아고리즘 쪽에 더 가깝다(로스 울브리히트의 실크로드를 생각해보자...!)

로스바드-호페의 질서자유주의와 콘킨의 아고리즘은 둘 다 자유지상주의의 실현을 목표로 하지만, 질서자유주의는 논리적으로 윤리적 정당성을 확보하고, 그러한 정당성을 바탕으로 자유지상주의를 실현시키기 위해 현실 세계에 이미 존재하는 제도들도 전략적으로 이용한다. 반면 콘킨의 아고리즘은 자유지상주의의 윤리적 정당성보다는 그걸 도래시키기 위한 전략들에 치중하며, 정치와 절대 타협하지 않고, 전략적으로 이용하려고도 하지 않는다. 목표는 같지만 서로 다른 방법을 취하는 것이다.

1980년 공개된 콘킨의 「신 자유주의자 선언」은 미제스와 로스바드, 르페브르에 대한 감사로 시작하지만, 1장에서 다음과 같은 문구도 나온다. (이것도 언제 다 번역해봐야겠다!)

"처음 나타난 반격은 ... 개혁주의—국가주의를—'개선'하겠다는 명분으로 국가의 직책을 받아들이는 것까지 포함한다!—이 모든 반反 원칙들에 대해서... 그중 가장 끔찍한 것은 '정당주의'인데, 이는 자유지상주의적 목적을 국가주의적 수단, 특히 정당을 통해 달성하려는 반反 개념이다. '자유지상주의' 정당은 국가가 이제 막 출현한 자유지상주의자들에게 퍼부은 두 번째 반격이었다. 처음에는 터무니 없는 모순으로, 그 다음에는 침략군으로 등장했다."

로스바드가 1992년 공화당 경선 후보였던 팻 뷰캐넌을 공개적으로 지지했을 때(이때 공화당 경선에서 뷰캐넌은 아버지 부시한테 졌고, 대선은 민주당 빌 클린턴 승리), 콘킨이 어떤 반응을 보였을지 상상해보자. 저런 선언문을 썼는데 말이다. 콘킨은 로스바드가 자유지상주의 원칙을 저버렸다면서 자신이 편집하는 잡지 『신 자유지상주의자』에서 로스바드의 행위를 "자유의 원칙을 포기한 행위"라고 비난했다.

반면 로스바드는 소수의 자유지상주의 지식인들만으로는 자유지상주의 사회를 건설할 수 없으므로 대중과 연합해야 한다고 주장했다. 팻 뷰캐넌 같은 인물을 통해 중산층이나 노동계층의 지지를 얻을 수 있고, 자유지상주의 목표를 달성할 수 있다고 했다. 이때 나온 전략이 자유주의적 경제 질서와 보수적 문화 질서를 결합한 '팔레오 자유지상주의'다. 로스바드는 아고리즘 세력에게 순수성만을 강조하며 현실 세계와 단절된 사람들은 무기력한 이상주의자들이라고 반박하며, 자신은 국가주의를 지지하는 게 아니라 그 세력 안에 있는 반국가적 잠재력을 이끌어내는 것이라고 했다.

그림 2. 아고리즘의 깃발

질서자유주의와 아고리즘의 공동체적 배제에 관한 입장 차이

콘킨의 아고리즘과 로스바드-호페 라인의 질서자유주의의 차이는 정치 같은 기존 제도들을 전략적으로 이용할 수 있는지뿐만 아니라 공동체적 배제에 관한 입장에서도 약간 갈라진다.

자유주의에서는 자유로운 수용과 자유로운 '배제'도 보장되어야 한다. 즉, 예를 들어 어떤 사람이 장사를 하는데 동성애자나 흑인이나 채식주의자를 직원이나 손님으로 받지 않는 것도 장사하는 사람의 자유로운 배제 권리라는 것이다. 자신의 사유지에 어떤 사람을 들일지, 들이지 않을지는 전적으로 소유자의 몫이다. 그리고 여기서 배제는 당연히 폭력으로 이어지지 않는 선에서의 자유로운 배제다.

이러한 배제가 한 공동체 전체로 퍼졌다고 해보자. 지금은 동성애자에 대한 예시만 들겠다(필자는 동성애에 대해 부정적 감정이 전혀 없으니 동성애자 분들은 오해 마시길). 만약 한 지역 소유자 공동체 전체가 동성애자에 대한 배제를 주장한다면 당연히 동성애자는 그 공동체에 들어갈 수가 없다.

여기서 이를 다루는 뉘앙스가 약간 다른데, 호페는 이를 자유로운 계약에 의한 공동체적 질서의 탄생이라 보며 긍정적으로 본다. 물론 절대로 이러한 배제가 폭력으로 이어져서는 안 된다. 폭력으로 이어지면 비침해성 공리 위반이므로 정당성이 없다.

아고리즘은 개인들의 자발적인 배제는 자유지만, 이것이 공동체적 배제로 발전하고 구조적 차별이나 집단적 억압으로 발전하는 건 국가의 또 다른 형태일 뿐이라 생각하여 이를 경계한다. 그래서 개인 차원의 자율적 배제는 정당하지만, 공동체 차원의 배제는 경계한다. 그렇다고 이걸 없애야 한다 이런 건 아니다(개인들의 자유로운 배제가 공동체 배제로도 이어질 수 있는 것이므로). 콘킨은 공동체적 배제가 탄생할 수 있지만 그것이 비합리적인 배제라면 대안 시장이 탄생할 것으로 본다. 동성애자들을 위한 시장과 마을이 생길 것이고, 비합리적인 배제는 이러한 고객들을 놓친 것에 대한 손실로 이어질 것이라고 본다. 즉, 모든 개인이 자유 시장 아고라에서 자발적으로 교환할 권리를 가져야 하며, 차별적인 배제들은 시장 안에서 경쟁할 수 있을 거라 본다. 만약 대안 시장이 없는 상황에서 모두가 배제한다면 이는 실질적 강제처럼 작동할 수 있기 때문이다.

자유지상주의 안에서 콘킨의 아고리즘은 차별이나 수용을 대하는 태도에서 좀 더 좌파적인 것처럼 보인다. 실제로 콘킨의 「신 자유주의자 선언」에 등장하는 용어들도 약간 그러한 뉘앙스가 있다. 콘킨은 전통적인 좌파 단어들을 전략적으로 차용했다. 예를 들면 혁명, 착취, 해방운동, 불복종, 저항, 암시장, 아나키즘 등의 단어다. 당연히 전통적인 좌파 단어의 뜻과는 완전히 다르다. 혁명은 아고라를 통한 "비정치적" 자유주의 혁명을 의미하며, 착취는 마르크스의 자본가가 노동자를 착취한다고 했던 그 착취가 아니라, 국가주의와 결탁한 크로니 자본주의자들의 제도적 진입장벽을 만들고, 캉티용 효과의 수혜를 누리는 그러한 오염된 자본주의자들이 하는 것을 착취라고 했다(아고리즘은 국가에 의존하지 않는 기업가와 국가로부터 특혜를 받는 착취적 기업가를 구분한다. 선언문 참고).

정리하자! 로스바드-호페의 질서 자유주의와 콘킨의 아고리즘의 차이점은 다음과 같다.

로스바드-호페의 질서 자유주의는 정치 등을 전략적으로 이용하는 것을 허용한다. 로스바드는 공화당 경선 후보를 공개적으로 지지하여 우파 사람들로부터 자유지상주의에 대한 관심을 끌려고 했고, 호페는 전국단위의 투표나 정당 활동은 거부해도 지역 단위의 투표는 승리 가능성에 따라 조건부로 허용한다. 반면 아고리즘은 어떠한 정치 활동도 거부하며 오직 국가의 통제로부터 동떨어진 자유로운 시장에 의한 혁명을 추구한다.

얼마 전에 있었던 비트코이너들이 보수 우파 스페이스에 들어가서 비트코인에 대해 전파하는 걸 상상해보면 쉽다. 우파 국가주의자들은 국가 시스템에 의한 문제 해결을 강력한 지도자가 등장해 모든 것을 해결해줘야 한다는 잘못된 방법론에 빠져있는 경우가 많은데(문제를 더 큰 문제로 해결하려는 셈...), 누군가는 이걸 보고 저런 사람들과 협력하면 안 된다고 할 것이고, 누군가는 비트코인과 자유주의를 전파하기 위해 그래도 가능성이 높은 이들 사회에 섞여들어가 이야기도 하고, 전파도 하려고 할 것이기 때문이다.

또한 한 가지 차이점은 질서 자유주의와 아고리즘 모두 공동체적 배제는 인정하나, 질서 자유주의는 이를 자유로운 계약에 의해 등장한 공동체적 질서로 보고, 아고리즘은 공동체적 배제가 집단적 억압으로 발전할 것을 경계한다. 아고리즘에서는 비합리적 차별에 의한 배제는 대안 시장이 생겨 극복될 수 있다고 본다.

자유주의 세상을 만들기 위해서는 어떻게 해야 하는가

이제 무엇이 옳은지 스스로 판단해보자. 지금부터는 개인적인 생각이 매우 많이 들어가있으므로 주의하라.

콘킨의 아고리즘은 암시장의 확대를 노려 정부 권한을 약화시키려 하지만 이는 대중의 지지를 얻기 어렵다. 또한, 이러한 병렬 경제는 한 곳에 집중되기 어렵고 넓고 약하게 퍼져있을 수밖에 없다.

로스바드-호페의 질서자유주의는 현실에 이미 존재하는 제도들을 전략적으로 활용한다. 현실적으로 대중의 지지를 얻을 가능성이 있고, 한 지역에 자유주의자들이 집중되면 적어도 그 지역에서는 지역 투표를 통해 위로부터의 전환이 가능하다. 하나의 자유지상주의적인 지역이 좋은 모범이 되면 다른 지역도 채택할 가능성이 커진다.

어떤 전략을 택해야 하는가? 나는 자유지상주의가 도래하게 하기 위해서는 두 전략 다 써야 한다고 생각한다. 질서자유주의자들의 주장대로 대중의 지지 없이는 자유지상주의가 도래하게 할 수 없다. 대한민국에 있는 "진짜" 비트코이너+자유지상주의자들이 대략 몇 명쯤 될까? 높게 잡아 1,000명 정도 된다고 해보자. 이들 전부가 특정 지역에 모인다고 해도 자유지상주의 질서를 건립할 수는 없다. 찾아보니 대한민국에서 인구가 가장 적은 시가 충남 계룡시라고 한다. 여기 인구는 약 4만3천 명인데, 여기에 51% 공격을 가하려고 해도 적어도 4만 명이 필요하다는 뜻이다. 따라서 아고리스트들처럼 대중의 지지를 얻기 위한 전략을 완고하게 거부하다간 어떠한 힘도 얻지 못하고 선민 의식에만 갇힐 수 있다.

반면 아고리스트들의 주장대로 병렬 경제도 필요하다. 잘 세뇌된 대중은 폭력 집단의 강탈이 있어야만 사회가 유지될 수 있다는 환상에 사로잡혀있다. 병렬 경제는 이러한 환상을 깨뜨릴 좋은 수단이다. 정부 추적이나 제3자 없이 부의 보존이 가능하고, 당사자끼리의 직접 결제가 가능하다는 것을 사람들이 경험하면 생각이 크게 바뀔 것이다. 비트코인으로 결제를 해본 사람과 한 번도 해본 적 없는 사람은 이런 자유지상주의 세상에 대한 이해의 폭이 다를 수밖에 없다. 또한, 비트코인은 개인들에게 큰 힘이 되는데 국가 시스템의 폭력으로부터 개인들이 생산 가치를 지킬 수 있는 강력한 방패이자 동시에 무기가 되기 때문이다.

그러나 아고리즘의 주장인 병렬 경제 중 특히 암시장 전략—국가의 통제가 미치지 않는 무기, 마약, 성매매 등을 확장하는 것—에는 동의하지 않는다. 당연히 자유지상주의자인 나는 총기나 마약, 성매매 등도 자발적인 계약에 의해 시장에서 더 건전하게 다뤄질 수 있다고 생각한다. 지금처럼 불법화되어있는 사회와 다르게 자유시장에서는 마약의 순도나 안정성에 대해 인증해주는 기관, 의사들도 등장할 것이고, 성매매도 비슷한 방식으로 질서화될 수 있다고 생각한다. 혹은 이러한 시장은 시간 선호를 지나치게 높이고 전통적인 가족 질서를 해칠 수 있으므로 공동체적 배제가 일어날 수도 있다. 무기, 마약, 성매매는 일반 대중들이 생각하는 '질서'와는 거리가 있다. 우리는 더 많은 사람들을 끌어들여야 하는데 이는 처음에 일단 거부감을 일으킬 수 있다.

따라서 자극적인 암시장보다는 사람들의 반감이 없는 상품들을 먼저 비트코인으로 거래하고, 국가가 추적하지 못하게 함으로써 납세 거부의 물결이 퍼지게 해야 한다. 동시에 더 많은 사람들에게 자유주의를 전파해야 한다. 더 많은 개인과 비트코인을 통한 병렬 경제라는 두 가지 무기가 함께 생겨야 지역 단위에서의 자유주의 세상을 만들 수 있을 것이다. 먼저 자유주의를 많은 사람들에게 전파해야 한다. 이 과정에서 좌파, 맑시즘, 케인지언들보다는 상대적으로 자유에 대한 이해가 좀 더 있는 집단인 우파 국가주의자들이나 기독교적 종교관을 가진 사람들 속에 섞여 들어가 거기서 전파를 할 수도 있다. 이러한 과정을 통해 자유주의자들이 많아지고, 한 지역에 모여야 한다. 비트코인이라는 무기를 가진 개인들이 한 지역에 모여 자유로운 시장을 형성하면, 호페가 말했던 것처럼 그 지역에서의 투표를 통해 작은 자유지상주의 세상을 만들 수 있다.

그림 3. 자유주의 세상을 만들기 위해서는 두 전략을 적절히 함께 써야 한다.

-

@ 91bea5cd:1df4451c

2025-06-10 14:52:18

@ 91bea5cd:1df4451c

2025-06-10 14:52:18Para um brasileiro, pode ser difícil entender como as estações do ano são capazes de influenciar o imaginário e a própria organização da sociedade.

Mas em países de clima temperado ou frio, onde primavera, verão, outono e inverno são mais demarcados, é contagiante a alegria com que o verão é celebrado, depois de meses de dias curtos, temperaturas frequentemente negativas e poucas possibilidades de interação social.

É por isso que desde os tempos mais antigos, as primeiras civilizações europeias já tinham festas específicas para celebrar tanto a chegada da primavera — a volta da vida desabrochando — quanto o solstício de verão — o ápice do sol, o dia mais longo do ano.

E, segundo pesquisadores, são esses dois tipos de celebração, depois abraçados pelo catolicismo, que explicam a origem das festas juninas, que no Brasil acabariam sendo reinventadas com um sotaque próprio.

"As origens são mesmo as antigas festas pagãs das antigas civilizações, ligadas aos ciclos da natureza, às estações do ano. Sociedades antigas realizavam grandes festividades, com durações longas, até de um mês, sobretudo nos períodos de plantio e de colheita", contextualiza o pesquisador de culturas populares Alberto Tsuyoshi Ikeda, professor da Universidade de São Paulo e consultor da cátedra Kaapora: da Diversidade Cultural e Étnica na Sociedade Brasileira, da Universidade Federal de São Paulo (#Unifesp).

"A primavera era bastante comemorada, como o reingresso da vida mais dinâmica, o rebrotar da natureza e das atividades depois do período do inverno, sempre de muita dificuldade, luta pela sobrevivência e recolhimento", comenta ele.

Se nessa época do ano o que se via era a explosão da natureza, a vida social espelhava isso. "Os grupos humanos realizavam grandes festividades dedicadas à própria natureza, muitas vezes rendendo homenagens aos antigos deuses relacionados à natureza, à vida animal, à vida vegetal de um modo geral. Eram festas comunitárias com muita alegria, muita alimentação e reunião de pessoas em grande número: foi o que deu origem às festas juninas que a gente conhece no Brasil e em outras partes do mundo."

Autora do livro Festas Juninas: Origens, Tradições e História, a socióloga Lucia Helena Vitalli Rangel, professora na Pontifícia Universidade Católica de São Paulo (PUC-SP), explica que a origem das festas juninas está nos "rituais de fertilidade agrícola" de diversos povos — da Europa, do Oriente Médio e do norte da África.

Os [mitológicos] casais #férteis #Afrodite e Adonis, Tamuz e Izta, Isis e #Osíris eram homenageados nesses #rituais, pois representavam a reprodução humana, numa época de evocação da colheita", afirma.

"Eram rituais para que a colheita fosse farta e para abençoar o próximo período #agrícola. Era período de congraçamento, de partilha e estabelecimento de alianças entre as comunidades. Eram rituais de fartura e abundância em todos os sentidos, no âmbito alimentar e na relação entre as famílias: casamentos, batizados e compadrio."

"No hemisfério norte o solstício de verão era o auge do período ritual e do trabalho agrícola coroado pela colheita", acrescenta a socióloga.

Vale ressaltar o óbvio, para que não fique um certo estranhamento ao leitor menos atento: no hemisfério norte, origem de tais celebrações, as estações do ano são invertidas em relação ao hemisfério sul, onde está o Brasil.

Apropriação católica

Mas onde então entram os santos nessa história? Na festa junina contemporânea, estão presentes algumas das figuras mais populares do catolicismo — e isso acabou impregnado de tal forma na celebração que a religiosidade se misturou ao folclore e às tradições populares, transcendendo os ritos normatizados pela Igreja Católica.

O primeiro dos santos juninos é Antônio (? - 1231), frade franciscano de origem portuguesa que ficou conhecido pelo que fez na Itália no início do século 13. Com fama de milagreiro, foi canonizado pela Igreja onze meses depois de sua morte — trata-se de um recorde até hoje não superado na história do catolicismo.

No imaginário popular, Antônio se tornou o #bonachão santo das coisas perdidas, sobretudo nos países europeus, e o casamenteiro, principalmente em Portugal e no Brasil. #Simpatias, #promessas e orações específicas marcam a devoção a ele. E sua presença nos festejos juninos geralmente está ligada a essas tradições — a Igreja fixou o 13 de junho, data da morte dele, como dia consagrado ao santo.

Em 24 de junho, o catolicismo celebra o nascimento de João Batista (2 a.C - 28 d.C.). É o santo máximo das comemorações juninas — há versões que apontam que originalmente eram "festas joaninas" e não festas juninas; e, sobretudo no nordeste brasileiro, a Festa de São João é um evento de dimensões impressionantes.

Personagem de historicidade controversa, João Batista é apontado como primo de Jesus Cristo e aquele que o batizou.

Em seu livro O Ramo de Ouro, o antropólogo escocês James Frazer (1854-1941) diz que ocorreu um processo histórico "de acomodação", deslocando para a figura de São João Batista a comemoração do solstício de verão.

Por fim, o mês de junho ainda tem a data do martírio de São Pedro (? - 67 d.C) e São Paulo (5 d.C. - 67 d.C.), dois dos pioneiros do cristianismo. Pedro foi um dos 12 apóstolos de Jesus e acabou depois considerado o primeiro papa do catolicismo.

Paulo de Tarso, por sua vez, é reputado como um dos mais influentes teólogos da história. Parte significativa dos textos que compõem o Novo Testamento da Bíblia é atribuída à sua pena. É dele, portanto, a autoria de parcela considerável da ressignificação de Jesus Cristo após sua morte na cruz — em outras palavras, é possível dizer que Paulo é responsável pela transformação de Jesus em um mito.

Uma observação necessária: apesar de a Igreja celebrar em conjunto a memória do martírio de Pedro e de Paulo, por tradição este último nem sempre é associado aos festejos juninos.

À medida que o catolicismo foi se transformando em religião do status quo, sobretudo a partir da cristianização do Império Romano, no ano de 380 d.C., diversos rituais tratados como pagãos acabaram sendo abraçados e apropriados pela Igreja. "A Igreja Católica não pôde desmanchar essas práticas", reconhece Rangel.

Com os rituais de primavera e verão, não foi diferente. "Várias dessas festividades foram adaptadas", conclui Alberto Ikeda, da USP. "Aos poucos passaram a ser tratadas como festas em honra aos santos juninos."

"Mas é importante notar que mesmo dentro do ciclo cristão, esses santos estão ligados tematicamente com aquelas mesmas ideias, os mesmos princípios das festividades [dessa época do ano] das antigas civilizações", pontua o pesquisador.

Santo Antônio, por exemplo, é o casamenteiro — em uma leitura lato sensu, poderia ser encarado como o santo da família, da unidade familiar, da reprodução humana. "São João também está ligado, sobretudo nos interiores do Brasil, a essa questão dos relacionamentos afetivos. Tradicionalmente, faz-se muito casamento no Dia de São João", diz Ikeda.

"Ele também traz a característica da fartura [que remete aos períodos de plantio e de colheita, em oposição aos rigorosos invernos], dos alimentos, das bebidas, aquilo que chamamos na antropologia de repasto ritual ou repasto cerimonial", afirma o pesquisador.

De modo geral, na leitura proposta por ele, todos os santos juninos estão ligados aos ciclos da natureza — fogo, água, fertilidade, abundância. Está aí São Pedro e a ideia de que ele é quem controla o tempo. "Vejo uma relação entre eles e os antigos rituais, uma relação ainda presente.

Embora a gente não perceba mais, eles têm essa ligação com os elementos fundamentais da existência humana", comenta.

Nas festas populares essas forças da natureza se fazem representadas, muito além da mesa farta.

Os mastros juninos que são erguidos representam a potência dos troncos, das árvores que resistem ao inverno. A fogueira é a luz: ilumina, aquece, afugenta animais ferozes, assa os alimentos.

Na releitura contemporânea, portanto, as festas juninas "guardam as reminiscências das ancestrais aglomerações festivas", conforme frisa Ikeda.

Tradição brasileira

Paçoca, pamonha, pipoca, bolo de fubá, canjica, curau, pé de moleque, maçã do amor. Vinho quente e quentão. Brincadeiras de pular fogueira e dançar a quadrilha. Chapéu de palha, camisa xadrez, calça com remendos. Bombinhas e rojões, fogos de artifício. Bandeirinhas coloridas penduradas em varais de barbante.

No Brasil, as festas juninas foram reinventadas e se tornaram uma exaltação das raízes caipiras. E muito além da religiosidade, tornou-se tradição, folclore. Como se o ciclo se fechasse: o que nasceu como ritual gregário, de celebração social, e depois foi apropriado por uma religião dominante, acabou na cultura popular sendo devolvido ao sentido original — ou seja, a festa pela alegria de festejar.

Não à toa, a folclorista Laura Della Mônica registrou em seu livro Os Três Santos do Mês de Junho que "respeitar as festas e orações dedicadas a cada um dos três santos do mês de junho, segundo a tradição, é obrigação e dever de todos nós, pelo menos culturalmente". O "todos nós" é o brasileiro. Porque mesmo nascida no Velho Mundo, as festas juninas assumiram uma identidade própria em território nacional.

"A colonização da América colocou novamente a questão [da apropriação cultural] para os jesuítas e todos os religiosos que se instalaram no continente sul-americano", pontua a socióloga Rangel.

"No caso do Brasil, houve uma coincidência do calendário. No inverno seco, o solstício de inverno marca o período dos trabalhos agrícolas mais importantes. Do mesmo modo que, para os povos do hemisfério norte é o período de rituais de fertilidade, [a festa por aqui também vem] com as mesmas características, congrega as famílias na evocação da abundância."

As tradições regionais guardam suas especificidades, como era de se esperar em um país de dimensões continentais. "Sempre foram festas e rituais populares", salienta Rangel.

"No Brasil temos expressões regionais muito fortes: o São João nordestino, o Boi Bumbá da região norte, o Boi de Mamão no sul, Cavalhadas no centro-oeste e as festas do Divino Espírito Santo e muitas regiões, particularmente no estado de São Paulo."

A pesquisadora comenta que "conforme os padres vão chegando nas paróquias, começam a interferir nas comemorações". É quando vem o sincretismo: a festa popular também é festa católica, a quermesse organizada pela igreja também tem os rituais populares.

"Até hoje as paróquias, as igrejas, realizam festas juninas. Mesmo que as maiores festas estejam predominantemente tendo somente o caráter festivo, mais comercial, de exploração pelo ganho financeiro, as igrejas continuam fazendo comemorações aos santos juninos", pontua Ikeda.

"Embora muitas pessoas não católicas também participem das festas, embora predomine uma visão genérica que as festas juninas não guardam mais relação com a religiosidade, há ainda um relacionamento das igrejas com esses santos juninos."

Para ele, a evolução da festividade consiste no fato de que "toda aglomeração possibilita o incentivo ao comércio". "E a alimentação está neste centro, na busca mesmo do repasto cerimonial e festividades, danças e músicas que sempre estiveram ligados aos antigos rituais." Ikeda lembra que a as festas populares têm uma importância antropológica por serem "práticas gregárias que ciclicamente comemoram a própria constituição, a própria existência das comunidades enquanto coletividade, a reunião de grupos humanos que preservam uma história comum".

"No caso da feste junina, esse vestir-se de caipira, simbolicamente, é um instrumento de importância até emocional e psicológico para as pessoas se sentirem com a identidade ligada ao passado, aos pais e avós que praticavam aquilo, comemorando de forma parecida", analisa o pesquisador.

"Assim, a prática possibilita a guarda de uma continuidade ao longo do tempo."

Suspensão sanitária

Nunca é demais enfatizar: com a pandemia de covid-19 ainda fora de controle, seria uma péssima ideia realizar qualquer tipo de festa neste período — se quer comemorar, faça em casa somente com seu núcleo familiar. Então, 2021 será o segundo ano consecutivo em que o Brasil não terá, ao menos de modo ostensivo, a tradição das festividades com bandeirinhas coloridas. Doutora em História das Ciências da Saúde e autora do livro A Gripe Espanhola na Bahia, a historiadora Christiane Maria Cruz de Souza afirma que esse cancelamento não ocorreu nem na epidemia de 100 anos atrás.

Isto porque a gripe chegou ao Brasil bem depois dos festejos de 1918. E, no ano seguinte, a epidemia estava controlada. "A gripe espanhola não teve nenhuma interferência no São João. Os primeiros registros da doença apareceram em setembro de 1918 e a doença foi se extinguindo aos poucos. Em Salvador, ele não avançou para o ano de 1919. Houve alguns surtos, em lugares mais remotos, até 1920, mas sem caráter epidêmico."

É de se supor, inclusive, que as festividades de 1919 tenham sido ainda mais animadas. "Passada a epidemia de gripe espanhola, tudo o que as pessoas queriam eram esquecê-la", afirma Souza.

Em 20 de junho de 1919, entretanto, surgiram os primeiros registros indicando uma epidemia de varíola na capital da Bahia. "Começaram a aparecer um caso aqui, outro ali, mas ainda sem a força suficiente para poucos dias depois interditar os festejos de São João", nota a pesquisadora.

"As autoridades sanitárias demoraram muito para reconhecer que ocorria uma epidemia terrível de varíola. Autoridades públicas só costumam reconhecer a existência de uma epidemia quando se torna inevitável devido ao acúmulo de adoecimentos e mortes, quando o número de doentes e mortos ultrapassa a normalidade esperada para os casos da doença. Isso demora um tempo."

Rangel ressalta, inclusive, que até a primeira metade do século 20, as festas juninas eram muito menores, restritas a familiares e pequenos grupos comunitários. Muito menos do que os eventos de hoje em dia. "Eram festas de arraial, de quintais, de quermesses", diz. "Elas só se transformaram em grandes espetáculos na segunda metade do século 20, na esteira da espetacularização do carnaval."

Fonte: BBC News 18 Junho 2021

-

@ ea181d3b:0fa4d7cd

2025-06-10 13:35:06

@ ea181d3b:0fa4d7cd

2025-06-10 13:35:06Originally shared on mirror.xyz/canurta.eth on May 24th, 2025

At Canurta, we’ve never followed convention for convention’s sake. We’re building a new blueprint for how biotech companies can scale — one that prioritizes financial resilience, founder-led execution, and long-term shareholder value. That’s why we’re anchoring our capital strategy to Bitcoin.

This is not a gimmick. It’s a deliberate financial move that increases our purchasing and R\&D power by 30–60% ARR and positions us to lead institutional biotech innovation in Canada with asymmetric upside and limited downside. We're creating the first adaptive medicine company backed by Bitcoin reserves — and with it, a new playbook for the capital markets.

So, Why Bitcoin

Strengthens Capital Efficiency

By integrating Bitcoin into our treasury model:

-

We gain exposure to an appreciating reserve asset

-

We minimize dilution by accessing BTC-backed financing tools

-

We enable strategic rebalancing to meet investor needs during volatility

Enables Optionality Without Fragility

With regulated Canadian OTC access and margin lending partners, we can:

-

Sell or collateralize BTC as needed, without relying on banks

-

Fund trials, operations, or acquisitions with non-dilutive capital

-

Maintain a steady NAV anchor (3:1) to issue optional securities if desired

Aligns with Institutional Trends

With FASB guidance and growing institutional adoption, BTC is no longer fringe — it’s part of the future. This gives Canurta a chance to front-run a shift in capital formation and stand out as an institutional-grade biotech that operates with the prudence of a sovereign investor.

Rethinking Risk

As Warren Buffett said:

“Risk is not volatility, but permanent loss of capital.”

We agree. Volatility is not the enemy — poor execution is.

Bitcoin offers volatility, yes — but also resilience, transparency, and global liquidity. By contrast, the permanent loss of purchasing power in fiat currencies, especially the USD, is the silent risk that most overlook.

What It Takes to Win

Executing a strategy like this requires:

-

Courage from the founder

-

Goodwill from the team

-

Trust from our investors

And most importantly: results. We're not asking to be believed — we're asking to be measured. Canurta’s team is here to execute.

The Broader Vision: Advancing Canadian Capital Markets

Our ambition goes beyond Canurta. We believe Canada can be a global leader in BTC-backed biotech finance. We're building this strategy not just for ourselves, but for:

-

CanadianMunicipalities, like Vancouver, with forward-thinking financial structures

-

Corporations and SMEs looking to access resilient, modern capital

-

Boards of Trade and innovation councils who can champion resilient business models across the country

This isn’t theory — it’s a testable, repeatable path. One step at a time, using open-source tools, transparency, and results.

The “Holy Grail” of Finance: Uncorrelated Alpha

Bitcoin gives us what traditional portfolios struggle to find: An uncorrelated asset that improves risk-adjusted returns.

We manage volatility through:

-

Position sizing and drawdown strategies

-

Keeping our mind on long time horizons that allow us to ride macro cycles

-

Quarterly rebalancing and capital rotation discipline

Closing Thought

Markets reward clarity and courage. We’re not chasing trends — we’re setting the terms.

BTC gives Canurta the freedom to execute without surrendering control. It strengthens our balance sheet, hedges systemic risk, and creates a durable advantage for our shareholders — one that compounds over time.

We're not here to play defense. We're here to win.

Let’s build the future of medicine — backed by the future of money.

Akeem Gardner | CEO & Founder | Canurta Therapeutics | akeem@canurta.com

-

-

@ 63d59db8:be170f6f

2025-06-10 12:17:39

@ 63d59db8:be170f6f

2025-06-10 12:17:39The pursuit of this body of work is to document the ongoing flux of novel events that I experience. My goal is to share my perception of the world so that others can see the beauty, color and humor.\ \ My journey as a photographer has taken me to places that I could have never imagined - from the basements of house shows, to traveling around the entire United States, Japan and most of Europe. I am incredibly thankful for all of the opportunities that have been given to me from touring with Vasudeva. In the course of all these years traveling, what I have come to understand is a deeper vision of myself and what it is that I do as a photographer; and that is to document people and places in the moment. To not seek compositions, but to allow the curiosity and discovery of myself to see and experience.

-

@ 8d5ba92c:c6c3ecd5

2025-06-10 10:30:44

@ 8d5ba92c:c6c3ecd5

2025-06-10 10:30:44Over the years, I’ve hit many different Bitcoin events across Europe, recently LATAM and Asia too. Small local meetups, bigger gatherings, mid-sized and large conferences, as well as cultural festivals like the one just held in Warsaw, Poland, Bitcoin FilmFest (aka BFF25, which I also co-run).

With probably an average of 7-10 gatherings a year, it’s a lot for some, not enough for others. For me, it’s a learning process hunting signal: real people, real ideas, real talks. In a way, Proof of Work—joining these events takes time and energy, it too yields the results—new connections, collaborations, or even just further steps toward our sovereign lives, meeting after meeting, just like adding a block to the chain.

When choosing a new place to join, location and program are important, almost equal, but what matters most is the overall theme and the vibe it creates with the ‘crowd’. Almost a paranormal synergy of what organizers bring and what attendees add with their presence.

May-June 2025...

First, culture without chains. Then privacy, tech, and cypher action. Still buzzing from BFF25, just a week later, a bit tired but stoked, I managed to take a 3-hour flight from Poland to Spain.

Worth it? Absolutely! Why? Continue reading to figure out.

BCC8333. Let’s first break down the name.

Barcelona Cyphers Conference, with “8333” referring to the port Bitcoin nodes use to sync the timechain in a decentralized network. Well, BCC8333 promised substance, not just empty fluff, from the very start. Honestly, I wouldn’t even call it a 'conference' but a high-signal, well-structured meetup of maybe 150-200 individuals. No influencers, no VIP rooms. No hype, no pressure.

Unleashing Decentralized Freedom.

Held at Palau Dalmases, a 17th-century palace in Barcelona’s Born district, the venue was pure magic. Its courtyard, with stair rails carved with mythological scenes, had an artistic, almost rebellious soul tied to its flamenco background (the venue officially hosts flamenco shows in the evenings). Not too big, not too small, it was just perfect for deep talks, hands-on workshops, signal-not-bullshit presentations, and real debates.

The courtyard, the heart of the venue, welcomed us with sunny weather and stylish décor, sparking some of the best daytime conversations I’ve had. The entire place, with its history and defiant spirit, felt ready for us to build something special. https://i.nostr.build/5CbApOqFnb8UoB0F.png

Organized by locals—Spanish Maxis with a cypherpunk soul—and attended by folks from across the globe, it was a perfect mix of knowledge and experiences. Deep discussions on tech, privacy, geo-politics, culture, communities, health, lifestyle, and philosophy. Precious moments with familiar faces or new ones, all working on very interesting projects. Fact: smaller crowd let you dive deep into talks and build genuine connections.

The program was thoughtfully structured. Intense sessions balanced with space to breathe, think, talk, and eat.

(Note: BCC8333, smack in the heart of Barcelona, meant plenty of nearby dining options despite tourist crowds and occasional long lines for top tapas bars. Breaks were long enough, so you could savor decent meals while enjoying the 5-10 minute walk here or there with other attendees. Could you pay in SATs everywhere? Not really, not outside the venue. But let’s be realistic: in a group of Bitcoiners, there’s always a way to use SATs, swapping fiat with others who’ll need it sooner or later. Win-win. Personally, I find these scenarios even better—Bitcoiners roaming the city for days, asking ‘Can I pay in bitcoin?’ again and again, spread a message stronger than just a group of us closed off at the venue doing our own thing. Moving around and repeating the same question will sooner or later inspire new places to take Bitcoin payments seriously. FYI: at one dinner, a delicious Brazilian steakhouse, we convinced a waiter to download a Lightning wallet, accept his tips in SATs, and vow to dig deeper into Bitcoin and Nostr in the coming days.)

Back To The Event and Its Agenda.

Practical workshops, sharp presentations, and real debates (sadly, still too rare in the space) covered topics like privacy, nodes, wallets, Bitaxe miners, and Nostr. Crucial stuff to forge the sovereign life.

https://i.nostr.build/PvD1bDKr9qQ87Mr5.png

- My personal highlights?

Friday’s sessions on the history and future of cypherpunks (Spanish / English, with Alfre Mancera, Entropy, Bebop, Max Hillebrand, and Begleri); Miniscripts Roundtable-Discussion (English, with Edouard from Liana, Landabaso from Rewind, Francesco from BitVault, Yuri da Silva from Great Wall); Self-Sufficient Houses (English with Matthew Prosser); and the debate on Op_return (English, with Peter Todd; Unhosted Marcellus, and Lunaticoin).

I couldn’t catch everything—too busy in hallway chats connecting dots from the past to the present for a stronger future ;) … Luckily, the main stage sessions were recorded by the organizers (follow Nostr: BCC833, with extra interviews/coverage done by Juan Cienfuegos (BitCorner Podcast). Sure, all of it will drop online soon.

https://i.nostr.build/lNppYMtEtz8DGNhi.png

- What left me in awe?

Pure, unfiltered signal.

First, the Spanish Bitcoin scene is a force. Well-organized, connected, decentralized but acting as one when needed. People relentlessly focused on building, not just talking. BCC8333 was proof.

Second, the fusion of ideas is remarkable; the power of plebs putting them into practice moves the world forward. Just as Bitcoin doesn’t need a CEO, Bitcoiners don’t need typical trendsetters or idols. Case by case, we verify truth ourselves, like nodes in a network, organically building, improving, brainstorming, discussing—not on flashy stages or in cold expo hangars, but in dynamic meetups like this one.

Third, the tribe. Don’t get me wrong, even with thousands of attendees, you can find your people if you try. But with a few hundred, free of overwhelming noise and far too many folks rushing around, you don’t miss the most valuable chats. BCC8333 was no different. I met and re-met my soulmates. The tribe you laugh with, but also work hard with when needed. Simply put: people who share the cypherpunk fire. Sovereignty and hands-on freedom.

- Bonus stuff?

Though the topics were serious (and important), the vibe still had plenty of fun. Barcelona’s nightlife was a great playground, but the organizers also brought joy right to the venue itself. https://i.nostr.build/ahJsprpg1d4qHFtV.png

Examples: Both days with Chain Duel to play in the courtyard and later a big-screen tournament, were cool to watch and join. Saturday’s concert by Roger 9000, with all of us shouting, “Tick tock, next block, it don’t stop. The love of freedom, it don’t stop!” to his energetic beats, made those moments truly spectacular.

Wrapping Up.

BCC8333 stands apart. As the title says, it was truly the event ‘Where Cypherpunk Spirit Forges Sovereign Minds.’ Cheers to the organizers, contributors, volunteers, and attendees! Those past few days in Barcelona were solid proof we’re keeping Bitcoin’s ethos alive—a strong case that it’s not about “going to the moon” but staying free on the ground.

Thank YOU!

BTC Your Mind. Let it Beat.

Şela

-

@ 866e0139:6a9334e5

2025-06-10 06:33:27

@ 866e0139:6a9334e5

2025-06-10 06:33:27Autor: Anna Nagel. (Bild: Lukas Karl). Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie auch in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Im ersten Teil von «Mitgefühl und Vergebung» bin ich, um eine Übersicht zu verschaffen, eher auf eine generelle Ebene eingegangen, und wie wir Schuldvorwürfe und Zorn durch Perspektivwechsel entschärfen können. Es ging mehr um die «großen» Themen, die Themengebiete, die unverzeihlich scheinen. In diesem Text möchte ich jetzt einmal näher heranzoomen und am direkten Beispiel einen Weg der Reflexion aufzeigen, der zu überraschenden – und hoffentlich auch für dich – versöhnlichen Ergebnissen führen kann. Denn häufig halten wir an kleineren Situationen und Verletzungen fest, und, obwohl der Verstand «weiß», dass man schon irgendwie loslassen könnte, weiß man manchmal nicht recht wie.

Teil 1 finden Sie hier.

Möchtest du das wirklich?

Vor einiger Zeit tat jemand etwas, das mir schwer zu Herzen ging. Es widersprach meinem Verständnis von Mitgefühl, Anstand, Moral und Freundschaft und obwohl ich nicht direkt angegriffen wurde, verletzte und empörte mich dieses Verhalten zutiefst. Ja, ich war verletzt und ja, ich war wütend. All das fühlte ich durch, akzeptierte es, doch loslassen konnte ich es anscheinend irgendwie noch nicht. Und obwohl ich weiß, dass Heilung Zeit braucht, spürte ich, dass noch irgendetwas fehlte. Irgendwas, was ich noch nicht sah, noch nicht erkannt oder gelernt hatte.

Es kamen mir also immer wieder verärgerte Gedanken in den Sinn und wenn durch irgendeinen «Zufall» das Thema wieder auf den Tisch kam, kam alles wieder hoch. Bis ich die Gedanken samt Gefühlen bis zum Schluss zurückverfolgte.

Ich fragte mich, was ich denn eigentlich wollte; was könnte dazu führen, dass dieser Anteil in mir befriedet wird? Was ist sein Antrieb? Der Anteil wollte nämlich die ganze Zeit über immer mal wieder Aktionen von mir fordern, von denen ich aber nicht den Eindruck hatte, dass es dadurch besser werden würde. Also fragte – besser gesagt stellte – ich diesen Anteil.

«Möchtest du, dass diese Person Schmerz erleidet? Dass es ihr emotional schlecht geht? Sie Reue, Schuld und Scham empfindet? Möchtest du, dass ihr gar Unglück geschieht, dass sie ihren Job verliert, oder ihr Geld? Liebe Anna, möchtest du das wirklich? Was ist das dann? Eifersucht? Neid? Rache? Schadenfreude? Glaubst du wirklich, dass es dir dann besser geht? Möchtest du so sein oder vielmehr: Bist du so? Liebe Wut, ist das deine Absicht?»

Etwas betroffen sah ich mich in mir um und es wurde still. Ein eigentümliches Gefühl breitete sich im Bauch aus. Die Wut war verflogen und es zeigte sich eher eine Mischung aus Scham, etwas Schuld aber auch Demut. Eigentlich wollte ich das nämlich nicht. Eigentlich bin ich nicht rachsüchtig. Und möchte es auch gar nicht sein.

«Nein, ich möchte nicht, dass es der Person schlecht geht», beschwichtigte vorsichtig eine leise innere Stimme, die sich traute die Stille zu durchbrechen. «Eigentlich», fügte sie zaghaft hinzu, «wünsche ich mir, dass sie sieht, wie es mir geht…».

Verstehen und Mitgefühl breiteten sich aus. Berührt bedankte ich mich für die Tiefe und Ehrlichkeit, die dieser Anteil mir entgegen gebracht hatte und nahm ihn innerlich fest in die Arme. «Ich sehe dich, ich fühle dich. Und ich liebe dich».

Gesehen werden

Diese Erkenntnis erinnerte mich an das Thema Anerkennung, das ich im Beitrag «Der Schmerz des Nicht-Anerkanntseins» bereits aufgefasst habe und daher in diesem Text nur kurz erwähne. Wer den Text kennt, weiß, dass ich gerne mit der eigenen Vorstellungskraft arbeite. Also stellte ich mir vor, wie diese Person vor mir steht und meinen Schmerz und mein Leid sieht, spürt und anerkennt. In dieser inneren Situation war ebenfalls keine Wut mehr, kein Impuls zu schreien oder zu argumentieren, zu debattieren. Es war alles gesagt. Es war alles in Ordnung. Wenn wir das Glück haben, dass diese Person erreichbar ist, ist es natürlich heilsam, wenn wir die Möglichkeit haben, ihr unsere Gefühle mitzuteilen. Dafür ist es aber nicht minder wichtig, sich darüber bewusst zu werden, was wir denn eigentlich brauchen. Es geht aber tatsächlich auch allein.

Und ich frage mich, ob es beim Thema Rache generell im Kern darum geht, dass wir uns nicht gesehen fühlen. Dass wir uns stumm und taub und hilflos – möglicherweise gar vollends machtlos – fühlen. Wenn unsere Grenzen verletzt oder überschritten, wenn sie möglicherweise komplett niedergerissen wurden, versucht etwas in uns, sich selbst zu behaupten.

«Du hast deine Kindheit vergessen, aus den Tiefen deiner Seele wirbt sie um dich. Sie wird dich so lange leiden machen, bis du sie erhörst.»

– Hermann Hesse

Manchmal aber können wir es nicht; wir können in einigen Fällen – und wollen in anderen – nicht mit gleicher Kraft zurückschlagen. Sei es, weil die Person nicht erreichbar ist (physisch oder mental) oder weil uns etwas innerlich bremst. Solange aber der Schmerz da ist, solange er nicht gesehen und geheilt wird, wird ein anderer Aspekt in uns immer lauter werden. Er bleibt im Verteidigungsmodus, er will aus der Ohnmacht zurück in die Selbstwirksamkeit. Und so meint er lauter und lauter werden zu müssen, um sich gesehen und gehört zu fühlen. Er meint, er müsse mit gleicher Wucht antworten oder sogar noch lauter werden, um seine Anerkennung zu bekommen – und letztlich seinen Frieden zu finden.

Da ist es diesem Verteidigungssystem schlicht nicht bewusst – oder auch egal –, ob das eigene Verhalten niederen moralischen Impulsen entspringt, «Der andere hat angefangen!», und auch, ob wir uns selbst damit schuldig machen sowie, ob unsere, möglicherweise irgendwann durch Überdruck entstandene Auslebung unserer Wut überhaupt noch die Person trifft, die uns eigentlich einst diese Wunde zufügte, oder ob wir sie auf andere projizieren. Hier bedarf es tiefer Ehrlichkeit mit uns und unseren Gefühlen und Impulsen.

DIE FRIEDENSTAUBE FLIEGT AUCH IN IHR POSTFACH!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt, vorerst für alle kostenfrei, wir starten gänzlich ohne Paywall. (Die Bezahlabos fangen erst zu laufen an, wenn ein Monetarisierungskonzept für die Inhalte steht). Sie wollen der Genossenschaft beitreten oder uns unterstützen? Mehr Infos hier oder am Ende des Textes.

Schuld und Frieden

Diese Form von Reflexion kann nur auf einer anderen Ebene stattfinden, als der des traumatisierten Anteils. Auf einer, von der aus wir auch sehen können, ob wir uns durch unsere eigene Unversöhnlichkeit schuldig machen.

Ab wann machen wir uns eigentlich selbst schuldig? Sind wir erst Schuldige, wenn wir handeln? Oder bereits, wenn wir jemand anderem Schlechtes wünschen? Gibt es eine «energetische Schuld»? Oder gibt es Schuld überhaupt? Und gibt es «Das Böse»? Sitzt es in jedem von uns? Diese Fragen kann sicherlich nur jedes Gewissen für sich selbst beantworten.

Falls es «Das Böse» gibt, scheint es sich durch unversöhnte Verletzungen in uns hineinzuschleichen oder auszubreiten. Die verletzten Anteile, die eigentlich nur gesehen werden wollen, fungieren als Trittbrett für Wut und Rachegelüste. Sie können im Extremfall als «Entschuldigung» oder Rechtfertigung dienen – oder vielleicht besser missbraucht werden –, endlich auch mal wütend und unmoralisch zu sein. Wenn im extremsten Fall sterbende Kinder im Krieg als Grund hergenommen werden, um auf der anderen Seite der Welt jemanden erschießen zu «dürfen», dann wird es, meinem Empfinden nach, arg düster.

Aber gleich, wo das «Böse» sitzt oder ob es es in Reinform gibt: Wir haben die Wahl. Immer. Unrecht im Außen ist keine Legitimation dafür, selbst Unrecht zu begehen, denn es wäre schlichtweg eine Ausrede. Der Kern unserer Gedanken und Handlungen findet sich in uns selbst. Daher ist es unsere Aufgabe, im eigenen Herzen Frieden zu schließen, unseren Schmerz anzuerkennen, unsere Wunden zu heilen und dem Bösen das Trittbrett zu entziehen, denn – ob es eine gedanklich «energetische» Schuld gibt oder nicht –, eines ist klar:

Wenn wir an Wut, Neid und Rachegedanken festhalten, bleiben wir uns unseres eigenen inneren Friedens schuldig. Ebenso des Anteils an Frieden, den wir in die Welt bringen könnten.

«Wenn wir den Frieden nicht in uns selbst finden, ist es sinnlos, ihn anderswo zu suchen.» – François de La Rochefoucauld

Und wenn das noch schwer fällt, erinnere ich an dieser Stelle noch einmal an die Worte der weisen Frau aus dem ersten Teil: «Dann verzeih dir wenigstens selber deine Unversöhnlichkeit», denn «Mitgefühl beginnt bei uns selbst», – worauf ich im nächsten Teil dieser Reihe näher eingehen werde. Denn niemand von uns ist frei von Schuld; und manchmal ist die schwierigste Aufgabe, sich selbst zu vergeben. Somit sind auch wir auf unsere eigene Gnade, unser eigenes Verständnis und Mitgefühl angewiesen.

Und wer es schafft, sich selbst zu verzeihen, dem wird es auch gleich leichter fallen, anderen zu vergeben.

«Vergeben heißt, einen Gefangenen zu befreien und zu entdecken, dass der Gefangene du warst.» – Lewis B. Smedes

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Die Genossenschaft ist bereits mitten im Gründungsprozess, in Kürze folgt eine Mail an alle Genossenschafter, danke für die Geduld!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ a296b972:e5a7a2e8

2025-06-10 06:08:47

@ a296b972:e5a7a2e8

2025-06-10 06:08:47Wie weit ist es noch her mit Einigkeit und Recht und Freiheit?

Wie weit sind diese wunderbaren Begriffe schon von Spaltung, Willkür und Bevormundung verdrängt worden?

Ein Land, dessen Werte aus dem Ruder gelaufen sind. Regiert von Teflonauten. Teflonauten? Das sind die, die sich vor Eintritt in die Politik in einem Fass Teflon-Lack haben taufen lassen, damit alle Vernunft an ihnen abperlt.

Für Deutschland gehen die Superlative aus, die den Gesamtzustand eines Staates beschreiben könnten, der in jeder Hinsicht aus den Fugen geraten ist. Wie in einem vorangegangenen Kommentar zu einem anderen Thema zu lesen war, die Satiriker werden langsam arbeitslos, weil die Realität alles überbietet.

Eine unsägliche Riege von Politikern demontiert eine Demokratie, die bis 2019 wenigstens noch einigermaßen erträglich funktioniert hat. Man hatte noch das Gefühl, man wird weitgehend in Ruhe gelassen.

Mit dem Corona-Ereignis wurde die Büchse der Pandora geöffnet. Seitdem fließen totalitäre Elemente in die Demokratie ein. Wer darauf hinweist, läuft Gefahr, es mit der vom Souverän gekaperten Macht zu tun zu bekommen.

Für die, die gegen die Bevölkerungsverdummung immun sind, wird es zunehmend unerträglicher, doch – da müssen wir durch.

Es ist gut, dass all die Machenschaften, die die Deutschen sonst nicht mitbekommen haben, allendhalben hier und da mal ein Skandälchen, ans Tageslicht kommen.

Es ist gut, dass es so offensichtlich ist, dass die dicksten Klopse, die sich die sogenannten Politiker erlauben, nicht den geringsten Anlass dazu geben, zurückzutreten. Vorbei die Zeiten, in den schon viel kleinere Vergehen, einen Politiker dazu genötigt haben. Es ist gut, weil so klar wird, dass das politische Gewissen nur noch im Museum besichtigt werden kann. Irgendwann versteht das auch noch der Letzte im hintersten Winkel des besten Deutschlands aller Zeiten.

Die Inkompetenz ist überall sichtbar, durch die, die unfähig sind, ihre Machenschaften zu verbergen.

Läppisch geschnitzte Pfeifen geben sich als wohlgestimmte Orgel aus und meinen, es gäbe niemanden, der die Kakophonie hören würde. Ein schräges Blockflöten-Konzert wird zum Musikgenuss hochstilisiert, von Leuten, die ständig ihren Notenschlüssel verlegen und dadurch nicht mehr in den Raum der Vernunft kommen.

Die Menschen in Deutschland haben sich aufgeteilt in die, die von all dem nichts wissen wollen und sich einreden, es sei doch alles in Ordnung. Für die, die sich brav ihre tägliche Gehirnwäsche in den inzwischen für die Qualität ihrer Propaganda bekannten Medien abholen, das sind noch rund 60%, gibt es keine Einschränkung der Meinungsfreiheit. Rund 40%, die der Meinung sind, dass man in Deutschland seine Meinung nicht mehr frei äußern kann, sind noch viel zu wenig! Für immer noch zu viele ist J. D. Vance ein Verschwörungstheoretiker, der die Sicherheitskonferenz in München dazu missbraucht hat, seine kruden Ansichten zu verbreiten.

Und dann gibt es die, die mitbekommen, was in Deutschland los ist. Die werden oft erschlagen von den Verstrickungen, Irrungen und Wirrungen, die sich immer mehr zeigen und immer dreister als Selbstverständlichkeit, als das Normalste von der Welt postuliert werden. Für die ist der gesundheitliche Zustand der deutschen Demokratie immer mehr ein Dauerpatient auf der Intensivstation.

Realitätsfremde Energiepolitik, Nordstream kaputt, gut so, kein Interesse an einer Wiederinbetriebnahme;

rückläufige Wirtschaft, zunehmende Firmenpleiten, Abwanderung von Unternehmen;

eklatante Steuergeldverbrennung, Northvolt in die Grütze gefahren, Maskendeals, zur Belohnung das nächste Pöstchen;

einseitige, weglassende Hofberichterstattung mit dem Hang zu Amnäsie;

fragwürdige Gerichtsurteile; Schauprozesse gegen Ballweg, Füllmich und viele andere, Masken, Atteste, Strafzahlungen, Majestätsbeleidigung etc. etc. etc..

Gewalt und Tod durch Messerfachkräfte, es sind ja die Messer, nicht die Menschen, die sie in der Hand haben, transparenter Aufklärungsrückstau;

intellektuelle Beleidigungen durch Schönrederei, man glaubt, die anderen sind noch dümmer als man selbst;

existenzbedrohende Kontenkündigungen, wir machen dich fertig;

politischer Dummschwätz, Wiederholungen, Wiederholungen, Wiederholungen;

Einzug totalitärer Strukturen, wer die Augen aufmacht, sieht sie;

infantile Repräsentanz Deutschlands im Ausland, Abwesenheit von Diplomatie;

Aufstachelung der Bürger, damit sie ja schön kriegsgeil werden, siehe auch Dummschwätz;

Angstpornos, bei ständigem Einlass in Kino 7;

lächerliche Preisverleihungen, armutsfördernde Preiserhöhungen;

zunehmendes Misstrauen gegenüber der eigenen Bevölkerung, der Feind im eigenen Land;

Bevormundung, betreutes Denken, Fühlen, Wollen;

bedrohlich zunehmende Überwachungsanstrengungen, digitale Identität, die als Sicherheit verkauft wird, jedoch nichts anderes ist, als der Versuch der Einrichtung eines Überwachungs-Kontroll-Systems;

nichts, aber auch rein gar nichts hat Konsequenzen, die dazu führen, dass die Verantwortlichen zum Sandkornzählen in die Wüste geschickt werden, damit sie den Rest ihres Lebens beschäftigt sind und kein Unheil mehr anrichten können.

Unaufhaltsam rast der Personal-Zug Deutschland, überfüllt mit Fahrgästen, die meinen, Trump ist verrückt und Putin ist die Personifizierung des Bösen, gezogen von einer mit heißer Luft betriebenen Lok, die von Heizern befeuert wird, die den Kessel unentwegt mit Angst und Wahnsinn schüren, auf den Berg aus Granit zu, der unweigerlich eine Katastrophe für die Demokratie von ungeahntem Ausmaß verursachen wird. Ständig wird die Strecke künstlich verlängert, indem neue Schienen und Schleifen hinzugefügt werden, statt den Zug rechtzeitig noch zum Halten zu bringen. Die Geschwindigkeit ist inzwischen schon so hoch, dass selbst der Geist, der zu Pfingsten ja ausgeschüttet wird, niemanden mehr erreicht.

Deutschland ist in der Hand von ideologisch vergifteten Versagern zweiter und letzter Wahl und einer verschworenen Gemeinschaft von Universal-Dilettanten, die den Untergang der freiheitlich-demokratischen Grundordnung fest im Zangengriff haben und keinerlei Anstalten machen, diesen wieder lösen zu wollen.

Das Land der Denker und Dichter geht vor die Hunde. Freiheitlich, wirtschaftlich, gesellschaftlich, politisch, rechtlich. Um die Manege sitzen immer noch viel zu viele sogenannte Bürger, die Beifall klatschen, oder sich zumindest einreden, es sei doch weitgehend alles in Ordnung. Bravo! Es ist so unglaublich unterhaltend, sich nach Strich und Faden an der Nase herumführen zu lassen.

Und die, die die Kraft haben, auf diesen Wahnsinn hinzuschauen, die wissen gar nicht, was sie zuerst tun sollen: Heulen, schreien, verzweifelt sein, unentwegt mit dem Kopf schütteln, dagegen anschreiben, wachrütteln, flüchten oder dableiben, sich in Sicherheit bringen?

Die Demokratie und Rechtsstaatlichkeit sind von „Demokraten“ gekidnappt worden, die behaupten, sie würden sie verteidigen. Dabei geht es ausschließlich nur um deren Machterhalt und die Besitzstandswahrung ihrer erbärmlichen Pöstchen, mit einer weiteren Diätenerhöhung von rund 600 Euro im Juli 2025. Deutschland ist zu einem drittklassigen Selbstbedienungsladen verkommen, und es wird unentwegt in die Kasse gegriffen, solange noch was zu holen ist. Und damit das auch noch eine Zeit lang so weitergehen kann, wird Luftgeld produziert und als Sondervermögen deklariert, und damit eine Hypothek geschaffen, die zukünftige Generationen niemals werden ausgleichen können.

Wie gelegen käme da ein Krieg, in dem all dieser menschengemachte Unsinn wertlos wird. Und ein Neuanfang danach wird dann als überragende politische Leistung verkauft, die zum Wohle des Volkes geschaffen wurde, damit ein neues Wirtschaftswunder möglich werden kann. Los, ran, wieder all das aufbauen, das Deppen zuvor in die Tonne gekloppt haben. Uns geht’s ja schon wieder so gut, wir wollen uns wirklich nicht beklagen. Wir haben ja von all dem nichts gewusst. Wir waren ja nur die Opfer einer fehlgeleiteten Politik. Was hätten wir denn tun können? So oder so ähnlich wird dann das eigene Gewissen wieder durch fadenscheinigen Selbstbetrug beruhigt.

Das ganze System stinkt zum Himmel. Unerträglicher Gestank nach Zersetzung und Verwesung, der uns als neuester Schrei der Parfum-Hersteller verkauft wird.

Man kann gar nicht so schnell schreiben, wie man sich aufregen möchte.

Das ist kein Ventil zum Ausdruck der unglaublichen Empörung. Das wäre zu einfach und bedeutungslos. Nein, mit jedem Wort und jedem Artikel und jedem neuen Abonnenten von pareto verbindet sich die Hoffnung, wieder jemanden zum Nachdenken anregen zu können. Damit die Zahl derjenigen, die die Demokratie verstanden haben, von Tag zu Tag größer wird. Damit sich von unten herauf eine geistige Kraft immer mehr entfaltet, die dieses impertinente Lügenkonstrukt zum Einstürzen bringt. Ein Leuchtfeuer muss ständig brennen, wenn Gefahr in Verzug ist. Wenn man so will, ist das Revolution, aber eine geistige und vor allem friedliche. Wenn immer mehr Menschen mutig verstehen, was in Deutschland abgeht, dann nagt das unermüdlich an den künstlich geschaffenen, unmenschlichen undemokratischen Strukturen, die den Stümpern die Macht rauben werden, damit dieses ganze Lügengebäude endlich implodieren kann.

Je lauter Delegitimierung geschrien wird, desto deutlicher tritt hervor, wer für die Delegitimierung der freiheitlich-demokratischen Grundordnung und die Aushöhlung des Grundgesetzes verantwortlich ist.

Deutschland kann nur wirklich in Richtung Souveränität gehen, wenn wir so weit gekommen sind, dass sich das deutsche Volk in freier Entscheidung eine Verfassung (gerne auf Grundlage des Grundgesetzes, das nach wie vor provisorischen Charakter hat) gegeben hat, in der Bürgerbeteiligung und Volksentscheide, gerne nach schweizerischem Vorbild, nicht nur zur Pflicht eines jeden Bürgers, sondern ganz selbstverständlich als notwendiger, alltäglicher Beitrag zur Demokratie fest in den Köpfen der Menschen verankert ist.

Gruß an das Amt für, aus Sicht des Bürgers, Fassungslosigkeit. Wenn ein leidenschaftliches Eintreten für Freiheit und Demokratie, durch berechtigte Kritik an den derzeitigen Verhältnissen, als rechts angesehen wird, dann ist der Autor gerne rechts. Eben ein rechter Demokrat, wie es sich gehört!

Vielleicht leidet der Autor auch an Demokratie-Tourette: Ihr Pfeifen, ihr Pfeifen, ihr Pfeifen! Was habt ihr nur aus unserem Land gemacht. Unserem, hört ihr, nicht eurem!

Der Autor hat fertig (jedenfalls für heute!), Deutschland leider auch.

“Dieser Beitrag wurde mit dem Pareto-Client geschrieben.”

* *

(Bild von pixabay)

-

@ 2b998b04:86727e47

2025-06-10 05:21:03

@ 2b998b04:86727e47

2025-06-10 05:21:03For years, GitHub has been the default home for open source developers. It built its reputation on transparency, collaboration, and a commitment to giving coders a place to share and improve their work. But since Microsoft's acquisition in 2018, subtle changes have begun to surface—not all of them in service to the user.

GitHub is still free. Public repositories remain free. Even private repositories are free, to a point. GitHub Pages, Actions, and Codespaces offer incredibly powerful tools to build and deploy projects at no cost—until you hit certain usage limits or need team-scale features.

But the deeper question is this: what do you give up in exchange?

Microsoft Doesn’t Give Away Infrastructure for Free

GitHub, VSCode, Copilot, and Azure form a tightly integrated ecosystem. On the surface, it's all about productivity. But underneath, it's about data. Your code trains their models. Your habits inform their products. Your workflows deepen their lock-in.

Take Copilot, for example: it’s not just a coding assistant, it’s a data-harvesting engine built on top of a centralized platform. The more you use GitHub, the more Microsoft knows about what developers are building—and what they might buy.

Free Isn’t Sovereign

As developers, we have to ask hard questions:

-

What happens when the free tier disappears or changes?

-

Can I take my work elsewhere without breaking my stack?

-

Who owns the insights derived from my development patterns?

These questions aren’t hypothetical. We’ve seen them play out with Heroku, Medium, Twitter, and countless others. Free turns into friction. Then friction becomes control.

Alternatives Are Emerging

Thankfully, there are options:

-

Codeberg, Gitea, and SourceHut for Git hosting

-

Cloudflare Pages for static sites + edge functions

-

Railway, Fly.io, or even VPS hosting for dynamic apps

-

Nostr and IPFS for decentralized publishing

These aren’t always drop-in replacements. But they represent a healthier direction—one aligned with freedom, transparency, and a proof-of-work ethos rather than a proof-of-data-capture business model.

My Move Away from GitHub (Sort Of)

I’m not deleting my GitHub account. It’s still the best way to reach other devs. But for key projects—especially those that touch on identity, sovereignty, or censorship resistance—I’m migrating:

-

Private infrastructure where needed

-

Cloudflare for front-end deployments

-

Nostr for publishing and archiving

-

Git mirroring to open alternatives

Because the tools we use shape the future we build. And if the platform is free, but the product is you—it's time to re-evaluate.

#ProofOfWork #OpenSource #Cloudflare #DecentralizeEverything #Nostr #GitSovereignty #MicrosoftStack

-

-

@ 2b998b04:86727e47

2025-06-10 04:00:54

@ 2b998b04:86727e47

2025-06-10 04:00:54Turning 60

Ten years ago, I turned 50 with a vague sense that something was off.

I was building things, but they didn’t feel grounded.\ I was "in tech," but tech felt like a treadmill—just faster, sleeker tools chasing the same hollow outcomes.\ I knew about Bitcoin, but I dismissed it. I thought it was just “tech for tech’s sake.”

Less than a year later, I fell down the rabbit hole.

It didn’t happen all at once. At first it was curiosity. Then dissonance. Then conviction.

Somewhere in that process, I realized Bitcoin wasn’t just financial—it was philosophical. It was moral. It was real. And it held up a mirror to a life I had built on momentum more than mission.

So I started pruning.

I left Web3.\ I pulled back from projects that ran on hype instead of honesty.\ I repented—for chasing relevance instead of righteousness.\ And I began stacking—not just sats, but new habits. New thinking. New rhythms of faith, work, and rest.

Now at 60, I’m not where I thought I’d be.

But I’m more myself than I’ve ever been.\ More convicted.\ More rooted.\ More ready.

Not to start over—but to build again, from the foundation up.

If you're in that middle place—between chapters, between convictions, between certainty and surrender—you're not alone.

🟠 I’m still here. Still building. Still listening.

Zap if this resonates, or send your story. I’d love to hear it.

[*Zap *](https://tinyurl.com/yuyu2b9t)

-

@ 472f440f:5669301e

2025-06-10 03:58:15

@ 472f440f:5669301e

2025-06-10 03:58:15Marty's Bent

via me

"The man in the coma" has been a long-running archetype of a bitcoiner on TFTC and Rabbit Hole Recap. Over the years, we've referenced the man in the coma in regards to bitcoin being a backward compatible distributed network that would enable an individual, in the case of our example - a man who fell into a coma, to be able to wake up many years, even decades, after falling into a deep sleep, go back to his bitcoin node and be able to participate in the network and validate his own transactions as if the network was operating the same it was the day he slipped into a coma. As a distributed network, this is one of bitcoin's greatest value props; consistency for the individual running it, no matter the version.